FORM 10-K

| |

|

1

|

|

|

|

5

|

|

Item 1.

|

|

5

|

|

Item 1A.

|

|

29

|

|

Item 1B.

|

|

74

|

|

Item 2.

|

|

74

|

|

Item 3.

|

|

74

|

|

Item 4.

|

|

74

|

|

|

|

75

|

|

Item 5.

|

|

75

|

|

Item 6.

|

|

75

|

|

Item 7.

|

|

76

|

|

Item 7A.

|

|

84

|

|

Item 8.

|

|

85

|

|

Item 9.

|

|

116

|

|

Item 9A.

|

|

116

|

|

Item 9B.

|

|

117

|

|

Item 9C.

|

|

117

|

|

|

|

117

|

|

Item 10.

|

|

117

|

|

Item 11.

|

|

117

|

|

Item 12.

|

|

117

|

|

Item 13.

|

|

117

|

|

Item 14.

|

|

117

|

|

|

|

118

|

|

Item 15.

|

|

118

|

|

Item 16.

|

|

120

|

| |

|

121

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical facts contained in this Annual Report on Form 10-K are forward-looking statements. In some cases,

you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the

negative of these terms or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements include, but are not limited to, statements concerning:

• our ability to obtain additional financing to fund the clinical development and commercialization of our product candidate FemBloc® permanent birth control, if approved for sale, approved products and fund our

operations;

• our ability to pay our convertible notes due November 2025 when due, if not converted into common stock;

• our ability to obtain U.S. Food and Drug Administration (FDA) approval for our product candidate, FemBloc, for permanent birth control;

• our ability to successfully grow sales of FemaSeed® intratubal insemination;

• estimates regarding the total addressable market for our products and product candidate;

• competitive companies and technologies in our industry;

• our business model and strategic plans for our products, product candidate, technologies and business, including our implementation thereof;

• commercial success and market acceptance of our products and product candidate;

• our ability to achieve and maintain adequate levels of coverage or reimbursement for FemBloc or any future product candidates, and our products we seek to commercialize;

• our ability to accurately forecast customer demand for our products and product candidate, and manage our inventory;

• our ability to build, manage and maintain our direct sales and marketing organization, and to market and sell our FemaSeed artificial insemination product, FemBloc permanent birth control system (if approved for

sale), and women-specific medical product solutions in markets in and outside of the United States;

• our ability to establish, maintain, grow or increase sales and revenues;

• our expectations about market trends;

• our ability to continue operating as a going concern;

• our ability to develop and advance our product candidate, FemBloc and successfully initiate and complete clinical trials;

• the ability of our clinical trials to demonstrate safety and effectiveness of our product candidate, FemBloc and other positive results;

• our ability to enroll subjects in the clinical trial for our product candidate, FemBloc in order to advance the development thereof on a timely basis;

• our ability to manufacture our products and product candidate, if approved, in compliance with applicable laws, regulations and requirements and to oversee third-party suppliers, service providers and vendors in the performance of any contracted activities in accordance with applicable laws, regulations and requirements; • our ability to hire and retain our senior management and other highly qualified personnel;

• FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the United States and international markets;

• the timing or likelihood of regulatory filings and approvals or clearances;

• our ability to establish and maintain intellectual property protection for our products and product candidate and our ability to avoid claims of infringement; and

• the volatility of the trading price of our common stock.

The forward-looking statements in this Annual Report on Form 10-K are only predictions and are based largely on our current expectations and projections about future events and financial trends that we believe may

affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K and are subject to a number of known and unknown risks, uncertainties and

assumptions, including those described under the sections in this Annual Report on 10-K entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on

10-K. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as

predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we

operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. You should read this Annual Report on Form 10-K and the

documents that we reference in this Annual Report on Form 10-K and have filed with the U.S. Securities and Exchange Commission (SEC) as exhibits hereto completely and with the understanding that our actual future results may be materially

different from any future results expressed or implied by these forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result

of any new information, future events, changed circumstances or otherwise. The forward-looking statements contained in this Annual Report on 10-K are excluded from the safe harbor protection provided by the Private Securities Litigation Reform

Act of 1995 and Section 27A of the Securities Act of 1933, as amended.

Risk Factor Summary

The following is a summary of the principal risk factors associated with an investment in our common stock.

Risks Related to Our Financial Position and Need for Additional Capital

• We have incurred significant operating losses since inception, and we expect to incur operating losses in the future.

• We need substantial additional funding and may be unable to raise equity capital or debt financing when needed.

• There is substantial doubt about our ability to

continue as a going concern.

• Our financial results may fluctuate significantly.

• Our ability to use our net operating losses and research and development credit carryforwards to offset future taxable income, if any, may be subject to certain limitations.

Risks Related to Discovery and Development

• Enrollment and retention of subjects in clinical trials is an expensive and time-consuming process.

• The FDA may not allow us to continue the ongoing pivotal trial for FemBloc Premarket approval (PMA) due to safety concerns.

• Our current product candidate is in late-stage development.

• We are substantially dependent on the FDA’s permission to market our FemBloc system.

• The clinical development process required to obtain regulatory approvals is lengthy and expensive with uncertain outcomes.

• Interim, “topline,” and preliminary data from our clinical trials that we announce or publish from time to time may change as more data become available.

• Our products may fail to gain increased market acceptance.

• Our FemaSeed artificial insemination solution may fail to gain market acceptance.

• If we are unable to achieve and maintain adequate levels of coverage or reimbursement for our FemBloc permanent birth control solution, our commercial success may be severely hindered.

• Third-party payors and healthcare practitioners who do not cover or use our permanent birth control solution or other women’s healthcare devices may require additional clinical data prior to adopting or maintaining

coverage of our FemBloc system.

• The training required for healthcare practitioners to use our FemBloc permanent birth control solution could reduce the market acceptance of our product candidate.

• Some of our competitors have longer operating histories and more established products or greater resources than we do.

• Our long-term growth depends on our ability to enhance our solutions, expand our indications and develop and commercialize additional products.

• Our results of operations could be materially harmed if we are unable to accurately forecast customer demand and manage our inventory.

• We manufacture and assemble components for our products and product candidate, and a loss or degradation in performance of our manufacturing capabilities could have a material adverse effect on our business.

• We rely on a limited number of third-party suppliers for components for our products and product candidate.

• Performance issues, service interruptions or price increases by our shipping carriers could adversely affect our business.

• We have limited experience marketing and selling our women-specific medical product solutions.

• We plan to rely on our own direct sales force in North America to market our women-specific medical products.

• We plan to rely on distribution partners outside of North America to market our women-specific medical products.

• We face the risk of product liability claims that could be expensive.

• If the quality of our solutions do not meet the expectations of healthcare practitioners or patients, then our brand and reputation or our business could be adversely affected.

Risks Related to Managing Growth and Employee Matters

• We face risks related to health epidemics and outbreaks.

• Failure of a key information technology system, process or site could have an adverse effect on our business.

• Our facilities could become damaged or inoperable.

• Our ability to maintain our competitive position depends on our ability to attract and retain highly qualified talent.

• We will need to grow the size of our organization, and we may experience difficulties in managing this growth.

Risks Related to Government Regulation

• Our products and operations are subject to extensive government regulations.

• We may not receive the necessary regulatory approvals, classifications, or clearances to grow our business.

• Modifications to our product candidate if FDA approved may require us to obtain new PMA approval or approvals of a PMA supplement.

• Failure to comply with post-marketing regulatory requirements could subject us to enforcement actions.

• Our products must be manufactured in accordance with federal and state regulations.

• If treatment guidelines for permanent birth control or other women healthcare treatments change or the standard of care evolves, we may need to redesign and seek new marketing authorization from the FDA for one or

more of our products.

