UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of September 2025

Commission File No. 001-42797

BULLISH

10A Building A, 60 Nexus Way, Camana Bay,

George Town, Grand Cayman, Cayman Islands, KY1-9005

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On September 17, 2025, Bullish issued a press release titled “Bullish Reports Second Quarter 2025 Results.” A copy of the press release, the unaudited second quarter 2025 results and the earnings presentation are furnished as Exhibits 99.1, 99.2 and 99.3, respectively, to this report on Form 6-K.

Incorporation By Reference

The unaudited condensed consolidated statements of profit or loss and other comprehensive income/(loss), unaudited condensed consolidated balance sheets, unaudited condensed consolidated statements of changes in equity and unaudited condensed consolidated statements of cash flows attached as Exhibit 99.2 to this report on Form 6-K are hereby incorporated by reference into Bullish’s registration statement on Form S-8 (Registration No. 333- 289553) (including any prospectuses forming a part of such registration statement), to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

INDEX TO EXHIBITS

| Exhibit No. | Description |

| 99.1 | Bullish Reports Second Quarter 2025 Results |

| 99.2 | Second Quarter 2025 Unaudited Condensed Consolidated Financial Statements |

| 99.3 | Second Quarter 2025 Earnings Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BULLISH | ||

| Date: September 17, 2025 | By: | /s/ David W. Bonanno |

| David W. Bonanno | ||

| Chief Financial Officer | ||

Exhibit 99.1

Bullish Reports Second Quarter 2025 Results

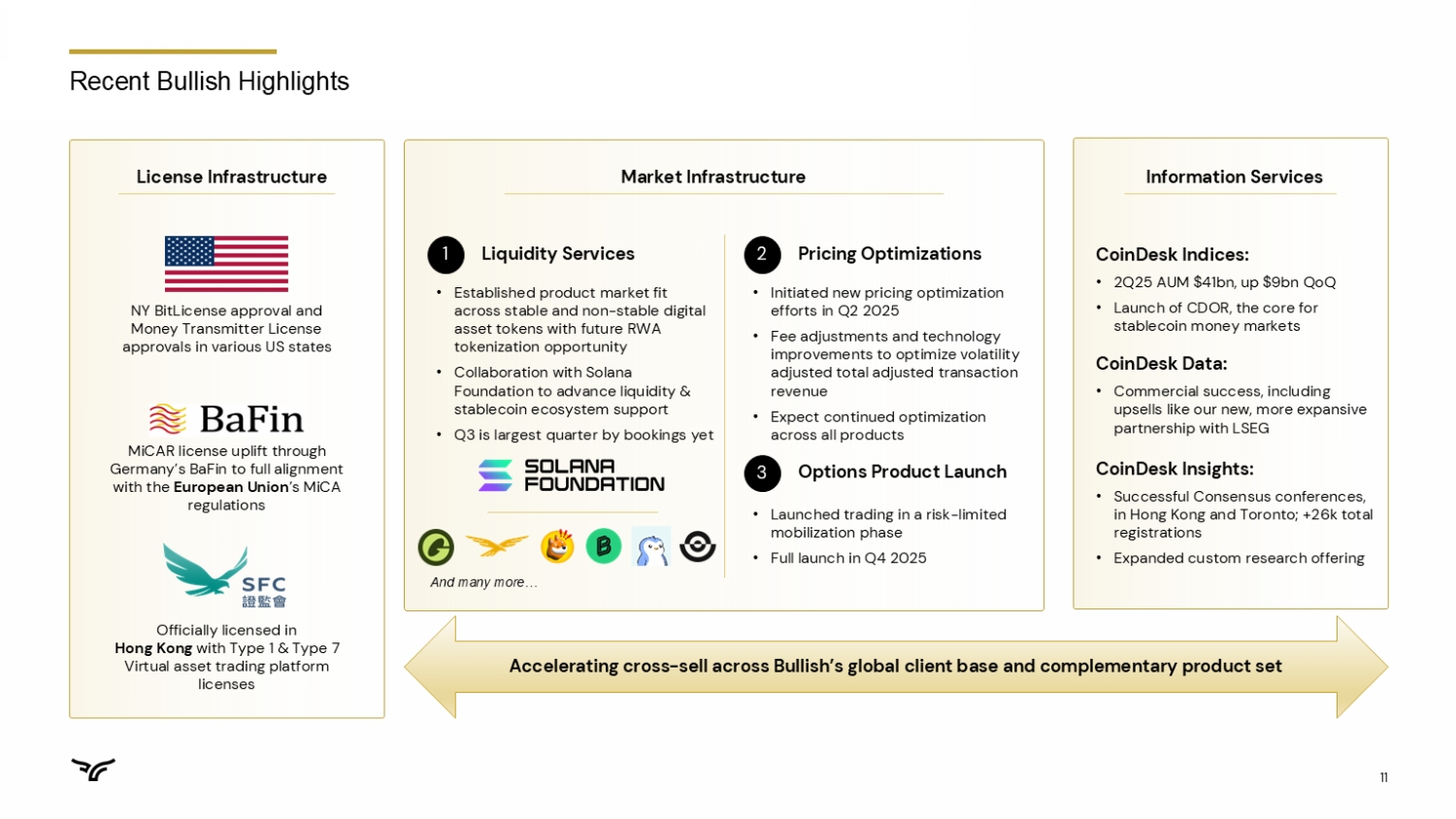

| ● | Bullish obtains New York DFS BitLicense, unlocking Q4’2025 US market entry |

| ● | Q2’2025 Digital asset sales of $58.6 billion and net income of $108.3 million |

| ● | Q2’2025 Adjusted Revenue of $57.0 million and Adjusted EBITDA of $8.1 million |

| ● | Q3’2025 Adjusted Revenue Guidance of $69.0 to $76.0 million and Adjusted EBITDA of $25.0 to $28.0 million |

Cayman Islands, September 17, 2025 – Bullish (NYSE: BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services, today announced financial results for the second quarter ended June 30, 2025.

Tom Farley, CEO: ”We are pleased with our results for the quarter - we saw exciting liquidity services growth, executed on a successful Consensus conference, and prepared for what would be a successful IPO. We’re excited that the work we did in the second quarter is already directly contributing to strong business momentum in the third quarter and beyond. Our recent receipt of the prestigious New York DFS Bitlicense is testament to our institutional rigor and truly global reach.”

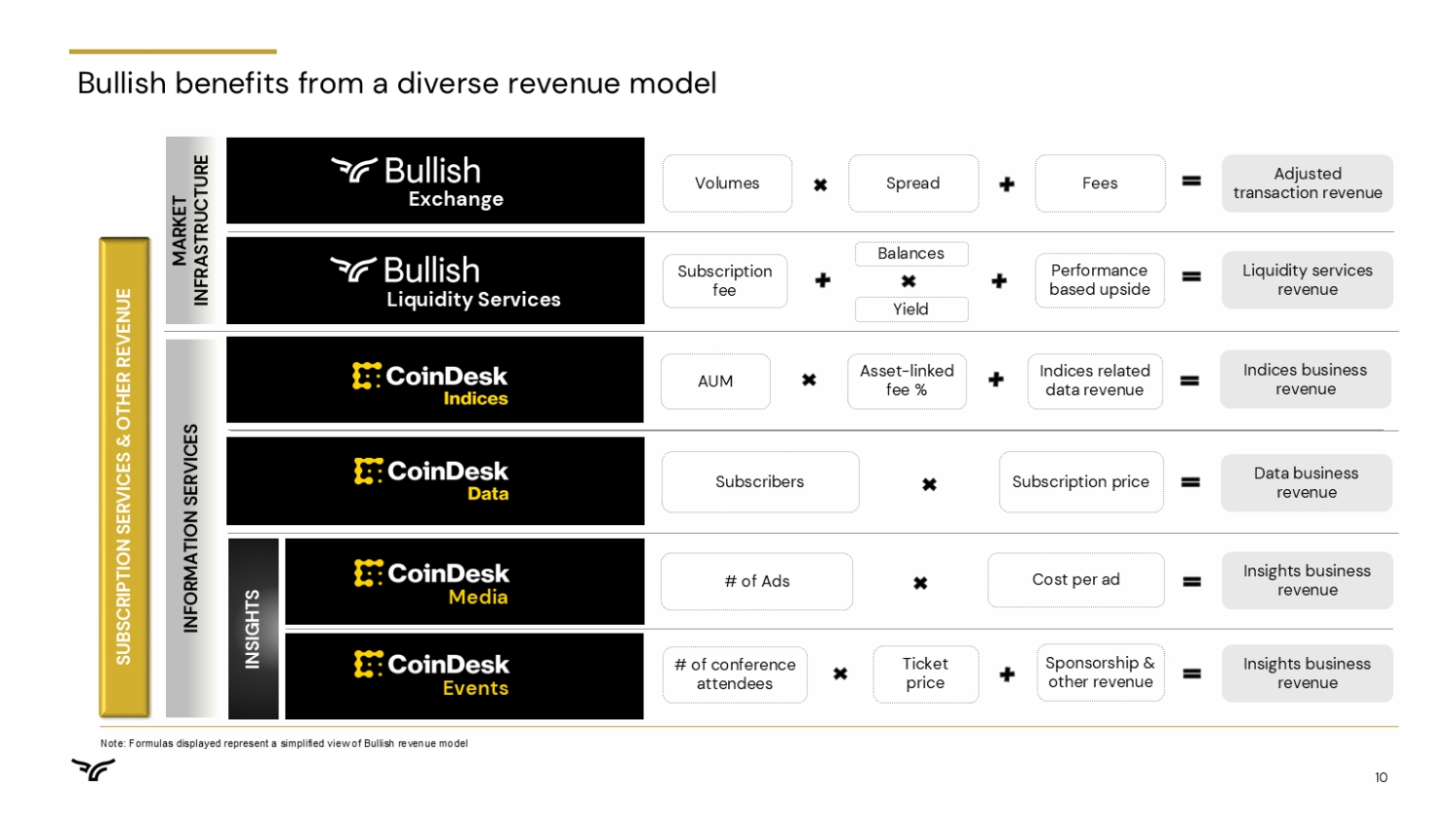

David Bonanno, CFO: "We believe that our first quarterly earnings report as a public company demonstrates the resilience of our business model and the importance of revenue diversification. We are excited to welcome our new public shareholders and look forward to updating you on our progress going forward."

Q2 2025 Financial Highlights

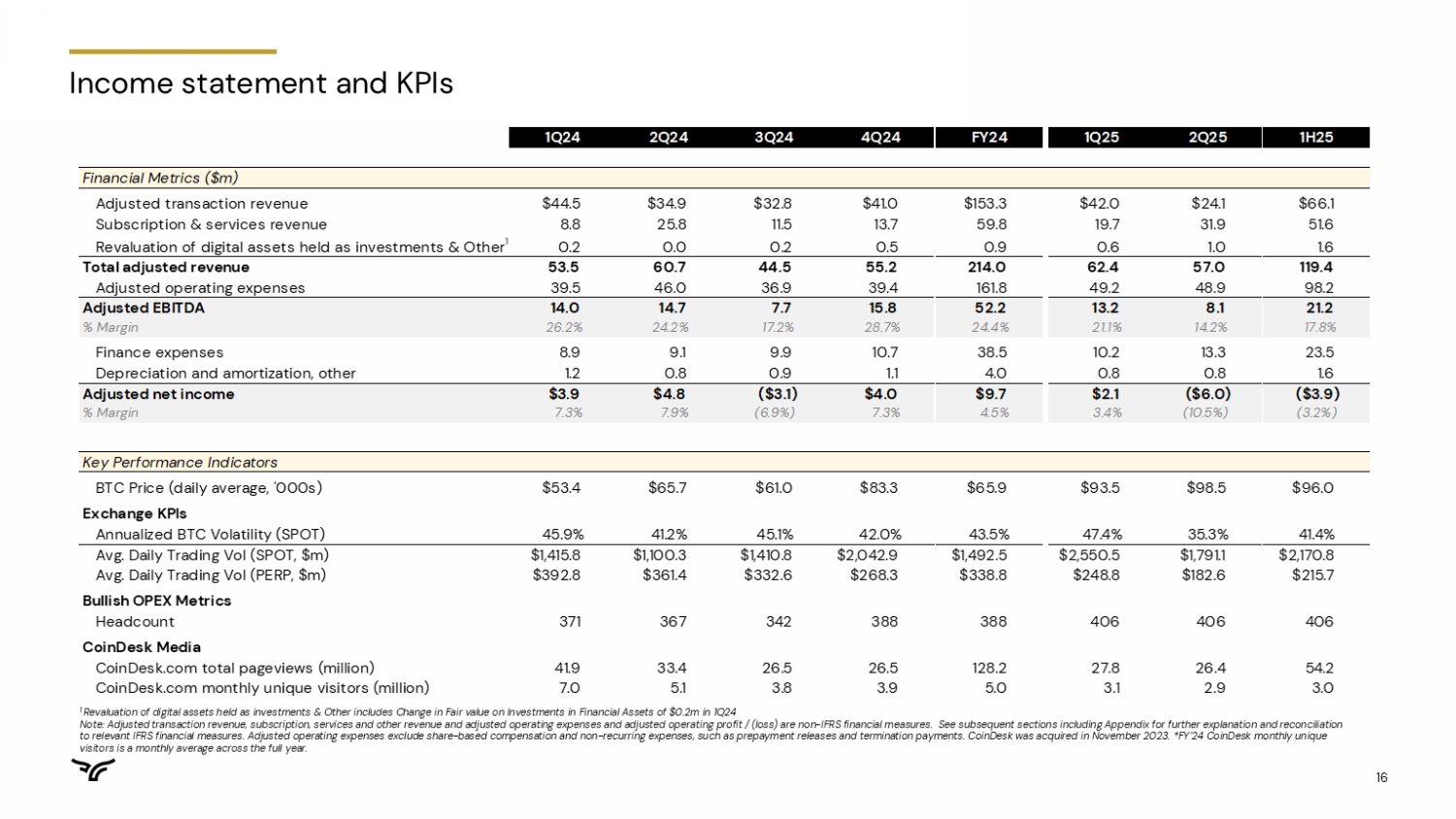

All amounts compared to Q2 2024

| - | Digital asset sales were $58.6 billion vs. $49.6 billion |

| - | Net income (loss) was $108.3 million or $0.93 per diluted share vs. $(116.4) million or $(1.03) per diluted share |

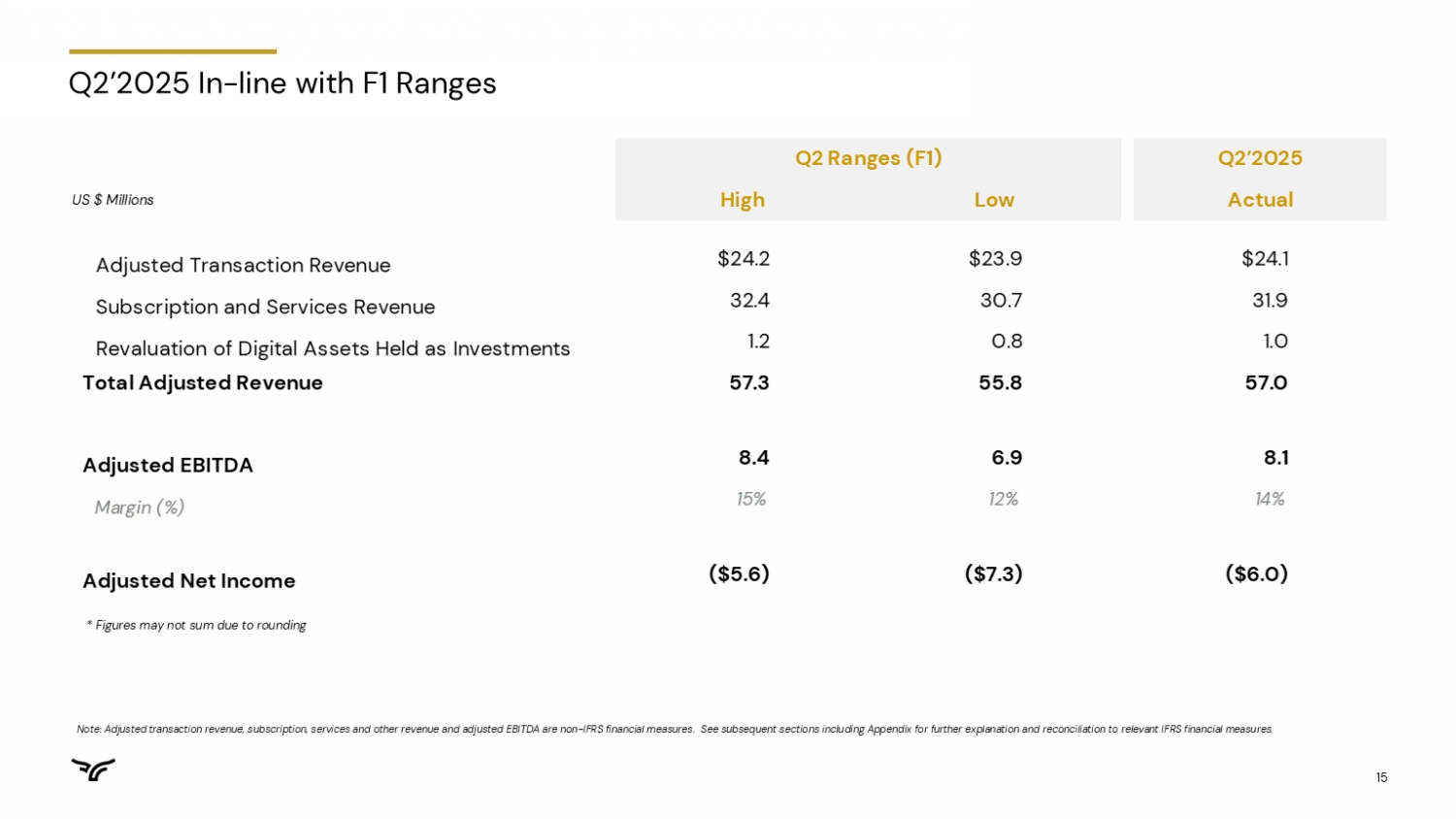

| - | Adjusted revenue (non-IFRS) was $57.0 million vs. $60.7 million |

| - | Adjusted transaction revenue (non-IFRS) was $24.1 million vs. $34.9 million |

| - | Adjusted net income (non-IFRS) was $(6.0) million vs. $4.8 million |

| - | Adjusted EBITDA (non-IFRS) was $8.1 million vs. $14.7 million |

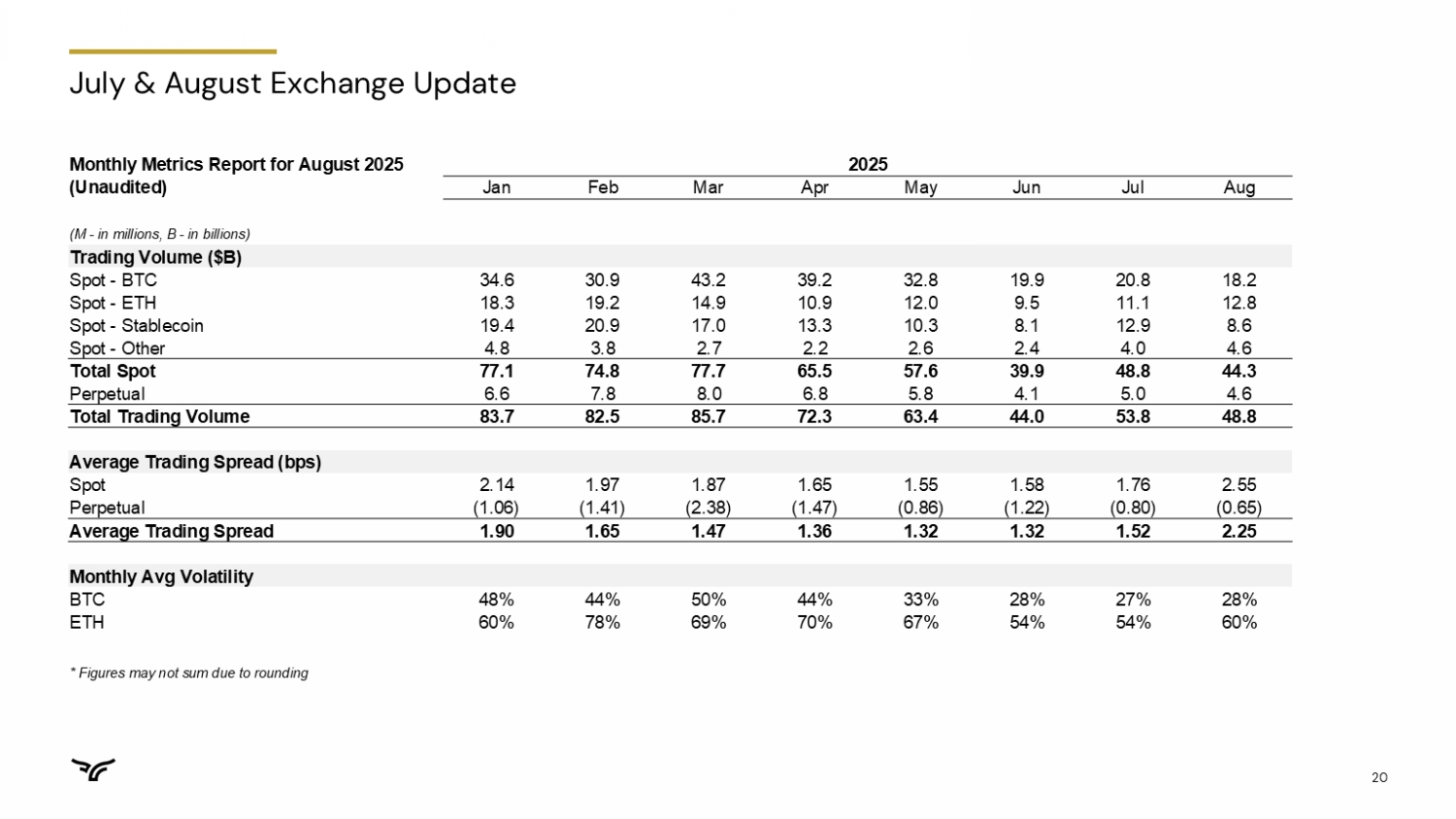

Q2 2025 Key Business Metrics

All amounts compared to Q2 2024

| - | Trading volume totaled $179.6 billion vs. $133.0 billion |

| - | Average daily volume totaled 1.974 billion vs. 1.462 billion |

| - | Average trading spread of 1.3 bps vs. 2.6 bps |

Business Highlights

| - | Expanded Regulatory Footprint: Secured the prestigious New York DFS Bitlicense in September 2025, becoming only the third entity to receive both the Bitlicense and the New York MTL since 2023. This approval, along with the recent MiCA license uplift in the EU, and our Hong Kong SFC licenses, gives Bullish a truly global regulatory footprint which complements our one global order book. |

| - | Strong and Diversified Revenue Growth: Subscription, Services and Other (SS&O) revenue grew to $32.9 million in Q2, representing a 61.4% sequential increase and 27.4% year-over-year growth. |

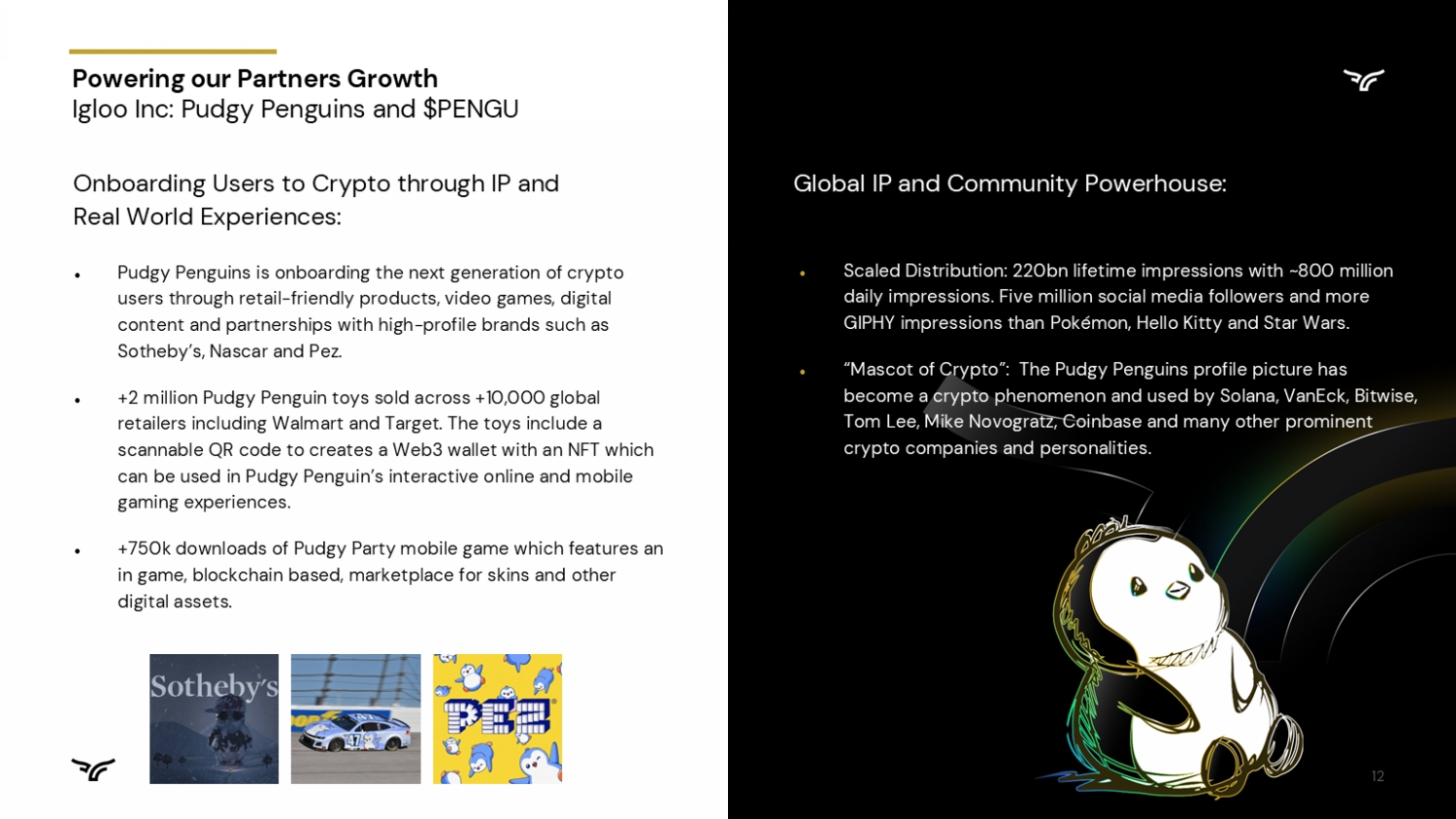

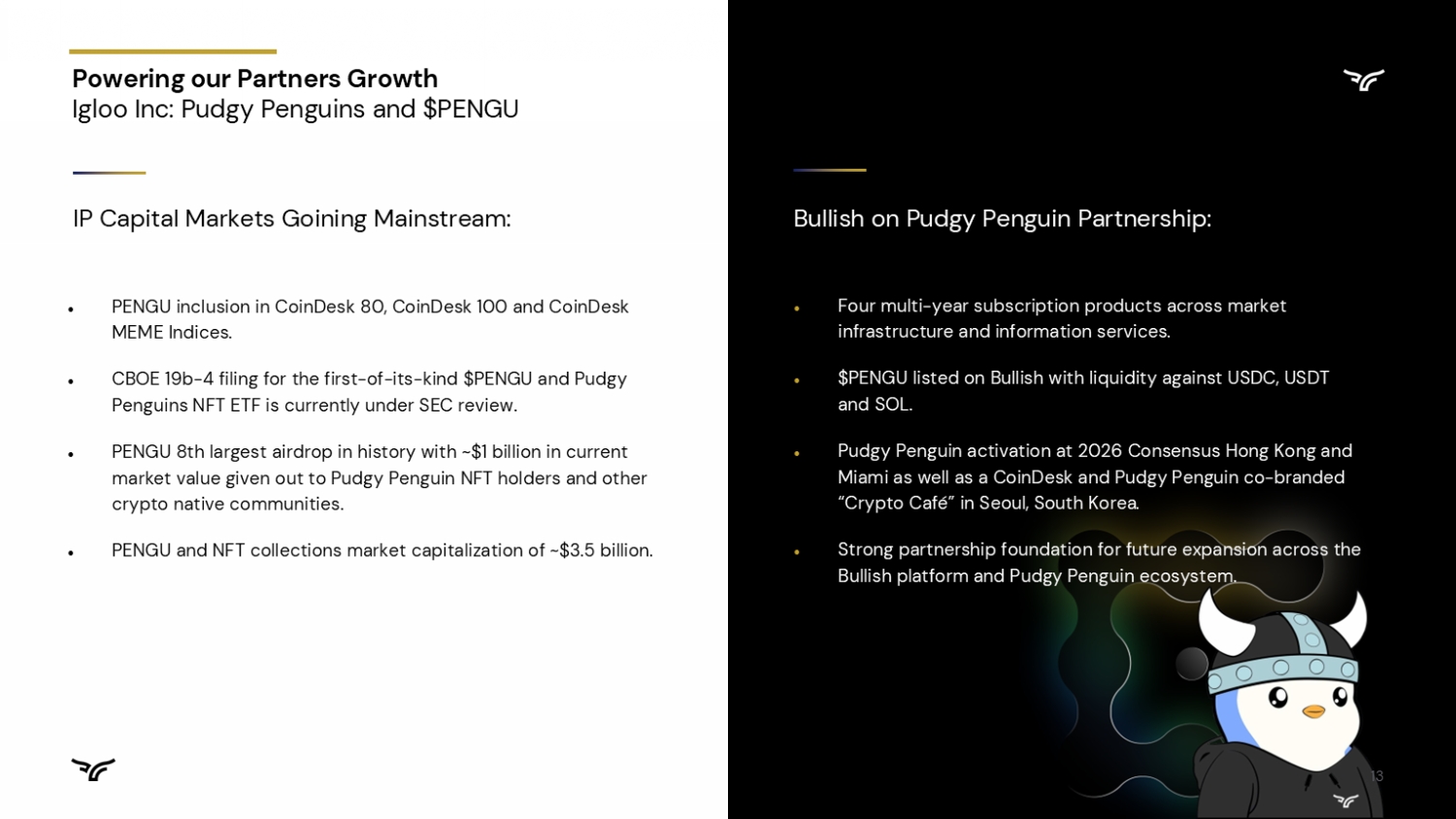

| - | Significant Client Wins and Cross-Selling Success: Signed multi-year, multi-product agreements with high-profile partners like Igloo Inc., the owner of Pudgy Penguins. The partnership leverages the company's liquidity services, CoinDesk Data, and Insights offerings, showcasing the power of the business's cross-sell strategy and a "flight to quality" among institutional clients. |

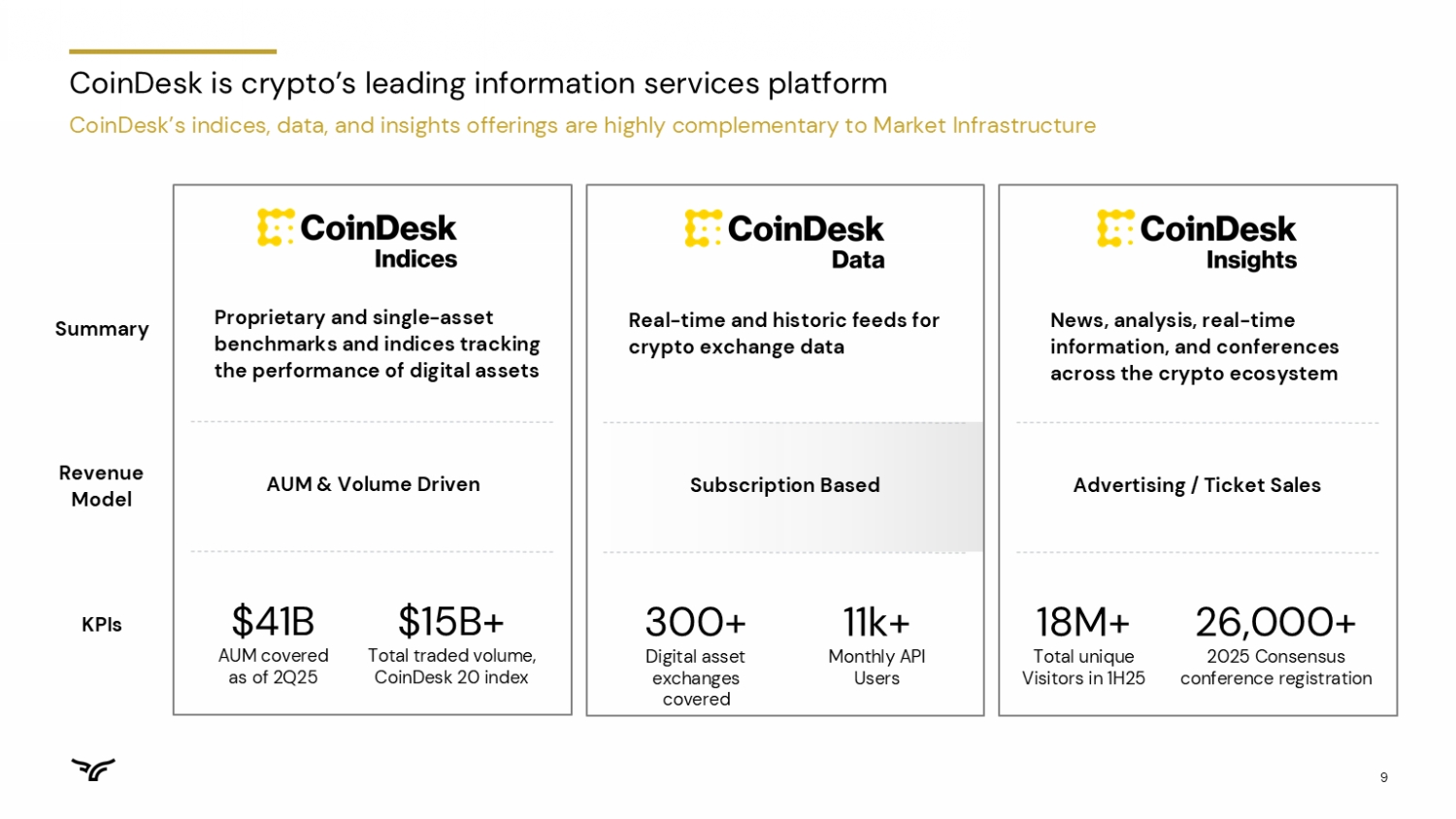

| - | Robust Information Services Growth: CoinDesk Indices ended the quarter with $41 billion in assets under management (AUM), an increase of over $9 billion from Q1. This growth, along with a newly launched stablecoin benchmark interest rate, CoinDesk Overnight Rates, underscores the value of our information services offering. |

| - | Strategic Product Development and Launch: Progressed well towards an anticipated full launch of the options trading platform in Q4, which is already in a limited mobilization phase with select clients. |

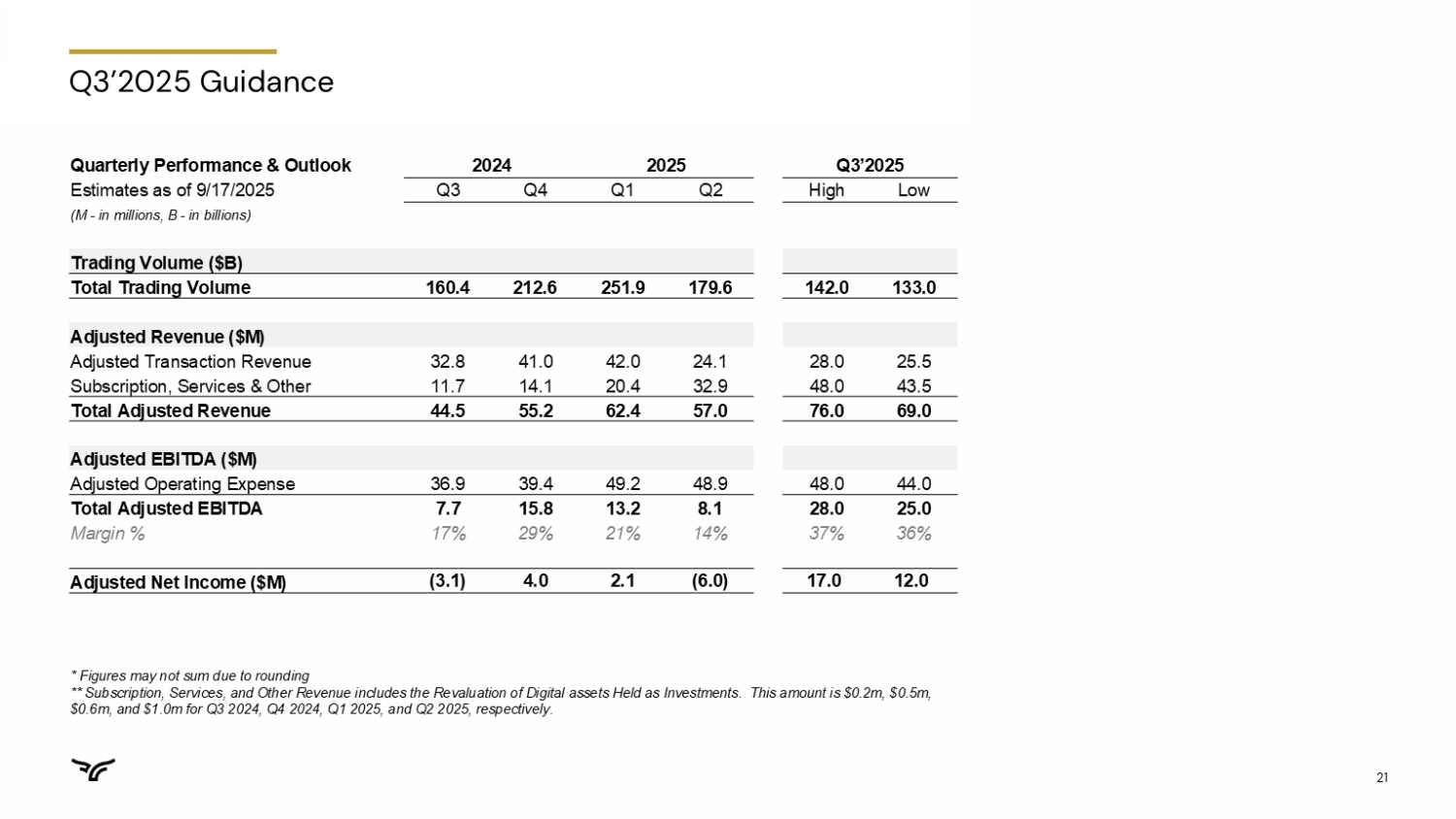

Q3 2025 Guidance

To give investors insight into our business and expectations, management is providing the following guidance for the third quarter 2025:

| - | Trading Volume of $133.0 billion to $142.0 billion |

| - | Adjusted Transaction Revenue (non-IFRS) of $25.5 million to $28.0 million |

| - | Subscriptions, Services & Other Revenue (non-IFRS) of $43.5 million to $48.0 million |

| - | Adjusted EBITDA (non-IFRS) of $25.0 million to $28.0 million |

| - | Adjusted Net Income (non-IFRS) of $12.0 million to $17.0 million |

Conference Call Webcast and Q&A Information

Bullish will host a call to discuss its results at 5:30 p.m. ET today. The live webcast can be accessed at investors.bullish.com, along with supplemental slides. Following the call, a replay and transcript will be available at investors.bullish.com.

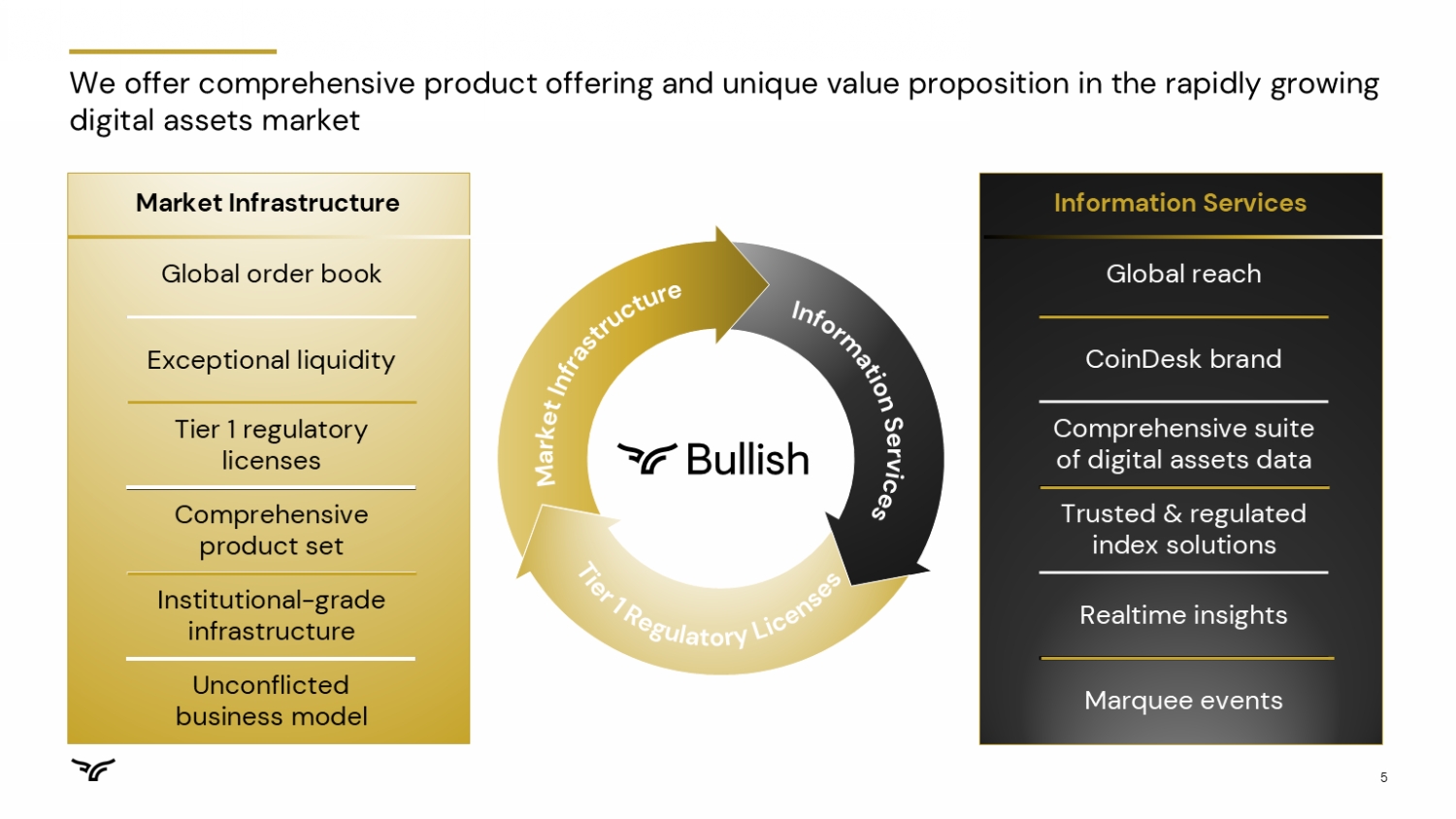

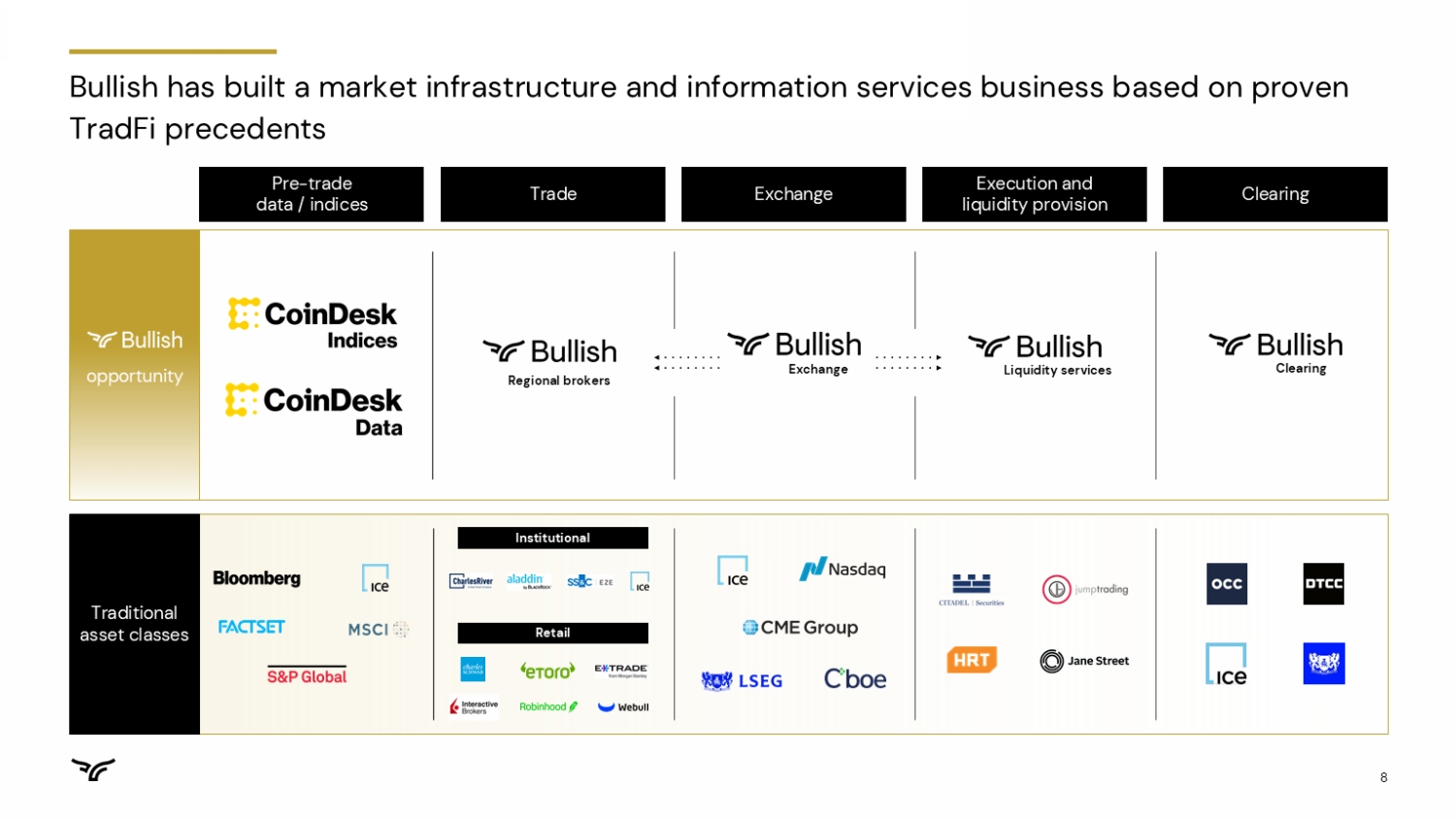

About Bullish

Bullish is an institutionally focused global digital asset platform that provides market infrastructure and information services. These include: Bullish Exchange – a regulated and institutionally focused digital assets spot and derivatives exchange, integrating a high-performance central limit order book matching engine with automated market making to provide deep and predictable liquidity. Bullish Exchange is regulated in the United States, Germany, Hong Kong, and Gibraltar. CoinDesk Indices – a collection of tradable proprietary and single-asset benchmarks and indices that track the performance of digital assets for global institutions in the digital assets and traditional finance industries. CoinDesk Data – a broad suite of digital assets market data and analytics, providing real-time insights into prices, trends, and market dynamics. CoinDesk Insights – a digital asset media and events provider and operator of Coindesk.com, a digital media platform that covers news and insights about digital assets, the underlying markets, policy, and blockchain technology. For more information, please visit bullish.com and follow LinkedIn and X.

Use of Websites to Distribute Material Company Information

We use the Bullish Investor Relations website (investors.bullish.com) and our X account (x.com/bullish) to publicize information relevant to investors, including information that may be deemed material, in addition to filings we make with the U.S. Securities and Exchange Commission (SEC) and press releases. We encourage investors to regularly review the information posted on our website and X account in addition to our SEC filings and press releases to be informed of the latest developments.

Contacts

Media: media@bullish.com

Investor Relations: investors@bullish.com

Source: Bullish

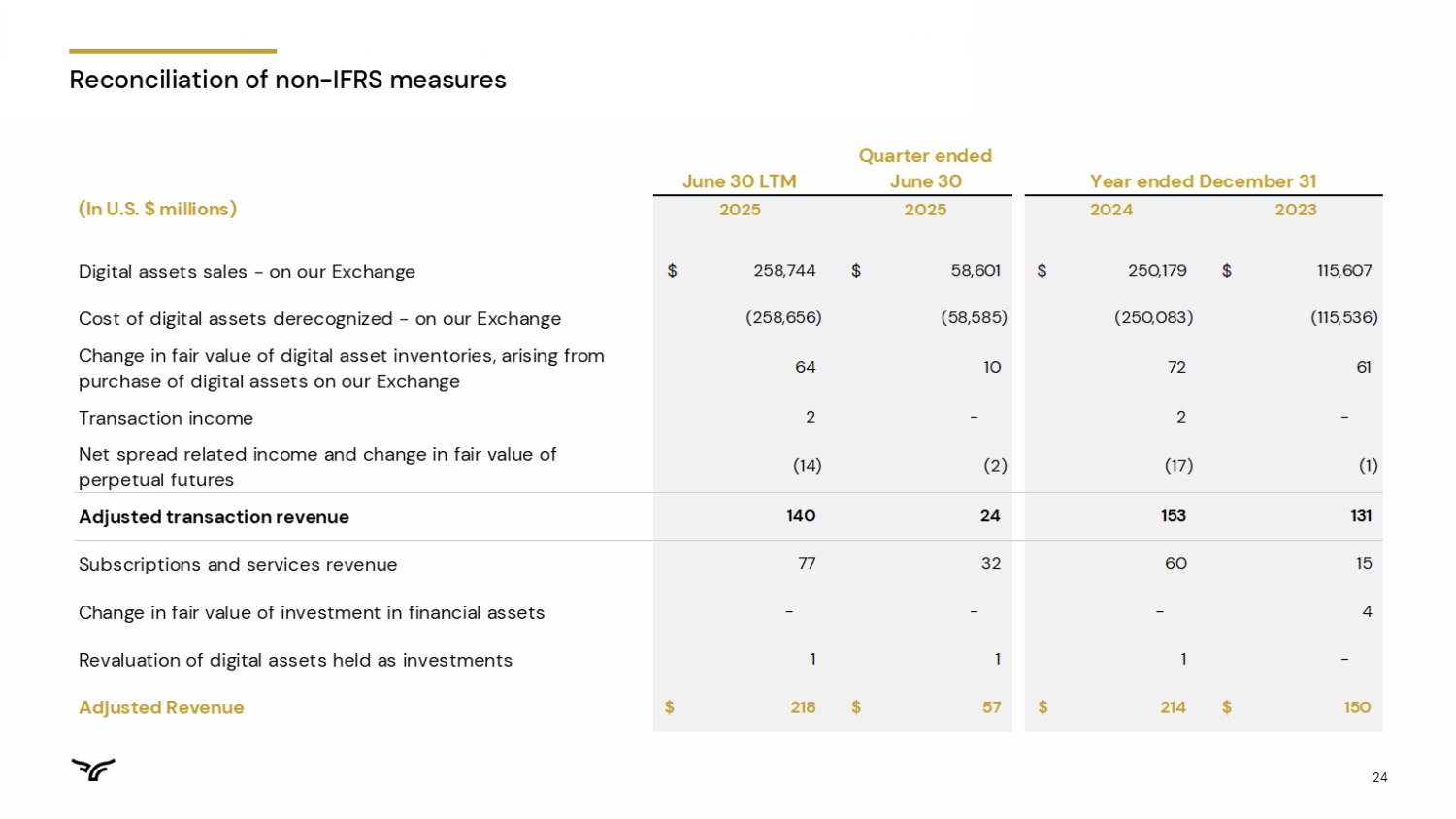

Non-IFRS financial measures and key performance indicators

This communication includes certain financial measures that are not recognized by the International Financial Reporting Standards (“IFRS”). These non-IFRS financial measures are “adjusted transaction revenue,” “adjusted revenue,” “adjusted net income (loss)” and “adjusted EBITDA,” “gross liquid assets” and “net liquid assets”, and “adjusted operating expense.” These non-IFRS financial measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under IFRS. We believe these non-IFRS financial measures provide useful information to management and investors regarding certain financial and business trends. These non-IFRS financial measures are subject to inherent limitations as they reflect the exercise of judgments about which items of expense and income are excluded or included in determining these non-IFRS financial measures. Refer to the section “Reconciliation of Non-IFRS Measures” for further details and a reconciliation of the non-IFRS financial measures presented to their most directly comparable IFRS financial measures.

This communication also provides our forward-looking “adjusted transaction revenue,” “subscription, services & other revenue,” “adjusted EBITDA,” and “adjusted net income” guidance for the upcoming fiscal quarter. Information reconciling upcoming fiscal quarter “adjusted transaction revenue,” “subscription, services & other revenue,” “adjusted EBITDA,” and “adjusted net income” to their most directly comparable IFRS financial measures is unavailable to us without unreasonable effort due to the high variability, complexity and lack of visibility in making accurate forecasts and projections to certain reconciling items. These items cannot be reasonably and accurately predicated without the investment of undue time, costs and other resources, and accordingly, no reconciliation of the forward-looking non-IFRS financial measures is included. These reconciling items could be material to our actual results for the period.

In addition, management is providing forward-looking guidance on the following key performance indicator, Trading Volume, for the upcoming fiscal quarter. Refer to the section “Definitions of Certain Metrics” in this communication for definitions of key performance indicators.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Sentences containing words such as “believe,” “intend,” “plan,” “may,” “expect,” “should,” “could,” “anticipate,” “estimate,” “predict,” “project,” or their negatives, or other similar expressions of a future or forward-looking nature generally should be considered forward-looking statements. Such statements include, without limitation, statements relating to our expected financial or operating performance, including for the upcoming fiscal quarter; our business strategy and potential market opportunities; current and prospective products, services or acquisitions; trends in, demand for, and growth and market size of, the digital assets industry; expectations regarding relationships with clients and third-party business partners; competition in our industry; the regulatory and legal environment, including regulatory proceedings or approvals; and general economic and business conditions. Such forward-looking statements are based upon estimates and assumptions that, while considered reasonable by us, are inherently uncertain and are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause results to differ from those expressed in our forward-looking statements include, but are not limited to intense competition in our industry, including from unregulated and less-regulated entities and platforms; our ability to execute our business strategy and grow our business and operations, including in new geographic locations; our ability to develop, launch and improve our products and services and their adoption; our ability to attract and retain customers; the evolving rules and regulations applicable to digital assets and our products and services; our ability to obtain and maintain regulatory approvals and stay in compliance with laws and regulations, and the costs of doing so; evolution and adoption of digital assets; interest rate fluctuations and digital asset price volatility; changes in, or unexpected, costs to operate our business; cybersecurity risks, including with respect to digital assets custody; disruptions to information and technology systems, blockchain networks and third-party services on which we rely; changes in general market, political or economic conditions; and other risks and uncertainties set forth in the section entitled “Risk Factors” in our final prospectus dated August 12, 2025 filed with the Securities and Exchange Commission (“SEC”), as well as as potential risks and uncertainties disclosed in our other filings with the SEC. We may not actually achieve the performance, plans, or expectations disclosed in our forward-looking statements. Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth therein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. We do not undertake any duty to update forward-looking statements.

Definitions of Certain Metrics

| ● | Adjusted transaction revenue is a non-IFRS financial measure intended to capture the fees and trading spreads earned from customers trading on our Exchange. We define adjusted transactional revenue as (i) the portion of “Digital asset sales”, as reported in accordance with IFRS, attributable to digital asset sales on our Exchange, less (ii) the “Cost of digital assets derecognized” excluding such costs from sales on venues other than the Exchange, plus (iii) the change in fair value of digital asset inventories, arising from purchase of digital assets on our Exchange (included within reported “Change in fair value of digital assets held, net”), plus (iv) transaction income (included within reported “Other revenues”), plus (v) net spread related income and change in fair value of perpetual futures on the Exchange. |

We exclude digital asset sales, and the related cost of digital assets derecognized, from trading activity on venues other than our Exchange. We also exclude subscription and services revenue (included within reported other revenues). In each case, this approach is intended to ensure that our adjusted transaction revenue metric reflects the core performance of our trading operations and provides a clearer understanding of our business activities on our Exchange.

While we include change in fair value of digital asset inventories, specifically the bid-offer spread earned from the purchase of digital assets on our Exchange, as part of our adjusted transaction revenue, we do not include other reported changes in fair value, such as subsequent remeasurements and mark-to-market adjustments. This is because these remeasurements, including impairment losses of digital assets held under intangible assets, are not considered part of our ongoing business operations and do not align with our intention to avoid taking directional trading positions.

| ● | Adjusted revenue is a non-IFRS financial measure intended to reflect the revenues generated by our trading and information services and also from our investing activities. We define adjusted revenue as adjusted transaction revenue, plus (i) subscription and services revenue, which is included in reported other revenues and includes interest and revenues from CoinDesk and CCData, plus (ii) for periods prior to 2024 only, change in fair value of investment in financial assets, plus (iii) the net income from DeFi protocols excluding the fair value change of underlying digital assets, that is reported under OCI. |

Specifically, adjusted revenue includes the fees and trading spreads earned from customers trading on our Exchange, excludes gains or losses from the remeasurement of our digital assets and includes other fees such as interest and revenue from CoinDesk and CCData businesses that we acquired in November 2023 and October 2024, respectively.

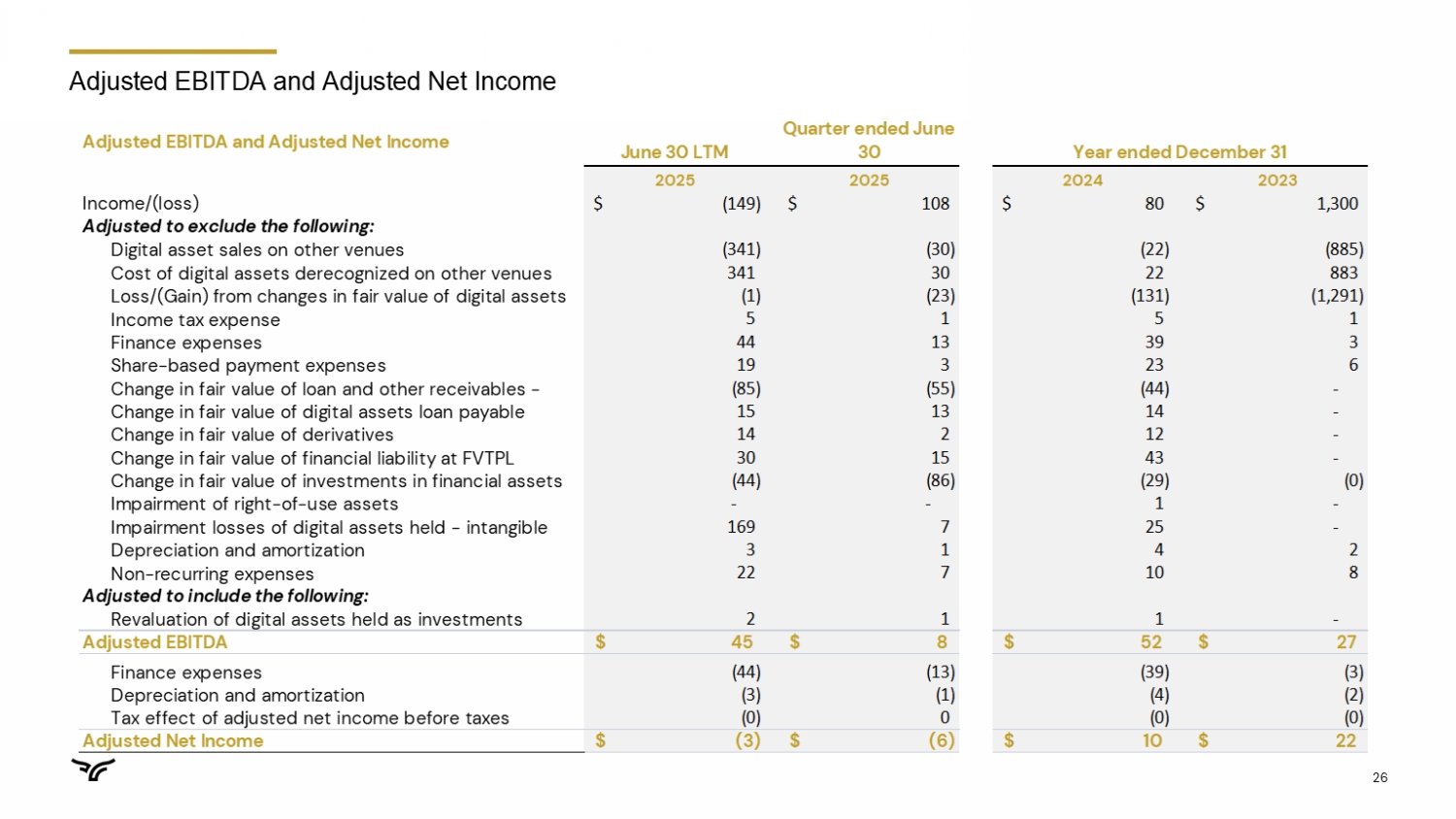

| ● | Adjusted EBITDA is calculated as income/(loss) after tax adjusted to exclude: |

| ○ | digital asset sales and the cost of digital assets derecognized on other venues, as these transactions do not directly reflect the core activities of liquidity provision and client facilitation on our Exchange. Excluding these is intended to ensure that our Adjusted EBITDA remains focused on the fundamental operations that drive our business; |

| ○ | gains or losses from the remeasurement of our digital assets, as these assets are held to facilitate client trading rather than for proprietary trading purposes. Such remeasurement reflects mark-to-market (MTM) adjustments including the impairment losses of digital assets held under intangible assets that are not part of our ongoing business operations and do not align with our intention to avoid taking directional trading positions. The primary focus of our business model is to provide liquidity and facilitate client transactions on our Exchange, with the key performance metric being the bid-offer spread earned from digital asset spot transactions. Including MTM adjustments would introduce volatility that is not reflective of our core operational performance and could mislead stakeholders about the true drivers of our business; |

| ○ | certain non-cash charges such as share-based compensation expenses and depreciation and amortization because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations; |

| ○ | provision for or benefit from income tax and finance expenses; |

| ○ | change in fair value of derivatives and financial liability at FVTPL; |

| ○ | the change in fair value of investments in financial assets related to digital asset funds. These investments are not central to our core operations, as they do not directly contribute to our primary business activities of liquidity provision and client facilitation. The fair value changes are primarily driven by the mark-to-market (MTM) adjustments of the underlying digital assets within the funds. Including these fair value changes would introduce volatility of digital assets that does not accurately represent the operational metrics that are indicative of our business performance. Our core operating performance focuses on providing liquidity and facilitating client transactions, and we aim to avoid taking directional trading positions; |

| ○ | certain acquisition-related and integration costs associated with business combinations, various restructuring and other costs, and goodwill impairment charges, all of which are not normal operating expenses. These adjustments aid in the comparability of our results across periods. Acquisition related costs include amounts paid to redeem acquirees’ unvested share-based compensation awards, legal, accounting, valuation, and due diligence costs. Integration costs include advisory and other professional services or consulting fees necessary to integrate acquired businesses. Restructuring and other costs that are not reflective of our core business operating expenses may include severance costs, contingent losses, impairment charges, and certain litigation and regulatory charges; and |

| ○ | the net income from DeFi protocols, excluding the fair value change of underlying digital assets, which is a component of the “Revaluation of digital assets held as investments” under OCI. Deploying our digital assets in these protocols are a strategic component of our business model, providing additional yield and enhancing our liquidity management capabilities. Including this net income in Adjusted EBITDA reflects the performance of our investment activities and supports our focus on core operations. |

| ● | Adjusted net income/(loss) is calculated as income/(loss) after tax adjusted by the same adjustment items taken into account for determining adjusted EBITDA, with further adjustment to add back finance expense and depreciation and amortization, and reduced by tax effect of the adjustments. |

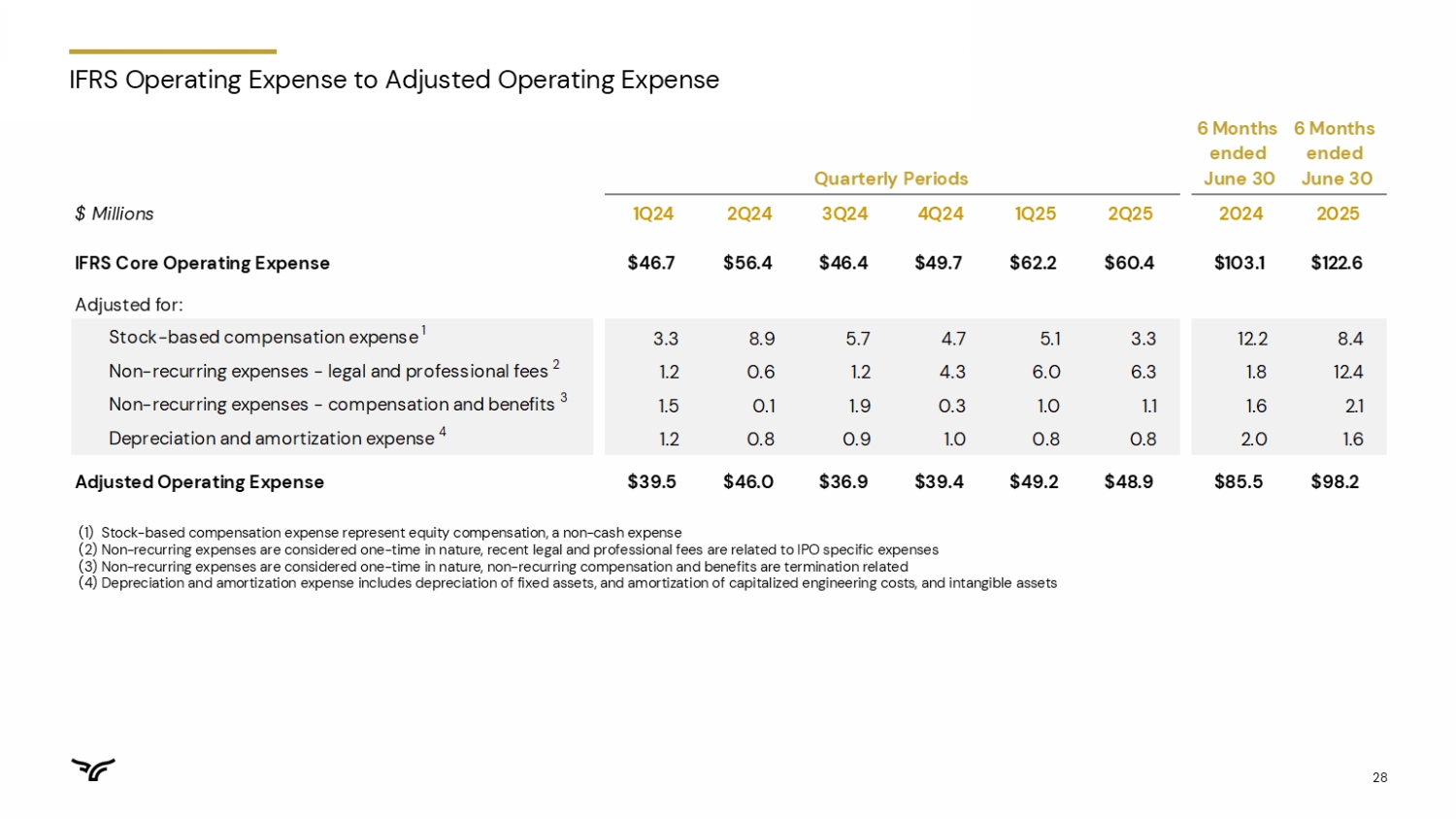

| ● | Adjusted operating expense is calculated by taking total operating expenses (which includes Administrative expenses and Other expenses) and excluding items we do not consider representative of our core, ongoing operating performance. These excluded items Stock-based compensation expense, Depreciation and amortization expense, and certain non-recurring expenses. |

We believe Adjusted Operating Expense is a useful supplemental measure for investors, as it provides a clearer view of our operational efficiency by removing non-cash expenses (depreciation, amortization, and stock-based compensation) and other items not indicative of ongoing business trends. Management uses this measure to assess business performance and to plan for future periods.

| ● | Subscription, services & other revenue is a non-IFRS financial measure intended to provide a comprehensive view of our diverse revenue streams beyond core transaction fees and spreads. This measure includes revenue from lending and liquidity services, such as interest earned from third-party lending arrangements like credit line facilities and margin loans, interest on our own cash and stablecoins, fees from liquidity services and promotional income, and revenues from CoinDesk services such as sponsorships, event admissions, and index data licensing fees. It also incorporates the net income from DeFi protocols (excluding any fair value changes of the underlying digital assets). This non-IFRS measure is calculated by taking "Subscription and services revenue" (as reported within the "Other revenues") and adding "Net income from DeFi protocols, excluding the fair value change of underlying digital assets" (as reported within “Revaluation of digital assets held as investments”). By consolidating these various income sources, we believe this measure offers a more distinct view of the growth and performance of our service-oriented business lines, separate from our core transaction-based revenues. |

| ● | Trading volume represents the notional value of trades, i.e., the product of the quantity of assets transacted and the trade price at the time the spot transaction was executed. The quantity represents the total U.S. dollar equivalent value of matched trades transacted between a buyer and seller through our platform during the period of measurement. |

| ● | Average daily volume represents the total Trading Volume for the applicable period divided by the number of trading days in such period. |

| ● | Average trading spread represents total commissions earned from transactions on the Bullish Exchange for the period, expressed as a percentage of the trading volume for the period. Management reviews this metric, which reflects the cost of trading on the Bullish Exchange, changes in fair value of perpetual futures, and rebates, for insight into the average revenue generated per unit of trading volume on our platform. |

BULLISH

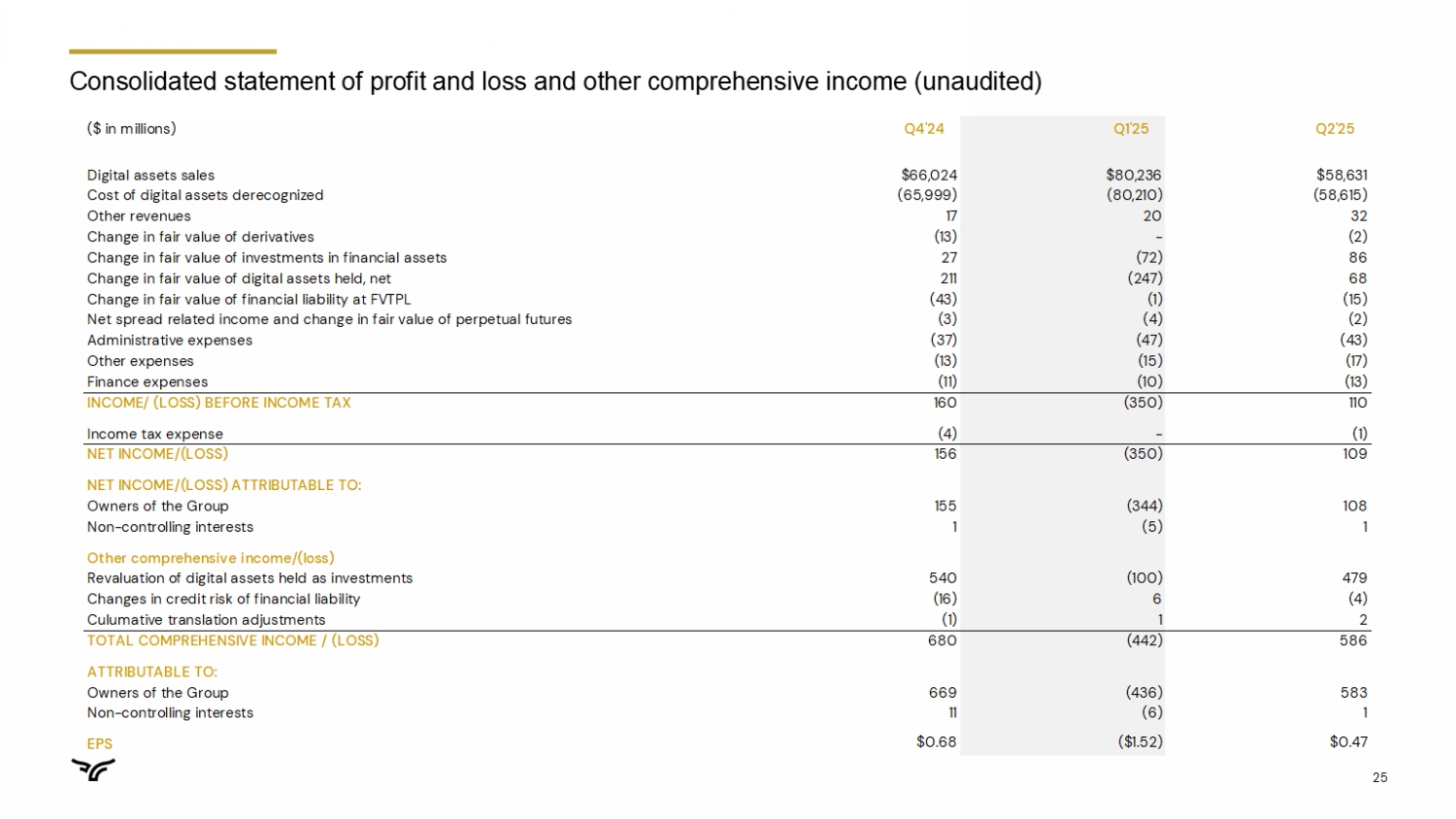

CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME/(LOSS) (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(In thousands, except per share data)

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Digital assets sales | $ | 58,630,645 | $ | 49,578,206 | $ | 138,866,802 | $ | 129,982,783 | ||||||||

| Cost of digital assets derecognized | (58,615,273 | ) | (49,556,478 | ) | (138,824,914 | ) | (129,932,051 | ) | ||||||||

| Other revenues | 32,292 | 26,257 | 52,596 | 35,623 | ||||||||||||

| Change in fair value of digital assets held, net | 68,409 | (99,372 | ) | (178,353 | ) | 62,802 | ||||||||||

| Net spread related income and change in fair value of perpetual futures on the Exchange | (1,989 | ) | (4,797 | ) | (5,691 | ) | (9,017 | ) | ||||||||

| Change in fair value of investment in financial assets | 86,359 | (738 | ) | 14,549 | (389 | ) | ||||||||||

| Administrative expenses | (43,017 | ) | (39,662 | ) | (90,203 | ) | (76,419 | ) | ||||||||

| Other expenses | (17,362 | ) | (16,720 | ) | (32,425 | ) | (26,636 | ) | ||||||||

| Finance expense | (13,291 | ) | (9,063 | ) | (23,531 | ) | (17,992 | ) | ||||||||

| Change in fair value of derivatives | (2,379 | ) | 175 | (2,379 | ) | (351 | ) | |||||||||

| Change in fair value of financial liability at FVTPL | (15,250 | ) | 6,100 | (16,150 | ) | (29,500 | ) | |||||||||

| Income/(loss) before income tax | $ | 109,144 | $ | (116,092 | ) | $ | (239,699 | ) | $ | (11,147 | ) | |||||

| Income tax expense | (876 | ) | (302 | ) | (655 | ) | (478 | ) | ||||||||

| Net income/(loss) | $ | 108,268 | $ | (116,394 | ) | $ | (240,354 | ) | $ | (11,625 | ) | |||||

| Attributable to: | ||||||||||||||||

| Owners of the Group | 107,513 | (115,346 | ) | (236,481 | ) | (11,773 | ) | |||||||||

| Non-controlling interests | 755 | (1,048 | ) | (3,873 | ) | 148 | ||||||||||

| Net income/(loss) | $ | 108,268 | $ | (116,394 | ) | $ | (240,354 | ) | $ | (11,625 | ) | |||||

| Other comprehensive income/(loss) | ||||||||||||||||

| Items that will not be subsequently reclassified to profit or loss: | ||||||||||||||||

| Revaluation of digital assets held as investments | 478,689 | (175,436 | ) | 378,786 | 429,531 | |||||||||||

| Fair value gain/(loss) on financial liabilities designated as at FVTPL attributable to changes in credit risk | (4,350 | ) | (1,450 | ) | 1,700 | (18,300 | ) | |||||||||

| $ | 474,339 | $ | (176,886 | ) | $ | 380,486 | $ | 411,231 | ||||||||

| Items that may be reclassified subsequently to profit or loss: | ||||||||||||||||

| Foreign exchange differences on translation of foreign operations | 1,591 | — | 2,134 | — | ||||||||||||

| Total comprehensive income/(loss) | $ | 584,198 | $ | (293,280 | ) | $ | 142,266 | $ | 399,606 | |||||||

| Attributable to: | ||||||||||||||||

| Owners of the Group | 576,422 | (290,544 | ) | 140,104 | 396,033 | |||||||||||

| Non-controlling interests | 7,776 | (2,736 | ) | 2,162 | 3,573 | |||||||||||

| Total comprehensive income/(loss) | $ | 584,198 | $ | (293,280 | ) | $ | 142,266 | $ | 399,606 | |||||||

| Weighted average number of ordinary shares for the purposes of basic and diluted earnings/(loss) per share | ||||||||||||||||

| Basic | 113,215 | 112,500 | 113,215 | 112,500 | ||||||||||||

| Diluted | 115,951 | 112,500 | 113,215 | 112,500 | ||||||||||||

| Earnings/(Loss) per share | ||||||||||||||||

| Basic | $ | 0.95 | $ | (1.03 | ) | $ | (2.09 | ) | $ | (0.10 | ) | |||||

| Diluted | $ | 0.93 | $ | (1.03 | ) | $ | (2.09 | ) | $ | (0.10 | ) | |||||

BULLISH

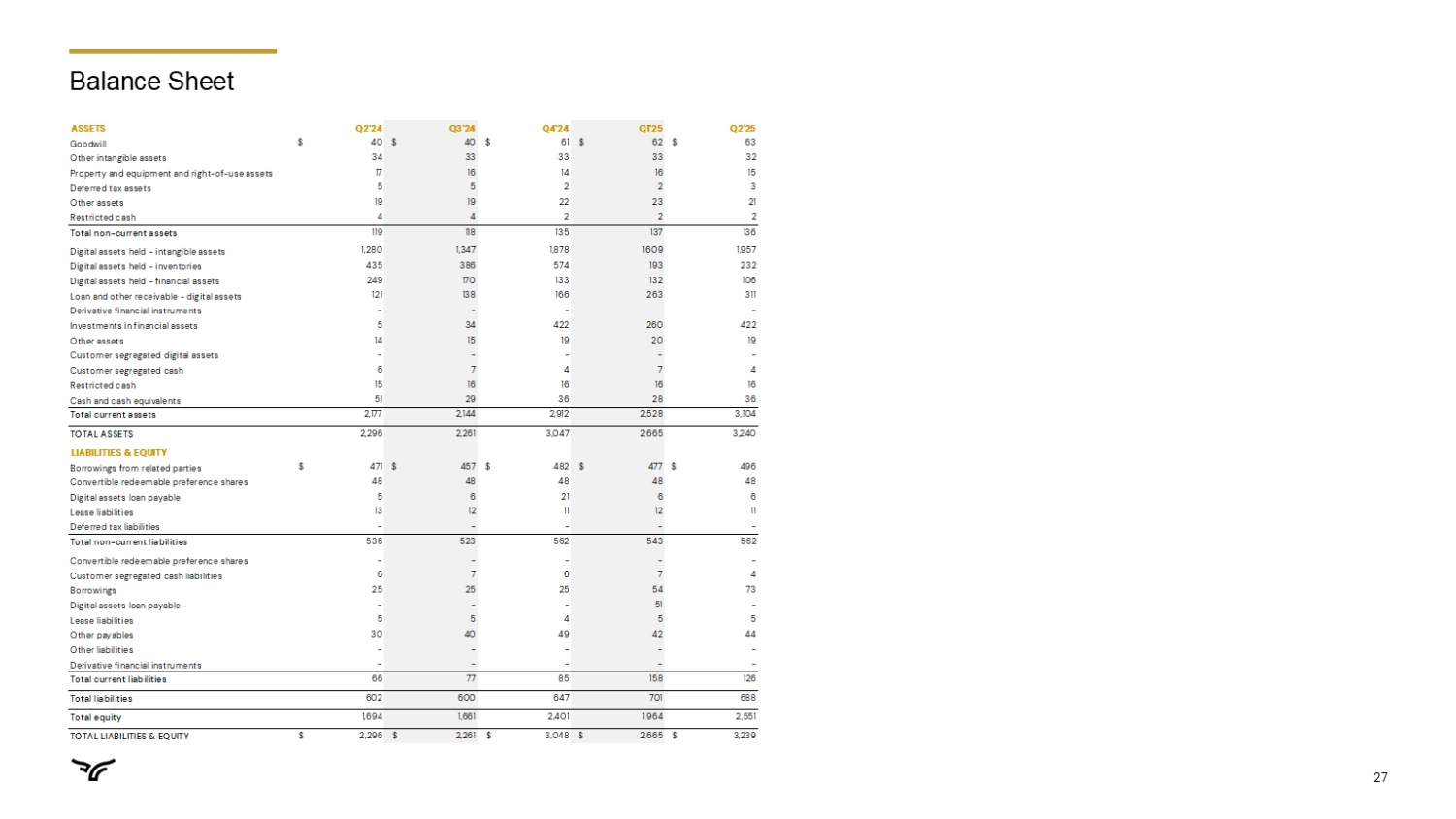

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS OF JUNE 30, 2025 AND DECEMBER 31, 2024

(In thousands)

| 30-Jun-25 | 31-Dec-24 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Non-current assets | ||||||||

| Goodwill | $ | 63,458 | $ | 61,475 | ||||

| Other intangible assets | 32,232 | 33,298 | ||||||

| Property and equipment and right-of-use assets | 14,856 | 14,118 | ||||||

| Deferred tax assets | 2,519 | 2,088 | ||||||

| Other assets | 20,583 | 22,087 | ||||||

| Restricted cash | 1,968 | 1,968 | ||||||

| Total non-current assets | $ | 135,616 | $ | 135,034 | ||||

| Current assets | ||||||||

| Digital assets held - inventories | $ | 231,870 | $ | 573,876 | ||||

| Digital assets held - intangible assets | 1,957,402 | 1,878,268 | ||||||

| Digital assets held - financial assets | 106,020 | 132,649 | ||||||

| Loan and other receivables - digital assets | 310,927 | 166,388 | ||||||

| Derivative financial instruments | 181 | — | ||||||

| Investments in financial assets | 422,470 | 86,173 | ||||||

| Other assets | 19,133 | 21,209 | ||||||

| Customer segregated cash | 4,138 | 6,382 | ||||||

| Restricted cash | 16,193 | 15,893 | ||||||

| Cash and cash equivalents | 35,560 | 31,540 | ||||||

| Total current assets | $ | 3,103,894 | $ | 2,912,378 | ||||

| Total assets | $ | 3,239,510 | $ | 3,047,412 | ||||

| LIABILITIES | ||||||||

| Non-current liabilities | ||||||||

| Borrowings from related parties | $ | 496,900 | $ | 482,450 | ||||

| Convertible redeemable preference shares | 47,879 | 47,879 | ||||||

| Digital assets loan payable | 6,111 | 20,613 | ||||||

| Lease liabilities | 11,073 | 10,756 | ||||||

| Deferred tax liabilities | 12 | 6 | ||||||

| Total non-current liabilities | $ | 561,975 | $ | 561,704 | ||||

| Current liabilities | ||||||||

| Customer segregated cash liabilities | $ | 4,138 | $ | 6,382 | ||||

| Borrowings | 73,173 | 25,000 | ||||||

| Digital assets loan payable | 273 | — | ||||||

| Lease liabilities | 4,533 | 4,246 | ||||||

| Other payables | 44,104 | 49,421 | ||||||

| Total current liabilities | $ | 126,221 | $ | 85,049 | ||||

| Total liabilities | $ | 688,196 | $ | 646,753 | ||||

| Net assets | $ | 2,551,314 | $ | 2,400,659 | ||||

| EQUITY | ||||||||

| Share capital and share premium | $ | 3,821,537 | $ | 3,821,537 | ||||

| Option premium on convertible redeemable preference shares | 18,399 | 18,399 | ||||||

| Reserves | 1,073,863 | 858,797 | ||||||

| Accumulated deficit | (2,375,625 | ) | (2,309,053 | ) | ||||

| Total shareholders' equity attributable to the owners of the Group | $ | 2,538,174 | $ | 2,389,680 | ||||

| Non-controlling interests | 13,140 | 10,979 | ||||||

| Total equity | $ | 2,551,314 | $ | 2,400,659 | ||||

BULLISH

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(In thousands)

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Cash flows from operating activities | ||||||||||||||||

| Net income/(loss) | $ | 108,268 | $ | (116,394 | ) | $ | (240,354 | ) | $ | (11,625 | ) | |||||

| Adjustments for: | ||||||||||||||||

| Interest income | (3,394 | ) | (1,958 | ) | (6,026 | ) | (3,139 | ) | ||||||||

| Loan interest expense | 13,013 | 8,715 | 23,000 | 17,473 | ||||||||||||

| Lease interest expense | 278 | 348 | 531 | 519 | ||||||||||||

| Net foreign exchange (gain)/loss | 218 | 29 | (44 | ) | 51 | |||||||||||

| Share-based payments expenses | 3,256 | 8,900 | 8,389 | 12,190 | ||||||||||||

| Depreciation of property and equipment and right-of-use assets | 1,632 | 1,752 | 3,130 | 3,271 | ||||||||||||

| Amortization of other intangible assets | 557 | 542 | 1,173 | 1,084 | ||||||||||||

| Impairment of right-of-use asset | — | 956 | — | 956 | ||||||||||||

| (Gain)/loss from revaluation of digital assets and investments in financial assets at FVTPL, net | (159,120 | ) | 95,445 | 17,364 | (66,930 | ) | ||||||||||

| Change in fair value of financial liability at FVTPL | 15,250 | (6,100 | ) | 16,150 | 29,500 | |||||||||||

| Impairment losses of digital assets | 6,731 | 4,490 | 148,819 | 4,868 | ||||||||||||

| Operating cash flows before changes in operating assets and liabilities | (13,311 | ) | (3,275 | ) | (27,868 | ) | (11,782 | ) | ||||||||

| (Increase)/decrease in other assets | 1,835 | 2,007 | 3,019 | (4,026 | ) | |||||||||||

| Increase in deferred tax assets | (163 | ) | (1,129 | ) | (431 | ) | (1,216 | ) | ||||||||

| (Increase)/decrease in digital assets held - inventories | (9,464 | ) | (31,825 | ) | 273,380 | (38 | ) | |||||||||

| (Increase)/decrease in digital assets held - financial assets | (560,705 | ) | 13,104 | (825,304 | ) | (27,430 | ) | |||||||||

| (Increase)/decrease in loan and other receivables - digital assets | 596,379 | 33,157 | 593,256 | (10,687 | ) | |||||||||||

| Increase/(decrease) in other payables | 2,165 | (6,046 | ) | (5,273 | ) | (12,348 | ) | |||||||||

| Increase/(decrease) in customer segregated cash liabilities | (2,460 | ) | 5,525 | (2,244 | ) | 5,526 | ||||||||||

| Increase/(decrease) in deferred tax liabilities | (4 | ) | (14 | ) | 6 | (12 | ) | |||||||||

| Interest received | 2,733 | 1,958 | 4,885 | 3,139 | ||||||||||||

| Net cash provided by/(used in) operating activities | $ | 17,005 | $ | 13,462 | $ | 13,426 | $ | (58,874 | ) | |||||||

| Cash flows from investing activities | ||||||||||||||||

| Purchase of investment in financial assets | $ | — | $ | — | $ | (1,275 | ) | $ | — | |||||||

| Proceeds on investment in financial assets | — | — | — | 161 | ||||||||||||

| Purchase of investment in derivative financial instruments | — | 192 | — | (334 | ) | |||||||||||

| Purchase of property and equipment | (54 | ) | (42 | ) | (250 | ) | (221 | ) | ||||||||

| Purchase of digital assets held - intangible assets | (173 | ) | — | (41,664 | ) | (163 | ) | |||||||||

| Prepayment on intangible assets | — | (10,001 | ) | — | (10,001 | ) | ||||||||||

| Proceeds on disposal of digital assets held - intangible assets | — | — | 30,448 | — | ||||||||||||

| Net cash used in investing activities | $ | (227 | ) | $ | (9,851 | ) | $ | (12,741 | ) | $ | (10,558 | ) | ||||

| Cash flows from financing activities | ||||||||||||||||

| Interest paid | (10,399 | ) | (9,063 | ) | (20,639 | ) | (9,227 | ) | ||||||||

| Proceeds from borrowings | 100,000 | 25,000 | 174,300 | 25,000 | ||||||||||||

| Repayment of borrowings | (100,000 | ) | — | (149,300 | ) | — | ||||||||||

| Repayment on lease liabilities | (1,532 | ) | (1,181 | ) | (2,863 | ) | (2,121 | ) | ||||||||

| Net cash provided by/(used in) financing activities | $ | (11,931 | ) | $ | 14,756 | $ | 1,498 | $ | 13,652 | |||||||

| Net increase/(decrease) in cash and cash equivalents, customer segregated cash and restricted cash | 4,847 | 18,367 | 2,183 | (55,780 | ) | |||||||||||

| Cash and cash equivalents, customer segregated cash and restricted cash at beginning of the period | 52,888 | 57,379 | 55,783 | 131,526 | ||||||||||||

| Effects of exchange rate changes on cash and cash equivalents, customer segregated cash and restricted cash | 124 | — | (107 | ) | — | |||||||||||

| Cash and cash equivalents, customer segregated cash and restricted cash at end of the period | $ | 57,859 | $ | 75,746 | $ | 57,859 | $ | 75,746 | ||||||||

| Cash and cash equivalents, customer segregated cash and restricted cash consisted of the following: | ||||||||||||||||

| Customer segregated cash | 4,138 | 5,588 | 4,138 | 5,588 | ||||||||||||

| Restricted cash | 18,161 | 18,925 | 18,161 | 18,925 | ||||||||||||

| Cash and cash equivalents | 35,560 | 51,233 | 35,560 | 51,233 | ||||||||||||

| Total cash and cash equivalents, customer segregated cash and restricted cash | $ | 57,859 | $ | 75,746 | $ | 57,859 | $ | 75,746 | ||||||||

| Supplemental schedule of non-cash investing and financing activities | ||||||||||||||||

| Recognition of right-of-use assets against lease liabilities | $ | 752 | $ | 8,445 | $ | 3,467 | $ | 8,445 | ||||||||

| Purchase of digital assets held - intangible assets | (23,617,796 | ) | (8,707 | ) | (35,764,843 | ) | (66,219 | ) | ||||||||

| Proceeds on disposal of digital assets held - intangible assets | 23,660,500 | 1,420 | 35,478,545 | 34,097 | ||||||||||||

| Digital asset loan receivables made/(returned), net | (4,335 | ) | 13,509 | 28,137 | 58,261 | |||||||||||

| Digital asset pledged as collateral posted/(returned), net | (4,163 | ) | 52,551 | 79,974 | 52,551 | |||||||||||

| Purchase of investment in financial assets via USDC | — | — | (10,116 | ) | (4,602 | ) | ||||||||||

| Prepayment on intangible assets (made)/returned, net | 2,036 | (8,043 | ) | 2,036 | (8,043 | ) | ||||||||||

| Proceeds from borrowings via digital assets | 1,649,361 | — | 2,326,320 | — | ||||||||||||

| Repayment from borrowings via digital assets | (1,630,389 | ) | — | (2,303,147 | ) | — | ||||||||||

| Proceeds from digital assets loan payable via digital assets | 132,189 | — | 216,743 | — | ||||||||||||

| Repayments from digital assets loan payable via digital assets | (180,466 | ) | — | (215,362 | ) | — | ||||||||||

Non-IFRS Measures Summarized

In US$ millions

| Three months ended | Six months ended | |||||||||||||||

| June 30 | June 30 | June 30 | June 30 | |||||||||||||

| ($ in millions) | 2025 | 2024 | 2025 | 2024 | ||||||||||||

| Non-IFRS Financial Measures | ||||||||||||||||

| Adjusted transaction revenue | $ | 24.1 | $ | 34.9 | $ | 66.1 | $ | 79.4 | ||||||||

| Adjusted revenue | $ | 57.0 | $ | 60.7 | $ | 119.4 | $ | 114.2 | ||||||||

| Adjusted EBITDA | $ | 8.1 | $ | 14.7 | $ | 21.2 | $ | 28.6 | ||||||||

| Adjusted Net Income | $ | (6.0 | ) | $ | 4.8 | $ | (3.8 | ) | $ | 8.7 | ||||||

| Period ended | ||||||||||||||||

| June 30 | December 31 | |||||||||||||||

| ($ in millions) | 2025 | 2024 | ||||||||||||||

| Gross Liquid Assets | $ | 3,064.2 | $ | 2,868.9 | ||||||||||||

| Net Liquid Assets | $ | 2,179.3 | $ | 1,699.4 | ||||||||||||

Reconciliation of Non-IFRS Measures

In US$ millions

| ($ in millions) | Three months ended | Six months ended | ||||||||||||||

| June 30 | June 30 | June 30 | June 30 | |||||||||||||

| Adjusted Transaction Revenue and Adjusted Revenue | 2025 | 2024 | 2025 | 2024 | ||||||||||||

| Digital assets sales | $ | 58,630.6 | $ | 49,578.2 | $ | 138,866.8 | $ | 129,982.8 | ||||||||

| Digital asset sales on venues other than Exchange | (30.1 | ) | (8.8 | ) | (333.9 | ) | (14.5 | ) | ||||||||

| Digital asset sales - on our Exchange | $ | 58,600.6 | $ | 49,569.4 | $ | 138,532.9 | $ | 129,968.3 | ||||||||

| Cost of digital assets derecognized - on our Exchange | (58,585.1 | ) | (49,547.6 | ) | (138,490.9 | ) | (129,917.5 | ) | ||||||||

| Change in fair value of digital assets inventories, arising from purchase of digital assets on our Exchange | 10.2 | 17.5 | 28.9 | 36.6 | ||||||||||||

| Transaction income | 0.4 | 0.4 | 0.9 | 1.0 | ||||||||||||

| Net spread related income and change in fair value of perpetual futures | (2.0 | ) | (4.8 | ) | (5.7 | ) | (9.0 | ) | ||||||||

| Adjusted Transaction Revenue | $ | 24.1 | $ | 34.9 | $ | 66.1 | $ | 79.4 | ||||||||

| Subscriptions and services revenue | 31.9 | 25.8 | 51.6 | 34.6 | ||||||||||||

| Change in fair value of investment in financial assets | - | - | - | 0.2 | ||||||||||||

| Revaluation of digital assets held as investments | 1.0 | - | 1.6 | - | ||||||||||||

| Adjusted Revenue | $ | 57.0 | $ | 60.7 | $ | 119.4 | $ | 114.2 | ||||||||

| Adjusted EBITDA and Adjusted Net Income | ||||||||||||||||

| Income/(loss) | $ | 108.3 | $ | (116.4 | ) | $ | (240.4 | ) | $ | (11.6 | ) | |||||

| Adjusted to exclude the following: | ||||||||||||||||

| Digital asset sales on other venues | (30.1 | ) | (8.8 | ) | (333.9 | ) | (14.5 | ) | ||||||||

| Cost of digital assets derecognized on other venues | 30.2 | 8.9 | 334.0 | 14.5 | ||||||||||||

| Loss/(Gain) from changes in fair value of digital assets inventories net payable to customers | (22.8 | ) | 102.1 | 92.4 | (37.7 | ) | ||||||||||

| Income tax expense | 0.9 | 0.3 | 0.7 | 0.5 | ||||||||||||

| Finance expenses | 13.3 | 9.1 | 23.5 | 18.0 | ||||||||||||

| Share-based payment expenses | 3.3 | 8.9 | 8.4 | 12.2 | ||||||||||||

| Change in fair value of loan and other receivables - digital assets | (55.0 | ) | 11.8 | (33.6 | ) | 8.1 | ||||||||||

| Change in fair value of digital assets loan payable | 8.7 | (1.5 | ) | (0.5 | ) | (1.5 | ) | |||||||||

| Change in fair value of derivatives | 2.4 | (0.2 | ) | 2.4 | 0.4 | |||||||||||

| Change in fair value of financial liability at FVTPL | 15.3 | (6.1 | ) | 16.2 | 29.5 | |||||||||||

| Change in fair value of investments in financial assets | (86.4 | ) | 0.7 | (14.5 | ) | 0.6 | ||||||||||

| Impairment losses of digital assets held - intangible assets | 6.7 | 4.5 | 148.8 | 4.9 | ||||||||||||

| Impairment of right-of-use assets | - | 1.0 | - | 1.0 | ||||||||||||

| Non-recurring expenses | 7.4 | (0.3 | ) | 14.5 | 2.4 | |||||||||||

| Depreciation and amortization | 0.8 | 0.8 | 1.6 | 2.0 | ||||||||||||

| Adjusted to include the following: | ||||||||||||||||

| Revaluation of digital assets held as investments | 1.0 | - | 1.6 | - | ||||||||||||

| Adjusted EBITDA | $ | 8.1 | $ | 14.7 | $ | 21.2 | $ | 28.6 | ||||||||

| Finance expenses | (13.3 | ) | (9.1 | ) | (23.5 | ) | (18.0 | ) | ||||||||

| Depreciation and amortization | (0.8 | ) | (0.8 | ) | (1.6 | ) | (2.0 | ) | ||||||||

| Tax effect of adjusted net income before taxes | 0.0 | 0.0 | 0.1 | 0.1 | ||||||||||||

| Adjusted Net Income | $ | (6.0 | ) | $ | 4.8 | $ | (3.8 | ) | $ | 8.7 | ||||||

Gross and Net Liquid Assets

In US$ millions

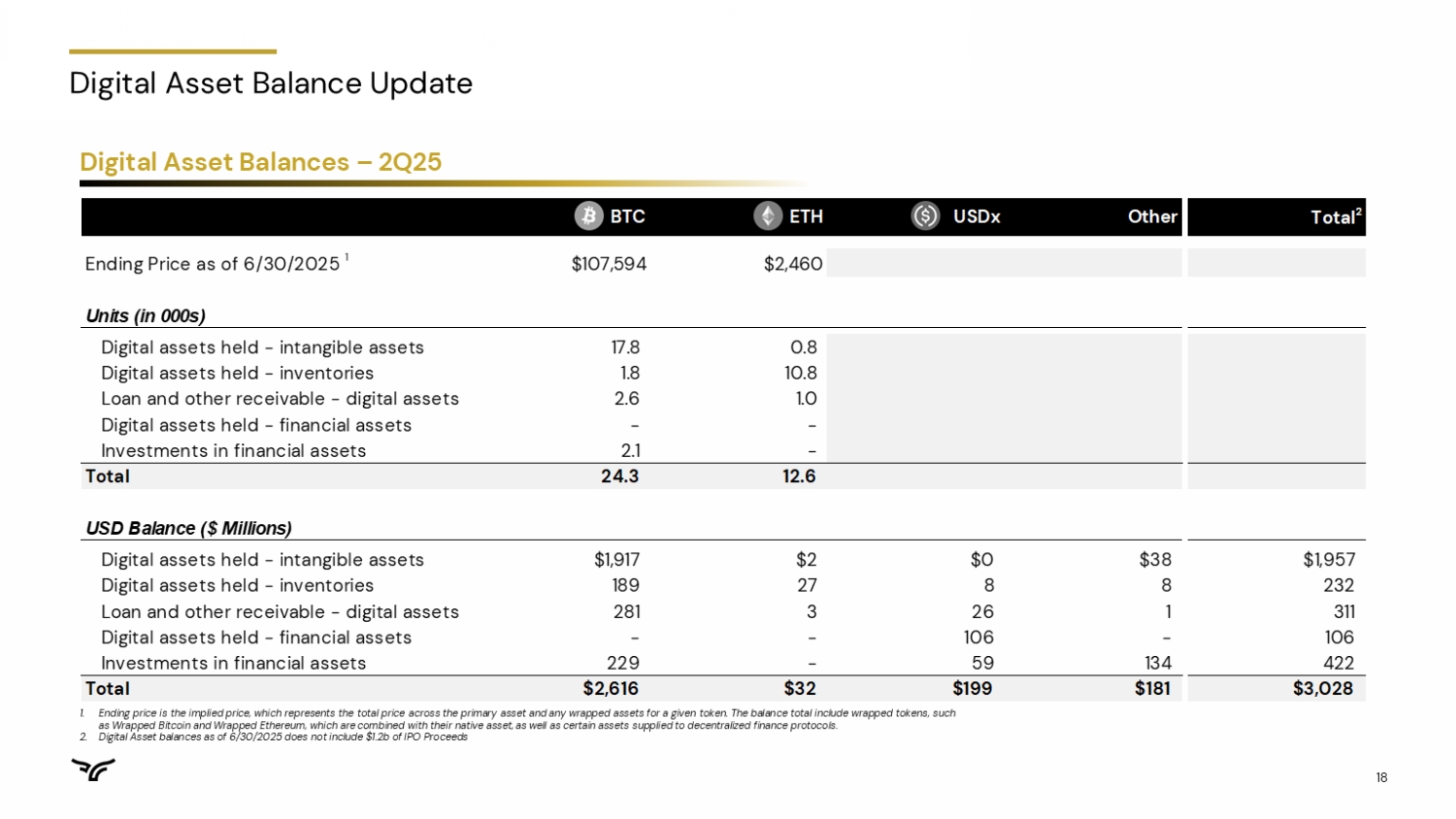

| June 30, 2025 | December 31, 2024 | |||||||

| Digital assets held - inventories | $ | 231.9 | $ | 573.9 | ||||

| Digital assets held - intangible assets | 1,957.4 | 1,878.3 | ||||||

| Digital assets held - financial assets (on Exchange) | 76.7 | 67.5 | ||||||

| Digital assets held - financial assets (off Exchange) | 29.4 | 65.1 | ||||||

| Loan and other receivable | 310.9 | 166.4 | ||||||

| Investments in financial assets | 422.5 | 86.2 | ||||||

| Cash and cash equivalents | 35.6 | 31.5 | ||||||

| Gross Liquid Assets | $ | 3,064.2 | $ | 2,868.9 | ||||

| (-) Digital assets held - inventories | $ | (231.9 | ) | $ | (573.9 | ) | ||

| (-) Digital assets held - financial assets (on Exchange) | (76.7 | ) | (67.5 | ) | ||||

| (-) Digital assets loan payable | (6.4 | ) | (20.6 | ) | ||||

| (-) Borrowings | (73.2 | ) | (25.0 | ) | ||||

| (-) Borrowings from related parties | (496.9 | ) | (482.5 | ) | ||||

| Net Liquid Assets | $ | 2,179.3 | $ | 1,699.4 | ||||

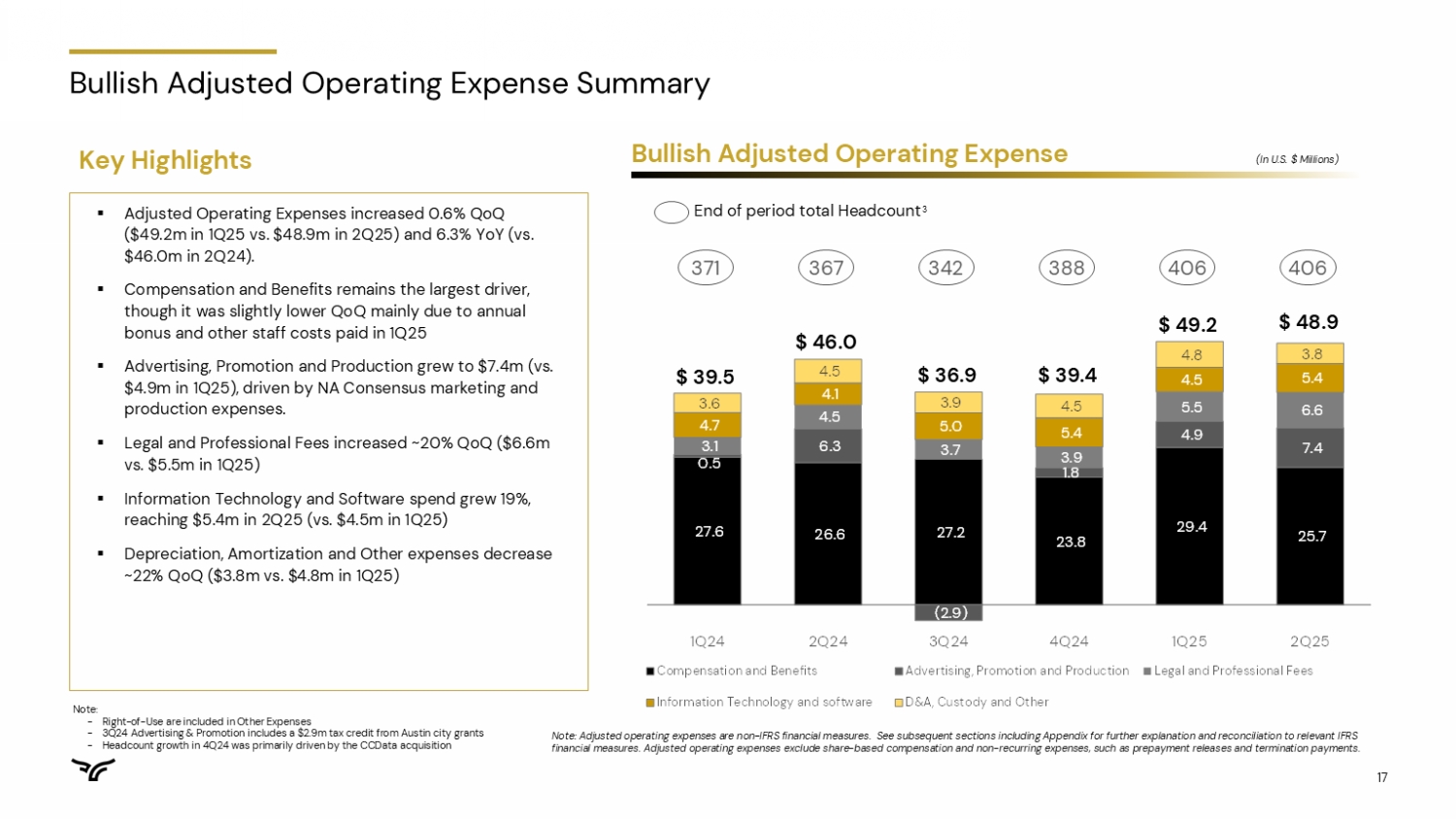

Reconciliation of Adjusted Operating Expense

In US$ millions

| ($ in millions) | Three months ended | Six months ended | ||||||||||||||

| June 30 | June 30 | June 30 | June 30 | |||||||||||||

| IFRS Core Operating Expense to Adjusted Operating Expense | 2025 | 2024 | 2025 | 2024 | ||||||||||||

| IFRS Core Operating Expense | $ | 60.4 | $ | 56.4 | $ | 122.6 | $ | 103.1 | ||||||||

| Adjusted for | ||||||||||||||||

| Stock-based compensation expense | 3.3 | 8.9 | 8.4 | 12.2 | ||||||||||||

| Non-recurring expenses - legal and professional fees | 6.3 | 0.6 | 12.4 | 1.8 | ||||||||||||

| Non-recurring expenses - compensation and benefits | 1.1 | 0.1 | 2.1 | 1.6 | ||||||||||||

| Depreciation and amortization expense | 0.8 | 0.8 | 1.6 | 2.0 | ||||||||||||

| Adjusted Operating Expense | $ | 48.9 | $ | 46.0 | $ | 98.2 | $ | 85.5 | ||||||||

Exhibit 99.2

INDEX TO FINANCIAL STATEMENTS

| Page | |

| BULLISH — UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | |

| Unaudited Condensed Consolidated Statements of Profit or Loss and Other Comprehensive Income/(Loss) for the three and six months ended June 30, 2025 and 2024 | F-2 |

| Unaudited Condensed Consolidated Balance Sheets as of June 30, 2025 and December 31, 2024 | F-3 |

| Unaudited Condensed Consolidated Statements of Changes in Equity for the three and six months ended June 30, 2025 and 2024 | F-5 |

| Unaudited Condensed Consolidated Statements of Cash Flows for the three and six months ended June 30, 2025 and 2024 | F-7 |

| Notes to the Unaudited Condensed Consolidated Financial Statements | F-9 |

F-

BULLISH

CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME/(LOSS) (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(In thousands, except per share data)

| Three months

ended June 30, |

Six months

ended June 30, |

||||||||||||||||||

| Notes | 2025 | 2024 | 2025 | 2024 | |||||||||||||||

| Digital assets sales | 4 | $ | 58,630,645 | $ | 49,578,206 | $ | 138,866,802 | $ | 129,982,783 | ||||||||||

| Cost of digital assets derecognized | 5 | (58,615,273 | ) | (49,556,478 | ) | (138,824,914 | ) | (129,932,051 | ) | ||||||||||

| Other revenues | 6 | 32,292 | 26,257 | 52,596 | 35,623 | ||||||||||||||

| Change in fair value of digital assets held, net | 7 | 68,409 | (99,372 | ) | (178,353 | ) | 62,802 | ||||||||||||

| Net spread related income and change in fair value of perpetual futures on the Exchange | (1,989 | ) | (4,797 | ) | (5,691 | ) | (9,017 | ) | |||||||||||

| Change in fair value of investment in financial assets | 14 | 86,359 | (738 | ) | 14,549 | (389 | ) | ||||||||||||

| Administrative expenses | 8 | (43,017 | ) | (39,662 | ) | (90,203 | ) | (76,419 | ) | ||||||||||

| Other expenses | 9 | (17,362 | ) | (16,720 | ) | (32,425 | ) | (26,636 | ) | ||||||||||

| Finance expense | 10 | (13,291 | ) | (9,063 | ) | (23,531 | ) | (17,992 | ) | ||||||||||

| Change in fair value of derivatives | (2,379 | ) | 175 | (2,379 | ) | (351 | ) | ||||||||||||

| Change in fair value of financial liability at FVTPL | 22 | (15,250 | ) | 6,100 | (16,150 | ) | (29,500 | ) | |||||||||||

| Income/(loss) before income tax | $ | 109,144 | $ | (116,092 | ) | $ | (239,699 | ) | $ | (11,147 | ) | ||||||||

| Income tax expense | 11 | (876 | ) | (302 | ) | (655 | ) | (478 | ) | ||||||||||

| Net income/(loss) | $ | 108,268 | $ | (116,394 | ) | $ | (240,354 | ) | $ | (11,625 | ) | ||||||||

| Attributable to: | |||||||||||||||||||

| Owners of the Group | 107,513 | (115,346 | ) | (236,481 | ) | (11,773 | ) | ||||||||||||

| Non-controlling interests | 755 | (1,048 | ) | (3,873 | ) | 148 | |||||||||||||

| Net income/(loss) | $ | 108,268 | $ | (116,394 | ) | $ | (240,354 | ) | $ | (11,625 | ) | ||||||||

| Other comprehensive income/(loss) | |||||||||||||||||||

| Items that will not be subsequently reclassified to profit or loss: | |||||||||||||||||||

| Revaluation of digital assets held as investments | 478,689 | (175,436 | ) | 378,786 | 429,531 | ||||||||||||||

| Fair value gain/(loss) on financial liabilities designated as at FVTPL attributable to changes in credit risk | 22 | (4,350 | ) | (1,450 | ) | 1,700 | (18,300 | ) | |||||||||||

| $ | 474,339 | $ | (176,886 | ) | $ | 380,486 | $ | 411,231 | |||||||||||

| Items that may be reclassified subsequently to profit or loss: | |||||||||||||||||||

| Foreign exchange differences on translation of foreign operations | 1,591 | — | 2,134 | — | |||||||||||||||

| Total comprehensive income/(loss) | $ | 584,198 | $ | (293,280 | ) | $ | 142,266 | $ | 399,606 | ||||||||||

| Attributable to: | |||||||||||||||||||

| Owners of the Group | 576,422 | (290,544 | ) | 140,104 | 396,033 | ||||||||||||||

| Non-controlling interests | 7,776 | (2,736 | ) | 2,162 | 3,573 | ||||||||||||||

| Total comprehensive income/(loss) | $ | 584,198 | $ | (293,280 | ) | $ | 142,266 | $ | 399,606 | ||||||||||

| Weighted average number of ordinary shares for the purposes of basic and diluted earnings/(loss) per share | |||||||||||||||||||

| Basic | 28 | 113,215 | 112,500 | 113,215 | 112,500 | ||||||||||||||

| Diluted | 28 | 115,951 | 112,500 | 113,215 | 112,500 | ||||||||||||||

| Earnings/(Loss) per share | |||||||||||||||||||

| Basic | 28 | $ | 0.95 | $ | (1.03 | ) | $ | (2.09 | ) | $ | (0.10 | ) | |||||||

| Diluted | 28 | $ | 0.93 | $ | (1.03 | ) | $ | (2.09 | ) | $ | (0.10 | ) | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-

BULLISH

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS OF JUNE 30, 2025 AND DECEMBER 31, 2024

(In thousands)

| Notes | June 30, 2025 | December 31, 2024 | |||||||||

| (Unaudited) | (Audited) | ||||||||||

| ASSETS | |||||||||||

| Non-current assets | |||||||||||

| Goodwill | 15 | $ | 63,458 | $ | 61,475 | ||||||

| Other intangible assets | 15 | 32,232 | 33,298 | ||||||||

| Property and equipment and right-of-use assets | 16 | 14,856 | 14,118 | ||||||||

| Deferred tax assets | 2,519 | 2,088 | |||||||||

| Other assets | 17 | 20,583 | 22,087 | ||||||||

| Restricted cash | 18 | 1,968 | 1,968 | ||||||||

| Total non-current assets | $ | 135,616 | $ | 135,034 | |||||||

| Current assets | |||||||||||

| Digital assets held - inventories | 12 | $ | 231,870 | $ | 573,876 | ||||||

| Digital assets held - intangible assets | 12 | 1,957,402 | 1,878,268 | ||||||||

| Digital assets held - financial assets | 12 | 106,020 | 132,649 | ||||||||

| Loan and other receivables - digital assets | 13 | 310,927 | 166,388 | ||||||||

| Derivative financial instruments | 25 | 181 | — | ||||||||

| Investments in financial assets | 14 | 422,470 | 86,173 | ||||||||

| Other assets | 17 | 19,133 | 21,209 | ||||||||

| Customer segregated cash | 4,138 | 6,382 | |||||||||

| Restricted cash | 18 | 16,193 | 15,893 | ||||||||

| Cash and cash equivalents | 19 | 35,560 | 31,540 | ||||||||

| Total current assets | $ | 3,103,894 | $ | 2,912,378 | |||||||

| Total assets | $ | 3,239,510 | $ | 3,047,412 | |||||||

| LIABILITIES | |||||||||||

| Non-current liabilities | |||||||||||

| Borrowings from related parties | 22 | $ | 496,900 | $ | 482,450 | ||||||

| Convertible redeemable preference shares | 20 | 47,879 | 47,879 | ||||||||

| Digital assets loan payable | 23 | 6,111 | 20,613 | ||||||||

| Lease liabilities | 11,073 | 10,756 | |||||||||

| Deferred tax liabilities | 12 | 6 | |||||||||

| Total non-current liabilities | $ | 561,975 | $ | 561,704 | |||||||

F-

BULLISH

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS OF JUNE 30, 2025 AND DECEMBER 31, 2024

(In thousands)

| Notes | June 30, 2025 | December 31, 2024 | |||||||||

| (Unaudited) | (Audited) | ||||||||||

| Current liabilities | |||||||||||

| Customer segregated cash liabilities | $ | 4,138 | $ | 6,382 | |||||||

| Borrowings | 22 | 73,173 | 25,000 | ||||||||

| Digital assets loan payable | 23 | 273 | — | ||||||||

| Lease liabilities | 4,533 | 4,246 | |||||||||

| Other payables | 21 | 44,104 | 49,421 | ||||||||

| Total current liabilities | $ | 126,221 | $ | 85,049 | |||||||

| Total liabilities | $ | 688,196 | $ | 646,753 | |||||||

| Net assets | $ | 2,551,314 | $ | 2,400,659 | |||||||

| EQUITY | |||||||||||

| Share capital and share premium | 24 | $ | 3,821,537 | $ | 3,821,537 | ||||||

| Option premium on convertible redeemable preference shares | 18,399 | 18,399 | |||||||||

| Reserves | 1,073,863 | 858,797 | |||||||||

| Accumulated deficit | (2,375,625 | ) | (2,309,053 | ) | |||||||

| Total shareholders' equity attributable to the owners of the Group | $ | 2,538,174 | $ | 2,389,680 | |||||||

| Non-controlling interests | 13,140 | 10,979 | |||||||||

| Total equity | $ | 2,551,314 | $ | 2,400,659 | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-

BULLISH

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

FOR THE THREE MONTHS ENDED JUNE 30, 2025 AND 2024

(In thousands)

| Option | Reserves | |||||||||||||||||||||||||||||||||||||||

| Share capital |

Share premium |

premium

on convertible redeemable preference shares |

Share- based payment reserves |

Revaluation reserves for digital assets held as investments |

Other reserves |

Accumulated deficit |

Total

equity attributable to the owners of the Group |

Non- controlling interests |

Total

equity |

|||||||||||||||||||||||||||||||

| As of April 1, 2024 | $ | 225 | $ | 3,786,883 | $ | 18,399 | $ | 72,047 | $ | 581,323 | $ | 57,129 | $ | (2,544,693 | ) | $ | 1,971,313 | $ | 7,157 | $ | 1,978,470 | |||||||||||||||||||

| Net loss | — | — | — | — | — | — | (115,346 | ) | (115,346 | ) | (1,048 | ) | (116,394 | ) | ||||||||||||||||||||||||||

| Other comprehensive loss for the period | — | — | — | — | (173,748 | ) | (1,450 | ) | — | (175,198 | ) | (1,688 | ) | (176,886 | ) | |||||||||||||||||||||||||

| Total comprehensive loss | — | — | — | — | (173,748 | ) | (1,450 | ) | (115,346 | ) | (290,544 | ) | (2,736 | ) | (293,280 | ) | ||||||||||||||||||||||||

| Issuance of shares, including exercise of stock options | — | 21,492 | — | (21,492 | ) | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Equity settled share-based payments | — | — | — | 8,900 | — | — | — | 8,900 | — | 8,900 | ||||||||||||||||||||||||||||||

| Transfer of revaluation gain of digital assets held as investments upon disposal | — | — | — | — | (36,395 | ) | 36,395 | — | — | — | ||||||||||||||||||||||||||||||

| As of June 30, 2024 | $ | 225 | $ | 3,808,375 | $ | 18,399 | $ | 59,455 | $ | 371,180 | $ | 55,679 | $ | (2,623,644 | ) | $ | 1,689,669 | $ | 4,421 | $ | 1,694,090 | |||||||||||||||||||

| As of April 1, 2025 | $ | 226 | $ | 3,821,311 | $ | 18,399 | $ | 74,988 | $ | 581,600 | $ | 63,672 | $ | (2,601,700 | ) | $ | 1,958,496 | $ | 5,364 | $ | 1,963,860 | |||||||||||||||||||

| Net income | — | — | — | — | — | — | 107,513 | 107,513 | 755 | 108,268 | ||||||||||||||||||||||||||||||

| Other comprehensive income/(loss) for the period | — | — | — | 6 | 471,718 | (2,815 | ) | — | 468,909 | 7,021 | 475,930 | |||||||||||||||||||||||||||||

| Total comprehensive income/(loss) | — | — | — | 6 | 471,718 | (2,815 | ) | 107,513 | 576,422 | 7,776 | 584,198 | |||||||||||||||||||||||||||||

| Equity settled share-based payments | — | — | — | 3,256 | — | — | — | 3,256 | — | 3,256 | ||||||||||||||||||||||||||||||

| Transfer of revaluation gain of digital assets held as investments upon disposal | — | — | — | — | (118,562 | ) | — | 118,562 | — | — | — | |||||||||||||||||||||||||||||

| As of June 30, 2025 | $ | 226 | $ | 3,821,311 | $ | 18,399 | $ | 78,250 | $ | 934,756 | $ | 60,857 | $ | (2,375,625 | ) | $ | 2,538,174 | $ | 13,140 | $ | 2,551,314 | |||||||||||||||||||

F-

BULLISH

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

FOR THE SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(In thousands)

| Option | Reserves | |||||||||||||||||||||||||||||||||||||||

| Share capital |

Share premium |

premium

on convertible redeemable preference shares |

Share- based payment reserves |

Revaluation reserves for digital assets held as investments |

Other reserves |

Accumulated deficit |

Total

equity attributable to the owners of the Group |

Non- controlling interests |

Total

equity |

|||||||||||||||||||||||||||||||

| As of January 1, 2024 | $ | 225 | $ | 3,786,883 | $ | 18,399 | $ | 68,757 | $ | — | $ | 73,979 | $ | (2,666,797 | ) | $ | 1,281,446 | $ | 848 | $ | 1,282,294 | |||||||||||||||||||

| Net income/(loss) | — | — | — | — | — | — | (11,773 | ) | (11,773 | ) | 148 | (11,625 | ) | |||||||||||||||||||||||||||

| Other comprehensive income/(loss) for the period | — | — | — | — | 426,106 | (18,300 | ) | — | 407,806 | 3,425 | 411,231 | |||||||||||||||||||||||||||||

| Total comprehensive income/(loss) | — | — | — | — | 426,106 | (18,300 | ) | (11,773 | ) | 396,033 | 3,573 | 399,606 | ||||||||||||||||||||||||||||

| Issuance of shares, including exercise of stock options | — | 21,492 | — | (21,492 | ) | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Equity settled share-based payments | — | — | — | 12,190 | — | — | — | 12,190 | — | 12,190 | ||||||||||||||||||||||||||||||

| Transfer of revaluation gain of digital assets held as investments upon disposal | — | — | — | — | (54,926 | ) | — | 54,926 | — | — | — | |||||||||||||||||||||||||||||

| As of June 30, 2024 | $ | 225 | $ | 3,808,375 | $ | 18,399 | $ | 59,455 | $ | 371,180 | $ | 55,679 | $ | (2,623,644 | ) | $ | 1,689,669 | $ | 4,421 | $ | 1,694,090 | |||||||||||||||||||

| As of January 1, 2025 | $ | 226 | $ | 3,821,311 | $ | 18,399 | $ | 69,852 | $ | 731,838 | $ | 57,107 | $ | (2,309,053 | ) | $ | 2,389,680 | $ | 10,979 | $ | 2,400,659 | |||||||||||||||||||

| Net loss | — | — | — | — | — | — | (236,481 | ) | (236,481 | ) | (3,873 | ) | (240,354 | ) | ||||||||||||||||||||||||||

| Other comprehensive income for the period | — | — | — | 9 | 372,827 | 3,750 | — | 376,586 | 6,034 | 382,620 | ||||||||||||||||||||||||||||||

| Total comprehensive income/(loss) | — | — | — | 9 | 372,827 | 3,750 | (236,481 | ) | 140,105 | 2,161 | 142,266 | |||||||||||||||||||||||||||||

| Equity settled share-based payments | — | — | — | 8,389 | — | — | — | 8,389 | — | 8,389 | ||||||||||||||||||||||||||||||

| Transfer of revaluation gain of digital assets held as investments upon disposal | — | — | — | — | (169,909 | ) | — | 169,909 | — | — | — | |||||||||||||||||||||||||||||

| As of June 30, 2025 | $ | 226 | $ | 3,821,311 | $ | 18,399 | $ | 78,250 | $ | 934,756 | $ | 60,857 | $ | (2,375,625 | ) | $ | 2,538,174 | $ | 13,140 | $ | 2,551,314 | |||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-

BULLISH

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(In thousands)

| Six months

ended June 30, |

||||||||||

| Notes | 2025 | 2024 | ||||||||

| Cash flows from operating activities | ||||||||||

| Net income/(loss) | $ | (240,354 | ) | $ | (11,625 | ) | ||||

| Adjustments for: | ||||||||||

| Interest income | 6 | (6,026 | ) | (3,139 | ) | |||||

| Loan interest expense | 10 | 23,000 | 17,473 | |||||||

| Lease interest expense | 10 | 531 | 519 | |||||||

| Net foreign exchange (gain)/loss | (44 | ) | 51 | |||||||

| Share-based payments expenses | 29 | 8,389 | 12,190 | |||||||

| Depreciation of property and equipment and right-of-use assets | 9 | 3,130 | 3,271 | |||||||

| Amortization of other intangible assets | 15 | 1,173 | 1,084 | |||||||

| Impairment of right-of-use asset | 9 | — | 956 | |||||||

| (Gain)/loss from revaluation of digital assets and investments in financial assets at FVTPL, net | 7 | 17,364 | (66,930 | ) | ||||||

| Change in fair value of financial liability at FVTPL | 22 | 16,150 | 29,500 | |||||||

| Impairment losses of digital assets | 12 | 148,819 | 4,868 | |||||||

| Operating cash flows before changes in operating assets and liabilities | (27,868 | ) | (11,782 | ) | ||||||

| (Increase)/decrease in other assets | 3,019 | (4,026 | ) | |||||||

| Increase in deferred tax assets | (431 | ) | (1,216 | ) | ||||||

| (Increase)/decrease in digital assets held - inventories | 273,380 | (38 | ) | |||||||

| (Increase)/decrease in digital assets held - financial assets | (825,304 | ) | (27,430 | ) | ||||||

| (Increase)/decrease in loan and other receivables - digital assets | 593,256 | (10,687 | ) | |||||||

| Increase/(decrease) in other payables | (5,273 | ) | (12,348 | ) | ||||||

| Increase/(decrease) in customer segregated cash liabilities | (2,244 | ) | 5,526 | |||||||

| Increase/(decrease) in deferred tax liabilities | 6 | (12 | ) | |||||||

| Interest received | 4,885 | 3,139 | ||||||||

| Net cash provided by/(used in) operating activities | $ | 13,426 | $ | (58,874 | ) | |||||

F-

BULLISH

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(In thousands)

| Six months

ended June 30, |

||||||||||

| Notes | 2025 | 2024 | ||||||||

| Cash flows from investing activities | ||||||||||

| Purchase of investment in financial assets | $ | (1,275 | ) | $ | — | |||||

| Proceeds on investment in financial assets | — | 161 | ||||||||

| Purchase of investment in derivative financial instruments | — | (334 | ) | |||||||

| Purchase of property and equipment | 16 | (250 | ) | (221 | ) | |||||

| Purchase of digital assets held - intangible assets | (41,664 | ) | (163 | ) | ||||||

| Prepayment on intangible assets | — | (10,001 | ) | |||||||

| Proceeds on disposal of digital assets held - intangible assets | 30,448 | — | ||||||||

| Net cash used in investing activities | $ | (12,741 | ) | $ | (10,558 | ) | ||||

| Cash flows from financing activities | ||||||||||

| Interest paid | 10 | (20,639 | ) | (9,227 | ) | |||||

| Proceeds from borrowings | 174,300 | 25,000 | ||||||||

| Repayment of borrowings | (149,300 | ) | — | |||||||

| Repayment on lease liabilities | (2,863 | ) | (2,121 | ) | ||||||

| Net cash provided by/(used in) financing activities | $ | 1,498 | $ | 13,652 | ||||||

| Net increase/(decrease) in cash and cash equivalents, customer segregated cash and restricted cash | 2,183 | (55,780 | ) | |||||||

| Cash and cash equivalents, customer segregated cash and restricted cash at beginning of the period | 55,783 | 131,526 | ||||||||

| Effects of exchange rate changes on cash and cash equivalents, customer segregated cash and restricted cash | (107 | ) | — | |||||||

| Cash and cash equivalents, customer segregated cash and restricted cash at end of the period | $ | 57,859 | $ | 75,746 | ||||||

| Cash and cash equivalents, customer segregated cash and restricted cash consisted of the following: | ||||||||||

| Customer segregated cash | 4,138 | 5,588 | ||||||||

| Restricted cash | 18 | 18,161 | 18,925 | |||||||

| Cash and cash equivalents | 19 | 35,560 | 51,233 | |||||||

| Total cash and cash equivalents, customer segregated cash and restricted cash | $ | 57,859 | $ | 75,746 | ||||||

| Supplemental schedule of non-cash investing and financing activities | ||||||||||

| Recognition of right-of-use assets against lease liabilities | $ | 3,467 | $ | 8,445 | ||||||

| Purchase of digital assets held - intangible assets | (35,764,843 | ) | (66,219 | ) | ||||||

| Proceeds on disposal of digital assets held - intangible assets | 35,478,545 | 34,097 | ||||||||

| Digital asset loan receivables made/(returned), net | 28,137 | 58,261 | ||||||||

| Digital asset pledged as collateral posted/(returned), net | 79,974 | 52,551 | ||||||||

| Purchase of investment in financial assets via USDC | (10,116 | ) | (4,602 | ) | ||||||

| Prepayment on intangible assets (made)/returned, net | 2,036 | (8,043 | ) | |||||||

| Proceeds from borrowings via digital assets | 2,326,320 | — | ||||||||

| Repayment from borrowings via digital assets | (2,303,147 | ) | — | |||||||

| Proceeds from digital assets loan payable via digital assets | 216,743 | — | ||||||||

| Repayments from digital assets loan payable via digital assets | (215,362 | ) | — | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-

BULLISH

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1 General information

Bullish (the “Company”) is an exempted company incorporated and domiciled in the Cayman Islands with limited liability. The Company and its subsidiaries are collectively referred to as “the Group.” These Unaudited Condensed Consolidated Interim Financial Statements are for the three and six months ended June 30, 2025 and 2024.

Prior to July 23, 2024, the Company was majority owned by block.one. Effective July 23, 2024 and August 21, 2024, block.one transferred the majority of the Class A common shares in tranches to certain of its shareholders.

The principal activity of the Group is providing infrastructure and information services. This includes the operations of its subsidiary, Bullish (GI) Limited, which operates a digital asset trading platform (the “Exchange”) and CoinDesk Inc. (“CoinDesk”) which provides digital asset media and information services. On October 9, 2024, the Group completed the acquisition of Crypto Coin Comparison Ltd (“CCData”). Further details on the nature of the Group’s operations and these entities can be found in the Group’s audited consolidated financial statements for the year ended December 31, 2024 (the “Annual Financial Statements”).

The Unaudited Condensed Consolidated Interim Financial Statements are presented in United States dollars, which is the same as the functional currency of the Group.

Operating segments are defined as components of an entity for which separate financial information is available and that are regularly reviewed by the Chief Operating Decision Maker (“CODM”) in deciding how to allocate resources to an individual segment and in assessing performance. For the Group, the Chief Executive Officer (“CEO”) serves as the CODM. The CODM reviews financial information presented on a global consolidated basis for purposes of making operating decisions, allocating resources, and evaluating financial performance. As such, the Group has determined that it operates as one operating segment and one reportable segment.

Reverse Stock Split and IPO Reorganization

On July 31, 2025, the Company’s Board of Directors approved a reverse stock split of the Company’s Class A common shares, Class B preference shares, and Class C common shares on a 1-for-2 basis (the “Reverse Split”) which became effective on August 1, 2025. Accordingly, all holders of record of Class A common shares and Class B preference shares on August 1, 2025 (no Class C common shares were outstanding on such date), received respectively one issued and outstanding Class A common share and one issued and outstanding Class B preference share of the Company in exchange for two issued and outstanding Class A common shares and two issued and outstanding Class B preference shares of the Company. The Company also redesignated Class A shares as Ordinary shares. No fractional shares were issued in connection with the Reverse Split. All fractional shares created by the Reverse Split were rounded up to the nearest whole number of shares.

All information referencing outstanding shares of the Company, including earnings and loss per share, in the current and comparative periods presented herein give retroactive effect to the Reverse Split.

The following transactions impacting shares, options, and restricted stock units (“RSUs”) in Bullish Global and BMC1 interests occurred in connection with the IPO Reorganization and were adjusted for the effect of the Reverse Split described above. However, the information related to shares, options, and RSUs in Bullish Global and BMC1 interests below are not restated as a result of the Reverse Split.

· Bullish Global RSUs converted into RSUs of Ordinary Shares on a 1-for-2 basis;

· Bullish Global options converted into options to acquire Ordinary shares on a 1-for-2 basis with the exercise price for each converted option being twice the pre-conversion exercise price (subject to the same vesting conditions); and

· Certain conversion rights with respect to the BMC1 equity became effective. These conversion rights, subject to vesting, entitle holders of an aggregate outstanding 13,643,618 units of BMC1 equity to receive 7,075,504 Ordinary shares.

F-

BULLISH

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Subsequently, as part of the transaction that, collectively with the Reverse Split and the issuance of Ordinary shares to the third party investor in Bullish Global, we refer to as the "IPO Reorganization," the 2,735,938 issued and outstanding Class B preference shares (post Reverse Split) were mandatorily converted into an equal number of Ordinary shares. The accounting for this conversion involved derecognizing the $47.9 million financial liability associated with the Convertible redeemable preference shares and reclassifying the $18.4 million Option premium on convertible redeemable preference shares equity component; both amounts were transferred to Share capital and share premium.

2 Summary of principal accounting policies

The accounting policies have been consistently applied to the current and prior financial years presented, as are the methods of computation, unless otherwise stated below.

2.1 Basis of preparation

(i) Compliance with IFRS

The Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended June 30, 2025 and 2024, have been prepared in accordance with International Accounting Standard (“IAS”) 34, Interim Financial Reporting, issued by the International Accounting Standards Board (“IASB”). The financial statements comply with IFRS as issued by the IASB.

These Unaudited Condensed Consolidated Financial Statements do not include all the information and disclosures required in the Annual Financial Statements and should be read in conjunction with the Annual Financial Statements. For details on principal accounting policies, including but not limited to, principles of consolidation, business combinations, revenue recognition, financial instruments, leases, and taxation, refer to the Annual Financial Statements.

The accounting policies adopted in the preparation of these Unaudited Condensed Consolidated Interim Financial Statements are consistent with those followed in the preparation of the Group’s Annual Financial Statements, except for the adoption of new standards and interpretations effective as of January 1, 2025, and as described below.

(ii) Going concern

The Directors have, at the time of approving the Unaudited Condensed Consolidated Interim Financial Statements, a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. Thus, they continue to adopt the going concern basis of accounting in preparing the Unaudited Condensed Consolidated Financial Statements.

(iii) Reclassification of digital assets

Effective January 1, 2024, the Group reclassified certain portfolios of digital assets not allocated for market-making purposes from inventory to indefinite-life intangible assets under IAS 38. This reclassification was applied prospectively. Details of this reclassification were provided in the Annual Financial Statements.

(iv) New standard and amendments to standards which are not yet effective

Certain new standards and amendments to IFRS have been issued but are not yet effective for the period ended June 30, 2025, and have not been early adopted by the Group. IFRS 18 “Presentation and Disclosure in Financial Statements” replaces IAS 1 and is effective for annual reporting periods beginning on or after January 1, 2027. The Group is currently assessing the impact of IFRS 18. For other new standards and amendments not yet effective, refer to the Annual Financial Statements.

2.2 Digital assets held - intangible assets and inventories

Prior to December 31, 2023:

Before December 31, 2023, the Group classified all digital assets as inventories under IAS 2, as they were primarily held for the purpose of facilitating market-making activities on the Bullish Exchange. These assets were measured at fair value less costs to sell, with changes in fair value recognized in the Consolidated Statement of Profit or Loss under Change in fair value of digital assets held, net.

F-

BULLISH

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Starting from January 1, 2024:

Effective January 1, 2024, the Group reclassified a portion of its existing digital assets, previously classified as inventory measured at fair value less costs to sell, to intangible assets, utilizing the revaluation method as digital assets are traded in active markets. For the purpose of revaluation, fair value is measured by reference to the Company’s principal market at subsequent measurement dates. This change would impact Other comprehensive income/(loss) (“OCI”) as increases in the fair value of these intangible assets are recognized directly in equity under Revaluation reserves for digital assets held as investments. This reserve represents the revaluation adjustment of intangible assets, capturing the change of fair value from their weighted average cost prospectively on or after January 1, 2024. This reclassification is driven by a significant change in the operation of its business, characterized by a substantial reduction in the quantity of digital assets deployed for liquidity provision and market-making activities on the Exchange.

In addition to the reclassification of existing assets, new digital assets acquired from this date will be classified as either intangible assets or inventory, reflecting their intended use within the Group’s updated operational business model framework. This strategic realignment ensures that the Group’s financial reporting accurately reflects the change in the nature of its business operations and asset management practices.

For digital assets classified as intangible assets, if the carrying amount of a digital asset increases as a result of revaluation, the increase is recognized in OCI and accumulated in Equity under Reserves. However, if the increase in the carrying amount of the digital asset reverses a previous revaluation decrease recognized in Net income/(loss), it is recognized in Net income/(loss).

Conversely, if the carrying amount decreases due to revaluation, the decrease is recognized in Net income/(loss). However, if there is a credit balance in the Revaluation reserves for that asset, the decrease is recognized in OCI, reducing the equity under the Revaluation reserves heading.

The cumulative Revaluation reserves included in Equity may be transferred directly to Accumulated deficit when the surplus is realized, either upon the retirement or disposal of the asset. Transfers from Revaluation reserves to Accumulated deficit are not routed through Net income/(loss).

Digital assets held — intangible assets associated with decentralized finance protocols

The Group engages with decentralized finance (“DeFi”) protocols, which are smart contracts designed to perform specific functions, predominantly built on various blockchain platforms. These protocols enable the Group to provide or access liquidity and facilitate the exchange of digital assets directly on the blockchain.

To provide liquidity, the Group deposits or transfers its digital assets to the smart contracts of these DeFi protocols. In return, the Group typically receives protocol-specific digital assets that represent its claims on the underlying digital assets deposited.

Most DeFi protocols have the capability to utilize the Group’s deposited digital assets for various purposes, including lending or trading them with other participants in the DeFi protocol. Upon transferring digital assets to the smart contracts, the Group derecognizes the original digital assets and recognizes the protocol-specific digital assets received in return. The protocol-specific digital assets are classified as intangible assets utilizing the revaluation method as the protocol-specific digital assets are traded in active markets. Upon redeeming the protocol-specific asset for the underlying digital asset, the protocol-specific digital asset is derecognized and the returned digital asset is recognized.

F-

BULLISH

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

3 Critical accounting judgments and key sources of estimation uncertainty

In preparing these Unaudited Condensed Consolidated Interim Financial Statements, management has made judgments, estimates, and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities, income, and expense. Actual results may differ from these estimates.

Refer to the Annual Financial Statements for a comprehensive discussion of critical accounting judgments and key sources of estimation uncertainty.

The significant judgments made by management in applying the Group’s accounting policies and the key sources of estimation uncertainty were the same as those described in the Annual Financial Statements, with the following updates or emphasis for the interim period:

(i) Fair market value of digital assets held

The determination of fair value for digital assets continues to require judgment, particularly in identifying principal markets.

(ii) Goodwill and Other intangible assets impairment