UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15 (d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 5, 2025

OCUGEN, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-36751 | 04-3522315 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

11 Great Valley Parkway

Malvern, Pennsylvania 19355

(484) 328-4701

(Address, including zip code, and telephone number, including area code, of principal executive office)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.01 par value per share | OCGN |

The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On November 5, 2025, Ocugen, Inc. (the "Company") issued a press release announcing certain financial results for the quarter ended September 30, 2025. The Company has scheduled a conference call and webcast for 8:30 a.m. Eastern Time on November 5, 2025, to discuss these financial results and business updates. The Company will use presentation materials in connection with the conference call and webcast, which presentation materials will be posted on the Company's website at www.ocugen.com. Copies of the press release and presentation materials are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K (this "Report") and incorporated herein by reference.

The information disclosed under Item 2.02 of this Report, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any Company filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are being furnished herewith:

(d) Exhibits

| Exhibit No. | Document | |

| 99.1 | Press Release of Ocugen, Inc. dated November 5, 2025. | |

| 99.2 | Earnings Release Presentation issued November 5, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 5, 2025

| OCUGEN, INC. | ||

| By: | /s/ Shankar Musunuri | |

| Name: Shankar Musunuri | ||

| Title: Chairman, Chief Executive Officer, & Co-Founder | ||

Exhibit 99.1

Ocugen Provides Business Update with Third Quarter 2025 Financial Results

Conference Call and Webcast Today at 8:30 a.m. ET

| ● | Phase 2/3 OCU410ST GARDian3 pivotal confirmatory trial is progressing toward 1H 2027 Biologics License Application (BLA) filing with 50% enrollment completed to date |

| o | European Medicines Agency provided acceptability of a single U.S.-based trial for submission of a Marketing Authorization Application (MAA) |

| ● | Executed licensing agreement with Kwangdong Pharmaceutical for exclusive rights in South Korea to OCU400 |

| o | Sales milestones of $1.5 million for every $15 million of sales in South Korea, projected to reach $180 million or more in first 10 years of commercialization and royalties equaling 25% of net sales |

| ● | Closed $20 million registered direct offering of common stock and accompanying premium warrants |

| o | The Company will receive $30 million of additional gross proceeds if the warrants are exercised in full |

MALVERN, Pa., November 5, 2025 (GLOBE NEWSWIRE) – Ocugen, Inc. (“Ocugen” or the “Company”) (NASDAQ: OCGN), a pioneering biotechnology leader in gene therapies for blindness diseases, today reported third quarter 2025 financial results along with a general business update.

“With two late-stage modifier gene therapies on track to meet 2026 and 2027 BLA/MAA filings, it’s remarkable to look back and recognize we only began dosing the first patient in the Phase 1/2 OCU400 clinical trial in 2022,” said Dr. Shankar Musunuri, Chairman, CEO, and Co-founder of Ocugen. “The OCU410ST Phase 2/3 GARDian3 pivotal confirmatory trial is following close behind the OCU400 Phase 3 liMeLiGhT clinical trial, and with 50% enrollment completed to date, we believe recruitment will be completed in the first quarter of 2026. This progress not only reinforces our commitment to file three BLAs in the next three years, but it also brings us closer to addressing the incredible unmet medical needs that exist for patients facing vision loss.”

In September, Ocugen announced its exclusive licensing agreement with Kwangdong Pharmaceutical Co., Ltd. (Kwangdong) for the rights to OCU400 in South Korea. Under the agreement, the Company will receive up to $7.5 million in upfront and development milestone payments, plus sales milestones of $1.5 million for every $15 million of sales in South Korea, projected to reach $180 million or more in the first 10 years of commercialization. The Company will also earn a 25% royalty on net sales generated by Kwangdong and will be responsible for manufacturing and supplying OCU400. A regional approach preserves Ocugen’s rights to larger geographies to maximize total patient reach while also generating a potential return for shareholders.

Enrollment in the OCU400 Phase 3 liMeliGhT clinical trial is nearing completion, and the program remains on track for BLA and MAA submissions in 2026. This is the only known broad retinitis pigmentosa (RP) gene-agnostic trial to address multiple genetic mutations and multiple disease pathways with a single therapeutic approach. There are approximately 300,000 people in the U.S. and Europe combined living with RP, which affects greater than 100 genes. Ocugen’s gene-agnostic approach has the potential to treat multiple gene mutations associated with RP with a single, one-time subretinal injection.

