|

Date: November 17, 2025

|

|||

|

CREDICORP LTD.

(Registrant)

|

|||

|

By:

|

/s/ Milagros Cigüeñas

|

||

|

Milagros Cigüeñas

|

|||

|

Authorized Representative

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Operating and Financial Highlights | 03 |

|

|

||

|

Senior Management Quotes

|

04 |

|

|

||

|

Third Quarter 2025 Earnings Conference Call

|

05 |

|

|

||

|

Summary of Financial Performance and Outlook

|

06 |

|

Financial Overview | 11 |

|

Credicorp’s Strategy Update | 12 |

|

Analysis of 3Q25 Consolidated Results |

|

01

|

Loan Portfolio

|

17

|

|

|

02

|

Deposits

|

20

|

|

|

03

|

Interest Earning Assets and Funding

|

23

|

|

|

04

|

Net Interest Income (NII)

|

25

|

|

|

05

|

Portfolio Quality and Provisions

|

28

|

|

|

06

|

Other Income

|

32

|

|

|

07

|

Insurance Underwriting Results and the Medical Services

|

36

|

|

|

08

|

Operating Expenses

|

39

|

|

|

09

|

Operating Efficiency

|

41

|

|

|

10

|

Regulatory Capital

|

42

|

|

|

11

|

Economic Outlook

|

44

|

|

|

12

|

Appendix

|

48

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

|

| • |

Net income attributable to Credicorp increased 14.1% YoY and declined 4.6% QoQ to S/1,738.7 million, with ROE at 19.6% driven by contributions from all lines of

business.

|

| • |

Credicorp’s total assets declined 2.1% YoY due to a non-cash FX revaluation of Bolivia’s balance sheet. Loan and deposit figures exclude this accounting adjustment.

|

| • |

Total Loans in quarter-end balances rose 4.4% YoY and 7.0% FX Neutral, reflecting growth at BCP through Retail Banking, by Mortgages and Consumer Loans, and Wholesale

Banking. QoQ, Total Loans increased 1.6% and 2.4% FX Neutral, led by the same segments, along with SMEs at BCP and Mibanco.

|

| • |

Total Deposits increased 5.9% (+10.8% FX Neutral) YoY and 1.3% (+3.8% FX Neutral) QoQ, mainly driven by growth in both Low-cost deposits and Term deposits. Low-cost

deposits accounted for 69.8% of total deposits and 58.1% of the total funding base.

|

| • |

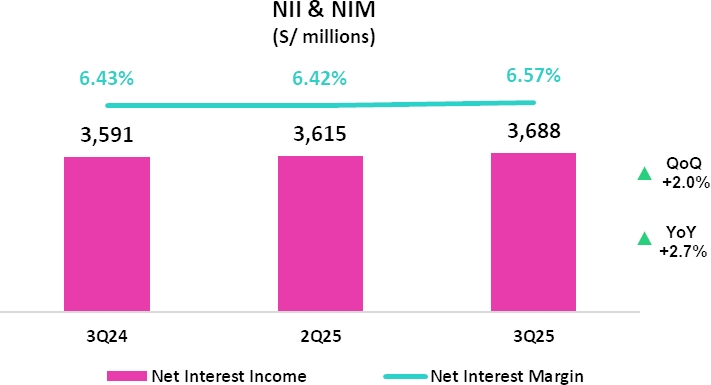

Net interest income (NII) rose 2.7% YoY, driven by a further strengthened funding mix and higher-yielding loan portfolio; and increased 2.0% QoQ. Net Interest Margin (NIM) reached 6.57%, expanding 14 bps YoY and 15 bps QoQ.

|

| • |

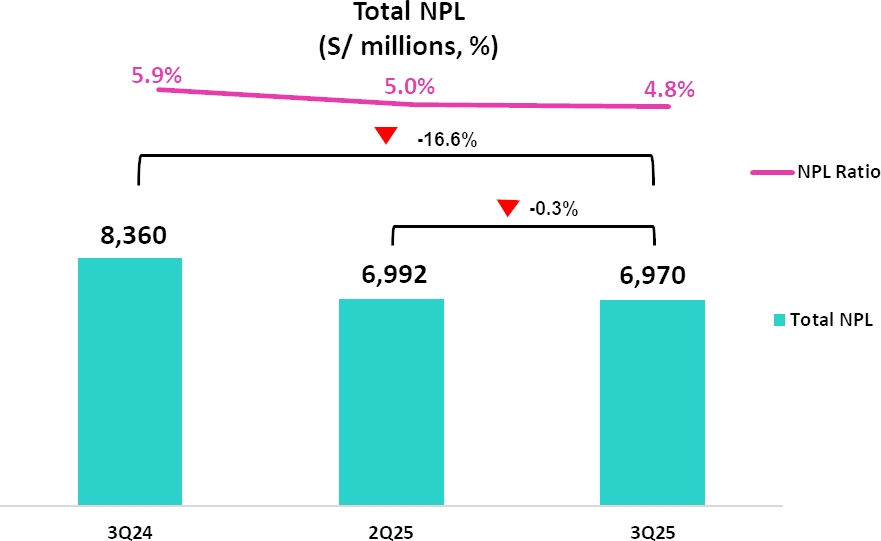

NPL Ratio improved across all segments, declining 105 bps YoY to 4.8%, principally reflecting debt repayments at BCP and a drop in overdue loans at BCP and Mibanco.

QoQ, the NPL Ratio improved by 15 bps.

|

| • |

Provisions declined by 30.5% YoY, driven by BCP and Mibanco, which registered improvements in payment performance due to economic recovery and an increase in

lower-risk vintages’ share of the portfolio mix. QoQ, provisions increased 4.8%. Cost of Risk declined 71 bps YoY to 1.7%, while Risk-Adjusted NIM reached

a record 5.5%.

|

| • |

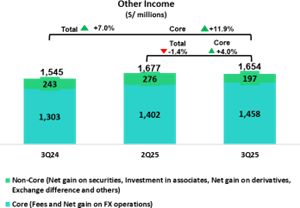

Other Core Income up 11.9% YoY, supported by the strong performance of BCP core business and the dynamism of Yape, reflecting the consistent execution of our revenue

diversification and decoupling from macroeconomic factors strategy. Other Non-Core Income declined 19.0%, reflecting the base effect generated by an extraordinary income recorded last year.

|

| • |

Insurance Underwriting Results rose 33.1% YoY, principally due to a stronger Insurance Service Result in the Life business; and was up 10.7% QoQ.

|

| • |

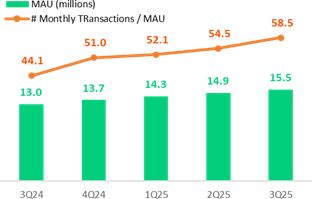

Yape reached 15.5 million Monthly Active Users (MAU), with operating leverage continuing to expand and accounting for 6.6% of Credicorp’s total risk-adjusted revenue.

Lending reached 20% of Yape revenues, up from 7% in 3Q24.

|

| • |

Efficiency ratio at 45.7% for 9M25, on track with full-year guidance. Operating Expenses rose 12.8% YoY in this period,

fueled mainly by BCP’s core business and innovation portfolio.

|

| • |

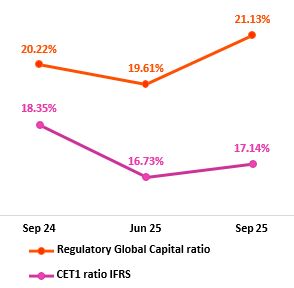

IFRS CET 1 Ratio at 13.17% for BCP and at 17.14% for Mibanco.

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Third Quarter 2025 Earnings Conference Call

|

|||

|

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

|

|

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

|

|

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Universal Banking

|

| |

|

BCP reported solid profitability this quarter, backed by increasing margins; diversified sources of income; and a cost of risk level below that seen in 2024. NIM stood at 6.1%, driven mainly

by a shift in the mix towards a higher preponderance of retail loans and by solid transactional funding. Core income remained robust, backed by a growing and diversified income base in both Yape and the core business.

