UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-41484

TRIPLE FLAG PRECIOUS METALS CORP.

(Translation of the registrant’s name into English)

TD Canada Trust Tower, 161 Bay Street, Suite 4535, Toronto, Ontario, Canada M5J 2S1

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Exhibits 99.1 and 99.2 of this Form 6-K are incorporated by reference into Triple Flag Precious Metals Corp.’s registration statements on Form F-10 (File No. 333-279789) and Form S-8 (File No. 333-267209).

EXHIBIT INDEX

The following documents, which are attached as exhibits hereto, are incorporated by reference herein:

Exhibit |

|

Title |

99.1 |

|

|

99.2 |

|

|

99.3 |

|

|

99.4 |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

TRIPLE FLAG PRECIOUS METALS CORP. |

|

|

|

|

Date: November 4, 2025 |

By: |

/s/ C. Warren Beil |

|

|

Name: C. Warren Beil |

|

|

Title: General Counsel |

Exhibit 99.1

Management’s Discussion and Analysis of

Triple Flag Precious Metals Corp.

For the three and nine months ended September 30, 2025

(Expressed in United States Dollars)

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management’s Discussion and Analysis (‘‘MD&A’’) is intended to help the reader understand Triple Flag Precious Metals Corp. (‘‘TF Precious Metals’’), its operations, financial performance and the present and anticipated future business environment. This MD&A, which has been prepared as of November 4, 2025, should be read in conjunction with the unaudited condensed interim consolidated financial statements of TF Precious Metals as at and for the three and nine months ended September 30, 2025 (the “Interim Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards” or “IFRS”), applicable to the preparation of interim financial statements, including International Accounting Standard (“IAS”) 34, Interim Financial Reporting. The unaudited condensed interim consolidated financial statements have been prepared on a basis consistent with the audited consolidated financial statements of TF Precious Metals as at December 31, 2024, and for the years ended December 31, 2024 and 2023 (the “Annual Financial Statements”), which have been prepared in accordance with IFRS Accounting Standards. Certain notes to the Annual Financial Statements are specifically referred to in this MD&A. All amounts in this MD&A are in U.S. dollars unless otherwise indicated. References to “US$”, “$” or “dollars” are to United States dollars, references to “C$” are to Canadian dollars and references to “A$” are to Australian dollars. In this MD&A, all references to ‘‘Triple Flag’’, the ‘‘Company’’, ‘‘we’’, ‘‘us’’ or ‘‘our’’ refer to TF Precious Metals together with its subsidiaries, on a consolidated basis.

This MD&A contains forward-looking information. Forward-looking information is necessarily based on a number of opinions, estimates and assumptions that we considered appropriate and reasonable as of the date such statements were made, and are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to the risk factors described in the ‘‘Risk Factors” section of the Company’s most recent annual information form available from time to time on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, users should not place undue reliance on forward-looking information, which speaks only as of the date made. See ‘‘Forward-Looking Information’’ in this MD&A.

2

|

|

4 |

|

5 |

|

7 |

|

7 |

|

Portfolio of Streaming and Related Interests and Royalty Interests |

8 |

11 |

|

13 |

|

17 |

|

18 |

|

20 |

|

24 |

|

25 |

|

26 |

|

28 |

|

28 |

|

29 |

|

IFRS Accounting Standards Critical Accounting Policies and Accounting Estimates |

29 |

30 |

|

33 |

|

33 |

|

34 |

|

35 |

3

Triple Flag is a precious metals streaming and royalty company. We offer investors exposure to gold and silver, primarily from the Americas and Australia. Our mission is to be a preferred funding partner to mining companies throughout the commodity cycle by providing customized streaming and royalty financing.

Since inception, we have invested in and systematically developed a long-life, high-margin, top-tier diversified portfolio of streams and royalties providing exposure primarily to gold and silver. As at November 4, 2025, our portfolio is comprised of 239 assets, consisting of 16 streams and 223 royalties.

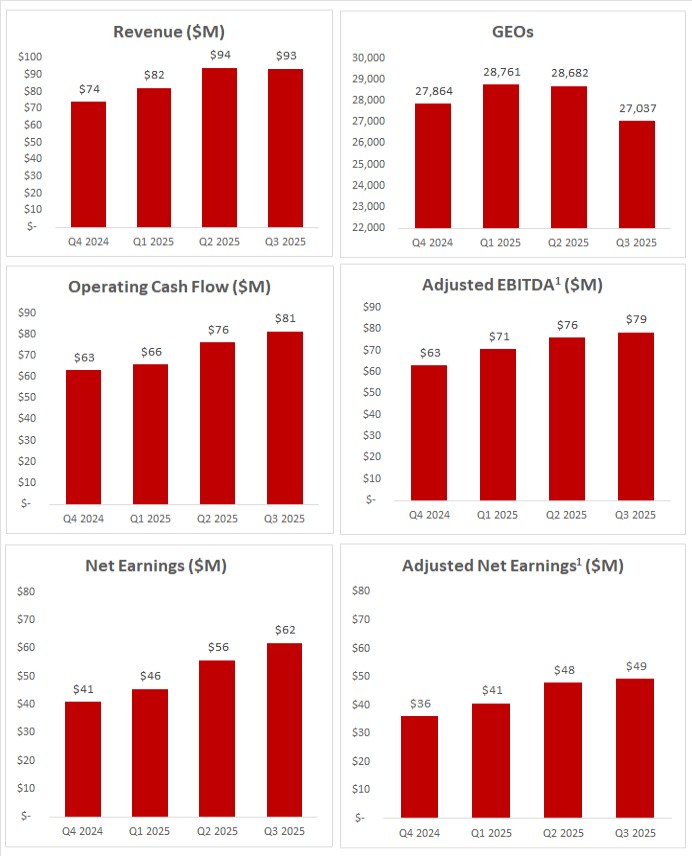

The following charts highlight our recent quarterly performance:

| 1. | Adjusted EBITDA and adjusted net earnings are non-IFRS financial performance measures with no standardized meaning under IFRS Accounting Standards and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-IFRS measure to the most directly comparable IFRS Accounting Standards measure, see ‘‘Non-IFRS Financial Performance Measures’’ in this MD&A. |

4

Asset Count1 |

|

|

Producing |

|

33 |

Development & Exploration2 |

|

206 |

Total |

|

239 |

| 1. | Asset count as at November 4, 2025. |

| 2. | Represents 52 development stage assets and 154 exploration stage and other assets. |

Our portfolio is underpinned by a stable base of cash flow generating streams and royalties and is designed to grow intrinsically over time through exposure to potential mine life extensions, exploration success, new mine builds and throughput expansions. In addition, we are focused on further enhancing portfolio quality by executing accretive investments to grow the scale and enhance the quality of our portfolio of precious metals streams and royalties. We focus on ‘‘per share’’ metrics with the objective of pursuing accretive new investments while managing the capital structure to effectively compete for quality assets without incurring long-term financial leverage.

The market prices of gold and silver are primary drivers of our profitability and ability to generate operating cash flow per share.

The following table sets forth the average gold and silver prices, and the average exchange rate between the Canadian and U.S. dollars, for the periods indicated.

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

||||

Average Metal Prices/Exchange Rates |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Gold (US$/oz)1 |

|

3,457 |

|

2,474 |

|

3,201 |

|

2,296 |

Silver (US$/oz)2 |

|

39.40 |

|

29.43 |

|

35.05 |

|

27.22 |

Exchange rate (US$/C$)3 |

|

1.3773 |

|

1.3641 |

|

1.3988 |

|

1.3604 |

| 1. | Based on the London Bullion Market Association (“LBMA”) PM fix. |

| 2. | Based on the LBMA fix. |

| 3. | Based on the Bank of Canada daily average exchange rate. |

Gold

The price of gold is inherently volatile and influenced by a variety of macroeconomic factors, including the U.S. dollar’s value, central bank activity, interest rates, inflation, supply and demand dynamics, and geopolitical events. In recent periods, gold prices have shown relative resilience, supported by ongoing global economic uncertainty and inflationary pressures. Despite short-term fluctuations, gold’s role as a safe-haven asset remained strong amid changing interest rates and geopolitical tensions. Central banks’ continued diversification into gold further supported demand.

