|

Exhibit

|

|

Description

|

|

|

|

|

|

Interim Financial Report for the Six Months Ended December 31, 2023

|

||

|

101.INS

|

Inline XBRL Instance Document. (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL

document).

|

|

|

101.SCH

|

Inline XBRL Taxonomy Extension Schema Document.

|

|

|

101.CAL

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

|

101.DEF

|

Inline XBRL Taxonomy Extension Definition Linkbase Document.

|

|

|

101.LAB

|

Inline XBRL Taxonomy Extension Label Linkbase Document.

|

|

|

101.PRE

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document.

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

|

IPERIONX LIMITED

|

|

|

(registrant)

|

|

|

|

|

Date: March [●], 2024

|

By: /s/ Marcela Castro

|

|

|

Name: Marcela Castro

|

|

|

Title: Chief Financial Officer

|

|

North Carolina

|

Tennessee

|

Virginia

|

Utah

|

|

129 W Trade Street, Suite 1405

Charlotte, NC 28202

|

279 West Main Street

Camden, TN 38320

|

1080 Confroy Drive

South Boston, VA 24592

|

1782 W 2300 S

West Valley City, UT 84119

|

|

Corporate Directory

|

|

|

DIRECTORS

Mr. Todd Hannigan – Executive Chairman

Mr. Anastasios Arima – CEO & Managing Director

Ms. Lorraine Martin – Independent Non-Executive Director

Mr. Vaughn Taylor – Independent Non-Executive Director

Ms. Melissa Waller – Independent Non-Executive Director

Ms. Beverly Wyse – Independent Non-Executive Director

COMPANY SECRETARY

Mr Gregory Swan

OFFICES

North Carolina

129 W Trade Street, Suite 1405

Charlotte, NC 28202, UNITED STATES

Tennessee

279 West Main Street

Camden, TN 38320, UNITED STATES

Virginia

1080 Confroy Drive

South Boston, VA 24592, UNITED STATES

Utah

1782 W 2300 S

West Valley City, UT 84119, UNITED STATES

Registered office

28 The Esplanade, Level 9

Perth, WA 6000, AUSTRALIA

|

WEBSITE

www.iperionx.com

STOCK EXCHANGE LISTINGS

Nasdaq Capital Market:

American depositary shares (NASDAQ: IPX)

Australian Securities Exchange:

Fully paid ordinary shares (ASX: IPX)

SHARE REGISTRY

Automic Pty Ltd

T: 1300 288 664 (within Australia)

T: +61 2 9698 5414 (international)

LAWYERS

United States

Gibson, Dunn & Crutcher

Johnston Allison & Hord

Australia

Thomson Geer Lawyers

AUDITOR

PricewaterhouseCoopers

|

|

CONTENTS

|

|

|

Page

|

|

|

Directors’ Report

|

1

|

|

Auditor’s Independence Declaration

|

8

|

|

Condensed Consolidated Statement of Profit or Loss and Other Comprehensive Income

|

9

|

|

Condensed Consolidated Statement of Financial Position

|

10

|

|

Condensed Consolidated Statement of Changes in Equity

|

11

|

|

Condensed Consolidated Statement of Cash Flows

|

12

|

|

Notes to the Condensed Consolidated Financial Statements

|

13

|

|

Directors’ Declaration

|

19

|

|

Independent Auditor’s Review Report

|

20

|

|

|

|

|

Directors’ Report

|

|

|

Mr. Todd Hannigan

|

Executive Chairman

|

|

Mr. Anastasios Arima

|

Chief Executive Officer & Managing Director

|

|

Ms. Lorraine Martin

|

Independent Non-Executive Director

|

|

Mr. Vaughn Taylor

|

Independent Non-Executive Director

|

|

Ms. Melissa Waller

|

Independent Non-Executive Director

|

|

Ms. Beverly Wyse

|

Independent Non-Executive Director

|

|

Directors’ Report (continued)

