UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EXHIBIT INDEX

| Exhibit Number | Description | |

| 99.1 | NI 43-101 Technical Report – Quellaveco Property; November 3,2025 |

SIGNATURE

| Teck Resources Limited | ||

| (Registrant) | ||

| Date: November 10, 2025 | By: | /s/ Amanda R. Robinson |

| Amanda R. Robinson | ||

| Corporate Secretary | ||

Exhibit 99.1

NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru

Prepared for Anglo

American plc by

Datamine Australia Pty Ltd (Snowden Optiro)

Project Number DA214498

Qualified Persons:

Mr. Allan Earl, FAusIMM

Mr. Aaron Radonich, FAusIMM (CP)

Mr. Ian Glacken, FAusIMM (CP)

Mr. Graeme Lyall, FAusIMM

Mr. Paulo Laymen, FAusIMM

Mr. Gordon Cunningham, FSAIMM

Mr Peter Theron, MSAIMM, Pr Eng ECSA

Ms. Gené Main, EAPASA, Pr.Sci.Nat. SACNASP

Effective Date: November 3, 2025

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

This report was prepared as a National Instrument 43-101 Standards of Disclosure for Mineral Projects Technical Report for Anglo American plc (Anglo American) by Datamine Australia Pty Ltd (Snowden Optiro). The quality of information, conclusions, and estimates contained herein are consistent with the quality of effort involved in Snowden Optiro’s services. The information, conclusions, and estimates contained herein are based on: i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Anglo American subject to the terms and conditions of its contract with Snowden Optiro and relevant securities legislation. The contract permits Anglo American to file this report as a Technical Report with Canadian securities regulatory authorities under Teck Resources Limited’s profile pursuant to National Instrument 43-101. Except for the purposes legislated under Canadian securities law, any other uses of this report by any third party are at that party’s sole risk. The responsibility for this disclosure remains with Anglo American. The user of this document should ensure that this is the most recent Technical Report for the property as it is not valid if a new Technical Report has been issued.

Ó 2025

All rights are reserved. No part of this document may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Snowden Optiro.

| Issued by: | Perth Office | |

| Document ref: | DA214498 AA Quellaveco NI 43-101 TR (Final).docx |

|

| Issue date: | November 3, 2025 | |

| Effective date: | November 3, 2025 |

| OFFICE LOCATIONS |

| PERTH | LIMA | www.snowdenoptiro.com |

| BRISBANE | BELO HORIZONTE | comtact@snowdenoptiro.com |

| JOHANNESBURG | DENVER | |

| LONDON | SANTIAGO | Snowden Optiro is a business unit of |

| ALMATY CITY | SUDBURY | the Datamine Software group |

| NEW DELHI | JAKARTA | |

| MOSCOW |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

Table of contents

| 1 | Summary | 11 | |||

| 1.1 | Property description, ownership and background | 11 | |||

| 1.2 | History | 13 | |||

| 1.3 | Geological setting, mineralization and deposit type | 13 | |||

| 1.4 | Drilling | 14 | |||

| 1.5 | Sampling, analyses and data verification | 14 | |||

| 1.6 | Mineral processing and metallurgical testing | 15 | |||

| 1.7 | Mineral Resource estimates | 16 | |||

| 1.8 | Mining and Mineral Reserve estimates | 18 | |||

| 1.9 | Processing methods and infrastructure | 20 | |||

| 1.10 | Permitting, environmental and social | 22 | |||

| 1.11 | Costs and economic analysis | 22 | |||

| 1.12 | Market studies and contracts | 23 | |||

| 1.13 | Conclusions and recommendations | 24 | |||

| 2 | Introduction | 25 | |||

| 2.1 | Terms of reference | 25 | |||

| 2.2 | Abbreviations and units | 27 | |||

| 3 | Reliance on other experts | 30 | |||

| 4 | Property description and location | 31 | |||

| 4.1 | Area and location | 31 | |||

| 4.2 | Type of mineral tenure | 31 | |||

| 4.2.1 | Legal framework | 31 | |||

| 4.2.2 | Property mineral titles | 31 | |||

| 4.3 | Issuer’s interest | 40 | |||

| 4.4 | Surface rights | 40 | |||

| 4.5 | Royalties, back-in rights, payments, agreements, encumbrances | 40 | |||

| 4.6 | Environmental liabilities | 40 | |||

| 4.7 | Permits | 40 | |||

| 4.8 | Other significant factors and risks | 40 | |||

| 5 | Accessibility, climate, local resources, infrastructure, and physiography | 42 | |||

| 5.1 | Topography, elevation and vegetation | 42 | |||

| 5.2 | Access | 42 | |||

| 5.3 | Proximity to population centre and transport | 42 | |||

| 5.4 | Climate and length of operating season | 42 | |||

| 5.5 | Infrastructure | 42 | |||

| 5.6 | Workforce | 45 | |||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 6 | History | 46 | |||

| 6.1 | Previous exploration | 46 | |||

| 6.2 | Historical resource estimates | 46 | |||

| 6.3 | Production history | 47 | |||

| 7 | Geological setting and mineralization | 48 | |||

| 7.1 | Regional geology | 48 | |||

| 7.1.1 | Toquepala Group | 48 | |||

| 7.1.2 | Regional Granodiorite | 49 | |||

| 7.1.3 | Huaylillas Formation | 49 | |||

| 7.1.4 | Regional structure | 51 | |||

| 7.2 | Local geology | 51 | |||

| 7.2.1 | Lithology | 52 | |||

| 7.2.2 | Local structure | 54 | |||

| 7.3 | Mineralization | 54 | |||

| 7.3.1 | Hypogene mineralization and alteration | 55 | |||

| 7.3.2 | Supergene alteration and mineralization | 56 | |||

| 8 | Deposit types | 57 | |||

| 9 | Exploration | 58 | |||

| 10 | Drilling | 59 | |||

| 10.1 | Type and extent | 59 | |||

| 10.2 | Procedures | 60 | |||

| 10.2.1 | Collar and downhole surveying | 60 | |||

| 10.2.2 | Core photo register | 60 | |||

| 10.2.3 | Core logging and sampling | 61 | |||

| 10.2.4 | Core recovery measurements | 61 | |||

| 10.2.5 | RC drilling and processing | 61 | |||

| 10.2.6 | Drilling data management | 62 | |||

| 10.2.7 | Qualified Person’s opinion of drilling quality | 62 | |||

| 11 | Sample preparation, analyses and security | 63 | |||

| 11.1 | Sample preparation and analysis | 63 | |||

| 11.1.1 | Core processing | 63 | |||

| 11.1.2 | RC sample processing | 64 | |||

| 11.1.3 | Sample preparation – DD core and RC | 64 | |||

| 11.2 | Sample analysis | 64 | |||

| 11.3 | Bulk density determination | 65 | |||

| 11.4 | QAQC procedures | 66 | |||

| 11.4.1 | Historical QAQC and re-assaying | 66 | |||

| 11.4.2 | Recent QAQC (since 2008) | 67 | |||

| 11.4.3 | RC sample processing at site laboratory | 70 | |||

| 11.5 | Sample security and storage | 70 | |||

| 11.6 | Qualified Person’s opinion on the adequacy of sample preparation, security and analytical procedures | 70 | |||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 12 | Data verification | 71 | |||

| 12.1 | Introduction | 71 | |||

| 12.2 | Data management | 71 | |||

| 12.3 | Surveying | 71 | |||

| 12.3.1 | 2023 | 71 | |||

| 12.3.2 | 2025 | 71 | |||

| 12.4 | Drilling and sampling | 72 | |||

| 12.4.1 | 2023 | 72 | |||

| 12.4.2 | 2025 | 72 | |||

| 12.5 | Sample analysis | 73 | |||

| 12.6 | Density verification | 73 | |||

| 12.7 | Qualified Person’s opinion on the adequacy of the data for the purposes used in the Technical Report | 73 | |||

| 13 | Mineral processing and metallurgical testing | 74 | |||

| 13.1 | Introduction | 74 | |||

| 13.2 | Historical evaluation | 74 | |||

| 13.3 | Historical testwork | 74 | |||

| 13.3.1 | 1974–1975 program | 74 | |||

| 13.3.2 | 1994–1995 program | 75 | |||

| 13.3.3 | 1996–1997 program | 75 | |||

| 13.3.4 | 2007 program | 75 | |||

| 13.3.5 | 2013–2014 program | 76 | |||

| 13.3.6 | Recent evaluations | 76 | |||

| 13.4 | Expected recovery performance | 76 | |||

| 13.5 | Copper concentrate quality | 77 | |||

| 14 | Mineral Resource estimates | 78 | |||

| 14.1 | Introduction | 78 | |||

| 14.2 | Mineral Resource estimation criteria | 78 | |||

| 14.2.1 | Data preparation and analysis | 78 | |||

| 14.2.2 | Exploratory data analysis and domaining | 81 | |||

| 14.2.3 | Contact analysis | 81 | |||

| 14.2.4 | Compositing | 82 | |||

| 14.2.5 | Flattening of supergene enrichment blanket | 82 | |||

| 14.2.6 | Top cuts | 83 | |||

| 14.2.7 | Variography | 84 | |||

| 14.2.8 | Cross-validation | 84 | |||

| 14.2.9 | Quantitative kriging neighborhood analysis | 85 | |||

| 14.2.10 | Search strategy | 85 | |||

| 14.2.11 | Kriging parameters | 85 | |||

| 14.2.12 | Treatment of missing values | 86 | |||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 14.2.13 | Geological interpretation and modelling | 86 | |||

| 14.2.14 | Block modelling | 86 | |||

| 14.2.15 | Grade estimation | 87 | |||

| 14.2.16 | Density | 87 | |||

| 14.2.17 | Model validation | 87 | |||

| 14.2.18 | Reconciliation | 88 | |||

| 14.2.19 | Classification | 88 | |||

| 14.3 | Mineral Resources | 88 | |||

| 14.3.1 | Reasonable prospects of economic extraction (RPEE) | 90 | |||

| 14.3.2 | Independent review | 90 | |||

| 14.3.3 | Internal controls | 90 | |||

| 15 | Mineral Reserve estimates | 91 | |||

| 15.1 | Key parameters and assumptions | 91 | |||

| 15.2 | Pit optimization | 92 | |||

| 15.3 | Pit design | 92 | |||

| 15.4 | Dilution and ore loss | 93 | |||

| 15.4.1 | Dilution | 93 | |||

| 15.4.2 | Ore loss | 94 | |||

| 15.5 | Cut-off grade | 94 | |||

| 15.6 | Mineral Reserve estimate | 94 | |||

| 15.7 | Risks and opportunities | 95 | |||

| 15.8 | Independent reviews | 95 | |||

| 16 | Mining methods | 96 | |||

| 16.1 | Geotechnical parameters | 96 | |||

| 16.2 | Hydrological parameters | 97 | |||

| 16.3 | Mining method and parameters | 98 | |||

| 16.3.1 | Mining and ancillary fleet requirements | 99 | |||

| 16.4 | Life-of-asset plan production schedule | 100 | |||

| 17 | Recovery methods | 101 | |||

| 17.1 | Process flowsheet design and specifications | 101 | |||

| 17.2 | Ancillary processing facilities | 102 | |||

| 17.3 | Recent performance | 102 | |||

| 18 | Project infrastructure | 105 | |||

| 18.1 | Concentrate transport and port facilities | 105 | |||

| 18.2 | Tailings storage facility | 106 | |||

| 18.2.1 | Facility layout and infrastructure | 106 | |||

| 18.2.2 | Capacity and design criteria | 106 | |||

| 18.2.3 | Operations and water management | 106 | |||

| 18.2.4 | Expansion and in-pit disposal | 107 | |||

| 18.2.5 | Closure considerations | 107 | |||

| 18.2.6 | GISTM conformance | 108 | |||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 18.3 | Waste rock dumps | 108 | |||

