| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

|

|

Kentucky

|

61-0979818

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

|

346 North Mayo Trail

P.O. Box 2947

Pikeville, Kentucky

|

41502

|

|

| (Address of principal executive offices) | (Zip code) |

| (606) 432-1414 |

| (Registrant’s telephone number) |

| Securities registered pursuant to Section 12(b) of the Act: |

|

Common Stock

(Title of class)

|

|

CTBI

|

The NASDAQ Global Select Market

|

|

(Trading symbol)

|

(Name of exchange on which registered)

|

|

Yes ☐

|

No ☑

|

|

Yes ☐

|

No ☑

|

|

Yes ☑

|

No ☐

|

|

Yes ☑

|

No ☐

|

|

Large Accelerated Filer ☐

|

Accelerated Filer ☑

|

Non-accelerated Filer ☐

|

|

Smaller Reporting Company ☐

|

Emerging Growth Company ☐

|

|

Yes ☑

|

No ☐

|

|

Yes ☐

|

No ☑

|

| 1 | |

|

|

|

| 1 | |

| 1 | |

| 4 | |

| 15 | |

| 15 | |

| 17 | |

| 17 | |

| 17 | |

| 18 | |

| 19 |

|

| 19 |

|

| 20 | |

| 21 | |

| 38 | |

| 39 |

|

| 43 | |

| 99 | |

| 101 | |

| 101 | |

| 103 | |

| 103 | |

| 103 | |

| 103 | |

| 103 | |

| 103 | |

| 103 | |

| 104 | |

| 104 | |

| 105 | |

| 106 |

| Item 1. |

Business

|

|

•

|

Clients may not want, need, or qualify for our products and services;

|

|

•

|

Borrowers may not be able to repay their loans;

|

|

•

|

The value of the collateral securing our loans to borrowers may decline; and

|

|

•

|

The quality of our loan portfolio may decline.

|

|

•

|

The rate of inflation;

|

|

•

|

The rate of economic growth;

|

|

•

|

Employment levels;

|

|

•

|

Monetary policies; and

|

|

•

|

Instability in domestic and foreign financial markets.

|

|

•

|

The length and severity of downturns in the local economies in which we operate or the national economy;

|

|

•

|

The length and severity of downturns in one or more of the business sectors in which our customers operate, particularly the automobile, hotel/motel, and residential development industries; or

|

|

•

|

A rapid increase in interest rates.

|

|

•

|

Commercial Real Estate Residential. Repayment is dependent on income being generated in amounts sufficient to cover

operating expenses and debt service. As of December 31, 2023, commercial real estate residential loans comprised approximately 10% of our total loan portfolio.

|

|

•

|

Commercial Real Estate Nonresidential. Repayment is dependent on income being generated in amounts sufficient to cover

operating expenses and debt service. As of December 31, 2023, commercial real estate nonresidential loans comprised approximately 19% of our total loan portfolio.

|

|

•

|

Hotel/Motel. The hotel and motel industry is highly susceptible to changes in the domestic and global economic environments, which has caused the industry to

experience substantial volatility due to the recent global pandemic. As of December 31, 2023, hotel/motel loans comprised approximately 10% of our total loan portfolio.

|

|

•

|

Other Commercial Loans. Repayment is generally dependent upon the successful operation of the borrower’s business. In

addition, the collateral securing the loans may depreciate over time, be difficult to appraise, be illiquid, or fluctuate in value based on the success of the business. As of December 31, 2023, other commercial loans comprised

approximately 10% of our total loan portfolio.

|

|

•

|

Safety and soundness guidelines;

|

|

•

|

Compliance with all laws including the USA PATRIOT Act, the International Money Laundering Abatement and Anti-Terrorist Financing Act, the Sarbanes-Oxley Act and the related rules and regulations

promulgated under such Act or the Exchange Act, the Equal Credit Opportunity Act, the Fair Housing Act, the Community Reinvestment Act, the Home Mortgage Disclosure Act, and all other applicable fair lending and consumer protection laws

and other laws relating to discriminatory business practices; and

|

|

•

|

Anti-competitive concerns with the proposed transaction.

|

|

•

|

Actual or anticipated variations in earnings;

|

|

•

|

Changes in analysts’ recommendations or projections;

|

|

•

|

CTBI’s announcements of developments related to our businesses;

|

|

•

|

Operating and stock performance of other companies deemed to be peers;

|

|

•

|

New technology used or services offered by traditional and non-traditional competitors;

|

|

•

|

News reports of trends, concerns, and other issues related to the financial services industry; and

|

|

•

|

Additional governmental policies and enforcement of current laws.

|

| Item 2. |

Properties

|

|

Location

|

Owned

|

Leased

|

Total

|

|||||||||

|

Banking locations:

|

||||||||||||

|

Community Trust Bank, Inc.

|

||||||||||||

|

* Pikeville Market (lease land at 3 owned locations)

|

9

|

1

|

10

|

|||||||||

|

10 locations in Pike County, Kentucky

|

||||||||||||

|

Floyd/Knott/Johnson Market (lease land at 1 owned location)

|

3

|

1

|

4

|

|||||||||

|

2 locations in Floyd County, Kentucky, 1 location in Knott County, Kentucky, and 1 location in Johnson County, Kentucky

|

||||||||||||

|

Tug Valley Market (lease land at 1 owned location)

|

2

|

0

|

2

|

|||||||||

|

1 location in Pike County, Kentucky, 1 location in Mingo County, West Virginia

|

||||||||||||

|

Whitesburg Market (lease land at 1 owned location)

|

4

|

1

|

5

|

|||||||||

|

5 locations in Letcher County, Kentucky

|

||||||||||||

|

Hazard Market (lease land at 2 owned locations)

|

3

|

0

|

3

|

|||||||||

|

3 locations in Perry County, Kentucky

|

||||||||||||

|

* Lexington Market (lease land at 3 owned locations)

|

4

|

2

|

6

|

|||||||||

|

6 locations in Fayette County, Kentucky

|

||||||||||||

|

Winchester Market

|

2

|

0

|

2

|

|||||||||

|

2 locations in Clark County, Kentucky

|

||||||||||||

|

Richmond Market (lease land at 1 owned location)

|

3

|

0

|

3

|

|||||||||

|

3 locations in Madison County, Kentucky

|

||||||||||||

|

Mt. Sterling Market

|

2

|

0

|

2

|

|||||||||

|

2 locations in Montgomery County, Kentucky

|

||||||||||||

|

Versailles Market (lease land at 2 owned locations)

|

3

|

2

|

5

|

|||||||||

|

1 location in Woodford County, Kentucky, 2 locations in Franklin County, Kentucky, and 2 locations in Scott County, Kentucky

|

||||||||||||

|

* Danville Market (lease land at 1 owned location)

|

3

|

0

|

3

|

|||||||||

|

2 locations in Boyle County, Kentucky and 1 location in Mercer County, Kentucky

|

||||||||||||

|

* Ashland Market (lease land at 1 owned location)