• There may be misuse or off-label use of our products in the marketplace.

• Our products may cause or contribute to adverse medical events or be subject to failures or malfunctions.

• If we do not obtain and maintain international regulatory registrations or approvals for our products, we will be unable to market and sell our products outside of the United States.

• Legislative or regulatory reforms in the United States or the European Union may make it more difficult and costly for us to obtain regulatory clearances or approvals for our products.

• Our business involves the use of hazardous materials.

Risks Related to Intellectual Property Matters

• If we are unable to adequately protect our intellectual property rights, our competitive position could be harmed.

• Obtaining and maintaining patent protection depends on compliance with various governmental requirements.

• Litigation or other proceedings or third-party claims of intellectual property infringement could require us to spend significant time and money.

• We may be unable to enforce our intellectual property rights throughout the world.

• Third parties may assert that our employees or consultants have wrongfully used or disclosed confidential information or misappropriated trade secrets.

• Recent changes in U.S. patent laws could diminish the value of patents in general.

• Patent terms may be inadequate to protect our competitive position on our products.

Risks Related to Our Common Stock

• Our directors, officers and principal stockholders have significant voting power.

• We incur significant costs as a result of being a public company.

• We are obligated to develop and maintain proper and effective internal controls over financial reporting.

• Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud.

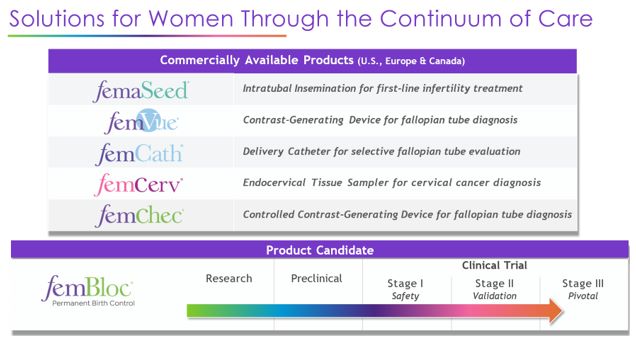

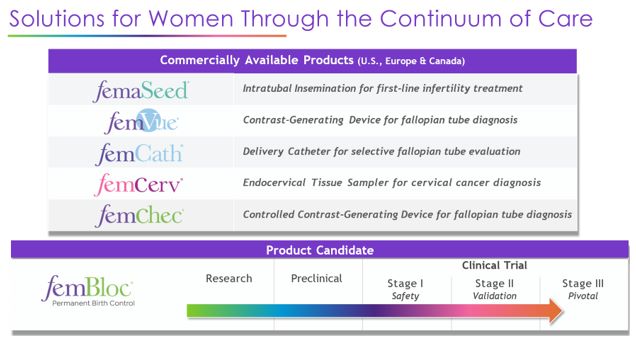

Business Overview

We are a leading biomedical innovator, addressing significant unmet needs in women’s health worldwide, with a broad patent-protected portfolio of

disruptive, accessible, in-office therapeutic and diagnostic products. The Company is a U.S. manufacturer that has received global regulatory approvals for its product portfolio worldwide, which is currently being commercialized in the U.S.

and key international markets. FemaSeed® Intratubal Insemination, a groundbreaking first-line infertility treatment delivering sperm directly to the site of conception, is U.S. FDA-cleared and approved in Europe, United Kingdom

(UK), Canada and Israel. Peer-reviewed publication of positive data from its pivotal clinical trial of FemaSeed demonstrated effectiveness and safety with high satisfaction from both patients and practitioners. FemVue®, a companion

diagnostic for fallopian tube assessment via ultrasound, is U.S. FDA-cleared and approved in Europe, UK, Canada, Japan and Israel. FemCerv®, an endocervical tissue sampler for cervical cancer diagnosis, is U.S. FDA-cleared and approved in

Europe, UK, Canada and Israel. Our product candidate, FemBloc® permanent birth control, is a revolutionary first-of-its-kind non-surgical approach, that involves minimally-invasive placement of a patented delivery system for precise delivery

of our proprietary synthetic tissue adhesive (blended polymer) into both fallopian tubes simultaneously. Over time, the blended polymer fully degrades and produces nonfunctional scar tissue to permanently block the fallopian tubes in the

safest most natural approach. This is in stark contrast to centuries-old surgical sterilization with reported risks that include infection, minor or major bleeding, injury to nearby organs, anesthesia-related events, and even death. Along

with the various surgical risks, some patients may not qualify as good surgical candidates due to obesity or medical comorbidities. The FemBloc non-surgical approach has the potential to offer a safer, more accessible in-office alternative

with fewer risks, contraindications, and substantially lower cost. Peer-reviewed publication of positive data from its initial clinical trials of FemBloc have demonstrated compelling effectiveness and five-year safety with high satisfaction

from both patients and practitioners. In March 2025, we announced Conformité Européene (CE) mark certification under European Union Medical Device Regulation (EU MDR) as the first regulatory approval in the world for the FemBloc delivery

system for non-surgical female permanent birth control. For the FemBloc blended polymer, an integral part of the FemBloc permanent birth control, we have successfully completed an expedited G12 Special MDR Audit for Class III devices and the

Notified Body has recommended for CE mark approval pending the final stages of European Medical Agency (EMA) review, with potential approval expected mid-2025. In March 2025, we announced strategic distribution partnerships for FemBloc in

Spain. The pivotal clinical trial (clinicaltrials.gov: NCT05977751) is now enrolling participants for U.S. approval. FemCath® and FemChec®, companion diagnostic products for FemBloc’s ultrasound-based confirmation test, are U.S. FDA-cleared

and approved in Europe and Canada. The Company is a woman-founded and led company with an expansive, internally created intellectual property portfolio with approximately 200 issued patents globally, in-house chemistry, manufacturing, and

controls (CMC) and device manufacturing capabilities and proven ability to develop products with commercialization efforts underway. Our suite of products and product candidate addresses what we believe are multi-billion dollar global market

segments in which there has been little advancement for many years, helping women avoid pharmaceutical solutions, implants and surgery that can be expensive and expose women to harm.

The following table summarizes our current products and product candidate pipeline:

FemaSeed – Our Artificial Insemination Therapeutic Solution and

FemVue – Our Companion Diagnostic for Tubal Evaluation. FemaSeed, our FDA-cleared innovative advancement in artificial insemination is designed to enhance fertilization by precisely delivering sperm into the fallopian tube, the

natural site of conception. It offers a safe, accessible and cost-effective first-line therapeutic option for infertile women, men and couples seeking pregnancy through insemination. FemaSeed offers a revolutionary alternative to intrauterine

insemination (IUI), enabling healthcare professionals to expand their practice services with a more effective approach as demonstrated in the pivotal trial (NCT0468847) for low male sperm count. It serves as an affordable, less burdensome and

lower-risk first step before IVF. FemaSeed is U.S. FDA-cleared and approved in Europe, UK, Canada and Israel. Our first-line therapeutic infertility solution, FemaSeed Intratubal Insemination (ITI), is complemented by our diagnostic companion

product, FemVue, the first FDA-cleared product that creates natural saline and air contrast for a safe, reliable, real-time evaluation of the fallopian tubes using ultrasound. When combined with a uterine cavity assessment, it provides a

comprehensive exam in the comfort of the gynecologist’s office. Since FemaSeed infertility treatment requires at least one open fallopian tube, FemVue is an essential companion diagnostic. FemVue is U.S. FDA-cleared with approvals in Europe,

UK, Canada, Japan and Israel. FemVue can be used with our FDA-cleared and marketed FemCath device, which allows for selective evaluation of the fallopian tube. We believe FemVue offers significant advantages over other existing approaches,

including being able to provide ultrasound evaluation of a woman’s fallopian tubes as part of an existing diagnostic infertility assessment.

