|

Ohio

|

31-1359191

|

|

(State of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

420 Third Avenue,

Gallipolis, Ohio

|

45631

|

|

(Address of principal executive offices)

|

(ZIP Code)

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Shares, without par value

|

OVBC

|

The NASDAQ Stock Market LLC

(The NASDAQ Global Market)

|

|

Large accelerated filer □

|

Accelerated filer □

|

|

|

Non-accelerated filer ☑

|

Smaller reporting company ☑

|

|

|

Emerging growth company ☐

|

|

(1)

|

Portions of the 2023 Annual Report to Shareholders of Ohio Valley Banc Corp. (Exhibit 13) are incorporated by

reference into Part I, Items 1 and 2 and Part II, Items 5, 6, 7, 7A, 8 and 9A.

|

|

(2)

|

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on May 15, 2024, are

incorporated by reference into Part III, Items 10, 11, 12, 13 and 14.

|

|

•

|

acquire direct or indirect ownership or control of more than 5% of the voting shares of any bank that is not already majority-owned by it;

|

|

•

|

acquire all or substantially all of the assets of another bank or bank holding company; or

|

|

•

|

merge or consolidate with any other bank holding company.

|

|

•

|

Community Reinvestment Act of 1977: imposes a continuing and affirmative obligation to fulfill the credit needs of its

entire community, including low- and moderate-income neighborhoods.

|

|

•

|

Equal Credit Opportunity Act: prohibits discrimination in any credit transaction on the basis of any of various

criteria.

|

|

•

|

Truth in Lending Act: requires that credit terms are disclosed in a manner that permits a consumer to understand and

compare credit terms more readily and knowledgeably.

|

|

•

|

Fair Housing Act: makes it unlawful for a lender to discriminate in its housing-related lending activities against any

person on the basis of any of certain criteria.

|

|

•

|

Home Mortgage Disclosure Act: requires financial institutions to collect data that enables regulatory agencies to

determine whether the financial institutions are serving the housing credit needs of the communities in which they are located.

|

|

•

|

Real Estate Settlement Procedures Act: requires that lenders provide borrowers with disclosures regarding the nature and

cost of real estate settlements and prohibits abusive practices that increase borrowers’ costs.

|

|

•

|

Privacy provisions of the Gramm-Leach-Bliley Act: requires financial institutions to establish policies and procedures to

restrict the sharing of non-public customer data with non-affiliated parties and to protect customer information from unauthorized access.

|

| A. & B |

The average balance sheet information and the related analysis of net interest earnings for the years ended December 31, 2023 and 2022 are incorporated herein by reference to the information appearing under the caption “Table I – Consolidated Average Balance Sheet & Analysis of Net Interest Income,” within “Management’s Discussion and Analysis of Financial Condition and Results of Operations” located in Ohio Valley’s 2023 Annual Report to Shareholders. |

|

|

C. |

Tables setting forth the effect of volume and rate changes on interest income and expense for the years ended December 31, 2023 and 2022 are incorporated herein by

reference to the information appearing under the caption “Table II - Rate Volume Analysis of Changes in Interest Income & Expense,” within “Management’s Discussion and Analysis of Financial Condition and Results of Operations” located

in Ohio Valley’s 2023 Annual Report to Shareholders.

|

|

|

A. |

Information required by this item is incorporated herein by reference to the information appearing under the caption “Table III - Securities,” within “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” located in Ohio Valley’s 2023 Annual Report to Shareholders

|

|

|

B. |

Excluding obligations of the United States Government and its agencies, no concentration of securities exists of any issuer that is greater than 10% of shareholders’

equity of Ohio Valley.

|

| A. | Maturities and Sensitivities of Loans to Changes in Interest Rates - Information required by this item is incorporated herein by reference to the information appearing under the caption “Table V - Maturity and Repricing Data of Loans,” within “Management’s Discussion and Analysis of Financial Condition and Results of Operations” located in Ohio Valley’s 2023 Annual Report to Shareholders. |

| A. & B |

Discussion of factors that influenced management in determining the amount of additions charged to provision expense is incorporated herein by reference to the information appearing under the captions “Provision Expense” and “Allowance for Credit Losses” within “Management’s Discussion and Analysis of Financial Condition and Results of Operations” located in Ohio Valley’s 2023 Annual Report to Shareholders. |

|

|

A. |

Deposit Summary - Information required by this item is incorporated herein by reference to the information appearing under the caption “Table I - Consolidated Average

Balance Sheet & Analysis of Net Interest Income,” within “Management’s Discussion and Analysis of Financial Condition and Results of Operations” located in Ohio Valley’s 2023 Annual Report to Shareholders.

|

| C & D |

Foreign Deposits - There were no foreign deposits outstanding at December 31, 2023 or 2022. |

|

|

E. |

Uninsured Deposits – Uninsured deposits were estimated at $366,649 and $254,993 at December 31, 2023 and December 31, 2022, respectively.

|

|

|

F. |

Schedule of Maturities - The following table provides the uninsured portion of time deposits at December 31, 2023, with a maturity of:

|

|

December 31, 2023

|

Over

|

Over

|

||||||||||||||

|

(dollars in thousands)

|

3 months

|

3 through

|

6 through

|

Over

|

||||||||||||

|

or less

|

6 months

|

12 months

|

12 months

|

|||||||||||||

|

Total uninsured time deposits

|

$

|

36,254

|

$

|

7,466

|

$

|

18,906

|

$

|

15,174

|

||||||||

|

•

|

the time and costs associated with identifying and evaluating potential acquisitions or new products or services;

|

|

•

|

the potential inaccuracy of estimates and judgments used to evaluate credit, operations, management and market risk with

respect to the target institutions;

|

|

•

|

the time and costs of evaluating new markets, hiring local management and opening new offices, and the delay between

commencing these activities and the generation of profits from the expansion;

|

|

•

|

our ability to finance an acquisition or other expansion and the possible dilution to our existing shareholders;

|

|

•

|

the diversion of management’s attention to the negotiation of a transaction and the integration of the operations and

personnel of the combining businesses;

|

|

•

|

entry into unfamiliar markets;

|

|

•

|

the possible failure of the introduction of new products and services into our existing business;

|

|

•

|

the incurrence and possible impairment of goodwill associated with an acquisition and possible adverse short-term effects

on our results of operations; and

|

|

•

|

the risk of loss of key employees and customers.

|

|

•

|

Maintaining policies and procedures regarding security operations and governance through the implementation of the Company’s Information

Security Program;

|

|

•

|

Implementing multi-layered controls to avoid reliance on single controls;

|

|

•

|

Utilizing both preventative and detective tools to monitor and block suspicious activity and to alert us of potential threats;

|

|

•

|

Keeping abreast of new technology and evaluating tools to help respond to threats to cybersecurity in an efficient and effective manner;

|

|

•

|

Collaborating with third-party cybersecurity consultants that perform regular penetration testing, vulnerability assessments, and other

procedures to identify potential weaknesses in our systems and processes;

|

|

•

|

Utilizing a third-party risk management program for purposes of identifying, assessing, and managing risks involved with external service

providers;

|

|

•

|

Conducting thorough due diligence concerning our third-party service providers, including evaluating their cybersecurity practices; and

|

|

•

|

Providing regular cybersecurity training for both our employees and our Board of Directors.

