|

☒ Form 20-F

|

☐ Form 40-F

|

|

Integrated Annual Report for Atlantica Sustainable Infrastructure plc for the year ended December 31, 2023 that has been made available to the shareholders on March 4, 2024

|

|

ATLANTICA SUSTAINABLE INFRASTRUCTURE PLC

|

||

|

By:

|

/s/Santiago Seage

|

|

|

Name:

|

Santiago Seage

|

|

|

Title:

|

Chief Executive Officer

|

|

|

Date:

|

March 14, 2024

|

|

Exhibit 99.1

| Content |

| Atlantica in Two Minutes | 3 |

| Our Purpose and Values | 5 |

| About This Report | 6 |

| Strategic Report | 11 |

| Our Sustainable Business Model and Strategy | 12 |

| Events During the Period | 20 |

| Key Performance Indicators | 30 |

| A Fair Review of the Business | 33 |

| Financial Review | 38 |

| Principal Risks and Uncertainties | 56 |

| ESG Materiality Analysis | 74 |

| Environmental Sustainability | 80 |

| Social Sustainability | 117 |

| Asset Management | 150 |

| Innovation Management | 154 |

| Cybersecurity and Data Privacy | 155 |

| Tax Management | 158 |

| Section 172 Statement | 160 |

| Going Concern Basis | 165 |

| Governance | 167 |

| Business Ethics |

167 |

| Sustainability Governance | 174 |

| Directors’ Report | 178 |

| Audit Committee Report | 198 |

| Directors’ Remuneration Report | 204 |

| Directors’ Responsibilities Statement | 230 |

| Shareholder Engagement | 232 |

| Other Information | 233 |

| Asset Portfolio | 234 |

| Definitions | 236 |

| Reconciliations | 242 |

| Global Reporting Initiative (GRI) Content Index | 244 |

| Sustainability Accounting Standards Board (SASB) Index | 253 |

| Environmental, Social and Other Key Performance Indicators | 257 |

| Independent Auditor’s Report | 270 |

| Consolidated Financial Statements | 280 |

| Company Financial Statements | 366 |

Atlantica in Two Minutes

| Our Business |

| 2023 Selected Financial and Operational Metrics |

|

Revenue

$1,100 Million |

Adjusted EBITDA

$795 Million |

Cash available for Distribution

$236 Million |

|

Operating Profit

$342 Million |

Dividends Paid per Share

$1.78 |

Renewable Energy

5,458 GWh Produced |

|

Total Assets as of December 31, 2023 $8.7 bn |

Renewable Generation Pipeline Growth ▲12% vs. 2022 |

|

1 100% Contracted or regulated. Regulated revenues in Spain, Chile TL 3 and Italy and non-contracted nor regulated in the case of Chile PV 1 and Chile PV 3.

2 Based on CAFD estimates for the 2024-2027 period as of March 1, 2024, for the assets as of December 31, 2023, including assets that have reached COD before March 1, 2023.

3 We refer to section “Strategic Report” for further detail regarding the pipeline description.

| Our Values |

|

Integrity, Compliance and Safety Value Creation Sustainability |

Excellence and Efficiency Collaborative Environment

|

| Enabling the Energy Transition |

|

Science Based Targets initiative (SBTi) approved target: Reduce Scope 1 and 2 GHG emissions per kWh of energy generated by 70% by 2035 from a 2020 base year |

|

Other Targets

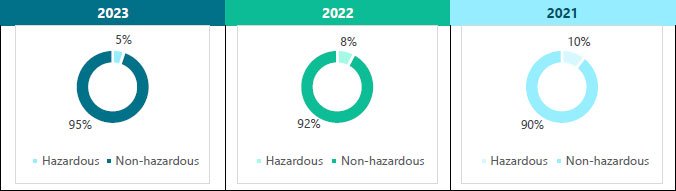

ü Reduce Scope 3 GHG emissions per kWh of energy generated by 70% by 2035 from a 2020 base year ü Achieve Net Zero GHG emissions by 2040 ü Reduce non-GHG emissions per kWh of energy generated by 50% by 2035 from a 2020 ü Reduce our water consumption per kWh of energy generated by 50% by 2035 from a 2020 base year ü Reduce our hazardous and non-hazardous waste4 per unit of energy generated by 30% and 40%, respectively, by 2035 from a 2023 base year. |

| Key KPIS | |||

| EU Taxonomy assessment: 97% of CapEx invested in sustainable activities according to EU Taxonomy. |

GHG Emissions Avoided 7.0 million tons of CO2e |

GHG Emissions Offset 380 thousand tons of CO2e ▲ 23% vs 2021 |

Scope 1&2 emission rate per unit of energy generated 162 tons of gCO2/kWh Improved 9% vs 2021 |

| 2023 Selected Social Metrics |

|

Health and Safety: LTFI5 and TRFI4 below sector average

ü LTFI and TRFI Decreased vs. 2022

|

Training hours per employee

33 as of Dec. 2023 |

Local Communities

$1.5 million invested |

4 The target does not include the waste generated during end-of-life decommissioning of the assets.

5 We refer to section “Occupational Health and Safety” for further detail.

Our Purpose and Values

| Our Purpose |

Our purpose is to support the transition towards a more sustainable world by developing, building, investing in and managing sustainable infrastructure assets, while creating long-term value for our stakeholders.

| Our Values |

Our values define who we are and how we behave both as individuals and as a Company. These values, described below in order of importance, serve as a compass for our day-to-day decisions and guide our relationships with stakeholders.

|

Integrity, Compliance and Safety. We will always do what is right. We are strongly committed to complying with all rules and regulations. |

|

Value creation. We pursue a proactive approach to creating long-term value for our shareholders. Our core corporate policies are supported by a solid commitment to risk management that guides all our decisions. |

|

Sustainability. We invest in assets that are environmentally sustainable and we manage them in a sustainable manner. We follow policies that analyse, evaluate, and propose measures aimed at minimising the environmental impacts of our business activity. |

|

Excellence and Efficiency. We believe in outstanding and disciplined asset management of our operations to be the best-in-class operator, while seeking excellence on a cost-efficient basis. |

|

Collaborative Environment. Respect and Teamwork are key to achieving our goals. We treat others as we would like to be treated ourselves and we put the team ahead of personal success. To build strong teams, we recruit, train, and promote the best people. |

About This Report

Atlantica Sustainable Infrastructure plc and its subsidiaries (“Atlantica” or “the Company”), as part of its commitment to transparency and reporting best practices, has published an Integrated Annual Report, which integrates our financial and non-financial information, including environment, social and governance (ESG) disclosures.

Integrated Annual Report Information

Atlantica’s Integrated Annual Report has been prepared in accordance with the relevant U.K. requirements for the year ended December 31, 2023.

The Consolidated Financial Statements contained in this Report have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IASB”) and UK adopted International Accounting Standards (collectively as “IFRS”), on a basis consistent with the prior year. The Parent Company Financial Statements have been prepared in conformity with Financial Reporting Standard 101 “Reduced Disclosure Framework (“FRS 101”)”. We refer to Note 2 to the Consolidated Financial Statements, and Note 1 to the Parent Company Financial Statements for accounting policies detailed information.

In addition, this report has been prepared by Management in accordance with the Global Reporting Initiative (GRI) Standards. We report GRI in line with the matters that are important and / or material to our business.

This report has also been prepared by Management in accordance with the SASB Electric Utilities & Power Generators sustainability accounting standard and its reporting requirements. In addition, we have followed SASB Solar Technology & Project Developers sustainability accounting standards and its reporting requirements for aspects which are material to our business.

Data in this report for the year ended and as of December 31, 2023, except where otherwise noted. Comparative data for the years ended December 31, 2022, and 2021 is also provided. Our 2022, 2021 and 2020 Integrated Annual Report, U.K. Annual Reports and ESG Reports are available for download from our website.

ESG data reported corresponds to all consolidated subsidiaries. For Companies where Atlantica has joint financial control, we are consolidating the percentage of equity ownership for each of the ESG KPIs reported. Green House Gas emissions are accounted for following the financial control approach from the GHG Protocol. Emissions from joint ventures where partners have joint financial control are accounted for based on the equity share approach. We are accounting for proportional scope 1 and scope 2 emissions of equity investments in scope 3, category 15 (Investments).

A multi-disciplinary team participated in the preparation of this report.