|

5

|

0

|

5

|

|||||||||

|

4 locations in Boyd County, Kentucky and 1 location in Greenup County, Kentucky

|

||||||||||||

|

Flemingsburg Market

|

3

|

0

|

3

|

|||||||||

|

3 locations in Fleming County, Kentucky

|

||||||||||||

|

Advantage Valley Market

|

3

|

1

|

4

|

|||||||||

|

2 locations in Lincoln County, West Virginia, 1 location in Wayne County, West Virginia, and 1 location in Cabell County, West Virginia

|

||||||||||||

|

Summersville Market

|

1

|

0

|

1

|

|||||||||

|

1 location in Nicholas County, West Virginia

|

||||||||||||

|

Middlesboro Market (lease land at 1 owned location)

|

3

|

0

|

3

|

|||||||||

|

3 locations in Bell County, Kentucky

|

||||||||||||

|

Williamsburg Market

|

5

|

0

|

5

|

|||||||||

|

2 locations in Whitley County, Kentucky and 3 locations in Laurel County, Kentucky

|

||||||||||||

|

Campbellsville Market (lease land at 2 owned locations)

|

8

|

0

|

8

|

|||||||||

|

2 locations in Taylor County, Kentucky, 2 locations in Pulaski County, Kentucky, 1 location in Adair County, Kentucky, 1 location in Green County, Kentucky, 1 location in Russell County, Kentucky, and 1

location in Marion County, Kentucky

|

||||||||||||

|

Mt. Vernon Market

|

2

|

0

|

2

|

|||||||||

|

2 locations in Rockcastle County, Kentucky

|

||||||||||||

|

* LaFollette Market

|

3

|

0

|

3

|

|||||||||

|

2 locations in Campbell County, Tennessee and 1 location in Anderson County, Tennessee

|

||||||||||||

|

Total banking locations

|

71

|

8

|

79

|

|||||||||

|

Operational locations:

|

||||||||||||

|

Community Trust Bank, Inc.

|

||||||||||||

|

Pikeville (Pike County, Kentucky) (lease land at 1 owned location)

|

1

|

0

|

1

|

|||||||||

|

Total operational locations

|

1

|

0

|

1

|

|||||||||

|

Total locations

|

72

|

8

|

80

|

|||||||||

| Item 3. |

Legal Proceedings

|

| Item 4. |

Mine Safety Disclosures

|

|

Name and Age (1)

|

Positions and Offices

Currently Held

|

Date First Became

Executive Officer

|

Principal Occupation

|

||

|

Mark A. Gooch; 65

|

Vice Chairman, President, and Chief Executive Officer

|

1997

|

(2)

|

|

Vice Chairman, President, and CEO of CTBI

|

|

Kevin J. Stumbo; 63

|

Executive Vice President, Chief Financial Officer, and Treasurer

|

2002

|

Executive Vice President/Chief Financial Officer of CTBI

|

||

|

Richard W. Newsom; 69

|

Executive Vice President

|

2002

|

(3)

|

|

Executive Vice President/President of CTB

|

|

Andy D. Waters; 58

|

Executive Vice President

|

2011

|

President and CEO of CTIC

|

||

|

C. Wayne Hancock; 49

|

Executive Vice President and Secretary

|

2014

|

(4)

|

|

Executive Vice President/Chief Legal Officer of CTB

|

|

James B. Draughn; 64

|

Executive Vice President

|

2001

|

Executive Vice President/Operations of CTB

|

||

|

Steven E. Jameson; 67

|

Executive Vice President

|

2004

|

(5)

|

|

Executive Vice President/Chief Internal Audit & Risk Officer of CTB

|

|

Ricky D. Sparkman; 61

|

Executive Vice President

|

2002

|

Executive Vice President/South Central Region President of CTB

|

||

|

D. Andrew Jones; 61

|

Executive Vice President

|

2010

|

Executive Vice President/Northeastern Region President of CTB

|

||

|

David Tackett; 58

|

Executive Vice President

|

2022

|

(6)

|

|

Executive Vice President/Eastern Region President of CTB

|

|

Billie J. Dollins; 63

|

Executive Vice President

|

2023

|

(7)

|

|

Executive Vice President/Central Kentucky Region President of CTB

|

|

Mark E. Smith; 53

|

Executive Vice President

|

2024

|

(8)

|

|

Executive Vice President/Chief Credit Officer of CTB

|

| (1) |

The ages listed for CTBI’s executive officers are as of February 28, 2024.

|

| (2) |

Mr. Gooch became President of CTBI on July 27, 2021 and assumed the additional positions of Vice Chairman and Chief Executive Officer of CTBI effective February 7, 2022, upon the retirement of Jean R. Hale. Mr. Gooch retained his

previous position as Chief Executive Officer of CTB and assumed the additional roles of Chairman of CTB and Chairman of CTIC also effective with Ms. Hale’s retirement on February 7, 2022.

|

| (3) |

Mr. Newsom became President of CTB on February 7, 2022. He previously served as President of the Eastern Region of CTB.

|

| (4) |

Mr. Hancock became Secretary of CTBI on February 7, 2022.

|

| (5) |

Mr. Jameson is a non-voting member of the Executive Committee.

|

| (6) |

Mr. Tackett became Executive Vice President of CTBI and President of the Eastern Region of CTB on February 7, 2022. He previously held the position of President of the Floyd, Knott, and Johnson Market of CTB.

|

| (7) |

Ms. Dollins became Executive Vice President of CTBI and President of the Central Kentucky Region of CTB on January 3, 2023, following the retirement of Larry W. Jones. She previously held the position of President of the Versailles

Market of CTB.

|

| (8) |

James J. Gartner, former Executive Vice President of CTBI and Executive Vice President/Chief Credit Officer of CTB, retired effective December 29, 2023. Mr. Smith was named Executive Vice President of CTBI and Executive Vice

President/Chief Credit Officer of CTB effective January 2, 2024.

|

| Item 5. |

Market for the Registrant’s Common Equity, Related Shareholder Matters, and Issuer Purchases of Equity Securities

|

|

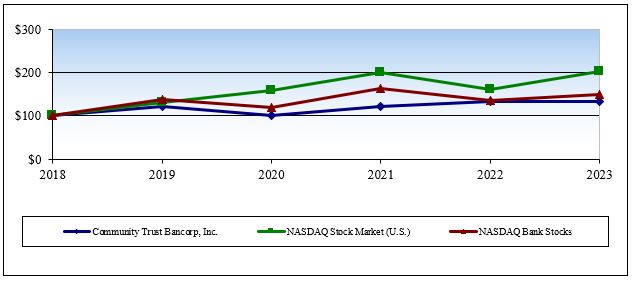

Fiscal Year Ending December 31 ($)

|

||||||

|

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

|

Community Trust Bancorp, Inc.

|

100.00

|

121.48

|

100.49

|

122.54

|

133.78

|

132.99

|

|

NASDAQ Stock Market (U.S.)

|

100.00

|

131.17

|

159.07

|

200.26

|

160.75

|

203.23

|

|

NASDAQ Bank Stocks

|

100.00

|

137.18

|

119.62

|

164.26

|

135.89

|

149.56

|

| Item 6. |

[Reserved]

