UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EXHIBIT INDEX

| Exhibit Number |

Description | |

| 99.1 | NI 43-101 Technical Report, Collahuasi Copper Mine, Tarapacá Region, Chile; November 3, 2025 |

SIGNATURE

| Teck Resources Limited | ||

| (Registrant) | ||

| Date: November 10, 2025 | By: | /s/ Amanda R. Robinson |

| Amanda R. Robinson | ||

| Corporate Secretary | ||

Exhibit 99.1

NI 43-101 TECHNICAL REPORT, COLLAHUASI COPPER MINE, TARAPACÁ REGION, CHILE

Prepared for

Anglo American Plc

Effective Date: 31 December 2024

Issue Date: 03 November 2025

Prepared by Qualified Persons

Tim Lucks, Corporate Consultant (Project Evaluation), AusIMM(CP)

Martin Pittuck, Corporate Consultant (Resource Geology), CEng, FGS, MIMMM(QMR)

Max Brown, Principal Consultant (Geotechnics), CEng, MIMMM

Francois Taljaard, Principal Consultant (Mining Engineering), Pr.Eng

John Willis, Principal Consultant (Mineral Processing), MAusIMM(CP)

Richard Martindale, Principal Consultant (Geotechnical/ Tailings Engineering), CEng, MIMMM

James Bellin, Principal Consultant (Water), CGeol FGS

Colin Chapman, Principal Consultant (Infrastructure), CEng, MIMMM(QMR)

Project Number: UK32812

SRK Consulting (UK) Limited

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Details |

NI 43-101 TECHNICAL REPORT, COLLAHUASI COPPER MINE, TARAPACÁ REGION, CHILE

Issuer:

Anglo American Plc

17 Charterhouse Street

London

EC1N 6RA

United Kingdom

Effective Date: 31 December 2024

Issue Date: 03 November 2025

Project Number: UK32812

Technical Report Author:

Qualified Persons

Employees of SRK Consulting (UK) Limited

5th Floor Churchill House

17 Churchill Way

Cardiff, CF10 2HH

Wales, United Kingdom

Other SRK Experts:

Emily Harris, Principal Consultant (Sustainability), CEnv, MISEP

SRK Peer Reviewers:

Iestyn Humphreys, Corporate Consultant (Due Diligence)

| November 2025 |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Table of Contents |

Table of Contents

| ITEM 1 | SUMMARY | 1 |

| 1.1 | Introduction | 1 |

| 1.2 | Property Description | 2 |

| 1.3 | History | 3 |

| 1.4 | Geology Setting, Mineralisation and Deposit Type | 6 |

| 1.5 | Exploration, Drilling, Sampling, Analysis and Data Verification | 6 |

| 1.6 | Mineral Processing and Metallurgical Testwork | 8 |

| 1.7 | Mineral Resource and Mineral Reserve Estimates | 8 |

| 1.8 | Mining Operations | 15 |

| 1.9 | Processing and Recovery Operations | 15 |

| 1.10 | Infrastructure, Power, Permitting and Compliance | 16 |

| 1.11 | Development Projects | 18 |

| 1.12 | Production, Capital and Operating costs | 19 |

| 1.13 | Exploration Potential | 20 |

| 1.14 | Conclusions and Recommendations | 21 |

| ITEM 2 | INTRODUCTION | 30 |

| 2.1 | Terms of Reference | 31 |

| 2.2 | Qualified Persons | 31 |

| 2.3 | Personal Inspection of the Collahuasi Property | 32 |

| 2.4 | Forward-Looking Statements | 34 |

| ITEM 3 | RELIANCE ON OTHER EXPERTS | 34 |

| 3.1 | Legal Title | 34 |

| 3.2 | Environmental, Social and Governance | 34 |

| 3.3 | Taxation | 34 |

| ITEM 4 | PROPERTY DESCRIPTION AND LOCATION | 35 |

| 4.1 | Property Description and Ownership | 35 |

| 4.2 | Location | 35 |

| 4.3 | Mineral Rights | 37 |

| 4.3.1 | Regulatory framework | 37 |

| 4.3.2 | Concession status | 38 |

| 4.3.3 | Surface rights | 40 |

| 4.3.4 | Water rights | 40 |

| 4.4 | Property Boundaries and Mine Site Layout | 41 |

| 4.5 | Environmental Approvals | 43 |

| 4.5.1 | Regulatory framework | 43 |

| 4.5.2 | Permitting Status | 44 |

| 4.5.3 | Compliance | 46 |

| 4.6 | Environmental Liabilities | 46 |

| ITEM 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 47 |

| 5.1 | Accessibility | 47 |

| 5.2 | Infrastructure and Facilities | 47 |

| 5.3 | Environmental and Social Setting | 47 |

| 5.3.1 | Mine site | 47 |

| 5.3.2 | Pipeline and port | 53 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| ITEM 6 | HISTORY | 55 |

| ITEM 7 | GEOLOGICAL SETTING AND MINERALIZATION | 62 |

| 7.1 | Regional Geology | 62 |

| 7.2 | Local Geology | 64 |

| 7.2.1 | Lithology | 64 |

| 7.2.2 | Mineralisation | 65 |

| 7.2.3 | Alteration | 67 |

| ITEM 8 | DEPOSIT TYPES | 69 |

| ITEM 9 | EXPLORATION | 70 |

| 9.1 | Pre-Mining | 70 |

| 9.2 | Early Mining | 70 |

| 9.3 | Expansion and Mine Studies | 70 |

| ITEM 10 | DRILLING | 71 |

| 10.1 | Introduction | 71 |

| 10.2 | Historical Drilling | 74 |

| 10.3 | Early Operations | 74 |

| 10.4 | Post 2010 Drill-out | 74 |

| 10.5 | Drilling Since MRE Cutoff Date | 74 |

| 10.6 | Summary Drill History | 75 |

| 10.7 | Blast Hole Drilling | 77 |

| 10.8 | Down Hole Survey | 77 |

| 10.9 | Topographic Survey | 77 |

| ITEM 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 78 |

| 11.1 | Core Transport | 78 |

| 11.2 | Database Management | 78 |

| 11.3 | Core Logging | 78 |

| 11.4 | Sampling | 79 |

| 11.5 | Sample Preparation | 79 |

| 11.6 | Assaying | 80 |

| 11.7 | Quality Control | 81 |

| 11.7.1 | Historical Results | 82 |

| 11.8 | Summary | 82 |

| ITEM 12 | DATA VERIFICATION | 84 |

| 12.1 | Independent Peer Review | 84 |

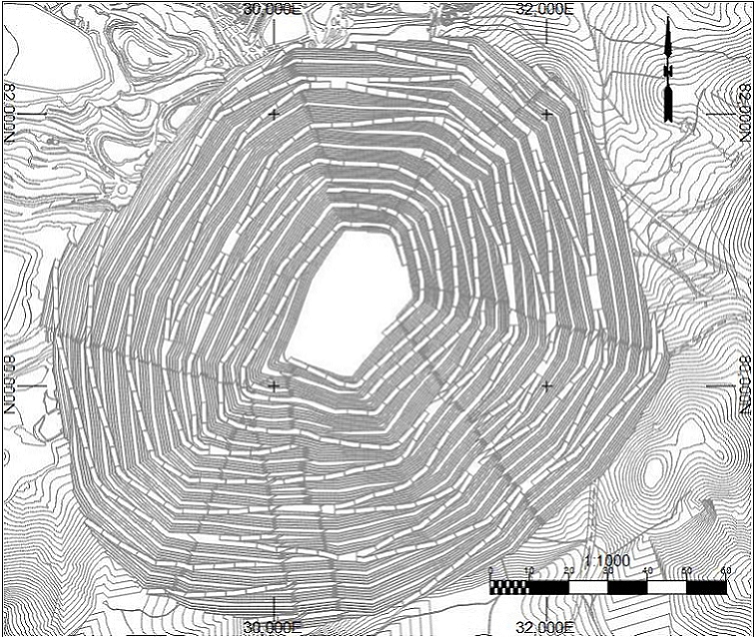

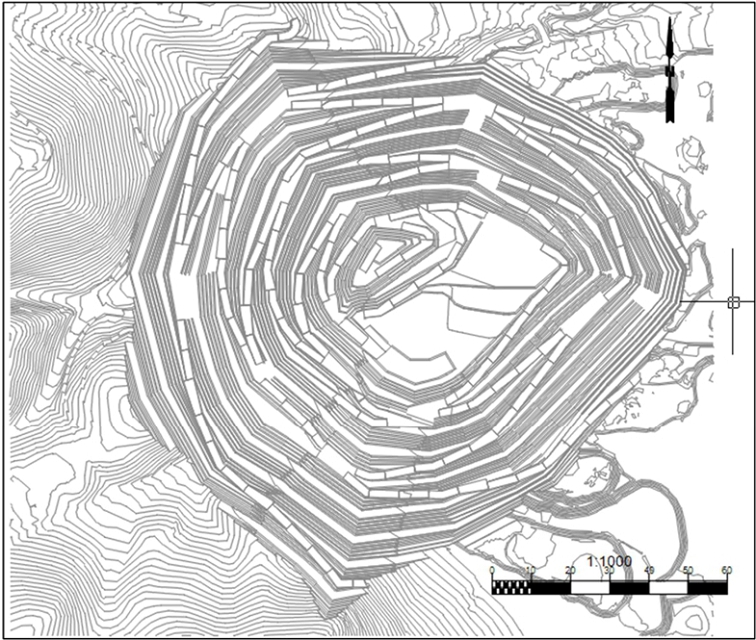

| 12.2 | Quality Control and Library Records | 84 |

| 12.3 | Site Visit Inspection | 85 |

| 12.4 | Data Entry Checks | 87 |

| 12.5 | Block Model Estimation Data Assessment | 88 |

| 12.5.1 | Core Recovery | 88 |

| 12.5.2 | RC vs DD Comparison | 88 |

| 12.5.3 | Ujina Old vs New Drilling Comparison | 89 |

| 12.5.4 | Rosario Resource Model Reconciliation | 89 |

| ITEM 13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 93 |

| 13.1 | Historical Metallurgical Domaining | 93 |

| 13.2 | Geometallurgical Modelling – Rosario, Rosario West | 94 |

| 13.3 | Geometallurgical Modelling - Ujina | 101 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| ITEM 14 | MINERAL RESOURCE ESTIMATES | 102 |

| 14.1 | Introduction | 102 |

| 14.2 | Resource Estimation Procedures | 102 |

| 14.3 | The Resource Database | 103 |

| 14.4 | Geological Modelling | 104 |

| 14.4.1 | Structural model | 104 |

| 14.4.2 | Lithological model | 105 |

| 14.4.3 | Alteration model | 106 |

| 14.4.4 | Cu Mineralogy model | 117 |

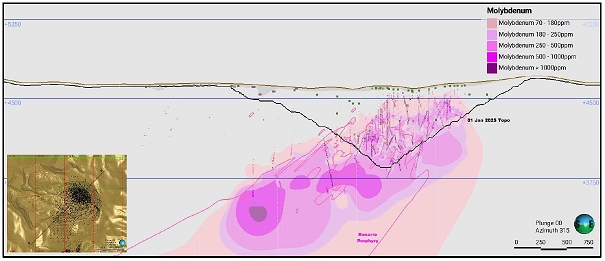

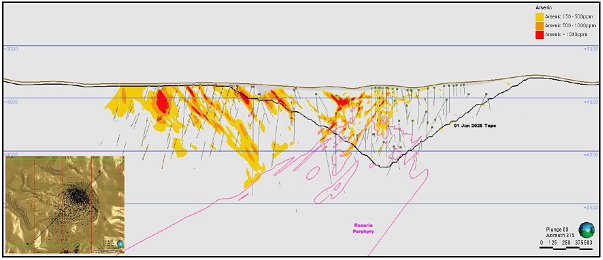

| 14.4.5 | Cu and Mo Grade shells | 108 |

| 14.4.6 | Additional models | 110 |

| 14.4.7 | Final estimation domains | 110 |

| 14.5 | Data Conditioning | 112 |

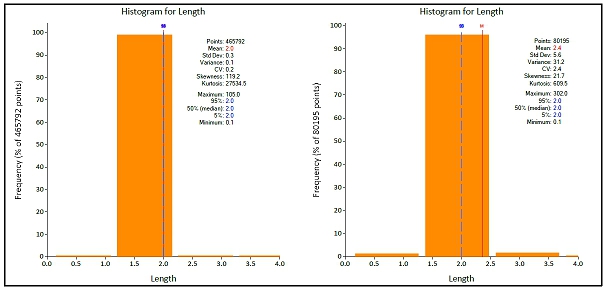

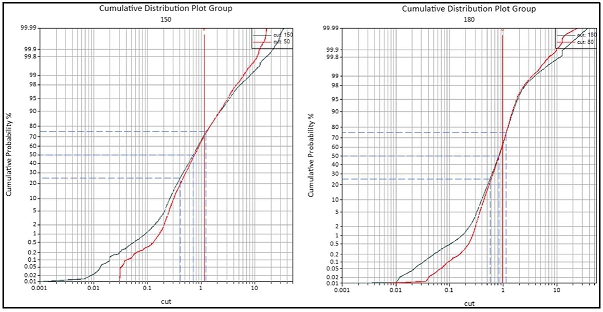

| 14.5.1 | Compositing | 112 |

| 14.5.2 | High-grade distance restrictions | 113 |

| 14.6 | Statistical Analysis | 116 |

| 14.6.1 | Copper | 116 |

| 14.6.2 | Molybdenum | 118 |

| 14.6.3 | Density | 120 |

| 14.7 | Grade Continuity Analysis | 120 |

| 14.7.1 | Rosario | 121 |

| 14.7.2 | Rosario West | 121 |

| 14.7.3 | Ujina | 121 |

| 14.8 | Block Model Definition | 121 |

| 14.9 | Grade Interpolation | 122 |

| 14.9.1 | Rosario | 122 |

| 14.9.2 | Rosario West | 123 |

| 14.9.3 | Ujina | 124 |

| 14.10 | Validation of Block Model Estimates | 124 |

| 14.10.1 | Visual validation | 124 |

| 14.10.2 | Swath plots and histograms | 125 |

| 14.10.3 | Global statistics | 127 |

| 14.10.4 | Validation summary | 128 |

| 14.11 | Resource Classification | 128 |

| 14.11.1 | Rosario | 129 |

| 14.11.2 | Rosario West | 129 |

| 14.11.3 | Ujina | 129 |

| 14.12 | Dilution Considerations | 130 |

| 14.13 | Reasonable Prospects for Eventual Economic Extraction | 130 |

| 14.14 | Stockpiles | 132 |

| 14.15 | Mineral Resource Statement | 133 |

| 14.16 | Comparison with Previous Mineral Resource Estimate | 135 |

| 14.17 | Grade and Tonnage Sensitivity | 136 |

| ITEM 15 | MINERAL RESERVE ESTIMATES | 138 |

| 15.1 | Mineral Reserve Estimation Approach | 138 |

| 15.2 | Mineral Reserve Assumptions | 138 |

| 15.2.1 | Block models and surfaces | 138 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| 15.2.2 | Open pit geotechnical design criteria | 139 |

| 15.2.3 | Rosario pit | 139 |

| 15.2.4 | Ujina pit | 140 |

| 15.3 | Re-blocking, Dilution and Ore Loss | 141 |

| 15.4 | Metallurgical Considerations | 142 |

| 15.5 | Economic Parameters | 142 |

| 15.6 | Pit Optimisation Results | 145 |

| 15.6.1 | Rosario optimisation results | 145 |

| 15.6.2 | Ujina optimisation results | 147 |

| 15.7 | Pit Design | 149 |

| 15.7.1 | Rosario open pit | 150 |

| 15.7.2 | Ujina open pit | 152 |

| 15.7.3 | Waste Rock Dumps | 154 |

| 15.7.4 | Waste Rock Dump design | 154 |

| 15.8 | Mineral Reserve Statement | 155 |

| 15.9 | Comparison with Previous Mineral Reserve Estimate | 157 |

| ITEM 16 | MINING METHODS | 158 |

| 16.1 | Pit Dewatering and Depressurisation | 158 |

| 16.1.1 | Rosario | 158 |

| 16.1.2 | Ujina | 163 |

| 16.2 | Open Pit Geotechnical Engineering | 163 |

| 16.2.1 | Geotechnical data | 163 |

| 16.2.2 | Geological model | 165 |

| 16.2.3 | Large-scale structural model | 165 |

| 16.2.4 | Rock mass model | 166 |

| 16.2.5 | Hydrogeological model | 169 |

| 16.2.6 | Slope design geometry | 169 |

| 16.2.7 | Slope design implementation and pit wall performance | 170 |

| 16.2.8 | Slope displacement monitoring | 171 |

| 16.2.9 | Stability assessment of Rosario slope design (five-year plan) | 174 |

| 16.2.10 | Stability assessment of Rosario LoM slope design | 175 |

| 16.2.11 | Ujina LoM slope design stability assessment | 178 |

| 16.2.12 | Geotechnical sustaining process | 180 |

| 16.2.13 | Geotechnical governance and assurance | 181 |

| 16.3 | Life of Mine Plan | 182 |

| 16.4 | Mine Planning Process | 183 |

| 16.5 | Mining Equipment | 184 |

| 16.6 | Equipment Operating Hours | 185 |

| 16.7 | Haulage Analysis | 187 |

| 16.8 | Equipment Requirements and Replacement | 189 |

| 16.8.1 | Truck Fleet | 190 |

| 16.8.2 | Loading Fleet | 191 |

| 16.8.3 | Drill Requirements | 192 |

| 16.8.4 | Support equipment requirements | 192 |

| 16.9 | Mining Production Schedule | 193 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| 16.10 | Production Scheduling Results | 194 |

| 16.11 | Mill Feed Scheduling Results | 196 |

| ITEM 17 | RECOVERY METHODS | 201 |

| 17.1 | Concentrator | 201 |

| 17.2 | Expansion / De-bottlenecking Projects | 203 |

| 17.2.1 | 185 ktpd | 203 |

| 17.2.2 | 210 ktpd | 203 |

| 17.2.3 | ACP Growth Phase 370 ktpd | 204 |

| 17.2.4 | Throughput recovery relationship | 204 |

| 17.3 | Production Statistics | 204 |

| 17.3.1 | Historical | 204 |

| 17.3.2 | Forecast | 206 |

| ITEM 18 | PROJECT INFRASTRUCTURE | 211 |

| 18.1 | Introduction | 211 |

| 18.2 | Waste Rock Dumps | 211 |

| 18.2.1 | Location | 211 |

| 18.2.2 | Waste rock geochemistry | 212 |

| 18.2.3 | Ground investigations & slope stability | 212 |

| 18.3 | Tailings Storage & Management | 214 |

| 18.3.1 | Introduction | 214 |

| 18.3.2 | TSF design, construction, and raising strategy | 215 |

| 18.3.3 | Geotechnical characterisation | 217 |

| 18.3.4 | Facility capacity, tailings deposition and expansion | 218 |

| 18.3.5 | Water management | 218 |

| 18.3.6 | Monitoring systems and performance assessment | 219 |

| 18.3.7 | Dam breach assessment and consequence classification | 220 |

| 18.3.8 | Oversight, permitting and regulatory compliance | 221 |

| 18.3.9 | Dam safety review (December 2023 / May 2024) | 223 |

| 18.3.10 | Expansion options assessment | 224 |

| 18.4 | Water Supply | 226 |

| 18.4.1 | Water balance | 226 |

| 18.4.2 | Water demand | 226 |

| 18.4.3 | Groundwater supply | 227 |

| 18.4.4 | C20+ Project | 228 |

| 18.4.5 | Water supply up to 210 ktpd | 228 |

| 18.4.6 | Expansion scenarios beyond 210 ktpd | 229 |

| 18.5 | Surface Water Management | 230 |

| 18.6 | Power Supply | 231 |

| 18.7 | Site Infrastructure | 232 |

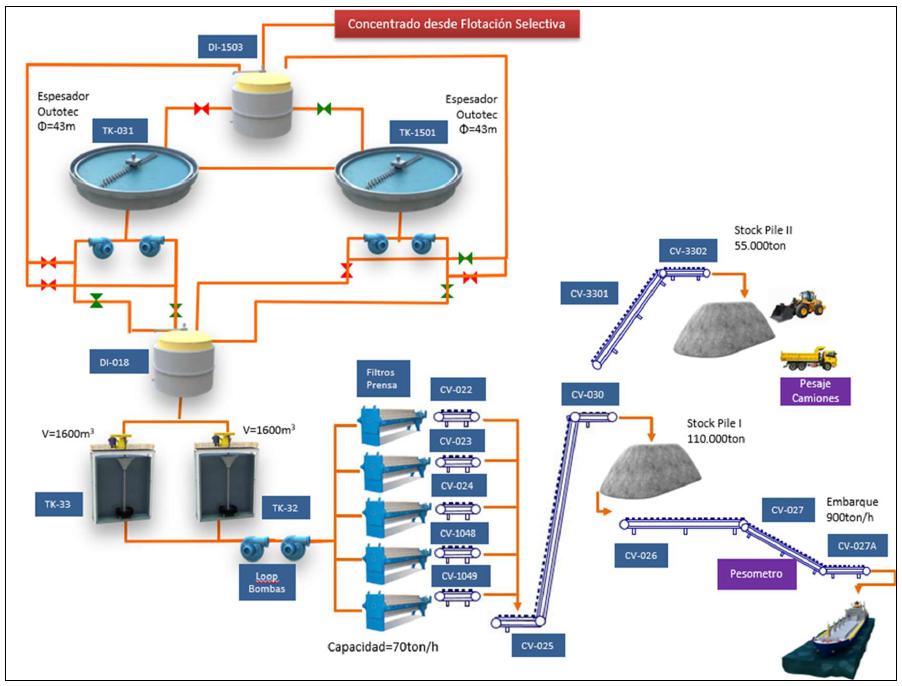

| 18.8 | Concentrate Logistics | 233 |

| 18.9 | Construction Projects – Capex / Progress | 236 |

| 18.9.1 | Overview | 236 |

| 18.9.2 | C20+ Project: desalination and pipeline | 236 |

| 18.9.3 | Capacity 185 ktpd (Project No. P333 / PG3A) | 237 |

| 18.9.4 | Capacity 210 ktpd (Project No. PG210) | 237 |

| 18.9.5 | ACP Growth Project | 238 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| ITEM 19 | MARKET STUDIES AND CONTRACTS | 239 |

