UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2025

Commission File Number: 001-41794

Aris Mining Corporation

(Translation of registrant’s name into English)

SUITE 2400 - 1021 WEST HASTINGS ST., VANCOUVER, BC, CANADA V6E 0C3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURES

| ARIS MINING CORPORATION | ||

| By: | (s) Ashley Baker | |

| Ashley Baker | ||

| General Counsel and Corporate Secretary | ||

Date: October 28, 2025

EXHIBIT INDEX

See the Exhibits listed below.

| Exhibit Number | Description |

| 99.1 | NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana, dated October 28, 2025 |

Exhibit 99.1

NI 43-101 Technical Report

Preliminary Economic Assessment for the Toroparu Project

Cuyuni-Mazaruni Region, Guyana

|

|

|

|

Prepared by:

Vaughn Duke, Pr.Eng.

Jan Eklund, P.E.

Pamela De Mark, P.Geo.

Prepared for:

Aris Mining Corporation

1021 West Hastings Street

Suite 2400

Vancouver BC V6E 0C3

Canada

Effective Date: October 21, 2025

Report Date: October 28, 2025

NI 43-101 Technical Report Preliminary economic assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana.

Forward looking information

This technical report may contain or incorporate by reference information that constitutes “forward-looking information” or “forward-looking statements” (collectively, forward-looking information) within the meaning of the applicable securities legislation. All statements, other than statements of historical fact, contained or incorporated by reference in this technical report including, but not limited to, statements related to those items listed below, constitute forward-looking information. Forward-looking information involves known and unknown risks, uncertainties, and other factors that may cause the actual results, performance or achievements of Aris Mining to be materially different from the forward-looking information contained herein. When used in this technical report, such information uses words such as “aims”, “anticipates”, “assumes”, “believes”, “budget”, “committed”, “continue”, “plans”, “project”, “endeavors”, “ensures”, “estimates”, “expects”, “focus”, “forecasts”, “forward”, “guidance”, “intends”, “likely”, “opportunity”, “outlook”, “pending”, “possible”, “potentially”, “predicts”, “proposed”, “scheduled”, “seeks”, “strives”, “targets” or variations of such words and phrases or statements that certain actions, events or results “can”, “could”, “generally”, “may”, “might”, “should”, “will” or “would” occur or be achieved and any other similar terminology.

The forward-looking information contained herein reflects current expectations regarding future events and operating performance and speaks only as of the date of this technical report. Generally, forward-looking information involves significant risks and uncertainties; therefore, it should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved. Undue reliance should not be placed on such statements. A number of factors could cause the actual results to differ materially from the results discussed in the forward-looking information. Although the forward-looking information is based on what management of Aris Mining believes are reasonable assumptions, Aris Mining cannot assure readers that actual results will be consistent with the forward-looking information.

This technical report includes forward-looking information pertaining to, among other factors, the following: the projections, assumptions and estimates related to the Project, including, without limitation, those relating to development, capital and operating costs, production, grade, recoveries, metal prices, life of mine, mine sequencing, economic assumptions such as capital expenditures, cash flow and revenue, mine design, permitting and licensing, mining techniques and processes, timing of estimated production, equipment, staffing, emissions, use of land, estimates of mineral resources, use of energy storage technologies, the timing and expectations for other future studies, the operation of Aris Mining, the development and future operation of the Project, and the ability to secure permits for the Project.

Forward-looking information is based upon a number of estimates and assumptions that, while considered reasonable by Aris Mining as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. With respect to forward-looking information contained herein, the assumptions made by Aris Mining include but are not limited to:

| · | the environmental liabilities to which the Project is subject; |

| · | political developments in any jurisdiction in which Aris Mining operates being consistent with Aris Mining’s current expectations; |

| · | the validity of its existing title to the Property and mineral claims; |

| · | Aris Mining’s ability to maintain surface rights and legal access to the Property and mineral claims; |

| · | experts retained by Aris Mining, technical and otherwise, being appropriately reputable and qualified; |

| · | the viability, economically and otherwise, of developing the Project; |

| · | Aris Mining’s ability to obtain qualified staff and equipment in a timely and cost-efficient manner to meet Aris Mining’s demand; and |

| · | the impact of acquisitions, dispositions, suspensions or delays on Aris Mining’s business. |

Forward-looking information is based on current expectations, estimates and projections that involve a number of risks which could cause the actual results to vary and, in some instances, to differ materially from those described in the forward-looking information contained in this technical report. These material risks include, but are not limited to:

| Effective October 21, 2025 | Page |

Aris Mining Corporation |

NI 43-101 Technical Report Preliminary economic assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana.

| · | local environmental and regulatory requirements and delays in obtaining required environmental and other licenses, including delays associated with local communities and indigenous peoples; |

| · | changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada or Guyana; |

| · | uncertainties and hazards associated with gold exploration, development and mining, including but not limited to, environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding, polymetallic concentrate losses, and blockades and operational stoppages; |

| · | risks associated with costs, supply chain disruptions, and financial risks due to changes in tariffs, trade policies, international trade disputes, or regulatory shifts; |

| · | economic and political risks associated with operating in foreign jurisdictions, including emerging country risks, exchange controls, expropriation risks, political instability and corruption; |

| · | risks associated with capital and operating cost estimates; |

| · | dependence of operations on construction and maintenance of adequate infrastructure; |

| · | fluctuations in foreign exchange or interest rates and stock market volatility; |

| · | operational and technical problems; |

| · | Aris Mining’s ability to maintain good relations with employees and contractors; |

| · | reliance on key personnel; |

| · | competition for, among other things, capital, and the acquisition of mining properties and undeveloped lands; |

| · | uncertainties relating to title to property and mineral resource and mineral reserve estimates; |

| · | risks associated with acquisitions and integration; |

| · | risks associated with Aris Mining’s ability to meet its financial obligations as they fall due; |

| · | volatility in the price of salable metal or certain other commodities relevant to Aris Mining’s operations, such as diesel fuel and electricity; |

| · | risks that Aris Mining’s actual production may be less than is currently estimated; |

| · | risks associated with servicing Aris Mining’s indebtedness and additional funding requirements for exploration, operational programs or expansion properties, as well as to complete any large scale development projects; |

| · | risks associated with general economic factors, including ongoing economic conditions, investor sentiment, market accessibility and market perception; |

| · | changes in the accessibility and availability of insurance for mining operations and property; |

| · | environmental, sustainability and governance practices and performance; |

| · | risks associated with climate change; |

| · | risks associated with the reliance on experts outside of Canada; |

| · | costs associated with the decommissioning of Aris Mining’s mines and exploration properties; |

| · | potential conflicts of interest among the directors of Aris Mining; |

| · | uncertainties relating to the enforcement of civil labilities and service of process outside of Canada; |

| · | risks associated with keeping adequate cyber-security measures; |

| · | risks associated with operating a joint venture; and |

| · | other factors further discussed in the section entitled "Risk Factors" in Aris Mining’s Annual Information Form for the year ended December 31, 2024 which is available on Aris Mining’s website at www.aris-mining.com, on SEDAR+ at www.sedarplus.ca and included as part of Aris Mining’s Annual Report on Form 40-F, filed with the SEC at www.sec.gov. |

Readers are cautioned that the foregoing lists of factors are not exhaustive. There can be no assurance that forward-looking information will prove to be accurate. Forward-looking information is provided for the purpose of providing information about management’s expectations and plans relating to the future. The forward-looking information included in this technical report is qualified by these cautionary statements and those made in Aris Mining’s other filings with the securities regulators of Canada including, but not limited to, the cautionary statements made in the “Risks and Uncertainties” section of Aris Mining’s Management’s Discussion and Analysis for the three and six months ended June 30, 2025 which is available on Aris Mining’s website at www.aris-mining.com, on SEDAR+ at www.sedarplus.ca and on Aris Mining’s profile with the SEC at www.sec.gov.

| Effective October 21, 2025 | Page |

Aris Mining Corporation |

NI 43-101 Technical Report Preliminary economic assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana.

The forward-looking information contained herein is made as of the date of this technical report and Aris Mining assumes no obligations to update or revise it to reflect new events or circumstances, other than as required by applicable securities laws.

Non-GAAP financial measures

This technical report refers to a number of non-GAAP financial measures, which are not measures recognized under International Financial Reporting Standards (IFRS) and do not have a standardized meaning prescribed by IFRS. These non-GAAP financial measures described below do not have standardized meanings under IFRS, may differ from those used by other issuers, and may not be comparable to similar financial measures reported by other issuers. Accordingly, these measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Cash costs – Cash cost and cash cost per ounce ($ per oz) are a common financial performance measure and ratio in the mining industry; however, they have no standard meaning under IFRS. Cash cost ($ per oz) is calculated by dividing total cash costs by the number of gold ounces projected to be produced on a payable basis.

All-in sustaining costs (AISC) – AISC and AISC ($ per oz) sold are a common financial performance measure and ratio in the mining industry; however, they have no standard meaning under IFRS. AISC is calculated by dividing AISC by the number of gold ounces projected to be produced on a payable basis.

