UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

October 1st, 2025

Commission File Number 001-10888

TotalEnergies SE

(Translation of registrant’s name into English)

2, place Jean Millier

La Défense 6

92400 Courbevoie

France

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

TotalEnergies SE is providing on this Form 6-K a description of certain recent developments relating to its business.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TotalEnergies SE | |||

| Date: October 1st, 2025 | By: | /s/ DENIS TOULOUSE | |

| Name: | Denis Toulouse | ||

| Title: | Company Treasurer | ||

Exhibit 99.1

|

PRESS RELEASE |

Republic of the Congo: TotalEnergies is Awarded

a New

Exploration Permit

Paris, September 1, 2025 – TotalEnergies (50%, operator), together with its partners QatarEnergy (35%) and the national company SNPC (15%), has been awarded the Nzombo exploration permit in the Republic of the Congo.

The 1,000 square kilometer Nzombo permit is located 100 kilometers off the coast of Pointe-Noire, close to the Moho production facilities operated by TotalEnergies EP Congo. The work program includes the drilling of one exploration well, which is expected to spud before the end of 2025.

“This award of a promising Exploration permit, with the material Nzombo prospect, reflects our continued strategy of expanding our Exploration portfolio with high impact prospects, which can be developed leveraging our existing facilities, and confirms our longstanding partnership with the Republic of the Congo,” said Kevin McLachlan, Senior Vice-President Exploration at TotalEnergies.

***

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to providing as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.2

Disclosure of Transactions in Own Shares

Paris, September 1, 2025 – In accordance with the authorizations given by the shareholders’ general meeting on May 23, 2025, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) declares the following purchases of its own shares (FR0000120271) from August 25 to August 29, 2025:

| Transaction Date | Total daily volume (number of shares) |

Daily weighted average purchase price of shares (EUR/share) |

Amount

of transactions (EUR) |

Market (MIC Code) |

| 25/08/2025 | 20,010 | 54.249633 | 1,085,535.16 | AQEU |

| 25/08/2025 | 111,305 | 54.247544 | 6,038,022.88 | CEUX |

| 25/08/2025 | 310,660 | 54.250188 | 16,853,363.40 | XPAR |

| 25/08/2025 | 36,575 | 54.247359 | 1,984,097.16 | TQEX |

| 26/08/2025 | 38,995 | 53.120367 | 2,071,428.71 | AQEU |

| 26/08/2025 | 149,062 | 53.119535 | 7,918,104.13 | CEUX |

| 26/08/2025 | 429,861 | 53.115283 | 22,832,188.67 | XPAR |

| 26/08/2025 | 41,004 | 53.123231 | 2,178,264.96 | TQEX |

| 27/08/2025 | 25,696 | 53.289310 | 1,369,322.11 | AQEU |

| 27/08/2025 | 151,775 | 53.269150 | 8,084,925.24 | CEUX |

| 27/08/2025 | 341,722 | 53.303913 | 18,215,119.76 | XPAR |

| 27/08/2025 | 37,344 | 53.277022 | 1,989,577.11 | TQEX |

| 28/08/2025 | 20,822 | 53.157893 | 1,106,853.65 | AQEU |

| 28/08/2025 | 125,774 | 53.148228 | 6,684,665.23 | CEUX |

| 28/08/2025 | 313,306 | 53.123721 | 16,643,980.53 | XPAR |

| 28/08/2025 | 33,514 | 53.174684 | 1,782,096.36 | TQEX |

| 29/08/2025 | 28,336 | 53.516527 | 1,516,444.31 | AQEU |

| 29/08/2025 | 158,985 | 53.501595 | 8,505,951.08 | CEUX |

| 29/08/2025 | 290,985 | 53.479214 | 15,561,649.09 | XPAR |

| 29/08/2025 | 30,230 | 53.512849 | 1,617,693.43 | TQEX |

| Total | 2,695,961 | 53.427807 | 144,039,282.96 |

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 1 47 44 46 99 l mailto:presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Disclaimer:

The terms “TotalEnergies”, “TotalEnergies company” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities.

This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to the financial condition, results of operations, business activities and strategy of TotalEnergies. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies, including with respect to climate change and carbon neutrality (net zero emissions). An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document.

These forward-looking statements are not historical data and should not be interpreted as assurances that the perspectives, objectives, or goals announced will be achieved. They may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto.

Readers are cautioned not to consider forward-looking statements as accurate, but as an expression of the Company’s views only as of the date this document is published. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. The information on risk factors that could have a significant adverse effect on TotalEnergies’ business, financial condition, including its operating income and cash flow, reputation, outlook or the value of financial instruments issued by TotalEnergies is provided in the most recent version of the Universal Registration Document which is filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (“SEC”).

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.3

|

PRESS RELEASE |

Nigeria: TotalEnergies is Awarded Two Offshore Exploration Permits

Paris, September 2nd, 2025 – TotalEnergies (80%, operator), together with its partner South Atlantic Petroleum (20%), have signed the Production Sharing Contract (PSC) for the PPL 2000 and PPL 2001 exploration licenses offshore Nigeria, which were awarded following the 2024 Exploration Round organized by the Nigerian Upstream Petroleum Regulatory Commission.

PPL 2000 & 2001, covering an area of approximately 2,000 square kilometers, are located in the prolific West Delta basin. The work program includes drilling one firm exploration well.

