0001144879FALSE00011448792024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 30, 2024

(Date of earliest event reported)

APPLIED DIGITAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Nevada |

001-31968 |

95-4863690 |

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3811 Turtle Creek Blvd., |

Suite 2100, |

Dallas, |

TX |

75219 |

| (Address of principal executive offices) |

(Zip Code) |

214-427-1704

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

o Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

APLD |

Nasdaq Global Select Market |

Item 1.01. Entry into a Material Definitive Agreement.

The information provided in Item 2.03 of this Current Report on Form 8-K is incorporated by reference into this Item 1.01.

Item 1.02 Termination of a Material Definitive Agreement.

On February 5, 2024, SAI Computing LLC (the “Borrower”), a wholly-owned subsidiary of Applied Digital Corporation (the “Company”), entered into a Termination of Loan and Security letter with B. Riley Commercial Capital, LLC and B. Riley Securities, Inc. (the “Lenders”), B. Riley Commercial Capital, LLC as Collateral Agent, and the Company as Guarantor (the “Termination Letter”). The Termination Letter terminated the Loan and Security Agreement dated as of May 23, 2023, as amended, among the parties, which had provided for a term loan (the “Loan Agreement”) in the principal amount of $50,000,000 with a maturity date of May 23, 2025. At the time of the Termination Letter, all principal, interest and fees under the Loan Agreement had been paid in full. No early termination penalty was paid in connection with the Termination Letter.

The foregoing description of the Termination Letter is qualified in its entirety by reference to such document, which is filed as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangement of a Registrant.

On January 30, 2024, the Company issued an Unsecured Promissory Note (the “Note”) payable to AI Bridge Funding LLC (the “Lender”), providing for an unsecured loan in the aggregate principal amount of up to $20,000,000 (the “Principal Amount”), of which $15,000,000 was available immediately and funded upon the execution of the Note. The obligation of the Lender to advance the remaining $5,000,000 shall be in the Lender’s sole discretion.

The outstanding Principal Amount will mature on January 30, 2026 (the “Maturity Date”) unless earlier redeemed, exchanged, repurchased or repaid and bears interest at a rate per annum of 12.50%, compounded quarterly and shall be payable in arrears on a quarterly basis on the first business day of each calendar quarter and on the Maturity Date. Subject to the repayment fee described below, all accrued and unpaid interest shall be paid on the earlier of (i) prepayment in full of the outstanding Principal Amount and (ii) the Maturity Date. In the event that any amount due under the Note is not paid when due, such overdue amount shall bear interest at an annual rate of 4.0% in excess of the interest rate otherwise payable under the Note until such unpaid amounts are paid in full.

The Company may, upon at least one Business Day’s prior written notice to the Lender, prepay the outstanding Principal Amount and any accrued and unpaid interest, in whole or in part, at any time prior to the Maturity Date without any interest, premium or penalty. Subject to certain exceptions and qualifications, the Company shall prepay the outstanding Principal Amount and any accrued and unpaid interest upon (i) the sale of all or substantially all of the consolidated assets of the Company or its subsidiaries to a non-affiliated third party purchaser or (ii) a merger, consolidation, recapitalization or reorganization of the Company with or into a non-affiliated third party purchaser. Additionally, upon the receipt by the Company or any of its subsidiaries of any cash proceeds from either (a) the incurrence of any indebtedness (other than indebtedness evidenced by the Note) or (b) the issuance of any equity interests in the Company, and in in each case of the preceding clauses (a) and (b) which in aggregate are in excess of $35,000,000, the Company shall apply the net cash proceeds of such incurrence of any indebtedness or issuance of any equity interests, as applicable, toward the prepayment of the outstanding principal of the Note.

Pursuant to the terms of the Note, upon the earlier to occur of (i) prepayment of the outstanding Principal Amount in full and (ii) the Maturity Date, and after giving effect to (and without duplication of) all amounts payable thereunder, including without limitation, interest, the Company is obligated to pay to the Lender a repayment fee in an amount sufficient (if any) for the Lender to receive an aggregate amount equal to 1.25x the aggregate principal amount funded as loans by the Lender to the Company in accordance with the terms and provisions of the Note.

The Note includes customary representations, warranties and covenants and sets forth certain events of default after which the outstanding Principal Amount may be declared immediately due and payable and sets forth certain types of bankruptcy or insolvency events of default involving the Company after which the outstanding Principal Amount becomes automatically due and payable.

Affiliates of the Lender are both an investor in B. Riley Financial, Inc. and also an investment management client of B. Riley Asset Management.

As previously disclosed, Wes Cummins, the Company’s Chairman and Chief Executive Officer, served as the President of B. Riley Asset Management, and effective February 5, 2024, resigned from that position. Mr. Cummins is no longer employed by B. Riley Financial, Inc. or any affiliate thereof. As previously disclosed, affiliates of B. Riley Financial, Inc. were lenders to the Company and its subsidiaries, which loans were repaid in full, and one or more of such affiliates were, and to the Company’s knowledge no longer are, investors in the Company.

