UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number 001--39966

New Found Gold Corp.

(Translation of Registrant’s name into English)

Suite 3500, The Stack,

1133 Melville Street,

Vancouver, British Columbia,

Canada V6E 4E5

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x Exhibits 99.1 and 99.2 to this Form 6-K are incorporated by reference as additional exhibits to the registrant’s Registration Statement on Form F-10 (File No.

INCORPORATION BY REFERENCE

333-287547).

DOCUMENTS INCLUDED AS PART OF THIS REPORT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| New Found Gold Corp. | |||

| Date: November 6, 2025 | By: | /s/ Hashim Ahmed | |

| Name: | Hashim Ahmed | ||

| Title: | Chief Financial Officer | ||

Exhibit 99.1

TABLE OF CONTENTS

| Condensed interim statements of financial position | 1 |

| Condensed interim statements of loss and comprehensive loss | 2 |

| Condensed interim statements of cash flows | 3 |

| Condensed interim statements of changes in equity | 4 |

| Notes to the condensed interim financial statements | 5 |

New Found Gold Corp.

Condensed Interim Statements of Financial Position

(Unaudited - Expressed in Canadian Dollars)

| Note |

September 30, 2025 $ |

December 31, 2024 $ |

||||||||

| ASSETS | ||||||||||

| Current assets | ||||||||||

| Cash and cash equivalents | 71,136,121 | 22,317,548 | ||||||||

| Investments | 5 | 540,096 | 926,019 | |||||||

| Interest receivable | 282 | - | ||||||||

| Sales taxes recoverable | 1,750,210 | 2,209,948 | ||||||||

| Prepaid expenses and deposits | 1,454,185 | 1,480,341 | ||||||||

| Secured notes | 7 | - | 2,817,554 | |||||||

| Total current assets | 74,880,894 | 29,751,410 | ||||||||

| Non-current assets | ||||||||||

| Exploration and evaluation assets | 3 | 34,574,784 | 34,505,484 | |||||||

| Investment in Kirkland Lake Discoveries Corp. | 6 | 2,322,095 | 1,525,756 | |||||||

| Property and equipment | 4 | 7,848,920 | 7,938,149 | |||||||

| Right-of-use assets | 62,346 | 118,509 | ||||||||

| Other assets | 256,534 | 179,703 | ||||||||

| Total non-current assets | 45,064,679 | 44,267,601 | ||||||||

| Total Assets | 119,945,573 | 74,019,011 | ||||||||

| LIABILITIES | ||||||||||

| Current liabilities | ||||||||||

| Accounts payable and accrued liabilities | 9,11 | 6,511,740 | 7,325,203 | |||||||

| Flow-through share premium | 8 | 11,992,641 | - | |||||||

| Lease liabilities | 450 | 53,783 | ||||||||

| Share-based compensation liabilities | 10 | 40,808 | - | |||||||

| Total current liabilities | 18,545,639 | 7,378,986 | ||||||||

| Lease liabilities | 68,741 | 69,320 | ||||||||

| Total non-current liabilities | 68,741 | 69,320 | ||||||||

| Total liabilities | 18,614,380 | 7,448,306 | ||||||||

| EQUITY | ||||||||||

| Share capital | 10 | 407,822,989 | 341,346,716 | |||||||

| Reserves | 10 | 35,718,073 | 34,988,421 | |||||||

| Deficit | (342,209,869 | ) | (309,764,432 | ) | ||||||

| Total equity | 101,331,193 | 66,570,705 | ||||||||

| Total Liabilities and Equity | 119,945,573 | 74,019,011 | ||||||||

NATURE OF OPERATIONS AND GOING CONCERN (Note 1)

COMMITMENTS (Note 3)

SUBSEQUENT EVENTS (Notes 3(i), 6 and 16)

These condensed interim financial statements are authorized for issue by the Board of Directors on November 6, 2025. They are signed on the Company’s behalf by:

| “Paul Huet” | , Director | |

| “William Hayden” | , Director |

The accompanying notes are an integral part of these condensed interim financial statements.

-

New Found Gold Corp.

Condensed Interim Statements of Loss and Comprehensive Loss

(Unaudited - Expressed in Canadian Dollars, except share amounts)

| Three months ended September 30, |

Nine

months ended |

|||||||||||||||||

| Note |

2025 $ |

2024 $ |

2025 $ |

2024 $ |

||||||||||||||

| Expenses | ||||||||||||||||||

| Exploration and evaluation expenditures | 3,11 | 13,423,595 | 12,861,119 | 27,794,432 | 37,150,120 | |||||||||||||

| Salaries and consulting | 11 | 1,298,781 | 602,260 | 4,026,378 | 2,066,939 | |||||||||||||

| Corporate development and investor relations | 11 | 839,097 | 192,858 | 1,338,980 | 581,974 | |||||||||||||

| Share-based compensation | 10,11 | 766,158 | 188,857 | 2,125,090 | 815,246 | |||||||||||||

| Depreciation | 4 | 183,182 | 195,958 | 582,363 | 615,238 | |||||||||||||

| Professional fees | 399,730 | 362,187 | 1,239,263 | 1,185,478 | ||||||||||||||

| Office and sundry | 178,117 | 195,030 | 600,196 | 594,750 | ||||||||||||||

| Travel | 156,408 | 66,900 | 448,345 | 125,019 | ||||||||||||||

| Transfer agent and regulatory fees | 26,162 | 60,824 | 381,943 | 341,137 | ||||||||||||||

| Loss from operating activities | (17,271,230 | ) | (14,725,993 | ) | (38,536,990 | ) | (43,475,901 | ) | ||||||||||

| Other income (expenses) | ||||||||||||||||||

| Settlement of flow-through share premium | 8 | 3,495,191 | 3,189,263 | 4,249,959 | 9,095,737 | |||||||||||||

| Gains (losses) on equity investment | 6 | 864,087 | (321,932 | ) | 796,339 | (1,062,312 | ) | |||||||||||

| Foreign exchange gain (loss) | 28,272 | (59,233 | ) | (115,821 | ) | 25,847 | ||||||||||||

| Part XII.6 tax | 8 | (67,143 | ) | (190,140 | ) | (67,143 | ) | (819,179 | ) | |||||||||

| Gains on secured notes | 7 | - | 63,310 | 55,911 | 104,527 | |||||||||||||

| Interest expense | (3,409 | ) | (6,031 | ) | (12,882 | ) | (18,730 | ) | ||||||||||

| Interest income | 511,795 | 730,741 | 892,946 | 2,373,638 | ||||||||||||||

| Investment gains (losses) | 5 | (502,357 | ) | (263,651 | ) | 292,243 | (1,334,287 | ) | ||||||||||

| Settlement of legal claim | 10,14 | - | - | - | (1,750,100 | ) | ||||||||||||

| Total | 4,326,436 | 3,142,327 | 6,091,552 | 6,615,141 | ||||||||||||||

| Loss and comprehensive loss for the period | (12,944,794 | ) | (11,583,666 | ) | (32,445,437 | ) | (36,860,760 | ) | ||||||||||

| Loss per share – basic and diluted ($) | 12 | (0.06 | ) | (0.06 | ) | (0.15 | ) | (0.19 | ) | |||||||||

| Weighted average number of shares outstanding – basic and diluted | 12 | 235,018,399 | 198,019,407 | 214,761,519 | 192,324,461 | |||||||||||||

The accompanying notes are an integral part of these condensed interim financial statements.

-

New Found Gold Corp.

Condensed Interim Statements of Cash Flows

(Unaudited - Expressed in Canadian Dollars)

| Nine months ended September 30, | ||||||||

|

2025 $ |

2024 $ |

|||||||

| Cash flows from operating activities | ||||||||

| Loss for the period | (32,445,437 | ) | (36,860,760 | ) | ||||

| Adjustments for: | ||||||||

| Depreciation | 582,363 | 615,238 | ||||||

| Gains (losses) on equity investment | (796,339 | ) | 1,062,312 | |||||

| Interest income | (74,468 | ) | (227,463 | ) | ||||

| Interest expense | 12,882 | 18,730 | ||||||

| Gains on secured notes | (55,911 | ) | (104,527 | ) | ||||

| Settlement of legal claim | - | 1,750,100 | ||||||

| Foreign exchange loss (gain) on secured notes | 95,465 | (50,514 | ) | |||||

| Unrealized foreign exchange loss (gain) | 10,334 | (11,888 | ) | |||||

| Settlement of flow-through share premium | (4,249,959 | ) | (9,095,737 | ) | ||||

| Share-based compensation | 2,125,090 | 815,246 | ||||||

| Investment (gains) losses | (292,243 | ) | 1,334,287 | |||||

| (35,088,223 | ) | (40,754,976 | ) | |||||

| Change in non-cash working capital items: | ||||||||

| Decrease in prepaid expenses and deposits | 26,156 | 62,854 | ||||||

| Decrease in sales taxes recoverable | 459,738 | 1,544,694 | ||||||

| Decrease in other assets | 179,703 | - | ||||||

| Increase in interest receivable | (282 | ) | - | |||||

| (Decrease) in accounts payable and accrued liabilities | (290,793 | ) | (49,844 | ) | ||||

