|

Exhibit

|

Description

|

|

|

Press Release

|

|

ioneer Ltd

|

|

|

(registrant)

|

|

|

Date: September 3, 2025

|

By: /s/ Ian Bucknell

|

|

Name: Ian Bucknell

|

|

|

Title: Chief Financial Officer & Company Secretary

|

|

|

|

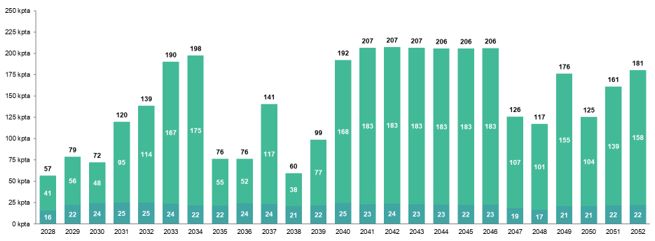

Leach Optimisation and New Mine Plan Yields

Material Improvement in Project Economics

|

||

|

|

||

|

|

● |

38% increase in unlevered life of mine NPV to US$1,888 million

|

|

|

● |

16% increase in unlevered life of mine IRR to 16.8%

|

|

|

● |

20% increase in annual lithium hydroxide production years 3-25 to 25,500 tpa

|

|

|

● |

9% increase in annual boric acid production years 1-25 to 126,700 tpa

|

|

|

● |

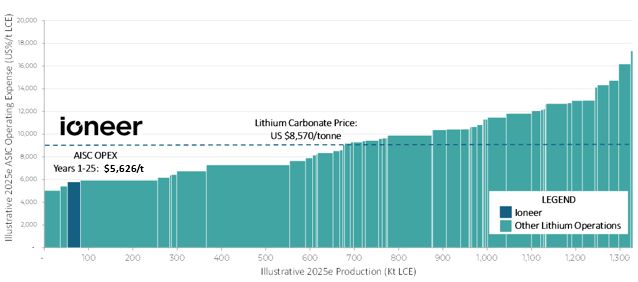

All-in sustaining cash cost of US$5,626 per metric tonne lithium carbonate equivalent

|

|

|

● |

Made possible by reducing vat leach retention time from three days to two days, enabling a reduction in acid consumption per tonne of ore processed and a subsequent 25% increase in the amount of ore processed from 2.4 Mtpa to 3.0

Mtpa using the available surplus acid, far exceeding earlier expectations

|

| ● |

Rhyolite Ridge is the only known lithium deposit globally that is amenable to vat and heap leaching, reflecting its unique mineralogy and allows for on-site production of lithium and

boron high-purity chemicals

|

|

|

|

|

|

|

|

● |

The large Ore Reserve and Mineral Resource supports future expansions to further increase lithium and boron production to supply the rapidly growing US strategic demand for both products

|

|

|

|

|

|

|

● |

Improvements made possible with no increase in project capital costs and no change to process plant design

|

|

|

|

|

|

|

KEY PARAMETERS

|

UNIT

|

YEARS 1-25

AVERAGE

|

LOM

AVERAGE

|

|

|

PHYSICALS

|

||||

|

Ore processing rate

|

Mtpa

|

3.0

|

3.2

|

|

|

Total tonnes processed

|

Mt

|

75.2

|

260.3

|

|

|

Lithium carbonate grade (equivalent)

|

%

|

0.94

|

0.78

|

|

|

Boric acid grade (equivalent)

|

%

|

5.48

|

3.04

|

|

|

Recoveries – Lithium carbonate

|

%

|

83.5

|

81.6

|

|

|

Recoveries – Lithium hydroxide (year three and beyond)

|

%

|

96.0

|

96.0

|

|

|

Recoveries – Boric acid

|

%

|

76.1

|

65.9

|

|

|

Lithium carbonate equivalent (LCE) production1

|

tpa

|

~22,400

|

~19,300

|

|

|

Lithium hydroxide (year three and beyond) production

|

tpa

|

~25,500

|

~21,900

|

|

|

Boric acid production

|

tpa

|

~126,700

|

~68,000

|

|

|

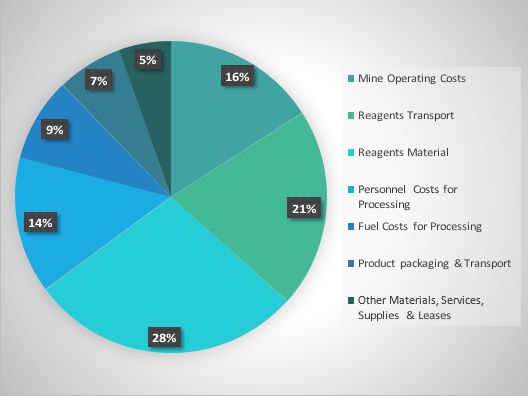

OPERATING AND CAPITAL COSTS

|

||||

|

LCE All-in Sustaining Cost (AISC) (net of boric acid credit)

|

US$/t LCE

|

5,626

|

7,165

|

|

|

LCE direct cost (C1) (net of boric acid credit)

|

US$/t LCE

|

3,554

|

5,636

|

|

|

Mining cost per ore tonne (inclusive of waste)

|

US$/t

|

21.0

|

10.1

|

|

|

|

Processing cost per ore tonne

|

US$/t

|

61.9

|

53.3

|

|

|

Mining cost per total tonnes (ore and waste)

|

US$/t

|

2.33

|

2.28

|

|

KEY PARAMETERS

|

UNIT

|

YEARS 1-25

AVERAGE

|

LOM

AVERAGE

|

|

|

PRICING ASSUMPTIONS

|

||||

|

Lithium hydroxide index price2

|

US$/t

|

23,040

|

23,012

|

|

|

Boric acid price3

|

US$/t

|

1,296

|

1,368

|

|

|

FINANCIAL PERFORMANCE

|

||||

|

Annual revenue

|

US$Mpa

|

724.8

|

575.4

|

|

|

Annual revenue – Lithium

|

US$Mpa

|

555.1

|

482.7

|

|

|

Annual revenue – Boric acid

|

US$Mpa

|

169.6

|

92.7

|

|

|

Annual EBITDA

|

US$Mpa

|

497.2

|

383.8

|

|

|

Annual EBITDA margin

|

%

|

68.6

|

66.7

|

|

|

After-tax unlevered NPV @ 8% real discount rate

|

US$M

|

1,444.9

|

1,887.8

|

|

|

After-tax Internal unlevered Rate of Return (IRR)

|

%

|

16.4

|

16.8

|

|

|

After-tax levered NPV @ 8% real discount rate

|

US$M

|

1,998.1

|

||

|

After-tax levered Internal Rate of Return (IRR)

|

%

|

20.9

|

||

|

Payback period (from start of operations)

|

years

|

7.0

|

|

KEY PARAMETERS

|

UNIT

|

YEARS 1-25

TOTAL

|

LOM

TOTAL

|

|

|

CAPITALIZED EXPENDITURE

|

||||

|

Initial capital expenditure (including contingencies)

|

US$M

|

1,667.9

|

||

|

Sustaining capital expenditure

|

US$M

|

1,033.2

|

2,242.0

|

|

|

Capitalized deferred pre-stripping costs4

|

US$M

|

546.9

|

798.3

|

|

|

|

|

|

|

• |

Lithium Carbonate (Technical Grade), available from start-up and reprocessed into lithium hydroxide monohydrate from year 3,

|

|

|

• |

Lithium Hydroxide Monohydrate (Battery Grade) from year 3, and

|

|

|

• |

Boric Acid (technical grade), available from start-up.

|

|

|

|

|

|

|

KEY HIGHLIGHTS

|

||

|

|

|

● |

Fully permitted and engineering ready

|

|

|

|

● |

Water rights fully secured

|

|

|

|||

|

|

|

● |

Closed DOE LPO loan for US$996 million (including capitalised interest during construction of US$28 million5).

DOE LPO loan has conditions to first draw

|

|

|

|||

|

|

|

● |

Robust, strategic partner process launched with Goldman Sachs in late June

|

|

|

|||

|

|

|

● |

Compelling Project Economics for Stage One of Project

|

|

|

|||

|

|

|

● |

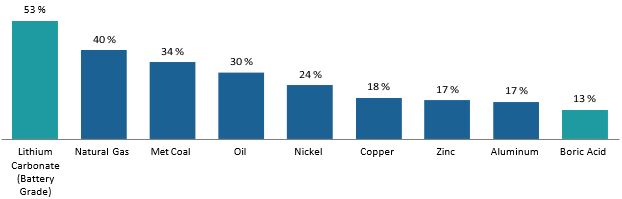

All-in Sustaining Cash Cost in the lowest quartile of the Global Cost Curve

|

| |

|||

|

|

|

● |

Well Defined and Reliable Operating Cost and Capital Cost Estimates (AACE Class 2)

|

|

|

|||

|

|

|

● |

Long-Life Resource with Optimisation Upside and Verified Expansion Potential

|

|

|

|||

|

|

|

● |

US Advantage and Low-Risk, Mining-Friendly Jurisdiction

|

|

|

|

|

|

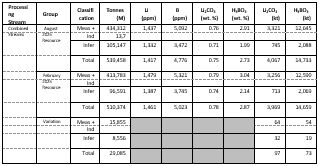

Processing

Stream

|

Group

|

Classification

|

Tonnes

(M)