| 19.1 | Introduction | 239 |

| 19.2 | Historical Performance | 241 |

| 19.3 | Commodity Pricing | 244 |

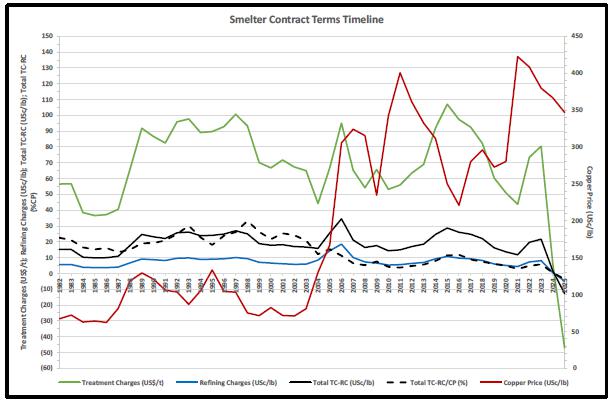

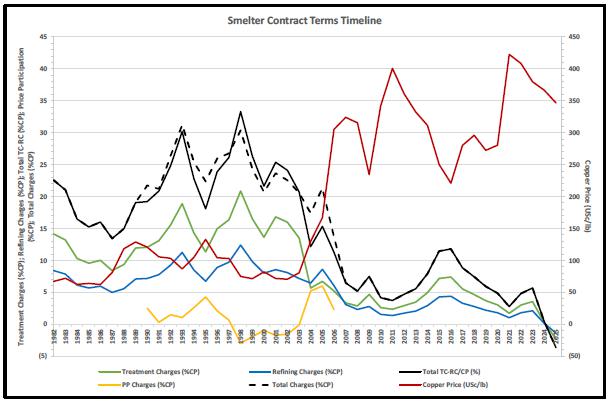

| 19.4 | Concentrate Markets | 247 |

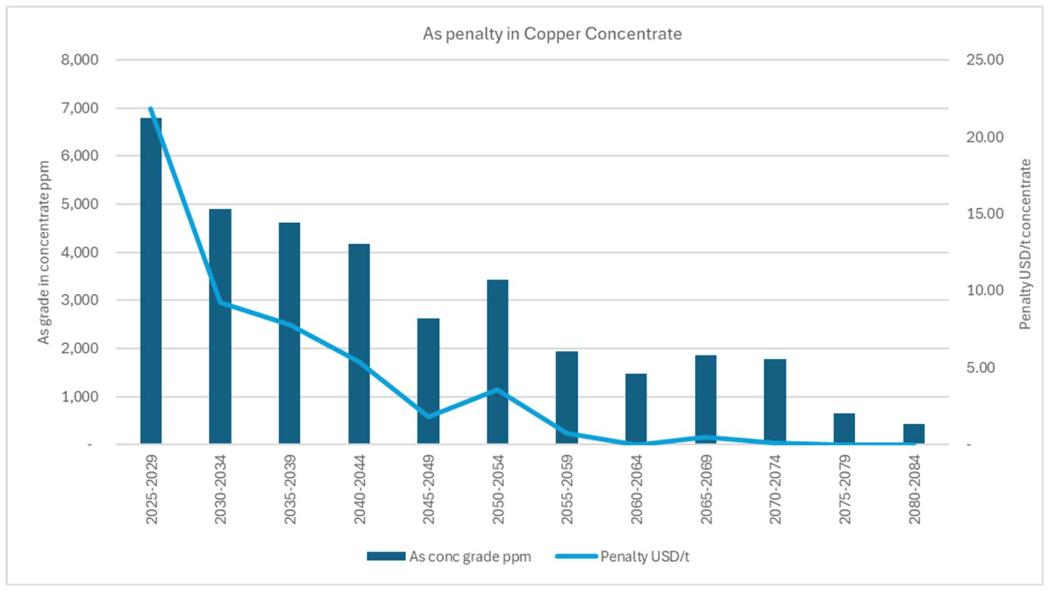

| 19.4.1 | Copper Concentrate | 247 |

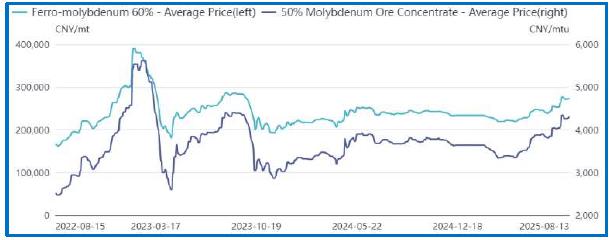

| 19.4.2 | Molybdenum Concentrate | 253 |

| 19.5 | Off-take Agreements | 255 |

| 19.5.1 | Copper Concentrate Agreement | 255 |

| 19.5.2 | Molybdenum Concentrate | 256 |

| 19.6 | LoMp Summary | 256 |

| ITEM 20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 261 |

| 20.1 | Introduction | 261 |

| 20.2 | Environmental and Social Management | 261 |

| 20.2.1 | Status of assessments and studies | 261 |

| 20.2.2 | Management and monitoring | 262 |

| 20.2.3 | Stakeholder engagement | 263 |

| 20.3 | ESG Factors | 263 |

| 20.3.1 | Permitting and compliance | 264 |

| 20.3.2 | Mine waste management | 265 |

| 20.3.3 | Potential water impacts | 266 |

| 20.3.4 | Community relations | 267 |

| 20.3.5 | Decarbonisation | 267 |

| 20.3.6 | Closure planning and provisions | 269 |

| ITEM 21 | CAPITAL AND OPERATING COSTS | 273 |

| 21.1 | Introduction | 273 |

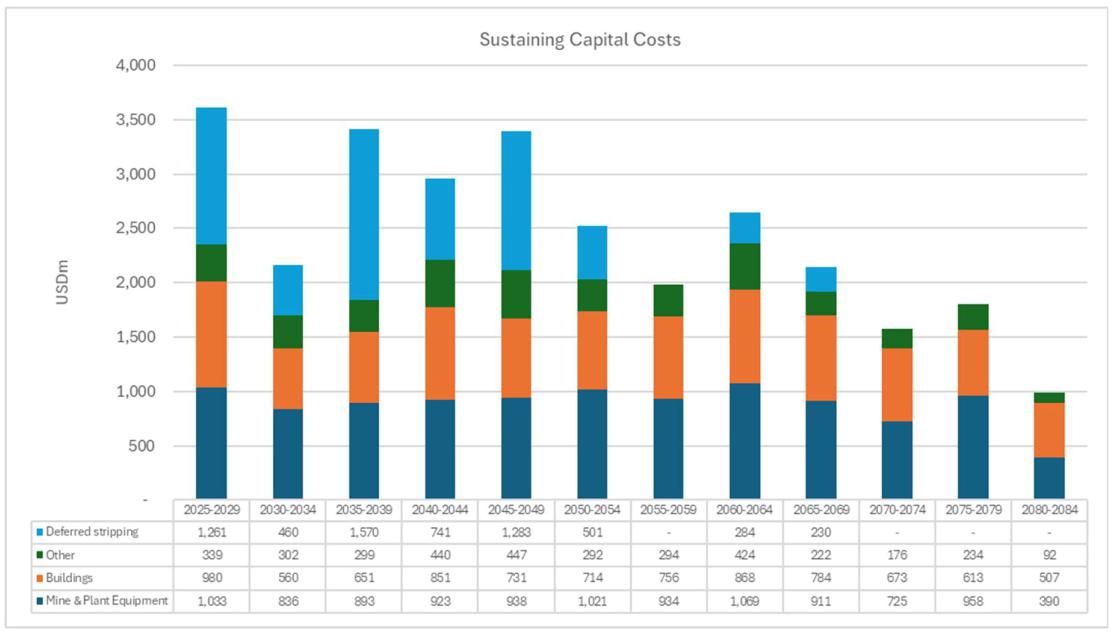

| 21.2 | Capital Costs | 277 |

| 21.2.1 | Project capital | 277 |

| 21.2.2 | Sustaining capital | 277 |

| 21.3 | Operating Costs | 278 |

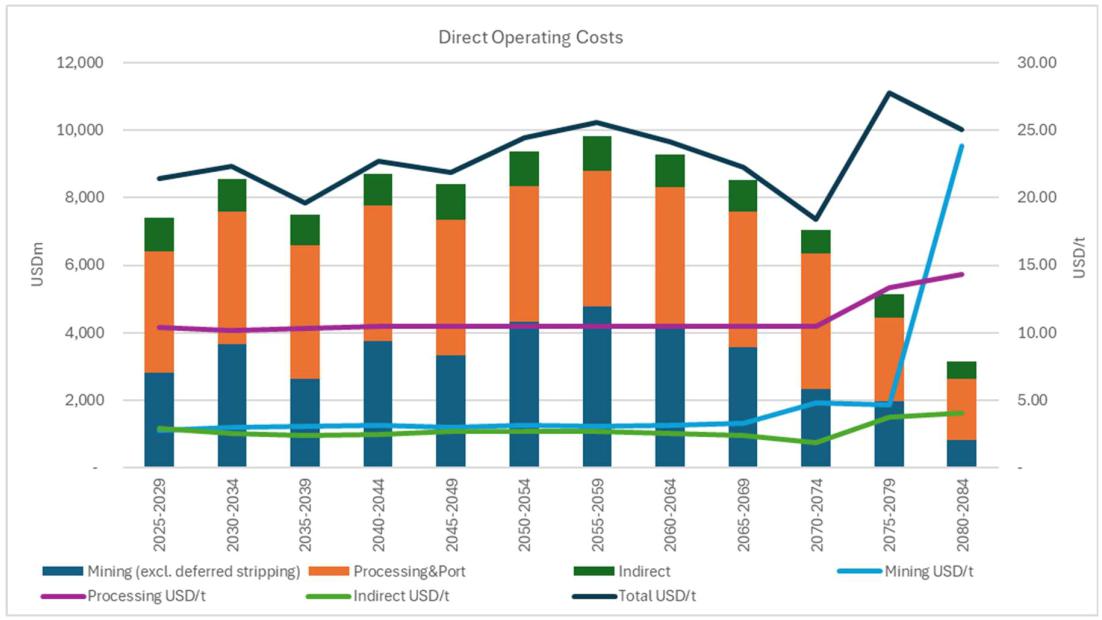

| 21.3.1 | Direct operating costs | 278 |

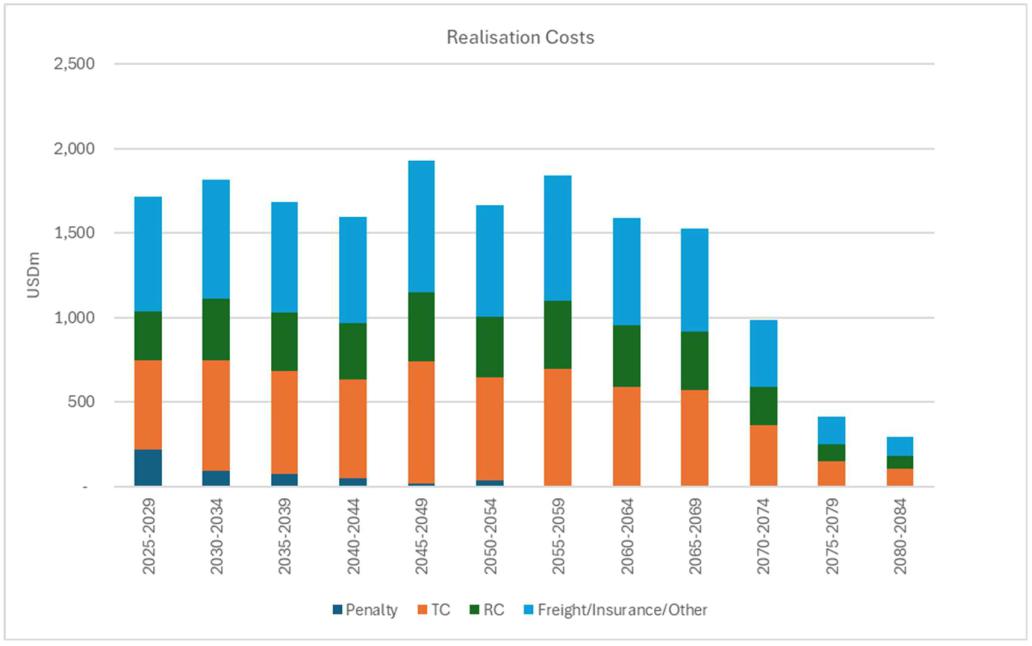

| 21.3.2 | Realisation costs | 279 |

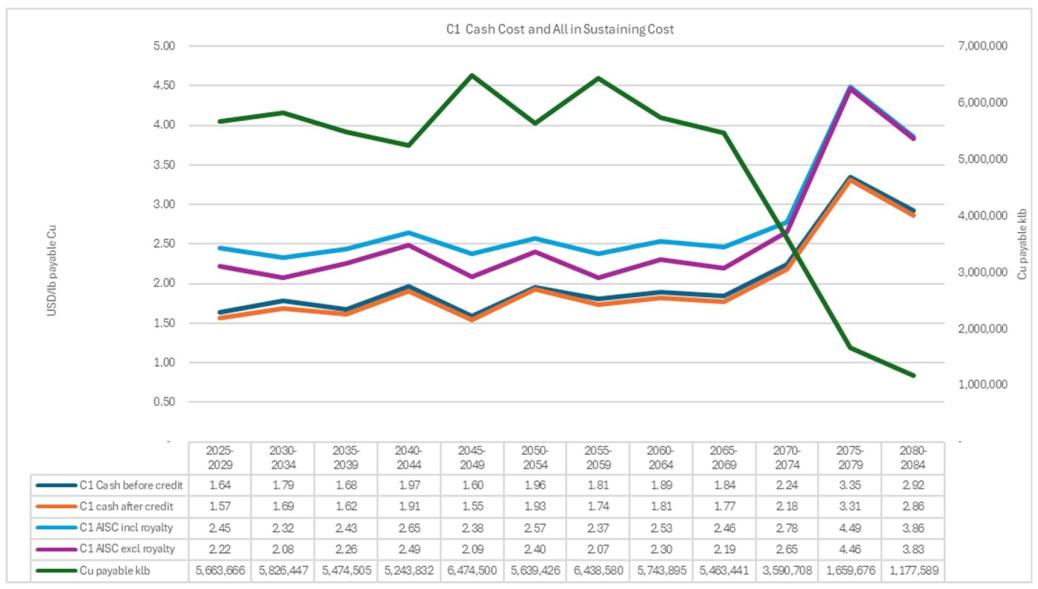

| 21.3.3 | C1 Cash cost and all in sustaining cost | 281 |

| 21.4 | Reserves Reporting Assessment | 281 |

| ITEM 22 | ECONOMIC ANALYSIS | 282 |

| ITEM 23 | ADJACENT PROPERTIES | 282 |

| ITEM 24 | OTHER RELEVANT DATA AND INFORMATION | 282 |

| ITEM 25 | INTERPRETATION AND CONCLUSIONS | 282 |

| ITEM 26 | RECOMMENDATIONS | 291 |

| ITEM 27 | REFERENCES | i |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

List of Tables

| Table 1-1: | Historical production and costs 2019-2024, 2025 (actuals to September) | 4 |

| Table 1-2: | CMDIC Exclusive Mineral Resources for the Rosario, Rosario West and Ujina deposits, and associated stockpiles as at 31 December 2024 | 9 |

| Table 1-3: | CMDIC Mineral Reserves for the Rosario, Rosario West and Ujina deposits, and associated stockpiles as at 31 December 2024 | 13 |

| Table 1-4: | Life of Mine and 2025-2029 production, operating and capital costs (5-year increments) on a 100% attributable basis | 19 |

| Table 2-1: | Qualified Persons | 32 |

| Table 4-1: | Summary of CMDIC mining concessions | 38 |

| Table 4-2: | Concession name and surface area | 39 |

| Table 4-3: | Surface Rights for CMDIC infrastructure and mine lots | 40 |

| Table 4-4: | CMDIC Water Rights | 41 |

| Table 6-1: | CMDIC Mineral Resources 2024, Anglo American Plc (Source: Ore Reserves and Mineral Resources 2024 Report) | 56 |

| Table 6-2: | CMDIC Mineral Reserves 2024, Anglo American Plc (Source: Ore Reserves and Mineral Resources 2024 Report) | 57 |

| Table 6-3: | Historical production and costs 2019-2024, 2025 (actuals to September) | 59 |

| Table 10-1: | Drilling summary for data supporting CMDIC resource models | 76 |

| Table 11-1: | Mechanical preparation procedure | 80 |

| Table 12-1: | Production Reconciliation | 91 |

| Table 13-1: | CMDIC metallurgical domains | 93 |

| Table 14-1: | Final Estimation Domain Matrix for Cu | 111 |

| Table 14-2: | Final Estimation Domain Matrix for Mo | 112 |

| Table 14-3: | Rosario West CuT(%) and MoT(%) Capping and High-Yield threshold values | 115 |

| Table 14-4: | CuT(%) and MoT(%) Capping and High-Yield Threshold values for Ujina. | 116 |

| Table 14-5: | Rosario Cu Estimation Domains raw 6 m CuT Composite Statistics | 117 |

| Table 14-6: | Rosario West Cu Estimation Domains Raw and Capped 2 m CuT Composite Statistics | 118 |

| Table 14-7: | Ujina Cu Estimation Domains Raw and Capped 2 m CuT Composite Statistics | 118 |

| Table 14-8: | Rosario Mo Estimation Domain Raw 6 m MoT Composite Statistics and Rosario West and Ujina in Mo Estimation Domains Raw 2 m MoT Composite Statistics | 119 |

| Table 14-9: | Rosario, Rosario West and Ujina in Density Estimation Domains Density Statistics | 120 |

| Table 14-10: | Rosario and Rosario West Sub-Block Models Block Extents and Dimensions | 122 |

| Table 14-11: | Rosario and Rosario West Regularized Model Block Extents and Dimensions | 122 |

| Table 14-12: | Ujina Block Model Block Extents and Dimensions | 122 |

| Table 14-13: | Global Mean and CoV for Cu Estimates versus Composites | 128 |

| Table 14-14: | CMDIC Exclusive Mineral Resources for the Rosario, Rosario West and Ujina deposits, and associated stockpiles as at 31 December 2024 | 133 |

| Table 15-1: | Rosario Economic Parameters | 143 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| Table 15-2: | Ujina Economic Parameters | 144 |

| Table 15-3: | Summary of Final Pit Results for Rosario and Ujina | 145 |

| Table 15-4: | Mine Design Parameters | 149 |

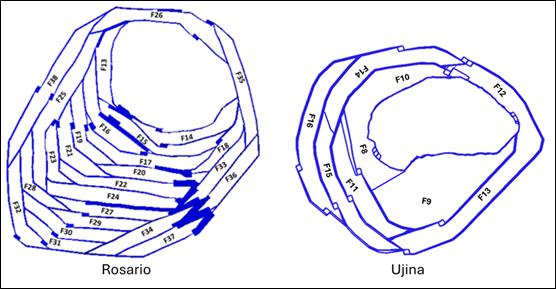

| Table 15-5: | Rosario Phase Inventories | 152 |

| Table 15-6: | Ujina Phase Inventories | 153 |

| Table 15-7: | Rosario and Ujina WRD Capacities | 154 |

| Table 15-8: | CMDIC Mineral Reserves for Rosario and Ujina deposit as at 31 December 2024 | 155 |

| Table 16-1: | Summary of drill hole meters by geotechnical unit (CMDIC, 2024) | 164 |

| Table 16-2: | Rosario main geotechnical units descriptions (WSP Golder, 2024) | 165 |

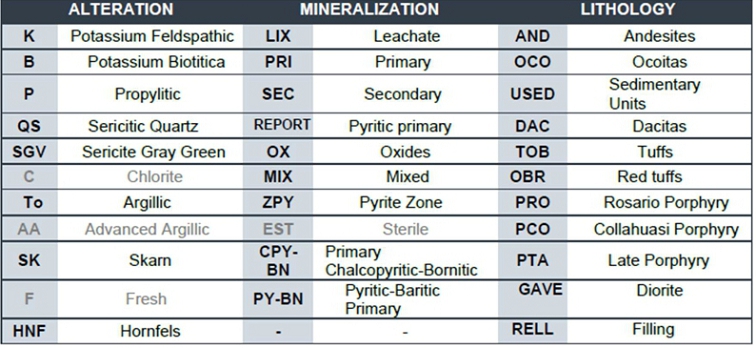

| Table 16-3: | Rosario Alteration Codes, Mineral Zones and Lithology nomenclature (WSP Golder, 2024) | 165 |

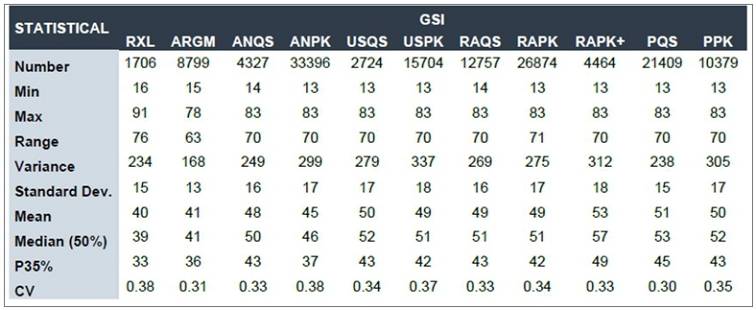

| Table 16-4: | Rosario GU GSI statistics (WSP Golder, 2024) | 169 |

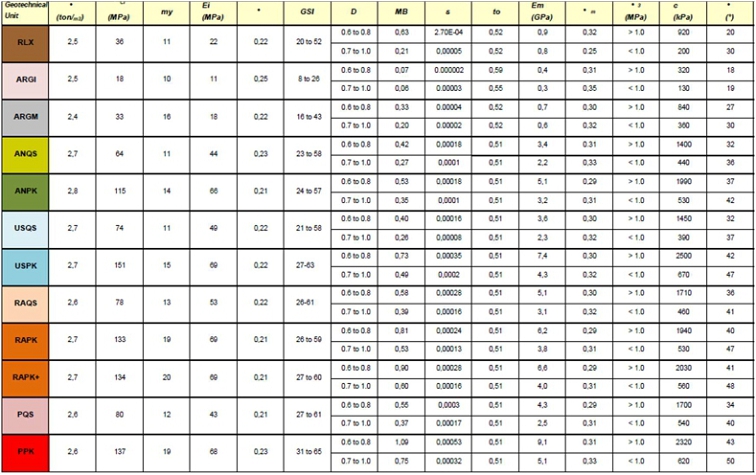

| Table 16-5: | Rosario GU geomechanical properties (Karzulovic & Associates, 2020) | 169 |

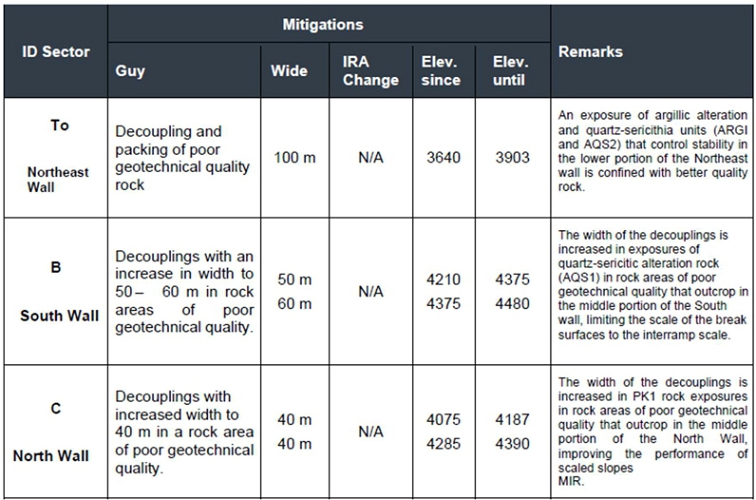

| Table 16-6: | Rosario LoM 2024 stability analysis mitigation proposal measures (WSP Golder, 2024) | 176 |

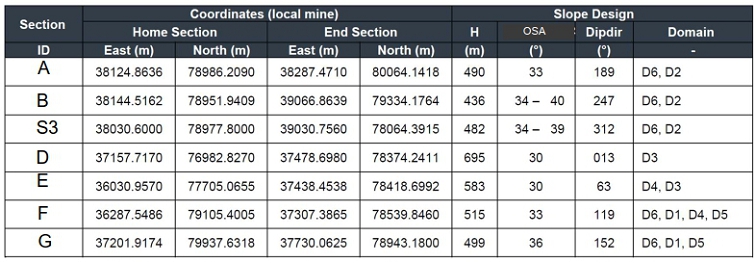

| Table 16-7: | Ujina geotechnical cross section summary (WSP Golder, 2024) | 179 |

| Table 16-8: | Summary of LoMP Totals for Rosario and Ujina | 184 |

| Table 16-9: | Effective Time Applied | 187 |

| Table 16-10: | Summary of Main Haulage Inputs | 188 |

| Table 16-11: | Assumed Useful Life per Equipment | 190 |

| Table 16-12: | LoM Support Equipment Requirements | 193 |

| Table 16-13: | LoM Mining Schedule | 199 |

| Table 16-14: | LoM Processing Schedule | 200 |

| Table 17-1: | Historical Processing Statistics | 205 |

| Table 18-1: | Predicted make-up water demand (L/s) according to GoldSim water balance, excluding recirculation from TSF and capture wells (Source: Asesorías en Recursos Hídricos, 2025) | 226 |

| Table 18-2: | Licensed abstractions from key water supply sources in L/s (CMDIC Lombook, 2024) | 228 |

| Table 18-3: | Predicted water demand and supply capacity aligned to the 210ktpd production scenario (adapted from CMDIC Lombook, 2024) | 228 |

| Table 18-4: | Summary of main water supply sources for key mine plan scenarios | 230 |

| Table 18-5: | Estimated increase in power demand (Port and Mine) | 231 |

| Table 18-6: | Project No. P333 / PG3A Project Progress to the end of August 2025 (August Monthly Exhibit, 2025) | 237 |

| Table 18-7: | Project No. PG210 Balance Project Progress to the end of August 2025 (August Monthly Exhibit, 2025) | 238 |

| Table 19-1: | Historical Concentrate Sales (Physicals): 2020 through 2025 Q3 YTD | 241 |

| Table 19-2: | Historical Concentrate Sales (Sales Revenue and Concentrate Charges): 2020 through 2025 Q3 YTD | 243 |

| Table 19-3: | Copper Concentrate Benchmark Quality Assessment | 250 |

| Table 19-4: | Typical copper concentrate physical recovery calculations for a (28%Cu concentrate grade) | 252 |

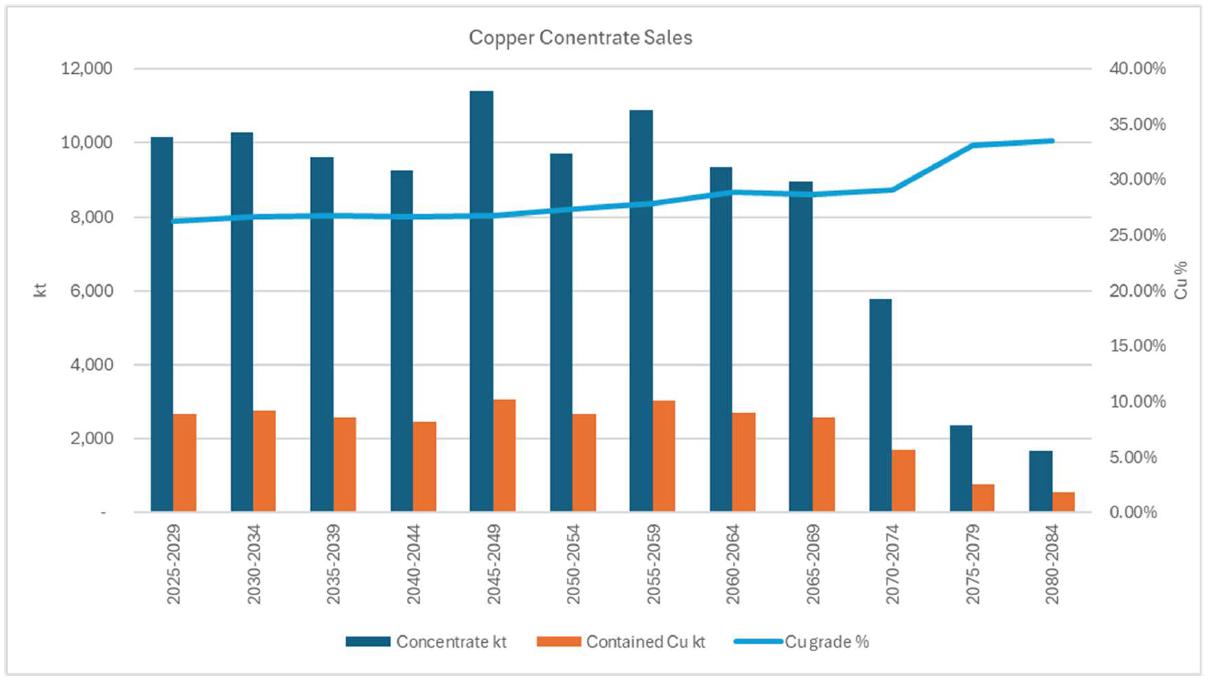

| Table 19-5: | LoMp Concentrate Sales: 2025 through 2059 | 258 |

| Table 19-6: | LoMp Concentrate Sales: 2060 through 2094 | 259 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| Table 21-1: | Life of Mine production, operating and capital costs (5-year increments) | 274 |

