UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EXHIBIT INDEX

| Exhibit Number |

Description | |

| 99.1 | Minas Rio NI 43-101 Technical Report; November 3, 2025 |

SIGNATURE

| Teck Resources Limited | ||

| (Registrant) | ||

| Date: November 10, 2025 | By: | /s/ Amanda R. Robinson |

| Amanda R. Robinson | ||

| Corporate Secretary | ||

Exhibit 99.1

| NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| Prepared

for Anglo American plc by Datamine Australia Pty Ltd (Snowden Optiro) |

| Project Number DA214498 |

Qualified Persons:

Mr. Allan Earl, FAusIMM

Mr. Aaron Radonich, FAusIMM (CP)

Mr. Frank Blanchfield, FAusIMM

Mr. Michael Andrew, FAusIMM

Mr. Leonardo de Souza, MAusIMM (CP)

Mr. Gordon Cunningham, FSAIMM

Mr. Peter Theron, MSAIMM, Pr Eng ECSA

Ms. Gené Main, EAPASA, Pr.Sci.Nat. SACNASP

Effective Date: November 3, 2025

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

|

This report was prepared as a National Instrument 43-101 Standards of Disclosure for Mineral Projects Technical Report for Anglo American plc (Anglo American) by Datamine Australia Pty Ltd (Snowden Optiro). The quality of information, conclusions, and estimates contained herein are consistent with the quality of effort involved in Snowden Optiro’s services. The information, conclusions, and estimates contained herein are based on: i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Anglo American subject to the terms and conditions of its contract with Snowden Optiro and relevant securities legislation. The contract permits Anglo American to file this report as a Technical Report with Canadian securities regulatory authorities under Teck Resources Limited’s profile pursuant to National Instrument 43-101. Except for the purposes legislated under Canadian securities law, any other uses of this report by any third party are at that party’s sole risk. The responsibility for this disclosure remains with Anglo American. The user of this document should ensure that this is the most recent Technical Report for the property as it is not valid if a new Technical Report has been issued.

Ó 2025

All rights are reserved. No part of this document may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Snowden Optiro.

|

||

| Issued by: | Perth Office | |

| Doc ref: | DA214498 AA Minas Rio NI 43-101 TR (Final) .docx | |

| Issue date: | November 3, 2025 | |

| Effective date: | November 3, 2025 | |

| OFFICE LOCATIONS | ||

| PERTH | LIMA | www.snowdenoptiro.com |

| BRISBANE | BELO HORIZONTE | comtact@snowdenoptiro.com |

| JOHANNESBURG | DENVER | Snowden Optiro is a business unit of the Datamine Software group |

| LONDON | SANTIAGO | |

| ALMATY CITY | SUDBURY | |

| NEW DELHI | JAKARTA | |

| MOSCOW |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

Table of contents

| 1 | Summary | 12 | ||

| 1.1 | Property description, ownership and background | 12 | ||

| 1.2 | History | 14 | ||

| 1.3 | Geological setting, mineralization and deposit type | 14 | ||

| 1.4 | Drilling | 15 | ||

| 1.5 | Sampling, analyses and data verification | 16 | ||

| 1.6 | Mineral processing and metallurgical testwork | 17 | ||

| 1.7 | Mineral Resource estimates | 17 | ||

| 1.8 | Mining and Mineral Reserve estimates | 20 | ||

| 1.9 | Processing methods and infrastructure | 22 | ||

| 1.10 | Permitting, environmental and social | 22 | ||

| 1.11 | Costs and economic analysis | 23 | ||

| 1.12 | Other relevant data and information | 25 | ||

| 1.13 | Conclusions and recommendations | 25 | ||

| 2 | Introduction | 27 | ||

| 2.1 | Terms of reference | 27 | ||

| 2.1.1 | Abbreviations and units | 29 | ||

| 3 | Reliance on other experts | 32 | ||

| 4 | Property description and location | 33 | ||

| 4.1 | Location and area | 33 | ||

| 4.2 | Type of mineral tenure | 33 | ||

| 4.2.1 | Legal framework | 33 | ||

| 4.2.2 | Property mineral titles | 34 | ||

| 4.3 | Issuer’s interest | 40 | ||

| 4.4 | Surface rights | 40 | ||

| 4.5 | Royalties, back-in rights, payments, agreements, encumbrances | 42 | ||

| 4.6 | Environmental liabilities | 42 | ||

| 4.7 | Permits | 42 | ||

| 4.8 | Other significant factors and risks | 42 | ||

| 5 | Accessibility, climate, local resources, infrastructure, and physiography | 43 | ||

| 5.1 | Topography, elevation and vegetation | 43 | ||

| 5.2 | Access | 43 | ||

| 5.3 | Proximity to population centre and transport | 43 | ||

| 5.4 | Climate and length of operating season | 43 | ||

| 5.5 | Infrastructure | 43 | ||

| 5.6 | Workforce | 44 | ||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 6 | History | 45 | ||

| 6.1 | Previous exploration | 45 | ||

| 6.1.1 | Vale and MMX | 45 | ||

| 6.1.2 | MMX and Anglo American | 45 | ||

| 6.2 | Historical resource estimates | 47 | ||

| 6.3 | Production history | 48 | ||

| 7 | Geological setting and mineralization | 49 | ||

| 7.1 | Regional geology | 49 | ||

| 7.2 | Local geology | 52 | ||

| 7.2.1 | Serra do Sapo | 52 | ||

| 7.2.2 | Itapanhoacanga | 52 | ||

| 7.2.3 | Stratigraphy | 53 | ||

| 7.2.4 | Structural geology | 55 | ||

| 7.3 | Mineralization | 55 | ||

| 7.3.1 | Friable itabirite (IF) | 55 | ||

| 7.3.2 | Semi-friable itabirite (ISF) | 55 | ||

| 7.3.3 | High alumina friable itabirite (IFX) | 56 | ||

| 7.3.4 | Itabirite (IT) | 56 | ||

| 7.3.5 | Hematite (HM) | 56 | ||

| 7.3.6 | Compact itabirite (CI) | 56 | ||

| 7.3.7 | Canga (CG) and mineralized canga (CGM) | 56 | ||

| 8 | Deposit types | 57 | ||

| 9 | Exploration | 58 | ||

| 9.1 | Geological mapping | 58 | ||

| 9.2 | Airborne geophysics | 58 | ||

| 10 | Drilling | 59 | ||

| 10.1 | Type and extent | 59 | ||

| 10.2 | Procedures | 63 | ||

| 10.2.1 | Topographic surveying | 63 | ||

| 10.2.2 | Drillhole surveying | 63 | ||

| 10.2.3 | Logging | 63 | ||

| 10.2.4 | Data management | 64 | ||

| 10.2.5 | Twin drillhole study | 65 | ||

| 10.2.6 | Results | 67 | ||

| 11 | Sample preparation, analyses and security | 68 | ||

| 11.1 | Sampling | 68 | ||

| 11.2 | Sample preparation | 69 | ||

| 11.3 | Analysis | 71 | ||

| 11.4 | QAQC | 71 | ||

| 11.4.1 | Historical QAQC | 71 | ||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 11.4.2 | Recent (post-2008) QAQC | 72 | ||

| 11.5 | Qualified Person’s opinion on the adequacy of sample preparation, security, and analytical procedures | 77 | ||

| 12 | Data verification | 78 | ||

| 12.1 | Introduction | 78 | ||

| 12.2 | Surveying | 78 | ||

| 12.3 | Drilling and sampling | 79 | ||

| 12.4 | Sample analysis | 81 | ||

| 12.5 | Geology | 82 | ||

| 12.6 | Geological model | 83 | ||

| 12.6.1 | Comparison between block model ore lithology codes and internal waste proportions | 83 | ||

| 12.6.2 | Comparison between block model ore-type codes and drillhole lithology codes (ore and waste) | 84 | ||

| 12.7 | Qualified Person’s opinion on the adequacy of the data for the purposes used in the Technical Report | 84 | ||

| 13 | Mineral processing and metallurgical testing | 85 | ||

| 13.1 | Introduction | 85 | ||

| 13.2 | Historical and recent metallurgical testwork | 85 | ||

| 13.3 | Product sampling | 85 | ||

| 13.3.1 | Product quality | 85 | ||

| 14 | Mineral Resource estimates | 87 | ||

| 14.1 | Introduction | 87 | ||

| 14.2 | Mineral Resource estimation criteria | 87 | ||

| 14.2.1 | Data preparation and analysis | 87 | ||

| 14.2.2 | Geological interpretation | 89 | ||

| 14.2.3 | Block modelling and coding | 92 | ||

| 14.2.4 | Compositing | 94 | ||

| 14.2.5 | Exploratory data analysis | 95 | ||

| 14.2.6 | Cut-off grade | 99 | ||

| 14.2.7 | Domaining and boundary analysis | 100 | ||

| 14.2.8 | Variography and anisotropy | 102 | ||

| 14.2.9 | Grade estimation and validation | 104 | ||

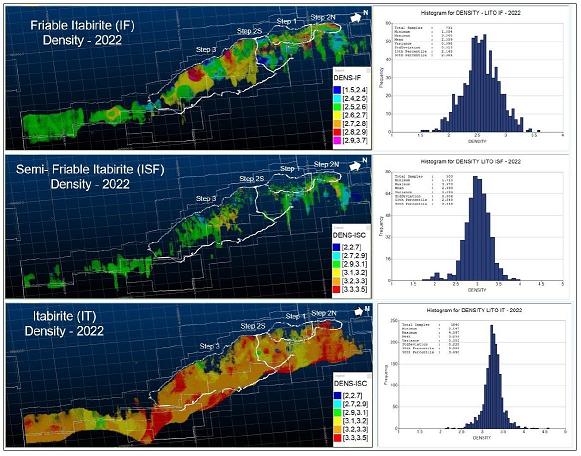

| 14.2.10 | Density determination | 112 | ||

| 14.2.11 | Moisture determination | 115 | ||

| 14.2.12 | Resource classification | 119 | ||

| 14.3 | Mineral Resources | 121 | ||

| 14.3.1 | Reasonable prospects for economic extraction (RPEE) | 124 | ||

| 14.3.2 | Reconciliation | 125 | ||

| 14.3.3 | Independent reviews | 127 | ||

| 14.3.4 | Internal controls | 127 | ||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 15 | Mineral Reserve estimates | 128 | ||

| 15.1 | Cut-off grade | 128 | ||

| 15.2 | Key parameters and assumptions | 128 | ||

| 15.3 | Dilution and ore loss | 129 | ||

| 15.4 | Pit optimization | 129 | ||

| 15.5 | Pit designs | 130 | ||

| 15.6 | Risks and opportunities | 133 | ||

| 15.7 | Independent reviews | 133 | ||

| 15.8 | Qualified Person’s opinion | 133 | ||

| 16 | Mining methods | 135 | ||

| 16.1 | Geotechnical | 135 | ||

| 16.1.1 | Testwork and data analysis | 135 | ||

| 16.1.2 | Pit design parameters | 136 | ||

| 16.2 | Hydrology | 137 | ||

| 16.2.1 | Studies | 137 | ||

| 16.2.2 | Operational dewatering | 138 | ||

| 16.3 | Mining method | 138 | ||

| 16.4 | Mining and ancillary fleet requirements | 139 | ||

| 16.5 | Life-of-mine production schedule | 139 | ||

| 16.5.1 | Pushbacks and sequencing | 140 | ||

| 16.6 | Qualified Person’s opinion | 140 | ||

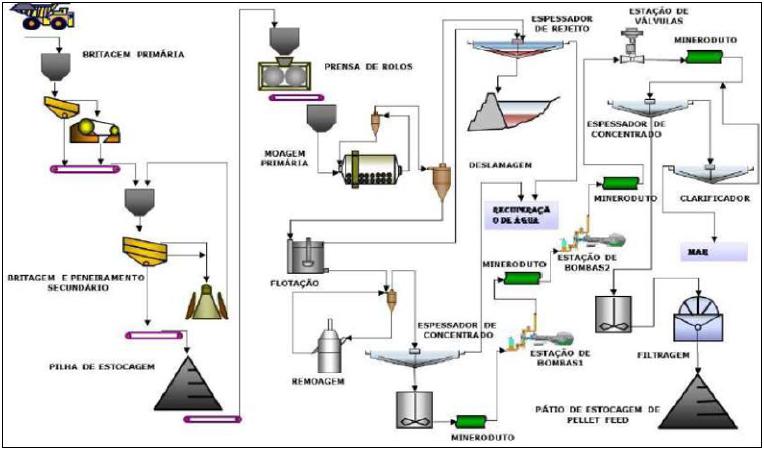

| 17 | Recovery methods | 141 | ||

| 17.1 | Process flowsheet design and specifications | 141 | ||

| 17.1.1 | Metallurgical projects | 142 | ||

| 17.2 | Ancillary processing facilities | 142 | ||

| 17.2.1 | Pipeline | 142 | ||

| 17.2.2 | Filter plant | 143 | ||

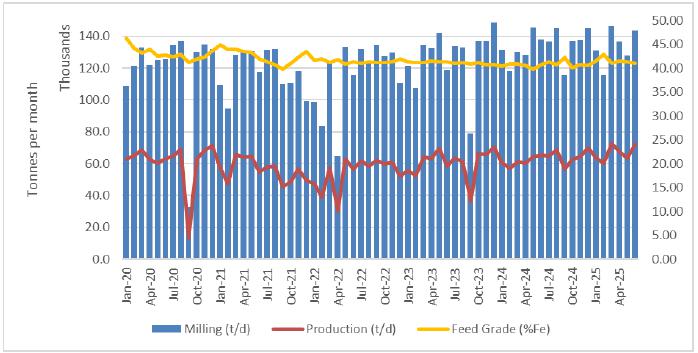

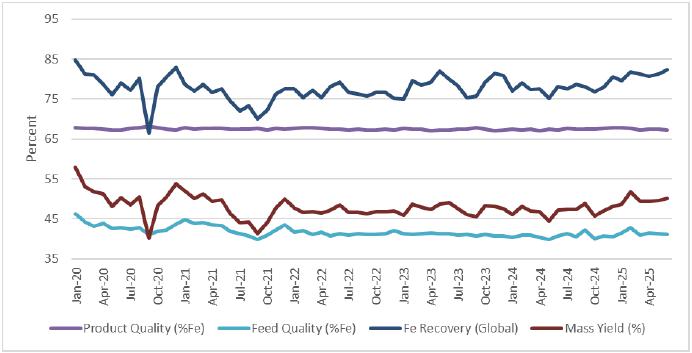

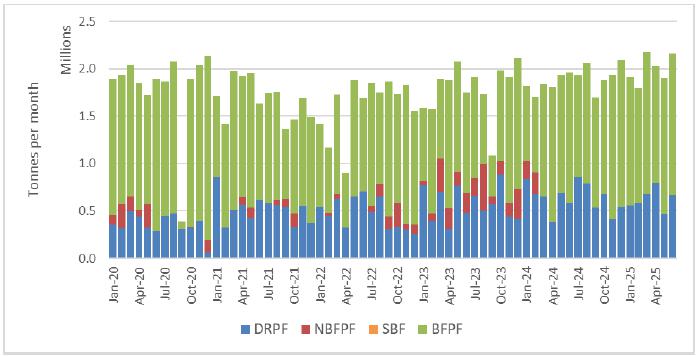

| 17.3 | Recent performance | 144 | ||

| 17.4 | Analytical laboratory | 145 | ||

| 17.5 | Energy requirements | 145 | ||

| 17.6 | Water requirements | 145 | ||

| 17.7 | Process materials and reagents | 145 | ||

| 17.8 | Qualified Person’s opinion | 146 | ||

| 18 | Project infrastructure | 147 | ||

| 18.1 | Site layout | 147 | ||

| 18.2 | Port facilities | 147 | ||

| 18.3 | Tailings storage facility | 147 | ||

| 18.3.1 | Second TSF raise | 148 | ||

| 18.3.2 | Filtered tailings deposition | 149 | ||

| 18.3.3 | Management and governance | 149 | ||

| 18.3.4 | GISTM conformance | 150 | ||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 18.3.5 | Risks/considerations | 150 | ||