The U.S. Federal Reserve’s cautious approach to interest rate adjustments contributed to periods of price stability, with real yields playing a significant role in price movements. Additionally, sustained physical demand from major markets such as India and China reinforced market fundamentals.

This favorable gold price environment during the period has supported healthy margins and effective capital deployment within the mining industry. However, investors continue to monitor potential changes in monetary policy and global trade dynamics closely.

The market price of gold remains a key factor influencing the performance of our gold streams and related royalty interests. During the three months ended September 30, 2025, the gold price ranged from $3,299 to $3,827 per ounce, averaging $3,457 per ounce for the period, a 40% increase from the same period in the prior year. During the nine months ended September 30, 2025, the gold price ranged from $2,633 to $3,827 per ounce, averaging $3,201 per ounce for the period, a 39% increase from the same period in the prior year.

5

As at September 30, 2025, the gold price was $3,825 per ounce (based on the LBMA PM fix).

Silver

Silver prices are also subject to volatile price movements, influenced by both investment demand and its substantial industrial use. As a key material in sectors such as electronics, renewable energy, and manufacturing, silver’s demand closely follows industrial activity. While silver has experienced greater price fluctuations than gold—due in part to supply chain challenges and variable industrial demand—its long-term outlook remains positive.

Overall, the market price of silver, impacted by factors similar to those affecting gold, plays an important role in the performance of our silver streams. During the three months ended September 30, 2025, the silver price reached all-time highs, ranging from $36.22 to $46.95 per ounce, averaging $39.40 per ounce for the period, a 34% increase from the same period in the prior year. During the nine months ended September 30, 2025, the silver price ranged from $29.41 to $46.95 per ounce, averaging $35.05 per ounce for the period, a 29% increase from the same period in the prior year. As at September 30, 2025, the silver price was $46.18 per ounce (based on the LBMA fix).

Currency Exchange Rates

We are subject to minimal currency fluctuations as the majority of our revenue and cost of sales are denominated in U.S. dollars, with the majority of general administration costs denominated in Canadian dollars. The Company monitors foreign currency risk as part of its risk management program. As at September 30, 2025, there were no hedging programs in place for non-U.S. denominated dollar expenses. In the second and third quarter of 2025, the Company had a hedging program in place for non-U.S. dollar denominated payments related to the Orogen Royalties Inc. acquisition (refer to “Key Developments” in this MD&A for more details). This acquisition was completed on July 9, 2025 and the hedge positions were closed out.

6

Financial and Operating Highlights

Three and nine months ended September 30, 2025, compared to the three and nine months ended September 30, 2024

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||

($ thousands except GEOs, per share metrics, and asset margin) |

2025 |

|

2024 |

|

|

2025 |

|

|

2024 |

||

Financial measures: |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

93,456 |

|

$ |

73,669 |

|

$ |

269,788 |

|

$ |

194,778 |

Gross Profit |

|

64,059 |

|

|

36,663 |

|

|

176,329 |

|

|

108,826 |

Depletion |

|

18,628 |

|

|

21,492 |

|

|

59,854 |

|

|

56,368 |

General Administration Costs |

|

7,894 |

|

|

5,144 |

|

|

21,651 |

|

|

17,129 |

Impairment (reversal) charges and expected credit losses1 |

|

(1,800) |

|

|

— |

|

|

(4,300) |

|

|

148,034 |

Net earnings (loss) |

|

61,916 |

|

|

29,649 |

|

|

163,173 |

|

|

(64,364) |

Net earnings (loss) per share – basic |

|

0.30 |

|

|

0.15 |

|

|

0.81 |

|

|

(0.32) |

Net earnings (loss) per share – diluted |

|

0.30 |

|

|

0.15 |

|

|

0.80 |

|

|

(0.32) |

Operating Cash Flow |

|

81,366 |

|

|

61,798 |

|

|

223,335 |

|

|

150,030 |

Operating Cash Flow per Share |

|

0.39 |

|

|

0.31 |

|

|

1.10 |

|

|

0.74 |

GEOs |

|

27,037 |

|

|

29,773 |

|

|

84,480 |

|

|

84,759 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-IFRS measures2: |

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Earnings |

|

49,292 |

|

|

28,327 |

|

|

137,904 |

|

|

73,411 |

Adjusted Net Earnings per Share - basic and diluted |

|

0.24 |

|

|

0.14 |

|

|

0.68 |

|

|

0.36 |

Adjusted EBITDA |

|

78,509 |

|

|

61,702 |

|

|

225,370 |

|

|

157,220 |

Free Cash Flow |

|

81,366 |

|

|

61,798 |

|

|

223,335 |

|

|

150,030 |

Asset Margin |

|

93% |

|

|

92% |

|

|

92% |

|

|

92% |

| 1. | Impairment reversals for the three and nine months ended September 30, 2025 are due to a reversal of impairment losses relating to previous impairments taken on the Elevation loan receivables, following a recovery under a formal CCAA process. Impairment charges and expected credit losses for the nine months ended September 30, 2024 are largely due to impairments taken on the Nevada Copper Corp. (“Nevada Copper”) stream and related interests as well as impairments taken on the Elevation Gold Ltd. (“Elevation Gold”) stream and related interests. |

| 2. | Adjusted net earnings, adjusted net earnings per share, adjusted EBITDA, free cash flow and asset margin as presented above are non-IFRS financial performance measures with no standardized meaning under IFRS Accounting Standards and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-IFRS measure to the most directly comparable IFRS Accounting Standards measure, see ‘‘Non-IFRS Financial Performance Measures’’ in this MD&A. |

The following contains forward-looking information. Reference should be made to the “Forward-Looking Information” and “Technical and Third-Party Information” sections at the end of this MD&A.

Our 2025 guidance is as follows:

| ● | Our GEOs sales guidance for 2025 is 105,000 to 115,000 ounces and is based on a gold to silver ratio of 85. Based on the same ratio for the fourth quarter, we expect to achieve sales between the midpoint and high-end of GEOs guidance for 2025. |

| ● | We expect depletion expense in 2025 to be within our guidance range of $70 million to $80 million. |

| ● | General administration costs in 2025 are expected to exceed the top end of our guidance range of $25 million due to non-cash, mark-to-market adjustments relating to stock-based compensation as a result of Triple Flag’s strong share price performance throughout the course of the year. |

7

| ● | The Australian cash tax rate is expected to meet guidance of ~25%. Australian cash taxes are payable for Triple Flag’s Australian royalty interests, which include Beta Hunt, Fosterville, Stawell and Henty. |

|

|

|

Our 2025 outlook on stream and royalty interests is based on publicly available forecasts of the owners or operators of the underlying properties and/or operations on which we have stream and royalty interests. When publicly available forecasts on properties are not available, we obtain internal forecasts from the owners or operators, or use our own best estimate. We conduct our own independent analysis of this information to reflect our expectations based on an operator’s historical performance and track record of replenishing mineral reserves and their publicly disclosed guidance on future production, the conversion of mineral resources to mineral reserves, timing risk adjustments, drill results, our view on opportunities for mine plan optimization and other factors. We may also make allowances for the risk of uneven stream deliveries, timing differences in the deliveries under our streams or the payment of our royalties, and the attainment of public guidance ranges for our counterparties. Achievement of the GEOs and the other metrics set forth in the guidance above is subject to risks and uncertainties, including changes in commodity prices and the ability of operators to attain the results set out in their forecasts. Accordingly, we can provide no assurance that the actual GEOs and such other metrics for 2025 will be within the ranges set forth above. In addition, we may revise our guidance during the year to reflect more current information. If we are unable to achieve our anticipated guidance, or if we revise our guidance, our future results of operations may be adversely affected and our share price may decline.

Portfolio of Streaming and Related Interests and Royalty Interests

The following tables present our revenue and GEOs sold by asset for the periods indicated. GEOs are based on stream and related interests as well as royalty interests and are calculated on a quarterly basis by dividing all revenue from such interests for the quarter by the average gold price during that quarter. The gold price is determined based on the LBMA PM fix. For periods greater than one quarter, GEOs are summed for each quarter in the period. Management uses this measure internally to evaluate our underlying operating performance across our stream and royalty portfolio for the reporting period presented and to assist with the planning and forecasting of future operating results.

