UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2024

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-35776

Grace Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| State of Delaware | | 98-1359336 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

103 Carnegie Center Suite 300

Princeton, New Jersey 08540

(Address of principal executive offices, including zip code)

609-322-1602

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | GRCE | Nasdaq Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of outstanding shares of common stock of the registrant, par value per share of $0.0001, as of February 12, 2025, was 10,139,861.

GRACE THERAPEUTICS, INC.

(Formerly ACASTI PHARMA INC.)

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended December 31, 2024

| |

|

|

Table of Contents |

| |

|

Page |

PART I. FINANCIAL INFORMATION |

| |

Item 1. |

|

5 |

| |

|

|

Item 2. |

|

19 |

| |

|

|

Item 3. |

|

41 |

| |

|

|

Item 4. |

|

41 |

| |

|

|

PART II. OTHER INFORMATION |

| |

Item 1. |

|

41 |

| |

|

|

Item 1A. |

|

42 |

| |

|

|

Item 2. |

|

42 |

| |

|

|

Item 3. |

|

42 |

| |

|

|

Item 4. |

|

42 |

| |

|

|

Item 5. |

|

42 |

| |

|

|

Item 6. |

|

42 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report contains information that may be forward-looking statements within the meaning of U.S. federal securities laws and forward-looking statements within the meaning of Canadian securities laws, both of which we refer to in this quarterly report as forward-looking statements. Forward- looking statements can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not statements about historical facts. Forward-looking statements in this quarterly report include, among other things, information, or statements about:

- our ability to build a

late-stage pharmaceutical company focused in rare and orphan diseases and, on

developing and commercializing products that improve clinical outcomes using

our novel drug delivery technologies;

- our ability to apply new

proprietary formulations to existing pharmaceutical compounds to achieve

enhanced efficacy, faster onset of action, reduced side effects, and more

convenient drug delivery that can result in increased patient compliance;

- the potential for our drug

candidates to receive orphan drug designation and exclusivity from the U.S.

Food and Drug Administration (“FDA”) or regulatory approval under the Section

505(b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act

(“FDCA”);

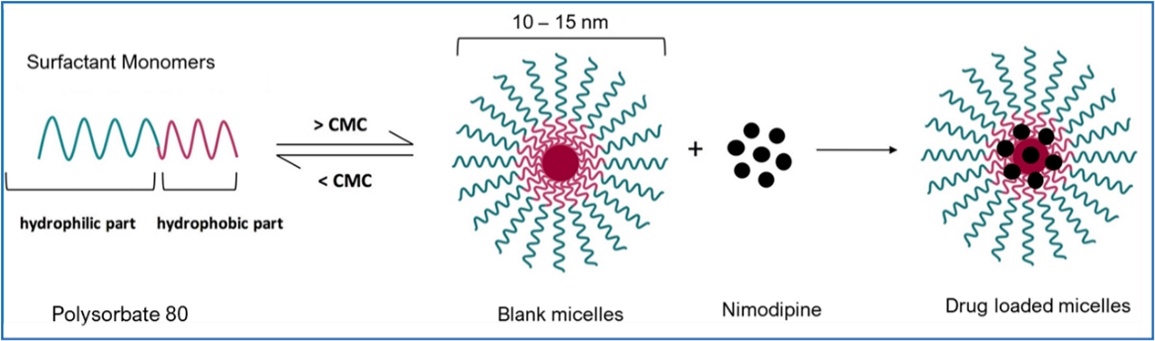

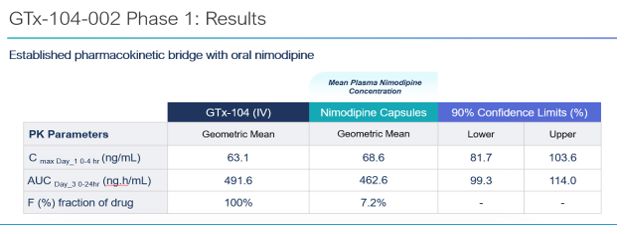

- the future prospects of our GTx-104 drug candidate, including but not limited to GTx-104’s potential to be administered to improve the management of hypotension in patients with aneurysmal subarachnoid hemorrhage (“aSAH”); the ability of GTx-104 to achieve a pharmacokinetic (“PK”) and safety profile similar to the oral form of nimodipine; GTx-104’s potential to provide improved bioavailability; GTx-104’s potential to achieve pharmacoeconomic benefit over the oral form of nimodipine; our ability to ultimately file a new drug application (“NDA”) for GTx-104 under Section 505(b)(2) of the FDCA; the acceptance of the NDA by the FDA; and the timing and ability to receive FDA approval for marketing GTx-104;

- our plan to prioritize the

development of GTx-104;

-

our plan to maximize the value of our de-prioritized drug candidates, GTx-102 and GTx-101, including through potential development, licensing, or sale of those drug candidates;

