| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Ordinary shares, nominal value $0.025 per share |

GHRS

|

The Nasdaq

Stock Market LLC

|

|

Title of Class

|

Number of Shares Outstanding

|

|

Ordinary shares

|

52,028,145

|

| Large Accelerated Filer ☐ | Accelerated Filer ☒ | Non-accelerated Filer ☐ |

|

|

|

Emerging Growth Company ☒ |

|

|

☐ |

U.S. GAAP

|

|

|

☒ |

International Financial Reporting Standards as issued by the International Accounting Standards Board

|

|

|

☐ |

Other

|

|

iii

|

||

|

iii

|

||

|

vi

|

||

|

1

|

||

|

ITEM 1.

|

1

|

|

|

A.

|

1

|

|

|

B.

|

1

|

|

|

C.

|

1

|

|

|

ITEM 2.

|

1

|

|

|

A.

|

1

|

|

|

B.

|

1

|

|

|

ITEM 3.

|

1

|

|

|

A.

|

1

|

|

|

B.

|

1

|

|

|

C.

|

1

|

|

|

D.

|

1

|

|

|

ITEM 4.

|

84

|

|

|

ITEM 4A.

|

128

|

|

|

ITEM 5.

|

128

|

|

|

A.

|

128

|

|

|

B.

|

135

|

|

|

C.

|

138

|

|

|

D.

|

138

|

|

|

E.

|

138

|

|

|

ITEM 6.

|

138

|

|

|

A.

|

138

|

|

|

B.

|

140

|

|

|

C.

|

142

|

|

|

D.

|

144

|

|

|

E.

|

144

|

|

|

F.

|

144 | |

|

ITEM 7.

|

144 | |

|

A.

|

144 | |

|

B.

|

146

|

|

|

C.

|

146

|

|

|

ITEM 8.

|

146

|

|

|

A.

|

146

|

|

|

B.

|

147

|

|

|

ITEM 9.

|

147

|

|

|

A.

|

147

|

|

|

B.

|

147

|

|

|

C.

|

147

|

|

|

D.

|

147

|

|

|

E.

|

148

|

|

|

F.

|

148

|

|

|

ITEM 10.

|

148

|

|

|

A.

|

148

|

|

|

B.

|

148

|

|

|

C.

|

148

|

|

|

D.

|

148

|

|

|

E.

|

149

|

|

|

F.

|

156

|

|

|

G.

|

156

|

|

|

H.

|

156

|

|

|

I.

|

157

|

|

|

J.

|

157

|

|

|

ITEM 11.

|

157

|

|

|

ITEM 12.

|

158

|

|

|

A.

|

158

|

|

|

B.

|

158

|

|

|

C.

|

158

|

|

|

D.

|

158

|

|

|

158

|

||

|

ITEM 13.

|

158

|

|

|

ITEM 14.

|

158

|

|

|

ITEM 15.

|

159

|

|

|

A.

|

159

|

|

|

B.

|

159

|

|

|

C.

|

159

|

|

|

D.

|

159

|

|

|

ITEM 16.

|

160

|

|

|

A.

|

160

|

|

|

B.

|

160

|

|

|

C.

|

160

|

|

|

D.

|

161

|

|

|

E.

|

161

|

|

|

F.

|

161

|

|

|

G.

|

161

|

|

|

H.

|

162

|

|

|

I.

|

162

|

|

|

J.

|

162

|

|

|

K.

|

162

|

|

|

163

|

||

|

ITEM 17.

|

163

|

|

|

ITEM 18.

|

163

|

|

|

ITEM 19.

|

163

|

|

|

165

|

||

|

F-1

|

||

|

|

• |

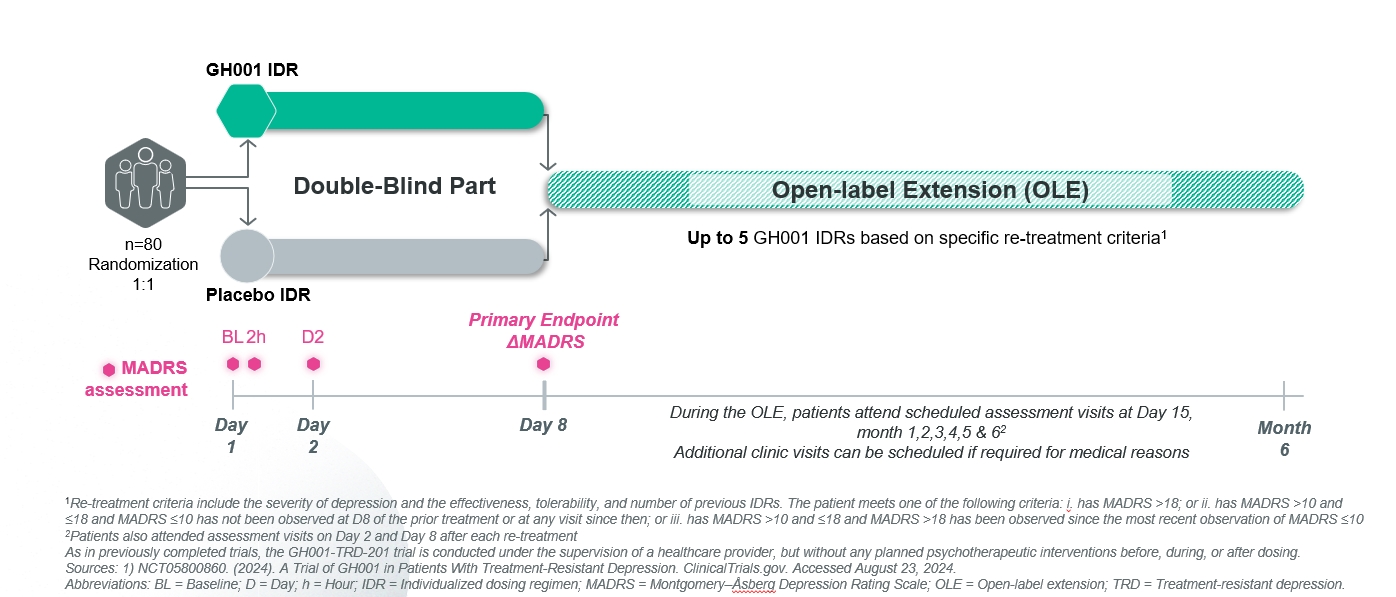

the commencement, timing, progress and results of our research and development programs, nonclinical studies and clinical trials, including the ongoing open label extension phase of our Phase 2b trial with GH001 in TRD;

|

|

|

• |

the timing, progress and results of developing and conducting clinical trials for our GH001 and GH002 product candidates and the medical devices required to deliver these product candidates, such as our proprietary aerosol delivery

device for GH001, for our initial and any additional indications;

|

|

|

• |

our efforts to expand into other jurisdictions such as the United States and in the European Union, or EU;

|

|

|

• |

our expectations related to the technical development and expansion of our external manufacturing capabilities for our GH001 and GH002 product candidates as well as the medical devices required to deliver these product candidates, such

as our proprietary aerosol delivery device for GH001;

