Document

Exhibit 99.1

|

|

|

|

|

|

|

|

|

|

|

Travelzoo

590 Madison Avenue

35th Floor

New York, NY 10022

Investor Relations:

ir@travelzoo.com

|

FOR IMMEDIATE RELEASE

Travelzoo Reports First Quarter 2024 Results

NEW YORK, April 24, 2024 — Travelzoo® (NASDAQ: TZOO):

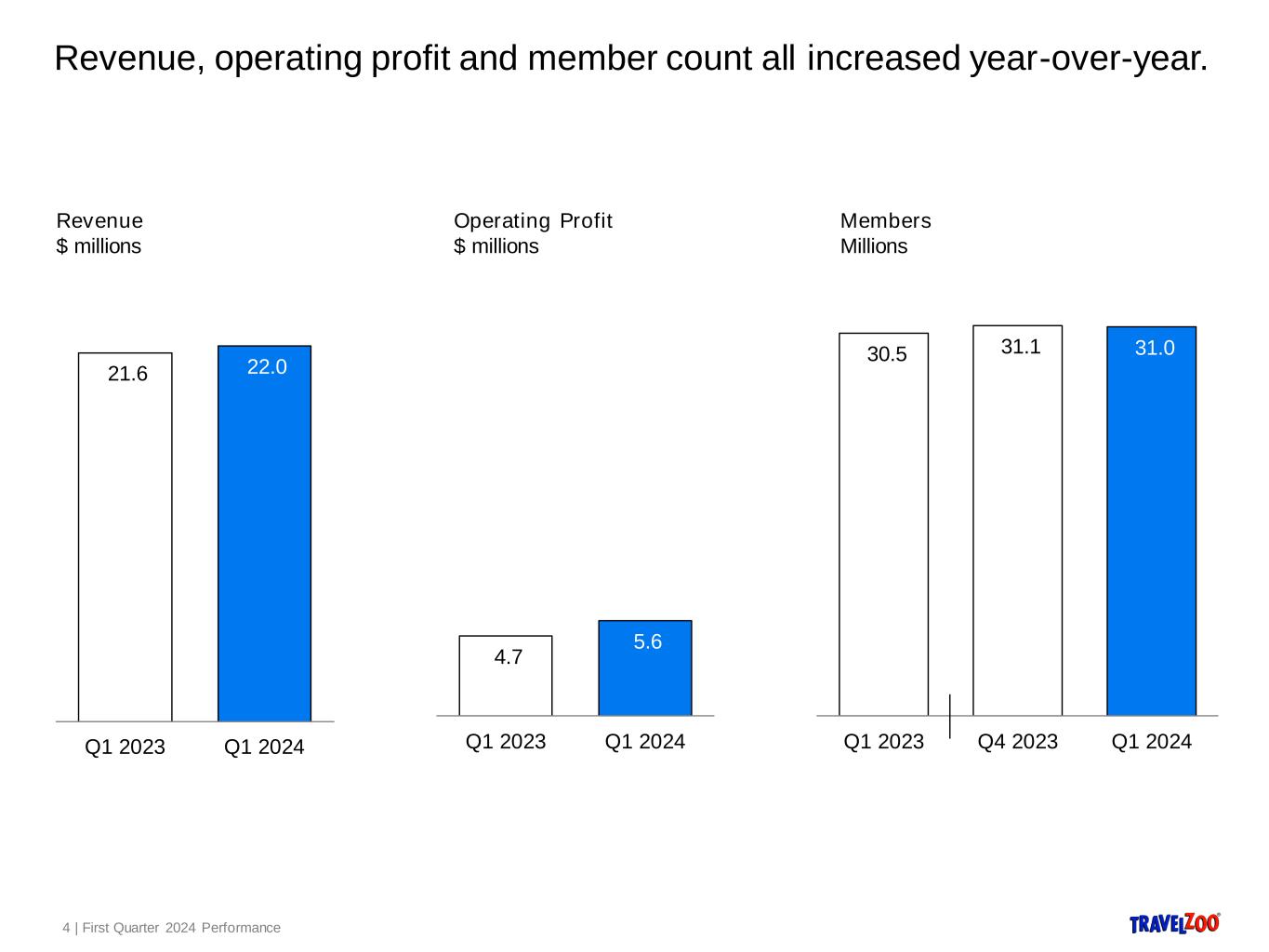

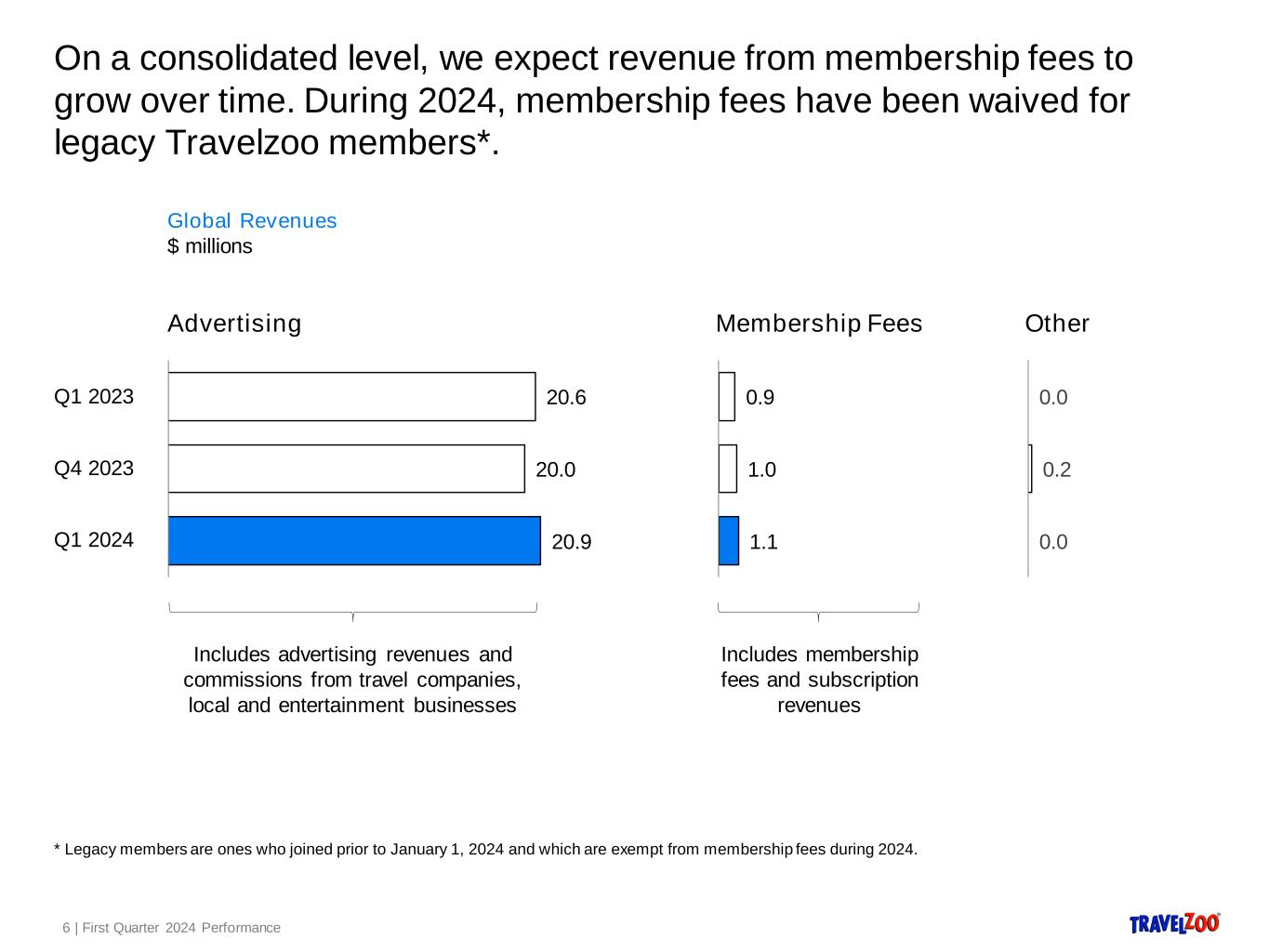

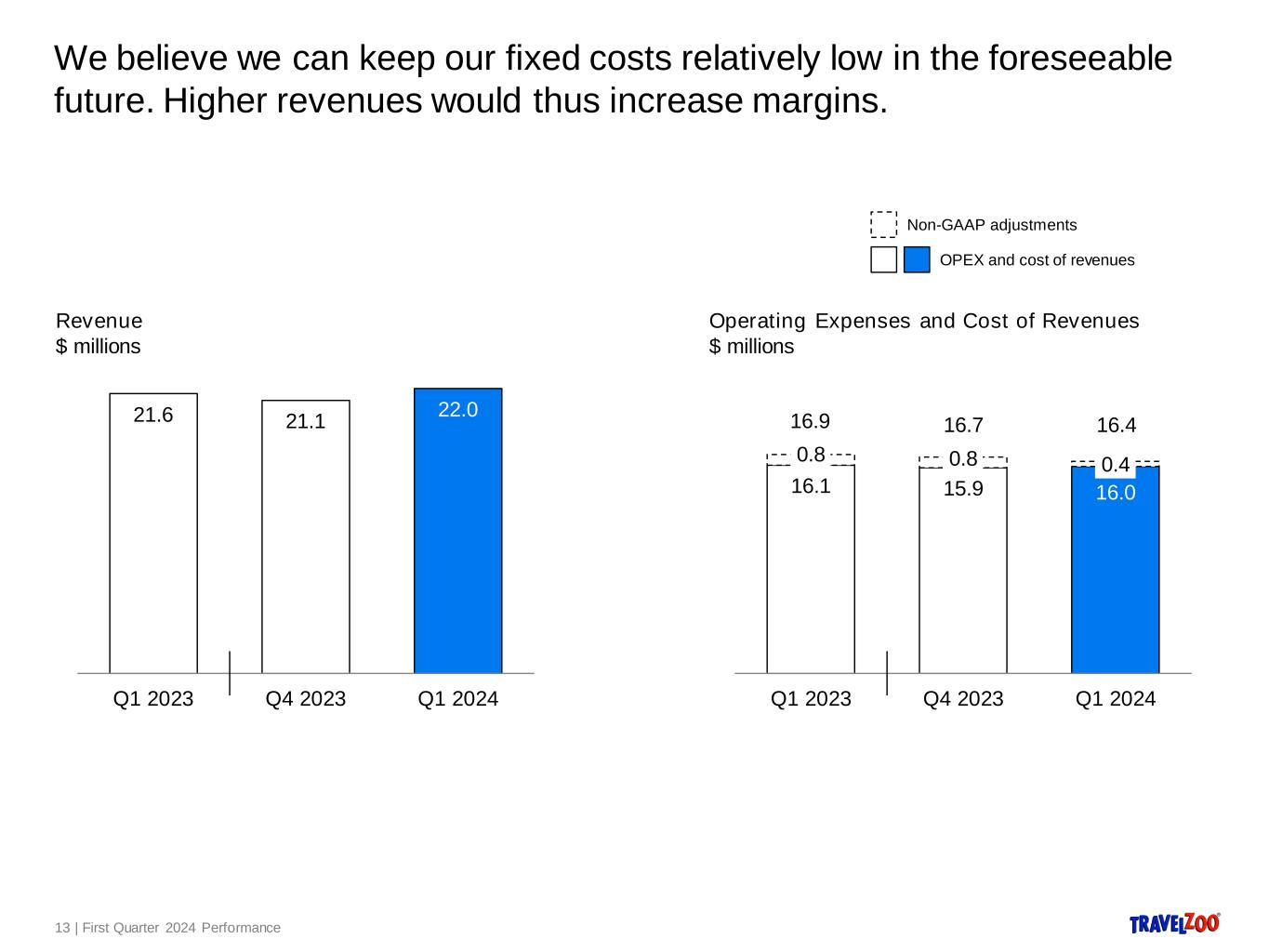

•Revenue of $22.0 million, up 2% year-over-year

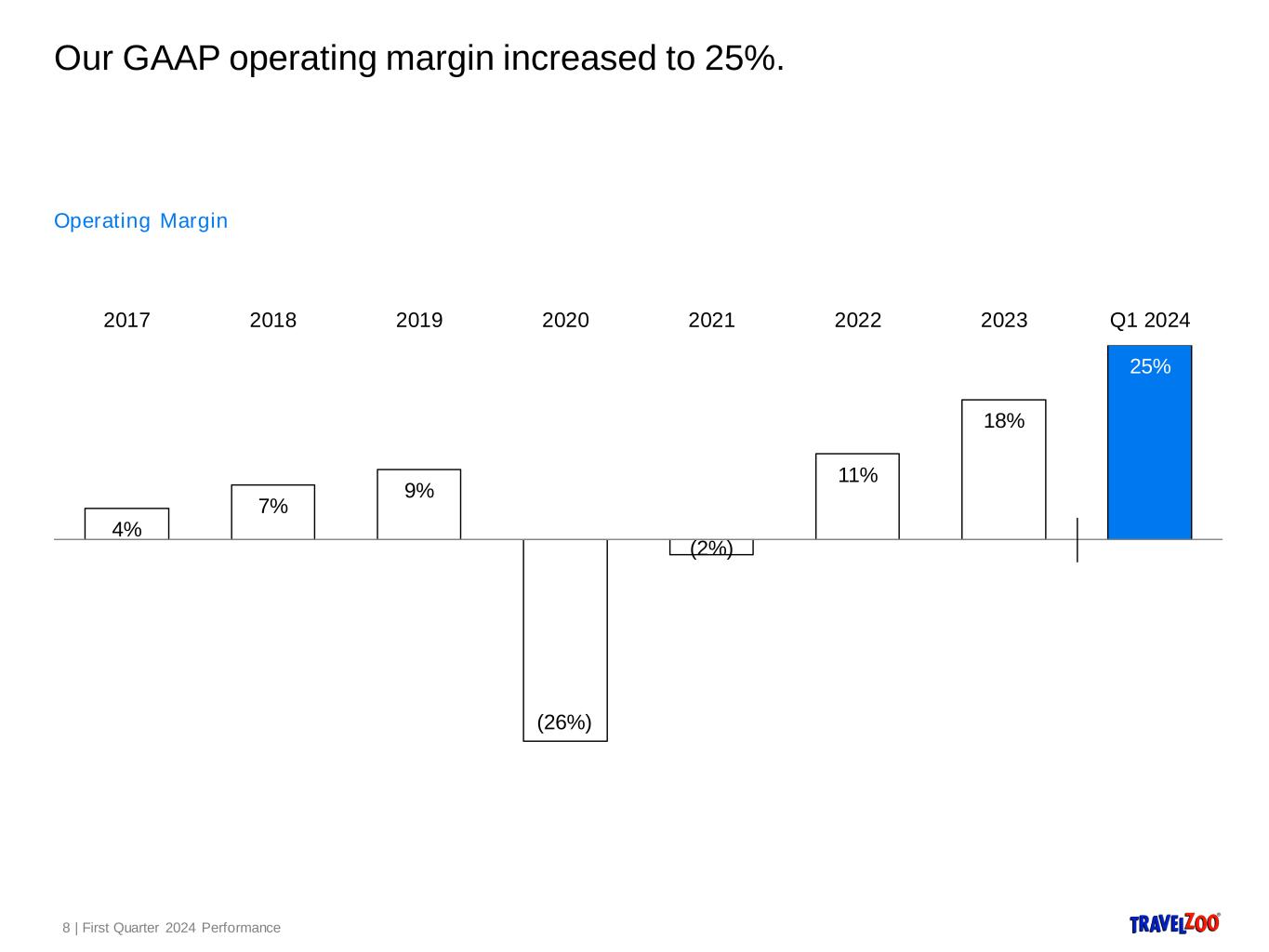

