| For the fiscal year ended | Dec. 31, 2023 |

Commission file number | 001-15214 | ||||||||

| Title of each class | Trading Symbols | Name of each exchange | ||||||

| on which registered | ||||||||

| Common Shares, no par value | TAC | New York Stock Exchange | ||||||

| Common Share Purchase Rights | TAC | New York Stock Exchange | ||||||

☒ Annual information form |

☒ Audited annual financial statements |

||||

Yes x |

No o |

||||

Yes x |

No o |

||||

| Form | Registration No. | ||||

| S-8 | 333-72454 | ||||

| S-8 | 333-101470 | ||||

| S-8 | 333-236894 | ||||

| S-8 | 333-260935 | ||||

| F-10 | 333-271953 |

||||

| Year Ended Dec. 31 | 2023 | 2022 | ||||||||||||

| Audit Fees | $ | 3,206,475 | $ | 3,175,932 | ||||||||||

Audit-related fees(1) |

1,224,851 | 1,754,943 | ||||||||||||

| Tax fees | 5,850 | 66,050 | ||||||||||||

| All other fees | 39,025 | — | ||||||||||||

| Total | $ | 4,476,201 | $ | 4,996,925 | ||||||||||

| 13.1 | TransAlta Corporation Annual Information Form for the year ended Dec. 31, 2023 | |||||||

| 13.2 | Management’s Discussion and Analysis for the year ended Dec. 31, 2023 | |||||||

| 13.3 | Consolidated Audited Annual Financial Statements for the year ended Dec. 31, 2023 | |||||||

| 13.4 | Management’s Annual Report on Internal Control over Financial Reporting (included on page F2 of Exhibit 13.3 filed herewith) |

|||||||

| 23.1 | Consent of Independent Registered Public Accounting Firm | |||||||

| 31.1 | Certification of President and Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|||||||

| 31.2 | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|||||||

| 32.1 | Certification of President and Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|||||||

| 32.2 | Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|||||||

97 |

Executive Compensation Clawback Policy |

|||||||

| 101 | Interactive Data File (formatted as Inline XBRL) | |||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |||||||

| TRANSALTA CORPORATION | |||||

/s/ Todd J. Stack |

|||||

Todd J. Stack |

|||||

| Executive Vice-President, Finance and Chief Financial Officer | |||||

Dated: February 22, 2024 |

|||||

Credit Ratings |

|||||

Dividends |

|||||

Market for Securities |

|||||

2023 Revenues |

2022 Revenues |

|||||||

| Hydro | 16 | % | 20 | % | ||||

| Wind and Solar | 10 | % | 10 | % | ||||

| Gas | 45 | % | 41 | % | ||||

| Energy Transition | 22 | % | 24 | % | ||||

| Energy Marketing | 7 | % | 5 | % | ||||

| Facility Name | Province/ State | Nameplate Capacity (MW)(1) |

Consolidated Interest | Gross Installed Capacity(1) |

Ownership | Net Capacity Ownership Interest (MW)(1) |

Commercial Operation Date(2) |

Revenue Source(3) |

Contract Expiry Date(4) |

||||||||||||||||||||

Alberta - Bow River System |

|||||||||||||||||||||||||||||

Barrier(5)(6) |

AB | 13 | 100 | % | 13 | 100 | % | 13 | 1947 | Merchant | ‑ | ||||||||||||||||||

Bearspaw(5)(6) |

AB | 17 | 100 | % | 17 | 100 | % | 17 | 1954 | Merchant | ‑ | ||||||||||||||||||

Cascade(5)(6) |

AB | 36 | 100 | % | 36 | 100 | % | 36 | 1942, 1957 | Merchant | ‑ | ||||||||||||||||||

Ghost(5)(6) |

AB | 54 | 100 | % | 54 | 100 | % | 54 | 1929, 1954 | Merchant | ‑ | ||||||||||||||||||

Horseshoe(5)(6) |

AB | 14 | 100 | % | 14 | 100 | % | 14 | 1911 | Merchant | ‑ | ||||||||||||||||||

Interlakes(5)(6) |

AB | 5 | 100 | % | 5 | 100 | % | 5 | 1955 | Merchant | ‑ | ||||||||||||||||||

Kananaskis(5)(6) |

AB | 19 | 100 | % | 19 | 100 | % | 19 | 1913, 1951 | Merchant | ‑ | ||||||||||||||||||

Pocaterra(6) |

AB | 15 | 100 | % | 15 | 100 | % | 15 | 1955 | Merchant | ‑ | ||||||||||||||||||

Rundle(5)(6) |

AB | 50 | 100 | % | 50 | 100 | % | 50 | 1951, 1960 | Merchant | ‑ | ||||||||||||||||||

Spray(5)(6) |

AB | 112 | 100 | % | 112 | 100 | % | 112 | 1951, 1960 | Merchant | ‑ | ||||||||||||||||||

Three Sisters(5) |

AB | 3 | 100 | % | 3 | 100 | % | 3 | 1951 | Merchant | ‑ | ||||||||||||||||||

Alberta - Oldman River System |

|||||||||||||||||||||||||||||

Belly River(6) |

AB | 3 | 100 | % | 3 | 100 | % | 3 | 1991 | Merchant | ‑ | ||||||||||||||||||

St. Mary(6) |

AB | 2 | 100 | % | 2 | 100 | % | 2 | 1992 | Merchant | ‑ | ||||||||||||||||||

Taylor(6) |

AB | 13 | 100 | % | 13 | 100 | % | 13 | 2000 | Merchant | ‑ | ||||||||||||||||||

Waterton(6) |

AB | 3 | 100 | % | 3 | 100 | % | 3 | 1992 | Merchant | ‑ | ||||||||||||||||||

Alberta - North Saskatchewan River System(6) |

|||||||||||||||||||||||||||||

Bighorn(5)(6) |

AB | 120 | 100 | % | 120 | 100 | % | 120 | 1972 | Merchant | ‑ | ||||||||||||||||||

Brazeau(5)(6) |

AB | 355 | 100 | % | 355 | 100 | % | 355 | 1965, 1967 | Merchant | ‑ | ||||||||||||||||||

| BC Hydro | |||||||||||||||||||||||||||||

Akolkolex(6) |

BC | 10 | 100 | % | 10 | 100 | % | 10 | 1995 | LTC | 2046 | ||||||||||||||||||

Bone Creek(6) |

BC | 19 | 100 | % | 19 | 100 | % | 19 | 2011 | LTC | 2031 | ||||||||||||||||||

Pingston(6) |

BC | 45 | 50 | % | 22.5 | 100 | % | 23 | 2003, 2004 | LTC | 2043 | ||||||||||||||||||

Upper Mamquam(6) |

BC | 25 | 100 | % | 25 | 100 | % | 25 | 2005 | LTC | 2025 | ||||||||||||||||||

| Ontario Hydro | |||||||||||||||||||||||||||||

Misema |

ON | 3 | 100 | % | 3 | 100 | % | 3 | 2003 | LTC | 2027 | ||||||||||||||||||

Moose Rapids(6) |

ON | 1 | 100 | % | 1 | 100 | % | 1 | 1997 | LTC | 2030 | ||||||||||||||||||

Ragged Chute |

ON | 7 | 100 | % | 7 | 100 | % | 7 | 1991 | LTC | 2029 | ||||||||||||||||||

| Total Hydroelectric Capacity | 944 | 921.5 | 922 | ||||||||||||||||||||||||||

| Facility Name | Province/ State | Nameplate Capacity (MW)(1) |

Consolidated Interest | Gross Installed Capacity(1) |

Ownership | Net Capacity Ownership Interest (MW)(1) |

Commercial Operation Date(2) |

Revenue Source(3) |

Contract Expiry Date(4) |

||||||||||||||||||||

| Alberta Wind | |||||||||||||||||||||||||||||

Ardenville(5) |

AB | 69 | 100 | % | 69 | 100 | % | 69 | 2010 | Merchant | ‑ | ||||||||||||||||||

Blue Trail and Macleod Flats(5) |

AB | 69 | 100 | % | 69 | 100 | % | 69 | 2009 and 2004 | Merchant | ‑ | ||||||||||||||||||

Castle River(5)(6) |

AB | 44 | 100 | % | 44 | 100 | % | 44 | 1997‑2001 | Merchant | - | ||||||||||||||||||

