UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

| For the month of | October | 2025 | |

| Commission File Number | 001-40569 |

| Standard Lithium Ltd. |

| (Translation of registrant’s name into English) |

|

Suite 1625, 1075 W Georgia Street Vancouver, British Columbia, Canada V6E 3C9 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F o Form 40-F x

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 of this Report on Form 6-K are incorporated by reference into the Registration Statements on Form F-10EF (File No. 333-289110) and Form S-8 (File No. 333-262400) of the Registrant, as amended or supplemented.

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| Exhibit | |

| 99.1 | Material change report, dated August 15, 2025. |

| 99.2 | Material change report, dated September 9, 2025. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Standard Lithium Ltd. | |||||

| (Registrant) | |||||

| Date: | October 10, 2025 | By: | /s/ Salah Gamoudi | ||

| Name: | Salah Gamoudi | ||||

| Title: | Chief Financial Officer | ||||

Exhibit 99.1

FORM 51-102F3

Material Change Report

| ITEM 1 | Name and Address of Company |

Standard Lithium Ltd. (the “Company”)

Suite 1625, 1075 West Georgia Street

Vancouver, British Columbia

V6E 3C9

| ITEM 2 | Date of Material Change |

August 8, 2025

| ITEM 3 | News Release |

A news release announcing the material change was disseminated on August 8, 2025 and subsequently filed on SEDAR+.

| ITEM 4 | Summary of Material Changes |

The Company established an “at-the-market” equity program (the “ATM Program”) that allows the Company to issue and sell, from time to time through agents, up to US$50,000,000 (or the Canadian dollar equivalent) of its common shares (the “Offered Shares”) from treasury to the public, at the Company’s discretion (the “Offering”).

| ITEM 5 | Full Description of Material Change |

The Company established the ATM Program to allow the Company to issue and sell, from time to time through agents, up to US$50,000,000 (or the Canadian dollar equivalent) Offered Shares from treasury to the public, at the Company’s discretion.

Sales of Offered Shares, if any, under the ATM Program are anticipated to be made in transactions that are deemed to be “at-the-market distributions” as defined in National Instrument 44-102 – Shelf Distributions and an “at-the-market offering” within the meaning of the U.S. Securities Act of 1933, as amended, including sales made directly on the TSX Venture Exchange (the “TSXV”), the NYSE American LLC (the “NYSE American”), or any other trading market for the Offered Shares in Canada or the United States, at the prevailing market price at the time of sale. The volume and timing of sales under the ATM Program, if any, will be determined in the Company’s sole discretion, and at the market price prevailing at the time of each sale, and, as a result, sale prices may vary.

Distributions of the Offered Shares through the ATM Program, if any, will be made pursuant to the terms of an “at-the-market” sales agreement (the “Sales Agreement”) among the Company and Canaccord Genuity and Evercore ISI. The ATM Program will be effective until the issuance and sale of all of the Offered Shares issuable pursuant to the ATM Program, unless terminated prior to such date in accordance with the terms of the Sales Agreement.

-

The Company expects to use the net proceeds of the Offering to fund ongoing work programs to advance the South West Arkansas Project, exploration, leasehold acquisition and development activities in East Texas, for working capital and for general corporate purposes.

Listing of the Offered Shares sold pursuant to the ATM Program on the TSXV and/or the NYSE American will be subject to fulfilling all applicable listing requirements.

The sale of Offered Shares through the ATM Program is being made pursuant to a prospectus supplement dated August 8, 2025 (the “Prospectus Supplement”) to the Company’s short form base shelf prospectus dated July 30, 2025 (the “Base Prospectus”) filed with the securities commissions in each of the provinces and territories of Canada, and in the United States pursuant to a prospectus supplement dated August 8, 2025 (the “U.S. Prospectus Supplement”) to the Company’s short form base shelf prospectus contained in the Company’s effective registration statement on Form F-10 (File No. 333-289110) (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission under the U.S./Canada Multijurisdictional Disclosure System. The Prospectus Supplement, the Base Prospectus, the U.S. Prospectus Supplement and the Registration Statement contain important detailed information about the Company and the ATM Program. Prospective investors should read the Prospectus Supplement, the Base Prospectus, the Registration Statement, the U.S. Prospectus Supplement and the other documents the Company has filed for more complete information about the Company and the ATM Program before making an investment decision. Copies of the Prospectus Supplement and the Base Prospectus are available on SEDAR+ at www.sedarplus.ca and copies of the U.S. Prospectus Supplement and the Registration Statement are available on EDGAR at www.sec.gov.

