|

Delaware

|

001-41370

|

87-4407005

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

FIP

|

The Nasdaq Global Select Market

|

| Item 1.01 |

Entry into a Material Definitive Agreement.

|

| Item 2.01 |

Completion of Acquisition or Disposition of Assets.

|

| Item 3.02 |

Unregistered Sales of Equity Securities.

|

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

| Item 9.01 |

Financial Statements and Exhibits.

|

| (a) |

Financial Statements of Business Acquired

|

| (b) |

Pro Forma Financial Information

|

| (d) |

Exhibits.

|

|

Exhibit Number

|

Description

|

|

|

Purchase Agreement, dated as of February 26, 2025, by and among FTAI Infrastructure Inc., Ohio River Partners Holdco LLC and Long Ridge Energy & Power LLC, and Labor Impact Fund,

L.P., Labor Impact Feeder Fund, L.P., Labor Impact Real Estate (Cayman) Holdings, L.P. and LIF LR Holdings LLC.

|

||

|

Second Certificate of Amendment to the Certificate of Designations of Series A Senior Preferred Stock of FTAI Infrastructure Inc., dated as of February 26, 2025.

|

||

|

Certificate of Designations of Series B Convertible Junior Preferred Stock of FTAI Infrastructure Inc., dated as of February 26, 2025.

|

||

|

Investor Rights Agreement, dated as of February 26, 2025, by and among FTAI Infrastructure Inc., Labor Impact Fund, L.P., LIF AIV 1, L.P., Labor Impact Feeder Fund, L.P. and Labor Impact

Real Estate (Cayman) Holdings, L.P.

|

||

|

Amended and Restated Warrant Agreement, dated as of February 26, 2025, by and between FTAI Infrastructure Inc. and Equiniti Trust Company, LLC (f/k/a American Stock Transfer & Trust

Company, LLC).

|

||

|

104

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document.

|

|

FTAI INFRASTRUCTURE INC.

|

|||

|

By:

|

/s/ Kenneth J. Nicholson

|

||

|

Name:

|

Kenneth J. Nicholson

|

||

|

Title:

|

Chief Executive Officer and President

|

||

|

Date: February 26, 2025

|

| (A) |

a duly executed IRS Form W-9 from LIF and LIF Feeder, and a duly executed IRS Form W-8 from LIF Real Estate;

|

|

|

(B) |

an assignment and assumption agreement, substantially in the form attached hereto as Exhibit B (the “Assignment and Assumption Agreement”), duly executed by each Seller; and

|

|

|

(C) |

an investor rights agreement, substantially in the form attached hereto as Exhibit C (the “Investor Rights Agreement”), duly executed by each Seller (or designee(s) thereof).

|

|

|

(A) |

the FIP Convertible Junior Preferred Shares in book entry form, free and clear of any liens or other restrictions (other than those arising under this Agreement, the Certificate of Designations, the Investor Rights Agreement or

applicable securities laws) in the name of Sellers (or designee(s) thereof);

|

|

|

(B) |

a copy of the records of FIP’s transfer agent, or other evidence showing Sellers (or designee(s) thereof) as the owner of the FIP Convertible Junior Preferred Shares on and as of the Closing Date;

|

|

|

(C) |

a certified copy of the certificate of incorporation of FIP (the “FIP Certificate of Incorporation”), which shall include a certificate of designations, in the form attached hereto as Exhibit

D (the “Certificate of Designations”);

|

|

|

(D) |

the LRE&P Promissory Note, duly executed by LRE&P;

|

|

|

(E) |

a certificate of good standing of FIP issued by the office of the Delaware Secretary of State, dated within ten (10) days of the Closing Date;

|

|

|

(F) |

the Assignment and Assumption Agreement, duly executed by FIP;

|

|

|

(G) |

the Investor Rights Agreement, duly executed by FIP; and

|

| (H) |

by wire transfer of immediately available funds to the account(s) designated by each Seller, an aggregate amount equal to the percentage of the Cash Consideration set forth

opposite such Seller’s name on Schedule 1 hereto.

|

| 3 |

Note to Draft: GCM continuing to review. Note to GCM: Given the anticipated signing/closing date, FIP would not expect any disclosures to be made for the first time at this stage.

|

| 4 |

Note to Draft: FIP to provide evidence of this approval having been obtained.

|

|

SELLERS:

|

||

|

LABOR IMPACT FUND, L.P.

|

||

|

767 Fifth Avenue, 14th Floor

|

||

|

New York, NY 10153

|

||

|

Attention: Matthew Rinklin; General Counsel

|

||

|

By:

|

/s/ Todd Henigan | |

|

Name: Todd Henigan

|

||

|

Title: Authorized Signatory

|

||

|

LABOR IMPACT FEED FUND, L.P.

|

||

|

767 Fifth Avenue, 14th Floor

|

||

|

New York, NY 10153

|

||

|

Attention: Matthew Rinklin; General Counsel

|

||

|

By:

|

/s/ Todd Henigan | |

|

Name: Todd Henigan

|

||

|

Title: Authorized Signatory

|

||

|

LABOR IMPACT REAL ESTATE (CAYMAN) HOLDINGS, L.P.

|

||

|

767 Fifth Avenue, 14th Floor

|

||

|

New York, NY 10153

|

||

|

Attention: Matthew Rinklin; General Counsel

|

||

|

By:

|

/s/ Todd Henigan | |

|

Name: Todd Henigan

|

||

|

Title: Authorized Signatory

|

||

|

ORPH:

|

||

|

OHIO RIVER PARTNERS HOLDCO LLC

|

||

|

c/o FIG LLC

|

||

|

111 West 19th Street

|

||

|

New York, NY 10011

|

||

|

Attention: Bo Wholey

|

||

|

By:

|

/s/ Robert Wholey

|

|

|

Name: Robert Wholey

|

||

|

Title: President

|

||

|

FIP:

|

||

|

FTAI INFRASTRUCTURE INC.

|

||

|

c/o FIG LLC

|

||

|

111 West 19th Street

|

||

|

New York, NY 10011

|

||

|

Attention: Ken Nicholson

|

||

|

By:

|

/s/ Kenneth Nicholson

|

|

|

Name: Kenneth Nicholson

|

||

|

Title: Chief Executive Officer

|

||

|

LRE&P:

|

||

|

LONG RIDGE ENERGY & POWER LLC

|

||

|

501 Corporate Drive, Suite 210

|

||

|

Canonsburg, PA 15317

|

||

|

Attention: Bo Wholey

|

||

|

By:

|

/s/ Robert Wholey | |

|

Name: Robert Wholey

|

||

|

Title: President

|

||

|

LIF HOLDINGS:

|

||

|

LIF LR HOLDINGS, LLC

|

||

|

767 Fifth Avenue, 14th Floor

|

||

|

New York, NY 10153

|

||

|

Attention: Matthew Rinklin; General Counsel

|

||

|

By:

|

/s/ Todd Henigan | |

|

Name: Todd Henigan

|

||

|

Title: Authorized Signatory

|

||

|

FTAI INFRASTRUCTURE INC.

|

|||

|

By:

|

/s/ Kenneth Nicholson | ||

|

Name: Kenneth Nicholson

|

|||

|

Title: Chief Executive Officer

|

|||

| 1. |

Series B Preferred Stock.

|

|

|

(a) |

Designation. A total of 160,000 shares of Preferred Stock of the Corporation shall be designated as a series known as “Series B Convertible Junior Preferred Stock”, with each such

share having an initial Stated Value of $1,000 per share (the “Series B Preferred Stock”), which Series B Preferred Stock will have the respective designations, powers, preferences and relative, participating, optional, special and

other rights, and the qualifications, limitations and restrictions set forth in this certificate of designations (this “Certificate of Designations”).