| Table 21-2: | TC/RC, Freight | 279 |

List of Figures

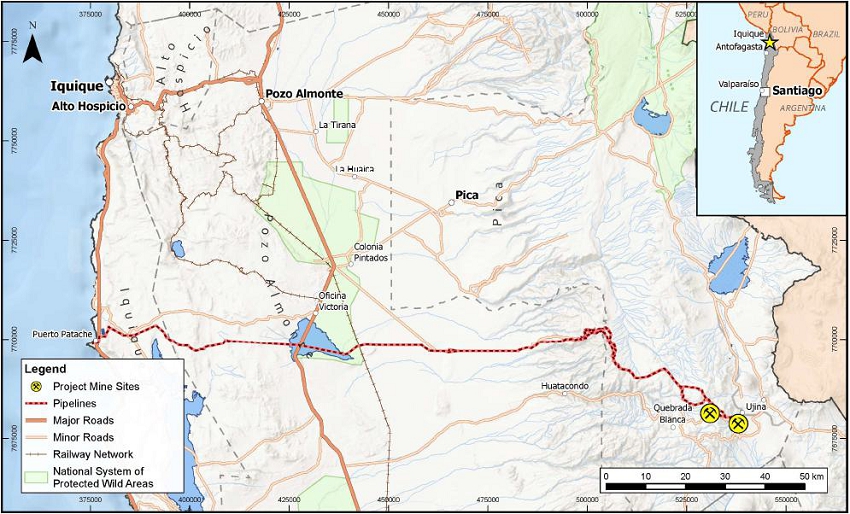

| Figure 4-1: | CMDIC location map (SRK, 2025) | 36 |

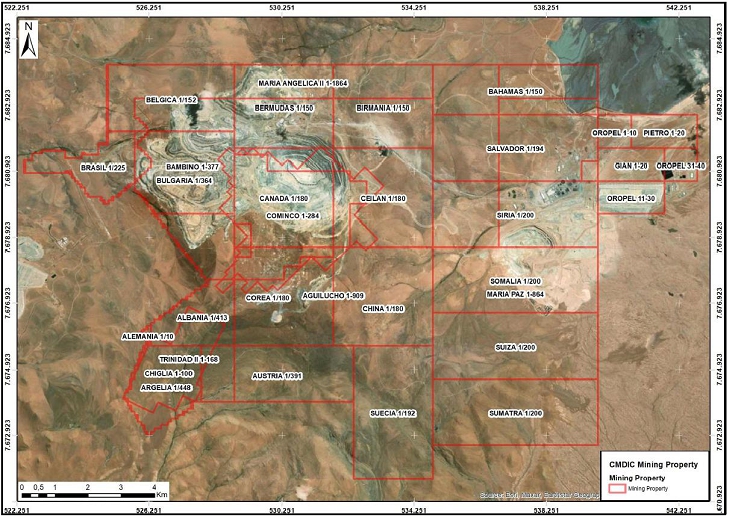

| Figure 4-2: | CMDIC mining concessions (SRK, 2025) | 40 |

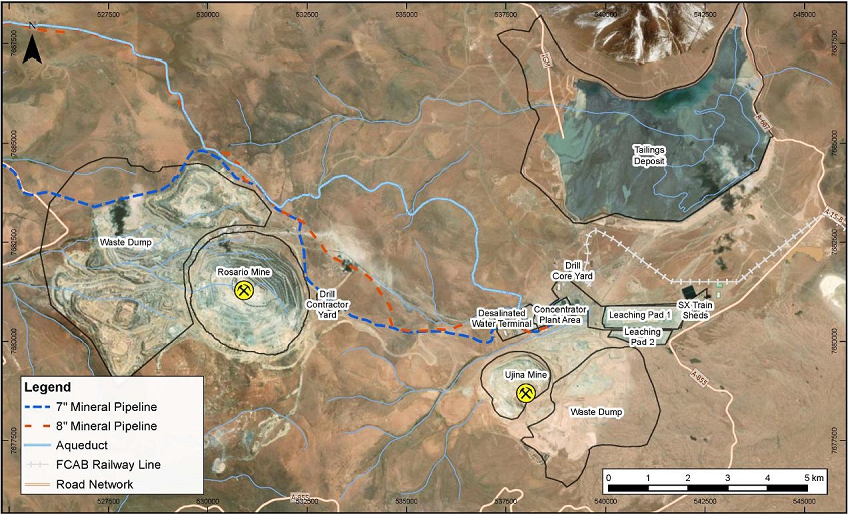

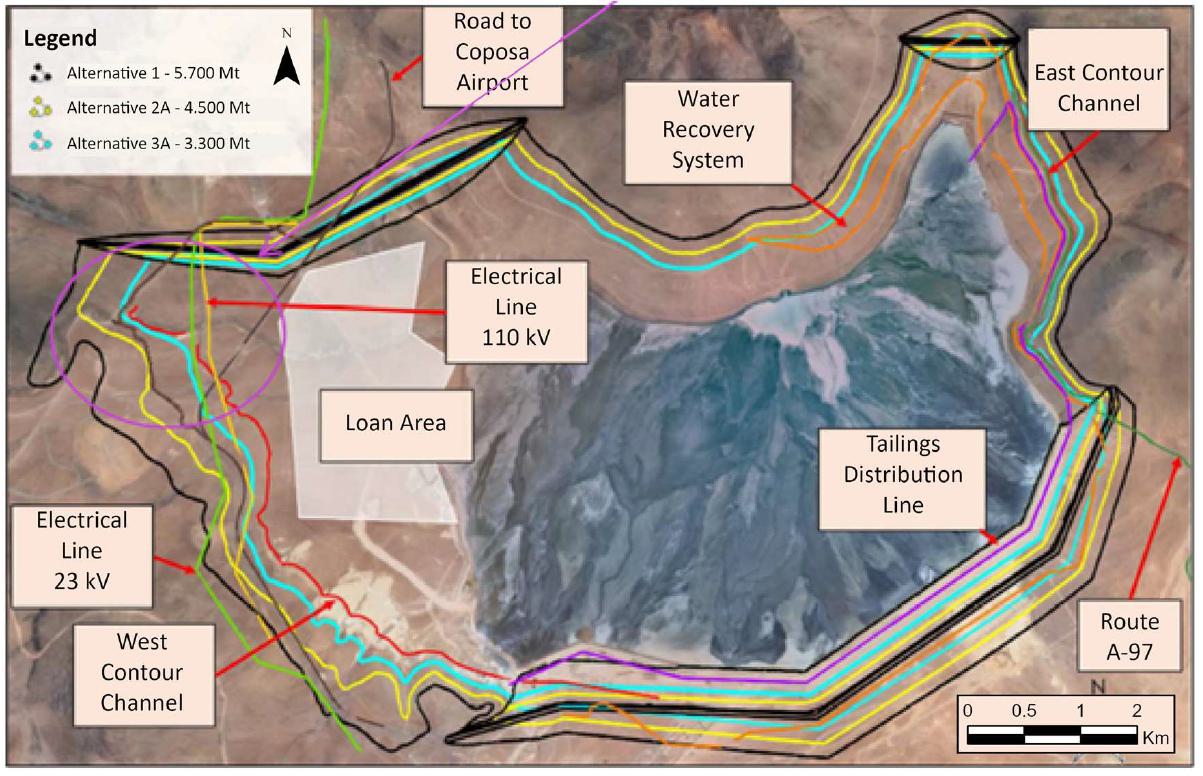

| Figure 4-3: | CMDIC mining operation layout (SRK, 2025) | 42 |

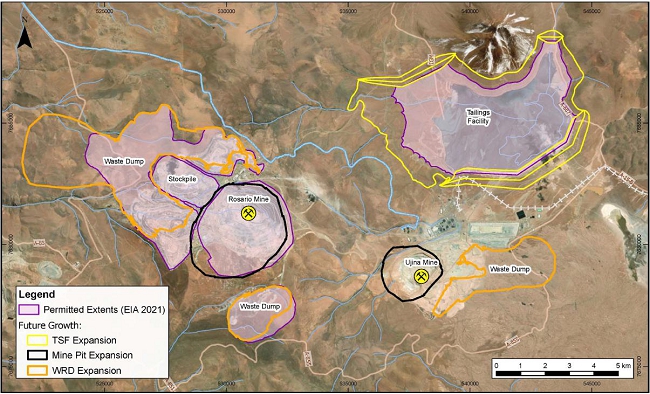

| Figure 4-4: | Currently permitted footprint (purple) and unpermitted expanded footprint for future ACP Growth Project (SRK, 2025) | 46 |

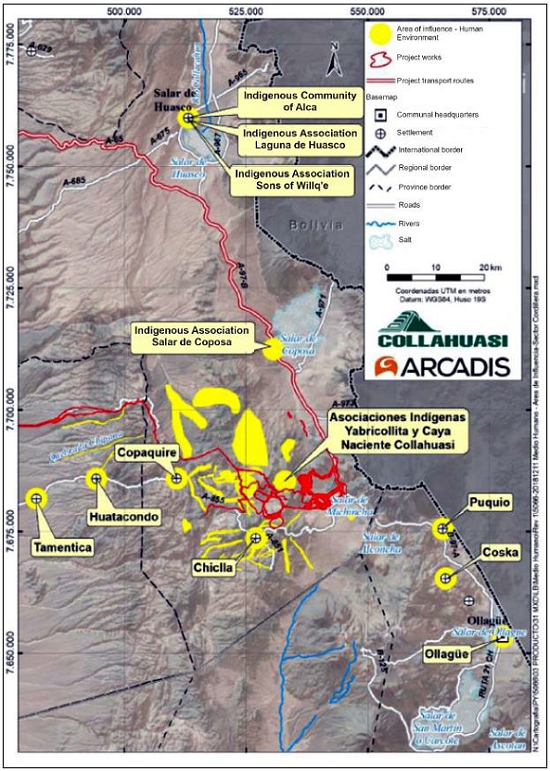

| Figure 5-1: | Communities and land use around mine site (Arcadis, 2018) | 48 |

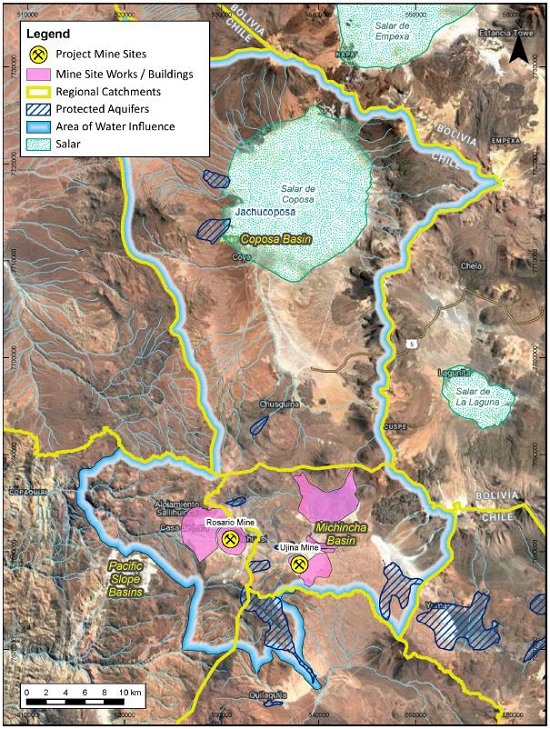

| Figure 5-2: | Local hydrological features (SRK, 2025) | 52 |

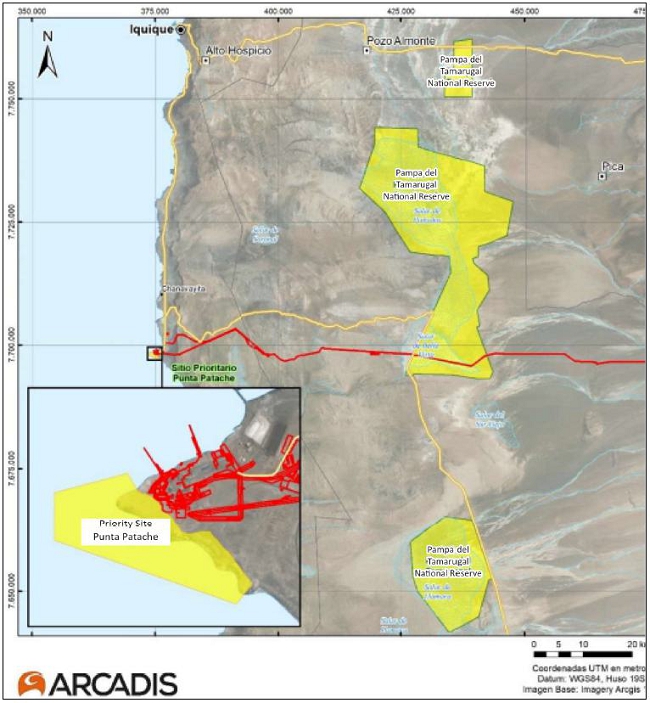

| Figure 5-3: | Protected areas (pipeline and port) (Arcadis, 2018) | 54 |

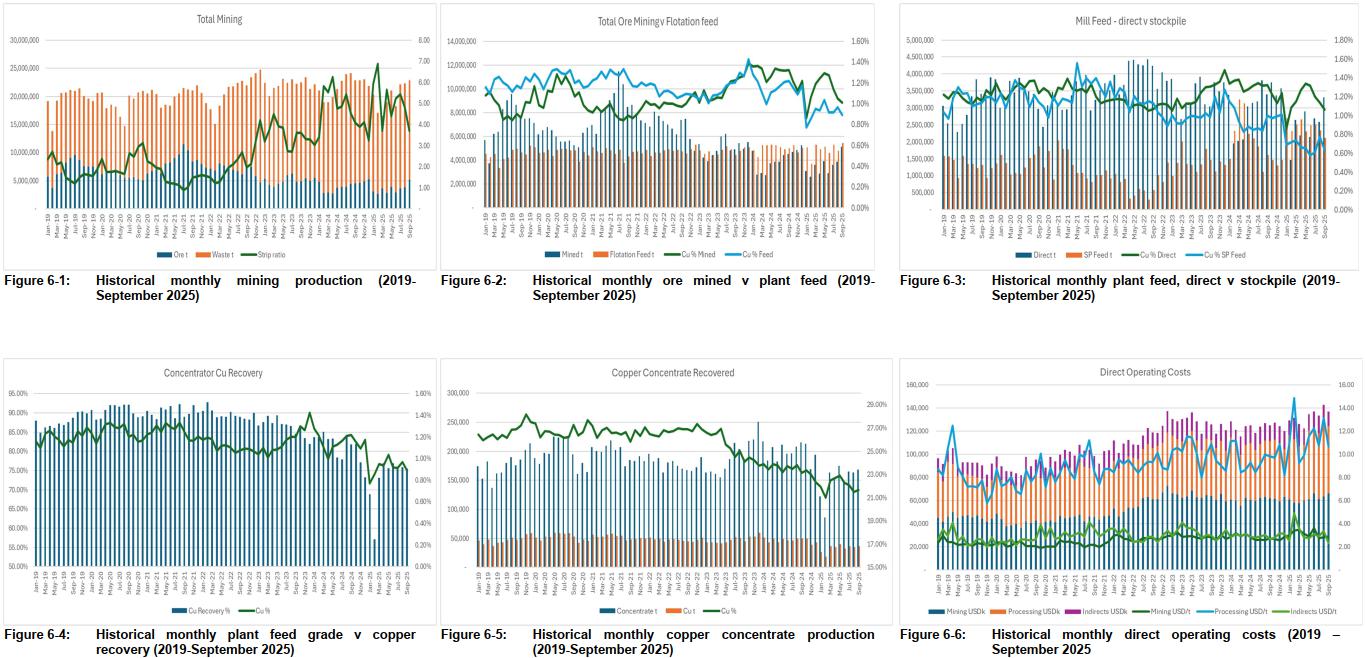

| Figure 6-1: | Historical monthly mining production (2019-September 2025) | 61 |

| Figure 6-2: | Historical monthly ore mined v plant feed (2019-September 2025) | 61 |

| Figure 6-3: | Historical monthly plant feed, direct v stockpile (2019-September 2025) | 61 |

| Figure 6-4: | Historical monthly plant feed grade v copper recovery (2019-September 2025) | 61 |

| Figure 6-5: | Historical monthly copper concentrate production (2019-September 2025) | 61 |

| Figure 6-6: | Historical monthly direct operating costs (2019 – September 2025 | 61 |

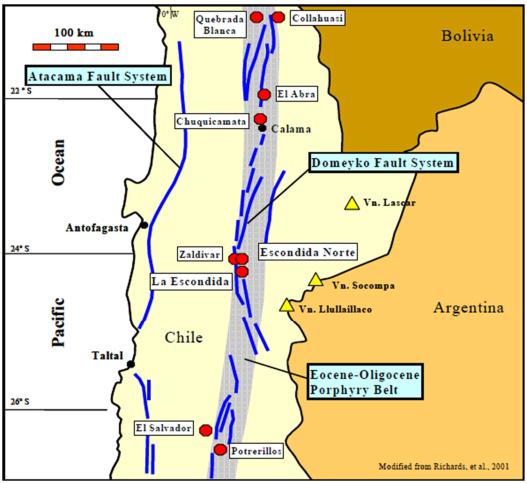

| Figure 7-1: | Regional schematic showing Eocene-Oligocene porphyry copper belt (Xstrata, 2012) | 62 |

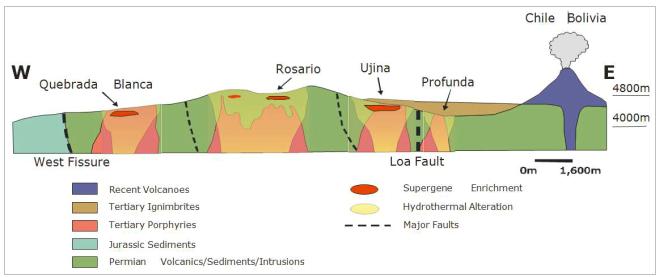

| Figure 7-2: | Regional schematic W-E geological section of CMDIC district showing distribution major mineralised systems (Xstrata, 2012) | 63 |

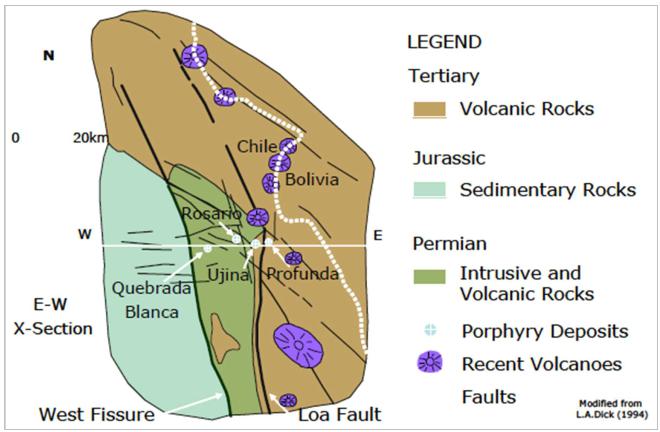

| Figure 7-3: | Collahuasi area district schematic geology (Xstrata, 2012) | 64 |

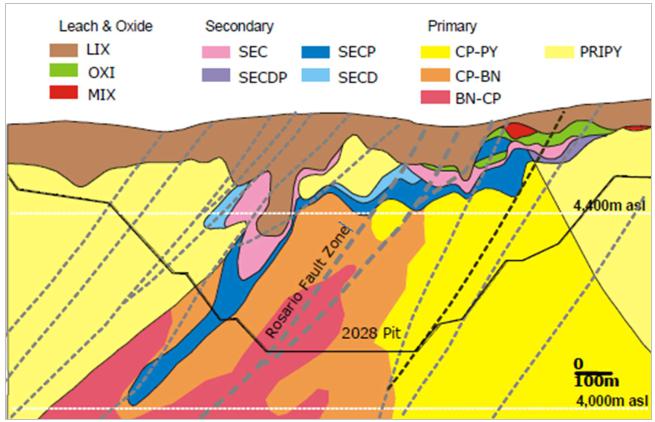

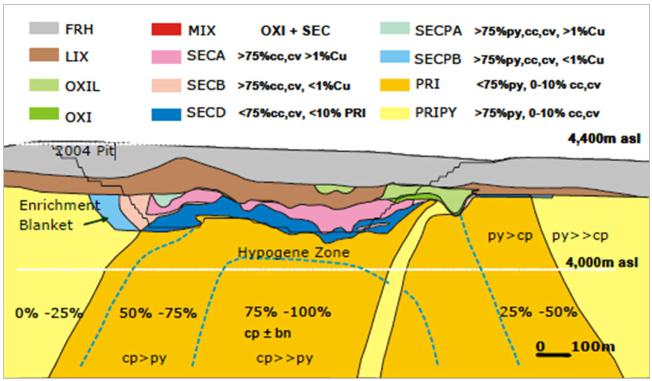

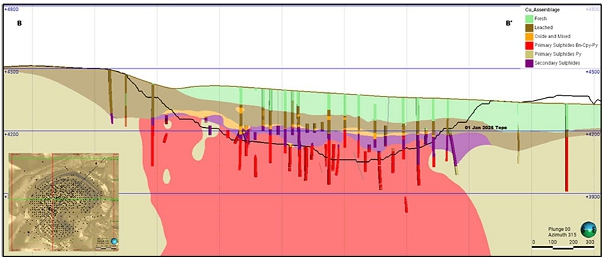

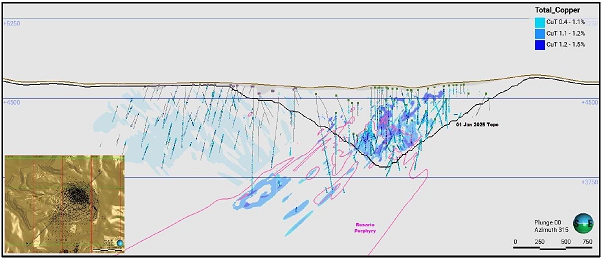

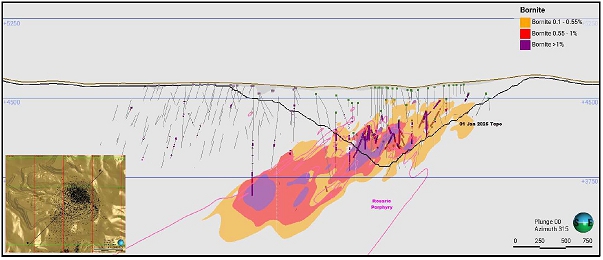

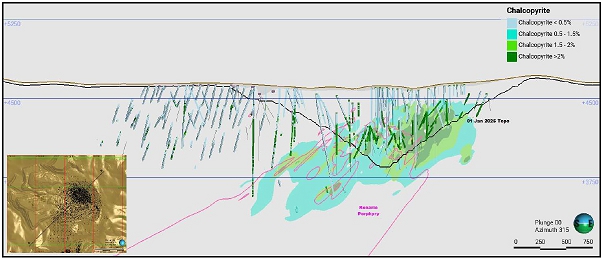

| Figure 7-4: | Typical mineralisation cross section of Rosario at 20NE, looking to NW (Xstrata, 2012) | 66 |

| Figure 7-5: | Typical mineralisation cross section of Ujina at 128NE, looking to NE (Xstrata, 2012) | 67 |

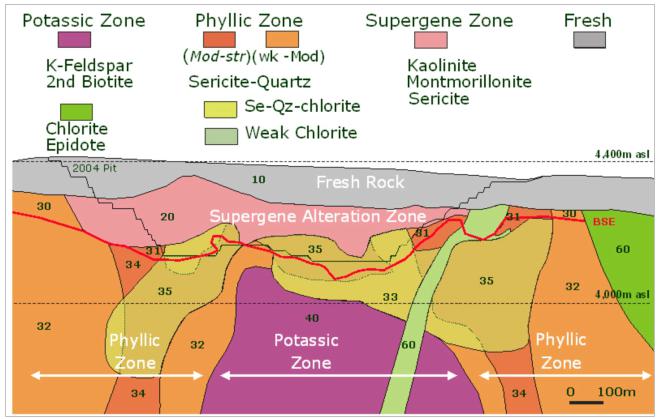

| Figure 7-6: | Typical alteration cross section of Rosario at 20NE, looking to NW (Xstrata,2012, after CMDIC internal presentation) | 68 |

| Figure 7-7: | Typical alteration cross section of Ujina at 128NE, looking to NE (Xstrata, 2012) | 68 |

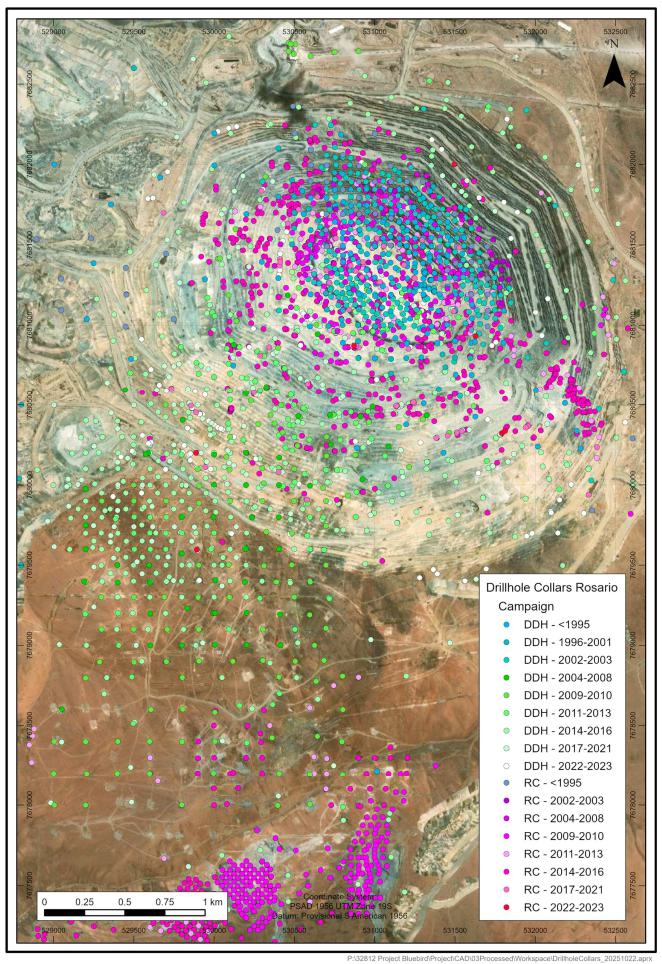

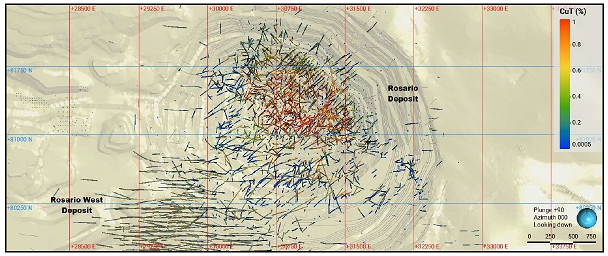

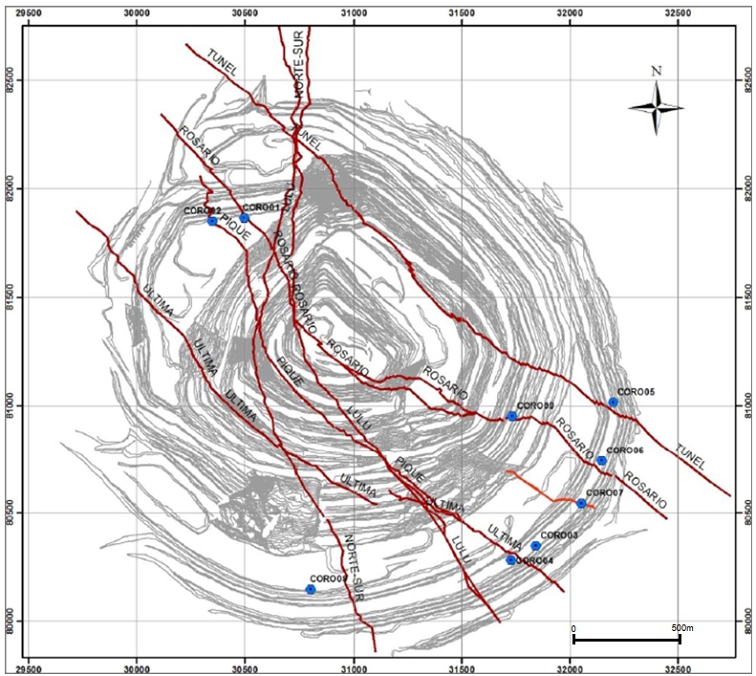

| Figure 10-1: | Rosario and Rosario West Drillhole Collars used for 2024 MRE (SRK, 2025) | 72 |

