2024 REFERENCE FORM 2024 Itaú Unibanco Holding S.A.

Itaú Unibanco Holding S.A. REFERENCE FORM Base Date: 12.31.2024 (in accordance with Attachment C to CVM Resolution No 80 of March 29, 2022 “CVM Resolution No 80”) Identification ltaú Unibanco Holding S.A., a corporation enrolled under the National Register of Legal Entities/Ministry of Finance (CNPJ/MF) under No. 60.872.504/0001-23, with its Articles of lncorporation registered with the Trade Board of the State of São Paulo under NlRE No. 35.3.0001023-0, and registered as a publicly-held company with the Brazilian Securities and Exchange Commission ("CVM") under No. 19348 ("Bank" or "lssuer"). Head Office The lssuer's head office is located at Praça Alfredo Egydio de Souza Aranha, 100, Torre Olavo Setubal, Parque Jabaquara, in the City and State of São Paulo, Brazil, Zip Code 04344-902. Investor Relations Office The lnvestor Relations department is located at Praça Alfredo Egydio de Souza Aranha, 100, Torre Conceição, 12º andar, Parque Jabaquara, in the City and State of São Paulo, Brazil, Zip Code 04344-902. The Group Head of lnvestor Relations is Mr. Gustavo Lopes Rodrigues. The lnvestor Relations Department's telephone number is +5511 2794-3547, fax number is +55 11 5019-8717, and email is ri@itau-unibanco.com.br. lndependent Auditors Firm PricewaterhouseCoopers Auditores Independentes Ltda. for the years ended 12/31/2024, 12/31/2023 and 12/31/2022. Bookkeeping Agent Itaú Corretora de Valores S.A. Stockholders Service The lssuer's stockholders' service is carried out at the branches of ltaú Unibanco S.A., the head office of which is located at Praça Alfredo Egydio de Souza Aranha, 100, Torre Walther Moreira Salles, Parque Jabaquara, in the City and State of São Paulo, Brazil, Zip Code 04344-902. Newspapers from which the Company discloses lnformation O Estado de São Paulo newspaper. Website The information contained on the Company's website is not an integral part of this Reference Form. https://www.itau.com.br/relacoes-com-investidores/en/ Last update of this Reference Form 12/11/2025

Historical resubmission Version Reasons for resubmission Date of update V2 Updated items: 7.1D, 7.3, 7.4 and 7.8 06/11/2025 V3 Updated items: 7.3, 7.4 and 7.8 06/24/2025 V4 Updated items: 3.1, 3.2 and 8.1 08/05/2025 V5 Updated items 4.4, 4.5, 4.7 and 12.7 08/14/2025 V6 Updated items 7.4, 7.8 and 12.7 09/03/2025 V7 Updated items 7.4, 7.8 and 12.7 10/20/2025 V8 Updated items 3.1, 3.2, 7.3 and 7.8 11/04/2025 V9 Updated items 4.4, 4.5, 4.7, 6.1/6.2, 6.3, 6.4, 6.5, 6.6, 7.3, 7.8, 12.1 and 12.9 12/11/2025 V10 Updated items 6.3 and 6.5 12/11/2025

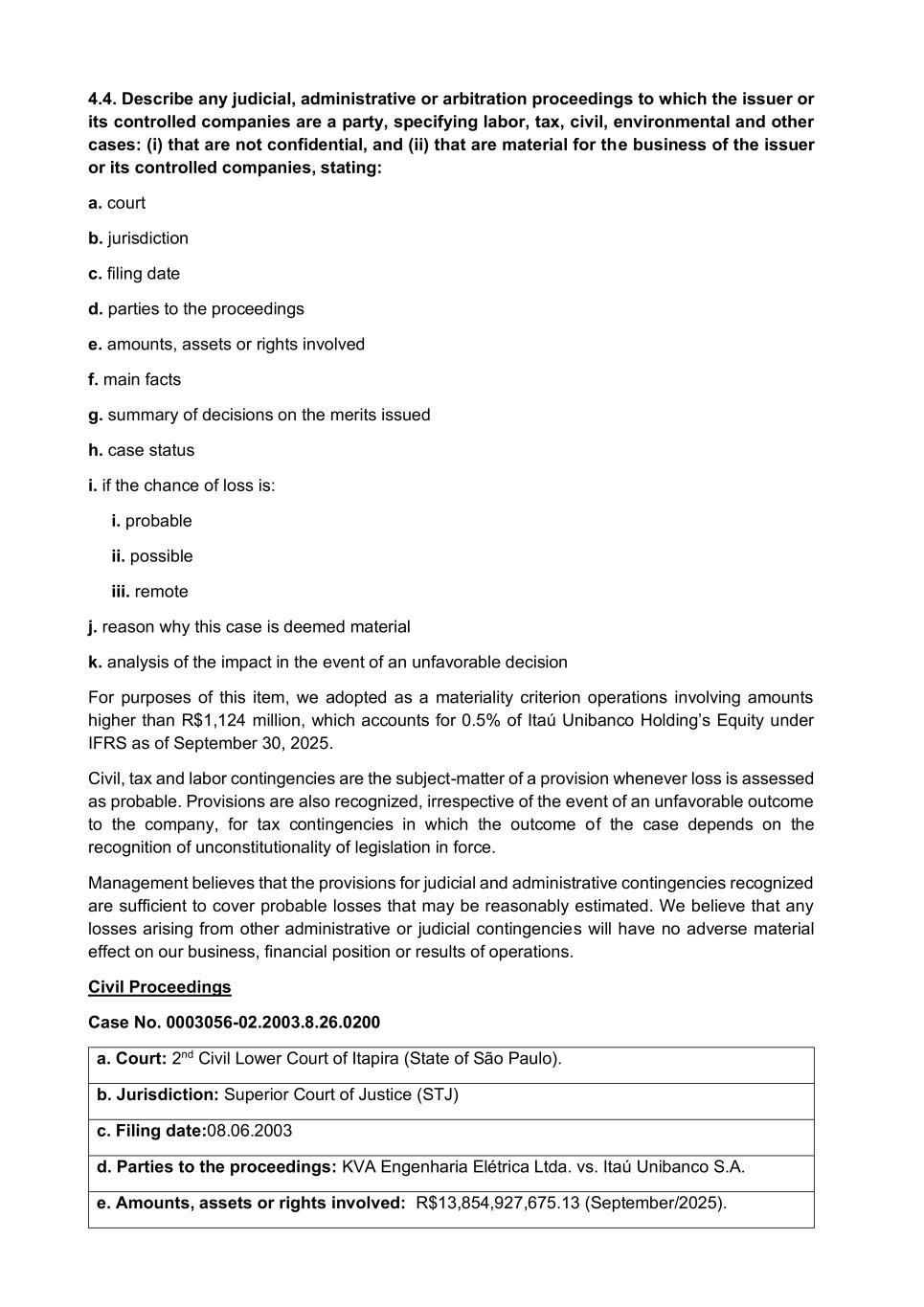

4.4. Describe any judicial, administrative or arbitration proceedings to which the issuer or its controlled companies are a party, specifying labor, tax, civil, environmental and other cases: (i) that are not confidential, and (ii) that are material for the business of the issuer or its controlled companies, stating: a. court b. jurisdiction c. filing date d. parties to the proceedings e. amounts, assets or rights involved f. main facts g. summary of decisions on the merits issued h. case status i. if the chance of loss is: i. probable ii. possible iii. remote j. reason why this case is deemed material k. analysis of the impact in the event of an unfavorable decision For purposes of this item, we adopted as a materiality criterion operations involving amounts higher than R$1,124 million, which accounts for 0.5% of Itaú Unibanco Holding’s Equity under IFRS as of September 30, 2025. Civil, tax and labor contingencies are the subject-matter of a provision whenever loss is assessed as probable. Provisions are also recognized, irrespective of the event of an unfavorable outcome to the company, for tax contingencies in which the outcome of the case depends on the recognition of unconstitutionality of legislation in force. Management believes that the provisions for judicial and administrative contingencies recognized are sufficient to cover probable losses that may be reasonably estimated. We believe that any losses arising from other administrative or judicial contingencies will have no adverse material effect on our business, financial position or results of operations. Civil Proceedings Case No. 0003056-02.2003.8.26.0200 a. Court: 2nd Civil Lower Court of Itapira (State of São Paulo). b. Jurisdiction: Superior Court of Justice (STJ) c. Filing date:08.06.2003 d. Parties to the proceedings: KVA Engenharia Elétrica Ltda. vs. Itaú Unibanco S.A. e. Amounts, assets or rights involved: R$13,854,927,675.13 (September/2025).

f. Main facts: This is a lawsuit to review current account, loan and renegotiation agreements, in which the bank was ordered, by a final and unappealable decision (December 12, 2007), to exclude interest capitalization and refund overpaid amounts, adjusted to include interest in the same proportion as it had been charged by the bank. Upon calculation of the liquid amount, the lower court, based on the capitalized interest criterion and with 2,400.64% of compensatory interest incurred from 2003 to 2007, approved the amount of approximately R$7.6 billion to be refunded to the plaintiff (May 21, 2018). The Appellate Court of the State of São Paulo (TJSP) overturned this judgment to exclude capitalization and charge simple interest as of the date of summons (2003), reducing the award amount to approximately R$3.5 million (May 2, 2019). Itaú made a judicial deposit of the adjusted awards amount (R$5.9 million in August 2019). Plaintiff filed a motion for clarification, which was denied (November 4, 2019). Plaintiff and former lawyer filed special appeals, which were granted by the TJSP (April 20, 2021) and the case is to be held by the judge under advisement at the Superior Court of Justice (STJ). g. Summary of decisions on the merits issued: The decision issued at the cognizance phase, which is final and unappealable, has ruled that the bank review the contracts and exclude the capitalization amount, as well as refund twice the overstated amounts charged, adjusted to include interest earned at the same rates charged by the bank. Upon calculation of the liquid amount, a decision was issued approving the expert evidence in the amount of R$7.6 billion, with the following assumptions: capitalized interest and 2,400.64% of compensation interest from 2003 to 2007. The Appellate Court partially overruled this decision, reducing the amount in dispute to R$3.5 million by excluding capitalization and determining the inclusion of simple interest from the date of summons. h. Case status: The special appeals filed by the Plaintiff and former lawyer before the STJ against the appellate decision issued by the TJSP on April 22, 2019 are pending trial. i. Chance of loss: Remote. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In August 2019, the bank paid the award in effect in the amount of R$5.9 million. The remaining remote risk of loss is R$13.8 billion. Cases No. 0012488-09.2002.8.14.0301 and No. 0035211-78.2002.8.14.0301 a. Court: 5th Civil Lower Court of Belém (State of Pará). b. Jurisdiction: Appellate Court of the State of Pará (TJPA) c. Filing date: 03.18.2002 and 10.14.2002 d. Parties to the proceedings: Rondhevea Administração e Participações Ltda. vs. Itaú Unibanco S.A. and Itaú Corretora de Valores Mobiliários e Câmbio. e. Amounts, assets or rights involved: R$7,727,062,162.90 (September/2025). f. Main facts: Itaú is a defendant in two lawsuits filed by Mr. Antonio Cabral (later succeeded by Rondhvea Adm. e Participações). Itaú allegedly would have sold 6,360 shares issued by Itaú and 5,000 shares issued by Banco União Comercial (succeeded by Itaú) in 1985, without the plaintiff’s authorization. In a final and unappealable decision, Itaú was ordered to award the plaintiff an amount corresponding to the share value and respective accessory obligations. Upon calculating the number of shares, under calculation of the liquid amount, the expert

appraiser disregarded the reverse split of shares as set forth by CVM Instruction No. 56/87, which took place in March 1987, at 1,000 for 1 share, and thus determined the amount of R$4 billion (expert opinion of August 30, 2017). These expert opinions were approved by the lower court judge (September 18, 2020), thus prompting Itaú to file the proper appeals, which were both granted with suspensive effect. One of the bank's appeals has already been adjudicated and granted, annulling the homologation decision due to lack of reasoning; a new judgment at the first instance is pending. The other appeal is still pending trial. Itaú had also filed complaints with the Disciplinary Board of Courts and the National Justice Board (CNJ), which were dismissed as the judge in charge had passed away. Itaú made a judicial deposit of the amount it understands as effectively due, which corresponds to the price of shares and accessory obligations based on the reverse split carried out in March 1987 (R$895,004.60 – October 2020). g. Summary of decisions on the merits issued: At the cognizance phase, the bank was ordered to pay plaintiff the amount corresponding to the shares sold without evidence of plaintiff’s authorization, as well as corresponding earnings. Upon calculation of the liquid amount, the lower court judge approved the expert witness report (September 18, 2020), and stated, in both lawsuits, that the bank owed about R$4 billion. An appellate decision has already been handed down in one of the lawsuits, granting the appeal filed by the bank to annul the judgment of ratification due to lack of statement of reasons (ruling on May 15, 2023). h. Case status: In one of the cases, the motion for clarification was tried in February 2025 and the records are awaiting new decision in respect to liquidation issued at the lower court level. In the other, the appeal filed by the bank is pending trial by the TJPA. i. Chance of loss: Remote j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: Pay award corresponding to the value of shares and respective accessory obligations. Tax Claims Case No.16327.720661/2021-45 a. Court: Administrative appellate court - Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative appellate court (CARF). c. Filing date: 09.22.2021 d. Parties to the proceedings: Federal Government (National Treasury) vs. Banco Itaucard S.A. e. Amounts, assets or rights involved: R$1,231,917,544.38 (September/2025). f. Main facts: On September 22, 2021, a tax assessment notice was received aimed at the collection of social contribution (CSLL) on the grounds of alleged lack of addition, in Part A of LACS book, of debit balances related to counterparts of surplus and deficit of depreciation in 2017, as tax authorities consider them nondeductible. This assessment notice was upheld by the Federal Revenue Service Judgment Office (DRJ) at the trial of the objection filed, and a voluntary appeal was filed. O This voluntary appeal started to be tried at CARF, where, instead of entering judgment, the judge ordered the production of more evidence.

g. Summary of decisions on the merits issued: DRJ justified its decision on the grounds that the adjustments arising from surplus and deficit of depreciation cause no tax effects on CSLL, and should be neutralized off books by excluding or adding any corresponding revenues or expenses in the calculation of the contribution calculation basis. h. Case status: Appellate decision by DRJ: 09.23.2022; Voluntary Appeal filed before CARF is pending trial. i. Chance of loss: Possible. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required. Case No. 16327.721240/2019-17 a. Court: Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative appellate court (CARF). c. Filing date: 12.30.2019 d. Parties to the proceedings: Federal Government (National Treasury) vs. Banco Itaucard S.A. e. Amounts, assets or rights involved: R$1,527,876,792.80 (September/2025). f. Main facts: Tax assessment notices levied aimed at the collection of PIS/Cofins on the grounds of alleged failure to submit for taxation the economic-financial result of leasing operations carried out, with a 150% fine levied. Lawsuit attached to Case No. 16327.721239/2019-92 about the same subject matter challenged. On May 25, 2020, the administrative lower court handed down a ruling to uphold the tax assessment, with the company thus filing a voluntary appeal. The voluntary appeal started to be tried at CARF, where, instead of entering judgment, the judge ordered the production of more evidence. g. Summary of decisions on the merits issued: DRJ stated the reasons for upholding the tax assessment notice on the grounds that, during the contract term, the Bank accurately calculated the PIS/COFINS basis but had unduly reversed the depreciation surplus amounts at the end of each contract. h. Case status: Appellate decision by DRJ: 05.25.2020; Voluntary Appeal filed before CARF is pending trial. i. Chance of loss: Possible (R$168,527,410.14) and Remote (R$1,359,349,382.66). j. Reason why this case is deemed material: Amount in dispute.

k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required. Case No. 16327.720188/2019-81 a. Court: Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative appellate court (CARF). c. Filing date: 02.27.2019 d. Parties to the proceedings: Federal Government (National Treasury) vs. Itaú Unibanco S.A. e. Amounts, assets or rights involved: R$1.561.558.885,86 (September/2025). f. Main facts: Tax assessment notice levied aimed at the collection of social security tax due on payments of employee and management profit sharing, meal voucher and food allowance paid in tickets and hiring bonus in 2014 On February 11, 2021, the administrative lower court handed down a ruling to partially uphold the tax assessment, with the company thus filing a voluntary appeal. On November 7, 2023, CARF ruled to grant the voluntary appeal to fully cancel the tax assessment. The Office of the General Counsel to the National Treasury (PGFN) filed a motion for clarification, which was granted but had no modificatory character, as it was handed down to merely correct clerical mistakes in the appellate decision document. A Special Appeal was filed by the PGFN, which is awaiting admissibility g. Summary of decisions on the merits issued: DRJ cancelled part of the tax assessment, which had been subject to review at the evidentiary remedy stage, during which an error in the assessed calculation was identified. With respect to the other cases presented by the defense, DRJ just upheld the tax assessment filed. Upon the trial of the Voluntary appeal filed, CARF ruled to cancel the tax assessment in full due to its groundlessness regarding the meal voucher and food allowance paid in tickets and hiring bonus, as well as to declare the tax assessment in connection with employee profit sharing null and void, in addition to dismissing the fine on assessment levied on debits on management profit sharing, considering that the amount due has been suspended at the judicial level. h. Case status: Appellate decision by DRJ: 02.11.2021; Appellate decision by CARF: 11.07.2023; Appellate decision by CARF on Motions for Clarification: 10.01.2024; Awaiting to be notified and a possible filing of a Special Appeal by the PGFN. i. Chance of loss: Possible (R$737,917,151.04) and Remote (R$823,641,734.82). j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required.

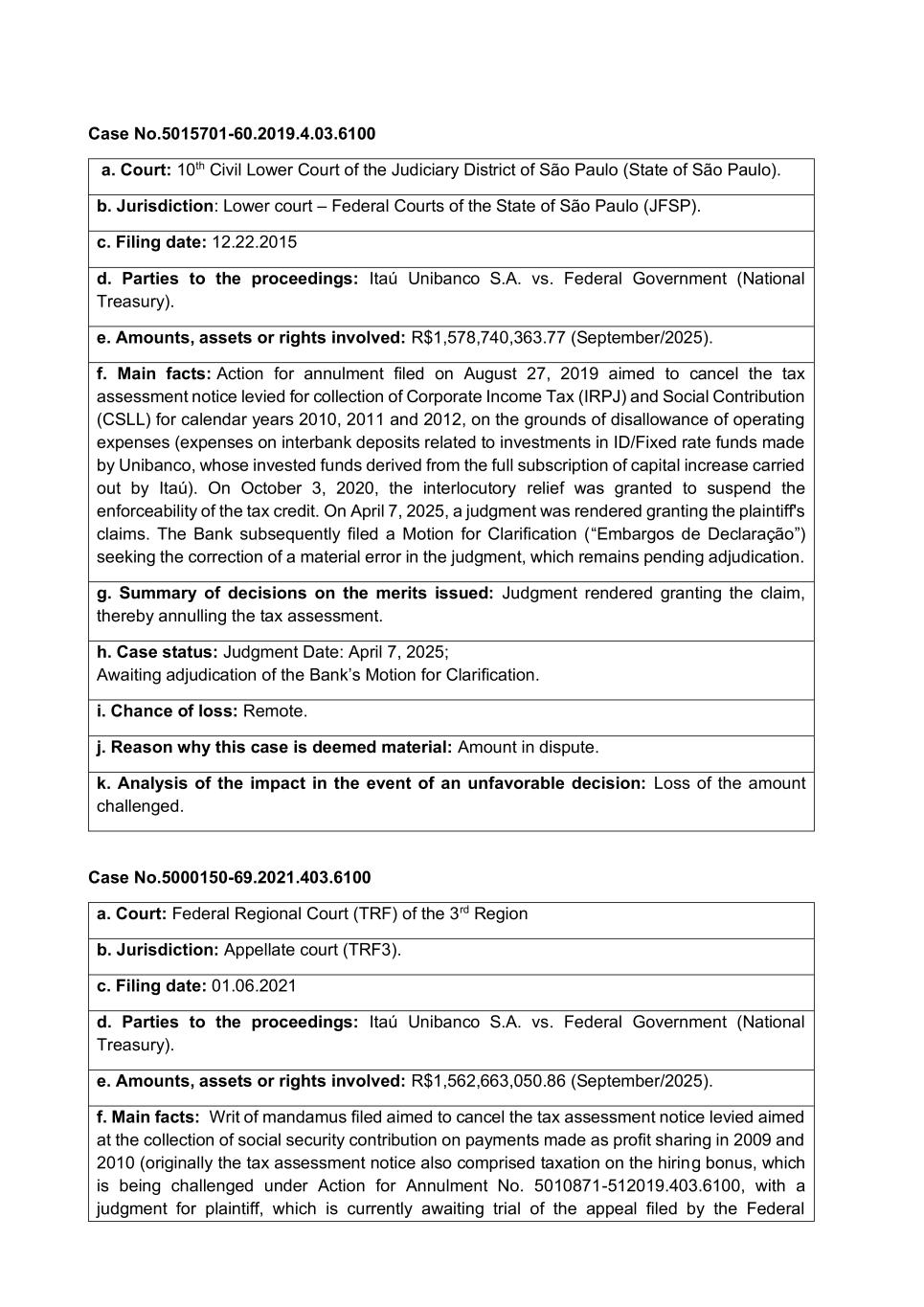

Case No.5015701-60.2019.4.03.6100 a. Court: 10th Civil Lower Court of the Judiciary District of São Paulo (State of São Paulo). b. Jurisdiction: Lower court – Federal Courts of the State of São Paulo (JFSP). c. Filing date: 12.22.2015 d. Parties to the proceedings: Itaú Unibanco S.A. vs. Federal Government (National Treasury). e. Amounts, assets or rights involved: R$1,578,740,363.77 (September/2025). f. Main facts: Action for annulment filed on August 27, 2019 aimed to cancel the tax assessment notice levied for collection of Corporate Income Tax (IRPJ) and Social Contribution (CSLL) for calendar years 2010, 2011 and 2012, on the grounds of disallowance of operating expenses (expenses on interbank deposits related to investments in ID/Fixed rate funds made by Unibanco, whose invested funds derived from the full subscription of capital increase carried out by Itaú). On October 3, 2020, the interlocutory relief was granted to suspend the enforceability of the tax credit. On April 7, 2025, a judgment was rendered granting the plaintiff's claims. The Bank subsequently filed a Motion for Clarification (“Embargos de Declaração”) seeking the correction of a material error in the judgment, which remains pending adjudication. g. Summary of decisions on the merits issued: Judgment rendered granting the claim, thereby annulling the tax assessment. h. Case status: Judgment Date: April 7, 2025; Awaiting adjudication of the Bank’s Motion for Clarification. i. Chance of loss: Remote. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: Loss of the amount challenged. Case No.5000150-69.2021.403.6100 a. Court: Federal Regional Court (TRF) of the 3rd Region b. Jurisdiction: Appellate court (TRF3). c. Filing date: 01.06.2021 d. Parties to the proceedings: Itaú Unibanco S.A. vs. Federal Government (National Treasury). e. Amounts, assets or rights involved: R$1,562,663,050.86 (September/2025). f. Main facts: Writ of mandamus filed aimed to cancel the tax assessment notice levied aimed at the collection of social security contribution on payments made as profit sharing in 2009 and 2010 (originally the tax assessment notice also comprised taxation on the hiring bonus, which is being challenged under Action for Annulment No. 5010871-512019.403.6100, with a judgment for plaintiff, which is currently awaiting trial of the appeal filed by the Federal