|

Li

(ppm)

|

B

(ppm)

|

Li2CO3

(wt. %)

|

H3BO3

(wt. %)

|

Li2CO3

(kt)

|

H3BO3

(kt)

|

||

|

Combined

Streams

|

August 2025

Resource

|

Mea + Ind

|

434.3

|

1,437

|

5,092

|

0.76

|

2.91

|

3,321

|

12,645

|

||

|

Inf

|

105.1

|

1,332

|

3,472

|

0.71

|

1.99

|

745

|

2,088

|

||||

|

Total

|

539.5

|

1,417

|

4,776

|

0.75

|

2.73

|

4,067

|

14,733

|

||||

|

February

2025

Resource

|

Mea + Ind

|

413.8

|

1,479

|

5.321

|

0.79

|

3.04

|

3,257

|

12,591

|

|||

|

Inf

|

96.6

|

1,387

|

3,745

|

0.74

|

2.14

|

713

|

2,069

|

||||

|

Total

|

510.4

|

1,462

|

5,023

|

0.78

|

2.87

|

3,970

|

14,659

|

||||

|

Variation

|

Mea + Ind

|

20.5

|

64.6

|

54.7

|

|||||||

|

Inf

|

8.6

|

32.3

|

19.0

|

||||||||

|

Total

|

29.1

|

97.0

|

73.7

|

|

Group

|

Classification

|

Tonnes

(Mt)

|

Li

(ppm)

|

B

(ppm)

|

Li2CO3

(wt. %)

|

H3BO3

(wt. %)

|

Li2CO3

(kt)

|

H3BO3

(kt)

|

|

|

August 2025

Reserve

|

Proved

|

89.5

|

1,574

|

6,589

|

0.84

|

3.77

|

750

|

3,373

|

|

|

Probable

|

170.8

|

1,386

|

4,473

|

0.74

|

2.56

|

1,260

|

4,369

|

||

|

Total

|

260.3

|

1,451

|

5,201

|

0.77

|

2.97

|

2,010

|

7,742

|

||

|

May 2025

Reserve

|

Proved

|

85.7

|

1,572

|

6,814

|

0.84

|

3.90

|

717

|

3,341

|

|

|

Probable

|

160.9

|

1,407

|

4,715

|

0.75

|

2.70

|

1,205

|

4,337

|

||

|

Total

|

246.6

|

1,464

|

5,444

|

0.78

|

3.11

|

1,922

|

7,678

|

||

|

Variation

|

Proved

|

3.8

|

2

|

-225

|

33

|

32

|

|||

|

Probable

|

9.9

|

-21

|

-242

|

55

|

32

|

||||

|

Total

|

13.7

|

-13

|

-243

|

88

|

-64

|

|

|

• |

Secure equity financing to sit alongside U.S. Government debt ($996 million)7

|

|

|

• |

Final Investment Decision once equity and debt are in place

|

|

|

• |

Construction Phase. Expected to take approximately 36 months (including procurement of long lead items)

|

|

|

|

|

• |

First Production – 36 months from FID1

|

|

|

• |

Pathway to future growth

|

|

Chad Yeftich

Ioneer USA Corporation

Investor Relations (USA)

T: +1 775 993 8563

E: ir@ioneer.com

|

Ian Bucknell

Ioneer Limited

Investor Relations (AUS)

T: +61 434 567 155

E: ibucknell@ioneer.com

|

|

Daniel Francis, FGS Global

E: daniel.francis@fgsglobal.com

|

|

|

|

|

|

|

|

June 2025

3-day leach

|

August 2025

2-day leach

|

|

|

$1,367 million

|

Unlevered NPV8

|

$1,888 million

|

|

|

|

|

|

|

|

|

|

$497 million

|

Avg. LOM Annual Revenue

|

$575 million

|

|

|

|

|

|

|

|

|

|

17,200 tpa

|

Avg. LOM Annual LCE

Production

|

19,300 tpa

|

|

|

|

|

|

|

|

|

|

60,400 tpa

|

Avg. LOM Annual Boric Acid

Production

|

68,000 tpa

|

|

|

|

|

|

|

|

|

|

246.6 Mt

|

Ore Processed

|

260.3 Mt

|

|

|

|

|

|

|

|

|

|

95 years

|

Life of Project

|

82 years

|

|

|

|

|

|

|

|

|

|

$319 million

|

Average Annual EBITDA

|

$384 million

|

|

|

|

|

|

|

|

|

|

$1,667.9 million

AACE Class 2 estimate

|

Capital Costs

|

$1,667.9 million

AACE Class 2 estimate

|

|

|

|

|

|

|

|

|

|

$1,830 million

|

Sustaining Capex

|

$2,242 million

|

|

|

|

|

|

|

|

|

|

14.5%

|

Unlevered IRR

|

16.8%

|

|

|

|

|

|

|

|

|

|

8.0 years

(from operations)

|

Payback Period

|

7.0 years

(from operations)

|

|

|

|

|

|

|

|

|

|

P65

|

Confidence Level

|

P65

|

|

|

|

|

|

|

|

Stream

|

Group

|

Classification

|

Tonnage

(ktonnes)

|

Li

ppm

|

B

ppm

|

Li2CO3

Wt. %

|

H3BO3

Wt. %

|

Contained

|

|

|

Li2CO3

(ktonnes)

|

H3BO3

(ktonnes)

|

||||||||

|

Stream 1

(>=5,000 ppm B)

|

Upper

Zone

M5 Unit

|

Measured

|

4,562

|

2,350

|

7,592

|

1.25

|

4.34

|

57

|

198

|

|

Indicated

|

4,224

|

2,231

|

7,450

|

1.19

|

4.26

|

50

|

180

|

||

|

Inferred

|

763

|

2,197

|

6,515

|

1.17

|

3.73

|

9

|

28

|

||

|

Total

|

9,549

|

2,285

|

7,443

|

1.22

|

4.26

|

116

|

406

|

||

|

Upper

Zone

B5 Unit

|

Measured

|

38,404

|

1,891

|

15,282

|

1.01

|

8.74

|

386

|

3,356

|

|

|

Indicated

|

38,670

|

1,743

|

13,996

|

0.93

|

8.00

|

359

|

3,095

|

||

|

Inferred

|

10,628

|

1,712

|

10,563

|

0.91

|

6.04

|

97

|

642

|

||

|

Total

|

87,702

|

1,804

|

14,143

|

0.96

|

8.09

|

842

|

7,092

|

||

|

Upper

Zone

S5 Unit

|

Measured

|

3,693

|

1,419

|

7,641

|

0.75

|

4.37

|

28

|

161

|

|

|

Indicated

|

4,747

|

1,285

|

7,415

|

0.68

|

4.24

|

32

|

201

|

||

|

Inferred

|

1,572

|

1,400

|

6,469

|

0.75

|

3.70

|

12

|

58

|

||

|

Total

|

10,013

|

1,352

|

7,350

|

0.72

|

4.20

|

72

|

421

|

||

|

Upper

Zone

Total

|

Measured

|

46,660

|

1,899

|

13,926

|

1.01

|

7.96

|

471

|

3,715

|

|

|

Indicated

|

47,641

|

1,741

|

12,760

|

0.93

|

7.30

|

441

|

3,476

|

||

|

Inferred

|

12,963

|

1,703

|

9,828

|

0.91

|

5.62

|

117

|

728

|

||

|

Total

|

107,264

|

1,805

|

12,913

|

0.96

|

7.38

|

1,030

|

7,920

|

||

|

Lower

Zone L6

Unit

|

Measured

|

17,726

|

1,366

|

9,361

|

0.73

|

5.35

|

129

|

949

|

|

|

Indicated

|

39,731

|

1,324

|

9,507

|

0.70

|

5.44

|

280

|

2,160

|

||

|

Inferred

|

13,914

|

1,415

|

12,287

|

0.75

|

7.03

|

105

|

978

|

||

|

Total

|

71,370

|

1,352

|

10,012

|

0.72

|

5.73

|

514

|

4,086

|

||

|

Total

Stream 1

(all zones)

|

Measured

|

64,385

|

1,752

|

12,669

|

0.93

|

7.24

|

600

|

4,664

|

|

|

Indicated

|

87,372

|

1,551

|

11,280

|

0.83

|

6.45

|

721

|

5,636

|

||

|

Inferred

|

26,877

|

1,554

|

11,101

|

0.83

|

6.35

|

222

|

1,706

|

||

|

Total

|

178,634

|

1,624

|

11,754

|

0.86

|

6.72

|

1,544

|

12,006

|

||

|

Stream 2

($11.13/tonne

net value cut- off

grade, Low

Clay)