The CoR stood at 1.3%, due to a greater share of lower-risk loans in the portfolio, supported by a more favorable economic environment.

|

| |

|

Insurance and Pensions

|

|

|

|

Grupo Pacífico's Net Income reflects a solid performance of the underlying business, particularly in the Life and P&C businesses, which continue to show robust

underwriting results. The consolidation o Empresas Banmedica’s operations has further strengthened results for Medical Services. These positive

dynamics were partially offset by a credit downgrade of two assets in the investment portfolio.

|

|

Microfinance

|

|

|

|

Profitability at Mibanco continued to recover, fueled primarily by a rebound in disbursements; fortified risk management; and efficient interest rate

strategies. NIM remained strong, bolstered by active loan pricing and a reduction in the funding cost.

Mibanco Colombia’s results continued to improve on the back of restructuring efforts over the past year and an improvement in the economic environment

for the microfinance sector. Growth remained stable, and risk levels controlled.

|

| |

|

Investment Management and

Advisory

|

|

Operating profitability in the Investment Management and Advisory remained at sound levels. The core business reported solid results, where good performance helped offset an increase in

operating expenses. The Asset Management and Wealth Management business reported a significant uptick in AUMs.

|

|

|

|

Outlook

|

|

We reaffirm our previously published guidance for ROE 2025 of around 19.0%. This expectation is based on (i)

accelerated loan growth, led by the retail segment, (ii) the increase of our NIM, and (iii) a cost of risk again below previous expectations.

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Financial Overview

|

|

Credicorp Ltd.

|

|

Quarter |

% change

|

Up to

|

% change

|

|||

|

S/ 000

|

3Q24

|

2Q25

|

3Q25

|

QoQ

|

YoY

|

Sep 24

|

Sep 25

|

Sep 25 / Sep 24

|

|

Net interest, similar income and expenses

|

3,590,750

|

3,615,371

|

3,687,829

|

2.0%

|

2.7%

|

10,485,337

|

10,875,212

|

3.7%

|

|

Provision for credit losses on loan portfolio, net of recoveries

|

(868,081)

|

(575,159)

|

(602,918)

|

4.8%

|

-30.5%

|

(2,776,151)

|

(1,759,970)

|

-36.6%

|

|

Net interest, similar income and expenses, after provision for credit losses on loan portfolio

|

2,722,669

|

3,040,212

|

3,084,911

|

1.5%

|

13.3%

|

7,709,186

|

9,115,242

|

18.2%

|

|

Other income

|

1,545,344

|

1,677,373

|

1,654,191

|

-1.4%

|

7.0%

|

4,529,233

|

5,021,780

|

10.9%

|

|

Insurance underwriting result

|

291,776

|

350,873

|

388,350

|

10.7%

|

33.1%

|

886,338

|

1,068,357

|

20.5%

|

|

Medical services result

|

-

|

123,319

|

123,953

|

0.5%

|

n.a.

|

-

|

289,961

|

n.a.

|

|

Total expenses

|

(2,448,229)

|

(2,630,310)

|

(2,744,642)

|

4.3%

|

12.1%

|

(7,055,916)

|

(7,907,826)

|

12.1%

|

|

Profit before income tax

|

2,111,560

|

2,561,467

|

2,506,763

|

-2.1%

|

18.7%

|

6,068,841

|

7,587,514

|

25.0%

|

|

Income tax

|

(555,117)

|

(696,969)

|

(728,308)

|

4.5%

|

31.2%

|

(1,602,927)

|

(2,129,746)

|

32.9%

|

|

Net profit

|

1,556,443

|

1,864,498

|

1,778,455

|

-4.6%

|

14.3%

|

4,465,914

|

5,457,768

|

22.2%

|

|

Non-controlling interest

|

32,655

|

42,483

|

39,800

|

-6.3%

|

21.9%

|

91,373

|

119,401

|

30.7%

|

|

Net profit attributable to Credicorp

|

1,523,788

|

1,822,015

|

1,738,655

|

-4.6%

|

14.1%

|

4,374,541

|

5,338,367

|

22.0%

|

|

Dividends paid to third parties

|

875,992

|

3,181,440

|

-

|

-100.0%

|

-100.0%

|

3,667,644

|

3,181,440

|

-13.3%

|

|

Net income / share (S/)

|

19.1

|

22.8

|

21.8

|

-4.6%

|

14.1%

|

54.8

|

66.9

|

22.0%

|

|

Dividends per Share (S/)

|

11.00

|

39.89

|

-

|

-100.0%

|

-100.0%

|

46.0

|

39.9

|

-13.3%

|

|

Loans

|

142,568,785

|

140,961,978

|

144,752,254

|

2.7%

|

1.5%

|

142,568,785

|

144,752,254

|

1.5%

|

|

Deposits and obligations

|

154,435,451

|

154,723,334

|

158,430,455

|

2.4%

|

2.6%

|

154,435,451

|

158,430,455

|

2.6%

|

|

Net equity

|

33,462,591

|

34,459,012

|

36,560,502

|

6.1%

|

9.3%

|

33,462,591

|

36,560,502

|

9.3%

|

|

Profitability

|

||||||||

|

Net interest margin(1)

|

6.4%

|

6.4%

|

6.6%

|

15 bps

|

14 bps

|

6.3%

|

6.3%

|

2 bps

|

|

Risk-adjusted Net interest margin

|

4.9%

|

5.4%

|

5.5%

|

9 bps

|

60 bps

|

4.7%

|

5.3%

|

64 bps

|

|

Funding cost(2)

|

2.7%

|

2.4%

|

2.4%

|

-1 bps

|

-25 bps

|

0.03%

|

2.4%

|

-43 bps

|

|

ROAE

|

18.5%

|

20.7%

|

19.6%

|

-110 bps

|

110 bps

|

17.7%

|

20.1%

|

240 bps

|

|

ROAA

|

2.4%

|

2.9%

|

2.8%

|

-10 bps

|

40 bps

|

2.4%

|

2.8%

|

40 bps

|

|

Loan portfolio quality

|

||||||||

|

Internal overdue ratio(3)

|

4.2%

|

3.6%

|

3.4%

|

-16 bps

|

-81 bps

|

4.2%

|

3.4%

|

-81 bps

|

|

Internal overdue ratio over 90 days

|

3.4%

|

3.0%

|

2.9%

|

-10 bps

|

-50 bps

|

3.4%

|

2.9%

|

-50 bps

|

|

NPL ratio(4)

|

5.9%

|

5.0%

|

4.8%

|

-15 bps

|

-105 bps

|

5.9%

|

4.8%

|

-105 bps

|

|

Cost of risk(5)

|

2.4%

|

1.6%

|

1.7%

|

6 bps

|

-71 bps

|

2.6%

|

1.6%

|

-95 bps

|

|

Coverage ratio of IOLs

|

136.9%

|

151.8%

|

154.9%

|

310 bps

|

1800 bps

|

136.9%

|

154.9%

|

1800 bps

|

|

Coverage ratio of NPLs

|

98.7%

|

109.5%

|

110.1%

|

60 bps

|

1140 bps

|

98.7%

|

110.1%

|

1140 bps

|

|

Operating efficiency

|

||||||||

|

Operating income(6)

|

5,211,162

|

5,529,301

|

5,670,690

|

2.6%

|

8.8%

|

15,288,024

|

16,540,190

|

8.2%

|

|

Operating expenses(7)

|

2,313,324

|

2,483,493

|

2,629,461

|

5.9%

|

13.7%

|

6,696,919

|

7,555,043

|

12.8%

|

|

Efficiency ratio(8)

|

44.4%

|

44.9%

|

46.4%

|

150 bps

|

200 bps

|

43.8%

|

45.7%

|

190 bps

|

|

Operating expenses / Total average assets

|

3.7%

|

3.9%

|

4.2%

|

27 bps

|

48 bps

|

3.7%

|

3.9%

|

20 bps

|

|

Capital adequacy - BCP Stand-alone

|

||||||||

|

Global Capital Ratio(9)

|

18.96%

|

17.33%

|

17.72%

|

42 bps

|

-126 bps

|

18.96%

|

17.72%

|

-124 bps

|

|

Ratio Tier 1(10)