| ITEM 6 | Reliance on Subsection 7.1(2) of National Instrument 51-102 Not applicable. |

| ITEM 7 | Omitted Information |

No information has been omitted on the basis that it is confidential information.

| ITEM 8 | Executive Officer |

The name and telephone number of the officer of the Company who is knowledgeable about the material change and the material change report is:

Salah Gamoudi

Chief Financial Officer

Tel. (604) 409-8154

| ITEM 9 | Date of Report |

August 15, 2025

-

This material change report may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects”, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved”. The forward-looking statements contained herein may include, but is not limited to, information concerning the expected sale of Offered Shares under the ATM Program, the price, volume and timing of the sale and distribution of Offered Shares under the ATM Program, the anticipated use of proceeds of any offering under the ATM Program and statements regarding the anticipated benefits and impacts of the ATM Program. Forward-looking statements are based on the Company’s current beliefs and assumptions as to the outcome and timing of future events, including, but not limited to, that the Company makes sales of Offered Shares under the ATM Program, that the proceeds of any offering conducted under the ATM Program will be deployed as anticipated and the anticipated benefits and impacts of the ATM Program being realized. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include, among other things: the ability of the Company to successfully close a financing, including the ATM Program, the price, volume and timing of sale of Offered Shares under the ATM Program not being determinable at this time, the anticipated use of proceeds from any offering made under the Company’s Base Prospectus and any offerings to be conducted thereunder including the ATM Program, the benefits and impacts of the ATM Program not being as anticipated, the risks and uncertainties relating to exploration and development, the ability of the Company to obtain additional financing, the need to comply with environmental and governmental regulations in Canada and the United States, fluctuations in the prices of commodities, operating hazards and risks, competition and other risks and uncertainties and other such factors as are set forth in the Base Prospectus and the Prospectus Supplement, as well as the management discussion and analysis and other disclosures of risk factors for Standard, filed on SEDAR+ at www.sedarplus.ca. and on EDGAR at www.sec.gov. Although the Company believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this material change report, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Exhibit 99.2

FORM 51-102F3

MATERIAL CHANGE REPORT

| Item 1. | Name and Address of Company |

Standard Lithium Ltd. (the “Company”)

Suite 1625 – 1075 West Georgia Street

Vancouver, BC V6E 3C9

| Item 2. | Date of Material Change |

September 3, 2025

| Item 3. | News Release |

The news release was disseminated by Globe Newswire on September 3, 2025, and was subsequently filed on SEDAR+.

| Item 4. | Summary of Material Change |

The Company, through its joint venture (“JV”), Smackover Lithium, announced positive definitive feasibility study results for its South West Arkansas Project (the “SWA Project” or “Project”).

| Item 5. | Full Description of Material Change |

The Company announced the results of its definitive feasibility study (the “DFS”) for the SWA Project.

All figures are in US dollars unless otherwise stated. All terms not otherwise defined have the meaning given to them under the CIM Definition Standards for mineral resources and mineral reserves.