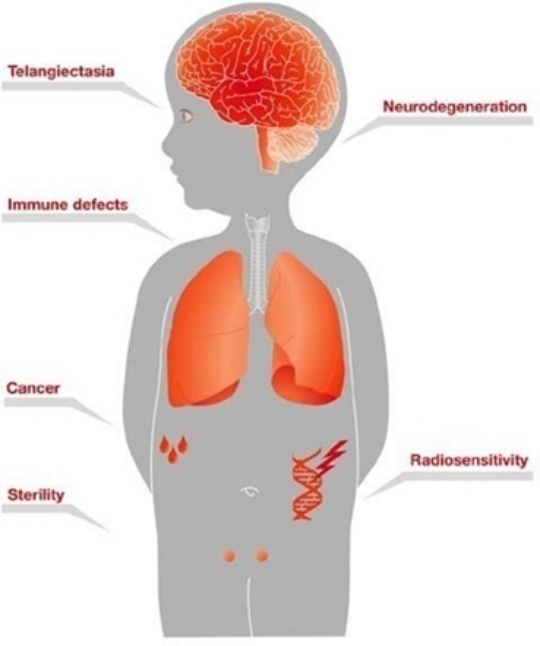

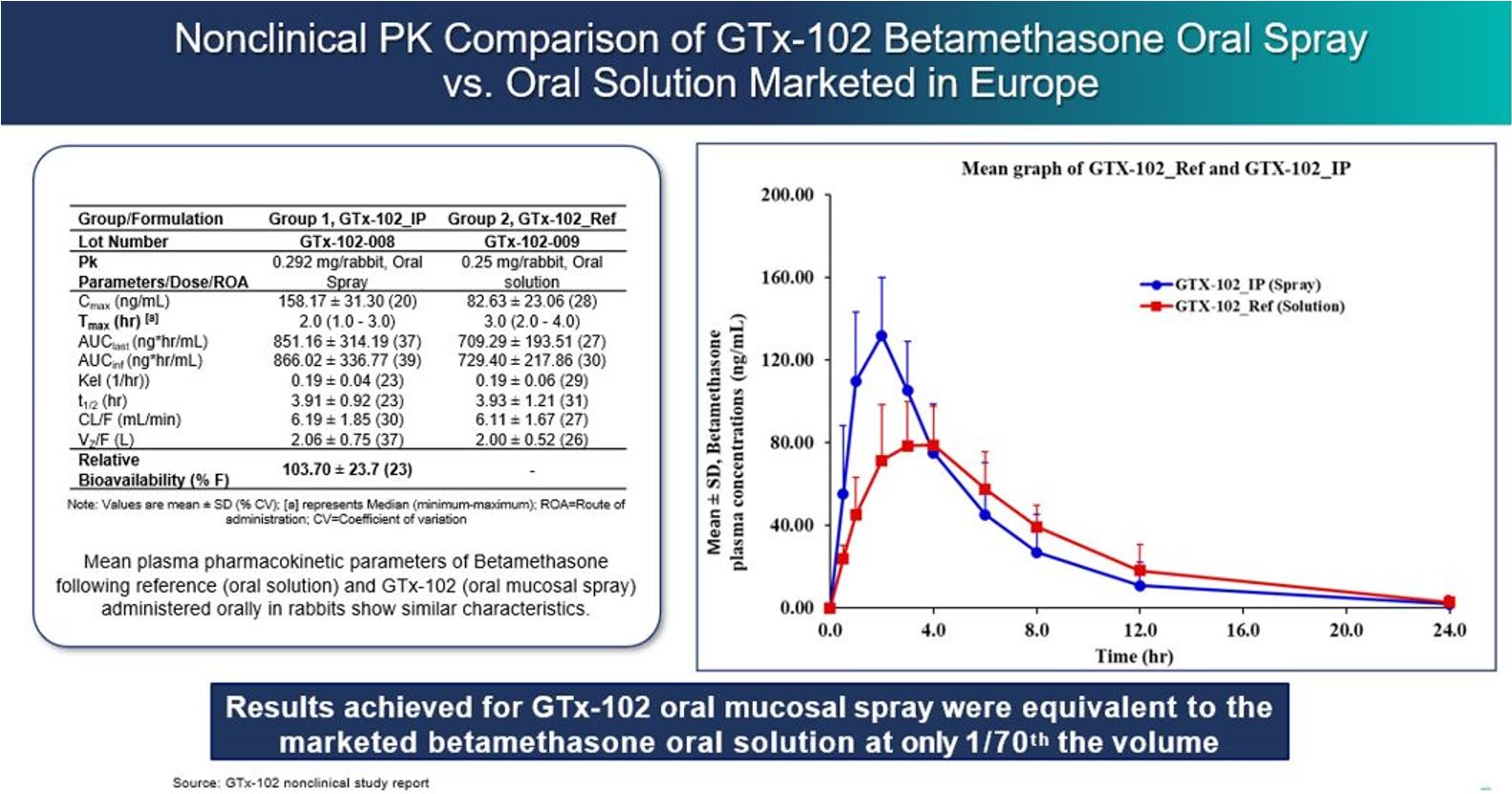

- the future prospects of our

GTx-102 drug candidate, including but not limited to GTx-102’s potential to

provide clinical benefits to decrease symptoms associated with Ataxia

Telangiectasia; GTx-102’s potential ease of drug administration; the timing and

outcomes of a Phase 3 efficacy and safety study for GTx-102; the timing of an

NDA filing for GTx-102 under Section 505(b)(2) of the FDCA; and the timing and ability to

receive FDA approval for marketing GTx-102;

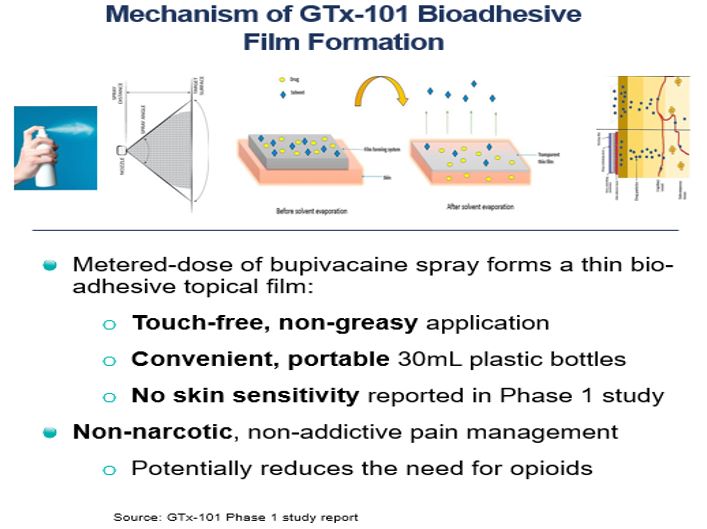

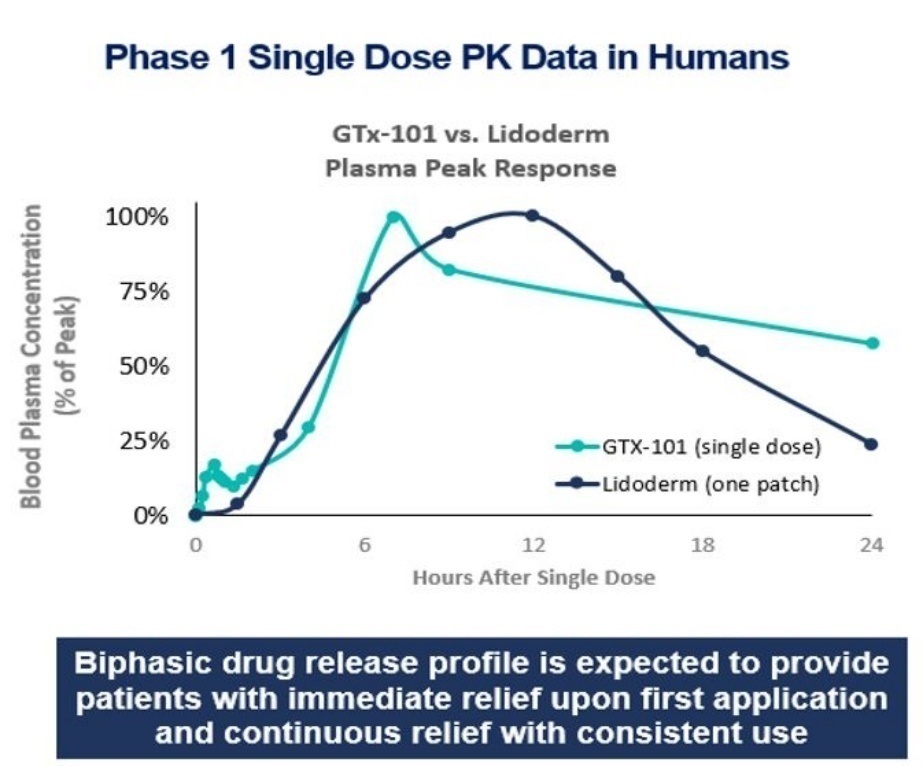

- the future prospects of our

GTx-101 drug candidate, including but not limited to GTx-101’s potential to be

administered to postherpetic neuralgia (“PHN”) patients to treat the severe

nerve pain associated with the disease; assumptions about the biphasic delivery

mechanism of GTx-101, including its potential for rapid onset and continuous

pain relief for up to eight hours; and the timing and outcomes of single

ascending dose/multiple ascending dose and PK bridging studies, and a Phase 2

and Phase 3 efficacy and safety study; the timing of an NDA filing for GTx-101 under

Section 505 (b)(2) of the FDCA; and the timing and ability to receive FDA

approval for marketing GTx-101;

- the quality of our clinical

data, the cost and size of our development programs, expectations and forecasts

related to our target markets and the size of our target markets; the cost and

size of our commercial infrastructure and manufacturing needs in the United

States, European Union, and the rest of the world; and our expected use of a

range of third-party contract research organizations (“CROs”) and contract

manufacturing organizations (“CMOs”) at multiple locations;

- expectations and forecasts

related to our intellectual property portfolio, including but not limited to

the probability of receiving orphan drug exclusivity from the FDA for our

leading pipeline drug candidates; our patent portfolio strategy; and outcomes

of our patent filings and extent of patent protection;

- our intellectual property

position and duration of our patent rights;

- our strategy, future

operations, prospects, and the plans of our management with a goal to enhance

shareholder value;

- our need for additional financing, and our estimates regarding our operating runway and timing for future financing and capital requirements;

- our expectations regarding

our financial performance, including our costs and expenses, liquidity, and

capital resources;

- our projected capital

requirements to fund our anticipated expenses; and

- our ability to

commercialize GTx-104 in the United States or establish strategic partnerships

or commercial collaborations or obtain non-dilutive funding.