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

❖

|

Our Business

|

|

❖

|

Financial Goals and Performance

|

|

❖

|

Results of Operations and Financial Condition

|

|

❖

|

Liquidity and Market Risk

|

|

❖

|

Interest Rate Risk

|

|

❖

|

Capital Resources

|

|

❖

|

Impact of Inflation, Changing Prices, and Economic Conditions

|

|

❖

|

Stock Repurchase Program

|

|

❖

|

Critical Accounting Policies and Estimates

|

|

2023 Goals

|

2023 Performance

|

2024 Goals

|

|

|

Basic earnings per share

|

$4.57 - $4.75

|

$4.36

|

$4.31 - $4.49

|

|

Net income

|

$82.0 - $85.4 million

|

$78.0 million

|

$77.7 - $80.8 million

|

|

ROAA

|

1.50% - 1.56%

|

1.40%

|

1.33% - 1.39%

|

|

ROAE

|

12.26% - 12.76%

|

11.75%

|

10.99% - 11.44%

|

|

Revenues

|

$237.9 - $247.6 million

|

$230.8 million

|

$236.8 - $246.5 million

|

|

Noninterest revenue as % of total revenue

|

24.00% - 26.00%

|

25.00%

|

23.50% - 25.50%

|

|

Assets

|

$5.38 - $5.72 billion

|

$5.77 billion

|

$5.74 - $6.10 billion

|

|

Loans

|

$3.77 - $3.92 billion

|

$4.05 billion

|

$4.18 - $4.35 billion

|

|

Deposits, including repurchase agreements

|

$4.64 - $4.83 billion

|

$4.95 billion

|

$4.97 - $5.17 billion

|

|

Shareholders’ equity

|

$686.5 - $714.5 million

|

$702.2 million

|

$711.2 - $740.3 million

|

|

❖

|

Net interest income for the year ended December 31, 2023 increased $4.0 million, or 2.4%, from December 31, 2022 with a $114.8 million increase in average earning assets.

|

|

❖

|

Provision for credit losses was $6.8 million for the year ended December 31, 2023 compared to $4.9 million for the year ended December 31, 2022.

|

|

❖

|

Our loan portfolio increased $341.6 million, or 9.2%, from December 31, 2022 to December 31, 2023.

|

|

❖

|

Net loan charge-offs were $3.2 million, or 0.08% of average loans annualized, for the year ended December 31, 2023 compared to $0.7 million, or 0.02% of average loans annualized, for the year ended

December 31, 2022.

|

|

❖

|

Our total nonperforming loans at $14.0 million at December 31, 2023 decreased $1.3 million, or 8.8%, from December 31, 2022. Nonperforming assets at $15.6 million decreased $3.4 million, or 17.9%, from

December 31, 2022.

|

|

❖

|

Deposits, including repurchase agreements, at December 31, 2023 increased $308.3 million, or 6.6%, from December 31, 2022.

|

|

❖

|

Noninterest income for the year ended December 31, 2023 of $57.7 million decreased $0.3 million, or 0.4%, compared to the year ended December 31, 2022.

|

|

❖

|

Noninterest expense for the year ended December 31, 2023 of $125.4 million increased $4.3 million, or 3.6%, compared to the year ended December 31, 2022.

|

|

(dollars in thousands)

|

Change 2023 vs. 2022

|

|||||||||||||||

|

Year Ended December 31

|

2023

|

2022

|

Amount

|

Percent

|

||||||||||||

|

Net interest income

|

$

|

173,110

|

$

|

169,102

|

$

|

4,008

|

2.4

|

%

|

||||||||

|

Provision for credit losses (recovery)

|

6,811

|

4,905

|

1,906

|

38.9

|

||||||||||||

|

Noninterest income

|

57,659

|

57,916

|

(257

|

)

|

(0.4

|

)

|

||||||||||

|

Noninterest expense

|

125,390

|

121,071

|

4,319

|

3.6

|

||||||||||||

|

Income taxes

|

20,564

|

19,228

|

1,336

|

6.9

|

||||||||||||

|

Net income

|

$

|

78,004

|

$

|

81,814

|

$

|

(3,810

|

)

|

(4.7

|

)%

|

|||||||

|

Average earning assets

|

$

|

5,244,128

|

$

|

5,129,345

|

$

|

114,783

|

2.2

|

%

|

||||||||

|

Yield on average earnings assets, tax equivalent*

|

5.15

|

%

|

3.87

|

%

|

1.28

|

%

|

33.1

|

%

|

||||||||

|

Cost of interest bearing funds

|

2.72

|

%

|

0.85

|

%

|

1.87

|

%

|

220.0

|

%

|

||||||||

|

Net interest margin, tax equivalent*

|

3.32

|

%

|

3.32

|

%

|

0.0

|

%

|

0.0

|

%

|

||||||||

|

2023

|

2022

|

|||||||||||||||||||||||

|

(in thousands)

|

Average

Balances

|

Interest

|

Average

Rate

|

Average

Balances

|

Interest

|

Average

Rate

|

||||||||||||||||||

|

Earning assets:

|

||||||||||||||||||||||||

|

Loans (1)(2)(3)

|

$

|

3,888,585

|

$

|

231,114

|

5.94

|

%

|

$

|

3,552,941

|

$

|

169,950

|

4.78

|

%

|

||||||||||||

|

Loans held for sale

|

228

|

31

|

13.60

|

893

|

94

|

10.53

|

||||||||||||||||||

|

Securities:

|

||||||||||||||||||||||||

|

U.S. Treasury and agencies

|

855,300

|

17,369

|

2.03

|

1,022,511

|

14,699

|

1.44

|

||||||||||||||||||

|

Tax exempt state and political subdivisions (3)

|

105,158

|

3,568

|

3.39

|

119,118

|

3,795

|

3.19

|

||||||||||||||||||

|

Other securities

|

243,012

|

9,894

|

4.07

|

260,423

|

6,996

|

2.69

|

||||||||||||||||||

|

Federal Reserve Bank and Federal Home Loan Bank stock

|

10,841

|

759

|

7.00

|

12,388

|

603

|

4.87

|

||||||||||||||||||

|

Federal funds sold

|

256

|

9

|

3.52

|

414

|

15

|

3.62

|

||||||||||||||||||

|

Interest bearing deposits

|

138,646

|

6,968

|

5.03

|

158,563

|

2,484

|

1.57

|

||||||||||||||||||

|

Other investments

|

245

|

0

|

0.00

|

245

|

0

|

0.00

|

||||||||||||||||||

|

Investment in unconsolidated subsidiaries

|

1,857

|

129

|

6.95

|

1,849

|

62

|

3.35

|

||||||||||||||||||

|

Total earning assets

|

$

|

5,244,128

|

$

|

269,841

|

5.15

|

%

|

$

|

5,129,345

|

$

|

198,698

|

3.87

|

%

|

||||||||||||

|

Allowance for credit losses

|

(47,606

|

)

|

(43,081

|

)

|

||||||||||||||||||||

|

5,196,522

|

5,086,264

|

|||||||||||||||||||||||

|

Nonearning assets:

|

||||||||||||||||||||||||

|

Cash and due from banks

|

61,184

|

59,645

|

||||||||||||||||||||||

|

Premises and equipment and right of use assets, net

|

60,232

|

53,928

|

||||||||||||||||||||||

|

Other assets

|

254,203

|

238,859

|

||||||||||||||||||||||

|

Total assets

|

$

|

5,572,141

|

$

|

5,438,696

|

||||||||||||||||||||

|

Interest bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Savings and demand deposits

