|

☐

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

N/A

|

AUSTRALIA

|

|

|

(Translation of Registrant’s name into English)

|

(Jurisdiction of incorporation or organization)

|

|

Title of each class:

|

Trading Symbol(s):

|

Name of each exchange on which registered or to be registered:

|

|

American Depositary Shares each representing 40 Ordinary Shares, no par value

|

IONR

|

The Nasdaq Capital Market

|

|

(1)

|

Evidenced by American Depositary Receipts

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☒

|

Emerging growth company ☒

|

|

3

|

|

|

|

|

|

5

|

|

|

|

|

|

6

|

|

|

|

|

|

7

|

|

|

|

|

|

8

|

|

9

|

|||

|

|

|

|

|

|

|

ITEM 1.

|

9

|

|

|

|

ITEM 2.

|

9

|

|

|

|

ITEM 3.

|

9

|

|

|

|

A.

|

9

|

|

|

|

B.

|

9

|

|

|

|

C.

|

9

|

|

|

|

D.

|

9

|

|

|

|

ITEM 4.

|

26

|

|

|

|

A.

|

26

|

|

|

|

B.

|

39

|

|

|

|

C.

|

42

|

|

|

|

D.

|

43

|

|

|

|

ITEM 4A.

|

44

|

|

|

|

ITEM 5.

|

44

|

|

|

|

A.

|

45

|

|

|

|

B.

|

48

|

|

|

|

C.

|

49

|

|

|

|

D.

|

49

|

|

|

|

E.

|

49

|

|

|

|

ITEM 6.

|

50

|

|

|

|

A.

|

50

|

|

|

|

B.

|

52

|

|

|

|

C.

|

62

|

|

|

|

D.

|

63

|

|

|

|

E.

|

64

|

|

|

|

ITEM 7.

|

65

|

|

|

|

A.

|

65

|

|

|

|

B.

|

66

|

|

|

|

C.

|

66

|

|

|

|

ITEM 8.

|

66

|

|

|

|

A.

|

66

|

|

|

|

B.

|

66

|

|

|

|

ITEM 9.

|

66

|

|

|

|

A.

|

66

|

|

|

|

B.

|

67

|

|

|

|

C.

|

67

|

|

|

|

D.

|

67

|

|

|

|

E.

|

67

|

|

|

|

F.

|

67

|

|

|

|

ITEM 10.

|

67

|

|

|

|

A.

|

67

|

|

|

|

B.

|

67

|

|

|

C.

|

79

|

||

|

D.

|

80

|

||

|

E.

|

80

|

||

|

F.

|

89

|

||

|

G.

|

89

|

||

|

H.

|

89

|

||

|

I.

|

89

|

||

|

J.

|

90

|

||

|

ITEM 11.

|

90

|

||

|

ITEM 12.

|

90

|

||

|

A.

|

90

|

||

|

B.

|

90

|

||

|

C.

|

90

|

||

|

D.

|

90

|

||

|

|

|

|

|

|

92

|

|||

|

|

|

|

|

|

ITEM 13.

|

92

|

||

|

ITEM 14.

|

92

|

||

|

ITEM 15.

|

92

|

||

|

ITEM 16.

|

93

|

||

|

ITEM 16A.

|

93

|

||

|

ITEM 16B.

|

93

|

||

|

ITEM 16C.

|

93

|

||

|

ITEM 16D.

|

94

|

||

|

ITEM 16E.

|

94

|

||

|

ITEM 16F.

|

94

|

||

|

ITEM 16G.

|

94

|

||

|

ITEM 16H.

|

95

|

||

|

ITEM 16I.

|

95

|

||

|

ITEM 16J.

|

95

|

||

|

ITEM 16K.

|

95

|

||

|

|

96

|

||

|

|

|

|

|

|

ITEM 17.

|

96

|

||

|

ITEM 18.

|

96

|

||

|

ITEM 19.

|

97

|

||

| • |

“ioneer” refers to ioneer Ltd, unless otherwise indicated;

|

| • |

“the Company”, “we”, “us”, or “our” refer to

ioneer Ltd and its consolidated subsidiaries, through which it conducts its business, unless otherwise indicated;

|

| • |

“shares” or “ordinary shares” refers to our ordinary shares;

|

| • |

“ADS” refers to the American depositary shares; and

|

| • |

“ASX” refers to the Australian Securities Exchange.

|

| • |

risks related to our limited operating history in the lithium and boron industry;

|

| • |

risks related to our status as a development stage company;

|

| • |

risks related to our ability to identify mineralization and achieve commercial mining at the Project;

|

| • |

risks related to mining, exploration and mine construction, if warranted, on our properties;

|

| • |

risks related to our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities;

|

| • |

risks related to investment risk and operational costs associated with our exploration activities;

|

| • |

risks related to our ability to access capital and the financial markets;

|

| • |

risks related to compliance with government regulations;

|

| • |

risks related to our ability to acquire necessary mining licenses, permits or access rights;

|

| • |

risks related to environmental liabilities and reclamation costs;

|

| • |

risks related to volatility in lithium or boron prices or demand for lithium or boron;

|

| • |

risks related to stock price and trading volume volatility;

|

| • |

risks relating to the development of an active trading market for the ADSs;

|

| • |

risks related to ADS holders not having certain shareholder rights;

|

| • |

risks related to ADS holders not receiving certain distributions; and

|

| • |

risks related to our status as a foreign private issuer and emerging growth company.

|

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE

|

| ITEM 3. |

KEY INFORMATION

|

| A. |

[Reserved]

|

| B. |

Capitalization and Indebtedness

|

| C. |

Reasons for the Offer and Use of Proceeds

|

| D. |

Risk Factors

|

| • |

the discovery of unusual or unexpected geological formations;

|

| • |

accidental fires, floods, earthquakes or other natural disasters;

|

| • |

unplanned power outages and water shortages;

|

| • |

controlling water and other similar mining hazards;

|

| • |

operating labor disruptions and labor disputes;

|

| • |

the ability to obtain suitable or adequate machinery, equipment, or labor;

|

| • |

our liability for pollution or other hazards; and

|

| • |

other known and unknown risks involved in the conduct of exploration and operation of mines.

|

| • |

a significant, prolonged decrease in the market prices of lithium or boron;

|

| • |

difficulty in marketing and/or selling lithium or boron;

|

| • |

significantly higher than expected capital costs to construct our mine;

|

| • |

significantly higher than expected extraction costs;

|

| • |

significantly lower than expected ore extraction quantities;

|

| • |

significantly lower than expected recoveries;

|

| • |

significant delays, reductions or stoppages of ore extraction activities;

|

| • |

significant delays in achieving commercial operations; and

|

| • |

the introduction of significantly more stringent regulatory laws and regulations.

|

| • |

adverse economic conditions;

|

| • |

adverse general capital market conditions;

|

| • |

poor performance and health of the lithium or mining industries in general;

|

| • |

bankruptcy or financial distress of unrelated lithium companies or marketers;

|

| • |

significant decrease in the demand for lithium; or

|

| • |

adverse regulatory actions that affect our exploration and construction plans or the use of lithium generally.

|

| • |

our ability to develop existing properties;

|

| • |

our ability to obtain leases or options on properties;

|

| • |

our ability to identify and acquire new exploratory prospects;

|

| • |

our ability to continue to retain and attract skilled personnel;

|

| • |

our ability to maintain or enter into new relationships with project partners and independent contractors;

|

| • |

the results of our development and exploration programs;

|

| • |

the market prices for our production;

|

| • |

our access to capital; and

|

| • |

our ability to enter into sales arrangements.

|

| • |

changes or delays in development or exploration activities;

|

| • |

actual or expected fluctuations in our prospects or operating results;

|

| • |

changes in the demand for, or market prices of, lithium or boron;

|

| • |

additions to or departures of our key personnel;

|

| • |

fluctuations of exchange rates between the U.S. dollar and the Australian dollar;

|

| • |

changes or proposed changes in laws and regulations;

|

| • |

changes in trading volume of ADSs on Nasdaq and of our ordinary shares on the ASX;

|

| • |

sales or perceived potential sales of the ADSs or ordinary shares by us, our directors, senior management or our shareholders in the future;

|

| • |

announcement or expectation of additional financing efforts; and

|

| • |

conditions in the U.S. or Australian financial markets or changes in general economic conditions.

|

| • |

it did not have jurisdiction;

|

| • |

it was not an appropriate forum for such proceedings;

|

| • |

applying Australian conflict of laws rule, U.S. law (including U.S. securities laws) did not apply to the relationship between holders of our ordinary shares or ADSs and us or our directors and officers; or

|

| • |

the U.S. securities laws were of a public or penal nature and should not be enforced by the Australian court.

|

| • |

effect service of process within the United States upon certain directors and executive officers or on us;

|

| • |

enforce in U.S. courts judgments obtained against any of our directors and executive officers or us in the U.S. courts in any action, including actions under the civil liability provisions of U.S.