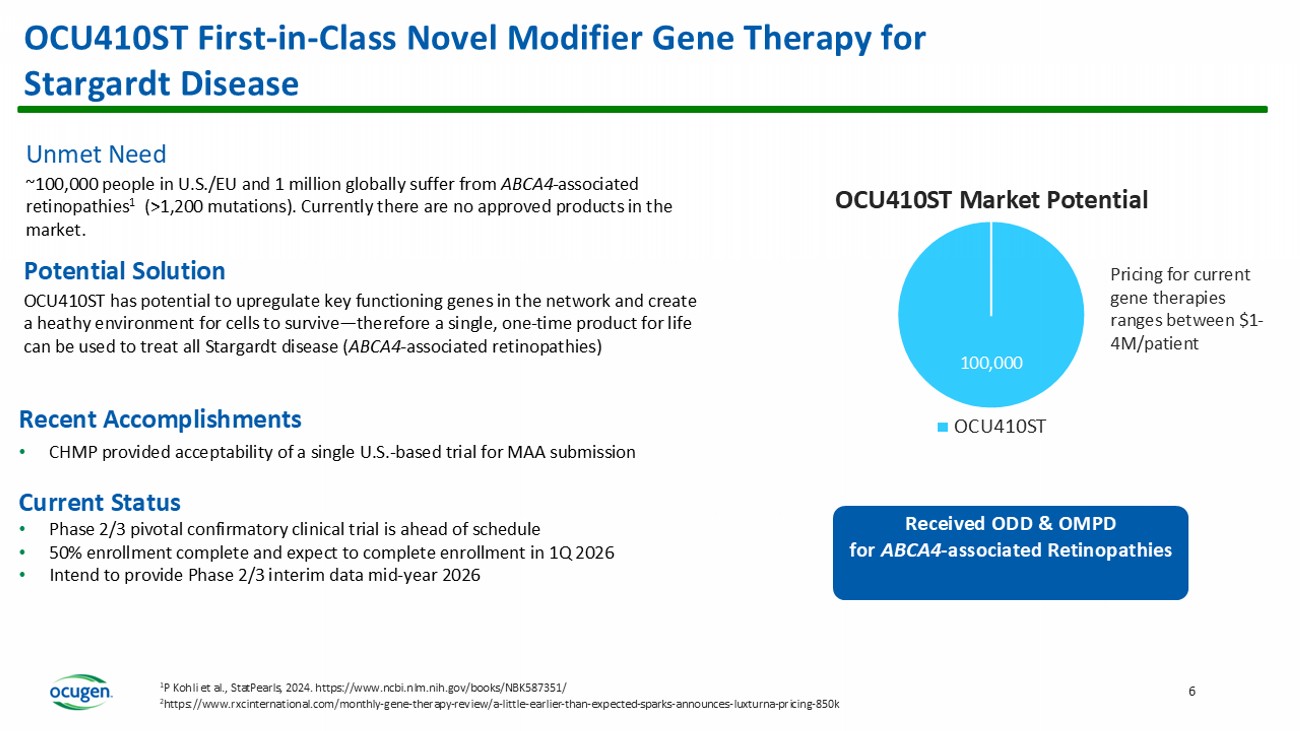

The Phase 2/3 GARDian3 pivotal confirmatory trial for OCU410ST for Stargardt disease is well underway and in August the Company announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) provided acceptability of a single U.S.-based trial for submission of an MAA. Stargardt disease affects approximately 100,000 people in the U.S. and Europe combined, and approximately 1 million globally. Currently, there is no FDA-approved treatment available for Stargardt disease.

Also in August, Ocugen closed a registered direct offering pursuant to a securities purchase agreement with Janus Henderson, for the purchase and sale of 20,000,000 shares of common stock and warrants to purchase up to an aggregate of 20,000,000 shares of common stock at a purchase price of $1.00 per share and accompanying warrant at a premium exercise price of $1.50 per share. The gross proceeds to the Company were approximately $20 million, which Ocugen anticipates will extend the Company’s cash runway into the second quarter of 2026. The Company will receive $30 million of additional gross proceeds if the warrants are exercised in full extending runway into 2027.

“We will continue to pursue financing opportunities along with strategic business development to fund the Company into commercialization,” said Dr. Musunuri. “We have engaged with potential funding and business partners during various investor and global conferences. I look forward to additional substantive conversations between now and the end of the year.”