| 18.4 | Ancillary infrastructure | 108 | |||

| 18.5 | Water supply | 108 | |||

| 18.6 | Power supply | 109 | |||

| 18.7 | Access and security | 109 | |||

| 18.8 | Accommodation | 109 | |||

| 18.9 | Communications | 110 | |||

| 18.10 | Logistics | 110 | |||

| 19 | Market studies and contracts | 111 | |||

| 19.1 | Market studies | 111 | |||

| 19.2 | Products | 111 | |||

| 19.3 | Offtake agreements | 111 | |||

| 19.4 | Price assumptions and market studies | 111 | |||

| 19.5 | Material contracts | 112 | |||

| 19.6 | Qualified Person review | 112 | |||

| 20 | Environmental studies, permitting, and social or community impact | 113 | |||

| 20.1 | Background | 113 | |||

| 20.1.1 | Climate | 113 | |||

| 20.1.2 | Air quality | 113 | |||

| 20.1.3 | Noise | 113 | |||

| 20.1.4 | Biodiversity | 113 | |||

| 20.1.5 | Land use | 114 | |||

| 20.1.6 | Hydrology | 114 | |||

| 20.1.7 | Hydrogeology | 114 | |||

| 20.1.8 | Social | 115 | |||

| 20.1.9 | Heritage | 115 | |||

| 20.2 | Environmental studies | 115 | |||

| 20.3 | Waste disposal, site monitoring, and water management | 115 | |||

| 20.4 | Approvals and permitting | 116 | |||

| 20.5 | Social and community | 118 | |||

| 20.5.1 | Social performance framework | 118 | |||

| 20.5.2 | Stakeholder engagement | 118 | |||

| 20.5.3 | Resettlement and land access | 118 | |||

| 20.5.4 | Community development and livelihood restoration | 119 | |||

| 20.5.5 | Social management and monitoring | 119 | |||

| 20.5.6 | Social licence to operate | 119 | |||

| 20.6 | Mine closure | 119 | |||

| 20.7 | Risks and opportunities | 120 | |||

| 20.7.1 | Risks | 120 | |||

| 20.7.2 | Opportunities | 121 | |||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 21 | Capital and operating costs | 122 | ||