| Net cash and cash equivalents (used in) operating activities | (34,713,701 | ) | (39,197,272 | ) | ||||

| Cash flows from investing activities | ||||||||

| Expenditures on claim staking and mineral license renewals | (69,300 | ) | (3,450 | ) | ||||

| Interest received on secured notes | - | 229,688 | ||||||

| Other assets | (173,025 | ) | (111,108 | ) | ||||

| Purchases of exploration and evaluation assets | (676,921 | ) | (2,413,010 | ) | ||||

| Proceeds from sale of secured notes | 2,778,000 | - | ||||||

| Proceeds on disposal of investments | 752,634 | 688,220 | ||||||

| Purchases of property and equipment | (365,948 | ) | (370,303 | ) | ||||

| Net cash and cash equivalents generated from (used in) investing activities | 2,245,440 | (1,979,963 | ) | |||||

| Cash flows from financing activities | ||||||||

| Issuance of common shares in prospectus offering | 63,480,000 | 27,522,494 | ||||||

| Issuance of common shares in a private placement | 20,000,001 | - | ||||||

| Share issue costs | (3,912,782 | ) | (921,158 | ) | ||||

| Other assets | - | (174,552 | ) | |||||

| Stock options exercised | 1,797,025 | 87,500 | ||||||

| Lease principal payments | (53,912 | ) | (105,549 | ) | ||||

| Lease interest payments | (12,882 | ) | (18,730 | ) | ||||

| Net cash and equivalents generated from financing activities | 81,297,450 | 26,390,005 | ||||||

| Effect of exchange rate fluctuations on cash and cash equivalents | (10,616 | ) | 10,842 | |||||

| Net increase (decrease) in cash and cash equivalents | 48,818,573 | (14,776,388 | ) | |||||

| Cash and cash equivalents at beginning of period | 22,317,548 | 53,884,809 | ||||||

| Cash and cash equivalents at end of period | 71,136,121 | 39,108,421 | ||||||

SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS (Note 13)

The accompanying notes are an integral part of these condensed interim financial statements.

-

New Found Gold Corp.

Condensed Interim Statements of Changes in Equity

(Unaudited - Expressed in Canadian Dollars, except share amounts)

| Share capital | Reserves | |||||||||||||||||||||||

|

Number of shares |

Amount $ |

Equity

settled $ |

Warrants $ |

Deficit $ |

Total equity $ |

|||||||||||||||||||

| Balance at December 31, 2023 | 186,873,012 | 290,244,029 | 34,751,151 | 3,918 | (259,496,078 | ) | 65,503,020 | |||||||||||||||||

| Issued pursuant to acquisition of the Kingsway Project (Note 3(i)) | 5,263,157 | 20,000,000 | - | - | - | 20,000,000 | ||||||||||||||||||

| Issued pursuant to acquisition of exploration and evaluation assets | 300,000 | 1,011,000 | - | - | - | 1,011,000 | ||||||||||||||||||

| Issued in prospectus offering | 5,857,242 | 27,522,494 | - | - | - | 27,522,494 | ||||||||||||||||||

| Share issue costs | - | (917,610 | ) | - | - | - | (917,610 | ) | ||||||||||||||||

| Issued in settlement of legal claim | 370,000 | 1,750,100 | - | - | - | 1,750,100 | ||||||||||||||||||

| Share-based compensation | - | - | 815,246 | - | - | 815,246 | ||||||||||||||||||

| Stock options exercised | 175,000 | 154,020 | (66,520 | ) | - | - | 87,500 | |||||||||||||||||

| Total loss and comprehensive loss for the period | - | - | - | - | (36,860,760 | ) | (36,860,760 | ) | ||||||||||||||||

| Balance at September 30, 2024 | 198,838,411 | 339,764,033 | 35,499,877 | 3,918 | (296,356,838 | ) | 78,910,990 | |||||||||||||||||

| Issued pursuant to acquisition of exploration and evaluation assets | 69,583 | 215,707 | - | - | - | 215,707 | ||||||||||||||||||

| Share issue costs | - | 2,803 | - | - | - | 2,803 | ||||||||||||||||||

| Stock options exercised | 1,550,000 | 1,364,173 | (589,173 | ) | - | - | 775,000 | |||||||||||||||||

| Share-based compensation | - | - | 73,799 | - | - | 73,799 | ||||||||||||||||||

| Total loss and comprehensive loss for the period | - | - | - | - | (13,407,594 | ) | (13,407,594 | ) | ||||||||||||||||

| Balance at December 31, 2024 | 200,457,994 | 341,346,716 | 34,984,503 | 3,918 | (309,764,432 | ) | 66,570,705 | |||||||||||||||||

| Issued in prospectus offering | 28,980,000 | 63,480,000 | - | - | - | 63,480,000 | ||||||||||||||||||

| Issued in private placement | 12,269,939 | 20,000,001 | - | - | 20,000,001 | |||||||||||||||||||

| Flow-through premium | - | (16,242,600 | ) | - | - | (16,242,600 | ) | |||||||||||||||||

| Share issue costs | - | (3,912,782 | ) | - | - | - | (3,912,782 | ) | ||||||||||||||||

| Stock options exercised | 1,329,329 | 3,151,654 | (1,354,629 | ) | - | - | 1,797,025 | |||||||||||||||||

| Share-based compensation | - | - | 2,084,281 | - | - | 2,084,281 | ||||||||||||||||||

| Total loss and comprehensive loss for the period | - | - | - | - | (32,445,437 | ) | (32,445,437 | ) | ||||||||||||||||

| Balance at September 30, 2025 | 243,037,262 | 407,822,989 | 35,714,155 | 3,918 | (342,209,869 | ) | 101,331,193 | |||||||||||||||||

The accompanying notes are an integral part of these condensed interim financial statements.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 1. | NATURE OF OPERATIONS AND GOING CONCERN |

New Found Gold Corp. (the “Company”) was incorporated on January 6, 2016, under the Business Corporations Act in the Province of Ontario. On September 23, 2020, the Company continued as a British Columbia corporation under the Business Corporations Act in the Province of British Columbia. The Company’s registered office is located at Suite 3500, The Stack, 1133 Melville Street, Vancouver, British Columbia V6E 4E5.

The Company is a mineral exploration company engaged in the acquisition, exploration and evaluation of resource properties with a focus on gold properties located in Newfoundland and Labrador, Canada. The Company’s exploration and evaluation assets presently have no proven or probable reserves. The recoverability of amounts shown for exploration and evaluation assets are dependent upon the existence of economically recoverable reserves or the Company’s ability to recover the value of exploration and evaluation assets through their sale, the ability of the Company to obtain necessary financing to complete the development of those reserves and upon future profitable production.

These condensed interim financial statements (“financial statements”) have been prepared assuming the Company will continue on a going concern basis and do not include adjustments to amounts and classifications of assets and liabilities that might be necessary, should the Company be unable to continue operations. Such adjustments could be material. The ability of the Company to continue as a going concern depends upon its ability to develop profitable operations or to continue to raise adequate financing. As at September 30, 2025, the Company had an accumulated deficit of $342,209,869 and shareholders’ equity of $101,331,193. In addition, the Company has a working capital surplus, calculated as current assets less current liabilities, of $56,335,255, consisting primarily of cash and cash equivalents, and negative cash flow from operating activities of $34,713,701 for the nine months ended September 30, 2025.

Management is actively targeting sources of additional financing including through the issuance of shares, which would assure continuation of the Company’s operations and exploration programs. In order for the Company to meet its liabilities as they come due and to continue its operations, the Company is solely dependent upon its ability to generate such financing. Although the Company has been successful in the past in generating financing, there is no assurance it will be able to do so in the future. These items give rise to material uncertainties that cast significant doubt as to the Company’s ability to continue as a going concern.

These condensed interim financial statements were approved by the Board of Directors of the Company on November 6, 2025.

| 2. | MATERIAL ACCOUNTING POLICY INFORMATION |

The principal accounting policies applied in the preparation of these financial statements are set out below.

| a) | Statement of compliance |

The Company’s condensed interim financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as applicable to interim financial reports including International Accounting Standards 34 “Interim Financial Reporting” issued by the International Accounting Standards Board (“IASB”).

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 2. | MATERIAL ACCOUNTING POLICY INFORMATION (continued) |

| a) | Statement of compliance (continued) |

These condensed interim financial statements do not include all the information and note disclosures required by IFRS for annual financial statements and should be read in conjunction with the annual financial statements for the year ended December 31, 2024, which have been prepared in accordance with IFRS as issued by the IASB.

The policies applied in these condensed interim financial statements are the same as those applied in the most recent annual financial statements and were consistently applied to all the periods presented.

| b) | Basis of presentation |

These condensed interim financial statements are expressed in Canadian dollars and have been prepared on a historical cost basis except for financial instruments classified as subsequently measured at fair value. In addition, these financial statements have been prepared using the accrual basis of accounting, except for cash flow information.

Certain comparative figures on the income statement, cash flow statement and in Note 3 have been aggregated to conform to the current year presentation.

| c) | Significant accounting estimates and judgments |

The preparation of these condensed interim financial statements requires management to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of expenses during the reporting period. Actual outcomes could differ from these estimates.