|

|

|

(b) |

Uncertificated Shares. The Series B Preferred Stock will be represented in the form of uncertificated shares. The Corporation shall evidence the share(s) of Series B Preferred

Stock in the form of an electronic book entry maintained by the Corporation or the Corporation’s transfer agent. Any reference in this Certificate of Designations to the “delivery” of the shares will be deemed to be satisfied upon the

registration of the electronic book entry representing such shares of Series B Preferred Stock in the name of the applicable Holder.

|

| 2. |

Rank. All shares of the Series B Preferred Stock shall rank (a) senior to (i) Dividend Junior Securities with respect to the payment of dividends; and (ii) Liquidation Junior Securities with respect

to the distribution of assets upon the Corporation’s liquidation, dissolution or winding up; (b) equally with (i) Dividend Parity Securities with respect to the payment of dividends; and (ii) Liquidation Parity Securities with respect to

the distribution of assets upon the Corporation’s liquidation, dissolution or winding up; and (c) junior to (i) Dividend Senior Securities with respect to the payment of dividends; and (ii) Liquidation Senior Securities with respect to

the distribution of assets upon the Corporation’s liquidation, dissolution or winding up.

|

| 3. |

Dividends.

|

|

|

(a) |

Generally. Except as set forth in Section 6, Dividends shall be payable to the Holders as they appear on the records of the Corporation on the Record Date for such

Dividends. The Dividend Payment Date, to the extent the Board determines to declare Dividends in respect any Dividend Period, shall be declared by the Board during each Dividend Period on the date that is at least 10 Business Days prior

to the Dividend Payment Date and the Record Date shall be the date the Board declares such Dividend Payment Date or such other date prior to the Dividend Payment Date as the Board may declare.

|

|

|

(b) |

Dividend Calculation. From and after the Initial Issue Date, cumulative dividends (“Dividends”) shall accrue and accumulate on each share of Series B Preferred Stock

outstanding on a daily basis in arrears at the applicable Dividend Rate then in effect whether or not declared and paid in cash, and, if not declared and paid in cash, shall accrue and be compounded as described below. Dividends with

respect to each Dividend Period shall be the sum of the dividends calculated on a daily basis during such period. The daily dividend shall be calculated as the product of (i) the Stated Value of each share of the Series B Preferred Stock

outstanding, and (ii) the applicable Dividend Rate specified in clause (c) below for each day elapsed during such Dividend Period divided by 360. Dividends will be due and payable quarterly in arrears, at the election of the

Corporation, at any time when, as and if declared by the Board or a duly authorized committee hereof, out of the assets of the Corporation and its Subsidiaries on each Dividend Payment Date. To the extent any Dividends are not paid in

cash, such Dividends shall be automatically compounded quarterly on each Dividend Payment Date. On each Dividend Payment Date related to a Dividend Period for which the Corporation does not for any reason (including because payment of any

Dividend is prohibited by law) timely pay in cash all Dividends that accumulated during such Dividend Period, any such accrued but unpaid Dividends shall (whether or not earned or declared) become part of the Stated Value of such share as

of the applicable Dividend Payment Date (“Compounded Dividends”). The Corporation shall inform the Holders of the intention that Dividends for any such Dividend Period will be paid in cash on or prior to the fifth (5th) Business

Day prior to the end of the applicable Dividend Period, and if such notice is not provided, then such Dividends shall not be deemed as timely paid in cash such that the decrease of Dividend Rate as provided in the proviso of Section

3(c) shall not apply. The Corporation may at any time elect to declare and pay (or set apart cash to pay) to Holders in cash all or any portion of Compounded Dividends accrued with respect to prior Dividend Periods, together with

any interest accrued and unpaid thereon to the date of such payment (a “Catch-Up Dividend Payment”). Such accrued Dividends shall be deemed to be paid in full as of the date cash is set apart for payment of or paid as a Catch-Up

Dividend Payment, and the Stated Value shall be automatically reduced by the amount of the Catch-Up Dividend Payment. The procedures for declaring and paying such Catch-Up Dividend Payment shall be the same as the procedures set forth in

Section 3(a) with respect to the declaration and payment of Dividends.

|

|

|

(c) |

Dividend Rate. The dividend rate (the “Dividend Rate”) for the Series B Preferred Stock shall be 10.00% per annum; provided, that,

with respect to any Dividends that are timely paid in cash on an applicable Dividend Payment Date, the Dividend Rate for such Dividend Period shall be decreased by 1.00%.

|

|

|

(d) |

No Cash Dividend Permitted. No dividends may be declared or paid on any shares of Series B Preferred Stock in cash for so long as any shares of Series A Preferred Stock remain

outstanding.

|

|

|

(e) |

Conversion Following a Record Date. If the Conversion Date of any share of Series B Preferred Stock to be converted is after a Record Date for a declared Dividend on the Series B

Preferred Stock and on or before the next Dividend Payment Date, then Holders will not be entitled to such Dividend notwithstanding anything herein to the contrary, and if such Dividend is paid, the Holder must return it to the

Corporation as a condition to the receipt of shares of Common Stock upon conversion.

|

|

|

(f) |

Junior and Parity Securities. So long as any share of the Series B Preferred Stock remains outstanding, no Dividend Parity Securities, Liquidation Parity Securities,

Dividend Junior Securities or Liquidation Junior Securities shall be, directly or indirectly, purchased, redeemed or otherwise acquired for consideration by the Corporation or any of its Subsidiaries unless all accumulated and unpaid

dividends on the shares of Series B Preferred Stock for all preceding Dividend Periods, including any Compounded Dividends, have been declared and paid in full in cash (including pursuant to one or more Catch-Up Dividend Payments) upon

all outstanding shares of Series B Preferred Stock; provided, that the preceding does not apply to purchases, redemptions or other acquisitions for consideration (i) pursuant to an exchange for or

conversion or reclassification into other securities that are not Dividend Senior Securities, Liquidation Senior Securities, Dividend Parity Securities or Liquidation Parity Securities, (ii) pursuant to the repurchase of shares of Common

Stock from current or former employees, officers, directors, consultants or other persons performing or who performed services for the Corporation in the ordinary course of business, (iii) pursuant to purchases of fractional interests in

shares of Capital Stock upon conversion or exchange of securities that are not Dividend Senior Securities or Liquidation Senior Securities or (iv) repurchases of Capital Stock deemed to occur upon exercise of stock options or warrants if

such Capital Stock represents a portion of the exercise price of such options or warrants and repurchases of Capital Stock or options to purchase Capital Stock in connection with the exercise of stock options to the extent necessary to

pay applicable withholding taxes. Unless all accrued and unpaid dividends on shares of Series B Preferred Stock have been paid in full in cash on any Dividend Payment Date, (x) no dividends may be declared or paid on any Dividend Parity

Securities unless dividends are declared on the Series B Preferred Stock such that the respective amounts of such dividends declared on the Series B Preferred Stock and each such other class or series of Dividend Parity Securities shall

bear the same ratio to each other as all accumulated and unpaid dividends per share on the shares of the Series B Preferred Stock and such class or series of Dividend Parity Securities (subject to their having been declared by the Board

out of legally available funds) bear to each other, in proportion to their respective liquidation preferences at the time of declaration (provided, that any unpaid dividends on the Series B

Preferred Stock will continue to accrue and accumulate) and (y) no dividends may be declared or paid on any Dividend Junior Securities. Notwithstanding anything to the contrary herein, the Corporation shall be permitted to declare or pay

(or set aside for payment) Dividends on the Common Stock at any time; provided, that any such Dividends so declared or paid (or set aside for payment) shall not exceed $0.03 per share of Common