|

13.25%

|

12.24%

|

12.82%

|

62 bps

|

-45 bps

|

13.25%

|

12.82%

|

-43 bps

|

|

Ratio common equity tier 1(11) (13)

|

13.42%

|

12.56%

|

13.17%

|

57 bps

|

-22 bps

|

13.42%

|

13.17%

|

-25 bps

|

|

Capital adequacy - Mibanco

|

||||||||

|

Global Capital Ratio(9)

|

20.22%

|

19.61%

|

21.13%

|

153 bps

|

88 bps

|

20.22%

|

21.13%

|

90 bps

|

|

Ratio Tier 1(10)

|

17.85%

|

16.48%

|

17.13%

|

63 bps

|

-75 bps

|

17.85%

|

17.13%

|

-80 bps

|

|

Ratio common equity tier 1(11) (13)

|

18.35%

|

16.73%

|

17.14%

|

44 bps

|

-125 bps

|

18.35%

|

17.14%

|

-130 bps

|

|

Employees(14)

|

46,555

|

48,241

|

48,878

|

1.3%

|

5.0%

|

46,555

|

48,878

|

5.0%

|

|

Share Information

|

||||||||

|

Issued Shares

|

94,382

|

94,382

|

94,382

|

0.0%

|

0.0%

|

94,382

|

94,382

|

0.0%

|

|

Treasury Shares(12)

|

14,949

|

15,016

|

15,016

|

0.0%

|

0.4%

|

14,949

|

15,016

|

0.4%

|

|

Outstanding Shares

|

79,433

|

79,366

|

79,366

|

0.0%

|

-0.1%

|

79,433

|

79,366

|

-0.1%

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

•

|

Scalability and monetization of the ecosystem: Credicorp accelerates financial inclusion and expansion of the formal economy, generating new income flows and deepening relationships

with more than 18 million clients.

|

|

•

|

We drive growth through business synergies: By sharing capabilities in data, artificial intelligence, and cross-functional platforms, we diversify our value proposition, unlock new

revenue streams, expand our reach to underserved segments and enhance operating efficiency.

|

|

•

|

Discipline in execution and creation of sustainable value: maintaining an eye on long-term profitability and efficient allotment of capital, backed by robust governance.

|

|

Core Businesses Transformation (1)

|

|

Quarter |

Up to

|

||

|

3Q24

|

2Q25

|

3Q25

|

Sep 24

|

Sep 25

|

|

|

Credicorp

|

|||||

|

Innovation Portfolio Risk-Adjusted Revenue Share (2)

|

4.5%

|

6.2%

|

7.4%

|

3.9%

|

6.3%

|

|

BCP Stand-alone

|

|||||

|

Digital clients (3)

|

74%

|

78%

|

79%

|

74%

|

78%

|

|

Digital monetary transactions (4)

|

84%

|

88%

|

89%

|

70%

|

87%

|

|

Cashless transactions (5)

|

60%

|

65%

|

65%

|

58%

|

64%

|

|

Mibanco

|

|||||

|

Disbursements through leads (6)

|

66%

|

65%

|

68%

|

69%

|

67%

|

|

Disbursements through alternative channels (7)

|

10%

|

12%

|

10%

|

10%

|

11%

|

|

Relationship managers productivity (8)

|

23.6

|

25.9

|

29.2

|

23.4

|

26.4

|

|

Pacifico

|

|||||

|

Digital Policies (thousands) (9)

|

650.3

|

579.0

|

580.5

|

1,761.8

|

1,881.8

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

Management KPI's (1)

|

|

Quarter |

Change %

|

Up to

|

Change %

|

|||

|

3Q24

|

2Q25

|

3Q25

|

QoQ

|

YoY

|

Sep 24

|

Sep 25

|

Sep 25 / Sep 24

|

|

|

Users

|

||||||||

|

Users (millions)

|

16.6

|

18.6

|

18.7

|

0.6%

|

12.7%

|

16.6

|

18.7

|

12.7%

|

|

Monthly Active Users (MAU) (millions) (2)

|

13.0

|

14.9

|

15.5

|

3.6%

|

18.8%

|

13.0

|

15.5

|

18.8%

|

|

Revenue Generating MAU (millions)

|

10.4

|

12.6

|

13.2

|

5.1%

|

27.3%

|

10.4

|

13.2

|

27.3%

|

|

Engagement

|

||||||||

|

# Transactions (millions)

|

1,664.2

|

2,384.9

|

2,640.1

|

10.7%

|

58.6%

|

4,192.5

|

7,050.4

|

68.2%

|

|

# Transactions / MAU

|

44.1

|

54.5

|

58.5

|

7.4%

|

32.6%

|

44.1

|

58.5

|

32.6%

|

|

# Average Functionalities / MAU

|

2.4

|

2.7

|

2.7

|

1.5%

|

12.5%

|

2.4

|

2.7

|

12.5%

|

|

Experience

|

||||||||

|

NPS (3)

|

73.5

|

77.0

|

76.0

|

-100 bps

|

250 bps

|

73.5

|

76.0

|

250 bps

|

|

Unit Economics

|

||||||||

|

Monthly Indicators (4)

|

||||||||

|

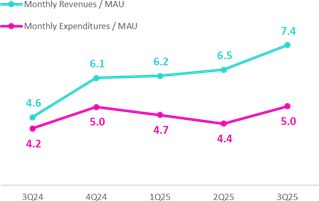

Revenues / MAU (S/)

|

4.6

|

6.5

|

7.4

|

14.9%

|

60.4%

|

4.6

|

7.4

|

60.4%

|

|

Expenses / MAU (S/)

|

-4.2

|

-4.4

|

-5.0

|

15.4%

|

20.6%

|

-4.2

|

-5.0

|

20.6%

|

|

Quarterly Indicators (5)

|

||||||||

|

Revenues / MAU (S/)

|

4.7

|

6.4

|

7.4

|

15.6%

|

58.0%

|

3.9

|

6.5

|

64.3%

|

|

Expenses / MAU (S/)

|

-4.2

|

-4.5

|

-4.8

|

6.5%

|

14.7%

|

-4.0

|

-4.5

|

13.6%

|

|

Drivers Monetization

|

||||||||

|

Total TPV (S/, billions) (6)

|

76.9

|

103.4

|

113.9

|

10.2%

|

48.1%

|

189.5

|

308.8

|

63.0%

|

|

Total Revenue Generating TPV (S/, billions) (7)

|

||||||||

|

Payments

|

6.3

|

10.1

|

12.0

|

18.6%

|

91.1%

|

15.0

|

30.9

|

106.6%

|

|

# Bill Payments transactions (millions)

|

35

|

50

|

56

|

12.0%

|

62.3%

|

87

|

151

|

74.7%

|

|

Financials

|

||||||||

|

# Loans Disbursements (thousands)

|

1,296

|

3,855

|

4,196

|

8.8%

|

223.8%

|

2,560

|

11,151

|

335.6%

|

|

E-Commerce

|

||||||||

|

GMV (S/, millions) (8)

|

111.8

|

129.1

|

168.6

|

30.6%

|

50.8%

|

245.8

|

422.2

|

71.7%

|

|

Financial Results (1)

|

|

Quarter |

|

Change %

|

Up to

|

Change %

|

||

| S/ millions |

3Q24

|

2Q25

|

3Q25

|

QoQ

|

YoY

|

Sep 24

|

Sep 25

|

Sep 25 / Sep 24

|

|

Net Interest Income after Provisions (2)

|

70.2

|

123.9

|

146.4

|

18.1%

|

108.7%

|

106.9

|

363.3

|

239.9%

|

|

Other Income (3)

|

108.2

|

159.0

|

195.2

|

22.8%

|

80.3%

|

139.7

|

495.8

|

254.9%

|

|

Total Income

|

178.4

|

282.9

|

341.6

|

20.7%

|

91.5%

|

246.6

|

859.1

|

248.4%

|

|

Total Operating Expenses

|

-158.4

|

-197.1

|

-220.1

|

11.7%

|

39.0%

|

-426.7

|

-596.9

|

39.9%

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

|

|

The financial business, which has the highest potential for long-term growth, maintained solid momentum. This evolution was driven primarily by the lending business, which now exceeds 3.4 million

disbursed clients with at least one loan received. 30% of loan borrowers received their first formal loans in the financial system through Yape, which consolidates the app’s fundamental role in financial

inclusion. Credicorp aspires to include 8 million people as of 2028 by focusing on penetrating the lowest levels of the socio-economic pyramid. Currently, Yape reports more than 4 million disbursements

per quarter with average tickets that range between S/200 and S/2,500 depending on the product. To accelerate lending disbursements, Yape plans to increase its pool of pre-approved loans by 30% by 2028,

up from the current 6 million as of 3Q25. The app has begun a pilot for the SME segment, seeking to extend portfolio durations and ticket sizes, where it leverages synergies of Credicorp’s ecosystem to

bolster the value proposition. At quarter-end, the loan portfolio is primarily comprised of multi-installment loans, reflecting greater effectiveness in loan conversion. Revenue from floating continues to

grow, impacted by inflows from statutory bonus payments.