Currency amounts are expressed in U.S. Dollars unless otherwise noted.

ESG Data Review

Atlantica’s management is responsible for the completeness, accuracy and validity of the information contained in this report. The data presented is based on the input received from internal data collection, management systems and external stakeholders. Certain parts of this report have been subject to external and/or internal assurance. We conduct regular internal audits to review our management system, including the procedures to collect information from our assets and the main data reported.

In 2023, independent third parties have been engaged to verify our reported Scope 1, 2 and 3 GHG emissions under a reasonable level of assurance.

DNV, an independent expert in assurance and risk management, verifies all our reported Scope 1, 2 and 3 GHG emissions in all the geographies where we are present. In addition, we also hired:

| - | ANCE, a leading certification association across industries in Mexico, to verify Scope 1 and 2 greenhouse emissions in that geography, |

| - | AENOR, a not-for-profit entity that fosters standardisation and certification across industrial and service sectors in Spain, to review our Scope 1 stationary GHG emissions in that geography. |

In addition, DNV has also been engaged to verify Atlantica’s air quality (i.e., non-GHG emissions), waste and water indicators and their compliance with GRI Reporting under a limited level of assurance.

In addition, in 2023 Atlantica’s Internal Audit team reviewed the completeness and accuracy of certain environmental, social and governance performance indicators, including GHG emissions, water and waste management, health and safety, energy consumption, supply chain, people and culture and investment in local communities.

Furthermore, Atlantica’s Accounting and Disclosure Committee reviewed this Integrated Annual Report prior to its publication.

Atlantica’s Board of Directors approved this report prior to its publication.

Non-GAAP Financial Measures:

This report contains non-GAAP financial measures including Adjusted EBITDA, CAFD and CAFD per share.

Non-GAAP financial measures are not measurements of our performance or liquidity under IFRS and should not be considered alternatives to operating profit or profit for the period or any other performance measures derived in accordance with IFRS or any other generally accepted accounting principles or as alternatives to cash flow from operating, investing or financing activities. Please refer to the section “Other Information- Reconciliation of non-GAAP measures” of this report for a reconciliation of the non-GAAP financial measures included in this Report to the most directly comparable financial measures prepared in accordance with IFRS. Also, please refer to the following paragraphs in this section for an explanation of the reasons why management believes the use of non-GAAP financial measures (including CAFD, CAFD per share and Adjusted EBITDA) in this Report provides useful information to investors.

We present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. The non-GAAP financial measures may not be comparable to other similarly titled measures employed by other companies and they may have limitations as analytical tools. These measures may not be fit for isolated consideration or as a substitute for analysis of our operating results as reported under IFRS as issued by the IASB. Non-GAAP financial measures and ratios are not measurements of our performance or liquidity under IFRS as issued by the IASB. Thus, they should not be considered as alternatives to operating profit, profit for the period, any other performance measures derived in accordance with IFRS as issued by the IASB, any other generally accepted accounting principles or as alternatives to cash flow from operating, investing or financing activities. Some of the limitations of these non-GAAP measures are:

Some of the limitations of these non-GAAP measures are:

| • | they do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | they do not reflect changes in, or cash requirements for, our working capital needs; |

| • | they may not reflect the significant interest expense, or the cash requirements necessary, to service interest or principal payments, on our debts; |

| • | although depreciation and amortisation are non-cash charges, the assets being depreciated and amortised will often need to be replaced in the future and Adjusted EBITDA, CAFD and CAFD per share do not reflect any cash requirements that would be required for such replacements; and |

| • | the fact that other companies in our industry may calculate Adjusted EBITDA, CAFD and CAFD per share differently than we do, which limits their usefulness as comparative measures. |

We define Adjusted EBITDA as profit/(loss) for the period attributable to the parent company, after adding back loss/(profit) attributable to noncontrolling interest, income tax expense, financial expense (net), depreciation, amortisation and impairment charges of entities included in our Annual Consolidated Financial Statements and depreciation and amortisation, financial expense and income tax expense of unconsolidated affiliates (pro-rata of our equity ownership). CAFD is calculated as cash distributions received by the Company from its subsidiaries minus cash expenses of the Company, including third-party debt service and general and administrative expenses and including proceeds from the sale of assets. CAFD per share is calculated as CAFD divided by the weighted average number of outstanding ordinary shares of the Company during the period.

Our management believes Adjusted EBITDA, CAFD and CAFD per share are useful to investors and other users of our financial statements in evaluating our operating performance because such measures provide investors with additional tools to compare business performance across companies and across periods. Adjusted EBITDA is widely used by investors to measure a company’s operating performance without regard to items such as interest expense, taxes, depreciation and amortisation, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which assets were acquired. Our management believes CAFD and CAFD per share are relevant supplemental measure of the Company’s ability to earn and distribute cash returns to investors and is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of our ability to make quarterly distributions. In addition, CAFD and CAFD per share are used by our management team for determining future acquisitions and managing our growth. Our management uses Adjusted EBITDA, CAFD and CAFD per share as measures of operating performance to assist in comparing performance from period to period and aims to use them on a consistent basis moving forward. They also readily view operating trends as a measure for planning and forecasting overall expectations, for evaluating actual results against such expectations, and for communicating with our board of directors, shareholders, creditors, analysts and investors concerning our financial performance. Adjusted EBITDA, CAFD and CAFD per share are widely used by other companies in the same industry.

Information presented as the pro rata share of our unconsolidated affiliates reflects our proportionate ownership of each asset in our portfolio that we do not consolidate and has been calculated by multiplying our unconsolidated affiliates’ financial statement line items by the Company’s percentage ownership thereto. Note 7 to the Annual Consolidated Financial Statements includes a description of our unconsolidated affiliates and our pro rata share thereof. We do not control the unconsolidated affiliates. Multiplying our unconsolidated affiliates’ financial statement line items by the Company’s percentage ownership may not accurately represent the legal and economic implications of holding a non-controlling interest in an unconsolidated affiliate. We include depreciation and amortisation, financial expense and income tax expense of unconsolidated affiliates (pro rata of our equity ownership) because we believe it assists investors in estimating the effect of such items in the profit/(loss) of entities carried under the equity method (which is included in the calculation of our Adjusted EBITDA) based on our economic interest in such unconsolidated affiliates. Each unconsolidated affiliate may report a specific line item in its financial statements in a different manner. In addition, other companies in our industry may calculate their proportionate interest in unconsolidated affiliates differently than we do, limiting the usefulness of such information as a comparative measure. Because of these limitations, the information presented as the pro rata share of our unconsolidated affiliates should not be considered in isolation or as a substitute for our or such unconsolidated affiliates’ financial statements as reported under applicable accounting principles. Please refer to “Other Information” section for additional information regarding reconciliations from non-GAAP measures.

| Strategic Report |

Strategic Report

This Strategic Report has been prepared to provide shareholders with information that will aid them in assessing Atlantica’s strategies and the potential of such strategies to succeed.

The Strategic Report contains certain forward-looking statements that are made by the directors in good faith and based on the information available to them up to the time of their approval of this report. These statements should be treated with caution due to the uncertainties, including both economic and business risk factors, inherent in such forward-looking information.

The directors have prepared this Strategic Report in compliance with Section 414C of the Companies Act 2006.

The Strategic Report discusses the following areas:

| - | Our sustainable business model and strategy. |

| - | Events during the period. |

| - | United Nations Global Compact (UNGC). |

| - | Key performance indicators. |

| - | A fair review of the business. |

| - | Principal risks and uncertainties. |

| - | Environment sustainability. |

| - | Social sustainability. |

| - | Asset management |

| - | Cybersecurity and data privacy. |

| - | Innovation management. |

| - | Tax management. |

| - | Section 172 statement. |

| - | Non-Financial and Sustainability Information Statement. |

| - | Going concern basis. |

Our Sustainable Business Model and Strategy

Our Business

We are a sustainable infrastructure company with a majority of our business in renewable energy assets. Our purpose is to support the transition towards a more sustainable world by developing, building, investing and managing sustainable infrastructure assets, while creating long-term value for our investors and the rest of our stakeholders. In 2023, renewables represented 73% of our revenue, with solar energy representing 63%. We complement our renewable assets portfolio with storage, efficient natural gas and transmission infrastructure assets, as enablers of the transition towards a clean energy mix. We also hold water assets, a relevant sector for sustainable development.