|

|

•

|

Identify and analyze cybersecurity risks;

|

|

•

|

Provide the Company with direction on effectively managing such risks;

|

|

•

|

Approve information security plans, policies, and programs;

|

|

•

|

Assess whether the Company’s current security programs are effective; and

|

|

•

|

Provide recommendations for corrective action.

|

|

(a)

|

None.

|

|

(b)

|

None.

|

|

Exhibit Number

|

Exhibit Description

|

|

|

3.1

|

||

|

3.2

|

||

|

4.1

|

||

|

4.2

|

||

|

10.1*

|

||

|

10.2*

|

||

|

10.3(a)*

|

||

|

10.3(b)*

|

||

|

10.4(a)*

|

||

|

|

|

Exhibit Number

|

Exhibit Description

|

|

|

10.4(b)*

|

||

|

10.5(a)*

|

||

|

10.5(b)*

|

||

|

10.5(c)*

|

||

|

10.5(d)*

|

||

|

10.6(a)*

|

||

|

10.6(b)*

|

||

|

10.6(c)*

|

|

Exhibit Number

|

Exhibit Description

|

|

|

10.6(d)*

|

||

|

10.6(e)*

|

||

|

10.6(f)*

|

||

|

10.6(g)*

|

||

|

10.7*

|

||

|

10.8*

|

Summary

of Bonus Program of Ohio Valley Banc Corp.: Filed herewith.

|

|

|

10.9*

|

||

|

10.10*

|

||

|

10.11*

|

|

Exhibit Number

|

Exhibit Description

|

|

|

10.12*

|

||

|

10.13*

|

||

|

10.14*

|

||

|

10.15*

|

||

|

10.16*

|

||

|

10.17*

|

||

|

10.18*

|

||

|

10.19(a)*

|

|

Exhibit Number

|

Exhibit Description

|

|

|

10.19(b)*

|

||

|

10.20(a)*

|

||

|

10.20(b)*

|

||

|

13

|

Ohio

Valley’s Annual Report to Shareholders for the fiscal year ended December 31, 2023: Filed herewith. (Not deemed filed except for portions thereof specifically incorporated by reference into this Annual Report on Form 10-K.)

|

|

|

19

|

Ohio

Valley Banc Corp. Insider Trading Policy: Filed herewith.

|

|

|

21

|

Subsidiaries

of Ohio Valley: Filed herewith.

|

|

|

23

|

Consent

of Crowe LLP.: Filed herewith.

|

|

|

31.1

|

Rule

13a-14(a)/15d-14(a) Certification (Principal Executive Officer): Filed herewith.

|

|

|

31.2

|

Rule

13a-14(a)/15d-14(a) Certification (Principal Financial Officer): Filed herewith.

|

|

|

32

|

||

|

97

|

||

|

101.INS #

|

XBRL Instance Document: Submitted electronically herewith. #

|

|

|

101.SCH #

|

XBRL Taxonomy Extension Schema: Submitted electronically herewith. #

|

|

|

101.CAL #

|

XBRL Taxonomy Extension Calculation Linkbase: Submitted electronically herewith. #

|

|

|

101.DEF #

|

XBRL Taxonomy Extension Definition Linkbase: Submitted electronically herewith. #

|

|

|

Exhibit Number

|

Exhibit Description

|

|

|

101.LAB #

|

XBRL Taxonomy Extension Label Linkbase: Submitted electronically herewith. #

|

|

|

101.PRE #

|

XBRL Taxonomy Extension Presentation Linkbase: Submitted electronically herewith. #

|

|

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

|

|

# Attached as Exhibit 101 to Ohio Valley’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are the following documents

formatted in XBRL (eXtensive Business Reporting Language): (i) Consolidated Statements of Condition at December 31, 2023 and December 31, 2022; (ii) Consolidated Statements of Income for the years ended December 31, 2023 and 2022; (iii)

Consolidated Statements of Comprehensive Income for the years ended December 31, 2023 and 2022; (iv) Consolidated Statements of Changes in Shareholders’ Equity for the years ended December 31, 2023 and 2022; (v) Consolidated Statements of

Cash Flows for the years ended December 31, 2023 and 2022; and (vi) Notes to the Consolidated Financial Statements.

|

|

OHIO VALLEY BANC CORP.

|

|||

|

Date:

|

March 15, 2024

|

By:

|

/s/Larry E. Miller, II |

|

Larry E. Miller, II

|

|||

|

President and Chief Executive Officer

|

|

Name

|

Capacity

|

|

| /s/Larry E. Miller, II |

President and Chief Executive Officer

|

|

|

Larry E. Miller, II

|

(principal executive officer) and Director

|

|

| /s/Scott W. Shockey |

Senior Vice President and Chief

|

|

|

Scott W. Shockey

|

Financial Officer (principal financial officer and principal accounting officer)

|

|

| /s/Thomas E. Wiseman |

Chairman of the Board

|

|

|

Thomas E. Wiseman

|

||

| /s/Anna P. Barnitz |

Director

|

|

|

Anna P. Barnitz

|

||

| /s/David W. Thomas |

Director

|

|

|

David W. Thomas

|

||

| /s/Brent A. Saunders |

Director

|

|

|

Brent A. Saunders

|

||

| /s/Brent R. Eastman |

Director

|

|

|

Brent R. Eastman

|

||

| /s/Kimberly A. Canady |

Director

|

|

|

Kimberly A. Canady

|

||

| /s/Edward J. Robins |

Director

|

|

|

Edward J. Robbins

|

||

| /s/K. Ryan Smith |

Director

|

|

|

K. Ryan Smith

|

||

| /s/Edward B. Roberts |

Director

|

|

|

Edward B. Roberts

|

||

| /s/Larry E. Miller, II |

|

Larry E. Miller, II

|

|

President and Chief Executive Officer

|

|

Ohio Valley Banc Corp.

