|

SEANERGY MARITIME HOLDINGS CORP.

|

||

|

(Exact name of Registrant as specified in its charter)

|

|

(Translation of Registrant’s name into English)

|

||

| Republic of the Marshall Islands | ||

|

(Jurisdiction of incorporation or organization)

|

||

|

154 Vouliagmenis Avenue, 166 74 Glyfada, Greece

|

||

|

(Address of principal executive offices)

|

||

|

Stamatios Tsantanis, Chairman & Chief Executive Officer

|

||

|

Seanergy Maritime Holdings Corp.

|

||

|

154 Vouliagmenis Avenue, 166 74 Glyfada, Greece

|

||

|

Telephone: +30 213 0181507, Fax: +30 210 9638404

|

||

|

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

|

|

Title of class

|

Trading Symbol(s)

|

Name of exchange on which Registered

|

|

Common Shares, par value $0.0001 per share

|

SHIP

|

The Nasdaq Stock Market LLC

|

|

Preferred Stock Purchase Rights

|

|

The Nasdaq Stock Market LLC

|

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

Non-accelerated filer ☐

|

|

Emerging growth company ☐

|

|

U.S. GAAP ☒

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

|

Other ☐

|

|

☐ Item 17

|

☐ Item 18

|

|

☐ Yes

|

☒ No

|

|

|

☐ Yes

|

☐ No

|

|

|

ITEM 1.

|

1 |

||

|

ITEM 2.

|

1 |

||

|

ITEM 3.

|

1 |

||

|

ITEM 4.

|

35 |

||

|

ITEM 4A.

|

57 |

||

|

ITEM 5.

|

57 |

||

|

ITEM 6.

|

74 |

||

|

ITEM 7.

|

78 |

||

|

ITEM 8.

|

80 |

||

|

ITEM 9.

|

81 |

||

|

ITEM 10.

|

82 |

||

|

ITEM 11.

|

90 |

||

|

ITEM 12.

|

90 |

||

|

ITEM 13.

|

91 |

||

|

ITEM 14.

|

91 |

||

|

ITEM 15.

|

91 |

||

|

ITEM 16.

|

92 |

||

|

ITEM 16A.

|

92 |

||

|

ITEM 16B.

|

92 |

||

|

ITEM 16C.

|

92 |

||

|

ITEM 16D.

|

93 |

||

|

ITEM 16E.

|

93 |

||

|

ITEM 16F.

|

93 |

||

|

ITEM 16G.

|

93 |

||

|

ITEM 16H.

|

94 |

||

|

ITEM 16I.

|

94 |

||

|

ITEM 16J.

|

94 |

||

|

ITEM 16K.

|

94 |

||

|

ITEM 17.

|

95 |

||

|

ITEM 18.

|

95 |

||

|

ITEM 19.

|

96 |

||

|

|

• |

changes in shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand;

|

|

|

• |

changes in seaborne and other transportation patterns;

|

|

|

• |

changes in the supply of or demand for dry bulk commodities, including dry bulk commodities carried by sea, generally or in particular regions;

|

|

|

• |

changes in the number of newbuildings under construction in the dry bulk shipping industry;

|

|

|

• |

changes in the useful lives and the value of our vessels and the related impact on our compliance with loan covenants;

|

|

|

• |

the aging of our fleet and increases in operating costs;

|

|

|

• |

changes in our ability to complete future, pending or recent acquisitions or dispositions;

|

|

|

• |

our ability to achieve successful utilization of our fleet;

|

|

|

• |

changes to our financial condition and liquidity, including our ability to pay amounts that we owe and obtain additional financing to fund capital expenditures, acquisitions and other general

corporate activities;

|

|

|

• |

risks related to our business strategy, areas of possible expansion or expected capital spending or operating expenses;

|

|

|

• |

changes in our ability to leverage the relationships and reputation in the dry bulk shipping industry of V.Ships Greece Ltd., or V.Ships Greece, and Global Seaways S.A., or Global Seaways, our

technical and crew managers of certain of our vessels, and Fidelity Marine Inc., or Fidelity, our commercial manager;

|

|

|

• |

changes in the availability of crew, number of off-hire days, classification survey requirements and insurance costs for the vessels in our fleet;

|

|

|

• |

changes in our relationships with our contract counterparties, including the failure of any of our contract counterparties to comply with their agreements with us;

|

|

|

• |

loss of our customers, charters or vessels;

|

|

|

• |

damage to our vessels;

|

|

|

• |

potential liability from future litigation and incidents involving our vessels;

|

|

|

• |

our future operating or financial results;

|

|

|

• |

acts of terrorism, war, piracy, and other hostilities;

|

|

|

• |

public health threats, pandemics, epidemics, other disease outbreaks or calamities (including, without limitation, the coronavirus, or COVID-19 pandemic), and governmental responses thereto;

|

|

|

• |

risks associated with the reemergence of the COVID-19 pandemic (and various variants that may emerge), including its effects on demand for dry bulk products, crew changes and the transportation

thereof;

|

|

|

• |

changes in global and regional economic and political conditions;

|

|

|

• |

general domestic and international political conditions or events, including “trade wars” and the ongoing war between Russia and Ukraine and related sanctions, the war between Israel and Hamas or

the Houthi crisis in the Red Sea;

|

|

|

• |

changes in governmental rules and regulations or actions taken by regulatory authorities, particularly with respect to the dry bulk shipping industry;

|

|

|

• |

our ability to continue as a going concern; and

|

|

|

• |

other factors discussed in “Item 3. Key Information—D. Risk Factors.”

|

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE

|

| ITEM 3. |

KEY INFORMATION

|

| A. |

[Reserved]

|

| B. |

Capitalization and Indebtedness

|

| C. |

Reasons for the Offer and Use of Proceeds

|

| D. |

Risk Factors

|

|

|

• |

Charter hire rates for dry bulk vessels are cyclical and volatile and the dry bulk market remains significantly below its historic high. This may adversely affect our earnings,

revenue and profitability and our ability to comply with our loan covenants or covenants in other financing agreements.

|

|

|

• |

Outbreaks of epidemic and pandemic diseases, including COVID-19, and any relevant governmental responses thereto could adversely affect our business, results of operations or

financial condition.

|

|

|

• |

We are currently dependent on index-linked charters, while in the past a part of our fleet was employed on a spot voyage basis. Any decrease in spot freight charter rates or

indices in the future may adversely affect our earnings.

|

|

|

• |

An over-supply of dry bulk vessel capacity may depress the current charter rates and vessel values and, in turn, adversely affect our profitability.

|

|

|

• |

If economic conditions throughout the world decline, it will negatively impact our results of operations, financial condition and cash flows, and could cause the market price of

our common shares to decline.

|

|

|

• |

Political instability, terrorist attacks or other attacks, war, and international hostilities could affect our business, results of operations, cash flows and financial

condition.

|

|

|

• |

Risks associated with operating ocean-going vessels could affect our business and reputation, which could adversely affect our revenues and expenses.

|

|

|

• |

Rising fuel prices may adversely affect our profits.

|

|

|

• |

Worldwide inflationary pressures could negatively impact our results of operations and cash flows.