In e-commerce the monthly GMV reached S/168.5 million, driven mainly by Yape Promos, which registered a signficant rise in visits and transactions over the period. Brand Solutions and Gaming also

posted positive results on the back of an uptick in commercial campaigns.

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

o

|

BCP and Yape financially included 200 thousand people in 3Q25, to reach a total of 6.3 million since 2020 (+11% vs 4Q24). More than 3.4 million people have disbursed at least one

loan through Yape to date, 30% of which were first-time borrowers in the formal financial system.

|

|

o

|

At the end of 3Q25, Pacifico reported over 3.3 million clients protected by inclusive insurance products1, of which more than 2.9 million belong to mass-market

segments, distributed through BCP, Mibanco, Yape, and third-party partnerships. In August, the company launched Compra Segura (in partnership with Falabella) to cover

theft or accidental damage of purchases of S/ 50 and above; these policies also offer online medical consultations. Meanwhile, Pacífico Salud insured more than 416,000 individuals with inclusive health

insurance plans YTD.

|

|

o

|

To jump-start financial inclusion in peri-urban and rural areas, we are conducting pilots to develop innovative ways to generate trust and be closer to people. For example,

Yape’s Financial Inclusion Project in Cuzco and Mibanco’s Sobre Ruedas aim to drive banking penetration in underserved areas in Lambayeque.

|

|

o

|

We have broadened the scope our financial education programs. Thus far this year, the following initiatives have been particularly noteworthy: i) Academia del Progreso at Mibanco, which trained +372 thousand clients; ii) ABC at BCP, which improved the financial behavior of +491 thousand people; and iii) “Aprende con Yape”, which offers

financial education modules through the app, imparted 146 thousand courses.

|

|

o

|

On the front Support to Micro, Small and Medium Enterprises (MSMEs), our main initiatives achieved the following:

|

|

o

|

On the Sustainable Finances front, our subsidiaries advance as follows:

|

|

o

|

Finally, we continue to strengthen the Resilience of individuals and businesses through risk prevention training. On this front,

Pacifico has reached 315 thousand people thus far this year (including clients, non-clients and employees at businesses) through programs such as “ABC de Pacífico,” “Comunidad Segura” and “Protege365”.

|

|

o

|

On the trust front, we advanced the “OrguYO” initiative at BCP, which aims to generate civic-mindedness and integrity through personal examples. We value the ripple effect that our employees can generate

when they promote these values.

|

|

Indicator

|

Company

|

Unit

|

3Q24

|

2Q25

|

3Q25

|

|

|

Inclusion

|

||||||

|

People included financially through BCP and Yape – cumulative since 20202

|

BCP Peru and Yape

|

Millions

|

5.3

|

6.1

|

6.3

|

|

|

Clients included in inclusive insurance services

|

Pacifico

|

Millions

|

N.D.

|

2.9

|

2.9

|

|

|

Finance for the Future

|

||||||

|

Total loan disbursements for MSMEs3

|

Mibanco Peru

|

S/ Millions

|

10,059

|

7,757

|

11,812

|

|

|

Disbursements of sustainable financings - YTD

|

BCP Peru

|

$ Millions

|

1,110

|

1,517

|

2,1304

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

| 01 |

Loan Portfolio

|

|

This quarter, total loans were once again impacted by the asset revaluation at BCP

Bolivia. If we exclude this impact, total loans in quarter-end balances increased 1.6% QoQ and 4.4% YoY, on track to meeting our guidance by year-end.

Excluding the impact of the USD devaluation against PEN, total loans in quarter-end balances grew 2.4% QoQ in

FX neutral terms. The main dynamics that drove this evolution were (i) growth in disbursements in Small Businesses, (ii) growth in demand for loans in Mortgage and (iii) record-high disbursements in the

month of September at Mibanco.

YoY, total loans in quarter-end balances rose 7.0% in FX neutral terms. The main drivers of this

result were (i) growth in disbursements in Mortgage and an increase in the appetite for risk in Consumer (ii) an increase in the demand for short-term financing in Middle Market Banking and (iii) an

upswing in the dynamism of disbursements at Mibanco.

|

|

Total Loans

(S/ Millions)

|

|

As of

|

Volume change

|

USD/PEN Neutral

Volume change

|

USD/PEN Neutral

% Change

|

||||

|

Sep 24

|

Jun 25

|

Sep 25

|

QoQ

|

YoY

|

QoQ

|

YoY

|

QoQ

|

YoY

|

|

|

BCP Stand-alone

|

117,687

|

120,999

|

123,089

|

1.7%

|

4.6%

|

2,929

|

8,186

|

2.4%

|

7.0%

|

|

Mibanco

|

12,119

|

12,785

|

13,096

|

2.4%

|

8.1%

|

311

|

977

|

2.4%

|

8.1%

|

|

Mibanco Colombia

|

1,774

|

1,976

|

2,158

|

9.2%

|

21.7%

|

227

|

533

|

11.5%

|

30.1%

|

|

BCP Bolivia

|

9,830

|

4,189

|

5,505

|

31.4%

|

-44.0%

|

n.a.

|

n.a.

|

n.a.

|

n.a.

|

|

ASB Bank Corp.

|

1,928

|

1,559

|

1,422

|

-8.8%

|

-26.3%

|

-108

|

-408

|

-6.9%

|

-21.2%

|

|

Others (1)

|

-768

|

-546

|

-519

|

-5.1%

|

-32.5%

|

28

|

251

|

-5.2%

|

-32.6%

|

|

Total Loans BAP

|

142,569

|

140,962

|

144,752

|

2.7%

|

1.5%

|

n.a.

|

n.a.

|

n.a.

|

n.a.

|

|

BCP Bolivia (Adjusted for Asset Revaluation)

|

9,830

|

9,684

|

9,554

|

-1.3%

|

-2.8%

|

68

|

382

|

0.7%

|

3.9%

|

|

Total Loans BAP (Adjusted for Asset Revaluation)

|

142,569

|

146,457

|

148,801

|

1.6%

|

4.4%

|

3,455

|

9,921

|

2.4%

|

7.0%

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

01. Loan Portfolio

|

|

Total Loans

(S/ Millions)

|

As of

|

QoQ Change

|

Balance in USD/PEN Neutral

As of

|

QoQ Change

in USD/PEN Neutral

|

||||

|

Jun 25

|

Sep 25

|

Volume

|

%

|

Jun 25

|

Sep 25

|

Volume

|

%

|

|

|

BCP Stand-alone

|

120,999

|

123,089

|

2,090

|

1.7%

|

120,999

|

123,928

|

2,929

|

2.4%

|

|

Wholesale Banking

|

53,025

|

53,340

|

315

|

0.6%

|

53,025

|

53,982

|

956

|

1.8%

|

|

Corporate

|

30,496

|

31,485

|

989

|

3.2%

|

30,496

|

31,865

|

1,369

|

4.5%

|

|

Middle - Market

|

22,529

|

21,855

|

-674

|

-3.0%

|

22,529

|

22,117

|

-413

|

-1.8%

|

|

Retail Banking

|

66,176

|

67,958

|

1,782

|

2.7%

|

66,176

|

68,130

|

1,954

|

3.0%

|

|

SME - Business

|

7,692

|

8,097

|

405

|

5.3%

|

7,692

|

8,169

|

477

|

6.2%

|

|

SME - Pyme

|

16,091

|

16,447

|

356

|

2.2%

|

16,091

|

16,449

|

359

|

2.2%

|

|

Mortgage

|

22,824

|

23,377

|

553

|

2.4%

|

22,824

|

23,411

|

587

|

2.6%

|

|

Consumer

|

13,446

|

13,781

|

335

|

2.5%

|

13,446

|

13,822

|

376

|

2.8%

|

|

Credit Card

|

6,124

|

6,257

|

133

|

2.2%

|

6,124

|

6,278

|

154

|

2.5%

|

|

Others (1)

|

1,797

|

1,791

|

-6

|

-0.3%

|

1,797

|

1,816

|

19

|

1.1%

|

|

Larger contraction in volume

|

|

Larger expansion in volume

|

|

•

|

Small businesses, due to growth in disbursements of negotiable invoices and working capital loans in SME-Business and SME-Pyme, respectively.

