UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

FORM 20-F

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

OR |

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2023 |

|

|

OR |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ____________ to ____________ |

|

|

OR |

|

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Date of event requiring this shell company report ____________ |

|

Commission file number 001-37889

|

TOP SHIPS INC. |

|

(Exact name of Registrant as specified in its charter) |

|

(Translation of Registrant’s name into English) |

|

Republic of the Marshall Islands |

|

(Jurisdiction of incorporation or organization) |

|

1 Vasilisis Sofias and Megalou Alexandrou Str, 15124 Maroussi, Greece |

|

(Address of principal executive offices) |

|

Alexandros Tsirikos, (Tel) + 30 210 812 8107, info@topships.org 1 Vasilisis Sofias and Megalou Alexandrou Str, 15124 Maroussi, Greece |

|

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

TOPS

|

|

Nasdaq Capital Market

|

|

Preferred Stock Purchase Rights

|

|

|

|

Nasdaq Capital Market

|

|

NONE

|

|

(Title of class)

|

|

NONE

|

|

(Title of class)

|

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2023, 4,626,197 shares of common stock, par value $0.01 per share, 100,000 Series D Preferred Shares, par value $0.01 per share, and 3,659,627 Series F Preferred Shares, par value $0.01 per share, were outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes |

☐ |

No |

☒ |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

Yes |

☐ |

No |

☒ |

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes |

☒ |

No |

☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Sec.232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

|

Yes |

☒ |

No |

☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

☒ |

U.S. GAAP |

|

☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board |

|

☐ |

Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

|

☐ |

Item 17 |

☐ |

Item 18 |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes |

☐ |

No |

☒ |

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. N/A

|

Yes |

☐ |

No |

☐ |

| 1 |

||

|

ITEM 1.

|

1 |

|

|

ITEM 2.

|

1 |

|

|

ITEM 3.

|

1 |

|

|

ITEM 4.

|

31 |

|

|

ITEM 4A.

|

51 |

|

|

ITEM 5.

|

51 |

|

|

ITEM 6.

|

63 |

|

|

ITEM 7.

|

66 |

|

|

ITEM 8.

|

69 |

|

|

ITEM 9.

|

69 | |

|

ITEM 10.

|

69 | |

|

ITEM 11.

|

87 |

|

|

ITEM 12.

|

88 |

|

| 88 |

||

|

ITEM 13.

|

88 | |

|

ITEM 14.

|

89 |

|

|

ITEM 15.

|

89 |

|

|

ITEM 16.

|

90 |

|

|

ITEM 16A.

|

90 |

|

|

ITEM 16B.

|

90 |

|

|

ITEM 16C.

|

91 | |

|

ITEM 16D.

|

91 | |

|

ITEM 16E.

|

91 | |

|

ITEM 16F.

|

91 | |

|

ITEM 16G.

|

91 |

|

|

ITEM 16H.

|

92 |

|

|

ITEM 16I.

|

92 | |

|

ITEM 16J.

|

92 | |

|

ITEM 16K.

|

92 | |

| 93 |

||

|

ITEM 17.

|

93 |

|

|

ITEM 18.

|

93 |

|

|

ITEM 19.

|

94 |

|

|

● |

our ability to maintain or develop new and existing customer relationships with major refined product importers and exporters, major crude oil companies and major commodity traders, including our ability to

enter into long-term charters for our vessels;

|

|

|

● |

our future operating and financial results;

|

|

|

● |

our future vessel acquisitions, our business strategy and expected and unexpected capital spending or operating expenses, including any dry-docking, crewing, bunker costs and insurance costs;

|

|

|

● |

our financial condition and liquidity, including our ability to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities;

|

|

|

● |

oil and chemical tanker industry trends, including fluctuations in charter rates and vessel values and factors affecting vessel supply and demand;

|

|

|

● |

our ability to take delivery of, integrate into our fleet, and employ any newbuildings we may acquire or order in the future and the ability of shipyards to deliver vessels on a timely basis;

|

|

|

● |

the aging of our vessels and resultant increases in operation and dry-docking costs;

|

|

|

● |

the ability of our vessels to pass classification inspections and vetting inspections by oil majors and big chemical corporations;

|

|

|

● |

significant changes in vessel performance, including increased vessel breakdowns;

|

|

|

● |

the creditworthiness of our charterers and the ability of our contract counterparties to fulfill their obligations to us;

|

|

|

● |

our ability to repay outstanding indebtedness, to obtain additional financing and to obtain replacement charters for our vessels, in each case, at commercially acceptable rates or at all;

|

|

|

● |

changes to governmental rules and regulations or actions taken by regulatory authorities and the expected costs thereof;

|

|

|

● |

our ability to comply with additional costs and risks related to our environmental, social and governance policies;

|

|

|

● |

potential liability from litigation and our vessel operations, including discharge of pollutants;

|

|

|

● |

changes in general economic and business conditions;

|

|

|

● |

general domestic and international political conditions, potential disruption of shipping routes due to accidents, political events, including “trade wars,” piracy, acts by terrorists or other hostilities;

|

|

|

● |

changes in production of or demand for oil and petroleum products and chemicals, either globally or in particular regions;

|

|

|

● |

the strength of world economies and currencies, including fluctuations in charterhire rates and vessel values;

|

|

|

● |

potential liability from future litigation and potential costs due to any environmental damage and vessel collisions;

|

|

|

● |

the length and severity of public health threats, epidemics and pandemics, including the global outbreak of the novel coronavirus (“COVID-19”) (and various variants that may emerge), and other disease

outbreaks and their impact on the demand for commercial seaborne transportation and the condition of the financial markets and governmental responses thereto; and

|

|

|

● |

and other important factors discussed “Item 3. Key Information—D. Risk Factors” or described from time to time in the reports filed by us with the U.S. Securities and Exchange Commission, or the SEC.

|

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE

|

| ITEM 3. |

KEY INFORMATION

|

| A. |

[Reserved]

|

| B. |

Capitalization and Indebtedness

|

| C. |

Reasons for the Offer and Use of Proceeds

|

| D. |

Risk Factors

|

|

|

● |

The international tanker industry has historically been both cyclical and volatile.

|

|

|

● |

The current state of the world financial market and current economic conditions could have a material adverse impact on our results of operations, financial condition and cash flows.

|

|

|

● |

Our financial results may be adversely affected by the outbreak of epidemic and pandemic diseases, such as COVID-19, and the related governmental responses thereto.

|

|

|

● |

The market value of our vessels, and those we may acquire in the future, may fluctuate significantly, which could cause us to incur losses if we decide to sell them following a decline in their market values

or we may be required to write down their carrying value, which will adversely affect our earnings.

|

|

|

● |

An over-supply of tanker capacity may lead to reductions in asset prices, charter hire rates and profitability.

