| ☒ |

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

| ☐ |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

|

Delaware

|

11-3516358

|

|

(State or other jurisdiction of

incorporation or organization)

8 Davis Drive, Suite 220

Durham, NC

(Address of principal executive offices) |

(I.R.S. Employer

Identification No.)

(Zip Code)

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

IRD

|

The Nasdaq Stock Market LLC

|

|

Large accelerated filer ☐

|

|

|

Accelerated filer ☐

|

|

|

|

|

|

||

|

Non-accelerated filer ☒

|

|

|

Smaller reporting company ☒

|

|

|

Emerging growth company ☐

|

||||

|

PART I

|

5 |

||

|

|

|||

|

ITEM 1.

|

5 | ||

|

ITEM 1A.

|

51 | ||

|

ITEM 1B.

|

95 | ||

|

ITEM 1C.

|

95 | ||

|

ITEM 2.

|

96 | ||

|

ITEM 3.

|

96 | ||

|

ITEM 4.

|

97 | ||

|

|

|

||

|

PART II

|

|

||

|

|

|||

|

ITEM 5.

|

97 | ||

|

ITEM 6.

|

98 | ||

|

ITEM 7.

|

98 | ||

|

ITEM 7A.

|

112 | ||

|

ITEM 8.

|

112 |

||

|

ITEM 9.

|

112 |

||

|

ITEM 9A.

|

112 |

||

|

ITEM 9B.

|

113 |

||

|

ITEM 9C.

|

113 |

||

|

|

|||

|

PART III

|

113 |

||

|

|

|||

|

ITEM 10.

|

113 |

||

|

ITEM 11.

|

114 |

||

|

ITEM 12.

|

114 |

||

|

ITEM 13.

|

114 |

||

|

ITEM 14.

|

114 |

||

|

|

|||

|

PART IV

|

114 |

||

|

|

|

||

|

ITEM 15.

|

114 |

||

|

ITEM 16.

|

115 |

||

|

|

|||

| 146 |

|||

|

|

• |

Failure to successfully integrate our businesses with Former Opus (as defined below) could have a material adverse effect on our business,

financial condition and results of operations.

|

|

|

• |

The Opus Acquisition (as defined below) significantly expanded our product pipeline and business operations and shifted our business

strategies, which may not improve the value of our common stock.

|

|

|

• |

Our gene therapy product candidates are based on a novel technology that is difficult to develop and manufacture, which may result in delays and difficulties in obtaining regulatory approval.

|

|

|

• |

Our planned clinical trials may face substantial delays, result in failure, or provide inconclusive or adverse results that may not satisfy FDA requirements to further develop our therapeutic products.

|

|

|

• |

Delays or difficulties associated with patient enrollment in clinical trials may affect our ability to conduct and complete those clinical trials and obtain necessary regulatory approvals.

|

|

|

• |

Changes in regulatory requirements could result in increased costs or delays in development timelines.

|

|

|

• |

We depend heavily on the success of our product pipeline; if we fail to find strategic partners or fail to adequately develop or commercialize our pipeline products, our business will be materially harmed.

|

|

|

• |

Others may discover, develop, or commercialize products similar to those in our pipeline before or more successfully than we do or develop generic variants of our products even while our product patents remain

active, thereby reducing our market share and potential revenue from product sales.

|

|

|

• |

We do not currently have any sales or marketing infrastructure in place and we have limited drug research and discovery capabilities.

|

|

|

• |

The future commercial success of our products could significantly depend upon several uncertain factors, including third-party reimbursement practices and the existence of competitors with similar products.

|

|

|

• |

Product liability lawsuits against us or our suppliers or manufacturers could cause us to incur substantial liabilities and could limit commercialization of any product candidate that we may develop.

|

|

|

• |

Failure to comply with health and safety laws and regulations could lead to material fines.

|

|

|

• |

We have not generated significant revenue from sales of any products and expect to incur losses for the foreseeable future.

|

|

|

• |

Our future viability is difficult to assess due to our short operating history and our future need for substantial additional capital, access to which could be limited by any adverse developments that

affect the financial markets.

|

|

|

• |

Raising additional capital may cause our stockholders to be diluted, among other adverse effects.

|

|

|

• |

We operate in a highly regulated industry and face many challenges adapting to sudden changes in legislative reform or the regulatory environment, which affects our pipeline stability and could impair our

ability to compete in international markets.

|

|

|

• |

We may not receive regulatory approval to market our developed product candidates within or outside of the U.S.

|

|

|

• |

With respect to any of our product candidates that receive marketing approval, we may be subject to substantial penalties if we fail to comply with applicable regulatory requirements.

|

|

|

• |

Our potential relationships with healthcare providers and third-party payors will be subject to certain healthcare laws and regulations, which could expose us to extensive potential liabilities.

|

|

|

• |

We rely on third parties for material aspects of our business, such as conducting our nonclinical and clinical trials and supplying and manufacturing bulk drug substances, which exposes us to certain risks.

|

|

|

• |

We may be unsuccessful in entering into or maintaining licensing arrangements or establishing strategic alliances on favorable terms, which could harm our business.

|

|

|

• |

Our current focus on the cash-pay utilization for future sales of RYZUMVI may limit our ability to increase sales or achieve profitability with this product.

|

|

|

• |

Inadequate patent protection for our product candidates may result in our competitors developing similar or identical products or technology, which would adversely affect our ability to successfully

commercialize.

|

|

|

• |

We may be unable to obtain full protection for our intellectual property rights under U.S. or foreign laws.

|

|

|

• |

We may become involved in lawsuits for a variety of reasons associated with our intellectual property rights, including alleged infringement suits initiated by third parties.

|

|

|

• |

We are dependent on our key personnel, and if we are not successful in attracting and retaining highly qualified personnel, we may not be able to successfully implement our business strategy.

|

|

|

• |

As we grow, we may not be able to operate internationally or adequately develop and expand our sales, marketing, distribution, and other corporate functions, which could disrupt our operations.

|

|

|

• |

The market price of our common stock is expected to be volatile and subject to certain dilutive risks associated with our Equity Line of Credit arrangement.

|

|

|

• |

Factors out of our control related to our securities, such as securities litigation or actions of activist stockholders, could adversely affect our business and stock price and cause us to incur significant

expenses.

|

|

|

• |

In April 2018, Ocuphire Pharma, Inc. merged with Ocularis Pharma, LLC, the original innovator of phentolamine mesylate ophthalmic solution.

|

|

|

• |

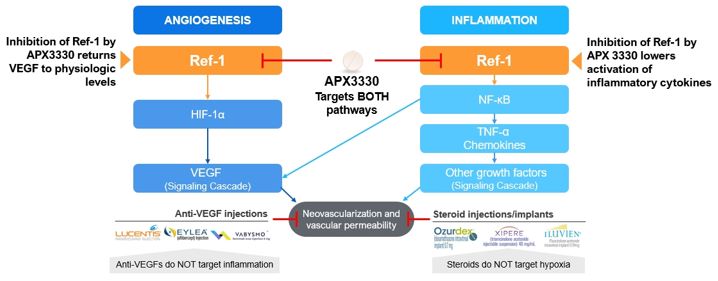

In January 2020, Ocuphire Pharma, Inc. obtained from Apexian Pharmaceuticals, Inc. certain rights to its Ref-1 inhibitor program, including APX3330.

|

|

|

• |

In November 2020, Ocuphire Pharma, Inc. completed a reverse merger into Rexahn Pharmaceuticals, Inc. (“Rexahn”), a publicly traded company that had ceased

its business of drug development activities, and simultaneously raised just over $21 million through an offering of common shares and warrants to purchase common shares. The combined company continued to operate under the name of

Ocuphire Pharma, Inc.

|

|

|

• |

On October 22, 2024, Ocuphire Pharma, Inc. acquired a private corporation then operating under the name of “Opus Genetics Inc.” (“Private Opus”) pursuant to the terms of an Agreement and Plan of Merger, dated as of October 22, 2024

(such agreement, the “Merger Agreement” and the transaction consummated via the Merger Agreement, the “Opus Acquisition”), by and among the Company, Opus, and certain merger subsidiaries party thereto.

