Document

MANAGEMENT'S DISCUSSION & ANALYSIS

March 31, 2024

May 9, 2024

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This discussion and analysis should be read in conjunction with our unaudited condensed interim consolidated financial statements and notes thereto as at and for the three months ended March 31, 2024, and should also be read in conjunction with the audited consolidated financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) contained in our annual report for the year ended December 31, 2023. The financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). Unless otherwise indicated, all references to "$" and "dollars" in this discussion and analysis mean Canadian dollars.

All references in this MD&A to "the Company," "Oncolytics," "we," "us," or "our" and similar expressions refer to Oncolytics Biotech Inc. and the subsidiaries through which it conducts its business unless otherwise indicated.

Forward-Looking Statements

The following discussion contains forward-looking statements, within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended and forward-looking information under applicable Canadian securities laws (such forward-looking statements and forward-looking information are collectively referred to herein as "forward-looking statements"). Forward-looking statements, including: our belief as to the potential and mechanism of action of pelareorep, an intravenously delivered immunotherapeutic agent, as a cancer therapeutic; our expectation that pelareorep’s ability to enhance innate adaptive immune responses within the TME will play an increasingly important role as our clinical development program advances; our business strategy, goals, focus, and objectives for the development of pelareorep, including our immediate primary focus on advancing our programs in hormone receptor-positive / human epidermal growth factor 2-negative metastatic breast cancer and metastatic pancreatic ductal adenocarcinoma to registration-enabling clinical studies and our exploration of opportunities for registrational programs in other gastrointestinal cancers through our GOBLET platform study; our belief that our approach will increase opportunities for expanding our clinical program and business development and partnering opportunities, has the most promise for generating clinically impactful data and offers the most expeditious path to regulatory approval; our expectation that we will incur substantial losses and will not generate significant revenues until and unless pelareorep becomes commercially viable; our belief that we can fund our operations for at least the next twelve months from the balance sheet date with the cash and cash equivalent on hand, utilizing our ATM equity distribution agreement, and exploring potential collaborations and strategic transactions; our belief that we currently have sufficient drug product to support our clinical development program and our focus on expanding the scale of our production capabilities to ensure we will be registration ready; our belief that continued positive results in the anal cancer cohort could potentially expand pelareorep's opportunity beyond breast and pancreatic cancers; the anticipated timing of median OS analysis for our BRACELET-1 study; our expected pelareorep development plan for 2024, including our plans to commence a registration-enabling study in pancreatic cancer and to begin enrolling our expanded anal cancer cohort and new pancreatic cancer cohort; our plans to have a Type C meeting with the FDA and to seek guidance on our breast cancer program protocol design and the anticipated timing thereof; our intention to finalize our breast cancer program registration pathway and commence the relevant clinical study; the focus of and plans for our manufacturing program; our plans for our intellectual property program; our ongoing evaluation of all types of financing arrangements and our expectation that we will continue to access our equity arrangement to help support our operations; our intention to renew our current Base Shelf prior to expiry; our continued management of our research and development plan; our belief that we have ability to reduce or eliminate planned expenditures to extend our operating runway until we obtain sufficient financing; our expectation that we will increase our spending in connection with the research and development of pelareorep over the next several years as we look to advance our breast and gastrointestinal cancer programs into later stages of clinical development; the factors that affect our cash usage; our approach to credit rate, interest rate, foreign exchange, and liquidity risk mitigation; our anticipated use of the remaining proceeds raised as part of our 2023 public offering of common shares and warrants; our intention to enter into a new ATM equity distribution agreement prior to expiry; the effectiveness of our internal control systems; and other statements that are not historical facts or which are related to anticipated developments in our business and technologies. In any forward-looking statement in which we express an expectation or belief as to future results, such expectations or beliefs are expressed in good faith and are believed to have a reasonable basis, but there can be no assurance that the statement or expectation, or belief will be achieved. Forward-looking statements involve known and unknown risks and uncertainties, which could cause our actual results to differ materially from those in the forward-looking statements.

Such risks and uncertainties include, among others, the need for and availability of funds and resources to pursue research and development projects, the efficacy of pelareorep as a cancer treatment, the success and timely completion of clinical studies and trials, our ability to successfully commercialize pelareorep, uncertainties related to the research, development, and manufacturing of pelareorep, uncertainties related to competition, changes in technology, the regulatory process, and general changes to the economic environment.

With respect to the forward-looking statements made within this MD&A, we have made numerous assumptions regarding, among other things: our ability to recruit and retain employees, our continued ability to obtain financing to fund our clinical development plan, our ability to receive regulatory approval to commence enrollment in the clinical studies which are part of our clinical development plan, our ability to maintain our supply of pelareorep, and future expense levels being within our current expectations.

Investors should consult our quarterly and annual filings with the Canadian and U.S. securities commissions for additional information on risks and uncertainties relating to the forward-looking statements. Forward-looking statements are based on assumptions, projections, estimates, and expectations of management at the time such forward-looking statements are made, and such assumptions, projections, estimates and/or expectations could change or prove to be incorrect or inaccurate. Investors are cautioned against placing undue reliance on forward-looking statements. We do not undertake any obligation to update these forward-looking statements except as required by applicable law.

Company Overview

We are a clinical-stage biopharmaceutical company developing pelareorep, a safe and well-tolerated intravenously delivered immunotherapeutic agent that activates the innate and adaptive immune systems and weakens tumor defense mechanisms. This improves the ability of the immune system to fight cancer, making tumors more susceptible to a broad range of oncology treatments.

