| Delaware | 000-50171 | 36-4415727 | |||||||||

|

(State or Other

Jurisdiction of

Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|||||||||

|

590 Madison Avenue, 35th Floor

New York, New York

|

10022 | ||||||||||

(Address of principal executive offices) |

(Zip Code) | ||||||||||

|

Registrant’s telephone number, including area code +1 (212) 516-1300

| |||||||||||

| (Former Name or Former Address, if Changed Since Last Report) | |||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value | TZOO | The NASDAQ Stock Market | ||||||||||||

| TRAVELZOO | |||||||||||

| Date: | February 25, 2025 | By: | /s/ Lijun Qi | ||||||||

| Lijun Qi Chief Accounting Officer |

|||||||||||

| Exhibit | Description | ||||

Press Release, dated February 25, 2025. |

|||||

Supplemental investor presentation provided in connection with the fourth quarter 2024 earnings call of Travelzoo, dated February 25, 2025. |

|||||

|

Travelzoo

590 Madison Avenue

35th Floor

New York, NY 10022

Investor Relations:

ir@travelzoo.com

|

|||||||

| Three months ended | Twelve months ended | ||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

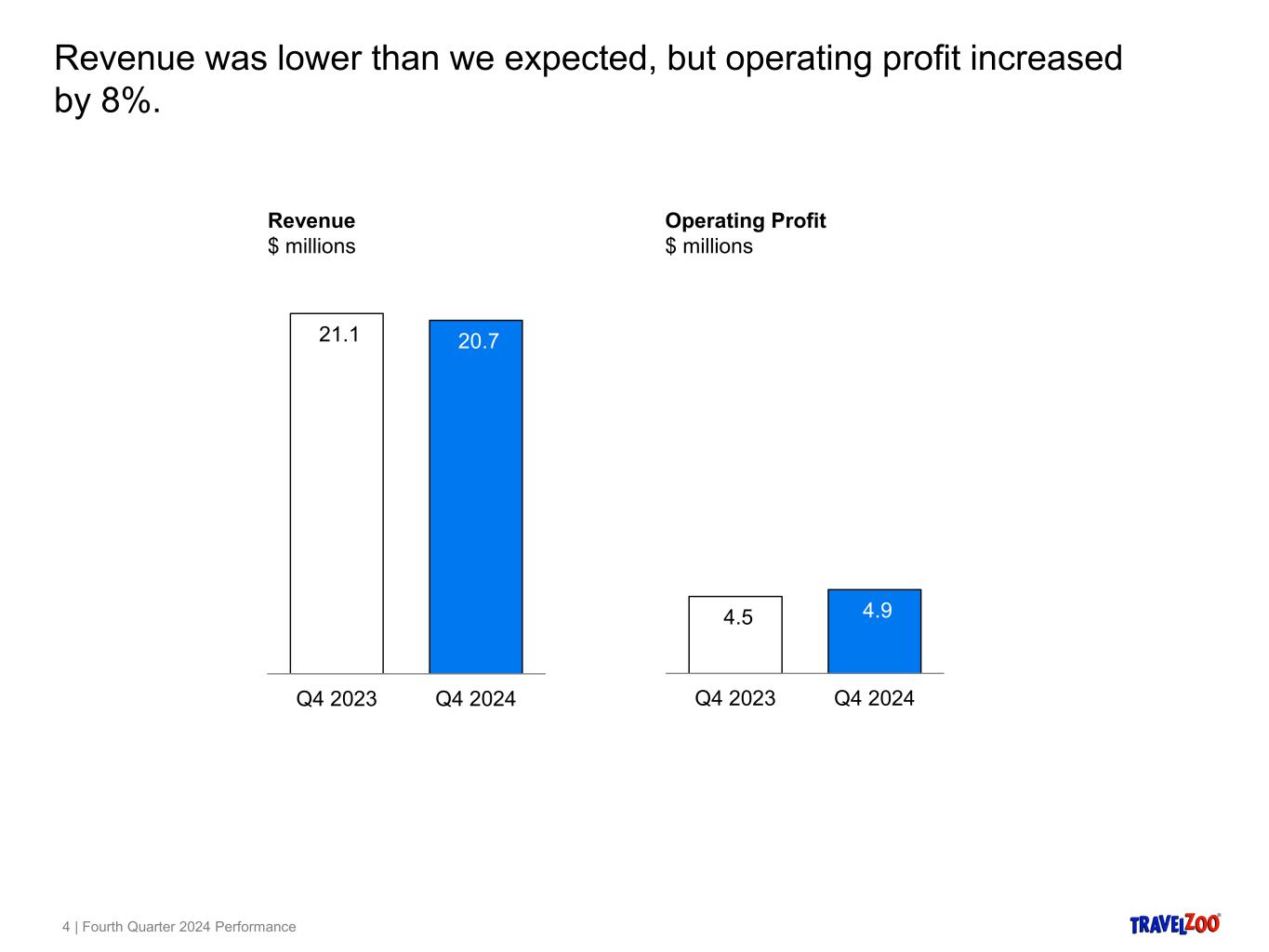

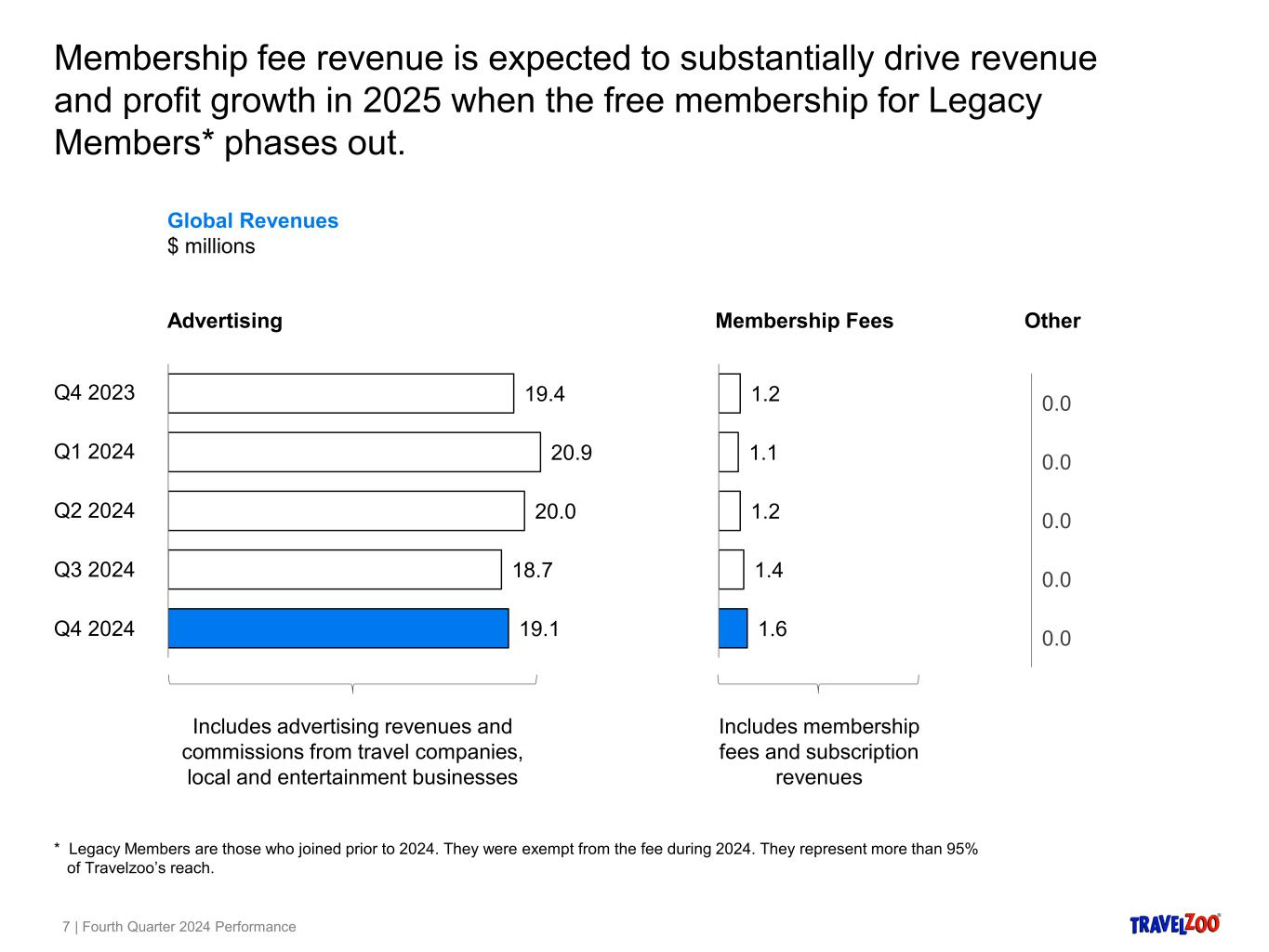

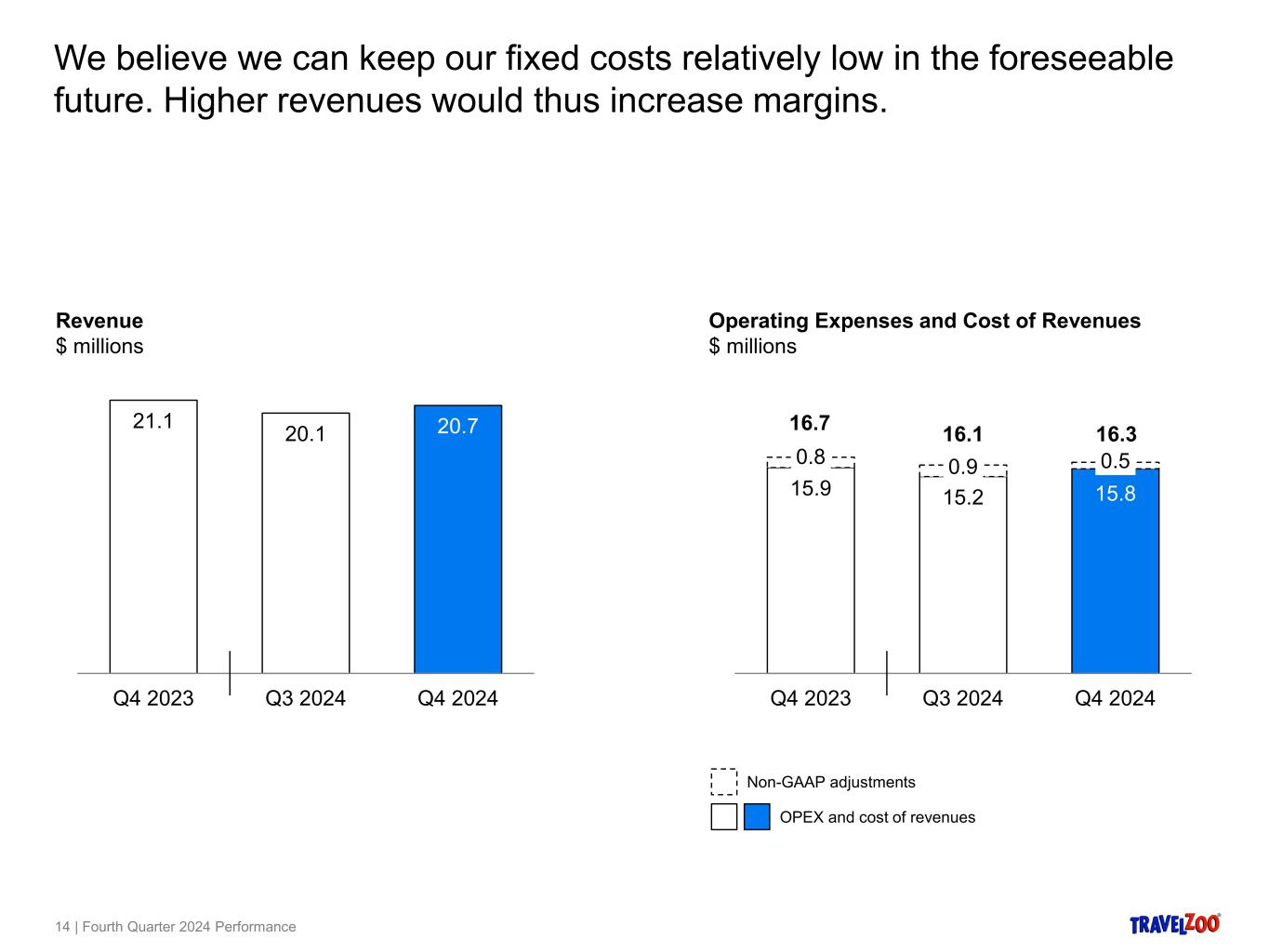

| Revenues | $ | 20,678 | $ | 21,149 | $ | 83,902 | $ | 84,477 | |||||||||||||||

| Cost of revenues | 2,761 | 2,698 | 10,469 | 10,934 | |||||||||||||||||||

| Gross profit | 17,917 | 18,451 | 73,433 | 73,543 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Sales and marketing | 8,256 | 8,496 | 34,466 | 37,774 | |||||||||||||||||||

| Product development | 644 | 580 | 2,407 | 2,113 | |||||||||||||||||||

| General and administrative | 4,183 | 4,896 | 18,058 | 18,084 | |||||||||||||||||||

| Total operating expenses | 13,083 | 13,972 | 54,931 | 57,971 | |||||||||||||||||||

