| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Commission File Number 1-12368

|

|

Delaware

|

75-2543540

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

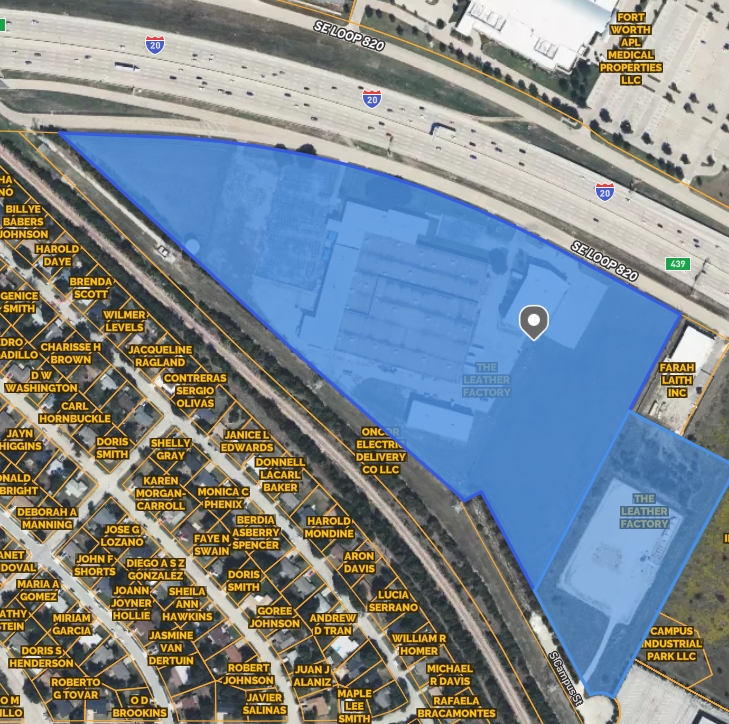

1900 Southeast Loop 820

Fort Worth, Texas 76140

|

76140

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0024

|

TLF

|

The Nasdaq Capital Market

|

|

3

|

|

|

3

|

|

|

8

|

|

|

15

|

|

|

15

|

|

|

16

|

|

|

16

|

|

|

16

|

|

|

17

|

|

|

17

|

|

|

17

|

|

| 18 |

|

|

25

|

|

|

52

|

|

|

52

|

|

|

53

|

|

|

53

|

|

|

53

|

|

|

53

|

|

|

53

|

|

|

53

|

|

|

53

|

|

|

54

|

|

| 54 |

|

|

55

|

|

|

58

|

|

|

58

|

| • |

manage our cost base and use of cash and focus on strengthening our sales by leveraging our competitive advantage of our retail stores.

|

| • |

improving our employee product knowledge, customer service level, and in-store and virtual classes and community engagement as well as expanding workshop space in stores with machines are the highest priorities.

|

| • |

give customers good reasons to visit stores, and an excellent return on their time investment when they do.

|

|

Name

|

Age

|

Executive

Since |

Position

|

|||

|

Janet Carr

|

63

|

2018

|

Chief Executive Officer

|

| • |

unavailability of, or significant fluctuations in the cost of, raw materials;

|

| • |

disruptions or delays in shipments; and volatility of pricing in shipment costs.

|

| • |

loss or impairment of key assembly or distribution sites, which also could result in a former manufacturer beginning to produce similar products that compete with ours;

|

| • |

inability to engage new independent manufacturers that meet the Company’s cost-effective sourcing model;

|

| • |

product quality issues;

|

| • |

compliance by us and our independent manufacturers and suppliers with labor laws and other foreign governmental regulations;

|

| • |

imposition of additional duties, taxes, new tariffs, and other charges on imports or exports;

|

| • |

embargoes against products originating in countries from which we source;

|

| • |

increases in the cost of labor, fuel (including volatility in the price of oil), travel and transportation;

|

| • |

compliance by our independent manufacturers and suppliers with our Code of Business Conduct and Ethics and our Animal Welfare Policy;

|

| • |

political unrest;

|

| • |

unforeseen public health crises, such as pandemic (e.g., the COVID-19 pandemic) and epidemic diseases;

|

| • |

natural disasters or other extreme weather events, whether as a result of climate change or otherwise; and

|

| • |

acts of war or terrorism and other external factors over which we have no control.

|

|

|

• |

Advanced security infrastructure with state-of-the-art firewalls and intrusion detection systems.

|

|

|

• |

Regular cybersecurity training for employees.

|

|

|

• |

Strict data access controls and authentication protocols.

|

|

|

• |

Continuous monitoring of our networks and systems for signs of unauthorized activity.

|

|

|

• |

Partnerships with leading cybersecurity software and hardware providers for real-time systems monitoring and threat intelligence.

|

|

|

• |

Immediate containment and assessment of the incident.

|

|

|

• |

Notification to relevant stakeholders, including officers, board members, investors and customers where appropriate, in compliance with legal and regulatory requirements.

|

|

|

• |

Cooperation with law enforcement and regulatory bodies as needed.

|

|

|

• |

Post-incident analysis and measures to prevent future occurrences.

|

|

U. S. Locations:

|

||||

|

Alabama

|

1

|

Missouri

|

3

|

|

|

Alaska

|

1

|

Montana

|

1

|

|

|

Arizona

|

3

|

Nebraska

|

1

|

|

|

Arkansas

|

1

|

Nevada

|

2

|

|

|

California

|

7

|

New Jersey

|

1

|

|

|

Colorado

|

4

|

New Mexico

|

2

|

|

|

Connecticut

|

1

|

New York

|

2

|

|

|

Florida

|

4

|

North Carolina

|

2

|

|

|

Georgia

|

2

|

Ohio

|

3

|

|

|

Idaho

|

1

|

Oklahoma

|

2

|

|

|

Illinois

|

1

|

Oregon

|

2

|

|

|

Indiana

|

1

|

Pennsylvania

|

2

|

|

|

Iowa

|

1

|

South Dakota

|

1

|

|

|

Kansas

|

1

|

Tennessee

|

3

|

|

|

Kentucky

|

1

|

Texas

|

18

|

|

|

Louisiana

|

2

|

Utah

|

4

|

|

|

Maryland

|

1

|

Washington

|

3

|

|

|

Massachusetts

|

1

|

Wisconsin

|

1

|

|

|

Michigan

|

2

|

Wyoming

|

1

|

|

|

Minnesota

|

2

|

Virginia

|

1

|

|

|

Canadian Locations:

|

||||

|

Alberta

|

3

|

Ontario

|

2

|

|

|

British Columbia

|

1

|

Saskatchewan

|

1

|

|

|

Manitoba

|

1

|

|

|

|

|

Nova Scotia

|

1

|

|

|

|

|

|

|

|

||

|

International Locations:

|

||||

|

Spain

|

1

|

|

|

|

|

(in thousands)

|

2024

|

2023

|

$

Change

|

%

Change

|

||||||||||||

|

Sales

|

$

|

74,391

|

$

|

76,229

|

$

|

(1,838

|

)

|

(2.4

|

)%

|

|||||||

|

Gross profit

|

41,804

|

45,163

|

(3,359

|

)

|

(7.4

|

)%

|

||||||||||

|

Gross margin percentage

|

56.2

|

%

|

59.2

|

%

|

-

|

(3.0

|

)%

|

|||||||||

|

Operating expenses

|

41,176

|

40,753

|

423

|

1.0

|

%

|

|||||||||||

|

Income from operations

|

$

|

628

|

$

|

4,410

|

$

|

(3,782

|

)

|

(85.8

|

)%

|

|||||||

|

(amounts in thousands)

|

2024

|

2023

|

||||||

|

Net cash provided by operating activities

|

$

|

4,548

|

$

|

4,537

|

||||

|

Net cash used in investing activities

|

(2,983

|

)

|

(576

|

)

|

||||

|

Net cash used in financing activities

|

(1

|

)

|

(26

|

)

|

||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(452

|

)

|

249

|

|||||

|

Net increase in cash and cash equivalents

|

$

|

1,112

|

$

|

4,184

|

||||

|

|

• |

We obtained an understanding of the controls over the valuation of inventory.