Upcoming inflection points for Ocugen’s novel modifier gene therapy platform include OCU410 (Geographic Atrophy) Phase 2 full data release expected in the first quarter of 2026, OCU410ST (Stargardt disease) interim data on 50% of patients at eight months of treatment expected mid-year 2026, and OCU400 (RP) Phase 3 top line data expected in the fourth quarter of 2026. The Company looks forward to providing the market and key stakeholders with near-term catalysts supporting Ocugen’s strong path forward.

Modifier Gene Therapy Platform—a Novel First-in-Class Platform

| ● | OCU400 – Enrollment in the Phase 3 liMeliGhT clinical trial is nearing completion. The Company secured an exclusive licensing agreement with Kwangdong for rights to OCU400 in South Korea and will continue to pursue regional partnerships. Intend to initiate BLA rolling submission in the first half of 2026 and release Phase 3 top-line data in the fourth quarter of 2026. |

| ● | OCU410ST – Pivotal confirmatory Phase 2/3 trial is ahead of schedule. CHMP of the EMA provided acceptability of a single U.S.-based trial for submission of an MAA. Intend to release interim data (50% of patients at 8 months of treatment) mid-year 2026. |

| ● | OCU410 – Intend to release full data from the Phase 2 clinical trial in the first quarter of 2026 and begin Phase 3 in 2026. |

Ophthalmic Biologic Product

| ● | OCU200 – Intend to complete enrollment in the Phase 1 clinical trial in 4Q 2025. |

Third Quarter 2025 Financial Results

| ● | With the recent $20 million financing in the third quarter, we expect our current cash position provides sufficient runway to operate through 2Q 2026. |

| ● | The Company’s cash, cash equivalents and restricted cash totaled $32.9 million as of September 30, 2025, compared to $58.8 million as of December 31, 2024. |

| ● | Total operating expenses for the three months ended September 30, 2025 were $19.4 million and included research and development expenses of $11.2 million and general and administrative expenses of $8.2 million. This compares to total operating expenses for the three months ended September 30, 2024 of $14.4 million that included research and development expenses of $8.1 million and general and administrative expenses of $6.3 million. |

Conference Call and Webcast Details

Ocugen has scheduled a conference call and webcast for 8:30 a.m. ET today to discuss the financial results and recent business highlights. Ocugen’s senior management team will host the call, which will be open to all listeners. There will also be a question-and-answer session following the prepared remarks.

Attendees are invited to participate on the call or webcast using the following details:

Dial-in

Numbers: (800) 715-9871 for U.S. callers and (646) 307-1963 for international callers

Conference ID: 3029428

Webcast: Available on the events section of the Ocugen investor site

A replay of the call and archived webcast will be available for approximately 45 days following the event on the Ocugen investor site.

About

Ocugen, Inc.

Ocugen, Inc. is a pioneering biotechnology leader in gene therapies for blindness diseases. Our breakthrough modifier

gene therapy platform has the potential to address significant unmet medical need for large patient populations through our gene-agnostic

approach. Unlike traditional gene therapies and gene editing, Ocugen’s modifier gene therapies address the entire disease—complex

diseases that are potentially caused by imbalances in multiple gene networks. Currently we have programs in development for inherited

retinal diseases and blindness diseases affecting millions across the globe, including retinitis pigmentosa, Stargardt disease, and geographic

atrophy—late stage dry age-related macular degeneration. Discover more at www.ocugen.com and follow us on X and LinkedIn.

Cautionary

Note on Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act

of 1995, including, but not limited to, strategy, business plans and objectives for Ocugen’s clinical programs, plans and timelines

for the preclinical and clinical development of Ocugen’s product candidates, including the therapeutic potential, clinical benefits

and safety thereof, expectations regarding timing, success and data announcements of current ongoing preclinical and clinical trials,

the ability to initiate new clinical programs, Ocugen’s financial condition and expected cash runway into the second quarter of

2026, statements regarding qualitative assessments of available data, potential benefits, expectations for ongoing clinical trials, anticipated

regulatory filings and anticipated development timelines, and Ocugen’s projections under its license agreement with

Kwangdong Pharmaceutical Co., Ltd., which are subject to risks and uncertainties. We may, in some cases, use terms such as

“predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,”

“anticipates,” “expects,” “plans,” “intends,” “may,” “could,”

