Document

Ex 99.1 - Earnings Release

JETBLUE ANNOUNCES THIRD QUARTER 2025 RESULTS

Delivered results at better end of guidance ranges, supported by improving demand and solid cost execution

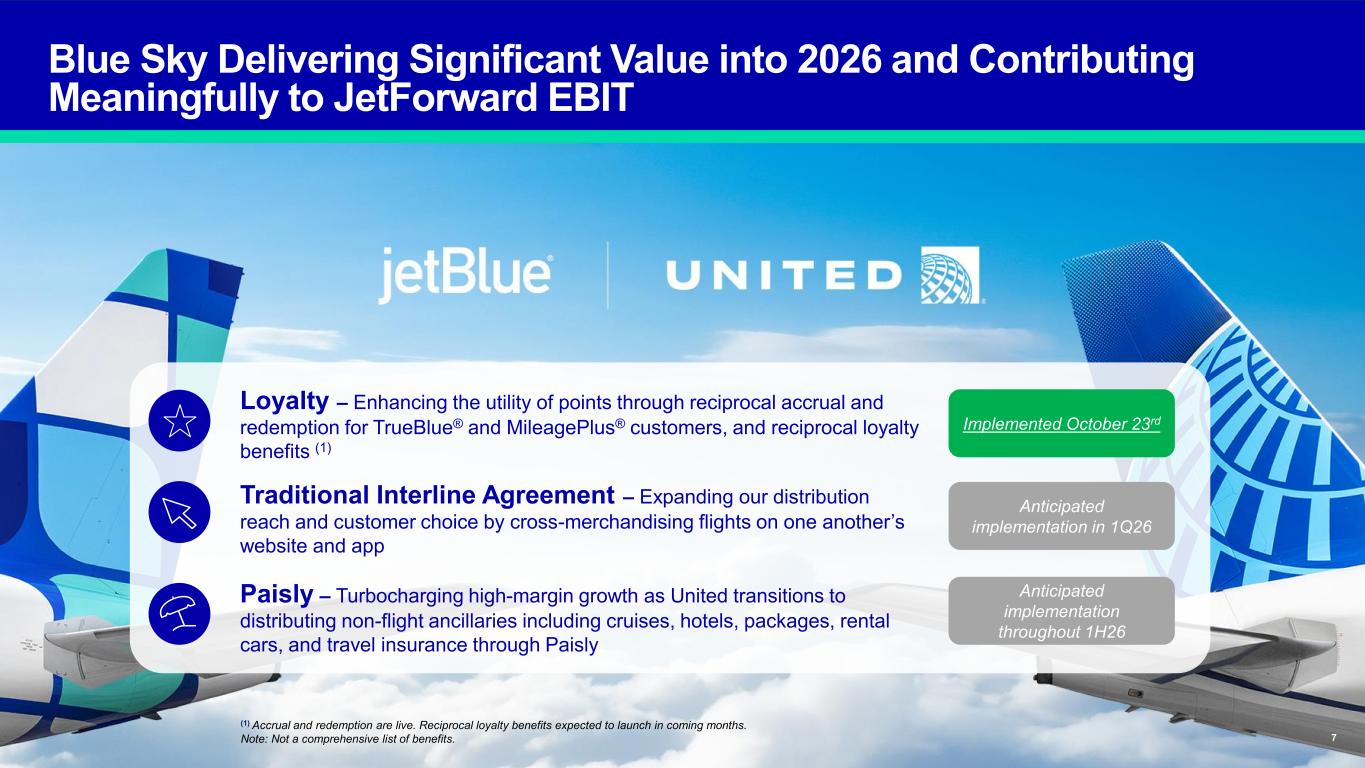

Building commercial momentum with launch of initial Blue Sky loyalty benefits (1) and expansion in Fort Lauderdale

JetForward on track to deliver $290 (2) million of incremental EBIT by year-end

NEW YORK (October 28, 2025) - JetBlue Airways Corporation (NASDAQ: JBLU) today reported its financial results for the third quarter of 2025.

"JetBlue's progress toward profitability is gaining momentum as a result of the swift actions we've taken to implement our JetForward strategy and set a strong foundation for 2026," said Joanna Geraghty, JetBlue's chief executive officer. "Revenue and costs came in at the better half of their respective guidance ranges, significantly improving our financial performance throughout the quarter," continued Geraghty. "This wouldn't be possible without our 23,000 crewmembers delivering reliable and caring service in the face of a challenging operating environment this summer, especially in July. Thank you for taking care of each other and our customers. As a result, our customer satisfaction scores remain up double digits year to date."

"We are providing customers with more opportunities to choose JetBlue's differentiated product and service, from our expansion in Fort Lauderdale to the launch of reciprocal loyalty accrual and redemption as part of our Blue Sky collaboration," said Marty St. George, JetBlue's president. "Through these unique JetForward initiatives and others coming online next year, we expect to see margin momentum."

JetBlue Reaffirms Position as Fort Lauderdale's Largest Airline

•In 2025, we plan to launch 17 new routes and add frequencies on 12 high-demand routes from Fort Lauderdale.

•Anticipate offering our largest ever schedule, up 35% year-over-year, cementing our position as Fort Lauderdale's #1 airline.

•Scheduled to offer over 25 daily flights touching Fort Lauderdale with our award-winning Mint® service, offering more transcontinental lie-flat seats from South Florida than any other carrier.

•Expected to open a dedicated Mint® base for inflight crewmembers in early 2026, creating even more jobs in South Florida.

JetForward On Track to Deliver $290M of Incremental EBIT in 2025

JetBlue delivered $90 million of incremental EBIT during the first half of 2025 as part of its JetForward strategy, bringing cumulative gains since inception to $180 million. Progress in the second half is tracking in-line with expectations toward its cumulative $290 million target, with plans to share full-year results in January 2026.

•Reliable & Caring Service

◦Third quarter 2025 on-time performance was up two points, with completion factor in-line to last year.

◦Net Promoter Score was up low-single digits for the quarter and remained up double digits for the year, building on improvements from 2024.