|

$

|

2,136,653

|

$

|

52,336

|

2.45

|

%

|

$

|

2,020,065

|

$

|

16,526

|

0.82

|

%

|

||||||||||||

|

Time deposits

|

1,071,584

|

28,831

|

2.69

|

1,027,726

|

7,542

|

0.73

|

||||||||||||||||||

|

Repurchase agreements and federal funds purchased

|

219,591

|

8,994

|

4.10

|

243,102

|

2,540

|

1.04

|

||||||||||||||||||

|

Advances from Federal Home Loan Bank

|

18,494

|

1,004

|

5.43

|

898

|

20

|

2.23

|

||||||||||||||||||

|

Long-term debt

|

64,351

|

4,257

|

6.62

|

57,841

|

1,943

|

3.36

|

||||||||||||||||||

|

Finance lease liability

|

3,469

|

118

|

3.40

|

1,589

|

69

|

4.34

|

||||||||||||||||||

|

Total interest bearing liabilities

|

$

|

3,514,142

|

$

|

95,540

|

2.72

|

%

|

$

|

3,351,221

|

$

|

28,640

|

0.85

|

%

|

||||||||||||

|

Noninterest bearing liabilities:

|

||||||||||||||||||||||||

|

Demand deposits

|

1,343,917

|

1,398,778

|

||||||||||||||||||||||

|

Other liabilities

|

50,418

|

46,274

|

||||||||||||||||||||||

|

Total liabilities

|

4,908,477

|

4,796,273

|

||||||||||||||||||||||

|

Shareholders’ equity

|

663,664

|

642,423

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

5,572,141

|

$

|

5,438,696

|

||||||||||||||||||||

|

Net interest income, tax equivalent

|

$

|

174,301

|

$

|

170,058

|

||||||||||||||||||||

|

Less tax equivalent interest income

|

1,191

|

956

|

||||||||||||||||||||||

|

Net interest income

|

$

|

173,110

|

$

|

169,102

|

||||||||||||||||||||

|

Net interest spread

|

2.43

|

%

|

3.02

|

%

|

||||||||||||||||||||

|

Benefit of interest free funding

|

0.89

|

0.30

|

||||||||||||||||||||||

|

Net interest margin

|

3.32

|

%

|

3.32

|

%

|

||||||||||||||||||||

|

Total

Change

|

Change Due to

|

|||||||||||

|

(in thousands)

|

2023/2022

|

Volume

|

Rate

|

|||||||||

|

Interest income:

|

||||||||||||

|

Loans

|

$

|

61,164

|

$

|

17,147

|

$

|

44,017

|

||||||

|

Loans held for sale

|

(63

|

)

|

(55

|

)

|

(8

|

)

|

||||||

|

U.S. Treasury and agencies

|

2,670

|

(2,122

|

)

|

4,792

|

||||||||

|

Tax exempt state and political subdivisions

|

(227

|

)

|

(426

|

)

|

199

|

|||||||

|

Other securities

|

2,898

|

(440

|

)

|

3,338

|

||||||||

|

Federal Reserve Bank and Federal Home Loan Bank stock

|

156

|

(68

|

)

|

224

|

||||||||

|

Federal funds sold

|

(6

|

)

|

(6

|

)

|

0

|

|||||||

|

Interest bearing deposits

|

4,484

|

(275

|

)

|

4,759

|

||||||||

|

Other investments

|

0

|

0

|

0

|

|||||||||

|

Investment in unconsolidated subsidiaries

|

67

|

0

|

67

|

|||||||||

|

Total interest income

|

71,143

|

13,755

|

57,388

|

|||||||||

|

Interest expense:

|

||||||||||||

|

Savings and demand deposits

|

35,810

|

1,007

|

34,803

|

|||||||||

|

Time deposits

|

21,289

|

335

|

20,954

|

|||||||||

|

Repurchase agreements and federal funds purchased

|

6,454

|

(223

|

)

|

6,677

|

||||||||

|

Advances from Federal Home Loan Bank

|

984

|

917

|

67

|

|||||||||

|

Long-term debt

|

2,314

|

241

|

2,073

|

|||||||||

|

Finance lease liability

|

49

|

67

|

(18

|

)

|

||||||||

|

Total interest expense

|

66,900

|

2,344

|

64,556

|

|||||||||

|

Net interest income

|

$

|

4,243

|

$

|

11,411

|

$

|

(7,168

|

)

|

|||||

|

(dollars in thousands)

Year Ended December 31

|

2023

|

2022

|

Percent Change

|

|||||||||

|

Components of net interest income:

|

||||||||||||

|

Income on earning assets

|

$

|

268,650

|

$

|

197,742

|

35.9

|

%

|

||||||

|

Expense on interest bearing liabilities

|

95,540

|

28,640

|

233.6

|

%

|

||||||||

|

Net interest income

|

173,110

|

169,102

|

2.4

|

%

|

||||||||

|

TEQ

|

1,191

|

956

|

24.6

|

%

|

||||||||

|

Net interest income, tax equivalent

|

$

|

174,301

|

$

|

170,058

|

2.5

|

%

|

||||||

|

Average yield and rates paid:

|

||||||||||||

|

Earning assets yield

|

5.15

|

%

|

3.87

|

%

|

33.1

|

%

|

||||||

|

Rate paid on interest bearing liabilities

|

2.72

|

%

|

0.85

|

%

|

220.0

|

%

|

||||||

|

Gross interest margin

|

2.43

|

%

|

3.02

|

%

|

(19.6

|

)%

|

||||||

|

Net interest margin

|

3.32

|

%

|

3.32

|

%

|

0.0

|

%

|

||||||

|

Average balances:

|

||||||||||||

|

Investment securities

|

$

|

1,203,470

|

$

|

1,402,052

|

(14.2

|

)%

|

||||||

|

Loans

|

$

|

3,888,585

|

$

|

3,552,941

|

9.4

|

%

|

||||||

|

Earning assets

|

$

|

5,244,128

|

$

|

5,129,345

|

2.2

|

%

|

||||||

|

Interest-bearing liabilities

|

$

|

3,514,142

|

$

|

3,351,221

|

4.9

|

%

|

||||||

|

(dollars in thousands)

Year Ended December 31

|

2023

|

2022

|

Percent

Change

|

|||||||||

|

Deposit service charges

|

$

|

29,935

|

$

|

29,049

|

3.0

|

%

|

||||||

|

Trust revenue

|

13,025

|

12,394

|

5.1

|

%

|

||||||||

|

Gains on sales of loans

|

395

|

1,525

|

(74.1

|

)%

|

||||||||

|

Loan related fees

|

3,792

|

6,185

|

(38.7

|

)%

|

||||||||

|

Bank owned life insurance revenue

|

3,517

|

2,708

|

29.8

|

%

|

||||||||

|

Brokerage revenue

|

1,473

|

1,846

|

(20.2

|

)%

|

||||||||

|

Other

|

5,522

|

4,209

|

31.2

|

%

|

||||||||

|

Total noninterest income

|

$

|

57,659

|

$

|

57,916

|

(0.4

|

)%

|

||||||

|

(dollars in thousands)