•Consolidated operating profit of $5.6 million

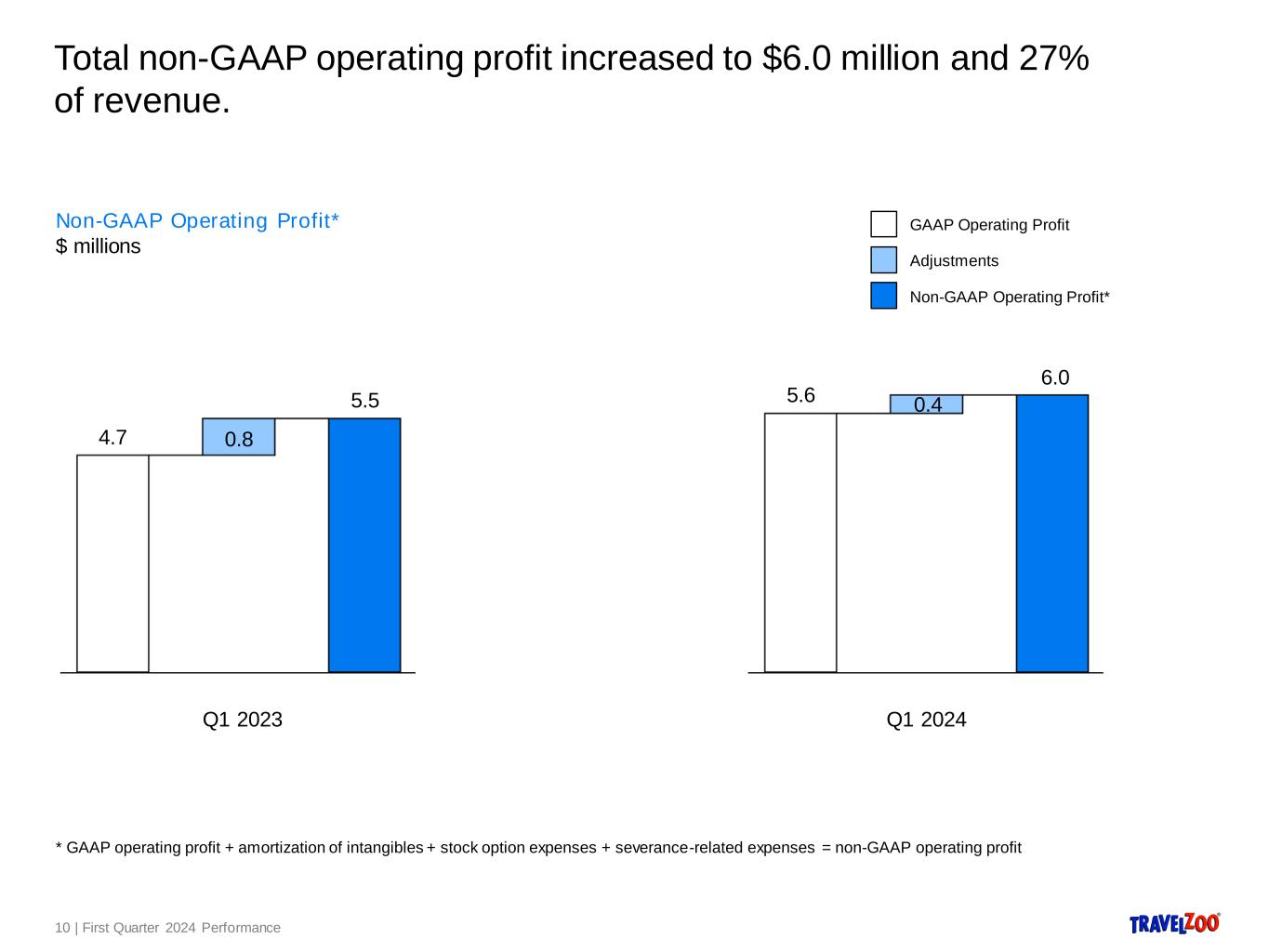

•Non-GAAP consolidated operating profit of $6.0 million

•Cash flow from operations of $4.6 million

•Earnings per share (EPS) of $0.31

Travelzoo, the club for travel enthusiasts, today announced financial results for the first quarter ended March 31, 2024. Consolidated revenue was $22.0 million, up 2% from $21.6 million year-over-year. In constant currencies, revenue was $21.8 million, up 1% year-over-year. Travelzoo's reported revenue consists of advertising revenues and commissions, derived from and generated in connection with purchases made by Travelzoo members, and membership fees

Net income attributable to Travelzoo was $4.2 million for Q1 2024, or $0.31 per share, compared with $0.23 in the prior-year period. Net income attributable to Travelzoo from continuing operations was $4.2 million for Q1 2024, or $0.31 per share, compared with $0.23 in the prior-year period.