|

|

•

|

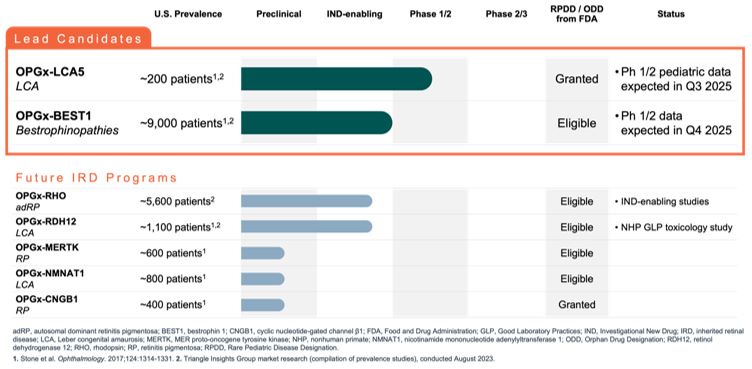

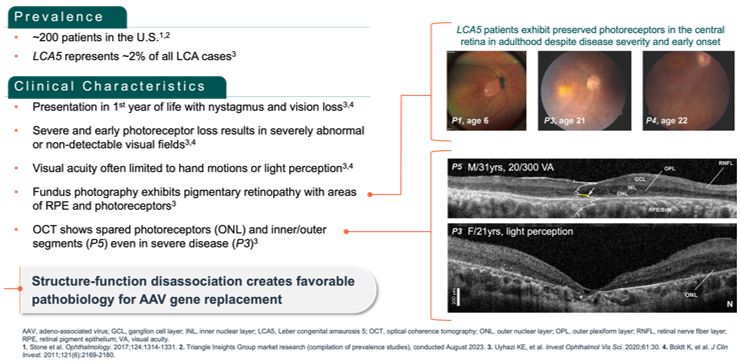

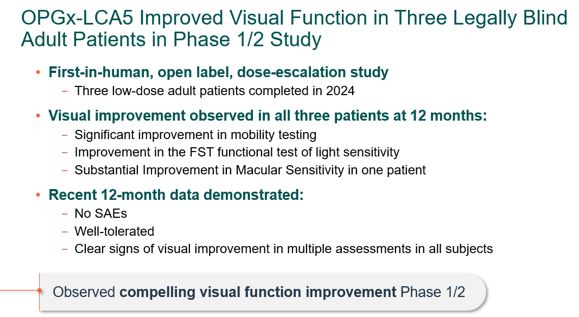

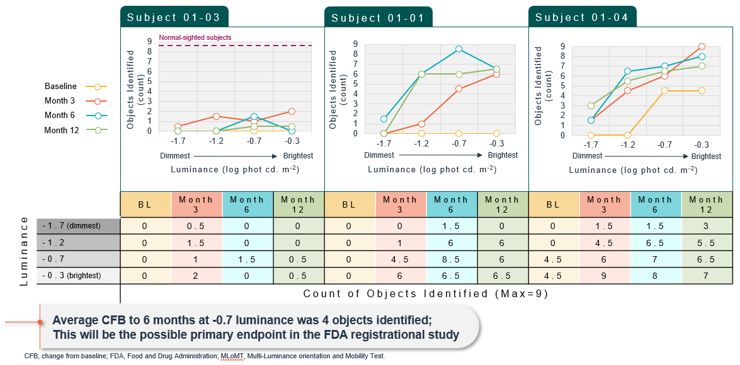

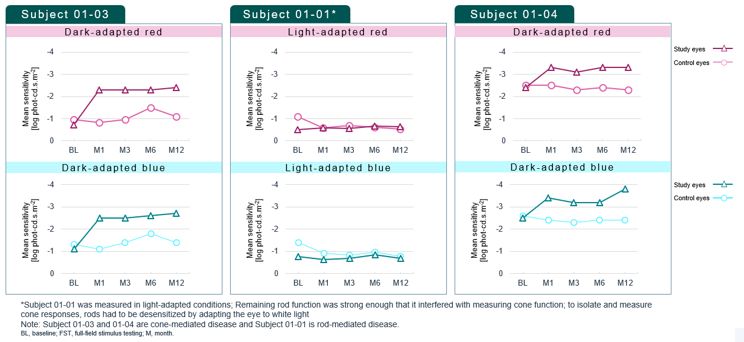

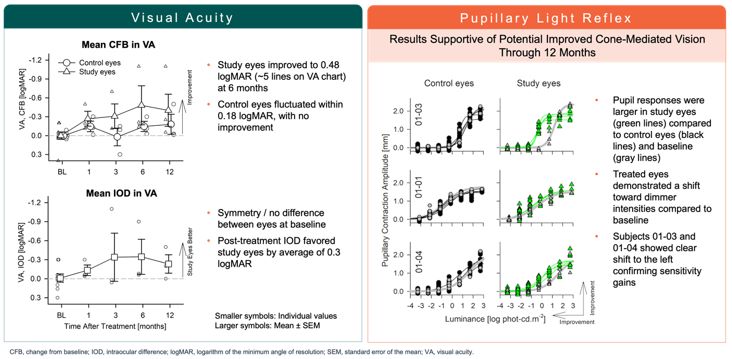

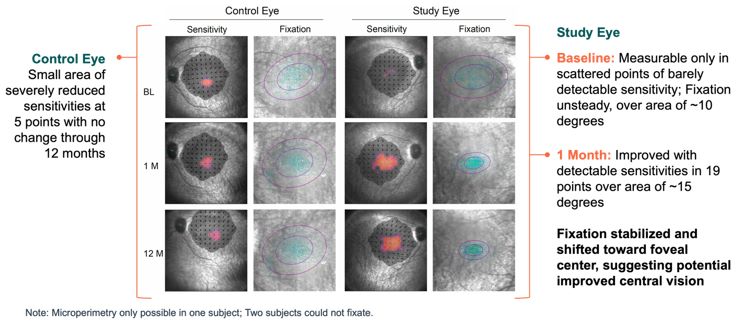

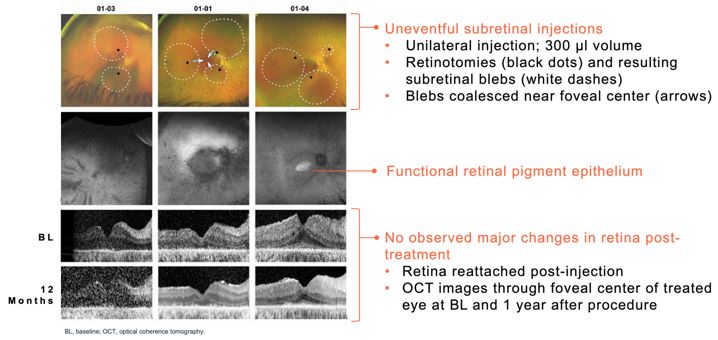

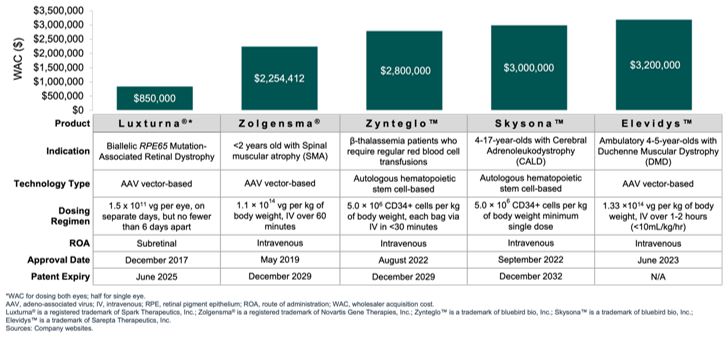

Advance the clinical development of our gene therapy products. OPGx-LCA5 is designed to address a form of LCA due to biallelic mutations in the LCA5, which

encodes the lebercilin protein. New six-month efficacy and safety data on OPGx-LCA5 were presented at a virtual KOL event on December 11, 2024 and showed improvement in visual function in the first three adult patient cohort treated,

each of whom has late-stage disease. Twelve-month data on OPGx-LCA5 in the adult patients cohort will be presented at ARVO in May 2025. A pediatric cohort to test the therapy in younger subjects is in progress