| 18.4 | Waste rock facilities | 150 | ||

| 18.5 | Water supply | 151 | ||

| 18.6 | Power supply | 151 | ||

| 18.7 | Access and security | 152 | ||

| 18.8 | Ancillary facilities | 152 | ||

| 18.9 | Accommodation | 153 | ||

| 18.10 | Communications | 153 | ||

| 18.11 | Logistics | 154 | ||

| 18.11.1 | Mine and plant logistics | 154 | ||

| 18.11.2 | Port logistics (Port of Açu) | 154 | ||

| 18.11.3 | Inbound logistics and supplies | 154 | ||

| 19 | Market studies and contracts | 155 | ||

| 19.1 | Market overview | 155 | ||

| 19.2 | Products | 155 | ||

| 19.3 | Offtake agreements | 155 | ||

| 19.4 | Markets and distribution | 156 | ||

| 19.5 | Price assumptions and market studies | 156 | ||

| 19.6 | Material contracts | 156 | ||

| 19.7 | Qualified Person’s review | 156 | ||

| 20 | Environmental studies, permitting and social or community impact | 157 | ||

| 20.1 | Environmental and social baseline | 157 | ||

| 20.2 | Environmental studies | 158 | ||

| 20.3 | Waste disposal, site monitoring and water management | 159 | ||

| 20.4 | Approvals and permitting | 160 | ||

| 20.5 | Social and community | 161 | ||

| 20.5.1 | Social management and monitoring | 162 | ||

| 20.5.2 | Stakeholder engagement | 162 | ||

| 20.5.3 | Incident and grievance reporting | 163 | ||

| 20.5.4 | Resettlement | 163 | ||

| 20.5.5 | Community health and safety, and agreement with local communities | 164 | ||

| 20.5.6 | Human rights and security | 164 | ||

| 20.6 | Mine closure | 164 | ||

| 20.7 | Risks | 165 | ||

| 21 | Capital and operating costs | 166 | ||

| 21.1 | Capital costs | 166 | ||

| 21.2 | Operating costs | 166 | ||

| 22 | Economic analysis | 168 | ||

| 23 | Adjacent properties | 169 | ||

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 24 | Other relevant data and information | 170 | ||

| 24.1 | Serra da Serpentina | 170 | ||

| 24.1.1 | Introduction | 170 | ||

| 24.1.2 | Geology | 170 | ||

| 24.1.3 | History | 171 | ||

| 24.1.4 | Drilling | 172 | ||

| 24.1.5 | Sample collection, preparation and analysis | 174 | ||

| 24.1.6 | Density | 174 | ||

| 24.1.7 | Historical resource estimates | 174 | ||

| 25 | Interpretation and conclusions | 175 | ||

| 25.1 | Conclusions | 175 | ||

| 25.2 | Risks | 175 | ||

| 26 | Recommendations | 177 | ||

| 27 | References | 178 | ||

| 28 | Certificates | 179 | ||

| 28.1 | Certificate of Qualified Person | 179 | ||

Figures

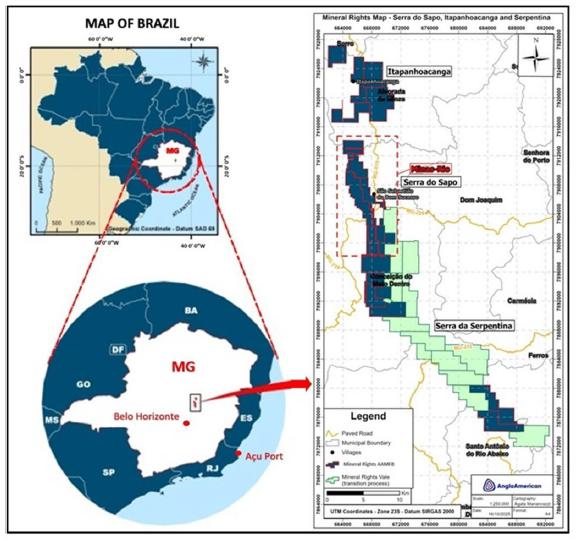

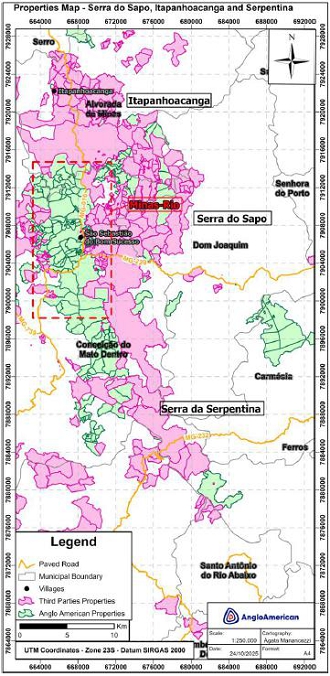

| Figure 1.1 | Minas-Rio Property location | 13 |

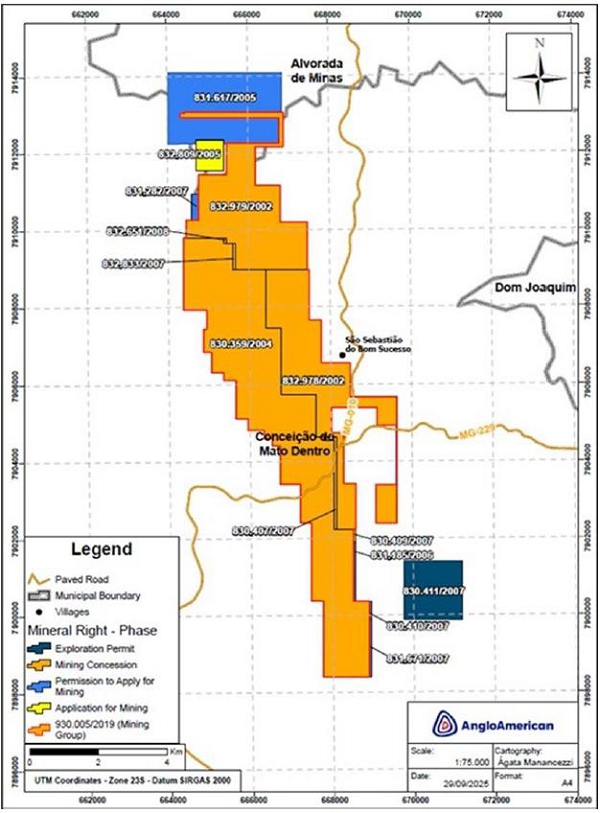

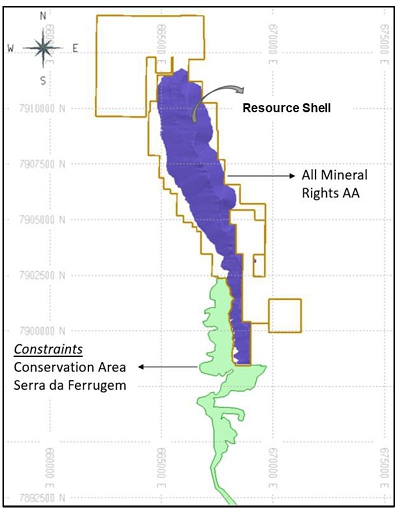

| Figure 4.1 | Serra do Sapo project mineral titles | 35 |

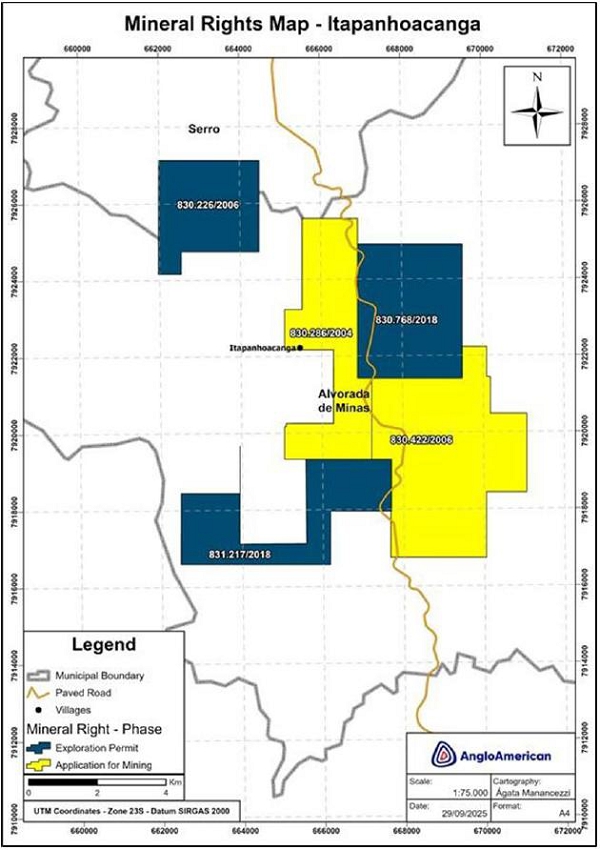

| Figure 4.2 | Itapanhoacanga project mineral titles | 37 |

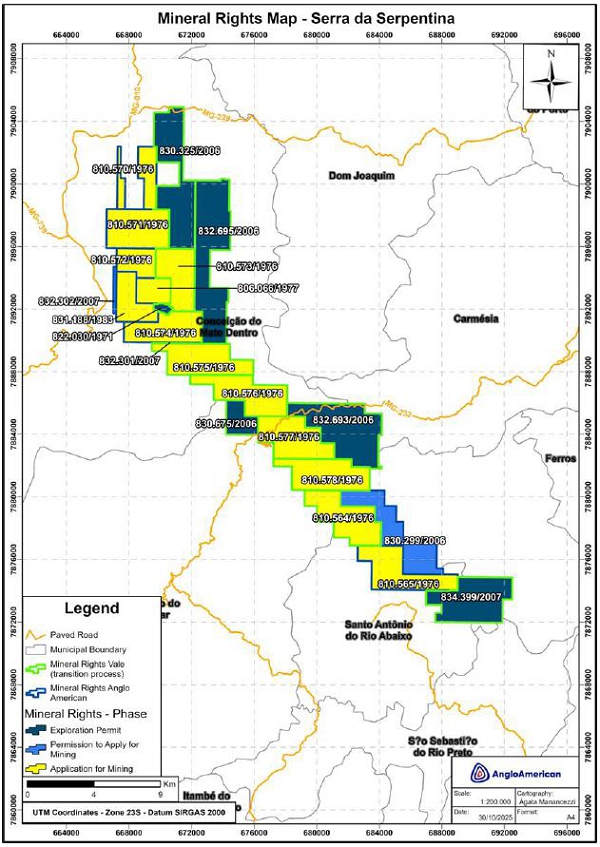

| Figure 4.3 | Serra da Serpentina project mineral titles | 39 |

| Figure 4.4 | Minas-Rio surface ownership rights | 41 |

| Figure 5.1 | Site layout plan | 44 |

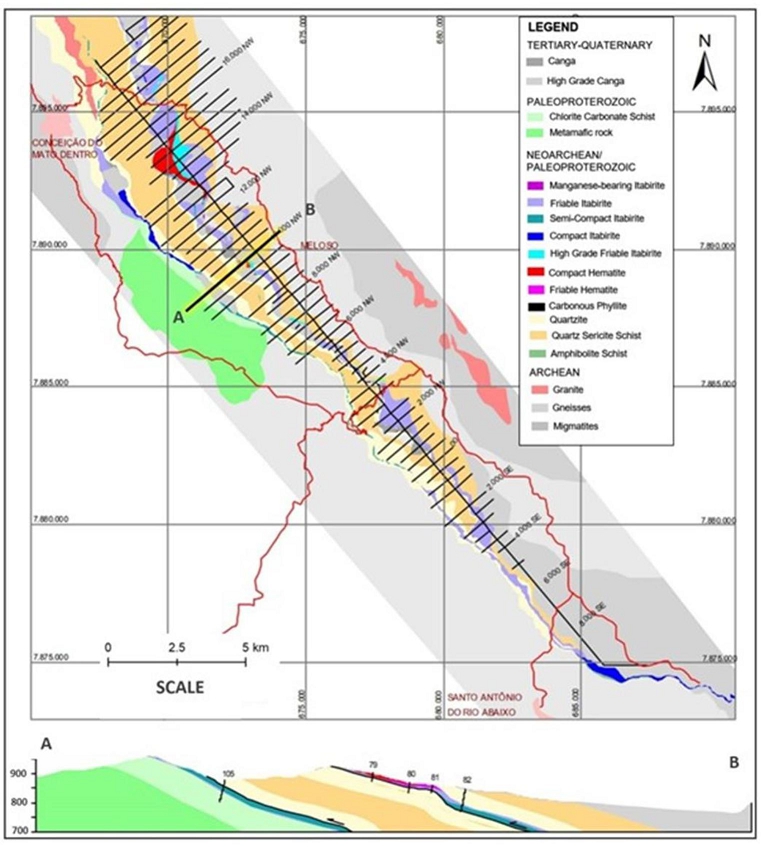

| Figure 7.1 | Regional geological map showing the Quadrilátero Ferrifero (Iron Quadrangle) and SdEM, and the Serra do Sapo, Itapanhoacanga and Serra da Serpentina deposits | 50 |

| Figure 7.2 | Geological map of the Serra do Sapo, Itapanhoacanga and Serra da Serpentina deposits (left) and stratigraphic column for the Serra da Serpentina Group (right) | 51 |

| Figure 7.3 | Serra do Sapo representative geological cross-section (looking north) | 52 |

| Figure 7.4 | Itapanhoacanga representative geological cross-section | 53 |

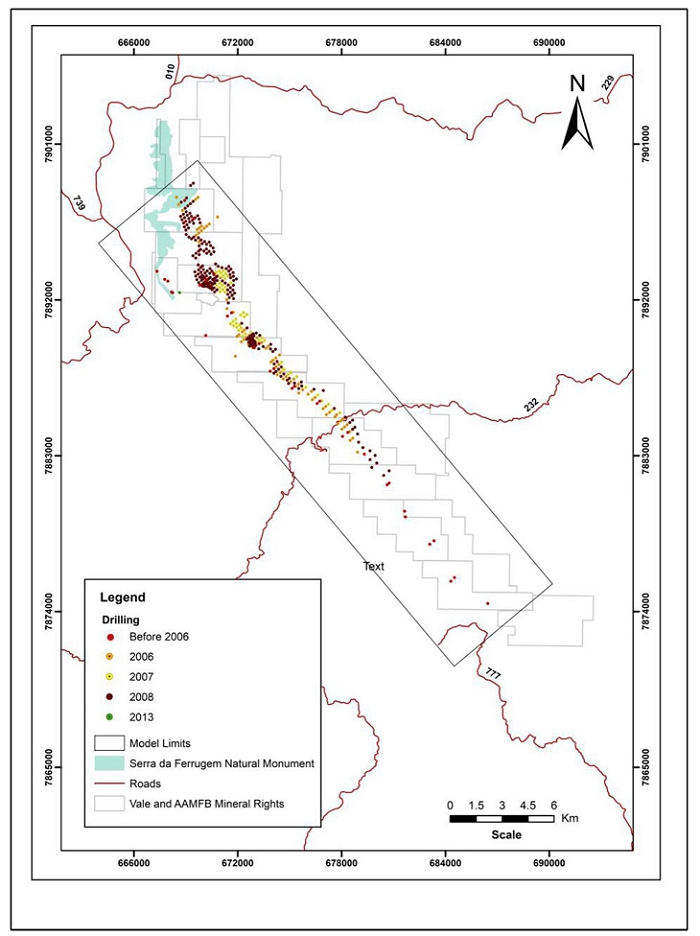

| Figure 10.1 | Serra do Sapo drillhole location plan | 60 |

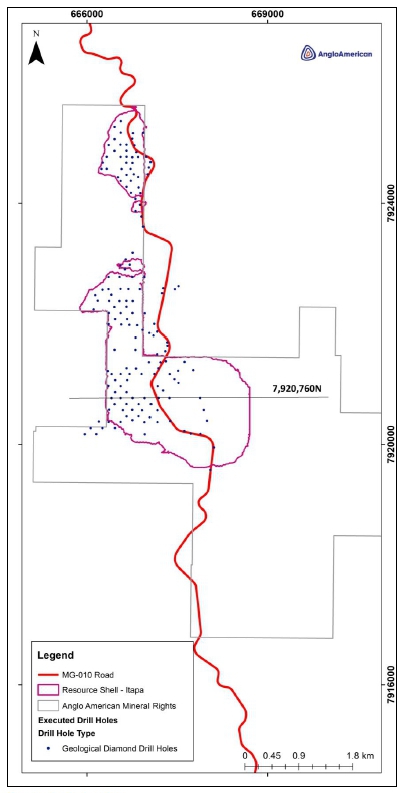

| Figure 10.2 | Itapanhoacanga drillhole location plan | 62 |

| Figure 10.3 | Serra do Sapo twin drillhole plan | 66 |

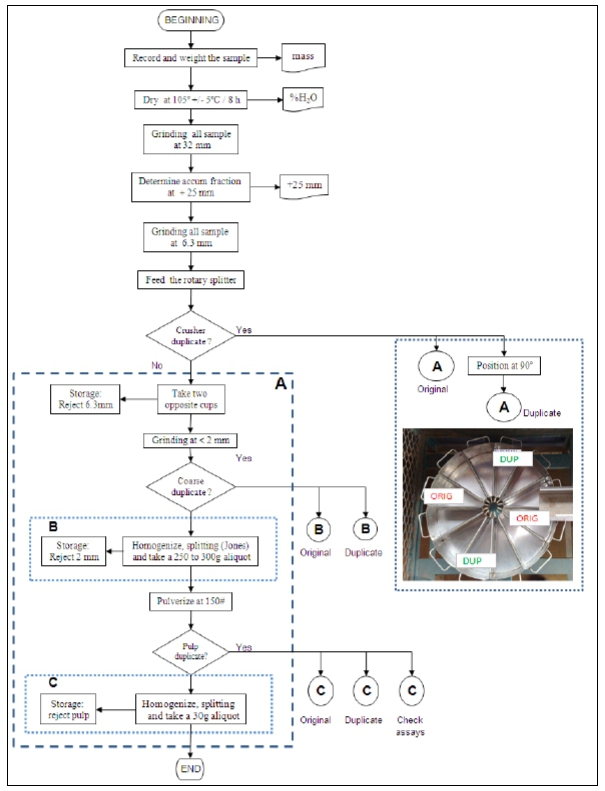

| Figure 11.1 | Serra do Sapo DD and RC sample preparation flowsheet (Anglo American) | 70 |