“TotalEnergies is honored to be the first international company to be awarded exploration licenses in a bid round in Nigeria in more than a decade, marking a new milestone in our long-term partnership with the country,” said Kevin McLachlan, Senior Vice-President Exploration at TotalEnergies. “These promising block captures are fully aligned with our strategy of strengthening our Exploration portfolio with drill-ready and high impact prospects, that have the potential for low-cost and low-emissions developments from new discoveries in our core areas of expertise.”

***

About TotalEnergies in Nigeria

TotalEnergies has been present in Nigeria for more than 60 years and employs today more than 1,800 people across different business segments. Nigeria is one of the main contributing countries to TotalEnergies’ hydrocarbon production with 209,000 boe/d produced in 2024. TotalEnergies also operates an extensive distribution network which includes about 540 service stations in the country. In all its operations, TotalEnergies is particularly attentive to the socio-economic development of the country and is committed to working with local communities.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE.

Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.4

Disclosure of Transactions in Own Shares

Paris, September 8, 2025 – In accordance with the authorizations given by the shareholders’ general meeting on May 23, 2025, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) declares the following purchases of its own shares (FR0000120271) from September 1 to September 5, 2025:

| Transaction Date | Total

daily volume (number of shares) |

Daily

weighted average purchase price of shares (EUR/share) |

Amount

of (EUR) |

Market (MIC Code) |

| 01/09/2025 | 167,877 | 53.526122 | 8,985,804.78 | XPAR |

| 01/09/2025 | 86,563 | 53.524387 | 4,633,231.51 | CEUX |

| 01/09/2025 | 15,774 | 53.522797 | 844,268.60 | TQEX |

| 01/09/2025 | 8,545 | 53.519864 | 457,327.24 | AQEU |

| 02/09/2025 | 468,001 | 53.852420 | 25,202,986.41 | XPAR |

| 02/09/2025 | 150,000 | 53.960610 | 8,094,091.50 | CEUX |

| 02/09/2025 | 30,000 | 54.081411 | 1,622,442.33 | TQEX |

| 02/09/2025 | 20,000 | 54.022191 | 1,080,443.82 | AQEU |

| 03/09/2025 | 374,589 | 53.260483 | 19,950,791.07 | XPAR |

| 03/09/2025 | 170,762 | 53.275957 | 9,097,508.97 | CEUX |

| 03/09/2025 | 42,500 | 53.290954 | 2,264,865.55 | TQEX |

| 03/09/2025 | 42,000 | 53.249994 | 2,236,499.75 | AQEU |

| 04/09/2025 | 373,187 | 52.851477 | 19,723,484.15 | XPAR |

| 04/09/2025 | 171,584 | 52.849562 | 9,068,139.25 | CEUX |

| 04/09/2025 | 36,459 | 52.851276 | 1,926,904.67 | TQEX |

| 04/09/2025 | 31,065 | 52.856816 | 1,641,996.99 | AQEU |

| 05/09/2025 | 451,386 | 52.370070 | 23,639,116.42 | XPAR |

| 05/09/2025 | 160,000 | 52.397042 | 8,383,526.72 | CEUX |

| 05/09/2025 | 46,000 | 52.303392 | 2,405,956.03 | TQEX |

| 05/09/2025 | 30,000 | 52.379352 | 1,571,380.56 | AQEU |

| Total | 2,876,292 | 53.134649 | 152,830,766.31 |

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 1 47 44 46 99 l mailto:presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Disclaimer:

The terms “TotalEnergies”, “TotalEnergies company” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities.

This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to the financial condition, results of operations, business activities and strategy of TotalEnergies. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies, including with respect to climate change and carbon neutrality (net zero emissions). An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document.

These forward-looking statements are not historical data and should not be interpreted as assurances that the perspectives, objectives, or goals announced will be achieved. They may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto.

Readers are cautioned not to consider forward-looking statements as accurate, but as an expression of the Company’s views only as of the date this document is published. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. The information on risk factors that could have a significant adverse effect on TotalEnergies’ business, financial condition, including its operating income and cash flow, reputation, outlook or the value of financial instruments issued by TotalEnergies is provided in the most recent version of the Universal Registration Document which is filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (“SEC”).

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.5

|

PRESS RELEASE |

South Korea: TotalEnergies to supply 1 million tons per year of LNG to KOGAS for 10 years

Paris, September 9, 2025 – TotalEnergies and KOGAS, South Korea’s national natural gas company, announce the signing of a Heads of Agreement (HoA) for the annual delivery in South Korea of 1 million tons (Mt) of LNG per year over a 10-year period starting from the end of 2027.

Awarded to TotalEnergies by KOGAS following an international tender, this contract increases to 3 Mt per year from 2028 onward the volume of LNG supplied by TotalEnergies to KOGAS, currently the world's largest LNG importer. These additional LNG volumes will then be delivered to Korean industries, businesses, and households. They will come from TotalEnergies’ global supply portfolio, and particularly from its U.S. LNG production and offtake.

"We thank KOGAS for its trust in TotalEnergies’ ability to supply its Asian customers with reliable and competitive LNG through its global portfolio. This agreement enables TotalEnergies to secure long-term outlets in Asia, consistently with the growth of its LNG supply, particularly from the United States", said Patrick Pouyanné, Chairman and CEO of TotalEnergies.

