Document

Contents

|

|

|

|

This document contains important information for Shareholders. Your participation is very important. Please take a minute to submit your proxy or voting instruction form today or vote by phone or through the internet in accordance with the instructions set forth in the proxy or voting instruction form. |

|

|

|

|

|

|

|

| 2025 Management Proxy Circular |

i |

Letter and Invitation to Shareholders

|

|

|

|

|

|

|

|

|

|

|

Meeting

April 24, 2025, 11:30 a.m.

(Mountain Time)

Virtual-only meeting format

https://meetings.lumiconnect.com/

400-164-661-424

|

|

John P. Dielwart

Chair of the Board

of Directors

|

John H. Kousinioris

President and Chief

Executive Officer

|

March 7, 2025

Dear Fellow Shareholders,

On behalf of the Board of Directors and management of TransAlta Corporation (the “Company”), you are cordially invited to attend our 2025 Annual and Special Meeting of Shareholders (the “Meeting”), which will take place on Thursday, April 24, 2025, at 11:30 a.m. (Mountain Time). The Meeting will take place in a virtual-only format to provide all holders of common shares ("Shareholders") at the close of business on March 7, 2025, the record date set for the Meeting, an equal opportunity to participate regardless of geographic location or particular circumstances that could otherwise prohibit their participation. Shareholders who attend the Meeting virtually will have an opportunity to participate, ask questions and vote in real time, provided they follow the procedures set out in our Management Proxy Circular.

The Notice of Annual and Special Meeting of Shareholders and Management Proxy Circular are attached. The Management Proxy Circular describes business to be conducted at the Meeting and provides information regarding our executive compensation program and corporate governance practices. During the Meeting, Shareholders will receive our audited consolidated financial statements for the year ended Dec. 31, 2024, and the auditors’ report, and will be asked to elect the directors; reappoint the auditors and authorize their remuneration to be fixed; participate in the advisory vote on our approach to executive compensation (say on pay); and continue our shareholder rights plan.

We encourage you to carefully review the Management Proxy Circular and vote on the business items to be considered at the Meeting.

Your vote and participation are very important. In 2024, we were pleased to have 194,587,285 votes cast in person or by proxy at our annual meeting of shareholders, representing 63.21 per cent of eligible common shares. We encourage all Shareholders to participate at this year’s Meeting. If you are unable to attend the Meeting, you may vote by telephone, via the internet or by completing and returning the enclosed form of proxy or voting instruction form. Please refer to the “How to Vote” section of the Management Proxy Circular for more information. We also encourage you to visit our website at any time before the Meeting as it provides important information about the Company.

We also invite you to review the Letter from the President and CEO in our 2024 Integrated Report, which outlines our strong performance in 2024.

Finally, we would like to extend our gratitude to directors Mr. Harry Goldgut and Ms. Sarah Slusser, who have announced their decision to not stand for re-election at the Meeting. Each have been valuable contributors to our Board since 2019 in the case of Mr. Goldgut, and since 2021 in the case of Ms. Slusser. We thank them for their commitment and insights during their respective tenures with the Board.

|

|

|

|

|

|

| 2025 Management Proxy Circular |

1 |

We look forward to your participation at the Meeting.

Sincerely,

|

|

|

|

|

|

|

|

|

John P. Dielwart

Chair of the Board

of Directors

|

John H. Kousinioris

President and Chief

Executive Officer

|

Forward-looking Statements

This Proxy Circular (as defined herein) includes “forward-looking information”, within the meaning of applicable Canadian securities laws, and “forward-looking statements”, within the meaning of applicable United States securities laws, including the Private Securities Litigation Reform Act of 1995 (collectively referred to herein as “forward- looking statements”).

Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as "may", "will", "can", "could", "would", "shall", "believe", "expect", "estimate", "anticipate", "intend", "plan", "forecast", "foresee", "potential", "enable", "continue" or other comparable terminology. These statements are not guarantees of our future performance, events or results and are subject to risks, uncertainties and other important factors that could cause our actual performance, events or results to be materially different from those set out in or implied by the forward-looking statements.

In particular, this Proxy Circular contains forward-looking statements about the following, among other things:

•the business and procedure of the Meeting, the composition of our Board of Directors (the "Board") following the Meeting;

•the strategic objectives of the Company and that the execution of the Company’s strategy will realize value for Shareholders;

•our sustainability goals and targets, including those in our 2024 Sustainability Report;

•optimizing and diversifying our existing assets;

•our executive compensation philosophy and practices, including the mix of short- and long-term incentives;

•the Company’s governance policies; the Company’s internal talent pipeline; and the Company’s pension plans.

The forward-looking statements contained in this Proxy Circular are based on many assumptions including, but not limited to, the following:

•no significant changes to applicable laws and regulations;

•no unexpected delays in obtaining required regulatory approvals;

•no material adverse impacts to investment and credit markets;

•no significant changes to power price and hedging assumptions;

•no significant changes to gas commodity price assumptions and transport costs;

•no significant changes to interest rates;

•no significant changes to the demand and growth of renewables generation;

•no significant changes to the integrity and reliability of our assets;

•no significant changes to the Company's debt and credit ratings;

•no unforeseen changes to economic and market conditions;

•no significant event occurring outside the ordinary course of business.

These assumptions are based on information currently available to TransAlta, including information obtained from third-party sources. Actual results may differ materially from those predicted by such assumptions.

Factors that may adversely impact what is expressed or implied by forward-looking statements contained in this Proxy Circular include, but are not limited to:

•fluctuations in power prices;

•changes in supply and demand for electricity;

•our ability to contract our electricity generation for prices that will provide expected returns;

•our ability to replace contracts as they expire;

•risks associated with development projects and acquisitions;

•any difficulty raising needed capital in the future on reasonable terms or at all;

•our ability to achieve our targets relating to ESG;

•long-term commitments on gas transportation capacity that may not be fully utilized over time;

•changes to the legislative, regulatory and political environments;

•environmental requirements and changes in, or liabilities under, these requirements;

•operational risks involving our facilities, including unplanned outages and equipment failure;

|

|

|

|

|

|

| 2025 Management Proxy Circular |

3 |

•disruptions in the transmission and distribution of electricity;

•reductions in production;

•impairments and/or writedowns of assets;

•adverse impacts on our information technology systems and our internal control systems, including increased cybersecurity threats;

•commodity risk management and energy trading risks;

•reduced labour availability and ability to continue to staff our operations and facilities;

•disruptions to our supply chains;

•climate change-related risks;

•reductions to our generating units' relative efficiency or capacity factors;

•general economic risks, including deterioration of equity markets, increasing interest rates or rising inflation;

•general domestic and international economic and political developments, including potential trade tariffs;

•industry risk and competition;

•counterparty credit risks;

•inadequacy or unavailability of insurance coverage;

•increases in the Company's income taxes and any risk of reassessments;

•legal, regulatory and contractual disputes and proceedings involving the Company;

•reliance on key personnel; and

•labour relations matters.

The foregoing risk factors, among others, are described in further detail under the heading "Governance and Risk Management" in our Management's Discussion and Analysis for the year ended Dec. 31, 2024 (MD&A).

Readers are urged to consider these factors carefully when evaluating the forward-looking statements, which reflect the Company's expectations only as of the date hereof, and are cautioned not to place undue reliance on them. The forward-looking statements included in this document are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events or otherwise, except as required by applicable laws. In light of these risks, uncertainties and assumptions, the forward-looking statements might occur to a different extent or at a different time than we have described or might not occur at all. We cannot provide assurance that projected results or events will be achieved.

