UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 25, 2025

Orange County Bancorp, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-40711 | 26-1135778 |

| (State or Other Jurisdiction) | (Commission File No.) | (I.R.S. Employer |

| of Incorporation) | Identification No.) |

| 212 Dolson Avenue, Middletown, New York | 10940 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (845) 341-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, par value $0.25 | OBT | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

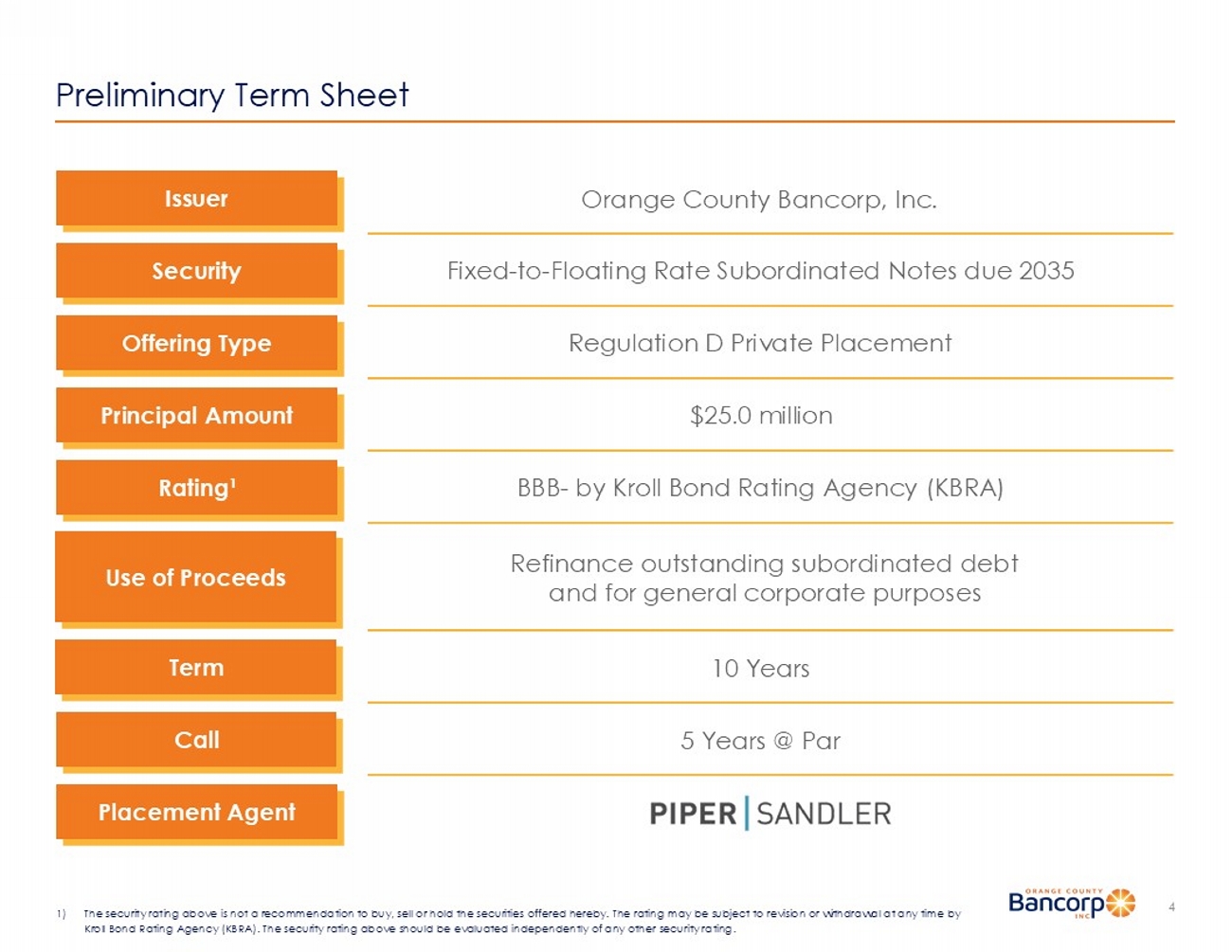

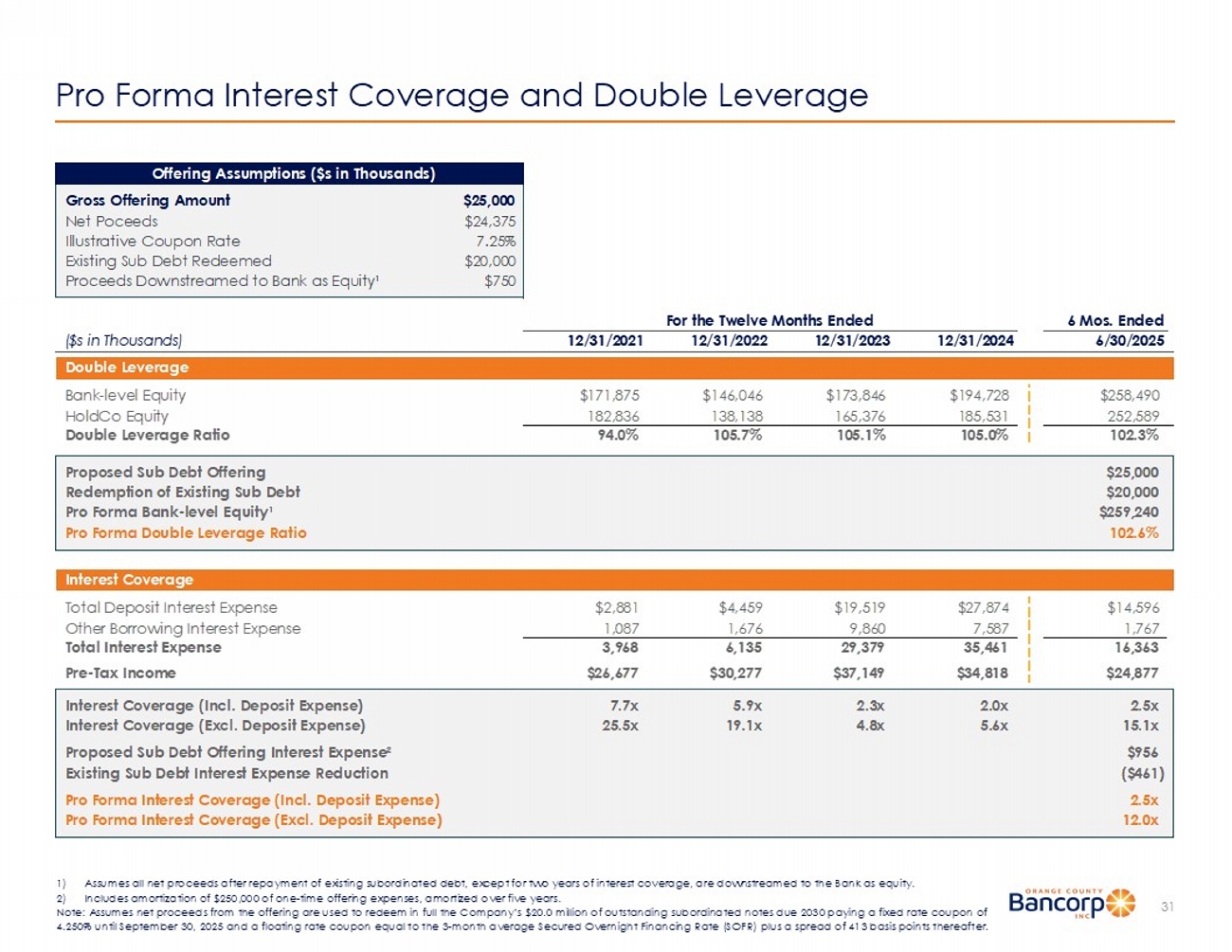

On September 25, 2025, Orange County Bancorp, Inc. (the “Company”), the holding company for Orange Bank & Trust Company, a New York trust company, entered into Subordinated Note Purchase Agreements (the “Agreements”) with certain qualified institutional buyers (the “Purchasers”) and, pursuant to the Agreements, issued to the Purchasers $25.0 million in aggregate principal amount of the Company’s 6.50% Fixed-to-Floating Rate Subordinated Notes due 2035 (the “Notes”). The Notes were offered and sold in a private placement in reliance on exemptions from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 of Regulation D thereunder.

The Company intends to use the net proceeds from the issuance and sale of the Notes for general corporate purposes, which may include the redemption of its currently outstanding 4.25% Fixed to Floating Rate Subordinated Notes due 2030. The Notes are intended to qualify at the holding company level as Tier 2 capital under the capital guidelines of the Federal Reserve Board.

The Notes, which mature on September 30, 2035, bear interest at a fixed annual rate of 6.50% for the period up to, but excluding, September 30, 2030 (the “Fixed Interest Rate Period”). From and including September 30, 2030 until maturity or redemption (the “Floating Interest Rate Period”), the interest rate will adjust to a floating rate equal to a benchmark rate, which is expected to be the then-current Three-Month Term SOFR, plus 320.5 basis points. The Company will pay interest in arrears semi-annually during the Fixed Interest Rate Period and quarterly during the Floating Interest Rate Period. The Notes constitute unsecured and subordinated obligations of the Company and rank junior in right of payment to any senior indebtedness and obligations to general and secured creditors. Subject to limited exceptions, the Company cannot redeem the Notes before the fifth anniversary of the issuance date.

The Agreements and Notes contain customary subordination provisions, representations and warranties, covenants, and events of default.