Earnings before interest, taxes, depreciation and amortization (EBITDA) – EBITDA is a common financial performance measure in the mining industry; however, it has no standard meaning under IFRS. EBITDA represents earnings before interest, income taxes and depreciation, depletion and amortization.

| Effective October 21, 2025 | Page |

Aris Mining Corporation |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

Contents

| 1 Summary | 11 |

| 1.1 Introduction | 11 |

| 1.2 Property description, location, and access | 13 |

| 1.2.1 Location and access | 13 |

| 1.2.2 Mineral tenure, Aris Mining’s interest, surface rights, and obligations | 13 |

| 1.2.3 Agreements and encumbrances | 14 |

| 1.2.4 Royalties | 14 |

| 1.2.5 Significant factors and risks | 15 |

| 1.3 History | 15 |

| 1.4 Geological setting, mineralization, and deposit types | 16 |

| 1.4.1 Regional, local, and property geology | 16 |

| 1.4.2 Mineralization | 16 |

| 1.4.3 Deposit types | 17 |

| 1.5 Exploration | 17 |

| 1.6 Drilling | 17 |

| 1.7 Sampling, analysis, and data verification | 18 |

| 1.7.1 Sample preparation and security measures | 18 |

| 1.7.2 Quality assurance and quality control | 18 |

| 1.7.3 Analytical procedures | 18 |

| 1.7.4 Data verification | 19 |

| 1.8 Mineral processing and metallurgical testing | 19 |

| 1.8.1 Testwork history | 19 |

| 1.8.2 Mineralogical testwork | 20 |

| 1.8.3 Comminution testwork | 20 |

| 1.8.4 Flotation, cyanidation, and gravity recovery testwork | 20 |

| 1.8.5 Metallurgical recovery | 20 |

| 1.8.6 Deleterious elements | 20 |

| 1.9 Mineral resource estimate | 20 |

| 1.10 Mining operations | 21 |

| 1.11 Processing and recovery operations | 22 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 1.12 Infrastructure, permitting, and compliance activities | 22 |

| 1.12.1 Infrastructure | 23 |

| 1.12.2 Tailings management facility | 23 |

| 1.12.3 Waste rock management facilities | 25 |

| 1.12.4 Water sources and management | 25 |

| 1.12.5 Offsite logistics | 26 |

| 1.12.6 Power | 26 |

| 1.12.7 Environmental factors | 26 |

| 1.12.8 Permitting factors | 28 |

| 1.12.9 Social or community factors | 28 |

| 1.13 Capital and operating costs | 29 |

| 1.13.1 Capital cost estimates | 29 |

| 1.13.2 Operating cost estimates | 30 |

| 1.14 Economic analysis | 31 |

| 1.15 Exploration, development, and production | 34 |

| 1.16 Conclusions | 34 |

| 1.17 Recommendations | 34 |

| 1.17.1 Drilling recommendations | 34 |

| 1.17.2 Mineral processing and metallurgical testing recommendations | 34 |

| 1.17.3 Mining recommendations | 35 |

| 1.17.4 Surface infrastructure recommendations | 37 |

| 1.17.5 Tailings management facility recommendations | 37 |

| 1.17.6 Environmental recommendations | 38 |

| 2 Introduction | 39 |

| 2.1 Issuer and purpose of the technical report | 39 |

| 2.2 Source information | 39 |

| 2.3 Qualified persons and personal property inspections | 39 |

| 2.4 Currencies, units, and coordinate system | 40 |

| 3 Reliance on other experts | 41 |

| 4 Property description and location | 42 |

| 4.1 Property location | 42 |

| 4.2 Mineral tenure and Aris Mining’s interest | 42 |

| 4.3 Royalties, agreements, and encumbrances | 43 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 4.3.1 The Alphonso Joint Venture | 43 |

| 4.3.2 The Godette Joint Venture | 44 |

| 4.3.3 The Toroparu Precious Metals Purchase Agreement (the Toroparu PMPA) | 44 |

| 4.3.4 The Consulting Agreement | 44 |

| 4.3.5 Royalties | 45 |

| 4.4 Environmental liabilities | 45 |

| 4.5 Permits | 45 |

| 4.6 Significant factors and risks | 45 |

| 5 Accessibility, climate, local resources, infrastructure, and physiography | 46 |

| 5.1 Topography, elevation, vegetation, and climate | 46 |

| 5.2 Property access, transport, population centres, and mining personnel | 46 |

| 5.3 Surface rights | 46 |

| 5.4 Infrastructure | 47 |

| 5.5 Power and water | 47 |

| 6 History | 48 |

| 6.1 Early work | 48 |

| 6.2 ETK – 1999 to 2009 | 48 |

| 6.3 Sandspring – 2010 to 2021 | 48 |

| 6.4 GCM Mining (renamed to Aris Mining) – 2021 to present | 50 |

| 6.5 Historical mineral resource and mineral reserve estimates | 50 |

| 6.6 Past production | 50 |

| 7 Geological setting and mineralization | 51 |

| 7.1 Regional geology | 51 |

| 7.2 Local geology | 51 |

| 7.3 Property geology | 53 |

| 7.4 Mineralization and alteration | 54 |

| 7.5 Structure | 56 |

| 8 Deposit types | 57 |

| 9 Exploration | 58 |

| 9.1 Geological mapping | 58 |

| 9.2 Surface sampling | 58 |

| 9.3 Geophysics | 59 |

| 10 Drilling | 60 |

| 10.1 Drilling summary | 60 |

| 10.2 Drilling procedures | 62 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 10.2.1 Drillhole collar and downhole surveys | 62 |

| 10.2.2 Diamond drilling procedures | 62 |

| 10.2.3 Geological logging | 62 |

| 10.2.4 Core recovery | 62 |

| 10.2.5 Reverse circulation drilling procedures | 62 |

| 10.3 Recommendations | 63 |

| 10.4 Material impact on the accuracy and reliability of drilling results | 63 |

| 11 Sample preparation, analysis, and security | 64 |

| 11.1 Introduction | 64 |

| 11.2 Core sampling and security | 64 |

| 11.3 Laboratory sample preparation procedures and analytical methods | 64 |

| 11.4 Quality assurance and quality control procedures | 65 |

| 11.5 Bulk density | 65 |

| 11.6 Material impact on the accuracy and reliability of sample data | 65 |

| 12 Data verification | 66 |

| 12.1 Geology data reviews | 66 |

| 12.2 Metallurgical and mineral processing data reviews | 66 |

| 12.3 Mining data reviews | 66 |

| 13 Mineral processing and metallurgical testing | 67 |

| 13.1 Introduction | 67 |

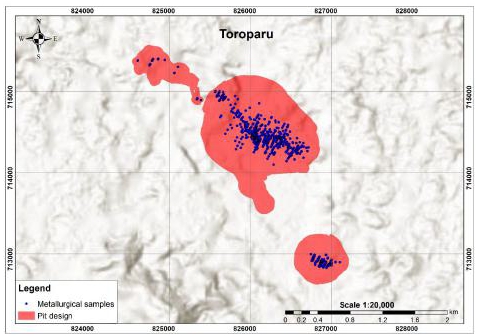

| 13.2 Samples | 67 |

| 13.3 Mineralogy, gold deportment, and liberation studies | 68 |

| 13.4 Comminution | 69 |

| 13.4.1 Toroparu | 69 |

| 13.4.2 Sona Hill | 69 |

| 13.5 Flotation, cyanidation, and gravity recovery | 69 |

| 13.5.1 Toroparu | 69 |

| 13.5.2 Sona Hill | 71 |

| 13.6 Detoxification | 71 |

| 13.7 Metallurgical recovery | 71 |

| 13.8 Deleterious elements | 72 |

| 13.9 Conclusions | 72 |

| 13.10 Recommendations | 73 |

| 14 Mineral resource estimates | 75 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 14.1 Disclosure | 75 |

| 14.2 Available data | 75 |

| 14.3 Geological interpretation | 75 |

| 14.4 Mineralization interpretation | 75 |

| 14.5 Statistics, compositing, and treatment of extreme grades | 75 |

| 14.6 Block model | 77 |

| 14.7 Composite search and interpolation parameters | 77 |

| 14.8 Estimation validation | 77 |

| 14.9 Mineral resource classification | 78 |

| 14.10 Cut-off grade and mineral resource constraint | 78 |

| 14.11 Mineral resource tabulation | 79 |

| 15 Mineral reserve estimates | 80 |

| 16 Mining methods | 81 |

| 16.1 Introduction | 81 |

| 16.2 Geotechnical parameters | 81 |

| 16.3 Hydrogeology, hydrology, and mine water management | 82 |

| 16.3.1 Site description | 82 |

| 16.3.2 Hydrogeology | 82 |

| 16.3.3 Hydrology and mine water management | 83 |

| 16.4 Open pit optimization | 84 |

| 16.5 Open pit design | 85 |

| 16.6 Mine planning and schedule | 87 |

| 16.7 Material handling | 89 |

| 16.8 Mine equipment | 89 |

| 16.9 Mine personnel | 90 |

| 16.10 Recommendations | 92 |

| 17 Recovery methods | 94 |

| 17.1 Introduction | 94 |

| 17.2 Primary run of mine handling and crushing | 94 |

| 17.3 Grinding circuit | 94 |

| 17.4 Gold recovery circuits | 95 |

| 17.4.1 Gravity concentration and intensive leach circuit | 95 |

| 17.4.2 Pre-leach thickening circuit | 95 |

| 17.4.3 Carbon in leach circuit | 95 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 17.4.4 Flotation circuit | 96 |

| 17.5 Reagents and consumables | 97 |

| 17.6 Power, water, and air | 97 |

| 17.7 Conclusions | 98 |

| 17.8 Recommendations | 98 |

| 18 Project infrastructure | 100 |

| 18.1 Introduction | 100 |

| 18.2 Site access | 100 |

| 18.3 Accommodation camp and site buildings | 101 |

| 18.4 Mine support facilities | 101 |

| 18.5 Process support facilities | 102 |

| 18.6 Tailings management facilities | 102 |

| 18.6.1 Site description | 102 |

| 18.6.2 Site investigations and engineering analyses | 102 |

| 18.6.3 Design | 102 |

| 18.6.4 Construction and tailings placement | 103 |

| 18.6.5 Tailings geochemical characterization | 103 |

| 18.6.6 Water management | 103 |

| 18.6.7 Monitoring | 104 |

| 18.6.8 Closure and reclamation | 104 |

| 18.7 Waste rock management facilities | 105 |

| 18.8 Stormwater management | 105 |

| 18.9 Utilities | 105 |

| 18.10 On site roads | 106 |

| 18.11 Off site logistics | 106 |

| 18.12 Recommendations | 107 |

| 19 Market studies and contracts | 109 |

| 19.1 Market studies | 109 |

| 19.1.1 Indicative commercial terms for the copper concentrates | 109 |

| 19.2 Contracts | 109 |

| 19.3 Review and confirmation by the qualified person | 109 |

| 20 Environmental studies, permitting, and social or community impact | 110 |

| 20.1 Environmental setting, studies, and issues | 110 |

| 20.1.1 Environmental setting | 110 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 20.1.2 Environmental studies | 110 |

| 20.1.3 Environmental issues | 111 |

| 20.1.4 Environmental management approach | 111 |

| 20.2 Social setting and community requirements | 111 |

| 20.2.1 Social setting | 111 |

| 20.2.2 Community engagement | 111 |

| 20.2.3 Community employment, diversity, and socioeconomic opportunities | 112 |

| 20.3 Tailings and waste rock management facilities | 112 |

| 20.4 Site monitoring | 113 |

| 20.5 Water management | 113 |

| 20.6 Permitting requirements | 114 |

| 20.7 Mine closure requirements | 114 |

| 20.8 Recommendations | 115 |

| 21 Capital and operating costs | 116 |

| 21.1 Introduction | 116 |

| 21.2 Contingency and treatment of uncertainty | 116 |

| 21.3 Capital costs | 116 |

| 21.3.1 Mining capital costs | 116 |

| 21.3.2 Processing capital costs | 117 |

| 21.3.3 Capital cost summary | 117 |

| 21.4 Operating costs | 118 |

| 21.4.1 Mining operating costs | 118 |

| 21.4.2 Processing operating costs | 119 |

| 21.4.3 G&A operating costs | 120 |

| 21.4.4 Operating cost summary | 120 |

| 22 Economic analysis | 123 |

| 22.1 Estimate methodology | 123 |

| 22.2 Project schedule | 123 |

| 22.3 Taxes, royalties, and the Toroparu PMPA | 127 |

| 22.4 Marketing assumptions | 127 |

| 22.5 Commodity prices and gross revenue | 127 |

| 22.6 Economic analysis results | 130 |

| 22.7 Sensitivity analysis | 134 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 22.8 Conclusions | 135 |

| 23 Other relevant data and information | 136 |

| 24 Adjacent properties | 137 |

| 25 Interpretation and conclusions | 138 |

| 26 Recommendations | 139 |

| 26.1 Drilling recommendations | 139 |

| 26.2 Mineral processing and metallurgical testing recommendations | 139 |

| 26.3 Mining recommendations | 140 |

| 26.4 Surface infrastructure recommendations | 141 |

| 26.5 Tailings management facility recommendations | 142 |

| 26.6 Environmental recommendations | 142 |

| 27 References | 144 |

| 28 Date, signatures, and certificates of qualified persons | 145 |

| Appendix A – Toroparu mineral titles | 148 |

| Table 1-1 | Sensitivity of key economic indicators to gold price | 12 |

| Table 1-2 | Upper Puruni Concession list | 13 |

| Table 1-3 | Toroparu mineral resources effective October 21, 2025 | 21 |

| Table 1-4 | Life of mine production | 22 |

| Table 1-5 | Estimated initial capital costs | 29 |

| Table 1-6 | Estimated deferred and sustaining capital costs, including contingency | 29 |

| Table 1-7 | Estimated operating costs | 30 |

| Table 1-8 | Estimated life of mine unit operating costs | 30 |

| Table 1-9 | Total mine production | 32 |

| Table 1-10 | Total metal production | 32 |

| Table 1-11 | Economic evaluation results | 32 |

| Table 1-12 | Sensitivity of NPV to discount rate | 33 |

| Table 1-13 | Sensitivity of key economic indicators to gold price | 33 |

| Table 2-1 | Responsibilities of each Qualified Person | 39 |

| Table 4-1 | Upper Puruni Concession list | 43 |

| Table 10-1 | Project drill summary table | 60 |

| Table 13-1 | Proposed processing parameters | 72 |

| Table 14-1 | Composited and top cut composited data statistics | 75 |

| Table 14-2 | Bulk density values applied to the block model | 77 |

| Table 14-3 | Mineral resource cut-off grades | 78 |

| Table 14-4 | Toroparu mineral resources effective October 21, 2025 | 79 |

| Table 16-1 | Recommended pit slope configurations | 81 |

| Table 16-2 | Pit optimization parameters | 84 |

| Table 16-3 | Life of mine production schedule | 88 |

| Table 16-4 | Fleet requirements | 89 |

| Table 16-5 | Labour requirements | 90 |

| Table 21-1 | Estimated initial capital costs | 117 |

| Table 21-2 | Estimated deferred and sustaining capital costs, including contingency | 118 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| Table 21-3 | Estimated capital expenditure schedule | 118 |

| Table 21-4 | Estimated capital expenditure per depreciation class | 118 |

| Table 21-5 | Estimated operating costs | 120 |

| Table 21-6 | Estimated life of mine unit operating costs | 121 |

| Table 21-7 | Estimated life of mine operating cost schedule | 122 |

| Table 22-1 | Total mine production | 124 |

| Table 22-2 | Total metal production | 124 |

| Table 22-3 | Mining and processing schedule | 126 |

| Table 22-4 | Copper concentrate marketing terms | 127 |

| Table 22-5 Annual payable metals, gold revenue, by-product credits, and treatment and refining charges, penalties, and freight | 129 | |

| Table 22-6 | Economic evaluation results | 130 |

| Table 22-7 | Sensitivity of NPV to discount rate | 131 |

| Table 22-8 | Annual after tax cash flow schedule | 132 |

| Table 22-9 | Sensitivity of key economic indicators to gold price | 134 |

| Table 22-10 | Sensitivity of NPV5% to operating and capital costs and gold price | 135 |

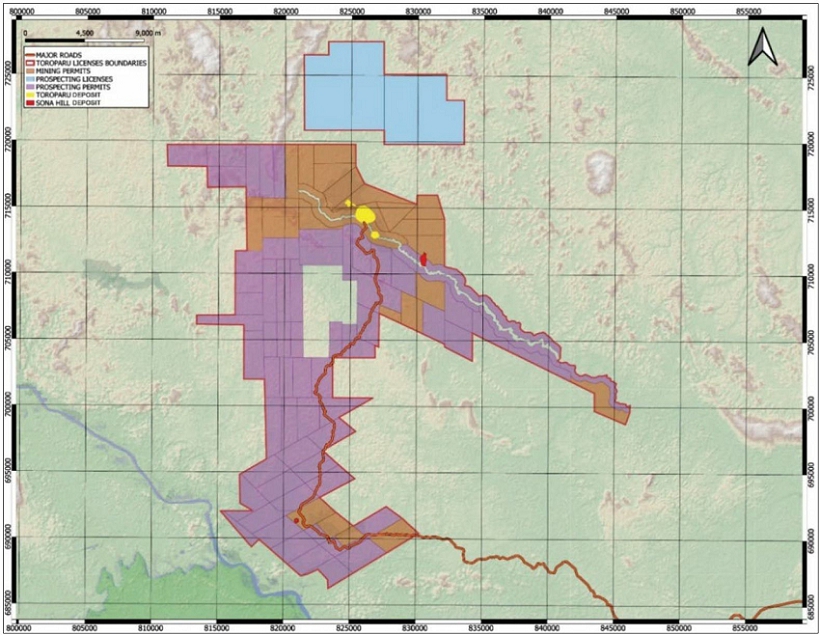

| Figure 4-1 | Toroparu location map | 42 |

| Figure 4-2 | Map of Property titles | 43 |

| Figure 7-1 | Regional geology map | 52 |

| Figure 7-2 | Local geology map | 52 |

| Figure 7-3 | Aeromagnetic data interpretation plan | 53 |

| Figure 7-4 | Property geology map | 54 |

| Figure 7-5 | Plan of Property gold and copper mineralization | 55 |

| Figure 7-6 | Schematic structural model for Toroparu | 56 |

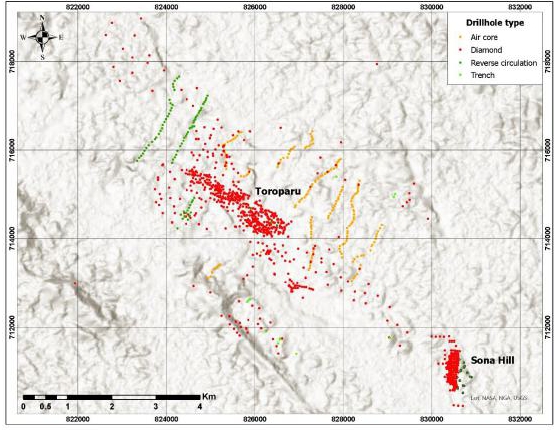

| Figure 10-1 | Plan of Project drill collar locations | 61 |

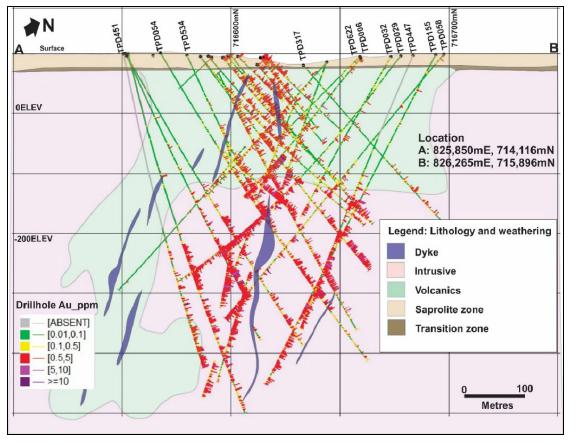

| Figure 10-2 | Typical cross section of drilling at the Project | 61 |

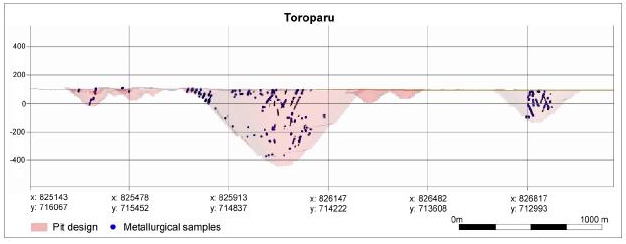

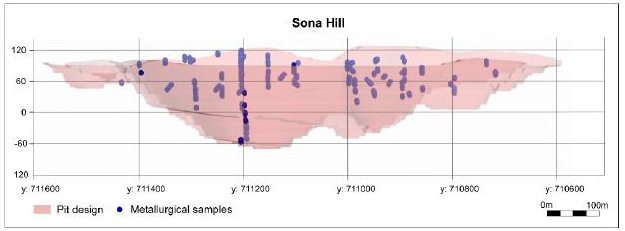

| Figure 13-1 | Location of metallurgical samples within Project pit designs | 67 |

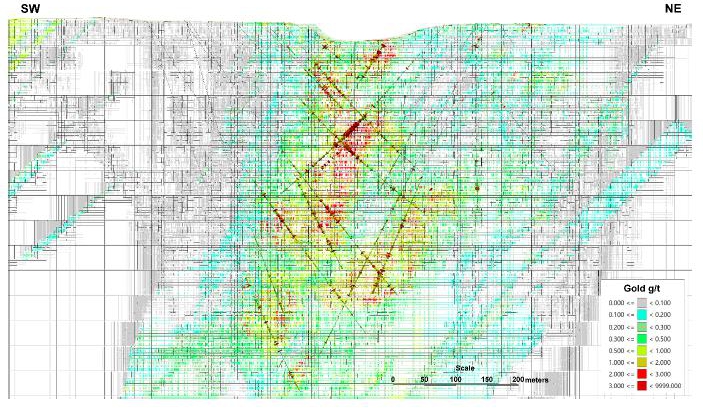

| Figure 14-1 | Example cross section of Toroparu gold estimate | 78 |

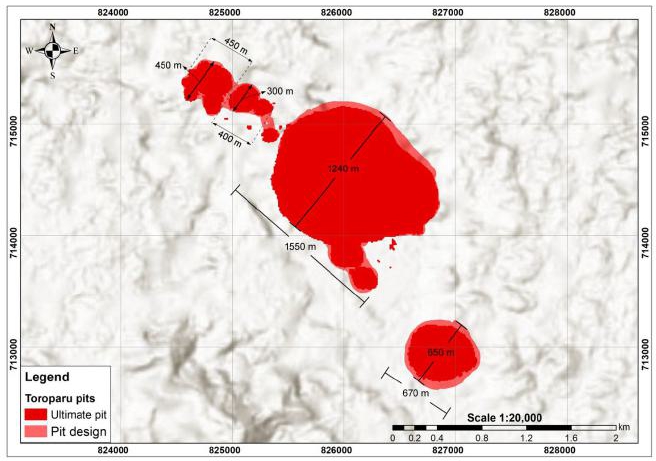

| Figure 16-1 | Plan and long sections of open pit design and optimized pits | 86 |

| Figure 18-1 | Project infrastructure plan | 100 |

| Figure 22-1 | Annual tonnes mined | 124 |

| Figure 22-2 | Annual processed grade and gold produced | 125 |

| Figure 22-3 | Sensitivity of NPV5% to operating and capital costs and gold price | 134 |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 1 | Summary |

| 1.1 | Introduction |

This technical report has been prepared for Aris Mining Corporation (Aris Mining) in compliance with the disclosure requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101) to disclose material updates to the Toroparu Project (Toroparu, the Project, or the Property) resulting from updated mineral resource estimates and the results of a preliminary economic assessment (PEA).

The Project contains two gold deposits with mineral resources, referred to as the Toroparu deposit and the Sona Hill deposit (collectively Toroparu unless otherwise indicated). The Sona Hill deposit is located approximately 5 km to the southeast of the Toroparu deposit. The Project and adjacent properties are collectively known as the Upper Puruni Concessions. Toroparu is an undeveloped, PEA stage open pit gold project.

This PEA outlines a long life open pit gold mine with robust economics and low operating costs. The Project will generate significant long term benefits for Guyana.

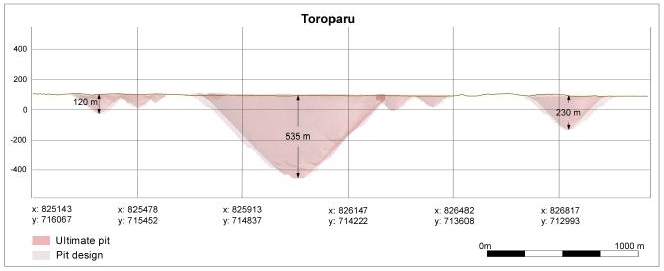

The Toroparu and Sona Hill deposits have been defined by nearly 800 drillholes. The mineralization at the main Toroparu pit has been defined over a strike length of 1.3 km, 500 m across strike, down to a depth of approximately 550 m below surface. Two smaller pits are located to the northwest and southeast of the main Toroparu pit. Sona Hill has been defined over a strike length of 950 m, 300 m across strike, down to a depth of around 200 m below surface.

A conventional open pit mining operation has been designed to mine mill feed from three pits at Toroparu and one pit at Sona Hill at a rate of 7 million tonnes per annum (Mtpa) utilizing an owner operated mining fleet.

The processing plant has been designed to separately treat surface oxidized material and underlying sulphide mill feed types on a campaign basis at a rate of 7 Mtpa using industry standard gravity concentration, carbon in leach, and flotation methods. The gravity concentrator will produce a gold and silver doré from oxide material and gold, silver, and copper doré from sulphide material. The carbon in leach circuit will produce a gold and silver doré from both oxide and sulphide material. The flotation circuit will produce a gold and silver rich copper concentrate from sulphide material at Toroparu only as Sona Hill has a low copper content. The oxide processing circuit enables stable operating conditions with predictable reagent use and minimal logistical overhead and provides a low cost, high recovery gold profile for early stage production. The operating cost for the sulphide processing operation is primarily driven by additional power and reagent requirements and high concentrate handling costs, but results in greater overall revenue at moderate incremental cost. The sulphide circuit is competitive with solid metallurgical recoveries and commercially marketable concentrate quality. Both processing routes deliver positive operating margins, confirming the economic robustness of the Project under the current design and energy assumptions. The results reinforce the scalability of the processing plant.

There is readily available water within the Project area for all aspects of the operation including mining, processing, the camp, and other activities. Water will be sourced from the Puruni River, which passes through the mining area, as well as from groundwater, rainwater, and water recycled from the processing plant and tailings management facility.

The peak workforce during Project construction is estimated at 1,763. During operations, the peak workforce is estimated at 744. The Project will target a high percentage of the workforce to be hired from within Guyana.

The Project’s expected mine life of 21.3 years is based on measured, indicated, and inferred material in the current mineral resource estimate, and there are opportunities for future mine extension if additional mineral resources are defined through continued exploration. The production profile is supported by a consistent milled grade ranging from 1.0 to 1.3 grams per tonne (g/t) gold. The long, steady production profile highlights the grade continuity of the deposit. In addition, the optimized pits and designs were constrained using a gold price assumption of $1,950 per ounce and a cut-off grade of 0.45 g/t Au. This conservative approach indicates meaningful upside potential for resource and mine-life expansion in a higher gold price environment.

Over its life, the Project is expected to produce doré and copper concentrates containing 5.0 million ounces (Moz) of gold, 4.9 Moz of silver, and 260 million pounds (Mlb) of copper. The average annual gold production is estimated at 235 thousand ounces (koz) over the mine life.

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

The total estimated upfront capital expenditure is $820.3 million, including pre-production costs and $96 million of contingency. This reflects a $38 million initial capital reduction compared to a mining fleet purchase scenario, as the $73 million cost of the initial mining fleet is reduced to approximately $35 million of upfront and construction period lease payments. The strategy is to maintain access to modern, well supported equipment under comprehensive maintenance and parts supply programs over the long +20 year mine life. In addition, the Project has a historic precious metals purchase agreement (PMPA) with Wheaton Precious Metals International Ltd (WPMI) for an additional $138 million of committed funding, further reducing upfront funding requirements to $682 million.

The original PMPA was entered into in 2013 and amended in 2015, when the Project was owned by Sandspring Resources Ltd. (Sandspring), a single-asset junior developer. Under this agreement, WPMI may elect to provide $138 million in construction funding following completion of a full development plan, in exchange for the right to purchase 10% of the Project’s gold production and 50% of its silver production at fixed prices of $400 per ounce of gold and $3.90 per ounce of silver, with both prices subject to escalation beginning on the fourth anniversary of commercial production. The parties intend to explore opportunities for amending the terms of the agreement to align with the updated Project parameters.

Plant throughput is expected to ramp up quickly following mechanical completion and commissioning, supported by a large stockpile of pre-strip and pre-production mill feed accumulated during the construction period. By the end of the three year construction phase, approximately 6.1 million tonnes of mineralized material are expected to be stockpiled adjacent to the process plant. This stockpile represents the majority of the first year’s mill feed and provides operational flexibility during the start up period.

The pre-production stockpile enables a low risk transition into operations, ensuring consistent mill feed as mining advances and allowing for controlled optimization of the crushing and processing circuits and confirmation of metallurgical recoveries of near surface mill feed.

With this strategy, plant throughput is forecast to reach nameplate capacity of 7.0 Mtpa within the first operating year, maintaining steady state production thereafter. The approach minimizes start up risk, smooths working capital requirements, and enhances the reliability of early year cashflow projections presented in the economic analysis.

The cumulative after tax net cash flow is estimated at $3.9 billion, including all initial capital costs, PMPA financing, pre-production costs, sustaining capital costs, closure costs, and contingency. At the base case assumption of $3,000 per ounce of gold, the life of mine average cash costs per ounce of gold are estimated at $826 and all in sustaining costs (AISC) per ounce of gold are estimated at $1,289. The project has an after tax net present value at a 5% discount rate (NPV5%) of $1.8 billion, an internal rate of return (IRR) of 25.2%, and a pay back period of 3.0 years.

The Project is estimated to contribute $2.2 billion in income taxes and $1.2 billion in royalty payments to the Guyanese government.

The sensitivity analysis shows that at higher gold prices, returns increase substantially beyond the attractive levels of the base case scenario, as shown in Table 1-1.

| Table 1-1 | Sensitivity of key economic indicators to gold price |

| Gold price | $2,400/oz | $2,600/oz | $2,800/oz | $3,000/oz Base case |

$3,200/oz | $3,400/oz | $3,600/oz |

| Indicator | |||||||

| After-tax NPV5% ($M) | 944 | 1,231 | 1,518 | 1,805 | 2,091 | 2,378 | 2,664 |

| After-tax IRR (%) | 16.6 | 19.6 | 22.5 | 25.2 | 27.7 | 30.2 | 32.6 |

| Payback period (years) | 4.4 | 3.7 | 3.3 | 3.0 | 2.7 | 2.5 | 2.3 |

All dollar amounts presented in this technical report are expressed in U.S. dollars, unless otherwise indicated.

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 1.2 | Property description, location, and access |

| 1.2.1 | Location and access |

The Project is located in the Cuyuni-Mazaruni Region of Guyana, approximately 215 kilometres (km) southwest of the capital city of Georgetown.

Road access to the Property from Georgetown is via 110 km of paved highway south to the town of Linden, then 18 km of public gravel road to Bartica, a ferry crossing of the Essequibo River at Bartica to Itaballi, then 200 km of public gravel road to the south gate at Toroparu Junction, then 25 km north to the Project site. Overland travel time is approximately 10 to 12 hours in the dry season.

The Project can also be accessed via a one hour, 220 km charter flight from Eugene Correia International (Ogle) Airport in Georgetown to the 650 m long unpaved airstrip at the Project, which can accommodate Cessna Caravan flights holding up to 13 persons or 1,200 kg of cargo. The airstrip is licensed and certified by the Guyana Aviation Agency.

Heavy equipment and cargo may be transported by small ocean-going vessels and barges on the Essequibo River to Itaballi, then loaded on to trucks for the 230 km overland journey to Toroparu, crossing the Puruni River at the town of Puruni Landing, located approximately 60 km from Itaballi, on a company operated 40 tonne ferry barge.

| 1.2.2 | Mineral tenure, Aris Mining’s interest, surface rights, and obligations |

The Project is 100% owned by Aris Mining through its indirect, wholly owned subsidiary, ETK, Inc. (ETK).

A summary of the Upper Puruni Concessions is provided in Table 1-1. Mineral properties in Guyana allow for four scales of operation. ETK holds or has applied for each of the four types of titles, including Mining Permits (MPs), Prospecting Permits Medium Scale (PPMSs), and Small Scale Claims, and two open Prospecting Licenses (PLs) applications which have been with the Guyana Geology and Mines Commission (GGMC) for approval since February 2020. Rentals on the claims and permits controlled by ETK are payable annually by the expiry date of each claim and permit. A work performance bond equal to 10% of the approved budget is required for mining licenses.

The four scales are defined as follows:

| · | Small Scale Claim licenses are 460 by 245 metres (m) or a river claim consisting of one mile of a navigable river. The cost is $1,000 Guyanese dollars per year for a land claim and $2,000 Guyanese dollars per year for a river claim. |

| · | MPs for medium scale mining operations and PPMSs cover between 150 and 1,200 acres each and are restricted to Guyanese ownership or by a joint venture between a Guyanese and a foreigner, whereby the two parties jointly develop the Property. The rental rates for each of the MPs are $1.00 per acre per year and the rental rates for each of the PPMSs are $0.25 per acre for the first year with an increment of $0.10 per acre for every additional year. |

| · | PLs cover between 500 and 12,800 acres and are granted to local or foreign companies. Rental rates for PLs are $0.50 per acre for the first year, $0.60 per acre for the second year, and $1.00 per acre for the third year with an increase of $0.50 per acre for the fourth and fifth years. Large areas for geological surveys are granted as Permission for Geological and Geophysical Surveys with the objective of applying for PLs over the favourable ground. |

| · | Mining Licenses are granted for large scale mining operations and cost $5.00 per acre per year. |

| Table 1-2 | Upper Puruni Concession list |

| Title Description | Number | Area (Acres) |

| Mining Permits | 26 | 25,402.0 |

| Prospecting Permits Medium Scale | 65 | 63,256.0 |

| Small Scale Claims | 16 | 202.5 |

| Prospecting License Applications | 2 | 16,824.0 |

| Total | 109 | 105,684.5 |

ETK is the beneficial holder of all right, title and interest in the lands subject to the Project and therefore also has all surface rights.

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 1.2.3 | Agreements and encumbrances |

The Toroparu deposit is located on property that was originally subject to the Mining Joint Venture Agreement (as defined herein) dated effective August 1, 1999, and as amended and restated in 2008 by the A&R Joint Venture Agreement (as defined herein).

In March 2020, ETK exercised its option under the A&R Joint Venture Agreement to purchase all of Mr. Alfro Alphonso’s right, title and interest to the claims and permits on the Property listed in Appendix A hereto and all minerals and mineral deposits, ores, concentrates, metals, materials, tailings, dumps and mine wastes, in, on and under the claims (the Option Interest) excepting and reserving only to Mr. Alphonso the right to conduct the alluvial mining activities on certain lands not associated with the Project, all as more particularly described in the A&R Joint Venture Agreement, and the use by Mr. Alphonso of certain roads and an airstrip constructed by ETK. ETK paid $20 million to exercise the option to acquire the Option Interest and extinguish its obligations to make further payments under the A&R.

In connection with the option exercise, Mr. Alphonso delivered to ETK a written affirmation, declaration of trust and receipt acknowledging that he hold all lands and permits subject to the A&R Joint Venture Agreement in trust for the exclusive benefit of ETK until such time that the GGMC (as defined herein) and the Minister of Natural Resources of Guyana convert certain of the Small Scale Claim licenses and Mining Permits that are subject to the A&R Joint Venture Agreement to large scale Mining Licenses, and issue the same in the name of ETK. Mr. Alphonso further acknowledged that he is obligated to take any such action as may be reasonably requested by ETK, the GGMC or the Minister of Natural Resources to complete such conversion.

The Sona Hill deposit is located on property that was originally subject to the Godette Joint Venture (as defined herein) effective April 1, 2008. The Godette Heirs remain the registered owners of four mining permits but have irrevocably contributed and committed all their right, title, and interest in the mining permits for the benefit of ETK and the Godette Joint Venture and have granted ETK the exclusive right to conduct operations until such time as the large scale mining licenses have been secured. The cost of such conversion process is the responsibility of ETK but the Godette Heirs have agreed to execute such documents and agreements and take such actions as are reasonably necessary to assist in the transition of the mining permits to large scale mining licenses.

The Toroparu PMPA refers to the Amended and Restated Precious Metals Purchase Agreement among WPMI, Aris Mining Toroparu Holdings Ltd. (formerly GoldHeart Investment Holdings Ltd. (GoldHeart)), a wholly-owned subsidiary of Aris Mining, and Aris Mining Guyana Holdings Corp. (formerly Sandspring, an indirect, wholly-owned subsidiary of Aris Mining) dated April 22, 2015.

Pursuant to the terms and conditions of the Toroparu PMPA, WPMI has agreed to purchase 10% of the gold and 50% of the silver production from the Project in exchange for cash deposits totalling $153.5 million. WPMI has made initial payments totalling $15.5 million, with the remaining $138.0 million to be paid in instalments during construction of the Project, subject to WPMI’s election to proceed following receipt of a final feasibility study for the Project, environmental study and impact assessment and other project related documents.

A consulting agreement was executed between ETK and Alphonso & Sons (A&S) on November 1,2013 (the Consulting Agreement) and which survived the exercise by ETK of the option under the A&R Joint Venture Agreement as described above. Pursuant to the consulting agreement, A&S is to be paid, commencing on the first anniversary of ETK receiving cashflow sufficient to develop and construct a conventional open pit mining and flotation and cyanide leach process operation on the Property with on-site and off-site support operations (with such cash flow to be determined in a definitive feasibility study), eight annual payments of a minimum of $1.0 million adjusted upwards in accordance with the indexing formula set out in the Consulting Agreement (to a maximum of $2.0 million), followed by five extended payments of a maximum of $1.0 million (provided the daily price of gold averaged over a twelve-month period or a calendar month period, as applicable, exceeds $1,750 per ounce) subject to downward indexation based on a formula set out in the Consulting Agreement. Under the base case gold price of $3,000 per ounce applied in this study, the aggregate amount payable to the consultant under the Consulting Agreement is estimated at $21 million and has been considered in the financial analysis.

| 1.2.4 | Royalties |

ETK executed a mineral agreement with the Government of Guyana on November 9, 2011 (the Mineral Agreement) that details all fiscal, property, import-export procedures, taxation provisions, and other related conditions for the continued

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

exploration and future mine development and operation of an open pit mine at Toroparu. The Mineral Agreement implements a two-tiered gold royalty structure of 5% of gold sales at gold prices up to $1,000 per ounce and 8% of gold sales at gold prices above $1,000 per ounce, as well as a royalty of 1.5% on sales of other valuable metals and minerals.

To the extent known, there are no other royalties, back-in rights, payments, or other agreements and or encumbrances to which the Property is subject.

| 1.2.5 | Significant factors and risks |

Aris Mining is not aware of any significant factors or risks that may affect access, title, or the right or ability to perform on-going work programs on the Property.

| 1.3 | History |

The first known gold mining in the Project area was by alluvial mining methods around 1887. Regional and local mapping was undertaken in 1950. In 1997 Mr. Alphonso began mining old tailings and river alluvium at Toroparu and by 1999 the alluvial material was mostly exhausted and work proceeded deeper into the underlying saprolite, which eventually developed into the Toroparu saprolite open pit. This operation continued until 2001.

Exploration by ETK at Toroparu began in 1999 with the Alphonso Joint Venture, which named ETK as the Project operator. Between 1999 and 2018, ETK conducted extensive auger drill sampling campaigns, geochemical and trench sampling, and geophysical surveys around the Toroparu saprolite open pit and on a regional scale. ETK conducted intermittent, seasonal test mining from saprolite at the saprolite open pit from late 2004 to early 2007. The first diamond drilling on the Property began in late 2006 and the first mineral resource estimate was prepared in 2008. In 2009, ETK conducted an initial metallurgical scoping test program on core samples from the Toroparu deposit.

On November 24, 2009, Sandspring acquired 100% of GoldHeart, which through its wholly owned subsidiary ETK held the mineral and prospecting rights to the Project and adjacent properties.

Sandspring began a diamond drilling program in 2010, conducted geophysical surveys over the Toroparu deposit and reconnaissance grids over other prospects, and completed two mineral resource estimates in 2010. In 2011, Sandspring conducted a mineral resource definition diamond drilling campaign that identified the main lithologies and controls on mineralization. Additional diamond drilling was conducted later in 2011 to explore for nearby satellite deposits. In 2011, Sandspring prepared an updated mineral resource estimate and PEA and a prefeasibility study (PFS) level pit slope design report. Other exploration work conducted by Sandspring in 2011 included a regional saprolite geochemistry sampling program, semi-regional and detailed geochemical sampling, geophysical surveys, and a light detection and ranging (LIDAR) survey. In 2012, Sandspring completed diamond drilling programs and prepared an updated mineral resource estimate and PEA. Other exploration work in 2012 included regional and detailed auger sampling, geochemical sampling surveys, and reverse circulation drilling. In 2013, Sandspring completed a mineral resource estimate and the first mineral reserve estimate for an open pit project as part of a PFS (the 2013 PFS).

On November 11, 2013, Sandspring completed a $148.5 million precious metals streaming agreement with Silver Wheaton (now WMPI), with the capital commitment representing approximately 30% of the $464 million project finance required for the Toroparu Project as determined in the 2013 PFS. The precious metals streaming agreement was subsequently amended in 2015.

Following the 2013 PFS, Sandspring continued to conduct exploration to evaluate other areas on the Property, including auger and soil sampling of regional targets and exploration diamond drilling. Diamond drillhole programs were conducted at Sona Hill in 2015, 2016, and 2018, and utilized for the first mineral resource estimate for Sona Hill in 2018. Other work at Sona Hill included geochemical sampling and geophysical surveys conducted between 2015 and 2016. Additional diamond drillholes were completed at other exploration targets in 2016 and 2018. Sandspring changed its name to Gold X Mining Corp. (Gold X) on November 29, 2019. Diamond drilling programs were undertaken in 2020 and 2021.

On June 4, 2021, Gran Colombia Mining Corp. (Gran Colombia) acquired all of the issued and outstanding shares of Gold X, and indirectly, the Project. On November 29, 2021 Gran Colombia changed its name to GCM Mining Corp (GCM Mining). GCM Mining completed an updated mineral resource estimate and PEA on the Project in 2021. GCM Mining also began pre-construction activities in 2021, undertook infill drilling, and worked with the local governmental agencies to finalize the

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

amended mining license for a large-scale mining license incorporating an open pit and underground mine operating plan as outlined in the 2021 PEA.

On September 26, 2022, Aris Gold Corporation completed a business combination with GCM Mining, and the combined entity was renamed Aris Mining. Following the business combination, Aris Mining started a re-evaluation and optimization process for the Project, reduced the previously planned construction expenditures, and undertook a new detailed structural analysis and in early 2023 prepared an updated geological model and mineral resource estimate.

None of these historical estimates and studies are considered to be current. They should not be relied on and have been superseded by the current mineral resource estimate and PEA disclosed in this technical report.

| 1.4 | Geological setting, mineralization, and deposit types |

| 1.4.1 | Regional, local, and property geology |

Regionally, the Toroparu and Sona Hill deposits are located in the Amazonian Craton of the Guiana Shield, within the northwest trending Puruni volcano-sedimentary belt, in a sequence of meta-sedimentary and meta-volcanic rocks located along the contact of a small intra-belt pluton. Other gold deposits in Guyana related to similar intrusive bodies include Aurora, located approximately 50 km to the northeast of Toroparu, Oko and Oko West, located approximately 140 km to the east of Toroparu, and Omai, located approximately 180 km to the southeast of Toroparu.

Locally, the Toroparu and Sona Hill deposits are hosted in a sequence of meta-sedimentary and meta-volcanic rocks in a greenstone belt between Proterozoic aged granitoid batholiths.

At the Property, thin, discontinuous mineralized shear zones at the Toroparu deposit are developed mainly in volcanic rocks. Higher grade, discontinuous shear zone hosted mineralization is narrow and mostly parallel to the schistosity. The main controls on mineralization are the west-northwest striking axial planar schistosity and vein swarms that are well developed in the volcanic rocks, and the folded contact between an intrusive complex and the volcanic rocks, particularly the contact of an igneous breccia that forms an important rheological contrast, similar to many other orogenic gold deposits that are strongly controlled by competency contrasts. The Toroparu deposit dips roughly 55° to the west. The Sona Hill deposit has similar controls on mineralization but strikes to the north and dips around 30° to the west.

Two dyke phases are present including hornblende porphyritic andesite dykes and dolerite dykes. Most dykes have an apparent thickness of less than 0.5 m, but some dykes up to 2.5 m thick also occur. Despite being sheared and folded, the dykes are mostly non-mineralized, although some mineralized veins occur along the contacts. Some of these dykes are cut by mineralized shear zones. The dykes are less abundant and more discontinuous at Sona Hill compared to Toroparu.