|

|

|

• |

Our revenues are subject to seasonal fluctuations, which could affect our operating results and ability to service our debt or pay dividends.

|

|

|

• |

Climate change and greenhouse gas restrictions may be imposed.

|

|

|

• |

Pending and future tax law changes may result in significant additional taxes to us.

|

|

|

• |

Our operations may be adversely impacted by severe weather, including as a result of climate change.

|

|

|

• |

Increased regulation as well as scrutiny of environmental, social and governance matters may impact our business and reputation.

|

|

|

• |

Our vessels may call on ports located in or may operate in countries that are subject to restrictions or sanctions imposed by the United States, the European Union or other

governments that could result in fines or other penalties imposed on us and may adversely affect our reputation and the market price of our common shares.

|

|

|

• |

Sulfur regulations to reduce air pollution from ships have required retrofitting of vessels and may cause us to incur significant costs.

|

|

|

• |

We are subject to regulation and liability under environmental laws that could require significant expenditures and affect our cash flows and net income.

|

|

|

• |

Regulations relating to ballast water discharge may adversely affect our revenues and profitability.

|

|

|

• |

Increased inspection procedures, tighter import and export controls and new security regulations could increase costs and disrupt our business.

|

|

|

• |

Acts of piracy on ocean-going vessels could adversely affect our business.

|

|

|

• |

The operation of dry bulk vessels has particular operational risks.

|

|

|

• |

If any of our vessels fails to maintain its class certification or fails any annual survey, intermediate survey, or special survey, or if any scheduled class survey takes longer

or is more expensive than anticipated, this could have a material adverse impact on our financial condition and results of operations.

|

|

|

• |

As we employ seafarers covered by industry-wide collective bargaining agreements, a failure of industry groups to renew such agreements may disrupt our operations and adversely

affect our earnings.

|

|

|

• |

Maritime claimants could arrest or attach one or more of our vessels, which could interrupt our cash flows.

|

|

|

• |

Governments could requisition our vessels during a period of war or emergency, which could negatively impact our business, financial condition, results of operations, and

available cash.

|

|

|

• |

The market values of our vessels may decrease, which could limit the amount of funds that we can borrow or trigger breaches of certain financial covenants under our current or

future loan agreements and other financing agreements, and we may incur an impairment or, if we sell vessels following a decline in their market value, a loss.

|

|

|

• |

Newbuilding projects are subject to risks that could cause delays.

|

|

|

• |

We may be unable to obtain financing for the vessels we have agreed to acquire or any vessels we may acquire in the future.

|

|

|

• |

If the vessels we have agreed to acquire or may agree to acquire in the future are not delivered on time or are delivered with significant defects, our earnings and financial

condition could suffer.

|

|

|

• |

Substantial debt levels could limit our flexibility to obtain additional financing and pursue other business opportunities.

|

|

|

• |

Our loan agreements and other financing arrangements contain, and we expect that other future loan agreements and financing arrangements will contain, restrictive covenants that

may limit our liquidity and corporate activities, which could limit our operational flexibility and have an adverse effect on our financial condition and results of operations. In addition, because of the presence of cross-default

provisions in our loan agreements and financing arrangements, a default by us under one loan agreement or financing arrangement could lead to defaults under multiple loans and financing agreements.

|

|

|

• |

We depend on officers and directors who are associated with United Maritime Corporation, of the Republic of the Marshall Islands (“United”), which may create conflicts of

interest.

|

|

|

• |

If we fail to manage our planned growth properly, we may not be able to successfully expand our market share.

|

|

|

• |

Vessel aging and purchasing and operating secondhand vessels, such as our current fleet, may result in increased operating costs and vessel off-hire, which could adversely affect

our financial condition and results of operations.

|

|

|

• |

Volatility of SOFR and potential changes of the use of SOFR as a benchmark could affect our profitability, earnings, and cash flow.

|

|

|

• |

The failure of our current or future counterparties to meet their obligations under our current or future contracts, including any charter agreements, could cause us to suffer

losses or otherwise adversely affect our business.

|

|

|

• |

Rising crew costs may adversely affect our profits.

|

|

|

• |

We may not be able to attract and retain key management personnel and other employees in the shipping industry, which may negatively affect the effectiveness of our management

and our results of operations.

|

|

|

• |

Our vessels may suffer damage, and we may face unexpected repair costs, which could adversely affect our cash flow and financial condition.

|

|

|

• |

We are exposed to U.S. dollar and foreign currency fluctuations and devaluations that could harm our reported revenue and results of operations.

|

|

|

• |

We maintain cash with a limited number of financial institutions including financial institutions that may be located in Greece, which will subject us to credit risk.

|

|

|

• |

We are a holding company and we depend on the ability of our subsidiaries to distribute funds to us in order to satisfy financial obligations or to pay dividends.

|

|

|

• |

In the highly competitive international shipping industry, we may not be able to compete for charters with new entrants or established companies with greater resources, which may

adversely affect our results of operations.

|

|

|

• |

Due to our lack of fleet diversification, adverse developments in the maritime dry bulk shipping industry would adversely affect our business, financial condition, and operating

results.

|

|

|

• |

We are currently subject to litigation and we may be subject to similar or other litigation in the future.

|

|

|

• |

The shipping industry has inherent operational risks that may not be adequately covered by our insurances. Further, because we obtain some of our insurances through protection

and indemnity associations, we have been and may in the future be retrospectively subject to calls or premiums in amounts based not only on our own claim records, but also on the claim records of all other members of the

protection and indemnity associations.

|

|

|

• |

Failure to comply with the U.S. Foreign Corrupt Practices Act of 1977, or FCPA, could result in fines, criminal penalties, and an adverse effect on our business.

|

|

|

• |

We partly depend on third-party technical and commercial managers for technical and commercial management of our ships. Our operations could be negatively affected if third-party

managers fail to perform their services satisfactorily.

|

|

|

• |

Management fees will be payable to our managers regardless of our profitability, which could have a material adverse effect on our business, financial condition and results of

operations.

|

|

|

• |

We may be classified as a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. holders of our common stock.

|

|

|

• |

We may have to pay tax on U.S. source income, which would reduce our earnings.

|

|

|

• |

We may be subject to tax in the jurisdictions in which we or our vessel-owning or management subsidiaries are incorporated or operate.

|

|

|

• |

We are a “foreign private issuer,” which could make our common stock less attractive to some investors or otherwise harm our stock price.

|

|

|

• |

Our corporate governance practices are in compliance with, and are not prohibited by, the laws of the Republic of the Marshall Islands, and as such we are entitled to exemption

from certain Nasdaq corporate governance standards. As a result, you may not have the same protections afforded to stockholders of companies that are subject to all of the Nasdaq corporate governance requirements.

|

|

|

• |

We conduct business in China, where the legal system is not fully developed and has inherent uncertainties that could limit the legal protections available to us.

|

|

|

• |

Changing laws and evolving reporting requirements could have an adverse effect on our business.

|

|

|

• |

A cyber-attack could materially disrupt our business.

|

|

|

• |

The smuggling of drugs or other contraband onto our vessels may lead to governmental claims against us.

|

|

|

• |

The international nature of our operations may make the outcome of any potential bankruptcy proceedings difficult to predict.