In April 2021 we received an IDE approval from the FDA that allowed us to initiate a pivotal trial for the FemaSeed device. The first subject was enrolled in July 2021. In October 2022, we announced an updated

study design for the pivotal trial to focus on couples experiencing male factor infertility, an underserved patient segment. In April 2023 we received approval to sell FemaSeed in Canada. In September 2023 we announced 510(k) clearance from

the FDA for FemaSeed for ITI. The clinical trial was still ongoing at the time of receiving U.S. regulatory clearance from FDA, however, the study was concluded with enrollment completed in November 2023. Topline results of the clinical trial

were announced in March 2024. In November 2024, we announced a peer-review publication of positive data from its pivotal trial in the Journal of Gynecology & Reproductive Medicine (JGRM), a leading journal covering gynecology and

reproductive medicine. The publication entitled, “FemaSeed Directional Intratubal Artificial Insemination for Couples with Male-Factor or Unexplained Infertility Associated with Low Male Sperm Count,” includes positive data from the

pivotal trial (Clinicaltrials.gov NCT04968847). The trial met its primary endpoint with a pregnancy rate per subject of 26.3% (95%CI: 13.4‒43.1%; n=10/38) and 17.5%

per cycle (95%LCB: 7.6%, 95%CI: 5.7‒29.4%; n=10/57), which was significantly higher than the performance goal of 7% based on the historical control (one-sided P=0.041). Safety reports were consistent with IUI. The vast majority of subjects stated they would probably or definitely recommend FemaSeed, and investigator satisfaction was similarly high.

Targeted intratubal insemination of washed spermatozoa using the FemaSeed ITI device is a safe artificial insemination technique that demonstrated

high effectiveness for couples with male-factor/unexplained infertility associated with low male sperm count. Delivery of washed spermatozoa directly into the utero-tubal ostium and fallopian tube without catheterization likely increases

sperm-oocyte interaction, suggestive of improved efficiency over conventional intrauterine insemination particularly for male-factor infertility. In March 2024, we announced the first commercial use of FemaSeed. In September 2024, we

announced the strategic distribution partnerships for FemaSeed and FemVue in Spain. In October and December 2024 and March 2025, we announced partnerships with prominent infertility center conglomerates, Boston IVF, HRC Fertility and CNY

Fertility, respectively.

FemBloc – Our Permanent Birth Control Solution and FemChec – Our

Companion Diagnostic for Tubal Occlusion Confirmation. FemBloc is our revolutionary first-of-its-kind non-surgical approach, that involves minimally-invasive placement of a patented delivery system for precise delivery of our

proprietary synthetic tissue adhesive (blended polymer) into both fallopian tubes simultaneously. Over time, the blended polymer fully degrades and produces nonfunctional scar tissue to permanently block the fallopian tubes in the safest most

natural approach. This is in stark contrast to centuries-old surgical sterilization with reported risks that include infection, minor or major bleeding, injury to nearby organs, anesthesia-related events, and even death. Along with the

various surgical risks, some patients may not qualify as good surgical candidates due to obesity or medical comorbidities. The FemBloc non-surgical approach has the potential to offer a safer, more accessible in-office alternative with fewer

risks, contraindications, and substantially lower cost. Our non-surgical permanent birth control solution, FemBloc, is complimented by our diagnostic companion product, FemChec, an FDA-cleared product that creates natural saline and air

contrast that is delivered in a controlled manner for a safe, reliable, real-time evaluation of the fallopian tubes using ultrasound for confirmation of procedure success often by the same healthcare practitioner. Since FemBloc requires both

fallopian tubes are blocked for use as permanent birth control, FemChec is an essential companion diagnostic. FemChec is U.S. FDA-cleared with approvals in Europe and Canada. FemChec can be used with our FDA-cleared and marketed FemCath

device, which allows for selective evaluation of each fallopian tube. Blocked fallopian tubes are necessary for successful permanent birth control, and FemChec offers significant advantages over other existing approaches, including use of

existing ultrasound.

In June 2023 we received an IDE approval from the FDA to allow us to initiate the pivotal trial for the FemBloc system followed by a confirmation test with FemChec (Clinicaltrials.gov NCT05977751). The first subject

was enrolled in August 2023. The FINALE [Prospective Multi-Center Trial for FemBloc INtratubal Occlusion for TranscervicAL PErmanent Birth Control] pivotal trial is a prospective, multi-center, open-label, single-arm study design with primary

endpoint of pregnancy rate, which is to be analyzed once 401 women have relied on FemBloc for one year for permanent birth control. In addition, the study is designed as a roll-in beginning with enrollment of 50 women for a clinical readout

primarily of preliminary safety data prior to enrolling the remaining subjects. An interim analysis of clinical data endpoints is planned once 300 women have relied on FemBloc. Subjects are currently being enrolled in the pivotal trial and we

expect to complete the enrollment of the first 50 patients in the second quarter of 2025.

In February 2025, we announced a peer-reviewed publication of positive data from our initial clinical trials of FemBloc permanent birth control in the Journal of Gynecology & Reproductive Medicine (JGRM), a

leading journal covering gynecology and reproductive medicine. The publication entitled, “FemBloc Non-Surgical Permanent Contraception for Occlusion of the Fallopian Tubes” includes positive data from three initial clinical trials

(Clinicaltrials.gov NCT03067272, NCT03433911, and NCT04273594). The pregnancy rate for FemBloc subjects, who met trial eligibility and were determined bilaterally occluded after a confirmation test with FemChec three months post-FemBloc was 0%

(95%UCB: 0.057; n=0/51). This is significantly lower than the performance goal of 6% based on the historical control, surgical sterilization (one-sided p-value=0.0426). Safety reports were consistent with those typically observed for

intrauterine transcervical procedures, with no on-going safety concerns through five years. There were no reports of serious adverse events (n=0/229). The vast majority of subjects stated they would probably or definitely recommend FemBloc, and

investigator satisfaction was similarly high.

In March 2025, we announced CE mark certification under EU MDR as the first regulatory approval in the world for the FemBloc delivery system for

non-surgical female permanent birth control. For the FemBloc blended polymer, an integral part of the FemBloc permanent birth control, we have successfully completed an expedited G12 Special MDR Audit for Class III devices and the Notified

Body has recommended for CE mark approval pending the final stages of EMA review, with potential approval expected mid-2025. If approved, we expect FemBloc to be the first and only non-surgical permanent birth control option, using a

minimally-invasive delivery system that locally instills a degradable blended polymer, which is designed to cause the fallopian tubes to close using the patient’s own nonfunctional scar tissue, resulting in permanent birth control for the

patient without a permanent implant. In March 2025, we announced strategic distribution partnerships for FemBloc in Spain. FemBloc has the potential to offer significant advantages over the only existing option, surgical sterilization (i.e.,

tubal ligation or “having her tubes tied”), including a significant cost savings at likely half the overall cost and a confirmation test to ensure procedure success. FemBloc is a procedure that can be completed in a healthcare practitioner’s

office, with no anesthesia, no incisions or cannulation, no specialty skill set or capital equipment and minimal pain and recovery time, and no residual implant remaining in the patient’s body after the tissue in-growth develops. We believe

there are also significant advantages over other temporary or reversible methods that women may be using in lieu of the surgical tubal ligation option, as FemBloc does not use hormones or leave a long-term implant behind.

