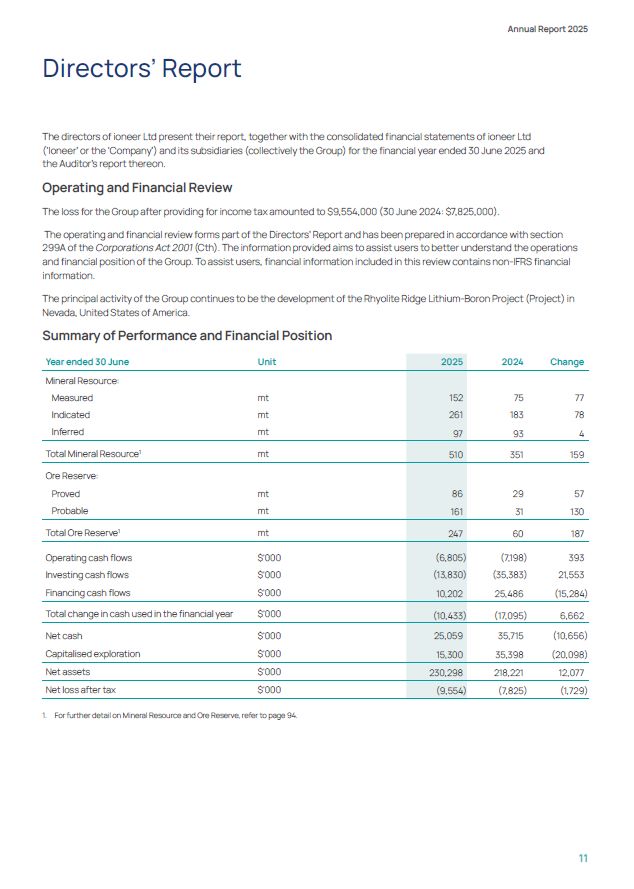

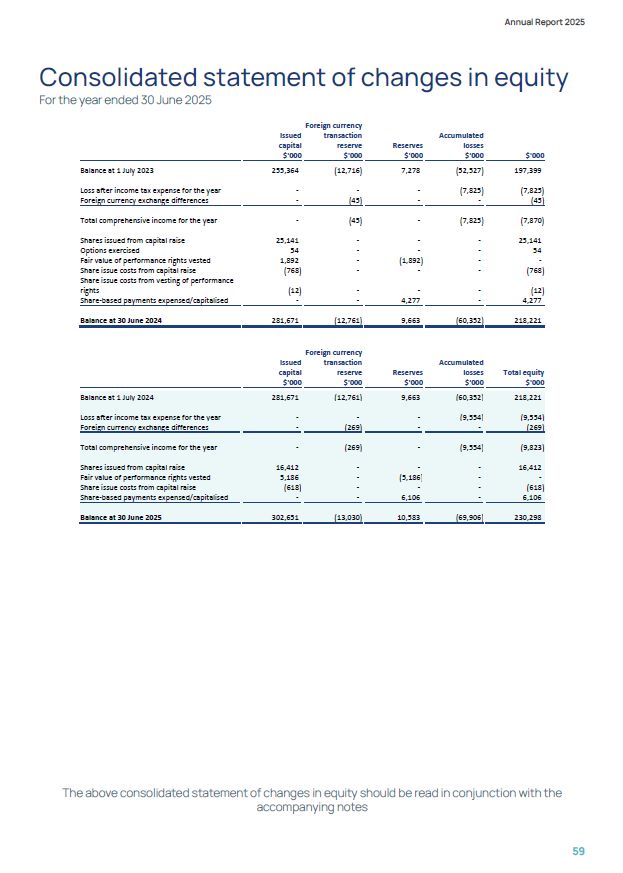

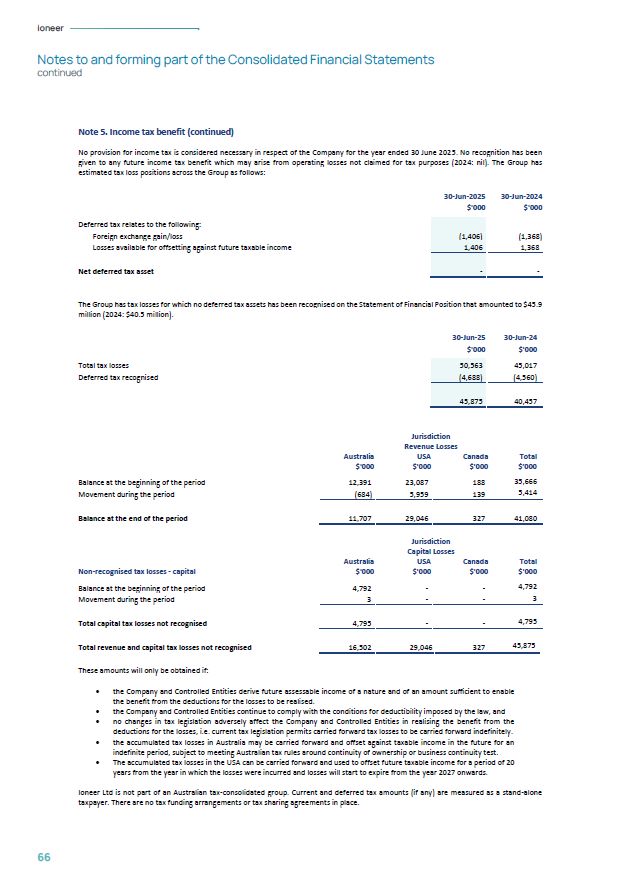

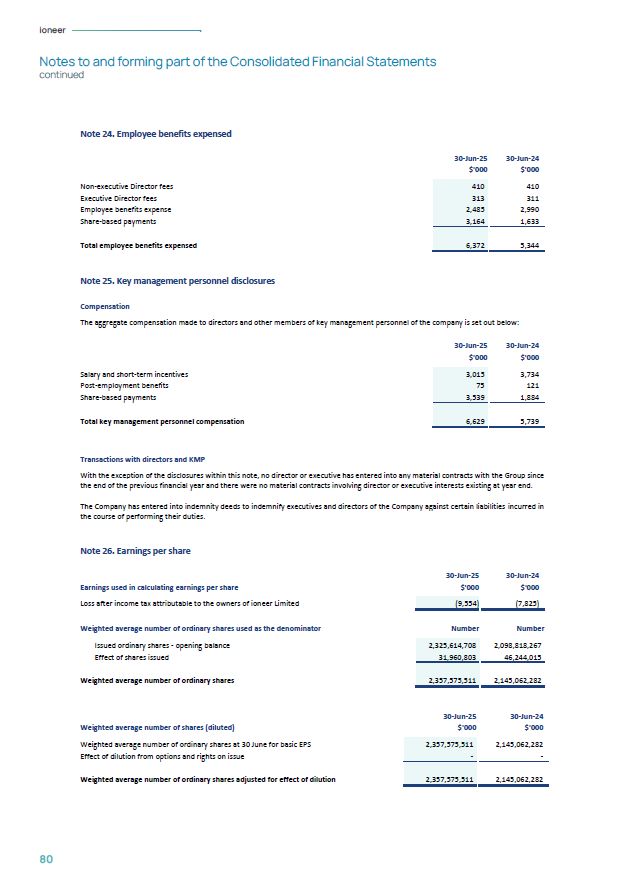

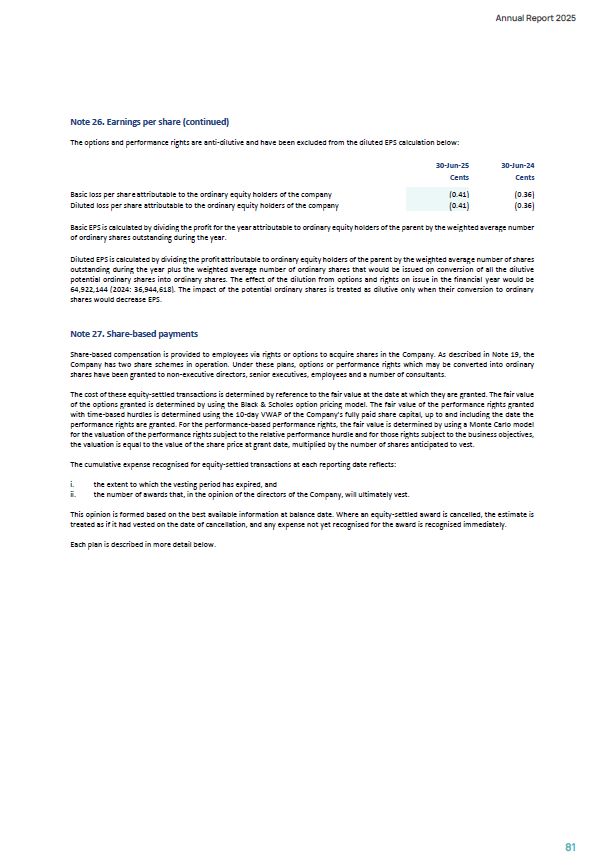