|

|

•

|

Mortgage, due to an uptick in demand for loans in a more favorable economic context marked by on-going low interest rates.

|

|

•

|

Consumer, driven by growth in disbursements, mainly through BCP and Yape.

|

|

Total Loans

(S/ Millions)

|

As of

|

YoY Change

|

Balance in Neutral USDPEN

As of

|

YoY Change

in Neutral USDPEN

|

||||

|

Sep 24

|

Sep 25

|

Volume

|

%

|

Sep 24

|

Sep 25

|

Volume

|

%

|

|

|

BCP Stand-alone

|

117,687

|

123,089

|

5,402

|

4.6%

|

117,687

|

125,873

|

8,186

|

7.0%

|

|

Wholesale Banking

|

51,663

|

53,340

|

1,677

|

3.2%

|

51,663

|

55,470

|

3,807

|

7.4%

|

|

Corporate

|

31,383

|

31,485

|

102

|

0.3%

|

31,383

|

32,746

|

1,363

|

4.3%

|

|

Middle - Market

|

20,280

|

21,855

|

1,575

|

7.8%

|

20,280

|

22,724

|

2,444

|

12.1%

|

|

Retail Banking

|

64,384

|

67,958

|

3,574

|

5.6%

|

64,384

|

68,528

|

4,144

|

6.4%

|

|

SME - Business

|

7,912

|

8,097

|

184

|

2.3%

|

7,912

|

8,337

|

425

|

5.4%

|

|

SME - Pyme

|

16,268

|

16,447

|

178

|

1.1%

|

16,268

|

16,456

|

188

|

1.2%

|

|

Mortgage

|

21,614

|

23,377

|

1,764

|

8.2%

|

21,614

|

23,490

|

1,876

|

8.7%

|

|

Consumer

|

12,709

|

13,781

|

1,072

|

8.4%

|

12,709

|

13,917

|

1,208

|

9.5%

|

|

Credit Card

|

5,881

|

6,257

|

376

|

6.4%

|

5,881

|

6,329

|

447

|

7.6%

|

|

Others (1)

|

1,640

|

1,791

|

151

|

9.2%

|

1,640

|

1,875

|

234

|

14.3%

|

|

Larger contraction in volume

|

|

Larger expansion in volume

|

|

•

|

Mortgage, due to the same dynamics in play QoQ.

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

01. Loan Portfolio

|

|

•

|

Consumer, due to growth in disbursements, which rose on the back of an increase in the appetite for risk at BCP, followed by an uptick in disbursements through

Yape.

|

|

•

|

Middle Market Banking, due to growth in the demand for short-term loans, particularly in the agriculture sector.

|

|

•

|

Corporate banking, spurred by the same dynamics seen QoQ.

|

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

| 02 |

Deposits

|

|

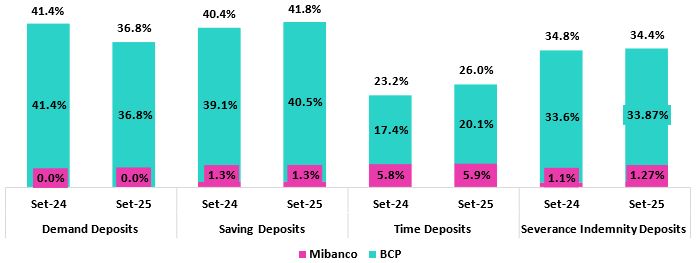

|

This quarter, Total Deposits were once again impacted by asset revaluation at BCP Bolivia. If we exclude this

impact, total deposits rose 1.3% QoQ and 5.9% YoY.

Excluding the impact of the USD devaluation against PEN, total deposits grew 3.8% QoQ in FX neutral terms. This

growth was primarily attributable to: (i) growth in the balance of demand deposits held by wholesale clients, (ii) expansion in the balance of Savings Deposits, which were bolstered by statutory bonus

payments in July and (iii) an increase in the balance of time deposits in LC, which rose on the back of our funding strategy’s focus on growing captures of wholesale clients.

YoY, Total Deposits rose 10.8% in FX neutral terms. This increase, which was driven by the same factors that drove

growth QoQ, was partially offset by a decline in LC Demand Deposits due the remaining impact of pension fund withdrawals.

At the end of 3Q25, 69.8% of Total Deposits were low cost (Demand + Savings). Credicorp continued to lead the market

for low-cost deposits, with a market share of 39.5% at the end of September

|

|

| Deposits |

As of

|

Volume (%)

|

USD/PEN Neutral

Volume change

|

USD/PEN Neutral

% Change

|

|||||

|

S/000

|

Sep 24

|

Jun 25

|

Sep 25

|

QoQ

|

YoY

|

QoQ

|

YoY

|

QoQ

|

YoY

|

|

Demand deposits

|

53,149,144

|

49,237,039

|

50,930,173

|

3.4%

|

-4.2%

|

2,883,595

|

2,332,144

|

5.6%

|

4.4%

|

|

Saving deposits

|

54,474,960

|

59,086,275

|

60,580,840

|

2.5%

|

11.2%

|

2,419,443

|

9,581,346

|

4.0%

|

17.6%

|

|

Time deposits

|

42,514,849

|

42,361,180

|

43,115,987

|

1.8%

|

1.4%

|

1,158,309

|

4,785,244

|

2.6%

|

11.3%

|

|

Severance indemnity deposits

|

2,989,705

|

3,268,583

|

2,956,446

|

-9.5%

|

-1.1%

|

-275,884

|

34,792

|

-8.4%

|

1.2%

|

|

Interest payable

|

1,306,793

|

770,257

|

847,009

|

10.0%

|

-35.2%

|

10,367

|

-1,108

|

0.8%

|

-0.1%

|

|

Low-cost deposits (1)

|

107,624,104

|

108,323,314

|

111,511,013

|

2.9%

|

3.6%

|

||||

|

Total Deposits

|

154,435,451

|

154,723,334

|

158,430,455

|

2.4%

|

2.6%

|

||||

|

Low-cost deposits (1)

|

107,624,104

|

111,757,648

|

114,236,696

|

2.2%

|

6.1%

|

5,303,038

|

11,913,490

|

4.7%

|

11.1%

|

|

Total Deposits

|

154,435,451

|

161,439,586

|

163,607,971

|

1.3%

|

5.9%

|

6,195,830

|

16,732,417

|

3.8%

|

10.8%

|

|

|

● |

Growth of 5.6% in the balance of Demand Deposits, fueled mainly by growth in volumes of FC deposits held by wholesale clients at BCP Stand-alone. These deposits rose primarily on the back of an upswing in institutional activity and secondarily due to a drop in the exchange rate, which led

institutional clients to convert funds.

|

|

|

● |

An 4% increase in the balance of Savings Deposits, which was driven primarily by growth in volumes at BCP Stand-alone and in

Individuals in particular, spurred by: (i) an increase in the volume in LC, fueled by statutory bonus payments in July and (ii) an increase in the FC volume, given that clients sought to save in USD

following three consecutive quarters of declines in the USDPEN FX. Growth in the balance of Savings Deposits reflects the success of our transactional offering, which allows us to capture deposits in an

environment marked by higher liquidity.

|

|

|

● |

An increase of 2.6% in the balance for Time Deposits, which was driven by growth in captures of LC deposits held by wholesale clients

at BCP Stand-alone, in line with the objectives of our funding strategy.

