UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 15, 2025

HELIUS MEDICAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38445 | 36-4787690 |

(State or other jurisdiction |

(Commission | (IRS Employer |

| of incorporation or organization) | File Number) | Identification No.) |

|

642 Newtown Yardley Road, Suite 100 Newtown, PA |

18940 | |

| (Address of principal executive offices) | (Zip Code) |

Registrants’ telephone number, including area code: (215) 944-6100

N/A

(Former name of former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 | HSDT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter)

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

Securities Purchase Agreements

On September 15, 2025, Helius Medical Technologies, Inc. (the “Company”) entered into securities purchase agreements (the “Cash Securities Purchase Agreements”) with certain accredited investors (the “Cash Purchasers”) pursuant to which the Company agreed to sell and issue to the Cash Purchasers in a private placement offering (the “Cash Offering”) an aggregate offering of (i) either shares (the “Cash Shares”) of Class A common stock of the Company, par value $0.001 per share (the “Common Stock”) at an offering price of $6.881 per Cash Share (the “Per Share Cash Purchase Price”); and/or pre-funded warrants (the “Cash Pre-Funded Warrants”) to purchase shares of the Common Stock (the “Cash Pre-Funded Warrant Shares”) at an offering price of the Per Share Cash Purchase Price less $0.001 per Cash Pre-Funded Warrant, and (ii) stapled warrants (the “Cash Stapled Warrants” and, together with the Cash Shares and the Cash Pre-Funded Warrants, the “Cash Securities”) to purchase shares of the Common Stock (the “Cash Stapled Warrant Shares”) at an exercise price of $10.134 per Cash Stapled Warrant. In the Cash Offering, the Cash Purchasers will tender any of U.S. dollars, USDC or USDT (or a combination thereof) to the Company as consideration for the Cash Shares, Cash Stapled Warrants and Cash Pre-Funded Warrants.

Each of the Cash Pre-Funded Warrants is exercisable for one share of Common Stock at the remaining exercise price of $0.001 per Cash Pre-Funded Warrant Share, immediately exercisable by the registered holder, and may be exercised at any time following registration until all of the Cash Pre-Funded Warrants issued in the Cash Offering are exercised in full. Each Purchaser’s ability to exercise its Cash Pre-Funded Warrants in exchange for shares of Common Stock is subject to certain beneficial ownership limitations set forth therein. Each of the Cash Stapled Warrants is exercisable for one share of Common Stock at the exercise price of $10.134 per Cash Stapled Warrant Share, immediately exercisable upon registration, and may be exercised at any time following registration until the earlier of (i) 36 months after the closing of the Cash Offering or (ii) all of the Cash Stapled Warrants issued in the Cash Offering are exercised in full. If the daily volume-weighted average price of the Common Stock is above 200% of the share offering price during any 20 trading days in a 30-trading day period (the “Measurement Period”) and for each of the last five (5) consecutive trading days during the Measurement Period, at the election of the Company, the Company can require the Cash Stapled Warrants be exercised.

Additionally, on September 15, 2025, the Company entered into securities purchase agreements (the “Cryptocurrency Securities Purchase Agreements,” and together with the Cash Securities Purchase Agreements, the “Securities Purchase Agreements”) with certain accredited investors (the “Cryptocurrency Purchasers,” and together with the Cash Purchasers, the “Purchasers”) pursuant to which the Company agreed to sell and issue to the Cryptocurrency Purchasers in a private placement (the “Cryptocurrency Offering,” and together with the Cash Offering, the “Offerings”) (i) pre-funded warrants (“Cryptocurrency Pre-Funded Warrants” and, together with the Cash Pre-Funded Warrants, the “Pre-Funded Warrants”) to purchase shares of Common Stock (“Cryptocurrency Pre-Funded Warrant Shares” and, together with the Cash Pre-Funded Warrant Shares, the “Pre-Funded Warrant Shares”) at an offering price of $6.881 less $0.001 and (ii) stapled warrants (the “Cryptocurrency Stapled Warrants,” and together with the Cash Stapled Warrants, the “Stapled Warrants”) to purchase shares of Common Stock (the “Cryptocurrency Stapled Warrant Shares,” and together with the Cash Stapled Warrant Shares, the “Stapled Warrant Shares”) at an exercise price of $10.134 per Cryptocurrency Stapled Warrant. In the Cryptocurrency Offering, the Cryptocurrency Purchasers will tender either Unlocked SOL tokens or Locked SOL tokens to the Company as consideration for the Cryptocurrency Pre-Funded Warrants and the Cryptocurrency Stapled Warrants.

The exercise of the Cryptocurrency Pre-Funded Warrants and Cryptocurrency Stapled Warrants into Cryptocurrency Pre-Funded Warrant Shares and Cryptocurrency Stapled Warrant Shares, respectively, is subject to stockholder approval (“Stockholder Approval”) and such warrants will not be exercisable for Common Stock until such Shareholder Approval is received. Pursuant to the Cryptocurrency Securities Purchase Agreement, the Company will hold a special meeting of stockholders to obtain Stockholder Approval as soon as practicable after the closing date of the Offerings.

Each of the Cryptocurrency Pre-Funded Warrants is exercisable for one share of Common Stock at the exercise price of $0.001 per Cryptocurrency Pre-Funded Warrant Share, immediately exercisable following Stockholder Approval (the “Effective Date”), and may be exercised at any time on or after the Effective Date until all of the Cryptocurrency Pre-Funded Warrants issued in the Offerings are exercised in full. Each Cryptocurrency Purchaser’s ability to exercise its Cryptocurrency Pre-Funded Warrants in exchange for shares of Common Stock is subject to certain beneficial ownership limitations set forth therein. Each of the Cryptocurrency Stapled Warrants is exercisable for one share of Common Stock at the exercise price of $10.134 per Cryptocurrency Stapled Warrant Share, immediately exercisable on or after the Effective Date, and may be exercised at any time on or after the Effective Date until the earlier of (i) 36 months after the closing of the Cryptocurrency Offering or (ii) all of the Cryptocurrency Stapled Warrants issued in the Cryptocurrency Offering are exercised in full. If the daily volume-weighted average price of the Common Stock is above 200% of the share offering price during the Measurement Period and for each of the last five (5) consecutive trading days during the Measurement Period, and subject to election and notice by the Company, the Company can require the Cryptocurrency Stapled Warrants be exercised.

The Common Stock, the Pre-Funded Warrants, the Pre-Funded Warrant Shares, the Stapled Warrants, and the Stapled Warrant Shares are being offered in reliance upon the exemption from the registration requirement of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereof and/or Rule 506(b) of Regulation D promulgated thereunder, and applicable state securities laws. The issuance of the Common Stock, the Pre-Funded Warrants, the Pre-Funded Warrant Shares, the Stapled Warrants, and the Stapled Warrant Shares have not been registered under the Securities Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