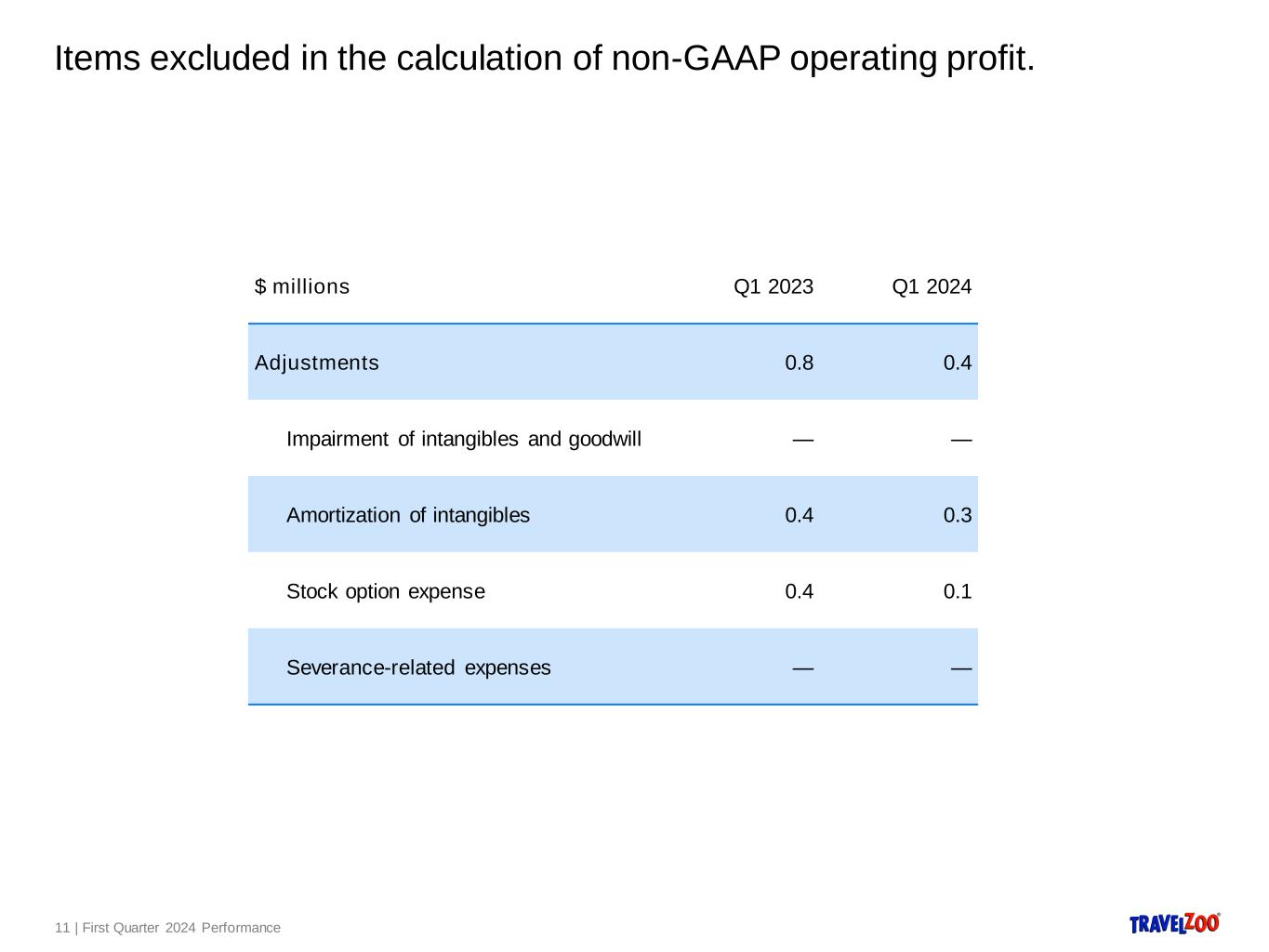

Non-GAAP operating profit was $6.0 million. Non-GAAP operating profit excludes amortization of intangibles ($0.3 million) and stock option expenses ($95,000). Please refer to “Non-GAAP Financial Measures” and the tabular reconciliation below.

“We will continue to leverage Travelzoo's global reach, trusted brand, and strong relationships with top travel suppliers to negotiate more exclusive offers for members,” said Holger Bartel, Travelzoo's Global CEO. “It is in times of large increases in travel prices that Travelzoo is most valuable for consumers. Travelzoo members enjoy high quality travel experiences that represent outstanding value."

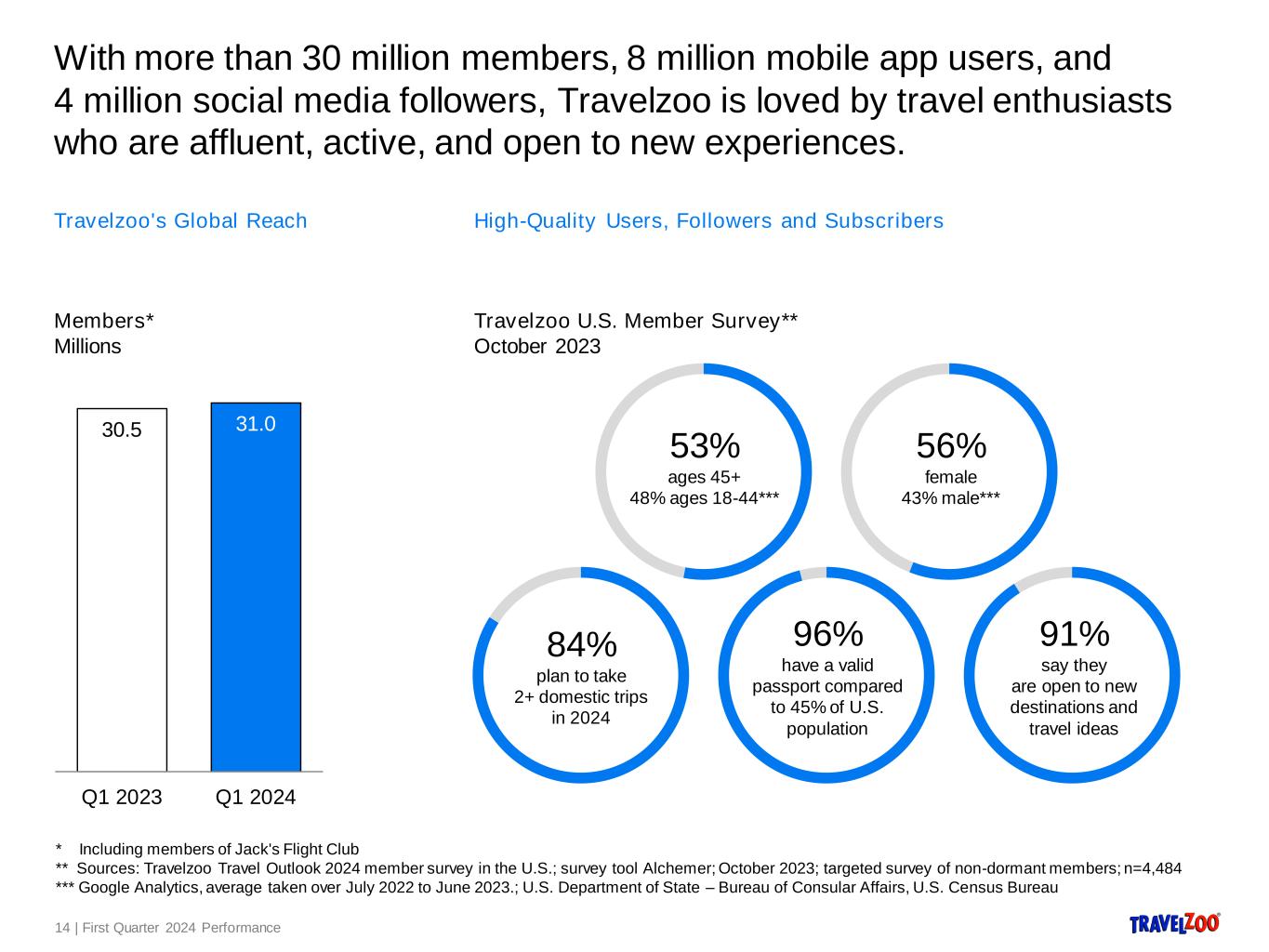

“With more than 30 million members, 8 million mobile app users, and 4 million social media followers, Travelzoo is loved by travel enthusiasts who are affluent, active, and open to new experiences.”