| 21.1 | Capital costs | 122 | ||

| 21.2 | Operating costs | 123 | ||

| 22 | Economic analysis | 125 | ||

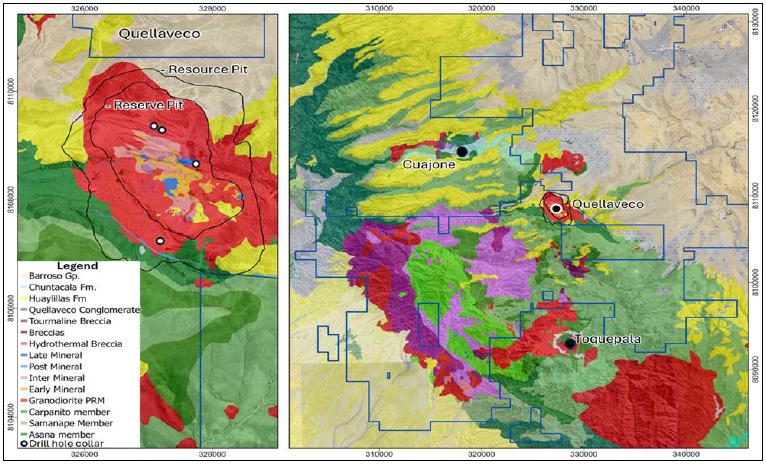

| 23 | Adjacent properties | 126 | ||

| 23.1 | Cuajone | 127 | ||

| 23.2 | Toquepala | 127 | ||

| 24 | Other relevant data and information | 128 | ||

| 25 | Interpretation and conclusions | 129 | ||

| 25.1 | Conclusions | 129 | ||

| 25.2 | Risks | 129 | ||

| 26 | Recommendations | 130 | ||

| 27 | References | 131 | ||

| 28 | Certificates | 132 | ||

| 28.1 | Certificate of Qualified Person | 132 | ||

| Figures | |||

| Figure 1.1 | Location of Quellaveco mine | 12 | |

| Figure 1.2 | LoAP concentrate production (five-year periods) | 20 | |

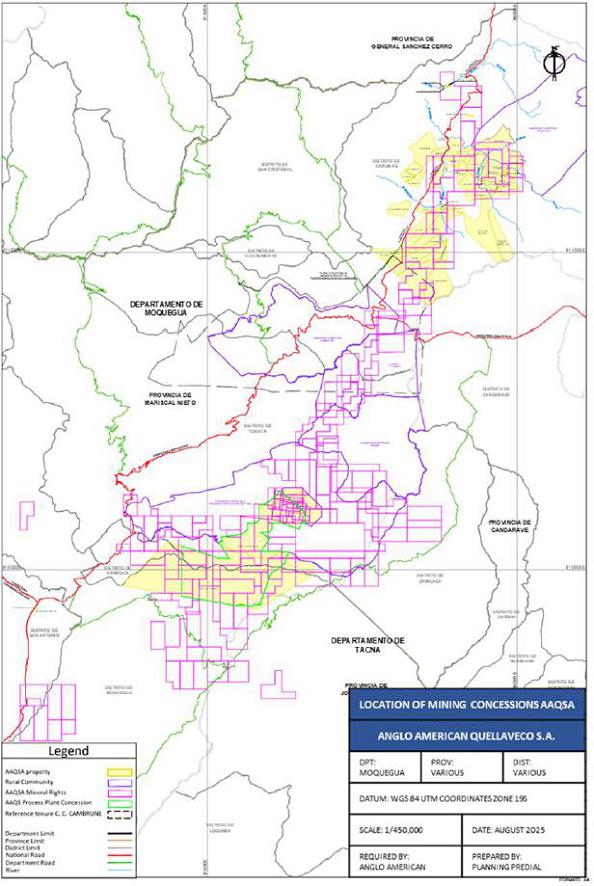

| Figure 4.1 | Quellaveco concessions | 32 | |

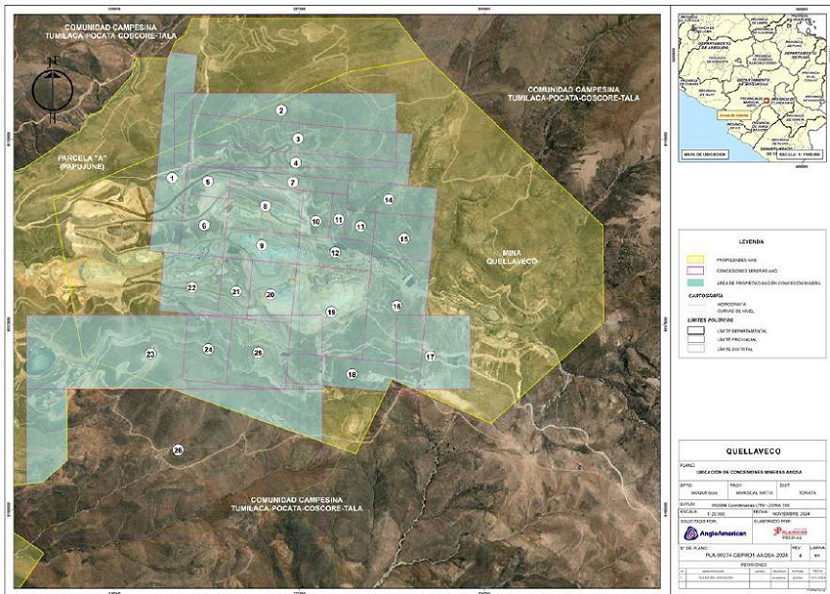

| Figure 4.2 | Quellaveco mine area mineral titles | 39 | |

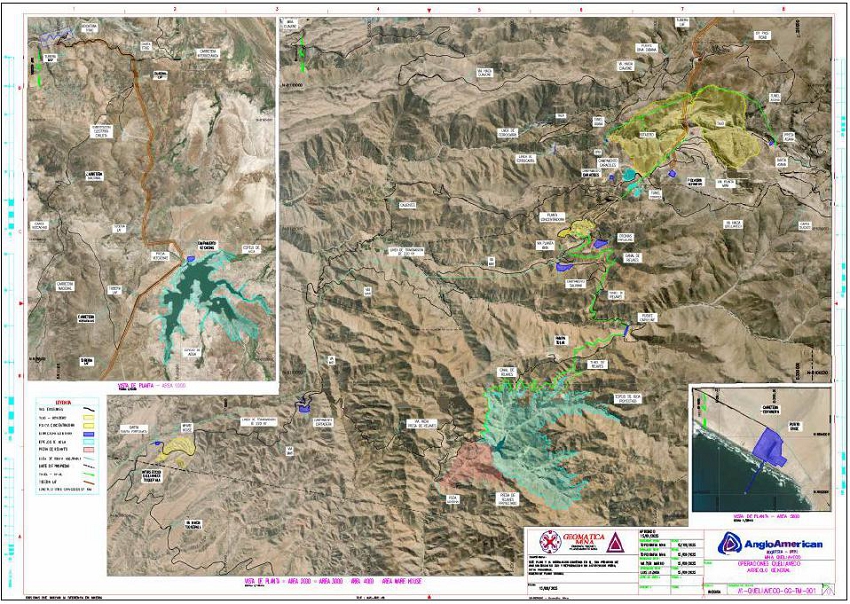

| Figure 5.1 | Quellaveco site layout | 44 | |

| Figure 7.1 | Regional geological setting | 48 | |

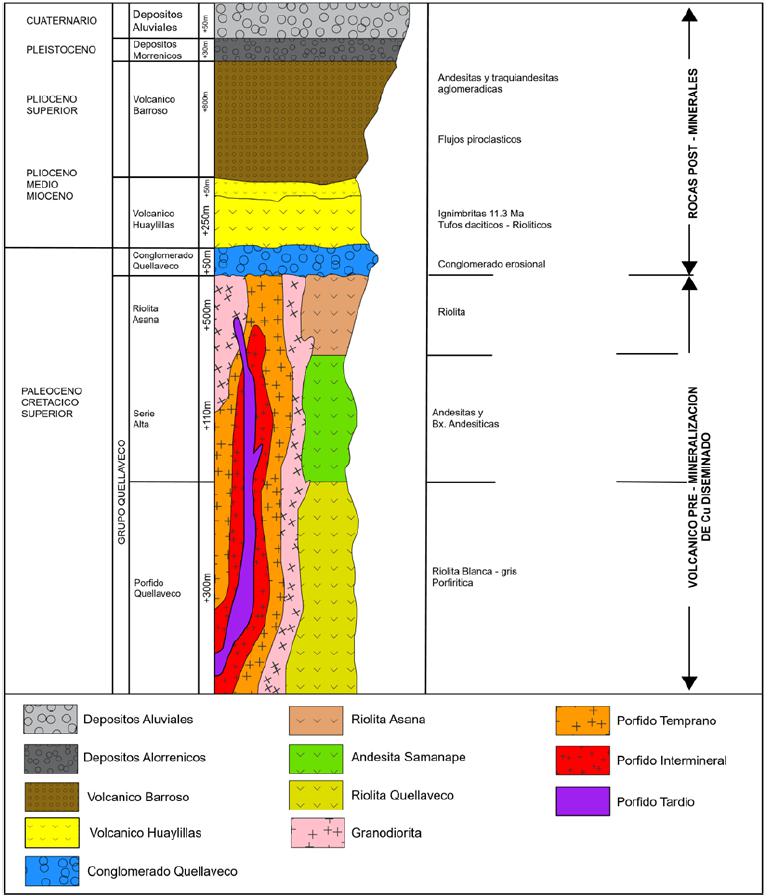

| Figure 7.2 | Generalized stratigraphic column | 50 | |

| Figure 7.3 | Quellaveco local geology | 52 | |

| Figure 7.4 | Representative cross-section looking north | 55 | |

| Figure 10.1 | Example of core photographic register | 60 | |

| Figure 10.2 | Schramm T660 RC drill rig and associated Involution Cyclone sample collection system | 62 | |

| Figure 11.1 | Core processing and storage inspection: (a) core reception, regularization and measurement of sample recovery, (b) logging, (c) core photography, (d) splitting, (e) storage | 63 | |

| Figure 11.2 | Salviani site laboratory inspection: (a) sample reception; (b) barcoding and drying; (c) crushing; (d) pulverizing and splitting; (e) weighing (f) digestion – specific to geological samples (g) ICP-OES determinations; (h) AAS determinations | 65 | |

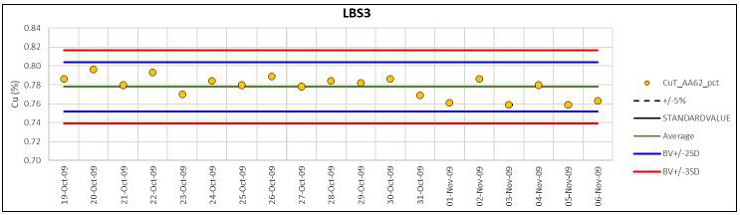

| Figure 11.3 | 2009 drilling: total copper CRM control chart LBS3 – all assays performed using “ore”-grade AA62 method | 68 | |

| Figure 11.4 | 2008–2009 drilling: total copper CRM control chart LBS7 – assays using AA61 trace-element method showing low bias (-6%) | 68 | |

| Figure 11.5 | 2019–2022 drilling – total copper control chart for CRM QV-STD2 | 68 | |

| Figure 11.6 | Coarse blanks 2008–2022 drilling, total copper control chart | 69 | |

| Figure 11.7 | Coarse blanks 2008–2022 drilling, molybdenum control chart | 69 | |

| Figure 12.1 | Core inspection – selected mineralization intervals: (a) AQDEX25012 at 242 m – chalcopyrite (b) AQDEX25012 at 242 m – molybdenite (+ chalcopyrite); (c) AQEX24004 at >900 m – chalcopyrite-magnetite stockwork | 72 |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| Figure 14.1 | Quellaveco drilling plan | 80 | |

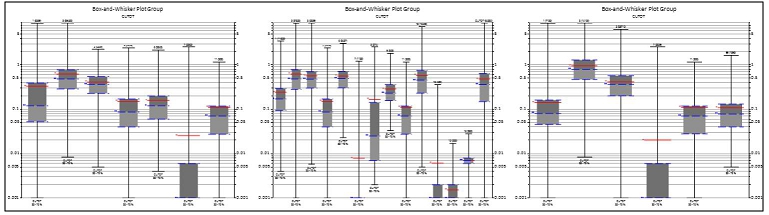

| Figure 14.2 | Boxplots showing the distribution of total CuT grades by alteration type, lithology and minzone (from left to right) | 81 | |

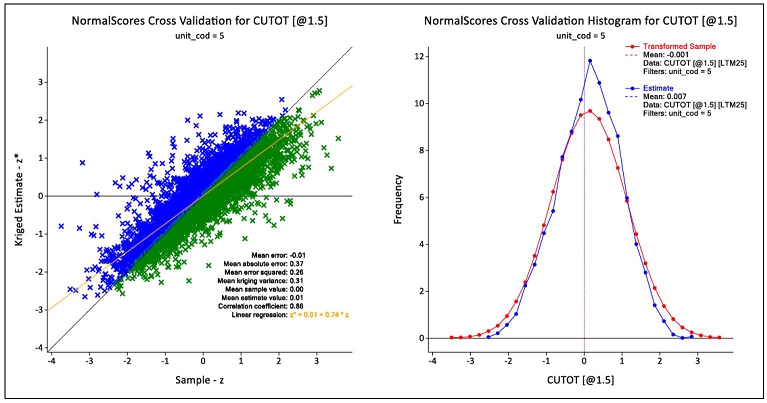

| Figure 14.3 | Cross-validation for supergene enrichment zone | 85 | |

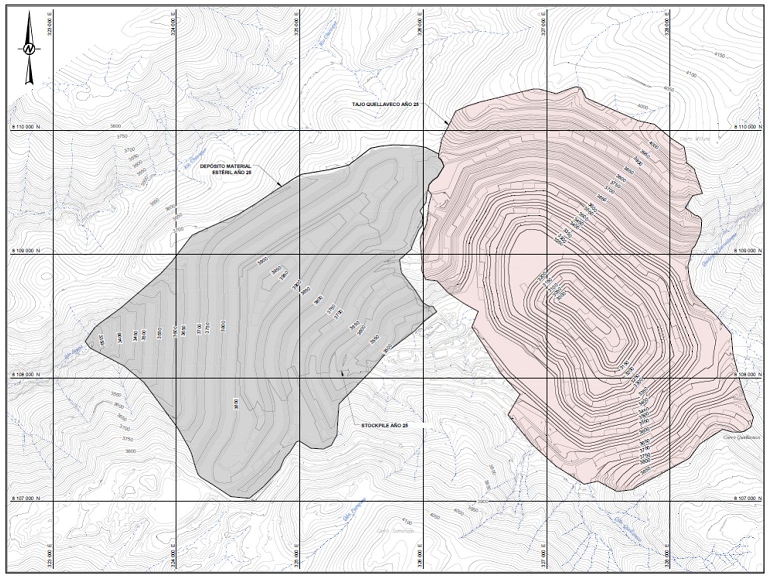

| Figure 15.1 | Plan view of the Quellaveco open pit and waste dump showing end of life general arrangement | 93 | |

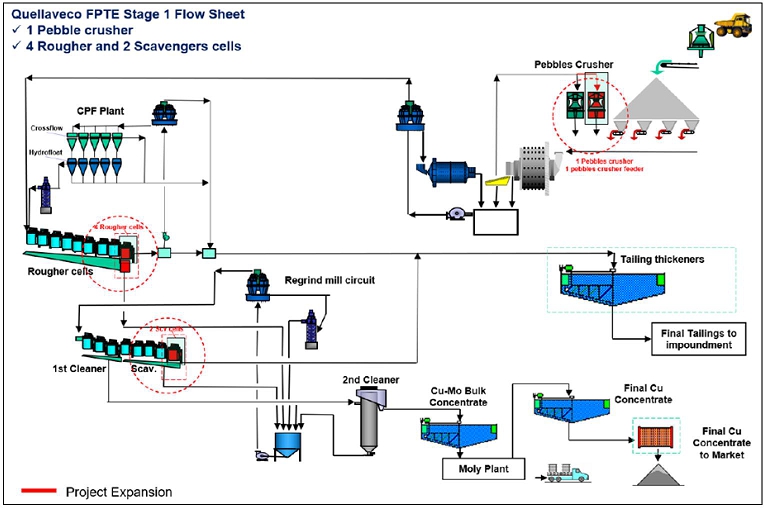

| Figure 17.1 | Simplified 142 kt/d Quellaveco process flowsheet | 102 | |

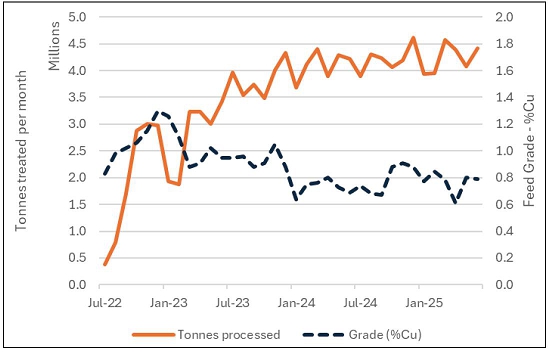

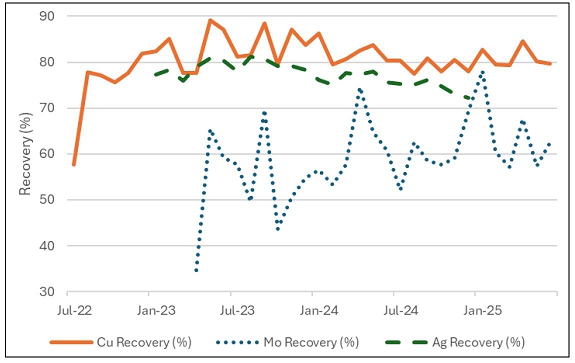

| Figure 17.2 | Recent concentrator throughput performance | 103 | |

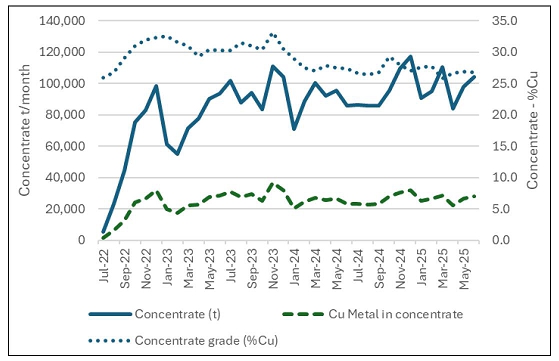

| Figure 17.3 | Concentrate performance | 103 | |

| Figure 17.4 | Concentrate recovery performance | 104 | |

| Figure 18.1 | Plan view of the port facilities | 105 | |

| Figure 20.1 | Quellaveco 5-year permitting plan | 118 | |

| Figure 23.1 | Quellaveco adjacent properties | 126 |

Tables

| Table 1.1 | Quellaveco production history | 13 | |

| Table 1.2 | Quellaveco Mineral Resources as of 31 December 2025 reported at a cut-off grade of 0.18% Cu (100% attributable basis) | 17 | |