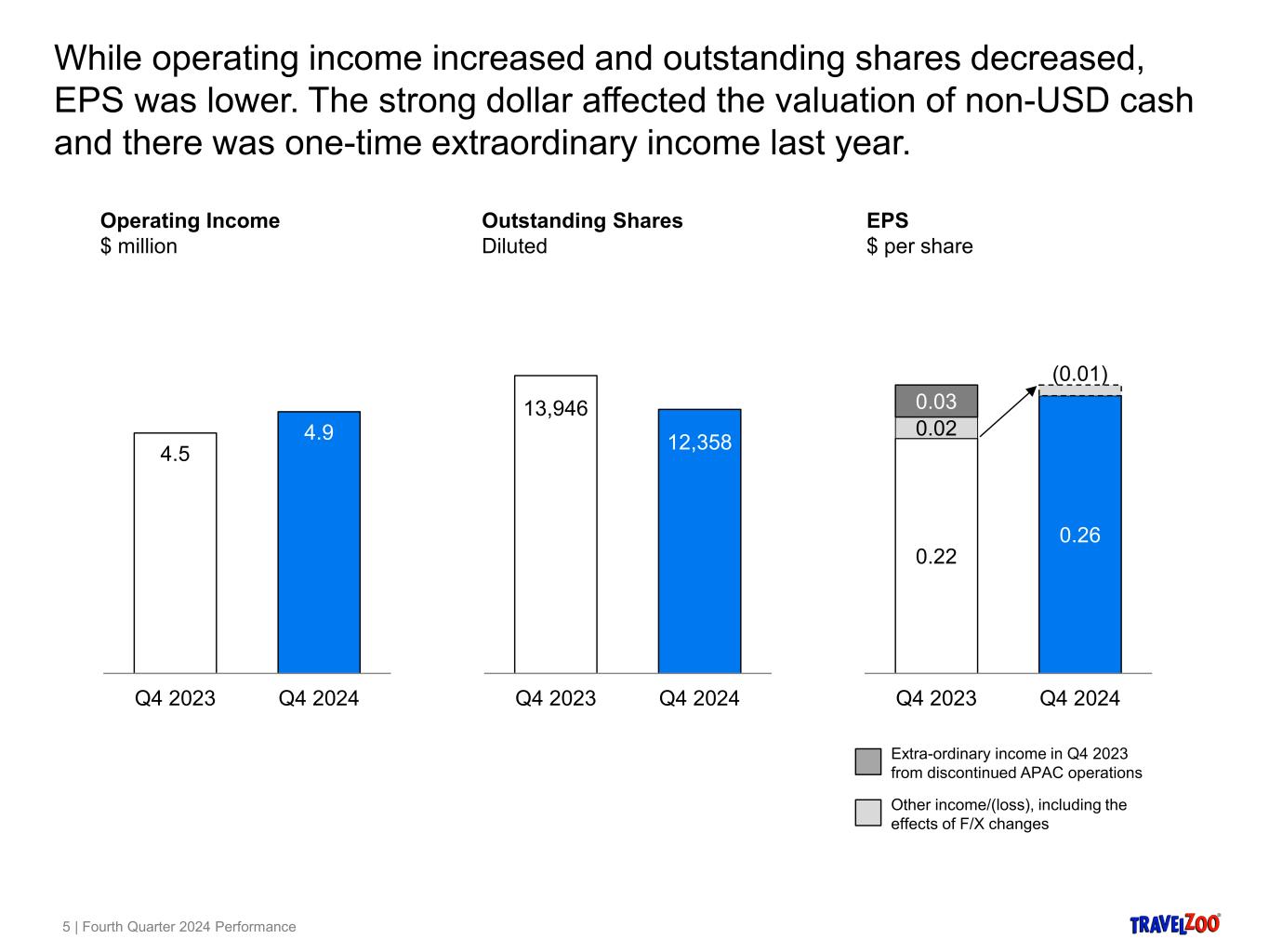

| Operating income | 4,834 | 4,479 | 18,502 | 15,572 | |||||||||||||||||||

| Other income (expense), net | (86) | 398 | 588 | 1,541 | |||||||||||||||||||

| Income from continuing operations before income taxes | 4,748 | 4,877 | 19,090 | 17,113 | |||||||||||||||||||

| Income tax expense | 1,484 | 1,618 | 5,404 | 5,105 | |||||||||||||||||||

| Income from continuing operations | 3,264 | 3,259 | 13,686 | 12,008 | |||||||||||||||||||

| Income from discontinued operations, net of tax | — | 465 | — | 460 | |||||||||||||||||||

| Net income | 3,264 | 3,724 | 13,686 | 12,468 | |||||||||||||||||||

| Net income attributable to non-controlling interest | 64 | 5 | 118 | 102 | |||||||||||||||||||

| Net income attributable to Travelzoo | $ | 3,200 | $ | 3,719 | $ | 13,568 | $ | 12,366 | |||||||||||||||

| Net income attributable to Travelzoo—continuing operations | $ | 3,200 | $ | 3,254 | $ | 13,568 | $ | 11,906 | |||||||||||||||

| Net income attributable to Travelzoo—discontinued operations | $ | — | $ | 465 | $ | — | $ | 460 | |||||||||||||||

| Income per share—basic | |||||||||||||||||||||||

| Continuing operations | $ | 0.27 | $ | 0.24 | $ | 1.08 | $ | 0.80 | |||||||||||||||

| Discontinued operations | $ | — | $ | 0.03 | $ | — | $ | 0.03 | |||||||||||||||

| Net income per share—basic | $ | 0.27 | $ | 0.27 | $ | 1.08 | $ | 0.83 | |||||||||||||||

| Income per share—diluted | |||||||||||||||||||||||

| Continuing operations | $ | 0.26 | $ | 0.24 | $ | 1.06 | $ | 0.80 | |||||||||||||||

| Discontinued operations | $ | — | $ | 0.03 | $ | — | $ | 0.03 | |||||||||||||||

| Net income per share—diluted | $ | 0.26 | $ | 0.27 | $ | 1.06 | $ | 0.83 | |||||||||||||||

| Shares used in per share calculation from continuing operations—basic | 11,831 | 13,873 | 12,594 | 14,897 | |||||||||||||||||||

| Shares used in per share calculation from discontinued operations—basic | 11,831 | 13,873 | 12,594 | 14,897 | |||||||||||||||||||

| Shares used in per share calculation from continuing operations—diluted | 12,358 | 13,946 | 12,852 | 14,964 | |||||||||||||||||||

| Shares used in per share calculation from discontinued operations—diluted | 12,358 | 13,946 | 12,852 | 14,964 | |||||||||||||||||||

| December 31, 2024 |

December 31, 2023 |

||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 17,064 | $ | 15,713 | |||||||

| Accounts receivable, net | 12,825 | 12,965 | |||||||||

| Prepaid income taxes | 736 | 629 | |||||||||

| Prepaid expenses and other | 1,148 | 1,461 | |||||||||

| Total current assets | 31,773 | 30,768 | |||||||||

| Deposits and other | 374 | 1,115 | |||||||||

| Deferred tax assets | 3,380 | 3,196 | |||||||||

| Restricted cash | 675 | 675 | |||||||||

| Operating lease right-of-use assets | 5,655 | 6,015 | |||||||||

| Property and equipment, net | 423 | 578 | |||||||||

| Intangible assets, net | 1,498 | 2,091 | |||||||||

| Goodwill | 10,944 | 10,944 | |||||||||

| Total assets | $ | 54,722 | $ | 55,382 | |||||||

| Liabilities and Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 6,134 | $ | 4,546 | |||||||