securities laws;

|

| • |

enforce in U.S. courts judgments obtained against any of our directors and senior management or us in courts of jurisdictions outside the United States in any action, including actions under the civil

liability provisions of U.S. securities laws; or

|

| • |

bring an original action in an Australian court to enforce liabilities against any of our directors and executive officers or us based upon U.S. securities laws.

|

| • |

the last day of the fiscal year during which we have total annual gross revenues of US$1,235,000,000 (as such amount is indexed for inflation every five years by the United States Securities and Exchange

Commission, or SEC) or more;

|

| • |

the last day of our fiscal year following the fifth anniversary of the completion of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act,

which is currently expected to be June 30, 2028, unless we change our fiscal year to December 31, in which case such date will be December 31, 2027;

|

| • |

the date on which we have, during the previous three-year period, issued more than US$1,000,000,000 in non-convertible debt; or

|

| • |

the date on which we are deemed to be a “large accelerated filer”, as defined in Rule 12b-2 of the Exchange Act, which would occur in future fiscal years if the

market value of our ordinary shares and ADSs that are held by non-affiliates exceeds US$700,000,000 as of the last day of our most recently-completed second fiscal quarter.

|

| ITEM 4. |

INFORMATION ON THE COMPANY

|

| A. |

History and Development of the Company

|

| • |

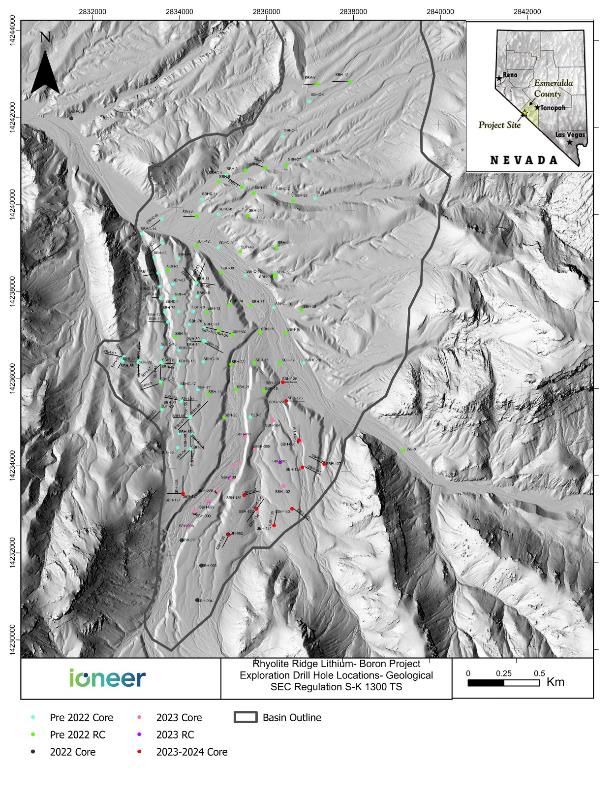

Stauffer Chemicals drilling boreholes in the vicinity more than 50 years ago.

|

| • |

U.S. Borax drilled 16 holes on the Cave Spring property between 1987 and 1992 and excavated and sampled numerous trenches. U.S. Borax held claims until sometime after 2000, at which time the property was

released by U.S. Borax and acquired by Gold Summit Corp.

|

| • |

In 2003, our predecessor, Global Geoscience Limited, began exploratory operations in Nevada under the leadership of our current Managing Director, Bernard Rowe.

|

| • |

In 2010 and 2011, JOGMEC-American Lithium, after acquiring the property from Gold Summit, resampled existing trenches and drilled a total of 21 diamond core HQ-sized core holes (approximately 16,850 feet)

as well as 15 reverse circulation (RC) rotary percussion holes (approximately 12,000 feet) in the South Basin, for a total of nearly 29,000 feet of drilling.

|

| • |

In 2015, Boundary Peak Minerals acquired mineral rights to the property prior to its transfer to us in 2016.

|

| • |

In 2016, we acquired our initial interest in the Rhyolite Ridge Project under a Mining Lease and Option to Purchase Agreement with Boundary Peak Minerals dated June 3, 2016. We exercised our option to

purchase and acquired title to the unpatented mining claims in May 2017.

|

| • |

During 2016 and 2017, we drilled an additional 28 RC holes (17,330 feet) and 3 diamond HQ core holes (about 2,800 feet) at the property, for a total of over 20,000 feet of drilling.

|

| • |

During 2017 and 2018, we performed all payment obligations under the mining lease.

|

| • |

In October 2018, we completed a Prefeasibility Study (“PFS”).

|

| • |

During 2018 and 2019, we commissioned additional infill drilling to further define the lithium-boron resource at the site, collecting and testing approximately 29,000 feet of additional core and installing

one test well, three monitoring wells, and five vibrating wire piezometers. In addition, we signed our first binding offtake agreement for boron.

|

| • |

In 2020, we completed a Definitive Feasibility Study (“DFS”) which affirmed the Project’s scale, long life and potential to become a low-cost and globally significant

producer of both lithium and boron products.

|

| • |

During 2021, we announced our first lithium offtake agreement and continued to advance engineering, funding discussions and project permitting.

|

| • |

In June 2021, we agreed a binding 3-year offtake agreement with EcoPro Innovation for 2,000 tpa of lithium carbonate.

|

| • |

In September 2021, we agreed to enter into the Strategic Partnership with Sibanye-Stillwater to develop the Rhyolite Ridge Project. Under the terms of the agreement, subject to the satisfaction of

conditions precedent, Sibanye-Stillwater will contribute US$490 million for a 50% interest in the Joint Venture holding the project, with ioneer maintaining a 50% interest and retaining operatorship.

|

| • |

In October 2021, the Company completed a US$70 million strategic investment by Sibanye-Stillwater.

|

| • |

In February 2022, we announced that EcoPro Innovation, a major Korean battery manufacturer had increased its 3-year lithium offtake volume to 7,000 tpa.

|

| • |

In June 2022, our ADSs were listed and commenced trading on Nasdaq.

|

| • |

In July 2022, we agreed a binding 5-year offtake agreement with the Ford Motor Company for 7,000 tpa of lithium carbonate.

|

| • |

In August 2022, we announced a binding 5-year offtake agreement with Prime Planet Energy & Solutions, Inc. (“PPES”), a joint venture between Toyota Motor

Corporation and Panasonic Corporation, for 4,000 tpa of lithium carbonate.

|

| • |

In December 2022, the BLM announced its decision to publish the Notice of Intent for Rhyolite Ridge Lithium-Boron Project in the federal register, representing a major milestone toward completion of the

NEPA process and approval of the Project’s Plan of Operations.

|

| • |

In January 2023, we announced finalization of a term sheet and offer of a Conditional Commitment for a proposed loan of up to US$700 million from the DOE Loan Programs Office for financing the construction

of the Rhyolite Ridge Lithium-Boron Project.

|

| • |

In May 2023, we announced a lithium offtake agreement with Dragonfly Energy Holdings Corp. (NASDAQ: DFLI), a Nevada-based industry leader in energy storage for 250 tpa of lithium carbonate.

|

| • |

In October 2023, we announced a Research and Development Memorandum of Understanding with EcoPro Innovation Co Ltd, a global leader in battery grade high purity lithium hydroxide conversion. The Lithium

Clay R&D project is currently excluded from the Stage 1 Project design and economics.

|

| • |

In April 2024, we announced the draft Environmental Impact Statement (“DEIS”) for the Project was made public by the Federal Bureau of Land Management (BLM) and was

published in the Federal Register.

|

| • |

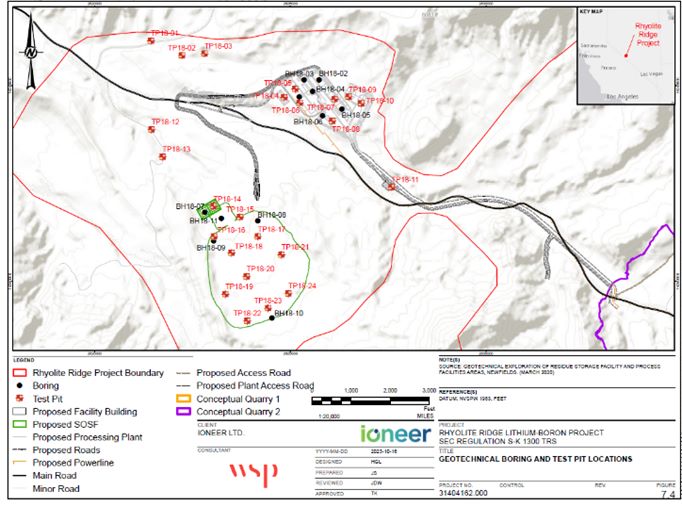

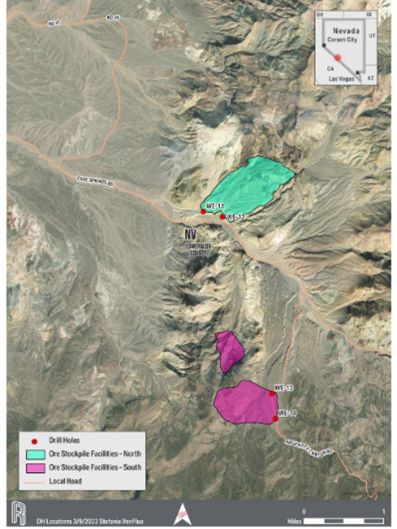

In April 2024, we announced that we had completed three separate geotechnical drilling programs (53 drill holes in total) under 2920 permits with a primary reason to collect geotechnical data. The 53 holes

were drilled outside of the then mineral resource over an area of approximately 0.8 km2 – compared to the 3 km2 footprint of the current Resource.