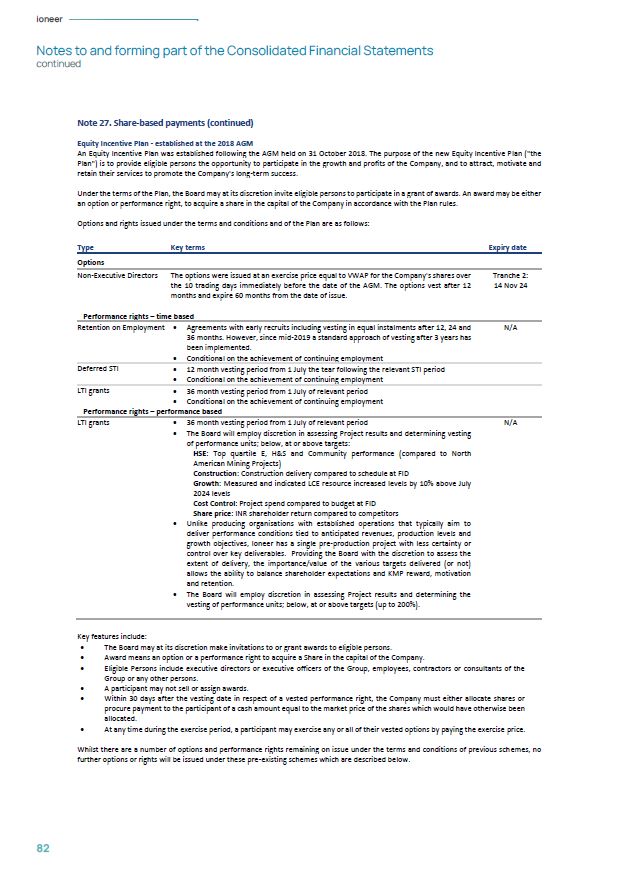

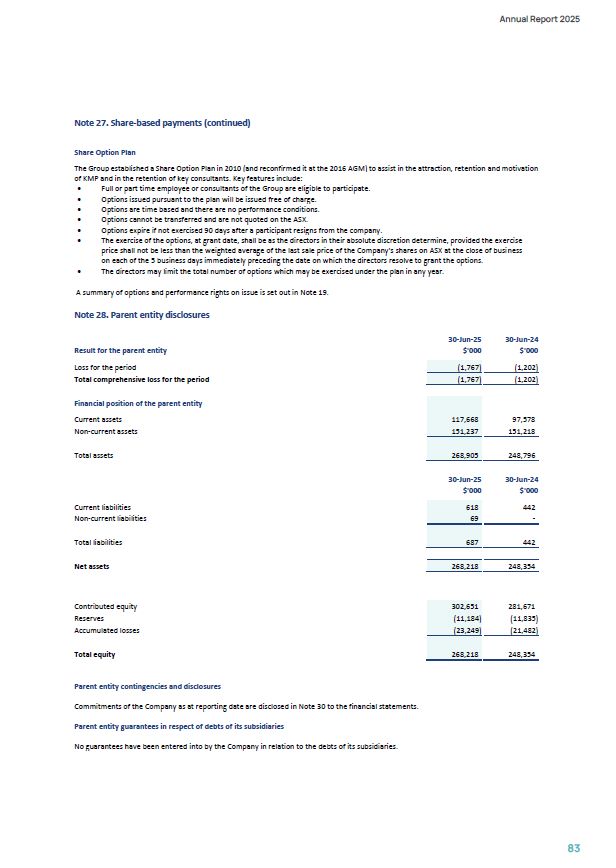

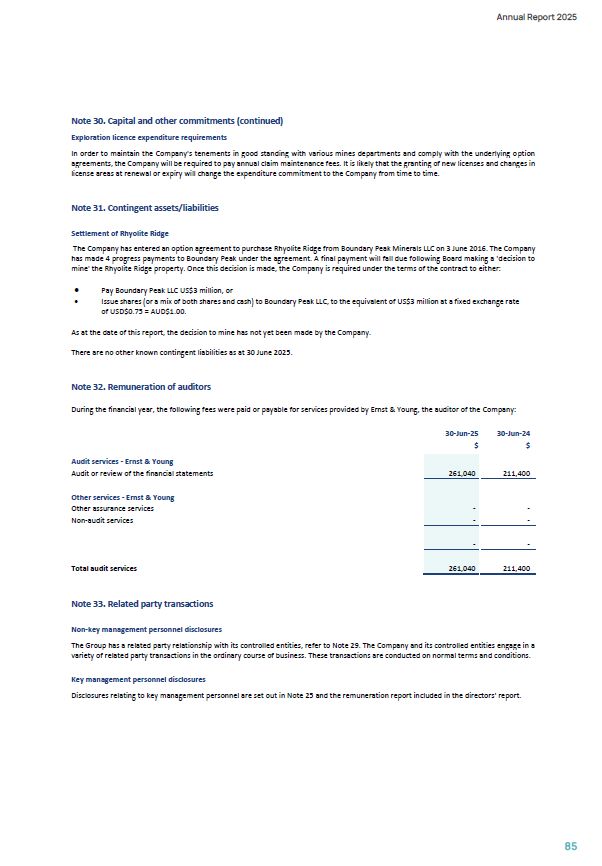

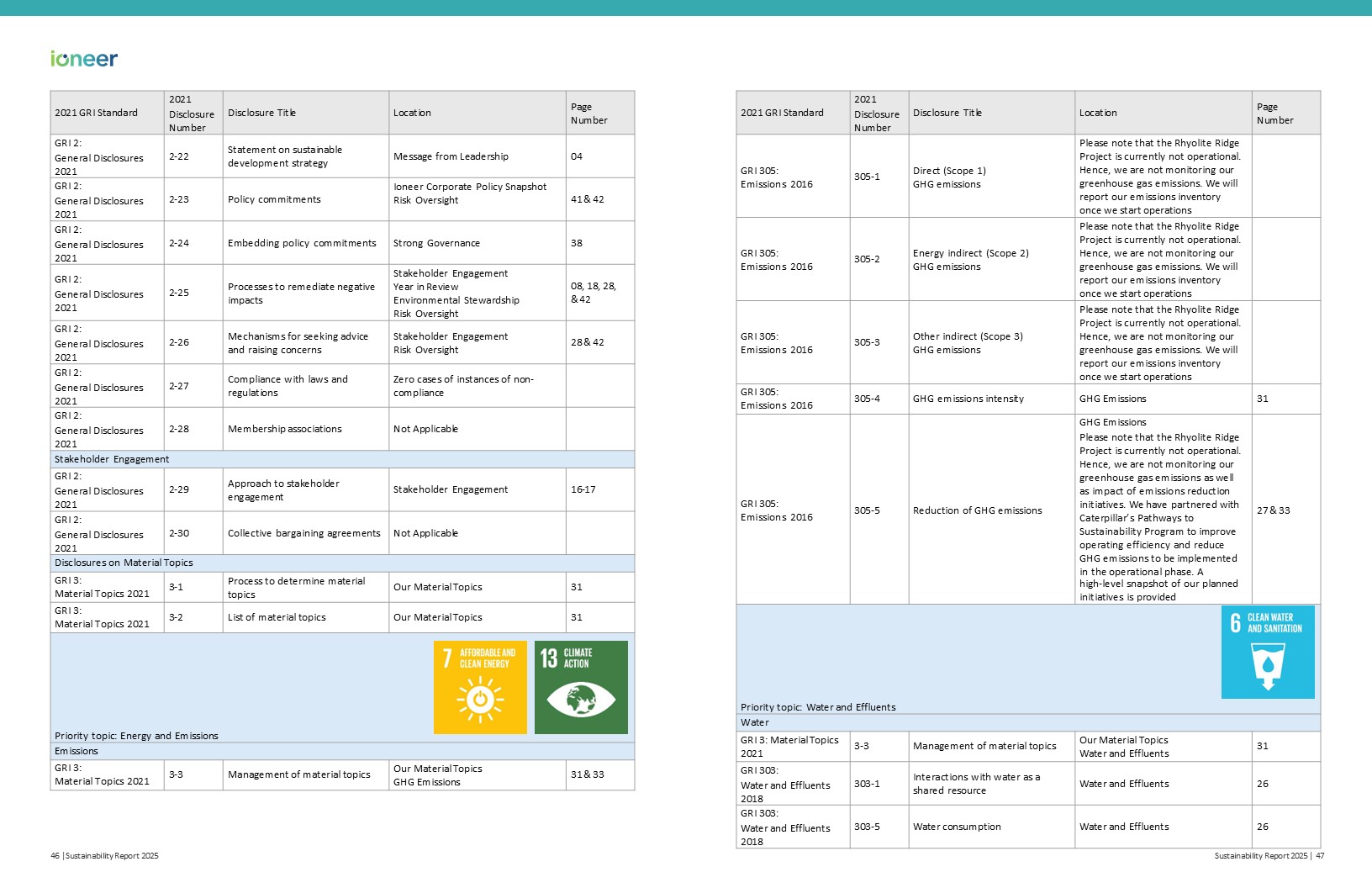

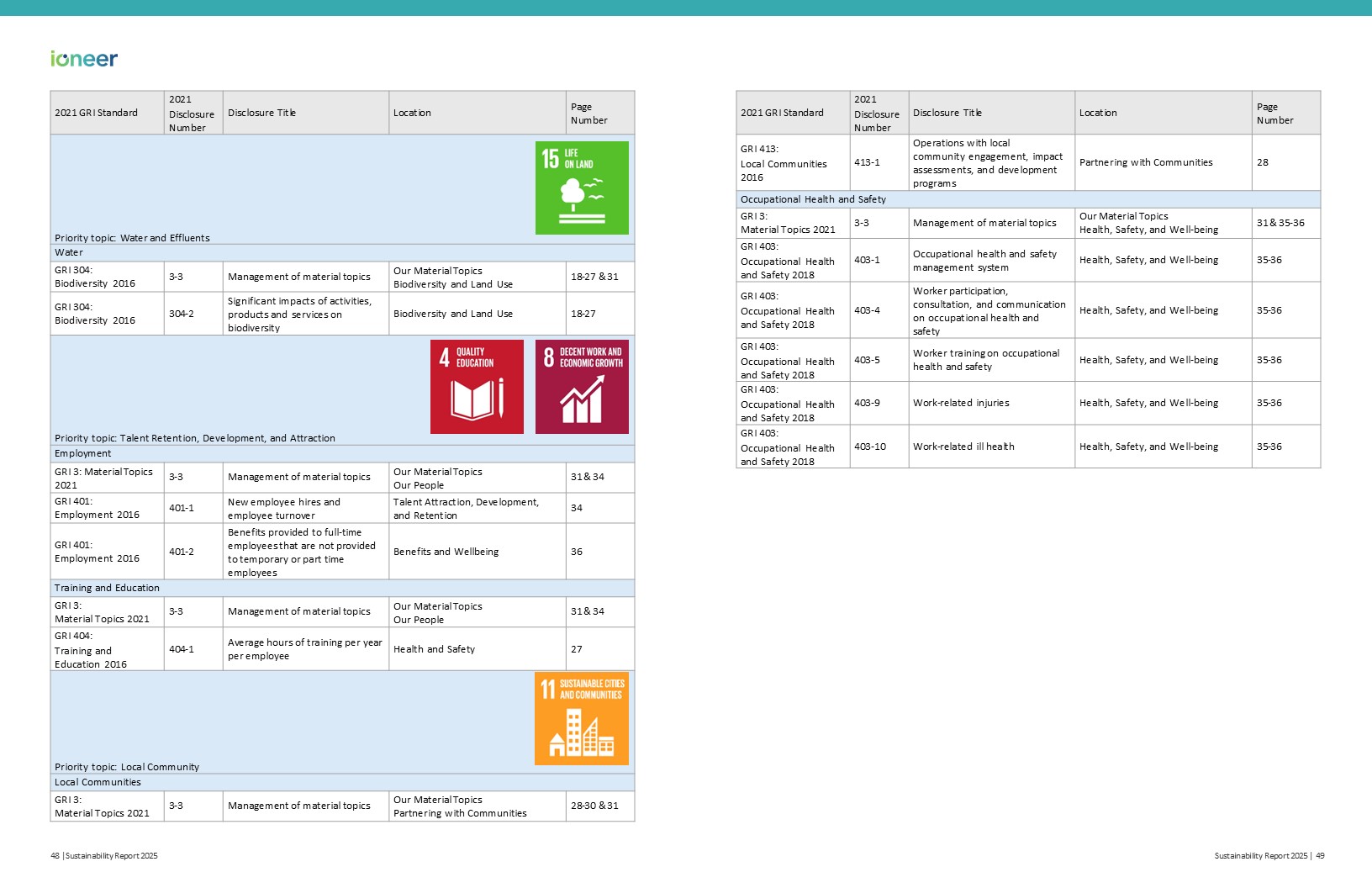