| Merchant payables | 16,294 | 20,622 | |||||||||

| Accrued expenses and other | 3,404 | 3,658 | |||||||||

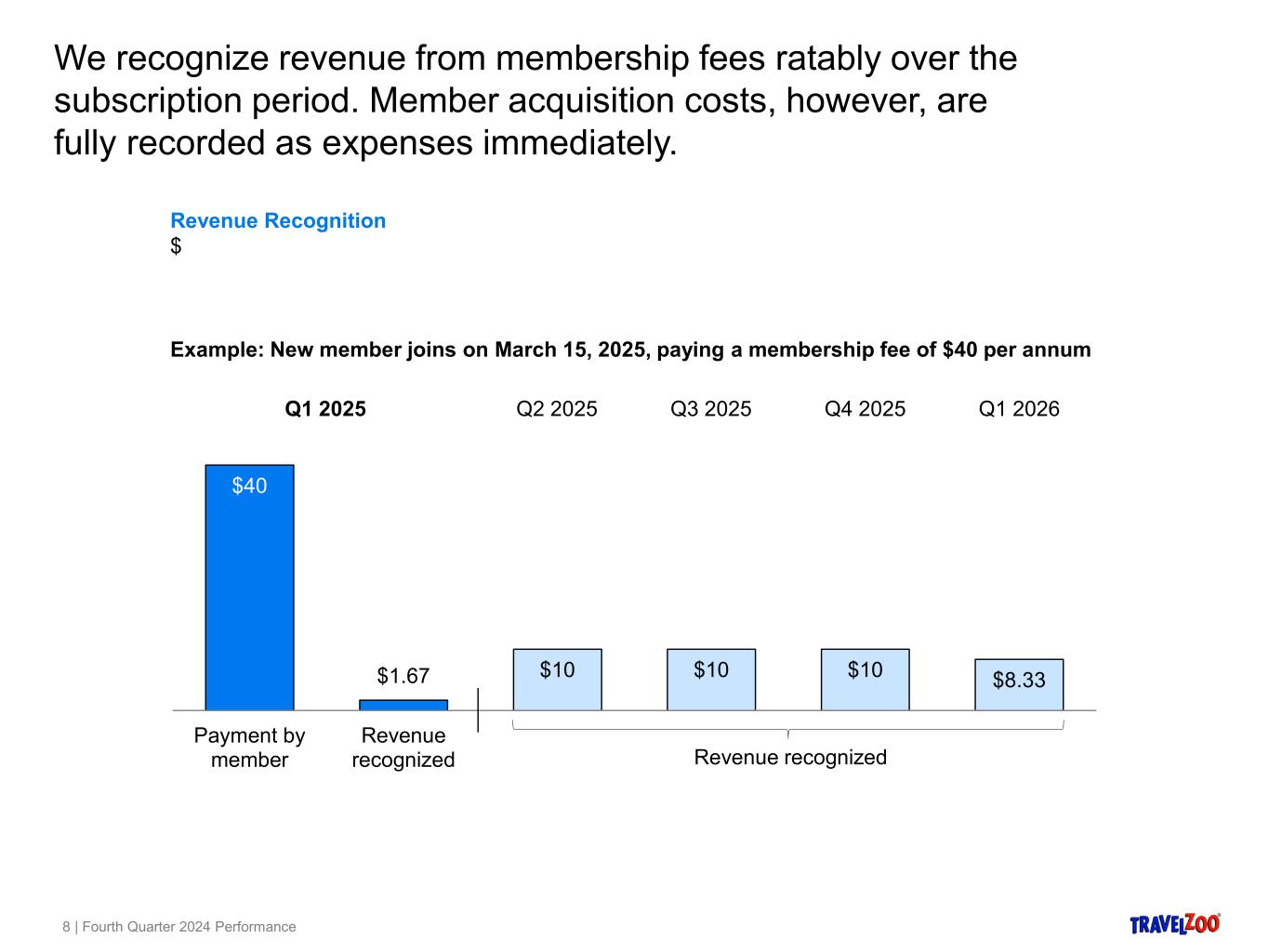

| Deferred revenue | 6,545 | 2,044 | |||||||||

| Income tax payable | 1,619 | 766 | |||||||||

| Operating lease liabilities | 2,472 | 2,530 | |||||||||

| Liabilities from discontinued operations | 28 | 24 | |||||||||

| Total current liabilities | 36,496 | 34,190 | |||||||||

| Long-term tax liabilities | 7,851 | 4,681 | |||||||||

| Long-term operating lease liabilities | 5,646 | 6,717 | |||||||||

| Other long-term liabilities | 376 | 911 | |||||||||

| Total liabilities | 50,369 | 46,499 | |||||||||

| Common stock | 118 | 136 | |||||||||

| Tax indemnification | (9,537) | (9,537) | |||||||||

| Note receivable from shareholder | — | (1,753) | |||||||||

| Additional paid-in capital | — | 439 | |||||||||

| Retained earnings | 14,284 | 19,508 | |||||||||

| Accumulated other comprehensive loss | (5,327) | (4,607) | |||||||||

| Total Travelzoo stockholders’ equity (deficit) | (462) | 4,186 | |||||||||

| Non-controlling interest | 4,815 | 4,697 | |||||||||

| Total stockholder's equity | 4,353 | 8,883 | |||||||||

| Total liabilities and equity | $ | 54,722 | $ | 55,382 | |||||||

| Three months ended | Twelve months ended | ||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Cash flows from operating activities: | |||||||||||||||||||||||

| Net income | $ | 3,264 | $ | 3,724 | $ | 13,686 | $ | 12,468 | |||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||||||||||

| Depreciation and amortization | 170 | 476 | 907 | 1,893 | |||||||||||||||||||

| Stock-based compensation | 405 | 381 | 1,645 | 1,568 | |||||||||||||||||||

| Deferred income tax | (476) | 159 | (515) | 48 | |||||||||||||||||||

| Loss on long-lived assets | — | — | — | 10 | |||||||||||||||||||

| Net foreign currency effects | 132 | (115) | (33) | (62) | |||||||||||||||||||

| Provision of loss (net recoveries) on accounts receivable and refund reserves | (81) | (72) | 40 | (1,016) | |||||||||||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||||||||

| Accounts receivable | 113 | (2,231) | (145) | 1,086 | |||||||||||||||||||

| Prepaid income taxes | 354 | 61 | (107) | 1,189 | |||||||||||||||||||

| Prepaid expenses, deposits and other | 319 | 1,603 | 950 | 3,835 | |||||||||||||||||||

| Accounts payable | 1,286 | 1,181 | 1,716 | (523) | |||||||||||||||||||

| Merchant payables | (709) | (3,338) | (4,057) | (12,095) | |||||||||||||||||||

| Accrued expenses and other | (661) | (665) | (289) | (685) | |||||||||||||||||||