Year Ended December 31

|

2023

|

2022

|

Percent

Change

|

|||||||||

|

Salaries

|

$

|

51,283

|

$

|

48,934

|

4.8

|

%

|

||||||

|

Employee benefits

|

22,428

|

23,556

|

(4.8

|

)%

|

||||||||

|

Net occupancy and equipment

|

11,843

|

11,083

|

6.9

|

%

|

||||||||

|

Data processing

|

9,726

|

8,910

|

9.2

|

%

|

||||||||

|

Legal and professional fees

|

3,350

|

3,434

|

(2.4

|

)%

|

||||||||

|

Advertising and marketing

|

3,214

|

3,005

|

7.0

|

%

|

||||||||

|

Taxes other than property and payroll

|

1,706

|

1,570

|

8.7

|

%

|

||||||||

|

Net other real estate owned expense

|

350

|

456

|

(23.4

|

)%

|

||||||||

|

Other

|

21,490

|

20,123

|

6.8

|

%

|

||||||||

|

Total noninterest expense

|

$

|

125,390

|

$

|

121,071

|

3.6

|

%

|

||||||

|

(dollars in thousands)

|

December 31, 2023

|

|||||||||||||||||||

|

Loan Category

|

Balance

|

Variance from Prior Year

|

Net (Charge-Offs)/ Recoveries

|

Nonperforming

|

ACL

|

|||||||||||||||

|

Commercial:

|

||||||||||||||||||||

|

Hotel/motel

|

$

|

395,765

|

15.2

|

%

|

$

|

0

|

$

|

0

|

$

|

4,592

|

||||||||||

|

Commercial real estate residential

|

417,943

|

12.1

|

97

|

1,557

|

4,285

|

|||||||||||||||

|

Commercial real estate nonresidential

|

778,637

|

2.1

|

393

|

2,950

|

7,560

|

|||||||||||||||

|

Dealer floorplans

|

70,308

|

(9.3

|

)

|

0

|

0

|

659

|

||||||||||||||

|

Commercial other

|

321,082

|

2.8

|

(1,434

|

)

|

850

|

3,760

|

||||||||||||||

|

Total commercial

|

1,983,735

|

6.1

|

(944

|

)

|

5,357

|

20,856

|

||||||||||||||

|

Residential:

|

||||||||||||||||||||

|

Real estate mortgage

|

937,524

|

13.6

|

(99

|

)

|

7,298

|

10,197

|

||||||||||||||

|

Home equity

|

147,036

|

22.0

|

(17

|

)

|

743

|

1,367

|

||||||||||||||

|

Total residential

|

1,084,560

|

14.7

|

(116

|

)

|

8,041

|

11,564

|

||||||||||||||

|

Consumer:

|

||||||||||||||||||||

|

Consumer direct

|

159,106

|

1.0

|

(237

|

)

|

15

|

3,261

|

||||||||||||||

|

Consumer indirect

|

823,505

|

11.7

|

(1,952

|

)

|

555

|

13,862

|

||||||||||||||

|

Total consumer

|

982,611

|

9.8

|

(2,189

|

)

|

570

|

17,123

|

||||||||||||||

|

Total loans

|

$

|

4,050,906

|

9.2

|

%

|

$

|

(3,249

|

)

|

$

|

13,968

|

$

|

49,543

|

|||||||||

|

(dollars in thousands)

|

2023

|

2022

|

Percent

Change

|

|||||||||

|

Noninterest bearing deposits

|

$

|

1,260,690

|

$

|

1,394,915

|

(9.6

|

)%

|

||||||

|

Interest bearing deposits

|

||||||||||||

|

Interest checking

|

123,927

|

112,265

|

10.4

|

%

|

||||||||

|

Money market savings

|

1,525,537

|

1,348,809

|

13.1

|

%

|

||||||||

|

Savings accounts

|

535,063

|

654,380

|

(18.2

|

)%

|

||||||||

|

Time deposits

|

1,279,405

|

915,774

|

39.7

|

%

|

||||||||

|

Repurchase agreements

|

225,245

|

215,431

|

4.6

|

%

|

||||||||

|

Total interest bearing deposits and repurchase agreements

|

3,689,177

|

3,246,659

|

13.6

|

%

|

||||||||

|

Total deposits and repurchase agreements

|

$

|

4,949,867

|

$

|

4,641,574

|

6.6

|

%

|

||||||

|

(in thousands)

|

2023

|

2022

|

||||||

|

Deposits:

|

||||||||

|

Noninterest bearing deposits

|

$

|

1,343,917

|

$

|

1,398,778

|

||||

|

Interest bearing deposits

|

128,061

|

104,631

|

||||||

|

Money market accounts

|

1,407,611

|

1,248,067

|

||||||

|

Savings accounts

|

600,981

|

667,367

|

||||||

|

Certificates of deposit of $100,000 or more

|

572,959

|

556,849

|

||||||

|

Certificates of deposit < $100,000 and other time deposits

|

498,625

|

470,877

|

||||||

|

Total deposits

|

4,552,154

|

4,446,569

|

||||||

|

Other borrowed funds:

|

||||||||

|

Repurchase agreements and federal funds purchased

|

219,591

|

243,102

|

||||||

|

Advances from Federal Home Loan Bank

|

18,494

|

898

|

||||||

|

Long-term debt

|

64,351

|

57,841

|

||||||

|

Finance lease liability

|

3,469

|

1,589

|

||||||

|

Total other borrowed funds

|

305,905

|

303,430

|

||||||

|

Total deposits and other borrowed funds

|

$

|

4,858,059

|

$

|

4,749,999

|

||||

|

Estimated Maturity at December 31, 2023

|

||||||||||||||||||||||||||||||||||||||||||||

|

Within 1 Year

|

1-5 Years

|

5-10 Years

|

After 10 Years

|

Total Fair Value

|

Amortized Cost

|

|||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

|||||||||||||||||||||||||||||||||

|

U.S. Treasury, government agencies, and government sponsored agency mortgage-backed securities

|

$

|

25,996

|

2.66

|

%

|

$

|

336,805

|

1.31

|

%

|

$

|

61,380

|

4.11

|

%

|

$

|

387,372

|

2.25

|

%

|

$

|

811,553

|

2.01

|

%

|

$

|

900,104

|

||||||||||||||||||||||

|

State and political subdivisions

|

3,782

|

3.66

|

22,458

|

2.90

|

100,655

|

2.12

|

138,050

|

2.49

|

264,945

|

2.40

|

313,147

|

|||||||||||||||||||||||||||||||||

|

Asset-backed securities

|

0

|

0.00

|

0

|

0.00

|

68,053

|

7.01

|

19,173

|

6.39

|

87,226

|

6.88

|

87,993

|

|||||||||||||||||||||||||||||||||

|

Total

|

$

|

29,778

|

2.79

|

%

|

$

|

359,263

|

1.41

|

%

|

$

|

230,088

|

4.10

|

%

|

$

|

544,595

|

2.46

|

%

|

$

|

1,163,724

|

2.47

|

%

|

$

|

1,301,244

|

||||||||||||||||||||||

|

Maturity at December 31, 2023

|

||||||||||||||||

|

(in thousands)