ioneer Notes to and forming part of the Consolidated Financial

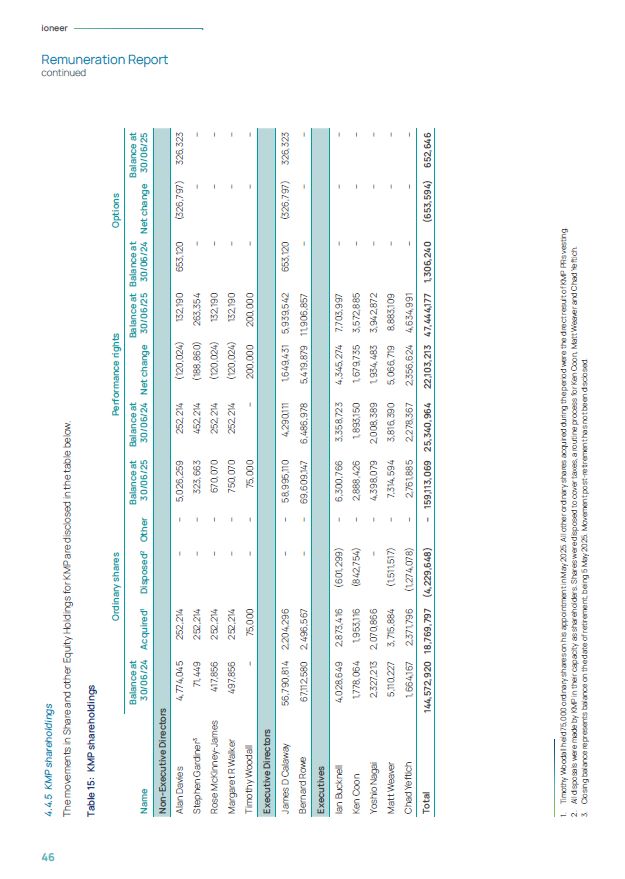

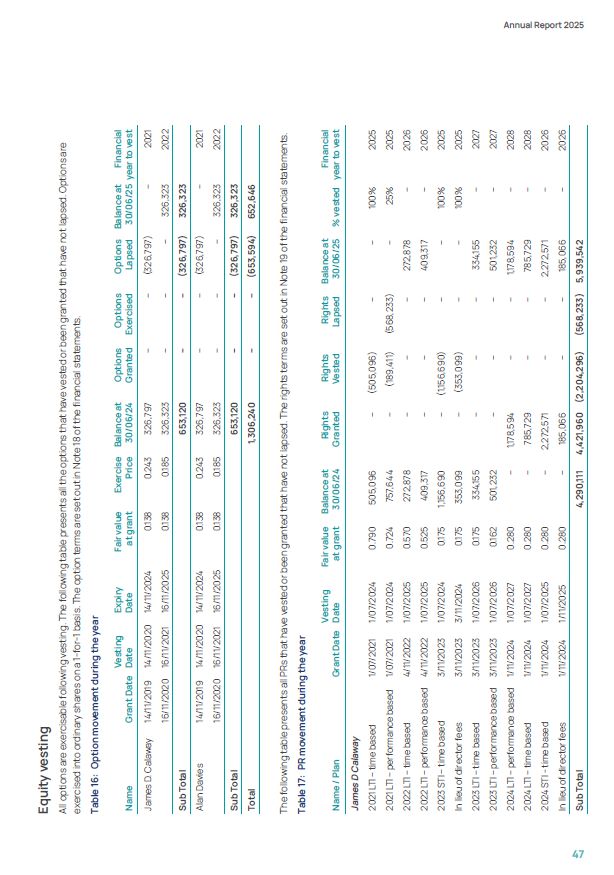

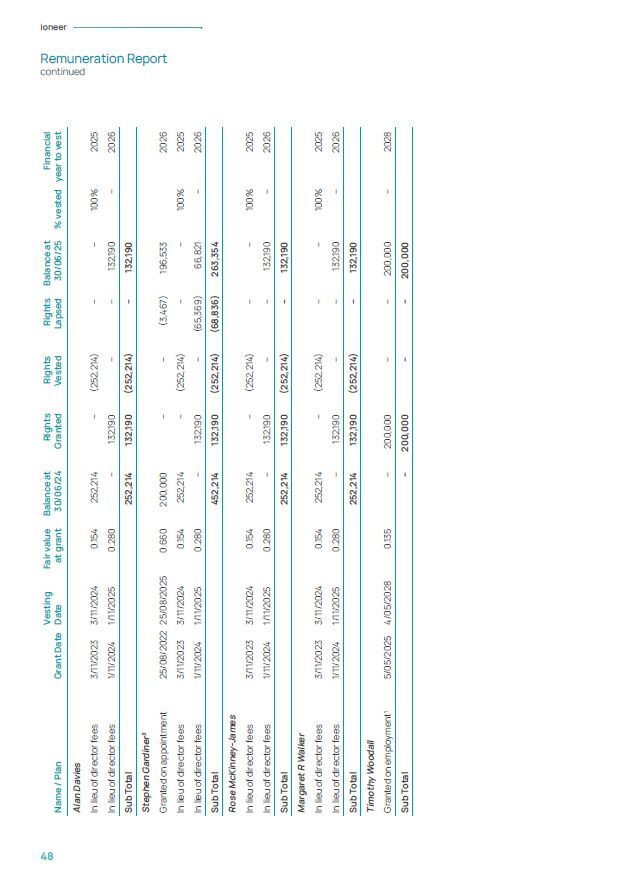

