UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EXHIBIT INDEX

SIGNATURE

| Teck Resources Limited | ||

| (Registrant) | ||

| Date: November 10, 2025 | By: | /s/ Amanda R. Robinson |

| Amanda R. Robinson | ||

| Corporate Secretary | ||

Exhibit 99.1

HALF YEAR FINANCIAL REPORT

for the six months ended 30 June 2025

This page has been intentionally left blank.

31 July 2025

Anglo American Interim Results 2025

Copper and iron ore lead strong operational and cost performance

| • | Portfolio simplification: successful demerger of Valterra Platinum unlocked significant value for shareholders; steelmaking coal and nickel sales agreed; and De Beers in process |

| • | Strong production and cost performance: EBITDA margins of 48% in copper and 44% in premium iron ore |

| • | Underlying EBITDA* of $3.0 billion from continuing operations, reflecting challenging rough diamond trading conditions |

| • | On track to deliver committed $1.8 billion of cost savings: $1.3 billion realised by the end of June 2025 |

| • | Strong cash conversion* at 108%, with further reductions in working capital delivered |

| • | Net debt* of $10.8 billion, prior to receipt of majority of portfolio simplification proceeds |

| • | $0.1 billion interim dividend, equal to $0.07 per share, consistent with our 40% payout policy, reflecting negative earnings from discontinued operations and lack of contribution from De Beers |

Note: Continuing operations includes Anglo American’s future portfolio and De Beers, per accounting requirements; discontinued operations includes the Platinum, Steelmaking Coal and Nickel businesses.

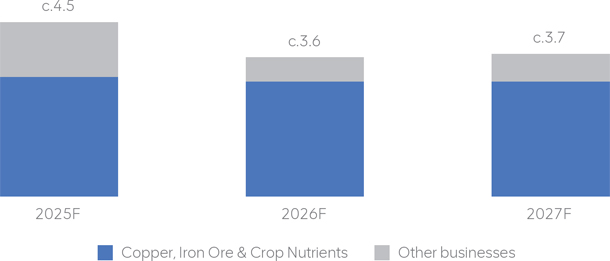

Duncan Wanblad, CEO of Anglo American, said: “We are delivering on our strategy, transforming Anglo American into a higher margin, more cash generative and more valuable mining company. By focusing on our exceptional copper, premium iron ore and crop nutrients resource endowments, each with significant value-accretive growth options, we are unlocking material value for our shareholders by delivering the see-through value of our portfolio, in which we expect copper to account for more than 60% of EBITDA.

“Safety is our number one value and always our first priority. We continue to make progress towards our goal of zero harm, with a further major improvement in the first half on what was our lowest-ever injury rate in 2024. I am, though, sorry to report the loss of two colleagues following accidents in Brazil and Zimbabwe. We are unconditional in our commitment to safety and we extend our heartfelt condolences to their families, friends and colleagues.

“I am delighted that the first half saw our continued strong operational and cost performance in copper and iron ore, coupled with further momentum towards our committed $1.8 billion of cost savings. Group underlying EBITDA of $3.0 billion from continuing operations reflects this focus on cost discipline, despite the challenging rough diamond market conditions. While 2025 is very much a year of transition, we maintained a strong EBITDA margin for our go-forward business at 43% (consistent with the prior period, on a pro forma basis(1)), compared with our current overall margin position of 32% from continuing operations (2024: 37%).

“We have made further good progress towards our simplified portfolio. In May, we completed the demerger of the majority of our interest in Valterra Platinum to our shareholders and we expect to monetise our residual 19.9% interest – currently valued at $2.6 billion – responsibly over time. We are also continuing to progress the agreed steelmaking coal and nickel business sale transactions. We expect a material strengthening of our balance sheet flexibility upon receipt of proceeds from these transactions. The work to separate De Beers is well under way, with action taken to strengthen cash flow as we position De Beers for long-term success and value realisation.

“Our clear and decisive actions are transforming Anglo American into a highly attractive and differentiated value proposition for the long term, offering strong cash generation to support sustainable shareholder returns combined with the capabilities and longstanding relationship networks to deliver our full value and growth potential.”

|

Six months ended US$ million, unless otherwise stated |

30 June 2025 | 30

June 2024 (re-presented)(2) |

Change | |||||||||

| Continuing operations | ||||||||||||

| Revenue | 8,954 | 9,584 | (7 | )% | ||||||||

| Underlying EBITDA* | 2,955 | 3,672 | (20 | )% | ||||||||

| EBITDA margin* | 32 | % | 37 | % | ||||||||

| Attributable free cash flow* | 322 | 191 | 69 | % | ||||||||

| Basic underlying earnings per share*($) | 0.32 | 0.71 | (55 | )% | ||||||||

| Attributable ROCE* | 9 | % | 12 | % | (3 | )% | ||||||

| Total (including discontinued operations) | ||||||||||||

| Loss attributable to equity shareholders of the Company | (1,879 | ) | (672 | ) | 180 | % | ||||||

| Basic underlying earnings per share* ($) | 0.15 | 1.06 | (86 | )% | ||||||||

| Loss per share ($) | (1.58 | ) | (0.55 | ) | 187 | % | ||||||

| Interim dividend per share ($) | 0.07 | 0.42 | (83 | )% | ||||||||

Terms with this symbol * are defined as Alternative Performance Measures (APMs). For more information, refer to page 88.

| (1) | Pro forma basis represents reported performance of continuing operations excluding De Beers, adjusted for committed cost savings. |

| (2) | Comparative figures are re-presented to show separately results from discontinued operations, see note 22. |

| Anglo American plc Interim Results 2025 | 1 |

Anglo American Interim Results

Sustainability performance

Key sustainability performance indicators(1)

Anglo American tracks its strategic progress using KPIs that are based on our seven pillars of value: safety and health, financial, cost, environment, people, production and socio-political. In addition to the financial and cost performance set out above and our operational performance on pages 3-30, our performance for the remaining four pillars is set out below, with further detail on pages 12-14.

Sustainability reporting accounts for 100% of managed operations (including both continuing and discontinued operations) until the date of divestment.

| Pillar of value | Metric | 30 June 2025 | 30 June 2024 | Target(2) | Target achieved | |||||

| Safety and health | Work-related fatal injuries(3) | 2 | 2 | Zero | Not achieved | |||||

| Total recordable injury frequency rate (TRIFR) per million hours | 1.20 | 1.69 | Reduction year on year | On track | ||||||

| New cases of occupational disease | 4 | 9 | Reduction year on year | On track | ||||||

| Environment | GHG emissions – Scopes 1 & 2 (Mt CO2e)(4) | 4.3 | 5.0 | Reduce absolute GHG emissions by 30% by 2030 | On track | |||||

| Fresh water withdrawals (ML)(4) (9) | 12,423 | 17,009 | Reduce fresh water abstraction in water scarce areas by 50% by 2030 | On track for 2030 target | ||||||

| Level 4–5 environmental incidents | 0 | 0 | Zero | Achieved | ||||||

| People | Women in management(5) | 36 | % | 35 | % | To achieve 33% by 2023 | Achieved | |||

| Women in the workforce | 26 | % | 26 | % | ||||||

| Voluntary labour turnover | 4.5 | % | 4 | % | < 5% | Achieved | ||||

| Socio-political | Number of jobs supported off site(6) (9) | 157,199 | 144,004 | |||||||

| Local procurement spend ($bn)(7) | 5.1 | 6.2 | ||||||||

| Taxes and royalties ($m)(8) | 1,991 | 2,481 |

| (1) | Sustainability performance indicators for the six months ended 30 June 2025 and the comparative period are not externally assured. |

| (2) | Targets indicated are in reference to our existing Sustainable Mining Plan’s commitments and goals. |

| (3) | 2025 reported performance includes one work-related fatality at the PGMs business (considered a discontinued operation under financial reporting, but included in sustainability data per the sustainability basis of preparation). |

| (4) | Data for current and prior period is to 31 May 2025 and 31 May 2024, respectively. |

| (5) | Management includes middle and senior management across the Group. |

| (6) | Jobs supported since 2018, in line with the Sustainable Mining Plan’s Livelihoods stretch goal. Current and prior period data represented is at 31 December 2024 and 2023 respectively. |

| (7) | Local procurement is defined as procurement from businesses that are registered and based in the country of operation – also referred to as in-country procurement – and includes local procurement expenditure from the Group’s subsidiaries and a proportionate share of the Group’s joint operations, based on shareholding. |

| (8) | Taxes and royalties include all taxes and royalties borne and taxes collected by the Group. This includes corporate income taxes, withholding taxes, mining taxes and royalties, employee taxes and social security contributions and other taxes, levies and duties directly incurred by the Group, as well as taxes incurred by other parties (e.g. customers and employees) but collected and paid by the Group on their behalf. Figures disclosed are based on cash remitted, being the amounts remitted by entities consolidated for accounting purposes, plus a proportionate share, based on the percentage shareholding, of joint operations. Taxes borne and collected by equity accounted associates and joint ventures are not included. Data is inclusive of both continuing and discontinued operations, in alignment with the sustainability performance reporting basis of preparation. |

| (9) | Prior period comparatives have been restated to reflect data model updates and the results of external assurance findings at 31 December 2024. |

| 2 | Anglo American plc Interim Results 2025 |

Anglo American Interim Results

Operational and financial review of Group results for the six months ended 30 June 2025