As of the date of this annual report, we own or have an interest in a portfolio of assets and new projects under development diversified in terms of business sector and geographic footprint. Our portfolio consists of 45 assets with 2,171 MW of aggregate renewable energy installed generation capacity (of which approximately 73% is solar), 343 MW of efficient natural gas-fired power generation capacity, 55 MWt of district heating capacity, 1,229 miles of electric transmission lines and 17.5 M ft3 per day of water desalination.

We currently own and manage operating facilities and projects under development in North America (United States, Canada and Mexico), South America (Peru, Chile, Colombia and Uruguay) and EMEA (Spain, Italy, Algeria and South Africa). Our assets generally have contracted or regulated revenue. As of December 31, 2023, our assets had a weighted average remaining contract life of approximately 13 years6.

We intend to grow our business through the development and construction of projects including expansion and repowering opportunities, as well as greenfield developments, third-party acquisitions, and the optimisation of our existing portfolio. We currently have a pipeline of assets under development of approximately 2.2 GW of renewable energy and 6.0 GWh of storage. Approximately 47% of the projects are PV, 41% storage, 11% wind and 1% other projects, while 22% are expected to reach ready-to-build (“RTB”) in 2024-2025, 28% are in an advanced development stage and 50% are in early stage. Also, 20% are expansion or repowering opportunities of existing assets and 80% greenfield developments.

Our objective is to pay a consistent and growing cash dividend to shareholders that is sustainable on a long-term basis. We expect to distribute a significant percentage of our cash available for distribution as cash dividends and we will seek to increase such cash dividends over time through organic growth, investments in new assets and acquisitions.

Our plan for executing this strategy includes the following key components:

Grow our business by developing new projects and investing in new assets with a focus on renewable energy and storage.

We intend to develop new assets and, in some cases, to invest in assets under development or construction. We believe that our know-how and operating expertise in our key markets together with a critical mass of assets in several geographic areas as well as our access to capital will assist us in achieving our growth plans.

Focus on stable assets in renewable energy, storage and transmission, generally contracted or regulated.

We intend to focus on owning and operating stable, sustainable infrastructure assets, with long useful lives, generally contracted, for which we believe we have extensive experience and proven systems and management processes, as well as the critical mass to benefit from operating efficiencies and scale. We intend to maintain a diversified portfolio with a large majority of our Adjusted EBITDA generated from low-carbon footprint assets, as we believe these sectors will see significant growth in our targeted geographies.

Maintain diversification across our business sectors and geographies.

Our focus on three core geographies, North America, Europe and South America, helps to ensure exposure to markets in which we believe renewable energy, storage and transmission will continue to grow significantly. We believe that our diversification by business sector and geography limits risks, reinforces stability and provides us with better growth opportunities.

Grow our business through the optimisation of the existing portfolio and through investments in the expansion of our current assets.

We intend to grow our business through organic growth that we expect to deliver through the optimisation of the existing portfolio, price escalation factors in many of our assets as well as through investments in the expansion and repowering of our current assets and hybridisation of existing assets with other complementary technologies including storage, particularly in our renewable energy assets and transmission lines.

6 Calculated as weighted average years remaining as of December 31, 2023 based on CAFD estimates for the 2024-2027 period, including assets that have reached COD before March 1, 2024.

Maintain a low-risk approach.

We intend to maintain a portfolio of sustainable infrastructure assets, generally totally or partially contracted, with a low-risk profile for a significant part of our revenue. We generally seek to invest in assets with proven technologies in which we generally have significant experience, located in countries where we believe conditions to be stable and safe. We may complement our portfolio with investments or co-investments in assets with shorter contracts or with partially contracted or merchant revenue or in assets with revenue in currencies other than the U.S. dollar or euro. We have a set of policies and a risk management system in place which define thorough risk management processes.

Maintain a prudent financial policy and financial flexibility.

Non-recourse project debt is an important principle for us. We intend to continue financing our assets with project debt progressively amortised using the cash flows from each asset and where lenders do not have recourse to the holding company assets. The majority of our consolidated debt is project debt.

In addition, we hedge a significant portion of our interest rate risk exposure. We estimate that as of December 31, 2023, approximately 93% of our total interest risk exposure was fixed or hedged, generally for the long-term. We also limit our foreign exchange exposure. We intend to ensure that at least 80% of our cash available for distribution is always in U.S. dollars and euros. Furthermore, we hedge net distributions in euros for the upcoming 24 months on a rolling basis.

We also intend to maintain a solid financial position through a combination of cash on hand

and undrawn credit facilities. In order to maintain financial flexibility, we use diversified sources of financing in our project and corporate debt including banks, capital markets and private investor financing. In recent years we have been active

in green financing initiatives, improving our access to new debt investors.

Our Competitive Strengths

We believe that we are well-positioned to execute our business strategies thanks to the following competitive strengths:

Stable and predictable long-term cash flows.

We believe that our portfolio of sustainable infrastructure has a stable cash flow profile. We estimate that the off-take agreements or regulation in place at our assets have a weighted average remaining term of approximately 137 years as of December 31, 2023, providing long-term cash flow visibility. In 2023, approximately 54% of our revenue was non-dependent on natural resource, not subject to the volatility that natural resource may have, especially solar and wind resources. This includes our transmission lines, our efficient natural gas plant, our water assets and approximately 76% of the revenue received from our solar assets in Spain with most of their revenues based on capacity in accordance with the regulation in place. In these assets, our revenue is not subject to (or has low dependence on) solar, wind or geothermal resources, which translates into a more stable cash-flow generation. Going forward, our new investments will probably be more dependent on the natural resource. Additionally, our facilities have minimal or no fuel risk.

Our diversification by geography and business sector also strengthens the stability of our cash flow generation. We expect our well-diversified asset portfolio, in terms of business sector and geography to maintain cash flow stability.

Positioned in business sectors with high growth prospects.

The renewable energy industry has grown significantly in recent years and it is expected to continue to grow in the coming decades. According to Bloomberg New Energy Finance (BNEF), the next three decades will require between $46 trillion and $131 trillion of investment which translates into an annual range of $1.5-$4.4 trillion. BNEF projects an annual investment of $1.2-$3.9 trillion in low-carbon energy sources, including renewables, surpassing the $1 trillion invested in 20228. Furthermore, clean energy is on track to set new records. Global installation of wind, solar and storage is expected to exceed 680 GW in 2024, up 22% from 2023. Solar is anticipated to lead the way in 2024 with over 500 GW expected to be installed; which will likely make it the largest source of new capacity and new generation worldwide. Onshore wind follows as the second-highest, with close to 100 GW projected to be installed in 2024, followed by storage capacity, of which around 50 GW is expected to be installed9.

The significant increase expected in the renewable energy space over the coming decades also requires significant new investments in electric transmission and distribution lines for power supply, as well as storage and natural gas generation for dispatchability, with each becoming key elements to support additional wind and solar energy generation. We believe that we are well positioned in sectors with solid growth expectations.

We also believe that our diversified exposure to international markets will allow us to pursue improved growth opportunities and achieve higher returns than we would have if we had a narrower geographic or technological focus. If certain geographies and business sectors become more competitive for investments in the future, we believe we can continue to execute on our growth strategy by having the flexibility to invest in other regions or in other business sectors.

7 Calculated as weighted average years remaining as of December 31, 2023 based on CAFD estimates for the 2024-2027 period, including assets that have reached COD before March 1, 2024.

8 BNEF Theme: Energy Investment and Climate Scenarios.

9 Where Energy Markets and Climate Policy Are Headed in 2024: BNEF.

Well positioned to capture growth opportunities.

We have in-house development capabilities and partnerships with third parties to co-develop new projects. Our development asset identification is supported by rigorous analysis and deeply rooted industry knowledge and experience. In addition, we follow a disciplined approach to make capital allocation decisions and we have strict minimum required returns for development projects and acquisitions that we update frequently. In addition, our current portfolio of assets offers growth opportunities through the expansion and repowering of existing assets and through hybridisation of existing assets with other complementary technologies. We can also grow by adding storage to our existing renewable assets or by developing standalone storage close to our existing assets.

Proven capabilities in operation and maintenance.

We perform operation and maintenance in-house in a majority of our assets. We believe this approach allows us to have full control of our assets and to optimise their performance. We can benefit from synergies in shared resources and centralised purchasing management, among other advantages. Our corporate operations departments have a plan to periodically review all our assets in detail to identify best practices and improvement actions which are then implemented across the portfolio.