The foregoing description of the Agreements and the Notes does not purport to be complete and is qualified in its entirety by reference to the form of the Agreements and the form of the Notes, which are filed as Exhibits 10.1 and 4.1, respectively, to this Current Report on Form 8-K and are incorporated by reference into this Item 1.01.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant |

The discussion under Item 1.01 is incorporated by reference into this Item 2.03.

| Item 7.01 | Regulation FD Disclosure |

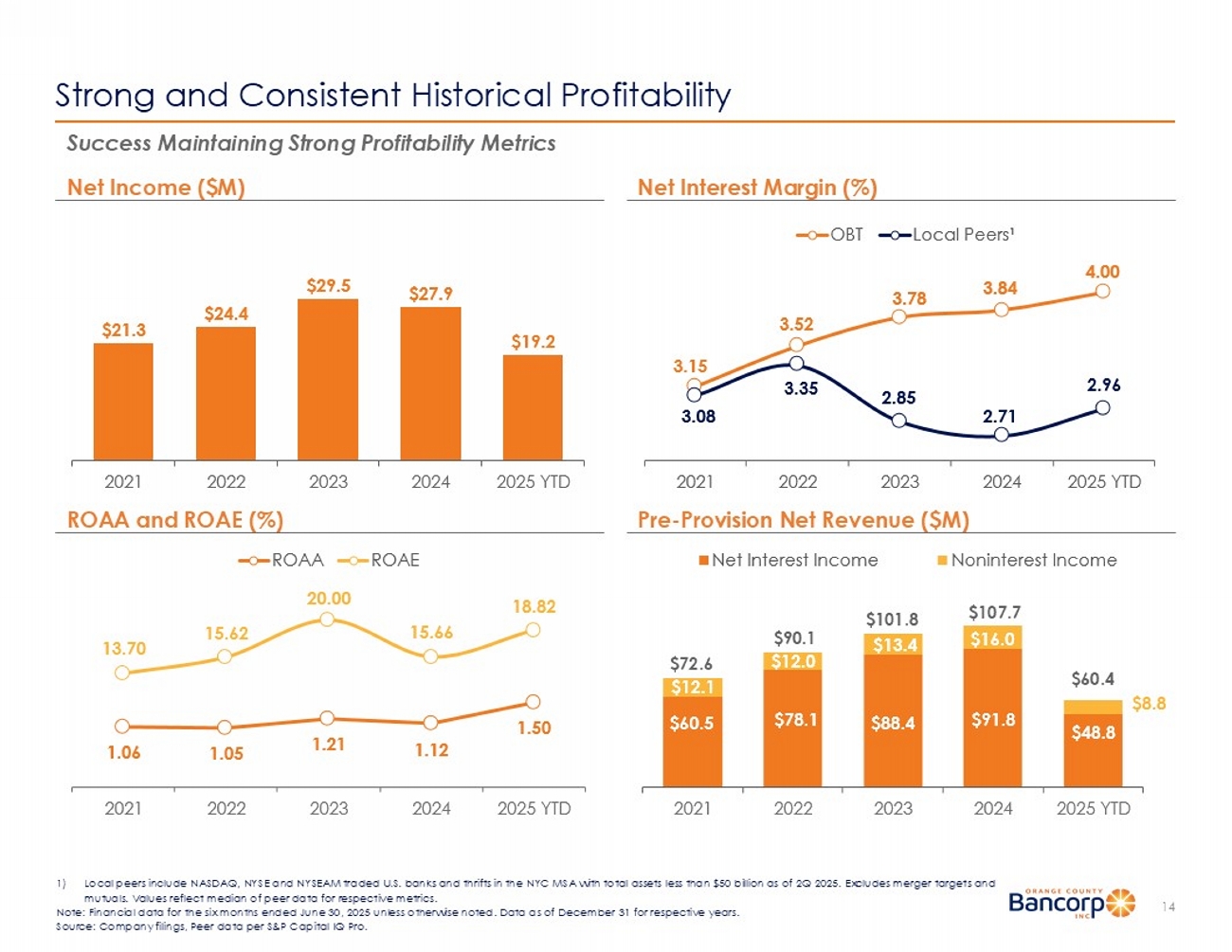

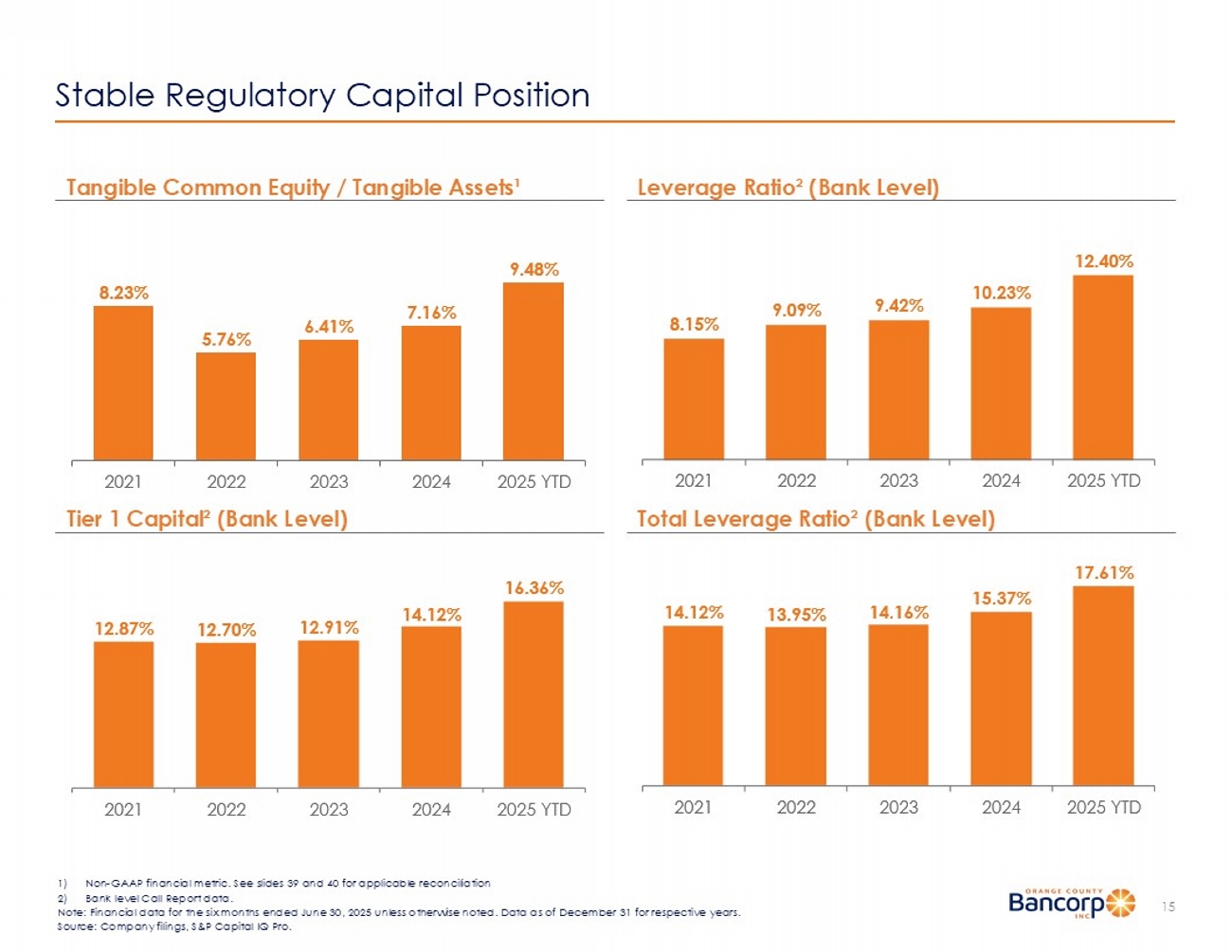

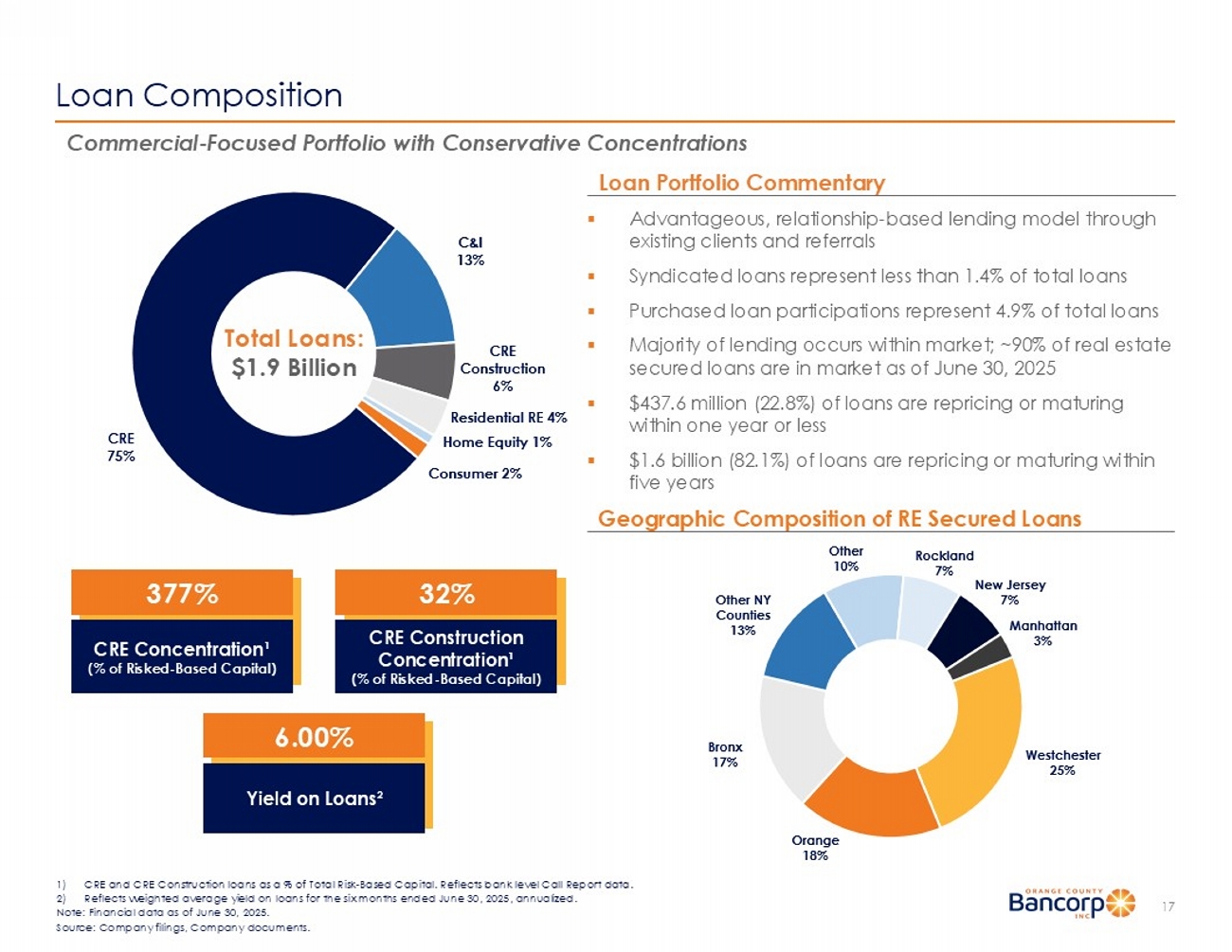

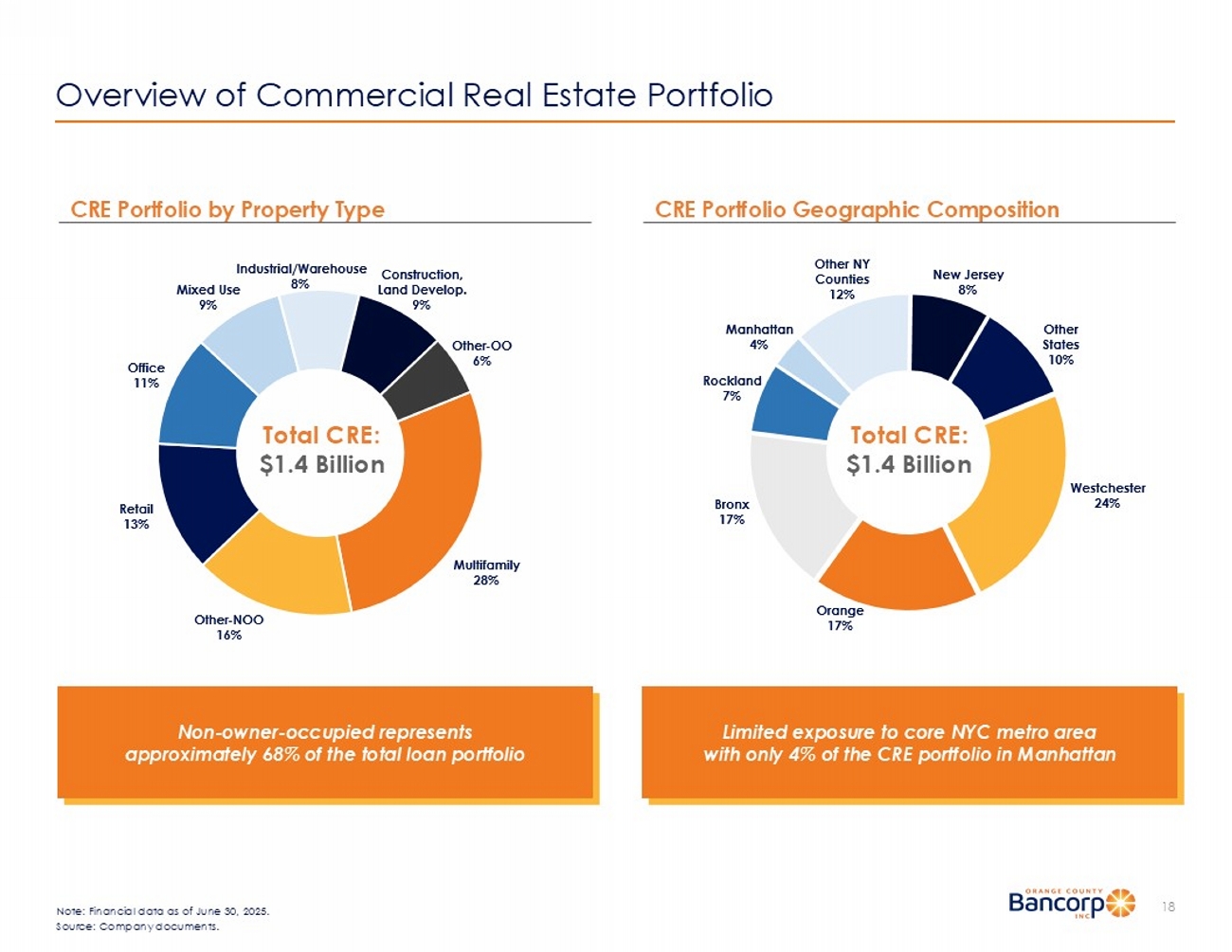

In connection with the offering of the Notes, the Company delivered an investor presentation to potential investors on a confidential basis, a copy of which is furnished herewith as Exhibit 99.1.

The information furnished in this Item 7.01 and in Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Securities Exchange Act, and the Private Securities Litigation Reform Act of 1995. The Company intends its forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in this Current Report on Form 8-K. All statements regarding the Company’s expected financial position and operating results, the Company’s business strategy, the Company’s financial plans, forecasted demographic and economic trends relating to the Company’s industry and similar matters are forward-looking statements. These statements can sometimes be identified by the Company’s use of forward-looking words such as “may,” “will,” “anticipate,” “estimate,” “expect,” or “intend.” The Company cannot guarantee that its expectations in such forward-looking statements will turn out to be correct. The Company’s actual results could be materially different from expectations because of various factors, including changes in economic conditions or interest rates, credit risk, inflation, tariffs, cybersecurity risks, changes in FDIC assessments, bank failures, difficulties in managing the Company’s growth, competition, changes in law or the regulatory environment, and changes in general business and economic trends. Information concerning these and other factors, including Risk Factors, can be found in the Company’s periodic filings with the Securities and Exchange Commission, including the discussion under the heading “Item 1A. Risk Factors” in the Company’s 2024 Annual Report on Form 10-K. The Company does not undertake, and specifically disclaims, any obligation to publicly revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. Accordingly, you should not place undue reliance on forward-looking statements.

| Item 9.01 | Financial Statements and Exhibits |

| (a) | Financial statements of businesses acquired. None. | ||

| (b) | Pro forma financial information. None. | ||

| (c) | Shell company transactions: None. | ||

| (d) | Exhibits. | ||

| 4.1 | Form of 6.50% Fixed-to-Floating Rate Subordinated Note due 2035 of Orange County Bancorp, Inc. | ||

| 10.1 | Form of Subordinated Note Purchase Agreement, dated as of September 25, 2025, by and between Orange County Bancorp, Inc. and the several Purchasers | ||

| 99.1 | Investor Presentation | ||

| 104 | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| ORANGE COUNTY BANCORP, INC. | ||