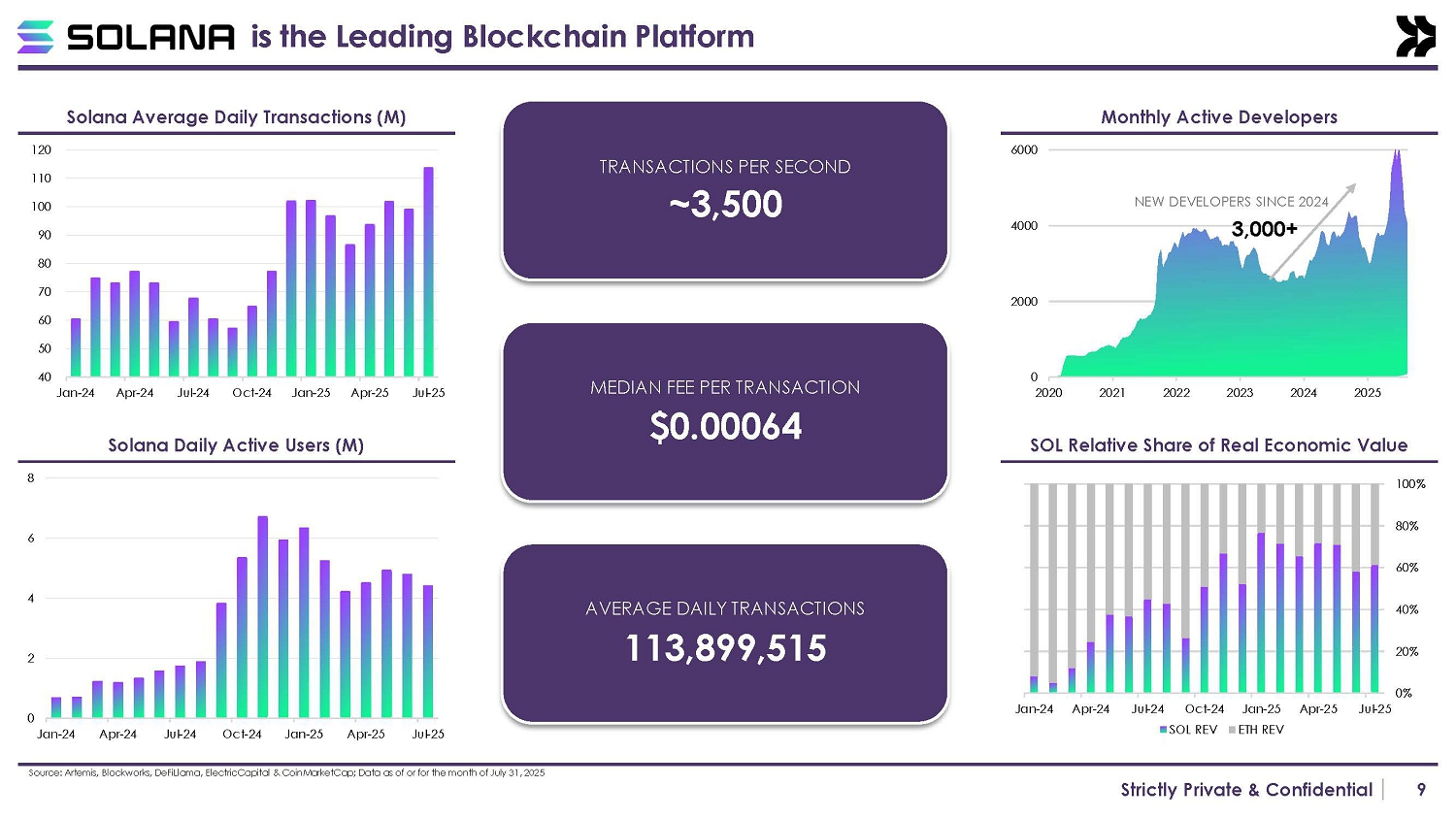

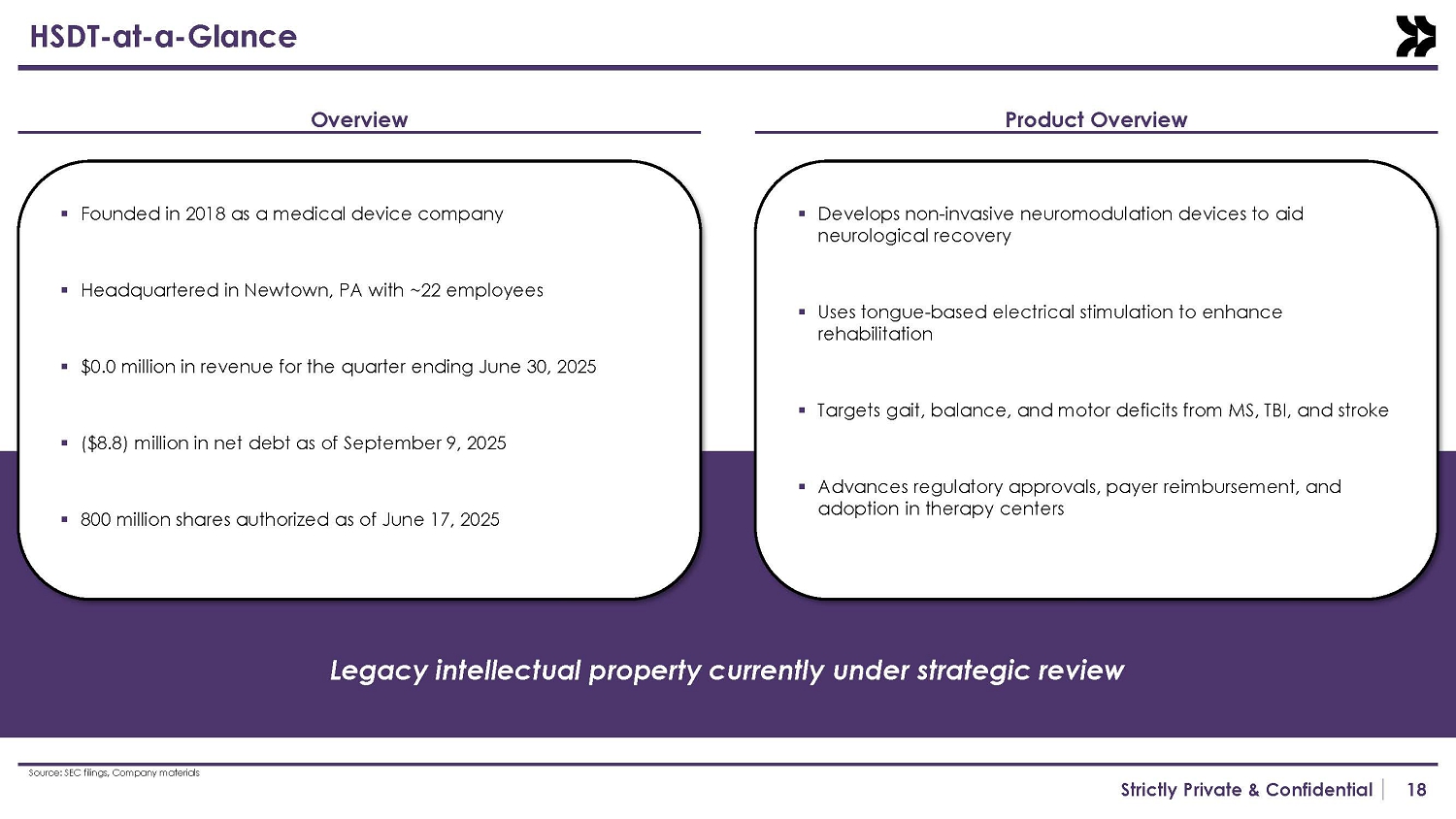

The closing of the Offerings is expected to occur on or about September 18, 2025, subject to the satisfaction of customary closing conditions. The Company intends to use the net proceeds from the Offerings to fund the acquisition of SOL, the native cryptocurrency of the Solana Foundation blockchain, through open market purchases only and the establishment of the Company’s Solana treasury operations, as well as for working capital, general corporate purposes and to pay all transaction fees and expenses related thereto. The Company will not use the net proceeds from the Offerings: (a) for the redemption of any outstanding Common Stock or Common Stock equivalents of the Company, (b) for the settlement of any outstanding litigation or (c) in violation of the Foreign Corrupt Practices Act of 1977, as amended or the Office of Foreign Assets Control of the U.S. Treasury Department regulations.

The Securities Purchase Agreements contain customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company, other obligations of the parties and termination provisions. Additionally, pursuant to the Purchase Agreements, the Company agreed to use commercially reasonable efforts to file a registration statement with the U.S. Securities and Exchange Commission, within 30 days of the closing of the Offering registering the resale of the Common Stock sold in the Offering, the Pre-Funded Warrants, the Pre-Funded Warrant Shares, the Stapled Warrants, the Stapled Warrant Shares, and certain securities to be issued to the Company’s strategic advisor.

Each of the Cash Purchasers have agreed to not to sell, transfer, pledge, hedge, or otherwise dispose of any Cash Securities until the resale registration statement is declared effective (the “Effectiveness Date”), and with respect to 50% of the Cash Securities, until 30 calendar days following the Effectiveness Date (the “PIPE Lock-Up Period”), except with the Company’s prior written consent and subject to certain customary exceptions. Each of the Cryptocurrency Purchasers have agreed to not to sell, transfer, pledge, hedge, or otherwise dispose of any Cryptocurrency Securities during the PIPE Lock-Up Period, except with the Company’s prior written consent and subject to certain customary exceptions.

The foregoing summaries of the Cash Pre-Funded Warrants, Cryptocurrency Pre-Funded Warrants, the Cash Stapled Warrants, the Cryptocurrency Stapled Warrants, the Cash Purchase Agreement, the Cryptocurrency Purchase Agreement and the PIPE Lock-Up Agreement, do not purport to be complete and are qualified in their entirety by reference to the complete text of those agreements, which are attached hereto as Exhibits 4.1, 4.2, 4.3, 4.4, and 10.1, 10.2 and 10.3, respectively, to this Current Report on Form 8-K (this “Current Report”) and are hereby incorporated by reference into this Item 1.01.