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

02. Deposits

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

02. Deposits

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

| 03 |

Interest-earning Assets (IEA) and Funding

|

|

|

In 3Q25, IEA rose 1.7% QoQ and 0.4% YoY. Funding, in turn, dropped 2.0% QoQ and 0.5% YoY. If we exclude the impact on

Credicorp’s balance sheet of the accounting adjustment in BCP Bolivia, the evolution of IEA and Funding was driven by the following dynamics:

QoQ, IEA rose 0.9% due to loan expansion at BCP and Mibanco. Growth in the balance for Cash and due from banks,

which reflected an increase in Deposits, also contributed to growth in IEA, albeit to a lesser extent. Funding rose 0.6%, primarily on the back of an increase in Deposits, while an uptick in the

balance for BCRP Instruments, which reflects an increase in positions to diversify funding, acted as a secondary driver.

YoY, IEA rose 2.3%, driven by loan growth, primarily at BCP. This dynamic was partially offset by a reduction in balances

for Cash and due from banks and Total investments as part of balance sheet management. Finally, Funding rose 3.1%, driven by Deposits, and low-cost deposits in particular. This growth was partially

offset by a reduction for balances for Bonds and notes issued, impacted by recent debt expirations.

|

|

| 3.1. |

IEA

|

|

Interest Earning Assets

|

As of

|

% change

|

|||

|

S/000

|

Sep 24

|

Jun 25

|

Sep 25

|

QoQ

|

YoY

|

|

Cash and due from banks

|

37,007,966

|

34,206,000

|

35,862,184

|

4.8%

|

-3.1%

|

|

Total investments

|

53,328,873

|

51,603,447

|

51,186,579

|

-0.8%

|

-4.0%

|

|

Cash collateral, reverse repurchase agreements and securities borrowing

|

1,419,305

|

4,593,501

|

3,404,639

|

-25.9%

|

139.9%

|

|

Loans

|

142,568,785

|

140,961,978

|

144,752,254

|

2.7%

|

1.5%

|

|

Total interest earning assets

|

234,324,929

|

231,364,926

|

235,205,656

|

1.7%

|

0.4%

|

|

Total interest earning assets (Adjusted for Asset Revaluation)

|

234,324,929

|

237,642,758

|

239,824,996

|

0.9%

|

2.3%

|

|

Total interest earning assets (Adjusted for Asset Revaluation, FX Neutral USDPEN)

|

1.8%

|

5.5%

|

|||

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

03. Interest-earning Assets (IEA) and Funding

|

| 3.2. |

Funding

|

|

Funding

|

As of

|

% change

|

|||

|

S/ 000

|

Sep 24

|

Jun 25

|

Sep 25

|

QoQ

|

YoY

|

|

Deposits and obligations

|

154,435,451

|

154,723,334

|

158,430,455

|

2.4%

|

2.6%

|

|

Due to banks and correspondents

|

12,704,234

|

11,152,813

|

11,241,079

|

0.8%

|

-11.5%

|

|

BCRP instruments

|

4,788,939

|

5,096,459

|

6,643,892

|

30.4%

|

38.7%

|

|

Repurchase agreements with clients and third parties

|

2,594,165

|

6,168,934

|

3,537,281

|

-42.7%

|

36.4%

|

|

Bonds and notes issued

|

16,952,011

|

12,112,403

|

12,209,724

|

0.8%

|

-28.0%

|

|

Total funding

|

191,474,800

|

189,253,943

|

192,062,431

|

1.5%

|

0.3%

|

|

Total funding (Adjusted for Asset Revaluation)

|

191,474,800

|

196,368,181

|

197,503,936

|

0.6%

|

3.1%

|

|

Total funding (Adjusted for Asset Revaluation, FX Neutral USDPEN)

|

2.5%

|

1.3%

|

|||

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

04

|

Net Interest Income (NII)

|

|

|

In 2Q25 Net Interest Income (NII) rose 2.0% QoQ. This evolution was driven mainly by Interest on loans, which rose

on the back of loan growth, particularly in retail segments.

YoY, NII increased 2.7% due to a reduction in Interest and similar expenses. This decline was

fueled primarily by a drop in expenses for deposits, which reflected a decrease in interest rates, and secondarily by an increase in low-cost deposits’ share of the funding structure.

NIM expanded 14 bps YoY to stand at 6.57%, propelled by a drop in the funding cost in a context

marked by a downward trend in interest rates. It is important to note that growth in retail loans helped contain the negative impact that rates exerted on the IEA yield. Finally,

risk-adjusted NIM reached a record high1 of 5.53%.

|

|

|

Net interest income

|

Quarter

|

% change

|

Up to

|

% Change

|

||||

|

S/000

|

3Q24

|

2Q25

|

3Q25

|

QoQ

|

YoY

|

Sep 24

|

Sep 25

|

Sep 25 / Sep 24

|

|

Interest and Similar Income

|

4,995,971

|

4,922,292

|

4,987,693

|

1.3%

|

-0.2%

|

14,857,135

|

14,804,775

|

-0.4%

|

|

Interest and Similar Expenses

|

(1,405,221)

|

(1,306,921)

|

(1,299,864)

|

-0.5%

|

-7.5%

|

(4,371,798)

|

(3,929,563)

|

-10.1%

|

|

Interest Expense (excluding Net Insurance Financial Expenses)

|

(1,276,643)

|

(1,167,866)

|

(1,158,421)

|

-0.8%

|

-9.3%

|

(3,996,530)

|

(3,513,443)

|

-12.1%

|

|

Net Insurance Financial Expenses

|

(128,578)

|

(139,055)

|

(141,443)

|

1.7%

|

10.0%

|

(375,268)

|

(416,120)

|

10.9%

|

|

Net Interest, similar income and expenses

|

3,590,750

|

3,615,371

|

3,687,829

|

2.0%

|

2.7%

|

10,485,337

|

10,875,212

|

3.7%

|

|

|

||||||||

|

Balances

|

||||||||

|

Average Interest Earning Assets (IEA)

|

231,316,507

|

233,761,957

|

233,285,291

|

-0.2%

|

0.9%

|

229,452,866

|

237,958,451

|

3.7%

|

|

Average Funding

|

190,855,164

|

191,161,476

|

190,658,187

|

-0.3%

|

-0.1%

|

188,110,844

|

195,494,018

|

3.9%

|

|

|

||||||||

|

Yields

|

||||||||

|

Yield on IEAs

|

8.64%

|

8.42%

|

8.55%

|

13 bps

|

-9 bps

|

8.63%

|

8.30%

|

-33 bps

|

|

Cost of Funds(1)

|

2.68%

|

2.44%

|

2.43%

|

-1 bps

|

-25 bps

|

2.83%

|

2.40%

|

-43 bps

|

|

Net Interest Margin (NIM)(1)

|

6.43%

|

6.42%

|

6.57%

|

15 bps

|

14 bps

|

6.31%

|

6.33%

|

2 bps

|

|

Risk-Adjusted Net Interest Margin(1)

|

4.93%

|

5.44%

|

5.53%

|

9 bps

|

60 bps

|

4.70%

|

5.34%

|

64 bps

|

|

Peru's Reference Rate

|

5.25%

|

4.50%

|

4.25%

|

-25 bps

|

-100 bps

|

5.25%

|

4.25%

|

-100 bps

|

|

FED funds rate

|

5.00%

|

4.50%

|

4.25%

|

-25 bps

|

-75 bps

|

5.00%

|

4.25%

|

-75 bps

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

04. Net Interest income (NII)

|

|

Interest Income / IEA

|

3Q24

|

2Q25

|

3Q25

|

Sep 24

|

Sep 25

|

|||||||||||

|

S/ millions

|

Average

|

Income

|

Yields

|

Average

|

Income

|

Yields

|

Average

|

Income

|

Yields

|

Average

|

Income

|

Yields

|

Average

|

Income

|

Yields

|

|

|

Balance

|

Balance

|

Balance

|

Balance

|

Balance

|

||||||||||||

|

Total (LC + FC)