Operational performance

| Production – continuing operations | H1 2025 | H1 2024 | % vs H1 2024 | |||||||||

| Copper (kt)(1) | 342 | 394 | (13 | )% | ||||||||

| Iron ore (Mt)(2) | 31.4 | 30.7 | 2 | % | ||||||||

| Manganese ore (kt)(3) | 1,094 | 1,140 | (4 | )% | ||||||||

| Diamonds (Mct)(4) | 10.2 | 13.3 | (23 | )% | ||||||||

| (1) | Contained metal basis. Reflects copper production from the Copper operations in Chile and Peru only (excludes copper production from the Platinum Group Metals business). |

| (2) | Wet basis. |

| (3) | Anglo American’s 40% attributable share of saleable production. |

| (4) | Production is on a 100% basis, except for the Gahcho Kué joint operation which is on an attributable 51% basis. |

Continuing operations

Production volumes decreased by 9% on a copper equivalent basis, reflecting lower production at Copper Chile and De Beers.

Copper production decreased by 13% versus the prior period. At Copper Chile, anticipated lower grades, lower copper recoveries and temporary water supply constraints impacted Collahuasi, and the planned closure of the smaller Los Bronces processing plant in July 2024 impacted production at Los Bronces versus H1 2024. This was partly offset by a 6% increase in production at Copper Peru resulting from strong plant stability and higher grades.

Iron ore production increased by 2% driven by a 7% increase at Minas-Rio which was underpinned by improved mass recovery. This was partly offset by a 1% decrease at Kumba Iron Ore, facilitating the proactive drawdown of on-mine stockpiles.

Manganese production decreased by 4% reflecting the temporary suspension of the Australian operations since March 2024 as a result of the impact of tropical cyclone Megan.

At De Beers, the continued production response to the prolonged period of lower demand and higher than normal levels of inventory in the midstream impacted production in the period.

Group unit costs increased by 3% on a copper equivalent basis driven by the impact of lower production at Copper Chile and increased inflationary pressures. Excluding negligible foreign exchange impacts, unit costs also increased by 3%.

For more information on each Business’ production and unit cost performance, please refer to the following pages 16-28.

Discontinued operations

For operational information on each Business’ production and unit cost performance, please refer to the following pages 29-30.

| Anglo American plc Interim Results 2025 | 3 |

Anglo American Interim Results

Financial performance

Continuing operations Underlying EBITDA* decreased by 20% to $3.0 billion largely driven by $0.5 billion lower earnings from De Beers due to continuing challenging trading conditions. Gross cost savings of $0.3 billion delivered in the rest of the continuing operations portfolio remain on track to realise $0.5 billion of cost reductions by the end of 2025 and supported EBITDA Margin* of 32% despite a 1% reduction in the Group basket price, lower sales volumes and the impact of inflation. As a consequence, continuing operations contributed $0.4 billion to total underlying earnings of $0.2 billion.

Despite lower earnings, management actions to support the release of $0.4 billion of working capital primarily through inventory management, as well as net proceeds on disposal of Jellinbah, ensured only a modest increase in net debt to $10.8 billion with deleveraging to benefit from future divestment proceeds.

Underlying EBITDA* – Continuing operations

Underlying EBITDA decreased by $0.7 billion to $3.0 billion (30 June 2024: $3.7 billion). Financial results were predominantly impacted by the challenging rough diamond trading conditions at De Beers, alongside lower sales at Copper Chile, driven by the lower production. Despite these pressures, cost reductions partly offset these impacts and supported an EBITDA margin* of 32% (30 June 2024: 37%). Our ongoing focus on cost control and cash generation has positioned us well as we execute our strategy. A reconciliation of ‘Profit before net finance costs and tax’, the closest equivalent IFRS measure to underlying EBITDA, is provided within note 4 to the Condensed financial statements.

Underlying EBITDA* by segment

| $ million | Six months ended 30 June 2025 |

Six months ended 30 June 2024 (re-presented)(1) |

||||||

| Copper | 1,756 | 2,038 | ||||||

| Iron Ore | 1,410 | 1,413 | ||||||

| Manganese | (11 | ) | 11 | |||||

| Crop Nutrients | (30 | ) | (22 | ) | ||||

| De Beers | (189 | ) | 300 | |||||

| Corporate and other | 19 | (68 | ) | |||||

| Total | 2,955 | 3,672 | ||||||

| (1) | Comparative figures are re-presented to show separately results from discontinued operations, see note 22. |

Underlying EBITDA* reconciliation for the six months ended 30 June 2024 to six months ended 30 June 2025

The reconciliation of underlying EBITDA from $3.7 billion in 2024 to $3.0 billion in 2025 shows the major controllable factors (e.g. cost and volume), as well as those outside of management control (e.g. price, foreign exchange and inflation), that drive the Group’s performance.

| $ billion | ||||

| H1 2024 underlying EBITDA* | 3.7 | |||

| De Beers | (0.5 | ) | ||

| Price | – | |||

| Foreign exchange | – | |||

| Inflation | (0.1 | ) | ||

| Volume | (0.2 | ) | ||

| Cost | 0.2 | |||

| Other | (0.1 | ) | ||

| H1 2025 underlying EBITDA* | 3.0 | |||

De Beers

Rough diamond trading conditions remained challenged in the first half of 2025 resulting in a reduction in the rough price index, alongside the stock rebalancing initiatives at De Beers and including the impact of a one-off benefit from the fair value uplift of a non-diamond royalty right in H1 2024 saw underlying EBITDA* contribution reduce by $0.5 billion.

| 4 | Anglo American plc Interim Results 2025 |

| Anglo American Preliminary Results | Financial performance |

Price

Excluding the impact of De Beers, average market prices for the Group’s basket of products decreased by 1% compared with H1 2024. This was driven by a 4% reduction in the weighted average realised price for iron ore. This was partially offset by a 2% increase in the weighted average realised price for copper.

Foreign exchange

The Group’s average foreign exchange rate basket was broadly in line with H1 2024, creating no period-on-period impact to underlying EBITDA. The favourable impact of the weaker Chilean peso and Brazilian real was offset by the stronger South African rand and Peruvian sol.

Inflation

The Group’s weighted average CPI was 4% in 2025, broadly in line with the prior period. The impact of CPI inflation on costs reduced underlying EBITDA by $0.1 billion (30 June 2024: $0.3 billion).

Net cost and volume

Lower sales volumes impacted EBITDA by $0.2 billion, due to lower production at Copper Chile. This was partly offset by strong iron ore sales.

This was further offset by the realisation of savings delivered in 2024 seeing a gross $0.3 billion reduction in costs driven by lower headcount and mining costs at Kumba and lower overhead costs in Corporate partly offset by $0.1 billion of headwinds at Collahuasi. We are well on track to realise $0.5 billion of committed savings in 2025.

Other

The $0.1 billion unfavourable movement was driven by lower earnings at Manganese due to the suspension of operations following the tropical cyclone in March 2024.

Reconciliation from underlying EBITDA* to underlying earnings* – Continuing operations

Group underlying earnings decreased to $0.4 billion (30 June 2024: $0.9 billion), driven by lower underlying EBITDA, partly offset by lower income tax expense due to the lower earnings.

| $ million | Six months

ended 30 June 2025 |

Six

months ended 30 June 2024 (re-presented)(1) |

||||||

| Underlying EBITDA* | 2,955 | 3,672 | ||||||

| Depreciation and amortisation | (1,130 | ) | (1,071 | ) | ||||

| Net finance costs | (293 | ) | (275 | ) | ||||

| Income tax expense | (746 | ) | (1,025 | ) | ||||

| Non-controlling interests | (399 | ) | (440 | ) | ||||

| Underlying earnings* – continuing operations | 387 | 861 | ||||||

| (1) | Comparative figures are re-presented to show separately results from discontinued operations, see note 22. |

Depreciation and amortisation

Depreciation and amortisation was broadly in line at $1.1 billion (30 June 2024: $1.1 billion), as lower shipping rates and the impact of the impairment at De Beers in 2024 were offset by higher depreciation at Kumba from the reversal of an impairment at the end of 2024 and the capitalisation of Kapstevel South in June 2024, as well as Minas-Rio due to higher production and Copper Chile due to the capitalisation of material projects during the second half of 2024.