Additional Women’s Health Solutions. Our FemCerv product, an endocervical tissue sampler for

cervical cancer diagnosis, is U.S. FDA-cleared and approved in Europe, UK, Canada, and Israel. FemCerv is a tissue sampling device for endocervical curettage that can be used to obtain a comprehensive sample of cervical cells and tissue

circumferentially with sample containment within the device to minimize contamination. We sponsored a post-market study of FemCerv where subjects found the procedure to be relatively pain-free and the sample obtained was complete for analysis,

which we believe may aid in reliable diagnosis. Our FemCerv product was made available to the United States market in September 2022, however, the focus of the commercial efforts remains the infertility line of products.

Our Team

We are a woman-founded, woman-led biomedical company, with a team of experienced biotechnology and medical device developers. Our founder and Chief Executive Officer, Kathy Lee-Sepsick has over 30 years of

entrepreneurial and executive experience in the medical technology field with approximately 200 patents issued globally. Dov Elefant, our Chief Financial Officer, has over 30 years of experience leading public and private biotech companies

throughout various stages of financing. Dr. James Liu, MD, our Chief Medical Officer, has over 40 years of practicing as a reproductive endocrinologist and expertise in medical affairs and clinical strategy development. Daniel Currie, our Chief

Operating Officer, has over 30 years of operational experience in the medical device industry, including assignments at early stage and large, established companies. Christine Thomas, our Chief Regulatory & Clinical Officer, has over 25

years of successful leadership including global regulatory strategy development and clinical operations for established medical device companies. Our experienced leadership team with concentrated development and execution expertise has an

unwavering commitment to advancing women’s health. We have raised over $130 million since inception from both institutional and strategic investors, including Medtronic and executives from leading life science companies and our initial public

offering, or IPO, in June 2021.

Our Intellectual Property and Production Capabilities

We have designed and developed the proprietary methods utilized in our women’s health solutions so that they are protected by patents, know-how, and trade secrets. Each product and product candidate in our portfolio

is covered by both design and utility patents in the U.S. and significant ex-U.S. markets. As of December 31, 2024, we owned 53 issued U.S. patents and 169 issued foreign patents, 18 pending U.S. patent applications and 41 pending foreign

patent applications. These issued patents, and any patents granted from such applications, are expected to expire between 2025 and 2046, without taking potential patent term extensions or adjustments into account.

All of our products are manufactured or assembled at our facility, and manufacturing activities are conducted to ensure compliance with the FDA and other international governing bodies, and good manufacturing

practices with significant CMC and device manufacturing infrastructure in compliance with QSR. We have passed numerous manufacturing audits, including those by the FDA and international notified bodies.

Our Strategy

Our goal is to become a global leader in women’s health providing safe and effective solutions that have the potential to disrupt and grow the market segments for which they address. To achieve this goal and to

contribute to our future success and growth, we are pursuing the following strategies:

Address unmet clinical needs in multiple large markets for women. Our initial focus is on critical areas of unmet need in reproductive health, which is a growing challenge for

women that is not optimally addressed with existing therapies. Two ends of the spectrum (infertility treatment with artificial insemination and contraception with permanent birth control) represent large, growing total addressable market

opportunities. Patients who wish to control their risk of pregnancy are often utilizing temporary or reversible options or are choosing the only permanent option that bears surgical risk and expense. We believe our FemBloc system has the

potential to offer the first non-surgical, non-implant option performed exclusively in the providers’ office without the use of anesthesia, which would potentially allow a doctor to perform multiple procedures in the same room. We estimate that

the U.S. market for the FemBloc system may be over $20 billion with an immediate addressable market of over $3 billion annually. We consider those electing surgery for permanent birth control annually to be our immediately addressable market.

On the other end of the spectrum, patients who are struggling to become pregnant or are seeking assistance to become pregnant (e.g., same sex couples or single women) are often referred to highly specialized healthcare practitioners for

treatment with age-old technology. We believe our FemaSeed product has the potential to offer a first-line approach with local delivery of sperm directly to the fallopian tube where conception occurs. We estimate the immediately addressable

U.S. market for FemaSeed and FemVue, a companion diagnostic product, may be over $1 billion.

Execute on our clinical program to achieve FDA approval to advance our FemBloc system for use together with FemChec, our companion diagnostic device for ultrasound confirmation, as the

preferred option for permanent birth control for women. We have studied FemBloc in three earlier clinical trials each pursuant to an FDA-approved IDE evaluating safety in 228 subjects in total. In February 2025, we announced a

peer-reviewed publication of positive data from its initial clinical trials of FemBloc permanent birth control in the Journal of Gynecology & Reproductive Medicine (JGRM), a leading journal covering gynecology and reproductive medicine. The

publication entitled, “FemBloc Non-Surgical Permanent Contraception for Occlusion of the Fallopian Tubes” includes positive data from three initial clinical trials (Clinicaltrials.gov NCT03067272, NCT03433911, and NCT04273594). The pregnancy

rate for FemBloc subjects, who met trial eligibility and were determined bilaterally occluded after a confirmation test three months post-FemBloc was 0% (95%UCB: 0.057; n=0/51). This is significantly lower than the performance goal of 6% based

on the historical control, surgical sterilization (one-sided p-value=0.0426). Safety reports were consistent with those typically observed for intrauterine transcervical procedures, with no on-going safety concerns through five years. There

were no reports of serious adverse events (n=0/229). The vast majority of subjects stated they would probably or definitely recommend FemBloc, and investigator satisfaction was similarly high.

In June 2023 we received FDA approval of our IDE to evaluate the safety and efficacy of FemBloc, our non-surgical, non-implant, in-office solution for permanent birth control in a pivotal clinical trial. In August 2023, we announced the initiation of enrollment in the FINALE [Prospective Multi-Center Trial for FemBloc INtratubal Occlusion for TranscervicAL PErmanent Birth Control] pivotal trial. This prospective, multi-center, open-label, single-arm study design includes pregnancy rate as the primary endpoint, which will be analyzed once 401 women have used FemBloc for one year for permanent birth control. In addition, the study is designed as a roll-in beginning with enrollment of 50 women for a clinical readout primarily of preliminary safety data prior to enrolling the remaining subjects. An interim analysis of clinical data endpoints is planned once 300 women have used FemBloc for permanent birth control for one year. Follow-up will continue annually for five years post-market. We expect to complete the enrollment of the first 50 patients in the second quarter of 2025 Execute on our commercial strategy to market our FemaSeed product for use together with FemVue, our companion diagnostic, as the first-line option for infertility treatment and build a commercialization infrastructure with a specialized direct sales and marketing team.

In March 2025, we announced CE mark certification under EU MDR as the first regulatory approval in the world for the FemBloc delivery system for

non-surgical female permanent birth control. For the FemBloc blended polymer, an integral part of the FemBloc permanent birth control, we have successfully completed an expedited G12 Special MDR Audit for Class III devices and the Notified

Body has recommended for CE mark approval pending the final stages of EMA review, with potential approval expected mid-2025. In March 2025, we announced strategic distribution partnerships for FemBloc in Spain.