|

|

|

• |

our reliance on the success of our GH001 and GH002 product candidates;

|

|

|

• |

the timing, scope or likelihood of regulatory filings and approvals by the FDA, the European Medicines Agency, or the EMA, or other comparable foreign regulatory authorities, for our GH001 and GH002 product candidates and our initial and

any additional indications;

|

|

|

• |

our expectations related to the clinical hold imposed by the FDA on the study we proposed in our IND for GH001, including our plans and expectations for progressing any nonclinical programs and any other work to lift the clinical hold,

the timing required to lift such clinical hold and for discussions with the FDA and the outcomes and resolution of such discussions;

|

|

|

• |

our expectations regarding the size of the eligible patient populations for our GH001 and GH002 product candidates, if approved for commercial use;

|

|

|

• |

our ability to identify third-party clinical trial sites to conduct trials and our ability to identify and train appropriately qualified therapists to administer our investigational therapy;

|

|

|

• |

the effect of pandemics, such as the COVID-19 pandemic, epidemics, outbreaks of an infectious disease or similar events on aspects of our business or operations, including delays in the regulatory approval process, contracting with

clinical trial sites and engaging in clinical trials;

|

|

|

• |

our ability to implement our business model and our strategic plans for our business and GH001 and GH002 product candidates;

|

|

|

• |

our ability to identify, develop or acquire and obtain approval by the FDA, EMA or other comparable foreign regulatory authorities of medical devices required to deliver our GH001 and GH002 product candidates, such as our proprietary

aerosol delivery device for GH001;

|

|

|

• |

our commercialization and marketing capabilities and strategy;

|

|

|

• |

the effects of undesirable clinical trial outcomes and potential adverse public perception regarding the use of mebufotenin and psychedelics generally on the regulatory approval process and future development of our product;

|

|

|

• |

the pricing, coverage and reimbursement of our GH001 and GH002 product candidates, if approved;

|

|

|

• |

the scalability and commercial viability of our manufacturing methods and processes;

|

|

|

• |

the rate and degree of market acceptance and clinical utility of our GH001 and GH002 product candidates;

|

|

|

• |

our reliance on third-party suppliers for our nonclinical study, clinical trial drug substance and product candidate supplies, as well as key raw materials used in our manufacturing processes;

|

|

|

• |

our ability to establish or maintain collaborations or strategic relationships or obtain additional funding;

|

|

|

• |

our expectations regarding potential benefits of our GH001 and GH002 product candidates and our approach generally;

|

|

|

• |

our expectations around regulatory development paths and with respect to Controlled Substances Act, or CSA, classification;

|

|

|

• |

the scope of protection we and any current or future licensors or collaboration partners are able to establish and maintain for intellectual property rights covering our GH001 and GH002 product candidates;

|

|

|

• |

our ability to operate our business without infringing, misappropriating, or otherwise violating the intellectual property rights and proprietary technology of third parties;

|

|

|

• |

our ability to protect our intellectual property rights, including enforcing and defending intellectual property-related claims;

|

|

|

• |

regulatory developments in the United States, under the laws and regulations of the EU and other jurisdictions;

|

|

|

• |

continuing inflation, interest rates and foreign currency exchange rates, disruptions in global supply chains and labor markets, volatility and stress within the banking sector and the measures governments and financial services

companies have taken in response, and geopolitical risks and global hostilities, including any direct or indirect economic impacts resulting from Russia’s invasion of Ukraine, the ongoing military conflict between Israel and Hamas and any

resulting conflicts in the region, or increased tensions between China and Taiwan;

|

|

|

• |

developments and projections relating to our competitors and our industry;

|

|

|

• |

our ability to maintain an effective system of internal control over financial reporting;

|

|

|

• |

the amount of time that our existing cash, cash equivalents, other financial assets and marketable securities will be sufficient to fund our operations and capital expenditures;

|

|

|

• |

our estimates regarding expenses, capital requirements and needs for additional financing;

|

|

|

• |

our ability to effectively manage our anticipated growth;

|

|

|

• |

our ability to attract and retain qualified employees and key personnel;

|

|

|

• |

whether we are classified as a passive foreign investment company for current and future periods;

|

|

|

• |

our expectations regarding the time during which we will be an emerging growth company under the Jumpstart our Business Startups Act of 2012, or the JOBS Act, and as a foreign private issuer;

|

|

|

• |

the future trading price of the ordinary shares and impact of securities analysts’ reports on these prices; and

|

|

|

• |

other risks and uncertainties, including those listed under “Item 3. Key Information—D. Risk Factors.”

|

| A. |

Directors and Senior Management

|

| B. |

Advisors

|

| C. |

Auditors

|

| A. |

Offer Statistics

|

| B. |

Method And Expected Timetable

|

| A. |

[Reserved]

|

| B. |

Capitalization and Indebtedness

|

| C. |

Reasons for the Offer and Use of Proceeds

|

| D. |

Risk Factors

|

|

|

• |

We are a clinical-stage biopharmaceutical company and we have incurred significant losses since our inception. We expect that we will continue to incur significant losses for the foreseeable future;

|

|

|

• |

We will need substantial additional funding, which may not be available on acceptable terms, or at all. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product discovery and development

programs or commercialization efforts;

|

|

|

• |

Preliminary, top-line or interim data from our clinical trials that we announce or publish from time to time may change as more data become available, and are subject to audit and verification procedures that could result in material

changes in the final results or could otherwise harm our business, financial condition, results of operation and prospects;

|

|

|

• |

It may take considerable time and expense to resolve the clinical hold that has been placed by the FDA on the study we proposed in our IND for GH001, and no assurance can be given that the FDA will remove the clinical hold, which could

have a material adverse effect on our clinical development efforts or could otherwise harm our business, financial condition, results of operation and prospects;

|

|

|

• |

Drug and drug-device combination product development is a highly uncertain undertaking and involves a substantial degree of risk;

|

|

|

• |

GH001 and GH002 are investigational mebufotenin therapies based on a novel technology, which makes it difficult to predict the time and cost of development and of subsequently obtaining regulatory approval. To our knowledge, no such

therapies have been approved in the United States or the EU for commercialization;

|

|

|

• |

Developing our proprietary aerosol delivery device for GH001 is a costly and uncertain process, and any failure of, or delay in, the development or manufacturing of the device may have a material adverse effect on our business and

results of operations;

|

|

|

• |

Clinical development involves a lengthy, complex and expensive process, with an uncertain outcome. The outcome of nonclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and the

results of our currently completed clinical trials, which to date have only been conducted in Europe, and of our ongoing and future clinical trials, may not satisfy the requirements of the FDA, EMA or other comparable foreign regulatory

authorities;

|

|

|

• |

Our product candidates or use of our product candidates through participation in our clinical trials, may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit their

commercial potential or result in significant negative consequences;

|

|

|

• |

GH001 and GH002, and any other product candidates we may develop, are subject to controlled substance laws and regulations in the territories where the product will be marketed, such as the United States, the EU, the United Kingdom, or