Net finance costs

Net finance costs, before special items and remeasurements, were broadly in line with the prior period at $0.3 billion (30 June 2024: $0.3 billion).

| Anglo American plc Interim Results 2025 | 5 |

| Anglo American Preliminary Results | Financial performance |

Income tax expense

The underlying effective tax rate was higher than the prior period at 48.7% (30 June 2024: 44.1%), impacted by the relative levels of profits arising in the Group’s operating jurisdictions. The tax charge for the period, before special items and remeasurements, was $0.7 billion (30 June 2024: $1.0 billion).

Non-controlling interests

The share of underlying earnings attributable to non-controlling interests was flat at $0.4 billion (30 June 2024: $0.4 billion). Amounts principally relate to minority shareholdings in Iron Ore and Copper.

Reconciliation from underlying EBITDA* to underlying earnings* – Discontinued operations

| $ million | Six months ended 30 June 2025 |

Six months ended 30 June 2024 (re-presented)(1) |

||||||

| Underlying EBITDA - discontinued operations* | 93 | 1,308 | ||||||

| Depreciation and amortisation | (212 | ) | (446 | ) | ||||

| Net finance costs | (85 | ) | (139 | ) | ||||

| Income tax expense | – | (204 | ) | |||||

| Non-controlling interests | (8 | ) | (90 | ) | ||||

| Underlying earnings* - discontinued operations | (212 | ) | 429 | |||||

| (1) | Comparative figures are re-presented to show separately results from discontinued operations, see note 22. |

Underlying earnings from discontinued operations was significantly lower largely driven by lower purchases of concentrate and the impact of flooding at Amandelbult in Platinum Group Metals (PGMs), as well as the impact in Steelmaking Coal due to the suspension of Grosvenor from July 2024, the sale of Jellinbah at the end of 2024 and the underground incident at Moranbah in March 2025. Due to the lower earnings, tax and non-controlling interests were both consequently lower.

Reconciliation from underlying EBITDA - Total Group* to underlying earnings*

| $ million | Six months ended 30 June 2025 |

Six months ended 30 June 2024 |

||||||

| Underlying EBITDA - Total Group* | 3,048 | 4,980 | ||||||

| Depreciation and amortisation | (1,342 | ) | (1,517 | ) | ||||

| Net finance costs | (378 | ) | (414 | ) | ||||

| Income tax expense | (746 | ) | (1,229 | ) | ||||

| Non-controlling interests | (407 | ) | (530 | ) | ||||

| Underlying earnings* | 175 | 1,290 | ||||||

Special items and remeasurements – Continuing operations

Special items and remeasurements (after tax and non-controlling interests) from continuing operations are a net credit of $0.1 billion (H1 2024: net charge of $1.9 billion). This principally relates to tax functional currency remeasurements of $0.2 billion partially offset by restructuring costs related to the Group’s strategic change programme of $0.1 billion.

Full details of the special items and remeasurements recorded are included in note 11 to the Condensed financial statements.

| 6 | Anglo American plc Interim Results 2025 |

| Anglo American Preliminary Results | Financial performance |

Net debt*

| 2024 | ||||||||

| $ million | 2025 | (re-presented)(1) | ||||||

| Opening net debt* at 1 January | (10,623 | ) | (10,615 | ) | ||||

| Underlying EBITDA* from subsidiaries and joint operations | 2,923 | 3,626 | ||||||

| Working capital movements | 361 | 675 | ||||||

| Other cash flows from operations | (17 | ) | (301 | ) | ||||

| Cash flows from operations | 3,267 | 4,000 | ||||||

| Capital repayments of lease obligations | (133 | ) | (167 | ) | ||||

| Cash tax paid | (612 | ) | (739 | ) | ||||

| Dividends from associates, joint ventures and financial asset investments | 28 | 42 | ||||||

| Net interest(2) | (405 | ) | (485 | ) | ||||

| Distributions paid to non-controlling interests | (220 | ) | (257 | ) | ||||

| Sustaining capital expenditure | (1,298 | ) | (1,495 | ) | ||||

| Sustaining attributable free cash flow* | 627 | 899 | ||||||

| Growth capital expenditure and other(3) | (305 | ) | (708 | ) | ||||

| Attributable free cash flow* | 322 | 191 | ||||||

| Dividends to Anglo American plc shareholders | (270 | ) | (503 | ) | ||||

| Acquisitions and disposals | (49 | ) | – | |||||

| Foreign exchange and fair value movements | 69 | (3 | ) | |||||

| Other net debt movements(4) | (121 | ) | (401 | ) | ||||

| Total movement in net debt* – continuing operations | (49 | ) | (716 | ) | ||||

| Total movement in net debt* – discontinued operations(5) | (92 | ) | 243 | |||||

| Closing net debt* at 30 June | (10,764 | ) | (11,088 | ) | ||||

| (1) | The 2024 results have been restated to exclude the discontinued operations for comparability to the current year. |

| (2) | Includes cash outflows of $128 million (30 June 2024: outflows of $243 million), relating to interest payments on derivatives hedging net debt, which are included in cash flows from derivatives related to financing activities. |

| (3) | Growth capital expenditure and other includes $17 million (30 June 2024: $46 million) of expenditure on non-current intangible assets. |

| (4) | Includes the purchase of shares (including for employee share schemes) of $40 million and other movements in lease liabilities (excluding variable vessel leases) increasing net debt by $26 million. 30 June 2024 Includes the purchase of shares (including for employee share schemes) of $99 million and other movements in lease liabilities (excluding variable vessel leases) increasing net debt by $165 million |

| (5) | Includes cash received from the Jellinbah disposal of $870 million; finance leases included within held for sale at 30 June and thus excluded from net debt of $141m; offset by capital expenditure of $518 million; Valterra Platinum dividends paid to non-controlling interests of $297 million and the net debt impact of the demerger of Valterra Platinum of $151 million including tax and transaction costs. 30 June 2024 includes cash flows from discontinued operations of $1,117 million; partially offset by capital expenditure of $762 million and cash tax paid of $145 million. |

Net debt (including related derivatives) of $10.8 billion has increased by $0.2 billion from 31 December 2024. Net debt at 30 June 2025 represented gearing (net debt to total capital) of 29% (31 December 2024: 27%). The net debt to EBITDA ratio increased to 1.8x (31 December 2024: 1.3x), as a result of the slightly higher net debt coupled with the lower underlying EBITDA. This is temporarily elevated as the portfolio transitions, with proceeds from expected divestments to be used to deleverage.

Cash flow

Cash flows from operations and Cash conversion* – Continuing operations

Cash flows from operations decreased to $3.3 billion (30 June 2024: $4.0 billion), reflecting the lower Underlying EBITDA from subsidiaries and joint operations and lower working capital inflow of $0.4 billion (30 June 2024: inflow of $0.7 million). An inventory inflow of $0.6 billion was partly offset by a $0.2 billion payables outflow.

These factors contributed to the Group’s cash conversion increasing to 108% (30 June 2024: 93%).

| Anglo American plc Interim Results 2025 | 7 |

| Anglo American Preliminary Results | Financial performance |

Capital expenditure* – Continuing operations

| $ million | Six months ended 30 June 2025 |

Six months ended 30 June 2024 (re-presented)(1) |

||||||

| Stay-in-business | 913 | 1,068 | ||||||

| Development and stripping | 292 | 258 | ||||||

| Life-extension projects | 101 | 173 | ||||||

| Proceeds from disposal of property, plant and equipment | (8 | ) | (5 | ) | ||||

| Sustaining capital | 1,298 | 1,494 | ||||||

| Growth projects | 288 | 635 | ||||||

| Total capital expenditure | 1,586 | 2,129 | ||||||

| (1) | Comparative figures are re-presented to show separately results from discontinued operations, see note 22. |

Capital expenditure was $0.5 billion lower compared to the prior period at $1.6 billion (30 June 2024: $2.1 billion).

Sustaining capital expenditure was lower at $1.3 billion (30 June 2024: $1.5 billion), primarily due to the Collahuasi desalinisation project spend reducing as it progresses towards completion in 2026.

Growth capital expenditure primarily relates to spend on the Woodsmith project (Crop Nutrients), the first phase of the Collahuasi debottlenecking initiative (Copper Chile) and the Kumba Ultra High Dense-Media-Separation (UHDMS) project (Iron Ore). Growth capital expenditure was lower at $0.3 billion (30 June 2024: $0.6 billion), due to the slow down in development of Woodsmith in the near term.