Stock in any fiscal quarter; provided, however that, during the period beginning on the Initial Issue Date and ending on, and including, the date that is

the third anniversary of the Initial Issue Date, in no event shall any such Dividends on the Common Stock so declared or paid (or set aside for payment) exceed an aggregate amount equal to $36.0 million unless all accumulated and unpaid

dividends on the shares of Series B Preferred Stock for all preceding Dividend Periods, including any Compounded Dividends, have been declared or paid (or set aside for payment) in full in cash (including pursuant to one or more Catch-Up

Dividend Payments) upon all outstanding shares of Series B Preferred Stock.

|

|

|

(g) |

Series A Preferred Stock. So long as any share of the Series A Preferred Stock remains outstanding, no shares of Series B Preferred Stock shall be, directly or indirectly,

purchased, redeemed or otherwise acquired for consideration by the Corporation or any of its Subsidiaries; provided, that the Corporation shall be permitted to issue shares of Common Stock upon

conversion of the Series B Preferred Stock or exercise of the Warrants, as applicable.

|

| 4. |

Liquidation Rights.

|

|

|

(a) |

Liquidation. In the event of any Liquidation, the Holders shall be entitled, out of the assets of the Corporation available for distribution to its stockholders, pari passu with the holders of any Liquidation Parity Securities, but before any distribution or payment out of the assets of the Corporation shall be made to the holders of Liquidation Junior

Securities by reason of their ownership thereof, and subject to the rights of the holders of any other Liquidation Senior Securities, and the rights of the Corporation’s existing and future creditors, to receive in full a liquidating

distribution in cash and in the amount per share of Series B Preferred Stock equal to the greater of (i) the Liquidation Value with respect to such shares of Series B Preferred Stock as of the date of such Liquidation and (ii) the amount

such Holders would have received had such Holders, immediately prior to such Liquidation, converted such shares of Series B Preferred Stock into Common Stock pursuant to Section 8, without regard to any of the limitations on

convertibility contained herein. Holders shall not be entitled to any further payments in the event of any such Liquidation other than what is expressly provided for in this Section 4 and will have no right or claim to any of the

Corporation’s remaining assets.

|

|

|

(b) |

Partial Payment. If in connection with any distribution described in Section 4(a), the assets of the Corporation or proceeds therefrom are not sufficient to pay in full

the aggregate liquidating distributions required to be paid pursuant to Section 4(a) to all Holders and the liquidating distributions payable to all holders of Liquidation Parity Securities, (i) the amounts distributed to the

Holders and to the holders of all such Liquidation Parity Securities shall be paid pro rata in accordance with the respective aggregate liquidating distributions to which they would otherwise be entitled if all amounts payable thereon

were paid in full and (ii) the Corporation shall not make or agree to make, or set aside for the benefit of the holders of Liquidation Junior Securities, any payments to the holders of Liquidation Junior Securities by reason of their

ownership thereof.

|

|

|

(c) |

Merger, Consolidation and Sale of Assets Not Liquidation. For purposes of this Section 4, (i) the sale, conveyance, exchange or transfer (for cash, shares of stock,

securities or other consideration) of all or substantially all of the property and assets of the Corporation shall not be deemed a Liquidation, nor shall (ii) the merger, consolidation, statutory exchange or any other business combination

transaction of the Corporation into or with any other Person or the merger, consolidation, statutory exchange or any other business combination transaction of any other Person into or with the Corporation be deemed to be a Liquidation.

|

| 5. |

Optional Redemption.

|

|

|

(a) |

Optional Redemption. Provided that no shares of Series A Preferred Stock are then outstanding, at any time and from time to time, to the extent not prohibited by law, the

Corporation may elect to redeem all outstanding shares of Series B Preferred Stock, or any portion thereof, in cash at a redemption price per share of Series B Preferred Stock equal to the Optional Redemption Price on the terms and

subject to the conditions set forth in this Section 5 (an “Optional Redemption”); provided, that nothing in this Section 5 shall prevent any Holder from exercising their

conversion rights pursuant to Section 8(e)(iii) herein.

|

|

|

(b) |

Optional Redemption Price. The total price for each share of Series B Preferred Stock redeemed pursuant to this Section 5 shall be an amount per share of Series B

Preferred Stock, calculated as of the Optional Redemption Date, equal to the following:

|

|

|

(i) |

if the Optional Redemption Date occurs on or prior to the second anniversary of the Initial Issue Date, the Base Preferred Return Amount plus

43.75 Warrants; and

|

|

|

(ii) |

if the Optional Redemption Date occurs after the second anniversary of the Initial Issue Date, 102% of the Liquidation Value (each of clauses (i) and (ii), as applicable,

the “Optional Redemption Price”).

|

|

|

(c) |

Optional Redemption Mechanics.

|

|

|

(i) |

Any election by the Corporation pursuant to this Section 5 shall be made by delivery to the Holders of written notice (the “Optional

Redemption Notice”) of the Corporation’s election to redeem, at least 10 calendar days but no more than 60 calendar days prior to the elected redemption date (each such date, an “Optional Redemption Date”), which Optional

Redemption Notice shall state:

|

|

|

(A) |

that an Optional Redemption is being made and the number of shares of Series B Preferred Stock being redeemed; and

|

|

|

(B) |

(1) the Optional Redemption Price, (2) the bank, trust company or exchange agent with which the cash portion of the aggregate Optional Redemption Price shall be deposited on or prior to

the Optional Redemption Date and (3) the Optional Redemption Date (or, to the extent not ascertainable at the time of such notice, a good faith estimate of the Optional Redemption Date).

|

|

|

(ii) |

Any Optional Redemption Notice may, at the Corporation’s discretion, be subject to one or more conditions precedent.

|

|

|

(iii) |

Any Optional Redemption that is effected pursuant to this Section 5 shall be made on a pro rata basis among all Holders in proportion to the number of shares of Series B

Preferred Stock held by such Holders. For the avoidance of doubt, shares of the Series B Preferred Stock are not redeemable at the Corporation’s election except pursuant to this Section 5.

|

|

|

(iv) |

On or before any Optional Redemption Date, the Corporation shall deposit (A) the cash portion of the applicable aggregate Optional Redemption Price with a bank, trust company or exchange

agent having an office in New York City in trust for the benefit of such Holders and (B) where applicable, issue or cause to be issued any Warrants; provided,

that where the Optional Redemption Date would occur within the five (5) Business Days preceding a Change of Control Event, such Warrants shall be delivered no later than five (5) Business Days prior to such Change of Control Event. On the

Optional Redemption Date, the Corporation shall cause to be paid the applicable aggregate Optional Redemption Price for such shares of Series B Preferred Stock to such Holders, including, in the case of the cash portion, at an account or

accounts designated by such Holders. Upon such payment in full, such shares of Series B Preferred Stock will be deemed to have been redeemed, and Dividends with respect to such redeemed shares of Series B Preferred Stock shall cease to

accumulate and all designations, rights, preferences, powers, qualifications, restrictions and limitations of such redeemed shares of Series B Preferred Stock shall forthwith terminate.

|

|

|

(v) |

If any shares of Series B Preferred Stock are not redeemed on the Optional Redemption Date for any reason, until such shares are redeemed, all such unredeemed shares of Series B

Preferred Stock shall remain outstanding and entitled to all of the designations, powers, preferences and relative, participating, optional, special and other rights, and the qualifications, limitations and restrictions of the Series B

Preferred Stock set forth in this Certificate of Designations, including the right to accumulate and receive Dividends thereon as set forth in Section 3 until the date on which the Corporation redeems and pays in full the Optional

Redemption Price for such Series B Preferred Stock.

|

| 6. |

Mandatory Redemption.

|

|

|

(a) |

Mandatory Redemption. Provided that all shares of Series A Preferred Stock then outstanding are redeemed in full before redemption of any shares of Series B Preferred Stock

pursuant to this Section 6, at the time of the occurrence of any Change of Control Event, the Corporation shall, to the extent not prohibited by law, redeem all of the shares of Series B Preferred Stock (such redemption, a “Mandatory