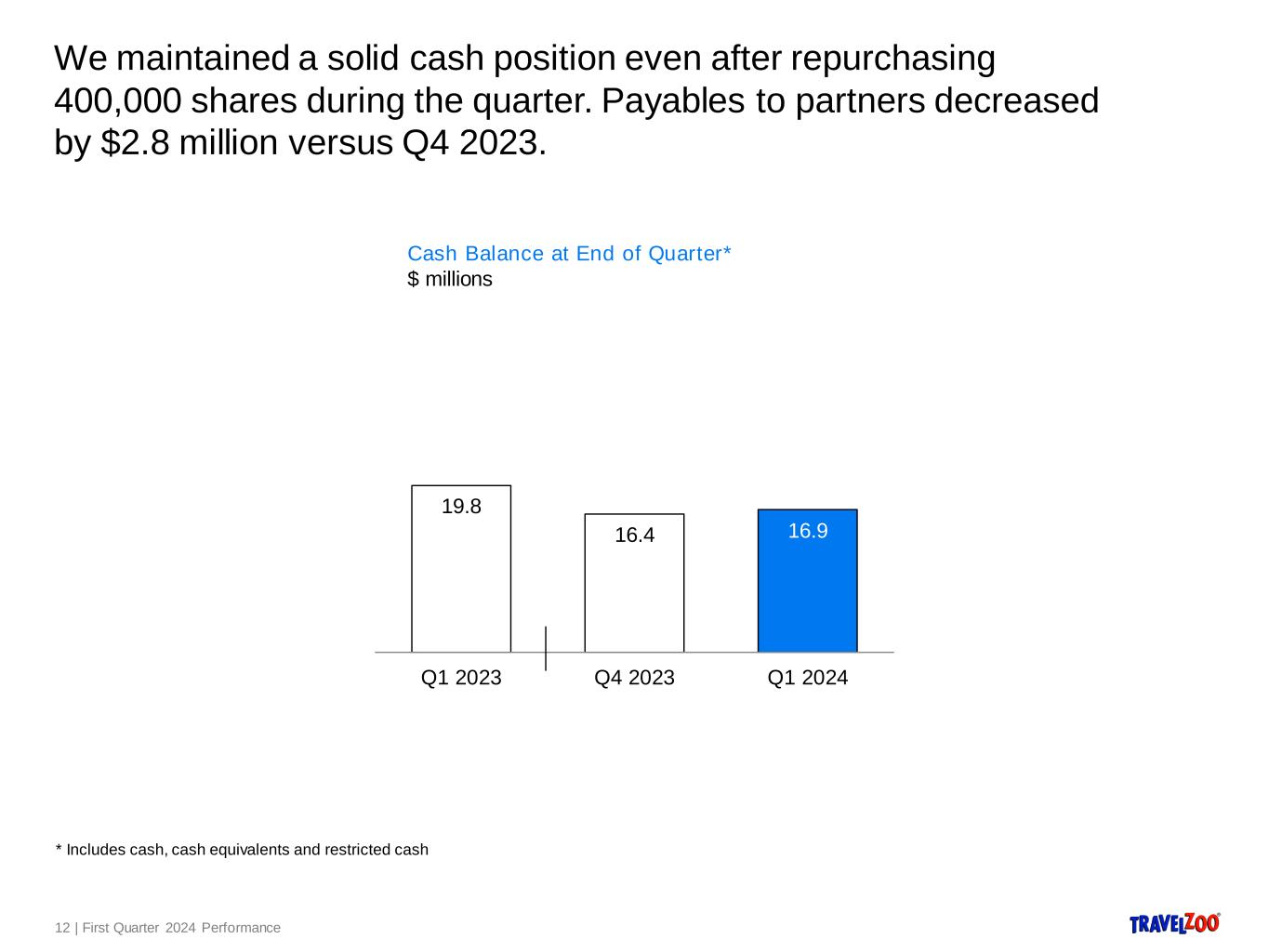

Cash Position

As of March 31, 2024, consolidated cash, cash equivalents and restricted cash were $16.9 million. Net cash provided by operations was $4.6 million.