Attributable free cash flow* – Continuing operations

The Group’s attributable free cash flow was $0.3 billion (30 June 2024: $0.2 billion). Despite lower cash flows from operations this period of $3.3 billion (30 June 2024: $4.0 billion) driven by lower earnings and a smaller working capital outflow, a reduction in total capex to $1.6 billion (30 June 2024: $2.1 billion) and cash tax to $0.6 billion (30 June 2024: $0.7 billion) fully offset this decrease.

Other movements in net debt – Continuing operations

In addition to the movements in attributable free cash flow, the total movement in net debt was impacted by dividends to Anglo American plc shareholders, acquisitions and disposals, foreign exchange and fair value movements and other net debt movements. The dividend paid to Anglo American plc shareholders reduced to $0.3 billion (30 June 2024: $0.5 billion), driven by a reduction in underlying earnings.

Shareholder returns

In line with the Group’s established dividend policy to pay out 40% of underlying earnings, the Board has proposed an interim dividend of 40% of first half total underlying earnings, equal to $0.07 per share (30 June 2024: $0.42 per share), equivalent to $0.1 billion (30 June 2024: $0.5 billion).

Balance sheet

Net assets decreased by $3.0 billion to $25.6 billion (31 December 2024: $28.5 billion), driven principally by the demerger of the PGMs business, whereby net assets of $5.6 billion were demerged. This was partially offset by the recognition of a financial asset investment of $2.3 billion as at 30 June 2025 for the residual 19.9% holding in the PGMs business held at fair value.

Attributable ROCE* – Continuing operations

Attributable ROCE decreased to 9% (30 June 2024: 12%). Attributable underlying EBIT decreased to $2.0 billion (30 June 2024: $3.1 billion), reflecting the impact of lower underlying EBITDA. Average attributable capital employed decreased to $22.8 billion (2024: $25.6 billion), primarily due to the impact from the impairment recognised in the prior year at De Beers.

| 8 | Anglo American plc Interim Results 2025 |

| Anglo American Preliminary Results | Financial performance |

Liquidity and funding

Group liquidity was $12.0 billion (31 December 2024: $15.3 billion), comprising $5.8 billion of cash and cash equivalents (31 December 2024: $8.1 billion) and $6.2 billion of undrawn committed facilities (31 December 2024: $7.2 billion).

In March 2025, the Group partially bought back Euro and US dollar denominated bonds with maturities in 2027 and 2028. The Group used $1.0 billion of cash to retire $1.0 billion of contractual repayment obligations (including derivatives hedging the bonds).

Consequently, the weighted average maturity on the Group’s bonds increased to 7.8 years (31 December 2024: 7.6 years).

Attractive growth options

Anglo American continues to evolve its portfolio of competitive, world-class assets towards those future-enabling products that are essential for decarbonising the global economy, improving living standards, and supporting food security. In addition to these expansion opportunities, we also have value-accretive adjacencies in our portfolio where we expect significant value to be unlocked.

Growth projects (metrics presented on a 100% basis unless otherwise indicated)

Progress and current expectations in respect of our key growth projects are as follows:

| Operation | Scope | Capex $bn |

Remaining capex $bn |

First production |

||||

| Copper | ||||||||

| Collahuasi | Debottlenecking investment in additional crushing capacity and flotation cells is expected to increase plant throughput from c.170 ktpd to c.185 ktpd, adding production of c.10 ktpa (44% share) on average from 2026. | c.0.2 (44% share) |

c.0.1 (44% share) |

2026 | ||||

| Further investments in debottlenecking initiatives have been approved and are expected to expand the existing plant to the total permitted capacity of 210 ktpd and will add c.15 ktpa (44% share) of production from late 2027. | c.0.3 (44% share) |

c.0.3 (44% share) |

Late 2027 | |||||

| Beyond that, studies and permitting are required to be finalised for a fourth processing line in the plant and mine expansion that would add up to c.150 ktpa (44% share) of production from the early 2030s. The desalination plant that is currently under construction has been designed to accommodate capital efficient expansion in light of the growth potential at the asset. | Subject to ongoing studies, permitting, and approvals | |||||||

| Quellaveco | The plant throughput was initially permitted to a level of 127.5 ktpd and a change in legislation in June 2024 has increased the permit allowance from 5% to 10%, enabling throughput of up to c.140 ktpd. | |||||||

| In order to maximise throughput within the parameters of the current EIA permit, a rapid permit to increase throughput to 150 ktpd plus the 10% allowance was obtained in 2025. This provides added flexibility to design optimal throughput for the plant with limited configuration changes, subject to sectorial permits associated with the specific design and water availability. | ||||||||

| In light of this, the stage one expansion has been approved and will increase throughput to c.142 ktpd by late 2026, involving installation of a second pebble crusher and additional floatation cells. | c. 0.1 | c.0.1 | Late 2026 | |||||

| Efforts will continue to further debottleneck the plant, while conducting early studies to support Quellaveco’s long-term expansion prospects. | Subject to ongoing studies, permitting and approvals |

| Anglo American plc Interim Results 2025 | 9 |

| Anglo American Preliminary Results | Financial performance |

| Operation | Scope | Capex $bn |

Remaining capex $bn |

First production |

||||

| Sakatti | Polymetallic greenfield project in Finland containing copper, nickel, platinum, palladium, gold, silver and cobalt. The mine design has been updated to reflect the latest studies and production profile, expected to deliver 60-80 ktpa copper equivalent production from a state-of-the-art mine design with minimal surface footprint. The EIA was approved by the Finnish authorities in 2023 and we are progressing with work to augment existing studies in support of a Natura 2000 update. | Subject to ongoing studies, permitting, and approvals | Early 2030s | |||||

| Los Bronces | A memorandum of understanding with Codelco was signed in February 2025 to implement a joint mine plan between Los Bronces and Andina, which is expected to contribute an additional c.60 ktpa copper equivalent production (average over 2030-2051). |

Subject to definitive agreement, ongoing studies, permitting, and approvals. | 2030 | |||||

Work is progressing towards a definitive agreement in H2 2025, with the joint mine plan expected to start from 2030. |

||||||||

| The underground project will partly replace lower grade open-pit tonnes with higher grade underground tonnes. It is located 5 km from the existing pit and will use the same plant and tailings deposit capacity used by the current operation, without requiring any additional fresh water. |

||||||||

| The underground development was permitted as part of the wider Los Bronces integrated project permit granted in 2023. Studies are under way with the aim being to develop a modern operation with minimal surface impact while maximising value delivery from the project. |

||||||||

| Timing of the underground project is under review, dependent on the finalisation of the joint mine plan agreement with Codelco. The joint mine plan excludes the endowments related to Los Bronces underground. | Beyond 2030 | |||||||

| Premium iron ore | ||||||||

| Minas-Rio | The implementation of recleaner flotation columns to enable higher throughput while maintaining product quality. The average impact on production from the implementation of the recleaners from 2028 to 2040 is expected to be ~2.8 Mtpa. | c.0.3 | c.0.2 | 2028 | ||||

| The acquisition of the neighbouring Serpentina resource from Vale completed in Q4 2024. Serpentina is of a higher iron ore grade than Minas-Rio’s ore and contains predominantly softer friable ore that together are expected to translate into lower unit costs and capital requirements. | Subject to studies, permitting and approvals. | |||||||

| The combination of Minas-Rio with the scale and quality of the Serpentina endowment provides a high value option to double Minas-Rio’s production. Vale will also have an option to acquire an additional 15% shareholding in the enlarged Minas-Rio for cash (at fair value calculated at the time of exercise of the option), if and when certain events relating to a future expansion occur. Near-term access to the Serpentina ore as well as the potential future expansion are both subject to obtaining normal licences, which are expected to take a number of years. | ||||||||

| Kumba | The conversion of Sishen’s Dense Media Separation plant to an UHDMS plant will enable Sishen to reduce its ROM cut-off grade (from 48% to 40%) and produce more premium-grade product (from less than 20% to more than 50% of production) | c.0.6 | c.0.4 | 2028 |

| 10 | Anglo American plc Interim Results 2025 |

| Anglo American Preliminary Results | Financial performance |

| Operation | Scope | Capex $bn |

Remaining capex $bn |

First production |

||||

| Crop Nutrients | ||||||||

| Woodsmith | New polyhalite (natural mineral fertiliser) mine being developed in North Yorkshire, UK. Expected to produce a premium quality, comparatively low carbon fertiliser suitable for organic use. Final design capacity of c.13 Mtpa is expected, subject to studies and approval. | Refer to page 23 for more information on project progress | ||||||

Life-extension projects (metrics presented on a 100% basis unless otherwise indicated)

Progress and current expectations in respect of our key life-extension projects are as follows:

| Operation | Scope | Capex $bn |

Remaining capex $bn |

Expected first production |

||||

| Diamonds | ||||||||

| Venetia |

The Venetia underground is a replacement for the open pit and currently is expected to produce c.4Mctpa. First production was achieved in 2023 with ramp-up over the next few years as development continues. |

c.2.3 | c.0.6 | Achieved in June 2023 | ||||

| The Venetia Underground Project is undergoing a review in order to optimise cost, capital and production in light of the current market environment. |

||||||||

| Jwaneng | 9 Mctpa (100% basis) replacement for Cuts 7 and 8. This will extend the life of the mine by 9 years to 2036. | c.0.4 (19.2% share) |

c.0.1 (19.2% share) |

2027 |

Technology projects(1)

The Group continues to invest in technology projects that relate to its FutureSmart MiningTM approach, including the delivery of Anglo American’s Sustainable Mining Plan targets, particularly those that relate to safety, energy, emissions and water. The Group has optimised its technology programme, focusing only on those technologies that will bring the most benefit to the operating assets and development projects, as well as determining the most effective manner to execute these programmes. For more information on technology, please refer to our 2024 Integrated Annual Report, from page 62.

| (1) | Expenditure relating to technology projects is included within operating expenditure, or if it meets the accounting criteria for capitalisation, within Growth capital expenditure. |

| Anglo American plc Interim Results 2025 | 11 |

Anglo American Preliminary Results

Sustainability performance

Sustainable Mining Plan

Anglo American’s longstanding and holistic approach to sustainability helps to build trust with our employees and stakeholders across society, reduces operational risk and delivers direct financial value for our business. Our reputation as a responsible mining company supports our ability to access future resource development opportunities, both from the significant endowments within our business and more broadly – critical to delivering our growth ambitions.

Our Sustainable Mining Plan is designed to be a flexible, living plan and we continue to evolve it as we learn and make progress, and as technologies develop, while also ensuring it stays relevant and suitably stretching, in tune with our employees’ and stakeholders’ ambitions for our business. We are finalising an update to the Sustainable Mining Plan to both reflect the Group’s future portfolio, and to ensure that our sustainability ambitions deliver tangible value to our many stakeholders at a local level, where it matters most. Progress against the existing Sustainable Mining Plan targets is discussed below.

Zero mindset

Occupational safety

We tragically lost two colleagues in fatal incidents in the first half of 2025. On 4 February, Mr Edvan de Jesus Pinto Bogea, a colleague working for MIP Engenharia, a contractor company working on the construction of the Filtering Plant Project at Minas-Rio in Brazil was fatally injured in a fall from height incident during construction activities. On 20 April, Mr Felix Kore, a colleague working at the Unki PGMs mine in Zimbabwe was fatally injured in a mobile equipment incident.

The loss of a colleague is a profound reminder of how deeply safety matters. It affects not just the workplace, but every life connected to it, and we keep them in our thoughts at this very difficult time. We must remain focused and vigilant at all times, staying alert to hazards and the risks that surround us.

We are pleased to report continued progress in our safety performance during the first half of 2025. Our Total Recordable Injury Frequency Rate (TRIFR) has shown a sustained downward trend, building on the improvements achieved in 2024 (2024 FY: 1.57; 2025 H1: 1.20). Importantly, we have also seen a consistent decline in High Potential Incidents, reflecting the effectiveness of our risk mitigation strategies and operational discipline.

These improvements in our lagging safety indicators are underpinned by strong performance in key leading indicators. Hazard reporting remains robust, demonstrating a proactive reporting culture across our operations. Visible Felt Leadership continues to drive accountability and engagement at all levels. Planned maintenance is being executed with precision, reducing unplanned work and enhancing reliability.

Our commitment to safety is unwavering, and these results reflect the strength of our systems, our people, and our leadership. We remain focused on continuous improvement to ensure a safe and sustainable operating environment.

Occupational health

Our health and well-being strategy, aligned with the World Health Organization (WHO) Healthy Workplace model, has been updated to include Total Worker Health concepts that integrate actions to support the health and well-being of our workforce and host communities. This integrated strategy incorporates our WeCare well-being programme and other social performance activities, including our livelihoods-support programmes. It requires us to work synergistically to support our people and achieve our health and well-being goals.

Occupational diseases

To date in 2025, there were four reported new cases of occupational disease, all of which were hearing loss related to historic noise exposure (2024 H1: 9; 2024 FY: 19, of which 14 were related to noise exposure and one was musculoskeletal). The challenge in occupational disease reporting is that many hazards do not cause immediately detectable health harms, with most occupational diseases not clinically definable until many years post exposure. This means disease cases reported in a given year reflect accumulated and/or past working conditions and exposures. This is termed “latency of presentation”, and the challenge underscores the importance of ongoing robust environment monitoring, comprehensive worker education and health surveillance, regularly updated risk assessments, and proactive control of hazards with levels over the Occupational Exposure Limit. This is why reduction and prevention strategies to control all known workplace hazards down to scientifically proven protective levels remain an ongoing focus at Anglo American.

| 12 | Anglo American plc Interim Results 2025 |

| Anglo American Preliminary Results | Sustainability Performance |

We continue to maintain efforts on quality data and evolving the reporting of our health data to help inform our future decision making.

Healthy environment

Our existing Sustainable Mining Plan includes commitments to be a leader in environmental stewardship. These include our aims, by 2030, to reduce operational greenhouse gas (GHG) emissions (Scopes 1 and 2) by 30%; achieve a 50% reduction in fresh water abstraction in water scarce areas; and deliver net-positive impacts in biodiversity across our managed operations.

Climate change

In the first half of 2025, Scope 1 and 2 GHG emissions for the current portfolio, including PGMs, were 14% lower than the same period in 2024. This was largely driven by the shutdown of the Grosvenor mine at Steelmaking Coal and the Mortimer smelter at PGMs, as well as planned lower production at some assets, compared to 2024.

We are making progress towards achieving carbon neutrality across our operations by 2040. Compared with 2019, when our emissions peaked, by 2024 we had delivered a 31% reduction in our total Scope 1 and 2 emissions. Year-on-year improvements in the management of methane in our steelmaking coal business made the largest contribution to this reduction, with the completion of our renewable energy rollout in South America in 2023 also making a significant contribution. A major milestone so far in 2025 was the shift of our managed operations in Australia to 100% renewable electricity supply. Added to our South American operations, which have been supplied with 100% renewable electricity since 2023, this means that approximately 60% of the global grid supply for the current Anglo American portfolio (including PGMs) is currently drawn from renewable sources.

We continue to make progress towards addressing Anglo American’s largest remaining current source of Scope 2 emissions – our electricity supply in southern Africa. Our jointly owned renewable energy venture with EDF Power Solutions, known as Envusa Energy, is continuing construction of three renewable energy projects, known as the Koruson 2 cluster. These projects, located on the border of the Northern and Eastern Cape provinces of South Africa, are designed to have a total capacity of 520 MW of wind and solar electricity generation. In the first half of 2025, the Anglo American Board approved construction of a 63MW solar plant on one of the waste rock dumps at Kumba’s Sishen mine.

Water

With more than 80% of our global assets (including PGMs) located in water scarce areas, we need to reduce our dependence on fresh water and are working on a number of projects and technologies to help us achieve our fresh water reduction targets.

By the end of 2024, we had reduced fresh water withdrawals by 27% against the 2015 baseline that informs the Sustainable Mining Plan target of a 50% reduction in fresh water withdrawals by 2030. At mid-year 2025, fresh water withdrawals are down an additional 27% compared to H1 2024. Our operations continue to improve their water re-use and recycling rates, reducing their reliance on fresh water. Group-wide water efficiency increased to 86% in 2024 (2023: 84%). This focus on efficiency continues at all our operations throughout 2025, with reported H1 2025 efficiency at 85%.

Biodiversity

As custodians of the land and ecosystems around our operations, we seek to improve the footprint of our operations and direct our efforts towards delivering positive and lasting environmental outcomes for host communities and our wide range of stakeholders.

We have now completed detailed biodiversity baseline assessments across all our managed operations, defining and assessing significant biodiversity features including key habitats and species, as well as identifying those ecosystems that require protection and restoration. The progress towards Net Positive Impact (NPI) was reassessed in 2023, enabling us to begin developing each site’s pathway to maintaining an NPI position throughout the life of the asset. Detailed biodiversity management programmes have been developed for each site and have been independently reviewed by our NGO partners.

We continue to implement a range of biodiversity programmes across our its operations to support delivery of the Biodiversity Management Plans. These include large-scale land conservation at El Soldado and Minas-Rio, restoration of degraded land at Los Bronces, and connecting fragmented ecosystems at Kumba and Minas-Rio. At Quellaveco, collaboration with International Union for Conservation of Nature and UNEP World Conservation Monitoring Centre is advancing species monitoring while also supporting community engagement and afforestation. Collectively, these initiatives contribute to species protection, ecosystem restoration, data sharing, and long term biodiversity resilience across landscapes.

| Anglo American plc Interim Results 2025 | 13 |

| Anglo American Preliminary Results | Sustainability Performance |

Thriving communities

We continue working to strengthen and broaden our social performance competencies through embedding our social performance management system – the Social Way – across Anglo American. Through the implementation of the Social Way, which we believe is one of the most robust and comprehensive social performance management systems in the mining sector, we protect and enable both business and stakeholder value. Through our collaborative regional development initiatives, we are working actively to support local and regional economies, as well as the lives and livelihoods of the communities where we operate.

In 2024 we completed an efficiency review of the Social Way Assurance programme and the revised approach to assurance will be piloted in H2 2025.

Since the launch of our Sustainable Mining Plan, we have supported more than 157,000 off site jobs through livelihoods programmes. One example of where we are offering support beyond traditional social investment is our Impact Finance Network (IFN), which supports local growth-stage SMEs to prepare for and access funding from investors, provides pre-investment technical assistance, investor matching and catalytic capital and unlocks impact capital at scale, working with partners to build effective impact investment ecosystems. To date, the IFN has provided technical assistance and matching to more than 100 companies globally, supporting more than 53,000 jobs and raising over $117 million of third-party capital. Building off the work in southern Africa, we now have a strong footprint in South America. We are into our third year of operation in Chile and into our second year in Peru, while rolling out the IFN to Brazil, with a pilot running to the end of 2025.

Trusted corporate leader

Tightly linked to our safety imperative and our Values, we strive to create a workplace that places people at its heart. We are committed to promoting an inclusive and diverse environment where every colleague is valued and respected for who they are, and has the opportunity to fulfil their potential.

At mid-year 2025, we have continued to increase female representation across the business for our management population, reaching 36%. In addition, in regard to female representation on the Executive Leadership Team (ELT) we have increased to 30% (from 25% at the end of 2024). Female representation on the ELT, plus those reporting to an ELT member, increased to 35% (from 34% in 2024). In addition to ELT representation, we continue to work on other key performance metrics, such as the percentage of women in the overall workforce, which has remained at 26%.

To demonstrate the high standards to which we operate, we have actively worked with multi-stakeholder groups developing and adopting some of the most trusted sustainability certification programmes for the mining sector, including the Initiative for Responsible Mining Assurance (IRMA) and the Responsible Jewellery Council (RJC).

Having met our Sustainable Mining Plan interim target of having half of our operations undergo third-party audits against recognised responsible mine certification systems in 2022, we continue to work towards our 2025 target to have initiated third-party audits of all our relevant operations.

Sites that have undergone third-party assessment include:

| – | Minas-Rio and Barro Alto mines in Brazil are the first iron ore and nickel-producing mines in the world to complete an IRMA audit. Both mines achieved the IRMA 75 level of performance. |

| – | Kolomela and Sishen mines in South Africa are the first iron ore mines in Africa to complete IRMA audits, achieving an IRMA 75 level of performance. |

| – | Los Bronces and El Soldado copper operations have achieved The Copper Mark certification. Our first audits in Steelmaking Coal, using the Towards Sustainable Mining (TSM) standard, were completed at the Capcoal and Aquila mines. |

The success of our business is shared with a wide range of stakeholders, including national governments and host communities, through the significant corporate tax, mining tax and royalty payments that we make. Total taxes and royalties borne and taxes collected amounted to $1,991 million, a 20% decrease compared with the $2,481 million paid in the prior reporting period.

| 14 | Anglo American plc Interim Results 2025 |

Anglo American Preliminary Results

The Board

Changes to the composition of the Board in 2025 are set out below.

As announced in December 2024, Anne Wade joined the Board as a non-executive director and a member of the Board’s Audit and Sustainability committees on 1 January 2025.

At the date of this report, five (45%) of the 11 Board directors are female and two (18%) identify as minority ethnic. The names of the directors at the date of this report and the skills and experience our Board members contribute to the long term sustainable success of Anglo American are set out on the Group’s website:

www.angloamerican.com/about-us/leadership-team

Principal risks and uncertainties

Anglo American is exposed to a variety of risks and uncertainties which may have a financial, operational or reputational impact on the Group, and which may also have an impact on the achievement of social, economic and environmental objectives.

The principal risks and uncertainties facing the Group relate to the following:

| – | Catastrophic and natural catastrophe risks |

| – | Product prices |

| – | Geopolitical |

| – | Cybersecurity |

| – | Permitting and regulatory |

| – | Operational performance |

| – | Safety |

| – | Corruption |

| – | Portfolio and organisational transformation |

| – | Community stakeholder conflict |

| – | Water |

| – | Pandemic |

| – | Climate change |

The Group is exposed to changes in the economic environment, including tax rates and regimes, as with any other business. Details of any key risks and uncertainties specific to the period are covered in the business reviews on pages 16–30. Details of relevant tax matters are included in note 7 to the Condensed financial statements. The principal risks and uncertainties facing the Group at the 2024 year end are set out in detail in the strategic report section of the Integrated Annual Report 2024, published on the Group’s website www.angloamerican.com, on 3 March 2025.

| Anglo American plc Interim Results 2025 | 15 |

Copper

Operational and financial business review

Copper

Operational and financial metrics

| Production volume |

Sales volume |

Price | Unit cost* |

Group revenue* |

Underlying EBITDA* |

EBITDA margin* |

Underlying EBIT* |

Capex* | ROCE* | |||||||||||||

| kt(1) | kt(2) | c/lb(3) | c/lb(4) | $m(5) | $m | $m | $m | |||||||||||||||

| Copper Total | 342 | 345 | 436 | 155 | 3,666 | 1,756 | 48 | % | 1,214 | 712 | 18 | % | ||||||||||

| Prior period | 394 | 391 | 429 | 152 | 3,875 | 2,038 | 53 | % | 1,564 | 855 | 25 | % | ||||||||||

| Copper Chile | 186 | 192 | 444 | 211 | 2,142 | 715 | 33 | % | 360 | 543 | 13 | % | ||||||||||

| Prior period | 247 | 242 | 437 | 176 | 2,455 | 1,196 | 49 | % | 893 | 620 | 33 | % | ||||||||||

| Los Bronces(6) | 80 | 82 | n/a | 248 | 813 | 293 | 36 | % | 126 | 121 | n/a | |||||||||||

| Prior period | 97 | 92 | – | 241 | 873 | 369 | 42 | % | 244 | 146 | – | |||||||||||

| Collahuasi(7) | 83 | 86 | n/a | 181 | 859 | 379 | 44 | % | 253 | 403 | n/a | |||||||||||

| Prior period | 125 | 127 | – | 119 | 1,204 | 782 | 65 | % | 654 | 463 | – | |||||||||||

| Other operations(8) | 22 | 24 | n/a | n/a | 470 | 43 | 9 | % | (19) | 19 | n/a | |||||||||||

| Prior period | 24 | 23 | – | – | 378 | 45 | 12 | % | (5) | 11 | – | |||||||||||

| Copper

Peru (Quellaveco)(9) |

157 | 153 | 427 | 88 | 1,524 | 1,041 | 68 | % | 854 | 169 | 23 | % | ||||||||||

| Prior period | 147 | 149 | 415 | 112 | 1,420 | 842 | 59 | % | 671 | 235 | 17 | % | ||||||||||

| (1) | Shown on a contained metal basis. Reflects copper production from the Copper operations in Chile and Peru only (excludes copper production from the PGMs business). |

| (2) | Shown on a contained metal basis. Excludes 175 kt third-party sales (30 June 2024: 168 kt). |

| (3) | Represents realised copper price and excludes impact of third-party sales. |

| (4) | C1 unit cost includes by-product credits. Total copper unit cost is a weighted average. |

| (5) | Group revenue is shown after deduction of treatment and refining charges (TC/RCs). |

| (6) | Figures on a 100% basis (Group’s share: 50.1%). |

| (7) | 44% share of Collahuasi production, sales and financials. |

| (8) | Other operations form part of the results of Copper Chile. Production and sales are from El Soldado mine (figures on a 100% basis, Group’s share: 50.1%). Financials include El Soldado and Chagres (figures on a 100% basis, Group’s share: 50.1%), third-party trading, projects, including Sakatti, and corporate costs. El Soldado mine C1 unit costs increased by 16% to 259c/lb (30 June 2024: 224c/lb). |

| (9) | Figures on a 100% basis (Group’s share: 60%). |

Operational performance

Copper Chile

Copper production of 185,600 tonnes decreased by 25% (30 June 2024: 246,500 tonnes), due to the anticipated lower grade and lower copper recovery at Collahuasi and the planned closure of the smaller of the two Los Bronces processing plants.

At Los Bronces, production decreased by 17% to 80,300 tonnes (30 June 2024: 97,100 tonnes), primarily due to the impact of the smaller Los Bronces processing plant being put on care and maintenance at the end of July 2024, partially offset by higher ore grade (0.54% vs 0.48%) and copper recovery.

At Collahuasi, Anglo American’s attributable share of copper production decreased by 33% to 83,400 tonnes (30 June 2024: 125,000 tonnes), due to anticipated lower ore grade (0.91% vs 1.13%) as well as lower copper recovery and throughput associated with lower ore feed quality from processing lower grade stockpiles and temporary water supply constraints.

Production at El Soldado decreased by 10% to 21,900 tonnes (30 June 2024: 24,400 tonnes), principally due to planned lower grade (0.88% vs 0.94%).

| 16 | Anglo American plc Interim Results 2025 |

Copper

Copper Peru

Quellaveco production increased by 6% to 156,600 tonnes (30 June 2024: 147,300 tonnes), reflecting strong plant performance and higher grades (0.77% vs 0.73%). As planned, in 2025, the mine is expected to average similar grades as 2024, while the next phases are opened and developed, allowing for greater flexibility in the medium and long term. Optimising plant stability and throughput remains a priority during 2025 as we continue to work to improve recoveries, including at the coarse particle recovery plant.

Markets

| 30 June 2025 | 30 June 2024 | |||||||

| Average market price (c/lb) | 428 | 412 | ||||||

| Average realised price (Copper Chile – c/lb) | 444 | 437 | ||||||

| Average realised price (Copper Peru – c/lb) | 427 | 415 | ||||||

The differences between the market price and the realised prices are largely a function of provisional pricing adjustments and the timing of sales across the period.

Copper prices were volatile during the first half of 2025 as strong Chinese refined demand and a tariff-related surge in US refined copper imports were partly offset by uncertainty regarding the wider economic impact of US tariffs. The LME copper price averaged 428 c/lb, up 4% from the comparative period (30 June 2024: 412 c/lb), with the anticipation of Section 232 tariffs on copper driving a 127% period-on-period surge in US refined imports during the first 5 months of the year, drawing refined copper away from more typical demand centres in Asia and Europe. Chinese refined demand has remained robust, despite evolving US trade policies, while longer term copper prices are expected to remain well-supported by continued electrification and energy transition infrastructure investment.

Financial performance

Underlying EBITDA for Copper decreased by 14% to $1,756 million (30 June 2024: $2,038 million), driven by lower sales volumes, despite the higher copper price.

Copper Chile

Underlying EBITDA decreased by 40% to $715 million (30 June 2024: $1,196 million), primarily driven by lower sales volumes and higher unit costs, partially offset by higher copper prices. C1 unit costs increased by 20% to 211 c/lb (30 June 2024: 176 c/lb), reflecting the impact of lower production coupled with a shift in the production mix between Los Bronces and Collahuasi, partially offset by the benefit of higher by-product credits, lower treatment and refining charges and a weaker Chilean peso.

Capital expenditure decreased by 12% to $543 million (30 June 2024: $620 million), driven by expected lower expenditure at Collahuasi on the desalination plant project and a weaker Chilean peso.

Copper Peru

Underlying EBITDA increased by 24% to $1,041 million (30 June 2024: $842 million), reflecting higher sales volumes and prices as well as lower C1 unit costs. C1 unit costs decreased by 21% to 88 c/lb (30 June 2024: 112 c/lb), reflecting the benefit from lower treatment and refining charges, lower fuel and maintenance contract costs as well as the deferral of some costs into the second half of the year.

Capital expenditure decreased by 28% to $169 million (30 June 2024: $235 million), due to rephasing of spend on the tailings management facility and completion of tailings dam phases.

Operational outlook

Copper Chile

Los Bronces

Los Bronces is a world-class copper deposit, accounting for more than 2% of the world’s known copper resources. A single phase with harder ore is currently been mined, and until the economics improve, the smaller (c.40% of total plant capacity) Los Bronces processing plant will remain on care and maintenance.

Good progress is being made in the development of Donoso 2, the next phase of the mine, which has higher grade and softer ore. Development activities for this phase continue and it is expected to be fully opened by early 2027. The first phase of the Los Bronces integrated water security project is also ongoing, which will secure a large portion of the mine’s water needs through a desalinated water supply from 2026.

| Anglo American plc Interim Results 2025 | 17 |

Copper

The permitted Los Bronces integrated project work is progressing as planned. For the mine pit expansion, the first mine phase development has already started, and for Los Bronces underground, the pre-feasibility study is advancing and is expected to be finalised during the second half of 2025.

Collahuasi

Collahuasi is a world-class orebody with significant growth potential, accounting for more than 2% of the world´s known copper resources with over 2.6 billion tonnes of sulphide Ore Reserves at 0.96% TCu grade. The mine is currently transitioning between phases in the main Rosario pit and is expected to continue drawing on lower grade stockpiles over the coming period, while remaining focused on optimising plant feed to mitigate the impact of this transitional period and completing the key debottlenecking projects. Various debottlenecking options have been approved and are in execution that are expected to add c.25,000 tonnes per annum (tpa) (our 44% share) of production from late 2027. Beyond that, studies and permitting are under way for a fourth processing line in the plant and mine expansion that would add up to c.150,000 tpa (our 44% share) of production. Timing of that expansion is subject to the permitting process; depending on permit approval, first production could follow from the early 2030s.

A desalination plant is currently under construction that will meet a large portion of the mine’s water requirements by mid-2026 when fully operational and has been designed to accommodate capital-efficient expansion to support the fourth processing line expansion project. Until then, the operation continues to progress mitigation measures to optimise and reduce water consumption, as well as securing third-party water sources including the provision of ultra-filtered sea water that was delivered in July for system testing and is expected to ramp-up during the second half of 2025.

El Soldado

Production in 2025 is expected to return to 2023 production levels (c.40,000 tpa) due to planned lower grades, before declining to 30,000–35,000 tpa until end of mine life which is expected by mid-2028. Options to extend the life of the mine beyond 2028 are being evaluated.

Copper Chile

These factors are reflected in the unchanged guidance provided on pages 31-33. Production guidance for Chile for 2025 is 380,000–410,000 tonnes, subject to water availability, and is expected to be weighted to the second half of 2025 given the impact from lower grades in the first half from Collahuasi, particularly in Q1.

2025 unit cost guidance is c.195 c/lb(1). The first half unit cost of 211 c/lb, was higher than guidance, reflecting the impact of the production mix between Los Bronces and Collahuasi.

Copper Peru

Quellaveco in Peru remains a cornerstone in our portfolio of world-class copper assets, designed to produce on average c.300,000 tonnes of copper per annum in its first 10 years of operation.

In the latter part of 2023, a revised mine plan was put into place due to a localised geotechnical fault. The stripping and mine development work is progressing well, with other lower grade phases being mined and opened up to increase the flexibility in the mine. After five years of operating, maintenance will be carried out on the concentrator, including the mills and conveyors; this is expected to occur in 2027 and 2028, modestly impacting production in those years.

There is significant expansion potential that could sustain production beyond the initial high-grade area. The original plant throughput design capacity was 127,500 tonnes per day (tpd) and a change in legislation in the middle of 2024 increased the permit allowance from 5% to 10%, enabling throughput to increase from 133,800 tpd to c.140,000 tpd. In order to maximise throughput within the parameters of the current Environmental Impact Assessment permit, a rapid permit to increase throughput to 150,000 tpd plus the 10% allowance was obtained in 2025. This provides added flexibility to design optimal throughput for the plant with limited configuration changes, subject to sectorial permits associated with the specific design and water availability.

In light of this, the stage one expansion has been approved and will increase throughput to c.142,000 tpd by late 2026, involving the installation of a second pebble crusher and additional flotation cells. This project represents the first stage to full optimisation of the plant with minimal capital investment, delivering robust returns. Efforts will continue to further debottleneck the plant, while conducting early studies to support Quellaveco’s long-term expansion prospects, underpinned by an exploration drilling campaign below and around the current pit shell, which to date has yielded promising results.

| 18 | Anglo American plc Interim Results 2025 |

Copper

These factors are reflected in the unchanged guidance provided on pages 31-33. Production guidance for Peru for 2025 is 310,000–340,000 tonnes. 2025 unit cost guidance is c.100 c/lb(1). The first half unit cost of 88 c/lb was lower than guidance, reflecting higher molybdenum volumes due to mine phasing with strong pricing realisations, the impact of mine sequencing and lower treatment and refining charges.

| (1) | The copper unit costs are impacted by FX rates and pricing of by-products, such as molybdenum. 2025 unit cost guidance was set at c.950 CLP:USD for Chile and c.3.75 PEN:USD for Peru. |

| Anglo American plc Interim Results 2025 | 19 |

Iron Ore

Iron Ore

Operational and financial metrics

| Production volume |

Sales volume |

Price | Unit cost* |

Group revenue* |

Underlying EBITDA* |

EBITDA margin* |

Underlying EBIT* | Capex* | ROCE* | |||||||||||||||||||||||||||||||

| Mt(1) | Mt(1) | $/t(2) | $/t(3) | $m | $m | $m | $m | |||||||||||||||||||||||||||||||||

| Iron Ore Total | 31.4 | 31.0 | 89 | 35 | 3,224 | 1,410 | 44 | % | 1,055 | 520 | 18 | % | ||||||||||||||||||||||||||||

| Prior period | 30.7 | 29.5 | 93 | 37 | 3,296 | 1,413 | 43 | % | 1,171 | 495 | 21 | % | ||||||||||||||||||||||||||||

| Kumba Iron Ore(4) | 18.2 | 18.7 | 91 | 39 | 1,886 | 849 | 45 | % | 645 | 246 | 38 | % | ||||||||||||||||||||||||||||

| Prior period | 18.5 | 18.1 | 97 | 39 | 1,988 | 888 | 45 | % | 742 | 266 | 47 | % | ||||||||||||||||||||||||||||

| Iron Ore Brazil (Minas-Rio) | 13.1 | 12.3 | 86 | 29 | 1,338 | 561 | 42 | % | 410 | 274 | 12 | % | ||||||||||||||||||||||||||||

| Prior period | 12.3 | 11.4 | 86 | 33 | 1,308 | 525 | 40 | % | 429 | 229 | 14 | % | ||||||||||||||||||||||||||||

| (1) | Production and sales volumes are reported as wet metric tonnes. Product is shipped with c.1.5% moisture from Kumba and c.9% moisture from Minas-Rio. |

| (2) | Prices for Kumba Iron Ore are the average realised export basket price (FOB Saldanha) (wet basis). Prices for Minas-Rio are the average realised export basket price (FOB Brazil) (wet basis). Prices for total iron ore are a blended average. |

| (3) | Unit costs are reported on an FOB wet basis. Unit costs for total iron ore are a weighted average. |

| (4) | Sales volumes, stock and realised price could differ to Kumba’s stand-alone reported results due to sales to other Group companies. |

Operational performance

Kumba(1)

Total production of 18.2 Mt is marginally lower than the prior period (30 June 2024: 18.5 Mt) reflecting a flexible production approach to managing Sishen and Kolomela as an integrated complex. Production was 6% lower at Sishen at 12.4 Mt (30 June 2024: 13.2 Mt) following a proactive drawdown of high mine stockpiles in the first quarter and maintenance activities in the second quarter. This was mostly offset by an increase of 12% at Kolomela to 5.9Mt (30 June 2024: 5.3Mt) due to the improved third-party rail availability to the mine.

Sales volumes increased by 3% to 18.7 Mt (30 June 2024: 18.1 Mt), due to improved equipment availability at Saldanha Bay Port.

The third-party rail performance improved by 0.8 Mt to 18.9 Mt (30 June 2024: 18.1 Mt) due to improved running times. Total finished stock remained broadly flat in the first six months of the year at 7.4 Mt, with stock at the mines decreasing by 0.5 Mt to 6.4 Mt and stock at the port increasing by 0.5 Mt to 1.0 Mt.

Minas-Rio

Minas-Rio delivered a strong performance in the first six months of the year, with production increasing by 7% to 13.1 Mt (30 June 2024: 12.3 Mt). This performance was underpinned by improved mass recovery at the beneficiation plant, which in turn was driven by reduced ore variability, higher iron ore content, enhanced operational discipline and stability through improved equipment availability to ensure consistent ore feed supply.

Markets

| 30 June 2025 | 30 June 2024 | |||||||

| Average market price (Platts 62% Fe CFR China – $/tonne) | 101 | 118 | ||||||

| Average market price (MB 65% Fe Fines CFR – $/tonne) | 113 | 131 | ||||||

| Average realised price (Kumba export – $/tonne) (FOB wet basis) | 91 | 97 | ||||||

| Average realised price (Minas-Rio – $/tonne) (FOB wet basis) | 86 | 86 | ||||||

The Platts 65-62 differential averaged $12/dmt in H1 2025, down from $13/dmt in H1 2024, reflecting a shift in demand towards low to mid-grade iron ore. The shift has prompted consecutive narrowing of the spread throughout the first six months of the year, as steelmakers sought to reduce costs amid sustained margin pressure. The lump premium averaged $0.1514/dmtu in H1 2025, up from $0.1339/dmtu a year earlier, supported by a significant decline in metallurgical coke prices that incentivised greater lump usage in blast furnace operations.

Kumba’s FOB realised price of $91/wet metric tonne (wmt) was above the equivalent Platts 62% Fe FOB Saldanha market price (adjusted for moisture) of $84/wmt in the first six months of the year. The premiums for iron content (64.1% Fe) and lump product (approximately 67%) were partially offset by provisionally priced sales volumes.

| 20 | Anglo American plc Interim Results 2025 |

Iron Ore

Minas-Rio’s pellet feed product is higher grade (with iron content of c.67% and lower impurities) so the MB 65 Fines index is used when referring to the Minas-Rio product. The Minas-Rio realised price of $86/wmt FOB was 5% higher than the equivalent MB 65 FOB Brazil index (adjusted for moisture) of $82/wmt FOB, benefitting from the premium for our high quality product, including higher (~67%) Fe content, partially offset by provisionally priced sales volumes.

Financial performance

Underlying EBITDA for Iron Ore remained broadly flat at $1,410 million (30 June 2024: $1,413 million), as a 4% lower realised iron ore price was fully offset by a 5% increase in sales volumes.

Kumba(1)

Underlying EBITDA was 4% lower at $849 million (30 June 2024: $888 million), as the lower realised price was largely offset by higher sales volumes. Unit costs were maintained at $39/tonne (30 June 2024: $39/tonne), as a result of ongoing cost optimisation work that offset the effects of inflation and the stronger South African rand.

Capital expenditure decreased by 8% to $246 million (30 June 2024: $266 million) reflecting lower stay-in-business spend as a result of optimisation initiatives and phasing as projects are ramping up in the second half of the year, partially offset by higher deferred stripping capitalisation.

Minas-Rio

Underlying EBITDA increased by 7% to $561 million (30 June 2024: $525 million), driven primarily by higher sales volumes and lower unit cost. Unit costs decreased by 12% to $29/tonne (30 June 2024: $33/tonne), mainly due to a weaker Brazilian real and higher production volumes.

Capital expenditure was 20% higher at $274 million (30 June 2024: $229 million), primarily associated to the tailings filtration project, which is expected to start up in early 2026.

Operational outlook

Kumba

Production is expected to remain at 35–37 Mtpa in the near term, apart from 2026, which is expected to decrease by c.4Mt to 31-33 Mtpa reflecting the tie-in of the Ultra High Dense-Media-Separation (UHDMS) project which was announced by Kumba in August 2024. Unit costs are expected to be between $39–40/tonne during this three-year period.

These factors are reflected in the unchanged guidance provided on pages 31-33. Production guidance for 2025 is 35– 37Mt, subject to third-party rail and port availability and performance. 2025 unit cost guidance is c.$39/tonne(2). The first half unit cost of $39/tonne was in line with guidance.

| (1) | Production and sales volumes, stock and realised price are reported on a wet basis and could differ from Kumba’s stand-alone results due to sales to other Group companies. |

Minas-Rio

An inspection of the 529 km pipeline that carries iron ore slurry from the plant to the port is planned for Q3 2025. Plant maintenance has been scheduled to coincide with the operational stoppage. Pipeline inspections take place every five years and are validated by external consultants and agreed with the Brazilian Environmental Authorities.

These factors are reflected in the unchanged guidance provided on pages 31-33. Production guidance for 2025 is 22–24 Mt. 2025 unit cost guidance is c.$32/tonne(2). The first half unit cost of $29/tonne, was lower than guidance, due to production volumes being weighted to the first half of the year.