| Exhibit No. | Description | |||||||

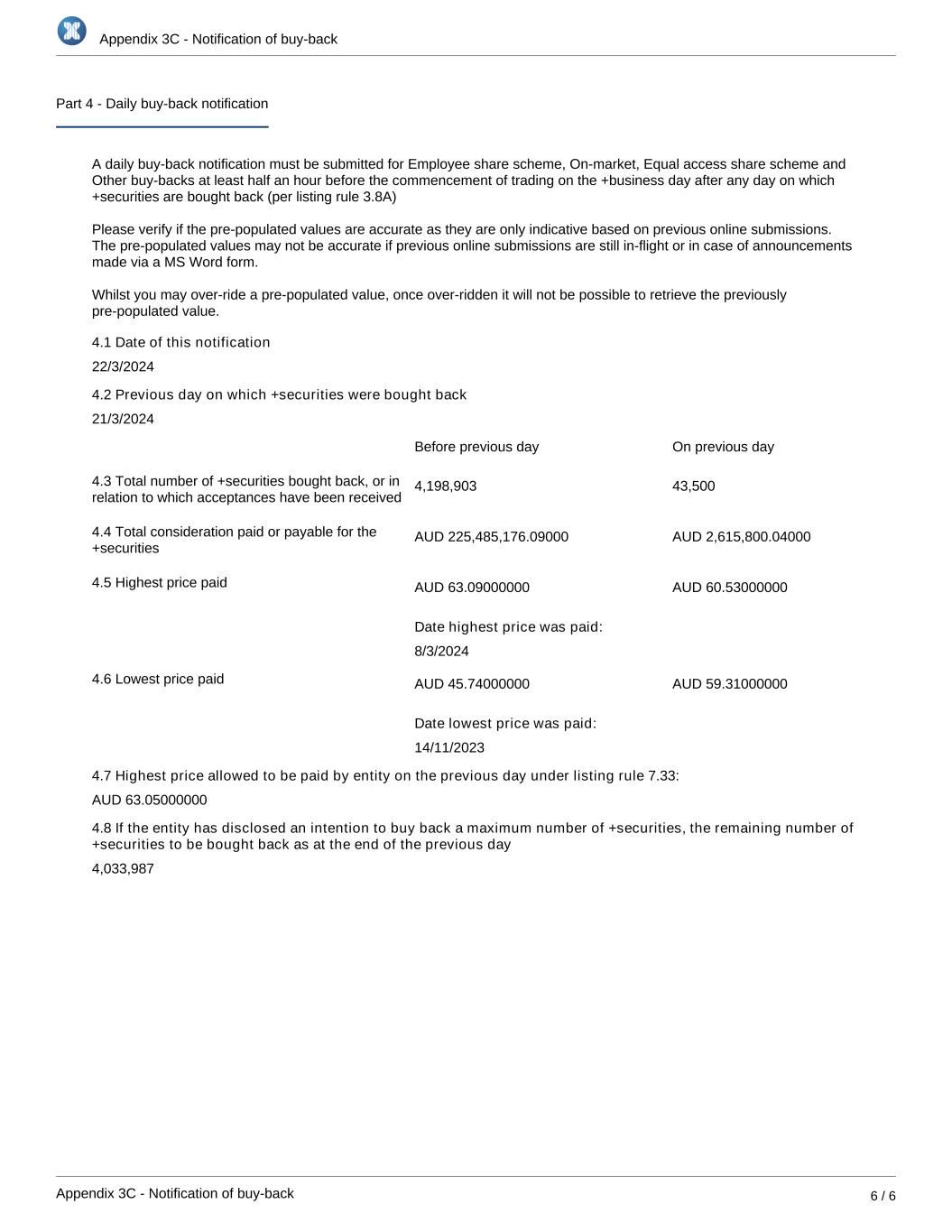

| Update - Notification of buy-back - JHX | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

| Change in substantial holding | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

| Application for quotation of securities - JHX | ||||||||

| Appendix 3Y - P LISBOA | ||||||||

| Appendix 3Y - A LLOYD | ||||||||

| Appendix 3Y - R RODRIGUEZ | ||||||||

| Appendix 3Y - N STEIN | ||||||||

| Appendix 3Y - H WIENS | ||||||||

| Appendix 3Y - S ROWLAND | ||||||||

| Appendix 3Y - R PETERSON | ||||||||

| Appendix 3Y - PJ DAVIS | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

| James Hardie Industries plc | ||||||||

| Date: 22 March 2024 | By: /s/ Aoife Rockett |

|||||||

Aoife Rockett |

||||||||

Company Secretary |

||||||||

| Exhibit No. | Description | |||||||

| Update - Notification of buy-back - JHX | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

| Change in substantial holding | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

| Application for quotation of securities - JHX | ||||||||

| Appendix 3Y - P LISBOA | ||||||||

| Appendix 3Y - A LLOYD | ||||||||

| Appendix 3Y - R RODRIGUEZ | ||||||||

| Appendix 3Y - N STEIN | ||||||||

| Appendix 3Y - H WIENS | ||||||||

| Appendix 3Y - S ROWLAND | ||||||||

| Appendix 3Y - R PETERSON | ||||||||

| Appendix 3Y - PJ DAVIS | ||||||||

| Update - Notification of buy-back - JHX | ||||||||

|

Classification: James Hardie Collaborate

Exhibit 99.7

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Persio LISBOA | ||||

| Date of last notice | 20 December 2023 | ||||

| Direct or indirect interest | Direct | ||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