Although the forward-looking statements in this quarterly report are based upon what we believe are reasonable assumptions, you should not place undue reliance on those forward-looking statements since actual results may vary materially from them.

In addition, the forward-looking statements in this quarterly report are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our control, that could cause our actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking statements, including, among others:

- We are heavily dependent on the success of our lead drug candidate, GTx-104.

- Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. Failure can occur at any stage of clinical development.

- We are subject to uncertainty relating to healthcare reform measures and reimbursement policies that, if not favorable to our drug candidates, could hinder or prevent our drug candidates’ commercial success.

- If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our drug products, if approved, we may be unable to generate any revenue.

-

If we are unable to differentiate

our drug products from branded reference drugs or existing generic therapies

for similar treatments, or if the FDA or other applicable regulatory

authorities approve products that compete with any of our drug products, our

ability to successfully commercialize our drug products would be adversely

affected.

-

We

do not have internal manufacturing capabilities, and if we fail to develop and

maintain supply relationships with various third-party manufacturers, or if

such third parties fail to provide us with sufficient quantities of active

pharmaceutical ingredients, excipients, or drug products, or fail to do so at

acceptable quality levels or prices or fail to maintain or achieve satisfactory

regulatory compliance, we may be unable to develop or commercialize our drug

candidates.

-

Our

manufacturers may encounter difficulties involving, among other things,

production yields, regulatory compliance, quality control and quality

assurance, as well as shortages of qualified personnel. Approval of our drug

candidates could be delayed, limited, or denied if the FDA does not approve and

maintain the approval of our contract manufacturer’s processes or facilities.

-

The

design, development, manufacture, supply, and distribution of our drug

candidates are highly regulated and technically complex.

-

The

other risks and uncertainties identified in Item 1A. Risk Factors and Item 7

Management’s Discussion and Analysis of Financial Condition and Results of

Operations included in our Annual Report on Form 10-K for the year ended March

31, 2024, Quarterly Report on Form 10-Q for the period ended June 30, 2024 and

Quarterly Report on Form 10-Q for the period ended September 30, 2024.

All of the forward-looking statements in this quarterly report are qualified by this cautionary statement. There can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the consequences or effects on our business, financial condition, or results of operations that we anticipate. As a result, you should not place undue reliance on these forward-looking statements. Except as required by applicable law, we do not undertake to update or amend any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are made as of the date of this quarterly report.

We express all amounts in this quarterly report in thousands of U.S. dollars, except share and per share amounts or otherwise indicated. References to “$” are to U.S. dollars and references to “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this quarterly report to “Grace,” “Grace Therapeutics”, “Acasti,” “the Company,” “we,” “us” and “our” refer to Grace Therapeutics, Inc. (formerly known as Acasti Pharma Inc.) and its consolidated subsidiary.

PART I. FINANCIAL INFORMATION

Item 1. Financial Information

Unaudited Condensed Consolidated Financial Statements

GRACE THERAPEUTICS, INC.

(Formerly ACASTI PHARMA INC.)

Condensed Consolidated Balance Sheets

(Unaudited)

| |

|

December 31, 2024 |

|

|

March 31, 2024 |

|

(Expressed in thousands except share data) |

|

|

$

|

|

|

|

$

|

|

Assets |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

11,055 |

|

|

|

23,005 |

|

Receivables |

|

|

301 |

|

|

|

722 |

|

Prepaid expenses |

|

|

583 |

|

|

|

283 |

|

Total current assets |

|

|

11,939 |

|

|

|

24,010 |

|

| |

|

|

|

|

|

|

|

|

Equipment, net |

|

|

19 |

|

|

|

24 |

|

Intangible assets |

|

|

41,128 |

|

|

|

41,128 |

|

Goodwill |

|

|

8,138 |

|

|

|

8,138 |

|

Total assets |

|

|

61,224 |

|

|

|

73,300 |

|

| |

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Trade and other payables |

|

|

1,971 |

|

|

|

1,684 |

|

Total current liabilities |

|

|

1,971 |

|

|

|

1,684 |

|

| |

|

|

|

|

|

|

|

|

Derivative warrant liabilities |

|

|

3,781 |

|

|

|

4,359 |

|

Deferred tax liability |

|

|

3,333 |

|

|

|

5,514 |

|

Total liabilities |

|

|

9,085 |

|

|

|

11,557 |

|

| |

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value per share; 10,000,000 authorized; none issued and outstanding |

|

|

— |

|

|

|

— |

|

Common stock, $0.0001 par value per share; 100,000,000 authorized; 10,139,861 and 9,399,404 shares issued and outstanding as of December 31, 2024 and March 31,

2024, respectively |

|

|

1 |

|

|

|

1 |

|

Additional paid-in capital |

|

|

279,499 |

|

|

|

278,899 |

|

Accumulated other comprehensive loss |

|

|

(6,038 |

) |

|

|

(6,038 |

) |

Accumulated deficit |

|

|

(221,323 |

) |

|

|

(211,119 |

) |

Total stockholders' equity |

|

|

52,139 |

|

|

|

61,743 |

|

| |

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

|

61,224 |

|

|

|

73,300 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Formerly ACASTI PHARMA INC.)

Condensed Consolidated Statements of Loss and Comprehensive Loss

(Unaudited)

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

(Expressed in thousands, except share and per share data) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses, net of government assistance |

|

|

(2,194 |

) |

|

|

(1,443 |

) |

|

|

(7,877 |

) |

|

|

(2,998 |

) |

General and administrative expenses |

|

|

(1,510 |

) |

|

|

(1,600 |

) |

|

|

(5,619 |

) |

|

|

(5,106 |

) |

Restructuring cost |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,485 |

) |

Loss from operating activities |

|

|

(3,704 |

) |

|

|

(3,043 |

) |

|

|

(13,496 |

) |

|

|

(9,589 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange (loss) gain |

|

|

(16 |

) |

|

|

3 |

|

|

|

(11 |

) |

|

|

(2 |

) |

Change in fair value of derivative warrant liabilities |

|

|

(1,178 |

) |

|

|

125 |

|

|

|

578 |

|

|

|

(1,701 |

) |

Interest and other income, net |

|

|

138 |

|

|

|

316 |

|

|

|

544 |

|

|

|

662 |

|

Total other income (expenses), net |

|

|

(1,056 |

) |

|

|

444 |

|

|

|

1,111 |

|

|

|

(1,041 |

) |

Loss before income tax benefit |

|

|

(4,760 |

) |

|

|

(2,599 |

) |

|

|

(12,385 |

) |

|

|

(10,630 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit |

|

|

605 |

|

|

|

208 |

|

|

|

2,181 |

|

|

|

943 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and total comprehensive loss |

|

|

(4,155 |

) |

|

|

(2,391 |

) |

|

|

(10,204 |

) |

|

|

(9,687 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

|

(0.36 |

) |

|

|

(0.21 |

) |

|

|

(0.89 |

) |

|

|

(1.09 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of shares outstanding |

|

|

11,506,234 |

|

|

|

11,506,257 |

|

|

|

11,506,234 |

|

|

|

8,874,872 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Formerly ACASTI PHARMA INC)