Government). In the records of the writ of mandamus, on January 12, 2021, a preliminary injunction was granted to suspend the enforceability of the tax credit related to the collection of social security contribution on profit sharing. On July 16, 2021 the judgment that partially granted the preliminary injunction was rendered. On October 10, 2022, the TRF of 3rd Region handed down the appellate decision that upheld the judgment. The parties filed Special Appeals and the PGFN otherwise filed an Extraordinary Appeal, with the former being denied and the latter being not entertained. The interlocutory appeals filed by the parties are pending trial. The Special Appeal interlocutory motions were acknowledged by the Superior Court of Justice (STJ), and the Special Appeals were denied. The case is currently awaiting the potential filing of Internal Appeals by the parties. Internal Appeals were filed by the parties, pending judgment. g. Summary of decisions on the merits issued: Preliminary injunction and writ of mandamus were partially granted to dismiss the assessed portion calculated on a portion of profit sharing (the one meeting the legal frequency limits) which, therefore, is excluded from taxation. Furthermore, the part of the initial pleading intended to avert the entire original assessment (portion already paid, which we asked for refund only) was dismissed. The appellate decision on this appeal upheld the judgment, on the grounds that the defect of part of the profit sharing payments regarding the frequency does not apply to the entire profit sharing. h. Case status: Preliminary injunction: 01.12.2021; Judgment: 07.16.2021; Ruling on motion for clarification: 09.21.2021; Appellate decision on appeal and official review: 10.10.2022; Appellate decision on first motion for clarification: 03.14.2023; Appellate decision on second motion for clarification: 07.10.2023; Special appeals denied and extraordinary appeal not being entertained: 06.10.2024; Decisions denying the Special Appeals: 07.02.2025; Awaiting judgment of Internal Appeals by the parties. i. Chance of loss: Remote. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: Loss of the amount challenged. Case No. 5026711-91.2025.4.03.6100 a. Court: 9th Federal Civil Court, São Paulo, State of São Paulo. b. Jurisdiction: Lower court – Federal Courts of the State of São Paulo (JFSP). c. Filing date: 01.18.2018 d. Parties to the proceedings: Federal Government (National Treasury) vs. Banco Itaucard S.A. e. Amounts, assets or rights involved: R$1,532,722,984.63 (September/2025).

f. Main facts: Annulment action seeking to invalidate Tax Assessment Notice No. 16327.720004/2018-01, issued in connection with the assessment of PIS and COFINS contributions, based on the alleged failure to subject the economic and financial results of leasing transactions to taxation. g. Summary of decisions on the merits issued: To date, no judicial decision on the merits has been rendered in this proceeding. h. Case status: Pending adjudication at the lower court level. i. Chance of loss: Possible. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: Loss of the amount under dispute. Case No. 16327.720774/2018-45 a. Court: Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative appellate court (CARF). c. Filing date: 10.26.2018 d. Parties to the proceedings: Federal Government (National Treasury) vs. Itaú Unibanco S.A. e. Amounts, assets or rights involved: R$3,847,460,990.80 (September/2025). f. Main facts: Tax assessment notice for the collection of corporate income tax (IRPJ), social contribution (CSLL), PIS and COFINS (taxes on income) and fines (2012 to 2013) arising from disallowance of operating expenses (interbank deposits) related to funds capitalized among Group companies. DRJ dismissed the appeal filed. Meanwhile, CARF granted part of the voluntary appeal. A motion for clarification was filed by the company, and a special appeal was filed by the Federal Government. As the motion for clarification filed by the Taxpayer was denied, the company filed a special appeal on December 23, 2024. The special appeals filed by both the Taxpayer and the Federal Government are pending trial. g. Summary of decisions on the merits issued: DRJ upheld the assessment notice as it understood that these transactions had no business intent. CARF, on merits and by the casting vote, upheld this understanding, but averted the aggravation of the fine on assessment and recognized the partial preemption of the IPJ and CSLL taxable events. h. Case status: Appellate decision by DRJ: 06.11.2019; Appellate decision by CARF: 05.29.2023; Special appeals filed by both the Federal Government and the Bank are pending trial. i. Chance of loss: Possible (R$1,297,789,504.42) and Remote (R$2,549,671,486.38). j. Reason why this case is deemed material: Amount in dispute.

k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required. Case No.5026528-67.2018.4.03.6100 a. Court: Federal Regional Court (TRF) of the 3rd Region b. Jurisdiction: Appellate court (TRF3). c. Filing date: 11.14.2013 d. Parties to the proceedings: Itaú Unibanco S.A. vs. Federal Government (National Treasury). e. Amounts, assets or rights involved: R$3,712,419,635.75 (September/2025). f. Main facts: Tax assessment notice for the collection of corporate income tax (IRPJ) and social contribution (CSLL) on the grounds of alleged capital gain arising from the association between the Itaú and Unibanco conglomerates, assigned to E. Johnston Representação e Participações. A voluntary appeal was filed by the taxpayer, which was dismissed by CARF. The case was terminated with an unfavorable decision rendered by CSRF on September 28, 2018. Therefore, on October 22, 2018, the company filed Action for Annulment No. 5026528- 67.2018.4.03.6100, which is currently pending at the Federal Courts of São Paulo. Interlocutory relief was granted in connection with this action on October 26, 2018, with the claim granted on October 2, 2020. The appeal filed by the Federal Government is currently pending trial. g. Summary of decisions on the merits issued: Favorable judgment at trial court fully granted the claim to nullify the tax assessment notice. h. Case status: Interlocutory relief: 10.26.2018; Judgment: 10.02.2020; The appeal filed before the TRF3 is pending trial. i. Chance of loss: Remote. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: Loss of the amount challenged. Case No. 0204699-55.0500.8.26.0090 (204.699/05) a. Court: Municipal Tax Foreclosure Court of São Paulo (state of São Paulo). b. Jurisdiction: Lower court – Municipal Tax Foreclosure Court of São Paulo. c. Assignment date: 11.30.2005 d. Parties to the proceedings: Municipality of São Paulo vs. Banco Itauleasing S.A. (formerly Cia Itauleasing de Arrendamento Mercantil).

e. Amounts, assets or rights involved: R$5,209,807,835.92 (September/2025). f. Main facts: Tax foreclosure filed by the Municipality of São Paulo to collect service tax (ISS) on leasing operations on the grounds that such amounts were unduly paid to the Municipality of Poá. A motion to stay execution is pending trial. g. Summary of decisions on the merits issued: Judgment for defendant on motion to stay execution was rendered, which was later rendered null and void by means of the appeal filed by the Appellate Court of the State of São Paulo, h. Case status: Lower court ruling is pending. (previous judgment- nullified: August 20, 2008; appellate decision by the TJSP that rendered the previous judgment null and void: 02.27.2014) i. Chance of loss: Remote. j. reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: Loss of the amount challenged. Case No. 1000510-36.2021.8.26.0462 a. Court: 2nd Civil Lower Court of Poá (State of São Paulo). b. Jurisdiction: Lower court (Poá/state of São Paulo). c. Filing date: 02.22.2021 d. Parties to the proceedings: Banco Itaucard S.A. vs. Municipality of São Paulo vs. Municipality of Poá e. Amounts, assets or rights involved: R$8,636,738,798.22 (September/2025). f. Main facts: Tax assessment notices levied by the Municipality of São Paulo to challenge the place of payment of service tax (ISS) on credit card and leasing operations, on the grounds that these payments were unduly made to the Municipality of Poá. After unfavorable decisions at the administrative level, the company filed a lawsuit to obtain a statement of existence of a legal tax relationship between Banco Itaucard and the Municipality of Poá and the resulting cancellation of the charges made by the Municipality of São Paulo or the recovery of the undue payment made to the Municipality of Poá. g. Summary of decisions on the merits issued: Decisions on the merits for this case have not yet been rendered. h. Case status: Awaiting judgment to be rendered. i. Chance of loss: Possible (R$4,317,746,118.99) and Remote (R$4,318,992,679.23). j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: Loss of the amount challenged.

Case No. 16561.720011/2020-46 a. Court: Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative appellate court (CARF). c. Filing date: 04.15.2020 d. Parties to the proceedings: Federal Government (National Treasury) vs. Redecard S.A. and Others. e. Amounts, assets or rights involved: R$6,972,830,530.07 (September/2025). f. Main facts: Tax assessment notice levied on Redecard arising from disallowance of goodwill on acquisition of Redecard’s shares by Banestado through a public offering of shares, and a 150% fine and a separate fine were levied on the alleged non-payment of monthly estimates. Objection was filed and partially granted at the Federal Revenue Service Judgment Office (DRJ) to exclude the aggravated fine and the presumed joint and several liability. A voluntary appeal and a mandatory review were filed. On February 20, 2024, CARF upheld the exclusion of the aggravated fine and joint and several liability, as well as granting part the voluntary appeal filed by the Taxpayer. The Federal Government filed a special appeal, whereas the Taxpayer filed a motion for clarification, and both are pending trial. g. Summary of decisions on the merits issued: DRJ rendered a partially favorable decision to exclude the aggravated fine and the joint and several liability. CARF’s decisions on the appeals were as follows: (i) denied the aggravated fine and joint and several liability; (ii) denied the collection of the portion of goodwill related to interests acquired from Itaú Group’s non-related parties; (iii) upheld the assessment notice of the portion of goodwill related to interests acquired from Itaú Group’s related parties; and (iv) upheld the levy of the separate fine. h. Case status: Appellate decision by DRJ: 12.07.2020; Appellate decision by CARF: 02.20.2024; The Federal Government filed a special appeal, whereas the Taxpayer filed a motion for clarification, and both are pending trial. i. Chance of loss: Remote. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required.

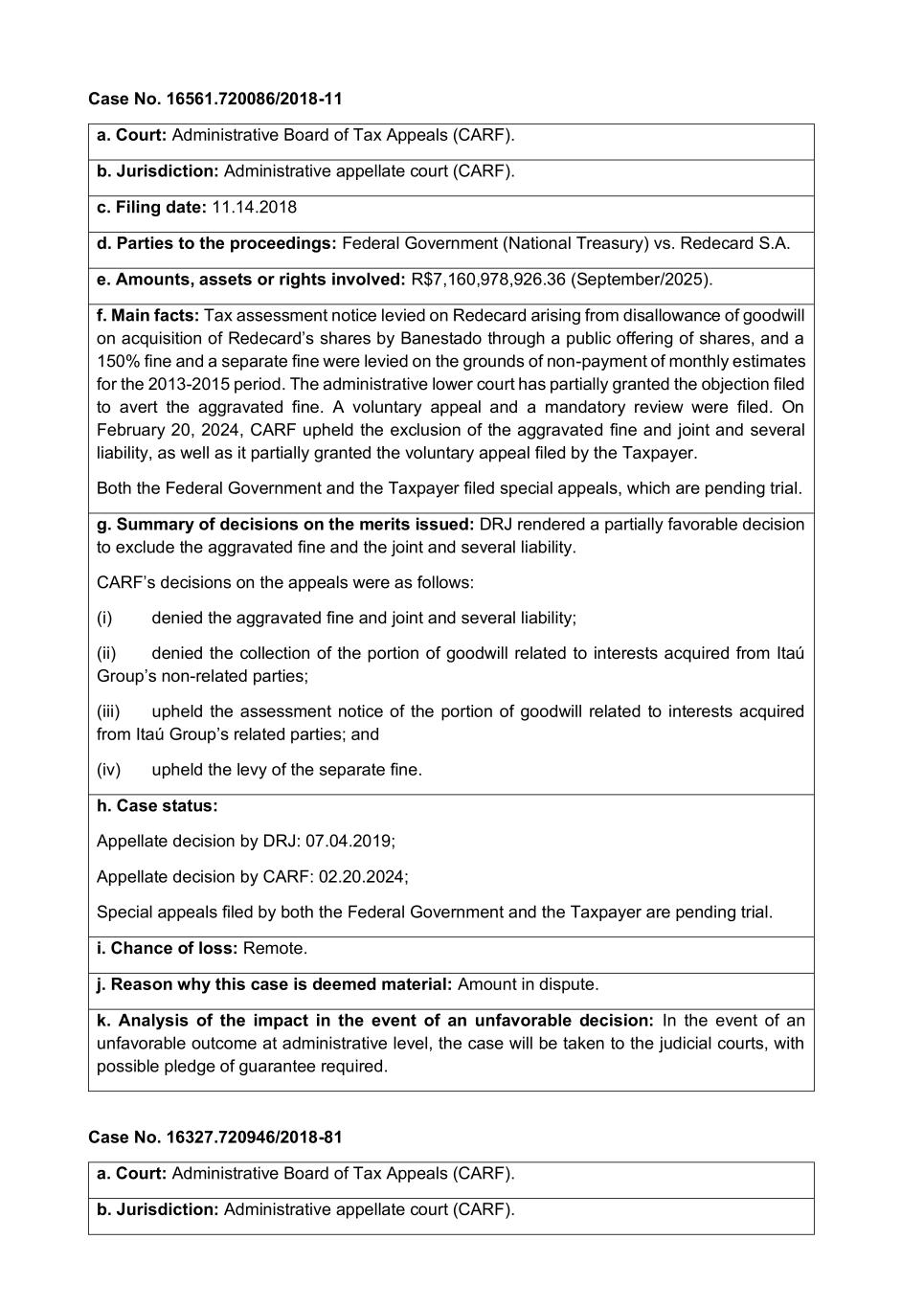

Case No. 16561.720086/2018-11 a. Court: Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative appellate court (CARF). c. Filing date: 11.14.2018 d. Parties to the proceedings: Federal Government (National Treasury) vs. Redecard S.A. e. Amounts, assets or rights involved: R$7,160,978,926.36 (September/2025). f. Main facts: Tax assessment notice levied on Redecard arising from disallowance of goodwill on acquisition of Redecard’s shares by Banestado through a public offering of shares, and a 150% fine and a separate fine were levied on the grounds of non-payment of monthly estimates for the 2013-2015 period. The administrative lower court has partially granted the objection filed to avert the aggravated fine. A voluntary appeal and a mandatory review were filed. On February 20, 2024, CARF upheld the exclusion of the aggravated fine and joint and several liability, as well as it partially granted the voluntary appeal filed by the Taxpayer. Both the Federal Government and the Taxpayer filed special appeals, which are pending trial. g. Summary of decisions on the merits issued: DRJ rendered a partially favorable decision to exclude the aggravated fine and the joint and several liability. CARF’s decisions on the appeals were as follows: (i) denied the aggravated fine and joint and several liability; (ii) denied the collection of the portion of goodwill related to interests acquired from Itaú Group’s non-related parties; (iii) upheld the assessment notice of the portion of goodwill related to interests acquired from Itaú Group’s related parties; and (iv) upheld the levy of the separate fine. h. Case status: Appellate decision by DRJ: 07.04.2019; Appellate decision by CARF: 02.20.2024; Special appeals filed by both the Federal Government and the Taxpayer are pending trial. i. Chance of loss: Remote. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required. Case No. 16327.720946/2018-81 a. Court: Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative appellate court (CARF).

c. Filing date: 12.21.2018 d. Parties to the proceedings: Federal Government (National Treasury) vs. Banco Itaucard S.A. e. Amounts, assets or rights involved: R$15,564,999,972.20 (September/2025). f. Main facts: Tax assessment notice for collection of corporate income tax (IRPJ), social contribution (CSLL), PIS and COFINS (taxes on income) and fines (2012 to 2015) arising from disallowance of operating expenses (interbank deposits) related to funds capitalized among Group companies. DRJ dismissed the appeal filed. A voluntary appeal was lodged and partially upheld; service of the CARF ruling remains pending. g. Summary of decisions on the merits issued: DRJ upheld the assessment notice as it understood that these transactions had no business intent. CARF adjudicated the voluntary appeal as follows: (i) by casting vote, sustained the disallowance of IRPJ/CSLL deductions and the isolated fine; and (ii) unanimously, set aside the aggravated penalty and annulled the periods barred by prescription. h. Case status: Appellate decision by DRJ: 05.31.2019. CARF appellate decision: 08.26.2025 Waiting service for CARF appellate decision. i. Chance of loss: Possible (R$4,398,881,115.49) and Remote (R$11,166,118,856.71). j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required. Case No.16327.720680/2013-61 a. Court: Administrative Board of Tax Appeals (CARF). b. Jurisdiction: Administrative higher court (Higher Chamber of Tax Appeals (CSRF). c. Filing date: 06.25.2013 d. Parties to the proceedings: Federal Revenue Service vs. Itaú Unibanco Holding S.A. e. Amounts, assets or rights involved: R$36,528,121,217.03 (September/2025). f. Main facts: Tax assessment notice for collection of corporate income tax (IRPJ) and social contribution (CSLL) for fiscal year 2008, arising from the transaction that led to the association between Itaú Holding and Unibanco Holding S.A. On April 10, 2017, CARF rendered a decision for the Company by cancelling the tax assessment notice. The special appeal filed by the Federal Revenue Service was suspended by CARF until the final trial of Writ of Mandamus No.

1017987-56.2017.4.01.3400 filed against the admissibility of the special appeal lodged by the Federal Government, with the appeal filed by the Federal Government pending trial. g. Summary of decisions on the merits issued: PA 16327.720680/2013-61: On majority of votes. The voluntary appeal to cancel the assessment in full was granted at CARF. Writ of mandamus (MS) 1017987-56.2017.4.01.3400: preliminary injunction and writ of mandamus were granted to dismiss the admissibility of the special appeal filed by the Federal Government, thus rendering a final and unappealable decision at the administrative level for the company. On October 11, 2021 the appeal filed by the Federal Government was dismissed by majority of votes (2x1), with the resulting suspension of the trial so that a broader trial is held in accordance with Article 942 of the Code of Civil Procedure (CPC). h. Case status: Administrative level: Appellate decision by CARF: 04.10.2017; Special appeal filed by the Federal Government (National Treasury) suspended and awaiting the termination of MS 017987.56.2017.4.01.3400. At judicial level: Preliminary injunction: 12.14.2017; Judgment: 07.18.2018; Awaiting the broader trial on the appeal filed by the Federal Government, which has already been denied by majority of votes. i. Chance of loss: Remote. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required. Case No.16327.720021/2024-88 (Partial Adhesion to the PTI) a. Court: Federal Revenue Service (Federal Revenue Service Judgment Office (DRJ). b. Jurisdiction: Administrative lower court (DRJ). c. Filing date: 12.04.2024 d. Parties to the proceedings: Federal Government (National Treasury) vs. Itaú Unibanco S.A. e. Amounts, assets or rights involved: R$4,007,712,242.43 (September/2025). f. Main facts: Tax assessment notice aimed to the collection of income tax (IRPJ) and social contribution (CSLL) on the grounds of alleged insufficient balance of Income tax and social contribution loss carryforwards offset in 2019. The Federal Revenue Service understands that a number of lawsuits and administrative proceedings, which have not yet become final and unappealable, definitively impact balances. An objection was filed, which is pending trial, In respect of the outstanding installment under the PTI.

g. Summary of decisions on the merits issued: Decisions on the merits for this case have not yet been rendered. h. Case status: Objection filed at DRJ is pending trial. i. Chance of loss: Possible. j. Reason why this case is deemed material: Amount in dispute. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at administrative level, the case will be taken to the judicial courts, with possible pledge of guarantee required. Case No. 16327.986118/2025-32 a. Court: Federal Revenue Secretariat of Brazil (Tax Appeals Office – DRJ) b. Jurisdiction: First-Level Administrative Instance (Tax Appeals Office – DRJ) c. Filing date:06.10.2025 d. Parties to the proceedings: Union (National Treasury) v. Itaú Unibanco S.A. e. Amounts, assets or rights involved: R$2,678,507,970.33 (September/2025). f. Main facts: Denial of offsetting a negative IRPJ balance in 2019, resulting from the disallowance of a tax credit generated between 2013 and 2017. The primary ground for the denial was the interpretation that the utilization of such tax credits in subsequent years is conditional upon the existence of tax losses in the original periods — an understanding that lacks legal basis and is subject to strong legal arguments for its dismissal. A Statement of Nonconformity has been submitted. g. Summary of decisions on the merits issued: No decisions on the merits have yet been rendered in this case. h. Case status: Awaiting adjudication of the Notice of Nonconformity before the Tax Appeals Office (DRJ). i. Chance of loss: Remote j. Reason why this case is deemed material: Amount of the contingency involved. k. Analysis of the impact in the event of an unfavorable decision: In the event of an unfavorable outcome at the administrative level, the debt will be challenged in the judicial sphere, with the potential submission of a guarantee. Labor Claims No labor claims in the period, under the materiality criteria set for this document. Administrative Proceeding Case No.08700.008182/2016-57 a. Court: Brazilian antitrust agency (CADE). b. Jurisdiction: Administrative lower court – General Superintendency of the Brazilian antitrust agency (CADE). c. Filing date: Published in the Official Gazette of the Federal Government on December 8, 2016. d. Parties to the proceedings: CADE ex officio vs. Banco Itaú BBA S.A and Others.

e. Amounts, assets or rights involved: In accordance with Law No. 12529/11, Article 37, item I, any violation of the economic order subjects the company to a fine ranging from one- tenth percent (0.1%) to twenty percent (20%) of the gross revenue of such company, group or conglomerate, earned in the last year prior to the filing of the administrative proceeding, in the business field in which the alleged violation was committed, which will never be lower than the alleged advantage gained whenever such calculation is possible. On the grounds of lack of definition of the calculation basis to be applicable, as well as the significant wide range of percentages applicable, it is not possible to estimate the fine amounts in the event of an unfavorable decision. f. Main facts: This is an administrative proceeding filed to investigate alleged cartel in the Brazilian onshore foreign exchange market involving the Brazilian currency (Brazilian real). These presumed antitrust conducts would have been engaged mainly in the FX spot and futures (derivatives) markets. These practices under investigation would have been engaged in Brazil by certain financial institutions (Banco Itaú BBA S.A., among them) and individuals located in the Brazilian territory. The defense was timely filed on January 8, 2018. No material developments occurred, even though settlements were signed with CADE, notably by Citibank. g. Summary of decisions on the merits issued: No decisions on merits have been issued yet. h. Case status: Still under review by the General Superintendency of CADE. i. Chance of loss: Possible. j. Reason why this case is deemed material: Image risk. k. Analysis of the impact in the event of an unfavorable decision: payment of a fine. Case No.08700.002066/2019-77 a. Court: Brazilian antitrust agency (CADE). b. Jurisdiction: Administrative appellate court. c. Filing date: April 18, 2019 (start of investigation) d. Parties to the proceedings: CADE ex officio vs. Itaú Unibanco S.A and Redecard S.A. e. Amounts, assets or rights involved: Not applicable. f. Main facts: In April 2019, the General Superintendency of CADE filed an administrative proceeding against Itaú Unibanco and Redecard to investigate an alleged antitrust practice in the credit card receivables market. Redecard had launched a program under which it would settle/clear credit card receivables in an account held at Itaú Unibanco in mere two days. CADE filed a preliminary injunction requesting the program to be suspended, which was dismissed as the program was upheld by virtue of a preliminary decision issued by the Federal Courts. In December 2019, Redecard decided to clear all bank accounts within two days, regardless of whether they were held at Itaú Unibanco, and as a result the lawsuit that upheld the program lost its purpose. Redecard and Itaú Unibanco filed their defenses, including legal and economic opinions, to evidence the inexistence of antitrust practices. The case was granted a favorable decision by the General Superintendency of CADE and the Department of Economic Studies, which understood there was no antitrust conduct in the case in question. Case currently pending at the Appellate Court (Member Camila Alves, after the vote cast by Member Victor

Fernandes to dismiss the case. The latter subsequently voted, after having requested to see the records, on the adverse vote of Member Gustavo Augusto who did not levied a fine to the defendants). Member Gustavo Augusto had determined the testimony of the Federal Public Prosecution Office and the Counsel to CADE, who also expressed their opinions for the termination of the case. Three court members (José Levi, Charles Jaques, and Camila Alves) still need to vote. Members Diogo Thompson and Alexandre Cordeiro were disqualified from voting. That is the appellate court who will decide either against the defendants or to terminate the case. g. Summary of decisions on the merits issued: The General Superintendency of CADE and the Department of Economic Studies, Federal Public Prosecution Office, and Member Victor Fernandes have issued a technical note, in the first case, and cast a vote, in the later, understanding that there was no antitrust conduct in D+2. h. Case status: Currently pending at the CADE, with records to be seen by Member Camila Alves, who notified the Central Bank of Brazil as BACEN to provide information on the receivables market. In its response, the Central Bank has not provided significant information to the case. Member Camila Alves has set a ten-day period (counting from 4.7) for a statement to be expressed on Central Bank’s response. Case may be included in the Appellate Court’s agenda for a final decision to be rendered (if no other requests to see the records are made) by the end of the second half of 2025. i. Chance of loss: Possible. j. Reason why this case is deemed material: Image risk. k. Analysis of the impact in the event of an unfavorable decision: Administrative fine (not possible to estimate) and reputational damage. Arbitration Proceedings The Issuer is not a party to any arbitration proceeding pending on September 30, 2025 that is material in terms of the matter or amount involved. Environmental Proceedings No environmental proceeding was filed in the period, in accordance with the materiality criteria set for this document.