Project Overview

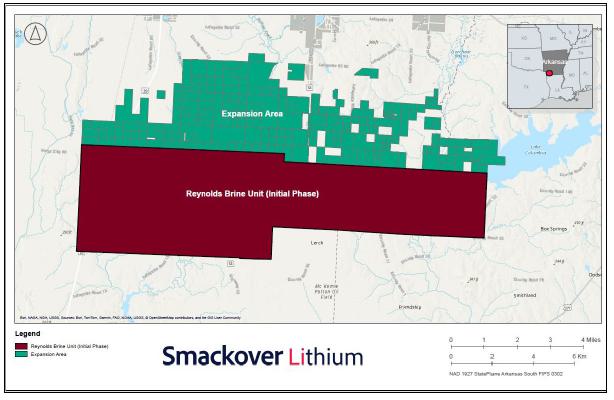

Smackover Lithium, a 55:45 owned JV between the Company and Equinor is developing a greenfield lithium extraction and chemicals production facility in the southwestern region of Arkansas. The Project is located approximately 15 miles (24 kilometers) west of Magnolia in Columbia County and 7 miles (11 kilometers) south of Lewisville in Lafayette County. The SWA Project encompasses approximately 30,000 acres of brine leases in the region, and the upgraded Resource in the DFS considers this total area. The first commercial phase of the Project is focused on the approved the Reynolds Brine Unit (see news release dated 24th April 2025) in the southern portion of the total Project area (see Figure 1). The DFS Project economics are focused on this initial phase of development, but the JV is planning to develop additional phases of the Project throughout the total Project area.

-

The SWA Project is intended as the first of several projects to be developed by the JV throughout the Smackover Region, and it is envisaged that the major design decisions and learnings from this first greenfield facility will form the basis for future expansion phases or projects. The Project team consciously used conservative adoption of pilot and demonstration plant learnings during the front-end engineering design (“FEED”) phase for this Project. As such, certain process redundancies, resource producibility and operating practice assumptions have been utilized throughout in order to ensure robustness. It is expected that learnings from this first commercial phase will result in reduced capital intensity and operating costs for future projects developed by the JV in the Smackover Formation. The initial phase of the SWA Project as illustrated is projected to produce battery-quality lithium carbonate with 22,500 tpa of total production capacity over a 20-year operating life. Highlights from this initial phase of production are provided in Table 1 below.

Table 1: Definitive Feasibility Study Highlights

| Annual Production Capacity of Li2CO3 | tpa[1] | 22,500 | [2] | ||||

| Modeled Plant Operating Life | years | 20 | [2] | ||||

| Brine Flowrate at Start of Production | bbl/d[3] | 148,000 | |||||

| Average Brine Flowrate over Modeled Plant Operating Life | bbl/d[3] | 168,000 | |||||

| Lithium Grade at Start of Production | mg/L | 549 | |||||

| Average Lithium Grade over Plant Operating Life | mg/L | 481 | |||||

| Total CAPEX | $ millions | 1,449 | [4,5] | ||||

| Average Annual Cash OPEX | $/t | 4,516 | |||||

| Average Annual All-in OPEX | $/t | 5,924 | [6,7] | ||||

| Selling Price | $/t | 22,400 | [8] | ||||

| Discount Rate | % | 8.0 | |||||

| Net Present Value (NPV) Pre-Tax | $ millions | 1,666 | |||||

| Net Present Value (NPV) After-Tax | $ millions | 1,275 | [9] | ||||

| Internal Rate of Return (IRR) Pre-Tax | % | 20.2 | |||||

| Internal Rate of Return (IRR) After-Tax | % | 18.2 | [9] |

Notes:

All model outputs are expressed on a 100% ownership basis with no adjustments for project financing assumptions. The Company’s

economic interest in the Project is 55%. Any discrepancies in the totals are due to rounding effects.

[1] Tonnes (1,000 kg) per annum.

[2] Plant design and financial modelling based on 20-year economic life. Proven and Probable Reserves together support a 40-year operating life.

[3] Barrels per day. 1 cubic meter per hour = 151 barrels per day.

[4] Capital Expenditures include 12.3% contingency determined with Monte Carlo Risk analysis.

-

[5] No inflation or escalation factor has been applied for

the economic modelling.[6] Includes operating expenditures, royalties, sustaining capital and closure costs.

[7] Royalties include quarterly gross lithium royalty of 2.5% as approved by the Arkansas Oil and Gas Commission (“AOGC”),

an additional brine fee of $65/acre per year and override fees payable on certain optioned brine leases.

[8] Selling price of battery-quality

lithium carbonate based on a flat assumed price of $22,400/t over total Project lifetime. Represents average of 20-year forward pricing

curve provided by Fastmarkets for battery-quality lithium carbonate, commencing in 2028.

[9] Illustrative after-tax calculations based on assumption that SWA Lithium, LLC is taxed as a stand-alone US C-Corporation, and does

not include the potential impact of currently held corporate net operating losses or credits, nor potential tax shields generated from

financing. Assumes a U.S. Federal income tax rate of 21%, a State of Arkansas income tax rate of 3.4%, and includes the impact of ad

valorem and other local taxes.