Date of change |

15 March 2024 |

||||

|

No. of securities held prior to change

|

•Indirect interest in 12,174 ADRs, equivalent to a holding of 12,174 ordinary shares/CUFS. The registered holder is Merrill Lynch Pierce Fenner, & Smith and they are held on account for the beneficial owner, Persio Lisboa.

•Direct interest in 6,765 ADRs, equivalent to a holding of 6,765 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 496 ADRs, equivalent to a holding of 496 ordinary shares/CUFS. | ||||

| Number disposed | Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$18,624.80 | ||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Appendix 3Y

Change of Director’s Interest Notice

| ||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 12,174 ADRs, equivalent to a holding of 12,174 ordinary shares/CUFS. The registered holder is Merrill Lynch Pierce Fenner, & Smith and they are held on account for the beneficial owner, Persio Lisboa.

•Direct interest in 7,261 ADRs, equivalent to a holding of 7,261 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

| Detail of contract | Not applicable |

||||

Nature of interest |

Not applicable | ||||

|

Name of registered holder

(if issued securities)

|

Not applicable | ||||

| Date of change | Not applicable | ||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable | ||||

| Interest acquired | Not applicable | ||||

| Interest disposed | Not applicable | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable | ||||

| Interest after change | Not applicable | ||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Exhibit 99.8

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Anne LLOYD | ||||

| Date of last notice | 20 December 2023 | ||||

+ See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 15 March 2024 |

||||

| No. of securities held prior to change |

•Indirect interest in 18,000 ADRs, equivalent to a holding of 18,000 ordinary shares/CUFS. The ADRs are issued by Deutsche Bank Trust Company Americas. The registered holder is Pershing LLC and they are held on account for the beneficial owners, Anne Lloyd and Steven Lloyd.

•Direct interest in 2,463 ADRs, equivalent to a holding of 2,463 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 364 ADRs, equivalent to a holding of 364 ordinary shares/CUFS. | ||||

| Number disposed | Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$13,668.20 | ||||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 18,000 ADRs, equivalent to a holding of 18,000 ordinary shares/CUFS. The ADRs are issued by Deutsche Bank Trust Company Americas. The registered holder is Pershing LLC and they are held on account for the beneficial owners, Anne Lloyd and Steven Lloyd.

•Direct interest in 2,827 ADRs, equivalent to a holding of 2,827 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

+ See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

Nature of interest |

Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Exhibit 99.9

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Rada RODRIGUEZ | ||||

| Date of last notice | 20 December 2023 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 15 March 2024 |

||||

| No. of securities held prior to change | Direct interest in 3,958 ADRs, equivalent to a holding of 3,958 ordinary shares/CUFS. |

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 381 ADRs, equivalent to a holding of 381 ordinary shares/CUFS. | ||||

| Number disposed | Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$14,306.55 | ||||

| No. of securities held after change |

Current relevant interest is:

•Direct interest in 4,339 ADR’s, equivalent to a holding of 4,339 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend rei0nvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable | ||||

Nature of interest |

Not applicable | ||||

|

Name of registered holder

(if issued securities)

|

Not applicable | ||||

| Date of change | Not applicable | ||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable | ||||

| Interest acquired | Not applicable | ||||

| Interest disposed | Not applicable | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable | ||||

| Interest after change | Not applicable | ||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Exhibit 99.10

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Nigel STEIN | ||||

| Date of last notice | 20 December 2023 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

Date of change |

15 March 2024 | ||||

No. of securities held prior to change |

•Indirect interest in 3,400 ordinary shares/CUFS. The registered holder is Evelyn Partners Investment Services Limited (Formerly Pershing Securities Limited) and they are held on account for beneficial owner, Nigel Stein.

•Direct interest in 3,826 ADRs, equivalent to a holding of 3,826 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 379 ADRs, equivalent to a holding of 379 ordinary shares/CUFS. | ||||

| Number disposed | Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$14,231.45 | ||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Appendix 3Y

Change of Director’s Interest Notice

| ||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 3,400 ordinary shares/CUFS. The registered holder is Investment Services Limited (Formerly Pershing Securities Limited) and they are held on account for beneficial owner, Nigel Stein.