Advisory Agreements

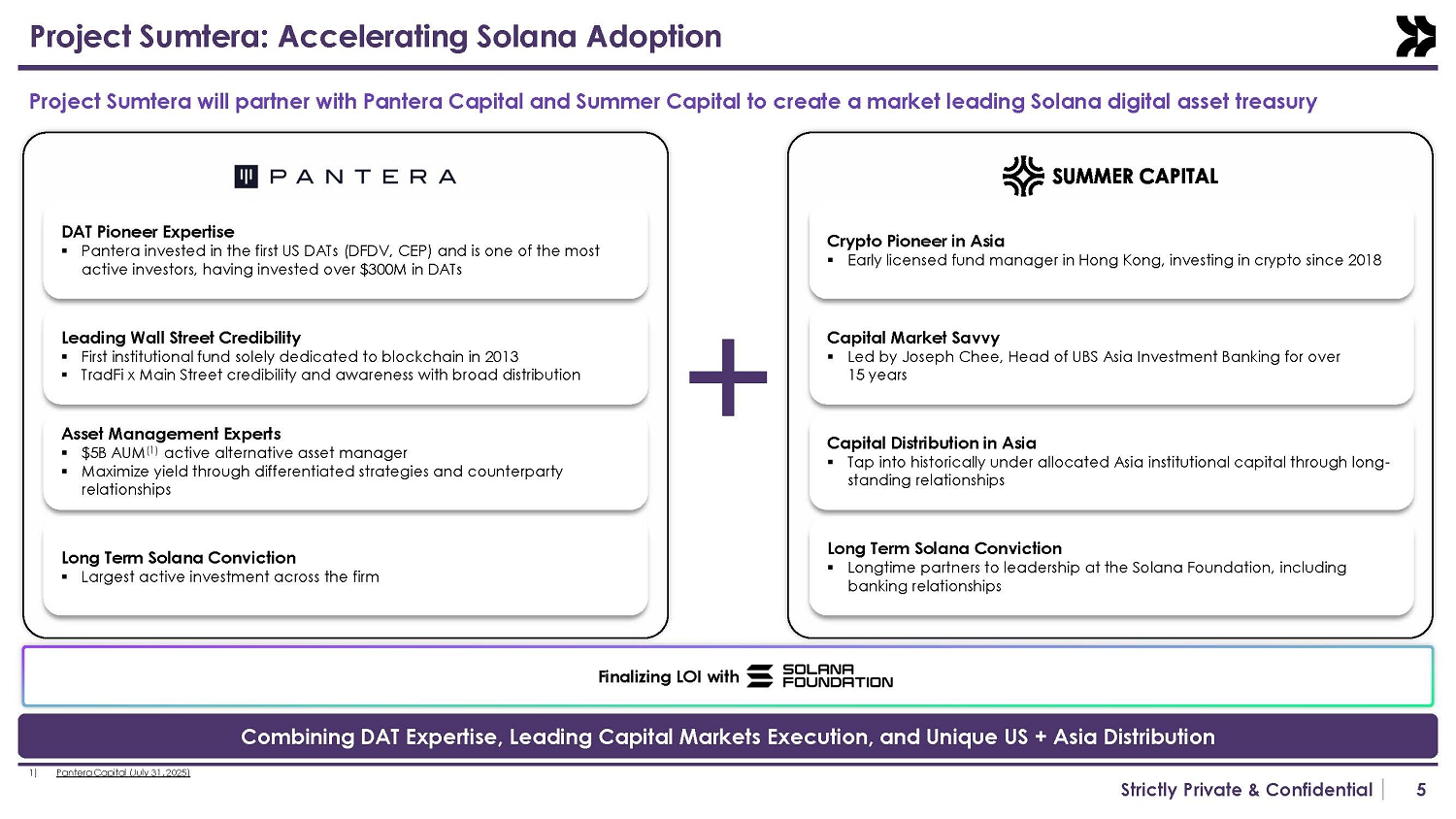

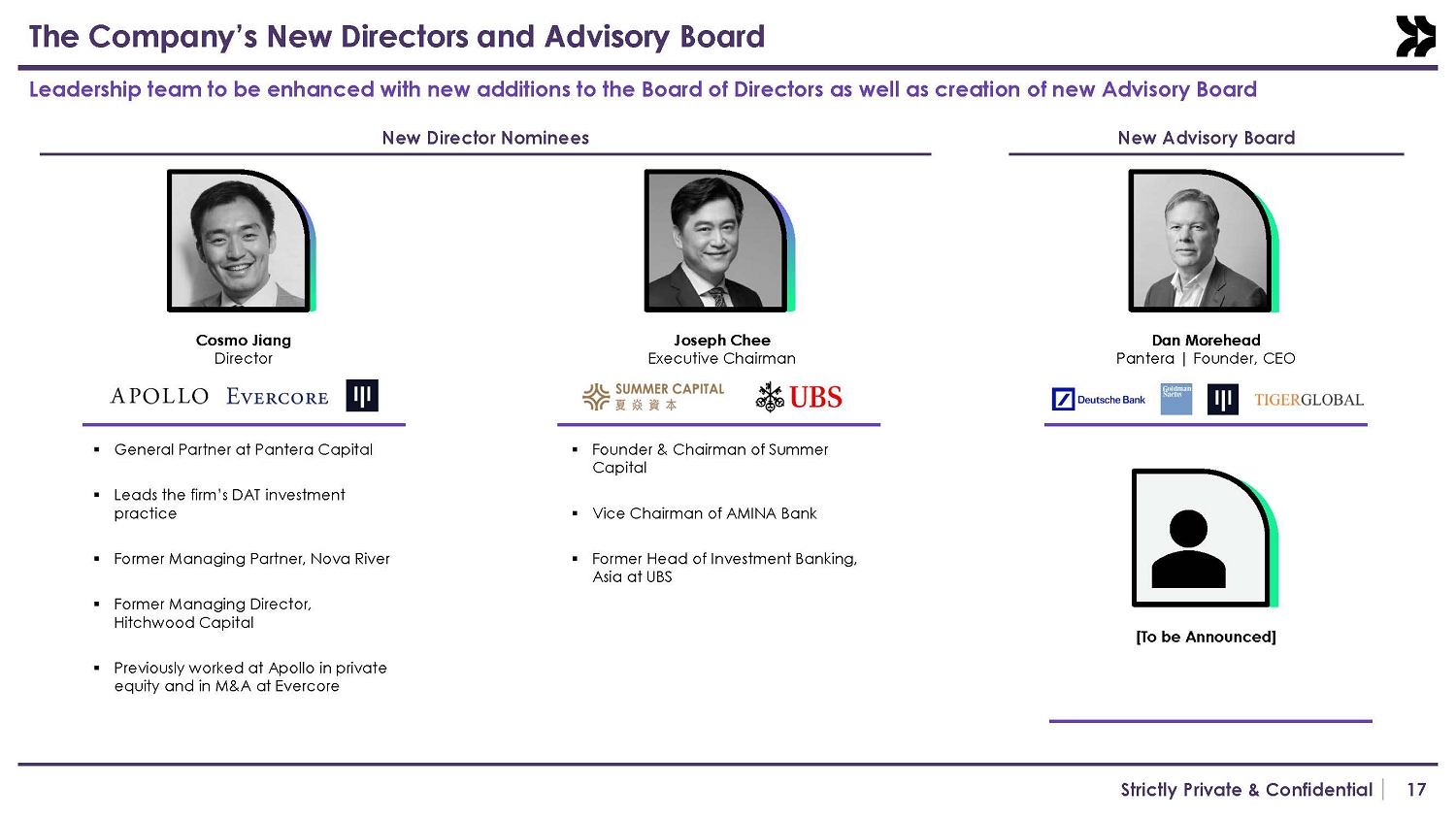

On September 15, 2025, the Company entered into a Strategic Advisor Agreement (the “Strategic Advisor Agreement”) with Pantera Capital Management LP, a Delaware limited partnership (“Pantera”) and Summer Wisdom Holdings Limited (“Summer” and with Pantera, the “Advisors”), pursuant to which the Company engaged each of Pantera and Summer to provide strategic advice and guidance relating to the Company’s business, operations, growth initiatives and industry trends in the crypto technology sector for an initial term of two (2) years, which term automatically renews for successive periods of one (1) year each. Either the Company or the Advisors may terminate the Strategic Advisor Agreement upon written notice of a material breach by the other party that has not been cured within thirty (30) days’ of receipt of the written notice. Pursuant to the terms of the Strategic Advisor Agreement, the Company issued (i) to Pantera, the Strategic Advisor warrants (the “Strategic Advisor Warrants”) to purchase shares of the Company’s Common Stock (the “Strategic Advisor Base Warrant Shares”) equal to 7% of the aggregate number of shares of Cash Shares and the Pre-Funded Warrant Shares and (ii) to Summer, Strategic Advisor Warrants to purchase shares of the Company’s Common Stock equal to 3% of the aggregate number of shares of Cash Shares and the Pre-Funded Warrant Shares. Upon the exercise of each Stapled Warrant, each of Pantera and Summer shall receive an additional grant of Strategic Advisor Warrants to purchase an amount of shares of Common Stock equal to their respective portion of 5% of the Stapled Warrant Shares underlying such exercised Stapled Warrant (such shares of Common Stock underlying the Strategic Advisor Warrants, the “Strategic Advisor Performance Shares” and, together with the Strategic Advisor Base Warrant Shares, the “Strategic Advisor Warrant Shares”). The Performance Warrant shall (i) have an exercise price equal to $0.001 per Strategic Advisor Performance Share, (ii) a term ending on the fifth (5th) anniversary of the issue date, and (iii) terminate automatically, without consideration, to the extent unvested upon the expiration of its term. The Performance Warrant will permit cashless exercise and will be settled solely in shares. Summer is controlled by Joeseph Chee, who is expected to be named Executive Chairman following the Closing of the Offerings.

The exercise of the Strategic Advisor Warrants is subject to stockholder approval and such warrants will not be exercisable for Common Stock until such stockholder approval is received.

The exercise price per share of the Strategic Advisor Warrants shall be equal to $0.001 per Strategic Advisor Warrant Share. The Strategic Advisor Warrants shall be exercisable, in whole or in part, at any time and from time to time following the receipt of stockholder approval, for a period of five (5) years from the date of issuance. The Strategic Advisor Agreements also contain customary representations and warranties, confidentiality provisions and limitations on liability.

The Strategic Advisor Warrants and the Strategic Advisor Warrant Shares are being offered in reliance upon the exemption from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) thereof and/or Rule 506(b) of Regulation D promulgated thereunder, and applicable state securities laws. The issuance of the Strategic Advisor Warrants and the Strategic Advisor Warrant Shares have not been registered under the Securities Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

Pursuant to the Strategic Advisory Agreement, Pantera agreed not to sell, transfer, pledge, hedge, or otherwise dispose of any shares underlying the Strategic Advisory Warrants for 180 days after the closing of the Offering (the “Advisor Lock-Up Period”), except (i) transfers to affiliates that agree in writing to be bound by the remainder of the Advisor Lock-Up Period, or (ii) with the Company’s prior written consent.

Additionally, on September 15, 2025, the Company entered into a Trading Advisory Agreement (the “Trading Advisory Agreement”) with Pantera, pursuant to which the Company engaged Pantera to manage the investment of substantially all of Company’s digital assets, digital asset derivatives, cash and other assets for an initial term of ten (10) years, which term automatically renews for successive periods of one (1) year each, subject to the mutual agreement of the Company and Pantera. The management fees pursuant to the Trading Advisory Agreement shall be equal to: (a) 1.0%, if the Client’s Assets Under Management is less than or equal to $1 billion, (b) 0.75% per annum of assets under management (“AUM”) if AUM is more than $1 billion but less than or equal to $5 billion and (c) 0.50% per annum of AUM if AUM is more than $5 billion.

The foregoing description of the Strategic Advisor Agreements, Trading Advisory Agreement and Strategic Advisor Warrants do not purport to be complete and are qualified in their entirety by reference to the full texts of such agreements, copies of which are attached hereto as Exhibits, 10.4, 10.5 and 4.5, respectively, and incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities

The disclosure required by this Item is included in Item 1.01 of this Current Report on Form 8-K and is incorporated herein by reference. Based in part upon the representations of the Purchasers in the Purchase Agreement, the offering and sale of the Shares, the Pre-Funded Warrant Shares, the Stapled Warrants and the Stapled Warrant Shares, will be exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended and/or Rule 506(b) of Regulation D promulgated thereunder, and applicable state securities laws.

Item 7.01. Regulation FD Disclosure.