In preparing these condensed interim financial statements, the Company applied the critical judgments and estimates disclosed in Note 2 of its audited financial statements for the year ended December 31, 2024.

| d) | Initial application of standards, interpretations and amendments to standards and interpretations in the reporting period |

The IASB issued certain new accounting standards or amendments that are mandatory for accounting periods on or after January 1, 2025. The effect of such new accounting standards or amendments did not have a material impact on the Company and therefore the Company did not record any adjustments to the financial statements.

| e) | New and amended IFRS standards not yet effective |

Certain new accounting standards or interpretations have been published that are not mandatory for the current period and have not been early adopted. These standards and interpretations are not expected to have a material impact on the Company’s financial statements, except for IFRS 18 “Presentation and Disclosure in Financial Statements”.

IFRS 18 includes requirements for all entities applying IFRS for the presentation and disclosure of information in financial statements and has an effective date of January 1, 2027. The effects of the adoption of IFRS 18 on the Company’s financial statements have not yet been determined.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 3. | EXPLORATION AND EVALUATION ASSETS |

The schedules below summarize the carrying amounts of acquisition costs and exploration expenditures incurred to date for each exploration and evaluation asset that the Company is continuing to explore as at September 30, 2025 and December 31, 2024:

| Nine months ended September 30, 2025 |

Queensway(i) $ |

Other $ |

Total $ |

|||||||||

| Exploration and evaluation assets | ||||||||||||

| Balance as at December 31, 2024 | 34,390,976 | 114,508 | 34,505,484 | |||||||||

| Additions: | ||||||||||||

| Claim staking and license renewal costs | 65,975 | 3,325 | 69,300 | |||||||||

| Balance as at September 30, 2025 | 34,456,951 | 117,833 | 34,574,784 | |||||||||

| Exploration and evaluation expenditures | ||||||||||||

| Cumulative exploration expense - December 31, 2024 | 267,847,694 | 575,695 | 268,423,389 | |||||||||

| Drilling | 10,389,100 | - | 10,389,100 | |||||||||

| Salaries and consulting | 6,918,652 | - | 6,918,652 | |||||||||

| Assays | 2,808,386 | - | 2,808,386 | |||||||||

| Supplies and equipment | 1,290,164 | - | 1,290,164 | |||||||||

| Geophysics | 1,275,692 | - | 1,275,692 | |||||||||

| Environmental studies | 780,496 | - | 780,496 | |||||||||

| Office and general | 684,167 | - | 684,167 | |||||||||

| Metallurgy | 625,537 | - | 625,537 | |||||||||

| Travel and accommodations | 576,725 | - | 576,725 | |||||||||

| Preliminary economic assessment | 538,038 | - | 538,038 | |||||||||

| Reclamation | 463,802 | - | 463,802 | |||||||||

| Trenching | 417,726 | - | 417,726 | |||||||||

| Technical reports | 258,647 | - | 258,647 | |||||||||

| Engineering and evaluation studies | 243,724 | - | 243,724 | |||||||||

| Waste rock geochemistry | 227,566 | - | 227,566 | |||||||||

| Resource estimate | 222,480 | - | 222,480 | |||||||||

| Other | 73,530 | - | 73,530 | |||||||||

| 27,794,432 | - | 27,794,432 | ||||||||||

| Cumulative exploration expense – September 30, 2025 | 295,642,126 | 575,695 | 296,217,821 | |||||||||

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 3. | EXPLORATION AND EVALUATION ASSETS (continued) |

| Nine months ended September 30, 2024 |

Queensway(i) $ |

Other $ |

Total $ |

|||||||||

| Exploration and evaluation assets | ||||||||||||

| Balance as at December 31, 2023 | 9,014,478 | 78,709 | 9,093,187 | |||||||||

| Additions: | ||||||||||||

| Acquisition costs – Kingsway Project | 20,838,541 | - | 20,838,541 | |||||||||

| Acquisition costs – royalty purchases | 3,024,620 | - | 3,024,620 | |||||||||

| Acquisition costs – other claims | 51,655 | - | 51,655 | |||||||||

| Claim staking and license renewal costs | 3,450 | - | 3,450 | |||||||||

| Balance as at September 30, 2024 | 32,932,744 | 78,709 | 33,011,453 | |||||||||

| Exploration and evaluation expenditures | ||||||||||||

| Cumulative exploration expense - December 31, 2023 | 215,285,192 | 574,857 | 215,860,049 | |||||||||

| Drilling | 15,689,676 | - | 15,689,676 | |||||||||

| Salaries and consulting | 7,189,306 | 488 | 7,189,794 | |||||||||

| Assays | 4,941,692 | - | 4,941,692 | |||||||||

| Trenching | 2,025,311 | - | 2,025,311 | |||||||||

| Reclamation | 1,163,413 | - | 1,163,413 | |||||||||

| Other | 1,191,162 | 350 | 1,191,512 | |||||||||

| Supplies and equipment | 1,045,732 | - | 1,045,732 | |||||||||

| Metallurgy | 1,031,331 | - | 1,031,331 | |||||||||

| Environmental studies | 744,420 | - | 744,420 | |||||||||

| Geophysics | 566,411 | - | 566,411 | |||||||||

| Travel and accommodations | 556,717 | - | 556,717 | |||||||||

| Permitting | 507,639 | - | 507,639 | |||||||||

| Office and general | 496,472 | - | 496,472 | |||||||||

| 37,149,282 | 838 | 37,150,120 | ||||||||||

| Cumulative exploration expense – September 30, 2024 | 252,434,474 | 575,695 | 253,010,169 | |||||||||

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 3. | EXPLORATION AND EVALUATION ASSETS (continued) |

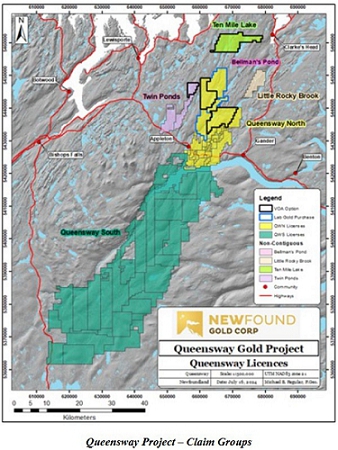

| (i) | Queensway Project – Gander, Newfoundland and Labrador |

As at September 30, 2025, the Company owned a 100% interest in 98 (December 31, 2024 – 103) mineral licenses including 7,018 claims (December 31, 2024 – 7,024 claims) comprising 175,450 hectares of land (December 31, 2024 – 175,600) located near Gander, Newfoundland and Labrador. The project rights were acquired by map staking mineral licenses and making staged payments in cash and common shares of the Company from 2016 through 2022 under ten separate option agreements, of which nine are completed.

On November 2, 2022, the Company entered into the VOA Option Agreement to acquire a 100% interest in five mineral licenses located in Gander, Newfoundland and Labrador. Under the terms of the VOA Option Agreement, the Company may exercise the option by issuing an aggregate of 487,078 common shares in the capital of the Company and making aggregate cash payments of $2,350,000 to the optionors as follows:

| · | $200,000 (paid) and 39,762 common shares (issued) on the later of (i) staking confirmation date as defined in the Option Agreement and (ii) the receipt of the TSX Venture Exchange’s approval; |

| · | $200,000 (paid) and 39,762 common shares on or before November 2, 2023 (issued); |

| · | $250,000 (paid) and 69,583 common shares on or before November 2, 2024 (issued); |

| · | $300,000 (paid subsequent to September 30, 2025) and 89,463 common shares on or before November 2, 2025 (issued subsequent to September 30, 2025); |

| · | $600,000 and 129,224 common shares on or before November 2, 2026; and |

| · | $800,000 and 119,284 common shares on or before November 2, 2027. |

The Queensway Project carries various net smelter return (“NSR”) royalties ranging from 0.4% to 3.00%, many of which include buy-back provisions that allow the Company, at its option, to reduce the NSR by making lump-sum payments ranging from $250,000 to $1,000,000 to the holders of the royalties.

On July 29, 2024, the Company entered into three royalty purchase agreements (the “Royalty Purchase Agreements”) with arm’s length royalty holders (together, the “Vendors” and each, a “Vendor”) to purchase part of each Vendor’s royalty interest in aggregate, 0.6% of the Vendors’ 1.6% net smelter returns royalty underlying several zones at the Company’s Queensway project (the “Royalty Interests”). The transaction closed on August 8, 2024. Pursuant to the transaction, the Company paid aggregate cash consideration of $1,950,000 and aggregate share consideration of 300,000 common shares with a combined value of $1,011,000 to the Vendors (Note 10). The Company paid $63,620 in professional fees in connection with the royalty purchases.