|

| • |

In September 2024, the BLM published the Final Environmental Impact Statement (“EIS”) regarding the Rhyolite

Ridge Project, which included the FWS Biological Opinion concluding the Project would not jeopardize ESA-listed Tiehm’s buckwheat or adversely modify its critical habitat. Publication of the Final EIS begins a 30-day statutory

waiting period before a Record of Decision can be issued.

|

| • |

In October 2024, ioneer announced it had received a positive Record of Decision, being final approval from the U.S. Government to develop the Rhyolite Ridge Project.

|

| • |

In January 2025, ioneer announced the closing of a US$996 million loan (consisting of $968 million in principal and $28 million of capitalized interest) from the U.S. Department of Energy Loan

Programs Office under the Advanced Technology Vehicles Manufacturing program to support the development of an on-site processing facility at the Rhyolite Ridge Lithium-Boron Project.

|

| • |

In February 2025, Sibanye-Stillwater announced that it had decided not to proceed with the proposed joint venture in the Rhyolite Ridge Project.

|

| • |

In March 2025, the Company announced a 45% increase in the mineral resource estimate for the Rhyolite Ridge Project to 510 Million tonne (“Mt”).

|

| • |

In June 2025, ioneer announced the more than quadrupling of ore reserve to 247 Mt, and updated economics for the Project.

|

| • |

In September 2025, ioneer announced a further material improvement in Project economics achieved through leach optimization.

|

| • |

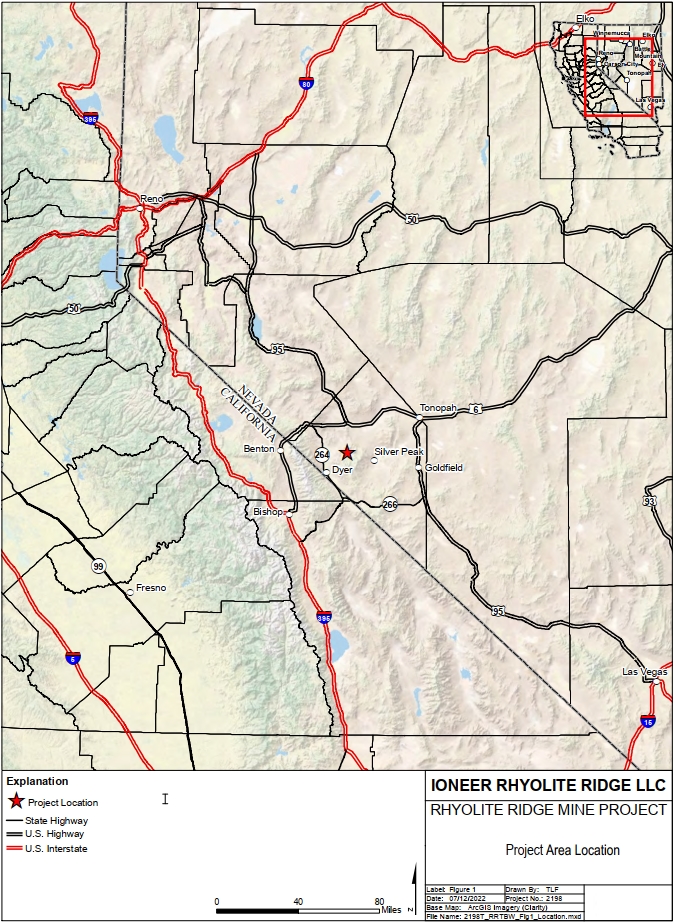

Demonstrated potential to become a world-class lithium-boron producer

|

| • |

Definitive Feasibility Study (2020) and updated Project economics (2025) confirm plans for a large, long-life, low-cost operation

|

| • |

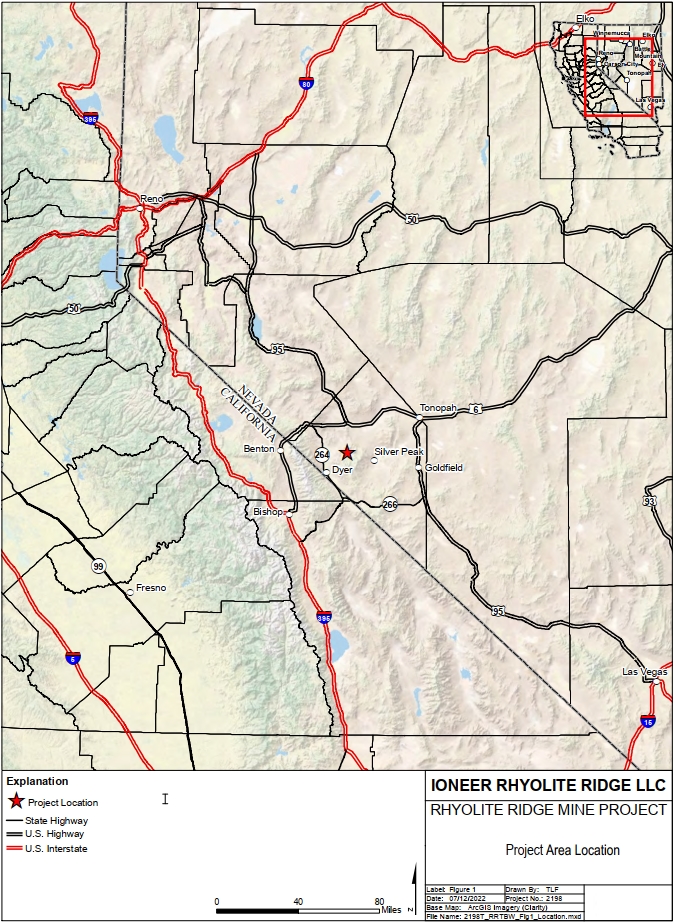

Strategically advantageous location in a tier-one mining jurisdiction with easy access to key US and Asian markets

|

| • |

Set to produce two materials essential in a modern world and well-positioned to capitalize on expected lithium demand boom

|

| • |

Completed offtake strategy for both boron and lithium production, obtained significant debt financing, subject to the satisfaction of conditions precedent, via the US$996 million conditional loan from U.S.

Department of Energy Loan Programs Office

|

| • |

Engaged top-tier mining, engineering, processing and environmental partners in Fluor, Veolia, and AtkinsRealis (previously SNC Lavalin). Approximately 70% detailed engineering has been completed on a

state-of-the-art facility

|

| • |

Highly experienced board and management with necessary skills to develop, build and operate a world-class lithium-boron mine

|

| • |

Complete required permitting and zoning activities. Though we must obtain several permits, there are three key permits necessary before we can begin

construction at Rhyolite Ridge, namely:

|

| • |

a Class II Air Quality Permit from the Nevada State Government (Received in June 2021) was resubmitted for approval to amend it for the updated approved mine plan - received July 2025

|

| • |

a Water Pollution Control Permit from the Nevada State Government (Received July 2021) was resubmitted for approval to amend it for the updated approved mine plan – received August 2025; and

|

| • |

completion of an environmental review and final decision by the federal government authorizing the use of federal land under the National Environmental Policy Act (“NEPA”)

– received in October 2024.

|

| • |

Undertake discussions with potential offtake parties for future sales of lithium and boron products.

|

| • |

Lithium – We announced our first lithium offtake agreement on June 30, 2021 with EcoPro Innovation (“EcoPro”), a large Korean lithium and battery materials

manufacturer. On February 16, 2022 we announced that EcoPro had exercised an option under the agreement to increase the annual supply volume. Under the agreement, we will deliver 7,000 tonnes per annum (tpa) of lithium carbonate to

EcoPro over a three-year term, which we estimate will represent approximately one-third of our projected lithium carbonate production over that period. On July 22, 2022 we announced a five-year binding offtake agreement with the Ford

Motor Company for the supply of 7,000 tpa of technical grade lithium carbonate. On August 1, 2022 we announced the signing of a further five-year binding offtake agreement with PPES, a joint venture battery company between Toyota Motor