Press Release on Announcing the Offering

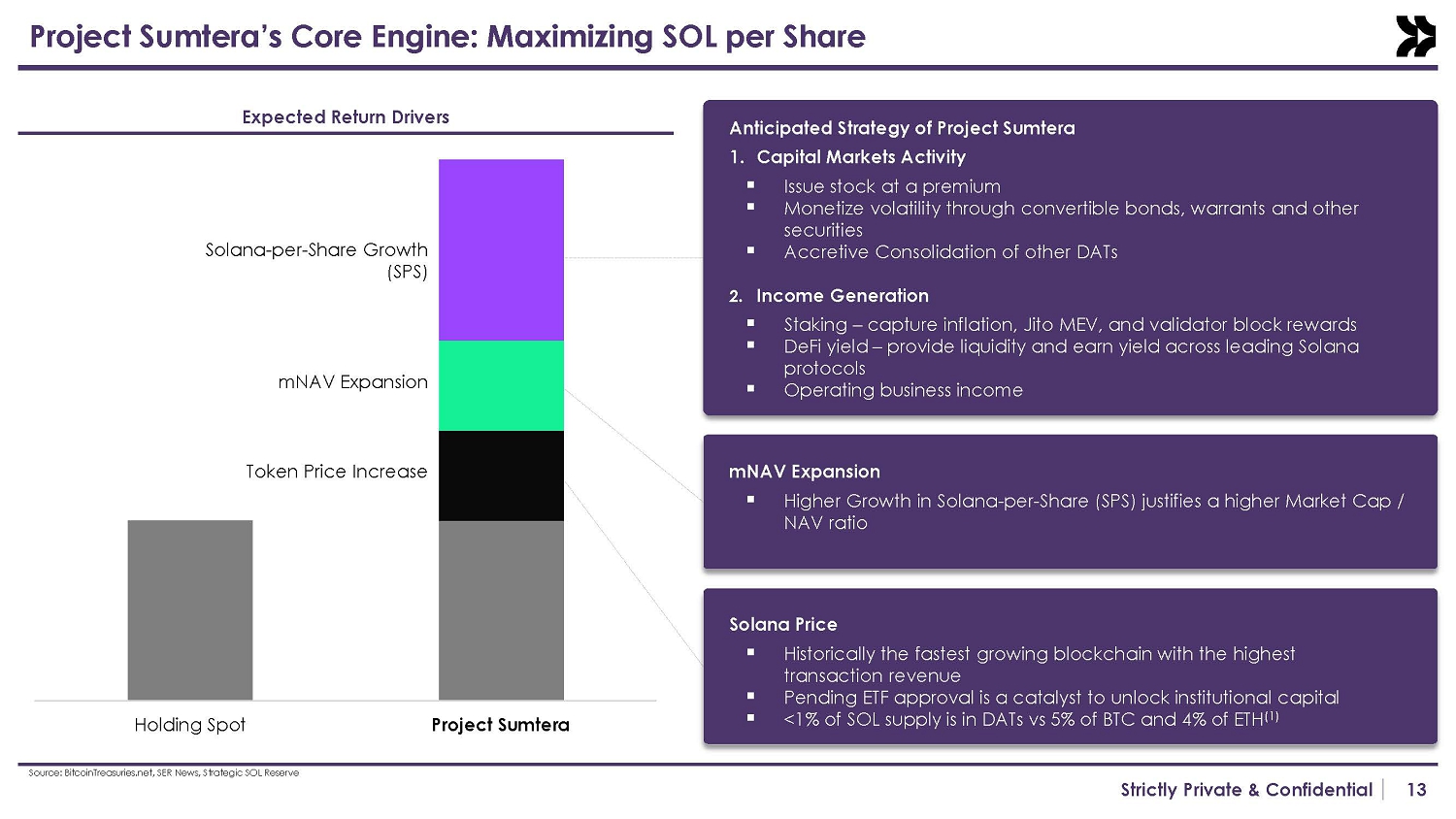

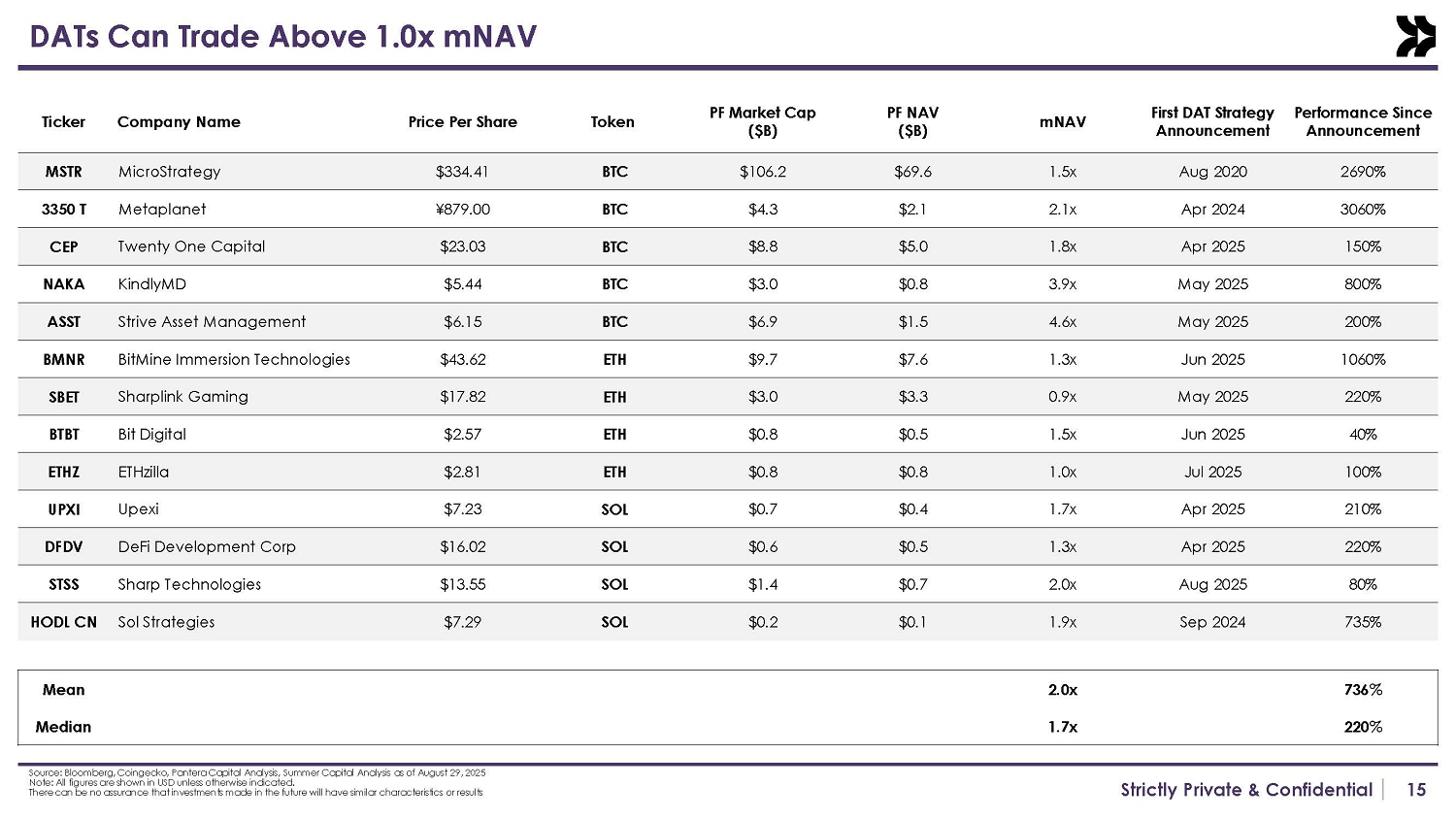

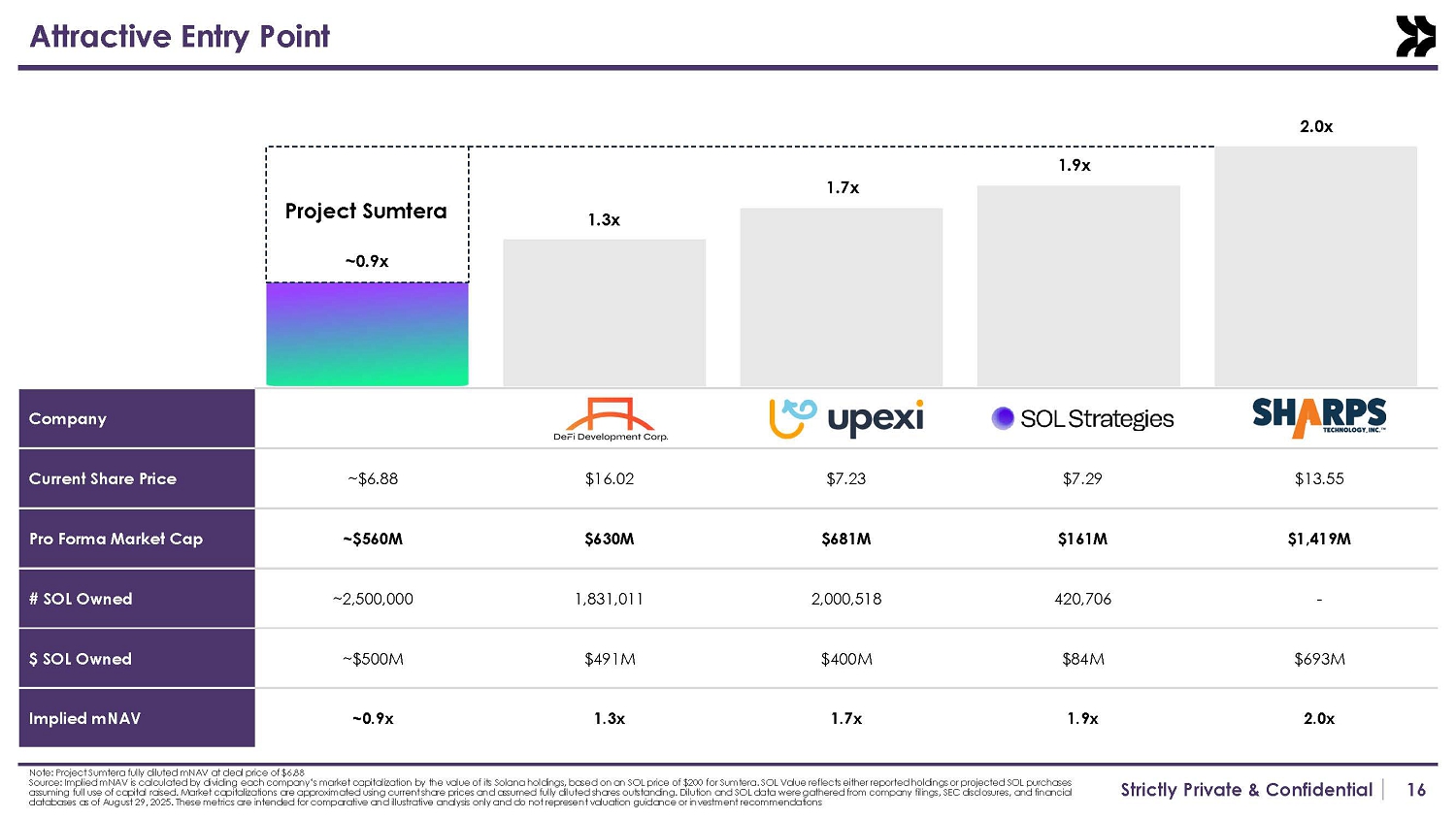

On September 15, 2025, the Company issued a press release announcing the signing of the Purchase Agreements and pricing of the Offerings and estimated aggregate gross proceeds of approximately $500 million in cash, before deducting placement agent fees and other offering expenses, to implement a SOL treasury strategy. A copy of the press release is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Investor Presentation

