|

Exhibit

No.

|

Description

|

|

|

Iris Energy Limited (dba IREN), May 2024 Monthly Investor Update, dated June 6, 2024

|

|

|

Iris Energy Limited

|

|

|

|

|

|

|

Date: June 6, 2024

|

By:

|

/s/ Daniel Roberts

|

|

|

|

Daniel Roberts

|

|

|

|

Co-Chief Executive Officer and Director

|

|

Bitcoin Mining

|

|

AI Cloud Services

|

|

• 230 Bitcoin mined in May

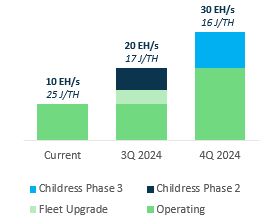

• 10 EH/s operating

• 20 EH/s in 3Q, 30 EH/s in 4Q

|

• 816 NVIDIA H100 GPUs

• Currently servicing Poolside AI and on-demand

customers

|

||

|

Data Centers

|

|

Corporate

|

|

• 260MW

operating, 510MW in 2024

• Childress Phase 2 & 3 construction progressing to

schedule

|

• $322m cash, no debt1

• 3Q FY24 results,

replay here

|

|

Key Metrics

|

May-24

|

Apr-24

|

Mar-24

|

|

Bitcoin Mining2

|

|||

|

Average operating hashrate (PH/s)

|

9,414

|

8,238

|

7,107

|

|

Renewable energy usage (MW)3

|

246

|

220

|

195

|

|

Bitcoin mined

|

230

|

358

|

353

|

|

Mining revenue (US$’000)

|

15,079

|

23,691

|

23,705

|

|

Electricity costs (US$’000)4

|

8,167*

|

7,002

|

7,172

|

|

Hardware profit margin (%)5

|

46%

|

70%

|

70%

|

|

Revenue per Bitcoin (US$)

|

65,498

|

66,210

|

67,235

|

|

Electricity cost per Bitcoin (US$)

|

35,475

|

19,569

|

20,343

|

|

AI Cloud Services

|

|||

|

AI Cloud Services revenue (US$’000)

|

892

|

581

|

408

|

|

Electricity costs (US$’000)

|

16

|

7

|

9

|

|

Hardware profit margin (%)5

|

98%

|

99%

|

98%

|

|

Bitcoin Mining

|

|

Expansion schedule

|

May operations

• Average operating hashrate of 9.4 EH/s

(now expanded to 10 EH/s)

• Decrease in Bitcoin mined in May due to reduced block subsidy

(post-halving), partially offset by 14% increase in average operating hashrate

2024 expansion plans increased to 30 EH/s

• Secured latest-generation Bitmain S21 Pro miners with

nameplate efficiency of 15 J/TH

• At 30 EH/s,

nameplate fleet efficiency of 16 J/TH and indicative electricity cost per BTC of $17k6

• Upgrade of existing miner fleet across BC and Texas

• Miners

secured to support 40 EH/s in 1H 2025

|

|

AI Cloud Services

|

IREN CCO Kent Draper discussing how IREN is solving AI and sustainability challenges at Dell Tech World

|

AI Cloud Services

• 816 NVIDIA H100 GPUs operating

o 504 GPUs contracted

with Poolside AI

o Servicing on-demand market

• 816 GPUs generates an estimated ~$14-$17m of annualized hardware profit (~24 month

payback)7

• Customer conversations ongoing with respect to both cloud

and colocation solutions

• Exploring

growth financing opportunities

|

|

Data Centers

|

Childress (May 2024)

|

510MW of data centers in 2024

• Childress Phase 1 (100MW) – completed ahead of schedule

• Childress Phase 2 (100MW) – 3Q 2024

o Foundations, building structures and electrical works ongoing

• Childress Phase 3 (150MW) – 4Q 2024

o Civil works underway

• >3,000MW power & land portfolio presents significant opportunity

|

|

Data Center

|

Capacity

(MW) |

Capacity

(EH/s)8

|

Timing

|

Status

|

|

Canal Flats (BC, Canada)

|

30

|

0.9

|

Complete

|

Operating

|

|

Mackenzie (BC, Canada)

|

80

|

2.7

|

Complete

|

Operating

|

|

Prince George (BC, Canada)

|

50

|

1.6

|

Complete

|

Operating

|

|

Childress Phase 1 (Texas, USA)

|

100

|

4.8

|

Complete

|

Operating

|

|

Total Operating

|

260

|

10

|

||

|

Fleet Upgrade (Incremental)

|

-

|

4

|

3Q 2024

|

Miners secured

|

|

Childress Phase 2 (Texas, USA)

|

100

|

6

|

3Q 2024

|

Under construction

|

|

Childress Phase 3 (Texas USA)

|

150

|

10

|

4Q 2024

|

Under construction

|

|

Total Operating & Construction

|

510

|

30

|

||

|

Childress Phase 4-6 (Texas, USA)

|

250

|

TBD

|

Power available

|

|

|

Development Site (Texas, USA)

|

1,400

|

Late 2026

|

Connection underway

|

|

|

Additional Pipeline

|

>1,000

|

Development

|

||

|

Total

|

>3,000

|

|

Corporate

|

The IREN Canal Flats team was proud to participate in the annual Canal Days celebration and parade

|

Corporate

• Reported 3Q FY24 results

o Record revenue,

adjusted EBITDA and operating cashflow

o $322m cash, no debt1

o Watch the webcast replay here

• Partnered with the District of Mackenzie to bring high speed

fibre-optic connectivity to Mackenzie

o Enhances connectivity

for residents

o Provides dual

redundancy to data center

Upcoming events

• Collision, Toronto (Jun 17 - 20, 2024)

• IREN Analyst Day, NYC (Jul 23, 2024)

• IREN Investor Event, NYC (Jul 23, 2024)

• Bitcoin 2024, Nashville

(Jul 25 - 27, 2024)

|

| 1. |

Reflects USD equivalent, unaudited cash and cash equivalents as of April 30, 2024.

|

| 2. |

Bitcoin and Bitcoin mined in this investor update are presented in accordance with our revenue recognition policy which is determined on a Bitcoin received basis (post deduction of mining

pool fees).

|

| 3. |

Comprises actual power usage for Canal Flats, Mackenzie, Prince George, and Childress. The Company’s Canal Flats, Mackenzie and Prince George sites have been powered by 100% renewable

energy since inception of which approximately 98% is directly from renewable energy sources; approximately 2% is from the purchase of RECs. The Company’s Childress site has been powered by 100% renewable energy since inception via the

purchase of RECs.

|

| 4. |

Electricity costs presented on a net basis and calculated as IFRS electricity charges net of realized gain/(loss) on financial asset, ERS revenue (included in other income) and ERS fees

(included in other operating expenses). Figures are based on current internal estimates and exclude REC purchases.

|

| 5. |

Hardware profit margin for Bitcoin mining and AI Cloud Services is calculated as revenue less net electricity costs, divided by revenue (for each respective revenue stream) and excludes

all other costs.

|

| 6. |

Represents indicative electricity cost per bitcoin mined assuming 30 EH/s, nameplate fleet efficiency of 16 J/TH, weighted average power cost of $0.037/kWh ($0.045/kWh in BC and

$0.033/kWh in Texas – latter calculated using actual monthly average net power price at Childress during 3Q YTD FY24 (i.e. July 2023 to March 2024), including ERS revenue and adjusted for now eligible 4CP benefit), global hashrate of 603

EH/s, block reward of 3.125 BTC per block and transaction fees of 0.3 BTC per block.

|

| 7. |

Illustrative annualized hardware profit = revenue less assumed electricity costs (excludes all other site, overhead and REC costs). GPU calculations assume 1.25kW power draw required for

1 GPU, $0.05/kWh electricity costs and $2.00-2.50 per GPU hour revenue assumption. Capex assumes ~$40k per GPU.

|

| 8. |

Capacity to be installed comprises Bitmain T21 and S21 Pro miner purchases and miner purchase options. Additional S21 Pro miners secured will also be used to upgrade the existing fleet.

Final decisions with respect to exercising miner purchase options will be made during 2024 taking into consideration market and funding conditions.

|

|

Media

Jon Snowball

Domestique

+61 477 946 068

Danielle Ghigliera

Aircover Communications

+1 510 333 2707

|

Investors

Lincoln Tan

IREN

+61 407 423 395

lincoln.tan@iren.com

|

|