UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2025

Commission File Number 001-42300

Baird Medical Investment Holdings Limited

Room 202, 2/F, Baide Building, Building 11, No.15

Rongtong Street, Yuexiu District, Guangzhou,

Peoples Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ |

Form 40-F ☐ |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: December 5, 2025 |

|

|

|

|

|

By: |

/s/ Haimei Wu |

|

Name: Haimei Wu |

|

|

Title: Chairwoman and Chief Executive Officer |

|

EXHIBIT INDEX

Exhibit |

|

Description |

99.1 |

|

|

99.2 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

101.INS |

|

Inline XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

101.SCH |

|

Inline XBRL Taxonomy Extension Schema Document |

101.CAL |

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF |

|

Inline XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB |

|

Inline XBRL Taxonomy Extension Label Linkbase Document |

101.PRE |

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document |

104 |

|

Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

Exhibit 99.1

BAIRD MEDICAL INVESTMENT HOLDINGS LIMITED

INDEX TO FINANCIAL STATEMENTS

|

|

Page |

Baird Medical Investment Holdings Limited |

|

|

Unaudited Interim Condensed Consolidated Balance Sheets as of December 31, 2024 and June 30, 2025 |

|

F-2 |

|

F-3 |

|

|

F-4 |

|

|

F-5 |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

F-6 |

F-1

BAIRD MEDICAL INVESTMENT HOLDINGS LIMITED

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(All amounts in U.S. dollars, except for share data, or otherwise noted)

|

|

As of |

||||

|

|

December 31, 2024 |

|

June 30, 2025 |

||

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash |

|

$ |

2,970,199 |

|

$ |

2,171,492 |

Accounts receivable, net |

|

|

46,575,776 |

|

|

40,824,995 |

Inventories |

|

|

1,296,577 |

|

|

1,430,376 |

Prepayments, net |

|

|

10,274,207 |

|

|

15,983,806 |

Deposits and other assets, net |

|

|

295,754 |

|

|

332,689 |

Due from related parties |

|

|

2,862 |

|

|

2,916 |

Total Current Assets |

|

|

61,415,375 |

|

|

60,746,274 |

NON-CURRENT ASSETS |

|

|

|

|

|

|

Property and equipment, net |

|

|

7,141,064 |

|

|

6,705,182 |

Intangible assets, net |

|

|

16,528 |

|

|

12,631 |

Deferred tax assets |

|

|

714,461 |

|

|

700,524 |

Right-of-use assets |

|

|

475,119 |

|

|

289,395 |

Goodwill |

|

|

57,772 |

|

|

58,869 |

Prepayments – non current |

|

|

8,021,046 |

|

|

8,353,796 |

Deposits and other assets – non current |

|

|

121,505 |

|

|

123,811 |

Total Non-Current Assets |

|

|

16,547,495 |

|

|

16,244,208 |

Total Assets |

|

$ |

77,962,870 |

|

$ |

76,990,482 |

CURRENT LIABILITIES |

|

|

|

|

|

|

Short-term bank loans |

|

|

16,166,000 |

|

|

13,953,020 |

Tax payables |

|

|

2,873,453 |

|

|

2,452,315 |

Salaries and benefits payable |

|

|

797,912 |

|

|

693,309 |

Contract liability |

|

|

792,102 |

|

|

1,093,434 |

Short-term lease liabilities |

|

|

264,316 |

|

|

118,607 |

Accounts payable |

|

|

1,252,667 |

|

|

2,136,075 |

Amounts due to a related party |

|

|

3,703,700 |

|

|

4,502,547 |

Accrued listing expenses payable |

|

|

5,341,848 |

|

|

5,282,105 |

Accrued expenses and other payables |

|

|

2,518,175 |

|

|

2,623,151 |

Deferred tax liabilities |

|

|

45,238 |

|

|

21,559 |

Long-term loan – current portion |

|

|

867,772 |

|

|

2,591,659 |

Total Current Liabilities |

|

|

34,623,183 |

|

|

35,467,781 |

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

Long-term lease liabilities |

|

|

136,683 |

|

|

84,459 |

Long-term loan – non current |

|

|

3,442,526 |

|

|

5,814,171 |

Total Non-Current Liabilities |

|

|

3,579,209 |

|

|

5,898,630 |

Total Liabilities |

|

$ |

38,202,392 |

|

$ |

41,366,411 |

Commitments and Contingencies |

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Preferred shares, $0.0001 par value; 5,000,000 shares authorized; 290,000 shares issued and outstanding as of December 31, 2024 and June 30,2025 |

|

|

29 |

|

|

29 |

Ordinary shares, $0.0001 par value; 500,000,000 shares authorized; 35,728,625 shares issued,25,555,096 shares outstanding as of December 31, 2024; 40,979,382 shares issued, 26,552,370 shares outstanding as of June 30, 2025 * |

|

|

2,556 |

|

|

2,655 |

Additional paid-in capital* |

|

|

11,441,712 |

|

|

17,770,394 |

Statutory reserve |

|

|

4,591,151 |

|

|

4,611,287 |

Retained earnings |

|

|

26,764,751 |

|

|

15,450,720 |

Accumulated other comprehensive loss |

|

|

(3,141,061) |

|

|

(2,247,122) |

Total Baird Medical Investment Holdings Limited’s Shareholders’ Equity |

|

|

39,659,138 |

|

|

35,587,963 |

Non-controlling interests |

|

|

101,340 |

|

|

36,108 |

Total Equity |

|

|

39,760,478 |

|

|

35,624,071 |

Total Liabilities and Equity |

|

$ |

77,962,870 |

|

$ |

76,990,482 |

*Shares related information and additional paid-in capital for all periods retrospectively reflect the adjustments for Reverse Recapitalization (Note 3).

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-2

BAIRD MEDICAL INVESTMENT HOLDINGS LIMITED

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME/LOSS

(All amounts in U.S. dollars, except for share and per share data, or otherwise noted)

|

|

For the six months ended June 30, |

||||

|

|

2024 |

|

2025 |

||

Revenues |

|

$ |

13,136,588 |

|

$ |

7,959,494 |

Cost of revenues |

|

|

(1,645,559) |

|

|

(1,424,240) |

Gross profit |

|

|

11,491,029 |

|

|

6,535,254 |

Operating expenses: |

|

|

|

|

|

|

Selling and marketing expenses |

|

|

(1,168,576) |

|

|

(1,127,725) |

General and administrative expenses |

|

|

(3,205,845) |

|

|

(8,677,640) |

Research and development expenses |

|

|

(2,027,439) |

|

|

(7,180,293) |

Total operating expenses |

|

|

(6,401,860) |

|

|

(16,985,658) |

Income from operations |

|

|

5,089,169 |

|

|

(10,450,404) |

Interest expense |

|

|

(238,919) |

|

|

(358,215) |

Interest income |

|

|

264 |

|

|

762 |

Subsidy income |

|

|

265 |

|

|

56,968 |

Other expenses, net |

|

|

5,627 |

|

|

(49,107) |

Income/(loss) before income tax |

|

|

4,856,406 |

|

|

(10,799,996) |

Income tax provision |

|

|

(481,279) |

|

|

(559,131) |

Net income/(loss) |

|

|

4,375,127 |

|

|

(11,359,127) |

Less: Net income/(loss) attributable to non-controlling interests |

|

|

(44,860) |

|

|

(65,232) |

Net income/(loss) attributable to Baird Medical Investment Holdings Limited’s shareholders |