In connection with the Offerings, the Company delivered an investor presentation to potential investors on a confidential basis, a copy of which is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information under this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the expected settlement of the Offerings, the Company’s existing operations and the implementation of a SOL treasury strategy. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. Important factors that may affect actual results or outcomes include, but are not limited to: risks related to whether the Company will be able to satisfy the conditions required to close the Offerings; the potential impact of market and other general economic conditions; the ability of the Company to successfully execute its business plan, including the implementation of the SOL treasury strategy and achieve the intended benefits thereof; the Company’s failure to manage growth effectively; the Company’s failure to fully realize the anticipated benefits of the Offerings and use of proceeds therefrom; and other risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on March 23, 2025, and in the Company’s subsequent filings with the SEC. These forward-looking statements speak only as of the date hereof, and the Company disclaims any obligation to update these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this Current Report. Investors are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this Current Report speak only as of the date of this document, and the Company undertakes no obligation to update or revise any of these statements. The Company’s business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

No Offer or Solicitation

None of this Current Report nor the exhibits attached hereto constitutes an offer to sell, or a solicitation of an offer to buy the Securities described herein, nor shall there be any sale of such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Item 8.01 Other Matters

In connection with the Offerings and related transactions described herein, the Company is filing certain updated risk factors disclosure applicable to its business for the purpose of supplementing and updating disclosures contained in the Company’s prior public filings, including those discussed under the heading “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the Securities and Exchange Commission on March 25, 2025. The supplemental updated risk factors are filed herewith as Exhibit 99.3 and are incorporated herein by reference

Item 9.01 Financial Statements and Exhibits

(a) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Helius Medical Technologies Inc. | ||

| Dated: September 15, 2025 | By: | /s/ Jeffrey S. Mathiesen |

| Name: | Jeffrey S. Mathiesen | |

| Title: | Chief Financial Officer, Treasurer and Secretary | |

Exhibit 4.1

Form of Pre-Funded Warrant

THIS WARRANT AND THE SHARES OF CLASS A COMMON STOCK ISSUABLE UPON THE EXERCISE OF THIS WARRANT (THE “SECURITIES”) HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THE SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE OFFERED, SOLD, TRANSFERRED, ASSIGNED OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO (I) AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR (II) AN AVAILABLE EXEMPTION FROM SUCH REGISTRATION AND THE DELIVERY TO THE COMPANY OF AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH REGISTRATION IS NOT REQUIRED.

FORM OF PRE-FUNDED WARRANT TO PURCHASE COMMON STOCK

Number of Shares: [●]

(subject to adjustment)

| Warrant No. [●] | Original Issue Date: [●], 2025 |

Helius Medical Technologies, Inc., a Delaware corporation (the “Company”), hereby certifies that, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, [●] or its registered assigns (the “Holder”), is entitled, subject to the terms set forth below, to purchase from the Company up to a total of [●] shares of Class A common stock of the Company, $0.001 par value per share, and any other class of securities into which such securities may hereafter be reclassified or changed (the “Common Stock”), of the Company (each such share, a “Warrant Share” and all such shares, the “Warrant Shares”) at the remaining exercise price per share equal to $0.001 per Warrant Share (the “Remaining Exercise Price” and, together with the pre-funded purchase price per share, the “Exercise Price”), in each case as adjusted from time to time as provided in Section 9, upon surrender of this Pre-Funded Warrant to Purchase Common Stock (including any Warrants to purchase Common Stock issued in exchange, transfer or replacement hereof, the “Warrant”) at any time and from time to time on or after the date hereof (the “Original Issue Date”), subject to the following terms and conditions:

This Warrant is one of a series of similar warrants issued pursuant to that certain Subscription Agreement, dated September 15, 2025, by and among the Company and the Subscribers identified therein (the “Purchase Agreement”). Certain capitalized terms used below and not otherwise defined have the meanings given to such terms in the Purchase Agreement.

1. Definitions. For purposes of this Warrant, the following terms shall have the following meanings:

“Affiliate” means, with respect to any specified Person, (a) any other Person that, directly or indirectly through one or more intermediates, controls, is controlled by or is under common control with such Person or (b) in the event that the specified Person is a natural Person, a Member of the Immediate Family of such Person; provided that the Company and each of its subsidiaries shall be deemed not to be Affiliates of any Subscriber. As used in this definition, the term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise; provided that the Affiliates of any Person that is an investment fund shall not include any portfolio companies of such investment fund or any affiliated investment fund.

“Attribution Parties” means, collectively, the following Persons and entities: (i) any direct or indirect Affiliates of the Holder, (ii) any investment vehicle, including, any funds, feeder funds or managed accounts, currently, or from time to time after the date hereof, directly or indirectly managed or advised by the Holder’s investment manager or any of its Affiliates or principals, (iii) any Person acting or who could be deemed to be acting as a Group together with the Holder or any Attribution Parties and (iv) any other Persons whose beneficial ownership of the Company’s Common Stock would or could be aggregated with the Holder’s and/or any other Attribution Parties for purposes of Section 13(d) or Section 16 of the Exchange Act. For clarity, the purpose of the foregoing is to subject collectively the Holder and all other Attribution Parties to the Maximum Percentage.

“Closing Sale Price” means, for any security as of any date, the last trade price for such security on the Principal Trading Market for such security, as reported by Bloomberg Financial Markets, or, if such Principal Trading Market begins to operate on an extended hours basis and does not designate the last trade price, then the last trade price of such security prior to 4:00 P.M., New York City time, as reported by Bloomberg Financial Markets, or if the foregoing do not apply, the last trade price of such security in the over-the-counter market on the electronic bulletin board for such security as reported by Bloomberg Financial Markets. If the Closing Sale Price cannot be calculated for a security on a particular date on any of the foregoing bases, the Closing Sale Price of such security on such date shall be the fair market value as mutually determined by the Company and the Holder. If the Company and the Holder are unable to agree upon the fair market value of such security, then the Board of Directors of the Company shall use its good faith judgment to determine the fair market value. The Board of Directors’ determination shall be binding upon all parties absent demonstrable error. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination or other similar transaction during the applicable calculation period.

“Commission” means the U.S. Securities and Exchange Commission.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended, and all of the rules and regulations promulgated thereunder.

“Group” shall have the meaning ascribed to it in Section 13(d) of the Exchange Act, and all related rules, regulations and jurisprudence.

“Member of the Immediate Family” means, with respect to any Person who is an individual, (a) each parent, spouse (but not including a former spouse or a spouse from whom such Person is legally separated) or child (including those adopted) of such individual and (b) each trustee, solely in his or her capacity as trustee, for a trust naming only one or more of the Persons listed in sub-clause (a) as beneficiaries.

“Person” means an individual, partnership, corporation, limited liability company, business trust, joint stock company, trust, incorporated or unincorporated association, joint venture, government (or an agency or subdivision thereof) or any other entity or organization.

“Principal Trading Market” means the national securities exchange or other trading market on which the Common Stock is primarily listed on and quoted for trading, which, as of the Original Issue Date, is The Nasdaq Capital Market.

“Securities Act” means the U.S. Securities Act of 1933, as amended, and all of the rules and regulations promulgated thereunder.

“Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, for the Principal Trading Market with respect to the Common Stock that is in effect on the date of delivery of an applicable Exercise Notice, which as of the Original Issue Date was “T+1.”

“Trading Day” means any weekday on which the Principal Trading Market is open for trading.

“Transfer Agent” means Equiniti Trust Company, LLC, the Company’s transfer agent and registrar for the Common Stock, and any successor appointed in such capacity.

2. Issuance of Securities; Registration of Warrants. The Company shall register ownership of this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant Register”), in the name of the record Holder (which shall include the initial Holder or, as the case may be, any assignee to which this Warrant is permissibly assigned hereunder) from time to time. The Company may deem and treat the registered Holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual notice to the contrary.

3. Registration of Transfers. This Warrant and all rights hereunder (including, without limitation, any registration rights in respect of the Warrant Shares) are transferable, in whole or in part, upon surrender of this Warrant at the principal office of the Company or its designated agent, together with a written assignment of this Warrant substantially in the form attached hereto duly executed by the Holder or its agent or attorney, duly authorized, and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Subject to compliance with all applicable securities laws, the Company shall, or will cause its Transfer Agent to, register the transfer of all or any portion of this Warrant in the Warrant Register, upon surrender of this Warrant, and payment for all applicable transfer taxes (if any). Upon any such registration or transfer, a new warrant to purchase Common Stock in substantially the form of this Warrant (any such new warrant, a “New Warrant”) evidencing the portion of this Warrant so transferred shall be issued to the transferee, and a New Warrant evidencing the remaining portion of this Warrant not so transferred, if any, shall be issued to the transferring Holder. The acceptance of the New Warrant by the transferee thereof shall be deemed acceptance by such transferee of all of the rights and obligations in respect of the New Warrant that the Holder has in respect of this Warrant. The Company shall, or will cause its Transfer Agent to, prepare, issue and deliver at the Company’s own expense any New Warrant under this Section 3. Until due presentment for registration of transfer, the Company may treat the registered Holder hereof as the owner and holder for all purposes, and the Company shall not be affected by any notice to the contrary.

4. Exercise of Warrants.

(a) All or any part of this Warrant shall be exercisable by the registered Holder in any manner permitted by this Warrant (including Section 11) at any time and from time to time on or after the Original Issue Date, and such rights shall not expire until exercised in full.

(b) The Holder may exercise this Warrant by delivering to the Company (i) an exercise notice, in the form attached as Schedule 1 hereto (the “Exercise Notice”), completed and duly signed, and (ii) payment of the Remaining Exercise Price for the number of Warrant Shares as to which this Warrant is being exercised (which may take the form of a “cashless exercise” if so indicated in the Exercise Notice pursuant to Section 10 below), and the date on which the last of such items is delivered to the Company (as determined in accordance with the notice provisions hereof) is an “Exercise Date.” The Holder shall not be required to deliver the original Warrant in order to effect an exercise hereunder. Execution and delivery of the Exercise Notice shall have the same effect as cancellation of the original Warrant and issuance of a New Warrant evidencing the right to purchase the remaining number of Warrant Shares, if any.

(c) The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this section, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof.