A thick, gradational, 10 to 35 m thick layer of saprolite with preserved mineralized quartz veins and veinlets, showing evidence of some gold leaching, is present at the surface at Toroparu and reaches up to 60 m thick at Sona Hill. The overburden has abundant low grade gold mineralization but little high grade.

| 1.4.2 | Mineralization |

Mineralization at the Toroparu deposit estimated as mineral resources in the main zone has a volume of around 1.3 km along strike, around 500 m across strike, and a depth of 550 m. There is a zone of mineral resources approximately 1.1 km to the southeast of the main zone with a volume of around 400 m along strike, 230 m across strike, and a depth of 250 m. There are a few other small zones of mineral resources on the order of 100 m long along strike of and parallel to the main zone. The mineralized shear zones are narrow and discontinuous. Sona Hill has a volume of around 950 m along strike, up to 300 m wide, and a depth of around 200 m. Sona Hill is characterized by a lower copper content. Both deposits are open at depth.

The main body of mineralization at Toroparu is characterized by three different vein assemblages including:

| · | gold mineralized quartz and chalcopyrite or bornite veinlets occur both in the volcanic and intrusive rocks and appear to be focused on the boundary between them, particularly within a marginal igneous breccia. Chalcopyrite and quartz are commonly coarse and intergrown. The veinlets are more abundant and thinner in the volcanic rocks, are parallel to the schistosity, and tend to have lower gold grades. The veins are less continuous in the intrusive rocks and igneous |

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| breccia but tend to be of higher gold grade and contain molybdenite. Within the intrusive rocks, the veins show an intense chlorite alteration halo. Vein swarms in the volcanic rocks are in zones up to tens of metres thick with low to medium gold grades, with scattered high grades coinciding with high chalcopyrite content. In places, the veins are folded and boudinaged, with chalcopyrite often concentrated in the boudin necks. Veins range between less than 1 mm up to a few centimetres thick. There are rare 0.4 to 0.5 m thick veins. |

| · | gold mineralized chalcopyrite only veinlets occur in the volcanic and intrusive rocks. These veinlets are up to a few millimetres thick and are strongly transposed and dismembered parallel to schistosity and are also folded. In places, chalcopyrite veinlets form a scattered network in quartz veins. |

| · | gold mineralized quartz and molybdenite veins are also present, mostly in the igneous breccia along the intrusive-volcanic contact. These veins are scattered and contain high gold grades. |

| 1.4.3 | Deposit types |

The interpretation of the deposit type at Toroparu is uncertain, with possibilities including an unusually copper rich orogenic gold deposit on the basis of the host greenschist metamorphic rocks and a strong control of mineralization due to competency contrasts, as well as a metamorphosed porphyry gold-copper deposit. Recent structural interpretation work suggests that Toroparu is not a classic lode type orogenic gold deposit and is unlikely to be a deformed porphyry deposit (Pratt and Smeraglia, 2022). A disseminated or sheeted vein type deposit can be used as a guide for exploration planning purposes.

| 1.5 | Exploration |

Exploration at the Property followed a typical progression from mapping, surface sampling and geophysical surveys to generate drilling targets, short auger drilling of the targets, and mineral resource drilling by reverse circulation and diamond drilling.

Regional and local mapping has been undertaken in phases since 1950, both by the title holders and by external parties, including the GGMC. The GGMC undertook regional mapping supported by geochemical drainage sampling in 2000, which showed gold and copper anomalies in the immediate Toroparu area.

ETK began auger drill sampling in 1999 and further auger drilling was completed by ETK and Sandspring between 2001 and 2018. Trench channel samples were completed by ETK in 2005, 2006, and 2009. In 2006 and 2007, ETK conducted a high resolution tri-sensor magnetic and radiometric airborne survey around the Toroparu saprolite open pit area. This identified a magnetic low area just to the north of a large magnetic high area of unknown origin. The survey outlined a number of magnetic and radiometric anomalies in the areas adjacent to the Toroparu saprolite open pit.

In 2010 and 2011, Sandspring conducted gradient array induced polarization and magnetometer surveys over the Toroparu deposit area and other prospects. The induced polarization surveys showed anomalies corresponding to the Toroparu granodiorite pluton. Chargeability was low over areas of high gold-copper mineralization despite the presence of sulfides. At Sona Hill, Sandspring conducted an induced polarization survey in 2015 to 2016 over the saprolite geochemical sampling grid, which suggested an extension of the shear zone to the west, with the potential for additional mineralization in the hangingwall. The chargeability survey did not reveal any significant results due to the low sulfide content of the Sona Hill mineralization. Resistivity did not provide reliable information to differentiate lithology, due to the similar mineralogy of the intrusives and volcanics. In 2011 and 2012, Sandspring conducted a regional saprolite geochemistry sampling campaign in the Upper Puruni area. Semi-regional and detailed geochemical sampling was performed on areas where alluvial mining activities showed gold potential. At Sona Hill, Sandspring conducted geochemical sampling and geophysical surveys during 2015 and 2016. In 2011, Sandspring flew a LIDAR survey over the Toroparu deposit to produce a detailed topographic contour map.

| 1.6 | Drilling |

Drilling has taken place at the Property from 2006 to 2022, mostly for resource definition at the Toroparu and Sona Hill deposits, and for exploration at other prospects. All drilling at the Project has been undertaken on behalf of the Property owners by Orbit Garant Drilling Services (Orbit) of Canada. All diamond drilling was undertaken using a triple tube initiated as HQ diameter (77 mm) and completed through the first 30 to 40 m of saprolite into hard rock, and then reduced to NQ diameter (60 mm) for the remainder of the drillhole. There are no details available regarding the reverse circulation drilling

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

procedure. However, these holes are mostly located in non-mineralized or very low grade zones and have minimal impact on the mineral resource estimates.

A total of 1,326 drillholes for 265,948 m are present in the Project drilling database. The drillholes in the Toroparu and Sona Hill deposits have adequate spacing between holes to define mineral resources for the mineralization style. Some of the drillholes at the periphery of the deposits or with a wider drilling grid have not been considered for the mineral resources estimate. Drilling considered for the mineral resource estimate corresponds to 617 diamond drill holes at Toroparu and 152 diamond and 29 reverse circulation holes at Sona Hill. Both deposits are open at depth.

As the drillhole intersections through the mineralized zones are used as an input into the mineral resource estimate, the relevancy of the raw drillhole sample assay results are superseded by the mineral resource estimate and are more meaningfully described in the context of the mineral resource estimate.

| 1.7 | Sampling, analysis, and data verification |

| 1.7.1 | Sample preparation and security measures |

The sample intervals were marked by the geologist and the core was cut in half with a diamond bladed saw. Saprolite samples were split with a trowel. Both the diamond bladed saw and trowel were cleaned before each sample. The majority of sample lengths are 1.5 m, with a minimum width of 0.5 m respecting lithological contacts. There are unmineralized narrow dykes less than 0.5 m, and in this case the sample was proportionally completed with wall rock up to 0.50 m.

The sampled half of the core was placed in a labelled bag with a tag number, and the remaining half of the core was retained as reference core kept in the core boxes and photographed.

All on-site sampling was conducted by company employees who managed the security and chain of custody throughout the receipt of the core at the drill rig, the logging, sampling, and delivery to the laboratory.

| 1.7.2 | Quality assurance and quality control |

Sandspring initiated a QAQC protocol in 2010 for Toroparu and Sona Hill that included the submission of one coarse duplicate, two certified standards, and a blank sample for each 32 regular samples. Monthly QAQC reports of assay results were subject to a pass/fail process where QAQC data were evaluated against set parameters and were either passed or failed. Where the QAQC sample failed the evaluation, a corrective action was taken which sometimes included re-assay of the entire batch. Re-assays were subject to the same evaluation process.

QAQC data submitted with the Toroparu deposit drill samples prior to 2020 included 4,220 submissions from a pool of 14 different gold/copper certified standards, 2,784 coarse blanks, and 1,252 core duplicates. Ninety-two sample swaps or laboratory failures were identified in the results returned for the certified standards. The blank results returned indicate possible short-term calibration issues at the laboratory, but no significant grade contamination is evident. No issues are identified with the duplicate sample results.

During the 2020 to 2021 drilling campaigns at the Toroparu deposit, QAQC data submissions included 622 samples from a pool of five different gold/copper/silver certified standards and 854 coarse blanks. No issues were identified with the standard results, and no significant grade contamination is evident.

Drill samples from the Sona Hill deposit submitted during 2012 and 2017 to 2018 included 421 submissions from a pool of six different certified standards, 216 coarse blanks, and 257 core duplicate samples. No issues were identified with the standards, blank samples, and the duplicate samples.

| 1.7.3 | Analytical procedures |

Between June 1, 2011, to 2014, sample preparation was completed at the on-site facility managed and operated directly by Acme. The prepared samples were then flown to Acme Laboratories in Georgetown, Guyana, and from there shipped to either Acme of Santiago, Chile, or Acme of Vancouver, Canada, for analysis.

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

Before Acme was acquired by Bureau Veritas, it was accredited under the general ISO 9001:2000. Most of the sample were prepared on-site by Acme and analyzed at their facility in Chile. Acme is ISO 9001:2008 and ISO/IEC 17025:2005 certified, and sample preparation and analyses were done at their facility in Canada.

The samples sent to the MSA Laboratory were prepared and analyzed at their Georgetown facility. MSA has ISO 45001:2018 and ISO 9001 certifications, and ISO 17025 accreditation.

There are no records of accreditation for ACT. All the samples analyzed by ACT underwent preparation and analysis at their Georgetown facility.

Acme, MSA and ACT operate as independent commercial certified laboratories both locally and internationally and have no relationship with the past or present Project operators.

Sample preparation at Acme involved initial weighing and drying each sample. The entire sample was then crushed to 80% passing -10 mesh and a 250 gram split was taken and pulverized to 85% passing -200 mesh.

At MSA, the entire sample was dried and crushed to 70% passing -10 mesh. A 250 gram sample split was taken for each sample and pulverized to 85% passing -200 mesh.

There are no records of the sample preparation method used at the ACT facility.

All samples were assayed for gold using by fire assay on a 50 gram charge with atomic absorption spectrometry (AAS) finish. Any sample with an assay greater than 10 g/t Au was re-analyzed using fire assay with gravimetric finish. Most of the Toroparu samples were assayed for copper while at Sona Hill, copper analysis was performed selectively, given the low copper content at the deposit. Samples were not regularly assayed for silver. For copper and silver, the samples were analyzed by four acid digest with AAS finish on a 0.5 gram charge.

| 1.7.4 | Data verification |

The qualified person responsible for geology verified the geological data supporting the mineral resource estimate through the personal inspections and through collaboration with the Project team, including:

| · | reviews of the geological and geographic environment of the Project; |

| · | reviews of the nature and extent of exploration work completed by the Project owners; |

| · | reviews of mineralized and non-mineralized core intersections; |

| · | reviews of the sample storage facilities for core, coarse rejects, and pulp rejects; |

| · | reviews of the geology database; |

| · | reviews of the QAQC results; |

| · | reviews of the geological interpretations; and |

| · | reviews of the grade estimation parameters and results. |

In the opinion of the qualified person, the data used for the purpose of estimating the mineral resources are sufficiently reliable.

| 1.8 | Mineral processing and metallurgical testing |

| 1.8.1 | Testwork history |

Numerous metallurgical testwork programs starting in 2009 have been undertaken to characterize the feed grade mineralization of the Toroparu and Sona Hill deposits, including both oxidized saprolite and sulphide fresh rock, and the material’s response to comminution, gravity concentration, rougher and cleaner flotation, and cyanide leaching. The testwork utilized samples that were representative of the growing mineral resource as it was known at the time of the studies. These studies included processing method trade off studies as well as refinements of the selected operating parameters, as the properties and response of the samples under the testwork conditions were increasingly better understood.

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| 1.8.2 | Mineralogical testwork |

A mineralogical assessment showed that the sample was dominated by silicates and with chalcopyrite the predominant sulphide mineral.

Gold deportment studies at a P80 of 150 microns showed that the majority of the gold was present as native gold, indicating that gravity recovery should be considered in the process flowsheet. Other gold minerals included electrum, maldonite, petzite, and hessite.

Liberation studies showed that the liberation of copper minerals improves substantially at grinds finer than 150 microns. In contrast pyrite is widely distributed with significant liberation in the range of 80 to over 90% at all size fractions. Copper minerals and pyrite have negligible mutual association, so producing a marketable concentrate was expected to be possible.

| 1.8.3 | Comminution testwork |

Comminution test results on samples from the Toroparu pits showed that the feed material is in the moderate to hard category and within the abrasive range. Testwork on saprolite samples from Sona Hill showed the feed material to be very soft and not abrasive. Testwork on sulphide rock samples from Sona Hill showed the feed material to be moderately hard and mildly abrasive.

Processing saprolitic material will add viscosity considerations, and the softness will reduce the power demand in the milling circuit. High saprolite blends may allow elevated processing rates of hard material.

| 1.8.4 | Flotation, cyanidation, and gravity recovery testwork |

The testwork includes flotation testwork, gravity recovery, cyanidation, flowsheet testing, the response of recovery to grind size, reagent consumption and optimization, detoxification.

The flotation, cyanidation, and gravity recovery testwork shows that the Toroparu and Sona Hill mill feed responds well to flotation and gravity recovery.

| 1.8.5 | Metallurgical recovery |

The combined metallurgical recoveries for sulphide material are estimated at 93% for gold, 78% for silver, and 88% for copper. For oxide material the combined metallurgical recoveries are estimated at 97% for gold and 46% for silver. Overall, recoveries are estimated at 93.6% for gold, 77.0% for silver, and 86.1% for copper.

| 1.8.6 | Deleterious elements |

There are no known processing factors or deleterious elements that could have a significant effect on the economic extraction of the mill feed that have not been considered and accounted for in the processing plan and economic model. Mineral analysis on the copper concentrates produced from the Toroparu deposit identified deleterious elements that may have some penalty on concentrates, including bismuth, selenium, tellurium, and arsenic.

| 1.9 | Mineral resource estimate |

The mineral resource estimate for open pit resources has been tabulated using a cut-off grade of 0.45 g/t gold, based on a gold price of $1,950 per ounce, an overall gold metallurgical recovery of 95%, a mining cost of $3.20 per tonne, a processing and surface infrastructure cost of $14.70 per tonne, a general and administration (G&A) cost of $4.60 per tonne, and an 8% gold royalty. The mineral resource estimate for underground resources has been tabulated using a cut-off grade of 1.5 g/t gold, based on the same assumptions as open pit resources with the exception of mining costs of $60 per tonne and G&A costs of $5 per tonne.

The mineral resource estimate is constrained within optimized pit and optimized stopes created using a gold price of $1,950 per ounce and cut-off grades of 0.45 g/t gold for open pit mineral resources and 1.5 g/t gold for underground mineral resources.

The Toroparu mineral resource estimate effective October 21, 2025, is shown in Table 1-2.

| Effective October 21, 2025 | Page |

NI 43-101 Technical Report Preliminary Economic Assessment for the Toroparu Project, Cuyuni-Mazaruni Region, Guyana

| Table 1-3 | Toroparu mineral resources effective October 21, 2025 |

| Area | Classification | Tonnes Mt |

Grade gold (g/t) |

Grade silver (g/t) |

Grade copper (%) |

Contained gold (koz) |

Contained silver (koz) |

Contained copper (Mlb) |

| Open pit | Measured | 48.4 | 1.31 | 1.8 | 0.14 | 2,030 | 2,747 | 150 |

| Indicated | 74.9 | 1.26 | 1.2 | 0.08 | 3,041 | 3,008 | 127 | |

| Measured + Indicated | 123.3 | 1.28 | 1.5 | 0.10 | 5,071 | 5,755 | 276 | |

| Inferred | 11.4 | 1.13 | 0.7 | 0.04 | 414 | 275 | 9 | |

| Underground | Measured | 0.1 | 1.89 | 0.4 | 0.03 | 8 | 2 | - |

| Indicated | 3.5 | 2.05 | 0.7 | 0.05 | 231 | 74 | 4 | |

| Measured + Indicated | 3.6 | 2.05 | 0.7 | 0.05 | 239 | 76 | 4 | |

| Inferred | 11.5 | 2.07 | 0.7 | 0.04 | 763 | 263 | 10 | |

| Total | Measured | 48.5 | 1.31 | 1.8 | 0.14 | 2,038 | 2,749 | 150 |

| Indicated | 78.4 | 1.30 | 1.2 | 0.08 | 3,272 | 3,082 | 131 | |

| Measured + Indicated | 126.9 | 1.30 | 1.4 | 0.10 | 5,310 | 5,831 | 280 | |

| Inferred | 22.9 | 1.60 | 0.7 | 0.04 | 1,177 | 538 | 19 | |

|

Notes: 1. Mineral resources are not mineral reserves and have no demonstrated economic viability. 2. The mineral resource estimate was prepared under the supervision of or was reviewed by Pamela De Mark, P.Geo., Senior Vice President Geology and Exploration of Aris Mining, who is a qualified person as defined by NI 43-101. 3. Totals may not add up due to rounding. 4. Mineral resources were estimated using a gold price of $1,950 per ounce. Open pit mineral resources are reported above a cut-off grade of 0.45 g/t gold within an optimized pit shell and underground mineral resources are reported above a cut-off grade of 1.5 g/t gold within optimized stope shapes. 5. There are no known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources.

|

||||||||

| 1.10 | Mining operations |

The Toroparu and Sona Hill deposits will be mined using conventional open pit mining methods. The operation will utilize conventional drill rigs, excavators, haul trucks, dozers, graders, water trucks, and utility vehicles.

Run of mine material from the Toroparu pits will be hauled from the pit benches to a dedicated run of mine stockpile located close to the Toroparu open pit area and processing plant. Run of mine material from the Sona Hill pit will be hauled approximately 8 km to the run of mine stockpile at the processing plant. Waste material will be hauled from the Toroparu and Sona Hill pits to their designated waste storage facilities located in close proximity around the two open pit areas. Topsoil will be stored separately for future rehabilitation requirements.