| Deferred revenue | 2,767 | (785) | 4,557 | (191) | |||||||||||||||||||

| Income tax payable | 264 | 456 | 857 | 749 | |||||||||||||||||||

| Other liabilities | 507 | 547 | 1,888 | 2,401 | |||||||||||||||||||

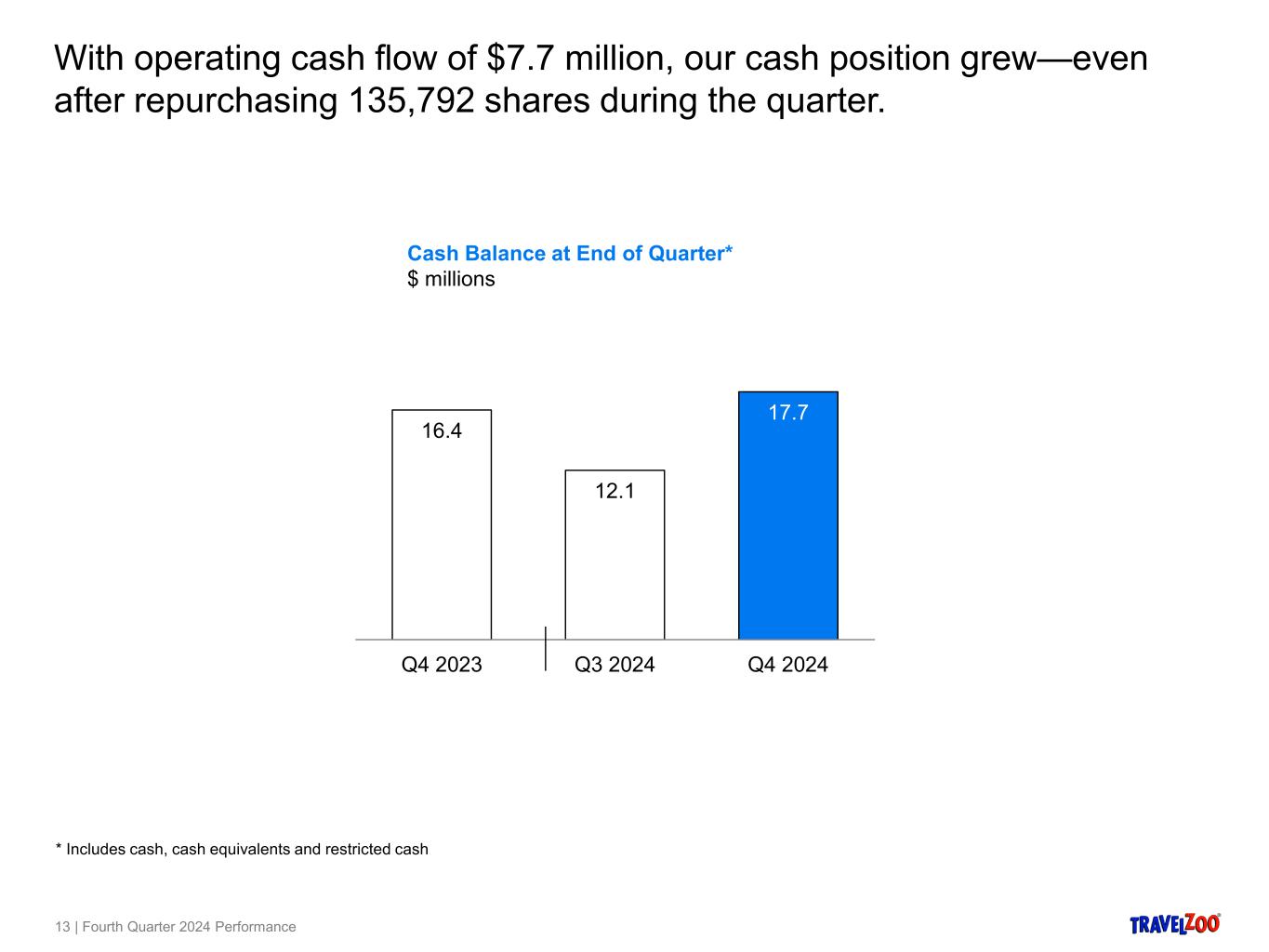

| Net cash provided by operating activities | 7,654 | 1,382 | 21,100 | 10,675 | |||||||||||||||||||

| Cash flows from investing activities: | |||||||||||||||||||||||

| Proceeds from note receivable | — | 103 | — | 216 | |||||||||||||||||||

| Purchases of property and equipment | (48) | (38) | (177) | (255) | |||||||||||||||||||

| Net cash used in investing activities | (48) | 65 | (177) | (39) | |||||||||||||||||||

| Cash flows from financing activities: | |||||||||||||||||||||||

| Repurchase of common stock | (2,324) | (5,015) | (18,929) | (16,781) | |||||||||||||||||||

| Proceeds from note receivable and account receivable from shareholder | 1,920 | 3,000 | 1,753 | 3,000 | |||||||||||||||||||

| Exercise of stock options and taxes paid for net share settlement of equity awards | (1,195) | (70) | (1,787) | (369) | |||||||||||||||||||

| Net cash used in financing activities | (1,599) | (2,085) | (18,963) | (14,150) | |||||||||||||||||||

| Effect of exchange rate on cash, cash equivalents and restricted cash | (390) | 445 | (605) | 525 | |||||||||||||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | 5,617 | (193) | 1,355 | (2,989) | |||||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 12,106 | 16,582 | 16,389 | 19,378 | |||||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 17,723 | $ | 16,389 | $ | 17,744 | $ | 16,389 | |||||||||||||||

| Three months ended December 31, 2024 | Travelzoo North America |

Travelzoo Europe | Jack's Flight Club | New Initiatives | Consolidated | ||||||||||||||||||||||||