Redemption”) at the time of the occurrence of such Change of Control Event (the “Mandatory Redemption Time”), in cash (to be paid in accordance with Section 6(c)) at a price per share of Series B Preferred Stock equal

to the Mandatory Redemption Price. If, at the Mandatory Redemption Time, the Corporation is prohibited by law from redeeming all shares of Series B Preferred Stock held by Holders, then the Corporation shall redeem such Series B Preferred

Stock on a pro rata basis among Holders thereof to the fullest extent not so prohibited. Any shares of Series B Preferred Stock that are not redeemed pursuant to the immediately preceding sentence shall remain outstanding and entitled to

all of the designations, powers, preferences and relative, participating, optional, special and other rights, and the qualifications, limitations and restrictions of the Series B Preferred Stock set forth in this Certificate of

Designations, including the right to continue to accumulate and receive Dividends thereon as set forth in Section 3 and, under such circumstances, the redemption requirements provided hereby shall be continuous, so that at any

time thereafter when the Corporation is not prohibited by law from redeeming such shares of Series B Preferred Stock, the Corporation shall immediately redeem such shares of Series B Preferred Stock at a price per share of Series B

Preferred Stock equal to the Mandatory Redemption Price as of the Mandatory Redemption Time in accordance with this Section 6 together with payment of an amount equal to the additional accumulated and unpaid Dividends following

the Mandatory Redemption Time; provided, that nothing in this Section 6 shall prevent any Holder from exercising their conversion rights pursuant to Section 8(e)(iii) herein.

|

|

|

(b) |

Mandatory Redemption Price. The total price for each share of Series B Preferred Stock redeemed pursuant to this Section 6 shall be an amount per share of Series B

Preferred Stock equal to 102% of the Liquidation Value (the “Mandatory Redemption Price”), calculated as of the Mandatory Redemption Time.

|

|

|

(c) |

Mandatory Redemption Mechanics.

|

|

|

(i) |

With respect to a Change of Control Event, the Corporation shall send a notice to each Holder (the “Mandatory Redemption Notice”), at least 15 Business Days prior to the

anticipated date of closing of the Change of Control, which Mandatory Redemption Notice shall state:

|

|

|

(A) |

that a Mandatory Redemption is being made and that all of such Holder’s shares of Series B Preferred Stock will be redeemed pursuant to this Section 6;

|

|

|

(B) |

(1) the Mandatory Redemption Price, (2) the bank, trust company or exchange agent with which the aggregate Mandatory Redemption Price shall be deposited on or prior to the Mandatory

Redemption Time and (3) the Mandatory Redemption Time (or, to the extent not ascertainable at the time of such notice, a good faith estimate of the Mandatory Redemption Time); and

|

|

|

(C) |

a reasonably detailed description of the Change of Control Event, including the terms and conditions thereof.

|

|

|

(ii) |

With respect to a Change of Control Event, the Corporation shall cause the aggregate Mandatory Redemption Price to be paid in accordance with this Section 6(c) prior to or

concurrently with the effective date of such Change of Control Event. In furtherance of the foregoing, the Corporation shall ensure that concurrently with and as a condition to the consummation of a Change of Control, the Mandatory

Redemption shall be effected in full.

|

|

|

(iii) |

On or before any Mandatory Redemption Time, the Corporation shall deposit the amount of the applicable aggregate Mandatory Redemption Price with a bank, trust company or exchange agent

having an office in New York City irrevocably in trust for the benefit of such Holders. At the Mandatory Redemption Time, the Corporation shall immediately cause to be paid in cash the applicable Mandatory Redemption Price for such shares

of Series B Preferred Stock to such Holders at an account or accounts designated by such Holders. Upon such payment in full, such shares of Series B Preferred Stock will be deemed to have been redeemed, and Dividends with respect to such

redeemed shares of Series B Preferred Stock shall cease to accumulate and all designations, rights, preferences, powers, qualifications, restrictions and limitations of such redeemed shares of Series B Preferred Stock shall forthwith

terminate.

|

|

|

(iv) |

The Corporation shall comply, to the extent applicable, with the requirements of Section 14 of the Exchange Act and any other securities laws (or rules of any exchange on which any

Series B Preferred Stock are then listed) in connection with a redemption under this Section 6. To the extent there is any conflict between the notice or other timing requirements of this Section 6 and the applicable

requirements of Section 14 of the Exchange Act, Section 14 of the Exchange Act shall govern.

|

|

|

(d) |

Corporate Efforts. The Corporation shall take such actions as are necessary to give effect to the provisions of this Section 6, including in the event the Corporation is

prohibited by law from redeeming or is otherwise unable to redeem any shares of Series B Preferred Stock in connection with any Change of Control Event at the Mandatory Redemption Time, taking any action necessary or appropriate to the

extent not prohibited by law to remove promptly any impediments to its ability to redeem such shares of Series B Preferred Stock required to be so redeemed, including (i) reducing the stated capital of the Corporation or revaluing the

assets of the Corporation to their fair market values under Section 154 of the DGCL if such reduction or revaluation would create surplus sufficient to make all or any portion of such Mandatory Redemption payment, and (ii) generating

legally available funds (whether by incurring indebtedness, issuing equity, selling assets, effecting a Deemed Liquidation Event or otherwise) sufficient to make all or any portion of such Mandatory Redemption payment. In the event of any

Change of Control Event in which the Corporation is not the continuing or surviving corporation or entity, proper provision shall be made so that the ultimate parent of such continuing or surviving corporation or entity shall agree to

carry out and observe the obligations of the Corporation under this Certificate of Designations.

|

|

|

(e) |

Redemption Preference. Any redemption under Section 5 or this Section 6 shall be in preference to and in priority over any dividend, distribution or redemption

rights of any Dividend Junior Securities and any Liquidation Junior Securities.

|

|

|

(f) |

Unclaimed Funds. If the Holders of any shares of Series B Preferred Stock that have been redeemed pursuant to Section 5 or this Section 6 shall not within two (2)

years (or any longer period required by law) after the applicable redemption date claim any amount so deposited in trust for the redemption of such shares, then such bank or trust company shall, if permitted by applicable law, pay over to

the Corporation any such unclaimed amount so deposited with it and thereupon shall be relieved of all responsibility in respect thereof; and thereafter the Holders of such shares shall, subject to applicable unclaimed property laws, look

only to the Corporation for payment of the Optional Redemption Price or the Mandatory Redemption Price, as applicable, for such shares, without interest.

|

| 7. |

Voting.

|

|

|

(a) |

General. The Holders have no voting rights with respect to the Series B Preferred Stock except as set forth in this Certificate of Designations (including without limitation, Section

7(b)), the Certificate of Incorporation, the Bylaws or as otherwise required by law.

|

|

|

(b) |

Voting Rights with Respect to Specified Matters.

|

|

|

(i) |

As long as any shares of the Series B Preferred Stock issued on the Initial Issue Date remain outstanding, the Corporation shall not, directly or indirectly (whether by amending the

Certificate of Incorporation (including this Certificate of Designations), or by reclassification, merger, consolidation, reorganization, recapitalization or otherwise) do any of the following without (in addition to any other vote

required by applicable law or the Certificate of Incorporation) the written consent or affirmative vote of the Majority Holders, given in writing or by vote at a meeting, consenting or voting (as the case may be) separately as a class:

(A) create or authorize the creation of (including by increasing the authorized amount of) or issue any Liquidation Senior Securities, Dividend Senior Securities, Liquidation Parity Securities or Dividend Parity Securities, or any

securities convertible into or exercisable or exchangeable for any of the foregoing securities or (B) reclassify, alter or amend any existing class or series of equity securities in a manner that would result in such class or series of

equity securities being Liquidation Senior Securities, Dividend Senior Securities, Liquidation Parity Securities or Dividend Parity Securities; provided, that this Section 7(b)(i) shall

not apply to (i) the issuance, creation, reclassification, alteration or exchange of the Series A Preferred Stock or (ii) to any Liquidation Senior Securities, Dividend Senior Securities, Liquidation Parity Securities or Dividend Parity