|

|

|

• |

We tested the inventory costs incurred by the Company by reviewing supplier invoices and ensuring that appropriate application of the first-in first-out principle was followed.

|

|

|

• |

We evaluated the appropriateness and consistency of management’s methodology used in allocating overhead costs to inventory.

|

|

|

• |

We evaluated the appropriateness of the capitalized overhead costs by analyzing them against actual overhead costs incurred during the year.

|

|

|

• |

We tested the mathematical accuracy of the Company’s inventory obsolescence reserve calculation.

|

|

|

• |

We evaluated the appropriateness and consistency of management’s methodology and assumptions used in developing its estimate of the inventory obsolescence reserve.

|

|

|

• |

We performed analytical procedures on the current year reserve by comparing it to the prior year reserve and obtaining corroborating evidence to support any assumptions.

|

|

|

• |

We tested on a sample basis, sales subsequent to year-end of the written-down items to ensure that the net realizable value was not lower than the previously written down value.

|

|

•

|

We obtained an understanding of the controls over the valuation of inventory.

|

|

•

|

We tested the inventory costs incurred by the Company by reviewing supplier invoices and ensuring that appropriate application of the first-in

first-out principle was followed.

|

|

•

|

We tested the inventory cost layers through computer assisted audit tools to ensure the cost layers were mathematically accurate.

|

|

•

|

We evaluated the appropriateness and consistency of management’s methodology used in allocating overhead costs to inventory.

|

|

•

|

We evaluated the appropriateness of the capitalized overhead costs by analyzing them against actual overhead costs incurred during the year.

|

|

•

|

We tested the mathematical accuracy of the Company’s inventory obsolescence reserve calculation.

|

|

•

|

We evaluated the appropriateness and consistency of management’s methodology and assumptions used in developing its estimate of the inventory

obsolescence reserve.

|

|

•

|

We performed analytical procedures on the current year reserve by comparing it to the prior year reserve and obtaining corroborating evidence

to support any assumptions.

|

|

•

|

We tested on a sample basis, sales subsequent to year-end of the written-down items to ensure that the net realizable value was not lower than

the previously written down value.

|

| December 31, |

December 31, |

|||||||

| 2024 | 2023 | |||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$

|

13,271

|

$

|

12,159

|

||||

|

Accounts receivable-trade, net of allowance for doubtful accounts of $49 and $31 at December 31, 2024 and December 31, 2023, respectively

|

331

|

264

|

||||||

|

Inventory, net

|

35,556

|

37,993

|

||||||

|

Income tax receivable

|

384

|

248

|

||||||

|

Prepaid expenses

|

898

|

475

|

||||||

|

Other current assets

|

96

|

113

|

||||||

|

Total current assets

|

50,536

|

51,252

|

||||||

|

Property and equipment, at cost

|

31,655

|

28,678

|

||||||

|

Less accumulated depreciation

|

(19,320

|

)

|

(18,131

|

)

|

||||

|

Property and equipment, net

|

12,335

|

10,547

|

||||||

|

Operating lease assets

|

10,323

|

8,995

|

||||||

|

Financing lease assets

|

-

|

23

|

||||||

| Deferred income taxes |

1,213 | 880 | ||||||

|

Other assets

|

517

|

438

|

||||||

|

TOTAL ASSETS

|

$

|

74,924

|

$

|

72,135

|

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Accounts payable-trade

|

$

|

3,110

|

$

|

2,333

|

||||

|

Accrued expenses and other liabilities

|

3,571

|

3,140

|

||||||

|

Income taxes payable

|

- | 288 | ||||||

|

Current portion of operating lease liabilities

|

3,205

|

3,172

|

||||||

|

Total current liabilities

|

9,886

|

8,933

|

||||||

| Deferred income taxes |

- | 9 | ||||||

|

Uncertain tax positions

|

248

|

388

|

||||||

|

Other non-current liabilities

|

76

|

205

|

||||||

|

Operating lease liabilities, non-current

|

7,561

|

6,253

|

||||||

|

Finance lease liabilities, non-current

|

-

|

1

|

||||||

|

COMMITMENTS AND CONTINGENCIES (Note 8)

|

|

|

||||||

|

STOCKHOLDERS’ EQUITY:

|

||||||||

|

Common stock, $0.0024 par value; 25,000,000 shares authorized; 9,920,957 and 9,823,621 shares issued at December 31,

2024 and December 31,

2023, respectively; 8,496,581

and 8,399,245 shares outstanding at December 31, 2024 and December 31, 2023, respectively

|

23

|

23

|

||||||

|

Paid-in capital

|

4,529

|

3,981

|

||||||

|

Retained earnings

|

64,486

|

63,659

|

||||||

|

Treasury stock at cost (1,424,376 shares at December 31, 2024 and December 31, 2023)

|

(9,773

|

)

|

(9,773

|

)

|

||||

|

Accumulated other comprehensive loss, net of tax

|

(2,112

|

)

|

(1,544

|

)

|

||||

|

Total stockholders’ equity

|

57,153

|

56,346

|

||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

$

|

74,924

|

$

|

72,135

|

||||

|

For the Years Ended December 31,

|

||||||||

|

2024

|

2023

|

|||||||

|

Net sales

|

$

|

74,391

|

$

|

76,229

|

||||

|

Cost of sales

|

32,587

|

31,066

|

||||||

|

Gross profit

|

41,804

|

45,163

|

||||||

|

Operating expenses

|

41,176

|

40,753

|

||||||

|

Income from operations

|

628

|

4,410

|

||||||

|

Other income:

|

||||||||

|

Interest income

|

331

|

93

|

||||||

|

Other, net

|

132

|

42

|

||||||

|

Total other income

|

463 | 135 | ||||||

|

Income before income taxes

|

1,091

|

4,545

|

||||||

|

Income tax provision

|

264

|

777

|

||||||

|

Net income

|

$

|

827

|

$

|

3,768

|

||||

|

Foreign currency translation adjustments, net of tax

|

(568

|

)

|

356

|

|||||

|

Comprehensive income

|

$

|

259

|

$

|

4,124

|

||||

|

Net income per common share:

|

||||||||

|

Basic

|

$

|

0.10

|

$

|

0.45

|

||||

|

Diluted

|

$

|

0.09

|

$

|

0.45

|

||||

|

Weighted average number of shares outstanding:

|

||||||||

|

Basic

|

8,493,989

|

8,339,658

|

||||||

|

Diluted

|

8,783,063

|

8,369,976

|

||||||

|

For the Years Ended December 31,

|

||||||||

|

2024

|

2023

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$

|

827

|

$

|

3,768

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation and amortization

|

1,183

|

1,199

|

||||||

|

Operating lease asset amortization

|

3,548

|

3,427

|

||||||

|

Stock-based compensation

|

548

|

770

|

||||||

|

Deferred income taxes

|

(342

|

)

|

(902

|

)

|

||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable-trade

|

(72 | ) |

107

|

|||||

|

Inventory

|

1,992

|

231

|

||||||

|

Prepaid expenses

|

(424

|

)

|

(202

|

)

|

||||

|

Other current assets

|

17

|

(12

|

)

|

|||||

|

Accounts payable-trade

|

1,116 |

(752

|

)

|

|||||

|

Accrued expenses and other liabilities

|

322

|

462

|

||||||

|

Income taxes, net

|

(574

|

)

|

84

|

|||||

|

Other assets

|

(81 | ) |

(45

|

)

|

||||

|

Operating lease liabilities

|

(3,512

|

)

|

(3,598

|

)

|

||||

|

Total adjustments

|

3,721

|

769

|

||||||

|

Net cash provided by operating activities

|

4,548

|

4,537

|

||||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of property and equipment