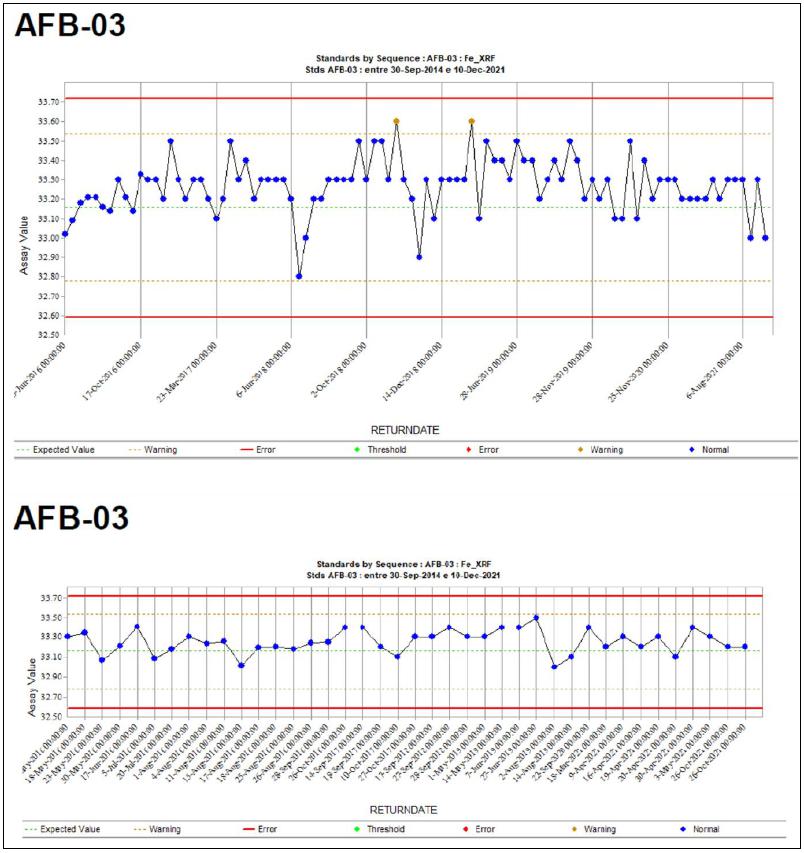

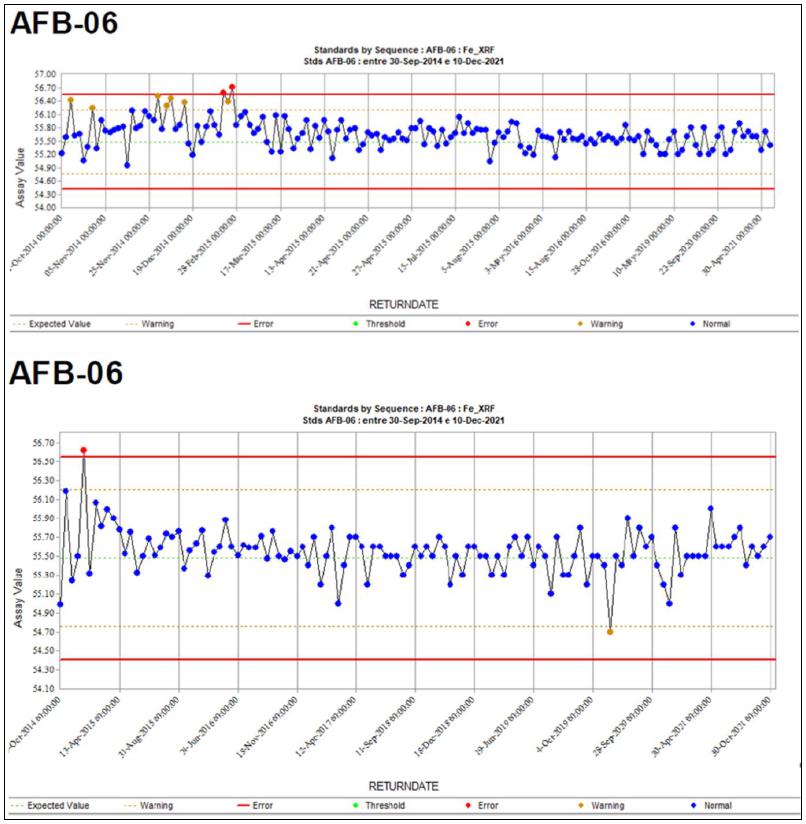

| Figure 11.2 | Control chart for MM-CRM AFB-03 (DD = top and RC = bottom) | 74 |

| Figure 11.3 | Control chart for MM-CRM AFB-06 (DD = top and RC = bottom) | 75 |

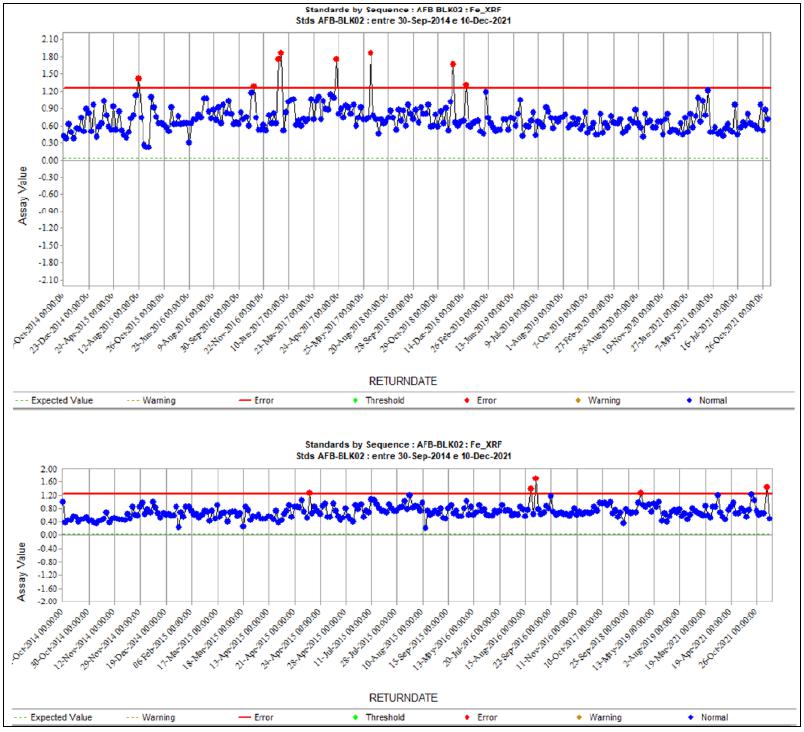

| Figure 11.4 | Control chart for blank AFB-06 (DD = top and RC = bottom) | 76 |

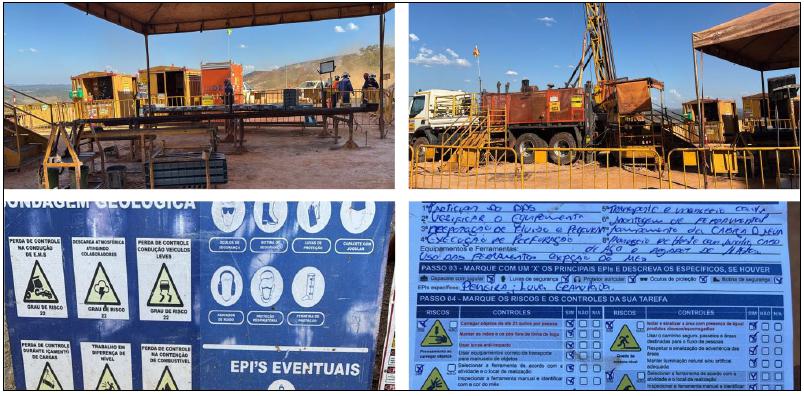

| Figure 12.1 | Two Geosedna drill rigs conducting RC drilling (taken 7 October 2025 at the Serra do Sapo mine, looking east) | 79 |

| Figure 12.2 | DD site, safety signage and safe work method statement | 80 |

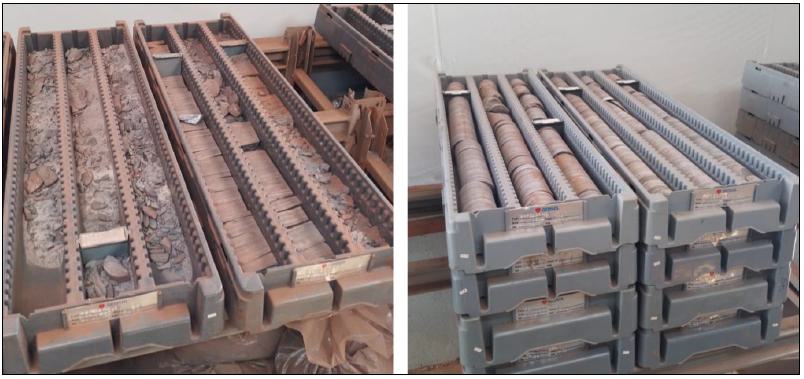

| Figure 12.3 | Serra do Sapo DD core cut and uncut | 80 |

| Figure 12.4 | Serra do Sapo RC chip box (left) and DD core tray (right) storage | 81 |

| Figure 12.5 | Equipment used for sample preparation and assay at the Minas-Rio internal laboratory | 81 |

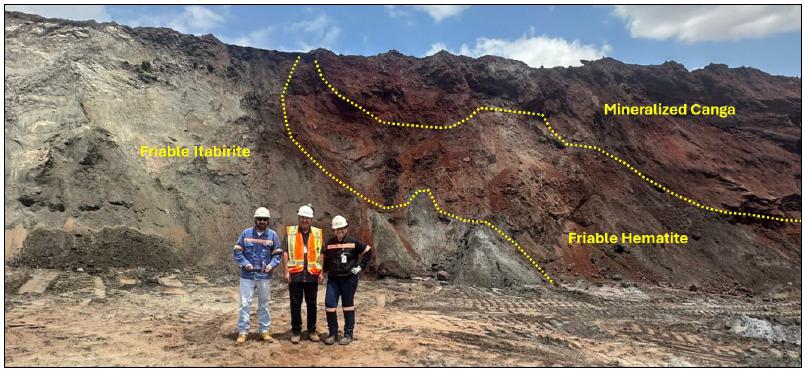

| Figure 12.6 | Serra do Sapo mine, bench 850, Step 3, central domain; contact between friable itabirite, friable hematite and mineralized canga | 82 |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| Figure 12.7 | Serra do Sapo mine, southern limit of Step 3, looking north along highway MG-10; contacts between compact itabirite, semi-friable itabirite, and friable itabirite | 83 |

