false000115846300011584632024-03-122024-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 12, 2024

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

000-49728 |

87-0617894 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

|

27-01 Queens Plaza North |

Long Island City |

New York |

11101 |

| (Address of principal executive offices) |

(Zip Code) |

(718) 286-7900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

JBLU |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On March 12, 2024, JetBlue Airways Corporation ("JetBlue" or the "Company") announced an operational and financial update of its expected first quarter 2024 results. The update is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information included under this Item 7.01 (including Exhibit 99.1) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number |

|

Description |

| 99.1 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JETBLUE AIRWAYS CORPORATION |

|

|

|

(Registrant) |

|

|

|

|

| Date: |

March 12, 2024 |

By: |

/s/ Dawn Southerton |

|

|

|

Dawn Southerton |

|

|

|

Vice President, Controller |

|

|

|

(Principal Accounting Officer) |

|

EX-99.1

2

jetbluejpmorganinvestorp.htm

EX-99.1

jetbluejpmorganinvestorp

0 J.P. Morgan Industrials Conference March 12, 2024 1

1 Safe Harbor This Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this Presentation may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Presentation include, without limitation, statements regarding our outlook and future results of operations and financial position, our business strategy and plans for future operations, and the associated impacts on our business. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the occurrence of any event, change or other circumstances, including outcomes of legal proceedings, our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to our NEA with American Airlines and our wind-down of the NEA; expenses related to the termination of the Merger; the impact of the Merger termination on JetBlue’s earnings per share; risks associated with cybersecurity and privacy, including potential disruptions to our information technology systems or information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; restrictions as a result of our participation in governmental support programs under the CARES Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance (“ESG”) matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Presentation, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2023, as may be updated by our other SEC filings. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. Our forward-looking statements speak only as of the date of this Presentation. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. 2

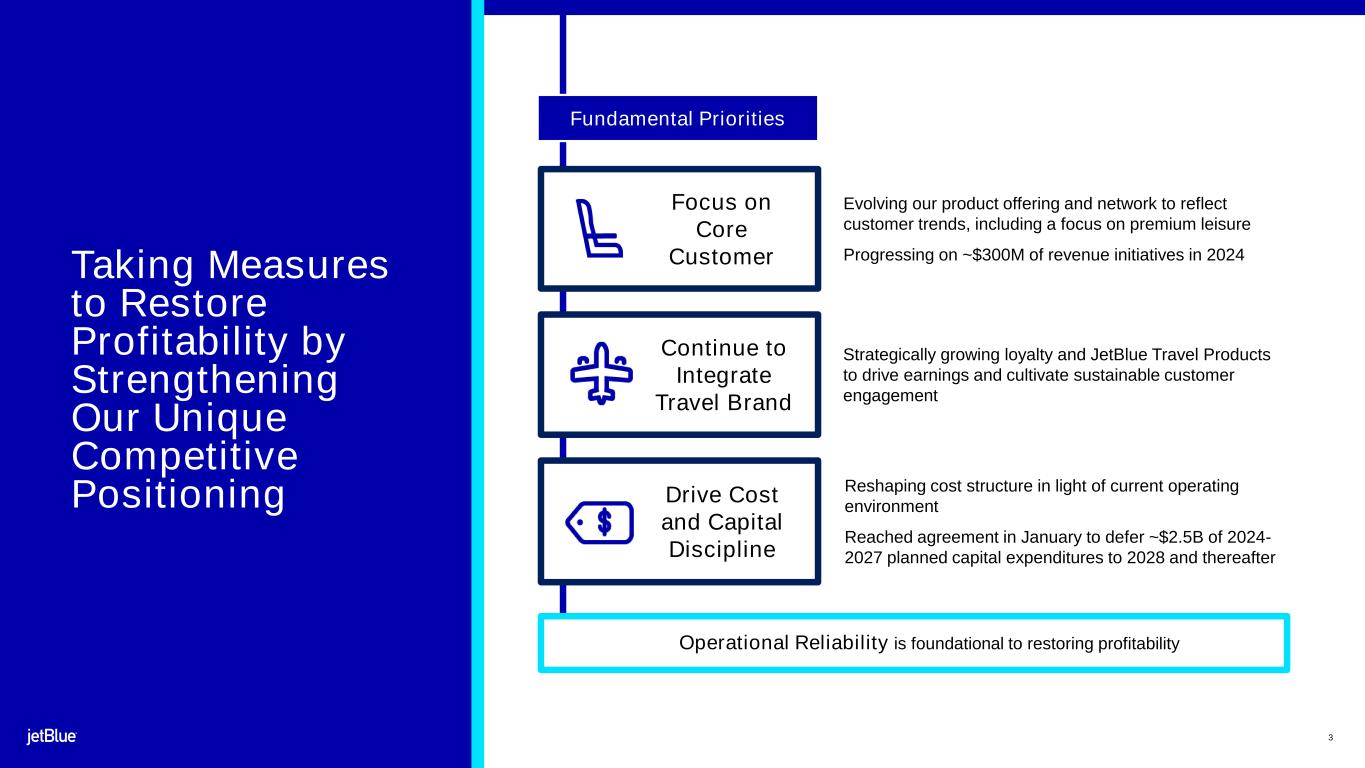

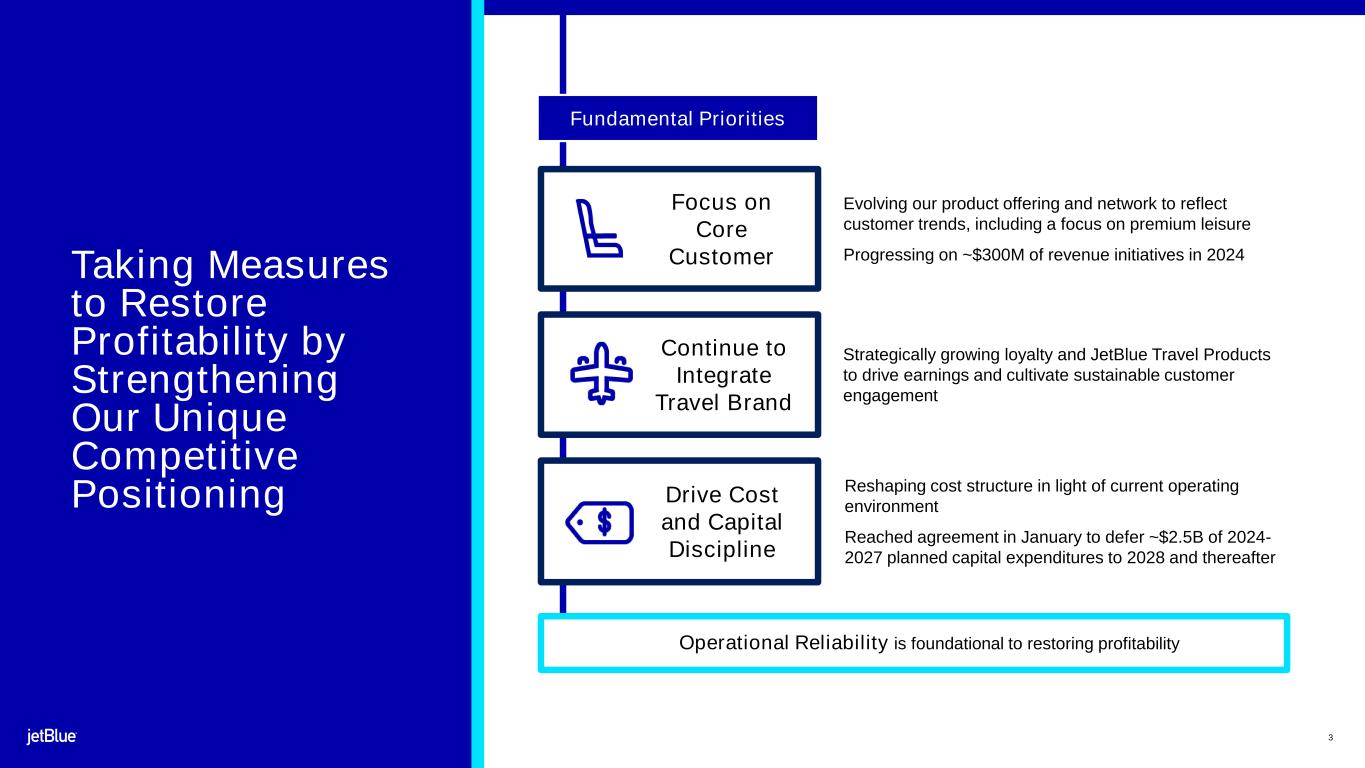

2 Taking Measures to Restore Profitability by Strengthening Our Unique Competitive Positioning Reshaping cost structure in light of current operating environment Reached agreement in January to defer ~$2.5B of 2024- 2027 planned capital expenditures to 2028 and thereafter Drive Cost and Capital Discipline Evolving our product offering and network to reflect customer trends, including a focus on premium leisure Progressing on ~$300M of revenue initiatives in 2024 Focus on Core Customer Continue to Integrate Travel Brand Strategically growing loyalty and JetBlue Travel Products to drive earnings and cultivate sustainable customer engagement Operational Reliability is foundational to restoring profitability Fundamental Priorities 3

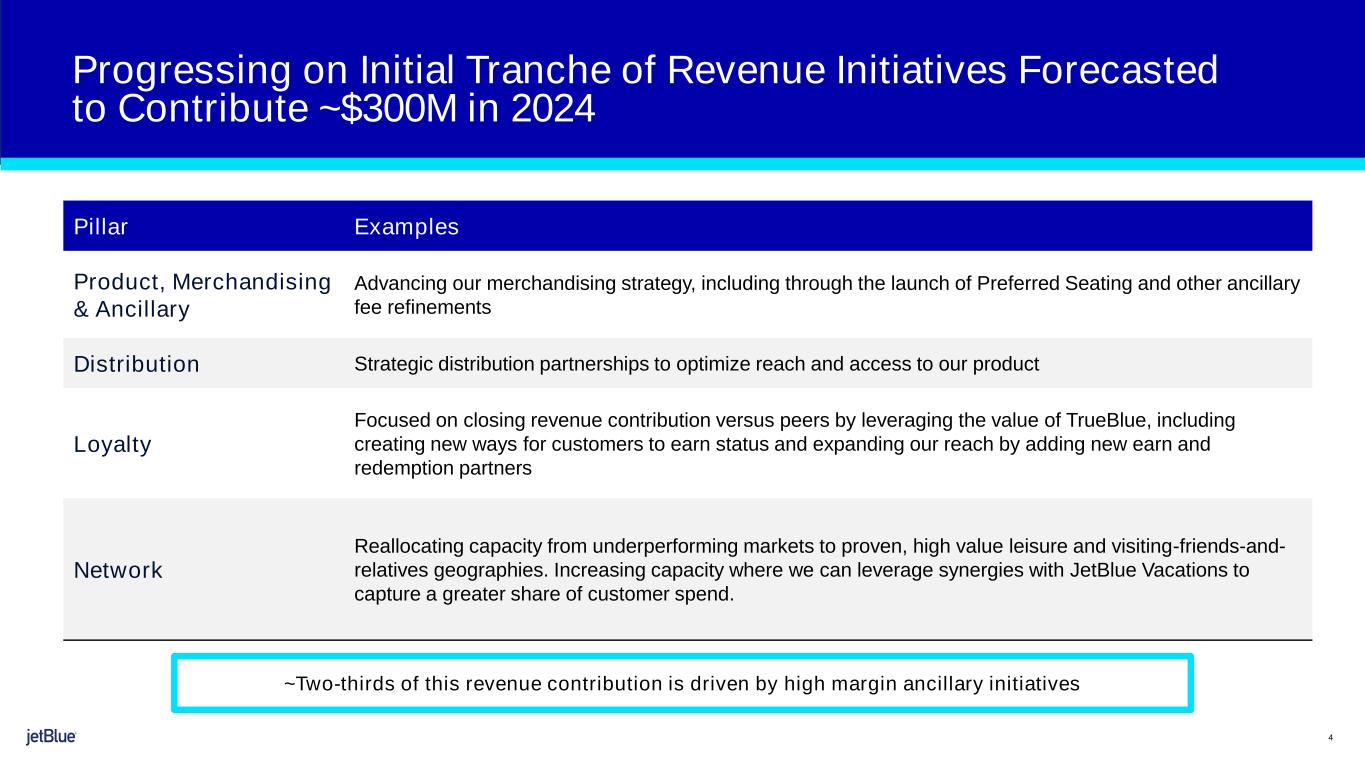

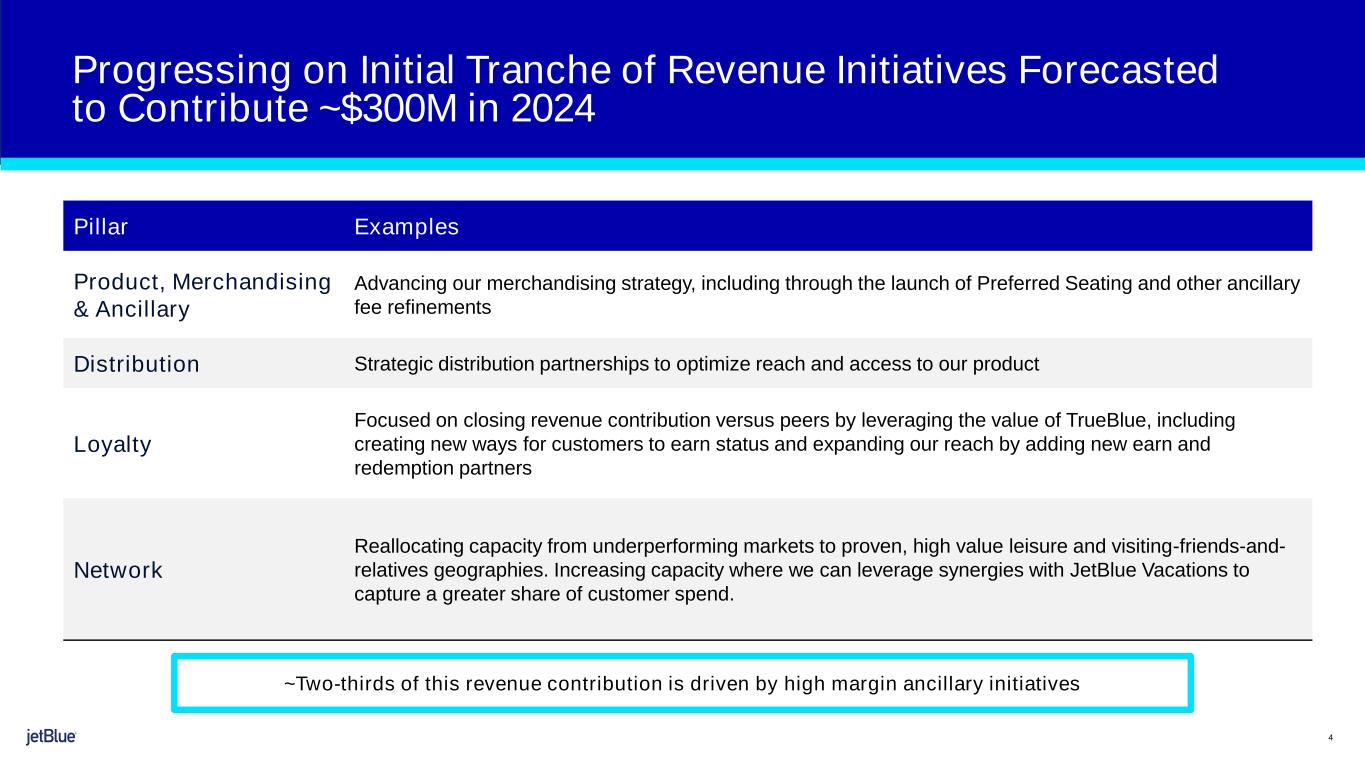

3 Progressing on Initial Tranche of Revenue Initiatives Forecasted to Contribute ~$300M in 2024 Pillar Examples Product, Merchandising & Ancillary Advancing our merchandising strategy, including through the launch of Preferred Seating and other ancillary fee refinements Distribution Strategic distribution partnerships to optimize reach and access to our product Loyalty Focused on closing revenue contribution versus peers by leveraging the value of TrueBlue, including creating new ways for customers to earn status and expanding our reach by adding new earn and redemption partners Network Reallocating capacity from underperforming markets to proven, high value leisure and visiting-friends-and- relatives geographies. Increasing capacity where we can leverage synergies with JetBlue Vacations to capture a greater share of customer spend. ~Two-thirds of this revenue contribution is driven by high margin ancillary initiatives 4

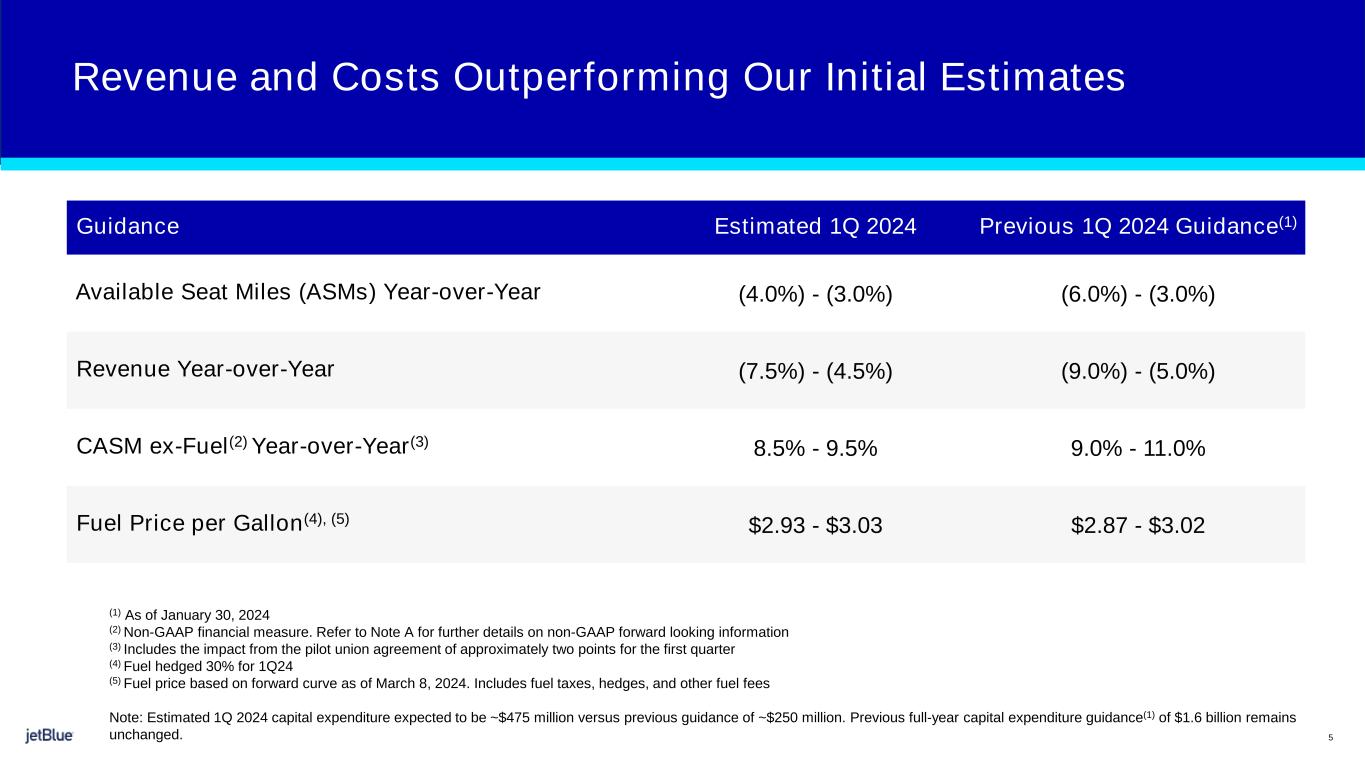

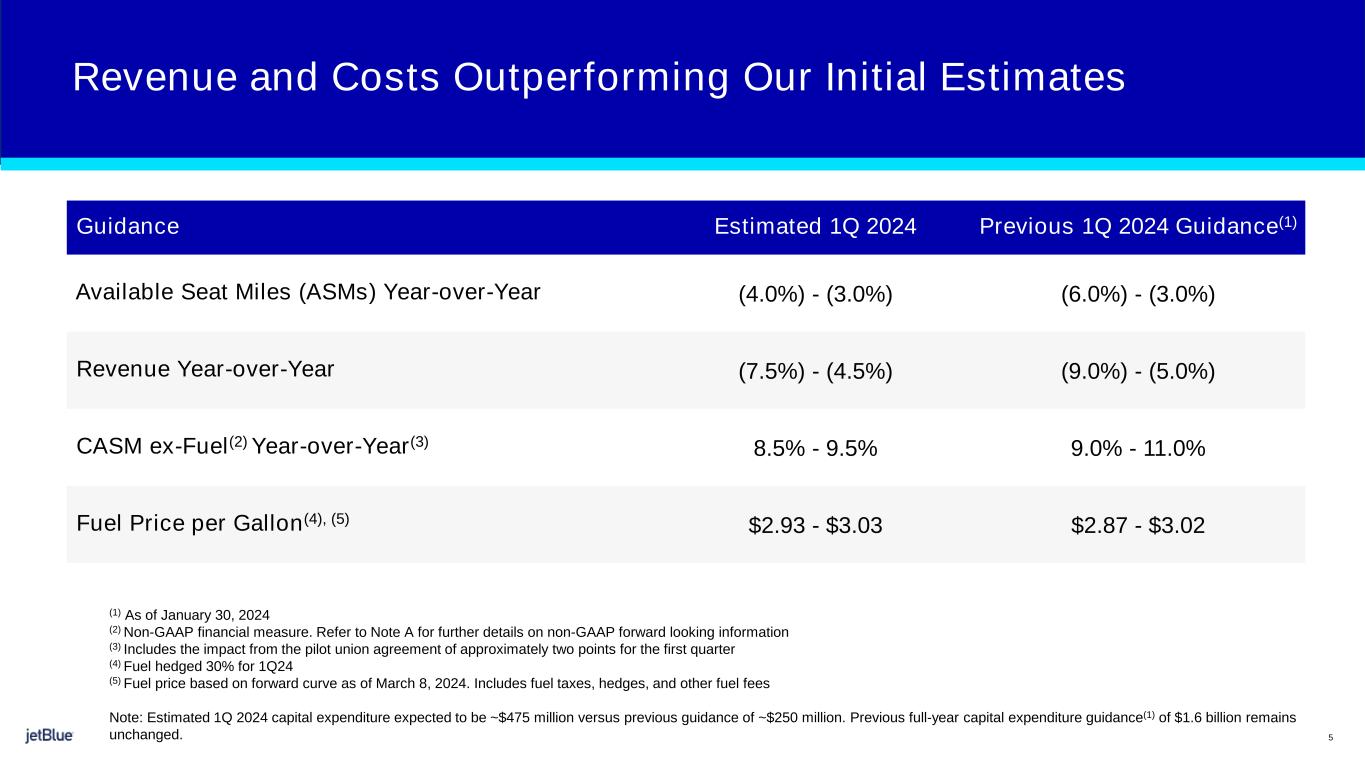

4 Guidance Estimated 1Q 2024 Previous 1Q 2024 Guidance(1) Available Seat Miles (ASMs) Year-over-Year (4.0%) - (3.0%) (6.0%) - (3.0%) Revenue Year-over-Year (7.5%) - (4.5%) (9.0%) - (5.0%) CASM ex-Fuel(2) Year-over-Year(3) 8.5% - 9.5% 9.0% - 11.0% Fuel Price per Gallon(4), (5) $2.93 - $3.03 $2.87 - $3.02 (1) As of January 30, 2024 (2) Non-GAAP financial measure. Refer to Note A for further details on non-GAAP forward looking information (3) Includes the impact from the pilot union agreement of approximately two points for the first quarter (4) Fuel hedged 30% for 1Q24 (5) Fuel price based on forward curve as of March 8, 2024. Includes fuel taxes, hedges, and other fuel fees Note: Estimated 1Q 2024 capital expenditure expected to be ~$475 million versus previous guidance of ~$250 million. Previous full-year capital expenditure guidance(1) of $1.6 billion remains unchanged. Revenue and Costs Outperforming Our Initial Estimates 5

56

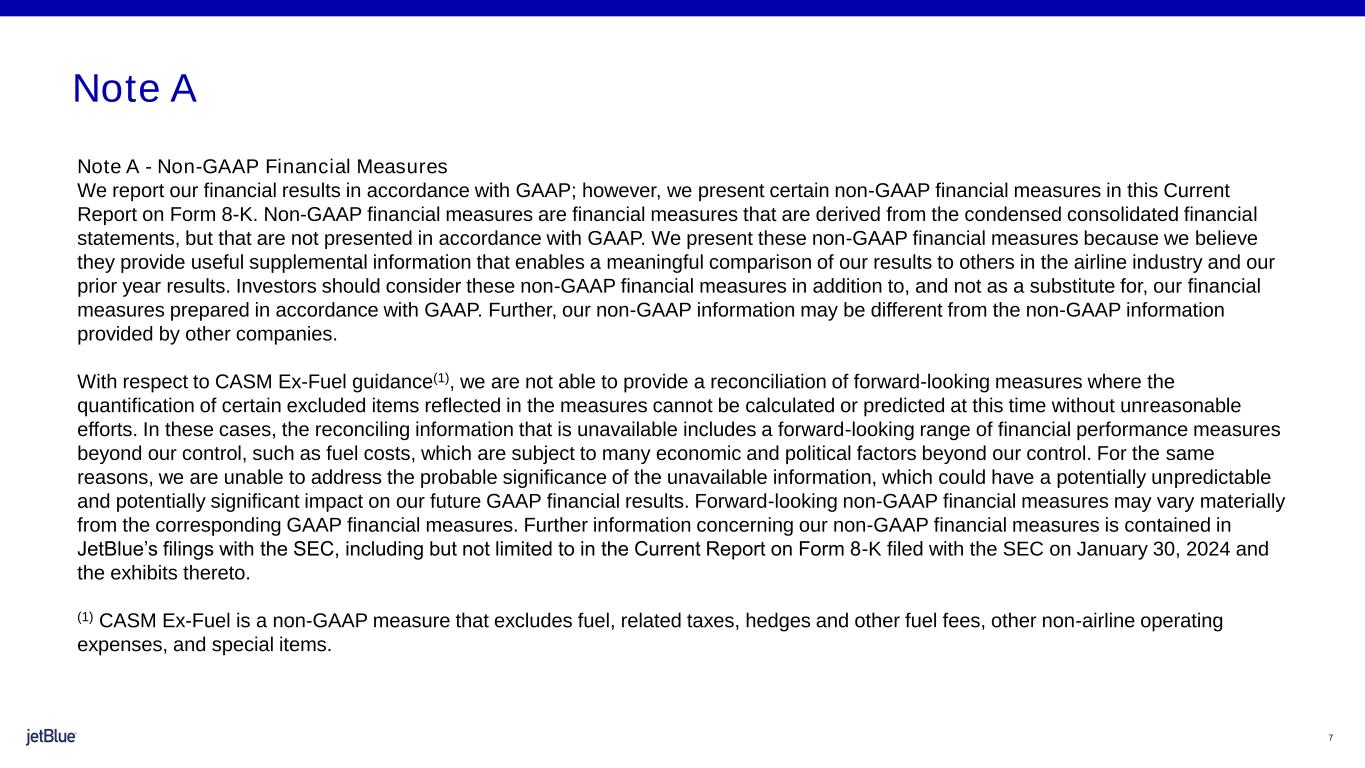

6 Note A Note A - Non-GAAP Financial Measures We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Current Report on Form 8-K. Non-GAAP financial measures are financial measures that are derived from the condensed consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. With respect to CASM Ex-Fuel guidance(1), we are not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measures cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results. Forward-looking non-GAAP financial measures may vary materially from the corresponding GAAP financial measures. Further information concerning our non-GAAP financial measures is contained in JetBlue’s filings with the SEC, including but not limited to in the Current Report on Form 8-K filed with the SEC on January 30, 2024 and the exhibits thereto. (1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, related taxes, hedges and other fuel fees, other non-airline operating expenses, and special items. 7