Securities issued or created for the purpose of refinancing all of the shares of Series A Preferred Stock issued and outstanding as of the date thereof.

|

|

|

(ii) |

So long as a number of shares of Series B Preferred Stock having a Liquidation Value greater than $25.0 million in the aggregate are then outstanding, the Corporation shall not, and

shall not cause or permit any Subsidiary to, without the written consent or affirmative vote of the Majority Holders, given in writing or by vote at a meeting, consenting or voting (as the case may be) separately as a class, Incur

Indebtedness unless (A) such Indebtedness constitutes Refinancing Indebtedness or equity securities as permitted pursuant to the proviso to Section 7.1(b)(i), (B) the Consolidated Total Leverage Ratio, calculated on a pro forma

basis at the time of such Incurrence, would not exceed 12.0 or (C) with respect to Indebtedness of a Subsidiary, such Indebtedness is Non-Recourse Indebtedness.

|

|

|

(c) |

Voting Power. At the time of any vote or consent of any of the Holders under this Certificate of Designations, any other Related Agreement or as otherwise required by law, each

Holder shall be entitled to one (1) vote for each share of Series B Preferred Stock held by such Holder.

|

| 8. |

Conversion. The Holders of Series B Preferred Stock shall have conversion rights as follows:

|

|

|

(a) |

Optional Right to Convert by Holders.

|

|

|

(i) |

Each share of Series B Preferred Stock shall be convertible, at the option of the Holder thereof, at any time and from time to time, including, for the avoidance of doubt, pursuant to Section

8(e)(iii) herein, and without the payment of additional consideration by the Holder thereof, in whole or in part (pro-rated for partial conversions), into such number of fully paid and non-assessable shares of Common Stock equal to

the quotient (rounded up to the nearest whole number of shares) of (A) the Liquidation Value, divided by (B) the Conversion Price in effect at the time of conversion. The “Conversion Price” shall initially be equal to $8.18. The

Conversion Price, and the rate at which shares of Series B Preferred Stock may be converted into shares of Common Stock, shall be subject to adjustment as provided below.

|

|

|

(ii) |

In order for a Holder of Series B Preferred Stock to voluntarily convert shares of Series B Preferred Stock into shares of Common Stock, such Holder shall provide written notice to the

Corporation’s transfer agent at the office of the transfer agent for the Series B Preferred Stock (or at the principal office of the Corporation if the Corporation serves as its own transfer agent) that such Holder elects to convert all

or any number of such Holder’s shares of Series B Preferred Stock and, if applicable, any event upon which such conversion is, or such future time at which such conversion shall be, effective (a “Conversion Notice”). Such

Conversion Notice shall state such Holder’s name or the names of the nominees in which such Holder desires the shares of Common Stock to be issued. The close of business on the date of receipt by the transfer agent (or by the Corporation

if the Corporation serves as its own transfer agent) of the Conversion Notice (or as applicable, the future event or time upon which the effectiveness of the conversion was contingent), shall be the time of conversion unless regulatory or

governmental consents are required in connection with such conversion, as determined in the reasonable discretion of the Holder, in which case, the time of conversion shall be three (3) Business Days following the date on which any such

regulatory or governmental consents required for such consent are obtained, if later (as applicable, the “Optional Conversion Time”), and the shares of Common Stock issuable upon conversion of the specified shares shall be deemed

to be outstanding of record as of such Optional Conversion Time.

|

|

|

(iii) |

The Corporation shall, as soon as practicable (but in no event later than 10 Business Days) after the Optional Conversion Time, issue and deliver to such Holder of Series B Preferred

Stock, or to his, her or its nominees, a notice of issuance of uncertificated shares in lieu of certificates for the number of full shares of Common Stock issuable upon such conversion in accordance with the provisions hereof and a notice

of issuance of uncertificated shares in lieu of certificates for the number (if any) of the shares of Series B Preferred Stock that were not converted into Common Stock. In the event a Conversion Notice set forth any event upon which such

conversion is, or such future time at which such conversion was to be, conditioned or effective (including regulatory or governmental consent required in connection with such conversion, as determined in the reasonable discretion of the

Holder), at any time prior to the Optional Conversion Time, the Holder of the Series B Preferred Stock may revoke its Conversion Notice, by written notice to the Corporation.

|

|

|

(b) |

Mechanics of Conversion.

|

|

|

(i) |

Reservation of Shares. The Corporation shall, at all times when Series B Preferred Stock shall be outstanding, reserve and keep available out of its authorized but unissued

capital stock, for the purpose of effecting the conversion of Series B Preferred Stock, such number of its duly authorized shares of Common Stock as shall from time to time be sufficient to effect

the conversion of all outstanding Series B Preferred Stock; and, if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of Series B

Preferred Stock, the Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose, including, without

limitation, engaging in reasonable best efforts to call a meeting of the stockholders and obtain the requisite stockholder approval of any necessary amendment to the Certificate of Incorporation.

|

|

|

(ii) |

Effect of Conversion. All rights with respect to Series B Preferred Stock converted into Common Stock, including the rights, if any, to receive notices and vote (other than as a

holder of Common Stock), will terminate at the Optional Conversion Time, except only the rights of the Holders thereof to receive the items provided for upon such conversion. Any Holder of shares of Series B Preferred Stock that have been

surrendered for conversion as herein provided shall be deemed to be the holder of the Common Stock issuable upon the conversion as of the Optional Conversion Time. Any shares of Series B Preferred Stock so converted shall be retired and

cancelled and may not be reissued as shares of such series and the Corporation may thereafter take such appropriate action (without the need for stockholder action) as may be necessary to reduce the authorized number of shares of Series B

Preferred Stock by an amount not in excess of the number of surrendered shares.

|

|

|

(C) |

Adjustments for Subdivisions, Combinations and Stock Dividends. If the Corporation exclusively issues shares of Common Stock as a dividend or distribution on all or

substantially all shares of the Common Stock, or

|

|

|

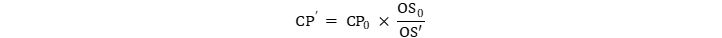

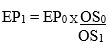

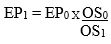

if the Corporation effects a share split or share combination, the Conversion Price shall be adjusted based on the following formula:

|

|

|

(d) |

Notice as to Adjustment. Promptly following any adjustment of the Conversion Price, the Corporation shall (A) furnish to each Holder (which may be by electronic mail) notice of

such adjustment setting forth in reasonable detail such adjustment or (B) publish a notice containing such information on the Corporation’s website.

|

|

|

(e) |

Limitation on Conversion Rights.

|

|

(i)

|

Ownership Limitation. Notwithstanding anything to the contrary in this Certificate of Designations, no shares of Common Stock will be issued or delivered upon any proposed

conversion of any Series B Preferred Stock of any Holder thereof, and no Series B Preferred Stock of any Holder thereof will be convertible, in each case to the extent, and only to the extent, that such issuance, delivery, conversion or

convertibility would cause such Holder to become, directly or indirectly, a Beneficial Owner of a number of shares of Common Stock in excess of 19.99% of the total number of shares of Common Stock issued and outstanding immediately

following such conversion (the “Beneficial Ownership Limitation”). For these purposes, beneficial ownership and calculations of percentage ownership will be determined in accordance with Rule 13d-3 under the Exchange Act. For

purposes of this Section 8(e)(i) only, a Person shall be deemed the “Beneficial Owner” of and shall be deemed to beneficially own any shares Common Stock that such Person or any of such person’s affiliates (as defined in