UK, and the rest of Europe, as well as the United Nations, or UN, international drug control treaties, and failure to comply with these laws and regulations, or the cost of compliance with these laws and regulations, may adversely affect

the results of our business operations, both during clinical development and post-approval, and our financial condition. In addition, during the review process of GH001 and GH002, and prior to approval, the FDA, EMA and/or other comparable

foreign regulatory authorities may require additional data, including with respect to whether GH001 or GH002 have abuse or misuse potential. This may delay approval and any potential rescheduling process;

|

|

|

• |

Mebufotenin is currently classified as a Schedule I drug in the United States and any product containing this substance, such as GH001 and GH002, must be rescheduled to be marketed. There can be no assurance that the Drug Enforcement

Administration, or DEA, will make a favorable scheduling decision. Even assuming categorization as a Schedule II or lower controlled substance (i.e., Schedule III, IV or V) at the federal level, such substances would also require scheduling

determinations under state laws and regulations;

|

|

|

• |

The potential reclassification of mebufotenin by the DEA in the United States could create additional regulatory burdens on our operations and negatively affect our results of operations;

|

|

|

• |

Our commercial success depends upon attaining significant market acceptance of our product candidates, if approved, among physicians, patients, third-party payors and other members of the medical community;

|

|

|

• |

We currently have no marketing and sales organization and have no experience as a company in commercializing products, and we may have to invest significant resources to develop these capabilities. If we are unable to establish marketing

and sales capabilities or enter into agreements with third parties to market and sell our product candidates, if approved, we may not be able to generate product revenue;

|

|

|

• |

Our business and commercialization strategy depends on our ability to identify, qualify, prepare, certify, and support third-party clinics or treatment centers offering any of our product candidates, if approved. If we are unable to do

so, our commercialization prospects would be limited and our business, financial condition, and results of operations would be harmed;

|

|

|

• |

We rely on patents, applications for patents and other intellectual property rights to protect our GH001 and GH002 product candidates, the prosecution, enforcement, defense and maintenance of which may be challenging and costly. Failure

to adequately prosecute, maintain, enforce or protect these rights could harm our ability to compete and impair our business;

|

|

|

• |

We rely on third parties to assist in conducting our nonclinical studies and clinical trials. If they do not perform satisfactorily, we may not be able to initiate new clinical trials, successfully complete clinical trials, obtain

regulatory approval or commercialize our product candidates, or such approval or commercialization may be delayed, and our business could be substantially harmed;

|

|

|

• |

The development and manufacture of our active pharmaceutical ingredients, product candidates and medical devices required to deliver such product candidates is complex, and we may encounter difficulties during further development or in

production. We currently rely completely on third parties to develop, formulate and manufacture our nonclinical study and clinical trial supplies. The development and commercialization of any of our active pharmaceutical ingredients,

product candidates and medical devices required to deliver such product candidates could be stopped, delayed or made less profitable if those third parties fail to provide us with sufficient quantities of such drug supplies or fail to do so

at acceptable quality levels, including in accordance with rigorously enforced regulatory requirements or contractual obligations, and our operations could be harmed as a result;

|

|

|

• |

We depend heavily on our executive officers, principal consultants and others, and the loss of their services would materially harm our business;

|

|

|

• |

We previously identified and remediated material weaknesses in our internal control over financial reporting. If we experience additional material weaknesses or otherwise fail to maintain an effective system of internal controls in the

future, our ability to accurately or timely report our financial condition or results of operations may be adversely affected; and

|

|

|

• |

We believe that we were a passive foreign investment company, or a PFIC, for our 2024 taxable year, and we anticipate that we will likely be a PFIC in 2025 and potentially also in future years, which could subject U.S. investors in our

ordinary shares to significant adverse U.S. federal income tax consequences.

|

|

|

• |

continue to develop and conduct clinical trials, including in expanded geographies such as the United States, for our GH001 and GH002 product candidates for our initial indications and any additional indications;

|

|

|

• |

continue both the technical development and expansion of our external manufacturing capabilities for our current product candidates GH001 and GH002 and of the medical devices required to deliver these product candidates, such as our

proprietary aerosol delivery device for GH001;

|

|

|

• |

initiate and continue research and development, including technical, nonclinical, clinical, and discovery efforts for any future product candidates;

|

|

|

• |

seek to identify additional product candidates;

|

|

|

• |

seek regulatory approvals for our product candidates GH001 and GH002, including the medical devices required to deliver these product candidates, such as our proprietary aerosol delivery device for GH001, or any other product candidates

that successfully complete clinical development;

|

|

|

• |

progress any nonclinical programs and any other work that may be required to lift the clinical hold imposed by the FDA on the study we proposed in our IND for GH001;

|

|

|

• |

add operational, financial and management information systems and personnel, including personnel to support our product candidate and device development and help us comply with our obligations as a public company;

|

|

|

• |

hire and retain additional personnel, such as clinical, quality control, scientific, commercial, sales, marketing and administrative personnel;

|

|

|

• |

continue to prepare, file, prosecute, maintain, protect and enforce our intellectual property rights and claims;

|

|

|

• |

establish sales, marketing, distribution, manufacturing, supply chain and other commercial infrastructure in the future to commercialize various products for which we may obtain regulatory approval;

|

|

|

• |

comply with ongoing regulatory requirements for products approved for commercial sale, if ever;

|

|

|

• |

adapt to ongoing changes in global economic conditions, including but not limited to changes in tariffs and trade barriers, heightened inflation, disruptions in global supply chains and labor markets and geopolitical risks and global

hostilities, including any direct or indirect economic impacts resulting from conflicts in Eastern Europe and the Middle East and any resulting conflicts in such regions, or increased tensions between China and Taiwan;

|

|

|

• |

acquire or in-license other product candidates, medical devices to deliver our product candidates, and other technologies; and

|

|

|

• |

incur increased costs as a result of operating as a public company.

|

|

|

• |

the scope, progress, results and costs of researching and developing our GH001 and GH002 product candidates, additional mebufotenin delivery approaches and the medical devices required to deliver these therapies, such as our proprietary

aerosol delivery device for GH001, for our initial and any additional indications as well as other product candidates we may develop;

|

|

|

• |

the timing and uncertainty of, and the costs involved in, obtaining marketing approvals for our GH001 and GH002 product candidates including the medical devices required to deliver these therapies for our initial and any additional

indications, and other product candidates we may develop and pursue;

|

|

|

• |

the duration of the clinical hold imposed by the FDA on the study we proposed in our IND for GH001, including the progression of, and associated costs from, any nonclinical programs and any other work necessary to lift the clinical hold,

as well as discussions with the FDA and the outcomes and resolution of such discussions;

|

|

|

• |

the number of future product candidates that we may pursue and their development requirements;

|

|

|

• |

the number of jurisdictions in which we plan to seek regulatory approvals;

|

|

|

• |

if approved, the costs of commercialization activities for GH001 and GH002 for any approved indications, or any other product candidate that receives regulatory approval to the extent such costs are not the responsibility of any future

collaborators, including the costs and timing of establishing product sales, marketing, distribution, and manufacturing capabilities;

|

|

|

• |

subject to receipt of regulatory approval, revenue, if any, received from commercial sales of GH001 and GH002 and the respective medical devices for any approved indications or any other product candidates;

|

|

|

• |

if approved, the establishment and maintenance of coverage and adequate reimbursement from third-party payors for GH001, GH002 or any other product candidates;

|

|

|

• |

the extent to which we may in-license or acquire rights to other products, product candidates, medical devices or technologies;

|

|

|

• |

our headcount growth and associated costs as we expand our research and development, increase our office space, and establish a commercial infrastructure;

|

|

|

• |

the costs of preparing, filing and prosecuting patent applications and maintaining and protecting our intellectual property rights, including enforcing and defending intellectual property-related claims;

|

|

|

• |

the effect of competing product and market developments; and

|

|

|

• |

the ongoing costs of operating as a public company.