During the year ended December 31, 2024, the Company purchased the remaining 1.0% net smelter returns royalty from the Vendors for $1,000,000 in aggregate in cash, of which $666,667 was paid during the nine months ended September 30, 2025. The Company also paid $16,225 in professional fees in connection with the purchase.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 3. | EXPLORATION AND EVALUATION ASSETS (continued) |

| (i) | Queensway Project – Gander, Newfoundland and Labrador (continued) |

Acquisition of Kingsway Project

On July 9, 2024, the Company acquired a 100% interest in LabGold’s Kingsway Project, located near Gander, Newfoundland and Labrador, as well as certain related assets of LabGold. The Kingsway Project is contiguous to Queensway and the Company considers it to be part of the Queensway Project. Pursuant to the acquisition, the Company issued 5,263,157 common shares of the Company with a value of $20,000,000 (Note 10). The Company paid $438,541 in professional and filing fees in connection with the acquisition. The Company also paid a $750,000 Expenditure Target Payment to the optionors upon completion of an aggregate of $30,000,000 of exploration expenditures incurred on the property during the year ended December 31, 2024.

The Kingsway Project carries a 1.0% NSR payable to the royalty holders upon commencement of commercial production. The Company will also pay to the royalty holders $1 per ounce of gold contained within the property in the indicated mineral resource and measured mineral resource categories (the “Resource Payment”) as defined by the Canadian Institute of Mining, Metallurgy and Petroleum, and established in a National Instrument 43-101 – Standards of Disclosure for Mineral Projects or like technical report for the development of the property. The Resource Payment is payable upon the commencement of commercial production. An advance royalty payment of $50,000 per year will be payable commencing on March 3, 2026 and continuing each year until the commencement of commercial production. Any advance royalties paid will be deducted from the royalty payable after commencement of commercial production.

| 4. | PROPERTY AND EQUIPMENT |

| Property and Buildings |

Computer Equipment |

Geological Equipment and Other Facilities |

Vehicles | Office Furniture and Equipment |

Total | |||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Cost | ||||||||||||||||||||||||

| Balance at December 31, 2023 | 6,365,256 | 136,492 | 2,311,030 | 935,323 | 38,353 | 9,786,454 | ||||||||||||||||||

| Additions - Kingsway Project | 100,000 | - | 250,000 | - | - | 350,000 | ||||||||||||||||||

| Additions - other | 3,615 | - | 583,610 | 38,550 | - | 625,775 | ||||||||||||||||||

| Balance at December 31, 2024 | 6,468,871 | 136,492 | 3,144,640 | 973,873 | 38,353 | 10,762,229 | ||||||||||||||||||

| Additions | - | - | 194,196 | 242,775 | - | 436,971 | ||||||||||||||||||

| Balance at September 30, 2025 | 6,468,871 | 136,492 | 3,338,836 | 1,216,648 | 38,353 | 11,199,200 | ||||||||||||||||||

| Accumulated Depreciation | ||||||||||||||||||||||||

| Balance at December 31, 2023 | 413,031 | 85,549 | 1,016,219 | 625,256 | 7,791 | 2,147,846 | ||||||||||||||||||

| Depreciation | 277,685 | 33,153 | 184,532 | 173,193 | 7,671 | 676,234 | ||||||||||||||||||

| Balance at December 31, 2024 | 690,716 | 118,702 | 1,200,751 | 798,449 | 15,462 | 2,824,080 | ||||||||||||||||||

| Depreciation | 206,095 | 10,624 | 126,487 | 177,241 | 5,753 | 526,200 | ||||||||||||||||||

| Balance at September 30, 2025 | 896,811 | 129,326 | 1,327,238 | 975,690 | 21,215 | 3,350,280 | ||||||||||||||||||

| Carrying Amount | ||||||||||||||||||||||||

| At December 31, 2024 | 5,778,155 | 17,790 | 1,943,889 | 175,424 | 22,891 | 7,938,149 | ||||||||||||||||||

| At September 30, 2025 | 5,572,060 | 7,166 | 2,011,598 | 240,958 | 17,138 | 7,848,920 | ||||||||||||||||||

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 5. | INVESTMENTS |

The Company classifies its investments at fair value through profit or loss. Realized gains and losses on disposal of investments and unrealized gains and losses in the fair value of investments are reflected in profit or loss in the period in which they occur.

Investments consist of the following as at September 30, 2025 and December 31, 2024:

| September 30, 2025 | December 31, 2024 | |||||||

| $ | $ | |||||||

| Equities held (i) | 540,096 | 779,019 | ||||||

| Warrants held (ii) | - | 147,000 | ||||||

| Total Investments | 540,096 | 926,019 | ||||||

(i) Equities held

The Company held the following equities as at September 30, 2025 and December 31, 2024:

| Quantity | Cost $ |

Fair Value September 30, 2025 $ |

||||||||||

| Exploits Discovery Corp. | 4,157,466 | 2,659,473 | 291,023 | |||||||||

| Maritime Resources Corp. | 102,923 | 74,468 | 249,073 | |||||||||

| Total Equities | 2,733,941 | 540,096 | ||||||||||

| Quantity | Cost $ |

Fair Value December 31, 2024 $ |

||||||||||

| Exploits Discovery Corp. | 4,157,466 | 2,659,473 | 187,086 | |||||||||

| Labrador Gold Corp. | 9,865,556 | 6,953,907 | 591,933 | |||||||||

| Total Equities | 9,613,380 | 779,019 | ||||||||||

Investments in Exploits Discovery Corp., Maritime Resources Corp. and Labrador Gold Corp. represent investments in public companies that are quoted on an active exchange and are measured using the quoted market price of these companies.

(ii) Warrants held

The Company held the following warrants as at December 31, 2024:

| Quantity | Cost $ |

Fair Value December 31, 2024 $ |

||||||||||

| Maritime Resources Corp. (1) | 1,532,457 | 174,500 | 147,000 | |||||||||

| Total Warrants | 174,500 | 147,000 | ||||||||||

(1) Each warrant was exercisable into one common share of Maritime Resources Corp. at a price of $0.70 per warrant until August 14, 2025. The number of warrants and the exercise price have been adjusted for the 10:1 share consolidation completed by Maritime Resources Corp. in June 2025. All the warrants expired unexercised on August 14, 2025.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 5. | INVESTMENTS (continued) |

Warrants that do not have a quoted market price are valued using a Black-Scholes option pricing model using assumptions including risk free interest rate, expected dividend yield, expected volatility, and expected remaining life of the warrant, which are supported by observable market conditions.

An analysis of investments including related gains and losses for the nine months ended September 30, 2025 and 2024 is as follows:

| Nine months ended September 30, | ||||||||

|

2025 $ |

2024 $ |

|||||||

| Investments, beginning of period | 926,019 | 3,596,592 | ||||||

| Received as interest income (Note 7) | 74,468 | - | ||||||

| Proceeds on disposal of investments | (752,634 | ) | (688,220 | ) | ||||

| Realized gains (losses) on investments | 160,701 | (247,660 | ) | |||||

| Unrealized gains (losses) on investments | 131,542 | (1,086,627 | ) | |||||

| Investments, end of period | 540,096 | 1,574,085 | ||||||

| 6. | INVESTMENT IN KIRKLAND LAKE DISCOVERIES CORP. |

The investment in Kirkland Lake Discoveries Corp. (“KLDC”) represents 24.67% (December 31, 2024 - 25.91%) of the issued and outstanding common shares of KLDC at September 30, 2025. KLDC and the Company had a director and officer in common up until December 16, 2024, being Denis Laviolette, former Director and President of the Company. Based on assessments of the relevant facts and circumstances, primarily, the Company's ownership interests, board representation and ability to influence operating, strategic and financing decisions, the Company concluded that it continues to have significant influence over KLDC, and as a result has accounted for it as an investment in an associate since the acquisition of its ownership interest on May 25, 2023.

The following tables illustrate the summarised financial information of the Company’s investment in KLDC as at September 30, 2025 and December 31, 2024 on a 100% basis and reflecting adjustments made by the Company, including fair value adjustments made at the time of acquisition and adjustments for differences due to accounting policies:

| September 30, 2025 $ |

December 31, 2024 $ |

|||||||

| Summarised Statement of Financial Position | ||||||||

| Current assets | 1,364,697 | 1,913,417 | ||||||

| Non-current assets | 8,433,529 | 4,551,364 | ||||||

| Current liabilities | (386,336 | ) | (576,261 | ) | ||||

| Net assets | 9,411,890 | 5,888,520 | ||||||

| The Company’s ownership interest | 24.67 | % | 25.91 | % | ||||

| Share of KLDC’s net assets | 2,322,095 | 1,525,756 | ||||||

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statement

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

6. INVESTMENT IN KIRKLAND LAKE DISCOVERIES CORP. (continued)

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| Summarised Statement of Loss and Comprehensive Loss | 2025 $ |

2024 $ |

2025 $ |

2024 $ |

||||||||||||

| Net loss and comprehensive loss for the period | (766,868 | ) | (997,155 | ) | (982,367 | ) | (3,290,413 | ) | ||||||||

| Share of KLDC’s loss for the period | (186,324 | ) | (321,932 | ) | (244,116 | ) | (1,062,312 | ) | ||||||||

The Company performs an impairment indicator assessment on its investment in KLDC at each period end. The assessment is based on the review of recent share price history, industry statistics and assessment of the current market conditions. At December 31, 2024, there were no indicators of impairment of the Company’s investment in KLDC. The Company had previously recognized an impairment loss of $1,000,237 on its equity investment in Kirkland Lake Discoveries Corp. during the year ended December 31, 2023. This impairment loss was reversed at September 30, 2025 due to a significant increase in stock price of Kirkland Lake Discoveries Corp. during the three months ended September 30, 2025.