In April 2023 we received approval to sell FemaSeed in Canada. In September 2023, we announced 510(k) clearance from the FDA for FemaSeed for Intratubal Insemination (ITI). We concluded the clinical trial that had been ongoing when we received 510(k) clearance from the FDA, with enrollment completed in November 2023. In March 2024, topline data was announced, followed by the data published in the Journal of Gynecology & Reproductive Medicine (JGRM) in November 2024. The publication titled, “FemaSeed directional intratubal artificial insemination for couples with male-factor or unexplained infertility associated with low male sperm count,” includes positive data from the pivotal trial (Clinicaltrials.gov NCT04968847). The trial met its primary endpoint with a pregnancy rate per subject of 26.3% (95%CI: 13.4‒43.1%; n=10/38) and 17.5% per cycle (95%LCB: 7.6%, 95%CI: 5.7‒29.4%; n=10/57), which was significantly higher than the performance goal of 7% based on the historical control (one-sided P=0.041). Safety reports were consistent with IUI. The vast majority of subjects stated they would probably or definitely recommend FemaSeed, and investigator satisfaction was similarly high. In March 2024, we announced the first commercial use of FemaSeed. In September 2024, we announced the strategic distribution partnerships for FemaSeed and FemVue in Spain. In October and December 2024 and March 2025, we announced partnerships with prominent infertility center conglomerates, Boston IVF, HRC Fertility, and CNY Fertility, respectively. FemVue is U.S. FDA-cleared with approvals in Europe, UK, Canada, Japan and Israel. In March 2024, we announced the first commercial use of FemaSeed. In September 2024, we announced the strategic distribution partnerships for FemaSeed and FemVue in Spain. In October and December 2024 and March 2025, we announced partnerships with prominent infertility center conglomerates, Boston IVF, HRC Fertility, and CNY Fertility, respectively.

Continuously innovate to introduce additional product offerings for women. We intend to continue to invest in research and development activities focused on improvements and

enhancements to our FemaSeed and FemBloc system and other existing products, and additional women-specific medical products. We have designed and developed proprietary methods utilized in our women’s health solutions and have protected these

internally conceived advancements by patents, know-how, and trade secrets. Our team has demonstrated the ability to achieve marketing authorizations and clearances in the U.S., Europe, Canada, Japan, UK and Israel, and to manufacture in

accordance with FDA and other international governing bodies. Availability of the additional product offerings will expand our suite of solutions for reproductive health and women’s health in general over time with the goal of addressing

aspects of care that have had negligible advancement over decades to create improved patient care and improved healthcare practitioner treatment options.

Penetrate the addressable markets by promoting patient and practice awareness. It is estimated in the U.S. alone over 10 million women

(https://www.cdc.gov/nchs/nsfg/key_statistics/i-keystat.htm) are infertile and approximately 40-50% of all infertility is attributed to male factor (Kumar et al, 2015) likely due to the over 50% decline in male sperm count worldwide (Levine et

al, 2023). Only a little over half of women proceed with some form of intervention and only a very small proportion undergo more advanced technologies. We believe the major factor that influences this light penetration of the market is the cost

and burden of the existing technologies despite the familiarity of intrauterine insemination and in-vitro fertilization (IVF) as options. We intend to increase healthcare practitioner awareness through engagement and continued publication of

scientific data in peer reviewed journals. Additionally, we intend to engage women and couples suffering from infertility or who wish to undergo insemination for pregnancy through direct patient outreach. On the other end of the spectrum, it is

estimated in the U.S. alone, approximately 1.2 million women elect surgical tubal ligation (Martinez, 2024) and 500,000 men elect vasectomy (Ostrowski, et al, 2018) annually for permanent birth control. There are another 12 million women who

utilize a non-permanent birth control option (Daniels, et al., 2020), many of whom we believe may prefer a permanent option if it were non-surgical. We believe the major factor that influences this light penetration of the market is the

limitations of the existing technology despite the likely familiarity of surgical tubal ligation as an option. Like our infertility portfolio, we plan to increase healthcare practitioner awareness prior to direct patient outreach.

From the outset, we spent significant time understanding the unmet needs of patients and healthcare practitioners through patient and healthcare practitioner surveys and early engagement of healthcare practitioners

and key opinion leaders to properly position our solutions. We have established an initial commercial infrastructure following the clearance of our FemaSeed product. Our already commercially available FemVue device is being marketed along with

the FemaSeed product to the same target healthcare practitioner: the reproductive endocrinologist. We intend to focus the significant majority of our sales and marketing efforts in North America since we believe that initially nearly 90% of the

potential annual global FemaSeed/FemVue sales would be generated in this market. Our priority in the U.S. is to target existing FemVue customers followed by reproductive endocrinologists in high volume areas. We have hired a specialty sales

force of 10 sales representatives for our infertility products and plan to increase the sales force as necessary for the FemBloc system, to the target healthcare practitioner: the gynecologist. Our already commercially available FemCerv device

will be marketed along with the FemBloc product to the same target healthcare practitioner: the gynecologist. In addition, we plan to continue to expand our in-house manufacturing capabilities as we scale to meet the demand and introduce new

products while evaluating potential suppliers to assess the viability of outsourcing portions of our manufacturing and assembly processes to ensure significant growth, profitability and operating leverage.

Expand gynecologists’ practice capabilities by diversifying products and services to include artificial insemination with FemaSeed. There are a limited number of gynecological

practices performing infertility services and treatment today, but we believe this has the potential to grow over time, in particular with the introduction of FemaSeed. FemaSeed is designed to be an in-office infertility procedure that can be

done by a gynecologist or advanced practice provider (i.e., nurse, physician assistant) as applicable using his or her existing skillset, expanding the number of gynecological practices that can offer effective fertility services to their

patients without needing to refer them to an infertility specialist. We plan to use our gynecologic sales force for FemBloc, if approved, to introduce those healthcare practitioners to FemaSeed and broaden our sales force reach for our

infertility treatment and other companion products, such as FemVue, beyond our initial focus on reproductive endocrinologists.

The Current Market Landscape

For permanent birth control, tubal ligation, an invasive surgical procedure requiring implants, incisions, hospitalization and general anesthesia, has been offered for decades, so risks are known. It is performed

either immediately after cesarean delivery or via laparoscopic procedures, which has notable disadvantages and risk of complications. The most significant morbidity arising from surgical tubal ligation is associated with the use of electrical

energy and inadvertent thermal damage to the bowel. Introduction of surgical instruments into the abdominal cavity carries substantial risk of injury to intra-abdominal organs and blood vessels, with approximately 1% of all procedures resulting

in unintended further major surgery. In addition, anesthesia risk, bleeding, bowel damage, and long recovery times are inherent complication risks of surgical tubal ligation. Temporary and reversible contraceptive methods, such as birth control

and intrauterine devices (IUDs), are being used by women long-term as a compromise by women who are unwilling to undergo a surgical sterilization procedure because of the surgical risks, not wanting an incision, or to be exposed to risk of

anesthesia. Some may be contraindicated for surgical sterilization because of obesity or medical conditions. Long-term use of hormonal birth control, including IUDs, have drawbacks as well. Hormonal birth control is associated with health

risks, such as an increased risk of breast cancer and blood clots, and device-based birth control can result in uterine perforation and increased risks of pelvic inflammatory disease and ectopic pregnancy. Previously available non-surgical

methods utilizing permanent implants for closing the fallopian tubes have been removed from the market due to safety or intellectual property infringement issues, and thus the only currently available permanent birth control option is surgical

tubal ligation. For artificial insemination, traditional intrauterine insemination is an undirected procedure delivering sperm into the uterine cavity that has been offered for decades. IUI continues to be offered as a first-line treatment

option in spite of its low success rate due to its low cost and ease, with a short learning curve and minimal equipment requirements. Although current IUI devices address the unfavorable environment sperm would encounter in the vagina and

cervix by placing sperm into the uterine cavity, the biology of sperm transport is complex and of the millions of sperm inseminated in the uterus, almost all fail to reach the fallopian tubes. In contrast to the unfavorable environment of the

uterus, the fallopian tubes act as a reservoir for traveling sperm and is the location of conception. Sperm count is declining at an accelerated pace globally by greater than 50% with an increasing proportion of men having sperm counts below

any given threshold for sub-fertility or infertility. This substantial and persistent decline is now recognized as a significant public health concern. (Levine et al, 2023). In vitro fertilization (IVF) or intracytoplasmic sperm injection

(ICSI) are highly effective treatments with reported pregnancy rates of approximately 25% for male factor infertility, however, these approaches are associated with significant cost and clinical risks (Ravitsky et al, 2019). Many infertile

women and couples are unwilling to undergo treatment mostly due to financial reasons. IVF is extremely expensive, costing as much as $15,000 to $30,000 per IVF cycle according to Forbes Health, 2021 (with cycle effectiveness usually only around

25%), and often not covered by insurance. Genetic testing of the eggs or embryo, also known as preimplantation genetic testing (PGT), are often optional costs up to $10,000 or more if disorders are tested. IVF/ICSI is also physically and

emotionally demanding for the patient, with an increased risk of ectopic pregnancy and miscarriage. The American Society for Reproductive Medicine provided guidance (committee opinion, 2021) promoting singleton gestation to reduce the risk of

multiple pregnancies. There are over ten million women in the United States known to be infertile and only approximately 200,000 IVF cycles completed per year, indicating that IVF is not a realistic solution available to most women or couples.