Corporation and Panasonic Corporation. The agreement is for a total of 4,000 tonnes per annum of lithium carbonate from ioneer’s Rhyolite Ridge Lithium-Boron operation in Nevada and represents approximately 20% of annual output in the

first five years of production. In total, the three binding offtake agreements account for approximately 90% of our expected first three years of production of lithium carbonate. In May 2023, we announced a commercial offtake agreement

partnership with Dragonfly Energy Holdings Corp. (“Dragonfly”) for a variable amount of surplus tonnes available after meeting previously announced offtake commitments. The contract duration is three years beginning when ioneer notifies

Dragonfly that the project has been fully completed and commissioned.

|

| • |

Boron – On December 18, 2019, we announced our first binding offtake agreement for the sale of boric acid to Dalian Jinma Boron Technology Group Co. Ltd (“Jinma”)

for 105,000 tpa of boric acid which included a distribution agreement for the territories of China and Taiwan. On May 21, 2020, we announced that we had secured two separate boric acid Distribution and Sales Agreements for the supply of

boric acid to Kintamani Resources Pte Limited and Boron Bazar Limited. In aggregate, the volume commitments and minimum volume targets in these agreements place 100% of our first four years of projected boric acid production. As with

our lithium carbonate agreements, we anticipate entering into offtake and other sales agreements with a variety of partners to build a diversified customer base for our boric acid production. We anticipate that our boric acid production

will account for approximately 25% of the Project’s revenue.

|

| • |

Complete pre-construction engineering. This workstream includes progressing engineering to the start of the Full Notice to Proceed (“FNTP”) phase; also known as the Engineering, Procurement, and Construction Management (“EPCM”) phase. The key aim of ongoing activities is to be construction

ready to support construction mobilization following FNTP award. The FNTP award will be dependent on the receipt of all permitting.

|

| • |

Complete required financing activities. We estimated in June 2025 that development of the Rhyolite Ridge Project would require approximately US$1,668

million, and we will update the cost estimate prior to making a FID. If we ultimately make an FID to develop the Project, we will need to secure substantial additional funds to complete development. We plan to fund the capital expense by

raising equity capital by selling an interest in the Rhyolite Ridge Project to a strategic partner and drawing on the DOE Loan Program’s Office loan of US$996 million, subject to the satisfaction of conditions precedent. Even if the

conditions precedent to first draw of the DOE loan are met, we may need to secure substantial additional funds, through future debt or equity financings, to complete development of the Project.

|

| • |

Complete Construction at the Rhyolite Ridge Project. We are targeting to commence construction as soon as all permitting is received, funding is in

place and the Company makes an FID to construct the Project. The timing of making an FID and starting construction is dependent on the outcomes of the strategic partnering process. Construction is expected to be approximately 36 months

(including the supply of long-lead items). We anticipate a 6-month period of ramp-up of production post the start of construction.

|

| • |

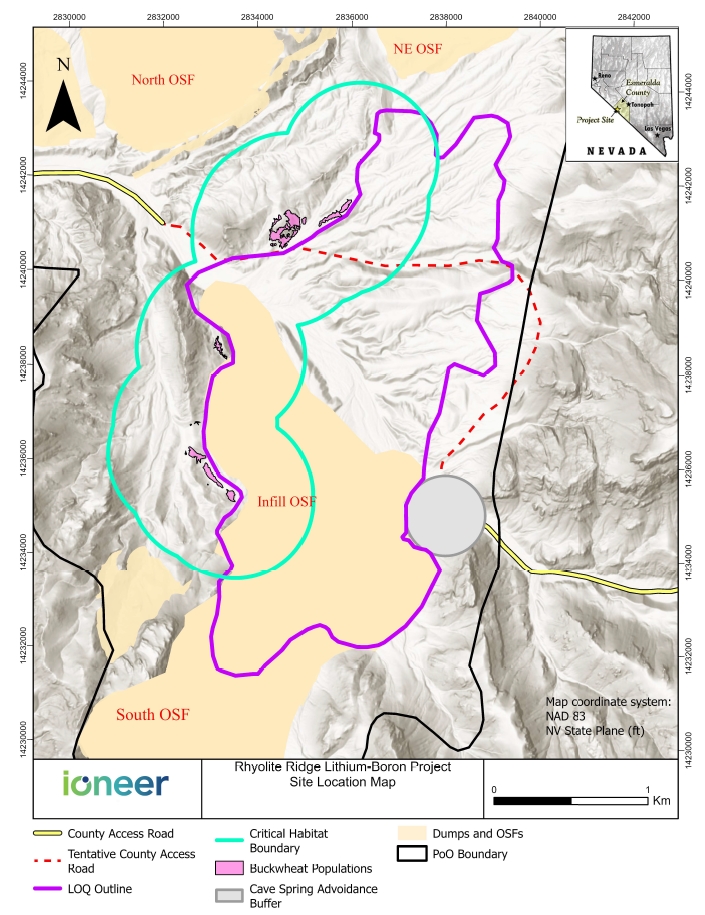

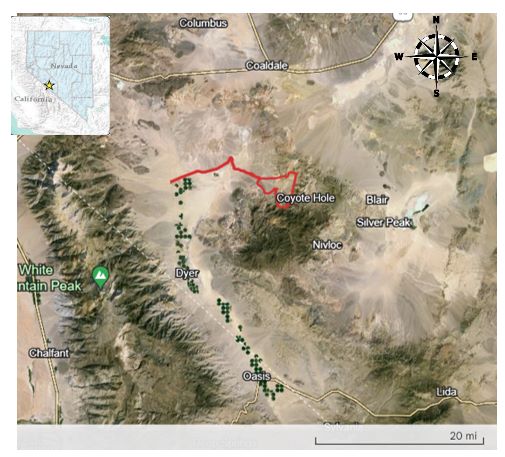

Continue our exploration programs. Our development of the Rhyolite Ridge Project is situated in the southern basin (the “South Basin”) and all resource and reserve estimates are for the South Basin. Pursuant to our mine plan of operations, we intend to conduct further activities to define additional reserves and resources in the South

Basin. We are also currently undertaking technical studies to assess the additional economic potential of the northern basin of Rhyolite Ridge (the “North Basin”) and defining additional reserves

and resources.

|

|

Stream

|

Group

|

Classification

|

Tonnage

kt

|

Li

ppm

|

B

ppm

|

Li2CO3

wt. %

|

H3BO3

wt. %

|

Contained

Li2CO3 kt

|

Contained

H3BO3 kt

|

|

Stream 1 (>= 5,000 ppm B)

|

Upper Zone

B5 Unit |

Measured

|

10,414

|

1,921

|

15,063

|

1.02

|

8.61

|

106

|

897

|

|

Indicated

|

7,214

|

1,749

|

13,240

|

0.93

|

7.57

|

67

|

546

|

||

|

Total (M&I)

|

17,628

|

1,850

|

14,317

|

0.98

|

8.19

|

174

|

1,443

|

||

|

Inferred

|

10,628

|

1,712

|

10,563

|

0.91

|

6.04

|

97

|

642

|

||

|

Total (MII)

|

28,255

|

1,798

|

12,905

|

0.96

|

7.38

|

270

|

2,085

|

||

|

Upper Zone

M5 Unit |

Measured

|

1,073

|

2,186

|

7,397

|

1.16

|

4.23

|

12

|

45

|

|

|

Indicated

|

814

|

2,100

|

7,535

|

1.12

|

4.31

|

9

|

35

|

||

|

Total (M&I)

|

1,887

|

2,149

|

7,456

|

1.14

|

4.26

|

22

|

80

|

||

|

Inferred

|

763

|

2,197

|

6,515

|

1.17

|

3.73

|

9

|

28

|

||

|

Total (MII)

|

2,650

|

2,163

|

7,185

|

1.15

|

4.11

|

31

|

109

|

||

|

Upper Zone

S5 Unit |

Measured

|

1,456

|

1,561

|

7,467

|

0.83

|

4.27

|

12

|

62

|

|

|

Indicated

|

1,393

|

1,571

|

7,132

|

0.84

|

4.08

|

12

|

57

|

||

|

Total (M&I)

|

2,849

|

1,566

|

7,303

|

0.83

|

4.18

|

24

|

119

|

||

|

Inferred

|

1,572

|

1,400

|

6,469

|

0.75

|

3.70

|

12

|

58

|

||

|

Total (MII)

|

4,421

|

1,507

|

7,006

|

0.80

|

4.01

|

35

|

177

|

||

|

Upper Zone Total

|

Measured

|

12,943

|

1,902

|

13,573

|

1.01

|

7.76

|

131

|

1,004

|

|

|

Indicated

|

9,420

|

1,753

|

11,844

|

0.93

|

6.77

|

88

|

638

|

||

|

Total (M&I)