8

Three and nine months ended September 30, 2025, compared to three and nine months ended September 30, 2024

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||

Revenue ($000s) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||

Stream and Related Interests |

|

|

|

|

|

|

|

|

|

|

|

|

Northparkes |

|

$ |

36,698 |

|

$ |

16,671 |

|

$ |

93,664 |

|

$ |

45,159 |

Cerro Lindo |

|

|

15,359 |

|

|

17,298 |

|

|

54,067 |

|

|

50,997 |

Buriticá |

|

|

7,131 |

|

|

4,538 |

|

|

14,300 |

|

|

9,955 |

Impala Bafokeng |

|

|

4,707 |

|

|

3,416 |

|

|

14,053 |

|

|

9,881 |

Auramet |

|

|

4,596 |

|

|

3,068 |

|

|

12,444 |

|

|

8,606 |

Bonikro |

|

|

3,110 |

|

|

5,038 |

|

|

9,558 |

|

|

5,038 |

Agbaou |

|

|

2,215 |

|

|

3,314 |

|

|

7,165 |

|

|

3,314 |

La Colorada |

|

|

466 |

|

|

683 |

|

|

3,613 |

|

|

2,822 |

Altan Tsagaan Ovoo ("ATO") |

|

|

— |

|

|

3,936 |

|

|

2,690 |

|

|

9,716 |

Other |

|

|

— |

|

|

845 |

|

|

1,223 |

|

|

1,921 |

|

|

$ |

74,282 |

|

$ |

58,807 |

|

$ |

212,777 |

|

$ |

147,409 |

Royalty Interests |

|

|

|

|

|

|

|

|

|

|

|

|

Beta Hunt |

|

$ |

3,872 |

|

$ |

2,725 |

|

$ |

13,274 |

|

$ |

8,614 |

Fosterville |

|

|

2,579 |

|

|

3,102 |

|

|

8,073 |

|

|

7,385 |

Young-Davidson |

|

|

2,312 |

|

|

1,760 |

|

|

6,147 |

|

|

4,691 |

Florida Canyon |

|

|

2,172 |

|

|

1,123 |

|

|

5,509 |

|

|

3,334 |

Camino Rojo |

|

|

1,392 |

|

|

1,570 |

|

|

5,434 |

|

|

4,361 |

Agbaou |

|

|

1,288 |

|

|

405 |

|

|

4,340 |

|

|

2,012 |

Kensington |

|

|

1,195 |

|

|

683 |

|

|

3,026 |

|

|

5,851 |

Stawell |

|

|

970 |

|

|

985 |

|

|

2,908 |

|

|

2,342 |

Henty |

|

|

1,085 |

|

|

600 |

|

|

2,333 |

|

|

1,471 |

Other |

|

|

2,309 |

|

|

1,909 |

|

|

5,967 |

|

|

5,936 |

|

|

$ |

19,174 |

|

$ |

14,862 |

|

$ |

57,011 |

|

$ |

45,997 |

Revenue from contracts with customers |

|

$ |

93,456 |

|

$ |

73,669 |

|

$ |

269,788 |

|

$ |

193,406 |

Revenue – Other |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

1,372 |

Total |

|

$ |

93,456 |

|

$ |

73,669 |

|

$ |

269,788 |

|

$ |

194,778 |

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||

Revenue ($000s) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||

Gold |

|

$ |

67,972 |

|

$ |

49,104 |

|

$ |

194,291 |

|

$ |

124,701 |

Silver |

|

|

25,484 |

|

|

24,565 |

|

|

75,497 |

|

|

70,077 |

Total |

|

$ |

93,456 |

|

$ |

73,669 |

|

$ |

269,788 |

|

$ |

194,778 |

The following tables reconciles Revenue with GEOs:

|

2025 |

||||||

($ thousands, except average gold price and GEOs information) |

Q3 |

|

Q2 |

|

Q1 |

|

Nine months ended September 30 |

Revenue |

93,456 |

|

94,087 |

|

82,245 |

|

269,788 |

Average gold price per ounce |

3,457 |

|

3,280 |

|

2,860 |

|

|

GEOs1 |

27,037 |

|

28,682 |

|

28,761 |

|

84,480 |

| 1. | GEOs are calculated on a quarterly basis by dividing all revenue from such interests for the quarter by the average gold price during such quarter. The gold price is determined based on the LBMA PM fix. For periods longer than one quarter, GEOs are summed for each quarter in the period. |

9

|

|

|

2024 |

||||

($ thousands, except average gold price and GEOs information) |

Q3 |

|

Q2 |

|

Q1 |

|

Nine months ended September 30 |

Revenue |

73,669 |

|

63,581 |

|

57,528 |

|

194,778 |

Average gold price per ounce |

2,474 |

|

2,338 |

|

2,070 |

|

|

GEOs1 |

29,773 |

|

27,192 |

|

27,794 |

|

84,759 |

| 1. | GEOs are calculated on a quarterly basis by dividing all revenue from such interests for the quarter by the average gold price during such quarter. The gold price is determined based on the LBMA PM fix. For periods longer than one quarter, GEOs are summed for each quarter in the period. |

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||

GEOs (ounces) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Stream and Related Interests |

|

|

|

|

|

|

|

|

Northparkes |

|

10,617 |

|

6,738 |

|

29,129 |

|

19,644 |

Cerro Lindo |

|

4,443 |

|

6,991 |

|

16,894 |

|

22,160 |

Impala Bafokeng |

|

1,362 |

|

1,381 |

|

4,424 |

|

4,323 |

Buriticá |

|

2,063 |

|

1,834 |

|

4,409 |

|

4,263 |

Auramet |

|

1,329 |

|

1,240 |

|

3,884 |

|

3,753 |

Bonikro |

|

900 |

|

2,036 |

|

3,029 |

|

2,036 |

Agbaou |

|

641 |

|

1,339 |

|

2,291 |

|

1,339 |

La Colorada |

|

135 |

|

275 |

|

1,179 |

|

1,252 |

ATO |

|

— |

|

1,591 |

|

941 |

|

4,221 |

Other |

|

— |

|

342 |

|

378 |

|

862 |

|

|

21,490 |

|

23,767 |

|

66,558 |

|

63,853 |

Royalty Interests |

|

|

|

|

|

|

|

|

Beta Hunt |

|

1,120 |

|

1,101 |

|

4,194 |

|

3,759 |

Fosterville |

|

746 |

|

1,254 |

|

2,554 |

|

3,206 |

Young-Davidson |

|

669 |

|

711 |

|

1,914 |

|

2,040 |

Camino Rojo |

|

403 |

|

635 |

|

1,723 |

|

1,904 |

Florida Canyon |

|

628 |

|

454 |

|

1,714 |

|

1,451 |

Agbaou |

|

373 |

|

164 |

|

1,377 |

|

889 |

Kensington |

|

346 |

|

276 |

|

946 |

|

2,741 |

Stawell |

|

281 |

|

398 |

|

908 |

|

1,022 |

Henty |

|

314 |

|

398 |

|

724 |

|

786 |

Other |

|

667 |

|

615 |

|

1,868 |

|

2,445 |

|

|

5,547 |

|

6,006 |

|

17,922 |

|

20,243 |

GEOs – Other |

|

— |

|

— |

|

— |

|

663 |

Total |

|

27,037 |

|

29,773 |

|

84,480 |

|

84,759 |

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||

GEOs (ounces) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Gold |

|

19,664 |

|

19,845 |

|

60,986 |

|

54,278 |

Silver |

|

7,373 |

|

9,928 |

|

23,494 |

|

30,481 |

Total |

|

27,037 |

|

29,773 |

|

84,480 |

|

84,759 |

For the three months ended September 30, 2025, we sold 27,037 GEOs, a decrease of 9% from 29,773 GEOs sold for the same period in the prior year largely due to lower GEOs from Cerro Lindo and ATO driven by lower deliveries. This was partially offset by higher GEOs from Northparkes due to higher deliveries. For the nine months ended September 30, 2025, we sold 84,480 GEOs, in line with the 84,759 GEOs sold for the same period in the prior year.