|

|

Name

|

Current Salary

|

|

Thomas E. Wiseman

|

247,770

|

|

Larry E. Miller II

|

355,794

|

|

Scott W. Shockey

|

223,529

|

|

As of December 31

|

||||||||

|

|

2023

|

2022

|

||||||

|

(dollars in thousands, except share and per share data)

|

||||||||

|

Assets

|

||||||||

|

Cash and noninterest-bearing deposits with banks

|

$

|

14,252

|

$

|

14,330

|

||||

|

Interest-bearing deposits with banks

|

113,874

|

31,660

|

||||||

|

Total cash and cash equivalents

|

128,126

|

45,990

|

||||||

|

Certificates of deposit in financial institutions

|

—

|

1,862

|

||||||

|

Securities available for sale

|

162,258

|

184,074

|

||||||

|

Securities held to maturity, net of allowance for credit losses of $2 in 2023 and $0 in 2022; (estimated fair value: 2023 - $7,390; 2022 - $8,460)

|

7,986

|

9,226

|

||||||

|

Restricted investments in bank stocks

|

5,037

|

5,953

|

||||||

|

Total loans

|

971,900

|

885,049

|

||||||

|

Less: Allowance for credit losses

|

(8,767

|

)

|

(5,269

|

)

|

||||

|

Net loans

|

963,133

|

879,780

|

||||||

|

Premises and equipment, net

|

21,450

|

20,436

|

||||||

|

Premises and equipment held for sale, net

|

573

|

593

|

||||||

|

Accrued interest receivable

|

3,606

|

3,112

|

||||||

|

Goodwill

|

7,319

|

7,319

|

||||||

|

Other intangible assets, net

|

8

|

29

|

||||||

|

Bank owned life insurance and annuity assets

|

40,593

|

39,627

|

||||||

|

Operating lease right-of-use asset, net

|

1,205

|

1,294

|

||||||

| Deferred tax assets | 6,306 | 6,266 | ||||||

|

Other assets

|

4,535

|

5,226

|

||||||

|

Total assets

|

$

|

1,352,135

|

$

|

1,210,787

|

||||

|

Liabilities

|

||||||||

|

Noninterest-bearing deposits

|

$

|

322,222

|

$

|

354,413

|

||||

|

Interest-bearing deposits

|

804,914

|

673,242

|

||||||

|

Total deposits

|

1,127,136

|

1,027,655

|

||||||

|

Other borrowed funds

|

44,593

|

17,945

|

||||||

|

Subordinated debentures

|

8,500

|

8,500

|

||||||

|

Operating lease liability

|

1,205

|

1,294

|

||||||

| Allowance for credit losses on off-balance sheet commitments |

692 | — | ||||||

|

Other liabilities

|

26,002

|

20,365

|

||||||

|

Total liabilities

|

1,208,128

|

1,075,759

|

||||||

|

Commitments and Contingent Liabilities (See Note L)

|

||||||||

|

Shareholders’ Equity

|

||||||||

|

Common stock ($1.00 stated value per share, 10,000,000 shares authorized; 2023 - 5,470,453

shares issued; 2022 - 5,465,707 shares issued)

|

5,470

|

5,465

|

||||||

|

Additional paid-in capital

|

51,842

|

51,722

|

||||||

|

Retained earnings

|

114,871

|

109,320

|

||||||

|

Accumulated other comprehensive income (loss)

|

(11,428

|

)

|

(14,813

|

)

|

||||

|

Treasury stock, at cost (2023 - 697,321 shares; 2022 – 693,933 shares)

|

(16,748

|

)

|

(16,666

|

)

|

||||

|

Total shareholders’ equity

|

144,007

|

135,028

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

1,352,135

|

$

|

1,210,787

|

||||

|

For the years ended December 31

|

2023

|

2022

|

||||||

|

(dollars in thousands, except per share data)

|

||||||||

|

Interest and dividend income:

|

||||||||

|

Loans, including fees

|

$

|

54,821

|

$

|

42,273

|

||||

|

Securities:

|

||||||||

|

Taxable

|

3,678

|

3,340

|

||||||

|

Tax exempt

|

162

|

180

|

||||||

|

Dividends

|

324

|

316

|

||||||

|

Interest-bearing deposits with banks

|

2,870

|

1,493

|

||||||

|

Other interest

|

10

|

14

|

||||||

|

61,865

|

47,616

|

|||||||

|

Interest expense:

|

||||||||

|

Deposits

|

14,174

|

2,130

|

||||||

|

Other borrowed funds

|

1,067

|

412

|

||||||

|

Subordinated debentures

|

597

|

296

|

||||||

|

15,838

|

2,838

|

|||||||

|

Net interest income

|

46,027

|

44,778

|

||||||

|

Provision for (recovery of) credit losses

|

2,090

|

(32

|

)

|

|||||

|

Net interest income after provision for (recovery of) credit losses

|

43,937

|

44,810

|

||||||

|

Noninterest income:

|

||||||||

|

Service charges on deposit accounts

|

2,700

|

2,443

|

||||||

|

Trust fees

|

326

|

325

|

||||||

|

Income from bank owned life insurance and annuity assets

|

860

|

883

|

||||||

|

Mortgage banking income

|

175

|

697

|

||||||

|

Electronic refund check / deposit fees

|

675

|

675

|

||||||

|

Debit / credit card interchange income

|

4,860

|

4,862

|

||||||

|

Loss on sale of securities

|

(23 | ) | (1,537 | ) | ||||

|

Tax preparation fees

|

669

|

743

|

||||||

|

Other

|

2,387

|

1,071

|

||||||

|

12,629

|

10,162

|

|||||||

|

Noninterest expense:

|

||||||||

|

Salaries and employee benefits

|

23,391

|

21,615

|

||||||

|

Occupancy

|

1,903

|

1,910

|

||||||

|

Furniture and equipment

|

1,321

|

1,170

|

||||||

|

Professional fees

|

1,656

|

1,609

|

||||||

|

Marketing expense

|

1,010

|

1,428

|

||||||

|

FDIC insurance

|

569

|

335

|

||||||

|

Data processing

|

2,809

|

2,761

|

||||||

|

Software

|

2,649

|

2,197

|

||||||

|

Foreclosed assets

|

15

|

63

|

||||||

|

Amortization of intangibles

|

21

|

35

|

||||||

|

Other

|

6,024

|

5,917

|

||||||

|

41,368

|

39,040

|

|||||||

|

Income before income taxes

|

15,198

|

15,932

|

||||||

|

Provision for income taxes

|

2,567

|

2,594

|

||||||

|

NET INCOME

|

$

|

12,631

|

$

|

13,338

|

||||

|

Earnings per share

|

$

|

2.65

|

$

|

2.80

|

||||

|

For the years ended December 31

|

2023

|

2022

|

||||||

|

(dollars in thousands)

|

||||||||

|

NET INCOME

|

$

|

12,631

|

$

|

13,338

|

||||

|

Other comprehensive income (loss):

|

||||||||

|

Change in unrealized gain (loss) on available for sale securities

|

4,067

|

(21,184

|

)

|

|||||

| Reclassification adjustment for realized losses |

23 | 1,537 | ||||||

| 4,090 | (19,647 | ) | ||||||

|

Related tax effect

|

(705

|

)

|

4,126

|

|||||

|

Total other comprehensive income (loss), net of tax

|

3,385

|

(15,521

|

)

|

|||||

|

Total comprehensive income

|

$

|

16,016

|

$

|

(2,183

|

)

|

|||

|

For the years ended December 31, 2023 and 2022

|

||||||||||||||||||||||||

|

(dollars in thousands, except share and per share data)

|

||||||||||||||||||||||||

|

Common

Stock

|

Additional Paid-In

Capital

|

Retained

Earnings

|

Accumulated Other

Comprehensive

Income (Loss)

|

Treasury

Stock

|

Total

Shareholders’