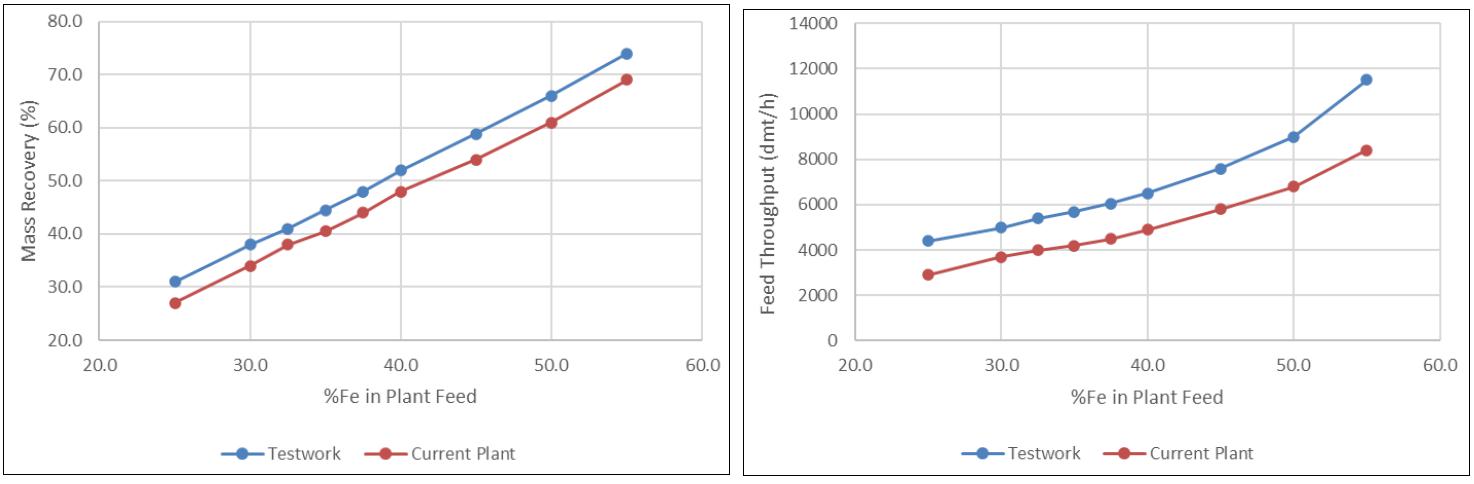

| Figure 13.1 | Mass recovery and throughput testwork results | 85 |

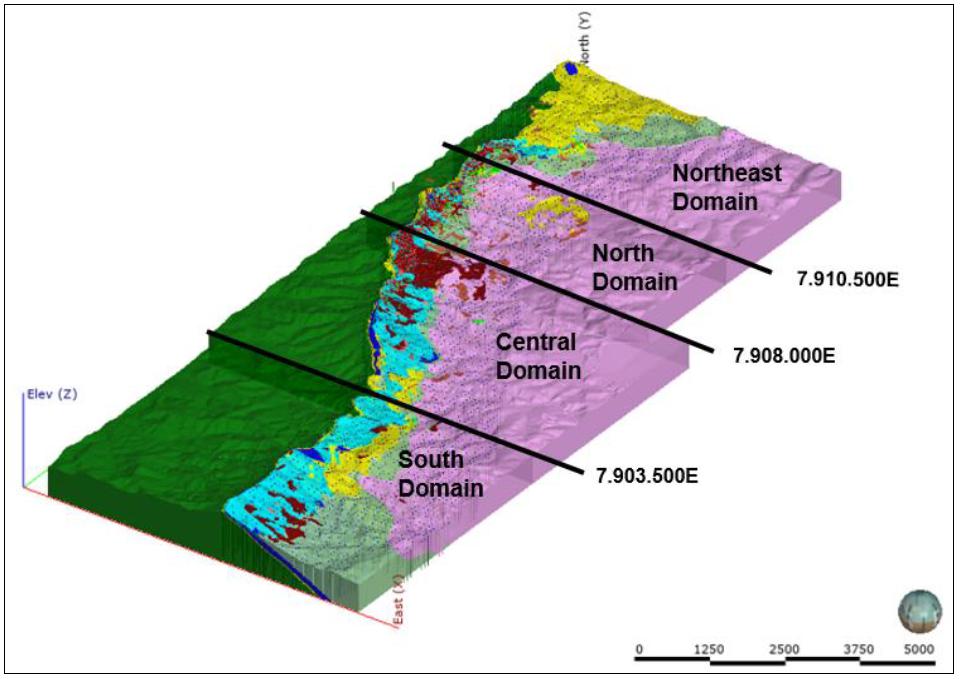

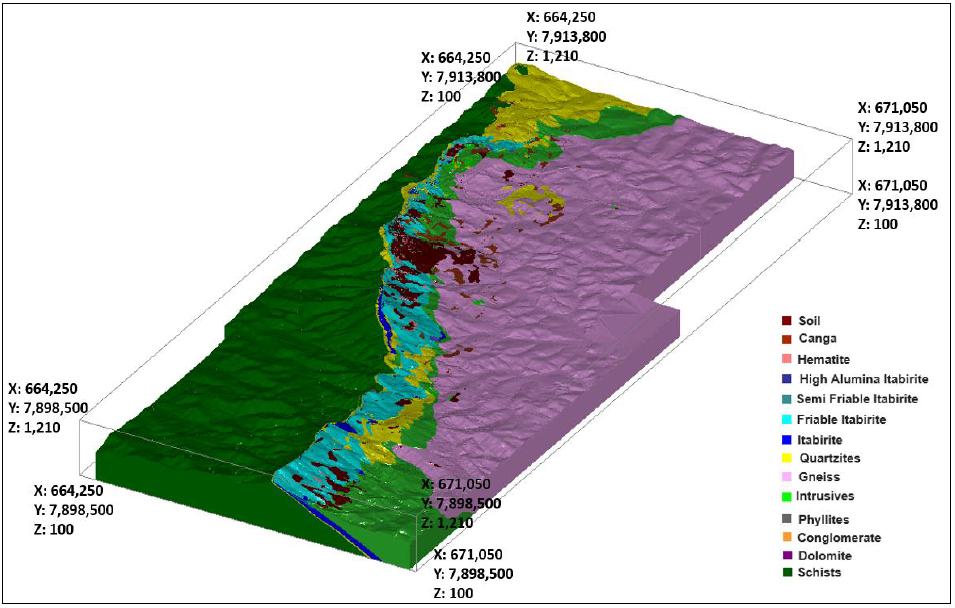

| Figure 14.1 | 3D view of the Serra do Sapo geological model divided into four domains | 90 |

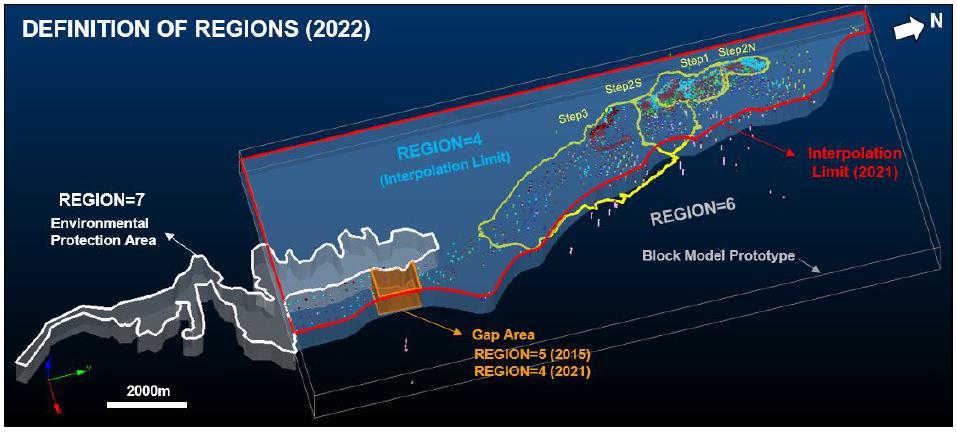

| Figure 14.2 | Block model coded by REGION | 91 |

| Figure 14.3 | 2022 Serra do Sapo prototype block model | 93 |

| Figure 14.4 | 2012 Itapanhoacanga prototype block model (green = 2009 model boundary, red = 2012 model boundary, white = Anglo American mineral rights boundary) | 94 |

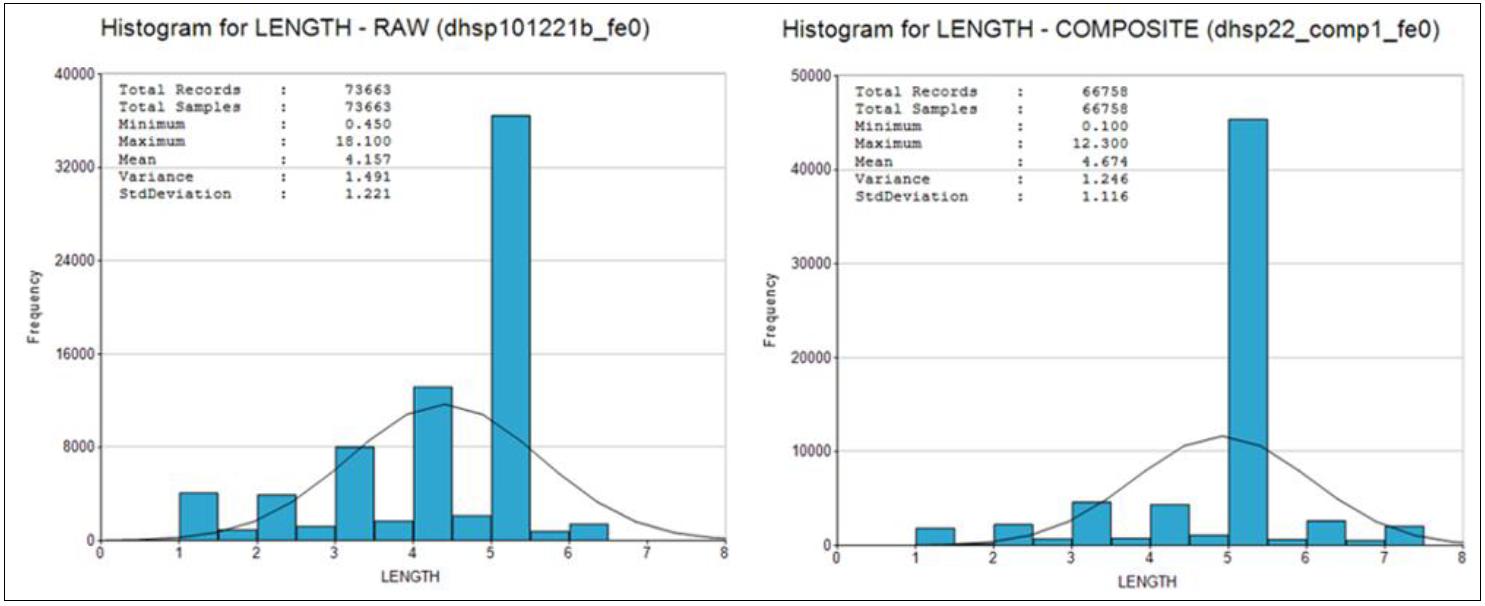

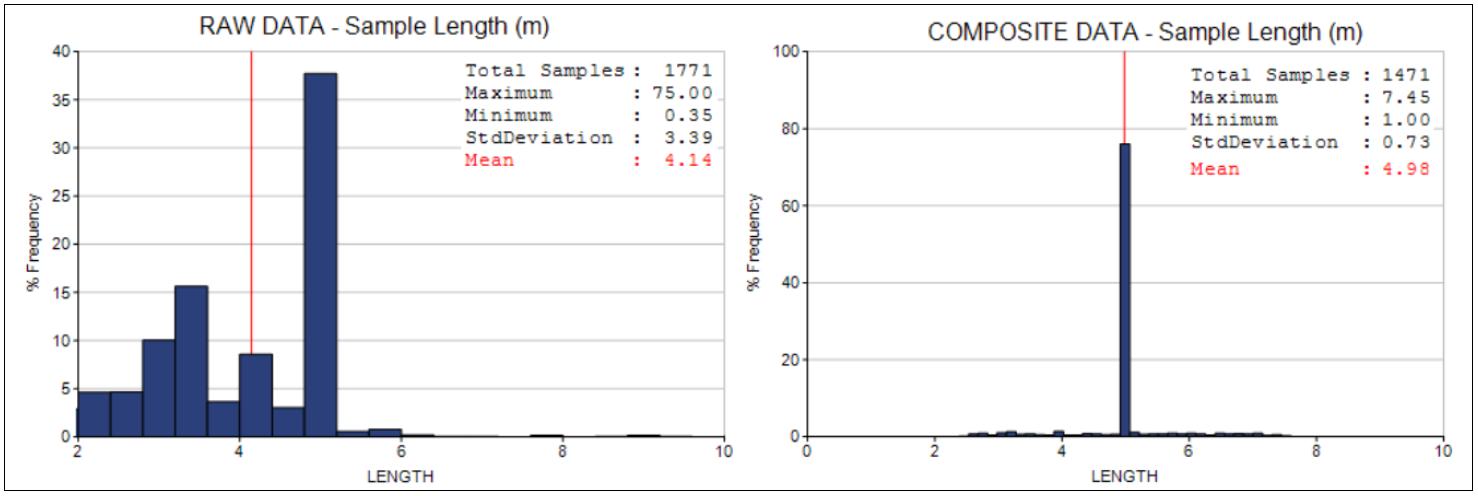

| Figure 14.5 | Frequency histograms of Serra do Sapo sample length before and after compositing (all assayed data) | 95 |

| Figure 14.6 | Frequency histograms of Itapanhoacanga sample length before and after compositing (all assayed data) | 95 |

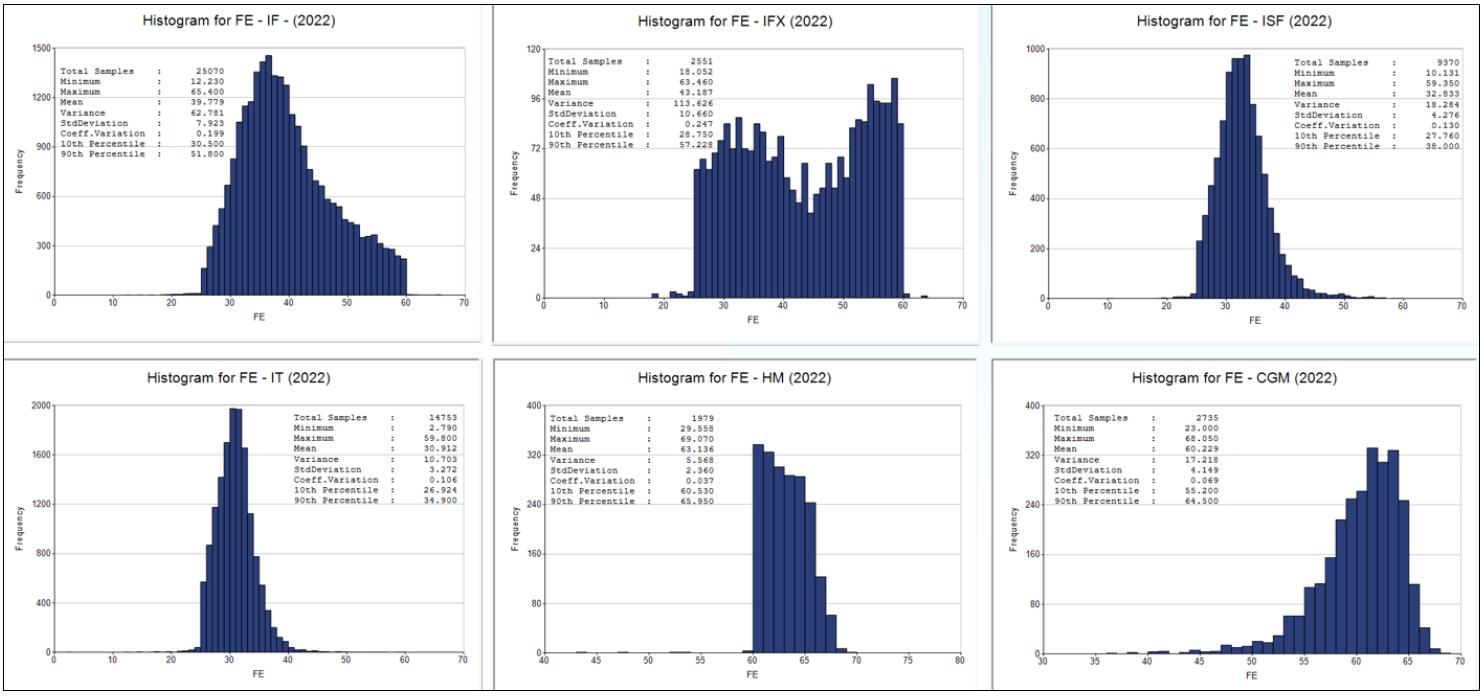

| Figure 14.7 | Composite samples histograms of IF, ISF, IFX, IT, HM, and CGM for FE at Serra do Sapo | 99 |

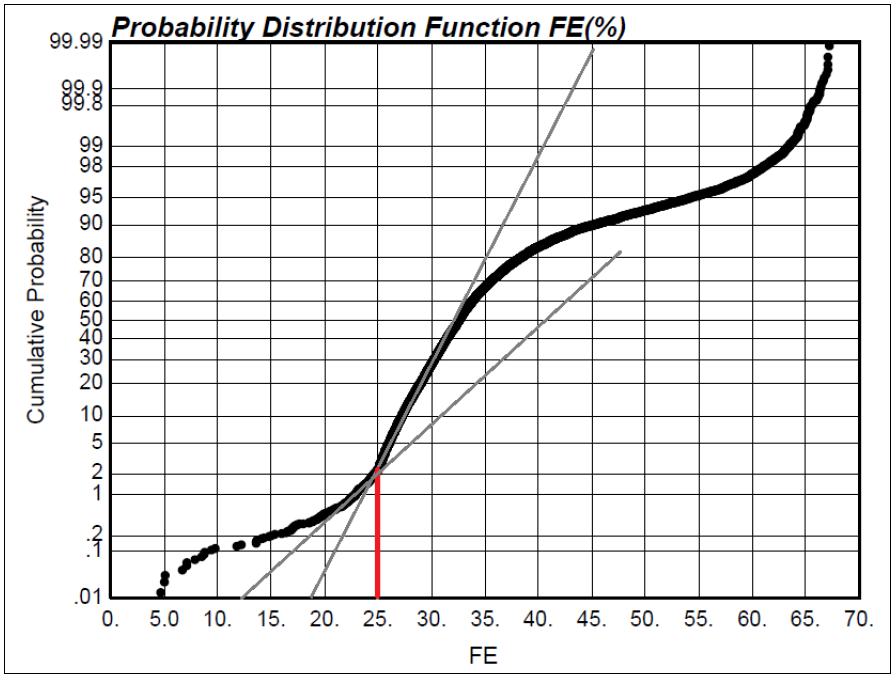

| Figure 14.8 | Cumulative distribution function of FE grades for all iron-bearing lithologies | 100 |