5. Delivery of Warrant Shares.

(a) Upon exercise of this Warrant, the Company shall promptly (but in no event later than the number of Trading Days comprising the Standard Settlement Period following the Exercise Date), upon the request of the Holder, cause the Transfer Agent to credit such aggregate number of shares of Common Stock specified by the Holder in the Exercise Notice and to which the Holder is entitled pursuant to such exercise (the “Exercise Shares”) to (i) the Holder’s or its designee’s balance account with The Depository Trust Company (“DTC”) through its Deposit Withdrawal At Custodian system or (ii) in book-entry form via a direct registration system (“DRS”) maintained by or on behalf of the Transfer Agent, in each case, so long as either (A) there is an effective registration statement permitting the issuance of the Warrant Shares to or the resale of such Warrant Shares by the Holder or (B) the Exercise Shares are eligible for resale by the Holder without volume or manner-of-sale restrictions pursuant to Rule 144 promulgated under the Securities Act (assuming cashless exercise of this Warrant). If (A) and (B) above are not true, the Company shall cause the Transfer Agent to either (i) record the Exercise Shares in the name of the Holder or its designee on the certificates reflecting the Exercise Shares with an appropriate legend regarding restriction on transferability and stop transfer notation, which shall be issued and dispatched by overnight courier to the address as specified in the Exercise Notice, and on the Company’s share register or (ii) issue such Exercise Shares in the name of the Holder or its designee in restricted book-entry form in the Company’s share register reflecting such legend and notation. The Holder, or any Person so designated by the Holder to receive Warrant Shares, shall be deemed to have become the holder of record of such Warrant Shares as of the Exercise Date, irrespective of the date such Warrant Shares are credited to the Holder’s DTC account, the date of the book entry positions or the date of delivery of the certificates evidencing such Exercise Shares, as the case may be.

(b) In addition to any other rights available to the Holder, if the Company fails to cause the Transfer Agent to deliver to the Holder or its designee Exercise Shares in the manner required pursuant to Section 5(a) within the Standard Settlement Period following the Exercise Date (other than a failure caused by incorrect or incomplete information provided by the Holder to the Company) and the Holder or the Holder’s broker on its behalf purchases (in an open market transaction or otherwise) shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving upon such exercise (a “Buy-In”) but did not receive within the Standard Settlement Period, then the Company shall, within two (2) Trading Days after the Holder’s request and in the Holder’s sole discretion, promptly honor its obligation to deliver to the Holder or its designee the Exercise Shares pursuant to Section 5(a) and pay cash to the Holder in an amount equal to the excess (if any) of the Holder’s total purchase price (including brokerage commissions, if any) for the shares of Common Stock so purchased in the Buy-In, less the product of (A) the number of shares of Common Stock purchased in the Buy-In, times (B) the Closing Sale Price of a share of Common Stock on the Exercise Date. The Holder shall provide the Company written notice promptly after the occurrence of a Buy-In, indicating the amounts payable to the Holder in respect of the Buy-In together with applicable confirmations and other evidence reasonably requested by the Company.

(c) To the extent permitted by law and subject to Section 5(b), the Company’s obligations to issue and deliver Warrant Shares in accordance with and subject to the terms hereof (including the limitations set forth in Section 11 below) are absolute and unconditional, irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by the Holder or any other Person of any obligation to the Company or any violation or alleged violation of law by the Holder or any other Person, and irrespective of any other circumstance that might otherwise limit such obligation of the Company to the Holder in connection with the issuance of Warrant Shares. Subject to Section 5(b), nothing herein shall limit the Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver Exercise Shares; provided, however, that the Holder shall not be entitled to both (i) require the Company to reinstate the portion of the Warrant and equivalent number of Warrant Shares for which such exercise was not timely honored and (ii) receive the number of shares of Common Stock that would have been issued if the Company had timely complied with its delivery requirements under Section 5(a).

6. Charges, Taxes and Expenses. Issuance and delivery of Exercise Shares shall be made without charge to the Holder for any issue or transfer tax, transfer agent fee or other incidental tax or expense (excluding any applicable stamp duties) in respect of the issuance of such shares, all of which taxes and expenses shall be paid by the Company; provided, however, that the Company shall not be required to pay any tax that may be payable in respect of any transfer involved in the registration of any Warrant Shares or the Warrants in a name other than that of the Holder. The Holder shall be responsible for all other tax liabilities that may arise as a result of holding or transferring this Warrant or receiving Warrant Shares upon exercise hereof. Each party hereto intends that this Warrant shall be treated as stock for U.S. federal (and applicable state and local) income tax purposes.

7. Replacement of Warrant. If this Warrant is mutilated, lost, stolen or destroyed, the Company shall issue or cause to be issued in exchange and substitution for and upon cancellation hereof, or in lieu of and substitution for this Warrant, a New Warrant, but only upon receipt of evidence reasonably satisfactory to the Company of such loss, theft or destruction (in such case) and, in each case, a customary contractual indemnity reasonably acceptable to the Company, if requested. If a New Warrant is requested as a result of a mutilation of this Warrant, then the Holder shall deliver such mutilated Warrant to the Company as a condition precedent to the Company’s obligation to issue the New Warrant.

8. Reservation of Warrant Shares. The Company covenants that it will, at all times while this Warrant is outstanding, reserve and keep available out of the aggregate of its authorized but unissued and otherwise unreserved Common Stock, solely for the purpose of enabling it to issue Warrant Shares upon exercise of this Warrant as herein provided, the number of Warrant Shares that are at all times issuable and deliverable upon the exercise of this entire Warrant (without regard to any limitations or restrictions on exercise of this Warrant, including without limitation, the Maximum Percentage (as defined below)), free from preemptive rights or any other contingent purchase rights of persons other than the Holder (taking into account the adjustments and restrictions of Section 9). The Company covenants that all Warrant Shares so issuable and deliverable shall, upon issuance and the payment of the applicable Remaining Exercise Price in accordance with the terms hereof, be duly and validly authorized, issued and fully paid and non-assessable. The Company will take all such action as may be reasonably necessary to assure that such shares of Common Stock may be issued as provided herein without violation by the Company of any applicable law or regulation, or of any requirements of any securities exchange or automated quotation system upon which the Common Stock may be listed. The Company further covenants that it will not, without the prior written consent of the Holder, take any actions to increase the par value of the Common Stock at any time while this Warrant is outstanding.

9. Certain Adjustments. The Remaining Exercise Price and number of Warrant Shares issuable upon exercise of this Warrant (the “Number of Warrant Shares”) are subject to adjustment from time to time as set forth in this Section 9.

(a) Stock Dividends and Splits. If the Company, at any time while this Warrant is outstanding, (i) pays a stock dividend on its Common Stock or otherwise makes a distribution on any class of capital stock issued and outstanding on the Original Issue Date and in accordance with the terms of such stock on the Original Issue Date or as amended, that is payable in shares of Common Stock, (ii) subdivides its outstanding shares of Common Stock into a larger number of shares of Common Stock, (iii) combines its outstanding shares of Common Stock into a smaller number of shares of Common Stock or (iv) issues by reclassification of shares of capital stock any additional shares of Common Stock of the Company, then in each such case the Number of Warrant Shares shall be multiplied by a fraction, the numerator of which shall be the number of shares of Common Stock outstanding immediately after such event and the denominator of which shall be the number of shares of Common Stock outstanding immediately before such event. Any adjustment made pursuant to clause (i) of this paragraph shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution, provided, however, that if such record date shall have been fixed and such dividend is not fully paid on the date fixed therefor, the Number of Warrant Shares shall be recomputed accordingly as of the close of business on such record date and thereafter the Number of Warrant Shares shall be adjusted pursuant to this paragraph as of the time of actual payment of such dividends. Any adjustment pursuant to clause (ii), (iii) or (iv) of this paragraph shall become effective immediately after the effective date of such subdivision, combination or issuance.

(b) Pro Rata Distributions. If, on or after the Original Issue Date, the Company shall declare or make any dividend or other pro rata distribution of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property, options, evidence of indebtedness or any other assets by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction, but, for the avoidance of doubt, excluding any distribution of shares of Common Stock subject to Section 9(a), any distribution of Purchase Rights (as defined below) subject to Section 9(c) and any Fundamental Transaction (as defined below) subject to Section 9(d)) (a “Distribution”) then, in each such case, the Holder shall be entitled to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations or restrictions on exercise of this Warrant, including without limitation, the Maximum Percentage) immediately before the date on which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation in such Distribution; provided, that to the extent that the Holder’s right to participate in any such Distribution would result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, then the Holder shall not be entitled to participate in such Distribution to such extent (and shall not be entitled to beneficial ownership of such shares of Common Stock as a result of such Distribution (and beneficial ownership) to such extent) and the portion of such Distribution shall be held in abeyance for the benefit of the Holder until such time or times as its right thereto would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, at which time or times the Holder shall be granted such Distribution (and any Distributions declared or made on such initial Distribution or on any subsequent Distribution held similarly in abeyance) to the same extent as if there had been no such limitation.

(c) Purchase Rights. If at any time on or after the Original Issue Date, the Company grants, issues or sells any Options, Convertible Securities or rights to purchase stock, warrants, securities or other property, in each case pro rata to the record holders of any class of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations or restrictions on exercise of this Warrant, including without limitation, the Maximum Percentage) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of Common Stock are to be determined for the grant, issuance or sale of such Purchase Rights; provided, that to the extent that the Holder’s right to participate in any such Purchase Right would result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, then the Holder shall not be entitled to participate in such Purchase Right to such extent (and shall not be entitled to beneficial ownership of such Common Stock as a result of such Purchase Right (and beneficial ownership) to such extent) and at the Holder’s election, in its sole discretion, either (1) such Purchase Right to such extent shall be held in abeyance for the benefit of the Holder until such time or times as its right thereto would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, at which time or times the Holder shall be granted such right (and any Purchase Right granted, issued or sold on such initial Purchase Right or on any subsequent Purchase Right to be held similarly in abeyance) to the same extent as if there had been no such limitation or (2) the Company shall offer the Holder the right upon exercise of such Purchase Right to acquire a security (e.g. a pre-funded warrant) that would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage but will otherwise to the extent possible have economic and other rights, preferences and privileges substantially consistent and on par with the securities or other property issuable upon exercise of the originally offered Purchase Rights). As used in this Section 9(c), (i) “Options” means any rights, warrants or options to subscribe for or purchase shares of Common Stock or Convertible Securities and (ii) “Convertible Securities” mean any stock or securities (other than Options) directly or indirectly convertible into or exercisable or exchangeable for shares of Common Stock.