| DATE: September 25, 2025 | By: | /s/ Michael Lesler |

| Michael Lesler | ||

| Executive Vice President and Chief Financial Officer | ||

Exhibit 4.1

ORANGE COUNTY BANCORP, INC.

6.50% FIXED-TO-FLOATING RATE SUBORDINATED NOTE DUE SEPTEMBER 30, 2035

THE INDEBTEDNESS EVIDENCED BY THIS SUBORDINATED NOTE IS NOT A DEPOSIT AND IS NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY OR FUND.

THE INDEBTEDNESS EVIDENCED BY THIS SUBORDINATED NOTE IS SUBORDINATED AND JUNIOR IN RIGHT OF PAYMENT TO SENIOR INDEBTEDNESS (AS DEFINED IN SECTION 3 (SUBORDINATION) OF THIS SUBORDINATED NOTE) OF ORANGE COUNTY BANCORP, INC. (THE “COMPANY”), INCLUDING OBLIGATIONS OF THE COMPANY TO ITS GENERAL AND SECURED CREDITORS AND IS UNSECURED. IT IS INELIGIBLE AS COLLATERAL FOR ANY EXTENSION OF CREDIT BY THE COMPANY OR ANY OF ITS SUBSIDIARIES.

THIS SUBORDINATED NOTE IS A GLOBAL SUBORDINATED NOTE WITHIN THE MEANING OF SECTION 5 OF THIS SUBORDINATED NOTE AND IS REGISTERED IN THE NAME OF CEDE & CO AS NOMINEE OF THE DEPOSITORY TRUST COMPANY (“DTC”) OR A NOMINEE OF DTC. THIS SUBORDINATED NOTE IS EXCHANGEABLE FOR SUBORDINATED NOTES REGISTERED IN THE NAME OF A PERSON OTHER THAN DTC OR ITS NOMINEE ONLY IN THE LIMITED CIRCUMSTANCES DESCRIBED IN SECTION 5 OF THIS SUBORDINATED NOTE, AND NO TRANSFER OF THIS SUBORDINATED NOTE (OTHER THAN A TRANSFER OF THIS SUBORDINATED NOTE AS A WHOLE BY DTC TO A NOMINEE OF DTC OR BY A NOMINEE OF DTC TO DTC OR ANOTHER NOMINEE OF DTC) MAY BE REGISTERED EXCEPT IN LIMITED CIRCUMSTANCES SPECIFIED IN THIS SUBORDINATED NOTE.

UNLESS THIS SUBORDINATED NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF DTC TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE, OR PAYMENT, AND ANY SUBORDINATED NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO, OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT HEREON IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

TRANSFERS OF THIS SUBORDINATED NOTE WILL BE LIMITED TO TRANSFERS IN WHOLE, BUT NOT IN PART, TO NOMINEES OF DTC OR A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE AND TRANSFERS OF PORTIONS OF THIS SUBORDINATED NOTE WILL BE LIMITED TO TRANSFERS MADE IN ACCORDANCE WITH THE RESTRICTIONS SET FORTH IN SECTION 5 OF THIS SUBORDINATED NOTE.

IN THE EVENT OF LIQUIDATION ALL HOLDERS OF SENIOR INDEBTEDNESS OF THE COMPANY SHALL BE ENTITLED TO BE PAID IN FULL WITH SUCH INTEREST AS MAY BE PROVIDED BY LAW BEFORE ANY PAYMENT SHALL BE MADE ON ACCOUNT OF PRINCIPAL OF OR INTEREST ON THIS SUBORDINATED NOTE. AFTER PAYMENT IN FULL OF ALL SUMS OWING TO SUCH HOLDERS OF SENIOR INDEBTEDNESS, THE HOLDER OF THIS SUBORDINATED NOTE, TOGETHER WITH THE HOLDERS OF ANY OBLIGATIONS OF THE COMPANY RANKING ON A PARITY WITH THE SUBORDINATED NOTES, SHALL BE ENTITLED TO BE PAID FROM THE REMAINING ASSETS OF THE COMPANY THE UNPAID PRINCIPAL AMOUNT OF THIS SUBORDINATED NOTE PLUS ACCRUED AND UNPAID INTEREST THEREON BEFORE ANY PAYMENT OR OTHER DISTRIBUTION, WHETHER IN CASH, PROPERTY OR OTHERWISE, SHALL BE MADE (I) WITH RESPECT TO ANY OBLIGATION THAT BY ITS TERMS EXPRESSLY IS JUNIOR IN THE RIGHT OF PAYMENT TO THE SUBORDINATED NOTES, (II) WITH RESPECT TO ANY INDEBTEDNESS BETWEEN THE COMPANY AND ANY OF ITS SUBSIDIARIES OR AFFILIATES OR (III) ON ACCOUNTOF ANY SHARES OF CAPITAL STOCK OF THE COMPANY.

THIS SUBORDINATED NOTE WILL BE ISSUED AND MAY BE TRANSFERRED ONLY IN MINIMUM DENOMINATIONS OF $100,000 AND MULTIPLES OF $1,000 IN EXCESS THEREOF. ANY ATTEMPTED TRANSFER OF THIS SUBORDINATED NOTE IN A DENOMINATION OF LESS THAN $100,000 SHALL BE DEEMED TO BE VOID AND OF NO LEGAL EFFECT WHATSOEVER. ANY SUCH PURPORTED TRANSFEREE SHALL BE DEEMED NOT TO BE THE HOLDER OF THIS SUBORDINATED NOTE FOR ANY PURPOSE, INCLUDING, BUT NOT LIMITED TO, THE RECEIPT OF PAYMENTS ON THIS SUBORDINATED NOTE, AND SUCH PURPORTED TRANSFEREE SHALL BE DEEMED TO HAVE NO INTEREST WHATSOEVER IN THIS SUBORDINATED NOTE.

THIS SUBORDINATED NOTE MAY BE SOLD ONLY IN COMPLIANCE WITH APPLICABLE FEDERAL AND STATE SECURITIES LAWS. THIS SUBORDINATED NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY APPLICABLE STATE SECURITIES LAWS, OR ANY OTHER APPLICABLE SECURITIES LAWS. NEITHER THIS SUBORDINATED NOTE NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD, ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF SUCH REGISTRATION OR UNLESS SUCH TRANSACTION IS EXEMPT FROM, OR NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.

CERTAIN ERISA CONSIDERATIONS:

THE HOLDER OF THIS SUBORDINATED NOTE, OR ANY INTEREST HEREIN, BY ITS ACCEPTANCE HEREOF OR THEREOF AGREES, REPRESENTS AND WARRANTS THAT IT IS NOT AN EMPLOYEE BENEFIT PLAN, INDIVIDUAL RETIREMENT ACCOUNT OR OTHER PLAN OR ARRANGEMENT SUBJECT TO TITLE I OF THE EMPLOYEE RETIREMENT INCOME SECURITY ACT OF 1974, AS AMENDED (“ERISA”), OR SECTION 4975 OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED (THE “CODE”) (EACH, A “PLAN”), OR AN ENTITY WHOSE UNDERLYING ASSETS INCLUDE “PLAN ASSETS” BY REASON OF ANY PLAN’S INVESTMENT IN THE ENTITY, AND NO PERSON INVESTING “PLAN ASSETS” OF ANY PLAN MAY ACQUIRE OR HOLD THIS SUBORDINATED NOTE OR ANY INTEREST HEREIN, UNLESS SUCH PURCHASER OR HOLDER IS ELIGIBLE FOR THE EXEMPTIVE RELIEF AVAILABLE UNDER U.S. DEPARTMENT OF LABOR PROHIBITED TRANSACTION CLASS EXEMPTION 96-23, 95-60, 91-38, 90-1 OR 84-14 OR ANOTHER APPLICABLE EXEMPTION OR ITS PURCHASE AND HOLDING OF THIS SUBORDINATED NOTE, OR ANY INTEREST HEREIN, ARE NOT PROHIBITED BY SECTION 406 OF ERISA OR SECTION 4975 OF THE CODE WITH RESPECT TO SUCH PURCHASE AND HOLDING. ANY PURCHASER OR HOLDER OF THIS SUBORDINATED NOTE OR ANY INTEREST HEREIN WILL BE DEEMED TO HAVE REPRESENTED BY ITS PURCHASE AND HOLDING THEREOF THAT EITHER: (I) IT IS NOT AN EMPLOYEE BENEFIT PLAN OR OTHER PLAN TO WHICH TITLE I OF ERISA OR SECTION 4975 OF THE CODE IS APPLICABLE, A TRUSTEE OR OTHER PERSON ACTING ON BEHALF OF ANY SUCH EMPLOYEE BENEFIT PLAN OR OTHER PLAN, OR ANY OTHER PERSON OR ENTITY USING THE “PLAN ASSETS” OF ANY SUCH PLAN OR OTHER PLAN TO FINANCE SUCH PURCHASE OR (II) SUCH PURCHASE OR HOLDING WILL NOT RESULT IN A PROHIBITED TRANSACTION UNDER SECTION 406 OF ERISA OR SECTION 4975 OF THE CODE FOR WHICH FULL EXEMPTIVE RELIEF IS NOT AVAILABLE UNDER APPLICABLE STATUTORY OR ADMINISTRATIVE EXEMPTION.

ANY FIDUCIARY OF ANY PLAN WHO IS CONSIDERING THE ACQUISITION OF THIS SUBORDINATED NOTE OR ANY INTEREST HEREIN SHOULD CONSULT WITH ITS, HIS OR HER LEGAL COUNSEL PRIOR TO ACQUIRING THIS SUBORDINATED NOTE OR ANY INTEREST HEREIN.

| No. [●] | CUSIP: [●] |

ORANGE COUNTY BANCORP, INC.

6.50% FIXED-TO-FLOATING RATE SUBORDINATED NOTE DUE SEPTEMBER 30, 2035

1. Subordinated Notes. This Subordinated Note is one of an issue of notes of Orange County Bancorp, Inc., a Delaware corporation (the “Company”), designated as the “6.50% Fixed-to-Floating Rate Subordinated Notes due 2035” (the “Subordinated Notes”) issued pursuant to that Subordinated Note Purchase Agreement dated as of the date upon which this Subordinated Note was originally issued (the “Issue Date”) between the Company and the several purchasers of the Subordinated Notes identified in the signature pages thereto (the “Purchase Agreement”).

2. Payment. The Company, for value received, promises to pay to Cede & Co., as nominee of The Depository Trust Company, or its registered assigns, the principal sum of [●] (U.S.) ($[●]), plus accrued but unpaid interest on September 30, 2035 (the “Maturity Date”) and to pay interest thereon (i) from and including the original issue date of the Subordinated Notes to but excluding September 30, 2030 or the earlier redemption date contemplated by Section 4 (Redemption) of this Subordinated Note (the “Fixed Rate Period”), at the rate of 6.50% per annum, computed on the basis of a 360-day year consisting of twelve 30-day months and payable semi-annually in arrears on March 30 and September 30 of each year (each payment date, a “Fixed Interest Payment Date”), beginning March 30, 2026, and (ii) from and including September 30, 2030 to but excluding the Maturity Date or earlier redemption date contemplated by Section 4 (Redemption) of this Subordinated Note (the “Floating Rate Period”), at the rate per annum, reset quarterly, equal to the Floating Interest Rate (as defined below) determined on the Floating Interest Determination Date (as defined below) of the applicable interest period plus 320.5 basis points, provided, that in the event the Floating Interest Rate is less than zero, then the Floating Interest Rate shall be deemed to be zero, computed on the basis of a 360-day year and the actual number of days elapsed and payable quarterly in arrears (each quarterly period a “Floating Interest Period”) on March 30, June 30, September 30 and December 30 of each year (each payment date, a “Floating Interest Payment Date”). Dollar amounts resulting from this calculation shall be rounded to the nearest cent, with one-half cent being rounded up. The term “Floating Interest Determination Date” means the date upon which the Floating Interest Rate is determined by the Calculation Agent (as defined below) pursuant to the Three-Month Term SOFR Conventions (as defined below).

(a) An “Interest Payment Date” is either a Fixed Interest Payment Date or a Floating Interest Payment Date, as applicable.

(b) The “Floating Interest Rate” means:

(i) Initially, Three-Month Term SOFR (as defined below).

(ii) Notwithstanding the foregoing clause (i) of this Section 2(b):

(1) If the Calculation Agent, determines prior to the relevant Floating Interest Determination Date that a Benchmark Transition Event and its related Benchmark Replacement Date (each of such terms as defined below) have occurred with respect to Three-Month Term SOFR, then the Company shall promptly provide notice of such determination to the Noteholders and Section 2(c) (Effect of Benchmark Transition Event) will thereafter apply to all determinations, calculations and quotations made or obtained for the purposes of calculating the Floating Interest Rate payable on the Subordinated Notes during a relevant Floating Interest Period.

(2) However, if the Calculation Agent, determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Three-Month Term SOFR, but for any reason the Benchmark Replacement has not been determined as of the relevant Floating Interest Determination Date, the Floating Interest Rate for the applicable Floating Interest Period will be equal to the Floating Interest Rate on the last Floating Interest Determination Date for the Subordinated Notes, as determined by the Calculation Agent.

(iii) If the then-current Benchmark is Three-Month Term SOFR and any of the foregoing provisions concerning the calculation of the interest rate and the payment of interest during the Floating Rate Period are inconsistent with any of the Three-Month Term SOFR Conventions determined by the Company, then the relevant Three-Month Term SOFR Conventions will apply.

(c) Effect of Benchmark Transition Event.

(i) If the Calculation Agent determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the Reference Time (as defined below) in respect of any determination of the Benchmark (as defined below) on any date, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the Subordinated Notes during the relevant Floating Interest Period in respect of such determination on such date and all determinations on all subsequent dates.

(ii) In connection with the implementation of a Benchmark Replacement, the Calculation Agent will have the right to make Benchmark Replacement Conforming Changes from time to time, and such changes shall become effective without consent from the relevant Noteholders (as defined below) or any other party.

(iii) Any determination, decision or election that may be made by the Calculation Agent pursuant to the benchmark transition provisions set forth herein, including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date, and any decision to take or refrain from taking any action or any selection:

(1) will be conclusive and binding absent manifest error;

(2) if made by the Company as the Calculation Agent, will be made in the Company’s sole discretion; (3) if made by a Calculation Agent other than the Company, will be made after consultation with the Company, and the Calculation Agent will not make any such determination, decision or election to which the Company reasonably objects; and

(4) notwithstanding anything to the contrary in this Subordinated Note or the Purchase Agreement, shall become effective without consent from the relevant Noteholders (as defined below) or any other party.

(iv) For the avoidance of doubt, after a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, interest payable on this Subordinated Note for the Floating Rate Period will be an annual rate equal to the sum of the applicable Benchmark Replacement and the spread specified on the face hereof.

(v) As used in this Subordinated Note:

(1) “Benchmark” means, initially, Three-Month Term SOFR; provided that if the Calculation Agent determines on or prior to the Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Three-Month Term SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

(2) “Benchmark Replacement” means the Interpolated Benchmark with respect to the then-current Benchmark, plus the Benchmark Replacement Adjustment for such Benchmark; provided that if (a) the Calculation Agent cannot determine the Interpolated Benchmark as of the Benchmark Replacement Date or (b) the then-current Benchmark is Three-Month Term SOFR and a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Three-Month Term SOFR (in which event no Interpolated Benchmark with respect to Three-Month Term SOFR shall be determined), then “Benchmark Replacement” means the first alternative set forth in the order below that can be determined by the Calculation Agent, as of the Benchmark Replacement Date:

a. The sum of (i) Compounded SOFR and (ii) the Benchmark Replacement Adjustment;

b. the sum of: (i) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark for the applicable Corresponding Tenor and (ii) the Benchmark Replacement Adjustment;

c. the sum of: (i) the ISDA Fallback Rate and (ii) the Benchmark Replacement Adjustment; or

d. the sum of: (i) the alternate rate of interest that has been selected by the Company as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar denominated floating rate notes at such time and (ii) the Benchmark Replacement Adjustment.

(3) “Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Calculation Agent, as of the Benchmark Replacement Date:

a. the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

b. if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment;

c. the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar denominated floating rate notes at such time.

(4) “Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “Floating Interest Period,” timing and frequency of determining rates with respect to each Floating Interest Period and making payments of interest, rounding of amounts or tenors and other administrative matters) that the Calculation Agent decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Calculation Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Calculation Agent determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Calculation Agent determines is reasonably necessary).

(5) “Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

a. in the case of clause (a) of the definition of “Benchmark Transition Event,” the relevant Reference Time in respect of any determination;

b. in the case of clause (b) or (c) of the definition of “Benchmark Transition Event,” the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or

c. in the case of clause (d) of the definition of “Benchmark Transition Event,” the date of such public statement or publication of information referenced therein.

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for purposes of such determination.

(6) “Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

a. if the Benchmark is Three-Month Term SOFR, the Company determines that the use of a forward-looking rate for a tenor of three months based on SOFR is not administratively feasible;

b. a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark;

c. a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or

d. a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

(7) “Calculation Agent” means such bank or other entity (which may be the Company or an Affiliate of the Company) as may be appointed by the Company to act as Calculation Agent for the Subordinated Notes during the Floating Rate Period.

(8) “Compounded SOFR” means the compounded average of SOFRs for the applicable Corresponding Tenor, with the rate, or methodology for this rate, and conventions for this rate being established by the Calculation Agent in accordance with:

a. the rate, or methodology for this rate, and conventions for this rate selected or recommended by the Relevant Governmental Body for determining compounded SOFR; provided that:

b. if, and to the extent that, the Calculation Agent determines that Compounded SOFR cannot be determined in accordance with clause (a) above, then the rate, or methodology for this rate, and conventions for this rate that have been selected by the Calculation Agent giving due consideration to any industry-accepted market practice for U.S. dollar denominated floating rate notes at such time.

For the avoidance of doubt, the calculation of Compounded SOFR will exclude the Benchmark Replacement Adjustment and the spread specified on the face hereof.

(9) “Corresponding Tenor” with respect to a Benchmark Replacement means a tenor (including overnight) having approximately the same length (disregarding Business Day adjustment) as the applicable tenor for the then-current Benchmark.

(10) “FRBNY” means the Federal Reserve Bank of New York.

(11) “FRBNY’s Website” means the website of the FRBNY at http://www.newyorkfed.org, or any successor source.

(12) “Interpolated Benchmark” with respect to the Benchmark means the rate determined for the Corresponding Tenor by interpolating on a linear basis between: (1) the Benchmark for the longest period (for which the Benchmark is available) that is shorter than the Corresponding Tenor and (2) the Benchmark for the shortest period (for which the Benchmark is available) that is longer than the Corresponding Tenor.

(13) “ISDA” means the International Swaps and Derivatives Association, Inc. or any successor thereto.

(14) “ISDA Definitions” means the 2006 ISDA Definitions published by the ISDA or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

(15) “ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

(16) “ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

(17) “Reference Time” with respect to any determination of a Benchmark means (1) if the Benchmark is Three-Month Term SOFR, the time determined by the Calculation Agent after giving effect to the Three-Month Term SOFR Conventions, and (2) if the Benchmark is not Three-Month Term SOFR, the time determined by the Calculation Agent after giving effect to the Benchmark Replacement Conforming Changes.

(18) “Relevant Governmental Body” means the Board of Governors of the Federal Reserve System (the “Federal Reserve”) and/or the FRBNY, or a committee officially endorsed or convened by the Federal Reserve and/or the FRBNY or any successor thereto.

(19) “SOFR” means the daily Secured Overnight Financing Rate provided by the FRBNY, as the administrator of the Benchmark (or a successor administrator), on the FRBNY’s Website.

(20) “Term SOFR” means the forward-looking term rate based on SOFR as published by the Term SOFR Administrator.

(21) “Term SOFR Administrator” means CME Group Benchmark Administration Limited (CBA) (or a successor administrator of Three-Month Term SOFR selected by the Calculation Agent in its reasonable discretion).

(22) “Three-Month Term SOFR” means the rate for Term SOFR for a tenor of three months that is published by the Term SOFR Administrator at the Reference Time for any Floating Interest Period, as determined by the Calculation Agent after giving effect to the Three-Month Term SOFR Conventions.

(23) “Three-Month Term SOFR Conventions” means any determination, decision or election with respect to any technical, administrative or operational matter (including with respect to the manner and timing of the publication of Three-Month Term SOFR, or changes to the definition of “Floating Interest Period”, timing and frequency of determining Three-Month Term SOFR with respect to each Floating Interest Period and making payments of interest, rounding of amounts or tenors, and other administrative matters) that the Calculation Agent decides may be appropriate to reflect the use of Three-Month Term SOFR as the Benchmark in a manner substantially consistent with market practice (or, if the Calculation Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Calculation Agent determines that no market practice for the use of Three-Month Term SOFR exists, in such other manner as the Calculation Agent determines is reasonably necessary).

(24) “Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

(d) In the event that any Fixed Interest Payment Date during the Fixed Rate Period falls on a day that is not a Business Day (as defined below), the interest payment due on that date shall be postponed to the next day that is a Business Day and no additional interest shall accrue as a result of that postponement. In the event that any Floating Interest Payment Date during the Floating Rate Period falls on a day that is not a Business Day (as defined below), the interest payment due on that date shall be postponed to the next day that is a Business Day and interest shall accrue to but excluding the date interest is paid. However, if the postponement would cause the day to fall in the next calendar month during the Floating Interest Period, the Floating Interest Payment Date shall instead be brought forward to the immediately preceding Business Day. The term “Business Day” means any day other than a Saturday or Sunday or any other day on which banking institutions in the State of New York are generally authorized or required by law or executive order to be closed.

3. Subordination.

(a) The indebtedness of the Company evidenced by this Subordinated Note, including the principal and interest on this Subordinated Note, shall be subordinate and junior in right of payment to the prior payment in full of all existing claims of creditors of the Company and depositors of any bank subsidiary of the Company, including the Bank, whether now outstanding or subsequently created, assumed, guaranteed or incurred (collectively, “Senior Indebtedness”), which shall consist of principal of (and premium, if any) and interest, if any, on: (i) all indebtedness and obligations of, or guaranteed or assumed by, the Company for money borrowed, whether or not evidenced by bonds, debentures, securities, notes or other similar instruments, and including, but not limited to, all deposits of any bank subsidiary of the Company, including the Bank, and all obligations to the Company’s general and secured creditors; (ii) any deferred obligations of the Company for the payment of the purchase price of property or assets acquired other than in the ordinary course of business; (iii) all obligations, contingent or otherwise, of the Company in respect of any letters of credit, bankers’ acceptances, security purchase facilities and similar direct credit substitutes; (iv) any capital lease obligations of the Company; (v) all obligations of the Company in respect of interest rate swap, cap or other agreements, interest rate future or option contracts, currency swap agreements, currency future or option contracts, commodity contracts and other similar arrangements or derivative products; (vi) all obligations that are similar to those in clauses (i) through (v) of other persons for the payment of which the Company is responsible or liable as obligor, guarantor or otherwise arising from an off-balance sheet guarantee; (vii) all obligations of the types referred to in clauses (i) through (vi) of other persons secured by a lien on any property or asset of the Company; and (viii) in the case of (i) through (vii) above, all amendments, renewals, extensions, modifications and refundings of such indebtedness and obligations; except “Senior Indebtedness” does not include (A) the Subordinated Notes, (B) any obligation that by its terms expressly is junior to, or ranks equally in right of payment with, the Subordinated Notes, or (C) any indebtedness between the Company and any of its subsidiaries or Affiliates. This Subordinated Note is not secured by any assets of the Company or any of its subsidiaries or Affiliates. The term “Affiliate(s)” means, with respect to any Person (as such term is defined in the Purchase Agreement), such Person’s immediate family members, partners, members or parent and subsidiary corporations, and any other Person directly or indirectly controlling, controlled by, or under common control with said Person and their respective Affiliates.

(b) In the event of liquidation of the Company, holders of Senior Indebtedness of the Company shall be entitled to be paid in full with such interest as may be provided by law before any payment shall be made on account of principal of or interest on this Subordinated Note. Additionally, in the event of any insolvency, dissolution, assignment for the benefit of creditors or any liquidation or winding up of or relating to the Company, whether voluntary or involuntary, holders of Senior Indebtedness shall be entitled to be paid in full before any payment shall be made on account of the principal of or interest on the Subordinated Notes, including this Subordinated Note. In the event of any such proceeding, after payment in full of all sums owing with respect to the Senior Indebtedness, the registered holders of the Subordinated Notes from time to time (each a “Noteholder” and, collectively, the “Noteholders”), together with the holders of any obligations of the Company ranking on parity with the Subordinated Notes, shall be entitled to be paid from the remaining assets of the Company the unpaid principal thereof, and the unpaid interest thereon before any payment or other distribution, whether in cash, property or otherwise, shall be made (i) with respect to any obligation that by its terms expressly is junior in the right of payment to the Subordinated Notes, (ii) with respect to any indebtedness between the Company and any of its subsidiaries or Affiliates or (iii) on account of any capital stock.

(c) If there shall have occurred and be continuing (i) a default in any payment with respect to any Senior Indebtedness or (ii) an event of default with respect to any Senior Indebtedness as a result of which the maturity thereof is accelerated, unless and until such payment default or event of default shall have been cured or waived or shall have ceased to exist, no payments shall be made by the Company with respect to the Subordinated Notes. The provisions of this paragraph shall not apply to any payment with respect to which the immediately preceding paragraph of this Section 3 (Subordination) would be applicable.

(d) Nothing herein shall act to prohibit, limit or impede the Company from issuing additional debt of the Company having the same rank as the Subordinated Notes or which may be junior or senior in rank to the Subordinated Notes. Each Noteholder, by its acceptance hereof, further acknowledges and agrees that the foregoing subordination provisions are, and are intended to be, an inducement and a consideration for each holder of any Senior Indebtedness, whether such Senior Indebtedness was created or acquired before or after the issuance of the Subordinated Notes, to acquire and continue to hold, or to continue to hold, such Senior Indebtedness, and such holder of Senior Indebtedness shall be deemed conclusively to have relied on such subordination provisions in acquiring and continuing to hold or in continuing to hold such Senior Indebtedness.

| 4. | Redemption. |

(a) Redemption Prior to Fifth Anniversary. This Subordinated Note shall not be redeemable by the Company in whole or in part prior to September 30, 2030 except in the event of a: (i) Tier 2 Capital Event (as defined below); (ii) Tax Event (as defined below); or (iii) Investment Company Event (as defined below). Upon the occurrence of a Tier 2 Capital Event, a Tax Event or an Investment Company Event, the Company may redeem this Subordinated Note, subject to Section 4(f) (Regulatory Approvals) hereof, in whole but not in part at any time, upon giving not less than 10 days’ notice to the holder of this Subordinated Note at an amount equal to 100% of the outstanding principal amount being redeemed plus accrued but unpaid interest, to but excluding the redemption date. “Tier 2 Capital Event” means the Company’s good faith determination that, as a result of (1) any amendment to, or change in, the laws, rules or regulations of the United States (including, for the avoidance of doubt, any agency or instrumentality of the United States, including the Federal Reserve and other federal bank regulatory agencies) or any political subdivision of or in the United States that is enacted or becomes effective after the issue date of this Subordinated Note, (2) any proposed change in those laws, rules or regulations that is announced or becomes effective after the issue date of this Subordinated Note, or (3) any official administrative decision or judicial decision or administrative action or other official pronouncement interpreting or applying those laws, rules, regulations, policies or guidelines with respect thereto that is announced after the issue date of this Subordinated Note, there is more than an insubstantial risk that the Company will not be entitled to treat the Subordinated Notes then outstanding as Tier 2 capital (or its equivalent) for purposes of capital adequacy guidelines of the Federal Reserve Board, as then in effect and applicable to the Company (“Tier 2 Capital”), for so long as any Subordinated Notes are outstanding. “Tax Event” means the receipt by the Company of an opinion of independent tax counsel experienced in such matters to the effect that as a result of (1) an amendment to or change (including any announced prospective amendment or change) in any law or treaty, or any regulation thereunder, of the United States or any of its political subdivisions or taxing authorities; (2) a judicial decision, administrative action, official administrative pronouncement, ruling, regulatory procedure, regulation, notice or announcement, including any notice or announcement of intent to adopt or promulgate any ruling, regulatory procedure or regulation (any of the foregoing, an “Administrative or Judicial Action”); or (3) an amendment to or change in any official position with respect to, or any interpretation of, an Administrative or Judicial Action or a law or regulation of the United States that differs from the previously generally accepted position or interpretation, in each case, which change or amendment or challenge becomes effective or which pronouncement, decision or challenge is announced on or after the issue date of this Subordinated Note, there is more than an insubstantial risk that interest payable by the Company on the Subordinated Notes is not, or within 90 days of such opinion, will not be, deductible by the Company, in whole or in part, for United States federal income tax purposes. “Investment Company Event” means receipt by the Company of an opinion of independent counsel experienced in such matters to the effect that there is more than an insubstantial risk that the Company is or, within 90 days of the date of such legal opinion will be, considered an “investment company” that is required to be registered under the Investment Company Act of 1940, as amended.

(b) Redemption on or after Fifth Anniversary. On any Interest Payment Date on or after September 30, 2030, subject to the provisions of Section 4(f) (Regulatory Approvals) hereof, this Subordinated Note shall be redeemable at the option of and by the Company, in whole or in part, at an amount equal to 100% of the outstanding principal amount being redeemed plus accrued but unpaid interest to but excluding the redemption date, but in all cases in a principal amount with integral multiples of $1,000. In the case of any redemption of this Subordinated Note pursuant to the foregoing sentence, the Company will give the holder hereof notice of redemption, which notice shall indicate the aggregate principal amount of Subordinated Notes to be redeemed, not less than thirty (30) nor more than sixty (60) calendar days prior to the redemption date. In addition, subject to Section 4(f) (Regulatory Approvals) hereof, the Company may redeem all or a portion of the Subordinated Notes, at any time upon 10 days’ notice upon the occurrence of a Tier 2 Capital Event, Tax Event or an Investment Company Event.

(c) Partial Redemption. If less than the then outstanding principal amount of this Subordinated Note is redeemed, (i) a new Subordinated Note shall be issued representing the unredeemed portion without charge to the holder thereof and (ii) such redemption shall be effected on a pro rata basis as to the Noteholders, subject to adjustments in the discretion of the Company to ensure the unredeemed principal portion of this Subordinated Note remains in an authorized denomination hereunder. For purposes of clarity, any redemption made pursuant to the terms of this Subordinated Note shall be made on a pro rata basis, and, for purposes of a redemption processed through DTC, on a “Pro Rata Pass-Through Distribution of Principal” basis, among all of the Subordinated Notes outstanding at the time thereof; provided, however, that the Company may round the portion of the principal amount to be redeemed of this Subordinated Note up or down so that the unredeemed principal amount remains an authorized denomination hereunder, without any impact on the pro rata amount to be redeemed from other Noteholders.

(d) No Redemption at Option of Noteholder. This Subordinated Note is not subject to redemption at the option of the holder of this Subordinated Note.

(e) Effectiveness of Redemption. If notice of redemption has been duly given and notwithstanding that this Subordinated Note has been called for redemption but has not yet been surrendered for cancellation, on and after the date fixed for redemption interest shall cease to accrue on the portion of this Subordinated Note called for redemption, this Subordinated Note shall no longer be deemed outstanding with respect to the portion called for redemption and all rights with respect to the portion of this Subordinated Note called for redemption shall forthwith on such date fixed for redemption cease and terminate unless the Company shall default in the payment of the redemption price, except only the right of the holder hereof to receive the amount payable on such redemption, without interest.

(f) Regulatory Approvals. Any such redemption shall be subject to receipt of any and all required federal and state regulatory approvals or non-objections, including, but not limited to, the consent of the Federal Reserve.

(g) Purchase and Resale of the Subordinated Notes. Subject to any required federal and state regulatory approvals and the provisions of this Subordinated Note, the Company shall have the right to purchase any of the Subordinated Notes at any time in the open market, private transactions or otherwise. If the Company purchases any Subordinated Notes, it may, in its discretion, hold, resell or cancel any of the purchased Subordinated Notes.

| 5. | Global Subordinated Notes. |

(a) Provided that applicable depository eligibility requirements are met, the Subordinated Notes owned by Noteholders that are “Qualified Institutional Buyers” and/or institutional “accredited investors” shall be issued in the form of one or more Global Subordinated Notes (each a “Global Subordinated Note”) registered in the name of The Depository Trust Company or another organization registered as a clearing agency under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and designated as Depositary by the Company or any successor thereto (the “Depositary”) or a nominee thereof and delivered to such Depositary or a nominee thereof.

(b) Notwithstanding any other provision herein, no Global Subordinated Note may be exchanged in whole or in part for Subordinated Notes registered, and no transfer of a Global Subordinated Note in whole or in part may be registered, in the name of any person other than the Depositary for such Global Subordinated Note or a nominee thereof unless (i) such Depositary advises the Company in writing that such Depositary is no longer willing or able to properly discharge its responsibilities as Depositary with respect to such Global Subordinated Note, and no qualified successor is appointed by the Company within ninety (90) days of receipt by the Company of such notice, (ii) such Depositary ceases to be a clearing agency registered under the Exchange Act and no successor is appointed by the Company within ninety (90) days after obtaining knowledge of such event, (iii) the Company elects to terminate the book-entry system through the Depositary or (iv) an Event of Default (as defined in Section 6 (Events of Default; Acceleration)) shall have occurred and be continuing. Upon the occurrence of any event specified in clause (i), (ii), (iii) or (iv) of this Section 5(b), the Company or its agent shall notify the Depositary and instruct the Depositary to notify all owners of beneficial interests in such Global Subordinated Note of the occurrence of such event and of the availability of Subordinated Notes to such owners of beneficial interests requesting the same.

(c) If any Global Subordinated Note is to be exchanged for other Subordinated Notes or canceled in part, or if another Subordinated Note is to be exchanged in whole or in part for a beneficial interest in any Global Subordinated Note, then either (i) such Global Subordinated Note shall be so surrendered for exchange or cancellation as provided in this Section 5 or (ii) the principal amount thereof shall be reduced or increased by an amount equal to the portion thereof to be so exchanged or canceled, or equal to the principal amount of such other Subordinated Note to be so exchanged for a beneficial interest therein, as the case may be, by means of an appropriate adjustment made on the records of the Company or, if applicable, the Company’s registrar and transfer agent (“Registrar”), whereupon the Company or, if applicable, the Registrar, in accordance with the applicable rules and procedures of the Depositary (“Applicable Depositary Procedures”), shall instruct the Depositary or its authorized representative to make a corresponding adjustment to its records. Upon any such surrender or adjustment of a Global Subordinated Note by the Depositary, accompanied by registration instructions, the Company shall execute and deliver any Subordinated Notes issuable in exchange for such Global Subordinated Note (or any portion thereof) in accordance with the instructions of the Depositary.

(d) Every Subordinated Note executed and delivered upon registration of transfer of, or in exchange for or in lieu of, a Global Subordinated Note or any portion thereof shall be executed and delivered in the form of, and shall be, a Global Subordinated Note, unless such Subordinated Note is registered in the name of a person other than the Depositary for such Global Subordinated Note or a nominee thereof.

(e) The Depositary or its nominee, as the registered owner of a Global Subordinated Note, shall be the holder of such Global Subordinated Note for all purposes under this Subordinated Note, and owners of beneficial interests in a Global Subordinated Note shall hold such interests pursuant to Applicable Depositary Procedures. Accordingly, any such owner’s beneficial interest in a Global Subordinated Note shall be shown only on, and the transfer of such interest shall be effected only through, records maintained by the Depositary or its nominee or its Depositary participants. If applicable, the Registrar shall be entitled to deal with the Depositary for all purposes relating to a Global Subordinated Note (including the payment of principal and interest thereon and the giving of instructions or directions by owners of beneficial interests therein and the giving of notices) as the sole holder of the Subordinated Note and shall have no obligations to the owners of beneficial interests therein. The Registrar shall have no liability in respect of any transfers undertaken by the Depositary.

(f) The rights of owners of beneficial interests in a Global Subordinated Note shall be exercised only through the Depositary and shall be limited to those established by law and agreements between such owners and the Depositary and/or its participants.

(g) No holder of any beneficial interest in any Global Subordinated Note held on its behalf by a Depositary shall have any rights with respect to such Global Subordinated Note, and such Depositary may be treated by the Company and any agent of the Company as the owner of such Global Subordinated Note for all purposes whatsoever. Neither the Company nor any agent of the Company will have any responsibility or liability for any aspect of the records relating to or payments made on account of beneficial ownership interests of a Global Subordinated Note or maintaining, supervising or reviewing any records relating to such beneficial ownership interests. Notwithstanding the foregoing, nothing herein shall prevent the Company or any agent of the Company from giving effect to any written certification, proxy or other authorization furnished by a Depositary or impair, as between a Depositary and such holders of beneficial interests, the operation of customary practices governing the exercise of the rights of the Depositary (or its nominee) as holder of any Subordinated Note.

6. Events of Default; Acceleration.

Each of the following events shall constitute an “Event of Default”:

(a) the entry of a decree or order for relief in respect of the Company by a court having jurisdiction in the premises in an involuntary case or proceeding under any applicable bankruptcy, insolvency, or reorganization law, now or hereafter in effect of the United States or any political subdivision thereof, and such decree or order will have continued unstayed and in effect for a period of sixty (60) consecutive days;

(b) the commencement by the Company of a voluntary case under any applicable bankruptcy, insolvency or reorganization law, now or hereafter in effect of the United States or any political subdivision thereof, or the consent by the Company to the entry of a decree or order for relief in an involuntary case or proceeding under any such law;

(c) the Company (i) becomes insolvent or is unable to pay its debts as they mature, (ii) makes an assignment for the benefit of creditors, (iii) admits in writing its inability to pay its debts as they mature or (iv) ceases to be a bank holding company or financial holding company under the Bank Holding Company Act of 1956, as amended;

(d) the failure of the Company to pay any installment of interest on any of the Subordinated Notes as and when the same will become due and payable, and the continuation of such failure for a period of fifteen (15) days;

(e) the failure of the Company to pay all or any part of the principal of any of the Subordinated Notes as and when the same will become due and payable;

(f) the liquidation of the Company (for avoidance of doubt, “liquidation” does not include any merger, consolidation, sale of equity or assets or reorganization (exclusive of a reorganization in bankruptcy) of the Company or any of its subsidiaries);

(g) the failure of the Company to perform any other covenant or agreement on the part of the Company contained in the Subordinated Notes, and the continuation of such failure for a period of thirty (30) days after the date on which notice specifying such failure, stating that such notice is a “Notice of Default” hereunder and demanding that the Company remedy the same, will have been given, in the manner set forth in Section 22 (Notices), to the Company by a Noteholder; or

(h) the default by the Company under any bond, debenture, note or other evidence of indebtedness for money borrowed by the Company having an aggregate principal amount outstanding of at least $25,000,000, whether such indebtedness now exists or is created or incurred in the future, which default (i) constitutes a failure to pay any portion of the principal of such indebtedness when due and payable after the expiration of any applicable grace period or (ii) results in such indebtedness becoming due or being declared due and payable prior to the date on which it otherwise would have become due and payable without, in the case of clause (i), such indebtedness having been discharged or, in the case of clause (ii), without such indebtedness having been discharged or such acceleration having been rescinded or annulled.

Unless the principal amount of this Subordinated Note already shall have become due and payable, if an Event of Default set forth in Section 6(a) or Section 6(b) above shall have occurred and be continuing, the Noteholder, by notice in writing to the Company, may declare the principal amount, and any accrued and unpaid interest thereon, of this Subordinated Note to be due and payable immediately and, upon any such declaration, the same shall become and shall be immediately due and payable, and the Company waives demand, presentment for payment, notice of nonpayment, notice of protest, and all other notices. Notwithstanding the foregoing, because the Company will treat the Subordinated Notes as Tier 2 Capital, upon the occurrence and during the continuance of an Event of Default other than an Event of Default described in Section 6(a) or Section 6(b), no Noteholder may accelerate the maturity of the Subordinated Notes and make the principal of, and any accrued and unpaid interest on, the Subordinated Notes, immediately due and payable. The Company, within forty-five (45) calendar days after the receipt of written notice from any Noteholder of the occurrence of an Event of Default with respect to this Subordinated Note, shall mail to all Noteholders, at their addresses shown on the Security Register (as defined in Section 14 (Registration of Transfer, Security Register) below), such written notice of Event of Default, unless such Event of Default shall have been cured or waived before the giving of such notice as certified by the Company in writing.

7. Failure to Make Payments. In the event of an Event of Default under Section 6(c), Section 6(d) or Section 6(e) above, the Company will, upon demand of the Noteholder, pay to the Noteholder the amount then due and payable on this Subordinated Note for principal and interest (without acceleration of the Subordinated Note in any manner), with interest on the overdue principal and interest at the per annum rate borne by this Subordinated Note, to the extent permitted by applicable law. If the Company fails to pay such amount upon such demand, the holder of this Subordinated Note may, among other things, institute a judicial proceeding for the collection of the sums so due and unpaid and such amount as shall be sufficient to cover the reasonable costs and expenses of collection, including the reasonable compensation, expenses, disbursements and advances of such Noteholder, its agents and counsel, may prosecute such proceeding to judgment or final decree and may enforce the same against the Company and collect the amounts adjudged or decreed to be payable in the manner provided by law out of the property of the Company.

Upon the occurrence of a failure by the Company to make any required payment of principal or interest on this Subordinated Note or an Event of Default, until such Event of Default is cured by the Company or waived by the Noteholders in accordance with Section 18 (Waiver and Consent) hereof, except as may be required by any federal or state bank regulatory agency, the Company shall not: (a) declare or pay any dividends or distributions on, or redeem, purchase, acquire, or make a liquidation payment with respect to, any of the Company’s capital stock; (b) make any payment of principal or interest or premium, if any, on or repay, repurchase or redeem any indebtedness of the Company that ranks equal with or junior to the Subordinated Notes; or (c) make any payments under any guarantee that ranks equal with or junior to the Subordinated Notes, other than: (i) any dividends or distributions in shares of, or options, warrants or rights to subscribe for or purchase shares of, any class of the Company’s common stock; (ii) any declaration of a non-cash dividend in connection with the implementation of a shareholders’ rights plan, or the issuance of stock under any such plan in the future, or the redemption or repurchase of any such rights pursuant thereto; (iii) as a result of a reclassification of the Company’s capital stock or the exchange or conversion of one class or series of the Company’s capital stock for another class or series of the Company’s capital stock; (iv) the purchase of fractional interests in shares of the Company’s capital stock pursuant to the conversion or exchange provisions of such capital stock or the security being converted or exchanged; or (v) purchases of any class of the Company’s common stock related to the issuance of common stock or rights under any benefit plans for the Company’s directors, officers or employees or any of the Company’s dividend reinvestment plans (the foregoing clauses (i) through (v) are collectively referred to as the “Permitted Dividends”).

| 8. | Affirmative Covenants of the Company. |

(a) Notice of Certain Events. To the extent permitted by applicable statute, rule or regulation, unless the Company is then subject to Section 13 or 15(d) of the Exchange Act, the Company shall provide written notice to the Noteholder of the occurrence of any of the following events as soon as practicable, but in no event later than fifteen (15) Business Days following the Company becoming aware of the occurrence of such event:

(i) The total risk-based capital ratio, Tier 1 risk-based capital ratio, common equity Tier 1 risk-based capital ratio or leverage ratio of the Company (but only to the extent the Company is required to measure and report such ratios on a consolidated basis under applicable law) or any of the Company’s banking subsidiaries becomes less than eight percent (8.0%), six percent (6.0%), four and one-half percent (4.5%) or four percent (4.0%), respectively, as of the end of any fiscal quarter;

(ii) The Company, or any of the Company’s subsidiaries, or any officer of the Company (in such capacity), becomes subject to any formal, written regulatory enforcement action (as defined by the applicable state or federal bank regulatory authority);

(iii) The ratio of non-performing assets to total assets of the Company on a consolidated basis as of the end of any fiscal quarter, as calculated by the Company in the ordinary course of business and consistent with past practices, becomes greater than five percent (5.0%);

(iv) The appointment, resignation, removal or termination of the chief executive officer or president of the Company or Orange Bank & Trust Company (the “Bank”); or

(v) There is a change in ownership of 25% or more of the outstanding securities of the Company entitled to vote for the election of directors.

(b) Payment of Principal and Interest. The Company covenants and agrees for the benefit of the Noteholder that it will duly and punctually pay the principal of, and interest on, this Subordinated Note, in accordance with the terms hereof.

(c) Maintenance of Office. The Company will maintain an office or agency in the State of New York or the City of Houston, Texas, unless the Company has provided due notice to the Noteholders of such change in office or agency location, where Subordinated Notes may be surrendered for registration of transfer or for exchange and where notices and demands to or upon the Company in respect of the Subordinated Notes may be served.

The Company may also from time to time designate one or more other offices or agencies where the Subordinated Notes may be presented or surrendered for any or all such purposes and may from time to time rescind such designations; provided that no such designation or rescission will in any manner relieve the Company of its obligation to maintain an office or agency in the State of New York or the State of Texas. The Company will give prompt written notice to the Noteholders of any such designation or rescission and of any change in the location of any such other office or agency.

(d) Corporate Existence. The Company will do or cause to be done all things necessary to preserve and keep in full force and effect: (i) the corporate existence of the Company (provided, however, that this clause (i) shall not prohibit any merger of the Company permitted under the provisions of Section 9(b) (Merger or Sale of Assets) hereof); (ii) the existence (corporate or other) of each subsidiary; and (iii) the rights (constituent governing documents and statutory), licenses and franchises of the Company and each of its subsidiaries; provided, however, that the Company will not be required to preserve the existence (corporate or other) of any of its subsidiaries or any such right, license or franchise of the Company or any of its subsidiaries if the Board of Directors of the Company determines that the preservation thereof is no longer desirable in the conduct of the business of the Company and its subsidiaries taken as a whole and that the loss thereof will not be disadvantageous in any material respect to the Noteholders.

(e) Maintenance of Properties. The Company will, and will cause each subsidiary to, cause all its properties used or useful in the conduct of its business to be maintained and kept in good condition, repair and working order and supplied with all necessary equipment and will cause to be made all necessary repairs, renewals, replacements, betterments and improvements thereof, all as in the judgment of the Company may be necessary so that the business carried on in connection therewith may be properly and advantageously conducted at all times; provided, however, that nothing in this Section 8(e) will prevent the Company or any subsidiary from discontinuing the operation and maintenance of any of their respective properties if such discontinuance is, in the reasonable judgment of the Board of Directors of the Company or of any subsidiary, as the case may be, desirable in the conduct of its business.

(f) Transfer of Voting Stock. Except pursuant to Section 9(b) (Merger or Sale of Assets) hereof, Company will not, nor will it permit the Bank to, directly or indirectly, sell, assign, transfer or otherwise dispose of any shares of, securities convertible into, or options, warrants or rights to subscribe for or purchase shares of, Voting Stock (as defined below) of the Bank or any successor thereof or any subsidiary of the Company that is a depository institution and that has consolidated assets equal to 30% or more of the Company’s consolidated assets (“Material Subsidiary”), nor will the Company permit the Material Subsidiary to issue any shares of, or securities convertible into, or options, warrants or rights to subscribe for or purchase shares of, Voting Stock of the Material Subsidiary if, in each case, after giving effect to any such transaction and to the issuance of the maximum number of shares of Voting Stock of the Material Subsidiary issuable upon the exercise of all such convertible securities, options, warrants or rights, the Company would cease to own, directly or indirectly, at least 80% of the issued and outstanding Voting Stock of the Material Subsidiary. “Voting Stock” means outstanding shares of capital stock having voting power for the election of directors, whether at all times or only so long as no senior class of stock has such voting power because of default in dividends or other default.

(g) Waiver of Certain Covenants. The Company may omit in any particular instance to comply with any term, provision or condition set forth in Section 8(c) (Maintenance of Office), Section 8(d) (Corporate Existence), Section 8(e) (Maintenance of Properties), or Section 8(f) (Transfer of Voting Stock) above, with respect to this Subordinated Note if before the time for such compliance the Noteholders of at least a majority in aggregate principal amount of the outstanding Subordinated Notes, by act of such Noteholders, either will waive such compliance in such instance or generally will have waived compliance with such term, provision or condition, but no such waiver will extend to or affect such term, provision or condition except to the extent so expressly waived, and, until such waiver will become effective, the obligations of the Company in respect of any such term, provision or condition will remain in full force and effect.

(h) Tier 2 Capital. Whether or not the Company is subject to consolidated capital requirements under applicable regulations of the Federal Reserve, if all or any portion of the Subordinated Notes ceases to be deemed to be Tier 2 Capital, other than due to the limitation imposed on the capital treatment of subordinated debt during the five (5) years immediately preceding the Maturity Date of the Subordinated Notes, the Company will promptly notify the Noteholders and thereafter, if requested by the Company, the Company and the Noteholders will work together in good faith to execute and deliver all agreements as reasonably necessary in order to restructure the applicable portions of the obligations evidenced by the Subordinated Notes to qualify as Tier 2 Capital; provided, however, that nothing contained in this Section 8(h) (Tier 2 Capital) shall limit the Company’s right to redeem the Subordinated Notes upon the occurrence of a Tier 2 Capital Event pursuant to Section 4(a) (Redemption Prior to Fifth Anniversary) or Section 4(b) (Redemption on or after Fifth Anniversary).

(i) Compliance with Laws. The Company shall comply with the requirements of all laws, regulations, orders and decrees applicable to it or its properties, except for such noncompliance that would not reasonably be expected to have a Material Adverse Effect (as such term is defined in the Purchase Agreement) on the Company and its subsidiaries taken as a whole.

(j) Taxes and Assessments. The Company shall punctually pay and discharge all material taxes, assessments, and other governmental charges or levies imposed upon it or upon its income or upon any of its properties; provided, that no such taxes, assessments or other governmental charges need be paid if they are being contested in good faith by the Company.

(k) Financial Statements; Access to Records.

(i) Unless the Company is then subject to Section 13 or 15(d) of the Exchange Act, not later than forty-five (45) days following the end of each semi-annual or quarterly period, as applicable, for which the Company has not submitted a Consolidated Financial Statements for Holding Companies Reporting Form FR Y-9C to the Federal Reserve, upon request, the Company shall provide the Noteholder with a copy of the Company’s unaudited parent company only balance sheet and statement of income (loss) for and as of the end of such immediately preceding fiscal quarter, prepared in accordance with past practice. Quarterly financial statements, if required herein, shall be unaudited and need not comply with GAAP.

(ii) Unless the Company is then subject to Section 13 or 15(d) of the Exchange Act, not later than ninety (90) days from the end of each fiscal year (or, if the Company’s auditors have not yet then issued the auditor’s report, promptly following the issuance of such report), upon request, the Company shall provide the Noteholder with copies of the Company’s audited financial statements consisting of the consolidated balance sheet of the Company as of the fiscal year end and the related statements of income (loss) and retained earnings, stockholders’ equity and cash flows for the fiscal year then ended. Such financial statements shall be prepared in accordance with GAAP applied on a consistent basis throughout the period involved.

(iii) In addition to the foregoing Sections 8(k)(i) and (ii), if a Noteholder holds at least fifty percent (50%) in aggregate principal amount (excluding any Subordinated Notes held by Company or any of its Affiliates) of the Subordinated Notes at the time outstanding, the Company agrees to furnish to such Noteholder, upon request, with such financial and business information of the Company and the Bank as such Noteholder may reasonably request as may be reasonably necessary or advisable to allow such Noteholder to confirm compliance by the Company with this Note.

(l) Company Statement as to Compliance. The Company will deliver to the Noteholders, within one hundred twenty (120) days after the end of each fiscal year, an Officer’s Certificate covering the preceding fiscal year, stating whether or not, to the best of the certifying officer’s knowledge, the Company is in default in the performance and observance of any of the terms, provisions and conditions of this Subordinated Note (without regard to notice requirements or periods of grace) and if the Company will be in default, specifying all such defaults and the nature and status thereof of which such officer may have knowledge.

| 9. | Negative Covenants of the Company. |

(a) Limitation on Dividends. The Company shall not declare or pay any dividend or make any distribution on capital stock or other equity securities of any kind of the Company if the Company is not “well capitalized” for regulatory purposes immediately prior to the declaration of such dividend or distribution, except for Permitted Dividends.

(b) Merger or Sale of Assets. The Company shall not merge into another entity, effect a Change in Bank Control (as defined below) or convey, transfer or lease substantially all of its properties and assets to any person, unless:

(i) the continuing entity into which the Company is merged or the person which acquires by conveyance or transfer or which leases substantially all of the properties and assets of the Company shall be a corporation, association or other legal entity organized and existing under the laws of the United States of America, any State thereof or the District of Columbia and expressly assumes the due and punctual payment of the principal of and any premium and interest on the Subordinated Notes according to their terms, and the due and punctual performance of all covenants and conditions hereof on the part of the Company to be performed or observed; and

(ii) immediately after giving effect to such transaction, no Event of Default (as defined above), and no event which, after notice or lapse of time or both, would become an Event of Default, shall have occurred and be continuing.

“Change in Bank Control” means the sale, transfer, lease or conveyance by the Company, or an issuance of equity securities by the Bank other than to the Company, in either case resulting in ownership by the Company of less than 50% of the Bank.

10. Denominations. The Subordinated Notes are issuable only in registered form without interest coupons in minimum denominations of $100,000 and integral multiples of $1,000 in excess thereof.

11. Charges and Transfer Taxes. No service charge will be made for any registration of transfer or exchange of this Subordinated Note, or any redemption or repayment of this Subordinated Note, or any conversion or exchange of this Subordinated Note for other types of securities or property, but the Company may require payment of a sum sufficient to pay all taxes, assessments or other governmental charges that may be imposed in connection with the transfer or exchange of this Subordinated Note from the Noteholder requesting such transfer or exchange.