|

Within

one year |

After one

but within

five years

|

After

five years

|

Total

|

||||||||||||

|

Commercial secured by real estate and commercial other

|

$

|

225,512

|

$

|

163,087

|

$

|

1,423,460

|

$

|

1,812,059

|

||||||||

|

Commercial and real estate construction

|

70,070

|

23,270

|

193,066

|

286,406

|

||||||||||||

|

$

|

295,582

|

$

|

186,357

|

$

|

1,616,526

|

$

|

2,098,465

|

|||||||||

|

Rate sensitivity:

|

||||||||||||||||

|

Predetermined rate

|

$

|

52,585

|

$

|

86,552

|

$

|

73,797

|

$

|

212,934

|

||||||||

|

Adjustable rate

|

242,997

|

99,805

|

1,542,729

|

1,885,531

|

||||||||||||

|

$

|

295,582

|

$

|

186,357

|

$

|

1,616,526

|

$

|

2,098,465

|

|||||||||

|

(in thousands)

|

Certificates of Deposit

|

Other Time Deposits

|

Total

|

|||||||||

|

Three months or less

|

$

|

165,959

|

$

|

7,721

|

$

|

173,680

|

||||||

|

Over three through six months

|

246,052

|

24,859

|

270,911

|

|||||||||

|

Over six through twelve months

|

241,584

|

18,360

|

259,944

|

|||||||||

|

Over twelve through sixty months

|

50,627

|

11,529

|

62,156

|

|||||||||

|

Over sixty

|

0

|

0

|

0

|

|||||||||

|

$

|

704,222

|

$

|

62,469

|

$

|

766,691

|

|||||||

|

Change in Interest Rates

(basis points)

|

Percentage Change in Net Interest Income

(12 Months)

|

|

+400

|

11.50%

|

|

+300

|

8.89%

|

|

+200

|

6.29%

|

|

+100

|

3.65%

|

|

-100

|

(0.67)%

|

|

-200

|

(2.41)%

|

|

-300

|

(4.06)%

|

|

-400

|

(5.68)%

|

|

Change in Interest Rates

(basis points)

|

Percentage Change in Net Interest Income

(12 Months)

|

|

+400

|

9.98%

|

|

+300

|

7.26%

|

|

+200

|

4.60%

|

|

+100

|

1.94%

|

|

-100

|

(1.95)%

|

|

-200

|

(3.92)%

|

|

-300

|

(5.96)%

|

|

-400

|

(7.91)%

|

|

Board Authorizations

|

Repurchases*

|

Shares Available for

Repurchase

|

||

|

Average Price ($)

|

# of Shares

|

|||

|

1998

|

500,000

|

-

|

0

|

|

|

1999

|

0

|

14.45

|

144,669

|

|

|

2000

|

1,000,000

|

10.25

|

763,470

|

|

|

2001

|

0

|

13.35

|

489,440

|

|

|

2002

|

0

|

17.71

|

396,316

|

|

|

2003

|

1,000,000

|

19.62

|

259,235

|

|

|

2004

|

0

|

23.14

|

60,500

|

|

|

2005

|

0

|

-

|

0

|

|

|

2006

|

0

|

-

|

0

|

|

|

2007

|

0

|

28.56

|

216,150

|

|

|

2008

|

0

|

25.53

|

102,850

|

|

|

2009-2019

|

0

|

-

|

0

|

|

|

2020

|

1,000,000

|

33.64

|

32,664

|

|

|

2021

|

0

|

-

|

0

|

|

|

2022

|

0

|

-

|

0

|

|

|

2023

|

0

|

-

|

0

|

|

|

Total

|

3,500,000

|

16.17

|

2,465,294

|

1,034,706

|

|

(dollars in thousands)

December 31

|

2023

|

2022

|

||||||

|

Assets:

|

||||||||

|

Cash and due from banks

|

$

|

58,833

|

$

|

51,306

|

||||

|

Interest bearing deposits

|

212,567

|

77,380

|

||||||

|

Cash and cash equivalents

|

271,400

|

128,686

|

||||||

|

Certificates of deposit in other banks

|

245

|

245

|

||||||

|

Debt securities available-for-sale at fair value (amortized cost of $1,301,244 and $1,430,605, respectively)

|

1,163,724

|

1,256,226

|

||||||

|

Equity securities at fair value

|

3,158

|

2,166

|

||||||

|

Loans held for sale

|

152

|

109

|

||||||

|

Loans

|

4,050,906

|

3,709,290

|

||||||

| Allowance for credit losses |

(49,543

|

)

|

(45,981

|

)

|

||||

|

Net loans

|

4,001,363

|

3,663,309

|

||||||

|

Premises and equipment, net

|

45,311

|

42,633

|

||||||

|

Operating right-of-use assets

|

12,607

|

13,809

|

||||||

| Finance right-of-use assets |

3,096 | 3,262 | ||||||

|

Federal Home Loan Bank stock

|

4,712

|

6,676

|

||||||

|

Federal Reserve Bank stock

|

4,887

|

4,887

|

||||||

|

Goodwill

|

65,490

|

65,490

|

||||||

|

Bank owned life insurance

|

101,461

|

92,746

|

||||||

|

Mortgage servicing rights

|

7,665

|

8,468

|

||||||

|

Other real estate owned

|

1,616

|

3,671

|

||||||

| Deferred tax asset |

28,141 | 39,878 | ||||||

|

Accrued interest receivable

|

23,575

|

19,592

|

||||||

|

Other assets

|

31,093

|

28,463

|

||||||

|

Total assets

|

$

|

5,769,696

|

$

|

5,380,316

|

||||

|

Liabilities and shareholders’ equity:

|

||||||||

|

Deposits:

|

||||||||

|

Noninterest bearing

|

$

|

1,260,690

|

$

|

1,394,915

|

||||

|

Interest bearing

|

3,463,932

|

3,031,228

|

||||||

|

Total deposits

|

4,724,622

|

4,426,143

|

||||||

|

Repurchase agreements

|

225,245

|

215,431

|

||||||

|

Federal funds purchased

|

500

|

500

|

||||||

|

Advances from Federal Home Loan Bank

|

334

|

355

|

||||||

|

Long-term debt

|

64,241

|

57,841

|

||||||

|

Operating lease liability

|

12,958

|

14,160

|

||||||

|

Finance lease liability

|

3,435

|

3,468

|

||||||

|

Accrued interest payable

|

7,389

|

2,237

|

||||||

|

Other liabilities

|

28,764

|

32,134

|

||||||

|

Total liabilities

|

5,067,488

|

4,752,269

|

||||||

|

Commitments and contingencies (notes 17 and 19)

|

- |

- |

||||||

|

Shareholders’ equity:

|

||||||||

|

Preferred stock, 300,000 shares authorized and unissued

|

-

|

-

|

||||||

|

Common stock, $5.00

par value, shares authorized 25,000,000; shares outstanding 2023 – 17,999,840; 2022 – 17,918,280

|

89,999

|

89,591

|

||||||

|

Capital surplus

|

231,130

|

229,012

|

||||||

|

Retained earnings

|

484,400

|

438,596

|

||||||

|

Accumulated other comprehensive loss, net of tax

|

(103,321

|

)

|

(129,152

|

)

|

||||

|

Total shareholders’ equity

|

702,208

|

628,047

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

5,769,696

|

$

|

5,380,316

|

||||

|

(in thousands except per share data)

Year Ended December 31

|

2023

|

2022

|

2021

|

|||||||||

|

Interest income:

|

||||||||||||

|

Interest and fees on loans, including loans held for sale

|

$

|

230,844

|

$

|

169,885

|

$

|

160,198

|

||||||

|

Interest and dividends on securities:

|

||||||||||||

|

Taxable

|

27,263

|

21,695

|

13,981

|

|||||||||

|

Tax exempt

|

2,678

|

2,998

|

3,098

|

|||||||||

|

Interest and dividends on Federal Reserve Bank and Federal Home Loan Bank stock

|

759

|

603

|

486

|

|||||||||

|

Interest on Federal Reserve Bank deposits

|

6,831

|

2,439

|

372

|

|||||||||

|

Other, including interest on federal funds sold

|

275

|

122

|

34

|

|||||||||

|

Total interest income

|

268,650

|

197,742

|

178,169

|

|||||||||

|

Interest expense:

|

||||||||||||

|

Interest on deposits

|

81,167

|

24,068

|

12,753

|

|||||||||

|

Interest on repurchase agreements and federal funds purchased

|

8,994

|

2,540

|

1,254

|

|||||||||

|

Interest on advances from Federal Home Loan Bank

|

1,004

|

20

|

0

|

|||||||||

|

Interest on long-term debt

|

4,375

|

2,012

|

1,083

|

|||||||||

|

Total interest expense

|

95,540

|

28,640

|

15,090

|

|||||||||

|

Net interest income

|

173,110

|

169,102

|

163,079

|

|||||||||

| Provision for credit losses (recovery) |

6,811

|

4,905

|

(6,386

|

)

|

||||||||

| Net interest income after provision for credit losses (recovery) |

166,299

|

164,197

|

169,465

|

|||||||||

|

Noninterest income:

|

||||||||||||

|

Deposit related fees

|

29,935

|

29,049

|

26,529

|

|||||||||

|

Gains on sales of loans, net

|

395

|

1,525

|

6,820

|

|||||||||

|

Trust and wealth management income

|

13,025

|

12,394

|

12,644

|

|||||||||

|

Loan related fees

|

3,792

|

6,185

|

5,578

|

|||||||||

|

Bank owned life insurance

|

3,517

|

2,708

|

2,844

|

|||||||||

|

Brokerage revenue

|

1,473

|

1,846

|

1,962

|

|||||||||

|

Securities gains (losses)

|

996

|

(168

|

)

|

(158

|

)

|

|||||||

|

Other noninterest income

|

4,526

|

4,377

|

4,244

|

|||||||||

|

Total noninterest income

|

57,659

|

57,916

|

60,463

|

|||||||||

|

Noninterest expense:

|

||||||||||||

|

Officer salaries and employee benefits

|

15,206

|

15,922

|

19,713

|

|||||||||

|

Other salaries and employee benefits

|

58,505

|

56,568

|

54,401

|

|||||||||

|

Occupancy, net

|

8,900

|

8,380

|

8,306

|

|||||||||

|

Equipment

|

2,943

|

2,703

|

2,548

|

|||||||||

|

Data processing

|

9,726

|

8,910

|

8,039

|

|||||||||

|

Bank franchise tax

|

1,649

|

1,528

|

1,705

|

|||||||||

|

Legal fees

|

1,131

|

1,159

|

1,160

|

|||||||||

|

Professional fees

|

2,219

|

2,275

|

2,039

|

|||||||||

|

Advertising and marketing

|

3,214

|

3,005

|

2,928

|

|||||||||

|

FDIC insurance

|

2,483

|

1,447

|

1,381

|

|||||||||

|

Other real estate owned provision and expense

|

350

|

456

|

1,401

|

|||||||||

|

Repossession expense

|

531

|

546

|

344

|

|||||||||

|

Amortization of limited partnership investments

|

2,638

|

2,853

|

3,352

|

|||||||||

|

Other noninterest expense

|

15,895

|

15,319

|

11,968

|

|||||||||

|

Total noninterest expense

|

125,390

|

121,071

|

119,285

|

|||||||||

|

Income before income taxes

|

98,568

|

101,042

|

110,643

|

|||||||||

|

Income taxes

|

20,564

|

19,228

|

22,704

|

|||||||||

|

Net income

|

$

|

78,004

|

$

|

81,814

|

$

|

87,939

|

||||||

|

Other comprehensive income (loss):

|

||||||||||||

|

Unrealized holding gains (losses) on debt securities available-for-sale:

|

||||||||||||

|

Unrealized holding gains (losses) arising during the period

|

36,863

|

(168,060

|

)

|

(24,827

|

)

|

|||||||

|

Less: Reclassification adjustments for realized gains (losses) included in net income

|

4

|

(81

|

)

|

60

|

||||||||

|

Tax expense (benefit)

|

11,028

|

(43,675

|

)

|

(6,471

|

)

|

|||||||

|

Other comprehensive income (loss), net of tax

|

25,831

|

(124,304

|

)

|

(18,416

|

)

|

|||||||

|

Comprehensive income (loss)

|

$

|

103,835

|

$

|

(42,490

|

)

|

$

|

69,523

|

|||||

|

Basic earnings per share

|

$

|

4.36

|

$

|

4.59

|

$

|

4.94

|

||||||

|

Diluted earnings per share

|

$

|

4.36

|

$

|

4.58

|

$

|

4.94

|

||||||

|

Weighted average shares outstanding-basic

|

17,887

|

17,836

|

17,786

|

|||||||||

|

Weighted average shares outstanding-diluted

|

17,900

|

17,851

|

17,804

|

|||||||||

|

(in thousands except per share and share amounts)

|

Common

Shares

|

Common

Stock

|

Capital

Surplus

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Income (Loss),

Net of Tax

|

Total

|

||||||||||||||||||

|

Balance, December 31, 2020

|

17,810,401

|

$

|

89,052

|

$

|

225,507

|

$

|

326,738

|

$

|

13,568

|

$

|

654,865

|

|||||||||||||

|

Net income

|

87,939

|

87,939

|

||||||||||||||||||||||

|

Other comprehensive income (loss)

|

(18,416

|

)

|

(18,416

|

)

|

||||||||||||||||||||

|

Cash dividends declared ($1.57 per share)

|

(27,927

|

)

|

(27,927

|

)

|

||||||||||||||||||||

|

Issuance of common stock

|

41,168

|

205

|

760

|

965

|

||||||||||||||||||||

|

Issuance of restricted stock

|

9,193

|

46

|

(46

|

)

|

0

|

|||||||||||||||||||

|

Vesting of restricted stock

|

(17,681

|

)

|

(88

|

)

|

88

|

0

|

||||||||||||||||||

|

Stock-based compensation

|

776

|

776

|

||||||||||||||||||||||

|

Balance, December 31, 2021

|

17,843,081

|

89,215

|

227,085

|

386,750

|

(4,848

|

)

|

698,202

|

|||||||||||||||||

|

Net income

|

81,814

|

81,814

|

||||||||||||||||||||||

|

Other comprehensive income (loss)

|

(124,304

|

)

|

(124,304

|

)

|

||||||||||||||||||||

|

Cash dividends declared ($1.68 per share)

|

(29,968

|

)

|

(29,968

|

)

|

||||||||||||||||||||

|

Issuance of common stock

|

54,125

|

271

|

770

|

1,041

|

||||||||||||||||||||

|

Issuance of restricted stock

|

50,438

|

252

|

(252

|

)

|

0

|

|||||||||||||||||||

| Vesting of restricted stock |

(29,364 | ) | (147 | ) | 147 | 0 | ||||||||||||||||||

|

Stock-based compensation

|

1,262

|

1,262

|

||||||||||||||||||||||

|

Balance, December 31, 2022

|

17,918,280

|

89,591

|

229,012

|

438,596

|

(129,152

|

)

|

628,047

|

|||||||||||||||||

| Net income |

78,004 | 78,004 | ||||||||||||||||||||||

| Other comprehensive income (loss) |

25,831 | 25,831 | ||||||||||||||||||||||

| Cash dividends declared ($1.80 per share) |

(32,200 | ) | (32,200 | ) | ||||||||||||||||||||

| Issuance of common stock |

52,857 | 265 | 864 | 1,129 | ||||||||||||||||||||

| Issuance of restricted stock |

52,865 | 264 | (264 | ) | 0 | |||||||||||||||||||

| Vesting of restricted stock |

(23,372 | ) | (117 | ) | 117 | 0 | ||||||||||||||||||

|

Forfeiture of restricted stock

|

(790 | ) | (4 | ) | 4 | |||||||||||||||||||

| Stock-based compensation |

1,397 | 1,397 | ||||||||||||||||||||||

| Balance, December 31, 2023 | 17,999,840 | $ | 89,999 | $ | 231,130 | $ | 484,400 | $ | (103,321 | ) | $ | 702,208 | ||||||||||||

|

(in thousands)

Year Ended December 31

|

2023

|

2022

|

2021

|

|||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net income

|

$

|

78,004

|

$

|

81,814

|

$

|

87,939

|

||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

5,351

|

5,219

|

5,033

|

|||||||||

|

Deferred taxes

|

709

|

3,250

|

2,330

|

|||||||||

|

Stock-based compensation

|

1,576

|

1,366

|

850

|

|||||||||

| Provision for credit losses (recovery) |

6,811

|

4,905

|

(6,386

|

)

|

||||||||

|

Write-downs of other real estate owned and other repossessed assets

|

211

|

285

|

864

|

|||||||||

|

Gains on sale of loans held for sale

|

(395

|

)

|

(1,525

|

)

|

(6,820

|

)

|

||||||

| Securities gains (losses) |

(4

|

)

|

81

|

(60

|

)

|

|||||||

|

Fair value adjustment in equity securities

|

(992

|

)

|

87

|

218

|

||||||||

|

Gains on sale of assets, net

|

(408

|

)

|

(354

|

)

|

(165

|

)

|

||||||

|

Proceeds from sale of mortgage loans held for sale

|

15,203

|

65,974

|

307,843

|

|||||||||

|

Funding of mortgage loans held for sale

|

(14,851

|

)

|

(61,926

|

)

|

(280,396

|

)

|

||||||

|

Amortization of securities premiums and discounts, net

|

2,658

|

5,466

|

8,010

|

|||||||||

|

Change in cash surrender value of bank owned life insurance

|

(2,361

|

)

|

(1,650

|

)

|

(1,873

|

)

|

||||||

|

Payment of operating lease liabilities

|

(1,560

|

)

|

(1,773

|

)

|

(1,693

|

)

|

||||||

|

Mortgage servicing rights:

|

||||||||||||

|

Fair value adjustments

|

965

|

(1,069

|

)

|

(428

|

)

|

|||||||

|

New servicing assets created

|

(162

|

)

|

(625

|

)

|

(2,278

|

)

|

||||||

|

Changes in:

|

||||||||||||

|

Accrued interest receivable

|

(3,983

|

)

|

(4,177

|

)

|

403

|

|||||||

|

Other assets

|

(2,630

|

)

|

2,507

|

4,918

|

||||||||

|

Accrued interest payable

|

5,152

|

1,221

|

(227

|

)

|

||||||||

|

Other liabilities

|

(3,562

|

)

|

608

|

(2,387

|

)

|

|||||||

|

Net cash provided by operating activities

|

85,732

|

99,684

|

115,695

|

|||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Certificates of deposit in other banks:

|

||||||||||||

|

Purchase of certificates of deposit

|

(245

|

)

|

0

|

0

|

||||||||

|

Maturity of certificates of deposit

|

245

|

0

|

0

|

|||||||||

|

Securities available-for-sale (AFS):

|

||||||||||||

|

Purchase of AFS securities

|

(19,478

|

)

|

(179,627

|

)

|

(797,445

|

)

|

||||||

|

Proceeds from sales of AFS securities

|

21,529

|

11,462

|

1,080

|

|||||||||

|

Proceeds from prepayments, calls, and maturities of AFS securities

|

124,656

|

193,843

|

305,361

|

|||||||||

|

Change in loans, net

|

(344,217

|

)

|

(302,466

|

)

|

146,050

|

|||||||

|

Purchase of premises and equipment

|

(6,322

|

)

|

(6,218

|

)

|

(2,373

|

)

|

||||||

|

Proceeds from sale and retirement of premises and equipment

|

375

|

620

|

830

|

|||||||||

|

Redemption of stock by Federal Home Loan Bank

|

1,964

|

1,463

|

1,909

|

|||||||||

|

Proceeds from sale of other real estate owned and repossessed assets

|

1,295

|

988

|

2,819

|

|||||||||

| Additional investment in other real estate owned and repossessed assets |

(47 | ) | (73 | ) | 0 |

|||||||

|

Additional investment in bank owned life insurance

|

(6,690

|

)

|

0

|

(17,181

|

)

|

|||||||

|

Proceeds from settlement of bank owned life insurance

|

336

|

1

|

330

|

|||||||||

|

Net cash used in investing activities

|

(226,599

|

)

|

(280,007

|

)

|

(358,620

|

)

|

||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Change in deposits, net

|

298,479

|

81,851

|

328,210

|

|||||||||

|

Change in repurchase agreements and federal funds purchased, net

|

9,814

|

(55,657

|

)

|

(84,774

|

)

|

|||||||

|

Advances from Federal Home Loan Bank

|

225,000

|

45,000

|

0

|

|||||||||

|

Payments on advances from Federal Home Loan Bank

|

(225,021

|

)

|

(45,020

|

)

|

(20

|

)

|

||||||

|

Payment of finance lease liabilities

|

(33

|

)

|

(24

|

)

|

(19

|

)

|

||||||

|

Proceeds from long-term debt/other borrowings

|

6,563 | 0 | 0 | |||||||||

|

Repayment of long-term debt/other borrowings

|

(163

|

)

|