|

|

•

|

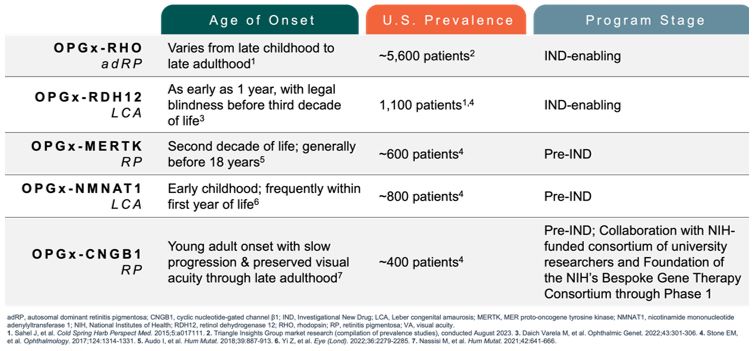

Future IRD programs. Beyond clinical development of OPGx-LCA5

and OPGx-BEST1, Opus has a preclinical portfolio of other AAV gene therapy candidates targeting different forms of vision threatening IRDs, including retinitis pigmentosa (e.g. adRP-RHO, CNGB1) and LCA (e.g., NMNAT1, RDH12). These

programs can be potentially further developed for clinical applications, subject to capital availability. We will continue IND-enabling work for these preclinical gene therapy programs, but these programs may require additional

funding to progress.

|

|

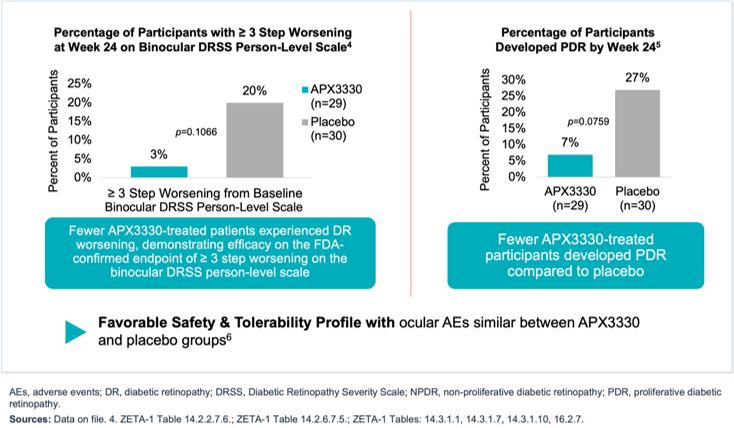

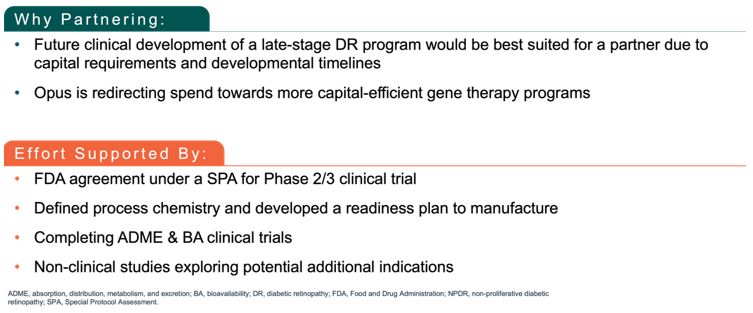

•

|

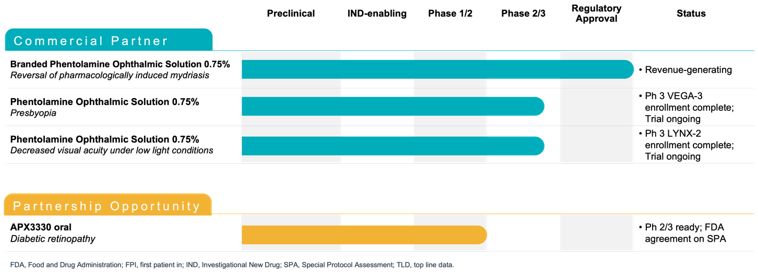

Maximize the value of APX3330 through partnership. In December 2024, we reached agreement with the FDA under SPA for a Phase 3 clinical trial evaluating oral

APX3330 for the treatment of moderate to severe NPDR. The SPA agreement reflects that the proposed Phase 3 trial design, and planned analyses adequately address the objectives necessary to support a New Drug Application (NDA)

submission for treatment of NPDR, subject to a successful outcome of the trial and review of all the data in the NDA, if submitted. The agreed primary endpoint for this clinical trial is a reduction in 3-step or greater worsening

on the binocular diabetic retinopathy severity scale (DRSS) score, compared to placebo. We are seeking a partner to advance the clinical development of APX3330, as we focus our resources on advancing our gene therapy candidates

for IRDs.

|

|

•

|

Complete late-stage development of PS programs. PS was approved by the FDA for the treatment for pharmacologically-induced mydriasis under the brand name

RYZUMVI in September 2023 and was launched commercially in April 2024.

|

|

•

|

Non-proliferative DR, or NPDR. NPDR is an earlier stage of DR and can progress into more severe forms of DR over time if left untreated and if

exposure to elevated blood sugar levels persist. Approximately 8 million patients in the U.S. have NPDR and are at risk of progressing to PDR (as defined below) if left untreated.

|

|

•

|

Proliferative DR, or PDR. PDR is a more advanced stage of DR than NPDR. It is characterized by retinal neovascularization and, if left

untreated, leads to permanent damage to the retina that results in loss of vision.

|

|

•

|

completion of preclinical laboratory tests, animal studies and formulation studies in compliance, as applicable, with the Animal Welfare Act and FDA’s good laboratory practice, or GLP, regulations;

|

|

•

|

submission to the FDA of an IND, which must take effect before human clinical trials may begin;

|

|

•

|

approval by an independent institutional review board, or IRB, representing each clinical site before each clinical trial may be initiated;

|

|

•

|

performance of human clinical trials, including adequate and well-controlled clinical trials, in accordance with good clinical practices, or GCP, and other applicable regulations to establish the safety

and efficacy of the proposed drug product, or the safety, purity, and potency of the proposed biologic, for each proposed indication;

|

|

•

|

manufacturing, packaging, labelling, and distribution of drug substances and drug products consistent with the FDA’s cGMP regulations, as well as GLP non-clinical and GCP clinical studies to investigate

the drug candidate;

|

|

•

|

development of product label, package inserts, and prescriber information that is intended to be used and included with the commercial product;

|

|

•

|

preparation and submission to the FDA of an NDA, BLA or supplements;

|

|

•

|

review of the product by an FDA advisory committee, where appropriate or if applicable;

|

|

•

|

satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the product, or components thereof, are produced to assess compliance with cGMP requirements

and to assure that the facilities, methods and controls are adequate to preserve the product’s identity, strength, quality and purity;

|

|

•

|

satisfactory completion of FDA audits of clinical trial site(s) to assure compliance with GCPs and the integrity of the clinical data;

|

|

•

|

FDA approval of application; and

|

|

•

|

compliance with any post-approval requirements, including Risk Evaluation and Mitigation Strategies, or REMS, and post-approval studies required by the FDA.

|

|

•

|

Phase 1. The drug or biological product is initially introduced into healthy human subjects or, in certain indications such as cancer, patients with the target

disease or condition and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early indication of its effectiveness and to determine optimal dosage.

|

|

•

|

Phase 2. The drug or biological product is administered to a limited patient population to identify possible adverse effects and safety risks, to preliminarily

evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

|

|

•

|

Phase 3. The drug or biological product is administered to an expanded patient population, generally at geographically dispersed clinical trial sites, in

well-controlled clinical trials to generate enough data to statistically evaluate the efficacy and safety of the product for approval, to establish the overall risk-benefit profile of the product and to provide adequate information

for the labelling of the product.

|

|

•

|

restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market or product recalls;

|

|

•

|

fines, warning letters or holds on post-approval clinical trials;

|

|

•

|

refusal of the FDA to approve pending NDAs or BLAs, or supplements to approved applications, or suspension or revocation of product license approvals;

|

|

•

|

product seizure or detention, or refusal to permit the import or export of products; or

|

|

•

|

injunctions or the imposition of civil or criminal penalties.