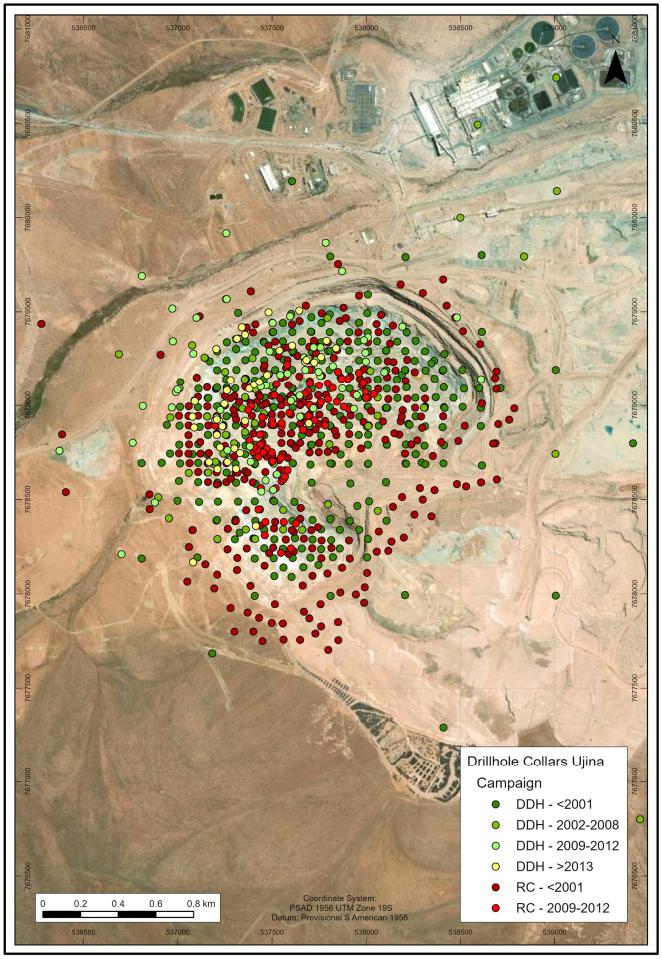

| Figure 10-2: | Ujina Drillhole Collars used for 2012 MRE and more recent collars (SRK, 2025) | 73 |

| Figure 11-1: | Pozo Almonte Core Logging Facility (October 2025) | 79 |

| Figure 12-1: | Core Storage Racks (October 2025) | 85 |

| Figure 12-2: | Drillcore for inspection at mine site (October 2025) | 86 |

| Figure 12-3: | Drill rig on DDH 1155 (October 2025) | 87 |

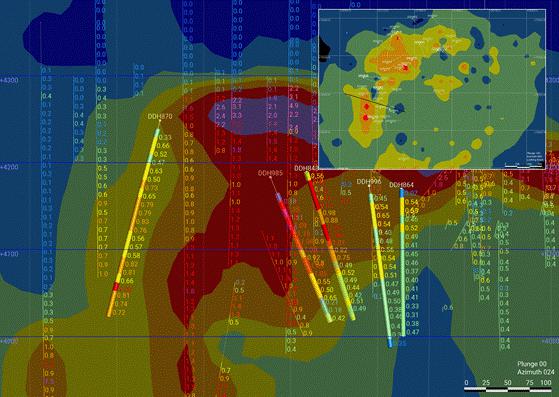

| Figure 12-4: | Ujina new drilling (thick trace lines) vs old (thin trace lines) (SRK, 2025) | 89 |

| Figure 13-1: | Geomet domain illustration (SRK, 2025) | 94 |

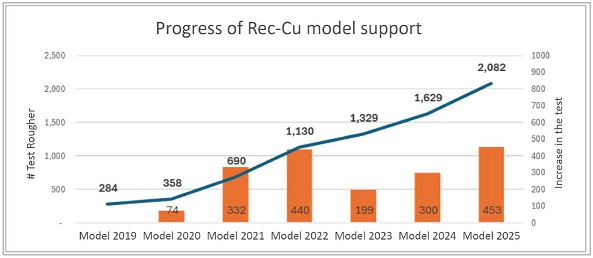

| Figure 13-2: | Geomet model database growth: rougher tests (CMDIC, 2025) | 95 |

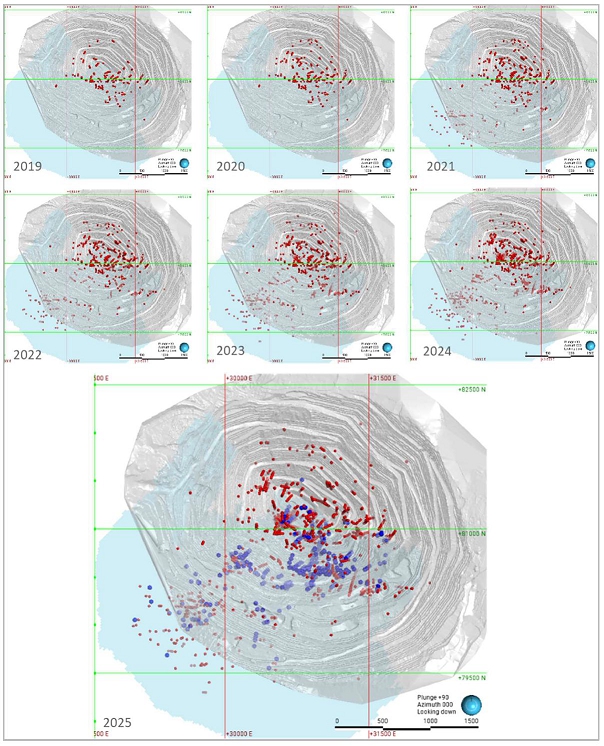

| Figure 13-3: | Geomet model database growth: sample locations (CMDIC, 2025) | 96 |

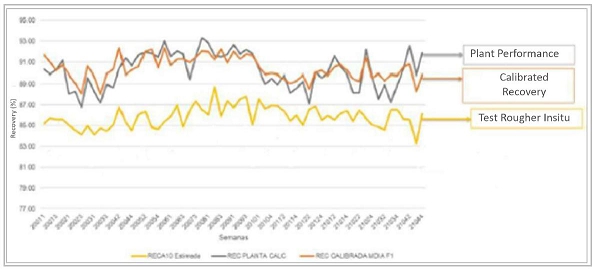

| Figure 13-4: | Comparison between model and plant: 2020-24 Cu recovery (CMDIC, 2024) | 98 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

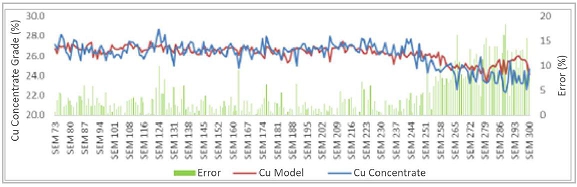

| Figure 13-5: | Comparison between model and plant: 2020-24 Cu concentrate grade (CMDIC, 2024) | 98 |

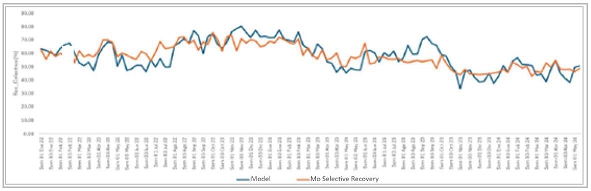

| Figure 13-6: | Comparison between model and plant: 2020-24 Mo selective recovery (CMDIC, 2024) | 98 |

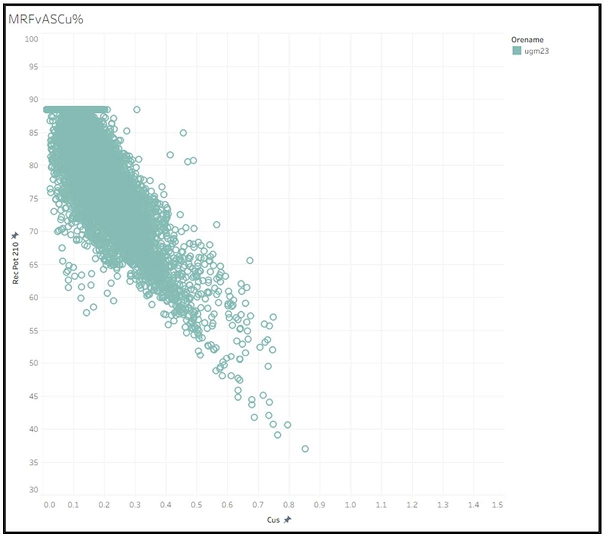

| Figure 13-7: | UGM 23 Cu Soluble versus Recovery for Measured and Indicated material with Mineral Reserve pit (SRK, 2025) | 99 |

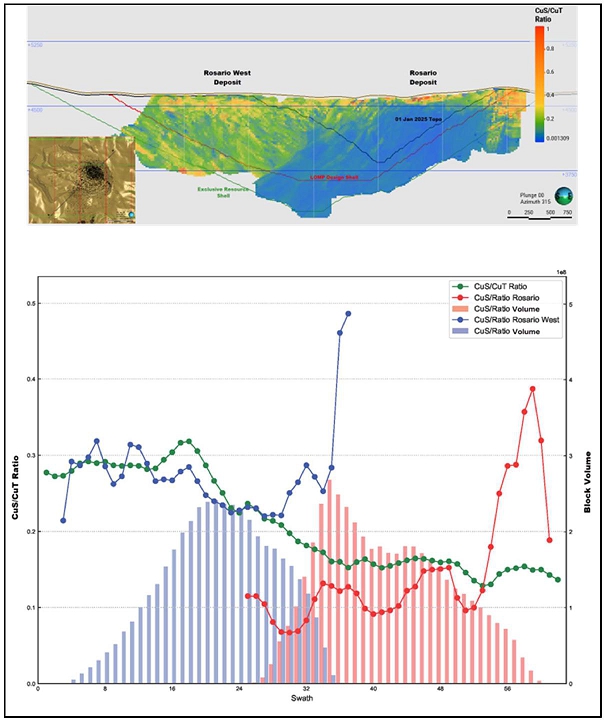

| Figure 13-8: | CuSol/CuT distribution (SRK, 2025) | 100 |

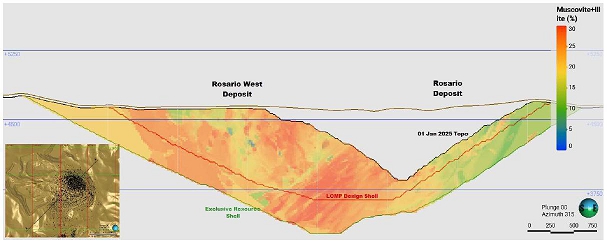

| Figure 13-9: | Cross Section illustrating Muscovite+Illite distribution within the Rosario and Rosario West domains (SRK, 2025) | 101 |

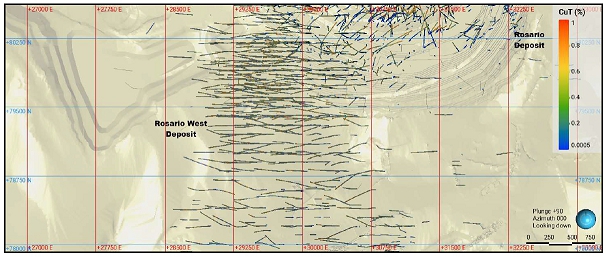

| Figure 14-1: | Rosario Deposit plan view of available CuT (%) drilling data (SRK, 2025) | 103 |

| Figure 14-2: | Rosario West Deposit plan view of available CuT (%) drilling data (SRK, 2025) | 103 |

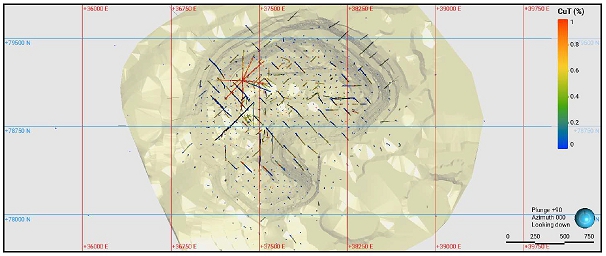

| Figure 14-3: | Ujina Deposit plan view of available CuT (%) drilling data (SRK, 2025) | 104 |

| Figure 14-4: | Rosario and Rosario West Structural Model plan view at 4320 m elevation; overlaid blast hole samples coloured by CuT% grade (SRK, 2025) | 105 |

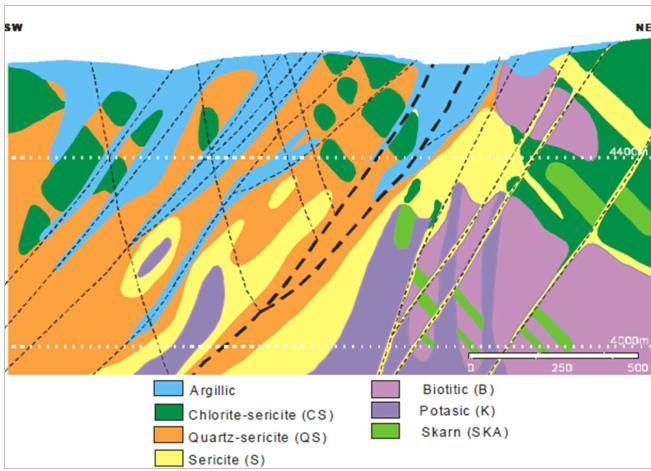

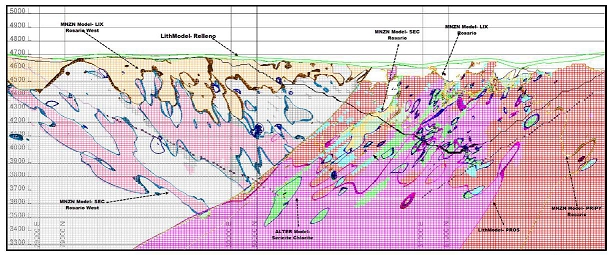

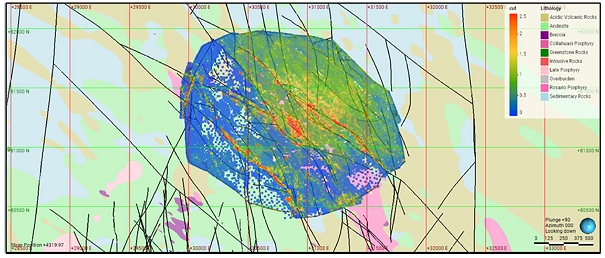

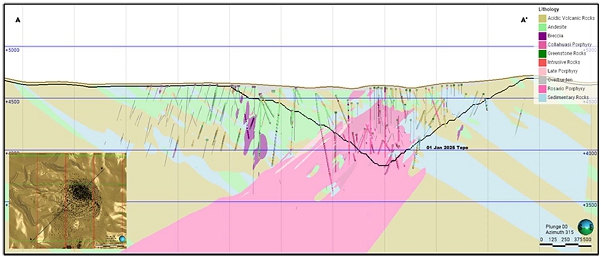

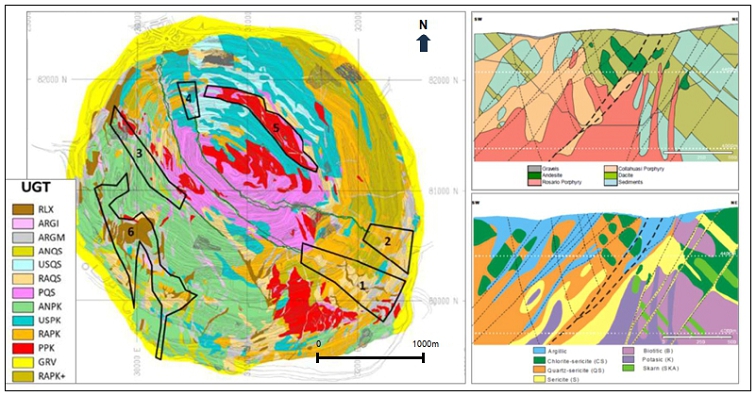

| Figure 14-5: | Rosario and Rosario West Lithological Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 105 |

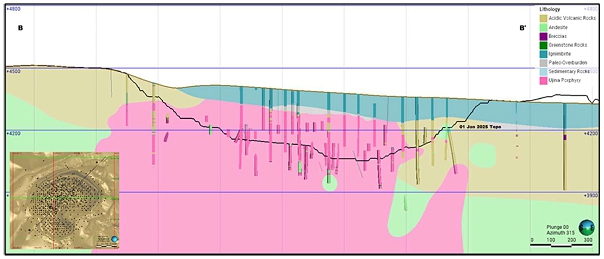

| Figure 14-6: | Ujina Lithological Model cross-section looking NW; Section B-B’ location inset left (SRK, 2025) | 106 |

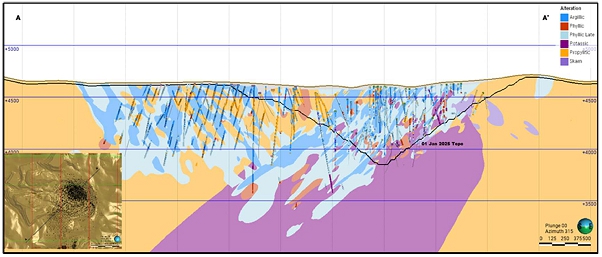

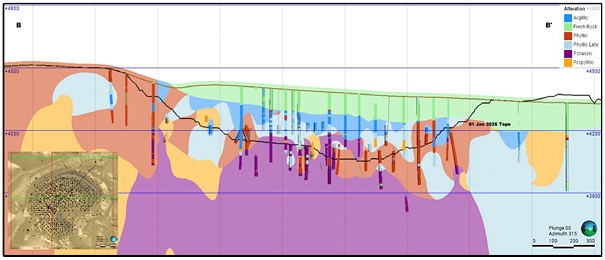

| Figure 14-7: | Rosario and Rosario West Alteration Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 106 |

| Figure 14-8: | Ujina Alteration Model cross-section looking NW; Section B-B’ location inset left (SRK, 2025) | 107 |

| Figure 14-9: | Rosario and Rosario West Cu Mineralogy Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 108 |

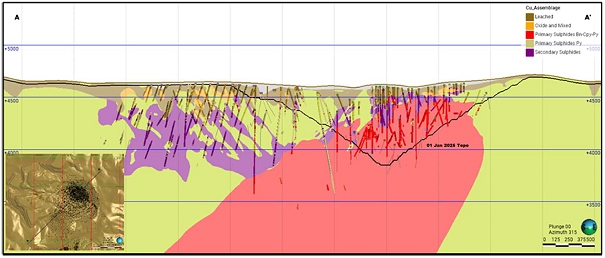

| Figure 14-10: | Ujina Cu Mineralogy Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 108 |

| Figure 14-11: | Rosario and Rosario West Cu Grade Shell Model cross-section looking NW; Section A-A’ location inset left | 109 |

| Figure 14-12: | Rosario Bornite Grade Shell Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 109 |

| Figure 14-13: | Rosario Chalcopyrite Grade Shell Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 109 |

| Figure 14-14: | Rosario Mo Grade Shell Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 110 |

| Figure 14-15: | Rosario and Rosario West As Grade Shell Model cross-section looking NW; Section A-A’ location inset left (SRK, 2025) | 110 |

| Figure 14-16: | Rosario and Rosario West (left) and Ujina (right) histogram of sample length (SRK, 2025) | 113 |

| Figure 14-17: | Cumulative log-probability plots of CuT in raw samples (black) and 6 m Composites (red) for Secondary Zone samples (left) and Primary Zone samples (right) (SRK, 2025) | 113 |

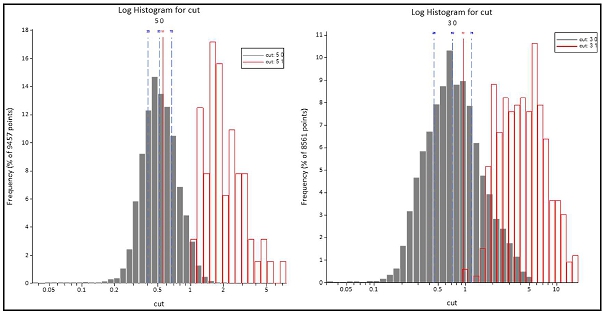

| Figure 14-18: | Rosario histograms of background CuT (grey) composites and vein CuT (red) in UGCUT domain 50 (Primary) and 30 (Secondary) (SRK, 2025) | 114 |

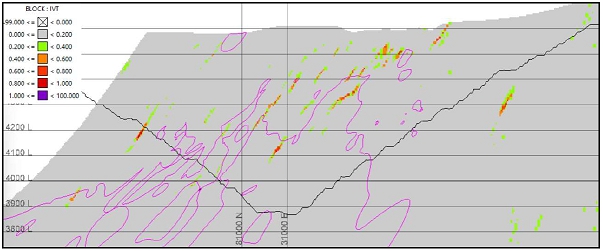

| Figure 14-19: | Rosario model Indicator (IVT) values cross-section looking NW (SRK, 2025) | 114 |

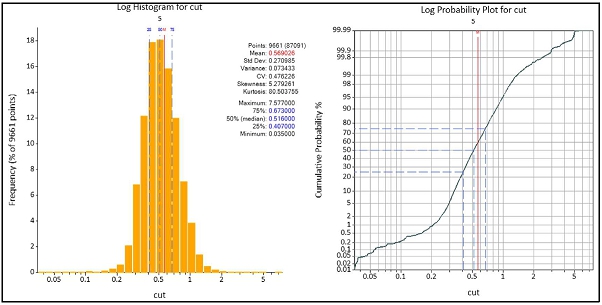

| Figure 14-20: | Rosario West log-histogram and Cumulative probability plots of CuT for UGCUT 13; | 115 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

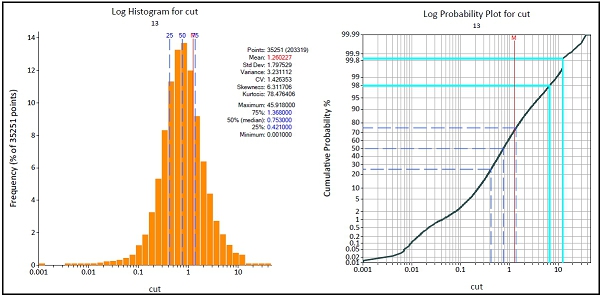

| Figure 14-21: | Rosario Cu Estimation domain 3 histogram and cumulative log-probability plot of CuT | 117 |

| Figure 14-22: | Rosario Cu Estimation domain 5 histogram and cumulative log-probability plot of CuT | 117 |

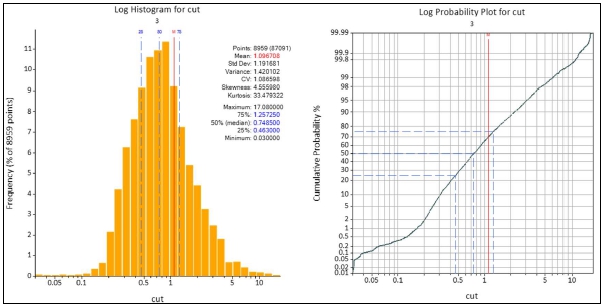

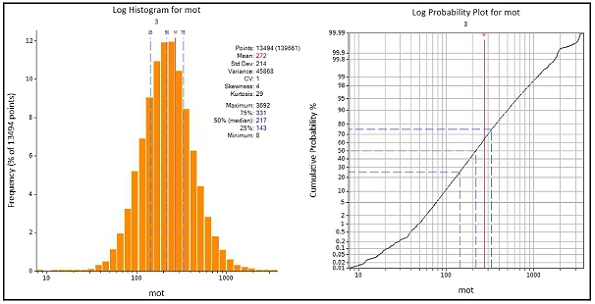

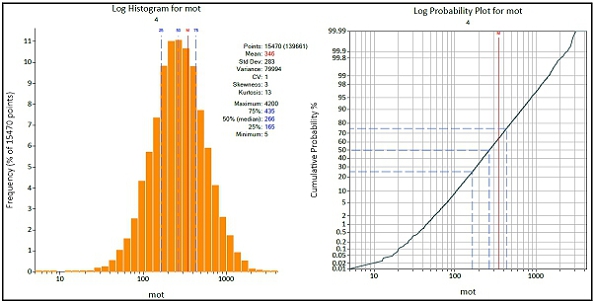

| Figure 14-23: | Rosario Mo Estimation domain 3 histogram and cumulative log-probability plot of MoT | 119 |

| Figure 14-24: | Rosario Mo Estimation domain 4 histogram and cumulative log-probability plot of MoT | 119 |

| Figure 14-25: | Rosario and Rosario West Block Model cross-section looking NW coloured by estimation domain with search ellipse orientations shown in pink (Rosario) and blue (Rosario West); Section A-A’ location inset left (SRK, 2025) | 123 |

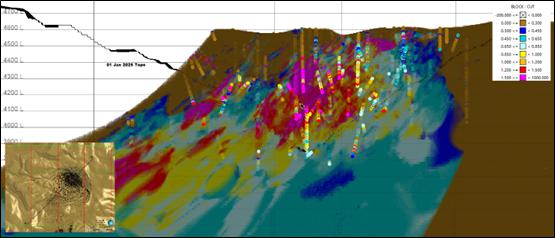

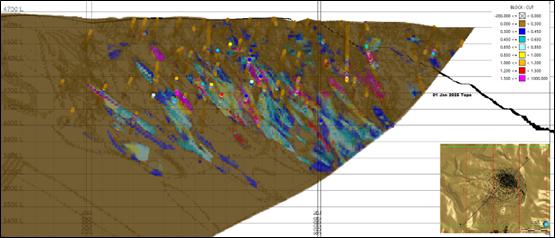

| Figure 14-26: | Rosario Block Model cross-section looking NW, composites coloured by CuT; Section A-A’ location inset left (SRK, 2025) | 124 |

| Figure 14-27: | Rosario West Block Mode cross-section looking NW l, composites coloured by CuT; Section A-A’ location inset right (SRK, 2025) | 125 |

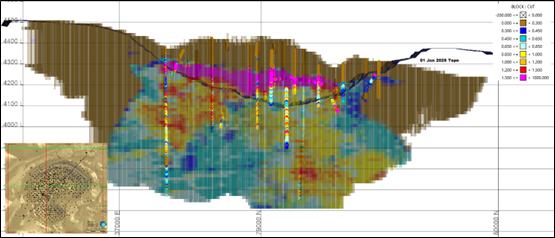

| Figure 14-28: | Ujina Block Model cross-section looking NW, composites coloured by CuT; Section A-A’ location inset left (SRK, 2025) | 125 |

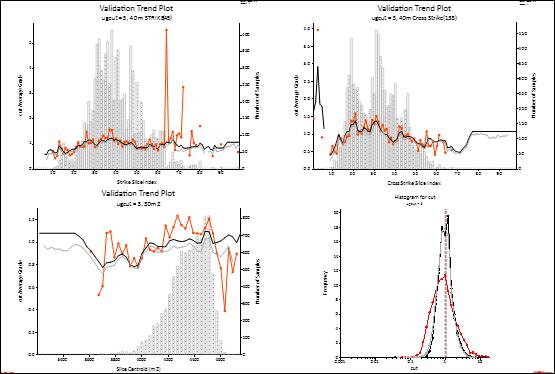

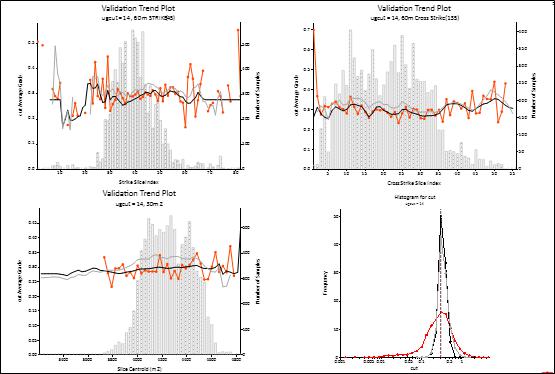

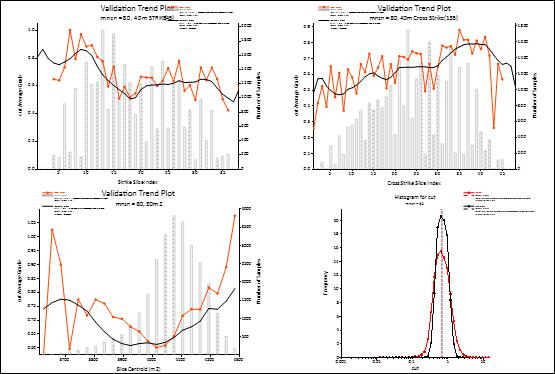

| Figure 14-29: | Rosario Domain 3 Swath Plots at 45 and 135 strike and by elevation; log-histogram of Cu composites (orange), sub-block estimates (black), regularized blocks (grey) | 126 |

| Figure 14-30: | Rosario West Domain 14Swath Plots at 45 and 135 strike, and by elevation; log-histogram of Cu composites (orange), sub-block estimates (black), regularized blocks (grey) | 126 |

| Figure 14-31: | Ujina Domain 80 (Primary) Swath Plots at 45 and 135 strike, and by elevation; log-histogram of Cu composites (orange), block estimates (black) | 127 |