Non-IFRS Measures

The Company evaluates its performance and the performance of its business segments using a variety of measures. Certain of the financial measures contained in this Proxy Circular, including earnings before interest, tax, depreciation and amortization (EBITDA) and free cash flow (FCF), are not standard measures defined under International Financial Reporting Standards (IFRS) and may not be comparable to similar measures presented by other entities. These measures have no standardized meaning under IFRS and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Non-IFRS measures are presented to provide management and investors with an understanding of our financial position and executive compensation programs. Certain additional disclosures and reconciliations for these non-IFRS financial measures have been incorporated by reference and can be found beginning on page M64 under the “Additional IFRS Measures and Non-IFRS Measures” section of our MD&A filed with Canadian securities regulators on www.sedarplus.ca and the U.S. Securities and Exchange Commission on www.sec.gov.

Notice of Annual and Special Meeting of Shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When:

April 24, 2025

11:30 a.m. (Mountain Time)

|

|

|

Where:

Virtual-only meeting format

https://meetings.lumiconnect.com/

400-164-661-424

|

|

|

|

|

|

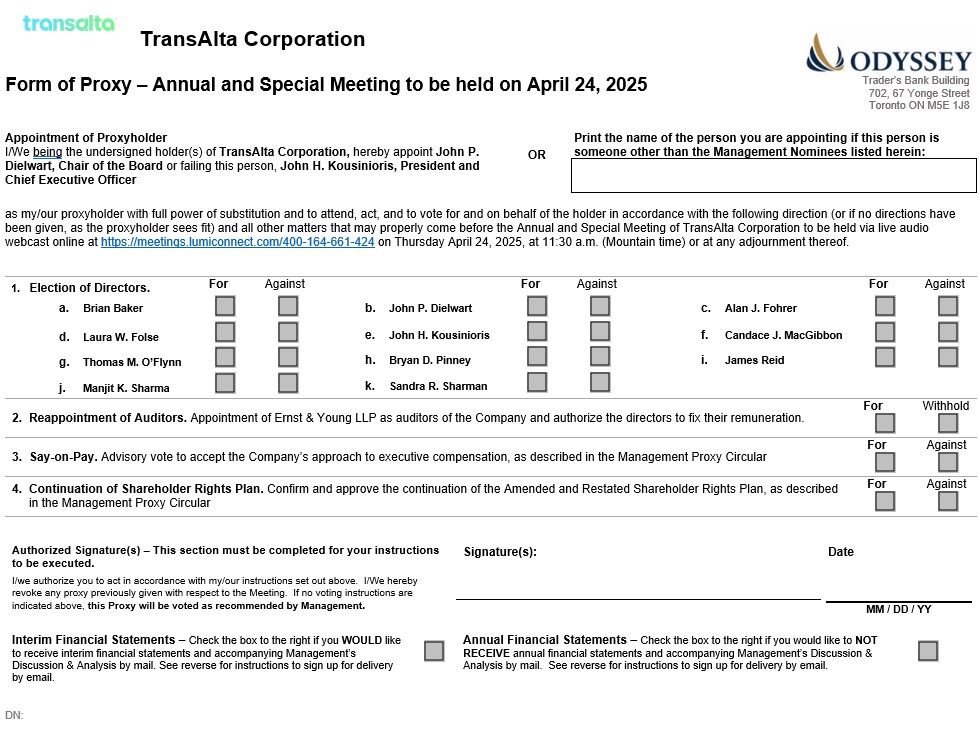

NOTICE IS HEREBY GIVEN that an annual and special meeting (the “Meeting”) of the holders of common shares (the “Shareholders”) of TransAlta Corporation ("TransAlta") will be held on April 24, 2025, at 11:30 a.m. (Mountain Time) in a virtual-only meeting format via live audio webcast at https://meetings.lumiconnect.com/ 400-164-661-424 to:

1.Elect each of the 11 director nominees of the Company for the ensuing year (see “Business of the Meeting – Election of Directors” in the accompanying Management Proxy Circular);

2.Receive the audited consolidated financial statements of the Company for the year ended Dec. 31, 2024, and the auditor’s report thereon (see “Business of the Meeting – Financial Statements” in the accompanying Management Proxy Circular);

3.Reappoint Ernst & Young LLP, the auditors of the Company, for the ensuing year and authorize the Board of Directors of the Company to fix their remuneration (see “Business of the Meeting – Reappointment of Auditors” in the accompanying Management Proxy Circular);

4.Consider a non-binding advisory resolution to accept the Company’s approach to executive compensation (see “Business of the Meeting – Advisory Vote on Executive Compensation” in the accompanying Management Proxy Circular);

5.Consider and, if deemed appropriate, pass, with or without variation, an ordinary resolution, the full text of which is reproduced starting on page

47 of the accompanying Management Proxy Circular, confirming and approving the continuation of the Amended and Restated Shareholder Rights Plan (see "Business of the Meeting — Renewal of Shareholder

Rights Plan" in the accompanying Management Proxy Circular); and

6.Transact such other matters as may properly come before the Meeting or any adjournment or postponement thereof.

The Management Proxy Circular of the Company dated March 7, 2025, and the form of proxy or the voting information form for the Meeting accompany this Notice of Annual and Special Meeting. We are providing access to our Management Proxy Circular and 2024 Integrated Report via the internet using notice-and-access procedures. These materials will be available at https://odysseytrust.com/client/transalta. You should carefully review all information contained in the Management Proxy Circular before voting.

This year, the Company is holding the Meeting via live audio webcast, which will provide all our Shareholders with an equal opportunity to participate, regardless of their geographic location. Registered Shareholders and duly appointed proxyholders will be able to attend the Meeting, ask questions and vote, all in real time, provided they are connected to the internet and comply with all requirements set out in the Management Proxy Circular. Beneficial Shareholders who have not duly appointed themselves as proxyholders will be able to attend the Meeting as guests; however, guests will not be able to ask questions or vote at the Meeting.

|

|

|

|

|

|

| 2025 Management Proxy Circular |

5 |

The Board of Directors unanimously recommends that you vote FOR all of the TransAlta director nominees and the other items of business at the Meeting.

March 7, 2025

By order of the Board of Directors of TransAlta Corporation

Jon Ozirny

Vice President, Legal and Corporate Secretary

Calgary, Alberta

Only Shareholders of record at the close of business on March 7, 2025, the record date set for the Meeting, are entitled to receive notice of, attend, ask questions at and vote at the Meeting or any adjournment or postponement thereof. The form of proxy must be signed, dated and returned to the Company’s registrar and transfer agent, Odyssey Trust Company, Attention: Proxy Department, Trader's Bank Building, 702 - 67 Yonge Street, Toronto, Ontario, M5E 1J8, for receipt before 11:30 a.m. (Mountain Time) on April 22, 2025, or, in the case of adjournment or postponement of the

Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the adjourned or postponed Meeting. Registered Shareholders who cannot attend the Meeting in person may use one of the voting options described in our Management Proxy Circular and the form of proxy. Non-registered Shareholders should follow the instructions on the voting instruction form or other form of proxy provided by their intermediaries with respect to the procedures to be followed for asking questions and voting.

Important Notice Regarding Proxy Materials and

Notice-and-Access Procedures

The Company has elected to use the notice-and-access provisions under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer and National Instrument 51-102 – Continuous Disclosure Obligations (“Notice-and-Access”) for distribution of the Meeting materials to registered and beneficial Shareholders. Notice-and-Access allows the Company to post electronic versions of its proxy-related materials on the System for Electronic Data Analysis and Retrieval (SEDAR+) and online at https://odysseytrust.com/client/transalta, rather than mailing paper copies to registered and beneficial Shareholders.

Under Notice-and-Access, instead of receiving printed copies of the Meeting materials, registered and beneficial Shareholders receive a Notice-and-Access notification containing details of the Meeting date, location and purpose, as well as information on how they can access the Meeting materials electronically.

The Meeting materials will be available at https://odysseytrust.com/client/transalta and on the Company's SEDAR+ profile at www.sedarplus.ca on or about March 25, 2025. The use of this alternative means of delivery is more environmentally friendly as it reduces paper use and also reduces the Company’s printing and mailing costs.