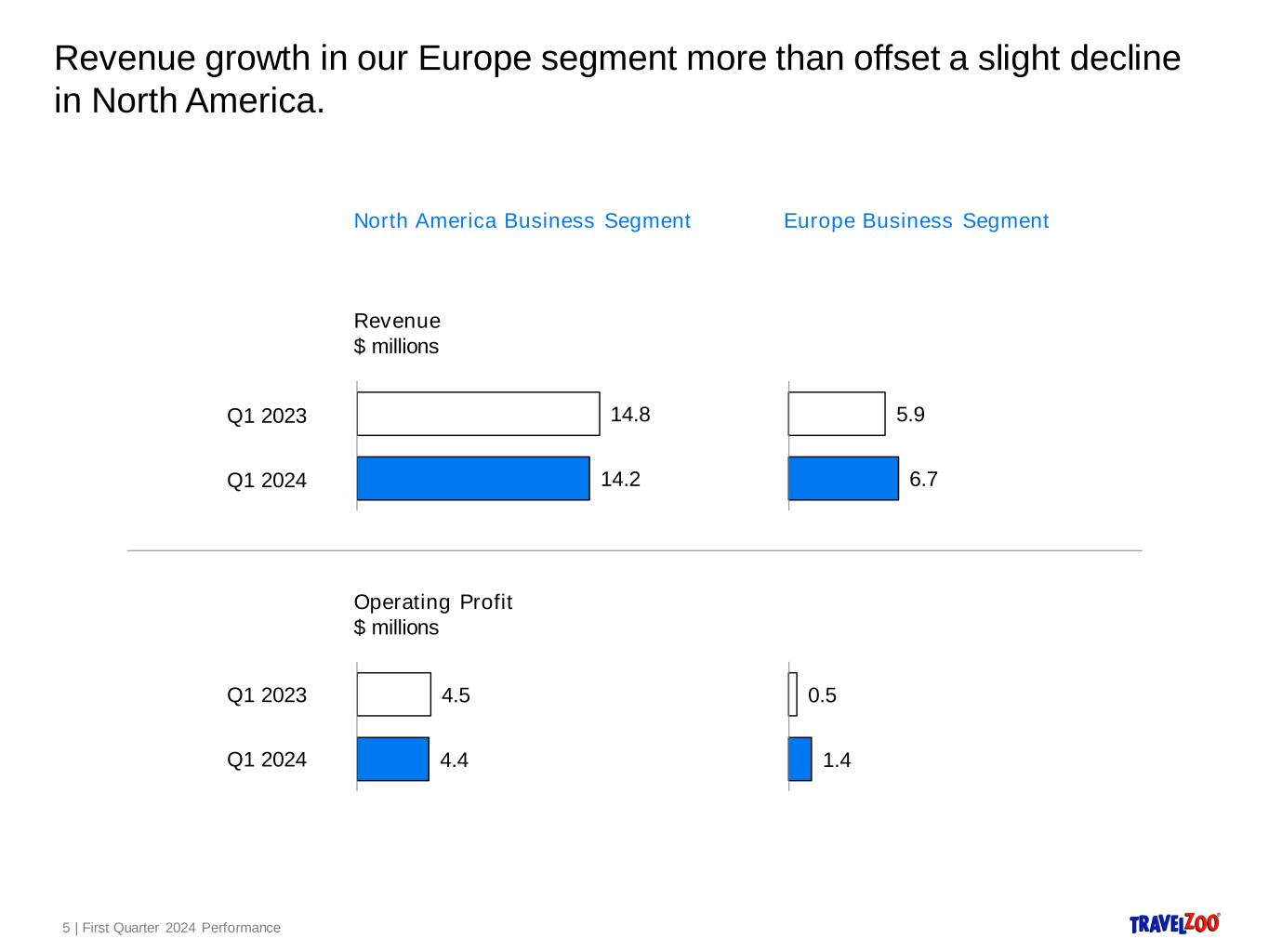

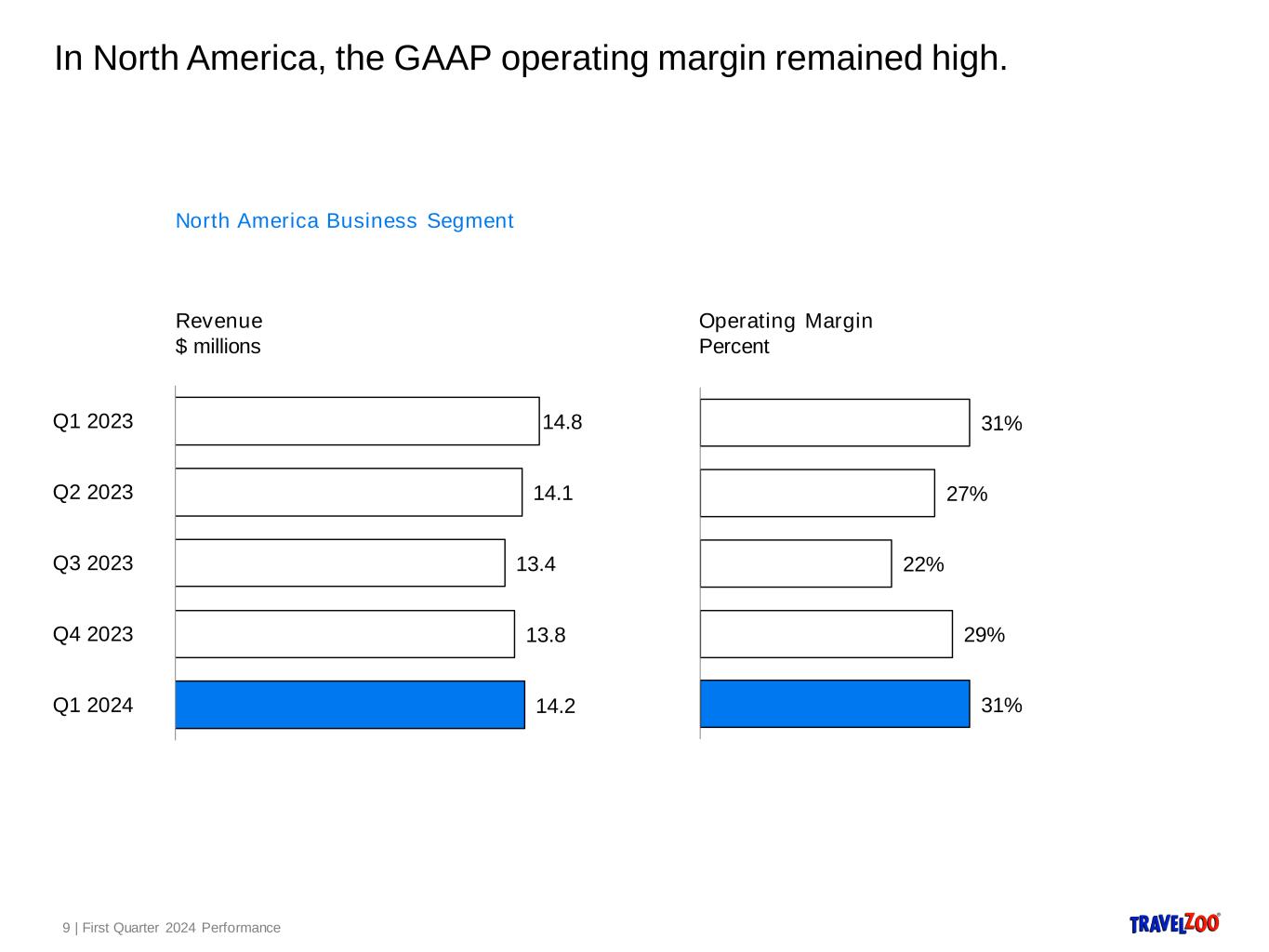

Travelzoo North America

North America business segment revenue decreased 4% year-over-year to $14.2 million. Operating profit for Q1 2024 was $4.4 million, or 31% of revenue, compared to operating profit of $4.5 million in the prior-year period.

Travelzoo Europe

Europe business segment revenue increased 13% year-over-year to $6.7 million. In constant currencies, Europe business segment revenue increased 10% year-over-year. Operating profit for Q1 2024 was $1.4 million, or 21% of revenue, compared to operating profit of $457,000 in the prior-year period.

Jack’s Flight Club

Jack’s Flight Club is a membership subscription service in which Travelzoo has a 60% ownership interest. Revenue from unaffiliated customers increased 16% year-over-year to $1.1 million. The number of premium subscribers increased 11% year-over-year. Jack’s Flight Club’s revenue from subscriptions is recognized ratably over the subscription period (quarterly, semi-annually, annually). Non-GAAP operating loss for Q1 2024 was $24,000, compared to a non-GAAP operating profit of $123,000 in the prior-year period. Non-GAAP operating loss excludes amortization of intangibles ($75,000) related to the acquisition of Travelzoo’s ownership interest in Jack’s Flight Club in 2020. The Q1 2024 operating loss was caused by marketing expenses in connection with growth in members.

New Initiatives

New Initiatives business segment revenue, which includes Licensing and Travelzoo META, was $32,000. Operating loss for Q1 2024 was $130,000.

In June 2020, Travelzoo entered into a royalty-bearing licensing agreement with a local licensee in Japan for the exclusive use of Travelzoo’s brand, business model, and members in Japan. In August of 2020, Travelzoo entered into a royalty-bearing licensing agreement with a local licensee in Australia for the exclusive use of Travelzoo’s brand, business models, and members in Australia, New Zealand, and Singapore. Under these arrangements, Travelzoo’s existing members in Australia, Japan, New Zealand, and Singapore will continue to be owned by Travelzoo as the licensor. Travelzoo recorded $7,000 in licensing revenue from the licensee in Japan in Q1 2024. Travelzoo recorded $10,000 in licensing revenue from the licensee in Australia, New Zealand, and Singapore in Q1 2024. Licensing revenue is expected to increase going forward.

Members and Subscribers

As of March 31, 2024, we were 31.0 million members worldwide, up from 30.5 million as of March 31, 2023. In North America, Travelzoo had 16.2 million unduplicated members as of March 31, 2024, down from 16.3 million as of March 31, 2023. In Europe, Travelzoo had 9.2 million unduplicated members as of March 31, 2024, up from 9.1 million as of March 31, 2023. Jack’s Flight Club had 2.4 million subscribers as of March 31, 2024, up from 2.0 million as of March 31, 2023.

Discontinued Operations

In March 2020, Travelzoo decided to exit its Asia Pacific business and operate it as a licensing business going forward. Consequently, the Asia Pacific business has been classified as discontinued operations.

Income Taxes

A provision of $1.5 million for income taxes was recorded for Q1 2024, compared to an income tax expense of $1.4 million in the prior-year period. Travelzoo intends to utilize available net operating losses (NOLs) to largely offset its actual tax liability for Q1 2024.