“We are pleased to finalize this agreement with TotalEnergies, which not only enhances the economic value of our LNG portfolio but also contributes to diversifying our sources of LNG supply. This engagement reinforces our commitment to securing a stable LNG supply amid a rapidly changing global energy landscape. We look forward to further strengthening our relationship with TotalEnergies to support a sustainable LNG value chain”, said Yeonhye Choi, President and CEO of KOGAS.

***

TotalEnergies, the world’s third largest LNG player

TotalEnergies is the world’s third largest LNG player with a global portfolio of 40 Mt/y in 2024 thanks to its interests in liquefaction plants in all geographies. The Company benefits from an integrated position across the LNG value chain, including production, transportation, access to more than 20 Mt/y of regasification capacity in Europe, trading, and LNG bunkering. TotalEnergies’ ambition is to increase the share of natural gas in its sales mix to close to 50% by 2030, to reduce carbon emissions and eliminate methane emissions associated with the gas value chain, and to work with local partners to promote the transition from coal to natural gas.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to providing as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.6

|

PRESS RELEASE |

United States: TotalEnergies reaches Final Investment

Decision with

its Partners on Rio Grande LNG Train 4, with a 10% Direct

Participating Interest and 1.5 MT LNG offtake

Paris, September 10, 2025 – TotalEnergies has signed agreements with NextDecade to take a 10% stake in the joint venture developing Train 4 of Rio Grande LNG (RGLNG), a liquefied natural gas (LNG) plant project located in South Texas. In addition to the 10% held directly, TotalEnergies will hold indirectly next to 7% in this Train 4 as a 17.1% shareholder of NextDecade.

At the same time, TotalEnergies, NextDecade (40%), and their partners Global Infrastructure Partners (GIP, 36.9%), GIC (7.9%), and Mubadala (5.2%) made the Final Investment Decision (FID) for the development of Train 4.

This fourth train, which has a capacity of approximately 6 million tons per annum (Mtpa), will bring the plant’s total capacity to approximately 24 Mtpa when it comes online in 2030. The project’s overall cost will be financed with approximately 40% equity and 60% debt.

“We are very pleased with the FID of RGLNG Train 4. This project from which we will offtake 1.5 Mtpa strengthens our LNG export capacity from the United States,” said Stéphane Michel, President of Gas, Renewables & Power at TotalEnergies. “It gives TotalEnergies access to competitive LNG thanks to its low production costs. The LNG from this fourth train will increase TotalEnergies’ U.S. LNG export capacity to over 16 Mtpa by 2030, further enhancing our ability to contribute to gas supply and building on our 10% market share worldwide.”

“We are pleased to have TotalEnergies, our largest LNG customer and equity partner for Phase 1 of Rio Grande LNG, extend their commitment to our project through Train 4,” said Matt Schatzman, NextDecade Chairman and Chief Executive Officer. “LNG exported by TotalEnergies from our project will provide affordable, reliable, and secure energy to customers around the world.”

TotalEnergies previously signed a Sales and Purchase Agreement (SPA) with NextDecade to offtake 1.5 Mtpa for 20 years of liquefied natural gas from the future Train 4. TotalEnergies currently holds a 16.7% interest in Phase 1 of Rio Grande LNG and will offtake 5.4 Mtpa. Phase 1 includes three liquefaction trains under construction in South Texas and is expected to start operations in 2027. TotalEnergies also holds a 17.1% stake in NextDecade, Rio Grande LNG’s shareholder and operator.

***

TotalEnergies, the world’s third largest LNG player

TotalEnergies is the world’s third largest LNG player with a global portfolio of 40 Mt/y in 2024 thanks to its interests in liquefaction plants in all geographies. The Company benefits from an integrated position across the LNG value chain, including production, transportation, access to more than 20 Mt/y of regasification capacity in Europe, trading, and LNG bunkering. TotalEnergies’ ambition is to increase the share of natural gas in its sales mix to close to 50% by 2030, to reduce carbon emissions and eliminate methane emissions associated with the gas value chain, and to work with local partners to promote the transition from coal to natural gas.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.7

|

PRESS RELEASE |

Iraq: TotalEnergies Launches the Construction of the Final Two Major Projects of the GGIP

| § | Ratawi field’s full field development will increase production to 210,000 barrels per day (bpd) with no routine flaring. | |

| § | The Common Seawater Supply Project (CSSP) with a 5 Mbpd capacity will help preserve the country’s freshwater resources. | |

| § | Following the start of construction of the 300 Mcf/d gas treatment plant and the 1 GWac solar facility at the beginning of this year, all parts of the multi-energy GGIP project are now in their execution phase. | |

| § | Already 2,700 workers, out of which 2,000 Iraqis, are mobilized on the ground and around 7,000 Iraqi workers will be mobilized at the peak of the construction. |

Baghdad, September 15, 2025 – Patrick Pouyanné, Chairman and Chief Executive Officer of TotalEnergies, and His Excellency Saad Sherida Al-Kaabi, Qatari Minister of State for Energy Affairs, President and Chief Executive Officer of QatarEnergy, met on Sunday, 14th of September in Baghdad with His Excellency Mohammed Shia al-Sudani, Prime Minister of the Republic of Iraq, and His Excellency Hayan Abulghani, Minister of Oil and Deputy Prime Minister, to announce the start of construction of the Common Seawater Supply Project (CSSP) and the full field development of the Ratawi oil field.

These are the two last major contracts of the Gas Growth Integrated Project (GGIP), led by TotalEnergies (45%, operator) alongside its partners Basra Oil Company (30%), and QatarEnergy (25%).