|

|

|

• |

devaluation in U.S. government bond investments held by the Company;

|

|

|

• |

inability to access capital markets, or increased difficulty in doing so; or

|

|

|

• |

government shutdown, or reduced operation, of agencies such as the FDA, which could impede our ability to progress our planned IND and/or other U.S. operations.

|

|

|

• |

completing research and technical, nonclinical and clinical development of our product candidates and the medical devices required to deliver these product candidates, such as our proprietary aerosol delivery device for GH001;

|

|

|

• |

obtaining regulatory approvals and marketing authorizations for product candidates, including the medical devices required to deliver these product candidates for which we successfully complete clinical development and clinical trials;

|

|

|

• |

progressing any nonclinical programs and any other work that may be required to lift the clinical hold on the study we proposed in our IND for GH001;

|

|

|

• |

developing a sustainable and scalable manufacturing process for our product candidates and the medical devices required to deliver these product candidates, as well as establishing and maintaining commercially viable supply relationships

with third parties that can provide adequate products and services to support clinical activities and commercial demand of our product candidates and medical devices;

|

|

|

• |

identifying, assessing, acquiring and/or developing new product candidates;

|

|

|

• |

negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter;

|

|

|

• |

successfully getting our product candidates rescheduled under the federal Comprehensive Drug Abuse Prevention and Control Act of 1970, also known as the Controlled Substances Act, or CSA, and comparable state laws by the DEA and other

applicable regulatory agencies inside and outside the United States;

|

|

|

• |

launching and successfully commercializing product candidates and the medical devices required to deliver these product candidates for which we obtain regulatory approval, either by collaborating with a partner or, if launched

independently, by establishing a sales, marketing and distribution infrastructure;

|

|

|

• |

obtaining and maintaining an adequate price for our product candidates and devices in the countries where our products are commercialized;

|

|

|

• |

obtaining coverage and adequate reimbursement for our product candidates and medical devices from payors;

|

|

|

• |

obtaining market acceptance of our product candidates as viable treatment options;

|

|

|

• |

addressing any competing technological and market developments;

|

|

|

• |

receiving milestone and other payments under any future collaboration arrangements;

|

|

|

• |

maintaining, protecting, expanding and enforcing our portfolio of intellectual property rights, including patents, trade secrets and know-how;

|

|

|

• |

attracting, hiring and retaining qualified personnel; and

|

|

|

• |

complying with laws and regulations, including laws applicable to controlled substances, data privacy and pre-commercial activities.

|

|

|

• |

delay or failure in establishing acceptable performance characteristics, quality manufacturing standards and manufacturing capabilities for our product candidates or for the medical devices required to deliver our product candidates;

|

|

|

• |

negative or inconclusive results from our nonclinical studies or clinical trials or the clinical trials of others for product candidates similar to ours, leading to a decision or requirement to conduct additional nonclinical testing or

clinical trials or abandon a program;

|

|

|

• |

product or device-related side effects experienced by subjects in our clinical trials or by individuals using drugs or therapeutics similar to our product candidates;

|

|

|

• |

delays in submitting INDs (or IDEs, if applicable) in the United States or comparable foreign applications or delays or failure in obtaining the necessary approvals from regulators or institutional review boards, or IRBs, to commence a

clinical trial, including Schedule I research protocols required by the DEA, or a suspension or termination of a clinical trial once commenced;

|

|

|

• |

if the FDA, EMA or other comparable foreign regulatory authorities do not find the earlier technical, nonclinical and clinical trial work sufficient, then we may need to conduct additional technical development work or nonclinical or

clinical trials beyond what we had previously planned. For example, our previously completed nonclinical data and device design verification information submitted with our GH001 IND was deemed by the FDA to

contain insufficient information to assess risks to human subjects, and the FDA therefore requested additional nonclinical toxicology studies and other work (including acceptable device design verification information) before the

FDA may lift the clinical hold and allow us to initiate clinical studies in the United States, such as the study we proposed in our IND for GH001. Any significant technical development, nonclinical or clinical trial delays could also

shorten any periods during which we may have the exclusive right to commercialize our drug candidates and medical devices or allow our competitors to bring products to market before we do and impair our ability to successfully commercialize

our drug candidates and medical devices and may harm our business and results of operations;

|

|

|

• |

conditions imposed by the FDA, EMA or other comparable foreign regulatory authorities regarding the scope or design of our clinical trials;

|

|

|

• |

the FDA, EMA or other comparable foreign regulatory authorities may disagree with our clinical trial design, including with respect to dosing levels administered in our planned clinical trials, or the medical devices used to deliver our

product candidates in the clinical trials, which may delay or prevent us from initiating our clinical trials with our originally intended trial design and the originally planned medical devices;

|

|

|

• |

delays in contracting with clinical trial sites or enrolling subjects in clinical trials, the inability to identify clinical trial sites willing to host our clinical trials and the required scheduled drug DEA researcher registration and

Schedule I research protocol in the United States and similar licenses in other jurisdictions to be obtained and maintained by our clinical investigators;

|

|

|

• |

delays or interruptions in the supply of materials necessary for the conduct of our clinical trials;

|

|

|

• |

regulators, IRBs or ethics committees may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site;

|

|

|

• |

the FDA has in relation to our clinical hold required, and it or the EMA or other comparable foreign regulatory authorities may in the future require, us to submit additional data such as long-term toxicology studies, additional device

design verification information or additional data for our product candidates or the medical devices required to deliver our product candidates;

|

|

|

• |

delays in reaching, or failure to reach, agreement on acceptable terms with prospective trial sites and prospective contract research organizations, or CROs, which can be subject to extensive negotiation and may vary significantly among

different CROs and trial sites;

|

|

|

• |

the number of subjects required for clinical trials of any product candidates may be larger than we anticipate, or subjects may drop out of these clinical trials or fail to return for post-treatment follow-up at a higher rate than we

anticipate;

|

|

|

• |

our third-party contractors for nonclinical studies or clinical trials may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all, or may deviate from the clinical trial

protocol or take actions that could cause clinical trial sites or clinical investigators to drop out of the trial, which may require that we add new clinical trial sites or investigators;

|

|

|

• |

due to the impact of a pandemic, epidemic, outbreak of an infectious disease or a similar event, we may experience some delays and interruptions to our technical development efforts, nonclinical studies, clinical trials and/or regulatory