Pelareorep is a proprietary isolate of reovirus, a naturally occurring, non-pathogenic double-stranded RNA (dsRNA) virus commonly found in environmental waters. Pelareorep has shown promising results in changing the tumor microenvironment (TME). This creates a more immunologically favorable TME, which in turn makes the tumor more susceptible to various treatment combinations. These treatments include chemotherapies, checkpoint inhibitors, and other immuno-oncology approaches such as CAR T therapies, bispecific antibodies, and CDK4/6 inhibitors. Pelareorep induces a new army of tumor-reactive T cells, helps these cells to infiltrate the tumor through an inflammatory process, and promotes the overexpression of PD-1/PD-L1. By priming the immune system with pelareorep, we believe we can increase the proportion of patients who respond to immunotherapies and other cancer treatments, especially in cancers where immunotherapies have failed or provided limited benefit.

As our clinical development program advances, we anticipate pelareorep's ability to enhance innate and adaptive immune responses within the TME will play an increasingly important role. This greatly increases opportunities for expanding our clinical program, business development, and partnering opportunities to address a broad range of cancers in combination with various other therapies. We believe this approach has the most promise for generating clinically impactful data and offers the most expeditious path to regulatory approval.

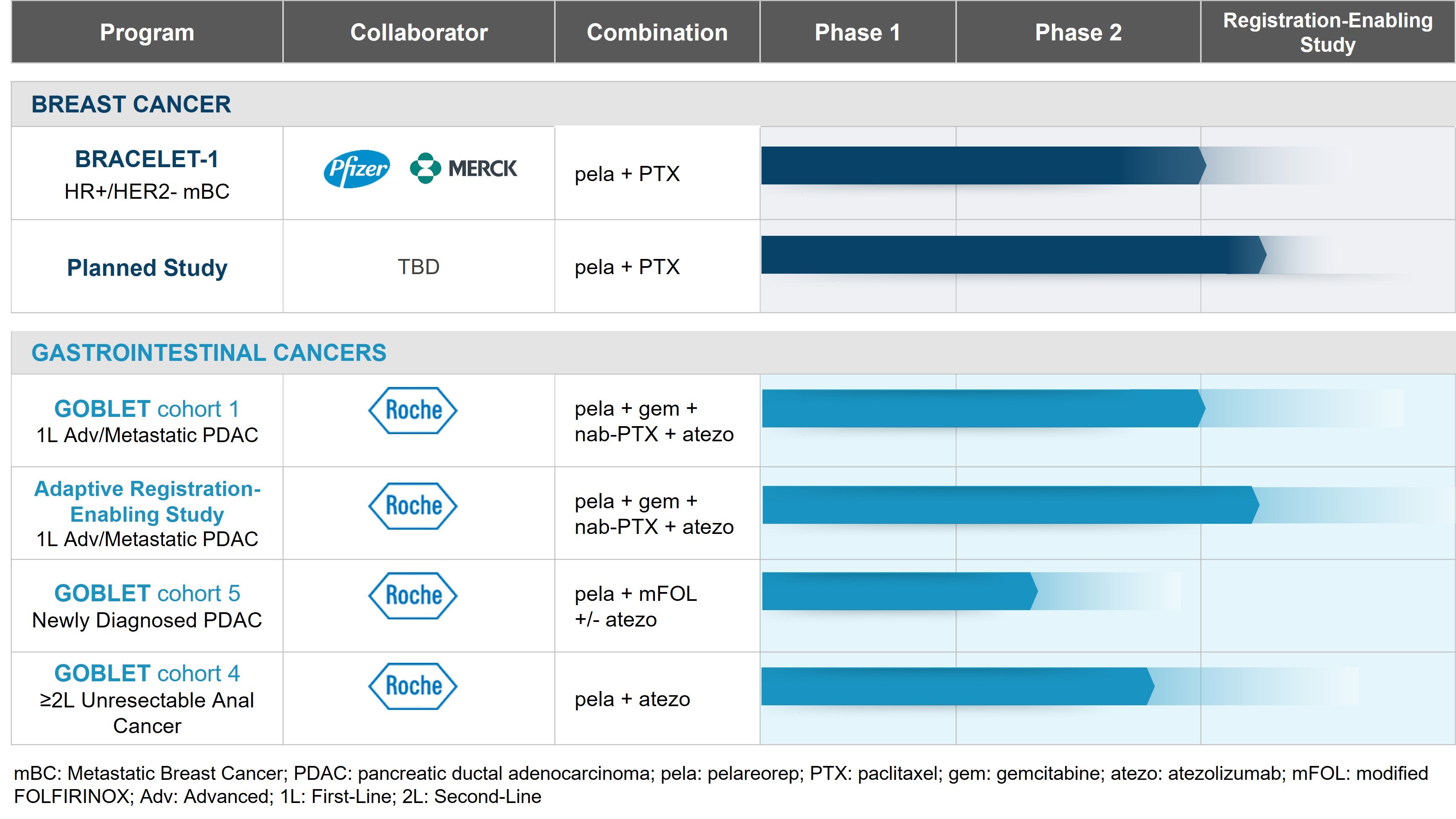

Our primary focus is to advance our programs in hormone receptor-positive / human epidermal growth factor 2-negative (HR+/HER2-) metastatic breast cancer (mBC) and metastatic pancreatic ductal adenocarcinoma (PDAC) to registration-enabling clinical studies. In addition, we are exploring opportunities for registrational programs in other gastrointestinal cancers through our GOBLET platform study.