|

(2,983

|

)

|

(576

|

)

|

||||

|

Net cash used in investing activities

|

(2,983

|

)

|

(576

|

)

|

||||

|

Cash flows from financing activities:

|

||||||||

|

Payment of finance lease obligations

|

(1

|

)

|

(15

|

)

|

||||

|

Repurchase of common stock

|

-

|

(11

|

)

|

|||||

|

Net cash used in financing activities

|

(1

|

)

|

(26

|

)

|

||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(452 | ) |

249

|

|||||

|

Net increase in cash and cash equivalents

|

1,112

|

4,184

|

||||||

|

Cash and cash equivalents, beginning of period

|

12,159

|

7,975

|

||||||

|

Cash and cash equivalents, end of period

|

$

|

13,271

|

$

|

12,159

|

||||

|

For the Years Ended December 31,

|

||||||||

|

2024

|

2023

|

|||||||

|

Supplemental disclosures of cash flow information:

|

||||||||

|

Interest paid during the period

|

$

|

-

|

$

|

-

|

||||

|

Income tax paid during the period, net

|

$

|

1,692

|

$

|

984

|

||||

|

Supplemental disclosures of non-cash activity:

|

||||||||

| Operating lease assets obtained in exchange for lease liabilities, net |

$ | 4,755 | $ | 3,396 | ||||

|

Number of

Shares

Common

Stock

Outstanding

|

Par

Value

|

Paid-in

Capital

|

Treasury

Stock

|

Retained

Earnings

|

Accumulated

Other Comprehensive

Income (Loss)

|

Total

|

||||||||||||||||||||||

|

Balance, December 31, 2022

|

8,293,150

|

$

|

23

|

$

|

3,222

|

$

|

(9,773

|

)

|

$

|

59,891

|

$

|

(1,900

|

)

|

51,463

|

||||||||||||||

|

Stock-based compensation expense

|

-

|

-

|

770

|

-

|

-

|

-

|

770

|

|||||||||||||||||||||

|

Issuance of restricted stock

|

108,796

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||

|

Repurchase of common stock

|

(2,701 | ) | - | (11 | ) | (11 | ) | |||||||||||||||||||||

|

Net income

|

-

|

-

|

-

|

-

|

3,768

|

-

|

3,768

|

|||||||||||||||||||||

|

Foreign currency translation adjustments, net of tax

|

-

|

-

|

-

|

-

|

-

|

356

|

356

|

|||||||||||||||||||||

|

Balance, December 31, 2023

|

8,399,245

|

$

|

23

|

$

|

3,981

|

$

|

(9,773

|

)

|

$

|

63,659

|

$

|

(1,544

|

)

|

$

|

56,346

|

|||||||||||||

|

Stock-based compensation expense

|

-

|

-

|

548

|

-

|

-

|

-

|

548

|

|||||||||||||||||||||

|

Vesting of restricted stock units

|

97,588

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||

| Repurchase of common stock | (252 | ) | - | - | - | |||||||||||||||||||||||

|

Net income

|

-

|

-

|

-

|

-

|

827

|

-

|

827

|

|||||||||||||||||||||

|

Foreign currency translation adjustments, net of tax

|

-

|

-

|

-

|

-

|

-

|

(568

|

)

|

(568

|

)

|

|||||||||||||||||||

|

Balance, December 31, 2024

|

8,496,581

|

23

|

4,529

|

(9,773

|

)

|

64,486

|

(2,112

|

)

|

57,153

|

|||||||||||||||||||

|

(in thousands)

|

2024

|

2023

|

||||||

|

United States

|

$

|

66,045

|

$

|

67,696

|

||||

|

Canada

|

7,313 | 7,301 | ||||||

|

Other

|

1,033 | 1,232 | ||||||

|

Net sales

|

$

|

74,391

|

$

|

76,229

|

||||

|

(in thousands, except share data)

|

2024

|

2023

|

||||||

|

Numerator:

|

||||||||

|

Net income

|

$

|

827

|

$

|

3,768

|

||||

|

Denominator:

|

||||||||

|

Basic weighted-average common shares outstanding

|

8,493,989

|

8,339,658

|

||||||

|

Dilutive effect of service-based restricted stock awards granted to Board of Directors under the Plan

|

5,529

|

3,218

|

||||||

|

Dilutive effect of service-based restricted stock awards granted to employees under the Plan

|

283,545 | 27,100 | ||||||

|

Diluted weighted-average common shares outstanding

|

8,783,063 | 8,369,976 | ||||||

|

|

||||||||

| Basic earnings per share |

0.10 | 0.45 | ||||||

| Diluted earnings per share |

0.09 | 0.45 | ||||||

|

|

Level 1 – observable inputs that reflect quoted prices in active markets for identical assets or liabilities.

|

|

|

Level 2 – significant observable inputs other than quoted prices in active markets for similar assets and liabilities, such as quoted prices for identical or

similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

|

|

|

Level 3 – significant unobservable inputs reflecting our own assumptions, consistent with reasonably available assumptions made by other market participants.

|

|

(in thousands)

|

December 31, 2024

|

December 31, 2023

|

||||||

|

On hand:

|

||||||||

|

Finished goods held for sale

|

$

|

31,022

|

$

|

33,350

|

||||

|

Raw materials and work in process

|

1,819

|

1,774

|

||||||

|

Inventory in transit

|

2,715

|

2,869

|

||||||

|

TOTAL

|

$

|

35,556

|

$

|

37,993

|

||||

|

(in thousands)

|

December 31, 2024

|

December 31, 2023

|

||||||

| Building | $ | 10,289 | $ | 9,277 | ||||

|

Land

|

1,451

|

1,451

|

||||||

|

Leasehold improvements

|

2,244

|

1,875

|

||||||

|

Equipment and machinery

|

8,937

|

8,469

|

||||||

|

Furniture and fixtures

|

8,556

|

7,452

|

||||||

|

Vehicles

|

178

|

154

|

||||||

|

31,655

|

28,678

|

|||||||

|

Less: accumulated depreciation

|

(19,320

|

)

|

(18,131

|

)

|

||||

|

TOTAL

|

$

|

12,335

|

$

|

10,547

|

||||

|

(in thousands)

|

December 31, 2024

|

December 31, 2023

|

||||||

|

United States

|

$

|

12,182

|

$

|

10,414

|

||||

|

Canada

|

132

|

133

|

||||||

|

Spain

|

21

|

-

|

||||||

|

$

|

12,335

|

$

|

10,547

|

|||||

|

Accrued Expenses and Other Liabilities

|

December 31, 2024

|

December 31, 2023

|

||||||

|

(in thousands)

|

||||||||

|

Accrued employee related costs

|

701

|

1,849

|

||||||

|

Unearned gift card revenue

|

320

|

223

|

||||||

|

Estimated returns

|

190

|

523

|

||||||

|

Sales and payroll taxes payable

|

546

|

283

|

||||||

|

Accrued vendor payables

|

314 |

262

|

||||||

|

Other Short Term Liability (1)

|

1,500 | - | ||||||

|

TOTAL

|

$

|

3,571

|

$

|

3,140

|

||||

| (1) |

This was the earnest money we received as

downpayment for the sales of our corporate property and is also a part of our ending cash balance. |

|

Leases

|

Balance Sheet Classification

|

December 31, 2024

|

December 31, 2023

|

|||||||

|

(in thousands)

|

||||||||||

|

Assets:

|

||||||||||

|

Operating

|

Operating lease assets

|

$

|

10,323

|

$

|

8,995

|

|||||

|

Finance

|

Financing lease assets

|

-

|

23

|

|||||||

|

Total assets

|

$

|

10,323

|

$

|

9,018

|

||||||

|

Liabilities:

|

||||||||||

|

Current

|

||||||||||

|

Operating

|

Current portion of operating lease liabilities

|

$

|

3,205

|

$

|

3,172

|

|||||

|

Finance

|

Current portion of finance lease liabilities

|

-

|

-

|

|||||||

|

Non-current

|

||||||||||

|

Operating

|

Operating lease liabilities, non-current

|

7,561

|

6,253

|

|||||||

|

Finance

|

Finance lease liabilities, non-current

|

-

|

1

|

|||||||

|

Total lease liabilities

|

$

|

10,766

|

$

|

9,426

|

||||||

|

Lease Cost

|

Income Statement Classification

|

December 31, 2024

|

December 31, 2023

|

|||||||

|

(in thousands)

|

||||||||||

|

Operating lease cost

|

Operating expenses

|

$ | 4,029 | $ | 3,908 | |||||

|

Operating lease cost

|

Impairment expense

|

(18 | ) | - | ||||||

| Short-term lease cost |

Operating expenses

|

- | - | |||||||

|

Variable lease cost (1)

|

Operating expenses

|

914 | 915 | |||||||

| Finance: |

||||||||||

|

Amortization of lease assets

|

Operating expenses

|

- | 7 | |||||||

|

Interest on lease liabilities

|

Interest expense

|

- | - | |||||||

|

Total lease cost

|

$ | 4,925 | $ | 4,830 | ||||||

|

December 31, 2024

|

||||||||

|

Maturity of Lease Liabilities

|

Operating Leases

|

Finance Leases

|

||||||

|

(in thousands)

|

||||||||

|

2025

|

|

3,840

|

|

- | ||||

|

2026

|

3,285

|

- | ||||||

|

2027

|

2,730

|

- | ||||||

|

2028

|

1,845

|

- | ||||||

|

Thereafter

|

1,319

|

- | ||||||

|

Total lease payments

|

$

|

13,019

|

$ | - | ||||

|

Less: Interest

|

(2,253

|

)

|

- | |||||

|

Present value of lease liabilities

|

$

|

10,766

|

$ | - | ||||

|

Other Information

|

December 31, 2024

|

December 31, 2023

|

||||||

|

(in thousands)

|

||||||||

|

Cash paid for amounts included in the measurement of lease liabilities:

|

||||||||

|

Operating cash flows used in operating leases

|

$

|

3,512

|

$

|

3,955

|

||||

|

Operating cash flows used in finance leases

|

-

|

-

|

||||||

|

Financing cash flows used in finance leases

|

1

|

15

|

||||||

|

Operating lease assets obtained in exchange for lease obligations

|

||||||||

|

Operating leases, initial recognition

|

4,755 | 3,396 | ||||||

|

Operating leases, modifications and remeasurements

|

- | - | ||||||

|

Lease Term and Discount Rate

|

December 31, 2024

|

December 31, 2023

|

||||||

|

Weighted-average remaining lease term (years):

|

||||||||

|

Operating leases

|

3.7 |

3.6 |

||||||

|

Finance leases

|

- |

- |

||||||

|

Weighted-average discount rate:

|

||||||||

|

Operating leases

|

5.3 |

% |

4.8 |

% |

||||

|

Finance leases

|

N/A |

|

6.0 |

% |

||||

|

(in thousands)

|

Year Ended December 31,

|

|||||||

|

Income Tax Provision (Benefits)

|

2024

|

2023

|

||||||

|

Current provision (benefit):

|

||||||||

|

Federal

|

$

|

261

|

$

|

892

|

||||

|

State

|

71

|

181

|

||||||

|

Foreign

|

(68

|

)

|

102

|

|||||

|

Related to UTP

|

(31

|

)

|

(34

|

)

|

||||

|

233

|

1,141

|

|||||||

| Deferred provision (benefit): | ||||||||

|

Federal

|

32 | (266 | ) | |||||

| State | 8 | (103 | ) | |||||

| Foreign | (9 | ) | 5 | |||||

| 31 | (364 | ) | ||||||

|

Total tax provision

|

$ | 264 | $ | 777 | ||||

|

(in thousands)

|

Year Ended December 31,

|

|||||||

|

Income Before Income Taxes

|

2024

|

2023

|

||||||

|

United States

|

$

|

1,382

|

$

|

3,765

|

||||

|

Spain

|

(259

|

)

|

25

|

|||||

|

Canada

|

(32

|

)

|

755

|

|||||

|

TOTAL

|

$

|

1,091

|

$

|

4,545

|

||||

|

Deferred income tax assets:

|

2024

|

2023

|

||||||

|

(in thousands)

|

||||||||

|

Inventory

|

$

|

391

|

$

|

412

|

||||

|

Stock-based compensation

|

39

|

55

|

||||||

|

Accounts receivable

|

12

|

8

|

||||||

|

Sales returns

|

78

|

49

|

||||||

|

Foreign currency translation gain in OCI

|

726

|

512

|

||||||

|

Goodwill and other intangible assets amortization

|

1 | - | ||||||

|

Net operating losses

|

184

|

182

|

||||||

|

Accrued expenses

|

41

|

170

|

||||||

|

Leases

|

111

|

108

|

||||||

|

Total deferred income tax assets

|

1,583

|

1,496

|

||||||

|

Less: valuation allowance

|

(156

|

)

|

(154

|

)

|

||||

|

Total deferred income tax assets, net of valuation allowance

|

$

|

1,427

|

$

|

1,342

|

||||

|

Property and equipment depreciation

|

$

|

(214

|

)

|

$

|

(471

|

)

|

||

|

Total deferred income tax liabilities

|

(214

|

)

|

(471

|

)

|

||||

|

Net deferred tax asset (liability)

|

$

|

1,213

|

$

|

871

|

||||

|

Year Ended December 31,

|

||||||||

| 2024 |

2023

|

|||||||

|

Statutory rate – Federal U.S. income tax

|

21.0

|

%

|

21.0

|

%

|

||||

|

State and local taxes

|

5.3

|

%

|

5.3

|

%

|

||||

|

Permanent book/tax differences

|

2.3

|

%

|

2.4

|

%

|

||||

|

Difference in tax rates in loss carryback periods

|

0.0 | % | 0.0 | % | ||||

|

Change in valuation allowance

|

0.2

|

%

|

(6.8

|

)%

|

||||

|

Rate differential on UTP reversals

|

(2.8

|

)%

|

(0.8

|

)%

|

||||

| Income tax credits |

0.0 | % | (2.3 | )% | ||||

|

Other, net

|

(1.8

|

)%

|

(1.7

|

)%

|

||||

|

Effective rate

|

24.2

|

%

|

17.1

|

%

|

||||

|

2024

|

2023

|

|||||||

|

UTP at beginning of the year

|

$

|

388

|

$

|

450

|

||||

|

Gross increase to tax positions in current period

|

(109

|

)

|

(27

|

)

|

||||

|

Interest expense

|

(31

|

)

|

(35 | ) | ||||

|

UTP at end of year

|

$

|

248

|

$

|

388

|

||||

| Shares | Weighted Average | |||||||

| (in thousands) | Share Price | |||||||

|

Balance, January 1, 2024

|

623

|

$

|

5.12

|

|||||

|

Granted

|

74

|

4.47

|

||||||

|

Forfeited

|

(190

|

)

|

4.27

|

|||||

|

Vested

|

(98

|

)

|

4.36

|

|||||

|

Balance, December 31, 2024

|

409

|

$

|

4.32

|

|||||

|

Unrecognized Expense

|

||||

|

2025

|

$

|

163

|

||

|

2026

|

119

|

|||

|

2027

|

34

|

|||

| 2028 | 6 | |||

|

$

|

322

|

|||

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

| ITEM 9A. |

CONTROLS AND PROCEDURES

|

| ITEM 9B. |

OTHER INFORMATION

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION*

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS*

|

| (a) |

The following are filed as part of this Form 10-K:

|

|

TANDY LEATHER FACTORY, INC. AND SUBSIDIARIES

EXHIBIT INDEX

|

|

|

Exhibit

Number

|

Description

|

|

Certificate of Incorporation of The Leather Factory, Inc., and Certificate of Amendment to Certificate of Incorporation of The Leather Factory, Inc. filed as Exhibit 3.1 to Tandy Leather Factory,