Equity

|

|||||||||||||||||||

|

Balances at January 1, 2022

|

$

|

5,447

|

$

|

51,165

|

$

|

100,702

|

$

|

708

|

$

|

(16,666

|

)

|

$

|

141,356

|

|||||||||||

|

Net income

|

—

|

—

|

13,338

|

—

|

—

|

13,338

|

||||||||||||||||||

|

Other comprehensive income (loss), net

|

—

|

—

|

—

|

(15,521

|

)

|

—

|

(15,521

|

)

|

||||||||||||||||

|

Cash dividends, $0.99 per share

|

—

|

—

|

(4,720

|

)

|

—

|

—

|

(4,720

|

)

|

||||||||||||||||

|

Common stock issued to

ESOP, 18,522 shares

|

18 | 557 | — | — | — | 575 | ||||||||||||||||||

|

Balances at December 31, 2022

|

5,465

|

51,722

|

109,320

|

(14,813

|

)

|

(16,666

|

)

|

135,028

|

||||||||||||||||

|

Cumulative change in

adopting ASU 2016-13

|

— | — | (2,209 | ) | — | — | (2,209 | ) | ||||||||||||||||

|

Balance at January 1,

2023 (as adjusted for change in adopting ASU 2016-13)

|

5,465 | 51,722 | 107,111 | (14,813 | ) | (16,666 | ) | 132,819 | ||||||||||||||||

|

Net income

|

—

|

—

|

12,631

|

—

|

—

|

12,631

|

||||||||||||||||||

|

Other comprehensive income (loss), net

|

—

|

—

|

—

|

3,385

|

—

|

3,385

|

||||||||||||||||||

|

Cash dividends, $1.02 per share

|

— | — | (4,871 | ) | — | — | (4,871 | ) | ||||||||||||||||

|

Common Stock issued to ESOP, 4,746 shares

|

5

|

120

|

—

|

—

|

—

|

125

|

||||||||||||||||||

| Shares acquired for treasury, 3,388

shares |

— | — | — | — | (82 | ) | (82 | ) | ||||||||||||||||

|

Balances at December 31, 2023

|

$

|

5,470

|

$

|

51,842

|

$

|

114,871

|

$

|

(11,428

|

)

|

$

|

(16,748

|

)

|

$

|

144,007

|

||||||||||

|

For the years ended December 31

|

2023

|

2022

|

||||||

|

(dollars in thousands)

|

||||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$

|

12,631

|

$

|

13,338

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Provision for (recovery of)

credit losses

|

2,090 | (32 | ) | |||||

|

Depreciation of premises and equipment

|

1,562

|

1,464

|

||||||

|

Accretion of building grant

|

(4 | ) | (3 | ) | ||||

|

Net amortization (accretion) of purchase accounting adjustments

|

(1

|

)

|

34

|

|||||

|

Net amortization (accretion) of securities

|

(478

|

)

|

100

|

|||||

|

Net realized loss on sale of securities

|

23 | 1,537 | ||||||

|

Proceeds from sale of loans in secondary market

|

125

|

7,831

|

||||||

|

Loans disbursed for sale in secondary market

|

(124

|

)

|

(7,134

|

)

|

||||

|

Amortization of mortgage servicing rights

|

53

|

71

|

||||||

|

Gain on sale of loans

|

(228

|

)

|

(768

|

)

|

||||

|

Amortization of intangible assets

|

21

|

35

|

||||||

|

Amortization of certificates of deposit premiums

|

7 | 22 | ||||||

|

Deferred tax (benefit) expense

|

(745

|

)

|

288

|

|||||

|

Contribution of common stock to ESOP

|

125 | 575 | ||||||

|

Earnings on bank owned life insurance and annuity assets

|

(860

|

)

|

(883

|

)

|

||||

|

Change in accrued interest receivable

|

(494

|

)

|

(417

|

)

|

||||

|

Change in other liabilities

|

5,567

|

1,223

|

||||||

|

Change in other assets

|

1,477

|

(1,291

|

)

|

|||||

|

Net cash provided by operating activities

|

20,747

|

15,990

|

||||||

|

Cash flows from investing activities:

|

||||||||

|

Proceeds from sales of securities available for sale

|

1,067 | 10,963 | ||||||

|

Proceeds from maturities and paydowns of securities available for sale

|

25,901

|

27,524

|

||||||

|

Purchases of securities available for sale

|

(586

|

)

|

(66,821

|

)

|

||||

|

Proceeds from calls and maturities of securities held to maturity

|

1,217

|

1,044

|

||||||

|

Proceeds from maturities of certificates of deposit in financial institutions

|

2,100

|

445

|

||||||

|

Purchases of certificates of deposit in financial institutions

|

(245

|

)

|

—

|

|||||

|

Purchases of restricted

investments in bank stocks

|

(969 | ) | — | |||||

|

Redemptions of restricted investments in bank stocks

|

1,885 | 1,312 | ||||||

|

Net change in loans

|

(87,481 | ) | (55,028 | ) | ||||

|

Purchases of premises and equipment

|

(2,689

|

)

|

(1,988

|

)

|

||||

|

Disposals of premises and equipment

|

219

|

420

|

||||||

|

Proceeds from building grant

|

— | 200 | ||||||

|

Reimbursement of building

grant

|

(100 | ) | — | |||||

|

Purchases of bank owned life insurance and annuity assets

|

(250 | ) | (1,463 | ) | ||||

|

Withdrawals from bank owned life insurance and annuity assets

|

144

|

—

|

||||||

|

Net cash (used in) investing activities

|

(59,787

|

)

|

(83,392

|

)

|

||||

|

Cash flows from financing activities:

|

||||||||

|

Change in deposits

|

99,481

|

(32,253

|

)

|

|||||

|

Cash dividends

|

(4,871

|

)

|

(4,720

|

)

|

||||

|

Purchases of treasury stock

|

(82 | ) | — | |||||

|

Proceeds from Federal Home Loan Bank borrowings

|

30,001

|

2

|

||||||

|

Repayment of Federal Home Loan Bank borrowings

|

(3,371

|

)

|

(1,909

|

)

|

||||

|

Change in other short-term borrowings

|

18

|

238

|

||||||

|

Net cash provided by (used in) financing activities

|

121,176

|

(38,642

|

)

|

|||||

|

Cash and cash equivalents:

|

||||||||

|

Change in cash and cash equivalents

|

82,136

|

(106,044

|

)

|

|||||

|

Cash and cash equivalents at beginning of year

|

45,990

|

152,034

|

||||||

|

Cash and cash equivalents at end of year

|

$

|

128,126

|

$

|

45,990

|

||||

|

Supplemental disclosure:

|

||||||||

|

Cash paid for interest

|

$

|

9,674

|

$

|

2,845

|

||||

|

Cash paid for income taxes

|

2,750

|

1,975

|

||||||

|

Transfers from loans to other real estate owned

|

129

|

—

|

||||||

|

Operating lease liability arising from obtaining right-of-use asset

|

187

|

108

|

||||||

|

Portfolio Segment

|

Measurement Method

|

Loss Driver

|

||

|

Residential real estate

|

Cumulative Undiscounted Expected Loss

|

National Unemployment, National GDP

|

||

|

Commercial real estate:

|

||||

|

Owner-occupied

|

Cumulative Undiscounted Expected Loss

|

National Unemployment, National GDP

|

||

|

Nonowner-occupied

|

Cumulative Undiscounted Expected Loss

|

National Unemployment, National GDP

|

||

|

Construction

|

Cumulative Undiscounted Expected Loss

|

National Unemployment, National GDP

|

||

|

Commercial and industrial

|

Cumulative Undiscounted Expected Loss

|

National Unemployment, National GDP

|

||

|

Consumer:

|

||||

|

Automobile

|

Cumulative Undiscounted Expected Loss

|

National Unemployment

|

||

|

Home equity

|

Cumulative Undiscounted Expected Loss

|

National Unemployment

|

||

|

Other

|

Cumulative Undiscounted Expected Loss,

Remaining Life Method

|

National Unemployment

|

|

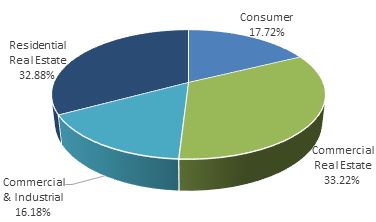

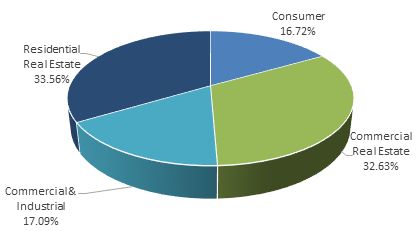

% of Total Loans

|

||||||||

|

2023

|

2022

|

|||||||

|

Residential real estate loans

|

32.88

|

%

|

33.56

|

%

|

||||

|

Commercial real estate loans

|

33.22

|

%

|

32.63

|

%

|

||||

|

Consumer loans

|

17.72

|

%

|

16.72

|

%

|

||||

|

Commercial and industrial loans

|

16.18

|

%

|

17.09

|

%

|

||||

|

100.00

|

%

|

100.00

|

%

|

|||||

|

|

January 1, 2023

|

|||||||||||

|

As Reported

Under ASC

326

|

Pre-ASC 326

Adoption

|

Impact of

ASC 326

Adoption

|

||||||||||

|

Assets:

|

||||||||||||

|

ACL - HTM debt securities

|

||||||||||||

|

Obligations of states and political subdivisions

|

$

|

3

|

$

|

—

|

$

|

3

|

||||||

|

ACL - Loans

|

||||||||||||

|

Residential real estate

|

2,026

|

681

|

1,345

|

|||||||||

|

Commercial real estate

|

2,200

|

2,038

|

162

|

|||||||||

|

Commercial and industrial

|

1,177

|

1,293

|

(116

|

)

|

||||||||

|

Consumer

|

2,028

|

1,257

|

771

|

|||||||||

|

Total ACL - Loans

|

$

|

7,431

|

$

|

5,269

|

$

|

2,162

|

||||||

|

Deferred tax assets

|

$

|

6,853

|

$

|

6,266

|

$

|

587

|

||||||

|

Liabilities:

|

||||||||||||

|

ACL - Off-balance sheet commitments

|

$

|

631

|

$

|

—

|

$

|

631

|

||||||

|

|

Amortized

Cost

|

Gross Unrealized

Gains

|

Gross Unrealized

Losses

|

Estimated

Fair Value

|

||||||||||||

|

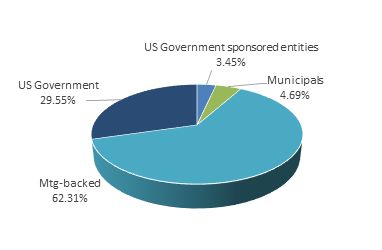

Securities Available for Sale

|

||||||||||||||||

|

December 31, 2023

|

||||||||||||||||

|

U.S. Government securities

|

$ | 52,174 | $ | — | $ | (1,877 | ) | $ | 50,297 | |||||||

|

U.S. Government sponsored entity securities

|

6,527

|

—

|

(650

|

)

|

5,877

|

|||||||||||

|

Agency mortgage-backed securities, residential

|

118,218

|

—

|

(12,134

|

)

|

106,084

|

|||||||||||

|

Total securities

|

$

|

176,919

|

$

|

—

|

$

|

(14,661

|

)

|

$

|

162,258

|

|||||||

|

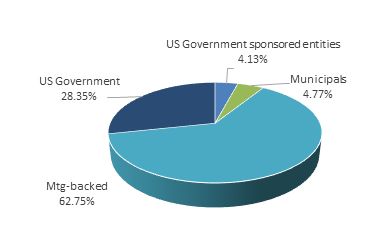

December 31, 2022

|

||||||||||||||||

|

U.S. Government securities

|

$ | 57,698 | $ | — | $ | (2,906 | ) | $ | 54,792 | |||||||

|

U.S. Government sponsored entity securities

|

8,845

|

—

|

(862

|

)

|

7,983

|

|||||||||||

|

Agency mortgage-backed securities, residential

|

136,282

|

—

|

(14,983

|

)

|

121,299

|

|||||||||||

|

Total securities

|

$

|

202,825

|

$

|

—

|

$

|

(18,751

|

)

|

$

|

184,074

|

|||||||

|

Amortized

Cost

|

Gross Unrecognized

Gains

|

Gross Unrecognized

Losses

|

Estimated

Fair Value

|

Allowance for Credit

Losses

|

||||||||||||||||

|

Securities Held to Maturity

|

||||||||||||||||||||

|

December 31, 2023

|

||||||||||||||||||||

|

Obligations of states and political subdivisions

|

$

|

7,987

|

$

|

17

|

$

|

(615

|

)

|

$

|

7,389

|

$ | (2 | ) | ||||||||

|

Agency mortgage-backed securities, residential

|

1

|

—

|

—

|

1

|

— | |||||||||||||||

|

Total securities

|

$

|

7,988

|

$

|

17

|

$

|

(615

|

)

|

$

|

7,390

|

$ |

(2 | ) | ||||||||

|

December 31, 2022

|

||||||||||||||||||||

|

Obligations of states and political subdivisions

|

$

|

9,225

|

$

|

32

|

$

|

(798

|

)

|

$

|

8,459

|

|||||||||||

|

Agency mortgage-backed securities, residential

|

1

|

—

|

—

|

1

|

||||||||||||||||

|

Total securities

|

$

|

9,226

|

$

|

32

|

$

|

(798

|

)