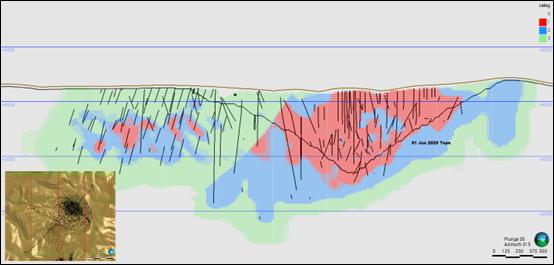

| Figure 14-32: | Rosario and Rosario West Block model cross-section looking NW coloured by classification; Section A-A’ location inset left (SRK, 2025) | 130 |

| Figure 14-33: | Ujina Block model cross-section looking NW coloured by classification; Section A-A’ location inset left (SRK, 2025) | 130 |

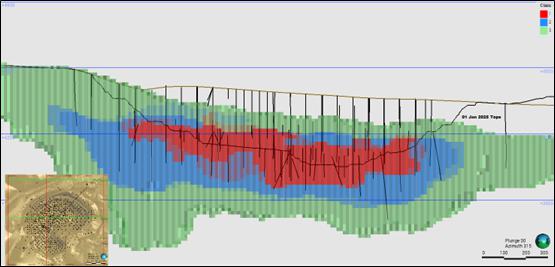

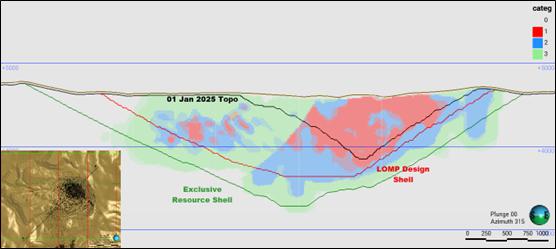

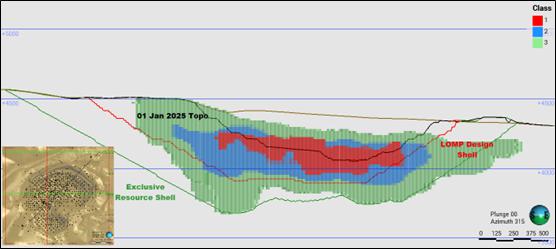

| Figure 14-34: | Rosario and Rosario West Block Model cross-section looking NW coloured by Mineral Resource category with LoMP Design shell and Exclusive Resource Reporting Shell; Section A-A’ location inset left (SRK, 2025) | 131 |

| Figure 14-35: | Ujina Block Model cross-section looking NW coloured by Mineral Resource category with LOMP Design shell and Exclusive Resource Reporting Shell; Section A-A’ location inset left (SRK, 2025) | 132 |

| Figure 14-36: | Plan View of the Rosario Mineralized Stockpiles (Green) with stockpile drill sampling locations in black. (SRK, 2025) | 132 |

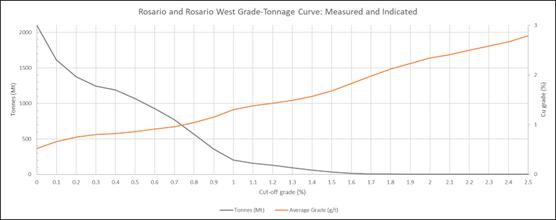

| Figure 14-37: | Rosario and Rosario West Grade Tonnage Curve for Measured & Indicated category material | 136 |

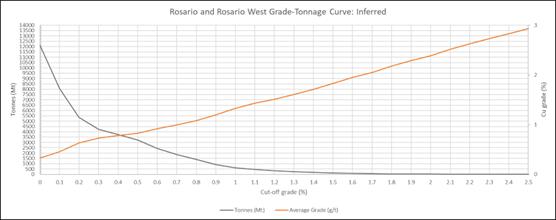

| Figure 14-38: | Rosario and Rosario West Grade Tonnage Curve for Inferred category material | 137 |

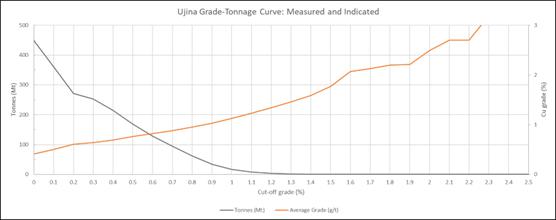

| Figure 14-39: | Ujina Grade Tonnage Curve for Measured & Indicated category material | 137 |

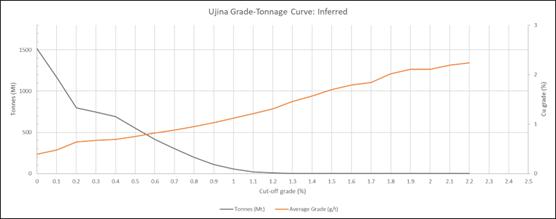

| Figure 14-40: | Ujina Grade Tonnage Curve for Inferred category material | 137 |

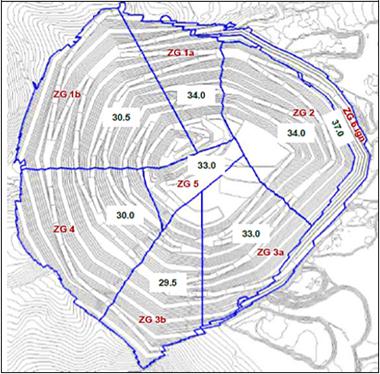

| Figure 15-1: | Rosario global pit slope angle for Whittle optimisation (Collahuasi CPR, 2023) | 140 |

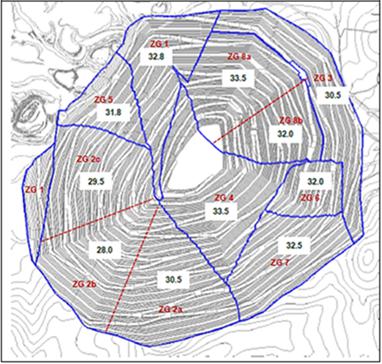

| Figure 15-2: | Ujina global pit slope angle for Whittle optimisation (Collahuasi CPR, 2023) | 141 |

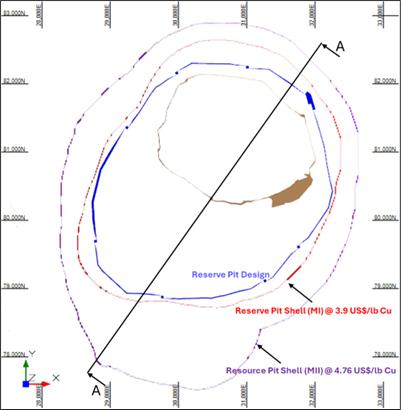

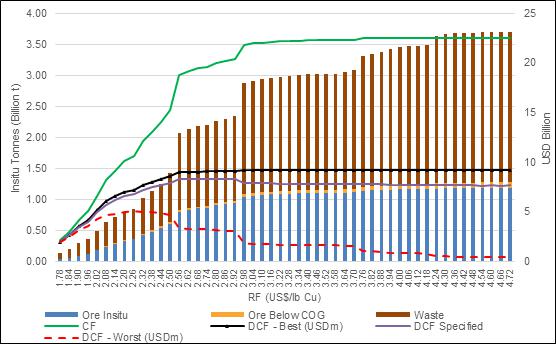

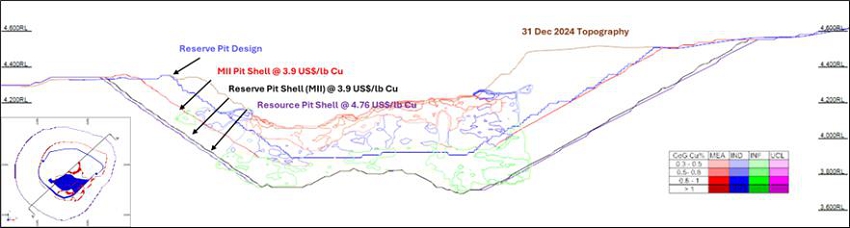

| Figure 15-3: | Rosario pit-by-pit graph (Measured and Indicated) | 146 |

| Figure 15-4: | Rosario Horizontal Section View (SRK, 2025) | 146 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

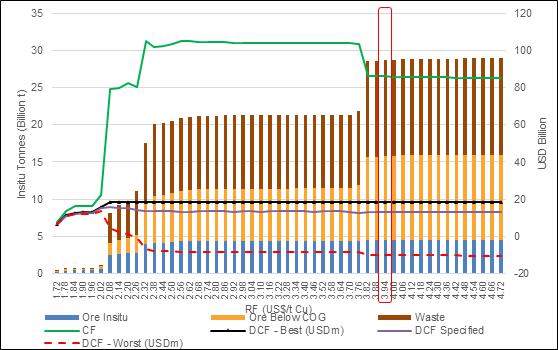

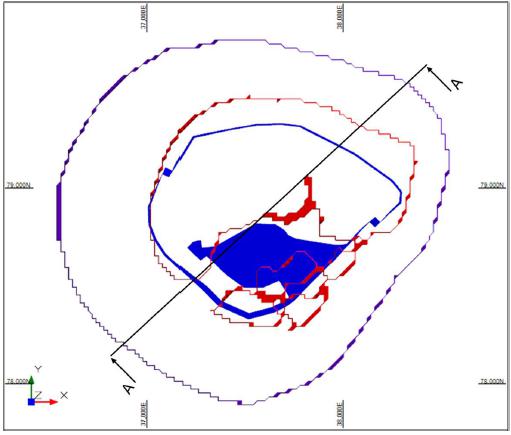

| Figure 15-5: | Ujina pit-by-pit graph (Measured and Indicated) | 147 |

| Figure 15-6: | Ujina Horizontal Section View (SRK, 2025) | 147 |

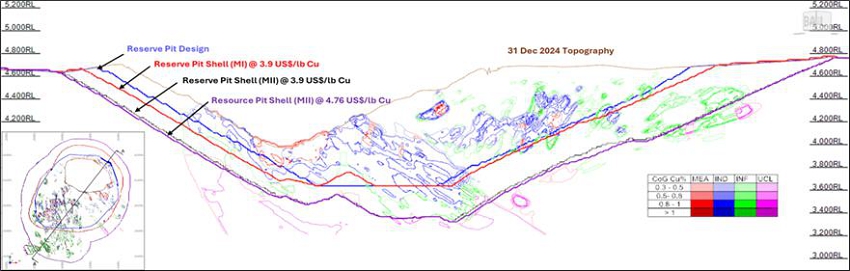

| Figure 15-7: | Rosario Section A-A (SRK, 2025) | 148 |

| Figure 15-8: | Ujina Section A-A (SRK, 2025) | 148 |

| Figure 15-9: | Rosario and Ujina Pushback Phases and Mining Sequence (CMDIC, 2024) | 149 |

| Figure 15-10: | Rosario Final Pit Layout (CMDIC, 2024) | 151 |

| Figure 15-11: | Ujina Final Pit Layout (CMDIC, 2024) | 153 |

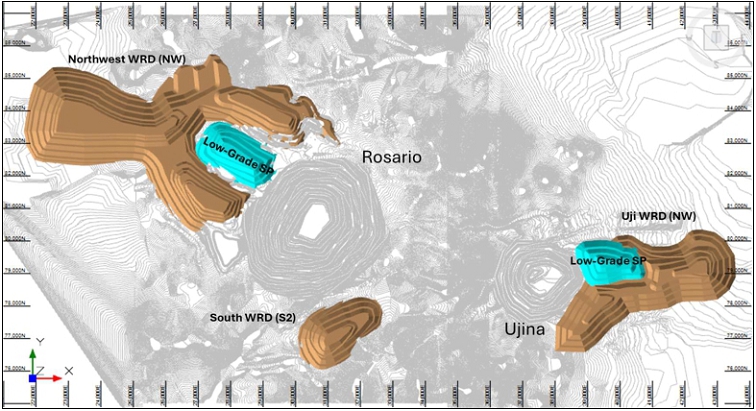

| Figure 15-12: | General WRD and LG SP Layout (SRK, 2025) | 154 |

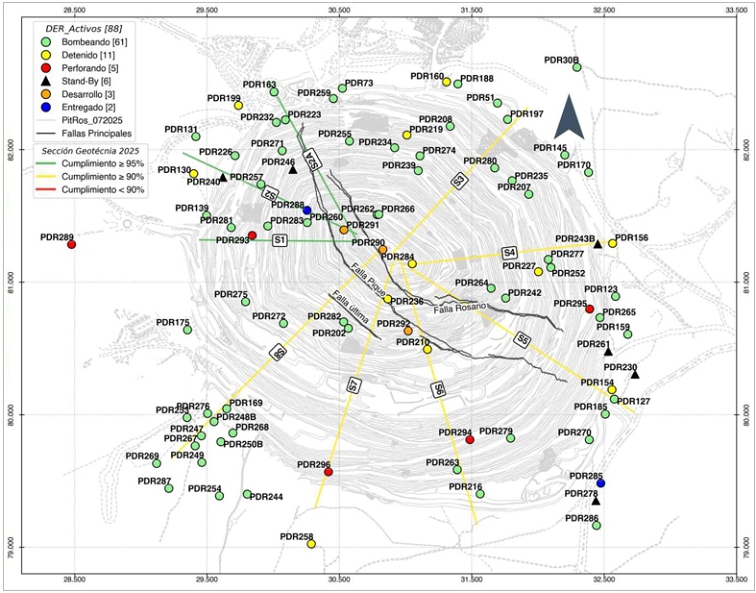

| Figure 16-1: | Rosario Dewatering wells and July 2025 status (CDMIC, 2025) | 159 |

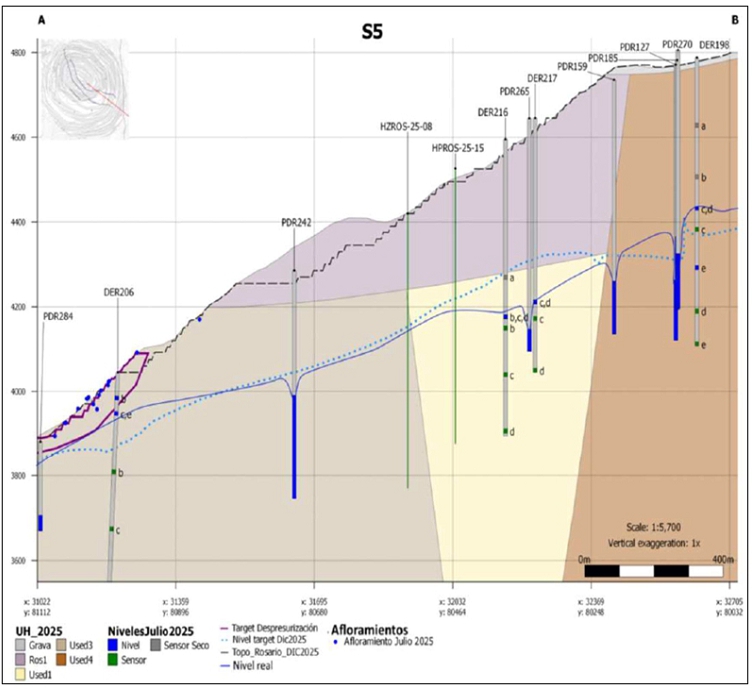

| Figure 16-2: | Rosario pit: Example depressurisation section; target in dotted blue line, actual in solid blue line, and zone where full depressurisation is required in maroon (CDMIC, 2025) | 161 |

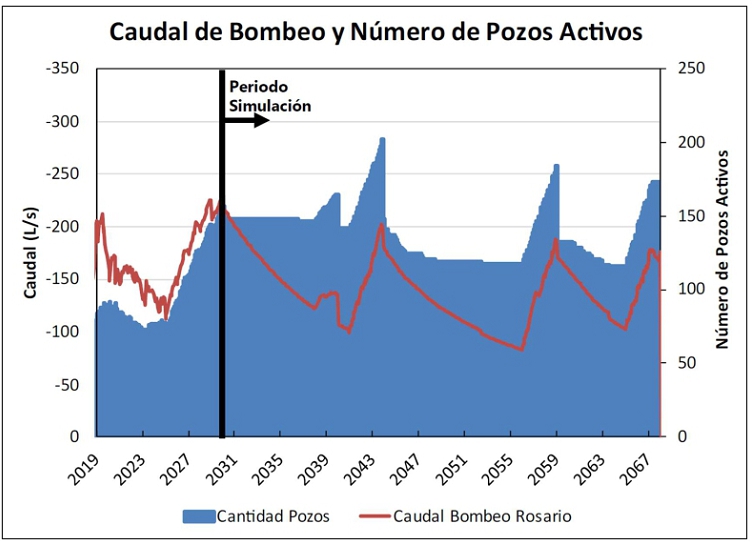

| Figure 16-3: | Modelled total dewatering volume (red, y1 axis) and dewatering wells (blue, y2 axis) for the LoM “Case 3” allowing for horizontal drain holes in fault zones (Itasca, 2024) | 162 |

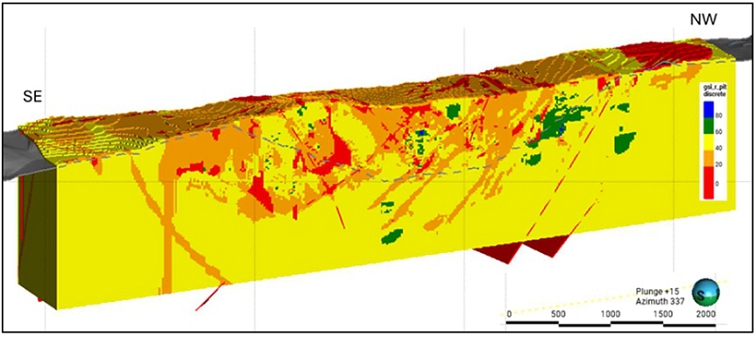

| Figure 16-4: | Example of block model displaying Geological Strength Index (GSI) (SRK, 2025) | 164 |

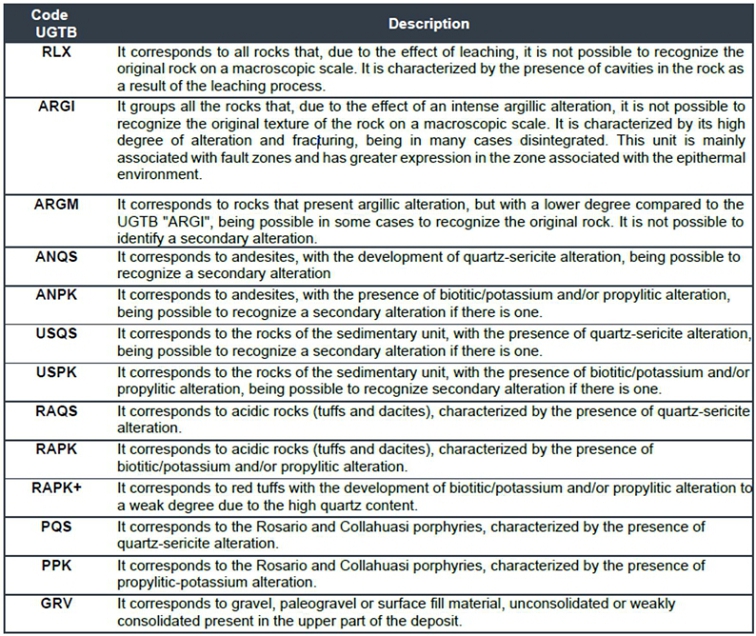

| Figure 16-5: | Rosario Pit : Model showing extent of geotechnical units projected onto 2025 design (left): CMDIC Instrumentation and Geotechnical Monitoring Report Background of Instabilities in Rosario Pit (2021- 2025), August 2025; cross sections (right) (CMDIC internal presentation) | 165 |

| Figure 16-6: | Rosario principal fault structures (Golder Associates, 2014) | 166 |

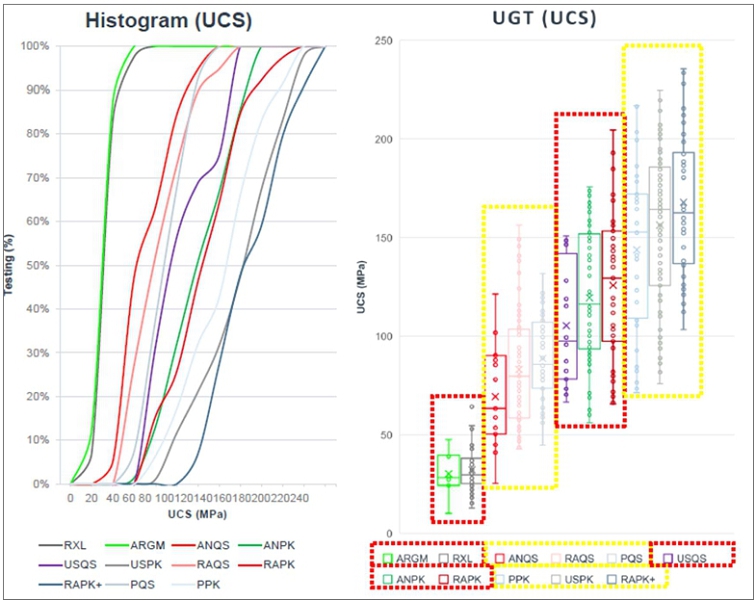

| Figure 16-7: | Rosario GU cumulative frequency histogram and uniaxial compression diagram (WSP Golder, 2024) | 168 |

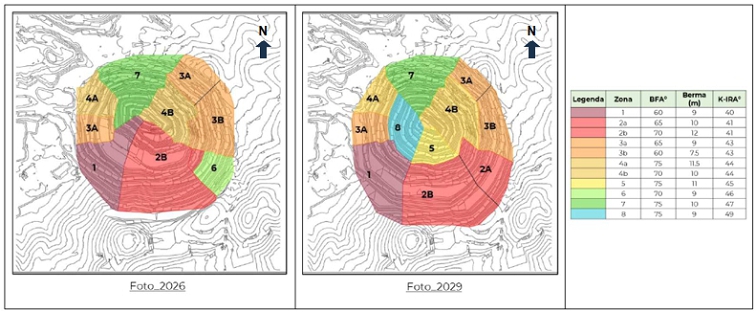

| Figure 16-8: | Rosario: kinematic design zones superimposed on 2026 and 2029 pit geometries of current 5-year plan (WSP Golder, 2025) | 170 |

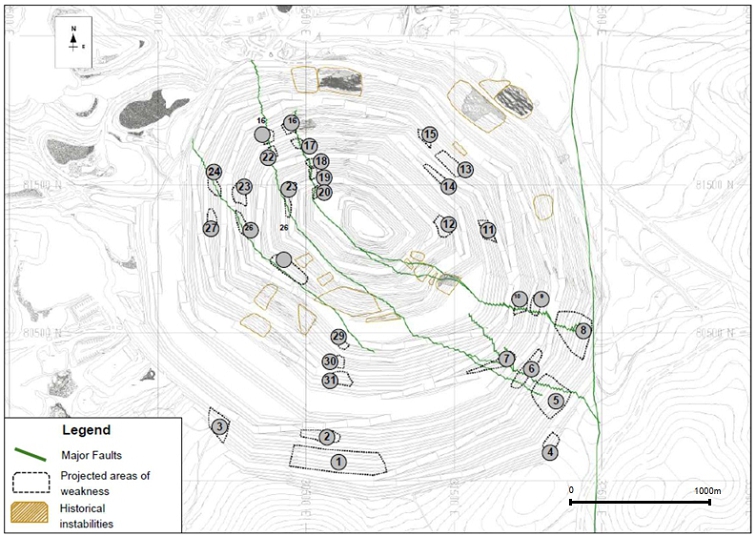

| Figure 16-9: | Rosario Pit: Location of historic instabilities and projected areas of weakness via low GSI, argillic alteration (CMDIC, 2025) | 171 |

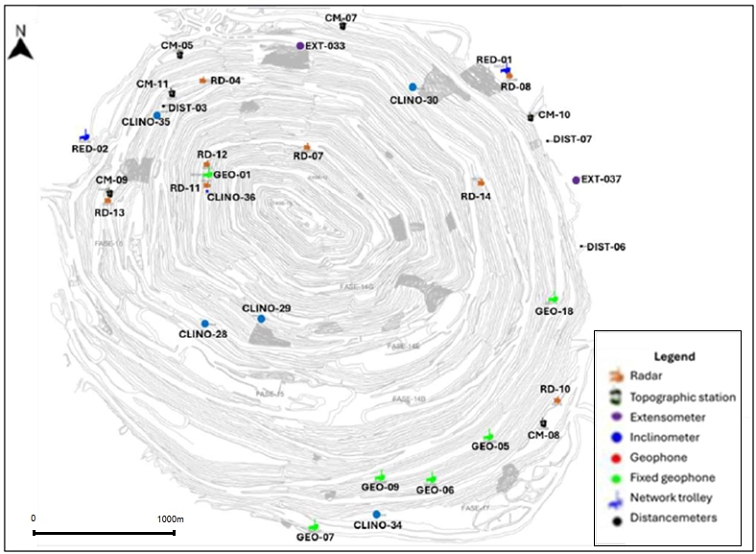

| Figure 16-10: | Rosario Pit: Location of key slope monitoring equipment and infrastructure (CMDIC, 2025) | 172 |