Our FemaSeed product establishes a new category within artificial insemination: a localized, directional delivery of sperm directly into the fallopian tube (intratubal insemination), precisely where conception occurs. We believe this in-office,

cost-effective solution can become a first-line treatment for infertility, specifically when male factor is involved, increasing access to infertility treatment for women, couples and the LGBTQ community.

The Reproductive Health Opportunity

There are an estimated 78 million reproductive aged women in the United States alone (World Health Organization, 2025). We intend to offer

comprehensive solutions for preventing pregnancy and achieving pregnancy for women, providing cost-effective and safe solutions while avoiding surgery. During their childbearing years, most women will want to control their risk of pregnancy.

Additionally, there are many women who wish to become pregnant that are unable to do so. According to a Centers for Disease Control and Prevention (CDC) report, the ability to plan when to be pregnant and how many pregnancies to initiate has

been called one of the ten great public health achievements in the twentieth century. Many women, who spend an average of three years seeking to become pregnant and thirty years avoiding pregnancy, are not satisfied with the current methods

for preventing unwanted pregnancies and achieving pregnancy (Gutttmacher Institute, 2019).

Approximately 1.2 million women undergo surgical tubal ligation each year in the United States alone (Martinez, 2024), with an average cost of approximately $6,000 per procedure (Planned Parenthood, 2019). However,

there are over an estimated 12 million women who remain on a non-permanent birth control option long-term (National Center for Health Statistics, 2015), which we believe is due to there being only a surgical permanent contraceptive option

available to women. In addition, 500,000 men undergo a vasectomy procedure every year (Ostrowski et al, 2018). While the 1.7 million women and their partners annually who want to permanently prevent pregnancy represent our initial near-term

market opportunity, we believe these numbers do not reflect the true demand for permanent birth control, as many do not want to submit to invasive surgical procedures such as vasectomies and tubal ligations. The market for female permanent

birth control is large and growing, and we believe the market opportunity in the U.S. alone could expand to exceed $20 billion with a safe and effective in-office option as women shift from temporary or reversible contraceptive alternatives to

more permanent solutions.

The overall decline in birth rates in the United States and globally has resulted in aging populations that present serious challenges for the global economy and economic stability. In the United States alone, it is

estimated by the Centers for Disease Control and Prevention that over ten million women desire pregnancy but are unable to achieve pregnancy (National Survey of Family Growth, 2019). Only a little over half of these women proceed with some form

of intervention, and only a very small proportion undergo more advanced assisted reproductive technologies such as IVF. Approximately 40-50% of infertility cases are due to a male factor (Kumar et al, 2015), which may be the result of the

greater than 50% decline worldwide in male sperm count (Levine et al, 2023). Although IUI, an artificial insemination option, is the oldest technique in reproductive medicine and a well-accepted first-line treatment method for couples with

unexplained infertility, mild male factor infertility, sexual dysfunction, and cervical factor infertility, its success rates remain relatively low. However, for couples with low total motile sperm count, treatment with highly effective IVF/

ICSI is advised given the comparatively reduced success rates for IUI. Alternative methods to IUI have not been advanced to meet the continuous demand for safe and effective first-line alternatives that are considerably less costly and less

invasive than more advanced assisted reproductive options. The market for assisted reproduction is large and growing, and we believe the market in the United States alone could exceed $2 billion with a safe and effective novel first-line

approach as women move to seek care for the treatment of infertility.

Clinical Development

Overview of Clinical Programs. We are developing a growing body of compelling clinical evidence for our intrauterine directional delivery product candidates.

Our Permanent Birth Control Solution – FemBloc and ultrasound confirmation with FemChec

Clinical Trials

Prior to the trials pursuant to the IDE discussed below, we conducted a number of clinical trials in 93 patients to evaluate various aspects of the development program. With respect to blended polymer effectiveness,

we conducted a clinical trial on ten patients pending a planned hysterectomy procedure, which is not an indicated population for FemBloc. Patients received the FemBloc treatment with the blended polymer through the delivery system and returned

4 weeks post-treatment to receive a complete hysterectomy with subsequent histopathology analysis of the fallopian tubes for indications of progression towards tubal occlusion and associated tissue reactions of the blended polymer. Although it

is expected that three months is required to effect complete tubal occlusion and for the confirmation of effectiveness and reliability as permanent birth control, at 4 weeks, 30% of the fallopian tubes had either complete luminal occlusion

where the lumen was obstructed by a healing tissue response or there was narrowing of the fallopian tube by 50-90% by a similar healing tissue response. As expected, blended polymer remained in many of the fallopian tubes and the inflammatory

response observed appeared to generally correlate with the presence of foreign material. There were no serious adverse events reported.

In February 2025, we announced a peer-reviewed publication of positive data from its initial clinical trials of FemBloc permanent birth control in the Journal of Gynecology & Reproductive Medicine (JGRM), a

leading journal covering gynecology and reproductive medicine. The publication entitled, “FemBloc Non-Surgical Permanent Contraception for Occlusion of the Fallopian Tubes” includes positive data from three initial clinical trials

(Clinicaltrials.gov NCT03067272, NCT03433911, and NCT04273594). The pregnancy rate for FemBloc subjects, who met trial eligibility and were determined bilaterally occluded after a confirmation test three months post-FemBloc was 0% (95%UCB:

0.057; n=0/51). This is significantly lower than the performance goal of 6% based on the historical control, surgical sterilization (one-sided p-value=0.0426). Safety reports were consistent with those typically observed for intrauterine

transcervical procedures, with no on-going safety concerns through five years. There were no reports of serious adverse events (n=0/229). The vast majority of subjects stated they would probably or definitely recommend FemBloc, and investigator

satisfaction was similarly high.

In March 2025, we announced CE mark certification under EU MDR as the first regulatory approval in the world for the FemBloc delivery system for

non-surgical female permanent birth control. For the FemBloc blended polymer, an integral part of the FemBloc permanent birth control, we have successfully completed an expedited G12 Special MDR Audit for Class III devices and the Notified

Body has recommended for CE mark approval pending the final stages of EMA review, with potential approval expected mid-2025. In March 2025, we announced strategic distribution partnerships for FemBloc in Spain.

In June 2023 we received FDA approval of our IDE to evaluate the safety and efficacy of FemBloc, our non-surgical, non-implant, in-office solution

for permanent birth control in a pivotal clinical trial. In August 2023, we announced the initiation of enrollment in the FINALE [Prospective Multi-Center Trial for FemBloc INtratubal Occlusion for TranscervicAL PErmanent Birth Control]

pivotal trial. This prospective, multi-center, open-label, single-arm study design includes pregnancy rate as the primary endpoint, which will be analyzed once 401 women have used FemBloc for one year for permanent birth control. In addition,

the study is designed as a roll-in beginning with enrollment of 50 women for a clinical readout primarily of preliminary safety data prior to enrolling the remaining subjects. An interim analysis of clinical data endpoints is planned once 300

women have used FemBloc for permanent birth control for one year. Follow-up will continue annually for five years post-market. Subjects are currently being enrolled in the pivotal trial and we expect to complete the enrollment of the first 50

patients in the second quarter of 2025.