|

|

4,330,267 |

|

|

(11,293,895) |

Other comprehensive loss |

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(828,730) |

|

|

893,939 |

Total comprehensive income/(loss) |

|

|

3,546,397 |

|

|

(10,465,188) |

Non-controlling interests |

|

|

(44,860) |

|

|

(65,232) |

Comprehensive income/(loss) attributable to Baird Medical Investment Holdings Limited’s shareholders |

|

$ |

3,501,537 |

|

$ |

(10,399,956) |

Net income/(loss) per share, basic* |

|

$ |

0.17 |

|

$ |

(0.43) |

Net income/(loss) per share, diluted* |

|

$ |

0.17 |

|

$ |

(0.43) |

Weighted average number of shares-basic* |

|

|

25,555,096 |

|

|

26,402,382 |

Weighted average number of shares-diluted* |

|

|

25,555,096 |

|

|

26,402,382 |

Stock-based compensation expenses included in |

|

|

|

|

|

|

General and administrative expenses |

|

$ |

— |

|

$ |

(6,328,781) |

*Shares related information for all periods retrospectively reflect the adjustments for Reverse Recapitalization (Note 3).

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-3

BAIRD MEDICAL INVESTMENT HOLDINGS LIMITED

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In U.S. dollars, except for share data, or otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

other |

|

Total |

|

Non- |

|

|

|

|||||

|

|

Preferred shares |

|

Ordinary shares* |

|

paid-in |

|

Statutory |

|

Retained |

|

comprehensive |

|

shareholder’s |

|

controlling |

|

|

|

||||||||||||

|

|

Shares |

|

Amounts |

|

Shares |

|

Amounts |

|

capital* |

|

reserve |

|

earnings |

|

loss |

|

equity |

|

interests |

|

Total equity |

|||||||||

Balance at December 31, 2023 |

|

— |

|

|

— |

|

25,555,096 |

|

$ |

2,556 |

|

$ |

18,850,677 |

|

$ |

4,508,366 |

|

$ |

14,394,167 |

|

$ |

(2,005,122) |

|

$ |

35,750,644 |

|

$ |

(43,389) |

|

$ |

35,707,255 |

Net income |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4,330,267 |

|

|

— |

|

|

4,330,267 |

|

|

44,860 |

|

|

4,375,127 |

Appropriation of statutory reserve |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

48,785 |

|

|

(48,785) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Foreign currency translation adjustment |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(828,730) |

|

|

(828,730) |

|

|

— |

|

|

(828,730) |

Balance at June 30, 2024 |

|

— |

|

|

— |

|

25,555,096 |

|

$ |

2,556 |

|

$ |

18,850,677 |

|

$ |

4,557,151 |

|

$ |

18,675,649 |

|

$ |

(2,833,852) |

|

$ |

39,252,181 |

|

$ |

1,471 |

|

$ |

39,253,652 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

|

other |

|

Total |

|

Non- |

|

|

|

||||

|

|

Preferred shares |

|

Ordinary shares* |

|

paid-in |

|

Statutory |

|

Retained |

|

comprehensive |

|

shareholder’s |

|

controlling |

|

|

|

||||||||||||

|

|

Shares |

|

Amounts |

|

Shares |

|

Amounts |

|

earnings |

|

reserve |

|

earnings |

|

loss |

|

equity |

|

interests |

|

Total equity |

|||||||||

Balance at December 31, 2024 |

|

290,000 |

|

$ |

29 |

|

25,555,096 |

|

$ |

2,556 |

|

$ |

11,441,712 |

|

$ |

4,591,151 |

|

$ |

26,764,751 |

|

$ |

(3,141,061) |

|

$ |

39,659,138 |

|

$ |

101,340 |

|

$ |

39,760,478 |

Net loss |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(11,293,895) |

|

|

— |

|

|

(11,293,895) |

|

|

(65,232) |

|

|

(11,359,127) |

Stock-based compensation to individuals |

|

— |

|

|

— |

|

363,745 |

|

|

36 |

|

|

2,134,783 |

|

|

— |

|

|

— |

|

|

— |

|

|

2,134,783 |

|

|

— |

|

|

2,134,819 |

Share issuance to third-party companies |

|

— |

|

|

— |

|

633,529 |

|

|

63 |

|

|

4,193,899 |

|

|

— |

|

|

— |

|

|

— |

|

|

4,193,899 |

|

|

— |

|

|

4,193,962 |

Appropriation of statutory reserve |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

20,136 |

|

|

(20,136) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Foreign currency translation adjustment |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

893,939 |

|

|

893,939 |

|

|

— |

|

|

893,939 |

Balance at June 30, 2025 |

|

290,000 |

|

$ |

29 |

|

26,552,370 |

|

$ |

2,655 |

|

$ |

17,770,394 |

|

$ |

4,611,287 |

|

$ |

15,450,720 |

|

$ |

(2,247,122) |

|

$ |

35,587,963 |

|

$ |

36,108 |

|

$ |

35,624,071 |

*Shares related information and additional paid-in capital for all periods retrospectively reflect the adjustments for Reverse Recapitalization (Note 3).

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-4

BAIRD MEDICAL INVESTMENT HOLDINGS LIMITED

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In U.S. dollars, except for share data, or otherwise noted)

|

|

For the six months ended June 30, |

||||

|

|

2024 |

|

2025 |

||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net income/(loss) |

|

$ |

4,375,127 |

|

$ |

(11,359,127) |

Adjustments to reconcile net income to net cash (used in)/provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

592,743 |

|

|

597,562 |

Deferred tax expense |

|

|

17,212 |

|

|

2,922 |

Stock-based compensation |

|

|

— |

|

|

6,328,781 |

Amortization of right-of-use assets |

|

|

181,219 |

|

|

192,370 |

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(4,139,051) |

|

|

6,554,286 |

Inventories |

|

|

(2,214) |

|

|

(107,862) |

Prepayments |

|

|

(4,044,770) |

|

|

(5,610,132) |

Deposits and other assets |

|

|

(10,655) |

|

|

(30,941) |

Accounts payable |

|

|

5,702 |

|

|

849,167 |

Contract liabilities |

|

|

51,274 |

|

|

282,814 |

Lease liabilities |

|

|

(299,861) |

|

|

(203,040) |

Accrued expenses and other payables |

|

|

(141,643) |

|

|

(220,957) |

Taxes payable |

|

|

(545,480) |

|

|

(469,878) |

Net cash used in operating activities |

|

|

(3,960,397) |

|

|

(3,194,035) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(484,839) |

|

|

(44,610) |

Net cash used in investing activities |

|

|

(484,839) |

|

|

(44,610) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from short-term bank loans |

|

|

8,454,600 |

|

|

9,646,105 |

Repayments of short-term bank loans |

|

|

(3,465,000) |

|

|

(12,135,200) |

Proceeds from long-term loan |

|

|

— |

|

|

4,963,986 |

Payment of long-term loan |

|

|

(393,601) |

|

|

(999,133) |

Due to a related party |

|

|

(8,433) |

|

|

719,685 |

Payment of listing cost |

|

|

(130,349) |

|

|

— |

Net cash provided by financing activities |

|

|

4,457,217 |

|

|

2,195,443 |

Effect of exchange rate changes |

|

|

(20,051) |

|

|

244,495 |

Net change in cash |

|

|

(8,070) |

|

|

(798,707) |

Cash at beginning of the period |

|

$ |

1,510,484 |

|

$ |

2,970,199 |

Cash at end of the period |

|

$ |

1,502,414 |

|

$ |

2,171,492 |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

919,829 |

|

$ |

632,467 |

Cash paid for interest |

|

$ |

238,919 |

|

$ |

358,215 |

SUPPLEMENTAL DISCLOSURE OF NONCASH FLOW INFORMATION: |

|

|

|

|

|

|

Stock-based compensation |

|

$ |

— |

|

$ |

6,328,781 |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-5

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. dollars, except for share data, or otherwise noted)

NOTE 1 — ORGANIZATION AND DESCRIPTION OF BUSINESS

Baird Medical Investment Holdings Limited (“PubCo”, “Baird Medical” or “the Company”) was incorporated as a private company under the laws of Cayman Island on June 16, 2023, as a direct wholly owned subsidiary of Betters Medical Investment Holdings Limited (“Betters Medical”).

On October 1, 2024 (the “Closing Date”), ExcelFin Acquisition Corp., a Delaware corporation (“ExcelFin” or “SPAC”), Betters Medical Investment Holdings Limited, a Cayman Islands exempted company, Baird Medical Investment Holdings Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of Betters Medical, Tycoon Choice Global Limited, a business company limited by shares incorporated under the laws of the British Virgin Islands and a wholly owned subsidiary of PubCo (“Tycoon”), Betters Medical Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of PubCo (“Merger Sub 1”), Betters Medical Merger Sub 2, Inc., a Delaware corporation and a direct, wholly owned subsidiary of PubCo (“Merger Sub 2”), and Betters Medical NewCo, LLC, a Delaware limited liability company and a direct, wholly-owned subsidiary of Betters Medical (“NewCo”), consummated the business combination (the “Closing”) pursuant to the terms of the Business Combination Agreement, dated as of June 26, 2023 (as amended on March 11, 2024, May 16, 2024, June 17, 2024 and August 23, 2024, the “Business Combination Agreement” and the transactions contemplated thereby, the “Business Combination”), pursuant to which, among other things, (a) on August 3, 2023, Betters Medical contributed all of the issued shares of Tycoon held by Betters Medical (“Tycoon Shares”) to PubCo in exchange for Ordinary Shares, such that Tycoon became a wholly-owned subsidiary of PubCo, and Betters Medical received in exchange therefor 29,411,764 Ordinary Shares (the “Share Contribution”) valued at $10.20 per share, that have an aggregate value equal to Three Hundred Million Dollars ($300,000,000); (b) prior to Closing, Betters Medical transferred 1,948,138 Ordinary Shares (which shares did not include the Baird Medical Earnout Shares, as defined below) to NewCo and certain minority shareholders of Betters Medical exchanged their ownership interests in Betters Medical for all of the outstanding ownership interests in NewCo; and (c) Merger Sub 1 merged with and into ExcelFin, with ExcelFin continuing as the surviving entity and wholly-owned subsidiary of PubCo and Merger Sub 2 merged with and into NewCo, with NewCo continuing as the surviving entity and wholly-owned subsidiary of PubCo (the “Second Merger”). However, 8,823,529 of the Ordinary Shares issued to Betters Medical (the “Baird Medical Earnout Shares”) will not vest unless and until within the eighth anniversary of the Closing (a) the volume weighted average price of the Ordinary Shares on Nasdaq is greater than or equal to $12.50 per share for any 20 trading days within a 30-day trading period or (b) a change of control of PubCo occurs with an implied value at or above $12.50 per share. The business purpose of the Second Merger was both to ensure compliance with Nasdaq’s public float requirement as well as to facilitate that additional Ordinary Shares would be held after closing by shareholders most likely to be long-term holders. 1,350,000 Ordinary Shares issued to the ExcelFin SPAC LLC, a Delaware limited liability company, in the Business Combination that will not vest unless and until within the fifth anniversary of the closing of the Business Combination (a) the volume weighted average price of the Ordinary Shares on the Nasdaq Global Market (the “Nasdaq”) is greater than or equal to $12.50 per share over any 20 trading days within any 30 day trading period or (b) a change of control of Baird Medical occurs.

Upon the consummation of the Business Combination, outstanding ExcelFin Warrants were assumed by us and converted into corresponding warrants to purchase an aggregate of 11,500,000 Ordinary Shares. The Assumed Public Warrants will not become exercisable until 30 days after the Closing, and will expire five years after the completion of the Business Combination. Each Assumed Public Warrant entitles the holder thereof to purchase one Ordinary Share at a price of $11.50 per whole share, subject to adjustment. The Assumed Public Warrants may be exercised only for a whole number of the Ordinary Shares. To the extent such warrants are exercised, additional Ordinary Shares will be issued, which will result in dilution to the then-existing holders of the Ordinary Shares and increase the number of shares eligible for resale in the public market. Sales of substantial numbers of such shares in the public market could adversely affect the market price of the Ordinary Shares. The exclusive forum provision in the amended and restated warrant agreement can result in increased costs to investors to bring a claim.

In connection with the signing of the Business Combination Agreement, ExcelFin SPAC LLC (“the Sponsor”), ExcelFin, and Baird Medical entered into the Sponsor Support Agreement. Pursuant to this agreement, the Sponsor agreed to surrender all 11,700,000 of the ExcelFin Private Placement Warrants which are owned by the Sponsor to ExcelFin for no additional consideration effective as of immediately prior to the at the effective time of the Business Combination (“Effective Time”).

F-6

The Business Combination was accounted for as a “reverse recapitalization” in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Under this method of accounting, ExcelFin will be treated as the “acquired” company for financial reporting purposes. This determination is primarily based on the shareholders of Baird Medical comprising the majority of the voting power of the Company and having the ability to nominate the members of our Board, Baird Medical’s operations prior to the acquisition comprising the only ongoing operations, and Baird Medical’s senior management comprising a majority of the Group’s senior management. Accordingly, for accounting purposes, the financial statements of the post-combination company will represent a continuation of the financial statements of Baird Medical with the Business Combination treated as the equivalent of Baird Medical issuing shares for the net assets of ExcelFin, accompanied by a recapitalization. The net assets of ExcelFin will be stated at historical costs, with no goodwill or other intangible assets recorded. Operations prior to the Business Combination will be presented as those of Baird Medical in future reports. Transaction costs related to the Reverse Recapitalization as part of the Business Combination Agreement were charged to equity as a reduction of the net proceeds received in exchange for the shares issued to the shareholders.

The Company’s ordinary shares, par value $0.0001 per share (the “Ordinary Shares”), and the redeemable warrants to acquire one Ordinary Share at an exercise price of $11.50 per Ordinary Share (“Warrants”) are trading on the Nasdaq Capital Market (“Nasdaq”) under the symbols “BDMD” and “BDMD W”, respectively.

The principal business activities of the Company and its subsidiaries are to engage in research and development, manufacture and sales of microwave ablation (“MWA”) and other medical devices in the People’s Republic of China (the “PRC”).

As the Company were under same control of the shareholders and their entire equity interests were also ultimately held by the shareholders immediately prior to the reorganization, the consolidated statements of income and comprehensive income, consolidated statements of changes inequity and consolidated statements of cash flows are prepared as if the current group structure had been in existence throughout the year period ended December 31, 2024, and for the six months ended June 30, 2024 and 2025, respectively, or since the respective dates of incorporation/establishment of the relevant entity, where this is a shorter period. Shares related information and additional paid-in capital for all periods retrospectively reflect the adjustments for Reverse Recapitalization. The movement in the Company’s authorized share capital and the number of ordinary shares outstanding and issued in the Company are also detailed in the Note 16.

F-7

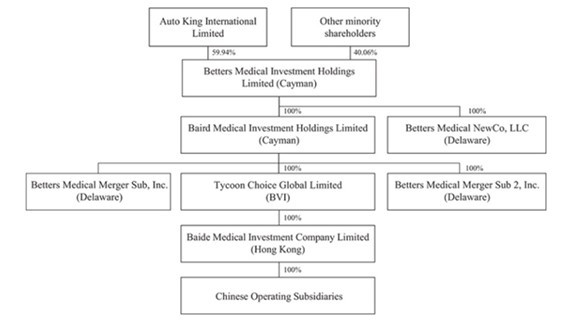

The Combined Company’s structure before and after the Business Combination. The ownership structure of Baird Medical before Closing is as follows:

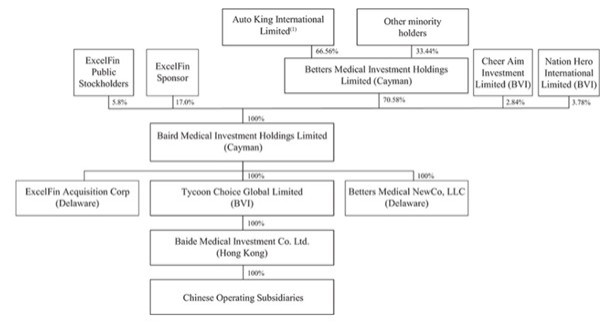

The ownership structure of the Combined Company giving effect to the Business Combination is as follows:

F-8

As at the date of this report, the Company has direct and indirect interests in the following subsidiaries:

Name of Entity |

|

Date of |

|

Place of |

|

Shareholders |

|

% of |

|

Principal |

|

Betters Medical NewCo, LLC (“NewCo”) |

June 17, 2024 |

Delaware (US) |

PubCo |

100% |

Holding |

||||||

ExcelFin Acquisition Corp. (“SPAC” or “ExcelFin”) |

|

March 15, |

|

Delaware (US) |

|

PubCo |

|

100% |

|

Holding |

|

Baird Medical LLC |

November 29, |

Delaware (US) |

PubCo |

100% |

Sales of MWA |

||||||

Tycoon Choice Global Limited (“Tycoon”) |

January 8, |

BVI |

PubCo |

100% |

Holding |

||||||

Baide Medical Investment Company Limited (“Baide HK”) |

January 29, |

Hong Kong |

Tycoon |

100% |

Holding |

||||||

Baide (Guangdong) Capital Management Company Limited (“Baide Capital”) |

March 3, |

The PRC |

Baide HK |

100% |

Sales of MWA |

||||||

Guangzhou Dedao Capital Management Company Limited (“Dedao”) |

March 4, |

The PRC |

Baide Capital |

99% |

Holding |

||||||

Guangzhou Baihui Corporate Management Company Limited (“Baihui”) |

December 4, |

The PRC |

Dedao |

99% |

Holding |

||||||

Guangzhou Zhengde Corporate Management Company Limited |

December 4, |

The PRC |

Dedao |

99% |

Holding |

||||||

Guangzhou Yide Capital Management Company Limited |

December 10, |

The PRC |

Dedao |

99% |

Holding |

||||||

Baide (Suzhou) Medical Company Limited (“Baide Suzhou”) |

June 5, |

The PRC |

Zhengde Yide, |

99% |

Research and |

||||||

Henan Ruide Medical Instrument Company Limited |

July 6, |

The PRC |

Baide Suzhou |

99% |

Sales of MWA and |

||||||

Nanjing Changcheng Medical Equipment Company Limited (“Nanjing Changcheng”) |

January 28, |

The PRC |

Baide Suzhou |

99% |

Research and |

||||||

Guizhou Baiyuan Medical Company Limited |

September 21, |

The PRC |

Baide Suzhou |

99% |

Sales of other |

||||||

Guoke Baide (Guangdong) Medical Company Limited (“Guoke Baide”) |

July 5, |

The PRC |

Baide Suzhou |

99% |

Sales of MWA |

Name of Entity |

|

Date of |

|

Place of |

|

Shareholders |

|

% of |

|

Principal |

|

Hunan Baide Medical Technology Company Limited |

November 26, |

The PRC |

Baide Suzhou |

99% |

Sales of MWA |

||||||

Ruikede Biological Technology (Xiamen) Company Limited (“Ruikede Xiamen”) |

July 17, 2019 |

The PRC |

Baide Suzhou |

99% |

Sales of MWA |

||||||

Guangzhou Fangda Medical Technology Company Limited |

December 22, |

The PRC |

Baide Capital |

100% |

Sales of MWA |

||||||

Junde (Guangzhou) Medical Technology Company Limited |

November 14, |

The PRC |

Guoke Baide |

99% |

Sales of MWA |

||||||

Shengde (Guangzhou) Medical Technology Company Limited |

November 29, |

The PRC |

Baide Capital |

100% |

Sales of MWA |

||||||

Suzhou Kangchuang Medical Company Limited |

December 6, |

The PRC |

Baide Capital |

100% |

Sales of MWA |

||||||

Hainan Haike Baide Medical Company Limited |

|

July 4,2024 |

|

The PRC |

|

Baide Suzhou |

|

100% |

|

Sales of MWA |

|

Note:Guizhou Baiyuan Medical Company Limited and Suzhou Kangchuang Medical Company Limited completed the liquidation procedures in the first half of 2025.

F-9

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Company prepares its consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and to the rules and regulations of the Securities and Exchange Commission (“SEC”), which requires the Company to make judgments, estimates and assumptions that affect reported amount of assets, liabilities, revenue, costs and expenses, and any related disclosures. Although there was no material changes made to the accounting estimates and assumptions in the past three years, the Company continually evaluates these estimates and assumptions based on the most recently available information, the Company’s own historical experience and various other assumptions that the Company believes to be reasonable under the circumstances. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from expectations as a result of changes in the Company’s estimates.

The Company believes that the following accounting policies involve a higher degree of judgment and complexity in their application and require us to make significant accounting estimates. Accordingly, these are the policies the Company believe are the most critical to understanding and evaluating the Company’s consolidated financial condition and results of operations.

Basis of presentation and principles of consolidation

These unaudited condensed consolidated financial statements for the six months ended June 30, 2025 have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and pursuant to the rules and regulations of the Securities and Exchange Commission pertaining to interim financial statements. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 20-F for the year ended December 31, 2024, from which the accompanying condensed consolidated balance sheet at December 31, 2024 was derived. In the opinion of management, all adjustments considered necessary for a fair presentation of the interim financial information have been included and are of a normal recurring nature.

The accompanying consolidated financial statements include the financial statements of the Company and its subsidiaries. Inter-company transactions and balances between group companies together with unrealized profits arising from inter-company transactions are eliminated in full in preparing the consolidated financial statements. Unrealized losses resulting from inter-company transactions are also eliminated unless the transaction provides evidence of impairment on the asset transferred, in which case the loss is recognized in consolidated profit or loss.

Use of estimates and assumptions

In preparing the consolidated financial statements in conformity with U.S. GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates are based on information as of the date of the consolidated financial statements. Significant estimates required to be made by management include, but are not limited to, useful lives of property and equipment, impairment of long-lived assets, allowance for credit losses, fair value of ordinary shares, preferred shares, warrants and earn out shares, realizability of deferred tax assets, inventory allowance, Business Combination related payments and prepayment for R&D. Actual results could differ from those estimates, and as such, differences may be material to the consolidated financial statements.

Functional currency and foreign currency translation

The Company’s reporting currency is the United States dollar (“US$”). The Company’s operations are principally conducted through the PRC subsidiaries where the local currency is the functional currency. Assets and liabilities are translated at the unified exchange rate as quoted by the Federal Reserve at the end of the period. The statement of operations accounts is translated at the average translation rates and the equity accounts are translated at historical rates. Translation adjustments resulting from this process are included in accumulated other comprehensive income (loss). Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

F-10

Translation adjustments included in accumulated other comprehensive loss amounted to $3.1 million and $2.2 million as of December 31, 2024 and June 30, 2025, respectively. The balance sheet amounts, with the exception of shareholders’ equity as of December 31, 2024 and June 30, 2025 were translated at RMB 7.2993 and RMB7.1636 to $1.00, respectively. The shareholders’ equity accounts were stated at their historical rate. The average translation rates applied to statement of operations accounts for the six months ended June 30, 2024 and 2025 were RMB7.2150 and RMB7.2526 to $1.00, respectively. Cash flows are also translated at average translation rates for the periods, therefore, amounts reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets.

Fair value measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, the Company considers the principal or most advantageous market in which it would transact and it considers assumptions that market participants would use when pricing the asset or liability.

The established fair value hierarchy requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The three levels of inputs that may be used to measure fair value include:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Observable, market-based inputs, other than quoted prices, in active markets for identical assets or liabilities.

Level 3: Unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

Accounting guidance also describes three main approaches to measuring the fair value of assets and liabilities: (1) market approach; (2) income approach and (3) cost approach. The market approach uses prices and other relevant information generated from market transactions involving identical or comparable assets or liabilities. The income approach uses valuation techniques to convert future amounts to a single present value amount. The measurement is based on the value indicated by current market expectations about those future amounts. The cost approach is based on the amount that would currently be required to replace an asset.

The Company does not have any non-financial assets or liabilities that are recognized or disclosed at fair value in the financial statements on a recurring basis.

The Company’s financial instruments consist principally of cash, accounts receivable and accounts payable.

As of December 31, 2024 and June 30, 2025, the carrying values of cash, accounts receivable, accounts payable and other liabilities approximated their fair values reported in the consolidated balance sheets due to the short-term maturities of these instruments.

Cash

Cash include cash in bank placed with banks, which have original maturities of three months or less at the time of purchase and are readily convertible to known amounts of cash.

Expected credit losses

In 2016, Financial Accounting Standards Board(“FASB”) issued Accounting Standards Codification (“ASC”) Topic 326, which amends previously issued guidance regarding the impairment of financial instruments by creating an impairment model that is based on expected losses. The Company adopted ASC Topic 326 on January 1, 2021.

The Company’s accounts receivable and other receivables included in prepayment and other current assets and other non-current assets are within the scope of ASC Topic 326.

F-11

For the six months ended June 30, 2024 and 2025, the Company used an individual basis and pool basis of the customers sharing similar risk characteristics by applying the aging group method under the Current Expected Credit Loss Model (“CECL Model”). The Company has identified the relevant risk characteristics of its customers and the related receivables and other receivables which include size, type of the products the Company provides, or a combination of these characteristics. Receivables with similar risk characteristics have been grouped into pools. For each pool, the Company considers the historical credit loss experience, current economic conditions, supportable forecasts of future economic conditions, and any recoveries in assessing the lifetime expected credit losses. Other key factors that influence the expected credit loss analysis include customer demographics, payment terms offered in the normal course of business to customers, and industry-specific factors that could impact the Company’s receivables. Additionally, external data and macroeconomic factors are also considered. They are assessed at each quarter based on the Company’s specific facts and circumstances. The Company uses aging group method to calculate average expected loss rate under pool basis.

Accounts receivable is presented net of any allowance for credit losses. An allowance for credit losses is recorded in the period when loss is probable. The Company recognizes loss allowance for expected credit loss (“ECL”) on accounts receivable. The Company writes off an account receivable when there is information indicating that the counterparty is in severe financial difficulty and there is no realistic prospect of recovery.

For the six months ended June 30, 2025, the credit period granted to the customers was generally for a period within 180 days. For the six months ended June 30, 2024, the credit period granted to the customers stipulated under contract was generally for a period within 90 days. The Company’s accounts receivable consists primarily of distributers, deliverers and hospitals. The Company’s additions charged to allowance for expected credit losses were $0.6 million and $0.3 million for the six months ended June 30, 2024 and 2025, respectively. The Company’s recovery of allowance for expected credit losses were $0.6 million and $0.3 million for the six months ended June 30, 2024 and 2025, respectively.

Inventories

Inventories are initially recognized at cost, and subsequently at the lower of cost and net realizable value. Cost comprises all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. Cost is calculated using the weighted average method. Net realizable value represents the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. For the six months ended June 30, 2024 and 2025, no impairment loss on inventories was recognized.

Prepayments

Prepayment primarily consist of prepaid expense for R&D and advances to suppliers for purchasing goods, equipment or services that have not been received or provided. These advances are interest free, unsecured and are reviewed periodically to determine whether their carrying value has become impaired. An allowance for credit loss is recorded in the period when loss is probable. As of December 31, 2024 and June 30, 2025, there was $4,867 and $4,959 allowance for the credit losses, respectively.

Deposits and other assets

Deposits and other assets primarily consist of deposit for office rental and long-term loan. These deposits and other assets are interest free, unsecured and are reviewed periodically to determine whether their carrying value has become impaired. An allowance for credit losses is recorded in the period when loss is probable. As of December 31, 2024 and June 30, 2025, there was $0.1 million and $0.1 million allowances for the credit losses, respectively.

F-12

Property and equipment, net

Property and equipment are stated at historical cost less accumulated depreciation and impairment, if any. Depreciation is calculated using the straight-line method over their estimated useful lives. The estimated useful lives are as follows:

|

Useful life |

||

Machinery |

3 – 10 years |

||

Furniture, fixtures and equipment |

3 – 5 years |

||

Vehicles |

4 years |

||

Medical equipment |

6 – 10 years |

||

Leasehold improvement |

Over the lease term or estimated useful lives of 5 years, whichever is shorter |

Expenditures for maintenance and repairs are expensed as incurred. The gain or income on the disposal of property and equipment is the difference between the net sales proceeds and the carrying amount of the relevant assets and is recognized in the consolidated statements of operations.

Deferred offering costs

The Company complies with ASC 340-10-S99-1 and SEC Staff Accounting Bulletin (“SAB”) Topic 5A — “Expenses of Offering”. Deferred offering cost consisted of underwriting, legal, accounting and other expenses incurred through the balance sheet date that were directly related to the Initial Public Offering (IPO), and it was charged to shareholders’ equity upon the completion of the IPO.

Goodwill

Goodwill represents the excess of the purchase consideration over the fair value of the identifiable tangible and intangible assets acquired and liabilities assumed from the acquired entity as a result of the Company’s acquisitions of interests in its subsidiaries. Goodwill is not amortized but is tested for impairment on an annual basis, or more frequently if events or changes in circumstances indicate that it might be impaired. The Company first assesses qualitative factors to determine whether it is necessary to perform the two-step quantitative goodwill impairment test. In the qualitative assessment, the Company considers primary factors such as industry and market considerations, overall financial performance of the reporting unit, and other specific information related to the operations. Based on the qualitative assessment, if it is more likely than not that the fair value of a reporting unit is less than the carrying amount, the quantitative impairment test is performed.

This allocation process is only performed for the purposes of evaluating goodwill impairment and does not result in an entry to adjust the value of any assets or liabilities. Application of a goodwill impairment test requires significant management judgment, including the identification of reporting units, allocation of assets, liabilities and goodwill to reporting units, and determination of the fair value of each reporting unit.

Intangible assets, net (other than goodwill)

Intangible assets acquired separately are initially recognized at cost. The cost of intangible assets acquired in a business combination is fair value at the date of acquisition. Subsequently, intangible assets with finite useful lives are carried at cost less accumulated amortization and accumulated impairment losses. Intangible assets with indefinite useful lives are carried at cost less any subsequent accumulated impairment losses.

Amortization is provided on a straight-line basis over their useful lives as follows. The amortization expense is recognized in profit or loss and included in administrative expenses.

|

Useful life |

||

Patent |

6 years |

||

Software |

5 years |

F-13

The estimates and associated assumptions of useful life determined by the Company are based on technical and commercial obsolescence, legal or contractual limits on the use of the asset and other relevant factors. Based on the functionalities and expiry date of the patent and software, the Company considers a useful life of 5 to 6 years to be their best estimation. Both the period and method of amortization are reviewed annually.

Impairment of long-lived assets other than goodwill

For other long-lived assets including property and equipment and other non-current assets, the Company evaluates for impairment whenever events or changes (triggering events) indicate that the carrying amount of an asset may no longer be recoverable. The Company assesses the recoverability of the long-lived assets by comparing the carrying value of the long-lived assets to the estimated undiscounted future cash flows expected to receive from use of the assets and their eventual disposition. Such assets are considered to be impaired if the sum of the expected undiscounted cash flows is less than the carrying amount of the assets. The impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. The Company did not recognize any impairment loss for six months ended June 30, 2024 and 2025.

Leases

In February 2016, FASB issued ASU 2016-02, Leases, which specifies the accounting for leases. Earlier application is permitted for all entities as of February 25, 2016, the issuance date of the final standard. The Company adopted ASC 842 on January 1, 2021, along with all subsequent ASU clarifications and improvements that are applicable to the Company, to each lease that existed in the years presented in the financial statements, using the modified retrospective transition method and used the commencement date of the leases as the date of initial application. Consequently, financial information and the disclosures required under ASC 842 are provided for dates and years presented in the financial statements. The Company has applied the practical expedient to not recognize short-term leases with lease terms of one year or less.

At inception of a contract, the Company assesses whether a contract is, or contains, a lease. A contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. To assess whether a contract conveys the right to control the use of an identified asset, the Company assesses whether:

| ● | the contract involves the use of an identified asset — this may be specified explicitly or implicitly, and should be physically distinct or represent substantially all of the capacity of a physically distinct asset. If the supplier has a substantive substitution right, then the asset is not identified; |

| ● | the customer has the right to obtain substantially all of the economic benefits from use of the asset throughout the period of use; and |

| ● | the customer has the right to direct the use of the asset. The customer has this right when it has the decision-making rights that are most relevant to changing how and for what purpose the asset is used. In rare cases where the decision about how and for what purpose the asset is used is predetermined, the customer has the right to direct the use of the asset if either the customer has the right to operate the asset; or the customer designed the asset in a way that predetermines how and for what purpose it will be used. |

The Company as lessee

The Company classifies each lease as either an operating lease or financing lease at the lease commencement date. The classification is not revised unless the lease is modified and that modification is not accounted for as a separate lease.

The lease is classified as a financing lease if both of the following criteria are met:

| ● | the present value of the lease payments and any residual value guarantee (from the lessee or an unrelated third party) equals or exceeds substantially all of the underlying asset’s fair value; and |

| ● | it is probable that the lessor will collect the lease payments plus any amount necessary to satisfy a residual value guarantee. |

If none of the above criteria are met, then the lease is classified as an operating lease.

F-14

Both classifications result in the Company recognizing a right-of-use asset and a lease liability. The Company can elect not to apply the lessee accounting model to leases with a lease term of 12 months or less (i.e. short-term leases). A lease that contains a purchase option can qualify as a short - term lease if the lessee is not reasonably certain to exercise its option to purchase the underlying asset. The Company recognizes short-term lease payments as an expense on a straight-line basis over the lease term.

On initial recognition, the right-of-use asset is measured at the initial amount of the lease liability, adjusted for any lease payments made at or before the commencement of the lease, plus any initial direct costs incurred and the amount of any provision recognized where the Company is contractually required to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentive received.

In an operating lease, right-of-use asset is subsequently amortized as the difference between the straight- line lease cost for the period and the periodic accretion of the lease liability using the effective interest method. In a financing lease, right-of-use asset is subsequently depreciated using the straight-line method from the commencement date of the lease over the shorter of the lease term or the useful life of the underlying asset. In addition, the right-of-use asset is reduced by impairment losses, if any, and adjusted for certain remeasurements of the lease liability.

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the lessee’s incremental borrowing rate.

The lease liability is subsequently measured by (i) increasing the carrying amount to reflect interest on the lease liability and (ii) reducing the carrying amount to reflect the lease payments made. The Company remeasured the lease liability to reflect any reassessment or lease modification, or to reflect revised in-substance fixed lease payments.

In cases of sale and leaseback transactions, if the transfer of the asset to the lessor does not qualify as a sale, then the transaction constitutes a failed sale and leaseback and is accounted for as a financing transaction. For a sale to have occurred, the control of the asset would need to be transferred to the buyer, and the buyer would need to obtain substantially all the benefits from the use of the asset.

Stock-based compensation

Stock-based compensation expenses arise from share-based awards, including share options for the purchase of ordinary shares and restricted shares. The Company accounts for share-based awards granted to employees in accordance with ASC 718 Compensation—Stock Compensation and share-based awards granted to nonemployee in accordance with ASC 505. Stock-based compensation expenses are recorded net of actual forfeitures using straight-line method during the service period requirement, such that expenses are recorded only for those share-based awards that are expected to ultimately vest.

Long-term loan

When the Company enters into sale-leaseback transactions as a seller-lessee, it applies the requirements in ASC 606 by assessing whether a contract exists and whether it satisfies a performance obligation by transferring control of an asset when determining whether the transfer of an asset shall be accounted for as a sale of the asset. If the Company transfers the control of an asset to the buyer-lessor, it accounts for the transfer of the asset as a sale and recognizes a corresponding gain or loss on disposal. The subsequent leaseback of the asset is accounted for in accordance with ASC 842 in the same manner as any other lease. If the Company does not transfer the control of an asset to the buyer-lessor, the failed sale-leaseback transaction is accounted for as a financing. The Company does not derecognize the transferred asset and accounts for proceeds received as borrowings for which the current portion is included in “long-term loan — current portion” and the non- current portion is included in “long-term loan — non-current” in the consolidated balance sheets.

Revenue recognition

Effective January 1, 2018, the Company adopted ASC Topic 606 using the modified retrospective adoption method. Based on the requirements of ASC Topic 606, revenue is recognized when control of the promised goods or services is transferred to the customers in an amount that reflects the consideration the Company expects to be entitled to receive in exchange for those goods or services. The Company primarily sells its products to hospitals.

F-15

The Company adopted ASC Topic 606 for all periods presented. Consistent with the criteria of Topic 606, the Company follows five steps for its revenue recognition: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract, and (v) recognize revenue when (or as) the entity satisfies a performance obligation.

According to ASC Topic 606, revenue is recognized when control of the promised good or service is transferred to the customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services.

The Company’s revenue is primarily derived from sales of medical devices. Customers obtain control of goods when either the goods are delivered to the customer or picked up by the customer and such customer has accepted the goods. Revenue is thus recognized at the point in time when the customers have accepted the goods.

Principal versus agent

When another party is involved in providing goods or services to a customer, the Company determines whether the nature of its promise is a performance obligation to provide the specified goods or services itself (i.e. the Company is a principal) or to arrange for those goods or services to be provided by the other party (i.e. the Company is an agent).

The Company is a principal if it controls the specified good or service before that good or service is transferred to a customer.

The Company is an agent if its performance obligation is to arrange for the provision of the specified good or service by another party. In this case, the Company does not control the specified good or service provided by another party before that good or service is transferred to the customer. When the Company acts as an agent, it recognizes revenue in the amount of any fee or commission to which it expects to be entitled in exchange for arranging for the specified goods or services to be provided by the other party.

The Company acts as a principal in the sales of medical devices to hospitals (i.e. directly or through deliverers) and distributors as the Company controls the medical devices before that they are transferred to customers, and accordingly recognizes the revenue which the Company expects to be entitled from the sales of goods to its end-customers.

Revenue from sales of medical devices

The Company sells medical devices though two channels, which is directly or through deliverers to hospitals, and through distributors to the end customers. Various sources of revenue of the Company is recognized on the following bases:

| (1) | Revenue from sales to hospitals |

The Company acts as a principal in the sales of medical devices to hospitals (i.e., directly or through deliverers) as the Company controls the medical devices before they are transferred to end-customers (i.e., hospitals).

F-16

The key indicators that demonstrate the Company’s control over the products include: (i) it is the Company’s responsibility to fulfill the promise of providing products to the hospitals through deliverers, in which the deliverers are just acting on the Company’s behalf. The deliverers bear no rights and obligations on the medical devices and the deliverers do not take any responsibility on the product damage before and after the products are delivered to the hospital’s designated premises and accepted by the hospital; (ii) the Company, instead of the deliverers, are subject to the inventory risk given that the deliverers are prohibited from delivering products to end-customers other than the designated hospitals (as designated through the authorization letter); and (iii) the selling prices of products are predetermined by the Company at tender price. The deliverers do not have pricing power and are only entitled to a specific service fee calculated as a fixed percentage of the relevant transaction of products which is a commission or fee basis. From the above indicators, the deliverers do not obtain control of the medical devices and thus the Company still retain control over the products before the products are delivered to the hospital’s designated premises and accepted by the hospital. Under such limitation, the deliverers do not act as the ‘principal’ in the sales through deliverer model and therefore the designated hospitals are not the ‘customer’ of the deliverer. In other words, the deliverers are instructed by the Company to transfer the medical devices to the designated hospital. As such, it is determined that the Company is the principal, and the deliverers are the agents. Since the Company remains the principal over the goods regardless of if the goods are delivered to the hospital directly by the Company or through the deliverers as agents, there is no significant difference between the two types of good delivery as to when risk or control is transferred to the customer and when revenue is recognized from sales to hospitals.

The Company presents the revenue generated from its sales of products on a gross basis as the Company is a principal.

| (2) | Revenue from sales to distributors |

The Company acts as a principal in the sales of medical devices to distributors as the Company controls the medical devices before they are transferred to distributors.

The revenue is recognized at a point in time when the Company satisfies its performance obligation by transferring the promised product to its customers, the distributors, upon acceptance. The performance obligation is considered to be met and revenue is recognized when distributors obtain control of the goods or when risks and rewards are transferred to distributors which bear all inventory risks and revenue is recognized when the goods are accepted by the distributor.

The Company did not recognize any revenue from contracts with customers for performance obligations satisfied over time during the six months ended June 30, 2024 and 2025.

The transaction price is generally in the form of a fixed price which is agreed with the customer at contract inception. The transaction price is recorded net of any sales return, surcharges and value-added taxes on gross sales. Customers are required to pay over an agreed-upon credit period.

Return rights

Some of the Company’s contract with customers from the sales of goods provides customers a right of return (a right to exchange for the same product or to be refund in cash due to faulty products). For the six months ended June 30, 2024 and 2025, there is no significant sales return.

Value-added taxes and surcharges

The Company presents revenue net of value-added taxes (“VAT”) and surcharges incurred. Surcharge are sales related taxes representing the City Maintenance and Construction Tax and Education Surtax. VAT and surcharges collected from customers, net of VAT paid for purchases, are recorded as a liability in the consolidated balance sheets until these are paid to the tax authorities.

Disaggregation of revenue

The Company disaggregates its revenue by major products and customers, as the Company believes it best depicts the amount of its revenue and cash flows. See Note 21 to the segment reports.

F-17

Contract assets

A contract asset is the right to consideration in exchange for goods or services transferred to the customer. If the Company performs by transferring goods or services to a customer before the customer pays consideration or before payment is due, a contract asset is recognized for the earned consideration that is conditional. The Company does not have contract assets for the years presented.

Contract liabilities

The contract liabilities represent consideration that the Company has received but has not satisfied the related performance obligations. Contract liabilities primarily relate to the payments received for product selling in advance of revenue recognition. The increase in contract liabilities over the prior year was a result of the increase in consideration received from the Company’s customers, which was in line with the growth of revenues in product sales. Due to the generally short-term duration of the relevant contracts, the majority of the performance obligations are satisfied within one year.

The Company’s contract liabilities amounted to $0.8 million and $1.1 million as of December 31, 2024 and June 30, 2025, respectively. The revenue expected to be recognized on the remaining performance obligations of these contracts as of June 30, 2025 will be $1.1 million in the following 12 months.

Value-added taxes (“VAT”)

Revenue represents the invoiced value of goods or service, net of VAT. The VAT is based on gross sales price and VAT rates range up to 13%, depending on the type of goods or service provided. Entities that are VAT general taxpayers are allowed to offset qualified input VAT paid to suppliers against their output VAT liabilities. Net VAT balance between input VAT and output VAT is recorded in tax payables. All of the VAT returns filed by the Company’s subsidiaries in China, have been and remain subject to examination by the tax authorities for five years from the date of filing.

Research and development expenses

Research and development (“R&D”) expenses consist primarily of outsourced research and development costs, payroll and related expenses for research and development professionals, materials, sample testing fee, and depreciation of machinery and equipment for research and development. Nonrefundable payments made in advance to third-party R&D service provider for the related services is recorded as prepayments in the consolidated balance sheets until the services are rendered under ASC 730-20-25-13. Research and development costs are expensed as incurred in accordance with ASC 730. The Company recognizes R&D expenses based on the completion percentage of each R&D contract at the end of each quarter according to monthly discussions and progress meeting (if any) with internal management personnel and external R&D service providers or completion progress report provided by the third party-R&D service providers as to the progress or stage of completion of services.

Income taxes

Current income taxes are provided on the basis of net income for financial reporting purposes, adjusted for income and expense items which are not assessable or deductible for income tax purposes, in accordance with the regulations of the relevant tax jurisdictions.

Deferred income taxes are accounted for using an asset and liability method. Under this method, deferred income taxes are recognized for the tax consequences of temporary differences by applying enacted statutory rates applicable to future years to differences between the financial statement carrying amounts and the tax bases of existing assets and liabilities. The tax base of an asset or liability is the amount attributed to that asset or liability for tax purpose. The effect on deferred taxes of a change in tax rates is recognized in the consolidated statements of comprehensive income in the period of change. A valuation allowance is provided to reduce the amount of deferred tax assets if it is considered more likely than not that some portion of, or all of the deferred tax assets will not be realized.

Penalties and interest incurred related to underpayment of income tax are classified as income tax expense in the period incurred.

F-18

Uncertain tax positions

The guidance on accounting for uncertainties in income taxes prescribes a more likely than not threshold for financial statements recognition and measurement of a tax position taken or expected to be taken in a tax return. Guidance was also provided on derecognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods, and income tax disclosures. Significant judgment is required in evaluating the Company’s uncertain tax positions and determining its provision for income taxes. The Company did not recognize any significant interest and penalties associated with uncertain tax positions for the six months ended June 30, 2024 and 2025. As of December 31, 2024 and June 30, 2025, the Company did not have any significant unrecognized uncertain tax positions.

In accordance with PRC Tax Administration Law on the Levying and Collection of Taxes, the PRC authorities generally have up to five years to assess underpaid tax plus penalties and interest for PRC entities’ tax filings. In case of tax evasion. which is not clearly defined in the law, there is no limitation on the tax years open for investigation. Accordingly, the PRC entities remain subject to examination by the tax authorities based on above.

Subsidy income

Subsidy income primarily consists of financial subsidies received from local governments for operating a business in their jurisdictions and compliance with specific policies promoted by the local governments. There are no defined rules and regulations to govern the criteria necessary for companies to receive such benefits, and the amount of financial subsidy is determined at the discretion of the relevant government authorities. The government subsidies with no further conditions to be met are recorded as “Other income, net” when received. The government subsidies with certain operating conditions are recorded as liabilities when received and will be recorded as operating income when the conditions are met. For the six months ended June 30, 2024 and 2025, the Company received financial subsidies of $265 and $56,968 from the local PRC government authorities, respectively.

Statutory reserves

As stipulated by the relevant PRC laws and regulations applicable to the Company’s entities in the PRC, the Company is required to make appropriations from net income as determined in accordance with the PRC GAAP to non-distributable reserves, which include a statutory surplus reserve. The PRC laws and regulations require that annual appropriations of 10% of after-tax income should be set aside prior to payments of dividends as reserve fund, the appropriations to statutory surplus reserve are required until the balance reaches 50% of the PRC entity registered capital. The Company allocate income of $0.05 million and $0.02 million to statutory reserves during the six months ended June 30, 2024 and 2025, respectively.

Business combination and noncontrolling interests

The Company accounts for its business combinations using the acquisition method of accounting in accordance with ASC 805, Business Combinations. Transaction costs directly attributable to the acquisition are expensed as incurred. Identifiable assets and liabilities acquired or assumed are measured separately at their fair values as of the acquisition date, irrespective of the extent of any noncontrolling interests. The excess of (i) the total costs of acquisition, fair value of the noncontrolling interests and acquisition date fair value of any previously held equity interest in the acquiree over (ii) the fair value of the identifiable net assets of the acquiree is recorded as goodwill. During the measurement period, which can be up to one year from the acquisition date, the Company may record adjustments to the assets acquired and liabilities assumed with the corresponding offset to goodwill. Upon the conclusion of the measurement period or final determination of the values of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded as gain or loss on the consolidated statements of operations and comprehensive loss.

In a business combination achieved in stages, the Company re-measures the previously held equity interests in the acquiree when obtaining control at its acquisition date fair value and the re-measurement gain or loss, if any, is recognized in the consolidated statements of operations and comprehensive loss.

For the Company’s majority-owned subsidiaries, noncontrolling interests are recognized to reflect the portion of the equity which is not attributable, directly or indirectly, to the Company as the controlling shareholder. Noncontrolling interests acquired through a business combination are recognized at fair value at the acquisition date, which is estimated with reference to the purchase price per share as of the acquisition date.

F-19