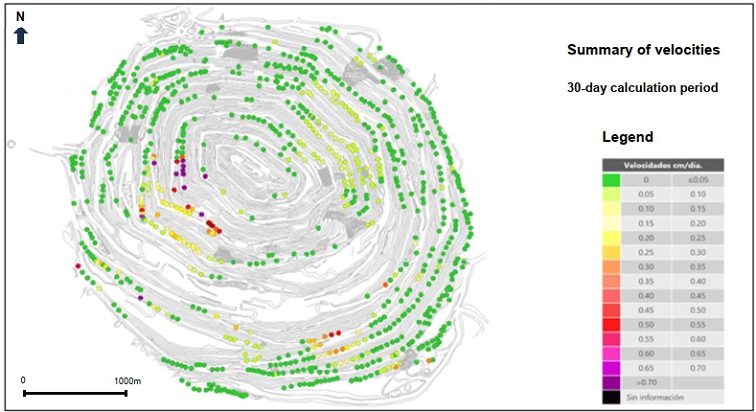

| Figure 16-11: | Rosario Pit: Example showing location of topographic prisms and surface displacement trends (cm/day) (CMDIC, 2025) | 172 |

| Figure 16-12: | Rosario stability risk classification and matrix (CMDIC, 2025) | 173 |

| Figure 16-13: | Rosario 2025 mining plan geotechnical risk analysis (CMDIC, 2025) | 174 |

| Figure 16-14: | Rosario Pit: Main areas of risks associated with development of Phases 14 to 17 (WSP Golder, 2025) | 175 |

| Figure 16-15: | Rosario slopes LoM 2024 stability analysis: plan view (left) and deterministic analysis results for static scenario (right), red dotted line approximate position of recommended mitigation proposals for long-term operation (WSP Golder, 2024) | 176 |

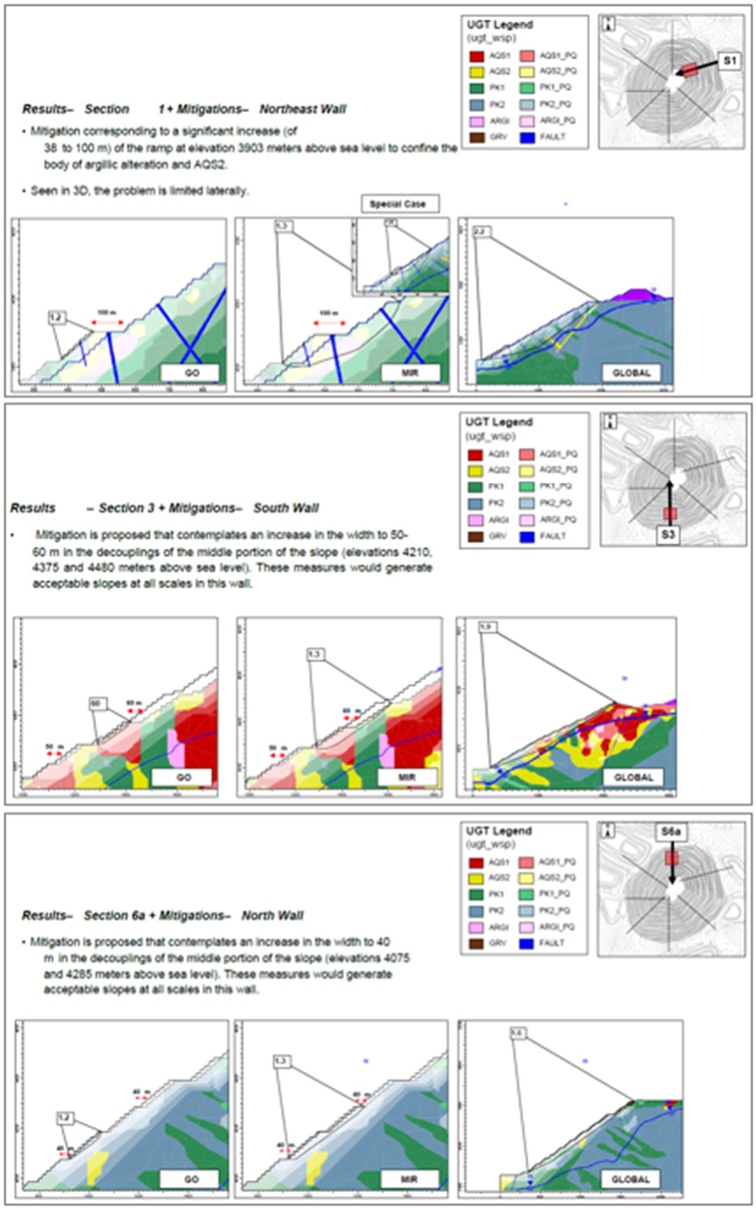

| Figure 16-16: | Rosario LoM 2024 stability analysis: evaluated mitigation proposals for geotechnical design Sections 1 (NE wall), 3 (south wall) and 6 (north wall) (WSP Golder, 2024) | 177 |

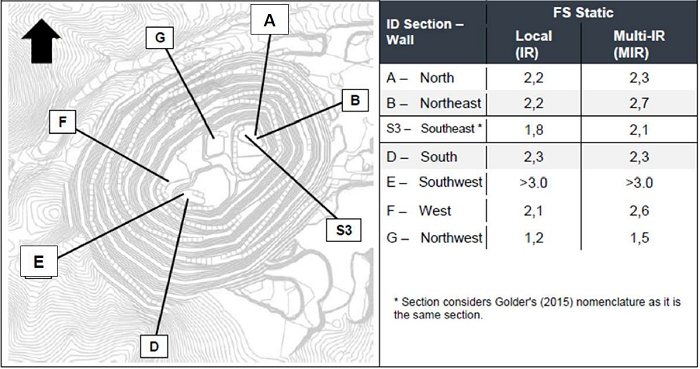

| Figure 16-17: | Ujina LoM 2024 stability analysis: plan view (left) and deterministic analysis results for the static scenario (right) (WSP Golder, 2024) | 180 |

| Figure 16-18: | Rosario geotechnical sustaining process (CMDIC, 2025) | 181 |

| Figure 16-19: | CMDIC Operating Time Model (CMDIC internal file) | 185 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| Figure 16-20: | Weighted Average Haulage Distance and Cycle Time | 189 |

| Figure 16-21: | Total Material Moved and Required Fleet Hours | 189 |

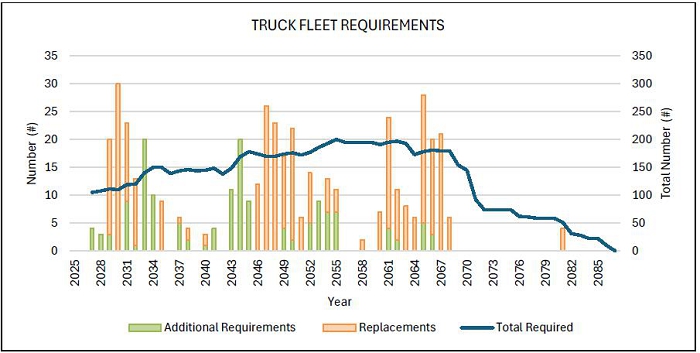

| Figure 16-22: | LoM Truck Fleet Requirements | 190 |

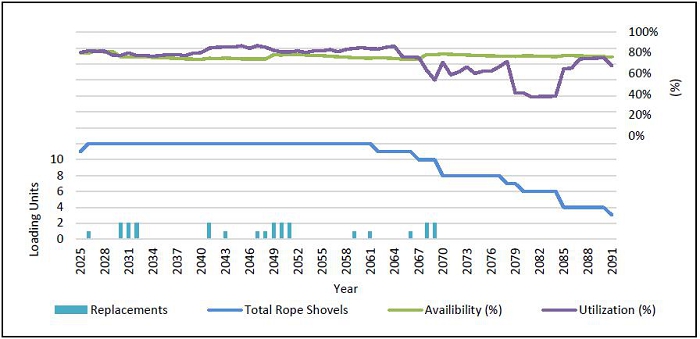

| Figure 16-23: | LoM Rope Shovel Requirements | 191 |

| Figure 16-24: | LoM FEL Requirements | 191 |

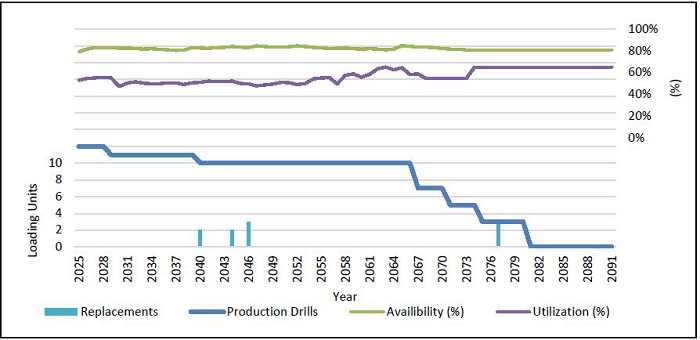

| Figure 16-25: | LoM Production Drill Requirements | 192 |

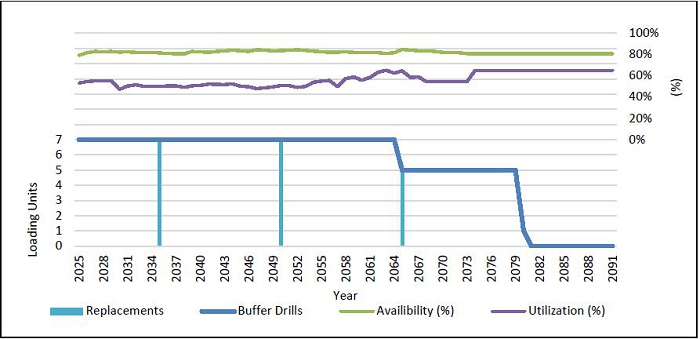

| Figure 16-26: | LoM Buffer Drill Requirements | 192 |

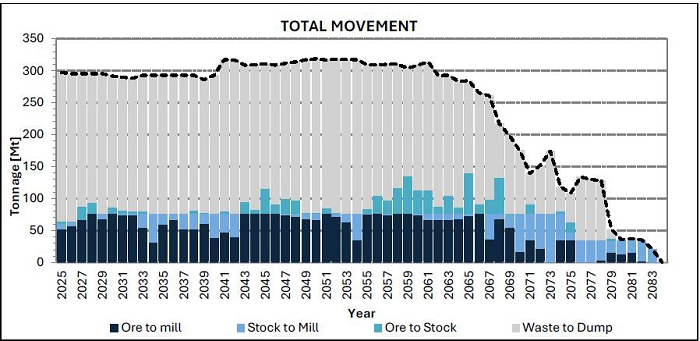

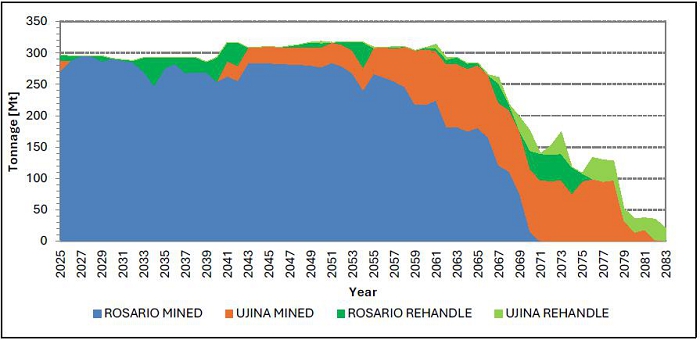

| Figure 16-27: | Rosario and Ujina LoM Total Material Movement | 194 |

| Figure 16-28: | Total LoM Material Movement Split by Mine | 195 |

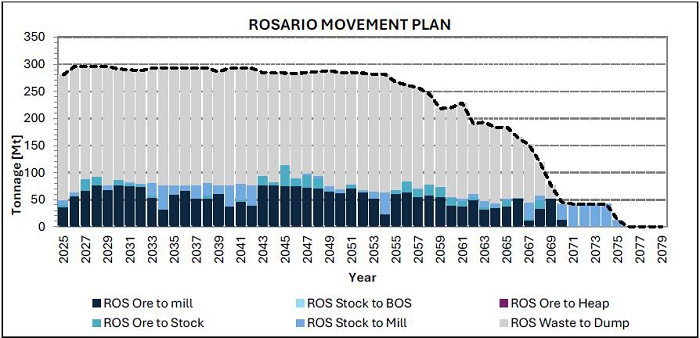

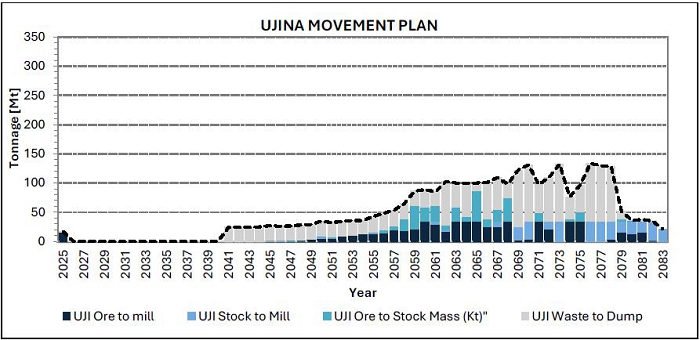

| Figure 16-29: | Rosario LoM Material Movement | 195 |

| Figure 16-30: | Ujina LoM Material Movement | 195 |

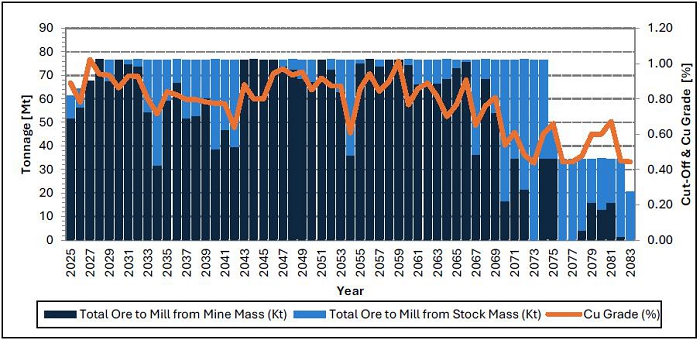

| Figure 16-31: | LoM Process Feed and Grade | 196 |

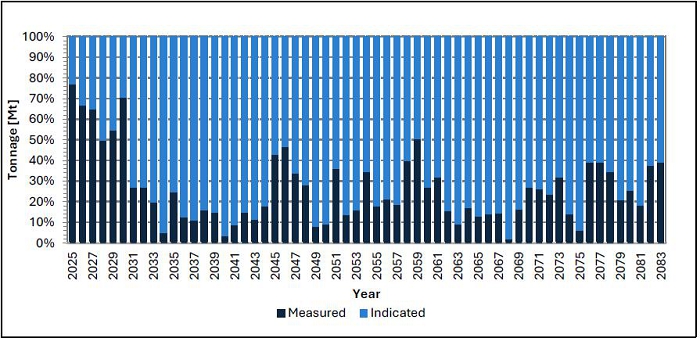

| Figure 16-32: | LoM Process Feed per Ore Classification | 197 |

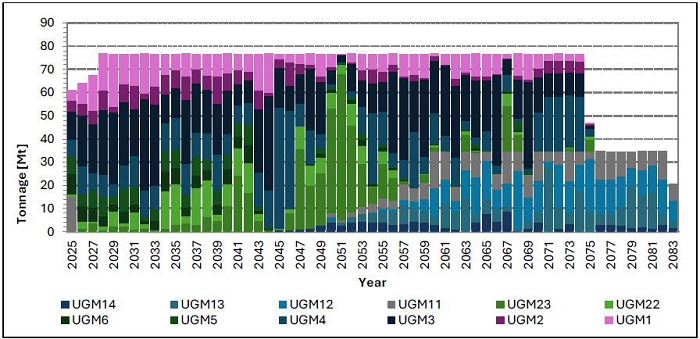

| Figure 16-33: | LoM Ore Feed contribution per UGM Zone | 197 |

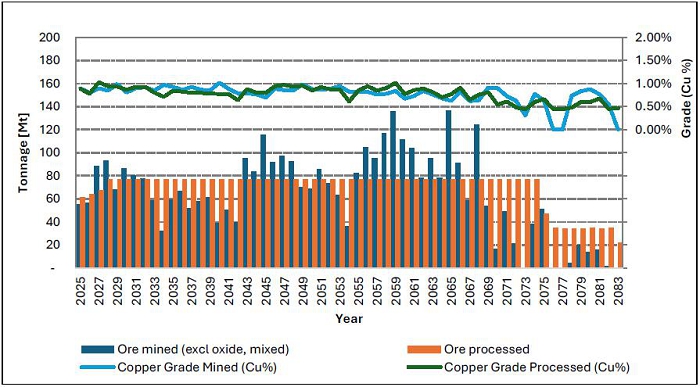

| Figure 16-34: | LoM Ore Mined and Grade vs Process Feed | 197 |

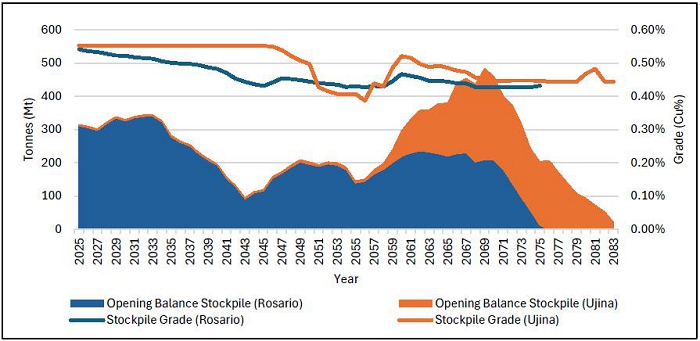

| Figure 16-35: | LoM Stockpile Balance | 198 |

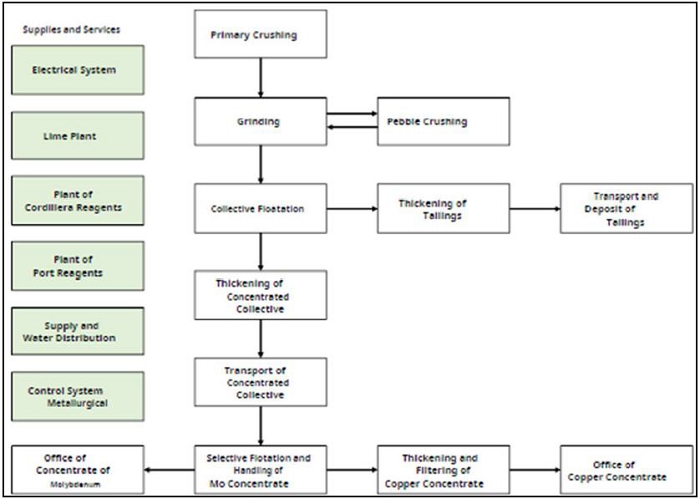

| Figure 17-1: | Simplified Flowsheet Block Diagram (CMDIC,2020) | 201 |

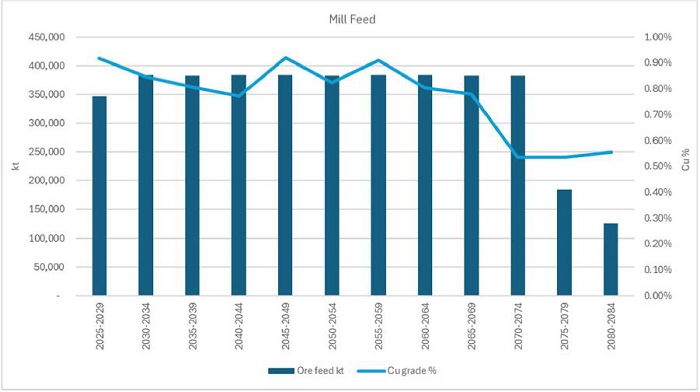

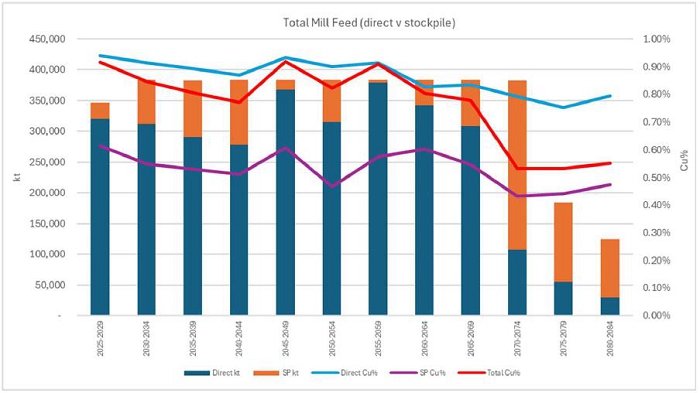

| Figure 17-2: | LoM Forecast Production Plant Feed and Feed Cu Grade | 206 |

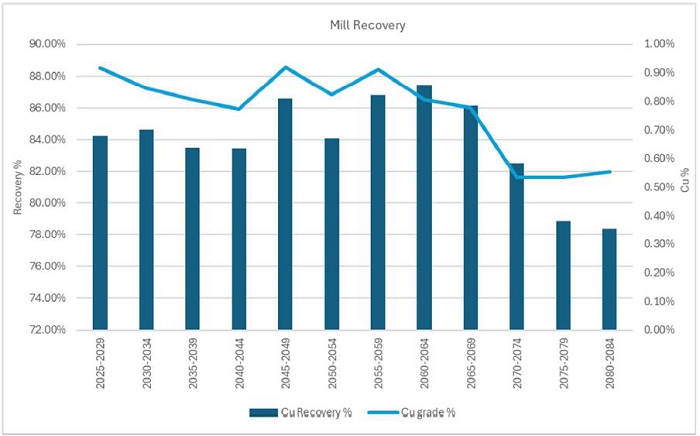

| Figure 17-3: | LoM Forecast Production: Plant Feed Cu Grade and Cu Recovery | 207 |

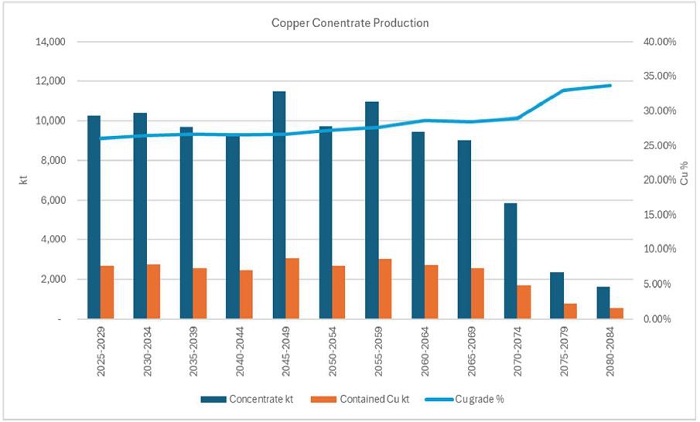

| Figure 17-4: | LoM Forecast Production: Copper Concentrate Production | 207 |

| Figure 17-5: | LoM Forecast Production: Molybdenum Concentrate Production | 208 |

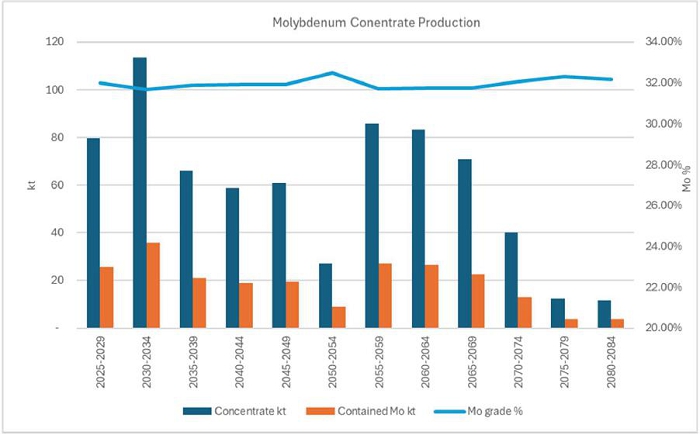

| Figure 17-6: | LoM Forecast Production: Mill feed, direct v stockpile | 209 |

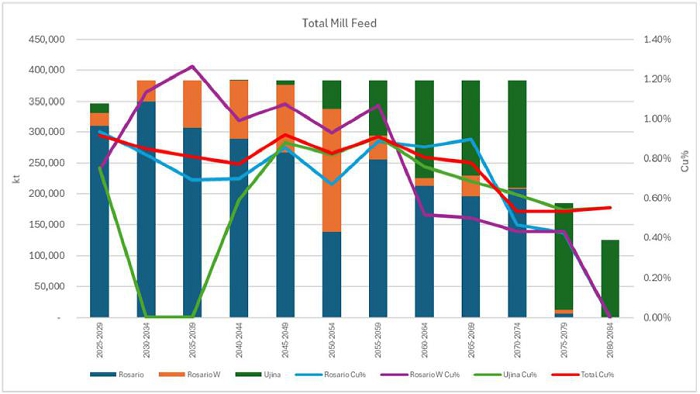

| Figure 17-7: | LoM Forecast Production: Total Mill feed by deposit | 209 |

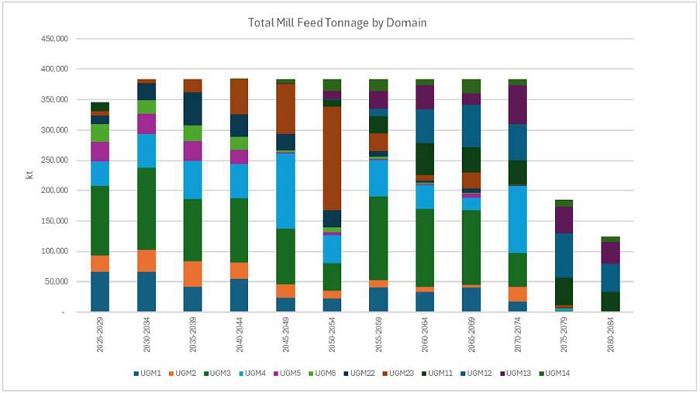

| Figure 17-8: | LoM Forecast Production: Total Mill feed tonnage by domain | 210 |

| Figure 17-9: | LoM Forecast Production: Total Mill feed grade by domain | 210 |