|

Upper

Zone

B5 Unit

|

Measured

|

4,966

|

2,228

|

2,212

|

1.19

|

1.26

|

59

|

63

|

|

Indicated

|

4,746

|

2,116

|

2,511

|

1.13

|

1.44

|

53

|

68

|

||

|

Inferred

|

3,696

|

1,694

|

1,774

|

0.90

|

1.01

|

33

|

37

|

||

|

Total

|

13,408

|

2,041

|

2,197

|

1.09

|

1.26

|

146

|

168

|

||

|

Upper

Zone

S5 Unit

|

Measured

|

24,405

|

1,012

|

1,164

|

0.54

|

0.67

|

131

|

162

|

|

|

Indicated

|

35,477

|

867

|

1,014

|

0.46

|

0.58

|

164

|

206

|

||

|

Inferred

|

15,491

|

889

|

1,014

|

0.47

|

0.58

|

73

|

90

|

||

|

Total

|

75,373

|

918

|

1,063

|

0.49

|

0.61

|

368

|

458

|

||

|

Upper

Zone

|

Measured

|

29,371

|

1,218

|

1,341

|

0.65

|

0.77

|

190

|

225

|

|

|

Indicated

|

40,223

|

1,014

|

1,191

|

0.54

|

0.68

|

217

|

274

|

||

|

Total

|

Inferred

|

19,187

|

1,044

|

1,160

|

0.56

|

0.66

|

107

|

127

|

|

|

Total

|

88,782

|

1,088

|

1,234

|

0.58

|

0.71

|

514

|

626

|

||

|

Lower

Zone

L6 Unit

|

Measured

|

43,979

|

1,211

|

1,582

|

0.64

|

0.90

|

283

|

398

|

|

|

Indicated

|

120,143

|

1,180

|

1,573

|

0.63

|

0.90

|

754

|

1,081

|

||

|

Inferred

|

47,474

|

1,244

|

790

|

0.66

|

0.45

|

314

|

214

|

||

|

Total

|

211,597

|

1,201

|

1,399

|

0.64

|

0.80

|

1,352

|

1,693

|

||

|

Total

Stream 2

(all zones)

|

Measured

|

73,350

|

1,214

|

1,486

|

0.65

|

0.85

|

474

|

623

|

|

|

Indicated

|

160,367

|

1,138

|

1,477

|

0.61

|

0.84

|

972

|

1,354

|

||

|

Inferred

|

66,662

|

1,186

|

897

|

0.63

|

0.51

|

421

|

342

|

||

|

Total

|

300,378

|

1,167

|

1,350

|

0.62

|

0.77

|

1,866

|

2,319

|

||

|

Stream

3($11.13/tonne net

value cut-off

|

Total

Stream 3

(M5 zone)

|

Measured

|

19,223

|

2,201

|

1,550

|

1.17

|

0.89

|

225

|

170

|

|

Indicated

|

29,615

|

2,089

|

1,168

|

1.11

|

0.67

|

329

|

198

|

||

|

Inferred

|

11,608

|

1,654

|

601

|

0.88

|

0.34

|

102

|

40

|

||

|

Total

|

60,446

|

2,041

|

1,181

|

1.09

|

0.68

|

657

|

408

|

||

|

Grand Total All Streams

and All Units

|

Measured

|

156,958

|

1,555

|

6,081

|

0.83

|

3.48

|

1,299

|

5,458

|

|

|

Indicated

|

277,354

|

1,370

|

4,532

|

0.73

|

2.59

|

2,022

|

7,188

|

||

|

Inferred

|

105,147

|

1,332

|

3,472

|

0.71

|

1.99

|

745

|

2,088

|

||

|

Total

|

539,458

|

1,417

|

4,776

|

0.75

|

2.73

|

4,067

|

14,733

|

||

|

|

7. |

The mineral resource is reported inclusive of the mineral reserves.

|

|

Processing

Stream

|

Group

|

Classification

|

Tonnes

(M)

|

Li

(ppm)

|

B

(ppm)

|

Li2CO3

(wt. %)

|

H3BO3

(wt. %)

|

Li2CO3

(kt)

|

H3BO3

(kt)

|

|

Combined

Streams

|

August 2025

Resource

|

Mea + Ind

|

434.3

|

1,437

|

5,092

|

0.76

|

2.91

|

3,321

|

12,645

|

|

Inf

|

105.1

|

1,332

|

3,472

|

0.71

|

1.99

|

745

|

2,088

|

||

|

Total

|

539.5

|

1,417

|

4,776

|

0.75

|

2.73

|

4,067

|

14,733

|

||

|

February 2025

Resource

|

Mea + Ind

|

413.8

|

1,479

|

5.321

|

0.79

|

3.04

|

3,257

|

12,591

|

|

|

Inf

|

96.6

|

1,387

|

3,745

|

0.74

|

2.14

|

713

|

2,069

|

||

|

Total

|

510.4

|

1,462

|

5,023

|

0.78

|

2.87

|

3,970

|

14,659

|

||

|

Variation

|

Mea + Ind

|

20.5

|

64.6

|

54.7

|

|||||

|

Inf

|

8.6

|

32.3

|

19.0

|

||||||

|

Total

|

29.1

|

97.0

|

73.7

|

|

|

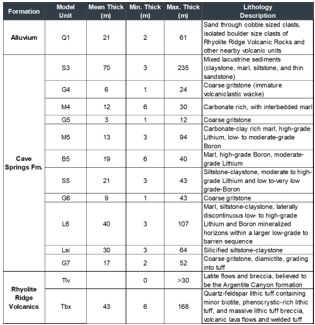

• |

Reduced leach retention time is reduced from three days to two days;

|

|

|

• |

The reduction in retention time reduced the recovery of lithium and boron in the B5, S5 and L6 seams, the predominate impact is to Stream 2;

|

|

|

• |

The reduction in retention time also reduced the acid consumption of the gangue minerals in the B5, S5 and L6 seams for both Streams 1 and 2;

|

|

|

• |

The definition of the resource pit shell includes a G&A cost of $US 11.13/tonne down from $16.54/tonne in the August 2025 estimate, and:

|

|

|

• |

Decreased the net value cutoff for Streams 2 and 3 from $16.54 per tonne to $11.13 per tonne.

|

|

|

• |

The Rhyolite Ridge Mineral Resource area extends over a north-south strike length of 4,240 m (from 4,337,540 mN – 4,341,780mN), has a maximum width of 2,110m (863,330 mE – 865,440 mE) and includes the 585 m vertical interval from

2,065mRL to 1,480 mRL.

|

|

|

• |

The Rhyolite Ridge Project tenements (unpatented mining claims) are owned by Ioneer Minerals Corporation, a company wholly owned by Ioneer Ltd. The unpatented mining claims are located on US federal land administered by the Bureau

of Land Management (BLM).

|

|

|

• |

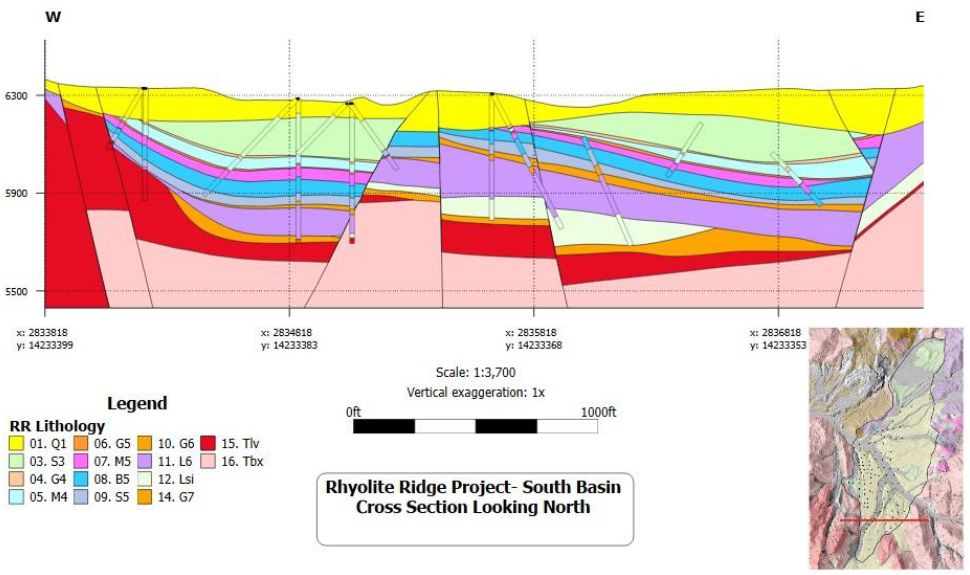

Lithium and boron mineralisation is stratiform in nature and is hosted within Late Miocene-age carbonate-rich sedimentary rock, deposited in a lacustrine environment in the Basin and Range terrain of Nevada, USA.

|

|

|

• |

Drill holes used in the Mineral Resource estimate included 50 reverse circulation (RC) holes and 110 core holes for a total of 32,530m within the defined mineralisation. The full database for

the South Basin contains records for 166 drill holes for 33,519m of drilling.

|

|

|

• |

Drill hole spacing is 100m by 100m (or less) over most of the deposit.

|

|

|

• |

Drill holes were logged for a combination of geological and geotechnical attributes. The core has been photographed and measured for RQD and core recovery.

|

|

|

• |

Drilling was conducted by American Lithium Minerals Inc., the previous owner of the property between 2010 and 2011 and by Ioneer in 2017 to 2019 and 2022 to 2024. For RC drilling, a 12.7-centimetre (cm) hammer was used with sampling conducted on 1.52m intervals and split using a rig mounted rotary splitter. The hammer was replaced with a tri-cone bit in instances of high groundwater flow. For

diamond core, PQ and HQ core size diameter with standard tube was used. Core recoveries of 93% were achieved by Ioneer at the project. The core was sampled as half core at 1.52m intervals using a standard electric core saw.

|

|

|

• |

Samples were submitted to ALS Minerals Laboratory in Reno, Nevada for sample preparation and analysis. The entire sample was oven dried at 105˚C and crushed to -2 millimetre (mm). A

sub-sample of the crushed material was then pulverised to better than 85% passing -75 microns (µm) using a LM5 pulveriser. The pulverised sample was split with multiple feed in a Jones riffle

splitter until a 100-200 gram (g) sub-sample was obtained for analysis.

|

|

|

• |

Analysis of the samples was conducted using aqua regia 2-acid for ICP-MS on a multi-element suite. This method is appropriate for understanding sedimentary lithium deposits and is a total method.

|

|

|

• |

Standards for lithium and boron and blanks were routinely inserted into sample batches and acceptable levels of accuracy were reportedly obtained. Based on an evaluation of the quality assurance and quality control (QA/QC) results all assay data has been deemed by the IMC Competent Person as suitable and fit for purpose in Mineral Resource estimation.

|

|

|

• |

The Mineral Resource estimate presented in this Report has been constrained by the application of an optimized Mineral Resource pit shell. The Mineral Resource pit shell was developed using the Independent Mining Consultants,

Inc. (IMC) Mine Planning software.

|

|

|

• |

The Mineral Resource estimate assumes the use of three processing streams: one which can process ore with boron content greater than 5,000 ppm and two which can process ore with boron content less than 5,000 ppm.

|

|

|

• |

The Mineral Resource estimate has been constrained by applying a 5,000 ppm Boron cut-off grade to HiB-Li mineralisation within the B5, M5, S5 and L6 geological units as well as a $11.13/tonne net value cut-off grade to LoB-Li

mineralisation in the M5, B5, S5 and L6 geological units.

|

|

|

• |

Key input parameters and assumptions for the Mineral Resource pit shell included the following:

|

|

|

• |

B cut-off grade of 5,000 ppm for HiB-Li processing stream and no B cut-off grade for LoB-Li processing stream

|

|

|

• |

No Li cut-off grade for HiB-Li processing stream and net value cutoff of $11.13/tonne for LoB- Li processing stream

|

|

|

• |

Overall pit slope angle of 42 degrees in all rock units (wall angle guidance provided by Geo- Logic Associates who developed the geotechnical design)

|

|

|

• |

Fixed mining cost of US$1.69 /tonne and a variable incremental mining cost of $0.005/tonne per vertical meter from reference elevation of 6,210 ft amsl

|

|

|

• |

G&A cost of US$11.13/tonne processed

|

|

|

• |

Ore processing and grade control costs include a fixed cost per tonne and a variable cost of acid based on the acid consumption rate which is calculated for each block within the mineralized seams. For Stream 1 the total

(combined fixed and acid) cost is between $34.18/mt and $92.84/mt. For Stream 2, the combined cost ranges between $18.87/mt to $78.57/mt and for Stream 3 costs ranged between $45.99/mt and $98.63/mt This wide range is explained by

the variability in acid consumption for each of these streams, mostly due to the variability in calcium grade.

|

|

|

• |

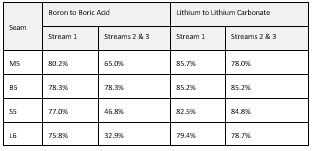

Boron and Lithium recovery are variable by lithology for Stream 1 and are respectively for boron and lithium: M5 80.2% and 85.7%, B5 78.3% and 85.2%, S5 77.0% and 82.5%, L6 75.8% and 79.4%.

|

|

|

• |

Boron Recovery for Stream 2 and 3 are variable by lithology as follows: 65% in M5 Unit, 78.3% in B5 unit, 46.8% in S5 unit, and 32.9% in L6 unit

|

|

|

• |

Lithium Recovery for Stream 2 and 3 are variable by lithology as follows: 78% in M5 unit, 85.2% in B5 unit, 84.8% in S5 unit, and 78.7% in L6 unit

|

|

|

• |

Boric Acid sales price of US$1,172.78/tonne

|

|

|

• |

Lithium Carbonate sales price of US$19,351.38/tonne

|

|

|

• |

Sales/Transport costs are included in the G&A cost

|

|

|

• |

Drill core samples were assayed on nominal 1.52 m lengths and this data set was composited to 1.52m lengths which respected seam contacts and was used for the interpolation of grade data into a 1.52m bench height block model.

The data set honoured geological contacts (i.e. assay intervals did not span unit contacts).

|

|

|

• |

Based on a statistical analysis, extreme B grade values were identified in some of the units other than the targeted G5, B5, M5, S5, G6, L6 and Lsi units. The units other than these units were not

estimated so no grade capping was applied to the drill hole database. The units B5, M5, S5 and L6 are the units of economic interest and the grades in these units and the adjacent units were estimated for completeness when

re-blocking to a 9.14m bench height block model used to tabulate the mineral resource.

|

|

|

• |

The geological model was developed as a gridded surface stratigraphic model with fault domains included which offset the stratigraphic units in various areas of the deposit. The geological model was

developed by GSI under direction of Ioneer and provided to IMC as the geologic basis for grade estimation. IMC has reviewed the geological model and accepts the interpretation.

|

|

|

• |

Domaining in the model was constrained by the roof and floor surfaces of the geological units. The unit boundaries were modelled as hard boundaries, with samples interpolated only within the unit in which they occurred.

|

|

|

• |

The geological model used as the basis for estimating Mineral Resources was developed as a stratigraphic gridded surface model using a 7.6m regularized grid in plan. The grade block model was developed using a 7.6m north-south

by 7.6m east-west by 1.52m vertical block dimension (no sub- blocking was applied). The grid cell and block size dimensions represent 25 percent of the nominal drill hole spacing across the model area. The model was reblocked to

9.14 m high blocks (six 1.52m blocks combined vertically) for assigning the economic attributes and tabulating the mineral resource.

|

|

|

• |

Inverse Distance Squared (‘ID2’) grade interpolation was used for the estimate, constrained by stratigraphic unit roof and floor surfaces from the

geological model. The search direction for estimating grade varied and followed the floor orientation of the seams which changed within the fault block domains. The search distances ranged from 533 m in B5 to 229 m in S5. The

number of drill hole composites used to estimate the grades of a model block ranges from a minimum of two composites to a maximum of 10 composites, with no more than 3 composites from one drill hole.

|

|

|

• |

The density values used to convert volumes to tonnages were assigned on a by-geological unit basis using mean values calculated from 120 density samples collected from drill core during the 2018 and more recent 2022-2023 P1 and

P2 drilling programs. The density values by seam ranged from 1.53 grams per cubic centimeter (‘g/cm3’) for S3 to 1.98/cm3 in seam L6. The density analyses performed by geotechnical consultants present during both the 2018 and 2022-2023 drilling programs (P1 and P2) followed a strict repeatable

process in sample collection and analysis utilizing the Archimedes-principle (water displacement) method for density determination, with values reported in dry basis. This provided consistent representative data. The 2018 and

2022-2023 data aligned well and proved to be representative across the resource.

|

|

|

• |

Estimated Mineral Resources were classified as follows:

|

|

|

• |

Measured: Between 107 and 122m spacing between points of observation depending on the seam, with sample interpolation from a minimum of four drill holes.

|

|

|

• |

Indicated: Between 168 and 244m spacing between points of observation depending on the seam, with sample interpolation from a minimum of two drill holes.

|

|

|

• |

Inferred: To the limit of the estimation range (maximum 533m, depending on the seam), with sample interpolation from a minimum of one drill hole (2 composites).

|

|

|

• |

The Mineral Resource classification included the consideration of data reliability, spatial distribution and abundance of data and continuity of geology, fault structures and grade parameters.

|

|

|

• |

The Mineral Resource estimate presented in this Report was developed with the assumption that the HiB-Li mineralisation within the Mineral Resource pit shell has a reasonable prospect for eventual

economic extraction using current conventional open pit mining methods.

|

|

|

• |

The basis of the mining assumptions made in establishing the reasonable prospects for eventual economic extraction of the HiB-Li mineralisation are based on preliminary results from mine design and

planning work that is in-progress as part of an ongoing update to the Feasibility Study for the Project based on new information.

|

|

|

• |

The basis of the metallurgical assumptions made in establishing the reasonable prospects for eventual economic extraction of the HiB-Li (Stream 1) mineralisation are based on results from

metallurgical and material processing work that was developed as part of the ongoing Feasibility Study for the Project. This test work was performed using current processing and recovery methods for producing Boric acid and

Lithium carbonate products.

|

|

|

• |

A second process stream (Stream 2) to recover Li from low boron mineralized- low clay (LoB-Li) units has been confirmed. Current results indicate a reasonable process and expectation for economic

extraction of the LoB-Li from the S5, B5 and L6 units. This test work was performed using current processing and recovery methods for producing Boric acid and Lithium carbonate products.

|

|

|

• |

A third process stream (Stream 3) to recover Li from low boron high clay mineralized (LoB-Li) units has been confirmed. Current results indicate a reasonable process and expectation for economic

extraction of the LoB-Li from M5 unit. This test work was performed using current processing and recovery methods for producing Boric acid and Lithium carbonate products.

|

|

Area

|

Group

|

Classification

|

Metric

|

Lithium

|

Boron

|

Contained

Equivalent

Grade2

|

Contained6

Equivalent2

Tonnes

|

Recovered6

Equivalent2

Tonnes |

|||||

|

Tonnes2

|

Grade7

|

Grade7

|

|||||||||||

|

Li

|

B

|

Li2CO3

|

H3BO3

|

Li2CO3

|

H3BO3

|

Li2CO3

|

H3BO3

|

||||||

|

(ktonnes)

|

(ppm)

|

(ppm)

|

(Wt.

%)

|

(Wt.

%)

|

(kt)

|

(kt)

|

(kt)

|

(kt)

|

|||||

|

Stream 1

(>= 5,000 ppm B)

|

Upper

Zone

|

Proven

|

3,489

|

2,401

|

7,652

|

1.28

|

4.38

|

45

|

153

|

38

|

122

|

||

|

M5 Unit

|

Probable

|

3,410

|

2,262

|

7,430

|

1.20

|

4.25

|

41

|

145

|

35

|

116

|

|||

|

Sub-total B5

Unit

|

6,899

|

2,332

|

7,542

|

1.24

|

4.31

|

86

|

298

|

73

|

239

|

||||

|

Upper

Zone

|

Proven

|

27,991

|

1,880

|

15,364

|

1.00

|

8.79

|

280

|

2,459

|

239

|

1,925

|

|||

|

B5 Unit

|

Probable

|

31,456

|

1,742

|

14,169

|

0.93

|

8.10

|

292

|

2,549

|

248

|

1,995

|

|||

|

Sub-total M5

Unit

|

59,447

|

1,807

|

14,732

|

0.96

|

8.42

|

572

|

5,008

|

487

|

3,921

|

||||

|

Upper

Zone

|

Proven

|

2,237

|

1,326

|

7,754

|

0.71

|

4.43

|

16

|

99

|

13

|

76

|

|||

|

S5 Unit

|

Probable

|

3,355

|

1,166

|

7,533

|

0.62

|

4.31

|

21

|

145

|

17

|

111

|

|||

|

Sub-total S5

Unit

|

5,592

|

1,230

|

7,621

|

0.65

|

4.36

|

37

|

244

|

30

|

187

|

||||

|

Upper

Zone

|

Proven

|

33,717

|

1,897

|

14,061

|

1.01

|

8.04

|

340

|

2,711

|

290

|

2,124

|

|||

|

(B5, M5

& S5)

|

Probable

|

38,221

|

1,738

|

12,985

|

0.92

|

7.42

|

353

|

2,838

|

301

|

2,223

|

|||

|

Sub-

Total

|

Sub-

total Upper

Zone

|

71,938

|

1,813

|

13,489

|

0.96

|

7.71

|

694

|

5,549

|

591

|

4,347

|

|||

|

Lower

Zone

|

Proven

|

5,712

|

1,389

|

8,357

|

0.74

|

4.78

|

42

|

273

|

34

|

207

|

|||

|

L6 Unit

|

Probable

|

13,592

|

1,334

|

7,856

|

0.71

|

4.49

|

96

|

611

|

77

|

463

|

|||

|

Sub-

total Lower

Zone

|

19,303

|

1,350

|

8,004

|

0.72

|

4.58

|

139

|

883

|

110

|

670

|

||||

|

Total

Stream 1

(all zones)

|

Proven

|

39,428

|

1,824

|

13,235

|

0.97

|

7.57

|

383

|

2,984

|

323

|

2,331

|

|||

|

Probable

|

51,813

|

1,632

|

11,640

|

0.87

|

6.66

|

450

|

3,448

|

377

|

2,686

|

||||

|

Sub-

total Stream

1

|

91,241

|

1,715

|

12,329

|

0.91

|

7.05

|

833

|

6,432

|

700

|

5,017

|

||||

|

Stream 2

($16.54/tonne net

value cut-off grade,

Low Clay)

|

Upper Zone

|

Proven

|

4,528

|

2,219

|

2,143

|

1.18

|

1.23

|

53

|

55

|

46

|

43

|

||

|

B5 Unit

|

Probable

|

4,384

|

2,118

|

2,415

|

1.13

|

1.38

|

49

|

61

|

42

|

47

|

|||

|

Sub-

total B5 Unit

|

8,912

|

2,169

|

2,277

|

1.15

|

1.30

|

103

|

116

|

88

|

91

|

||||

|

Upper

Zone

|

Proven

|

15,005

|

1,022

|

1,125

|

0.54

|

0.64

|

82

|

97

|

69

|

45

|

|||

|

S5 Unit

|

Probable

|

27,495

|

825

|

866

|

0.44

|

0.50

|

121

|

136

|

102

|

64

|

|||

|

Sub-

total S5 Unit

|

42,500

|

895

|

957

|

0.48

|

0.55

|

202

|

233

|

172

|

109

|

||||

|

Upper

Zone

|

Proven

|

19,533

|

1,299

|

1,361

|

0.69

|

0.78

|

135

|

152

|

115

|

89

|

|||

|

(B5 & S5)

|

Probable

|

31,880

|

1,003

|

1,079

|

0.53

|

0.62

|

170

|

197

|

144

|

111

|

|||

|

Sub- Total

|

Sub- total Upper

Zone

|

51,413

|

1,116

|

1,186

|

0.59

|

0.68

|

305

|

349

|

259

|

200

|

|||

|

Lower

Zone

|

Proven

|

24,936

|

1,254

|

1,279

|

0.67

|

0.73

|

166

|

182

|

131

|

60

|

|||

|

L6 Unit

|

Probable

|

68,952

|

1,196

|

1,535

|

0.64

|

0.88

|

439

|

605

|

345

|

199

|

|||

|

Sub- total Lower

Zone

|

93,888

|

1,211

|

1,467

|

0.64

|

0.84

|

605

|

788

|

476

|

259

|

||||

|

Total Stream 2 (all zones)

|

Proven

|

44,469

|

1,274

|

1,315

|

0.68

|

0.75

|

302

|

334

|

246

|

149

|

|||

|

Probable

|

100,832

|

1,135

|

1,391

|

0.60

|

0.80

|

609

|

802

|

490

|

310

|

||||

|

Sub-

total Stream

2

|

145,301

|

1,177

|

1,368

|

0.63

|

0.78

|

911

|

1,136

|

736

|

459

|

||||

|

Stream 3

($16.54/tonne

net value cut-

off

grade, High

Clay)

|

Total Stream 3 (M5

zone)

|

Proven

|

5,621

|

2,199

|

1,702

|

1.17

|

0.97

|

66

|

55

|

51

|

36

|

||

|

Probable

|

18,178

|

2,082

|

1,145

|

1.11

|

0.65

|

201

|

119

|

157

|

77

|

||||

|

Sub-

total Stream 3

|

23,799

|

2,110

|

1,277

|

1.12

|

0.73

|

267

|

174

|

208

|

113

|

||||

|

TOTAL of All Streams, All Seams, and All

Proven & Probable

|

260,341

|

1,451 |

5,201

|

0.77

|

2.97

|

2,010

|

7,742

|

1,645

|

5,588

|

||||

|

1.

|

The statement of estimates of Ore Reserves has been compiled by Mr. Joseph S.C. McNaughton, a Competent Person is a Registered Professional Engineer in State of Arizona. Mr

McNaughton is a full-time employee of IMC Inc. and is independent of Ioneer and its affiliates. Mr. Joseph McNaughton is responsible for the estimate, has sufficient experience that is relevant to the style of mineralisation and

type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code (2012).

|

|

2.

|

The ore reserve estimates the result of determining the measured and indicated resource that incorporates modifying factors demonstrating that it is economically minable, allowing

for the conversion to proven and probable. In making this determination, constraints were applied to the geological model based upon a pit optimization analysis that defined a conceptual pit shell limit. The conceptual pit shell

was based upon a net value per tonne calculation including a 5,000ppm boron cut-off grade for high boron – high lithium (HiB-Li) mineralisation (Stream 1) and a $11.13/tonne net value cut-off grade for low boron (LoB-Li)

mineralisation below 5,000ppm boron broke into two material types, low clay and high clay material respectfully (Stream 2 and Stream 3). The pit shell was constrained by a conceptual Mineral Resource optimized pit shell for the

purpose of establishing reasonable prospects of eventual economic extraction based on potential mining, metallurgical and processing grade parameters identified by mining, metallurgical and processing studies performed to date on

the Project. The conceptual pit shell was used a guide to the engineered quarry designs used to constrain the Mineral Reserves.

|

|

3.

|

Key inputs in developing the Mineral Resource pit shell included a 5,000ppm boron cut-off grade for HiB-Li mineralisation, $11.13/tonne net value cut-off grade for LoB-Li low clay

mineralisation and LoB-Li high clay mineralisation; mining cost of US$1.69 /tonne; G&A cost of US$11.13 /process tonne; plant feed processing and grade control costs which range between US$18.87/tonne and US$98.63/tonne of

plant feed (based on the acid consumption per stream and the mineral resource average grades); boron and lithium recovery for Stream 1 by seam: M5 80.2% and 85.7%, B5 78.3% and 85.2%, S5 77.0% and 82.5%, L6 76.8% and 79.4% ;

Stream 2 and 3: M5 65% and 78%, B5 78.3% and 85.2%, S5 46.8% and 84.8%, L6 32.9% and 78.7%, respectively; boric acid sales price of US$1,172.78/tonne; lithium carbonate sales price of US$19,351.38/tonne were selected based on the

market analysis.

|

|

4.

|

Ore reserves are based on a block model that is 7.62m x 7.62m30 in plan and 9.14m high. The model block size used for the ore reserve estimate is based on selected mining equipment

and approached used within the mine plan. As a result, the dilution and ore loss are incorporated within the block model

|

|

5.

|

Ore reserves reported on a dry in-situ basis. The contained and recovered lithium carbonate and boric acid are reported in the table above in metric tonnes. Lithium is converted to

equivalent contained tonnes of lithium carbonate using a stochiometric conversion factor of 5.322, and boron is converted to equivalent contained tonnes of boric acid using a stochiometric conversion factor of 5.718. Equivalent

stochiometric conversion factors are derived from the molecular weights of the individual elements which make up lithium carbonate and boric acid. The equivalent recovered tons of lithium carbonate and boric acid is the portion of

the contained tonnage that can be recovered after processing.

|

|

6.

|

All ore reserve figures represent estimates as of August 2025. Ore reserve estimates are not precise calculations, being dependent on the interpretation of limited information on the

location, shape and continuity of the occurrence and on the available sampling results. The totals have been rounded to reflect the relative uncertainty of the estimate. Totals may not sum due to rounding.

|

|

7.

|

Kt – thousand metric tonnes, MT – million metric tonnes, ktonne = thousand metric tons; Li = lithium; B = boron; ppm= parts per million; Li2CO3 = lithium carbonate; H3BO3 = boric

acid. Equivalent lithium carbonate and boric acid grades have been rounded to the nearest tenth of a percent.

|

|

Group

|

Classification

|

Tonnes

(Mt)

|

Li

(ppm)

|

B

(ppm)

|

Li2CO3

(wt. %)

|

H3BO3

(wt. %)

|

Li2CO3

(kt)

|

H3BO3

(kt)

|

|

August 2025

Reserve

|

Proved

|

89.5

|

1,574

|

6,589

|

0.84

|

3.77

|

750

|

3,373

|

|

Probable

|

170.8

|

1,386

|

4,473

|

0.74

|

2.56

|

1,260

|

4,369

|

|

|

Total

|

260.3

|

1,451

|

5,201

|

0.77

|

2.97

|

2,010

|

7,742

|

|

|

May 2025

Reserve

|

Proved

|

85.7

|

1,572

|

6,814

|

0.84

|

3.90

|

717

|

3,341

|

|

Probable

|

160.9

|

1,407

|

4,715

|

0.75

|

2.70

|

1,205

|

4,337

|

|

|

Total

|

246.6

|

1,464

|

5,444

|

0.78

|

3.11

|

1,922

|

7,678

|

|

|

Variation

|

Proved

|

3.8

|

2

|

-225

|

33

|

32

|

||

|

Probable

|

9.9

|

-21

|

-242

|

55

|

32

|

|||

|

Total

|

13.7

|

-13

|

-243

|

88

|

-64

|

|

•

|

Revised with increase of 2 % in proven and probable total tonnes.

|

|

•

|

With an increase in Stream2 Ore feed overall lithium grade has remained relatively the same but Boron grade decreased by 2%.

|

|

•

|

The changes as compared to the previous ore reserve estimate primarily relate to:

|

|

o

|

Decrease of vat resident leach time

|

|

o

|

Decrease in acid consumption

|

|

o

|

Inclusion of addition Stream 2 and Stream 3

|

|

o

|

Decrease in boron and lithium recovery in seams B5, S5 and L6.

|

|

•

|

Modifying factors;

|

|

•

|

Unit costs, including mining, processing, and sales costs;

|

|

•

|

Metallurgical recovery;

|

|

•

|

Sales prices;

|

|

•

|

Cut-off grades;

|

|

•

|

Geotechnical criteria, including overall quarry slopes;

|

|

•

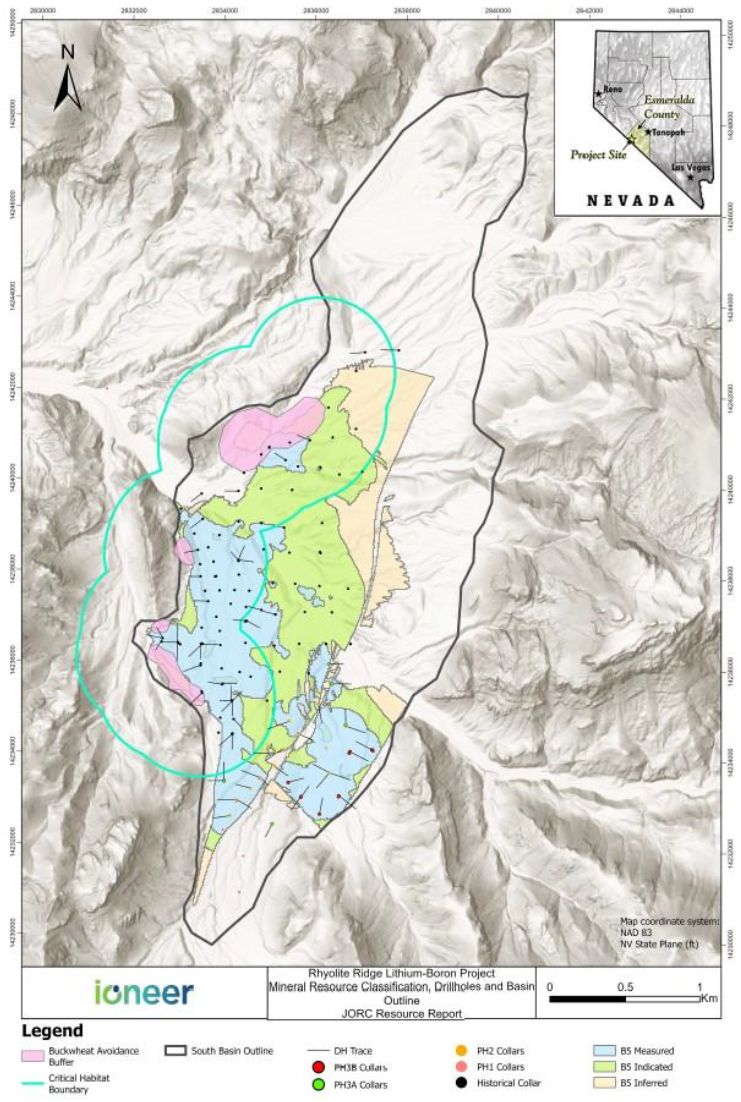

|

Other external constraints such as the locations of buckwheat, permit boundaries, public utilities and infrastructure.

|

|

|

Seam

|

Boron to Boric Acid

|

Lithium to Lithium Carbonate

|

||||||

|

Stream 1

|

Streams 2 & 3

|

Stream 1

|

Streams 2 & 3

|

||||||

|

|

M5

|

80.2%

|

65.0%

|

85.7%

|

78.0%

|

||||

|

|

B5

|

78.3%

|

78.3%

|

85.2%

|

85.2%

|

||||

|

|

S5

|

77.0%

|

46.8%

|

82.5%

|

84.8%

|

||||

|

|

L6

|

75.8%

|

32.9%

|

79.4%

|

78.7%

|

||||

|

Item

|

Unit

|

Description

|

|||

|

Revenue

|

US$ million

|

47,179

|

|||

|

Pre-tax cash flow

|

US$ million

|

26,716

|

|||

|

Post-tax cash flow

|

US$ million

|

23,788

|

|||

|

Unlevered post-tax net present value

|

US$ million

|

1,888

|

|||

|

Unlevered post-tax internal rate of return

|

%

|

16.78

|

|||

|

Payback period (including construction)

|

Years

|

10

|

|||

|

Mine life

|

Years

|

83

|

|||

|

Ore Processing period

|

Years

|

82

|

|

|

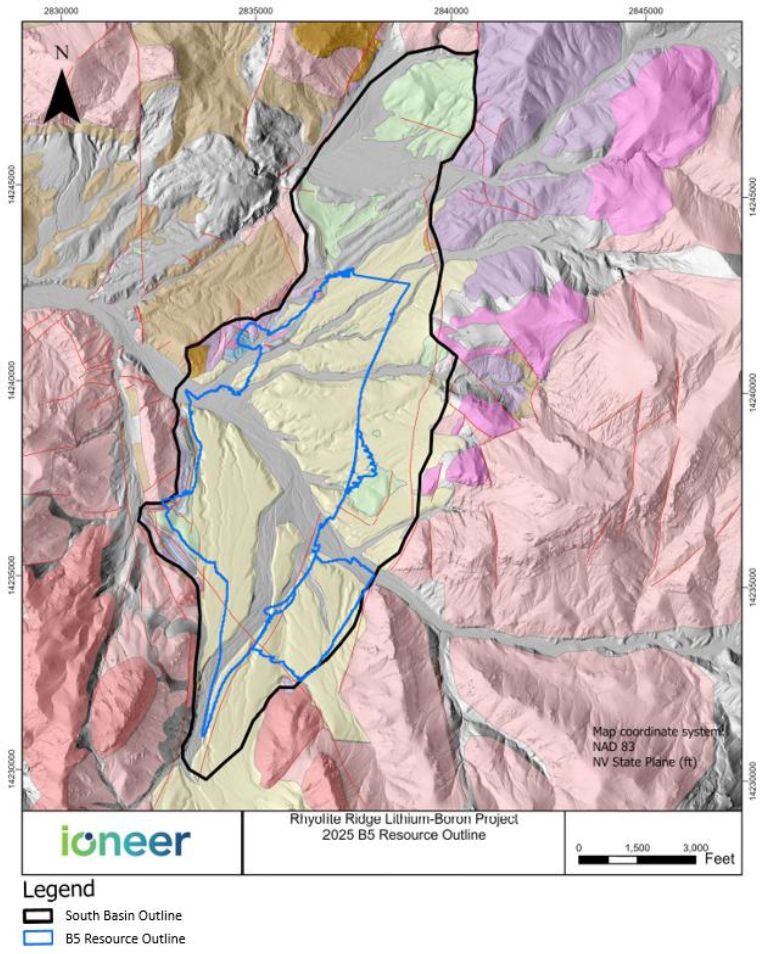

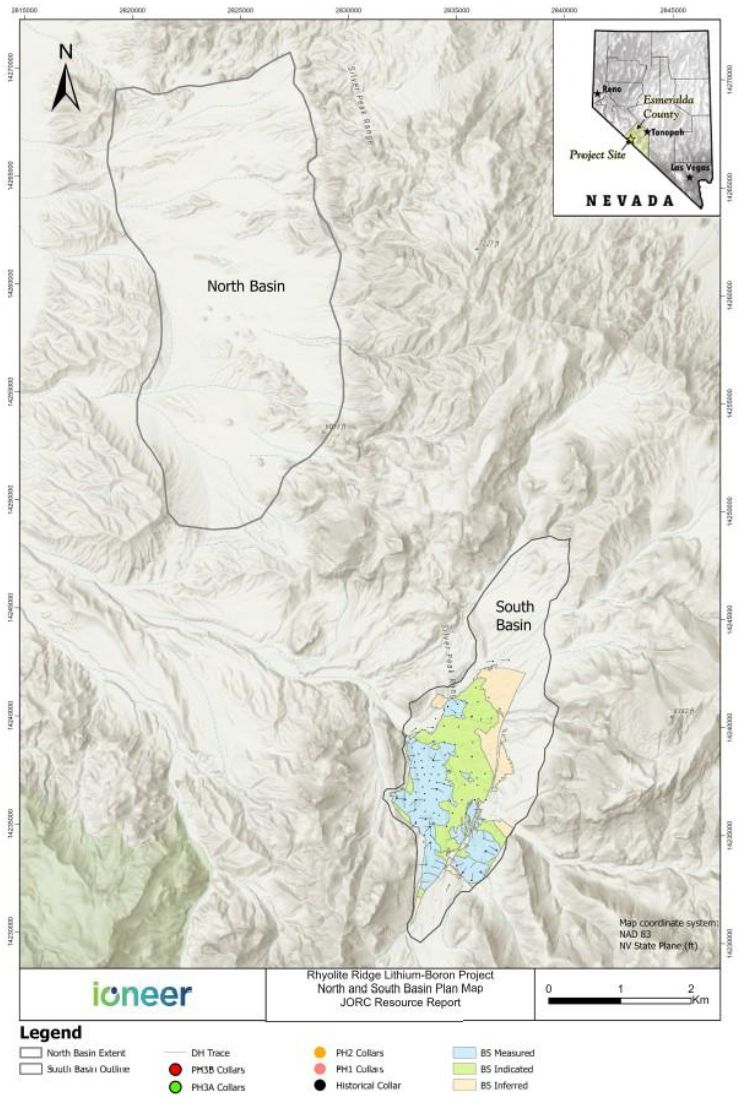

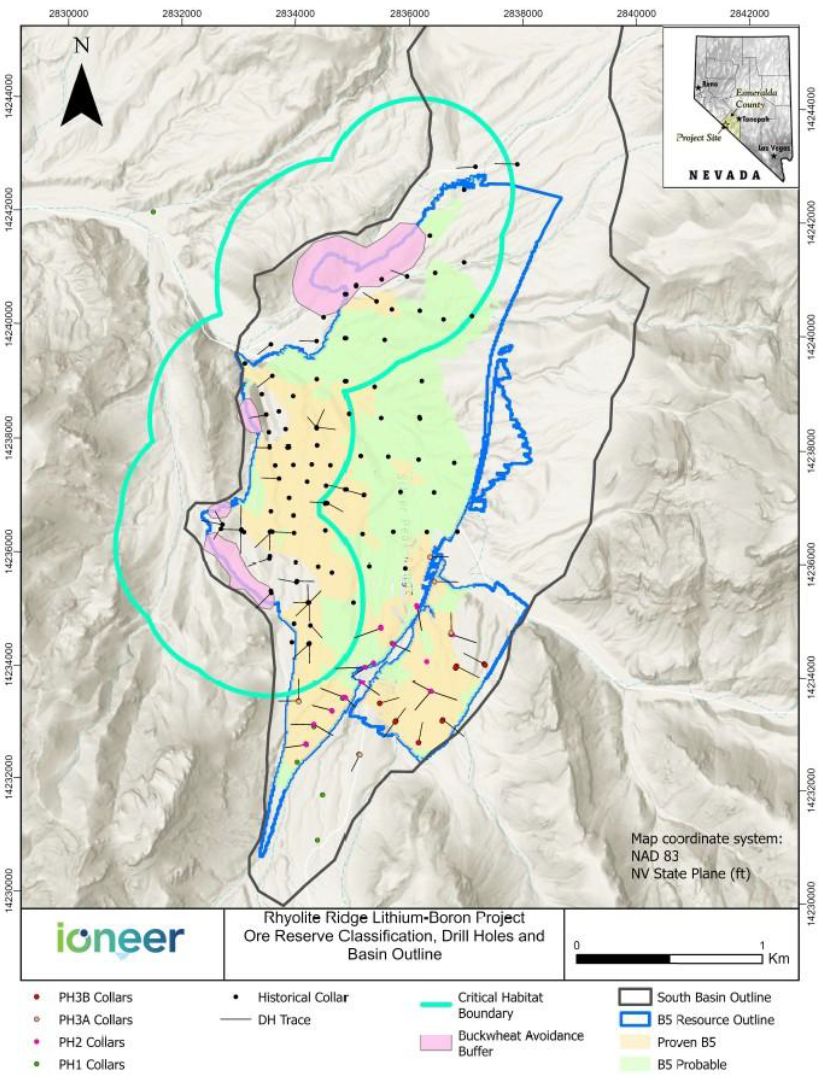

1. |

North and South Basin plan showing the location of drill holes, Resource and tenement boundary.

|

|

|

2. |

South Basin plan showing outlines of Measured, Indicated and Inferred Mineral Resources

|

|

|

3. |

South Basin South- North Cross Section looking West

|

|

|

4. |

South Basin Cross Section Looking North

|

|

|

5. |

South Basin plan showing outlines of Proved and Probable Ore Reserves

|

|

APPENDIX D: JORC Code, 2012 Edition - Table 1

|

|

Criteria

|

JORC Code 2012 Explanation

|

Commentary

|

||||

|

Sampling

Techniques

|

• Nature and quality of sampling (e.g. cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the

minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc.). These examples should not be taken as limiting the broad meaning of sampling

|

• The nature and quality of the sampling from the various sampling programs includes the following:

• Reverse circulation (RC) Drilling: a sample was collected every 1.52 metre (m) from a 127-millimetre (mm) diameter drill

hole and split using a rig-mounted rotary splitter. Samples, with a mean weight of 4.8 kilograms (kg) were submitted to ALS Minerals laboratory in Reno, NV where they were processed for assay. RC

samples represent 49% of the total intervals sampled to date.

• Core Drilling: Core samples were collected from HQ (63.5 mm core diameter) and PQ (85.0 mm core diameter) drill core, on a mean interval of 1.52 m, and cut using a

water-cooled diamond blade core saw. Samples, with a mean weight of 1.8 kg, were submitted to ALS where they were proceeded for assay.

• Drill Hole Deviation: Inclined core drill holes were surveyed to obtain downhole deviation by the survey company (International Directional Services, LLC) or

drilling company (Idea Drilling, Alford Drilling, IG Drilling, Boart Long Year, Major Drilling,) with a downhole Reflex Mems Gyros and Veracio TruShot tools and, for all but three of the drill holes. One drill hole could not be surveyed due

to tool error (SBH-72), and two were intentionally surveyed using an Acoustic Televiewer (SBH-60, SBH-79).

• Trenches: In addition to sampling from drill holes, samples were collected from 19 mechanically excavated trenches in 2010. The trenches were excavated from the

outcrop/subcrop using a backhoe and or hand tools.

|

|

APPENDIX D: JORC Code, 2012 Edition - Table 1

|

|

Criteria

|

JORC Code 2012 Explanation

|

Commentary

|

||||

|

Chip samples were then collected from the floor of the trench. Due to concerns with correlation and reliability of the results from the trenches, The Competent Person has not included any

of this data in the geological model or Mineral Resource estimate.

|

||||||

|

• Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used.

|

• Measures taken to ensure sample representivity include the following:

• Due to the nature of RC samples, lithological boundaries are not easily honoured; therefore, continuous 1.52 m sample intervals were taken to ensure as

representative a sample as possible. Lithological boundaries were adjusted as needed by a senior Ioneer geologist once the assay results were received.

• Core sample intervals were selected to reflect visually identifiable lithological boundaries wherever possible, to ensure sample representivity. In cases where the

lithological boundaries were gradational, the best possible interval was chosen and validated by geochemical assay results.