|

||||||||||||||||

|

Cash and equivalents

|

32,083

|

365

|

4.6%

|

35,864

|

342

|

3.8%

|

35,034

|

316

|

3.6%

|

31,494

|

1,019

|

4.3%

|

37,991

|

1,003

|

3.5%

|

|

|

Other IEA

|

1,598

|

26

|

6.5%

|

3,215

|

69

|

8.6%

|

3,999

|

68

|

6.8%

|

1,415

|

80

|

7.5%

|

2,219

|

157

|

9.4%

|

|

|

Investments

|

52,877

|

681

|

5.2%

|

53,604

|

670

|

5.0%

|

51,396

|

643

|

5.0%

|

52,772

|

2,042

|

5.2%

|

52,506

|

1,996

|

5.1%

|

|

|

Loans

|

144,757

|

3,924

|

10.8%

|

141,079

|

3,841

|

10.9%

|

142,857

|

3,961

|

11.1%

|

143,773

|

11,715

|

10.9%

|

145,242

|

11,649

|

10.7%

|

|

|

Total IEA

|

231,315

|

4,996

|

8.6%

|

233,762

|

4,922

|

8.4%

|

233,286

|

4,988

|

8.6%

|

229,454

|

14,856

|

8.6%

|

237,958

|

14,805

|

8.3%

|

|

|

IEA (LC)

|

55.7%

|

68.8%

|

10.7%

|

56.5%

|

71.1%

|

10.6%

|

56.7%

|

71.4%

|

10.8%

|

56.3%

|

69.4%

|

10.6%

|

55.8%

|

71.0%

|

10.6%

|

|

|

IEA (FC)

|

44.3%

|

31.2%

|

6.1%

|

43.5%

|

28.9%

|

5.6%

|

43.3%

|

28.6%

|

5.7%

|

43.7%

|

30.6%

|

6.0%

|

44.2%

|

29.0%

|

5.4%

|

|

|

Interest Income / Funding

|

3Q24

|

2Q25

|

3Q25

|

Sep 24

|

Sep 25

|

|||||||||||

|

S/ millions

|

Average

|

Expense

|

Yields

|

Average

|

Expense

|

Yields

|

Average

|

Expense

|

Yields

|

Average

|

Expense

|

Yields

|

Average

|

Expense

|

Yields

|

|

|

Balance

|

Balance

|

Balance

|

Balance

|

Balance

|

||||||||||||

|

Total (LC + FC)

|

||||||||||||||||

|

Deposits

|

153,203

|

678

|

1.8%

|

156,171

|

541

|

1.4%

|

156,577

|

565

|

1.4%

|

151,070

|

2,195

|

1.9%

|

160,136

|

1,726

|

1.4%

|

|

|

BCRP + Due to Banks

|

17,828

|

262

|

5.9%

|

17,107

|

265

|

6.2%

|

17,067

|

253

|

5.9%

|

18,617

|

794

|

5.7%

|

17,643

|

785

|

5.9%

|

|

|

Bonds and Notes

|

17,453

|

201

|

4.6%

|

13,252

|

193

|

5.8%

|

12,161

|

165

|

5.4%

|

15,773

|

598

|

5.1%

|

14,739

|

525

|

4.7%

|

|

|

Others

|

2,371

|

264

|

44.5%

|

4,632

|

307

|

26.5%

|

4,853

|

317

|

26.1%

|

2,651

|

785

|

39.5%

|

2,976

|

894

|

40.1%

|

|

|

Total Funding

|

190,855

|

1,405

|

2.9%

|

191,162

|

1,306

|

2.7%

|

190,658

|

1,300

|

2.7%

|

188,111

|

4,372

|

3.1%

|

195,494

|

3,930

|

2.7%

|

|

|

Funding (LC)

|

49.3%

|

48.5%

|

2.9%

|

52.4%

|

51.9%

|

2.7%

|

52.6%

|

52.8%

|

2.7%

|

49.3%

|

50.8%

|

3.2%

|

51.9%

|

52.7%

|

2.7%

|

|

|

Funding (FC)

|

50.7%

|

51.5%

|

3.0%

|

47.6%

|

48.1%

|

2.8%

|

47.4%

|

47.2%

|

2.7%

|

50.7%

|

49.2%

|

3.0%

|

48.1%

|

47.3%

|

2.6%

|

|

|

NIM(1)

|

231,315

|

3,591

|

6.2%

|

233,762

|

3,616

|

6.2%

|

233,286

|

3,688

|

6.3%

|

229,454

|

10,484

|

6.1%

|

237,958

|

10,875

|

6.1%

|

|

|

NIM (LC)

|

55.7%

|

76.8%

|

8.6%

|

56.5%

|

78.0%

|

8.5%

|

56.7%

|

77.9%

|

8.7%

|

56.3%

|

77.1%

|

8.4%

|

55.8%

|

77.6%

|

8.5%

|

|

|

NIM (FC)

|

44.3%

|

23.2%

|

3.3%

|

43.5%

|

22.0%

|

3.1%

|

43.3%

|

22.1%

|

3.2%

|

43.7%

|

22.9%

|

3.2%

|

44.2%

|

22.4%

|

3.1%

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

04. Net Interest income (NII)

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

05

|

Portfolio Quality and Provisions

|

|

|

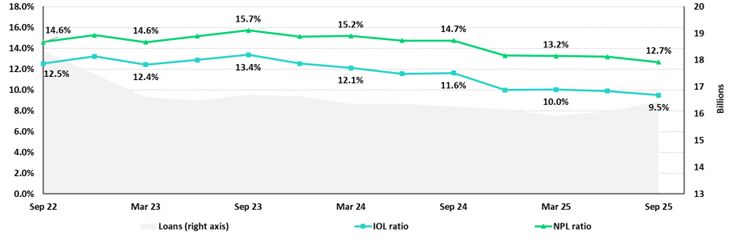

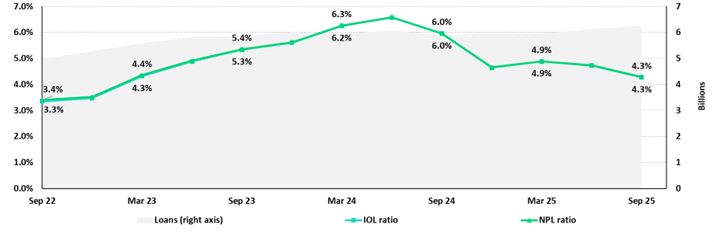

Portfolio quality indicators have continued to evolve positively over the last year, driven by

fortified risk management and backed by improvements in payment performance and in the Peruvian economy.

QoQ, the drop in the NPL balance at BCP Stand-alone was fueled mainly by ongoing improvements in origination and

debt collections management in Consumer and Credit Cards. At Mibanco, the reduction in the NPL balance was spurred primarily by a drop in overdue loans. In this context, the NPL ratio

dropped 15 bps and 105 bps QoQ and YoY, respectively, to stand at 4.8%.