|

22,363

|

1,839

|

12,845

|

0.98

|

7.34

|

219

|

1,642

|

||

|

Inferred

|

12,963

|

1,703

|

9,828

|

0.91

|

5.62

|

117

|

728

|

||

|

Total (MII)

|

35,326

|

1,789

|

11,738

|

0.95

|

6.71

|

336

|

2,371

|

||

|

Lower Zone

L6 Unit |

Measured

|

12,014

|

1,355

|

9,838

|

0.72

|

5.63

|

87

|

676

|

|

|

Indicated

|

26,139

|

1,319

|

10,365

|

0.70

|

5.93

|

183

|

1,549

|

||

|

Total (M&I)

|

38,153

|

1,330

|

10,199

|

0.71

|

5.83

|

270

|

2,225

|

||

|

Inferred

|

13,914

|

1,415

|

12,287

|

0.75

|

7.03

|

105

|

978

|

||

|

Total (MII)

|

52,067

|

1,353

|

10,757

|

0.72

|

6.15

|

375

|

3,203

|

||

|

Total Stream 1 (all zones)

|

Measured

|

24,957

|

1,639

|

11,775

|

0.87

|

6.73

|

218

|

1,680

|

|

|

Indicated

|

35,559

|

1,434

|

10,757

|

0.76

|

6.15

|

271

|

2,187

|

||

|

Total (M&I)

|

60,516

|

1,518

|

11,177

|

0.81

|

6.39

|

489

|

3,867

|

||

|

Inferred

|

26,877

|

1,554

|

11,101

|

0.83

|

6.35

|

222

|

1,706

|

||

|

Total (MII)

|

87,393

|

1,529

|

11,153

|

0.81

|

6.38

|

711

|

5,573

|

||

|

Stream 2 (>= 11.13/tonne net value, < 5,000 ppm B. Low Clay)

|

Upper Zone

B5 Unit |

Measured

|

438

|

2,321

|

2,925

|

1.24

|

1.67

|

5

|

7

|

|

Indicated

|

362

|

2,092

|

3,674

|

1.11

|

2.10

|

4

|

8

|

||

|

Total (M&I)

|

800

|

2,217

|

3,264

|

1.18

|

1.87

|

9

|

15

|

||

|

Inferred

|

3,690

|

1,695

|

1,776

|

0.90

|

1.02

|

33

|

37

|

||

|

Total (MII)

|

4,491

|

1,788

|

2,041

|

0.95

|

1.17

|

43

|

52

|

||

|

Upper Zone

S5 Unit |

Measured

|

9,400

|

996

|

1,226

|

0.53

|

0.70

|

50

|

66

|

|

|

Indicated

|

7,981

|

1,012

|

1,524

|

0.54

|

0.87

|

43

|

70

|

||

|

Total (M&I)

|

17,382

|

1,003

|

1,363

|

0.53

|

0.78

|

93

|

135

|

||

|

Inferred

|

15,491

|

889

|

1,014

|

0.47

|

0.58

|

73

|

90

|

||

|

Total (MII)

|

32,873

|

949

|

1,198

|

0.51

|

0.69

|

166

|

225

|

||

|

Upper Zone Total

|

Measured

|

9,839

|

1,055

|

1,302

|

0.56

|

0.74

|

55

|

73

|

|

|

Indicated

|

8,343

|

1,059

|

1,617

|

0.56

|

0.92

|

47

|

77

|

||

|

Total (M&I)

|

18,182

|

1,057

|

1,447

|

0.56

|

0.83

|

102

|

150

|

||

|

Inferred

|

19,187

|

1,044

|

1,160

|

0.56

|

0.66

|

107

|

127

|

||

|

Total (MII)

|

37,369

|

1,050

|

1,300

|

0.56

|

0.74

|

209

|

278

|

||

|

Lower Zone

L6 Unit |

Measured

|

19,043

|

1,155

|

1,979

|

0.61

|

1.13

|

117

|

215

|

|

|

Indicated

|

51,191

|

1,158

|

1,624

|

0.62

|

0.93

|

316

|

475

|

||

|

Total (M&I)

|

70,234

|

1,157

|

1,720

|

0.62

|

0.98

|

433

|

691

|

||

|

Inferred

|

47,474

|

1,244

|

790

|

0.66

|

0.45

|

314

|

214

|

||

|

Total (MII)

|

117,708

|

1,192

|

1,345

|

0.63

|

0.77

|

747

|

905

|

||

|

Total Stream 2 (all zones)

|

Measured

|

28,881

|

1,121

|

1,748

|

0.60

|

1.00

|

172

|

289

|

|

|

Indicated

|

59,535

|

1,144

|

1,623

|

0.61

|

0.93

|

363

|

553

|

||

|

Total (M&I)

|

88,416

|

1,137

|

1,664

|

0.60

|

0.95

|

535

|

841

|

||

|

Inferred

|

66,662

|

1,186

|

897

|

0.63

|

0.51

|

421

|

342

|

||

|

Total (MII)

|

155,078

|

1,158

|

1,334

|

0.62

|

0.76

|

956

|

1,183

|

||

|

Stream 3(>= 11.13/tonne net value, < 5,000 ppm B, High Clay)

|

Total Stream 3 (M5 zone)

|

Measured

|

13,602

|

2,202

|

1,487

|

1.17

|

0.85

|

159

|

116

|

|

Indicated

|

11,437

|

2,100

|

1,205

|

1.12

|

0.69

|

128

|

79

|

||

|

Total (M&I)

|

25,039

|

2,155

|

1,358

|

1.15

|

0.78

|

287

|

194

|

||

|

Inferred

|

11,608

|

1,654

|

601

|

0.88

|

0.34

|

102

|

40

|

||

|

Total (MII)

|

36,647

|

1,997

|

1,118

|

1.06

|

0.64

|

389

|

234

|

||

|

All Streams

|

M&I Resource

|

Measured

|

67,440

|

1,530

|

5,406

|

0.81

|

3.09

|

549

|

2,085

|

|

Indicated

|

106,531

|

1,344

|

4,627

|

0.72

|

2.65

|

762

|

2,818

|

||

|

Total (M&I)

|

173,971

|

1,416

|

4,929

|

0.75

|

2.82

|

1,311

|

4,903

|

||

|

Inferred Resource

|

Inferred

|

105,147

|

1,332

|

3,472

|

0.71

|

1.99

|

745

|

2,088

|

|

|

Total (MII)

|

279,117

|

1,384

|

4,380

|

0.74

|

2.50

|

2,056

|

6,991

|

| 1. |

Ktonnes = thousand tonnes; Li = Lithium; B = Boron; ppm = parts per million; Li2CO3 = Lithium carbonate; H3BO3 =

boric acid.

|

| 2. |

Totals may differ due to rounding, mineral resources reported on a dry in-situ basis. Lithium is converted to Equivalent Contained Tonnes of Lithium Carbonate (Li2CO3) using a stochiometric conversion

factor of 5.322, and boron is converted to Equivalent Contained Tonnes of Boric Acid (H3BO3) using a stochiometric conversion factor of 5.718. Equivalent stochiometric conversion factors are derived from the molecular weights of the

individual elements which make up Lithium Carbonate (Li2CO3) and Boric Acid (H3BO3).

|

| 3. |

The statement of estimates of mineral resources has been compiled by Independent Mining Consultants, Inc. (“IMC”) and is independent of ioneer and its affiliates. IMC has sufficient experience that is

relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Qualified Person as defined in Subpart 1300.

|

| 4. |

All mineral resource figures reported in the table above represent estimates at August 2025. Mineral resource estimates are not precise calculations, being dependent on the interpretation of limited

information on the location, shape and continuity of the occurrence and on the available sampling results. The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimate.

|

| 5. |

Mineral resources have been prepared in accordance with requirements of Subpart 1300. Mineral resources are also reported in accordance with the Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee Code – JORC 2012 Edition).