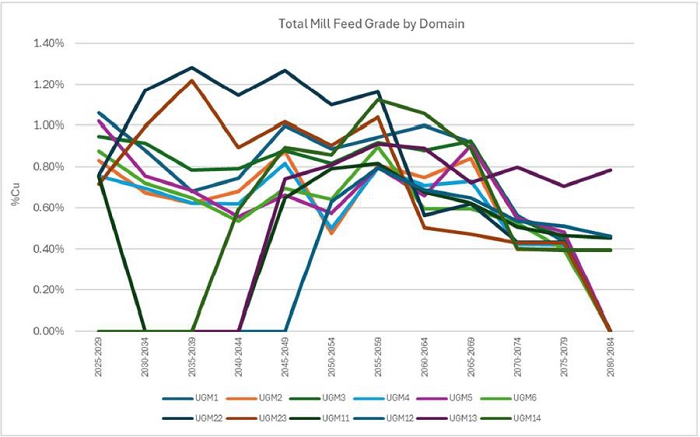

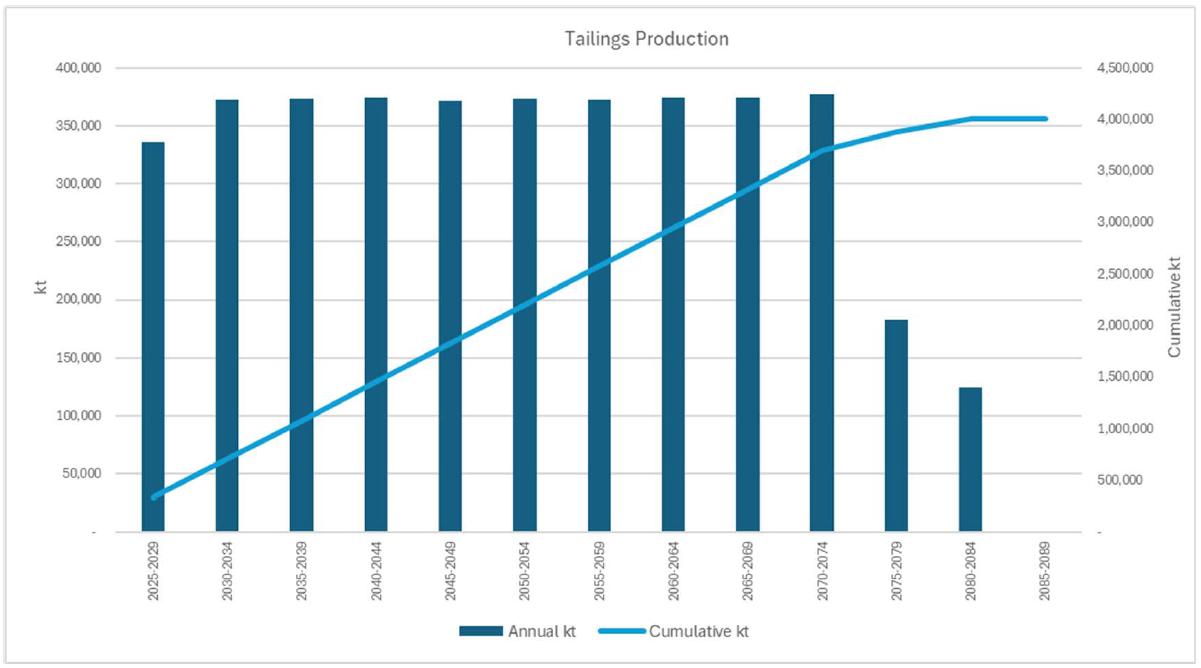

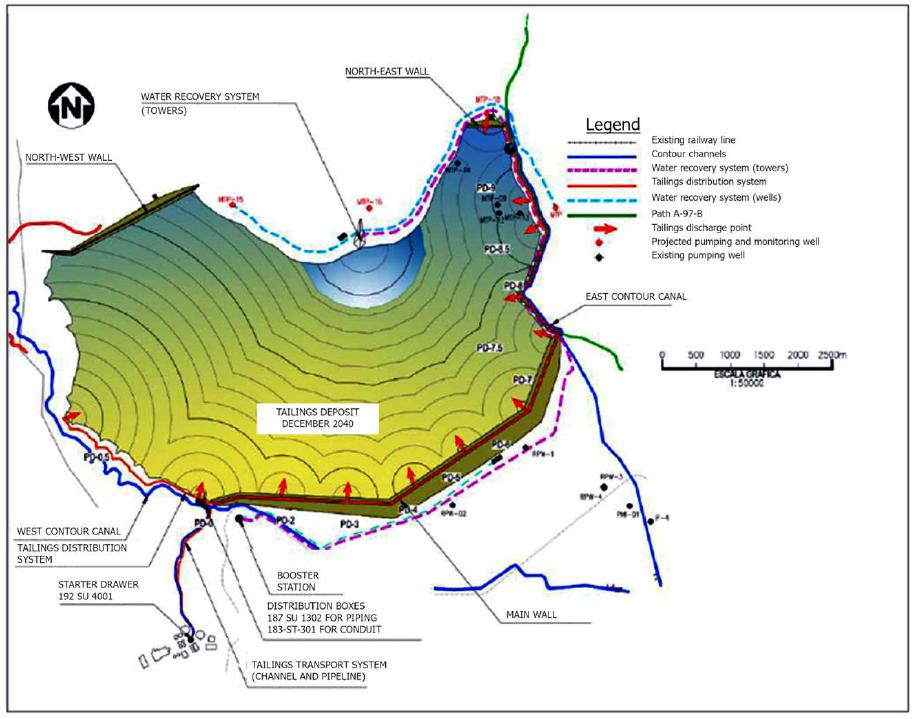

| Figure 18-1: | Reserves case LoM plan tailings production (5-year increments) | 215 |

| Figure 18-2: | Pampa Pabellón Tailings Storage Facility project to 2041 (WSP, 2022) | 216 |

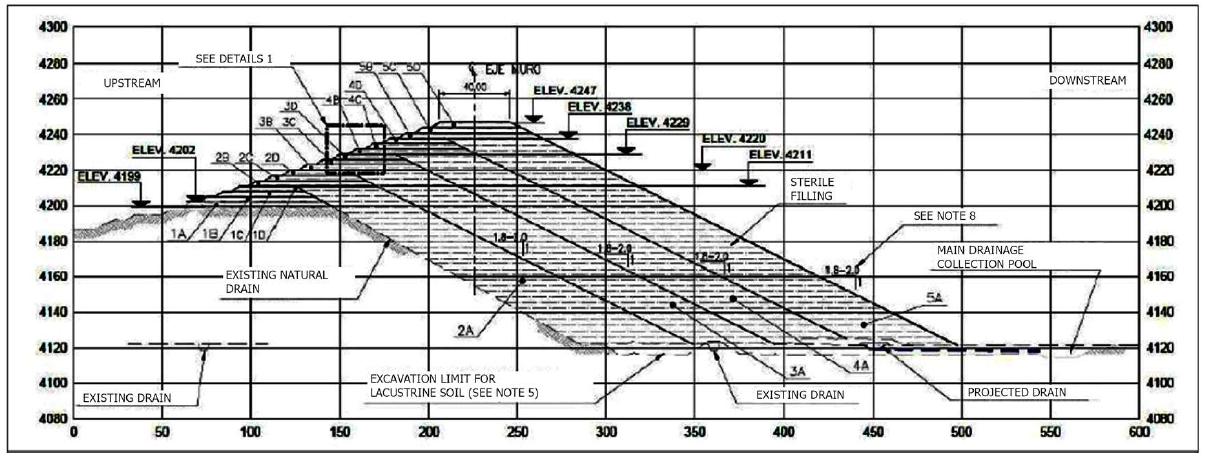

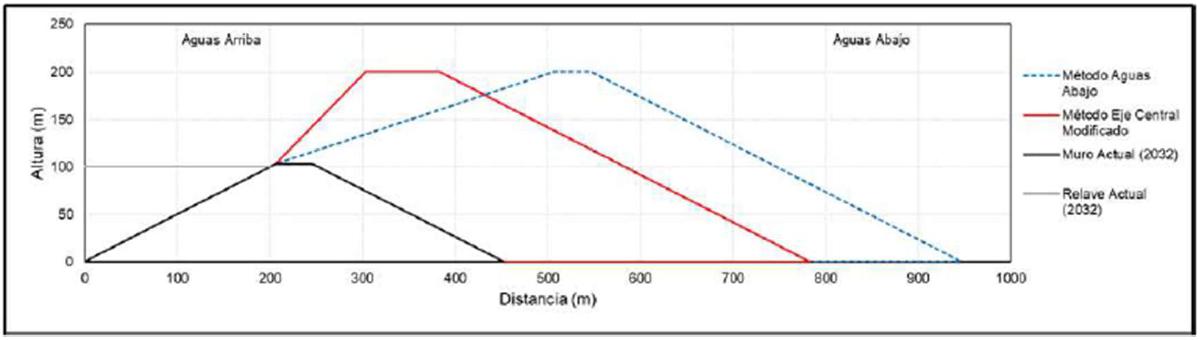

| Figure 18-3: | Pampa Pabellón Tailings Storage Facility (2041 permitted design); construction methodology and cross section of main embankment (WSP, 2023) | 217 |

| Figure 18-4: | Pampa Pabellón Tailings Storage Facility (2041 permitted design); construction methodology and cross section of NW auxiliary embankment (WSP, 2023) | 217 |

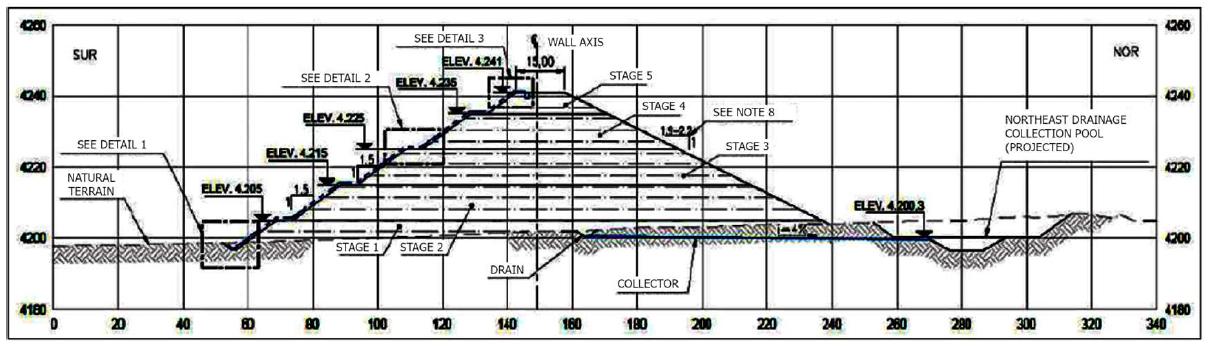

| Figure 18-5: | Footprint of hypothetical tailings runout in central section of TSF main wall; numerical model under normal condition (1) and extreme hydrological condition (2) (Wood, 2020) | 221 |

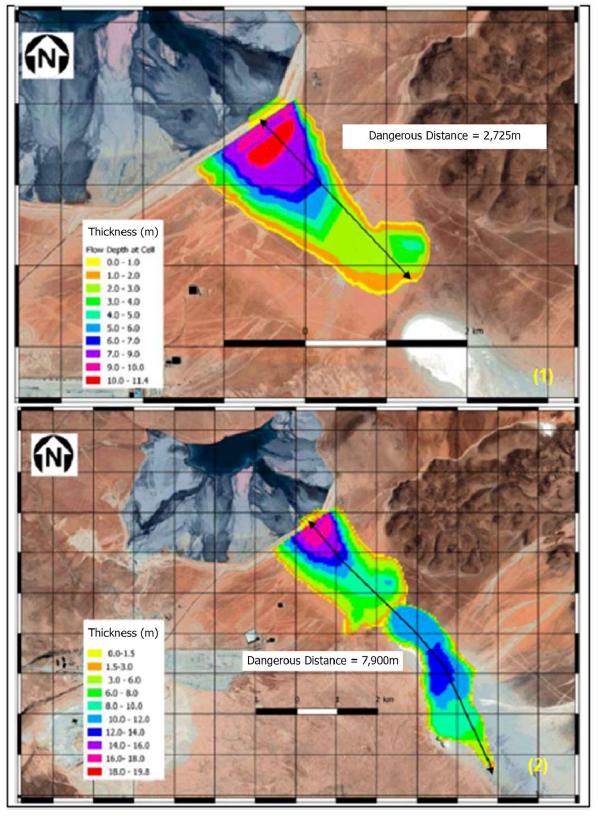

| Figure 18-6: | Expanded footprint of TSF for 5.7 Bt storage capacity including environmentally sensitive areas around and within footprint boundary (WSP, 2024) | 222 |

| Figure 18-7: | Expanded footprint of TSF for 5.7 Bt storage capacity (black outline) (WSP, 2024) | 225 |

| Figure 18-8: | Schematic section showing TSF expansion by conventional downstream raising (blue) or by modified downstream raising (red) (WSP, 2024) | 226 |

| Figure 18-9: | Copper concentrate export (dmt) | 233 |

| Figure 18-10: | Port schematic flow sheet (CDMIC, 2025) | 235 |

| Figure 18-11: | View of berth and shiploader (2025) | 236 |

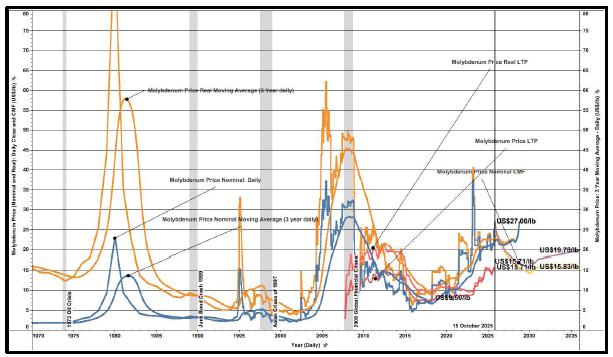

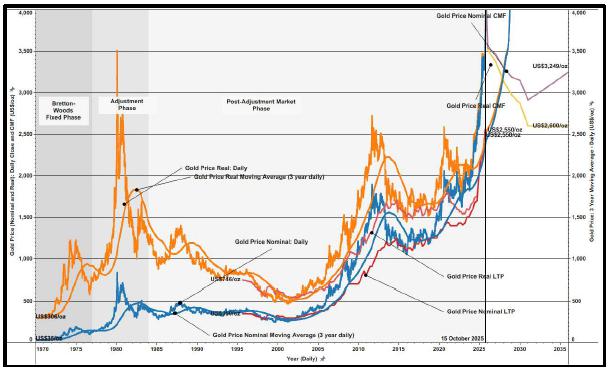

| Figure 19-1: | Historical Copper Price nominal and real (1 October) statistics for historical data through 15 October 2025 and forecast (consensus) to 2024 | 245 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine – Table of Contents |

| Figure 19-2: | Historical Molybdenum Price nominal and real (1 October) statistics for historical data through 15 October 2025 and forecast (consensus) to 2024 | 245 |

| Figure 19-3: | Historical Silver Price nominal and real (1 October) statistics for historical data through 15 October 2025 and forecast (consensus) to 2024 | 246 |

| Figure 19-4: | Historical Gold Price nominal and real (1 October) statistics for historical data through 15 October 2025 and forecast (consensus) to 2024 | 246 |

| Figure 19-5: | Historical Copper Concentrate terms: 1982 through October 2025 | 252 |

| Figure 19-6: | Historical Copper Concentrate terms (copper price relative): 1982 through October 2025 | 253 |

| Figure 19-7: | Historical Molybdenum pricing (2022 through 2025): SMM | 255 |

| Figure 21-1: | Sustaining capital costs | 278 |

| Figure 21-2: | Direct operating costs | 279 |

| Figure 21-3: | Arsenic penalty in copper concentrate | 280 |

| Figure 21-4: | Copper concentrate realisation costs | 280 |

| Figure 21-5: | C1 Cash Cost and All in Sustaining Cost | 281 |

| November 2025 | ||

| Page |

|

SRK Consulting (UK) Limited |

| 5th Floor Churchill House | |

| 17 Churchill Way | |

| Cardiff CF10 2HH | |

| Wales, United Kingdom | |

| E-mail: enquiries@srk.co.uk | |

| URL: www.srk.com | |

| Tel: + 44 (0) 2920 348 150 |

NI 43-101 TECHNICAL REPORT, COLLAHUASI COPPER MINE, TARAPACÁ REGION, CHILE

| ITEM 1 | SUMMARY |

| 1.1 | Introduction |

SRK Consulting (UK) Limited (SRK) is an associate company of the international group holding company, SRK Consulting (Global) Limited (the SRK Group). SRK has been requested by Anglo American plc (Anglo American, or the Company or the Client) to prepare a Technical Report on the Mineral Assets comprising the Doña Inés de Collahuasi copper mine (Collahuasi), located in the Tarapacá Region of northern Chile, in accordance with the CIM Definitions Standards (2014).

Compañía Minera Doña Inés de Collahuasi (CMDIC) is owned by subsidiaries of Anglo American plc (44%), subsidiaries of Glencore plc (44%) and a consortium of Japanese companies led by Mitsui & Co Ltd (12%).

CMDIC’s mining operations correspond to a cluster of open pit mines located in the Tarapacá Region Region of Chile, about 225 km by road SE of the city of Iquique at elevations between 4,200 and 4,800 masl. The main pit in operation is the Rosario pit. The original pit where the operations started, Ujina, is not currently in production but is part of the Life of Mine (LoM) plan (LoMP).

The Mineral Resources and Mineral Reserves estimates dated 31 December 2024 were prepared by CMDIC personnel and were reviewed by a multidisciplinary team of qualified persons from SRK. The estimates were reviewed in detail including parameters, assumptions, supporting factual data, procedures and electronic files. SRK carried out a site visit to the operation in October 2025 and has reviewed reconciliation results between production data and the estimates.

This report and the Mineral Resources and Mineral Reserves estimates have been prepared in compliance with the disclosure and reporting requirements set forth in the current Canadian Securities Administrator’s National Instrument 43-101, Companion Policy 43-101CP, and Form 43-101F1.

The Effective Date of the Mineral Resources and Mineral Reserves reported herein is 31 December 2024 (Effective Date). This Technical Report discloses the results of the Mineral Resource and Mineral Reserve updates carried out by CMDIC as part of their annual planning cycle, audited by SRK.

|

Registered Address: 21 Gold Tops, City and County of Newport, NP20 4PG, Wales, United Kingdom. SRK Consulting (UK) Limited Reg No 01575403 (England and Wales) |

Group Offices: Africa Asia Australia Europe North America South America |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

| 1.2 | Property Description |

Collahuasi is located in the Tarapacá Region of Chile, in the Andean cordillera, approximately 5 to 10 km from the border with Bolivia, 185 km SE of Iquique at elevations between 4,200 and 4,800 masl. The mine, associated infrastructure, and port facilities are all accessed via tarmacked highway.

The Collahuasi mining property consists of 841 groups of current exploitation concessions, covering 230,152 hectares, and 98 exploration concessions covering 43,500 hectares. In addition, there are 38 SCM Michincha exploitation concessions (50% Collahuasi and 50% Quebrada Blanca) covering 22,820 hectares. The exploitation and exploration concessions are located in the municipalities of Iquique, Pica, Pozo Almonte, and Calama.

The reported Mineral Resources and Mineral Reserves are located within CMDIC mining concessions. The mining concessions have no expiry and remain valid through annual payments. Surface rights for the operating infrastructure are predominantly held through land ownership and easements for linear infrastructure. CMDIC owns water rights to use underground water in the Coposa Salar basin and Minchincha Salar basin.

Collahuasi is subject to a mining royalty which consists of: 1) a 1% ad valorem component on copper revenue; and 2) a profit based component ranging from 8% to 26% on adjusted operating profits (this is capped so the overall effective tax rate for royalties, corporate tax and dividend withholding tax does not exceed 46.5%). A corporate tax rate of 27% on taxable profits is applicable to CMDIC.

The operation has environmental approvals in place and is monitoring compliance with associated commitments. The main environmental approval for the current phase of operation is Resolucion Extenta (Res. Ex.) No. 20219900112 (2021 RCA) that was obtained in December 2021 for a period of 20 years. Activities permitted through this approval include continuation of operations and extension of the Rosario pit and waste rock dumps, increased production capacity from 170 ktpd to 210 ktpd, expansion of the Pampa Pabellón tailing storage facility (TSF) to a total capacity of 2,329 Mt and installation of a desalination plant and water pipeline from the coast. This approval expires in 2041.

Mining from the Ujina pit was not included in the 2021 approval and is permitted through Res. Ex. No. 027/2018 which expires in 2027. An application to mine waste from Ujina for construction of the tailings facility walls is in progress through an Environmental Impact Declaration (DIA) which is due to be submitted in Q1 2026 with approval anticipated in Q1 2027.

CMDIC is preparing an Environmental Impact Assessment (EIA) to permit operations beyond 2041 (including mining at Rosario and Ujina) for submission in 2027. Approval for an extended operational period is anticipated to be in place by 2030.

The latest Mine Closure Plan was submitted in 2021 and the valuation of the plan was approved in March 2023 (Res. Ex. No. 0324). This closure plan is an update of the previous plan, approved in 2015 and includes all existing activities across the mine, pipeline and port as well as the new activities approved in the 2021 RCA. The closure cost was estimated at UF17,272,965 (as of 23 August 2021) which equated to USD656,136,544. The quantum of financial guarantee was calculated in line with legal requirements and CMDIC provides annual contributions via a combination of permitted instruments which are selected at the time that each provision is made.

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

| 1.3 | History |

The Collahuasi region was initially explored in 1880, with various periods of activity leading up to the discovery of a series of Cu deposits through various geophysical and reconnaissance activities in the early 1990s. Feasibility and environmental impact studies for the Collahuasi project were approved in 1995, with the operations commencing in 1998. Operations have ramped up through a series of phases of expansion from the initial production rate of 60 ktpd, to the current processing capacity of 170 ktpd (mill feed).

Table 1-1 presents a summary of the annual production and cost statistics for the period 2019-2024 and 2025 to date (9 months to end-September 2025). Contained copper in sold copper concentrate has varied between 549 kt and 631 kt per annum up to 2024 and overall copper recovery to concentrate has varied between 81.1% and 90.6% over this period with lower recoveries seen in 2023 and 2024. Contained copper in sold copper concentrate to end-September 2025 was 303 kt. Recovery to end-September 2025 has been lower, at 73.5%. It is noted that during 2024 and 2025 to date, notably less ore has been mined than fed to the processing plant with the operations drawing from lower grade stockpiles to supplement the plant feed.

Total direct operating costs (mining, including deferred stripping costs, processing and indirects) have varied between USD1,087m and USD1,522m per annum or between USD19.5/t and USD26.5/t milled in total over the period 2019 to 2024 with higher unit costs seen between 2022 and 2024 (USD777m-USD1,404m excluding deferred stripping, or between USD13.9/t and USD24.5/t milled in total). During 2025, actual costs to end-September 2025 including deferred stripping were USD1,194m or USD27.0/t processed (USD993m or USD22.5/t processed excluding deferred stripping). Capital costs (project, sustaining and deferred stripping) have varied between USD720m and USD1,990m per annum between 2019 and 2024 with significant project capital expenditure being incurred in 2023 and 2024. Capital costs to end-September 2025 were USD1,213m. Sustaining capital expenditure (excluding deferred stripping costs) has varied between USD300-500m per annum over the period 2019 to 2024.

C1 Cash Costs are presented in Table 1-1 in USD terms and unit costs per pound payable copper production with direct mining costs adjusted to exclude capitalised deferred stripping costs. Realisation costs include TC/RC, impurity penalties (As in concentrate), metallurgical deductions and freight. By-product credits include revenue from sale of molybdenum concentrate (credits for gold and silver payable in concentrate are excluded). C1 All in Sustaining Costs are also included in Table 1-1 include stock movements, other costs (including closure costs), deferred stripping and sustaining capital costs and are presented before and after the impact of royalties.

Between 2019 and 2024 actual C1 Cash Costs (after by-product credits) have varied between USD0.70 and USD1.45/lb payable copper but have increased to USD1.83/lb during 2025 (9 months to September) due to lower copper production. C1 All in Sustaining Costs have varied between USD1.21/lb and USD1.86/lb between 2019 and 2024 before royalties (USD1.31/lb to USD2.18/lb including royalties) but have increased to USD2.71/lb during 2025 to date (USD2.89/lb including royalties).

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

Table 1-1: Historical production and costs 2019-2024, 2025 (actuals to September)

| Description | Units | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

2025 Actual |

| Mining | ||||||||

| Ore mined | kt | 86,644 | 71,898 | 101,611 | 81,789 | 58,865 | 48,412 | 30,916 |

| Copper grade | %CuT | 0.96% | 1.10% | 0.91% | 1.00% | 1.17% | 1.28% | 1.12% |

| Contained copper | Cu kt | 836 | 787 | 925 | 821 | 689 | 618 | 347 |

| Waste mined | kt | 149,925 | 157,530 | 139,301 | 172,563 | 207,314 | 213,247 | 148,694 |

| Total material mined | kt | 236,569 | 229,428 | 240,913 | 254,352 | 266,178 | 261,659 | 179,610 |

| Strip ratio | w:o | 1.73 | 2.19 | 1.37 | 2.11 | 3.52 | 4.40 | 4.81 |

| Processing | ||||||||

| Ore processed | kt | 54,133 | 55,832 | 55,681 | 57,316 | 57,352 | 60,048 | 44,209 |

| Copper grade | %CuT | 1.19% | 1.24% | 1.25% | 1.11% | 1.17% | 1.15% | 0.92% |

| Contained copper | Cu kt | 645 | 694 | 696 | 637 | 670 | 692 | 405 |

| Molybdenum grade | ppm | 206 | 313 | 292 | 322 | 256 | 233 | 177 |

| Contained Mo | Mo kt | 11 | 18 | 16 | 18 | 15 | 14 | 8 |

| Copper concentrate (pre-Moly & Filter plant) | kt | 2,119 | 2,357 | 2,362 | 2,135 | 2,296 | 2,394 | 1,346 |

| Copper grade | %CuT | 26.75% | 26.66% | 26.63% | 26.75% | 25.15% | 23.43% | 22.13% |

| Contained copper | Cu kt | 567 | 628 | 629 | 571 | 577 | 561 | 298 |

| Contained copper | Cu klb | 1,249,638 | 1,385,102 | 1,386,417 | 1,258,925 | 1,273,165 | 1,236,293 | 656,495 |

| Overall copper recovery | % | 87.87% | 90.59% | 90.32% | 89.71% | 86.17% | 81.09% | 73.50% |

| Molybdenum concentrate | kt | 10 | 13 | 13 | 16 | 12 | 7 | 4 |

| Molybdenum grade | %Mo | 28.83% | 29.31% | 35.94% | 41.66% | 39.66% | 28.69% | 26.91% |

| Contained molybdenum | Mo kt | 3 | 4 | 5 | 7 | 5 | 2 | 1 |

| Overall molybdenum recovery | % | 26.24% | 21.39% | 28.80% | 36.49% | 31.11% | 14.55% | 12.65% |

| Product Sales | ||||||||

| Copper concentrate | kt | 2,170 | 2,366 | 2,338 | 2,178 | 2,244 | 2,347 | 1,395 |

| Copper grade | %CuT | 26.58% | 26.67% | 26.55% | 26.66% | 25.12% | 23.41% | 21.75% |

| Contained copper | Cu kt | 577 | 631 | 621 | 581 | 564 | 549 | 303 |

| Contained copper | Cu klb | 1,271,609 | 1,391,172 | 1,368,485 | 1,280,210 | 1,243,017 | 1,211,040 | 668,826 |

| Molybdenum concentrate | kt | 10 | 13 | 13 | 16 | 12 | 7 | 3 |

| Molybdenum grade | %Mo | 29.62% | 29.11% | 35.95% | 41.46% | 40.58% | 29.00% | 26.87% |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

| Description | Units | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

2025 Actual |

| Contained molybdenum | Mo kt | 3 | 4 | 5 | 7 | 5 | 2 | 1 |

| Direct operating costs | ||||||||

| Mining (incl. deferred stripping) | USDm | 545 | 495 | 543 | 699 | 766 | 731 | 556 |

| Deferred stripping | USDm | -235 | -310 | -383 | -31 | -118 | -134 | -201 |

| Mining (excl. deferred stripping) | USDm | 310 | 185 | 161 | 668 | 647 | 597 | 355 |

| Unit mining cost (per tonne mined) | USD/t | 2.30 | 2.16 | 2.25 | 2.75 | 2.88 | 2.79 | 3.09 |

| Processing & Port | USDm | 436 | 442 | 490 | 522 | 571 | 572 | 501 |

| Unit processing cost (per tonne processed) | USD/t | 8.05 | 7.91 | 8.81 | 9.10 | 9.96 | 9.53 | 11.34 |

| G&A | USDm | 147 | 150 | 177 | 169 | 185 | 177 | 137 |

| Unit G&A cost (per tonne processed) | USD/t | 2.72 | 2.70 | 3.17 | 2.95 | 3.23 | 2.95 | 3.09 |

| Total Direct Operating Cost (excl. deferred stripping) | USDm | 893 | 777 | 827 | 1,358 | 1,404 | 1,346 | 993 |

| Total Unit cost (per tonne processed) | USD/t | 16.50 | 13.92 | 14.86 | 23.70 | 24.48 | 22.42 | 22.45 |

| Capital costs | ||||||||

| Project capital | USDm | 52 | 102 | 216 | 402 | 1,385 | 1,373 | 696 |

| Stay in Business capital (excl deferred stripping) | USDm | 454 | 308 | 340 | 315 | 363 | 483 | 316 |

| Deferred stripping | USDm | 235 | 310 | 383 | 31 | 118 | 134 | 201 |

| Total Capital Costs | USDm | 740 | 720 | 939 | 749 | 1,866 | 1,990 | 1,213 |

| C1 Cash Cost | ||||||||

| Production - payable | Cu klb | 1,204,808 | 1,340,463 | 1,342,472 | 1,216,035 | 1,221,318 | 1,190,268 | 633,130 |

| Direct production cost (excl deferred stripping, incl stockpile inventories) | USDm | 945 | 829 | 873 | 1,139 | 1,430 | 1,416 | 1,115 |

| Realisation costs | USDm | 433 | 373 | 449 | 449 | 477 | 485 | 167 |

| C1 cash cost before credits | USDm | 1,378 | 1,202 | 1,322 | 1,588 | 1,907 | 1,901 | 1,282 |

| By product credits | USDm | (138) | (260) | (368) | (417) | (357) | (296) | (123) |

| C1 cash cost after credits | USDm | 1,239 | 942 | 954 | 1,171 | 1,550 | 1,605 | 1,159 |

| Direct production cost (excl deferred stripping, incl stockpile inventories) | USD/lb Cu | 0.78 | 0.62 | 0.65 | 0.94 | 1.17 | 1.19 | 1.76 |

| Realisation costs | USD/lb Cu | 0.36 | 0.28 | 0.33 | 0.37 | 0.39 | 0.41 | 0.26 |

| C1 cash cost before credits | USD/lb Cu | 1.14 | 0.90 | 0.98 | 1.31 | 1.56 | 1.60 | 2.02 |

| By product credits | USD/lb Cu | (0.11) | (0.19) | (0.27) | (0.34) | (0.29) | (0.25) | (0.19) |

| C1 cash cost after credits | USD/lb Cu | 1.03 | 0.70 | 0.71 | 0.96 | 1.27 | 1.35 | 1.83 |

| C1 All in Sustaining Cost | ||||||||

| All in Sustaining cost (excl royalty) | USDm | 1,904 | 1,621 | 1,724 | 1,606 | 2,069 | 2,211 | 1,716 |

| Royalty | USDm | 75 | 141 | 427 | 173 | 203 | 383 | 116 |

| All in Sustaining cost (incl royalty) | USDm | 1,979 | 1,762 | 2,151 | 1,780 | 2,272 | 2,594 | 1,832 |

| All in Sustaining cost (excl royalty) | USD/lb Cu | 1.58 | 1.21 | 1.28 | 1.32 | 1.69 | 1.86 | 2.71 |

| Royalty | USD/lb Cu | 0.06 | 0.10 | 0.32 | 0.14 | 0.17 | 0.32 | 0.18 |

| All in Sustaining cost (excl royalty) | USD/lb Cu | 1.64 | 1.31 | 1.60 | 1.46 | 1.86 | 2.18 | 2.89 |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

| 1.4 | Geology Setting, Mineralisation and Deposit Type |

Collahuasi forms part of the cluster that includes several porphyry Cu-Mo and Cu vein deposits within a Permo-Triassic uplifted block, which is part of the NS Tertiary porphyry belt, controlled by the north-south trending West Fissure fault system.