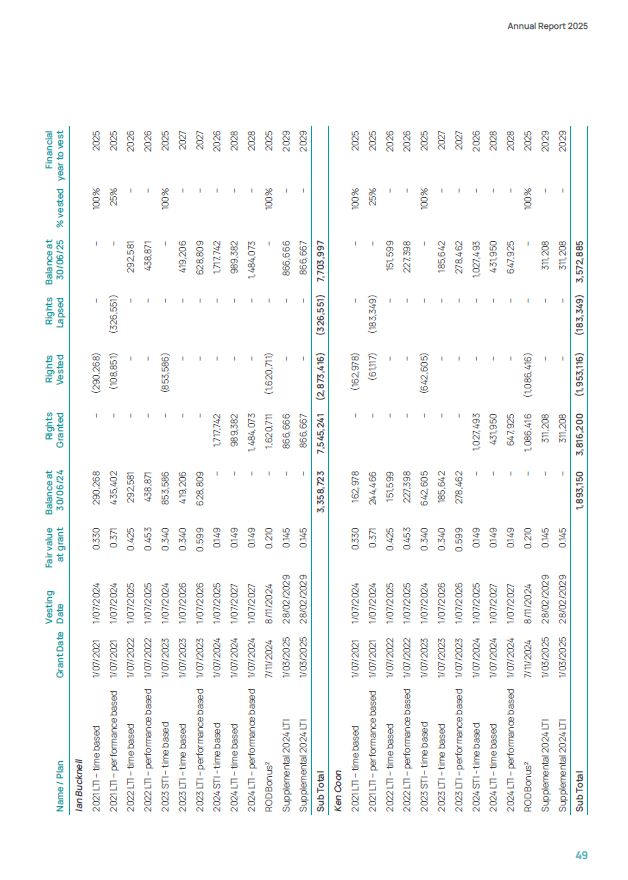

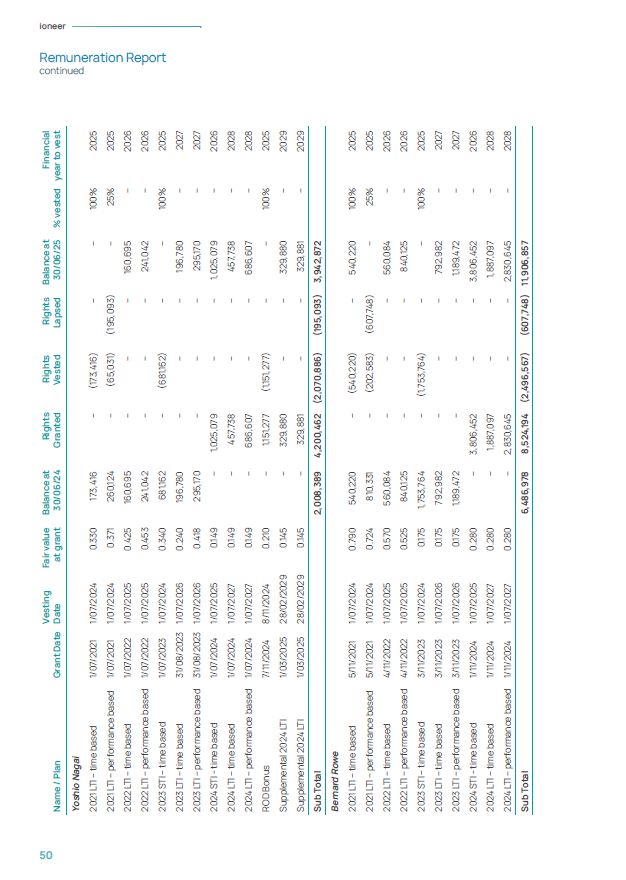

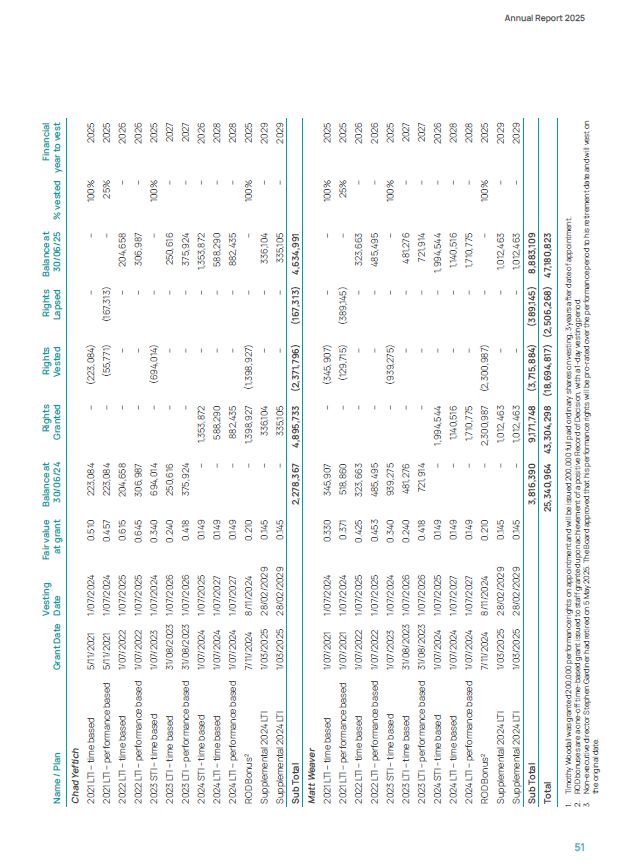

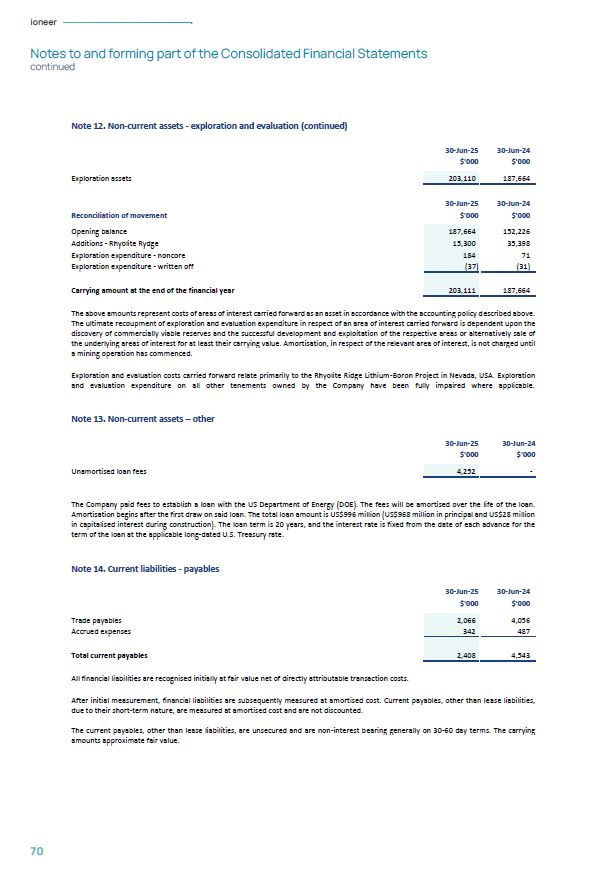

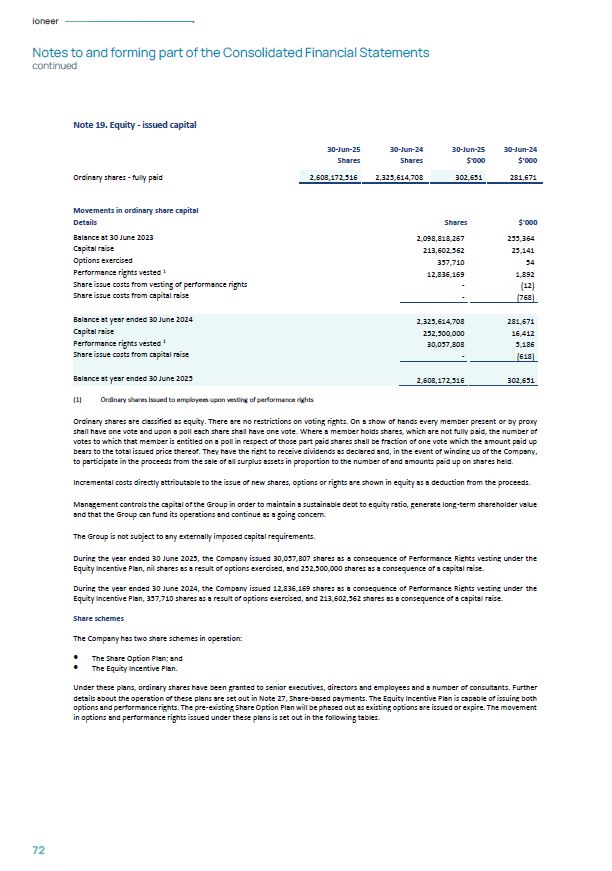

