Financial Report Grupo Financiero Galicia S.A. 20244th. quarter

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima This report is a summary analysis of Grupo Galicia’s financial condition and results of operations as of and for the periods indicated above. For a correct interpretation, this report must be read in conjunction with GFG’s financial statements, as well as with all other information periodically filed with the National Securities Commission (www.cnv.gob.ar), BYMA (www.byma.com.ar) and the Nasdaq (www.nasdaq.com). Readers of this report must note that this is a free translation made from an original version written and expressed in Spanish. Therefore, any matters of interpretation should be referred to the original version in Spanish. Grupo Galicia Buenos Aires, Argentina, February 28, 2025, Grupo Financiero Galicia S.A. (“Grupo Galicia” o “GFG”, BYMA/NASDAQ: GGAL), announced its financial results for the fourth quarter, ended on December 31, 2024. Gonzalo Fernández Covaro Chief Financial Officer Conference Call February 28, 2025 11:00 am (Eastern Time) 1:00 pm (Argentina) To participate, register here. Pablo Firvida Head of Investor Relations The information in this report was adjusted and restated to constant currency, in accordance with IAS 29 “Financial Information in Hyperinflationary Economies” except otherwise noted. Grupo Financiero Galicia

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima 3 Galicia Más On April 9, 2024, Banco Galicia and Grupo Galicia entered into an agreement with HSBC to acquire HSBC's business in Argentina. On December 6, 2024, the transaction was closed, with the Bank acquiring 57.89% and Grupo Galicia the remaining 42.11%. In this way, Banco Galicia and Grupo Galicia acquired HSBC's business in Argentina, which includes the Bank, a mutual fund manager and two insurance companies. The acquisition price was set at US$475 million, the Bank paid an amount equivalent to US$275 million, and Grupo Galicia paid with 113,821,610 class B shares issued in favor of HSBC (represented in American Depositary Receipts –“ADRs”). Additionally, Grupo Galicia acquired a subordinated debt issued by Banco GGAL for a nominal value of US$100 million. This price was adjusted based on parameters established in the Agreement, which are usual in this type of transaction. This price adjustment was paid and capitalized through the issuance of 17,740,028 Class B shares of Grupo Galicia. The impact on results of this transaction amounted to Ps.724,525 million, which corresponds to the difference between the fair value of the acquired company and the amount paid. In this way, Grupo Galicia will consolidate its position as the largest private financial group in Argentina, confirming its commitment to the development and sustainable growth of the country. This operation thus allows the Group to generate economies of scale and strengthen its value proposition around the three strategic pillars - experience, growth and profitability - and thus continue to differentiate itself from the competition, improve the daily life of customers and complement the product offering, generating capabilities for the development of businesses and interest groups. Furthermore, the acquisition of life and retirement insurance businesses represents a strategic move in the insurance sector, adding two product segments with great potential to the Group's portfolio. This opportunity represents an excellent proposal to continue adding assets and businesses, strengthening our economic and financial position; solvency and liquidity; and the sustainability of the organization. In this report you will find information about: • Grupo Galicia consolidated • Banco Galicia individual • Banco Galicia consolidated with Galicia Más • Banco Galicia Más

Financial Report Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Grupo Galicia includes Banco de Galicia y Buenos Aires S.A.U. (Galicia), GGAL Holdings S.A. (Galicia Más), Tarjetas Regionales S.A. (Naranja X), Sudamericana Holding S.A. (Galicia Seguros), Galicia Asset Management S.A.U. (Fondos Fima), IGAM LLC (Inviu), Galicia Securities S.A.U., Agri Tech Investments LLC (Nera), Galicia Investments LLC, Galicia Ventures LP and Galicia Holdings US, Inc. It is one of the main financial services holding companies in the country. It provides savings, credit and investment opportunities to people and companies, and its board of directors has a high commitment in customer experience and sustainable development.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Ps.1,618,596 million Net income for the year attributable to Grupo Galicia +121% vs. 12M 2023 Net profit per share 4Q24 Ps.361.58 Capital Ratio 21.61% ROE 33.98% +1,659 bp vs. 12M 2023 Efficiency 46.91% -668 bp vs. 12M 2023 Employees 12,179 Branches and other points of sale 521 Deposits accounts In thousands 16,176 Credit cards In thousands 15,494 5 Ps.574,380 million Net income for the quarter attributable to Grupo Galicia +203% vs. 4Q 2023 ROE 44.98% +2,796 bp vs. 4Q 2023 Efficiency 77.82% +2,888 bp vs. 4Q 2023 Highlights Nera Market share: Loans to the private sector(1) 16.43% Market share: Deposits to the private sector(1) 14.68% (1) Market share calculated for Banco Galicia, Naranja X (Naranja Digital) and Banco Galicia Más.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Selected ratios Percentages 2024 2024 2023 Variation (bp) 4Q 3Q 4Q vs.3Q24 vs.4Q23 ROA 7.92 3.14 3.49 478 443 ROE 44.98 15.26 17.02 2,972 2,796 Financial Margin 23.15 28.61 63.63 (546) (4,048) Efficiency ratio (1) 77.82 49.99 48.94 2,783 2,888 Capital ratio (2) 21.61 24.51 23.74 (290) (213) NPL Ratio 2.36 2.66 2.45 (30) (9) Allowance for loan losses / Private-sector financing 4.28 4.20 3.67 8 61 Coverage 181.56 157.70 149.35 2,386 3,221 Non-accrual portfolio with guarantees to non-accrual portfolio 5.40 3.68 4.74 172 66 Cost of risk 10.99 7.38 6.51 361 448 6 Selected financial information (1) The efficiency ratio excluding the restructuring provision is 50.17% (2) Galicia consolidated with Naranja X and Galicia Más

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Net income attributable to Grupo Galicia for the fiscal year 2024 amounted to Ps.1,618,596 million, which represented a 6.97% return on average assets and a 33.98% return on average shareholder’s equity. Said result is mainly due to profits from its interest in Galicia (Ps.1,326,626 million), in Naranja X (Ps.227,914 million), in Fondos Fima (Ps.68,250 million), offset by a loss in Galicia Seguros (Ps.8,107 million). The result for the year includes a result of Ps.724,525 million as a result of the acquisition of HSBC's businesses in Argentina. This result, net of adjustments and provisions related to the transaction, totaled Ps.485,060 million. 7 Results of the main companies Results for the fiscal year 1,326,626 227,914 (8,107) 68,250 615,777 29,892 17,854 53,794 2024 2023 Galicia Naranja X Galicia Seguros Fondos Fima

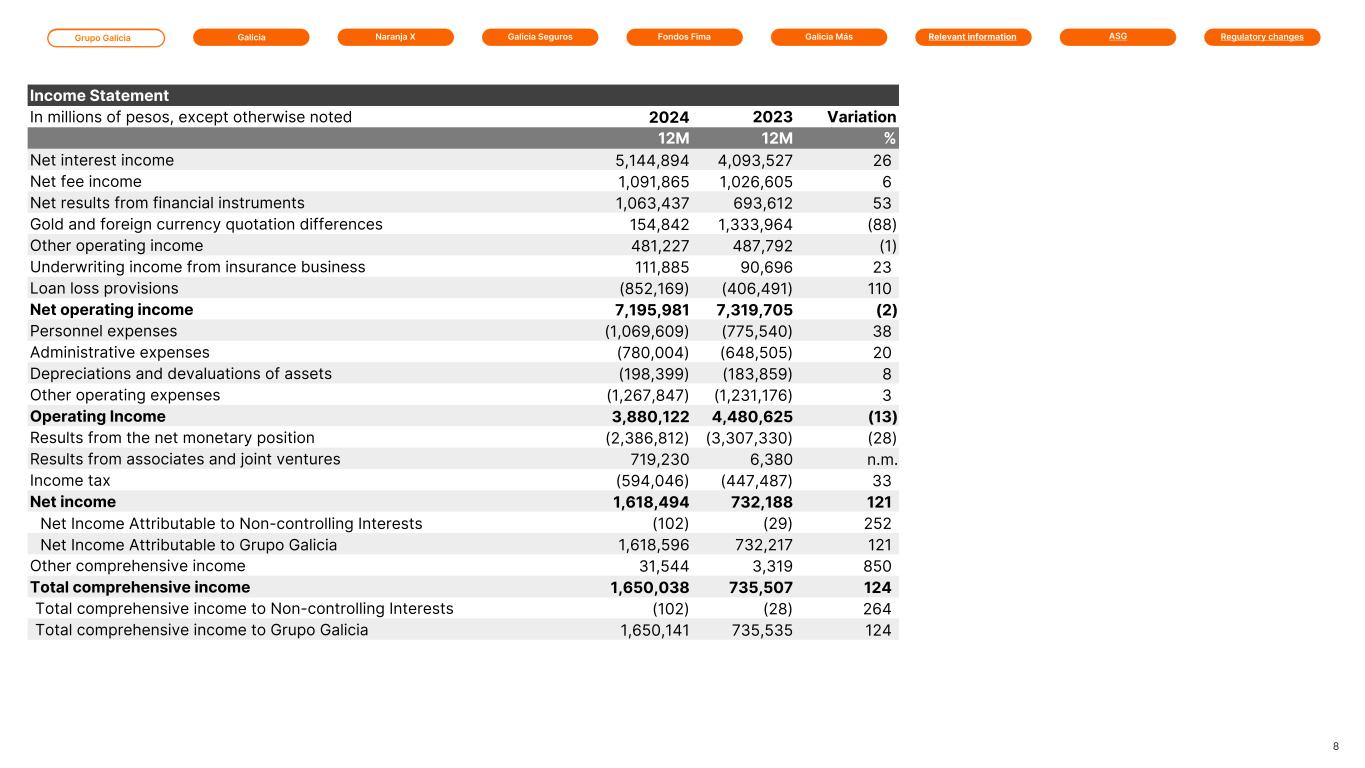

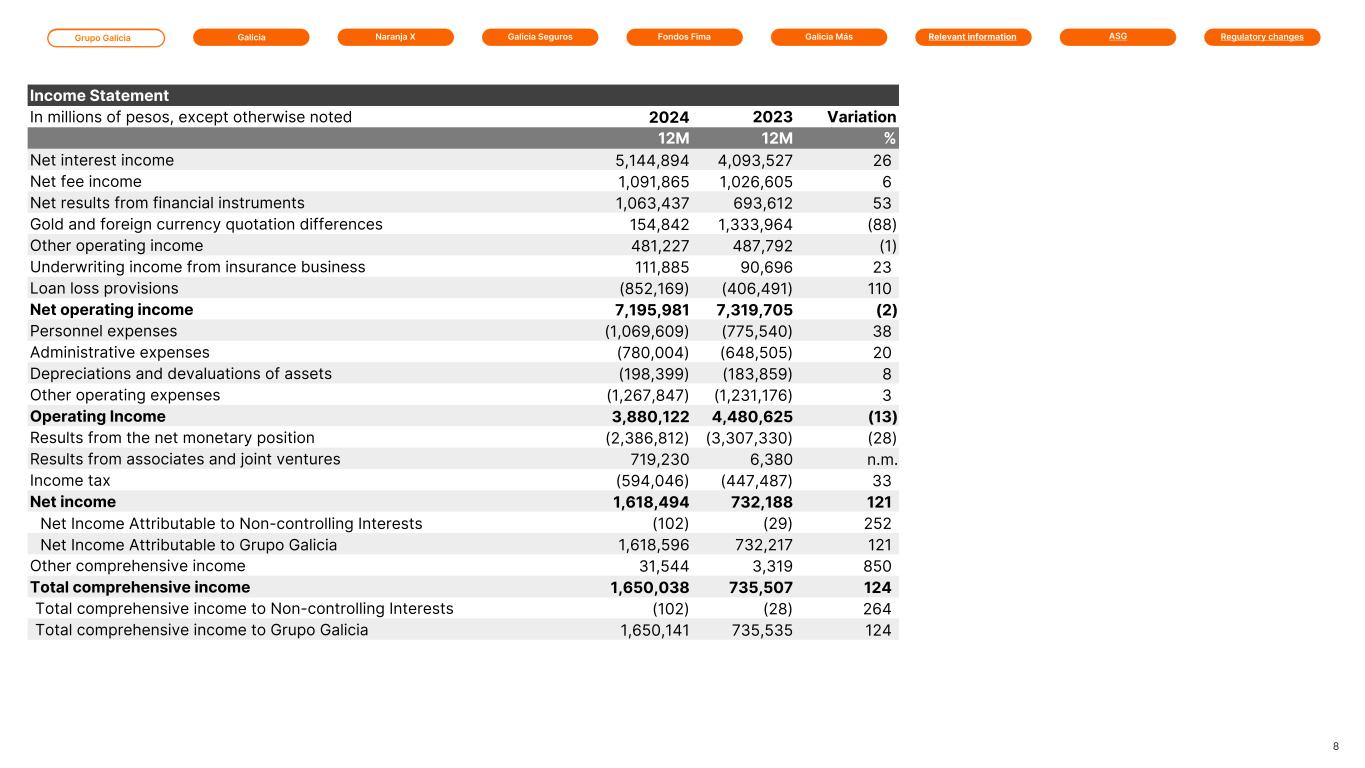

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2023 Variation 12M 12M % Net interest income 5,144,894 4,093,527 26 Net fee income 1,091,865 1,026,605 6 Net results from financial instruments 1,063,437 693,612 53 Gold and foreign currency quotation differences 154,842 1,333,964 (88) Other operating income 481,227 487,792 (1) Underwriting income from insurance business 111,885 90,696 23 Loan loss provisions (852,169) (406,491) 110 Net operating income 7,195,981 7,319,705 (2) Personnel expenses (1,069,609) (775,540) 38 Administrative expenses (780,004) (648,505) 20 Depreciations and devaluations of assets (198,399) (183,859) 8 Other operating expenses (1,267,847) (1,231,176) 3 Operating Income 3,880,122 4,480,625 (13) Results from the net monetary position (2,386,812) (3,307,330) (28) Results from associates and joint ventures 719,230 6,380 n.m. Income tax (594,046) (447,487) 33 Net income 1,618,494 732,188 121 Net Income Attributable to Non-controlling Interests (102) (29) 252 Net Income Attributable to Grupo Galicia 1,618,596 732,217 121 Other comprehensive income 31,544 3,319 850 Total comprehensive income 1,650,038 735,507 124 Total comprehensive income to Non-controlling Interests (102) (28) 264 Total comprehensive income to Grupo Galicia 1,650,141 735,535 124 8

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Net income attributable to Grupo Galicia for the quarter amounted to Ps.574,380 million, which represented a 7.92% annualized return on average assets and a 44.98% annualized return on average shareholder’s equity. Said result was mainly due to profits from its interest in Galicia (Ps.527,412 million), in Naranja X (Ps.23,329 million), and in Fondos Fima (Ps.19,283 million), offset by a loss in Galicia Seguros (Ps.3,902 million). The result for the quarter includes a result of Ps.724,525 million as a result of the acquisition of HSBC's businesses in Argentina. his result, net of adjustments and provisions related to the transaction, totaled Ps.485,060 million. 9 Results for the quarter Results of the main companies 527,412 23,329 3,902 19,283 128,311 33,474 8,017 10,349 4Q 2024 4Q 2023 Galicia Naranja X Galicia Seguros Fondos Fima

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Net interest income 802,667 823,513 1,349,156 (3) (41) Net fee income 337,878 276,489 265,104 22 27 Net results from financial instruments 304,979 224,791 34,112 36 794 Gold and foreign currency quotation differences 15,353 35,826 907,662 (57) (98) Other operating income 145,304 110,113 130,040 32 12 Underwriting income from insurance business 23,856 43,435 31,993 (45) (25) Loan loss provisions (370,836) (181,004) (134,014) 105 177 Net operating income 1,259,201 1,333,163 2,584,053 (6) (51) Personnel expenses (507,814) (166,641) (273,430) 205 86 Administrative expenses (230,036) (188,086) (188,609) 22 22 Depreciations and devaluations of assets (71,209) (42,029) (48,009) 69 48 Other operating expenses (308,677) (238,013) (410,297) 30 (25) Operating Income 141,465 698,394 1,663,708 (80) (91) Results from the net monetary position (249,752) (432,788) (1,275,578) (42) (80) Results from associates and joint ventures 723,109 (1,134) 9,698 n.m. n.m. Income tax (40,454) (82,607) (208,504) (51) (81) Net income 574,368 181,865 189,324 216 203 Net Income Attributable to Non-controlling Interests (12) (30) (29) (60) (59) Net Income Attributable to Grupo Galicia 574,380 181,895 189,353 216 203 Other comprehensive income 12,962 18,495 2,331 (30) n.m. Total comprehensive income 587,330 200,360 191,655 193 206 Total comprehensive income Attributable to Non-controlling Interests (12) (30) (28) (60) (57) Total comprehensive income Attributable to Grupo Galicia 587,345 200,390 191,682 193 206 10

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Balance Sheet In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Assets Cash and due from banks 6,547,817 6,585,165 4,346,312 (1) 51 Debt securities 1,501,924 1,183,867 1,303,958 27 15 Net loans and other financing 14,464,569 9,504,020 6,750,124 52 114 Other financial assets 7,964,089 6,242,937 8,180,195 28 (3) Investment in subsidiaries, associates and joint ventures 4,088 2,922 5,771 40 (29) Property, bank premises, equipment 995,521 795,882 773,625 25 29 Intangible assets 304,486 264,720 266,183 15 14 Other assets 711,762 236,841 574,096 201 24 Assest from insurance contracts 218,713 158,214 196,743 38 11 Assets available for sale 14,526 21 163 n.m. n.m. Total assets 32,727,495 24,974,589 22,397,170 31 46 Liabilities Deposits 18,634,331 14,803,293 12,429,469 26 50 Financing from financial entities 441,781 288,292 300,795 53 47 Other financial liabilities 3,943,476 3,561,907 2,958,099 11 33 Negotiable obligations 1,009,506 209,892 201,902 381 400 Subordinated negotiable obligations 266,114 264,836 447,750 — (41) Other liabilities 1,550,630 759,767 1,309,210 104 18 Liabilities from insurance contracts 805,586 278,183 355,586 190 127 Total liabilities 26,651,424 20,166,170 18,002,811 32 48 Total Shareholders' equity 6,076,071 4,808,419 4,394,359 26 38 11 Selected financial information

Grupo Galicia Galicia Financial Report Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Since 1905, Galicia works for the development of Argentina, being the main private bank controlled by national capital. Through its assisted and digital distribution channels, it markets a wide range of financial products and services for individuals and companies throughout the country. Galicia defines the customer experience and digital transformation as strategic focuses to efficiently achieve successful growth.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Ps.1,326,626 million Net income for the year +115% vs. 12M 2023 Portfolio Quality 1.85% +1 bp. vs. 4Q 2023 Coverage 186.25% +185 bp. vs. 4Q 2023 ROE 34.48% +1,630 bp vs. 12M 2023 Efficiency 41.38% -1,005 bp vs. 12M 2023 13 Ps.527,412 million Net income for the quarter +311% vs. 4Q 2023 ROE 52.30% +3,810 bp vs. 4Q 2023 Efficiency 69.58% +1,911 bp vs. 4Q 2023 Cost of risk 6.48% -1 bp. vs. 4Q 2023 Cost of risk 12M 5.67% +2 bp. vs. 12M 2023 Capital Ratio 18.49% -626 bp. vs. 4Q 2023 12.82% Market share: Loans to the private sector 13.79% Market share: Deposits to the private sector +189 bp vs. 4Q 2023 +396 bp vs. 4Q 2023 Highlights Branches Deposit accounts In thousands Employees Credit Cards In thousands 290 8,074 5,675 4,455 Digital clients 93%

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2023 Variation 12M 12M % Net interest income 4,032,441 3,514,836 15 Net fee income 617,043 634,364 (3) Net results from financial instruments 765,839 352,328 117 Gold and foreign currency quotation differences 139,425 1,159,859 (88) Other operating income 192,433 270,224 (29) Loan-loss provisions (435,349) (266,287) 63 Net operating income 5,311,832 5,665,324 (6) Personnel expenses (616,754) (547,795) 13 Administrative expenses (509,846) (445,472) 14 Depreciations and devaluations of assets (133,856) (152,802) (12) Other operating expenses (811,766) (893,683) (9) Operating income 3,239,610 3,625,572 (11) Results from the net monetary position (1,941,525) (2,668,113) (27) Results from associates and joint businesses 570,001 (1,971) n.m. Income tax (541,460) (339,711) 59 Net Income 1,326,626 615,777 115 Other comprenhensive income 32,859 31 n.m. Total comprenhensive income 1,359,485 615,808 121 14 Results for the fiscal year In fiscal year 2024, Galicia registered a net income of Ps.1,326,626 million, Ps.710,849 million (115%) higher than the result of the previous year, which represented an ROE of 34.48% and an ROA of 7.40%. Net operating income was Ps.5,311,832 million, Ps.353,492 million (6%) lower, compared to the Ps.5,665,324 million recorded in the previous year. This decrease was mainly due to a lower result from the price difference of gold and foreign currency of Ps.1,020,434 million (88%), offset by a higher net result from interest for Ps.517,605 million (15%) and from financial instruments for Ps.413,511 million (117%). It is also important to highlight that a result from associates and joint ventures of Ps.570,001 million was recorded, generated mainly by the acquisition of HSBC's business in Argentina.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima 15 Profitability and efficiency 7.40% 3.34% 2024 2023 34.48% 18.18% 2024 2023 46.34% 36.15% 2024 2023 41.38% 51.43% 2024 2023 Financial margin Efficiency ratio (1) ROA ROE (1) The efficiency ratio excluding the restructuring provision is 38.10%.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Net interest income 520,949 590,851 1,196,800 (12) (56) Net fee income 178,881 153,838 161,991 16 10 Net results from financial instruments 193,802 179,404 (144,312) 8 (234) Gold and foreign currency quotation differences 20,325 31,683 750,295 (36) (97) Other operating income 48,471 43,912 69,667 10 (30) Loan-loss provisions (150,262) (118,109) (83,426) 27 80 Net operating income 812,166 881,579 1,951,015 (8) (58) Personnel expenses (233,569) (109,326) (195,120) 114 20 Administrative expenses (144,631) (123,450) (125,761) 17 15 Depreciations and devaluations of assets (36,931) (32,712) (39,921) 13 (7) Other operating expenses (163,885) (145,715) (257,450) 12 (36) Operating income 233,150 470,376 1,332,763 (50) (83) Results from the net monetary position (204,765) (326,861) (1,036,040 ) (37) (80) Results from associates and joint businesses 575,136 (1,267) (84) n.m. n.m. Income tax (76,109) (51,877) (168,329) 47 (55) Net Income 527,412 90,371 128,310 484 311 Other comprenhensive income 13,958 17,894 (16) (22) (87,338) Total comprenhensive income 541,370 108,265 128,294 400 322 16 Results for the quarter In the fourth quarter of 2024, Galicia registered a net income of Ps.527,412 million, Ps.399,102 million (311%) higher than the result of the same quarter of the previous year, which represented an annualized ROE of 52.30% and an ROA of 10.05%. The operating result was Ps.1,099,613 million (83%) lower than in the fourth quarter of 2023, as a consequence of a lower net operating income. Net operating income reached Ps.812,166 million, Ps.1,138,849 million (58%) lower than the Ps.1,951,015 million in the same quarter of the previous year, mainly as a consequence of a lower net interest income for Ps.675,851 million (56%) and a lower result from gold and foreign currency quotation differences for Ps.729,970 million (97%). It is also important to highlight that a result from associates and joint ventures of Ps.575,136 million was recorded, generated mainly by the acquisition of HSBC's business in Argentina.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima 17 Profitability and efficiency Financial margin Efficiency ratio (1) ROA ROE 10.05% 2.00% 2.97% 4Q 2024 3Q 2024 4Q 2023 52.30% 9.32% 14.20% 4Q 2024 3Q 2024 4Q 2023 22.67% 27.18% 60.17% 4Q 2024 3Q 2024 4Q 2023 69.58% 51.47% 50.47% 4Q 2024 3Q 2024 4Q 2023 (1) The efficiency ratio excluding the restructuring provision is 52.69%.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Interest-earning assets(1) Average balances: in millions of pesos. Yields and rates: annualized nominal % 2024 2024 2023 Variation (% | bp) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Avg Bce Yield Avg Bce Yield Avg Bce Yield Avg Bce Yield Avg Bce Yield In pesos 9,597,857 47.84 9,615,716 51.39 9,548,083 107.69 — (355) 1 (5,985) Government securities 3,570,593 58.77 4,302,055 62.80 3,104,101 122.36 (17) (403) 15 (6,359) Loans 5,578,282 44.78 4,416,480 48.53 4,411,270 91.70 26 (375) 26 (4,692) Other interest-earning assets 448,982 (1.13) 897,181 10.80 2,032,712 119.97 (50) (1,193) (78) (12,110) In foreign currency 2,098,859 3.87 1,342,940 6.75 1,354,544 (20.32) 56 (288) 55 2,419 Government securities 335,896 5.33 344,027 8.61 924,881 (31.63) (2) (328) (64) 3,696 Loans 1,733,224 3.72 973,894 6.07 270,053 5.71 78 (235) 542 (199) Other interest-earning assets 29,739 (3.85) 25,019 7.69 159,610 1.21 19 (1,154) (81) (506) Interest-earning assets 11,696,716 39.95 10,958,656 45.92 10,902,627 91.78 7 (597) 7 (5,183) (1) Does not include foreign currency quotation differences. Annual nominal interest rates were calculated using a 360-day denominator. Average interest-earning assets reached Ps.11,696,716 million, registering an increase of Ps.794,089 million (7%), compared to the fourth quarter of 2023. This increase was mainly the result of a higher volume of loans in foreign currency for Ps.1,463,171 million (542%) and in loans in pesos for Ps.1,167,012 million (26%), offset by a lower volume of other interest-earning assets in pesos for Ps.1,583,730 million (78%). The average yield on interest-earning assets for the fourth quarter was 39.95%, representing a decrease of 5,183 bp, compared to the same quarter of the previous year. This variation is mainly justified by lower average yields on government securities in pesos. 18 Yields and rates

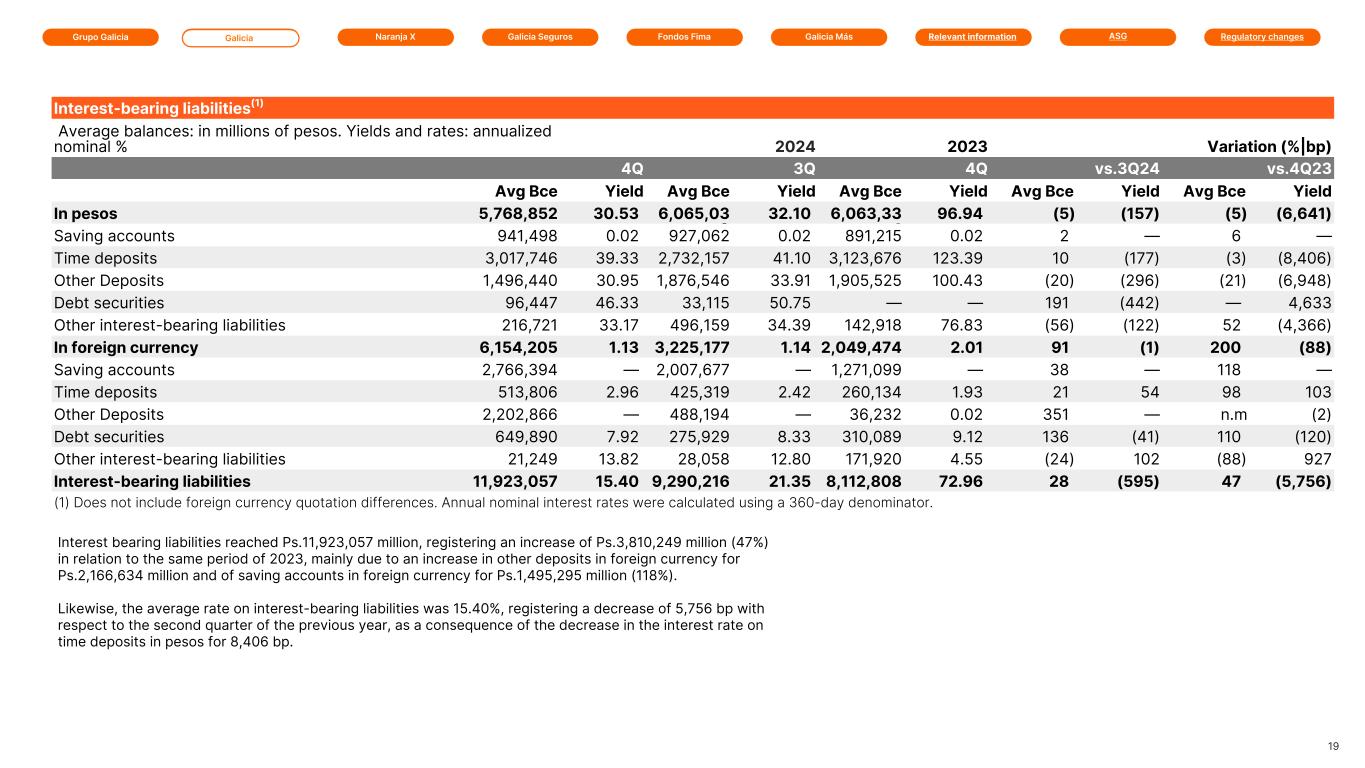

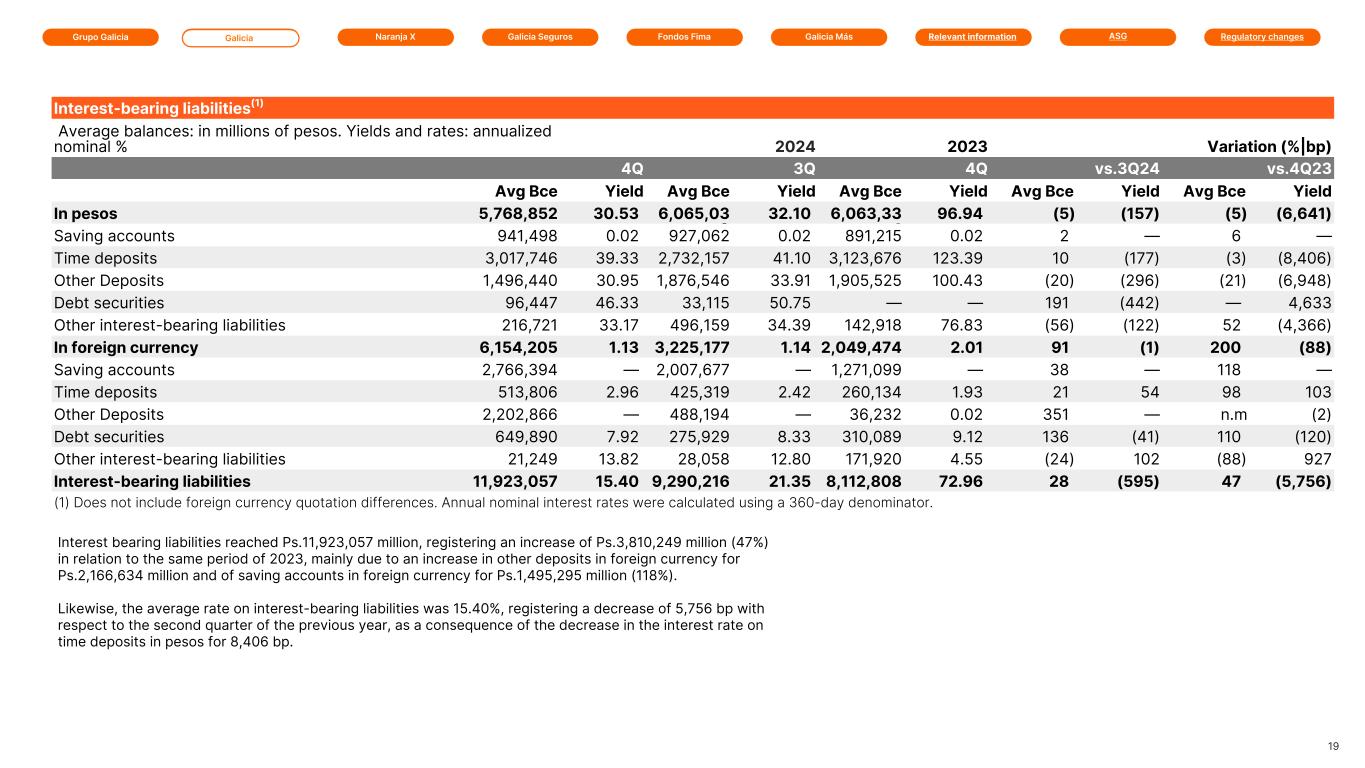

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Interest-bearing liabilities(1) Average balances: in millions of pesos. Yields and rates: annualized nominal % 2024 2024 2023 Variation (%|bp) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Avg Bce Yield Avg Bce Yield Avg Bce Yield Avg Bce Yield Avg Bce Yield In pesos 5,768,852 30.53 6,065,03 9 32.10 6,063,33 4 96.94 (5) (157) (5) (6,641) Saving accounts 941,498 0.02 927,062 0.02 891,215 0.02 2 — 6 — Time deposits 3,017,746 39.33 2,732,157 41.10 3,123,676 123.39 10 (177) (3) (8,406) Other Deposits 1,496,440 30.95 1,876,546 33.91 1,905,525 100.43 (20) (296) (21) (6,948) Debt securities 96,447 46.33 33,115 50.75 — — 191 (442) — 4,633 Other interest-bearing liabilities 216,721 33.17 496,159 34.39 142,918 76.83 (56) (122) 52 (4,366) In foreign currency 6,154,205 1.13 3,225,177 1.14 2,049,474 2.01 91 (1) 200 (88) Saving accounts 2,766,394 — 2,007,677 — 1,271,099 — 38 — 118 — Time deposits 513,806 2.96 425,319 2.42 260,134 1.93 21 54 98 103 Other Deposits 2,202,866 — 488,194 — 36,232 0.02 351 — n.m (2) Debt securities 649,890 7.92 275,929 8.33 310,089 9.12 136 (41) 110 (120) Other interest-bearing liabilities 21,249 13.82 28,058 12.80 171,920 4.55 (24) 102 (88) 927 Interest-bearing liabilities 11,923,057 15.40 9,290,216 21.35 8,112,808 72.96 28 (595) 47 (5,756) Interest bearing liabilities reached Ps.11,923,057 million, registering an increase of Ps.3,810,249 million (47%) in relation to the same period of 2023, mainly due to an increase in other deposits in foreign currency for Ps.2,166,634 million and of saving accounts in foreign currency for Ps.1,495,295 million (118%). Likewise, the average rate on interest-bearing liabilities was 15.40%, registering a decrease of 5,756 bp with respect to the second quarter of the previous year, as a consequence of the decrease in the interest rate on time deposits in pesos for 8,406 bp. (1) Does not include foreign currency quotation differences. Annual nominal interest rates were calculated using a 360-day denominator. 19

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Interest Income In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Government securities 331,855 517,098 1,140,674 (36) (71) Other financial assets 42 — — N/A N/A Loans and other financing 643,758 551,354 1,025,039 17 (37) Financial sector 10,571 8,629 10,078 23 5 Non-financial private sector 633,187 542,725 1,014,961 17 (38) Overdrafts 45,677 58,082 120,989 (21) (62) Promissory notes 189,165 170,502 448,398 11 (58) Mortgage loans 60,972 54,388 112,220 12 (46) Pledge loans 16,814 11,370 15,813 48 6 Personal loans 154,361 117,134 96,840 32 59 Credit-card loans 155,722 124,518 214,835 25 (28) Financial leases 2,748 2,003 3,577 37 (23) Pre-financing and export financing 3,723 2,734 806 36 362 Other 4,005 1,994 1,483 101 170 Repurchase agreement transactions 3,855 18,427 510,981 (79) (99) Interest income 979,510 1,086,879 2,676,696 (10) (63) Net interest income Net interest income for the quarter amounted to Ps.520,949 million, with a Ps.675,854 million (56%) decrease compared to the Ps.1,196,803 million profit from the same quarter of 2023. Interest income for the quarter reached Ps.979,510 million, 63% lower than the Ps.2,676,696 million registered in the fourth quarter of 2023. This decrease was a consequence of: • lower interest on government securities for Ps.808,819 million (71%). It is important to note that in the fourth quarter of 2023 there were instruments issued by the BCRA (Leliqs) in the portfolio, • lower interest on repurchase agreement transactions for Ps.507,126 million (99%), • lower interest on loans and other financing for Ps.381,281 million (37%), as a result of lower income from promissory notes (58%) and overdrafts (62%). 20

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Interest expenses totaled Ps.458,561 million, registering a decrease of Ps.1,021,332 million (69%), compared to the same quarter of 2023. This decrease was a consequence of lower interest expenses on time deposits and term investments for Ps.664,306 million (69%), generated by the decrease in the annual nominal interest rate and the average volume of deposits and lower interest expenses on other deposits for Ps.362,663 million (76%). Interest expenses In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Deposits 416,336 442,442 1,443,301 (6) (71) Saving accounts 40 37 36 8 11 Time deposits and term investments 300,525 283,309 964,831 6 (69) Other 115,771 159,096 478,434 (27) (76) Financing from financial institutions 2,016 1,273 2,323 58 (13) Repurchase agreement transactions 7,114 4,304 3,096 65 130 Other interest-bearing liabilities 9,611 38,057 24,111 (75) (60) Negotiable obligations 18,042 4,410 339 309 n.m. Subordinated Negotiable obligations 5,442 5,542 6,723 (2) (19) Interest expenses 458,561 496,028 1,479,893 (8) (69) 21

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Net Fee Income In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Credit cards 73,939 66,732 70,817 11 4 Deposit accounts 31,712 28,301 30,194 12 5 Insurance 5,517 5,201 4,411 6 25 Financial fees 1,537 258 214 496 618 Credit- related fees 1,989 1,537 1,020 29 95 Foreign trade 7,534 9,516 4,892 (21) 54 Collections 16,442 16,369 17,187 — (4) Utility-Bills collection services 13,548 12,555 16,610 8 (18) Mutual Funds 6,295 5,891 4,607 7 37 Fees from bundles of products 25,147 19,184 24,328 31 3 Other 27,699 23,152 18,983 20 46 Total fee income 211,359 188,696 193,263 12 9 Total expenditures (32,478) (34,858) (31,274) (7) 4 Net fee income 178,881 153,838 161,989 16 10 The net fee income reached Ps.178,881 million, registering an increase of 10% compared to Ps.161,989 million in the fourth quarter of 2023. This increase was mainly due to higher other income for Ps.8,716 million (46%). 22 Net fee income

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Net Income from Financial Instruments In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Government securities 148,199 114,193 (194,728) 30 176 Private sector securities (9,103) 4,462 15,847 (304) (157) Derivative financial instruments 5,349 22,060 20,867 (76) 74 Forward transactions 5,349 12,501 28,153 (57) (81) Options – 9,559 (7,286) 100 100 Results of other financial assets/liabilities (31) — 4 N/A (875) Results from derecognition of assets 49,388 38,689 13,698 28 261 Net income from financial instruments 193,802 179,404 (144,312) 8 234 The result from quotation differences of gold and foreign currency for the quarter was a Ps.20,325 million profit, Ps.729,970 million (97%) lower than the profit of Ps.750,295 million registered in the same quarter of the previous year. It should be noted that the difference in exchange rates from the previous year was positively affected by the devaluation, with the exchange rate increasing by 131%. The net result from financial instruments was Ps.193,802 million, Ps.338,114 million higher than the Ps.144,312 million recorded in the same quarter of 2023. This increase was a consequence of a higher result from government securities of Ps.342,927 million (176%), offset by a lower result from private sector securities for Ps.24,950 million (157%). 23 Gold and foreign currency quotation differences Net income from financial instruments

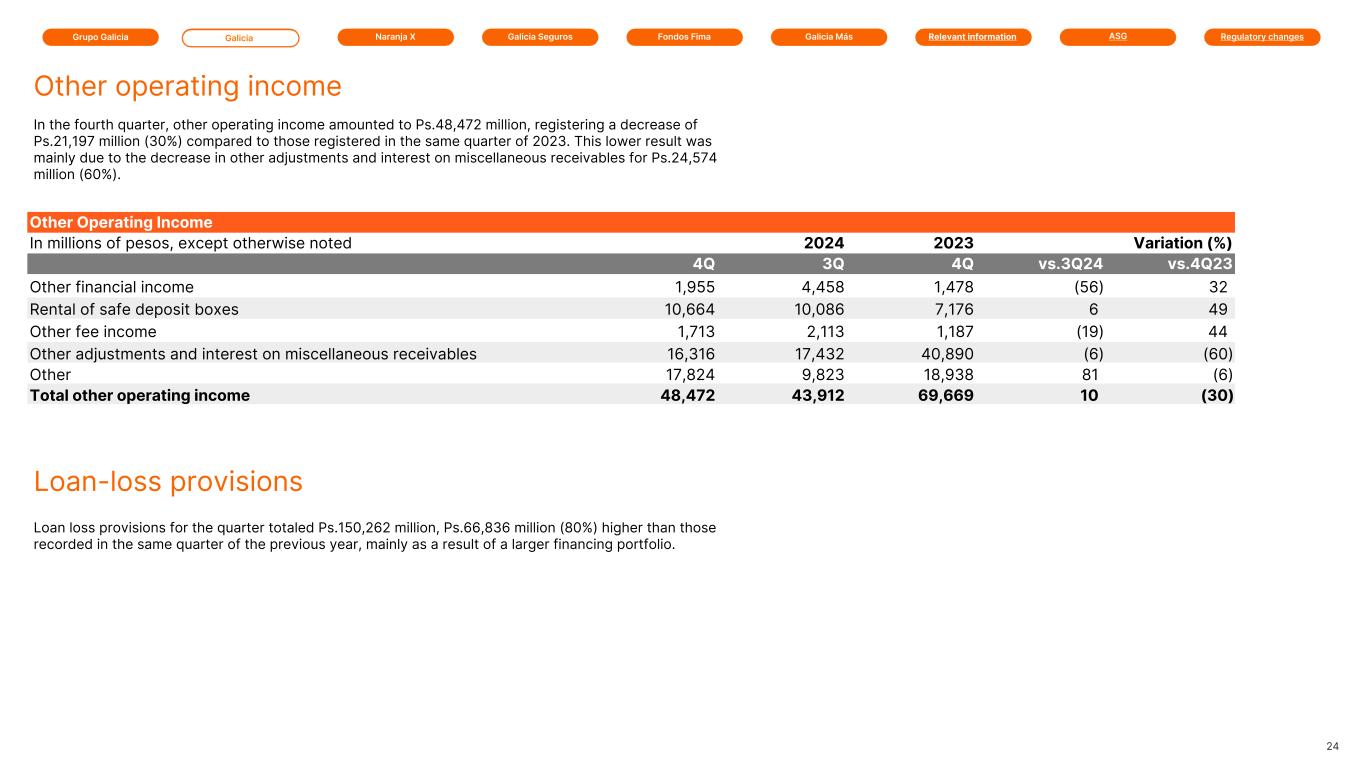

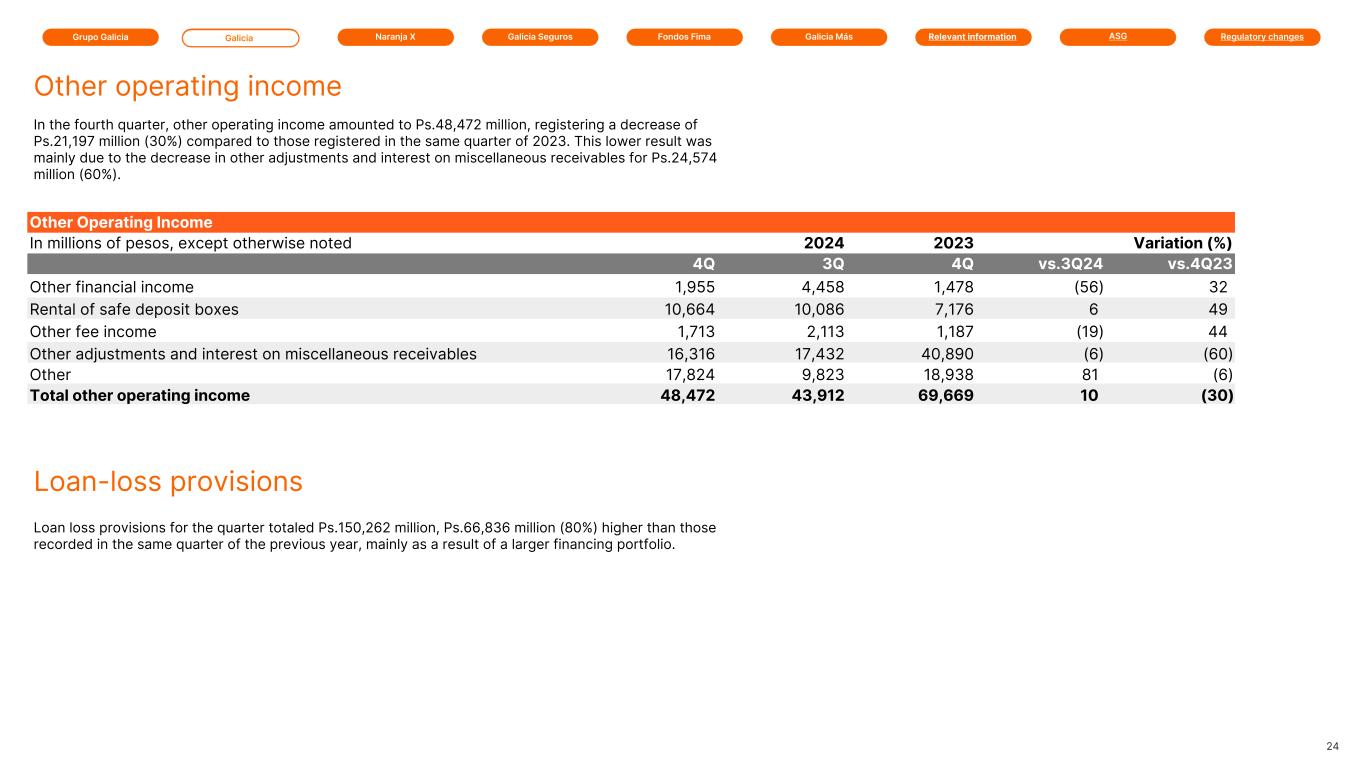

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Other Operating Income In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Other financial income 1,955 4,458 1,478 (56) 32 Rental of safe deposit boxes 10,664 10,086 7,176 6 49 Other fee income 1,713 2,113 1,187 (19) 44 Other adjustments and interest on miscellaneous receivables 16,316 17,432 40,890 (6) (60) Other 17,824 9,823 18,938 81 (6) Total other operating income 48,472 43,912 69,669 10 (30) In the fourth quarter, other operating income amounted to Ps.48,472 million, registering a decrease of Ps.21,197 million (30%) compared to those registered in the same quarter of 2023. This lower result was mainly due to the decrease in other adjustments and interest on miscellaneous receivables for Ps.24,574 million (60%). Loan loss provisions for the quarter totaled Ps.150,262 million, Ps.66,836 million (80%) higher than those recorded in the same quarter of the previous year, mainly as a result of a larger financing portfolio. 24 Loan-loss provisions Other operating income

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Administrative Expenses In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Fees and compensations for services 14,108 11,869 10,564 19 34 Fees to directors and syndics 158 188 158 (16) — Publicity, promotion and research expenses 6,925 5,758 6,080 20 14 Taxes 27,662 24,824 31,641 11 (13) Maintenance and repairment of goods and IT 29,803 25,321 22,382 18 33 Electricity and communications 6,788 6,667 5,921 2 15 Stationery and office supplies 842 739 924 14 (9) Hired administrative services 28,585 24,632 25,337 16 13 Security 4,201 4,059 3,180 3 32 Insurance 1,171 1,263 1,062 (7) 10 Other 24,388 18,130 18,512 35 32 Total administrative expenses 144,631 123,450 125,761 17 15 Administrative expenses for the quarter reached Ps.144,631 million, registering an increase of Ps.18,870 million (15%) compared to the fourth quarter of the previous year. This increase was a consequence of higher expenses for maintenance and repairment of goods and IT for Ps.7,421 million (33%), higher expenses for fees and compensations for services for Ps.3,544 million (34%) and higher expenses for hired administrative services for Ps.3,248 million (13%). Personnel expenses reached Ps.233,569 million, registering an increase of Ps.38,449 million (20%) compared to the same quarter of 2023, mainly due to higher provisions for restructuring for Ps.99,900 million. 25 Administrative expenses Personnel expenses

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Other Operating Expenses In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Contribution to the Deposit Insurance Fund 4,933 3,789 4,060 30 22 Other financial results 26 — 10,102 N/A 100 Turnover tax 77,784 61,532 160,685 26 (52) On financial income 65,440 53,821 136,507 22 (52) On fees 10,826 6,669 14,980 62 (28) On other items 1,518 1,042 9,198 46 (83) Other fee-related expenses 50,591 65,498 58,015 (23) (13) Charges for other provisions 4,124 5,086 13,347 (19) (69) Claims 4,713 6,673 5,416 (29) (13) Other 21,714 3,137 5,824 592 273 Total other operating expenses 163,885 145,715 257,449 12 (36) Other operating expenses for the quarter reached Ps.163,885 million, which represented a decrease of Ps.93,564 million (36%), compared to the Ps.257,449 million recorded in the fourth quarter of the previous year. This decrease was mainly generated by lower turnover tax for Ps.82,901 million (52%), mainly related to financial operations. The result from depreciation and devaluation of assets reached Ps.36,931 million, registering a decrease of 7% compared to the same quarter of 2023. 26 Other operating expenses Depreciation and devaluation of assets

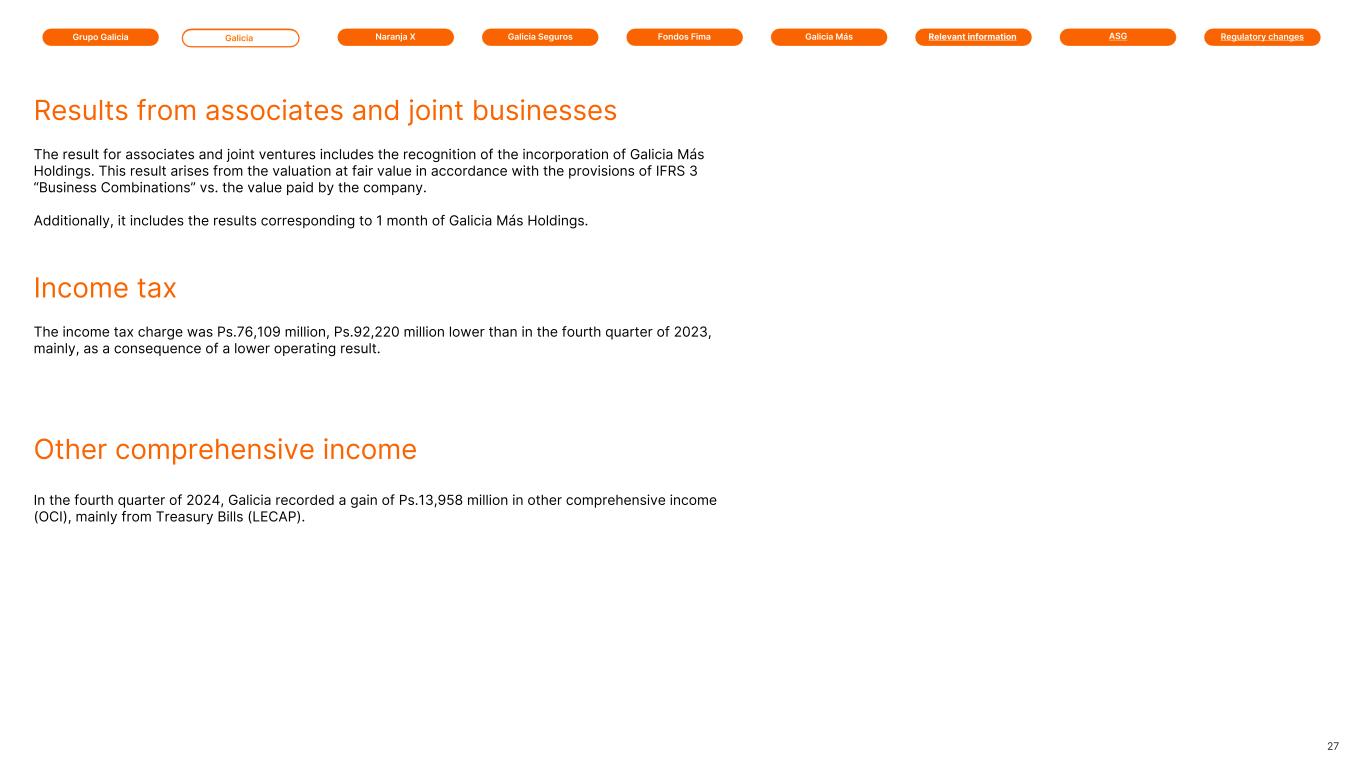

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima The income tax charge was Ps.76,109 million, Ps.92,220 million lower than in the fourth quarter of 2023, mainly, as a consequence of a lower operating result. 27 In the fourth quarter of 2024, Galicia recorded a gain of Ps.13,958 million in other comprehensive income (OCI), mainly from Treasury Bills (LECAP). Other comprehensive income Income tax The result for associates and joint ventures includes the recognition of the incorporation of Galicia Más Holdings. This result arises from the valuation at fair value in accordance with the provisions of IFRS 3 “Business Combinations” vs. the value paid by the company. Additionally, it includes the results corresponding to 1 month of Galicia Más Holdings. Results from associates and joint businesses

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Balance Sheet In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Assets Cash and due from banks 5,284,749 6,431,078 4,188,668 (18) 26 Debt securities 973,136 937,023 1,007,305 4 (3) Net loans and other financing 9,090,278 6,750,166 4,875,993 35 86 Other financial assets 4,362,375 5,550,740 7,476,249 (21) (42) Equity investments in subsidiaries, associates and joint businesses 949,363 7,431 12,395 n.m n.m Property, bank premises, equipment 698,228 720,090 698,485 (3) — Intangible assets 229,097 224,710 223,992 2 2 Other assets 105,059 83,439 403,567 26 (74) Assets available for sale 21 21 163 — (87) Total assets 21,692,306 20,704,698 18,886,817 5 15 Liabilities Deposits 14,268,420 14,252,166 12,074,935 — 18 Financing from financial entities 82,380 56,105 94,765 47 (13) Other financial liabilities 1,285,706 1,652,700 1,649,852 (22) (22) Negotiable obligations 683,302 107,963 33,833 533 n.m Subordinated negotiable obligations 266,114 264,836 452,485 — (41) Other liabilities 700,454 506,368 979,205 38 (28) Total liabilities 17,286,376 16,840,138 15,285,075 3 13 Shareholders' equity 4,405,930 3,864,560 3,601,742 14 22 Foreign currency assets and liabilities Assets 7,634,195 7,696,647 6,005,406 (1) 27 Liabilities 7,621,971 7,399,486 4,872,766 3 56 Net forward purchases/(sales) of foreign currency (1) (118,776) (128,311) 180,114 (7) (166) Net global position in foreign currency (106,552) 168,850 1,312,754 (163) (108) (1) Recorded off-balance sheet. 28 Selected financial information

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Financing to the Private Sector(1) In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 In pesos 7,491,763 6,205,905 4,799,763 21 56 Loans 6,125,579 5,154,408 4,241,789 19 44 UVA-adjusted loans 613,310 422,748 301,679 45 103 Financial leases 23,722 17,287 12,940 37 83 Other financing(2) 729,152 611,462 243,355 19 200 In foreign currency 3,052,129 1,777,485 1,188,272 72 157 Loans 2,401,101 1,229,183 353,123 95 580 Financial leases 1,941 1,282 1,106 51 75 Other financing(2) 649,087 547,020 834,043 19 (22) Total financing to the private sector 10,543,892 7,983,390 5,988,035 32 76 (1) Includes IFRS adjustments. (2) Includes certain off-balance sheet accounts related to guarantees granted. 29 As of December 31, 2024, financing to the private sector reached Ps.10,543,892 million, registering a 76% increase compared to the same period of the previous year. This increase was mainly due to higher loans in foreign currency for Ps.2,047,978 million (580%) and higher loans in pesos for Ps.1,883,790 million (44%). The market share of total loans to the private sector as of December 31, 2024, reached 12.82%, which represented an increase of 189 bp compared to the fourth quarter of 2023. Financing Level of activity

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Breakdown of loans and other financing In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Financial entities 146,975 84,160 59,534 75 147 Loans 146,975 84,160 59,447 75 147 Other financing — — 89 N/A (100) Non-financial private sector and residents abroad 9,256,813 6,896,025 4,995,905 34 85 Loans 8,993,015 6,722,179 4,837,144 34 86 Overdrafts 422,033 488,399 379,172 (14) 11 Promissory notes 3,393,900 2,501,842 1,550,037 36 119 Mortgage loans 316,901 126,815 82,567 150 284 Pledge loans 259,543 166,645 98,194 56 164 Personal loans 1,028,720 792,388 397,615 30 159 Credit-card loans 2,484,760 2,045,763 1,901,627 21 31 Pre-financing and financing of exports 426,428 152,211 70,971 180 501 Other Loans 336,115 125,376 35,019 168 860 Accrued interest, adjustments and foreign currency quotation differences receivable 348,537 344,564 351,224 1 (1) Documented interest (23,922) (21,824) (29,282) 10 (18) Financial leases 25,663 18,569 14,046 38 83 Other financing 238,135 155,277 144,715 53 65 Non-financial public sector 739 2,621 1,004 (72) (26) Total loans and other financing 9,404,527 6,982,806 5,056,443 35 86 Allowances (314,249) (232,640) (180,450) 35 74 Loans (308,259) (228,101) (177,723) 35 73 Financial leases (847) (383) (292) 121 190 Other financing (5,143) (4,156) (2,435) 24 111 Net loans and other financing 9,090,278 6,750,166 4,875,993 35 86 As of December 31, 2024, the loan portfolio and other financing net of provisions reached Ps.9,090,278 million, registering a 86% increase compared to the fourth quarter of the previous year. The main increases were in: • promissory notes for Ps.1,843,863 million (119%), • personal loans for Ps.631,105 million (159%), and • credit cards for Ps.583,133 million (31%). 30

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Net Exposure to the Argentine Public Sector(1) In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Government securities' net Position 4,676,977 5,041,059 5,484,782 (7) (15) Measured at fair value 1,159,976 956,054 917,928 21 26 In pesos 502,122 798,512 (12,143) (37) n.m Adjusted by CER 574,429 98,126 194,121 485 196 In foreign currency 54,991 44,490 39,454 24 39 Bono Dual 28,434 14,926 696,496 90 (96) Measured at amortized cost 2,187,417 2,729,932 4,566,854 (20) (52) In pesos 244,562 317,153 1,251,878 (23) (80) Adjusted by CER 1,653,280 2,081,255 2,332,936 (21) (29) In foreign currency 289,575 295,901 140,822 (2) 106 Leliq — — 210,191 N/A (100) Lediv — 35,623 631,027 (100) (100) Measured at fair value through OCI 1,329,584 1,355,073 — (2) N/A In pesos 1,225,584 1,355,073 — (10) N/A Adjusted by CER 104,000 — — — N/A Other receivables resulting from financial brokerage 739 2,621 2,319,481 (72) (100) Repurchase agreement transactions -Argentine Central Bank — — 2,318,168 — (100) Loans and other financing 739 2,621 1,093 (72) (32) Trust certificates of participation and securities — — 220 N/A (100) Total exposure to the public sector 4,677,716 5,043,680 7,804,263 (7) (40) (1) Excludes deposits with the Argentine Central Bank, which constitutes one of the items by which the Bank complies with minimum cash requirements. 31 Exposure to the Argentine public sector

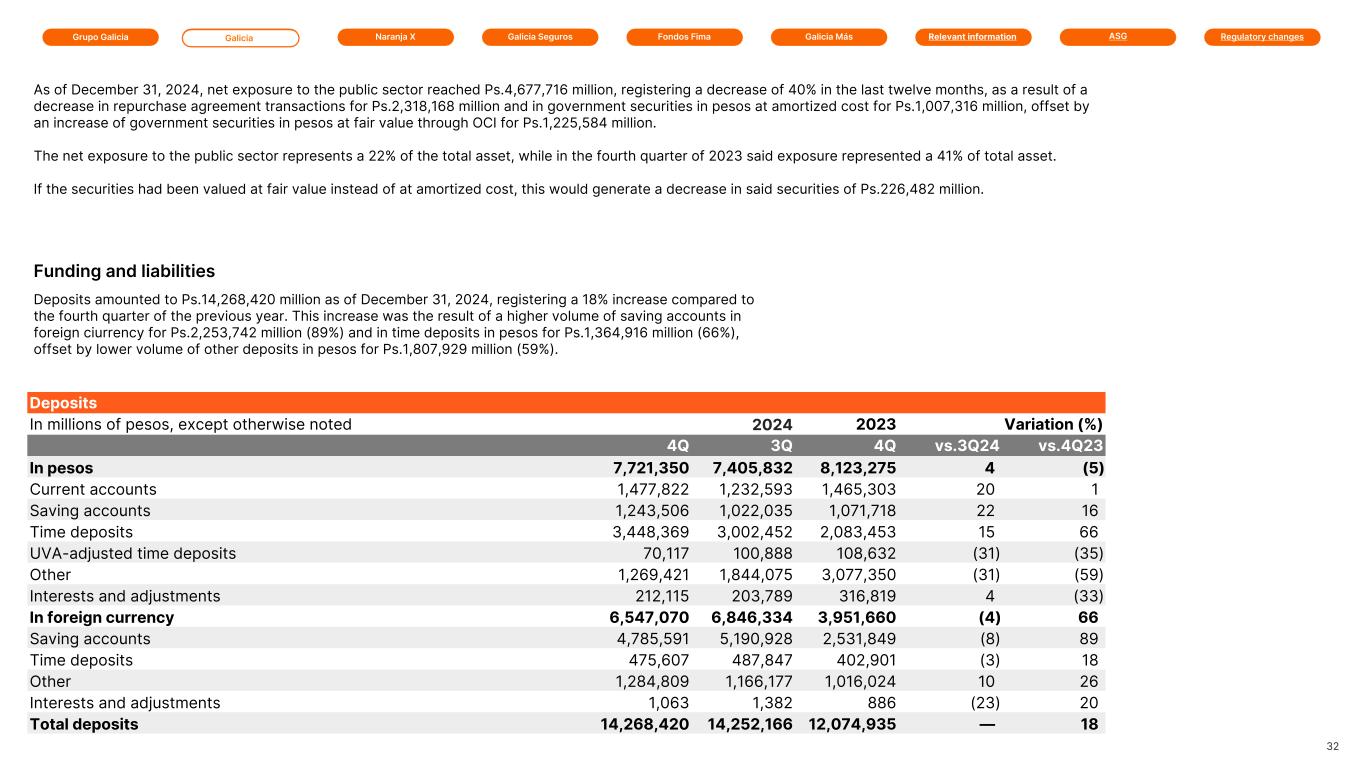

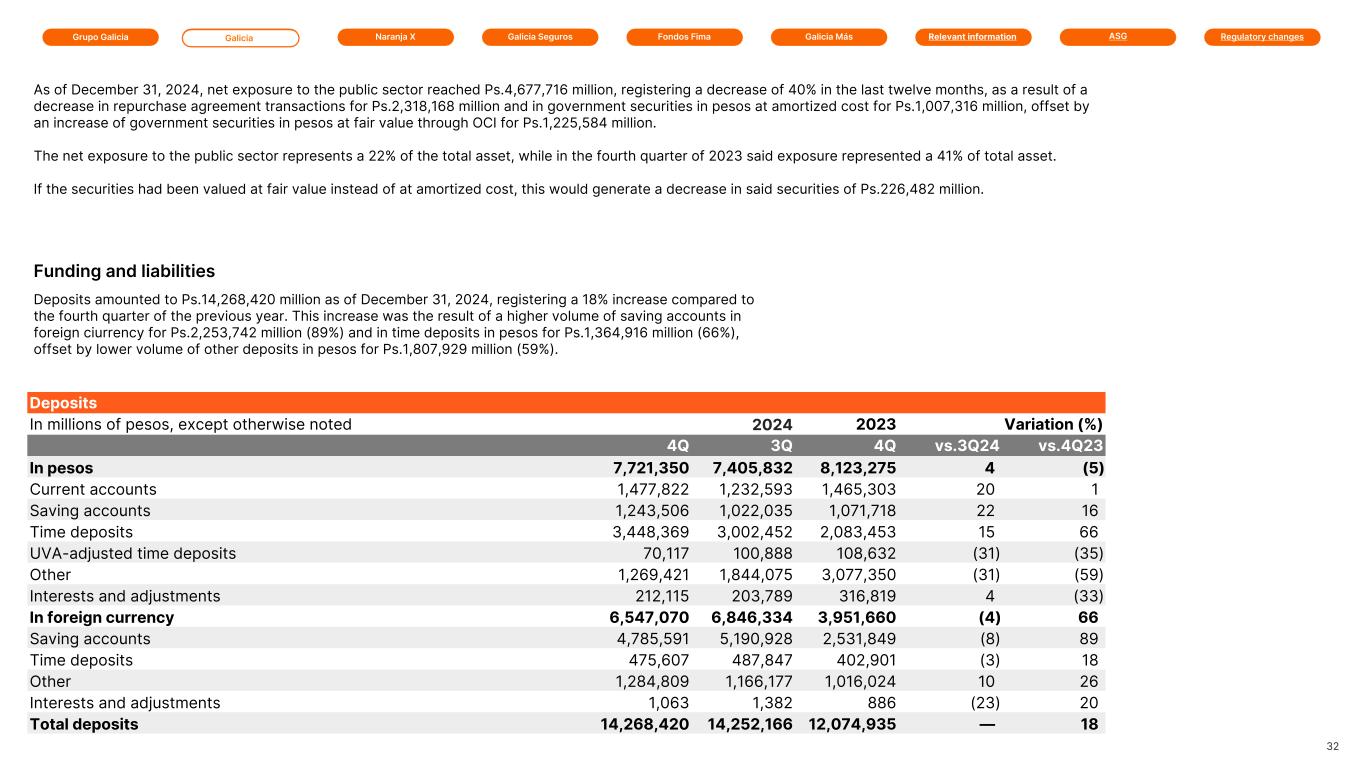

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Deposits In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 In pesos 7,721,350 7,405,832 8,123,275 4 (5) Current accounts 1,477,822 1,232,593 1,465,303 20 1 Saving accounts 1,243,506 1,022,035 1,071,718 22 16 Time deposits 3,448,369 3,002,452 2,083,453 15 66 UVA-adjusted time deposits 70,117 100,888 108,632 (31) (35) Other 1,269,421 1,844,075 3,077,350 (31) (59) Interests and adjustments 212,115 203,789 316,819 4 (33) In foreign currency 6,547,070 6,846,334 3,951,660 (4) 66 Saving accounts 4,785,591 5,190,928 2,531,849 (8) 89 Time deposits 475,607 487,847 402,901 (3) 18 Other 1,284,809 1,166,177 1,016,024 10 26 Interests and adjustments 1,063 1,382 886 (23) 20 Total deposits 14,268,420 14,252,166 12,074,935 — 18 Deposits amounted to Ps.14,268,420 million as of December 31, 2024, registering a 18% increase compared to the fourth quarter of the previous year. This increase was the result of a higher volume of saving accounts in foreign ciurrency for Ps.2,253,742 million (89%) and in time deposits in pesos for Ps.1,364,916 million (66%), offset by lower volume of other deposits in pesos for Ps.1,807,929 million (59%). 32 Funding and liabilities As of December 31, 2024, net exposure to the public sector reached Ps.4,677,716 million, registering a decrease of 40% in the last twelve months, as a result of a decrease in repurchase agreement transactions for Ps.2,318,168 million and in government securities in pesos at amortized cost for Ps.1,007,316 million, offset by an increase of government securities in pesos at fair value through OCI for Ps.1,225,584 million. The net exposure to the public sector represents a 22% of the total asset, while in the fourth quarter of 2023 said exposure represented a 41% of total asset. If the securities had been valued at fair value instead of at amortized cost, this would generate a decrease in said securities of Ps.226,482 million.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Financial Liabilities In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Financial entities 82,380 56,105 94,764 47 (13) Financing from credit-card purchases 629,988 507,773 512,461 24 23 Negotiable obligations 683,302 107,963 33,834 533 n.m. Subordinated negotiable obligations 266,114 264,836 452,485 — (41) Creditors from purchases of foreign currency 37,998 6,315 79,425 502 (52) Collections on account of third parties 248,661 232,221 285,251 7 (13) Other financial liabilities 369,059 906,390 772,714 (59) (52) Total financial liabilities 2,317,502 2,081,603 2,230,934 11 4 Financial liabilities amounted to Ps.2,317,502 million, registering an increase of Ps.86,568 million (4%) compared to the Ps.2,230,934 million registered in the fourth quarter of 2023. The variation was mainly due to an increase in negotiables obligations for Ps.649,468 million, offset by a decrease in other financial liabilities for Ps.403,655 million (52%). On October 10, 2024, Banco Galicia issued Class XVI of Notes for a nominal value of US$325 million at an annual nominal rate of 7.75% and maturing on October 10, 2028. On November 4, 2024, Banco Galicia issued Class XVII of Notes for a nominal value of US$83.5 million at an annual nominal rate of 2% and maturing on April 30, 2025. On December 4, 2024, Banco Galicia issued Classes XVIII and XIX of Notes. Class XVIII was for a nominal value of Ps.23,496 million at an effective monthly rate of 3% and maturing on April 30, 2025. Class XIX was for a nominal value of US$97.7 million at an annual nominal rate of 4.25% and maturing on June 4, 2025. Finally, on December 27, 2024, Banco Galicia issued Class XX of Negotiable Bonds for a nominal value of Ps.35,089 million at a TAMAR rate +2.7% and maturing on December 27, 2025. 33 Financial Liabilities Total deposit accounts as of December 31, 2024, reached 8.1 million, with an increase of 9% compared to the same date of the previous year. The market share of private sector deposits reached 13.79% as of December 31, 2024, registering an increase of 396 bp compared to the fourth quarter of 2023.

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Liquidity Percentages, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Cash and due from banks 5,284,749 6,431,078 4,188,668 (18) 26 Government securities 236,013 437,971 1,408,983 (46) (83) Call-money 40,606 46,195 10,392 (12) 291 Overnight placements in correspondent banks 363,685 89,947 36,186 304 905 Repurchase agreement transactions (35,425) (24,891) 2,314,237 42 (102) Escrow accounts 266,554 216,695 207,071 23 29 Other financial assets 197,023 709,195 3,870 (72) n.m. Total liquid assets 6,353,205 7,906,190 8,169,407 (20) (22) Liquidity ratios (%) Variation (bp) Liquid assets as a percentage of transactional deposits 63.60 76.36 96.92 (1,276) (3,332) Liquid assets as a percentage of total deposits 44.53 55.47 67.66 (1,094) (2,313) As of December 31, 2024, the Bank’s liquid assets represented 63.60% of the Bank’s transactional deposits and 44.53% of its total deposits, compared to 96.92% and 67.66%, respectively, as of December 31, 2023. 34 Liquidity

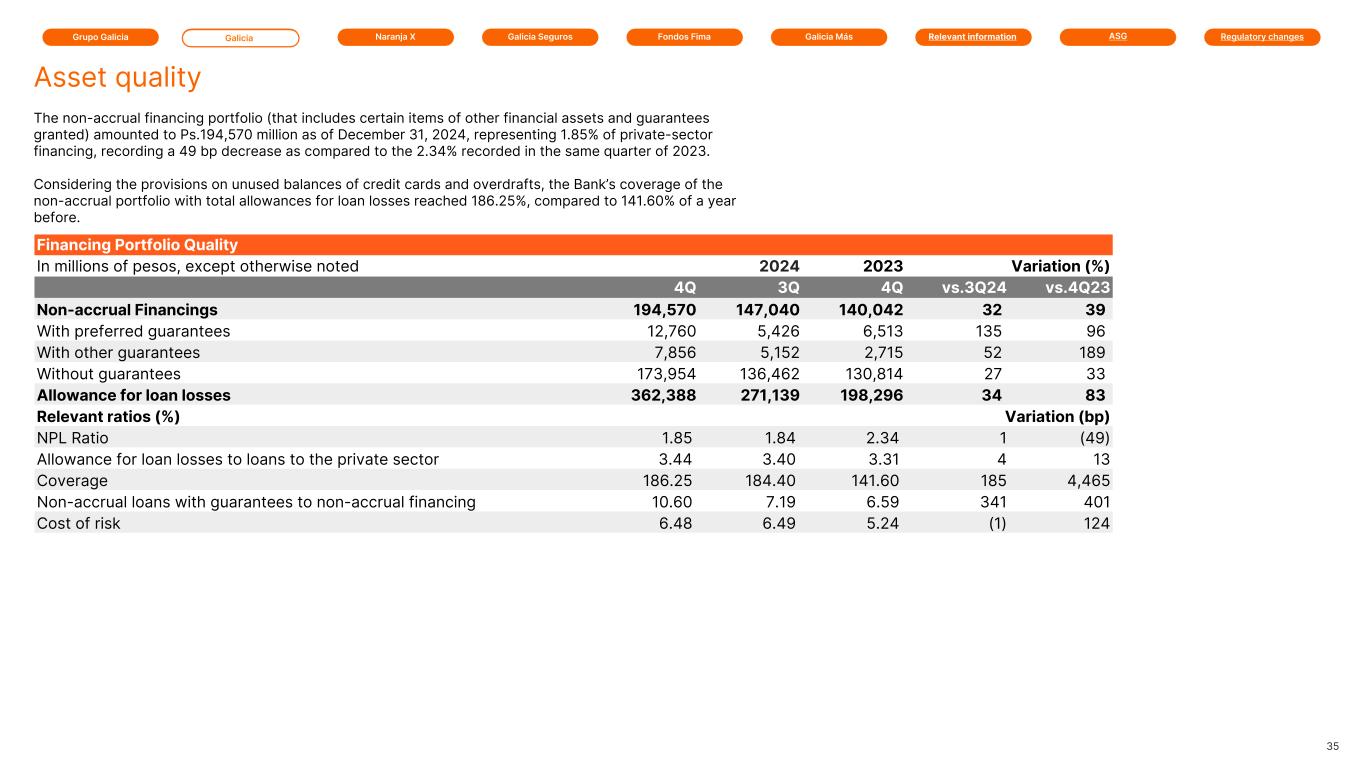

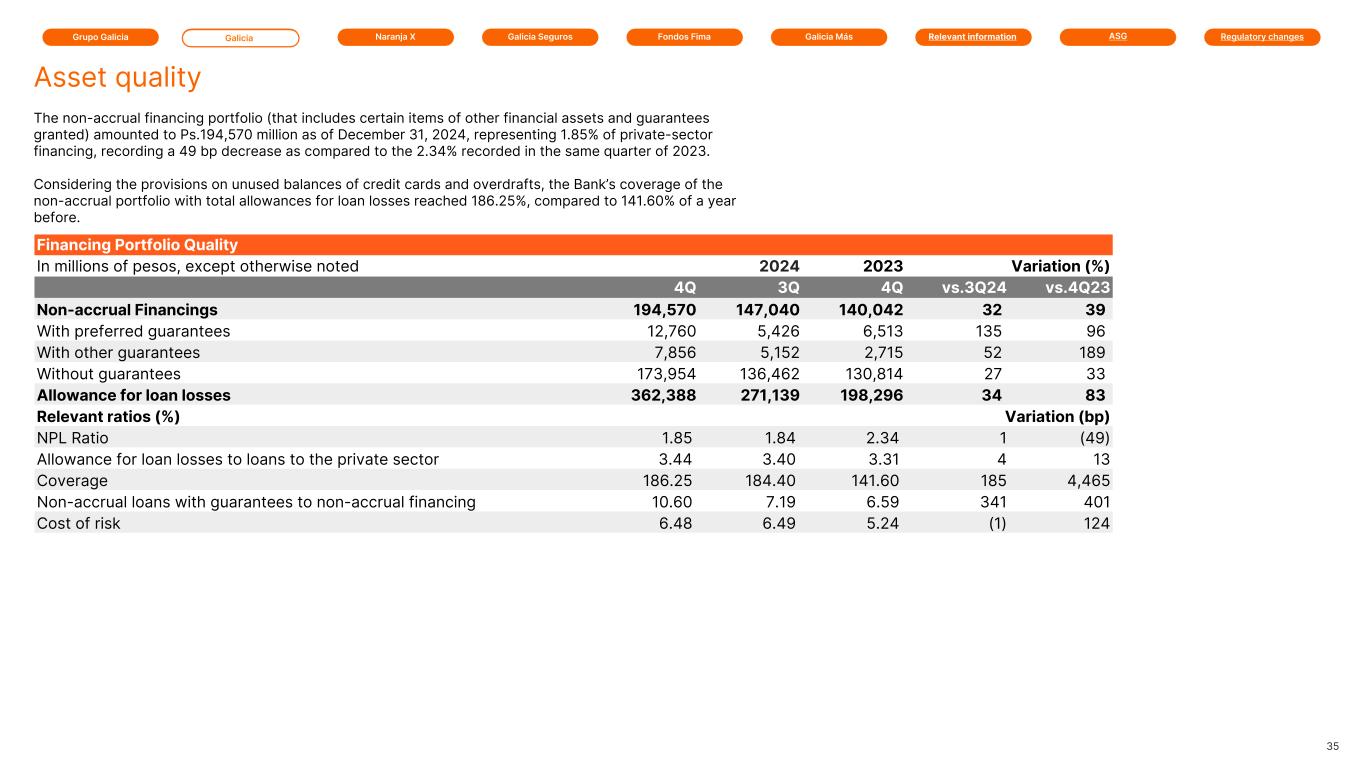

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Financing Portfolio Quality In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Non-accrual Financings 194,570 147,040 140,042 32 39 With preferred guarantees 12,760 5,426 6,513 135 96 With other guarantees 7,856 5,152 2,715 52 189 Without guarantees 173,954 136,462 130,814 27 33 Allowance for loan losses 362,388 271,139 198,296 34 83 Relevant ratios (%) Variation (bp) NPL Ratio 1.85 1.84 2.34 1 (49) Allowance for loan losses to loans to the private sector 3.44 3.40 3.31 4 13 Coverage 186.25 184.40 141.60 185 4,465 Non-accrual loans with guarantees to non-accrual financing 10.60 7.19 6.59 341 401 Cost of risk 6.48 6.49 5.24 (1) 124 The non-accrual financing portfolio (that includes certain items of other financial assets and guarantees granted) amounted to Ps.194,570 million as of December 31, 2024, representing 1.85% of private-sector financing, recording a 49 bp decrease as compared to the 2.34% recorded in the same quarter of 2023. Considering the provisions on unused balances of credit cards and overdrafts, the Bank’s coverage of the non-accrual portfolio with total allowances for loan losses reached 186.25%, compared to 141.60% of a year before. 35 Asset quality

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Analysis of Loan Loss Experience In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Allowance for loan losses At the beginning of the quarter 271,139 209,305 221,681 30 22 Changes in the allowance for loan losses Provisions charged to income 149,415 117,524 82,835 27 80 Charge offs (35,155) (29,904) (16,781) 18 109 Inflation effect (23,011) (25,786) (89,439) (11) (74) Allowance for loan losses at the end of the quarter 362,388 271,139 198,296 34 83 Charge to the income statement Provisions charged to income (149,415) (117,523) (82,832) 27 80 Direct charge offs (847) (586) (596) 45 42 Bad debts recovered 2,903 3,042 5,563 (5) (48) Net charge to the income statement (147,359) (115,067) (77,865) 28 89 During the quarter, Ps.35,155 million were charged off against the allowance for loan losses and direct charges to the income statement for Ps.847 million were made. 36

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Regulatory Capital In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Minimum capital requirement (A) 1,282,067 1,001,482 454,011 28 182 Allocated to credit risk 878,871 666,169 288,667 32 204 Allocated to market risk 38,581 21,051 52,838 83 (27) Allocated to operational risk 364,615 314,262 112,506 16 224 Computable capital (B) 2,903,779 3,240,768 1,376,284 (10) 111 Tier I 2,852,154 3,192,222 1,295,436 (11) 120 Tier II 51,625 48,546 80,848 6 (36) Excess over required capital (B) (A) 1,621,712 2,239,286 922,273 (28) 76 Risk weighted assets 15,703,410 12,275,986 5,561,837 28 182 Ratios (%) Variation (bp) Total capital ratio 18.49 26.40 24.75 (791) (626) Tier I capital ratio 18.16 26.00 23.29 (784) (513) The minimum capital requirement and the corresponding computable capital are presented below. Balances are disclosed in accordance with the applicable regulation in force and in currency of each period. As of December 31, 2024, the computable capital was Ps.2,903,779 million and the minimum capital requirement was Ps.1,282,067 million, which represented an excess of Ps.1,621,712 million (126%). This excess was Ps.922,273 million (203%) as of the same date in 2023. The capital requirement increased Ps.828,056 million and the computable capital increased Ps.1,527,495 million, compared to the fourth quarter of 2023. The total capital ratio was 18.49%, registering a decrease of 626 bp compared to the fourth quarter of 2023 and a decrease of 791 bp with respect to the third quarter of 2024. This decrease was mainly due to the deduction of the participation in Galicia Más. This same ratio, consolidated in accordance with the rules established by the BCRA, amounts to 21.61%%. 37 Capitalization

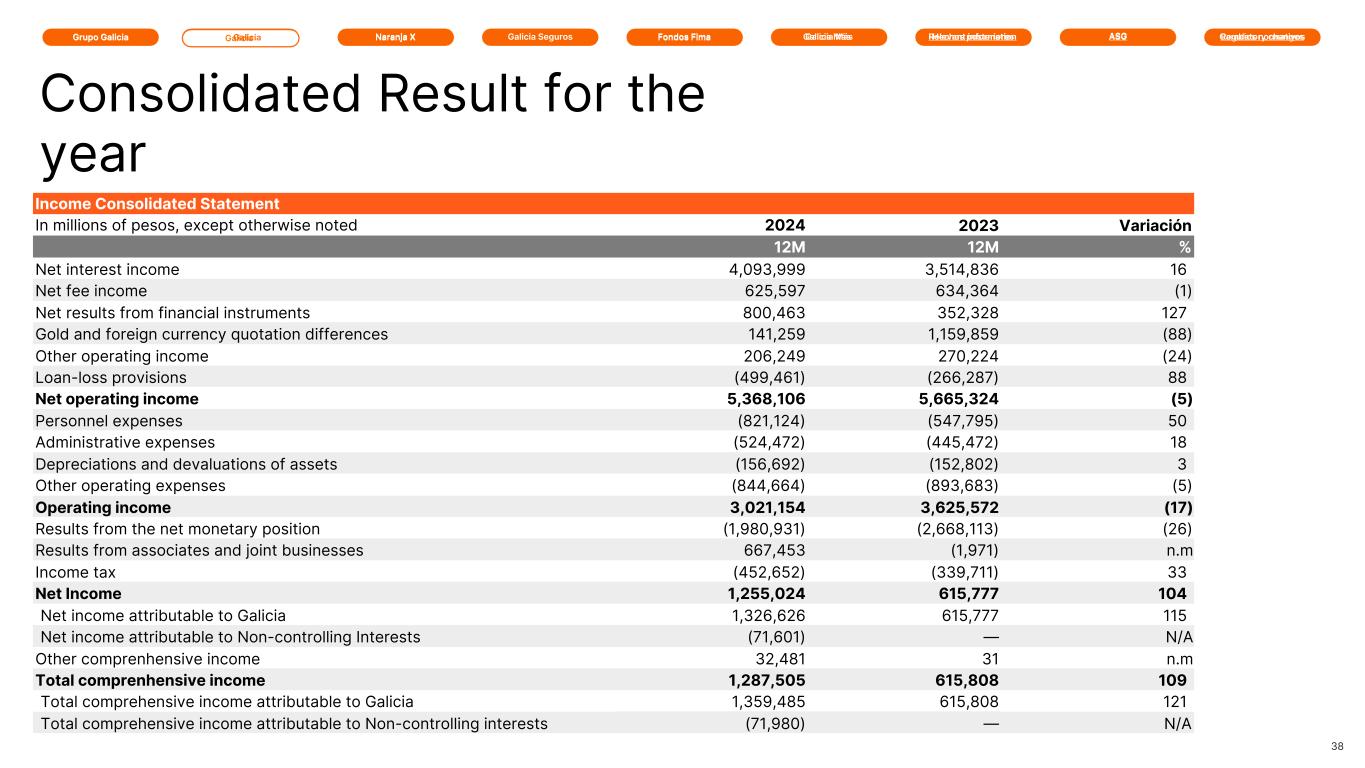

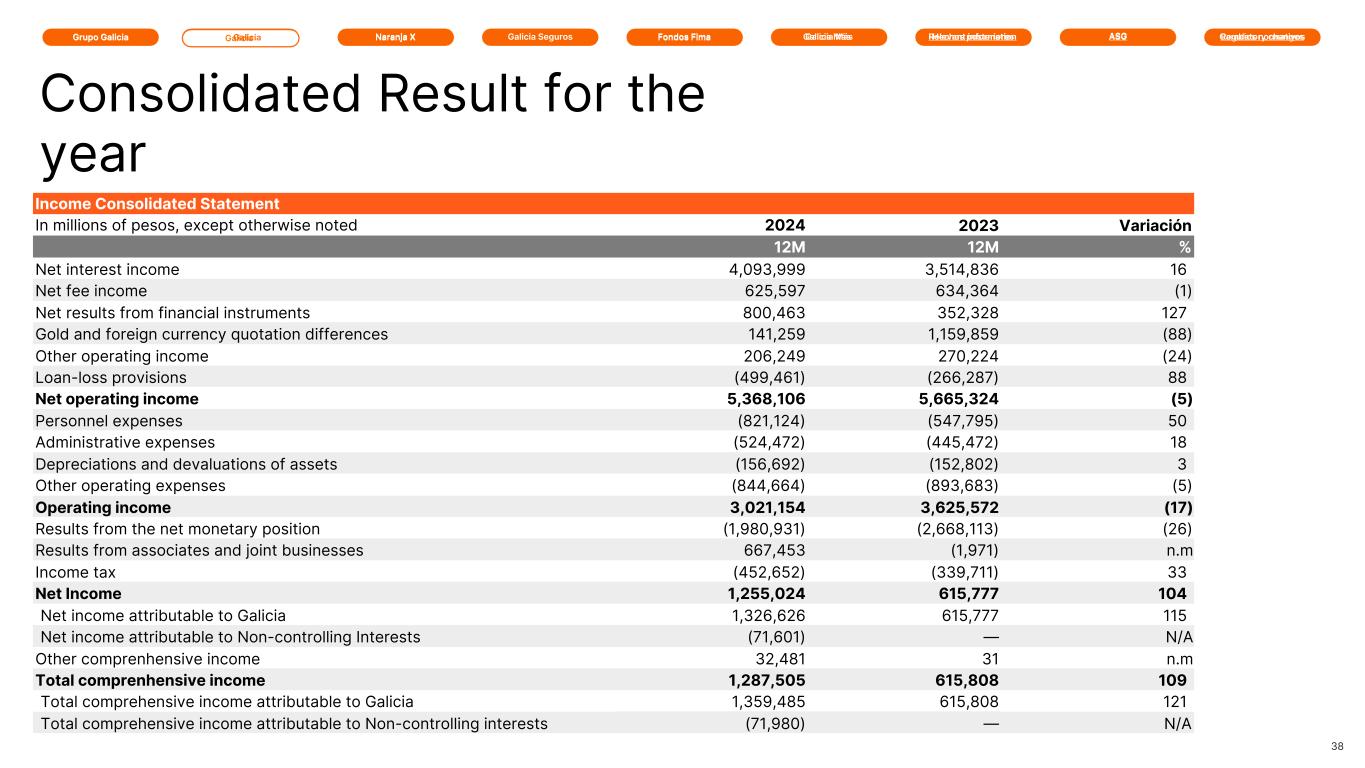

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima 38 Income Consolidated Statement In millions of pesos, except otherwise noted 2024 2023 Variación 12M 12M % Net interest income 4,093,999 3,514,836 16 Net fee income 625,597 634,364 (1) Net results from financial instruments 800,463 352,328 127 Gold and foreign currency quotation differences 141,259 1,159,859 (88) Other operating income 206,249 270,224 (24) Loan-loss provisions (499,461) (266,287) 88 Net operating income 5,368,106 5,665,324 (5) Personnel expenses (821,124) (547,795) 50 Administrative expenses (524,472) (445,472) 18 Depreciations and devaluations of assets (156,692) (152,802) 3 Other operating expenses (844,664) (893,683) (5) Operating income 3,021,154 3,625,572 (17) Results from the net monetary position (1,980,931) (2,668,113) (26) Results from associates and joint businesses 667,453 (1,971) n.m Income tax (452,652) (339,711) 33 Net Income 1,255,024 615,777 104 Net income attributable to Galicia 1,326,626 615,777 115 Net income attributable to Non-controlling Interests (71,601) — N/A Other comprenhensive income 32,481 31 n.m Total comprenhensive income 1,287,505 615,808 109 Total comprehensive income attributable to Galicia 1,359,485 615,808 121 Total comprehensive income attributable to Non-controlling interests (71,980) — N/A Consolidated Result for the year Galicia Hechos posteriores Cambios norm tivoalicia ás

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Consolidated Statement In millions of pesos, except otherwise noted 2024 2024 2023 Variación (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Net interest income 582,507 590,851 1,196,800 (1) (51) Net fee income 187,435 153,838 161,991 22 16 Net results from financial instruments 228,426 179,404 (144,312) 27 (258) Gold and foreign currency quotation differences 22,159 31,683 750,295 (30) (97) Other operating income 62,287 43,912 69,667 42 (11) Loan-loss provisions (214,374) (118,109) (83,426) 82 157 Net operating income 868,440 881,579 1,951,015 (1) (55) Personnel expenses (437,939) (109,326) (195,120) 301 124 Administrative expenses (159,257) (123,450) (125,761) 29 27 Depreciations and devaluations of assets (59,767) (32,712) (39,921) 83 50 Other operating expenses (196,783) (145,715) (257,450) 35 (24) Operating income 14,694 470,376 1,332,763 (97) (99) Results from the net monetary position (244,171) (326,861) (1,036,040) (25) (76) Results from associates and joint businesses 672,588 (1,267) (84) n.m n.m Income tax 12,699 (51,877) (168,329) (124) n.m Net Income 455,810 90,371 128,310 404 255 Net income attributable to Galicia 527,412 90,371 128,310 484 311 Net income attributable to Non-controlling Interests (71,601) — — N/A N/A Other comprenhensive income 13,580 17,894 (15) (24) (90,633) Total comprenhensive income 469,390 108,265 128,294 334 266 Total comprehensive income attributable to Galicia 541,370 108,265 128,294 400 322 Total comprehensive income attributable to Non-controlling interests (71,980) — — N/A N/A 39 Consolidated Result for the quarter Galicia Hechos posteriores Cambios norm tivoalicia ás

Grupo Galicia Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Balance Sheet In millions of pesos, except otherwise noted 2024 2024 2023 Variación (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Assets Cash and due from banks 6,394,900 6,431,078 4,188,668 (1) 53 Debt securities 1,369,946 937,023 1,007,305 46 36 Net loans and other financing 11,053,195 6,750,166 4,875,993 64 127 Other financial assets 6,528,764 5,550,740 7,476,249 18 (13) Equity investments in subsidiaries, associates and joint businesses 10,098 7,431 12,395 36 (19) Property, bank premises, equipment 917,501 720,090 698,485 27 31 Intangible assets 265,096 224,710 223,992 18 18 Other assets 514,795 83,439 403,567 517 28 Assets available for sale 14,526 21 163 n.m n.m Total assets 27,068,821 20,704,698 18,886,817 31 43 Liabilities Deposits 17,376,584 14,252,166 12,074,935 22 44 Financing from financial entities 82,392 56,105 94,765 47 (13) Other financial liabilities 1,788,299 1,652,700 1,649,852 8 8 Negotiable obligations 682,594 107,963 33,833 532 n.m Subordinated negotiable obligations 361,433 264,836 452,485 36 (20) Other liabilities 1,674,763 506,368 979,205 231 71 Total liabilities 21,966,065 16,840,138 15,285,075 30 44 Shareholders' equity 5,102,756 3,864,560 3,601,742 32 42 Shareholders' equity attributable to Galicia 4,405,930 3,864,560 3,601,742 14 22 Shareholders' equity attributable to Non-controlling Interests 696,826 — — N/A N/A Foreign currency assets and liabilities Assets 9,410,939 7,696,647 6,005,406 22 57 Liabilities 9,373,719 7,399,486 4,872,766 27 92 Net forward purchases/(sales) of foreign currency (1) (118,776) (128,311) 180,114 (7) (166) Net global position in foreign currency (81,556) 168,850 1,312,754 (148) (106) Consolidated Selected Financial Information (1) Contabilizados en partidas fuera de balance. 40 Galicia Hechos posteriores Cambios norm tivoalicia ás

Grupo Galicia Financial Report Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Naranja X is the fintech entity of Grupo Galicia that assists clients to promote the use of money. Naranja X creates technological solutions for the personal and business financials of millions of Argentines. Naranja X’s biggest challenge is being easily accessible to customers and providing them with simple tools to help them grow, improve their quality of life and access a world of possibilities.

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Ps.227,914 million Net income for the year attributable to Naranja X +662% vs. 12M 2023 ROE 33.13% +2,799 bp vs. 12M 2023 Efficiency ratio 39.13% -2,877 bp vs. 12M 2023 2,693 Employees 10,105 Credit cards In thousands 116 Branches and other points of sale 42 Ps.23,329 million Results for the quarter attributable to Naranja X -30% vs. 4Q 2023 ROE 11.98% -1,043 bp vs. 4Q 2023 Efficiency ratio 37.13% -1,575 bp vs. 4Q 2023 Highlights 6,991 Deposit accounts In thousands Ps.944 Average balance of deposits 4Q24 In billions 2.50% Market share: Saving accounts 4.60% Market share: Personal Loans 82% Digital clients

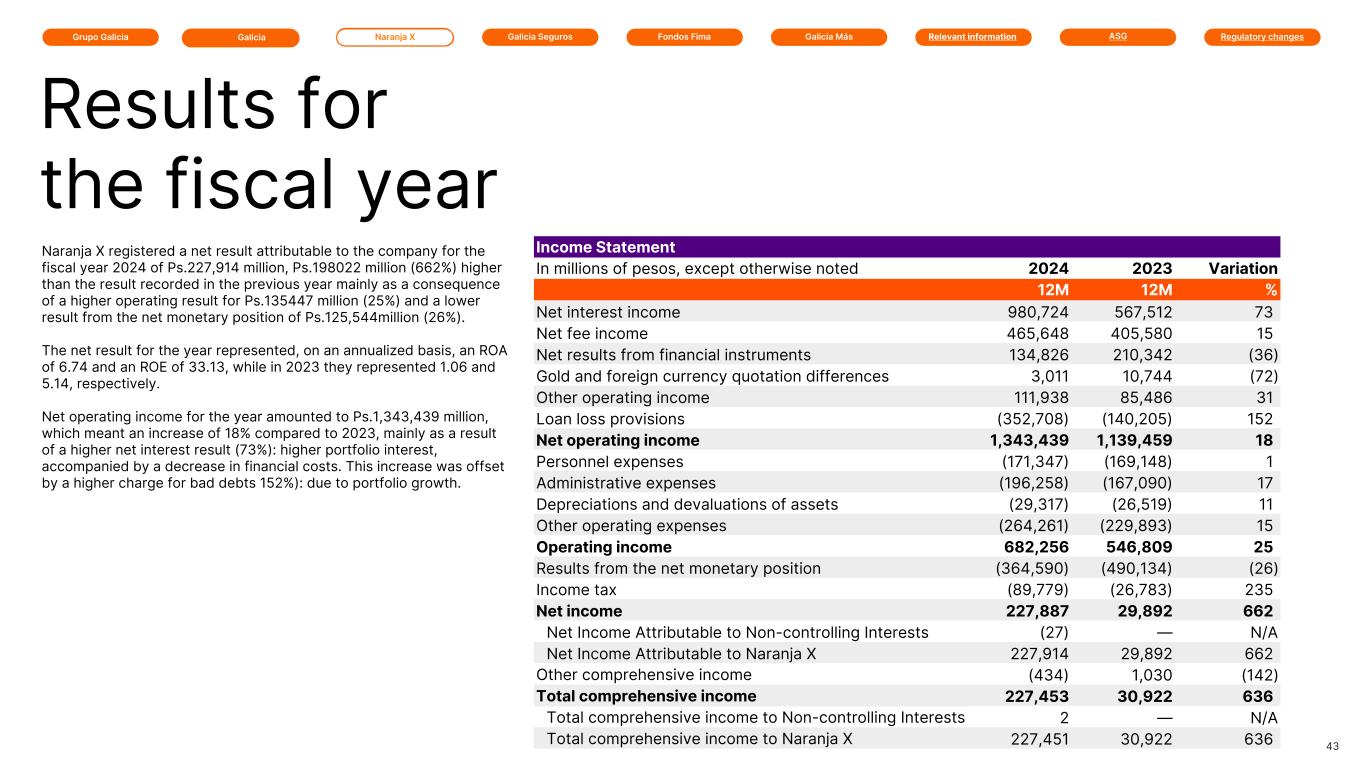

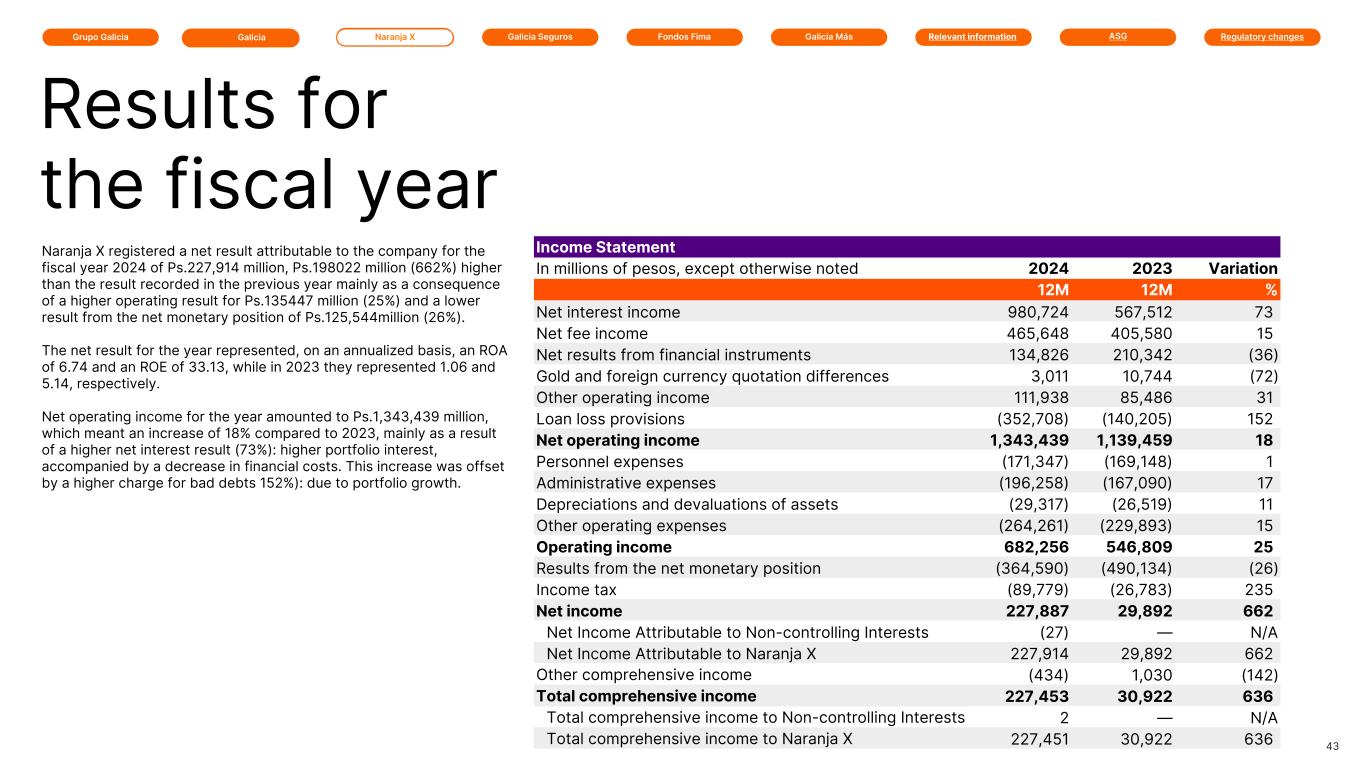

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2023 Variation 12M 12M % Net interest income 980,724 567,512 73 Net fee income 465,648 405,580 15 Net results from financial instruments 134,826 210,342 (36) Gold and foreign currency quotation differences 3,011 10,744 (72) Other operating income 111,938 85,486 31 Loan loss provisions (352,708) (140,205) 152 Net operating income 1,343,439 1,139,459 18 Personnel expenses (171,347) (169,148) 1 Administrative expenses (196,258) (167,090) 17 Depreciations and devaluations of assets (29,317) (26,519) 11 Other operating expenses (264,261) (229,893) 15 Operating income 682,256 546,809 25 Results from the net monetary position (364,590) (490,134) (26) Income tax (89,779) (26,783) 235 Net income 227,887 29,892 662 Net Income Attributable to Non-controlling Interests (27) — N/A Net Income Attributable to Naranja X 227,914 29,892 662 Other comprehensive income (434) 1,030 (142) Total comprehensive income 227,453 30,922 636 Total comprehensive income to Non-controlling Interests 2 — N/A Total comprehensive income to Naranja X 227,451 30,922 636 43 Naranja X registered a net result attributable to the company for the fiscal year 2024 of Ps.227,914 million, Ps.198022 million (662%) higher than the result recorded in the previous year mainly as a consequence of a higher operating result for Ps.135447 million (25%) and a lower result from the net monetary position of Ps.125,544million (26%). The net result for the year represented, on an annualized basis, an ROA of 6.74 and an ROE of 33.13, while in 2023 they represented 1.06 and 5.14, respectively. Net operating income for the year amounted to Ps.1,343,439 million, which meant an increase of 18% compared to 2023, mainly as a result of a higher net interest result (73%): higher portfolio interest, accompanied by a decrease in financial costs. This increase was offset by a higher charge for bad debts 152%): due to portfolio growth. Results for the fiscal year

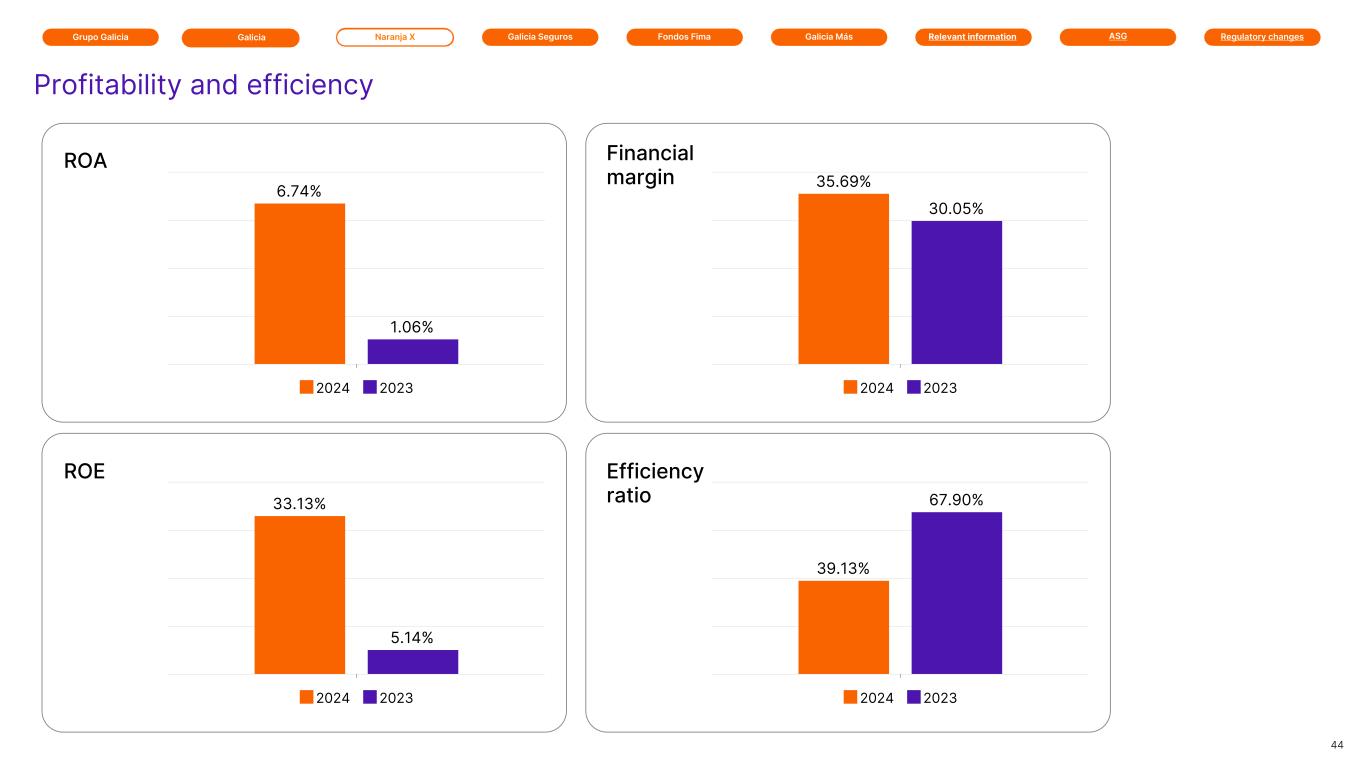

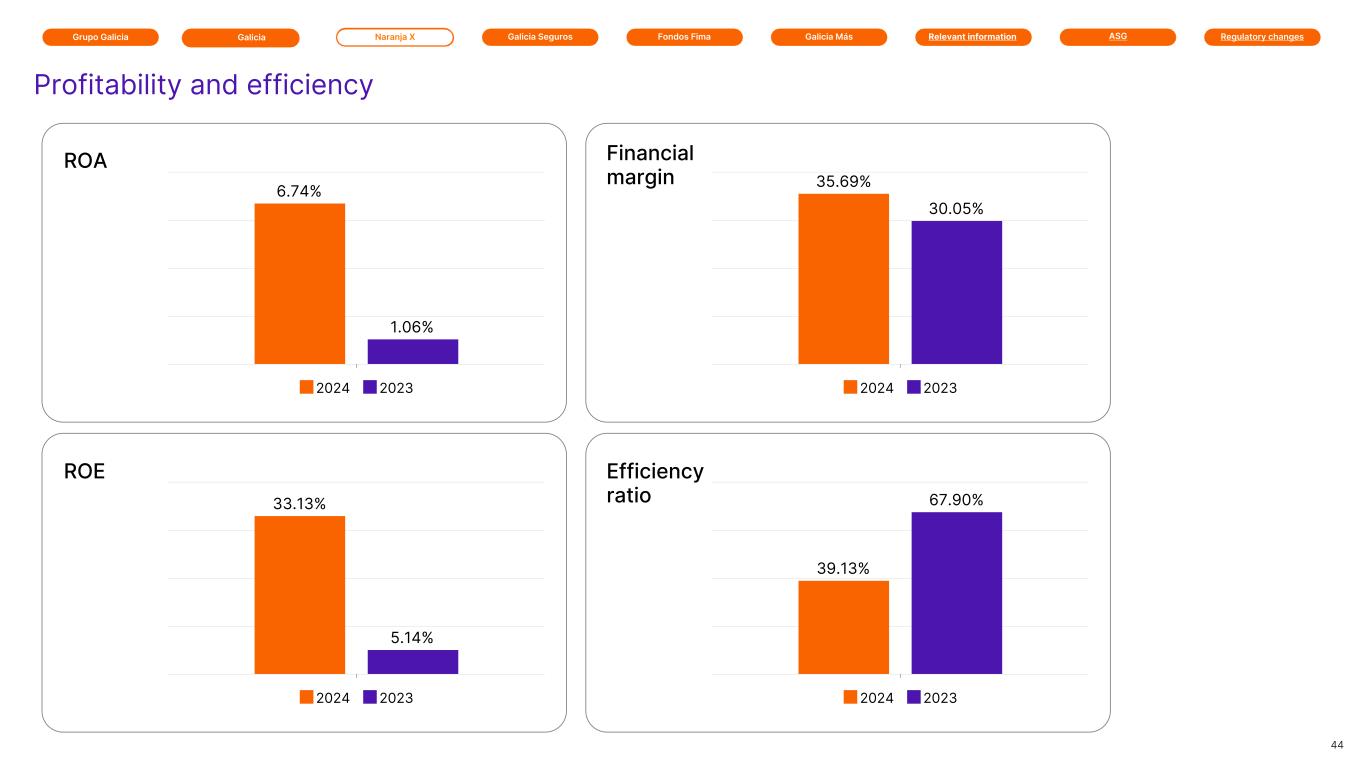

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima 44 Profitability and efficiency Financial margin Efficiency ratio ROA ROE 6.74% 1.06% 2024 2023 33.13% 5.14% 2024 2023 35.69% 30.05% 2024 2023 39.13% 67.90% 2024 2023

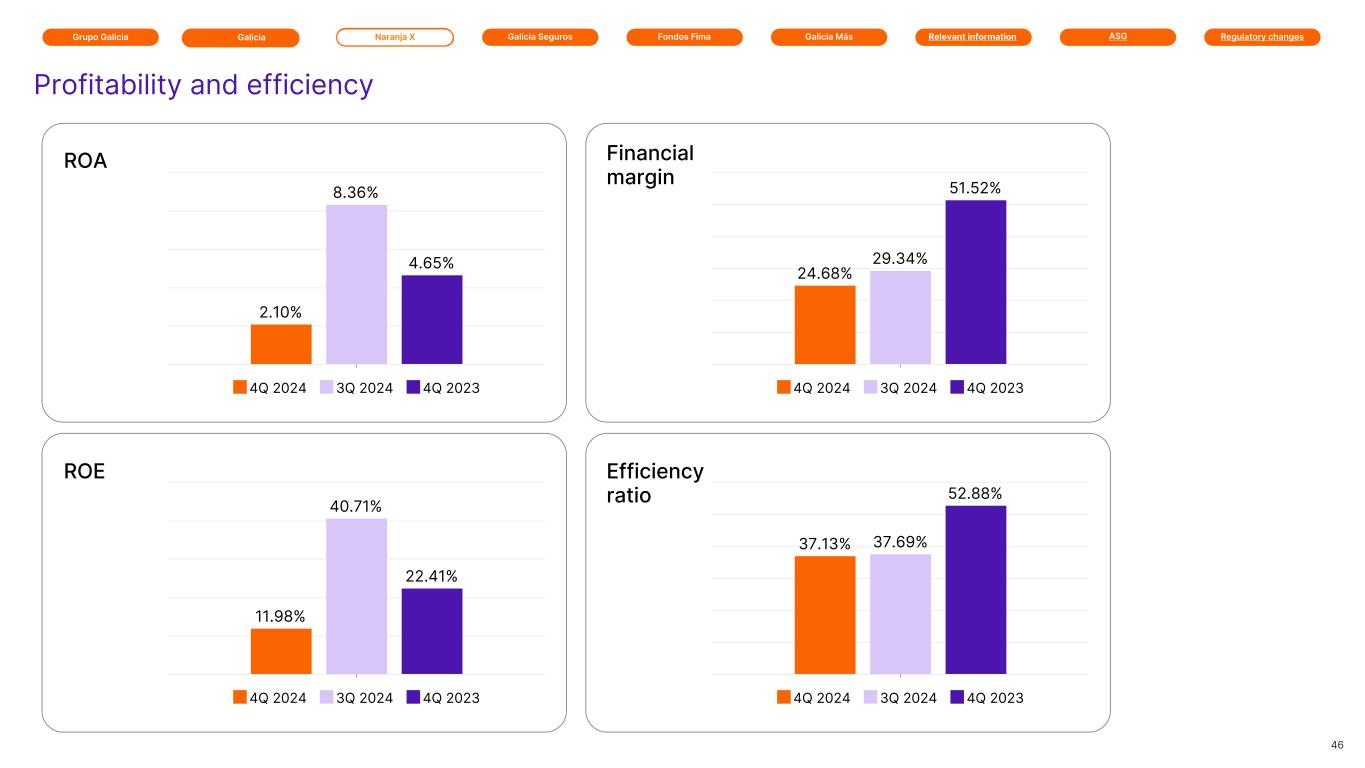

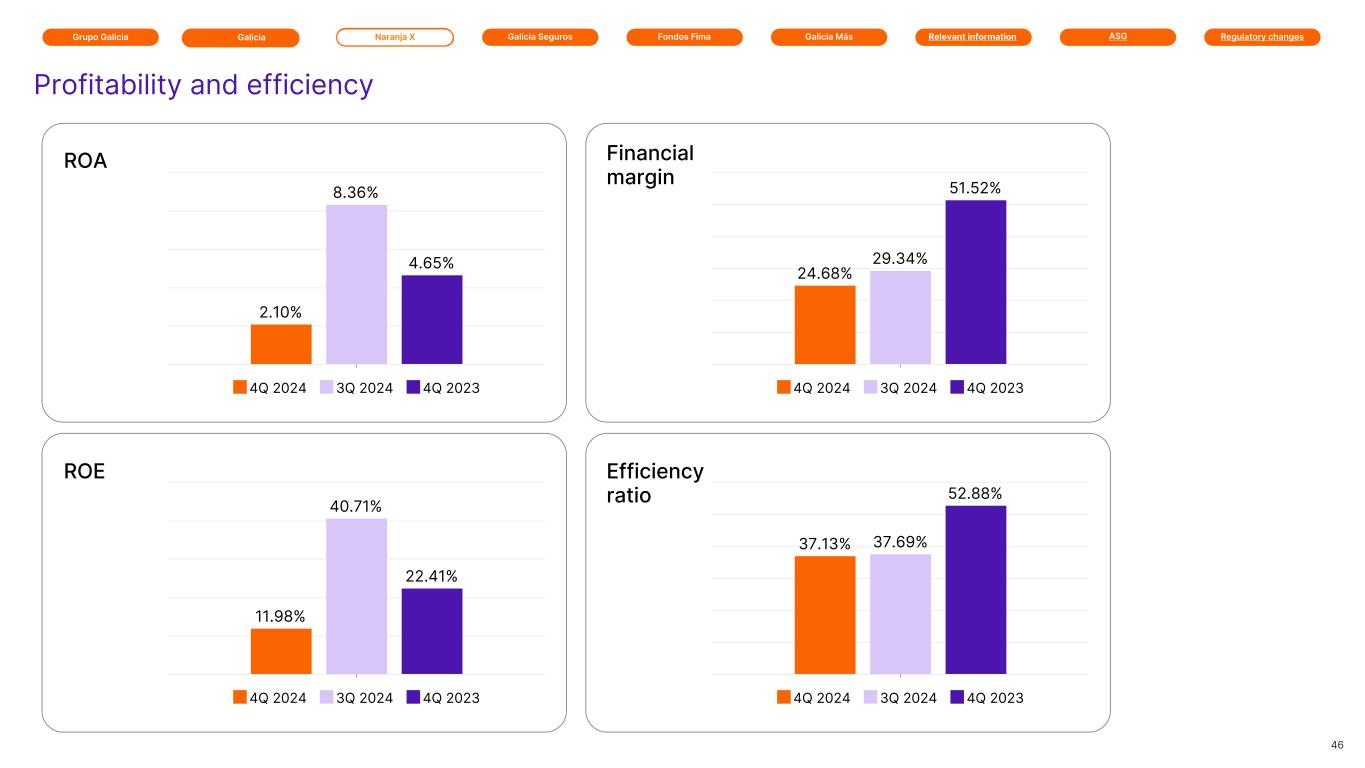

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Net interest income 202,057 221,107 156,191 (9) 29 Net fee income 136,593 128,379 105,290 6 30 Net results from financial instruments 54,459 26,192 149,042 108 (63) Gold and foreign currency quotation differences (3,558) 1,422 12,290 (350) (129) Other operating income 35,927 25,160 20,821 43 73 Loan loss provisions (156,461) (62,896) (50,588) 149 209 Net operating income 269,017 339,364 393,046 (21) (32) Personnel expenses (47,197) (40,706) (50,479) 16 (7) Administrative expenses (51,150) (51,229) (45,911) — 11 Depreciations and devaluations of assets (8,517) (6,395) (7,218) 33 18 Other operating expenses (75,656) (63,359) (65,835) 19 15 Operating income 86,497 177,675 223,603 (51) (61) Results from the net monetary position (47,291) (66,462) (178,027) (29) (73) Income tax (15,904) (36,955) (12,102) (57) 31 Net income 23,302 74,258 33,474 (69) (30) Net Income Attributable to Non-controlling Interests (27) — — N/A N/A Net Income Attributable to Naranja X 23,329 74,258 33,474 (69) (30) Other comprehensive income 366 203 913 80 (60) Total comprehensive income 23,668 74,461 34,387 (68) (31) Total comprehensive income to Non-controlling Interests 2 — — N/A N/A Total comprehensive income to Naranja X 23,666 74,461 34,387 (68) (31) 45 Results for the quarter In the fourth quarter, Naranja X recorded a net result attributable to the company of Ps.23,329 million in profit, Ps.10,145 million lower than the result recorded in the same period of the previous year. This is due to a decrease in the operating result, recording Ps.86,497 million, 61% lower than the Ps.223,603 million of the same quarter of 2023. Net operating income decreased by Ps.124,029 million (32%), mainly as a result of a decrease in net results from financial instruments for Ps.94,583 million (63%) and a higher loss for loans loss provisions for Ps.105,873 million (209%), offset by an increase in net interest income for Ps.45,866 million (29%) and higher net fee income for Ps.31,303 million (30%). The result for the quarter represented, on an annualized basis, an ROA of 2.10% and an ROE of 11.98%, while in the fourth quarter of 2023 they represented 4.65% and 22.41%, respectively.

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima 46 Profitability and efficiency Financial margin Efficiency ratio ROA ROE 2.10% 8.36% 4.65% 4Q 2024 3Q 2024 4Q 2023 11.98% 40.71% 22.41% 4Q 2024 3Q 2024 4Q 2023 24.68% 29.34% 51.52% 4Q 2024 3Q 2024 4Q 2023 37.13% 37.69% 52.88% 4Q 2024 3Q 2024 4Q 2023

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Balance Sheet In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Assets Cash and due from banks 66,070 56,235 42,464 17 56 Debt securities — 99,569 137,984 (100) (100) Net loans and other financing 3,506,908 2,916,260 2,008,131 20 75 Other financial assets 1,329,338 588,973 585,778 126 127 Property, bank premises, equipment 69,006 70,070 70,980 (2) (3) Intangible assets 17,735 17,084 19,124 4 (7) Other non-financial assets 98,572 61,411 79,462 61 24 Total assets 5,087,629 3,809,602 2,943,923 34 73 Liabilities Deposits 1,418,238 708,692 447,707 100 217 Financing from financial entities 454,186 384,097 330,221 18 38 Other financial liabilities 1,964,191 1,697,909 1,209,126 16 62 Negotiable obligations 252,900 105,758 194,239 139 30 Other non-financial liabilities 212,130 151,836 162,016 40 31 Total liabilities 4,301,645 3,048,292 2,343,309 41 84 Shareholders' equity 785,984 761,310 600,614 3 31 Shareholders' equity attributable to Non-controlling 1,007 — — N/A N/A Shareholders' equity attributable to Naranja X 784,977 761,310 600,614 3 31 47 Selected financial information Negotiable Obligation On November 26, 2024, Naranja X issued the Class LXIII Negotiable Obligation for a nominal value of US$179 million with maturity on November 28, 2025 and at an annual rate of 6.25%.

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Loan Portfolio Quality Percentages, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Non-accrual loans 187,556 140,689 54,816 33 242 Allowances for loan losses and provisions 256,175 182,604 92,767 40 176 Ratios (%) Variation (bp) NPL Ratio 5.15 4.98 2.74 17 241 Allowance for loan losses to loans to the private sector 7.03 6.46 4.64 57 239 Coverage 136.59 140.21 169.23 (362) (3,264) Cost of risk 17.99 9.56 9.89 843 810 Taking into consideration the provisions for unused credit-card balances, the coverage ratio as of December 31, 2024, amounted to 136.59%, compared to 169.23% on the same date of the previous year. 48 Assets quality

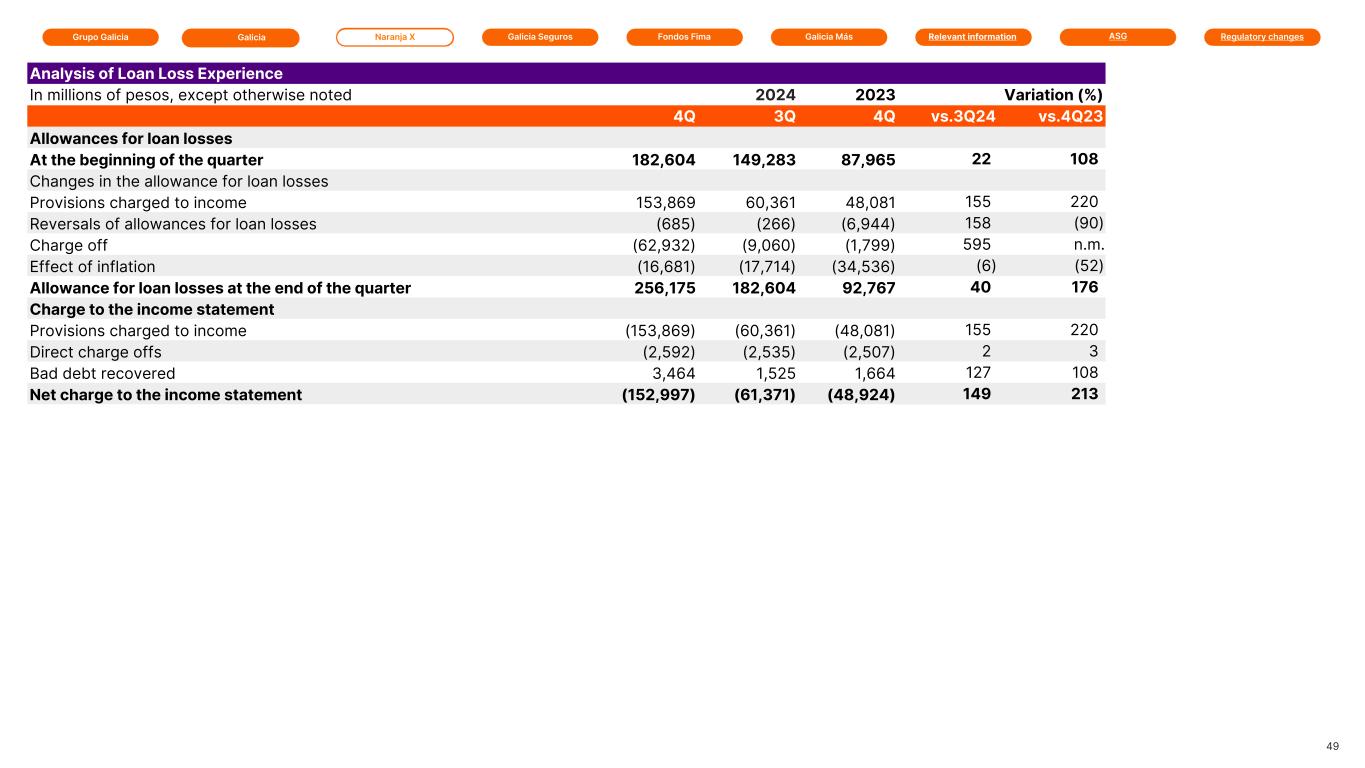

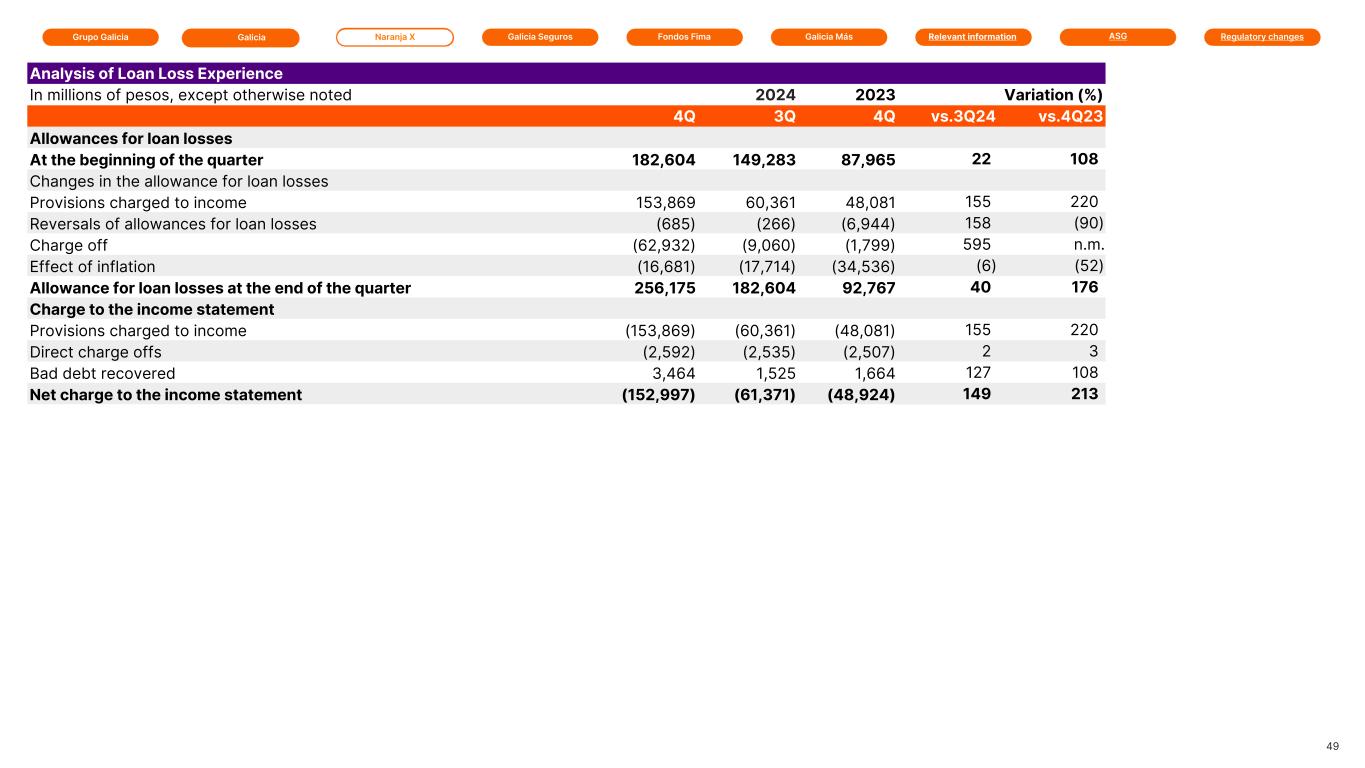

Grupo Galicia Naranja XGalicia Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos Fima Analysis of Loan Loss Experience In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Allowances for loan losses At the beginning of the quarter 182,604 149,283 87,965 22 108 Changes in the allowance for loan losses Provisions charged to income 153,869 60,361 48,081 155 220 Reversals of allowances for loan losses (685) (266) (6,944) 158 (90) Charge off (62,932) (9,060) (1,799) 595 n.m. Effect of inflation (16,681) (17,714) (34,536) (6) (52) Allowance for loan losses at the end of the quarter 256,175 182,604 92,767 40 176 Charge to the income statement Provisions charged to income (153,869) (60,361) (48,081) 155 220 Direct charge offs (2,592) (2,535) (2,507) 2 3 Bad debt recovered 3,464 1,525 1,664 127 108 Net charge to the income statement (152,997) (61,371) (48,924) 149 213 49

Grupo Galicia Galicia Seguros Financial Report Galicia Naranja X Galicia Más Relevant information ASG Regulatory changesFondos Fima Galicia Seguros’s commercial activity began in 1996 as a member of the Galicia Group. Provides insurance solutions for individuals, SMEs, large companies and the agricultural sector. Its commitment is reflected in a wide network of marketing channels that facilitate access to coverage adapted to the needs of each client.

Grupo Galicia Galicia SegurosGalicia Naranja X Galicia Más Relevant information ASG Regulatory changesFondos Fima Ps.(8,969) million Net income for the year attributable to Seguros -144% vs. 12M 2023 ROE (22.85)% -5,633 bp vs. 12M 2023 Combined Ratio 97.68% -404 bp vs. 12M 2023 697 3,038 Employees Polices In thousands 51 Clients In thousands Ps.4,181 million Net income for the quarter attributable to Seguros -53% vs. 4Q 2023 ROE 39.50% -1,854 bp vs. 4Q 2023 Combined Ratio 81.84% -3,450 bp vs. 4Q 2023 2,169 Highlights Sura As of the fourth quarter of 2023, Sudamericana Holding consolidates with Sura Argentina. Agencies 14

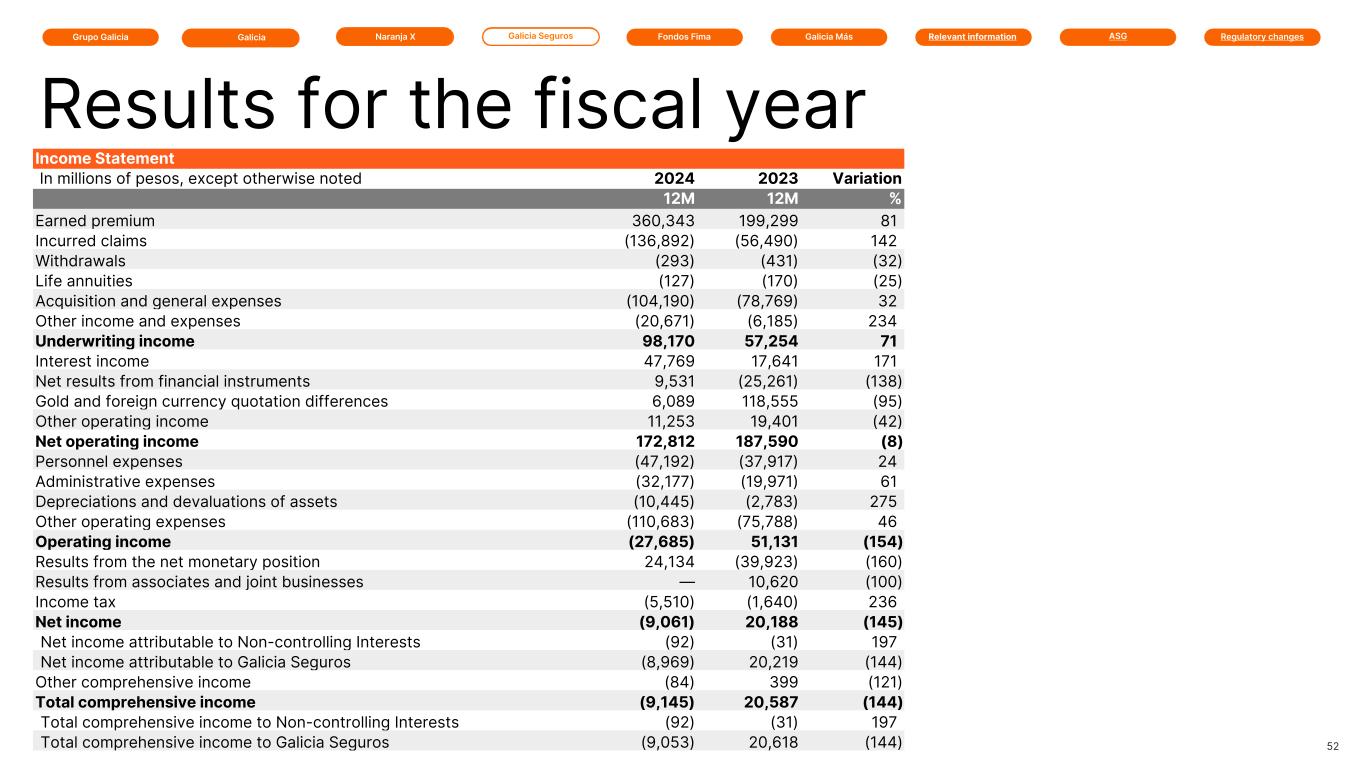

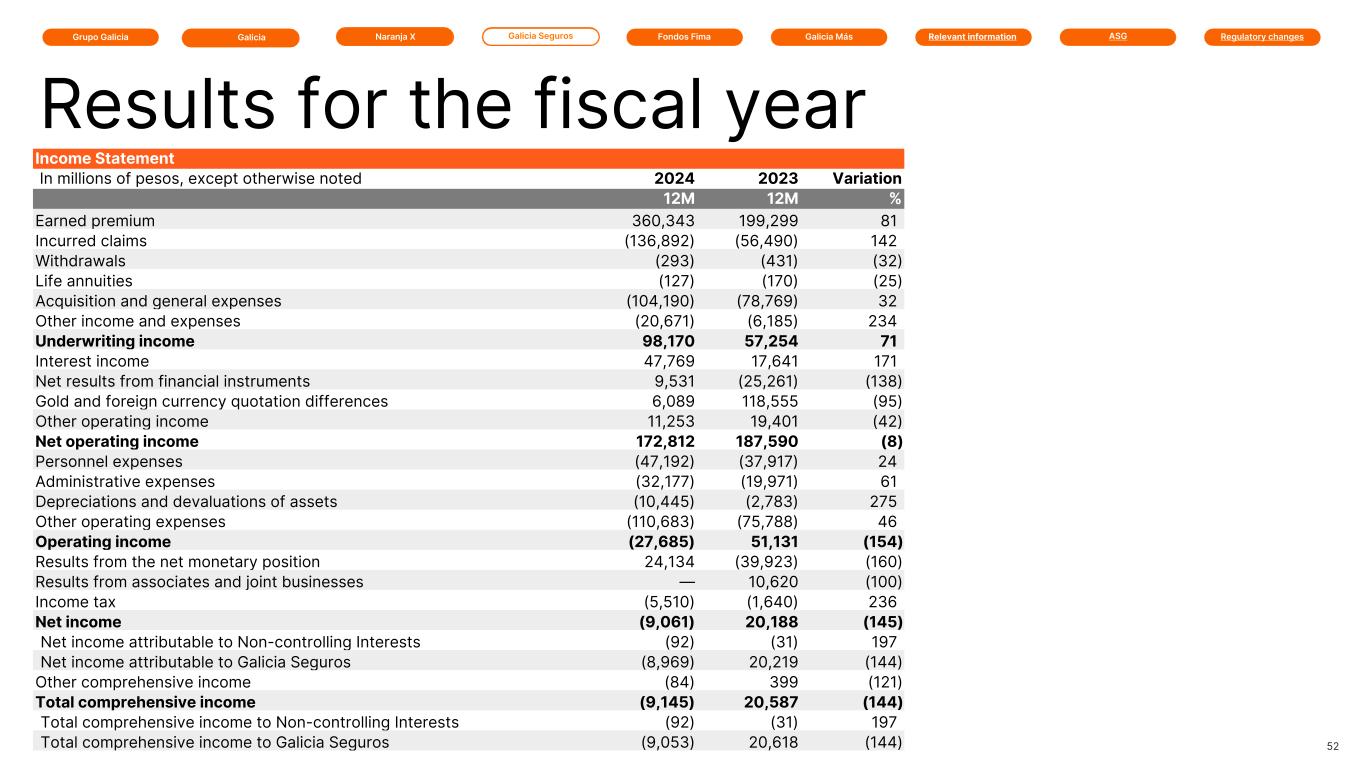

Grupo Galicia Galicia SegurosGalicia Naranja X Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2023 Variation 12M 12M % Earned premium 360,343 199,299 81 Incurred claims (136,892) (56,490) 142 Withdrawals (293) (431) (32) Life annuities (127) (170) (25) Acquisition and general expenses (104,190) (78,769) 32 Other income and expenses (20,671) (6,185) 234 Underwriting income 98,170 57,254 71 Interest income 47,769 17,641 171 Net results from financial instruments 9,531 (25,261) (138) Gold and foreign currency quotation differences 6,089 118,555 (95) Other operating income 11,253 19,401 (42) Net operating income 172,812 187,590 (8) Personnel expenses (47,192) (37,917) 24 Administrative expenses (32,177) (19,971) 61 Depreciations and devaluations of assets (10,445) (2,783) 275 Other operating expenses (110,683) (75,788) 46 Operating income (27,685) 51,131 (154) Results from the net monetary position 24,134 (39,923) (160) Results from associates and joint businesses — 10,620 (100) Income tax (5,510) (1,640) 236 Net income (9,061) 20,188 (145) Net income attributable to Non-controlling Interests (92) (31) 197 Net income attributable to Galicia Seguros (8,969) 20,219 (144) Other comprehensive income (84) 399 (121) Total comprehensive income (9,145) 20,587 (144) Total comprehensive income to Non-controlling Interests (92) (31) 197 Total comprehensive income to Galicia Seguros (9,053) 20,618 (144) 52 Results for the fiscal year

Grupo Galicia Galicia SegurosGalicia Naranja X Galicia Más Relevant information ASG Regulatory changesFondos Fima 53 Profitability and efficiency Combined Ratio Efficiency Ratio ROA ROE (2.23)% 4.85% 2024 2023 (22.85)% 33.48% 2024 2023 97.68% 101.72% 2024 2023 64.42% 61.59% 2024 2023

Grupo Galicia Galicia SegurosGalicia Naranja X Galicia Más Relevant information ASG Regulatory changesFondos Fima Income Statement In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Earned premium 105,217 91,424 91,022 15 16 Incurred claims (28,032) (33,236) (37,239) (16) (25) Withdrawals (65) (74) (111) (12) (41) Life annuities (31) (32) (36) (3) (14) Acquisition and general expenses (27,908) (27,321) (30,220) 2 (8) Other income and expenses (5,933) (7,084) (5,000) (16) 19 Underwriting income 43,248 23,677 18,416 83 135 Interest income 9,946 8,760 (10,466) 14 (195) Net results from financial instruments 2,066 (2,573) (21,072) (180) (110) Gold and foreign currency quotation differences (3,797) 1,789 118,281 (312) (103) Other operating income 1,590 1,730 10,866 (8) (85) Net operating income 53,053 33,383 116,025 59 (54) Personnel expenses (12,920) (10,886) (20,853) 19 (38) Administrative expenses (8,801) (7,783) (12,036) 13 (27) Depreciations and devaluations of assets (2,419) (2,392) (393) 1 516 Other operating expenses (22,470) (17,345) (75,721) 30 (70) Operating income 6,443 (5,023) 7,022 (228) (8) Results from the net monetary position 1,558 1,956 (19,421) (20) (108) Income tax (3,822) 2,005 10,584 (291) (136) Net income 4,179 (1,062) 8,805 (494) (53) Net Income Attributable to Parent Company’s Owners (2) (30) (31) (93) (94) Net Income Attributable to Non-controlling Interests 4,181 (1,032) 8,836 (505) (53) Other comprehensive income 21 6 396 250 (95) Total comprehensive income 4,200 (1,056) 9,201 (498) (54) Total comprehensive income Attributable to Non-controlling Interests (2) (31) (31) (94) (94) Total comprehensive income Attributable to Parent Company’s Owners 4,202 (1,025) 9,232 (510) (54) 54 Results for the quarter

Grupo Galicia Galicia SegurosGalicia Naranja X Galicia Más Relevant information ASG Regulatory changesFondos Fima 55 Profitability and efficiency Combined ratio Efficiency ratio ROA ROE 4.19% (1.11)% 8.39% 4Q 2024 3Q 2024 4Q 2023 39.50% (10.52)% 58.04% 4Q 2024 3Q 2024 4Q 2023 81.84% 97.14% 116.34% 4Q 2024 3Q 2024 4Q 2023 63.07% 77.21% 50.08% 4Q 2024 3Q 2024 4Q 2023

Grupo Galicia Galicia SegurosGalicia Naranja X Galicia Más Relevant information ASG Regulatory changesFondos Fima Balance Sheet In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Assets Cash and due from banks 4,970 2,727 9,812 82 (49) Debt securities 74,367 73,420 150,303 1 (51) Other financial assets 66,550 51,998 71,294 28 (7) Property, bank premises, equipment 6,365 6,150 5,712 3 11 Intangible assets 18,067 19,243 18,562 (6) (3) Assets for insurance contracts 195,951 158,214 196,743 24 — Other non-financial assets 56,903 57,527 60,890 (1) (7) Total assets 423,173 369,279 513,316 15 (18) Liabilities Liabilities for insurance contracts 320,282 278,215 355,593 15 (10) Other non-financial liabilities 58,992 51,362 96,497 15 (39) Total liabilities 379,274 329,577 452,090 15 (16) Shareholders' equity 43,899 39,702 61,226 11 (28) 56 Selected financial information

Financial Report Grupo Galicia Fondos FimaGalicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changes Since 1958, Fondos Fima has been managing mutual funds distributed by Galicia through its multiple channels and other agents.

Grupo Galicia Fondos FimaGalicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changes Ps.68,250 million Net income for the year +27% vs. 12M 2023 Ps.7,351 -3% vs. 4Q 2023 Assets under management In billions 12.9% Market share +170 bp vs. 4Q 2023 27 Employees 58 Assets under management 16Ps.19,283 million Net income for the quarter +86% vs. 4Q 2023 Highlights

Grupo Galicia Fondos FimaGalicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changes Income Statement In millions of pesos, except otherwise noted 2024 2023 Variation 12M 12M % Net results from financial instruments 22,390 46,288 (52) Gold and foreign currency quotation differences 64 283 (77) Other operating income 125,543 101,798 23 Net operating income 147,997 148,369 — Personnel and administrative expenses (11,745) (7,182) 64 Other operating expenses (8,153) (8,149) — Operating income 128,099 133,038 (4) Results from the net monetary position (24,449) (38,588) (37) Results from associates and joint businesses 277 — N/A Income tax (35,677) (40,656) (12) Net income 68,250 53,794 27 59 Results for the fiscal year

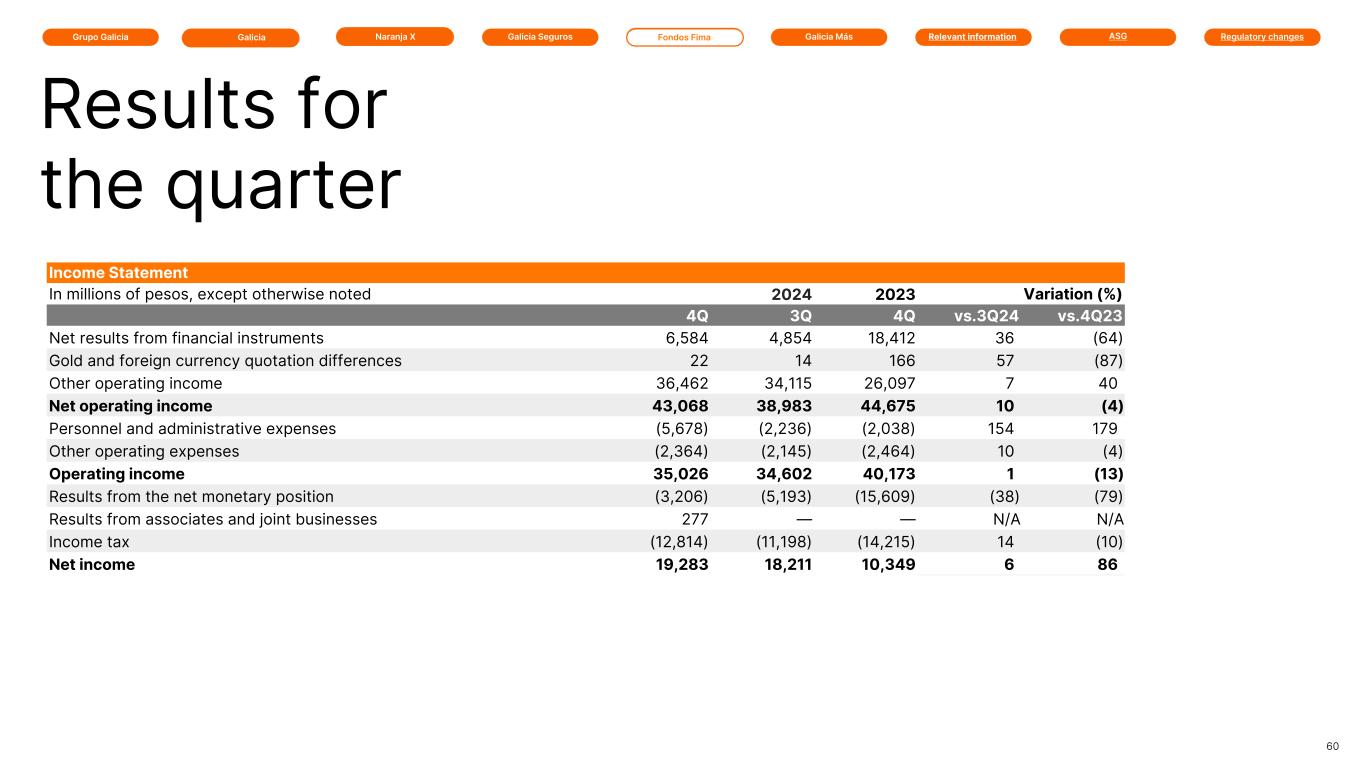

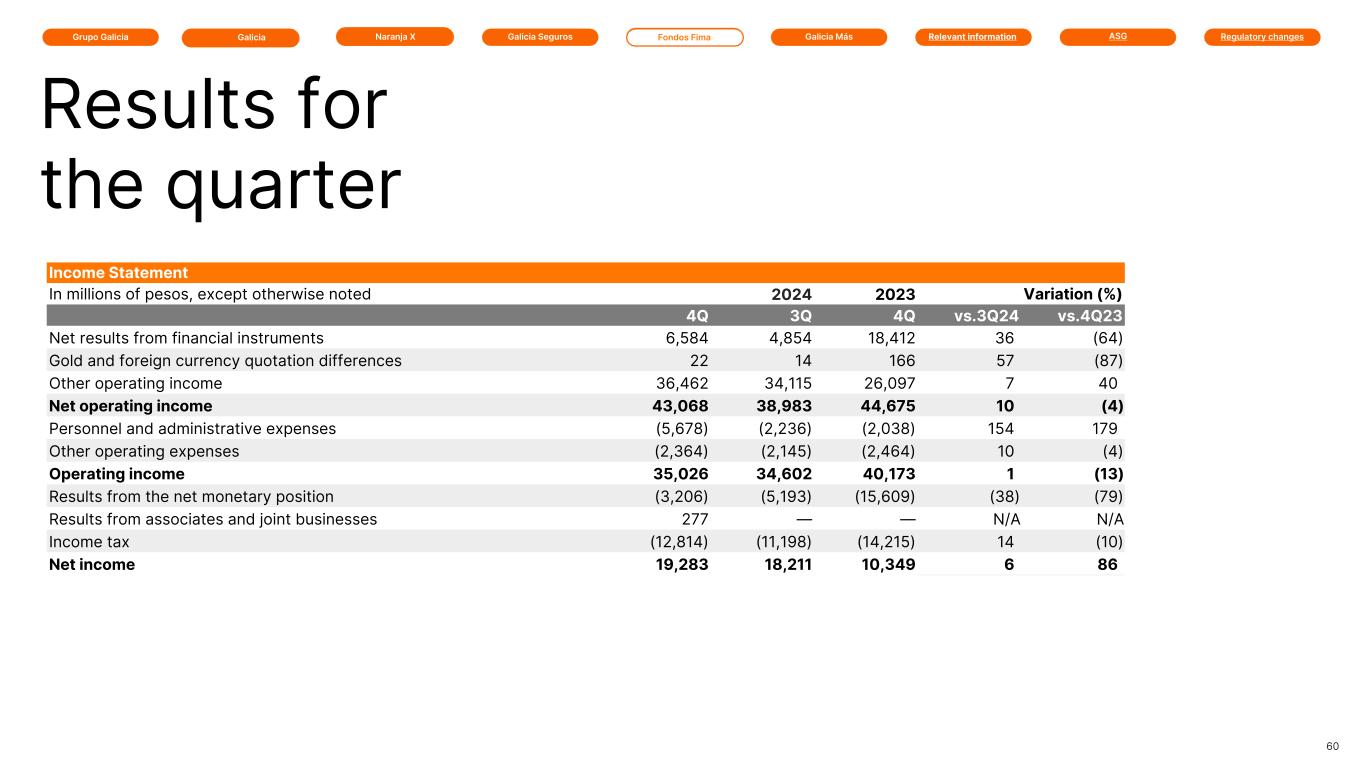

Grupo Galicia Fondos FimaGalicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changes Income Statement In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Net results from financial instruments 6,584 4,854 18,412 36 (64) Gold and foreign currency quotation differences 22 14 166 57 (87) Other operating income 36,462 34,115 26,097 7 40 Net operating income 43,068 38,983 44,675 10 (4) Personnel and administrative expenses (5,678) (2,236) (2,038) 154 179 Other operating expenses (2,364) (2,145) (2,464) 10 (4) Operating income 35,026 34,602 40,173 1 (13) Results from the net monetary position (3,206) (5,193) (15,609) (38) (79) Results from associates and joint businesses 277 — — N/A N/A Income tax (12,814) (11,198) (14,215) 14 (10) Net income 19,283 18,211 10,349 6 86 60 Results for the quarter

Grupo Galicia Fondos FimaGalicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changes Mutual fund In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Fima Acciones 117,874 75,720 61,788 56 91 Fima PB Acciones 66,210 45,805 35,513 45 86 Fima Renta en Pesos 119,739 104,112 176,672 15 (32) Fima Ahorro Pesos 415,250 332,777 129,589 25 220 Fima Renta Plus 90,075 73,254 120,458 23 (25) Fima Premium 5,749,292 5,733,097 6,272,607 — (8) Fima Ahorro Plus 387,791 331,524 217,618 17 78 Fima Capital Plus 143,283 136,367 488,518 5 (71) Fima Abierto Pymes 12,871 12,310 14,804 5 (13) Fima Mix I 28,448 25,953 40,530 10 (30) Fima Mix II 8,941 6,700 9,172 33 (3) Fima Renta Fija Internacional 4,044 5,767 10,359 (30) (61) Fima Sustentable ESG 3,305 4,158 7,970 (21) (59) Fima Acciones Latinoamericanas Dólares 395 525 1,155 (25) (66) Fima Renta Fija Dólares 64,889 3,508 — n.m. N/A Fima Mix Dólares 138,760 31,216 — 345 N/A Total assets under management 7,351,167 6,922,793 7,586,753 6 (3) 61 Assets under management

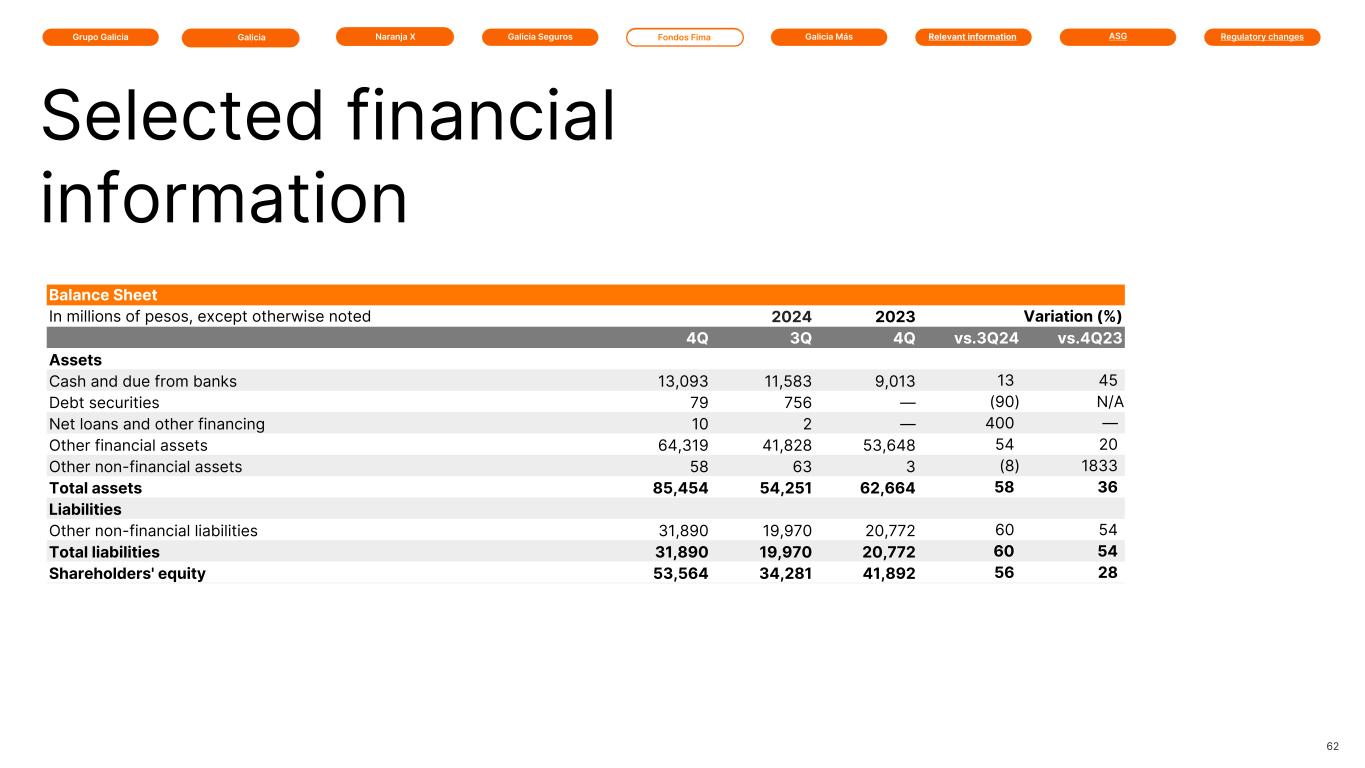

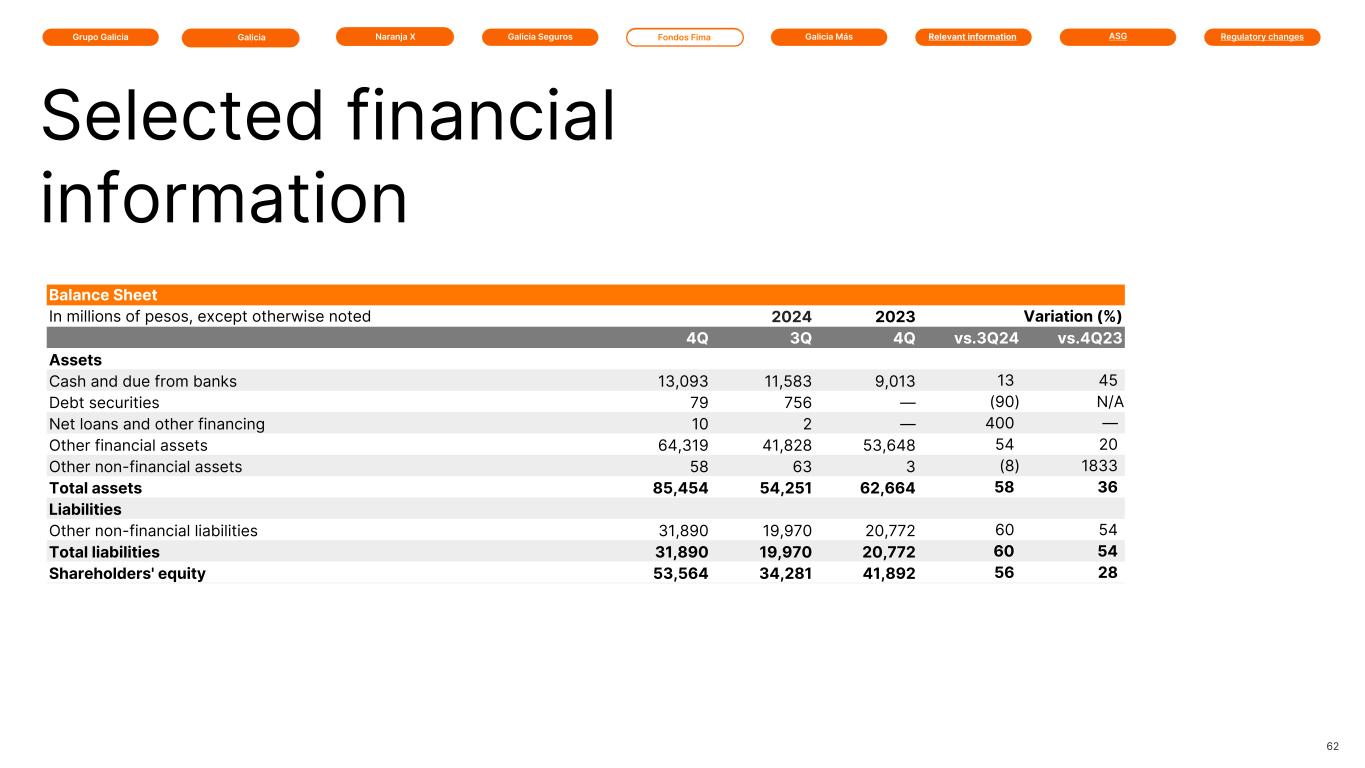

Grupo Galicia Fondos FimaGalicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changes Balance Sheet In millions of pesos, except otherwise noted 2024 2024 2023 Variation (%) 4Q 3Q 4Q vs.3Q24 vs.4Q23 Assets Cash and due from banks 13,093 11,583 9,013 13 45 Debt securities 79 756 — (90) N/A Net loans and other financing 10 2 — 400 — Other financial assets 64,319 41,828 53,648 54 20 Other non-financial assets 58 63 3 (8) 1833 Total assets 85,454 54,251 62,664 58 36 Liabilities Other non-financial liabilities 31,890 19,970 20,772 60 54 Total liabilities 31,890 19,970 20,772 60 54 Shareholders' equity 53,564 34,281 41,892 56 28 62 Selected financial information

Informe de Resultados Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos FimaGrupo Galicia Galicia Más (formerly HSBC) is one of the country's leading banks. Since December 6, 2024, Galicia Más belongs to the Grupo Galicia.

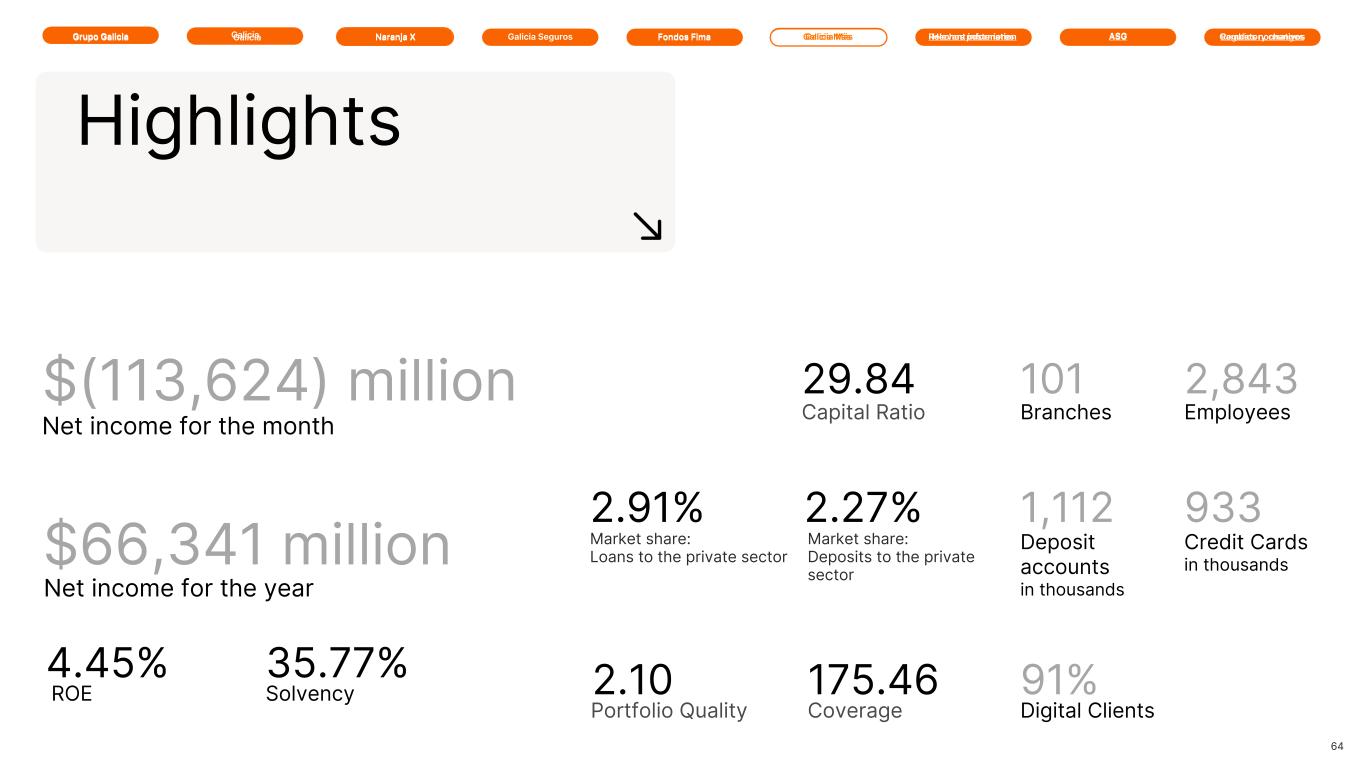

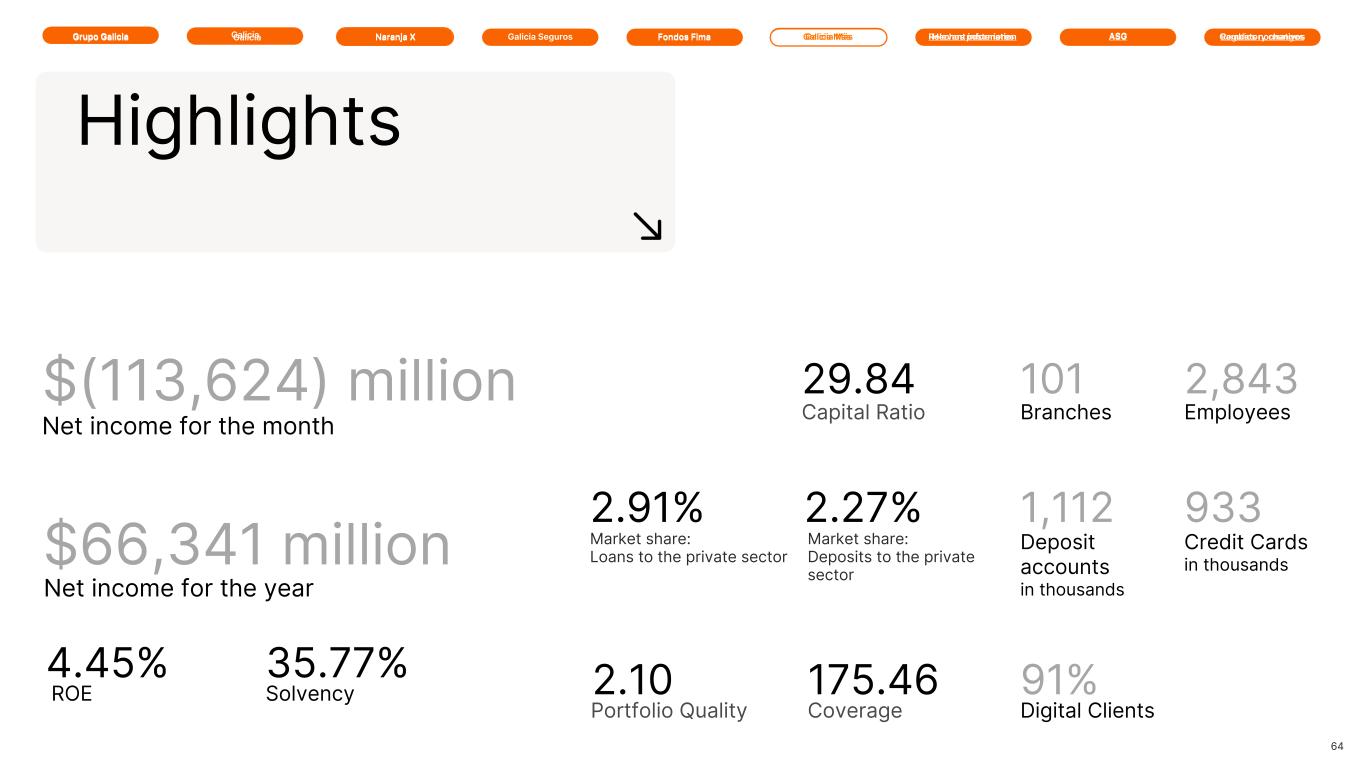

Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos FimaGrupo Galicia $66,341 million $(113,624) million 64 Net income for the year 4.45% 35.77% Portfolio Quality 2.10 Coverage 175.46 Capital Ratio 29.84 ROE 101 Branches 2,843 Employees 91% Digital Clients 1,112 Deposit accounts in thousands 933 Credit Cards in thousands Market share: Loans to the private sector 2.91% Market share: Deposits to the private sector 2.27% li i Galicia Hechos posteriores Cambios norm tivoalicia ás Net income for the month Solvency Highlights

Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos FimaGrupo Galicia aranja li i Galicia Hechos posteriores Cambios norm tivoalicia ás Results Net income In millions of pesos, except otherwise noted 2024 2024 december 12M Net interest income 61,695 1,453,310 Net fee income 10,245 116,191 Net results from financial instruments 18,193 146,178 Gold and foreign currency quotation differences 2,435 34,301 Other operating income 6,550 91,182 Loan-loss provisions (7,719) (59,967) Net operating income 91,399 1,781,195 Personnel expenses (194,135) (436,882) Administrative expenses (13,486) (194,839) Depreciations and devaluations of assets (21,637) (98,531) Other operating expenses (2,437) (212,312) Operating income (140,296) 838,631 Results from the net monetary position (34,358) (821,131) Results from associates and joint businesses — 2,060 Income tax 61,030 46,781 Net Income (113,624) 66,341 Other comprenhensive income (1,042) (87,728) Total comprenhensive income (114,666) (21,387) 65 In December 2024, Galicia Más recorded a negative result of Ps.113,624 million, while in fiscal year 2024, it recorded a net profit of Ps66,341 million. It should be noted that the result includes a provision for restructuring of Ps.174,596 million, established in December 2024.

Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos FimaGrupo Galicia aranja li i Galicia Hechos posteriores Cambios norm tivoalicia ás Balance Sheet In millions of pesos, except otherwise noted 2024 4Q Assets Cash and due from banks 1,106,276 Debt securities 50,229 Net loans and other financing 1,931,647 Other financial assets 1,926,043 Equity investments in subsidiaries, associates and joint businesses — Property, bank premises, equipment 214,252 Intangible assets — Other assets 254,091 Assets available for sale 14,505 Total assets 5,497,043 Liabilities Deposits 3,109,628 Financing from financial entities 11 Other financial liabilities 502,593 Negotiable obligations — Subordinated negotiable obligations 104,199 Other liabilities 332,498 Total liabilities 4,048,929 Shareholders' equity 1,448,114 Selected financial information 66

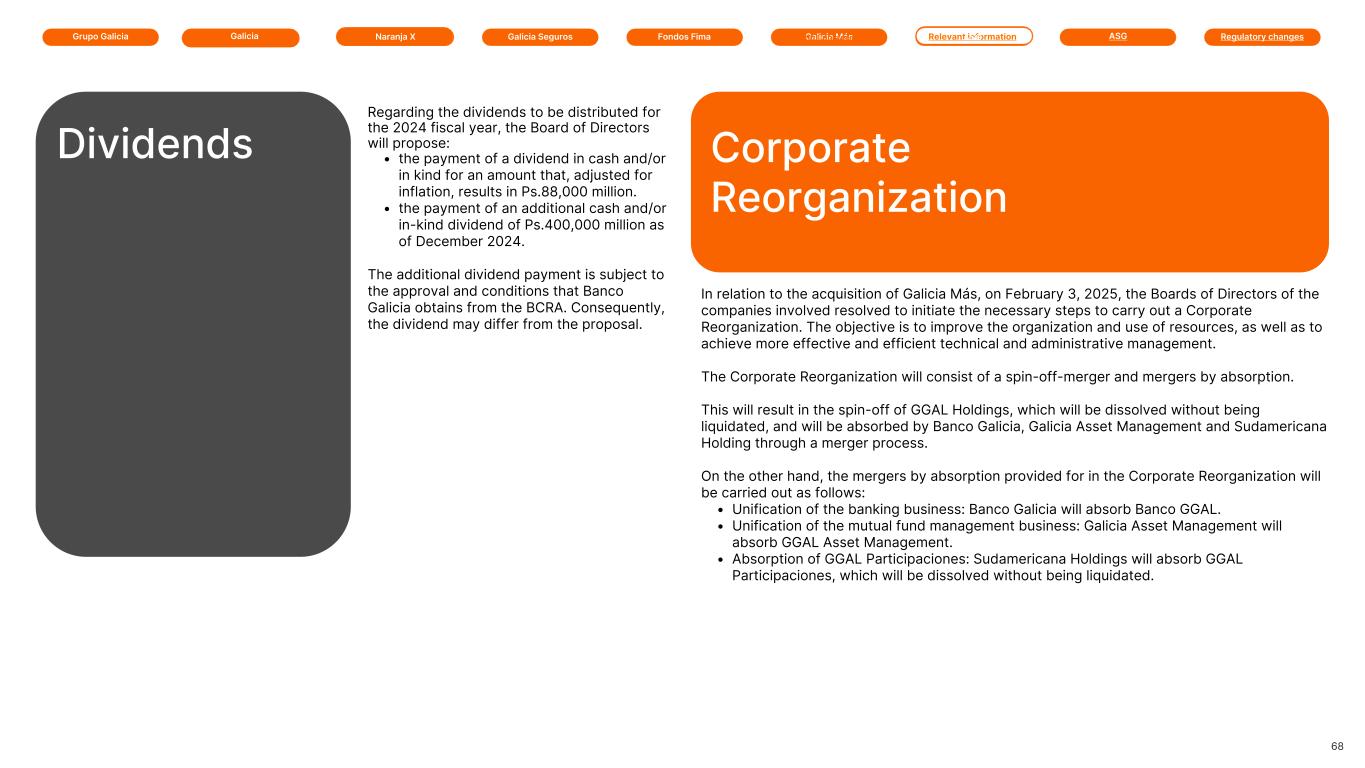

Galicia Naranja X Galicia Seguros Galicia Más Relevant information ASG Regulatory changesFondos FimaGrupo Galicia On February 25, 2024, an agreement was reached between Grupo Galicia and Banco Santander for the implementation of a joint venture with the aim of promoting the growth and expansion of Nera's business. For more information → Relevant Information 67 Relevant information xxxNegotiable Obligation On February 10, 2025, Banco Galicia issued the Class XXI and Class XXII Negotiable Obligation. Class XXI was issued for Ps.79.787 million with an interest rate of TAMAR +2.75% and due on February 10, 2026. The Class XXII was issued for US$74 million with an interest rate of 4.15% and due on August 10, 2025. CFO Nera On February 18, 2025, Gonzalo Fernández Covaro was appointed as CFO of Grupo Galicia.