4.5. State the total amount of provision, if any, for the proceedings described in item 4.4 The total amount provided for the claims described in 4.4. is R$1.27 million for civil proceedings, in base-date: 09.30.2025.

4.7. Describe other material contingencies not included in the previous items The amounts involved in the main tax and social security proceedings whose chance of loss is possible, which are not described in item 4.4, total R$26,584 million, as described below: R$ million Tax Issue Amount INSS INSS - Non-compensatory amounts: we defend the non-levy of non-compensatory amounts, profit sharing and stock option grant plan. 4,962 ISS Banking activities: We challenge the levy and/or place of payment of ISS for certain banking revenues. 3,590 IRPJ/CSLL/PIS/COFINS Request for offset rejected: cases in which liquidity and certainty of offset credit are analyzed. 2,435 IRPJ and CSLL Goodwill - Deduction: we challenge the deductibility of goodwill on acquisition of investments with expected future profitability. 2,368 IRPJ/CSLL Deductibility of losses in loan operations: we challenge tax assessment notices aimed at the collection of IRPJ and CSLL amounts due to alleged non-compliance with legal criteria for the deduction of losses on receipt of credits. 2,032 IRPJ and CSLL Disallowance of losses: We challenge the amount of tax loss and/or tax loss carryforwards used by the Federal Revenue Service in tax assessment notices, which are still pending a final decision. 1,703 PIS and COFINS Reversal of revenues from excess depreciation: we challenge the accounting and tax treatment granted to PIS and COFINS upon settlement of lease operations. 1,195 Total 18,285 Base date: 09.30.2025

6.1/6.2 - STOCKHOLDING POSITION BASE DATE 11.27.2025 Itaú Unibanco Holding S.A. Ordinary Shares % Preferrend Shares % Total % IUPAR - Itaú Unibanco Participações S.A. 2,820,492,844 51.713% - - 2,820,492,844 26.346% Nationality: Brasileira CNPJ (**) 04.676.564/0001-08 Itaúsa S.A. 2,138,297,234 39.205% 186,255 0.004% 2,138,483,489 19.975% Nationality: Brasileira CNPJ (**) 61.532.644/0001-15 BlackRock, INC - - 384,917,606 7.330% 384,917,606 3.595% Nationality: American CNPJ (**) n/a GQG Partners LLC - - 266,554,591 5.076% 266,554,591 2.490% Nationality: American CNPJ (**) n/a Treasury - - 334,624 0.006% 334,624 0.003% Others 495,329,317 9.082% 4,599,585,774 87.585% 5,094,915,091 47.591% Total 5,454,119,395 100.000% 5,251,578,850 100.000% 10,705,698,245 100.000% (*) Individual Taxpayer’s Registry (CPF) (**) National Register of Legal Entity (CNPJ) BASE DATE 12.31.2024 IUPAR - Itaú Unibanco Part. S.A. Ordinary Shares % Preferrend Shares % Total % Itaúsa S.A. 355,227,092 50.000% 350,942,273 100.000% 706,169,365 66.532% Nationality: Brasileira CNPJ (**) 61.532.644/0001-15 Cia. E. Johnston de Participações 355,227,092 50.000% - - 355,227,092 33.468% Nationality: Brasileira CNPJ (**) 04.679.283/0001-09 Total 710,454,184 100.000% 350,942,273 100.000% 1,061,396,457 100.000% BASE DATE 12.31.2024 Cia. E. Johnston de Part. Ordinary Shares % Preferrend Shares % Total % Fernando Roberto Moreira Salles 3,274,000 50.000% 6,548,000 50.000% 9,822,000 50.000% Nationality: Brasileira CPF (*) 002.938.068-53 Pedro Moreira Salles 2,881,120 44.000% 5,762,240 44.000% 8,643,360 44.000% Nationality: Brasileira CPF (*) 551.222.567-72 João Moreira Salles 392,880 6.000% 785,760 6.000% 1,178,640 6.000% Nationality: Brasileira CPF (*) 295.520.008-58 Total 6,548,000 100.000% 13,096,000 100.000% 19,644,000 100.000%

BASE DATE 10.31.2025 Itaúsa S.A. Ordinary Shares % Preferrend Shares % Total % Companhia ESA 34,363,487 0.910% 292,862 0.004% 34,656,349 0.315% Nationality: Brasileira CNPJ (**) 52.117.397/0001-08 Fundação Itaú 429,996,161 11.381% 52,811,594 0.732% 482,807,755 4.392% Nationality: Brasileira CNPJ (**) 59.573.030/0001-30 Fundação Antonio e Helena Zerrenner Instituição Nacional de Beneficência 581,825,725 15.400% 146,466,917 2.030% 728,292,642 6.625% Nationality: Brasileira CNPJ (**) 60.480.480/0001-67 Rudric ITH Participações Ltda. 3,156,066 0.084% 2,501,468 0.035% 5,657,534 0.051% Nationality: Brasileira CNPJ (**) 67.569.061/0001-45 Alfredo Egydio Arruda Villela Filho 483,333,114 12.793% 283,409,975 3.928% 766,743,089 6.974% Nationality: Brasileira CPF (*) 066.530.838-88 Ana Lúcia de Mattos Barreto Villela 483,333,078 12.793% 264,393,833 3.664% 747,726,911 6.801% Nationality: Brasileira CPF (*) 066.530.828-06 Ricardo Villela Marino 241,940,736 6.404% 187,614,375 2.600% 429,555,111 3.907% Nationality: Brasileira CPF (*) 252.398.288-90 Rodolfo Villela Marino 242,012,549 6.406% 187,731,924 2.602% 429,744,473 3.909% Nationality: Brasileira CPF (*) 271.943.018-81 Paulo Setubal Neto 41,295 0.001% 517,984 0.007% 559,279 0.005% Nationality: Brasileira CPF (*) 638.097.888-72 Carolina Marinho Lutz Setubal 51,421,530 1.361% 17,655,492 0.245% 69,077,022 0.628% Nationality: Brasileira CPF (*) 077.540.228-18 Julia Guidon Setubal 51,421,530 1.361% 17,655,492 0.245% 69,077,022 0.628% Nationality: Brasileira CPF (*) 336.694.358-08 Paulo Egydio Setubal 51,421,530 1.361% 17,655,492 0.245% 69,077,022 0.628% Nationality: Brasileira CPF (*) 336.694.318-10 Fernando Setubal Souza e Silva 27,964,891 0.740% 13,794,279 0.191% 41,759,170 0.380% Nationality: Brasileira CPF (*) 311.798.878-59 Guilherme Setubal Souza e Silva 27,965,030 0.740% 12,818,604 0.178% 40,783,634 0.371% Nationality: Brasileira CPF (*) 269.253.728-92 Tide Setubal Souza e Silva Nogueira 27,965,465 0.740% 14,542,859 0.202% 42,508,324 0.387% Nationality: Brasileira CPF (*) 296.682.978-81 Olavo Egydio Setubal Júnior 13,710,477 0.363% 55,261,510 0.766% 68,971,987 0.627% Nationality: Brasileira CPF (*) 006.447.048-29 Bruno Rizzo Setubal 40,959,536 1.084% 97,472 0.001% 41,057,008 0.373% Nationality: Brasileira CPF (*) 299.133.368-56 Camila Setubal Lenz Cesar 40,959,537 1.084% 100,349 0.001% 41,059,886 0.373% Nationality: Brasileira CPF (*) 350.572.098-41 Luiza Rizzo Setubal 40,959,542 1.084% 109,200 0.002% 41,068,742 0.374% Nationality: Brasileira CPF (*) 323.461.948-40 Roberto Egydio Setubal 71,637,561 1.896% 27,271,077 0.378% 98,908,638 0.900% Nationality: Brasileira CPF (*) 007.738.228-52 Mariana Lucas Setubal 32,209,962 0.853% 12,030,570 0.167% 44,240,532 0.402% Nationality: Brasileira CPF (*) 227.809.998-10 Paula Lucas Setubal 32,209,962 0.853% 12,030,570 0.167% 44,240,532 0.402% Nationality: Brasileira CPF (*) 295.243.528-69 José Luiz Egydio Setubal 109,007,641 2.885% 51,963,619 0.720% 160,971,260 1.464% Nationality: Brasileira CPF (*) 011.785.508-18 Beatriz de Mattos Setubal 8,788,102 0.233% 391,355 0.005% 9,179,457 0.083% Nationality: Brasileira CPF (*) 316.394.318-70 Gabriel de Mattos Setubal 8,788,102 0.233% 391,355 0.005% 9,179,457 0.083% Nationality: Brasileira CPF (*) 348.338.808-73 Olavo Egydio Mutarelli Setubal 8,788,102 0.233% 391,355 0.005% 9,179,457 0.083% Nationality: Brasileira CPF (*) 394.635.348-73 Alfredo Egydio Setubal 135,428,159 3.585% 54,148,287 0.750% 189,576,446 1.724% Nationality: Brasileira CPF (*) 014.414.218-07 Alfredo Egydio Nugent Setubal 2,720 0.000% 276 0.000% 2,996 0.000% Nationality: Brasileira CPF (*) 407.919.708-09 Marina Nugent Setubal 2,720 0.000% 276 0.000% 2,996 0.000% Nationality: Brasileira CPF (*) 384.422.518-80 Ricardo Egydio Setubal 135,366,135 3.583% 54,644,088 0.757% 190,010,223 1.728% Nationality: Brasileira CPF (*) 033.033.518-99 Marcelo Ribeiro do Valle Setubal 2,761 0.000% 381,724 0.005% 384,485 0.003% Nationality: Brasileira CPF (*) 230.936.378-21 Rodrigo Ribeiro do Valle Setubal 2,761 0.000% 381,724 0.005% 384,485 0.003% Nationality: Brasileira CPF (*) 230.936.298-02 Patricia Ribeiro do Valle Setubal 2,761 0.000% 355,627 0.005% 358,388 0.003% Nationality: Brasileira CPF (*) 230.936.328-62 BlackRock, Inc 0 0.000% 361,049,971 5.004% 361,049,971 3.284% Nationality: American CNPJ (**) n/a Treasury - - 2,294,423 0.032% 2,294,423 0.021% Others 361,083,833 9.557% 5,362,580,094 74.318% 5,723,663,927 52.063% Total 3,778,072,561 100.000% 7,215,738,072 100.000% 10,993,810,633 100.000%

BASE DATE 09.11.2025 Companhia ESA Ordinary Shares % Total % Rudric ITH Participações Ltda. 3,156,066 0.133% 3,156,066 0.133% Nationality: Brasileira CNPJ (**) 67.569.061/0001-45 Alfredo Egydio Arruda Villela Filho 483,333,114 20.387% 483,333,114 20.387% Nationality: Brasileira CPF (*) 066.530.838-88 Ana Lúcia de Mattos Barreto Villela 483,333,078 20.387% 483,333,078 20.387% Nationality: Brasileira CPF (*) 066.530.828-06 Ricardo Villela Marino 241,940,736 10.205% 241,940,736 10.205% Nationality: Brasileira CPF (*) 252.398.288-90 Rodolfo Villela Marino 242,012,549 10.208% 242,012,549 10.208% Nationality: Brasileira CPF (*) 271.943.018-81 Paulo Setubal Neto 41,295 0.002% 41,295 0.002% Nationality: Brasileira CPF (*) 638.097.888-72 Carolina Marinho Lutz Setubal 51,421,530 2.169% 51,421,530 2.169% Nationality: Brasileira CPF (*) 077.540.228-18 Julia Guidon Setubal Winandy 51,421,530 2.169% 51,421,530 2.169% Nationality: Brasileira CPF (*) 336.694.358-08 Paulo Egydio Setubal 51,421,530 2.169% 51,421,530 2.169% Nationality: Brasileira CPF (*) 336.694.318-10 Fernando Setubal Souza e Silva 27,964,891 1.180% 27,964,891 1.180% Nationality: Brasileira CPF (*) 311.798.878-59 Guilherme Setubal Souza e Silva 27,965,030 1.180% 27,965,030 1.180% Nationality: Brasileira CPF (*) 269.253.728-92 Tide Setubal Souza e Silva Nogueira 27,965,465 1.180% 27,965,465 1.180% Nationality: Brasileira CPF (*) 296.682.978-81 Olavo Egydio Setubal Júnior 13,710,477 0.578% 13,710,477 0.578% Nationality: Brasileira CPF (*) 006.447.048-29 Bruno Rizzo Setubal 40,959,536 1.728% 40,959,536 1.728% Nationality: Brasileira CPF (*) 299.133.368-56 Camila Setubal Lenz Cesar 40,959,537 1.728% 40,959,537 1.728% Nationality: Brasileira CPF (*) 350.572.098-41 Luiza Rizzo Setubal Kairalla 40,959,542 1.728% 40,959,542 1.728% Nationality: Brasileira CPF (*) 323.461.948-40 Roberto Egydio Setubal 71,637,561 3.022% 71,637,561 3.022% Nationality: Brasileira CPF (*) 007.738.228-52 Mariana Lucas Setubal 32,209,962 1.359% 32,209,962 1.359% Nationality: Brasileira CPF (*) 227.809.998-10 Paula Lucas Setubal 32,209,962 1.359% 32,209,962 1.359% Nationality: Brasileira CPF (*) 295.243.528-69 José Luiz Egydio Setubal 109,007,641 4.598% 109,007,641 4.598% Nationality: Brasileira CPF (*) 011.785.508-18 Beatriz de Mattos Setubal 8,788,102 0.371% 8,788,102 0.371% Nationality: Brasileira CPF (*) 316.394.318-70 Gabriel de Mattos Setubal 8,788,102 0.371% 8,788,102 0.371% Nationality: Brasileira CPF (*) 348.338.808-73 Olavo Egydio Mutarelli Setubal 8,788,102 0.371% 8,788,102 0.371% Nationality: Brasileira CPF (*) 394.635.348-73 Alfredo Egydio Setubal 135,428,159 5.712% 135,428,159 5.712% Nationality: Brasileira CPF (*) 014.414.218-07 Alfredo Egydio Nugent Setubal 2,720 0.000% 2,720 0.000% Nationality: Brasileira CPF (*) 407.919.708-09 Marina Nugent Setubal 2,720 0.000% 2,720 0.000% Nationality: Brasileira CPF (*) 384.422.518-80 Ricardo Egydio Setubal 135,366,135 5.710% 135,366,135 5.710% Nationality: Brasileira CPF (*) 033.033.518-99 Marcelo Ribeiro do Valle Setubal 2,761 0.000% 2,761 0.000% Nationality: Brasileira CPF (*) 230.936.378-21 Patricia Ribeiro do Valle Setubal 2,761 0.000% 2,761 0.000% Nationality: Brasileira CPF (*) 230.936.328-62 Rodrigo Ribeiro do Valle Setubal 2,761 0.000% 2,761 0.000% Nationality: Brasileira CPF (*) 230.936.298-02 Total 2,370,803,355 100.000% 2,370,803,355 100.000%

BASE DATE 12.31.2024 Rudric ITH Participações Ltda. Ordinary Shares % Total % Ricardo Villela Marino 37,507,724 50.000% 37,507,724 50.000% Nationality: Brasileira CPF (*) 252.398.288-90 Rodolfo Villela Marino 37,507,724 50.000% 37,507,724 50.000% Nationality: Brasileira CPF (*) 271.943.018-81 Total 75,015,448 100.000% 75,015,448 100.000%

6.3. - Distribution of Capital Date of last general stockholders' meeting/ Date of last update 04/17/2025 Number of stockholders - individuals (units) 512,628 Number of stockholders - companies (units) 12,896 Number of institutional investors (units) 1,382 Outstanding shares Outstanding shares correspond to the lssuer's total shares, except for those held by the parent company, the people related to the latter, the lssuer's management members, and treasury shares. Number of common shares (units) 442,831,339 8.119% Number of preferred shares (units) 5,194,426,579 98.912% Total 5,637,257,918 52.657%

6.4. Relevant companies in which the issuer has an interest Social Denomination Corporate Taxpayer ID (CNPJ) Issuer´s participation (%) Banco Itaú Uruguay S.A. 11.929.613/0001-24 100.000000 Banco Itaucard S.A. 17.192.451/0001-70 100.000000 Itaú Chile Inversiones, Servicios Y Administracion S.A. 08.988.150/0001-67 99.999470 IGA Participações S.A. 04.238.150/0001-99 100.000000 Itaú Consultoria de Valores Mobiliários e Participações S.A. 58.851.775/0001-50 100.000000 Banco Itaú Chile 12.262.596/0001-87 26.299650 Itaú Corretora de Valores S.A. 61.194.353/0001-64 99.999990 Itaú Rent Administração e Participações Ltda. 02.180.133/0001-12 14.17270 Itaú Seguros S.A. 61.557.039/0001-07 0.000220 Itaú Unibanco S.A. 60.701.190/0001-04 100.000000 ITB Holding Brasil Participações Ltda. 04.274.016/0001-43 0.000001 Oca S.A. 08.988.128/0001-17 100.000000 Redecard Instituição de Pagamento S.A. 01.425.787/0001-04 19.378540 Itauseg Participações S.A. 07.256.507/0001-50 26.422550 Luizacred S.A. Soc. Crédito Financiamento Investimento 02.206.577/0001-80 50.000000 Itaú Unibanco Veículos Administradora de Consórcios Ltda. 42.421.776/0001-25 99.999990 Microinvest S.A. Sociedade de Crédito a Microempreendedor 05.076.239/0001-69 99.999990 Banco Itaú Veículos S.A. 61.190.658/0001-06 100.000000 Itauseg Saúde S.A. 04.463.083/0001-06 53.71873 Albarus S.A. 05.786.118/0001-00 1.751690 Itaú Administradora de Consórcios Ltda. 00.000.776/0001-01 0.001000 Itau BBA Assessoria Financeira S.A. 04.845.753/0001-59 99.950830 Itaú International Holding (Cayman) Ltd. 05.706.252/0001-54 100.000000