Provisions rose QoQ, driven by an increase at BCP Stand-alone, reflecting both the recurring dynamics of Retail

Banking and specific impacts within Wholesale Banking, with Individuals stable, SMEs slightly higher due to a base effect, and one corporate client showing increased credit risk. This

evolution was partially offset by a drop in provisions at Mibanco, which reflects improvements in debt collections management. YoY, provisions dropped 30.5%, driven by BCP Stand-alone and

Mibanco. In this context, the cost of risk rose slightly 6 bps QoQ and fell 71 bps YoY, to stand at 1.7% at quarter-end.

|

|

| 5.1 |

Portfolio Quality

|

|

Loan Portfolio quality and Delinquency ratios

|

As of

|

% change

|

|||

|

S/000

|

Sep 24

|

Jun 25

|

Sep 25

|

QoQ

|

YoY

|

|

Total loans (Quarter-end balance)

|

142,568,785

|

140,961,978

|

144,752,254

|

2.7%

|

1.5%

|

|

Write-offs

|

923,946

|

581,373

|

713,933

|

22.8%

|

-22.7%

|

|

Internal overdue loans (IOLs)

|

6,026,341

|

5,044,212

|

4,953,303

|

-1.8%

|

-17.8%

|

|

Internal overdue loans over 90-days

|

4,851,591

|

4,171,379

|

4,142,080

|

-0.7%

|

-14.6%

|

|

Refinanced loans

|

2,333,814

|

1,947,709

|

2,016,442

|

3.5%

|

-13.6%

|

|

Non-performing loans (NPLs)

|

8,360,155

|

6,991,921

|

6,969,745

|

-0.3%

|

-16.6%

|

|

IOL ratio

|

4.2%

|

3.6%

|

3.4%

|

-16 bps

|

-81 bps

|

|

IOL over 90-days ratio

|

3.4%

|

3.0%

|

2.9%

|

-10 bps

|

-54 bps

|

|

NPL ratio

|

5.9%

|

5.0%

|

4.8%

|

-15 bps

|

-105 bps

|

|

|

|||

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

05. Portfolio Quality and Provisions

|

|

|

● |

Mibanco, where the NPL ratio fell 41 bps. This evolution was fueled primarily by a drop in NPL volumes and

secondarily, by loan growth.

|

|

|

● |

Mibanco, where the NPL ratio dropped 215 bps YoY, fueled mainly by a

reduction in NPL volumes and secondarily, by loan growth.

|

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

05. Portfolio Quality and Provisions

|

|

5.2

|

Provisions and Cost of Risk of the Total Portfolio

|

|

Loan Portfolio Provisions

|

Quarter

|

% change

|

Up to

|

% change

|

||||

|

S/000

|

3Q24

|

2Q25

|

3Q25

|

QoQ

|

YoY

|

Sep 24

|

Sep 25

|

Sep 25 / Sep 24

|

|

Gross provision for credit losses on loan portfolio

|

(981,870)

|

(683,965)

|

(720,445)

|

5.3%

|

-26.6%

|

(3,085,607)

|

(2,100,143)

|

-31.9%

|

|

Recoveries of written-off loans

|

113,789

|

108,806

|

117,527

|

8.0%

|

3.3%

|

309,456

|

340,173

|

9.9%

|

|

Provision for credit losses on loan portfolio, net of recoveries

|

(868,081)

|

(575,159)

|

(602,918)

|

4.8%

|

-30.5%

|

(2,776,151)

|

(1,759,970)

|

-36.6%

|

|

Cost of risk (1)

|

2.4%

|

1.6%

|

1.7%

|

6 bps

|

-71 bps

|

2.6%

|

1.6%

|

-95 bps

|

|

|

|

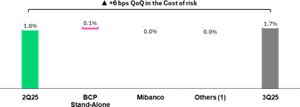

Cost of Risk by Subsidiary

|

|

|

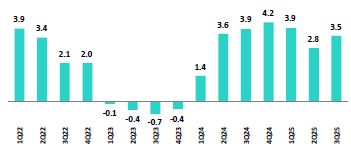

YoY, provisions dropped 30.5%, driven by BCP Stand-alone and Mibanco.

This evolution was fueled by improvements in payment performance in a context of economic recovery. At BCP Individual, the reduction in provisions was

attributable to Individuals and SME-Pyme, where the decine was mainly due to an increase in lower-risk vintages’ share

of total loans. This evolution was partially offset by Wholesale, which was impacted by the base effect generated by an uptick in reversals due to an increase in

debt repayments. At Mibanco, the decrease was led by an improvement in underlying risk as lower-risk vintages gained traction and currently represent 78% of

total loans. In this context, the CoR at Credicorp dropped 71 bps YoY to stand at 1.7%.

|

|

|

QoQ Cost of Risk Evolution

|

|

YoY Cost of Risk Evolution

|

|

(1) Others include BCP Bolivia, Mibanco Colombia, ASB and eliminations.

|

(1) Others include BCP Bolivia, Mibanco Colombia, ASB and eliminations.

|

|

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

05. Portfolio Quality and Provisions

|

|

Loan Portfolio Quality and Delinquency Ratios

|

|

As of |

% change

|

||

|

S/000

|

Sep 24

|

Jun 25

|

Sep 25

|

QoQ

|

YoY

|

|

Total loans (Quarter-end balance)

|

142,568,785

|

140,961,978

|

144,752,254

|

2.7%

|

1.5%

|

|

Allowance for loan losses

|

8,250,023

|

7,658,595

|

7,674,040

|

0.2%

|

-7.0%

|

|

Non-performing loans (NPLs)

|

8,360,155

|

6,991,921

|

6,969,745

|

-0.3%

|

-16.6%

|

|

Allowance for loan losses over Total loans

|

5.8%

|

5.4%

|

5.3%

|

-13 bps

|

-49 bps

|

|

Coverage ratio of NPLs

|

98.7%

|

109.5%

|

110.1%

|

58 bps

|

1143 bps

|

|

Allowance for loan losses

(in S/ millions)

|

|

|

|

|

QoQ, the allowance for loan losses rose slightly by 0.2%, driven mainly by BCP Bolivia and

Mibanco.

YoY, the allowance for loan losses fell 7.0%, fueled primarily by Retail Banking at BCP Stand-alone and secondarily by BCP Bolivia.

|

||

|

(1) Others include Mibanco Colombia, ASB and eliminations.

|

|||

|

NPL Coverage Ratio

|

|||

|

The NPL Coverage Ratio at Credicorp stood at 110.1% at the end of 3Q25.

QoQ

The NPL Coverage Ratio at Credicorp rose 58 bps, driven by the evolution at BCP

Stand-alone and Mibanco.

At BCP Stand-alone, the NPL Coverage Ratio increased 25 bps to stand at 109.6%. This evolution was primarily attributable to a decrease in NPLs, as

described in the QoQ analysis. At Mibanco, the NPL Coverage Ratio rose 730 bps to stand at 121.0%. This evolution

was also driven by the drop in NPLs, which is summarized in the QoQ analysis.

|

||

|

|

| |

Earnings Release 3Q / 2025

|

Analysis of 3Q25 Consolidated Results

|

|

06

|

Other Income

|

|

|

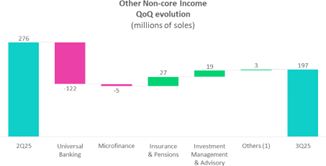

Other Income declined 1.4% QoQ but increased 7.0% YoY. The volatility in these results reflects fluctuations in Other

Non-Core Income, which included atypical items in prior quarters. Focusing on recurring components within Other Core Income:

QoQ, Other Core Income grew 4.0%, primarily driven by an uptick in Universal

Banking. Growth was supported by higher fees at Yape, fueled by increased revenue-generating transactions, and FX gains at BCP Bolivia, following the successful rollout of new foreign exchange

products.

YoY, Other Core Income rose 11.9%, mainly due to higher total fees at BCP

Stand-alone and FX gains within Universal Banking, underscoring consistent execution of our revenue diversification and decoupling strategy.

|

|

|

6.

|

Other Income1

|

|

Other Income (1)

|

Quarter

|

% Change

|

Up to

|

% change

|

||||

|

(S/ 000)

|

3Q24

|

2Q25

|

3Q25

|

QoQ

|

YoY

|

Sep 24

|

Sep 25

|

Sep 25 / Sep 24

|

|

Other Core Income

|

1,302,675

|

1,401,569

|

1,457,604

|

4.0%

|

11.9%

|

3,761,186

|

4,197,011

|

11.6%

|

|

Other Non-Core Income

|

242,670

|

275,804

|

196,587

|

-28.7%

|

-19.0%

|

768,047

|

824,769

|

7.4%

|

|

Total Other Income

|

1,545,345

|

1,677,373

|

1,654,191

|

-1.4%

|

7.0%

|

4,529,233

|

5,021,780

|

10.9%

|

|

6.1.

|

Other Core Income1

|

|

Other Core Income (1)

|

Quarter

|

% Change

|

Up to

|

% change

|

||||

|

(S/ 000)

|

3Q24

|

2Q25

|

3Q25

|

QoQ

|

YoY

|

Sep 24

|

Sep 25

|

Sep 25 / Sep 24

|