| Table 1.3 | Quellaveco Mineral Reserve estimate as of 31 December 2025 (100% attributable basis) | 18 | |

| Table 1.4 | LoAP mine production (five-year increments) | 19 | |

| Table 1.5 | LoAP SIB cost (2025–2057) | 22 | |

| Table 1.6 | LoAP unit costs | 23 | |

| Table 1.7 | LoAP opex ($million) in five-year periods | 23 | |

| Table 2.1 | Responsibilities of each Qualified Person | 25 | |

| Table 2.2 | Anglo American information sources | 26 | |

| Table 3.1 | Anglo American subject matter experts | 30 | |

| Table 4.1 | Property mineral titles | 33 | |

| Table 6.1 | Summary of previous drilling at Quellaveco | 46 | |

| Table 6.2 | Quellaveco production history | 47 | |

| Table 10.1 | Summary of drilling incorporated into the December 2025 Mineral Resource estimate | 59 | |

| Table 11.1 | Density determinations by campaign used for the resource modelling | 66 | |

| Table 13.1 | Copper concentrate quality | 77 | |

| Table 14.1 | Summary of drilling used for the December 2025 Mineral Resource estimate | 78 | |

| Table 14.2 | Impact of compositing strategy on CuT statistics | 82 | |

| Table 14.3 | Top cuts applied by domain | 83 | |

| Table 14.4 | Experimental variogram parameters | 84 | |

| Table 14.5 | Summary kriging parameters used for the December 2025 Mineral Resource estimate | 86 | |

| Table 14.6 | Block model parameters | 87 | |

| Table 14.7 | Quellaveco Mineral Resources as of 31 December 2025 reported at a cut-off grade of 0.18% Cu (100% attributable basis) | 89 | |

| Table 15.1 | Quellaveco Mineral Reserve estimate as of 31 December 2025 (100% attributable basis) | 95 | |

| Table 16.1 | Current mining fleet | 99 | |

| Table 16.2 | LoAP production and processing schedule (five-year increments) | 100 | |

| Table 20.1 | Environmental and associated approvals | 116 | |

| Table 21.1 | LoAP capital cost ($million) to 2056 | 122 | |

| Table 21.2 | LoAP average unit operating costs | 123 | |

| Table 21.3 | LoAP opex ($million) five-year increments | 123 | |

| Table 21.4 | Five-year plan mining operating costs | 124 |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

Forward-looking information

This Technical Report contains “forward-looking information” within the meaning of applicable Canadian securities legislation which involves a number of risks and uncertainties. Forward-looking information includes, but is not limited to: information with respect to strategy, plans, expectations or future financial or operating performance, such as expectations and guidance regarding project development, production outlook, including estimates of production, grades, recoveries and costs; estimates of Mineral Resources and Mineral Reserves; construction plans; mining and recovery methods; mining and mineral processing and rates; tailings disposal design and capacity; mine life; timing and success of exploration programs and project related risks as well as any other information that expresses plans and expectations or estimates of future performance. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking information is based on the opinions, estimates and assumptions of contributors to this Technical Report. Certain key assumptions are discussed in more detail. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any other future results, performance or achievements expressed or implied by the forward-looking information.

Such factors and assumptions underlying the forward-looking information in this Technical Report includes, but are not limited to: risks associated with community relationships; risks related to estimates of production, cash flows and costs; risks inherent to mining operations; shortages of critical supplies; the cost of non-compliance and compliance; volatility in commodity prices; risks related to compliance with environmental laws and liability for environmental contamination; the lack of availability of infrastructure; risks related to the ability to obtain, maintain or renew regulatory approvals, permits and licences; imprecision of Mineral Reserve and Mineral Resource estimates; deficient or vulnerable title to concessions, easements and surface rights; inherent safety hazards and risk to the health and safety of employees and contractors; risks related to the workforce and its labour relations; key talent recruitment and retention of key personnel; the adequacy of insurance; uncertainty as to reclamation and decommissioning; the uncertainty regarding risks posed by climate change; the potential for litigation; and risks due to conflicts of interest.

There may be other factors than those identified that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers are cautioned not to place undue reliance on forward-looking information. Unless required by Canadian securities legislation, the authors and Snowden Optiro undertake no obligation to update the forward-looking information if circumstances or opinions should change.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 1 | Summary |

This Technical Report was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) for Anglo American plc (Anglo American) to support the disclosure of Mineral Resources and Mineral Reserves for the Quellaveco Project (Quellaveco or the Property), a production stage property in the Moquegua Department of southern Peru.

This Technical Report was authored by the following Qualified Persons:

| · | Messrs. Glacken, Earl, Radonich, Lyall and Laymen of Snowden Optiro, a business unit of Datamine Australia Pty Ltd. Snowden Optiro was responsible for the preparation of this Technical Report, including the review of the drilling, data, geology, Mineral Resources, Mineral Reserves, mining, market studies and costs. |

| · | Mr. Gordon Cunningham of Turnberry Projects was responsible for the review of the metallurgical testwork, processing and infrastructure. |

| · | Mr. Peter Theron and Ms. Gené Main of Prime Resources were responsible for the review of the environment and permitting. |

The effective date of this Technical Report is 3 November 2025.

Unless otherwise specified, all units of currency are in United States dollars ($) and all measurements are metric.

| 1.1 | Property description, ownership and background |

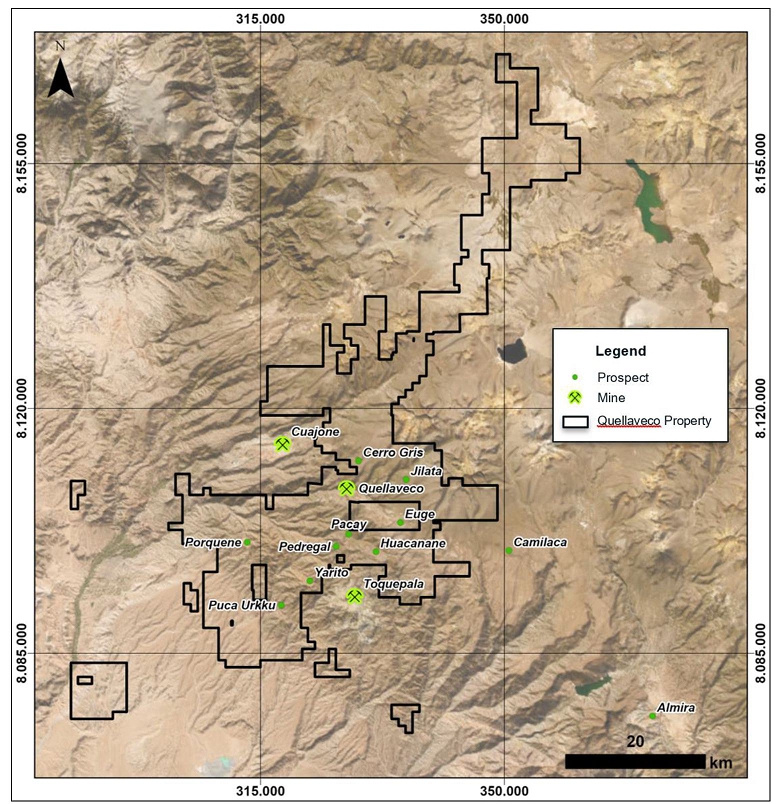

Quellaveco is in the Mariscal Nieto Province of southern Peru, approximately 48 km by road northeast of the town of Moquegua and approximately 220 km by road southeast of Arequipa city (Figure 1.1). Access from Moquegua to the Quellaveco mine site is via a paved road. The area of the Property is 1,206.93 km2.

The Property is owned by Anglo American Quellaveco S.A. (AAQSA), in which Anglo American holds a 60% interest and Mitsubishi Corporation holds a 40% interest. The Quellaveco operation is an autonomous truck-and-shovel open pit mine with an associated concentrator for comminution, flotation and filtration. The resulting copper concentrate is transported by road to the ore handling and shipping facilities at the Port of Ilo, operated under a long-term agreement with the owner, ENGIE. Molybdenum concentrate is sold to Anglo American Marketing entities for resale to global roasters.

The Quellaveco mine site is at an elevation of approximately 3,500 metres above sea level (masl) along the sparsely vegetated, rugged western flank of the Andes. The climate is characterized by a wet season between December and March and a dry season between April and November when the highest daytime temperatures are recorded. Subzero temperatures are frequently recorded during June and July, and the average annual rainfall is 268 mm recorded on an average of 62 days. Mining and processing operations at Quellaveco are conducted year-round.

Commercial copper production was achieved in September 2022. The 2024 copper equivalent in concentrate production volume was 306,300 tonnes at a unit cost of $1.05/lb inclusive of by-product credits. Production guidance for 2025 is 310,000–340,000 tonnes of copper at a unit cost of $1.00/lb.

The Life-of-Asset Plan (LoAP) is currently forecast to produce about 309,000 tonnes of copper equivalent in concentrate per annum on average over the next five years, gradually declining as lower-grade zones are mined in later phases of the 22-year Mineral Reserve mine plan and 31-year processing plan.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

Figure 1.1 Location of Quellaveco mine

Source: Fluor, 2017

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

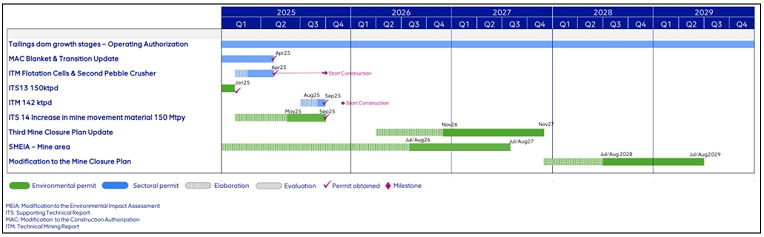

Quellaveco received approval for its Environmental Impact Assessment (EIA) in 2010. In 2015, the fourth Modification to the EIA (4th MEIA) was approved. This modification authorized the operation of the concentrator at a throughput rate of up to 127.5 kt/d and a total material movement of 140 Mt/a. Following the 4th MEIA, additional operational enhancements were approved through Supporting Technical Reports (Informes Técnicos Sustentatorios or ITS). The most recent approvals, ITS 12 and ITS 13 in 2025, permitted an increase in concentrator throughput to 150 kt/d and total mine material movement to 150 Mt/a.