Products

Our Artificial Insemination Solution.

510(k) Clearance for FemaSeed Intratubal Insemination Device

FemaSeed, our FDA-cleared innovative advancement in artificial insemination, is designed to enhance fertilization by precisely delivering sperm into the fallopian tube, the natural site of conception. It offers a

safe, accessible and cost-effective first-line therapeutic option for infertile women, men and couples seeking pregnancy through insemination. FemaSeed offers a revolutionary alternative to IUI, enabling healthcare professionals to expand their

practice services with a more effective approach as demonstrated in the pivotal trial (NCT0468847) for low male sperm count. It serves as an affordable, less burdensome and lower-risk first step before IVF. FemaSeed is U.S. FDA-cleared and

approved in Europe, UK, Canada and Israel.

We have studied FemaSeed pursuant to an FDA-approved IDE received in April 2021 to evaluate safety and efficacy in the LOCAL [Prospective

Multi-Center LOCALized Directional Insemination Trial for Artificial Insemination] pivotal trial. In October 2022, we announced an updated study

design for the pivotal trial, which focused on couples experiencing male factor infertility. The clinical trial was still ongoing at the time of receiving U.S. regulatory clearance from FDA, however, the study concluded with enrollment

completed in November 2023. Topline results of the clinical trial were announced in March 2024. The data was published in the Journal of Gynecology & Reproductive Medicine (JGRM) in November 2024. The publication titled, “FemaSeed

directional intratubal artificial insemination for couples with male-factor or unexplained infertility associated with low male sperm count,” includes positive data from the pivotal trial (Clinicaltrials.gov NCT04968847). The trial met its primary endpoint with a pregnancy rate per subject of 26.3% (95%CI: 13.4‒43.1%; n=10/38) and 17.5% per cycle (95%LCB: 7.6%, 95%CI:

5.7‒29.4%; n=10/57), which was significantly higher than the performance goal of 7% based on the historical control (one-sided P=0.041). Safety

reports were consistent with IUI. The vast majority of subjects stated they would probably or definitely recommend FemaSeed, and investigator satisfaction was similarly high. Targeted intratubal insemination of washed spermatozoa using the

FemaSeed ITI device is a safe artificial insemination technique that demonstrated high effectiveness for couples with male-factor/unexplained infertility associated with low male sperm count. Delivery of washed spermatozoa directly into the

utero-tubal ostium and fallopian tube without catheterization likely increases sperm-oocyte interaction, suggestive of improved efficiency over conventional intrauterine insemination particularly for male-factor infertility. In March 2024,

we announced the first commercial use of FemaSeed. In September 2024, we announced the strategic distribution partnerships for FemaSeed and FemVue in Spain. In October and December 2024 and March 2025, we announced partnerships with

prominent infertility center conglomerates, Boston IVF, HRC Fertility and CNY Fertility, respectively.

510(k) Clearance for Intrauterine Device for Selective Tubal Evaluation

FemCath Cornual Balloon Catheter, an innovative advancement in selective tubal evaluation, designed similar to FemaSeed but for a different indication, is authorized for marketing in the U.S., Europe and Canada. A

post-market study in 23 subjects (45 tubes) was conducted with the product and FemVue Saline-Air device to assess fallopian tubes selectively by infusion of saline-air contrast. 89% had contrast observed entering the proximal portion of the

fallopian tube combined with sustained flow or exit into the peritoneal cavity. This is the same intended location of delivery for the FemaSeed product. There were no serious adverse events reported. We began limited market release of the

FemCath product in December 2022 and it is being utilized in the pivotal trial for FemBloc, as part of the confirmation test with FemChec.

Post-Market Information

FemVue Saline - Air device, a contrast-generating product, is authorized for marketing in the United States, Europe, UK, Canada, Japan and Israel. There have been multiple publications and abstracts presented with

clinical evidence in support of FemVue, a diagnostic companion product to our artificial insemination solution. It has been concluded that tubal patency assessment with FemVue is comparable to fluoroscopic hysterosalpingogram (HSG), and it

appears to be a convenient and well-tolerable method that may be performed alongside conventional ultrasound and uterine cavity assessment as part of an infertility evaluation. Other publications have stated that FemVue is an accurate test for

diagnosing tubal occlusion, performs similarly to a fluoroscopic HSG and could potentially replace fluoroscopic HSG.

Our Endocervical Tissue Sampler.

Post-Market Information

FemCerv, a next generation endocervical tissue sampler for cervical cancer diagnosis, is U.S. FDA-cleared with approvals in Europe, UK, Canada and Israel. We sponsored a post-market study for FemCerv in 112 patients

undergoing further evaluation of an abnormal cervical tissue result. It was observed that FemCerv provided samples were reported as adequate when evaluated histologically in 94% of the patients. Healthcare practitioners reported that 95% of the

patients experienced mild or no discomfort during the FemCerv procedure and 92% of the healthcare practitioners reported the FemCerv device as easy to insert. There were no adverse events reported. We began limited market release in the U.S. in

September 2022, however, the commercial efforts are currently focused on the infertility portfolio.

Manufacturing

We have developed and implemented the infrastructure required to manufacture and distribute finished medical devices, including a robust medical

device quality management system, which meets the requirements of the FDA Quality System Regulation, and is certified to Medical Device Single Audit Program (MDSAP) and International Organization for Standardization (ISO) 13485:2016. We

currently manufacture or assemble all products and product candidate and source components from contract suppliers. We believe that we currently have sufficient capacity to meet clinical program demands, product supply and launch requirements

for the FemaSeed product and believe that we will be able to scale up our capacity relatively quickly with modest capital investment. We believe our manufacturing capacity is sufficient to meet global market demand for our products for the

foreseeable future until potential approval by the FDA for the FemBloc system. While we plan to continue manufacturing our product and product candidate, if approved or granted marketing authorization, we will consider outsourcing

arrangements for certain sub-assemblies as needed as we scale our commercial production.

We employ a rigorous supplier assessment, qualification, and selection process targeted to suppliers that meet the requirements of the FDA and the

ISO and quality standards supported by internal policies and procedures. Our quality assurance process monitors and maintains supplier performance through qualification and periodic supplier reviews and audits. We are required to maintain ISO

13485 certification for medical devices sold in the European Economic Area (EEA) which requires, among other items, an implemented quality system that applies to component quality, supplier control, product design and manufacturing

operations. In June 2024, we announced that we received the European Union Medical Device Regulation (EU MDR) certificate, demonstrating Femasys’ compliance with the highest required regulatory standards.

We inspect, test, and assemble our products under strict manufacturing processes supported by internal policies and procedures with significant CMC and device manufacturing infrastructure. We perform our own final

quality control testing of each product and product candidate, and we have complete control over all aspects of the manufacturing process and are compliant with QSR good manufacturing practice regulations applicable to our products.

Our suppliers are managed through our supplier management program that is focused on reducing supply chain risk. Key aspects of this program include managing component inventory at the supplier and second sourcing

approaches for specific suppliers. Typically, our outside vendors produce components to our specifications and in many instances to our designs. Our suppliers are audited periodically by our quality department to ensure conformity with the

specifications, policies and procedures for our products. In addition, we and our suppliers are subject to periodic unannounced inspections by U.S. and international regulatory authorities to ensure compliance with quality regulations. We

believe that, if necessary, alternative sources of supply would be available in a relatively short period of time and on commercially reasonable terms.