|

|

•

|

A special, non-deductible fee on any entity that manufactures or imports specified branded prescription drugs and biologic agents, apportioned among these entities according to their market share in

certain government healthcare programs, although this fee would not apply to sales of certain products approved exclusively for orphan indications;

|

|

•

|

Expansion of eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to certain individuals with income at or below 133% of the federal poverty

level, thereby potentially increasing a manufacturer’s Medicaid rebate liability;

|

|

•

|

Expansion of manufacturers’ rebate liability under the Medicaid Drug Rebate Program (“MDRP”) by (i) increasing the minimum rebate for both branded and generic drugs; (ii)

revising the definition of “average manufacturer price,” or AMP, which must be reported to the government for purposes of calculating Medicaid drug rebates on outpatient prescription drugs; and (iii) creating a new methodology by

which rebates owed by manufacturers under the MDRP are calculated for drugs that are inhaled, infused, instilled, implanted or injected;

|

|

•

|

Expansion of the types of entities eligible for the 340B drug discount program;

|

|

•

|

Provisions authorizing the creation of a new independent nonprofit organization called the Patient-Centered Outcomes Research Institute to oversee, identify

priorities in, and conduct comparative clinical effectiveness research, along with funding for such research; and

|

|

•

|

Establishment of the Center for Medicare and Medicaid Innovation within the Centers of Medicare and Medicaid Services (“CMS”) to test innovative payment and service

delivery models to lower Medicare and Medicaid spending, potentially including prescription drug spending.

|

|

•

|

The federal Anti-Kickback Statute (“AKS”), which is a criminal law that prohibits, among other things, persons and entities from knowingly and willfully soliciting, offering, receiving or providing

remuneration, directly or indirectly, in cash or in kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made, in whole or in

part, under a federal healthcare program such as Medicare or Medicaid. The AKS has been interpreted to apply to arrangements between pharmaceutical

manufacturers on the one hand and prescribers, pharmacies, purchasers, and formulary managers on the other, including, for example, consulting/speaking arrangements, discount and rebate offers, grants, charitable contributions, and

patient support offerings, among others. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. Further, courts

have found that the AKS has been violated if any “one purpose” of an arrangement involving remuneration is to induce referrals of federal healthcare program business. Violations of the AKS can result in significant civil

monetary penalties and criminal fines, per each violation, additional civil penalties and treble damages under the federal Civil False Claims Act (“FCA”), as described in detail further below, as

well as imprisonment and mandatory exclusion from participation in government health care programs, meaning that federal healthcare programs would no longer reimburse (directly or indirectly) for

products or services furnished by the excluded entity or individuals. Although there are a number of statutory exceptions and regulatory safe harbors to the AKS that protect certain common industry activities from prosecution, these

exceptions and safe harbors are narrowly drawn. Arrangements that do not fully satisfy all elements of an available exception or safe harbor are evaluated based on the specific facts and circumstances and are typically subject to

increased scrutiny;

|

|

•

|

The FCA, which may be enforced through civil whistleblower or qui tam actions and imposes significant civil penalties, treble damages and potential exclusion from government health care programs against

individuals or entities for, among other things, knowingly presenting, or causing to be presented, to the federal government, claims for payment that are false or fraudulent or for making a false record or statement material to an

obligation to pay the federal government or for knowingly and improperly avoiding, decreasing or concealing an obligation to pay money to the federal government. Further, a violation of the AKS can serve as a basis for liability

under the FCA. Manufacturers can be held liable under the FCA even when they do not submit claims directly to government payors if they are deemed to “cause” the submission of false or fraudulent

claims. Pharmaceutical manufacturers have been investigated and/or subject to government enforcement actions asserting liability under the FCA for a variety of alleged activities, including alleged off-label promotion of drugs,

purportedly concealing price concessions in the pricing information submitted to the government for government price reporting purposes, and allegedly providing free product to customers with the expectation that the customers would

bill federal healthcare programs for the product. Violations of the FCA may result in significant civil fines and penalties for each false claim, currently ranging from $14,308 - $28,619 per false claim or statement for penalties

assessed after January 15, 2025, treble damages, and potential exclusion from participation in federal healthcare programs. There is also the federal Criminal False Claims Act, which is similar to the FCA and imposes criminal

liability on those that make or present a false, fictitious or fraudulent claim to the federal government;

|

|

•

|

The federal Civil Monetary Penalties Law, which authorizes the imposition of substantial civil monetary penalties against an entity that engages in activities including, among others (1) knowingly

presenting, or causing to be presented, a claim for services not provided as claimed or that is otherwise false or fraudulent in any way; (2) arranging for or contracting with an individual or entity that is excluded from

participation in federal health care programs to provide items or services reimbursable by a federal health care program; (3) violations of the AKS; and (4) failing to report and return a known overpayment;

|

|

•

|

The federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, which created additional federal criminal statutes that impose criminal liability for knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including

private third-party payors, or to obtain, by means of false or fraudulent pretenses, representations, or promises, any of the money or property owned by, or under the custody or control of, any healthcare benefit program; knowingly

and willfully embezzling or stealing from a healthcare benefit program; willfully preventing, obstructing, misleading, or delaying a criminal investigation of a healthcare offense; and knowingly and willfully falsifying, concealing

or covering up a material fact or making any materially false statements in connection with the delivery of or payment for healthcare benefits, items, or services. Similar to the federal Anti-Kickback Statute, a person or entity

need not have actual knowledge of the statute or specific intent to violate it in order to have committed a violation;

|

|

•

|

The federal Physician Payments Sunshine Act (“Sunshine Act”), implemented as the Open Payments Program, which requires certain manufacturers of drugs, devices, biologics and medical supplies for which

payment is available under Medicare, Medicaid, or the Children’s Health Insurance Program, among others, to track and report annually to CMS, within HHS, information related to payments and other “transfers of value” made by that

entity to US-licensed physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors), physician assistants, nurse practitioners, clinical nurse specialists, anesthesiologist assistants, certified

registered nurse anesthetists, certified nurse midwives, and teaching hospitals. The Sunshine Act also requires certain manufacturers, among others, to track and report ownership and investment interests held by U.S.-licensed

physicians and their immediate family members. Failure to timely, accurately, and completely submit the required information for all payments, transfers of value and ownership or investment interests may result in civil monetary

penalties;

|

|

•

|

The federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) which imposes criminal and civil liability for, among other things,

executing or attempting to execute a scheme to defraud any healthcare benefit program, including any third-party payors, knowingly and willfully embezzling or stealing from a healthcare benefit program, willfully obstructing a

criminal investigation of a healthcare offense, and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statements or representations, or making

false statements relating to healthcare benefits, items or services. Similar to the AKS, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it to have committed a violation;

|

|

•

|

HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, which mandates, among other things, the adoption of uniform standards for the electronic exchange of

information in common health care transactions as well as standards relating to the privacy and security of individually identifiable health information. These standards require the adoption of administrative, physical and technical

safeguards to protect such information. In addition, many states have enacted comparable laws addressing the privacy and security of health information, some of which are more stringent than HIPAA. Failure to comply with these laws

can result in the imposition of significant civil and criminal penalties;

|

|

•

|

Analogous state and foreign laws and regulations, such as state anti-kickback and false claims laws, may apply to sales or marketing arrangements and claims involving healthcare items or services

reimbursed by non-governmental third-party payors, including private insurers, and may be broader in scope than their federal equivalents; and

|

|

•

|

State laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government;

require the reporting of certain pricing information, including information pertaining to and justifying price increases; prohibit prescription drug price gouging; or impose payment caps on certain pharmaceutical products deemed by

the state to be “high cost” in addition to requiring drug manufacturers to report information related to payments to physicians and other healthcare providers or marketing expenditures.

|

|

•

|

Additionally, we expect certain of our products, if and when approved, may be eligible for coverage under Medicare, the federal health care program that provides health care benefits to the aged and

disabled. Specifically, we expect our products would be primarily reimbursed under Medicare Part D, which provides an outpatient prescription drug benefit for Medicare beneficiaries. Medicare Part D is implemented through private

insurance plans under contractual arrangements between the plans and the federal government. Similar to pharmaceutical coverage through private health insurance, Part D plans develop formularies, impose utilization controls (such as

prior authorization, step therapy, and quantity limits), and negotiate discounts from drug manufacturers. Because of this, the list of prescription drugs covered by Part D plans varies by plan. However, with limited exceptions,

individual plans are required by statute to cover certain therapeutic categories and classes of drugs or biologics and to have at least two drugs in each unique therapeutic category or class. Our products may also be covered and

reimbursed under other government programs, including those discussed below:

|

|

•

|

We expect to be required to participate in the MDRP in order for federal payment to be available for our products under Medicaid. Medicaid is a government health insurance

program for eligible low-income adults, children, families, pregnant women, and people with certain disabilities and it is jointly funded by the federal and state governments. The MDRP requires pharmaceutical manufacturers

to enter into and have in effect a national rebate agreement with the Secretary of the HHS as a condition for states to receive federal matching funds for the manufacturer’s outpatient drugs furnished to Medicaid patients. Under the

MDRP, manufacturers must pay a rebate to each state Medicaid program for quantities of products utilized on an outpatient basis (with some exceptions) that are dispensed to Medicaid beneficiaries and paid for by a state Medicaid

program. MDRP rebates are calculated using a statutory formula, state-reported utilization data, and pricing data that are calculated and reported by manufacturers on a monthly and quarterly basis to CMS. These data include the AMP

and, in the case of single source and innovator multiple source products, the best price for each drug.

|

|

•

|

Under federal law, we further expect to be required to participate in the 340B drug pricing program, which 340B drug pricing program requires participating

manufacturers to agree to charge statutorily-defined covered entities no more than the 340B “ceiling price” for the manufacturer’s covered outpatient drugs. These 340B covered entities include health care organizations that have

certain federal designations or receive funding from specific federal programs, including Federally Qualified Health Centers, Ryan White HIV/AIDS Program grantees, and certain types of hospitals and specialized clinics, as well as

certain hospitals that serve a disproportionate share of low-income patients. The ACA expanded the 340B program to also include certain children’s hospitals, certain free-standing cancer hospitals, critical access hospitals, certain

rural referral centers and certain sole community hospitals, each as defined by ACA. The 340B ceiling price is calculated using a statutory formula, which is based on the AMP and rebate amount for the covered outpatient drug as

calculated under the MDRP, and in general, products subject to the MDRP are also subject to the 340B ceiling price calculation and discount requirement. Any changes to the definition of Medicaid AMP and the Medicaid rebate amount also

could affect our 340B ceiling price calculation for our products and could negatively impact our results of operations. In addition, after multiple delays, the final rule implementing civil monetary

penalties against manufacturers for instances of overcharging 340B covered entities became effective on January 1, 2019. Accordingly, if we have an approved product, we could be subject to such penalties if the government were to

find that we knowingly and intentionally overcharged a 340B covered entity.

|

|

•

|

Additionally, for a company to be eligible to have its products paid for with federal funds under the MDRP and Medicare Part B programs, as well as to be purchased by certain federal agencies and

grantees, it also must participate in the Department of Veterans Affairs (“VA”) Federal Supply Schedule (“FSS”) pricing program. To participate, manufacturers are required to enter into an FSS contract and other agreements with the VA

for any products which may qualify as “covered drugs.” Under these agreements, manufacturers must make such products available to the “Big Four” federal agencies-the VA, the Department of Defense

(“DoD”), the Public Health Service (including the Indian Health Service), and the Coast Guard-at pricing that is capped pursuant to a statutory federal ceiling price (“FCP”), formula set forth in Section 603 of the Veterans Health

Care Act of 1992 (“VHCA”). The FCP is based on a weighted average non-federal average manufacturer price (“Non-FAMP”), which manufacturers are required to report on a quarterly and annual basis to the VA.

|

|

•

|

Any failure to comply with price reporting and rebate payment obligations under federal healthcare programs could negatively impact our financial results. Civil monetary penalties can be applied if we

are found to have knowingly submitted any false price information to the government, if we are found to have made a misrepresentation in the reporting of our average sales price, or if we fail to submit the required price data on a

timely basis. Such conduct also could provide a basis for other potential liability under other federal laws such as the False Claims Act.

|

| ITEM 1A. |

RISK FACTORS

|

|

•

|

the inability to successfully combine our assets in a manner that permits us to expand our product pipeline or achieve the anticipated benefits from the Opus Acquisition, which would result in the

anticipated benefits of the Opus Acquisition not being realized partly or wholly in the time frame currently anticipated or at all;

|

|

•

|

the creation of uniform standards, controls, procedures, policies and information systems;

|

|

•

|

the addition of new personnel, including new management, which may be difficult to smoothly integrate; and

|

|

•

|

potential unknown liabilities and unforeseen increased expenses, delays or regulatory conditions associated with the Opus Acquisition.

|

|

•

|

regulatory authorities may suspend or withdraw approvals of such product candidate;

|

|

•

|

regulatory authorities may require additional warnings or limitations of use in product labeling;

|

|

•

|

we may be required to change the way a product candidate is administered or conduct additional clinical trials;

|

|

•

|

we could be sued and held liable for harm caused by our products to patients; and

|

|

•

|

our reputation may suffer.

|

|

•

|

delays in reaching a consensus with regulatory authorities on trial design;

|

|

•

|

delays in reaching agreement on acceptable terms with prospective CROs and clinical trial sites;

|

|

•

|

delays in opening clinical trial sites or obtaining required institutional review board or independent Ethics Committee approval at each clinical trial site;

|

|

•

|

delays in recruiting and enrolling suitable subjects to participate in our clinical trials, due to factors such as the size of the trial or subject population, process for identifying subjects, design

or expansion of protocols, eligibility and exclusive criteria, perceived risks and benefits of the relevant product candidate or gene therapy generally, availability of competing therapies and trials, severity of the disease under

investigation, need and length of time required to discontinue other potential therapies, availability of genetic testing, availability and proximity of trial sites for prospective subjects, ability to obtain subject consent and

referral practices of physicians;

|

|

•

|

imposition of a clinical hold by regulatory authorities, including as a result of a serious adverse event or after an inspection of our clinical trial operations or trial sites;

|

|

•

|

failure by us, any CROs we engage or any other third parties to adhere to clinical trial requirements;

|

|

•

|

failure to perform in accordance with GCP, or applicable regulatory guidelines in the European Union and other countries;

|

|

•

|

delays in the testing, validation, manufacturing and delivery of our product candidates to the clinical sites, including delays by third parties with whom we have contracted to perform;

|

|

•

|

delays in having subjects complete participation in a trial or return for post-treatment follow-up;

|

|

•

|

clinical trial sites or subjects dropping out of a trial;

|

|

•

|

selection of clinical endpoints that require prolonged periods of clinical observation or analysis of the resulting data;

|

|

•

|

occurrence of serious adverse events associated with the product candidate that are viewed to outweigh its potential benefits;

|

|

•

|

occurrence of serious adverse events in trials of the same class of agents conducted by other sponsors; or

|

|

•

|

changes in regulatory requirements and guidance that require amending or submitting new clinical protocols.

|

|

•

|

be delayed in obtaining marketing approval for our product candidates, if at all;

|

|

•

|

obtain approval for indications or patient populations that are not as broad as intended or desired;

|

|

•

|

obtain approval with labeling that includes significant use or distribution restrictions or safety warnings;

|

|

•

|

be subject to changes in the way the product is administered;

|

|

•

|

be required to perform additional clinical trials to support approval or be subject to additional post-marketing testing or other requirements;

|

|

•

|

have regulatory authorities withdraw, vary or suspend their approval of the product or impose restrictions on its distribution in the form of a modified risk evaluation and mitigation;

|

|

•

|

be subject to the addition of labeling statements, such as warnings or contraindications;

|

|

•

|

be sued; or

|

|

•

|

experience damage to our reputation.

|

|

•

|

perceived risks and benefits of gene therapy-based approaches or our product candidate under study;

|

|

•

|

availability of genetic testing for potential subjects;

|

|

•

|

availability and efficacy of medications already approved for the disease under investigation;

|

|

•

|

eligibility criteria and visit schedule for the trial in question;

|

|

•

|

competition for eligible patients with other companies conducting clinical trials for product candidates seeking to treat the same indication or patient population;

|

|

•

|

our payments for conducting clinical trials;

|

|

•

|

perceived risks and benefits of the product candidate under study;

|

|

•

|

efforts to facilitate timely enrollment in clinical trials;

|

|

•

|

patient referral practices of physicians;

|

|

•

|

the ability to monitor patients adequately during and after treatment; and

|

|

•

|

proximity and availability of clinical trial sites for prospective patients.

|

|

•

|

delays in, termination, or numerous unforeseen events during, or as a result of, manufacturing or clinical trials;

|

|

•

|

obtaining unfavorable results from nonclinical and clinical studies for our product candidates;

|

|

•

|

the cost of clinical trials being greater than anticipated;

|

|

•

|

the willingness of patients or medical investigators to follow our clinical trial protocols and the number of patients willing to participate;

|

|

•

|

delays in applying for and receiving marketing and NDA approvals from applicable regulatory authorities for our product candidates;

|

|

•

|

other government or regulatory delays and changes in regulatory requirements, policy and guidelines may require us to perform additional clinical trials or use substantial additional resources to obtain

regulatory approval;

|

|

•

|

issues with making arrangements with third-party manufacturers for commercial quantities of RYZUMVI and our product candidates and receiving regulatory approval of our manufacturing processes and our

third-party manufacturers’ facilities from applicable regulatory authorities;

|

|

•

|

establishing sales, marketing, and distribution capabilities and launching commercial sales of RYZUMVI and our product candidates, if and when approved, whether alone or in collaboration with others;

|

|

•

|

acceptance of RYZUMVI and our product candidates by patients, the medical community, and third-party payors;

|

|

•

|

effectively competing with other therapies, including the existing standard-of-care;

|

|

•

|

maintaining a continued acceptable safety profile of RYZUMVI and our product candidates following approval;

|

|

•

|

obtaining and maintaining coverage and adequate reimbursement from third-party payors;

|

|

•

|

obtaining and maintaining patent and trade secret protection and regulatory exclusivity;

|

|

•

|

protecting our rights in our intellectual property portfolio related to RYZUMVI and our product candidates; and

|

|

•

|

our ability to fulfill requests for additional data regarding our product candidates.

|

|

•

|

Viatris may not be able to manufacture our products in a timely or cost-effective manner;

|

|

•

|

Viatris may not timely perform its obligations under the Viatris License Agreement;

|

|

•

|

Viatris may fail to effectively commercialize our products;

|

|

•

|

Viatris may not be able to sublicense RYZUMVI or PS to one or more suitable parties outside the United States; or

|

|

•

|

contractual disputes or other disagreements between us and Viatris, including those regarding the development, manufacture, sub licensure and commercialization of our products, interpretation of the

License Agreement, and ownership of proprietary rights. Viatris may select a new development partner for RYZUMVI and PS in the U.S. upon 90 days’ notice to the Company.

|

|

•

|

we may discover that they are less effective, or identify undesirable side effects caused by our product candidates:

|

|

•

|

regulatory authorities may withdraw their approval of the product;

|

|

•

|

we may be required to recall the product, change the way this product is administered, conduct additional clinical trials, or change the labeling or distribution of the product (including REMS);

|

|

•

|

additional restrictions may be imposed on the marketing of, or the manufacturing processes for, the product;

|

|

•

|

we may be subject to fines, injunctions, or the imposition of civil or criminal penalties;

|

|

•

|

we could be sued and held liable for harm caused to patients;

|

|

•

|

the product may be rendered less competitive and sales may decrease; or

|

|

•

|

our reputation may suffer generally among both clinicians and patients.

|

|

•

|

the inability to recruit and retain adequate numbers of effective sales and marketing personnel or enter into distribution agreements with third parties;

|

|

•

|

the inability of sales personnel to obtain access to physicians or educate an adequate number of physicians as to the benefits of our products;

|

|

•

|

the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage relative to companies with more extensive product lines;

|

|

•

|

unforeseen costs and expenses associated with creating an independent sales and marketing organization; and

|

|

•

|

the inability to obtain sufficient coverage and reimbursement from third-party payors and governmental agencies.

|

|

•

|

efficacy and potential advantages compared to alternative treatments;

|

|

•

|

the ability to offer our product for sale at competitive prices;

|

|

•

|

the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies;

|

|

•

|

any restrictions on the use of our product together with other medications;

|

|

•

|

interactions of our product with other medicines patients are taking;

|

|

•

|

inability of certain types of patients to take our product;

|

|

•

|

demonstrated ability to treat patients and, if required by any applicable regulatory authority in connection with the approval for target indications as compared with other available therapies;

|

|

•

|

the relative convenience and ease of administration as compared with other treatments available for approved indications;

|

|

•

|

the prevalence and severity of any adverse side effects;

|

|

•

|

limitations or warnings contained in the labeling approved by the FDA;

|

|

•

|

availability of alternative treatments already approved or expected to be commercially launched in the near future;

|

|

•

|

the effectiveness of our or our partners’ sales and marketing strategies;

|

|

•

|

our or our partners’ ability to increase awareness through marketing efforts;

|

|

•

|

guidelines and recommendations of organizations involved in research, treatment and prevention of various diseases that may advocate for alternative therapies;

|

|

•

|

our or our partners’ ability to obtain sufficient third-party coverage and adequate reimbursement;

|

|

•

|

the willingness of patients to pay out-of-pocket in the absence of third-party coverage; and

|

|

•

|

physicians or patients may be reluctant to switch from existing therapies even if potentially more effective, safe or convenient.

|

|

•

|

ability of physicians to identify patients with rare genetic diseases (IRDs).

|

|

•

|

limited genetic testing conducted on potential patients.

|

|

•

|

decreased demand for any product candidate that we are developing;

|

|

•

|

injury to our reputation and significant negative media attention;

|

|

•

|

withdrawal of clinical trial participants;

|

|

•

|

increased FDA warnings on product labels;

|

|

•

|

significant costs to defend the related litigation;

|

|

•

|

substantial monetary awards to trial participants or patients;

|

|

•

|

distraction of management’s attention from our primary business;

|

|

•

|

loss of revenue;

|

|

•

|

the inability to commercialize any product candidate that we may develop;

|

|

•

|

the initiation of investigations by regulators; and

|

|

•

|

the inability to take advantage of limitations on product liability lawsuits that apply to generic drug products, which could increase our exposure to liability for products deemed to be dangerous or

defective.

|

|

•

|

the successful launch and widespread commercialization of our gene therapy candidates and other product candidates;

|

|

•

|

obtain approvals on late-stage drugs in development and the receipt of associated financial payments from our partner;

|

|

•

|

obtain favorable results from and complete the nonclinical and clinical development of our product candidates for their planned indications, including successful completion of additional clinical trials

for these indications;

|

|

•

|

submit applications to regulatory authorities for both product candidates and receive timely marketing approvals in the United States and foreign countries;

|

|

•

|

establish and maintain commercially viable supply and manufacturing relationships with third parties that can provide adequate, in both amount and quality, products and services to support clinical

development and meet the market demand for our product candidates that we develop, if approved;

|

|

•

|

establish sales and marketing capabilities to effectively market and sell our product candidates in the United States or other markets, either alone or with a pharmaceutical partner;

|

|

•

|

address any competing products and technological and market developments;

|

|

•

|

obtain coverage and adequate reimbursement for customers and patients from government and third-party payors for our product candidates that we develop; and

|

|

•

|

achieve market acceptance of our product candidates.

|

|

•

|

Delayed access to deposits or other financial assets or the uninsured loss of deposits or other financial assets;

|

|

•

|

Loss of access to revolving existing credit facilities or other working capital sources and/or the inability to refund, roll over or extend the maturity of, or enter into new credit facilities or other

working capital resources;

|

|

•

|

Potential or actual breach of contractual obligations that require us to maintain letters or credit or other credit support arrangements; or

|

|

•

|

Termination of cash management arrangements and/or delays in accessing or actual loss of funds subject to cash management arrangements.

|

|

•

|

the scope, size, rate of progress, results, and costs of researching and developing our product candidates, and initiating and completing our nonclinical studies and clinical trials;

|

|

•

|

the cost, timing and outcome of our efforts to obtain further marketing approval for our product candidates in the United States and other countries, including to fund the preparation and filing of NDAs

with the FDA for our product candidates and to satisfy related FDA requirements and regulatory requirements in other countries;

|

|

•

|

the number and characteristics of any additional product candidates we develop or acquire, if any;

|

|

•

|

our ability to establish and maintain collaborations on favorable terms, if at all;

|

|

•

|

the amount of revenue, if any, from commercial sales, should our product candidates receive marketing approval;

|

|

•

|

the costs associated with commercializing our product candidates, if we receive marketing approval, including the cost and timing of developing sales and marketing capabilities or entering into

strategic collaborations to market and sell our product candidates;

|

|

•

|

the ability to secure grant funding from government and nongovernment foundations;

|

|

•

|

the cost of manufacturing our product candidates or products we successfully commercialize; and

|

|

•

|

the costs associated with general corporate activities, such as the cost of filing, prosecuting and enforcing patent claims and making regulatory filings.

|

|

•

|

litigation involving patients taking our drugs;

|

|

•

|

restrictions on such drugs, manufacturers, or manufacturing processes;

|

|

•

|

restrictions on the labeling or marketing of a drug;

|

|

•

|

restrictions on drug distribution or use;

|

|

•

|

requirements to conduct post-marketing studies or clinical trials;

|

|

•

|

warning letters or untitled letters;

|

|

•

|

withdrawal of the drugs from the market;

|

|

•

|

refusal to approve pending applications or supplements to approved applications that we submit;

|

|

•

|

product recall or public notification or medical product safety alerts to healthcare professionals;

|

|

•

|

fines, restitution, or disgorgement of profits or revenues;

|

|

•

|

suspension or withdrawal of marketing approvals;

|

|

•

|

damage to relationships with any potential collaborators;

|

|

•

|

unfavorable press coverage and damage to our reputation;

|

|

•

|

refusal to permit the import or export of drugs;

|

|

•

|

product seizure; or

|

|

•

|

injunctions or the imposition of civil or criminal penalties.

|

|

•

|

comply with the regulations of the FDA and applicable non-U.S. regulators;

|

|

•

|

provide accurate information to the FDA and applicable non-U.S. regulators;

|

|

•

|

comply with healthcare fraud and abuse laws and regulations in the United States and abroad;

|

|

•

|

report financial information or data accurately; or

|

|

•

|

disclose unauthorized activities to us.

|

|

•

|

fail to comply with contractual obligations;

|

|

•

|

experience regulatory compliance issues;

|

|

•

|

undergo changes in ownership or management;

|

|

•

|

undergo changes in priorities or become financially distressed; or

|

|

•

|

form relationships with other entities, some of which may be our competitors.

|

|

•

|

collaborators have significant discretion in determining the efforts and resources that they will apply to these collaborations;

|

|

•

|

collaborators may not perform their obligations as expected;

|

|

•

|

collaborators may not pursue development and commercialization or may elect not to continue or renew development or commercialization programs based on clinical trial results, changes in the

collaborator’s strategic focus or available funding, or external factors such as an acquisition that diverts resources or creates competing priorities;

|

|

•

|

collaborators may delay clinical trials, provide insufficient funding for a clinical trial program, stop a clinical trial or abandon a product candidate, repeat or conduct new clinical trials, or

require a new formulation of a product candidate for clinical testing;

|

|

•

|

collaborators could independently develop, or develop with third parties, products that compete directly or indirectly with our product candidate if the collaborators believe that competitive products

are more likely to be successfully developed or can be commercialized under terms that are more attractive than ours;

|

|

•

|

a collaborator with marketing and distribution rights to one or more product candidates may not commit sufficient resources to the marketing or distribution of any such product candidate;

|

|

•

|

collaborators may not properly maintain or defend our intellectual property rights or may use our proprietary information in such a way as to invite litigation that could jeopardize or invalidate our

proprietary information or expose us to litigation;

|

|

•

|

collaborators may infringe the intellectual property rights of third parties, which may expose us to litigation and potential liability;

|

|

•

|

disputes may arise between us and collaborators that result in the delay or termination of research, development, or commercialization of our product candidates, or in litigation or arbitration that

diverts management attention and resources;

|

|

•

|

we may lose certain valuable rights under circumstances identified in our collaborations, including if we undergo a change of control;

|

|

•

|

collaborations may be terminated and such terminations may create a need for additional capital to pursue further development or commercialization of the applicable product candidates;

|

|

•

|

collaborators may learn about our discoveries and use this knowledge to compete with us in the future;

|

|

•

|

the results of collaborators’ nonclinical or clinical studies could harm or impair other development programs;

|

|

•

|

there may be conflicts between different collaborators that could negatively affect those collaborations and potentially others;

|

|

•

|

the number and nature of our collaborations could adversely affect our attractiveness to potential future collaborators or acquirers;

|

|

•

|

collaboration agreements may not lead to development or commercialization of our product candidate in the most efficient manner or at all. If a present or future collaborator of us were to be involved

in a business combination, the continued pursuit and emphasis on our product development or commercialization program under such collaboration could be delayed, diminished, or terminated;

|

|

•

|

collaborators may be unable to obtain the necessary marketing approvals; and

|

|

•

|

collaborators may determine, as a part of product life-cycle management, that changes to a product are necessary or required, including regarding such

product’s formulation, container closure system, packaging, or other characteristics, which could affect the development or commercialization of the applicable product candidate.

|

|

•

|

increased operating expenses and cash requirements;

|

|

•

|

the assumption of indebtedness or contingent liabilities;

|

|

•

|

the issuance of our equity securities which would result in dilution to our stockholders;

|

|

•

|

assimilation of operations, intellectual property, products and product candidates of an acquired company, including difficulties associated with integrating new personnel;

|

|

•

|

the diversion of management’s attention from our existing product candidates and initiatives in pursuing such an acquisition or strategic partnership;

|

|

•

|

retention of key employees, the loss of key personnel, and uncertainties in our ability to maintain key business relationships;

|

|

•

|

risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products or product candidates and regulatory approvals; and

|

|

•

|

our inability to generate revenue from acquired intellectual property, technology and/or products sufficient to meet our objectives or even to offset the associated transaction and maintenance costs.

|

|

•

|

any of our patents, or any of our pending patent applications, if issued, will include claims having a scope sufficient to protect our product candidates;

|

|

•

|

any of our pending patent applications will result in issued patents;

|

|

•

|

we will be able to successfully commercialize our product candidates, if approved, before our relevant patents expire;

|

|

•

|

we were the first to make the inventions covered by each of our patents and pending patent applications;

|

|

•

|

we were the first to file patent applications for these inventions;

|

|

•

|

others will not develop similar or alternative technologies that do not infringe our patents;

|

|

•

|

any of our patents will be valid and enforceable;

|

|

•

|

any patents issued to us will provide a basis for an exclusive market for our commercially viable products, will provide us with any competitive advantages or will not be challenged by third parties;

|

|

•

|

we will develop additional proprietary technologies or product candidates that are separately patentable; or

|

|

•

|

our commercial activities or products will not infringe upon the patents of others.

|

|

•

|

the scope of rights granted under the license agreement and other interpretation-related issues;

|

|

•

|

the extent to which our product candidates, technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement;

|

|

•

|

the sublicensing of patent and other rights under our collaborative development relationships;

|

|

•

|

our diligence obligations under the license agreement and what activities satisfy those diligence obligations;

|

|

•

|

the inventorship and ownership of inventions and know-how resulting from the joint creation or use of intellectual property; and

|

|

•

|

the priority of invention of patented technology.