“might,” “will,” “should,” or other words that convey uncertainty of future events or outcomes to

identify these forward-looking statements. Such statements are subject to numerous important factors, risks, and uncertainties that may

cause actual events or results to differ materially from our current expectations, including, but not limited to, the risks that preliminary,

interim and top-line clinical trial results may not be indicative of, and may differ from, final clinical data; that unfavorable new

clinical trial data may emerge in ongoing clinical trials or through further analyses of existing clinical trial data; that earlier non-clinical

and clinical data and testing of may not be predictive of the results or success of later clinical trials; and that that clinical trial

data are subject to differing interpretations and assessments, including by regulatory authorities. These and other risks and uncertainties

are more fully described in our annual and periodic filings with the Securities and Exchange Commission (SEC), including the risk factors

described in the section entitled “Risk Factors” in the quarterly and annual reports that we file with the SEC. Any forward-looking

statements that we make in this press release speak only as of the date of this press release. Except as required by law, we assume no

obligation to update forward-looking statements contained in this press release whether as a result of new information, future events,

or otherwise, after the date of this press release.

Contact:

Tiffany Hamilton

AVP, Head of Communications

Tiffany.Hamilton@ocugen.com

OCUGEN, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

| September 30, 2025 |

December 31, 2024 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash | $ | 32,565 | $ | 58,514 | ||||

| Prepaid expenses and other current assets | 5,074 | 3,168 | ||||||

| Total current assets | 37,639 | 61,682 | ||||||

| Property and equipment, net | 14,946 | 16,554 | ||||||

| Restricted cash | 314 | 307 | ||||||

| Other assets | 4,697 | 3,899 | ||||||

| Total assets | $ | 57,596 | $ | 82,442 | ||||

| Liabilities and stockholders' equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 4,574 | $ | 4,243 | ||||

| Accrued expenses and other current liabilities | 14,932 | 15,500 | ||||||

| Operating lease obligations | 855 | 519 | ||||||

| Current portion of long term debt | - | 1,326 | ||||||

| Total current liabilities | 20,361 | 21,588 | ||||||

| Non-current liabilities | ||||||||

| Operating lease obligations, less current portion | 3,709 | 3,313 | ||||||

| Long term debt, net | 28,400 | 27,345 | ||||||

| Other non-current liabilities | 1,593 | 564 | ||||||

| Total non-current liabilities | 33,702 | 31,222 | ||||||

| Total liabilities | 54,063 | 52,810 | ||||||

| Total stockholders' equity | 3,533 | 29,632 | ||||||

| Total liabilities and stockholders' equity | $ | 57,596 | $ | 82,442 | ||||

OCUGEN, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(Unaudited)

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Collaborative arrangement revenue | $ | 1,752 | $ | 1,136 | $ | 4,606 | $ | 3,291 | ||||||||

| Total revenue | 1,752 | 1,136 | 4,606 | 3,291 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Research and development | 11,149 | 8,108 | 29,081 | 23,836 | ||||||||||||

| General and administrative | 8,228 | 6,280 | 21,446 | 20,372 | ||||||||||||

| Total operating expenses | 19,377 | 14,388 | 50,527 | 44,208 | ||||||||||||

| Loss from operations | (17,625 | ) | (13,252 | ) | (45,921 | ) | (40,917 | ) | ||||||||

| Other income (expense), net | (2,426 | ) | 282 | (4,219 | ) | 743 | ||||||||||

| Net loss | $ | (20,051 | ) | $ | (12,970 | ) | $ | (50,140 | ) | $ | (40,174 | ) | ||||

Exhibit 99.2

Courageous Innovation Dedicated to Bringing Game - Changing Gene Therapies to Market and Working Even Harder to Provide Access to Patients Globally 3 Q 2025 Business Update November 5, 2025 2 This presentation contains forward - looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 , including, but not limited to, strategy, business plans and objectives for Ocugen’s clinical programs, plans and timelines for the precl ini cal and clinical development of Ocugen’s product candidates, including the therapeutic potential, clinical benefits and safety thereof, expect ati ons regarding timing, success and data announcements of current ongoing preclinical and clinical trials, the ability to initiate new clinic al programs; Ocugen’s expected cash runway, statements regarding qualitative assessments of available data, potential benefits, expectations for ongoing clinical trials, anticipated regulatory filings and anticipated development timelines and our expectations from our license agr eement with Kwangdong Pharmaceutical Co., Ltd. , which are subject to risks and uncertainties. We may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “ mig ht,” “will,” “should,” or other words that convey uncertainty of future events or outcomes to identify these forward - looking statements. Such statements are subject to numerous important factors, risks, and uncertainties that may cause actual events or results to differ materia lly from our current expectations, including, but not limited to, the risks that preliminary, interim and top - line clinical trial results may not be indicative of, and may differ from, final clinical data; that unfavorable new clinical trial data may emerge in ongoing clinical trials or through further analyses of existing clinical trial data; that earlier non - clinical and clinical data and testing of may not be predictive of th e results or success of later clinical trials; and that that clinical trial data are subject to differing interpretations and assessments, including by regulatory authorities; that a definitive agreement for the license with a Korean partner will be delayed or not executed at all, or tha t, if executed, it may not be on terms anticipated; that the OrthoCellix transaction may not close or, if closed, may not result in the benefits anticipated . These and other risks and uncertainties are more fully described in our annual and periodic filings with the Securities and Exchange Co mmi ssion (SEC), including the risk factors described in the section entitled “Risk Factors” in the quarterly and annual reports that we file wit h the SEC. Any forward - looking statements that we make in this presentation speak only as of the date of this presentation. Except as required by law, we assume no obligation to update forward - looking statements contained in this presentation whether as a result of new information, future events, or otherwise, after the date of this presentation.