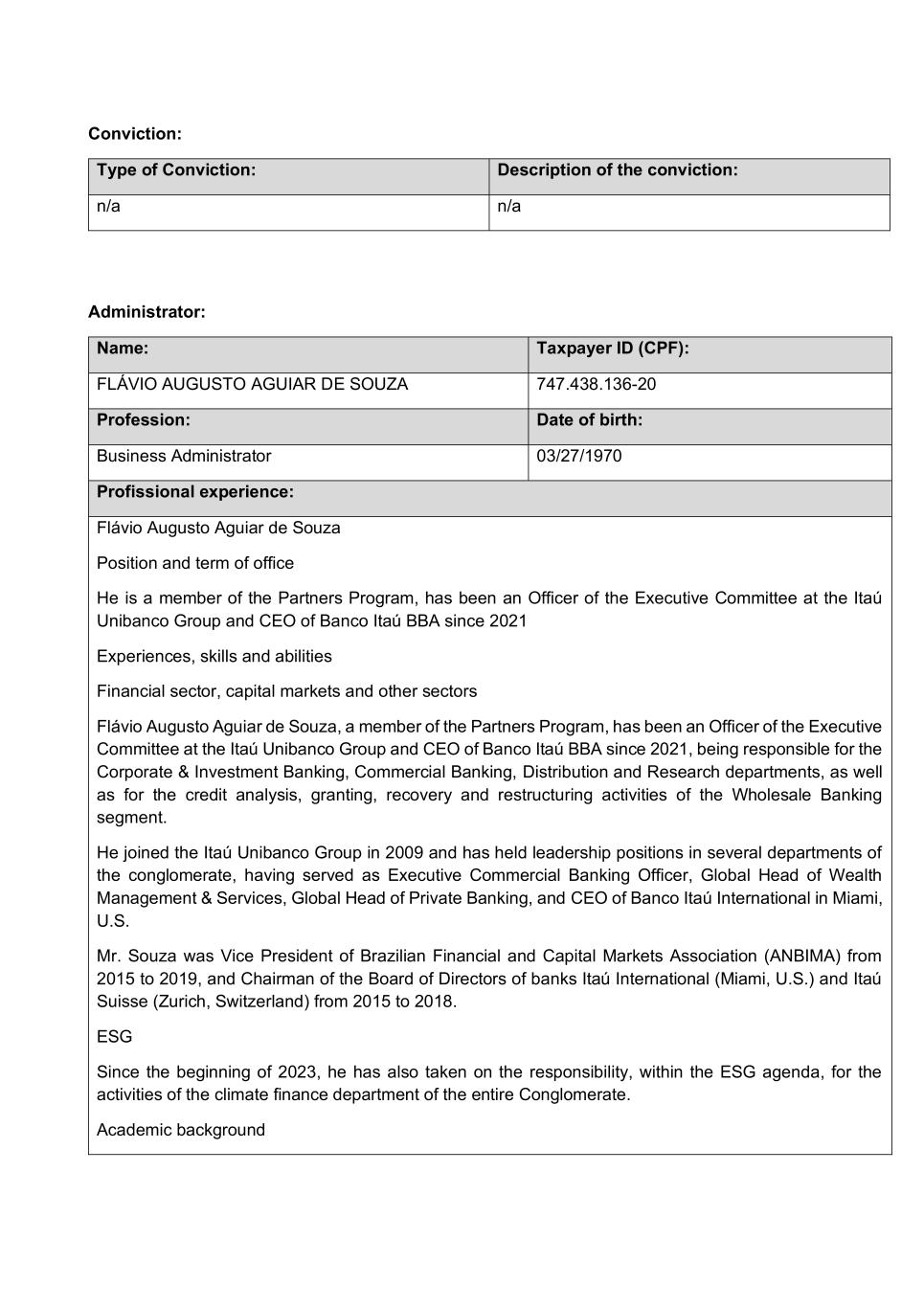

6.5 Insert the issuer's shareholder organization chart and the economic group to which it belongs. indicating: a. all direct and indirect controlling shareholders and. if the issuer wishes. the shareholders with participation equal to or greater than 5% of a class or type of shares Itaú U nibanco Holdin g S.A. IU PAR - Itaú U nibanco Participações Itaúsa S.A. 39.21% ON 19.83% Total 51.71% ON 26.15% Total 50.00% ON 100.00% PN 66.53% Total Free Float (*) (1) Cia. E . Johnston de Participações 8.12% ON 98.91% PN 52.66% Total 50.00 % ON 33.47% Total Family Egydio de Souza Aranha Free Float (*)(2)Family Moreira Salles 100.00% Total 63.52% ON 17.84% PN 33.54% Total 36.22% ON 81.17% PN 65.72% Total Banco Itaucard S.A.Itaú U nibanco S.A. Itaú Consultoria de Valores Mobiliários e Participações S.A. OCA S.A. Itaú Corretora de Valores S.A. Itaú BBA Assessoria Financeira S.A. Banco Itaú Uruguay S.A. 100.00% Total 100.00% Total 100.00% ON 100.00% PN 100.00%Total 99.99% ON 100.00% PN 99.99%Total 100.00% ON 100.00% PN 100.00%Total 99.95% ON 99.95% PN 99.95%Total 100.00% ON 100.00% PN 100.00%Total Itaú Chile Inversiones, Servicios Y Administracion S.A. 99.99% Total Banco Itaú Chile 26.30% Total IGA Participações S.A. 100.00% ON 100.00% PN 100.00%Total Itauseg Saúde S.A. Itaú Rent Administração e Participações Ltda. 14.17%Total ITB Holding Brasil Participações Ltda Banco Itaú Veículos S.A. Itaú U nibanco Veículos Administradora de Consórcios Ltda. Itauseg Participações S.A. Microinvest S.A. Sociedade de Crédito a Microempreendedor 100.00% Total 99.99% Total 26.42% Total 99.99% Total Redecard Instituição de Pagamento S.A. 19.38% Total Luizacred S.A. Soc. Crédito Financiamento Invest imento 50.00% Total 53.72% Total 0.000001% Total ON = common shares PN = preferred shares Base Date: 11.27.2025 (1) Base Date: 11.27.2025 Itaú Administradora de Consórcios Ltda. Itaú Seguros S.A. 0.001000% Total 0.000220% Total Albarus S.A. Itau BBA International Holdin g Cayman Ltd. 1.75% Total 100.00% Total

a) Direct and indirect controlling stockholders Direct controlling stockholders Itaúsa S.A. IUPAR - Itaú Unibanco Participações S.A. lndirect controlling stockholders Alfredo Egydio Arruda Villela Filho Alfredo Egydio Nugent Setubal Alfredo Egydio Setubal Ana Lúcia de Mattos Barretto Villela Beatriz de Mattos Setubal Bruno Rizzo Setubal Camila Setubal Lenz Cesar Carolina Marinho Lutz Setubal Cia. E. Jonhston de Participações Companhia ESA Fernando Roberto Moreira Salles Fernando Setubal Souza e Silva Gabriel de Mattos Setubal Guilherme Setubal Souza e Silva João Moreira Salles José Luiz Egydio Setubal Julia Guidon Setubal Luiza Rizzo Setubal Marcelo Ribeiro do Valle Setubal Mariana Lucas Setubal Marina Nugent Setubal Olavo Egydio Setubal Júnior Olavo Egydio Mutarelli Setubal Patrícia Ribeiro do Valle Setubal Paula Lucas Setubal Paulo Egydio Setubal Paulo Setubal Neto Pedro Moreira Salles Ricardo Egydio Setubal Ricardo Villela Marino Roberto Egydio Setubal Rodolfo Villela Marino Rodrigo Ribeiro do Valle Setubal Rudric ITH Participações Ltda. Tide Setubal Souza e Silva Nogueira

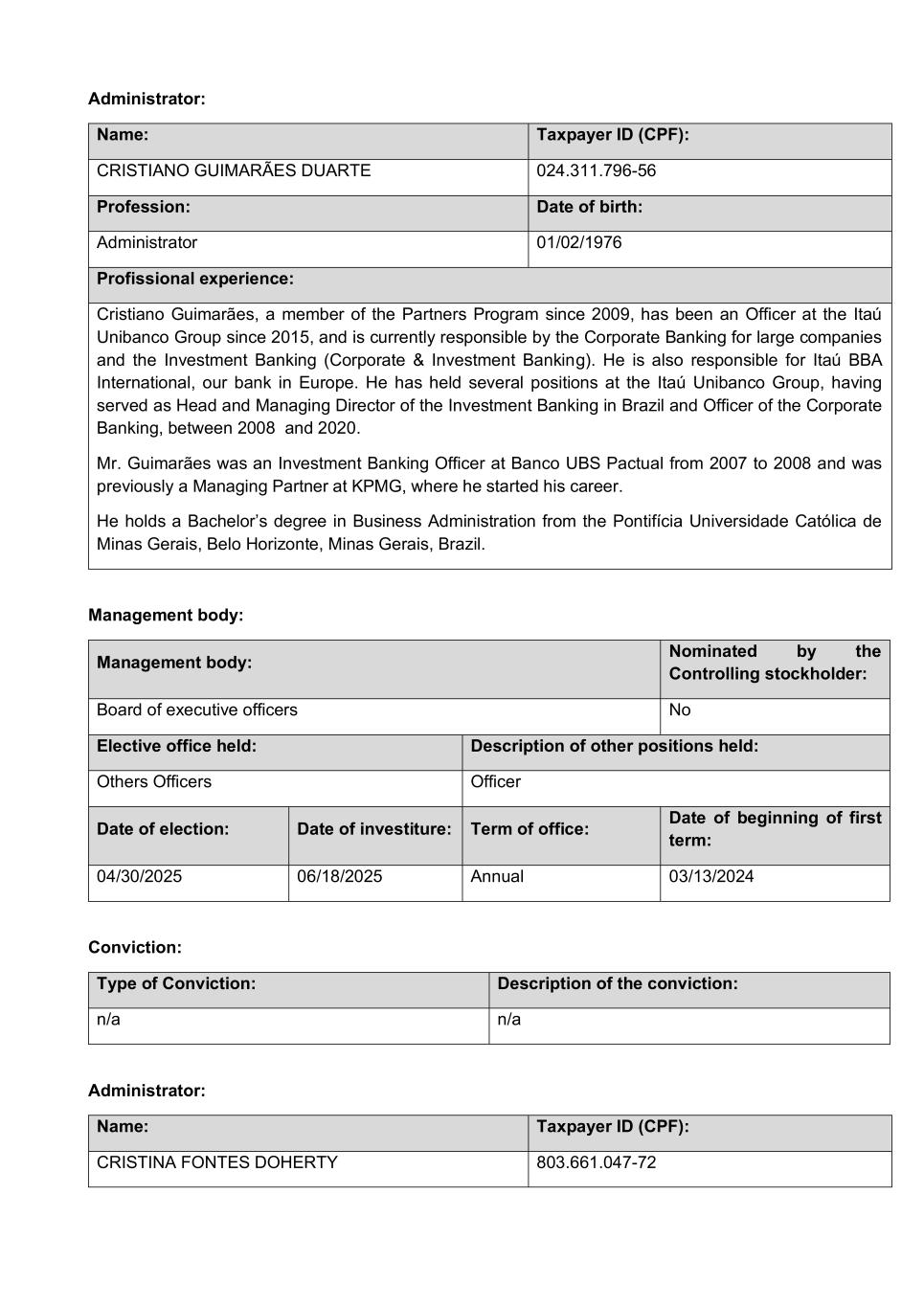

b) Subsidiary and affiliated companies c) Issuer's ownership interest in the group companies d) Group companies' ownership interest in the issuer e) Companies under common control Company Name Participatio n in the Voting Capital (%) Participatio n in the Share Capital (%) Controlled or Subsidiary In Brazil Itaú Unibanco S.A. 100.000000 100.000000 Subsidiary Redecard Instituição de Pagamento S.A. 19.378540 19.378540 Subsidiary Itaú Corretora de Valores S.A. 99.999997 99.999997 Subsidiary Itau BBA Assessoria Financeira S.A. 99.950832 99.950832 Subsidiary Itauseg Participações S.A. 26.422549 26.422549 Subsidiary IGA Participações S.A. 100.000000 100.000000 Subsidiary Itaú Consultoria de Valores Mobiliários e Participações S.A. 100.000000 100.000000 Subsidiary Luizacred S.A. Soc. Crédito Financiamento Investimento 50.000000 50.000000 Subsidiary Itauseg Saúde S.A. 53.718733 53.718733 Subsidiary Itaú Unibanco Veículos Administradora de Consórcios Ltda. 99.999999 99.999999 Subsidiary Itaú Rent Administração e Participações Ltda. 14.17270 14.17270 Subsidiary Microinvest S.A. Sociedade de Crédito a Microempreendedor 99.999999 99.999999 Subsidiary Banco Itaucard S.A. 100.000000 100.000000 Subsidiary Banco Itaú Veículos S.A. 100.000000 100.000000 Subsidiary Itaú Administradora de Consórcios Ltda. 0.001000 0.001000 Subsidiary Itaú Seguros S.A. 0.000220 0.000220 Subsidiary ITB Holding Brasil Participações Ltda. 0.000001 0.000001 Subsidiary Abroad Banco Itaú Chile 26.299648 26.299648 Subsidiary Banco Itaú Uruguay S.A. 100.000000 100.000000 Subsidiary Itaú Chile Inversiones. Servicios Y Administracion S.A. 99.999471 99.999471 Subsidiary Oca S.A. 100.000000 100.000000 Subsidiary Itau BBA International Cayman Ltd. (ex-Itau BBA International (Cayman) Ltd.) 100.000000 100.000000 Subsidiary Albarus S.A. 1.751688 1.751688 Subsidiary Base-date: 11.27.2025

6.6. Supply other information that the issuer may deem relevant Additional information on items 6.1/6.2 a) Regarding the stockholding position of the stockholder BlackRock, Inc. (“BlackRock”), the Company informs that on March 3, 2011 it received the information, as provided for in Article 12 of CVM Resolution nº 44/2021, as amended by CVM Instruction nº 568/2015, that, as investment manager of some of its clients, BlackRock acquired 159,335,737 preferred shares issued by the Company. Taking into consideration the many corporate events that took place at the Company since the acquisition of this interest, we present below the changes in BlackRock’s stockholding position, which represents 7.221% of the preferred shares and 3.569% of the total capital held by BlackRock. Statement of Changes in Blackrock's Stockholding Position Date Event Opening balance Event Closing balance 03/30/201 1 Opening balance at 03.30.2011, as provided by BlacKrocK (*) 159,335,737 - 159,335,737 11/01/201 1 stock split/reverse split according to notice of 09.01.2011 159,335,737 159,335,700 159,335,700 04/19/201 3 10% Bonus Share (ASM of 04.19.2013) 159,335,700 15,933,570 175,269,270 06/11/201 4 10% Bonus Share (ASM of 04.23.2014) 175,269,270 17,526,927 192,796,197 07/31/201 5 10% Bonus Share (ASM of 04.29.2015) 192,796,197 19,279,620 212,075,817 10/21/201 6 10% Bonus Share (ASM of 09.14.2016) 212,075,817 21,207,581 233,283,398 11/26/201 8 stocK split/reverse split according to notice of 11.01.2018 (ASM of 07.27.2018) 233,283,398 116,641,699 349,925,097 03/17/202 5 10% Bonus Share (Board of Directors' meeting of 02.05.2025) 349,925,097 34,992,509 384,917,606 (*) Ownership interest at base date 08.19.2010 provided by the Stockholder on March 30, 2011 b) With regard to the shareholding position of the shareholder GQG Partners LLC, on January 18, 2022, the company received information, in accordance with Article 12 of CVM Resolution 44/2021, that GQG Partners LLC now holds 253,506,105 preferred shares issued by the Company. Taking into consideration the many corporate events that took place at the Company since the acquisition of this interest, we present below the changes in GQG Partners LLC stockholding position, which represents 5.001% of the preferred shares and 2.472% of the total capital held by GQG Partners LLC.

Statement of Changes in GQG Partners LLC Stockholding Position Date Event Opening balance Event Closing balance 01/18/202 2 On 01/18/2022, according to correspondence from GQG Partners LLC (*) 253,506,105 - 253,506,105 04/25/202 4 On 04/25/2024, according to correspondence from GQG Partners LLC (**) 253,506,105 -14,600,821 238,905,284 08/29/202 4 On 08/29/2024, according to correspondence from GQG Partners LLC (***) 238,905,284 3,417,072 242,322,356 03/17/202 5 10% bonus in shares (Board of Directors' meeting of 02.05.2025) 242,322,356 24,232,235 266,554,591 (*) Shareholding on the base date of 01/18/2022, provided by the shareholder on 01/18/2022. (**) Shareholding on the base date of 04/25/2024, provided by the shareholder on 04/26/2024. (***) Inserted in the Reference Form on 08/29/2024 due to a stake of more than 5%. c) On February 24, 2022, the capital of Cia. E. Johnston de Participações "EJ", previously distributed among the brothers Fernando Roberto Moreira Salles, Walther Moreira Salles Júnior, Pedro Moreira Salles and João Moreira Salles, was divided between Fernando Roberto Moreira Salles, holder of 50% of EJ's capital and Pedro Moreira Salles and his son, João Moreira Salles, holders, respectively, of 44% and 6% of EJ's capital. Pedro Moreira Salles and João Moreira Salles are also members of the Board of Directors of Itaú Unibanco Holding. The brothers Walther Moreira Salles Júnior and João Moreira Salles therefore ceased to be shareholders of EJ, transferring their respective holdings to the remaining shareholders, Fernando and Pedro, and to the new shareholder, João, in share purchase and sale transactions. There was no change in the stake held by EJ in the capital of IUPAR, parent company of Itaú Unibanco Holding. Control of IUPAR continues to be exercised in accordance with the shareholders' agreement in force and, consequently, the transactions described did not result in any change in the management or governance of Itaú Unibanco Holding. Additional information on item 6.3 The number of individual and corporate stockholders and institutional investors stated in item 6.3 of this Form refers to the April 17, 2025 base date. The number of outstanding shares informed in item 6.3 of this Form refers to the November 27, 2025 base date.