approvals, we may experience delays or interruptions to our manufacturing supply chain, or we could suffer delays in reaching, or we may fail to reach, agreement on acceptable terms with third-party service providers on whom we rely;

|

|

|

• |

greater-than-anticipated clinical trial costs, including as a result of delays or interruptions that could increase the overall costs to finish our clinical trials as our fixed costs are not substantially reduced during delays;

|

|

|

• |

we may elect to, or regulators, IRBs, Data Safety Monitoring Boards, or DSMBs, or ethics committees may require that we or our investigators, suspend or terminate clinical research or trials for various reasons, including non-compliance

with regulatory requirements or a finding that the participants are being exposed to unacceptable health risks;

|

|

|

• |

we may not have the financial resources available to begin and complete the planned trials, or the cost of clinical trials of any product candidates may be greater than we anticipate;

|

|

|

• |

the supply or quality of our product candidates, medical devices required to deliver our product candidates, or other materials necessary to conduct clinical trials of our product candidates may be insufficient or inadequate to initiate

or complete a given clinical trial;

|

|

|

• |

inability to compete with other therapies;

|

|

|

• |

poor efficacy of our product candidates during clinical trials;

|

|

|

• |

failure to demonstrate an acceptable benefit/risk profile for our product candidates;

|

|

|

• |

inability to provide sufficient design, testing, manufacturing and quality information for the medical devices required to deliver our product candidates, including information to support their use and compatibility with the drug

constituent of our product candidates;

|

|

|

• |

unfavorable FDA, EMA or other comparable foreign regulatory authority inspection and review of clinical trial sites or manufacturing facilities;

|

|

|

• |

if the DEA, or any state or other jurisdiction, delays rescheduling or fails to reschedule mebufotenin to Schedule II, III, IV or V, or delays classifying or fails to classify our product candidates to Schedule II, III, IV or V;

|

|

|

• |

unfavorable product labeling associated with any product approvals and any requirements for a Risk Evaluation and Mitigation Strategy, or REMS, that may be required by the FDA or comparable requirements in other jurisdictions to ensure

the benefits of an individual product outweigh its risks;

|

|

|

• |

unfavorable acceptance of our product candidates or clinical trial data by the patient or medical communities or third-party payors;

|

|

|

• |

failure of our third-party contractors or investigators to comply with regulatory requirements or otherwise meet their contractual obligations in a timely manner, or at all;

|

|

|

• |

delays and changes in regulatory requirements, policy and guidelines, including the imposition of additional regulatory oversight around clinical testing generally or with respect to our technology in particular; or

|

|

|

• |

varying interpretations of data by the FDA, EMA or other comparable foreign regulatory authorities.

|

|

|

• |

nonclinical studies or clinical trials may show the product candidates to be ineffective or less effective than expected (e.g., a clinical trial could fail to meet its primary endpoint(s)) or to have unacceptable side effects or

toxicities;

|

|

|

• |

failure to reflect similarly efficacious activity in subsequent clinical trials with larger patient populations;

|

|

|

• |

failure to use clinical endpoints that applicable regulatory authorities would consider clinically meaningful;

|

|

|

• |

manufacturing issues or formulation issues with the product candidate or device that cannot be resolved;

|

|

|

• |

failure to receive the necessary regulatory approvals;

|

|

|

• |

manufacturing issues, formulation issues, pricing or reimbursement issues or other factors that make a product candidate or device uneconomical; and

|

|

|

• |

intellectual property and proprietary rights of others and their competing products and technologies that may prevent one of our product candidates from being commercialized.

|

|

|

• |

regulatory authorities may withdraw or limit their approval of such product candidates or medical devices;

|

|

|

• |

regulatory authorities may require the addition of labeling statements, such as a “Boxed Warning” or contraindications;

|

|

|

• |

we may be required to change the way such product candidates are distributed or administered, or change the labeling of the product candidates or medical devices;

|

|

|

• |

the FDA may require a REMS to mitigate risks, which could include medication guides, physician communication plans or elements to assure safe use, such as restricted distribution methods, patient registries and other risk minimization

tools, and regulatory authorities in other jurisdictions may require comparable risk mitigation plans;

|

|

|

• |

we may be subject to regulatory investigations and government enforcement actions;

|

|

|

• |

the FDA, EMA or a comparable foreign regulatory authority may require us to conduct additional technical development work or clinical trials or costly post-marketing testing and surveillance to establish and monitor the safety and

efficacy of the product;

|

|

|

• |

we could be sued and held liable for injury caused to individuals exposed to or taking our product candidates or operating our medical devices; and

|

|

|

• |

our reputation may suffer.

|

|

|

• |

the patient eligibility criteria defined in the protocol;

|

|

|

• |

the size of the patient population required for analysis of the trial’s primary endpoints;

|

|

|

• |

in the case of clinical trials focused on rare disease, the small size of the patient population and the potential of a patient being undiagnosed or misdiagnosed;

|

|

|

• |

the proximity of patients to trial sites;

|

|

|

• |

the design of the trial;

|

|

|

• |

our ability to recruit clinical trial investigators with the appropriate competencies and experience;

|

|

|

• |

competing clinical trials and clinicians’ and patients’ perceptions as to the potential advantages and risks of the product candidate being studied in relation to other available therapies, including any new drugs that may be approved

for the indications that we are investigating;

|

|

|

• |

reluctance of physicians to encourage patient participation in clinical trials;

|

|

|

• |

our ability to obtain and maintain patient consents; and

|

|

|

• |

the risk that patients enrolled in clinical trials will drop out of the trials before completion.

|

|

|

• |

our inability to design such product candidates with the pharmacological or pharmacokinetic properties that we desire; or

|

|

|

• |

potential product candidates may, on further study, be shown to have harmful side effects or other characteristics that indicate that they are unlikely to be medicines that will receive marketing approval and achieve market acceptance.

|

|

|

• |

decreased demand for any of our future approved products;

|

|

|

• |

injury to our reputation;

|

|

|

• |

initiation of investigations by regulators;

|

|

|

• |

withdrawal of clinical trial participants;

|

|

|

• |

termination of clinical trial sites or entire trial programs;

|

|

|

• |

significant litigation costs;

|

|

|

• |

substantial monetary awards to, or costly settlements with, patients or other claimants;

|

|

|

• |

product recalls or a change in the indications for which any approved drug products may be used;

|

|

|

• |

loss of revenue;

|

|

|

• |

diversion of management and scientific resources from our business operations; and

|

|

|

• |

the inability to commercialize our product candidates.

|

|

|

• |

greater financial, technical and human resources than we have at every stage of the discovery, development, manufacture and commercialization of products;

|

|

|

• |

more extensive experience in nonclinical studies, conducting clinical trials, obtaining regulatory approvals, and in manufacturing, marketing and selling drug products;

|

|

|

• |

more developed intellectual property portfolios;

|

|

|

• |

products that have been approved or are in late stages of development; and

|

|

|

• |

collaborative arrangements in our target markets with leading companies and research institutions.

|

|

|

• |

DEA registration and inspection of facilities. Facilities conducting research, manufacturing, distributing, importing or exporting, or dispensing controlled substances must be registered

(licensed) to perform these activities and have the security, control, record keeping, reporting and inventory procedures required by the DEA to prevent drug loss and diversion. All these facilities must renew their registrations annually,

except dispensing facilities (e.g. pharmacies), which must renew every three years. The DEA conducts periodic inspections of certain registered establishments that handle controlled substances. Failure to obtain or maintain the necessary

registrations may result in delay of the importation, manufacturing or distribution of GH001 or GH002. Furthermore, importation of controlled substances is subject to additional permits or approvals, which must be obtained prior to each

importation. Failure to comply with the CSA and implementing regulations promulgated by the DEA, particularly non-compliance resulting in theft, loss or diversion, can result in regulatory action that would have a material adverse effect on

our business, financial condition and results of operations. The DEA and the U.S. Department of Justice may seek civil penalties, refuse to renew necessary registrations, or initiate proceedings to restrict, suspend or revoke those

registrations. In certain circumstances, violations could lead to criminal proceedings.

|

|

|

• |

State-controlled substances laws. Individual U.S. states have also established controlled substance laws and regulations. Though state-controlled substances laws often mirror federal law, because

the states are separate jurisdictions, they will need to separately reschedule GH001 or GH002. While some states automatically schedule or reschedule a drug based on federal action, other states schedule drugs through rule making or a

legislative action. State scheduling may delay commercial sale of any product for which we obtain federal regulatory approval and adverse scheduling would have a material adverse effect on the commercial attractiveness of such product. We

or our partners must also obtain separate state registrations, permits or licenses in order to be able to obtain, handle, and distribute controlled substances for clinical trials or commercial sale, and failure to meet applicable regulatory

requirements could lead to enforcement and sanctions by the states in addition to those from the DEA or otherwise arising under federal law.

|

|

|

• |

Clinical trials. Because our GH001 and GH002 product candidates contain mebufotenin, to conduct clinical trials with GH001 and GH002 in the United States prior to approval, each of our research

sites must submit a research protocol to the DEA and obtain and maintain a DEA Schedule I researcher registration that will allow those sites to handle and dispense GH001 and GH002 and to obtain the product from our importer. If the DEA

delays or denies the grant of a researcher registration or approval of the research protocol to one or more research sites, the clinical trial could be significantly delayed, and we could lose clinical trial sites. The importer for the

clinical trials must also obtain a Schedule I importer registration and an import permit for each import.

|

|

|

• |

Post-Approval Importation. If GH001 or GH002 is approved and classified as a Schedule II, III or IV substance, an importer can import it for commercial purposes if it obtains an importer

registration and applies for and receives an import permit (Schedule II) or files an import declaration (Schedule III or IV) for each import shipment. The DEA provides annual assessments/estimates to the UN International Narcotics Control

Board, which guides the DEA in the amounts of controlled substances that the DEA authorizes to be imported. The failure to identify an importer or obtain the necessary import authority, including specific quantities, could affect the

availability of GH001 or GH002 and have a material adverse effect on our business, results of operations and financial condition. In addition, an application for a Schedule II importer registration must be published in the Federal Register,

and there is a notice and comment period to receive public comments. It is always possible that adverse comments may delay the grant of an importer registration. If GH001 or GH002 is approved and classified as a Schedule II controlled

substance, federal law may prohibit the import of the substance for commercial purposes. If GH001 or GH002 is listed as a Schedule II substance, we will not be allowed to import the drug for commercial purposes unless the DEA determines

that domestic supplies are inadequate or there is inadequate domestic competition among domestic manufacturers for the substance as defined by the DEA. Moreover, the DEA has not registered any companies to import Schedule I controlled

substances, including mebufotenin, for commercial purposes, only for scientific and research needs. Therefore, if neither GH001 or GH002, nor its drug substance could be imported, GH001 and GH002 would have to be wholly manufactured in the

United States, and we would need to secure a manufacturer that would be required to obtain and maintain a separate DEA registration for that activity.

|

|

|

• |

Manufacture in the United States. If, because of a Schedule II (and possibly Schedule III) classification or voluntarily, we were to conduct manufacturing or repackaging/relabeling in the United

States for commercial purposes, mebufotenin will be subject to an annual aggregate production quote established by the DEA and our contract manufacturers would be subject to the DEA’s annual and semi-annual manufacturing and procurement

quota requirements. Additionally, regardless of the scheduling of GH001 or GH002, the active ingredient in the final dosage form is currently a Schedule I controlled substance and would be subject to such quotas as this substance could

remain listed on Schedule I during the clinical trials. The annual and semi-annual quota allocated to us or our contract manufacturers for the active ingredient in GH001 or GH002 may not be sufficient to complete clinical trials or meet

commercial demand. Consequently, any delay or refusal by the DEA in establishing our, or our contract manufacturers’, procurement and/or production quota for controlled substances could delay or stop our clinical trials or product launches,

which would have a material adverse effect on our business, financial position and results of operations.

|

|

|

• |

Distribution in the United States and the UK. If GH001 or GH002 is scheduled as Schedule II, III, IV or V, we would also need to identify wholesale distributors with the appropriate DEA

registrations and authority to distribute GH001, GH002 and any other product candidates. These distributors would need to maintain Schedule II, III, IV or V distribution registrations. This limitation in the ability to distribute GH001 or

GH002 more broadly may limit commercial uptake and could negatively impact our prospects. The failure to obtain, or delay in obtaining, or the loss of any of those registrations could result in increased costs to us. If GH001 or GH002 is

classified as a Schedule II drug, participants in our supply chain may have to maintain enhanced security including specially constructed vaults at manufacturing and distribution facilities. This additional security may also discourage some

pharmacies from carrying the product. In addition, GH001 and/or GH002 could be required to be administered at our trial sites or other certified healthcare settings, which could limit commercial uptake. Furthermore, state and federal

enforcement actions, regulatory requirements, and legislation intended to reduce prescription drug abuse, such as the tracking of prescribing and dispensing of controlled substances through a state prescription drug monitoring program, may

make physicians less willing to prescribe, and pharmacies to dispense, certain controlled substances, especially Schedule II products. Similarly, the Medicines and Healthcare products Regulatory Agency, or MHRA, considers that all Schedule

1 drugs under the UK’s Misuse of Drugs Regulations 2001 (which Schedule includes mebufotenin) have no therapeutic benefit, and can only be imported, exported, produced, supplied, possessed and the like under a license issued by the UK

government’s Home Office. Mebufotenin may never be rescheduled under the Misuse of Drugs Regulations 2001, or reclassified under the UK’s Misuse of Drugs Act 1971 (under which it is a Class A controlled substance).