To support execution and a successful development approach, the SWA Project will be developed under the following key areas:

Wellfield: comprises four (4) well pads supporting twelve (12) supply and ten (10) injection wells, brine gathering pipelines from the well pads to the central processing facility, brine return pipelines from the central processing facility to the well pads and a gas gathering system from well pads to a disposal well in the area, with the ability to add a fifth well pad with two supply and two injection wells as needed.

Central Processing Facility (“CPF”): includes brine handling facilities suitable for processing up to 200,000 bbl/d (1,325 cubic meters per hour or “m3/h”) of brine, including sour gas handling, brine filtration, the LSS DLE (as defined below), purification and concentration of the lithium chloride stream, conversion to a battery-quality lithium carbonate with final product crystallization, drying, micronizing, bagging and handling facilities and all associated utilities. The CPF will be located on the SWA Property on a 118-acre plot within the wider Project boundary located approximately 7 miles (11 kilometers) south of Lewisville on State Highway 29.

Subject to a final investment decision (“FID”) which is currently targeted for around year-end 2025, the JV is aiming for construction to begin in 2026 with first commercial operations in 2028.

Processing Overview

The Project comprises a wellfield development for production of lithium rich brine from the upper unit of the Smackover Formation aquifer. Twelve (12) production wells grouped on four (4) pads will be used to pump brine to the surface and any gas will be separated at the wellhead and sent by pipeline to a third-party operator for disposal. The lithium rich brine will be sent to the CPF to extract the lithium in the form of lithium chloride and convert it into battery-quality lithium carbonate. The CPF is designed to process a feed brine flowrate of up to 200,000 bbl/d (1,325 m3/h) with annual production capacity of 22,500 tonnes of lithium carbonate.

-

The lithium depleted brine is subsequently returned to the wellfield for reinjection into the Smackover Formation via ten (10) injection wells grouped on three of the four production pads. The reinjection supports reservoir pressure maintenance and facilitates the sweep of fresh brine to the production wells. A fifth production and injection pad is planned to be added at a later date as needed to support operations.

The feed brine entering the production facility will be treated, filtered, and then processed via the licensed lithium selective sorption (“LSS”) process to produce raw lithium chloride (see news release dated 28th October 2024). The raw lithium chloride will then be purified and concentrated prior to conversion into battery-quality lithium carbonate while the lithium depleted brine and ancillary waste streams are returned for reinjection. The LSS technology licence guarantees lithium recovery (≥ 95%), contaminant rejection (including but not limited to calcium, sodium, potassium & magnesium ≥ 99%) and water use, as well as security of supply for the sorbent media.

The LSS process has been extensively de-risked in that it has been proven to selectively extract lithium chloride from Smackover brine for nearly three years, including operating a commercial scale direct lithium extraction (“DLE”) unit at the Company’s continuously operating demonstration plant located in El Dorado, Arkansas since April 2024. Over a four-month continuous operating period (April to July 2024), the LSS process consistently achieved average lithium recovery of 95.4% and average key contaminant rejection of >99% (see news release dated 24th October 2024).

In addition, the JV constructed a dedicated LSS field pilot plant and operated it over a 3-month period using brine sourced from the SWA Project area and successfully processed 2,385 bbl (379 m3) of brine. The LSS field pilot plant operated for nearly 500 operating cycles, produced approximately 23 barrels (3.7 m3) of concentrated and purified lithium chloride solution (6% LiCl) and exceeded key performance criteria to confirm the engineering design, recovering over 99% of lithium from the brine (see news release dated 11th March 2025).

The Company has completed over 12,000 cycles of LSS testing and has processed roughly 830,000 barrels (132,000 m3) of brine using the chosen DLE technology.

The LSS process produces a high-quality lithium chloride solution that is further purified and concentrated by means of reverse osmosis, chemical softening and ion exchange. After purification and concentration of the raw lithium chloride, a conventional two-stage lithium carbonate crystallization process will be used for final conversion of the polished concentrated lithium chloride into battery-quality lithium carbonate.