|

$

|

8,460

|

|||||||||||

|

Available for Sale

|

Held to Maturity

|

|||||||||||||||

|

Debt Securities:

|

Amortized

Cost

|

Estimated

Fair

Value

|

Amortized

Cost

|

Estimated

Fair

Value

|

||||||||||||

|

Due in one year or less

|

$

|

17,424

|

$

|

17,257

|

$

|

397

|

$

|

392

|

||||||||

|

Due in one to five years

|

41,277

|

38,917

|

3,974

|

3,780

|

||||||||||||

|

Due in five to ten years

|

—

|

—

|

1,490

|

1,297

|

||||||||||||

|

Due after ten years

|

— | — | 2,126 | 1,920 | ||||||||||||

|

Agency mortgage-backed securities, residential

|

118,218

|

106,084

|

1

|

1

|

||||||||||||

|

Total debt securities

|

$

|

176,919

|

$

|

162,258

|

$

|

7,988

|

$

|

7,390

|

||||||||

|

December 31, 2023

|

Less than 12 Months

|

12 Months or More

|

Total

|

|||||||||||||||||||||

|

Securities Available for Sale

|

Fair

Value

|

Unrealized

Loss

|

Fair

Value

|

Unrealized

Loss

|

Fair

Value

|

Unrealized

Loss

|

||||||||||||||||||

|

U.S. Government securities

|

$ | 9,474 | $ | (52 | ) | $ | 40,823 | $ | (1,825 | ) | $ | 50,297 | $ | (1,877 | ) | |||||||||

|

U.S. Government sponsored entity securities

|

— | — | 5,877 | (650 | ) | 5,877 | (650 | ) | ||||||||||||||||

|

Agency mortgage-backed securities, residential

|

—

|

—

|

106,084

|

(12,134

|

)

|

106,084

|

(12,134

|

)

|

||||||||||||||||

|

Total available for sale

|

$

|

9,474

|

$

|

(52

|

)

|

$

|

152,784

|

$

|

(14,609

|

)

|

$

|

162,258

|

$

|

(14,661

|

)

|

|||||||||

|

December 31, 2022

|

Less than 12 Months

|

12 Months or More

|

Total

|

|||||||||||||||||||||

|

Securities Available for Sale

|

Fair

Value

|

Unrealized

Loss

|

Fair

Value

|

Unrealized

Loss

|

Fair

Value

|

Unrealized

Loss

|

||||||||||||||||||

|

U.S. Government securities

|

$ | 36,460 | $ | (977 | ) | $ | 18,332 | $ | (1,929 | ) | $ | 54,792 | $ | (2,906 | ) | |||||||||

|

U.S. Government sponsored entity securities

|

2,786 | (60 | ) | 5,197 | (802 | ) | 7,983 | (862 | ) | |||||||||||||||

|

Agency mortgage-backed securities, residential

|

71,510

|

(7,178

|

)

|

49,789

|

(7,805

|

)

|

121,299

|

(14,983

|

)

|

|||||||||||||||

|

Total available for sale

|

$

|

110,756

|

$

|

(8,215

|

)

|

$

|

73,318

|

$

|

(10,536

|

)

|

$

|

184,074

|

$

|

(18,751

|

)

|

|||||||||

|

Held to Maturity Debt Securities

|

2023

|

|||

|

Allowance for credit losses:

|

||||

|

Beginning balance

|

$

|

—

|

||

|

Impact of adopting ASC 326

|

3

|

|||

|

Provision for (recovery of) credit loss expense

|

(1

|

)

|

||

|

Allowance for credit losses ending balance

|

$

|

2

|

||

|

2023

|

2022

|

|||||||

|

Residential real estate

|

$

|

319,504

|

$

|

297,036

|

||||

|

Commercial real estate:

|

||||||||

|

Owner-occupied

|

82,356

|

72,719

|

||||||

|

Nonowner-occupied

|

178,201

|

182,831

|

||||||

|

Construction

|

62,337

|

33,205

|

||||||

|

Commercial and industrial

|

157,298

|

151,232

|

||||||

|

Consumer:

|

||||||||

|

Automobile

|

61,461

|

54,837

|

||||||

|

Home equity

|

35,893

|

27,791

|

||||||

|

Other

|

74,850

|

65,398

|

||||||

|

971,900

|

885,049

|

|||||||

|

Less: Allowance for credit losses

|

(8,767

|

)

|

(5,269

|

)

|

||||

|

Loans, net

|

$

|

963,133

|

$

|

879,780

|

||||

| December 31, 2023 |

Loans Past

Due

90 Days And

Still Accruing

|

Nonaccrual

Loans With

No ACL

|

Nonaccrual

Loans With

an ACL

|

Total

Nonaccrual

Loans

|

||||||||||||

|

Residential real estate

|

$

|

9

|

$ | — | $ | 1,234 |

$

|

1,234

|

||||||||

|

Commercial real estate:

|

||||||||||||||||

|

Owner-occupied

|

—

|

775 | — |

775

|

||||||||||||

|

Nonowner-occupied

|

—

|

— | 61 |

61

|

||||||||||||

|

Construction

|

—

|

— | 1 |

1

|

||||||||||||

|

Commercial and industrial

|

—

|

— | 48 |

48

|

||||||||||||

|

Consumer:

|

||||||||||||||||

|

Automobile

|

56

|

— | 78 |

78

|

||||||||||||

|

Home equity

|

—

|

— | 95 |

95

|

||||||||||||

|

Other

|

54

|

— | 100 |

100

|

||||||||||||

|

Total

|

$

|

119

|

$ | 775 | $ | 1,617 |

$

|

2,392

|

||||||||

| December 31, 2022 |

Loans Past

Due 90 Days

And Still

Accruing

|

Nonaccrual

|

||||||

|

Residential real estate

|

$

|

100

|

$

|

1,708

|

||||

|

Commercial real estate:

|

||||||||

|

Owner-occupied

|

—

|

938

|

||||||

|

Nonowner-occupied

|

—

|

70

|

||||||

|

Construction

|

—

|

75

|

||||||

|

Commercial and industrial

|

—

|

150

|

||||||

|

Consumer:

|

||||||||

|

Automobile

|

27

|

82

|

||||||

|

Home equity

|

—

|

151

|

||||||

|

Other

|

411

|

59

|

||||||

|

Total

|

$

|

538

|

$

|

3,233

|

||||

|

December 31, 2023

|

30-59

Days

Past Due

|

60-89

Days

Past Due

|

90 Days

Or More

Past Due

|

Total

Past Due

|

Loans Not

Past Due

|

Total

|

||||||||||||||||||

|

Residential real estate

|

$

|

2,705

|

$

|

368

|

$

|

481

|

$

|

3,554

|

$

|

315,950

|

$

|

319,504

|

||||||||||||

|

Commercial real estate:

|

||||||||||||||||||||||||

|

Owner-occupied

|

2,580

|

—

|

775

|

3,355

|

79,001

|

82,356

|

||||||||||||||||||

|

Nonowner-occupied

|

681

|

—

|

—

|

681

|

177,520

|

178,201

|

||||||||||||||||||

|

Construction

|

—

|

—

|

—

|

—

|

62,337

|

62,337

|

||||||||||||||||||

|

Commercial and industrial

|

3,338

|

—

|

48

|

3,386

|

153,912

|

157,298

|

||||||||||||||||||

|

Consumer:

|

||||||||||||||||||||||||

|

Automobile

|

782

|

210

|

117

|

1,109

|

60,352

|

61,461

|

||||||||||||||||||

|

Home equity

|

353

|

62

|

95

|

510

|

35,383

|

35,893

|

||||||||||||||||||

|

Other

|

658

|

121

|

148

|

927

|

73,923

|

74,850

|

||||||||||||||||||

|

Total

|

$

|

11,097

|

$

|

761

|

$

|

1,664

|

$

|

13,522

|

$

|

958,378

|

$

|

971,900

|

||||||||||||

|

December 31, 2022

|

30-59

Days

Past Due

|

60-89

Days

Past Due

|

90 Days

Or More

Past Due

|

Total

Past Due

|

Loans Not

Past Due

|

Total

|

||||||||||||||||||

|

Residential real estate

|

$

|

1,799

|

$

|

701

|

$

|

497

|

$

|

2,997

|

$

|

294,039

|

$

|

297,036

|

||||||||||||

|

Commercial real estate:

|

||||||||||||||||||||||||

|

Owner-occupied

|

97

|

—

|

938

|

1,035

|

71,684

|

72,719

|

||||||||||||||||||

|

Nonowner-occupied

|

626

|

5

|

—

|

631

|

182,200

|

182,831

|

||||||||||||||||||

|

Construction

|

40

|

45

|

17

|

102

|

33,103

|

33,205

|

||||||||||||||||||

|

Commercial and industrial

|

21

|

—

|

150

|

171

|

151,061

|

151,232

|

||||||||||||||||||

|

Consumer:

|

||||||||||||||||||||||||

|

Automobile

|

804

|

240

|

97

|

1,141

|

53,696

|

54,837

|

||||||||||||||||||

|

Home equity

|

204

|

—

|

151

|

355

|

27,436

|

27,791

|

||||||||||||||||||

|

Other

|

875

|

113

|

452

|

1,440

|

63,958

|

65,398

|

||||||||||||||||||

|

Total

|

$

|

4,466

|

$

|

1,104

|

$

|

2,302

|

$

|

7,872

|

$

|

877,177

|

$

|

885,049

|

||||||||||||

|

Term Loans Amortized Cost Basis by Origination Year

|

||||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Commercial real estate:

|

||||||||||||||||||||||||||||||||

|

Owner-occupied

|

||||||||||||||||||||||||||||||||

|

Risk Rating

|

||||||||||||||||||||||||||||||||

|

Pass

|

$

|

18,120

|

$

|

7,911

|

$

|

10,679

|

$

|

5,973

|

$

|

6,125

|

$

|

15,925

|

$

|

459

|

$

|

65,192

|

||||||||||||||||

|

Special Mention

|

—

|

—

|

—

|

—

|

— |

427

|

—

|

427

|

||||||||||||||||||||||||

|

Substandard

|

—

|

— |

13,934

|

—

|

498

|

2,005

|

300

|

16,737

|

||||||||||||||||||||||||

|

Doubtful

|

—

|

—

|

—

|

—

|

—

|

—

|

— |

—

|

||||||||||||||||||||||||

|

Total

|

$

|

18,120

|

$

|

7,911

|

$

|

24,613

|

$

|

5,973

|

$

|

6,623

|

$

|

18,357

|

$

|

759

|

$

|

82,356

|

||||||||||||||||

|

Current Period gross charge-offs

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

||||||||||||||||

|

Term Loans Amortized Cost Basis by Origination Year

|

|

|||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Commercial real estate:

|

||||||||||||||||||||||||||||||||

|

Nonowner occupied

|

||||||||||||||||||||||||||||||||

|

Risk Rating

|

||||||||||||||||||||||||||||||||

|

Pass

|

$

|

12,688

|

$

|

29,344

|

$

|

32,235

|

$

|

20,484

|

$

|

15,415

|

$

|

61,809

|

$

|

1,128

|

$

|

173,103

|

||||||||||||||||

|

Special Mention

|

—

|

—

|

768

|

3,226

|

—

|

1,034

|

—

|

5,028

|

||||||||||||||||||||||||

|

Substandard

|

—

|

— |

70

|

— |

—

|

— |

—

|

70

|

||||||||||||||||||||||||

|

Doubtful

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

— | ||||||||||||||||||||||||

|

Total

|

$

|

12,688

|

$

|

29,344

|

$

|

33,073

|

$

|

23,710

|

$

|

15,415

|

$

|

62,843

|

$

|

1,128

|

$

|

178,201

|

||||||||||||||||

|

Current Period gross charge-offs

|

$

|

— |

$

|

— |

$

|

132

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

— |

$

|

132

|

||||||||||||||||

|

Term Loans Amortized Cost Basis by Origination Year

|

|

|||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Commercial real estate:

|

||||||||||||||||||||||||||||||||

|

Construction

|

||||||||||||||||||||||||||||||||

|

Risk Rating

|

||||||||||||||||||||||||||||||||

|

Pass

|

$

|

28,055

|

$

|

29,174

|

$

|

1,231

|

$

|

302

|

$

|

392

|

$

|

2,937

|

$

|

— |

$

|

62,091

|

||||||||||||||||

|

Special Mention

|

—

|

—

|

— |

—

|

—

|

—

|

—

|

—

|

||||||||||||||||||||||||

|

Substandard

|

—

|

— |

—

|

—

|

—

|

246

|

— |

246

|

||||||||||||||||||||||||

|

Doubtful

|

—

|

—

|

— |

—

|

—

|

—

|

— |

—

|

||||||||||||||||||||||||

|

Total

|

$

|

28,055

|

$

|

29,174

|

$

|

1,231

|

$

|

302

|

$

|

392

|

$

|

3,183

|

$

|

—

|

$

|

62,337

|

||||||||||||||||

|

Current Period gross charge-offs

|

$

|

— |

$

|

— |

$

|

—

|

$

|

—

|

$

|

— |

$

|

—

|

$

|

—

|

$

|

— | ||||||||||||||||

|

Term Loans Amortized Cost Basis by Origination Year

|

||||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Commercial and Industrial