The 4th MEIA does not encompass the full extent of the open pit as defined by the 2025 Mineral Reserve estimate and a 5th MEIA is currently under preparation, with submission planned in the first half of 2026 and regulatory approval anticipated by mid-2027. Upon approval of the 5th MEIA, the Quellaveco open pit will be fully permitted for development and operation.

| 1.2 | History |

The discovery of the Quellaveco porphyry copper-molybdenum deposit dates back to 1938. Following several changes in ownership, Anglo American acquired the Quellaveco deposit in 1992 through a privatization process by the state-owned mining company Minero Peru. In 1993, Anglo American reached an agreement with the International Finance Corporation (IFC) to jointly finance the development of the mine. IFC’s 18.11% interest in the Property was acquired by Mitsubishi Corporation in 2011. Mitsubishi Corporation increased its stake in AAQSA to 40% in 2018.

Following a series of studies culminating in the 2017 Feasibility Study (FS) for a 127,500 t/d operation, development of the mine and construction of a concentrator was approved in 2018. Commercial copper production was achieved in September 2022. The molybdenum plant commenced commercial production in 2023. The production history at Quellaveco is summarized in Table 1.1.

| Table 1.1 | Quellaveco production history |

| Year | Tonnes processed (Mt) |

Grade processed (% Cu) |

Copper concentrate produced (dmt) |

Copper produced (t) |

Mo concentrate produced (dmt) |

Mo produced (t) |

C1 unit cost incl. by- product credits ($/lb) |

Capex ($ M) |

| 2022 | 11.72 | 1.12 | 329,211 | 102,300 | 6,519 | 3,382 | 1.36 | 814 |

| 2023 | 39.76 | 0.96 | 1,031,000 | 319,000 | 10,880 | 5,663 | 1.11 | 416 |

| 2024 | 49.90 | 0.76 | 1,113,400 | 306,300 | 4,504 | 2,363 | 1.05 | 437 |

Source: Anglo American

| 1.3 | Geological setting, mineralization and deposit type |

The Quellaveco deposit forms part of the Paleocene-Eocene porphyry copper belt that hosts several major deposits such as Cerro Verde, Cuajone and Toquepala in the southwest of the Western Cordillera of Peru. The deposit is associated with a large granodioritic complex (~60 Ma) that intruded volcanic and volcaniclastic sequences of the Toquepala Group. Regionally, the Incapuquio Fault System and associated northwest-trending splays, particularly the Asana Fault, were the primary structural control on intrusion emplacement and mineralization.

The mineralized system measures approximately 1.5 km (northwest-southeast) by 3.5 km (northeast-southwest) and extends to depths exceeding 1 km. Copper-molybdenum mineralization is centred on multiple phases of monzonitic porphyry intrusions within the granodiorite host, associated with intense hydrothermal alteration and disseminated to vein-hosted chalcopyrite, molybdenite and pyrite mineralization. Alteration is zoned from a potassic core through phyllic (quartz-sericite) halos to outer propylitic assemblages.

Subsequent supergene enrichment produced a vertically zoned profile comprising a leached cap, oxide copper zones, and a secondary enriched sulphide blanket dominated by chalcocite and covellite. The enrichment zone averages ~60 m in thickness.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

The Quellaveco deposit is a classic porphyry copper system within the South American porphyry copper belt, which extends from central Chile to Panama. The system exhibits typical hypogene sulphide mineralization and concentric alteration zonation modified by supergene enrichment, forming a leached cap, oxide zones, and a secondary enrichment sulphide blanket.

| 1.4 | Drilling |

Between 1939 and 2024, multiple campaigns using churn drilling, diamond drilling (DD) and reverse circulation (RC) drilling techniques were completed. Drilling in the 1940s was led by Northern Peru Mining & Smelting, then by Southern Peru Copper Corporation (1972), Minero Perú (1972–1974) and Anglo American from 1993 to the present. None of the pre-1970 drilling has been used for Mineral Resource estimation.

Since 1970, 716 DD holes for 172,168 m and 649 RC holes for 52,270 m (inclusive of grade control drilling) have been completed. For Anglo American’s DD holes, standard DD drilling methods with PQ (85.0 mm), HQ (63.5 mm) and NQ (47.6 mm) core sizes were used. PQ is typically only used in weathered materials. Most holes were inclined at approximately -75°. For Anglo American’s RC holes, standard RC drilling methods included 127 mm (5-inch) diameter hammers, tricone bits and face bits with samples of up to 50 kg routinely collected at 1 m intervals via a fully enclosed cyclone system. For more recent RC drilling, 3 m sampling intervals were also used, yielding up to 100 kg of sample.

Recovered core is placed into core boxes, with the depth interval marked on core blocks at the end of each run, as measured by the driller, prior to delivery to the core shed. Core photography is conducted prior to sampling. Geotechnical and geological logging is conducted by company geologists or a contractor under close supervision at the core shed.

Geologists identify lithological units, geological contacts, fault and fracture zones, ferruginous horizons and internal waste zones. All logging information is reviewed and validated by a senior geologist. Digital logging using acQuire™ based tablets was implemented in 2016.

There is no available recovery information for drill campaigns prior to 2000. Campaigns conducted after 2000 have daily recovery reports from the drilling contractor that are verified by the geologist. Mean DD core recovery is reported at above 90%.

| 1.5 | Sampling, analyses and data verification |

DD core samples are collected for analysis following logging. Sampling is performed by cutting the core lengthwise in half. Prior to 2017, core was cut with a hydraulic splitter, after which the use of a diamond circular saw was implemented. One half of the cut core is placed into pre-numbered sample bags and dispatched to the laboratory; the other half is stored for reference

Since 2023, RC drilling has become an important evaluation component, focused on improving the predictability of the near-term production plan. RC holes are drilled on a 20 m spacing, and samples are collected over 3 m intervals using an Involution Cyclone system and placed into consecutively numbered sample bags for dispatch to the assay laboratory. Standards, blanks and duplicates are inserted into the sample number sequence at a rate of 1 in 20. Sieved reference rock chip samples are collected in chip trays for logging and are also photographed.

For recent drilling campaigns (2017 onwards), the primary assay laboratory is SGS Lima. Analysis is performed for copper, silver, molybdenum and arsenic using a four-acid total digestion (HNO3, HClO4, HF, and HCl) with reading by atomic absorption. Cyanide soluble and citric acid soluble copper assays are determined by atomic absorption. Batches also included a 35-element inductively coupled plasma-optical emission spectroscopy (ICP-OES) assay suite, following an aqua regia partial digestion (HNO3, and HCl).

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

For drilling campaigns conducted between 2008 and 2015, the primary assay laboratory was ALS Lima using similar protocols to those used later at SGS; however, it should be noted that two different protocols (AA61_ppm, and AA62_pct) were used for total copper. Information on assay protocols for drilling conducted prior to 2008 is not available.

Each batch of samples submitted for analysis must meet or exceed the minimum sample insertion rates for QAQC. The QAQC procedures used for samples analysed prior to 2000 are unknown; however, in 2018 a review of this information was conducted. A re-analysis campaign of 7,480 samples (approximately 25% of historical drillhole samples) was conducted by SGS Lima for total copper using Quellaveco’s standard four-acid protocol. In addition, 5,966 samples were assayed for molybdenum using a four-acid digestion.

QAQC measures during the re-assaying campaign included regular insertions of certified reference materials (CRMs) and duplicate samples. The results of the re-assays for total copper compared well with the original values without any indication of biases and showed acceptable levels of precision. Furthermore, the QAQC controls verified the reliability of the new assays. The exercise concluded that total copper assays from the historical assaying are reliable and no further re-assaying for total copper is required.

Historical molybdenum assays were conducted on 15 m composites, which did not cover all the available drillholes. Moreover, comparing the re-assay results composited to the same intervals as the original showed a bias, with the original results being approximately 25% higher than the re-assay determinations. As a result, in 2019 all available historical pulps (some 29,684 samples) were assayed for molybdenum at SGS Lima using the four-acid protocol. Control samples, including CRMs and duplicates were included, delivering acceptable results. The new assays replaced any historical molybdenum determinations in the Mineral Resource estimate.

Samples analysed after 2000 have QAQC reports indicating controls, results, actions and conclusions.

| 1.6 | Mineral processing and metallurgical testing |

Metallurgical testwork has been completed over a period exceeding 35 years to characterize the processing response of the Quellaveco porphyry copper-molybdenum mineralization. Test programs have progressively advanced from laboratory-scale studies to pilot and mini-pilot plant campaigns, supporting process design and metallurgical performance forecasts for feasibility and life-of-asset planning.

Early metallurgical investigations by Minero Perú and Southern Peru Copper Corporation (1976) established ore amenability to flotation. Subsequent testwork by AAQSA between 1993 and 1998 defined key parameters for grinding, flotation, thickening and filtration using samples representative of primary and secondary ore zones. These results formed the basis of the 2000 feasibility design.

Campaigns in 2007 and 2013–2014 incorporated methodologies such as JK drop-weight, Semi-Autogenous Grinding (SAG) Mill Comminution Test (SMC), SAG Power Index (SPI) and Bond Work Index (BWI) tests to construct a detailed geometallurgical model linking ore hardness, throughput and metallurgical recovery. Laboratory and mini-pilot flotation testing performed by SGS Chile confirmed robust copper recovery relationships with grind size and ore type.

Metallurgical performance is summarized as follows:

| · | Copper recovery: about 86% overall, varying with ore type and grind size (P80 150–180 µm). |

| · | Molybdenum recovery: 50–60% |

| · | Copper concentrate grade: 32% Cu (secondary ore) and 28% Cu (primary ore) |

| · | Molybdenum grades in molybdenum concentrate of about 52% |

| · | Tailings thickening: 50% solids underflow going to the tailings dam with reclaimed water returned to the process plant. |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 1.7 | Mineral Resource estimates |

The December 2025 Mineral Resource estimate is based on an acQuire™/SQL server database, Leapfrog Geo™ geological modelling, and block models generated using Anglo American’s Rapid Resources Modelling (RRM) platform. The following evaluation methodologies were used:

| · | Database compilation into a useable and verifiable format |

| · | Geological modelling and wireframing |

| · | Interpretation, definition and wireframing of mineralized domains |

| · | Geostatistical analysis and variography by domain |

| · | Block modelling, grade and bulk density estimation |

| · | Model validation. |

Only RC and DD holes were used for geological interpretation, compositing, geostatistical analysis, and resource estimation.

Geological modelling of each mineralization, lithology, and alteration unit was conducted where sufficient and reliable drillhole logging and pit mapping information were available. Statistical analysis and variography were conducted on 47 total copper (CuT), soluble copper (CuS), cyanide copper (CuCN), molybdenum (Mo), silver (Ag), arsenic (As), iron (Fe), zinc (Zn) lead (Pb), and specific gravity (SG) domains. Domaining was based on a combination of mineral zonation (minzone), alteration, and lithology. Grade estimation was conducted for five CuT (two supergene and three hypogene), three CuS (two supergene and one hypogene), two CuCN (one supergene and one hypogene), and three Mo domains. CuT domains were based on a combination of minzone, alteration, and lithology, CuS and CuCN domains were based exclusively on minzone, and Mo domains were based exclusively on lithology. Ag, As, Fe, S, Zn and Pb domains were also defined, however, these are not discussed in this report as they are not considered material to the Mineral Resource estimate. SG data was grouped into geological domains based on a combination of minzone, alteration and lithology. A total of 12 domains were defined.

