UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2025

Commission File Number: 001-34936

Noah Holdings Limited

(Registrant’s name)

No. 1226, South Shenbin Road, Minhang District,

Shanghai, People’s Republic of China

+86 (21) 8035-8292

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Noah Holdings Limited | ||

| By: | /s/ Qing Pan | |

| Name: | Qing Pan | |

| Title: | Chief Financial Officer | |

| Date: August 28, 2025 | ||

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

Noah Holdings

Noah Holdings Private Wealth and Asset Management Limited

諾亞控股私人財富資產管理有限公司

(Incorporated

in the Cayman Islands with limited liability under the name Noah Holdings Limited and

carrying on business in Hong Kong as Noah Holdings Private Wealth and Asset Management Limited)

(Stock Code: 6686)

DISCLOSEABLE

TRANSACTION IN RESPECT OF

SUBSCRIPTION IN A PRIVATE CREDIT DIGITAL YIELD FUND

THE SUBSCRIPTION

On August 27, 2025 (U.S. Eastern Time), Joy Triple Star, a wholly owned subsidiary of the Company, committed to subscribing for the Subscribed Interests in Olive Digital Fund with a total capital commitment of US$50.0 million (equivalent to approximately HK$389.2 million), subject to the terms and conditions of the Fund Documents in relation to the Subscription. Capital contributions in respect of the Subscribed Interests will be funded by the Group’s internal resources and are payable in cash.

By subscribing to the Subscribed Interests in Olive Digital Fund, the Group seeks to deploy treasury in a risk-defined private credit strategy, while within the limits permitted under the Fund Documents, obtaining controlled and ancillary exposure to the digital-asset ecosystem for diversification and capability-building purposes.

IMPLICATIONS UNDER THE HONG KONG LISTING RULES

The Subscription constitutes a discloseable transaction under Rule 14.06(2) of the Hong Kong Listing Rules as one or more of the applicable percentage ratios exceed 5% but all of them are less than 25%, and are therefore subject to the reporting and announcement requirements under Chapter 14 of the Hong Kong Listing Rules.

THE SUBSCRIPTION

On August 27, 2025 (U.S. Eastern Time), Joy Triple Star, a wholly owned subsidiary of the Company, as one of the Limited Partners, committed to subscribing for the Subscribed Interests in Olive Digital Fund with a total capital commitment of US$50.0 million (equivalent to approximately HK$389.2 million), subject to the terms and conditions of the Fund Documents in relation to the Subscription. Capital contributions in respect of the Subscribed Interests will be funded by the Group’s internal resources and are payable in cash.

Guided by its primary treasury objective of enhancing returns on the basis of capital preservation, the Group’s Subscription represents a strategic allocation to a “cash management plus” product. The investment employs a dual-allocation strategy, focusing primarily on generating stable income from a risk-defined credit portfolio, while obtaining controlled and ancillary exposure to the digital asset ecosystem for the purposes of long-term diversification and capability-building.

Principal Terms of Olive Digital Fund

The principal terms of Olive Digital Fund in relation to Subscribed Interests are as follows:

| Name of the Fund | : | Olive Partners Digital Yield Fund I, LP |

| General Partner | : | Olive Partners Cayman GP I, Ltd. |

| Investment Manager | : | Olive Partners Management LLC |

| Administrator | : | Maples Fund Services (Cayman) Limited |

| Custodians | : | City National Bank |

| Coinbase Custody Trust Company, LLC | ||

| Target size | : | The Fund has a target investment size of around US$80 million with the aim of achieving an internal rate of return (IRR) exceeding mid-single digit range. |

| Investment objective and strategy | : | The investment objective of the Fund is to achieve a blend of income generation and capital appreciation by deploying capital into a dual-allocation strategy that involves (i) lending U.S. dollar-pegged stablecoins to institutional counterparties and (ii) reinvesting a portion of the resulting yields into Bitcoin. Its strategy is intended to provide stable near-term returns while offering long-term exposure to potential upside in the digital assets. |