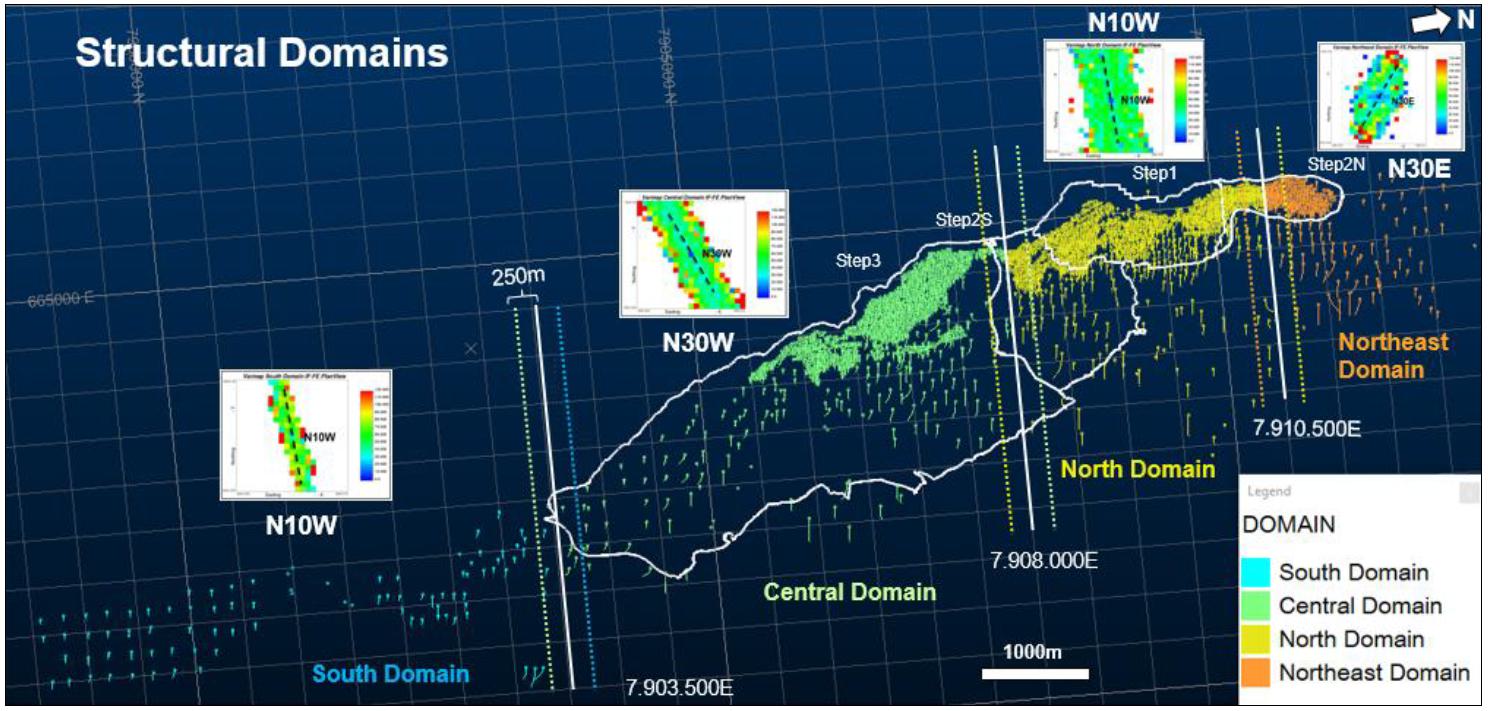

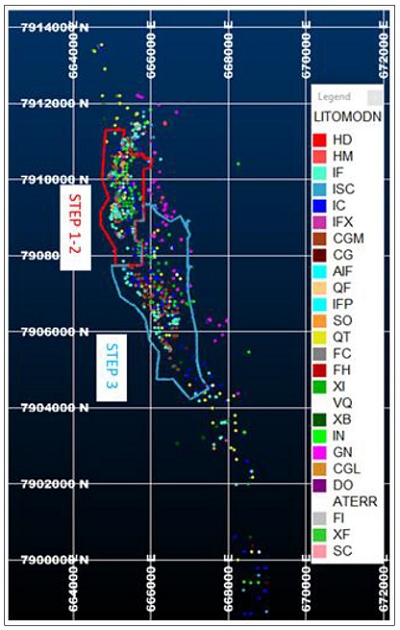

| Figure 14.9 | Spatial distribution of drillholes by domain | 101 |

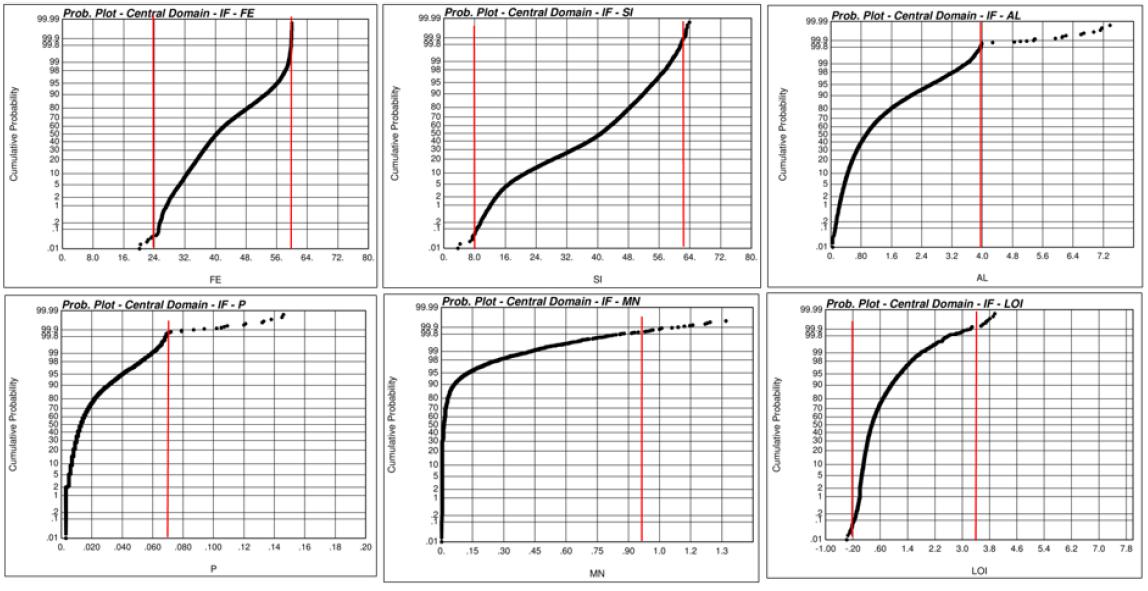

| Figure 14.10 | Probability plots of IF for all six main variables (Central Domain, Serra do Sapo) | 103 |

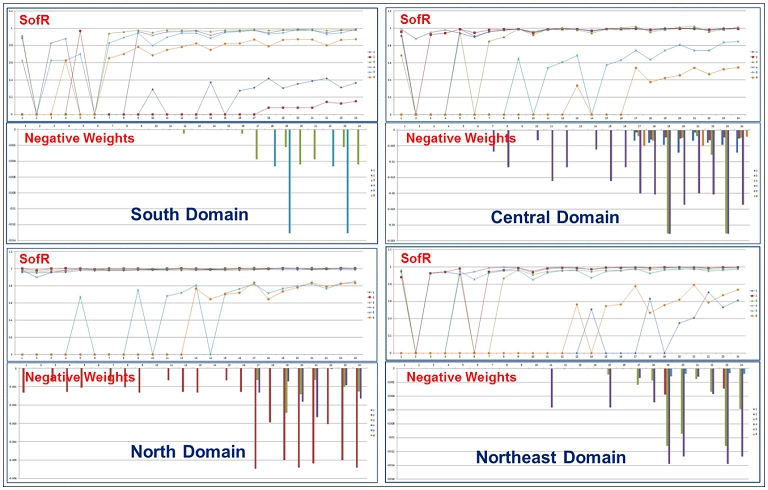

| Figure 14.11 | Example QKNA analysis, SofR, and negative weights output (Serra do Sapo) | 105 |

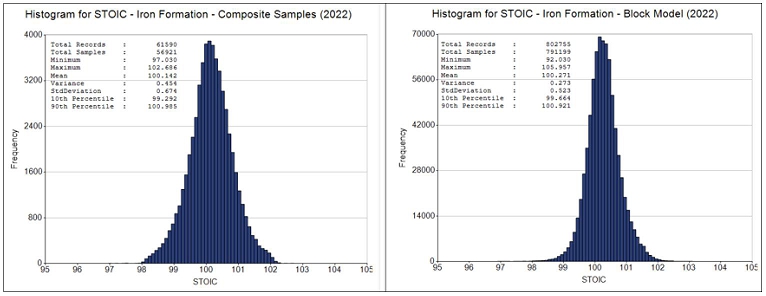

| Figure 14.12 | Histograms of stoichiometric balance for all iron formation lithological units at Serra do Sapo (L = composite samples, R = estimated block model) | 106 |

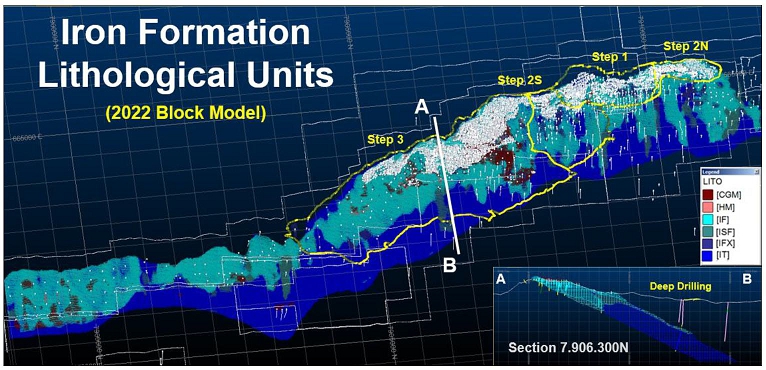

| Figure 14.13 | Spatial distribution of iron formation lithological units (unconstrained) | 108 |

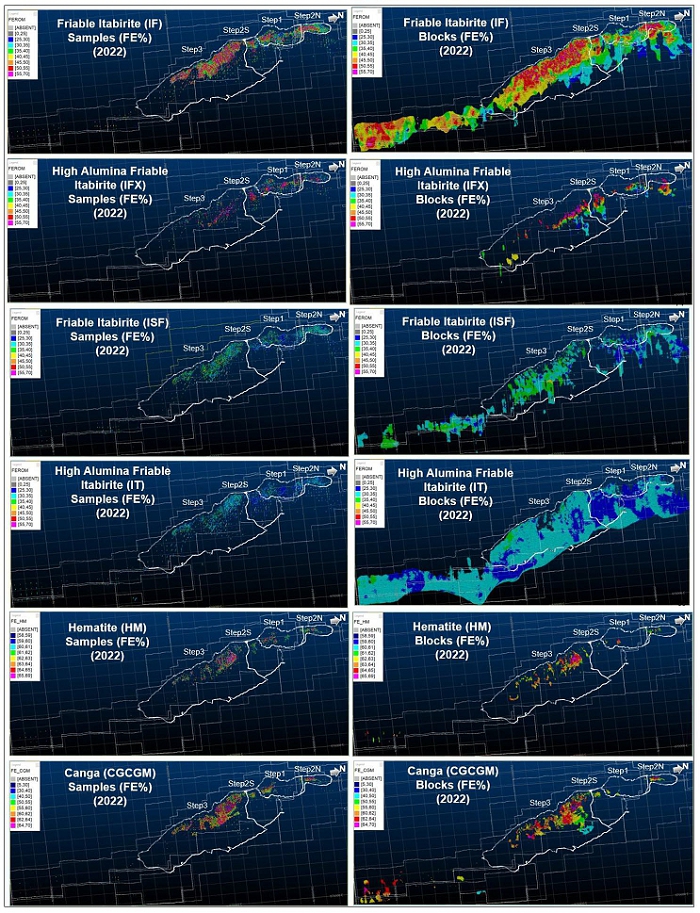

| Figure 14.14 | Composite sample values of iron formation for FE (left) and estimated block values (right) at Serra do Sapo | 109 |

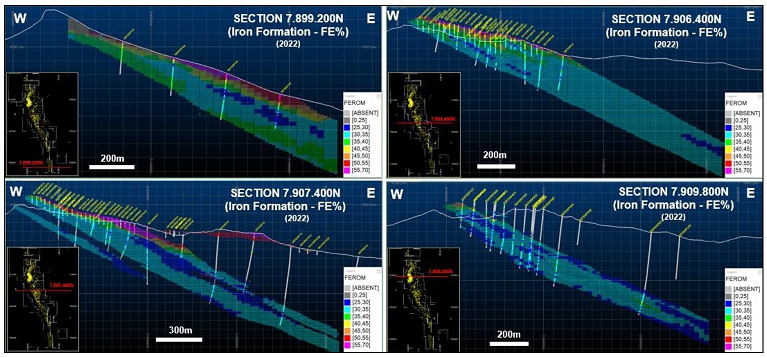

| Figure 14.15 | West-east cross-sections showing iron formation layers estimated with input 5 m composite sample and estimated block grades (FE variable) at Serra do Sapo | 110 |

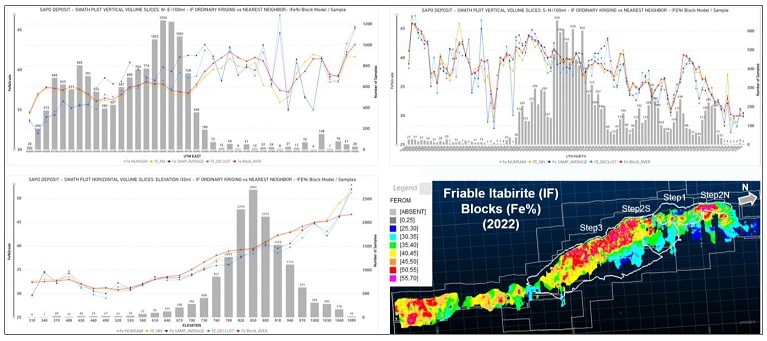

| Figure 14.16 | Vertical and horizontal volume slices in three directions showing swath plots (OK vs NN vs declustered sample averages) for the FE variable in the IF lithology at Serra do Sapo | 111 |

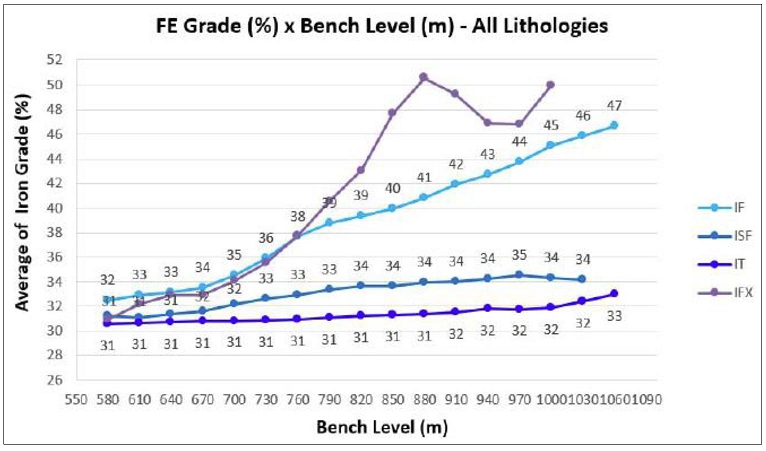

| Figure 14.17 | Iron grade behavior along the deposit with depth (IF, IFX, ISF and IT) | 112 |

| Figure 14.18 | Density sample locations for all lithologies | 113 |

| Figure 14.19 | Dry density estimation results for Friable Itabirite (IF), Semi-Friable Itabirite (ISF) and Itabirite (IT) | 114 |

| Figure 14.20 | RPEE constraints | 124 |

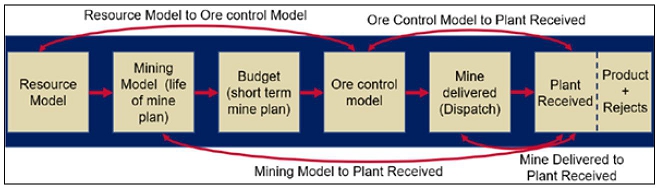

| Figure 14.21 | Minas-Rio reconciliation framework | 125 |

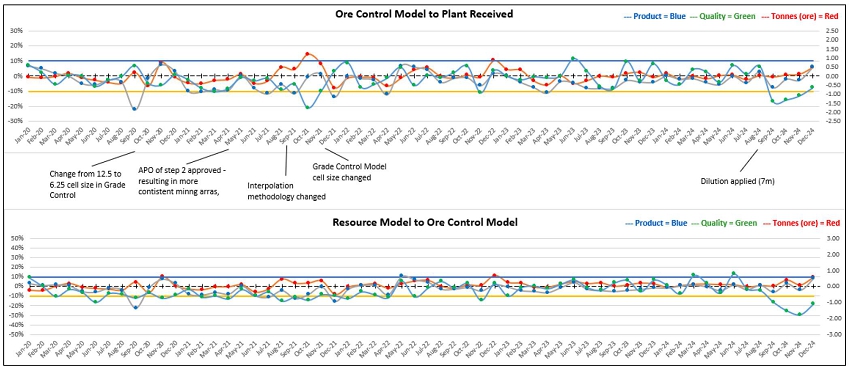

| Figure 14.22 | Serra do Sapo 2020–2024 model to beneficiation plant reconciliation (± 10% limits) | 126 |