Rule 12b-2 under the Exchange Act) or associates (as defined in Rule 12b-2 under the Exchange Act) is deemed to beneficially own, together with any Common Stock beneficially owned by any other persons whose beneficial ownership would be

aggregated with such Person for purposes of Section 13(d) of the Exchange Act. Subject to the following proviso, for purposes of this Section 8(e)(i) only,

beneficial ownership shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder as in effect on the date hereof; provided, that

the number of shares of Common Stock beneficially owned by such Person and its affiliates and associates and any other persons whose beneficial ownership would be aggregated with such Person for purposes of Section 13(d) of the Exchange

Act shall include the number of shares of Common Stock issuable upon exercise or conversion of any of the Corporation’s securities or rights to acquire the Common Stock, whether or not such securities or rights are currently exercisable

or convertible or are exercisable or convertible only after the passage of time (including the number of shares of Common Stock issuable upon conversion of the Series B Preferred Stock in respect of which the beneficial ownership

determination is being made), but shall exclude the number of shares of Common Stock that would be issuable upon (A) conversion of the remaining, unconverted portion of any Series B Preferred Stock beneficially owned by such Person or

any of its affiliates or associates and any other persons whose beneficial ownership would be aggregated with such Person for purposes of Section 13(d) of the Exchange Act and (B) exercise or conversion of the unexercised or unconverted

portion of any of the Corporation’s other securities subject to a limitation on conversion or exercise analogous to the limitation contained herein beneficially owned by such Person or any of its affiliates or associates and any other

persons whose beneficial ownership would be aggregated with such Person for purposes of Section 13(d) of the Exchange Act. Prior to the Optional Conversion Time, the Holder shall request that the Corporation confirm the number of shares

of Common Stock then outstanding, and the Corporation shall confirm such number of shares orally and in writing to such Holder within two (2) Business Days of such request. Upon any conversion of Series B Preferred Stock by a Holder in

accordance with Section 8, such Holder will be deemed to have made a representation that such Holder has evaluated the limitation set forth in this paragraph and determined that the issuance of the full number of shares of

Common Stock requested in such conversion is permitted under this Section 8(e)(i).

|

|

|

(ii) |

Share Cap. Notwithstanding anything to the contrary herein, the number of shares of Common Stock deliverable upon conversion of the Series B Preferred Stock shall not cause the

aggregate number of Issued Underlying Shares to exceed the Share Cap unless the Corporation shall have obtained the Requisite Stockholder Approval, provided, that such Requisite Stockholder

Approval shall be deemed obtained if 5635(a) of the Listing Rules (or its successor) does not require stockholder approval to issue the shares of Common Stock required to be issued upon conversion of the Series B Preferred Stock. Except

as otherwise provided herein, if shares of Common Stock are not delivered as a result of the Share Cap, then the Corporation will deliver, in lieu of any shares of Common Stock otherwise

deliverable, an amount of cash per share equal to the volume weighted average per share price of a share of Common Stock on the trading day immediately preceding the Conversion Date (such cash amount, the “Excess Amount”) and the

relevant shares of Series B Preferred Stock shall be deemed converted; provided, that such Excess Amount shall not be payable prior to the date that is 91 days after the earlier of the maturity

date of the notes issued under the Existing Indenture or the date the notes issued under the Existing Indenture are no longer outstanding.

|

|

|

(iii) |

Non-convertibility Immediately Preceding Redemption. Notwithstanding Section 8(a)(i), any Series B Preferred Stock that will be redeemed on an Optional Redemption Date or

at a Mandatory Redemption Time shall no longer be convertible at the option of the Holder thereof following the close of business on the second Business Day immediately preceding (x) the Optional Redemption Date or (y) the date on which

the Mandatory Redemption Time occurs, as applicable.

|

|

|

(iv) |

Regulatory or Governmental Consent. In connection with any regulatory or governmental consents that are required in connection with

the conversion of the Series B Preferred Stock in accordance with this Section 8, or any sale or transfer of the Series B Preferred Stock (or the shares of Common Stock received upon their conversion), in each case, as

determined in the reasonable discretion of the Holder, the Corporation shall cooperate in good faith with requests by the Holder to obtain any such consent as needed to permit the conversion of the Series B Preferred Stock in accordance

with this Section 8, or any sale of such Series B Preferred Stock (or the shares of Common Stock received upon their conversion);

provided, that in no event shall the Corporation be required to provide covenants to any governmental or administrative entity regarding the Corporation, its

Subsidiaries or their operations; provided further, that the Corporation shall bear all costs associated with obtaining such consent, including but not limited to all governmental filing fees

and costs related to any appeals in connection with obtaining any such consent, other than (x) such Holder’s own legal advisory costs incurred in the preparation of any related filings and otherwise obtaining such consent and (y) the

filing fees associated with any filing pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, in each case, for which such Holder shall be responsible.

|

| 9. |

Taxes.

|

|

|

(a) |

Transfer Taxes. The Corporation shall pay any and all stock transfer, documentary, stamp and similar taxes that may be payable in respect of any issuance or delivery of shares of

Series B Preferred Stock or shares of Common Stock or other securities issued on account of Series B Preferred Stock pursuant hereto. However, in the case of conversion of Series B Preferred Stock, the Corporation shall not be required to

pay any such tax that may be payable in respect of any transfer involved in the issuance or delivery of shares of Series B Preferred Stock, shares of Common Stock or other securities to a beneficial owner other than the beneficial owner

of the Series B Preferred Stock immediately prior to such conversion, and shall not be required to make any such issuance, delivery or payment unless and until the Person otherwise entitled to such issuance, delivery or payment has paid

to the Corporation the amount of any such tax or has established, to the satisfaction of the Corporation, that such tax has been paid or is not payable.

|

|

|

(b) |

Withholding.

|

|

|

(i) |

All payments and distributions (or deemed distributions) on the shares of Series B Preferred Stock (and on the shares of Common Stock received upon their conversion) shall be subject to

withholding and backup withholding of taxes to the extent required by law, subject to applicable exemptions, and amounts withheld, if any, shall be treated as received by the Holders.

|

|

|

(ii) |

Each Holder that is a United States person (as defined for U.S. federal income tax purposes) shall provide to the Corporation an executed copy of IRS Form W-9. Each Holder that is not a

United States person shall provide to the Corporation an executed copy of the IRS Form W-8 applicable to such Holder and any other applicable evidence, which shall establish any exemption from, or reduction in, U.S. federal withholding

tax to which such Holder is entitled in respect of the Series B Preferred Stock (or in respect of the shares of Common Stock received upon their conversion). If any form or any other applicable evidence that a Holder previously delivered

expires or becomes obsolete or inaccurate in any respect, such Holder shall promptly update such form and any other applicable evidence.

|

|

|

(iii) |

Notwithstanding anything herein to the contrary, if the Corporation pays, is assessed, or is otherwise liable for any withholding taxes in respect of amounts paid or deemed paid to a

Holder as result of an adjustment to the Conversion Price, a payment of dividends in the form of Series B Preferred Stock, increase in Stated Value, or any other circumstance in which the taxes are not satisfied by withholding from

amounts that would otherwise be paid to the Holder, the Corporation may, at its option, set off such taxes against any payments of cash, Series B Preferred Stock, or Common Stock that would be made to such Holder, including future

dividends, redemption proceeds, or shares of Common Stock issued upon a conversion of shares of Series B Preferred Stock, and the Holder shall indemnify and hold harmless the Corporation for any such taxes.

|

| 10. |

Amendments and Waivers.