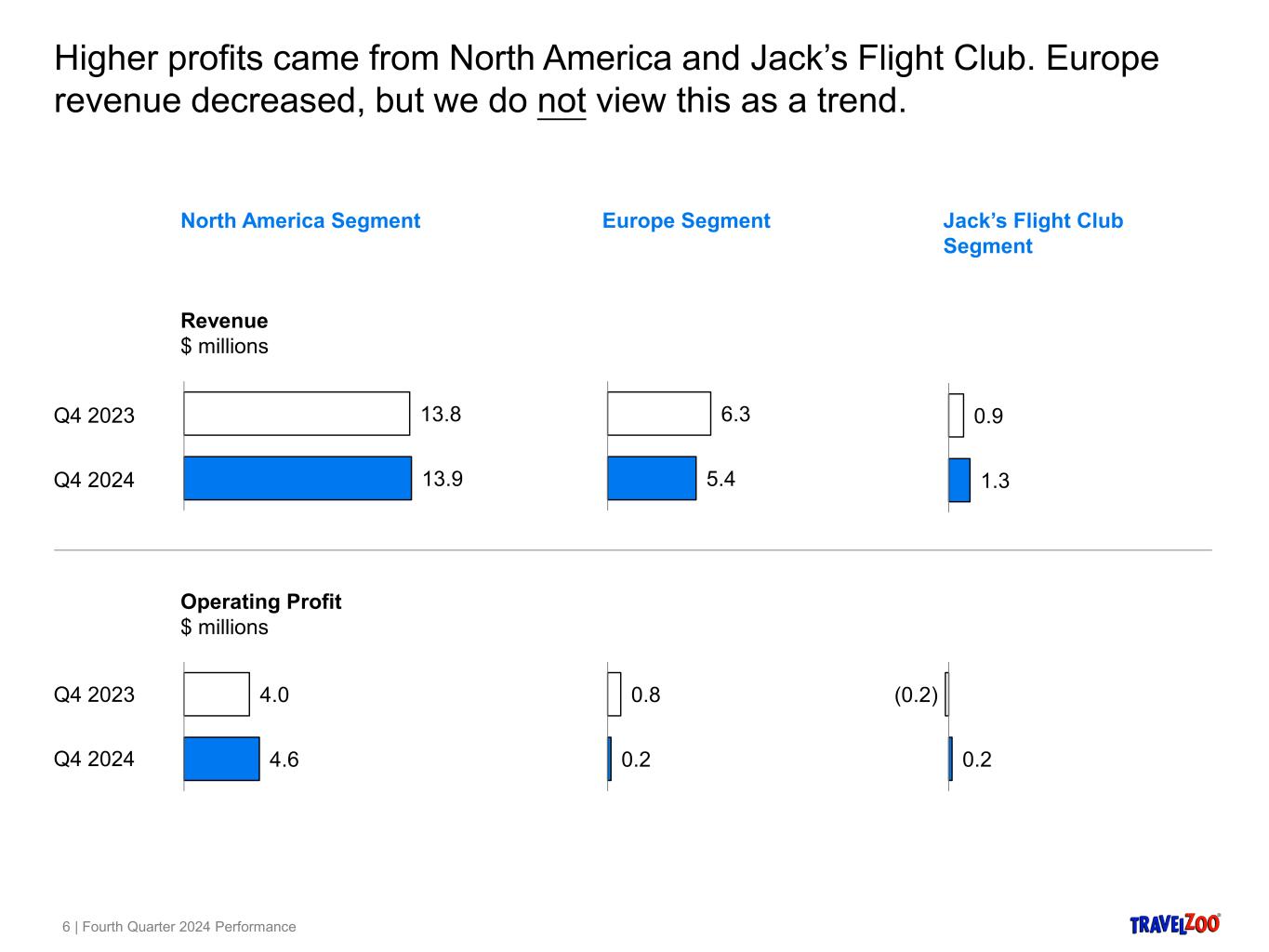

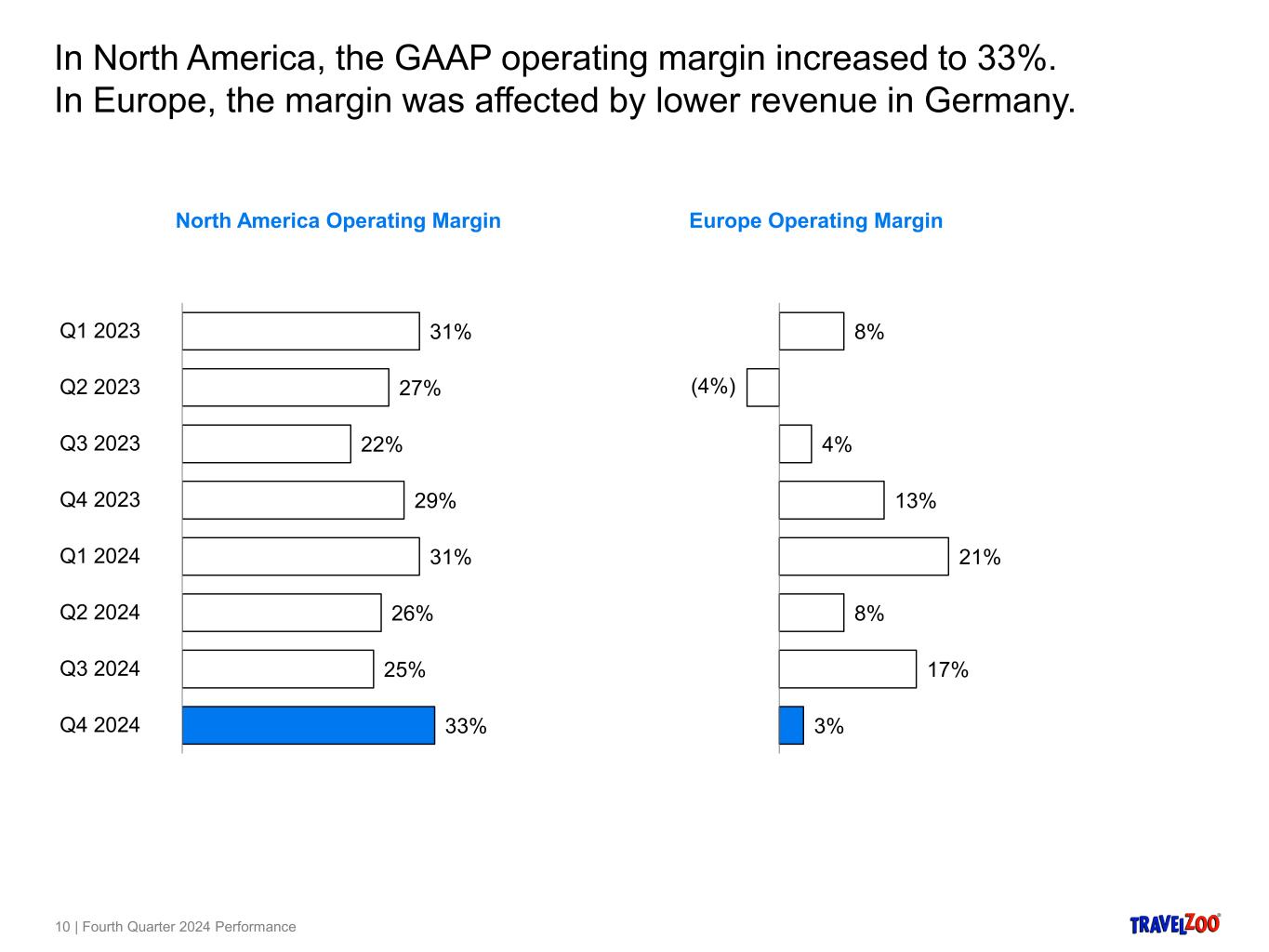

| Revenues from unaffiliated customers | $ | 13,834 | $ | 5,508 | $ | 1,317 | $ | 19 | $ | 20,678 | |||||||||||||||||||

| Intersegment revenues | 74 | (68) | (6) | — | — | ||||||||||||||||||||||||

| Total net revenues | 13,908 | 5,440 | 1,311 | 19 | 20,678 | ||||||||||||||||||||||||

| Sales and marketing expenses | 4,641 | 3,110 | 505 | — | 8,256 | ||||||||||||||||||||||||

| Other expenses | 4,689 | 2,171 | 656 | 55 | 7,571 | ||||||||||||||||||||||||

| Operating profit (loss) | $ | 4,578 | $ | 159 | $ | 150 | $ | (36) | 4,851 | ||||||||||||||||||||

| Other loss, net | (86) | ||||||||||||||||||||||||||||

| Income from continuing operations before income taxes | $ | 4,765 | |||||||||||||||||||||||||||

| Three months ended December 31, 2023 | Travelzoo North America |

Travelzoo Europe | Jack's Flight Club | New Initiatives | Consolidated | ||||||||||||||||||||||||

| Revenues from unaffiliated customers | $ | 13,534 | $ | 6,354 | $ | 1,106 | $ | 155 | $ | 21,149 | |||||||||||||||||||

| Intersegment revenues | 247 | (90) | (157) | — | — | ||||||||||||||||||||||||

| Total net revenues | 13,781 | 6,264 | 949 | 155 | 21,149 | ||||||||||||||||||||||||

| Sales and marketing expenses | 4,899 | 3,111 | 423 | 63 | 8,496 | ||||||||||||||||||||||||

| Other expenses | 4,912 | 2,321 | 745 | 196 | 8,174 | ||||||||||||||||||||||||

| Operating profit (loss) | $ | 3,970 | $ | 832 | $ | (219) | $ | (104) | 4,479 | ||||||||||||||||||||

| Other income, net | 398 | ||||||||||||||||||||||||||||

| Income from continuing operations before income taxes | $ | 4,877 | |||||||||||||||||||||||||||

| Twelve months ended December 31, 2024 | Travelzoo North America |

Travelzoo Europe | Jack's Flight Club | New Initiatives | Consolidated | ||||||||||||||||||||||||

| Revenues from unaffiliated customers | $ | 54,968 | $ | 24,113 | $ | 4,714 | $ | 107 | $ | 83,902 | |||||||||||||||||||