-

Purified, concentrated lithium chloride output from the LSS field pilot plant was sent to selected equipment vendors and converted into battery-quality lithium carbonate with positive results exceeding all purity specifications. These lithium carbonate samples are expected to play a key role in the qualification process with prospective off-take partners and aid in the ability of vendors to provide vendor guarantees for the entire carbonation circuit.

Production Plan and Assumptions

The DFS contemplates initial production capacity of 22,500 tonnes per annum of battery-quality lithium carbonate over a 20-year modeled operating life, producing 447,000 tonnes lithium carbonate equivalent (“LCE”) (Proven Reserves) from the Reynolds Brine Unit (see Table 6). This production represents 38% of the in-situ Measured and Indicated Resources (see Table 5). The Project has the potential to operate over a 40-year life based on the total Proven and Probable Reserves of 709,000 tonnes LCE (see Table 6).

CAPEX

A contingency of 12.3% was applied to total direct and indirect costs, resulting in an estimated all-in capital cost of $1.45 billion.

The JV has undertaken efforts to de-risk the design and construction process for the Project and achieve on-time delivery. In addition to a detailed FEED study supported by extensive equipment testing, this includes extensive market sounding and short-listing of execution phase contractors; vendor engagement; preparation and issuance of a detailed Request for Proposal including General Terms and Conditions which set out construction performance and schedule guarantees to achieve on-time construction; as well as guarantees related to the production of battery-quality lithium carbonate at the facilities’ designed capacity.

Table 2: CAPEX Summary[1,2,3]

| CAPEX ($ millions) | ||||

| Wellfield (Wells, Pipelines and Power) | 324 | |||

| Brine Preparation | 67 | |||

| Lithium Extraction | 158 | |||

| Lithium Purification / Concentration | 109 | |||

| Lithium Conversion | 100 | |||

| Product Handling | 36 | |||

| Utilities, Chemicals and Reagents | 79 | |||

| Infrastructure, Piperacks and Site Preparation | 104 | |||

| Indirect Costs | 146 | |||

| Owners and Miscellaneous Costs | 166 | |||

| Contingency (12.3%) | 160 | |||

| Total CAPEX[4] | $ | 1,449 | ||

-

Notes:

[1] Direct costs were estimated using vendor-supplied quotes for all major equipment.

[2] Indirect costs include all contractor costs (including engineering), indirect labor costs and owner’s engineer costs.

[3] All costs were developed by the Project’s selected FEED contractors at AACE Class III level and were benchmarked by an

external third-party to ensure robustness.

[4] Any discrepancies in the totals are due to rounding effects.

OPEX

The average cash operating cost over the life of the Project is $4,516/t of lithium carbonate. Average all-in operating cost, including sustaining capital expenditures and known brine royalties and fees, is $5,924/t.

Table 3: OPEX Summary

| Category | Average Annual Cost ($/t)[1] | |||

| Labor[2] | 430 | |||

| Wellfield & Subsurface | 455 | |||

| Power & Natural Gas | 563 | |||

| Reagents | 2,156 | |||

| Consumables | 106 | |||

| Maintenance and External Services[3] | 386 | |||

| Miscellaneous Costs[4] | 420 | |||

| Total Cash OPEX | $ | 4,516 | ||

| Royalties and Lease Overrides[5] | 1,083 | |||

| Sustaining and Closure CAPEX | 324 | |||

| Total All-in OPEX including Sustaining CAPEX[6] | $ | 5,924 | ||

Notes:

[1] Operating costs are calculated based on an average determined over the 20-year operating life.

[2] Approximately 106 full-time equivalent positions.

[3] Includes contract maintenance, solids waste disposal, mobile equipment and external lab service.

-

[4] Includes general and administrative expenses.

[5] Royalties include quarterly gross lithium royalty of 2.5% as approved by the AOGC, an additional brine fee of $65/acre per year and

override fees payable on certain optioned brine leases.

[6] Any discrepancies in the totals are due to rounding effects.

Project Economics

The Project’s financial results are derived from inputs based on the annual production schedule as set forth in the DFS and summarized in Table 1. Sensitivity analysis on the pre-tax unlevered economic results over a 20-year modeled operating life are summarized in Table 4 below.