It also helps expedite the receipt of our Meeting materials by Shareholders. Shareholders are reminded to review the Meeting materials before voting. If you would prefer to receive a paper copy of the Meeting materials, free of charge, or if you have any questions regarding Notice-and-Access, you can contact our transfer agent, Odyssey Trust Company (Odyssey), at 1-888-290-1175.

Beneficial Shareholders may request a paper copy by going online to www.proxyvote.com or by calling toll-free at 1-877-907-7643 and entering the control number located on their voting instruction form and following the instructions provided.

Requests for paper copies should be made as soon as possible but must be received no later than April 4, 2025, in order to allow sufficient time for Shareholders to receive and review the Meeting materials and return the proxy form or voting instruction form before the proxy deadline.

Shareholders who are unable to attend the Meeting are requested to complete, date and sign the enclosed form of proxy and return it, in the envelope provided, to Odyssey Trust Company, Attention: Proxy Department, Trader's Bank Building, 702 - 67 Yonge Street, Toronto, Ontario, M5E 1J8, so that it is received no later than 11:30 a.m. (Mountain Time) on April 22, 2025, or, if the Meeting is adjourned or postponed, no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Meeting.

|

|

|

|

|

|

| 2025 Management Proxy Circular |

7 |

General Information

This Management Proxy Circular (“Proxy Circular”) is dated March 7, 2025, and is provided to Shareholders in connection with the solicitation of proxies by and on behalf of the management of TransAlta Corporation (“TransAlta”, “Company”, “we” and “our”) and the Board of Directors of the Company (the “Board”) for use at the Annual and Special Meeting of Shareholders of the Company (the “Meeting”), to be held at 11:30 a.m. (Mountain Time) on April 24, 2025, or any adjournment or postponement thereof.

This Proxy Circular was provided to you because at the close of business on March 7, 2025, the record date set for the Meeting, you owned TransAlta common shares. As a Shareholder, you have the right to attend the Meeting, ask questions, and vote your TransAlta common shares in person or by proxy, as more fully described under “How to Vote” further below.

Solicitation of proxies will be primarily by mail, but may also be undertaken by telephone, by email, in person, over the internet, by oral communication or by other means of communication by the directors, officers, employees, consultants or agents of the Company and its subsidiaries, at no additional compensation.

All costs associated with the solicitation of proxies by or on behalf of the Company will be borne by the Company. TransAlta may use the Broadridge QuickVote™ service to assist beneficial Shareholders with voting their common shares over the telephone.

You will find additional information regarding our business in the Company's annual information form dated as of Feb. 19, 2025 (AIF), as well as our audited consolidated financial statements and accompanying MD&A. Copies of these documents and our other public documents are available on our website at www.transalta.com, on SEDAR+ at www.sedarplus.ca and on the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system at www.sec.gov.

Unless stated otherwise, all dollar amounts are expressed in Canadian dollars.

About Our Shareholder Meeting

Who Can Vote at the Meeting

If you held common shares at the close of business on March 7, 2025 (the “Record Date”), you are entitled to attend the Meeting, or any adjournment or postponement thereof, and vote your common shares. Each TransAlta common share entitles you to one vote.

At the close of business on March 7, 2025, there were 297,900,304 common shares issued and outstanding. Our common shares trade under the symbol “TA” on the Toronto Stock Exchange (TSX) and under the symbol “TAC” on the New York Stock Exchange (NYSE). As of the close of business on March 7, 2025, we also had 9,629,913 Series A preferred shares, 2,370,087 Series B

preferred shares, 9,955,701 Series C preferred shares, 1,044,299 Series D preferred shares, 9,000,000 Series E preferred shares, 6,600,000 Series G preferred shares and 400,000 Series I preferred shares issued and outstanding. Our Series A, B, C, D, E and G preferred shares trade under the symbols TA.PR.D, TA.PR.E, TA.PR.F, TA.PR.G, TA.PR.H and TA.PR.J, respectively, on the TSX. All of the outstanding Series I preferred shares are held by an affiliate of Brookfield Asset Management Inc. and are not publicly traded. The holders of our preferred shares do not have rights to receive notice of, attend or vote at the Meeting.

Principal Shareholders

To the knowledge of our directors and officers, there are no persons, firms or corporations, owning of record or beneficially, controlling or directing, directly or indirectly, 10 per cent or more of the issued and outstanding common shares.

|

|

|

|

|

|

| 2024 Management Proxy Circular |

9 |

Mailing and Availability of Proxy Circular and 2024 Integrated Report

The Company has elected to use Notice-and-Access for distribution of the Meeting materials and the Company’s 2024 Integrated Report, consisting of the audited consolidated financial statements for the fiscal year ended Dec. 31, 2024, together with the auditor’s report therein and related MD&A, to both registered and beneficial Shareholders (collectively the “2024 Integrated Report”). Notice-and-Access allows the Company to post electronic versions of these materials on SEDAR+ and online at https://odysseytrust.com/client/transalta, rather than mailing paper copies to registered and beneficial Shareholders. Under Notice-and-Access, instead of receiving printed copies of the Meeting materials and 2024 Integrated Report, registered and beneficial Shareholders receive a Notice-and-Access notification containing details of the Meeting date, location and purpose, as well as information on how they can access the Meeting materials and 2024 Integrated Report electronically.

The Meeting materials will be available at https://odysseytrust.com/client/transalta and on the Company's SEDAR+ profile at www.sedarplus.ca on or about March 25, 2025. The use of this alternative means of delivery is more environmentally friendly as it reduces paper use, and also reduces the Company’s printing and mailing costs. It also expedites receipt of our Meeting materials by Shareholders. Shareholders are reminded to review the Meeting materials before voting.

If you would prefer to receive a paper copy of the Meeting materials or 2024 Integrated Report, free of charge, or if you have any questions regarding Notice-and-Access, you can contact our transfer agent, Odyssey, at 1-888-290-1175. Requests for paper copies should be made as soon as possible but must be received no later than April 4, 2025, in order to allow sufficient time for Shareholders to receive and review the Meeting materials and return the proxy form

or voting instruction form before the proxy deadline. Beneficial Shareholders may request a paper copy by going online at www.proxyvote.com or by calling toll-free at 1-877-907-7643 and entering the control number located on the voting instruction form and following the instructions provided.

Shareholders who are unable to attend the Meeting are requested to complete, date and sign the form of proxy (or voting instruction form, as applicable) and return it to Odyssey Trust Company, Attention: Proxy Department, Trader's Bank Building, 702 - 67 Yonge Street, Toronto, Ontario, M5E 1J8, so that it is received no later than 11:30 a.m. (Mountain Time) on April 22, 2025, or, if the Meeting is adjourned or postponed, no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Meeting.

If you are a registered Shareholder and you (i) do not wish to receive our annual integrated report next year; or (ii) wish to receive interim reports, please fill out and return the form for registered Shareholders included in the Meeting materials. If you are a beneficial Shareholder and returned last year’s form requesting a copy of our annual or interim reports, you will be asked again this year whether you wish to receive these documents for 2025. If you would like to receive these documents, please fill out and return the form for beneficial Shareholders included in the Meeting materials.

You will find additional information regarding our business in our AIF for the fiscal year ended Dec. 31, 2024, and our financial information is provided in our audited consolidated financial statements and accompanying MD&A for the fiscal year ended Dec. 31, 2024. Copies of these documents along with our other public documents are available on our website at www.transalta.com, on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

The meeting materials will also be available on the Company's website at https://transalta.com/investor-centre/reports-and-filings on or about March 25, 2025.