Solid financing expertise.

Our Finance team has extensive experience in project financing and project refinancing in our different geographies. In our corporate financing, we have access to different pools of capital. We have issued bonds in the public markets, including convertibles, private placements with different types of investors, bank financing and commercial paper. Since a portion of the assets have revenues denominated in euros, we can issue corporate financings in euros, to take advantage of lower costs.

Lean corporate structure focused on value added activities.

We operate a lean and efficient organisation where corporate functions support each operating asset. Our core corporate policies are supported by a solid commitment to risk management that guides all our decisions. We believe that our internal management system ensures a nimble decision-making process while ensuring compliance with our policies and risk management system.

Well positioned in ESG.

In 2023, 72% of our Adjusted EBITDA was derived from renewable energy and 62% of our Adjusted EBITDA corresponded to solar energy production. Adjusted EBITDA from low carbon footprint assets represented 89%, including renewable energy, transmission infrastructure, as well as water assets. We have set a target to maintain over 85% of our Adjusted EBITDA generated from low-carbon footprint assets.

We have set a target to reduce our scope 1 and scope 2 GHG emissions per unit of energy generated10 by 70% by 2035, with 2020 as base year. This target was validated in 2021 by the Science Based Targets initiative. We have also set a target to reduce our scope 3 emissions per unit of energy generated by 70% by 2035 from a 2020 base year. With this, we target to achieve net zero GHG emissions by 2040. Additionally, we have also set targets to reduce non-GHG emissions per unit of energy generated and to reduce our water consumption per unit of energy generated.

In 2023, our key health and safety indicators met annual targets and remained below the sector average in all our geographies. Health and Safety is our number one priority, and we want our employees, partners, and contractors to apply the highest standards to ensure safe and sustainable operations.

10 Including thermal generation.

Regarding our local communities, we acknowledge that our day-to-day activities have impacts on nearby communities. We recognise that the communities where we operate are where some of our employees and other stakeholders live and raise their families, and where part of our future workforce is educated and trained. We foster communities’ economic prosperity through local purchases and by hiring local employees. As such, it is key for us to be both proactive and a valued member of our communities. In 2023 we invested $1.5 million. Atlantica’s investments in local communities are focused on improving infrastructure and supporting education.

In terms of governance, we maintain a simple structure with one class of shares. The majority of our Directors are independent, and all the board committees are formed exclusively by independent directors. 22% of our directors are women. We believe that we have a solid compliance framework with a set of policies approved and reviewed annually by the Board of Directors, a Code of Conduct which is acknowledged by all employees annually and internal procedures aimed at ensuring that all geographies comply with our policies.

We have been rated by various ESG rating agencies, which we believe can provide relevant information for investors.

Growth Visibility

Development Pipeline

We are developing new projects in most of our core geographies. In some cases, we do this with our local in-house teams and in other cases we have been working with local partners with whom we jointly invest in developing projects or with whom we have agreements based on milestones.

By focusing our development activities on locations where we already have assets in operation and by working in many cases with partners, we have been able to maintain our development cost at what we believe are low levels.

We currently have a pipeline of assets under development of approximately 2.2 GW of renewable energy and 6.0 GWh of storage. Approximately 47% of the projects are in PV, 41% in storage and 11% in wind, while 22% of the projects are expected to reach ready to build (“Rtb”) in 2023 or 2024, 28% are in an advanced development stage and 50% are in early stage.

Pipeline of Assets Under Development11

| Renewable Energy (GW) | Storage (GWh) | |

| North America | 1.2 | 4.3 |

| Europe | 0.4 | 1.6 |

| South America | 0.6 | 0.1 |

| Total | 2.2 | 6.0 |

11 Only includes projects estimated to be ready to build before or in 2030 of approximately 3.7 GW, 2.2 GW of renewable energy and 1.5 GW of storage (equivalent to 6.0 GWh). Capacity measured by multiplying the size of each project by Atlantica’s ownership. Potential expansions of transmission lines not included.

Events During the Period

Assets that entered into operation

During 2023, four assets that were under construction entered into operation:

| ● | Albisu, the 10 MW PV asset wholly owned by us reached COD in January 2023. Albisu is located in Uruguay and has a 15-year PPA with Montevideo Refrescos, S.R.L., a subsidiary of Coca-Cola Femsa, S.A.B. de C.V. The PPA is denominated in local currency with a maximum and minimum price in U.S. dollars and is adjusted monthly based on a formula referring to the U.S. Producer Price Index (PPI), Uruguay’s Consumer Price Index (CPI) and the applicable UYU/U.S. dollar exchange rate. |

| ● | La Tolua and Tierra Linda are two wholly owned solar PV assets in Colombia with a combined capacity of 30 MW both of which reached COD in the first quarter of 2023. Each plant has a 10-year PPA in local currency with Coenersa, the largest independent electricity wholesaler in Colombia. Each PPA provides for the sale of electricity at fixed base price indexed to local CPI. |

| ● | Honda 1, a 10 MW PV asset in Colombia reached COD in December 2023. Honda 1 is a 10 MW plant where we have a 50% ownership. The asset has a 7-year PPA with Enel Colombia, a major electricity company in the country. The PPA is denominated in local currency, with fixed base price, indexed to the local CPI. |

Assets under construction

As of December 31, 2023 we had the following assets under construction or ready to start construction in the short-term:

| Asset | Type | Location | Capacity (Gross) |

Expected COD |

Expected ($ million) |

Off-taker |

| Coso Batteries 1 | Battery Storage | California, US | 100 MWh | 2025 | 40-50 | Investment

grade utility |

| Coso Batteries 2 | Battery Storage | California, US | 80 MWh | 2025 | 35-45 | Investment grade utility |

| Chile PMGD2 | Solar PV | Chile | 80 MW | 2024 - 2025 | 303 | Regulated |

| ATN Expansion 3 | Transmission Line | Peru | 2.4 miles

220kV |

2024 | 12 | Conelsur |

| ATS Expansion 1 | Transmission Line | Peru | n.a. (substation) |

2025 | 30 | Republic of Peru |

| Honda 24 | Solar PV | Colombia | 10 MW | 2024 | 5.5 | Enel Colombia |

| Apulo 14 | Solar PV | Colombia | 10 MW | 2024 | 15.5 | - |

Notes-

(1) Includes nominal capacity on a 100% basis, not considering Atlantica’s ownership.

(2) Atlantica owns 49% of the shares, with joint control, in Chile PMGD.

(3) Corresponds to the expected investment by Atlantica.

(4) Atlantica owns 50% of the shares in Honda 1, Honda 2 and Apulo 1.

| ● | In October 2023, we entered into two 15-year tolling agreements (PPAs) with an investment grade utility for Coso Batteries 1 and Coso Batteries 2. Under each of the tolling agreements, Coso Batteries 1 and 2 will receive fixed monthly payments adjusted by the financial settlement of CAISO’s Day-Ahead market. In addition, we expect to obtain revenue from ancillary services in each of the asset. |

Coso Batteries 1 is a standalone battery storage project of 100 MWh (4 hours) capacity located inside Coso, our geothermal asset in California. Additionally, Coso Batteries 2 is a standalone battery storage project with 80 MWh (4 hours) capacity also located inside Coso. Our investment is expected to be in the range of $40 million to $50 million for Coso Batteries 1, and in the range of $35 to $45 million for Coso Batteries 2. Both projects were fully developed in-house and are now under construction. We have closed a contract with Tesla for the procurement of the batteries. COD is expected in 2025 for both projects.