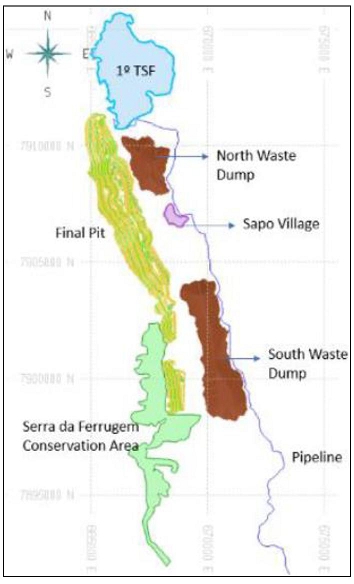

| Figure 15.1 | Plan view showing final Minas-Rio open pit and waste dump footprint | 131 |

| Figure 16.1 | LoAP mining and beneficiation schedule (5-year increments) | 140 |

| Figure 17.1 | Minas-Rio process plant flowsheet | 141 |

| Figure 17.2 | Minas-Rio filtration plant flowsheet | 143 |

| Figure 17.3 | Minas-Rio production statistics | 144 |

| Figure 17.4 | Minas-Rio concentrate product quality and mass yield | 144 |

| Figure 17.5 | Minas-Rio product split | 145 |

| Figure 24.1 | Serra da Serpentina local geology | 171 |

| Figure 24.2 | Serra da Serpentina drillhole distribution | 173 |

Tables

| Table 1.1 | Serra do Sapo iron ore production (2014 to H1 2025) | 14 |

| Table 1.2 | Serra do Sapo Mineral Resources as of 31 December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) | 18 |

| Table 1.3 | Itapanhoacanga Mineral Resources as of 31 December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) | 19 |

| Table 1.4 | Serra do Sapo Mineral Reserve estimate as of December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) | 20 |

| Table 1.5 | Serra do Sapo concentrate production from Mineral Reserves (100% attributable basis) | 20 |

| Table 1.6 | LoAP SIB capital cost | 24 |

| Table 1.7 | LoAP unit costs | 24 |

| Table 2.1 | Responsibilities of each Qualified Person | 27 |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| Table 2.2 | Anglo American information sources | 28 |

| Table 3.1 | Anglo American subject matter experts | 32 |

| Table 4.1 | Serra do Sapo project mineral titles | 34 |

| Table 4.2 | Itapanhoacanga project mineral titles | 36 |

| Table 4.3 | Serra da Serpentina project mineral titles | 38 |

| Table 6.1 | Serra do Sapo drilling by type and year | 46 |

| Table 6.2 | Itapanhoacanga drilling by type and year | 47 |

| Table 6.3 | Serra do Sapo iron ore production (2015 to H1 2025) | 48 |

| Table 10.1 | Serra do Sapo drilling used for the December 2024 Mineral Resource estimate by type | 61 |

| Table 10.2 | Itapanhoacanga drilling used for the December 2024 Mineral Resource estimate by type | 63 |

| Table 12.1 | Serra do Sapo field verified drillhole collar coordinates | 78 |

| Table 12.2 | Serra do Sapo block model ore lithology codes vs internal waste proportions | 83 |

| Table 12.3 | Serra do Sapo block model ore lithology codes vs drillhole lithology codes | 84 |

| Table 13.1 | Minas-Rio product specification | 86 |

| Table 14.1 | Serra do Sapo drilling used for the December 2024 Mineral Resource estimate by type | 87 |

| Table 14.2 | Itapanhoacanga drilling used for the December 2024 Mineral Resource estimate by type | 88 |

| Table 14.3 | 2022 Serra do Sapo prototype block model parameters | 93 |

| Table 14.4 | 2012 Itapanhoacanga prototype block model parameters | 94 |

| Table 14.5 | Geological model lithologies used for geostatistical evaluation at Serra do Sapo | 96 |

| Table 14.6 | Geological model lithologies used for geostatistical evaluation at Itapanhoacanga | 96 |

| Table 14.7 | Primary parameters applied during estimation with output variables generated (Serra do Sapo) | 107 |

| Table 14.8 | Serra do Sapo dry density values determined for all lithologies | 113 |

| Table 14.9 | Itapanhoacanga wet density values determined for all lithologies | 115 |

| Table 14.10 | Serra do Sapo moisture values determined for all lithologies | 116 |

| Table 14.11 | Itapanhoacanga moisture values determined for IF, ISC and HM | 117 |

| Table 14.12 | Itapanhoacanga moisture values determined for IC | 118 |

| Table 14.13 | Serra do Sapo Mineral Resources as of 31 December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) | 123 |

| Table 14.14 | Itapanhoacanga Mineral Resources as of 31 December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) | 123 |

| Table 15.1 | Serra do Sapo initial pit stage physicals | 131 |

| Table 15.2 | Serra do Sapo Mineral Reserve estimate as of December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) | 132 |

| Table 15.3 | Serra do Sapo concentrate production from Mineral Reserves (100% attributable) | 132 |

| Table 20.1 | Status of permits and schedule for licensing | 160 |

| Table 21.1 | LoAP SIB capital costs (5-year increments) | 167 |

| Table 21.2 | LoAP operating costs (5-year increments) | 167 |

| Table 24.1 | Serra da Serpentina drilling by type and year | 172 |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

Forward-looking information

This Technical Report contains “forward-looking information” within the meaning of applicable Canadian securities legislation which involves a number of risks and uncertainties. Forward-looking information includes, but is not limited to: information with respect to strategy, plans, expectations or future financial or operating performance, such as expectations and guidance regarding project development, production outlook, including estimates of production, grades, recoveries and costs; estimates of Mineral Resources and Mineral Reserves; construction plans; mining and recovery methods; mining and mineral processing and rates; tailings disposal design and capacity; mine life; timing and success of exploration programs and project related risks as well as any other information that expresses plans and expectations or estimates of future performance. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking information is based on the opinions, estimates and assumptions of contributors to this Technical Report. Certain key assumptions are discussed in more detail. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any other future results, performance or achievements expressed or implied by the forward-looking information.

Such factors and assumptions underlying the forward-looking information in this Technical Report includes, but are not limited to: risks associated with community relationships; risks related to estimates of production, cash flows and costs; risks inherent to mining operations; shortages of critical supplies; the cost of non-compliance and compliance; volatility in commodity prices; risks related to compliance with environmental laws and liability for environmental contamination; the lack of availability of infrastructure; risks related to the ability to obtain, maintain or renew regulatory approvals, permits and licenses; imprecision of Mineral Reserve and Mineral Resource estimates; deficient or vulnerable title to concessions, easements and surface rights; inherent safety hazards and risk to the health and safety of employees and contractors; risks related to the workforce and its labour relations; key talent recruitment and retention of key personnel; the adequacy of insurance; uncertainty as to reclamation and decommissioning; the uncertainty regarding risks posed by climate change; the potential for litigation; and risks due to conflicts of interest.

There may be other factors than those identified that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers are cautioned not to place undue reliance on forward-looking information. Unless required by Canadian securities legislation, the authors and Snowden Optiro undertake no obligation to update the forward-looking information if circumstances or opinions should change.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 1 | Summary |

This Technical Report was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) for Anglo American plc (Anglo American) to support the disclosure of Mineral Resources and Mineral Reserves for Minas-Rio (the Property or the Project), a production stage property in the State of Minas Gerais, Brazil.

This Technical Report was authored by the following Qualified Persons:

| · | Messrs. Earl, Radonich, Blanchfield, Andrew and de Souza of Snowden Optiro, a business unit of Datamine Australia Pty Ltd. Snowden Optiro was responsible for the preparation of this Technical Report, including the review of the drilling, data, geology, Mineral Resources, Mineral Reserves, mining, market studies and costs. |

| · | Mr. Gordon Cunningham of Turnberry Projects was responsible for the review of the metallurgical testwork, processing and infrastructure. |

| · | Mr. Peter Theron and Ms. Gené Main of Prime Resources were responsible for the review of the tailings, environment and permitting. |

The effective date of this Technical Report is 03 November 2025.

Unless otherwise specified, all units of currency are in United States dollars ($) and all measurements are metric.

| 1.1 | Property description, ownership and background |

Minas-Rio is in the State of Minas Gerais of southeastern Brazil, approximately 190 km by road northeast of the state capital Belo Horizonte and approximately 640 km by road north of Rio de Janeiro (Figure 1.1). The Property comprises the Serra do Sapo iron ore mining and processing operation, and the satellite Itapanhoacanga iron ore project approximately 20 km to the north. The recently acquired Serra da Serpentina iron ore exploration project adjoins Serra do Sapo to the immediate southeast.

The Property is owned by Anglo American Minério de Ferro Brasil S.A. (AAMFB), in which Anglo American holds an 85% interest and Vale S.A. (Vale) a 15% interest including most of the underlying mineral titles. Anglo American maintains a 100% interest in a single mining concession application covering a portion of the Itapanhoacanga deposit. Several mining concessions and exploration permits at Serra da Serpentina are pending transfer to AAMFB from Vale.

The combined area of the Property beneficially owned by AAMFB under granted mining concessions and exploration permits is 26,469.94 ha (264.7 km2)

Access to the Serra do Sapo processing facility is via a paved road approximately 20 km north of the town of Conceição do Mato Dentro, which in turn is 170 km northeast of Belo Horizonte via highway MG-10. The Property covers moderately rugged terrain with elevations ranging from 700 metres above sea level (masl) to 1,200 masl. Vegetation cover is dominated by areas of natural forest, secondary regrowth and land cleared for cattle grazing and agricultural purposes. The climate is classified as tropical savanna, with distinct wet (October to April) and dry (May to September) seasons. The average annual rainfall is approximately 1,400 mm. Mining, processing and exploration operate year-round.

The Serra do Sapo operation is a conventional truck-and-shovel open pit mining operation with an associated beneficiation plant for comminution, desliming, concentration (via flotation) and filtration. The resulting iron ore concentrate is transported through a 529 km slurry pipeline to the handling and shipping facilities at the Port of Açu in the State of Rio de Janeiro, which is 50% owned by Anglo American.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| Figure 1.1 | Minas-Rio Property location |

Source: Anglo American

The 2024 concentrate production total was 25 million wet metric tonnes (Mwmt) at a unit cost of $30/t. Production guidance for 2025 is 23–25 Mwmt at a unit cost of approximately $32/t.

The Life-of-Asset Plan (LoAP) defines the long-term operational and financial strategy for the Minas-Rio operation, reporting mine production, processing, and infrastructure requirements through the remaining life of the asset to 2073. The plan integrates 2022 resource models and pit designs, equipment replacement schedules, and capital forecasts to maintain steady-state, long-term production at approximately 26 - 28 million tonnes per annum (Mt/a) of pellet feed.

The LoAP assumptions incorporate current operating parameters, forecast operating and stay-in-business (SIB) capital costs and closure obligations. The plan serves as the basis for Mineral Reserve reporting and demonstrates that the LoAP is technically and economically achievable without a material expansion of the existing operation. The existing mining concessions, surface rights and operating permits are sufficient to support current operations.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

In December 2024, the transaction with Vale for Anglo American to acquire and integrate the Serra da Serpentina iron ore deposit with the Minas-Rio operation was completed. The combined project has the potential to deliver operational and logistical synergies to support a long-term increase in iron ore production.

| 1.2 | History |

Vale (formerly Companhia Vale do Rio Doce or CVRD) controlled the mineral rights over the Serra do Sapo and Itapanhoacanga deposit areas until 2004. MMX Mineração e Metálicos (MMX) subsequently acquired the mineral rights over these areas from private interests in 2006. Anglo American acquired an initial 49% interest in the Property in 2007 and assumed full ownership in August 2008. Open pit mining operations at Serra do Sapo and the first shipment of iron ore concentrate commenced in 2014.

On 22 February 2024, Anglo American entered into an agreement with Vale to acquire and integrate the adjacent Serra da Serpentina iron ore deposit with the Minas-Rio operation. Under the transaction terms, Vale contributed the Serra da Serpentina deposit plus $157.5 million in cash in exchange for a 15% equity interest in the enlarged Minas-Rio property. The transaction was completed in December 2024 with the transfer of the mineral titles in progress. Annualized iron ore production (dry tonnes) and concentrate sales (wet tonnes) from 2015 to June 2025 inclusive, is summarized in Table 1.1.

| Table 1.1 | Serra do Sapo iron ore production (2014 to H1 2025) |

| Year | Crushed (Mt) | Fe (%) | Concentrate (Mwmt) | Unit cost ($/t) |

| 2015 | 27.15 | 39.02 | 9.174 | 60 |

| 2016 | 37.65 | 39.04 | 16.140 | 28 |

| 2017 | 42.04 | 35.62 | 16.787 | 30 |

| 2018 | 9.60 | 32.20 | 3.381 | - ^ |

| 2019 | 44.89 | 41.78 | 23.114 | 21 |

| 2020 | 45.08 | 43.17 | 24.081 | 21 |

| 2021 | 44.23 | 42.48 | 22.949 | 24 |

| 2022 | 43.17 | 41.33 | 22.581 | 35 |

| 2023 | 47.74 | 41.13 | 24.211 | 33 |

| 2024 | 50.36 | 40.69 | 25.037 | 30 |

| H1 2025 | 25.38 | 41.46 | 13.134 | 29 |

Source: Anglo American

^ not available

| 1.3 | Geological setting, mineralization and deposit type |

Minas-Rio is situated in the eastern portion of the southern Serra do Espinhaço Meridional, which is the most extensive continuous orogenic belt in the Proterozoic Brasiliano Orogeny. This north-trending belt extends approximately 1,200 km from Belo Horizonte to the northern limits of Bahia and is subdivided into the Serra do Espinhaço Meridional (SdEM) in the south, and the Serra do Espinhaço Setentrional (SdES) in the north.

The SdEM comprises mainly quartzites, phyllites and metaconglomerates with mafic dike swarms, metagabbros, and greenschists. Metamorphism is generally low-grade, with greenschist facies conditions dominating. The SdEM is recognized for its gold and iron ore endowment mostly associated with metasedimentary rocks of the Espinhaço Supergroup, which is further subdivided into the Serra da Serpentina Group and Serra de São José Group. The iron ore deposits are low- to medium-grade iron formations (classified as itabirite). Grades vary according to the degree of weathering and compaction, with mineralization composed predominantly of hematite and quartz.

The Serra do Sapo and Itapanhoacanga deposits form a multi-kilometre mineralized corridor (12 km and 6 km strike length, respectively) trending north-northwest to south-southeast, with mineralized packages typically tens to a few hundred metres in thickness and locally thicker where folded or repeated. The deposits extend to the east at dips ranging between 20° and 30° from surface outcrop to at least several hundred metres depth, remaining open along strike and at depth in places.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

Iron mineralization at the Serra do Sapo deposit occurs primarily within metamorphosed banded iron formation (BIF) or itabirite, which conformably overlays quartz-chlorite-sericite schists and phyllites. The BIF consists mainly of alternating quartz- and hematite-rich bands, with minor magnetite, mica and accessory silicates. Low- to medium-grade metamorphism has overprinted and partially transposed the original sedimentary banding. Structurally, the deposit is influenced by folding and thrust faulting, producing repetitions of strata and local imbrication. The weathering profile has developed both friable and compact itabirite ore types.

The Itapanhoacanga deposit occurs within the same tectono-stratigraphic setting as Serra do Sapo. Iron mineralization is hosted in BIF and hematitic phyllites, with associated quartzites, metaconglomerates and schists. Like Serra do Sapo, the host rocks have undergone low- to medium-grade metamorphism and significant deformation, resulting in folding, thrust repetition and locally intense foliation development. The deposit hosts both friable and compact ore types derived from varying degrees of metamorphism and supergene alteration.

The Serra do Sapo and Itapanhoacanga deposits are classified as BIF-hosted iron deposits, typical of the Lake Superior-type iron formations that characterize the Quadrilátero Ferrífero (Iron Quadrangle) region of Minas Gerais.

| 1.4 | Drilling |

Since 2006, 1,107 diamond drilling (DD) holes for 211,011 m, 7,019 reverse circulation (RC) holes for 348,117 m (inclusive of grade control drilling) and 323 geotechnical (FG) holes for 40,929 m have been completed by MMX and Anglo American at Serra do Sapo. Over the same period, 194 DD holes for 27,164 m have been completed by MMX and Anglo American at Itapanhoacanga.