Ordinary kriging (OK) and simple kriging (SK) were selected as the preferred grade interpolation methods, dependent on the variable being estimated and the drill spacing of the estimation domain. Grade estimation was conducted on seven separate estimation domains, defined on the basis of mineralization, lithology and alteration characteristics.

Mineral Resource classification was determined through geostatistical uncertainty assessments, which were applied to the resource model according to average drillhole spacing.

The December 2025 Exclusive Mineral Resource estimate for Quellaveco above a cut-off grade of 0.18% Cu is summarized in Table 1.2.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

Table 1.2 Quellaveco Mineral Resources as of 31 December 2025 reported at a cut-off grade of 0.18% Cu (100% attributable basis)

| Mineralization type |

Resource category |

Tonnes (Mt) |

Cu (%) |

Contained Cu metal (kt) |

Mo (%) |

Contained Mo metal (kt) |

| Sulphide flotation | Measured | 108.2 | 0.37 | 403 | 0.014 | 15 |

| Indicated | 846.0 | 0.40 | 3,416 | 0.016 | 138 | |

| Measured + Indicated | 954.2 | 0.40 | 3,819 | 0.016 | 152 | |

| Inferred | 1,253.5 | 0.38 | 4,752 | 0.015 | 187 |

Source: Anglo American, 2025a

Notes:

| · | The Quellaveco Mineral Resources were updated in 2025, utilizing an updated geological model and LoAP. The estimates consider forecast production to the end of 2025 and are therefore quoted as of 31 December 2025, which aligns with Anglo American’s reporting cycle. |

| · | Tonnes and grades have been rounded and may result in minor discrepancies in the totals. |

| · | All tonnages reported on a dry basis. |

| · | Mineral Resources are reported exclusive of Mineral Reserves. |

| · | Mineral Resources are reported within an optimized Mineral Resource shell (using Anglo American’s $5.57/lb copper price assumption) and are constrained by Anglo American’s mineral rights. |

| · | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| · | Anglo American’s equity interest is 60%. |

| · | The Mineral Resources were prepared by an Anglo American Competent Person under the JORC Code and reviewed by the Qualified Person Mr Graeme Lyall. |

The December 2025 Quellaveco Mineral Resource estimate is reported above a 0.18% Cu cut-off grade within an optimized Lerchs-Grossmann Mineral Resource shell generated using Minesight™ software, and is based on Anglo American Reasonable Prospects of Economic Extraction (RPEE) standards and assessments and Anglo American’s copper price assumption of $5.57/lb.

The Qualified Person independently verified the Mineral Resource estimates presented in Table 14.7 and was able to reproduce the reported tonnages and grades within ±1%.

The Mineral Resource was initially classified in accordance with the guidelines of the 2012 Edition of the Australasian Joint Ore Reserves Committee Code (JORC Code, 2012). The confidence categories assigned under the JORC Code (2012) were reconciled to the confidence categories in the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (the 2014 CIM Standards). As the confidence category definitions are the same, no modifications to the confidence categories were required. Mineral Resources and Mineral Reserves in this Technical Report are reported in accordance with the 2014 CIM Definition Standards.

The Qualified Person, Mr. Graeme Lyall, has critically examined the Mineral Resource estimate, made his own enquiries, and applied his general mineral industry competence to conclude that the information is adequate for the purposes of this Technical Report, and that it complies with the definitions and guidelines of the CIM Standards. The Qualified Person considers the reported Mineral Resource to be a fair reflection of the exploration activity and modelling processes undertaken.

To the best of the Qualified Person’s knowledge, at the time of estimation, there were no known environmental, permitting, legal, title, taxation, socio-economic, marketing, political or other relevant issues that could materially impact the eventual extraction of the Mineral Resource.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 1.8 | Mining and Mineral Reserve estimates |

Quellaveco is a large-scale open-pit mine using conventional drill-and-blast, load-and-haul methods at high altitude. Mining advances through nine phases on 15 m benches (30 m double benches in final walls) at overall slope angles of up to 40°. Ore is hauled to a near-pit primary crusher or stockpiles, with waste placed in engineered dumps to the west. The operation sustains a 142 kt/d plant throughput and averages 125 Mt/a total material movement over the LoAP.

The diversion of the Asana River was an important environmental and engineering component, designed to protect local water resources and minimize downstream impact. Progressive in-pit co-disposal of tailings and waste from 2042 onwards will enable final closure and restoration of the Asana River.

The 2025 Quellaveco Mineral Reserve reported in Table 1.3 incorporates geological, geotechnical and geometallurgical parameters to define ore zones and grade distributions across nine pit phases. Metallurgical recoveries were derived from validated recovery factors for both primary and secondary ores, consistent with recent plant data.

Table 1.3 Quellaveco Mineral Reserve estimate as of 31 December 2025 (100% attributable basis)

| Category/classification | Tonnage (Mt) |

Cu grade (%) |

Mo grade (%) |

Cu contained (Mt) |

Mo contained (Mt) |

||

| Open pit | |||||||

| Proven | 457.1 | 0.61 | 0.020 | 2.81 | 0.09 | ||

| Probable | 1,016.3 | 0.43 | 0.016 | 4.40 | 0.16 | ||

| Subtotal open pit | 1,473.4 | 0.49 | 0.017 | 7.21 | 0.26 | ||

| Stockpiles | |||||||

| Probable | 14.4 | 0.65 | 0.011 | 0.09 | 0.00 | ||

| Subtotal stockpiles | 14.4 | 0.65 | 0.011 | 0.09 | 0.00 | ||

| Total | 1,487.8 | 0.49 | 0.017 | 7.31 | 0.26 | ||

Notes:

| · | The Quellaveco Mineral Reserves were updated in 2025, utilizing an updated geological model and LoAP. The estimates include forecast production to the end of 2025 and are therefore quoted as of 31 December 2025, which aligns with Anglo American’s reporting cycle. |

| · | Tonnes and grades have been rounded and may result in minor discrepancies in the totals. |

| · | Mineral Reserves are derived solely from Measured and Indicated Mineral Resources. |

| · | Point of reference is delivery to the process plant. |

| · | All tonnages are reported on a dry basis. |

| · | Anglo American’s equity interest is 60%. |

A pit optimization was completed considering only Measured and Indicated Resources. Cost assumptions were $2.99/t mined for mining, $13.33/t ore milled for processing and $3.07/t ore milled for general and administration (G&A), a Cu price of $5.58/lb, Mo $13.61/lb and with an average mill throughput of 142 kt/d (or 51.8 Mt/a). The economic shell selected for final design corresponded to revenue factor (RF) 0.5 equivalent to a copper price assumption of $2.78/lb. Process recoveries averaged 81.3% Cu. Key pit design parameters included overall slope angles of 34–40°, 15 m benches, 38 m haul ramps, a maximum gradient of 10%, and meeting waste and tailings capacity constraints.

A value-per-hour (VPH) optimization approach was applied for cut-off determination, ensuring only material with positive economic contribution (VPH >0) is included in the Mineral Reserve. Allowances for dilution (about 8–10%) and ore loss (3–5%) were embedded in the mine schedule. Environmental and permitting constraints are governed by the approved 4th MEIA, with the 5th MEIA under preparation for submission in 2026.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

The Ore Reserve categories reported under the JORC Code (2012) were also reconciled with the CIM classification framework. As a result, the Proved Ore Reserve under the JORC Code has been re-stated as Proven Mineral Reserves and Probable Ore Reserves have been re-stated at Probable Mineral Reserves, ensuring consistency in the levels of estimation confidence, data support and modifying factors between the two standards.

Hydrological and hydrogeological studies have supported Quellaveco from feasibility through the current LoAP. Baseline monitoring networks, aquifer testing and modelling defined pit inflows of 40–60 L/s, with operational inflows averaging 45 L/s. Dewatering capacity will be expanded to 65 L/s for deeper phases. Water supply is drawn from the Titire and Vizcachas Rivers (about 78% and 22%, respectively) complemented by stormwater diversions and continuous rainfall monitoring.

Geotechnical investigations support pit design, slope stability and infrastructure development. These included core logging, laboratory strength testing, structural mapping and in-pit performance monitoring, combined with detailed rock mass classification (RMR, GSI, Q-system). The pit area is divided into geotechnical domains based on lithology, alteration and weathering. Overall slope angles range from 34° to 40°, depending on material strength and structural orientation. Continuous slope monitoring, including survey prisms, radar systems, and piezometers, has been installed to monitor pit wall performance.

The primary loading fleet consists of electric rope shovels (56 m3) and hydraulic backhoes (34 m3), matched with a fleet of 300-tonne class haul trucks (CAT 794 AC). Drilling and blasting are performed using diesel rotary drills and emulsion blasting systems, with dozers, graders and water trucks providing auxiliary support. The current fleet provides sufficient capacity to meet long-term production targets, with periodic equipment replacement included in the stay-in-business (SIB) capital forecast under the LoAP plan.

Total material movement averages about 125 Mt/a, maintaining a strip ratio of about 0.61 (waste:ore) consistent with the long-term pit design. The LoAP schedule outlines a 22-year mine plan and a 31-year concentrator life, sustaining ore feed of 142 kt/d from 2028 onwards, with stockpiles providing lower grade concentrator feed for the last nine years (Table 1.4).