|

|

|

(a) |

Notwithstanding any provision in this Certificate of Designations to the contrary and, unless a greater percentage is required by law, any provision contained herein and any rights,

preferences or privileges of the shares of Series B Preferred Stock (and the Holders thereof) granted hereunder (including, but not limited to the covenants included in this Certificate of Designations) may be amended or waived (in each

case, including by merger, consolidation, reorganization, combination, sale or transfer of the Corporation’s capital stock or otherwise) as to all shares of Series B Preferred Stock (and the Holders thereof) upon the affirmative vote or

written consent of the Majority Holders; provided, that the Corporation shall not effect any of the following matters without the consent of each Holder that is adversely affected thereby:

|

|

|

(i) |

reduce the Dividend Rate or alter the timing or method of payment of any Dividends pursuant to Section 3, except as expressly provided by Section 3;

|

|

|

(ii) |

reduce the Stated Value;

|

|

|

(iii) |

alter any of the redemption provisions set forth in Sections 5 and 6 (or any terms applicable to such sections), other than with respect to notice periods and other

immaterial provisions;

|

|

|

(iv) |

alter or amend the provisions set forth in Sections 7 or 8 (or any terms applicable to such sections), other than with respect to immaterial alterations or amendments to

the provisions set forth in Sections 7 or 8 (or any terms applicable to such sections); or

|

|

|

(v) |

amend or waive the provisions of this Section 10.

|

|

|

(b) |

Notwithstanding the foregoing, the Corporation may amend, alter, supplement, or change any terms in this Certificate of Designations without the affirmative vote or written consent of

the Holders for the following purposes:

|

|

|

(i) |

to waive any of the Corporation’s rights with respect thereto; or

|

|

|

(ii) |

to file a certificate of correction with respect to this Certificate of Designations to the extent permitted by Section 103(f) of the DGCL.

|

| 11. |

Cancellation. No shares of Series B Preferred Stock acquired by the Corporation by reason of redemption, purchase or otherwise shall be reissued or held in treasury for reissuance, and the Corporation

shall take all necessary action to cause such shares of Series B Preferred Stock immediately to be canceled, retired and eliminated from the shares of Series B Preferred Stock which the Corporation shall be authorized to issue.

|

| 12. |

Rights and Remedies of Holders.

|

|

|

(a) |

The various provisions set forth under this Certificate of Designations are for the benefit of the Holders and, subject to the terms and conditions hereof and applicable law, will be

enforceable by them, including by one or more actions for specific performance.

|

|

|

(b) |

Except as expressly set forth herein, all remedies available under this Certificate of Designations, at law, in equity or otherwise, will be deemed cumulative and not alternative or

exclusive of other remedies. The exercise by any Holder of a particular remedy will not preclude the exercise of any other remedy.

|

| 13. |

[Reserved].

|

| 14. |

Notices. Unless otherwise provided in this Certificate of Designations or by applicable law, all notices, requests, demands, and other communications shall be in writing and shall be personally

delivered, delivered by email or courier service, or mailed, certified with first class postage prepaid, (i) to the address set forth on the books of the Corporation, in the case of communications to a stockholder, (ii) to the registered

office of the Corporation in the State of Delaware with a copy to the chief executive offices of the Corporation at 1345 Avenue of the Americas, New York, New York 10105, attention: Ken Nicholson; and Kevin Krieger, for all communications

to the Corporation or (iii) to such other address as the Corporation or any stockholder, as the case may be, shall have designated by notice similarly given. Each such notice, request, demand, or other communication shall be deemed to

have been given and received (whether actually received or not) on the date of actual delivery thereof, if personally delivered or delivered by email (if receipt is confirmed at the time of such transmission by telephone or

electronically), or on the third (3rd) day following the date of mailing, if mailed in accordance with this Section 14, or on the day specified for delivery to

the courier service (if such day is one on which the courier service will give normal assurances that such specified delivery will be made). Any notice, request, demand, or other communication given otherwise than in accordance with this

Section 14 shall be deemed to have been given on the date actually received. Whenever any notice is required to be given by law or by this Certificate of

Designations, a written waiver thereof, signed by the Person (or its authorized representative) entitled to notice, whether before or after the time stated therein, shall be deemed equivalent to the giving of notice.

|

| 15. |

Definitions. The following definitions shall be for all purposes, unless otherwise clearly indicated to the contrary, applied to the terms used in this Certificate of Designations:

|

|

|

(2) |

securities issued or directly and fully and unconditionally guaranteed or insured by the United States or Canadian government or any agency or instrumentality thereof the securities of which are

unconditionally guaranteed as a full faith and credit obligation of such government with maturities of 24 months or less from the date of acquisition;

|

|

|

(3) |

certificates of deposit, time deposits and eurodollar time deposits with maturities of 24 months or less from the date of acquisition, bankers’ acceptances with maturities not exceeding 24 months and

overnight bank deposits, in each case with any commercial bank having capital and surplus in excess of $500.0 million;

|

|

|

(4) |

repurchase obligations for underlying securities of the types described in clauses (2) and (3) above entered into with any financial institution meeting the qualifications specified in clause (3) above;

|

|

|

(5) |

commercial paper rated at least P-2 by Moody’s or at least A-2 by S&P and in each case maturing within 24 months after the date of creation thereof;

|

|

|

(6) |

investment funds investing 95% of their assets in securities of the types described in clauses (1) through (5) above;

|

|

|

(7) |

readily marketable direct obligations issued by any state of the United States of America or any political subdivision thereof or any Province of Canada having one of the two highest rating categories

obtainable from either Moody’s or S&P with maturities of 24 months or less from the date of acquisition; and

|

|

|

(8) |

Indebtedness or preferred stock issued by Persons with a rating of “A” or higher from S&P or “A2” or higher from Moody’s with maturities of 24 months or less from the date of acquisition.

|

|

|

(1) |

to purchase any such primary obligation or any property constituting direct or indirect security therefor,

|

|

|

(2) |

to advance or supply funds

|

|

|

(a) |

for the purchase or payment of any such primary obligation; or

|

|

|

(b) |

to maintain working capital or equity capital of the primary obligor or otherwise to maintain the net worth or solvency of the primary obligor; or

|

|

|

(3) |

to purchase property, securities or services primarily for the purpose of assuring the owner of any such primary obligation of the ability of the primary obligor to make payment of such primary obligation

against loss in respect thereof.

|

|

|

(a) |

currency exchange, interest rate, inflation or commodity swap agreements, currency exchange, interest rate, inflation or commodity cap agreements and currency exchange, interest rate, inflation or commodity

collar agreements; and

|

|

|

(b) |

other agreements or arrangements designed to protect such Person against fluctuations in currency exchange, interest rates, inflation or commodity prices.

|

|

|

(1) |

any indebtedness (including principal and premium) of such Person, whether or not contingent:

|

|

|

(a) |

in respect of borrowed money;

|

|

|

(b) |

evidenced by bonds, notes, debentures or similar instruments or letters of credit or bankers’ acceptances (or, without double counting, reimbursement agreements in respect thereof);

|

|

|

(c) |

representing the balance deferred and unpaid of the purchase price of any property (including Capitalized Lease Obligations), except (i) any such balance that constitutes a trade payable or similar

obligation to a trade creditor, in each case accrued in the ordinary course of business, (ii) any earn-out obligations until such obligation becomes a liability on the balance sheet of such Person in accordance with GAAP and is no longer

contingent and (iii) any purchase price holdbacks in respect of a portion of the purchase price of an asset to satisfy warranty or other unperformed obligations of the seller; or

|

|

|

(d) |

representing any Hedging Obligations;

|

|

|

(2) |

to the extent not otherwise included, any obligation by such Person to be liable for, or to pay, as obligor, guarantor or otherwise, on the Indebtedness of another Person, other than by endorsement of

negotiable instruments for collection in the ordinary course of business; provided, that the amount of Indebtedness of any Person for purposes of this clause (2) shall be deemed to be

equal to the lesser of (i) the aggregate unpaid amount of such Indebtedness and (ii) solely in the case of Non-Recourse Indebtedness, the fair market value of the property encumbered thereby as determined by such Person in good faith;

|

|

|

(3) |

to the extent not otherwise included, Indebtedness of another Person secured by a Lien on any asset owned by such Person, whether or not such Indebtedness is assumed by such Person;

|

|

|

(4) |

all monetary obligations under any receivables factoring, receivable sales or similar transactions and all monetary obligations under any synthetic lease or similar financing in which the asset is considered

owned by the Corporation or any Subsidiary for tax purposes; and

|

|

|

(5) |

preferred stock of the Corporation or any Subsidiary,

|

| 16. |

Interpretation.