|

|

| • |

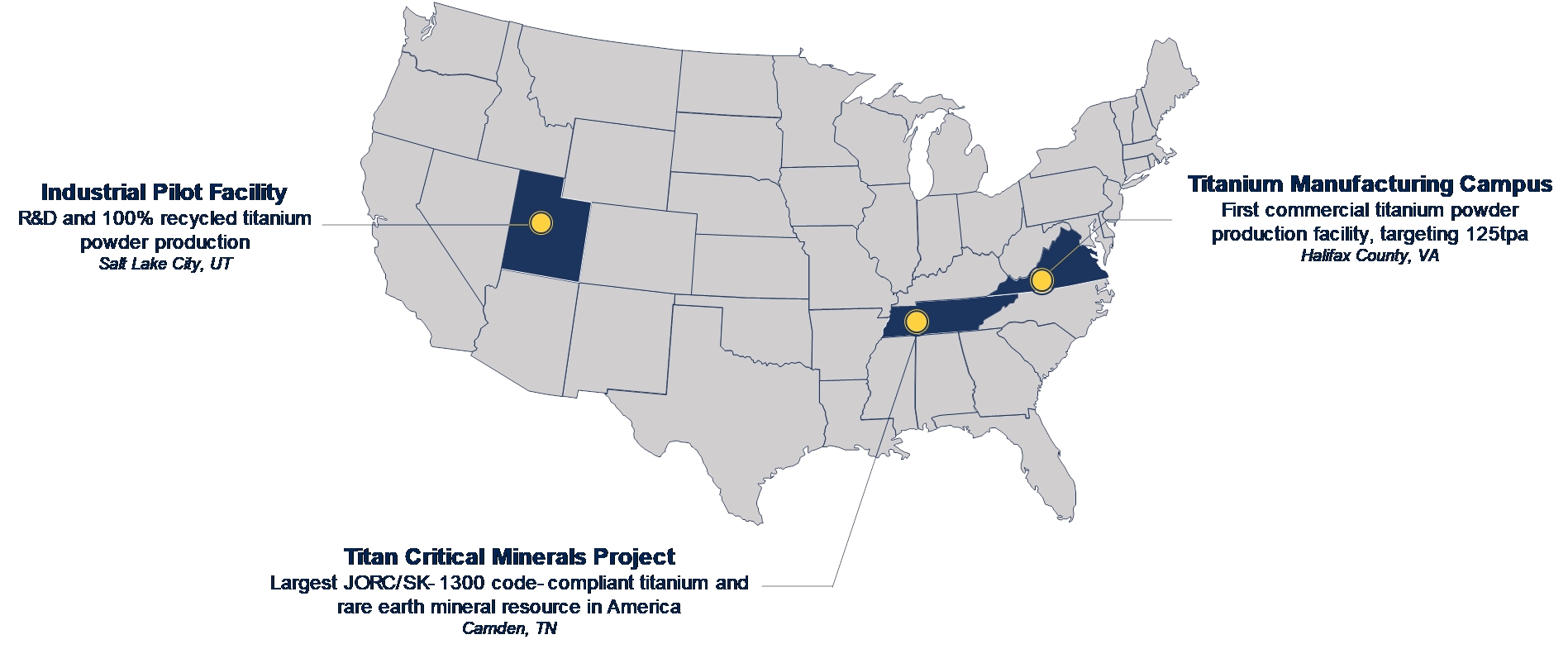

Titanium: IperionX intends to scale the Technologies to produce high performance titanium alloys and products at lower costs, with zero Scope 1 and 2 emissions, from either scrap titanium or titanium

minerals. IperionX currently produces titanium products made from scrap titanium at our Industrial Pilot Facility (“IPF”) in Utah, U.S. and is developing a commercial-scale Titanium Manufacturing Campus in Virginia, U.S.; and

|

| • |

Critical minerals: IperionX controls the Titan critical minerals project (the “Titan Project”) in Tennessee, U.S., which is currently one of the largest titanium, zircon and rare earth mineral resources,

reported in accordance with the JORC Code (2012 Edition), in the United States.

|

|

Directors’ Report (continued)

|

|

| ■ |

In February 2024, IperionX announced significant progress in advancing its commercial-scale titanium metal manufacturing capabilities at IperionX’s Titanium Manufacturing Campus in Virginia,

comprising the Titanium Production Facility and the Advanced Manufacturing Center

|

| ■ |

In October 2023, IperionX agreed to an order with GKN Aerospace for the delivery of titanium plate test components manufactured with IperionX’s advanced titanium technologies.