Standard DD methods with HW core recovery (63.5 mm core diameter) were used at Serra do Sapo and Itapanhoacanga by MMX. Standard DD methods with PQ (85.0 mm core diameter), HQ (63.5 mm core diameter) and NQ (47.6 mm core diameter) core recovery were used at Serra do Sapo and Itapanhoacanga by Anglo American. PQ coring is typically used in weathered material. Most holes were drilled vertically over the flatter portions of the deposit. Where the iron formation dips gently east, inclined drillholes (-75° to -85° toward azimuth 270°) were completed to intersect the mineralization perpendicular to strike. Maxibor and Deviflex downhole survey equipment were used to obtain deviation data for the inclined holes.

For Anglo American’s RC holes, standard drilling methods included 127 mm (5-inch) diameter hammers, tricone bits and face bits with samples collected from a fully enclosed cyclone system. Most holes were drilled at an inclination of approximately -75°. Maxibor and Deviflex downhole survey equipment were used to obtain deviation data for the inclined holes.

Recovered core is placed into core boxes, with the depth interval marked on core blocks at the end of each run as measured by the driller. Geotechnical and geological logging is conducted by company geologists or a contractor under close supervision at the core shed. The core is photographed prior to sampling.

Geologists record lithological units, geological contacts, fault and fracture zones, ferruginous horizons and internal waste zones. All logging information is reviewed and validated by a senior geologist. Digital logging using acQuire™ based tablets was implemented in 2016.

Sample recovery across the database averages approximately 83% (~90% for DD and ~80% for RC).

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 1.5 | Sampling, analyses and data verification |

DD core samples (generally 5 m in length but vary from 1–6 m, depending on mineralization and geological characteristics) are collected following geological and geotechnical logging, and core photography. Core sampling is performed by cutting the core lengthwise in half or into quarters. Core was cut with a hydraulic splitter until the beginning of 2017, after which the use of an electric diamond circular saw was implemented. The left side of the cut core is placed into pre-numbered sample bags and dispatched to the laboratory.

RC samples are collected from the drill rig cyclone every 1 m for the entire length of each hole (up to 50 kg of material per sample). The samples are reduced to 8–16 kg of material using a riffle (carousel-type) splitter to maintain representativeness. Archive samples are retained when the sample mass exceeds 16 kg. The standard sample batch generated in acQuire™ consists of 47 samples, 40 of which are primary samples, and 7 are control samples (quality assurance and quality control or QAQC). Sieved reference rock chip samples are collected in chip trays for logging. The trays are photographed and retained in the core shed facility.

Independent laboratories SGS Geosol Laboratorios Ltda (SGS Geosol) Vespasiano and SGS Geosol Belo Horizonte have been, and are, used for sample preparation and analysis of both DD and RC samples. Recent RC sample analysis has been performed at the Minas-Rio Process and Quality Laboratory (Anglo American owned, SGS Geosol managed internal laboratory) with surplus samples submitted to SGS Geosol Vespasiano. Both laboratories follow the same standardized sample preparation and analytical procedures. All analytical work is conducted under strict QAQC protocols to ensure consistency, accuracy and comparability of results between laboratories. The internal laboratory is currently not certified but is undergoing a certification process. As part of Anglo American’s quality assurance process, interlaboratory comparison assays are conducted annually. Results from the latest round (July and August 2025) of interlaboratory comparison assays show that the Minas-Rio Process and Quality Laboratory was deemed to have performed satisfactorily for all 26 assays (Al2O3, CaO, Fe, FeO, K2O, Mg, Mn, loss on ignition (LOI), Na2O, P, SiO2 and TiO2 were analysed).

After drying in a furnace at 105°C ± 5°C for 8 hours in the core shed, followed by a further 2 hours in the laboratory, the sample is passed through a jaw crusher, homogenized and passed through a rotary splitter to produce a 250–300 g subsample for pulverizing to 150 mesh. A 25 g pulp sample is fused and assayed by x-ray fluorescence (XRF) spectroscopy with the remaining coarse reject and pulp archived.

Samples are analysed for Al2O3, Ca, K2O, Mg, Mn, Na2O, P, SiO2, TiO2 and LOI. Original signed assay certificates and Microsoft™ Excel data files are provided to Anglo American.

During the 2006–2007 period, only SGS Geosol’s internal laboratory QAQC was used. SGS Geosol’s internal quality control consisted of quartz blanks and certified reference materials (CRMs) inserted every 40 samples. For every 10 samples analysed in the same batch, a duplicate and a replicate sample was inserted alternately. Since 2007, Anglo American has implemented the following improvements:

| · | Ultra Trace Pty Ltd (Ultra Trace) re-analysis campaign (2007) |

| · | Introduction of coarse duplicates (2008) |

| · | Introduction of first external laboratory CRM (2009) |

| · | Introduction of five new CRMs prepared by Ore Research and Exploration Pty Ltd (OREAS) (2009) |

| · | Application of QAQC procedures (2011) |

| · | Introduction of Anglo American QAQC procedures (current). |

During 2013, a total of 241 samples (pulps) were submitted to an external certified laboratory owned and operated by Intertek Group plc (Intertek), with an additional 100 samples sent during 2014. CRMs and blanks were included in each batch. The results obtained confirmed that SGS Geosol’s results are suitable for the purposes of Mineral Resource estimation. Since 2018, a total of 642 samples were sent to an external certified laboratory (ALS) for independent analysis. These samples represent approximately 5% of the original pulps from drilling campaigns conducted between 2014 and 2020. No additional external check assays have been conducted since 2020.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

Mr. Leonardo de Souza, the Qualified Person for Item 12, conducted verification of the drillhole location, drilling and sampling, sample analysis, geological, mineralization and geological modelling aspects of the Serra do Sapo deposit, and concluded that the data management systems quality control protocols, and geological interpretations in place provide a sound and reliable basis for geological modelling and Mineral Resource estimation.

| 1.6 | Mineral processing and metallurgical testwork |

Metallurgical testing has been undertaken to characterize the processing behaviour of the itabirite iron ore at Minas-Rio. The ore comprises banded quartz-hematite and hematite schist units, with weathered and unweathered zones containing 35–40% Fe and 30–32% Fe, respectively. Early laboratory and pilot-scale programs established the beneficiation response of these materials and have been periodically updated to support the process plant’s optimization campaigns.

Historical testwork included laboratory grinding, magnetic separation and flotation tests using drill core composites from across the deposit. Pilot plant trials validated the comminution and beneficiation flowsheet that underpins current operations. In 2019–2020, additional samples were tested to evaluate new processing technologies – most notably high-pressure grinding rolls (HPGR) and improved classification and dewatering circuits – to quantify potential improvements in mass yield, iron recovery and silica rejection.

The testing demonstrated that HPGR-based fine-grinding provides enhanced liberation and energy efficiency relative to conventional ball milling. Results confirmed that Minas-Rio ore consistently produces a high-grade pellet feed concentrate (> 67% Fe, <1% SiO2) at recoveries exceeding 80%. Testwork correlations between iron grade, mass recovery and throughput were used to refine plant operating parameters and predictive geometallurgical models.

Downstream testing covered thickening and filtration of concentrates and tailings to support the dewatering filter plant design. Filtration trials defined achievable cake moistures below 9% for concentrate and confirmed the suitability of tailings for filtered dry stacking, minimizing water losses and enabling safer tailings management.

Overall, the integrated laboratory and pilot programs confirm that Minas-Rio mineralization responds predictably to conventional beneficiation with HPGR-enhanced grinding, delivering a premium pellet-feed product that meets global market specifications and Anglo American’s process design standards.

| 1.7 | Mineral Resource estimates |

The December 2024 Mineral Resource estimate for Serra do Sapo used the December 2022 geological model depleted by mining to December 2024. The estimate is based on the acQuire™/SQL server database, Leapfrog Geo™ geological modelling, and block models generated using Datamine Studio™ software.

The December 2024 Mineral Resource estimate for Itapanhoacanga used the December 2012 geological model. The estimate is based on the acQuire™/SQL server database, and geological and block models generated using Datamine Studio™ software.

Similar methodologies were used for the Serra do Sapo and Itapanhoacanga Mineral Resource estimates:

| · | Database compilation into a useable and verifiable format |

| · | Geological modelling and wireframing |

| · | Interpretation, definition and wireframing of mineralized domains |

| · | Geostatistical analysis and variography by domain |

| · | Block modelling, grade and bulk density estimation |

| · | Model validation. |

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

Geological modelling of each ore and waste domain was conducted where sufficient and reliable drillhole logging and pit mapping information were available. A minimum downhole sample interval length of 3 m was used.

For Serra do Sapo, statistical analysis and variography were conducted on four separate domains. Each domain represented a single grade population of consistent orientation. Hard and soft boundaries were used for the estimation process. For Itapanhoacanga, statistical analysis and variography were conducted on five separate domains. Each domain represented a single grade population of consistent orientation. Boundary analysis was not conducted.

All drillholes were used for geological interpretation. Only RC and DD holes were used for compositing, geostatistical analysis and resource estimation at Serra do Sapo, and only DD holes at Itapanhoacanga.

Top cuts were applied during variographic analysis but not grade estimation for Serra do Sapo and Itapanhoacanga.

Block ordinary kriging (OK) was selected as the grade interpolation method for Serra do Sapo and Itapanhoacanga, as it uses information directly related to the underlying variability of the data to guide the estimation process. Grade estimation was conducted on each lithology type individually at Serra do Sapo. For Itapanhoacanga, grade estimation was conducted on each lithology type individually, except for Hard Hematite (HD) + Moderate Hematite (HM).

Mineral Resource classifications assigned used a combination of both quantitative and qualitative factors, i.e. geological confidence, ore probability, density/tonnage confidence, data quality and estimation quality.

The December 2024 Exclusive Mineral Resource estimate for Serra do Sapo reported at a cut-off grade of 25% Fe is summarized in Table 1.2.

| Table 1.2 | Serra do Sapo Mineral Resources as of 31 December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) |

| Mineralization type | Resource category |

Tonnes (Mt) |

Fe (%) |

| Friable itabirite and hematite |

Measured | 148.1 | 32.2 |

| Indicated | 120.0 | 33.9 | |

| Measured + Indicated | 268.1 | 33.0 | |

| Inferred | 41.5 | 36.1 | |

| Itabirite | Measured | 467.0 | 30.7 |

| Indicated | 909.4 | 31.2 | |

| Measured + Indicated | 1,376.4 | 31.0 | |

| Inferred | 362.6 | 31.0 |

Source: Anglo American, 2025

Notes:

| · | Tonnes and grades have been rounded and may result in minor discrepancies in the totals. |

| · | All tonnages are reported on a dry basis. |

| · | Mineral Resources are exclusive of Mineral Reserves. |

| · | Anglo American’s equity interest is 85%. |

| · | Mineral Resources are reported within an optimized Mineral Resource shell and constrained by mineral rights. |

| · | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

The December 2024 Serra do Sapo Mineral Resource estimate is reported above a 25% Fe cut-off grade for all iron formation types within an optimized Lerchs-Grossmann Mineral Resource shell based on 1.4x Anglo American’s metal price assumption of $94.89/t metal.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

The December 2024 Mineral Resource estimate for Itapanhoacanga above a cut-off grade of 25% Fe is summarized in Table 1.3.

| Table 1.3 | Itapanhoacanga Mineral Resources as of 31 December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) |

| Mineralization type | Resource category | Tonnes (Mt) | Fe (%) |

| Friable itabirite and hematite | Measured | 31.0 | 40.6 |

| Indicated | 117.5 | 41.3 | |

| Measured + Indicated | 148.6 | 41.1 | |

| Inferred | 114.5 | 40.4 | |

| Compact itabirite | Measured | 23.2 | 33.6 |

| Indicated | 73.4 | 34.5 | |

| Measured + Indicated | 96.6 | 34.3 | |

| Inferred | 57.0 | 34.5 |

Source: Anglo American, 2025

Notes:

| · | Tonnes and grades have been rounded and may result in minor discrepancies in the totals. |

| · | All tonnages are reported on a dry basis. |

| · | Anglo American maintains a 100% interest in a single Mining Concession application covering a portion of the Itapanhoacanga deposit, resulting in a weighted average equity interest of 95.1%. |

| · | Mineral Resources are reported within an optimized Mineral Resource shell and constrained by mineral rights. |

| · | Mineral Resources that are not Mineral Reserves and do not have demonstrated economic viability. |

The December 2024 Itapanhoacanga Mineral Resource estimate is reported above a 25% Fe cut-off grade for all iron formation types within an optimized Lerchs-Grossmann Mineral Resource shell based on Anglo American’s 2012 pellet feed price assumption of $133.60/wmt. The Qualified Person recommends an update to the pit optimization to align with the assumptions used for reporting the Serra do Sapo Mineral Resource estimate.

The Qualified Person independently verified the Mineral Resource estimates presented in Table 1.2 and Table 1.3 and was able to reproduce the reported tonnages and grades within ± 1% and ± 3%, respectively.

The Mineral Resources were initially classified in accordance with the guidelines of the JORC Code (2012). The confidence categories assigned under the JORC Code (2012) were reconciled to the confidence categories in the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (the 2014 CIM Definition Standards). As the confidence category definitions are the same, no modifications to the confidence categories were required. Mineral Resources and Mineral Reserves in this Technical Report are reported in accordance with the 2014 CIM Definition Standards.

The Qualified Person, Mr. Michael Andrew, has critically examined the Mineral Resource estimates, made his own enquiries, and applied his general mineral industry competence to conclude that the information is adequate for the purposes of this Technical Report, and complies with the definitions and guidelines of the CIM. The Qualified Person considers the reported Mineral Resource to be a fair reflection of the exploration activity and modelling processes undertaken.

To the best of the Qualified Person’s knowledge, at the time of estimation there were no known environmental, permitting, legal, title, taxation, socio-economic, marketing, political or other relevant issues that could materially impact the eventual extraction of the Mineral Resource.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 1.8 | Mining and Mineral Reserve estimates |

The Serra do Sapo Mineral Reserve was previously reported by Anglo American in December 2024 in accordance with the JORC Code (2012). The Qualified Person, Mr. Frank Blanchfield, has reviewed the estimation procedures, classification criteria, and modifying factors to ensure consistency with the 2014 CIM Definition Standards. Following this review, the Proved and Probable Ore Reserves under the JORC Code (2012) were restated as Probable Mineral Reserves, reflecting alignment in data density, estimation confidence and modifying factor application between the two reporting codes.

The 2024 Mineral Reserve, based on the 2022 LoAP and adjusted for production depletion to year-end 2024, totals 3,318.6 Mt at 32.9% Fe, reported at a 25% Fe plant cut-off grade as summarized in Table 1.4. Iron ore sales from the Mineral Reserve are reported in Table 1.5.

| Table 1.4 | Serra do Sapo Mineral Reserve estimate as of December 2024 reported at a cut-off grade of 25% Fe (100% attributable basis) |

| Mineralization type | Classification | Tonnes (Mt) | Fe (%) |

| Friable itabirite and hematite | Probable | 1,053.6 | 37.0 |

| Itabirite | Probable | 2,265.0 | 30.9 |

| Total | 3,318.6 | 32.9 | |

Source: Anglo American, 2025

Notes:

| · | Tonnes and grades have been rounded and may result in minor discrepancies in the totals. |

| · | All tonnages reported on a dry basis. |

| · | Point of reference for the Mineral Reserve is delivery to the beneficiation plant. |

| · | Mineral Reserves are derived solely from Measured and Indicated Mineral Resources. |

| · | Anglo American’s equity interest is 85%. |

The estimate incorporates allowances for mining dilution and ore loss and excludes short-term stockpiles. The cut-off grade was derived from economic analysis using product prices, operating and processing costs and metallurgical recoveries, and remains robust under sensitivity testing. The cut-off (plant feed basis) was calculated from an economic analysis incorporating a product price, operating costs and geological constraints reflecting lithological boundaries. Although breakeven cut-off grades were calculated at 16–17% Fe, a higher reporting cut-off of 25% Fe was adopted to align with geological domains and to provide resilience to market fluctuations.