Cowley North(5) |

AB | 20 | 100 | % | 20 | 100 | % | 20 | 2001 | Merchant | ‑ | ||||||||||||||||||

Garden Plain |

AB |

130 | 100 | % | 130 | 100 | % | 130 | 2023 | LTC |

2035-2041 |

||||||||||||||||||

McBride Lake(5) |

AB | 75 | 50 | % | 38 | 100 | % | 38 | 2004 | LTC | 2024 | ||||||||||||||||||

Oldman(5) |

AB | 4 | 100 | % | 4 | 100 | % | 4 | 2007 | Merchant | - | ||||||||||||||||||

Sinnott(5) |

AB | 7 | 100 | % | 7 | 100 | % | 7 | 2001 | Merchant | ‑ | ||||||||||||||||||

Soderglen(5) |

AB | 71 | 50 | % | 36 | 100 | % | 36 | 2006 | Merchant | ‑ | ||||||||||||||||||

Summerview 1(5) |

AB | 68 | 100 | % | 68 | 100 | % | 68 | 2004 | Merchant | ‑ | ||||||||||||||||||

Summerview 2 (5) |

AB | 66 | 100 | % | 66 | 100 | % | 66 | 2010 | Merchant | ‑ | ||||||||||||||||||

Windrise |

AB | 206 | 100 | % | 206 | 100 | % | 206 | 2021 | LTC | 2041 | ||||||||||||||||||

| Alberta Battery Energy Storage | |||||||||||||||||||||||||||||

WindCharger |

AB | 10 | 100 | % | 10 | 100 | % | 10 | 2020 | Merchant | ‑ | ||||||||||||||||||

| Eastern Canada Wind | |||||||||||||||||||||||||||||

Kent Breeze |

ON | 20 | 100 | % | 20 | 100 | % | 20 | 2011 | LTC | 2031 | ||||||||||||||||||

Kent Hills 1 |

NB | 96 | 100 | % | 96 | 83 | % | 80 | 2008 | LTC | 2045 | ||||||||||||||||||

Kent Hills 2 |

NB | 54 | 100 | % | 54 | 83 | % | 45 | 2010 | LTC | 2045 | ||||||||||||||||||

Kent Hills 3 |

NB | 17 | 100 | % | 17 | 83 | % | 14 | 2018 | LTC | 2045 | ||||||||||||||||||

Le Nordais(5)(7) |

QC | 98 | 100 | % | 98 | 100 | % | 98 | 1999 | LTC | 2033 | ||||||||||||||||||

Melancthon 1 |

ON | 68 | 100 | % | 68 | 100 | % | 68 | 2006 | LTC | 2031 | ||||||||||||||||||

Melancthon 2 |

ON | 132 | 100 | % | 132 | 100 | % | 132 | 2008 | LTC | 2028 | ||||||||||||||||||

New Richmond(5) |

QC | 68 | 100 | % | 68 | 100 | % | 68 | 2013 | LTC | 2033 | ||||||||||||||||||

Wolfe Island |

ON | 198 | 100 | % | 198 | 100 | % | 198 | 2009 | LTC | 2029 | ||||||||||||||||||

US Wind |

|||||||||||||||||||||||||||||

Antrim |

NH | 29 | 100 | % | 29 | 100 | % | 29 | 2019 | LTC | 2039 | ||||||||||||||||||

Big Level |

PA | 90 | 100 | % | 90 | 100 | % | 90 | 2019 | LTC | 2034 | ||||||||||||||||||

Lakeswind |

MN | 50 | 100 | % | 50 | 100 | % | 50 | 2014 | LTC | 2034 | ||||||||||||||||||

Skookumchuck Wind |

WA | 137 | 49 | % | 67 | 100 | % | 67 | 2020 | LTC | 2040 | ||||||||||||||||||

Wyoming Wind |

WY | 140 | 100 | % | 140 | 100 | % | 140 | 2003 | LTC | 2028 | ||||||||||||||||||

US Solar |

|||||||||||||||||||||||||||||

Mass Solar (7) |

MA | 21 | 100 | % | 21 | 100 | % | 21 | 2012-2015 | LTC | 2032-2045 | ||||||||||||||||||

North Carolina Solar(7) |

NC | 122 | 100 | % | 122 | 100 | % | 122 | 2019-2021 | LTC | 2033 | ||||||||||||||||||

Australian Solar |

|||||||||||||||||||||||||||||

Northern Goldfields(7) |

WA |

38 | 100 | % | 38 | 100 | % | 38 | 2023 | LTC |

2038 | ||||||||||||||||||

Australia Battery Energy Storage |

|||||||||||||||||||||||||||||

Northern Goldfields Battery |

WA |

10 | 100 | % | 10 | 100 | % | 10 | 2023 | LTC |

2038 | ||||||||||||||||||

Total Wind and Solar Capacity (8) |

2,227 | 2,085 | 2,057 | ||||||||||||||||||||||||||

| Facility Name | Type | Province/ State | Nameplate Capacity (MW)(1) |

Target Commercial Operation Date | Revenue Source | ||||||||||||

| US Facilities | |||||||||||||||||

Horizon Hill |

Wind | OK | 200 | Q1 2024 | LTC | ||||||||||||

White Rock |

Wind | OK | 300 | Q1 2024 | LTC | ||||||||||||

| Total Facilities Under Construction | 500 | ||||||||||||||||

| Facility Name | Province/ State | Nameplate Capacity (MW)(1) |

Consolidated Interest | Gross Installed Capacity(1) |

Ownership | Net Capacity Ownership Interest (MW)(1) |

Commercial Operation Date | Revenue Source(2) |

Contract Expiry Date(3) |

||||||||||||||||||||

| Alberta | |||||||||||||||||||||||||||||

Fort Saskatchewan(4) |

AB | 118 | 60 | % | 71 | 50 | % | 35 | 1999 | LTC/Merchant | 2029 | ||||||||||||||||||

Keephills Unit No. 2 |

AB | 395 | 100 | % | 395 | 100 | % | 395 | 1984 | Merchant | - | ||||||||||||||||||

| Keephills Unit No. 3 | AB | 463 | 100 | % | 463 | 100 | % | 463 | 2011 | Merchant | - | ||||||||||||||||||

Poplar Creek(5) |

AB | 230 | 100 | % | 230 | 100 | % | 230 | 2001 | LTC | 2030 | ||||||||||||||||||

Sheerness Unit No.1(4) |

AB | 400 | 50 | % | 200 | 50 | % | 100 | 1986 | Merchant | - | ||||||||||||||||||

Sheerness Unit No.2(4) |

AB | 400 | 50 | % | 200 | 50 | % | 100 | 1990 | Merchant | - | ||||||||||||||||||

Sundance Unit No. 6 |

AB | 401 | 100 | % | 401 | 100 | % | 401 | 1980 | Merchant | - | ||||||||||||||||||

| Total Alberta Gas Capacity | 2,407 | 1,960 | 1,724 | ||||||||||||||||||||||||||

Ontario and US |

|||||||||||||||||||||||||||||

Ada |

MI | 29 | 100 | % | 29 | 100 | % | 29 | 1991 | LTC | 2026 | ||||||||||||||||||

Ottawa(4) |

ON | 74 | 100 | % | 74 | 50 | % | 37 | 1992 | LTC/Merchant | 2033 | ||||||||||||||||||

Sarnia |

ON | 499 | 100 | % | 499 | 100 | % | 499 | 2003 | LTC | 2031 | ||||||||||||||||||

Windsor(4) |

ON | 72 | 100 | % | 72 | 50 | % | 36 | 1996 | LTC/Merchant | 2031 | ||||||||||||||||||

Total Ontario and US Gas Capacity |

674 | 674 | 601 | ||||||||||||||||||||||||||

| Australia | |||||||||||||||||||||||||||||

Fortescue River Gas Pipeline |

WA |

N/A | 100 | % | N/A | 43 | % | N/A | 2015 | LTC | 2035 | ||||||||||||||||||

Parkeston |

WA |

110 | 50 | % | 55 | 100 | % | 55 | 1996 | LTC/Merchant | 2026 | ||||||||||||||||||

South Hedland |

WA |

150 | 100 | % | 150 | 100 | % | 150 | 2017 | LTC |

2042 | ||||||||||||||||||

Southern Cross (6) |

WA |

245 | 100 | % | 245 | 100 | % | 245 | 1996 | LTC | 2038 | ||||||||||||||||||

Total Australian Gas Capacity |

505 | 450 | 450 | ||||||||||||||||||||||||||

Total Gas Capacity |

3,586 | 3,084 | 2,775 | ||||||||||||||||||||||||||

| Facility Name | Type | Province/ State | Nameplate Capacity (MW) |

Target Commercial Operation Date | Revenue Source | ||||||||||||

Mount Keith 132kV Expansion |

Transmission | WA | N/A |

Q1 2024 | LTC | ||||||||||||

| Facility Name | Province/ State | Nameplate Capacity (MW)(1) |

Consolidated Interest | Gross Installed Capacity(1) |

Ownership | Net Capacity Ownership Interest (MW)(1) |

Commercial Operation Date | Revenue Source | Contract Expiry Date | ||||||||||||||||||||

| US | |||||||||||||||||||||||||||||

| Centralia | WA | 670 | 100 | % | 670 | 100 | % | 670 | 1971 | LTC/Merchant | 2025 | ||||||||||||||||||

Skookumchuck(2) |

WA | 1 | 100 | % | 1 | 100 | % | 1 | 1970 | LTC | 2025 | ||||||||||||||||||

| Total Energy Transition Capacity | 671 | 671 | 671 | ||||||||||||||||||||||||||

| Mine or Operating Name/MSHA Identification Number |

Total Number of Section

104

Violations

for which

Citations

Received

|

Total Number of Orders Issued Under Section 104(b)) |

Total Number of Citations and Orders for Unwarrantable Failure to Comply with Mandatory Health or Safety Standards Under Section 104(d) |

Total Number of Flagrant Violations Under Section 110(b)(2) |

Total Number of Imminent Danger Orders Issued Under Section 107(a) |

Total Dollar

Value of

MSHA

Assessments

Proposed

|

Total

Number

of

Mining

Related

Fatalities

|

Received Notice of Pattern Violations Under Section 104(e) (yes/no) |

Received Notice of Potential to Have Pattern Under Section 104(e) (yes/no) |

Number of Legal

Actions Initiated or

Pending

During Period

|

||||||||||||||||||||||

| 4500416 | 10(1) |

0 | 0 | 0 | 0 | 1,430 (2) |

0 | No | No | 0 | ||||||||||||||||||||||

Number of shares (millions) |

|||||||||||

| As at | Feb. 22, 2024 | Dec. 31, 2023 | Dec. 31, 2022 | ||||||||

| Common shares issued and outstanding, end of period | 307.1 | 308.6 | 268.1 | ||||||||

| Preferred shares | |||||||||||

| Series A | 9.6 | 9.6 | 9.6 | ||||||||

| Series B | 2.4 | 2.4 | 2.4 | ||||||||

| Series C | 10.0 | 10.0 | 10.0 | ||||||||

| Series D | 1.0 | 1.0 | 1.0 | ||||||||

| Series E | 9.0 | 9.0 | 9.0 | ||||||||

| Series G | 6.6 | 6.6 | 6.6 | ||||||||

| Preferred shares issued and outstanding in equity | 38.6 | 38.6 | 38.6 | ||||||||