|

| ■ |

In September 2023, IperionX announced that it had executed a Test Services Agreement with the U.S. Army for metal characterization and ballistic testing properties of IperionX’s high-strength titanium

plate components.

|

| ■ |

In September 2023, IperionX announced that it had signed an agreement with Heroux-Devtek to underpin a 100% recycled titanium supply chain using scrap titanium metal from the aerospace industry.

|

| ■ |

In August 2023, IperionX announced that it had agreed to an order with Lockheed Martin for the delivery of titanium plate components produced using IperionX’s low-carbon, U.S. manufactured titanium.

|

| ■ |

In July 2023, IperionX announced that it would partner with Aperam Recycling, through its American entity ELG Utica Alloys (“ELG”), to create a low-carbon 100% recycled titanium supply chain.

|

| ■ |

In August 2023, IperionX announced that the Titan Project had received all key permits for development and operations, had received positive feasibility study metallurgical test work results, and was

advancing customer offtake and strategic financing partnerships.

|

| ■ |

During the period, a number of parties have expressed interest in sales, marketing, and investment proposals focused on the offtake of titanium and rare earth minerals from the Titan Project.

|

| ■ |

In November 2023, the U.S. Department of Defense (“DoD”) contracted to award IperionX US$12.7 million in funding under the Defense Production Act (DPA) Title III authorities to address U.S. titanium

supply chain vulnerabilities.

|

| ■ |

In November 2023, IperionX completed a placement of 21 million new fully paid ordinary shares at an issue price of A$1.25 per share to institutional, sophisticated and professional investors to raise

gross proceeds of A$26.3 million (approximately US$17.1 million).

|

|

Directors’ Report (continued)

|

|

| ■ |

In October 2023, IperionX received a Letter of Interest from the Export-Import Bank (“EXIM”) of the United States for US$11.5 million for development of IperionX’s Titanium Production Facility.

|

| ■ |

In November 2023, IperionX released its FY2023 Sustainability Report, which shares our Environment, Social, and Governance (“ESG”) vision and execution.

|

|

Directors’ Report (continued)

|

|

|

Directors’ Report (continued)

|

|

|

(a)

|

exploration and evaluation expense of US$1,458,125 (December 31, 2022: US$1,517,474), which is attributable to the Group’s accounting policy of expensing exploration and

evaluation expenditure (other than expenditures incurred in the acquisition of the rights to explore, including option payments to landowners) incurred by the Group in the period subsequent to the acquisition of the rights to explore

and up to the successful completion of definitive feasibility studies for each separate area of interest;

|

|

(b)

|

research and development costs of US$3,763,468 (December 31, 2022: US$2,099,309) which is attributable to the Group’s accounting policy of expensing research and development, or

R&D, expenses incurred by the Group in connection with the R&D of the Group’s titanium processing technologies, including salaries and related personnel expenses, subcontractor expenses, patent registration expenses, materials,

and other related R&D expenses associated with processing operations at our IPF in Utah and Titanium Manufacturing Campus in Virginia; and

|

|

(c)

|

equity settled share-based payment expenses of US$1,108,090 (December 31, 2022: US$1,566,231) which is attributable to expensing the value (estimated using an option pricing

model) of incentive securities granted to key employees, consultants and advisors. The value is measured at grant date and recognised over the period during which the option holders become unconditionally entitled to the options.

|

|

Directors’ Report (continued)

|

|

|

(a)

|

On January 30, 2024, the Company issued 3,006,163 shares to nominees of Blacksand Technology LLC (“Blacksand”) in lieu of future cash option payments totaling US$2,000,000 owed

to Blacksand under the option agreement between the Company and Blacksand pursuant to which the Company has the exclusive option to acquire the intellectual property rights of Blacksand to certain patented titanium technologies.

|

|

Auditor’s Independent

Declaration

|

|

| (a) |

no contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the review; and

|

|

(b)

|

no contraventions of any applicable code of professional conduct in relation to the review.