Condensed

Consolidated Statements of Stockholders’ Equity

(Unaudited)

| |

|

Common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Expressed in thousands except share data) |

|

Number |

|

|

Amount |

|

|

Additional paid-in

capital

|

|

|

Accumulated other

comprehensive loss

|

|

|

Accumulated deficit |

|

|

Total stockholders' equity |

|

| |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Balance, March 31, 2024 |

|

|

9,399,404 |

|

|

|

1 |

|

|

|

278,899 |

|

|

|

(6,038 |

) |

|

|

(211,119 |

) |

|

|

61,743 |

|

Issuance of common stock upon cashless exercise of pre-funded warrants |

|

|

740,457 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss and total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,617 |

) |

|

|

(2,617 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

238 |

|

|

|

— |

|

|

|

— |

|

|

|

238 |

|

Balance at June 30, 2024 |

|

|

10,139,861 |

|

|

|

1 |

|

|

|

279,137 |

|

|

|

(6,038 |

) |

|

|

(213,736 |

) |

|

|

59,364 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,432 |

) |

|

|

(3,432 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

202 |

|

|

|

— |

|

|

|

— |

|

|

|

202 |

|

Balance at September 30, 2024 |

|

|

10,139,861 |

|

|

|

1 |

|

|

|

279,339 |

|

|

|

(6,038 |

) |

|

|

(217,168 |

) |

|

|

56,134 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,155 |

) |

|

|

(4,155 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

160 |

|

|

|

— |

|

|

|

— |

|

|

|

160 |

|

Balance at December 31, 2024 |

|

|

10,139,861 |

|

|

|

1 |

|

|

|

279,499 |

|

|

|

(6,038 |

) |

|

|

(221,323 |

) |

|

|

52,139 |

|

| |

|

Common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Expressed in thousands except share data) |

|

Number |

|

|

Amount |

|

|

Additional paid-in

capital

|

|

|

Accumulated other

comprehensive loss

|

|

|

Accumulated deficit |

|

|

Total stockholders' equity |

|

| |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Balance, March 31, 2023 |

|

|

7,435,533 |

|

|

|

1 |

|

|

|

272,259 |

|

|

|

(6,038 |

) |

|

|

(198,266 |

) |

|

|

67,955 |

|

Net loss and total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,023 |

) |

|

|

(4,023 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

78 |

|

|

|

— |

|

|

|

— |

|

|

|

78 |

|

Balance at June 30, 2023 |

|

|

7,435,533 |

|

|

|

1 |

|

|

|

272,337 |

|

|

|

(6,038 |

) |

|

|

(202,289 |

) |

|

|

64,010 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock and pre-funded warrants through private placement, net of offering costs |

|

|

1,951,371 |

|

|

|

— |

|

|

|

5,707 |

|

|

|

— |

|

|

|

— |

|

|

|

5,707 |

|

Issuance of common stock upon the exercise of stock options |

|

|

12,500 |

|

|

|

— |

|

|

|

21 |

|

|

|

— |

|

|

|

— |

|

|

|

21 |

|

Net loss and total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,273 |

) |

|

|

(3,273 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

280 |

|

|

|

— |

|

|

|

— |

|

|

|

280 |

|

Balance at September 30, 2023 |

|

|

9,399,404 |

|

|

|

1 |

|

|

|

278,344 |

|

|

|

(6,038 |

) |

|

|

(205,562 |

) |

|

|

66,745 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,391 |

) |

|

|

(2,391 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

326 |

|

|

|

— |

|

|

|

— |

|

|

|

326 |

|

Balance at December 31, 2023 |

|

|

9,399,404 |

|

|

|

1 |

|

|

|

278,670 |

|

|

|

(6,038 |

) |

|

|

(207,953 |

) |

|

|

64,680 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Formerly ACASTI PHARMA INC.)

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| |

|

Nine months ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

(Expressed in thousands) |

|

$ |

|

|

$ |

|

Cash flows used in operating activities: |

|

|

|

|

|

|

Net loss |

|

|

(10,204 |

) |

|

|

(9,687 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

5 |

|

|

|

10 |

|

Gain on sale of equipment |

|

|

— |

|

|

|

(26 |

) |

Stock-based compensation |

|

|

600 |

|

|

|

684 |

|

Change in fair value of derivative warrant liabilities |

|

|

(578 |

) |

|

|

1,701 |

|

Deferred income tax benefit |

|

|

(2,181 |

) |

|

|

(943 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Receivables |

|

|

421 |

|

|

|

(157 |

) |

Prepaid expenses |

|

|

(300 |

) |

|

|

(213 |

) |

Trade and other payables |

|

|

287 |

|

|

|

(1,591 |

) |

Operating lease right of use asset |

|

|

— |

|

|

|

(23 |

) |

Net cash used in operating activities |

|

|

(11,950 |

) |

|

|

(10,245 |

) |

| |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Proceeds from sale of equipment |

|

|

— |

|

|

|

110 |

|

| Maturity of short-term investments |

|

|

15 |

|

|

|

— |

|

Purchase of short-term investments |

|

|

(15 |

) |

|

|

(6,554 |

) |

Net cash used in investing activities |

|

|

— |

|

|

|

(6,444 |

) |

| |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Net proceeds from issuance of common stock and warrants from private placement |

|

|

— |

|

|

|

7,338 |

|

Proceeds from issuance of common stock from exercise of stock options |

|

|

— |

|

|

|

21 |

|

Net cash provided by financing activities |

|

|

— |

|

|

|

7,359 |

|

| |

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

(11,950 |

) |

|

|

(9,330 |

) |

| |

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of period |

|

|

23,005 |

|

|

|

27,875 |

|

Cash and cash equivalents, end of period |

|

|

11,055 |

|

|

|

18,545 |

|

| |

|

|

|

|

|

|

|

|

Cash and cash equivalents are comprised of: |

|

|

|

|

|

|

|

|

Cash |

|

|

836 |

|

|

|

2,060 |

|

Cash equivalents |

|

|

10,219 |

|

|

|

16,485 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

GRACE THERAPEUTICS, INC.

(Formerly ACASTI PHARMA, INC.)

Notes to Condensed Consolidated Financial Statements

(Unaudited)

(Expressed in thousands except share and per share data)

1. Nature of operation

General

Grace Therapeutics, Inc. (formerly known as Acasti Pharma Inc.) (“Acasti Delaware” or “the Company”), is a Delaware corporation that, as further described below, previously existed under the laws of the Province of Québec, Canada (“Acasti Québec”), before changing its jurisdiction on October 1, 2024 to the Province of British Columbia, Canada (“Acasti British Columbia”). On October 7, 2024, Acasti British Columbia changed its jurisdiction to the State of Delaware. Effective October 28, 2024, the Company changed its corporate name to Grace Therapeutics, Inc.