|

|

|

• |

restrictions on the manufacturing of our products, the approved manufacturers or the manufacturing process;

|

|

|

• |

withdrawal of the product from the market or voluntary product recalls;

|

|

|

• |

requirements to conduct post-marketing studies or clinical trials;

|

|

|

• |

fines, restitution or disgorgement of profits or revenues;

|

|

|

• |

warning or untitled letters from the FDA or comparable notice of violations from comparable foreign regulatory authorities;

|

|

|

• |

suspensions of any of our ongoing clinical trials;

|

|

|

• |

refusal by the FDA or other comparable foreign regulatory authorities to approve pending applications or supplements to approved applications filed by us or suspension or withdrawal of marketing approvals;

|

|

|

• |

product seizure or detention or refusal to permit the import or export of products; and

|

|

|

• |

consent decrees, injunctions or the imposition of civil or criminal penalties.

|

|

|

• |

efficacy and potential advantages compared to alternative treatments;

|

|

|

• |

the ability to offer our products, if approved, for sale at competitive prices;

|

|

|

• |

relative convenience and ease of administration compared to alternative treatments;

|

|

|

• |

perceptions by the medical community, physicians, and patients, regarding the safety and effectiveness of our products and the willingness of the target patient population to try new therapies and of physicians to prescribe these

therapies;

|

|

|

• |

the size of the market for such product candidate, based on the size of the patient subsets that we are targeting, in the territories for which we gain regulatory approval;

|

|

|

• |

the recommendations with respect to our product candidates in guidelines published by various scientific organizations applicable to us and our product candidates;

|

|

|

• |

the strength of sales, marketing and distribution support;

|

|

|

• |

the timing of any such marketing approval in relation to other product approvals;

|

|

|

• |

any restrictions on concomitant use of other medications;

|

|

|

• |

support from patient advocacy groups;

|

|

|

• |

media coverage regarding psychedelic substances;

|

|

|

• |

the ability to obtain sufficient third-party coverage and adequate reimbursement from government and third-party payors; and

|

|

|

• |

the prevalence and severity of any side effects.

|

|

|

• |

a covered benefit under its health plan;

|

|

|

• |

safe, effective and medically necessary;

|

|

|

• |

appropriate for the specific patient;

|

|

|

• |

cost-effective; and

|

|

|

• |

neither experimental nor investigational.

|

|

|

• |

in the EU, member states can restrict the range of medicinal products for which their national health insurance systems provide reimbursement and, in most EU countries, the prices of medicinal products for human use must be approved by

national health authorities, before they may be supplied;

|

|

|

• |

a common criterion relied upon by almost all EU Member States for pricing decisions is international reference pricing (the methodology and weight to be attached varies between countries), whereas in the UK, international reference

pricing is not a criterion relied upon formally for pricing decisions;

|

|

|

• |

in the UK and many EU member states, prices of branded medicines must be notified or approved prior to product launch;

|

|

|

• |

reimbursement decisions in EU/European Economic Area, or EEA, and the UK are typically based on various forms of health technology assessment, including cost effectiveness determinations. From 2025, the EU’s Health Technology Assessment

Regulation (Regulation (EU) 2021/2282), or HTA Regulation, will start to come into effect providing for a common assessment of clinical effectiveness to be taken into account by national reimbursement authorities across EU/EEA. This will

not have direct effect in the UK, but may in practice be influential; and

|

|

|

• |

additionally public procurement tenders are widely used for purchasing of medicinal products by hospitals.

|

|

|

• |

the federal Anti-Kickback Statute, which prohibits, among other things, persons and entities from knowingly and willfully soliciting, receiving, offering or paying any remuneration (including any kickback, bribe, or rebate),

directly or indirectly, overtly or covertly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual, or the purchase, lease, order, arrangement or recommendation of any good, facility, item or

service for which payment may be made, in whole or in part, under a federal healthcare program, such as the Medicare and Medicaid programs. A person or entity can be found guilty of violating the statute without actual knowledge of

the statute or specific intent to violate it. The term remuneration has been interpreted broadly to include anything of value. Further, courts have found that if “one purpose” of remuneration is to induce referrals, the federal

Anti-Kickback Statute is violated. Violations are subject to significant civil and criminal fines and penalties for each violation, plus up to three times the remuneration involved, imprisonment and exclusion from government

healthcare programs. In addition, a claim submitted for payment to any federal healthcare program that includes items or services that were made as a result of a violation of the federal Anti-Kickback Statute constitutes a false or

fraudulent claim for purposes of the civil False Claims act, or the FCA. The Anti-Kickback Statute has been interpreted to apply to arrangements between biopharmaceutical manufacturers on the one hand and prescribers, purchasers and

formulary managers, among others, on the other. There are a number of statutory exceptions and regulatory safe harbors protecting some common activities from prosecution, but they are drawn narrowly, and practices that involve

remuneration intended to induce prescribing, purchasing or recommending may be subject to scrutiny if they do not qualify for an exception or safe harbor;

|

|

|

• |

the federal civil and criminal false claims laws, including the FCA, and civil monetary penalty laws which prohibit, among other things, individuals or entities from knowingly presenting, or causing to be presented, false,

fictitious or fraudulent claims for payment to, or approval by Medicare, Medicaid, or other federal healthcare programs; knowingly making, using or causing to be made or used, a false record or statement material to a false,

fictitious or fraudulent claim or an obligation to pay or transmit money or property to the federal government; or knowingly concealing or knowingly and improperly avoiding, decreasing or concealing an obligation to pay money to the

federal government. A claim that includes items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim under the FCA. Manufacturers can be held liable under the FCA even

when they do not submit claims directly to government payors if they are deemed to “cause” the submission of false or fraudulent claims. The FCA also permits a private individual acting as a “whistleblower” to bring qui tam actions

on behalf of the federal government alleging violations of the FCA and to share in any monetary recovery or settlement. When an entity is determined to have violated the FCA, the government may impose civil fines and penalties for

each false claim, plus treble damages, and exclude the entity from participation in Medicare, Medicaid and other federal healthcare programs;

|

|

|

• |

the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, which created additional federal criminal statutes that prohibit knowingly and willfully executing, or attempting to execute, a scheme to defraud

any healthcare benefit program, including private third-party payors, or obtain, by means of false or fraudulent pretenses, representations, or promises, any of the money or property owned by, or under the custody or control of, any

healthcare benefit program, regardless of the payor (e.g., public or private), and knowingly and willfully falsifying, concealing or covering up by any trick or device a material fact or making any materially false, fictitious or

fraudulent statement or representation, or making or using any false writing or document knowing the same to contain any materially false fictitious or fraudulent statement or entry in connection with the delivery of, or payment

for, healthcare benefits, items or services relating to healthcare matters. Similar to the federal Anti-Kickback Statute, a person or entity can be found guilty of violating HIPAA fraud provisions without actual knowledge of the

statute or specific intent to violate it;

|

|

|

• |

HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, or HITECH, and their respective implementing regulations, which impose, among other things, certain requirements relating to the

privacy, security and transmission of individually identifiable health information on certain covered healthcare providers, health plans and healthcare clearinghouses, known as covered entities, as well as their respective “business

associates,” those independent contractors or agents of covered entities that create, receive, maintain, transmit or obtain protected health information in connection with providing a service on behalf of a covered entity as well as

their covered subcontractors. HITECH also created new tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority

to file civil actions for damages or injunctions in federal courts to enforce the federal HIPAA laws and seek attorneys’ fees and costs associated with pursuing federal civil actions. In addition, there may be additional federal,