Series I - Exchangeable Securities |

0.4 | 0.4 | 0.4 | ||||||||

| Preferred shares issued and outstanding | 39.0 | 39.0 | 39.0 | ||||||||

Morningstar DBRS |

Moody's | S&P Global Ratings |

|||||||||

| Issuer Rating | BBB (low) | Not applicable | BB+ | ||||||||

| Corporate Family Rating | Not applicable | Ba1 | Not applicable | ||||||||

| Preferred Shares | Pfd-3 (low)(1) |

Not applicable | P-4(High) |

||||||||

| Unsecured Debt/MTNs | BBB (low) | Ba1/LGD4 | BB+ | ||||||||

| Rating Outlook | Stable | Stable | Stable | ||||||||

| Period | Dividend per Common Share | |||||||

| 2021 | First Quarter | $0.0450 | ||||||

| Second Quarter | $0.0450 | |||||||

| Third Quarter | $0.0450 | |||||||

| Fourth Quarter | $0.0500 | |||||||

| 2022 | First Quarter | $0.0500 | ||||||

| Second Quarter | $0.0500 | |||||||

| Third Quarter | $0.0500 | |||||||

| Fourth Quarter | $0.0550 | |||||||

| 2023 | First Quarter | $0.0550 | ||||||

| Second Quarter | $0.0550 | |||||||

| Third Quarter | $0.0550 | |||||||

| Fourth Quarter | $0.0550 | |||||||

2024 |

First Quarter(1) |

$0.0600 | ||||||

| Period | Dividend per Series A Share | |||||||

| 2021 | First Quarter | $0.16931 | ||||||

| Second Quarter | $0.17981 | |||||||

| Third Quarter | $0.17981 | |||||||

| Fourth Quarter | $0.17981 | |||||||

| 2022 | First Quarter | $0.17981 | ||||||

| Second Quarter | $0.17981 | |||||||

| Third Quarter | $0.17981 | |||||||

| Fourth Quarter | $0.17981 | |||||||

| 2023 | First Quarter |

$0.17981 | ||||||

| Second Quarter | $0.17981 | |||||||

| Third Quarter | $0.17981 | |||||||

| Fourth Quarter | $0.17981 | |||||||

2024 |

First Quarter(1) |

$0.17981 | ||||||

| Period | Dividend per Series B Share | |||||||

| 2021 | First Quarter | $0.13186 | ||||||

| Second Quarter | $0.13108 | |||||||

| Third Quarter | $0.13479 | |||||||

| Fourth Quarter | $0.13970 | |||||||

| 2022 | First Quarter | $0.13309 | ||||||

| Second Quarter | $0.16505 | |||||||

| Third Quarter | $0.22099 | |||||||

| Fourth Quarter | $0.33700 | |||||||

| 2023 | First Quarter |

$0.37991 | ||||||

| Second Quarter | $0.41100 | |||||||

| Third Quarter | $0.41545 | |||||||

| Fourth Quarter | $0.45288 | |||||||

2024 |

First Quarter(1) |

$0.43958 | ||||||

| Period | Dividend per Series C Share | |||||||

| 2021 | First Quarter | $0.25169 | ||||||

| Second Quarter | $0.25169 | |||||||

| Third Quarter | $0.25169 | |||||||

| Fourth Quarter | $0.25169 | |||||||

| 2022 | First Quarter | $0.25169 | ||||||

| Second Quarter | $0.25169 | |||||||

| Third Quarter | $0.36588 | |||||||

| Fourth Quarter | $0.36588 | |||||||

| 2023 | First Quarter |

$0.36588 | ||||||

| Second Quarter | $0.36588 | |||||||

| Third Quarter | $0.36588 | |||||||

| Fourth Quarter | $0.36588 | |||||||

2024 |

First Quarter(1) |

$0.36588 | ||||||

| Period | Dividend per Series D Share |

|||||||

| 2022 | Third Quarter | $0.28841 | ||||||

| Fourth Quarter | $0.40442 | |||||||

| 2023 | First Quarter |

$0.45578 | ||||||

Second Quarter |

$0.47769 | |||||||

Third Quarter |

$0.48287 | |||||||

| Fourth Quarter | $0.52030 | |||||||

| 2024 | First Quarter(1) |

$0.50609 | ||||||

| Period | Dividend per Series E Share | |||||||

| 2021 | First Quarter | $0.32463 | ||||||

| Second Quarter | $0.32463 | |||||||

| Third Quarter | $0.32463 | |||||||

| Fourth Quarter | $0.32463 | |||||||

| 2022 | First Quarter | $0.32463 | ||||||

| Second Quarter | $0.32463 | |||||||

| Third Quarter | $0.32463 | |||||||

| Fourth Quarter | $0.43088 | |||||||

| 2023 | First Quarter |

$0.43088 | ||||||

| Second Quarter | $0.43088 | |||||||

| Third Quarter | $0.43088 | |||||||

| Fourth Quarter | $0.43088 | |||||||

2024 |

First Quarter(1) |

$0.43088 | ||||||

| Period | Dividend per Series G Share | |||||||

| 2021 | First Quarter | $0.31175 | ||||||

| Second Quarter | $0.31175 | |||||||

| Third Quarter | $0.31175 | |||||||

| Fourth Quarter | $0.31175 | |||||||

| 2022 | First Quarter | $0.31175 | ||||||

| Second Quarter | $0.31175 | |||||||

| Third Quarter | $0.31175 | |||||||

| Fourth Quarter | $0.31175 | |||||||

| 2023 | First Quarter |

$0.31175 | ||||||

| Second Quarter | $0.31175 | |||||||

| Third Quarter | $0.31175 | |||||||

| Fourth Quarter | $0.31175 | |||||||

2024 |

First Quarter(1) |

$0.31175 | ||||||

| Price ($) | |||||||||||

| Month | High | Low | Volume | ||||||||

| 2023 | |||||||||||

| January | 13.64 | 11.85 | 10,563,874 | ||||||||

| February | 12.87 |

11.02 |

13,935,699 |

||||||||

| March | 11.93 |

10.60 |

14,287,018 |

||||||||

| April | 12.47 |

11.65 |

10,688,815 | ||||||||

| May | 13.48 |

12.04 |

12,229,463 |

||||||||

| June | 13.45 |

12.02 |

11,660,760 |

||||||||

| July | 13.68 |

11.54 |

11,732,249 | ||||||||

| August | 13.97 |

12.92 |

13,230,445 |

||||||||

| September | 13.24 |

11.76 |

14,112,624 |

||||||||

| October | 12.00 |

10.11 |

23,842,700 | ||||||||

| November | 11.68 |

10.02 |

17,583,646 | ||||||||

| December | 11.22 | 10.20 | 14,301,948 | ||||||||

| 2024 | |||||||||||

| January | 11.17 | 9.72 | 16,050,874 | ||||||||

February 1-22 |

9.89 | 9.16 | 8,843,459 | ||||||||

| Date of Issuance | Number of Securities(1)(2) |

Issue Price per Security | Description of Transaction | ||||||||

Dec. 10, 2010(1) |

12,000,000 Series A Shares | $25.00 | Public Offering | ||||||||

March 31, 2021(2) |

871,871 Series A Shares | N/A | Conversion of Series B Shares | ||||||||

| Price ($) | |||||||||||

| Month | High | Low | Volume | ||||||||

| 2023 | |||||||||||

| January | 14.17 | 13.11 | 57,996 | ||||||||

| February | 14.17 | 13.54 | 104,594 | ||||||||

| March | 13.95 | 12.81 | 123,624 | ||||||||

| April | 12.98 | 12.67 | 195,787 | ||||||||

| May | 12.99 | 12.30 | 55,875 | ||||||||

| June | 12.51 | 12.05 | 73,649 | ||||||||

| July | 12.30 | 12.00 | 80,427 | ||||||||

| August | 12.28 | 11.51 | 860,451 | ||||||||

| September | 11.95 | 11.52 | 100,471 | ||||||||

| October | 11.91 | 11.35 | 69,987 | ||||||||

| November | 12.67 | 11.67 | 94,725 | ||||||||

| December | 12.82 | 11.70 | 139,058 | ||||||||

| 2024 | |||||||||||

| January | 13.97 | 12.16 | 111,246 | ||||||||

February 1-22 |

14.30 | 13.33 | 58,871 | ||||||||

| Date of Issuance | Number of Securities(1)(2) |

Issue Price per Security | Description of Transaction | ||||||||

March 31, 2016(1) |

1,824,620 Series B Shares | N/A | Conversion of Series A Shares | ||||||||

March 31, 2021(2) |

1,417,338 Series B Shares | N/A | Conversion of Series A Shares | ||||||||

| Price ($) | |||||||||||

| Month | High | Low | Volume | ||||||||

| 2023 | |||||||||||

| January | 16.94 | 15.20 | 24,040 | ||||||||

| February | 16.95 | 16.20 | 19,346 | ||||||||

| March | 16.71 | 15.81 | 11,575 | ||||||||

| April | 16.29 | 15.32 | 6,438 | ||||||||

| May | 15.95 | 15.07 | 20,696 | ||||||||

| June | 15.34 | 14.90 | 32,390 | ||||||||

| July | 15.43 | 14.95 | 18,212 | ||||||||

| August | 15.43 | 14.83 | 68,244 | ||||||||

| September | 14.90 | 13.55 | 31,294 | ||||||||

| October | 15.00 | 13.60 | 76,142 | ||||||||

| November | 15.35 | 14.21 | 72,928 | ||||||||

| December | 15.40 | 14.25 | 83,476 | ||||||||

| 2024 | |||||||||||

| January | 16.23 | 14.34 | 85,144 | ||||||||

February 1-22 |

16.71 | 16.00 | 37,358 | ||||||||

| Date of Issuance | Number of Securities(1)(2) |

Issue Price per Security | Description of Transaction | ||||||||

Nov. 30, 2011(1) |

11,000,000 Series C Shares | $25.00 | Public Offering | ||||||||

June 30, 2022(2) |

9,955,701 Series C Shares | N/A | Conversion of Series D Shares | ||||||||

| Price ($) | |||||||||||

| Month | High | Low | Volume | ||||||||

| 2023 | |||||||||||

| January | 21.13 | 18.94 | 122,303 | ||||||||

| February | 20.89 | 19.87 | 33,135 | ||||||||

| March | 20.20 | 18.46 | 94,206 | ||||||||

| April | 19.00 | 18.60 | 56,167 | ||||||||

| May | 18.92 | 17.86 | 109,117 | ||||||||

| June | 18.78 | 17.92 | 33,155 | ||||||||

| July | 18.40 | 17.90 | 60,132 | ||||||||

| August | 18.32 | 17.32 | 76,745 | ||||||||

| September | 17.71 | 16.25 | 153,207 | ||||||||

| October | 16.88 | 15.88 | 84,963 | ||||||||

| November | 18.47 | 16.45 | 99,711 | ||||||||

| December | 18.14 | 17.45 | 89,476 | ||||||||

| 2024 | |||||||||||

| January | 18.68 | 17.85 | 105,265 | ||||||||

February 1-22 |

18.70 | 18.24 | 61,931 | ||||||||

| Date of Issuance | Number of Securities(1) |

Issue Price per Security | Description of Transaction | ||||||||

June 30, 2022(1) |

1,044,299 Series E Shares | N/A | Conversion of Series C Shares | ||||||||

| Price ($) | |||||||||||

| Month | High | Low | Volume | ||||||||

| 2023 | |||||||||||

January |

23.40 | 21.35 | 2,150 | ||||||||

February |

22.50 | 21.65 | 4,700 | ||||||||

March |

22.50 | 20.65 | 1,015 | ||||||||

April |

21.00 | 19.40 | 3,250 | ||||||||

May |

21.00 | 19.40 | 3,250 | ||||||||

June |

20.00 | 19.00 | 10,100 | ||||||||

July |

20.00 | 19.10 | 2,900 | ||||||||

| August | 20.00 | 18.20 | 15,100 | ||||||||

| September | 18.90 | 17.50 | 5,916 | ||||||||

| October | 19.79 | 17.19 | 1,800 | ||||||||

| November | 19.99 | 17.51 | 7,585 | ||||||||

| December | 19.65 | 17.75 | 4,500 | ||||||||

| 2024 | |||||||||||

| January | 20.10 | 18.40 | 6,770 | ||||||||

February 1-22 |

21.00 | 19.25 | 5,288 | ||||||||

| Date of Issuance | Number of Securities(1) |