Table 4: Sensitivity Analysis

| Pre-Tax NPV ($ millions) | Pre-Tax IRR (%) | |||||||

| Li2CO3 Price ($/t) | ||||||||

| -20% | 901 | 15.2 | % | |||||

| 0% | 1,666 | 20.2 | % | |||||

| +20% | 2,430 | 24.7 | % | |||||

| Production (tpa) | ||||||||

| -10% | 1,284 | 17.8 | % | |||||

| 0% | 1,666 | 20.2 | % | |||||

| +10% | 2,048 | 22.6 | % | |||||

| CAPEX ($ million) | ||||||||

| +20% | 1,408 | 17.1 | % | |||||

| 0% | 1.666 | 20.2 | % | |||||

| -20% | 1,923 | 24.6 | % | |||||

| OPEX ($/t) | ||||||||

| +20% | 1,506 | 19.3 | % | |||||

| 0% | 1,666 | 20.2 | % | |||||

| -20% | 1,826 | 21.2 | % | |||||

Mineral Resource Assessment

The SWA Project encompasses approximately 30,000 acres of brine leases in the region, and the upgraded resource in the DFS considers this total area, pictured in the map below (see Figure 1). The initial commercial phase of the Project is focused on the Reynolds Brine Unit in the southern half of the total Project area (20,854 acres of mineral leases approved for production). The DFS Project economics are focused on this initial phase of development, which contemplates production of battery-quality lithium carbonate at annual production capacity of 22,500 tonnes over a 20-year modeled operating life, but the JV is planning to develop additional phases of the Project in the total Project area, including the expansion area as shown in Figure 1 (the “Expansion Area”).

-

Figure 1: Brine Unit Map

The total in-situ Measured and Indicated Resource for the SWA Project is estimated at 1,177,000 tonnes LCE, or 221,000 tonnes of elemental lithium at an average concentration of 442 mg/L.

This updated Mineral Resource estimate was completed as part of the DFS, which resulted in an improvement of the Mineral Resource category from ‘Indicated’ to ‘Measured’ as compared to the Company’s prior prefeasibility study. This upgrading of the Mineral Resource is due to the JV’s advancements in lithium recovery, completion of additional reservoir characterization, brine sampling and geochemistry work.

-

Table 5: Measured, Indicated and Inferred Resource Estimation[1,2,3,4,5,6,7]

| Resource Category | Measured | Indicated | Measured and Indicated |

|||||||||

| Project Area | Reynolds Brine Unit |

Potential Expansion |

Total | |||||||||

| Upper Smackover | ||||||||||||

| Gross Aquifer Volume, km3 [8] | 4.33 | 2.12 | 6.45 | |||||||||

| Net Aquifer Volume, km3 [8] | 2.86 | 1.39 | 4.25 | |||||||||

| Average Porosity | 11.80 | % | 11.75 | % | 11.79 | % | ||||||

| Brine Volume, km3 [8,9,10] | 0.34 | 0.16 | 0.50 | |||||||||

| Average Lithium Concentration, mg/L | 514 | 293 | 442 | |||||||||

| Lithium Resource, thousand tonnes [2] | 173 | 48 | 221 | |||||||||

| LCE, thousand tonnes [2,11] | 922 | 255 | 1,177 | |||||||||

| Resource Category | Inferred | |||||||||||

| Project Area | Reynolds Brine Unit |

Potential Expansion |

Total | |||||||||

| Middle Smackover | ||||||||||||

| Gross Aquifer Volume, km3 [8] | 4.99 | 3.00 | 7.99 | |||||||||

| Net Aquifer Volume, km3 [8] | 0.96 | 0.61 | 1.57 | |||||||||

| Average Porosity | 9.05 | % | 9.88 | % | 9.37 | % | ||||||

| Brine Volume, km3 [8,10] | 0.09 | 0.06 | 0.15 | |||||||||

| Average Lithium Concentration, mg/L | 452 | 215 | 355 | |||||||||

| Lithium Resource, thousand tonnes [2] | 39 | 13 | 52 | |||||||||

| LCE, thousand tonnes [2,11] | 210 | 68 | 278 | |||||||||

Notes:

[1] The effective date of the Mineral Resource estimate is September 3, 2025.