| Intersegment revenues | 124 | (42) | (82) | — | — | ||||||||||||||||||||||||

| Total net revenues | 55,092 | 24,071 | 4,632 | 107 | 83,902 | ||||||||||||||||||||||||

| Sales and marketing expenses | 19,748 | 12,539 | 1,898 | 280 | 34,465 | ||||||||||||||||||||||||

| Other expenses | 19,461 | 8,451 | 2,690 | 337 | 30,939 | ||||||||||||||||||||||||

| Operating profit (loss) | $ | 15,883 | $ | 3,081 | $ | 44 | $ | (510) | 18,498 | ||||||||||||||||||||

| Other income, net | 588 | ||||||||||||||||||||||||||||

| Income from continuing operations before income taxes | $ | 19,086 | |||||||||||||||||||||||||||

| Twelve months ended December 31, 2023 | Travelzoo North America |

Travelzoo Europe | Jack's Flight Club | New Initiatives | Consolidated | ||||||||||||||||||||||||

| Revenues from unaffiliated customers | $ | 54,837 | $ | 25,291 | $ | 4,145 | $ | 204 | $ | 84,477 | |||||||||||||||||||

| Intersegment revenues | 1,243 | (1,270) | 27 | — | — | ||||||||||||||||||||||||

| Total net revenues | 56,080 | 24,021 | 4,172 | 204 | 84,477 | ||||||||||||||||||||||||

| Sales and marketing expenses | 22,029 | 13,636 | 1,788 | 321 | 37,774 | ||||||||||||||||||||||||

| Other expenses | 18,797 | 9,068 | 2,407 | 859 | 31,131 | ||||||||||||||||||||||||

| Operating profit (loss) | $ | 15,254 | $ | 1,317 | $ | (23) | $ | (976) | 15,572 | ||||||||||||||||||||

| Other income, net | 1,541 | ||||||||||||||||||||||||||||

| Income from continuing operations before income taxes | $ | 17,113 | |||||||||||||||||||||||||||

| Three months ended | Twelve months ended | ||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

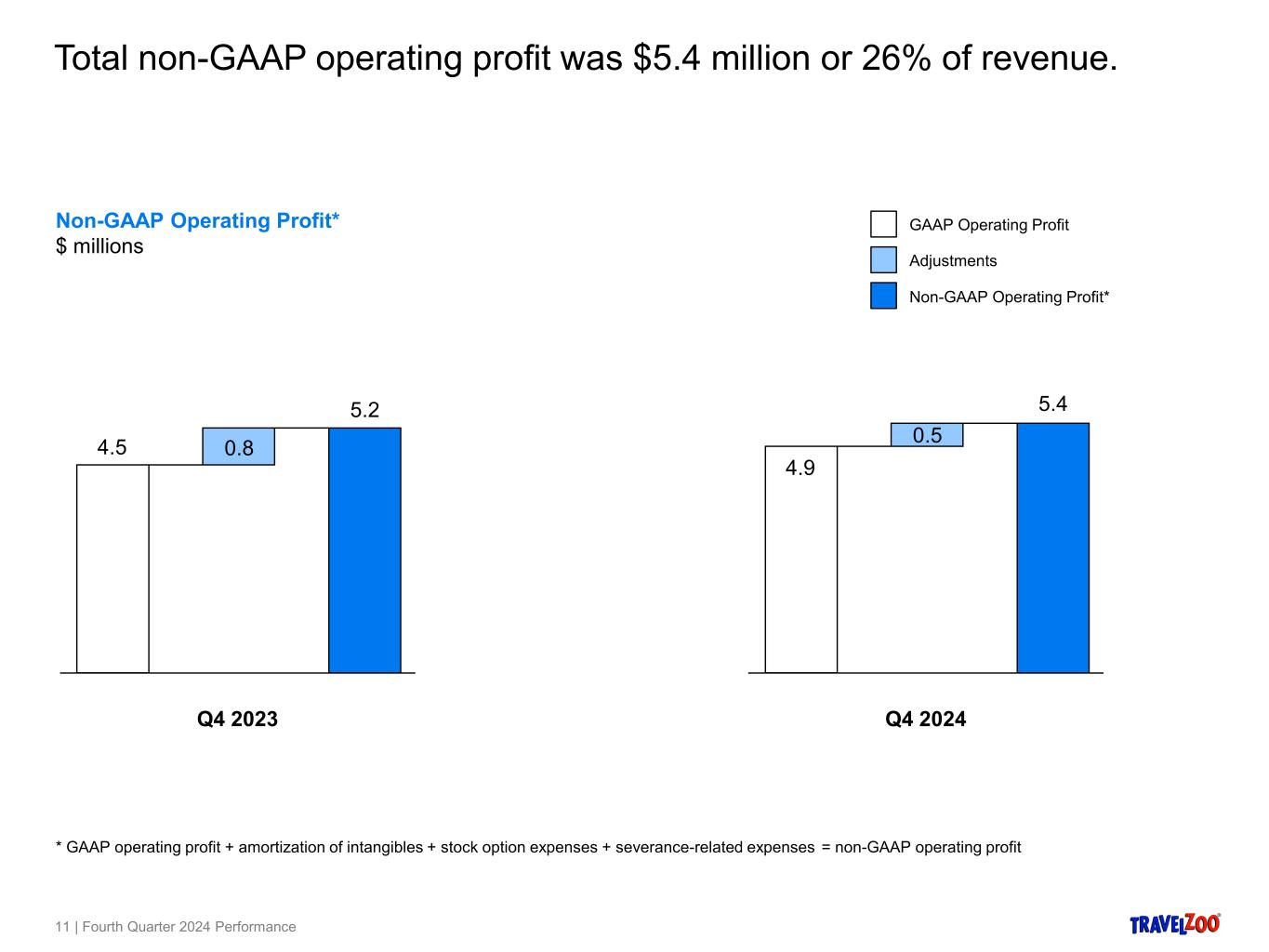

| GAAP operating expense | $ | 13,083 | $ | 13,972 | $ | 54,931 | $ | 57,971 | |||||||||||||||