|

|

|

● |

Volatility of SOFR could affect our profitability, earnings and cash flows.

|

|

|

● |

We are subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business.

|

|

|

● |

Climate change and greenhouse gas restrictions may adversely impact our operations and markets.

|

|

|

● |

Increasing growth of electric vehicles and renewable fuels could lead to a decrease in trading and the movement of crude oil and petroleum products worldwide.

|

|

|

● |

Our vessels may suffer damage due to the inherent operational risks of the tanker industry.

|

|

|

● |

We are subject to international safety regulations and requirements imposed by classification societies and the failure to comply with these regulations may subject us to increased liability, may adversely

affect our insurance coverage and may result in a denial of access to, or detention in, certain ports.

|

|

|

● |

If our vessels call on ports located in countries or territories that are the subject of sanctions or embargoes imposed by the U.S. government or other governmental authorities, it could lead to monetary

fines or adversely affect our business, reputation and the market for our common shares.

|

|

|

● |

Political instability, terrorist or other attacks, war, international hostilities and public health threats can affect the tanker industry, which may adversely affect our business.

|

|

|

● |

Acts of piracy on ocean-going vessels could adversely affect our business.

|

|

|

● |

Increased inspection procedures and tighter import and export controls could increase costs and disrupt our business.

|

|

|

● |

We rely on our information systems to conduct our business, and failure to protect these systems against security breaches could adversely affect our business and results of operations. Additionally, if these

systems fail or become unavailable for any significant period of time, our business could be harmed.

|

|

|

● |

Our financing facilities contain restrictive covenants that may limit our liquidity and corporate activities, and could have an adverse effect on our financial condition and results of operations.

|

|

|

● |

Servicing current and future debt (including SLBs) will limit funds available for other purposes and could impair our ability to react to changes in our business.

|

|

|

● |

Our President, Chief Executive Officer and Director has significant influence over us, and a trust established for the benefit of his family may be deemed to beneficially own, directly or indirectly, 100% of

our Series D Preferred Shares, and thereby to control the outcome of matters on which our shareholders are entitled to vote.

|

|

|

● |

We have been subject to litigation in the past and may be subject to similar or other litigation in the future.

|

|

|

● |

Any limitation in the availability or operation of our vessels could have a material adverse effect on our business, results of operations and financial condition.

|

|

|

● |

We expect to be dependent on a limited number of customers for a large part of our revenues, and failure of such counterparties to meet their obligations could cause us to suffer losses or negatively impact

our results of operations and cash flows.

|

|

|

● |

If we fail to manage our planned growth properly, we may not be able to successfully expand our market share.

|

|

|

● |

Delays or defaults by the shipyards in the construction of newbuildings could increase our expenses and diminish our net income and cash flows.

|

|

|

● |

Our ability to obtain additional debt financing may be dependent on our ability to charter our vessels, the performance of our charters and the creditworthiness of our charterers.

|

|

|

● |

The industry for the operation of tanker vessels and the transportation of oil, petroleum products and chemicals is highly competitive and we may not be able to compete for charters with new entrants or

established companies with greater resources.

|

|

|

● |

We maintain cash with a limited number of financial institutions, including financial institutions that may be located in Greece, which will subject us to credit risk.

|

|

|

● |

We may be unable to attract and retain key management personnel and other employees in the international tanker shipping industry, which may negatively impact the effectiveness of our management and our

results of operations.

|

|

|

● |

If labor interruptions are not resolved in a timely manner, they could have a material adverse effect on our business, results of operations, cash flows, financial condition and available cash.

|

|

|

● |

A drop in spot charter rates may provide an incentive for some charterers to default on their charters, which could affect our cash flow and financial condition.

|

|

|

● |

An increase in operating costs could decrease earnings and available cash.

|

|

|

● |

The aging of our fleet may result in increased operating costs in the future, which could adversely affect our earnings.

|

|

|

● |

Rising fuel prices may adversely affect our profits.

|

|

|

● |

Unless we set aside reserves or are able to borrow funds for vessel replacement, our revenue will decline at the end of a vessel’s useful life, which would adversely affect our business, results of operations

and financial condition.

|

|

|

● |

Purchasing and operating secondhand vessels may result in increased operating costs and vessels off-hire, which could adversely affect our earnings.

|

| ● | Our anticipated acquisition of an interest in a megayacht entails certain risks and uncertainties associated with our entry into ownership of a new class of vessels, and we cannot assure you that we will complete the acquisition or manage such risks successfully. |

|

|

● |

We may not have adequate insurance to compensate us if we lose any vessels that we acquire.

|

|

|

● |

We may be subject to increased premium payments, or calls, as we obtain some of our insurance through protection and indemnity associations.

|

|

|

● |

Increasing regulation as well as scrutiny and changing expectations from investors, lenders and other market participants with respect to our

Environmental, Social and Governance (“ESG”) policies may impose additional costs on us or expose us to additional risks.

|

|

|

● |

Technological innovation and quality and efficiency requirements from our customers could reduce our charter hire income and the value of our vessels.

|

|

|

● |

The smuggling of drugs or other contraband onto our vessels may lead to governmental claims against us.

|

|

|

● |

Maritime claimants could arrest our vessels or vessels we may acquire, which could interrupt our cash flow.

|

|

|

● |

Governments could requisition our vessels or vessels we acquire during a period of war or emergency, resulting in loss of earnings.

|

|

|

● |

U.S. federal tax authorities could treat us as a “passive foreign investment company,” which could have adverse U.S. federal income tax consequences to U.S. shareholders.

|

|

|

● |

We may be subject to U.S. federal income tax on our U.S. source income, which would reduce our earnings.

|

|

|

● |

We are a “foreign private issuer,” which could make our common shares less attractive to some investors or otherwise harm our stock price.

|

|

|

● |

The market price and trading volume of our common shares may continue to be highly volatile, which could lead to a loss of all or part of a shareholder’s investment.

|

|

|

● |

There is no guarantee of a continuing public market for you to resell our common shares.

|

|

|

● |

Nasdaq may delist our common shares from its exchange which could limit your ability to make transactions in our securities and subject us to additional trading restrictions.

|

|

|

● |

We have issued common shares in the past through various transactions and we may do so in the future without shareholder approval, which may dilute our existing shareholders, depress the trading price of our

securities and impair our ability to raise capital through subsequent equity offerings.

|

| ● | We may be unable to successfully consummate a planned spin-off of certain of our assets or to achieve some or all of the benefits that we expect to achieve from the spin-off, and may incur significant risks associated with the spin-off. |

|

|

● |

We are incorporated in the Republic of the Marshall Islands, which does not have a well-developed body of corporate law and as a result, shareholders may have fewer rights and protections under Marshall

Islands law than under a typical jurisdiction in the United States.

|

|

|

● |

It may not be possible for investors to serve process on or enforce U.S. judgments against us.

|

|

|

● |

Our By-laws provide that the High Court of the Republic of Marshall Islands shall be the sole and exclusive forum for certain disputes between us and our shareholders, which could limit our shareholders’

ability to obtain a favorable judicial forum for disputes with us or our directors, officers, or employees.

|

|

|

● |

We may not achieve the intended benefits of having a forum selection provision if it is found to be unenforceable.

|

|

|

● |

Anti-takeover provisions in our organizational documents could have the effect of discouraging, delaying or preventing a merger, amalgamation or acquisition, which could reduce the market price of our common

shares.

|

|

|

● |

Our Fleet Manager, on whom we are dependent to perform the day-to-day management of our fleet, may have conflicts of interest between us and its other clients and is a privately held company and there may be

limited or no publicly available information about it.

|

|

|

● |

supply and demand for oil, petroleum products and chemicals carried;

|

|

|

● |

changes in oil production and refining capacity resulting in shifts in trade flows for oil products;

|

|

|

● |

oil prices;

|

|

|

● |

the distance oil, petroleum products and chemicals are to be moved by sea;

|

|

|

● |

any restrictions on crude oil production imposed by the OPEC and non-OPEC oil producing countries;

|

|

|

● |

global and regional economic and political conditions, including “trade wars” and developments in international trade, national oil reserves policies, fluctuations in industrial and agricultural production,

armed conflicts and work stoppages;

|

|

|

● |

increases in the production of oil in areas linked by pipelines to consuming areas, the extension of existing, or the development of new pipeline systems in markets we may serve, or the conversion of existing

non-oil pipelines to oil pipelines in those markets;

|

|

|

● |

worldwide and regional availability of refining capacity and inventories;

|

|

|

● |

environmental and other legal and regulatory developments;

|

|

|

● |

economic slowdowns caused by public health events such as the COVID-19 pandemic and its variants and efforts throughout the world to contain their spread, or inflationary pressures and resultant governmental

responses;

|

|

|

● |

currency exchange rates;

|

|

|

● |

weather, natural disasters and other acts of God;

|

|

|

● |

increased use of renewable and alternative sources of energy;

|

|

|

● |

competition from alternative sources of energy, other shipping companies and other modes of transportation; and

|

|

|

● |

international sanctions, embargoes, import and export restrictions, nationalizations, piracy and wars or other conflicts, including the war in Ukraine, the war between Israel and Hamas or the Houthi crisis in

and around the Red Sea.

|

|

|

● |

the number of newbuilding deliveries;

|

|

|

● |

current and expected newbuilding orders for vessels;

|

|

|

● |

the scrapping rate of older vessels;

|

|

|

● |

the availability of financing for new or secondhand tankers;

|

|

|

● |

the price of steel;

|

|

|

● |

speed of vessel operation;

|

|

|

● |

vessel freight rates, which are affected by factors that may affect the rate of newbuilding, swapping and laying up of vessels;

|

|

|

● |

the price of steel and vessel equipment;

|

|

|

● |

technological advances in the design, capacity, propulsion technology, and fuel consumption efficiency of vessels;

|

|

|

● |

potential conversion of vessels for alternative use;

|

|

|

● |

changes in environmental and other regulations that may limit the useful lives of vessels;

|

|

|

● |

port or canal congestion;

|

|

|

● |

national or international regulations that may effectively cause reductions in the carrying capacity of vessels or early obsolescence of tonnage;

|

|

|

● |

environmental concerns and regulations, including ballast water management, low sulfur fuel consumption regulations, and reductions in CO2 emissions;

|

|

|

● |

the number of vessels that are out of service at a given time, namely those that are laid-up, drydocked, awaiting repairs or otherwise not available for hire, including those that are in drydock for the

purpose of installing exhaust gas cleaning systems, known as scrubbers; and

|

|

|

● |

changes in global petroleum and chemical production.

|

|

|

● |

general economic and market conditions affecting the shipping industry;

|

|

|

● |

prevailing level of charter rates;

|

|

|

● |

competition from other shipping companies;

|

|

|

● |

types, sizes and ages of vessels;

|

|

|

● |

the availability of other modes of transportation;

|

|

|

● |

supply and demand for vessels;

|

|

|

● |

shipyard capacity and slot availability;

|

|

|

● |

cost of newbuildings;

|

|

|

● |

price of steel;

|

|

|

● |

exchange rate levels;

|

|

|

● |

number of tankers scrapped;

|

|

|

● |

governmental or other regulations; and

|

|

|

● |

technological advances and the development, availability, and cost of nuclear power, natural gas, coal, renewable energy, and other alternative sources of energy.

|

|

|

• |

IMO Data Collection System (DCS): in October 2016, at MEPC 70, the IMO adopted a

mandatory data collection system, or the IMO DCS, which requires vessels above 5,000 gross tons to report consumption data for fuel oil, hours under way and distance travelled. This IMO DCS covers any maritime activity carried out by

ships, including dredging, pipeline laying, and offshore installations. Data is reported annually to the flag state, which issues to the vessel a statement of compliance.

|

|

|

• |

Amendments to MARPOL Annex VI: MEPC 79 adopted amendments to MARPOL, Annex VI

regarding reporting requirements in connection with the implementation of the Energy Efficiency Existing Ship Index, or EEXI, and carbon intensity indicator, or CII, framework, which amendments are expected to become effective on May 1,

2024. Beginning in January 2023, Annex VI requires EEXI and CII certification. The first annual reporting was to be completed in 2023, with initial ratings given in 2024.

|

|

|

• |

Net zero greenhouse emissions in the EU by 2050: in 2021, the EU adopted a

European Climate Law (Regulation (EU) 2021/1119), establishing the aim of reaching net zero greenhouse gas emissions in the EU by 2050, with an intermediate target of reducing greenhouse gas emissions by at least 55% by 2030, compared to

1990 levels. In July 2021, the European Commission launched the “Fit for 55” to support the climate policy agenda. As of January 2019, large ships calling at EU ports have been required to collect and publish data on carbon dioxide

emissions and other information.

|

|

|

• |

Maritime emissions trading scheme in force on January 1, 2024: the maritime

emissions trading scheme, or ETS, is to apply gradually over the period from 2024 to 2026. 40% of allowances would have to be surrendered in 2025 for the year 2024; 70% of allowances would have to be surrendered in 2026 for the year 2025;

and 100% of allowances would have to be surrendered in 2027 for the year 2026. Compliance is to be on a companywide (rather than per ship) basis and “shipping company” is defined widely to capture both the ship owner and any contractually

appointed commercial operator/ship manager/bareboat charterer who not only assume full compliance for ETS but also under the ISM Code. If the latter contractual arrangement is entered into this needs to be reflected in a certified mandate

signed by both parties and presented to the administrator of the scheme. The cap under the ETS would be set by taking into account EU MRV system emissions data for the years 2018 and 2019, adjusted, from year 2021 and is to capture 100%

of the emissions from intra-EU maritime voyages; 100% of emissions from ships at berth in EU ports and 50% of emissions from voyages which start or end at EU ports (but the other destination is outside the EU). Furthermore, the newly

passed EU Emissions Trading Directive 2023/959/EC makes clear that all maritime allowances would be auctioned and there will be no free allocation. 78.4 million emissions allowances are to be allocated specifically to maritime. New

systems, personnel, data management systems, costs recovery mechanisms, revised service agreement terms and emissions reporting procedures will have to be put in place to prepare for and manage the administrative aspect of ETS

compliance. The cost of compliance, and of our future EU emissions and costs to purchase an allowance for emissions (if we must purchase in order to comply) are unknown and difficult to predict, and are based on a number of factors,

including the size of our fleet, our trips within and to and from the EU, and the prevailing cost of allowances.

|

|

|

● |

maintain a consolidated leverage ratio of not more than 75%;

|

|

|

● |

maintain minimum free liquidity of $0.5 million per operating vessel but not less than $4.0 million in aggregate; and

|

|

|

● |

assure no change of control of the company takes place, except with the lessor’s/lender’s prior written consent.

|

|

|

● |

increase our vulnerability to general economic downturns and adverse competitive and industry conditions;

|

|

|

● |

require us to dedicate a substantial portion, if not all, of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital

expenditures and other general corporate purposes;

|

|

|

● |

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

|

● |

place us at a competitive disadvantage compared to competitors that have less debt or better access to capital;

|

|

|

● |

limit our ability to raise additional financing on satisfactory terms or at all; and

|

|

|

● |

adversely impact our ability to comply with the financial and other restrictive covenants of our current or future financing arrangements, which could result in an event of default under such agreements.

|

|

|

● |

generate excess cash flow for investment without jeopardizing our ability to cover current and foreseeable working capital needs (including debt service);

|

|

|

● |

raise equity and obtain required financing for our existing and new operations;

|

|

|

● |

locate and acquire suitable vessels;

|

|

|

● |

identify and consummate acquisitions or joint ventures;

|

|

|

● |

integrate any acquired business successfully with our existing operations;

|

|

|

● |

our manager’s ability to hire, train and retain qualified personnel and crew to manage and operate our growing business and fleet;

|

|

|

● |

enhance our customer base; and

|

|

|

● |

manage expansion.

|

|

|

• |

fluctuations in interest rates;

|

|

|

• |

fluctuations in the availability or the price of oil and chemicals;

|

|

|

• |

fluctuations in foreign currency exchange rates;

|

|

|

• |

announcements by us or our competitors;

|

|

|

• |

changes in our relationships with customers or suppliers;

|

|

|

• |

actual or anticipated fluctuations in our semi-annual and annual results and those of other public companies in our industry;

|

|

|

• |

changes in United States or foreign tax laws;

|

|

|

• |

international sanctions, embargoes, import and export restrictions, nationalizations, piracy and wars or other conflicts, including the war in Ukraine.

|

|

|

• |

actual or anticipated fluctuations in our operating results from period to period;

|

|

|

• |

shortfalls in our operating results from levels forecast by securities analysts;

|

|

|

• |

market conditions in the shipping industry and the general state of the securities markets;

|

|

|

• |

business interruptions caused by the outbreak of COVID-19 or the war in Ukraine;

|

|

|

• |

mergers and strategic alliances in the shipping industry;

|

|

|

• |

changes in government regulation;

|

|

|

• |

a general or industry-specific decline in the demand for, and price of, shares of our common shares resulting from capital market conditions independent of our operating performance;

|

|

|

• |

the loss of any of our key management personnel;

|

|

|

• |

our failure to successfully implement our business plan;

|

|

|

• |

issuance of shares; and

|

|

|

• |

stock splits / reverse stock splits.

|

|

|

• |

actual or anticipated fluctuations in our results and those of other public companies in our industry;

|

|

|

• |

mergers and strategic alliances in the shipping industry;

|

|

|

• |

market conditions in the shipping industry and the general state of the securities markets;

|

|

|

• |

changes in government regulation;

|

|

|

• |

shortfalls in our operating results from levels forecast by securities analysts; and

|

|

|

• |

announcements concerning us or our competitors.

|

|

|

● |

our existing shareholders’ proportionate ownership interest in us will decrease;

|

|

|

● |

the amount of cash available for dividends payable on the shares of our common shares may decrease;

|

|

|

● |

the relative voting strength of each previously outstanding common share may be diminished; and

|

|

|

● |

the market price of the shares of our common shares may decline.

|

|

|

• |

authorizing our Board of Directors to issue “blank check” preferred stock without stockholder approval;

|

|

|

• |

providing for a classified Board of Directors with staggered, three-year terms;

|

|

|

• |

prohibiting cumulative voting in the election of directors;

|

|

|

• |

authorizing the removal of directors only for cause and only upon the affirmative vote of the holders of at least 80% of the outstanding shares of our capital stock entitled to vote for the directors;

|

|

|

• |

prohibiting shareholder action by written consent unless the written consent is signed by all shareholders entitled to vote on the action;

|

|

|

• |

limiting the persons who may call special meetings of shareholders;

|

|

|

• |

establishing advance notice requirements for nominations for election to our Board of Directors or for proposing matters that can be acted on by shareholders at shareholder meetings; and

|

|

|

• |

restricting business combinations with interested shareholders.

|

|

|

● |

continue to operate our vessels and service our customers;

|

|

|

● |

renew existing charters upon their expiration;

|

|

|

● |

obtain new charters;

|

|

|

● |

obtain financing on commercially acceptable terms;

|

|

|

● |

obtain insurance on commercially acceptable terms;

|

|

|

● |

maintain satisfactory relationships with our customers and suppliers; and

|

|

|

● |

successfully execute our growth strategy.

|

| A. |

History and Development of the Company

|

|

|

● |

$10.0 million in cash.

|

|

|

● |

100% ownership in a Marshall Islands company that was a party to a shipbuilding contract for a high specification scrubber fitted Suezmax Tanker (to be named M/T Eco Oceano CA) delivered from Hyundai Samho

shipyard in March 2022. The shipowning company was party to a time charter, starting from the vessel’s delivery, with Central Tankers Chartering, a company affiliated with Mr. Evangelos J. Pistiolis, for a firm duration of five years at a

gross daily rate of $32,450, with a charterer’s option to extend for two additional years at $33,950 and $35,450.

|

|

|

● |

35% ownership in one Marshall Islands company that was a party to a shipbuilding contract for a high specification scrubber fitted VLCC tanker (to be named M/T Julius Caesar) delivered from Hyundai Heavy

Industries shipyard in January 2022. The shipowning company was party to a time charter, starting from the vessel’s delivery, with Trafigura, for a firm duration of three years at a gross daily rate of $36,000, with a charterer’s option to

extend for two additional years at $39,000 and $41,500.

|

|

|

● |

35% ownership in one Marshall Islands company that was a party to a shipbuilding contract for a high specification scrubber fitted VLCC tanker (to be named M/T Legio X Equestris) delivered from Hyundai Heavy

Industries shipyard in March 2022. The shipowning company was party to a time charter, starting from the vessel’s delivery, with Trafigura, for a firm duration of three years at a gross daily rate of $35,750, with a charterer’s option to

extend for two additional years at $39,000 and $41,500.

|

|

|

● |

A forgiveness of $1.2 million in payables to the buyer.

|

| B. |

Business Overview

|

|

Name

|

Deadweight

|

Charterer

|

End of firm

period

|

Charterer’s

Optional Periods

|

Gross Rate fixed period/

options

|

|

M/T Eco Marina Del Rey

|

50,000

|

Cargill / WECO Tankers A/S

|

May 2024 / May 2027

|

- / 1 year

|

Cargill: $15,100 /

WECO Tankers A/S: $20,500 / $22,500

|

|

Name

|

Deadweight

|

Charterer

|

End of firm

period

|

Charterer’s

Optional Periods

|

Gross Rate fixed period/

options

|

|

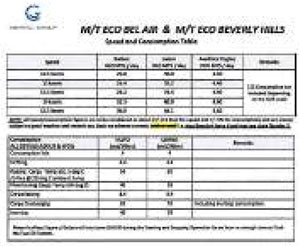

M/T Eco Bel Air

|

157,000

|

Trafigura

|

December 10, 2025

|

-

|

$24,000

|

|

M/T Eco Beverly Hills

|

157,000

|

Trafigura

|

July 2024

|

16 months

|

$24,000 / $24,000

|

|

Name

|

Deadweight

|

Charterer

|

End of firm

period

|

Charterer’s

Optional Periods

|

Gross Rate fixed period/

options

|

|

M/T Eco Oceano CA

|

157,000

|

Central Tankers Chartering

|

March 2037

|

none

|

$24,500

|

|

Name

|

Deadweight

|

Charterer

|

End of firm

period

|

Charterer’s Optional Periods

|

Gross Rate fixed

period/ options

|

|

M/T Eco West Coast

|

157,000

|

Clearlake

|

January 2027

|

1+1 years

|

$32,850 / $34,750 / $36,750

|

|

M/T Eco Malibu

|

157,000

|

Clearlake

|

March 2027

|

1+1 years

|

$32,850 / $34,750 / $36,750

|

|

Name

|

Deadweight

|

Charterer

|

End of firm

period

|

Charterer’s Optional

Periods

|

Gross Rate fixed period/

options

|

|

M/T Julius Caesar

|

300,000

|

Trafigura

|

January 2028

|

1+1 years

|

$36,000 up to January 2025 and $41,500 afterwards / $44,000 / $46,000

|

|

M/T Legio X Equestris

|

300,000

|

Trafigura

|

March 2028

|

1+1 years

|

$35,750 up to March 2025 and $41,500 afterwards / $44,000 / $46,000

|

|

Name

|

Deadweight

|

Charterer

|

End of firm period

|

Charterer’s

Optional Periods

|

Gross Rate fixed period/

options

|

|

M/T Eco Yosemite Park

|

50,000

|

Clearlake

|

March 2025

|

5+1+1 years

|

$17,400 / $18,650 / $19,900

|

|

M/T Eco Joshua Park

|

50,000

|

Clearlake

|

March 2025

|

5+1+1 years

|

$17,400 / $18,650 / $19,900

|

|

|

(i) |

injury to, destruction or loss of, or loss of use of, natural resources and related assessment costs;

|

|

|

(ii) |

injury to, or economic losses resulting from, the destruction of real and personal property;

|

|

|

(iii) |

net loss of taxes, royalties, rents, fees or net profit revenues resulting from injury, destruction or loss of real or personal property, or natural resources;

|

|

|

(iv) |

loss of subsistence use of natural resources that are injured, destroyed or lost;

|

|

|

(v) |

lost profits or impairment of earning capacity due to injury, destruction or loss of real or personal property or natural resources; and

|

|

|

(vi) |

net cost of increased or additional public services necessitated by removal activities following a discharge of oil, such as protection from fire, safety or health

hazards, and loss of subsistence use of natural resources.

|

| C. |

Organizational Structure

|

| D. |

Property, Plants and Equipment

|

| ITEM 4A. |

UNRESOLVED STAFF COMMENTS

|

| ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

| A. |

Operating Results

|

|

2022

|

2023

|

|||||||

|

FLEET DATA

|

||||||||

|

Total number of vessels at end of period (including leased vessels)

|

8

|

8

|

||||||

|

Average number of vessels(1)

|

8

|

8

|

||||||

|

Total calendar days for fleet

|

2,912

|

2,920

|

||||||

|

Total available days for fleet

|

2,901

|

2,920

|

||||||

|

Total operating days for fleet

|

2,893

|

2,920

|

||||||

|

Total time charter days for fleet

|

2,893

|

2,920

|

||||||

|

Total spot (voyage) days for fleet

|

-

|

-

|

||||||

|

Fleet utilization

|

99.72

|

%

|

100.00

|

%

|

||||

|

2022

|

2023

|

|||||||

|

AVERAGE DAILY RESULTS

|

||||||||

|

Time charter equivalent(2)

|

$

|

27,310

|

$

|

27,856

|

||||

|

Vessel operating expenses(3)

|

$

|

6,397

|

$

|

6,345

|

||||

|

General and administrative expenses(4)

|

$

|

555

|

$

|

2,293

|

| (1) |

Average number of vessels is the number of vessels that constituted our fleet (including chartered in vessels) for the relevant period, as measured by the sum of the number of days each vessel was a part of our fleet during the

period divided by the number of calendar days in that period.

|

| (2) |

Time charter equivalent rate, or TCE rate, is a measure of the average daily revenue performance of a vessel. Our definition of TCE may not be the same as

reported by other companies in the shipping industry or other industries. Our method of calculating TCE rate is determined by dividing TCE revenues by operating days for the relevant time period. TCE revenues are revenues minus

voyage expenses. Voyage expenses primarily consist of port, canal and fuel costs that are unique to a particular voyage, which would otherwise be paid by the charterer under a time charter contract, but are payable by us in the case

of a voyage charter, as well as commissions. TCE revenues and TCE rate, non-U.S. GAAP measures, are standard shipping industry performance measures that provide additional supplemental information in conjunction with shipping

revenues, the most directly comparable U.S. GAAP measure. We use TCE rates and TCE revenues to compare period-to-period changes in our performance and it assists investors and our management in evaluating our financial performance.

The following table reconciles our net revenues from vessel to TCE rate.

|

| (3) |

Operating expenses include crew wages and related costs, insurance, repairs and maintenance, spares and consumable stores, tonnage taxes and value added tax, or VAT, and other miscellaneous expenses. Daily vessel operating expenses

are calculated by dividing vessel operating expenses by fleet calendar days for the relevant time period. Our ability to control our fixed and variable expenses, including our daily vessel operating expenses, also affects our financial

results.

|

| (4) |

Daily general and administrative expenses are calculated by dividing general and administrative expenses by fleet calendar days for the relevant time period.

|

|

U.S. dollars in thousands, except average daily time charter equivalent and total operating days

|

2022

|

2023

|

||||||

|

On a consolidated basis

|

||||||||

|

Total Revenues

|

80,656

|

82,949

|

||||||

|

Less:

|

||||||||

|

Voyage expenses

|

(1,648

|

)

|

(1,609

|

)

|

||||

|

Time charter equivalent revenues

|

79,008

|

81,340

|

||||||

|

Total operating days

|

2,893

|

2,920

|

||||||

|

Average Daily Time Charter Equivalent (TCE)

|

$

|

27,310

|

$

|

27,856

|

||||

|

EBITDA*

|

||||||||

|

U.S. dollars in thousands

|

2022

|

2023

|

||||||

|

EBITDA

|

46,554

|

43,058

|

||||||

|

(Expressed in thousands of U.S. Dollars)

|

2022

|

2023

|

||||||

|

Net income

|

18,948

|

6,066

|

||||||

|

Add: Vessel depreciation

|

13,289

|

14,349

|

||||||

|

Add: Interest and finance costs

|

14,365

|

22,989

|

||||||

|

Less: Interest income

|

(48

|

)

|

(346

|

)

|

||||

|

EBITDA

|

46,554

|

43,058

|

||||||

|

|

• |

management of our financial resources, including banking relationships, i.e., administration of bank loans and bank accounts;

|

|

|

• |

management of our accounting system and records and financial reporting;

|

|

|

• |

administration of the legal and regulatory requirements affecting our business and assets; and

|

|

|

• |

management of the relationships with our service providers and customers.

|

|

|

• |

charter rates and periods of charter hire for our tankers;

|

|

|

• |

utilization of our tankers (earnings efficiency);

|

|

|

• |

levels of our tanker’s operating expenses and dry-docking costs;

|

|

|

• |

depreciation and amortization expenses;

|

|

|

• |

financing costs; and

|

|

|

• |

fluctuations in foreign exchange rates.

|

|

(Expressed in thousands of U.S. Dollars)

|

Year Ended December 31,

|

change

|

||||||||||||||

|

2022

|

2023

|

YE23 v YE22

|

||||||||||||||

|

$

|

%

|

|||||||||||||||

|

Total charter revenues

|

80,656

|

82,949

|

2,293

|

3

|

%

|

|||||||||||

|

Voyage expenses

|

1,648

|

1,609

|

(39

|

)

|

-2

|

%

|

||||||||||

|

Operating lease Expense

|

10,840

|

10,840

|

-

|

0

|

%

|

|||||||||||

|

Vessel operating expenses

|

18,628

|

18,527

|

(101

|

)

|

-1

|

%

|

||||||||||

|

Vessel depreciation

|

13,289

|

14,349

|

1,060

|

8

|

%

|

|||||||||||

|

Management fees-related parties

|

2,093

|

2,200

|

107

|

5

|

%

|

|||||||||||

|

General and administrative expenses

|

1,617

|

6,697

|

5,080

|

314

|

%

|

|||||||||||

|

Gain on sale of vessels

|

(78

|

)

|

-

|

78

|

-100

|

%

|

||||||||||

|

Operating income

|

32,619

|

28,727

|

(3,892

|

)

|

-12

|

%

|

||||||||||

|

Interest and finance costs

|

(14,365

|

)

|

(22,989

|

)

|

(8,624

|

)

|

60

|

%

|

||||||||

|

Interest income

|

48

|

346

|

298

|

621

|

%

|

|||||||||||

|

Equity gain/(loss) in unconsolidated joint ventures

|

646

|

(18

|

)

|

(664

|

)

|

-103

|

%

|

|||||||||

|

Total other expenses, net

|

(13,671

|

)

|

(22,661

|

)

|

(8,990

|

)

|

66

|

%

|

||||||||

|

Net income

|

18,948

|

6,066

|

(12,882

|

)

|

-68

|

%

|

||||||||||

|

|

1. |

Vessel depreciation

|

|

|

2. |

General and administrative expenses

|

|

|

3. |

Interest and Finance Costs

|

|

|

• |

a $7.3 million increase in interest costs mainly due to a) the increase in the variable interest rate of our credit facilities (LIBOR and SOFR) which increased from 4.74% in January 2023 to 5.62% in December 2023, while LIBOR ranged

from 0.10% in January 2022 to 4.74% in December 2022, and b) the three new SLBs for M/Ts Eco Oceano CA, Julius Caesar and Legio X Equestris that we closed in March, January and March 2022 respectively for an aggregate amount of $156.2

million, that where incurring interest expense for the whole year ended December 31, 2023. These increases were offset by a $0.9 million decrease in interest and finance costs relating to M/Ts Eco Los Angeles and Eco City of Angels that

were sold on February 28 and March 15, 2022;

|

|

|

• |

$3.5 million of amortization of debt discount relating to the Cargill facility (please see “Item 18. Financial Statements—Note 7—Debt”) that commenced in 2023; and

|

|

|

• |

an offsetting $1.3 million decrease in amortization of deferred financing fees mainly due to the acceleration of the amortization of $1.9 million of unamortized balances of deferred financing fees relating to the sale of M/Ts Eco Los

Angeles and Eco City of Angels and the prepayment of our Unsecured Bridge Loan in 2022. By comparison, in 2023 we accelerated $0.6 million of deferred financing fees relating to the prepayment of the ABN and the Alpha Bank facilities

(see “—B. Liquidity and Capital Resources—Debt Facilities— Prepayments of senior secured loans)”.

|

|

|

4. |

Equity gain/(loss) in unconsolidated joint ventures

|

| B. |

Liquidity and Capital Resources

|

| C. |

Research and Development, Patents and Licenses, Etc.

|

| D. |

Trend Information

|

| E. |

Critical Accounting Estimates

|

| ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

|

| A. |

Directors and Senior Management

|

|

Name

|

Age

|

Position

|

||

|

Evangelos J. Pistiolis

|

51

|

Director, President, Chief Executive Officer

|

||

|

Alexandros Tsirikos

|

49

|

Director, Chief Financial Officer

|

||

|

Konstantinos Patis

|

50

|

Chief Technical Officer

|

||

|

Vangelis G. Ikonomou

|

60

|

Chief Operating Officer

|

||

|

Konstantinos Karelas

|

51

|

Independent Non-Executive Director

|

||

|

Stavros Emmanuel

|

81

|

Independent Non-Executive Director

|

||

|

Paolo Javarone

|

50

|

Independent Non-Executive Director

|

| B. |

Compensation

|

| C. |

Board Practices

|

| D. |

Employees

|

| E. |

Share Ownership

|

| F. |

Disclosure of a registrant’s action to recover erroneously awarded compensation.

|

| ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

| A. |

Major Shareholders

|

|

Name and Address of Beneficial Owner

|

Number of Shares Owned

|

Percentage of

Class

|

Percentage

of

Total

Voting

Power

|

||||||

|

Lax Trust (1)

|

100,000 Series D Preferred Shares (1)

|

100

|

%

|

95.58

|

%

|

||||

|

3 Sororibus Trust(2)

|

2,930,718 Common Shares

|

63.35

|

%

|

2.80

|

%

|

||||

|

Evangelos J. Pistiolis(3)

|

446,446 Common Shares

|

9.65

|

%

|

0.43

|

%

|

||||

|

Executive officers, directors and key employees(4)

|

0 Common Shares

|

0

|

%

|

0.00

|

%

|

||||

| (1) |

The Lax Trust is an irrevocable trust established for the benefit of certain family members of Mr. Evangelos J. Pistiolis, our President, Chief Executive

Officer and Director. The business address of the Lax Trust is Level 3, 18 Stanley Street, Auckland 1010, New Zealand. As a prerequisite for the Navigare Lease, Mr. Evangelos J. Pistiolis personally guaranteed the performance of the

bareboat charters entered in connection with the lease, under certain circumstances, and in exchange, we amended the Certificate of Designations governing the terms of the Series D Preferred Shares, to adjust the voting rights per

share of Series D Preferred Shares such that during the term of the Navigare Lease, the combined voting power controlled by Mr. Evangelos J. Pistiolis and the Lax Trust does not fall below a majority of our total voting power,

irrespective of any new common or preferred stock issuances, and thereby complying with a relevant covenant of the bareboat charters entered in connection with the Navigare Lease. The above percentage of total voting power is based on

100,000,000 votes carried by the outstanding Series D Preferred Share (1,000 votes per Series D Preferred Share held).

|

| (2) |

The above information is derived, in part, from the Amendment No. 39 to the 13D/A filed with the SEC on February 14, 2024. 3 Sororibus Trust is an irrevocable trust established for the benefit of certain

family members of Mr. Evangelos J. Pistiolis. The business address of 3 Sororibus Trust is 31 Kitiou Kyprianou, 3036, Limassol, Cyprus. 3 Sororibus Trust is the sole shareholder of Family Trading Inc., or Family Trading, a Marshall

Islands corporation, and may be deemed to beneficially own all of the common shares beneficially owned by Family Trading.

|

| (3) |

The above information is derived, in part, from the Amendment No. 39 to the 13D/A filed with the SEC on February 14, 2024.

|

| (4) |

Excludes the shares held by Mr. Evangelos J. Pistiolis that are reported elsewhere in this table.

|

| B. |

Related Party Transactions

|

| C. |

Interests of Experts and Counsel

|

| ITEM 8. |

FINANCIAL INFORMATION

|

| A. |

Consolidated Statements and Other Financial Information

|

| B. |

Significant Changes

|

| ITEM 9. |

THE OFFER AND LISTING

|

| ITEM 10. |

ADDITIONAL INFORMATION

|

| A. |

Share Capital

|

| B. |

Memorandum and Articles of Association

|

|

|

● |

prior to the date of the transaction that resulted in the shareholder becoming an interested shareholder, the Board approved either the business combination or the transaction that resulted in the shareholder

becoming an interested shareholder;

|

|

|

● |

upon consummation of the transaction that resulted in the shareholder becoming an interested shareholder, the interested shareholder owned at least 85% of the voting stock of the corporation outstanding at the

time the transaction commenced;

|

|

|

● |

at or subsequent to the date of the transaction that resulted in the shareholder becoming an interested shareholder, the business combination is approved by the Board and authorized at an annual or special

meeting of shareholders by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested shareholder; and

|

|

|

● |

the shareholder became an interested shareholder prior to the consummation of the initial public offering.

|

|

|

● |

not be redeemable;

|

|

|

● |

entitle holders to quarterly dividend payments in an amount per share equal to the aggregate per share amount of all cash dividends, and the aggregate per share amount (payable in kind) of all non-cash

dividends or other distributions other than a dividend payable in our common shares or a subdivision of our outstanding common shares (by reclassification or otherwise), declared on our common shares since the immediately preceding

quarterly dividend payment date; and

|

|

|

● |

entitle holders to one vote on all matters submitted to a vote of our shareholders.

|

|

|

● |

Flip In. If an Acquiring Person obtains beneficial ownership of 15% or more of our common shares, then each Right will entitle the holder thereof to purchase, for the

Exercise Price, a number of our common shares (or, in certain circumstances, cash, property or other of our securities) having a then-current market value of twice the Exercise Price. However, the Rights are not exercisable following

the occurrence of the foregoing event until such time as the Rights are no longer redeemable by us, as further described below.

|

|

|

● |

Flip Over. If, after an Acquiring Person obtains 15% or more of our common shares, (i) we merge into another entity; (ii) an acquiring entity merges into us; or (iii)

we sell or transfer 50% or more of its assets, cash flow or earning power, then each Right (except for Rights that have previously been voided as set forth above) will entitle the holder thereof to purchase, for the Exercise Price, a

number of our common shares of the person engaging in the transaction having a then-current market value of twice the Exercise Price.

|

|

|

● |

Notional Shares. Shares held by affiliates and associates of an Acquiring Person, including certain entities in which the Acquiring Person beneficially owns a majority

of the equity securities, and Notional Common Shares (as defined in the Rights Agreement) held by counterparties to a Derivatives Contract (as defined in the Rights Agreement) with an Acquiring Person, will be deemed to be beneficially

owned by the Acquiring Person.

|

| C. |

Material Contracts

|

| D. |

Exchange controls

|

| E. |

Taxation

|

|

|

(1) |

we are organized in a foreign country, or our country of organization, that grants an “equivalent exemption” to corporations organized in the United States; and

|

|

|

(2) |

either

|

|

|

A. |

more than 50% of the value of our stock is owned, directly or indirectly, by individuals who are “residents” of our country of organization or of another foreign country that grants an “equivalent exemption”

to corporations organized in the United States (each such individual a “qualified shareholder” and such individuals collectively, “qualified shareholders”), which we refer to as the “50% Ownership Test,” or

|

|

|

B. |

our stock is “primarily and regularly traded on an established securities market” in our country of organization, in another country that grants an “equivalent exemption” to U.S. corporations, or in the United

States, which we refer to as the “Publicly Traded Test.”

|

|

|

● |

We have, or are considered to have, a fixed place of business in the United States involved in the earning of shipping income; and

|

|

|

● |

substantially all of our U.S.-source shipping income is attributable to regularly scheduled transportation, such as the operation of a vessel that follows a published schedule with repeated sailings at regular

intervals between the same points for voyages that begin or end in the United States, or is leasing income that is attributable to such fixed place of business in the United States.

|

|

|

● |

is a U.S. citizen or resident, U.S. corporation or other U.S. entity taxable as a corporation, an estate the income of which is subject to U.S. federal income taxation regardless of its source, or a trust (i)

if a court within the United States is able to exercise primary jurisdiction over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (ii) the trust has in

effect a valid election to be treated as a United States person for U.S. federal income tax purposes;

|

|

|

● |

owns the common shares as a capital asset, generally, for investment purposes; and

|

|

|

● |

owns less than 10% of our common shares for U.S. federal income tax purposes.

|

|

|

● |

at least 75% of our gross income for such taxable year consists of passive income (e.g., dividends, interest, capital gains and rents derived other than in the active conduct of a rental business); or

|

|

|

● |

at least 50% of the average value of the assets held by the corporation during such taxable year produce, or are held for the production of, passive income.

|

|

|

● |

the excess distribution or gain would be allocated ratably over the Non-Electing Holder’s aggregate holding period for the common shares;

|

|

|

● |

the amount allocated to the current taxable year and any taxable year before we became a PFIC would be taxed as ordinary income; and

|

|

|

● |

the amount allocated to each of the other taxable years would be subject to tax at the highest rate of tax in effect for the applicable class of taxpayer for that year, and an interest charge for the deemed

tax deferral benefit would be imposed with respect to the resulting tax attributable to each such other taxable year.

|

|

|

● |

the gain is effectively connected with a trade or business conducted by the Non-U.S. Holder in the United States. If the Non-U.S. Holder is entitled to the benefits of a U.S. income tax treaty with respect to

that gain, that gain is taxable only if it is attributable to a permanent establishment maintained by the Non-U.S. Holder in the United States; or

|

|

|

● |

the Non-U.S. Holder is an individual who is present in the United States for 183 days or more during the taxable year of disposition and other conditions are met.

|

|

|

● |

fail to provide an accurate taxpayer identification number;

|

|

|

● |

are notified by the IRS that you have failed to report all interest or dividends required to be shown on your U.S. federal income tax returns; or

|

|

|

● |

in certain circumstances, fail to comply with applicable certification requirements.

|

| F. |

Dividends and Paying Agents

|

| G. |

Statement by Experts

|

| H. |

Documents on Display

|

| I. |

Subsidiary Information

|

| J. |

Annual Report to Security Holders

|

| ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

| ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

| ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

|

| ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

| ITEM 15. |

CONTROLS AND PROCEDURES

|

| a) |

Disclosure Controls and Procedures

|

| b) |

Management’s Annual Report on Internal Control over Financial Reporting

|

|

|

● |

Pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets;

|

|

|

● |

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and

expenditures are being made only in accordance with authorizations of Company’s management and directors; and

|

|

|

● |

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

|

| c) |

Attestation Report of the Registered Public Accounting Firm

|

| d) |

Changes in Internal Control over Financial Reporting

|

| ITEM 16. |

RESERVED

|

| ITEM 16A. |

AUDIT COMMITTEE FINANCIAL EXPERT

|

| ITEM 16B. |

CODE OF ETHICS

|

| ITEM 16C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

|

U.S. dollars in thousands,

|

Year Ended

|

|||||||

|

2022

|

2023

|

|||||||

|

Audit Fees

|

379.5

|

410.3

|

||||||

| ITEM 16D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

|

| ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

|

| ITEM 16F. |

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT

|

| ITEM 16G. |

CORPORATE GOVERNANCE

|

|

|

● |

Audit Committee. Nasdaq requires, among other things, that a listed company has an audit committee with a minimum of three independent members, at least one of whom

meets certain standards of financial sophistication. As permitted under Marshall Islands law, our audit committee consists of three independent directors but we do not designate any one audit commit member as meeting the standards of

financial sophistication.

|

|

|

● |

As a foreign private issuer, we are not required to hold regularly scheduled board meetings at which only independent directors are present.

|

|

|

● |

In lieu of obtaining shareholder approval prior to the issuance of designated securities, we will comply with provisions of the BCA, which allows our Board of Directors to approve share issuances.

|

| ITEM 16H. |

MINE SAFETY DISCLOSURE

|

| ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

|

| ITEM 16J. |

INSIDER TRADING POLICIES

|

| ITEM 16K. |

CYBERSECURITY

|

| ITEM 17. |

FINANCIAL STATEMENTS

|

| ITEM 18. |

FINANCIAL STATEMENTS

|

| ITEM 19. |

EXHIBITS

|

|

Number

|

Description of Exhibits

|

|

1.1

|

|

|

|

|

|

1.2

|

|

|

|

|

|

1.3

|

|

|

|

|

|

1.4

|

|

|

|

|

|

1.5

|

|

|

|

|

|

1.6

|

|

|

|

|

|

1.7

|

|

|

|

|

|

1.8

|

|

|

|

|

|

1.9

|

|

|

|

|

|

1.10

|

|

|

|

|

|

1.11

|

|

|

|

|

|

1.12

|

|

|

|

|

|

1.13

|

|

|

|

|

|

1.14

|

|

|

|

|

|

2.1

|

|

|

|

|

|

2.2

|

|

|

|

|

|

2.3

|

|

2.4

|

|

|

|

|

|

2.5

|

|

2.6

|

|

|

|

|

|

2.7

|

|

|

|

|

|

2.8

|

|

|

|

|

|

4.1

|

|

|

|

|

|

4.2

|

|

|

|

|

|

4.3

|

|

|

|

|

|

4.4

|

|

|

|

|

|

4.5

|

|

|

|

|

|

4.6

|

|

|

|

|

|

4.7

|

|

|

|

|

|