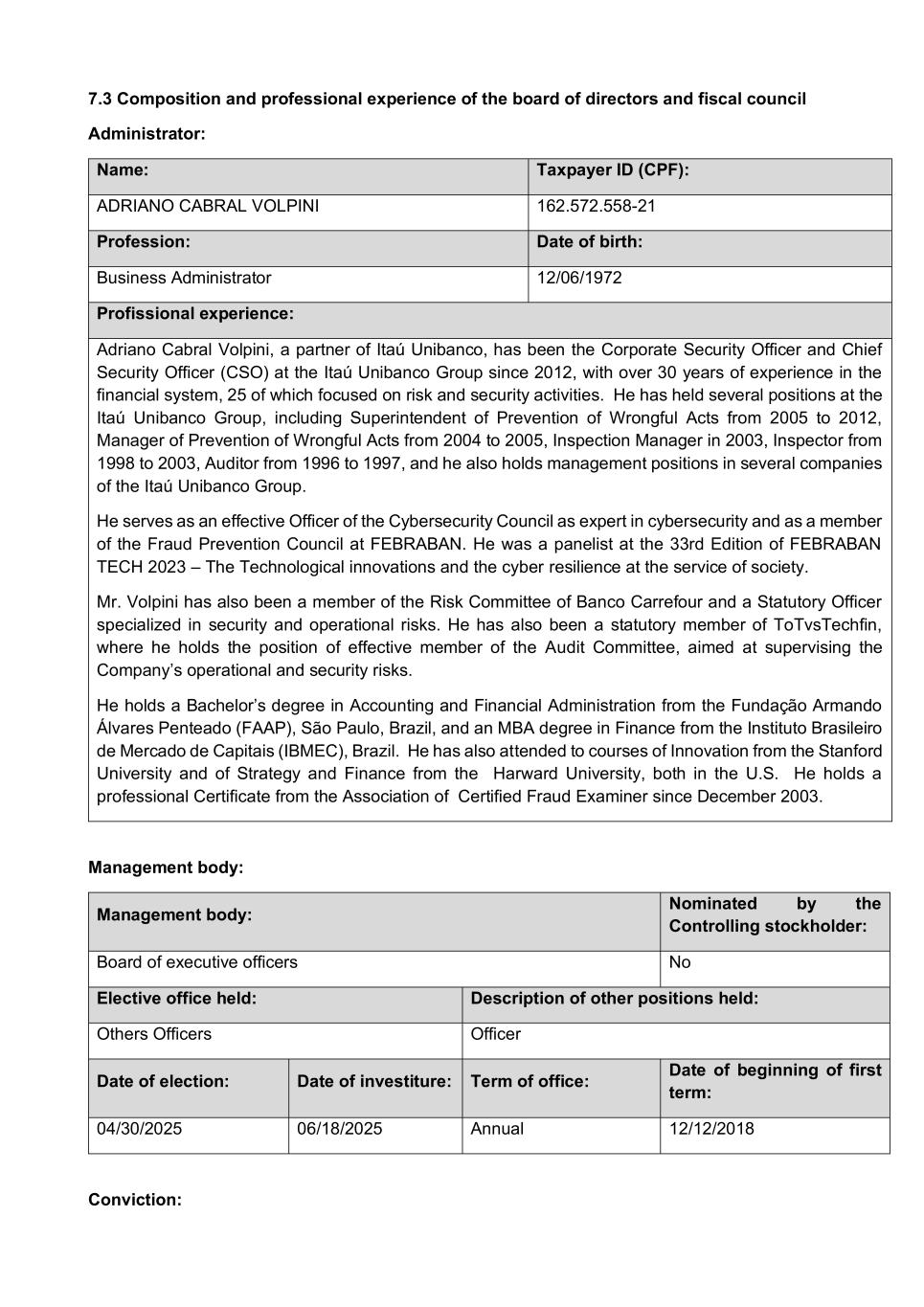

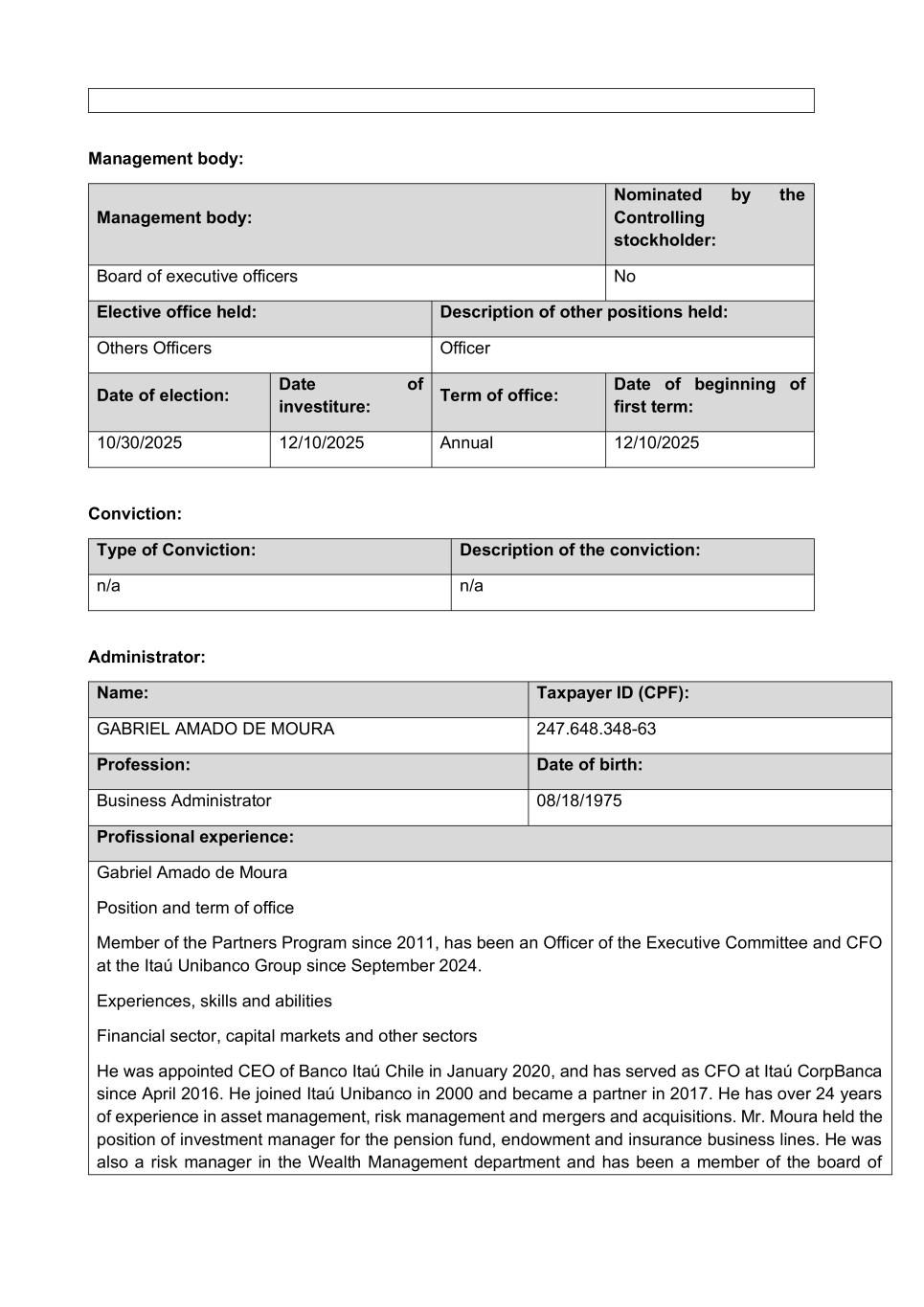

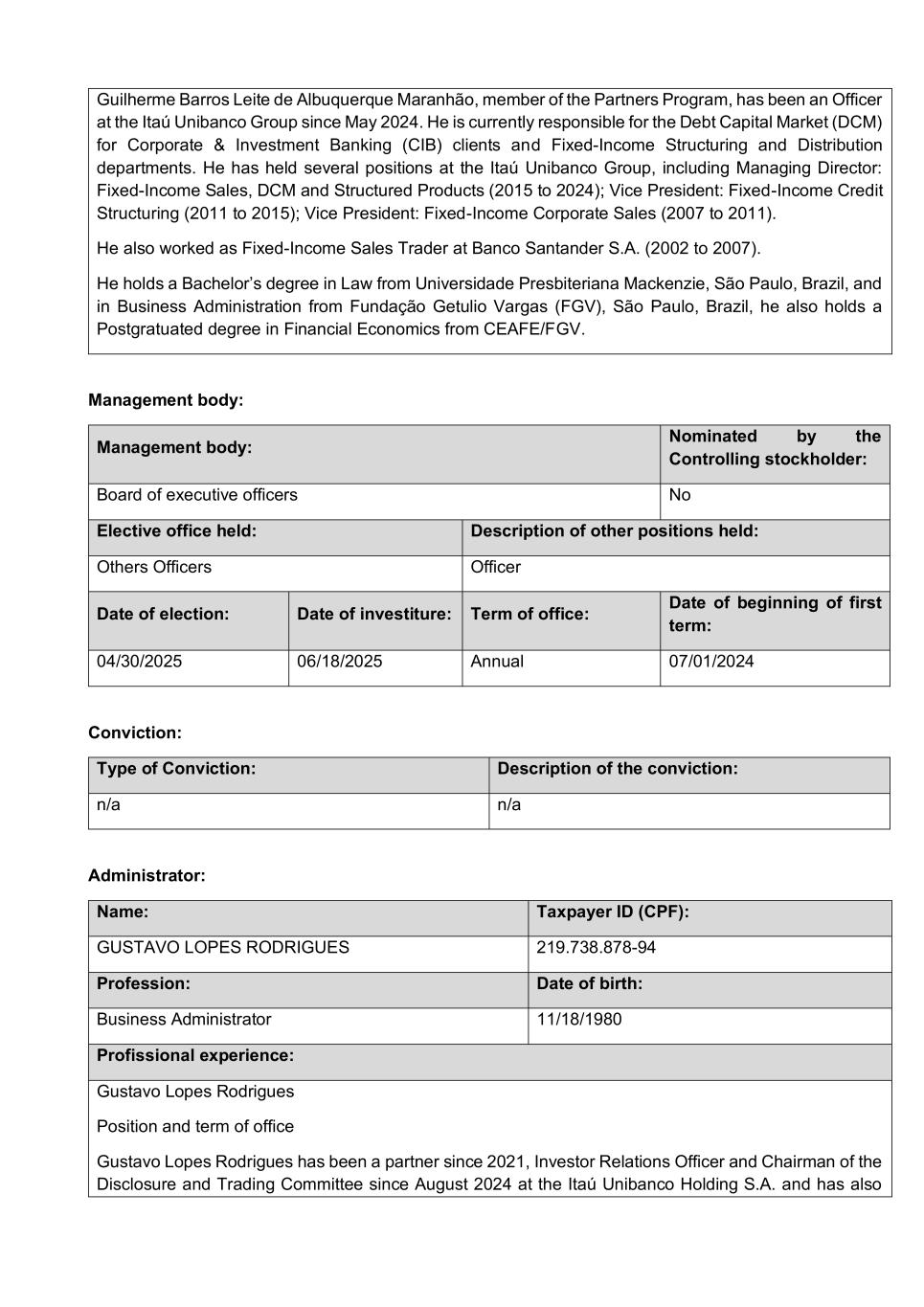

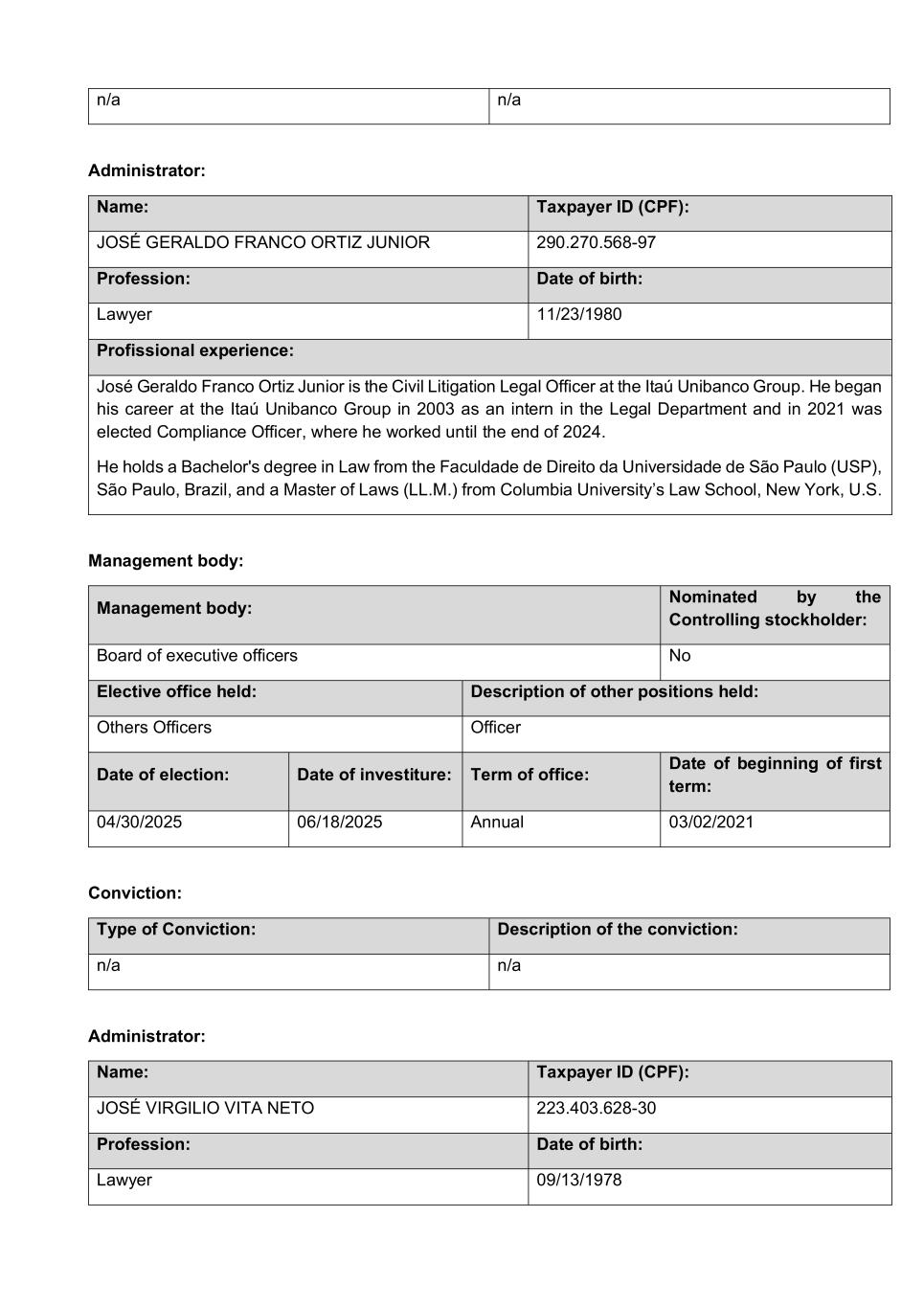

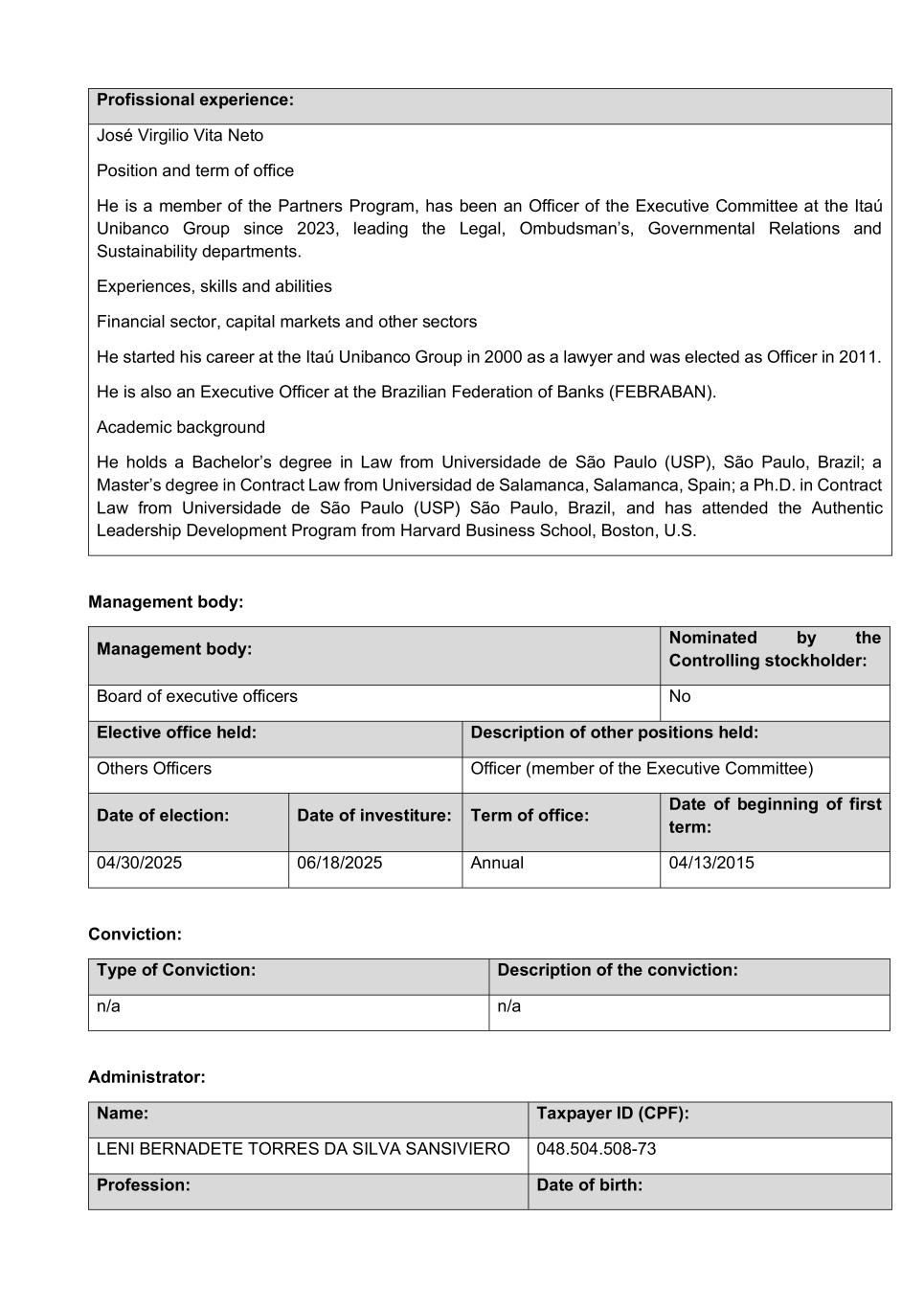

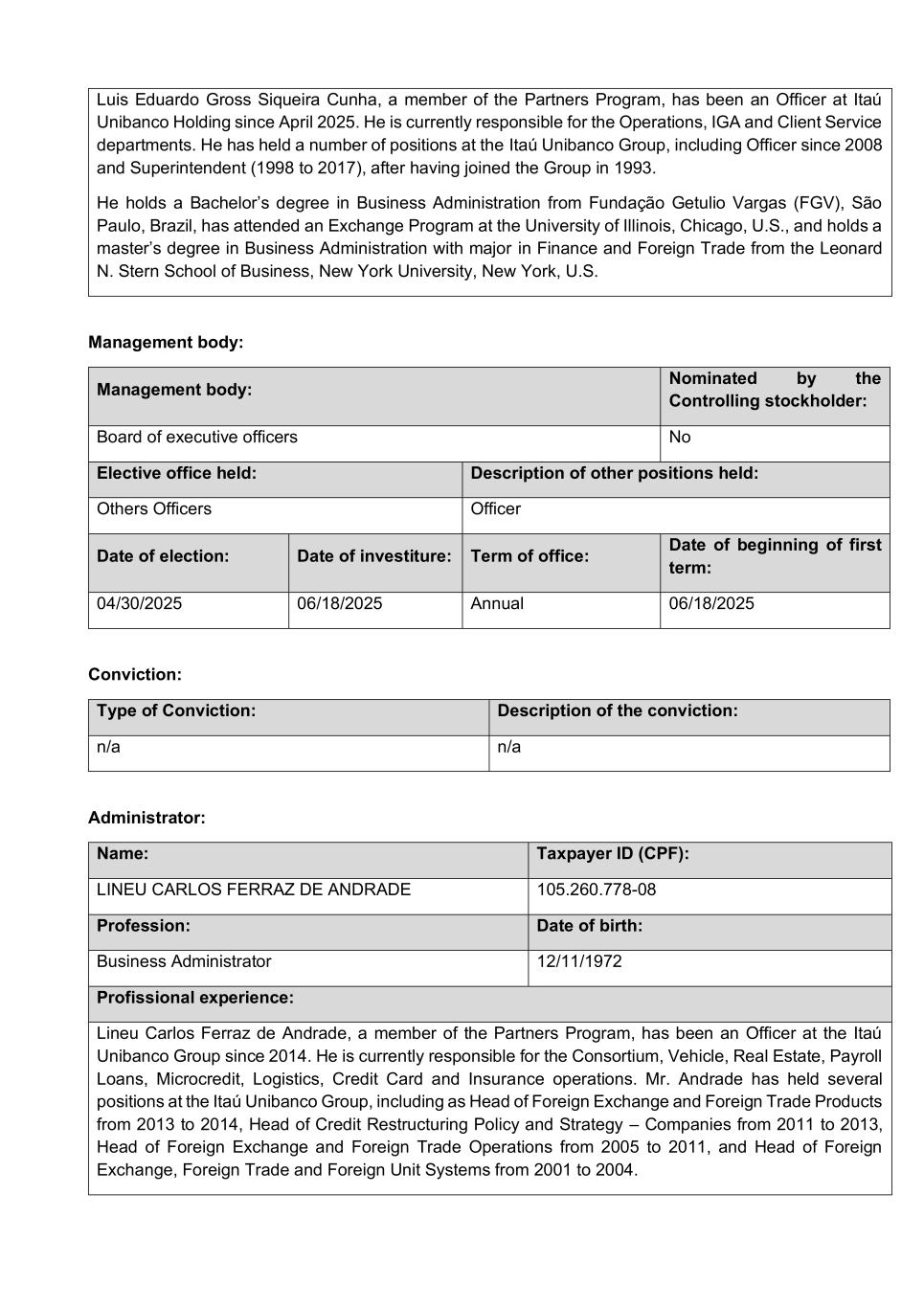

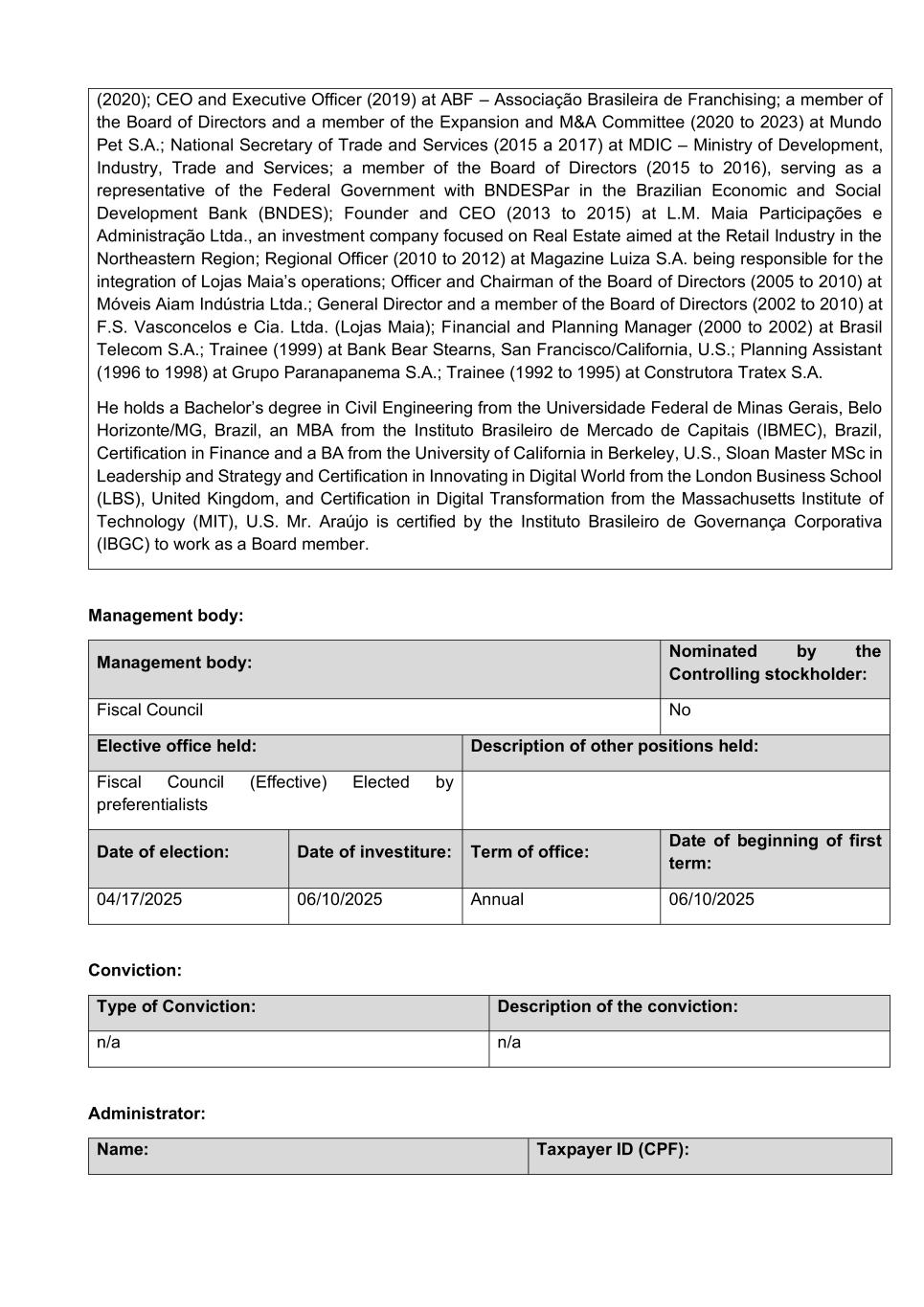

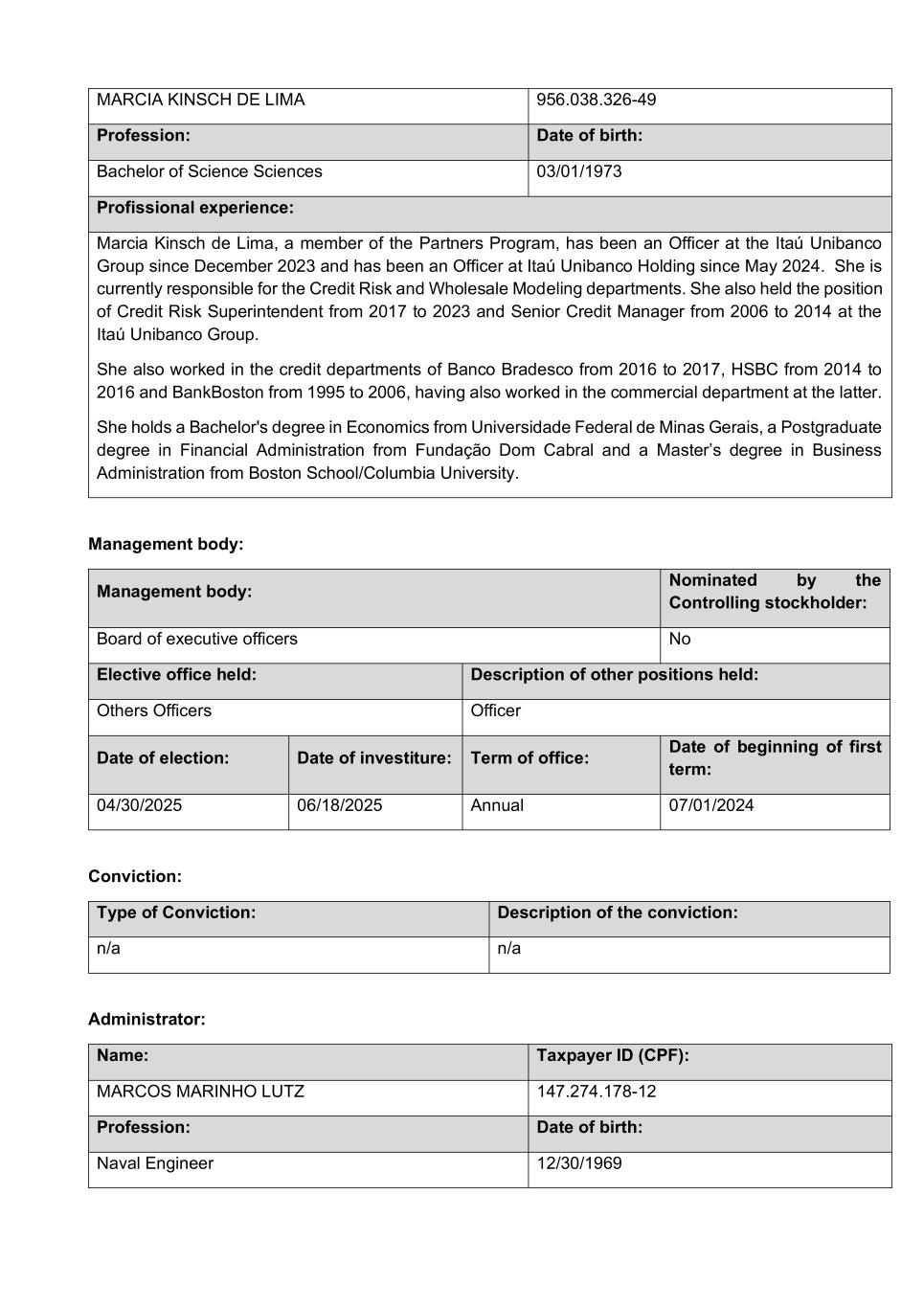

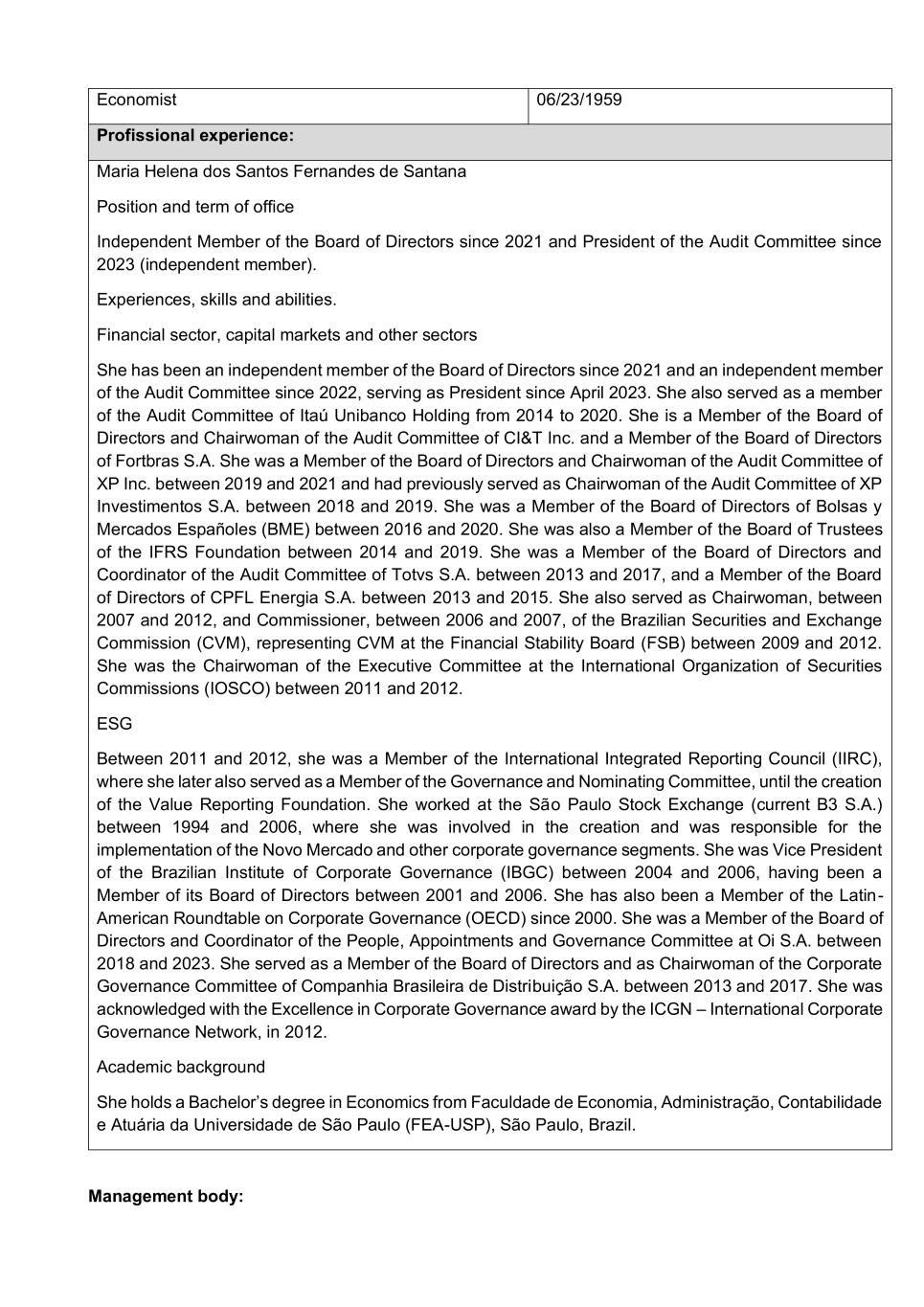

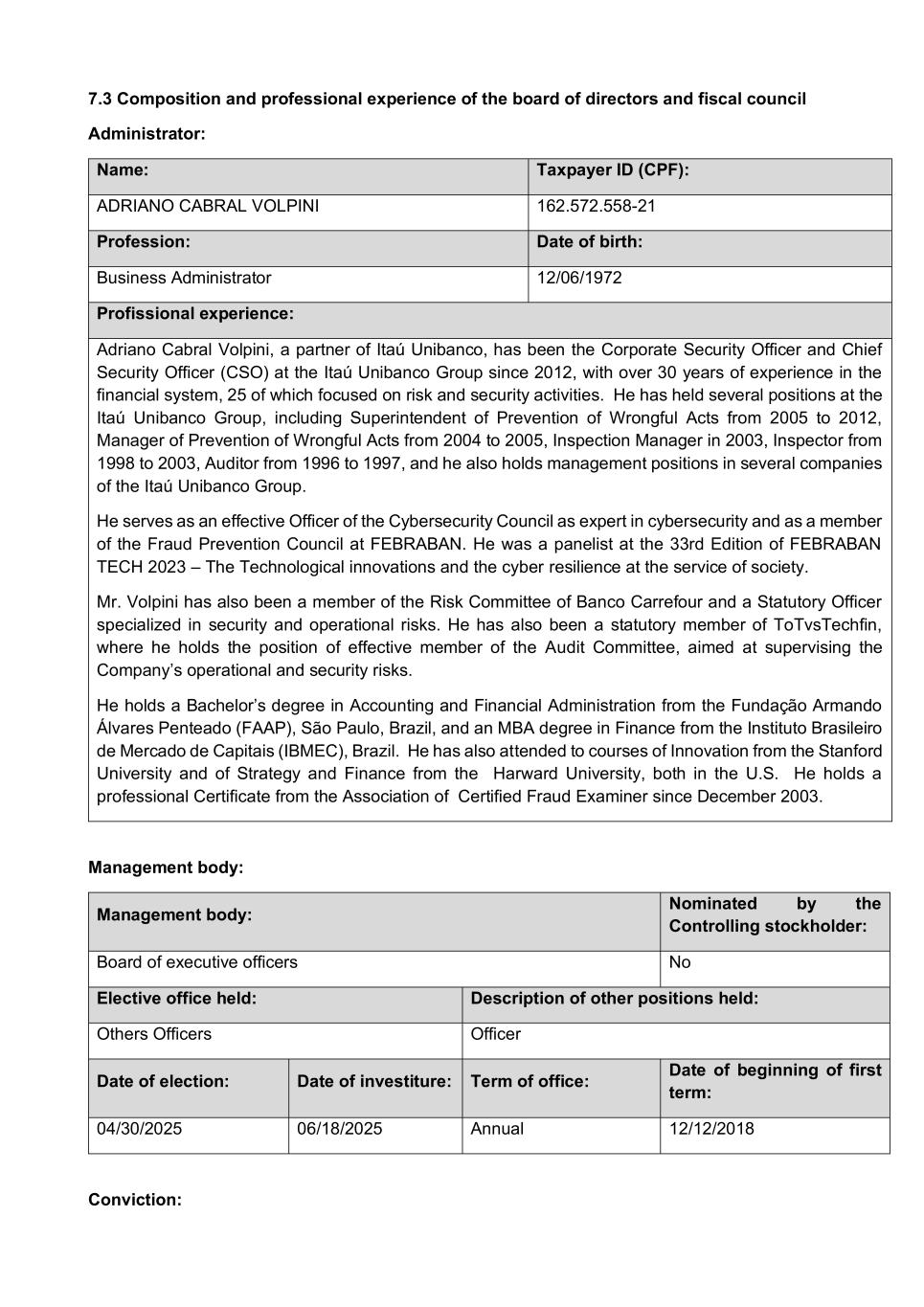

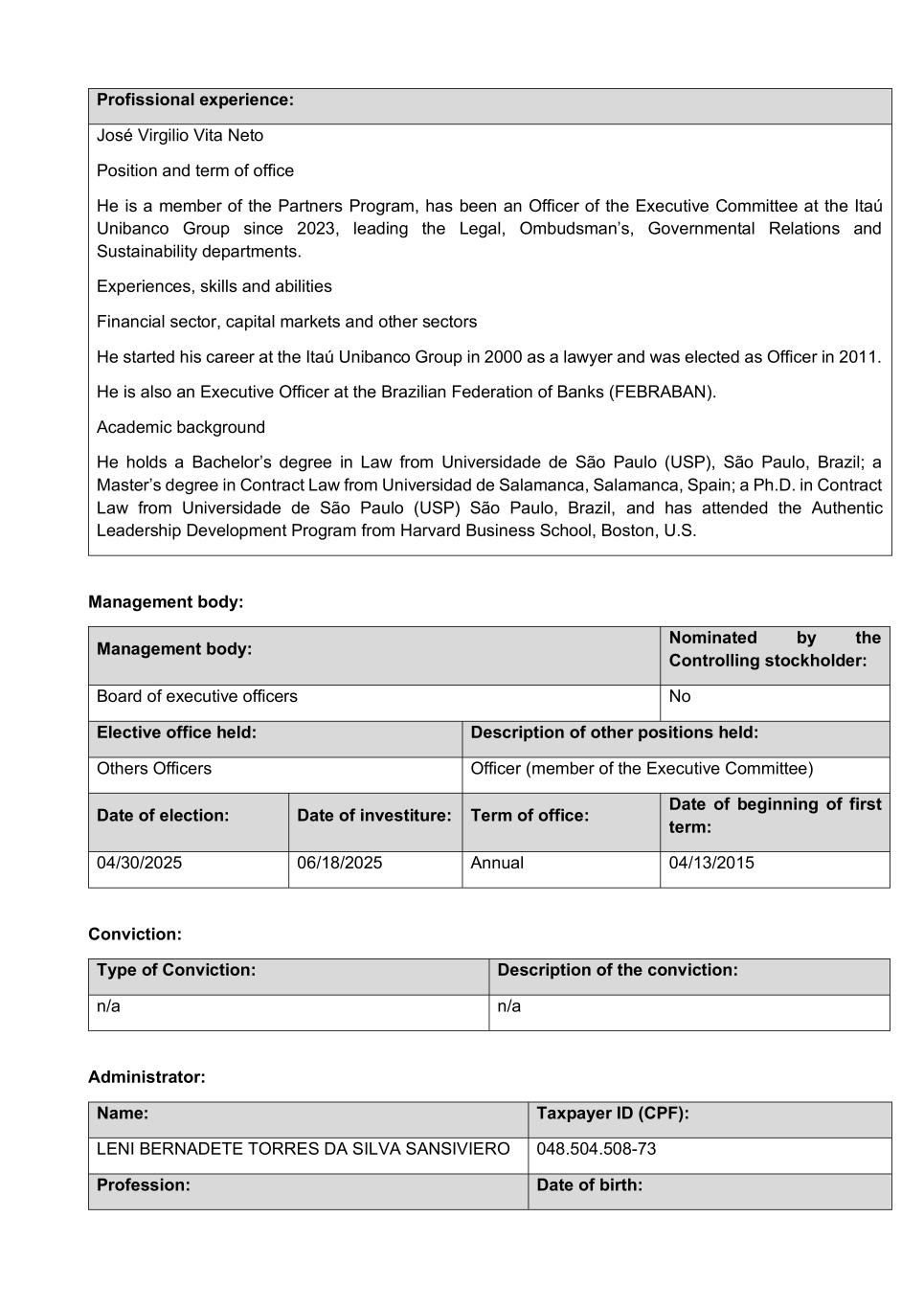

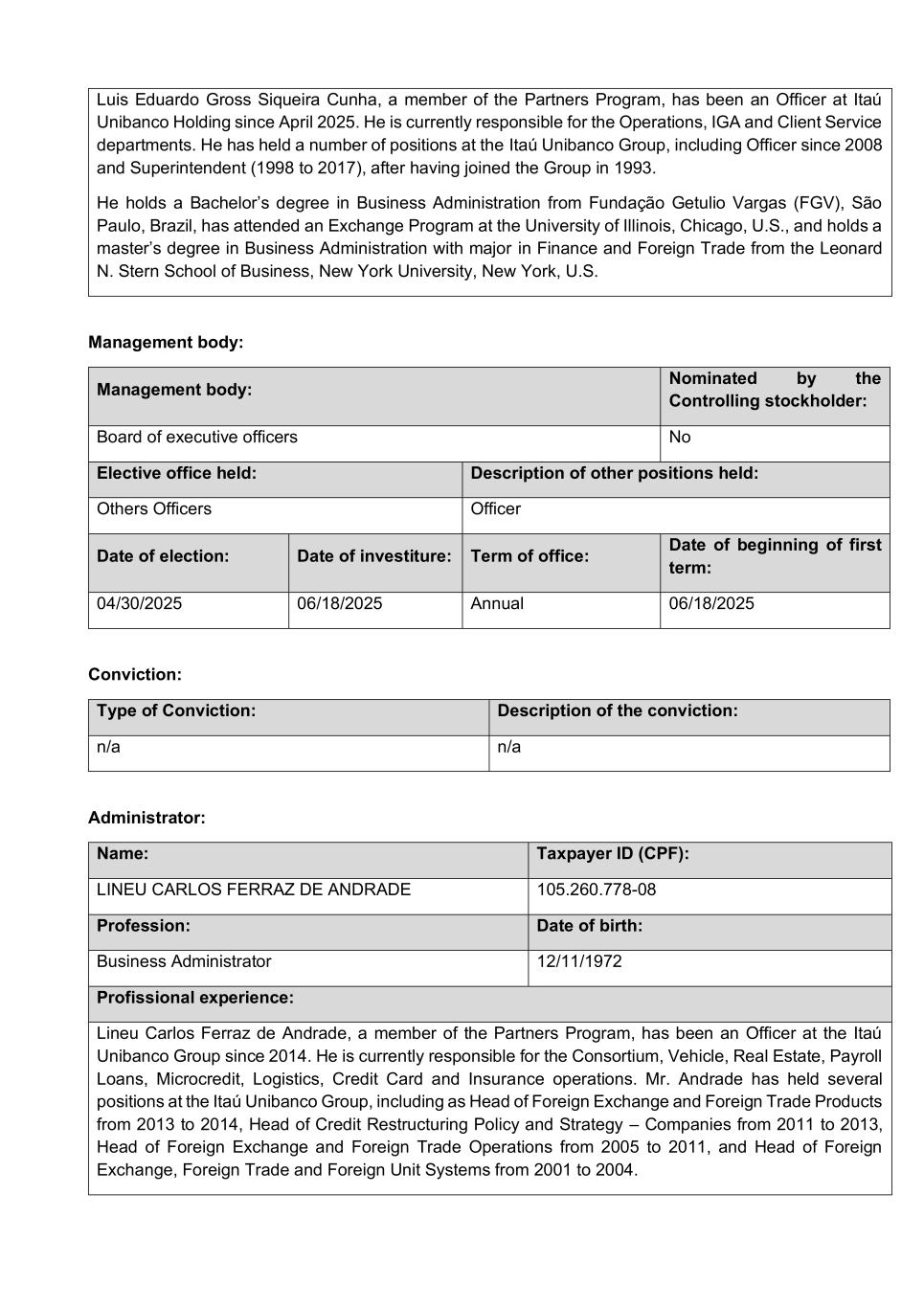

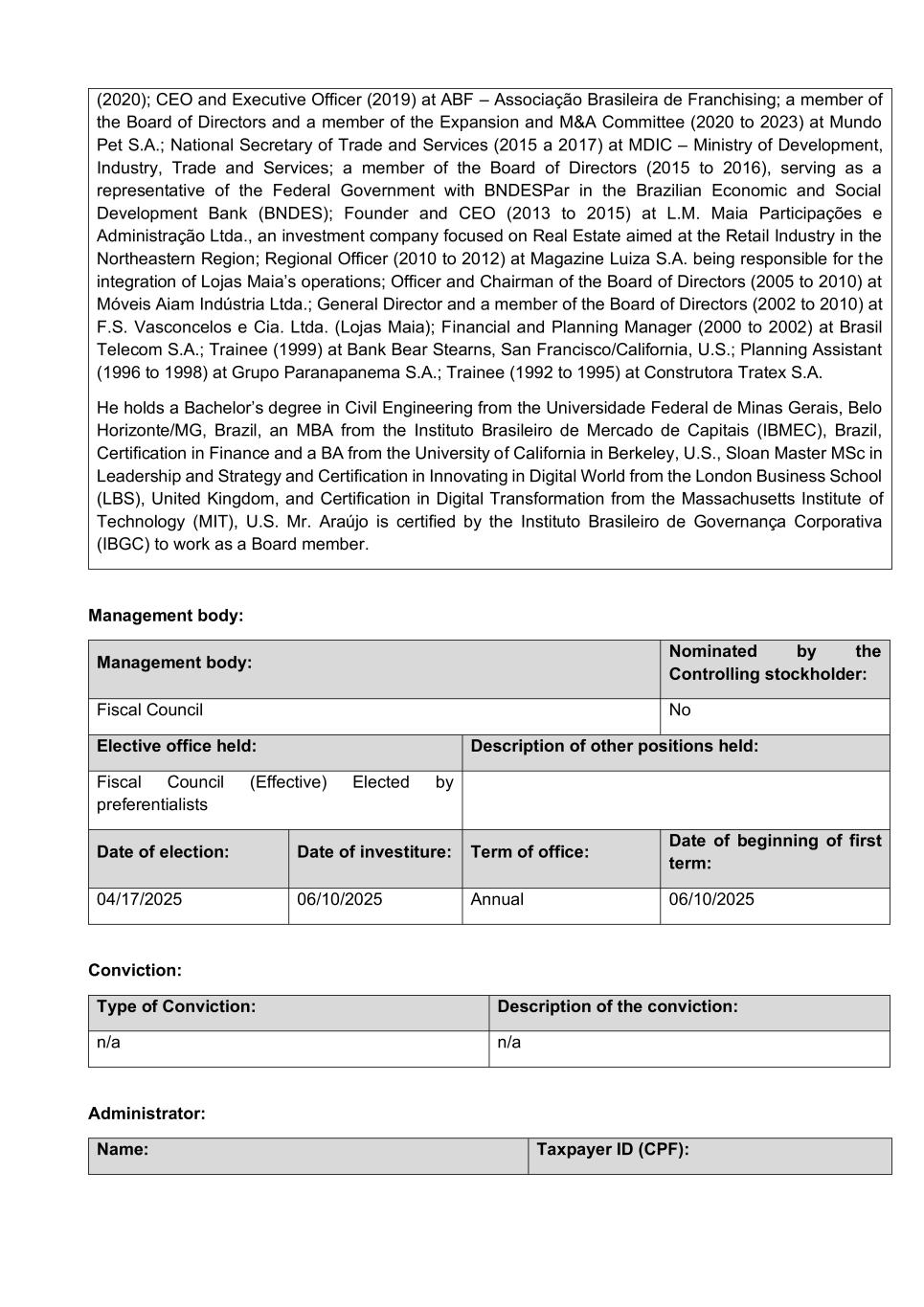

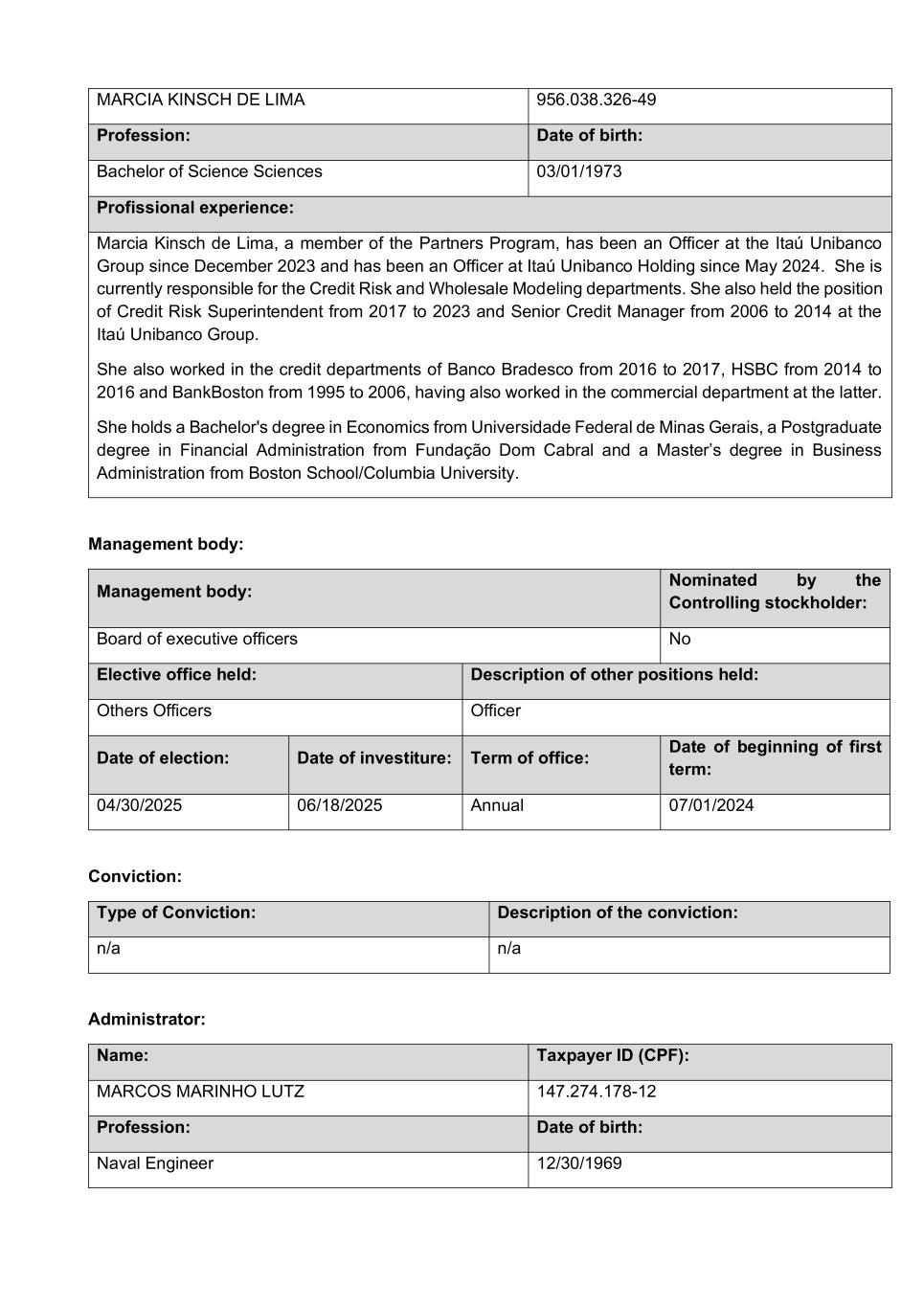

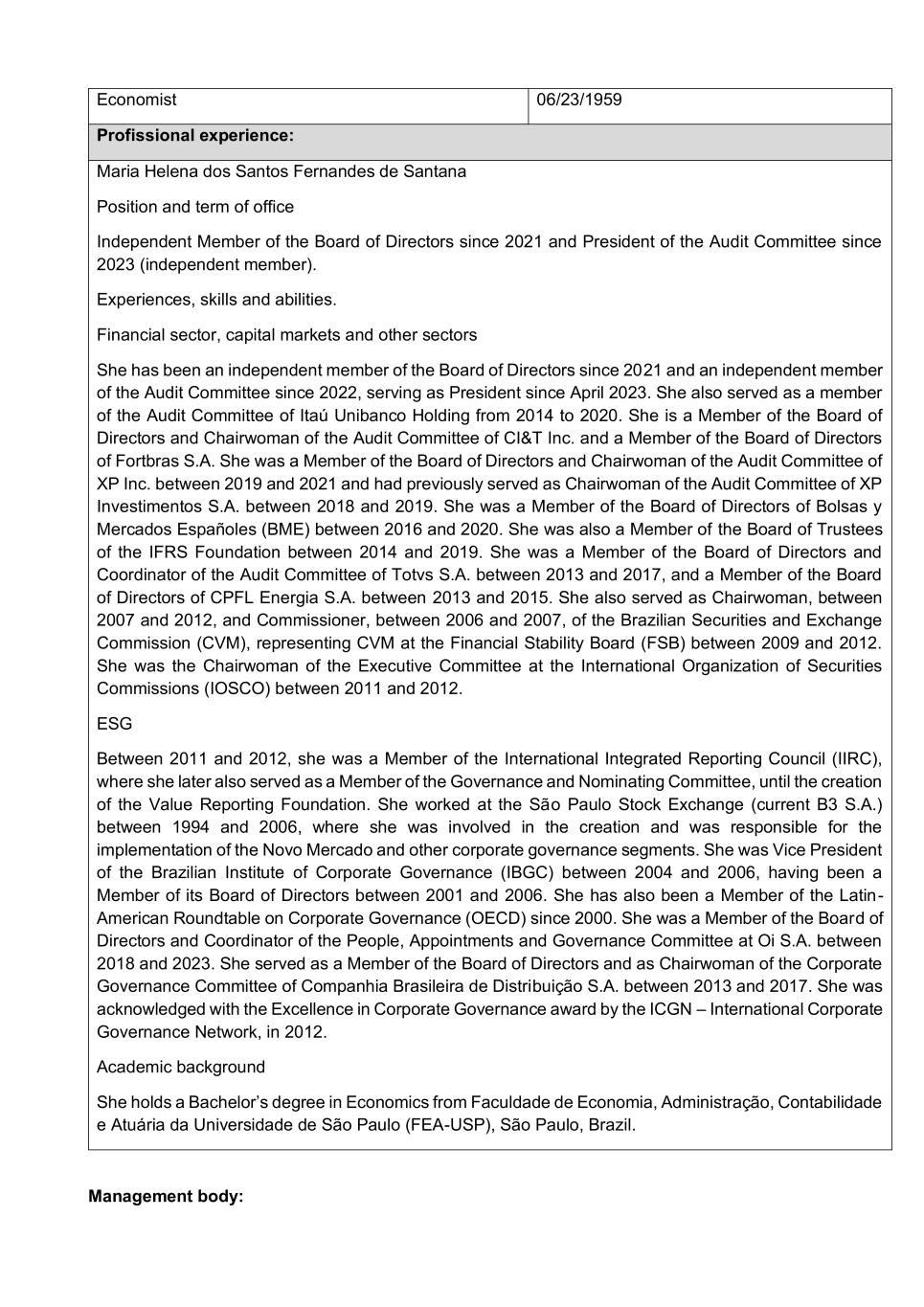

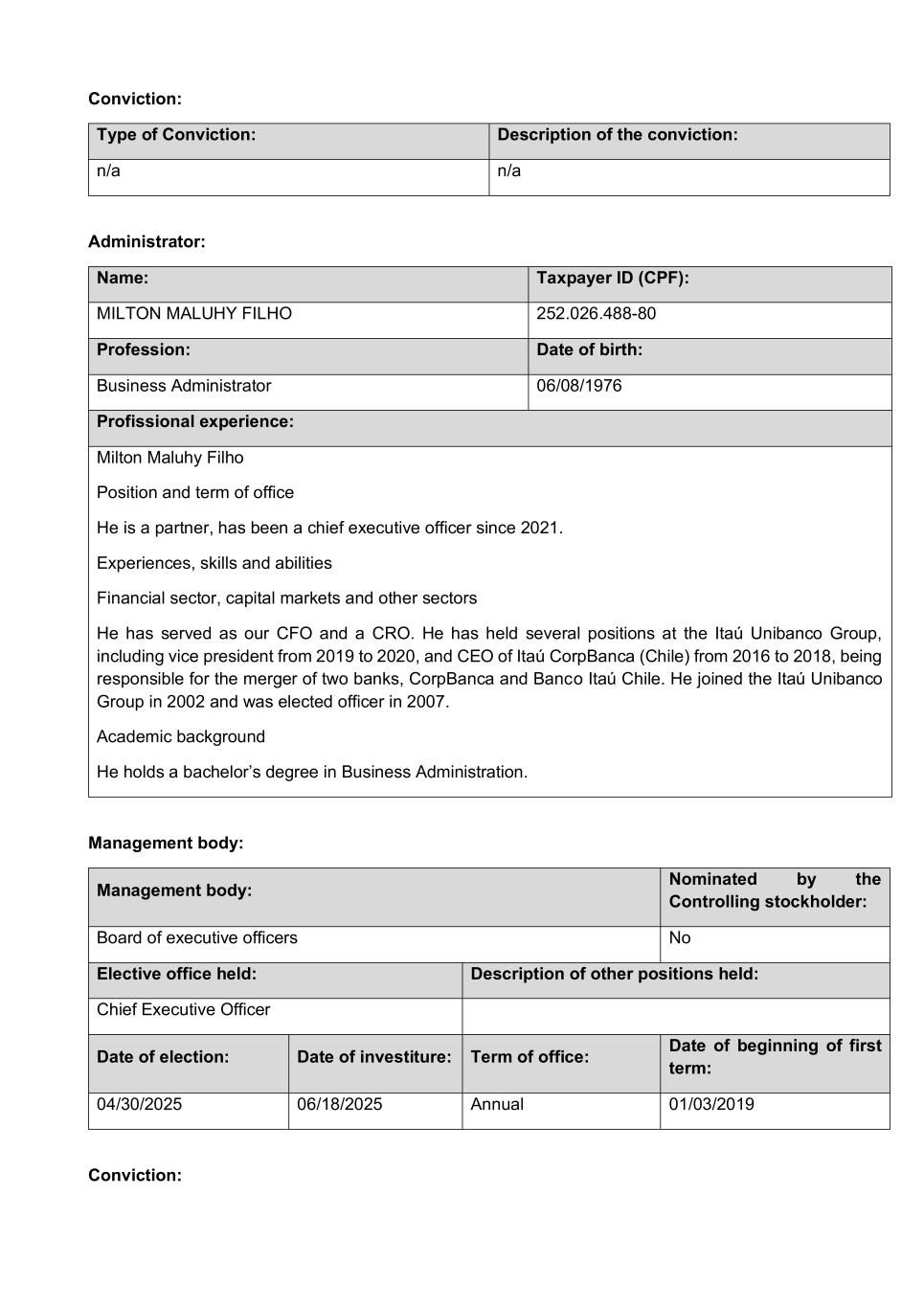

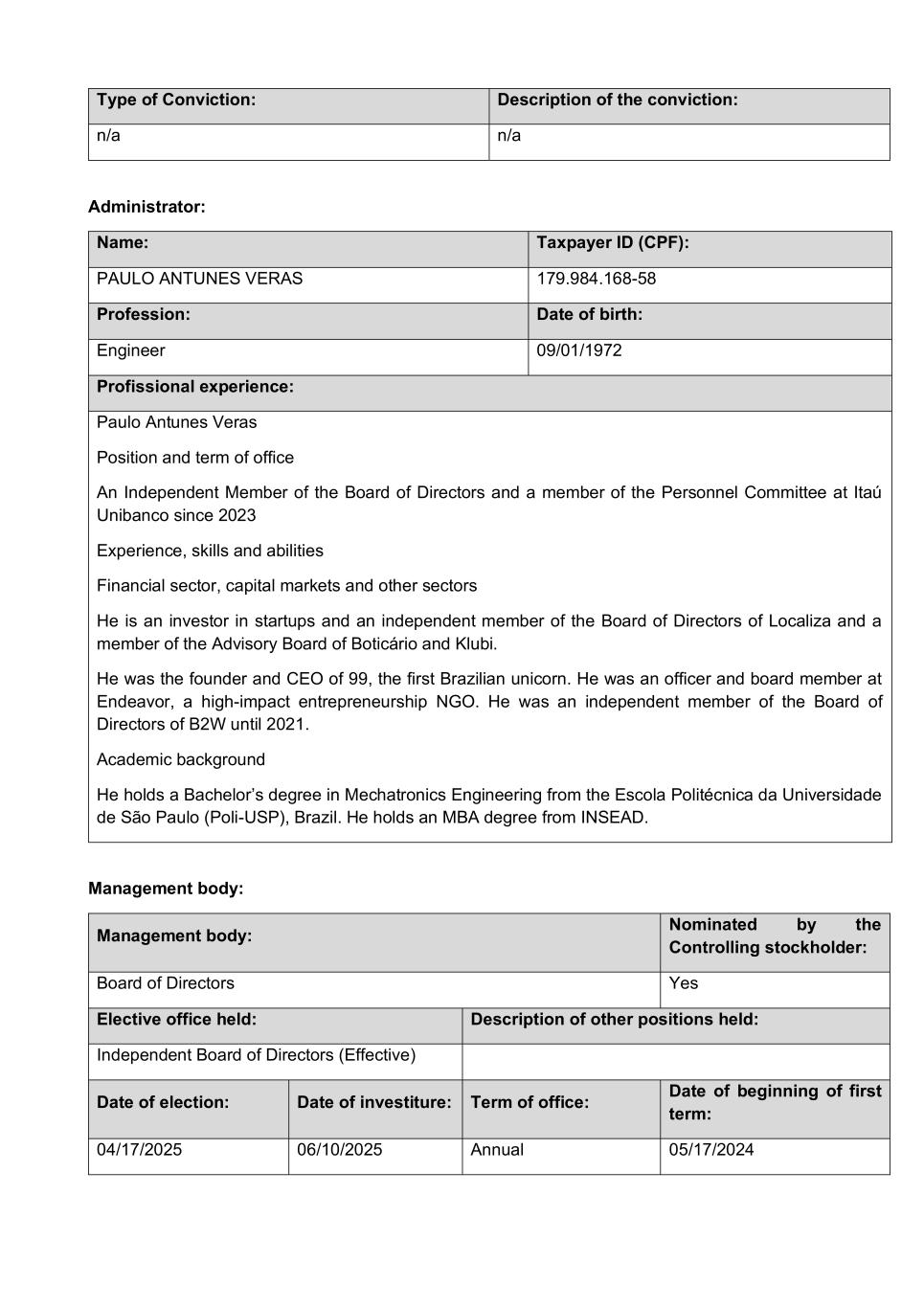

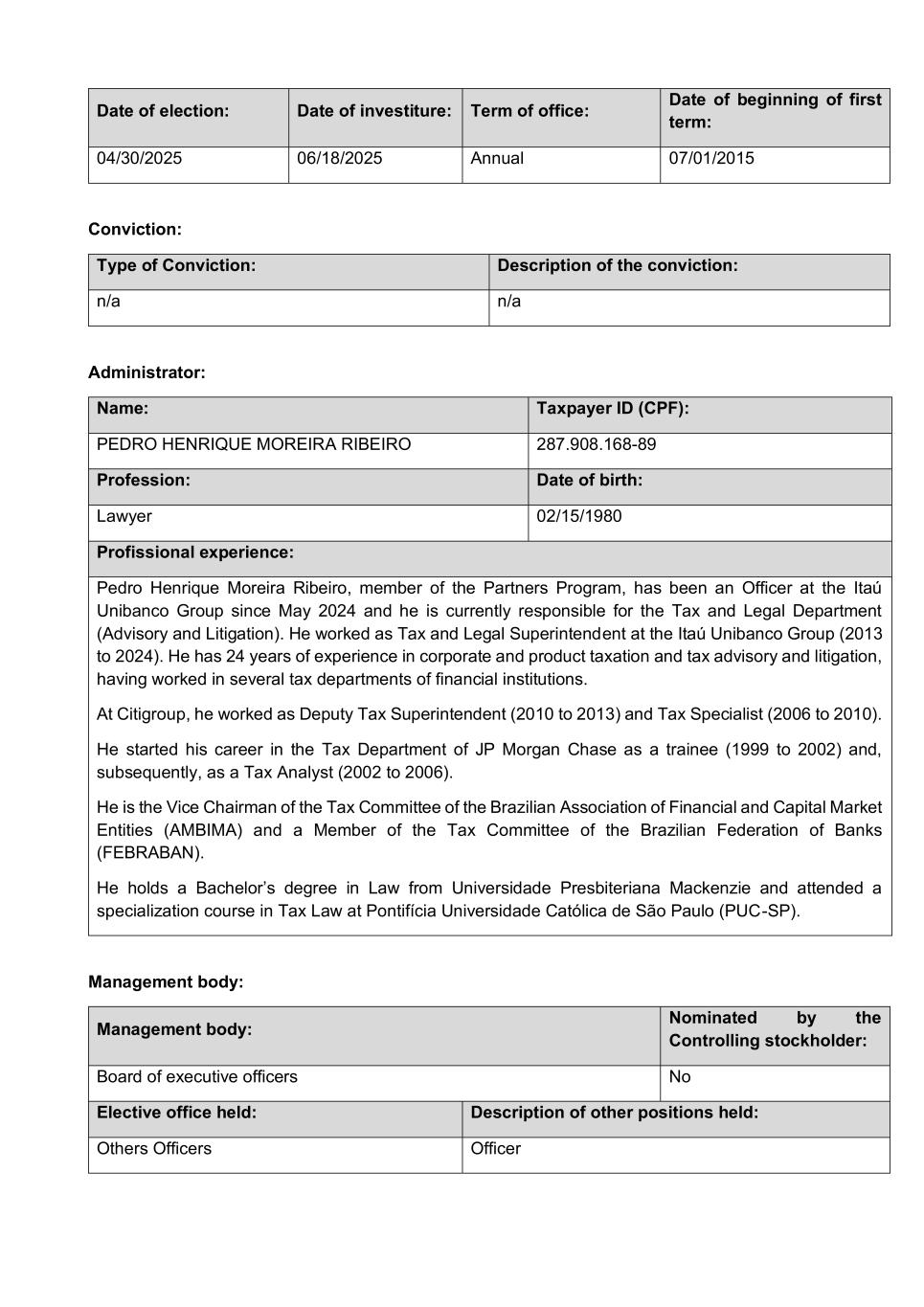

7.3 Composition and professional experience of the board of directors and fiscal council Administrator: Name: Taxpayer ID (CPF): ADRIANO CABRAL VOLPINI 162.572.558-21 Profession: Date of birth: Business Administrator 12/06/1972 Profissional experience: Adriano Cabral Volpini, a partner of Itaú Unibanco, has been the Corporate Security Officer and Chief Security Officer (CSO) at the Itaú Unibanco Group since 2012, with over 30 years of experience in the financial system, 25 of which focused on risk and security activities. He has held several positions at the Itaú Unibanco Group, including Superintendent of Prevention of Wrongful Acts from 2005 to 2012, Manager of Prevention of Wrongful Acts from 2004 to 2005, Inspection Manager in 2003, Inspector from 1998 to 2003, Auditor from 1996 to 1997, and he also holds management positions in several companies of the Itaú Unibanco Group. He serves as an effective Officer of the Cybersecurity