The foregoing description of the Note is not complete and is qualified in its entirety by reference to the full text of the Note, a copy of which is filed herewith as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

|

|

|

| 4.1 |

|

|

| 10.1 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dated: |

February 5, 2024 |

|

By: |

/s/ David Rench |

|

|

|

Name: |

David Rench |

|

|

|

Title: |

Chief Financial Officer |

|

|

|

|

|

EX-4.1

2

apld-unsecuredbridgenote.htm

EX-4.1

apld-unsecuredbridgenote

44987/7 215358230 THIS UNSECURED PROMISSORY NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR UNDER THE PROVISIONS OF ANY APPLICABLE STATE SECURITIES LAWS, BUT HAS BEEN ACQUIRED BY THE REGISTERED HOLDER HEREOF FOR PURPOSES OF INVESTMENT AND IN RELIANCE ON STATUTORY EXEMPTIONS UNDER THE SECURITIES ACT, AND UNDER ANY APPLICABLE STATE SECURITIES LAWS. ACCORDINGLY, THIS UNSECURED PROMISSORY NOTE MAY NOT BE SOLD, PLEDGED, TRANSFERRED OR ASSIGNED EXCEPT IN A TRANSACTION WHICH IS EXEMPT UNDER PROVISIONS OF THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS OR PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT. UNSECURED PROMISSORY NOTE January 30, 2024 FOR VALUE RECEIVED, Applied Digital Corporation, a Nevada corporation (the “Company”), hereby unconditionally promises to pay to the order of AI Bridge Funding LLC (the “Holder”) or its respective successors and assigns the aggregate principal sum of TWENTY MILLION AND 00/100 UNITED STATES DOLLARS ($20,000,000.00) or such lesser principal amount of the loans made and not repaid from time to time to the Company by the Holder pursuant to this Note (as shown in the records of the Holder), together with interest from the date set forth above on the unpaid principal balance of this Note in the form and at the rate set forth herein. 1. Definitions. Unless the context otherwise requires, when used herein the following terms shall have the meaning indicated: “Affiliate” shall mean, with respect to any Person, any other Person which directly or indirectly through one or more intermediaries Controls, is controlled by, or is under common control with, such Person. “Business Day” means any day other than a Saturday, Sunday or other day on which commercial banks are authorized or required by law to close in New York City. “Change of Control” means (a) the acquisition of ownership, directly or indirectly, beneficially or of record, by any Person or group (within the meaning of the Securities Exchange Act of 1934 and the rules of the Securities and Exchange Commission thereunder, as in effect on the date hereof), of Equity Interests representing more than 50% of the aggregate ordinary voting power represented by the issued and outstanding Equity Interests of the Company; or (b) the occupation of a majority of the seats (other than vacant seats) on the board of directors of the Company by Persons who were not directors of the Company on the date of this Note or nominated or appointed or approved by the board of directors of the Company (or by the nominating committee of such board). “Code” means the Internal Revenue Code of 1986, as amended. “Company” has the meaning set forth in the first paragraph hereof. “Control” (including the terms “controlling”, “controlled by” or “under common control with”) means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise. “Equity Interests” means shares of capital stock, partnership interests, membership interests in a limited liability company, beneficial interests in a trust or other equity ownership interests in a Person, and

-2- any warrants, options or other rights entitling the holder thereof to purchase or acquire any such equity interest. “Event of Default” has the meaning set forth in Section 7 hereof. “Federal Bankruptcy Code” means Title 11 of the United States Code entitled “Bankruptcy,” as now and hereafter in effect, or any successor statute. “Funded Loan Amount” means the portion of the Maximum Loan Amount actually funded as loans hereunder by the Holder to the Company pursuant to the terms and provisions of this Note. “Governmental Authority” means the government of any nation or any political subdivision thereof, whether at the national, state, territorial, provincial, municipal or any other level, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of, or pertaining to, government. “Holder” has the meanings set forth in the first paragraph hereof. “Indemnified Party” has the meaning set forth in Section 16 hereof. “Initial Loan” has the meaning set forth in Section 2(a) hereof. “Material Adverse Effect” means (a) a material adverse change in, or a material adverse effect upon, the business, assets, operations or financial condition of the Company; (b) a material impairment of the ability of the Company to perform its obligations under this Note; or (c) a material adverse effect upon the legality, validity, binding effect or enforceability against the Company of this Note. “Maturity Date” means January 30, 2026. “Maximum Loan Amount” means twenty million and 00/100 United States dollars ($20,000,000.00). “MOIC” means a multiple of invested capital, to be calculated as follows: (a) the sum of all amounts received in cash by the Holder (including, without limitation, interest) in respect of the loans funded and evidenced by this Note divided by (b) Funded Loan Amount. “MOIC Amount” has the meaning set forth in Section 4 hereof. “Note” means this unsecured promissory note, as amended, supplemented or otherwise modified from time to time. “Person” means an individual, corporation, partnership, limited liability company, trust, business trust, association, joint stock company, joint venture, sole proprietorship, unincorporated organization, governmental authority or any other form of entity not specifically listed herein. “Related Parties” with respect to any Person, means such Person’s Affiliates and the directors, officers, employees, partners, agents, trustees, administrators, managers, advisors and representatives of it and its Affiliates. 2. Loans, Principal and Interest.