Forward - Looking Statements Potential for Three Biologics License Applications (BLAs) in the Next Three Years Target BLA/MAA Submission U.S./EU Prevalence Status Product Candidate 2026 300,000 Phase 3 in progress, enrollment near completion (largest orphan gene therapy clinical trial) On target to file BLA in 2026 OCU400 Retinitis Pigmentosa (RP) (Gene - agnostic targeting >100 genes, broad indication) 2027 100,000 Initiated dosing in Phase 2/3 pivotal confirmatory clinical trial Enrollment on track to be completed in 1Q 2026 OCU410ST Stargardt Disease (ABCA4 - associated retinopathies >1,200 mutations) 2028 2 - 3 million Completed Phase 2 recruitment Planning to initiate Phase 3 in 2026 OCU410 Geographic Atrophy (GA) – Advanced dry age - related macular degeneration ( dAMD ) Leader in Ophthalmology Gene Therapies 3 OCU400 First - in - Class Novel Modifier Gene Therapy for RP Unmet Need ~300,000 people in the U.S./EU and 1.6 million globally suffer from RP, which affects > 100 genes One approved product (Luxturna ® ), a gene therapy, which can address only one gene ( RPE65 ) 4 2,000 298,000 OCU400 Market Potential Luxturna OCU 400 Luxturna peak annual sales $52M* (2023) with a patient population of ~2,000 OCU400 has the potential to treat 298,000 patients First Phase 3 gene therapy clinical trial to receive broad RP indication from FDA Received RMAT & ODD from FDA and OMPD & ATMP from EMA *https://assets.roche.com Potential Solution OCU400 uses a gene - agnostic approach that is delivered via a single, subretinal injection to target all 100 genes associated with RP A traditional gene therapy approach would require developing 100 different products to address all 100 genes Current Status of OCU400: • Enrollment in Phase 3 is nearing completion • Process validation (manufacturing) anticipated to be completed this year • Intend to initiate BLA rolling submission in the first half of 2026 and release Phase 3 top line data in the fourth quarter of 2026 Recent Accomplishment • Secured exclusive licensing agreement with Kwangdong Pharmaceutical Co., Ltd.

for the South Korean rights to OCU400 OCU410ST First - in - Class Novel Modifier Gene Therapy for Stargardt Disease 6 100,000 OCU410ST Market Potential OCU410ST Pricing for current gene therapies ranges between $1 - 4M/patient Received ODD & OMPD for ABCA4 - associated Retinopathies 2 https://www.rxcinternational.com/monthly - gene - therapy - review/a - little - earlier - than - expected - sparks - announces - luxturna - pricing - 85 0k 1 P Kohli et al., StatPearls , 2024. https://www.ncbi.nlm.nih.gov/books/NBK587351/ Unmet Need ~100,000 people in U.S./EU and 1 million globally suffer from ABCA4 - associated retinopathies 1 (>1,200 mutations). Currently there are no approved products in the market. Potential Solution OCU410ST has potential to upregulate key functioning genes in the network and create a heathy environment for cells to survive — therefore a single, one - time product for life can be used to treat all Stargardt disease ( ABCA4 - associated retinopathies) Recent Accomplishments • CHMP provided acceptability of a single U.S.

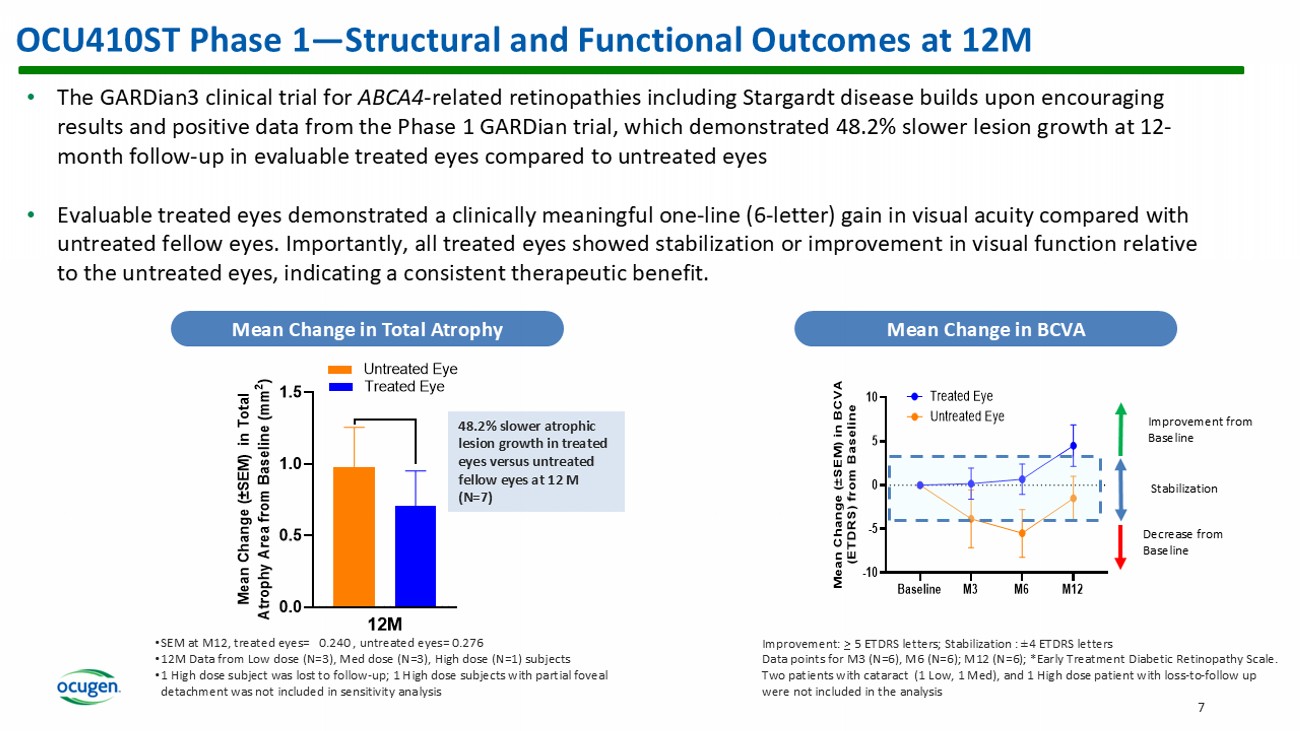

- based trial for MAA submission Current Status • Phase 2/3 pivotal confirmatory clinical trial is ahead of schedule • 50% enrollment complete and expect to complete enrollment in 1Q 2026 • Intend to provide Phase 2/3 interim data mid - year 2026 OCU410ST Phase 1 — Structural and Functional Outcomes at 12M 7 • The GARDian3 clinical trial for ABCA4 - related retinopathies including Stargardt disease builds upon encouraging results and positive data from the Phase 1 GARDian trial, which demonstrated 48.2% slower lesion growth at 12 - month follow - up in evaluable treated eyes compared to untreated eyes • Evaluable treated eyes demonstrated a clinically meaningful one - line (6 - letter) gain in visual acuity compared with untreated fellow eyes. Importantly, all treated eyes showed stabilization or improvement in visual function relative to the untreated eyes, indicating a consistent therapeutic benefit. Mean Change in Total Atrophy Mean Change in BCVA 0.0 0.5 1.0 1.5 12M M e a n C h a n g e ( ± S E M ) i n T o t a l A t r o p h y A r e a f r o m B a s e l i n e ( m m 2 ) Treated Eye Untreated Eye • SEM at M12, treated eyes= 0.240 , untreated eyes= 0.276 • 12M Data from Low dose (N=3), Med dose (N=3), High dose (N=1) subjects • 1 High dose subject was lost to follow - up; 1 High dose subjects with partial foveal detachment was not included in sensitivity analysis 48.2% slower atrophic lesion growth in treated eyes versus untreated fellow eyes at 12 M (N=7) Baseline M3 M6 M12 -10 -5 0 5 10 M e a n C h a n g e ( ± S E M ) i n B C V A ( E T D R S ) f r o m B a s e l i n e Treated Eye Untreated Eye Improvement: > 5 ETDRS letters ; Stabilization : ± 4 ETDRS letters Data points for M3 (N=6), M6 (N=6); M12 (N=6); *Early Treatment Diabetic Retinopathy Scale.