| The Fund offers multiple share classes with differentiated exposure to Bitcoin, including: (i) Class A Interests: anticipated to allocate monthly income derived from stablecoin lending into Bitcoin; and (ii) Class B Interests: structured similarly to Class A, with the additional feature of gradually deploying up to 20% of the original capital into Bitcoin over the course of the first year. The pace and extent of such deployment may vary depending on market conditions, fund liquidity, and manager discretion. |

| Term | : | The Fund has a four (4)-year term commencing on the date of the Limited Partnership Agreement, unless wound-up and dissolved earlier under the dissolution provisions provided in the Limited Partnership Agreement, including, among others, (i) the decision of the General Partner; (ii) the withdrawal, bankruptcy, insolvency or dissolution of the General Partner or the occurrence of any other event as stipulated in the governing laws and regulations; and (iii) an order of the Grand Court of the Cayman Islands for the winding-up and dissolution. |

| Redemption | : | Each Limited Partner may request withdrawals from its effective capital account in the Fund (the “Capital Account”) as of the end of each fiscal year, subject to a ninety (90)-day prior written notice period and the consent of the General Partner, which may be granted or withheld in its absolute and sole discretion. The General Partner may, in its sole discretion, cause the Fund to distribute cash or property to the General Partner and Limited Partners as part of withdrawal, at such times and in such amounts as it shall determine its sole discretion. |

| The General Partner is entitled to, among other things: (i) withhold up to 5% of the Capital Account for withdrawals of 90% or more of the Capital Account balance for the Fund’s liabilities and other contingencies until no later than thirty (30) days after the completion of its year-end audit; (ii) establish reserves and holdbacks for estimated accrued expenses, liabilities, and contingencies which could reduce the amount of a distribution upon withdrawal; and (iii) satisfy all or part of a withdrawal request by a distribution in kind of assets, including digital assets or securities in-kind. Furthermore, the General Partner may, by written notice, compel the withdrawal of all of a Limited Partner’s interest at any time and for any reason. Any withdrawal is also subject to the deduction of any accrued incentive allocation payable to the General Partner. | ||

| Transferability | : | The limited partnership interest, or any beneficial interest therein, may not be transferred, mortgaged, assigned or otherwise disposed of, in whole or in part, except with the written consent thereto of the General Partner given in its sole discretion. The transferring Limited Partner and the transferee shall have agreed in writing to provide the Fund with any information requested by the General Partner relating to the Fund’s obligation to make basis adjustments under applicable laws, rules and regulations. |

| Management | : | The General Partner is responsible for the overall management and operation of the Fund and has ultimate authority over its affairs. |

| The General Partner has engaged the Investment Manager to provide ongoing investment management and administrative services. Pursuant to this delegation, the Investment Manager is authorized to conduct the Fund’s day-to-day operations, manage investments, retain service providers, make tax and accounting elections, and perform other functions customarily performed by an investment manager. While the Investment Manager may delegate certain duties to affiliates or third parties, it remains responsible for the supervision of such delegates. | ||

| An advisory committee comprising the representatives of the Limited Partners (the “Advisory Committee”), may be constituted to act in a consultative capacity and will be consulted by the General Partner on certain matters as specified in the Limited Partnership Agreement, which include, among other things, potential conflicts of interest and approving the valuation policies of the Fund. The Advisory Committee will not have any authority to make investment decisions or otherwise participate in the Fund’s management or control of the business. | ||

| Management fee | : | For the initial year of operations, the annual management fee is 2.0% of the capital commitments made by the respective Limited Partners (the “Capital Commitments”), with half of the management fee (i.e., 1.0% of Capital Commitments) satisfied upfront at the time of its initial capital contribution. Commencing from the second year of operations, the annual management fee is 1.0% of Capital Contributions used to fund the cost of any unrealized investments then held by the Fund. |