Council as expert in cybersecurity and as a member of the Fraud Prevention Council at FEBRABAN. He was a panelist at the 33rd Edition of FEBRABAN TECH 2023 – The Technological innovations and the cyber resilience at the service of society. Mr. Volpini has also been a member of the Risk Committee of Banco Carrefour and a Statutory Officer specialized in security and operational risks. He has also been a statutory member of ToTvsTechfin, where he holds the position of effective member of the Audit Committee, aimed at supervising the Company’s operational and security risks. He holds a Bachelor’s degree in Accounting and Financial Administration from the Fundação Armando Álvares Penteado (FAAP), São Paulo, Brazil, and an MBA degree in Finance from the Instituto Brasileiro de Mercado de Capitais (IBMEC), Brazil. He has also attended to courses of Innovation from the Stanford University and of Strategy and Finance from the Harward University, both in the U.S. He holds a professional Certificate from the Association of Certified Fraud Examiner since December 2003. Management body: Management body: Nominated by the Controlling stockholder: Board of executive officers No Elective office held: Description of other positions held: Others Officers Officer Date of election: Date of investiture: Term of office: Date of beginning of first term: 04/30/2025 06/18/2025 Annual 12/12/2018 Conviction:

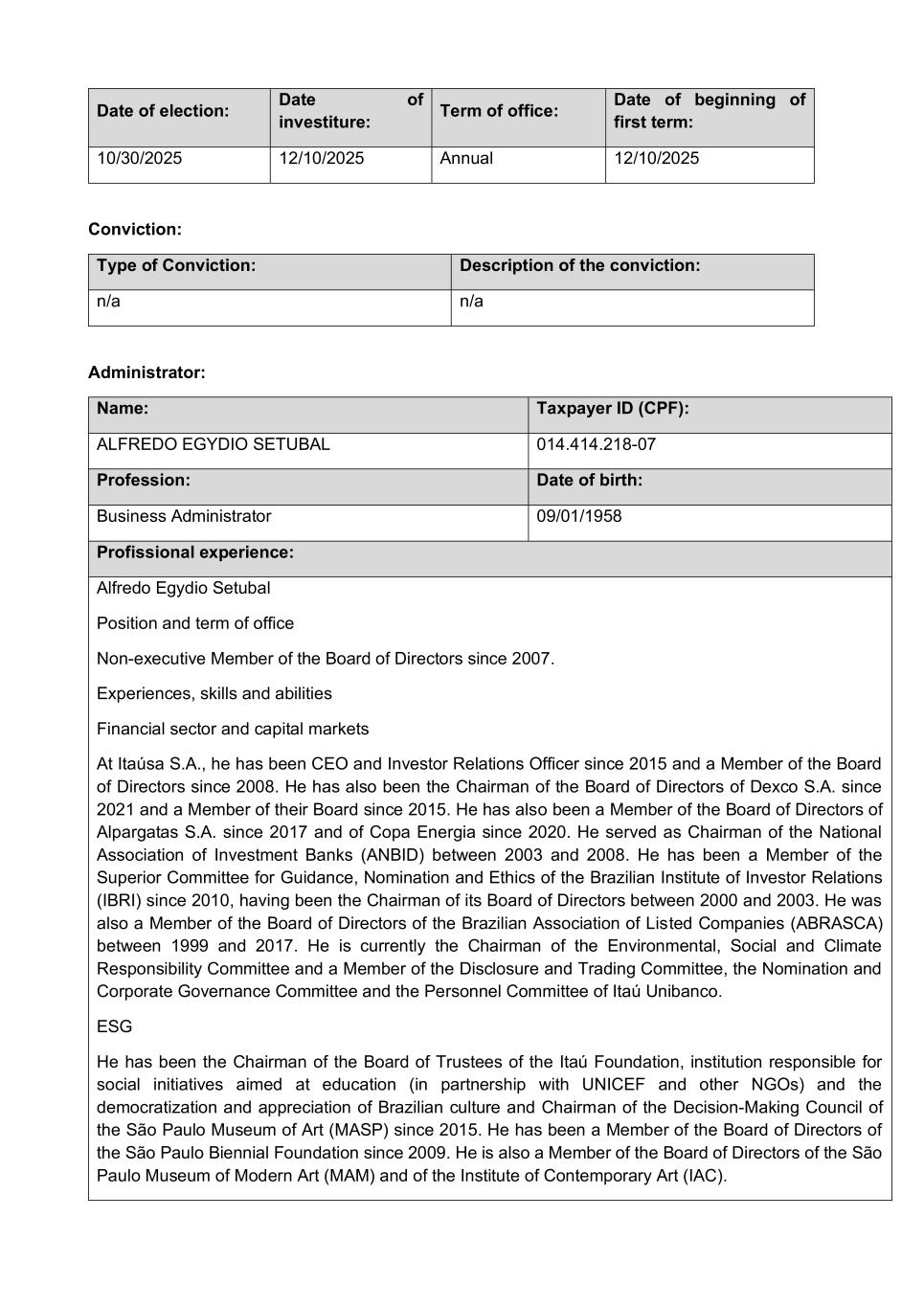

Type of Conviction: Description of the conviction: n/a n/a Administrator: Name: Taxpayer ID (CPF): ALBANO MANOEL ALMEIDA 286.052.458-40 Profession: Date of birth: Engineer 09/15/1979 Profissional experience: Albano Manoel Almeida, a member of the Partner