-3- (a) The Holder agrees, pursuant to the terms of this Note, upon the request of Company made at any time from and after the date hereof until the Maturity Date, and so long as no Event of Default has occurred and is continuing, to make one or more loans to the Company in an aggregate principal amount up to Maximum Loan Amount. Notwithstanding the foregoing or anything herein to the contrary, the Holder agrees to advance a loan to the Company on the date hereof pursuant to the terms of this Note in an aggregate principal amount of fifteen million and 00/100 United States dollars ($15,000,000.00) (such loan, the “Initial Loan”). (b) Other than with respect to the Initial Loan, which shall be funded on the date of this Note, the obligation of the Holder to make any loan hereunder shall be at the Holder’s sole discretion, up to the Maximum Loan Amount. (c) On the date any loan is made hereunder, the Holder is hereby authorized to record on its books and records, (i) the date of such loan made by the Holder to the Company, and (ii) the amount of the principal of such loan. The entries made in Holder’s books and records shall be, absent manifest error, prima facie evidence of the existence and amounts of the obligations recorded therein, provided that the failure to so record or any error therein shall not in any manner affect the obligation of the Company to repay any loan evidenced by this Note in accordance with the terms hereof. (d) Interest shall accrue on the unpaid principal amount of this Note from the date hereof until the outstanding principal amount of this Note is irrevocably paid in cash in full (other than inchoate indemnification obligations) at a rate per annum of twelve and one-half percent (12.50%), compounded quarterly. Interest on this Note shall be computed on the basis of a 365- or 366-day year for actual days elapsed. Except as otherwise set forth herein, interest on the unpaid principal amount of this Note shall be payable in arrears on a quarterly basis on the first Business Day of each calendar quarter and on the Maturity Date. (e) Subject to the other provisions of this Note (including, without limitation, Section 4 below), the Company shall on the earlier of (i) prepayment in full of this Note and (ii) the Maturity Date pay to the order of the Holder an amount equal to the aggregate principal amount of this Note then outstanding, plus accrued and unpaid interest due hereunder, plus all fees, costs, expenses and indemnities due and owing to Holder pursuant to this Note, unless and to the extent that this Note is earlier redeemed, exchanged, repurchased or repaid in accordance with the terms of this Note. All payments due under this Section 2(e) shall be applied first, to all costs, expenses and indemnities due and owing to the Holder pursuant to this Note, second, to any accrued and unpaid interest due hereunder, and third, to remaining principal under this Note. (f) In the event that any amount due hereunder is not paid when due, such overdue amount shall bear interest at an annual rate of four percent (4.0%) in excess of the interest rate otherwise payable hereunder until irrevocably paid in cash in full. In no event shall any interest charged, collected or reserved under this Note exceed the maximum rate then permitted by applicable law. (g) Whenever any payment to be made hereunder shall be due on a day that is not a Business Day, such payment shall be made on the next succeeding Business Day and such extension will be taken into account in calculating the amount of interest payable under this Note. All payments of principal and interest by the Company under this Note shall be made in United States dollars in immediately available funds. All payments made by the Company to the Holder hereunder shall be made without set-off, counterclaim or deduction and free and clear of all taxes, levies, imposts, deductions, charges or withholdings, and all liabilities with respect thereto. All sums payable by the Company under this Note shall be payable by wire transfer to the account specified by the Holder in writing to the Company, or to such other account or address as the Holder may from time to time designate in writing to the Company.

-4- 3. Prepayment. (a) Voluntary. Upon at least one (1) Business Day’s prior written notice to the Holder, the outstanding principal of this Note and any accrued and unpaid interest may be prepaid, in whole or in part, at any time prior to the Maturity Date without any interest, premium or penalty, but subject to Section 4 of this Note. (b) Mandatory. (i) No later than one (1) Business Day following (A) the sale of all or substantially all of the consolidated assets of the Company or its Subsidiaries to a non-Affiliated third party purchaser or (B) a merger, consolidation, recapitalization or reorganization of the Company with or into a non-Affiliated third party purchaser (the transactions in clauses (A) and (B), each a “Subject Transaction”), the Company shall, subject to Section 4 of this Note, apply 100% of the net cash proceeds of such Subject Transaction toward the prepayment of the outstanding principal of this Note. (ii) No later than one (1) Business Day following the receipt by the Company or its Subsidiaries of any cash proceeds from (A) the incurrence of any indebtedness by the Company (other than indebtedness evidenced by this Note), or (B) the issuance of Equity Interests by the Company, in each case of the preceding clauses (A) and (B) which in aggregate are in excess of $35,000,000, the Company shall, subject to Section 4 of this Note, apply 100% of the net cash proceeds of such incurrence of indebtedness or issuance of Equity Interests, as applicable, toward the prepayment of the outstanding principal of this Note. (c) Any prepayments made or due under this Section 3 shall, subject to Section 4, be accompanied by all accrued and unpaid interest on the principal amount of the Note being prepaid. All payments due under this Section 3(b) shall be applied first, to all costs, expenses and indemnities due and owing to the Holder pursuant to this Note, second, to any accrued and unpaid interest due hereunder, and third, to remaining principal under this Note. 4. MOIC Amount. On the earlier of (a) prepayment of this Note in full (other than inchoate indemnification obligations) and (b) the Maturity Date, and after giving effect to (and without duplication of) all amounts payable hereunder, including without limitation, interest, the Company shall pay to the Holder an amount sufficient, if any, for the Holder to achieve a MOIC of 1.25 on the Funded Loan Amount (such amount, the “MOIC Amount”). 5. Representations and Warranties. The Company hereby represents and warrants to the Holder on the date hereof as follows: (a) The Company is (i) a corporation, validly existing and in good standing under the laws of the State of Nevada and has the requisite corporate authority, and the legal right, to own, lease and operate its properties and assets and to conduct its business as it is now being conducted and (ii) in compliance with all applicable laws in respect of the conduct of its business and the ownership of its property, except such noncompliance that, individually or in the aggregate, could not reasonably be expected to result in a Material Adverse Effect. (b) The Company has the power and authority, and the legal right, to execute and deliver this Note and to perform its obligations hereunder.

-5- (c) The execution and delivery of this Note by the Company and the performance of its obligations hereunder have been duly authorized by all necessary corporate action in accordance with all applicable laws. The Company has duly executed and delivered this Note. (d) No consent or authorization of, filing with, notice to or other act by, or in respect of, any Governmental Authority is required in order for the Company to execute, deliver, or perform any of its obligations under this Note, other than such consents, authorizations, filings or other acts which have been made or obtained and those which, if not obtained or made, could not reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect. (e) The execution and delivery of this Note and the consummation by the Company of the transactions contemplated hereby and thereby do not and will not (i) violate any provision of the Company’s organizational documents; (ii) violate any law or order applicable to the Company or by which any of its properties or assets may be bound which has a Material Adverse Effect; or (iii) constitute a default under any material agreement or contract by which the Company may be bound which has a Material Adverse Effect. (f) This Note is a valid, legal and binding obligation of the Company, enforceable against the Company in accordance with its terms, terms except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at law). 6. Covenants. So long as any amount due under this Note is outstanding and until indefeasible payment in full of all amounts payable by the Company hereunder (other than inchoate indemnification obligations): (i) the Company shall (A) carry on and conduct its business in substantially the same manner and in substantially the same fields of enterprise as it is presently conducting, (B) do all things necessary to remain duly organized, validly existing, and in good standing as a corporation under the laws of its state of organization and (C) maintain all requisite authority to conduct its business in those jurisdictions in which its business is conducted, except to the extent that the failure to be so authorized would not reasonably be expected to have a Material Adverse Effect; and (ii) the Company shall promptly notify the Holder of the occurrence of any Event of Default. 7. Event of Default. The occurrence of any of following events shall constitute an “Event of Default” hereunder: (a) the failure of the Company to make any payment of principal or interest under this Note when due, whether at the Maturity Date, upon acceleration or otherwise; (b) the Company makes an assignment for the benefit of creditors or admits in writing its inability to pay its debts generally as they become due; or an order, judgment or decree is entered adjudicating the Company as bankrupt or insolvent; or any order for relief with respect to the Company is entered under the Federal Bankruptcy Code or any other bankruptcy or insolvency law; or the Company petitions or applies to any tribunal for the appointment of a custodian, trustee, receiver or liquidator of the Company or of any substantial part of the assets of the Company, or commences any proceeding relating to it under any bankruptcy, reorganization, arrangement, insolvency, readjustment of debt, dissolution or liquidation law of any jurisdiction; or any such petition or application is filed, or any such proceeding is commenced, against the Company and either (i) the Company by any act indicates its approval thereof, consents thereto or acquiescence therein or (ii) such petition application or proceeding is not dismissed within sixty (60) days;

-6- (c) a final, non-appealable judgment which, in the aggregate with other outstanding final judgments against the Company, exceeds $10,000,000 (not paid or fully covered by insurance) shall be rendered against the Company and within thirty (30) days after entry thereof, such judgment is not discharged or execution thereof stayed pending appeal, or within thirty (30) days after the expiration of such stay, such judgment is not discharged; provided, however, that a judgment that provides for the payment of royalties subsequent to the date of the judgment shall be deemed to be discharged so long as the Company is in compliance with the terms of such judgment; (d) any representation or warranty made or deemed made by the Company herein shall be incorrect in any material respect when made or deemed made and in the case of any such misrepresentations that is capable of being cured such misrepresentation continues for thirty (30) days after notice thereof by the Holder to the Company; (e) if the Company fails to observe or perform any of its covenants contained in this Note and such default shall not have been remedied or waived within thirty days after the earlier of (i) an officer of the Company becoming aware of such default or (ii) receipt by the Company of notice from the Holder of such default; (f) The occurrence of an event of default (subject to any applicable notices and grace or cure periods) under any loan (other than any loan evidenced by this Note) in excess of Five Million Dollars ($5,000,000) under which the Company is obligated; or (g) a Change of Control shall occur. Upon the occurrence of any such Event of Default, all unpaid principal and accrued interest under this Note shall become immediately due and payable (A) upon election the Holder, with respect to (a), (c), (d), (e), (f) and (g) of the immediately preceding sentence, and (B) automatically, with respect to (b) of the immediately preceding sentence. Upon the occurrence of any Event of Default, the Holder may, in addition to declaring all amounts due hereunder to be immediately due and payable, pursue any available remedy, whether at law or in equity. 8. Remedies Cumulative. No failure to exercise or delay in exercising any right, remedy, power or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege. The rights, remedies, powers and privileges herein provided are cumulative and not exclusive of any rights, remedies, powers and privileges provided by law. 9. Amendments. Any amendment or waiver of any term of this Note by any party shall be effective only if in writing and duly signed by the Company and the Holder. 10. Waivers. The Company hereby waives presentment, demand for payment, notice of dishonor, protest and notice of protest, and any or all other notices or demands in connection with the delivery, acceptance, performance, default or endorsement of this Note. The liability of the Company hereunder shall be unconditional and shall not be in any manner affected by any indulgence whatsoever granted or consented to by the Holder, including but not limited to any extension of time, renewal, waiver or other modification. Any failure of the Holder to exercise any right hereunder shall not be construed as a waiver of the right to exercise the same or any other right at any time and from time to time thereafter. The Holder may accept late payments, or partial payments, even though marked “payment in full” or containing words of similar import or other conditions, without waiving any of its rights. 11. Waiver of Jury Trial. EACH OF THE COMPANY AND THE HOLDER HEREBY WAIVES ITS RIGHT TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION ARISING OUT OF OR BASED

-7- UPON THIS NOTE OR ANY CONTEMPLATED TRANSACTION, INCLUDING CONTRACT, TORT, BREACH OF DUTY AND ALL OTHER CLAIMS. THE COMPANY HAS REVIEWED THIS WAIVER WITH ITS COUNSEL. 12. Unsecured Obligation. This Note is a general unsecured obligation of the Company. 13. Governing Law; Consent to Jurisdiction. This Note shall be governed by and construed under the law of the State of New York, without giving effect to the conflicts of law principles thereof. The Company and, by accepting this Note, the Holder, each irrevocably submits to the jurisdiction of the courts of the State of New York located in New York County and the United States District Court for the Southern District of New York for the purpose of any suit, action, proceeding or judgment relating to or arising out of this Note and the transactions contemplated hereby. Service of process in connection with any such suit, action or proceeding may be served on each party hereto anywhere in the world by the same methods as are specified for the giving of notices under this Note. The Company and, by accepting this Note, the Holder, each irrevocably consents to the jurisdiction of any such court in any such suit, action or proceeding and to the laying of venue in such court. The Company and, by accepting this Note, the Holder, each irrevocably waives any objection to the laying of venue of any such suit, action or proceeding brought in such courts and irrevocably waives any claim that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum. Nothing herein shall prevent the Holder from commencing any suit, action, proceeding or judgment relating to or arising out of this Note and the transactions contemplated hereby in any other court, jurisdiction or venue. 14. Notices. Any notice or demand required or permitted to be given or made to or upon any party hereto pursuant to any of the provisions of this Note shall be deemed to have been duly given or made for all purposes if in writing and delivered by hand against receipt, sent by e-mail or facsimile, sent by certified or registered mail, postage prepaid, return receipt requested, to such party at the respective address set forth below or such other address as any party hereto may at any time direct by notice given to the other party in accordance with this Section 14. The date of giving or making of any such notice or demand shall be (a) if sent by mail by certified or registered mail or sent by hand or overnight courier, the earlier of the date of actual receipt, or five (5) Business Days after such notice or demand is sent, (b) if sent by facsimile, during the recipient’s normal business hours (and if sent after normal business hours shall be deemed to have been given at the opening of the recipient’s business on the next Business Day), and (c) if sent by e-mail, upon the sender’s receipt of an acknowledgment from the intended recipient (such as by the “return receipt requested” function, as available, return e-mail or other written acknowledgment). Each party’s address for notice is as follows: Company: Applied Digital Corporation Attn: Wes Cummins 3811 Turtle Creek Blvd Suite 2100 Dallas, TX 75219 email: Wes@applieddigital.com with a copy (which shall not constitute notice) to: Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 Attention: Steven E. Siesser Email: ssiesser@lowenstein.com

-8- Holder: AI Bridge Funding LLC c/o Kim Calkin Cole Schotz P.C. 25 Main St. Hackensack, NJ 07601 Email: kcalkin@coleschotz.com 15. Lost, Stolen or Mutilated Notes. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Note, and in case of any such loss, theft or destruction, upon delivery of any customary indemnity agreement reasonably satisfactory to the Company, or in any case of any such mutilation, upon surrender and cancellation of this Note, the Company at its expense will, within five (5) Business Days, issue and deliver a new Note of like tenor in an amount equal to the amount of such lost, stolen or mutilated Note. 16. Indemnification. The Company agrees to indemnify and hold harmless the Holder and its respective Related Parties (each, an “Indemnified Party”) from and against, any and all claims, damages, losses, liabilities and related expenses (including the reasonable fees, charges and expenses of any counsel for any Indemnified Party), incurred by any Indemnified Party or asserted against any Indemnified Party by any Person (including the Company) arising out of, in connection with, or by reason of (a) the execution or delivery of this Note, the performance by the parties thereto of their respective obligations hereunder or the consummation of the transactions contemplated herewith; (b) the loans as evidenced by this Note or the actual or proposed use of the proceeds therefrom; or (c) any actual or prospective claim, investigation, litigation or proceeding relating to any of the foregoing, whether based on contract, tort or any other theory, whether brought by a third party or by the Company, and regardless of whether any Indemnified Party is a party thereto; provided such indemnity shall not, as to any Indemnified Party, be available to the extent that such losses, claims, damages, liabilities or related expenses have resulted from (i) the gross negligence or willful misconduct of such Indemnified Party or (ii) any dispute between or among Indemnified Parties not arising from an act or omission by the Company. 17. Rescission of Payments. If at any time any payment made by the Company under this Note is rescinded or must otherwise be restored or returned upon the insolvency, bankruptcy or reorganization of the Company or otherwise, the Company’s obligation to make such payment shall be reinstated as though such payment had not been made. 18. Severability. Whenever possible, each provision of this Note shall be interpreted in such manner as to be effective and valid, but if any provision of this Note is held to be invalid or unenforceable in any respect, such invalidity or unenforceability shall not render invalid or unenforceable any other provision of this Note. 19. Successors and Assigns; Transferability. This Note shall be binding upon and inure to the benefit of the Company and the Holder and their respective permitted successors and assigns. This Note may be assigned or transferred by the Holder to any Person. The Company may not assign or transfer this Note or any of its rights hereunder without the prior written consent of the Holder and any such assignment shall be null and void. 20. Holder Register. Company shall establish and maintain a register of Holders (the “Holder Register”) in which Company shall provide by book entry for registration and transfer of the Note and the respective rights to receive any payments pursuant to the Note. Company agrees to make the Holder Register available to each Holder for inspection from time to time, including without limitation to determine the then current mailing and/or email address for each of the Holders. The Note is intended to be treated as a registered obligation for federal income tax purposes and, consistent with Section 19 hereof, the right,

-9- title, and interest of Holder and its permitted assignees in and to the Note shall be transferable only in accordance with Section 19 hereof. This provision shall be construed so that the Note is at all times maintained in “registered form” within the meaning of the Code and any related regulations (or any successor provisions of the Code or such regulations). 21. Tax Treatment. Holder shall be responsible for any and all tax consequences resulting from this Note and Company shall have no liability for the tax consequences resulting from this Note or any related transactions. Company and Holder shall each treat this Note as a debt instrument for U.S. federal income tax purposes and to treat those payments that are provided for in this Note as payments in respect of the Note. Each of Company and Holder shall (i) prepare and file all tax returns in a manner consistent with this Section 21 and (ii) take no position or other any action inconsistent with such treatment, in each case unless otherwise required pursuant to applicable law and unless Company or Holder, as applicable, provides notice to the other party at least thirty (30) days prior to taking such action. [signature page follows]

IN WITNESS WHEREOF, the Company has caused this Unsecured Promissory Note to be signed in its name effective as of the date first above written. APPLIED DIGITAL CORPORATION By:_/s/ David Rench____________ Name: Title: Acknowledged and Agreed by Holder as of the date first written above: AI BRIDGE FUNDING LLC By: _/s/ John Rijo______________ Name: Title:

EX-10.1

3

a00loanterminationletter.htm

EX-10.1

a00loanterminationletter

February 5, 2024 SAI Applied Sai Computing LLC/Applied Digital Corporation 3811 Turtle Creek Blvd Suite 2100 Dallas, TX 75219 Attn: Chief Financial Officer Telephone: (214) 427 1738 Email: david@applieddigital.com Re: Termination of Loan and Security Agreement (this “Letter Agreement”) Ladies and Gentlemen: Reference is made to that certain Loan and Security Agreement (as amended, the “Loan Agreement”) dated as of May 23, 2023 by and among Sai Computing LLC (the “Borrower”), Applied Digital Corporation (the “Guarantor”), B. Riley Commercial Capital, LLC, as a lender (“BRCC”), B. Riley Securities, Inc., as a lender (“BRS”; each of BRS with BRCC, a “Lender” and, collectively, the “Lenders”), and BRCC as collateral agent (the “Collateral Agent”). As used herein, “Loan Parties” refers to the Borrower, the Guarantor and any other party that has guaranteed the Obligations under the Loan Agreement. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Loan Agreement. Borrower has requested that the Lenders provide this Letter Agreement to evidence the payment of Obligations under the Loan Agreement. The total amount necessary to pay in full as of this date the outstanding Obligations (other than DM Legal Fees (as defined on Schedule A attached hereto)) under the Loan Agreement through the Payoff Effective Time (as defined below) is set forth below: Description Amount Principal (Loans) $0.00 Interest (Loans) $0.00 Prepayment fees and premiums, if any $0.00 Fees due to Lenders $0.00

Effective upon: (i) receipt by the Lenders and the Collateral Agent of a fully executed counterpart of this Letter Agreement signed by the Borrower and Guarantor, and (ii) Duane Morris LLP’s receipt of its DM Legal Fees via federal funds wire transfer pursuant to the wire instructions set forth on Schedule A attached hereto (the time of satisfaction of clauses (i) and (ii), collectively, the “Payoff Effective Time”), then, except as otherwise provided in this Letter Agreement, (a) all Obligations shall immediately and automatically be deemed fully paid and satisfied, (b) the Loan Agreement and each other Loan Document shall be immediately and automatically terminated and be of no further force and effect in accordance with the terms hereof without any further action by any other Person, except in respect of any provision that by its express terms survive the termination of the Loan Agreement or the applicable Loan Document, (c) except to the extent provided in this Letter Agreement the Borrower and the other Loan Parties shall have no other or further obligations, liabilities or indebtedness under the Loan Agreement or any other Loan Document to the Collateral Agent and the Lenders, (d) all of the Collateral Agent’s and Lenders’ security interests in and Liens on any real or personal property of the Borrower or any other Loan Party (the “Collateral”) which the Borrower or other Loan Parties granted the Collateral Agent, for its benefit and the benefit of Lenders under the Loan Agreement or any other Loan Documents, shall be immediately and automatically terminated, released and discharged without any further action by Collateral Agent, Lenders or any other Person, and (e) the Borrower and the other Loan Parties (or their respective designees) shall be authorized to file the UCC-3 Termination Statements attached hereto as Exhibit A in the filing offices identified thereon to effect the release of all Liens created pursuant to the Loan Agreement or any other Loan Document (any and all such termination statements and termination agreements shall be prepared and recorded at the Borrower’s expense). Borrower hereby confirms that the commitments of the Collateral Agent and Lenders to make Loans under the Loan Documents are immediately, automatically and irrevocably terminated as of the Payoff Effective Time, and, as of the Payoff Effective Time, the Collateral Agent and Lenders shall not have any further obligation to make Loans to the Borrower. The Borrower agrees to pay the Collateral Agent on demand all reasonable costs and expenses, including, without limitation, all reasonable attorney’s fees and expenses, incurred by the Collateral Agent in connection with the matters referred to in the paragraph immediately above. If at any time after the Payoff Effective Time Lender or Collateral Agent repays, refunds, restores, or returns in whole or in part, any payment or property (including any proceeds of Collateral) previously paid or transferred to Lender or Collateral Agent in full or partial satisfaction of any Obligations or on account of any other obligation of Borrower or Guarantor under any Loan Document, because the payment, transfer, or the incurrence of the obligation so satisfied is asserted or declared to be void, voidable, or otherwise recoverable under any law relating to creditors’ rights, including provisions of the Bankruptcy Code relating to fraudulent transfers, preferences, or other voidable or recoverable obligations or transfers (each, a “Voidable Transfer”), or because Lender or Collateral Agent elects to do so on the reasonable advice of its counsel in connection with a claim that the payment, transfer, or incurrence is or may be a Voidable Transfer, then, as to any such Voidable Transfer, or the amount thereof Lender or Collateral Agent elects to repay, restore, or return (including pursuant to a settlement of any claim in respect thereof), and as to all costs, expenses, and attorneys’ fees of Lender related thereto, (i) the liability of the Borrower and Guarantor with respect to the amount or property paid, refunded, restored, or returned will automatically and immediately be revived, reinstated, and restored and will exist, and (ii) the

Collateral Agent’s Liens and the terms of the Loan Agreement shall be reinstated in full force and effect and the above noted releases, terminations, cancellations or surrenders shall not diminish, release, discharge, impair or otherwise affect the obligation of Borrower or Guarantor in respect of such liability or any Collateral securing such liability. For and in consideration of Collateral Agent’s and Lenders’ agreements contained herein and in the Loan Documents, Borrower, Guarantor and each other Loan Party hereby irrevocably and unconditionally forever releases and discharges the Collateral Agent and each Lender, and each of their respective officers, directors, employees, equity holders, agents, affiliates, attorneys, representatives, successors and assigns (collectively, the “Released Parties”) from any and all claims, causes of actions, damages and liabilities of any nature whatsoever, known or unknown, which such Borrower or such Loan Party ever had, now has or might hereafter have against one or more of the Released Parties which arise out of any of the Loan Documents, or the transactions relating thereto or hereto, to the extent that any such claim, cause of action, damage or liability shall be based in whole or in part upon facts, circumstances, actions or events existing on or prior to the date hereof. If any Borrower or any other Loan Party asserts or commences any claim, counter-claim, demand or cause of action in derogation of the foregoing release or challenges the enforceability of the forgoing release (in each case, a “Violation”), then Borrower agrees to pay in addition to such other damages as any Released Party actually sustains as a result of such Violation, all attorney fees and expenses incurred by such Related Party as a result of such Violation. Further, upon and after the Payoff Effective Time, the Collateral Agent agrees to promptly execute (as applicable) and deliver to the Borrower such other required releases terminations, or possessory collateral in form and substance reasonably satisfactory to the Borrower and the Collateral Agent, and take any other actions, as the Borrower may reasonably request in writing to evidence and/or effect the Collateral Agent’s release and termination of the Obligations (except as identified above with respect to continuing liabilities and obligations) and of any Liens and security interests in the Collateral which the Borrower or other Loan Parties have granted the Collateral Agent under the Loan Agreement or any other Loan Documents. The Borrower agrees to reimburse the Collateral Agent on demand for all reasonable costs and expenses incurred by the Collateral Agent in connection with the matters referred to in this paragraph. Each Borrower and each Guarantor further acknowledges that the Collateral Agent’s execution of and/or delivery of any documents releasing any security interest or claim in any Collateral as set forth in this Agreement is made without recourse, representation, warranty or other assurance of any kind by the Collateral Agent with respect to the condition or value of any Collateral. The Lenders hereby waive any requirement for advanced notice regarding termination of the Loan Documents. This Letter Agreement shall be governed by and construed in accordance with the law of the Commonwealth of Delaware. This Letter Agreement may be executed in any number of counterparts and by different parties in separate counterparts, each of which when so executed shall be deemed to be an original

and all of which taken together shall constitute one and the same Letter Agreement. Delivery of an executed signature page of this Letter Agreement by facsimile or electronic .pdf shall be effective as delivery of a manually executed counterpart hereof. [Signature page follows]

Very truly yours, B. RILEY COMMERCIAL CAPITAL LLC, as Lender and Collateral Agent By: ______________________________ Name: Phillip J. Ahn Title: Chief Financial Officer B. RILEY SECURITIES, INC., as Lender By: ______________________________ Name: Mike McCoy Title: Chief Financial Officer /s/ Phillip J. Ahn /s/ Mike McCoy

Acknowledged and Agreed as of the date set forth above: SAI Computing LLC By: ______________________________ Name: David Rench Title: Manager Applied Digital Corporation By: ______________________________ Name: David Rench Title: Chief Financial Officer /s/ David Rench /s/ David Rench

Schedule A Duane Morris LLP Legal Fees / DM Legal Fees Legal fees, costs and expenses of Duane Morris LLP (the “DM Legal Fees”) equal to $2,475.00. Payments of Duane Morris Legal Fees pursuant to this Letter Agreement should be made in immediately available wire transferred funds to: Account Name: Duane Morris LLP Receipts Bank Name: Wells Fargo Bank NA Account Number: ABA Number: 121000248 International Swift Code: WFBIUS6S Bank Address: One South Broad Street, Philadelphia, PA 19107 Ref. No.: K1180-287 – SAI Applied Payoff (please reference)

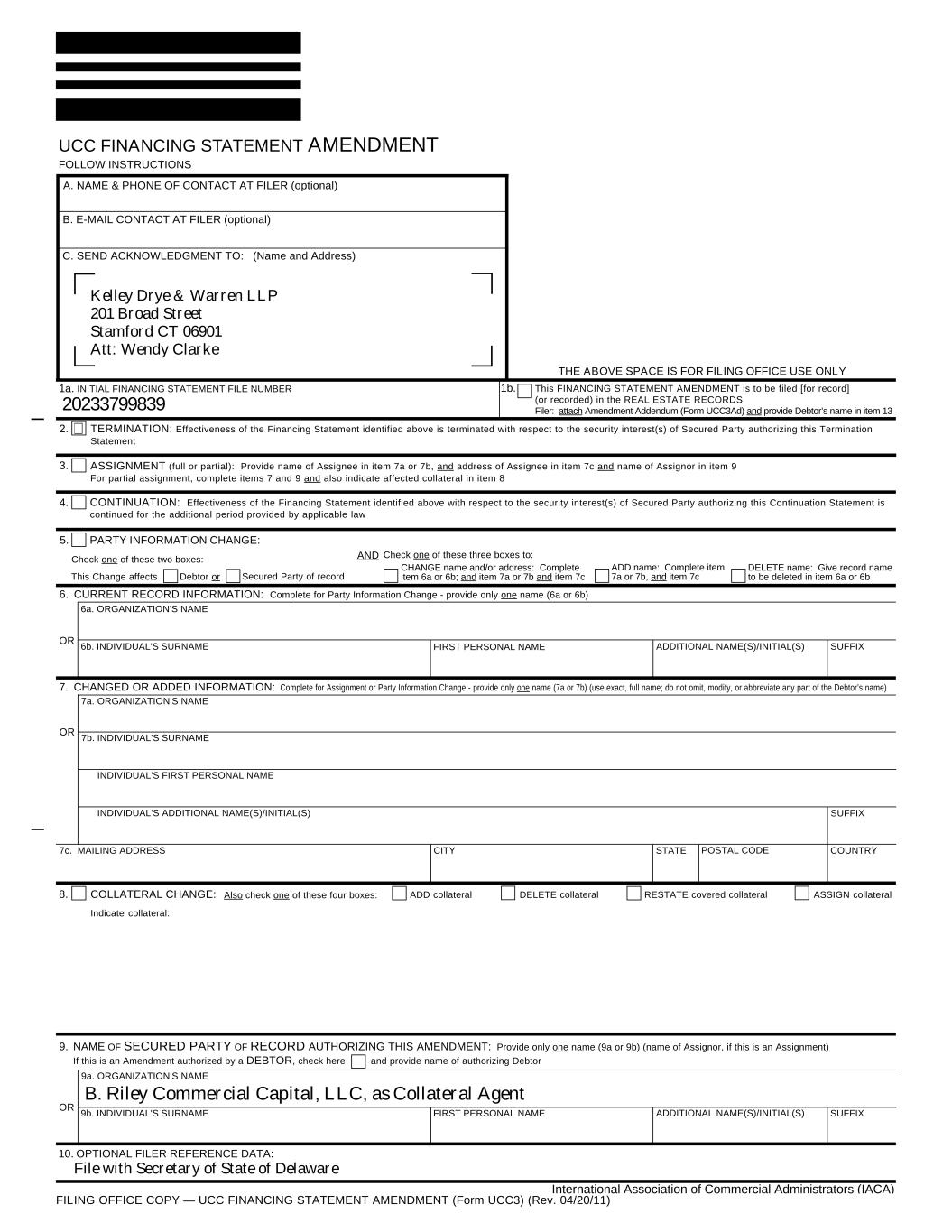

Exhibit A UCC-3 Termination Statement (See Attached)

1b. This FINANCING STATEMENT AMENDMENT is to be filed [for record] (or recorded) in the REAL ESTATE RECORDS Filer: attach Amendment Addendum (Form UCC3Ad) and provide Debtor’s name in item 13 THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY RESTATE covered collateral ASSIGN collateral Check one of these three boxes to: FIRST PERSONAL NAME SUFFIXADDITIONAL NAME(S)/INITIAL(S)OR A. NAME & PHONE OF CONTACT AT FILER (optional) 1a. INITIAL FINANCING STATEMENT FILE NUMBER PARTY INFORMATION CHANGE: ASSIGNMENT (full or partial): Provide name of Assignee in item 7a or 7b, and address of Assignee in item 7c and name of Assignor in item 9 For partial assignment, complete items 7 and 9 and also indicate affected collateral in item 8 TERMINATION: Effectiveness of the Financing Statement identified above is terminated with respect to the security interest(s) of Secured Party authorizing this Termination Statement CONTINUATION: Effectiveness of the Financing Statement identified above with respect to the security interest(s) of Secured Party authorizing this Continuation Statement is continued for the additional period provided by applicable law 2. 3. 4. 6b. INDIVIDUAL'S SURNAME 6a. ORGANIZATION'S NAME DELETE name: Give record name to be deleted in item 6a or 6b 6. CURRENT RECORD INFORMATION: Complete for Party Information Change - provide only one name (6a or 6b) 7. CHANGED OR ADDED INFORMATION: Complete for Assignment or Party Information Change - provide only one name (7a or 7b) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name) 8. UCC FINANCING STATEMENT AMENDMENT FOLLOW INSTRUCTIONS ADD name: Complete item 7a or 7b, and item 7c OR FIRST PERSONAL NAME ADDITIONAL NAME(S)/INITIAL(S) SUFFIX 9a. ORGANIZATION'S NAME 9b. INDIVIDUAL'S SURNAME 10. OPTIONAL FILER REFERENCE DATA: 9. NAME OF SECURED PARTY OF RECORD AUTHORIZING THIS AMENDMENT: Provide only one name (9a or 9b) (name of Assignor, if this is an Assignment) If this is an Amendment authorized by a DEBTOR, check here and provide name of authorizing Debtor B. E-MAIL CONTACT AT FILER (optional) C. SEND ACKNOWLEDGMENT TO: (Name and Address) CHANGE name and/or address: Complete item 6a or 6b; and item 7a or 7b and item 7cDebtor or Secured Party of record Check one of these two boxes: AND This Change affects 5. ADD collateral DELETE collateralCOLLATERAL CHANGE: Also check one of these four boxes: OR 7a. ORGANIZATION'S NAME POSTAL CODECITY7c. MAILING ADDRESS 7b. INDIVIDUAL'S SURNAME INDIVIDUAL'S FIRST PERSONAL NAME INDIVIDUAL'S ADDITIONAL NAME(S)/INITIAL(S) STATE SUFFIX COUNTRY Indicate collateral: FILING OFFICE COPY — UCC FINANCING STATEMENT AMENDMENT (Form UCC3) (Rev. 04/20/11) Kelley Drye & Warren LLP 201 Broad Street Stamford CT 06901 Att: Wendy Clarke 20233799839 ✔ B. Riley Commercial Capital, LLC, as Collateral Agent File with Secretary of State of Delaware International Association of Commercial Administrators (IACA)