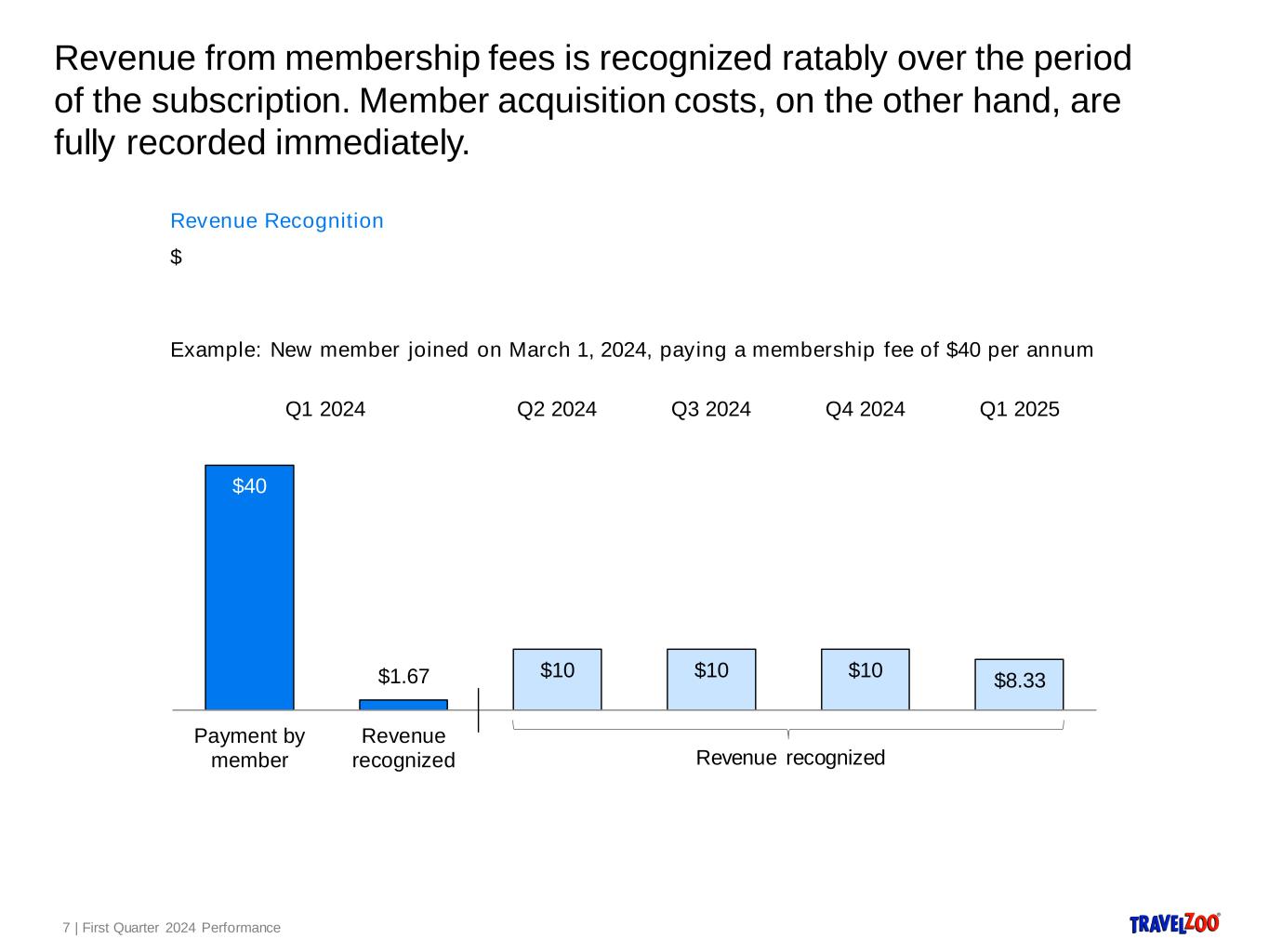

Looking Ahead

For Q2 2024, we expect continued growth in revenue year-over-year, albeit at a smaller pace than in 2023. We also expect for Q2 2024 higher profitability year-over-year . In December 2023, we announced the introduction of a membership fee for Travelzoo beginning January 1, 2024. We recognize membership fee revenue ratably over the subscription period. Legacy Travelzoo members as of December 31, 2023 are exempt from the fee during 2024. Therefore, we do not anticipate to generate membership fee revenue from these members before 2025.

Non-GAAP Financial Measures

Management calculates non-GAAP operating income when evaluating the financial performance of the business. Travelzoo’s calculation of non-GAAP operating income, also called “non-GAAP operating profit” in this press release and today’s earnings conference call, excludes the following items: impairment of intangible and goodwill, amortization of intangibles, stock option expenses and severance-related expenses. This press release includes a table which reconciles GAAP operating income to the calculation of non-GAAP operating income. Non-GAAP operating income is not required by, or presented in accordance with, generally accepted accounting principles in the United States of America ("GAAP"). This information should be considered as supplemental in nature and should not be considered in isolation or as a substitute for the financial information prepared in accordance with GAAP. In addition, these non-GAAP financial measures may not be the same as similarly titled measures reported by other companies.

Conference Call

Travelzoo will host a conference call to discuss first quarter 2024 results today at 11:00 a.m. ET. Please visit http://ir.travelzoo.com/events-presentations to

•download the management presentation (PDF format) to be discussed in the conference call

•access the webcast.

About Travelzoo

We, Travelzoo®, are the club for travel enthusiasts. Our 30 million members receive exclusive offers and one-of-a-kind experiences personally reviewed by our deal experts around the globe. We have our finger on the pulse of outstanding travel, entertainment, and lifestyle experiences. We work in partnership with more than 5,000 top travel suppliers—our long-standing relationships give Travelzoo members access to irresistible deals.

Certain statements contained in this press release that are not historical facts may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. These forward-looking statements may include, but are not limited to, statements about our plans, objectives, expectations, prospects and intentions, markets in which we participate and other statements contained in this press release that are not historical facts. When used in this press release, the words “expect”, “predict”, “project”, “anticipate”, “believe”, “estimate”, “intend”, “plan”, “seek” and similar expressions are generally intended to identify forward-looking statements. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including changes in our plans, objectives, expectations, prospects and intentions and other factors discussed in our filings with the SEC. We cannot guarantee any future levels of activity, performance or achievements. Travelzoo undertakes no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this press release.

Travelzoo

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

| |

March 31, |

|

|

| |

2024 |

|

2023 |

|

|

|

|

| Revenues |

$ |

21,985 |

|

|

$ |

21,601 |

|

|

|

|

|

| Cost of revenues |

2,640 |

|

|

2,691 |

|

|

|

|

|

| Gross profit |

19,345 |

|

|

18,910 |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Sales and marketing |

8,598 |

|

|

9,296 |

|

|

|

|

|

| Product development |

566 |

|

|

490 |

|

|

|

|

|

| General and administrative |

4,590 |

|

|

4,413 |

|

|

|

|

|

| Total operating expenses |

13,754 |

|

|

14,199 |

|

|

|

|

|

| Operating income |

5,591 |

|

|

4,711 |

|

|

|

|

|

| Other income, net |

139 |

|

|

350 |

|

|

|

|

|

| Income from continuing operations before income taxes |

5,730 |

|

|

5,061 |

|

|

|

|

|

| Income tax expense |

1,505 |

|

|

1,378 |

|

|

|

|

|

| Income from continuing operations |

4,225 |

|

|

3,683 |

|

|

|

|

|

| Loss from discontinued operations, net of tax |

— |

|

|

(2) |

|

|

|

|

|

| Net income |

4,225 |

|

|

3,681 |

|

|

|

|

|

| Net income (loss) attributable to non-controlling interest |

(11) |

|

|

8 |

|

|

|

|

|

| Net income attributable to Travelzoo |

$ |

4,236 |

|

|

$ |

3,673 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Travelzoo—continuing operations |