With these signatures, all four parts (natural gas, solar, oil, water) of the GGIP are now in execution phase. The GGIP, a showcase project for TotalEnergies’ multi-energy strategy, aims to sustainably develop Iraq’s natural resources to improve the country’s electricity supply while contributing to its energy independence and reducing its greenhouse gas emissions.

The seawater treatment plant, a key infrastructure to preserving the country’s water resources

The CSSP will be built on the coast near the town of Um Qasr. It will process and transport 5 million barrels of seawater per day to the main oil fields in southern Iraq.

Treated seawater will be substituted for the freshwater currently taken from the Tigris, Euphrates, and aquifers to maintain pressure in the oil wells. The project will therefore help alleviate water stress in the region and is expected to free up to 250,000 cubic meters of freshwater per day for irrigation and local agriculture needs.

Ongoing redevelopment of the Ratawi field, one of Iraq’s lowest-emission oil sites

The Ratawi redevelopment was launched in September 2023. Phase 1 aims to increase production to 120,000 bpd and is expected to come on stream by early 2026.

The launch of phase 2 (full field development) will enable to increase production to 210,000 bpd starting in 2028 with no routine flaring.

All 160 Mcf/d of associated gas produced every day will be fully processed thanks to the 300 Mcf/d Gas Midstream Project (GMP), whose construction began early 2025. The GMP, which will also treat previously flared gas from two other fields in southern Iraq, will deliver processed gas into the national grid where it will fuel power plants with a production capacity of approximately 1.5 GW, providing electricity to 1.5 million Iraqi households. An Early Production facility to process 50 Mcf/d of associated gas will start early 2026 together with the Ratawi phase 1 oil production.

“We are delighted today to award the two final contracts of the Gas Growth Integrated Project, in particular the seawater treatment plant which has been long awaited by the oil industry in Iraq. In less than 2 years since the GGIP effective date in August 2023, TotalEnergies and its partners have fully executed their commitment towards the people of Iraq and launched all projects included in the multienergy GGIP projet, the best showcase of TotalEnergies transition strategy. All these projects will bring a significant contribution to the Iraq economy and employ during the construction phase 7,000 Iraqi nationals.,” declared Patrick Pouyanné, Chairman and Chief Executive Officer of TotalEnergies. “Furthermore, I am proud to confirm that the first phase of the associated gas, oil and solar projects will start-up as soon as early 2026.”

***

About the Gas Growth Integrated Project in Iraq

In 2023, TotalEnergies launched the multi-energy Gas Growth Integrated Project (GGIP) in Iraq. The GGIP is designed to enhance the development of Iraq’s natural resources to improve the country’s electricity supply. This 4-in-1 project comprises the recovery of gas that is currently flared at three oil fields in southern Iraq to supply electric power plants, the redevelopment of the Ratawi oil field, the construction of a 1 GWac (1.25GWp) solar farm and of a seawater treatment plant.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to providing as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update

publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.8

Disclosure of Transactions in Own Shares

Paris, September 15, 2025 – In accordance with the authorizations given by the shareholders’ general meeting on May 23, 2025, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) declares the following purchases of its own shares (FR0000120271) from September 8 to September 12, 2025:

| Transaction Date | Total

daily volume (number of shares) |

Daily

weighted average purchase price of shares (EUR/share) |

Amount

of transactions (EUR) |

Market (MIC Code) |

| 08/09/2025 | 376,467 | 52.130341 | 19,625,353.09 | XPAR |

| 08/09/2025 | 180,020 | 52.105804 | 9,380,086.84 | CEUX |

| 08/09/2025 | 46,100 | 52.146507 | 2,403,953.97 | TQEX |

| 08/09/2025 | 41,000 | 52.124963 | 2,137,123.48 | AQEU |

| 09/09/2025 | 345,407 | 52.632746 | 18,179,718.90 | XPAR |

| 09/09/2025 | 168,372 | 52.647988 | 8,864,447.04 | CEUX |

| 09/09/2025 | 40,777 | 52.661166 | 2,147,364.37 | TQEX |

| 09/09/2025 | 28,789 | 52.635009 | 1,515,309.27 | AQEU |

| 10/09/2025 | 389,712 | 52.622472 | 20,507,608.81 | XPAR |

| 10/09/2025 | 147,232 | 52.647988 | 7,751,468.57 | CEUX |

| 10/09/2025 | 31,832 | 52.639724 | 1,675,627.69 | TQEX |

| 10/09/2025 | 24,786 | 52.626127 | 1,304,391.18 | AQEU |

| 11/09/2025 | 463,570 | 52.596020 | 24,381,936.99 | XPAR |

| 11/09/2025 | 201,000 | 52.570014 | 10,566,572.81 | CEUX |

| 11/09/2025 | 47,000 | 52.590128 | 2,471,736.02 | TQEX |

| 11/09/2025 | 30,000 | 52.657053 | 1,579,711.59 | AQEU |

| 12/09/2025 | 505,054 | 52.000548 | 26,263,084.77 | XPAR |

| 12/09/2025 | 180,000 | 51.994577 | 9,359,023.86 | CEUX |

| 12/09/2025 | 40,000 | 51.986040 | 2,079,441.60 | TQEX |

| 12/09/2025 | 25,000 | 51.937332 | 1,298,433.30 | AQEU |

| Total | 3,312,118 | 52.381103 | 173,492,394.15 |

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 1 47 44 46 99 l mailto:presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |

|

@TotalEnergies |

|

@TotalEnergies |

|

@TotalEnergies |

Disclaimer:

The terms “TotalEnergies”, “TotalEnergies company” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities.

This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to the financial condition, results of operations, business activities and strategy of TotalEnergies. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies, including with respect to climate change and carbon neutrality (net zero emissions). An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document.

These forward-looking statements are not historical data and should not be interpreted as assurances that the perspectives, objectives, or goals announced will be achieved. They may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto.

Readers are cautioned not to consider forward-looking statements as accurate, but as an expression of the Company’s views only as of the date this document is published. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. The information on risk factors that could have a significant adverse effect on TotalEnergies’ business, financial condition, including its operating income and cash flow, reputation, outlook or the value of financial instruments issued by TotalEnergies is provided in the most recent version of the Universal Registration Document which is filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (“SEC”).

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.9

|

PRESS RELEASE |

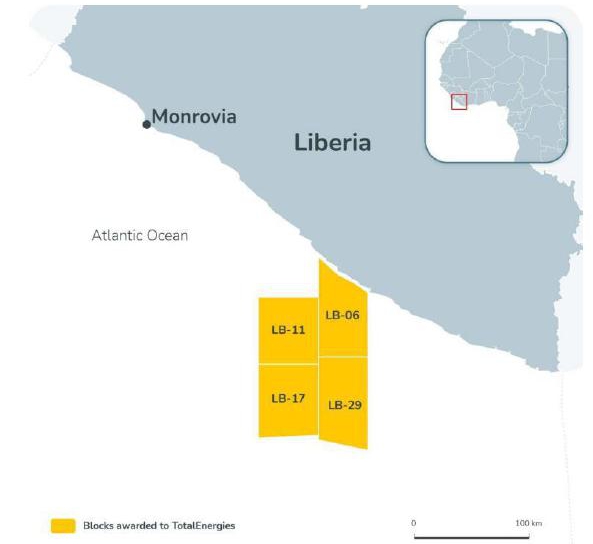

Liberia: TotalEnergies is Awarded Four Offshore Exploration

Permits

Paris, September 17, 2025 – TotalEnergies has signed four Production Sharing Contracts (PSC) for the LB-6, LB-11, LB-17 and LB-29 Exploration blocks offshore Liberia, which were awarded following the 2024 Direct Negotiation Licensing Round organized by the Liberia Petroleum Regulatory Agency.

The blocks LB-6, LB-11, LB-17 and LB-29, covering an area of approximately 12,700 square kilometers, are located in the south of the Liberia Basin. The work program includes acquiring one firm 3D seismic survey.

“TotalEnergies is enthusiastic to be part of the resumption of exploration activities in offshore Liberia,” said Kevin McLachlan, Senior Vice-President Exploration at TotalEnergies. “Entering these blocks aligns with our strategy of diversifying our Exploration portfolio in high-potential new oil-prone basins. These areas hold significant potential for prospects that have the potential for large-scale discoveries that lead to cost-effective, low-emission developments, leveraging the Company’s proven expertise in deepwater operations.”

***

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to providing as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |

|

@TotalEnergies |

|

@TotalEnergies |

|

@TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.10

Disclosure of Transactions in Own Shares

Paris, September 22, 2025 – In accordance with the authorizations given by the shareholders’ general meeting on May 23, 2025, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) declares the following purchases of its own shares (FR0000120271) from September 15 to September 19, 2025:

| Transaction Date | Total

daily volume (number of shares) |

Daily

weighted average purchase price of shares (EUR/share) |

Amount

of (EUR) |

Market (MIC Code) |

| 15/09/2025 | 397,508 | 52.630352 | 20,920,985.96 | XPAR |

| 15/09/2025 | 221,899 | 52.612131 | 11,674,579.26 | CEUX |

| 15/09/2025 | 50,390 | 52.629328 | 2,651,991.84 | TQEX |

| 15/09/2025 | 31,569 | 52.619086 | 1,661,131.93 | AQEU |

| 16/09/2025 | 200,110 | 52.312929 | 10,468,340.22 | XPAR |

| 16/09/2025 | 100,000 | 52.305227 | 5,230,522.70 | CEUX |

| 16/09/2025 | 24,000 | 52.291698 | 1,255,000.75 | TQEX |

| 16/09/2025 | 20,000 | 52.304335 | 1,046,086.70 | AQEU |

| 17/09/2025 | 202,909 | 51.889881 | 10,528,923.86 | XPAR |

| 17/09/2025 | 100,000 | 51.883637 | 5,188,363.70 | CEUX |

| 17/09/2025 | 24,000 | 51.885783 | 1,245,258.79 | TQEX |

| 17/09/2025 | 20,000 | 51.872281 | 1,037,445.62 | AQEU |

| 18/09/2025 | 603,717 | 51.953414 | 31,365,159.24 | XPAR |

| 18/09/2025 | 264,703 | 51.952665 | 13,752,026.28 | CEUX |

| 18/09/2025 | 45,530 | 51.947981 | 2,365,191.57 | TQEX |

| 18/09/2025 | 37,156 | 51.962852 | 1,930,731.73 | AQEU |

| 19/09/2025 | 760,047 | 51.974130 | 39,502,781.58 | XPAR |

| 19/09/2025 | 252,000 | 51.922164 | 13,084,385.33 | CEUX |

| 19/09/2025 | 45,000 | 51.909910 | 2,335,945.95 | TQEX |

| 19/09/2025 | 40,000 | 51.921101 | 2,076,844.04 | AQEU |

| Total | 3,440,538 | 52.120249 | 179,321,697.06 |

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 1 47 44 46 99 l mailto:presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Disclaimer:

The terms “TotalEnergies”, “TotalEnergies company” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities.

This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to the financial condition, results of operations, business activities and strategy of TotalEnergies. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies, including with respect to climate change and carbon neutrality (net zero emissions). An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document.

These forward-looking statements are not historical data and should not be interpreted as assurances that the perspectives, objectives, or goals announced will be achieved. They may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto.

Readers are cautioned not to consider forward-looking statements as accurate, but as an expression of the Company’s views only as of the date this document is published. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. The information on risk factors that could have a significant adverse effect on TotalEnergies’ business, financial condition, including its operating income and cash flow, reputation, outlook or the value of financial instruments issued by TotalEnergies is provided in the most recent version of the Universal Registration Document which is filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (“SEC”).

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.11

|

PRESS RELEASE |

France: TotalEnergies Selected by the State

as Operator of the

Country’s Largest Renewable Energy Project

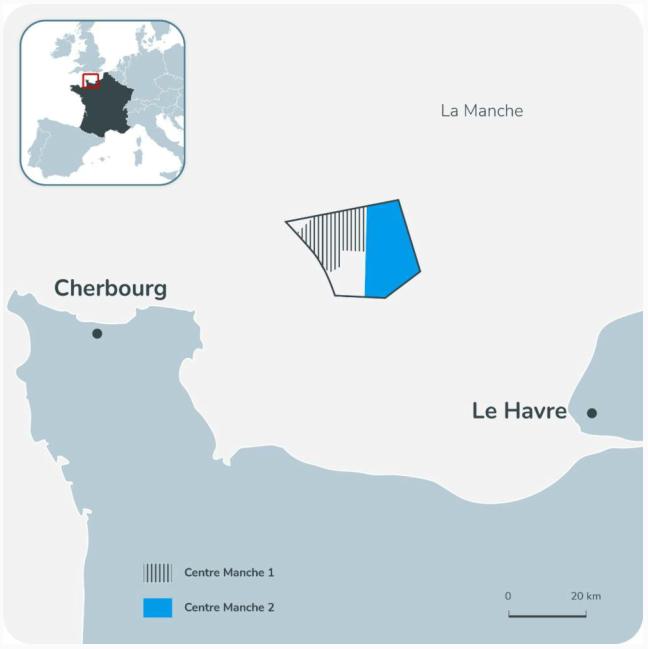

| · | TotalEnergies, in partnership with RWE, has been awarded the “Centre Manche 2” offshore wind tender as operator. |

| · | The project will represent an overall investment of approximately €4.5 billion, the largest made by TotalEnergies in the country in the past 30 years. |

| · | TotalEnergies made commitments on job creation in France, especially in Normandy, and chose to implement a European preference policy for major equipment, notably wind turbines and electricity cables. |

| · | The 1.5 GW wind farm will supply green electricity to over 1 million households at a competitive price. |

Paris, September 24, 2025 – The consortium formed by TotalEnergies and RWE has been selected by the Ministry in charge of Industry and Energy as the winner of the Centre Manche 2 (AO8) offshore wind tender. The consortium will be responsible for designing, developing, building, and operating a 1.5 gigawatt (GW) offshore wind farm off the coast of Normandy.

The Largest Renewable Project Ever Developed in France

Located more than 40 km off the coast of Normandy, this will be the largest renewable energy project ever developed in France. Once built, it will generate approximately 6 TWh per year and supply green electricity to the equivalent of over 1 million French households. The electricity will be sold at a competitive price of €66/MWh, as set by the tender.

TotalEnergies will be the operator of the project, relying on its expertise in offshore wind and the management of large-scale marine energy projects. The Company will continue the necessary studies to reach a final investment decision by early 2029. Electricity production is expected to begin in 2033, in line with RTE’s grid connection schedule.

“We are very proud to have won this tender for the construction of the largest renewable energy park in France to date. It embodies Total’s transformation into TotalEnergies in France. This project will be the largest investment made by TotalEnergies in France in decades and reflects our Company’s deep commitment to our country. As a long-standing player in Normandy, we are determined to mobilize our expertise to ensure this project is an industrial success while securing its acceptance by the region. We will work to support the local industrial ecosystem, which has already developed skills through the first offshore wind projects currently being installed. Finally, this project strengthens our development in green electricity production to offer competitive prices to our French customers”, said Patrick Pouyanné, Chairman and CEO of TotalEnergies.

As part of a strategic review of its investments, RWE has expressed the wish to exit the consortium, subject to French authorities’ approval. In any case, TotalEnergies will pursue the project, assuming all the commitments of the consortium, and will propose to bring a new partner into the project.

A €4.5 billion investment that will benefit the Normandy region and the European industry

The project is expected to represent a €4.5 billion investment and generate significant economic benefits for the Normandy region. Up to 2,500 people will be employed during the three years of construction, and TotalEnergies has committed to offering 500,000 hours of work to apprentices and individuals in professional reintegration. TotalEnergies also plans to engage the local economic ecosystem, which has already developed expertise in offshore wind.

The project will also benefit the European industry, as TotalEnergies intends to source primarily from European suppliers, particularly for wind turbines and electrical cables.

TotalEnergies will ensure the proper integration of the project into the region

In the coming months, a dedicated TotalEnergies team, based in Normandy, will continue the consultation work with local and regional stakeholders that began during the tender phase. It will ensure the proper integration of the project into the Normandy region, especially its coexistence with commercial fishing.

TotalEnergies will also implement crowdfunding financing that will allow local residents and authorities in the Normandy region to invest in the project and directly contribute to the energy transition of their territory. Additionally, TotalEnergies will fund a €10 million territorial fund to support initiatives in training, education, and culture in Normandy.

On environmental matters, TotalEnergies will allocate €45 million to measures aimed at avoiding, reducing, and offsetting the project’s impacts; as well as €15 million to a biodiversity promotion fund in Normandy.

Finally, TotalEnergies has committed to making this project exemplary in terms of recycling offshore wind farm components, with recycling, reuse, or repurposing rates of blades, towers, and nacelles equal to or greater than 95%, and 100% of generator magnets being recycled or reused.

TotalEnergies in France: a historic territorial presence

A leading economic player rooted in France for over a century, TotalEnergies continues to invest in the country to contribute to energy security and the supply of fuels, gas, and electricity across the territory.

Since 2020, while transforming its energy offer, TotalEnergies has invested more than €8 billion in France, nearly half of which has supported the energy transition of its assets and for its customers. With a renewable portfolio of 660 wind, solar, hydro, and battery storage plants, TotalEnergies meets the electricity needs of the equivalent of 1.8 million people in France, ranking among the top three renewable electricity providers in the country with over 2 GW of installed capacity. TotalEnergies supplies electricity and gas to 4.2 million residential and business customers.

***

(map on the next page)

TotalEnergies and offshore wind

TotalEnergies’ portfolio in offshore wind has a total capacity of 25 GW, with most farms bottom-fixed. These projects are located in the United Kingdom (Seagreen, Outer Dowsing, West of Orkney, Erebus), South Korea (Bada), Taiwan (Yunlin, Haiding 2), France (Eolmed and Centre Manche 2), the United States (Attentive Energy and Carolina Long Bay), in the Netherlands (OranjeWind), in Germany (Nordsee Energies 1, 2 & 3, Ostsee Energies, WindBostel Ost et West).

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies”, “TotalEnergies company” or “Company” in this document are used to designate TotalEnergies SE and the consolidated entities that are directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we”, “us” and “our” may also be used to refer to these entities or to their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate legal entities. This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TotalEnergies SE nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise. Information concerning risk factors, that may affect TotalEnergies’ financial results or activities is provided in the most recent Universal Registration Document, the French-language version of which is filed by TotalEnergies SE with the French securities regulator Autorité des Marchés Financiers (AMF), and in the Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Exhibit 99.12

|

PRESS RELEASE |

The Board of Directors

of Total Energies confirms

the relevance and progress of the Company’s strategy,

as

the differentiated and profitably growing energy major

- The Board of Directors confirms the priority given to dividend growth through cycles and decides to adjust the pace of share buybacks to energy environment in order to face economic and geopolitical uncertainties and to retain room to maneuver.

- The Board of Directors approves the 2026 capital increase reserved for employees that will bring employee shareholding to more than 9% of the Company's share capital.

- The Board of Directors also approves the technical project to convert ADRs (American Depositary Receipts) listed on the New York Stock Exchange since 1991 into ordinary shares.

Paris, September 24, 2025 – During its annual strategic seminar held on September 23 & 24, 2025 and its meeting on September 24, 2025, the Board of Directors of TotalEnergies reviewed the Company's 2030 strategic outlook that will be presented to investors on September 29.

The Board of Directors confirmed the relevance of the Company’s profitable growth transition strategy that is anchored on two pillars: oil and gas, mainly LNG, and Integrated Power. The Board of Directors is pleased by the progress of multiple projects that will contribute to the Company’s overall energy production (oil, gas, electricity) growth objective of 4% per year through 2030, while reducing emissions from its operations. In this context, the Board of Directors is pleased with the award of the offshore wind project "Centre Manche 2" to TotalEnergies, as the operator, materializing the Company's transition strategy in France.

Thanks to a clear and disciplined investment framework, the update of which will be presented on September 29, alongside strong cash flow growth during 2025-2030, the Board of Directors confirmed its commitment to deliver an attractive shareholder return policy while preserving balance sheet strength.

The Board of Directors therefore confirmed the shareholder return policy of at least 40% of annual cash flow from operations through cycles and reaffirmed the dividend as a priority in a low cycle environment. TotalEnergies’ dividend has grown more than 20% over the last three years and it has not been cut in 40 years.

The Board of Directors also confirmed the priority given to preserving a strong balance sheet and retaining maneuverability by maintaining a gearing ratio below 20% in an uncertain economic and geopolitical environment. Therefore, the Board of Directors has decided to adjust the pace of share buybacks to hydrocarbon prices, refining and petrochemical margins and the $/€ exchange rate. Considering the current environment, the Board of Directors has authorized $1.5 billion of share buybacks in the fourth quarter 2025, resulting in $7.5 billion of share buybacks for the full year 2025. In addition, the Board of Directors has approved for 2026 share buyback guidance of between $0.75 billion and $1.5 billion per quarter for a Brent price between $60 and $70/b and an exchange rate around 1.20 $/€.

The Board of Directors also approved the terms for the 2026 capital increase reserved for employees. It was delighted by the strong participation of employees, with employee shareholding reaching 8.9% of Company’s share capital in 2025 - an increase of more than 50% over the past ten years - making it #1 in employee shareholding in Europe in terms of capitalization held.

Finally, the Board of Directors also approved the technical project to convert the ADRs (American Depositary Receipts) that have been listed on the New York Stock Exchange since 1991 into ordinary shares. This operation will have no impact on holders of ordinary shares listed on Euronext Paris, which will remain the introduction’s market for TotalEnergies shares.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables and electricity. Our more than 100,000 employees are committed to providing as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

|

@TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |  |

TotalEnergies |

Cautionary Note

The terms “TotalEnergies,” “TotalEnergies company,” and “Company” in this document are used to designate TotalEnergies SE and the consolidated entities directly or indirectly controlled by TotalEnergies SE. Likewise, the words “we,” “us,” and “our” may also be used to refer to these entities or their employees. The entities in which TotalEnergies SE directly or indirectly owns a shareholding are separate and independent legal entities. This document may contain forward-looking statements (including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995), notably with respect to (i) the financial condition, results of operations, business activities and strategy of TotalEnergies, (ii) the contemplated conversion of the American Depositary Receipts (ADR), including the termination of the ADR program in connection therewith and (iii) the contemplated listing of TotalEnergies’ ordinary shares on the New York Stock Exchange. This document may also contain statements regarding the perspectives, objectives, areas of improvement and goals of TotalEnergies. An ambition expresses an outcome desired by TotalEnergies, it being specified that the means to be deployed do not depend solely on TotalEnergies. These forward-looking statements may generally be identified by the use of the future or conditional tense or forward-looking words such as “will”, “should”, “could”, “would”, “may”, “likely”, “might”, “envisions”, “intends”, “anticipates”, “believes”, “considers”, “plans”, “expects”, “thinks”, “targets”, “aims” or similar terminology. Such forward-looking statements included in this document are based on economic data, estimates and assumptions prepared in a given economic, competitive and regulatory environment and considered to be reasonable by TotalEnergies as of the date of this document. These statements may prove to be inaccurate in the future, and may evolve or be modified with a significant difference between the actual results and those initially estimated, due to the uncertainties notably related to the economic, financial, competitive and regulatory environment, or due to the occurrence of risk factors, such as, notably, the price fluctuations in crude oil and natural gas, the evolution of the demand and price of petroleum products, the changes in production results and reserves estimates, the ability to achieve cost reductions and operating efficiencies without unduly disrupting business operations, changes in laws and regulations including those related to the environment and climate, currency fluctuations, technological innovations, meteorological conditions and events, as well as socio-demographic, economic and political developments, changes in market conditions, loss of market share and changes in consumer preferences, or pandemics such as the COVID-19 pandemic. Additionally, certain financial information is based on estimates particularly in the assessment of the recoverable value of assets and potential impairments of assets relating thereto. The initial and continued listing of ordinary shares on the New York Stock Exchange, as well as the structure contemplated to support such listing, remain at the discretion of TotalEnergies’ management, subject to compliance with applicable law and the rules in force on the New York Stock Exchange, and the implementation and maintenance of the contemplated structure to support such listing. TotalEnergies SE and its subsidiaries have no obligation, make no commitment and expressly disclaim any responsibility to investors or any stakeholder to update or revise, particularly as a result of new information or future events, any forward-looking information or statement, objectives or trends contained in this document. In addition, the Company has not verified, and is under

no obligation to verify any third-party data contained in this document or used in the estimates and assumptions or, more generally, forward-looking statements published in this document. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction. The information on risk factors that could have a significant adverse effect on the financial results or activities of TotalEnergies is provided in the most recent version of the Universal Registration Document filed by TotalEnergies SE with the French Autorité des Marchés Financiers and the annual report on Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Cautionary Note to U.S. Investors – U.S. investors are urged to consider closely the disclosure in the Form 20-F of TotalEnergies SE, File N° 1-10888, available from us at 2, place Jean Millier – Arche Nord Coupole/Regnault - 92078 Paris-La Défense Cedex, France, or at the Company website totalenergies.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or on the SEC’s website sec.gov.

Exhibit 99.13

|

|

PRESS RELEASE

Digital Transformation: TotalEnergies and Cognite

Expand Their Partnership to Scale Industrial AI

Paris/Phoenix, 26 September - TotalEnergies, a major integrated energy company, and Cognite, a leader in industrial AI, announced today a new phase of their strategic partnership. This agreement will scale the deployment - over a period of three years - of the Cognite industrial data and AI platform, across all TotalEnergies' operated upstream assets worldwide, covering the entire value chain from drilling to production. The objective is to harness the potential of TotalEnergies’ data to enhance the industrial performance of its sites.

Building on a long-standing collaboration, this new initiative aims to make complex data AI-ready, thereby boosting the value of TotalEnergies’ existing data, to improve operational excellence across its assets. The collaboration will position industrial data and AI as strategic levers for TotalEnergies to provide more reliable, efficient, and sustainable energy. This will enable the Company to:

| l | Access more industrial data, to improve the accuracy of data analysis faster and shorten the lead to adopt applications by providing easy and quick access to relevant, high quality industrial data | |

| l | Enable dynamic visualization of assets to enhance decision-making throughout the production lifecycle and monitor critical equipment for production and operational safety | |

| l | Accelerate the use of AI to analyze and drive operational performance across sites |