[2] Results are presented in-situ. The number of tonnes was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects.

[3] The Qualified Persons (as defined below) for the Mineral Resources estimate are Randal M. Brush, PE and Robert Williams, PG, CPG.

[4] Mineral Resources are inclusive of Mineral Reserves.

[5] Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Reserves are shown in Table 6.

[6] The Mineral Resources estimate follows CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines.

[7] The Qualified Person is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or market issues, or any other relevant issue that could materially affect the potential development of Mineral Resources other than those discussed in the Mineral Resources estimate.

-

[8] Volumes are in-place.

[9]

Calculated brine volumes only include Measured and Indicated Mineral Resource volumes that, when blended from the well field, result

in feed above the lithium cut-off grade of 100 mg/L.

[10] Cutoff of 6% porosity.

[11] LCE is calculated using mass of LCE = 5.323 multiplied by mass of lithium metal.

The Proven and Probable Reserves for the Reynolds Brine Unit, a subset of the total Mineral Resource estimate completed as part of the DFS, are estimated at 709,000 tonnes of LCE, or 149,000 tonnes of elemental lithium at an average lithium concentration of 348 mg/L. The Reserves for the DFS are a quantification of the lithium that will be cumulatively processed by the Project over a nominal 40-year life, with Proven Reserves covering the initial 20 years and Probable Reserves covering the subsequent 20 years. The Reserves do not contemplate any other lithium production that could take place from future additional wells or unit expansions that could be used to supplement or bolster lithium production.

A numerical reservoir model was constructed using industry standard software. Reserves were calculated from the simulated Smackover Formation brine production rates and lithium concentrations in the Reynolds Brine Unit. Proven and Probable Reserves were estimated based on proven processing performance of the selected LSS technology for the project and the recently completed FEED work.

Table 6: Proven and Probable Reserves Estimation[1,2,3,4,5,6]

| Category | Units | Proven[7] | Probable[8] | Proven and Probable |

||||||||||

| Brine Volume Pumped[10] | million m3 | 195 | 232 | 427 | ||||||||||

| Average Lithium Concentration[9,10] | mg/L | 481 | 237 | 348 | ||||||||||

| Lithium Metal Reserves Produced to Facility[10] | thousand tonnes | 94 | 55 | 149 | ||||||||||

| LCE Reserves Recovered by Facility[11,12] | thousand tonnes | 447 | 262 | 709 | ||||||||||

Notes:

[1] The effective date of the Reserve estimate is September 3, 2025.

[2] Any discrepancies in the totals are due to rounding effects.

[3] The Qualified Person for the Mineral Reserve estimate is Randal M. Brush, PE.

[4] Converted Reserves are exclusive to the Reynolds Brine Unit.

[5] The Mineral Reserve estimate follows CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines.

-

[6] The Qualified Person is not aware of any known environmental,

permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issue, that could materially affect

the potential development of Mineral Reserves other than those discussed in the Mineral Reserve estimates.

[7] The Proven case assumes a 20-year modeled operating life with produced brine expected to exceed a lithium cut-off of 100 mg/L.

[8] Probable Reserves assumes a 40-year total operating life with produced brine during years 21 to 40 expected to exceed a lithium cut-off

of 100 mg/L.

[9] The average lithium concentration is weighted per well simulated extraction rates.

[10] The Reserves reference point for the brine pumped, average

lithium concentration, and elemental lithium metal is the brine inlet to the processing plant.

[11] The Reserves reference point for LCEs is the product output of the processing plant and accounts for plant processing efficiency

factors.

[12] LCE is calculated using mass of LCE = 5.323 multiplied by mass of lithium metal.

Development Timeline

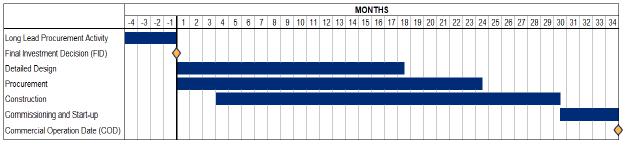

The development schedule for the Project is estimated at 34 months from start of construction to the commercial operation date and remains subject to multiple factors, including but not limited to finalization of commercial agreements, engineering, procurement and construction contract finalization and other related definitive documentation, market conditions and financing related activities (see Figure 2).