Issue Price per Security | Description of Transaction | ||||||||

Aug. 10, 2012(1) |

9,000,000 Series E Shares | $25.00 | Public Offering | ||||||||

| Price ($) | |||||||||||

| Month | High | Low | Volume | ||||||||

| 2023 | |||||||||||

| January | 23.36 | 22.08 | 139,424 | ||||||||

| February | 23.68 | 22.70 | 69,503 | ||||||||

| March | 23.09 | 21.71 | 72,576 | ||||||||

| April | 21.86 | 21.17 | 79,646 | ||||||||

| May | 21.74 | 20.80 | 81,612 | ||||||||

| June | 21.44 | 20.80 | 48,456 | ||||||||

| July | 21.56 | 20.80 | 91,039 | ||||||||

| August | 21.74 | 20.00 | 64,826 | ||||||||

| September | 20.40 | 19.60 | 63,719 | ||||||||

| October | 19.85 | 18.25 | 81,082 | ||||||||

| November | 22.00 | 18.52 | 115,144 | ||||||||

| December | 21.83 | 20.45 | 199,707 | ||||||||

| 2024 | |||||||||||

| January | 21.99 | 21.17 | 97,836 | ||||||||

February 1-22 |

21.78 | 21.33 | 52,931 | ||||||||

| Date of Issuance | Number of Securities(1) |

Issue Price per Security | Description of Transaction | ||||||||

Aug. 15, 2014(1) |

6,600,000 Series G Shares | $25.00 | Public Offering | ||||||||

| Price ($) | |||||||||||

| Month | High | Low | Volume | ||||||||

| 2023 | |||||||||||

| January | 21.48 | 20.04 | 57,218 | ||||||||

| February | 21.98 | 21.22 | 66,452 | ||||||||

| March | 21.89 | 20.04 | 72,473 | ||||||||

| April | 20.38 | 19.89 | 51,270 | ||||||||

| May | 20.10 | 19.01 | 49,851 | ||||||||

| June | 19.55 | 18.99 | 59,824 | ||||||||

| July | 19.96 | 18.92 | 88,652 | ||||||||

| August | 20.11 | 18.90 | 99,684 | ||||||||

| September | 20.49 | 18.60 | 68,908 | ||||||||

| October | 19.18 | 18.18 | 63,364 | ||||||||

| November | 20.30 | 18.50 | 158,554 | ||||||||

| December | 19.75 | 18.60 | 103,796 | ||||||||

| 2024 | |||||||||||

| January | 21.48 | 19.60 | 96,742 | ||||||||

February 1-22 |

21.49 | 20.61 | 35,569 | ||||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Rona H. Ambrose

Alberta, Canada

|

2017 | The Honourable Rona Ambrose is Chair of the Governance, Safety and Sustainability Committee. Ms. Ambrose is the Deputy Chairwoman of TD Securities. She was the former Leader of Canada's Official Opposition in the House of Commons and former leader of the Conservative Party of Canada until 2017. As a key member of the federal cabinet for a decade, she solved problems as a minister of the Crown across nine government departments, including serving as Vice Chair of the Treasury Board for several years and Chair of the cabinet committee for public safety, justice and Aboriginal issues. As the former environment minister responsible for the GHG regulatory regime across several industrial sectors, she understands the challenges facing the fossil fuel industry. Ms. Ambrose was personally responsible for the development of several federal policies, ranging from industrial strategies in military procurement to health innovation and improvements to sexual assault laws. She is a passionate advocate for women in Canada and around the world and led the global movement to create the "International Day of the Girl" at the United Nations. She was also responsible for ensuring that Aboriginal women in Canada were granted equal matrimonial rights. She successfully fought for the creation of a Canadian refugee program to bring Yazidi women and girls who have been sexually enslaved by ISIS to safety in Canada. She is Chair of Plan International Canada Inc., a charity dedicated to girls rights globally which is working in 80 countries presently. She is a Global Fellow at the Wilson Centre's Canada Institute in Washington, DC, serves on the advisory board of the Canadian Global Affairs Institute and is a director of Andlauer Healthcare Group. She has a Bachelor of Arts from the University of Victoria and a Master of Arts from the University of Alberta. She is also a graduate of the Harvard Kennedy School of Government Senior Leaders Program. Ms. Ambrose brings to the Company and the Board an extensive track record of strong leadership acquired through a wide range of experience at the most senior levels of the Canadian government. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

John P. Dielwart

Alberta, Canada

|

2014 | Mr. Dielwart is the Chair of the Board of Directors. He was formerly Chief Executive Officer of ARC Resources Ltd., overseeing the growth of the company from a start-up in 1996 to a company with a total capitalization of approximately $10 billion at the time of his retirement in 2013. After his retirement from ARC Resources, Mr. Dielwart re-joined ARC Financial Corp. as Vice-Chair and Partner. ARC Financial is Canada's leading energy-focused private equity manager. In 2020, Mr. Dielwart resigned from the Board of ARC Financial but remained as Partner and a member of ARC Financial's Investment Committee. He is currently representing ARC Financial on the board of Aspenleaf Energy Limited. He is a past-Chair of the Board of Governors of the Canadian Association of Petroleum Producers and a member of the Association of Professional Engineers and Geoscientists of Alberta. Mr. Dielwart has a Bachelor of Science with distinction (civil engineering) from the University of Calgary. The Board believes that Mr. Dielwart is a diligent, independent director who provides the Company with a wealth of experience in leadership, finance and entrepreneurship along with a strong understanding of the commodity markets in which we operate, specifically the oil and gas markets. |

||||||

|

Alan J. Fohrer

California, US

|

2013 | Mr. Fohrer is the former Chair and Chief Executive Officer of Southern California Edison Company, a subsidiary of Edison International ("Edison") that is one of the largest electric utilities in the US. Mr. Fohrer served as President and Chief Executive Officer of Edison Mission Energy ("EME") from 2000 to 2001, a former subsidiary of Edison that owned and operated independent power facilities. During his tenure at EME, Mr. Fohrer restructured a number of international projects, which enhanced the value of the assets sold in subsequent years. Mr. Fohrer also served as Vice-President, Senior Vice-President, Executive Vice-President and Chief Financial Officer of both Edison and Southern California Edison from 1991 to 2000. After 37 years with Edison, Mr. Fohrer retired in December 2010. Mr. Fohrer is currently an independent member of the board of PNM Resources, Inc., a publicly traded energy holding company. He is also a member of the Viterbi School of Engineering Board of Councilors for the University of Southern California and on the Board of the California Science Center Foundation. Mr. Fohrer has served on boards of directors of the Institute of Nuclear Power Operations, the California Chamber of Commerce, Duratek, Inc., Osmose Utilities Services, Inc., MWH, Inc., Blue Shield of California and Synagro. Mr. Fohrer holds a Master of Science in civil engineering from the University of Southern California, Los Angeles, as well as a Master of Business Administration from California State University in Los Angeles. Mr. Fohrer brings to the Company and the Board experience in accounting, finance, dam safety and the power industry from both a regulated and unregulated market perspective. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Laura W. Folse

Texas, US

|

2021 | Ms. Folse was the Chief Executive Officer of BP Wind Energy North America Inc. until 2016. As Chief Executive Officer for BP Wind Energy she led a business with over 500 employees and contractors that consisted of 14 wind farms across eight states with an operating capacity of over 2.5 gigawatts. Prior to her role as Chief Executive Officer of BP Wind Energy, she served at BP p.l.c. as Executive Vice President, Science, Technology, Environment and Regulatory Affairs, in which she led the operational, scientific and technological programs within the multi-billion dollar cleanup and restoration effort in response to the 2010 BP Macondo well explosion off the coast of Louisiana. At its peak, the cleanup project team that she led consisted of over 45,000 people working across the US Gulf and Mexico. She successfully negotiated with federal, state and local government officials to implement and conclude the offshore and onshore cleanup efforts. Prior thereto, she held numerous leadership roles with increasing responsibility and complexity within BP p.l.c. Ms. Folse is currently an independent member of the Board of Directors of Enerflex Ltd., a publicly traded energy services company and she is an independent member of the Board of Directors of Pacolet Milliken, a private investment company operating in real estate and power and infrastructure. Ms. Folse is a Board member for the Auburn University College of Arts and Sciences and was a Board member for the American Wind Energy Association from 2016 to 2019. Ms. Folse has a Master of Management in Business from Stanford University, a Master of Science in Geology from the University of Alabama and a Bachelor of Science in Geology from Auburn University. Ms. Folse brings to the Company and the Board experience in corporate risk management, large-scale crisis management, leveraging data analysis, leading large and complex organizations, and driving cultural change while realizing improvements in safety, operational and financial performance. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Harry A. Goldgut