10

During the nine months ended September 30, 2025, there were higher GEOs from Northparkes due to higher deliveries, offset by lower GEOs from Cerro Lindo and ATO due to lower deliveries as well as lower royalties from Kensington compared to the same period in the prior year. GEOs from Cerro Lindo in the current year were also impacted by a higher ratio of gold to silver prices. GEOs from Kensington for the nine months ended September 30, 2024 included GEOs from the Kensington litigation settlement (See “Key Developments” in this MD&A).

Subsequent to September 30, 2025

Disposal of the 25% silver stream on El Mochito

On October 31, 2025, Triple Flag entered into a binding commitment agreement in respect of the full settlement of the outstanding amounts and deliveries of silver under the silver stream agreement with Kirungu, on the El Mochito mine in Honduras. Under the agreement, Triple Flag will receive 350,000 ounces of silver at closing and will receive 20 monthly deliveries of 25,000 ounces of silver subsequent to closing.

For the nine months ended September 30, 2025, and September 30, 2024

Acquisition of Minera Florida Royalties (1.5% and 0.8% net smelter returns (“NSR”) royalties)

On August 27, 2025, Triple Flag acquired a portfolio of royalties (the “Minera Florida Royalties”) on the Minera Florida gold mine in Chile, operated by Pan American Silver Corp., from unrelated third parties for total cash consideration of $23.0 million. The portfolio consists of a 0.8% NSR royalty on the Agua Fria concessions, a 1.5% NSR royalty on the Mila concessions, and a 1.5 % NSR royalty on the Los Moscos and Piche concessions.

Acquisition of Orogen Royalties Inc. (“Orogen”)

On July 9, 2025, Triple Flag completed the acquisition of all the issued and outstanding common shares of Orogen pursuant to a plan of arrangement (the “Transaction”). Triple Flag paid in aggregate C$171.5 million in cash and issued 5,633,629 Triple Flag common shares to Orogen shareholders. All of Orogen’s royalty assets, except for the 1.0% NSR royalty on the Arthur gold project (formerly the Expanded Silicon gold project) in Nevada, were spun off to a separate publicly traded company (“Orogen Spinco”) as part of the Transaction. In conjunction with the completion of the transaction, Triple Flag invested C$10.0 million to acquire 6,756,757 common shares (an approximate ownership interest of 11%) of Orogen Spinco. Subsequent to the acquisition, Orogen Royalties Inc. was renamed to Triple Flag Nevada Inc. and Orogen Spinco assumed the name of Orogen Royalties Inc.

On April 23, 2025, Triple Flag entered into foreign exchange forward contracts for the anticipated acquisition of Orogen, as announced on April 22, 2025. These foreign exchange forward contracts, designated as cash flow hedges, had a combined notional value to sell US$130.4 million and buy C$180.0 million, at a forward contract rate of approximately US$/C$ of 1.38 on July 8, 2025. The fair value of the foreign exchange forward contracts upon closing, net of tax, resulted in a gain of $1.1 million, which was recorded within mineral interests.

11

Acquisition of an additional 1.5% gross revenue (“GR”) royalty on the Johnson Camp Mine

On June 26, 2025, Triple Flag acquired a 1.5% GR royalty from Greenstone Excelsior Holdings L.P (“Greenstone”) on the Johnson Camp Mine in Arizona, United States, operated by Gunnison Copper Corp. (“Gunnison”) for total cash consideration of $4.0 million. This royalty is in addition to the pre-existing 1.5% GR royalty which Triple Flag already owns on the Johnson Camp Mine.

Acquisition of 0.5% GR royalty on the Tres Quebradas lithium project

On March 19, 2025, Triple Flag completed the acquisition of an existing 0.5% GR royalty from Lithium Royalty Corp. for total cash consideration of $28.0 million. The royalty covers all mineral properties comprising the Tres Quebradas lithium project. Tres Quebradas, located in Catamarca province, Argentina, is 100%-owned and operated by Zijin Mining Group Co., Ltd. through its subsidiary Liex SA.

Acquisition of 5% silver and gold streams on Arcata and Azuca mines

On February 27, 2025, Triple Flag completed the acquisition of 5% silver and gold streams on each of the Arcata and Azuca mines (the “Sierra Sun Streams”) operated by Sierra Precious Metals S.A.C., for total cash consideration of $35.0 million. Triple Flag will make ongoing payments of 10% of the spot silver and gold price for each ounce delivered under the Sierra Sun Streams. The Sierra Sun Streams cover the existing mining and exploration licenses for the Arcata and Azuca mines, both located in Peru, for the life of the operations. There is no step-down in stream rates.

Acquisition of 3% gold streams on Agbaou and Bonikro

On August 14, 2024, Triple Flag completed the acquisition of 3% gold streams on each of the Agbaou and Bonikro mines (the “Allied Streams”) operated by Allied Gold Corp. (“Allied”) and also acquired the right to purchase metal based on production from January 1, 2024, to August 14, 2024 (“initial ounces”), for a total cash consideration of $53.0 million. Triple Flag will make ongoing payments of 10% of the spot gold price for each ounce delivered under the streams. The streams cover the existing mining and exploration licenses for the Agbaou and Bonikro mines, both located in Cote d’Ivoire.

The Agbaou gold stream will step down to 2% payable gold after the delivery of 29,000 ounces of gold, and the Bonikro gold stream will step down to 2% payable gold after the delivery of 39,300 ounces of gold. From 2024 to 2027, both streams are subject to a period of annual minimum deliveries. Under the Agbaou stream, an annual minimum of 2,500 to 2,750 ounces will be delivered and under the Bonikro stream, an annual minimum of 3,500 to 4,200 ounces will be delivered. A parent guarantee is provided by Allied under the terms of the respective stream agreements.

The total cash consideration of $53.0 million was comprised of $46.1 million relating to the Allied Streams and $6.9 million to the initial ounces. These ounces were sold prior to the end of the third quarter of 2024.

Acquisition of additional Tamarack royalty

On July 5, 2024, Triple Flag acquired an additional 1.0% NSR royalty from Talon Nickel (USA) LLC (“Talon”), a wholly owned subsidiary of Talon Metals Corp., a TSX-listed company, for total consideration of $8 million (“Additional Tamarack Royalty”). The royalty is on Talon’s participating interest in the Tamarack project. The royalty is subject to a buydown right to reduce the Additional Tamarack Royalty to 0.6% for $5.0 million, exercisable for a period of two years, subject to certain conditions. This Additional Tamarack Royalty is in addition to the 1.11% NSR royalty which Triple Flag already owns on the Tamarack project.

12

Kensington litigation settlement

On March 28, 2024, Triple Flag and Coeur Mining, Inc. (“Coeur”) entered into a settlement agreement to resolve litigation regarding the terms of a royalty held by Triple Flag on Coeur’s Kensington gold mine.

As part of the settlement agreement, Triple Flag received $6.75 million in Coeur shares ($3.0 million received in April 2024, and $3.75 million received in March 2025). The Coeur share consideration is in settlement of royalties in arrears and litigation expenses incurred. As such, the settlement amounts were recognized as revenue and recoupment of costs in the condensed interim consolidated statement of income for the nine months ended September 30, 2024.

Operating Assets – Performance

Our business is organized into one single operating segment, consisting of acquiring and managing precious metals and other high-quality streams and related interests and royalties. Our chief operating decision-maker, the CEO, makes capital allocation decisions, reviews operating results and assesses performance on a single operating segment basis.

Asset Performance — Streams and related assets (producing)

| 1. | Northparkes (Operator: Evolution Mining Limited (“Evolution”)) |

Under the stream agreement, we receive 54% of payable gold until an aggregate of 630,000 ounces have been delivered and 27% of payable gold thereafter. We also receive 80% of payable silver until an aggregate of 9 million ounces of silver have been delivered, and 40% of payable silver thereafter for the remainder of the life of mine. Typically, deliveries under the stream may lag production by approximately two months. As at September 30, 2025, 90,767 ounces of gold and 1,197,102 ounces of silver had been delivered under the stream agreement since inception.

For the three months ended September 30, 2025, we sold 9,699 ounces of gold and 69,630 ounces of silver delivered under the agreement. This compares to 5,816 ounces of gold and 63,735 ounces of silver delivered and sold for the same period in the prior year. GEOs sold were 10,617 for the three months ended September 30, 2025, compared to GEOs of 6,738 for the same period in the prior year, representing an increase of 58% period over period, driven by higher deliveries.

For the nine months ended September 30, 2025, we sold 26,885 ounces of gold and 180,885 ounces of silver delivered under the agreement. This compares to 16,950 ounces of gold and 206,803 ounces of silver delivered and sold for the same period in the prior year. GEOs sold were 29,129 for the nine months ended September 30, 2025, compared to GEOs of 19,644 for the same period in the prior year, representing an increase of 48% period over period, driven by higher deliveries.

Mining of the E31 and E31N open pits was completed in the first quarter of 2025 as planned, with material stockpiled. Evolution continues to expect higher-gold-grade stockpiled ore from E31 and E31N to contribute to processed feed and support stream deliveries through 2025.

Development of the sub-level cave (“SLC”) at E48 commenced in July 2024. As planned, production from the E48 SLC started in the second half of 2025, with this mining area expected to ramp up through 2026. A pre-feasibility study was completed in the first quarter of 2025, with a gold grade of 0.39 g/t Au for the E48 SLC. The outcome of this study is being integrated with the life of mine plan at Northparkes to confirm the development schedule and optimized production profile.

First production from the E22 orebody is expected during Evolution’s fiscal year ending June 30, 2029, subject to the completion of economic studies and board approval, with a previously disclosed reserve grade of 0.37 g/t Au.

13

| 2. | Cerro Lindo (Operator: Nexa Resources S.A. (“Nexa”)) |

Under the stream agreement with Nexa, we receive 65% of payable silver produced from the Cerro Lindo mine until 19.5 million ounces have been delivered and 25% thereafter. Typically, deliveries under the stream lag production by up to four months. As at September 30, 2025, 18.2 million ounces of silver had been delivered under the stream agreement with Nexa since inception. We continue to expect a step-down in the stream rate from 65% to 25% to begin at Cerro Lindo in 2026.

For the three months ended September 30, 2025, we sold 372,698 ounces of silver delivered under the agreement, compared to 576,744 ounces of silver delivered for the same period in the prior year. GEOs sold were 4,443 for the three months ended September 30, 2025, compared to GEOs of 6,991 for the same period in the prior year due to lower deliveries as well as a higher ratio of gold to silver prices during the three months ended September 30, 2025, as compared to the prior period.

For the nine months ended September 30, 2025, we sold 1,539,963 ounces of silver delivered under the agreement, compared to 1,845,843 ounces of silver delivered and sold for the same period in the prior year, driven by lower deliveries. GEOs sold were 16,894 for the nine months ended September 30, 2025, compared to GEOs of 22,160 for the same period in the prior year as a result of lower deliveries and a higher ratio of gold to silver prices during the nine months ended September 30, 2025, as compared to the prior period.

| 3. | Impala Bafokeng Operations (Operator: Impala Platinum Holdings Limited (“Implats”)) |

Under the stream agreement, we receive 70% of payable gold until 261,000 ounces are delivered and 42% of payable gold thereafter from the Impala Bafokeng Operations (“Impala Bafokeng”). Typically, deliveries under the stream may lag production by approximately five months. As at September 30, 2025, 38,455 ounces of gold had been delivered under the stream agreement since inception.

For the three months ended September 30, 2025, we sold 1,344 ounces of gold delivered under the stream agreement, compared to 1,376 ounces delivered and sold for the same period in the prior year. GEOs sold were 1,362 for the three months ended September 30, 2025, compared to GEOs of 1,381 for the same period in the prior year.

For the nine months ended September 30, 2025, we sold 4,383 ounces of gold delivered under the stream agreement, compared to 4,319 ounces delivered and sold for the same period in the prior year. GEOs sold were 4,424 for the nine months ended September 30, 2025, compared to GEOs of 4,323 for the same period in the prior year.

Development of the asset’s value driver, Styldrift, remains ongoing, with a steady ramp-up expected to deliver improved efficiencies given current market conditions. In 2024, Implats commenced a restructuring process at Impala Bafokeng to rationalize and optimize labor deployment across corporate and operational functions. The integration of processing facilities across the Western Limb operations of Impala Rustenburg and Impala Bafokeng has advanced, resulting in improved plant availability and recovery. Implats continues to expect monthly milled throughput of 230 thousand tonnes at Styldrift by the end of its 2027 fiscal year.

| 4. | Buriticá (Operator: Zijin Mining Group Co.) |

Under the stream agreement, we receive 100% of payable silver based on a fixed silver-to-gold ratio of 1.84 over the life of the asset and there is no step-down in stream rates. As at September 30, 2025, 2.3 million ounces of silver had been delivered under the stream agreement since inception.

For the three months ended September 30, 2025, we sold 174,020 ounces of silver delivered to the Company under the agreement, compared to 155,414 ounces of silver delivered and sold for the same period in the prior year. GEOs sold were 2,063 for the three months ended September 30, 2025, compared to GEOs of 1,834 for the same period in the prior year.

14

For the nine months ended September 30, 2025, we sold 389,485 ounces of silver delivered to the Company under the agreement, compared to 357,113 ounces of silver delivered and sold for the same period in the prior year. GEOs sold were 4,409 for the nine months ended September 30, 2025, compared to GEOs of 4,263 for the same period in the prior year.

Despite the ongoing presence of illegal miners, Buriticá continues to maintain overall steady operations. The operator continues to engage closely with the surrounding community on illegal mining with support by national institutions, including the National Police of Colombia.

During the third quarter of 2025, Zijin Mining Group Co., Ltd. (“Zijin”) completed the spin-off of its overseas gold assets into a subsidiary known as Zijin Gold International Company Limited, which includes Buriticá as a cornerstone mine.

| 5. | Agbaou and Bonikro (Operator: Allied Gold Corp. (“Allied”)) |

On August 14, 2024, Triple Flag completed the acquisition of 3% gold streams on each of the Agbaou and Bonikro mines operated by Allied (the “Allied Streams”). Under the stream agreements, we receive 3% of payable gold on each of the Agbaou and Bonikro mines until an aggregate of 29,000 ounces and 39,300 ounces, respectively, have been delivered, and 2% of payable gold thereafter. As at September 30, 2025, 4,140 ounces and 5,886 ounces have been delivered under the Agbaou and Bonikro stream agreements, respectively, since inception.

We also own a separate 2.5% NSR royalty interest on all gold production from the Agbaou mine.

For the three months ended September 30, 2025, we sold 609 ounces of gold delivered under the Agbaou stream agreement and 878 ounces of gold delivered under the Bonikro stream agreement. In the prior year comparable period, 1,313 ounces of gold were delivered under the Agbaou stream agreement and 2,000 ounces of gold under the Bonikro stream agreement. GEOs sold were 641 and 900 under the Agbaou and Bonikro streams, respectively, for the three months ended September 30, 2025 compared to GEOs of 1,339 and 2,036 under the Agbaou and Bonikro streams, respectively, for the same period in the prior year. GEOs earned from the Agbaou royalty were 373 for the three months ended September 30, 2025, compared to GEOs of 164 for the prior year.

For the nine months ended September 30, 2025, we sold 2,294 ounces of gold delivered under the Agbaou stream agreement and 3,024 ounces of gold delivered under the Bonikro stream agreement. In the prior year comparable period, we sold 1,313 ounces of gold delivered under the Agbaou stream agreement and 2,000 ounces of gold delivered under the Bonikro stream agreement. GEOs sold were 2,291 and 3,029 under the Agbaou and Bonikro streams, respectively, for the nine months ended September 30, 2025 compared to GEOs of 1,339 and 2,036 under the Agbaou and Bonikro streams, respectively, for the same period in the prior year. GEOs earned from the Agbaou royalty were 1,377 for the nine months ended September 30, 2025, compared to GEOs of 889 for the prior year.

Through 2026 and 2027, the operator expects to annually produce at least 87,000 ounces of gold at Agbaou and approximately 100,000 ounces of gold at Bonikro. Separately, Allied continues to advance initiatives to implement a centralized management model for both Agbaou and Bonikro, as both mines are contiguous to each other, with the two processing plants located only 20 km apart.

15

Asset Performance — Royalties (Producing)

| 1. | Beta Hunt (Operator: Westgold Resources Limited (“Westgold”), effective August 1, 2024) |

We own a 3.25% gross revenue return (“GRR”) and 1.5% NSR royalties on all gold production, as well as a 1.0% GRR and 0.5% NSR royalties on all nickel production, from the Beta Hunt mine, located in Australia.

GEOs earned were 1,120 for the three months ended September 30, 2025, compared to GEOs of 1,101 for the prior year. GEOs earned were 4,194 for the nine months ended September 30, 2025, compared to GEOs of 3,759 for the prior year.

The expansion project to achieve consistent mine throughput at Beta Hunt of 2 million tonnes per annum continues to advance, with recent capital investment focused on upgrades to primary ventilation, mine pumping and water supply. Westgold expects the mine expansion project at Beta Hunt to deliver higher steady-state productivity by the first half of 2026.

Following the declaration of a maiden resource in June 2025, infill and extensional drilling to determine the potential scale of the Fletcher Zone continues to be advanced before its integration into a life of mine plan. The Fletcher Zone is a significant discovery at Beta Hunt that is interpreted to represent a new gold mineralized structure parallel to the Western Flanks deposit of the mine and located 50 meters to the west. Western Flanks is currently the primary source of gold ore for Beta Hunt.

| 2. | Fosterville Gold Mine (Operator: Agnico Eagle Mines Limited (“Agnico Eagle")) |

We own a 2% NSR royalty interest in Agnico Eagle’s Fosterville mine in Australia.

GEOs earned were 746 for the three months ended September 30, 2025, compared to GEOs of 1,254 for the prior year. GEOs earned were 2,554 for the nine months ended September 30, 2025, compared to GEOs of 3,206 for the prior year.

In February 2025, Agnico Eagle released an updated three-year outlook. The operator expects Fosterville to produce between 140,000 to 160,000 ounces of gold in each of 2025, 2026 and 2027. Technical evaluations and drilling are ongoing to evaluate the potential to increase production at Fosterville to an average of approximately 175,000 ounces of gold per year, with a ramp-up in performance potentially starting in 2027.

| 3. | Camino Rojo (Operator: Orla Mining Ltd. (“Orla”) |

We own a 2% NSR royalty interest on oxide material at Orla‘s Camino Rojo mine in Mexico.

GEOs earned were 403 for the three months ended September 30, 2025, compared to GEOs of 635 for the prior year. GEOs earned were 1,723 for the nine months ended September 30, 2025, compared to GEOs of 1,904 for the prior year.

2025 production guidance for Camino Rojo of 95,000 to 105,000 ounces of gold is unchanged.

| 4. | Young-Davidson Gold Mine (Operator: Alamos Gold Inc.) |

We own a 1.5% NSR royalty interest in Alamos Gold Inc.’s (“Alamos”) Young-Davidson mine in Canada.

GEOs earned were 669 for the three months ended September 30, 2025, compared to GEOs of 711 for the same period in the prior year. GEOs earned were 1,914 for the nine months ended September 30, 2025, compared to GEOs of 2,040 for the same period in the prior year.

16

In October 2025, Alamos Gold Inc. revised 2025 production guidance for Young-Davidson to 160,000 to 165,000 ounces of gold (from 175,000 to 190,000 ounces previously).

Prepaid Gold Interests and Investments

The following table summarizes prepaid gold interests and investments as at September 30, 2025, and December 31, 2024:

|

|

As at |

|

As at |

||

($ thousands) |

|

September 30, 2025 |

|

December 31, 2024 |

||

Auramet 1 |

|

$ |

52,358 |

|

$ |

46,082 |

Steppe Gold Ltd. ("Steppe Gold")2 |

|

|

2,570 |

|

|

3,457 |

Total Prepaid Gold Interests |

|

$ |

54,928 |

|

$ |

49,539 |

Investments3 |

|

|

15,507 |

|

|

3,010 |

Total Prepaid Gold Interests and Investments |

|

$ |

70,435 |

|

$ |

52,549 |

| 1. | The prepaid gold interest contract requires Auramet to deliver 1,250 ounces of gold to Triple Flag per quarter. Triple Flag is required to make ongoing cash payments equal to 16% of the spot gold price for each gold ounce delivered. On September 27, 2031, and after 50,000 ounces of gold have been delivered, Auramet will have the option to terminate the prepaid interest agreement. As at September 30, 2025, 28,750 ounces of gold remains to be delivered under the contract. The Auramet Prepaid Gold Interest is accounted for as a financial asset at fair value through profit or loss and is classified as level 3 of the fair value hierarchy. |

| 2. | On March 15, 2024, Triple Flag and Steppe Gold agreed to amend and restate the Steppe Gold Prepaid Gold Interest Agreement such that the Company made a further cash payment of $5.0 million in exchange for delivery of 2,650 ounces of gold. The Steppe Gold Prepaid Gold Interest is accounted for as a financial asset at fair value through profit or loss and is classified as level 3 of the fair value hierarchy. On February 13, 2025, Triple Flag received a delivery of 1,000 ounces of gold under the Steppe Gold Prepaid Gold Interest Agreement. Subsequently, Steppe Gold did not make delivery of the remaining 1,650 gold ounces and defaulted on their obligation under the amended and restated agreement. On March 17, 2025, Triple Flag filed a statement of claim in the Ontario Superior Court of Justice demanding immediate delivery of the outstanding 1,650 gold ounces, or contractual damages owed, under the Steppe Gold Prepaid Gold Interest Agreement. The fair value of the prepaid gold interest as of September 30, 2025, was estimated by considering the credit risk associated with the financial asset due to the ongoing contractual dispute. For the three and nine months ended September 30, 2025, Steppe Gold is also in arrears on stream deliveries of gold and silver production at the ATO mine in Mongolia under the signed Steppe Gold Stream Agreement. On September 10, 2025, Triple Flag International, a subsidiary of Triple Flag Precious Metals, issued, through its counsel, a demand letter to Steppe Gold requiring delivery of outstanding ounces under the Steppe Gold Stream Agreement. On October 7, 2025, Triple Flag International filed a Request for Arbitration, under the Steppe Gold Stream Agreement, with the International Court of Arbitration of the International Chamber of Commerce requesting specific performance of the sale and delivery of the outstanding gold and silver, currently at 1,139 ounces of gold and 8,332 ounces of silver. |

| 3. | Investments comprise equity interests and warrants in publicly traded and private companies and have been recorded at fair value. The fair value of the public equity investments is classified as level 1 of the fair value hierarchy, as the primary valuation inputs used are quoted prices in active markets. The fair value of the private equity investments is classified as level 3 of the fair value hierarchy, as the relevant observable inputs are not available. |

17

Financial Condition and Shareholders’ Equity Review

Summary Condensed Consolidated Balance Sheets

The following table presents summarized consolidated balance sheet information as at September 30, 2025, and December 31, 2024:

|

|

As at |

|

As at |

||

($ thousands) |

|

September 30, 2025 |

|

December 31, 2024 |

||

Cash and cash equivalents |

|

$ |

8,914 |

|

$ |

36,245 |

Other current assets |

|

|

54,335 |

|

|

39,400 |

Non‑current assets |

|

|

1,983,060 |

|

|

1,694,334 |

Total assets |

|

$ |

2,046,309 |

|

$ |

1,769,979 |

|

|

|

|

|

|

|

Current liabilities |

|

$ |

37,745 |

|

$ |

27,126 |

Debt |

|

|

13,000 |

|

|

— |

Other non‑current liabilities |

|

|

14,307 |

|

|

7,133 |

Total liabilities |

|

|

65,052 |

|

|

34,259 |

Total shareholders’ equity |

|

|

1,981,257 |

|

|

1,735,720 |

Total liabilities and shareholders’ equity |

|

$ |

2,046,309 |

|

$ |

1,769,979 |

Total assets were $2,046.3 million as at September 30, 2025, compared to $1,770.0 million as at December 31, 2024. Our asset base primarily consists of non-current assets such as mineral interests, which consist of our interests in streams and related interests and royalties. Our asset base also includes current assets, which generally includes cash and cash equivalents, receivables, metal inventory and investments. The increase in total assets from December 31, 2024 was largely driven by the acquisition of mineral interests, namely the royalty on the Arthur gold project, the Minera Florida royalties, the Tres Quebradas royalty and the Sierra Sun Streams, partially offset by the depletion of mineral interests.

Total liabilities were $65.1 million as at September 30, 2025, compared to $34.3 million as at December 31, 2024. Total liabilities consist largely of amounts payable and other liabilities, deferred tax liabilities and lease obligations. The Credit Facility was drawn by $13.0 million at September 30, 2025, and undrawn at December 31, 2024. For information about the Credit Facility, see “Liquidity and Capital Resources” below.

Total shareholders’ equity as at September 30, 2025, was $1,981.3 million, compared to $1,735.7 million as at December 31, 2024. The increase in shareholders’ equity from December 31, 2024 largely reflects net earnings generated during the period and shares issued as part of the Orogen transaction, partially offset by dividends paid and shares repurchased under the Company’s Normal Course Issuer Bid (“NCIB”).

Shareholders’ Equity

As at September 30, 2025 |

|

Number of shares |

Common shares |

|

206,561,506 |

As at December 31, 2024 |

|

Number of shares |

Common shares |

|

201,211,843 |

Our common shares are listed on the TSX in Canadian dollars and on the NYSE in U.S. dollars, in each case under the symbol “TFPM”.

In November 2024, Triple Flag renewed its NCIB. Daily purchases are limited to 39,117 common shares, representing 25% of the average daily trading volume of the common shares on the TSX for the period from May 1, 2024, to October 31, 2024, (being 156,469 common shares), except where purchases are made in accordance with the “block purchase exemption” of the TSX rules.

18

All common shares that are repurchased by the Company under the NCIB will be canceled. Under the current NCIB, the Company may acquire up to 10,071,642 of its common shares from time to time in accordance with the NCIB procedures of the TSX. Repurchases under the NCIB are authorized until November 14, 2025.

For the three and nine months ended September 30, 2025, the Company purchased nil and 488,600 of its common shares under the NCIB, respectively (2024: 92,700 and 375,800) for $nil and $8.0 million, respectively (2024: $1.5 million and $5 million).

In connection with the NCIB, the Company established an automatic share purchase plan (“ASPP”) with the designated broker responsible for the NCIB. The ASPP is intended to allow for the purchase of common shares under the NCIB at times when the Company would ordinarily not be permitted to purchase its common shares due to regulatory restrictions and customary self-imposed blackout periods.

As at November 4, 2025, 206,561,506 common shares are issued and outstanding and stock options are outstanding to purchase a total of 1,218,882 common shares.

For the three and nine months ended September 30, 2025, we declared and paid dividends in United States dollars totaling $11.9 million and $34.0 million, respectively (2024: $11.1 million and $32.2 million). No shares were issued from treasury for participation in the Dividend Reinvestment Plan during the three and nine months ended September 30, 2025 (2024: nil).

19

Condensed Interim Consolidated Statements of Income

The following table presents summarized condensed interim consolidated statements of income information for the three and nine months ended September 30, 2025 and 2024:

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||

($ thousands except share and per share information) |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

Revenue |

|

$ |

93,456 |

|

$ |

73,669 |

|

$ |

269,788 |

|

$ |

194,778 |

Cost of sales |

|

|

(29,397) |

|

|

(37,006) |

|

|

(93,459) |

|

|

(85,952) |

Gross profit |

|

|

64,059 |

|

|

36,663 |

|

|

176,329 |

|

|

108,826 |

|

|

|

|

|

|

|

|

|

|

|

|

|

General administration costs |

|

|

(7,894) |

|

|

(5,144) |

|

|

(21,651) |

|

|

(17,129) |

Business development costs |

|

|

(1,442) |

|

|

(851) |

|

|

(3,479) |

|

|

(3,039) |

Impairment reversal (charges) and expected credit losses |

|

|

1,800 |

|

|

— |

|

|

4,300 |

|

|

(148,034) |

Operating income (loss) |

|

|

56,523 |

|

|

30,668 |

|

|

155,499 |

|

|

(59,376) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in fair value of investments and prepaid gold interests |

|

|

13,013 |

|

|

1,780 |

|

|

25,546 |

|

|

5,526 |

Gain on disposition of mineral interests |

|

|

1,356 |

|

|

— |

|

|

1,356 |

|

|

— |

Finance costs, net |

|

|

(1,382) |

|

|

(1,499) |

|

|

(2,884) |

|

|

(4,172) |

Sustainability initiatives |

|

|

(123) |

|

|

(38) |

|

|

(313) |

|

|

(431) |

Foreign currency translation (loss) gain |

|

|

(490) |

|

|

10 |

|

|

(465) |

|

|

105 |

Other expenses |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,766) |

Other income (expense) |

|

|

12,374 |

|

|

253 |

|

|

23,240 |

|

|

(738) |

Earnings (loss) before income taxes |

|

|

68,897 |

|

|

30,921 |

|

|

178,739 |

|

|

(60,114) |

Income tax expense |

|

|

(6,981) |

|

|

(1,272) |

|

|

(15,566) |

|

|

(4,250) |

Net earnings (loss) |

|

$ |

61,916 |

|

$ |

29,649 |

|

$ |

163,173 |

|

$ |

(64,364) |

Weighted average shares outstanding – basic |

|

|

206,044,876 |

|

|

201,456,258 |

|

|

202,626,906 |

|

|

201,282,930 |

Weighted average shares outstanding – diluted |

|

|

206,656,475 |

|

|

202,069,853 |

|

|

203,128,137 |

|

|

201,282,930 |

Earnings (loss) per share – basic |

|

$ |

0.30 |

|

$ |

0.15 |

|

$ |

0.81 |

|

$ |

(0.32) |

Earnings (loss) per share – diluted |

|

$ |

0.30 |

|

$ |

0.15 |

|

$ |

0.80 |

|

$ |

(0.32) |

Three months ended September 30, 2025, compared to three months ended September 30, 2024

Revenue was $93.5 million, an increase of 27% from $73.7 million for the same period in the prior year. The increase was largely driven by $17.7 million higher revenue due to higher gold prices, $8.8 million higher revenue due to higher silver prices, partially offset by a $5.3 million decrease due to lower volume from streams and related interests, and $1.4 million decrease in revenue from lower volumes from royalties. Lower volumes from streams and related interests were driven by lower deliveries from the Cerro Lindo, ATO and Allied Streams, partially offset by higher deliveries from Northparkes. Lower revenue from royalties was largely due to lower attributable royalty ounces from Fosterville and Camino Rojo.

The average market gold price and actual gold sales volume for our streams and related interests were $3,457 per ounce, a quarterly record, and 13,911 ounces, respectively, compared to $2,474 per ounce and 13,638 ounces, respectively, in the prior year.

20

The average market silver price and actual silver sales volume were $39.40 per ounce and 616,348 ounces, respectively, compared to $29.43 per ounce and 812,097 ounces, respectively, in the prior year.

Cost of sales primarily represented the price of metals acquired under our stream agreement and related interests, cost of sales related to prepaid gold interests, as well as the depletion expense for streams and royalties, both of which are calculated based on units of metal sold or attributable royalty ounces received. Cost of sales was $29.4 million (including depletion) from streams and related interests and royalties, compared to $37.0 million (including depletion) from streams and related interests and royalties for the same period in the prior year. Lower cost of sales was also driven by lower deliveries from the Cerro Lindo, ATO and Allied Streams, partially offset by higher deliveries from Northparkes.

Gross profit was $64.1 million, an increase of 75% from $36.7 million for the same period in the prior year. The increase was largely driven by higher gold and silver prices, combined with higher stream deliveries from the Northparkes stream, partially offset by lower gross profit from the Cerro Lindo, ATO and Allied Streams due to lower deliveries.