| ● | In November 2022, we closed the acquisition of a 49% interest, with joint control, in an 80 MW portfolio of solar PV projects in Chile which is currently under construction (Chile PMGD). Our economic rights are expected to be approximately 70%. Total investment in equity and preferred equity is expected to be approximately $30 million and COD is expected to be progressive in 2024 and 2025. Revenue for these assets is regulated under the Small Distributed Generation Means Regulation Regime (“PMGD”) for projects with a capacity equal or lower than 9 MW which allows to sell electricity at a stabilized price. |

| ● | In July 2022 we closed a 17-year transmission service agreement denominated in U.S. dollars that will allow us to build a substation and a 2.4-mile transmission line connected to our ATN transmission line serving a new mine in Peru (ATN Expansion 3). The substation is expected to enter in operation in 2024 and the investment is expected to be approximately $12 million. |

| ● | In July 2023, as part of the New Transmission Plan Update in Peru, the Ministry of Energy and Mines published the Ministerial Resolution that enables to start construction of our ATS Expansion 1 project, consisting in the reinforcement of two existing substation with new equipment. The expansion will be part of our existing concession contract, a 30-year contract with a fixed-price tariff base denominated in U.S. dollars adjusted annually in accordance with the U.S. Finished Goods Less Foods and Energy Index as published by the U.S. Department of Labor. Given that the concession ends in 2044, we will be compensated with a one-time payment for the remaining 9 years of concession. The expansion is expected to enter in operation in 2025 and the investment is expected to be approximately $30 million. |

| ● | In May 2022, we agreed to develop and construct Honda 1 and 2, two PV assets in Colombia with a combined capacity of 20 MW where we have a 50% ownership. Each plant has a 7-year PPA with Enel Colombia. Our investment is expected to be $5.5 million for each plant. Honda 1 entered in operation in December 2023 and Honda 2 is expected to enter into operation in the second quarter of 2024. |

Advanced Projects

| ● | In February 2024, we entered into a 15-year busbar PPA with an investment grade utility for Overnight. Overnight is a 150 MW PV project located in California. Under the PPA, Overnight is set to receive a fixed price per MWh, with no basis risk. The project is currently in an advanced development stage. Total investment is anticipated to be within the range of $165 to $185 million. We expect to include storage in a second phase of the project. |

| ● | In January 2024, we acquired from Liberty GES two PV projects in advanced development stage in Southern Spain with approximately 90 MW of combined generation capacity. The acquisition of land and interconnection are secured and the process for permits is well advanced. The projects were acquired in exchange for assuming the necessary guarantees, at no additional cost. |

Potential Asset Sale

Our partner in Monterrey initiated a process to sell its 70% stake in the asset. Such process is well advanced and, as part of it, we intend to sell our interest as well under the same terms. The net proceeds to Atlantica are expected to be in the range of $45 to $52 million, after tax. The closing of the transaction is subject to certain conditions precedent. We cannot guarantee that the transaction will finally close.

Project Debt Refinancing

In March 2023, we refinanced the Solaben 2 and Solaben 3 project debt by entering into two green senior euro-denominated loan agreements for the two assets with a syndicate of banks for a total amount of €198.0 million. The new project debt replaced the previous project loans for a similar amount and maturity was extended from December 2030 to June 2037.

In addition, in June 2023 we extended the maturity of the debt for Logrosan Solar Inversiones, S.A, the subsidiary-holding company of Solaben 2 & 3 and Solaben 1 & 6 from April 2025 to December 2028. We refer to section “Liquidity” under “Financial Review” for more information.

Operation and Maintenance

In March 2023, we completed the process of transitioning in-house the O&M services for our assets in Spain through the acquisition of the business of an Abengoa subsidiary which was still providing those services to some of our assets.

In addition, in July 2023 we internalised the O&M services for ATN, which were previously performed by Omega Peru. Additionally, the O&M contract for ATS with Omega Peru, which could be terminated every five years was modified and can now be terminated every three years (or two years under certain circumstances) and the contract for ATN2, which was a long-term contract expiring in 2027, was also amended to reflect the same termination provision.

Currently, we perform O&M services with our own personnel for assets representing approximately 74% of our consolidated revenue for the year ended December 31, 2023.

Regulation in Spain

In June 2023, the final parameters for the year 2023 were published, including a revised assumption for electricity prices for the years 2023, 2024 and 2025.

| Useful Life 2023 |

Remuneration on Investment 2023-2025 (Euros /MW) |

Remuneration on Operation 2024 (Euros/MW) |

Adjustment Rate |

Maximum Hours |

Minimum Hours 2024- 2025 |

Operating Threshold 2024-2025 |

|

| Solaben 2 | 25 years | 378,506 | 0 | 0.9854 | 2,004 | 1,202 | 701 |

| Solaben 3 | 25 years | 378,506 | 0 | 0.9854 | 2,004 | 1,202 | 701 |

| Solacor 1 | 25 years | 378,506 | 0 | 0.9854 | 2,004 | 1,202 | 701 |

| Solacor 2 | 25 years | 378,506 | 0 | 0.9854 | 2,004 | 1,202 | 701 |

| PS 10 | 25 years | 533,115 | 19.798 | 0.9948 | 1,837 | 1,102 | 643 |

| PS 20 | 25 years | 393,001 | 14.044 | 0.9942 | 1,837 | 1,102 | 643 |

| Helioenergy 1 | 25 years | 372,549 | 0 | 0.9845 | 2,004 | 1,202 | 701 |

| Helioenergy 2 | 25 years | 372,549 | 0 | 0.9845 | 2,004 | 1,202 | 701 |

| Helios 1 | 25 years | 387,136 | 0 | 0.9857 | 2,004 | 1,202 | 701 |

| Helios 2 | 25 years | 387,136 | 0 | 0.9857 | 2,004 | 1,202 | 701 |

| Solnova 1 | 25 years | 392,031 | 0 | 0.9849 | 2,004 | 1,202 | 701 |

| Solnova 3 | 25 years | 392,031 | 0 | 0.9849 | 2,004 | 1,202 | 701 |

| Solnova 4 | 25 years | 392,031 | 0 | 0.9849 | 2,004 | 1,202 | 701 |

| Solaben 1 | 25 years | 384,318 | 0 | 0.9860 | 2,004 | 1,202 | 701 |

| Solaben 6 | 25 years | 384,318 | 0 | 0.9860 | 2,004 | 1,202 | 701 |

| Seville PV | 30 years | 677,855 | 0 | 0.9809 | 2,030 | 1,218 | 711 |

Strategic Review

On February 21, 2023, Atlantica’s board of directors commenced a process to explore and evaluate potential strategic alternatives that may be available to Atlantica to maximise shareholder value. The Company believes it has attractive growth and other opportunities in front of it and is committed to ensuring it is best positioned to take advantage of those opportunities. The decision has the support of the Company’s largest shareholder, Algonquin. Atlantica expects to continue executing on its existing plans while the review of strategic alternatives is ongoing, including its current growth plan. As of the date of this annual report, the strategic review is ongoing. There is no assurance that any specific transaction will be consummated, or other strategic change will be implemented as a result of this strategic review. Please refer to the section: “Principal Risk and Uncertainties”.

Main ESG Actions during the year

Investing in and developing new sustainable infrastructure projects are only one part of our strategy. Managing those assets in a sustainable way is key to creating long-term value. We have launched several initiatives to ensure that we efficiently and sustainably manage key areas of our Company:

| 1. | Improved our Health and Safety Metrics: Health and Safety is our number one priority, and we want our employees, partners, and contractors to apply the highest standards to ensure safe and sustainable operations. In 2023, all our key health and safety indicators met annual targets, improved with respect to 2022 and remained below the sector average in all our geographies. Refer to the occupational health and safety section for further details on our safety culture. |

| 2. | Reduced our GHG emissions: We have reduced our Scope 1 and 2 GHG emissions per KWh of energy generated and our Scope 3 GHG emissions per KWh of energy generated for the fourth consecutive year. We refer to the “Environment” section for further detail on our environmental performance in 2023. |

| 3. | Offset our GHG emissions: Global warming is a challenge that requires the active participation of public and private organisations. In 2023, as part of our commitment to sustainability, we continued mitigating our GHG emissions. We encourage you to read our GHG emissions section for detailed information on our mechanism to offset GHG emissions. |

| 4. | Invested 97% of our capex in activities aligned with EU Taxonomy: 100% of our economic activities are eligible following the EU Taxonomy and 97% of our CapEx investment is aligned to the EU Taxonomy. We refer to the “Reporting under the European Union Taxonomy” section for further details on clean revenues, Adjusted EBITDA, and capital allocation and capital expenditures (investments and maintenance capex). |

| 5. | Reduced water consumption: We continue to reduce water consumption at our power generation assets. In 2023 water consumption decreased by 5% compared to 2022 mainly due to higher production efficiency at our solar assets in Spain and the U.S. (more recycled water in cooling towers). We refer to the “Environment” section for further detail on our environmental performance in 2023. |

| 6. | Reduced hazardous waste: Third consecutive year reducing our hazardous waste. In 2023, we reduced total hazardous waste by 27% compared to previous year. This reduction was mainly driven by an innovative water treatment

system installed at one of our solar assets in Spain. We refer to the “Environment” section for further detail on our environmental performance in 2023. |

| 7. | Improved our Ethics and Corporate Governance culture: In December 2023, the Board approved our Water Policy and updated the following documents: |

| ü | Stakeholder Policy |

| ü | Biodiversity Policy |

| ü | Environmental Policy |

| ü | Health and Safety Policy |

These policies are available on our website.

