|

001-34700

|

42-0935283

|

|

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

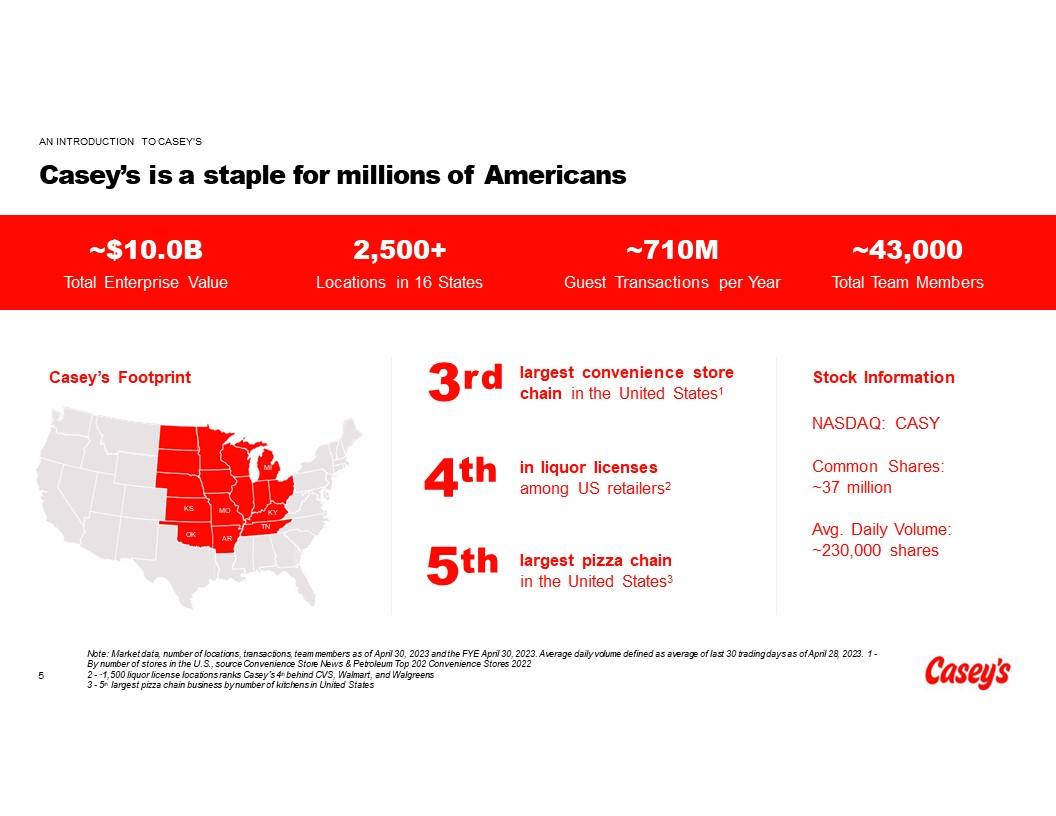

Common Stock, no par value per share

|

CASY

|

The NASDAQ Global Select Market

|

| Item 7.01. |

Regulation FD Disclosure

|

| Item 9.01. |

Financial Statements and Exhibits

|

| (d) |

Exhibits.

|

|

Exhibit No.

|

Description

|

|

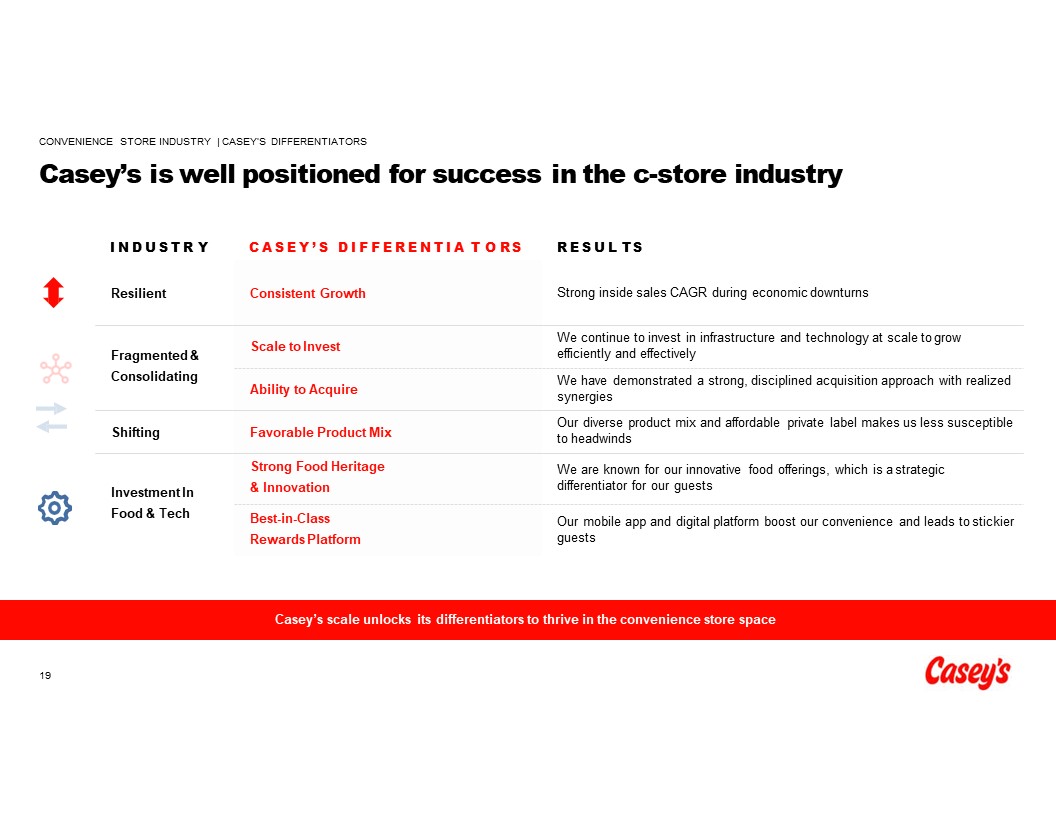

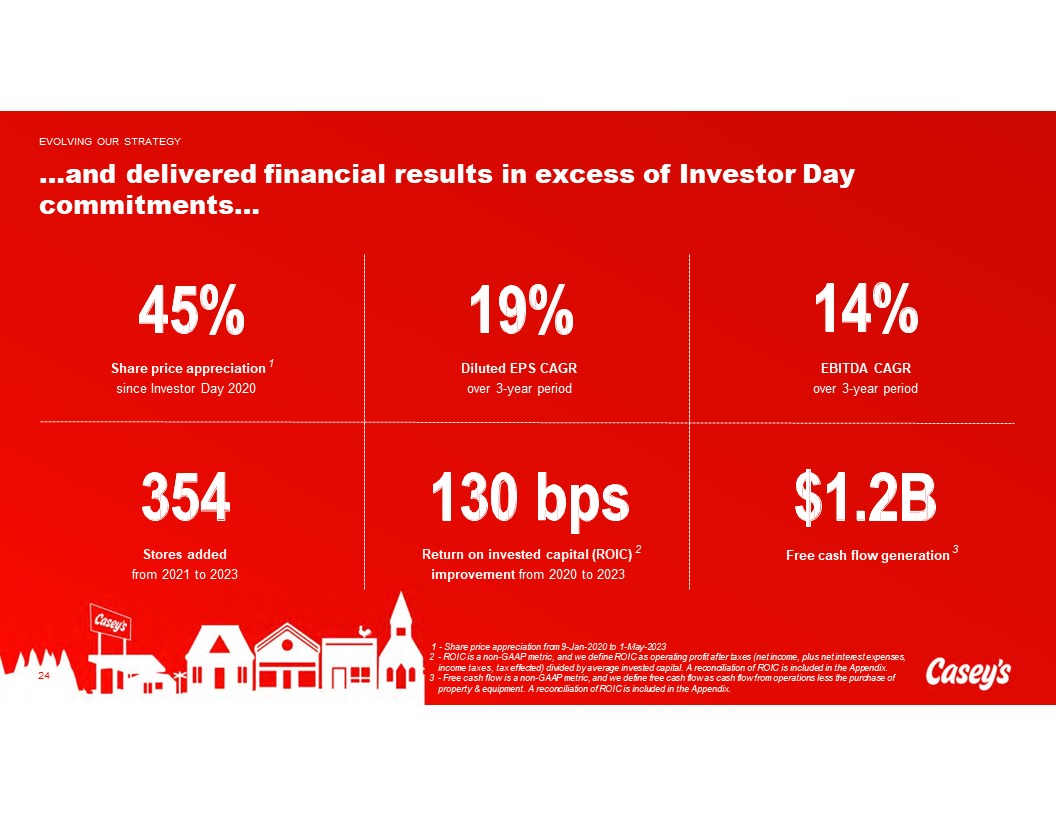

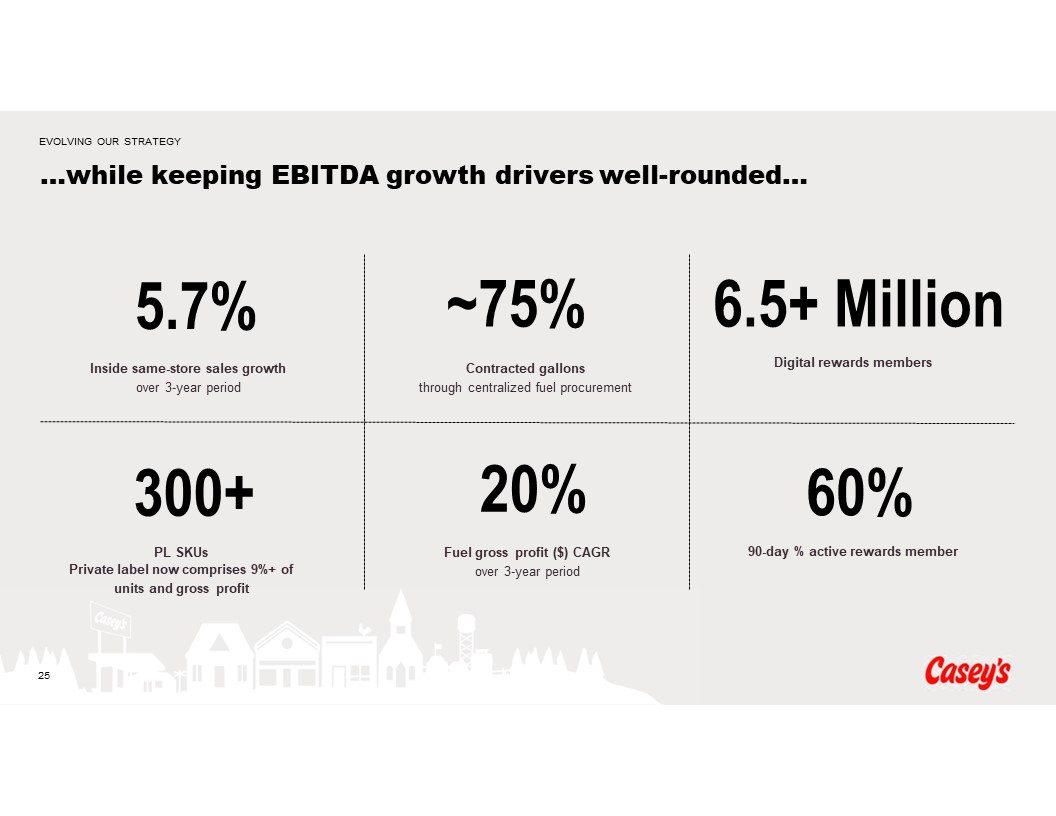

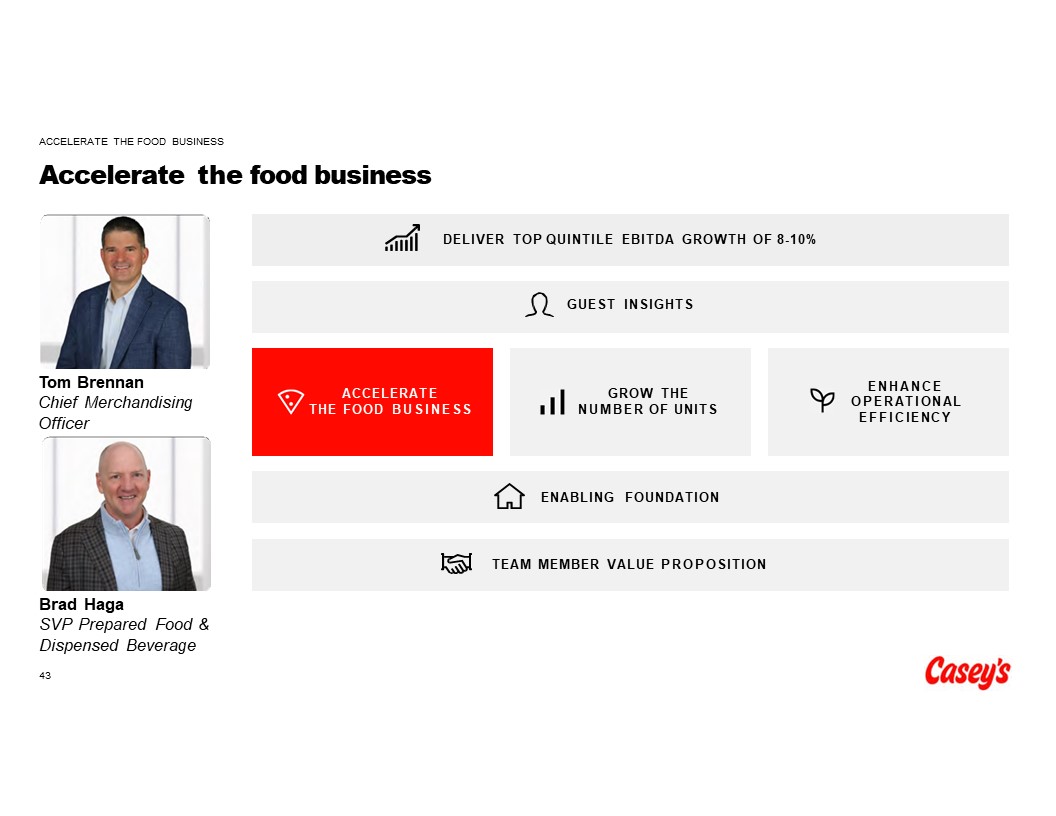

2023 Investor Day Presentation dated June 27, 2023

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

CASEY'S GENERAL STORES, INC.

|

||

|

Dated: June 27, 2023

|

By:

|

/s/ Stephen P. Bramlage, Jr.

|

|

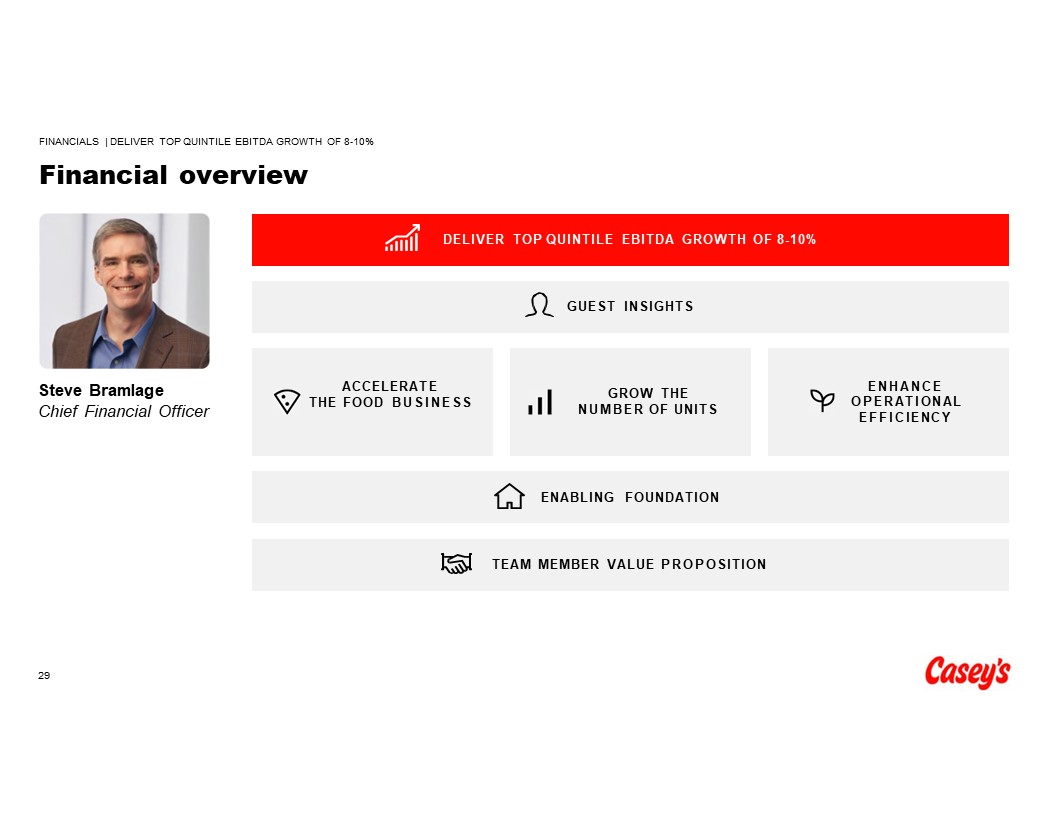

Stephen P. Bramlage Jr.

|

||

|

Chief Financial Officer

|