Communicating with the Board

Our Board values open dialogue and welcomes advice from our Shareholders. Our Board has adopted a Shareholder Engagement Policy that is intended to encourage and facilitate Shareholders expressing their views on strategic, governance and other matters directly to the Board. Our Board also encourages Shareholder participation at our annual Shareholder meetings. Further details about our Shareholder Engagement Policy and our Shareholder engagement practices are discussed beginning on page

88 under “Governance – Shareholder Engagement”. At the Meeting, registered Shareholders and duly appointed proxyholders (including beneficial Shareholders who have duly appointed themselves as proxyholders) will be able to ask questions of the Chair of the Board as well as our President and Chief Executive Officer. In between Shareholder meetings, the Company supports an open

and transparent process for Shareholders to contact the Board, including the chairs of the Board committees, through the office of the Corporate Secretary or at the email listed below.

Shareholders may communicate directly with the Board or any Board members by directing their correspondence to the Board by mail or by email as follows by marking it “Confidential – Board – Shareholder Engagement”:

Corporate Secretary

TransAlta Corporation

Suite 1400, 1100 1 St SE

Calgary, Alberta T2G 1B1

or:

corporate_secretary@transalta.com

Reporting Concerns

The Board, through the oversight of the Audit, Finance and Risk Committee (AFRC) and Human Resources Committee (HRC), has established several options for employees, contractors, Shareholders, suppliers and other stakeholders to report any accounting irregularities, ethical violations or any other matters they wish to bring to the attention of the Board. The AFRC or HRC, as applicable, may be contacted by:

+Web page (internet portal) at www.transalta.com/ethics-helpline; or

+A confidential, anonymous voicemail on TransAlta’s Ethics Helpline at 1-855-374-3801 (Canada/United States) and 1-800-40-5308 (Australia); or

+Mail addressed to:

+

|

|

|

|

|

|

|

|

|

|

Internal Audit

TransAlta Corporation

Suite 1400, 1100 1 St SE

Calgary, Alberta

T2G 1B1

|

or |

Chair of the AFRC/HRC

Subject Matter “004”

TransAlta Corporation

Suite 1400, 1100 1 St SE

Calgary, Alberta

T2G 1B1

|

+Further details about our Whistleblower Policy are discussed beginning on page

52 under “Governance – Our Ethical Commitment – Whistleblower Procedures”.

|

|

|

|

|

|

| 2025 Management Proxy Circular |

11 |

Shareholder Proposals

The Canada Business Corporations Act (CBCA) permits eligible Shareholders to submit shareholder proposals for consideration at each annual meeting of Shareholders. A proposal may be submitted by Shareholders to the Company for inclusion in the Proxy Circular in connection with the 2026 annual

meeting of Shareholders during the period of Nov. 25, 2025, to Jan. 24, 2026. Please refer to the CBCA and the regulations for details about how to submit a proposal and eligibility criteria for a proposal. All proposals must be sent by registered mail to:

TransAlta Corporation

Attention: Corporate Secretary

Suite 1400, 1100 1 St SE

Calgary, Alberta T2G 1B1

We have not received any shareholder proposals for consideration at the Meeting.

How to Vote

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Voting Method |

|

Vote at the Meeting |

|

Vote by Mail |

|

Vote by Internet |

|

|

Registered Shareholders

If your shares are registered in your own name.

|

|

Online ballot will be available at the Meeting. |

|

Complete, date and sign the proxy in accordance with the instructions included on the proxy, and return the completed proxy in the envelope provided. |

|

Access the website https://vote.odysseytrust.com and follow the instructions; refer to the proxy sent to you for the 15 digit control number, located on the back in the lower left corner of the proxy, and convey your voting instructions electronically over the internet. |

|

|

Beneficial Shareholders

If your shares are held with a broker, bank or other intermediary.

|

|

Must preregister as proxyholder before the Meeting. See further information below. |

|

Follow the instructions on the Voting Instruction Form provided by your intermediary. |

|

Follow the instructions for internet voting on the Voting Instruction Form provided by your intermediary. |

|

Voting at the Meeting

Registered Shareholders and duly appointed proxyholders (including beneficial Shareholders who have duly appointed themselves as proxyholders) who attend the Meeting online will be able to listen to the Meeting, ask questions and vote at the Meeting by completing a ballot that will be made available online during the Meeting, all in real time, provided that they are connected to the internet. Non-registered (beneficial) Shareholders who have not duly appointed themselves as proxyholder will not be able to vote or communicate at the Meeting. This is because the Company and our transfer agent, Odyssey, do not have a record of the non-registered Shareholders, and, as a result, have no knowledge of non-registered shareholdings or entitlements to vote unless non-registered Shareholders appoint themselves as proxyholder.

If you are a registered Shareholder and wish to appoint a third-party proxyholder to vote on your behalf at the Meeting, you must appoint such proxyholder by inserting their name in the space provided on the form of proxy sent to you and follow all of the instructions therein, within the prescribed deadline. Registered Shareholders wishing to appoint a third-party proxyholder (other than the TransAlta representative proxyholders indicated on the form of proxy) must also register their proxyholders by emailing appointee@odysseytrust.com. Please provide the name of the appointee, their email contact information and the amount of the appointment shares.

If you are a non-registered Shareholder and wish to vote at the Meeting, you must first appoint yourself as proxyholder by inserting your own name in the space provided on the voting instruction form sent to you and following all of the applicable instructions, within the prescribed deadline, provided by your intermediary and then registering yourself as proxyholder by emailing appointee@odysseytrust.com. Please provide the name of the appointee, their email contact information, the amount of the appointment shares and the intermediary that the shares are held with. After you register, Odyssey will provide you with a control number via email. If your voting instruction form does not provide a space for you to insert the name of your proxyholder, you may need to obtain a legal proxy and submit and deliver it to the Company or its registrar and transfer agent, Odyssey, before the proxy deadline.

In all cases, all proxies must be received and all proxyholders must be registered before 11:30 a.m. (Mountain Time) on April 22, 2025, or, in the case of an adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the adjourned or postponed Meeting in order to participate and vote at the Meeting.

The Meeting will be held in a virtual-only format and can be accessed by logging in online at https://meetings.lumiconnect.com/ 400-164-661-424. We recommend that you log in at least 15 minutes before the Meeting begins.

+Click “Login” and then enter your control number (see below) and password “transalta2025” (case sensitive); OR

+Click “Guest” and then complete the online form.

If you are a registered Shareholder, you can log into the Meeting online using the control number located on the form of proxy or in the email notification that you received and the password “transalta2025” (case sensitive). If you duly appoint and register a third-party proxyholder, Odyssey will provide such proxyholder with a control number by email after the proxy voting deadline has passed. Registration of third-party proxyholders as described above is an additional step that must be completed in order for proxyholders to attend and participate at the Meeting. Without a control number, proxyholders will not be able to ask questions or vote at the Meeting but will be able to listen in as a guest.

|

|

|

|

|

|

| 2025 Management Proxy Circular |

13 |

The Meeting will be available through an HTML client for mobile web and compatible with the latest versions of Chrome, Microsoft Edge and Safari. If you are having technical difficulties in joining the Meeting or participating during the Meeting, there will be live chat or support on the Lumi Global meeting platform that can assist with inquiries. It is also recommended that you obtain live event support by contacting our transfer agent and registrar, Odyssey, at 1-888-290-1175. If you continue to experience issues after following the advice given, please contact support@lumiglobal.com or “raise a ticket”. When you contact support at Lumi Global, please ensure you have the following information available in order for Lumi Global to help you as quickly as possible: Event Name, Meeting ID, Username, Control Number, Issue.

If you attend the Meeting online, it is important that you remain connected to the internet at all times during the

Meeting in order to vote when balloting begins. It is your responsibility to ensure connectivity for the duration of the Meeting. You should allow ample time to check into the Meeting online and complete the required procedure. If you have questions regarding your ability to participate in or vote at the Meeting, please contact Odyssey at 1-888-290-1175.

If you do not wish to vote at the Meeting, please refer to the Meeting materials (which are also accessible electronically) for information on how to vote by appointing a proxyholder, submitting a proxy or, in the case of a non-registered Shareholder, through an intermediary. Voting by proxy is the easiest way to vote, as it enables someone else to vote on your behalf. Voting in advance of the Meeting is available via the means described in your proxy or voting instruction form and our Meeting materials.

Asking Questions at the Meeting

We will hold a live question and answer session to answer any question submitted during the Meeting. The following attendees will be able to submit questions:

+registered Shareholders;

+non-registered or beneficial Shareholders who have appointed themselves proxyholder as outlined in the Proxy Circular, and

+other duly appointed proxyholders.

Guests will not be able to submit questions during the Meeting.

To ask a question, please type your question into the chat function. Additional instructions on how to ask questions will be explained during the Meeting.

We encourage you to submit your questions in advance of the Meeting to Investor Relations by emailing investor_relations@transalta.com.

We are committed to transparent communication at our Meeting. Questions asked related to the business of the Meeting will be answered in the order received for each item of business.

Appointing a Proxyholder

Use the form of proxy to appoint a proxyholder. By appointing a proxyholder, you are giving someone else the authority to attend the Meeting and vote for you.

|

|

|

|

|

|

|

Questions?

Contact our registrar and

transfer agent,

Odyssey Trust Company,

at 1-888-290-1175

|

Please note that you can appoint anyone to be your proxyholder. This person does not need to be a Shareholder of TransAlta or one of the TransAlta representatives named in the proxy. To appoint somebody else as your proxyholder, insert the name of the person you wish to act as your proxyholder in the blank space provided and follow the instructions set out above to register your proxyholder by emailing appointee@odysseytrust.com. Please provide the name of the appointee, along with their email contact information and the amount of the appointment shares. Please indicate the way you wish to vote on each item of business. Your proxyholder must vote your shares in accordance with your instructions at the Meeting. Please ensure that the person you appoint is aware that they have been appointed and attends the Meeting by following the instructions set out above. If your proxyholder does not attend the Meeting, your shares will not be voted. |

If you returned your signed proxy and did not appoint anyone to be your proxyholder, John P. Dielwart, Chair of the Board, and John H. Kousinioris, President and Chief Executive Officer of TransAlta, have agreed to act as your proxyholder to vote for or against, as applicable, your shares at the Meeting in accordance with your instructions.

If you decide to appoint John P. Dielwart and John H. Kousinioris as your proxyholders, and do not indicate how you want to vote, they will vote as follows:

+FOR electing each of TransAlta’s 11 nominated directors;

+FOR reappointing Ernst & Young LLP as the auditors and authorizing the Board to fix their remuneration;

+FOR the non-binding advisory vote on our approach to executive compensation; and

+FOR the ordinary resolution approving the continuation of the Company's Amended and Restated Shareholder Rights Plan.

On any ballot that may be called for, the common shares represented by proxies in favour of management’s proxyholders named in the proxy or voting instruction form will be voted for, or voted against, as applicable, each of the matters outlined in the Notice of Annual and Special Meeting, in each case, in accordance with the specifications made by each Shareholder, and if a Shareholder specifies a choice with respect to any matter to be acted upon, the common shares will be voted accordingly. The proxy confers discretionary authority upon the named proxyholder in respect of amendments to or variations of matters identified in the Notice of Annual and Special Meeting and any other matters that may properly come before the Meeting or any adjournment or postponement thereof.

|

|

|

|

|

|

| 2025 Management Proxy Circular |

15 |

Changing Your Vote

You can change a vote you made by proxy provided such change is received before 11:30 a.m. (Mountain Time) on April 22, 2025, or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Meeting by either:

+submitting a new proxy that is dated later than the proxy previously submitted and mailing it to Odyssey Trust Company, Attention: Proxy Department, Trader's Bank Building, 702 - 67 Yonge Street, Toronto, Ontario M5E 1J8;

+voting again by telephone or the internet; or

+any other means permitted by applicable law.

You can revoke a vote you made by proxy by submitting by mail a notice of revocation executed by you or by your attorney, or, if the Shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized, to Odyssey Trust Company, Attention: Proxy Department, Trader's Bank Building, 702 - 67 Yonge Street, Toronto, Ontario, M5E 1J8. Your notice of revocation must be received before 11:30 a.m. (Mountain Time) on April 22, 2025, or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the adjourned or postponed Meeting. If a registered Shareholder votes during the Meeting, that will revoke any proxy they have given.

Additional Information for Beneficial Shareholders

You are a beneficial Shareholder if your common shares are registered in the name of an intermediary and your certificate is held with a bank, trust company, securities broker, trustee or other institution (each, an “Intermediary”). TransAlta common shares beneficially owned by a beneficial Shareholder are registered either: (i) in the name of an Intermediary that the beneficial Shareholder deals with in respect of the TransAlta common shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (ii) in the name of a clearing agency (such as CDS Clearing and Depository Services Inc.), of which the Intermediary is a participant.

The Company has distributed copies of the Notice-and-Access notification to the Intermediaries and clearing agencies for distribution to beneficial Shareholders. The Company will pay for an Intermediary to deliver the Notice-and-Access notification (and printed copies of the Meeting materials, if requested) to objecting beneficial Shareholders.

If you are a beneficial Shareholder, your package includes a voting instruction form. Beneficial Shareholders should carefully follow the instructions provided in the voting instruction form by using one of the methods described to vote their TransAlta common shares. The voting instruction form is similar to a form of proxy; however, it can only instruct the registered Shareholder how to vote your shares.

As the Beneficial Shareholder, You May:

Option 1. Vote through your Intermediary

If you wish to vote through your Intermediary, follow the instructions on the voting instruction form provided by your Intermediary. Your Intermediary is required to ask for your voting instructions before the Meeting. Please contact your Intermediary if you did not receive a voting

instruction form. Alternatively, you may receive from your Intermediary a pre-authorized proxy indicating the number of common shares to be voted, which you should complete, sign, date and return as directed on the proxy.

Option 2. Vote at the meeting or by proxy

We do not have access to the names or holdings of our non-registered Shareholders. That means you can only vote your common shares at the Meeting if you have previously appointed yourself as the proxyholder for your common shares. If you wish to vote at the Meeting, appoint yourself as your proxyholder by writing your name in the space provided on the proxy or voting instruction form provided by your Intermediary and following the instructions under “How to Vote – Voting at the Meeting” above to register yourself as proxyholder. Do not complete the voting section on the proxy or voting instruction form as your vote will be taken at the Meeting. Return the proxy or voting instruction form to your Intermediary in the envelope provided. You may also appoint someone else as the proxyholder for your common shares by printing their name in the space in the proxy or voting instruction form provided by your Intermediary, submitting it as directed on the form and following the instructions under “How to Vote – Voting at the Meeting” above to register that person as your proxyholder. Your vote, or the vote of your proxyholder, will be taken and counted at the Meeting.

Your proxyholder must vote your shares in accordance with your instructions at the Meeting. Please ensure that the person you appoint is aware that they have been appointed and attends the Meeting. If your proxyholder does not attend the Meeting, your shares will not be voted. The proxy or voting instruction form confers discretionary authority upon the named proxyholder in respect of amendments to or variations of matters identified in the Notice of Meeting and any other matters that may properly come before the Meeting or any adjournment or postponement thereof.

Please note that if you are a US beneficial Shareholder and you wish to attend the Meeting and vote your shares, you must follow the instructions on the back of your proxy or voting instruction form to obtain a legal proxy. Once you have received your legal proxy, you will need to submit and deliver it to the Company or its registrar and transfer agent, Odyssey, before the proxy deposit date in order to vote your shares.

Option 3. Vote by telephone or the internet

If you wish to vote by telephone or the internet, follow the instructions for telephone or internet voting on the proxy or voting instruction form provided by your Intermediary.

TransAlta may use the Broadridge QuickVote™ service to assist beneficial Shareholders with voting their common shares over the telephone.

|

|

|

|

|

|

| 2025 Management Proxy Circular |

17 |

Changing Your Vote

If you have voted through your Intermediary and would like to change or revoke your vote, contact your Intermediary to discuss whether this is possible and what procedures you need to follow. The change or revocation of voting instructions by a beneficial Shareholder can

take several days or longer to complete and, accordingly, any such action should be completed well in advance of the deadline prescribed in the proxy or voting instruction form by the Intermediary or its service company to ensure it is given effect in respect of the Meeting.

Deadline for Voting

Whether beneficial Shareholders vote by mail, telephone or the internet, your voting instructions or legal proxy must be received by our transfer agent, Odyssey, or the Company or its agents, by no later than 11:30 a.m. (Mountain Time) on April 22, 2025, or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the adjourned or postponed Meeting. All required voting instructions must be submitted to your Intermediary sufficiently in advance

of this deadline to allow your Intermediary time to forward this information to our transfer agent, Odyssey, or the Company or its agents, before the proxy voting deadline. The time limit for the deposit of proxies may be waived or extended by the Chair of the Meeting, without notice. We reserve the right to accept late proxies and to waive the proxy cut-off deadline, with or without notice, but we are under no obligation to accept or reject any particular late proxy (or voting instruction form).

Business of the Meeting

There are six items of business to be considered at the Meeting, with items 1, 3, 4 and 5 noted below requiring a vote:

|

|

|

|

|

|

|

|

|

|

|

|

| Page |

Items of Business |

Recommendation |

|

1. Election of Directors |

a |

FOR |

|

2. Financial Statements |

|

— |

|

3. Reappointment of Auditors |

a |

FOR |

|

4. Advisory Vote on Executive Compensation |

a |

FOR |

|

5. Renewal of Shareholder Rights Plan |

a |

FOR |

|

6. Other Business |

|

— |

Item of Business 1: Election of Directors

TransAlta’s Articles of Amalgamation (the “Articles”) allow the Company to have not less than three and not more than 19 directors. Our Board considers annually the number of directors required.

The Board has determined that between nine and 14 directors are currently required in order to provide for effective decision-making, staffing of Board committees and to address succession planning requirements.

Nominees

Each of the director nominees has indicated their willingness to serve as a director. Each of the proposed nominees, with the exception of John H. Kousinioris, President and Chief Executive Officer, is “independent” within the meaning of National Instrument 58-101 – Disclosure of Corporate Governance Practices.

If elected, each director will serve until the next annual meeting of Shareholders or until their successor is elected or appointed. Our directors are elected annually, individually and by majority vote. Our majority voting policy is described under “Our Policy on Majority Voting” below. We believe our Board should reflect the right balance between those directors who have the skills and experience necessary to ensure our business and strategies can be executed upon and those who have the technical, industry, operating, financial, business and other competencies to maximize effective decision-making.

A skills and expertise matrix outlining the combined skills and expertise of our director nominees is included below under “Skills Matrix” on page

36 of this Proxy Circular. We also strive to maintain a diversity of experiences and perspectives on our Board, taking into consideration our skills matrix and our Board and Workforce Diversity Policy, which is described under “Governance – Board Characteristics – Diversity” on page

60 of this Proxy Circular.

|

|

|

|

|

|

| 2024 Management Proxy Circular |

19 |

The directors being nominated for election at the Meeting in 2025 are:

+Brian Baker

+John P. Dielwart

+Alan J. Fohrer

+Laura W. Folse

+John H. Kousinioris

+Candace J. MacGibbon

+Thomas M. O’Flynn

+Bryan D. Pinney

+James Reid

+Manjit K. Sharma

+Sandra R. Sharman

|

|

|

|

|

|

| a |

Vote FOR the TransAlta director nominees on the proxy today. The Board recommends a vote FOR all 11 director nominees. Unless otherwise instructed, the persons designated in the proxy intend to vote FOR each of the 11 director nominees listed above. |

The biographies of our nominees for election to the Board are provided in the following section.

|

|

|

|

|

|

|

Relevant Skills and Qualifications

+Operating Partner in Brookfield Asset Management's Infrastructure Group, working primarily with Brookfield's Midstream operating companies to set strategic direction, manage risk and support growth initiatives.

+Since joining Brookfield in 2007, has held several senior roles across Brookfield's Infrastructure Group, including heading investment activities in Europe and North America for over a decade where he oversaw acquisitions in the Data Infrastructure, Transportation, Utilities and Midstream sectors.

+One of two Brookfield nominees to the Board pursuant to the Investment Agreement (as defined below) between TransAlta and an affiliate of Brookfield discussed under “Governance – Board Characteristics – Independence of Directors”.

+Currently serves as Chair of the Board of Inter Pipeline Ltd., as well as serving in director roles for Rockpoint Gas Storage and NorthRiver Midstream Inc., all three of which are energy infrastructure companies located in western Canada.

+Bachelor of Commerce degree from the University of Calgary, with Distinction.

+Chartered Professional Accountant.

Mr. Baker brings to the Company and the Board extensive experience in strategic direction, risk management and growth. His background in infrastructure provides important insight to the Board. Accordingly, the Board recommends that Shareholders vote FOR Mr. Baker’s election to the Board.

|

|

Brian Baker(1)

Operating Partner, Infrastructure,

Brookfield Asset Management Inc.

Profile:

+Age: 54

+Residency: Alberta, Canada

+Director Since: Nominee

+Independent

Top Four Relevant Competencies:

+Accounting, Finance and Tax

+Electric Energy/Utility

+International Business

+Risk Management

|

|

|

|

|

|

|

| Prior Year’s Voting Results: Voting Results of 2024 Annual Meeting of Shareholders |

Votes For: N/A |

Votes Against: N/A |

|

|

|

|

|

|

|

|

|

|

|

|

Board/Committee Membership(4) |

Attendance |

Attendance Total |

Value of Compensation

Received in 2024

|

Board of Directors |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held as at December 31 of Respective Year |

| Year |

Common Shares |

Deferred Share Units |

Total |

Market Value(2) |

Share Ownership Requirement(3) |

| 2024 |

N/A |

N/A |

N/A |

N/A |

N/A(6) |

|

|

|

|

|

|

| Other Public Board Directorships and Committee Memberships |

| Company: |

None |

| Committee: |

None |

| Public Board Interlocks: |

None |

|

|

|

|

|

|

| 2025 Management Proxy Circular |

21 |

|

|

|

|

|

|

|

Relevant Skills and Qualifications

+Chair of the Board.

+Former Chief Executive Officer of ARC Resources Ltd., overseeing the growth of ARC Resources Ltd. from a startup in 1996 to a company with a total capitalization of approximately $10 billion at the time of his retirement.

+Former Vice-Chair and current Partner in ARC Financial Corp. ARC Financial is Canada’s leading energy-focused private equity manager. Mr. Dielwart remained as Partner and a member of ARC Financial’s Investment Committee after his resignation from the Board of Directors of ARC Financial in 2020 and is currently representing ARC Financial on the Board of Directors of Aspenleaf Energy Limited.

+Former Chair of the Board of Governors of the Canadian Association of Petroleum Producers.

+Bachelor of Science with distinction (civil engineering) from the University of Calgary and a member of the Association of Professional Engineers and Geoscientists of Alberta.

The Board believes that Mr. Dielwart is a diligent, independent director who provides the Company with a wealth of experience in leadership, finance and entrepreneurship along with a strong understanding of the commodity markets in which we operate, specifically the oil and gas markets. Accordingly, the Board recommends that Shareholders vote FOR Mr. Dielwart’s re-election to the Board.

|

|

John P. Dielwart(1)

Corporate Director

Profile:

+Age: 72

+Residency: Alberta, Canada

+Director Since: 2014

+Independent

Top Four Relevant Competencies:

+Engineering and Technical

+ESG/Sustainability/Climate Change

+HR/Executive Compensation

+Risk Management

|

|

|

|

|

|

|

| Prior Year’s Voting Results: Voting Results of 2024 Annual Meeting of Shareholders |

Votes For: 187,971,087 (99.50%) |

Votes Against: 952,208 (0.50%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

Attendance |

Attendance Total |

Value of Compensation

Received in 2024

|

| Board of Directors (Chair of the Board) |

6 of 6 |

100.0% |

$331,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held as at December 31 of Respective Year |

| Year |

Common Shares |

Deferred Share Units |

Total |

Market Value(2) |

Share Ownership Requirement(3) |

| 2024 |

60,109 |

164,005 |

224,114 |

$4,249,201 |

Meets |

| 2023 |

49,988 |

146,163 |

196,151 |

$2,122,354 |

| 2022 |

40,279 |

129,756 |

170,035 |

$2,137,340 |

|

|

|

|

|

|

| Other Public Board Directorships and Committee Memberships |

| Company: |

Veren Inc. |

| Committee: |

Reserves; Environmental, Health and Safety (Chair) |

| Public Board Interlocks: |

None |

|

|

|

|

|

|

|

Relevant Skills and Qualifications

+Former Chair and Chief Executive Officer of Southern California Edison Company, a subsidiary of Edison International (“Edison”), one of the largest electric utilities in the United States.

+Former President and Chief Executive Officer of Edison Mission Energy, a former subsidiary of Edison that owned and operated independent power facilities and restructured a number of international projects, which enhanced the value of the assets sold in subsequent years during his tenure at Edison Mission Energy.

+Former Vice-President, Senior Vice-President, Executive Vice-President and Chief Financial Officer of both Edison and Southern California Edison from 1991 to 2000, and retired in 2010 after 37 years with Edison.

+Independent member of the Board of Directors of TXNM Energy, Inc. (previously PNM Resources, Inc.), a publicly traded energy holding company.

+A member of the Viterbi School of Engineering Board of Councilors for the University of Southern California and on the Board of the California Science Center Foundation.

+Former director of the Institute of Nuclear Power Operations, the California Chamber of Commerce, Duratek, Inc., Osmose Utilities Services, Inc., MWH, Inc., Blue Shield of California and Synagro.

+Master of Science in civil engineering from the University of Southern California, Los Angeles and Master of Business Administration from California State University in Los Angeles.

Mr. Fohrer brings to the Company and the Board experience in accounting, finance, dam safety and the power industry from both a regulated and unregulated market perspective. Accordingly, the Board recommends that Shareholders vote FOR Mr. Fohrer’s re-election to the Board.

|

|

Alan J. Fohrer

Corporate Director

Profile:

+Age: 74

+Residency: California, United States

+Director Since: 2013

+Independent

Top Four Relevant Competencies:

+Accounting, Finance and Tax

+Electric Energy/Utility

+Engineering and Technical

+International Business

|

|

|

|

|

|

|

| Prior Year’s Voting Results: Voting Results of 2024 Annual Meeting of Shareholders |

Votes For: 187,736,517 (99.37%) |

Votes Against: 1,186,602 (0.63%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

Attendance |

Attendance Total |

Value of Compensation

Received in 2024

|

| Board of Directors |

6 of 6 |

100.0% |

$221,000 |

| Audit, Finance and Risk Committee |

9 of 9 |

| Governance, Safety and Sustainability Committee |

4 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held as at December 31 of Respective Year |

| Year |

Common Shares |

Deferred Share Units |

Total |

Market Value(2) |

Share Ownership Requirement(3) |

| 2024 |

6,398 |

152,114 |

158,512 |

$3,005,388 |

Meets |

| 2023 |

6,398 |

140,347 |

146,745 |

$1,587,781 |

| 2022 |

6,398 |

129,677 |

136,075 |

$1,710,463 |

|

|

|

|

|

|

| Other Public Board Directorships and Committee Memberships |

| Company: |

TXNM Energy, Inc. |

| Committee: |

Audit and Ethics (Chair); Nominating and Governance |

| Public Board Interlocks: |

None |

|

|

|

|

|

|

| 2025 Management Proxy Circular |

23 |

|

|

|

|

|

|

|

Relevant Skills and Qualifications

+Former Chief Executive Officer of BP Wind Energy North America Inc., leading a business with over 500 employees and contractors that included 14 wind energy generation plants across eight states with an operating capacity of over 2.5 gigawatts.

+Former Executive Vice President, Science, Technology, Environment and Regulatory Affairs at BP p.l.c., leading the operational, scientific and technological programs within the multibillion dollar cleanup and restoration effort in response to the 2010 BP Macondo well explosion off the coast of Louisiana.

+Led the cleanup project team at BP consisting of over 45,000 people working across the US Gulf and Mexico, and successfully negotiated with federal, state and local government officials to implement and conclude the offshore and onshore cleanup efforts.

+Held numerous leadership roles with increasing responsibility and complexity within BP p.l.c.

+Former Board member for the Auburn University College of Arts and Sciences.

+Independent member of the Board of Directors of Pacolet Milliken, a private investment company operating in real estate and power and infrastructure.

+Former member of the American Wind Energy Association from 2016 to 2019.

+Master of Management in business from Stanford University, Master of Science in geology from the University of Alabama and Bachelor of Science in geology from Auburn University.

Ms. Folse brings to the Company and the Board experience in corporate risk management, large-scale crisis management, leveraging data analysis, leading large and complex organizations, and driving cultural change while realizing improvements in safety, operational and financial performance. Accordingly, the Board recommends that Shareholders vote FOR Ms. Folse’s re-election to the Board.

|

|

Laura W. Folse

Corporate Director

Profile:

+Age: 66

+Residency: Texas, United States

+Director Since: 2021

+Independent

Top Four Relevant Competencies:

+Electric Energy/Utility

+Engineering and Technical

+Risk Management

+Technology/Telecommunications/Cybersecurity

|

|

|

|

|

|

|

| Prior Year’s Voting Results: Voting Results of 2024 Annual Meeting of Shareholders |

Votes For: 187,808,261 (99.41%) |

Votes Against: 1,116,958 (0.59%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

Attendance |

Attendance Total |

Value of Compensation

Received in 2024

|

| Board of Directors |

6 of 6 |

100.0% |

$224,500 |

| Governance, Safety and Sustainability Committee |

4 of 4 |

| Investment Performance Committee (Chair) |

4 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held as at December 31 of Respective Year |

| Year |

Common Shares |

Deferred Share Units |

Total |

Market Value(2) |

Share Ownership Requirement(3) |

| 2024 |

— |

30,374 |

30,374 |

$575,891 |

On Track |

| 2023 |

— |

21,306 |

21,306 |

$230,531 |

| 2022 |

— |

12,805 |

12,805 |

$160,959 |

|

|

|

|

|

|

| Other Public Board Directorships and Committee Memberships |

Company: |

None |

| Committee: |

N/A |

| Public Board Interlocks: |

None |

|

|

|

|

|

|

|

Relevant Skills and Qualifications

+President and Chief Executive Officer of the Company.

+Former Chief Operating Officer of the Company, overseeing operations, shared services, commercial, trading, customer solutions, hedging and optimization.

+Former Chief Growth Officer and Chief Legal and Compliance Officer of the Company.

+Former President of TransAlta Renewables Inc. until Feb. 5, 2021.

+Former partner and co-head of the corporate commercial department at Bennett Jones LLP with 30 years of experience in securities law, mergers and acquisitions and corporate governance matters.

+Chair of the Board of Governors of Bow Valley College and a member of the Board of Directors of the Calgary Stampede Foundation.

+Bachelor of Arts degree in honours business administration from the University of Western Ontario, Master of Business Administration degree from York University, Bachelor of Laws degree from Osgoode Hall Law School at York University, and completion of the Advanced Management Program at Harvard University.

As President and Chief Executive Officer of the Company, Mr. Kousinioris is responsible for the overall stewardship of the Company, including providing strategic leadership. Mr. Kousinioris has demonstrated outstanding vision and leadership with an unwavering commitment to the Company’s long-term success. Accordingly, the Board recommends that Shareholders vote FOR Mr. Kousinioris’ re-election to the Board.

|

|

John H. Kousinioris(1)

President and Chief Executive Officer of the Company

Profile:

+Age: 60

+Residency: Alberta, Canada

+Director Since: 2021

+Non-Independent

Top Four Relevant Competencies:

+Electric Energy/Utility

+ESG/Sustainability/Climate Change

+Legal and Regulatory

+M&A/Organizational Change

|

|

|

|

|

|

|

| Prior Year’s Voting Results: Voting Results of 2024 Annual Meeting of Shareholders |

Votes For: 187,992,591 (99.51%) |

Votes Against: 930,548 (0.49%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

Attendance |

Attendance Total |

Value of Compensation

Received in 2024

|

| Board of Directors |

6 of 6 |

100.0% |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held as at December 31 of Respective Year |

| Year |

Common Shares |

Share Units |

Total |

Market Value(2) |

Share Ownership Requirement(3) |

| 2024 |

510,130 |

210,793(7) |

720,923 |

$13,668,700 |

Meets(8) |

| 2023 |

387,570 |

174,688(7) |

562,258 |

$6,083,632 |

| 2022 |

291,088 |

138,451(7) |

429,539 |

$5,399,305 |

|

|

|

|

|

|

| Other Public Board Directorships and Committee Memberships |

| Company: |

None |

| Committee: |

N/A |

| Public Board Interlocks: |

None |

|

|

|

|

|

|

| 2025 Management Proxy Circular |

25 |

|

|

|

|

|

|

|

Relevant Skills and Qualifications

+Former Chief Executive Officer and Director of INV Metals Inc., a TSX-listed mining company, from 2015 to 2021, where she was responsible for determining and implementing corporate strategy.

+Former President and Chief Financial Officer of INV Metals Inc. from 2008 to 2015, in which role she was responsible for financial and regulatory reporting and for the company’s treasury, financial strength and investment policy.

+Previously held roles within global mining institutional equity sales with RBC Capital Markets and in base metals research as an equity research associate with BMO Capital Markets.

+Former manager at Deloitte LLP and cost analyst with Inco Limited.

+Board member of Osisko Gold Royalties and member of Osisko Gold Royalties Audit and Human Resources committees.

+President-elect of the Canadian Institute of Mining, Petroleum and Metallurgy.

+Chartered Professional Accountant with over 25 years’ experience in the mining sector and capital markets.

+Bachelor of Arts in economics from the University of Western Ontario and a Diploma in Accounting from Sir Wilfred Laurier University, and holds the ICD.D Directors designation.

Ms. MacGibbon was nominated as a director because of her financial expertise and ability to serve on the Audit, Finance and Risk Committee. She brings to the Board attributes and skills focused on leadership, collaboration and integrity as demonstrated through her prior successful senior leadership roles, including as a chief executive officer and a chief financial officer of INV Metals Inc. She also brings a focus on delivering results, which is complemented by her expertise in strategy, risk management, finance and accounting. Accordingly, the Board recommends that Shareholders vote FOR Ms. MacGibbon’s election to the Board.

|

|

Candace J. MacGibbon(1)

Corporate Director

Profile:

+Age: 50

+Residency: Ontario, Canada

+Director Since: 2023

+Independent

Top Four Relevant Competencies:

+Accounting, Finance and Tax

+International Business

+M&A/Organizational Change

+Risk Management

|

|

|

|

|

|

|

| Prior Year’s Voting Results: Voting Results of 2024 Annual Meeting of Shareholders |

Votes For: 187,620,471 (99.31%) |

Votes Against: 1,304,768 (0.69%) |

|

|

|

|

|

|

|

|

|

|

|

|

Board/Committee Membership(9) |

Attendance |

Attendance Total |

Value of Compensation

Received in 2024

|

| Board of Directors |

5 of 6 |

95.2% |

$201,000 |

| Audit, Finance and Risk Committee |

9 of 9 |

| Governance, Safety and Sustainability Committee |

2 of 2 |

| Human Resources Committee |

4 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held as at December 31 of Respective Year |

| Year |

Common Shares |

Deferred Share Units |

Total |

Market Value(2) |

Share Ownership Requirement(3) |

| 2024 |

5,383 |

28,489 |

33,872 |

$642,213 |

Meets |

| 2023 |

— |

11,068 |

11,068 |

$119,756 |

| 2022 |

— |

— |

— |

N/A |

|

|

|

|

|

|

| Other Public Board Directorships and Committee Memberships |

| Company: |

Osisko Gold Royalties Ltd. |

| Committees: |

Audit and Risks; Human Resources |

| Public Board Interlocks: |

None |

|

|

|

|

|

|

|

Relevant Skills and Qualifications

+Former CEO and Chief Investment Officer, AES Infrastructure Advisors.

+Former Executive Vice President and CFO, Head of US Renewables at AES Corporation, being responsible for all aspects of global finance and M&A teams across six global regions, helping to lead AES through a significant transformation, including strategic exits of non-core markets, that resulted in improved financial stability and allowed for the redeployment of cash to primary growth markets during his tenure, and being a key driver in initiating a major transition to renewables and green energy to significantly improve AES’s growth profile and reduce its carbon footprint. Directly managed AES’s US renewables business. AES’s total shareholder return increased 54 per cent during his tenure and its credit rating improved significantly.

+Lead Operating Director of Dimension Renewable Energy, a community solar company.

+Operating Director of Exus Management Partners, a renewables management and development company.

+Director of Nexus Water Group, a water utility company.

+Former Senior Advisor with Energy Impact Partners, a private energy technology fund investing in high-growth companies in the energy, utility and transportation industries.

+Former CFO of Powin Energy, a battery energy storage company in which Energy Impact Partners is a significant investor.

+Former Senior Advisor, Power and Utility Sector at the Blackstone Group Inc. and former chief operating officer and CFO of Transmission Developers Inc., a Blackstone-controlled entity that develops innovative power transmission projects in an environmentally responsible manner.

+Former Executive Vice President and CFO at Public Service Enterprise Group Inc. and former Head of North American Power at Morgan Stanley.

+Bachelor of Arts in economics from Northwestern University and Master of Business Administration in finance from the University of Chicago.

+Former adjunct professor at Northwestern University for a master’s program at the Institute for Sustainability and Energy.

Mr. O’Flynn has demonstrated an ability to realize shareholder value through his significant senior executive experience at large electricity companies. He has led successful organizational transformations, including by focusing on acquisitions and greenfield development. Accordingly, the Board recommends that Shareholders vote FOR Mr. O’Flynn’s re-election to the Board.

|

|

Thomas M. O'Flynn

Corporate Director

Profile:

+Age: 65

+Residency: New Jersey, United States

+Director Since: 2021

+Independent

Top Four Relevant Competencies:

+Accounting, Finance and Tax

+Electric Energy/Utility

+M&A/Organizational Change

+Risk Management

|

|

|

|

|

|

|

| Prior Year’s Voting Results: Voting Results of 2024 Annual Meeting of Shareholders |

Votes For: 182,108,667 (96.39%) |

Votes Against: 6,814,452 (3.61%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

Attendance |

Attendance Total |

Value of Compensation

Received in 2024

|

| Board of Directors |

6 of 6 |

100.0% |

$216,602 |

| Audit, Finance and Risk Committee (Chair) |

9 of 9 |

| Investment Performance Committee |

4 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held as at December 31 of Respective Year |

| Year |

Common Shares |

Deferred Share Units |

Total |

Market Value(2) |

Share Ownership Requirement(3) |

| 2024 |

5,171 |

30,374 |

35,545 |

$673,933 |

Meets |

| 2023 |

5,171 |

21,306 |

26,477 |

$286,481 |

| 2022 |

5,171 |

12,805 |

17,976 |

$225,958 |

|

|

|

|