UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2025

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-37836-1

|

|

INTERNATIONAL SEAWAYS, INC. |

(Exact name of registrant as specified in its charter) |

Marshall Islands |

|

98-0467117 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

|

|

|

600 Third Avenue, 39th Floor, New York, New York |

|

10016 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 212-578-1600 |

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock (no par value) |

INSW |

New York Stock Exchange |

Rights to Purchase Common Stock |

N/A |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Emerging growth company ☐ |

|

|

|

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practical date. The number of shares outstanding of the issuer’s common stock as of November 4, 2025: common stock, no par value, 49,394,531 shares.

INTERNATIONAL SEAWAYS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

DOLLARS IN THOUSANDS

(UNAUDITED)

|

|

September 30, 2025 |

|

December 31, 2024 |

||

ASSETS |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

412,569 |

|

$ |

157,506 |

Voyage receivables, net of allowance for credit losses of $90 and $86 |

|

|

|

|

|

|

including unbilled receivables of $145,726 and $181,211 |

|

|

155,017 |

|

|

185,521 |

Other receivables |

|

|

13,656 |

|

|

13,771 |

Inventories |

|

|

577 |

|

|

1,875 |

Prepaid expenses and other current assets |

|

|

9,396 |

|

|

15,570 |

Current portion of derivative asset |

|

|

753 |

|

|

2,080 |

Total Current Assets |

|

|

591,968 |

|

|

376,323 |

Vessels and other property, less accumulated depreciation of $246,413 and $466,356 |

|

|

1,947,662 |

|

|

2,050,211 |

Vessels construction in progress |

|

|

75,434 |

|

|

37,020 |

Deferred drydock expenditures, net |

|

|

101,484 |

|

|

90,209 |

Operating lease right-of-use assets |

|

|

9,860 |

|

|

21,229 |

Pool working capital deposits |

|

|

33,859 |

|

|

35,372 |

Long-term derivative asset |

|

|

36 |

|

|

801 |

Other assets |

|

|

29,275 |

|

|

25,232 |

Total Assets |

|

$ |

2,789,578 |

|

$ |

2,636,397 |

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable, accrued expenses and other current liabilities |

|

$ |

49,607 |

|

$ |

66,264 |

Current portion of operating lease liabilities |

|

|

5,617 |

|

|

14,617 |

Current installments of long-term debt |

|

|

282,489 |

|

|

50,054 |

Total Current Liabilities |

|

|

337,713 |

|

|

130,935 |

Long-term operating lease liabilities |

|

|

6,206 |

|

|

8,715 |

Long-term debt |

|

|

509,527 |

|

|

638,353 |

Other liabilities |

|

|

2,345 |

|

|

2,346 |

Total Liabilities |

|

|

855,791 |

|

|

780,349 |

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Capital - 100,000,000 no par value shares authorized; 49,371,469 and 49,194,458 |

|

|

|

|

|

|

shares issued and outstanding |

|

|

1,505,459 |

|

|

1,504,767 |

Retained earnings |

|

|

438,772 |

|

|

359,142 |

|

|

|

1,944,231 |

|

|

1,863,909 |

Accumulated other comprehensive loss |

|

|

(10,444) |

|

|

(7,861) |

Total Equity |

|

|

1,933,787 |

|

|

1,856,048 |

Total Liabilities and Equity |

|

$ |

2,789,578 |

|

$ |

2,636,397 |

See notes to condensed consolidated financial statements

1

INTERNATIONAL SEAWAYS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

(UNAUDITED)

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Shipping Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Pool revenues, including $46,687, $57,062, $151,640 and $211,050 |

|

|

|

|

|

|

|

|

|

|

|

|

from companies accounted for by the equity method |

|

$ |

146,023 |

|

$ |

170,007 |

|

$ |

432,391 |

|

$ |

603,970 |

Time charter revenues |

|

|

39,040 |

|

|

36,842 |

|

|

111,626 |

|

|

99,030 |

Voyage charter revenues |

|

|

11,325 |

|

|

18,341 |

|

|

31,406 |

|

|

54,000 |

|

|

|

196,388 |

|

|

225,190 |

|

|

575,423 |

|

|

757,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses |

|

|

3,920 |

|

|

5,503 |

|

|

15,791 |

|

|

14,537 |

Vessel expenses |

|

|

65,815 |

|

|

71,269 |

|

|

200,264 |

|

|

202,490 |

Charter hire expenses |

|

|

7,134 |

|

|

7,245 |

|

|

25,906 |

|

|

20,841 |

Depreciation and amortization |

|

|

41,170 |

|

|

39,304 |

|

|

122,224 |

|

|

109,974 |

General and administrative |

|

|

11,804 |

|

|

13,411 |

|

|

37,186 |

|

|

37,494 |

Other operating expenses |

|

|

1,520 |

|

|

985 |

|

|

1,737 |

|

|

2,715 |

Third-party debt modification fees |

|

|

— |

|

|

— |

|

|

— |

|

|

168 |

Gain on disposal of vessels and other assets, net |

|

|

(13,658) |

|

|

(13,499) |

|

|

(34,908) |

|

|

(41,402) |

Total operating expenses |

|

|

117,705 |

|

|

124,218 |

|

|

368,200 |

|

|

346,817 |

Income from vessel operations |

|

|

78,683 |

|

|

100,972 |

|

|

207,223 |

|

|

410,183 |

Other income |

|

|

1,486 |

|

|

3,211 |

|

|

5,370 |

|

|

8,525 |

Income before interest expense |

|

|

80,169 |

|

|

104,183 |

|

|

212,593 |

|

|

418,708 |

Interest expense |

|

|

(9,623) |

|

|

(12,496) |

|

|

(30,836) |

|

|

(37,808) |

Income before income taxes |

|

|

70,546 |

|

|

91,687 |

|

|

181,757 |

|

|

380,900 |

Income tax benefit |

|

|

— |

|

|

1 |

|

|

— |

|

|

1 |

Net income |

|

$ |

70,546 |

|

$ |

91,688 |

|

$ |

181,757 |

|

$ |

380,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Number of Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

49,348,406 |

|

|

49,544,412 |

|

|

49,326,459 |

|

|

49,302,367 |

Diluted |

|

|

49,606,210 |

|

|

49,881,317 |

|

|

49,537,318 |

|

|

49,677,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

1.43 |

|

$ |

1.85 |

|

$ |

3.68 |

|

$ |

7.72 |

Diluted net income per share |

|

$ |

1.42 |

|

$ |

1.84 |

|

$ |

3.67 |

|

$ |

7.66 |

See notes to condensed consolidated financial statements

2

INTERNATIONAL SEAWAYS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

DOLLARS IN THOUSANDS

(UNAUDITED)

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Net income |

|

$ |

70,546 |

|

$ |

91,688 |

|

$ |

181,757 |

|

$ |

380,901 |

Other comprehensive loss, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Net change in unrealized losses on cash flow hedges |

|

|

(829) |

|

|

(4,277) |

|

|

(2,439) |

|

|

(4,702) |

Defined benefit pension and other postretirement benefit plans: |

|

|

|

|

|

|

|

|

|

|

|

|

Net change in unrecognized prior service costs |

|

|

69 |

|

|

(467) |

|

|

(19) |

|

|

(457) |

Net change in unrecognized actuarial losses |

|

|

462 |

|

|

(3,063) |

|

|

(125) |

|

|

(3,001) |

Other comprehensive loss, net of tax |

|

|

(298) |

|

|

(7,807) |

|

|

(2,583) |

|

|

(8,160) |

Comprehensive income |

|

$ |

70,248 |

|

$ |

83,881 |

|

$ |

179,174 |

|

$ |

372,741 |

See notes to condensed consolidated financial statements

3

INTERNATIONAL SEAWAYS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

DOLLARS IN THOUSANDS

(UNAUDITED)

|

|

Nine Months Ended September 30, |

||||

|

|

|

2025 |

|

|

2024 |

Cash Flows from Operating Activities: |

|

|

|

|

|

|

Net income |

|

$ |

181,757 |

|

$ |

380,901 |

Items included in net income not affecting cash flows: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

122,224 |

|

|

109,974 |

Amortization of debt discount and other deferred financing costs |

|

|

2,980 |

|

|

3,093 |

Stock compensation |

|

|

5,810 |

|

|

5,736 |

Other – net |

|

|

(34) |

|

|

(561) |

Items included in net income related to investing and financing activities: |

|

|

|

|

|

|

Gain on disposal of vessels and other assets, net |

|

|

(34,908) |

|

|

(41,402) |

Payments for drydocking |

|

|

(63,181) |

|

|

(43,855) |

Insurance claims proceeds related to vessel operations |

|

|

1,914 |

|

|

1,004 |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Decrease in receivables |

|

|

30,504 |

|

|

56,072 |

Decrease in deferred revenue |

|

|

(6,549) |

|

|

(5,273) |

Purchase of insurance contract in connection with settlement of pension plan obligations |

|

|

— |

|

|

(3,649) |

Net change in inventories, prepaid expenses and other current assets, accounts |

|

|

|

|

|

|

payable, accrued expenses and other current and long-term liabilities |

|

|

(6,466) |

|

|

(8,524) |

Net cash provided by operating activities |

|

|

234,051 |

|

|

453,516 |

Cash Flows from Investing Activities: |

|

|

|

|

|

|

Expenditures for vessels, vessel improvements and vessels under construction |

|

|

(188,546) |

|

|

(216,589) |

Security deposits returned for vessel exchange transactions |

|

|

5,000 |

|

|

— |

Proceeds from disposal of vessels and other property, net |

|

|

209,903 |

|

|

71,915 |

Expenditures for other property |

|

|

(627) |

|

|

(880) |

Investments in short-term time deposits |

|

|

— |

|

|

(125,000) |

Proceeds from maturities of short-term time deposits |

|

|

— |

|

|

135,000 |

Pool working capital deposits |

|

|

(250) |

|

|

(1,532) |

Net cash provided by/(used in) investing activities |

|

|

25,480 |

|

|

(137,086) |

Cash Flows from Financing Activities: |

|

|

|

|

|

|

Borrowings on nonrevolving credit facility debt |

|

|

290,775 |

|

|

— |

Borrowings on revolving credit facilities |

|

|

20,000 |

|

|

50,000 |

Repayments on revolving credit facilities |

|

|

(164,581) |

|

|

(50,000) |

Repayments of debt |

|

|

— |

|

|

(39,851) |

Payments on sale and leaseback financing |

|

|

(37,381) |

|

|

(36,831) |

Payments of deferred financing costs |

|

|

(6,036) |

|

|

(5,759) |

Repurchase of common stock |

|

|

— |

|

|

(25,000) |

Cash dividends paid |

|

|

(102,127) |

|

|

(225,385) |

Cash paid to tax authority upon vesting or exercise of stock-based compensation |

|

|

(5,118) |

|

|

(7,055) |

Net cash used in financing activities |

|

|

(4,468) |

|

|

(339,881) |

Net increase/(decrease) in cash and cash equivalents |

|

|

255,063 |

|

|

(23,451) |

Cash and cash equivalents at beginning of year |

|

|

157,506 |

|

|

126,760 |

Cash and cash equivalents at end of period |

|

$ |

412,569 |

|

$ |

103,309 |

See notes to condensed consolidated financial statements

4

INTERNATIONAL SEAWAYS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

DOLLARS IN THOUSANDS

(UNAUDITED)

|

|

|

|

|

|

|

Accumulated |

|

|

|||

|

|

|

|

|

|

|

Other |

|

|

|

||

|

|

|

|

Retained |

|

Comprehensive |

|

|

||||

|

|

Capital |

|

Earnings |

|

Loss |

|

Total |

||||

For the nine months ended |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2025 |

|

$ |

1,504,767 |

|

$ |

359,142 |

|

$ |

(7,861) |

|

$ |

1,856,048 |

Net income |

|

|

— |

|

|

181,757 |

|

|

— |

|

|

181,757 |

Other comprehensive loss |

|

|

— |

|

|

— |

|

|

(2,583) |

|

|

(2,583) |

Dividends declared |

|

|

— |

|

|

(102,127) |

|

|

— |

|

|

(102,127) |

Common stock withheld related to net share settlement of equity awards |

|

|

(5,118) |

|

|

— |

|

|

— |

|

|

(5,118) |

Compensation relating to restricted stock awards |

|

|

782 |

|

|

— |

|

|

— |

|

|

782 |

Compensation relating to restricted stock units awards |

|

|

5,028 |

|

|

— |

|

|

— |

|

|

5,028 |

Balance at September 30, 2025 |

|

$ |

1,505,459 |

|

$ |

438,772 |

|

$ |

(10,444) |

|

$ |

1,933,787 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2024 |

|

$ |

1,490,986 |

|

$ |

226,834 |

|

$ |

(1,063) |

|

$ |

1,716,757 |

Net income |

|

|

— |

|

|

380,901 |

|

|

— |

|

|

380,901 |

Other comprehensive loss |

|

|

— |

|

|

— |

|

|

(8,160) |

|

|

(8,160) |

Dividends declared |

|

|

— |

|

|

(225,385) |

|

|

— |

|

|

(225,385) |

Common stock withheld related to net share settlement of equity awards |

|

|

(7,055) |

|

|

— |

|

|

— |

|

|

(7,055) |

Compensation relating to restricted stock awards |

|

|

811 |

|

|

— |

|

|

— |

|

|

811 |

Compensation relating to restricted stock units awards |

|

|

4,826 |

|

|

— |

|

|

— |

|

|

4,826 |

Compensation relating to stock option awards |

|

|

99 |

|

|

— |

|

|

— |

|

|

99 |

Equity consideration issued for purchase of vessels |

|

|

36,836 |

|

|

— |

|

|

— |

|

|

36,836 |

Repurchase of common stock |

|

|

(25,000) |

|

|

— |

|

|

— |

|

|

(25,000) |

Balance at September 30, 2024 |

|

$ |

1,501,503 |

|

$ |

382,350 |

|

$ |

(9,223) |

|

$ |

1,874,630 |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at July 1, 2025 |

|

$ |

1,503,687 |

|

$ |

406,238 |

|

$ |

(10,146) |

|

$ |

1,899,779 |

Net income |

|

|

— |

|

|

70,546 |

|

|

— |

|

|

70,546 |

Other comprehensive loss |

|

|

— |

|

|

— |

|

|

(298) |

|

|

(298) |

Dividends declared |

|

|

— |

|

|

(38,012) |

|

|

— |

|

|

(38,012) |

Common stock withheld related to net share settlement of equity awards |

|

|

(248) |

|

|

— |

|

|

— |

|

|

(248) |

Compensation relating to restricted stock awards |

|

|

262 |

|

|

— |

|

|

— |

|

|

262 |

Compensation relating to restricted stock units awards |

|

|

1,758 |

|

|

— |

|

|

— |

|

|

1,758 |

Balance at September 30, 2025 |

|

$ |

1,505,459 |

|

$ |

438,772 |

|

$ |

(10,444) |

|

$ |

1,933,787 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at July 1, 2024 |

|

$ |

1,524,400 |

|

$ |

364,452 |

|

$ |

(1,416) |

|

$ |

1,887,436 |

Net income |

|

|

— |

|

|

91,688 |

|

|

— |

|

|

91,688 |

Other comprehensive loss |

|

|

— |

|

|

— |

|

|

(7,807) |

|

|

(7,807) |

Dividends declared |

|

|

— |

|

|

(73,790) |

|

|

— |

|

|

(73,790) |

Compensation relating to restricted stock awards |

|

|

291 |

|

|

— |

|

|

— |

|

|

291 |

Compensation relating to restricted stock units awards |

|

|

1,812 |

|

|

— |

|

|

— |

|

|

1,812 |

Repurchase of common stock |

|

|

(25,000) |

|

|

— |

|

|

— |

|

|

(25,000) |

Balance at September 30, 2024 |

|

$ |

1,501,503 |

|

$ |

382,350 |

|

$ |

(9,223) |

|

$ |

1,874,630 |

See notes to condensed consolidated financial statements

5

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1 — Basis of Presentation:

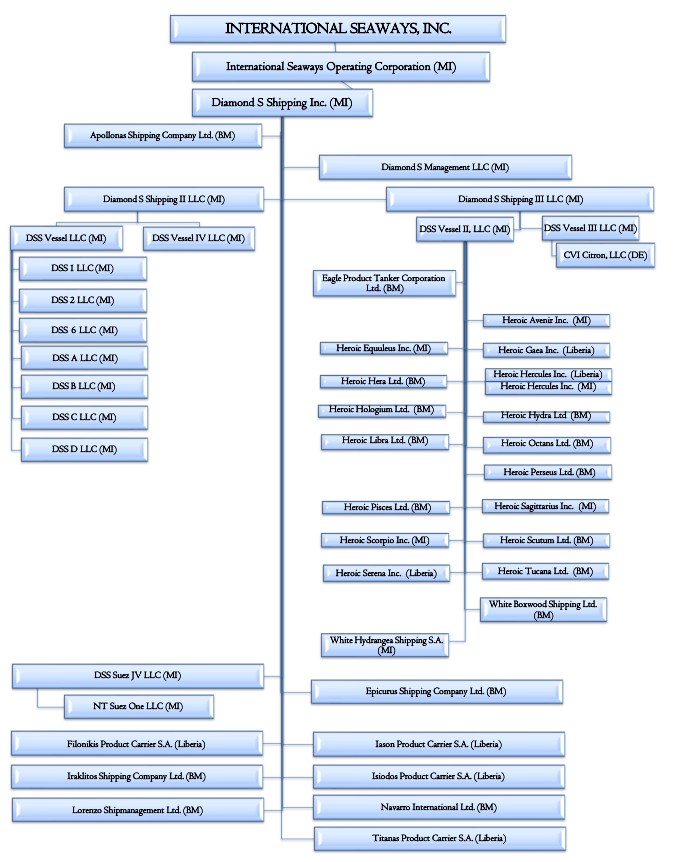

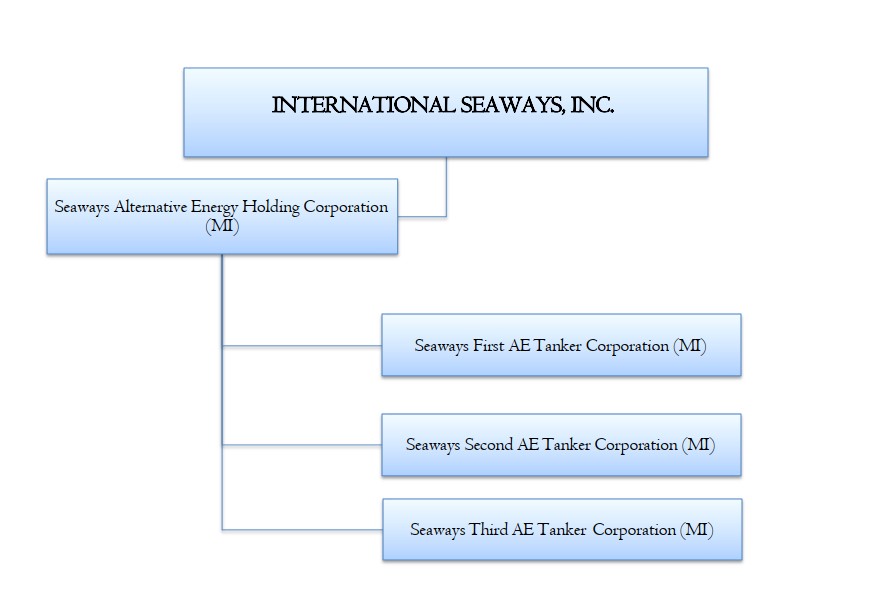

The accompanying unaudited condensed consolidated financial statements include the accounts of International Seaways, Inc. (“INSW”), a Marshall Islands corporation, and its wholly-owned subsidiaries. Unless the context indicates otherwise, references to “INSW”, the “Company”, “we”, “us” or “our”, refer to International Seaways, Inc. and its subsidiaries. As of September 30, 2025, the Company’s operating fleet consisted of 71 wholly-owned or lease financed and time chartered-in oceangoing vessels, engaged primarily in the transportation of crude oil and refined petroleum products in the International Flag trade through its wholly-owned subsidiaries. In addition to our operating fleet, five LR1 newbuilds are scheduled for delivery to the Company between the fourth quarter of 2025 and third quarter of 2026, bringing the total operating and newbuild fleet to 76 vessels.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. They do not include all of the information and notes required by generally accepted accounting principles in the United States. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the results have been included. Operating results for the three and nine months ended September 30, 2025 are not necessarily indicative of the results that may be expected for the year ending December 31, 2025.

The condensed consolidated balance sheet as of December 31, 2024 has been derived from the audited financial statements at that date but does not include all of the information and notes required by generally accepted accounting principles in the United States for complete financial statements. For further information, refer to the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

All intercompany balances and transactions within INSW have been eliminated.

Risks and Uncertainties

The unaudited condensed consolidated financial statements presented herein reflect estimates and assumptions made by management at September 30, 2025. These estimates and assumptions affect, among other things, the Company’s long-lived asset valuations; freight and other income tax contingencies; and the allowance for expected credit losses. Events and changes in circumstances arising after November 6, 2025, including those resulting from the impacts of macroeconomic volatility with respect to trade and tariffs, as well as the ongoing international conflicts, will be reflected in management’s estimates and assumptions for future periods.

Note 2 — Significant Accounting Policies:

For a description of all of the Company’s material accounting policies, see Note 2, “Summary of Significant Accounting Policies,” to the Company’s consolidated financial statements as of and for the year ended December 31, 2024 included in the Company’s Annual Report on Form 10-K. The following is a summary of any changes or updates to the Company’s critical accounting policies for the current period:

Concentration of Credit Risk — The allowance for credit losses is recognized as an allowance or contra-asset and reflects our best estimate of probable losses inherent in the voyage receivables balance. Activity for allowance for credit losses is summarized as follows:

6

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollars in thousands) |

|

|

Allowance for Credit Losses - |

Balance at December 31, 2024 |

|

$ |

86 |

Provision for expected credit losses |

|

|

4 |

Balance at September 30, 2025 |

|

$ |

90 |

The pools in which the Company participates accounted in aggregate for 94% and 98% of consolidated voyage receivables at September 30, 2025 and December 31, 2024, respectively.

Deferred finance charges — Finance charges incurred in the arrangement of new debt and/or amendments resulting in the modification of existing debt are deferred and amortized to interest expense on either an effective interest method or straight-line basis over the term of the related debt. Unamortized deferred finance charges of $9.3 million and $11.2 million relating to the $500 Million Revolving Credit Facility and the $160 Million Revolving Credit Facility (See Note 8, “Debt”) as of September 30, 2025 and December 31, 2024, respectively, are included in other assets in the accompanying condensed consolidated balance sheets. Unamortized deferred financing charges of $11.6 million and $6.4 million as of September 30, 2025 and December 31, 2024, respectively, relating to the Company’s outstanding debt facilities, are included in debt in the accompanying condensed consolidated balance sheets.

Interest expense relating to the amortization of deferred financing charges amounted to $1.4 million and $3.0 million for the three and nine months ended September 30, 2025, respectively, and $0.8 million and $2.5 million for the three and nine months ended September 30, 2024, respectively.

Vessels construction in progress — Interest costs are capitalized to vessels during the period that vessels are under construction.

Interest capitalized during the three and nine months ended September 30, 2025 totaled $1.2 million and $3.0 million, respectively, and $0.3 million and $0.7 million during the three and nine months ended September 30, 2024, respectively.

Recently Issued Accounting Standards — The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the sole source of authoritative GAAP other than United States Securities and Exchange Commission (“SEC”) issued rules and regulations that apply only to SEC registrants. The FASB issues Accounting Standards Updates (“ASU”) to communicate changes to the codification.

In November 2024, the FASB issued ASU No. 2024-03, Disaggregation of Income Statement Expenses. This guidance will require additional disclosures and disaggregation of certain costs and expenses presented on the face of the income statement. The amendments are effective for annual reporting periods beginning after December 15, 2026 and interim reporting periods beginning after December 15, 2027 with early adoption permitted. We are currently evaluating the impact of this new guidance on the disclosures to our consolidated financial statements.

Note 3 — Earnings per Common Share:

Basic earnings per common share is computed by dividing earnings, after the deduction of dividends and undistributed earnings allocated to participating securities, by the weighted average number of common shares outstanding during the period.

The computation of diluted earnings per share assumes the issuance of common stock for all potentially dilutive stock options and restricted stock units not classified as participating securities. Participating securities are defined by ASC 260, Earnings Per Share, as unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents and are included in the computation of earnings per share pursuant to the two-class method.

Weighted average shares of unvested restricted common stock considered to be participating securities totaled 28,072 and 22,192 for the three and nine months ended September 30, 2025, respectively, and 20,198 and 23,302 for the three and nine months ended September 30, 2024, respectively. Such participating securities are allocated a portion of income, but not losses under the two-class method.

7

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

As of September 30, 2025, there were 394,800 shares of restricted stock units and 156,975 stock options outstanding and considered to be potentially dilutive securities.

Reconciliations of the numerator and denominator of the basic and diluted earnings per share computations are as follows:

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

(Dollars in thousands) |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income allocated to: |

|

|

|

|

|

|

|

|

|

|

|

|

Common stockholders |

|

$ |

70,506 |

|

$ |

91,650 |

|

$ |

181,670 |

|

$ |

380,730 |

Participating securities |

|

|

40 |

|

|

38 |

|

|

87 |

|

|

171 |

|

|

$ |

70,546 |

|

$ |

91,688 |

|

$ |

181,757 |

|

$ |

380,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding, basic |

|

|

49,348,406 |

|

|

49,544,412 |

|

|

49,326,459 |

|

|

49,302,367 |

Dilutive effect of stock options |

|

|

93,319 |

|

|

108,433 |

|

|

83,455 |

|

|

110,201 |

Dilutive effect of performance-based restricted stock units |

|

|

70,585 |

|

|

125,599 |

|

|

47,374 |

|

|

124,706 |

Dilutive effect of restricted stock units |

|

|

93,900 |

|

|

102,873 |

|

|

80,031 |

|

|

139,963 |

Weighted-average common shares outstanding, diluted |

|

|

49,606,210 |

|

|

49,881,317 |

|

|

49,537,318 |

|

|

49,677,238 |

There were no antidilutive equity awards outstanding during the three months ended September 30, 2025. Awards of 35,713 for the nine months ended September 30, 2025, and 36,060 and 32,300 for the three and nine months ended September 30, 2024, respectively, were not included in the computation of diluted earnings per share because inclusion of these awards would be anti-dilutive.

Note 4 — Business and Segment Reporting:

The Company has two reportable segments: Crude Tankers and Product Carriers. Adjusted income from vessel operations for segment purposes is defined as income from vessel operations before general and administrative expenses, other operating expenses, and gain on disposal of vessels and assets, net. The accounting policies followed by the reportable segments are the same as those followed in the preparation of the Company’s condensed consolidated financial statements.

Information about the Company’s reportable segments as of and for the three and nine months ended September 30, 2025 and 2024 follows:

8

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

|

|

Crude |

|

Product |

|

|

|

||

(Dollars in thousands) |

|

Tankers |

|

Carriers |

|

Totals |

|||

Three months ended September 30, 2025: |

|

|

|

|

|

|

|

|

|

Shipping revenues |

|

$ |

96,466 |

|

$ |

99,922 |

|

$ |

196,388 |

Time charter equivalent revenues |

|

|

92,997 |

|

|

99,471 |

|

|

192,468 |

Vessel expenses |

|

|

29,840 |

|

|

35,975 |

|

|

65,815 |

Charter hire expenses |

|

|

3,830 |

|

|

3,304 |

|

|

7,134 |

Depreciation and amortization |

|

|

18,903 |

|

|

22,267 |

|

|

41,170 |

Loss/(gain) on disposal of vessels and other assets, net |

|

|

9 |

|

|

(13,667) |

|

|

(13,658) |

Adjusted income from vessel operations |

|

|

40,425 |

|

|

37,924 |

|

|

78,349 |

Adjusted total assets at September 30, 2025 |

|

|

1,294,587 |

|

|

1,061,252 |

|

|

2,355,839 |

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, 2024: |

|

|

|

|

|

|

|

|

|

Shipping revenues |

|

$ |

103,212 |

|

$ |

121,978 |

|

$ |

225,190 |

Time charter equivalent revenues |

|

|

98,821 |

|

|

120,866 |

|

|

219,687 |

Vessel expenses |

|

|

34,217 |

|

|

37,052 |

|

|

71,269 |

Charter hire expenses |

|

|

4,411 |

|

|

2,834 |

|

|

7,245 |

Depreciation and amortization |

|

|

20,536 |

|

|

18,768 |

|

|

39,304 |

Gain on disposal of vessels and other assets, net |

|

|

(18) |

|

|

(13,481) |

|

|

(13,499) |

Adjusted income from vessel operations |

|

|

39,656 |

|

|

62,213 |

|

|

101,869 |

Adjusted total assets at September 30, 2024 |

|

|

1,453,559 |

|

|

953,451 |

|

|

2,407,010 |

|

|

Crude |

|

Product |

|

|

|

||

(Dollars in thousands) |

|

Tankers |

|

Carriers |

|

Totals |

|||

Nine months ended September 30, 2025: |

|

|

|

|

|

|

|

|

|

Shipping revenues |

|

$ |

288,268 |

|

$ |

287,155 |

|

$ |

575,423 |

Time charter equivalent revenues |

|

|

276,534 |

|

|

283,098 |

|

|

559,632 |

Vessel expenses |

|

|

88,273 |

|

|

111,991 |

|

|

200,264 |

Charter hire expenses |

|

|

10,339 |

|

|

15,567 |

|

|

25,906 |

Depreciation and amortization |

|

|

56,351 |

|

|

65,873 |

|

|

122,224 |

Gain on disposal of vessels and other assets, net |

|

|

(9,871) |

|

|

(25,037) |

|

|

(34,908) |

Adjusted income from vessel operations |

|

|

121,571 |

|

|

89,667 |

|

|

211,238 |

Expenditures for vessels and vessel improvements |

|

|

13,524 |

|

|

175,022 |

|

|

188,546 |

Payments for drydocking |

|

|

6,547 |

|

|

56,634 |

|

|

63,181 |

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, 2024: |

|

|

|

|

|

|

|

|

|

Shipping revenues |

|

$ |

355,458 |

|

$ |

401,542 |

|

$ |

757,000 |

Time charter equivalent revenues |

|

|

343,639 |

|

|

398,824 |

|

|

742,463 |

Vessel expenses |

|

|

94,644 |

|

|

107,846 |

|

|

202,490 |

Charter hire expenses |

|

|

11,728 |

|

|

9,113 |

|

|

20,841 |

Depreciation and amortization |

|

|

60,571 |

|

|

49,403 |

|

|

109,974 |

Gain on disposal of vessels and other assets, net |

|

|

(20) |

|

|

(41,382) |

|

|

(41,402) |

Adjusted income from vessel operations |

|

|

176,696 |

|

|

232,462 |

|

|

409,158 |

Expenditures for vessels and vessel improvements |

|

|

763 |

|

|

215,826 |

|

|

216,589 |

Payments for drydocking |

|

|

6,333 |

|

|

37,522 |

|

|

43,855 |

9

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Reconciliations of time charter equivalent (“TCE”) revenues of the segments to shipping revenues as reported in the condensed statements of operations follow:

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

(Dollars in thousands) |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Time charter equivalent revenues |

|

$ |

192,468 |

|

$ |

219,687 |

|

$ |

559,632 |

|

$ |

742,463 |

Add: Voyage expenses |

|

|

3,920 |

|

|

5,503 |

|

|

15,791 |

|

|

14,537 |

Shipping revenues |

|

$ |

196,388 |

|

$ |

225,190 |

|

$ |

575,423 |

|

$ |

757,000 |

Consistent with general practice in the shipping industry, the Company uses time charter equivalent revenues, which represent shipping revenues less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. Time charter equivalent revenues, a non-GAAP measure, provide additional meaningful information in conjunction with shipping revenues, the most directly comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in evaluating their financial performance.

Reconciliations of total adjusted income from vessel operations of the segments to net income, as reported in the condensed consolidated statements of operations follow:

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

(Dollars in thousands) |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Total adjusted income from vessel operations of all segments |

|

$ |

78,349 |

|

$ |

101,869 |

|

$ |

211,238 |

|

$ |

409,158 |

General and administrative expenses |

|

|

(11,804) |

|

|

(13,411) |

|

|

(37,186) |

|

|

(37,494) |

Other operating expenses |

|

|

(1,520) |

|

|

(985) |

|

|

(1,737) |

|

|

(2,715) |

Third-party debt modification fees |

|

|

— |

|

|

— |

|

|

— |

|

|

(168) |

Gain on disposal of vessels and other assets, net |

|

|

13,658 |

|

|

13,499 |

|

|

34,908 |

|

|

41,402 |

Consolidated income from vessel operations |

|

|

78,683 |

|

|

100,972 |

|

|

207,223 |

|

|

410,183 |

Other income |

|

|

1,486 |

|

|

3,211 |

|

|

5,370 |

|

|

8,525 |

Interest expense |

|

|

(9,623) |

|

|

(12,496) |

|

|

(30,836) |

|

|

(37,808) |

Net income |

|

$ |

70,546 |

|

$ |

91,687 |

|

$ |

181,757 |

|

$ |

380,900 |

Reconciliations of total assets of the segments to amounts included in the condensed consolidated balance sheets follow:

(Dollars in thousands) |

|

September 30, 2025 |

|

September 30, 2024 |

||

Adjusted total assets of all segments |

|

$ |

2,355,839 |

|

$ |

2,407,010 |

Corporate unrestricted cash and cash equivalents |

|

|

412,569 |

|

|

103,309 |

Short-term investments |

|

|

— |

|

|

50,000 |

Other unallocated amounts |

|

|

21,170 |

|

|

27,527 |

Consolidated total assets |

|

$ |

2,789,578 |

|

$ |

2,587,846 |

Note 5 — Vessels:

Vessel Acquisitions and Construction Commitments

Between August 2023 and March 2024, the Company entered into agreements to construct six dual-fuel ready LNG 73,600 dwt LR1 Product Carriers at K Shipbuilding Co., Ltd.’s shipyard for an aggregate cost of approximately $359 million. On September 12, 2025, the first of six LR1 was delivered to the Company. The remaining five LR1s are expected to be delivered between the fourth quarter of 2025 through the third quarter of 2026. The remaining commitments on the contracts for the construction of the LR1 newbuilds as of September 30, 2025 were $229.7 million, which will be paid through a combination of borrowings under the ECA Credit Facility (See Note 8, “Debt”) and available liquidity.

10

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

On November 28, 2024, the Company entered into memoranda of agreements for the sale of one 2010-built VLCC and one 2011-built VLCC for an aggregate sales price of $116.6 million and the purchase of three 2015-built MRs for an aggregate purchase price of $119.5 million with the same counterparty. The Company closed on all five transactions between December 2024 and February 2025, with a net cash outflow of $2.9 million, representing the difference in transaction prices among the five vessels. In conjunction with the agreements, the buyer of each vessel was required to lodge a deposit equal to 10% of the vessel’s purchase price into an escrow account, and to ensure that all five vessel transactions were executed, the seller of each vessel was also required to make an additional security deposit of $2.5 million into an escrow account. These security deposits were refunded to each respective seller after all five vessel transactions were completed in February 2025.

In August 2025, the Company entered into a memorandum of agreement to purchase a 2020-built, scrubber-fitted VLCC for $119 million that is expected to deliver during the fourth quarter of 2025. The vessel purchase is expected to be funded with proceeds from vessel sales and available liquidity.

Disposal/Sales of Vessels

During the nine months ended September 30, 2025, the Company delivered one 2010-built VLCC, one 2011-built VLCC, two 2006-built LR1s, two 2007-built MRs, and three 2008-built MRs to their buyers and recognized an aggregate gain of $34.9 million.

In October 2025, the Company entered into memoranda of agreements for the sale of three 2007-built MR Product Carriers for net proceeds of approximately $36.8 million after fees and commissions. The vessels are expected to deliver to their buyers in the fourth quarter of 2025, at which time the Company will recognize gains on the sales.

Note 6 — Variable Interest Entities (“VIEs”):

Unconsolidated VIEs

As of September 30, 2025, all six commercial pools in which the Company participates were determined to be VIEs for which the Company is not considered a primary beneficiary.

The following table presents the carrying amounts of assets and liabilities in the condensed consolidated balance sheet related to the unconsolidated VIEs as of September 30, 2025:

(Dollars in thousands) |

|

|

|

|

Condensed |

|

Pool working capital deposits |

|

|

|

|

$ |

33,859 |

In accordance with accounting guidance, the Company evaluated its maximum exposure to loss related to these unconsolidated VIEs by assuming a complete loss of the Company’s investment in these VIEs. The table below compares the Company’s liability in the condensed consolidated balance sheet to the maximum exposure to loss at September 30, 2025:

(Dollars in thousands) |

|

|

Condensed |

|

Maximum Exposure to |

|

Other Liabilities |

|

$ |

– |

|

$ |

33,859 |

11

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

In addition, as of September 30, 2025, the Company had approximately $143.0 million of trade receivables due from the pools in which it participates. These trade receivables, which are included in voyage receivables in the accompanying condensed consolidated balance sheet, have been excluded from the above tables and the calculation of INSW’s maximum exposure to loss. The Company does not record the maximum exposure to loss as a liability because it does not believe that such a loss is probable of occurring as of September 30, 2025.

Note 7 — Fair Value of Financial Instruments, Derivatives and Fair Value Disclosures:

The estimated fair values of the Company’s financial instruments, other than derivatives that are not measured at fair value on a recurring basis, categorized based upon the fair value hierarchy, are as follows:

(Dollars in thousands) |

|

September 30, 2025 |

|

December 31, 2024 |

|

Fair Value Level |

|||

Cash and cash equivalents |

|

$ |

412,569 |

|

$ |

157,506 |

|

|

Level 1 |

2030 Bonds |

|

|

(250,130) |

|

|

— |

|

|

Level 1 |

ECA Credit Facility(1) |

|

|

(40,775) |

|

|

— |

|

|

Level 2 |

$500 Million Revolving Credit Facility (1) |

|

|

— |

|

|

(144,581) |

|

|

Level 2 |

Ocean Yield Lease Financing (1) |

|

|

(260,788) |

|

|

(282,627) |

|

|

Level 2 |

BoComm Lease Financing (2) |

|

|

(180,916) |

|

|

(188,370) |

|

|

Level 2 |

Toshin Lease Financing (2) |

|

|

(10,678) |

|

|

(11,662) |

|

|

Level 2 |

Hyuga Lease Financing (2) |

|

|

(10,583) |

|

|

(11,776) |

|

|

Level 2 |

Kaiyo Lease Financing (2) |

|

|

(9,444) |

|

|

(10,554) |

|

|

Level 2 |

Kaisha Lease Financing (2) |

|

|

(9,434) |

|

|

(10,656) |

|

|

Level 2 |

| (1) | Floating rate debt – the fair value of floating rate debt has been determined using level 2 inputs and is considered to be equal to the carrying value since it bears a variable interest rate, which is reset every three months. |

| (2) | Fixed rate debt – the fair value of fixed rate debt has been determined using level 2 inputs by discounting the expected cash flows of the outstanding debt. |

Derivatives

At September 30, 2025, the Company was party to amortizing interest rate swap agreements with major financial institutions participating in the $500 Million Revolving Credit Facility that effectively convert the Company’s interest rate exposure from a three-month SOFR floating rate to a fixed rate of 2.84% through the maturity date of February 22, 2027. The interest rate swap agreements, which contain no leverage features, are designated and qualify as cash flow hedges and have a remaining aggregate notional value of $145.9 million as of September 30, 2025, covering for accounting purposes, $145.9 million of debt outstanding under the Ocean Yield Lease Financing. Also, as of September 30, 2025, approximately $1.0 million in gain from previously terminated interest rate swaps is expected to be amortized out of accumulated other comprehensive loss to earnings over the next 12 months.

Derivatives are recorded on a net basis by counterparty when a legal right of offset exists. The Company had the following amounts recorded on a net basis by transaction in the accompanying unaudited condensed consolidated balance sheets related to the Company’s use of derivatives as of September 30, 2025 and December 31, 2024:

12

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollars in thousands) |

|

Current portion of derivative asset |

|

Long-term derivative |

|

Other |

|||

September 30, 2025: |

|

|

|

|

|

|

|

|

|

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

|

||

Interest rate swaps |

|

$ |

753 |

|

$ |

36 |

|

$ |

250 |

Total |

|

$ |

753 |

|

$ |

36 |

|

$ |

250 |

|

|

|

|

|

|

|

|

|

|

December 31, 2024: |

|

|

|

|

|

|

|

|

|

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

|

||

Interest rate swaps |

|

$ |

2,080 |

|

$ |

801 |

|

$ |

453 |

Total |

|

$ |

2,080 |

|

$ |

801 |

|

$ |

453 |

The following tables present information with respect to gains and losses on derivative positions reflected in the condensed consolidated statements of operations or in the condensed consolidated statements of comprehensive income.

The effect of cash flow hedging relationships recognized in other comprehensive income/(loss) excluding amounts reclassified from accumulated other comprehensive income for the three and nine months ended September 30, 2025 and 2024 follows:

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

(Dollars in thousands) |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

||

Interest rate swaps |

|

$ |

79 |

|

$ |

(2,383) |

|

$ |

68 |

|

$ |

1,766 |

Total other comprehensive income/(loss) |

|

$ |

79 |

|

$ |

(2,383) |

|

$ |

68 |

|

$ |

1,766 |

The effect of the Company’s cash flow hedging relationships on the condensed consolidated statement of operations for the three and nine months ended September 30, 2025 and 2024 follows:

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||

(Dollars in thousands) |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

||

Interest rate swaps |

|

$ |

(630) |

|

$ |

(1,734) |

|

$ |

(2,161) |

|

$ |

(5,699) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued hedging instruments: |

|

|

|

|

|

|

|

|

|

|

||

Interest rate swap |

|

|

(278) |

|

|

(160) |

|

|

(346) |

|

|

(769) |

Total interest expense |

|

$ |

(908) |

|

$ |

(1,894) |

|

$ |

(2,507) |

|

$ |

(6,468) |

See Note 11, “Accumulated Other Comprehensive Loss,” for disclosures relating to the impact of derivative instruments on accumulated other comprehensive income/(loss).

The following table presents the fair values, which are pre-tax, for assets and liabilities measured on a recurring basis:

(Dollars in thousands) |

|

September 30, 2025 |

|

December 31, 2024 |

|

Fair Value Level |

|||

Derivative Assets (interest rate swaps) |

|

$ |

1,039 |

|

$ |

3,334 |

|

|

Level 2(1) |

| (1) | For the interest rate swaps, fair values are derived using valuation models that utilize the income valuation approach. These valuation models take into account contract terms such as maturity, as well as other inputs such as interest rate yield curves and creditworthiness of the counterparty and the Company. |

13

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 8 — Debt:

Debt consists of the following:

(Dollars in thousands) |

|

September 30, 2025 |

|

December 31, 2024 |

||

$500 Million Revolving Credit Facility, due 2030 |

|

$ |

— |

|

$ |

144,581 |

ECA Credit Facility, due 2037, net of unamortized deferred finance costs of $1,501 |

|

|

39,274 |

|

|

— |

2030 Bonds, due 2030, net of unamortized deferred finance costs of $4,737 |

|

|

245,263 |

|

|

— |

Ocean Yield Lease Financing, due 2031, net of unamortized deferred finance costs of $1,809 and $2,154 |

|

|

258,979 |

|

|

280,473 |

BoComm Lease Financing, due 2030, net of unamortized deferred finance costs of $2,907 and $3,438 |

|

|

206,080 |

|

|

216,343 |

Toshin Lease Financing, due 2031, net of unamortized deferred finance costs of $202 and $243 |

|

|

11,454 |

|

|

12,510 |

Hyuga Lease Financing, due 2031, net of unamortized deferred finance costs of $169 and $207 |

|

|

11,182 |

|

|

12,270 |

Kaiyo Lease Financing, due 2030, net of unamortized deferred finance costs of $137 and $174 |

|

|

9,900 |

|

|

11,059 |

Kaisha Lease Financing, due 2030, net of unamortized deferred finance costs of $141 and $183 |

|

|

9,884 |

|

|

11,171 |

|

|

|

792,016 |

|

|

688,407 |

Less current portion(1) |

|

|

(282,489) |

|

|

(50,054) |

Long-term portion |

|

$ |

509,527 |

|

$ |

638,353 |

| (1) | The current portion of debt at September 30, 2025 includes the $260.8 million outstanding principal balance payable under the Ocean Yield Lease Financing facility, as discussed further in the “Ocean Yield Lease Financing” section below. |

Capitalized terms used hereafter have the meaning given in these condensed consolidated financial statements or in the respective transaction documents referred to below, including subsequent amendments thereto.

ECA Credit Facility

On August 20, 2025, the Company entered into a credit agreement (the “ECA Credit Facility”) with DNB Bank ASA, New York Branch, as facility agent, K-Sure agent, security agent and hedge counterparty; DNB Capital LLC, as lender; and DNB Markets, Inc., as arranger. The ECA Credit Facility consists of (1) a 12-year term loan facility of up to $239.7 million and (2) a commercial credit facility of up to $91.9 million, collectively for use in respect of partly financing the acquisition of six LR1 newbuildings currently under construction at K Shipbuilding Co., Ltd in Korea. The facilities combine for an effective 20-year amortization profile.

The ECA Credit Facility is secured by a first lien on the shares of the subsidiaries that will acquire the six newbuildings (one per subsidiary), along with (when delivered) a first lien on the vessels and the earnings, insurances, and certain other assets of those entities. A portion of each tranche of term loans are insured by Korea Trade Insurance Corporation (“K-Sure”), up to the aggregate approximate amount of $239.7 million (reflecting approximately 70% of the anticipated contract price of the first four vessels and approximately 60% of the contract price of the last two vessels). Each K-Sure covered term loan tranche shall be repaid in 24 equal consecutive semi-annual installments, the first of which shall be paid on the date falling six months after the loan is drawn. Any amounts outstanding under the commercial credit facility in respect of a vessel shall be repaid on the relevant maturity date of the K-Sure covered term loan tranche. The maturity dates for the ECA Credit Facility are subject to acceleration upon the occurrence of certain events, including prepayment options held by lenders which are exercisable on the sixth anniversary of each borrowing.

Interest on the ECA Credit Facility will be calculated based upon applicable Term SOFR plus the margin. The margin in respect of a K-Sure covered tranche is 1.10% per annum and the margin in respect of the commercial tranche is 1.45% per annum.

14

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

On September 12, 2025, the Company borrowed an initial $40.8 million under the ECA Credit Facility upon the delivery of the first LR1 newbuilding.

The ECA Credit Facility also contains customary representations, warranties, restrictions and covenants applicable to the Company, including financial covenants that require the Company to (i) maintain a minimum liquidity level of the greater of $50 million and 5% of the Company’s Consolidated Indebtedness; (ii) ensure the Company’s and its consolidated subsidiaries’ maximum leverage ratio will not exceed 0.65 to 1.00 at any time; and (iii) ensure that current assets exceeds current liabilities (which is defined to exclude the current potion of Consolidated Indebtedness).

2030 Bonds

On September 23, 2025, the Company issued $250 million aggregate principal amount of 7.125% senior unsecured bonds maturing on September 23, 2030, unless earlier redeemed or repurchased (the “2030 Bonds”), at an issue price of 100%.

Interest will be paid semi-annually in arrears on March 23 and September 23 each year (and subject to business day conventions), commencing March 23, 2026. The 2030 Bonds are senior unsecured obligations of the Company and will be equal in right of payment with all of the Company’s existing and future senior unsecured indebtedness. The 2030 Bonds have a denomination of $125,000, and application will be made to list the 2030 Bonds on the Oslo Stock Exchange.

The 2030 Bonds include customary representations, warranties, restrictions and covenants applicable to the Company and certain of its subsidiaries. These include financial covenants that are generally consistent with existing financial covenants in the Company’s revolving credit facilities and require the Company to (i) maintain a minimum free liquidity level of the greater of $50 million and 5% of the Company’s total indebtedness; (ii) ensure the Company’s and its consolidated subsidiaries’ ratio of net indebtedness to consolidated total capitalization is less than 0.65 to 1.00 at any time; (iii) ensure that current assets exceed current liabilities (defined to exclude the portion of consolidated indebtedness maturing within 12 months of the determination date) and (iv) have a minimum level of free liquidity in order to make permitted distributions. The 2030 Bonds also contain certain restrictions on distributions, mergers, consolidations and transfers of substantially all of the Company’s assets.

Upon the occurrence of specified put option events (a change of control or a share delisting event), the Company is required to offer to repurchase the 2030 Bonds at 101% of the principal amount, plus accrued and unpaid interest to the purchase date. In addition, the Company may redeem all of the outstanding 2030 Bonds at its option at a redemption price equal to 100% of the principal amount redeemed if, as a result of a change in applicable law implemented after September 17, 2025 or any decision by any applicable taxing authority made after that date, the Company is or will be required to gross up its payments of interest on the 2030 Bonds to compensate for a withholding tax. Furthermore, on or prior to the interest payment date in March 2028, the Company may redeem the 2030 Bonds at its option (in whole at any time or in part from time to time) at a redemption price equal to 100% of the principal amount of the 2030 Bonds redeemed, plus a “make whole” premium and accrued and unpaid interest and, thereafter, may redeem the 2030 Bonds at its option (in whole at any time or in part from time to time) at a redemption price that steps down over time from 103.5625% of the principal amount of the 2030 Bonds to be redeemed (plus accrued and unpaid interest) to 100% of the principal amount (plus accrued and unpaid interest) on or after the interest payment date in March 2030.

The Company will use the net proceeds from the 2030 Bonds to finance the repurchase of the six VLCCs secured by the Ocean Yield Lease Financing on the November 2025 purchase option exercise date (for which the Company has tendered irrevocable notice of its intention to exercise purchase options, as described below) and for general corporate purposes.

The 2030 Bonds were offered outside the United States in reliance on Regulation S under the Securities Act of 1933 (the “Securities Act”) and in the United States and its territories only to persons reasonably believed to be qualified institutional buyers as defined under Rule 144A under the Securities Act in reliance on the exemption from registration in Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder. The 2030 Bonds were not, and will not be, registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state laws.

15

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

$500 Million Revolving Credit Facility and $160 Million Revolving Credit Facility

On March 21, 2025, the Company entered into an agreement with the lenders under the $500 Million Revolving Credit Facility whereby two of the three MRs acquired in the vessel exchange transactions described in Note 5, “Vessels,” were pledged as collateral under the $500 Million Revolving Credit Facility. These vessels comprise Substitution Vessels, replacing one of the two VLCCs sold in the vessel exchange transactions.

On October 7, 2025, the Company and certain of its subsidiaries entered into amendments to each of the $500 Million Revolving Credit Facility and $160 Million Revolving Credit Facility with Nordea Bank Abp, New York Branch (as administrative agent, collateral agent, security trustee and a lender) and the other lenders thereunder. Pursuant to the amendments, the Borrower and certain subsidiary guarantors originally formed in the Republic of the Marshall Islands or the Republic of Liberia, as applicable, will be permitted to redomicile to Bermuda. The contemplated redomiciliations are expected to take place during the fourth quarter of 2025 (see Note 9, “Taxes”). There were no other material changes to the terms of the Credit Facilities.

During the nine months ended September 30, 2025, an additional $20.0 million was drawn and $164.6 million of the principal balance outstanding under the $500 Million Revolving Credit Facility was repaid, leaving no outstanding principal balance and an undrawn revolver capacity of $436.4 million on this facility as of September 30, 2025.

Ocean Yield Lease Financing

In April 2025, the Company tendered an irrevocable notice of its intention to exercise purchase options in November 2025 on six VLCCs that are currently bareboat chartered-in. The $257.7 million estimated aggregate purchase price for the six vessels represents the expected remaining debt balance outstanding under the Ocean Yield Lease Financing on November 10, 2025, the purchase option exercise date. The Company will use the net proceeds from the 2030 Bonds and available liquidity to finance the repurchase of the six VLCCs.

Debt Covenants

The Company was in compliance with the financial and non-financial covenants under all of its financing arrangements as of September 30, 2025.

Interest Expense

Total interest expense before the impact of capitalized interest, including amortization of deferred financing costs, commitment, administrative and other fees for all of the Company’s debt facilities for the three and nine months ended September 30, 2025 was $10.7 million and $33.3 million, respectively, and for the three and nine months ended September 30, 2024 was $12.6 million and $37.8 million, respectively. Interest paid, net of interest rate swap cash settlements, for the Company’s debt facilities for the three and nine months ended September 30, 2025 was $8.4 million and $27.4 million, respectively, and for the three and nine months ended September 30, 2024 was $11.3 million and $34.5 million, respectively.

Note 9 — Taxes:

As of September 30, 2025, the Company qualifies for an exemption from U.S. federal income taxes under Section 883 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) and U.S. Treasury Department regulations for the 2025 calendar year, as less than 50 percent of the total value of the Company’s stock was held by one or more shareholders who own 5% or more of the Company’s stock for more than half of the days of 2025.

The Company reviews its provisions for uncertain tax positions relating to freight taxes in various tax jurisdictions on a regular basis and may update its assessment of its tax positions based on available information at that time. Such information may include additional legal advice as to the applicability of freight taxes in relevant jurisdictions. Freight tax regulations are subject to change and interpretation; therefore, the amounts recorded by the Company may change accordingly. There were no changes in such reserve recorded during the three and nine months ended September 30, 2025 and 2024.

16

INTERNATIONAL SEAWAYS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

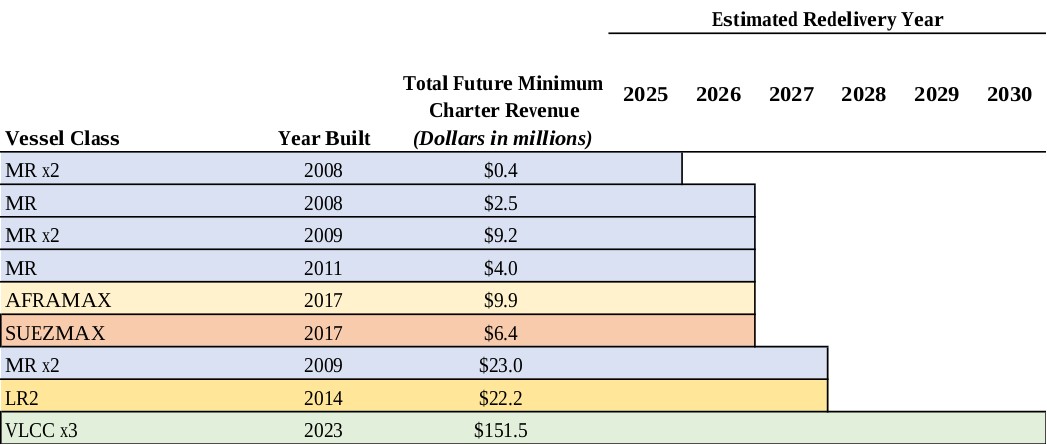

Additionally, a number of countries have drafted or are actively considering drafting legislation to implement the Organization for Economic Cooperation and Development's (“OECD”) international tax framework, including the Pillar Two Model Rules. These model rules call for a minimum global tax of 15% on large multinational enterprises with possible application from January 1, 2024 or later, depending on implementation by the individual countries in which the Company is domiciled. As currently enacted, the Pillar Two Model Rules are expected to have no impact on the Company’s consolidated financial statements in 2025, however, beginning in September 2025, in an effort to maximize future operational and strategic flexibility while maintaining compliance with evolving global tax regulations that are focused on the alignment of the jurisdictions in which an entity’s commercial or strategic management are performed with where its profits are realized, the Company began the process of changing the domicile of its international shipping income generating vessel-owning subsidiaries and various intermediate parent holding companies under International Seaways, Inc. (the “Bermuda Constituent Entity Group”) from the Marshall Islands and Liberia to Bermuda. The Company itself will remain organized under the laws of the Republic of the Marshall Islands. The Company expects the redomiciliation process to be completed by the end of the fourth quarter of 2025.