•Best East Coast Leisure Network

◦Reaffirmed position as Fort Lauderdale's largest airline with new routes, additional frequencies and more job opportunities for the region.

◦Announced new service from New York's John F. Kennedy International Airport (JFK) and Boston Logan International Airport (BOS) to Vero Beach and Daytona Beach. Also announced new routes from Tampa and Fort Myers to Islip, New York, further building on our robust presence across the state of Florida.

◦Cross-selling flights with United's complementary network expected to launch in early 2026, delivering more choices to fly across the globe for JetBlue and United customers.

•Products & Perks Customers Value

◦Launched reciprocal loyalty accrual and redemption with United to increase the value of TrueBlue® points and bring more value to our TrueBlue® members.

◦Enhanced EvenMore® offering is now selling via Global Distribution Systems, providing customers more opportunities to book our premium economy offering on a single ticket through travel agents and online travel agencies.

◦Lounge at JFK slated to open in the fourth quarter of 2025 followed by BOS in 2026.

◦JetBlue is on track to launch domestic first-class in 2026, with 25% of our non-Mint® fleet expected to be retrofitted next year, and the vast majority completed by the end of 2027.

◦Announced our agreement with Amazon's Project Kuiper to provide faster and more reliable connectivity to our on-board Wi-Fi, furthering our leadership in onboard connectivity. The roll-out is expected to begin on a portion of our fleet in 2027.

•A Secure Financial Future

◦Achieved unit cost guidance despite significant weather disruptions in the third quarter, and improved our full-year unit cost guidance.

◦Continue to advance over 100 cost initiatives. In 2025, initiatives are focused on AI and data science adoption, customer self-service, disruption management, and fuel consumption reduction.

◦Maintained strong liquidity position of $2.9 billion, excluding our $600 million revolving credit facility.

Third Quarter 2025 Financial Results and Highlights

•Third quarter 2025 system capacity increased by 0.9% year-over-year, at the higher end of our revised (3) guidance range of 0.0% to 1.0%.

•Operating revenue of $2.3 billion for the third quarter of 2025, a decrease of 1.8% year-over-year.

•Operating revenue per available seat mile ("RASM") decreased 2.7% year-over-year, at the top half of our revised guidance range of a decrease of 4.0% to a decrease of 1.5%, driven by strong close-in demand.

•Operating expense per available seat mile ("CASM") for the third quarter of 2025 decreased 0.1% year-over-year.

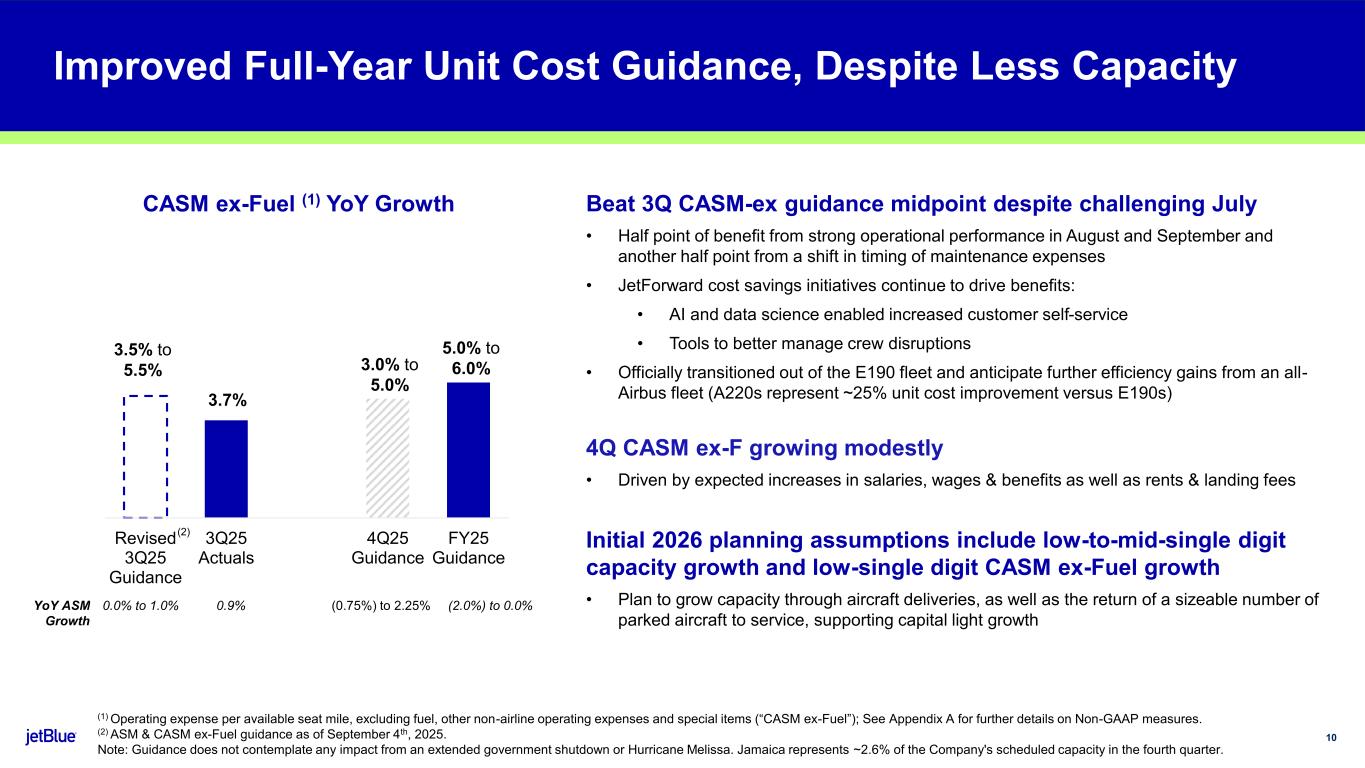

•Operating expense per available seat mile, excluding fuel, other non-airline operating expenses, and special items ("CASM ex-Fuel") (4) for the third quarter of 2025 increased 3.7% year-over-year, near the better end of our revised guidance range of 3.5% to 5.5%, driven partially by strong operational execution.