| 8. | Green Financing: We have developed a Green Finance Framework to issue green finance instruments to finance or refinance renewable energy infrastructure, as well as transmission lines dedicated to supplying renewable energy to the grid. The Framework is aligned with our strategy and the use of proceeds will contribute to the advancement of the United Nations Sustainable Development Goals (SDGs) of Affordable and Clean Energy. The framework has a Second Party Opinion (SPO) delivered by Sustainalytics. |

In 2023 we did two green project refinancings:

| (1) | In March 2023 we refinanced Solaben 2&3 for €198.0 million. The new project debt replaced the previous project loans. We refer to “Project Debt Refinancing” under “Events During the Period” section. |

| (2) | In June 2023 we extended the maturity of the debt of Logrosan Solar Inversiones, S.A.U., the sub-holding company of Solaben 1&6 and Solaben 2&3. The Green Project Finance was extended from April 2025 to December 2028 and the initial nominal amount was €140 million. |

| 9. | Improved our environment and social awareness: In 2023, we actively posted ESG content on social media to increase ESG awareness among our stakeholders. |

| 10. | Action Declaration on climate policy engagement: In November 2022, Atlantica endorsed the “Action Declaration on climate policy engagement” activities, an initiative from Corporate Knights and the Global 100 Council. This declaration intends to close the say-do gap on countries’ emission reductions by: |

| - | supporting climate action aligned with the Paris Agreement when engaging with trade associations; |

| - | working with major trade associations to advance alignment with the Paris Agreement; and |

| - | monitoring and disclosing climate policy alignment for our trade association. |

In 2023 we have assessed the trade associations with whom we collaborate. We refer to section “Trade Associations” under the “Governance” section for further detail.

Contribution to the Sustainable Development Goals

Atlantica is a signatory to the UNGC, the world’s largest corporate sustainability initiative with more than 20,000 signatories in over 160 countries. The UNGC is an initiative that encourages companies and organisations worldwide to adopt sustainable and socially responsible policies. Participation in the UNGC is voluntary and those entities that sign it pledge to uphold and promote the principles and report on their progress once they apply them in their management.

Atlantica formally adopted the ten fundamental UNGC principles in the fields of human rights, labour, environment, and anti-corruption and made the UNGC and its principles an integral part of our strategy, culture, and day-to-day operations.

The table below summarises Atlantica’s contribution to achieving 7 of the 17 Sustainable Development Goals (SDG): climate action; affordable and clean energy; clean water and sanitation; decent work and economic growth; gender equality; life on land; and industry, innovation, and infrastructure.

|

|

|

We are committed to using water efficiently in our power generation and water desalination activities. We plan to reduce our water consumption at our generating assets that use cycled water in the turbine circuit and in refrigeration processes. In 2023, we recycled 17% more water, which mainly contributed to a 4% decrease in our overall water consumption. In addition, we have a target approved by the Board of Directors to reduce our water consumption per unit of energy generated (KWh) by 50% by 2035, from a 2020 base year. In 2023, our water consumption per unit of energy generated decreased by 5% compared to 2022. We invest in water desalination plants that generate drinking water for local communities and industries through the desalination of sea water. In 2023, these assets generated purified seawater to meet the water needs of approximately 3 million people in regions with limited access to fresh water. We encourage you to read our water management section for more detailed information. |

|

The renewable energy industry has grown significantly in recent years and it is expected to continue to grow in the coming decades. This requires significant new investments in, among others, storage for dispatchability to support additional wind and solar energy generation. In 2023, our renewable sector accounted for 73% of our revenue, with solar energy representing 63%. We intend to grow our business through the development and construction of projects including expansion and repowering opportunities, as well as greenfield developments, third-party acquisitions and the optimisation of our portfolio. During 2023, four assets that were under construction entered into operation: - Albisu, the 10 MW PV asset reached COD in January 2023. - La Tolua and Tierra Linda, two PV assets with a combined capacity of 30 MW both reached COD in the first quarter of 2023. - Honda 1, a 10 MW PV asset reached COD in December 2023. In addition, we have 3 PV projects, 2 storage projects and 2 transmission lines that are currently under construction. We currently have a pipeline of assets under development of approximately 2.2 GW of renewable energy and 6.0 GWh of storage. We are also in the process of selling our 30% stake in one of our efficient natural gas assets. We encourage you to read section “Growth visibility” for further details on affordable and clean energy investments. |

|

We protect labour rights and are committed to promoting safe and secure working environments for all workers. We are committed to providing decent work for all women and men, young people and persons with disabilities and equal pay for work of equal value. We have always prioritised the health and safety of all our employees, contractors and partners working at our premises. Our key health and safety indicators met 2023 targets, improved with respect to 2022 and remained below the sector average in all our geographies. We have internal policies and procedures to support and ensure human rights, including the Human Rights Policy, the Code of Conduct and the Supplier Code of Conduct (available on our website). Our internal compliance team annually: (i) monitors human rights are internally respected, (ii) provides human rights related training to our employees, and (iii) assesses the supply chain across the jurisdictions in which we operate to identify any potential breach regarding human rights. In May 2023, the Board amended and approved our “U.K. Anti-Modern Slavery and Human Trafficking Statements” under the Modern Slavery Act, 2015 (available on our website). No human rights incidents were reported or identified during 2023. We are committed to supporting long-term development of the communities where we operate as part of our culture at Atlantica. It is key for us to be a proactive and valued member of our communities and to foster communities’ economic prosperity. In addition, we support local economic growth by choosing to buy from local businesses. In 2023, more than 90% of our total purchases in the geographies where we have assets were made to local suppliers. We encourage you to read our Social and Governance sections for details on occupational health and safety, human rights, supply chain management and training-related activities. |

|

Our activity has a positive impact on mitigating climate change. We are committed to the reduction of greenhouse gas emissions (GHG) by investing in renewable energy assets. Following our long-term commitment to sustainability, we have set an ambitious plan to reduce: 1. Our GHG emissions. We target to: (i) reduce our Scopes 1 and 2 GHG emissions per kWh of energy generated by 70% by 2035 from a 2020 base year12. This target has been approved by the Science Based Targets initiative (SBTi) (ii) reduce Scope 3 GHG emissions per kWh of energy generated by 70% by 2035 from a 2020 base year, and (iii) achieve Net Zero GHG emissions by 2040. 2. Our non-GHG emissions. We target to reduce our non-GHG emissions per kWh of energy generated by 50% by 2035 from a 2020 base year. In addition, we have a goal to maintain over 85% of our adjusted EBITDA generated from low carbon footprint assets including renewable energy, storage, transmission infrastructure and water assets. In 2023, we reduced (i) our Scopes 1 and 2 GHG emissions per kWh of energy generated by 14% compared to 2020 and (ii) our Scope 3 GHG emissions per kWh of energy generated by 20% compared to 2020. In addition, we helped avoid up to 7.0 million tonnes of equivalent CO2 compared to a 100% fossil fuel-based generation plant. Please read our Environmental Sustainability section for further details on our climate change related activities. |