|

|

|

(a) |

Any of the terms defined herein may, unless the context otherwise requires, be used in the singular or the plural, depending on the reference.

|

|

|

(b) |

The headings are for convenience only and shall not be given effect in interpreting this Certificate of Designations. References herein to any Section or Article shall be to a Section or

Article hereof unless otherwise specifically provided.

|

|

|

(c) |

References herein to any law shall mean such law, including all rules and regulations promulgated under or implementing such law, as amended from time to time and any successor law

unless otherwise specifically provided. Except as otherwise stated in this Certificate of Designations, references in this Certificate of Designations to any contract(s) or written agreement(s) shall mean such contract or written

agreement as in effect on the Purchase Agreement Date, regardless of any subsequent replacement, refunding, refinancing, extension, renewal, restatement, amendment, supplement or modification thereof or thereto and regardless of whether

the Corporation is, remains, was, or has ever been, a party thereto.

|

|

|

(d) |

The words “hereof,” “herein” and “hereunder” and words of similar import, when used in this Certificate of Designations, refer to this Certificate of Designations as a whole and not to

any particular provision of this Certificate of Designations.

|

|

|

(e) |

The use of the masculine, feminine or neuter gender or the singular or plural form of words shall not limit any provisions of this Certificate of Designations.

|

|

|

(f) |

The use herein of the word “include” or “including”, when following any general statement, term or matter, shall not be construed to limit such statement, term or matter to the specific

items or matters set forth immediately following such word or to similar items or matters, whether or not non-limiting language (such as “without limitation” or “but not limited to” or words of similar import) is used with reference

thereto, but rather shall be deemed to refer to all other items or matters that fall within the broadest possible scope of such general statement, term or matter.

|

|

|

(g) |

The word “will” shall be construed to have the same meaning as the word “shall”. With respect to the determination of any period of time, “from” shall mean “from and including”. The word

“or” shall not be exclusive. The word “extent” in the phrase “to the extent” shall mean the degree to which a subject or other thing extends, and such phrase shall not mean simply “if”.

|

|

|

(h) |

The terms “lease” and “license” shall include “sub-lease” and “sub-license”, as applicable.

|

|

|

(i) |

All references to “$”, currency, monetary values and dollars set forth herein shall mean U.S. dollars.

|

|

|

(j) |

When the terms of this Certificate of Designations refer to a specific agreement or other document or a decision by any body or Person that determines the meaning or operation of a

provision hereof, the secretary of the Corporation shall maintain a copy of such agreement, document or decision at the principal executive offices of the Corporation and a copy thereof shall be provided free of charge to any Holder who

makes a request therefor.

|

|

|

(k) |

Except as otherwise expressly provided herein, all terms of an accounting or financial nature shall be construed in accordance with GAAP, as in effect from time to time; provided, that, if the Corporation notifies the Holders that the Corporation requests an amendment to any provision hereof to eliminate the effect of any change occurring after the Purchase Agreement

Date in GAAP or in the application thereof on the operation of such provision, regardless of whether any such notice is given before or after such change in GAAP or in the application thereof, then such provision shall be interpreted on

the basis of GAAP as in effect and applied immediately before such change shall have become effective until such notice shall have been withdrawn or such provision amended in accordance herewith.

|

|

|

(l) |

Notwithstanding any other provision contained herein, all terms of an accounting or financial nature used herein shall be construed, and all computations of amounts and ratios referred

to herein shall be made, without giving effect to any election under FASB Accounting Standards Codification 805, 810 or 825 (or any other part of FASB Accounting Standards Codification having a similar result or effect), to value any

Indebtedness at “fair value”.

|

|

|

(m) |

Although the same or similar subject matters may be addressed in different provisions of this Certificate of Designations, it is intended that each such provision shall be read

separately, be given independent significance and not be construed as limiting any other provision of this Certificate of Designations (whether or not more general or more specific in scope, substance or content).

|

|

FTAI INFRASTRUCTURE INC.

|

||

|

By:

|

/s/ Kenneth Nicholson | |

|

Name:

|

Kenneth Nicholson | ||

|

Title:

|

Chief Executive Officer |

|

Article I

|

||

|

DEFINITIONS

|

||

|

Section 1.1

|

DEFINITIONS

|

1

|

|

Section 1.2

|

RULES OF CONSTRUCTION

|

7

|

|

Article II

|

||

|

TERMINATION

|

||

|

Section 2.1

|

TERM

|

8

|

|

Section 2.2

|

SURVIVAL

|

8

|

|

Article III

|

||

|

REGISTRATION RIGHTS

|

||

|

Section 3.1

|

DEMAND REGISTRATION

|

8

|

|

Section 3.2

|

PIGGYBACK REGISTRATION

|

11

|

|

Section 3.3

|

SHELF REGISTRATION

|

12

|

|

Section 3.4

|

WITHDRAWAL RIGHTS

|

14

|

|

Section 3.5

|

HOLDBACK AGREEMENTS

|

15

|

|

Section 3.6

|

REGISTRATION PROCEDURES

|

15

|

|

Section 3.7

|

REGISTRATION EXPENSES

|

20

|

|

Section 3.8

|

REGISTRATION INDEMNIFICATION

|

21

|

|

Section 3.9

|

SECURITIES ACT RESTRICTIONS

|

23

|

|

Article IV

|

||

|

ADDITIONAL AGREEMENTS

|

||

|

Section 4.1

|

BOARD REPRESENTATION.

|

24

|

|

Section 4.2

|

RESTRICTIONS ON TRANSFERS OF PREFERRED STOCK.

|

26

|

|

Section 4.3

|

EXEMPTION FROM CERTAIN TRANSFER RESTRICTIONS

|

28

|

|

Section 4.4

|

REFINANCING RIGHTS.

|

29

|

|

Section 4.5

|

WARRANT AGREEMENT

|

30

|

|

Article V

|

||

|

MISCELLANEOUS

|

||

|

Section 5.1

|

NOTICES

|

30

|

|

Section 5.2

|

HEADINGS

|

31

|

|

Section 5.3

|

SEVERABILITY

|

31

|

|

Section 5.4

|

COUNTERPARTS

|

32

|

|

Section 5.5

|

ENTIRE AGREEMENT

|

32

|

|

Section 5.6

|

FURTHER ASSURANCES

|

32

|

|

Section 5.7

|

GOVERNING LAW; EQUITABLE REMEDIES

|

32

|

|

Section 5.8

|

CONSENT TO JURISDICTION

|

33

|

|

Section 5.9

|

AMENDMENTS; WAIVERS

|

33

|

|

Section 5.10

|

TRANSFER OF RIGHTS; SUCCESSORS AND ASSIGNS

|

33

|

|

Section 5.11

|

NO THIRD-PARTY BENEFICIARIES

|

33

|

|

Exhibit A

|

Preferred Holder Joinder

|

|

|

Exhibit B

|

Form of Warrant Agreement

|

|

|

Annex I

|

Restrictive Legend to the Preferred Stock Certificate

|

|

|

Schedule A

|

List of Disqualified Transferees

|

| (1) |

the Company pursuant to or within the meaning of any Bankruptcy Law:

|

| (a) |

commences proceedings to be adjudicated bankrupt or insolvent;

|

|

|

(b) |