|

|

|

• |

We may issue additional common shares or other equity securities without shareholder approval, which would dilute our existing shareholders’ ownership interests and may depress

the market price of our common shares.

|

|

|

• |

The market price of our common shares has been and may in the future be subject to significant fluctuations. Further, there is no guarantee of a continuing public market to

resell our common shares.

|

|

|

• |

A possible “short squeeze” due to a sudden increase in demand of our common stock that largely exceeds supply may lead to further price volatility in our common shares.

|

|

|

• |

We may not have the surplus or net profits required by law to pay dividends. The declaration and payment of dividends will always be subject to the discretion of our board of

directors and will depend on a number of factors. Our board of directors may not declare dividends in the future.

|

|

|

• |

The superior voting rights of our Series B Preferred Shares may limit the ability of our common shareholders to control or influence corporate matters, and the interests of the

holder of such shares could conflict with the interests of common shareholders.

|

|

|

• |

Anti-takeover provisions in our restated articles of incorporation, as amended, and fourth amended and restated bylaws could make it difficult for our shareholders to replace or

remove our current board of directors or could have the effect of discouraging, delaying or preventing a merger or acquisition, which could adversely affect the market price of our common shares.

|

|

|

• |

Issuance of preferred shares, such as our Series B Preferred Shares, may adversely affect the voting power of our common shareholders and have the effect of discouraging,

delaying or preventing a merger or acquisition, which could adversely affect the market price of our common shares.

|

|

|

• |

We are incorporated in the Republic of the Marshall Islands, which does not have a well-developed body of corporate law, which may negatively affect the ability of shareholders

to protect their interests.

|

|

|

• |

We may fail to meet the continued listing requirements of Nasdaq, which could cause our common shares to be delisted.

|

|

|

• |

As a Marshall Islands corporation with principal executive offices in Greece, and also having subsidiaries in the Republic of the Marshall Islands and other offshore

jurisdictions such as the Republic of Liberia, and the British Virgin Islands, our operations may be subject to economic substance requirements.

|

|

|

• |

Our fourth amended and restated bylaws provide that the High Court of the Republic of Marshall Islands shall be the sole and exclusive forum for certain disputes between us and

our shareholders, which could limit our shareholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, or employees.

|

|

|

• |

We may not achieve the intended benefits of having a forum selection provision if it is found to be unenforceable.

|

|

|

• |

It may not be possible for investors to serve process on or enforce U.S. judgments against us.

|

| • |

decrease in available financing for vessels;

|

| • |

no active secondhand market for the sale of vessels;

|

| • |

decrease in demand for dry bulk vessels and limited employment opportunities;

|

| • |

charterers seeking to renegotiate the rates for existing time charters;

|

| • |

widespread loan covenant defaults in the dry bulk shipping industry due to the substantial decrease in vessel values; and

|

| • |

declaration of bankruptcy by some operators, charterers and vessel owners.

|

|

|

• |

supply of and demand for energy resources, commodities, and semi-finished consumer and industrial products and the location of consumption versus the location of their regional and global

exploration production or manufacturing facilities;

|

|

|

• |

the globalization of production and manufacturing;

|

|

|

• |

global and regional economic and political conditions and developments;

|

|

|

• |

armed conflicts and terrorist activities, including the ongoing war between Russia and Ukraine and the war outbreak between Israel and Hamas;

|

|

|

• |

natural disasters and weather;

|

|

|

• |

public health threats, pandemics, such as the COVID-19 pandemic, epidemics, and other disease outbreaks and governmental responses thereto;

|

|

|

• |

embargoes and strikes;

|

|

|

• |

disruptions and developments in international trade, including trade disputes or the imposition of tariffs on various commodities or finished goods;

|

|

|

• |

changes in seaborne and other transportation patterns, including the distance cargo is transported by sea;

|

|

|

• |

environmental and other legal or regulatory developments; and

|

|

|

• |

political developments, including changes to trade policies or trade wars, including the provision or removal of economic stimulus measures meant to counteract the effects of sudden market

disruptions due to financial, economic, or health crises.

|

| • |

the number of newbuilding orders and deliveries, including delays in new vessels’ deliveries;

|

| • |

the number of shipyards and their ability to deliver vessels;

|

| • |

potential disruption, including supply chain disruptions, of shipping routes due to accidents or political events;

|

| • |

scrapping and recycling rate of older vessels;

|

| • |

vessel casualties;

|

| • |

the price of steel and vessel equipment;

|

| • |

product imbalances (affecting the level of trading activity) and developments in international trade;

|

| • |

the number of vessels that are out of service, namely those that are laid-up, drydocked, awaiting repairs or otherwise not available for hire;

|

| • |

vessels’ average speed;

|

| • |

technological advances in vessel design and capacity;

|

| • |

availability of financing for new vessels and shipping activity;

|

| • |

the imposition of sanctions;

|

| • |

changes in national or international regulations that may effectively cause reductions in the carrying capacity of vessels or early obsolescence of tonnage;

|

| • |

changes in environmental and other regulations that may limit the useful life of vessels;

|

| • |

port or canal congestion; and

|

| • |

changes in market conditions, including political and economic events, wars (including the ongoing conflict between Russia and Ukraine and war outbreak between Israel and Hamas), acts of terrorism,

natural disasters (including diseases, epidemics and pandemics) and changes in interest rates or inflation rates.

|

| • |

general economic and market conditions affecting the shipping industry, including changes in global dry cargo commodity supply;

|

| • |

prevailing levels of charter rates;

|

| • |

competition from other shipping companies;

|

| • |

sophistication and condition of the vessels;

|

| • |

advances in efficiency, such as introduction of autonomous vessels;

|

| • |

where the vessel was built and as-built specifications and subsequent modifications and improvements;

|

| • |

lifetime maintenance record;

|

| • |

supply and demand for vessels;

|

| • |

types, sizes, and age of vessels;

|

| • |

number of newbuilding deliveries;

|

| • |

the cost to order and construct a new vessel;

|

| • |

number of vessels scrapped or otherwise removed from the world fleet;

|

| • |

the scrap value of vessels;

|

| • |

changes in environmental and other regulations that may limit the useful life of vessels;

|

| • |

decreased costs and increases in use of other modes of transportation;

|

| • |

cost of secondhand vessel acquisitions;

|

| • |

whether the vessel is equipped with scrubbers;

|

| • |

global economic or pandemic-related crises;

|

| • |

governmental and other regulations, including environmental regulations;

|

| • |

ability of buyers to access financing and capital;

|

| • |

technological advances; and

|

| • |

the cost of retrofitting or modifying existing ships to respond to technological advances in vessel design or equipment, changes in applicable environmental or other regulations or standards, or

otherwise.

|

| • |

our ability to obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes may be impaired, or such financing may be unavailable on favorable

terms, or at all;

|

| • |

we may need to use a substantial portion of our cash from operations to make principal and interest payments on our bank debt and financing liabilities, reducing the funds that would otherwise be

available for operations, future business opportunities and any future dividends to our shareholders;

|

| • |

our debt level could make us more vulnerable to competitive pressures or a downturn in our business or the economy generally than our competitors with less debt; and

|

| • |

our debt level may limit our flexibility in responding to changing business and economic conditions.