12 The target boundary includes steam generation.

Atlantica also supports other SDGs, as outlined below:

|

We promote equal opportunities for our employees and stakeholders. Atlantica’s Diversity and Inclusion Policy was approved by the Board of Directors in May 2020 and was last amended in December 2021 Atlantica stands for greater equality for women. We work to ensure that men and women are treated equally and have the same work opportunities. We aim to perform a human capital analysis every 4 years at certain locations. The objective of this analysis is to guarantee equal opportunities to our employees and to promote a culture of diversity and inclusion. We analyse gender pay gap, for the year ended December 31, 2023 the total overall pay gap decreased and was 5%. We encourage you to read the Social and Governance sections for further details on gender equality. |

|

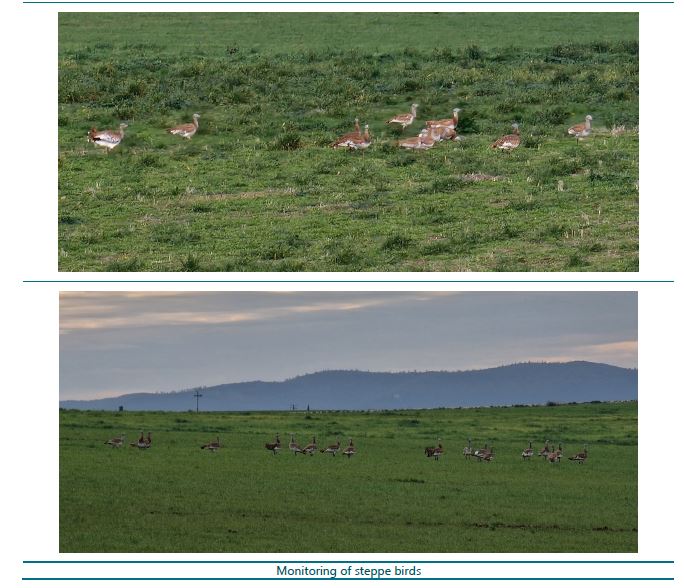

We work to protect flora and fauna in and around our assets. We are committed to achieving “no net loss” of biodiversity and “no net deforestation” in the areas where we operate and in all project phases through the application of the Mitigation Hierarchy. In 2023, we continued to: (i) monitor the impact of spinning blades on local species of birds at our wind farms in Uruguay, and (ii) collaborate with local administrations and other key stakeholders to protect species settled close to our assets in the U.S. and Spain. We have set a target to reduce our hazardous and non-hazardous waste per unit of energy generated by 30% and 40%, respectively, by 2035 from a 2023 base year. In addition, in 2023 we continued to deliver on our reforestation programme in Spain, where we invested approximately $445 thousand in reforesting a new 48-hectare area and maintaining previously reforested areas. We encourage you to read the Environmental Sustainability section for further details on our biodiversity initiatives. |

|

Infrastructure is a key driver of economic growth and social value creation. At Atlantica, we produce and transport electricity and we provide drinking water to approximately 3 million people living in high or extremely high-water stress areas. Our solar asset in South Africa contributes to providing clean electricity in a country that requires additional power capacity. In South America, our transmission lines help transport electricity to remote areas. In addition, we foster communities’ economic prosperity through local purchasing and by hiring local employees. In 2023, four PV assets that were under construction reached COD in Uruguay and Colombia. In addition, as of December 31, 2023, we have 2 battery storage projects in the U.S., 1 PV project in Chile, 2 transmission lines in Peru and 2 additional PV projects in Colombia that are under construction and that we expect will reach COD during 2024-2025. We also have a pipeline of assets under development of approximately 2.2 GW of renewable energy and 6.0 GWh of storage. Within the energy sector, innovation contributes to the fight against climate change through new or enhanced technologies that enable more sustainable, reliable and efficient solutions, including storage and green hydrogen solutions. To ensure reliability of our assets we: (1) own 22 patents and technology licences, as well as 4 patents currently in approval process, related to key components of our assets, to processes and to solutions to monitor, operate and maintain our assets in a sustainable and cost effective manner, (2) have an operations department to identify potential measures to improve asset performance, reducing operating costs and developing tools to manage our assets more efficiently, and (3) have an advanced analytics team to improve the performance of our technologies through data analytics and machine learning technologies. We encourage you to read the Asset Management and Innovation sections for further details on our industry, innovation and infrastructure initiatives. |

Communication on Progress (COP):

This Integrated Annual Report constitutes Atlantica’s “Communication on Progress” under the UNGC.

Key Performance Indicators

| Financial KPIs |

| $ in millions | 2023 | 2022 | 2021 |

| Revenue | 1,100 | 1,102 | 1,212 |

| Operating Profit | 342 | 278 | 354 |

| Adjusted EBITDA | 795 | 797 | 824 |

| Cash Available for Distribution (CAFD) | 236 | 238 | 226 |

| Cash Available for Distribution (CAFD) per share (in USD) | 2.03 | 2.07 | 2.03 |

| Total dividends paid | 207 | 203 | 190 |

| Operational KPIs |

| 2023 | 2022 | 2021 | |

| Renewable energy | |||

| MW in operation13 | 2,171 | 2,121 | 2,044 |

| GWh produced14 | 5,458 | 5,319 | 4,655 |

| Efficient natural gas | |||

| MW in operation15 | 398 | 398 | 398 |

| GWh produced16 | 2,549 | 2,501 | 2,292 |

| Electric Availability (%) | 99.6% | 98.9% | 100.6% |

| Electric transmission lines | |||

| Miles in operation | 1,229 | 1,229 | 1,166 |

| Availability (%) | 100.0% | 100.0% | 100.0% |

| Water | |||

| Mft3 in operation16 | 17.5 | 17.5 | 17.5 |

| Availability (%) | 99.7% | 102.3% | 97.9% |

We closely monitor the following key drivers of our business sectors’ performance to plan for our needs, and to adjust our expectations, financial budgets, and forecasts appropriately.

| • | MW in operation in the case of Renewable energy and Efficient natural gas and heat assets, miles in operation in the case of Transmission lines and Mft3 per day in operation in the case of Water assets, are indicators which provide information about the installed capacity or size of our portfolio of assets. |

| • | Production measured in GWh in our Renewable energy and Efficient natural gas and heat assets provides information about the performance of these assets. |

| • | Availability in the case of our Efficient natural gas and heat assets, Transmission lines and Water assets also provides information on the performance of the assets. In these business segments revenues are based on availability, which is the time during which the asset was available to our client totally or partially divided by contracted availability or budgeted availability, as applicable. |

13 Represents total installed capacity in assets owned or consolidated at the end of the year, regardless of our percentage of ownership in each of the assets except for Vento II for which we have included our 49% interest.

14 Includes 49% of Vento II wind portfolio production since its acquisition. Includes curtailment in wind assets for which we receive compensation.

15 Includes 43 MW corresponding to our 30% share in Monterrey and 55 MWt corresponding to Calgary District Heating.

16 GWh produced includes 30% of the production from Monterrey.

|

Selected Environmental Metrics |

| 2023 | 2022 | 2021 | |||

| Maintain over 85% of adjusted EBITDA from low carbon footprint assets | % | 89% | 89% | 88% | |

| GHG Emissions Breakdown Including Offset GHG Emissions | Scope 1 | thousand tonnes of CO2e | 1,395 | 1,524 | 1,535 |

| Scope 2 | 250 | 249 | 237 | ||

| Scope 3 | 799 | 814 | 798 | ||

| Total | 2,444 | 2,587 | 2,570 | ||

| Offset GHG Emissions | Scope 1 | thousand tonnes of CO2e | 380 | 320 | 260 |

| GHG Emissions Breakdown (without Offsets) | Scope 1 | thousand tonnes of CO2e | 1,775 | 1,844 | 1,795 |

| Scope 2 | 250 | 249 | 237 | ||

| Scope 3 | 799 | 814 | 798 | ||

| Total | 2,824 | 2,907 | 2,830 | ||

| Scopes 1 and 2 GHG Emission Rate per Unit of Energy Generated | gCO2/kWh | 162 | 168 | 185 | |

| GHG Emissions Avoided | million tonnes of CO2e | 7.0 | 6.9 | 5.9 | |

| Water Management in Power Generation | Withdrawal | m3 per MWh | 1.46 | 1.54 | 1.64 |

| Discharges | 0.17 | 0.18 | 0.22 | ||

| Waste Management | Hazardous waste | tonnes of waste | 1,402 | 1,908 | 2,576 |

| Non-hazardous waste | 25,993 | 23,142 | 22,212 | ||

Notes:

| 1. | Our target is to reduce our Scope 1 and Scope 2 GHG emissions per unit of energy generated by 70% by 2035, with 2020 as the base year (57gCO2/KWh by 2035). |

| 2. | Calculated considering GHG emissions Scope 1 and 2 and energy generation of our power generation assets, both electric and thermal energy. The GHG Equivalences Calculator uses the Avoided Emissions and Generation Tool (AVERT) U.S. national weighted average CO2 marginal emissions rate to convert reductions of Kilowatt-hours into avoided units of carbon dioxide emissions |