|

|

•

|

compliance with differing or unexpected regulatory requirements for our product candidates;

|

|

•

|

different medical practices and customs affecting acceptance of our product candidates, if approved, or any other approved product in the marketplace;

|

|

•

|

language barriers;

|

|

•

|

the interpretation of contractual provisions governed by foreign law in the event of a contract dispute;

|

|

•

|

difficulties in staffing and managing foreign operations, and an inability to control commercial or other activities where it is relying on third parties;

|

|

•

|

workforce uncertainty in countries where labor unrest is more common than in the United States;

|

|

•

|

potential liability under the Foreign Corrupt Practice Act of 1977 or comparable foreign regulations;

|

|

•

|

production shortages resulting from any events affecting raw material supply or manufacturing capability abroad;

|

|

•

|

foreign government taxes, regulations, and permit requirements;

|

|

•

|

U.S. and foreign government tariffs, trade restrictions, price and exchange controls, and other regulatory requirements, particularly changes that may occur as a result of the recent U.S. presidential

election;

|

|

•

|

economic weakness, including inflation, natural disasters, war, events of terrorism, or political instability in particular foreign countries;

|

|

•

|

fluctuations in currency exchange rates, which could result in increased operating expenses and reduced revenues;

|

|

•

|

compliance with tax, employment, immigration, and labor laws, regulations, and restrictions for employees living or traveling abroad;

|

|

•

|

changes in diplomatic and trade relationships; and

|

|

•

|

challenges in enforcing our contractual and intellectual property rights, especially in those foreign countries that do not respect and protect intellectual property rights to the same extent as the

United States.

|

|

•

|

the announcement of new products or product enhancements by us or our competitors;

|

|

•

|

changes in our relationships with our licensors or other strategic partners;

|

|

•

|

developments concerning intellectual property rights and regulatory approvals;

|

|

•

|

variations in ours and our competitors’ results of operations;

|

|

•

|

substantial sales of shares of our common stock due to the release of lock-up agreements;

|

|

•

|

the announcement of clinical trial results;

|

|

•

|

the announcement of potentially dilutive financings;

|

|

•

|

changes in earnings estimates or recommendations by securities analysts;

|

|

•

|

changes in the structure of healthcare payment systems;

|

|

•

|

developments and market conditions in the pharmaceutical and biotechnology industries;

|

|

•

|

any acquisitions or dispositions of products, product candidates or business; and

|

|

•

|

the results of clinical trials of our gene therapy products, PS, or any other product candidate that we may develop.

|

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS

|

| ITEM 3. |

LEGAL PROCEEDINGS

|

| ITEM 4. |

MINE SAFETY DISCLOSURES

|

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

| ITEM 6. |

[RESERVED]

|

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

• |

continue clinical trials for LCA5, BEST1, PS and for any other product candidate in our future pipeline;

|

|

|

• |

continue nonclinical studies for our pipeline of gene therapies;

|

|

|

• |

develop additional product candidates that we identify, in-license or acquire;

|

|

|

• |

seek regulatory approvals for any product candidates that successfully complete clinical trials;

|

|

|

• |

contract to manufacture our product candidates;

|

|

|

• |

maintain, expand and protect our intellectual property portfolio;

|

|

|

• |

hire additional staff, including clinical, scientific, operational and financial personnel, to execute our business plan;

|

|

|

• |

add operational, financial and management information systems and personnel to support our product development and potential future commercialization efforts;

|

|

|

• |

continue to operate as a public company; and

|

|

|

• |

establish on our own or with partners, a sales, marketing and distribution infrastructure to commercialize any products for which we may obtain regulatory approval.

|

|

For the Year Ended

December 31,

|

||||||||||||

|

2024

|

2023

|

Change

|

||||||||||

|

License and collaborations revenue

|

$

|

10,992

|

$

|

19,049

|

$

|

(8,057

|

)

|

|||||

|

Operating expenses:

|

||||||||||||

|

General and administrative

|

18,215

|

11,959

|

6,256

|

|||||||||

|

Research and development

|

26,851

|

17,653

|

9,198

|

|||||||||

|

Acquired in-process research and development expenses

|

28,000

|

—

|

28,000

|

|||||||||

|

Total operating expenses

|

73,066

|

29,612

|

43,454

|

|||||||||

|

Loss from operations

|

(62,074

|

)

|

(10,563

|

)

|

(51,511

|

)

|

||||||

|

Financing costs

|

—

|

(1,328

|

)

|

1,328

|

||||||||

|

Fair value change in derivative liabilities

|

72

|

80

|

(8

|

)

|

||||||||

|

Other income, net

|

4,470

|

1,837

|

2.633

|

|||||||||

|

Loss before income taxes

|

(57,532

|

)

|

(9,974

|

)

|

(47,558

|

)

|

||||||

|

Provision for income taxes

|

—

|

(12

|

)

|

12

|

||||||||

|

Net loss

|

$

|

(57,532

|

)

|

$

|

(9,986

|

)

|

$

|

(47,546

|

)

|

|||

|

For the Year Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2024

|

2023

|

Change

|

||||||||||

|

External costs:

|

||||||||||||

|

Phentolamine Ophthalmic Solution 0.75% (“PS”)

|

$

|

9,680

|

$

|

9,983

|

$

|

(303

|

)

|

|||||

|

APX 3330

|

11,466

|

4,818

|

6,648

|

|||||||||

|

IRD programs

|

902

|

—

|

902

|

|||||||||

|

Unallocated

|

414

|

678

|

(264

|

)

|

||||||||

|

Total external cost

|

22,462

|

15,479

|

6,983

|

|||||||||

|

Internal costs:

|

||||||||||||

|

Employee related expenses

|

4,216

|

2,148

|

2,068

|

|||||||||

|

Facilities, supplies and other

|

173

|

26

|

147

|

|||||||||

|

Total internal costs

|

4,389

|

2,174

|

2,215

|

|||||||||

|

Total research and development expenses

|

$

|

26,851

|

$

|

17,653

|

$

|

9,198

|

||||||

|

For the Year Ended

December 31,

|

||||||||

|

2024

|

2023

|

|||||||

|

Net cash used in by operating activities

|

$

|

(25,576

|

)

|

$

|

(1,112

|

)

|

||

|

Net cash provided by investing activities

|

1,210

|

—

|

||||||

|

Net cash provided by financing activities

|

4,186

|

8,979

|

||||||

|

Net (decrease) increase in cash and cash equivalents

|

$

|

(20,180

|

)

|

$

|

7,867

|

|||

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

| Item 9A |

CONTROLS AND PROCEDURES

|

| ITEM 9B. |

OTHER INFORMATION

|

| ITEM 9C. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

|

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

|

|

(a) |

Financial Statements: The financial statements filed as part of this report are listed in Part II, Item 8.

|

|

|

(b) |

Financial Statement Schedules: The schedules are either not applicable or the required information is presented in the financial statements or notes thereto.

|

|

|

(c) |

Exhibits: The following exhibits are incorporated by reference or filed as part of this Annual Report on Form 10-K:

|

|

EXHIBIT

NUMBER

|

DESCRIPTION OF DOCUMENT

|

|

Agreement and Plan of Merger, dated as of October 22, 2024, by and among the Company, Former Opus, Orange Merger Sub I, Inc., and Orange Merger

Sub II, LLC (incorporated by reference to Exhibit 2.1 to Registrant’s Current Report on Form 8-K, filed on October 22, 2024).

|

|

|

Restated Certificate of Incorporation of Ocuphire Pharma, Inc., dated as of June 12, 2024 (incorporated by reference to Exhibit 3.1 to the

Registrant’s Quarterly Report on Form 10-Q, filed on August 13, 2024).

|

|

|

Certificate of Amendment to the Restated Certificate of Incorporation of the Company, effective as of October 23, 2024 (incorporated by

reference to Exhibit 3.2 to Registrant’s Current Report on Form 8-K, filed on October 22, 2024).

|

|

|

Certificate of Designation of Series A Non-Voting Convertible Preferred Stock, effective as of October 22, 2024 (incorporated by reference to

Exhibit 3.1 to Registrant’s Current Report on Form 8-K, filed on October 22, 2024).

|

|

|

Amended and Restated Bylaws, dated as of March 19, 2025 (incorporated by reference to Exhibit 3.1 to Registrant’s Current Report on Form 8-K,

filed on March 20, 2025).

|

|

|