|

| /s/ Craig Heatley |

|

|

Craig Heatley

|

Perth

|

|

Partner

|

14 March 2024

|

|

PricewaterhouseCoopers

|

|

|

Condensed Consolidated Statement of Profit or Loss

and Other Comprehensive Income

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023

|

|

| Six

Months Ended |

Six

Months Ended |

|||||||||

| Note |

December 31, 2023

US$

|

December 31, 2022

US$

|

||||||||

|

Continuing operations

|

||||||||||

|

Research and development costs

|

(3,763,468

|

)

|

(2,099,309

|

)

|

||||||

|

Exploration and evaluation expenses

|

(1,458,125 |

) |

(1,517,474 |

) |

||||||

|

Corporate and administrative expenses

|

(2,470,238

|

)

|

(2,161,671

|

)

|

||||||

|

Business development expenses

|

(1,320,441

|

)

|

(1,333,073

|

)

|

||||||

|

Share-based payment expense

|

(1,108,090

|

)

|

(1,566,231

|

)

|

||||||

|

Finance income

|

210,558

|

198,282

|

||||||||

|

Finance costs

|

(61,638

|

)

|

(30,717

|

)

|

||||||

|

Other income and expenses

|

(523,577

|

)

|

(243,884

|

)

|

||||||

|

Loss before income tax

|

(10,495,019

|

)

|

(8,754,077

|

)

|

||||||

|

Income tax expense

|

-

|

-

|

||||||||

|

Loss for the period

|

(10,495,019

|

)

|

(8,754,077

|

)

|

||||||

|

Loss attributable to members of IperionX Limited

|

(10,495,019

|

)

|

(8,754,077

|

)

|

||||||

|

Other comprehensive income

|

||||||||||

|

Items that may be reclassified subsequently to profit or loss:

|

||||||||||

|

Exchange differences arising on translation of foreign operations

|

571,034

|

(102,645

|

)

|

|||||||

|

Other comprehensive loss for the period, net of tax

|

571,034

|

(102,645

|

)

|

|||||||

|

Total comprehensive loss for the period

|

(9,923,985

|

)

|

(8,856,722

|

)

|

||||||

|

Total comprehensive loss attributable to members of IperionX Limited

|

(9,923,985

|

)

|

(8,856,722

|

)

|

||||||

|

Loss per share

|

||||||||||

|

Basic and diluted loss per share (US$ per share)

|

(0.05

|

)

|

(0.06

|

)

|

||||||

|

Condensed Consolidated Statement of Financial Position

AS AT DECEMBER 31, 2023

|

|

|

Note

|

December 31, 2023

US$

|

June 30, 2023

US$

|

||||||||||

|

ASSETS

|

||||||||||||

|

Current Assets

|

||||||||||||

|

Cash and cash equivalents

|

17,329,952

|

11,937,941

|

||||||||||

|

Trade and other receivables

|

2,704,811

|

228,395

|

||||||||||

|

Prepayments

|

3,527,497

|

588,395

|

||||||||||

|

Total Current Assets

|

23,562,260

|

12,754,731

|

||||||||||

|

Non-Current Assets

|

||||||||||||

|

Property, plant and equipment

|

4

|

4,580,521

|

3,989,783

|

|||||||||

|

Exploration and evaluation assets

|

5 |

5,900,713 | 3,059,021 | |||||||||

| Prepayments |

- | 3,000,000 | ||||||||||

|

Total Non-Current Assets

|

10,481,234

|

10,048,804

|

||||||||||

|

TOTAL ASSETS

|

34,043,494

|

22,803,535

|

||||||||||

|

LIABILITIES

|

||||||||||||

|

Current Liabilities

|

||||||||||||

|

Trade and other payables

|

6

|

2,185,625

|

1,180,984

|

|||||||||

|

Loans and borrowings

|

7

|

440,482

|

382,626

|

|||||||||

|

Provisions

|

-

|

84,009

|

||||||||||

|

Total Current Liabilities

|

2,626,107

|

1,647,619

|

||||||||||

|

Non-Current Liabilities

|

||||||||||||

|

Loans and borrowings

|

7

|

1,241,626

|

592,688

|

|||||||||

|

Total Non-Current Liabilities

|

1,241,626

|

592,688

|

||||||||||

|

TOTAL LIABILITIES

|

3,867,733

|

2,240,307

|

||||||||||

|

NET ASSETS

|

30,175,761

|

20,563,228

|

||||||||||

|

EQUITY

|

||||||||||||

|

Contributed equity

|

8

|

78,897,119

|

58,764,248

|

|||||||||

|

Reserves

|

9

|

13,970,489

|

13,995,808

|

|||||||||

|

Accumulated losses

|

(62,691,847

|

)