|

| 6. |

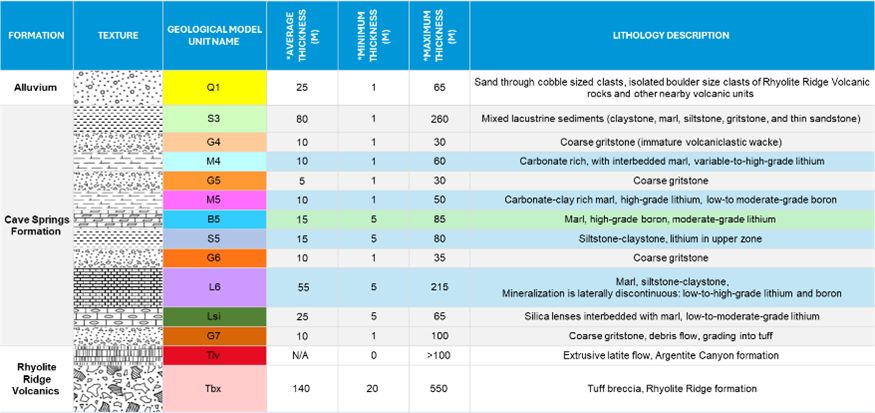

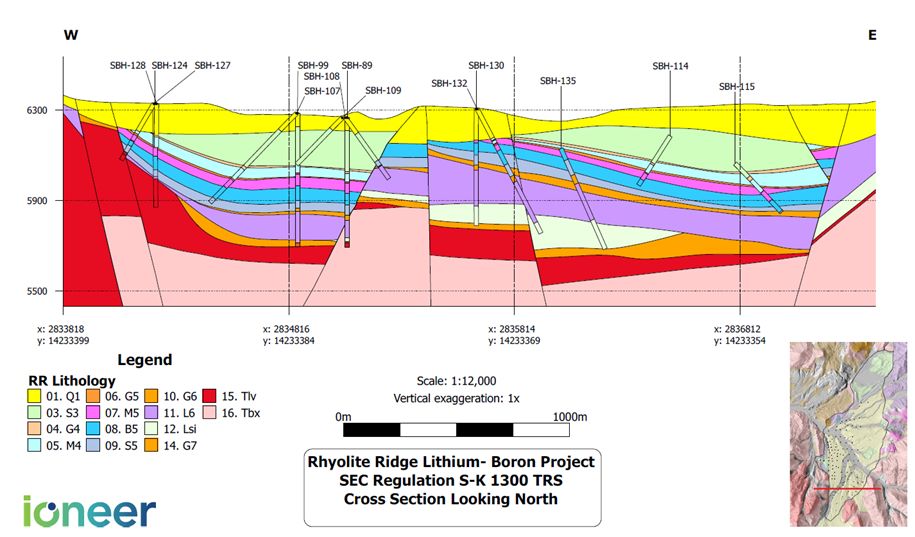

The mineral resource estimate is the result of determining the mineralized material that has a reasonable prospect of economic extraction. In making this determination, constraints were applied to the

geological model based upon a pit optimization analysis that defined a conceptual pit shell limit. The conceptual pit shell was based upon a net value per tonne calculation including a 5,000ppm boron cut-off grade for high boron – high

lithium (HiB-Li) mineralization (Stream 1) and a $11.13/tonne net value cut-off grade for low boron (LoB-Li) mineralization below 5,000ppm boron broke into two material types, low clay and high clay material respectfully (Stream 2 and

Stream 3). The pit shell was constrained by a conceptual mineral resource optimized pit shell for the purpose of establishing reasonable prospects of eventual economic extraction based on potential mining, metallurgical and processing

grade parameters identified by mining, metallurgical and processing studies performed to date on the Project. Key inputs in developing the mineral resource pit shell included a 5,000ppm boron cut-off grade for HiB-Li mineralization,

$11.13/tonne net value cut-off grade for LoB-Li low clay mineralization and LoB-Li high clay mineralization; mining cost of US$1.69 /tonne; G&A cost of US$11.13 /process tonne; plant feed processing and grade control costs which range

between US$18.87/tonne and US$98.63/tonne of plant feed (based on the acid consumption per stream and the mineral resource average grades); boron and lithium recovery (respectively) for Stream 1: M5 80.2% and 85.7%, B5 78.3% and 85.2%, S5

77.0% and 82.5%, L6 75.8% and 79.4%; Stream 2 and 3: M5 65.0% and 78.0%, B5 78.3% and 85.2%, S5 46.8% and 84.8%, L6 32.9% and 78.7%, respectively; boric acid sales price of US$1,172.78/tonne; lithium carbonate sales price of

US$19,351.38/tonne.

|

| 7. |

The mineral resource is reported exclusive of the mineral reserves.

|

|

Category

|

Tonnage (MT)1

|

Li, ppm

|

B,ppm

|

Li2CO3 ktonnes

|

H3BO3 ktonnes

|

|

|

August 2025

|

||||||

|

Measured

|

67.4

|

1,530

|

5,406

|

549

|

2,085

|

|

|

Indicated

|

106.5

|

1,344

|

4,627

|

762

|

2,818

|

|

|

Sum M&I

|

174.0

|

1,416

|

4,929

|

1,311

|

4,903

|

|

|

Inferred

|

105.1

|

1,332

|

3,472

|

745

|

2,088

|

|

|

Total

|

279.1

|

1,384

|

4,380

|

2,056

|

6,991

|

|

|

October 2023

|

||||||

|

Measured

|

17.1

|

1,503

|

9,374

|

137

|

919

|

|

|

Indicated

|

220.1

|

1,760

|

4,654

|

2,061

|

5,856

|

|

|

Sum M&I

|

237.2

|

1,741

|

4,995

|

2,198

|

6,775

|

|

|

Inferred

|

62.1

|

1,795

|

4,392

|

593

|

1,558

|

|

|

Total

|

299.3

|

1,752

|

4,870

|

2,791

|

8,334

|

|

|

Difference

|

||||||

|

Measured

|

50.3

|

412.2

|

1,165.7

|

|||

|

Indicated

|

-113.6

|

-1,299.4

|

-3,038.0

|

|||

|

Sum M&I

|

-63.3

|

-887.3

|

-1,872.3

|

|||

|

Inferred

|

43.1

|

152.7

|

529.2

|

|||

|

Total

|

-20.2

|

-734.5

|

-1,343.1

|

|||

| 1. |

MT = one million metric tonnes.

|

|

Area

|

Group

|

Classification

|

Metric

|

Lithium

|

Boron

|

Contained Equivalent Grade2

|

Contained6

Equivalent2 Tonnes |

Recovered6

Equivalent2 Tonnes |

|||

|

Tonnes2

|

Grade7

|

Grade7

|

|||||||||

|

|

Li

|

B

|

Li2CO3

|

H3BO3

|

Li2CO3

|

H3BO3

|

Li2CO3

|

H3BO3

|

|||

|

(ktonnes)

|

(ppm)

|

(ppm)

|

(Wt. %)

|

(Wt. %)

|

(kt)

|

(kt)

|

(kt)

|

(kt)

|

|||

|

Stream 1

(>= 5,000 ppm B) |

Upper Zone

|

Proven

|

3,489

|

2,401

|

7,652

|

1.28

|

4.38

|

45

|

153

|

38

|

122

|

|

M5 Unit

|

Probable

|

3,410

|

2,262

|

7,430

|

1.20

|

4.25

|

41

|

145

|

35

|

116

|

|

|

|

Sub-total B5 Unit

|

6,899

|

2,332

|

7,542

|

1.24

|

4.31

|

86

|

298

|

73

|

239

|

|

|

Upper Zone

|

Proven

|

27,991

|

1,880

|

15,364

|

1.00

|

8.79

|

280

|

2,459

|

239

|

1,925

|

|

|

B5 Unit

|

Probable

|

31,456

|

1,742

|

14,169

|

0.93

|

8.10

|

292

|

2,549

|

248

|

1,995

|

|

|

|

Sub-total M5 Unit

|

59,447

|

1,807

|

14,732

|

0.96

|

8.42

|

572

|

5,008

|

487

|

3,921

|

|

|

Upper Zone

|

Proven

|

2,237

|

1,326

|

7,754

|

0.71

|

4.43

|

16

|

99

|

13

|

76

|

|

|

S5 Unit

|

Probable

|

3,355

|

1,166

|

7,533

|

0.62

|

4.31

|

21

|

145

|

17

|

111

|

|

|

|

Sub-total S5 Unit

|

5,592

|

1,230

|

7,621

|

0.65

|

4.36

|

37

|

244

|

30

|

187

|

|

|

Upper Zone

|

Proven

|

33,717

|

1,897

|

14,061

|

1.01

|

8.04

|

340

|

2,711

|

290

|

2,124

|

|

|

(B5, M5 & S5)

|

Probable

|

38,221

|

1,738

|

12,985

|

0.92

|

7.42

|

353

|

2,838

|

301

|

2,223

|

|

|

Sub-Total

|

Sub-total Upper Zone

|

71,938

|

1,813

|

13,489

|

0.96

|

7.71

|

694

|

5,549

|

591

|

4,347

|

|

|

Lower Zone

|

Proven

|

5,712

|

1,389

|

8,357

|

0.74

|

4.78

|

42

|

273

|

34

|

207

|

|

|

L6 Unit

|

Probable

|

13,592

|

1,334

|

7,856

|

0.71

|

4.49

|

96

|

611

|

77

|

463

|

|

|

|

Sub-total Lower Zone

|

19,303

|

1,350

|

8,004

|

0.72

|

4.58

|

139

|

883

|

110

|

670

|

|

|

Total Stream 1 (all zones)