Program, has been an Officer at Itaú Unibanco Holding since October 2025. He is currently responsible for the CRM, Engagement, and Data. He has held several positions at the Itaú Unibanco Group, including Superintendent of CRM and Individual Engagement (2019 to 2025); Superintendent of Credit Products for Indivuals (2015 to 2019); Superintendent of Individual Checking Accounts and Projects (2014 to 2015); Customer Profitability Manager (2012 to 2014); Individual Tariffs and Checking Accounts Manager (2011 to 2012); Integrated Credit Offer Manager (2010 to 2011); Personnalité Studies and Models Manager (2009 to 2010); Individual Products Coordinator in the Customer Management Department (2008 to 2009); Coordinator of Special Studies for Individual Products (2007 to 2008); Analyst of Special Studies for Individual Products (2006 to 2007); and Trainee in Special Studies for Individual Products (2005 to 2006). He represents Itaú Unibanco in the Executive Commissions of Individual Products, with emphasis on topics such as Overdraft Self-Regulation, FIES Revision, and the New IN for Payroll Loans at Febraban. He worked as a Treasury Controller Trainee (2004 to 2005) at Banco Fibra. He holds a bachelor’s degree in Engineering from the Universidade of São Paulo (“USP”), São Paulo, Brazil, a CFM – Certificate in Financial Management from the Instituto de Ensino e Pesquisa (“INSPER”), São Paulo, Brazil, and completed the Program for Management Development at ISE Business School, São Paulo, Brazil. Management body: Management body: Nominated by the Controlling stockholder: Board of executive officers No Elective office held: Description of other positions held: Others Officers Officer