Two patients with cataract (1 Low, 1 Med), and 1 High dose patient with loss - to - follow up were not included in the analysis Improvement from Baseline Stabilization Decrease from Baseline OCU410 First - in - Class Novel Modifier Gene Therapy for GA 8 • 2 approved products for GA: FY ‘24 sales SYFOVRE ® (Apellis): $612M IZERVAY (Astellas): $379M • OCU410 has potential to treat 2 - 3 million patients in U.S. and EU • Pricing for current gene therapies ranges between $1 - 4M/patient There remains no approved treatment for GA in Europe ¹DB Rein et al., JAMA Ophthalmol , 2022. doi : 10.1001/jamaophthalmol.2022.4401 ²CJ Thomas et al., Med Clin North Am , 2021. doi : 10.1016/j.mcna.2021.01.003 (2021). Unmet Need ~19 million people in U.S. and EU and 260 million globally suffer from dAMD 1 ~2 - 3 million people in U.S. & EU and ~8 million globally suffer from GA — advanced dAMD 2 Currently, approved products target only one disease pathway associated with GA and address 25% the patient population. These treatments require 6 - 12 injections per year and have associated side effects.

Potential Solution OCU410 is designed to regulate all four pathways associated with GA: lipid metabolism, inflammation, oxidative stress, and complement with a single, subretinal injection Current Status of OCU410: • Phase 2 enrollment complete • Intend to release full data from Phase 2 clinical trial — structural and functional outcomes — in 1Q 2026 • Plan to initiate Phase 3 in 2026 and targeting BLA submission in 2028 OCU410 Phase 1 — Structural and Functional Outcomes at 12M 23% slower GA lesion growth in treated eyes versus fellow eyes after single injection Data points at 12M (N=6) 12M 0.0 0.5 1.0 1.5 2.0 M e a n c h a n g e f r o m B a s e l i n e i n G A l e s i o n ( m m 2 ) Treated Eye Untreated Eye 23 % 9 BL 3M 6M 12M -25 -20 -15 -10 -5 0 5 10 M e a n c h a n g e i n L L V A ( E T D R S ) f r o m B a s e l i n e Treated Eye Untreated Eye Treated eyes demonstrate 2 - line (10 - letter) stabilization/ gain in the visual acuity when compared to untreated fellow eyes Treated eyes demonstrated improvement compared to untreated in visual function demonstrating treatment benefit Stabilization : ± 4 letters from Baseline; Improvement: ≥5 Letters from Baseline Data points at 3M (N=8), 6M (N=7), 12M (N=6)