The Mineral Reserve is supported by a 49-year LoAP production schedule containing approximately 1.8% Inferred Mineral Resources within the mine plan. These are excluded from the Mineral Reserve statement and do not materially affect project economics. In the Qualified Person’s opinion, the Serra do Sapo Mineral Reserve represents the economically mineable portion of Measured and Indicated Mineral Resources and is cashflow positive, accounting for all key modifying factors including mining, metallurgical, environmental, social, statutory and financial considerations.

| Table 1.5 | Serra do Sapo concentrate production from Mineral Reserves (100% attributable basis) |

| Mineralization type | Iron ore sales tonnes (Mt) | Iron ore sales Fe (%) |

| Friable itabirite and hematite | 590 | 67 |

| Itabirite | 1,059 | 67 |

| Total | 1,649 | 67 |

Source: Anglo American, 2025

Remaining uncertainties primarily relate to permitting and licensing for future pit expansions, waste and tailings storage, and community and environmental approvals near populated and sensitive areas.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

The block model was regularized to 25 m x 25 m x 15 m blocks, incorporating internal waste and contact zones to simulate mining selectivity. Average ore loss and dilution were estimated at 3.7% and 3.2%, respectively, based on reconciliation between the resource model, mine production and plant feed.

The pit optimization completed in 2022 using NPV Scheduler (NPVS) applied standard open pit design and economic parameters. The optimization used a Blast Furnace Pellet Feed (BFPF) price of $98.63/t metal (real 2022 terms), a mining cost of $2.15/t moved and a total operating cost of $31.28/t metal, at an exchange rate of 4.99 BRL/US$. Slope angles ranged from 26° in weathered zones to 55° in compact rock, with exclusion zones established around infrastructure, villages and conservation areas. The selected pit design contains 3.81 billion tonnes (Bt) of ore at a strip ratio of 0.5:1 and is confirmed to be technically and economically viable under sensitivity testing.

Final pit designs, derived from NPVS shells, applied sector-based geotechnical parameters and practical mining geometries. Key design parameters include 15 m benches, 43.2 m wide ramps at a 10% gradient and setbacks of 75 m from infrastructure and 250 m from the tailings storage facility (TSF). Twenty-five staged pushbacks were created to target friable itabirite ore (≥25% Fe) while balancing waste stripping and processing capacity. Final designs resulted in an 8.8% increase in waste and 5–9% reduction in ore, reflecting operational constraints and geotechnical refinements.

The pit slope design is supported by an extensive geotechnical database developed through laboratory testing, field mapping and slope performance analysis. Two main geotechnical domains were defined – friable and compact/semi-compact materials – representing contrasting lithological and weathering conditions. Laboratory tests (2011–2016) included uniaxial/triaxial compression, Brazilian tensile and direct shear testing of itabirite, phyllite, quartzite and gneiss. Results were used to develop Mohr-Coulomb, Hoek-Brown and Barton-Bandis strength envelopes and slope stability models. Berm widths were 8–10 m, and inter-ramp angles ranged from 23° to 42°, depending on rock mass domain. Factors of safety meet Anglo American and international standards (≥1.2 to 1.3).

Hydrogeological studies (2009–2024) have characterized pit inflows, predicting increases from ~360 m3/h initially to ~860–917 m3/h by 2031. Dewatering is managed through pumping wells, horizontal drains, in-pit sumps and groundwater monitoring, with 11 new wells planned through 2027 to maintain drawdown ahead of mining.

Mining is by conventional truck-and-shovel methods, with ore hauled to a primary crushing system comprising twin jaw crushers and overland conveyors to the beneficiation plant. The current fleet includes Komatsu PC5500 and PC4000 excavators and 830E AC haul trucks. Peak production will require up to 116 trucks. The primary crusher (two Metso C-140 jaw crushers, grizzlies, feeders and an overland conveyor) handles an average of 8,440 t/h.

The LoAP to 2073 projects production increasing to 31 Mt/a (wet) by 2026 and remaining stable thereafter. The mine comprises 12 designed pushbacks grouped into two main phases:

| · | Phase I (2023–2038): Focused on friable itabirite with higher iron grades and low strip ratios at 0.5:1 with 66% of the friable rock mass blasted with a powder factor of about 0.15–0.3 kg/t. |

| · | Phase II (2039–2073): Transitioning to denser itabirite with lower grades and higher strip ratios (up to 1.4:1) with 100% of the itabirite rock mass blasted with a powder factor of about 0.30–0.59 kg/t. |

The Qualified Person has examined the Mineral Reserve estimate, made his own enquiries, and applied his general mineral industry competence to conclude that the information is adequate for the purposes of this Technical Report, and complies with the definitions and guidelines of the CIM. The Qualified Person considers the reported Mineral Reserve to be a fair representation of the forecast production.

To the best of the Qualified Person’s knowledge, at the time of estimation there were no known environmental, permitting, legal, title, taxation, socio-economic, marketing, political or other relevant issues that could materially impact the eventual extraction of the Mineral Reserve.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 1.9 | Processing methods and infrastructure |

The beneficiation plant, commissioned in 2014, has a nominal capacity of 8,440 t/h (about 48 Mt/a) and produces about 2 Mt per month of high-grade concentrate. Ore undergoes crushing, HPGR grinding, desliming, flotation, regrinding, thickening and pipeline transport to the Port of Açu. Product grades average 68.0% Fe for direct reduction pellet feed (DRPF) and 67.1% Fe for BFPF, with moisture controlled below the transportable moisture limit (TML) (about 9.7–9.8%).

At the beneficiation plant, tailings from the desliming and flotation circuits are thickened and partially dewatered prior to disposal in the TSF. Anglo American is currently implementing a tailings filtration project to enhance water recovery and reduce the environmental footprint of the TSF. Phase 1 construction is underway and scheduled for commissioning in early 2026.The system will comprise filter presses to produce a “filtered” or “dry stack” tailings product with moisture of about 15–20%.

A 529 km slurry pipeline transfers concentrate from the mine (700 m elevation) to the Açu Port filter plant (10 m elevation). The pipeline operates at 2,800–3,550 t/h, with two pump stations and cathodic protection for integrity. Routine maintenance includes biannual cleaning and five-year “smart pig” inspections.

At the Açu Port, operated by Ferroport (Anglo American–Prumo Logística Joint Venture), the filtration plant reduces concentrate moisture to ~9% using ceramic filters before stacking on 1.2 Mt stockpiles for shipment. The port handles up to 26.5 Mt/a (wet), with expansion potential to 30 Mt/a, loading Capesize vessels (≤220,000 tonnes) via offshore Terminal T1.

Recent plant performance (2020–2025) indicates an average feed rate of 5,995 t/h and dry concentrate output of 2,887 t/h, with crushing uptime at 65% and beneficiation uptime at 85%. The processing circuit is considered technically sound and suitable for producing high-grade pellet feed for both blast furnace and direct reduction markets.

The TSF lies about 4 km southeast of the plant in a natural valley selected for its containment potential and proximity to water reclaim systems. Tailings water is recycled to the plant, maintaining a closed-loop water balance. Two waste rock dumps north and south of the pit provide 1.26 Bm3 of total capacity.

Industrial water is supplied from the Peixe River via a 40 km pipeline and supplemented by reclaimed process water, dewatering wells, and rainfall catchments. Power is provided through a 138 kV transmission line connected to the CEMIG grid, with substations at Conceição do Mato Dentro and Alvorada de Minas supplying the mine, plant and tailings systems.

The operation is accessible year-round via paved highways, with dedicated access roads and controlled security gates. Ancillary facilities include heavy equipment workshops, reagent and fuel storage, HSE and emergency stations and on-site laboratories. A purpose-built accommodation complex supports rotational personnel, while permanent staff reside in nearby towns.

A fibre-optic communications network parallels the slurry pipeline, linking the mine, beneficiation plant and Port of Açu through the Integrated Operations Centre for Supervisory Control and Data Acquisition (SCADA) based monitoring and control. At the port, concentrate is filtered, stockpiled and loaded onto vessels via Ferroport.

| 1.10 | Permitting, environmental and social |

The Serra do Sapo operation is fully permitted. The mine, beneficiation plant and associated 529 km slurry pipeline to the Port of Açu are all licensed and operating in compliance with Brazilian environmental and mining legislation. Environmental and social management systems are aligned with International Finance Corporation (IFC) Performance Standards, the Equator Principles, International Council on Mining and Metals (ICMM) Good Practice Guidance, and Anglo American’s Social Way 3.0 and Global ESG Framework.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

The Property lies within the Espinhaço Range, a transitional zone between the Atlantic Forest and Cerrado biomes, both recognized as global biodiversity hotspots. Anglo American maintains a comprehensive suite of environmental programs covering biodiversity conservation, water and tailings management, air quality and noise control, and mine-closure planning. All activities are conducted under valid operating licences (LOs) and subject to continuous oversight by the State Secretariat for Environment and Sustainable Development (SEMAD), IBAMA and the National Water Agency (ANA).

Waste and water management are implemented through an integrated Environmental Management System and Water Resources Management Plan (PGRH). Tailings are stored in an engineered TSF designed to Global Industry Standard on Tailings Management (GISTM) standards and subject to annual independent audits. Waste rock dumps are constructed with stability and erosion controls, while potentially acid-forming material is encapsulated within inert layers. Process water recycling achieves efficiencies of approximately 80%, and no off-site groundwater contamination or depletion has been detected. Monitoring for air, noise, surface water and groundwater confirms compliance with regulatory thresholds.

The mine’s area of influence includes 13 priority communities in Minas Gerais and 33 municipalities along the pipeline corridor to the port. Anglo American applies the Social Way 3.0 and IFC Performance Standards 1, 2, 4 and 5 to manage stakeholder engagement, labour, community health and safety, and land-access impacts. Structured social performance programs, including workforce training, livelihood restoration, environmental education, and cultural-heritage protection, are implemented through annually audited management plans. The Stakeholder Engagement Plan (PES) guides transparent and inclusive dialogue, while the Safety and Health Integrated Risk Assessment (SHIRA) process systematically identifies and mitigates social and human-rights risks.

The relationship legacy with surrounding communities remains complex, reflecting the cumulative impacts from implementation and operation of Stage 1, 2 and 3, which have been the subject of sustained public discussion. The proximity of Stage 3 to local settlements has heightened community concerns regarding noise, vibration, dust and water supply.

Resettlement and land-access processes follow the Land Access and Displacement Strategy (LADS), updated annually and aligned with IFC Performance Standard 5 and state legislation. The principal ongoing initiative is the 15 km ZAS (Jassém) Collective Resettlement Project, conducted under judicial supervision by the Public Prosecutor’s Office of Minas Gerais (MPMG). Future resettlements associated with the second tailings dam raise and Sapo South expansion are being integrated into forthcoming environmental licensing procedures.

The Mine Closure Plan (2023 update) follows Anglo American’s corporate standards and ICMM/IBRAM good practice, covering physical stability, ecosystem restoration and socio-economic transition. Closure liabilities are fully costed and provisioned under the Asset Retirement Obligation and Life-of-Mine scenarios.

Overall, Minas-Rio operates in full regulatory compliance. The principal forward-looking risks relate to the timing of future licensing for expansion projects, land access negotiations, and potential climate-related impacts on water availability. These are being proactively managed through early technical studies, stakeholder engagement and adaptive environmental design. There are no unresolved environmental, social or permitting issues considered material to the Mineral Resource or Mineral Reserve estimates, and the Project’s licence to operate remains secure.

| 1.11 | Costs and economic analysis |

As no material expansion or production increase is currently planned at Minas-Rio, there are no expansion capital requirements. All forecast capital expenditures are SIB capital required to sustain ongoing operations and LoAP commitments.

LoAP SIB costs listed in Table 1.6 for Minas-Rio are estimated at $4,115 million from 1 January 2025 to 2073, including closure costs of about $126 million. These costs cover the mine fleet refurbishment and replacement, process plant refurbishment, mining equipment, mine footprint expansion, tailings dam lifts, social, closure and rehabilitation activities, and the port.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

Capital estimates are prepared using detailed engineering design, vendor quotations and benchmarked unit rates developed during each project phase. About 75% of SIB costs are compiled in Brazilian reais (BRL) and converted to nominal US dollars for reporting. The remaining 25% is compiled directly from US$ costs. Contingencies ranging from 10% to 20% are applied according to design maturity and risk exposure.

| Table 1.6 | LoAP SIB capital cost |

| SIB item | Cost ($ M) |

| Processing | 1,477 |

| Mining equipment | 1,141 |

| Mine continuity | 105 |

| TSF and waste dump | 488 |

| Social | 78 |

| Closure | 126 |

| Port | 486 |

| Other | 213 |

| Total LoAP | 4,115 |

Source: LoAP

Operating unit costs listed in Table 1.7 have been developed from first-principles estimates based on current performance and LoAP schedules. Costs are expressed in US dollars per wet metric tonne (wmt) of iron ore product and include mining, processing, pipeline transport, filtration, port handling and general administrative expenses. The total free-on-board (FOB) LoAP cash cost is estimated at $31.80/wmt and $36.54/wmt including SIB capital and royalties as summarized in Table 1.7. These costs reflect steady-state operations with no expansion project capital.

| Table 1.7 | LoAP unit costs |

| Cost item | Unit | Value |

| Mine | $/wmt | 8.48 |

| Beneficiation | $/wmt | 10.02 |

| Pipeline | $/wmt | 1.41 |

| Filtration | $/wmt | 1.17 |

| Operating support | $/wmt | 5.02 |

| Total C1 | $/wmt | 26.10 |

| Port | $/wmt | 2.96 |

| Other selling | $/wmt | 0.54 |

| Total FOB cash cost | $/wmt | 29.61 |

| SG&A | $/wmt | 1.69 |

| AAML | $/wmt | 0.50 |

| Total operating cash cost | $/wmt | 31.80 |

| SIB | $/wmt | 2.79 |

| Royalty | $/wmt | 1.95 |

| Total cash cost | $/wmt | 36.54 |

Source: LoAP

As no material expansion, production increase or new development phase is currently proposed for the Minas-Rio operation, an economic analysis has not been prepared or disclosed in this Technical Report. The Project remains an operating asset, and its financial performance is governed by Anglo American’s internal budgets and corporate reporting standards rather than a standalone discounted cashflow analysis.

| FINAL | 3 November 2025 | PAGE |

|

Anglo American plc NI 43-101 Technical Report – Minas-Rio Property, State of Minas Gerais, Brazil |

| 1.12 | Other relevant data and information |

On 22 February 2024, Anglo American entered into an agreement with Vale to acquire and integrate adjacent Serra da Serpentina iron ore deposit with the Minas-Rio operation in Brazil. Under the transaction terms, Vale contributed the Serra da Serpentina deposit plus $157.5 million in cash in exchange for a 15% equity interest in the enlarged Minas-Rio property. The transaction was completed in December 2024 with the transfer of the mineral titles to AAMFB in progress.

Serra da Serpentina hosts a large iron ore deposit characterized by softer, friable material with grades exceeding those of the Serra do Sapo deposit. The deposit is contiguous to Serra do Sapo to the southeast and extends over a strike length of approximately 30 km.

The deposit has been evaluated by 386 DD holes for 46,778 m since the 1970s. The drill grid spacing is around 200 m x 200 m, with some 100 m x 100 m coverage over the central portions of the deposit

An internal resource estimate was completed by Vale in 2020. The historical estimate does not meet CIM Definition Standards for Mineral Resources and Mineral Reserves, and the Qualified Person has not done sufficient work to classify the historical estimate as a current Mineral Resource. Anglo American is not treating the historical estimates as a current Mineral Resource and they should not be relied upon.

Anglo American is currently conducting a program of infill verification drilling on a 100 m x 100 m grid and plans to report a future Mineral Resource for Serra da Serpentina using the same parameters as used for Serra do Sapo.

| 1.13 | Conclusions and recommendations |

The Minas-Rio operation is a mature, integrated mine-to-port system producing high-grade iron ore pellet feed through a well-established processing, pipeline and export network. Current operations demonstrate technical robustness, stable metallurgical performance and effective water and tailings management. The LoAP supports continued production of approximately 26–28 Mt/a (dry) of pellet feed over the remaining mine life.

The LoAP financial model demonstrates that the declared Mineral Reserve is economically viable based on current operating parameters, cost assumptions and iron ore pricing, with all capital expenditure categorized as SIB capital. No material expansion or new development phase is currently proposed; therefore, no standalone economic analysis is presented in this Technical Report.

It is recommended that Anglo American: