| HOPE BANCORP INC | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 000-50245 | 95-4849715 | ||||||||||||

| (State of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||

| Common Stock | , | par value $0.001 per share | HOPE | NASDAQ Global Select Market | ||||||||||

| (Title of class) | (Trading Symbol) | (Name of exchange on which registered) | ||||||||||||

| Exhibit No. | Description of Exhibit | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|||||||

| HOPE BANCORP, INC. | |||||||||||

| Date: July 29, 2024 | By: | /s/ Kevin S. Kim | |||||||||

| Kevin S. Kim | |||||||||||

| Chairman, President and Chief Executive Officer | |||||||||||

| (dollars in thousands) (unaudited) | 6/30/2024 | 3/31/2024 | 6/30/2023 | ||||||||||||||||||||||||||||||||

| Balance | Percentage | Balance | Percentage | Balance | Percentage | ||||||||||||||||||||||||||||||

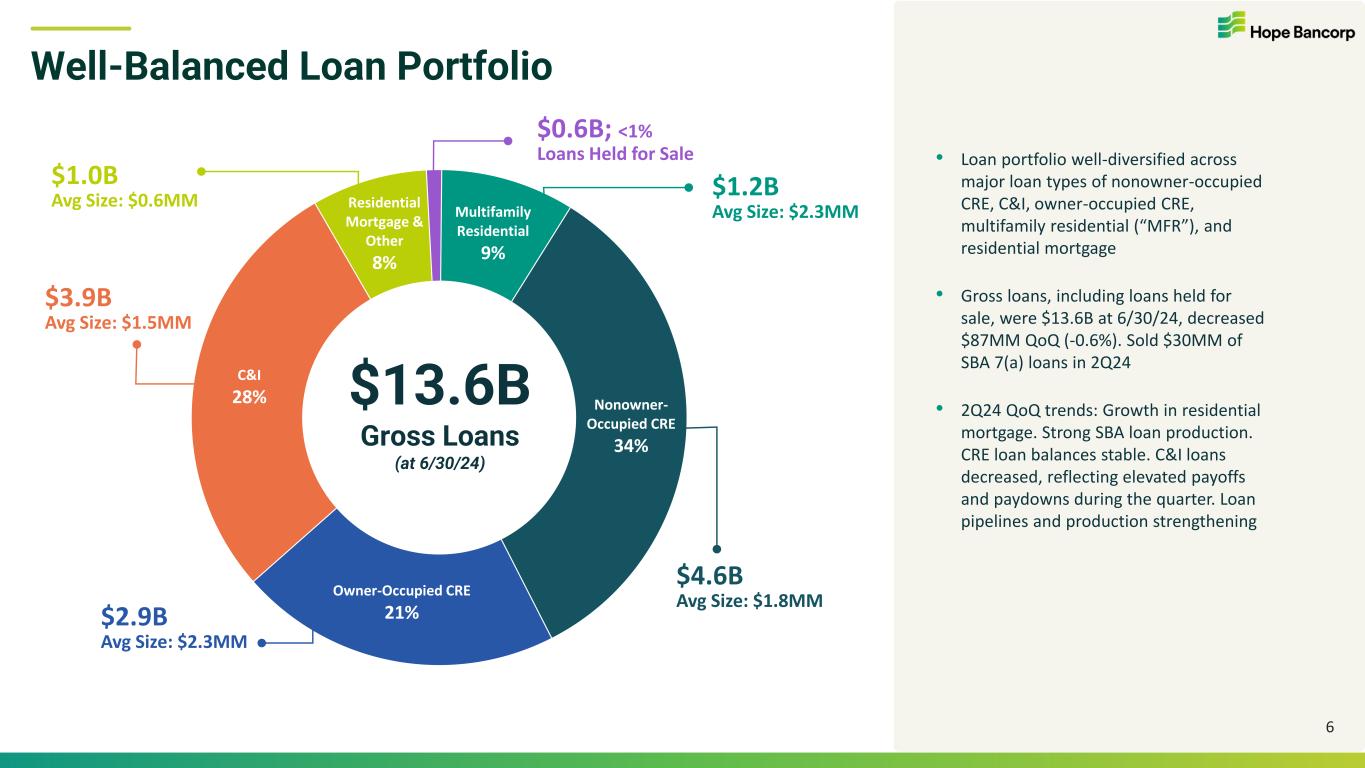

| Commercial real estate (“CRE”) loans | $ | 8,679,515 | 63.6 | % | $ | 8,707,673 | 63.5 | % | $ | 9,192,160 | 61.7 | % | |||||||||||||||||||||||

| Commercial and industrial (“C&I”) loans | 3,854,284 | 28.3 | % | 4,041,063 | 29.4 | % | 4,805,126 | 32.2 | % | ||||||||||||||||||||||||||

| Residential mortgage and other loans | 1,033,203 | 7.6 | % | 970,442 | 7.1 | % | 867,524 | 5.8 | % | ||||||||||||||||||||||||||

| Loans receivable | 13,567,002 | 99.5 | % | 13,719,178 | 100.0 | % | 14,864,810 | 99.7 | % | ||||||||||||||||||||||||||

| Loans held for sale | 68,316 | 0.5 | % | 2,763 | — | % | 49,246 | 0.3 | % | ||||||||||||||||||||||||||

| Gross loans | $ | 13,635,318 | 100.0 | % | $ | 13,721,941 | 100.0 | % | $ | 14,914,056 | 100.0 | % | |||||||||||||||||||||||

| (dollars in thousands) (unaudited) | 6/30/2024 | 3/31/2024 | 6/30/2023 | ||||||||||||||||||||||||||||||||

| Balance | Percentage | Balance | Percentage | Balance | Percentage | ||||||||||||||||||||||||||||||

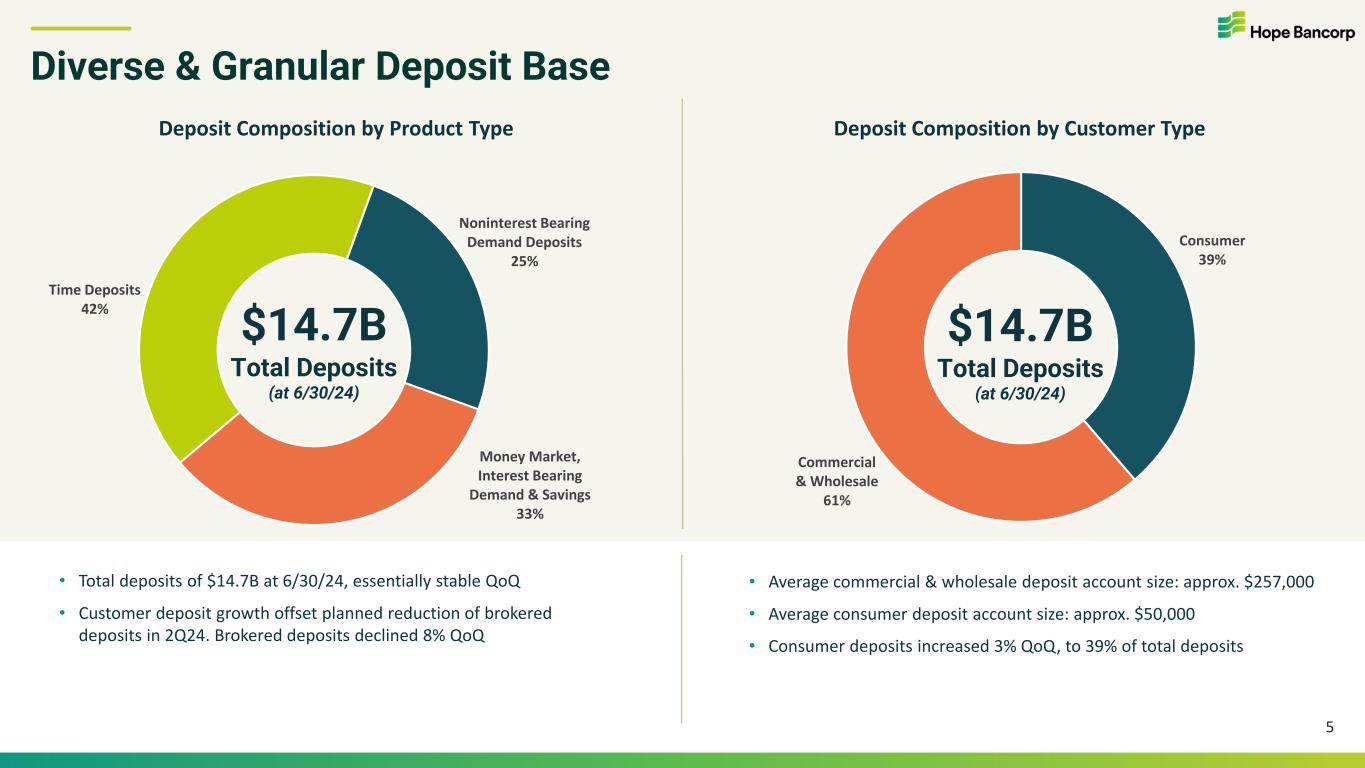

| Noninterest bearing demand deposits | $ | 3,671,192 | 24.9 | % | $ | 3,652,592 | 24.7 | % | $ | 4,229,247 | 27.1 | % | |||||||||||||||||||||||

| Money market, interest bearing demand, and savings deposits | 4,907,860 | 33.4 | % | 5,313,064 | 36.0 | % | 4,413,079 | 28.2 | % | ||||||||||||||||||||||||||

| Time deposits | 6,132,419 | 41.7 | % | 5,787,761 | 39.3 | % | 6,977,026 | 44.7 | % | ||||||||||||||||||||||||||

| Total deposits | $ | 14,711,471 | 100.0 | % | $ | 14,753,417 | 100.0 | % | $ | 15,619,352 | 100.0 | % | |||||||||||||||||||||||

| Gross loan-to-deposit ratio | 92.7 | % | 93.0 | % | 95.5 | % | |||||||||||||||||||||||||||||

| (dollars in thousands) (unaudited) | 6/30/2024 | 3/31/2024 | 6/30/2023 | |||||||||||||||||||||||

Loans on nonaccrual status (1) |

$ | 67,003 | $ | 59,526 | $ | 61,252 | ||||||||||||||||||||

Accruing delinquent loans past due 90 days or more |

273 | 47,290 | 15,182 | |||||||||||||||||||||||

| Total nonperforming loans | 67,276 | 106,816 | 76,434 | |||||||||||||||||||||||

| Other real estate owned | — | — | 938 | |||||||||||||||||||||||

| Total nonperforming assets | $ | 67,276 | $ | 106,816 | $ | 77,372 | ||||||||||||||||||||

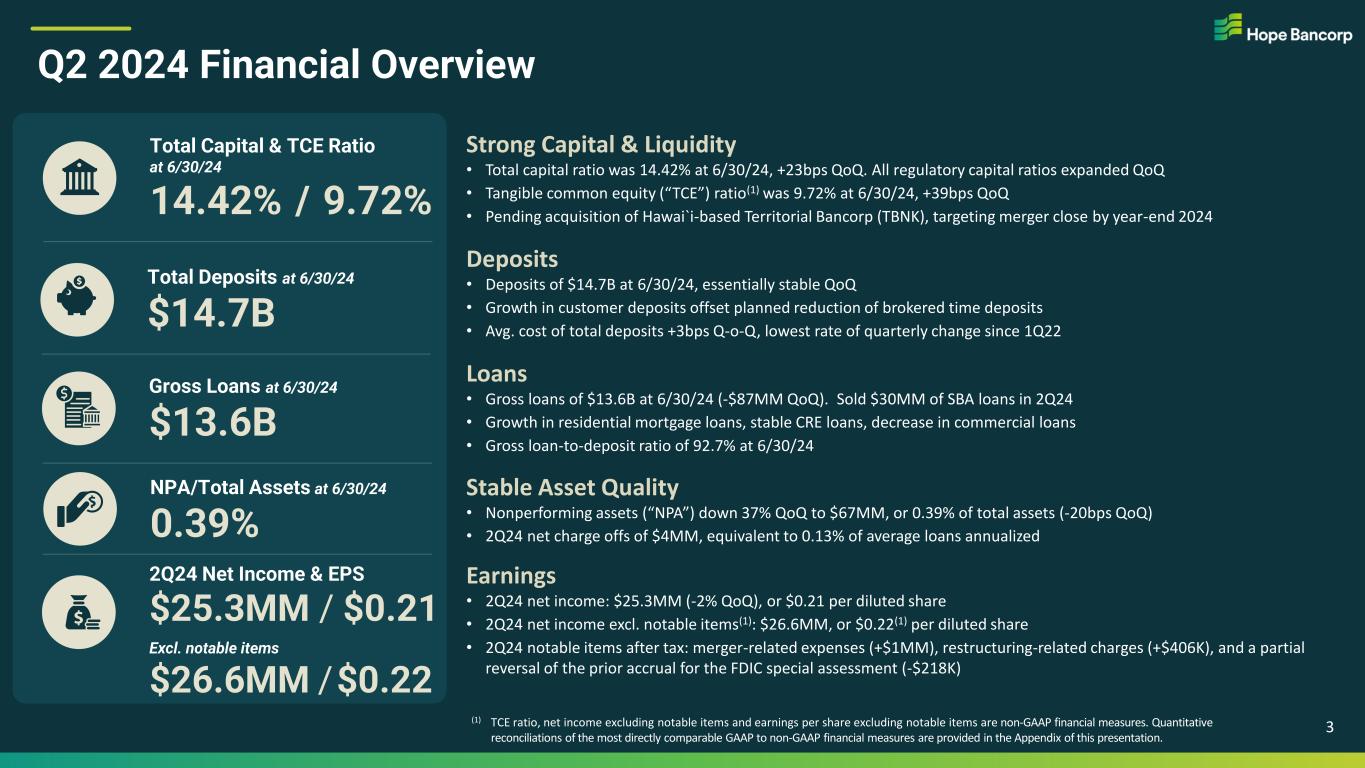

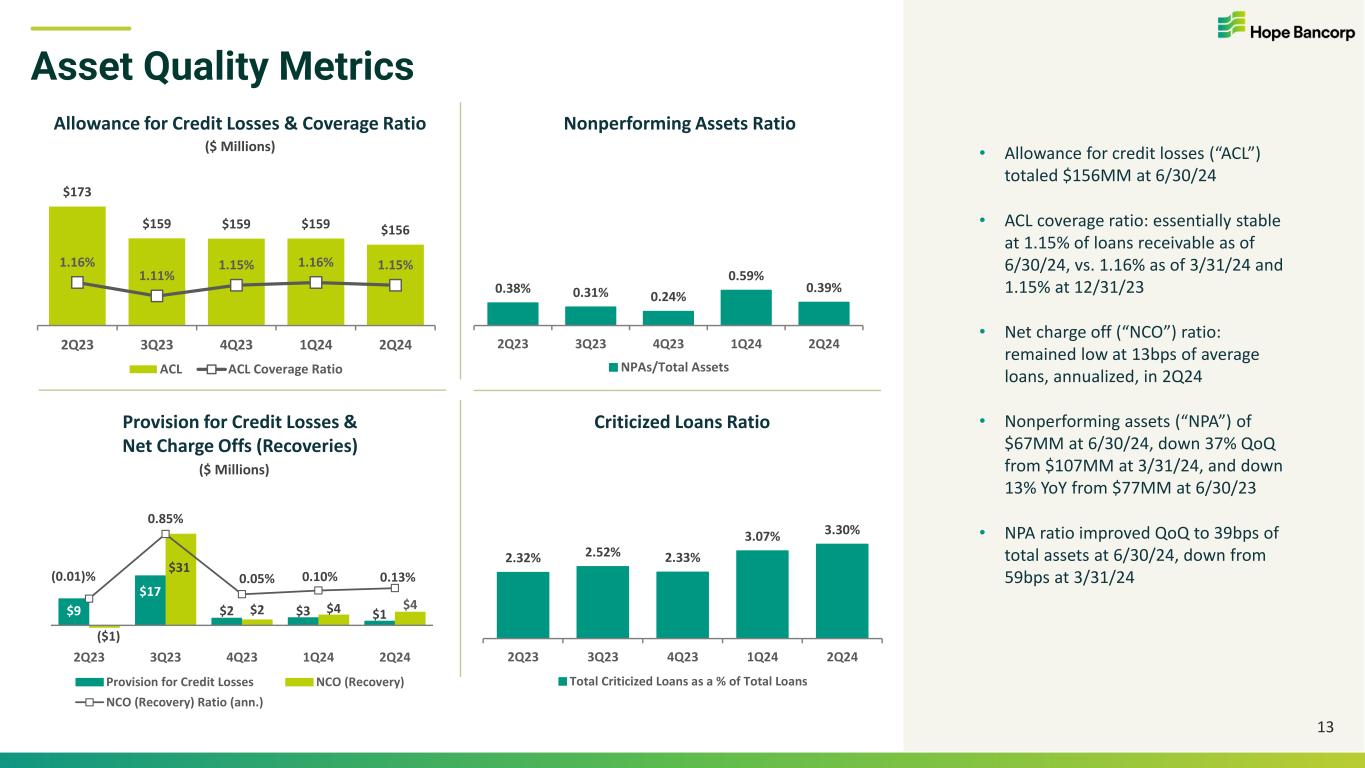

| Nonperforming assets/total assets | 0.39 | % | 0.59 | % | 0.38 | % | ||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||

| (dollars in thousands) (unaudited) | 6/30/2024 | 3/31/2024 | 6/30/2023 | |||||||||||||||||||||||

| Net charge offs (recoveries) | $ | 4,439 | $ | 3,536 | $ | (552) | ||||||||||||||||||||

| Annualized net charge offs (recoveries)/average loans | 0.13 | % | 0.10 | % | (0.01) | % | ||||||||||||||||||||

| (dollars in thousands) (unaudited) | 6/30/2024 | 3/31/2024 | 6/30/2023 | |||||||||||||||||||||||

| Allowance for credit losses | $ | 156,019 | $ | 158,758 | $ | 172,996 | ||||||||||||||||||||

| Allowance for credit losses/loans receivable | 1.15 | % | 1.16 | % | 1.16 | % | ||||||||||||||||||||

(unaudited) |

6/30/2024 | 3/31/2024 | 6/30/2023 | Minimum Guideline for “Well-Capitalized” | |||||||||||||||||||

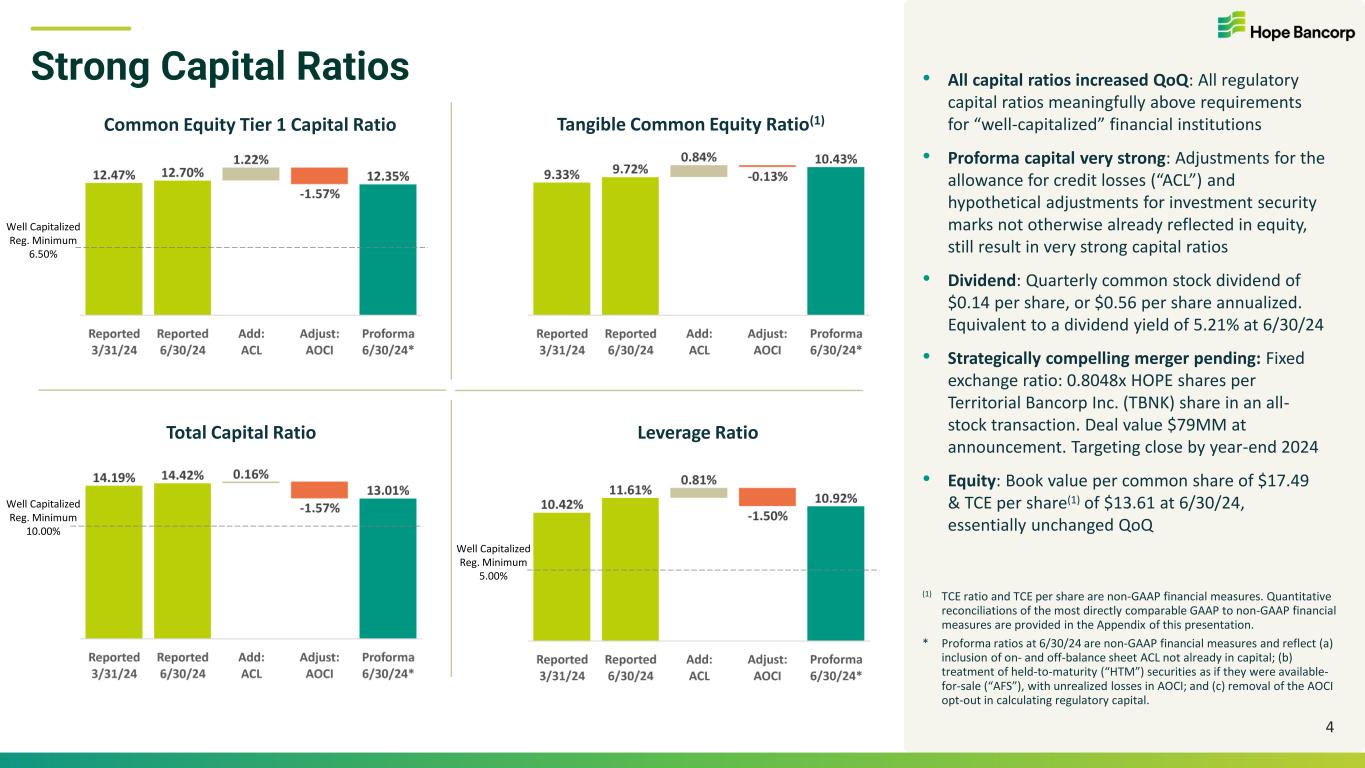

| Common Equity Tier 1 Capital Ratio | 12.70% | 12.47% | 11.05% | 6.50% | |||||||||||||||||||

| Tier 1 Capital Ratio | 13.40% | 13.17% | 11.68% | 8.00% | |||||||||||||||||||

| Total Capital Ratio | 14.42% | 14.19% | 12.64% | 10.00% | |||||||||||||||||||

| Leverage Ratio | 11.61% | 10.42% | 9.57% | 5.00% | |||||||||||||||||||

| (unaudited) | 6/30/2024 | 3/31/2024 | 6/30/2023 | ||||||||||||||

| TCE per share | $13.61 | $13.63 | $13.32 | ||||||||||||||

| TCE ratio | 9.72% | 9.33% | 8.04% | ||||||||||||||

Julianna Balicka |

Angie Yang |

|||||||

| EVP & Chief Financial Officer | SVP, Director of Investor Relations & Corporate Communications |

|||||||

213-235-3235 |

213-251-2219 |

|||||||

julianna.balicka@bankofhope.com |

angie.yang@bankofhope.com |

|||||||

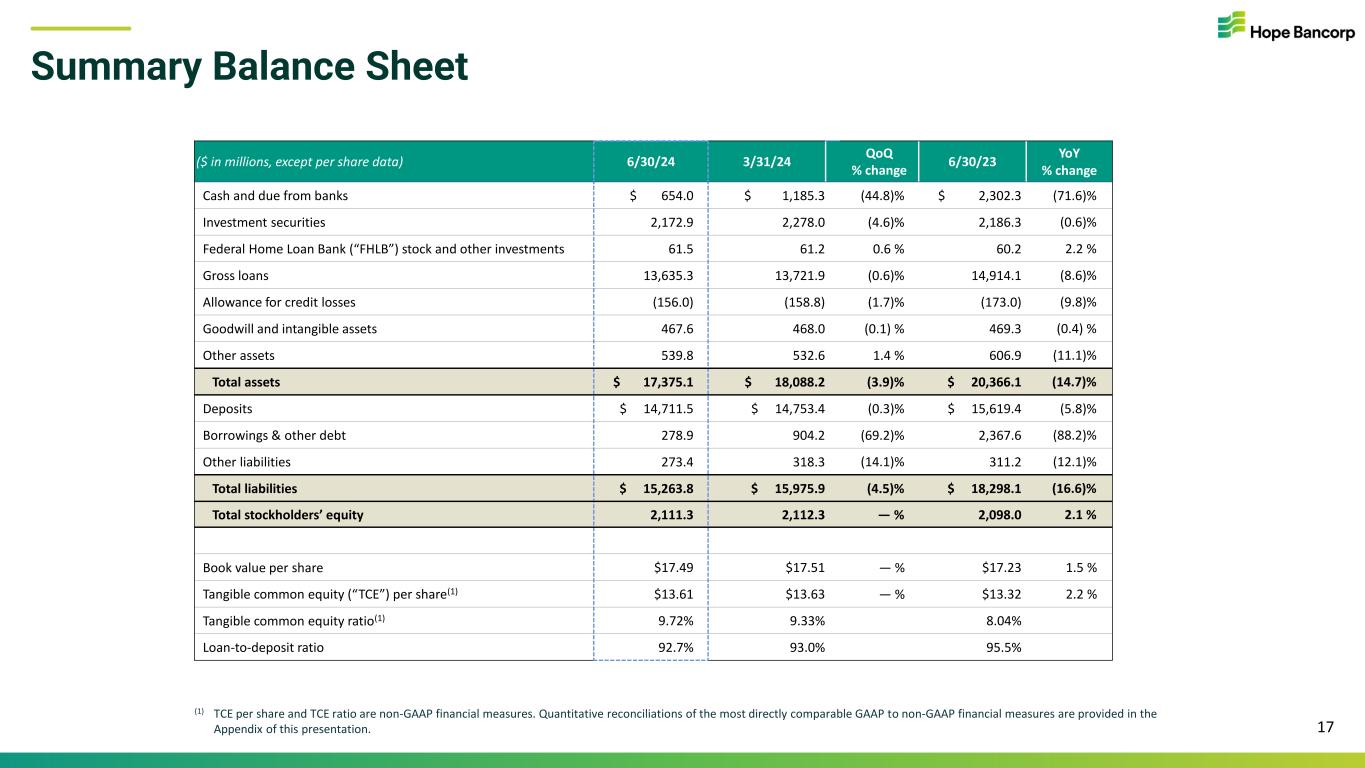

| Assets: | 6/30/2024 | 3/31/2024 | % change | 6/30/2023 | % change | ||||||||||||||||||||||||

| Cash and due from banks | $ | 654,044 | $ | 1,185,296 | (44.8) | % | $ | 2,302,339 | (71.6) | % | |||||||||||||||||||

| Investment securities | 2,172,859 | 2,277,990 | (4.6) | % | 2,186,346 | (0.6) | % | ||||||||||||||||||||||

| Federal Home Loan Bank (“FHLB”) stock and other investments | 61,528 | 61,175 | 0.6 | % | 60,213 | 2.2 | % | ||||||||||||||||||||||

| Gross loans, including loans held for sale | 13,635,318 | 13,721,941 | (0.6) | % | 14,914,056 | (8.6) | % | ||||||||||||||||||||||

| Allowance for credit losses | (156,019) | (158,758) | (1.7) | % | (172,996) | (9.8) | % | ||||||||||||||||||||||

| Accrued interest receivable | 57,645 | 60,316 | (4.4) | % | 60,118 | (4.1) | % | ||||||||||||||||||||||

| Premises and equipment, net | 50,919 | 50,541 | 0.7 | % | 50,513 | 0.8 | % | ||||||||||||||||||||||

| Goodwill and intangible assets | 467,583 | 467,984 | (0.1) | % | 469,280 | (0.4) | % | ||||||||||||||||||||||

| Other assets | 431,214 | 421,729 | 2.2 | % | 496,269 | (13.1) | % | ||||||||||||||||||||||

| Total assets | $ | 17,375,091 | $ | 18,088,214 | (3.9) | % | $ | 20,366,138 | (14.7) | % | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||

| Deposits | $ | 14,711,471 | $ | 14,753,417 | (0.3) | % | $ | 15,619,352 | (5.8) | % | |||||||||||||||||||

| FHLB and Federal Reserve Bank (“FRB”) borrowings | 170,000 | 795,634 | (78.6) | % | 2,260,000 | (92.5) | % | ||||||||||||||||||||||

| Subordinated debentures and convertible notes, net | 108,918 | 108,592 | 0.3 | % | 107,632 | 1.2 | % | ||||||||||||||||||||||

| Accrued interest payable | 86,779 | 122,467 | (29.1) | % | 109,236 | (20.6) | % | ||||||||||||||||||||||

| Other liabilities | 186,641 | 195,834 | (4.7) | % | 201,920 | (7.6) | % | ||||||||||||||||||||||

| Total liabilities | $ | 15,263,809 | $ | 15,975,944 | (4.5) | % | $ | 18,298,140 | (16.6) | % | |||||||||||||||||||

| Stockholders’ Equity: | |||||||||||||||||||||||||||||

| Common stock, $0.001 par value | $ | 138 | $ | 138 | — | % | $ | 137 | 0.7 | % | |||||||||||||||||||

| Additional paid-in capital | 1,440,963 | 1,439,484 | 0.1 | % | 1,433,788 | 0.5 | % | ||||||||||||||||||||||

| Retained earnings | 1,167,978 | 1,159,593 | 0.7 | % | 1,127,624 | 3.6 | % | ||||||||||||||||||||||

| Treasury stock, at cost | (264,667) | (264,667) | — | % | (264,667) | — | % | ||||||||||||||||||||||

| Accumulated other comprehensive loss, net | (233,130) | (222,278) | (4.9) | % | (228,884) | (1.9) | % | ||||||||||||||||||||||

| Total stockholders’ equity | 2,111,282 | 2,112,270 | — | % | 2,067,998 | 2.1 | % | ||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 17,375,091 | $ | 18,088,214 | (3.9) | % | $ | 20,366,138 | (14.7) | % | |||||||||||||||||||

| Common stock shares – authorized | 300,000,000 | 150,000,000 | 150,000,000 | ||||||||||||||||||||||||||

| Common stock shares – outstanding | 120,731,342 | 120,610,029 | 120,014,888 | ||||||||||||||||||||||||||

| Treasury stock shares | 17,382,835 | 17,382,835 | 17,382,835 | ||||||||||||||||||||||||||

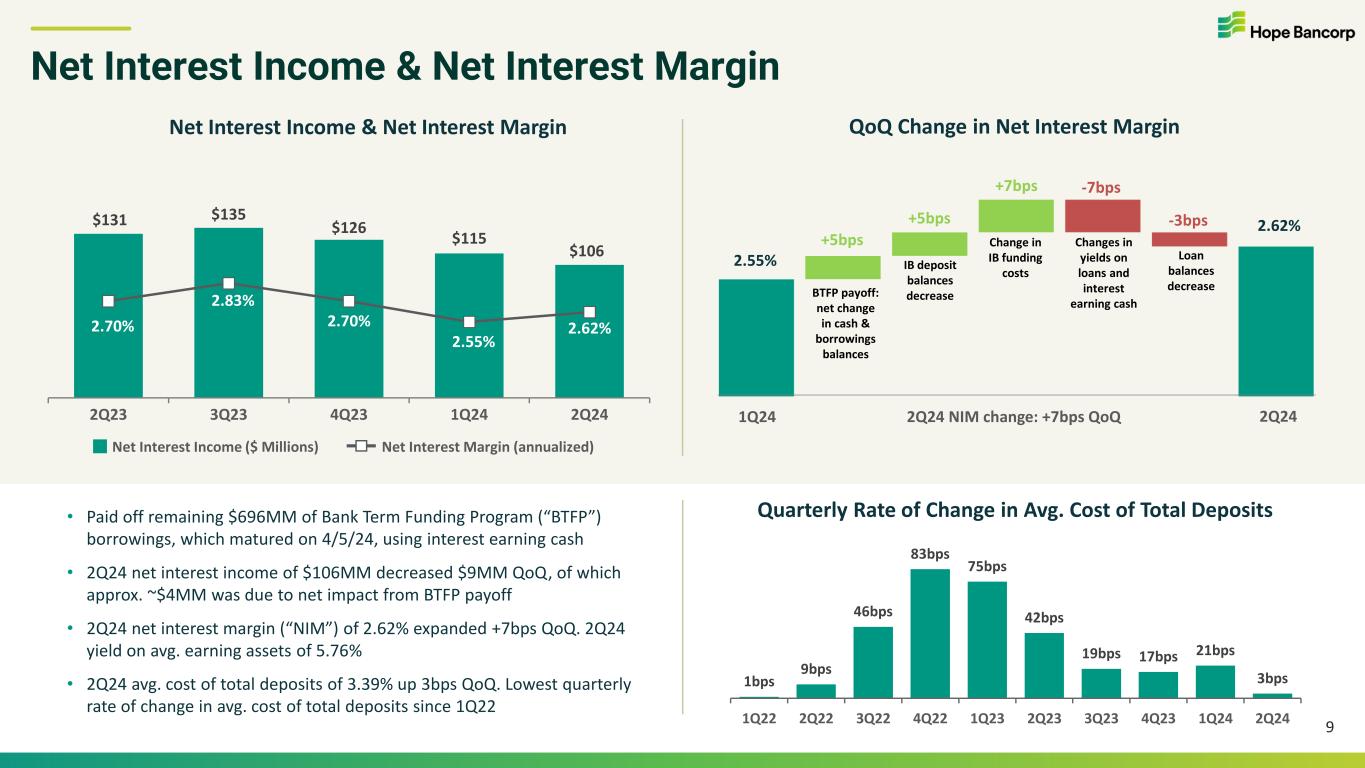

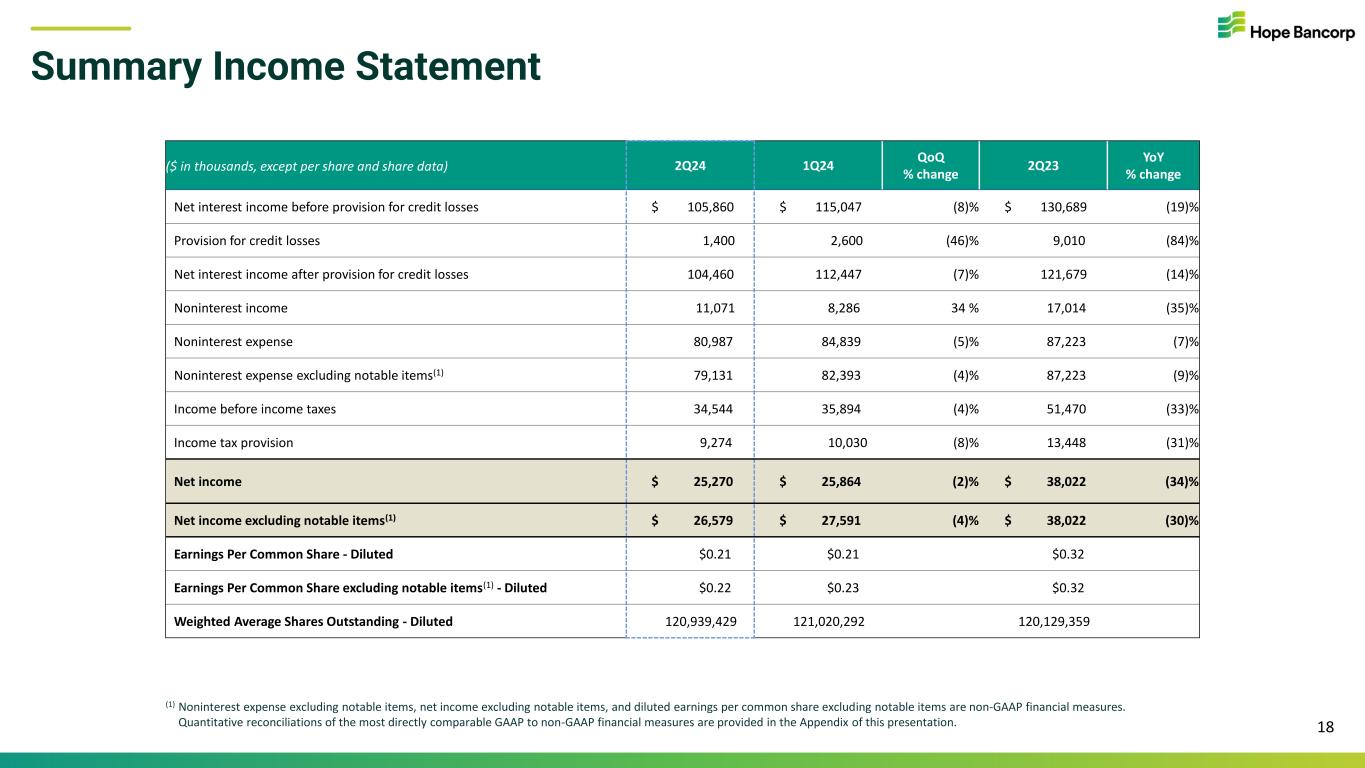

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| 6/30/2024 | 3/31/2024 | % change | 6/30/2023 | % change | 6/30/2024 | 6/30/2023 | % change | ||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 209,683 | $ | 213,626 | (2) | % | $ | 225,671 | (7) | % | $ | 423,309 | $ | 441,606 | (4) | % | |||||||||||||||||||||||||||||||

| Interest on investment securities | 16,829 | 18,049 | (7) | % | 15,534 | 8 | % | 34,878 | 30,659 | 14 | % | ||||||||||||||||||||||||||||||||||||

| Interest on cash and deposits at other banks | 5,284 | 27,183 | (81) | % | 25,295 | (79) | % | 32,467 | 30,217 | 7 | % | ||||||||||||||||||||||||||||||||||||

| Interest on other investments and FHLB dividends | 805 | 816 | (1) | % | 684 | 18 | % | 1,621 | 1,379 | 18 | % | ||||||||||||||||||||||||||||||||||||

| Total interest income | 232,601 | 259,674 | (10) | % | 267,184 | (13) | % | 492,275 | 503,861 | (2) | % | ||||||||||||||||||||||||||||||||||||

| Interest on deposits | 122,577 | 124,033 | (1) | % | 109,724 | 12 | % | 246,610 | 202,072 | 22 | % | ||||||||||||||||||||||||||||||||||||

| Interest on borrowings | 4,164 | 20,594 | (80) | % | 26,771 | (84) | % | 24,758 | 37,222 | (33) | % | ||||||||||||||||||||||||||||||||||||

| Total interest expense | 126,741 | 144,627 | (12) | % | 136,495 | (7) | % | 271,368 | 239,294 | 13 | % | ||||||||||||||||||||||||||||||||||||

| Net interest income before provision | 105,860 | 115,047 | (8) | % | 130,689 | (19) | % | 220,907 | 264,567 | (17) | % | ||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1,400 | 2,600 | (46) | % | 9,010 | (84) | % | 4,000 | 12,330 | (68) | % | ||||||||||||||||||||||||||||||||||||

| Net interest income after provision | 104,460 | 112,447 | (7) | % | 121,679 | (14) | % | 216,907 | 252,237 | (14) | % | ||||||||||||||||||||||||||||||||||||

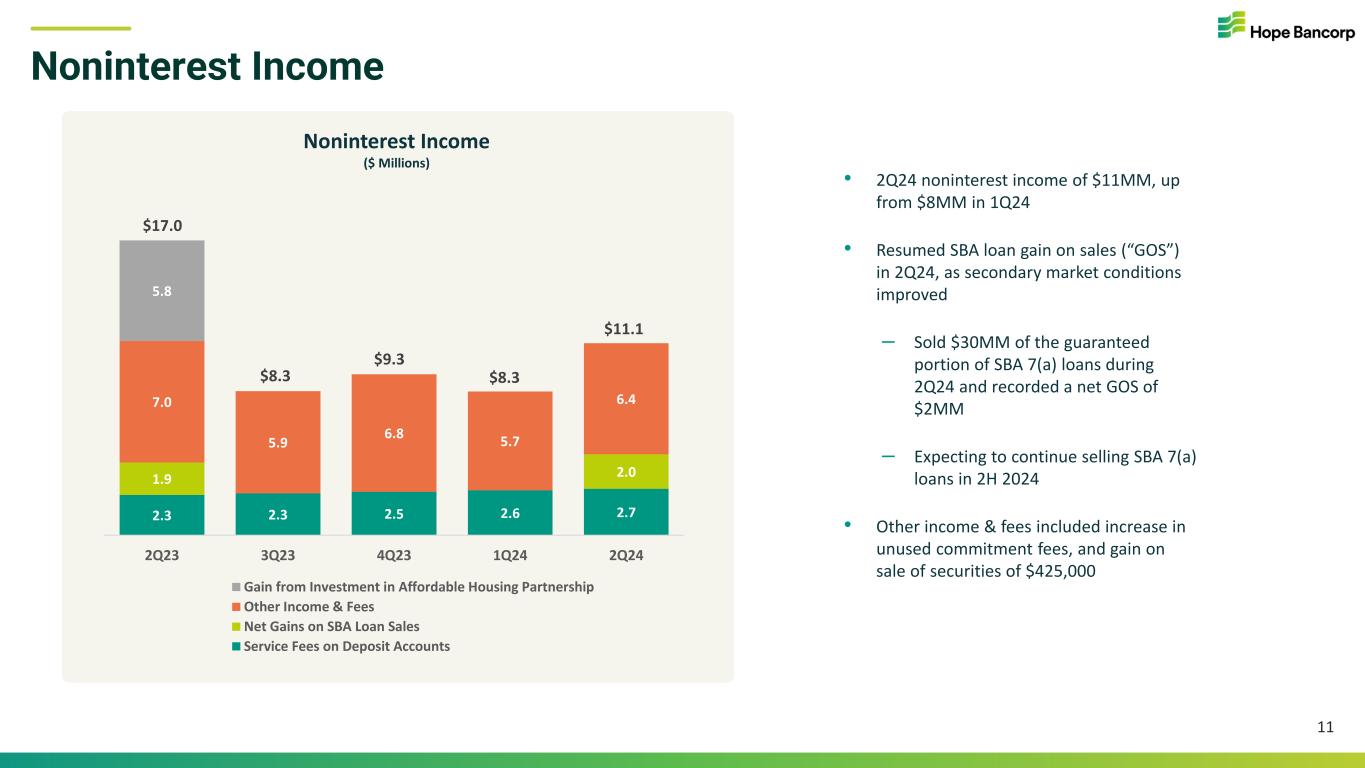

| Service fees on deposit accounts | 2,681 | 2,587 | 4 | % | 2,325 | 15 | % | 5,268 | 4,546 | 16 | % | ||||||||||||||||||||||||||||||||||||

| Net gains on sales of SBA loans | 1,980 | — | 100 | % | 1,872 | 6 | % | 1,980 | 4,097 | (52) | % | ||||||||||||||||||||||||||||||||||||

| Net gains on sales of securities available for sale | 425 | — | 100 | % | — | 100 | % | 425 | — | 100 | % | ||||||||||||||||||||||||||||||||||||

| Other income and fees | 5,985 | 5,699 | 5 | % | 12,817 | (53) | % | 11,684 | 19,349 | (40) | % | ||||||||||||||||||||||||||||||||||||

| Total noninterest income | 11,071 | 8,286 | 34 | % | 17,014 | (35) | % | 19,357 | 27,992 | (31) | % | ||||||||||||||||||||||||||||||||||||

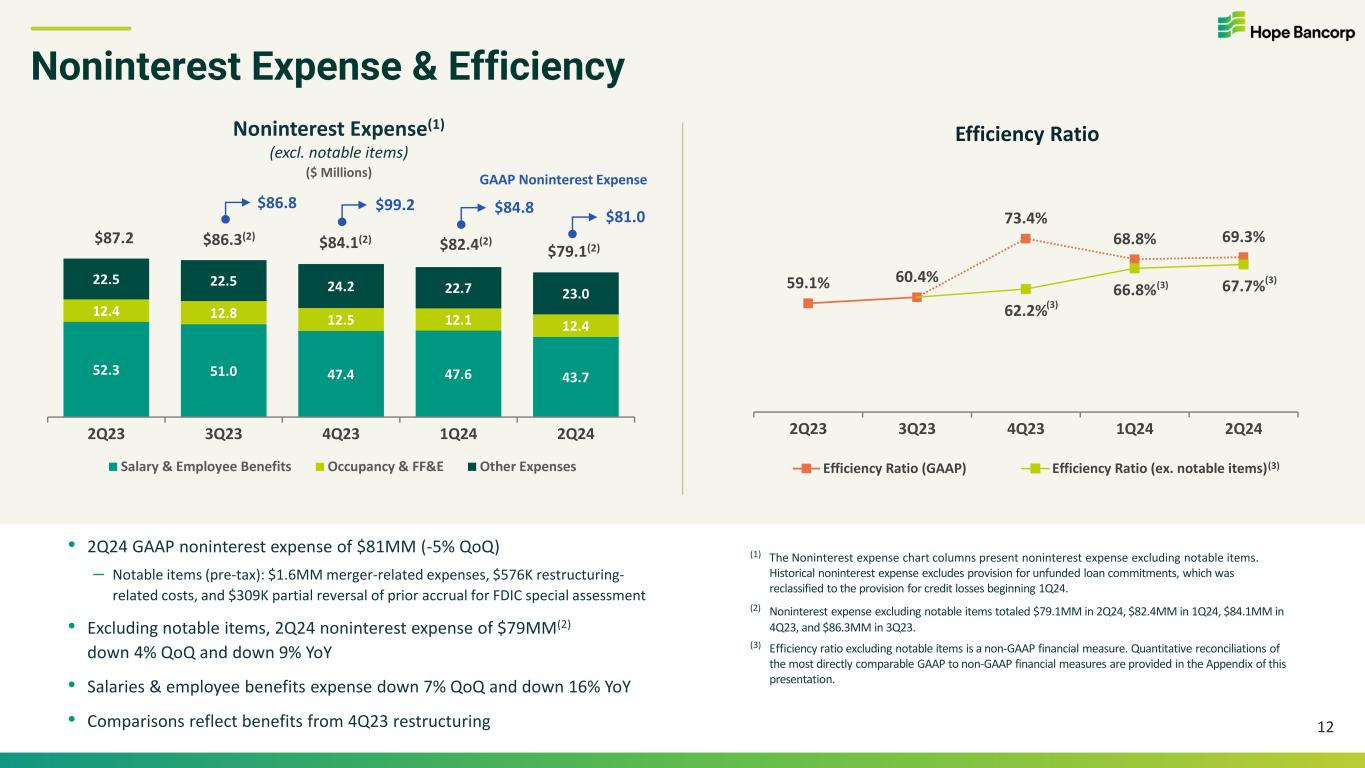

| Salaries and employee benefits | 44,107 | 47,577 | (7) | % | 52,305 | (16) | % | 91,684 | 109,474 | (16) | % | ||||||||||||||||||||||||||||||||||||

| Occupancy | 6,906 | 6,786 | 2 | % | 6,967 | (1) | % | 13,692 | 14,488 | (5) | % | ||||||||||||||||||||||||||||||||||||

| Furniture and equipment | 5,475 | 5,340 | 3 | % | 5,393 | 2 | % | 10,815 | 10,451 | 3 | % | ||||||||||||||||||||||||||||||||||||

| Data processing and communications | 2,997 | 2,990 | — | % | 2,917 | 3 | % | 5,987 | 5,739 | 4 | % | ||||||||||||||||||||||||||||||||||||

| FDIC assessment | 3,003 | 2,926 | 3 | % | 4,691 | (36) | % | 5,929 | 6,472 | (8) | % | ||||||||||||||||||||||||||||||||||||

| FDIC special assessment | (309) | 1,000 | N/A | — | 100 | % | 691 | — | 100 | % | |||||||||||||||||||||||||||||||||||||

| Earned interest credit | 6,139 | 5,834 | 5 | % | 5,090 | 21 | % | 11,973 | 9,517 | 26 | % | ||||||||||||||||||||||||||||||||||||

| Restructuring-related costs | 576 | 402 | 43 | % | — | 100 | % | 978 | — | 100 | % | ||||||||||||||||||||||||||||||||||||

| Merger-related costs | 1,589 | 1,044 | 52 | % | — | 100 | % | 2,633 | — | 100 | % | ||||||||||||||||||||||||||||||||||||

| Other noninterest expense | 10,504 | 10,940 | (4) | % | 9,860 | 7 | % | 21,444 | 19,816 | 8 | % | ||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 80,987 | 84,839 | (5) | % | 87,223 | (7) | % | 165,826 | 175,957 | (6) | % | ||||||||||||||||||||||||||||||||||||

| Income before income taxes | 34,544 | 35,894 | (4) | % | 51,470 | (33) | % | 70,438 | 104,272 | (32) | % | ||||||||||||||||||||||||||||||||||||

| Income tax provision | 9,274 | 10,030 | (8) | % | 13,448 | (31) | % | 19,304 | 27,129 | (29) | % | ||||||||||||||||||||||||||||||||||||

| Net income | $ | 25,270 | $ | 25,864 | (2) | % | $ | 38,022 | (34) | % | $ | 51,134 | $ | 77,143 | (34) | % | |||||||||||||||||||||||||||||||

| Earnings per common share – diluted | $ | 0.21 | $ | 0.21 | $ | 0.32 | $ | 0.42 | $ | 0.64 | |||||||||||||||||||||||||||||||||||||

| Weighted average shares outstanding – diluted | 120,939,429 | 121,020,292 | 120,129,359 | 120,964,149 | 120,179,443 | ||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Six Months Ended |

||||||||||||||||||||||||||||

| Profitability measures (annualized): | 6/30/2024 | 3/31/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||||||

| Return on average assets (“ROA”) | 0.59 | % | 0.54 | % | 0.74 | % | 0.56 | % | 0.78 | % | |||||||||||||||||||

ROA excluding notable items (1) |

0.62 | % | 0.58 | % | 0.74 | % | 0.60 | % | 0.78 | % | |||||||||||||||||||

| Return on average equity (“ROE”) | 4.82 | % | 4.87 | % | 7.34 | % | 4.84 | % | 7.49 | % | |||||||||||||||||||

ROE excluding notable items (1) |

5.07 | % | 5.19 | % | 7.34 | % | 5.13 | % | 7.49 | % | |||||||||||||||||||

Return on average tangible common equity (“ROTCE”) (1) |

6.20 | % | 6.24 | % | 9.49 | % | 6.22 | % | 9.70 | % | |||||||||||||||||||

ROTCE excluding notable items (1) |

6.53 | % | 6.66 | % | 9.49 | % | 6.59 | % | 9.70 | % | |||||||||||||||||||

| Net interest margin | 2.62 | % | 2.55 | % | 2.70 | % | 2.58 | % | 2.85 | % | |||||||||||||||||||

| Efficiency ratio (not annualized) | 69.26 | % | 68.79 | % | 59.05 | % | 69.02 | % | 60.14 | % | |||||||||||||||||||

Efficiency ratio excluding notable items (not annualized) (1) |

67.67 | % | 66.81 | % | 59.05 | % | 67.23 | % | 60.14 | % | |||||||||||||||||||

(1) ROA excluding notable items, ROE excluding notable items, ROTCE, ROTCE excluding notable items, and efficiency ratio excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the accompanying financial information on Table Pages 10 and 11. | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6/30/2024 | 3/31/2024 | 6/30/2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Annualized | Interest | Annualized | Interest | Annualized | ||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Income/ | Average | Average | Income/ | Average | Average | Income/ | Average | |||||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Yield/Cost | Balance | Expense | Yield/Cost | Balance | Expense | Yield/Cost | |||||||||||||||||||||||||||||||||||||||||||||

| INTEREST EARNING ASSETS: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

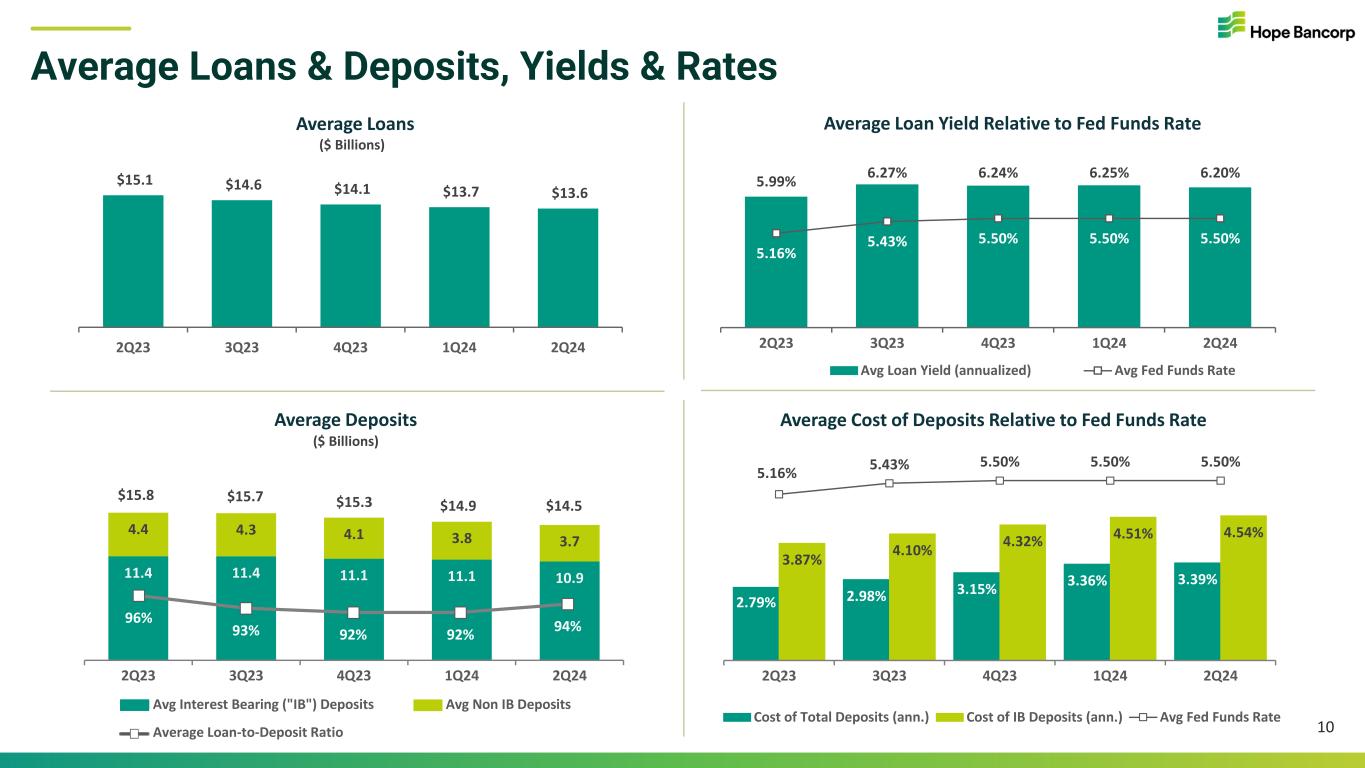

| Loans, including loans held for sale | $ | 13,591,936 | $ | 209,683 | 6.20 | % | $ | 13,746,219 | $ | 213,626 | 6.25 | % | $ | 15,105,212 | $ | 225,671 | 5.99 | % | |||||||||||||||||||||||||||||||||||

| Investment securities | 2,175,379 | 16,829 | 3.11 | % | 2,317,154 | 18,049 | 3.13 | % | 2,243,614 | 15,534 | 2.78 | % | |||||||||||||||||||||||||||||||||||||||||

| Interest earning cash and deposits at other banks |

428,062 | 5,284 | 4.96 | % | 2,019,769 | 27,183 | 5.41 | % | 1,996,924 | 25,295 | 5.08 | % | |||||||||||||||||||||||||||||||||||||||||

| FHLB stock and other investments | 48,463 | 805 | 6.68 | % | 48,136 | 816 | 6.82 | % | 47,044 | 684 | 5.83 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | $ | 16,243,840 | $ | 232,601 | 5.76 | % | $ | 18,131,278 | $ | 259,674 | 5.76 | % | $ | 19,392,794 | $ | 267,184 | 5.53 | % | |||||||||||||||||||||||||||||||||||

| INTEREST BEARING LIABILITIES: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Money market, interest bearing demand and savings |

$ | 4,948,708 | $ | 48,708 | 3.96 | % | $ | 5,072,782 | $ | 50,145 | 3.98 | % | $ | 4,495,879 | $ | 35,051 | 3.13 | % | |||||||||||||||||||||||||||||||||||

| Time deposits | 5,921,201 | 73,869 | 5.02 | % | 5,985,501 | 73,888 | 4.96 | % | 6,890,035 | 74,673 | 4.35 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing deposits | 10,869,909 | 122,577 | 4.54 | % | 11,058,283 | 124,033 | 4.51 | % | 11,385,914 | 109,724 | 3.87 | % | |||||||||||||||||||||||||||||||||||||||||

| FHLB and FRB borrowings | 219,402 | 1,430 | 2.62 | % | 1,683,334 | 17,853 | 4.27 | % | 2,177,264 | 23,622 | 4.35 | % | |||||||||||||||||||||||||||||||||||||||||

| Subordinated debentures and convertible notes |

104,822 | 2,734 | 10.32 | % | 104,493 | 2,741 | 10.38 | % | 199,744 | 3,149 | 6.24 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | $ | 11,194,133 | $ | 126,741 | 4.55 | % | $ | 12,846,110 | $ | 144,627 | 4.53 | % | $ | 13,762,922 | $ | 136,495 | 3.98 | % | |||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | 3,666,416 | 3,803,870 | 4,366,868 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total funding liabilities/cost of funds | $ | 14,860,549 | 3.43 | % | $ | 16,649,980 | 3.49 | % | $ | 18,129,790 | 3.02 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest income/net interest spread | $ | 105,860 | 1.21 | % | $ | 115,047 | 1.23 | % | $ | 130,689 | 1.55 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 2.62 | % | 2.55 | % | 2.70 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cost of deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | $ | 3,666,416 | $ | — | — | % | $ | 3,803,870 | $ | — | — | % | $ | 4,366,868 | $ | — | — | % | |||||||||||||||||||||||||||||||||||

| Interest bearing deposits | 10,869,909 | 122,577 | 4.54 | % | 11,058,283 | 124,033 | 4.51 | % | 11,385,914 | 109,724 | 3.87 | % | |||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 14,536,325 | $ | 122,577 | 3.39 | % | $ | 14,862,153 | $ | 124,033 | 3.36 | % | $ | 15,752,782 | $ | 109,724 | 2.79 | % | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Annualized | Interest | Annualized | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Income/ | Average | Average | Income/ | Average | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Yield/Cost | Balance | Expense | Yield/Cost | ||||||||||||||||||||||||||||||||||||||||||||||||

| INTEREST EARNING ASSETS: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans, including loans held for sale | $ | 13,669,078 | $ | 423,309 | 6.23 | % | $ | 15,169,939 | $ | 441,606 | 5.87 | % | |||||||||||||||||||||||||||||||||||||||||

| Investment securities | 2,246,266 | 34,878 | 3.12 | % | 2,246,033 | 30,659 | 2.75 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Interest earning cash and deposits at other banks |

1,223,916 | 32,467 | 5.33 | % | 1,239,343 | 30,217 | 4.92 | % | |||||||||||||||||||||||||||||||||||||||||||||

| FHLB stock and other investments | 48,299 | 1,621 | 6.75 | % | 47,044 | 1,379 | 5.91 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | $ | 17,187,559 | $ | 492,275 | 5.76 | % | $ | 18,702,359 | $ | 503,861 | 5.43 | % | |||||||||||||||||||||||||||||||||||||||||

| INTEREST BEARING LIABILITIES: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Money market, interest bearing demand and savings |

$ | 5,010,745 | $ | 98,852 | 3.97 | % | $ | 5,043,522 | $ | 77,276 | 3.09 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 5,953,351 | 147,758 | 4.99 | % | 6,220,422 | 124,796 | 4.05 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing deposits | 10,964,096 | 246,610 | 4.52 | % | 11,263,944 | 202,072 | 3.62 | % | |||||||||||||||||||||||||||||||||||||||||||||

| FHLB and FRB borrowings | 951,368 | 19,283 | 4.08 | % | 1,431,000 | 30,320 | 4.27 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debentures and convertible notes |

104,657 | 5,475 | 10.35 | % | 259,493 | 6,902 | 5.29 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | $ | 12,020,121 | $ | 271,368 | 4.54 | % | $ | 12,954,437 | $ | 239,294 | 3.73 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | 3,735,143 | 4,513,659 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total funding liabilities/cost of funds | $ | 15,755,264 | 3.46 | % | $ | 17,468,096 | 2.76 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Net interest income/net interest spread | $ | 220,907 | 1.22 | % | $ | 264,567 | 1.70 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 2.58 | % | 2.85 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | $ | 3,735,143 | $ | — | — | % | $ | 4,513,659 | $ | — | — | % | |||||||||||||||||||||||||||||||||||||||||

| Interest bearing deposits | 10,964,096 | 246,610 | 4.52 | % | 11,263,944 | 202,072 | 3.62 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 14,699,239 | $ | 246,610 | 3.37 | % | $ | 15,777,603 | $ | 202,072 | 2.58 | % | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES: | 6/30/2024 | 3/31/2024 | % change | 6/30/2023 | % change | 6/30/2024 | 6/30/2023 | % change | |||||||||||||||||||||||||||||||||||||||

| Gross loans, including loans held for sale | $ | 13,591,936 | $ | 13,746,219 | (1) | % | $ | 15,105,212 | (10) | % | $ | 13,669,078 | $ | 15,169,939 | (10) | % | |||||||||||||||||||||||||||||||

| Investment securities | 2,175,379 | 2,317,154 | (6) | % | 2,243,614 | (3) | % | 2,246,266 | 2,246,033 | — | % | ||||||||||||||||||||||||||||||||||||

| Interest earning cash and deposits at other banks | 428,062 | 2,019,769 | (79) | % | 1,996,924 | (79) | % | 1,223,916 | 1,239,343 | (1) | % | ||||||||||||||||||||||||||||||||||||

| Interest earning assets | 16,243,840 | 18,131,278 | (10) | % | 19,392,794 | (16) | % | 17,187,559 | 18,702,359 | (8) | % | ||||||||||||||||||||||||||||||||||||

| Goodwill and intangible assets | 467,822 | 468,229 | — | % | 469,515 | — | % | 468,026 | 469,752 | — | % | ||||||||||||||||||||||||||||||||||||

| Total assets | 17,256,638 | 19,140,775 | (10) | % | 20,468,810 | (16) | % | 18,198,707 | 19,781,806 | (8) | % | ||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | 3,666,416 | 3,803,870 | (4) | % | 4,366,868 | (16) | % | 3,735,143 | 4,513,659 | (17) | % | ||||||||||||||||||||||||||||||||||||

| Interest bearing deposits | 10,869,909 | 11,058,283 | (2) | % | 11,385,914 | (5) | % | 10,964,096 | 11,263,944 | (3) | % | ||||||||||||||||||||||||||||||||||||

| Total deposits | 14,536,325 | 14,862,153 | (2) | % | 15,752,782 | (8) | % | 14,699,239 | 15,777,603 | — | % | ||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities | 11,194,133 | 12,846,110 | (13) | % | 13,762,922 | (19) | % | 12,020,121 | 12,954,437 | (7) | % | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 2,097,108 | 2,126,333 | (1) | % | 2,072,859 | 1 | % | 2,111,720 | 2,059,583 | 3 | % | ||||||||||||||||||||||||||||||||||||

| LOAN PORTFOLIO COMPOSITION: | 6/30/2024 | 3/31/2024 | % change | 6/30/2023 | % change | ||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate (“CRE”) loans | $ | 8,679,515 | $ | 8,707,673 | — | % | $ | 9,192,160 | (6) | % | |||||||||||||||||||||||||||||||||||||

| Commercial and industrial (“C&I”) loans | 3,854,284 | 4,041,063 | (5) | % | 4,805,126 | (20) | % | ||||||||||||||||||||||||||||||||||||||||

| Residential mortgage and other loans | 1,033,203 | 970,442 | 6 | % | 867,524 | 19 | % | ||||||||||||||||||||||||||||||||||||||||

| Loans receivable | 13,567,002 | 13,719,178 | (1) | % | 14,864,810 | (9) | % | ||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 61,528 | 2,763 | NM | 49,246 | 25 | % | |||||||||||||||||||||||||||||||||||||||||

| Gross loans | 13,628,530 | 13,721,941 | (1) | % | 14,914,056 | (9) | % | ||||||||||||||||||||||||||||||||||||||||

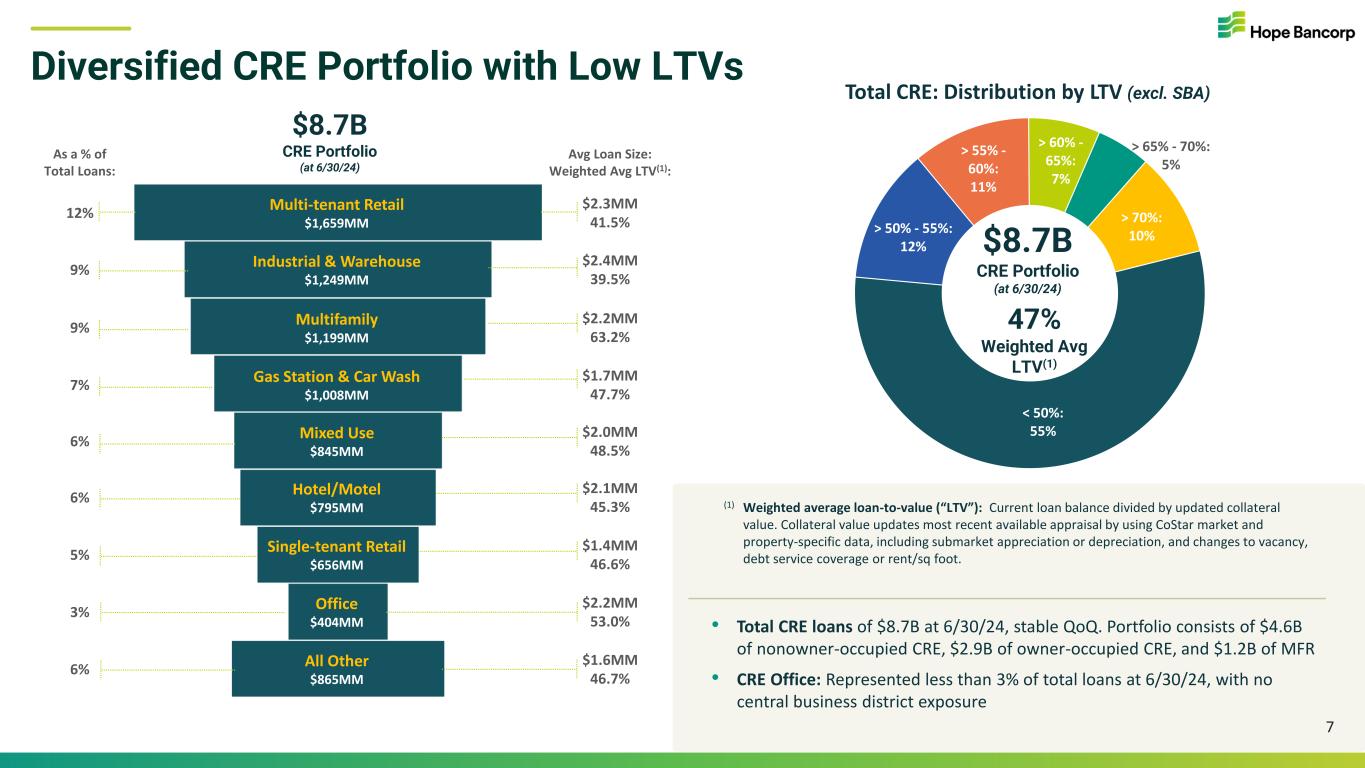

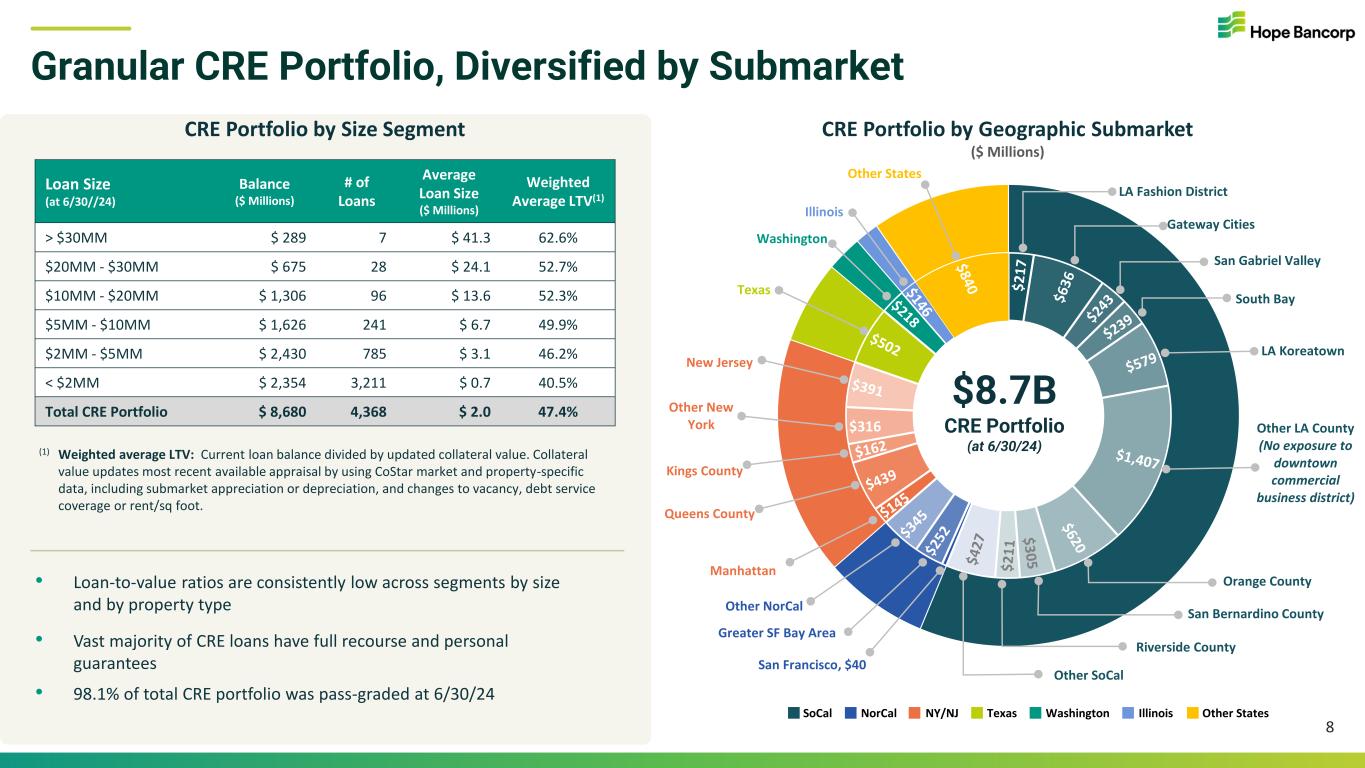

| CRE LOANS BY PROPERTY TYPE: | 6/30/2024 | 3/31/2024 | % change | 6/30/2023 | % change | ||||||||||||||||||||||||||||||||||||||||||

| Multi-tenant retail | $ | 1,659,083 | $ | 1,666,153 | — | % | $ | 1,778,068 | (7) | % | |||||||||||||||||||||||||||||||||||||

| Industrial warehouses | 1,249,255 | 1,221,852 | 2 | % | 1,301,075 | (4) | % | ||||||||||||||||||||||||||||||||||||||||

| Multifamily | 1,199,215 | 1,212,941 | (1) | % | 1,257,971 | (5) | % | ||||||||||||||||||||||||||||||||||||||||

| Gas stations and car washes | 1,007,680 | 1,013,708 | (1) | % | 1,042,290 | (3) | % | ||||||||||||||||||||||||||||||||||||||||

| Mixed-use facilities | 844,993 | 861,613 | (2) | % | 834,948 | 1 | % | ||||||||||||||||||||||||||||||||||||||||

| Hotels/motels | 795,253 | 786,198 | 1 | % | 868,286 | (8) | % | ||||||||||||||||||||||||||||||||||||||||

| Single-tenant retail | 655,540 | 667,898 | (2) | % | 690,418 | (5) | % | ||||||||||||||||||||||||||||||||||||||||

| Office | 403,861 | 401,392 | 1 | % | 463,998 | (13) | % | ||||||||||||||||||||||||||||||||||||||||

| All other | 864,635 | 875,918 | (1) | % | 955,106 | (9) | % | ||||||||||||||||||||||||||||||||||||||||

| Total CRE loans | $ | 8,679,515 | $ | 8,707,673 | — | % | $ | 9,192,160 | (6) | % | |||||||||||||||||||||||||||||||||||||

| DEPOSIT COMPOSITION: | 6/30/2024 | 3/31/2024 | % change | 6/30/2023 | % change | ||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | $ | 3,671,192 | $ | 3,652,592 | 1 | % | $ | 4,229,247 | (13) | % | |||||||||||||||||||||||||||||||||||||

| Money market, interest bearing demand, and savings | 4,907,860 | 5,313,064 | (8) | % | 4,413,079 | 11 | % | ||||||||||||||||||||||||||||||||||||||||

| Time deposits | 6,132,419 | 5,787,761 | 6 | % | 6,977,026 | (12) | % | ||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 14,711,471 | $ | 14,753,417 | — | % | $ | 15,619,352 | (6) | % | |||||||||||||||||||||||||||||||||||||

| CAPITAL & CAPITAL RATIOS: | 6/30/2024 | 3/31/2024 | 6/30/2023 | ||||||||||||||||||||||||||||||||||||||

| Total stockholders’ equity | $ | 2,111,282 | $ | 2,112,270 | $ | 2,067,998 | |||||||||||||||||||||||||||||||||||

| Total capital | $ | 2,137,513 | $ | 2,130,033 | $ | 2,102,625 | |||||||||||||||||||||||||||||||||||

| Common equity tier 1 ratio | 12.70 | % | 12.47 | % | 11.05 | % | |||||||||||||||||||||||||||||||||||

| Tier 1 capital ratio | 13.40 | % | 13.17 | % | 11.68 | % | |||||||||||||||||||||||||||||||||||

| Total capital ratio | 14.42 | % | 14.19 | % | 12.64 | % | |||||||||||||||||||||||||||||||||||

| Leverage ratio | 11.61 | % | 10.42 | % | 9.57 | % | |||||||||||||||||||||||||||||||||||

| Total risk weighted assets | $ | 14,828,070 | $ | 15,011,661 | $ | 16,640,323 | |||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 17.49 | $ | 17.51 | $ | 17.23 | |||||||||||||||||||||||||||||||||||

Tangible common equity (“TCE”) per share (1) |

$ | 13.61 | $ | 13.63 | $ | 13.32 | |||||||||||||||||||||||||||||||||||

TCE ratio (1) |

9.72 | % | 9.33 | % | 8.04 | % | |||||||||||||||||||||||||||||||||||

(1) TCE per share and TCE ratio are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the accompanying financial information on Table Page 10. | |||||||||||||||||||||||||||||||||||||||||

| ALLOWANCE FOR CREDIT LOSSES CHANGES: | Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||||||||

| 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 6/30/2024 | 6/30/2023 | |||||||||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 158,758 | $ | 158,694 | $ | 158,809 | $ | 172,996 | $ | 163,544 | $ | 158,694 | $ | 162,359 | |||||||||||||||||||||||||||

| ASU 2022-02 day 1 adoption impact | — | — | — | — | — | — | (407) | ||||||||||||||||||||||||||||||||||

| Provision for credit losses on loans | 1,700 | 3,600 | 1,700 | 16,800 | 8,900 | 5,300 | 10,600 | ||||||||||||||||||||||||||||||||||

| Recoveries | 2,099 | 1,184 | 306 | 2,938 | 1,531 | 3,283 | 1,918 | ||||||||||||||||||||||||||||||||||

| Charge offs | (6,538) | (4,720) | (2,121) | (33,925) | (979) | (11,258) | (1,474) | ||||||||||||||||||||||||||||||||||

| Balance at end of period | $ | 156,019 | $ | 158,758 | $ | 158,694 | $ | 158,809 | $ | 172,996 | $ | 156,019 | $ | 172,996 | |||||||||||||||||||||||||||

| 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | |||||||||||||||||||||||||||||||||||||

| Allowance for unfunded loan commitments | $ | 2,543 | $ | 2,843 | $ | 3,843 | $ | 3,143 | $ | 3,081 | |||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 6/30/2024 | 6/30/2023 | |||||||||||||||||||||||||||||||||||

| Provision for credit losses on loans | $ | 1,700 | $ | 3,600 | $ | 1,700 | $ | 16,800 | $ | 8,900 | $ | 5,300 | $ | 10,600 | |||||||||||||||||||||||||||

| (Credit) provision for unfunded loan commitments | (300) | (1,000) | 700 | 62 | 110 | (1,300) | 1,730 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | $ | 1,400 | $ | 2,600 | $ | 2,400 | $ | 16,862 | $ | 9,010 | $ | 4,000 | $ | 12,330 | |||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| NET LOAN CHARGE OFFS (RECOVERIES): | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||||||||||||||||

| CRE loans | $ | 514 | $ | (497) | $ | 1,560 | $ | (2,227) | $ | 438 | $ | 17 | $ | 329 | |||||||||||||||||||||||||||

| C&I loans | 3,900 | 4,072 | 138 | 33,145 | (1,091) | 7,972 | (895) | ||||||||||||||||||||||||||||||||||

| Residential mortgage and other loans | 25 | (39) | 117 | 69 | 101 | (14) | 122 | ||||||||||||||||||||||||||||||||||

| Net loan charge offs (recoveries) | $ | 4,439 | $ | 3,536 | $ | 1,815 | $ | 30,987 | $ | (552) | $ | 7,975 | $ | (444) | |||||||||||||||||||||||||||

| Net charge offs (recoveries)/average loans (annualized) | 0.13 | % | 0.10 | % | 0.05 | % | 0.85 | % | (0.01) | % | 0.12 | % | (0.01) | % | |||||||||||||||||||||||||||

| NONPERFORMING ASSETS: | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||||||||||||

Loans on nonaccrual status (1) |

$ | 67,003 | $ | 59,526 | $ | 45,204 | $ | 39,081 | $ | 61,252 | |||||||||||||||||||

| Accruing delinquent loans past due 90 days or more | 273 | 47,290 | 261 | 21,579 | 15,182 | ||||||||||||||||||||||||

| Total nonperforming loans | 67,276 | 106,816 | 45,465 | 60,660 | 76,434 | ||||||||||||||||||||||||

| Other real estate owned (“OREO”) | — | — | 63 | 1,043 | 938 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 67,276 | $ | 106,816 | $ | 45,528 | $ | 61,703 | $ | 77,372 | |||||||||||||||||||

| Nonperforming assets/total assets | 0.39 | % | 0.59 | % | 0.24 | % | 0.31 | % | 0.38 | % | |||||||||||||||||||

| Nonperforming loans/loans receivable | 0.50 | % | 0.78 | % | 0.33 | % | 0.42 | % | 0.51 | % | |||||||||||||||||||

| Nonaccrual loans/loans receivable | 0.49 | % | 0.43 | % | 0.33 | % | 0.27 | % | 0.41 | % | |||||||||||||||||||

| Allowance for credit losses/loans receivable | 1.15 | % | 1.16 | % | 1.15 | % | 1.11 | % | 1.16 | % | |||||||||||||||||||

| Allowance for credit losses/nonperforming loans | 231.91 | % | 148.63 | % | 349.05 | % | 261.80 | % | 226.33 | % | |||||||||||||||||||

(1) Excludes delinquent SBA loans that are guaranteed and currently in liquidation totaling $11.2 million, $10.9 million, $11.4 million, $12.1 million, and $11.9 million, at June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, and June 30, 2023, respectively. |

|||||||||||||||||||||||||||||

| NONACCRUAL LOANS BY TYPE: | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||||||||||||

| CRE loans | $ | 27,292 | $ | 37,836 | $ | 33,932 | $ | 26,687 | $ | 29,270 | |||||||||||||||||||

| C&I loans | 33,456 | 15,070 | 5,013 | 4,234 | 23,042 | ||||||||||||||||||||||||

| Residential mortgage and other loans | 6,255 | 6,620 | 6,259 | 8,160 | 8,940 | ||||||||||||||||||||||||

| Total nonaccrual loans | $ | 67,003 | $ | 59,526 | $ | 45,204 | $ | 39,081 | $ | 61,252 | |||||||||||||||||||

| ACCRUING DELINQUENT LOANS 30-89 DAYS PAST DUE: | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||||||||||||

| 30 - 59 days past due | $ | 9,073 | $ | 2,273 | $ | 2,833 | $ | 2,906 | $ | 9,295 | |||||||||||||||||||

| 60 - 89 days past due | 552 | 313 | 1,289 | 506 | 178 | ||||||||||||||||||||||||

| Total accruing delinquent loans 30-89 days past due | $ | 9,625 | $ | 2,586 | $ | 4,122 | $ | 3,412 | $ | 9,473 | |||||||||||||||||||

| ACCRUING DELINQUENT LOANS 30-89 DAYS PAST DUE BY TYPE: | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||||||||||||

| CRE loans | $ | 5,586 | $ | 1,639 | $ | 2,160 | $ | 611 | $ | 7,339 | |||||||||||||||||||

| C&I loans | 2,530 | 551 | 1,643 | 1,168 | 990 | ||||||||||||||||||||||||

| Residential mortgage and other loans | 1,509 | 396 | 319 | 1,633 | 1,144 | ||||||||||||||||||||||||

| Total accruing delinquent loans 30-89 days past due | $ | 9,625 | $ | 2,586 | $ | 4,122 | $ | 3,412 | $ | 9,473 | |||||||||||||||||||

| CRITICIZED LOANS: | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||||||||||||

| Special mention loans | $ | 204,167 | $ | 215,183 | $ | 178,992 | $ | 186,600 | $ | 210,806 | |||||||||||||||||||

| Substandard loans | 243,635 | 206,350 | 143,449 | 174,161 | 134,203 | ||||||||||||||||||||||||

| Total criticized loans | $ | 447,802 | $ | 421,533 | $ | 322,441 | $ | 360,761 | $ | 345,009 | |||||||||||||||||||

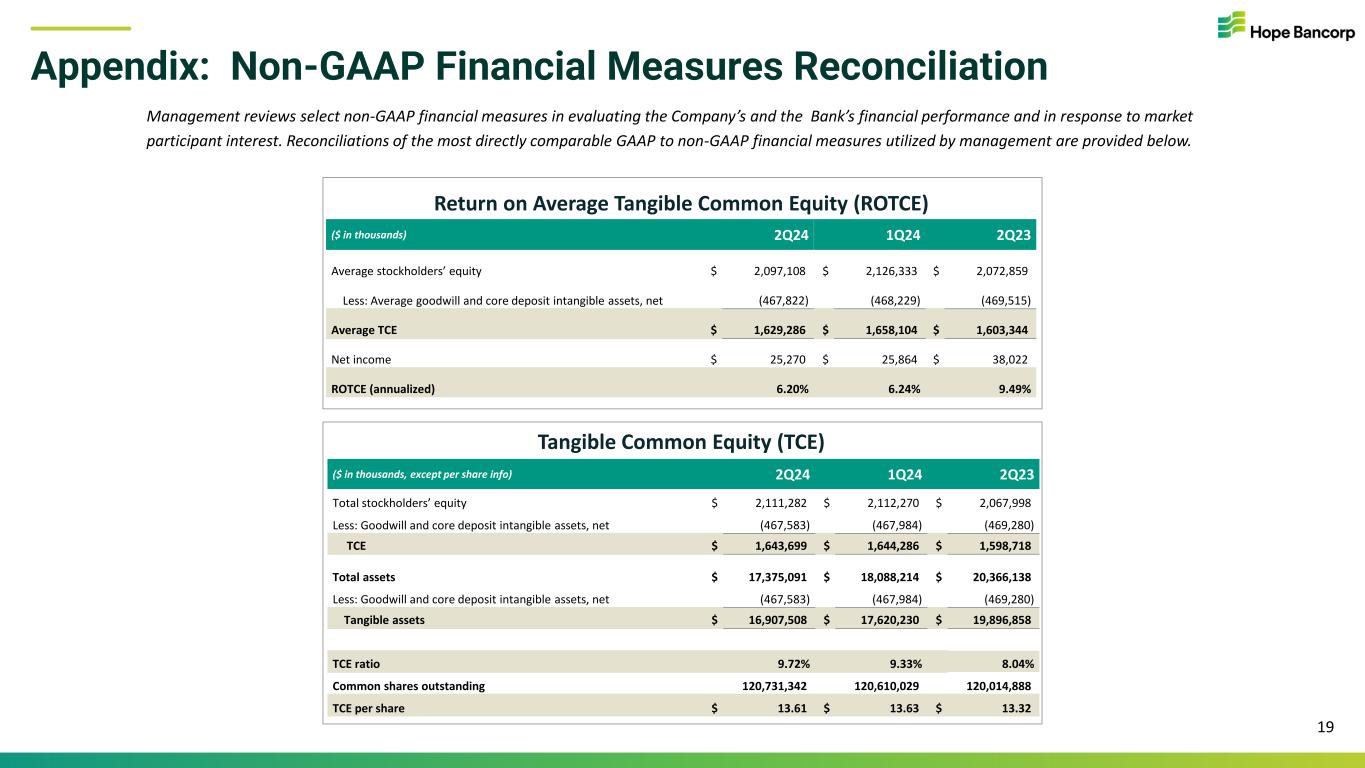

| Reconciliation of GAAP financial measures to non-GAAP financial measures | |||||||||||||||||||||||||||||

Management reviews select non-GAAP financial measures in evaluating the Company’s and the Bank’s financial performance and in response to market participant interest. Reconciliations of the most directly comparable GAAP to non-GAAP financial measures utilized by management are provided below. | |||||||||||||||||||||||||||||

| TANGIBLE COMMON EQUITY (“TCE”) | 6/30/2024 | 3/31/2024 | 6/30/2023 | ||||||||||||||||||||||||||

| Total stockholders’ equity | $ | 2,111,282 | $ | 2,112,270 | $ | 2,067,998 | |||||||||||||||||||||||

| Less: Goodwill and core deposit intangible assets, net | (467,583) | (467,984) | (469,280) | ||||||||||||||||||||||||||

| TCE | $ | 1,643,699 | $ | 1,644,286 | $ | 1,598,718 | |||||||||||||||||||||||

| Total assets | $ | 17,375,091 | $ | 18,088,214 | $ | 20,366,138 | |||||||||||||||||||||||

| Less: Goodwill and core deposit intangible assets, net | (467,583) | (467,984) | (469,280) | ||||||||||||||||||||||||||

| Tangible assets | $ | 16,907,508 | $ | 17,620,230 | $ | 19,896,858 | |||||||||||||||||||||||

| TCE ratio | 9.72 | % | 9.33 | % | 8.04 | % | |||||||||||||||||||||||

| Common shares outstanding | 120,731,342 | 120,610,029 | 120,014,888 | ||||||||||||||||||||||||||

| TCE per share | $ | 13.61 | $ | 13.63 | $ | 13.32 | |||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| RETURN ON AVERAGE TANGIBLE COMMON EQUITY | 6/30/2024 | 3/31/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||||||

| Average stockholders’ equity | $ | 2,097,108 | $ | 2,126,333 | $ | 2,072,859 | $ | 2,111,720 | $ | 2,059,583 | |||||||||||||||||||

| Less: Average goodwill and core deposit intangible assets, net | (467,822) | (468,229) | (469,515) | (468,026) | (469,752) | ||||||||||||||||||||||||

| Average TCE | $ | 1,629,286 | $ | 1,658,104 | $ | 1,603,344 | $ | 1,643,694 | $ | 1,589,831 | |||||||||||||||||||

| Net income | $ | 25,270 | $ | 25,864 | $ | 38,022 | $ | 51,134 | $ | 77,143 | |||||||||||||||||||

| ROTCE (annualized) | 6.20 | % | 6.24 | % | 9.49 | % | 6.22 | % | 9.70 | % | |||||||||||||||||||

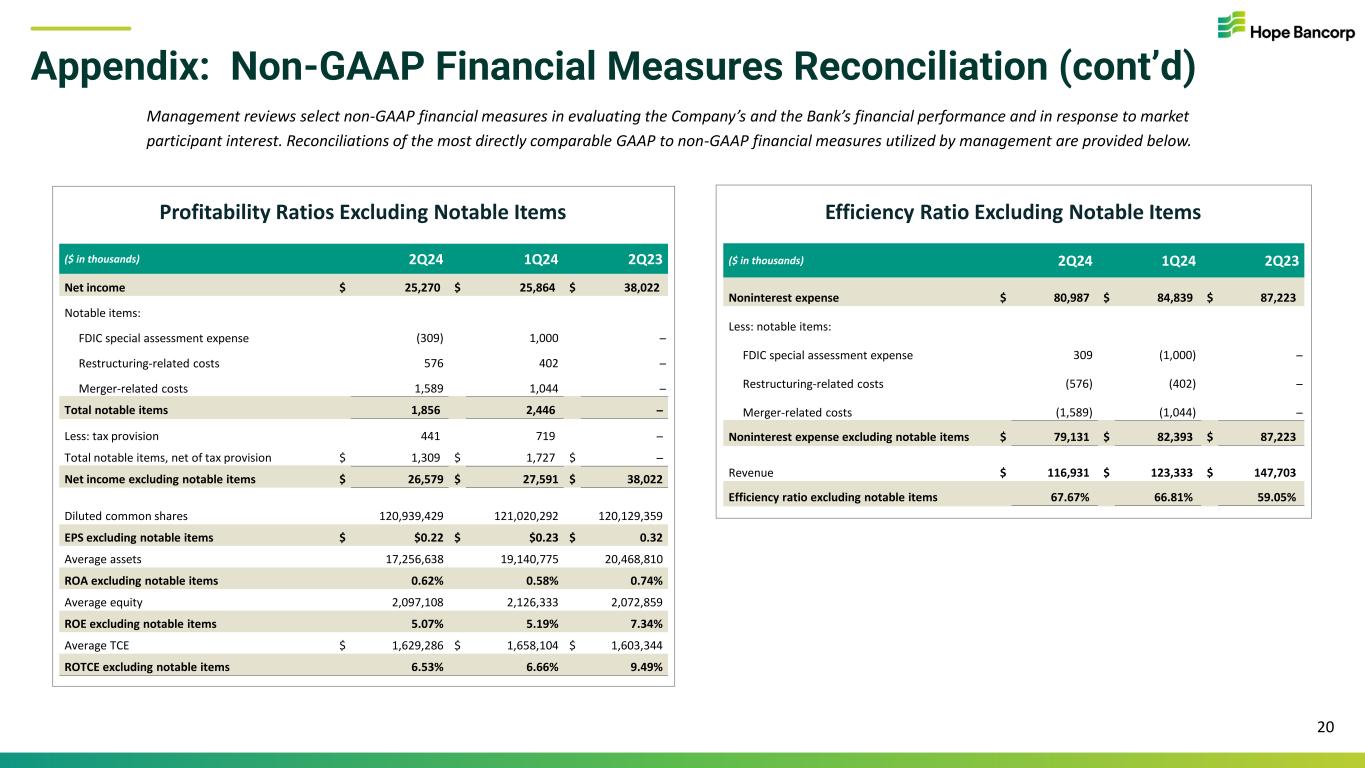

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| PROFITABILITY RATIOS EXCLUDING NOTABLE ITEMS | 6/30/2024 | 3/31/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||||||

| Net income | $ | 25,270 | $ | 25,864 | $ | 38,022 | $ | 51,134 | $ | 77,143 | |||||||||||||||||||

| Notable items: | |||||||||||||||||||||||||||||

| FDIC special assessment expense | (309) | 1,000 | — | 691 | — | ||||||||||||||||||||||||

| Restructuring-related costs | 576 | 402 | — | 978 | — | ||||||||||||||||||||||||

| Merger-related costs | 1,589 | 1,044 | — | 2,633 | — | ||||||||||||||||||||||||

| Total notable items | 1,856 | 2,446 | — | 4,302 | — | ||||||||||||||||||||||||

| Less: tax provision | 547 | 719 | — | 1,266 | — | ||||||||||||||||||||||||

| Total notable items, net of tax provision | $ | 1,309 | $ | 1,727 | $ | — | $ | 3,036 | $ | — | |||||||||||||||||||

| Net income excluding notable items | $ | 26,579 | $ | 27,591 | $ | 38,022 | $ | 54,170 | $ | 77,143 | |||||||||||||||||||

| Diluted common shares | 120,939,429 | 121,020,292 | 120,129,359 | 120,964,149 | 120,179,443 | ||||||||||||||||||||||||

| EPS excluding notable items | $ | 0.22 | $ | 0.23 | $ | 0.32 | $ | 0.45 | $ | 0.64 | |||||||||||||||||||

| Average Assets | $ | 17,256,638 | $ | 19,140,775 | $ | 20,468,810 | $ | 18,198,707 | $ | 19,781,806 | |||||||||||||||||||

| ROA excluding notable items | 0.62 | % | 0.58 | % | 0.74 | % | 0.60 | % | 0.78 | % | |||||||||||||||||||

| Average Equity | $ | 2,097,108 | $ | 2,126,333 | $ | 2,072,859 | $ | 2,111,720 | $ | 2,059,583 | |||||||||||||||||||

| ROE excluding notable items | 5.07 | % | 5.19 | % | 7.34 | % | 5.13 | % | 7.49 | % | |||||||||||||||||||

| Average TCE | $ | 1,629,286 | $ | 1,658,104 | $ | 1,603,344 | $ | 1,643,694 | $ | 1,589,831 | |||||||||||||||||||

| ROTCE excluding notable items | 6.53 | % | 6.66 | % | 9.49 | % | 6.59 | % | 9.70 | % | |||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| EFFICIENCY RATIO EXCLUDING NOTABLE ITEMS | 6/30/2024 | 3/31/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||||||

| Noninterest expense | $ | 80,987 | $ | 84,839 | $ | 87,223 | $ | 165,826 | $ | 175,957 | |||||||||||||||||||

| Less: notable items: | |||||||||||||||||||||||||||||

| FDIC special assessment expense | 309 | (1,000) | — | (691) | — | ||||||||||||||||||||||||

| Restructuring-related costs | (576) | (402) | — | (978) | — | ||||||||||||||||||||||||

| Merger-related costs | (1,589) | (1,044) | — | (2,633) | — | ||||||||||||||||||||||||

| Noninterest expense excluding notable items | $ | 79,131 | $ | 82,393 | $ | 87,223 | $ | 161,524 | $ | 175,957 | |||||||||||||||||||

| Revenue | $ | 116,931 | $ | 123,333 | $ | 147,703 | $ | 240,264 | $ | 292,559 | |||||||||||||||||||

| Efficiency ratio excluding notable items | 67.67 | % | 66.81 | % | 59.05 | % | 67.23 | % | 60.14 | % | |||||||||||||||||||

Julianna Balicka |

Angie Yang |

|||||||

| EVP & Chief Financial Officer | SVP, Director of Investor Relations & Corporate Communications |

|||||||

213-235-3235 |

213-251-2219 |

|||||||

julianna.balicka@bankofhope.com |

angie.yang@bankofhope.com |

|||||||