•Direct interest in 4,205 ADRs, equivalent to a holding of 4,205 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

| Detail of contract | Not applicable | ||||

Nature of interest |

Not applicable | ||||

|

Name of registered holder

(if issued securities)

|

Not applicable | ||||

| Date of change | Not applicable | ||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable | ||||

| Interest acquired | Not applicable | ||||

| Interest disposed | Not applicable | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable | ||||

| Interest after change | Not applicable | ||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Exhibit 99.11

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Harold WIENS | ||||

| Date of last notice | 20 December 2023 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 15 March 2024 | ||||

| No. of securities held prior to change |

•Indirect interest in 7,370 ADRs, equivalent to a holding of 7,370 ordinary shares/CUFS. The registered holder is UBS Financial Services Inc. and they are held on account for the joint beneficial owners, Harold and Claudia Wiens.

•Direct interest in 5,105 ADRs, equivalent to a holding of 5,105 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 847 ADRs, equivalent to a holding of 847 ordinary shares/CUFS. | ||||

| Number disposed | Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$31,804.85 | ||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Appendix 3Y

Change of Director’s Interest Notice

| ||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 7,370 ADRs, equivalent to a holding of 7,370 ordinary shares/CUFS. The registered holder is UBS Financial Services Inc. and they are held on account for the joint beneficial owners, Harold and Claudia Wiens.

•Direct interest in 5,952 ADRs, equivalent to a holding of 5,952 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

| Detail of contract | Not applicable | ||||

Nature of interest |

Not applicable | ||||

|

Name of registered holder

(if issued securities)

|

Not applicable | ||||

| Date of change | Not applicable | ||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable | ||||

| Interest acquired | Not applicable | ||||

| Interest disposed | Not applicable | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable | ||||

| Interest after change | Not applicable | ||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Exhibit 99.12

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Suzanne ROWLAND | ||||

| Date of last notice | 20 December 2023 | ||||

| Direct or indirect interest | Direct | ||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 15 March 2024 | ||||

| No. of securities held prior to change |

•Indirect interest in 5,000 ADRs, equivalent to a holding of 5,000 ordinary shares/CUFS. The registered holder is Charles Schwab & Co. Inc. and they are held on account for beneficial owner, Suzanne B. Rowland.

•Direct interest in 1,628 ADRs, equivalent to a holding of 1,628 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 385 ADRs, equivalent to a holding of 385 ordinary shares/CUFS. | ||||

| Number disposed | Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$14,456.75 | ||||

+ See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 5,000 ADRs, equivalent to a holding of 5,000 ordinary shares/CUFS. The registered holder is Charles Schwab & Co. Inc. and they are held on account for the beneficial owner, Suzanne B. Rowland.

•Direct interest in 2,013 ADRs, equivalent to a holding of 2,013 ordinary shares/CUFS.

•ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

| Detail of contract | Not applicable | ||||

Nature of interest |

Not applicable | ||||

|

Name of registered holder

(if issued securities)

|

Not applicable | ||||

| Date of change | Not applicable | ||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable | ||||

| Interest acquired | Not applicable | ||||

| Interest disposed | Not applicable | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable | ||||

| Interest after change | Not applicable | ||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Exhibit 99.13

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Renee PETERSON | ||||

| Date of last notice | 20 December 2023 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 15 March 2024 | ||||

| No. of securities held prior to change | •Direct interest in 1,215 ADRs, equivalent to a holding of 1,215 ordinary shares/CUFS. |

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 1,041 ADRs, equivalent to a holding of 1,041 ordinary shares/CUFS. | ||||

Number disposed |

Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$39,089.55 | ||||

| No. of securities held after change |

Current relevant interest is:

•Direct interest in 2,256 ADRs, equivalent to a holding of 2,256 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable | ||||

Nature of interest |

Not applicable | ||||

|

Name of registered holder

(if issued securities)

|

Not applicable | ||||

| Date of change | Not applicable | ||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable | ||||

| Interest acquired | Not applicable | ||||

| Interest disposed | Not applicable | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable | ||||

| Interest after change | Not applicable | ||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Exhibit 99.14

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Peter-John DAVIS | ||||

| Date of last notice | 20 December 2023 | ||||

| Direct or indirect interest | Direct | ||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Direct interest in ordinary shares/CUFS registered in the name of Peter John Charles Davis. | ||||

| Date of change | 15 March 2024 | ||||

| No. of securities held prior to change | Direct interest in 1,645 CUFS, equivalent to a holding of 1,645 ordinary shares/CUFS. |

||||

| Class | Ordinary shares/CUFS | ||||

| Number acquired | 390 | ||||

|

Number disposed

|

Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

A$22,206.60 | ||||

| No. of securities held after change |

Current relevant interest is:

•2,035 ordinary shares/CUFS registered in the name of Peter John Charles Davis.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of CUFs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

+ See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable | ||||

Nature of interest |

Not applicable | ||||

|

Name of registered holder

(if issued securities)

|

Not applicable | ||||

| Date of change | Not applicable | ||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable | ||||

| Interest acquired | Not applicable | ||||

| Interest disposed | Not applicable | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable | ||||

| Interest after change | Not applicable | ||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||