|

| • |

generate excess cash flow so that we can invest without jeopardizing our ability to cover current and foreseeable working capital needs, including debt service;

|

| • |

finance our operations;

|

| • |

locate and acquire suitable vessels;

|

| • |

identify and consummate acquisitions or joint ventures;

|

| • |

integrate any acquired businesses or vessels successfully with our existing operations;

|

| • |

hire, train and retain qualified personnel and crew to manage and operate our growing business and fleet; and

|

| • |

expand our customer base.

|

| • |

our existing shareholders’ proportionate ownership interest in us would decrease;

|

| • |

the proportionate amount of cash available for dividends payable per common share could decrease;

|

| • |

the relative voting strength of each previously outstanding common share could be diminished; and

|

| • |

the market price of our common shares could decline.

|

| • |

quarterly variations in our results of operations;

|

| • |

changes in market valuations of similar companies and stock market price and volume fluctuations generally;

|

| • |

changes in earnings estimates or the publication of research reports by analysts;

|

| • |

speculation in the press or investment community about our business or the shipping industry generally;

|

| • |

strategic actions by us or our competitors such as acquisitions or restructurings;

|

| • |

the thin trading market for our common shares, which makes it somewhat illiquid;

|

| • |

regulatory developments;

|

| • |

additions or departures of key personnel;

|

| • |

general market conditions; and

|

| • |

domestic and international economic, market and currency factors unrelated to our performance.

|

| ITEM 4. |

INFORMATION ON THE COMPANY

|

| A. |

History and Development of the Company

|

|

B.

|

Business Overview

|

|

Vessel Name

|

Year Built

|

Dwt

|

Flag

|

Yard

|

Type of Employment

|

|

Titanship

|

2011

|

207,855

|

LIB

|

NACKS

|

T/C Index Linked(1)

|

|

Patriotship

|

2010

|

181,709

|

MI

|

Imabari

|

T/C Index Linked(2)

|

|

Dukeship

|

2010

|

181,453

|

MI

|

Sasebo

|

T/C Index Linked(3)

|

|

Worldship

|

2012

|

181,415

|

MI

|

Koyo-Imabari

|

T/C Index Linked(4)

|

|

Paroship

|

2012

|

181,415

|

LIB

|

Koyo-Imabari

|

T/C Index Linked(5)

|

|

Hellasship

|

2012

|

181,325

|

LIB

|

Imabari

|

T/C Index Linked(6)

|

|

Honorship

|

2010

|

180,242

|

MI

|

Imabari

|

T/C Index Linked(7)

|

|

Fellowship

|

2010

|

179,701

|

MI

|

Daewoo

|

T/C Index Linked(8)

|

|

Championship

|

2011

|

179,238

|

MI

|

Sungdong SB

|

T/C Index Linked(9)

|

|

Partnership

|

2012

|

179,213

|

MI

|

Hyundai

|

T/C Index Linked(10)

|

|

Knightship

|

2010

|

178,978

|

LIB

|

Hyundai

|

T/C Index Linked (11)

|

|

Lordship

|

2010

|

178,838

|

LIB

|

Hyundai

|

T/C Index Linked(12)

|

|

Friendship

|

2009

|

176,952

|

LIB

|

Namura

|

T/C Index Linked(13)

|

|

Flagship

|

2013

|

176,387

|

MI

|

Mitsui

|

T/C Index Linked(14)

|

|

Geniuship

|

2010

|

170,057

|

MI

|

Sungdong SB

|

T/C Index Linked(15)

|

|

Premiership

|

2010

|

170,024

|

MI

|

Sungdong SB

|

T/C Index Linked(16)

|

|

Squireship

|

2010

|

170,018

|

LIB

|

Sungdong SB

|

T/C Index Linked(17)

|

|

Customer

|

2023

|

2022

|

2021

|

|||

|

A

|

28%

|

24%

|

15%

|

|||

|

B

|

25%

|

17%

|

23%

|

|||

|

C

|

18%

|

18%

|

13%

|

|||

|

D

|

12%

|

15%

|

11%

|

|||

|

E

|

-

|

-

|

10%

|

|||

|

Total

|

83%

|

74%

|

72%

|

| • |

Nine of our vessels are retrofitted with Exhaust Gas Cleaning Systems (“EGCS”) in order to comply with emissions standards, titled IMO-2020, set by the IMO.

|

| • |

We participate in the Poseidon Principles, which establish a framework for assessing and disclosing the climate alignment of ship finance portfolios and are consistent with the policies and

ambitions of the IMO to reduce shipping’s total annual GHG emissions by at least 40% by 2030.

|

| • |

We collaborate with our charterers within the scope of the Sea Cargo Charter, providing them with our vessel data to enable them to assess and report on the carbon intensity of the chartering

activities of these vessels.

|

| • |

We have engaged and actively participate in partnerships and alliances that promote sustainability in the maritime sector, including emission control and other environmental initiatives, such as the

Getting to Zero Coalition, the Hellenic Decarbonization committee of RINA Classification Society and the Hellenic Marine Environment Protection Association.

|

| • |

We are active participants in several projects for the development and/or deployment of new green technologies and alternative fuels, including with respect to:

|

|

|

- |

the adoption of various latest technology voyage optimization platforms which aim to reduce fuel consumption and therefore our fleet’s CO2 footprint;

|

|

|

- |

the installation of energy-saving devices, such as propeller ducts, propeller boss cap fins and variable frequency drives, which aim to reduce the required propulsion power and CO2 emissions of our

vessels;

|

|

|

- |

piloting and evaluating latest technology anti-fouling paints and hull cleaning technologies to reduce hull resistance and improve vessel’s energy efficiency; and

|

|

|

- |

the techno-economic feasibility assessment of alternative fuels in shipping by executing multiple biofuel trials;

|

| • |

We accomplished a strategic partnership via the European Union funded SAFeCRAFT Project Consortium (“SAFeCRAFT”), a breakthrough initiative concerning the utilization of alternative fuels. SAFeCRAFT

aims to demonstrate the safety and viability of Sustainable Alternative Fuels (“SAFs”) in seaborne transportation, accelerating the adoption of SAFs technologies. In particular:

|

|

|

- |

We will provide one of our existing, conventionally fueled Capesize vessels as the demonstrating vessel under SAFeCRAFT which will be retrofitted to utilize hydrogen (H2) as the main energy source

for electric power generation. This system is also expected to cover a portion of the vessel’s propulsion requirements and, therefore, to reduce reliance on conventional fuels.

|

|

|

- |

We will oversee the feasibility study and the retrofitting of the equipment in cooperation with Hydrus Engineering S.A., American Bureau of Shipping, National Technical University of Athens, Motor

Oil (Hellas) Corinth Refineries S.A., University of Patras, Dresden University of Technology, RINA Services SPA, Pherousa Green Technologies AS, Foundation WEGEMT and University of Strathclyde, aiming to physically demonstrate

this groundbreaking technology’s applicability to the existing maritime fleet.

|

| • |

We maintain high employee retention rates both on board and ashore and work to facilitate the professional development, continuous training and career advancement of our people.