We do not have long-term supply agreements and we purchase certain components for our products on a purchase order basis. We do not currently have arrangements in place for redundant supply of certain components of

our products. If our current third-party suppliers cannot perform as agreed, we may be required to replace those suppliers. Although we believe that there are several potential alternative suppliers who could provide these components, we may

incur added costs and delays in identifying and qualifying any such replacement.

Finally, for our products and product candidate, we utilize third-party sterilizers to ensure these single-use products are packaged and shipped

sterile for use. If our current contract sterilizer(s) cannot continue to perform as agreed, we may be required to identify and contract with another third-party contract sterilizer which may incur added costs and delays in identifying and

qualifying any such replacement.

Competition

The markets in which we compete are highly competitive and in limited areas are characterized by rapid and significant technological change. To

compete successfully, we need to continue to demonstrate the advantages of our products and product candidate compared to both well-established and new alternative procedures, products and technologies, and convince healthcare practitioners

and other healthcare decision makers of the advantages of our products and technologies.

With respect to our permanent birth control solution, we expect to compete with surgical tubal ligation, vasectomies for women’s partners, other methods of non-permanent birth control, including devices such as IUDs,

prescription drugs such as the birth control pill and injectable and implantable contraceptives and patches, and other contraceptive and birth control methods. There is no directly competing non-surgical, non-implant permanent birth control

product currently on the market, or, to our knowledge, in development.

With respect to our artificial insemination solution, we expect to compete with IUI, IVF/ ICSI and fertility-enhancing pharmaceuticals currently in the market and those in clinical and preclinical development. While

there is no direct competitor in our segment of the product category of artificial insemination, there are alternatives, such as IUI and IVF/ ICSI. Leading companies that produce IUI devices include Cook Medical LLC, a subsidiary of Cook Group,

Inc., Cooper Surgical, Inc., MedGyn Products, Inc. and Rocket Medical LLC.

With respect to our tissue sampling product, there are other procedures used in women’s health to evaluate the cervical canal, such as the Pap test, HPV test and colposcopy, which are well established and pervasive.

Companies such as Dysis Medical and Guided Therapeutics are also developing cervical tissue sampling product candidates.

Many of our competitors have access to greater resources required to develop and market a competitive product than we do. In addition, new

competition and products may arise due to consolidation within the industry and other companies may develop products that could compete with our products or product candidate, and there may be product candidates in early stages of development

of which we are not aware.

Sales & Marketing

FemaSeed – Our Artificial Intratubal Insemination Solution.

With the 510(k) clearance from the FDA and regulatory approval from Europe, UK, Canada and Israel for FemaSeed, we have recruited a direct sales force comprising approximately 10 sales representatives with strong

sales backgrounds and experience in medical device sales, and with possible existing relationships with reproductive endocrinologists and gynecologists for commercialization in the U.S. We intend to focus the significant majority of our direct

sales and marketing efforts in North America and continue to utilize distribution partners for international markets to generate revenue for FemaSeed and our companion product FemVue that has received regulatory FDA-clearance and approval in

Europe, UK, Canada, Japan and Israel. We have begun to target the approximately 1,700 reproductive endocrinologists at 450 practices, who are trained and have experience performing infertility procedures. Over 50% of the practices representing

approximately 60% of the assisted reproduction cycles performed are located in 8 states, which will be prioritized, along with the existing FemVue customers.

We plan to engage in awareness raising activities, highlighting the benefits of our FemaSeed product in jurisdictions where we are approved to market. We also intend to promote broader awareness of the FemaSeed

product as a first-line therapeutic option for infertility and those seeking artificial intratubal insemination for pregnancy among healthcare practitioners followed by patients.

FemBloc – Our Permanent Birth Control Solution.

In March 2025, we announced CE mark certification under EU MDR as the first regulatory approval in the world for the FemBloc delivery system for

non-surgical female permanent birth control. For the FemBloc blended polymer, an integral part of the FemBloc permanent birth control, we have successfully completed an expedited G12 Special MDR Audit for Class III devices and the Notified

Body has recommended for CE mark approval pending the final stages of EMA review, with potential approval expected mid-2025. In March 2025, we announced strategic distribution partnerships for FemBloc in Spain.

We initially plan to expand our sales force for FemaSeed to introduce FemBloc, if approved, to those gynecologists performing infertility treatment with FemaSeed, a secondary target beyond our initial focus on

reproductive endocrinologists. If approved, we expect to recruit, hire and train additional sales representatives for our direct sales force in the United States for FemBloc. We will seek to recruit representatives with strong sales backgrounds

and experience in medical device sales, and preferably with relationships with gynecologists. We intend to focus the significant majority of our sales and marketing efforts in North America and continue to utilize distribution partners for

international markets. Through our specialized and dedicated direct sales organization, we plan to target the approximately 40,000 gynecologists who are trained and have experience performing gynecologic procedures and offering family planning.

Over 60% of the practices representing over 60% of reproductive-aged women are located in 13 states, which will be prioritized.

Based on our clinical experience to date, we believe that healthcare practitioners experienced in intrauterine procedures, such as IUD placement, will require minimal training to start utilizing our FemBloc system as

is the case for our FemaSeed product. Additional sonographic training will be required for the healthcare practitioners or sonographers who will support the ultrasound confirmation test. Based on our clinical experience to date, we believe the

healthcare practitioners and sonographers will require minimal training and it can be accomplished largely online. Those with FemVue experience will require minimal training for the confirmation test. We expect to begin building our sales

organization prior to potential FDA approval of the product candidate in the U.S.

We plan to engage in awareness raising activities, highlighting the benefits of our FemBloc system in jurisdictions where we are approved to market. We also intend to promote broader awareness of the FemBloc system as

the first non-surgical, non-implant option for permanent birth control among patients and healthcare practitioners.

Reimbursement

In the United States, we anticipate deriving the majority of our revenue from the sale of products in our infertility portfolio, including the

FemaSeed and FemVue products, to fertility practices. These fertility practices typically bill the patient directly. Sometimes, for patients that have the appropriate insurance coverage, the fertility practices will bill the third-party payors

– such as private insurance companies and health maintenance organizations – first. However, reimbursement for fertility products, such as FemaSeed and FemVue product, are most often billed directly to the patient from the provider.

When third-party payors are engaged in the United States, they often require healthcare practitioners and hospitals to identify the product and/or

service for which they are seeking reimbursement for by using Current Procedural Terminology (CPT) codes, a five-digit alphanumeric code used to facilitate accurate

reporting and billing. CPT codes are created and maintained by the American Medical Association (“AMA”). As such, long-standing and well-established procedures, such as intrauterine insemination, are ingrained in the medical community and have

well-known CPTs, allowing for those procedures to be swiftly approved by third-party payors. Newer procedures however, such as FemaSeed, do not currently have CPT codes. While these procedures can still be covered by private health insurance,

it simply makes the reimbursement process more time-consuming for the patient than if the procedure had a CPT code. Outside of the United States, reimbursement processes vary significantly by country and region. For countries and/or regions

that adhere to a single-payor system, direct patient payment is most common because the annual healthcare budget limits the number of fertility treatments covered by third-party payors. As clear from the foregoing, reimbursement can be obtained

from a variety of sources, including government-sponsored insurance plans, private health insurance plans, or a combination of both.

In the United States, we expect to derive revenue from the sale of our FemBloc system, if approved, from gynecology offices, which typically bill

various third-party payors, including Medicare, Medicaid, private insurance companies, health maintenance organizations and other healthcare-related organizations. In addition, we expect that any portion of the costs and fees associated with