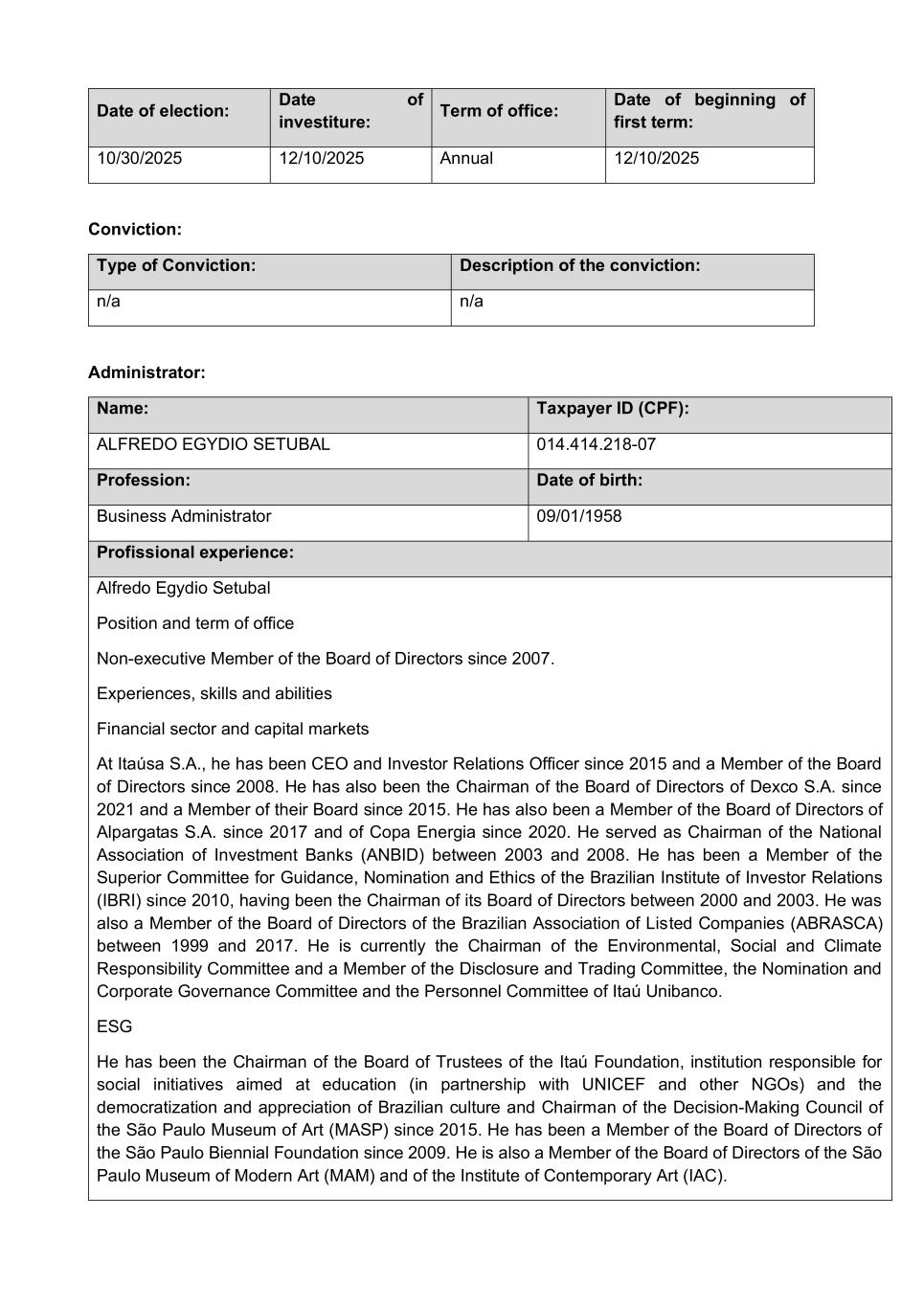

Date of election: Date of investiture: Term of office: Date of beginning of first term: 10/30/2025 12/10/2025 Annual 12/10/2025 Conviction: Type of Conviction: Description of the conviction: n/a n/a Administrator: Name: Taxpayer ID (CPF): ALFREDO EGYDIO SETUBAL 014.414.218-07 Profession: Date of birth: Business Administrator 09/01/1958 Profissional experience: Alfredo Egydio Setubal Position and term of office Non-executive Member of the Board of Directors since 2007. Experiences, skills and abilities Financial sector and capital markets At Itaúsa S.A., he has been CEO and Investor Relations Officer since 2015 and a Member of the Board of Directors since 2008. He has also been the Chairman of the Board of Directors of Dexco S.A. since 2021 and a Member of their Board since 2015. He has also been a Member of the Board of Directors of Alpargatas S.A. since 2017 and of Copa Energia since 2020. He served as Chairman of the National Association of Investment Banks (ANBID) between 2003 and 2008. He has been a Member of the Superior Committee for Guidance, Nomination and Ethics of the Brazilian Institute of Investor Relations (IBRI) since 2010, having been the Chairman of its Board of Directors between 2000 and 2003. He was also a Member of the Board of Directors of the Brazilian Association of Listed Companies (ABRASCA) between 1999 and 2017. He is currently the Chairman of the Environmental, Social and Climate Responsibility Committee and a Member of the Disclosure and Trading Committee, the Nomination and Corporate Governance Committee and the Personnel Committee of Itaú Unibanco. ESG He has been the Chairman of the Board of Trustees of the Itaú Foundation, institution responsible for social initiatives aimed at education (in partnership with UNICEF and other NGOs) and the democratization and appreciation of Brazilian culture and Chairman of the Decision-Making Council of the São Paulo Museum of Art (MASP) since 2015. He has been a Member of the Board of Directors of the São Paulo Biennial Foundation since 2009. He is also a Member of the Board of Directors of the São Paulo Museum of Modern Art (MAM) and of the Institute of Contemporary Art (IAC).

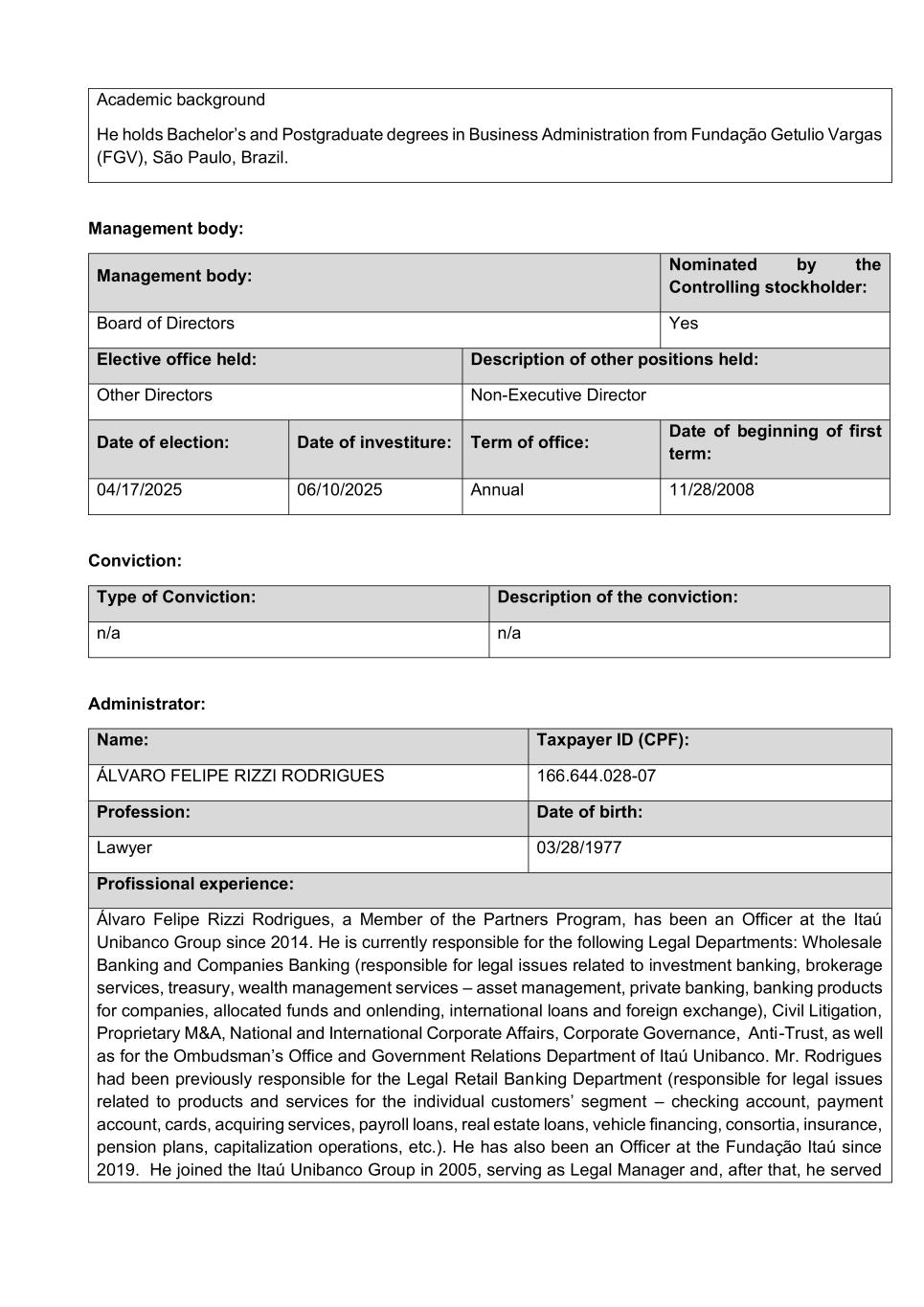

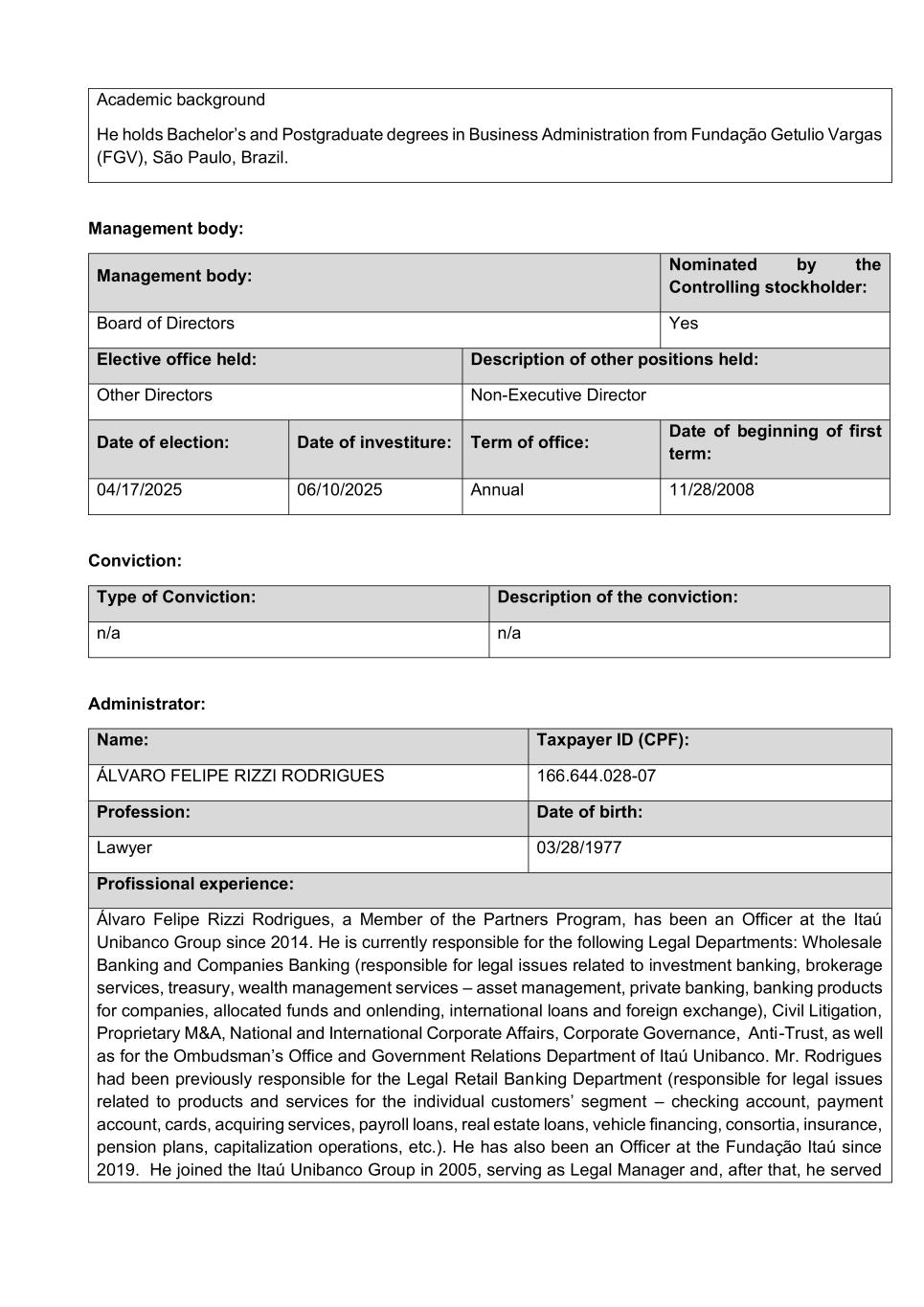

Academic background He holds Bachelor’s and Postgraduate degrees in Business Administration from Fundação Getulio Vargas (FGV), São Paulo, Brazil. Management body: Management body: Nominated by the Controlling stockholder: Board of Directors Yes Elective office held: Description of other positions held: Other Directors Non-Executive Director Date of election: Date of investiture: Term of office: Date of beginning of first term: 04/17/2025 06/10/2025 Annual 11/28/2008 Conviction: Type of Conviction: Description of the conviction: n/a n/a Administrator: Name: Taxpayer ID (CPF): ÁLVARO FELIPE RIZZI RODRIGUES 166.644.028-07 Profession: Date of birth: Lawyer 03/28/1977 Profissional experience: Álvaro Felipe Rizzi Rodrigues, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2014. He is currently responsible for the following Legal Departments: Wholesale Banking and Companies Banking (responsible for legal issues related to investment banking, brokerage services, treasury, wealth management services – asset management, private banking, banking products for companies, allocated funds and onlending, international loans and foreign exchange), Civil Litigation, Proprietary M&A, National and International Corporate Affairs, Corporate Governance, Anti-Trust, as well as for the Ombudsman’s Office and Government Relations Department of Itaú Unibanco. Mr. Rodrigues had been previously responsible for the Legal Retail Banking Department (responsible for legal issues related to products and services for the individual customers’ segment – checking account, payment account, cards, acquiring services, payroll loans, real estate loans, vehicle financing, consortia, insurance, pension plans, capitalization operations, etc.). He has also been an Officer at the Fundação Itaú since 2019. He joined the Itaú Unibanco Group in 2005, serving as Legal Manager and, after that, he served

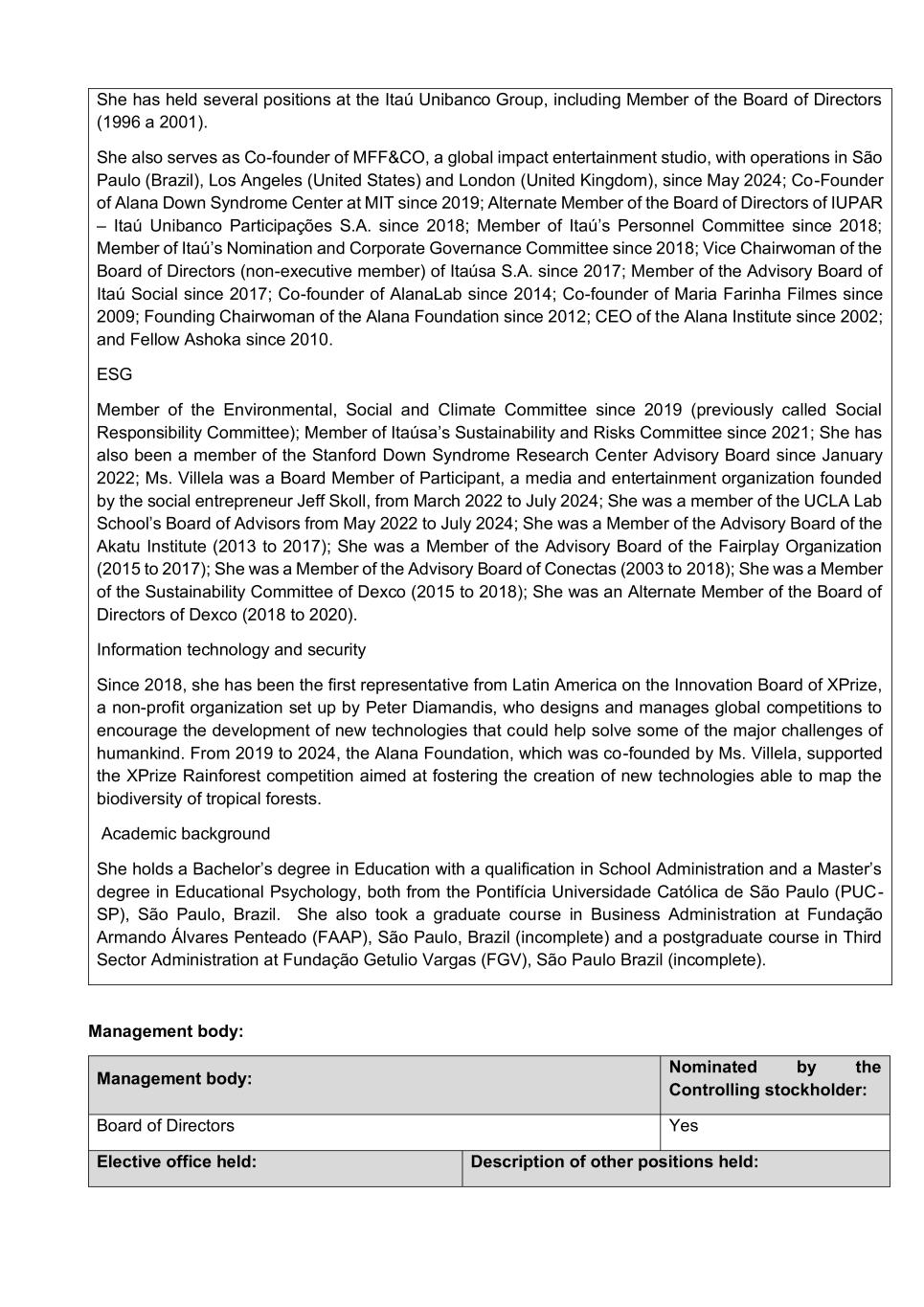

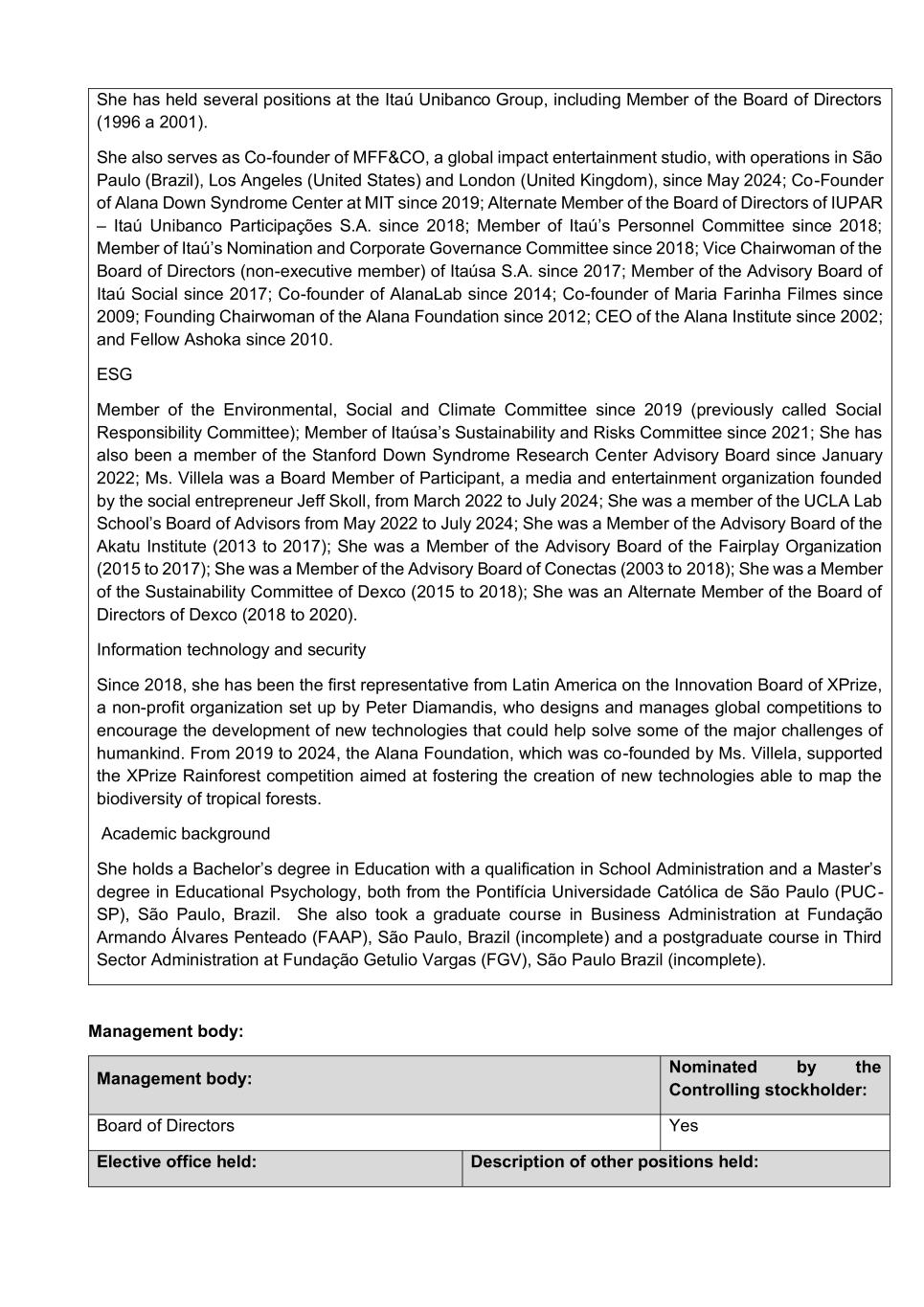

as Legal Superintendent (2005 to 2014). He also worked in the Corporate Law and Contract Law departments (1998 to 2005), at Tozzini Freire Advogados. He holds a Bachelor’s degree in Law from the Faculdade de Direito da Universidade de São Paulo (USP), São Paulo, Brazil. Mr. Rodrigues has also attended a specialization course in Corporate Law from the Pontifícia Universidade Católica de São Paulo (PUC-SP), São Paulo, Brazil. He holds a Master of Laws (L.L.M.) from the Columbia University Law School, New York, U.S. Management body: Management body: Nominated by the Controlling stockholder: Board of executive officers No Elective office held: Description of other positions held: Others Officers Officer Date of election: Date of investiture: Term of office: Date of beginning of first term: 04/30/2025 06/18/2025 Annual 04/13/2015 Conviction: Type of Conviction: Description of the conviction: n/a n/a Administrator: Name: Taxpayer ID (CPF): ANA LÚCIA DE MATTOS BARRETTO VILLELA 066.530.828-06 Profession: Date of birth: Pedagogic 10/25/1973 Profissional experience: Ana Lúcia de Mattos Barretto Villela (non-executive member) Position and term of office Non-executive Member of the Board of Directors since 2008. Experience, skills and abilities Financial sector, capital markets and other sectors