|

(52,196,828

|

)

|

||||||||

|

TOTAL EQUITY

|

30,175,761

|

20,563,228

|

||||||||||

|

Condensed Consolidated Statement of Changes in Equity

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023

|

|

|

Contributed

Equity

US$

|

Share-

Based

Payments

Reserve

US$

|

Foreign

Currency

Translation

Reserve

US$

|

Accumulated

Losses US$

|

Total

Equity

US$

|

||||||||||||||||

|

Balance at July 1, 2023

|

58,764,248

|

15,004,052

|

(1,008,244

|

)

|

(52,196,828

|

)

|

20,563,228

|

|||||||||||||

|

Net loss for the period

|

-

|

-

|

-

|

(10,495,019

|

)

|

(10,495,019

|

)

|

|||||||||||||

|

Exchange differences arising on translation of foreign operations

|

-

|

-

|

571,034

|

-

|

571,034

|

|||||||||||||||

|

Total comprehensive loss

|

-

|

-

|

571,034

|

(10,495,019

|

)

|

(9,923,985

|

)

|

|||||||||||||

|

Issue of shares - share placement

|

17,088,750

|

-

|

-

|

-

|

17,088,750

|

|||||||||||||||

|

Issue of shares - exercise of options

|

3,127,752

|

(1,388,649

|

)

|

-

|

-

|

1,739,103

|

||||||||||||||

|

Issue of shares - conversion of RSUs

|

225,735

|

(225,735

|

)

|

-

|

-

|

-

|

||||||||||||||

|

Issue of shares - conversion of employee rights

|

15,059 | (15,059 | ) | - | - | - | ||||||||||||||

| Issue of shares to a consultant |

75,000 | (75,000 | ) | - | - | - | ||||||||||||||

|

Share issue costs

|

(399,425

|

)

|

-

|

-

|

-

|

(399,425

|

)

|

|||||||||||||

|

Share-based payment expense

|

-

|

1,108,090

|

-

|

-

|

1,108,090

|

|||||||||||||||

|

Balance at December 31, 2023

|

78,897,119

|

14,407,699

|

(437,210

|

)

|

(62,691,847

|

)

|

30,175,761

|

|||||||||||||

|

Balance at July 1, 2022

|

29,782,268

|

12,985,856

|

(596,331

|

)

|

(34,752,074

|

)

|

7,419,719

|

|||||||||||||

|

Net loss for the period

|

-

|

-

|

-

|

(8,754,077

|

)

|

(8,754,077

|

)

|

|||||||||||||

|

Exchange differences arising on translation of foreign operations

|

-

|

-

|

(102,645

|

)

|

-

|

(102,645

|

)

|

|||||||||||||

|

Total comprehensive loss

|

-

|

-

|

(102,645

|

)

|

(8,754,077

|

)

|

(8,856,722

|

)

|

||||||||||||

|

Issue of shares - share placement

|

16,117,800

|

-

|

-

|

-

|

16,117,800

|

|||||||||||||||

|

Issue of shares - exercise of options

|

194,205

|

(72,935

|

)

|

-

|

-

|

121,270

|

||||||||||||||

|

Issue of shares - conversion of RSUs

|

167,487 | (167,487 | ) | - | - | - | ||||||||||||||

|

Share issue costs

|

(1,347,128

|

)

|

354,788

|

-

|

-

|

(992,340

|

)

|

|||||||||||||

|

Share-based payment expense

|

-

|

1,566,231

|

-

|

-

|

1,566,231

|

|||||||||||||||

|

Balance at December 31, 2022

|

44,914,632

|

14,666,453

|

(698,976

|

)

|

(43,506,151

|

)

|

15,375,958

|

|||||||||||||

|

Condensed Consolidated Statement of Cash Flows

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023

|

|

|

Note

|

Six Months Ended

December 31, 2023

US$

|

Six Months Ended

December 31, 2022

US$

|

||||||||||

|

Cash flows from operating activities

|

||||||||||||

|

Receipts from customers

|

25,415 | - | ||||||||||

|

Payments to suppliers and employees

|

(8,158,175

|

)

|

(7,625,235

|

)

|

||||||||

|

Interest received

|

210,558

|

46,412

|

||||||||||

|

Interest paid

|

(52,665

|

)

|

(12,137

|

)

|

||||||||

|

Net cash flows used in operating activities

|

(7,974,867

|

)

|

(7,590,960

|

)

|

||||||||

|

Cash flows from investing activities

|

||||||||||||

|

Purchase of property, plant and equipment

|

(2,005,366 | ) | (1,179,703 | ) | ||||||||

|

Purchase of exploration and evaluation assets

|

5

|

(2,841,692

|

)

|

(418,200

|

)

|

|||||||

|

Net cash flows used in investing activities

|

(4,847,058

|

)

|

(1,597,903

|

)

|

||||||||

|

Cash flows from financing activities

|

||||||||||||

|

Proceeds from issue of shares

|

18,827,852

|

16,239,070

|

||||||||||

|

Share issue costs

|

(399,425

|

)

|

(992,340

|

)

|

||||||||

|

Repayment of borrowings

|

(2,928

|

)

|

(2,751

|

)

|

||||||||

|

Payment of principal portion of lease liabilities

|

(198,121

|

)

|

(338,366

|

)

|

||||||||

|

Net cash flows from financing activities

|

18,227,378

|

14,905,613

|

||||||||||

|

Net increase in cash and cash equivalents

|

5,405,453

|

5,716,750

|

||||||||||

|

Net foreign exchange differences

|

(13,442

|

)

|

49,225

|

|||||||||

|

Cash and cash equivalents at the beginning of the period

|

11,937,941

|

5,672,551

|

||||||||||

|

Cash and cash equivalents at the end of the period

|

17,329,952

|

11,438,526

|

||||||||||

|

Notes to the Condensed

Consolidated Financial Statements

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023

|

|

|

Notes to the Condensed

Consolidated Financial Statements

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023 (continued)

|

|

|

Plant and

equipment

US$

|

Right-of-use

assets

US$

|

Total

US$

|

||||||||||

|

December 31, 2023

|

||||||||||||

|

Carrying value at July 1, 2023

|

2,822,765

|

1,167,018

|

3,989,783

|

|||||||||

|

Additions

|

2,005,366

|

907,843

|

2,913,209

|

|||||||||

| Disposals |

(2,030,083 | ) | - | (2,030,083 | ) | |||||||

|

Depreciation

|

(49,510

|

)

|

(242,878

|

)

|

(292,388

|

)

|

||||||

|

Carrying amount at December 31, 2023

|

2,748,538

|

1,831,983

|

4,580,521

|

|||||||||

|

- at cost

|

3,009,884

|

2,451,719

|

5,461,603

|

|||||||||

|

- accumulated depreciation

|

(261,346

|

)

|

(619,736

|

)

|

(881,082

|

)

|

||||||

|

June 30, 2023

|

||||||||||||

|

Carrying value at July 1, 2022

|

922,118

|

465,868

|

1,387,986

|

|||||||||

|

Additions

|

2,077,794

|

950,537

|

3,028,331

|

|||||||||

|

Depreciation

|

(177,147

|

)

|

(249,387

|

)

|

(426,534

|

)

|

||||||

|

Carrying amount at June 30, 2023

|

2,822,765

|

1,167,018

|

3,989,783

|

|||||||||

|

- at cost

|

3,034,599

|

1,543,876

|

4,578,475

|

|||||||||

|

- accumulated depreciation

|

(211,834

|

)

|

(376,858

|

)

|

(588,692

|

)

|

||||||

|

Notes to the Condensed

Consolidated Financial Statements

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023 (continued)

|

|

|

Titan Project

US$

|

||||

|

December 31, 2023

|

||||

|

Carrying value at July 1, 2023

|

3,059,021

|

|||

|

Additions

|

2,841,692

|

|||

|

Carrying amount at December 31, 2023 (1)

|

5,900,713

|

|||

|

June 30, 2023

|

||||

|

Carrying value at July 1, 2022

|

2,431,229

|

|||

|

Additions

|

627,792

|

|||

|

Carrying amount at June 30, 2023 (1)

|

3,059,021

|

|||

|

(1)

|

The ultimate recoupment of costs

carried forward for exploration and evaluation is dependent on the successful development and commercial exploitation or sale of the respective areas of interest.

|

|

December 31, 2023

US$

|

June 30, 2023

US$

|

|||||||

|

Current

|

||||||||

|

Trade payables

|

1,068,905

|

711,011

|

||||||

|

Accruals

|

1,100,562

|

455,241

|

||||||

|

Employee benefits

|

16,158

|

14,732

|

||||||

|

Total trade and other payables

|

2,185,625

|

1,180,984

|

||||||

|

Notes to the Condensed

Consolidated Financial Statements

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023 (continued)

|

|

|

December 31, 2023

US$

|

June 30, 2023

US$

|

|||||||

|

Current

|

||||||||

|

Lease liabilities

|

434,314

|

376,655

|

||||||

|

Other loans and borrowings

|

6,168

|

5,971

|

||||||

|

Total current loans and borrowings

|

440,482

|

382,626

|

||||||

|

Non-current

|

||||||||

|

Lease liabilities

|

1,219,860

|

567,796

|

||||||

|

Other loans and borrowings

|

21,766

|

24,892

|

||||||

|

Total non-current loans and borrowings

|

1,241,626

|

592,688

|

||||||

|

Total loans and borrowings

|

1,682,108

|

975,314

|

||||||

|

December 31, 2023

US$

|

June 30, 2023

US$

|

|||||||

|

224,297,550 ordinary shares (June 30, 2023: 193,493,973)

|

78,897,119

|

58,764,248

|

||||||

|

78,897,119

|

58,764,248

|

|||||||

|

No. of

Ordinary

Shares

|

No. of Class A

Performance

Shares

|

No. of Class B

Performance

Shares

|

US$

|

|||||||||||||

| December 31, 2023 |

||||||||||||||||

|

Opening balance at July 1, 2023

|

193,493,973

|

19,800,000

|

19,800,000

|

58,764,248

|

||||||||||||

|

Issue of shares - share placement

|

21,000,000

|

-

|

-

|

17,088,750

|

||||||||||||

|

Issue of shares - exercise of options

|

9,331,823

|

-

|

-

|

3,127,752

|

||||||||||||

| Issue of shares - conversion of rights |

13,755 | - | - | 15,059 | ||||||||||||

| Issue of shares - conversion of RSUs |

341,461 | - | - | 225,735 | ||||||||||||

|

Issue of shares to a consultant

|

116,538

|

-

|

-

|

75,000

|

||||||||||||

|

Share issue costs

|

-

|

-

|

-

|

(399,425

|

)

|

|||||||||||

|

Closing balance at December 31, 2023

|

224,297,550

|

19,800,000

|

19,800,000

|

78,897,119

|

||||||||||||

| December 31, 2022 |

||||||||||||||||

|

Opening balance at July 1, 2022

|

140,288,491

|

19,800,000

|

19,800,000

|

29,782,268

|

||||||||||||

|

Issue of shares - share placement

|

30,000,000

|

-

|

-

|

16,117,800

|

||||||||||||

|

Issue of shares - exercise of options

|

737,000

|

-

|

-

|

194,205

|

||||||||||||

| Conversion of RSUs |

200,001 | - | - | 167,487 | ||||||||||||

|

Share issue costs

|

-

|

-

|

-

|

(1,347,128

|

)

|

|||||||||||

|

Closing balance at December 31, 2022

|

171,225,492

|

19,800,000

|

19,800,000

|

44,914,632

|

||||||||||||

|

Notes to the Condensed

Consolidated Financial Statements

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023 (continued)

|

|

|

December 31, 2023

US$

|

June 30, 2023

US$

|

|||||||

|

Share based payments reserve

|

14,407,699

|

15,004,052

|

||||||

|

Foreign currency translation reserve

|

(437,210

|

)

|

(1,008,244

|

)