|

||||||||||||||||||||||||||||||||

|

Risk Rating

|

||||||||||||||||||||||||||||||||

|

Pass

|

$

|

8,770

|

$

|

30,885

|

$

|

26,806

|

$

|

31,247

|

$

|

344

|

$

|

27,632

|

$

|

27,510

|

$

|

153,194

|

||||||||||||||||

|

Special Mention

|

140

|

—

|

—

|

— | — |

8

|

66

|

214

|

||||||||||||||||||||||||

|

Substandard

|

—

|

— |

58

|

1,363

|

4

|

182

|

2,283

|

3,890

|

||||||||||||||||||||||||

|

Doubtful

|

—

|

—

|

—

|

—

|

—

|

— |

—

|

—

|

||||||||||||||||||||||||

|

Total

|

$

|

8,910

|

$

|

30,885

|

$

|

26,864

|

$

|

32,610

|

$

|

348

|

$

|

27,822

|

$

|

29,859

|

$

|

157,298

|

||||||||||||||||

|

Current Period gross charge-offs

|

$

|

— |

$

|

—

|

$

|

— |

$

|

—

|

$

|

— |

$

|

—

|

$

|

29

|

$

|

29

|

||||||||||||||||

|

December 31, 2022

|

Pass

|

Criticized

|

Classified

|

Total

|

||||||||||||

|

Commercial real estate:

|

||||||||||||||||

|

Owner-occupied

|

$

|

68,236

|

$

|

3,545

|

$

|

938

|

$

|

72,719

|

||||||||

|

Nonowner-occupied

|

177,479

|

5,352

|

—

|

182,831

|

||||||||||||

|

Construction

|

33,143

|

—

|

62

|

33,205

|

||||||||||||

|

Commercial and industrial

|

147,627

|

1,879

|

1,726

|

151,232

|

||||||||||||

|

Total

|

$

|

426,485

|

$

|

10,776

|

$

|

2,726

|

$

|

439,987

|

||||||||

|

Term Loans Amortized Cost Basis by Origination Year

|

||||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Residential Real Estate:

|

||||||||||||||||||||||||||||||||

|

Payment Performance

|

||||||||||||||||||||||||||||||||

|

Performing

|

$

|

50,484

|

$

|

44,640

|

$

|

50,949

|

$

|

44,818

|

$

|

21,854

|

$

|

91,956

|

$

|

13,560

|

$

|

318,261

|

||||||||||||||||

|

Nonperforming

|

—

|

—

|

— |

—

|

182

|

1,061

|

—

|

1,243

|

||||||||||||||||||||||||

|

Total

|

$

|

50,484

|

$

|

44,640

|

$

|

50,949

|

$

|

44,818

|

$

|

22,036

|

$

|

93,017

|

$

|

13,560

|

$

|

319,504

|

||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

Current Period gross charge-offs

|

$ | — |

$

|

—

|

$

|

3

|

$

|

—

|

$ | — |

$

|

118

|

$

|

—

|

$

|

121

|

||||||||||||||||

|

Term Loans Amortized Cost Basis by Origination Year

|

|

|||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Consumer:

|

||||||||||||||||||||||||||||||||

|

Automobile

|

||||||||||||||||||||||||||||||||

|

Payment Performance

|

||||||||||||||||||||||||||||||||

|

Performing

|

$

|

28,939

|

$

|

20,376

|

$

|

7,013

|

$

|

3,028

|

$

|

1,212

|

$

|

759

|

$ | — |

$

|

61,327

|

||||||||||||||||

|

Nonperforming

|

34

|

60

|

15

|

1

|

9

|

15

|

—

|

134

|

||||||||||||||||||||||||

|

Total

|

$

|

28,973

|

$

|

20,436

|

$

|

7,028

|

$

|

3,029

|

$

|

1,221

|

$

|

774

|

$

|

—

|

$

|

61,461

|

||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

Current Period gross charge-offs

|

$

|

51

|

$

|

163

|

$

|

116

|

$

|

6

|

$

|

29

|

$

|

3

|

$

|

—

|

$

|

368

|

||||||||||||||||

|

|

Term Loans Amortized Cost Basis by Origination Year

|

|

||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Consumer:

|

||||||||||||||||||||||||||||||||

|

Home Equity

|

||||||||||||||||||||||||||||||||

|

Payment Performance

|

||||||||||||||||||||||||||||||||

|

Performing

|

$

|

1,649

|

$

|

79

|

$ | — |

$

|

—

|

$

|

—

|

$

|

—

|

$

|

34,070

|

$

|

35,798

|

||||||||||||||||

|

Nonperforming

|

—

|

—

|

—

|

—

|

—

|

—

|

95

|

95

|

||||||||||||||||||||||||

|

Total

|

$

|

1,649

|

$

|

79

|

$

|

—

|

$

|

—

|

$

|

—

|

$ | — |

$

|

34,165

|

$

|

35,893

|

||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

Current Period gross charge-offs

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

$ | — |

$

|

87

|

$

|

87

|

||||||||||||||||

|

Term Loans Amortized Cost Basis by Origination Year

|

|

|||||||||||||||||||||||||||||||

|

December 31, 2023

|

2023

|

2022

|

2021

|

2020

|

2019

|

Prior

|

Revolving

Loans

Amortized

Cost Basis

|

Total

|

||||||||||||||||||||||||

|

Consumer:

|

||||||||||||||||||||||||||||||||

|

Other

|

||||||||||||||||||||||||||||||||

|

Payment Performance

|

||||||||||||||||||||||||||||||||

|

Performing

|

$

|

18,377

|

$

|

24,904

|

$

|

10,800

|

$

|

4,482

|

$

|

1,093

|

$

|

953

|

$

|

14,087

|

$

|

74,696

|

||||||||||||||||

|

Nonperforming

|

11

|

17

|

67

|

53

|

1

|

4

|

1

|

154

|

||||||||||||||||||||||||

|

Total

|

$

|

18,388

|

$

|

24,921

|

$

|

10,867

|

$

|

4,535

|

$

|

1,094

|

$

|

957

|

$

|

14,088

|

$

|

74,850

|

||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

Current Period gross charge-offs

|

$

|

306

|

$

|

119

|

$

|

119

|

$

|

84

|

$

|

28

|

$

|

53

|

$

|

246

|

$

|

955

|

||||||||||||||||

|

Consumer

|

||||||||||||||||||||

|

December 31, 2022

|

Automobile

|

Home Equity

|

Other

|

Residential

Real Estate

|

Total

|

|||||||||||||||

|

Performing

|

$

|

54,728

|

$

|

27,640

|

$

|

64,928

|

$

|

295,228

|

$

|

442,524

|

||||||||||

|

Nonperforming

|

109

|

151

|

470

|

1,808

|

2,538

|

|||||||||||||||

|

Total

|

$

|

54,837

|

$

|

27,791

|

$

|

65,398

|

$

|

297,036

|

$

|

445,062

|

||||||||||

|

December 31, 2023

|

Residential

Real Estate

|

Commercial

Real Estate

|

Commercial

& Industrial

|

Consumer

|

Total

|

|||||||||||||||

|

Allowance for credit losses:

|

||||||||||||||||||||

|

Beginning balance

|

$

|

681

|

$

|

2,038

|

$

|

1,293

|

$

|

1,257