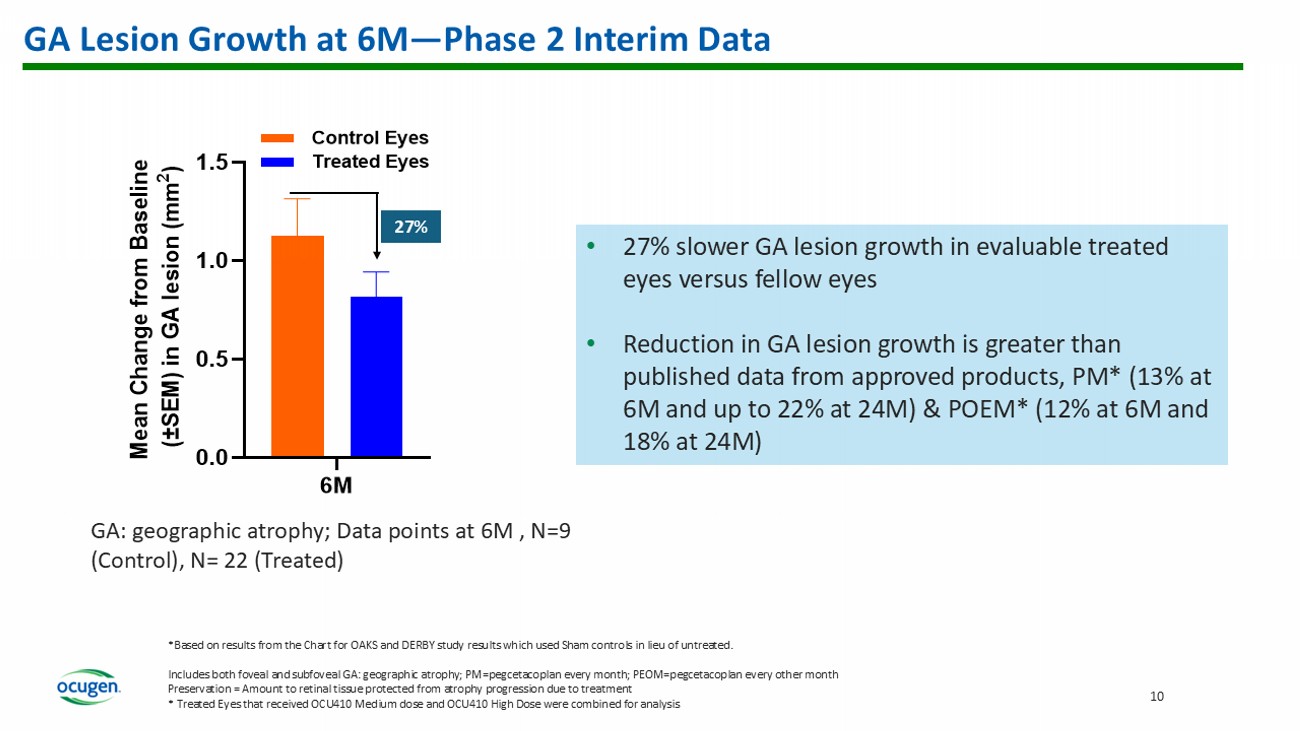

GA Lesion Growth at 6M — Phase 2 Interim Data • 27% slower GA lesion growth in evaluable treated eyes versus fellow eyes • Reduction in GA lesion growth is greater than published data from approved products, PM* (13% at 6M and up to 22% at 24M) & POEM* (12% at 6M and 18% at 24M) 6M 0.0 0.5 1.0 1.5 M e a n C h a n g e f r o m B a s e l i n e ( ± S E M ) i n G A l e s i o n ( m m 2 ) Control Eyes Treated Eyes GA: geographic atrophy; Data points at 6M , N=9 (Control), N= 22 (Treated) 27 % *Based on results from the Chart for OAKS and DERBY study results which used Sham controls in lieu of untreated. Includes both foveal and subfoveal GA: geographic atrophy; PM=pegcetacoplan every month; PEOM=pegcetacoplan every other month Preservation = Amount to retinal tissue protected from atrophy progression due to treatment * Treated Eyes that received OCU410 Medium dose and OCU410 High Dose were combined for analysis 10 11 0.14 0.12 0.31 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 PM (6M) PEOM (6M) OCU410(6M) Difference in Mean GA lesion Size between Treated and Untreated Eyes (mm 2 ) OCU410 Preserves Retinal Tissue in GA — Phase 2 Interim Data at 6M Based on reading from the Chart for OAKS and DERBY study results which used Sham controls in lieu of untreated.

Includes both foveal and subfoveal GA: geographic atrophy; PM= pegcetacoplan every month; PEOM= pegcetacoplan every other month Preservation = Amount to retinal tissue protected from atrophy progression due to treatment * Treated Eyes that received OCU410 Medium dose and OCU410 High Dose were combined for analysis Single sub - retinal injection of OCU410* was more effective in preserving retinal tissue around GA lesions when compared to PM and PEOM treatment OCU410 treatment preserves more retinal tissue around the GA lesions of treated eyes at 6M compared to PM and PEOM 0.13 Financial Update Three months ended September 30, 2025 Statement of Operations 2024 2025 $8.1 $11.2 Research and development expense 6.3 8.2 General and administrative expense 0.3 (1.1) Interest (expense) income, net $(13.0) $(20.0) Net loss $(0.05) $(0.07) Net loss per share of common stock — basic and diluted December 31, 2024 (audited) September 30 , 2025 Balance Sheet Data $58.8 $32.9* Cash and restricted cash $28.7 $28.4 Debt 291,367,558 312,319,623 Shares outstanding 13 *Cash and restricted cash includes $ 20 million of gross proceeds raised through Registered Direct Offering Except as otherwise noted, all amounts are unaudited; in millions, except per share amounts Certain amounts may not add due to rounding

Financial Update 12

Questions & Answers 14

Thank You 15