•Average fuel price in the third quarter of 2025 of $2.49 per gallon, in-line with our revised guidance range of $2.45 to $2.55.

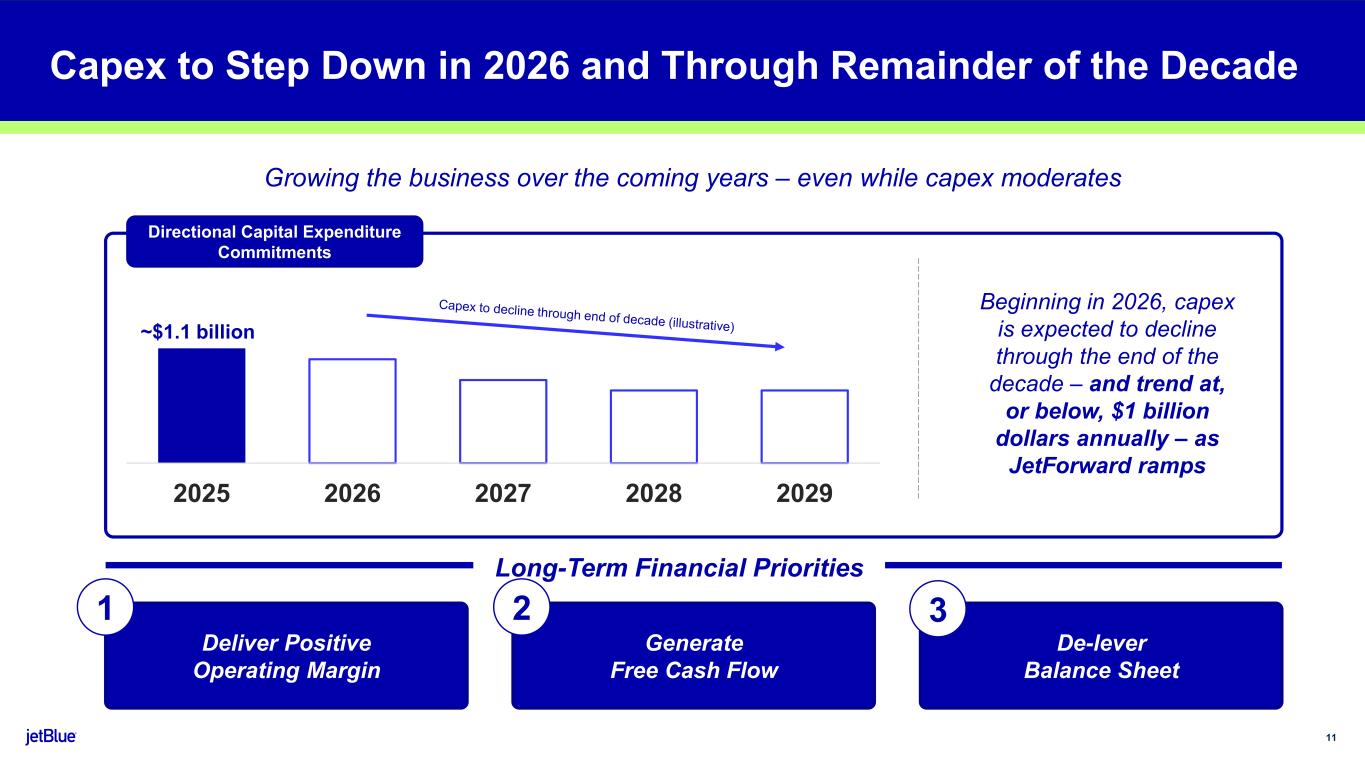

•Capital expenditures, including predelivery deposits, in the third quarter totaled $281 million versus our revised guidance of $325 million.

Outlook

"We are optimistic the demand environment will continue to improve through the end of the year," said St. George. "Peaks are expected to remain strong while troughs remain challenging, and we continue to expect relatively stronger demand for our premium offerings versus core."

"We improved the midpoint of our full-year cost guidance by half a point, despite capacity roughly one point lower than initial guidance, illustrating the benefits of our strong operation and cost-reduction programs," said Ursula Hurley, chief financial officer. She continued, "We are pleased with the progress we've made in the second half toward reaching our $290 million cumulative JetForward target, and we're excited about the momentum we have heading into 2026."

|

|

|

|

|

|

|

|

|

Fourth Quarter and Full Year 2025 Outlook |

Estimated 4Q 2025 |

Estimated FY 2025 |

| Available Seat Miles ("ASMs") Year-Over-Year |

(0.75%) - 2.25% |

(2.0%) - 0.0% |

| RASM Year-Over-Year |

(4.0%) - 0.0% |

- |

CASM Ex-Fuel (4) Year-Over-Year |

3.0% - 5.0% |

5.0% - 6.0% |

Fuel Price per Gallon (5), (6) |

$2.33 - $2.48 |

- |

| Interest Expense |

- |

~$590 million |

Capital Expenditures (7) |

~$300 million |

~$1.1 billion |

|

|

|

Note: Guidance does not contemplate any impact from an extended government shutdown or Hurricane Melissa. Jamaica represents ~2.6% of the Company's scheduled capacity in the fourth quarter.

Earnings Call Details

JetBlue will hold a conference call to discuss its quarterly earnings today, October 28, 2025 at 10:00 a.m. Eastern Time. A live broadcast of the conference call will also be available via the internet at http://investor.jetblue.com. The webcast replay and presentation materials will be archived on the company's website for at least 30 days.

For further details, see the third quarter 2025 Earnings Presentation available via the internet at http://investor.jetblue.com.

About JetBlue

JetBlue is New York's Hometown Airline®, and a leading carrier in Boston, Fort Lauderdale-Hollywood, Los Angeles, Orlando and San Juan. JetBlue, known for its low fares and great service, carries customers to more than 100 destinations throughout the United States, Latin America, the Caribbean, Canada and Europe. For more information and the best fares, visit jetblue.com.

Notes

(1)Initial loyalty benefits include reciprocal accrual and redemption.

(2)Management reviews the estimated amount of earnings before interest and taxes attributable to JetForward initiatives within a given period to evaluate progress against our financial and operational targets. Incremental EBIT reflects the estimated impact of strategic initiatives on profitability, such as partnerships, fleet optimization, network changes, and cost reduction programs.

(3)Revised guidance as of September 4, 2025.

(4)Non-GAAP financial measure; Note A provides a reconciliation of each non-GAAP financial measure used in this release to the most directly comparable GAAP financial measure and explains the reasons management believes that presentation of these non-GAAP financial measures provides useful information to investors regarding JetBlue's financial condition and results of operations. In addition, refer to Note A for further details on non-GAAP forward-looking information.

(5)Includes fuel taxes and other fuel fees.

(6)JetBlue utilizes the forward Brent crude curve and the forward Brent crude to jet crack spread to calculate fuel price for the current quarter. Fuel price is based on forward curve as of October 10, 2025.

(7)Capital expenditures exclude one Airbus A321neo XLR, which JetBlue has entered into an agreement to sell.

Forward-Looking Information

This Earnings Release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All statements other than statements of historical facts contained in this Release are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "expects," "plans" "intends," "anticipates," "indicates," "remains," "believes," "estimates," "forecast," "guidance," "outlook," "may," "will," "should," "seeks," "goals," "targets" or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Earnings Release include, without limitation, statements regarding our outlook and future results of operations and financial position, including our expected return to profitability, any expected headwinds, our product offerings and loyalty initiatives, and our business strategy and plans and objectives for future operations, such as our JetForward initiatives and its Blue Sky component. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; the risk associated with the execution of our strategic operating plans in the near-term and long-term; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to the NEA and our wind-down of the NEA; risks associated with stockholder activism; risks associated with cybersecurity and privacy, including information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; possible failure to comply with financial and other debt covenants included in the agreements governing our debt; financial risks associated with credit card processors; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with our development and use of AI-powered solutions; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing scrutiny of, and evolving expectations regarding, environmental and social matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Earnings Release, could cause our results to differ materially from those expressed in the forward- looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the "SEC"), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2024, as may be updated by our other SEC filings. In light of these risks and uncertainties, the forward-looking events discussed in this Earnings Release might not occur. Our forward-looking statements speak only as of the date of this Earnings Release. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| JETBLUE AIRWAYS CORPORATION |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (unaudited, in millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

| (percent changes based on unrounded numbers) |

2025 |

|

2024 |

|

Percent Change |

|

2025 |

|

2024 |

|

Percent Change |

|

| OPERATING REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

| Passenger |

$ |

2,135 |

|

|

$ |

2,198 |

|

|

(2.9) |

|

|

$ |

6,284 |

|

|

$ |

6,518 |

|

|

(3.6) |

|

|

| Other |

187 |

|

|

167 |

|

|

12.0 |

|

|

534 |

|

|

484 |

|

|

10.3 |

|

|

| Total operating revenues |

2,322 |

|

|

2,365 |

|

|

(1.8) |

|

|

6,818 |

|

|

7,002 |

|

|

(2.6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

| Aircraft fuel |

539 |

|

|

584 |

|

|

(7.6) |

|

|

1,554 |

|

|

1,835 |

|

|

(15.3) |

|

|

| Salaries, wages and benefits |

865 |

|

|

827 |

|

|

4.5 |

|

|

2,579 |

|

|

2,434 |

|

|

5.9 |

|

|

| Landing fees and other rents |

179 |

|

|

176 |

|

|

1.5 |

|

|

509 |

|

|

518 |

|

|

(1.7) |

|

|

| Depreciation and amortization |

173 |

|

|

165 |

|

|

4.8 |

|

|

512 |

|

|

487 |

|

|

5.2 |

|

|

| Aircraft rent |

21 |

|

|

21 |

|

|

0.3 |

|

|

60 |

|

|

73 |

|

|

(18.1) |

|

|

| Sales and marketing |

78 |

|

|

81 |

|

|

(4.1) |

|

|

225 |

|

|

245 |

|

|

(8.3) |

|

|

| Maintenance, materials and repairs |

210 |

|

|

160 |

|

|

31.1 |

|

|

598 |

|

|

442 |

|

|

35.2 |

|

|

| Special items |

5 |

|

|

27 |

|

|

(81.6) |

|

|

29 |

|

|

590 |

|

|

(95.2) |

|

|

| Other operating expenses |

352 |

|

|

362 |

|

|

(2.5) |

|

|

1,020 |

|

|

1,078 |

|

|

(5.5) |

|

|

| Total operating expenses |

2,422 |

|

|

2,403 |

|

|

0.8 |

|

|

7,086 |

|

|

7,702 |

|

|

(8.0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING LOSS |

(100) |

|

|

(38) |

|

|

NM |

(1) |

(268) |

|

|

(700) |

|

|

(61.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating margin |

(4.3) |

% |

|

(1.6) |

% |

|

(2.7) |

|

pts. |

(3.9) |

% |

|

(10.0) |

% |

|

6.1 |

|

pts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

(146) |

|

|

(100) |

|

|

46.4 |

|

|

(441) |

|

|

(215) |

|

|

NM |

|

| Interest income |

30 |

|

|

30 |

|

|

2.8 |

|

|

101 |

|

|

66 |

|

|

51.5 |

|

|

| Capitalized interest |

2 |

|

|

3 |

|

|

(53.0) |

|

|

8 |

|

|

12 |

|

|

(36.9) |

|

|

| Gain (loss) on investments, net |

8 |

|

|

(2) |

|

|

NM |

|

12 |

|

|

(25) |

|

|

NM |

|

| Gain on debt extinguishments |

— |

|

|

22 |

|

|

NM |

|

— |

|

|

22 |

|

|

NM |

|

| Other |

10 |

|

|

7 |

|

|

64.1 |

|

|

27 |

|

|

26 |

|

|

4.6 |

|

|

| Total other expense |

(96) |

|

|

(40) |

|

|

NM |

|

(293) |

|

|

(114) |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS BEFORE INCOME TAXES |