state and non-U.S. laws which govern the privacy and security of health and other personal information in certain circumstances, many of which differ from each other in significant ways and may not have the same effect, thus

complicating compliance efforts;

|

|

|

• |

the federal Physician Payments Sunshine Act, created under the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, or, collectively, the ACA, and its implementing

regulations, which require manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) to report

annually to CMS information related to direct or indirect payments and other transfers of value made to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors), certain non-physician providers,

including physician assistants, nurse practitioners, clinical nurse specialists, anesthesiologist assistants, certified registered nurse anesthetists and certified nurse midwives, and teaching hospitals, as well as ownership and

investment interests held by the physicians and their immediate family members;

|

|

|

• |

federal consumer protection and unfair competition laws, which broadly regulate marketplace activities and activities that potentially harm consumers; and

|

|

|

• |

analogous U.S. state, local and foreign laws and regulations, such as state anti-kickback and false claims laws, which may apply to sales or marketing arrangements and claims involving healthcare items or services reimbursed by

any third-party payor, including private insurers, and may be broader in scope than their federal equivalents; state and foreign laws that require biopharmaceutical companies to comply with the biopharmaceutical industry’s voluntary

compliance guidelines and other relevant compliance guidance promulgated by the federal government or otherwise restrict payments that may be made to healthcare providers and other potential referral sources; state and foreign laws

that require drug manufacturers to report information related to payments and other transfers of value to physicians and other healthcare providers, marketing expenditures or drug pricing; state and local laws that require the

registration of biopharmaceutical sales representatives; and state and foreign laws governing the privacy and security of health and other personal information, some of which may be more stringent than those in the United States

(such as the EU’s General Data Protection Regulation (Regulation (EU) 2016/679), or GDPR, which became effective in May 2018, or the UK’s General Data Protection Regulation, or UK GDPR) in certain circumstances, and may differ from

each other in significant ways and often are not preempted by HIPAA, thus complicating compliance efforts.

|

|

|

• |

strengthens the rules on placing medical devices on the market and reinforce surveillance once they are available;

|

|

|

• |

establishes explicit provisions on manufacturers’ responsibilities for the follow-up of the quality, performance and safety of medical devices placed on the market;

|

|

|

• |

improves the traceability of medical devices throughout the supply chain to the end-user or patient through a unique identification number;

|

|

|

• |

sets up a central database to provide patients, healthcare professionals and the public with comprehensive information on products available in the EU; and

|

|

|

• |

strengthens rules for the assessment of certain high-risk medical devices, such as implants, which may have to undergo an additional check by experts before they are placed on the market.

|

|

|

• |

2026 for class III custom made devices;

|

|

|

• |

2027 for class III and class IIb implantable devices;

|

|

|

• |

2028 for other class IIb, class IIa and class Is, Im devices; and

|

|

|

• |

2028 for class I up classified devices.

|

|

|

• |

for the period beginning on January 31, 2022 and ending on January 31, 2023, all clinical trial applications could be made either under the Clinical Trials Directive or under the CTR;

|

|

|

• |

from January 31, 2023, all initial clinical trial applications must be submitted under the CTR alone; and

|

|

|

• |

from January 31, 2023 to January 31, 2025, ongoing clinical trials authorized under the Clinical Trials Directive can remain under the Clinical Trials Directive or can transition to the CTR. However, as of January 31, 2023, no

new national clinical trial applications can be submitted under the Clinical Trials Directive 2001/20/EC. Consequently, if the sponsor chose to submit the clinical trial application under the Clinical Trials Directive during the

one-year transition period which ended on January 31, 2023, a new EU member state can only be added to the clinical trial after January 31, 2023, once the entire clinical trial has been transferred to CTIS. Further, substantial

amendments to trials authorized under the Clinical Trials Directive are permitted until January 31, 2025; and by January 31, 2025, all ongoing clinical trials will be required to have transitioned to the CTR.

|

|

|

• |

others may be able to make compositions that are the same as or similar to GH001, GH002 and any other product candidate compositions, or may be able to make medical devices to deliver such compositions, that are not covered by

the claims of the patents that we own or license;

|

|

|

• |

the patents of third parties may have an adverse effect on our business;

|

|

|

• |

we or our licensors or collaboration partners might not have been the first to conceive or reduce to practice the inventions covered by the issued patent or pending patent application that we own or license;

|

|

|

• |

we or our licensors or collaboration partners might not have been the first to file patent applications covering certain of our or their inventions;

|

|

|

• |

others may independently develop similar or alternative technologies or duplicate any of our technologies without infringing, misappropriating or otherwise violating our intellectual property rights;

|

|

|

• |

it is possible that current and future pending patent applications we own or in-license will not lead to issued patents;

|

|

|

• |

issued patents that we own or in-license may not provide us with any competitive advantage, or may be held invalid or unenforceable as a result of legal challenges by third parties;

|

|

|

• |

issued patents that we own or in-license may not have sufficient term or geographic scope to provide meaningful protection;

|

|

|

• |

our competitors might conduct research and development activities in countries that provide a safe harbor from patent infringement claims for certain research and development activities or in countries where we do not have patent

rights and then use the information learned from such activities to develop competitive therapies for sale in our major commercial markets;

|

|

|

• |

third parties performing manufacturing or testing for us using our therapies or technologies could use the intellectual property of others without obtaining a proper license;

|

|

|

• |

we may not develop additional technologies that are patentable; and

|

|

|

• |

we may choose not to file a patent in order to maintain certain trade secrets or know-how, and a third party may subsequently file a patent covering such intellectual property, or otherwise develop similar know-how.

|

|

|

• |

the scope of rights granted under the agreement and other interpretation-related issues;

|

|

|

• |

whether and the extent to which our technology and processes infringe, misappropriate or otherwise violate intellectual property of the licensor or collaboration partner that is not subject to the agreement;

|

|

|

• |

the sublicensing of patents and other rights under any current or future collaboration relationships;

|

|

|

• |

our diligence obligations under the agreement and what activities satisfy those diligence obligations;

|

|

|

• |

our rights to transfer or assign the agreement;

|

|

|

• |

the inventorship and ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our collaboration partners; and

|

|

|

• |

the priority of invention of patented technology.

|

|

|

• |

collaborators generally have significant discretion in determining the amount and timing of efforts and resources that they will apply to these collaborations;

|

|

|

• |

collaborators may not properly obtain, maintain, enforce or defend intellectual property or proprietary rights relating to our product candidates or research programs, or may use our proprietary information in such a way as to

expose us to potential litigation or other intellectual property-related proceedings, including proceedings challenging the scope, ownership, validity and enforceability of our intellectual property;

|

|

|

• |

collaborators may own or co-own intellectual property covering our product candidates or research programs that results from our collaboration with them, and in such cases, we may not have the exclusive right to commercialize

such intellectual property or such product candidates or research programs;

|

|

|

• |

we may need the cooperation of our collaborators to enforce or defend any intellectual property we contribute to or that arises out of our collaborations, which may not be provided to us;

|

|

|

• |