|

| • |

We have an annual contract with an international organization covering 24/7 all seamen onboard the vessels medically and psychologically.

|

| • |

We initiated semi-annual crewing conferences to meet and greet with your seafarers with the aim to foster a sense of community, address concerns, and ensure effective communication between the

management and the crew.

|

| • |

Our community investment activities focus on, but are not limited to, supporting vulnerable groups and youth education in Greece.

|

| • |

The Company is governed by a diverse and experienced, majority independent Board of Directors.

|

| • |

We have a transparent Code of Business Conduct & Ethics and Anti-Fraud Policy in place.

|

| • |

We implement strong internal controls structured to ensure robust risk management.

|

| • |

We continuously cultivate an open reporting culture with respect to any violations of the Code of Ethics.

|

| • |

During 2022, we established a Sustainability Committee at Board level to guide and support the company’s ESG strategy.

|

| • |

Our Company uses advanced Enterprise Resource Planning and Business Intelligence systems to streamline operations and facilitate effective decision-making. We continuously upgrade and enhance our

cybersecurity systems, processes, and policies to protect our company from cyber risks, both in the office and on our vessels.

|

| C. |

Organizational Structure

|

|

Subsidiary

|

Jurisdiction of Incorporation

|

|

Seanergy Management Corp.

|

Republic of the Marshall Islands

|

|

Seanergy Shipmanagement Corp.

|

Republic of the Marshall Islands

|

|

Honor Shipping Co.

|

Republic of the Marshall Islands

|

|

Sea Genius Shipping Co.

|

Republic of the Marshall Islands

|

|

Traders Shipping Co.

|

Republic of the Marshall Islands

|

|

Gladiator Shipping Co.

|

Republic of the Marshall Islands

|

|

Premier Marine Co.

|

Republic of the Marshall Islands

|

|

Emperor Holding Ltd.

|

Republic of the Marshall Islands

|

|

Champion Marine Co.

|

Republic of the Marshall Islands

|

|

Fellow Shipping Co.

|

Republic of the Marshall Islands

|

|

Patriot Shipping Co.

|

Republic of the Marshall Islands

|

|

Flag Marine Co.

|

Republic of the Marshall Islands

|

|

World Shipping Co.

|

Republic of the Marshall Islands

|

|

Partner Marine Co.

|

Republic of the Marshall Islands

|

|

Duke Shipping Co.

|

Republic of the Marshall Islands

|

|

Atsea Ventures Corp.

|

Republic of the Marshall Islands

|

|

Squire Ocean Navigation Co.

|

Republic of Liberia

|

|

Lord Ocean Navigation Co.

|

Republic of Liberia

|

|

Knight Ocean Navigation Co.

|

Republic of Liberia

|

|

Good Ocean Navigation Co.

|

Republic of Liberia

|

|

Hellas Ocean Navigation Co.

|

Republic of Liberia

|

|

Friend Ocean Navigation Co.

|

Republic of Liberia

|

|

Paros Ocean Navigation Co.

|

Republic of Liberia

|

|

Titan Ocean Navigation Co.

|

Republic of Liberia

|

|

Icon Ocean Navigation Co.

|

Republic of Liberia

|

|

Partner Shipping Co. Limited

|

Malta

|

|

Pembroke Chartering Services Limited

|

Malta

|

|

Martinique International Corp.

|

British Virgin Islands

|

|

Harbour Business International Corp.

|

British Virgin Islands

|

| D. |

Property, Plants and Equipment

|

| ITEM 4A. |

UNRESOLVED STAFF COMMENTS

|

| ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

| A. |

Operating Results

|

| • |

number of vessels owned and operated;

|

| • |

voyage charter rates;

|

| • |

time charter trip rates;

|

| • |

period time charter rates;

|

| • |

the nature and duration of our voyage charters;

|

| • |

vessels repositioning;

|

| • |

vessel operating expenses and direct voyage costs;

|

| • |

maintenance and upgrade work;

|

| • |

the age, condition and specifications of our vessels;

|

| • |

issuance of our common shares and other securities;

|

| • |

amount of debt obligations; and

|

| • |

financing costs related to debt obligations.

|

|

(In thousands of U.S. Dollars, except for share and per share data)

|

Year ended December

31,

|

Change

|

||||||||||||||

|

2023

|

2022

|

Amount

|

%

|

|||||||||||||

|

Revenues:

|

||||||||||||||||

|

Vessel revenue, net

|

107,036

|

122,629

|

(15,593

|

)

|

(13

|

)%

|

||||||||||

|

Fees from related parties

|

3,198

|

2,391

|

807

|

34

|

%

|

|||||||||||

|

Revenue, net

|

110,234

|

125,020

|

(14,786

|

)

|

(12

|

)%

|

||||||||||

|

Expenses:

|

||||||||||||||||

|

Voyage expenses

|

(2,851

|

)

|

(4,293

|

)

|

1,442

|

(34

|

)%

|

|||||||||

|

Vessel operating expenses

|

(42,260

|

)

|

(43,550

|

)

|

1,290

|

(3

|

)%

|

|||||||||

|

Management fees

|

(700

|

)

|

(1,368

|

)

|

668

|

(49

|

)%

|

|||||||||

|

General and administration expenses

|

(22,149

|

)

|

(17,412

|

)

|

(4,737

|

)

|

27

|

%

|

||||||||

|

Depreciation and amortization

|

(28,831

|

)

|

(28,297

|

)

|

(534

|

)

|

2

|

%

|

||||||||

|

Gain on sale of vessel, net

|

8,094

|

-

|

8,094

|

-

|

||||||||||||

|

Loss on forward freight agreements, net

|

(188

|

)

|

(417

|

)

|

229

|

(55

|

)%

|

|||||||||

|

Operating income

|

21,349

|

29,683

|

(8,334

|

)

|

(28

|

)%

|

||||||||||

|

Other income / (expenses), net:

|

||||||||||||||||

|

Interest and finance costs

|

(20,694

|

)

|

(15,332

|

)

|

(5,362

|

)

|

35

|

%

|

||||||||

|

Loss on extinguishment of debt

|

(540

|

)

|

(1,291

|

)

|

751

|

(58

|

)%

|

|||||||||

|

Interest and other income

|

2,443

|

1,361

|

1,082

|

80

|

%

|

|||||||||||

|

Gain on spin-off of United Maritime Corporation

|

-

|

2,800

|

(2,800

|

)

|

(100

|

)%

|

||||||||||

|

Foreign currency exchange losses, net

|

(276

|

)

|

(10

|

)

|

(266

|

)

|

(2,660

|

)%

|

||||||||

|

Total other expenses, net:

|

(19,067

|

)

|

(12,472

|

)

|

(6,595

|

)

|

53

|

%

|

||||||||

|

Net income before income taxes

|

2,282

|

17,211

|

(14,929

|

)

|

(87

|

)%

|

||||||||||

|

Income taxes

|

-

|

28

|

(28

|

)

|

(100

|

)%

|

||||||||||

|

Net income

|

2,282

|

17,239

|

(14,957

|

)

|

(87

|

)%

|

||||||||||

|

Net income per common share

|

||||||||||||||||

|

Basic

|

0.12

|

0.97

|

||||||||||||||

|

Diluted

|

0.12

|

0.96

|

||||||||||||||

|

Weighted average number of common shares outstanding

|

||||||||||||||||

|

Basic

|

18,394,419

|

17,439,033

|

||||||||||||||

|

Diluted

|

18,442,688

|

17,684,048

|

||||||||||||||

| B. |

Liquidity and Capital Resources

|

|

(In thousands of US Dollars)

|

Year ended December 31,

|

|||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

Cash Flow Data:

|

||||||||||||

|

Net cash provided by operating activities

|

31,323

|

37,286

|

80,760

|

|||||||||

|

Net cash provided by / (used in) investing activities

|

17,745

|

(56,263

|

)

|

(184,620

|

)

|

|||||||

|

Net cash (used in) / provided by financing activities

|

(56,617

|

)

|

5,828

|

127,435

|

||||||||

| • |

The Company prepaid $6.5 million of the principal amount of the Second JDH Loan on December 31, 2020.

|

| • |

In exchange for the settlement of all accrued and unpaid interest under the JDH Loan Facilities and JDH Notes through December 31, 2020 in an aggregate amount of $4.3 million and an amendment fee of

$1.2 million, the Company issued, on January 8, 2021, 798,691 units (“Units”) at a price of $7.0 per Unit, with each Unit consisting of one common share of the Company (or, at JDH’s option, one pre-funded warrant in lieu of such

common share) and ten warrants to purchase one common share at an exercise price of $7.0 per share.

|

| • |

The Company granted JDH an option, exercisable only once until 45 days after the effectiveness of the resale registration statement described below, to purchase up to 428,571 additional Units at a

price of $7.0 per Unit in exchange for the forgiveness of principal under the Second JDH Loan in an amount equal to the aggregate purchase price of the Units. On April 26, 2021, JDH exercised this option to purchase 428,571

additional Units at a price of $7.0 per Unit in exchange for the settlement of principal under the Second JDH Loan in an amount of $3.0 million.

|

| • |

The Company granted JDH customary registration rights covering common shares issuable pursuant to the Securities Purchase Agreement as well as common shares underlying the JDH Notes. The

registration statement covering the resale of these common shares was filed on February 19, 2021.

|

| • |

The Company and JDH agreed to amend the terms of each of the JDH Loan Facilities and JDH Notes pursuant to the omnibus supplemental agreements described below, including to extend the maturity date

to December 31, 2024, to reduce the annual interest rate to 5.5% and to amend the conversion price under the JDH Notes to $12.00 per common share.

|

| • |

JDH agreed to a standstill undertaking, applicable for at least as long as the common shares are listed on Nasdaq, precluding any acquisition of the common shares, including through the exercise of

warrants or the conversion of the JDH Notes, to the extent that it would result in JDH or its affiliates beneficially owning, including controlling the voting or disposition of, more than 9.99% of the outstanding common shares

after giving effect to the acquisition.

|

| (i) |

accrued and unpaid interest of an aggregate of $1.9 million through December 31, 2020 was deemed fully and finally settled;

|

| (ii) |

the interest rate payable from January 1, 2021 through the maturity date was fixed at 5.5% per annum;

|

| (iii) |

the maturity date was extended to December 31, 2024;

|

| (iv) |

the addition of cash sweep provisions whereby the Company will make prepayments semi-annually commencing the fiscal quarter ending March 31, 2021 of the greater of the Company’s cash balances in

excess of $25.0 million or the revenue of the Company’s Capesize fleet attributable to a time charter equivalent rate in excess of $18,000 but not exceeding $21,000;

|

| (v) |

a mandatory prepayment on each of December 31, 2022 and December 31, 2023 of $8.0 million less any prepayments previously made under the cash sweep provisions;

|

| (vi) |

an option to apply the proceeds of any cash exercise of the warrants issued to JDH as part of Units as a prepayment;

|

| (vii) |

an amendment to the existing mandatory prepayment provisions in two of the JDH Loan Facilities such that the Company will make a mandatory prepayment of an amount equal to 25% of the net proceeds of

any future public offering and any cash exercise of the Company’s outstanding Class E warrants (the prepayment obligations set forth in (iv)-(vi) above, the “Mandatory Prepayment Obligations”); and

|

| (viii) |

a cap of $12.0 million on all Mandatory Prepayment Obligations in any calendar year.

|

|

|

(i) |

accrued and unpaid interest of an aggregate of $2.4 million through December 31, 2020 was deemed fully and finally settled;

|

|

|

(ii) |

the interest rate payable from January 1, 2021 through the maturity date was fixed at 5.5% per annum;

|

|

|

(iii) |

the maturity date was extended to December 31, 2024;

|

|

|

(iv) |

the conversion price was amended to $12.0 per common share;

|

|

|

(v) |

the existing conversion provision was amended to include a beneficial ownership limitation of 9.99% of the number of the common shares outstanding immediately after giving effect to the issuance of

common shares issuable upon conversion; and

|

|

|

(vi) |

the addition of provisions analogous to the Mandatory Prepayment Obligations requiring mandatory prepayment of the JDH Notes following the full repayment of the JDH Loan Facilities, and a cap of

$12.0 million on all such mandatory prepayment obligations in any calendar year.

|

| C. |

Research and development, patents and licenses, etc.

|

| D. |

Trend Information

|

|

Year Ended December 31,

|

||||||||||||

|

Fleet Data:

|

2023

|

2022

|

2021

|

|||||||||

|

Ownership days

|

6,008

|

6,219

|

5,140

|

|||||||||

|

Available days(1)

|

6,008

|

5,954

|

5,040

|

|||||||||

|

Operating days(2)

|

5,953

|

5,905

|

4,987

|

|||||||||

|

Fleet utilization

|

99.1

|

%

|

95.0

|

%

|

97.0

|

%

|

||||||

|

Average Daily Results:

|

||||||||||||

|

TCE rate(3)

|

$

|

17,501

|

$

|

20,040

|

$

|

27,399

|

||||||

|

Daily Vessel Operating Expenses(4)

|

$

|

6,879

|

$

|

6,819

|

$

|

6,211

|

||||||

| (1) |

During the year ended December 31, 2023, we had no off-hire days for scheduled dry-dockings and ballast water treatment installation for our vessels. During the year ended December 31, 2022, we

incurred 265 off-hire days for seven scheduled dry-dockings and ballast water treatment installation on two of our vessels.

|

| (2) |

During the year ended December 31, 2023, we incurred 55 off-hire days due to unforeseen circumstances. During the year ended December 31, 2022, we

incurred 49 off-hire days due to unforeseen circumstances.

|

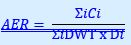

| (3) |

We include TCE rate, which is not a recognized measure under U.S. GAAP measure, as we believe it provides additional meaningful information in conjunction with net revenues from vessels, the most

directly comparable U.S. GAAP measure and because it assists our management in making decisions regarding the deployment and use of our vessel and because we believe that it provides useful information to investors regarding our

financial performance. Our calculation of TCE rate may not be comparable to that reported by other companies. The following table reconciles our net revenues from vessels to TCE rate.

|

|

Year Ended December 31,

|

||||||||||||

|

(In thousands of US Dollars, except operating days and TCE rate)

|

2023

|

2022

|

2021

|

|||||||||

|

Net revenues from vessels

|

$

|

107,036

|

$

|

122,629

|

$

|

153,108

|

||||||

|

Voyage expenses

|

(2,851

|

)

|

(4,293

|

)

|

(16,469

|

)

|

||||||

|

Time charter equivalent revenues

|

$

|

104,185

|

$

|

118,336

|

$

|

136,639

|

||||||

|

Operating days

|

5,953

|

5,905

|

4,987

|

|||||||||

|

Daily time charter equivalent rate

|

$

|

17,501

|

$

|

20,040

|

$

|

27,399

|

||||||

|

(4)

|

We include Daily Vessel Operating Expenses, which is not recognized under U.S. GAAP measure, as we believe it provides additional meaningful information and assists management in making decisions

regarding the deployment and the use of our vessels and because we believe that it provides useful information to investors regarding our financial performance. Our calculation of Daily Vessel Operating Expenses may not be

comparable to that reported by other companies. The following table reconciles our vessels operating expenses to Daily Vessel Operating Expenses.

|

|

(In thousands of US Dollars, except ownership days and Daily Vessel Operating Expenses)

|

Year Ended December 31,

|

|||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

Vessel operating expenses

|

$

|

42,260

|

$

|

43,550

|

$

|

36,332

|

||||||

|

Less: Pre-delivery expenses

|

(933

|

)

|

(1,144

|

)

|

(4,410

|

)

|

||||||

|

Vessel operating expenses before pre-delivery expenses

|

41,327

|

42,406

|

31,922

|

|||||||||

|

Ownership days

|

6,008

|

6,219

|

5,140

|

|||||||||

|

Daily Vessel Operating Expenses

|

$

|

6,879

|

$

|

6,819

|

$

|

6,211

|

||||||

| E. |

Critical Accounting Estimates

|

| • |

reports by industry analysts and data providers that focus on our industry and related dynamics affecting vessel values;

|

| • |

news and industry reports of similar vessel sales;

|

| • |

offers that we may have received from potential purchasers of our vessels; and

|

| • |

vessel sale prices and values of which we are aware through both formal and informal communications with shipowners, shipbrokers, industry analysts and various other shipping industry participants

and observers.

|

|

Carrying Value plus any unamortized dry-docking costs as of

|

|

Vessel

|

Year Built

|

Dwt

|

December 31, 2023

(in millions of U.S. dollars)

|

December 31, 2022

(in millions of U.S. dollars)

|

|||||||||

|

Titanship

|

2011

|

207,855

|

29.6

|

-

|

|||||||||

|

Patriotship

|

2010

|

181,709

|

23.2

|

24.6

|

|||||||||

|

Dukeship

|

2010

|

181,453

|

30.3

|

*

|

32.2

|

*

|

|||||||

|

Worldship

|

2012

|

181,415

|

29.9

|

31.6

|

*

|

||||||||

|

Paroship

|

2012

|

181,415

|

29.4

|

31.0

|

*

|

||||||||

|

Hellasship

|

2012

|

181,325

|

26.1

|

28.1

|

*

|

||||||||

|

Honorship

|

2010

|

180,242

|

31.4

|

*

|

33.5

|

*

|

|||||||

|

Fellowship

|

2010

|

179,701

|

24.2

|

25.8

|

*

|

||||||||

|

Championship

|

2011

|

179,238

|

33.0

|

*

|

35.6

|

*

|

|||||||

|

Partnership

|

2012

|

179,213

|

29.3

|

31.7

|

*

|

||||||||

|

Knightship

|

2010

|

178,978

|

19.4

|

20.6

|

|||||||||

|

Lordship

|

2010

|

178,838

|

18.9

|

19.9

|

|||||||||

|

Friendship

|

2009

|

176,952

|

23.2

|

25.3

|

*

|

||||||||

|

Flagship

|

2013

|

176,387

|

26.8

|

28.7

|

|||||||||

|

Geniuship

|

2010

|

170,057

|

20.8

|

22.2

|

|||||||||

|

Premiership

|

2010

|

170,024

|

24.0

|

25.4

|

*

|

||||||||

|

Squireship

|

2010

|

170,018

|

26.9

|

*

|

28.7

|

*

|

|||||||

|

TOTAL

|

446.4

|

444.9

|

|||||||||||

|

December 31,

2023

(in millions of U.S. dollars)

|

December 31,

2022

(in millions of U.S. dollars)

|

|||||||

|

Vessels, net

|

410.4

|

434.1

|

||||||

|

Finance lease, right-of use asset

|

29.6

|

-

|

||||||

|

Deferred charges and other investments, non-current

|

6.4

|

10.8

|

||||||

|

Total

|

446.4

|

444.9

|

||||||

| ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

|

| A. |

Directors and Senior Management

|

|

Name

|

Age

|

Position

|

Director Class

|

|||

|

Stamatios Tsantanis

|

52

|

Chairman, Chief Executive Officer & Director

|

A (term expires in 2025)

|

|||

|

Stavros Gyftakis

|

45

|

Chief Financial Officer

|

||||

|

Christina Anagnostara

|

53

|

Director*

|

B (term expires in 2026)

|

|||

|

Elias Culucundis

|

81

|

Director*

|

A (term expires in 2025)

|

|||

|

Dimitrios Anagnostopoulos

|

77

|

Director*

|

C (term expires in 2024)

|

|||

|

Ioannis Kartsonas

|

52

|

Director*

|

C (term expires in 2024)

|

|

*Independent Director

|

|

Board Diversity Matrix (As of March 28, 2024)

To be completed by Foreign Issuers (with principal executive offices outside of the U.S.) and Foreign Private Issuers

|

||||

|

Greece

|

||||

|

Foreign Private Issuer

|

Yes

|

|||

|

Disclosure Prohibited under Home Country Law

|

No

|

|||

|

Total Number of Directors

|

5

|

|||

|

Female

|

Male

|

Non-Binary

|

Did Not Disclose Gender

|

|

|

Part I: Gender Identity

|

||||

|

Directors

|

1

|

4

|

0

|

0

|

|

Part II: Demographic Background

|

||||

|

Underrepresented Individual in Home Country Jurisdiction

|

0

|

|||

|

LGBTQ+

|

0

|

|||

|

Did Not Disclose Demographic Background

|

0

|

|||

| B. |

Compensation

|

| C. |

Board Practices

|

| D. |

Employees

|

| E. |

Share Ownership

|

| ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

| A. |

Major Shareholders

|

|

Identity of Person or Group

|

Number of Shares Owned

|

Percent of Class (1)

|

|

Stamatios Tsantanis (2)

|

20,000 Series B Preferred Shares

|

100%

|

|

1,619,003 Common Shares

|

7.9%

|

|

|

George Economou (3)

|

1,859,096 Common Shares

|

9.1%

|

|

Konstantinos Konstantakopoulos (4)

|

1,265,847 Common Shares

|

6.2%

|

|

Stavros Gyftakis

|

231,345 Common Shares

|

1.1%

|

|

Christina Anagnostara

|

202,239 Common Shares

|

1.0%

|

|

Dimitrios Anagnostopoulos

|

93,333 Common Shares

|

0.5%

|

|

Ioannis Kartsonas

|

80,422 Common Shares

|

0.4%

|

|

Elias Culucundis

|

66,800 Common Shares

|

0.3%

|

|

Directors and executive officers as a group (6 individuals)

|

2,293,142 Common Shares

|

11.2%

|

| (1) |

Calculation of percent of class beneficially owned by each such person is based on 20,512,075 common shares outstanding as of March 28, 2024 and any

additional shares that such person may be deemed to beneficially own in accordance with Rule 13d-3 under the Exchange Act.

|

| (2) |

Stamatios Tsantanis beneficially owns 20,000 Series B Preferred Shares, constituting 100% of our issued and outstanding Series B Preferred Shares, which

were issued on December 10, 2021 pursuant to a stock purchase agreement between us and Stamatios Tsantanis. Through his ownership of common shares and Series B Preferred Shares, Stamatios Tsantanis controls 49.99% of the voting

power of our outstanding capital stock. For a description of the Series B Preferred Shares, see “Description of Securities” filed as Exhibit 2.5 hereto. In our annual reports for the years ended December 31, 2022, 2021, and

2020, Stamatios Tsantanis was reported to beneficially own 6.8%, 2.0%, and less than one percent of our outstanding common shares, respectively.

|

| (3) |

This information is derived from an Amendment No. 5 to Schedule 13D jointly filed with the Commission on March 5, 2024 by Sphinx Investment Corp.,

Maryport Navigation Corp. and George Economou. Based on this filing, Sphinx Investment Corp., Maryport Navigation Corp. and George Economou each have beneficial ownership of all shares indicated in the table above. Based on

this filing, Sphinx Investment Corp. is a Marshall Islands corporation wholly-owned by Maryport Navigation Corp., which is a Liberian corporation controlled by George Economou. In our annual reports for the three preceding

fiscal years, none of Sphinx Investment Corp., Maryport Navigation Corp. or George Economou was reported as an owner of five percent or more of our outstanding common shares.

|

| (4) |

This information is derived from an Amendment No. 1 to Schedule 13G jointly filed with the Commission on February 14, 2024 by Longshaw Maritime

Investments S.A. and Konstantinos Konstantakopoulos. Based on this filing, Longshaw Maritime Investments S.A. and Konstantinos Konstantakopoulos each have beneficial ownership of all shares indicated in the table above. Based on

this filing, Longshaw Maritime Investments S.A. is a Marshall Islands corporation controlled by Konstantinos Konstantakopoulos. In our annual reports for the three preceding fiscal years, neither of Longshaw Maritime Investments

S.A. nor Konstantinos Konstantakopoulos was reported as an owner of five percent or more of our outstanding common shares.

|

| B. |

Related Party Transactions

|

| C. |

Interests of Experts and Counsel

|

| ITEM 8. |

FINANCIAL INFORMATION

|

| A. |

Consolidated Statements and Other Financial Information

|

| B. |

Significant Changes

|

| ITEM 9. |

THE OFFER AND LISTING

|

| A. |

Offer and Listing Details

|

| B. |

Plan of Distribution

|

| C. |

Markets

|

| D. |

Selling Shareholders

|

| E. |

Dilution

|

|

F.

|

Expenses of the Issue

|

| ITEM 10. |

ADDITIONAL INFORMATION

|

| A. |

Share Capital

|

| B. |

Memorandum and Articles of Incorporation

|

| C. |

Material contracts

|

| D. |

Exchange controls

|

| E. |

Taxation

|

| • |

an individual citizen or resident of the United States;

|

| • |

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) that is created or organized (or treated as created or organized) in or under the laws of the United

States, any state thereof or the District of Columbia;

|

| • |

an estate whose income is includible in gross income for U.S. federal income tax purposes regardless of its source; or

|

| • |

a trust if (i) a U.S. court can exercise primary supervision over the trust’s administration and one or more U.S. persons are authorized to control all substantial decisions of the trust, or (ii) it

has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

|

| • |

financial institutions or “financial services entities”;

|

| • |

broker-dealers;

|

| • |

taxpayers who have elected mark-to-market accounting for U.S. federal income tax purposes;

|

| • |

tax-exempt entities;

|

| • |

governments or agencies or instrumentalities thereof;

|

| • |

insurance companies;

|

| • |

regulated investment companies;

|

| • |

real estate investment trusts;

|

| • |

certain expatriates or former long-term residents of the United States;

|

| • |

persons that actually or constructively own 10% or more (by vote or value) of our shares;

|

| • |

persons that own shares through an “applicable partnership interest”;

|

| • |

persons required to recognize income for U.S. federal income tax purposes no later than when such income is reported on an “applicable financial statement”;

|

| • |

persons that hold our common stock as part of a straddle, constructive sale, hedging, conversion or other integrated transaction; or

|

| • |

persons whose functional currency is not the U.S. dollar.

|

| • |

more than 50% of the value of our stock is owned, directly or indirectly, by “qualified shareholders,” that are persons (i) who are “residents” of our country of organization or of another foreign

country that grants an “equivalent exemption” to corporations organized in the United States, and (ii) we satisfy certain substantiation requirements, which we refer to as the “50% Ownership Test”; or

|

| • |

our stock is “primarily” and “regularly” traded on one or more established securities markets in our country of organization, in another country that grants an “equivalent exemption” to United

States corporations, or in the United States, which we refer to as the “Publicly-Traded Test.”

|

| • |

we have, or are considered to have, a fixed place of business in the United States involved in the earning of shipping income; and

|

| • |

substantially all of our U.S. source gross shipping income is attributable to regularly scheduled transportation, such as the operation of a vessel that follows a published schedule with repeated

sailings at regular intervals between the same points for voyages that begin or end in the United States, or, in the case of income from the leasing of a vessel, is attributable to a fixed place of business in the United States.

|

| • |

at least 75% of our gross income for such taxable year consists of passive income (e.g., dividends, interest, capital gains and rents derived other than in the active conduct of a rental business);

or

|

| • |

at least 50% of the average value of the assets held by us during such taxable year produce, or are held for the production of, passive income.

|

| • |

the excess distribution or gain would be allocated ratably over the Non-Electing Holders’ aggregate holding period for the common stock;

|

| • |

the amount allocated to the current taxable year and any taxable year before we became a passive foreign investment company would be taxed as ordinary income; and

|

| • |

the amount allocated to each of the other taxable years would be subject to tax at the highest rate of tax in effect for the applicable class of taxpayer for that year, and an interest charge for

the deemed deferral benefit would be imposed with respect to the resulting tax attributable to each such other taxable year.

|

| • |

fails to provide an accurate taxpayer identification number;

|

| • |

is notified by the IRS that backup withholding is required; or

|

| • |

fails in certain circumstances to comply with applicable certification requirements.

|

| F. |

Dividends and paying agents

|

| G. |

Statement by experts

|

| H. |

Documents on display

|

| I. |

Subsidiary information

|

| ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

Year

|

Amount

|

|

2024

|

$1.9 million

|

|

2025

|

$1.5 million

|

|

2026

|

$1.0 million

|

|

2027

|

$0.4 million

|

|

2028

|

$0.1 million

|