(196) |

|

|

(78) |

|

|

NM |

|

(561) |

|

|

(814) |

|

|

(31.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-tax margin |

(8.4) |

% |

|

(3.3) |

% |

|

(5.1) |

|

pts. |

(8.2) |

% |

|

(11.6) |

% |

|

3.4 |

|

pts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax benefit |

53 |

|

|

18 |

|

|

NM |

|

136 |

|

|

63 |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

$ |

(143) |

|

|

$ |

(60) |

|

|

NM |

|

$ |

(425) |

|

|

$ |

(751) |

|

|

(43.4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

|

|

$ |

(1.18) |

|

|

$ |

(2.18) |

|

|

|

|

| Diluted |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

|

|

$ |

(1.18) |

|

|

$ |

(2.18) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

363.7 |

|

|

346.9 |

|

|

|

|

359.7 |

|

|

344.0 |

|

|

|

|

| Diluted |

363.7 |

|

|

346.9 |

|

|

|

|

359.7 |

|

|

344.0 |

|

|

|

|

(1) Not meaningful or greater than 100% change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| JETBLUE AIRWAYS CORPORATION |

| COMPARATIVE OPERATING STATISTICS |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

| (percent changes based on unrounded numbers) |

|

|

|

|

|

|

2025 |

|

2024 |

|

Percent Change |

|

2025 |

|

2024 |

|

Percent Change |

|

| Revenue passengers (thousands) |

|

|

|

|

|

|

10,381 |

|

|

10,596 |

|

|

(2.0) |

|

|

29,618 |

|

|

30,556 |

|

|

(3.1) |

|

|

| Revenue passenger miles (RPMs) (millions) |

|

|

|

|

|

|

14,372 |

|

|

14,491 |

|

|

(0.8) |

|

|

40,600 |

|

|

41,685 |

|

|

(2.6) |

|

|

| Available seat miles (ASMs) (millions) |

|

|

|

|

|

|

16,884 |

|

|

16,740 |

|

|

0.9 |

|

|

49,126 |

|

|

49,940 |

|

|

(1.6) |

|

|

| Load factor |

|

|

|

|

|

|

85.1 |

% |

|

86.6 |

% |

|

(1.5) |

|

pts. |

82.6 |

% |

|

83.5 |

% |

|

(0.9) |

|

pts. |

Aircraft utilization (hours per day) (1) |

|

|

|

|

|

|

10.1 |

|

|

10.2 |

|

|

(1.0) |

|

|

10.0 |

|

|

10.2 |

|

|

(2.0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average fare |

|

|

|

|

|

|

$ |

205.67 |

|

|

$ |

207.46 |

|

|

(0.9) |

|

|

$ |

212.16 |

|

|

$ |

213.31 |

|

|

(0.5) |

|

|

| Yield per passenger mile (cents) |

|

|

|

|

|

|

14.86 |

|

|

15.17 |

|

|

(2.0) |

|

|

15.48 |

|

|

15.64 |

|

|

(1.0) |

|

|

| Passenger revenue per ASM (cents) |

|

|

|

|

|

|

12.65 |

|

|

13.13 |

|

|

(3.7) |

|

|

12.79 |

|

|

13.05 |

|

|

(2.0) |

|

|

| Operating revenue per ASM (cents) |

|

|

|

|

|

|

13.75 |

|

|

14.13 |

|

|

(2.7) |

|

|

13.88 |

|

|

14.02 |

|

|

(1.0) |

|

|

| Operating expense per ASM (cents) |

|

|

|

|

|

|

14.34 |

|

|

14.35 |

|

|

(0.1) |

|

|

14.42 |

|

|

15.42 |

|

|

(6.5) |

|

|

Operating expense per ASM, excluding fuel (cents) (2) |

|

|

|

|

|

|

11.02 |

|

|

10.62 |

|

|

3.7 |

|

|

11.10 |

|

|

10.48 |

|

|

6.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Departures |

|

|

|

|

|

|

79,016 |

|

|

80,037 |

|

|

(1.3) |

|

|

232,578 |

|

|

241,161 |

|

|

(3.6) |

|

|

| Average stage length (miles) |

|

|

|

|

|

|

1,317 |

|

|

1,298 |

|

|

1.5 |

|

|

1,308 |

|

|

1,290 |

|

|

1.4 |

|

|

| Average number of operating aircraft during period |

|

|

|

|

|

|

287 |

|

|

286 |

|

|

0.3 |

|

|

287 |

|

|

286 |

|

|

0.3 |

|

|

| Average fuel cost per gallon |

|

|

|

|

|

|

$ |

2.49 |

|

|

$ |

2.67 |

|

|

(6.8) |

|

|

$ |

2.48 |

|

|

$ |

2.83 |

|

|

(12.3) |

|

|

| Fuel gallons consumed (millions) |

|

|

|

|

|

|

217 |

|

|

219 |

|

|

(0.8) |

|

|

625 |

|

|

647 |

|

|

(3.4) |

|

|

| Fuel efficiency (ASMs per fuel gallon) |

|

|

|

|

|

|

78 |

|

|

77 |

|

|

1.7 |

|

|

79 |

|

|

77 |

|

|

1.8 |

|

|

| Average number of full-time equivalent crewmembers |

|

|

|

|

|

|

19,525 |

|

|

19,788 |

|

|

(1.3) |

|

|

19,208 |

|

|

20,036 |

|

|

(4.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes aircraft temporarily removed from service, including six aircraft impacted by the Pratt & Whitney engine groundings.

(2) Refer to Note A at the end of our Earnings Release for more information on this non-GAAP financial measure.

|

|

|

|

|

|

|

|

|

|

|

|

|

| JETBLUE AIRWAYS CORPORATION |

| SELECTED CONSOLIDATED BALANCE SHEET DATA |

| (in millions) |

|

September 30, 2025 |

|

December 31, 2024 |

|

(unaudited) |

|

|

| Cash and cash equivalents |

$ |

2,410 |

|

|

$ |

1,921 |

|

| Total investment securities |

483 |

|

|

2,025 |

|

| Total assets |

16,601 |

|

|

16,841 |

|

| Total debt |

8,475 |

|

|

8,539 |

|

| Stockholders' equity |

2,270 |

|

|

2,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| JETBLUE AIRWAYS CORPORATION |

| SELECTED CONSOLIDATED CASH FLOWS DATA |

| (in millions) |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

(unaudited) |

|

|

| Capital expenditures and pre-delivery deposits for flight equipment |

$ |

(777) |

|

(1) |

$ |

(1,202) |

|

(1) Capital expenditures and pre-delivery deposits for 2025 consisted of $187 million in Q1 2025, $309 million in Q2 2025, and $281 million in Q3 2025, totaling $777 million year-to-date.