Figure 2: Development Timeline

Permitting and Environmental Considerations

Acceptance of Federal Department of Energy (“DOE”) funding in the form of a $225 million grant from the DOE’s Office of Manufacturing and Energy Supply Chains (closed in January 2025), triggered the requirement for the Project to comply with the United States National Environmental Policy Act (“NEPA”), for which an environmental assessment was initiated in early 2025. The Project expects to receive a Finding of No Significant Impact prior to the end of this year. In support of the NEPA process, the JV has conducted environmental studies to establish baseline conditions within the Project area. The results of these studies will be used to determine environmental values associated with the development site, inform the design process and support future environmental performance monitoring.

-

Permit development activities for construction and operating permits are ongoing and on schedule for completion ahead of required timelines to support the construction and commissioning of the SWA Project.

The SWA Project maintains strong support from the local community, the state of Arkansas and the U.S. government. In addition to the federal grant, the Project was selected to be advanced under Executive Order 14241: Immediate Measures to Increase American Mineral Production as a priority critical mineral project in the Fast-41 Program. This was announced by the U.S. Federal Permitting Improvement Steering Council at the recommendation of the National Energy Dominance Council, with the designation ensuring increased transparency, accountability and predictability in the permitting review process.

Next Steps and Recommendation

The principal recommendation from the DFS is that the Project is ready to progress to a FID. The FID is targeted to be made around year-end 2025, and subject to this, construction is assumed to commence in 2026 with first production targeted in 2028.

Qualified Persons

All scientific and technical disclosure in this material change report was reviewed and approved by Mr. Stephen Ross, P.Geo., British Columbia, Vice President of Resource Development for the Company and a Qualified Person for purposes of, and as that term is defined in, National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Ross is not independent of the Company.

Department of Energy Acknowledgement and Disclaimer

This material is based upon work supported by the U.S. Department of Energy's Office of Manufacturing Energy and Supply Chains under award Number DE-MS-0000099. The views expressed herein do not necessarily represent the views of the U.S. Department of Energy or the United States Government.

| 5.2 | Disclosure for Restructuring Transactions |

Not applicable.

| Item 6. | Reliance on Subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

-

| Item 7. | Omitted Information |

None.

| Item 8. | Executive Officer |

David Park

Chief Executive Officer

(604) 409-8154 | investors@standardlithium.com

| Item 9. | Date of Report |

September 9, 2025

Use of Non-GAAP Measures

Certain financial measures referred to in this material change report are not measures recognized under International Financial Reporting Standards (“IFRS”) and are referred to as non-GAAP financial measures or ratios. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. The definitions established and calculations performed by Smackover Lithium are based on management’s reasonable judgement and are consistently applied. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-GAAP financial measures used in this material change report are common to the mining industry. All-in operating cost per tonne is a non-GAAP financial measure or ratio and has no standardized meaning under IFRS Accounting Standards and may not be comparable to similar measures used by other issuers. As the SWA Project is not in production, the Company does not have historical non-GAAP financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-GAAP financial measures may not be reconciled to the nearest comparable measures under IFRS.

Cautionary Note Regarding Forward-Looking Statements

This material change report may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this material change report, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “could”, “should”, “schedule”, “predict”, “budget”, “project”, “potential” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to intended development timelines, the timeline for completion of a DFS for the SWA Project, the cost and timing of any development of the Project, mining recoveries, processing method and rates, production rates, projected metallurgical recovery rates, capital and operating cost estimates, infrastructure, including the CPF and additional production and injection pads, the projected life of mine and other expected attributes of the Project, the NPV, IRR, future prices of commodities, prospective off-take partners, accuracy of mineral or resource exploration activity, reserves or resources, regulatory or government requirements or approvals, the reliability of third party information, continued access to mineral properties or infrastructure, fluctuations in the market for lithium and its derivatives, the use of non-GAAP measures in financial performance assessments, changes in exploration costs and government regulation in Canada and the United States, future expansion phases, the timing of the environmental assessment and other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.