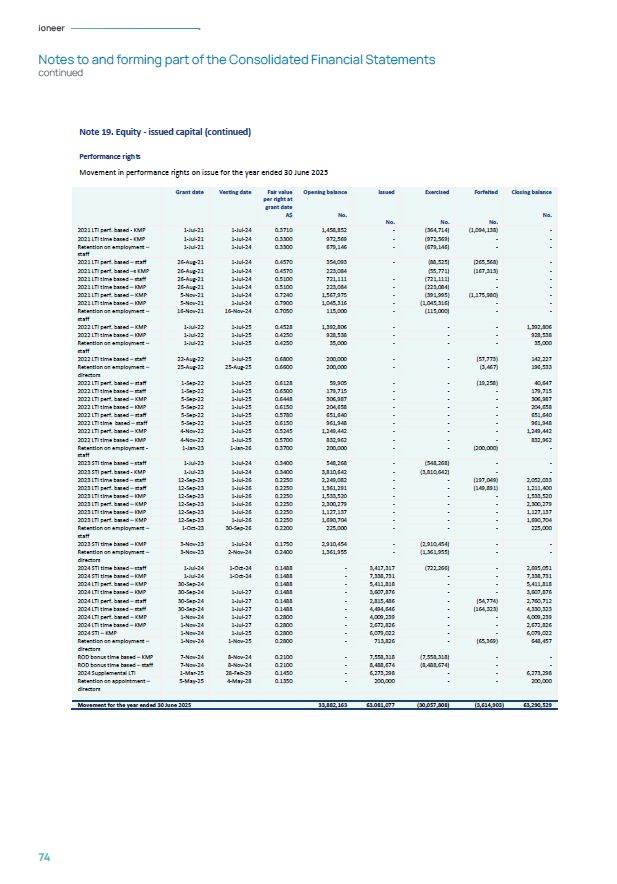

Statements continued 74 Note 19. Equity - issued capital (continued) Performance rights Movement in performance rights on issue for the year ended 30 June 2025 Grant date Vesting date Fair value Opening

balance Issued Exercised Forfeited Closing balance per right at grant date A$ No. No. No. No. No. 2021 LTI perf. based - KMP 1-Jul-21 1-Jul-24 0.3710 1,458,852 - (364,714) (1,094,138) - 2021 LTI time based - KMP

1-Jul-21 1-Jul-24 0.3300 972,569 - (972,569) - - Retention on employment – 1-Jul-21 1-Jul-24 0.3300 679,146 - (679,146) - - staff 2021 LTI perf. based – staff