Inc.’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 12, 2005 and incorporated by reference herein.

|

|

|

Bylaws of Tandy Leather Factory, Inc., filed as Exhibit 3.1 to Tandy Leather Factory, Inc.’s Current Report on Form 8-K filed with the Securities and Exchange Commission on December 8, 2021 and

incorporated by reference herein.

|

|

|

|

Certificate of Designations of Series A Junior Participating Preferred Stock of Tandy Leather Factory, Inc. filed as Exhibit 3.1 to Tandy Leather Factory, Inc.’s Current Report on Form 8-K filed

with the Securities and Exchange Commission on June 10, 2013 and incorporated by reference herein.

|

| 3.4 | Certificate of Amendment of Certificate of Incorporation of Tandy Leather Factory, Inc. dated March 1, 2023, filed as Exhibit 3.4 to Tandy Leather Factory, Inc.’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 31, 2023. |

|

|

|

|

Description of Securities filed as Exhibit 4.1 to Tandy Leather Factory, Inc.’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on June 22, 2021

and incorporated by reference herein.

|

|

|

Tandy Leather Factory, Inc. 2013 Restricted Stock Plan, filed as Exhibit 10.1 to Tandy Leather Factory’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November

14, 2013 and incorporated by reference herein.

|

|

|

Amendment #1 to Tandy Leather Factory, Inc. 2013 Restricted Stock Plan filed as Exhibit 10.5 to Tandy Leather Factory, Inc.’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on June 22, 2021 and incorporated by reference herein.

|

|

Form of Non-Employee Director Restricted Stock Agreement under Tandy Leather Factory, Inc.’s 2013 Restricted Stock Plan, filed as Exhibit 10.1 to Tandy Leather Factory, Inc.’s Current Report on Form

8-K filed with the Securities and Exchange Commission on February 14, 2014 and incorporated by reference herein.

|

|

|

Form of Employee Restricted Stock Award Agreement under Tandy Leather Factory, Inc.’s 2013 Restricted Stock Plan, filed as Exhibit 10.7 to Tandy Leather Factory, Inc.’s Current Report on Form 8-K

filed with the Securities and Exchange Commission on February 14, 2014 and incorporated by reference herein.

|

|

|

|

|

|

Form of Employment Agreement dated October 2, 2018 between the Company and Janet Carr, filed as Exhibit 10.1 to Tandy Leather Factory Inc.’s Current Report on Form 8-K filed with the Securities and

Exchange Commission on October 5, 2018 and incorporated by reference herein.

|

|

|

Form of Stand-Alone Restricted Stock Unit Agreement dated October 2, 2018 between the Company and Janet Carr, filed as Exhibit 10.2 to Tandy Leather Factory Inc.’s Current Report on Form 8-K filed

with the Securities and Exchange Commission on October 5, 2018 and incorporated by reference herein.

|

|

|

Form of Stand-Alone Restricted Stock Unit Agreement dated October 2, 2018 between the Company and Janet Carr, filed as Exhibit 10.3 to Tandy Leather Factory Inc.’s Current Report on Form 8-K filed

with the Securities and Exchange Commission on October 5, 2018 and incorporated by reference herein.

|

|

| 10.8 | Credit Agreement dated October 26, 2022 between the Company and JP Morgan Chase Bank, N.A., filed as Exhibit 10.8 to Tandy Leather Factory, Inc.’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 31, 2023 |

| 10.9 | Tandy Leather Factory, Inc. 2023 Incentive Stock Plan, filed as Exhibit 10.10 to Tandy Leather Factory, Inc.’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 14, 2023 |

| *10.10 |

Purchase and Sale Agreement dated December 6, 2024, between The Leather Factory, L.P. and Colonna Brothers, Inc.

|

| *10.11 |

Commercial Lease Agreement dated January 28, 2025, between the Company and Jackson-Shaw / Benbrook North, LP.

|

|

Letter agreement dated January 2, 2025, between the Company and Janet Carr

|

|

| *10.13 | Employment Agreement dated January 2, 2025, between the Company and Johan Hedberg |

| *10.14 | Form of Restricted Stock Unit Agreement dated February 19, 2025, between the Company and Johan Hedberg |

| *10.15 | Form of Restricted Stock Unit Agreement dated February 19, 2025, between the Company and Johan Hedberg |

| 14.1 | Code of Business Conduct and Ethics of Tandy Leather Factory, Inc., adopted by the Board of Directors on December 4, 2018, filed as Exhibit 14.1 to Tandy Leather Factory, Inc.’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on June 22, 2021 and incorporated by reference herein. |

|

Subsidiaries of Tandy Leather Factory, Inc.

|

|

|

Certification by the Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended.

|

|

|

Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

*101.INS

|

XBRL Instance Document.

|

|

*101.SCH

|

XBRL Taxonomy Extension Schema Document.

|

|

*101.CAL

|

XBRL Taxonomy Extension Calculation Document.

|

|

*101.DEF

|

XBRL Taxonomy Extension Definition Document.

|

|

*101.LAB

|

XBRL Taxonomy Extension Labels Document.

|

|

*101.PRE

|

XBRL Taxonomy Extension Presentation Document.

|

|

TANDY LEATHER FACTORY, INC.

|

|||

|

By:

|

/s/ Johan Hedberg | ||

|

|

Johan Hedberg | ||

|

|

Chief Executive Officer | ||

| Dated: February 26, 2025 | |||

|

Signature

|

Title

|

Date

|

|

/s/ Jefferson Gramm

|

Chairman of the Board

|

February 26, 2025

|

|

Jefferson Gramm

|

||

|

/s/ Johan Hedberg

|

Chief Executive Officer, Director

|

February 26, 2025

|

|

Johan Hedberg

|

(principal executive officer)

|

|

|

/s/ John Sullivan

|

Director

|

February 26, 2025

|

|

John Sullivan

|

||

|

/s/ Vicki Cantrell

|

Director

|

February 26, 2025

|

|

Vicki Cantrell

|

||

|

/s/ Sejal Patel

|

Director

|

February 26, 2025

|

|

Sejal Patel

|

||

|

/s/ Diana Saadeh-Jajeh

|

Director

|

February 26, 2025

|

|

Diana Saadeh-Jajeh

|

|

SELLER:

|

The Leather Factory, L.P.,

|

|

|

a Texas limited partnership

|

||

|

By:

|

The Leather Factory Inc.,

|

|

|

a Nevada corporation,

|

||

|

its General Partner

|

||

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

|

PURCHASER:

|

Colonna Brothers, Inc.,

|

||

|

a New Jersey corporation

|

|||

|

By:

|

|

||

|

Dylan Tighe, Chief Operating Officer

|

|||

|

1

|

Legal Description

|

|

1-A

|

Depiction of the Property

|

|

4.1(a)

|

Form of Special Warranty Deed

|

|

4.1(b)

|

Form of Bill of Sale

|

|

8.4-A

|

Form of Main Building and Auxiliary Warehouse Lease

|

|

8.4-B

|

Form of Retail Building Lease

|

| THE STATE OF TEXAS | § | |

|

|

§ | |

| COUNTY OF TARRANT | § |

|

Grantor:

|

||

|

The Leather Factory, L.P.,

|

||

|

a Texas limited partnership

|

||

|

By:

|

The Leather Factory Inc.,

|

|

|

a Nevada corporation,

|

||

|

its General Partner

|

||

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

|

THE STATE OF TEXAS

|

§

|

|

§

|

|

|

COUNTY OF TARRANT

|

§

|

|

|

||

|

Notary Public, State of Texas

|

||

|

SELLER:

|

||

|

|

The Leather Factory, L.P.,

|

|

|

a Texas limited partnership

|

||

|

By:

|

The Leather Factory Inc.,

|

|

|

a Nevada corporation,

|

||

|

its General Partner

|

||

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

| PURCHASER:, | ||

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

|

|

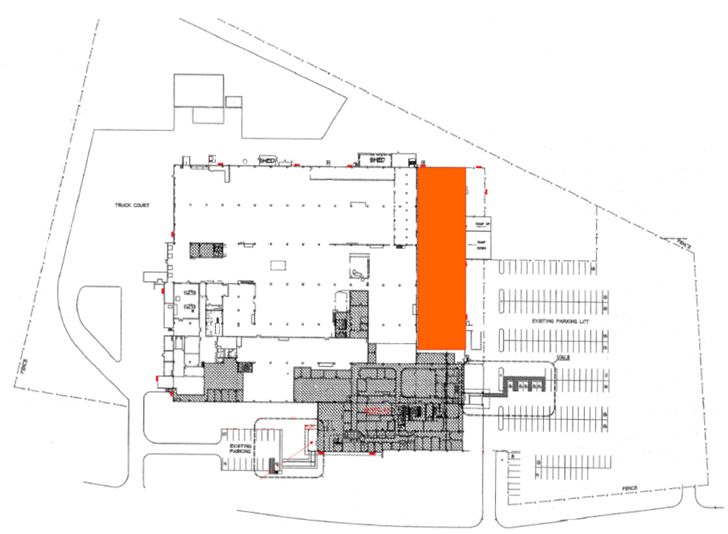

Adjustment Date

|

Relinquished Space

|

Adjusted Square Footage of the Main Building

|

|

No later than July 1, 2025

|

20,000 square feet (more or less) comprising of the factory area

|

170,000 square feet

|

| LESSOR: | ||

|

|

Colonna Brothers, Inc., | |

| a New Jersey corporation | ||

|

By:

|

|

||

|

Name:

|

|

||

|

Title:

|

|

| LESSEE: | ||

|

|

The Leather Factory, L.P.,

|

|

|

a Texas limited partnership

|

||

|

By:

|

The Leather Factory Inc.,

|

|

|

a Nevada corporation,

|

||

|

its General Partner

|

||

|

By:

|

||

|

|

||

|

Name:

|

||

|

Title:

|

||

|

|

||

|

|

ASSIGNOR: | |

|

|

The Leather Factory, L.P.,

|

|

|

a Texas limited partnership

|

||

|

By:

|

The Leather Factory Inc.,

|

|

|

a Nevada corporation,

|

||

|

its General Partner

|

||

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

|

ASSIGNEE:

|

|||

|

Colonna Brothers, Inc.,

|

|||

|

a New Jersey corporation

|

|||

|

By:

|

|

||

|

Name:

|

|

||

|

Title:

|

|

||

|

LESSOR:

|

|||

|

Colonna Brothers, Inc.,

|

|||

|

a New Jersey corporation

|

|||

|

By:

|

|||

|

Name:

|

|||

|

Title:

|

|||

| LESSEE: | |||

| The Leather Factory, L.P., | |||

| a Texas limited partnership | |||

|

By:

|

The Leather Factory Inc.,

|

||

|

a Nevada corporation,

|

|||

|

its General Partner

|

|||

| By: | |||

|

|

|||

|

|

|||

| Name: | |||

|

|

|

||

| Title: | |||

|

|

ASSIGNOR:

|

|

|

|

The Leather Factory, L.P.,

|

|

|

a Texas limited partnership

|

||

|

By:

|

The Leather Factory Inc.,

|

|

|

a Nevada corporation,

|

||

|

its General Partner

|

||

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

| ASSIGNEE: | |||

| Colonna Brothers, Inc., | |||

| a New Jersey corporation | |||

|

By:

|

|

||

|

Name:

|

|

||

|

Title:

|

|

||

|

Landlord:

|

JACKSON-SHAW / BENBROOK NORTH, LP, a Texas limited partnership

|

||

|

Landlord's Address:

|

4890 Alpha Road, Suite 100, Dallas, Texas 75244

|

||

| |

Contact Person: | John Stone | |

|

|

Phone:

|

972-628-7450 | |

|

|

Fax:

|

972-628-7444

|

|

|

|

Email:

|

jstone@jacksonshaw.com

|

|

|

With a copy to:

|

Andrews & Barth, PC

|

||

| |

4851 LBJ Freeway, Suite 500 |

|

|

| |

Dallas, Texas 75244 | ||

|

|

Contact Person:

|

Justin Tonick

|

|

|

|

Phone:

|

214-346-1185

|

|

|

|

Email:

|

jtonick@andrews-barth.com

|

|

|

Tenant:

|

TANDY LEATHER FACTORY, INC., a Delaware corporation

|

||

|

Tenant's Address:

|

Before the Commencement Date:

|

||

|

|

Contact Person:

|

Johan Hedberg/CEO

|

|

|

|

Phone:

|

817-872-3200

|

|

|

|

Fax:

|

|

|

|

|

Email:

|

johan.hedberg@tandyleather.com; c/o leaseadmin@tandyleather.com

|

|

| |

From and after the Commencement Date:

|

||

| 7602 SW Loop 820 Benbrook, Texas 76126 | |||

|

|

Contact Person:

|

Johan Hedberg/CEO

|

|

|

|

Phone:

|

817-872-3200

|

|

|

|

Fax:

|

|

|

|

|

Email:

|

johan.hedberg@tandyleather.com; c/o leaseadmin@tandyleather.com

|

|

|

Landlord's Broker:

|

CBRE, INC. (Stephen Koldyke, Kacy Jones, and Brian Gilchrist)

|

||

|

Tenant's Broker:

|

Cushman & Wakefield (Jay Benner)

|

||

|

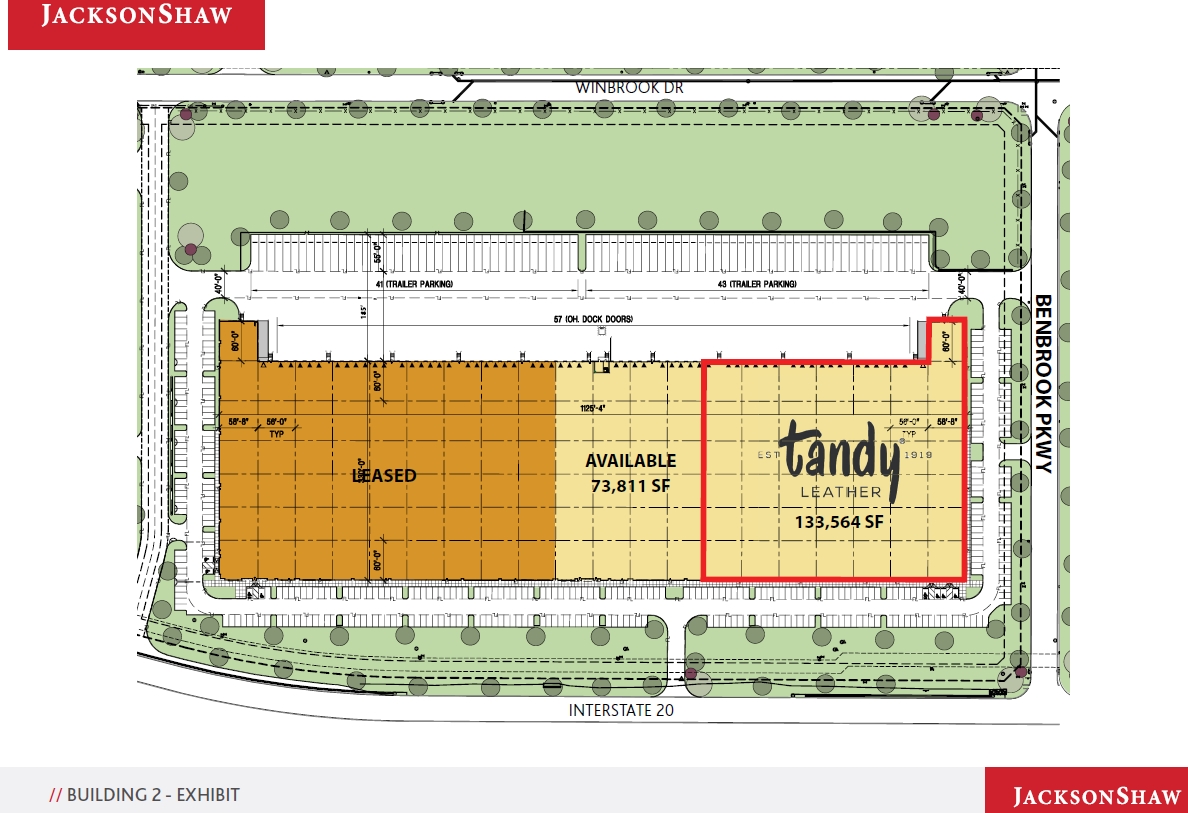

Leased Premises:

|

approximately 133,564 square feet of space, being Suite 101 located in the Building with an address of 7602 SW Loop 820 Benbrook, Texas 76126, as outlined on Exhibit "A-1" attached hereto

|

||

|

Project:

|

Chisholm 20 Commerce Park (containing approximately 917,374 square feet)

|

||

|

Building:

|

No. 2 (containing approximately 377,884 square feet)

|

||

|

Tenant's Proportionate Share of Project:

|

14.56%

|

|

Tenant's Proportionate Share of Building:

|

35.35%

|

|

Term:

|

123 Months

|

|

Commencement Date:

|

The earlier of (a) July 1, 2025, (b) subject to Section 8(b), the date

of Substantial Completion of the Tenant Improvements, and (c) the date Tenant opens for business at the Leased Premises.

|

|

Termination Date:

|

The last day of the 123rd month following the Commencement Date

|

|

Months

|

Annual Rate Per Sq. Ft.

|

Monthly Base Rent

|

|

1 – 12*

|

$7.55*

|

$84,034.02*

|

|

13 - 24

|

$7.84

|

$87,269.33

|

|

25 - 36

|

$8.14

|

$90,629.20

|

|

37 - 48

|

$8.46

|

$94,118.42

|

|

49 - 60

|

$8.78

|

$97,741.98

|

|

61 - 72

|

$9.12

|

$101,505.04

|

|

73 - 84

|

$9.47

|

$105,412.99

|

|

85 - 96

|

$9.84

|

$109,471.39

|

|

97 - 108

|

$10.21

|

$113,686.04

|

|

109 - 120

|

$10.61

|

$118,062.95

|

|

121 - 123

|

$11.02

|

$122,608.37

|

| Initial Estimated Additional Rent Payments | 1. Common Area | $ |

0.50 |

||

| (expressed per square foot/year): |

2. Taxes

|

$ | 1.80 |

||

| (estimates only and subject to |

3. Insurance

|

$ | 0.13 |

||

|

adjustment to actual costs and

|

Total:

|

$ | 2.43 |

||

|

expenses according to the

|

|||||

|

provisions of this Lease)

|

|

Total Initial Estimated Monthly Additional Rent Payments:

|

$

|

27,046.71

|

||

|

Total Initial Monthly Base Rent and Estimated Monthly Additional Rent Payments:

|

$

|

111,080.73

|

||

|

Security Deposit:

|

$ |

149,655.08

|

| Exhibit "A" – Legal Description of the Land |

| Exhibit "A-1" – Floor Plan of Leased Premises |

|

Exhibit "B" – Tenant Improvement Agreement

|

| Exhibit "C" – Sign Criteria |

| Exhibit "D" – Rules and Regulations |

|

Exhibit "E" – Subordination, Nondisturbance and Attornment Agreement

|

| Exhibit "F" – Form of Subordination of Landlord's Lien |

| Exhibit "G" – Renewal Option |

| Exhibit "H" – HVAC Maintenance Contract |

| Exhibit "I" – Form of Commencement Date Agreement |

|

"Landlord":

|

"Tenant":

|

|||

|

JACKSON-SHAW / BENBROOK NORTH, LP,

|

TANDY LEATHER FACTORY, INC.,

|

|||

|

a Texas limited partnership

|

a Delaware corporation

|

|||

|

|

|

|||

|

By:

|

JSC / BENBROOK NORTH GP, LLC,

|

|||

|

a Texas limited liability company,

|

||||

|

its General Partner

|

||||

|

By:

|

|

By:

|

|

|

|

Name:

|

|

|

Name: |

|

|

Title:

|

|

|

Title: |

|

|

LANDLORD'S REPRESENTATIVE:

|

TENANT'S REPRESENTATIVE: |

|||

|

|

|

|||

|

NAME:

|

Miles Terry

|

NAME:

|

Johan Hedberg

|

|

|

ADDRESS:

|

4890 Alpha Road, Suite 100

|

ADDRESS: | 1900 SE Loop 820 | |

|

|

Dallas, Texas 75244

|

Fort Worth, TX 76140

|

||

|

PHONE:

|

(405) 570-8713

|

PHONE: |

817-872-3200

|

|

|

|

1. |

Tenant shall be encouraged to identify its premises by erecting one (1) facia sign which shall be attached directly to the building fascia as described hereinafter. Subject to the

restrictions under "Type and Size of Sign: below, for buildings and leaseholds with one (1) front façade, (front façade being defined as the building surface directly facing a dedicated street, or where street frontage does not exist, it

shall be defined as the width of the lease space which contains the main entry).

|

|

|

2. |

Tenant signage shall be as close to tenant's main entrance as possible, subject to allowance for corner positioning.

|

|

|

1. |

Attached signs located at a height of 40 feet or less are permitted a maximum aggregate effective area equal to one-square foot per lineal foot of leasehold frontage, as applicable,

or 300 square feet, whichever is less.

|

|

|

2. |

Illuminated or reverse lighted individually pin mounted channel letters

|

|

|

3. |

Depth – 2" minimum, 5 ½"; maximum height – not-to-exceed 36". Multiple Rows – not-to-exceed 48" in total height including spaces between rows. Minimum Letter Size – 10". Letters

are to be pin mounted 1" off building fascia.

|

|

|

4. |

Matte finishes required.

|

|

|

5. |

Colors are subject to approval by Landlord or its representative

|

|

|

6. |

Returns and Fronts - aluminum .063 gauge (minimum) or channel formed acrylic 3/16" minimum.

|

|

|

7. |

All fasteners used are to be non-corrosive stainless steel.

|

|

|

1. |

If illuminated individual letters are to be backlit with neon tubing, such tubing must be concealed in the letter and project the light source back on the building fascia. All

transformers and secondary wiring are to be concealed behind parapets or within soffits.

|

|

|

1. |

Roof signs or box type signs

|

|

|

2. |

Exposed seam tubing

|

|

|

3. |

Animated or moving components

|

|

If to Lender:

|

Veritex Community Bank |

|

8214 Westchester Drive

|

|

| Dallas, Texas 75225 | |

| Attn: Craig Davis | |

|

with a copy to:

|

Jackson Walker L.L.P.

|

|

2323 Ross Ave., Suite 600

|

|

| Dallas, Texas 75201 | |

|

Attn: Kelly Hodge

|

|

|

If to Tenant:

|

Tandy Leather Factory, INC.