Ontario, Canada

|

2019 | Mr. Goldgut is Vice Chair of Brookfield's Infrastructure and Renewable Power and Transition groups and provides strategic advice related to Brookfield's open-ended Infrastructure Fund. He is also one of two Brookfield nominees to the Board. Mr. Goldgut was the Chief Executive Officer or Co-CEO and Chair of Brookfield Renewable Power Inc., from 2000 to 2008, and thereafter, until 2015, he was Chair of Brookfield's Power and Utilities Group. From 2015 to 2018, he served as Executive Chair of Brookfield's Infrastructure and Renewable Power groups. He joined Brookfield in 1997 and led the expansion of Brookfield's renewable power and utilities operations. He had primary responsibility for strategic initiatives, acquisitions and senior regulatory relationships. He was responsible for the acquisition of the majority of Brookfield's renewable power assets. He also played a role in the restructuring of the electricity industry in Ontario as a member of several governmental committees, including the Electricity Market Design Committee, the Minister of Energy's Advisory Committee, the Clean Energy Task Force, the Ontario Energy Board Chair's Advisory Roundtable and the Ontario Independent Electricity Operator CEO Roundtable on Market Renewal. Mr. Goldgut also serves on the board of directors of Isagen S.A. ESP, the third-largest power generation company in Colombia, and the Princess Margaret Cancer Foundation in Toronto. He holds a Bachelor of Laws degree from Osgoode Hall Law School at York University. Mr. Goldgut brings to the Company and the Board extensive experience in regulatory and government affairs, as well as experience in acquiring and operating renewable energy assets. Mr. Goldgut's background in renewable energy provides important insight to the Board. |

||||||

|

John H. Kousinioris

Alberta, Canada

|

2021 | Mr. Kousinioris is President and Chief Executive Officer of TransAlta. Prior to his appointment as President and CEO in 2021, Mr. Kousinioris served as Chief Operating Officer of the Company. As Chief Operating Officer, he was responsible for overseeing operations, shared services, commercial, trading, customer solutions, hedging and optimization at the Company. Prior thereto, Mr. Kousinioris was TransAlta's Chief Growth Officer and Chief Legal and Compliance Officer. Mr. Kousinioris’ prior leadership roles have provided him with responsibility for almost every aspect of the Company’s business. He was also the President of TransAlta Renewables Inc. until Feb. 5, 2021. Prior to joining TransAlta, Mr. Kousinioris was a partner and co-head of the corporate commercial department at Bennett Jones LLP with 30 years of experience in securities law, mergers and acquisitions and corporate governance matters. He is also Vice Chair of the Board of Governors of Bow Valley College and a member of the Board of Directors of the Calgary Stampede Foundation. Mr. Kousinioris has a Bachelor of Arts degree in Honors Business Administration from the Ivey Business School at the University of Western Ontario, a Master of Business Administration degree from York University and a Bachelor of Laws degree from Osgoode Hall Law School at York University. He has attended the Advanced Management Program at Harvard University. Mr. Kousinioris is responsible for the overall stewardship of the Company, including providing strategic leadership. Mr. Kousinioris has demonstrated outstanding vision and leadership with an unwavering commitment to the Company's long-term success. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Candace J. MacGibbon

Ontario, Canada

|

2023 |

Ms. MacGibbon is the former Chief Executive Officer and Director of INV Metals Inc., a TSX-listed mining company, from 2015 to 2021, where she was responsible for determining and implementing corporate strategy. Prior thereto, Ms. MacGibbon was the former President and Chief Financial Officer of INV Metals Inc. from 2008 to 2015, responsible for financial and regulatory reporting and for the company's treasury, financial strength and investment policy. Ms. MacGibbon previously held roles within global mining institutional equity sales with RBC Capital Markets and in base metals research as an equity research associate with BMO Capital Markets. Ms. MacGibbon was a former manager at Deloitte LLP and cost analyst with Inco Limited. She is also a board member of Osisko Gold Royalties and a member of Osisko Gold Royalties Audit and Human Resources Committees. Ms. MacGibbon is the president-elect of the Canadian Institute of Mining, Petroleum and Metallurgy. She is a Chartered Professional Accountant with over 25 years’ experience in the mining sector and capital markets. She holds a Bachelor of Arts degree in Economics from the University of Western Ontario and a Diploma in Accounting from Sir Wilfred Laurier University. Ms. MacGibbon brings to the Board attributes and skills focused on leadership, collaboration and integrity, which she has demonstrated through her prior successful senior leadership roles, including as a chief executive officer and a chief financial officer of INV Metals Inc. Ms. MacGibbon provides the Company and the Board energy and motivation with a focus on delivering results, which is complemented by her expertise in strategy, risk management, finance and accounting. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Thomas M. O'Flynn

New Jersey, US

|

2021 | Mr. O’Flynn was the Chief Executive Officer and Chief Investment Officer, AES Infrastructure Advisors. Prior thereto, until 2019, he was Executive Vice President and Chief Financial Officer at AES Corporation and responsible for all aspects of global finance and merger and acquisition teams across six global regions. During his tenure, Mr. O’Flynn helped lead AES through a significant transformation, including strategic exits of non-core markets, which resulted in improved financial stability and allowed for the redeployment of cash to primary growth markets. AES's total shareholder return increased 54 per cent during his tenure and its credit rating improved significantly. Mr. O’Flynn was also a key driver in initiating a major transition to renewables and green energy to significantly improve AES’s growth profile and reduce its carbon footprint. Mr. O'Flynn is the Lead Operating Director of Dimension Renewable Energy, a community solar company. He is a Director of Exus Management Partners, a renewables management and development company. Mr. O'Flynn is a Senior Advisor with Energy Impact Partners, a private energy technology fund investing in high-growth companies in the energy, utility and transportation industries. Mr. O’Flynn was Chief Financial Officer of Powin Energy from December 2021 until December 2022, a battery energy storage company in which Energy Impact Partners is a significant investor. Mr. O’Flynn was with The Blackstone Group Inc. where he was Senior Advisor, Power and Utility Sector, and Chief Operating Officer and Chief Financial Officer of Transmission Developers Inc., a Blackstone-controlled entity that develops innovative power transmission projects in an environmentally responsible manner. Prior thereto he was Executive Vice President and Chief Financial Officer at Public Service Enterprise Group Incorporated and was Head of North American Power at Morgan Stanley. Mr. O’Flynn has a Bachelor of Arts in Economics from Northwestern University and a Master of Business Administration in Finance from the University of Chicago. He is also an adjunct professor at Northwestern University for a master’s program at the Institute for Sustainability and Energy. He has led successful organizational transformations, including by focusing on acquisitions and greenfield development. Mr. O’Flynn provides the Company and Board with demonstrated ability to realize shareholder value through his significant senior executive experience at large electricity companies. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Bryan D. Pinney

Alberta, Canada

|

2018 | Mr. Pinney has over 30 years of experience serving many of Canada's largest corporations, primarily in energy and resources and construction. Mr. Pinney served as Calgary Managing Partner of Deloitte LLP from 2002 through 2007 and as National Managing Partner of Audit & Assurance from 2007 to 2011 and Vice-Chair until June 2015. Mr. Pinney was a past member of Deloitte LLP's Board of Directors. He was a partner at Andersen LLP and served as Calgary Managing Partner from 1991 through May 2002. Mr. Pinney is currently the lead director for North American Construction Group Ltd. (NYSE, TSX) and a director of SNDL Inc. (NASDAQ). Mr. Pinney is the former chair of the Board of Governors of Mount Royal University and has served on a number of non-profit boards. He is a Fellow of the Institute of Chartered Accountants, a Chartered Business Valuator and is a graduate of the Ivey Business School at the University of Western Ontario with an undergraduate honours degree in Business Administration. He is also a graduate of the Canadian Institute of Corporate Directors. Mr. Pinney's extensive leadership accomplishments, financial expertise, knowledge of regulatory and compliance matters and diverse range of industry experience make him an important contributor to the Board. |

||||||

|

James Reid

Alberta, Canada

|

2021 | Mr. Reid is a former Managing Partner of Brookfield Asset Management Inc. who led Brookfield's Private Equity Group in Calgary, Alberta, until 2021. In that role he was responsible for originating, evaluating and structuring investments and financings in the energy sector and overseeing operations in Brookfield's private equity energy segment. Prior to moving into the private equity group, Mr. Reid was the Chief Investment Officer, Energy for Brookfield’s Infrastructure Group. He established Brookfield’s Calgary office in 2003 after spending several years as Chief Financial Officer for two oil and gas exploration and production companies in Western Canada. Mr. Reid is also one of two Brookfield nominees to the Board pursuant to the Investment Agreement. Mr. Reid obtained his Chartered Accountant designation at PricewaterhouseCoopers in Toronto and holds a Bachelor of Arts in commerce from the University of Toronto. Mr. Reid brings to the Company and the Board considerable experience in leadership, finance, mergers and acquisitions and organizational change. His wealth of knowledge in the energy sector and his former role with Brookfield, our long-term shareholder, makes him an important addition to the Board. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Manjit K. Sharma

Ontario, Canada

|

2023 | Ms. Sharma has over 30 years of experience that spans a variety of industries (power generation, oil and gas, financial services, manufacturing, engineering services and others). Until 2021, she was the Chief Financial Officer of WSP Canada Inc. In this role, she was responsible for leading the finance, real estate, procurement, tax and shared services functions across Canada. She is a former member of the national executive team of General Electric Canada ("GE Canada"), serving as Chief Financial Officer from 2016 to 2019. From 1999 to 2016, she held various senior positions with GE Canada, with responsibilities that spanned business strategy development and execution, business product and services development, mergers and acquisitions, tax oversight, risk, governance, key components of human resources strategy (including compensation, union negotiations, pension and benefits), and diversity and inclusion. Ms. Sharma currently serves as a board member of each of Vermilion Energy Inc., Finning International Inc. and Export Development Canada. Ms. Sharma holds a Bachelor of Commerce degree (with Honours) from the University of Toronto, is a Fellow Chartered Accountant and holds the ICD.D Directors designation and the GCB.D Global Competent Boards designation. Ms. Sharma provides the Company and Board with diverse board experience, including executive, finance and leadership within different industries and businesses. |

||||||

| Name, Province (State) and Country of Residence | Year First Became Director | Principal Occupation | ||||||

|

Sandra R. Sharman

Ontario, Canada

|

2020 | Ms. Sharman is the Senior Vice President and Group Head, People, Culture and Brand of Canadian Imperial Bank of Commerce ("CIBC"). In this role, she leads the Human Resources, Communications, Marketing and Enterprise Real Estate teams at CIBC, supporting execution of business strategy, transforming to a purpose-driven bank and enabling a world-class culture. Ms. Sharman and her team are responsible for developing and delivering the Global Human Capital Strategy designed to challenge conventional thinking, drive business solutions and shape the culture of the bank. Her key areas of accountabilities also include workplace transformation, compensation and benefits, employee relations, policy and governance, talent management, marketing, corporate real estate, including the bank’s new global headquarters, CIBC Square, and all aspects of internal and external communications and public affairs, including government relations and awards. Ms. Sharman is a proven business leader with over 30 years of human resources and financial services experience in both Canada and the US, and she has played a leading role in shaping an inclusive and collaborative culture at CIBC, focused on empowering and enabling employees to reach their full potential. Ms. Sharman assumed the leadership of Human Resources at CIBC in 2014 and added accountability for communications and public affairs in 2017. Since then, her portfolio has expanded to encompass purpose, brand, marketing and, most recently, corporate real estate. Ms. Sharman earned her Master of Business Administration from Dalhousie University. Ms. Sharman provides the Company and Board with executive experience, diversity and inclusion related competencies and leadership accomplishments within an international and complex business. |