|

Proven

|

39,428

|

1,824

|

13,235

|

0.97

|

7.57

|

383

|

2,984

|

323

|

2,331

|

|

|

Probable

|

51,813

|

1,632

|

11,640

|

0.87

|

6.66

|

450

|

3,448

|

377

|

2,686

|

||

|

Sub-total Stream 1

|

91,241

|

1,715

|

12,329

|

0.91

|

7.05

|

833

|

6,432

|

700

|

5,017

|

||

|

Stream 2

($11.13/tonne net value cut-off grade, Low Clay) |

Upper Zone

|

Proven

|

4,528

|

2,219

|

2,143

|

1.18

|

1.23

|

53

|

55

|

46

|

43

|

|

B5 Unit

|

Probable

|

4,384

|

2,118

|

2,415

|

1.13

|

1.38

|

49

|

61

|

42

|

47

|

|

|

|

Sub-total B5 Unit

|

8,912

|

2,169

|

2,277

|

1.15

|

1.30

|

103

|

116

|

88

|

91

|

|

|

Upper Zone

|

Proven

|

15,005

|

1,022

|

1,125

|

0.54

|

0.64

|

82

|

97

|

69

|

45

|

|

|

S5 Unit

|

Probable

|

27,495

|

825

|

866

|

0.44

|

0.50

|

121

|

136

|

102

|

64

|

|

|

|

Sub-total S5 Unit

|

42,500

|

895

|

957

|

0.48

|

0.55

|

202

|

233

|

172

|

109

|

|

|

Upper Zone

|

Proven

|

19,533

|

1,299

|

1,361

|

0.69

|

0.78

|

135

|

152

|

115

|

89

|

|

|

(B5 & S5)

|

Probable

|

31,880

|

1,003

|

1,079

|

0.53

|

0.62

|

170

|

197

|

144

|

111

|

|

|

Sub-Total

|

Sub-total Upper Zone

|

51,413

|

1,116

|

1,186

|

0.59

|

0.68

|

305

|

349

|

259

|

200

|

|

|

Lower Zone

|

Proven

|

24,936

|

1,254

|

1,279

|

0.67

|

0.73

|

166

|

182

|

131

|

60

|

|

|

L6 Unit

|

Probable

|

68,952

|

1,196

|

1,535

|

0.64

|

0.88

|

439

|

605

|

345

|

199

|

|

|

|

Sub-total Lower Zone

|

93,888

|

1,211

|

1,467

|

0.64

|

0.84

|

605

|

788

|

476

|

259

|

|

|

Total Stream 2 (all zones)

|

Proven

|

44,469

|

1,274

|

1,315

|

0.68

|

0.75

|

302

|

334

|

246

|

149

|

|

|

Probable

|

100,832

|

1,135

|

1,391

|

0.60

|

0.80

|

609

|

802

|

490

|

310

|

||

|

Sub-total Stream 2

|

145,301

|

1,177

|

1,368

|

0.63

|

0.78

|

911

|

1,136

|

736

|

459

|

||

|

Stream 3

($11.13/tonne net value cut-off grade, High Clay) |

Total Stream 3 (M5 zone)

|

Proven

|

5,621

|

2,199

|

1,702

|

1.17

|

0.97

|

66

|

55

|

51

|

36

|

|

Probable

|

18,178

|

2,082

|

1,145

|

1.11

|

0.65

|

201

|

119

|

157

|

77

|

||

|

Sub-total Stream 3

|

23,799

|

2,110

|

1,277

|

1.12

|

0.73

|

267

|

174

|

208

|

113

|

||

|

TOTAL of All Streams, All Seams, and All Proven & Probable

|

260,341

|

1,451

|

5,201

|

0.77

|

2.97

|

2,010

|

7,742

|

1,645

|

5,588

|

||

|

|

1. |

Kt – thousand metric tonnes, MT – million metric tonnes, ktonne = thousand metric tons; Li= lithium; B= boron’ ppm= parts per million; Li2CO3 = lithium carbonate; H3BO3 = boric acid; kst = thousand metric

tonnes.

|

|

|

2. |

Totals may differ due to rounding, mineral reserves reported on a dry in-situ basis. The Contained and Recovered Lithium Carbonate (Li2CO3) and Boric Acid (H3BO3) are reported in the table above in short

tons. Lithium is converted to Equivalent Contained Tonnes of Lithium Carbonate (Li2CO3) using a stochiometric conversion factor of 5.322, and boron is converted to Equivalent Contained Tonnes of Boric Acid (H3BO3) using a stochiometric

conversion factor of 5.718. Equivalent stochiometric conversion factors are derived from the molecular weights of the individual elements which make up Lithium Carbonate (Li2CO3) and Boric Acid (H3BO3). The Equivalent Recovered Tons of

Lithium Carbonate (Li2CO3) and Boric Acid (H3BO3) is the portion of the contained tonnage that can be recovered after processing.

|

|

|

3. |

The statement of estimates of mineral reserves has been compiled by Independent Mining Consultants, Inc. (IMC) and is independent of ioneer and its affiliates. IMC has sufficient experience that is relevant

to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in Subpart 1300.

|

|

|

4. |

The mineral reserve estimate is the result of determining the measured and indicated resource that is economically minable allowing for the conversion to proven and probable. In making this determination,

constraints were applied to the geological model based upon a pit optimization analysis that defined a conceptual pit shell limit. The conceptual pit shell was based upon a net value per ton calculation including a 5,000ppm boron cut-off

grade for high boron – high lithium (HiB-Li) mineralization (Stream 1) and $11.13 Net value per tonne cut-off for low boron (LoB-Li) mineralization below 5,000ppm boron broke in to two material types low clay and high clay material

respectfully (Stream 2 and Stream 3). The conceptual pit shell was constrained by the measured and indicated resource that incorporates the potential mining, metallurgical and processing grade parameters identified by mining,

metallurgical and processing studies performed to date on the Project. The conceptual pit shell was used as a guide for an engineered pit design. Key inputs in developing the mineral reserve pit shell included a 5,000ppm boron cut-off

grade for HiB-Li mineralization, $11.13 Net Value per tonne cut-off for LoB-Li low clay mineralization and $11.13 Net value per tonne cut-off for LoB-Li high clay mineralization; base mining cost of US$1.69/tonne and incremental cost of

$0.055/tonne per bench below 6220ft elevation; plant feed processing and grade control costs which range between US$52.92/tonne and US$82.55/ton of plant feed for stream 1, US$18.87 and US$98.62 for streams 2&3; boron and lithium

recovery for Stream 1: M5= of 80.2% and 85.7%, B5=80.2% and 78.3%, S5=77.0% and 82.5%, L6=75.8% and 79.4%; Stream 2 and 3: M5 65% and 78%, B5 78.3% and 85.2%, S5 46.8% and 84.8%, L6 32.9% and 78.7%, respectively; boric acid sales price

of US$1,172.78/tonne; lithium carbonate sales price of $19,351.38/tonne.

|

|

|

5. |

Ore reserves are based on a block model that is 7.62m x 7.62m in plan and 9.14m high. The model block size used for the ore reserve estimate is based on selected mining equipment and approached used within

the mine plan. As a result, the dilution and ore loss are incorporated within the block model.

|

|

|

6. |

All ore reserve figures represent estimates as of August 2025. Ore reserve estimates are not precise calculations, being dependent on the interpretation of limited information on the location, shape and

continuity of the occurrence and on the available sampling results. The totals have been rounded to reflect the relative uncertainty of the estimate. Totals may not sum due to rounding.

|

|

|

7. |

Mineral reserves are reported in accordance with the US SEC Regulation S-K Subpart 1300. The mineral reserves in this report were estimated and reported using the regulation S-K §229.1304 of the United

States Securities and Exchange Commission (“SEC”). Mineral reserves are also reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee

Code – JORC 2012 Edition).

|

|

|

8. |

The mineral reserve is reported exclusive of mineral resources.

|

|

Group

|

Classification

|

Tonnes

(Mt)

|

Li

(ppm)

|

B

(ppm)

|

Li2CO3

(wt. %)

|

H3BO3

(wt. %)

|

Li2CO3

(kt)

|

H3BO3

(kt)

|

|

August 2025

Reserve

|

Proved

|

89.5

|

1,574

|

6,589

|

0.84

|

3.77

|

750

|

3,373

|

|

Probable

|

170.8

|

1,386

|

4,473

|

0.74

|

2.56

|

1,260

|

4,369

|

|

|

Total

|

260.3

|

1,451

|

5,201

|

0.77

|

2.97

|

2,010

|

7,742

|

|

|

October 2023

Reserve

|

Proved

|

29.0

|

1,900

|

16,250

|

1.00

|

9.30

|

290

|

2,700

|

|

Probable

|

31.5

|

1,700

|

14,650

|

0.90

|

8.40

|

280

|

2,620

|

|

|

Total

|

60.5

|

1,796

|

15,417

|

0.95

|

8.83

|

580

|

5,320

|

|

|

Variation

|

Proved

|

60.5

|

-326

|

-9,661

|

460

|

673

|

||

|

Probable

|

139.3

|

-314

|

-10,177

|

980

|

1,749

|

|||

|

Total

|

199.8

|

-345

|

-10,216

|

1,440

|

2,422

|

|

|

• |

Decrease in vat resident leach time;

|

|

|

• |

Optimization of acid consumption; and

|

|

|

• |

Inclusion of Stream 2 and Stream 3

|

| • |

the last day of the fiscal year during which we have total annual gross revenues of US$1,235,000,000 (as such amount is indexed for inflation every five years by the SEC) or more;

|

| • |

the last day of our fiscal year following the fifth anniversary of the completion of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act,

which is currently expected to be June 30, 2028, unless we change our fiscal year to December 31, in which case such date will be December 31, 2027;

|

| • |

the date on which we have, during the previous three-year period, issued more than US$1,000,000,000 in non-convertible debt; or

|

| • |

the date on which we are deemed to be a “large accelerated filer”, as defined in Rule 12b-2 of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange

Act, which would occur in future fiscal years if the market value of our ordinary shares and ADSs that are held by non-affiliates exceeds US$700,000,000 as of the last day of our most recently-completed second fiscal quarter.

|

| B. |

Business Overview

|

| • |

Binding lithium offtake supply agreement between the Company and EcoPro Innovation Co. Ltd, a three-year agreement for a total of 7,000 tpa of technical-grade lithium carbonate, upon commencement of

production.

|

| • |

Binding lithium offtake supply agreement between the Company and the Ford Motor Company, a five-year agreement for a total of 7,000 tpa of technical-grade lithium carbonate, upon commencement of production.

|

| • |

Binding lithium offtake supply agreement between the Company and PPES, a joint venture between Toyota Motor Corporation and Panasonic Corporation, a five-year agreement for a total of 4,000 tpa of

technical-grade lithium carbonate, upon commencement of production.

|

| • |

Binding lithium offtake supply agreement between the Company and Dragonfly Energy Holdings, a three-year agreement for a total of 250 tpa of technical-grade lithium carbonate, upon commencement of

production.

|

| • |

Binding boric acid offtake agreement between the Company and Dalian Jinma Boron Technology, a five-year agreement for 105,000 tpa of boric acid, upon commencement of production.

|

| • |

Three-year boric acid distribution and sales agreement with Kintamani Resources Pte Limited for certain minimum sales volume targets of boric acid, upon commencement of production.

|

| • |

Three-year boric acid distribution and sales agreement with Boron Bazar Limited for certain minimum sales volume targets of boric acid, upon commencement of production.

|

| • |

fluctuations in the market prices for lithium or boron;

|

| • |

fluctuating supplies of lithium or boron;

|

| • |

changes in the demand for, or market prices of, lithium or boron; and

|

| • |

mining activities of others.

|

| • |

require notice to stakeholders of proposed and ongoing operations;

|

| • |

require the installation of pollution control equipment;

|

| • |

restrict the types, quantities and concentration of various substances that can be released into the environment in connection with mining or drilling activities;

|

| • |

limit or prohibit mining or drilling activities on lands located within wetlands, areas inhabited by endangered species and other protected areas, or otherwise restrict or prohibit activities that could

impact the environment, including scarce water resources;

|

| • |

impose substantial liabilities for pollution resulting from current or former operations on or for any preexisting environmental impacts at the Project site; and

|

| • |

require preparation of an Environmental Assessment or an Environmental Impact Statement.

|

| • |

NEPA, which requires evaluation of the environmental impacts of mining operations that require federal approvals;

|

| • |

Clean Air Act, or CAA, and its amendments, which governs air emissions;

|

| • |

Clean Water Act, or CWA, which governs discharges to and excavations within the waters of the United States;

|

| • |

Safe Drinking Water Act, or SDWA, which governs the underground injection and disposal of wastewater;

|

| • |

FLPMA, which governs BLM’s management of the federal public lands;

|

| • |

Resource Conservation and Recovery Act, or RCRA, which governs the management of solid waste;

|

| • |

Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, which imposes liability where hazardous substances have been released into the environment (commonly known as Superfund);

and

|

| • |

Federal Mine Safety and Health Act, which established the primary safety and health standards regarding working conditions of employees engaged in mining, related operations, and preparation and milling of

the minerals extracted, as well as the Occupational Safety and Health Act, which regulates the protection of the health and safety of workers to the extent such protection is not already addressed by the Federal Mine Safety and Health

Act.

|

| C. |

Organizational Structure

|

| D. |

Property, Plant and Equipment

|

| ITEM 4A |

UNRESOLVED STAFF COMMENTS

|

| ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

| A. |

Operating Results

|

|

Consolidated Statement of Profit and Loss and Other

Comprehensive Income

(in thousands)

|

Fiscal

2025

|

Fiscal

2024

|

Fiscal

2023

|

|||||||||

|

|

US$’000

|

US$’000

|

US$’000

|

|||||||||

|

Exploration expenditure written off

|

(37

|

)

|

(31

|

)

|

(45

|

)

|

||||||

|

Other income

|

-

|

-

|

-

|

|||||||||

|

Employee benefits expensed

|

(6,372

|

)

|

(5,344

|

)

|

(5,967

|

)

|

||||||

|

Other expenses

|

(3,787

|

)

|

(3,850

|

)

|

(3,684

|

)

|

||||||

|

Loss from operating activities

|

(10,196

|

)

|

(9,225

|

)

|

(9,696

|

)

|

||||||

|

Finance income

|

653

|

1,411

|

3,321

|

|||||||||

|

Finance costs

|

(11

|

)

|

(11

|

)

|

(16

|

)

|

||||||

|

Net finance income / (costs)

|

642

|

1,400

|

3,305

|

|||||||||

|

Loss before tax

|

(9,554

|

)

|

(7,825

|

)

|

(6,391

|

)

|

||||||

|

Income tax expense

|

-

|

-

|

-

|

|||||||||

|

Loss for the year

|

(9,554

|

)

|

(7,825

|

)

|

(6,391

|

)

|

||||||

|

Loss attributable to equity holders of the company

|

(9,554

|

)

|

(7,825

|

)

|

(6,391

|

)

|

||||||

|

Consolidated Statement of Financial Position (in thousands)

|

Fiscal

2025

|

Fiscal

2024

|

||||||

|

|

US$’000

|

US$’000

|

||||||

|

Current assets

|

||||||||

|

Cash assets

|

25,059

|

35,715

|

||||||

|

Receivables

|

192

|

324

|

||||||

|

Prepayments

|

16

|

19

|

||||||

|

Total current assets

|

25,267

|

36,058

|

||||||

|

Non-current assets

|

||||||||

|

Receivables

|

289

|

276

|

||||||

|

Plant and equipment

|

289

|

406

|

||||||

|

Right of use asset

|

334

|

71

|

||||||

|

Exploration and evaluation expenditure

|

203,110

|

187,664

|

||||||

|

Other

|

4,252

|

-

|

||||||

|

Total non-current assets

|

208,274

|

188,417

|

||||||

|

Total assets

|

233,541

|

224,475

|

||||||

|

Current liabilities

|

||||||||

|

Payables

|

2,408

|

4,543

|

||||||

|

Lease liabilities

|

106

|

41

|

||||||

|

Provisions

|

462

|

428

|

||||||

|

Borrowings

|

-

|

1,200

|

||||||

|

Total current liabilities

|

2,976

|

6,212

|

||||||

|

Non-current liabilities

|

||||||||

|

Lease liabilities – non-current

|

267

|

42

|

||||||

|

Total non-current liabilities

|

267

|

42

|

||||||

|

Total liabilities

|

3,243

|

6,254

|

||||||

|

Net assets

|

230,298

|

218,221

|

||||||

|

Equity

|

||||||||

|

Contributed equity

|

302,651

|

281,671

|

||||||

|

Reserves

|

(2,447

|

)

|

(3,098

|

) | ||||

|

Accumulated losses

|

(69,906

|

)

|

(60,352

|

) | ||||

|

Total equity

|

230,298

|

218,221

|

||||||

|

Expenses incurred (in thousands)

|

Fiscal

2025

|

Fiscal

2024

|

Fiscal

2023

|

|||||||||

|

|

US$’000

|

US$’000

|

US$’000

|

|||||||||

|

Exploration expenditure written off

|

(37

|

)

|

(31

|

)

|

(45

|

)

|

||||||

|

Employee benefits expensed

|

(6,372

|

)

|

(5,344

|

)

|

(5,967

|

)

|

||||||

|

Other expenses

|

(3,787

|

)

|

(3,850

|

)

|

(3,684

|

)

|

||||||

|

Finance costs

|

(11

|

)

|

(11

|

)

|

(16

|

)

|

||||||

| • |

Employee benefits expense increased US$1,028,000;

|

| • |

Other expenses decreased US$63,000;

|

| • |