(d) Fundamental Transactions. If, at any time while this Warrant is outstanding (i) the Company, directly or indirectly, in one or more related transactions effects any merger or amalgamation or consolidation of the Company with or into another Person, in which the Company is not the surviving entity or in which the stockholders of the Company immediately prior to such merger or consolidation do not own, directly or indirectly, at least 50% of the voting power of the surviving entity immediately after such merger or consolidation, (ii) the Company effects any sale to another Person of all or substantially all of its assets in one or a series of related transactions, (iii) pursuant to any tender offer or exchange offer (whether by the Company or another Person), holders of capital stock tender shares representing more than 50% of the voting power of the capital stock of the Company and the Company or such other Person, as applicable, accepts such tender for payment, (iv) the Company consummates a stock purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person whereby such other Person acquires more than 50% of the voting power of the capital stock of the Company (except for any such transaction in which the stockholders of the Company immediately prior to such transaction maintain, in substantially the same proportions, the voting power of such Person immediately after the transaction) or (v) the Company effects any reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is converted into or exchanged for other securities, cash or property (other than as a result of a subdivision or combination of shares of Common Stock covered by Section 9(a) above) (in any such case, a “Fundamental Transaction”), then following such Fundamental Transaction, the Holder shall have the right to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, at the option of the Holder, the same amount and kind of securities of the successor or acquiring corporation or of the Company, cash or property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the holder of the number of Warrant Shares then issuable upon exercise in full of this Warrant (including any Distributions or Purchase Rights then held in abeyance pursuant to Sections 9(b) or 9(c) above) without regard to any limitations on exercise contained herein (the “Alternate Consideration”) (provided, that to the extent that the Holder’s right to receive any such Alternate Consideration would result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, then the holder shall not be entitled to receive such Alternate Consideration to such extent (and shall not be entitled to beneficial ownership of such Common Stock as a result of such Alternate Consideration (and beneficial ownership) to such extent) and at the Holder’s election, in its sole discretion, either (1) such Alternate Consideration to such extent shall be held in abeyance for the benefit of the Holder until such time or times as its right thereto would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, at which time or times the Holder shall be granted such right (and any Alternate Consideration granted, issued or sold on such initial receipt or on any subsequent receipt to be held similarly in abeyance) to the same extent as if there had been no such limitation) or (2) the Company shall offer the Holder the right upon receipt of such Alternate Consideration to acquire a security (e.g. a pre-funded warrant) that would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage but will otherwise to the extent possible have economic and other rights, preferences and privileges substantially consistent and on par with the securities or other property issuable upon exercise of the originally offered Alternate Consideration). The Company shall not effect any Fundamental Transaction in which the Company is not the surviving entity or the Alternate Consideration includes securities of another Person unless (i) the Alternate Consideration is solely cash and the Company provides for the simultaneous “cashless exercise” of this Warrant pursuant to Section 10 below or (ii) prior to or simultaneously with the consummation thereof, any successor to the Company, surviving entity or other Person (including any purchaser of assets of the Company) shall assume the obligation to deliver to the Holder such Alternate Consideration as, in accordance with the foregoing provisions, the Holder may be entitled to receive, and the other obligations under this Warrant. Notwithstanding, anything to the contrary contained herein, the Company shall cause any successor entity in a Fundamental Transaction in which the Company is not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Company under this Warrant in accordance with the provisions of this Section 9(d). Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Warrant and the other Transaction Documents referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under this Warrant with the same effect as if such Successor Entity had been named as the Company herein. For the avoidance of doubt, the Holder shall be entitled to the benefits of the provisions of this Section 9(d) regardless of (i) whether the Company has sufficient authorized shares of Common Stock for the issuance of Warrant Shares and/or (ii) whether a Fundamental Transaction occurs prior to the Exercise Date. The provisions of this paragraph (d) shall similarly apply to subsequent transactions analogous to a Fundamental Transaction type.

(e) Number of Warrant Shares. Simultaneously with any adjustment to the Number of Warrant Shares pursuant to Section 9, the Remaining Exercise Price shall be increased or decreased proportionately, so that after such adjustment the aggregate Remaining Exercise Price payable hereunder for the increased or decreased Number of Warrant Shares shall be the same as the aggregate Remaining Exercise Price in effect immediately prior to such adjustment. Notwithstanding the foregoing, in no event may the Remaining Exercise Price be adjusted below the par value of the Common Stock then in effect.

(f) Calculations. All calculations under this Section 9 shall be made to the nearest one-tenth of one cent or rounded down to the nearest whole share, as applicable.

(g) Notice of Adjustments. Upon the occurrence of each adjustment pursuant to this Section 9, the Company at its expense will, at the written request of the Holder, promptly compute such adjustment, in good faith, in accordance with the terms of this Warrant and prepare a certificate setting forth such adjustment, including a statement of the adjusted Remaining Exercise Price and adjusted number or type of Warrant Shares or other securities issuable upon exercise of this Warrant (as applicable), describing the transactions giving rise to such adjustments and showing in detail the facts upon which such adjustment is based. Upon written request, the Company will promptly deliver a copy of each such certificate to the Holder and to the Company’s transfer agent.

(h) Notice of Corporate Events. If, while this Warrant is outstanding, the Company (i) declares a dividend or any other distribution of cash, securities or other property in respect of its Common Stock, including, without limitation, any granting of rights or warrants to subscribe for or purchase any capital stock of the Company or any subsidiary, (ii) authorizes or approves, enters into any agreement contemplating or solicits stockholder approval for any Fundamental Transaction or (iii) authorizes the voluntary dissolution, liquidation or winding up of the affairs of the Company, then the Company shall deliver to the Holder a notice of such transaction at least ten (10) business days prior to the applicable record or effective date on which a Person would need to hold Common Stock in order to participate in or vote with respect to such transaction; provided, however, that the failure to deliver such notice or any defect therein shall not affect the validity of the corporate action required to be described in such notice. In addition, if while this Warrant is outstanding, the Company authorizes or approves, enters into any agreement contemplating or solicits stockholder approval for any Fundamental Transaction contemplated by Section 9(d), other than a Fundamental Transaction under clause (iii) of Section 9(d), the Company shall deliver to the Holder a notice of such Fundamental Transaction at least ten (10) business days prior to the date such Fundamental Transaction is consummated. Holder agrees to maintain any information disclosed pursuant to this Section 9(h) in confidence until such information is publicly available, and shall comply with applicable law with respect to trading in the Company’s securities following receipt of any such information. Notwithstanding anything in this Section 9 to the contrary, the Company shall be deemed to have provided the information required to be delivered to a Holder under this Section 9 if disseminated by press release or filed in any report or statement filed with the Commission prior to the applicable deadline.

10. Payment of Exercise Price. Notwithstanding anything contained herein to the contrary, the Holder may, in its sole discretion, satisfy its obligation to pay the Remaining Exercise Price through a “cashless exercise”, in which event the Company shall issue to the Holder the number of Warrant Shares in an exchange of securities effected pursuant to Section 3(a)(9) of the Securities Act, determined as follows:

X = Y [(A-B)/A]

where:

“X” equals the number of Warrant Shares to be issued to the Holder;

“Y” equals the total number of Warrant Shares with respect to which this Warrant is then being exercised if such exercise were by means of a cash exercise rather than a cashless exercise;

“A” equals the Closing Sale Price of the shares of Common Stock on the Trading Day immediately preceding the Exercise Date; and

“B” equals the Remaining Exercise Price then in effect for the applicable Warrant Shares at the time of such exercise.

The issue price for each such Warrant Shares to be issued pursuant to the cashless exercise of a Warrant will be equal to (B), as defined above, and the total issue price for the aggregate number of Warrant Shares issued pursuant to the cashless exercise of a Warrant will be deemed paid and satisfied in full by the deemed surrender to the Company of the portion of such Warrant being exercised in accordance with this Section 10.

For purposes of Rule 144 promulgated under the Securities Act, it is intended, understood and acknowledged that the Warrant Shares issued in a “cashless exercise” transaction shall be deemed to have been acquired by the Holder, and the holding period for the Warrant Shares shall be deemed to have commenced, on the Original Issue Date (provided that the Commission continues to take the position that such treatment is proper at the time of such exercise). In the event that a registration statement registering the issuance of Warrant Shares is, for any reason, not effective at the time of exercise of this Warrant, then this Warrant may only be exercised through a cashless exercise, as set forth in this Section 10. If the Warrant Shares are issued in such a cashless exercise, the Company acknowledges and agrees that, in accordance with Section 3(a)(9) of the Securities Act, the Exercise Shares issued in such exercise shall take on the registered characteristics of the Warrants being exercised and may be tacked on to the holding period of the Warrants being exercised. Except as set forth in Section 5(b) (Buy-in Remedy) and Section 12 (No Fractional Shares), in no event will the exercise of this Warrant be settled in cash.