||||||

|

Sarah A. Slusser

Washington, US

|

2021 | Ms. Slusser is the Chief Executive Officer of Cypress Creek Renewables, LLC ("Cypress Creek"), a solar and storage independent power producer that develops, owns and operates projects in the US. She joined Cypress Creek as Chief Executive Officer in 2019 to reposition the company for sustainable growth. Prior to this, she founded Point Reyes Energy Partners LLC, a solar and energy storage advisory and development company, where she provided strategic advice to a number of large companies in the renewable sector until 2016. She remains a founding partner of Point Reyes Energy Partners. Prior to this, she co-founded GeoGlobal Energy LLC, a geothermal company in the US, Chile and Germany, which was sold to its cornerstone investor in 2015. Before co-founding GeoGlobal Energy, Ms. Slusser worked at AES for 21 years, where she advanced into increasingly significant leadership roles, ultimately being appointed Senior Vice President and Managing Director reporting directly to the Chief Executive Officer and leading the corporate group. She was President of one of eight divisions of AES that was responsible for all development, construction and operations in the Caribbean, Mexico and Central America. Ms. Slusser is a member of the Board of Directors of the Redwood Foundation, a family foundation promoting education and the environment and Our Food Chain, a non-profit promoting healthy eating. Ms. Slusser holds a Bachelor of Arts (cum laude) in geology from Harvard University and a Master of Business Administration from the Yale School of Management. Ms. Slusser’s brings to the Company and the Board a broad range of experience in the electricity sector at innovative, competitive renewable and electricity companies and provides the Board with significant capital allocation and M&A expertise. |

||||||

| Name | Principal Occupation | Residence | ||||||

John H. Kousinioris |

President and Chief Executive Officer | Alberta, Canada | ||||||

| Todd J. Stack | Executive Vice President, Finance and Chief Financial Officer | Alberta, Canada | ||||||

Jane N. Fedoretz |

Executive Vice President, People, Culture and Chief Administrative Officer |

Alberta, Canada | ||||||

Kerry L. O'Reilly Wilks |

Executive Vice President, Growth and Energy Marketing |

Alberta, Canada | ||||||

| Christopher D. Fralick | Executive Vice President, Generation | Alberta, Canada | ||||||

Blain M. van Melle |

Executive Vice President, Commercial and Customer Relations |

Alberta, Canada | ||||||

Aron J. Willis |

Executive Vice President, Project Delivery and Construction |

Alberta, Canada | ||||||

Scott T. Jeffers |

Acting Executive Vice President, Legal and Corporate Secretary |

Alberta, Canada | ||||||

| Brent V. Ward | Senior Vice President, M&A, Strategy and Treasurer | Alberta, Canada | ||||||

David C. Little |

Senior Vice President, Growth |

California, USA |

||||||

| Name of AFRC Member | Relevant Education and Experience | ||||

| Bryan D. Pinney (Chair) | Mr. Pinney has 40 years of experience in financial auditing, valuation and advising companies in energy and natural resources. He is an independent director of North American Construction Group Ltd. and chair of its Audit and Finance Committee. He is also an independent director of SNDL, Inc. and chair of its Audit and Finance Committee. He served as a member of Deloitte’s Board of Directors and chair of the Finance and Audit Committee. He was the recent Chair and a member of the Board of Governors of Mount Royal University and has previously served on a number of non-profit boards. He has been a Chartered Accountant since December 1978, a Fellow of the Chartered Professional Accountants of Alberta since January 2009 and a Chartered Business Valuator of Canada since December 1990. Mr. Pinney obtained a Bachelor of Arts in business administration from the University of Western Ontario in 1975 and also completed the Directors Education Program offered by the Institute of Corporate Directors in Canada in 2012. | ||||

| Alan J. Fohrer | Prior to his retirement in December 2010, Mr. Fohrer was Chair and Chief Executive Officer of Southern California Edison Company, a subsidiary of Edison and one of the largest electric utilities in the US. Prior to that, Mr. Fohrer served as Vice-President, Senior Vice-President, Executive Vice-President and Chief Financial Officer of both Edison and Southern California Edison Company. Mr. Fohrer also serves on the audit committee of PNM Resources Inc., a public company. Mr. Fohrer holds a Master of Business Administration from California State University in Los Angeles. |

||||

| Thomas M. O'Flynn | Mr. O'Flynn was the Chief Financial Officer of Powin Energy, an entity in which Energy Impact Partners LP (a private energy technology fund) is a major investor. Prior thereto, Mr. O'Flynn was Chief Executive Officer and Chief Investment Officer at the AES Corporation, Executive Vice President and Chief Financial Officer at Public Service Enterprise Group Incorporated and Head of North American Power at Morgan Stanley. Mr. O'Flynn has a Bachelor of Arts in economics from Northwestern University and a Master of Business Administration, Finance from the University of Chicago. |

||||

Manjit K. Sharma |

Ms. Sharma was the Chief Financial Officer of WSP Canada Inc. Prior to WSP Canada Inc., she was on the National Executive Team of General Electric Canada (GE Canada), serving as Chief Financial Officer from 2016 to 2019. Ms. Sharma currently serves as a board member of each of Vermilion Energy Inc., Finning International Inc. and Export Development Canada. Ms. Sharma holds a Bachelor of Commerce degree (with honours) from the University of Toronto, is a Fellow Chartered Accountant and holds the ICD.D Directors designation and the GCB.D Global Competent Boards designation. |

||||

Candace J. MacGibbon(1) |

Ms. MacGibbon was the former Chief Executive Officer and Chief Financial Officer of INV Metals Inc. Prior to this, she was a former manager at Deloitte LLP and held roles within RBC Capital Markets and BMO Capital Markets. Ms. MacGibbon currently serves as a board member of each of Carbon Streaming Corp. and Osisko Gold Royalties, and she is a member of the Audit of Human Resources Committees of Osisko Gold Royalties. Ms. MacGibbon holds a Bachelor of Arts degree in economics from the University of Western Ontario and is a Chartered Professional Accountant with over 25 years of experience in the mining sector and capital markets. |

||||

| Governance, Safety and Sustainability Committee | Human Resources Committee | |||||||

Chair: Rona H. Ambrose |

Chair: Sandra R. Sharman | |||||||

| Alan J. Fohrer | Rona H. Ambrose | |||||||

| Laura W. Folse | Bryan D. Pinney | |||||||

| Sandra R. Sharman | Sarah A. Slusser | |||||||

Candace J. MacGibbon |

Manjit K. Sharma | |||||||

| Investment Performance Committee | ||||||||

Chair: Laura W. Folse |

||||||||

Thomas M. O'Flynn |

||||||||

Harry A. Goldgut |

||||||||

James Reid |

||||||||

Sarah A. Slusser |

||||||||

| Ernst & Young LLP | ||||||||||||||||||||

Year Ended Dec. 31 |

2023 | 2022 | ||||||||||||||||||

| Audit Fees | $ | 3,368,977 | $ | 2,873,395 | ||||||||||||||||

Audit-related fees(1) |

1,374,803 | 1,618,751 | ||||||||||||||||||

| Tax fees | 5,850 | 116,112 | ||||||||||||||||||

| All other fees | 39,025 | — | ||||||||||||||||||

| Total | $ | 4,788,655 | $ | 4,608,258 | ||||||||||||||||

M2

|

M59

|

|||||||||||||

M4

|

M59

|

|||||||||||||

M6

|

M62

|

|||||||||||||

M11

|

M67

|

|||||||||||||

M12

|

M67

|

|||||||||||||

M15

|

M69

|

|||||||||||||

M23

|

M70

|

|||||||||||||

M23

|

M72

|

|||||||||||||

M26

|

M75

|

|||||||||||||

M28

|

M81

|

|||||||||||||

M29

|

M84

|

|||||||||||||

M31

|

M94

|

|||||||||||||

M31

|

M97

|

|||||||||||||

M36

|

M103

|

|||||||||||||

M37

|

M106

|

|||||||||||||

M42

|

M112

|

|||||||||||||

M44

|

M113

|

|||||||||||||

M46

|

M114

|

|||||||||||||

M48

|

M125

|

|||||||||||||

| TransAlta Corporation | 2023 Integrated Report | M1 |

||||||

M2 |

TransAlta Corporation | 2023 Integrated Report | ||||||

| TransAlta Corporation | 2023 Integrated Report | M3 |

||||||

M4 |

TransAlta Corporation | 2023 Integrated Report | ||||||

| Hydro | Wind & Solar | Gas | Energy Transition | Total | ||||||||||||||||||||||||||||

|

Year ended

Dec. 31, 2023

|

Gross

Installed

Capacity

(MW)

|

Number of facilities |

Gross

Installed

Capacity

(MW)(1)

|

Number of facilities |

Gross

Installed

Capacity

(MW)(1)

|

Number of

facilities

|

Gross

Installed

Capacity

(MW)

|

Number of facilities |

Gross

Installed

Capacity

(MW)(1)

|

Number of facilities |

||||||||||||||||||||||

| Alberta | 834 | 17 | 766 | 14 | 1,960 | 7 | — | — | 3,560 | 38 | ||||||||||||||||||||||

Canada, excluding Alberta |

88 | 7 | 751 | 9 | 645 | 3 | — | — | 1,484 | 19 | ||||||||||||||||||||||

| US | — | — | 519 | 7 | 29 | 1 | 671 | 2 | 1,219 | 10 | ||||||||||||||||||||||

| Australia | — | — | 48 | 3 | 450 | 6 | — | — | 498 | 9 | ||||||||||||||||||||||

| Total | 922 | 24 | 2,084 | 33 | 3,084 | 17 | 671 | 2 | 6,761 | 76 | ||||||||||||||||||||||

As at Dec. 31, 2023 |

Hydro |

Wind &

Solar

|

Gas |

Energy

Transition

|

Total | ||||||||||||

| Alberta | — | 374 | 511 | — | 885 | ||||||||||||

Canada, excluding Alberta |

88 | 751 | 645 | — | 1,484 | ||||||||||||

| US | — | 519 | 29 | 381 | 929 | ||||||||||||

| Australia | — | 48 | 450 | — | 498 | ||||||||||||

| Total contracted capacity (MW) | 88 | 1,692 | 1,635 | 381 | 3,796 | ||||||||||||

| Contracted capacity as a % of total capacity (%) | 10 | % | 81 | % | 53 | % | 57 | % | 56 | % | |||||||