We have not been profitable since our inception and expect to continue to incur substantial losses as we continue research and development efforts. We do not expect to generate significant revenues until and unless pelareorep becomes commercially viable. As at March 31, 2024, we had cash and cash equivalents of $29,603. We plan to fund our operations for at least the next twelve months from the balance sheet date with the cash and cash equivalents on hand, utilizing our ATM equity distribution agreement (see note 7(a) of our condensed interim consolidated financial statements), and exploring potential collaborations and strategic transactions. We believe we have the ability to reduce or eliminate planned expenditures to extend our operating runway until we obtain sufficient financing. There can be no assurance that we will be able to raise additional funds through the sale of our common shares or other capital resources. Failure to raise additional capital would have a material adverse impact on our business, results of operations, and financial condition.

First Quarter 2024 Pelareorep Development Update

Clinical Trial Program

Gastrointestinal cancer program

Collaboration with Roche and AIO-Studien-gGmbH: GOBLET platform study

Our GOBLET platform study is a collaboration with Roche and AIO-Studien-gGmbH, a leading academic cooperative medical oncology group based in Germany. The study is investigating the use of pelareorep, in combination with Roche's anti-PD-L1 checkpoint inhibitor atezolizumab (Tecentriq®), in advanced or metastatic gastrointestinal tumors. The study is being conducted at 12 centers in Germany. The study's co-primary endpoints are safety and objective response rate and/or disease control rate at week 16. Key secondary and exploratory endpoints include additional efficacy assessments and evaluation of potential biomarkers. The study employs a two-stage design with Stage 1 comprising of patients with first-line advanced/metastatic and newly diagnosed metastatic PDAC, first- and third-line metastatic colorectal, and advanced anal cancers. Any cohort meeting pre-specified efficacy criteria in Stage 1 may be advanced to Stage 2 and enroll additional patients. Our first-line advanced/metastatic PDAC, third-line metastatic CRC, and advanced anal cancer cohorts have completed Stage 1 and met the pre-specified success criteria.

In the first quarter of 2024, we continued to monitor Stage 1 patients, evaluate patient outcomes, and perform patient sample analysis. The following were the key highlights of the GOBLET study in the first quarter of 2024:

Enrollment expansion of GOBLET anal cancer cohort

Based on the positive Stage 1 interim data presented at the 2nd International Multidisciplinary Anal Cancer Conference 2023, where we demonstrated a tripling of objective response compared to similar studies investigating checkpoint inhibition, we expanded enrollment for GOBLET's anal cancer cohort. This cohort is evaluating pelareorep in combination with atezolizumab (Tecentriq®) in patients with second-line or later unresectable squamous cell carcinoma of the anal canal. As there is currently no established standard therapy for anal carcinoma patients who have failed first-line treatment, continued positive results in the anal cancer cohort could potentially expand pelareorep's opportunity beyond breast and pancreatic cancers.

Initiation of new pancreatic cancer GOBLET cohort

As supported by the Pancreatic Cancer Action Network (PanCAN) Therapeutic Accelerator Award granted in 2023, we initiated a fifth cohort of the GOBLET platform study. This cohort is designed to evaluate newly diagnosed metastatic PDAC patients treated with pelareorep in combination with mFOLFIRINOX with or without atezolizumab (Tecentriq®). The co-primary endpoints of the cohort are objective response rate and safety, and submissions to the Regulatory and Ethics Committees are ongoing.

Breast cancer program

Type C meeting request to FDA: defining a path to registration

In the first quarter of 2024, we prepared a Type C meeting request for submission to the FDA. The preparation included reviewing data from our breast cancer studies (including IND.213, AWARE-1, and BRACELET-1) with key opinion leaders and assembling the briefing package, which included our proposed protocol design for a registration-enabling trial. The proposed protocol was designed to investigate pelareorep in combination with paclitaxel for the treatment of patients with HR+/HER2- mBC.

Co-development agreement with Pfizer Inc. and Merck KGaA, Darmstadt, Germany: BRACELET-1 study

We have entered into a co-development agreement with Merck KGaA, Darmstadt, Germany and Pfizer Inc. to co-develop pelareorep in combination with paclitaxel and avelumab (Bavencio®), a human anti-PD-L1 antibody, for the treatment of HR+/HER2- mBC. This phase 2 clinical trial was jointly funded by Oncolytics and Pfizer. The study, known as BRACELET-1, is a randomized open-label study that enrolled 48 patients into three cohorts: paclitaxel alone, paclitaxel in combination with pelareorep, and paclitaxel in combination with both pelareorep and avelumab. PrECOG LLC, a leading cancer research network, managed the BRACELET-1 study.

In the first quarter of 2024, we continued monitoring BRACELET-1 patients for progression-free survival and overall survival (OS) in all treatment groups. Additionally, we continued to have productive dialogues with current and potential clinical collaborators regarding optimal registrational study plans. The median OS analysis is currently planned for the second half of 2024.

Manufacturing and Process Development

While we currently have sufficient drug product supply to support our clinical development program, we continued our activities to expand our production capabilities as we focus on advancing our active drug substance and finished drug product towards registration readiness. During the first quarter of 2024, we executed a scaled-up cGMP (Current Good Manufacturing Practice) production run and the related batch testing and began preparations for an upcoming product fill. We also initiated potency assay validation using the master cell bank created in 2023 and started production of a new working cell bank. These activities ensure alignment with the clinical development timeline and anticipated registration-enabling programs. We also incurred storage and distribution costs to maintain our product supply. Ongoing bulk manufacturing and expanded filling capabilities are both part of the planned process validation. Continued process validation is required to ensure that the resulting product meets the specifications and quality standards and will form part of our submission to regulators, including the FDA, for product approval.

Intellectual Property

At the end of the first quarter of 2024, we had 147 patents, including 13 U.S. and 7 Canadian patents, and issuances in other jurisdictions. We have an extensive patent portfolio covering the oncolytic reovirus and formulations that we use in our clinical trial program. These patent rights extend to at least the end of 2031.

Financing Activity

U.S. "at-the-market" (ATM) equity distribution agreement

During the three months ended March 31, 2024, we sold 994,668 common shares for gross proceeds of $1,669 (US$1,244) at an average price of $1.68 (US$1.25). We received proceeds of $1,619 (US$1,207) after commissions of $50 (US$37). In total, we incurred share issue costs (including commissions) of $71.

Cash Resources

We ended the first quarter of 2024 with cash and cash equivalents of $29,603 (see "Liquidity and Capital Resources").

Subsequent Events

In April 2024, we submitted a Type C meeting request to the FDA to discuss our planned registration-enabling trial for pelareorep in HR+/HER2- mBC. We expect to meet with the agency in the second quarter of 2024 to align on the design and objectives of the registrational study.

Pelareorep Development for the Remainder of 2024

For the remainder of 2024, our clinical objectives will continue to revolve around our breast and pancreatic programs. We intend to commence a registration-enabling study on pancreatic cancer. We also plan to begin enrollment into GOBLET's expanded anal cancer and newly added pancreatic cancer cohorts. In relation to our breast cancer program, we anticipate having a Type C meeting with the FDA in the second quarter of 2024 to seek guidance on our protocol design. Upon receiving guidance from the FDA, we intend to finalize our registration pathway and commence the relevant clinical study. Our manufacturing program will focus on completing a second 200-L cGMP production run and the related batch testing. We also expect to fill product and perform the associated analytical testing, as well as labeling, packaging, and distribution of pelareorep to our various clinical sites for ongoing and upcoming activities. In addition, we will initiate the sourcing of a secondary fill/finish supplier. Finally, our intellectual property program includes filings for additional patents and monitoring activities required to protect our patent portfolio.

Results of Operations

Comparison of the three months ended March 31, 2024, and 2023:

Unless otherwise indicated, all amounts below are presented in thousands of Canadian dollars, except for share amounts.

Net loss for the three months ended March 31, 2024, was $6,894 compared to $6,437 for the three months ended March 31, 2023.

Research and development expenses (“R&D”)

Our R&D expenses increased by $2,204 from $3,539 for the three months ended March 31, 2023, to $5,743 for the three months ended March 31, 2024. The following table summarizes our R&D expenses for the three months ended March 31, 2024, and 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

Change |

| Clinical trial expenses |

$ |

802 |

|

|

$ |

909 |

|

|

$ |

(107) |

|

| Manufacturing and related process development expenses |

3,178 |

|

|

872 |

|

|

2,306 |

|

| Intellectual property expenses |

126 |

|

|

143 |

|

|

(17) |

|

|

|

|

|

|

|

| Personnel-related expenses |

1,271 |

|

|

1,380 |

|

|

(109) |

|

| Share-based compensation expense |

340 |

|

|

194 |

|

|

146 |

|

| Other expenses |

26 |

|

|

41 |

|

|

(15) |

|

| Research and development expenses |

$ |

5,743 |

|

|

$ |

3,539 |

|

|

$ |

2,204 |

|

The increase in our R&D expenses for the three months ended March 31, 2024, was primarily due to higher manufacturing and related process development expenses associated with completing a cGMP production run and the related batch testing. We also started preparations for an upcoming product fill.

General and administrative expenses ("G&A")

Our G&A expenses decreased by $212 from $3,195 for the three months ended March 31, 2023, to $2,983 for the three months ended March 31, 2024. The following table summarizes our G&A expenses for the three months ended March 31, 2024, and 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

Change |

| Public company-related expenses |

$ |

1,844 |

|

|

$ |

2,201 |

|

|

$ |

(357) |

|

| Office expenses |

780 |

|

|

774 |

|

|

6 |

|

| Share-based compensation expense |

236 |

|

|

123 |

|

|

113 |

|

| Depreciation - property and equipment |

28 |

|

|

21 |

|

|

7 |

|

| Depreciation - right-of-use assets |

95 |

|

|

76 |

|

|

19 |

|

| General and administrative expenses |

$ |

2,983 |

|

|

$ |

3,195 |

|

|

$ |

(212) |

|

The decrease in our G&A expenses for the three months ended March 31, 2024, was primarily due to lower public-company related expenses associated with lower investor relations activities and lower directors and officers liability insurance premiums.

Change in fair value of warrant derivative

For the three months ended March 31, 2024, we recognized a gain of $869 on the change in fair value of our warrant derivative compared to a gain of $31 for the three months ended March 31, 2023. The gain recognized in 2024 primarily related to the 7,667,050 warrants issued as part of our 2023 financing, where the underlying market price of these warrants changed from US$1.35 at December 31, 2023, to US$1.07 at March 31, 2024. The number of outstanding warrants was 7,731,085 at March 31, 2024, and December 31, 2023.

Foreign exchange

Our foreign exchange gains for the three months ended March 31, 2024, were $517 compared to $1 for the three months ended March 31, 2023. The foreign exchange impact mainly reflected the fluctuation of the U.S. dollar versus the Canadian dollar throughout the respective periods, primarily on our U.S. dollar-denominated cash and cash equivalents and marketable securities balances.

Summary of Quarterly Results

Historical patterns of expenditures cannot be taken as an indication of future expenditures. Our current and future expenditures are subject to numerous uncertainties, including the duration, timing, and costs of R&D activities ongoing during each period and the availability of funding from investors and prospective partners. As a result, the amount and timing of expenditures and, therefore, liquidity and capital resources may vary substantially from period to period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

2023 |

2022 |

|

March(4) |

Dec.(4) |

Sept. |

June |

March |

Dec. |

Sept. |

June |

| Revenue |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Net loss(1)(2)(3) |

(6,894) |

|

(3,949) |

|

(9,925) |

|

(7,441) |

|

(6,437) |

|

(8,554) |

|

(4,407) |

|

(5,095) |

|

Basic and diluted loss per common share(1)(2)(3) |

$ |

(0.09) |

|

$ |

(0.05) |

|

$ |

(0.14) |

|

$ |

(0.12) |

|

$ |

(0.10) |

|

$ |

(0.14) |

|

$ |

(0.08) |

|

$ |

(0.09) |

|

Total assets(5) |

34,750 |

38,820 |

46,089 |

31,966 |

|

35,328 |

|

37,334 |

|

38,959 |

|

40,239 |

|

Total cash, cash equivalents, and marketable securities(5) |

29,603 |

|

34,912 |

39,981 |

24,351 |

|

29,670 |

|

32,138 |

|

32,362 |

|

33,689 |

|

| Total long-term debt |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Cash dividends declared(6) |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

(1)Included in consolidated net loss and loss per common share were share-based compensation expenses of $576, $759, $599, $242, $317, $749, $500, and $490, respectively.

(2)Included in consolidated net loss and loss per common share were foreign exchange gains (losses) of $517, $(392), $310, $(394), $1, $(274), $1,526, and $888, respectively.

(3)Included in consolidated net loss and loss per common share was interest income of $461, $508, $324, $286, $280, $330, $165, and $70, respectively.

(4)Included in consolidated net loss and loss per common share were gains resulting from a change in fair value of warrant derivative of $869 and $4,846, respectively.

(5)We issued 995,808 common shares for net cash proceeds of $1.6 million in 2024 (2023 - 13,096,046 common shares for net cash proceeds of $31.8 million).

(6)We have not declared or paid any dividends since incorporation.

During the quarter ended September 30, 2023, we completed an engineering production run, resulting in higher manufacturing and related process development expenses. We also incurred higher public company-related expenses associated with higher investor relations activities and the portion of the 2023 public offering transaction costs allocated to warrants (see note 7(b) of our condensed interim consolidated financial statements). During the quarters ended December 31, 2023, and 2022, we incurred expenses related to annual short-term incentive awards.

Liquidity and Capital Resources

As a clinical-stage biopharmaceutical company, we have not been profitable since our inception. We expect to continue to incur substantial losses as we continue our research and development efforts. We do not expect to generate significant revenues until and unless pelareorep becomes commercially viable. To date, we have funded our operations mainly through issuing additional capital via public offerings, equity distribution arrangements, and the exercise of warrants and stock options. For the three months ended March 31, 2024, we were able to raise funds through our U.S. ATM.

We have no assurances that we will be able to raise additional funds through the sale of our common shares. Consequently, we will continue to evaluate all types of financing arrangements. On June 16, 2022, we renewed our short form base shelf prospectus (the "Base Shelf") that qualifies for distribution of up to $150.0 million of common shares, subscription receipts, warrants, or units (the "Securities") in either Canada, the U.S. or both. Under a Base Shelf, we may sell Securities to or through underwriters, dealers, placement agents, or other intermediaries. We may also sell Securities directly to purchasers or through agents, subject to obtaining any applicable exemption from registration requirements. The distribution of Securities may be performed from time to time in one or more transactions at a fixed price or prices, which may be subject to change, at market prices prevailing at the time of sale or at prices related to such prevailing market prices to be negotiated with purchasers and as set forth in an accompanying Prospectus Supplement.

Renewing our Base Shelf provides additional flexibility when managing our cash resources as, under certain circumstances, it shortens the time required to close a financing and is expected to increase the number of potential investors that may be prepared to invest in the Company. Funds received from using our Base Shelf would be used in line with our Board-approved budget and multi-year plan. Our current Base Shelf will be effective until July 16, 2024, and we intend to renew it prior to expiry.

Our Base Shelf allowed us to enter our ATM equity distribution agreement and 2023 public offering (see note 7 of our condensed interim consolidated financial statements). We use these equity arrangements to assist us in achieving our capital objective. These arrangements provide us with the opportunity to raise capital and better manage our cash resources. We expect to continue to access our equity arrangement to help support our operations.

As at March 31, 2024, and December 31, 2023, we had cash and cash equivalents as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

December 31,

2023 |

| Cash and cash equivalents |

$ |

29,603 |

|

|

$ |

34,912 |

|

|

|

|

|

We have no debt other than accounts payable and accrued liabilities and lease liabilities. We have commitments and contingent obligations relating to completing our research and development of pelareorep.

The following table summarizes our cash flows for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

Change |

| Cash used in operating activities |

$ |

(7,469) |

|

|

$ |

(7,829) |

|

|

$ |

360 |

|

| Cash (used in) provided by investing activities |

(46) |

|

|

6,669 |

|

|

(6,715) |

|

| Cash provided by financing activities |

1,495 |

|

|

5,271 |

|

|

(3,776) |

|

| Impact of foreign exchange on cash and cash equivalents |

711 |

|

|

95 |

|

|

616 |

|

| (Decrease) increase in cash and cash equivalents |

$ |

(5,309) |

|

|

$ |

4,206 |

|

|

$ |

(9,515) |

|

Cash used in operating activities

The change reflected higher net operating activities and non-cash working capital changes.

Cash used in operating activities for the three months ended March 31, 2024, consisted of a net loss of $6,894 less non-cash adjustments of $542 and non-cash working capital changes of $33. Non-cash items primarily included change in fair value of warrant derivative, share-based compensation expense, and unrealized foreign exchange gains. Non-cash working capital changes mainly reflected decreased prepaid expenses and increased accounts payable and accrued liabilities (see note 13 of our condensed interim consolidated financial statements).

Cash used in operating activities for the three months ended March 31, 2023, consisted of a net loss of $6,437 offset by non-cash adjustments of $163 less non-cash working capital changes of $1,555. Non-cash items primarily included share-based compensation expense and unrealized foreign exchange gains. Non-cash working capital changes mainly reflected an increased use of cash to decrease accounts payable and accrued liabilities (see note 13 of our condensed interim consolidated financial statements).

Cash (used in) provided by investing activities

The change was primarily related to the maturities of marketable securities in the first three months of 2023. We assess whether to acquire marketable securities based on a comparative analysis of the anticipated yield from an investment in marketable securities versus the interest earnings from our cash deposits in interest-bearing accounts.

Cash provided by financing activities

The change was mainly due to our U.S. ATM activities. During the three months ended March 31, 2024, we sold 994,668 common shares for gross proceeds of $1,669 (US$1,244) at an average price of $1.68 (US$1.25). During the three months ended March 31, 2023, we sold 2,663,036 common shares for gross proceeds of $5,552 (US$4,100) at an average price of $2.08 (US$1.54).

We desire to maintain adequate cash reserves to support our planned activities, including our clinical trial program, product manufacturing, administrative costs, and intellectual property protection. To do so, we estimate our future cash requirements by preparing a budget and a multi-year plan annually for review and approval by our Board. The budget establishes the approved activities for the upcoming year and estimates the associated costs. The multi-year plan estimates future activity along with the potential cash requirements and is based on our assessment of our current clinical trial progress along with the expected results from the coming year’s activity. Budget to actual variances are prepared and reviewed by management and are presented quarterly to the Board.

We continue to manage our research and development plan to ensure optimal use of our existing resources as we expect to fund our expenditure requirements and commitments with existing working capital. Additional activities continue to be subject to adequate resources, and we plan to fund our operations for at least the next twelve months from the balance sheet with the cash and cash equivalents on hand, utilizing our ATM equity distribution agreement (see note 7(a) of our condensed interim consolidated financial statements), and exploring potential collaborations and strategic transactions. We believe we have the ability to reduce or eliminate planned expenditures to extend our operating runway until we obtain sufficient financing. There can be no assurance that we will be able to raise additional funds through the sale of our common shares or other capital resources. Failure to raise additional capital would have a material adverse impact on our business, results of operations, and financial condition.

Factors that will affect our anticipated cash usage for which additional funding might be required include, but are not limited to, expansion of our clinical trial program, the timing of patient enrollment in our clinical trials, the actual costs incurred to support each clinical trial, the number of treatments each patient will receive, the timing of R&D activity with our clinical trial research collaborations, the number, timing and costs of manufacturing runs required to conclude the validation process and supply product to our clinical trial program, and the level of collaborative activity undertaken, and other factors described in the "Risk Factors" section of our most recent annual report on Form 20-F. We expect to increase our spending in connection with the research and development of pelareorep over the next several years as we look to advance our breast and gastrointestinal cancer programs into later stages of clinical development. A product candidate in later stages of clinical development generally has higher costs than those in earlier stages, primarily due to the increased size and duration of later-stage clinical trials. Additionally, we expect to continue to incur additional costs associated with operating as a public company.

Conducting clinical trials necessary to obtain regulatory approval is costly and time-consuming. We may never succeed in achieving marketing approval. The probability of successful commercialization of our drug candidates may be affected by numerous factors, including clinical data obtained in future trials, competition, manufacturing capability and commercial viability. As a result, we are unable to determine the duration and completion costs of our research and development projects or when and to what extent we will generate revenue from the commercialization and sale of any of our product candidates.

We are not subject to externally imposed capital requirements, and there have been no changes in how we define or manage our capital in 2024.

Contractual Obligations and Commitments

The following table summarizes our significant contractual obligations as at March 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

Less than 1 year |

1 -3 years

|

4 - 5 years

|

More than

5 years |

| Accounts payable and accrued liabilities |

$ |

3,610 |

|

$ |

3,610 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

| Lease obligations |

1,579 |

|

338 |

|

935 |

|

306 |

|

— |

|

| Total contractual obligations |

$ |

5,189 |

|

$ |

3,948 |

|

$ |

935 |

|

$ |

306 |

|

$ |

— |

|

In addition, we are committed to payments totaling approximately $10,400 for activities mainly related to our clinical trial and manufacturing programs, which are expected to occur over the next three years. We are able to cancel most of these agreements with notice. The ultimate amount and timing of these payments are subject to changes in our research and development plan.

Off-Balance Sheet Arrangements

As at March 31, 2024, we had not entered into any off-balance sheet arrangements.

Transactions with Related Parties

During the three months ended March 31, 2024, and 2023, we did not enter into any related party transactions other than compensation paid to key management personnel. Key management personnel are those persons having authority and responsibility for planning, directing, and controlling our activities as a whole. We have determined that key management personnel comprise the Board of Directors, Executive Officers, President, and Vice Presidents.

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

| Compensation and short-term benefits |

$ |

928 |

|

|

$ |

1,000 |

|

| Share-based compensation expense |

498 |

|

|

229 |

|

|

$ |

1,426 |

|

|

$ |

1,229 |

|

Critical Accounting Policies and Estimates

In preparing our condensed interim consolidated financial statements, we use IFRS as issued by the IASB. IFRS requires us to make certain estimates, judgments, and assumptions that we believe are reasonable based on the information available in applying our accounting policies. These estimates and assumptions affect the reported amounts and disclosures in our condensed interim consolidated financial statements and accompanying notes. Actual results could differ from those estimates, and such differences could be material.

Our critical accounting policies and estimates are described in our audited consolidated financial statements for the year ended December 31, 2023, and available on SEDAR+ at www.sedarplus.ca and contained in our annual report on Form 20-F filed on EDGAR at www.sec.gov/edgar.

There were no material changes to our critical accounting policies in the three months ended March 31, 2024.

Adoption of new accounting standards

IAS 1 Classification of Liabilities as Current or Non-Current

In October 2022, the IASB issued amendments to clarify how conditions with which an entity must comply within 12 months after the reporting period affect the classification of a liability. This is in addition to the amendment from January 2020 where the IASB issued amendments to IAS 1 Presentation of Financial Statements, to provide a more general approach to the presentation of liabilities as current or non-current based on contractual arrangements in place at the reporting date. These amendments specify that the rights and conditions existing at the end of the reporting period are relevant in determining whether the Company has a right to defer settlement of a liability by at least 12 months, provided that management's expectations are not a relevant consideration as to whether the Company will exercise its rights to defer settlement of a liability and clarify when a liability is considered settled.

The amendments became effective on January 1, 2024. Adopting the amendments did not have a material impact on our condensed interim consolidated financial statements.

Accounting standards and interpretations issued but not yet effective

IFRS 18 Presentation and Disclosure in Financial Statements

In April 2024, the IASB issued IFRS 18 Presentation and Disclosure in Financial Statements which replaces IAS 1 Presentation of Financial Statements. IFRS 18 introduces new requirements on presentation within the statement of profit or loss, including specified totals and subtotals. It also requires disclosure of management-defined performance measures and includes new requirements for aggregation and disaggregation of financial information based on the identified roles of the primary financial statements and the notes. Narrow scope amendments have been made to IAS 7 Statement of Cash Flows and some requirements previously included within IAS 1 have been moved to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, which has also been renamed IAS 8 Basis of Preparation of Financial Statements. IAS 34 Interim Financial Reporting has also been amended to require disclosure of management-defined performance measures. IFRS 18 and the amendments to the other standards are effective for annual periods beginning on or after January 1, 2027, with early application permitted. IFRS 18 applies retrospectively to both annual and interim financial statements. We are assessing the impact of adopting this standard on our consolidated financial statements.

Financial Instruments and Other Instruments

Fair value of financial instruments

Our financial instruments consist of cash and cash equivalents, other receivables, accounts payable and accrued liabilities, other liabilities, and warrant derivative. As at March 31, 2024, and December 31, 2023, the carrying amount of our cash and cash equivalents, other receivables, accounts payable and accrued liabilities, and other liabilities approximated their fair value due to their short-term maturity. The warrant derivative is a recurring Level 2 fair value measurement as these warrants have not been listed on an exchange and, therefore, do not trade on an active market. As at March 31, 2024, the fair value of our warrant derivative was presented as an asset of $623 (December 31, 2023 - liability of $200). The change was mainly due to the revaluation of our warrants issued as part of our 2023 public offering. As the unamortized discount balance was greater than the fair value of the warrant derivative liability at March 31, 2024, the net balance was presented as an asset on our condensed interim consolidated statement of financial position. An initial discount was recognized as the difference between the fair value of the warrants and their allocated proceeds, which is amortized on a straight-line basis over the expected life of the warrants (see note 6 of our condensed interim consolidated financial statements). We use the Black-Scholes valuation model to estimate fair value.

Financial risk management

Credit risk

Credit risk is the risk of a financial loss if a counterparty to a financial instrument fails to meet its contractual obligations. As at March 31, 2024, we were exposed to credit risk on our cash and cash equivalents in the event of non-performance by counterparties, but we do not anticipate such non-performance. Our maximum exposure to credit risk at the end of the period is the carrying value of our cash and cash equivalents.

We mitigate our exposure to credit risk connected to our cash and cash equivalents by maintaining our primary operating and investment bank accounts with Schedule I banks in Canada. For our foreign-domiciled bank accounts, we use referrals or recommendations from our Canadian banks to open foreign bank accounts. Our foreign-domiciled bank accounts are used solely for the purpose of settling accounts payable and accrued liabilities or payroll.

Interest rate risk

Interest rate risk is the risk that a financial instrument's fair value or future cash flows will fluctuate because of changes in market interest rates. We hold our cash and cash equivalents in bank accounts or high-interest investment accounts with variable interest rates. We mitigate interest rate risk through our investment policy that only allows the investment of excess cash resources in investment-grade vehicles while matching maturities with our operational requirements.

Fluctuations in market interest rates do not significantly impact our results of operations due to the short-term maturity of the investments held.

Foreign exchange risk

Foreign exchange risk arises from changes in foreign exchange rates that may affect the fair value or future cash flows of our financial assets or liabilities.

For the three months ended March 31, 2024, we were primarily exposed to the risk of changes in the Canadian dollar relative to the U.S. dollar, as a portion of our financial assets and liabilities were denominated in such currency. The impact of a $0.01 increase in the value of the U.S. dollar against the Canadian dollar would have decreased our total comprehensive loss in 2024 by approximately $216 (March 31, 2023 - $231).

We mitigate our foreign exchange risk by maintaining sufficient foreign currencies by purchasing foreign currencies or receiving foreign currencies from financing activities to settle our foreign accounts payable.

Significant balances denominated in U.S. dollars were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

December 31,

2023 |

| Cash and cash equivalents |

$ |

18,742 |

|

|

$ |

24,294 |

|

| Accounts payable and accrued liabilities |

(1,275) |

|

|

(1,476) |

|

|

$ |

17,467 |

|

|

$ |

22,818 |

|

Liquidity risk

Liquidity risk is the risk that we will encounter difficulty meeting obligations associated with financial liabilities. We manage liquidity risk by managing our capital structure as outlined in note 11 of our condensed interim consolidated financial statements. Accounts payable and accrued liabilities are all due within the current operating period.

Use of Proceeds

2023 public offering and use of proceeds

The following table provides an update on the anticipated use of proceeds raised as part of the 2023 public offering of common shares and warrants along with amounts actually expended. As at March 31, 2024, the following expenditures have been incurred (in thousands of U.S. dollars):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item |

Amount to Spend |

|

Spent to Date |

|

Adjustments |

|

Remaining to Spend |

| Pancreatic Cancer Program |

$ |

10,500 |

|

|

$ |

(458) |

|

|

$ |

— |

|

|

$ |

10,042 |

|

| Breast Cancer Program |

500 |

|

|

(500) |

|

|

— |

|

|

— |

|

| General and Administrative Expenses |

2,650 |

|

|

(168) |

|

|

— |

|

|

2,482 |

|

| Total |

$ |

13,650 |

|

|

$ |

(1,126) |

|

|

$ |

— |

|

|

$ |

12,524 |

|

ATM facility

On June 17, 2022, we entered into an ATM equity distribution agreement with Canaccord Genuity Inc. The ATM allows us to issue common shares, at prevailing market prices, with an aggregate offering value of up to US$65.0 million over a 25-month period through the facilities of the Nasdaq Capital Market in the United States. We intend to enter into a new ATM equity distribution agreement prior to expiry. Approximately $68.0 million (US$50.2 million) remains unused under the ATM equity distribution agreement.

Other MD&A Requirements

We have 75,853,097 common shares outstanding at May 9, 2024. If all of our options and restricted share awards (7,397,598) and common share purchase warrants (8,267,778) were exercised, we would have 91,518,473 common shares outstanding.

Our 2023 annual report on Form 20-F is available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Disclosure Controls and Procedures

Disclosure controls and procedures (“DC&P”) are designed to provide reasonable assurance that information required to be disclosed by the Company in its reports filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified in the securities legislation and include controls and procedures designed to ensure that information required to be disclosed by the Company in its reports filed or submitted under securities legislation is accumulated and communicated to the Company’s management, including its certifying officers, as appropriate to allow timely decisions regarding required disclosure.

There were no changes in our DC&P during the three months ended March 31, 2024, that materially affected or are reasonably likely to materially affect, our DC&P.

Internal Controls over Financial Reporting

The Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO") are responsible for designing internal controls over financial reporting (“ICFR”) or causing them to be designed under their supervision in order to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS. The CEO and CFO have designed, or caused to be designed under their supervision, ICFR to provide reasonable assurance that: (i) material information relating to the Company is made known to the Company's CEO and CFO by others; and (ii) information required to be disclosed by the Company in its reports filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time period specified in securities legislation. The Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) 2013 framework provides the basis for management’s design of internal controls over financial reporting. There were no changes in our ICFR during the three months ended March 31, 2024, that materially affected or are reasonably likely to materially affect, our ICFR.

Management, including the CEO and CFO, does not expect that our internal controls and procedures over financial reporting will prevent all errors and all fraud. A control system can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving our stated goals under all potential future conditions. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Risks and Uncertainties

We are a clinical-stage biopharmaceutical company. Prospects for biotechnology companies in the research and development stage should generally be regarded as speculative. It is not possible to predict, based on studies in animals, or early studies in humans, whether a new therapeutic will ultimately prove to be safe and effective in humans or whether necessary and sufficient data can be developed through the clinical trial process to support a successful product application and approval. If a product is approved for sale, product manufacturing at a commercial scale and significant sales to end users at a commercially reasonable price may not be successful. There can be no assurance that we will generate adequate funds to continue development or will ever achieve significant revenues or profitable operations. Many factors (e.g., competition, patent protection, appropriate regulatory approvals) can influence the revenue and product profitability potential. In developing a pharmaceutical product, we rely on our employees, contractors, consultants and collaborators, and other third-party relationships, including the ability to obtain appropriate product liability insurance. There can be no assurance that this reliance and these relationships will continue as required. In addition to developmental and operational considerations, market prices for securities of biotechnology companies generally are volatile, and may or may not move in a manner consistent with the progress we have made or are making.

Investment in our common shares involves a high degree of risk. An investor should carefully consider, among other matters, the risk factors in addition to the other information in our annual report on Form 20-F filed with the U.S. Securities and Exchange Commission (the "SEC"), as well as our other public filings with the Canadian securities regulatory authorities and the SEC, when evaluating our business because these risk factors may have a significant impact on our business, financial condition, operating results or cash flow. If any of the described material risks in our annual report or in subsequent reports we file with the regulatory authorities actually occur, they may materially harm our business, financial condition, operating results or cash flow. Additional risks and uncertainties that we have not yet identified or that we presently consider to be immaterial may also materially harm our business, financial condition, operating results, or cash flow. For information on risks and uncertainties, please refer to the "Risk Factors" section of our most recent annual report on Form 20-F and our other public filings available on www.sedarplus.ca and www.sec.gov/edgar.