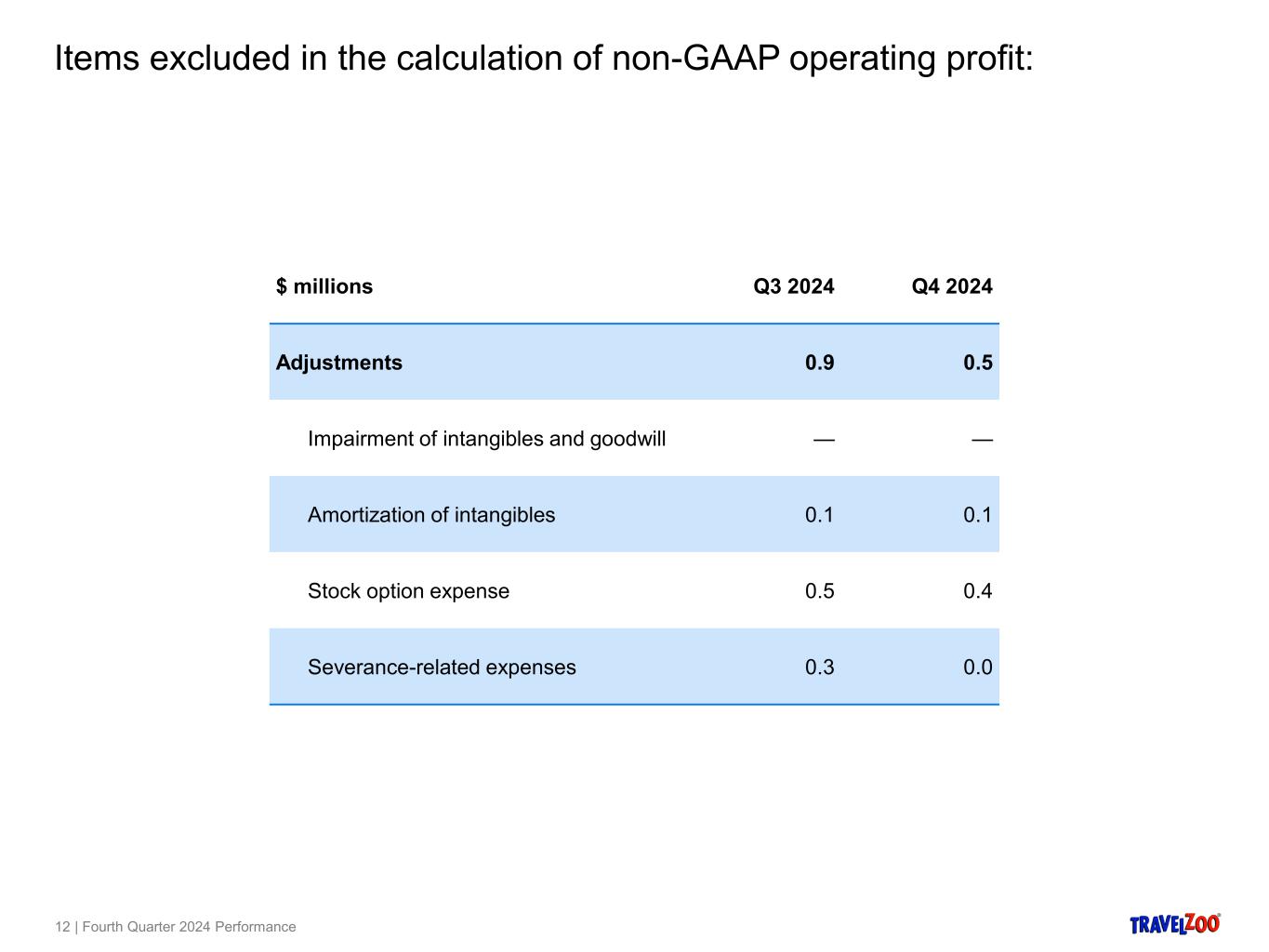

| Non-GAAP adjustments: | |||||||||||||||||||||||

| Amortization of intangibles (A) | 93 | 389 | 593 | 1,560 | |||||||||||||||||||

| Stock option expenses (B) | 405 | 380 | 1,644 | 1,566 | |||||||||||||||||||

| Severance-related expenses (C) | — | — | 360 | 56 | |||||||||||||||||||

| Non-GAAP operating expense | 12,585 | 13,203 | 52,334 | 54,789 | |||||||||||||||||||

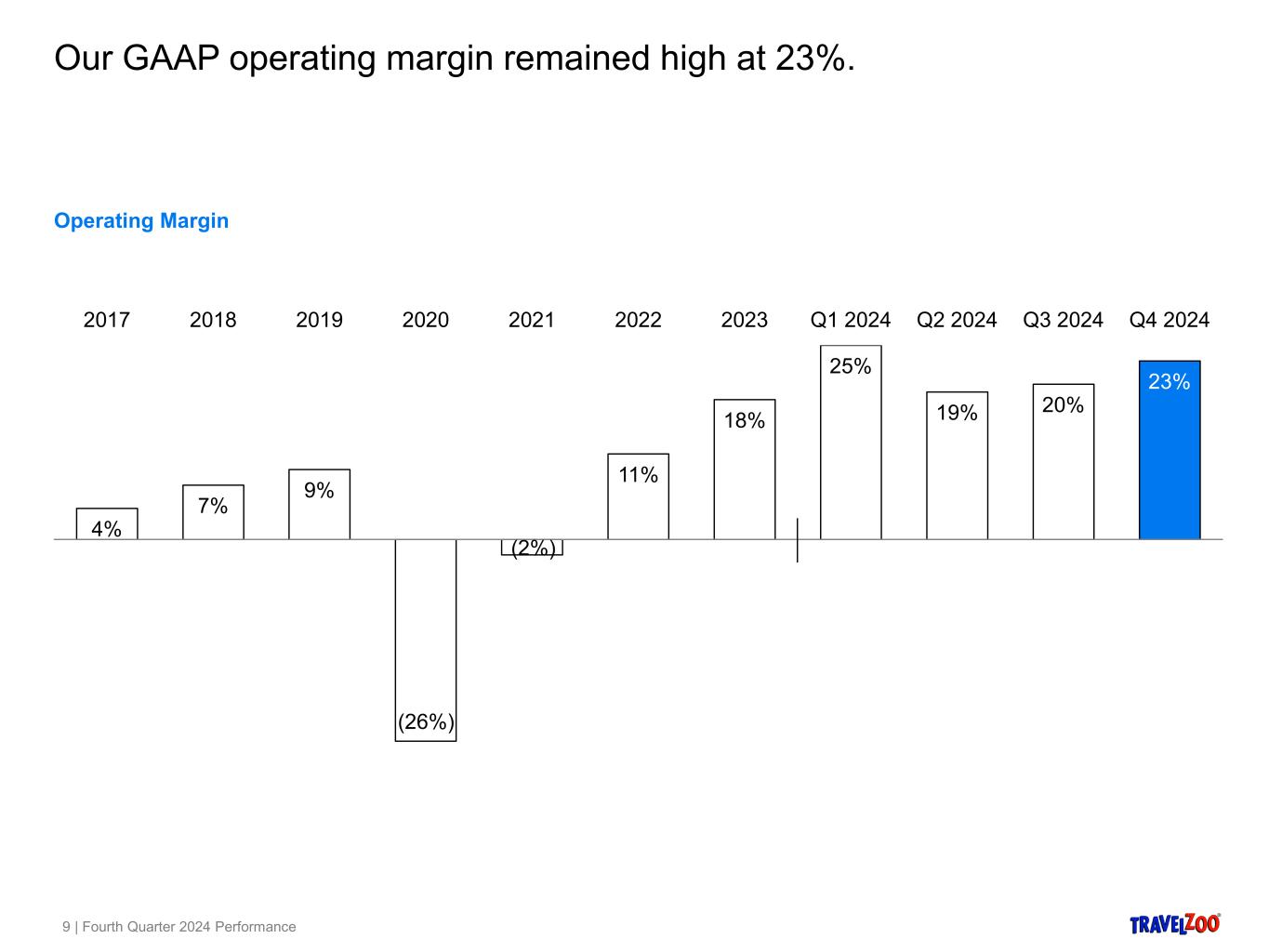

| GAAP operating profit | 4,834 | 4,479 | 18,502 | 15,572 | |||||||||||||||||||

| Non-GAAP adjustments (A through C) | 498 | 769 | 2,597 | 3,182 | |||||||||||||||||||

| Non-GAAP operating profit | 5,332 | 5,248 | 21,099 | 18,754 | |||||||||||||||||||