As at Dec. 31, 2023 |

Hydro |

Wind &

Solar

|

Gas |

Energy

Transition

|

Total | ||||||||||||

Alberta(1)(2) |

— | 16 | 7 | — | 11 | ||||||||||||

Canada, excluding Alberta(2) |

10 | 10 | 8 | — | 9 | ||||||||||||

US(2) |

— | 10 | 2 | 2 | 7 | ||||||||||||

Australia(2) |

— | 15 | 15 | — | 15 | ||||||||||||

Total weighted contract life (years)(2) |

10 | 12 | 10 | 2 | 10 | ||||||||||||

| TransAlta Corporation | 2023 Integrated Report | M5 |

||||||

| Year ended Dec. 31 | 2023 | 2022 | 2021 | ||||||||

| Operational information | |||||||||||

| Adjusted availability (%) | 88.8 | 90.0 | 86.6 | ||||||||

| Production (GWh) | 22,029 | 21,258 | 22,105 | ||||||||

| Select financial information | |||||||||||

| Revenues | 3,355 | 2,976 | 2,721 | ||||||||

| Earnings (loss) before income taxes | 880 | 353 | (380) | ||||||||

Adjusted EBITDA(1) |

1,632 | 1,634 | 1,286 | ||||||||

| Net earnings (loss) attributable to common shareholders | 644 | 4 | (576) | ||||||||

| Cash flows | |||||||||||

| Cash flow from operating activities | 1,464 | 877 | 1,001 | ||||||||

Funds from operations(1) |

1,351 | 1,346 | 994 | ||||||||

Free cash flow(1) |

890 | 961 | 585 | ||||||||

| Per share | |||||||||||

| Weighted average number of common shares outstanding | 276 | 271 | 271 | ||||||||

Net earnings (loss) per share attributable to common shareholders, basic and diluted |

2.33 | 0.01 | (2.13) | ||||||||

Dividends declared per common share |

0.22 | 0.21 | 0.19 | ||||||||

Funds from operations per share(1)(2) |

4.89 | 4.97 | 3.67 | ||||||||

Free cash flow per share(1)(2) |

3.22 | 3.55 | 2.16 | ||||||||

Liquidity and capital resources |

|||||||||||

| Available liquidity | 1,738 | 2,118 | 2,177 | ||||||||

Adjusted net debt to adjusted EBITDA(1) (times) |

2.5 | 2.2 | 2.6 | ||||||||

Total consolidated net debt(1)(3) |

3,453 | 2,854 | 2,636 | ||||||||

| As at Dec. 31 | 2023 | 2022 | 2021 | ||||||||

| Total assets | 8,659 | 10,741 | 9,226 | ||||||||

| Total long-term liabilities | 5,253 | 5,864 | 4,702 | ||||||||

| Total liabilities | 6,995 | 8,752 | 6,633 | ||||||||

M6 |

TransAlta Corporation | 2023 Integrated Report | ||||||

| Year ended Dec. 31 | 2023 | 2022 | 2021 | ||||||||

| Hydro | 90.8 | 96.7 | 92.4 | ||||||||

| Wind and Solar | 86.9 | 83.8 | 91.9 | ||||||||

| Gas | 91.6 | 94.6 | 85.7 | ||||||||

Energy Transition(1) |

79.8 | 79.0 | 78.8 | ||||||||

| Adjusted availability (%) | 88.8 | 90.0 | 86.6 | ||||||||

| 2023 | 2022 | 2021 | |||||||||||||||||||||||||||

| Year ended Dec. 31 |

Actual

production

(GWh)

|

LTA

generation

(GWh)

|

Production

as a % of

LTA

|

Actual

production

(GWh)

|

LTA

generation

(GWh)

|

Production

as a % of

LTA

|

Actual

production

(GWh)

|

LTA

generation

(GWh)

|

Production

as a % of

LTA

|

||||||||||||||||||||

| Hydro | 1,769 | 2,015 | 88 | % | 1,988 | 2,015 | 99 | % | 1,936 | 2,030 | 95 | % | |||||||||||||||||

| Wind and Solar | 4,243 | 5,387 | 79 | % | 4,248 | 4,950 | 86 | % | 3,898 | 4,345 | 90 | % | |||||||||||||||||

| Gas | 11,873 | 11,448 | 10,565 | ||||||||||||||||||||||||||

| Energy Transition | 4,144 | 3,574 | 5,706 | ||||||||||||||||||||||||||

| Total | 22,029 | 21,258 | 22,105 | ||||||||||||||||||||||||||

| TransAlta Corporation | 2023 Integrated Report | M7 |

||||||

Year ended Dec. 31, 2023 |

2023 | 2022 | 2021 | ||||||||

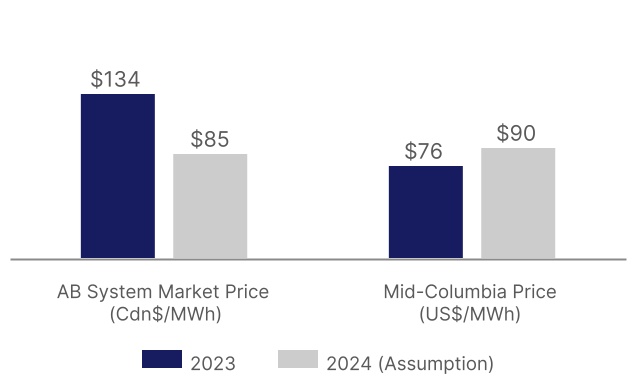

Alberta spot power price ($/MWh) |

134 | 162 | 102 | ||||||||

Mid-Columbia spot power price (US$/MWh) |

76 | 82 | 49 | ||||||||

Ontario spot power price ($/MWh) |

28 | 47 | 30 | ||||||||

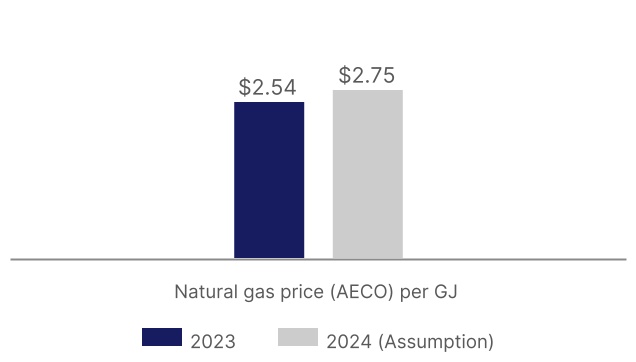

Natural gas price (AECO) per GJ ($) |

2.54 | 5.08 | 3.39 | ||||||||

| Year ended Dec. 31 | 2023 | 2022 | 2021 | |||||||||||

| Revenues | 3,355 | 2,976 | 2,721 | |||||||||||

| Fuel and purchased power | 1,060 | 1,263 | 1,054 | |||||||||||

| Carbon compliance | 112 | 78 | 178 | |||||||||||

| Operations, maintenance and administration | 539 | 521 | 511 | |||||||||||

| Depreciation and amortization | 621 | 599 | 529 | |||||||||||

| Asset impairment charges (reversals) | (48) | 9 | 648 | |||||||||||

Interest income |

59 | 24 | 11 | |||||||||||

| Earnings (loss) before income taxes | 880 | 353 | (380) | |||||||||||

| Income tax expense | 84 | 192 | 45 | |||||||||||

| Net earnings (loss) attributable to common shareholders | 644 | 4 | (576) | |||||||||||

Net earnings attributable to non-controlling interests |

101 | 111 | 112 | |||||||||||

M8 |

TransAlta Corporation | 2023 Integrated Report | ||||||

| TransAlta Corporation | 2023 Integrated Report | M9 |

||||||

|

Year ended

Dec. 31

|

|||||

| Adjusted EBITDA for the year ended Dec. 31, 2022 | 1,634 | ||||

Hydro: lower primarily due to lower ancillary services volumes, lower spot power and ancillary services prices and lower than average water resources, partially offset by realized gains from hedging and sales of environmental attributes. |

(68) | ||||

Wind and Solar: lower primarily due to lower environmental attribute revenues, lower spot power pricing in Alberta, lower wind resource across the operating fleets, lower liquidated damages recognized at the Windrise wind facility and higher OM&A, partially offset by the commercial operation of the Garden Plain wind facility, the Northern Goldfields solar facilities and the partial return of service of the Kent Hills wind facilities. |

(54) | ||||

Gas: higher primarily due to higher power price hedges partially offsetting the impacts of lower Alberta spot prices, lower natural gas commodity costs and higher production, partially offset by lower thermal revenues, higher carbon prices and higher carbon costs and fuel usage related to production. The Gas fleet significantly exceeded management's expectations. |

172 | ||||

Energy Transition: higher primarily due to higher production from higher availability and higher merchant sales volumes, partially offset by lower market prices compared to the prior year. |

36 | ||||

Energy Marketing: lower primarily due to lower realized settled trades during the year on market positions in comparison to prior year and higher OM&A. Energy Marketing results were in line with management's expectations and performance was consistent with our revised full year financial guidance provided in the second quarter of 2023. |

(74) | ||||

Corporate: lower primarily due to increased spending to support strategic and growth initiatives and higher costs associated with the relocation of the Company's head office. |

(14) | ||||

Adjusted EBITDA(1) for the year ended Dec. 31, 2023 |

1,632 | ||||

M10 |

TransAlta Corporation | 2023 Integrated Report | ||||||

|

Year ended

Dec. 31

|

|||||

FCF for the year ended Dec. 31, 2022 |

961 | ||||

Lower adjusted EBITDA: lower FCF due to the items noted in Adjusted EBITDA above. |

(2) | ||||

Higher interest income: Higher cash balances and favourable interest rates positively impacting FCF. |

35 | ||||

Lower current income tax expense: Previously restricted non-capital loss carryforwards were utilized to offset taxable income resulting in higher FCF. |

15 | ||||

Higher sustaining capital expenditures: Higher planned major maintenance costs for the Hydro and Gas segments, partially offset by lower planned major maintenance in Wind and Solar and Energy Transition segments, resulting in lower FCF. |

(31) | ||||

Higher distributions paid to subsidiaries' non-controlling interests: Related to timing of distributions paid to TA Cogen, partially offset by lower distributions paid to TransAlta Renewables resulting in lower FCF. |

(36) | ||||

Lower provisions: Lower provisions being accrued compared to the prior year, with no notable settlements being recorded in either year resulting in lower FCF due to the timing of provisions accrued. |

(26) | ||||

Other non-cash items(1) |

(12) | ||||

Other(2) |

(14) | ||||

FCF(3) for the year ended Dec. 31, 2023 |

890 | ||||

| Year ended Dec. 31 | 2023 | 2022 | 2021 | ||||||||

| Hydro | 41 | 35 | 26 | ||||||||

| Wind and Solar | 15 | 18 | 13 | ||||||||

| Gas | 76 | 41 | 128 | ||||||||

| Energy Transition | 15 | 19 | 19 | ||||||||

| Corporate | 27 | 29 | 13 | ||||||||

| Total sustaining capital expenditures | 174 | 142 | 199 | ||||||||

| TransAlta Corporation | 2023 Integrated Report | M11 |

||||||

| Year ended Dec. 31 | 2023 | 2022 | 2021 | ||||||||

| Hydro | 6 | 2 | 3 | ||||||||

| Wind and Solar | 659 | 759 | 124 | ||||||||

| Gas | 13 | 3 | 38 | ||||||||

| Energy Transition | — | — | 70 | ||||||||

Corporate(1) |

61 | 10 | 47 | ||||||||

| Total growth and development expenditures | 739 | 774 | 282 | ||||||||

M12 |

TransAlta Corporation | 2023 Integrated Report | ||||||

| TransAlta Corporation | 2023 Integrated Report | M13 |

||||||

M14 |

TransAlta Corporation | 2023 Integrated Report | ||||||

Adjusted EBITDA(1) |

|||||||||||

Year ended Dec. 31 |

2023 | 2022 | 2021 | ||||||||

| Hydro | 459 | 527 | 322 | ||||||||

| Wind and Solar | 257 | 311 | 262 | ||||||||

| Gas | 801 | 629 | 488 | ||||||||

| Energy Transition | 122 | 86 | 133 | ||||||||

| Energy Marketing | 109 | 183 | 166 | ||||||||

| Corporate | (116) | (102) | (85) | ||||||||

Total adjusted EBITDA(1) |

1,632 | 1,634 | 1,286 | ||||||||

| Earnings (loss) before income taxes | 880 | 353 | (380) | ||||||||

| TransAlta Corporation | 2023 Integrated Report | M15 |

||||||

| Year ended Dec. 31 | 2023 | 2022 | Change | 2021 | Change | ||||||||||||||||||

Gross installed capacity (MW)(1) |

922 | 922 | — | — | % | 925 | (3) | — | % | ||||||||||||||

LTA generation (GWh)(2) |

2,015 | 2,015 | — | — | % | 2,030 | (15) | (1) | % | ||||||||||||||

| Availability (%) | 90.8 | 96.7 | (5.9) | (6) | % | 92.4 | 4.3 | 5 | % | ||||||||||||||

| Production | |||||||||||||||||||||||

| Contract production (GWh) | 277 | 323 | (46) | (14) | % | 434 | (111) | (26) | % | ||||||||||||||

| Merchant production (GWh) | 1,492 | 1,665 | (173) | (10) | % | 1,502 | 163 | 11 | % | ||||||||||||||

| Total energy production (GWh) | 1,769 | 1,988 | (219) | (11) | % | 1,936 | 52 | 3 | % | ||||||||||||||

Ancillary service volumes (GWh)(3) |

2,582 | 3,124 | (542) | (17) | % | 2,897 | 227 | 8 | % | ||||||||||||||

Alberta Hydro Assets revenues(4)(5) |

291 | 328 | (37) | (11) | % | 185 | 143 | 77 | % | ||||||||||||||

Other Hydro Assets and other revenues(4)(6) |

51 | 42 | 9 | 21 | % | 41 | 1 | 2 | % | ||||||||||||||

Alberta Hydro ancillary services revenues(3) |

173 | 236 | (63) | (27) | % | 160 | 76 | 48 | % | ||||||||||||||

| Environmental attribute revenues | 14 | 1 | 13 | 1300 | % | 1 | — | — | % | ||||||||||||||

| Total gross revenues | 529 | 607 | (78) | (13) | % | 387 | 220 | 57 | % | ||||||||||||||

Net payment relating to Alberta Hydro PPA |

— | — | — | — | % | (4) | 4 | (100) | % | ||||||||||||||

Revenues(7) |

529 | 607 | (78) | (13) | % | 383 | 224 | 58 | % | ||||||||||||||

| Fuel and purchased power | 19 | 22 | (3) | (14) | % | 16 | 6 | 38 | % | ||||||||||||||

Gross margin(8) |

510 | 585 | (75) | (13) | % | 367 | 218 | 59 | % | ||||||||||||||

| OM&A | 48 | 55 | (7) | (13) | % | 42 | 13 | 31 | % | ||||||||||||||

| Taxes, other than income taxes | 3 | 3 | — | — | % | 3 | — | — | % | ||||||||||||||

Adjusted EBITDA(8) |

459 | 527 | (68) | (13) | % | 322 | 205 | 64 | % | ||||||||||||||

| Supplemental Information: | |||||||||||||||||||||||

| Gross revenues per MWh | |||||||||||||||||||||||

Alberta Hydro Assets energy ($/MWh)(4)(5) |

175 | 197 | (22) | (11) | % | 123 | 74 | 60 | % | ||||||||||||||

Alberta Hydro Assets ancillary ($/MWh)(3) |

67 | 76 | (9) | (12) | % | 55 | 21 | 38 | % | ||||||||||||||

M16 |

TransAlta Corporation | 2023 Integrated Report | ||||||

| TransAlta Corporation | 2023 Integrated Report | M17 |

||||||

| Year ended Dec. 31 | 2023 | 2022 | Change | 2021 | Change | ||||||||||||||||||||||||

Gross installed capacity (MW)(1) |

2,084 | 1,906 | 178 | 9 | % | 1,906 | — | — | % | ||||||||||||||||||||

| LTA generation (GWh) | 5,387 | 4,950 | 437 | 9 | % | 4,345 | 605 | 14 | % | ||||||||||||||||||||

| Availability (%) | 86.9 | 83.8 | 3.1 | 4 | % | 91.9 | (8.1) | (9) | % | ||||||||||||||||||||

| Production | |||||||||||||||||||||||||||||

| Contract production (GWh) | 3,095 | 3,182 | (87) | (3) | % | 2,850 | 332 | 12 | % | ||||||||||||||||||||

| Merchant production (GWh) | 1,148 | 1,066 | 82 | 8 | % | 1,048 | 18 | 2 | % | ||||||||||||||||||||

| Total production (GWh) | 4,243 | 4,248 | (5) | — | % | 3,898 | 350 | 9 | % | ||||||||||||||||||||

| Wind and Solar revenues | 347 | 357 | (10) | (3) | % | 320 | 37 | 12 | % | ||||||||||||||||||||

| Environmental attribute revenues | 26 | 50 | (24) | (48) | % | 28 | 22 | 79 | % | ||||||||||||||||||||

Revenues(2) |

373 | 407 | (34) | (8) | % | 348 | 59 | 17 | % | ||||||||||||||||||||

| Fuel and purchased power | 30 | 31 | (1) | (3) | % | 17 | 14 | 82 | % | ||||||||||||||||||||

| Carbon compliance | — | 1 | (1) | (100) | % | — | 1 | 100 | % | ||||||||||||||||||||

Gross margin(3) |

343 | 375 | (32) | (9) | % | 331 | 44 | 13 | % | ||||||||||||||||||||

| OM&A | 80 | 68 | 12 | 18 | % | 59 | 9 | 15 | % | ||||||||||||||||||||

| Taxes, other than income taxes | 12 | 12 | — | — | % | 10 | 2 | 20 | % | ||||||||||||||||||||

Net other operating income(2) |

(6) | (16) | 10 | (63) | % | — | (16) | (100) | % | ||||||||||||||||||||

Adjusted EBITDA(3) |

257 | 311 | (54) | (17) | % | 262 | 49 | 19 | % | ||||||||||||||||||||

| Supplemental information: | |||||||||||||||||||||||||||||

Kent Hills wind rehabilitation expenditures(4) |

87 | 77 | 10 | 13 | % | — | 77 | 100 | % | ||||||||||||||||||||

| Insurance proceeds - Kent Hills | (1) | (7) | 6 | (86) | % | — | (7) | (100) | % | ||||||||||||||||||||

M18 |

TransAlta Corporation | 2023 Integrated Report | ||||||

| TransAlta Corporation | 2023 Integrated Report | M19 |

||||||

| Year ended Dec. 31 | 2023 | 2022 | Change | 2021 | Change | ||||||||||||||||||||||||

| Gross installed capacity (MW) | 3,084 | 3,084 | — | — | % | 3,084 | — | — | % | ||||||||||||||||||||

| Availability (%) | 91.6 | 94.6 | (3.0) | (3) | % | 85.7 | 8.9 | 10 | % | ||||||||||||||||||||

| Production | |||||||||||||||||||||||||||||

Contract sales volume (GWh) |

4,172 | 3,609 | 563 | 16 | % | 3,622 | (13) | — | % | ||||||||||||||||||||

Merchant sales volume (GWh) |

7,889 | 7,927 | (38) | — | % | 7,084 | 843 | 12 | % | ||||||||||||||||||||

Purchased power (GWh)(1) |

(188) | (88) | (100) | 114 | % | (141) | 53 | (38) | % | ||||||||||||||||||||

| Total production (GWh) | 11,873 | 11,448 | 425 | 4 | % | 10,565 | 883 | 8 | % | ||||||||||||||||||||

Revenues(2) |

1,525 | 1,521 | 4 | — | % | 1,126 | 395 | 35 | % | ||||||||||||||||||||

Fuel and purchased power(2) |

449 | 637 | (188) | (30) | % | 374 | 263 | 70 | % | ||||||||||||||||||||

| Carbon compliance | 112 | 83 | 29 | 35 | % | 118 | (35) | (30) | % | ||||||||||||||||||||

Gross margin(3) |

964 | 801 | 163 | 20 | % | 634 | 167 | 26 | % | ||||||||||||||||||||

| OM&A | 192 | 195 | (3) | (2) | % | 173 | 22 | 13 | % | ||||||||||||||||||||

| Taxes, other than income taxes | 11 | 15 | (4) | (27) | % | 13 | 2 | 15 | % | ||||||||||||||||||||

| Net other operating income | (40) | (38) | (2) | 5 | % | (40) | 2 | (5) | % | ||||||||||||||||||||

Adjusted EBITDA(3) |