Table 1.4 LoAP mine production (five-year increments)

| Item | Unit | Total | 2025–29 | 2030–34 | 2035–39 | 2040–44 | 2045–49 | 2050–54 | 2055–59 |

| Ore mined | Mt | 1,544 | 375 | 357 | 333 | 392 | 87 | - | - |

| Mined grade | % | 0.50 | 0.60 | 0.44 | 0.51 | 0.43 | 0.53 | - | - |

| Waste mined | Mt | 948 | 295 | 248 | 235 | 146 | 24 | - | - |

| Total open pit movement |

Mt | 2,495 | 671 | 605 | 569 | 539 | 111 | - | - |

| Ore processed | Mt | 1,556 | 252 | 259 | 259 | 259 | 258 | 257 | 11 |

| Process grade | % | 0.50 | 0.72 | 0.54 | 0.58 | 0.51 | 0.41 | 0.24 | 0.23 |

| Process recovery | % | 83.05 | 84.81 | 84.99 | 87.42 | 87.14 | 79.25 | 75.00 | 75.00 |

| Cu contained | kt | 6,550 | 1,545 | 1,182 | 1,315 | 1,162 | 858 | 470 | 19 |

| Cu contained | Mlb | 14,439 | 3,406 | 2,605 | 2,898 | 2,562 | 1,891 | 1,035 | 42 |

| Cu concentrate | kt | 25,899 | 5,030 | 4,851 | 5,504 | 4,819 | 3,612 | 2,002 | 82 |

| Mo concentrate | kt | 304 | 47 | 59 | 65 | 54 | 52 | 26 | 1 |

Source: LoAP

Copper production averages approximately 309 kt/a copper in concentrate during the first five years, declining gradually as lower-grade zones are processed in later phases (Figure 1.2). Molybdenum and silver are recovered as by-products, contributing additional revenue.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

Figure 1.2 LoAP concentrate production (five-year periods)

Source: LoAP

The schedule maintains alignment with the tailings storage facility (TSF) and waste dump capacities. Equipment hours, haul profiles and bench advance rates match the available fleet capacity and processing constraints. The LoAP financial model confirms that the production schedule supports the declared Mineral Reserve and demonstrates a positive economic performance under the Mineral Reserve cost and metal price assumptions.

| 1.9 | Processing methods and infrastructure |

The Quellaveco concentrator employs a conventional crush-grind-flotation circuit designed to treat the copper-molybdenum ore from open pit mining operations. The plant is achieving a capacity of 142 kt/d throughput, which is the basis of the LoAP. The potential expansion to 150 kt/d is being considered by Anglo American.

Run-of-mine (ROM) ore is delivered to a primary gyratory crusher, then conveyed to a coarse ore stockpile. The material is fed to two 40’ x 22’ SAG mills followed by two 28’ x 44’ ball mills operating in closed circuit with cyclones to achieve a final grind of P80 of between 150 µm and 180 µm. Ground slurry is conditioned and pumped to the flotation area.

The flotation circuit consists of rougher, scavenger and cleaner stages producing a bulk copper-molybdenum concentrate. Concentrate is thickened and pumped to the molybdenum separation circuit, where molybdenite concentrate is recovered via selective flotation. Final copper and molybdenum concentrates are filtered to low moisture content and dispatched for transport.

Tailings are thickened to approximately 50% solids and pumped to the Cortadera TSF, where reclaim water is returned to the plant for reuse. The plant includes integrated reagent preparation facilities with water reclaim and process control systems (Supervisory Control and Data Acquisition – SCADA).

The flow configuration is proven, and based on extensive pilot and laboratory testwork, ensuring efficient metal recovery, energy performance and water recycling.

The process plant is about 4 km from the primary crusher and the open pit, and includes crushing, grinding, flotation, thickening and filtration facilities, along with reagent storage, laboratories and workshops. Tailings are deposited in the Cortadera TSF, a downstream-constructed impoundment with an ultimate capacity exceeding 1,300 Mt, incorporating reclaim-water systems for recycling process water to the plant.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

The TSF comprises a single containment wall (valley fill) designed to be developed using the downstream raising method. The initial containment is provided by an 85 m high earth fill starter wall constructed from compacted borrow material. Future development includes two additional downstream raises, which will be constructed using compacted cyclone slurry underflow (cycloned sand). Construction of the embankment for the first raise has commenced and is currently below the starter wall crest. The final dam height is planned to reach 315 m, inclusive of the cycloned sand embankment.

Tailings, with a solids concentration of 50%, are delivered to the TSF via an 18.4 km long concrete launder. The tailings are deposited as slimes (cyclone overflow) and are contained by the high-density polyethylene (HDPE) lined starter embankment and subsequent raises. Water recovered from the tailings pond, as well as from the drainage and seepage collection systems, is returned to the process water circuit via a steel pipeline. The tailings delivery launder and return water pipeline follow the same route, traversing varied terrain with tunnels and bridge structures constructed along the alignment.

The TSF was originally designed to accommodate 1,000 Mt of tailings, as approved in the 2000 EIA. The capacity was subsequently increased by approximately 30% to support the 2017 FS base case plant throughput of 127.5 kt/d, resulting in a total storage capacity of approximately 1,300 Mt, inclusive of both basin and sand dam volumes. The current capacity is reported to be 1,350 Mt. The TSF and associated infrastructure were designed for a 127.5 kt/d throughput scenario but can accommodate an increase in throughput to 150 kt/d. In the event of a production capacity increase, selected infrastructure can be readily upgraded, particularly through raising the tailings launder walls with appropriate structural reinforcements. Based on the current Mineral Reserves and TSF capacity, in-pit co-disposal of tailings is planned from 2050, providing an additional capacity of approximately 240 Mt.

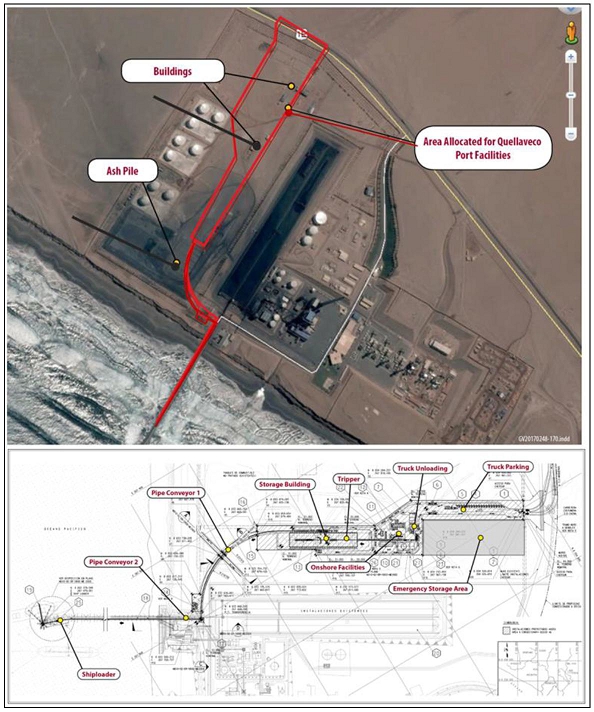

Copper concentrate produced at the Quellaveco concentrator is thickened and filtered on site before being transported by sealed trucks to the Port of Ilo, located approximately 82 km southwest of the mine. The concentrate is hauled along a dedicated, paved mine-to-port corridor designed to minimize dust generation and environmental impacts, following the Ilo–Moquegua highway route. The site is accessed via a 48 km paved mine access road from Moquegua, with heavy equipment transported from the coast via the Ilo–Moquegua corridor. A maximum of 120 trips is allowed per day.

At the port, concentrate is received at Anglo American’s dedicated storage and ship-loading facilities, which include enclosed storage sheds, conveyor systems and a mechanical ship loader. The Port of Ilo handles all copper concentrate exports, with water recovered from port filtration returned to the process water circuit where feasible.

Industrial water is supplied from licensed abstraction at the Titire and Vizcachas rivers, supplemented by pit dewatering systems and process water reclaim from the TSF. A dedicated 220 kV powerline connects the site to the national grid, supplying power to the mine, concentrator and associated infrastructure through on-site substations.

Supporting infrastructure includes mine workshops, administrative offices, maintenance areas, fuel and reagent storage facilities, communication systems and accommodation for operational and contractor personnel. An Integrated Operations Centre (IOC) coordinates production, logistics and environmental monitoring across the operation.

All major facilities including the process plant, workshops and administrative buildings are pressurized and climate-controlled to maintain worker comfort and limit altitude-related fatigue. The accommodation village provides medical and acclimatization facilities, including on-site clinics staffed with medical personnel trained in high-altitude health management.

Emergency response infrastructure includes oxygen supply systems, first-aid stations and dedicated aeromedical evacuation capabilities coordinated with regional hospitals in Moquegua and Arequipa. Personnel transportation between the camp, mine and nearby communities is provided through company-operated buses. Rotation schedules are designed to minimize altitude exposure and fatigue, with medical support and acclimatization protocols integrated into site operations.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 1.10 | Permitting, environmental and social |

Quellaveco operates under an approved EIA (EIA, 2000) and subsequent modifications authorized by the Peruvian Ministry of Energy and Mines. All key permits covering water use, tailings storage, waste rock management, and river diversion are in place, and compliance is overseen by the Environmental Assessment and Enforcement Agency of Peru (OEFA). Quellaveco implements an Environmental Management System consistent with Anglo American and IFC Performance Standards, addressing biodiversity, water, air quality, and rehabilitation. Extensive community engagement through the Moquegua Dialogue Table established commitments on water management, employment, and regional development, supported by ongoing social investment and transparent reporting to authorities and stakeholders.

| 1.11 | Costs and economic analysis |

As no material expansion, production increase or new development phase is currently proposed for the Quellaveco LoAP, an economic analysis has not been prepared or disclosed in this Technical Report. The project remains an operating asset, and its financial performance is governed by Anglo American’s internal budgets and corporate reporting standards rather than a standalone discounted cashflow analysis.

LoAP SIB costs listed in Table 1.5 are estimated at $5,883 million from 1 January 2025 to 2057. These costs cover the mine fleet refurbishment and replacement, process plant refurbishment, mining equipment, mine footprint expansion, tailings dam lifts, social, closure and rehabilitation activities, and the port. Capital estimates are prepared using engineering design, vendor quotations and benchmarked unit rates developed during each project phase.

| Table 1.5 | LoAP SIB cost (2025–2057) |

| SIB item | Cost ($ M) |

| Open pit SIB | 725 |

| Processing | 4,597 |

| Other SIB | 449 |

| Other capital | 113 |

| Total | 5,883 |

Source: LoAP

The Quellaveco LoAP includes post-production closure costs totalling $1,412 million, scheduled for the period 2058 to 2065. These costs cover the principal closure and rehabilitation commitments defined in the LoAP, namely:

| · | Final rehabilitation of the pit (including backfilling and Asana River restoration) |

| · | Decommissioning of the plant and tailings facilities |

| · | Post-closure monitoring and water management commitments. |

Operating unit costs listed in Table 1.6 were developed from first-principles estimates based on current performance and the first five years of the LoAP. Costs are expressed as unit rates in $/t of rock moved, $/t of ore, royalty (%), and $/t of concentrate, and are projected forward for the full mine life. LoAP operating costs are summarised in five-year periods in Table 1.7.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| Table 1.6 | LoAP unit costs |

| Item | Unit | Value |

| Mining | $/t rock mined | 3.63 |

| Processing | $/t ore processed | 7.89 |

| G&A | $/t ore processed | 2.34 |

| Royalty | % net revenue | 3.58 |

| Freight | $/t conc | 112 |

| As penalty | $/ lb Cu | 0.39 |

| TCs | $/ t conc | 47.89 |

| RCs | $/ lb Cu | 0.05 |

Source: LoAP

| Table 1.7 | LoAP opex ($ million) in five-year periods |

| Cost centre | Total | 2025–29 | 2030–34 | 2035–39 | 2040–44 | 2045–49 | 2050–54 | 2055–57 |

| Mining | 9,068 | 2,088 | 1,845 | 1,717 | 1,845 | 865 | 557 | 151 |

| Processing | 12,275 | 1,925 | 2,027 | 2,027 | 2,028 | 2,044 | 2,106 | 117 |

| G&A | 3,636 | 802 | 761 | 761 | 761 | 330 | 152 | 67 |

| Royalty | 2,888 | 593 | 541 | 601 | 529 | 398 | 217 | 9 |

| Freight | 2,931 | 549 | 554 | 628 | 550 | 412 | 228 | 9 |

| As penalty | 6 | 0 | 0 | 0 | 0 | 0 | 5 | 0 |

| TC | 1,255 | 211 | 243 | 275 | 241 | 181 | 100 | 4 |

| RC | 665 | 136 | 125 | 139 | 123 | 91 | 50 | 2 |

| Total | 32,722 | 6,305 | 6,096 | 6,148 | 6,078 | 4,320 | 3,416 | 360 |

Source: LoAP

| 1.12 | Market studies and contracts |

Quellaveco produces two primary concentrate products: copper concentrate and molybdenum concentrate. Production is allocated between the shareholders according to their ownership interests – Anglo American (60%) and Mitsubishi (40%) – with Anglo American acting as the operating partner. All copper and molybdenum concentrate production is sold to the shareholders under long-term offtake agreements that collectively cover 100% of Quellaveco’s output. The terms and conditions of these agreements are the same for both shareholders and are consistent with customary industry practices for related-party offtake arrangements.