Q3 2025 excludes approximately $40 million of aircraft lease buyouts previously assumed in our capital expenditure guidance as of September 4, 2025. These aircraft lease buyouts were reflected as finance leases and as such, recorded as a repayment of long-term debt and finance lease obligations.

Note A - Non-GAAP Financial Measures

We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Earnings Release. Non-GAAP financial measures are financial measures that are derived from the condensed consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information below provides an explanation of each non-GAAP financial measure used in this Earnings Release and shows a reconciliation of certain non-GAAP financial measures used in this Earnings Release to the most directly comparable GAAP financial measures.

With respect to JetBlue's CASM Ex-Fuel (1) guidance, JetBlue is not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measure cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as interest rates and fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results.

(1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, other non-airline operating expenses, and special items.

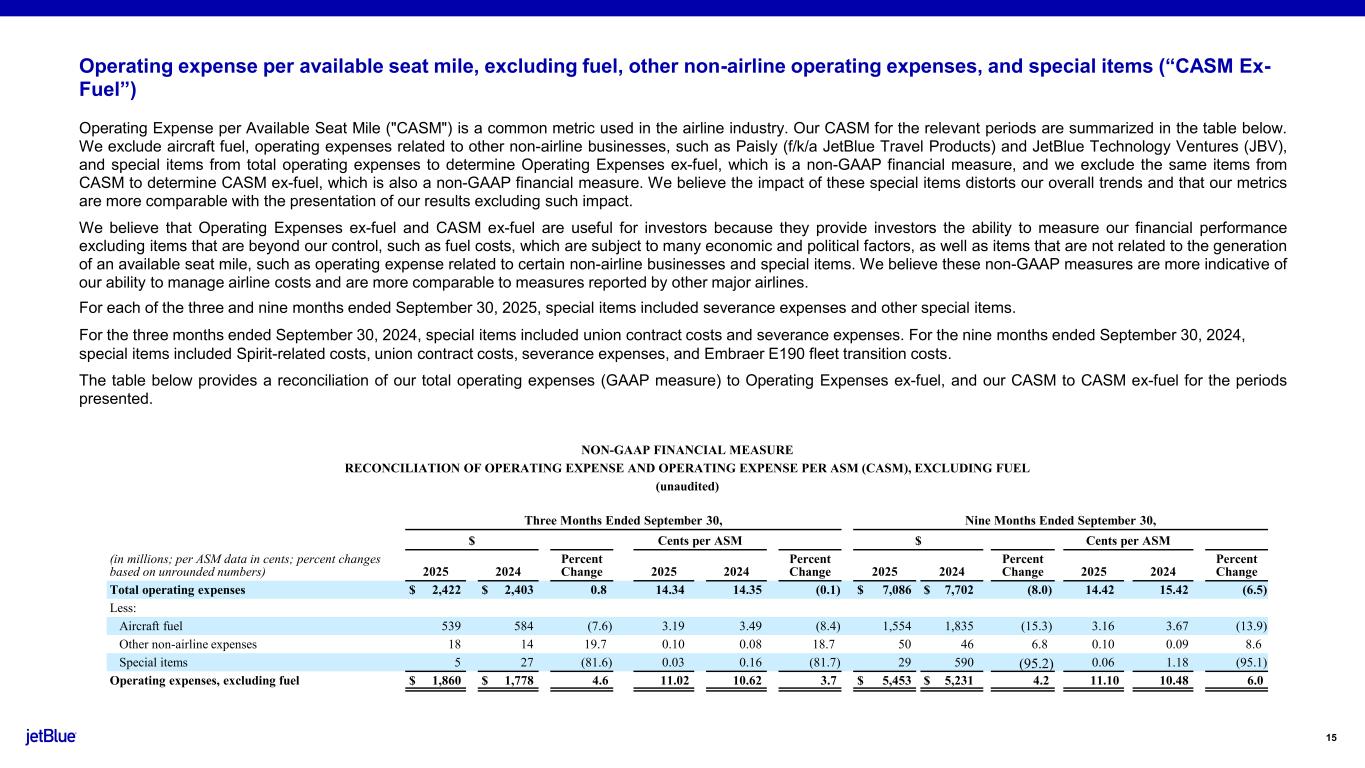

Operating expense per available seat mile, excluding fuel, other non-airline operating expenses, and special items ("CASM ex-fuel")

CASM is a common metric used in the airline industry. Our CASM for the relevant periods are summarized in the table below. We exclude aircraft fuel, operating expenses related to other non-airline businesses, such as Paisly (f/k/a JetBlue Travel Products) and JetBlue Technology Ventures (JBV), and special items from total operating expenses to determine Operating Expenses ex-fuel, which is a non-GAAP financial measure, and we exclude the same items from CASM to determine CASM ex-fuel, which is also a non-GAAP financial measure. We believe the impact of these special items distorts our overall trends and that our metrics are more comparable with the presentation of our results excluding such impact.

For each of the three and nine months ended September 30, 2025, special items included severance expenses and other special items.

For the three months ended September 30, 2024, special items included union contract costs and severance expenses. For the nine months ended September 30, 2024, special items included Spirit-related costs, union contract costs, severance expenses, and Embraer E190 fleet transition costs.

We believe Operating Expenses ex-fuel and CASM ex-fuel are useful for investors because they provide investors the ability to measure our financial performance excluding items that are beyond our control, such as fuel costs, which are subject to many economic and political factors, as well as items that are not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses and special items. We believe these non-GAAP measures are more indicative of our ability to manage airline costs and are more comparable to measures reported by other major airlines.

The table below provides a reconciliation of our total operating expenses ("GAAP measure") to Operating Expenses ex-fuel, and our CASM to CASM ex-fuel for the periods presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-GAAP FINANCIAL MEASURE |

RECONCILIATION OF OPERATING EXPENSE AND OPERATING EXPENSE PER ASM (CASM),

EXCLUDING FUEL |

| (unaudited) |

|

Three Months Ended September 30, |

|

|

$ |

|

|

|

Cents per ASM |

|

|

|

|

|

|

| (in millions; per ASM data in cents; percent changes based on unrounded numbers) |

2025 |

|

2024 |

|

Percent Change |

|

2025 |

|

2024 |

|

Percent Change |

|

|

|

|

| Total operating expenses |

$ |

2,422 |

|

$ |

2,403 |

|

0.8 |

|

|

14.34 |

|

14.35 |

|

|

(0.1) |

|

|

|

|

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aircraft fuel |

539 |

|

584 |

|

(7.6) |

|

|

3.19 |

|

3.49 |

|

|

(8.4) |

|

|

|

|

|

| Other non-airline expenses |

18 |

|

14 |

|

19.7 |

|

|

0.10 |

|

0.08 |

|

|

18.7 |

|

|

|

|

|

| Special items |

5 |

|

27 |

|

(81.6) |

|

|

0.03 |

|

0.16 |

|

|

(81.7) |

|

|

|

|

|

| Operating expenses, excluding fuel |

$ |

1,860 |

|

$ |

1,778 |

|

4.6 |

|

|

11.02 |

|

10.62 |

|

|

3.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-GAAP FINANCIAL MEASURE |

RECONCILIATION OF OPERATING EXPENSE AND OPERATING EXPENSE PER ASM (CASM),

EXCLUDING FUEL |

| (unaudited) |

|

Nine Months Ended September 30, |

|

|

$ |

|

|

|

Cents per ASM |

|

|

|

|

|

|

| (in millions; per ASM data in cents; percent changes based on unrounded numbers) |

2025 |

|

2024 |

|

Percent Change |

|

2025 |

|

2024 |

|

Percent Change |

|

|

|

|

| Total operating expenses |

$ |

7,086 |

|

$ |

7,702 |

|

(8.0) |

|

|

14.42 |

|

15.42 |

|

|

(6.5) |

|

|

|

|

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aircraft fuel |

1,554 |

|

1,835 |

|

(15.3) |

|

|

3.16 |

|

3.67 |

|

|

(13.9) |

|

|

|

|

|

| Other non-airline expenses |

50 |

|

46 |

|

6.8 |

|

|

0.10 |

|

0.09 |

|

|

8.6 |

|

|

|

|

|

| Special items |

29 |

|

590 |

|

(95.2) |

|

|

0.06 |

|

1.18 |

|

|

(95.1) |

|

|

|

|

|

| Operating expenses, excluding fuel |

$ |

5,453 |

|

$ |

5,231 |

|

4.2 |

|

|

11.10 |

|

10.48 |

|

|

6.0 |

|

|

|

|

|

Operating Expense, Operating Loss, Operating Margin, Pre-tax Loss, Pre-tax Margin, Net Loss and Loss per Share, excluding Special Items, Gain (Loss) on Investments and Gain on Debt Extinguishments

Our GAAP results in the applicable periods were impacted by credits and charges that were deemed special items.

For each of the three and nine months ended September 30, 2025, special items included severance expenses and other special items.

For the three months ended September 30, 2024, special items included union contract costs and severance expenses. For the nine months ended September 30, 2024, special items included Spirit-related costs, union contract costs, severance expenses, and Embraer E190 fleet transition costs.

Certain gains and losses on our investments, net and the gain on debt extinguishments were also excluded from our September 30, 2025 and 2024 non-GAAP results.

We believe the impact of these items distort our overall trends and that our metrics are more comparable with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impact of these items for the periods presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-GAAP FINANCIAL MEASURE |

| RECONCILIATION OF OPERATING EXPENSE, OPERATING LOSS, OPERATING MARGIN, PRE-TAX LOSS, PRE-TAX MARGIN, NET LOSS, LOSS PER SHARE, EXCLUDING SPECIAL ITEMS, GAIN (LOSS) ON INVESTMENTS AND GAIN ON DEBT EXTINGUISHMENTS |

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| (in millions except percentages) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Total operating revenues |

$ |

2,322 |

|

|

$ |

2,365 |

|

|

$ |

6,818 |

|

|

$ |

7,002 |

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF OPERATING EXPENSE |

|

|

|

|

|

|

| Total operating expenses |

$ |

2,422 |

|

|

$ |

2,403 |

|

|

$ |

7,086 |

|

|

$ |

7,702 |

|

| Less: Special items |

5 |

|

|

27 |

|

|

29 |

|

|

590 |

|

| Total operating expenses excluding special items |

$ |

2,417 |

|

|

$ |

2,376 |

|

|

$ |

7,057 |

|

|

$ |

7,112 |

|

| Percent change |

1.7 |

% |

|

|

|

(0.8) |

% |

|

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF OPERATING LOSS |

|

|

|

|

|

|

| Operating loss |

$ |

(100) |

|

|

$ |

(38) |

|

|

$ |

(268) |

|

|

$ |

(700) |

|

| Add back: Special items |

5 |

|

|

27 |

|

|

29 |

|

|

590 |

|

| Operating loss excluding special items |

$ |

(95) |

|

|

$ |

(11) |

|

|

$ |

(239) |

|

|

$ |

(110) |

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF OPERATING MARGIN |

|

|

|

|

|

|

| Operating margin |

(4.3) |

% |

|

(1.6) |

% |

|

(3.9) |

% |

|

(10.0) |

% |

|

|

|

|

|

|

|

|

| Operating loss excluding special items |

$ |

(95) |

|

|

$ |

(11) |

|

|

$ |

(239) |

|

|

$ |

(110) |

|

| Total operating revenues |

2,322 |

|

|

2,365 |

|

|

6,818 |

|

|

7,002 |

|

| Adjusted operating margin |

(4.1) |

% |

|

(0.4) |

% |

|

(3.5) |

% |

|

(1.6) |

% |

|

|

|

|

|

|

|

|

| RECONCILIATION OF PRE-TAX LOSS |

|

|

|

|

|

|

| Loss before income taxes |

$ |

(196) |

|

|

$ |

(78) |

|

|

$ |

(561) |

|

|

$ |

(814) |

|

| Add back: Special items |

5 |

|

|

27 |

|

|

29 |

|

|

590 |

|

| Less: Gain (loss) on investments, net |

8 |

|

|

(2) |

|

|

12 |

|

|

(25) |

|

| Less: Gain on debt extinguishments |

— |

|

|

22 |

|

|

— |

|

|

22 |

|

| Loss before income taxes excluding special items, gain (loss) on investments and gain on debt extinguishments |

$ |

(199) |

|

|

$ |

(71) |

|

|

$ |

(544) |

|

|

$ |

(221) |

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF PRE-TAX MARGIN |

|

|

|

|

|

|

| Pre-tax margin |

(8.4) |

% |

|

(3.3) |

% |

|

(8.2) |

% |

|

(11.6) |

% |

|

|

|

|

|

|

|

|

| Loss before income taxes excluding special items, gain (loss) on investments and gain on debt extinguishments |

$ |

(199) |

|

|

$ |

(71) |

|

|

$ |

(544) |

|

|

$ |

(221) |

|

| Total operating revenues |

2,322 |

|

|

2,365 |

|

|

6,818 |

|

|

7,002 |

|

| Adjusted pre-tax margin |

(8.6) |

% |

|

(3.0) |

% |

|

(8.0) |

% |

|

(3.2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-GAAP FINANCIAL MEASURE |

| RECONCILIATION OF OPERATING EXPENSE, OPERATING LOSS, OPERATING MARGIN, PRE-TAX LOSS, PRE-TAX MARGIN, NET LOSS, LOSS PER SHARE, EXCLUDING SPECIAL ITEMS, GAIN (LOSS) ON INVESTMENTS AND GAIN ON DEBT EXTINGUISHMENTS |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| (in millions except percentages) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| RECONCILIATION OF NET LOSS |

|

|

|

|

|

|

|

| Net loss |

$ |

(143) |

|

|

$ |

(60) |

|

|

$ |

(425) |

|

|

$ |

(751) |

|

| Add back: Special items |

5 |

|

|

27 |

|

|

29 |

|

|

590 |

|

| Less: Income tax benefit related to special items |

— |

|

|

6 |

|

|

7 |

|

|

14 |

|

| Less: Gain (loss) on investments, net |

8 |

|

|

(2) |

|

|

12 |

|

|

(25) |

|

| Less: Income tax benefit (expense) related to gain (loss) on investments, net |

(2) |

|

|

— |

|

|

(3) |

|

|

6 |

|

| Less: Gain on debt extinguishments |

— |

|

|

22 |

|

|

— |

|

|

22 |

|

| Less: Income tax expense related to gain on debt extinguishments |

— |

|

|

(5) |

|

|

— |

|

|

(5) |

|

| Net loss excluding special items, gain (loss) on investments and gain on debt extinguishments |

$ |

(144) |

|

|

$ |

(54) |

|

|

$ |

(412) |

|

|

$ |

(173) |

|

|

|

|

|

|

|

|

|

| CALCULATION OF LOSS PER SHARE |

|

|

|

|

|

|

|

| Loss per common share |

|

|

|

|

|

|

|

| Basic |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

$ |

(1.18) |

|

|

$ |

(2.18) |

|

| Add back: Special items |

0.01 |

|

|

0.07 |

|

|

0.08 |

|

|

1.72 |

|

| Less: Income tax benefit related to special items |

— |

|

|

0.02 |

|

|

0.02 |

|

|

0.04 |

|

| Less: Gain (loss) on investments, net |

0.02 |

|

|

(0.01) |

|

|

0.04 |

|

|

(0.07) |

|

| Less: Income tax benefit (expense) related to gain (loss) on investments, net |

— |

|

|

— |

|

|

(0.01) |

|

|

0.02 |

|

| Less: Gain on debt extinguishments |

— |

|

|

0.06 |

|

|

— |

|

|

0.06 |

|

| Less: Income tax expense related to gain on debt extinguishments |

— |

|

|

(0.01) |

|

|

— |

|

|

(0.01) |

|

| Basic excluding special items, gain (loss) on investments and gain on debt extinguishments |

$ |

(0.40) |

|

|

$ |

(0.16) |

|

|

$ |

(1.15) |

|

|

$ |

(0.50) |

|

|

|

|

|

|

|

|

|

| Diluted |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

$ |

(1.18) |

|

|

$ |

(2.18) |

|

| Add back: Special items |

0.01 |

|

|

0.07 |

|

|

0.08 |

|

|

1.72 |

|

| Less: Income tax benefit related to special items |

— |

|

|

0.02 |

|

|

0.02 |

|

|

0.04 |

|

| Less: Gain (loss) on investments, net |

0.02 |

|

|

(0.01) |

|

|

0.04 |

|

|

(0.07) |

|

| Less: Income tax benefit (expense) related to gain (loss) on investments, net |

— |

|

|

— |

|

|

(0.01) |

|

|

0.02 |

|

| Less: Gain on debt extinguishments |

— |

|

|

0.06 |

|

|

— |

|

|

0.06 |

|

| Less: Income tax expense related to gain on debt extinguishments |

— |

|

|

(0.01) |

|

|

— |

|

|

(0.01) |

|

| Diluted excluding special items, gain (loss) on investments and gain on debt extinguishments |

$ |

(0.40) |

|

|

$ |

(0.16) |

|

|

$ |

(1.15) |

|

|

$ |

(0.50) |

|

CONTACTS

JetBlue Investor Relations

Tel: +1 718 709 2202

ir@jetblue.com

JetBlue Corporate Communications

Tel: +1 718 709 3089

corpcomm@jetblue.com

Ex 99.2 - Investor Update

Ex 99.2 - Investor Update Investor Update

Investor Update Investor Update

Investor Update Investor Update

Investor Update