$ |

4,236 |

|

|

$ |

3,675 |

|

|

|

|

|

| Net loss attributable to Travelzoo—discontinued operations |

$ |

— |

|

|

$ |

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income per share—basic |

|

|

|

|

|

|

|

| Continuing operations |

$ |

0.31 |

|

|

$ |

0.23 |

|

|

|

|

|

| Discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

|

|

|

| Net income per share—basic |

$ |

0.31 |

|

|

$ |

0.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income per share—diluted |

|

|

|

|

|

|

|

| Continuing operations |

$ |

0.31 |

|

|

$ |

0.23 |

|

|

|

|

|

| Discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

|

|

|

| Net income per share—diluted |

$ |

0.31 |

|

|

$ |

0.23 |

|

|

|

|

|

| Shares used in per share calculation from continuing operations—basic |

13,489 |

|

|

15,697 |

|

|

|

|

|

| Shares used in per share calculation from discontinued operations—basic |

13,489 |

|

|

15,697 |

|

|

|

|

|

| Shares used in per share calculation from continuing operations—diluted |

13,625 |

|

|

15,779 |

|

|

|

|

|

| Shares used in per share calculation from discontinued operations—diluted |

13,625 |

|

|

15,779 |

|

|

|

|

|

Travelzoo

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

December 31,

2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

16,190 |

|

|

$ |

15,713 |

|

| Accounts receivable, net |

13,151 |

|

|

12,965 |

|

| Prepaid income taxes |

566 |

|

|

629 |

|

| Prepaid expenses and other |

1,681 |

|

|

1,460 |

|

| Assets from discontinued operations |

1 |

|

|

1 |

|

| Total current assets |

31,589 |

|

|

30,768 |

|

| Deposits and other |

225 |

|

|

1,115 |

|

| Deferred tax assets |

3,107 |

|

|

3,196 |

|

| Restricted cash |

675 |

|

|

675 |

|

| Operating lease right-of-use assets |

5,892 |

|

|

6,015 |

|

| Property and equipment, net |

532 |

|

|

578 |

|

| Intangible assets, net |

1,773 |

|

|

2,091 |

|

| Goodwill |

10,944 |

|

|

10,944 |

|

| Total assets |

$ |

54,737 |

|

|

$ |

55,382 |

|

| Liabilities and Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

5,514 |

|

|

$ |

4,546 |

|

| Merchant payables |

17,827 |

|

|

20,622 |

|

| Accrued expenses and other |

3,634 |

|

|

3,658 |

|

| Deferred revenue |

3,247 |

|

|

2,044 |

|

| Income tax payable |

805 |

|

|

766 |

|

| Operating lease liabilities |

2,463 |

|

|

2,530 |

|

| Liabilities from discontinued operations |

24 |

|

|

24 |

|

| Total current liabilities |

33,514 |

|

|

34,190 |

|

| Long-term tax liabilities |

5,596 |

|

|

4,681 |

|

| Long-term operating lease liabilities |

6,458 |

|

|

6,717 |

|

| Other long-term liabilities |

377 |

|

|

911 |

|

| Total liabilities |

45,945 |

|

|

46,499 |

|

| Common stock |

132 |

|

|

136 |

|

| Tax indemnification |

(9,537) |

|

|

(9,537) |

|

| Note receivable from shareholder |

(1,753) |

|

|

(1,753) |

|

| Additional paid-in capital |

— |

|

|

439 |

|

| Retained earnings |

20,125 |

|

|

19,508 |

|

| Accumulated other comprehensive loss |

(4,861) |

|

|

(4,607) |

|

| Total Travelzoo stockholders’ equity |

4,106 |

|

|

4,186 |

|

| Non-controlling interest |

4,686 |

|

|

4,697 |

|

| Total stockholder's equity |

8,792 |

|

|

8,883 |

|

| Total liabilities and equity |

$ |

54,737 |

|

|

$ |

55,382 |

|

Travelzoo

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

| |

March 31, |

|

|

| |

2024 |

|

2023 |

|

|

|

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

| Net income |

$ |

4,225 |

|

|

$ |

3,681 |

|

|

|

|

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

| Depreciation and amortization |

383 |

|

|

478 |

|

|

|

|

|

| Stock-based compensation |

95 |

|

|

396 |

|

|

|

|

|

| Deferred income tax |

(15) |

|

|

(68) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net foreign currency effects |

3 |

|

|

3 |

|

|

|

|

|

| Net recoveries of accounts receivable and refund reserves |

(33) |

|

|

(712) |

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

| Accounts receivable |

(235) |

|

|

372 |

|

|

|

|

|

| Prepaid income taxes |

63 |

|

|

407 |

|

|

|

|

|

| Prepaid expenses, deposits and other |

582 |

|

|

160 |

|

|

|

|

|

| Accounts payable |

1,008 |

|

|

(1,321) |

|

|

|

|

|

| Merchant payables |

(2,678) |

|

|

(4,591) |

|

|

|

|

|

| Accrued expenses and other |

972 |

|

|

911 |

|

|

|

|

|

| Income tax payable |

54 |

|

|

— |

|

|

|

|

|

| Other liabilities |

197 |

|

|

819 |

|

|

|

|

|

| Net cash provided by operating activities |

4,621 |

|

|

535 |

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

| Proceeds from repayment of note receivable |

— |

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

(35) |

|

|

(111) |

|

|

|

|

|

| Net cash used in investing activities |

(35) |

|

|

(72) |

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

| Repurchase of common stock |

(3,872) |

|

|

(186) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

(3,872) |

|

|

(186) |

|

|

|

|

|

| Effect of exchange rate on cash, cash equivalents and restricted cash |

(238) |

|

|

171 |

|

|

|

|

|

| Net increase in cash, cash equivalents and restricted cash |

476 |

|

|

448 |

|

|

|

|

|

| Cash, cash equivalents and restricted cash at beginning of period |

16,389 |

|

|

19,378 |

|

|

|

|

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

16,865 |

|

|

$ |

19,826 |

|

|

|

|

|

Travelzoo

Segment Information from Continuing Operations

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three months ended March 31, 2024 |

Travelzoo North

America |

|

Travelzoo Europe |

|

Jack's Flight Club |

|

New Initiatives |

|

Consolidated |

| Revenues from unaffiliated customers |

$ |

14,273 |

|

|

$ |

6,580 |

|

|

$ |

1,100 |

|

|

$ |

32 |

|

|

$ |

21,985 |

|

| Intersegment revenues |

(45) |

|

|

82 |

|

|

(37) |

|

|

— |

|

|

— |

|

| Total net revenues |

14,228 |

|

|

6,662 |

|

|

1,063 |

|

|

32 |

|

|

21,985 |

|

| Operating income (loss) |

$ |

4,438 |

|

|

$ |

1,382 |

|

|

$ |

(99) |

|

|

$ |

(130) |

|

|

$ |

5,591 |

|

|

|

|

|

|

|

|

|

|

|

| Three months ended March 31, 2023 |

Travelzoo North

America |

|

Travelzoo Europe |

|

Jack's Flight Club |

|

New Initiatives |

|

Consolidated |

| Revenues from unaffiliated customers |

$ |

14,567 |

|

|

$ |

6,078 |

|

|

$ |

948 |

|

|

$ |

8 |

|

|

$ |

21,601 |

|

| Intersegment revenues |

191 |

|

|

(191) |

|

|

— |

|

|

— |

|

|

— |

|

| Total net revenues |

14,758 |

|

|

5,887 |

|

|

948 |

|

|

8 |

|

|

21,601 |

|

| Operating income (loss) |

$ |

4,516 |

|

|

$ |

457 |

|

|

$ |

(45) |

|

|

$ |

(217) |

|

|

$ |

4,711 |

|

Travelzoo

Reconciliation of GAAP to Non-GAAP Information

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

| |

March 31, |

|

|

| |

2024 |

|

2023 |

|

|

|

|

| GAAP operating expense |

$ |

13,754 |

|

|

$ |

14,199 |

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

| Amortization of intangibles (A) |

317 |

|

|

398 |

|

|

|

|

|

| Stock option expenses (B) |

95 |

|

|

396 |

|

|

|

|

|

| Severance-related expenses (C) |

— |

|

|

39 |

|

|

|

|

|

| Non-GAAP operating expense |

13,342 |

|

|

13,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating income |

5,591 |

|

|

4,711 |

|

|

|

|

|

| Non-GAAP adjustments (A through C) |

412 |

|

|

833 |

|

|

|

|

|

| Non-GAAP operating income |

6,003 |

|

|

5,544 |

|

|

|

|

|

###