The following table illustrates the movement in investment in associate for the period from December 31, 2023 to September 30, 2025:

| Net carrying amount – December 31, 2023 | $ | 2,861,250 | ||

| Share of loss from operations of associate during the period | (1,306,722 | ) | ||

| Loss on dilution of equity investment | (28,772 | ) | ||

| Net carrying amount – December 31, 2024 | $ | 1,525,756 | ||

| Share of loss from operations of associate during the period | (244,116 | ) | ||

| Gain on dilution of equity investment | 40,218 | |||

| Reversal of impairment from equity investment | 1,000,237 | |||

| Net carrying amount – September 30, 2025 | $ | 2,322,095 |

The estimated fair value of the Company’s investment in KLDC is $10,040,126 as at September 30, 2025 (December 31, 2024 - $1,287,563) based on the quoted market price of its common shares on the TSX Venture exchange.

Subsequent to September 30, 2025, the Company’s ownership interest was further diluted and it lost significant influence over KLDC.

7. SECURED NOTES

On August 14, 2023, the Company participated in a brokered note offering completed by Maritime Resources Corp. (“Maritime”) consisting of the issuance of non-convertible senior secured notes (the “Notes”) and common share purchase warrants. The Notes had a maturity date of August 14, 2025 (the “Initial Maturity Date”). The Notes bore interest at a rate equal to the Secured Overnight Financing Rate (“SOFR”) plus 6% per annum, payable quarterly in arrears.

Based on the business model in which the secured notes are held and the characteristics of their contractual cash flows, the secured notes were classified as a financial instrument at fair value through profit and loss ("FVTPL") in accordance with IFRS 9 “Financial Instruments”.

The issuance of the Notes included a 40% warrant coverage resulting in the Company receiving 15,324,571 warrants (“Warrants”). These warrants were classified by the Company as investments at FVTPL (Note 5).

The Company allocated the gross investment of $2,638,500 (US$1,960,000) to the Notes and warrants based on their respective fair values at initial recognition. At the time of issuance, the fair value of the Notes was $2,464,000 (US$1,830,300) and the fair value of the warrants was $174,500 (US$129,700).

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statemen

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

7. SECURED NOTES (continued)

During the nine months ended September 30, 2025, the Company sold the Notes for gross proceeds of $2,778,000 (US$2,000,000).

The following table illustrates the movement in the Company’s secured notes for the period from December 31, 2023 to September 30, 2025:

| Secured notes at December 31, 2023 | $ | 2,454,300 | ||

| Revaluation of secured notes | 140,786 | |||

| Foreign exchange gain | 222,468 | |||

| Secured notes at December 31, 2024 | $ | 2,817,554 | ||

| Proceeds on disposal of secured notes | (2,778,000 | ) | ||

| Realized gain on disposal of secured notes | 55,911 | |||

| Foreign exchange loss | (95,465 | ) | ||

| Secured notes at September 30, 2025 | $ | - |

During the nine months ended September 30, 2025, the Company received $74,468 of interest income paid in common shares of Maritime on the secured notes (September 30, 2024 – $227,463).

8. FLOW-THROUGH SHARE PREMIUM

| Issued November 2023 |

Issued June 2025 |

Total | ||||||||||

| $ | $ | $ | ||||||||||

| Balance at December 31, 2023 | 12,426,322 | - | 12,426,322 | |||||||||

| Settlement of flow-through share premium on expenditures incurred | (5,906,474 | ) | - | (5,906,474 | ) | |||||||

| Balance at September 30, 2024 | 6,519,848 | - | 6,519,848 | |||||||||

| Settlement of flow-through share premium on expenditures incurred | (6,519,848 | ) | - | (6,519,848 | ) | |||||||

| Balance at December 31, 2024 | - | - | - | |||||||||

| Liability incurred on flow-through shares issued | - | 16,242,600 | 16,242,600 | |||||||||

| Settlement of flow-through share premium on expenditures incurred | - | (4,249,959 | ) | (4,249,959 | ) | |||||||

| Balance at September 30, 2025 | - | 11,992,641 | 11,992,641 | |||||||||

Flow-through share arrangements entitle the holder of the flow-through share to a 100% tax deduction in respect of qualifying Canadian exploration expenses as defined in the Income Tax Act, Canada (“Qualifying CEE”).

During the nine months ended September 30, 2025, the Company incurred $14,746,070 (nine months ended September 30, 2024 – $21,627,242) in Qualifying CEE and amortized a total of $4,249,959 (nine months ended September 30, 2024 – $5,906,474) of its flow-through share premium liabilities. The flow-through share premium liability does not represent a cash liability to the Company and is to be fully amortized to the statement of loss and comprehensive loss pro-rata with the amount of qualifying expenditures that will be incurred.

During the nine months ended September 30, 2025, the Company incurred $67,143 (nine months ended September 30, 2024 - $629,039) in Part XII.6 tax in respect of unspent flow-through proceeds renounced in year 1 under the Look-Back Rules, in accordance with the Income Tax Act of Canada. As at September 30, 2025, the Company must spend another $41,610,830 of Qualifying CEE by December 31, 2026, to satisfy its remaining current flow-through share premium liability of $11,992,641.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 9. | ACCOUNTS PAYABLE AND ACCRUED LIABILITIES |

| September 30,

2025 $ |

December 31,

2024 $ |

|||||||

| Accounts payable and accrued liabilities | 3,913,045 | 4,898,825 | ||||||

| Reclamation provision(1) | 2,598,695 | 2,426,378 | ||||||

| Accounts payable and accrued liabilities, end of period | 6,511,740 | 7,325,203 | ||||||

(1) Provincial laws and regulations concerning environmental protection affect the Company’s exploration and operations. Under current regulations, the Company is required to meet performance standards to minimize the environmental impact from its activities and to perform site restoration and other reclamation activities. The Company’s reclamation provision is based on known requirements.

The breakdown of the Company’s reclamation provision is as follows:

| September 30,

2025 $ |

December 31,

2024 $ |

|||||||

| Balance, beginning of period | 2,426,378 | 1,285,031 | ||||||

| Additions to reclamation provision | 330,601 | 1,515,593 | ||||||

| Change in estimate | (7,232 | ) | 26,784 | |||||

| Reclamation costs incurred | (151,052 | ) | (401,030 | ) | ||||

| Balance, end of period | 2,598,695 | 2,426,378 | ||||||

The Company has estimated that the reclamation obligations are current costs and as such considers the present value of the provision at September 30, 2025 to be equal to the total future undiscounted cash flows to settle the provision for reclamation, being $2,598,695 (December 31, 2024 - $2,426,378). Additions to the reclamation provision are included in the total amount of exploration and evaluation expenditures in the condensed interim statement of loss and comprehensive loss.

| 10. | SHARE CAPITAL AND RESERVES |

Authorized Share Capital

At September 30, 2025, the authorized share capital comprised an unlimited number of common shares. The common shares do not have a par value. All issued shares are fully paid.

Details of Common Shares Issued During the Nine Months Ended September 30, 2025

On June 12, 2025, the Company completed a bought deal offering of 24,610,000 flow-through common shares, closing the first tranche of the offering on June 3, 2025 and the second and final tranche of the offering on June 12, 2025, at a price of $2.29 per common share and 4,370,000 non-flow-through common shares at a price of $1.63 per common share, for aggregate gross proceeds of $63,480,000. The Company incurred share issuance costs of $3,912,782 in cash of which $2,602,373 was paid to the underwriters. The premium received on the flow-through shares issued was determined to be $16,242,600.

On August 27, 2025, the Company completed a non-brokered private placement and issued 12,269,939 common shares at a price of $1.63 per common share for gross proceeds of $20,000,001.

During the nine months ended September 30, 2025, 1,329,329 common shares were issued on exercise of 1,345,000 stock options. They options were exercised at a weighted average exercise price of $1.38 per share for gross proceeds of $1,797,025.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 10. | SHARE CAPITAL AND RESERVES (continued) |

Details of Common Shares Issued During the Year Ended December 31, 2024

In August 2022, the Company filed a prospectus supplement to its short form base shelf prospectus, pursuant to which the Company may, at its discretion and from time-to-time, sell common shares of the Company for aggregate gross proceeds of up to US$100,000,000. The sale of common shares is to be made through “at-the-market distributions” ("ATM"), as defined in the Canadian Securities Administrators’ National Instrument 44-102 Shelf Distributions, directly on the TSX Venture Exchange and the NYSE American stock exchange.

During the year ended December 31, 2024, the Company sold 5,857,242 common shares of the Company under the ATM program at an average price of $4.70 for gross proceeds of $27,522,494 or net proceeds of $26,607,687, and paid an aggregate commission of $914,807. At December 31, 2024, the Company completed $51,798,893 of the ATM program. As at December 31, 2024, the ATM had expired.

On November 1, 2024, the Company issued 69,583 common shares with a value of $215,707 pursuant to the acquisition of exploration and evaluation assets in accordance with the terms of certain property option agreements (Note 3 (i)).

On August 8, 2024, the Company issued 300,000 common shares with a value of $1,011,000 pursuant to the acquisition of certain royalty interests (Note 3(i)).

On July 9, 2024, the Company issued 5,263,157 common shares to LabGold with a value of $20,000,000 pursuant to the acquisition of the Kingsway Project (Note 3(i)).

On June 26, 2024, the Company issued 370,000 common shares with a value of $1,750,100 pursuant to a legal claim settlement agreement (Note 14).

During the year ended December 31, 2024, 1,725,000 share purchase options were exercised at a weighted average exercise price of $0.50 per share for gross proceeds of $862,500.

Share Purchase Option Compensation Plan

As at September 30, 2025, the Company has a share purchase option plan (the “Option Plan”) approved by the Company’s shareholders that allows it to grant share purchase options, subject to regulatory and corporate approval, to its officers, directors, employees and service providers. The Option Plan is based on the maximum number of eligible shares not exceeding 10% in the aggregate and 5% with respect to any one optionee of the Company’s outstanding common shares in any twelve-month period. If outstanding share purchase options are exercised or expire, and/or the number of issued and outstanding common shares of the Company increases, then the share purchase options available to grant under the Option Plan increase proportionately. The exercise price and vesting terms of each share purchase option is set by the Board of Directors at the time of grant. Share purchase options granted may be subject to a four-month hold period and exercisable for a period determined by the Board of Directors which cannot exceed ten years.

Share Unit Compensation Plan

The Company adopted a share unit plan (the “Share Unit Plan”). Under the Share Unit Plan, the Company may grant incentive awards (the “Awards”) consisting of restricted share units (“RSUs”), deferred share units (“DSUs”), and performance share units (“PSUs”), subject to regulatory and corporate approvals, to its officers, directors, employees and service providers (the “Participants”). The Share Unit Plan, in conjunction with the Option Plan, cannot exceed 10% of the issued and outstanding common shares of the Company. The terms of the Awards are set by the Board of Directors at the time of grant.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 10. | SHARE CAPITAL AND RESERVES (continued) |

Share Purchase Options

The continuity of share purchase options for the nine months ended September 30, 2025 is as follows:

|

Expiry date |

Exercise Price |

Outstanding December 31, 2024 |

Granted | Exercised |

Cancelled/ Forfeited/ Expired |

Outstanding September 30, 2025 |

Exercisable September 30, 2025 |

|||||||||||||||||||||

| April 18, 2025 | $ | 1.00 | 100,000 | - | (100,000 | ) | - | - | - | |||||||||||||||||||

| May 23, 2025 | $ | 1.075 | 75,000 | - | (75,000 | ) | - | - | - | |||||||||||||||||||

| August 11, 2025 | $ | 1.40 | 1,125,000 | - | (1,125,000 | ) | - | - | - | |||||||||||||||||||

| September 3, 2025 | $ | 2.07 | 50,000 | - | (20,000 | ) | (30,000 | ) | - | - | ||||||||||||||||||

| October 1, 2025 | $ | 2.15 | 25,000 | - | (25,000 | ) | - | - | - | |||||||||||||||||||

| December 31, 2025 | $ | 4.10 | 5,305,000 | - | - | (4,530,000 | ) | 775,000 | 775,000 | |||||||||||||||||||

| April 29, 2026 | $ | 6.79 | 891,500 | - | - | (398,500 | ) | 493,000 | 493,000 | |||||||||||||||||||

| May 17, 2026 | $ | 8.62 | 200,000 | - | - | (200,000 | ) | - | - | |||||||||||||||||||

| September 27, 2026 | $ | 8.70 | 125,000 | - | - | - | 125,000 | 125,000 | ||||||||||||||||||||

| November 8, 2026 | $ | 8.04 | 7,500 | - | - | - | 7,500 | 7,500 | ||||||||||||||||||||

| January 4, 2027 | $ | 8.98 | 15,000 | - | - | (7,500 | ) | 7,500 | 7,500 | |||||||||||||||||||

| August 19, 2027 | $ | 5.75 | 340,000 | - | - | (150,000 | ) | 190,000 | 190,000 | |||||||||||||||||||

| September 8, 2027 | $ | 5.00 | 20,000 | - | - | - | 20,000 | 20,000 | ||||||||||||||||||||

| December 27, 2027 | $ | 5.68 | 2,037,750 | - | - | (887,750 | ) | 1,150,000 | 1,114,375 | |||||||||||||||||||

| February 20, 2029 | $ | 4.59 | 200,000 | - | - | - | 200,000 | 200,000 | ||||||||||||||||||||

| May 6, 2029 | $ | 4.78 | 40,000 | - | - | (40,000 | ) | - | - | |||||||||||||||||||

| May 13, 2030 | $ | 1.67 | - | 3,770,000 | - | - | 3,770,000 | 1,166,667 | ||||||||||||||||||||

| September 26, 2030 | $ | 2.97 | - | 809,167 | - | - | 809,167 | - | ||||||||||||||||||||

| 10,556,750 | 4,579,167 | (1,345,000 | ) | (6,243,750 | ) | 7,547,167 | 4,099,042 | |||||||||||||||||||||

| Weighted average exercise price $ | 3.97 | 1.90 | 1.38 | 4.68 | 3.32 | 4.42 | ||||||||||||||||||||||

| Weighted average contractual remaining life (years) | 1.50 | - | - | - | 3.41 | 2.34 | ||||||||||||||||||||||

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 10. | SHARE CAPITAL AND RESERVES (continued) |

Share Purchase Options (continued)

The continuity of share purchase options for the nine months ended September 30, 2024 is as follows:

| Expiry date | Exercise

Price |

Outstanding

December 31, 2023 |

Granted | Exercised | Cancelled/ Forfeited/ Expired |

Outstanding

September 30, 2024 |

Exercisable

September 30, 2024 |

|||||||||||||||||||||

| December 17, 2024 | $ | 0.50 | 1,725,000 | - | (175,000 | ) | - | 1,550,000 | 1,550,000 | |||||||||||||||||||

| April 18, 2025 | $ | 1.00 | 100,000 | - | - | - | 100,000 | 100,000 | ||||||||||||||||||||

| May 23, 2025 | $ | 1.075 | 75,000 | - | - | - | 75,000 | 75,000 | ||||||||||||||||||||

| August 11, 2025 | $ | 1.40 | 1,125,000 | - | - | - | 1,125,000 | 1,125,000 | ||||||||||||||||||||

| September 3, 2025 | $ | 2.07 | 50,000 | - | - | - | 50,000 | 50,000 | ||||||||||||||||||||

| October 1, 2025 | $ | 2.15 | 25,000 | - | - | - | 25,000 | 25,000 | ||||||||||||||||||||

| December 31, 2025 | $ | 4.10 | 5,305,000 | - | - | - | 5,305,000 | 5,305,000 | ||||||||||||||||||||

| April 29, 2026 | $ | 6.79 | 962,875 | - | - | (36,375 | ) | 926,500 | 926,500 | |||||||||||||||||||

| May 17, 2026 | $ | 8.62 | 200,000 | - | - | - | 200,000 | 200,000 | ||||||||||||||||||||

| September 27, 2026 | $ | 8.70 | 125,000 | - | - | - | 125,000 | 125,000 | ||||||||||||||||||||

| November 8, 2026 | $ | 8.04 | 47,500 | - | - | (40,000 | ) | 7,500 | 6,375 | |||||||||||||||||||

| January 4, 2027 | $ | 8.98 | 22,500 | - | - | (7,500 | ) | 15,000 | 12,750 | |||||||||||||||||||

| August 19, 2027 | $ | 5.75 | 340,000 | - | - | - | 340,000 | 283,000 | ||||||||||||||||||||

| September 8, 2027 | $ | 5.00 | 20,000 | - | - | - | 20,000 | 20,000 | ||||||||||||||||||||

| December 27, 2027 | $ | 5.68 | 2,156,250 | - | - | (116,250 | ) | 2,040,000 | 1,926,375 | |||||||||||||||||||

| February 20, 2029 | $ | 4.59 | - | 200,000 | - | - | 200,000 | 200,000 | ||||||||||||||||||||

| May 6, 2029 | $ | 4.78 | - | 40,000 | - | - | 40,000 | 4,000 | ||||||||||||||||||||

| 12,279,125 | 240,000 | (175,000 | ) | (200,125 | ) | 12,144,000 | 11,934,000 | |||||||||||||||||||||

| Weighted average exercise price $ | 3.97 | 4.62 | 0.50 | 6.48 | 3.99 | 3.96 | ||||||||||||||||||||||

| Weighted average contractual remaining life (years) | 2.25 | - | - | - | 1.56 | 1.53 | ||||||||||||||||||||||

The table below summarizes the weighted average fair value of share purchase options granted, exercised and the share price at the date of exercise:

| Nine months ended September 30, | |||||||||

| 2025 | 2024 | ||||||||

| Weighted average: | |||||||||

| Fair value of share purchase options granted | $ | 1.11 | $ | 3.06 | |||||

| Fair value of share purchase options exercised | $ | 1.02 | $ | 0.38 | |||||

| Closing share price at the date of exercise | $ | 2.32 | $ | 4.24 | |||||

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 10. | SHARE CAPITAL AND RESERVES (continued) |

Share Purchase Options (continued)

Options were priced based on the Black-Scholes option pricing model using the following weighted average assumptions to estimate the fair value of options granted:

| Nine months ended September 30, | ||||||||

| 2025 | 2024 | |||||||

| Risk-free interest rate | 2.80 | % | 3.59 | % | ||||

| Expected option life in years | 5 | 5 | ||||||

| Expected share price volatility | 68.33 | % | 80.23 | %(i) | ||||

| Grant date share price | $ | 1.90 | $ | 4.62 | ||||

| Expected forfeiture rate | Nil | Nil | ||||||

| Expected dividend yield | Nil | Nil | ||||||

| (i) | The expected share price volatility was based on the average historical share price of comparable companies over the life of the option. |

Restricted Share Units (“RSUs”)

During the nine months ended September 30, 2025, the Company granted 300,000 RSUs of the Company (2024 – Nil) to a consultant. These RSUs are cash settled and vest on September 26, 2026. The Company recorded a share-based compensation expense of $40,808 related to these RSUs (2024 – $Nil), net of forfeitures of $Nil.

The continuity of the share-based compensation liabilities in connection with these RSUs for the nine months ended September 20, 2025 is as follows:

| Balance at December 31, 2024 | $ | - | ||

| Share-based compensation for the period | 40,808 | |||

| Forfeitures | - | |||

| Settlement | - | |||

| Balance at September 30, 2025 | $ | 40,808 |

During the nine months ended September 30, 2025, the Company also granted 2,053,000 RSUs of the Company (2024 – Nil) to directors and officers of the Company. These RSUs are expected to be equity settled. 1/3 of the RSUs vest on September 26, 2026, 1/3 vest on September 26, 2027 and 1/3 vest on September 26, 2028. The Company recorded a share-based compensation expense of $58,950 related to these RSUs (2024 – $Nil), net of forfeitures of $Nil.

As at September 30, 2025, outstanding RSUs are as follows:

| Vesting date | Number of RSUs | |||

| September 26, 2026 | 984,334 | |||

| September 26, 2027 | 684,333 | |||

| September 26, 2028 | 684,333 | |||

| Total | 2,353,000 | |||

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 10. | SHARE CAPITAL AND RESERVES (continued) |

Restricted Share Units (“RSUs”) (continued)

The continuity of the equity-settled RSUs for the nine months ended September 30, 2025 is as follows:

| Balance at December 31, 2024 | - | ||||

| Granted | 2,353,000 | ||||

| Vested | - | ||||

| Forfeited | - | ||||

| Balance at September 30, 2025 | 2,353,000 | ||||

11. RELATED PARTY BALANCES AND TRANSACTIONS

All transactions with related parties have occurred in the normal course of operations and are measured at the amount of consideration paid or received. A summary of the Company’s related party transactions with corporations having similar directors and officers is as follows:

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||||||

| 2025 $ |

2024 $ |

2025 $ |

2024 $ |

|||||||||||||

| Amounts paid to PJH Consulting, LLC (i) included in salaries and consulting | 20,615 | - | 63,134 | - | ||||||||||||

| Amounts paid to EarthLabs Inc. (ii) for exploration and evaluation | - | 4,500 | - | 13,500 | ||||||||||||

| Amounts paid to Notz Capital Corp. (iii) for corporate development and investor relations | - | 44,397 | 46,921 | 132,361 | ||||||||||||

| (i) | Amounts incurred for administrative services provided by a close family member of Paul Huet, Chair of the Board of directors. PJH Consulting, LLC is a related entity of Paul Huet, Chair of the Board of Directors. |

| (ii) | Amounts incurred for administrative services provided by EarthLabs Inc., a related entity of Denis Laviolette, former Director and President. |

| (iii) | Amounts incurred for corporate development and investor relations services provided by a close family member of Collin Kettell, former Executive Chairman and Chief Executive Officer. |

There are no ongoing contractual commitments resulting from these transactions with related parties.

Key management personnel compensation

Key management personnel include those persons having authority and responsibility for planning, directing and controlling the activities of the Company as a whole. The Company has determined that key management personnel consist of executive and non-executive members of the Company’s Board of Directors and corporate officers.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 11. | RELATED PARTY BALANCES AND TRANSACTIONS (continued) |

| Three months ended September 30, 2025 | Salaries

and Consulting $ |

Share-based

compensation $ |

Bonus $ |

Total $ |

||||||||||||

| Keith Boyle, Chief Executive Officer | 112,500 | 205,079 | - | 317,579 | ||||||||||||

| Melissa Render, President | 90,000 | (1) | 94,789 | - | 184,789 | |||||||||||

| Hashim Ahmed, Chief Financial Officer | 15,256 | 5,736 | - | 20,992 | ||||||||||||

| Robert Assabgui, Chief Operating Officer | 13,542 | 2,704 | - | 16,246 | ||||||||||||

| Michael Kanevsky, Former Chief Financial Officer | 204,120 | (2) | - | - | 204,120 | |||||||||||

| Paul Huet, Director | 41,229 | 334,132 | - | 375,361 | ||||||||||||

| William Hayden, Director | 18,000 | 8,614 | - | 26,614 | ||||||||||||

| Chad Williams, Director | 18,000 | 8,614 | - | 26,614 | ||||||||||||

| Vijay Mehta, Director | 15,000 | - | - | 15,000 | ||||||||||||

| Tamara Brown, Director | 8,400 | 8,614 | - | 17,014 | ||||||||||||

| Dr. Andrew Furey, Director | 6,000 | 8,614 | - | 14,614 | ||||||||||||

| Total | 542,047 | 676,896 | - | 1,218,943 | ||||||||||||

| (1) | Salary recorded in exploration and evaluation expenditures in the statement of loss and comprehensive loss. |

| (2) | Includes termination benefit of $174,960 in accordance with the terms of their management agreement. |

| Three months ended September 30, 2024 | Salaries

and Consulting $ |

Share-based

compensation $ |

Bonus $ |

Total $ |

||||||||||||

| Collin Kettell, Former Executive Chairman and Chief Executive Officer | 97,200 | - | - | 97,200 | ||||||||||||

| Denis Laviolette, Former President | 68,040 | - | - | 68,040 | ||||||||||||

| Michael Kanevsky, Former Chief Financial Officer | 29,160 | - | - | 29,160 | ||||||||||||

| Greg Matheson, Former Chief Operating Officer | 70,680 | - | - | 70,680 | ||||||||||||

| Ron Hampton, Former Chief Development Officer | 84,240 | (1) | 21,269 | - | 105,509 | |||||||||||

| Doug Hurst, Former Director | 18,000 | - | - | 18,000 | ||||||||||||

| Raymond Threlkeld, Former Director | 18,000 | - | - | 18,000 | ||||||||||||

| Vijay Mehta, Director | 18,000 | - | - | 18,000 | ||||||||||||

| Total | 403,320 | 21,269 | - | 424,589 | ||||||||||||

| (1) | Salary and bonus recorded in exploration and evaluation expenditures in the statement of loss and comprehensive loss. |

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

| 11. | RELATED PARTY BALANCES AND TRANSACTIONS (continued) |

| Nine months ended September 30, 2025 | Salaries

and Consulting $ |

Share-based

compensation $ |

Bonus $ |

Total $ |

||||||||||||

| Keith Boyle, Chief Executive Officer | 313,306 | 309,080 | - | 622,387 | ||||||||||||

| Collin Kettell, Former Executive Chairman and Chief Executive Officer | 38,400 | - | 1,031,760 | 1,070,160 | ||||||||||||

| Melissa Render, President | 270,000 | (1) | 307,724 | - | 577,724 | |||||||||||

| Hashim Ahmed, Chief Financial Officer | 15,256 | 5,736 | - | 20,992 | ||||||||||||

| Robert Assabgui, Chief Operating Officer | 13,542 | 2,704 | - | 16,246 | ||||||||||||

| Michael Kanevsky, Former Chief Financial Officer | 262,440 | (2) | - | - | 262,440 | |||||||||||

| Greg Matheson, Former Chief Operating Officer | 471,200 | (3) | - | - | 471,200 | |||||||||||

| Ron Hampton, Former Chief Development Officer | 562,529 | (1)(4) | - | - | 562,529 | |||||||||||

| Paul Huet, Director | 126,268 | 1,481,849 | - | 1,608,117 | ||||||||||||

| William Hayden, Director | 54,000 | 8,614 | - | 62,614 | ||||||||||||

| Chad Williams, Director | 42,000 | 8,614 | - | 50,614 | ||||||||||||

| Vijay Mehta, Director | 51,000 | - | - | 51,000 | ||||||||||||

| Tamara Brown, Director | 8,400 | 8,614 | - | 17,014 | ||||||||||||

| Dr. Andrew Furey, Director | 6,000 | 8,614 | - | 14,614 | ||||||||||||

| Total | 2,234,341 | 2,141,549 | 1,031,760 | 5,407,650 | ||||||||||||

| (1) | Salary recorded in exploration and evaluation expenditures in the statement of loss and comprehensive loss. |

| (2) | Includes termination benefit of $174,960 in accordance with the terms of their management agreement. |

| (3) | Includes termination benefit of $424,080 in accordance with the terms of their management agreement. |

| (4) | Includes termination benefit of $505,440 in accordance with the terms of their management agreement. |

| Nine months ended September 30, 2024 | Salaries

and Consulting $ |

Share-based

compensation $ |

Bonus $ |

Total $ |

||||||||||||

| Collin Kettell, Former Executive Chairman and Chief Executive Officer | 291,600 | - | 129,600 | 421,200 | ||||||||||||

| Denis Laviolette, Former President | 204,120 | - | 90,720 | 294,840 | ||||||||||||

| Michael Kanevsky, Former Chief Financial Officer | 87,480 | - | 38,880 | 126,360 | ||||||||||||

| Greg Matheson, Former Chief Operating Officer | 199,540 | - | 84,240 | 283,780 | ||||||||||||

| Ron Hampton, Former Chief Development Officer | 252,720 | (1) | 80,566 | 112,320 | (1) | 445,606 | ||||||||||

| Doug Hurst, Former Director | 54,000 | - | - | 54,000 | ||||||||||||

| Raymond Threlkeld, Former Director | 54,000 | - | - | 54,000 | ||||||||||||

| Vijay Mehta, Director | 54,000 | - | - | 54,000 | ||||||||||||

| Total | 1,197,460 | 80,566 | 455,760 | 1,733,786 | ||||||||||||

| (1) | Salary and bonus recorded in exploration and evaluation expenditures in the statement of loss and comprehensive loss. |

As at September 30, 2025, there was $31,494 owed to Keith Boyle, the Company’s Chief Executive Officer, for travel expenditures, $15,000 owed to Melissa Render, the Company’s President, for compensation, $15,256 owed to Hashim Ahmed, the Company’s Chief Financial Officer, for compensation, $3,000 owed to Chad Williams for directors fees, and $3,000 owed to Tamara Brown for directors fees included in accounts payable and accrued liabilities (December 31, 2024 - $56,040 comprised of $15,000 for compensation and $1,533 for travel expenditures owed to Melissa Render, the Company’s President, $22,426 for travel expenditures owed to Greg Matheson, former Chief Operating Officer, $2,163 for travel expenditures owed to Collin Kettell, former Executive Chairman and Chief Executive Officer, $152 to Michael Kanevsky, Chief Financial Officer for office expenditures, $14,040 for compensation and $725 for travel expenditures owed to Ron Hampton, the Company’s former Chief Development Officer). The amounts are unsecured, non-interest bearing and without fixed terms of repayment.

Under the terms of their management agreements, certain officers of the Company are entitled to 18 months of base pay in the event of their agreements being terminated without cause.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

12. BASIC AND DILUTED LOSS PER COMMON SHARE

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Basic weighted average number of common shares outstanding | 235,018,399 | 198,019,407 | 214,761,519 | 192,324,461 | ||||||||||||

| Effect of outstanding securities | - | - | - | - | ||||||||||||

| Diluted weighted average number of common shares outstanding | 235,018,399 | 198,019,407 | 214,761,519 | 192,324,461 | ||||||||||||

For the three and nine months ended September 30, 2025 and 2024, the Company incurred net loss and comprehensive loss. As such, diluted loss per share excludes any potential conversion of 7,547,167 (2024 - 12,144,000) share purchase options and 2,353,000 RSU’s (2024 – Nil) as they are anti-dilutive.

| 13. | SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS |

| Nine months ended September 30, | ||||||||

| 2025 $ |

2024 $ |

|||||||

| Non-cash investing and financing activities: | ||||||||

| Right-of-use assets and liabilities | - | 75,041 | ||||||

| Interest income received in common shares of Maritime Resources Corp. | 74,468 | - | ||||||

| Share issuance costs included in accounts payable and accrued liabilities | - | 6,302 | ||||||

| Other assets included in accounts payable and accrued liabilities | 83,509 | 79,724 | ||||||

| Property and equipment included in accounts payable and accrued liabilities | 71,023 | 24,500 | ||||||

| Exploration and evaluation assets included in accounts payable and accrued liabilities | - | 840,806 | ||||||

| Shares issued pursuant to acquisition of exploration and evaluation assets (Note 3(i)) | - | 20,661,000 | ||||||

| Shares issued pursuant to acquisition of property and equipment (Note 3(i)) | - | 350,000 | ||||||

| Cash paid for income taxes | - | - | ||||||

| Cash paid for interest | 12,882 | 18,730 | ||||||

| Cash received for interest | 818,196 | 2,375,863 | ||||||

14. SETTLEMENT OF LEGAL CLAIM

Claims and Legal Proceedings

On November 15, 2019, ThreeD Capital Inc. (“ThreeD”) and 1313366 Ontario Inc. (“131” and together with ThreeD, the “Plaintiffs”) each entered into share purchase agreements (the “Share Purchase Agreements”) with Palisades Goldcorp Ltd. (“Palisades”) under which Palisades agreed to purchase the 13,500,000 common shares of the Company owned by ThreeD and the 4,000,000 common shares of the Company owned by 131 for $0.08 per common share. The transactions closed on November 20, 2019. As a private company with restrictions on the transfer of its common shares, the Company had to approve the proposed transfer, which it did by a consent resolution of the Board.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

14. SETTLEMENT OF LEGAL CLAIM (continued)

On March 10, 2020, ThreeD Capital Inc. and 131 filed a statement of claim in the Ontario Superior Court of Justice against Collin Kettell, Palisades and the Company (the “Defendants” and the “ThreeD Claim”). Pursuant to the ThreeD Claim, the Plaintiffs are challenging the validity of the sale of 17,500,000 common shares by the Plaintiffs to Palisades on November 20, 2019. ThreeD and 131 claim that at the time of negotiation and execution of the Share Purchase Agreements, Palisades and Mr. Kettell were aware of positive drill results from the Company’s 2019 Drill Program and the results were not disclosed to ThreeD and 131 to their detriment. Palisades and Mr. Kettell strongly deny ThreeD and 131’s allegations.

On June 5, 2024, the Company entered into a Settlement Agreement, pursuant to which the Plaintiffs received a total of 3,750,000 common shares of the Company from the Defendants. Palisades transferred 2,607,434 common shares of the Company to ThreeD and 772,566 common shares of the Company to 131. The Company issued 285,429 common shares to ThreeD and 84,571 common shares to 131 with a total value of $1,750,100 recorded in the statement of loss and comprehensive loss for the year ended December 31, 2024. The Settlement Agreement resolves the lawsuit completely, does not include any admission of liability and provides for fulsome releases by the Plaintiffs to the Defendants.

15. FINANCIAL INSTRUMENTS

a) Fair Values

Financial assets and liabilities measured at fair value are recognized according to a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities and the lowest priority to unobservable inputs. The three levels of fair value hierarchy are as follows:

| Level 1 – | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. | |

| Level 2 – | Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability. | |

| Level 3 – | Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

The Company’s financial instruments measured at fair value are its investments, which includes equities, warrants and Notes held. The fair value of equities held is determined using closing prices at the statement of financial position date with any unrealized gain or loss recognized in profit or loss. The Company’s equities that are subject to non-standard restrictions, warrants and Notes are classified within level 2 of the fair value hierarchy. Warrants are not traded on an active exchange and are valued using the Black-Scholes option pricing model using assumptions including risk-free interest rate, expected dividend yield, expected volatility and expected remaining life of the warrant which are supported by observable market conditions. The Notes are not traded on an active exchange and are valued using the Hull-White valuation model using assumptions including coupon rate, credit spread, mean reversion, rate volatility, riskless rate curve and redemption prices.

The carrying values of other financial instruments, including cash and cash equivalents, deposits, amounts receivable, interest receivable, accounts payable and accrued liabilities, and lease liabilities approximate their fair values due to the short-term maturity of these financial instruments.

-

New Found Gold Corp.

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2025 and 2024

(Unaudited - Expressed in Canadian Dollars Unless Otherwise Noted)

15. FINANCIAL INSTRUMENTS (continued)

The Company’s financial instruments carried at fair value and categorized according to the fair value hierarchy are as follows as at September 30, 2025:

| Level 1 $ |

Level 2 $ |

Level 3 $ |

Total $ |

|||||||||||||||||

| Recurring measurements | Carrying amount | Fair value | ||||||||||||||||||

| Investments | 540,096 | 540,096 | - | - | 540,096 | |||||||||||||||

The Company’s financial instruments carried at fair value and categorized according to the fair value hierarchy are as follows as at December 31, 2024:

| Level 1 $ |

Level 2 $ |

Level 3 $ |

Total $ |

|||||||||||||||||

| Recurring measurements | Carrying amount | Fair value | ||||||||||||||||||

| Investments | 926,019 | 779,019 | 147,000 | - | 926,019 | |||||||||||||||