Copper concentrates are sold on a cost, insurance and freight (CIF) basis through the Port of Ilo, under market-referenced terms that include London Metal Exchange (LME) copper pricing, London Bullion Market Association (LBMA) precious metal credits, benchmark treatment costs/refining charges (TC/RCs), and impurity adjustments. Molybdenum concentrate is sold to Anglo American Marketing entities for resale to global roasters at Platts-referenced prices with standard quality deductions. The products are clean, low-impurity concentrates suitable for major international smelters and are marketed globally to customers in Asia, Europe, and the Americas through Anglo American’s established marketing network.

Quellaveco does not engage in metal price hedging, and sales proceeds are fully exposed to prevailing market prices for copper and molybdenum at the time of settlement. Price assumptions and market outlooks are based on Anglo American’s long-term planning case, supported by internal market analyses benchmarked against external consensus forecasts. The Qualified Person has reviewed the offtake agreements and related assumptions and considers them reasonable and consistent with current market practice.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 1.13 | Conclusions and recommendations |

Quellaveco is a large-scale, long-life copper-molybdenum operation owned by Anglo American (60%) and Mitsubishi Corporation (40%), located in southern Peru’s Moquegua Department. The project has transitioned to stable operations following successful commissioning in 2022, with the molybdenum circuit achieving commercial production in 2023.

The LoAP schedule outlines a 22-year mine life and 31-year concentrator life processing lower-grade stockpiles in the final years, sustaining ore feed of about 50 - 52 Mt/a to the concentrator at a nominal throughput of 142 kt/day. Total material movement averages about 120-125 Mt/a, maintaining a strip ratio of about 0.61 (waste: ore) consistent with the long-term pit design. Ore is processed through a conventional crush-grind-flotation circuit, producing clean, low-impurity copper and molybdenum concentrates.

The 2025 Mineral Reserve (reported at 31 December 2025) stands at 1,488 Mt at 0.49% Cu and 0.017% Mo. Metallurgical recoveries average 84% Cu with a 2.2% coarse particle flotation (CPF) uplift. The LoAP financial model confirms that the declared Mineral Reserve is economically viable under Anglo American’s metal price and cost assumptions.

All major permits and environmental approvals are in place for the current production rate. The 5th MEIA, planned for submission in 2026, will support the full pit expansion based on 2025 Mineral Reserve estimate. Continuous slope monitoring, water management, and community engagement programs remain integral to maintaining safe and responsible operations.

The Qualified Persons recommend that AAQSA:

| · | Proceeds with preparation and submission of the 5th MEIA to secure approvals for the expanded pit and waste dump |

| · | Continue refinement of geotechnical and hydrogeological models, with emphasis on the north pit wall and deeper mining phases, to ensure slope stability and dewatering efficiency |

| · | Maintains optimization of mining and processing parameters through ongoing reconciliation, CPF performance tracking and recovery model updates. |

| · | Advance studies for a throughput expansion to 150 kt/d, contingent on 5th MEIA approvals and water-supply augmentation |

| · | Sustain community engagement and environmental monitoring programs consistent with Anglo American’s Social Way 3.0 (AASW3) and IFC Performance Standards. |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

| 2 | Introduction |

| 2.1 | Terms of reference |

This Technical Report was prepared in accordance with NI 43-101 for Anglo American to support the disclosure of Mineral Resources and Mineral Reserves for the Quellaveco Project, a production stage property in the Moquegua Department of southern Peru. The Technical Report was authored by the following Qualified Persons:

| · | Messrs. Glacken, Earl, Radonich, Lyall and Laymen of Snowden Optiro, a business unit of Datamine Australia Pty Ltd. Snowden Optiro was responsible for the preparation of this Technical Report, including the review of the drilling, data, geology, Mineral Resources, Mineral Reserves, mining, market studies and costs. |

| · | Mr. Gordon Cunningham of Turnberry Projects was responsible for the review of the metallurgical testwork, processing and infrastructure. |

| · | Mr. Peter Theron and Ms. Gené Main of Prime Resources were responsible for the review of the environment and permitting. |

Messrs. Lyall and Laymen completed a three-day site visit to the Property in October 2025. The site visit included an inspection of drilling activities, core processing and storage facilities, the site laboratory, the mining area, an inspection of the open pit, mineral processing facilities, site offices, mine management operational centre, waste dumps, ROM pad and primary crusher. Snowden Optiro has prior familiarity with the Property, with Mr. Lyall and another consultant completing a site visit in 2023 as part of a Mineral Resource and Ore Reserve audit.

All the Qualified Persons are eligible members in good standing of a recognized professional organization (RPO) within the mining industry and have at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that the Qualified Person is undertaking as disclosed in Table 2.1 at the time this Technical Report was prepared.

| Table 2.1 | Responsibilities of each Qualified Person |

| Qualified Person | Employer | Qualifications and affiliation | Details of site inspection |

Responsibility |

| Mr. Ian Glacken | Snowden Optiro | BSc (Hons) Geology (University of Durham); MSc, DIC (Mining Geology) (Royal School of Mines); MS (Geostatistics) (Stanford University); Grad. Dip Computing (Deakin University) FAusIMM (CP); FAIG; MIMMM; CEng | - | Snowden Optiro’s Qualified Person responsible for this report. Items 1 to 6, 9 to 11, and 23 to 27. |

| Mr. Allan Earl | Snowden Optiro | AWASM, FAusIMM | - | Items 18.3 to 18.10, 19, 21. |

| Mr. Aaron Radonich | Snowden Optiro | PGradCert (Geostatistics); BSc (Hons) Geology, FAusIMM (CP) | - | Items 7 and 8. |

| Mr. Graeme Lyall | Snowden Optiro | BSc (Hons) Geology FAusIMM | Oct 24–26, 2023; Oct 14–16, 2025 | Items 12 and 14. |

| Mr. Paulo Laymen | Snowden Optiro | BEng, MEng (Mining Engineering) - Universidad Politécnica de Madrid; FAusIMM | Oct 14–16, 2025 | Items 15 and 16. |

| Mr. Gordon Cunningham | Turnberry Projects | BE (Chemical), FSAIMM | - | Items 13,17 and 18.1. |

| Mr. Peter Theron | Prime Resources | B Eng (Civil), MSAIMM, Pr Eng ECSA | - | Item 18.2. |

| Ms. Gené Main | Prime Resources | MSc (Botany), Member EAPASA; Pr.Sci.Nat. SACNASP | - | Item 20. |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

Unless otherwise stated, the information and data contained in this Technical Report or used in its preparation was provided by the Property owner, Anglo American. The Qualified Persons of this Technical Report reviewed data, information and documents provided by Anglo American. The primary information sources are listed in Item 27.

Further information was received from the Anglo American representatives listed in Table 2.2 in response to queries submitted by Snowden Optiro.

| Table 2.2 | Anglo American information sources |

| Name | Position |

| Dr. Alastair Cornah | Vice President Resources and Reserves |

| Mr. Juan Pablo Llanos | Principal Ore Reserves Base Metals |

| Mr. Fernando Camana | Mineral Resource Superintendent |

| Mr. Daniel Endara | Specialist Ore Reserves Base Metals |

| Mr. Andrew Smith | Vice President Ore Reserves |

The Quellaveco Mineral Resources and Mineral Reserves were initially classified under the 2012 Edition of the Australasian Joint Ore Reserves Committee Code (JORC Code, 2012). The confidence categories assigned under the JORC Code (2012) were reconciled and reported to the confidence categories in the CIM Definition Standards for Mineral Resources and Mineral Reserves (the 2014 CIM Definition Standards).

For the Mineral Resources, the confidence category definitions are the same and no modifications to the confidence categories were required. The Ore Reserve categories reported under the JORC Code (2012) were also reconciled with the CIM classification framework. As a result, the Proved Ore Reserve under the JORC Code has been restated as Proven Mineral Reserves and Probable Ore Reserves have been re-stated at Probable Mineral Reserves, ensuring consistency in the levels of estimation confidence, data support and modifying factors between the two standards.

The Qualified Persons listed in Table 2.1 were responsible for this Technical Report and declare that they have taken all reasonable care to ensure that the information contained in this report is, to the best of their knowledge, in accordance with the facts and contains no material omissions.

In preparing this report, the Qualified Persons have extensively relied on information collated by other parties. The Qualified Persons have critically examined this information, made their own enquiries, and applied their general mineral industry competence to conclude that the information presented in this Technical Report complies with the definitions and guidelines of the CIM.

The Qualified Persons believe that their opinions must be considered as a whole, and that selection of portions of the analysis or factors considered by them, without considering all factors and analyses together, could create a misleading view of the process underlying the opinions presented in this Technical Report. The preparation of a Technical Report is a complex process and does not lend itself to partial analysis or summary.

Except for the purposes legislated under applicable securities laws, any use of this Technical Report by a third party is at that party’s sole risk.

A draft copy of this Technical Report was provided to Anglo American for review on omission and factual accuracy. The Qualified Persons who have authored this Technical Report do not disclaim responsibility for the contents of this report.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Quellaveco Property, Mariscal Nieto Province, Peru |

The effective date of this Technical Report is 3 November 2025. As at the effective date of this Technical Report, none of the Qualified Persons had an association with Anglo American or its individual employees, or any interest in the securities of Anglo American or any other interests that could reasonably be regarded as capable of affecting their ability to give an independent unbiased opinion in relation to the Property.

Snowden Optiro will be paid a fee for the preparation by its Qualified Persons of this Technical Report based on a standard schedule of rates for professional services, plus any expenses incurred. This fee is not contingent on the outcome of the Technical Report, and neither Snowden Optiro nor the Qualified Persons will receive any other benefit for the preparation of this report.