|

| 7602 SW Loop 820, Suite 101 | |

| Benbrook, Texas 76126 | |

|

Attn: Johan Hedberg/CEO

|

|

|

If to Landlord:

|

Jackson-Shaw / Benbrook North, LP

|

| 4890 Alpha Road, Suite 100 | |

| Dallas, Texas 75244 | |

| Attn: John Stone | |

|

Email: jstone@jacksonshaw.com

|

|

|

with a copy to:

|

Andrews & Barth, PC

|

|

4851 LBJ Freeway, Suite 500

|

|

| Dallas, Texas 75244 | |

|

Attn: Justin Tonick

|

|

|

Email: jtonick@andrews-barth.com

|

|

LANDLORD:

|

||

|

JACKSON-SHAW / BENBROOK NORTH, LP,

|

||

|

a Texas limited partnership

|

||

|

By:

|

JSC / BENBROOK NORTH GP, LLC,

|

|

|

a Texas limited liability company,

|

||

|

its General Partner

|

||

|

By:

|

|

|

Name:

|

|

|

Title:

|

|

|

STATE OF TEXAS

|

§

|

|

§

|

|

|

COUNTY OF DALLAS

|

§

|

|

|

|

|

Notary Public, State of Texas

|

|

TENANT:

|

||

|

TANDY LEATHER FACTORY, INC.,

|

||

|

a Delaware corporation

|

||

|

|

|||

|

By:

|

|||

|

Name:

|

Jeff Gramm |

|

Title:

|

Chairman |

|

THE STATE OF

|

|

§

|

|

§

|

|||

|

COUNTY OF

|

§

|

|

Notary Public in and for the State of Texas

|

| LENDER: | ||

| VERITEX COMMUNITY BANK | ||

| By: |

||

| Name: |

| Title: |

| THE STATE OF TEXAS | § |

| § | |

| COUNTY OF DALLAS | § |

|

|

|

|

Notary Public in and for the State of Texas

|

|

To Secured Party:

|

|

||

|

|

|||

|

|

|

Attention:

|

|

|

To Tenant:

|

Tandy Leather Factory, INC.

|

||

|

7602 SW Loop 820, Suite 101

|

|||

|

Benbrook, Texas 76126

|

|||

|

Attn: CEO

|

|||

|

To Landlord:

|

Jackson-Shaw / Benbrook North, LP

|

||

|

4890 Alpha Road, Suite 100

|

|||

|

Dallas, Texas 75244

|

|||

|

Attn: John Stone

|

|||

|

with a copy to:

|

Andrews & Barth, PC

|

||

|

4851 LBJ Freeway, Suite 500

|

|||

|

Dallas, Texas 75244

|

|||

|

Attention: Justin Tonick

|

|

LANDLORD:

|

||

|

JACKSON-SHAW / BENBROOK NORTH, LP,

|

||

|

a Texas limited partnership

|

||

|

By:

|

JSC / BENBROOK NORTH GP, LLC,

|

|

|

a Texas limited liability company,

|

||

|

its General Partner

|

||

| |

By: |

|

| |

Printed Name: |

|

|

|

Title:

|

|

|

TENANT:

|

||

|

TANDY LEATHER FACTORY, INC.,

|

||

|

a Delaware corporation

|

||

|

By:

|

|

|

Printed Name:

|

|

Title:

|

|

SECURED PARTY:

|

||

|

|

||

|

By:

|

|

Printed Name:

|

|

Title:

|

|

|

1. |

Tenant has accepted possession of the Leased Premises pursuant to the Lease. Any improvements required by the terms of the Lease to be made by Landlord have been completed to the

full and complete satisfaction of Tenant in all respects and Landlord has fulfilled all of its duties under the Lease with respect to such Tenant Improvements.

|

|

|

2. |

The Commencement Date as referred to in the Lease is established as ______________, and the expiration date of the initial Lease term is established as _______________.

|

|

|

3. |

The first Lease Year as referred to in the Lease is established as _____________, ending___________.

|

|

LANDLORD:

|

|

,

|

|

|

a

|

|

||

|

By:

|

|

|

Name:

|

| |

Title:

|

|

TENANT:

|

, |

||

| a |

|||

|

By:

|

|

Name:

|

|

Title:

|

|

|

a. |

You must not resign from your employment with Tandy or be terminated for “Cause” (as defined in your employment agreement) before that date. If you are terminated without Cause,

you will remain eligible for the bonus if you satisfy the other eligibility factors below;

|

|

|

b. |

You will continue to perform your duties in good faith and consistent with the Company’s best interests, and to sustain an acceptable level of performance, work quality and

attendance, as determined by the Board; and

|

|

|

c. |

If requested, you must sign and timely deliver to the Company, and not revoke, a release agreement provided by the Company which will contain confidentiality and non-disparagement

provisions and a release of claims or additional compensation in favor of the Company, in a form acceptable to the Company (“Release”).

|

|

TANDY LEATHER FACTORY, INC.

|

||||

|

By:

|

|

|||

|

Janet Carr

|

Jefferson Gramm

|

|||

|

Chairman of the Board of Directors

|

||||

|

|

• |

Company EBITDA from operations in any calendar year of $5 million;

|

|

|

• |

Company EBITDA from operations in any calendar year of $7 million;

|

|

|

• |

Company EBITDA from operations in any calendar year of $9 million;

|

|

|

• |

The Company’s common stock trading on its principal stock market/exchange for 15 consecutive trading days with a daily closing price of $5.50 or more;

|

|

|

• |

The Company’s common stock trading on its principal stock market/exchange for 15 consecutive trading days with a daily closing price of $6.50 or more; and

|

|

|

• |

The Company’s common stock trading on its principal stock market/exchange for 15 consecutive trading days with a daily closing price of $7.50 or more.

|

|

If to the Company:

|

Tandy Leather Factory, Inc.

c/o General Counsel

1900 SE Loop 820

Fort Worth, Texas 76140

or, after a Company move from such location, to such subsequent address at which the Company maintains its principal offices

|

|

|

If to Executive:

|

Johan Hedbeg

Executive’s address in the Company’s personnel records

|

|

THE “COMPANY”

|

||

|

Tandy Leather Factory, Inc.

|

||

|

Date: January 2, 2025

|

By:

|

|

|

Name:

|

||

|

Title:

|

||

|

THE “EXECUTIVE”

|

|

|

Date: January 2, 2025

|

|

|

Johan Hedberg

|

|

GRANTED TO (“Participant”):

|

Johan Hedberg

|

||

|

GRANT DATE:

|

February 19, 2025

|

||

|

NUMBER OF RSUs:

|

100,000

|

||

|

VESTING DATE(S):

|

February 19, 2026

|

||

|

TANDY LEATHER FACTORY, INC.

|

|||

|

By:

|

|

||

|

Name: Leann Day

|

|||

|

Title: VP Human Resources

|

|||

|

By:

|

|

||

|

Johan Hedbeg

|

|||

|

GRANTED TO (“Participant”):

|

Johan Hedberg

|

||

|

GRANT DATE:

|

February 19, 2025

|

||

|

NUMBER OF PRSUs:

|

900,000

|

||

|

VESTING DATE(S):

|

See Section 3 Below

|

||

|

|

• |

The Company achieves EBITDA from operations in any calendar year of $5 million;

|

|

|

• |

The Company achieves EBITDA from operations in any calendar year of $7 million;

|

|

|

• |

The Company achieves EBITDA from operations in any calendar year of $9 million;

|

|

|

• |

The Company’s common stock trades on its principal stock market/exchange for 15 consecutive trading days with a daily closing price of $5.50 or more;

|

|

|

• |

The Company’s common stock trades on its principal stock market/exchange for 15 consecutive trading days with a daily closing price of $6.50 or more; and

|

|

|

• |

The Company’s common stock trades on its principal stock market/exchange for 15 consecutive trading days with a daily closing price of $7.50 or more.

|

|

TANDY LEATHER FACTORY, INC.

|

|||

|

By:

|

|

||

|

|

Name: Leann Day

|

||

|

|

Title: VP Human Resources

|

||

|

By:

|

|

||

|

Johan Hedbeg

|

|||

| Date: February 26, 2025 |

/s/ Johan Hedberg

|

|

|

|

|

|

Johan Hedberg

|

|

|

Chief Executive Officer |

|

|

(principal executive officer and principal financial officer) |