Selected Social Metrics

| 2023 | 2022 | 2021 | ||

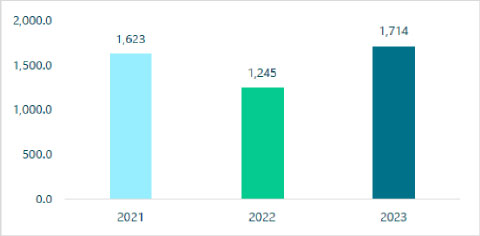

| Health and Safety | Total Recordable Frequency Index | 4.3 | 5.2 | 6.4 |

| Lost Time Frequency Index | 1.9 | 3.1 | 2.4 | |

| Total Recordable Deviation Index | 1,714 | 1,246 | 1,623 | |

| Employees | Voluntary Turnover by year-end | 7.6% | 12.8% | 11.0% |

| Total turnover by year-end | 10.7% | 16.8% | 15.9% | |

| Average Annual Training per employee (in hours) | 33 | 29 | 37 | |

| Percentage of Women | At Management Level | 17% | 23% | 23% |

| Over Total Number of Employees | 17% | 20% | 25% | |

| Gender Pay Gap3 | Total overall pay gap | 5% | 13% | 26% |

| Community Investment and Development | Investments focused on improving infrastructure and supporting education | |||

Notes:

| 1. | Turnover rates calculated based on the average number of employees in each year excluding temporary employees and employees hired to replace sick or leaves. |

| 2. | Health and safety industry benchmarks provided in the Health and Safety section. job function, level, education, performance, location, or exchange rate differences. Overtime has not been included. |

| 3. | Data includes fixed salary, short-term bonus and long-term incentive plans without adjusting for factors such as CEO has been excluded from the analysis as we believe that including his compensation would distort the results. |

| 4. | Total Recordable Frequency Index (TRFI) represents the total number of recordable accidents with and without leave (lost time injury) recorded in the last twelve months per one million worked hours. |

| 5. | Lost Time Frequency Index (LTFI) represents the total number of recordable accidents with leave (lost time injury) recorded in the last twelve months per one million worked hours |

A Fair Review of the Business

Factors that Affect Comparability of our Results of Operations

| ▪ | Investments |

The results of operations of Chile TL4, Italy PV 4 and Chile PV 3 have been fully consolidated since January 2022, April 2022 and September 2022, respectively and the results of Albisu, Tierra Linda and La Tolua have been fully consolidated since these assets entered into operation in the first quarter of 2023. For the full year 2023, these investments represented revenues and Adjusted EBITDA of $14.1 million and $10.5 million respectively, which represents an increase of $7.9 million in revenue and $7.6 million in Adjusted EBITDA for the year ended December 31, 2023 with respect to 2022.

| ▪ | Impairment |

In 2023, considering that expected electricity prices in Chile over the remaining useful life of Chile PV1 have decreased, we have identified an impairment triggering event, in accordance with IAS 36 (Impairment of Assets). As a result, an impairment test has been performed and resulted in an impairment loss of $16.1 million in 2023 in the line “Depreciation, amortisation, and impairment charges”. In 2022, we also recorded an impairment loss of $20.4 million in Chile PV1 and Chile PV2. Our equity interest in Chile PV 1 and Chile PV 2 is 35%. As a result, the impact of the impairment charges in “Profit / (loss) for the year attributable to the parent company” after non-controlling interest was $5.6 million in 2023 and $7.1 million in 2022.

During 2022 we recorded an impairment loss of $41.2 million in Solana with no corresponding triggering event and impairment in 2023.

In addition, IFRS 9 requires impairment provisions to be based on expected credit losses on financial assets rather than on actual credit losses, which affects the concessional assets accounted for as financial assets. For the year 2023 we recorded a decrease in the expected credit loss impairment provision of $13.2 million reflected in the line item “Depreciation, amortisation, and impairment charges” and was primarily related to ACT ($10.9 million). In 2022 we recorded an increase in the expected credit loss impairment provision of $6.7 million, also primarily related to ACT ($4.0 million).

| ▪ | Electricity market prices |

Total revenues in Spain were stable in 2023 compared to the previous year. In addition to regulated revenue, our solar assets in Spain receive revenue from the sale of electricity at market prices. The average electricity market price captured by our assets was approximately €69.9 per MWh during 2023 compared to approximately €145.3 per MWh during 2022. Revenue from the sale of electricity at current market prices represented $84.3 million during 2023, compared to $142.9 million in 2022. Regulated revenues are revised periodically to reflect, among other things, the difference between expected and actual market prices if the difference is higher than a pre-defined threshold and as a result, we record a provision. We decreased our provision by $3.5 million in 2023, with no cash impact, compared to an increase of $25.3 million in the previous year.

In 2023, we have calculated the provision assuming that the average market price must be corrected using the solar time of day adjustment factor (“coeficiente de apuntamiento”), as it was stated in the regulations published since 2020. This factor, which is 90% for 2023, aims to capture the difference between the daily (24 hours) average market price and the price captured by solar assets. Although the factor is not mentioned in the regulation for 2023, we believe the last order includes a clerical error that we expect is going to be corrected.

On May 12, 2022, remuneration parameters in Spain for the year 2022 were published and became final on December 14, 2022, with a decrease in regulated revenue. In addition, on June 30, 2023, the new parameters were published, including a revised assumption on electricity prices for the years 2023, 2024 and 2025. Revenue from the sale of electricity at market prices net of the incremental market price provision was $84.0 million for the full year 2023, compared to $117.6 million for the full year 2022. This decrease was offset by higher production in 2023.

Additionally, in 2022 we collected revenue from our assets in line with the parameters corresponding to the regulation in place at the beginning of the year 2022, however revenue for the year ended December 31, 2022 was recorded in accordance with the new parameters that became final on December 14, 2022, which were lower. Collections were regularised in the first quarter of 2023.

| ▪ | Exchange rates |

We refer to “Exchange rates” below.

Significant Trends Affecting Results of Operations

| ▪ | Investments and acquisitions |

If the recently built assets and the recently closed acquisitions perform as anticipated, we expect these assets to positively impact our results of operations in 2024 and upcoming years.

| ▪ | Solar, wind and geothermal resources |

The availability of solar, wind and geothermal resources affects the financial performance of our renewable assets, which may impact our overall financial performance. Due to the variable nature of solar, wind and geothermal resources, we cannot predict future availabilities or potential variances from expected performance levels from quarter to quarter. Based on the extent to which the solar, wind and geothermal resources are not available at expected levels, this could have a negative impact on our results of operations.

| ▪ | Capital markets conditions |

The capital markets in general are subject to volatility that is unrelated to the operating performance of companies. Our growth strategy depends on our ability to close acquisitions, which often requires access to debt and equity financing to complete these acquisitions. Fluctuations in capital markets may affect our ability to access this capital through debt or equity financings.

| ▪ | Exchange rates |

Our presentation currency and the functional currency of most of our subsidiaries is the U.S. dollar, as most of their revenue and expenses are denominated or linked to U.S. dollars. All our companies located in North America, with the exception of Calgary, with revenue in Canadian dollars, and most of our companies in South America have their revenue and financing contracts signed in or indexed totally or partially to U.S. dollars. Our solar power plants in Europe have their revenue and expenses denominated in euros; Kaxu, our solar plant in South Africa, has its revenue and expenses denominated in South African rand, La Sierpe, La Tolua and Tierra Linda, Honda 1, our solar plants in Colombia, have their revenue and expenses denominated in Colombian pesos and Albisu, our solar plant in Uruguay, has its revenue denominated in Uruguayan pesos, with a maximum and a minimum price in U.S. dollars.

Project financing is typically denominated in the same currency as that of the contracted revenue agreement, which limits our exposure to foreign exchange risk. In addition, we maintain part of our corporate general and administrative expenses and part of our corporate debt in euros which creates a natural hedge for the distributions we receive from our assets in Europe. To further mitigate this exposure, our strategy is to hedge cash distributions from our assets in Europe. We hedge the exchange rate for the net distributions in euros (after deducting interest payments and general and administrative expenses in euros). Through currency options, we have hedged 100% of our euro-denominated net exposure for the next 12 months and 75% of our euro-denominated net exposure for the following 12 months. We expect to continue with this hedging strategy on a rolling basis.