UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number 001-42611

ISOENERGY LTD.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

217 Queen Street West, Suite 303

Toronto, Ontario

M5V 0R2

Tel: 1-833-572-2333

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x The exhibits to this report on Form 6-K are incorporated by reference into, and as exhibits to, the Registration Statements on Form F-10 (Commission File No.

INCORPORATION BY REFERENCE

333-287236) and Form S-8 (Commission File No. 333-287876) of the registrant, IsoEnergy Ltd.

EXHIBIT INDEX

| Exhibit Number | Description |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ISOENERGY LTD. | ||

| Date: November 6, 2025 | By: | /s/ Graham du Preez |

| Name: Graham du Preez | ||

| Title: Chief Financial Officer | ||

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the Three and Nine Months Ended September 30, 2025 and 2024

Dated: November 6, 2025

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

GENERAL INFORMATION

This Management’s Discussion and Analysis (“MD&A”) is management’s interpretation of the results and financial condition of IsoEnergy Ltd. and its subsidiaries (“IsoEnergy” or the “Company”) for the three and nine months ended September 30, 2025 and includes events up to the date of this MD&A. This discussion should be read in conjunction with the unaudited condensed consolidated interim financial statements for the three and nine months ended September 30, 2025 and 2024 and the notes thereto (the “Interim Financial Statements”) and other corporate filings, including the Company’s audited consolidated financial statements for the years ended December 31, 2024 and 2023 and the notes thereto (the “Annual Financial Statements”) and Annual Information Form for the year ended December 31, 2024 (the “AIF”), which are available under the Company’s profile on SEDAR+ at www.sedarplus.ca and in the Company’s initial registration Form 40-F available on EDGAR at www.sec.gov. All dollar figures stated herein are expressed in Canadian dollars and referenced as “$”, unless otherwise specified. Monetary amounts expressed in US dollars and Australian dollars are referenced as “US$” and “AUD$”, respectively. This MD&A contains forward-looking information. Please see “Note Regarding Forward-Looking Information” for a discussion of certain of the risks, uncertainties and assumptions used to develop the Company’s forward-looking information.

Technical Disclosure

All scientific and technical information in this MD&A has been reviewed and approved by Dr. Dan Brisbin, P.Geo., Ph.D., IsoEnergy’s Vice-President, Exploration. Dr. Brisbin is a “Qualified Person” for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”). Dr. Brisbin has verified the data disclosed, including sampling, analytical and test data.

All chemical analyses disclosed in this MD&A were completed for the Company by SRC Geoanalytical Laboratories in Saskatoon, Saskatchewan, which is independent of the Company.

All references in this MD&A to “Mineral Resource”, “Inferred Mineral Resource”, “Indicated Mineral Resource”, and “Mineral Reserve” have the meanings ascribed to those terms by the Canadian Institute of Mining, Metallurgy and Petroleum, as the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council, as amended.

For additional information regarding the Company’s 100% owned Larocque East, Tony M, and Radio Projects and its 50% owned Thorburn Lake Project, including its Quality Assurance and Quality Control (“QA/QC”) and data verification procedures, please see the AIF and corresponding technical reports entitled “Technical Report on the Larocque East Project, Northern Saskatchewan, Canada” prepared by SLR Consulting (Canada) Ltd. and dated effective July 8, 2022 (the “Larocque East Technical Report”), “Technical Report on the Tony M Mine, Utah, USA, Report for NI 43-101” prepared by SLR International Corporation and dated effective September 9, 2022 (the “Tony M Technical Report”), “Technical Report for the Radio Project, Northern Saskatchewan” prepared by Tim Maunula, P. Geo. and dated effective August 19, 2016 and “Technical Report for the Thorburn Lake Project, Northern Saskatchewan” prepared by Tim Maunula, P. Geo. and dated effective September 26, 2016, all of which are available under the Company’s profile on SEDAR+ at www.sedarplus.ca.

Each of the Mineral Resource estimates with respect to the properties of IsoEnergy contained in this MD&A, except for the Larocque East Project and the Tony M Mine, are considered to be “historical estimates” as defined under NI 43-101 and are not considered to be current by IsoEnergy. See “Historical Estimates” for additional details.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Differences in United States and Canadian Reporting Practices

This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements promulgated by the Securities and Exchange Commission (the “SEC”). For example, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this MD&A may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements. The Company prepares its financial statements, which are referred to in this MD&A, in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), and the audit of its annual financial statements is subject to Canadian auditing and auditor independence standards.

Industry and Economic Factors that May Affect the Business

The business of mining for minerals involves a high degree of risk. IsoEnergy is an exploration and development company and is subject to risks and challenges similar to companies in a comparable stage and industry. These risks include, but are not limited to, the challenges of securing adequate capital; exploration, development and operational risks inherent in the mining industry; changes in government policies and regulations; the ability to obtain the necessary permitting; as well as global economic and uranium price volatility; all of which are uncertain.

As with other companies involved with mineral exploration and development, the Company is subject to cost inflation on exploration drilling and development activities and the Company may experience difficulty and / or delays in securing goods (including spare parts) and services from time-to-time.

The underlying value of the Company’s exploration and development assets is dependent upon the existence and economic recovery of Mineral Reserves and is subject to, among others, the risks and challenges identified above. Changes in future conditions could require material write-downs of the carrying value of the Company’s exploration and development assets. The Company does not have any current Mineral Reserves.

In particular, the Company does not generate revenue. As a result, IsoEnergy continues to be dependent on third party financing to continue exploration and development activities on the Company’s properties. Accordingly, the Company’s future performance will be most affected by its access to financing, whether debt, equity or other means. Access to such financing, in turn, is affected by general economic conditions, the price of uranium, exploration risks and the other factors some of which are described in the section entitled “Risk Factors” included below.

ABOUT ISOENERGY

IsoEnergy was incorporated on February 2, 2016 under the Business Corporations Act (British Columbia) to acquire certain exploration assets of NexGen Energy Ltd. (“NexGen”). On October 19, 2016, IsoEnergy was listed on the TSX Venture Exchange (“TSXV”). On June 20, 2024, the Company completed its continuance from the province of British Columbia to the province of Ontario under the same name. The Company’s common shares were delisted from the TSXV and began trading on the Toronto Stock Exchange (the “TSX”) on July 8, 2024 under the trading symbol “ISO”. On March 20, 2025, the Company completed the consolidation of its issued and outstanding common shares on the basis of one post-consolidation common share for every four pre-consolidation common shares (the “Share Consolidation”). Throughout this MD&A, references to common shares, stock options, restricted share units and per share amounts are restated to post-consolidation amounts where applicable. The Share Consolidation was implemented in connection with the Company’s application to list its common shares on the NYSE American LLC (the “NYSE American”). On May 5, 2025, the Company’s common shares began trading on the NYSE American under the trading symbol “ISOU”. As of the date hereof, NexGen holds approximately 30.1% of IsoEnergy’s outstanding common shares.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

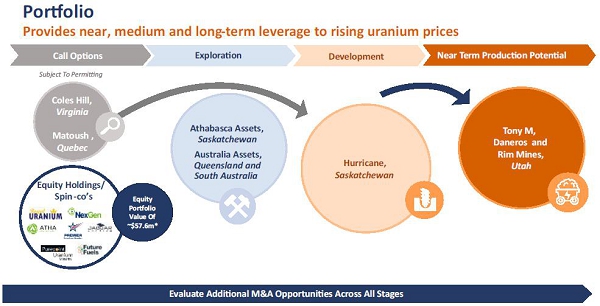

The principal business activity of IsoEnergy is the acquisition, exploration and development of uranium mineral properties in Canada, the United Sates, and Australia.

* Equity holdings include investments in NexGen, Premier American Uranium Inc., Atha Energy Corp., Purepoint Uranium, and Future Fuels Inc., based on market close of November 3, 2025, and Jaguar Uranium Inc. and Royal Uranium Inc. at cost translated to Canadian dollars using the Bank of Canada USD:CAD exchange rate on the same date.

The Company is currently advancing it’s Larocque East Project in the Athabasca Basin, Saskatchewan, Canada, which is home to the Hurricane deposit (“Hurricane” or “Hurricane Deposit”), which has the world’s highest grade published Indicated uranium Mineral Resource – 48.6 million pounds of U3O8 at an average grade of 34.5% contained in 63,800 tonnes. The Company also holds a portfolio of permitted, past-producing conventional uranium mines in Utah with toll milling agreements in place with Energy Fuels Inc. (“Energy Fuels”). These mines are currently on stand-by, ready for a potential restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer. The Company also has a 50% interest in a joint venture formed on December 18, 2024 with Purepoint Uranium Group Inc. (“Purepoint Uranium”), with respect to a portfolio of exploration projects in the Athabasca Basin (the “Purepoint Joint Venture”). The Company’s projects are at varying stages of exploration and development, providing near, medium, and long-term leverage to rising uranium prices. None of the Company’s projects are currently in production and no decisions have been made to bring any of the Company’s projects to the production stage.

IsoEnergy’s uranium mineral properties are reflected below.

| 1. | For additional information please refer to the Tony M Technical Report. |

| 2. | This estimate is a “historical estimate” as defined under NI 43-101. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources and the Company is not treating the historical estimate as current mineral resources. See “Historical Estimates” below for additional details. |

| 3. | For additional information please refer to the Larocque East Technical Report. |

| 4. | Jurisdiction rankings are based on the Investment Attractiveness Index from the Fraser Institute Annual Survey of Mining Companies 2024. |

As an exploration stage company, IsoEnergy does not have revenues and is expected to generate operating losses. As of September 30, 2025, the Company had cash and cash equivalents of $72,158,305, an accumulated deficit of $99,039,025 and adjusted working capital of $129,861,074 (as defined in “Non-IFRS Financial Measures” below).

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

YEAR-TO-DATE 2025 HIGHLIGHTS

| · | Exploration update in the Athabasca Basin and Utah |

A total of 6,396 metres of drilling in 17 diamond drill holes were successfully completed early in 2025 along the Larocque East Project focused on the Larocque regional geological-geophysical corridor (“Larocque Trend”), which hosts the Hurricane Deposit (Figure 4). Drilling intersected strongly elevated radioactivity along the eastern extensions of the Hurricane Deposit’s Main and South trends (Figure 2), as well as at Area D, 2.8 kilometres east (Figure 4), highlighting the potential for additional uranium zones near the deposit and along the Larocque Trend. The summer 2025 exploration drilling programs at Larocque East and Hawk have been completed; as well as the inaugural drill program at the Dorado project, operated through the Purepoint Joint Venture, which has confirmed the presence of high-grade uranium mineralization and led to the recent discovery of the Nova zone.

The majority of 2025 exploration programs at other exploration targets across the Athabasca Basin and in Quebec have been completed. These exploration programs are highlighted by helicopter-borne MobileMT surveys at the East Rim project, ground electromagnetic (“EM”) and Ambient Noise Tomography (“ANT”) surveys on the Hawk project, and prospecting work at the Bulyea River project in the Athabasca Basin, as well as ground geophysical and geochemical surveys at the Matoush and airborne geophysical surveys at the Dieter Lake projects in Quebec.

The Company commenced its 2025 exploration program in Utah in summer 2025. The program includes an initial drilling campaign on the Flatiron claims located in the Henry Mountains property, and geological fieldwork at the Daneros and Sage Plain projects. The work is currently ongoing and the results of the exploration program is expected to guide future exploration targets.

| · | Commencement of key work programs at Tony M |

The Company has initiated several work programs at the Tony M Mine that are intended to optimize operational readiness and reduce future production costs. Technical studies are underway, including ore sorting and High-Pressure Slurry Ablation (“HPSA”) testing programs, as well as an enhanced evaporation study. Multiple mining methods are being evaluated to optimize future production scenarios. The Tony M Mine remains fully permitted and these efforts will assist in the planning of, and the determination of a uranium price, that will support mining activities at the Tony M Mine.

| · | Exercise of put option on Joint Venture Agreement with Purepoint Uranium |

On January 14, 2025, the Company exercised a put option to sell to Purepoint Uranium 10% of the Company’s initial participation interest in the Purepoint Joint Venture in exchange for 4,000,000 common shares of Purepoint Uranium. After the exercise of the put option, each of the Company and Purepoint Uranium holds a 50% interest in the Purepoint Joint Venture.

| · | Terminated transaction with Anfield Energy |

On January 14, 2025, Anfield Energy Inc. (“Anfield Energy”) provided IsoEnergy with notice of termination of the previously announced arrangement agreement pursuant to which, among other things, IsoEnergy agreed to acquire all the issued and outstanding common shares of Anfield Energy by way of a court-approved plan of arrangement (the “AEC Arrangement”). IsoEnergy had provided a bridge loan (“Bridge Loan”) to Anfield Energy in the form of a promissory note of approximately $6.0 million and an indemnity for up to US$3.0 million in principal (the “Indemnity”) with respect to certain of Anfield Energy’s property obligations. On January 21, 2025, the Bridge Loan was fully repaid, including accrued interest at 15% per annum. On March 3, 2025, the Indemnity was released in full.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

| · | Sale of Mountain Lake property |

On February 14, 2025, the Company completed the sale of its Mountain Lake property located in Nunavut pursuant to an asset purchase agreement with Future Fuels Inc. ("Future Fuels"). As consideration for this sale, the Company received 12,500,000 common shares of Future Fuels on closing, a 2% NSR payable on all future uranium production from Mountain Lake, of which half can be repurchased by Future Fuels for $1.0 million, and a 1% NSR payable on all future uranium production on all other Future Fuels properties. The Company received an additional 2,500,000 common shares of Future Fuels in October 2025, upon the earliest date practicable such that it did not result in the Company owning or controlling more than 19.99% of all outstanding common shares of Future Fuels.

| · | Flow Through Financing and Concurrent Private Placement |

On February 28, 2025, the Company closed a financing with a syndicate of underwriters (the “Underwriters”) under a bought deal financing arrangement (the “February 2025 Flow-Through Financing”) whereby the Company issued 1,333,825 “flow-through” common shares at a price of $15.00 per share, for gross proceeds of approximately $20.0 million. The Underwriters were paid a cash commission of 6.0% of the gross proceeds of the February 2025 Flow-Through Financing.

Concurrent with the February 2025 Flow-Through Financing, the Company completed a non-brokered private placement with NexGen to issue 625,000 common shares at a price of $10.00 per share for total gross proceeds of approximately $6.3 million (the “Concurrent Private Placement”). The Concurrent Private Placement enabled NexGen to maintain its pro-rata ownership interest in the Company at approximately 31.8%.

| · | Listing on the NYSE American |

On May 5, 2025, the Company’s common shares commenced trading on the NYSE American under the trading symbol “ISOU”.

| · | Sale of royalty assets |

On May 15, 2025, the Company completed the sale of all the current royalty interests held by IsoEnergy and a subsidiary with respect to properties in Nunavut and Argentina, to Royal Uranium Inc. (“Royal Uranium”) for 8,000,000 Royal Uranium shares at a price of $0.35 per share, for total proceeds of $2,800,000.

| · | Launch of At-The-Market equity program |

On June 2, 2025, the Company entered into an equity distribution agreement (the “Distribution Agreement”) with a group of agents (the “Agents”). The Distribution Agreements allows to Company to distribute up to $75.0 million of its common shares, through the Agents, through the NYSE American or TSX (the “ATM Program”).

| · | Bought Deal Financing |

On June 24, 2025, the Company issued 5,121,500 common shares at a price of $10.00 per share for gross proceeds of $51.2 million (the “Bought Deal Financing”). A cash commission of up to 5% of the gross proceeds of the financing was paid to the brokers involved in the Bought Deal Financing. NexGen participated in the Bought Deal Financing and purchased 1,200,000 common shares.

| · | Sustainability Report |

On July 15, 2025, the Company released its inaugural sustainability report for the year ended December 31, 2024 (the “Sustainability Report”). The Sustainability Report highlights the Company’s progress in advancing its global uranium portfolio with a focus on environmental stewardship, Indigenous partnerships, and responsible governance, and marks a milestone in the Company’s evolution. The full Sustainability Report is available on the Company’s website at www.isoenergy.ca.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

| · | Proposed Acquisition of Toro Energy Limited |

On October 12, 2025, the Company and Toro Energy Limited (“Toro Energy”) entered into a scheme implementation deed (the “SID”) pursuant to which IsoEnergy, through one of its wholly owned subsidiaries, will acquire all of the issued and outstanding ordinary shares of Toro Energy (each whole share, a “Toro Energy Share”) (together with the Toro Energy Shares, the “Toro Scheme”). Toro Energy is a Australian Securities Exchange (“ASX”) listed company that owns 100% of the Wiluna uranium project in Western Australia, Australia, as well as other exploration stage uranium properties in Australia.

Under the terms of the SID, shareholders of Toro Energy (the “Toro Energy Shareholders”) will receive 0.036 of a common share of IsoEnergy (each whole share, an “IsoEnergy Share”) for each Toro Energy Share. Completion of the Toro Scheme is subject to various conditions, including but not limited to: approval from more than 50% of the Toro Energy Shareholders voting and at least 75% of the total votes cast; court approval; there being no formal changes in Western Australia uranium policy to permit uranium mining and/or mining or development of all or any part of the Wiluna uranium project; all Toro Energy unquoted options having lapsed, been exercised, or cancelled; applicable regulatory approvals in Australia, as well as approval by the ASX, TSX, and NYSE American; an independent expert concluding and continuing to conclude that the Toro Scheme is in the best interests of Toro Energy Shareholders; and no material adverse change or prescribed occurrences as defined in the SID occurring in relation to either IsoEnergy or Toro Energy and no regulatory restraints.

The SID includes customary representations and warranties for a transaction of this nature, as well as notification obligations and a matching right regime in the event any superior proposal is received by Toro Energy. The SID also provides for customary deal-protection measures, including a break fee of approximately AUD$700,000, payable by either IsoEnergy or Toro Energy in certain circumstances.

Following the completion of the Toro Scheme, the IsoEnergy Shares will continue to trade on the TSX and NYSE American and the Toro Energy Shares will be delisted from the ASX. The Company retained an investment bank to advise on the Toro Scheme and provide a fairness opinion to the Company’s Board of Directors, for which the investment bank is entitled to a fixed fee customary for this type of transaction, no part of which is contingent upon the opinion being favourable or upon completion the Toro Scheme or any alternative transaction. The Company has also agreed to pay an additional fee for the investment bank’s advisory services in connection with the Toro Scheme, which is contingent on its successful completion. Toro Energy Shareholders will be asked to approve the Toro Scheme at a shareholder meeting (the “Toro Energy Shareholders Meeting”). The Toro Scheme is expected to close after the Toro Energy Shareholders Meeting, which is expected to take place in the first half of 2026.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

DISCUSSION OF OPERATIONS

Nine months ended September 30, 2025

During the nine months ended September 30, 2025, the Company incurred $19,568,680 of exploration and evaluation spending on its exploration properties globally, as set out below. Most of the spending was at the Company’s Larocque East Project in the Athabasca Basin as further discussed below. See “Outlook” below for future exploration plans.

Exploration and evaluation spending

| Canada | United States | Australia | Total | |||||||||||||

| Drilling | $ | 7,488,522 | $ | 83,380 | $ | - | $ | 7,571,902 | ||||||||

| Geological and geophysical | 2,626,138 | 117,502 | 207,648 | 2,951,288 | ||||||||||||

| Labour and wages | 1,204,197 | 910,181 | 8,936 | 2,123,314 | ||||||||||||

| Camp costs | 1,931,181 | 32,644 | 51,727 | 2,015,552 | ||||||||||||

| Claim holding costs and advance royalties | 41,514 | 708,648 | 219,641 | 969,803 | ||||||||||||

| Studies and mine site management | 84,778 | 824,856 | - | 909,634 | ||||||||||||

| Community relations | 489,441 | - | - | 489,441 | ||||||||||||

| Travel | 277,255 | 87,463 | 40,751 | 405,469 | ||||||||||||

| Health and safety and environmental | 234,942 | 9,053 | 58,180 | 302,175 | ||||||||||||

| Geochemistry and assays | 169,569 | 24,373 | 18,724 | 212,666 | ||||||||||||

| Net extension of claim refunds | (71,408 | ) | - | - | (71,408 | ) | ||||||||||

| Other | 384,856 | 305,192 | 29,812 | 719,860 | ||||||||||||

| Cash expenditures | $ | 14,860,985 | $ | 3,103,292 | $ | 635,419 | $ | 18,599,696 | ||||||||

| Share-based compensation | 716,190 | 397,513 | - | 1,113,703 | ||||||||||||

| Foreign exchange movements | - | (170,687 | ) | 25,968 | (144,719 | ) | ||||||||||

| Total expenditures | $ | 15,577,175 | $ | 3,330,118 | $ | 661,387 | $ | 19,568,680 | ||||||||

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

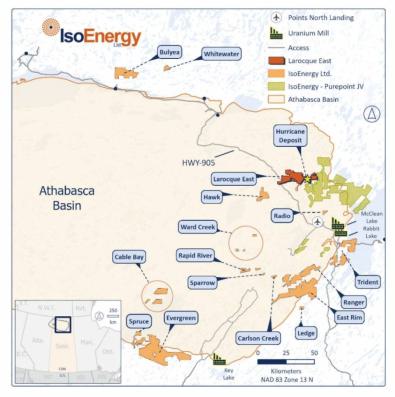

Canada

Expenditures on the Company’s properties in the Athabasca Basin (Figure 1) and Quebec were primarily focused on the following projects during the nine months ended September 30, 2025:

| Larocque East |

Hawk | Purepoint JV | East Rim | Other | Total | |||||||||||||||||||

| Drilling | $ | 4,738,186 | $ | 1,459,643 | $ | 1,290,693 | $ | - | $ | - | $ | 7,488,522 | ||||||||||||

| Geological and geophysical | 114,611 | 895,110 | 28,338 | 789,779 | 798,300 | 2,626,138 | ||||||||||||||||||

| Camp costs | 1,142,727 | 479,940 | 232,046 | - | 76,468 | 1,931,181 | ||||||||||||||||||

| Labour and wages | 690,400 | 154,162 | 170,694 | 46,118 | 142,823 | 1,204,197 | ||||||||||||||||||

| Community Relations | 264,191 | 122,778 | 65,592 | 20,567 | 16,313 | 489,441 | ||||||||||||||||||

| Travel | 217,824 | 12,014 | 24,673 | - | 22,744 | 277,255 | ||||||||||||||||||

| Health and safety and environmental | 217,441 | 5,574 | 2,493 | 1,109 | 8,325 | 234,942 | ||||||||||||||||||

| Geochemistry and assays | - | - | - | - | 84,778 | 84,778 | ||||||||||||||||||

| Studies | 1,985 | - | 350 | 525 | 38,654 | 41,514 | ||||||||||||||||||

| Claim holding costs | 131,425 | 31,000 | 3,019 | - | 4,125 | 169,569 | ||||||||||||||||||

| Net extension of claim refunds | - | - | - | - | (71,408 | ) | (71,408 | ) | ||||||||||||||||

| Other | 45,642 | 23,762 | 180,096 | 1,143 | 134,213 | 384,856 | ||||||||||||||||||

| Cash expenditures | $ | 7,564,432 | $ | 3,183,983 | $ | 1,997,994 | $ | 859,241 | $ | 1,255,335 | $ | 14,860,985 | ||||||||||||

| Share-based compensation | 379,861 | 167,429 | 100,977 | 44,933 | 22,990 | 716,190 | ||||||||||||||||||

| Total expenditures | $ | 7,944,293 | $ | 3,351,412 | $ | 2,098,971 | $ | 904,174 | $ | 1,278,325 | $ | 15,577,175 | ||||||||||||

Figure 1 – Athabasca Basin Property Location Map

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Larocque East Project

Winter 2025 – Diamond Drilling and Geophysical Work

The winter 2025 drilling program focused on testing resource expansion targets near the Hurricane Deposit and at the Target Area D 2.8 kilometres east-northeast of Hurricane along the prospective Larocque Trend where ANT surveys in 2023 and 2024 outlined prospective velocity anomalies. The winter 2025 drilling program was designed to drill at these identified targets and 17 diamond drill holes totalling 6,396 metres were completed. The drilling intersected strongly elevated radioactivity in five holes along the eastern extensions of the Hurricane Deposit main and south trends, as well as at Area D, 2.8 kilometres east of Hurricane, highlighting the potential for additional zones of uranium mineralization both immediately on strike of Hurricane and regionally along the 9 kilometres of the Larocque Trend on the Project (Figures 2 and 4).

A total of 13 holes were completed to test three interpreted structural trends at Hurricane (Figure 2). Four holes (LE25-194, 195, 198, 203) were drilled to test the projected eastern extension of the faults that control the main high-grade portion of Hurricane (the “Main Trend”). Seven holes (LE25-197, 199, 200, 201, 207, 208, 210) were drilled to test the projected extension of faults that control the Hurricane southern high-grade lens (the “South Trend”). Two holes (LE25-196, 205A) were drilled to test a structure intersected in historic drill holes in the middle sandstone north of Hurricane at the unconformity.

In the Main Trend, hole LE25-194 tested down-dip of structure and anomalous geochemistry intersected in LE21-89 and LE21-95A (Figure 3). Hole LE25-194 intersected widespread moderate to strongly bleached core through most of the sandstone. Strong pervasive bleaching, clay alteration and desilicification were intersected below 295 metres. Moderate hematite and grey alteration, typical of Hurricane were intersected immediately above the unconformity associated with strongly elevated radioactivity over 3.5 metres from 316.0 to 319.5 metres which included a 0.5 metre-long interval with an average RS-125 spectrometer value of 3,100 counts per second (“cps”) and a corresponding gamma ray (“2PGA”) probe value of 30,829 cps. Mineralization styles include worm-rock replacement, fault-controlled and disseminated. Hole LE25-198 drilled 100 metres east of hole LE25-194, intersected widespread bleaching throughout the sandstone. Clay and limonite alteration, centered on a fault, were intersected from 259 to 263 metres. A broad structural zone with continuous strong bleaching, desilicification, and clay alteration is present below 287 metres. Fault-controlled hydrothermal hematite and weak grey alteration were intersected approximately 10 metres above the unconformity, indicating the hole overshot the ideal target. Strong pervasive limonite and clay alteration continued to the unconformity at 316.5 metres. The basement rock immediately below the unconformity is moderately argillitized and chloritized, with above-background radioactivity as measured on core and by downhole gamma probing extending from 314.0 metres in sandstone down to 321.1 metres in basement. Peak values recorded on drill core with the RS-125 spectrometer and with the 2PGA downhole probe are 625 cps average over a 0.5 metre interval and 26,503 cps respectively. Hole LE25-198 is interpreted to have overshot the target, and potential for mineralization remains high to the north. Hole LE25-203 tested north of hole LE25-194 and intersected strong bleaching, moderate clay and desilicification centred on structural zones below 283 metres. Fault-controlled hematite alteration was intersected at 320.3 metres. A peak of 4,809 cps was recorded on the 2PGA probe at 325.0 metres, one metre below the unconformity.

In the South Trend, hole LE25-207 was drilled between holes LE21-101 and LE22-115A to test for continuity of mineralization. Hole LE25-207 intersected moderate bleaching beginning at 245 metres. Elevated radioactivity was intersected within hematitic breccia at 293 metres. Strong structurally controlled bleaching and moderate clay alteration were observed from 301 metres to the unconformity at 323.8 metres, with significant core loss recorded from 308 to 323 metres. Strongly elevated radioactivity was recorded over 6.0 metres from 323.0 metres in the sandstone to 329.0 metres in the basement (Figure 5). The interval included RS-125 spectrometer and 2PGA probe values of 8,800 cps averaged over a 0.5 metre interval and 30,096 cps, respectively. Hole LE25-210 tested down-dip of the sandstone structure intersected in hole LE22-118A. Strong bleaching, clay alteration, and desilicification were observed below 251 metres. Weak to moderate fault-controlled hematite alteration was intersected at 319.5 metres and 323.6 metres. Continuous radioactivity exceeding 350 cps was intersected in sandstone at 319 metres and extended into the basement to 324 metres. The highest radioactivity measured on core of 3,700 cps averaged over a 0.5 metre interval and a corresponding 2PGA downhole probe peak of 20,280 cps were recorded within a basement-hosted fault, highlighting the potential for a basement extension of Hurricane.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Drilling in Area D along the Larocque Trend had the best radioactivity intercept to date outside of the Hurricane deposit area and confirms regional potential. Four holes (LE25-202, 204, 206 and 209) were completed this winter (Figure 4). Three holes on one section in the northwest end of Target Area D in which strongly anomalous radioactivity was intersected are summarized below.

Hole LE25-202, the first drill hole on section (Figure 5), intersected weak to moderate bleaching in the upper sandstone. In the lower sandstone, below 206 metres, alteration is moderate to strong with a broad bleached, clay and desilicified zone centred on faults. Moderate to strong limonite in present over a 10 metre interval below 254 metres. The hole intersected unconformity at 270.3 metres and hematitic breccia immediately below unconformity. A second hematitic fault was intersected at 282 metres before the drill hole intersected a moderately hematitic radioactive zone from 286.5 to 291.0 metres. Blebs and fracture-hosted uranium mineralization are associated with the highest RS-125 spectrometer value reading of 6,200 cps over 0.5 metres. Hole LE25-204, drilled to the south and designed to test down dip of the LE25-202 intersection, intersected broad bleaching throughout the sandstone. Moderate clay alteration and desilicification with significant core loss were intersected below 245 metres to unconformity at 262.9 metres.

A new geophysical model generated from joint inversion of ground loop domain EM and direct current resistivity data collected during historic EM and resistivity surveys, has highlighted a previously underexplored conductive structure 800 metres north of the main Hurricane conductor (Figure 6). This 2,500-metre trend has been inadequately tested by two historic drill holes, which is referred to as Area K and exhibits two geophysical features like those at Hurricane (Figure 4).

Summer 2025 – Diamond Drilling and Resource Expansion

The summer 2025 drilling program has been completed, with a total of 22 diamond drill holes totalling 9,561 metres testing Areas D, E, F, and K along a six-kilometre prospective segment of the Larocque Trend (Figure 4). The Company is awaiting the full suite of geochemical assays and structural interpretations of the summer 2025 drill program at Larocque East. Once received, the results will support detailed planning for follow-up drilling in 2026.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

See the Company’s press releases dated April 23, 2025 entitled “IsoEnergy Intersects Strongly Elevated Radioactivity in Multiple Holes Immediately Along Strike of Hurricane and In Step-Out Target Area D, 2.8km East” and dated June 12, 2025 entitled “IsoEnergy Commences Athabasca Basin Summer 2025 Exploration Program” for additional information regarding the results of the 2025 winter exploration program and plans for the summer 2025 exploration program, respectively.

Figure 2 – Location of winter 2025 drill holes with respect to the Hurricane Deposit resource footprint (blue) and the ANT seismic low velocity zone in which the deposit occurs, and projected Hurricane mineralization-controlling fault zones. RS-125 spectrometer values are highest averages over 0.5 metre intervals.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Figure 3 – Main Trend: Cross section through LE25-194 and LE25-203 on the Main Trend looking east.

Figure 4 – Compilation map of Larocque East project showing the Hurricane deposit, winter 2025 and summer 2024 drill hole locations and ANT seismic velocity anomalies (A though J) on a plan view of the 2025 conductivity model 50 metres below the unconformity. 22 drill holes completed during the summer will test targets at Hurricane, in target areas D, E and F, and at the untested northern conductive trend (Target K)

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Figure 5 – Cross section through LE25-202, 204 and 206 on the west end of Target Area ‘D’ looking east.

Figure 6 – Joint resistivity – electromagnetic inversion model of the Larocque East project that highlights an untested 2,500m northern conductivity trend

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Purepoint Joint Venture – Dorado Project

2025 – Drilling and Geophysical Work

Drilling at the Q48 target at the Dorado project, which was completed by Purepoint Uranium as the operator of the exploration program, intersected uranium mineralization in four holes and led to the “Nova Discovery” intercepts at the Q48 target area. The recent Nova Discovery further defines the mineralized trend at the Q48 target as a steeply dipping, uranium-bearing structure hosted within the basement rocks, underscoring the potential scale and strength of the system emerging at the Dorado project.

Drill hole PG25-04 is located approximately 800 metres northwest of the Company’s previous drilling in 2022 (Figure 7). This drill hole was collared with a dip of -60 degrees and encountered Athabasca sandstone to a depth of 321 metres. Clay altered granitic gneiss and pegmatites were drilled to 393 meteres then garnet-rich pelitic gneiss, with local pyrite and graphite, was drilled to the completion depth of 489 metres. The altered radioactive gouge seams were hosted by a chloritized pegmatite and returned an average of 64,220 cps over 0.4 metres. Drill hole PG25-05 was collared using the same azimuth as PG25-04 and intercepted radioactive structure approximately 40 metres up-dip of the latter hole (Figure 8). This drill hole encountered unconformity at 309 metres, clay altered granitic gneiss and pegmatites to 371 metres, then garnet-rich pelitic gneiss, with local pyrite and graphite, was drilled to the completion depth of 498 metres.

Assay results received from drill holes PG25-04 and PG25-05 validate the significance of the mineralization encountered at the Q48 target. The PG25-05 sample returned 1.0 metre grading 2.2% U3O8, including 0.3 metres at 5.4% U3O8. The PG25-04 sample returned 0.6 metres grading 1.0% U3O8.

Drill hole PG25-06 targeted the brittle fault associated with mineralization at the unconformity (Figure 8). The drill hole was collared with a dip of -64 degrees and encountered Athabasca sandstone to a depth of 316 metres. Granitic gneiss displaying paleo-weathering alteration was drilled to 341 metres then generally unaltered granite, pegmatites and pelitic gneiss was drilled to the completion depth of 482 metres. Projection of the Nova Discovery zone mineralization suggests the radioactive sandstone interval of 1,040 cps over 2.3 metres in the Mount Sopris 2PGA-1000 downhole gamma probe is related to the primary mineral structure.

Assay results received from drill hole PG25-07A (Figure 8) returned 2.1 metres grading 1.6% U3O8, including 0.4 metres at 8.1% U3O8and an additional 4.9 metres at 0.52% U3O8. This represents the most significant assay intervals reported to date from the Nova discovery zone.

The Q48 target zone lies within the southern portion of the Dorado project and is characterized by a steeply dipping, north-south trending conductive package identified through geophysical surveys. Drilling by the Company in 2022 confirmed that the conductive trend at the Q48 target hosts structure, shearing, and alteration, characteristics of uranium-bearing hydrothermal systems in the Athabasca Basin. The recently discovered Nova zone shows mineralization within granitic gneiss at 382.3 metres and extends into pelitic gneiss to a depth of 396.3 metres returning an average of 11,100 cps over 14.0 metres. A primary mineralized structure of the Nova zone is hosted in sheared, reddish-brown altered granitic gneiss with pitchblende that returned an average of 82,300 cps over 0.6 metres with a peak of 110,800 cps.

Drilling at the Turaco target area is complete and totalled 832 metres in two holes, targeting two parallel, newly reinterpreted airborne EM conductors within Zone 3. While neither hole encountered anomalous radioactivity, the results will help calibrate the Dorado project’s updated geophysical model. Drilling at the Serin Gris is complete and totalled 1,032 metres in two holes. Anomalous radioactivity was hosted by a 6- metre-wide chloritized pegmatite in drill hole SL25-11.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

The Company is awaiting the full suite of geochemical assays and structural interpretations of the 2025 drill program. Once received, the results will support detailed planning for follow-up drilling in 2026. The focus is expected to be on expanding the Nova deposit and testing priority corridors across the broader Dorado project.

See the Company’s press releases dated July 8, 2025 entitled “IsoEnergy and Purepoint Confirm Uranium Discovery In Initial Drilling at the Dorado Joint Venture Project”, dated July 23, 2025 entitled “IsoEnergy and Purepoint Extend High-Grade Mineralization at the Dorado JV with a 70 Metre Step-Out Peaking at 110,800 CPS”, dated August 6, 2025 entitled “IsoEnergy and Purepoint Report Assay Grades of up to 5.4% U3O8 from Initial Holes at the Nova Discovery on the Dorado JV”, and dated September 18, 2025 entitled “IsoEnergy and Purepoint Intersect Up to 8.1% U3O8 at Dorado Project” for additional information regarding the results of the 2025 exploration program at the Dorado project.

Figure 7 – Location of Q48 Nova Discovery, Q2, Turaco, and Serin target areas, the initial focus of the 2025 drill program

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Figure 8 – Location map of 2025 drill program at Q48 target area and the new Nova Discovery

Hawk

Exploration work for summer 2025 at the Hawk project, including drilling and geophysical surveying, has been completed. A stepwise moving loop EM survey was completed to more accurately locate conductors for drill hole targeting, and ANT surveys were completed over the northern portion of the project to test for the extension of the existing ANT velocity anomaly along the conductivity corridor in an area where there is 35 metres of unconformity elevation change between 2023 drill holes HK23-01 and HK23-02.

Four diamond drill holes totalling 3,591 metres were drilled in 2025 after interpretations of 2025 geophysical survey results were received and integrated with existing geoscience information. The drilling was done to target coincident EM conductors and ANT velocity anomalies along a sparsely drill-tested 15-kilometre-long prospective corridor. Previous drilling at the Hawk project intersected structural disruption, alteration, and elevated uranium geochemistry and radiometric responses, which are consistent with a setting conductive to unconformity-style uranium mineralization (Figure 9). The Company is awaiting the full suite of geochemical assays and structural interpretations of the summer 2025 exploration program at Hawk. Once received, the results will support detailed planning for future exploration plans.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Figure 9 – Hawk project map showing the locations of the summer 2025 geophysical surveys. The locations of four drill holes completed late in the summer will be updated after drill hole data is finalized. Locations of past drill holes, interpreted ground EM conductors, and drill intersected faults are shown on a colour ZTEM conductivity map.

East Rim

A helicopter-borne MobileMT conductivity and magnetic survey was completed over the East Rim project. Data processing and interpretation are in progress and information obtained for the survey will inform targets for future exploration programs on the East Rim project.

Other Canadian projects

The majority of exploration and evaluation costs incurred for other projects in Canada during the nine months ended September 30, 2025, relate to assessment report writing and community engagement payments accrued for properties in the Athabasca Basin, geophysical and geochemical survey fieldwork at the Matoush property in Quebec, and an airborne geophysical survey at the Dieter Lake property in Quebec. See “Outlook” below for further details on the 2025 exploration program plans for the Company’s properties in Canada.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

United States

Expenditure on the Company’s properties in the United States was as follows during the nine months ended September 30, 2025:

| Tony M | Other | Total | ||||||||||

| Labour and wages | $ | 276,845 | $ | 633,336 | $ | 910,181 | ||||||

| Studies and mine site management | 208,967 | 615,889 | 824,856 | |||||||||

| Claim holding costs and advance royalties | 497,924 | 210,724 | 708,648 | |||||||||

| Geological and geophysical | - | 117,502 | 117,502 | |||||||||

| Travel | 50,720 | 36,743 | 87,463 | |||||||||

| Drilling | - | 83,380 | 83,380 | |||||||||

| Camp costs | 30,559 | 2,085 | 32,644 | |||||||||

| Geochemistry and assays | - | 24,373 | 24,373 | |||||||||

| Health, safety and environmental | 3,426 | 5,627 | 9,053 | |||||||||

| Other | 64,325 | 240,867 | 305,192 | |||||||||

| Cash expenditures | $ | 1,132,766 | $ | 1,970,526 | $ | 3,103,292 | ||||||

| Share-based compensation | 214,856 | 182,657 | 397,513 | |||||||||

| Foreign exchange movements | (170,687 | ) | - | (170,687 | ) | |||||||

| Total expenditures | $ | 1,176,935 | $ | 2,153,183 | $ | 3,330,118 | ||||||

Tony M Mine

The Company is in the process of performing ore sorting and high-pressure slurry ablation testing programs to evaluate material processing and reduce haulage and operating costs, as well as an evaporation study with the aim to reduce capital costs and increase evaporation rates at the existing evaporation pond infrastructure at the Tony M Mine. For the ore sorting study, the Company engaged Steinert Group to test sensor-based ore sorting on mineralized material from the Tony M Mine. This study utilizes technology that uses a combination of 3D, color, induction, and x-ray sensors to identify and separate target material, with the potential to: reduce haulage costs by concentrating mineralization and lowering transport volumes to the White Mesa Mill, where toll-milling will take place; improve mining productivity by reducing waste and enhancing ore advance rates; and minimize dilution through more precise material handling. The Company is also testing mineralized material from Tony M at Disa Technologies using their patented HPSA process. This process uses high-pressure slurry streams to separate uranium coatings from sand grains, with the intended benefit of improving process efficiency and reducing costs. Lastly, the Company is working with RWI Enhanced Evaporation to evaluate the use of landshark evaporators on the Tony M Mine evaporation pond. Preliminary results suggest that enhanced evaporation could eliminate the need for constructing additional pond capacity, reducing future dewatering timelines and associated costs for the later stages of mining. The Company also expects to commence a bulk sampling study towards the end of 2025.

The Company continues to secure and install new equipment on site, and intends to use the results of the above studies as inputs for an updated technical and economic study which will likely commence in 2026. See “Outlook” below for further details on the Company’s planned 2025 work program at the Tony M Mine.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Utah Exploration

The Company commenced its exploration program in Utah in October 2025. The Company plans to drill 10 surface rotary holes with core tails on the Flatiron project, located approximately seven miles northwest of the Tony M Mine. The Company initially staked 370 lode claim that comprise the Flatiron project in 2024 and then added two additional Utah state leases to bring the total land position of the Flatiron project to 8,800 acres. The Flatiron project is one of the largest contiguous land positions in the historically productive Henry Mountains uranium district. This initial drill program is designed to follow-up on historical exploration conducted by Plateau Resources in the 1980s and represents the Company’s first phase of testing on the Flatiron claims (Figure 10). The target unit for the initial drill program is the lowest sandstone unit of the Salt Wash Member of the Morrison Formation. This distinct sandstone package contains a suitable amount of reductant material and the hydrogeologic setting for uranium mineralization of commercially viable grade. Low grades of vanadium are also expected to be encountered in the host unit.

Figure 10 – Location of the Flatiron project in proximity to the Tony M Mine in Utah

The 2025 exploration program in Utah will also continue fieldwork at the Daneros and Sage Plain properties. These properties include past producing mines. The Company has been focused on detailed fieldwork designs to reveal the sedimentary framework that controls the local mineralization. This work includes mapping the extent of the prospective host units, as well as numerous detailed measured sections of the available outcrop used to identify modern analogs of the distributary channel systems to provide a conceptual target generation framework. This information is expected to guide future exploration, including determining the most appropriate geophysical survey techniques to locate the productive units without the need for expensive and pervasive surface drilling.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Claim Staking and Claim Maintenance

The Company staked additional ground adjacent to the Tony M Mine during the nine months ended September 30, 2025 at a cost of $2,630 and incurred $708,648 in expenditure on annual state lease fees, advance royalties, other short-term lease payments, and land management fees related to the Company’s properties in Utah.

The Company renegotiated the royalty on the Utah Trust Lands (SITLA) lease at the Tony M Mine. The royalty on uranium production was previously 8% gross and has been reduced to 3%. In addition, the advanced minimum royalty has been meaningfully reduced.

Year ended December 31, 2024

During the year ended December 31, 2024, the Company incurred $23,495,786 of exploration and evaluation spending primarily on its exploration properties in Canada and in Utah, as set out below. Total exploration and evaluation spending in the year ended December 31, 2024 excludes $378,879 spent on properties in Argentina, which the Company disposed of during the year ended December 31, 2024.

Exploration and evaluation spending from continuing operations

| Canada | United States | Australia | Total | |||||||||||||

| Drilling | $ | 6,000,455 | $ | 154,306 | $ | - | $ | 6,154,761 | ||||||||

| Geological & geophysical | 4,968,309 | 522,167 | 5,895 | 5,496,371 | ||||||||||||

| Labour & wages | 1,537,927 | 1,290,233 | 247,070 | 3,075,230 | ||||||||||||

| Camp costs | 1,936,029 | 83,738 | - | 2,019,767 | ||||||||||||

| Claim holding costs and advance royalties | 50,449 | 1,236,488 | 226,100 | 1,513,037 | ||||||||||||

| Engineering and underground access | 70,687 | 1,150,702 | - | 1,221,389 | ||||||||||||

| Travel | 364,385 | 247,757 | 33,430 | 645,572 | ||||||||||||

| Community relations | 575,462 | - | - | 575,462 | ||||||||||||

| Health and safety and environmental | 444,369 | 43,566 | 73,635 | 561,570 | ||||||||||||

| Geochemistry & Assays | 312,268 | 48,391 | 2,119 | 362,778 | ||||||||||||

| Extension of claim refunds | (67,713 | ) | - | - | (67,713 | ) | ||||||||||

| Other | 254,853 | 153,439 | 75,601 | 483,893 | ||||||||||||

| Cash expenditures | $ | 16,447,480 | $ | 4,930,787 | $ | 663,850 | $ | 22,042,117 | ||||||||

| Share-based compensation | 1,095,546 | 343,121 | 11,041 | 1,449,708 | ||||||||||||

| Foreign exchange movements | - | 4,528 | (567 | ) | 3,961 | |||||||||||

| Total expenditures | $ | 17,543,026 | $ | 5,278,436 | $ | 674,324 | $ | 23,495,786 | ||||||||

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Expenditure on the Company’s properties in Canada during the year ended December 31, 2024 was primarily on Larocque East, Hawk, Matoush, and East Rim, as set out below. Spending at Matoush also included travel and labour and wages related to community engagement work.

| Larocque East | Hawk | Matoush | East Rim | Other | Total | |||||||||||||||||||

| Drilling | $ | 4,757,266 | $ | 1,243,189 | $ | - | $ | - | $ | - | $ | 6,000,455 | ||||||||||||

| Geological & geophysical | 1,816,725 | 151,953 | 811,982 | 538,928 | 1,648,721 | 4,968,309 | ||||||||||||||||||

| Camp costs | 1,282,932 | 483,469 | 134,789 | - | 34,839 | 1,936,029 | ||||||||||||||||||

| Labour & wages | 867,305 | 205,730 | 178,760 | 72,371 | 213,761 | 1,537,927 | ||||||||||||||||||

| Community relations | 321,550 | 73,500 | 1,299 | 14,600 | 164,513 | 575,462 | ||||||||||||||||||

| Health and safety and environmental | 402,329 | 18,048 | 533 | 4,099 | 19,360 | 444,369 | ||||||||||||||||||

| Travel | 252,175 | 24,894 | 87,294 | - | 22 | 364,385 | ||||||||||||||||||

| Geochemistry & Assays | 219,942 | 51,924 | 40,000 | 402 | - | 312,268 | ||||||||||||||||||

| Engineering | 70,687 | - | - | - | - | 70,687 | ||||||||||||||||||

| Claim holding costs | - | - | 50,449 | - | - | 50,449 | ||||||||||||||||||

| Extension of claim refunds | - | - | - | (21,529 | ) | (46,184 | ) | (67,713 | ) | |||||||||||||||

| Other | 76,896 | 56,168 | 48,355 | 20,983 | 52,451 | 254,853 | ||||||||||||||||||

| Cash expenditures | 10,067,807 | 2,308,875 | 1,353,461 | 629,854 | 2,087,483 | 16,447,480 | ||||||||||||||||||

| Share-based compensation | 725,609 | 166,516 | 6,162 | 44,899 | 152,360 | 1,095,546 | ||||||||||||||||||

| Total expenditures | $ | 10,793,416 | $ | 2,475,391 | $ | 1,359,623 | $ | 674,753 | $ | 2,239,843 | $ | 17,543,026 | ||||||||||||

Expenditure on the Company’s properties in the United States during the year ended December 31, 2024, was primarily focused on reopening access to the Tony M Mine and exploration activities on Henry Mountains, Daneros, and Sage Plain in Utah, as set out below:

| Tony M | Other | Total | ||||||||||

| Labour and wages | $ | 1,254,659 | $ | 35,574 | $ | 1,290,233 | ||||||

| Claim holding costs and advance royalties | 1,191,257 | 45,231 | 1,236,488 | |||||||||

| Engineering and underground access | 1,150,702 | - | 1,150,702 | |||||||||

| Geological & geophysical | 496,671 | 25,496 | 522,167 | |||||||||

| Camp costs | 81,921 | 1,817 | 83,738 | |||||||||

| Travel | 245,060 | 2,697 | 247,757 | |||||||||

| Drilling | 154,306 | - | 154,306 | |||||||||

| Geochemistry and assays | 48,391 | - | 48,391 | |||||||||

| Health and safety and environmental | 43,566 | - | 43,566 | |||||||||

| Other | 153,172 | 267 | 153,439 | |||||||||

| Cash expenditures | 4,819,705 | 111,082 | 4,930,787 | |||||||||

| Share-based compensation | 343,121 | - | 343,121 | |||||||||

| Foreign exchange movements | 4,528 | - | 4,528 | |||||||||

| Total expenditures | $ | 5,167,354 | $ | 111,082 | $ | 5,278,436 | ||||||

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

OUTLOOK

The Company intends to actively explore all of its exploration projects as and when resources permit. The nature and extent of further exploration on any of the Company’s properties, however, will depend on the results of completed and ongoing exploration activities, an assessment of the Company’s recently acquired properties and the Company’s financial resources.

Remaining activities in Canada for 2025 include completing a geophysical survey at the Evergreen project in the Athabasca Basin. As further outlined in “Discussion of Operations” above, activities in Canada for 2025 also include evaluating the exploration results from the 2025 exploration programs to propose future exploration work.

The Company’s planned work program at the Tony M Mine in 2025 includes completing the ore sorting study, evaporation trade-off study, and evaluation of multiple mining methods. The ore sorting study has been undertaken in an effort to reduce haulage costs to the Energy Fuels White Mesa Mill. The evaporation trade-off study has shown some early potential for minimising the cost, work and timeline for full dewatering of the underground when the mine is put back into production. Results of these studies, when completed, could provide important inputs for a technical and economic study, which would likely begin in 2026 and would include a mine plan, production rates, expected operational costs and capital requirements. In any such plan, the price of uranium will be a key factor. Activities in the US also include completing the 2025 exploration programs at the Flatiron, Daneros, and Sage Plain projects in Utah.

The Company intends to undertake internal technical studies on several non-material properties in 2025.

SELECTED FINANCIAL INFORMATION

Management is responsible for the Interim Financial Statements referred to in this MD&A. The Audit Committee of the Board of Directors (the “Board”) has been delegated the responsibility to review the Interim Financial Statements and MD&A and make recommendations to the Board. The Board is responsible for final approval of the Interim Financial Statements and MD&A.

The Interim Financial Statements have been prepared in accordance with IAS 34, Interim Financial Reporting as issued by the IFRS and interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”). The Company’s presentation currency and the functional currency of its Canadian operations is Canadian dollars; the functional currency of its Australian operations is the Australian dollar; and the functional currency of its United States operations and the Argentinian discontinued operations is the US dollar.

The Company’s Interim Financial Statements have been prepared using IFRS applicable to a going concern, which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The ability of the Company to continue as a going concern is dependent on its ability to obtain financing and achieve future profitable operations.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Financial Position

The following financial data is derived from and should be read in conjunction with the Interim Financial Statements and the Annual Financial Statements. As an exploration stage company, IsoEnergy does not have revenues.

| September 30, 2025 | December 31, 2024 |

December 31, 2023 Restated |

||||||||||

| Exploration and evaluation assets | $ | 277,586,305 | $ | 262,291,098 | $ | 274,756,338 | ||||||

| Total assets | 430,550,452 | 340,835,023 | 347,198,222 | |||||||||

| Total current liabilities | 15,258,006 | 35,103,977 | 41,065,120 | |||||||||

| Total non-current liabilities | 3,120,376 | 2,567,887 | 3,112,545 | |||||||||

| Adjusted working capital (1) | 129,861,074 | 56,116,942 | 51,644,330 | |||||||||

| Cash dividends declared per share | Nil | Nil | Nil | |||||||||

| (1) | Adjusted working capital is a non-IFRS financial measure, as discussed below, and is defined as current assets less current liabilities, excluding flow-though share premium liabilities and convertible debenture liabilities. |

In the nine months ended September 30, 2025, the Company capitalized $19,568,680 of exploration and evaluation costs, as further described in “Discussion of Operations” above. Exploration and evaluation assets of $1,060,000 relating to 10% of the Company’s interest in the Purepoint Joint Venture and $151,010 relating to the Mountain Lake property were disposed of, as further described in “Year-to-date 2025 Highlights” above. Total assets increased primarily due to $51,215,000 raised in the Bought Deal Financing and $26,257,375 raised in the February 2025 Flow-Through Financing and Concurrent Private Placement, with associated share issuance costs of $4,478,929. Total assets also increased due to the fair value of marketable securities increasing by $26,196,501, primarily from a fair value gain of $11,541,178, as well as the receipt of $8,625,000 of Future Fuels common shares on the disposal of the Mountain Lake property, $2,800,000 of Royal Uranium common shares on the disposal of certain of the Company’s royalty assets, $1,060,000 of Purepoint Uranium common shares from the exercise of the put option in the Purepoint Joint Venture, and $2,170,323 on marketable securities of Atha Energy, Future Fuels, Purepoint Uranium, and Verdera Energy Corp. purchased during the nine months ended September 30, 2025.

Current liabilities as at September 30, 2025, include a flow through share premium liability of $5,702,326 relating to the February 2025 Flow-Through Financing (as defined below). Accounts payable and accrued liabilities increased by $370,083 during the nine months ended September 30, 2025 mostly from the ongoing 2025 summer exploration programs in the Athabasca Basin and the commencement of the 2025 exploration program in Utah, as well as the timing of business development activities of the Company. The fair value of the Company’s 2020 Debentures and the US$4 million in principle of unsecured convertible debentures issued on December 6, 2022 (the “2022 Debentures” and collectively with the 2020 Debentures, the “Debentures”) decreased by $24,602,241 during the nine months ended September 30, 2025 mostly due to the conversion of US$6 million principal of the 2020 Debentures, further described in “Year-to-date 2025 Highlights” above and discussed in “Results of Operations” below.

Adjusted working capital increased during the nine months ended September 30, 2025 mainly due to the Bought Deal Financing, February 2025 Flow-Through Financing, and Concurrent Private Placement, as well as an increase in the fair value of marketable securities during the period, partly offset by exploration and evaluation spending discussed above.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Results of Operations

The following financial data is derived from and should be read in conjunction with the Interim Financial Statements.

| For the three months ended September 30 |

For the nine months ended September 30 |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| General and administrative costs | ||||||||||||||||

| Share-based compensation | $ | 2,143,422 | $ | 2,003,488 | $ | 5,190,658 | $ | 4,234,813 | ||||||||

| Administrative salaries, contractor and directors’ fees | 755,315 | 1,284,005 | 2,339,427 | 3,157,120 | ||||||||||||

| Investor relations | 396,796 | 214,342 | 919,883 | 665,002 | ||||||||||||

| Office and administrative | 240,159 | 201,240 | 777,616 | 607,225 | ||||||||||||

| Professional and consultant fees | 351,783 | 702,859 | 2,302,253 | 2,063,571 | ||||||||||||

| Travel | 116,858 | 172,078 | 383,175 | 435,828 | ||||||||||||

| Public company costs | 361,572 | 249,227 | 987,425 | 510,181 | ||||||||||||

| Total general and administrative costs | $ | (4,365,905 | ) | $ | (4,827,239 | ) | $ | (12,900,437 | ) | $ | (11,673,740 | ) | ||||

| Interest income | 626,450 | 849,788 | 1,301,134 | 1,899,865 | ||||||||||||

| Interest expense | (34,686 | ) | (56,402 | ) | (110,744 | ) | (96,705 | ) | ||||||||

| Interest on convertible debentures | (168,083 | ) | (310,333 | ) | (657,227 | ) | (928,428 | ) | ||||||||

| Fair value gain on convertible debentures | 115,898 | 4,779,418 | 454,395 | 23,558 | ||||||||||||

| Gain on disposal of assets | - | 5,300,611 | 11,189,425 | 5,300,611 | ||||||||||||

| Foreign exchange gain (loss) | 5,429 | (36,810 | ) | (63,516 | ) | (24,276 | ) | |||||||||

| Other loss | (167,938 | ) | - | (167,938 | ) | - | ||||||||||

| Other income | 144,760 | 69,666 | 668,701 | 116,368 | ||||||||||||

| (Loss) income from operations | $ | (3,844,075 | ) | $ | 5,768,699 | $ | (286,207 | ) | $ | (5,382,747 | ) | |||||

| Deferred income tax recovery (expense) | 4,131,951 | (1,607,555 | ) | 3,792,428 | (1,118,881 | ) | ||||||||||

| Income (loss) from continuing operations | $ | 287,876 | $ | 4,161,144 | $ | 3,506,221 | $ | (6,501,628 | ) | |||||||

| Loss from discontinued operations (1) | - | (1,859 | ) | - | (128,358 | ) | ||||||||||

| Income (loss) for period | $ | 287,876 | $ | 4,159,285 | $ | 3,506,221 | $ | (6,629,986 | ) | |||||||

| Income (loss) per share – basic (2) | $ | 0.01 | $ | 0.09 | $ | 0.07 | $ | (0.15 | ) | |||||||

| (Loss) income per share – diluted (2) | $ | (0.01 | ) | $ | 0.00 | $ | 0.05 | $ | (0.15 | ) | ||||||

| Loss per share relating to discontinued operations – basic and diluted (1)(2) | Nil | $ | (0.00 | ) | Nil | $ | (0.00 | ) | ||||||||

| (1) | Loss from discontinued operations, net of tax, relates to the Argentina reporting segment, which was disposed of during the year ended December 31, 2024. |

| (2) | (Loss) income per share amounts in the comparative period were retroactively restated on a post-consolidation basis. Refer to the discussion on the Share Consolidation, as described above in “About IsoEnergy”. |

Three months ended September 30, 2025

During the three months ended September 30, 2025, the Company recorded a net income of $287,876, compared to a net income of $4,159,285 in the three months ended September 30, 2024. Included in the net income for the three months ended September 30, 2024, is a $1,859 loss from discontinued operations relating to the Argentina reporting segment that was sold in 2024, which led to a gain of $5,300,611 in the three months ended September 30, 2024. The main driver of the difference between the two periods was a decrease in the fair value gain on the Debentures of $4,663,520, partially offset by a deferred income tax recovery of $4,131,951. Other factors causing the difference between the two periods are further described below.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

General and administrative costs

Share-based compensation was $2,143,422 in the three months ended September 30, 2025, compared to $2,003,488 in the three months ended September 30, 2024. The share-based compensation expense is a non-cash charge based on the Black-Scholes value of stock options, calculated using the graded vesting method. Stock options granted to directors, consultants and employees typically vest in three tranches – 1/3 immediately, 1/3 on the first anniversary of the grant date, and the remaining 1/3 on the second anniversary of the grant date, with the corresponding share-based compensation expense being recognized over this period. The similar expense in both periods is consistent with the fact that there were material grants of stock options in both periods.

Administrative salaries, contractor and directors’ fees of $755,315 for the three months ended September 30, 2025, decreased from $1,284,005 during the prior period primarily due to a smaller management team as compared to the prior period. Included in the three months ended September 30, 2024, was an additional payment to the former President of the Company in accordance with the terms of their employment contract following their resignation effective August 31, 2024.

Investor relations expenses relate primarily to costs incurred in communicating with existing and potential shareholders, conferences and marketing. The increase in the current period is primarily from additional marketing activities in Europe.

Office and administrative expenses primarily consist of office operating costs and other general administrative costs. The increase in office and administrative expenses from the prior period is primarily from the Company being responsible for all costs for its new office in Saskatoon, Saskatchewan, whereas previously it shared its office and office-related services in that city with NexGen.

Professional and consultant fees were $351,783 for the three months ended September 30, 2025, compared to $702,859 for the three months ended September 30, 2024. Professional fees of $516,280 incurred to September 30, 2025 relating to the Toro Scheme are included in prepaid expenses. There was also a reduction in tax consulting services compared to the prior period.

Travel expenses primarily relate to travel and accommodation costs for conferences, business development activities, public relations activities, and general corporate purposes. Travel costs decreased slightly from the prior period mainly due to timing of site visits undertaken compared to the prior period.

Public company costs consist primarily of costs associated with the Company’s continuous disclosure obligations, listing fees, directors and officers insurance, transfer agent costs, press releases and other shareholder communications. The increase in public company costs from $249,227 to $361,572 is primarily due to the additional costs of listing on the NYSE American, including the initial listing and sustaining fees, additional insurance requirements, and filing costs.

Other items

The Company recorded interest income of $626,450 in the three months ended September 30, 2025, compared to $849,788 in the three months ended September 30, 2024, which represents interest earned on cash balances. The amounts were lower in the three months ended September 30, 2025 mainly due to decreases in interest rates earned on cash and a one-time interest credit on its cash balances earned in the prior period, partially offset by a higher average cash balance in the current period.

Interest expense on the Debentures was $168,083 in the three months ended September 30, 2025, which was lower than the $310,333 in the three months ended September 30, 2024. The 2020 Debentures and 2022 Debentures bear interest of 8.5% and 10%, respectively, per annum and are payable, with a combination of cash and common shares of the Company, on June 30 and December 31. The decrease is primarily due to the remaining US$3 million principal of the 2020 Debentures being converted during the three months ended September 30, 2025.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

The fair value of the Debentures on September 30, 2025 was $5,677,065 compared to $15,980,791 on June 30, 2025. The decrease in the fair value of the Debentures is primarily due to the conversion of the remaining US$3 million principal of the 2020 Debentures during the three months ended September 30, 2025. The fair value of the 2020 Debentures was measured up to the date of conversion, which assumed a discount of 0%, as it is assumed that the 2020 Debentures can be converted immediately and the shares received can be sold at the fair market value of the conversion shares, with no additional discount. The decrease in fair value include a decrease in the fair value of the Debentures of $115,898 included in the statement of income, partially offset by a fair value gain attributable to the change in credit risk of $7,051 included in other comprehensive income (loss). The Company’s Debentures are classified as measured at fair value through profit and loss. In accordance with IFRS 9 – Financial Instruments, the part of a fair value change due to an entity’s own credit risk is presented in other comprehensive income (loss). As of September 30, 2025, the time to maturity of the 2022 Debentures was 2.2 years.

Foreign exchange gain was $5,429 in the three months ended September 30, 2025, compared to a loss of $36,810 in the three months ended September 30, 2024, and mainly relates to exchange movements on working capital in United States dollars held by the Company. The Company has larger US dollar denominated cash balances compared to the prior period which combined with the increase of the US dollar compared to the Canadian dollar, led to an increased foreign exchange gain.

Other income was $144,760 in the three months ended September 30, 2025, compared to $69,666 in the three months ended September 30, 2024. This primarily relates to higher timber sales and an increase in rental income earned from the Company’s operations in the US.

The Company records a deferred tax recovery or expense which is comprised of a recovery on losses or expense on gains recognized in the period and, when applicable, the release of flow-through share premium liability which is offset by the renunciation of flow-through share expenditures to shareholders. In the three months ended September 30, 2025, this resulted in a recovery of $4,131,951, compared to an expense of $1,607,555 in the three months ended September 30, 2024. The decrease in expense to a recovery is mostly due to the gain on the sale of the Argentina reporting segment in the prior period and a larger proportion of flow-through share spending renounced during the three months ended September 30, 2025.

Nine months ended September 30, 2025

During the nine months ended September 30, 2025, the Company recorded net income of $3,506,221, compared to net loss of $6,629,986 in the nine months ended September 30, 2024. Included in the net loss for the nine months ended September 30, 2024, is a $128,358 loss from discontinued operations relating to the Argentina reporting segment that was sold in 2024. The sale resulted in a gain of $5,300,611 in the nine months ended September 30, 2024. The main driver of the difference between the two periods was a gain on the sale of the Mountain Lake property and certain royalty assets of $11,189,425 and a deferred income tax recovery of $3,792,428 in the nine months ended September 30, 2025, partially offset by an increase in general and administrative costs of $1,226,697. Other factors causing the difference between the two periods are further described below.

General and administrative costs

Share-based compensation was $5,190,658 in the nine months ended September 30, 2025, compared to $4,234,813 in the nine months ended September 30, 2024. The increase in the current period was primarily due to a higher number of stock options granted during the nine months ended September 30, 2025 compared to the prior period.

Administrative salaries, contractor and directors’ fees of $2,339,427 for the nine months ended September 30, 2025, decreased from $3,157,120 during the prior period primarily for similar reasons discussed above for the three months ended September 30, 2025.

ISOENERGY LTD.

For the three and nine months ended September 30, 2025 and 2024

Investor relations expenses relate primarily to costs incurred in communicating with existing and potential shareholders, conferences and marketing. The increase in the current period is primarily for similar reasons discussed above for the three months ended September 30, 2025.

Office and administrative expenses primarily consist of office operating costs and other general administrative costs. The increase in the current period is for similar reasons discussed above for the three months ended September 30, 2025, as well as an accrual for Part XII.6 tax that the Company expects to file relating to the timing of the eligible exploration expenditures incurred in 2025 in respect of the 2024 Flow-Through Financing.

Professional and consultant fees were $2,302,253 for the nine months ended September 30, 2025, compared to $2,063,571 for the nine months ended September 30, 2024. Professional fees were higher mainly due to legal fees incurred for the Company’s listing on the NYSE American, increased business development activities, and legal fees related to the now terminated AEC Arrangement, including costs incurred for completing customary termination procedures such as repayment of the Bridge Loan and release of the Indemnity.

Travel expenses primarily relate to travel and accommodation costs for conferences, business development activities, public relations activities, and general corporate purposes. The decrease in the current period is primarily for similar reasons discussed above for the three months ended September 30, 2025.

Public company costs consist primarily of costs associated with the Company’s continuous disclosure obligations, listing fees, directors and officers insurance, transfer agent costs, press releases and other shareholder communications. The increase in public company costs from the prior period is for similar reasons discussed above for the three months ended September 30, 2025.

Other items