|

||||

|

Total reserves

|

13,970,489

|

13,995,808

|

||||||

|

No. of

Unlisted

Options

|

No. of

Performance

Rights

|

No. of

RSUs

|

US$

|

|||||||||||||

|

December 31, 2023

|

||||||||||||||||

|

Opening balance at July 1, 2023

|

23,011,372

|

28,746,000

|

824,371

|

15,004,052

|

||||||||||||

|

Grant of employee incentive securities

|

-

|

3,921,000

|

405,124

|

-

|

||||||||||||

|

Exercise of options

|

(9,362,000

|

)

|

-

|

-

|

(1,388,649

|

)

|

||||||||||

|

Conversion of RSUs

|

-

|

-

|

(341,461

|

)

|

(225,735

|

)

|

||||||||||

| Conversion of performance rights |

- | (21,000 | ) | - | (15,059 | ) | ||||||||||

|

Issue of shares to a consultant

|

- |

-

|

-

|

(75,000 | ) | |||||||||||

|

Share-based payments expense

|

-

|

-

|

-

|

1,108,090 | ||||||||||||

|

Closing balance at December 31, 2023

|

13,649,372

|

32,646,000

|

888,034

|

14,407,699

|

||||||||||||

|

December 31, 2022

|

||||||||||||||||

|

Opening balance at July 1, 2022

|

23,824,000

|

27,620,000

|

600,000

|

12,985,856

|

||||||||||||

|

Grant of employee incentive securities

|

424,372

|

1,135,000

|

424,372

|

-

|

||||||||||||

|

Exercise of options

|

(737,000

|

)

|

-

|

-

|

(72,935

|

)

|

||||||||||

| Conversion of RSUs |

- | - | (200,001 | ) | (167,487 | ) | ||||||||||

| Grant of options to advisor |

1,000,000 | - | - | 354,788 | ||||||||||||

|

Share-based payment expense

|

-

|

-

|

-

|

1,566,231

|

||||||||||||

|

Closing balance at December 31, 2022

|

24,511,372

|

28,755,000

|

824,371

|

14,666,453

|

||||||||||||

| Equity Interest |

|||||||||

|

Country of

Incorporation

|

December 31, 2023

%

|

June 30, 2023

%

|

|||||||

|

IperionX Inc.

|

USA

|

100

|

%

|

100

|

%

|

||||

|

IperionX Critical Minerals, LLC

|

USA

|

100

|

%

|

100

|

%

|

||||

|

IperionX Technology, LLC

|

USA

|

100

|

%

|

100

|

%

|

||||

|

Hyperion Metals (Australia) Pty Ltd

|

Australia

|

100

|

%

|

100

|

%

|

||||

|

Calatos Pty Ltd, LLC

|

USA

|

100

|

%

|

100

|

%

|

||||

|

Notes to the Condensed

Consolidated Financial Statements

FOR THE SIX MONTHS ENDED DECEMBER 31, 2023 (continued)

|

|

|

(a)

|

On January 30, 2024, the Company issued 3,006,163

shares to nominees of Blacksand Technology LLC (“Blacksand”) in lieu of future cash option payments totaling US$2,000,000

owed to Blacksand under the option agreement between the Company and Blacksand pursuant to which the Company has the exclusive option to acquire the intellectual property rights of Blacksand to certain patented titanium

technologies.

|

|

Directors’ Declaration

|

|

|

(a)

|

the attached financial statements and notes are in accordance with the Corporations Act 2001, including:

|

|

(i)

|

section 304 (compliance with accounting standards and Corporations Regulations 2001); and

|

|

(ii)

|

section 305 (true and fair view); and

|

|

(b)

|

there are reasonable grounds to believe that the Company will be able to pay its debts as and when they become due and payable.

|

|

Independent Auditor’s

Review Report

|

|

| 1. |

giving a true and fair view of the Group's financial position as at 31 December 2023 and of its performance for the half-year ended on that date

|

| 2. |

complying with Accounting Standard AASB 134 Interim Financial Reporting and the Corporations Regulations 2001.

|

|

Independent Auditor’s

Review Report (continued)

|

|

|

/s/ Craig Heatley

|

|

|

Craig Heatley

|

Perth

|

|

Partner

|

14 March 2024

|