Continuance and Domestication

On

October 1, 2024, Acasti Québec changed its jurisdiction of incorporation from

the Province of Québec in Canada to the Province of British Columbia in Canada

pursuant to a “continuance” effected in accordance with Chapter XII of the

Business Corporations Act (Québec) (the “Continuance”). Subsequently on October

7, 2024 (the “Effective Date”), Acasti British Columbia changed its

jurisdiction of incorporation from the Province of British Columbia in Canada

to the State of Delaware in the United States of America pursuant to a

“continuance” effected in accordance with Section 308 of the Business

Corporations Act (British Columbia) and a “domestication” (the “Domestication”)

under Section 388 of the General Corporation Law of the State of Delaware. Both

the Continuance and the Domestication were approved by the Company’s

shareholders at the Company’s Annual and Special Meeting of Shareholders held

on September 30, 2024.

Prior

to the Continuance and Domestication, the Company’s Class A common shares,

without par value per share (“Common Shares”), were listed on The Nasdaq Stock

Market LLC (“Nasdaq”) under symbol “ACST.” Upon the effectiveness of the

Continuance, each outstanding Class A common share of Acasti Québec at the time

of the Continuance remained issued and outstanding as a common share, without

par value per share, of Acasti British Columbia. Upon effectiveness of the

Domestication, each outstanding common share of Acasti British Columbia at the

time of the Domestication automatically became one outstanding share of common

stock, par value $0.0001 per share, of Acasti Delaware (“Common Stock”). The

Common Stock continues to be listed for trading on Nasdaq and in connection

with its corporate name change to Grace Therapeutics, Inc., commenced trading

under the symbol “GRCE” on October 28, 2024.

The

Continuance and Domestication has been accounted for as an exchange of equity

interest among entities under common control resulting in a change in reporting

entity, and has been retroactively reflected in the accompanying unaudited

condensed consolidated financial statements and notes thereto. All assets and

liabilities of Acasti British Columbia were deemed assumed by the Company at

the Effective Date, resulting in the retention of the historical basis of

accounting as if they had always been combined for accounting and financial

reporting purposes. Any excess resulting from the automatic conversion of each

outstanding Common Share of Acasti British Columbia into one outstanding share

of Common Stock of Acasti Delaware, is presented as Additional Paid-in Capital

in the equity section of the accompanying unaudited condensed consolidated

financial statements and notes thereto. All per share amounts for all periods

presented in the accompanying unaudited condensed consolidated financial

statements and notes thereto have been adjusted retroactively, where

applicable, to reflect the effect of the change in par value.

Liquidity and Financial Condition

The Company has incurred operating losses and negative cash flows from operations in each period since its inception. The Company expects to incur significant expenses and continued operating losses for the foreseeable future.

In May 2023, the Company implemented a strategic realignment plan to enhance shareholder value that resulted in the Company engaging a new management team, streamlining its research and development activities, and greatly reducing its workforce. Following the realignment, the Company is a smaller, more focused organization, based in the United States, and concentrated on its development of its lead product candidate GTx-104. Further development of GTx-102 and GTx-101 will occur at such a time when the Company is able to secure additional funding or enters into strategic partnerships for license or sale with third parties.

In September 2023, the Company entered into a securities purchase agreement (the “2023 Purchase Agreement”) with certain institutional and accredited investors (the “2023 Private Placement”). Gross proceeds to the Company from the 2023 Private Placement were approximately $7,500, before deducting fees and expenses. The Company issued and sold an aggregate of 1,951,371 Common Shares, pre-funded warrants (the “2023 Pre-funded Warrants”) to purchase up to an aggregate of 2,106,853 Common Shares, each at a purchase price of $1.848 per Common Share and accompanying common warrants (the “2023 Common Warrants” and, together with the 2023 Pre-funded Warrants, the “2023 Warrants”) to purchase up to an aggregate of 2,536,391 Common Shares. In connection with the Continuance and the Domestication, the Company continues its obligations under the Purchase Agreement and the 2023 Warrants. Refer to Note 6, Stockholders’ Equity, for additional information. At effectiveness of the Continuance, each outstanding 2023 Common Warrant exercisable for Common Shares remained exercisable for an equivalent number of common shares of Acasti British Columbia for the equivalent exercise price per share without any action by the holder. At effectiveness of the Domestication, each outstanding warrant exercisable for common shares of Acasti British Columbia remained exercisable for an equivalent number of shares of Common Stock for the equivalent exercise price per share without any action by the holder.

In

February 2025, the Company completed a

private placement of Company securities with certain institutional and accredited investors. Net proceeds to the

Company were approximately $13,800. Refer to Note 11, Subsequent events, for

additional information.

The Company plans to use its current cash and the net proceeds from the 2025 Private Placement (as defined below) for clinical trial expenses to further the Phase 3 clinical trial for GTx-104, pre-commercial planning, commercial team buildout, and product launch if GTx-104 is approved, working capital and other general corporate purposes. The Company believes its existing cash and cash equivalents will be sufficient to sustain planned operations through at least 12 months from the issuance date of these unaudited condensed consolidated financial statements.

The Company will require additional capital to fund its daily

operating needs beyond that time. The Company does not expect to generate

revenue from product sales unless and until it successfully completes drug

development and obtains regulatory approval, which is subject to significant

uncertainty. To date, the Company has financed its operations primarily through

public offerings and private placements of its common equity, warrants and

convertible debt and the proceeds from research tax credits. Until such time

that the Company can generate significant revenue from drug product sales, if

ever, it will require additional financing, which is expected to be sourced

from a combination of public or private equity or debt financing or other

non-dilutive sources, which may include fees, milestone payments and royalties

from collaborations with third parties. Arrangements with collaborators or

others may require the Company to relinquish certain rights related to its

technologies or drug product candidates. Adequate additional financing may not

be available to the Company on acceptable terms, or at all. The Company’s

inability to raise capital as and when needed could have a negative impact on

its financial condition and its ability to pursue its business strategy. The

Company plans to raise additional capital in order to maintain adequate

liquidity. Negative results from studies or trials, if any, or depressed prices

of the Company’s stock could impact the Company’s ability to raise additional

financing. Raising additional equity capital is subject to market conditions

that are not within the Company’s control. If the Company is unable to raise

additional funds, the Company may not be able to realize its assets and

discharge its liabilities in the normal course of business.

The

Company remains subject to risks similar to other development stage companies

in the biopharmaceutical industry, including compliance with government

regulations, protection of proprietary technology, dependence on third-party

contractors and consultants and potential product liability, among others.

Please refer to the risk factors included in Part 1, Item 1A of the Company’s

Annual Report on Form 10-K for the year ended March 31, 2024, filed with the

SEC on June 21, 2024 (the “Annual Report”).

2. Summary of significant accounting policies:

Basis of presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X under the Securities Exchange Act of 1934. Any reference in these notes to applicable guidance is meant to refer to the authoritative U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and as amended by Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

The unaudited condensed consolidated financial statements have

been prepared on the same basis as the audited annual consolidated financial

statements as of and for the year ended March 31, 2024, and, in the opinion of

management, reflect all adjustments, consisting of normal recurring

adjustments, necessary for the fair presentation of the Company’s consolidated

financial position as of December 31, 2024, the consolidated results of its

operations for the three and the nine months ended December 31, 2024 and 2023,

its statements of stockholders’ equity for the nine months ended December 31,

2024 and 2023, and its consolidated cash flows for the nine months ended

December 31, 2024 and 2023.

These unaudited condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements and the accompanying notes for the year ended March 31, 2024 included in the Company’s Annual Report. The condensed consolidated balance sheet data as of March 31, 2024 presented for comparative purposes was derived from the Company’s audited consolidated financial statements. The results for the three and the nine months ended December 31, 2024 are not necessarily indicative of the operating results to be expected for the full year or for any other subsequent interim period.

The Company’s significant accounting policies are disclosed in the audited consolidated financial statements for the year ended March 31, 2024 included in the Annual Report. There have been no changes to the Company’s significant accounting policies since the date of the audited consolidated financial statements for the year ended March 31, 2024 included in the Annual Report.

Use of estimates

The preparation of these unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, income, and expenses. Actual results may differ from these estimates.

Estimates are based on management’s best knowledge of current events and actions that management may undertake in the future. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Estimates and assumptions include the measurement of stock-based compensation, derivative warrant liabilities, accruals for research and development contracts and contract organization agreements, and valuation of intangibles and goodwill. Estimates and assumptions are also involved in determining the extent to which research and development expenses qualify for research and development tax credits. The Company recognizes tax credits once it has reasonable assurance that they will be realized.

Reclassifications

The Company reclassified sales and marketing

expenses to general and administrative expenses to conform to the current period reporting classifications. This reclassification did not have an impact on previously reported results of

operations.

Recent accounting pronouncements

In November 2023, the FASB

issued ASU 2023-07, “Improvements to

Reportable Segment Disclosures” (“ASU 2023-07”). The ASU includes enhanced

disclosure requirements, primarily related to significant segment expenses that

are regularly provided to and used by the chief operating decision maker

("CODM"). The amendments are to be applied retrospectively to all

prior periods presented in the financial statements. ASU 2023-07 is effective

for fiscal years beginning after December 15, 2023, and interim periods within

fiscal years beginning after December 15, 2024, with early adoption permitted.

The Company is currently evaluating the effect of adopting this pronouncement

on its consolidated financial statements and disclosures, and will reflect the

effect on the fiscal year consolidated financial statements ending

March 31, 2025. The Company does not expect that the adoption of ASU 2023-07

will have a material impact on its consolidated financial statements and

disclosures.

The Company has considered all other recent accounting

pronouncements and concluded that they are either not applicable to the

Company’s business or that the effect is not expected to be material to the

unaudited condensed consolidated financial statements as a result of future

adoption.

3. Fair Value Measurements

Assets and liabilities measured at fair value on a recurring basis as of December 31, 2024 are as follows:

| |

|

Total |

|

|

Quoted prices

in active markets

(Level 1)

|

|

|

Significant other

observable inputs

(Level 2)

|

|

|

Significant

unobservable inputs

(Level 3)

|

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Treasury bills and term deposits classified as cash equivalents |

|

|

10,219 |

|

|

|

10,219 |

|

|

|

— |

|

|

|

— |

|

Guaranteed investment certificate classified as short-term investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total assets |

|

|

10,219 |

|

|

|

10,219 |

|

|

|

— |

|

|

|

— |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative warrant liabilities |

|

|

3,781 |

|

|

|

— |

|

|

|

— |

|

|

|

3,781 |

|

Total liabilities |

|

|

3,781 |

|

|

|

— |

|

|

|

— |

|

|

|

3,781 |

|

Assets and liabilities measured at fair value on a recurring basis as of March 31, 2024 are as follows:

| |

|

Total |

|

|

Quoted prices

in active markets

(Level 1)

|

|

|

Significant other

observable inputs

(Level 2)

|

|

|

Significant

unobservable inputs

(Level 3)

|

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed investment certificates and term deposits classified as cash equivalents |

|

|

19,725 |

|

|

|

19,725 |

|

|

|

— |

|

|

|

— |

|

Total assets |

|

|

19,725 |

|

|

|

19,725 |

|

|

|

— |

|

|

|

— |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative warrant liabilities |

|

|

4,359 |

|

|

|

— |

|

|

|

— |

|

|

|

4,359 |

|

Total liabilities |

|

|

4,359 |

|

|

|

— |

|

|

|

— |

|

|

|

4,359 |

|

There were no changes in valuation techniques or transfers between

Levels 1, 2 or 3 during the three and the nine months ended December 31, 2024.

The Company’s derivative warrant liabilities are measured at fair value on a

recurring basis using unobservable inputs that are classified as Level 3

inputs. Refer to Note 6, Stockholders’ Equity, for the valuation techniques and

assumptions used in estimating the fair value of the derivative warrant

liabilities.

4. Receivables

| |

|

December 31, 2024 |

|

|

March 31, 2024 |

|

| |

|

$ |

|

|

$ |

|

Sales tax receivables |

|

|

281 |

|

|

|

316 |

|

Government assistance |

|

|

— |

|

|

|

356 |

|

Interest receivable |

|

|

— |

|

|

|

15 |

|

Other receivables |

|

|

20 |

|

|

|

35 |

|

Total receivables |

|

|

301 |

|

|

|

722 |

|

Government assistance is comprised of research and development investment tax credits from the Québec provincial government, which relate to quantifiable research and development expenditures under the applicable tax laws. The amounts recorded as receivable are subject to a government tax audit and the final amounts received may differ from those recorded.

5. Trade and other payables

| |

|

December 31, 2024 |

|

|

March 31, 2024 |

|

| |

|

$ |

|

|

$ |

|

Trade payables |

|

|

665 |

|

|

|

1,007 |

|

Accrued liabilities and other payables |

|

|

814 |

|

|

|

176 |

|

Employee salaries and benefits payable |

|

|

492 |

|

|

|

501 |

|

Total trade and other payables |

|

|

1,971 |

|

|

|

1,684 |

|

6. Stockholders’

Equity

Preferred Stock

The Company is authorized to issue up to 10,000,000 shares of preferred stock, par value $0.0001 per share. No shares of the Company’s preferred stock are issued or outstanding.

Common Stock

In connection with the consummation of the Domestication, on

October 7, 2024, the Company adopted a Certificate of Incorporation (as amended,

the “Charter”) and Bylaws (as amended, the “Bylaws”). The rights of holders of

the Company’s Common Stock are now governed by the Charter, the Bylaws, and the

General Corporation Law of the State of Delaware. The Company is authorized to

issue up to 100,000,000 shares of Common Stock, par value $0.0001 per share.

2023 Private Placement

In

September 2023, the Company entered into the Purchase Agreement with certain

institutional and accredited investors in connection with the 2023 Private

Placement. Pursuant to the Purchase Agreement, the Company offered and sold

1,951,371 Common Shares, at a purchase price of $1.848 per Common Share and 2023

Pre-funded Warrants to purchase up to 2,106,853 Common Shares at a purchase

price equal to the purchase price per Common Share less $0.0001. Each 2023 Pre-funded

Warrant is exercisable for one Common Share at an exercise price of $0.0001 per

Common Share, is immediately exercisable, and will expire once exercised in

full. Pursuant to the Purchase Agreement, the Company also issued, to such

institutional and accredited investors, 2023 Common Warrants to purchase Common

Shares exercisable for an aggregate of 2,536,391 Common Shares. Under the terms

of the Purchase Agreement, for each Common Share and each 2023 Pre-funded

Warrant issued in the 2023 Private Placement, an accompanying five-eighths

(0.625) of a 2023 Common Warrant was issued to the purchaser thereof. Each

whole 2023 Common Warrant is exercisable for one Common Share at an exercise

price of $3.003 per Common Share, is immediately exercisable, and will expire

on the earlier of (i) the 60th day after the date of the acceptance

by the FDA of an NDA for the Company’s product candidate GTx-104 or (ii) five

years from the date of issuance. The 2023 Private Placement closed on September

25, 2023. The net proceeds to the Company from the 2023 Private Placement were

$7,338, after deducting fees and expenses.

The

2023 Private Placement included the issuance of Common Shares, 2023 Pre-funded

Warrants, and 2023 Common Warrants to related parties Shore Pharma LLC, an entity

that was controlled by Vimal Kavuru, the Chair of the Company’s Board of

Directors, at the time of the 2023 Private Placement, and SS Pharma LLC, the

beneficial owner of 5.5% of Common Shares outstanding prior to the 2023 Private

Placement, resulting in proceeds of $2,500. As of December 31, 2024 and March

31, 2024, the balance of derivative warrant liabilities from these related

parties was $1,265 and $1,453, respectively.

During

the nine months ended December 31, 2024, 740,480 2023 Pre-funded Warrants were

exercised into 740,457 Common Shares or Common Stock, as applicable. There were

no 2023 Common Warrants exercised during the nine months ended December 31, 2024.

Warrants

As further discussed above, on September 25, 2023, the Company

issued 2023 Pre-Funded Warrants and 2023 Common Warrants exercisable for an aggregate of

4,643,244 Common Shares in the 2023 Private Placement pursuant to the terms of

the Purchase Agreement entered into with certain institutional and accredited

investors.

The 2023 Common Warrants issued as a part of the 2023 Private Placement are derivative

warrant liabilities given that the 2023 Common Warrants did not meet the

fixed-for-fixed criteria and that the 2023 Common Warrants are not indexed to the

Company’s own stock.

Proceeds were allocated amongst Common Shares, 2023 Pre-funded

Warrants, and 2023 Common Warrants by applying the residual method, with fair

value of the 2023 Common Warrants determined using the Black-Scholes model,

resulting in initial derivative warrant liabilities of $1,631 and issuance

costs of $45 allocated to 2023 Common Warrants. Accordingly, $2,822 and $3,047

of the gross proceeds were allocated to Common Shares and 2023 Pre-funded

Warrants, respectively, and $78 and $84 of issuance costs were allocated to

Common Shares and 2023 Pre-funded Warrants, respectively.

The derivative warrant liabilities are measured at fair value at each reporting period and the reconciliation of changes in fair value is presented in the following table:

| |

|

For the nine months ended

December 31, 2024

|

|

|

For the nine months ended

December 31, 2023

|

|

| |

|

$ |

|

|

$ |

|

Beginning balance |

|

|

4,359 |

|

|

|

— |

|

Issued during the year |

|

|

— |

|

|

|

1,631 |

|

Change in fair value |

|

|

(578 |

) |

|

|

1,701 |

|

Ending balance |

|

|

3,781 |

|

|

|

3,332 |

|

The fair value of derivative warrant liabilities were determined

based on the fair value of the 2023 Common Warrants at the issue date and the

reporting dates using the Black-Scholes model with the following weighted-average

assumptions that take into account the probability that the 2023 Common Warrants will

expire on the earlier of (i) the 60th day after the date of the acceptance by

the FDA of an NDA for the Company’s product candidate GTx-104 or (ii) five

years from the date on issuance.

| |

|

December 31, 2024 |

|

|

March 31, 2024 |

|

Risk-free interest rate |

|

|

4.20 |

% |

|

|

4.69 |

% |

Stock price |

|

$ |

3.85 |

|

|

$ |

3.43 |

|

Expected warrant life |

|

|

1.34 |

|

|

|

2.03 |

|

Dividend yield |

|

|

0 |

% |

|

|

0 |

% |

Expected volatility |

|

|

64.66 |

% |

|

|

85.94 |

% |

The weighted-average fair values of the 2023 Common Warrants were determined to be $1.50 and $1.72 per 2023 Common Warrant as of December 31, 2024, and March 31, 2024, respectively. The risk-free interest rate at the issue date and on the reporting date of December 31, 2024 was based on the interest rate corresponding to the U.S. Treasury rate issue with a remaining term equal to the expected term of the 2023 Common Warrants. The expected volatility was based on the historical volatility for the Company.

At

December 31, 2024, the Company had outstanding 2023 Common Warrants to purchase

2,536,391 shares of Common Stock, with an exercise price of $3.003, all of

which were classified as derivative warrant liabilities. At December 31, 2024,

the Company had outstanding 2023 Pre-funded Warrants to purchase 1,366,373 shares of

Common Stock, with an exercise price of $0.0001, all of which were classified

within stockholders’ equity.

In connection with the Continuance and the Domestication, the

Company continues its obligations under the Purchase Agreement and the 2023 Warrants.

At effectiveness of the Continuance, each outstanding 2023 Warrant exercisable for Common

Shares remained exercisable for an equivalent number of common shares of Acasti

British Columbia for the equivalent exercise price per share without any action

by the holder. At effectiveness of the Domestication, each outstanding warrant exercisable

for common shares of Acasti British Columbia remained exercisable for an

equivalent number of shares of Common Stock for the equivalent exercise price

per share without any action by the holder.

7. Stock-based compensation

2024 Equity Incentive Plan

At the Annual and Special Meeting of Shareholders on September 30,

2024, the Company’s shareholders approved the Acasti Pharma Inc. 2024 Equity

Incentive Plan (the “2024 Plan”) which became effective on the date of the

Domestication. The 2024 Plan replaced the Acasti Pharma Inc. Stock Option Plan

and the Acasti Pharma Inc. Equity Incentive Plan (the “Prior Plans”). The 2024

Plan provides for the grant of awards of stock options, stock appreciation

rights, restricted stock, restricted stock units, deferred stock units,

unrestricted stock, dividend equivalent rights, performance-based awards and other

equity-based awards to eligible persons as defined under the 2024 Plan. Any of

these awards may, but need not, be made as performance incentives to reward the

holders of such awards for the achievement of performance goals in accordance

with the terms of the 2024 Plan. Stock options granted under the 2024 Plan may

be non-qualified stock options or incentive stock options, as provided in the

2024 Plan.

In connection with the Continuance and the Domestication, the

Company continues its obligations under the Prior Plans and all of the

outstanding equity awards under the Prior Plans. Upon effectiveness of the

Continuance, each outstanding option exercisable for and restricted share unit

settleable into Common Shares remained exercisable for or able to be settled

into an equivalent number of common shares of Acasti British Columbia for the

equivalent exercise price per share (if applicable), without any action by the

holder. Upon effectiveness of the Domestication, each outstanding option exercisable

for and restricted share unit settleable into common shares of Acasti British

Columbia remained exercisable for or able to be settled into an equivalent

number of shares of Common Stock for the equivalent exercise price per share

(if applicable), without any action by the holder.

Following

the Effective Date of the 2024 Plan, no awards shall be made under the Prior

Plans. However, Common Shares reserved under the Prior Plans to settle awards

which were made under the Prior Plans may be issued and delivered following the

Effective Date to settle such awards.

The 2024 Plan is administered by a committee designated from time

to time, by resolution of the Company’s Board of Directors. The committee

will also be responsible for determining, among others, the key terms of the

awards including their grant dates, pricing, basis for fair value

determination, vesting terms, restrictions, and terminations. The Board has

designated its Compensation Committee to administer the 2024 Plan. There are

1,350,000 shares of Common Stock available for issuance under the 2024 Plan.

The

2024 Plan will terminate automatically ten years after the Effective Date and

may be terminated on any earlier date as provided by the 2024 Plan.

The

following table summarizes information about activities within the 2024 Plan

and Prior Plans for the nine months ended December 31, 2024:

| |

|

Number of

Options

|

|

|

Weighted-average

Exercise Price

|

|

|

Remaining

Contractual Term

(years)

|

|

|

Aggregate Intrinsic

Value (in

thousands)

|

|

| |

|

|

|

|

$ |

|

|

|

|

|

|

|

Outstanding, March 31, 2024 |

|

|

721,793 |

|

|

|

3.68 |

|

|

|

9.08 |

|

|

|

527 |

|

Granted |

|

|

213,130 |

|

|

|

2.98 |

|

|

|

|

|

|

|

|

|

Outstanding, December 31, 2024 |

|

|

934,923 |

|

|

|

3.52 |

|

|

|

8.55 |

|

|

|

865 |

|

Exercisable, December 31, 2024 |

|

|

526,065 |

|

|

|

4.10 |

|

|

|

8.28 |

|

|

|

473 |

|

The weighted-average grant date fair value of awards for options granted during the nine months ended December 31, 2024 was $2.53. The fair value of options granted was estimated using the Black-Scholes option pricing model, resulting in the following weighted-average assumptions for the options granted:

| |

|

Nine months ended

December 31, 2024

|

|

|

Nine months ended

December 31, 2023

|

|

| |

|

Weighted-average |

|

|

Weighted-average |

|

Exercise price |

|

$ |

2.98 |

|

|

$ |

2.50 |

|

Share price |

|

$ |

2.98 |

|

|

$ |

2.50 |

|

Dividend |

|

|

— |

|

|

|

— |

|

Risk-free interest |

|

|

4.42 |

% |

|

|

3.95 |

% |

Estimated life (years) |

|

|

5.81 |

|

|

|

5.66 |

|

Expected volatility |

|

|

114.20 |

% |

|

|

117.80 |

% |

Compensation expense recognized under the 2024 Plan is summarized as follows:

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Research and development expenses |

|

|

50 |

|

|

|

61 |

|

|

|

176 |

|

|

|

145 |

|

General and administrative expenses |

|

|

110 |

|

|

|

265 |

|

|

|

424 |

|

|

|

539 |

|

| |

|

|

160 |

|

|

|

326 |

|

|

|

600 |

|

|

|

684 |

|

As of December 31, 2024, there was $415 of total unrecognized compensation cost, related to non-vested stock options, which is expected to be recognized over a remaining weighted-average vesting period of 1.23 years.

8. Loss per share

The Company has generated a net loss for all periods presented. Therefore, diluted loss per share is the same as basic loss per share since the inclusion of potentially dilutive securities would have had an anti-dilutive effect. All currently outstanding options and warrants could potentially be dilutive in the future.

The Company excluded the following potential Common Stock,

presented based on amounts outstanding at each period end, from the computation

of diluted net loss per share attributable to stockholders for the periods

indicated because including them would have had an anti-dilutive effect:

| |

|

Nine months ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

Options outstanding |

|

|

934,923 |

|

|

|

721,793 |

|

September 2023 Common Warrants |

|

|

2,536,391 |

|

|

|

2,536,391 |

|

Basic and diluted net loss per share is calculated based upon the

weighted-average number of shares of Common Stock outstanding during the

period. Common Stock underlying the 2023 Pre-funded Warrants are included in the

calculation of basic and diluted earnings per share.

9. Commitments and contingencies

Research and development contracts and contract research organizations agreements

The Company utilizes CMOs for the development and production of

clinical materials and CROs to perform services related to its clinical trials.

Pursuant to the agreements with these CMOs and CROs, the Company has either the

right to terminate the agreements without penalties or under certain penalty

conditions. As of December 31, 2024, the Company has $230 of commitments to

CMOs and $1,500 of commitments to CROs for the next twelve months.

Raw krill oil supply contract

On October 25, 2019, the Company signed a supply agreement with

Aker BioMarine Antarctic AS. (“AKBM”) to purchase raw krill oil product for a

committed volume of commercial starting material for CaPre, one of the

Company’s former drug candidates, for a total fixed value of $3,100 based on

the value of krill oil at that time. As of March 31, 2022, the remaining

balance of commitment amounted to $2,800. During the second calendar quarter of

2022, AKBM informed the Company that AKBM believed it had satisfied the terms

of the supply agreement as to their obligation to deliver the remaining balance

of raw krill oil product, and that the Company was therefore required to accept

the remaining product commitment. The Company disagreed with AKBM’s position

and believed that AKBM was not entitled to further payment under the supply

agreement. Accordingly, no liability was recorded by the Company. The dispute

remained unresolved as of both March 31, 2023 and 2022. On October 18, 2023,

the Company entered into an agreement with AKBM to settle any and all potential

claims regarding amounts due under the supply agreement (“Settlement

Agreement”). Pursuant to the terms of the Settlement Agreement, in exchange for

a release and waiver of claims arising out of the supply agreement by AKBM and

any of AKBM’s affiliates, the Company and AKBM agreed to the following: (a)

AKBM retained ownership of all raw krill oil product, including amounts

previously delivered to the Company, (b) AKBM acquired and took ownership of

all production equipment related to the production of CaPre, (c) AKBM acquired

and took ownership of all data from research, clinical trials and pre-clinical

studies with respect to CaPre, and (d) AKBM acquired and took ownership over

all rights, title and interest in and to all intellectual property rights,

including all patents and trademarks, related to CaPre owned by the Company.

Pursuant to the terms of the Settlement Agreement, AKBM acknowledged that the

CaPre assets were transferred on an “as is” basis, and in connection therewith

the Company disclaimed all representations and warranties in connection with

the CaPre assets, including any representations with respect to performance or

sufficiency. The value of the raw krill oil previously delivered to the

Company, the production equipment, and the intellectual property rights related

to CaPre were fully impaired in prior reporting periods and had a carrying value

of zero as of March 31, 2023. For the three and the nine months ended December

31, 2024, there were $22 and $215, respectively, in expenses recorded by the

Company in relation to shipping cost to transport the Company’s production

equipment related to the production of CaPre.

Legal proceedings and disputes

In the ordinary course of business, the Company is at times

subject to various legal proceedings and disputes. The Company assesses its

liabilities and contingencies in connection with outstanding legal proceedings

utilizing the latest information available. Where it is probable that the

Company will incur a loss and the amount of the loss can be reasonably

estimated, the Company records a liability in its unaudited condensed consolidated

financial statements. These legal contingencies may be adjusted to reflect any

relevant developments on a quarterly basis. Where a loss is not probable or the

amount of loss is not estimable, the Company does not accrue legal

contingencies. While the outcome of legal proceedings is inherently uncertain,

based on information currently available, management believes that it has

established appropriate legal reserves. No reserves or liabilities have been accrued at

December 31, 2024.

10. Restructuring costs

On

May 8, 2023, the Company communicated its decision to terminate a substantial

amount of its workforce as part of a plan that intended to align the Company’s

organizational and management cost structure to prioritize resources to

GTx-104, thereby reducing losses to improve cash flow and extend available cash

resources. During the nine months ended December 31, 2023, the Company incurred

$1,485 in costs primarily consisting of employee severance costs and legal

fees. There were no restructuring costs incurred during the three and the nine

months ended December 31, 2024.

11. Subsequent events

2025 Private Placement