11. Limitations on Exercise.

(a) Notwithstanding anything to the contrary contained herein, the Company shall not effect the exercise of any portion of this Warrant, and the Holder of this Warrant shall not have the right to exercise any portion of the Warrant, and any such exercise shall be null and void ab initio and treated as if the exercise had not been made, to the extent that immediately prior to or following such exercise, the Holder, together with the Attribution Parties, beneficially owns or would beneficially own as determined in accordance with Section 13(d) of the Exchange Act and the rules promulgated thereunder, in excess of 4.99% or 9.99% (or such other amount as a holder may specify) (the “Maximum Percentage”) of the Common Stock that would be issued and outstanding following such exercise. For purposes of calculating beneficial ownership for determining whether the Maximum Percentage is or will be exceeded, the aggregate number of shares of Common Stock held and/or beneficially owned by the Holder together with the Attribution Parties, shall include the number of shares of Common Stock held and/or beneficially owned by the Holder together with the Attribution Parties plus the number of shares of Common Stock issuable upon exercise of the relevant Warrant with respect to which the determination is being made but shall exclude the number of shares of Common Stock which would be issuable upon (i) exercise of the remaining, unexercised Warrant held and/or beneficially owned by the Holder or the Attribution Parties and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company held and/or beneficially owned by such Holder or any Attribution Party (including, without limitation, any convertible notes, convertible stock or warrants) that are subject to a limitation on conversion or exercise analogous to the limitation contained herein. For purposes of this Section 11(a), beneficial ownership of the Holder or the Attribution Parties shall, except as set forth in the immediately preceding sentence, be calculated and determined in accordance with Section 13(d) of the Exchange Act and the rules promulgated thereunder. For purposes of this Warrant, in determining the number of outstanding shares of Common Stock, a Holder of this Warrant may rely on the number of outstanding shares of Common Stock as reflected in (1) the Company’s most recent Form 10-K, Form 10-Q, Current Report on Form 8-K or other public filing with the Securities and Exchange Commission, as the case may be, (2) a more recent public announcement by the Company or (3) any other notice by the Company or the Company’s transfer agent setting forth the number of shares of Common Stock outstanding (such issued and outstanding shares, the “Reported Outstanding Share Number”). For any reason at any time, upon the written or oral request of the Holder, the Company shall within one business day confirm orally and in writing or by electronic mail to the Holder the number of shares of Common Stock then outstanding. The Holder shall disclose to the Company the number of shares of Common Stock that it, together with the Attribution Parties holds and/or beneficially owns and has the right to acquire through the exercise of derivative securities and any limitations on exercise or conversion analogous to the limitation contained herein contemporaneously or immediately prior to submitting an Exercise Notice for the relevant Warrant. If the Company receives an Exercise Notice from the Holder at a time when the actual number of outstanding shares of Common Stock is less than the Reported Outstanding Share Number, the Company shall (i) notify the Holder in writing of the number of shares of Common Stock then outstanding and, to the extent that such Exercise Notice would otherwise cause the Holder’s, together with the Attribution Parties’, beneficial ownership, as determined pursuant to this Section 11(a), to exceed the Maximum Percentage, the Holder must notify the Company of a reduced number of Warrant Shares to be purchased pursuant to such Exercise Notice (the number of shares by which such purchase is reduced, the “Reduction Shares”) or that no reduction is necessary in order to receive shares in compliance with the Maximum Percentage, and (ii) as soon as reasonably practicable, the Company shall return to the Holder any exercise price paid by the Holder for the Reduction Shares (if any) and to issue the shares to the Holder (reduced by the Reduction Shares, if applicable). In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant, by the Holder and the Attribution Parties since the date as of which the Reported Outstanding Share Number was reported. In the event that the issuance of Common Stock to the Holder upon exercise of this Warrant results in the Holder, together with the Attribution Parties, being deemed to beneficially own, in the aggregate, more than the Maximum Percentage of the number of outstanding shares of Common Stock (as determined under Section 13(d) of the Exchange Act), the number of shares so issued by which the Holder’s, together with the Attribution Parties’, aggregate beneficial ownership exceeds the Maximum Percentage (the “Excess Shares”) shall be deemed null and void and shall be cancelled ab initio, and the Holder and/or the Attribution Parties shall not have the power to vote or to transfer the Excess Shares. As soon as reasonably practicable after the issuance of the Excess Shares has been deemed null and void, the Company shall return to the Holder the exercise price paid by the Holder for the Excess Shares and the Holder shall return such Excess Shares (if in its possession) to the Company. By written notice to the Company, a Holder of this Warrant may from time to time increase or decrease the Maximum Percentage to any other percentage specified in such notice, provided, however, that (1) in no case shall the percentage specified be in excess of 19.99% and (2) any increase in the Maximum Percentage will not be effective until the 61st day after such notice is delivered to the Company and shall not negatively affect any partial exercise effected prior to such change.

(b) This Section 11 shall not restrict the number of shares of Common Stock which a Holder or the Attribution Parties may receive or beneficially own in order to determine the amount of securities or other consideration that such Holder or the Attribution Parties may receive in the event of a Fundamental Transaction as contemplated in Section 9(c) of this Warrant. For purposes of clarity, the shares of Common Stock issuable pursuant to the terms of this Warrant in excess of the Maximum Percentage shall not be deemed to be beneficially owned by the Holder or the Attribution Parties for any purpose including for purposes of Section 13(d) of the Exchange Act and the rules promulgated thereunder or Section 16 of the Exchange Act and the rules promulgated thereunder, including Rule 16a-1(a)(1). No prior inability to exercise this Warrant pursuant to this paragraph shall have any effect on the applicability of the provisions of this paragraph with respect to any subsequent determination of exercisability. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 11 to the extent necessary to correct this paragraph or any portion of this paragraph which may be defective or inconsistent with the intended beneficial ownership limitation contained in this Section 11 or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitation contained in this paragraph may not be waived and shall apply to a successor holder of this Warrant.

12. No Fractional Shares. No fractional Warrant Shares will be issued in connection with any exercise of this Warrant. In lieu of any fractional shares that would otherwise be issuable, the number of Warrant Shares to be issued shall be rounded down to the next whole number.

13. Notices. Any and all notices or other communications or deliveries hereunder (including, without limitation, any Exercise Notice) shall be in writing and shall be deemed given and effective on the earliest of (a) the date of transmission, if such notice or communication is delivered confirmed e-mail prior to 5:00 P.M., New York City time, on a Trading Day, (b) the next Trading Day after the date of transmission, if such notice or communication is delivered via confirmed e-mail on a day that is not a Trading Day or later than 5:00 P.M., New York City time, on any Trading Day, (c) the Trading Day following the date of mailing, if sent by nationally recognized overnight courier service specifying next business day delivery, or (d) upon actual receipt by the Person to whom such notice is required to be given, if by hand delivery:

(a) If to the Company, addressed as follows:

Helius Medical Technologies, Inc.

642 Newtown Yardley Road, Suite 100

Newtown, Pennsylvania 18940

Attention: Dane Andreeff

with a copy (which shall not constitute notice):

Honigman LLP

650 Trade Centre Way, Suite 200

Kalamazoo, Michigan 49002

Attn: Phillip D. Torrence

(b) If to the Holder, at its address or e-mail address set forth in the books and records of the Company, which may be modified by written notice from the Holder to the Company.

14. Warrant Agent. The Company shall initially serve as warrant agent under this Warrant. Upon ten (10) days’ notice to the Holder, the Company may appoint a new warrant agent. Any corporation into which the Company or any new warrant agent may be merged or any corporation resulting from any consolidation to which the Company or any new warrant agent shall be a party or any corporation to which the Company or any new warrant agent transfers substantially all of its corporate trust or shareholders services business shall be a successor warrant agent under this Warrant without any further act. Any such successor warrant agent shall promptly cause notice of its succession as warrant agent to be mailed (by first class mail, postage prepaid) to the Holder at the Holder’s last address as shown on the Warrant Register. The Holder acknowledges that this Warrant may be held in book-entry form through the facilities of the Company’s warrant agent and, at the request of the Holder, may be issued in definitive form.

15. Miscellaneous.

(a) No Rights as a Stockholder. Except as otherwise set forth in this Warrant, the Holder, solely in such Person’s capacity as a holder of this Warrant, shall not be entitled to vote or receive dividends or be deemed the holder of share capital of the Company for any purpose, nor shall anything contained in this Warrant be construed to confer upon the Holder, solely in such Person’s capacity as the Holder of this Warrant, any of the rights of a stockholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, amalgamation, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise, prior to the issuance to the Holder of the Warrant Shares which such Person is then entitled to receive upon the due exercise of this Warrant. In addition, nothing contained in this Warrant shall be construed as imposing any liabilities on the Holder to purchase any securities (upon exercise of this Warrant or otherwise) or as a stockholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

(b) Further Assurances. Except and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its certificate or articles of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of Holder as set forth in this Warrant against impairment. Without limiting the generality of the foregoing, the Company will (i) not increase the par value of any Warrant Shares above the amount payable therefor upon such exercise immediately prior to such increase in par value, (ii) take all such action as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and non-assessable Warrant Shares upon the exercise of this Warrant, and (iii) use commercially reasonable efforts to obtain all such authorizations, exemptions or consents from any public regulatory body having jurisdiction thereof as may be necessary to enable the Company to perform its obligations under this Warrant. Before taking any action which would result in an adjustment in the number of Warrant Shares for which this Warrant is exercisable or in the Exercise Price, the Company shall obtain all such authorizations or exemptions thereof, or consents thereto, as may be necessary from any public regulatory body or bodies having jurisdiction thereof.

(c) Successors and Assigns. Subject to compliance with applicable securities laws, this Warrant may be assigned by the Holder. This Warrant may not be assigned by the Company without the written consent of the Holder, except to a successor in the event of a Fundamental Transaction. This Warrant shall be binding on and inure to the benefit of the Company and the Holder and their respective successors and assigns. Subject to the preceding sentence, nothing in this Warrant shall be construed to give to any Person other than the Company and the Holder any legal or equitable right, remedy or cause of action under this Warrant.

(d) Amendment and Waiver. This Warrant may be amended only in writing signed by the Company and the Holder, or their successors and assigns. Except as otherwise provided herein, the Company may take any action herein prohibited, or omit to perform any act herein required to be performed by it, only if the Company has obtained the written consent of the Holder.

(e) Acceptance. Receipt of this Warrant by the Holder shall constitute acceptance of and agreement to all of the terms and conditions contained herein.

(f) Governing Law; Jurisdiction. ALL QUESTIONS CONCERNING THE CONSTRUCTION, VALIDITY, ENFORCEMENT AND INTERPRETATION OF THIS WARRANT SHALL BE GOVERNED BY AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS OF LAW THEREOF. EACH OF THE COMPANY AND THE HOLDER HEREBY IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF THE STATE AND FEDERAL COURTS SITTING IN THE CITY OF WILMINGTON, FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION HEREWITH OR WITH ANY TRANSACTION CONTEMPLATED HEREBY OR DISCUSSED HEREIN (INCLUDING WITH RESPECT TO THE ENFORCEMENT OF ANY OF THE TRANSACTION DOCUMENTS), AND HEREBY IRREVOCABLY WAIVES, AND AGREES NOT TO ASSERT IN ANY SUIT, ACTION OR PROCEEDING, ANY CLAIM THAT IT IS NOT PERSONALLY SUBJECT TO THE JURISDICTION OF ANY SUCH COURT. EACH OF THE COMPANY AND THE HOLDER HEREBY IRREVOCABLY WAIVES PERSONAL SERVICE OF PROCESS AND CONSENTS TO PROCESS BEING SERVED IN ANY SUCH SUIT, ACTION OR PROCEEDING BY MAILING A COPY THEREOF VIA REGISTERED OR CERTIFIED MAIL OR OVERNIGHT DELIVERY (WITH EVIDENCE OF DELIVERY) TO SUCH PERSON AT THE ADDRESS IN EFFECT FOR NOTICES TO IT AND AGREES THAT SUCH SERVICE SHALL CONSTITUTE GOOD AND SUFFICIENT SERVICE OF PROCESS AND NOTICE THEREOF. NOTHING CONTAINED HEREIN SHALL BE DEEMED TO LIMIT IN ANY WAY ANY RIGHT TO SERVE PROCESS IN ANY MANNER PERMITTED BY LAW. EACH OF THE COMPANY AND THE HOLDER HEREBY WAIVES ALL RIGHTS TO A TRIAL BY JURY.