• All chip and core sampling were completed by or supervised by a senior Ioneer geologist. The senior Ioneer, Newfield’s and WSP geologists referenced here, and

throughout this Table 1, have sufficient relevant experience for the exploration methods employed, the type of mineralisation being evaluated, and are registered professional geologists in their jurisdiction; however, they are not Competent

Persons according to the definition presented in JORC as they are not members of one of the Recognized Professional Organization” included in the ASX list referenced by JORC.

• The Competent Person was not directly involved during the exploration drilling programs and except for observing sampling procedures on two drill holes during the

site visit (August 10, 2023), was not present to observe sample selection. Based on review of the procedures during the site visit and subsequent review of the data, it is the opinion of the Competent Person that the measures taken to

ensure sample representivity were reasonable for the purpose of estimating Mineral Resources.

|

|||||

|

• Aspects of the determination of mineralisation that are Material to the Public Report. In cases where‘industry

|

• Aspects of the determination of mineralisation included visual identification of mineralized intervals by a senior Ioneer geologist using lithological characteristics including clay

and carbonate content, grain size and the presence of key minerals such as Ulexite (hydrated sodium calcium borate hydroxide) and Searlesite

|

|

APPENDIX D: JORC Code, 2012 Edition - Table 1

|

|

Criteria

|

JORC Code 2012 Explanation

|

Commentary

|

||||

|

standard’ work has been done this would be relatively simple (eg ‘reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire

assay’). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (e.g. submarine nodules) may warrant disclosure of detailed

information

|

(sodium borosilicate). A visual distinction between some units, particularly where geological contacts were gradational was initially made. Final unit contacts were then determined by a

senior Ioneer geologist once assay data were available.

• The Competent Person was not directly involved during the exploration drilling programs; however, the visual identification of mineralized zones and the process

for updating unit and mineralized contacts was reviewed with the Ioneer senior geologist during the site visit. The Competent Person evaluated the identified mineralized intervals against the analytical results and agrees with the

methodology used by Ioneer to determine material mineralisation.

|

|||||

|

Drilling

techniques

|

• Drill type (e.g. core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc..) and details (e.g. core diameter, triple

or standard tube, depth of diamond tails, face- sampling bit or other type, whether core is oriented and if so, by what method, etc.).

|

• Both RC and core drilling techniques have been used on the Project. Exploration drilling programs targeting Lithium-Boron (Li-B)

mineralisation on the Project have been implemented by American Lithium Minerals Inc. (2010-2012) and Ioneer (formerly Global Geoscience) in 2016, 2017, 2018, 2019, 2022, and 2023.

• Prior to 2018, all RC drilling was conducted using a 127 mm hammer. All pre-2018 core drill holes were drilled using HQ sized core with a double- tube core barrel.

• For the 2018-2023 drilling programs, all core holes (vertical and inclined) were tricone drilled through unconsolidated alluvium, then cored through to the end of

the drill hole. A total of 91 core holes were drilled, 64 holes were PQ diameter and 27 were drilled as HQ diameter. Drilling was completed using a triple-tube core barrel (split inner tube) which was preferred to a double-tube core barrel

(solid inner tube) as the triple-tube improved core recovery and core integrity during core removal from the core barrel.

|

||||

|

Drill sample

recovery

|

• Method of recording and assessing core and chip sample recoveries and results assessed.

|

• Prior to 2017, chip recovery was not recorded for the RC drilling therefore the Competent Person cannot comment on drill sample recovery for this period of

drilling.

For the 2017 RC drilling program, the drill holes were geologically logged as they were being drilled; however, no estimates of chip recoveries were recorded. Therefore, the Competent

Person cannot comment on drill sample recovery for this period of drilling.

• For the 2010-2012 and 2016 core drilling programs, both core recovery and rock quality index (RQD) were recorded for each

|

|

APPENDIX D: JORC Code, 2012 Edition - Table 1

|

|

Criteria

|

JORC Code 2012 Explanation

|

Commentary

|

||||

|

cored interval. Core recovery was determined by measuring the recovered linear core length and then calculating the recovered percentage against the total length of the core run from the

drill advance. The core recovery for all the drilling ranged from 0% to 100%, with over 65 % of the drill holes having greater than 80% mean core recovery. The core recovery values were recorded by the logging geologist and reviewed by the

senior Ioneer geologist. The majority of the 2010-2012 and 2016 core drill holes reported greater than 95% recovery in the B5, M5 and L6 mineralized intervals.

• For the 2018-2019 drilling program, both core recovery and RQD were recorded for each cored interval. Core recovery was determined by measuring the recovered

linear core length and then calculating the recovered percentage against the total length of the core run from the drill advance. The core recovery for all the drilling ranged from 41% to 100%, with over 65% of the drill holes having

greater than 90% mean core recovery. The core recovery values were recorded by the logging geologist and reviewed by the senior Ioneer geologist. In the target mineralized intervals (M5, B5 & L6), the mean core recovery was 86% in the

B5, 87% in the M5 and 95% in the L6 units, with most of the drill holes reporting greater than 90% recovery in the mineralized intervals.

• The Competent Person considers the core recovery for the 2023, 2022, 2018- 2019, 2016 and 2010-2012 core drilling programs to be acceptable based on statistical

analysis which identified no grade bias between sample intervals with high versus low core recoveries. On this basis, the Competent Person has made the reasonable assumption that the sample results are reliable for use in estimating Mineral

Resources.

|

||||||

|

• Measures taken to maximise sample recovery and ensure representative nature of the samples.

|

• Chip recoveries were not recorded for the 2010-2012 and 2017 RC drilling programs, and there is no indication of measures taken to maximize sample recovery and ensure representative

nature of samples.

• No specific measures for maximizing sample recovery were documented for the 2010-2012 and 2016 core drilling programs.

• During the 2018-2023 drilling programs, Ioneer used a triple-tube core barrel to maximize sample recovery and ensure

|

|

APPENDIX D: JORC Code, 2012 Edition - Table 1

|

|

Criteria

|

JORC Code 2012 Explanation

|

Commentary

|

||||

|

• representative nature of samples. The use of triple-tube was originally used during the 2018 drill program. A triple-tube core barrel generally provides improved

core recovery over double-tube core barrels, resulting in more complete and representative intercepts for core logging, sampling and geotechnical evaluation. It also limited any potential sample bias due to preferential loss/gain of

material.

|

||||||

|

• Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential

loss/gain of fine/coarse material.

|

• Chip recovery was not recorded for the 2010-2012 and 2017 RC drilling program and, therefore, there is no basis for evaluating the relationship between grade and

sample recovery for samples from these programs.

• Based on the Competent Person’s review of the 2010-2012, 2016 and 2018- 2019, 2022-2023 core drilling recovery and grade data there was no observable relationship

between sample recovery and grade.

|

|||||

|

Logging

|

• Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource

estimation, mining studies and metallurgical studies.

|

• All core and chip samples have been geologically logged to a level of detail to support appropriate Mineral Resource estimation, such that there are lithological

intervals for each drill hole, with a correlatable geological/lithological unit assigned to each interval.

• The 2018-2019 and 2022-2023 drilling were also geotechnically logged to a level of detail to support appropriate Mineral Resource estimation.

• The Competent Person has reviewed all unit boundaries in conjunction with the Ioneer senior geologist, and where applicable, adjustments have been made to the

mineralized units based on the assay results intervals to limit geological dilution.

|

||||

|

• Whether logging is qualitative or quantitative in nature.

|

• The RC and core logging were both qualitative (geological/lithological descriptions and observations) and quantitative (unit lengths, angles of contacts and

structural features and fabrics).

|

|||||

|

• Core (or costean, channel, etc.) photography.

|

• All chip trays and Core photography was completed on every core drill hole for the 2010-2012, 2016, 2018-2019 and 2022-2023 drilling programs.

|

|||||

|

• The total length and percentage of the relevant intersections logged.

|

• Prior to 2018, a total length of 8,900 m of RC drilling and 6,000 m of core drilling was completed for the Project, 100% of which was geologically logged by a

logging geologist and reviewed by the senior Ioneer geologist.

• For the 2018-2019 drilling, a total length of 548 m of RC drilling and

|

|

APPENDIX D: JORC Code, 2012 Edition - Table 1

|

|

Criteria

|

JORC Code 2012 Explanation

|

Commentary

|

||||

|

• The total length and percentage of the relevant intersections logged. (Con’t)

|

• 9,321 m of core drilling was completed for the Project, 100% of which was geologically logged by a logging geologist and reviewed by the senior Ioneer geologist

• For the 2018-2019 drilling, 86% of the 9,321 m of core was geotechnically logged by an engineering geologist/ geotechnical engineer and reviewed by the senior Ioneer

geologist.

• For the 2022-2023 drilling, 100% of the 7,362m of core was geotechnically logged by an engineering geologist/ geotechnical engineer and reviewed by the senior Ioneer

geologist

The Competent Person reviewed the geological core logging and sample selection for two drill holes.

|

|||||

|

• If core, whether cut or sawn and whether quarter, half or all core taken.

|

• The following sub-sampling techniques and sample selection procedures apply to drill core samples:

• During the 2010-2012 and 2016 program, core samples were collected on a mean 1.52 m down hole interval and cut in two halves using a manual core splitter. The entire

sample was submitted for analysis with no sub-sampling prior to submittal.