The host rocks in the area are continental to shallow marine volcanic and sedimentary rocks of the Permo-Triassic Collahuasi Formation. The mineralisation at Collahuasi is related to various Permian to Oligocene porphyry intrusives, including the Ines porphyry, the Collahuasi porphyry, the Rosario porphyry and the Inca porphyry.

Porphyry copper deposits at Rosario and Ujina and a high sulphidation epithermal deposit at Rosario West consist of primary sulphide mineralisation beneath secondary enriched sulphides and overlying oxides near surface. Whilst some oxide heap leaching occurred historically (ceased production in 2017), with relatively minor amounts of oxide mineralisation remaining, the operations have principally focused on copper sulphide mineralization which is mainly represented by chalcocite, chalcopyrite and bornite and molybdenum mineralisation primarily represented as molybdenite.

| 1.5 | Exploration, Drilling, Sampling, Analysis and Data Verification |

Historical exploration consisted of a combination of remote sensing and geophysical activities which progressed to reconnaissance drilling. Since the start of the operations at Collahuasi, CMDIC has carried out infill drilling campaigns aimed at updating resource classification as well as exploration drilling to expand its resource base.

The drilling database that supports the Mineral Resource estimate reported herein is based on a substantial amount of drilling data, inclusive of:

| · | Rosario and Rosario West: 3,610 drillholes for a total length of 1,093 km; |

| · | Ujina: 882 drillholes for a total length of 219 km. |

Reverse Circulation (RC) and Diamond Drill Hole (DDH) have been drilled for infill and exploration purposes. Grade control drilling is also included to inform the geological interpretation. The drilling tasks are performed by external contractors, following CMDIC internal procedures.

Drill core in secure boxes and RC sample splits are currently delivered to the CMDIC dedicated logging facility in Pozo Almonte, some 150 km NW of the mine and some 40 km east of Iquique; this facility came into use in 2018. Prior to this, when the majority of drilling was conducted on the Rosario, Rosario West and Ujina deposits, logging and sample dispatch were conducted on the mine site under contract by SGS SA (SGS) and Geoanalitica SA (Geoanalitica).

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

The logging of data from drill core includes geological, geotechnical and physical attributes, RC samples are also logged for geology. Currently, these data are captured digitally in the core shed using predefined standards and protocols. Drill core is halved before being sampled. RC and DDH samples are both sampled predominately at 2 m intervals, with the DDH samples additionally separated at lithology, mineralisation and/or alteration contacts. Density samples are also taken routinely. A similar sampling and logging strategy has been in place for at least 10 years, digital data capture and use of the acQuireTM (acQuire) database software was initiated in 2007 prior to which conventional paper logging was routine.

Samples dispatched from the Pozo Almonte facility are securely bagged with sample identity bar code markers; since 2017 these have been sent to the Bureau Veritas (BV) Cesmec laboratory in Alto Hospicio, where they are dried, crushed, sieved, and subdivided to prepare pulps for analysis following standard industry practices. Assaying for the main metals of interest is also conducted at BV using assay method AAS0025, comprising a 3-acid digest followed by atomic absorption spectrometry. Assay certificates are issued digitally and these are imported directly into the AcQuire database.

Prior to 2017, samples were sent to other well established laboratories in Chile such as SGS, Geoanalitica and CIMM Tecnologías y Servicios S.A (CIMM).

For all drilling programs developed by CMDIC, the process of sample preparation, assaying, analytical, and quality control procedures have always followed established internal protocols based on industry standard practices at the time they were conducted.

A QAQC programme has been in place for all the drilling, although the documentation and reporting of results is variable; and reportedly not available for work conducted before 2006 (some 20% of Rosario data and some 80% of Ujina data). The approach has included the insertion of:

| · | standard reference material (standards are generated using material from the mine) to monitor accuracy; |

| · | coarse blank material to monitor contamination and sample mix-ups; and |

| · | field, coarse and pulp duplicates to monitor precision. |

SRK considers that sample preparation and assay laboratory performance has been monitored thoroughly using an industry standard approach and that results indicate generally reliable laboratory performance giving good confidence in the data collected since 2007. This gives good QAQC coverage for Rosario but not for Ujina; therefore other verification methods have been used to augment Mineral Resource estimation confidence, inclusive of a limited amount of twin drilling at Ujina and production reconciliation between 2020-2024.

Since 2007, all data are entered in an acQuire database designed to store the geological, collar topography, survey and chemical assay information of the drill-holes, where the data are captured and validated within the software.

CMDIC operate a governance process where the data supporting the estimates themselves have been audited many times as the data, geological models and grade estimates have evolved over 30 years; the most recent being 2022 for Rosario and Rosario West and 2012 for Ujina.

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

| 1.6 | Mineral Processing and Metallurgical Testwork |

CMDIC has developed a geometallurgical (geomet) model which is integrated into the mine and processing planning activities. The geomet model incorporates testwork data collected from geomet drilling focused on the next 5 years of operation and plant data incorporated and used to calibrate the model through machine learning approaches.

The geomet model subdivides the deposit into a series of domains which reflect lithology, alteration, primary and secondary mineralisation, and classification according to certain mineral processing parameters derived from the testwork. One of the key aspects of the geomet model is the incorporation of the clay model which attempts to differentiate the clay species in the different sectors of the deposit (particularly for Rosario West) which has an impact on process performance and operating parameters.

The overall processing recovery forecast over the LoM is projected to be 84.7% in the aggregate (86.3% Rosario; 80.8% Rosario West; 82.6% Ujina) and 84.2% over the next five years (2025-2029). Where material has been sourced from the low grade stockpiles, an adjustment has been applied to reflect partial oxidation of the material at surface.

| 1.7 | Mineral Resource and Mineral Reserve Estimates |

Mineral Resources

Geological models have been developed on a combined basis for Rosario and Rosario West, and separately for Ujina.

The distribution of Cu and Mo mineralization at the Rosario, Rosario West, and Ujina deposits is controlled by a combination of lithological, structural, geochemical and hydrothermal processes. In order to suitably characterize the Cu and Mo distribution, the following models have been prepared:

| · | Lithological Model: Including key intrusive phases and host volcanic stratigraphy. |

| · | Structural Model: Including syn-mineralization features, major post-mineralization structures which offset the stratigraphy and intrusives, as well as late structures associated with supergene enrichment. |

| · | Alteration Model: Including key differentiation between alteration assemblages indicative of Cu mineralization (Potassic and Phyllic versus Argillic). |

| · | Cu Mineralogy Model: Including differentiation between primary and secondary Cu sulphide assemblages and Cu Oxide assemblages. |

| · | Cu and Mo Grade Shells: Indicative of (hydrothermal) zonation of Cu and Mo mineralization intensity, particularly within the primary sulphide zone. |

Cu and Mo estimation domains for Rosario, Rosario West, and Ujina deposits have been developed using a combination of the above models to establish geologically and statistically reasonable volumes within which to estimate block grades.

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

The block grade estimates include total copper, soluble copper, molybdenum, and arsenic. Grade estimation was carried out using Ordinary Kriging (OK) for the majority of estimation domains. Multiple estimation passes were defined reflecting the ranges established as part of the correlogram modelling. Mineral Resources at the Rosario, Rosario West, and Ujina deposits are classified in the Measured, Indicated, and Inferred categories based on considerations of data density and relative geological complexity.

The grade estimation was validated using standard industry techniques, prior to the models being re-blocked to a regular block size for the purpose of mine planning and Mineral Resource reporting.

Stockpile inventories reflect the closing balances at 31 December 2024 of the sulphide stockpiles. Validation drilling and sampling conducted on a portion of the low-grade stockpiles (“SBL”) has confirmed that the grades assumed for the reported stockpile balances is reasonable.

Table 1-2 summarizes the Mineral Resource figures, reported on an exclusive basis, for the in situ deposits (Rosario, Rosario West, Ujina) and the stockpiles, respectively.

| Table 1-2: | CMDIC Exclusive Mineral Resources for the Rosario, Rosario West and Ujina deposits, and associated stockpiles as at 31 December 2024 |

| Material type |

Category | Tonne (Mt) | Grade CuT (%) |

Grade MoT (ppm) |

Metal CuT (kt) |

Metal Mo (kt) |

| Rosario | ||||||

| In situ Sulphide Cut-off 0.3% Copper Total (CuT) |

Measured | 32 | 0.79 | 295 | 254 | 9 |

| Indicated | 1,100 | 0.79 | 317 | 8,681 | 348 | |

| Total Measured and Indicated | 1,132 | 0.79 | 316 | 8,935 | 357 | |

| Inferred | 2,272 | 0.68 | 257 | 15,430 | 584 | |

| Stockpiles (Sulphide) Cut-off 0.3% CuT |

Measured | |||||

| Indicated | ||||||

| Total Measured and Indicated | ||||||

| Inferred | ||||||

| Total Rosario Main | Measured | 32 | 0.79 | 295 | 254 | 9 |

| Indicated | 1,100 | 0.79 | 317 | 8,681 | 348 | |

| Total Measured and Indicated | 1,132 | 0.79 | 316 | 8,935 | 357 | |

| Inferred | 2,272 | 0.68 | 257 | 15,430 | 584 | |

| Rosario West | ||||||

| In situ Sulphide Cut-off 0.3% CuT |

Measured | 10 | 0.94 | 11 | 92 | 0 |

| Indicated | 102 | 0.90 | 8 | 914 | 1 | |

| Total Measured and Indicated | 112 | 0.90 | 8 | 1,006 | 1 | |

| Inferred | 1,971 | 0.78 | 7 | 15,356 | 15 | |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

| Material type |

Category | Tonne (Mt) | Grade CuT (%) |

Grade MoT (ppm) |

Metal CuT (kt) |

Metal Mo (kt) |

| Stockpiles (Sulphide) Cut-off 0.3% CuT |

Measured | |||||

| Indicated | ||||||

| Total Measured and Indicated | ||||||

| Inferred | ||||||

| Total Rosario West | Measured | 10 | 0.94 | 11 | 92 | 0 |

| Indicated | 102 | 0.90 | 8 | 914 | 1 | |

| Total Measured and Indicated | 112 | 0.90 | 8 | 1,006 | 1 | |

| Inferred | 1,971 | 0.78 | 7 | 15,356 | 15 | |

| Ujina | ||||||

| In situ Sulphide Cut-off 0.3% CuT |

Measured | 5 | 0.52 | 69 | 24 | 0 |

| Indicated | 248 | 0.64 | 162 | 1,590 | 40 | |

| Total Measured and Indicated | 253 | 0.64 | 160 | 1,614 | 40 | |

| Inferred | 748 | 0.67 | 160 | 4,976 | 120 | |

| Stockpiles (Sulphide) Cut-off 0.3% CuT |

Measured | |||||

| Indicated | ||||||

| Total Measured and Indicated | ||||||

| Inferred | ||||||

| Total Ujina | Measured | 5 | 0.52 | 69 | 24 | 0 |

| Indicated | 248 | 0.64 | 162 | 1,590 | 40 | |

| Total Measured and Indicated | 253 | 0.64 | 160 | 1,614 | 40 | |

| Inferred | 748 | 0.67 | 160 | 4,976 | 120 | |

| Total | Measured | 47 | 0.80 | 193 | 370 | 9 |

| Indicated | 1,450 | 0.77 | 268 | 11,185 | 389 | |

| Total Measured and Indicated | 1,497 | 0.77 | 266 | 11,555 | 398 | |

| Inferred | 4,990 | 0.72 | 144 | 35,762 | 719 | |

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

Important information regarding the Mineral Resources disclosed in Table 1-2:

| · | Martin Pittuck (CEng, FGS, MIMMM, QMR) of SRK Consulting (UK) Ltd, has reviewed the geology and Mineral Resource estimate reported herein and takes responsibility for the 31 December 2024 Resource Estimate. Mr Pittuck is a qualified person and independent for the purposes of National Instrument 43-101. |

| · | The Measured and Indicated Mineral Resources are exclusive of those Mineral Resources modified to produce the Mineral Reserves. |

| · | Mineral Resources have been defined within an optimised pit shell using Measured, Indicated and Inferred Mineral Resources, based on input parameters: copper price of USD4.76/lb, a selling cost of USD0.51/lb Cu, and a molybdenum price of USD14.00/lb Mo. Average LoM mining operating costs are estimated at USD3.19/t (total) for Rosario and USD2.65/t (total) for Ujina. Processing costs (including G&A) have been applied on a material-specific basis, resulting in average costs of USD15.02/t of ore for Rosario and USD14.63/t of ore for Ujina. Processing recoveries are based on the defined Geometallurgical Units and range from 80.3% to 84.3% for copper and from 26.3% to 46.8% for molybdenum. No allowance for royalty is included in the optimisation parameters, where this would account for USD0.30/lb at the copper price of USD4.76/lb for the given inventory. The optimisation process relied on for constraining the reporting of Mineral Resources is conditional on the assumed relocation/redesign of LoM waste rock dump and low grade stockpiles located on the western side of the pit, including appropriate standoffs. |

| · | Estimates were depleted against the topography as at 31 December 2024. |

| · | Stockpiles inventories reflecting closing balances 31 December 2024 of the sulphide stockpiles. Discounted process recoveries are applied to stockpile material with average LoM values of 77%. All stockpile material is converted to Mineral Reserves. |

| · | Mineral Resources are reported based on a regularised block size of 20 x20 x15 m. The Mineral Resources are thereafter reported at a Cut-off grade of 0.3%CuT for in situ material and 0.3%CuT for stockpile material (aligned to the stockpiling strategy). |

| · | All tonnages are reported on a dry basis. |

| · | Mineral Resource tonnages have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding. |

| · | Mineral Resources are estimated and reported on 100% attributable basis. |

Mineral Reserves

CMDIC operates a series of high-altitude open-pit mines in northern Chile, with current production sourced primarily from the Rosario Pit, with future contributions derived from the neighbouring Ujina pit as part of the LoMP. Sulphide ore is processed, through a 170 ktpd flotation plant, with the scheduled expansion to 210 ktpd due to be fully ramped up by 2028. Concentrate is transported via a 203 km pipeline to the Port of Patache. Oxide and mixed ore are excluded from current production, and cathode production ceased in 2017.

Block models were estimated using OK, with the block size aligned to 15 m benches. Historical reconciliation confirms that kriging-derived smoothing reflects expected dilution and recovery, so no additional dilution factors were applied in Mineral Reserve conversion.

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

Mineral Reserves are reported within engineered pit designs supported by detailed schedules and financial analysis. The final pit design, incorporating haul road geometry and geotechnical parameters such as inter-ramp and overall slope angles, batter angles and berm widths, all varied by azimuth and depth based on geotechnical domains.

Pit optimisation was completed in Whittle Four-X (Whittle) using the Lerchs-Grossmann algorithm, with appropriate cost, price, recovery, and slope parameters. Inferred Mineral Resources were excluded from optimisation and scheduling.

The final pit design defines the Mineral Reserve, and subsequently, the LoM production schedule/cashflows. Hence, pit optimisation is the first step in developing any LoMP. In addition to defining the ultimate size of the open pit, the pit optimisation process also indicates possible mining pushbacks. These intermediate mining stages allow the pit to be developed practically and incrementally while at the same time targeting high-grade ore and deferring waste stripping.

LoM cut-off grade and cutback sequencing were optimised in COMET using Lane’s methodology with an NPV objective function. Operational constraints included equipment utilisation, development rates, pit geometry and processing capacities. Mining costs were based on recent actuals and aligned with CMDIC five-year budget.

| November 2025 | ||

| Page |

| SRK Consulting (UK) Limited | Mineral Resources and Mineral Reserves, Collahuasi Copper Mine - Main Report |

Table 1-3 summarizes the CMDIC Mineral Reserve estimates for the insitu deposits at Rosario, Rosario West and Ujina, respectively and associated stockpiles as at December 31, 2024:

| Table 1-3: | CMDIC Mineral Reserves for the Rosario, Rosario West and Ujina deposits, and associated stockpiles as at 31 December 2024 |

| Material type | Category | Tonnes | Grade | Grade | Metal | Metal |

| Mt | % CuT | Mo ppm | kt CuT | kt Mo | ||

| Rosario | ||||||

| Sulphide | Proven | 566 | 0.83 | 204 | 4,687 | 115 |

| Cut-off 0.30% CuT | Probable | 1,658 | 0.82 | 314 | 13,531 | 521 |

| Total Sulphide | Total | 2,224 | 0.82 | 286 | 18,218 | 637 |

| Stockpiles (Sulphide) | Proven | |||||

| Cut-off 0.30% CuT | Probable | 312 | 0.54 | 140 | 1,695 | 44 |

| Total Stockpile | Total | 312 | 0.54 | 140 | 1,695 | 44 |

| Proven | 566 | 0.83 | 204 | 4,687 | 115 | |

| Total Rosario Main | Probable | 1,970 | 0.77 | 287 | 15,226 | 565 |

| Total | 2,536 | 0.79 | 268 | 19,913 | 680 | |

| Rosario West | ||||||

| Sulphide | Proven | 129 | 1.11 | 7 | 1,437 | 1 |

| Cut-off 0.30% CuT | Probable | 503 | 0.95 | 7 | 4,807 | 3 |

| Total Sulphide | Total | 633 | 0.99 | 7 | 6,244 | 4 |

| Stockpiles (Sulphide) | Proven | |||||

| Cut-off 0.30% CuT | Probable | |||||

| Total Stockpile | Total | |||||

| Proven | 129 | 1.11 | 7 | 1,437 | 1 | |

| Total Rosario West | Probable | 503 | 0.95 | 7 | 4,807 | 3 |

| Total | 633 | 0.99 | 7 | 6,244 | 4 | |

| Proven | 696 | 0.88 | 167 | 6,124 | 116 | |

| Sub-total Rosario | Probable | 2,473 | 0.81 | 230 | 20,033 | 568 |

| Total | 3,169 | 0.83 | 216 | 26,157 | 685 | |

| UJINA | ||||||

| Sulphide | Proven | 336 | 0.69 | 163 | 2,333 | 55 |

| Cut-off 0.30% CuT | Probable | 597 | 0.66 | 151 | 3,944 | 90 |

| Total Sulphide | Total | 933 | 0.67 | 156 | 6,276 | 145 |

| Stockpiles (Sulphide) | Proven | |||||

| Cut-off 0.30% CuT | Probable | 4.58 | 0.55 | 221 | 25 | 1 |

| Total Stockpile | Total | 4.58 | 0.55 | 221 | 25 | 1 |

| Proven | 336 | 0.69 | 163 | 2,333 | 55 | |

| Sub-total UJINA | Probable | 602 | 0.66 | 152 | 3,969 | 91 |

| Total | 938 | 0.67 | 156 | 6,302 | 146 | |

|

Total Mineral Reserves |

Proven | 1,032 | 0.82 | 166 | 8,457 | 171 |

| Probable | 3,075 | 0.78 | 215 | 24,002 | 660 | |

| Total | 4,107 | 0.79 | 202 | 32,458 | 831 |

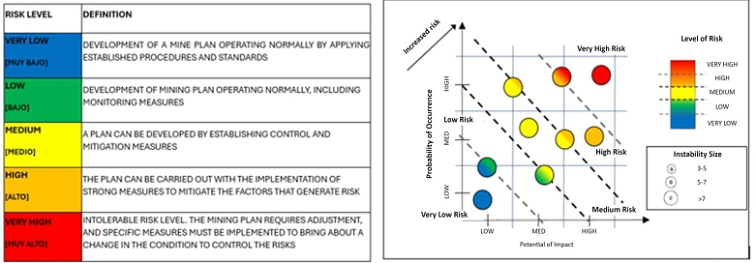

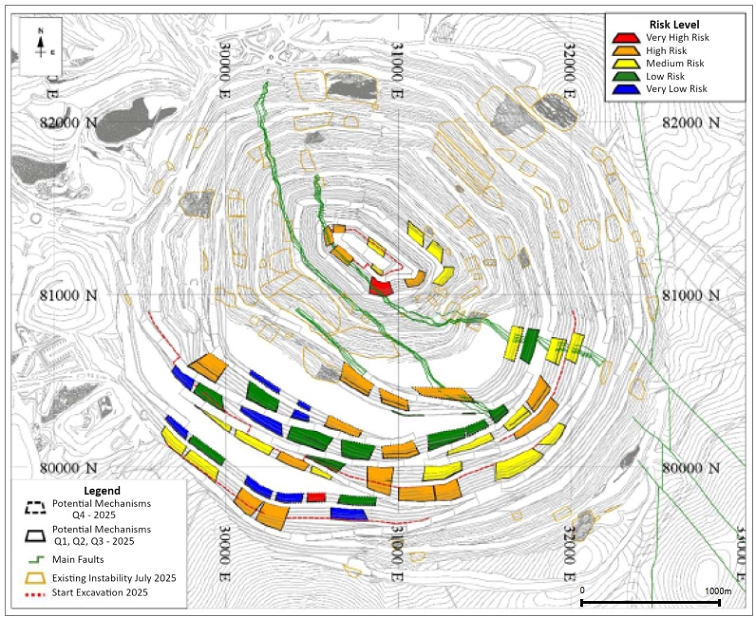

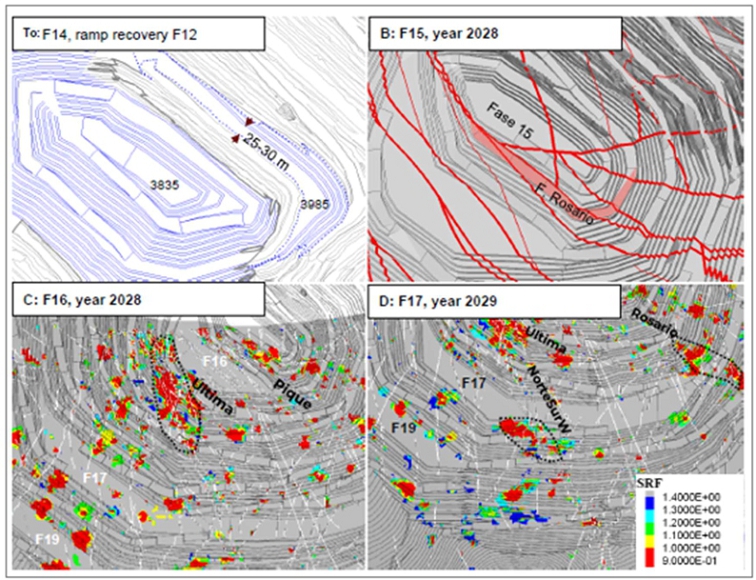

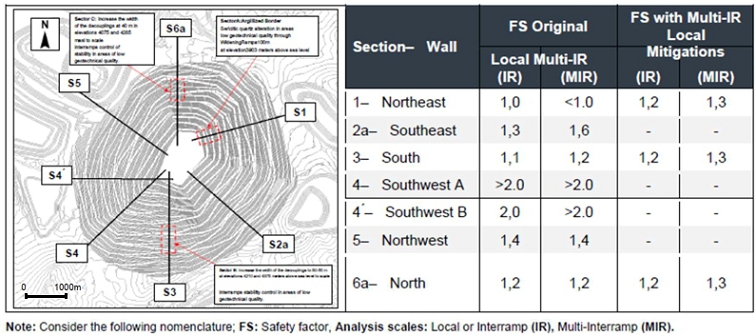

Important information regarding the Mineral Reserves disclosed in Table 1-3: