UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2025

Commission File Number 001-42819

SAYONA MINING LIMITED

(Translation of registrant’s name into English)

Level 28,

10 Eagle Street

Brisbane, Queensland 4000

Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Sayona Mining Limited (the “Registrant”) is filing the following exhibits on this Report on Form 6-K, each of which is hereby incorporated by reference:

Exhibit

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SAYONA MINING LIMITED | ||

| Date: September 16, 2025 | By: |

/s/ Dylan Roberts Name: Dylan Roberts |

| Title: Company Secretary and General Counsel | ||

Exhibit 99.1

NAL EXPANSION SCOPING STUDY CONFIRMS LOWER COSTS AND STRONG RETURNS

North American lithium producer Sayona Mining Limited (“Sayona”) (ASX:SYA; NASDAQ:ELVR; OTCQB:SYAXF) announced today outcomes of a Scoping Study for Expansion of the existing North American Lithium (NAL) operation, delivering additional annual concentrate production and reduced unit operating costs.

Highlights

| · | Process plant design feed rate increased from 4,200 tonnes per day (tpd) to 6,500 tpd; average Life of Mine (LOM) recovery of 71.2%; spodumene concentrate at grade of 5.4% Li2O. |

| · | The expansion project provides a total project post-tax NPV(8%) of C$1,284M, an increase of C$479M versus the base case NPV. |

| · | Incremental post-tax net cash flow of C$837M over the base case; IRR of 26.4% and payback of 46 months. |

| · | Annual nominal SC5.4 production rate of 315 ktpa following ramp-up of the expansion. |

| · | C1 unit cost of C$759/t (US$562/t)1 and AISC of C$920/t (US$681/t)1 once the expansion is fully operational vs base case C1 of C$935/t (US$692/t)1 and AISC of C$1,128/t (US$835/t)1. |

| · | Initial capex of C$366M, (US$270M)1. Construction forecast to be complete by end CY29. |

| · | The Company’s existing NAL Ore Reserves solely underpin the NAL Expansion production profile with a revised life of mine of 24 years. |

Sayona’s Chief Executive Officer and Managing Director, Lucas Dow, said: “The results of this Scoping Study mark another important milestone in Sayona’s strategy to build a long-life, low-cost lithium operation at North American Lithium. The study clearly demonstrates the strong economic case for expansion, with higher concentrate production, reduced unit costs and robust returns across a 24-year mine life.

“By incorporating a second concentrator line and leveraging flowsheet enhancements, we have been able to target improved recoveries and enhanced flexibility in plant operations. The flowsheet enhancements are driven by the deep operational knowledge gained through our recent path to record production. The ability to stagger maintenance shutdowns across two lines underpins overall plant availability of 92%, reinforcing our capacity to deliver consistent and reliable output.

“This expansion will allow Sayona to increase spodumene concentrate production to more than 300,000 tonnes per annum, further strengthening our position as North America’s leading hard-rock lithium producer. Importantly, this growth is being achieved using our existing Ore Reserves, highlighting the quality and scale of the NAL resource base.

“Looking ahead, we are confident that this project will continue to generate significant value for our shareholders, local communities and stakeholders. As global demand for lithium accelerates, Sayona is well positioned to play a pivotal role in supplying the critical materials needed for the clean energy transition.”

1 Converted at CAD/USD = 0.74

Scoping Study Highlights

Analysis of the financial model on the key economic assumptions indicates that the Project is robust in terms of operating costs and capex. The Project is most sensitive to changes in commodity prices, exchange rates, and recoveries.

The Project demonstrates robust operational and financial metrics, with the key Project assumptions and outputs shown in the tables below:

Table 1 – Main financial assumptions and results summary for the NAL Expansion Project

| Parameters | Base | Expansion | ||||||||

| Average Price 6% Li2O1 | USD$/t | $ | 1,387 | $ | 1,392 | |||||

| Life of mine (from 2025) | yrs | 35 | 24 | |||||||

| Total Waste | Mt | 337 | 336 | |||||||

| Total Ore | Mt | 47 | 47 | |||||||

| Strip Ratio | - | 7.1 | 7.1 | |||||||

| Average Annual ROM | Mt/y | 1.3 | 2.0 | |||||||

| Average Feed Grade | % Li2O | 1.11 | % | 1.11 | % | |||||

| LOM 5.4% Li2O Produced | Mt | 6.75 | 6.93 | |||||||

| Average Annual 5.4% Li2O production | kt/y | 192 | 315 | |||||||

Table 2 – Project Economics

| Project Economics | Base | Expansion | ||||||||

| LOM C1 Cost Concentrate | C$/t conc | 954 | 799 | |||||||

| LOM AISC | C$/t conc | 1,154 | 974 | |||||||

| C1 Cost of Concentrate | C$/t conc | 935 | 759 | |||||||

| AISC | C$/t conc | 1,128 | 920 | |||||||

| Total SUSEX | C$M | 512 | 517 | |||||||

| Total initial CAPEX | C$M | - | 366 | |||||||

| NPV (8%) (post-tax) | C$M | 805 | 1,284 | |||||||

| IRR Expansion (post-tax) | % | - | 26.4 | % | ||||||

| Payback (post-tax) | Months | - | 46 | |||||||

1 Average LOM SC6 pricing may vary between the cases due to longer mine life at the long-term US$1,350 price for the base case (2040 and beyond).

|

|

Sayona Mining Limited |

Notes:

| · | All costs and sales are presented in constant 2025 CAD, with no inflation or escalation factors considered. |

| · | $M = millions of dollars. |

| · | The financial analysis was performed on existing Ore Reserves as outlined in this report. |

| · | The valuation calculations are unlevered. |

| · | The average metallurgical recovery over the LOM is 71.2% for the expansion and 69.2% for the base case due to improvement in the mill flowsheet specifically attributable to ore-sorting and wet high-intensity magnetic separator (WHIMS) improvements. |

| · | Plant availability a is calculated at 92% given the flexibility introduced in the circuit and improvements in the design versus the base case plant availability of 89%. |

| · | Tonnes of concentrate are presented as dry metric tonnes. |

| · | An exchange rate of 0.74 CAD/USD was fixed over the LOM for the Project. |

| · | The average 6% Li2O concentrate price is based on a market analysis from Benchmark Mineral Intelligence for Q1 2025 as described in the market section and varies over the LOM from US$1,320/t to US$1,925/t. |

| · | Average LOM SC6 pricing may vary between the cases due to longer mine life at the long-term US$1,350 price for the base case (2040 and beyond). |

| · | A discount rate of 8% was used for the base case and expansion scenarios. |

| · | Net Cash Flow and valuation calculations include investment tax credit on CAPEX. |

| · | The numbers have been rounded. Any discrepancy in the totals is due to rounding effects. |

Cautionary Statements

The Scoping Study discussed herein has been undertaken to determine the feasibility of an expansion production plant constructed adjacent to the existing NAL operation. The Scoping Study is a preliminary technical and economic study of the feasibility of an expansion development of the NAL Operation. The Scoping Study is based on low-level technical and economic assessments, and is insufficient to provide assurance of an economic development case at this stage

The Scoping Study evaluation work and appropriate studies have provided Scoping level estimates of cost and rates of return. The production target underpinning financial forecasts included in the Scoping Study are based solely upon current Ore Reserves estimated in the Announcement (See Sayona ASX announcement dated 27 August 2025).

The Scoping Study is based on the material assumptions outlined elsewhere in this announcement. These include assumptions about the availability of funding. There is no certainty that the Project will be able to be funded when needed (nor any certainty as to the form such funding may take, such as disclosed in this announcement). It is also possible that such funding may only be available on terms that dilute or otherwise affect the value of the Company’s shares. While Sayona considers all of the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Scoping Study will be achieved. This announcement contains forward-looking statements. Sayona has concluded it has a reasonable basis for providing the forward-looking statements included in this announcement. However, a number of factors could cause actual results, or expectations to differ materially from the results expressed or implied in the forward-looking statements. Given the uncertainties involved, investors should not make any investment decisions based solely on the results of the Scoping Study and are cautioned not to place undue reliance on the Scoping Study or the production targets referred to in this announcement.

|

|

Sayona Mining Limited |

Overview

The North American Lithium operation is a hard-rock lithium mining and concentration facility located in La Corne, within the Abitibi-Témiscamingue region of Quebec, Canada. NAL was successfully restarted in March 2023 and is currently permitted for 4,500 tpd of production.

The current processing operation consists of three distinct processing areas:

| · | Crushing and ore sorting of the ROM ore to produce an upgraded plant feed for downstream processing. |

| · | A spodumene concentrator producing a saleable spodumene concentrate using grinding, magnetic separation and flotation. |

| · | Dewatering of the final spodumene concentrate and the concentrator tailing material. |

The NAL process plant expansion is designed to increase the overall plant capacity to a design rate of 6,500 tpd representing a 44% increase versus the current permitted rate of 4,500 tpd. This will be achieved by:

| · | Replacement of the existing crushing and ore sorting area with a new circuit capable of processing 6,800 tpd of ROM ore. Crushed ore will be conveyed from the crushing and ore sorting area to a covered crushed ore stockpile with 15,000 tonnes live storage. The stockpile is designed to be equipped with 2 reclaim tunnels, each with 2 feeders and conveyors, providing feed to Concentrator 1 (existing) and Concentrator 2 (new). |

| · | The addition of a second concentrator (Concentrator 2) to be operated in parallel to the existing concentrator will enable a combined concentrator process rate of 6,500 tpd of feed using grinding, desliming, magnetic separation and spodumene flotation. |

| · | Additional concentrate filters, and replacement of the existing tails dewatering area with a new tailings thickener receiving tail streams from both the existing Concentrator 1 and new Concentrator 2. |

| · | Redundancy in existing WHIMS circuit is achieved by adding a third WHIMS. |

| · | Concentrate storage facility integrated into the existing plant building combining flows of Concentrator 1 and new Concentrator 2, improving on current plant concentrate rehandling. |

Property Status

The NAL Expansion Project properties (the “Properties”) are situated in the La Corne Township in the Abitibi-Témiscamingue region in the Province of Québec, Canada (Figure 1).

Site Access and Existing Infrastructure

The Project is located approximately 38km southeast of Amos, 15km west of Barraute and 60km north of Val-d’Or in the Province of Québec, Canada. The site is accessible by provincial Highway 111, connecting Val-d’Or and Amos, or alternatively by provincial Highway 397, connecting Val-d’Or and Barraute. An all-weather secondary road, known as Route du Lithium, connecting the site to the Val-d’Or – Amos highway, which was used to traverse the Property and which constrained pit operations, has now been relocated to avoid the mining area. The site is also accessible from Mont-Vidéo, through an all-weather road that connects further east to the Val-d’Or – Barraute highway.

The site is approximately 550km north of Montréal and is serviced by road, rail, and air. The town of Val-d’Or, with a population of approximately 32,750 residents (Canadian Census, 2021), is located 60km south of the Property, along the provincial Highway 111. Since Val-d’Or was founded in the 1920s, it has been a mining service centre. Val-d’Or is one of the largest communities in the Abitibi region and has all major services, including an airport with scheduled service from Montréal. Canadian National (CN) railway line is about 49km east of the Property, connecting east through to Montréal and west to the North American rail network. Val-d’Or is a 6-hour drive from Montréal, and there are daily bus services between Montréal and the other cities and towns in the Abitibi region.

The town of Amos, with a population of approximately 12,675 residents (Canadian Census, 2021), is located approximately 38km northwest of the NAL site. Amos is served by highways 109, 111, and 395 and the Amos/Magny airport.

|

|

Sayona Mining Limited |

A high-voltage power line (120 kV) passes approximately 2km to the west of the Property and a 25 kV electric line, running along the Route du Lithium, services the Mont-Vidéo ski and recreation area.

Figure 1 – NAL Property Location

Geology and Mineralisation

North American Lithium’s pegmatite dykes have been delineated over a strike length of approximately 3,550m and to a vertical depth of approximately 700m. Dykes have variable widths up to 70m. The model comprises 117 mineralised dykes which are generally more than 2m in thickness and open at depth (Figure 2).

The project is located in the region of The Archean Preissac-Lacorne syn- to post-tectonic intrusion that was emplaced in the southern Volcanic Zone of the Abitibi Greenstone Belt of the Superior Province of Québec. The rocks are split between granodiorite, volcanics, gabbro and the mineralised pegmatites dykes that are cross-cutting the granodiorite and the volcanics rocks.

Volcanic rocks on the property are represented by dark green mafic metavolcanics and medium grey silicified intermediate volcanics. The mafic rocks are medium grey to dark grey-green, and cryptocrystalline to very fine grained. Both mafic and intermediate volcanic rocks are affected by moderate to strong pervasive silicification, minor chloritisation and patchy to pervasive lithium alteration.

The granodiorite is medium grey to greenish grey, massive, coarse grained to porphyritic, and exhibits a salt-pepper appearance. The main mineral constituents are light grey to greenish white plagioclase (40-45 vol%), dark green to black amphibole, most likely hornblende (15-20 vol%), mica (20 vol%), represented by biotite and muscovite, grey quartz (10-15%vol) and minor epidote, chlorite and disseminated sulphides.

|

|

Sayona Mining Limited |

Figure 2 - Plan view illustrating the pegmatite dykes, the host rock and the 2025 Mineral Resource Estimate pit for the North American Lithium operation

|

|

Sayona Mining Limited |

Mineral Resources and Ore Reserves

The Scoping Study production schedule is solely based upon current NAL Ore Reserves as at June 30 2025.

The current Mineral Resource Estimate and Ore Reserve estimate are presented in Table 3 and Table 4 below. The Mineral Resource and Ore Reserve estimates were prepared by Competent Persons in accordance with the 2012 JORC Code.

Table 3 – North American Lithium – Mineral Resource Estimates (0.60% Li2O cut-off grade for the RPEEE pit and 0.70% Li2O cut-off grade for underground domain)

| Resource

Classification |

Method | Tonnes (Mt) | Li2O

Grade (%) |

Cut-Off Grade (%) | ||||||||||

| Indicated | Open Pit | 76.2 | 1.17 | 0.60 | ||||||||||

| Inferred | Open Pit | 8.6 | 1.13 | 0.60 | ||||||||||

| Indicated | Underground | - | - | - | ||||||||||

| Inferred | Underground | 10.3 | 1.01 | 0.70 | ||||||||||

| Total | 95.0 | 1.15 | ||||||||||||

The North American Lithium Ore Reserves have been estimated for a total of 48.6Mt of Proven and Probable Ore Reserves at an average grade of 1.11% Li2O, which is comprised of 0.3Mt of Proven Ore Reserves at an average grade of 1.01% Li2O and 48.2Mt of Probable Ore Reserves at an average grade of 1.11% Li2O, as shown in Table 4 below.

Table 4 – North American Lithium – Ore Reserves estimate, as at June 30, 2025

| Resource

Classification |

Tonnes (Mt) | Li2O

Grade (%) |

Cut-Off Grade (%) |

Fe Grade (%)2 | ||||||||||||

| Proved Ore Reserves | 0.3 | 1.01 | 0.60 | 1.55 | ||||||||||||

| Probable Ore Reserves | 48.2 | 1.11 | 0.60 | 0.82 | ||||||||||||

| Total | 48.6 | 1.11 | 0.60 | 0.83 | ||||||||||||

The information on Mineral Resources and Ore Reserves are extracted from the announcement entitled “NAL Resources and Reserves Increases” published on the ASX on 27th August 2025 and is available to view on the Sayona’s website or on the ASX. The company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and, in the case of estimates of Mineral Resources or Ore Reserves, that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

2 It should be noted that the Fe Grade (%) column in Table 4 was erroneously mislabeled as Fe2O3 Grade (%) in the comparable table of ASX release “NAL Resources and Reserve Increases” dated 27 August 2025. Both tables are correct and unchanged in all other respects.

|

|

Sayona Mining Limited |

Mine Design

The NAL final pit design, as shown in Figure 3, was based on a pit optimisation assessment which determined the economic limits of the deposit. The in-pit haul road has been designed on the hanging wall side of the deposit to maximise ore recovery within the pit shell, provide more direct access to the waste storage facilities and ROM and to provide access for the final mining pushback. The final pit reaches a maximum depth of approximately 380m below topography.

Figure 3 – NAL Final Pit Design

The final pit design was subdivided into a total of seven mining phases, with the physicals and ore grades contained within each phase shown in Table 5. Special attention was given to the historical underground openings when setting the physical limits for every phase, with consideration taken to ensure that the phase walls did not intersect the old workings. The current life-of-mine plan will be clear of all historic undergrounds by the end of 2030.

The following criteria were applied during the phase design construction:

| · | Minimum mining width of 60m considered between phases on the surface and 40m at the phase base; |

| · | Ease of access to different mining areas; |

| · | Mining and processing production rate; and |

| · | Physical constraints posed by historical underground workings. |

|

|

Sayona Mining Limited |

Table 5 – NAL Physicals by Phase

| Item | Units | Total | Phase 2 |

Phase 3 |

Phase 4 |

Phase

5 |

Phase 6 |

Phase 7 |

Phase 8 |

||||||||||||||||||

| Total In-Pit | Mt | 395.3 | 0.3 | 39.9 | 55.0 | 55.9 | 47.3 | 182.1 | 14.7 | ||||||||||||||||||

| Waste Rock | Mt | 347.1 | 0.2 | 33.9 | 47.7 | 49.8 | 40.3 | 162.2 | 13.0 | ||||||||||||||||||

| ROM Ore | Mt | 48.2 | 0.1 | 6.1 | 7.4 | 6.1 | 7.0 | 19.9 | 1.8 | ||||||||||||||||||

| Lithium Grade | % Li2O | 1.11 | % | 1.34 | % | 1.11 | % | 1.09 | % | 1.05 | % | 1.22 | % | 1.10 | % | 1.04 | % | ||||||||||

| Iron Grade | % Fe | 0.82 | % | 0.58 | % | 0.92 | % | 0.91 | % | 0.85 | % | 0.75 | % | 0.79 | % | 0.71 | % | ||||||||||

| Strip Ratio | twaste : tore | 7.2 | 3.1 | 5.6 | 6.5 | 8.2 | 5.7 | 8.2 | 7.3 | ||||||||||||||||||

The mining solids, which formed the basis of the life-of-mine schedule, were developed using the following process:

| · | In-situ solids were generated within each phase, based on the 2025 Mineral Resource estimate geological model, including the modelled qualities for all ore solids. |

| · | The in-situ solids, which were as small as 1.25m x 1.25m x 5m, were reblocked to 5m x 5m x 5m solids. |

| · | The quantities and the qualities of the 5m x 5m solids were then assessed to calculate the mineable quantities of ore within in each solid: |

| o | All 5m x 5m x 5m solids which contain more than 30m3 (approximately one truckload) of indicated ore, were assessed for potential Reserves. Approximately 16.9% of in-situ indicated ore was excluded from the Reserves at this step. |

| o | The quantity of dilution applied to the indicated ore fluctuated between 0% and 40% depending on the percentage of ore contained within each 5m x 5m x 5m solid. Dilution accounts for ~15.3% of all mined Reserves. |

| o | The loss values applied to the indicated ore fluctuated between 0% and 25% depending on the percentage of ore contained within each 5m x 5m x 5m solid. An average 7.0% loss was incurred on all mined Reserves. |

| o | All indicated ore with an Li2O grade >= 0.60% after the application of loss and dilution were included in the Reserves. All other material was classified as waste, including all inferred and unclassified ore which was converted to waste. |

The quantities and qualities for each solid were then imported into Spry mine scheduling software for detailed scheduling and haulage modelling.

The life-of-mine schedule for the scoping study utilised similar class equipment that is currently operating at NAL, with 200t class excavators added to the fleet as required to assist with maintaining the required stripping quantities. The annual ore tonnes and ROM feed grades for Li2O and Fe are shown in Figure 4.

|

|

Sayona Mining Limited |

Figure 4 – Annual Ore Processing

Annual movements from each of the phases across the life-of-mine is shown in Figure 5.

Figure 5 – Annual Quantities by Phase

NAL Expansion Concentrator Feed and Production Profile

The Scoping Study production schedule is based solely upon current NAL Ore Reserves as at June 30 2025.

The NAL Expansion concentrator ore feed will be blended at the ROM to control Li2O grade and Fe contamination. The average head grade is 1.11% Li2O over the LOM. Figure 4 presents yearly head feed tonnage and grade over the LOM.

The NAL Expansion increases the total process plant throughput to approximately 2.2 Mtpa with a process plant availability of 92%. Based on the LOM Plan, the circuit will on average produce a nominal 315 ktpa of spodumene flotation concentrate, with a 71.2% Li2O recovery at a target product grade of 5.4% Li2O once the expansion circuit is fully operational.

|

|

Sayona Mining Limited |

Metallurgy

The NAL deposit has undergone extensive metallurgical testwork. Metallurgical recovery assumptions are based on historical metallurgical tests and test work completed during 2018 – 2023. Testwork programs began in 2008 to establish the metallurgical character of the orebody, and allow the development of a process flowsheet, testing of that flowsheet, evaluate the impact of head grade on performance and then produce the engineering data for plant design. This testwork occurred under the supervision of independent QPs and Sayona representatives.

The testwork evaluated a number of processing techniques including flotation, DMS, LIMS and ore sorting. The progression of this testwork took the form of batch scale tests looking at flotation, DMS and grindability leading to locked cycle tests flotation tests and then pilot scale continuous tests. WHIMS and DMS were not included in the original flowsheet based on the outcomes of the testwork. The testwork outcomes formed the design basis of the NAL concentrator that commenced operation in March 2013 but ceased operation in September 2014. This was principally due to higher than anticipated dilution of the ore with host rock, and lower than target spodumene recovery and concentrate grade.

Subsequent testwork programs were undertaken to characterise and mitigate the effect of the dilution including hardness testing and WHIMS testwork (on both plant samples and pegmatite samples of varying levels of dilution of the two major dilution host rocks). The impact of the WHIMS on flotation was also examined, and the final spodumene flotation concentrate was 6% Li2O at an estimated testwork recovery of 80 to 83%.

Modifications were made to the plant based upon this testwork with the addition of WHIMS units prior to flotation and additional ore sorting capacity on the feed. The plant was restarted in 2017 following these changes and consistently achieved concentrate grades of 5.4 to 6.0 % Li2O at recoveries from 55 to 70%. The plant subsequently shutdown due to market conditions prior to name plate capacity being achieved.

Further modifications were made to the plant prior to the restart in 2023 but these were focused on operational issues identified from the previous operation rather than underlying metallurgical issues relating to the ore. (i.e. capacity related).

The 2023 DFS testwork assessed NAL/Authier ore feed blends and the figure below summarises the spodumene concentrate grade vs testwork recovery curve (DFS 2023).

Figure 6 – 2023 DFS testwork grade-recovery curve

A comparison of the global Li2O recovery comparing the testwork recovery curve (without any industrial derating) against the NAL operational quarterly performance data (from Q3 FY24 to Q4 FY25) is presented below. The recent quarterly performance (Q4 FY25) with a spodumene concentrate grade of 5.2% Li2O at 73% global recovery is also shown. The expansion forecast recovery curve also includes the datapoint of 71.2% recovery at 5.4% Li2O concentrate grade.

|

|

Sayona Mining Limited |

Figure 7 – Li2O Grade Recovery Curve including NAL Quarterly Performance

Historical metallurgical testwork from the above described previous phases, along with current operational performance has been used as the basis for the NAL expansion scoping study.

Based on the previous laboratory testwork and current operational performance, an average global recovery of 71.2% at a spodumene concentrate grade of 5.4% Li2O has been applied across the NAL Mine Plan for the purposes of the scoping study.

The impact of ore sorters was analysed through statistical methods for impact on recovery from operating data. A recovery increase of 2% above the base case is included in the above 71.2% with additional ore sorting performance testing underway.

|

|

Sayona Mining Limited |

Mineral Processing and Flowsheet

The current NAL operation has a design capacity of 4,200 tpd with a permitted rate of 4,500 tpd of Run of Mine ore to produce spodumene concentrate. It consists of three distinct processing areas:

| · | Crushing and ore sorting on the ROM ore sorting to produce an upgraded plant feed for downstream processing |

| · | A spodumene concentrator producing a saleable spodumene concentrate using grinding, desliming, magnetic separation and flotation |

| · | Dewatering of the final spodumene concentrate and the concentrator tailing material. |

The NAL process plant expansion is designed to increase the overall plant capacity to a design rate of 6,500 tpd. This will be achieved by via:

| · | Replacement of the crushing and ore sorting area with a new circuit capable of processing 6,800 tpd of ROM ore. Crushed ore is conveyed from the crushing and ore sorting area to a covered crushed ore stockpile with 15,000 tonnes live storage. The stockpile is equipped with 2 reclaim tunnels, each with 2 feeders and conveyors, providing feed to Concentrator 1 (existing) and Concentrator 2 (new). |

| · | The addition of a second concentrator (Concentrator 2) to be operated in parallel to the existing concentrator will enable a combined concentrator process rate of 6,500 tpd of feed using grinding, desliming, magnetic separation and spodumene flotation. |

| · | Additional concentrate filters, and replacement of the existing tails dewatering area with a new tailings thickener receiving tail streams from both the existing Concentrator 1 and new Concentrator 2. |

| · | Redundancy in existing WHIMS circuit is fulfilled by adding a third WHIMS. |

| · | Concentrate storage facility integrated into the existing plant building combining flows of Concentrator 1 and new Concentrator 2, improving on current plant concentrate rehandling. |

The upgraded design will be based on the existing facility, and as such the lithium recovery anticipated following this expansion is 71.2% (at SC5.4 grade) and based on current plant performance and improvements of ore sorting and WHIMS. Future testwork and increased lithium recovery initiatives are planned for the next stage of the project.

The NAL project expansion is designed to increase the circuit capacity, through the addition of new process equipment, and increase the production of saleable spodumene flotation concentrate.

The key process areas of the post expansion facility are as follows:

| · | Primary Crushing and Secondary Crushing (New) |

| · | Ore Sorting (New) |

| · | Tertiary Crushing and Fine Ore Storage (New) |

| · | Concentrator 1 (Existing) |

| o | Grinding and desliming |

| o | Magnetic Separation with addition of a redundant WHIMS (New) |

| o | Spodumene flotation |

| · | Concentrator 2 (New/Expansion) |

| o | Grinding and desliming |

| o | Magnetic Separation |

| o | Spodumene flotation |

| · | Spodumene Concentrate Dewatering – Concentrator 1 (Existing) |

| · | Spodumene Concentrate Dewatering – Concentrator 2 (New/Expansion) |

| · | Addition of concentrate storage and loadout facility (New/Expansion) |

| · | Tailings Thickening and storage at TSF (New/Expansion) |

|

|

Sayona Mining Limited |

The table below provides a high-level overview of the main design criteria for the NAL concentrator expansion.

Table 6 – General Process Design Criteria

| Criterion | Unit | Base | Expansion | |||||||||

| Crushing Plant Availability | % | 65 | 65 | |||||||||

| Ore Sorting Plant Availability | % | 65 | 65 | |||||||||

| Concentrator Availability | % | 89 | 92 | |||||||||

| Total ROM Crusher Feed | tpd | 4,385 | 6,800 | |||||||||

| Concentrator 1 Capacity (Existing) | tpd | 4,200 | 4,200 | |||||||||

| Concentrator 2 Capacity (New) | tpd | - | 2,300 | |||||||||

| Total Concentrator Capacity | tpd | 4,200 | 6,500 | |||||||||

| Total Concentrator Capacity (nominal) | Mt/y | 1.4 | 2.2 | |||||||||

| Concentrator Feed Grade | % Li2O | 1.11 | 1.11 | |||||||||

| Target Spodumene Concentrate Grade | % Li2O | 5.4 | 5.4 | |||||||||

| Overall Lithium Recovery | % Li2O | 69.2 | 71.2 | |||||||||

Note: all parameters are design rating unless noted otherwise

The post expansion block flow is given below in Figure 8 and Figure 9.

|

|

Sayona Mining Limited |

Figure 8 – Simplified Block Flow

A ROM blend feeds the coarse ore to the Primary Crusher at a top size of 900mm, and the crushed ore at a nominal Closed Size Setting (CSS) of 130mm is transferred to the Oversize Grizzley via the Primary Conveyor which screens the ore at 90mm. The +90mm oversize from the Grizzley is fed to the Secondary Crusher and the resultant re-crushed ore at a nominal CSS of 90mm is discharged onto the Primary Conveyor to join the material from the Primary Crusher and thus transferred to the Oversize Grizzly for rescreening.

The under-size material from the grizzly is transferred to Ore Sorting. Crushed material from Primary and Secondary Crushing is fed to the Sorter Screen where it is separated by size into 4 products:

| · | Material from the top deck (-90mm + 75mm) is transferred to the Primary Sorter Screen and wet screened. Washed over size material is fed to the Primary Sorter, while wet screen undersize nominally -4mm in size is transferred as a slurry to the existing Concentrator 1 rod mill. |

| · | Material from the second deck (-75mm + 50mm) is transferred to the Secondary Ore Sorter |

| · | Material from the bottom deck (-50mm + 25mm) is transferred to the Tertiary Ore Sorter |

| · | The screen undersize (-25mm) reports to the Fine Ore Conveyor for transfer to the Covered Stockpile. |

| · | Rejects from all sorters are conveyed to the rejects stockpile to be loaded by front end loader onto trucks for disposal with the mine waste. |

The sorter products are fed to the tertiary crushing circuit which consists of the Tertiary Crusher (nominal CSS of 18mm) in closed circuit with the Tertiary Crusher Screen (cut size = 20mm). The sorter stream is introduced to the circuit at the feed to the Tertiary Crusher Screen. Screen oversize is transferred to the Tertiary Crusher and the crushed material from the Tertiary Crusher returned to the screen.

|

|

Sayona Mining Limited |

The existing concentrator process flow is as follows:

| · | The grinding circuit consists of primary open circuit rod mill followed by a ball mill working in a closed circuit with 6 x Stack Sizer Screens. The rod mill is fed via conveyor at a design rate of 4,200 tpd by the dedicated reclaim feeders on the Covered Crushed Ore Stockpile and also receives the screen undersize slurry from the Primary Sorter Screen. |

| · | The Rod Mill product is pumped to the Ball Mill and the Ball Mill product is pumped to the Stack Sizer Screens. The oversize with a nominal P80 of 970 microns is returned to the ball mill. The undersize at a nominal P80 of 200 microns is deslimed by 17 x Primary Deslime Cyclones to remove slime material (nominal overflow cut size D50 = 10µm). The slime material reports to the Tailings Thickener. |

| · | The deslimed underflow from the above is diluted with process water and then pumped to a low-intensity magnetic separator (“LIMS”) followed by 2 x wet high-intensity magnetic separator (“WHIMS”) in parallel (2 Duty/1 Standby (new)). The magnetics extracted by both stages are combined and pumped to the Tailings Thickener. |

| · | The non-magnetic slurry from the above undergoes high-intensity conditioning at 55% w/w solids with a fatty acid collector in the Rougher Conditioning Tanks, 2 x 48 m3 tanks in series. The conditioned slurry is fed to the feed box of the rougher flotation circuit via gravity. |

The expansion concentrator process flow is as follows:

| · | The circuit is fed via conveyor from the dedicated reclaim feeders drawing material from underneath the Covered Crushed Ore Stockpile at a design rate of 2,300 tpd. |

| · | The grinding circuit consists of a single stage ball mill working in a closed circuit with 4 x Mill Cyclones targeting a grind size of P80 of 200 microns. Mill Cyclone underflow returns to the ball mill. Mill Cyclone overflow is deslimed by 12 x Primary Deslime Cyclones to remove slime material. The slime material reports to the Tailings Thickener. |

| · | The deslimed Primary Deslime Cyclone Underflow from the above is diluted with process water and pumped to a low-intensity magnetic separator (“LIMS”) followed by 2 x wet high-intensity magnetic separator (“WHIMS”) in parallel (1 Duty/1 Standby). The magnetics extracted by both stages are combined and pumped to the Tailings Thickener. |

| · | The non-magnetic slurry from the above undergoes high-intensity conditioning with a fatty acid collector at 55% w/w solids in the Rougher Conditioning Tanks, 2 x 26 m3 tanks in series. The conditioned slurry is fed to the feed box of the rougher flotation circuit via gravity. |

Spodumene concentrate is then pumped to the Concentrate Storage Tank which serves as a buffer between the upstream process and the downstream filtration. The spodumene concentrate slurry from the Storage Tank is fed to Concentrate Filters 2 and 3, two 32 m2 horizontal belt filters operated in parallel which dewater the concentrate down to a filter cake of nominally 8% moisture. This cake is discharged directly into the Concentrate Storage building.

The Tailings Thickener, a high-rate thickener receives the following tail streams from the Existing Concentrator (Concentrator 1) and the Expansion Concentrator (Concentrator 2).

| · | Slime Material from Primary Desliming |

| · | Magnetic Materials from Magnetic Separation |

| · | Slime Material from Scavenger Desliming |

| · | Scavenger Tailings |

| · | Cleaner 1 Tailings |

These combined tailings are thickened to 50% w/w solids with the aid of an anionic flocculant and the underflow is then pumped to the TSF for disposal. The overflow reports to Process Water Storage for reuse within the operation.

|

|

Sayona Mining Limited |

Figure 9 – Simplified Process Flow

|

|

Sayona Mining Limited |

Concentrator Production and Recoveries

The Expansion is scheduled to produce a design rate of 6,500 tpd of blended ore.

The crushing and sorting area of the plant, which includes primary, secondary, and tertiary crushing and screening, as well as ore sorting, is designed to operate with an availability of 65%. From the crushed ore storage silo, 6,500 tpd at 92% plant availability are then fed to the concentrator, which includes grinding mills, desliming, magnetic separation and flotation circuits, which make up the concentrator portion of the plant. The concentrator operates on a 24-hour per day and 7 days per week basis.

The expansion circuit provides additional operational flexibility including:

| · | 15,000 tonne live capacity within the crushed ore stockpile. Additional capacity is available with inclusion of a loader within the crushed ore dome and the existing crushed ore storage for longer outages. |

| · | The crushed ore storage dome can feed both the existing and expansion circuits which may improve the scheduling of planned outages while minimising plant downtime. |

For the purposes of this Scoping Study, an overall plant availability factor of 92% has been adopted for the expansion case. This reflects the operational strategy whereby maintenance shutdowns are scheduled on a staggered basis, allowing one processing line to continue operating while the alternate line undergoes planned maintenance. Further detailed availability analysis will be undertaken in the next phase.

Ramp-up for the expansion circuit is undertaken over a 9-month period with 60% of aggregate concentrate production over this period. Impacts for the existing circuit are anticipated to be minimal and included within the ramp up concentrate assumptions. Expansion to 6,500 tpd will require a series of studies and authorisations to be issued by government authorities. There is no indication at this time that these authorisations will not be obtained.

Figure 10 – Preliminary Layout – Expansion

|

|

Sayona Mining Limited |

Tailings Storage Facilities

The mine plan for NAL forecasts mining operations continuing beyond the capacity of the existing Tailings Storage Facility (TSF) No. 1. The current site includes a conventional tailings pond (TSF-1) as part of the tailings management infrastructure, located 500m south of the processing plant.

A second TSF (TSF-2) is required to encompass the current base case LOM. TSF-2 was originally envisaged as a dry tailings deposition management concept. After conducting an analysis of different mining residue disposal technologies, the choice of wet disposal was previously confirmed for the existing NAL operation over the duration of the existing LOM.

The recently published Ore Reserves require new waste management facilities (e.g., waste rock and tailings) to accommodate the volumes associated to these new reserves. The additional tailings will be managed in a new tailings facility (TSF-3). A preliminary location and design for TSF-3 has been undertaken for the purposes of the scoping study. The final location of the tailings and waste rock management facilities will be confirmed through a detailed Variant Analysis that will be conducted in the next phase of study. There is no indication at this time that it will be unfeasible to obtain the necessary approvals from government authorities.

Total tailings to be managed by the facilities over LOM is 41.8Mt.

Results from previous geochemical studies showed that waste rock is neither Acid Rock Draining (ARD), nor Metal Leaching (ML); therefore, no indication that special requirements are required by the Ministère de l’Environnement, de la Lutte contre les Changements Climatiques, de la Faune et des Parcs (MELCCFP) for stockpiling and water management.

Additional tailings and waste rock characterisation testwork is planned during the next phase of the project.

The plan view for the tailings storage facilities are displayed in Figure 11.

Figure 11 – Plan view – Preliminary Tailings storage facility locations

|

|

Sayona Mining Limited |

Infrastructure

Site infrastructure at the NAL operation is established and operating, the expansion requires additional infrastructure as outlined below.

The current site infrastructure includes:

| · | Open pit. |

| · | Processing plant and ROM ore pad. |

| · | Waste rock and overburden storage areas (WR#2, WR#3 & OB#1). |

| · | Conventional tailings pond (TSF-1). |

| · | TSF-2 (future). |

| · | Administration facility, including offices and personnel changing area (dry). |

| · | Workshop, tyre change, warehouse, and storage areas. |

| · | Fuel, lube, and oil storage facility. |

| · | Reticulated services, including power, lighting and communications, raw water and clean water for fire protection, process water and potable water, potable water treatment plant, sewage collection, treatment, and disposal. |

| · | Crushed ore dome. |

| · | Access roads. |

| · | Water management infrastructures. |

Additional infrastructure required for the expansion include:

| · | Expansion of the open pit. |

| · | New crushing and ore sorting circuit including crushed ore dome. |

| · | New grinding, magnetic separation and flotation. |

| · | Concentrate dewatering filters. |

| · | Tailings thickening. |

| · | Concentrate storage building. |

| · | Additional mechanical workshop, operation room, and supervisor offices. |

| · | Additional tailings management facilities: |

| o | TSF#3. |

| o | Additional waste stockpile area (HS#4) and associated water management structures. |

Multi-service buildings:

| · | Additional offices, engineering, administration etc. |

| · | Additional capacity for the mine change rooms, showers and ablutions. |

| · | Additional mine offices and mining dispatch control room. |

Mine maintenance shop:

| · | Two additional mining service bays. |

| · | Additional warehouse storage. |

| · | Additional supervisory and administration offices. |

| · | Wash bay. |

Auxiliary buildings:

| · | Warehouse domes. |

| · | Relocation of the mine fuel depot and additional capacity. |

|

|

Sayona Mining Limited |

Power Supply and Distribution

Power for the Project is taken at 120 kV from transmission line No. 1301, which is owned by the provincial utility company, Hydro Québec. This transmission line runs on the west side of the Project site and the spur feeding the plant is approximately 600m long.

The expansion infrastructure will be powered with electrical capacity originally allocated for the carbonate plant.

Water Management

The Project has no infrastructure in place to draw water from any external source for processing purposes and the expansion does not require the installation of water drawing infrastructure. Groundwater and run-off from the mine pit is recovered for use as fresh water in the process plant. All water used in the concentrator is recycled internally or is reclaimed from the tailings ponds, where levels must be managed seasonally.

To support the NAL expansion, a site-wide water balance was performed based on major infrastructure expansion footprint. The water balance shows an excess of water on the overall site for all stages of development. Water infrastructure (ponds and ditches) was added to the project to ensure proper environmental and operational water management.

Environment and Social

The NAL project has existing environmental permits for mining operations including the disposal of waste rock, storage of tailings, drawing water for process and the release of treated water to the environment. Sayona is currently operating in accordance with existing approvals by provincial and federal authorities. The concentrator has approval for throughput of 4,500 tpd.

The extension of mineral resources under Lac Lortie will require the approval from the Ministère des Ressources naturelles et des Forêts (MRNF) for the expansion of the existing mining lease. The MRNF will require an update to the Closure and Rehabilitation Plan and the update of the approval by the Ministère de l’Environnement, de la Lutte contre les Changements Climatiques, de la Faune et des Parcs (MELCCFP) of the environmental authorisation. The two authorisations must be obtained before the extension mining lease can be granted. Also, the process for authorising the extension of the mining lease includes consultation with the Communities of Interest (COI). This process includes public consultations, including First Nations, that will allow the communities to provide feedback regarding the expansion project.

The Department of Fisheries and Oceans Canada (DFO) will require that effects of mining activities on the fish habitat in Lac Lortie be offset by an approved habitat compensation project. Consultation will be undertaken with First Nations in design of the compensation project.

The NAL site is located in a recreational zoning class of the Municipality of La Corne as defined under local by-laws. This zoning allows mining activities however, consultation will be undertaken to ensure community acceptance with the aim to minimise impact on local recreational and tourism activities. Any possible effect on the Harricana moraine will be documented.

The increase in ore processing capacity is below the threshold for triggering both provincial and federal impact assessments. Both the plant’s processing capacity and the footprint of the new mining infrastructure are below the 50% increase threshold allowed under Canadian law. The environmental impact of additional mining activities (tailings management facilities, mine waste rock dump, etc.) will be evaluated during the next phase of studies.

A former tailings facility, under the responsibility of the Province of Quebec since 2010, is located within the mineral resource footprint. The management of tailings from previous mining operations are subject to specific conditions, depending on their geochemical characteristics. The MRNF has stated in 2010 that these tailings do not show acid rock drainage potential. However, the MELCCFP requirements for geochemical characterisation have increased since 2020 and a more comprehensive characterisation will be required.

|

|

Sayona Mining Limited |

Finally, the responsibility for historical infrastructure will be assessed and discussed with the MRNF as additional resources beyond current permits are accessed.

Project Schedule and Implementation

A preliminary project schedule was developed for the scoping study and is shown in Figure 12.

The project has identified an opportunity to accelerate the project timeline by moving directly to the Feasibility stage. This opportunity is currently under consideration and is not yet reflected in the project timeline.

Further development and detailed execution planning will be undertaken in the next phases.

Figure 12 – Indicative timeline

|

|

Sayona Mining Limited |

Capital (CAPEX) and Sustaining (SUSEX) Expenditures

Table 7 presents a summary of the capital costs including contingencies in millions of Canadian dollars ($M).

Table 7 – Summary of total expansion CAPEX by area

|

Area Currency: CAD |

CAPEX $M |

|||

| Direct Costs | ||||

| Infrastructure and Facilities | $ | 11.0 | ||

| Process Plant | $ | 172.8 | ||

| Indirect Costs | ||||

| Owner’s cost (including EPCM) | $ | 49.2 | ||

| Indirect costs | $ | 48.7 | ||

| TOTAL CAPEX | $ | 281.7 | ||

| Contingency (30%) | 84.5 | |||

| Total | $ | 366.2 | ||

Basis of Estimate

The estimate prepared is Class 5 Capital Cost Estimate (CCE) in line with the Association for the Advancement of Cost Engineering (AACE) with a nominal target accuracy range of -20/+35%. The level of estimation is supported by vendor quotation for major equipment and previous installation cost data at NAL for some items.

The estimate was developed from a combination of factoring from similar projects and more detailed estimating calculation in some areas. Equipment and material cost factors have been sourced from projects of similar scope and design with costs escalated where necessary.

The estimate was based on the following general approach:

| · | Major mechanical equipment costs for the expansion were obtained from vendor budget quotation. |

| · | Secondary and minor equipment was sourced from an in-house database for similar projects. |

| · | An estimate base date of July 2025. |

| · | An Estimate Base Currency of Canadian Dollars (CAD). |

| · | Project executed through EPCM delivery model. |

| · | All costs exclusive of escalation beyond the base date. |

| · | Exclusive of taxes. |

|

|

Sayona Mining Limited |

Sustaining Capital

Sustaining capital for the base case and expansion project was estimated using current operational budgets and factors of direct plant cost. Tailings SUSEX costs were derived using previous estimates and quantities applied over preliminary facility designs. The Expansion case includes additional sustaining costs for a second concentrator which are offset by the shorter mine life of this scenario.

Table 8 – Summary of sustaining capital

|

Area Currency: CAD |

Base $M | Expansion $M | ||||||

| TOTAL SUSTAINING CAPITAL | $ | 512 | $ | 517 | ||||

Operating Costs

The operating cost estimate (OPEX) for the base and expansion cases are calculated from NAL operating budgets. The base case includes a design feed rate of 4,200 tpd while the expansion case accounts for the associated increase in feed to 6,500 tpd.

The variation in costs under the base case relative to prior figures is primarily attributable to foreign exchange translation effects, inflation in labour and consumables, and the inclusion of cost, insurance and freight costs (CIF) under customer offtake arrangements. These cost increases have been partially offset by the inclusion of operational synergies.

The OPEX was developed in accordance with the requirement of a scoping level study with a nominal accuracy range of ±20%. The level of estimation is supported by actual operational information including salaries, consumables, maintenance costs and established contracts and therefore are more precise given this is a brownfield project.

The OPEX results represent annual steady state operations therefore no escalation or inflation is included within the estimate. A summary of the average LOM OPEX costs (all values in CAD$) and comparison between scenarios can be found in Table 9. OPEX costs are evaluated commencing as of Fiscal Year 2027.

Table 9 – Total OPEX Summary

| Item | Units | Base | Expansion | |||||||

| LOM | Yrs | 35 | 24 | |||||||

| Milling Rate | Mt/yr | 1.3 | 2.0 | |||||||

| Mining Cost (ore & waste) | C$/t mined | 8.9 | 7.6 | |||||||

| Processing Cost | C$/t milled | 42.2 | 35.4 | |||||||

| G&A | C$/t milled | 16.7 | 13.4 | |||||||

| Transport Cost | C$/t conc | 141.7 | 123.8 | |||||||

| Total OPEX | C$M | 7,150 | 6,062 | |||||||

| C1 Cost Concentrate | C$/t conc | 954 | 799 | |||||||

Principal drivers influencing C1 Cost reduction are driven by the following:

| · | 20% reduction in G&A per tonne processed resultant from relatively fixed costs between scenarios with adjustments required for additional head count, insurance and employee benefits. |

|

|

Sayona Mining Limited |

| · | 13% reduction in shipping costs per tonne concentrate directly related to increased movement of material and improvements in material handling on site with new concentrate loading facility reducing on site tramming of material and material loadout. |

| · | 16% reduction in Processing cost driven mostly by relative low increase in head count required (34% relative to plant increase of 55% capacity), addition of line power reticulation replacing diesel generators on site for pumping. Considering new crushing circuit capable of feeding new and existing plant reduction in current pre-crush facility costs are considered. Power costs and reagents have no impact between the scenarios as same unit rates are used. |

| · | 15% reduction in mining costs are estimated based on increased volume, use of larger shovels in waste and benefits from fixed management and administration costs relative to increased tonnage for both contractor and owner costs. |

Labour

All mine, processing plant and administration site staff personnel work 10-hour shifts on a 4 on / 3 off basis. Contracted mine operations will work 12-hour shifts. For the processing plant, operations and maintenance crews will work two 12-hour shifts. There will be four shift crews rotating on a 7 on / 7 off schedule.

Staffing requirements are built as bottom-up and based off existing operations. The main increases in labour between the base and expansion case are summarised from operational site roles. The plant increase covers the most significant increase which is attributable to additional operators for grinding and floatation extensions as well as increased maintenance (mechanical / piping / electrical / instrumentation). Mine technical services are augmented to cover increased throughput, assay treatment and geology support. G&A costs are impacted by an increase in site support for Health and Safety, Environment and Increased Surface and Warehousing support.

Table 10 – Staff and Hourly Count (Sayona Employees)

| Area | Base | Expansion | Change (%) | |||||||||

| G&A | 59 | 70 | 19 | % | ||||||||

| Plant | 125 | 168 | 43 | % | ||||||||

| Mine | 40 | 51 | 28 | % | ||||||||

| Total | 224 | 289 | 29 | % | ||||||||

Power

Power is estimated from current power consumption with rates as per contracted supply with Hydro Quebec scaled for the additional throughput. Power is calculated to account for $2.0 / t processed for both scenarios. In further studies the benefits of a complete load study will allow for closer estimate of power savings given the expansion.

Reagents

Reagent costs are calculated from NAL’s current operating contracts with consumptions escalated for the additional throughput.

|

|

Sayona Mining Limited |

Market and Lithium Price

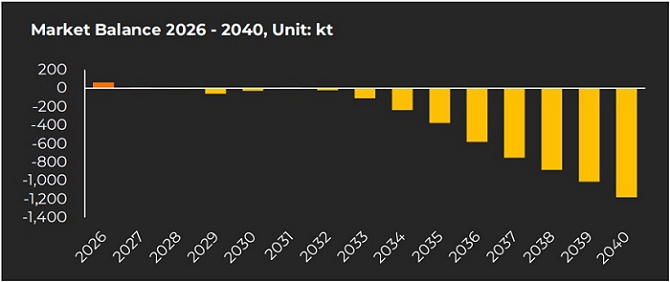

The lithium market is projected to enter a deficit from 2030 onwards. From this point onwards there is an ever-growing deficit which will lead to either demand destruction or yet-to-be identified new supply coming online to bridge the supply gap (Figure 13).

It is forecast that the emerging deficit will push up lithium carbonate prices to a peak level in 2030 before prices retreat to the long-term incentive price by 2034. These prices will be sufficient to incentivise new supply to catch up with demand.

Figure 13 – Lithium Market Balance Forecast 2026 – 2040

Forecast lithium product sale prices for the Benchmark Mineral Intelligence (BMI) Q1 2025 base case scenario are shown in Figure 14. The average sale price of 6% spodumene concentrate in the BMI analysis averages approximately US$1,271 (base) and US$1,393/t (high) between 2026 and 2040.

Figure 14 – Lithium Product Price Forecast 2026 – 2040 (Base Case)

The scoping study utilises BMI Q1 2025 high price scenario and varies over the LOM from US$1,320/t to US$1,925/t with an SC6 price of US$1,350 adopted for years past the 2040 forecast period.

|

|

Sayona Mining Limited |

Recent spodumene price movements have been noted, however the commencement of production timeline for NAL Expansion aligns with medium-term product pricing.

Financial Analysis

The main highlights of the Project’s financial analysis are presented in Table 11 and Table 12. Financial Analysis was performed commencing as of Fiscal Year 2027.

Table 11 – Main financial assumptions and results summary for the NAL Expansion Project

| Parameters | Base | Expansion | ||||||||

| Average Price 6% Li2O | USD$/t | $ | 1,387 | $ | 1,392 | |||||

| Life of mine | yrs | 35 | 24 | |||||||

| Total Waste | Mt | 337 | 336 | |||||||

| Total Ore | Mt | 47 | 47 | |||||||

| Strip Ratio | - | 7.1 | 7.1 | |||||||

| Average Annual ROM | Mt/y | 1.3 | 2.0 | |||||||

| Average Feed Grade | % Li2O | 1.11 | % | 1.11 | % | |||||

| LOM 5.4% Li2O Produced | Mt | 6.75 | 6.93 | |||||||

| LOM Average Annual 5.4% Li2O | kt/y | 193.0 | 288.9 | |||||||

| Average Annual 5.4% Li2O production | kt/y | 192 | 315 | |||||||

Table 12 – Project Economics

| Project Economics | Base | Expansion | ||||||||

| Exchange Rate | CAD/USD | 1.35 | 1.35 | |||||||

| Mining Cost (ore and waste) | C$/t mined | 8.9 | 7.6 | |||||||

| Process cost | C$/t milled | 42.2 | 35.4 | |||||||

| G&A | C$/t milled | 16.7 | 13.4 | |||||||

| Transport Cost | C$/t conc | 141.7 | 123.8 | |||||||

| Total OPEX | C$M | 7,150 | 6,062 | |||||||

| LOM C1 Cost Concentrate | C$/t conc | 954 | 799 | |||||||

| LOM AISC | C$/t conc | 1,154 | 974 | |||||||

| C1 Cost of Concentrate | C$/t conc | 935 | 759 | |||||||

| AISC | C$/t conc | 1,128 | 920 | |||||||

|

|

Sayona Mining Limited |

| Project Economics | Base | Expansion | ||||||||

| Total SUSEX | C$M | 512 | 517 | |||||||

| Total initial CAPEX | C$M | - | 366 | |||||||

| Net Cash Flow (pre-tax) | C$M | 3,584 | 4,626 | |||||||

| NPV (8%) (pre-tax) | C$M | 1,170 | 1,798 | |||||||

| NPV Expansion Only (8%) (pre-tax) | C$M | - | 628 | |||||||

| IRR Expansion (pre-tax) | % | - | 26.4 | % | ||||||

| Payback (pre-tax) | Months | - | 36 | |||||||

| Net Cash Flow (post-tax) | C$M | 2,411 | 3,249 | |||||||

| NPV (8%) (post-tax) | C$M | 805 | 1,284 | |||||||

| NPV Expansion Only (8%) (post-tax) | C$M | - | 479 | |||||||

| IRR Expansion (post-tax) | % | - | 26.4 | % | ||||||

| Payback (post-tax) | Month | - | 46 | |||||||

Notes:

| · | All costs and sales are presented in constant 2025 CAD, with no inflation or escalation factors considered. |

| · | $M = millions of dollars. |

| · | The financial analysis was performed on existing Ore Reserves as outlined in this report. |

| · | The valuation calculations are unlevered. |

| · | The average metallurgical recovery over the LOM is 71.2% for the expansion and 69.2% for the base case due to improvement in the mill flowsheet specifically attributable to ore-sorting and WHIMS improvements. |

| · | Plant availability a is calculated at 92% given the flexibility introduced in the circuit and improvements in the design versus the base case plant availability of 89%. |

| · | Tonnes of concentrate are presented as dry metric tonnes. |

| · | An exchange rate of 0.74 CAD/USD was fixed over the LOM for the Project. |

| · | The average 6% Li2O concentrate price is based on a market analysis from Benchmark Mineral Intelligence for Q1 2025 as described in the market section and varies over the LOM from US$1,320/t to US$1,925/t. |

| · | Average LOM SC6 pricing may vary between the cases due to longer mine life at the long term $1,350 price for the base case (2040 and beyond). |

| · | A discount rate of 8% was used for the base case and expansion scenarios. |

| · | Net Cash Flow and valuation calculations include investment tax credit on CAPEX. |

| · | The numbers have been rounded. Any discrepancy in the totals is due to rounding effects. |

There are other costs that have been considered in the Project’s financial analysis, including the following.

Closure Cost

Closure and rehabilitation costs include a post-closure monitoring/inspection program, engineering, contracts, supervision, reporting, removal of Project infrastructure, (i.e., ponds, buildings, electrical poles, tanks, roads, etc.), and site restoration activities as per the Project site restoration plan submitted to governmental agencies.

Closure cost estimate was updated from 2024 closure cost as accepted by Ministry using the same cost per unit. The concept of closure remains unchanged from the previous closure plan. Additional areas were considered for the reclamation of TSF#3, HS#4. Reserves closure cost also includes an additional amount for demolition and restoration of crushing and mill expansion.

Reclamation and closure costs for the Expansion Project have been evaluated to be $62.4M, increased from the $60.4M base case.

|

|

Sayona Mining Limited |

Other Environmental Costs

Other environmental costs related to the Project include:

| · | Compensation for loss of wetlands and water bodies |

| · | Compensation for loss of fish habitats |

| · | Compensation for loss of forest land |

The calculated total for these other environmental costs is $25.6M for the expansion scenario.

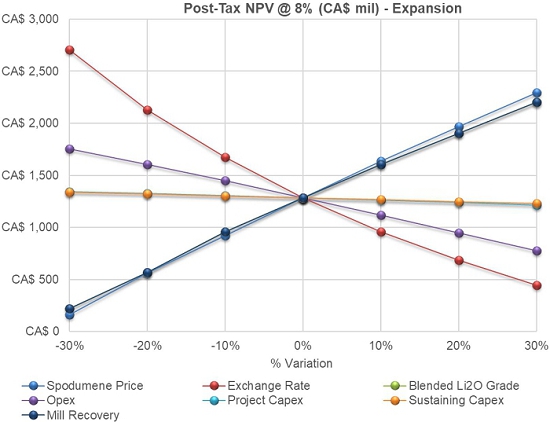

Sensitivity Analysis

A sensitivity analysis was conducted on the factors presented below:

| · | Spodumene Price |

| · | Exchange Rate |

| · | Blended Li2O Grade |

| · | Opex |

| · | Project Capex |

| · | Sustaining Capex |

| · | Mill Recovery |

Post-Tax NPV(8%) sensitivities range from -30% to +30% for all factors. The impact of the NPV (in CAD $M) outputs was tested at discount rate of 8%. The results of the sensitivity analysis are summarised in Figure 15.

Figure 15 – Sensitivity analysis on NPV (8%)

|

|

Sayona Mining Limited |

Funding

Funding requirements will be determined during future phases of the project. If the Company proceeds with the expansion, Sayona will consider available funding options including cashflows from existing production, new loan facilities, equity investments, strategic partners, offtake funding or other sources.

Risks and Opportunities

Project Risk Assessment

Principal risks on the Project relate to obtaining permits, social license in the Project footprint, capital escalation, and geotechnical information related to placing of infrastructure.

As the mitigations identified will be applied in subsequent phases, the likelihood of such risks will diminish or be removed.

Project Opportunities

There are several opportunities, including the potential for cost reduction opportunities, process recovery enhancements and design improvements. Specific examples of opportunities being investigated in the next phase include the potential for owner operator mining, optimisation of recovery, ore sorting performance optimisation, mill utilisation across the two trains along with cost synergies and optimisation. Federal and Provincial government incentives have the potential to reduce the cost of the project either by direct support or tax incentives, and this will be pursued further in future work.

Announcement authorised for release by Sayona’s Board of Directors.

About Sayona Mining

Sayona Mining Limited is a North American lithium producer (ASX:SYA; NASDAQ:ELVR; OTCQB:SYAXF), with projects in Québec, Canada, United States, Ghana and Western Australia.

In Québec, Sayona’s assets comprise North American Lithium (100%) and a 60% stake in the Moblan Lithium Project in northern Québec. In the United States, Sayona has the Carolina Lithium project (100%) and in Ghana the Ewoyaa Lithium project (22.5%) in joint venture with Atlantic Lithium.

In Western Australia, the Company holds a large tenement portfolio in the Pilbara region prospective for gold and lithium.

For more information, please visit us at www.sayonamining.com.au

References to Previous ASX Releases

| · | Sayona ASX announcement “NAL Resources and Reserves Increases” dated 27 August 2025 |

| · | Sayona ASX announcement “Quarterly Activities Report - June 2025” dated 30 July 2025 |

| · | Sayona ASX announcement “Quarterly Activities Report - March 2025” dated 28 April 2025 |

| · | Sayona ASX announcement “Quarterly Activities Report - December 2024” dated 31 January 2025 |

| · | Sayona ASX announcement “Quarterly Activities Report - September 2024” dated 24 October 2024 |

| · | Sayona ASX announcement “Quarterly Activities/Appendix 5B Cash Flow Report” dated 25 July 2024 |

| · | Sayona ASX announcement “Quarterly Activities/Appendix 5B Cash Flow Report” dated 26 April 2024 |

|

|

Sayona Mining Limited |

Competent Person’s Statement

The information on Mineral Resources and Ore Reserves are extracted from the announcement entitled “NAL Resources and Reserves Increases” published on the ASX on 27th August 2025 and is available to view on the Sayona’s website or on the ASX. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and all material assumptions and technical parameters continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements

The information in this announcement and the ASX release dated 27th August 2025 that relates to Mineral Resources for the NAL project is based on and fairly represents information compiled by Mrs Emilie Gosselin, a member of the Ordre des Ingénieurs du Québec (OIQ). Mrs Gosselin is a full-time employee of BBA Inc. Mrs Gosselin has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which she is undertaking to qualify as a Competent Person as defined in the JORC Code (2012 Edition) of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves.” The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements.

The information in this announcement and the ASX release dated 27th August 2025 relating to Ore Reserves for the North American Lithium project is based on, and fairly represents, information and supporting documentation prepared by Mr. Tony O’Connell an independent consultant employed by Optimal Mining Solutions Pty Ltd and is a member of the Australasian Institute of Mining and Metallurgy (AusIMM). Mr O’Connell has sufficient experience which is relevant to the type of deposits and mining method under consideration and to the activity which has been undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements.

Forward Looking Statements

This ASX release contains certain forward-looking statements. Such statements include, but are not limited to, statements relating to “reserves” or “resources”. Forward-looking statements are based on certain assumptions and involve known and unknown risks, uncertainties and other factors, many of which are beyond Sayona’s control. Actual events or results may differ materially from the events or results expressed or implied in any forward-looking statement. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such forward-looking statements.

No representation, warranty, or guarantee, express or implied, is made by the Company, its directors, officers, employees, advisers, or agents that any forward-looking statement contained in this ASX release will be achieved or prove to be correct. Investors are cautioned not to place undue reliance on such statements. Except as required by law or the ASX Listing Rules, the Company undertakes no obligation to update any forward-looking statements after the date of this report to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

For more information, please contact:

Andrew Barber

Investor Relations

Ph: +617 3369 7058

|

|

Sayona Mining Limited |

Exhibit 99.2

ASX:SYA • NASDAQ:ELVR • OTCQB:SYAXF Elevra Lithium The Merger of Piedmont and Sayona SEPTEMBER 2025 Exhibit 99.2 Contents ELEVRA LITHIUM 2 Introduction 01 Corporate Overview 02 Synergies & Progress 03 Resource Base & Operations 04 Growth Projects 05 Strategy & Market Outlook 06 Financials & Guidance 07 Appendix 08

01 Introduction

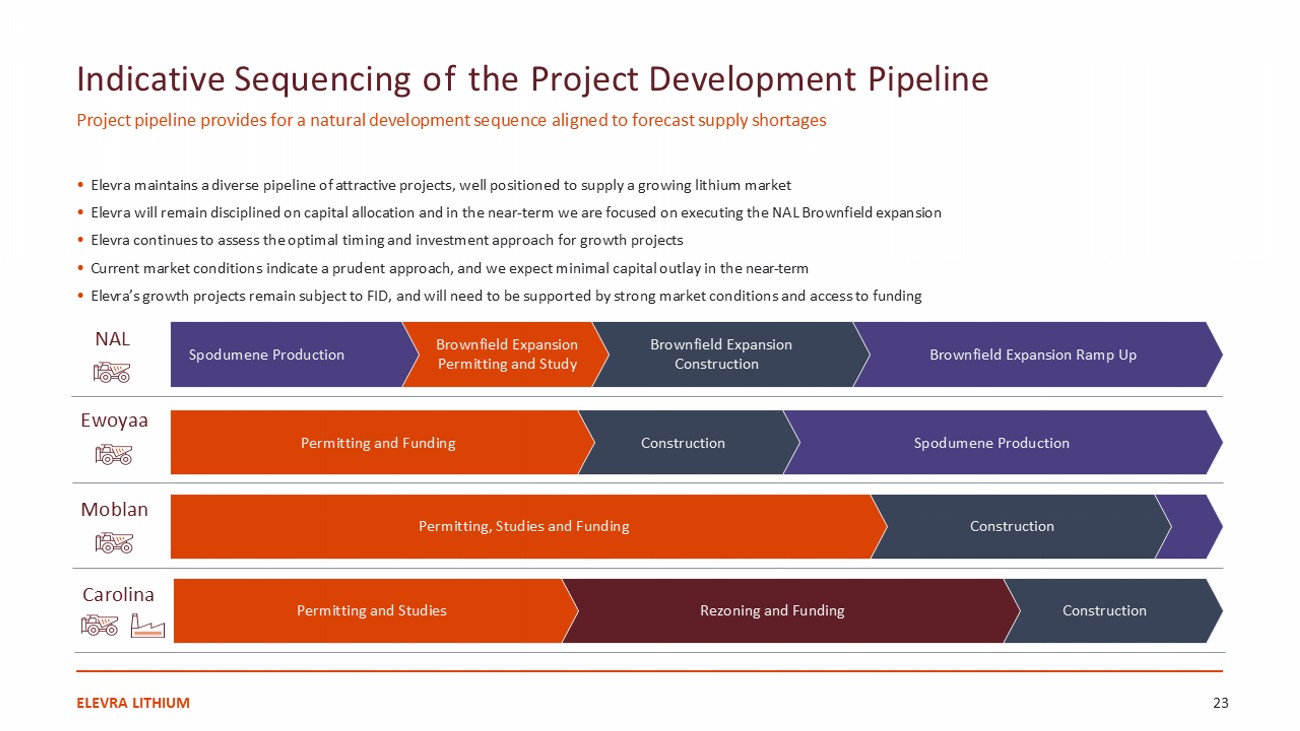

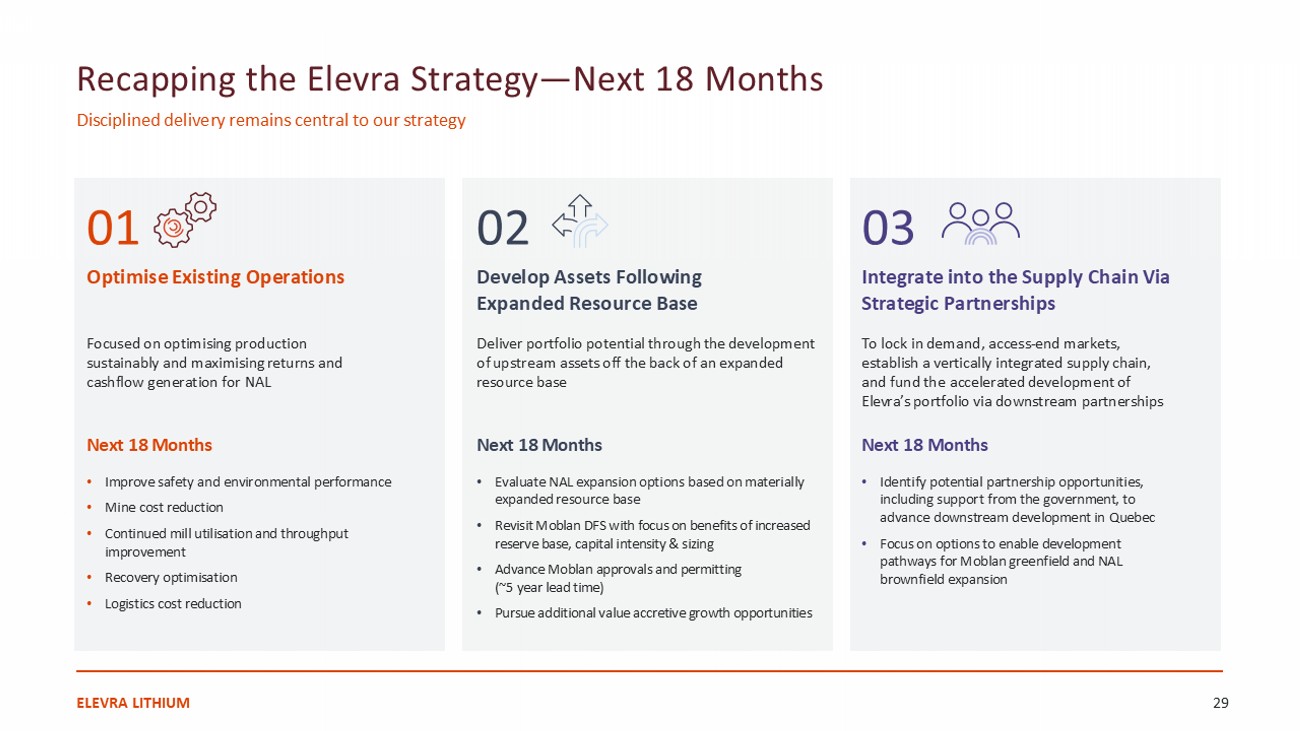

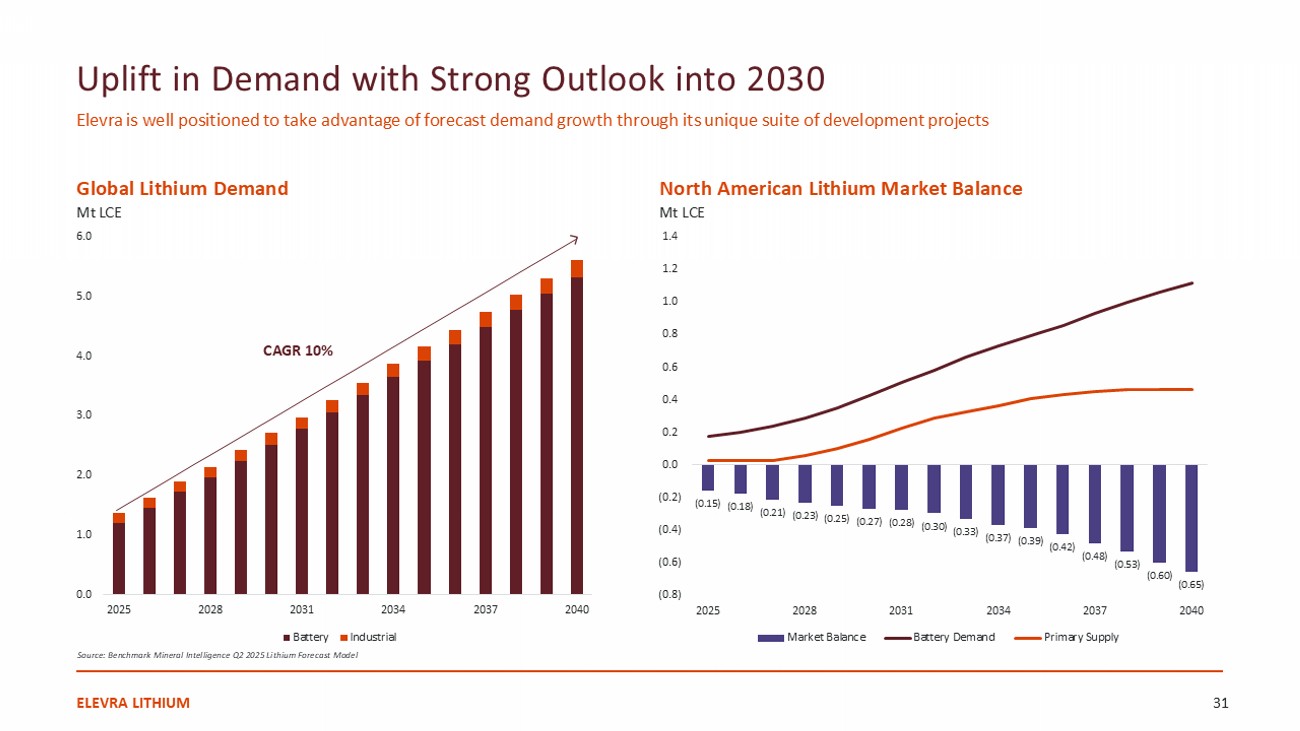

#1 North American hard rock pure - play lithium producer. Significant combined lithium Ore Reserve Estimate of 106Mt @ 1.15% Li 2 O and M&I Mineral Resource estimate totalling 183Mt @ 1.16% Li 2 O 1 . Improved strategic relevance to global battery and EV supply chains. Aligns economic interests in pursuing NAL B rownfield expansion. Significantly strengthened balance sheet to support growth pipeline. Enhanced portfolio optionality to pursue growth. Potential to deliver into different supply - chain /products in a highly dynamic market. Consolidated North American Lithium (“NAL”) offtake economics. Complementary technical capabilities. Unified ownership structure enhancing scope for project optimisation. Material logistics, procurement and marketing synergies. Recapping the Merger Strategic Rationale Unlocking synergies, strengthening our market position and delivering long term value Scale Optimisation Growth 1. Combined spodumene ore reserve estimates and mineral resource estimates (in the measured and indicated category, inclusive of reserves and exclusive of inferred resources). Ore reserve and mineral resource estimates reported in accordance with the JORC code. Metrics as reported and shown on a net attributable basis following updated NAL and Moblan announcements in August 2025. Refer to the Appendix for supporting data. Strategic Rationale ELEVRA LITHIUM 4 Introducting Elevra Lithium Electricity Evoking energy, power and the shift towards electrification.

Era Marking a new chapter in sustainable industry and clean energy. The meaning behind the name Elevate Upward momentum, leadership and innovation. Providing a secure and reliable supply of lithium to power the future ELEVRA LITHIUM 5 Integrity Respect Resilience Collaboration Execution Elevra represents a company driving the energy transition forward, rising as a leader in the lithium and critical minerals sector Our Core Values ELEVRA LITHIUM 6

02 Corporate Overview

Merger Update • ~168mm shares on issue post consolidation. • Elevra pro - forma cash position of ~A$227mm 1 as at 30 June 2025, including proceeds of A$69mm from RCF, excluding merger completion costs. • Name change to the new entity expected in late September 2025 subject to ASIC regulatory approvals. • Post name change ASX shares of the merged company will be listed on the ASX under the ticker ELV whilst ADS shares will trade on the NASDAQ under the ticker ELVR. North America’s Leading Hard - Rock Lithium Producer A larger, stronger operating business with quality development projects ELEVRA LITHIUM 8 1. AUDUSD = 0.65. 205 kdmt FY25 record spodumene concentrate produced Scale Elevra is North America’s largest hard - rock lithium producer. Growth NAL expansion study results confirms lower costs and strong returns. Strategically Positioned Exporting globally, supplying the battery materials EV chain.

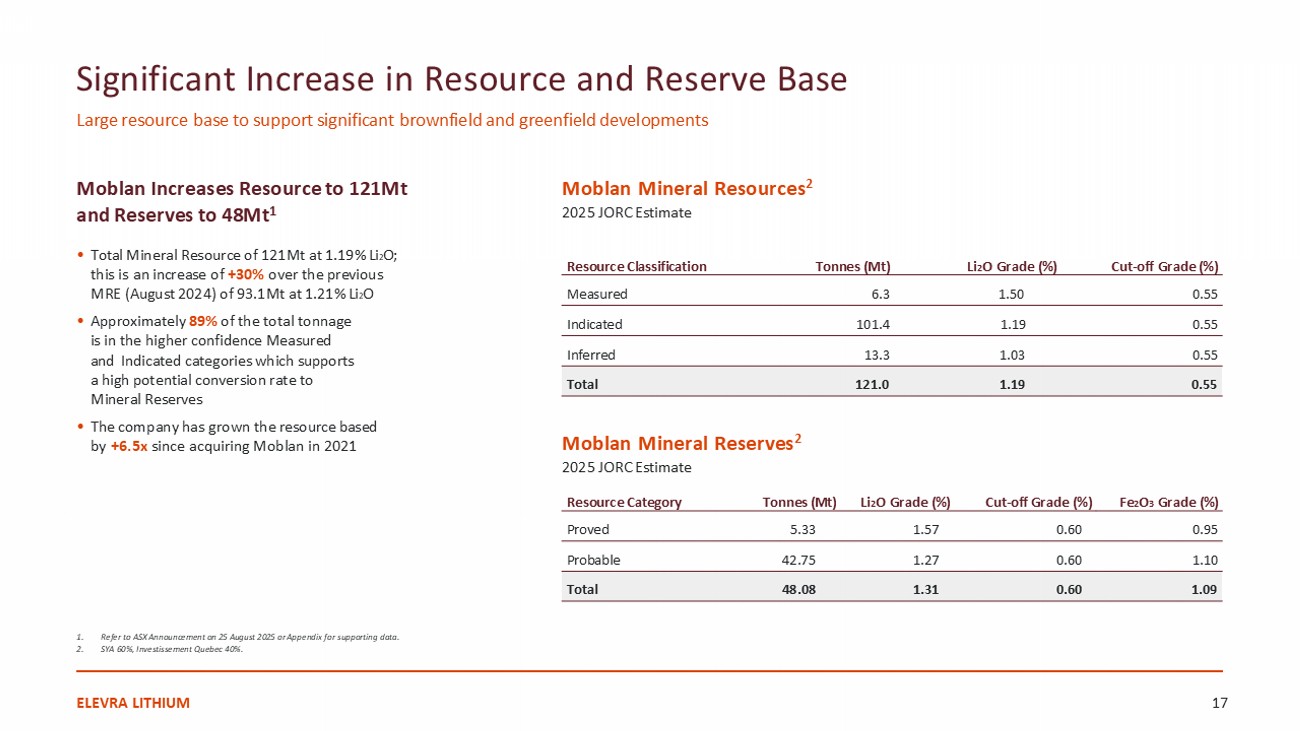

121Mt +35% resource at Moblan over previous Aug 2024 MRE A$1,198/t FY25 unit operating cost produced (FOB) 26.4% IRR (post - tax) from NAL expansion scoping study Highly Experienced and Diverse Board Structured to support and enable Elevra’s growth • Board of Directors of Elevra consists of a total of 8 members, including Dawne Hickton as Chair of the Board and Lucas Dow as Managing Director & CEO. • Highly experienced and diverse board representation with decades of combined executive experience. • The Audit and Risk Committee will be comprised of 4 Board members with Ms. Laurie Lefcourt serving as Chair, and the Nomination and Remuneration Committee will be comprised of 4 Board members with Ms. Dawne Hickton serving as Chair. Board of Directors Dawne Hickton Chair Allan Buckler Director Lucas Dow Managing Director & CEO Jeff Armstrong Director James Brown Director Laurie Lefcourt Director Christina Alvord Director Jorge M.

Beristain Director ELEVRA LITHIUM 9 Elevra’s Management Team Experienced team with strong operational and project development experience • Elevra is proud to introduce the company’s senior leadership team — a committed group of individuals ready to guide Elevra’s evolution and champion the company’s vision: to operate responsibly and grow sustainably. • The management team brings extensive experience and operational excellence in the lithium space.

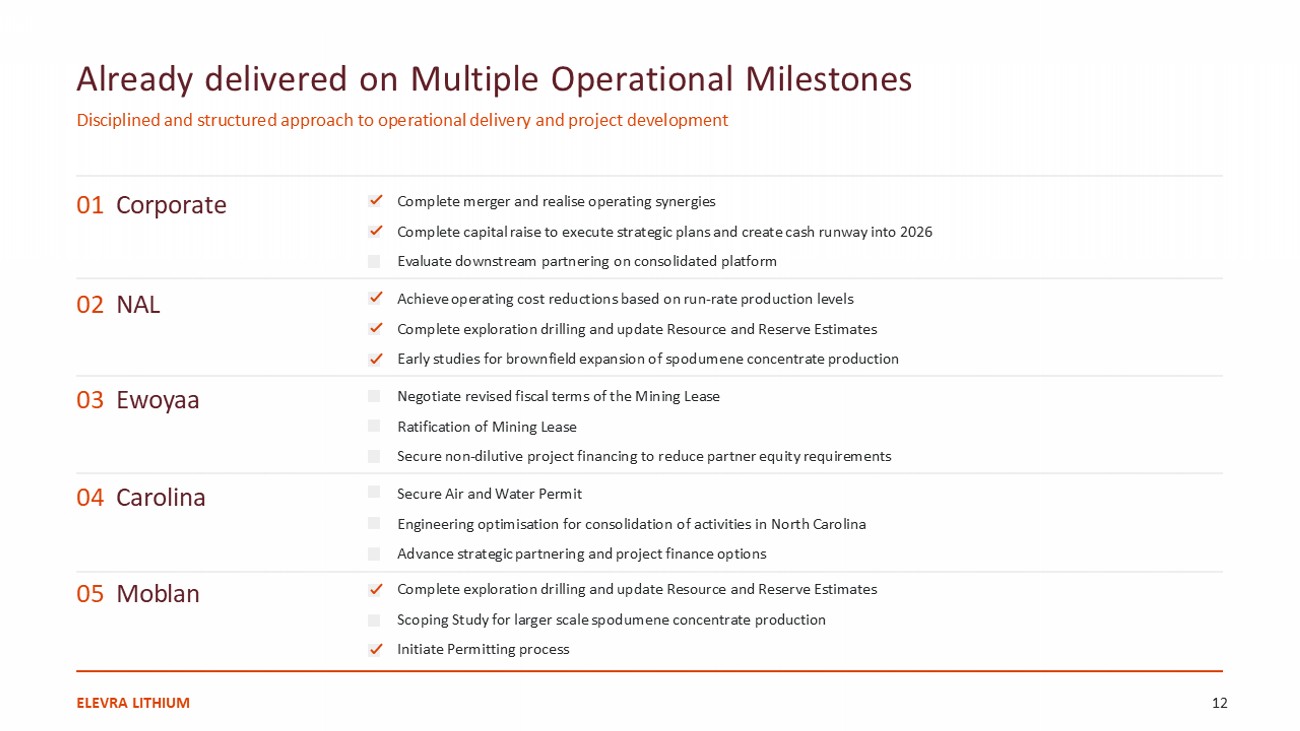

03 Synergies & Progress

Management Team Monique Parker Chief Sustainability Officer Dougal Elder Chief Financial Officer Lucas Dow Managing Director & CEO Dylan Roberts General Counsel & Company Secretary Sylvain Collard President Canada & Group COO Andrew Barber Chief Development & Investor Relations Officer Sandra Tremblay Chief People Officer Malissa Gordon Vice President, Government Affairs US ELEVRA LITHIUM 10 01 Corporate 02 NAL 03 Ewoyaa 04 Carolina 05 Moblan Already delivered on Multiple Operational Milestones Disciplined and structured approach to operational delivery and project development Complete merger and realise operating synergies Complete capital raise to execute strategic plans and create cash runway into 2026 Evaluate downstream partnering on consolidated platform Achieve operating cost reductions based on run - rate production levels Complete exploration drilling and update Resource and Reserve Estimates Early studies for brownfield expansion of spodumene concentrate production Negotiate revised fiscal terms of the Mining Lease Ratification of Mining Lease Secure non - dilutive project financing to reduce partner equity requirements Secure Air and Water Permit Engineering optimisation for consolidation of activities in North Carolina Advance strategic partnering and project finance options Complete exploration drilling and update Resource and Reserve Estimates Scoping Study for larger scale spodumene concentrate production Initiate Permitting process ELEVRA LITHIUM 12 Merger Synergies Good progress already made and on track to deliver synergies in excess of US$15M on an annual basis SG&A Optimisation of corporate and JV functions Reduction of corporate costs and overheads Consolidation of corporate offices Ability to re - route and share staff across various corporate functions and projects Asset Optimisation Enhanced management and technical expertise to expand production base NAL brownfield scoping study completed Reduce unit operating costs at NAL to improve cashflow generation through market cycles Strengthened positioning and balance sheet to optimise growth projects and pursue downstream supply - chain integration strategies Logistics and Procurement Removing de - synergies from previous NAL arrangement Marketing synergies through significantly expanded customer relationships Optimised project logistics and procurement to deliver lower operating cost profile Expected to be realised in 1H FY2026 ELEVRA LITHIUM 13