UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 27, 2025

Philip Morris International Inc.

(Exact name of registrant as specified in its charter)

| Virginia | 1-33708 | 13-3435103 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

677 Washington Blvd, Suite 1100 Stamford, Connecticut |

06901 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (203) 905-2410

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, no par value | PM | New York Stock Exchange | ||

| 2.750% Notes due 2026 | PM26A | New York Stock Exchange | ||

| 2.875% Notes due 2026 | PM26 | New York Stock Exchange | ||

| 0.125% Notes due 2026 | PM26B | New York Stock Exchange | ||

| 3.125% Notes due 2027 | PM27 | New York Stock Exchange | ||

| 3.125% Notes due 2028 | PM28 | New York Stock Exchange | ||

| 2.875% Notes due 2029 | PM29 | New York Stock Exchange | ||

| 3.375% Notes due 2029 | PM29A | New York Stock Exchange | ||

| 2.750% Notes due 2029 | PM29D | New York Stock Exchange | ||

| 3.750% Notes due 2031 | PM31B | New York Stock Exchange | ||

| 0.800% Notes due 2031 | PM31 | New York Stock Exchange | ||

| 3.250% Notes due 2032 | PM32 | New York Stock Exchange | ||

| 3.125% Notes due 2033 | PM33 | New York Stock Exchange | ||

| 2.000% Notes due 2036 | PM36 | New York Stock Exchange | ||

| 1.875% Notes due 2037 | PM37A | New York Stock Exchange | ||

| 6.375% Notes due 2038 | PM38 | New York Stock Exchange | ||

| 1.450% Notes due 2039 | PM39 | New York Stock Exchange | ||

| 4.375% Notes due 2041 | PM41 | New York Stock Exchange | ||

| 4.500% Notes due 2042 | PM42 | New York Stock Exchange | ||

| 3.875% Notes due 2042 | PM42A | New York Stock Exchange | ||

| 4.125% Notes due 2043 | PM43 | New York Stock Exchange | ||

| 4.875% Notes due 2043 | PM43A | New York Stock Exchange | ||

| 4.250% Notes due 2044 | PM44 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On October 29, 2025, Philip Morris International Inc. (“PMI”) issued $300,000,000 aggregate principal amount of its Floating Rate Notes due 2028 (the “Floating Rate Notes”), $750,000,000 aggregate principal amount of its 3.875% Notes due 2028 (the “2028 Notes”), $750,000,000 aggregate principal amount of its 4.000% Notes due 2030 (the “2030 Notes”), $850,000,000 aggregate principal amount of its 4.250% Notes due 2032 (the “2032 Notes”) and $850,000,000 aggregate principal amount of its 4.625% Notes due 2035 (the “2035 Notes” and, together with the Floating Rate Notes, the 2028 Notes, the 2030 Notes and the 2032 Notes, the “Notes”). The Notes were issued pursuant to an Indenture dated April 25, 2008, by and between PMI and HSBC Bank USA, National Association, as trustee.

In connection with the issuance of the Notes, on October 27, 2025, PMI entered into a Terms Agreement (the “Terms Agreement”) with BBVA Securities Inc., BofA Securities, Inc., Citigroup Global Markets Inc., Deutsche Bank Securities Inc., Wells Fargo Securities, LLC, Goldman Sachs & Co. LLC, HSBC Securities (USA) Inc. and UBS Securities LLC, as representatives of the several underwriters named therein (the “Underwriters”), pursuant to which PMI agreed to issue and sell the Notes to the Underwriters. The provisions of an Underwriting Agreement, dated April 25, 2008 (the “Underwriting Agreement”), are incorporated by reference in the Terms Agreement.

PMI has filed with the Securities and Exchange Commission a Prospectus dated February 10, 2023 and a Prospectus Supplement (the “Prospectus Supplement”) dated October 27, 2025 (Registration No. 333-269690) in connection with the public offering of the Notes.

PMI intends to add the net proceeds of the offering to its general funds, which may be used for general corporate purposes, to repay all or a portion of outstanding commercial paper, refinance its outstanding U.S. dollar denominated 4.875% Notes due 2026, U.S. dollar denominated 2.750% Notes due 2026 or euro denominated 2.875% Notes due 2026 or to meet its working capital requirements. Nothing contained in this Current Report on Form 8-K constitutes a notice of redemption of the U.S. dollar denominated 4.875% Notes due 2026, the U.S. dollar denominated 2.750% Notes due 2026 or the euro denominated 2.875% Notes due 2026.

The Notes are subject to certain customary covenants, including limitations on PMI’s ability, with significant exceptions, to incur debt secured by liens and engage in sale/leaseback transactions. PMI may redeem the 2028 Notes, the 2030 Notes, the 2032 Notes and the 2035 Notes, in whole or in part, at the applicable redemption prices described in the Prospectus Supplement, plus accrued and unpaid interest thereon to, but excluding, the applicable redemption date. PMI may also redeem all, but not part, of the Notes of each series upon the occurrence of specified tax events as described in the Prospectus Supplement.

Interest on the Floating Rate Notes is payable from October 29, 2025 quarterly in arrears on January 27, April 27, July 27 and October 27 of each year, commencing January 27, 2026, to holders of record on the preceding January 12, April 12, July 12 or October 12, as the case may be. Interest on the 2028 Notes is payable from October 29, 2025 semiannually in arrears on April 27 and October 27 of each year, commencing April 27, 2026, to holders of record on the preceding April 12 or October 12, as the case may be. Interest on the 2030 Notes is payable from October 29, 2025 semiannually in arrears on April 29 and October 29 of each year, commencing April 29, 2026, to holders of record on the preceding April 14 or October 14, as the case may be. Interest on the 2032 Notes is payable from October 29, 2025 semiannually in arrears on April 29 and October 29 of each year, commencing April 29, 2026, to holders of record on the preceding April 14 or October 14, as the case may be. Interest on the 2035 Notes is payable from October 29, 2025 semiannually in arrears on April 29 and October 29 of each year, commencing April 29, 2026, to holders of record on the preceding April 14 or October 14, as the case may be.

The Floating Rate Notes will mature on October 27, 2028, the 2028 Notes will mature on October 27, 2028, the 2030 Notes will mature on October 29, 2030, the 2032 Notes will mature on October 29, 2032 and the 2035 Notes will mature on October 29, 2035.

The Notes will be PMI’s senior unsecured obligations and will rank equally in right of payment with all of its existing and future senior unsecured indebtedness.

For a complete description of the terms and conditions of the Underwriting Agreement, the Terms Agreement and the Notes, please refer to such agreements and the form of Notes, each of which is incorporated herein by reference and is an exhibit to this Current Report on Form 8-K as Exhibits 1.1, 1.2, 4.1, 4.2, 4.3, 4.4 and 4.5, respectively.

Certain of the Underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory, commercial and investment banking services for PMI, for which they received or will receive customary fees and expenses. Certain of the Underwriters and their respective affiliates are lenders under PMI’s credit facilities. PMI and some of its subsidiaries may enter into foreign exchange and other derivative arrangements with certain of the Underwriters or their respective affiliates. In addition, certain of the Underwriters or their respective affiliates act as dealers in connection with PMI’s commercial paper programs.

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| Exhibit Number |

Description |

| 1.1 | Underwriting Agreement, dated as of April 25, 2008 (incorporated by reference to Exhibit 1.1 of PMI’s Registration Statement on Form S-3 (No. 333-150449)) |

| 1.2 | Terms Agreement, dated October 27, 2025, among PMI and BBVA Securities Inc., BofA Securities, Inc., Citigroup Global Markets Inc., Deutsche Bank Securities Inc., Wells Fargo Securities, LLC, Goldman Sachs & Co. LLC, HSBC Securities (USA) Inc. and UBS Securities LLC, as representatives of the several underwriters named therein |

| 4.1 | Form of Floating Rate Notes due 2028 |

| 4.2 | Form of 3.875% Notes due 2028 |

| 4.3 | Form of 4.000% Notes due 2030 |

| 4.4 | Form of 4.250% Notes due 2032 |

| 4.5 | Form of 4.625% Notes due 2035 |

| 5.1 | Opinion of Hunton Andrews Kurth LLP |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PHILIP MORRIS INTERNATIONAL INC. | ||

| By: | /s/ DARLENE QUASHIE HENRY | |

| Name: | Darlene Quashie Henry | |

| Title: | Vice President, Associate General Counsel and Corporate Secretary | |

DATE: October 29, 2025

Exhibit 1.2

PHILIP MORRIS INTERNATIONAL INC.

(the “Company”)

Debt Securities

TERMS AGREEMENT

October 27, 2025

Philip Morris

International Inc.

677 Washington Boulevard, Suite 1100

Stamford, Connecticut 06901

United States

| Attention: | Frank de Rooij |

| Vice President Treasury and Corporate Finance |

Dear Ladies and Gentlemen:

On behalf of the several Underwriters named in Schedule A hereto and for their respective accounts, we offer to purchase, on and subject to the terms and conditions of the Underwriting Agreement relating to Debt Securities and Warrants to Purchase Debt Securities dated as of April 25, 2008 in connection with Philip Morris International Inc.’s registration statement on Form S-3 (No. 333-269690) and which is incorporated herein by reference (the “Underwriting Agreement”), the following securities on the following terms:

Debt Securities

Title:

Floating Rate Notes due 2028 (the “Floating Rate Notes”), 3.875% Notes due 2028 (the “2028 Notes”), 4.000% Notes due 2030 (the “2030 Notes”), 4.250% Notes due 2032 (the “2032 Notes”) and 4.625% Notes due 2035 (the “2035 Notes”, together with the Floating Rate Notes, the 2028 Notes, the 2030 Notes and the 2032 Notes, the “Notes”).

Principal Amount:

In the case of the Floating Rate Notes, $300,000,000.

In the case of the 2028 Notes, $750,000,000.

In the case of the 2030 Notes, $750,000,000.

In the case of the 2032 Notes, $850,000,000.

In the case of the 2035 Notes, $850,000,000.

Interest Rate:

In the case of the Floating Rate Notes, Compounded SOFR (calculated as described in that certain preliminary prospectus supplement of the Company dated October 27, 2025 (the “Prospectus Supplement”)), plus 0.660% per annum, from October 29, 2025, payable quarterly in arrears on January 27, April 27, July 27 and October 27, commencing January 27, 2026, to holders of record on the preceding January 12, April 12, July 12 or October 12, as the case may be.

In the case of the 2028 Notes, 3.875% per annum, from October 29, 2025, payable semi-annually in arrears on April 27 and October 27, commencing April 27, 2026, to holders of record on the preceding April 12 or October 12, as the case may be.

In the case of the 2030 Notes, 4.000% per annum, from October 29, 2025, payable semi-annually in arrears on April 29 and October 29, commencing April 29, 2026, to holders of record on the preceding April 14 or October 14, as the case may be.

In the case of the 2032 Notes, 4.250% per annum, from October 29, 2025, payable semi-annually in arrears on April 29 and October 29, commencing April 29, 2026, to holders of record on the preceding April 14 or October 14, as the case may be.

In the case of the 2035 Notes, 4.625% per annum, from October 29, 2025, payable semi-annually in arrears on April 29 and October 29, commencing April 29, 2026, to holders of record on the preceding April 14 or October 14, as the case may be.

Maturity:

In the case of the Floating Rate Notes, October 27, 2028.

In the case of the 2028 Notes, October 27, 2028.

In the case of the 2030 Notes, October 29, 2030.

In the case of the 2032 Notes, October 29, 2032.

In the case of the 2035 Notes, October 29, 2035.

Currency of Denomination:

United States Dollars ($).

Currency of Payment:

United States Dollars ($).

Form and Denomination:

Book-entry form only represented by one or more global securities deposited with The Depository Trust Company, or DTC, Clearstream Banking, société anonyme, or Clearstream, or Euroclear Bank SA/NV, or Euroclear, or their respective designated custodian, as the case may be, in denominations of $2,000 and integral multiples of $1,000 in excess thereof.

Conversion Provisions:

None.

Optional Redemption:

Except as noted under the caption “Description of Notes — Redemption for Tax Reasons” in the Prospectus Supplement, the Floating Rate Notes may not be redeemed prior to their maturity.

Prior to the date that is one month prior to maturity, the Company may redeem the 2028 Notes, in whole or in part, at the Company’s election at a make-whole price, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

On or after the date that is one month prior to maturity, the Company may redeem the 2028 Notes, in whole or in part, at the Company’s election, at par, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

Prior to the date that is one month prior to maturity, the Company may redeem the 2030 Notes, in whole or in part, at the Company’s election at a make-whole price, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

On or after the date that is one month prior to maturity, the Company may redeem the 2030 Notes, in whole or in part, at the Company’s election, at par, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

Prior to the date that is two months prior to maturity, the Company may redeem the 2032 Notes, in whole or in part, at the Company’s election at a make-whole price, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

On or after the date that is two months prior to maturity, the Company may redeem the 2032 Notes, in whole or in part, at the Company’s election, at par, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

Prior to the date that is three months prior to maturity, the Company may redeem the 2035 Notes, in whole or in part, at the Company’s election at a make-whole price, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

On or after the date that is three months prior to maturity, the Company may redeem the 2035 Notes, in whole or in part, at the Company’s election, at par, as described under the caption “Description of Notes—Optional Redemption” in the Prospectus Supplement.

Optional Tax Redemption:

The Company may redeem all, but not part, of the Notes of each series upon the occurrence of specified tax events described under the caption “Description of Notes—Redemption for Tax Reasons” in the Prospectus Supplement.

Option to Elect Repayment:

None.

Sinking Fund:

None.

Listing:

None.

Delayed Delivery Contracts:

None.

Payment of Additional Amounts:

In addition, the Company shall pay additional amounts to holders as and to the extent set forth under the caption “Description of Notes—Payment of Additional Amounts” in the Prospectus Supplement.

Purchase Price:

In the case of the Floating Rate Notes, 99.800% of the principal amount of the Floating Rate Notes.

In the case of the 2028 Notes, 99.655% of the principal amount of the 2028 Notes.

In the case of the 2030 Notes, 98.855% of the principal amount of the 2030 Notes.

In the case of the 2032 Notes, 98.393% of the principal amount of the 2032 Notes.

In the case of the 2035 Notes, 98.400% of the principal amount of the 2035 Notes.

Expected Reoffering Price:

In the case of the Floating Rate Notes, 100.000% of the principal amount of the Floating Rate Notes.

In the case of the 2028 Notes, 99.855% of the principal amount of the 2028 Notes.

In the case of the 2030 Notes, 99.155% of the principal amount of the 2030 Notes.

In the case of the 2032 Notes, 98.743% of the principal amount of the 2032 Notes.

In the case of the 2035 Notes, 98.850% of the principal amount of the 2035 Notes.

Names and Addresses of the Representatives of the Several Underwriters:

BBVA Securities Inc.

Two Manhattan West

375 Ninth Avenue, 9th Floor

New York, New York 10001

BofA Securities, Inc.

114 West 47th Street

NY8-114-07-01

New York, New York 10036

Citigroup Global Markets Inc.

388 Greenwich Street

New York, New York 10013

Deutsche Bank Securities Inc.

1 Columbus Circle

New York, New York 10019

Wells Fargo Securities, LLC

550 South Tryon Street, 5th Floor

Charlotte, North Carolina 28202

Goldman Sachs & Co. LLC

200 West Street

New York, New York 10282

HSBC Securities (USA) Inc.

66 Hudson Boulevard

New York, New York 10001

UBS Securities LLC

11 Madison Avenue

New York, New York 10010

Attention: Fixed Income Syndicate

The respective principal amounts of the Debt Securities to be severally purchased by each of the Underwriters are set forth opposite their names in Schedule A hereto.

Except as set forth below, the provisions of the Underwriting Agreement are incorporated herein by reference and the following provisions are hereby added thereto and made a part thereof:

1. For purposes of the Underwriting Agreement, the “Applicable Time” is 5:07 p.m. New York City time on the date of this Terms Agreement.

2. Subsection (aa) of Section 2 of the Underwriting Agreement is hereby amended as follows:

“(aa) Neither the Company nor any of its subsidiaries nor, to the knowledge of the Company, any director, officer, agent, employee or affiliate of the Company or any of its subsidiaries is currently subject to any sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”), the European Union or the United Kingdom (collectively, “Sanctions”); neither the Company nor any of its subsidiaries is located or organized in a country or region which is itself subject to Sanctions (at the time of this Agreement, the Crimea, so-called Luhansk People’s Republic, and Donetsk People’s Republic regions of Ukraine, and the portions of the regions of Kherson and Zaporizhzhia that are not controlled by the government of Ukraine, Cuba, Iran and North Korea) (a “Sanctioned Territory”); and the Company will not use the proceeds of the offering or otherwise make available such proceeds to any subsidiary, joint venture partner or other person or entity, for the purpose of financing the activities of or business in any Sanctioned Territory, or the activities of any person or entity that is, at such time, subject to any Sanctions or in any manner that would result in a violation of Sanctions. The Company has instituted and maintains policies and procedures designed to ensure continued compliance with Sanctions.”

3. For purposes of Section 6 of the Underwriting Agreement, the only information furnished to the Company by the Underwriters for use in the Prospectus Supplement consists of the following information: the concession and reallowance figures appearing in the third paragraph under the caption “Underwriting” in the Prospectus Supplement and the information contained in the fifth, sixth, seventh, ninth, eleventh and twelfth paragraphs under the caption “Underwriting” in the Prospectus Supplement. In addition, subsection (a) of Section 6 of the Underwriting Agreement is hereby amended by replacing “Pricing Prospectus” with “Pricing Prospectus or the Prospectus.”

4. The following selling restrictions apply to the offer and sale of the Notes:

(a) Each Underwriter hereby severally represents and agrees that it has not offered, sold or delivered and it will not offer, sell or deliver, directly or indirectly, any of the Notes or distribute the Prospectus, or any other offering material relating to the Notes, in or from any jurisdiction except under circumstances that will result in compliance with the applicable laws and regulations thereof and that will not impose any obligations on the Company except as agreed to with the Company in advance of such offer, sale or delivery.

(b) Each Underwriter hereby severally represents and agrees that it has not offered, sold or otherwise made available, and will not offer, sell or otherwise make available, any Notes to any retail investor in the European Economic Area. For the purposes of this provision:

(i) the expression “retail investor” means a person who is one (or more) of the following:

a. a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or

b. a customer within the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or

c. not a qualified investor as defined in Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”).

(c) Each Underwriter hereby severally represents and agrees that it has not offered, sold or otherwise made available, and will not offer, sell or otherwise make available, any Notes to any retail investor in the United Kingdom. For the purposes of this provision:

(i) the expression “retail investor” means a person who is one (or more) of the following:

a. a retail client as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”);

b. a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (as amended, “FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or

c. not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the EUWA (the “UK Prospectus Regulation”).

(d) Each Underwriter hereby severally represents and agrees that (1) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) received by it in connection with the issue or sale of the Notes in circumstances in which Section 21(1) of the FSMA does not apply to the Company; and (2) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the Notes in, from or otherwise involving the United Kingdom.

(e) Each Underwriter hereby severally represents and agrees that (1) it has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any Notes other than (A) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “SFO”) and any rules made thereunder; or (B) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong (the “C(WUMP)O”) or which do not constitute an offer to the public within the meaning of the C(WUMP)O; and (2) it has not issued or had in its possession for the purposes of issue, and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the Notes, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to Notes which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the SFO and any rules made thereunder.

(f) Each Underwriter hereby severally represents and agrees that (1) the Prospectus has not been registered as a prospectus with the Monetary Authority of Singapore and (2) it will not offer or sell the Notes or make the Notes the subject of an invitation for subscription or purchase nor may it circulate or distribute the Prospectus or any other document or material in connection with the offer or sale or invitation for subscription or purchase of any Notes, whether directly or indirectly, to any person in Singapore other than (A) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001 of Singapore, as modified or amended from time to time (the “SFA”)) pursuant to Section 274 of the SFA or (B) to an accredited investor (as defined in Section 4A of the SFA) pursuant to and in accordance with the conditions specified in Section 275 of the SFA.

(g) Each Underwriter hereby severally represents and agrees that the Notes have not been and will not be registered under the Financial Instruments and Exchange Act of Japan (Law No. 25 of 1948, as amended (the “FIEA”)), and it has not and will not offer or sell any Notes, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan (which term as used herein means any person resident in Japan, including any corporation or other entity organized under the laws of Japan), or to others for re-offering or resale, directly or indirectly, in Japan or to, or for the benefit of, a resident of Japan except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the FIEA and any other applicable laws, regulations and ministerial guidelines of Japan.

(h) Each Underwriter hereby severally represents and agrees that it has offered or sold and will offer or sell the Notes in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations; any resale of the Notes will be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws; and pursuant to section 3A.3 of National Instrument 33-105 Underwriting Conflicts (NI 33-105), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with the offering of the Notes.

(i) Each Underwriter hereby severally represents and agrees that the Notes will not be publicly offered, directly or indirectly, in Switzerland within the meaning of the Swiss Financial Services Act (“FinSA”) and no application has or will be made to admit the Notes to trading on any trading venue (exchange or multilateral trading facility) in Switzerland. Neither the prospectus supplement, the accompanying prospectus nor any other offering or marketing material relating to the Notes constitutes a prospectus pursuant to the FinSA, and neither the prospectus supplement, the accompanying prospectus nor any other offering or marketing material relating to the Notes may be publicly distributed or otherwise made publicly available in Switzerland.

5. Section 13 of the Underwriting Agreement is hereby amended as follows:

“13. Counterparts. The Terms Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, but all such counterparts shall together constitute one and the same Agreement. Counterparts may be delivered via facsimile, electronic mail (including any electronic signature covered by the Electronic Signatures in Global and National Commerce Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law (e.g., www.docusign.com)) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be legally valid, effective and enforceable for all purposes.”

6. Section 14 of the Underwriting Agreement is hereby added as follows:

“14. Recognition of the U.S. Special Resolution Regimes

(a) In the event that any Underwriter that is a Covered Entity becomes subject to a proceeding under a U.S. Special Resolution Regime, the transfer from such Underwriter of the Underwriting Agreement, and any interest and obligation in or under the Underwriting Agreement, will be effective to the same extent as the transfer would be effective under the U.S. Special Resolution Regime if the Underwriting Agreement, and any such interest and obligation, were governed by the laws of the United States or a state of the United States.

(b) In the event that any Underwriter that is a Covered Entity or a BHC Act Affiliate of such Underwriter becomes subject to a proceeding under a U.S. Special Resolution Regime, Default Rights under the Underwriting Agreement that may be exercised against such Underwriter are permitted to be exercised to no greater extent than such Default Rights could be exercised under the U.S. Special Resolution Regime if the Underwriting Agreement were governed by the laws of the United States or a state of the United States.

For purposes of this Section 14:

“BHC Act Affiliate” has the meaning assigned to the term “affiliate” in, and shall be interpreted in accordance with, 12 U.S.C. § 1841(k).

“Covered Entity” means any of the following:

(i) a “covered entity” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 252.82(b);

(ii) a “covered bank” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 47.3(b); or

(iii) a “covered FSI” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 382.2(b).

“Default Right” has the meaning assigned to that term in, and shall be interpreted in accordance with, 12 C.F.R. §§ 252.81, 47.2 or 382.1, as applicable.

“U.S. Special Resolution Regime” means each of (i) the Federal Deposit Insurance Act and the regulations promulgated thereunder and (ii) Title II of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the regulations promulgated thereunder.”

7.

(a) Notwithstanding and to the exclusion of any other term of this agreement, the Underwriting Agreement or any other agreements, arrangements, or understanding between the Underwriters and the Company, each party acknowledges and accepts that a BRRD Liability arising under this agreement may be subject to the exercise of Bail-in Powers by the Relevant Resolution Authority, and acknowledges, accepts, and agrees to be bound by:

(i) the effect of the exercise of Bail-in Powers by the Relevant Resolution Authority in relation to any BRRD Liability of the Underwriters to the Company under this agreement and the Underwriting Agreement, that (without limitation) may include and result in any of the following, or some combination thereof: (w) the reduction of all, or a portion, of the BRRD Liability or outstanding amounts due thereon; (x) the conversion of all, or a portion, of the BRRD Liability into shares, other securities or other obligations of the Underwriters or another person (and the issue to or conferral on the Company of such shares, securities or obligations); (y) the cancellation of the BRRD Liability; and (z) the amendment or alteration of any interest, if applicable, thereon, the maturity or the dates on which any payments are due, including by suspending payment for a temporary period; and

(ii) the variation of the terms of this agreement and the Underwriting Agreement, as deemed necessary by the Relevant Resolution Authority, to give effect to the exercise of Bail-in Powers by the Relevant Resolution Authority.

(b) As used in this Section 7,

“Bail-in Legislation” means in relation to a member state of the European Economic Area which has implemented, or which at any time implements, the BRRD, the relevant implementing law, regulation, rule or requirement as described in the EU Bail-in Legislation Schedule from time to time;

“Bail-in Powers” means any Write-down and Conversion Powers as defined in the EU Bail-in Legislation Schedule in relation to the relevant Bail-in Legislation;

“BRRD” means Directive 2014/59/EU establishing a framework for the recovery and resolution of credit institutions and investment firms;

“BRRD Liability” means a liability in respect of which the relevant Write-down and Conversion Powers in the applicable Bail-in Legislation may be exercised;

“EU Bail-in Legislation Schedule” means the document described as such, then in effect, and published by the Loan Market Association (or any successor person) from time to time at http://www.lma.eu.com/pages.aspx?p=499; and

“Relevant Resolution Authority” means the resolution authority with the ability to exercise any Bail-in Powers in relation to the Underwriters.

(c) For the avoidance of doubt, to the extent an Underwriter’s obligation to purchase Securities hereunder constitutes a BRRD Liability and such Underwriter does not, on the Closing Date, purchase the full amount of the Notes that it has agreed to purchase hereunder due to the exercise by the Relevant Resolution Authority of its powers under the relevant Bail-in Legislation with respect to such BRRD Liability, such Underwriter shall be deemed, for all purposes of Section 7 of the Underwriting Agreement, to have defaulted on its obligation to purchase such Notes that it has agreed to purchase hereunder but has not purchased, and Section 7 of the Underwriting Agreement shall remain in full force and effect with respect to the obligations of the other Underwriters.

8.

(a) Notwithstanding and to the exclusion of any other term of this agreement, the Underwriting Agreement or any other agreements, arrangements, or understanding between the Underwriters and the Company, each party acknowledges and accepts that a UK Bail-in Liability arising under this agreement may be subject to the exercise of UK Bail-in Powers by the Relevant UK Resolution Authority, and acknowledges, accepts, and agrees to be bound by:

(i) the effect of the exercise of UK Bail-in Powers by the Relevant UK Resolution Authority in relation to any UK Bail-in Liability of the Underwriters to the Company under this agreement and the Underwriting Agreement, that (without limitation) may include and result in any of the following, or some combination thereof: (w) the reduction of all, or a portion, of the UK Bail-in Liability or outstanding amounts due thereon; (x) the conversion of all, or a portion, of the UK Bail-in Liability into shares, other securities or other obligations of the Underwriters or another person, and the issue to or conferral on the Company of such shares, securities or obligations; (y) the cancellation of the UK Bail-in Liability; and (z) the amendment or alteration of any interest, if applicable, thereon, the maturity or the dates on which any payments are due, including by suspending payment for a temporary period; and (ii) the variation of the terms of this agreement and the Underwriting Agreement, as deemed necessary by the Relevant UK Resolution Authority, to give effect to the exercise of UK Bail-in Powers by the Relevant UK Resolution Authority.

(b) As used in this Section 8,

“Relevant UK Resolution Authority” means the resolution authority with the ability to exercise any UK Bail-in Powers in relation to the Underwriters.

“UK Bail-in Legislation” means Part I of the UK Banking Act 2009 and any other law or regulation applicable in the UK relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (otherwise than through liquidation, administration or other insolvency proceedings);

“UK Bail-in Liability” means a liability in respect of which the UK Bail-in Powers may be exercised;

“UK Bail-in Powers” means the powers under the UK Bail-In Legislation to cancel, transfer or dilute shares issued by a person that is a bank or investment firm or affiliate of a bank or investment firm, to cancel, reduce, modify or change the form of a liability of such a person or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability.

(c) For the avoidance of doubt, to the extent an Underwriter’s obligation to purchase Securities hereunder constitutes a UK Bail-in Liability and such Underwriter does not, on the Closing Date, purchase the full amount of the Notes that it has agreed to purchase hereunder due to the exercise by the Relevant UK Resolution Authority of its powers under the relevant UK Bail-in Legislation with respect to such UK Bail-in Liability, such Underwriter shall be deemed, for all purposes of Section 7 of the Underwriting Agreement, to have defaulted on its obligation to purchase such Notes that it has agreed to purchase hereunder but has not purchased, and Section 7 of the Underwriting Agreement shall remain in full force and effect with respect to the obligations of the other Underwriters.

9. Section 6(a) of the Underwriting Agreement is hereby amended as follows:

“The Company will indemnify and hold harmless each Underwriter against any losses, claims, damages or liabilities, joint or several, to which such Underwriter may become subject, under the Act or otherwise, insofar as such losses, claims, damages or liabilities (or actions in respect thereof) arise out of or are based upon any untrue statement or alleged untrue statement of any material fact contained in any Registration Statement, the Basic Prospectus, any Preliminary Prospectus, the Pricing Prospectus, or any amendment or supplement thereto, any Issuer Free Writing Prospectus, any other information identified on Schedule B(d) of the Terms Agreement or any “issuer information” filed or required to be filed pursuant to Rule 433(d) under the Act, or arise out of or are based upon the omission or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein not misleading, and will reimburse each Underwriter for any legal or other expenses reasonably incurred by such Underwriter in connection with investigating or defending any such loss, claim, damage, liability or action as such expenses are incurred; provided, however, that the Company will not be liable in any such case to the extent that any such loss, claim, damage or liability arises out of or is based upon an untrue statement or alleged untrue statement in or omission or alleged omission from any of such documents in reliance upon and in conformity with written information furnished to the Company by any Underwriter through the Representatives, if any, specifically for use therein, it being understood and agreed that the only such information furnished by any Underwriter consists of the information described as such in or pursuant to the Terms Agreement (the “Underwriter Information”).”

10.

(a) Recognition of Financial Services and Markets (Resolution of Financial Institutions) Regulations 2024: Notwithstanding anything to the contrary in, and to the exclusion of any other term or condition of, this Agreement or any other agreement, arrangement, or understanding, each party to this Agreement agrees, in accordance with regulation 33 of the FSM Regulations, to be bound by:

(i) section 92 of the FSM Act; and

(ii) any suspension of the exercise of any termination right in this Agreement made by the MAS under section 93 of the FSM Act,

in relation to the qualifying pertinent financial institution or its subsidiary relating to this Agreement to the extent required by and in accordance with the FSM Regulations.

This Section shall be interpreted in accordance with the FSM Regulations and the FSM Act.

(b) As used in this Section 10,

“FSM Act” shall mean the Financial Services and Markets Act 2022 of Singapore.

“FSM Regulations” shall mean the Financial Services and Markets (Resolution of Financial Institutions) Regulations 2024 of Singapore.

“MAS” shall mean the Monetary Authority of Singapore.

“qualifying pertinent financial institution” means a bank that is incorporated in Singapore and to which a direction is issued under section 52(1) of the FSM Act.

“termination right” shall have the meaning set out in section 91 of the FSM Act.

The closing will take place at 9:00 a.m., New York City time, on October 29, 2025 (the “Closing Date”), at the offices of Hunton Andrews Kurth LLP, 200 Park Avenue, New York, New York 10166.

The Notes will be made available for checking at the offices of Hunton Andrews Kurth LLP, 200 Park Avenue, New York, New York 10166 (unless another location shall be agreed to by the Company and the Underwriters) at least 24 hours prior to the Closing Date.

Please signify your acceptance by signing the enclosed response to us in the space provided and returning it to us.

| Very truly yours, | |||

| BBVA SECURITIES INC. | |||

| By: | /s/ Babak Ghatan | ||

| Name: | Babak Ghatan | ||

| Title: | Managing Director, Debt Capital Markets | ||

| BOFA SECURITIES, INC. | |||

| By: | /s/ Douglas A. Muller | ||

| Name: | Douglas A. Muller | ||

| Title: | Managing Director | ||

| CITIGROUP GLOBAL MARKETS INC. | |||

| By: | /s/ Adam D. Bordner | ||

| Name: | Adam D. Bordner | ||

| Title: | Managing Director | ||

| DEUTSCHE BANK SECURITIES INC. | |||

| By: | /s/ John Han | ||

| Name: | John Han | ||

| Title: | Managing Director | ||

| By: | /s/ Shamit Saha | ||

| Name: | Shamit Saha | ||

| Title: | Director | ||

| WELLS FARGO SECURITIES, LLC | |||

| By: | /s/ Carolyn Hurley | ||

| Name: | Carolyn Hurley | ||

| Title: | Managing Director | ||

| GOLDMAN SACHS & CO. LLC | |||

| By: | /s/ Crystal Gao | ||

| Name: | Crystal Gao | ||

| Title: | Vice President | ||

| HSBC SECURITIES (USA) INC. | |||

| By: | /s/ Patrice Altongy | ||

| Name: | Patrice Altongy | ||

| Title: | Managing Director | ||

| UBS SECURITIES LLC | |||

| By: | /s/ Todd Mahoney | ||

| Name: | Todd Mahoney | ||

| Title: | Head of DCM and Syndicate, Americas | ||

| By: | /s/ Igor Grinberg | ||

| Name: | Igor Grinberg | ||

| Title: | Managing Director | ||

Accepted:

| PHILIP MORRIS INTERNATIONAL INC. | |||

| By: | /s/ Frank de Rooij | ||

| Name: | Frank de Rooij | ||

| Title: | Vice President Treasury and Corporate Finance | ||

SCHEDULE A

DEBT SECURITIES

| Underwriters | Floating Rate Notes |

2028 Notes | 2030 Notes | 2032 Notes | 2035 Notes | |||||||||||||||

| BBVA Securities Inc. | $ | 37,320,000 | $ | 93,300,000 | $ | 93,300,000 | $ | 105,740,000 | $ | 105,740,000 | ||||||||||

| BofA Securities, Inc. | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Citigroup Global Markets Inc. | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Deutsche Bank Securities Inc. | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Wells Fargo Securities, LLC | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Goldman Sachs & Co. LLC | 27,000,000 | 67,500,000 | 67,500,000 | 76,500,000 | 76,500,000 | |||||||||||||||

| HSBC Securities (USA) Inc. | 27,000,000 | 67,500,000 | 67,500,000 | 76,500,000 | 76,500,000 | |||||||||||||||

| UBS Securities LLC | 27,000,000 | 67,500,000 | 67,500,000 | 76,500,000 | 76,500,000 | |||||||||||||||

| Bank of China (Europe) S.A. | 10,800,000 | 27,000,000 | 27,000,000 | 30,600,000 | 30,600,000 | |||||||||||||||

| DBS Bank Ltd. | 10,800,000 | 27,000,000 | 27,000,000 | 30,600,000 | 30,600,000 | |||||||||||||||

| Morgan Stanley & Co. LLC | 10,800,000 | 27,000,000 | 27,000,000 | 30,600,000 | 30,600,000 | |||||||||||||||

| Total | $ | 300,000,000 | $ | 750,000,000 | $ | 750,000,000 | $ | 850,000,000 | $ | 850,000,000 | ||||||||||

SCHEDULE B

| (a) | Issuer Free Writing Prospectuses not included in the Pricing Disclosure Package: None |

| (b) | Issuer Free Writing Prospectuses included in the Pricing Disclosure Package: Final Term Sheet, attached as Schedule C hereto |

| (c) | Additional Documents Incorporated by Reference: None |

SCHEDULE C

Filed Pursuant to Rule 433

Registration No. 333-269690

FINAL TERM SHEET

Philip Morris International Inc.

Dated October 27, 2025

|

Floating Rate Notes due 2028 3.875% Notes due 2028 4.000% Notes due 2030 4.250% Notes due 2032 4.625% Notes due 2035

|

|

| Issuer: |

Philip Morris International Inc.

|

| Offering Format: |

SEC Registered

|

| Security: |

Floating Rate Notes due 2028 (the “Floating Rate Notes”) 3.875% Notes due 2028 (the “2028 Notes”) 4.000% Notes due 2030 (the “2030 Notes”) 4.250% Notes due 2032 (the “2032 Notes”) 4.625% Notes due 2035 (the “2035 Notes”)

|

| Aggregate Principal Amount: |

Floating Rate Notes: $300,000,000 2028 Notes: $750,000,000 2030 Notes: $750,000,000 2032 Notes: $850,000,000 2035 Notes: $850,000,000

|

| Maturity Date: |

Floating Rate Notes: October 27, 2028 2028 Notes: October 27, 2028 2030 Notes: October 29, 2030 2032 Notes: October 29, 2032 2035 Notes: October 29, 2035 |

| Coupon: |

Floating Rate Notes: Compounded SOFR (calculated as described in that certain preliminary prospectus supplement of the Issuer dated October 27, 2025), plus 0.660% per annum 2028 Notes: 3.875% 2030 Notes: 4.000% 2032 Notes: 4.250% 2035 Notes: 4.625%

|

| Interest Payment Dates: |

Floating Rate Notes: Quarterly on each January 27, April 27, July 27 and October 27, commencing January 27, 2026 2028 Notes: Semi-annually on each April 27 and October 27, commencing April 27, 2026 2030 Notes: Semi-annually on each April 29 and October 29, commencing April 29, 2026 2032 Notes: Semi-annually on each April 29 and October 29, commencing April 29, 2026 2035 Notes: Semi-annually on each April 29 and October 29, commencing April 29, 2026

|

| Record Dates: |

Floating Rate Notes: January 12, April 12, July 12 and October 12 2028 Notes: April 12 and October 12 2030 Notes: April 14 and October 14 2032 Notes: April 14 and October 14 2035 Notes: April 14 and October 14

|

| Price to Public: |

Floating Rate Notes: 100.000% of principal amount 2028 Notes: 99.855% of principal amount 2030 Notes: 99.155% of principal amount 2032 Notes: 98.743% of principal amount 2035 Notes: 98.850% of principal amount

|

| Underwriting Discount: |

Floating Rate Notes: 0.200% of principal amount 2028 Notes: 0.200% of principal amount 2030 Notes: 0.300% of principal amount 2032 Notes: 0.350% of principal amount 2035 Notes: 0.450% of principal amount |

| Net Proceeds: |

Floating Rate Notes: $299,400,000 (before expenses) 2028 Notes: $747,412,500 (before expenses) 2030 Notes: $741,412,500 (before expenses) 2032 Notes: $836,340,500 (before expenses) 2035 Notes: $836,400,000 (before expenses)

|

| Benchmark Treasury: |

Floating Rate Notes: N/A 2028 Notes: 3.500% due October 15, 2028 2030 Notes: 3.625% due September 30, 2030 2032 Notes: 3.875% due September 30, 2032 2035 Notes: 4.250% due August 15, 2035

|

| Benchmark Treasury Price/Yield: |

Floating Rate Notes: N/A 2028 Notes: 100-00 ¼ / 3.497% 2030 Notes: 100-02 ¼ / 3.609% 2032 Notes: 100-18 / 3.781% 2035 Notes: 102-02+ / 3.991%

|

| Spread to Benchmark Treasury: |

Floating Rate Notes: N/A 2028 Notes: +43 basis points 2030 Notes: +58 basis points 2032 Notes: +68 basis points 2035 Notes: +78 basis points

|

| Yield to Maturity: |

Floating Rate Notes: N/A 2028 Notes: 3.927% 2030 Notes: 4.189% 2032 Notes: 4.461% 2035 Notes: 4.771%

|

| Optional Redemption: |

Floating Rate Notes: Except as noted under the caption “Description of Notes – Redemption for Tax Reasons” in the prospectus supplement, the Floating Rate Notes are not redeemable prior to maturity.

2028 Notes: Prior to September 27, 2028: Make-whole redemption at Treasury plus 10 bps On or after September 27, 2028: Redemption at par |

|

2030 Notes: Prior to September 29, 2030: Make-whole redemption at Treasury plus 10 bps On or after September 29, 2030: Redemption at par

2032 Notes: Prior to August 29, 2032: Make-whole redemption at Treasury plus 15 bps On or after August 29, 2032: Redemption at par

2035 Notes: Prior to July 29, 2035: Make-whole redemption at Treasury plus 15 bps On or after July 29, 2035: Redemption at par

|

|

| Settlement Date (T+2): |

October 29, 2025*

|

| CUSIP/ISIN: | Floating Rate | CUSIP Number: 718172 EB1 |

| Notes: | ISIN Number: US718172EB10 | |

| 2028 Notes: | CUSIP Number: 718172 DX4 | |

| ISIN Number: US718172DX49 | ||

| 2030 Notes: | CUSIP Number: 718172 DY2 | |

| ISIN Number: US718172DY22 | ||

| 2032 Notes: | CUSIP Number: 718172 DZ9 | |

| ISIN Number: US718172DZ96 | ||

| 2035 Notes: | CUSIP Number: 718172 EA3 | |

| ISIN Number: US718172EA37 | ||

| Listing: |

None

|

| Joint Book-Running Managers: |

BBVA Securities Inc. BofA Securities, Inc. Citigroup Global Markets Inc. Deutsche Bank Securities Inc. Wells Fargo Securities, LLC Goldman Sachs & Co. LLC HSBC Securities (USA) Inc. UBS Securities LLC |

| Co-Managers: |

Bank of China (Europe) S.A. DBS Bank Ltd. Morgan Stanley & Co. LLC |

| Allocations: | Floating Rate Notes |

2028 Notes | 2030 Notes | 2032 Notes | 2035 Notes | |||||||||||||||

| BBVA Securities Inc. | $ | 37,320,000 | $ | 93,300,000 | $ | 93,300,000 | $ | 105,740,000 | $ | 105,740,000 | ||||||||||

| BofA Securities, Inc. | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Citigroup Global Markets Inc. | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Deutsche Bank Securities Inc. | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Wells Fargo Securities, LLC | 37,320,000 | 93,300,000 | 93,300,000 | 105,740,000 | 105,740,000 | |||||||||||||||

| Goldman Sachs & Co. LLC | 27,000,000 | 67,500,000 | 67,500,000 | 76,500,000 | 76,500,000 | |||||||||||||||

| HSBC Securities (USA) Inc. | 27,000,000 | 67,500,000 | 67,500,000 | 76,500,000 | 76,500,000 | |||||||||||||||

| UBS Securities LLC | 27,000,000 | 67,500,000 | 67,500,000 | 76,500,000 | 76,500,000 | |||||||||||||||

| Bank of China (Europe) S.A. | 10,800,000 | 27,000,000 | 27,000,000 | 30,600,000 | 30,600,000 | |||||||||||||||

| DBS Bank Ltd. | 10,800,000 | 27,000,000 | 27,000,000 | 30,600,000 | 30,600,000 | |||||||||||||||

| Morgan Stanley & Co. LLC | 10,800,000 | 27,000,000 | 27,000,000 | 30,600,000 | 30,600,000 | |||||||||||||||

| Total | $ | 300,000,000 | $ | 750,000,000 | $ | 750,000,000 | $ | 850,000,000 | $ | 850,000,000 | ||||||||||

* Under Rule 15c6-1 under the Exchange Act, trades in the secondary market are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the delivery date will be required, by virtue of the fact that the Notes initially settle in T+2, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement.

No EEA or UK PRIIPs KID – No EEA or UK PRIIPs key information document (KID) has been prepared as the notes are not available to retail investors in the EEA or the UK.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling BBVA Securities Inc. toll free at 1-800-422-8692, BofA Securities, Inc. toll-free at 1-800-294-1322, Citigroup Global Markets Inc. toll free at 1-800-831-9146, Deutsche Bank Securities Inc. toll free at 1-800-503-4611 or Wells Fargo Securities, LLC toll free at 1-800-645-3751.

Exhibit 4.1

REGISTERED

No.

PHILIP MORRIS INTERNATIONAL INC.

FLOATING RATE NOTES DUE 2028

| PRINCIPAL AMOUNT | |

| $ | |

| CUSIP NO. 718172 EB1 | |

| ISIN NO. US718172EB10 |

THIS NOTE IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR NOTES IN CERTIFICATED FORM, THIS NOTE MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY THE DEPOSITORY TRUST COMPANY (THE “DEPOSITARY”) TO A NOMINEE OF THE DEPOSITARY OR BY THE DEPOSITARY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITARY OR A NOMINEE OF SUCH SUCCESSOR DEPOSITARY. UNLESS THIS NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITARY TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITARY (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITARY), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

PHILIP MORRIS INTERNATIONAL INC., a Virginia corporation (hereinafter called the “Company”, which term includes any successor corporation under the Indenture hereinafter referred to), for value received, hereby promises to pay to Cede & Co. or registered assigns, the principal sum of ($ ) on October 27, 2028, and to pay interest thereon as set forth on the reverse of this Note.

Payment of the principal of (and premium, if any) and interest on this Note will be made at the office or agency of the Company maintained for that purpose in the Borough of Manhattan, The City of New York, in such coin or currency of the United States of America as at the time of payment shall be legal tender for the payment of public and private debts; provided, however, that at the option of the Company payment of interest may be made by check mailed to the address of the Person entitled thereto as such address shall appear on the Securities Register or by wire transfer at such place and to such account at a banking institution in the United States as may be designated in writing to the Trustee at least 15 days prior to the date for payment by the person entitled thereto. All payments of principal, premium, if any, and interest in respect of this Note will be made by the Company in immediately available funds.

Additional provisions of this Note are contained on the reverse hereof, and such provisions shall have the same effect as though fully set forth in this place.

Unless the certificate of authentication hereon has been executed by or on behalf of the Trustee for the Notes by manual or electronic signature, this Note shall not be entitled to any benefit under the Indenture, or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, PHILIP MORRIS INTERNATIONAL INC. has caused this instrument to be duly executed.

| Dated: October 29, 2025 | ||

| PHILIP MORRIS INTERNATIONAL INC. | ||

| By: | ||

| Name: | Frank de Rooij | |

| Title: | Vice President Treasury and Corporate Finance | |

| Attest: | ||

| By: | ||

| Name: | Darlene Quashie Henry | |

| Title: | Vice President, Associate General Counsel and Corporate Secretary | |

CERTIFICATE OF AUTHENTICATION

This is one of the Securities of the series designated therein described in the within-mentioned Indenture.

| HSBC BANK USA, NATIONAL ASSOCIATION, | ||

| as Trustee | ||

| By: | ||

| Authorized Officer | ||

(Reverse of Note)

PHILIP MORRIS INTERNATIONAL INC.

This Note is one of a duly authorized issue of debentures, notes or other evidences of indebtedness (hereinafter called the “Securities”) of the Company of the series hereinafter specified, which series is issued in an initial aggregate principal amount of $300,000,000, all such Securities issued and to be issued under an Indenture dated as of April 25, 2008 between the Company and HSBC Bank USA, National Association, as Trustee (herein called the “Indenture”), to which Indenture and all other indentures supplemental thereto reference is hereby made for a statement of the rights and limitations of rights thereunder of the Holders of the Securities and of the rights, obligations, duties and immunities of the Trustee for each series of Securities and of the Company, and the terms upon which the Securities are and are to be authenticated and delivered. As provided in the Indenture, the Securities may be issued in one or more series, which different series may be issued in various aggregate principal amounts, may mature at different times, may bear interest, if any, at different rates, may be subject to different redemption provisions, if any, may be subject to different sinking, purchase or analogous funds, if any, may be subject to different covenants and Events of Default and may otherwise vary as in the Indenture provided or permitted. This Note is one of a series of the Securities designated therein as Floating Rate Notes due 2028 (the “Notes”).

Section 1010 of the Indenture shall be applicable to the Notes, except that (i) the term “Holder,” when used in Section 1010 of the Indenture, shall mean the beneficial owner of a Note or any person holding on behalf or for the account of the beneficial owner of a Note; (ii) the following language shall replace subsection (k) to Section 1010 of the Indenture: “any tax, assessment or other governmental charge imposed pursuant to the provisions of Sections 1471 through 1474 of the Code” and (iii) the following language shall be included as subsection (l) to Section 1010 of the Indenture: “any combination of items (a), (b), (c), (d), (e), (f), (g), (h), (i), (j) and (k).”

The Notes will bear interest at a floating rate per annum equal to Compounded SOFR plus 0.660%, payable quarterly in arrears on January 27, April 27, July 27 and October 27 of each year (each, an “Interest Payment Date”), commencing January 27, 2026, to the persons in whose names the Notes are registered at the close of business on the preceding January 12, April 12, July 12 or October 12, as the case may be. Interest on the Notes will be computed on the basis of a 360-day year and the actual number of days in the relevant Observation Period. Any such interest not so punctually paid or duly provided for shall forthwith cease to be payable to the Holder on such Regular Record Date and may be paid to the Person in whose name this Note (or one or more Predecessor Securities) is registered at the close of business on a Special Record Date for the payment of such Defaulted Interest to be fixed by the Trustee for the Notes, notice whereof shall be given to Holders of Notes not less than 10 days prior to such Special Record Date, or may be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Notes may be listed, and upon such notice as may be required by such exchange, all as more fully provided in said Indenture.

If any Interest Payment Date falls on a day that is not a business day, the Company will make the interest payment on the next succeeding business day unless that business day is in the next succeeding calendar month, in which case (other than in the case of the maturity date) the Company will make the interest payment on the immediately preceding business day. If an interest payment is made on the next succeeding business day, no interest will accrue as a result of the delay in payment. If the maturity date for the Notes falls on a day that is not a business day, the payment due on such date will be postponed to the next succeeding business day, and no further interest will accrue in respect of such postponement.

On each Interest Payment Determination Date relating to the applicable Interest Payment Date, the calculation agent will calculate the amount of accrued interest payable on the Notes for each interest period by multiplying (i) the outstanding principal amount of the Notes by (ii) the product of (a) the interest rate for the relevant interest period multiplied by (b) the quotient of the actual number of calendar days in such Observation Period divided by 360. In no event will the interest rate on the Notes be higher than the maximum rate permitted by New York law as the same may be modified by U.S. law of general application, or less than zero.

The term “interest period,” with respect to the Notes, means the period from and including any Interest Payment Date (or, with respect to the initial interest period only, commencing October 29, 2025) to, but excluding, the next succeeding Interest Payment Date, and in the case of the last such period, from and including the Interest Payment Date immediately preceding the maturity date to, but excluding, the maturity date.

Compounded SOFR

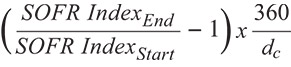

“Compounded SOFR” will be determined by the calculation agent in accordance with the following formula (and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point):

where:

“SOFR IndexStart” means for periods other than the initial interest period, the SOFR Index value on the preceding Interest Payment Determination Date, and, for the initial interest period, the SOFR Index value on October 27, 2025;

“SOFR IndexEnd” means the SOFR Index value on the Interest Payment Determination Date relating to the applicable Interest Payment Date (or, in the final interest period, relating to the maturity date, or in the case of a redemption of the Notes upon the occurrence of specified tax events described herein, relating to the applicable redemption date); and

“dc” is the number of calendar days in the relevant Observation Period.

For purposes of determining Compounded SOFR:

“Interest Payment Determination Date” means the date two U.S. Government Securities Business Days before each Interest Payment Date (or, in the final interest period, before the maturity date, or in the case of a redemption of the Notes upon the occurrence of specified tax events described herein, before the applicable redemption date).

“Observation Period” means, in respect of each interest period, the period from, and including, the date two U.S. Government Securities Business Days preceding the first date in such interest period to, but excluding, the Interest Payment Date for such interest period.

“SOFR Index” means, with respect to any U.S. Government Securities Business Day, the SOFR Index value as published by the SOFR Administrator as such index appears on the SOFR Administrator’s Website at 3:00 p.m. (New York time) on such U.S. Government Securities Business Day (the “SOFR Index Determination Time”); provided that if a SOFR Index value does not so appear at the SOFR Index Determination Time, then (i) if a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, then Compounded SOFR shall be the rate determined pursuant to the “SOFR Index Unavailable Provisions” described below; or (ii) if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR, then Compounded SOFR shall be the rate determined pursuant to the “Effect of Benchmark Transition Event” provisions described below.

“SOFR” means the daily secured overnight financing rate as provided by the SOFR Administrator on the SOFR Administrator’s Website.

“SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of SOFR).

“SOFR Administrator’s Website” means the website of the Federal Reserve Bank of New York, currently at http://www.newyorkfed.org, or any successor source.

“U.S. Government Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Notwithstanding anything to the contrary in the documentation relating to the Notes, if the Company or its designee determines on or prior to the relevant Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to determining Compounded SOFR, then the benchmark replacement provisions set forth below under “Effect of Benchmark Transition Event” will thereafter apply to all determinations of the rate of interest payable on the Notes.

For the avoidance of doubt, in accordance with the benchmark replacement provisions, after a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the interest rate for each interest period on the Notes will be an annual rate equal to the sum of the Benchmark Replacement and the applicable margin.

SOFR Index Unavailable Provisions

If a SOFR IndexStart or SOFR IndexEnd is not published on the associated Interest Payment Determination Date and a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, “Compounded SOFR” means, for the applicable interest period for which such index is not available, the rate of return on a daily compounded interest investment calculated in accordance with the formula for SOFR averages, and definitions required for such formula, published on the SOFR Administrator’s Website, initially located at https://www.newyorkfed.org/markets/treasury-repo-reference-rates-information. For the purposes of this provision, references in the SOFR averages compounding formula and related definitions to “calculation period” shall be replaced with “Observation Period” and the words “that is, 30-, 90-, or 180-calendar days” shall be removed. If SOFR does not so appear for any day “i” in the Observation Period, SOFRi for such day “i” shall be SOFR published in respect of the first preceding U.S. Government Securities Business Day for which SOFR was published on the SOFR Administrator’s Website.

Effect of Benchmark Transition Event

If the Company or its designee determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the relevant Reference Time in respect of any determination of the Benchmark on any date, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the Notes in respect of such determination on such date and all determinations on all subsequent dates.

In connection with the implementation of a Benchmark Replacement, the Company or its designee will have the right to make Benchmark Replacement Conforming Changes from time to time.

Any determination, decision or election that may be made by the Company or its designee pursuant to the benchmark replacement provisions described herein, including any determination with respect to tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection:

| · | will be conclusive and binding absent manifest error; |

| · | if made by the Company, will be made in its sole discretion; |

| · | if made by the Company’s designee, will be made after consultation with the Company, and such designee will not make any such determination, decision or election to which the Company objects; and |

| · | notwithstanding anything to the contrary herein or in the other documents relating to the Notes, shall become effective without consent from the holders of the Notes or any other party. |

Any determination, decision or election pursuant to the benchmark replacement provisions shall be made by the Company or its designee (which may be the Company’s affiliate) on the basis as described above. The calculation agent shall have no obligation to make, and shall have no liability with respect to, any such determination, decision or election.

Certain Defined Terms

“Benchmark” means, initially, Compounded SOFR, as such term is defined above; provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR (or the published SOFR Index used in the calculation thereof) or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by the Company or its designee as of the Benchmark Replacement Date:

| (a) | the sum of: (1) an alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark and (2) the Benchmark Replacement Adjustment; |

| (b) | the sum of: (1) the ISDA Fallback Rate and (2) the Benchmark Replacement Adjustment; or |

| (c) | the sum of: (1) the alternate rate of interest that has been selected by the Company or its designee as the replacement for the then-current Benchmark giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar denominated floating rate notes at such time and (2) the Benchmark Replacement Adjustment. |

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company or its designee as of the Benchmark Replacement Date:

| (a) | the spread adjustment (which may be a positive or negative value or zero), or method for calculating or determining such spread adjustment, that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement; |

| (b) | if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; or |

| (c) | the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company or its designee giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar denominated floating rate notes at such time. |

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definitions or interpretations of interest period, the timing and frequency of determining rates and making payments of interest, the rounding of amounts or tenors, and other administrative matters) that the Company or its designee decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company or its designee decides that adoption of any portion of such market practice is not administratively feasible or if the Company or its designee determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company or its designee determines is reasonably practicable).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark (including any daily published component used in the calculation thereof):

| (a) | in the case of clause (a) or (b) of the definition of “Benchmark Transition Event,” the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark (or such component); or |

| (b) | in the case of clause (c) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein. |

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

| (a) | a public statement or publication of information by or on behalf of the administrator of the Benchmark (or such component) announcing that such administrator has ceased or will cease to provide the Benchmark (or such component), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); |

| (b) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark (or such component), the central bank for the currency of the Benchmark (or such component), an insolvency official with jurisdiction over the administrator for the Benchmark (or such component), a resolution authority with jurisdiction over the administrator for the Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark (or such component), which states that the administrator of the Benchmark (or such component) has ceased or will cease to provide the Benchmark (or such component) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); or |

| (c) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative. |

“ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.