26-Aug-21 1-Jul-24 0.4570 354,093 - (88,525) (265,568) - 2021 LTI perf. based –s KMP 26-Aug-21 1-Jul-24 0.4570 223,084 (55,771) (167,313) - 2021 LTI time based – staff

26-Aug-21 1-Jul-24 0.5100 721,111 - (721,111) - - 2021 LTI time based – KMP 26-Aug-21 1-Jul-24 0.5100 223,084 - (223,084) - - 2021 LTI perf. based – KMP 5-Nov-21 1-Jul-24 0.7240 1,567,975 - (391,995) (1,175,980) - 2021

LTI time based – KMP 5-Nov-21 1-Jul-24 0.7900 1,045,316 - (1,045,316) - - Retention on employment – 16-Nov-21 16-Nov-24 0.7050 115,000 - (115,000) - - staff 2022 LTI perf. based – KMP

1-Jul-22 1-Jul-25 0.4528 1,392,806 - - - 1,392,806 2022 LTI time based – KMP 1-Jul-22 1-Jul-25 0.4250 928,538 - - - 928,538 Retention on employment – 1-Jul-22 1-Jul-25 0.4250 35,000 - - - 35,000 staff 2022 LTI time

based – staff 22-Aug-22 1-Jul-25 0.6800 200,000 - - (57,773) 142,227 Retention on employment – 25-Aug-22 25-Aug-25 0.6600 200,000 - - (3,467) 196,533 directors 2022 LTI perf. based – staff

1-Sep-22 1-Jul-25 0.6128 59,905 - - (19,258) 40,647 2022 LTI time based – staff 1-Sep-22 1-Jul-25 0.6500 179,715 - - - 179,715 2022 LTI perf. based – KMP 5-Sep-22 1-Jul-25 0.6448 306,987 - - - 306,987 2022 LTI time based

– KMP 5-Sep-22 1-Jul-25 0.6150 204,658 - - - 204,658 2022 LTI perf. based – staff 5-Sep-22 1-Jul-25 0.5780 651,640 - - - 651,640 2022 LTI time based – staff 5-Sep-22 1-Jul-25 0.6150 961,948 - - - 961,948 2022 LTI perf.

based – KMP 4-Nov-22 1-Jul-25 0.5245 1,249,442 - - - 1,249,442 2022 LTI time based – KMP 4-Nov-22 1-Jul-25 0.5700 832,962 - - - 832,962 Retention on employment -

1-Jan-23 1-Jan-26 0.3700 200,000 - - (200,000) - staff 2023 STI time based – staff 1-Jul-23 1-Jul-24 0.3400 548,268 - (548,268) - - 2023 STI perf. based - KMP 1-Jul-23 1-Jul-24 0.3400 3,810,642 - (3,810,642) - - 2023

LTI time based – staff 12-Sep-23 1-Jul-26 0.2250 2,249,082 - - (197,049) 2,052,033 2023 LTI perf. based – staff 12-Sep-23 1-Jul-26 0.2250 1,361,291 - - (149,891) 1,211,400 2023 LTI time based – KMP

12-Sep-23 1-Jul-26 0.2250 1,533,520 - - - 1,533,520 2023 LTI perf. based – KMP 12-Sep-23 1-Jul-26 0.2250 2,300,279 - - - 2,300,279 2023 LTI time based – KMP 12-Sep-23 1-Jul-26 0.2250 1,127,137 - - - 1,127,137 2023 LTI

perf. based – KMP 12-Sep-23 1-Jul-26 0.2250 1,690,704 - - - 1,690,704 Retention on employment – 1-Oct-23 30-Sep-26 0.2200 225,000 - - - 225,000 staff 2023 STI time based – KMP

3-Nov-23 1-Jul-24 0.1750 2,910,454 - (2,910,454) - - Retention on employment – 3-Nov-23 2-Nov-24 0.2400 1,361,955 - (1,361,955) - - directors 2024 STI time based – staff

1-Jul-24 1-Oct-24 0.1488 - 3,417,317 (722,266) - 2,695,051 2024 STI time based – KMP 1-Jul-24 1-Oct-24 0.1488 - 7,338,731 - - 7,338,731 2024 LTI perf. based – KMP 30-Sep-24 0.1488 - 5,411,818 - - 5,411,818 2024 LTI time

based – KMP 30-Sep-24 1-Jul-27 0.1488 - 3,607,876 - - 3,607,876 2024 LTI perf. based – staff 30-Sep-24 1-Jul-27 0.1488 - 2,815,486 - (54,774) 2,760,712 2024 LTI time based – staff

30-Sep-24 1-Jul-27 0.1488 - 4,494,646 - (164,323) 4,330,323 2024 LTI perf. based – KMP 1-Nov-24 1-Jul-27 0.2800 - 4,009,239 - - 4,009,239 2024 LTI time based – KMP 1-Nov-24 1-Jul-27 0.2800 - 2,672,826 - - 2,672,826 2024

STI – KMP 1-Nov-24 1-Jul-25 0.2800 - 6,079,022 - - 6,079,022 Retention on employment – 1-Nov-24 1-Nov-25 0.2800 - 713,826 - (65,369) 648,457 directors ROD bonus time based – KMP

7-Nov-24 8-Nov-24 0.2100 - 7,558,318 (7,558,318) - - ROD bonus time based – staff 7-Nov-24 8-Nov-24 0.2100 - 8,488,674 (8,488,674) - - 2024 Supplemental LTI 1-Mar-25 28-Feb-29 0.1450 - 6,273,298 - - 6,273,298 Retention

on appointment – 5-May-25 4-May-28 0.1350 - 200,000 - - 200,000 directors Movement for the year ended 30 June 2025 33,882,163 63.081,077 (30,057,808) (3,614,903) 63,290,529