General administration costs were $7.9 million, compared to $5.1 million for the same period in the prior year. Higher costs for the three months ended September 30, 2025 were largely due to higher mark-to-market remeasurements on share-based compensation due to a significant increase in the Company’s share price over the period. Mark-to-market remeasurements on share-based compensation for the three months ended September 30, 2025, were $3.8 million, compared to $0.4 million for the same period in the prior year.

Business development costs were $1.4 million, compared to $0.9 million for the same period in the prior year. Business development costs represent ongoing costs incurred throughout the year including use of third-party service providers, net of costs capitalized, and costs reimbursed from our counterparties.

Impairment reversal was $1.8 million, compared to impairment charges of $nil for the same period in the prior year. The reversal of impairment charges related to the previous impairment taken on the Elevation Gold loan receivables, following a recovery under a formal CCAA process.

The increase in fair value of investments and prepaid gold interests for the three months ended September 30, 2025, was $13.0 million, compared to $1.8 million for the same period in the prior year. The increase related primarily to an increase in the fair value of our prepaid gold interests, which was driven by higher market gold prices during the period as well as mark-to-market adjustments on the Company’s investment in Orogen Spinco.

Finance costs, net were $1.4 million, compared to $1.5 million for the same period in the prior year. The finance costs, net largely reflect interest charges and standby fees on the Credit Facility, net of interest earned on cash and loan balances. The decrease is largely driven by lower interest charges on a lower average debt balance drawn during the period.

Income tax expense was $7.0 million, compared to $1.3 million for the same period in the prior year. The increase in income tax expense was due to higher taxes driven by the increase in fair value of investments and prepaid gold interests, combined with higher taxes driven by the current year sales mix.

Net earnings were $61.9 million, compared to $29.7 million for the same period in the prior year. Net earnings were largely driven by higher gross profit across the portfolio, as well as an increase in the fair value of investments and prepaid gold interests, driven by higher metal prices, partially offset by higher taxes.

Nine months ended September 30, 2025, compared to nine months ended September 30, 2024

Revenue was $269.8 million, an increase of 39% from $194.8 million for the same period in the prior year. The increase was largely driven by $40.5 million higher revenue due to higher gold prices, $18.7 million higher revenue due to higher silver prices, $14.4 million higher revenue due to higher volume from streams and related interests, partially offset by $4.0 million lower volume from royalties.

21

Higher volume from streams and related interests were driven by higher deliveries from Northparkes, as well as deliveries from the Allied Streams acquired during the third quarter of 2024, partially offset by lower deliveries from Cerro Lindo and ATO. Lower volume from royalties was largely due to lower attributable ounces from Fosterville and Dargues.

The average market gold price and actual gold sales volume for our streams and related interests were $3,201 per ounce, and 41,518 ounces, respectively, compared to $2,296 per ounce and 33,466 ounces, respectively, in the prior year. The average market silver price and actual silver sales volume were $35.05 per ounce and 2.1 million ounces, respectively, compared to $27.22 per ounce and 2.5 million ounces, respectively, in the prior year.

Cost of sales primarily represented the price of metals acquired under our stream agreements and related interests, cost of sales related to prepaid gold interests, as well as the depletion expense for streams and royalties, both of which are calculated based on units of metal sold or attributable royalty ounces. Cost of sales was $93.5 million (including depletion) from streams and related interests and royalties, compared to $86.0 million (including depletion) from streams and related interests and royalties for the same period in the prior year. Cost of sales for the nine months ended September 30, 2025, included $2.6 million of costs relating to gold delivered by ATO under the prepaid gold interest agreement, which was recorded at the prevailing market price. Higher cost of sales was also driven by higher gold and silver prices, as well as higher deliveries from the Northparkes stream and the Allied Streams, partially offset by lower deliveries from Cerro Lindo and ATO.

Gross profit was $176.3 million, an increase of 62% from $108.8 million for the same period in the prior year. The increase was largely driven by higher gold and silver prices, combined with higher stream deliveries from Northparkes and the Allied Streams, partially offset by lower gross profit from the Cerro Lindo and ATO streams due to lower deliveries.

General administration costs were $21.7 million, compared to $17.1 million for the same period in the prior year. Higher costs for the nine months ended September 30, 2025 were largely due to higher mark-to-market remeasurements on share-based compensation due to a significant increase in the Company’s share price over the period. Mark-to-market remeasurements on share-based compensation for the nine months ended September 30, 2025, was $9.0 million, compared to $1.5 million for the same period in the prior year.

Business development costs were $3.5 million, compared to $3.0 million for the same period in the prior year. Business development costs represent ongoing costs incurred throughout the year including use of third-party service providers, net of costs capitalized, and costs reimbursed from our counterparties.

Impairment reversal was $4.3 million, compared to impairment charges and expected credit losses of $148.0 million for the same period in the prior year. The reversal of impairment charges related to the previous impairments taken on the Elevation Gold loan receivables, following a recovery under a formal CCAA process. Impairment charges and expected credit losses for the nine months ended September 30, 2024, was largely due to impairments and expected credit losses taken on the Nevada Copper stream and related interests as well as impairments and expected credit losses taken on the Elevation Gold stream and related interests.

The increase in fair value of investments and prepaid gold interests for the nine months ended September 30, 2025, was $25.6 million, compared to $5.5 million for the same period in the prior year. The increase related primarily to an increase in the fair value of our prepaid gold interests, which was driven by higher market gold prices during the period as well as mark-to-market adjustments on the Company’s investment in Orogen Spinco.

Finance costs, net were $2.9 million, compared to $4.2 million for the same period in the prior year. The finance costs, net largely reflect interest charges and standby fees on the Credit Facility, net of interest earned on cash and loan balances. The decrease is largely driven by lower interest charges on a lower average debt balance drawn during the period.

22

Income tax expense was $15.6 million, compared to $4.3 million for the same period in the prior year. The increase in income tax expense was due to taxes driven by the increase in fair value of investments and prepaid gold interests, combined with higher taxes driven by the current year sales mix. Prior year income tax included recovery due to impairment charges and expected credit losses.

Net earnings were $163.2 million, compared to a net loss of $64.4 million for the same period in the prior year. Net earnings were largely driven by higher gross profit across the portfolio, as well as an increase in the fair value of investments and prepaid gold interests, driven by higher metal prices, partially offset by higher taxes. The net loss in the prior period was primarily as a result of impairment charges and expected credit losses.

Condensed Interim Consolidated Statements of Cash Flows

The following table presents summarized consolidated statements of cash flow information for the three and nine months ended September 30, 2025 and 2024:

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

||||||||

($ thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||

Operating cash flow before working capital and taxes |

|

$ |

77,146 |

|

$ |

60,931 |

|

$ |

224,326 |

|

$ |

157,508 |

Income taxes paid |

|

|

(1,971) |

|

|

(1,858) |

|

|

(8,485) |

|

|

(6,735) |

Operating cash flow before working capital |

|

|

75,175 |

|

|

59,073 |

|

|

215,841 |

|

|

150,773 |

Change in working capital |

|

|

6,191 |

|

|

2,725 |

|

|

7,494 |

|

|

(743) |

Operating cash flow |

|

|

81,366 |

|

|

61,798 |

|

|

223,335 |

|

|

150,030 |

Net Cash used in investing activities |

|

|

(154,107) |

|

|

(60,776) |

|

|

(217,630) |

|

|

(82,196) |

Net Cash (used in) from financing activities |

|

|

(67) |

|

|

1,557 |

|

|

(33,027) |

|

|

(61,593) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(48) |

|

|

(40) |

|

|

(9) |

|

|

(18) |

(Decrease) increase in cash during the period |

|

|

(72,856) |

|

|

2,539 |

|

|

(27,331) |

|

|

6,223 |

Cash and cash equivalents at beginning of period |

|

|

81,770 |

|

|

21,063 |

|

|

36,245 |

|

|

17,379 |

Cash and cash equivalents at end of period |

|

$ |

8,914 |

|

$ |

23,602 |

|

$ |

8,914 |

|

$ |

23,602 |

Three months ended September 30, 2025, compared to three months ended September 30, 2024