| Distributions | : | In the discretion of the General Partner, following consultation with the Investment Manager, a Limited Partner may receive in-kind distributions from the Partnership’s portfolio. Such investments so distributed may not be readily marketable or saleable and may have to be held by such Limited Partner for an indefinite period of time. Any such in-kind distributions will not materially prejudice the interests of the remaining Limited Partners in the same class, to the extent applicable. If the Partnership distributes securities in-kind in satisfaction of a withdrawal request, the General Partner may, in its sole discretion, at the request of any Limited Partner and to the extent practicable, hold any such securities in trust or in a liquidating special purpose vehicle and liquidate such securities on the Limited Partner’s behalf in which case (i) payment to such Limited Partner of that portion of its withdrawal attributable to such securities will be delayed until such time as such securities can be liquidated and (ii) the amount otherwise due to such Limited Partner will be increased or decreased to reflect the performance of such securities through the date on which the liquidation of such securities is effected, and any applicable expenses, the management fee and accrued incentive allocation. |

| If a Limited Partner is obligated pursuant to applicable law, rules and regulations to return a distribution made to it where the Fund is insolvent, such distribution shall be returned without the application of interest. | ||

| Incentive allocation | : | Subject to different classes of interests the Limited Partners subscribe to, the General Partner may be entitled to receive an allocation equal to an incentive allocation percentage of the net income allocated to such Limited Partner. In relation to the Subscribed Interests, the General Partner is not entitled to receive any incentive allocation, while the net income or net loss of the Fund (including realized and unrealized gains and losses) will be allocated to Joy Triple Star in proportion to its Capital Account balance. |

| Payment | : | Each Limited Partner is expected to fund its entire capital commitment in cash within five days upon admission to the Partnership. |

INFORMATION ON THE UNDERLYING ASSET IN RELATION TO THE SUBSCRIBED INTERESTS

The Subscribed Interests provide the Group with an economic exposure derived from the Fund’s deployment of capital into a dual-allocation strategy. In the initial year of operations, this strategy primarily consists of a secured credit loan of USDC extended to Coinbase Custody International Limited, which is expected to be collateralized by Bitcoin with a target collateralization ratio over 100%. Actual collateral levels and recovery prospects will depend on prevailing market conditions and the terms of the lending arrangement. Commencing from the second year of operations, the Fund intends to reinvest yield proceeds annually into digital assets, including but not limited to Bitcoin, based on prevailing market terms and negotiated rates.

The Subscribed Interests are under Class A Interests of the Fund, which are designed to allocate the monthly income generated from stablecoin lending activities into Bitcoin. All lending, trading, and custody activities are intended to be conducted through Coinbase, Inc., a U.S.-based digital asset platform that is publicly listed and subject to regulatory oversight.

Notwithstanding the foregoing credit enhancements, the Subscription may be subject to certain risks in association with the Fund’s structure, including the risk of total loss of invested capital, as well as other risks such as digital asset volatility, stablecoin depegging, lending counterparty default, custodian failure, and adverse changes in regulatory treatment of digital assets.

REASONS FOR AND BENEFITS OF THE SUBSCRIPTION

The amount of Capital Commitment for the Subscription was determined by the Subscriber after considering (i) the terms of the Funds Documents as compared to that offered by other comparable investment products available in the market; (ii) the Fund’s investment strategy and underlying assets, in particular its dual-allocation portfolio consisting of secured lending of U.S. dollar-pegged stablecoins and reinvestment of yield proceeds into Bitcoin and other digital assets, and the potential of such strategy to generate income and long-term capital appreciation; (iii) the Group’s existing investment portfolio, with reference to its overall exposure, diversification, expected return profile, and risk tolerance; and (iv) the Group’s cash management requirements, including an assessment of the Fund’s liquidity terms.

In line with its investment objectives, the Company conducts regular reviews of its investment portfolios and makes timely adjustments to optimize capital preservation, with the aim of delivering consistent, risk-adjusted returns to its Shareholders. The Directors believe that the Subscription is in line with the Group’s long-term investment strategy, is on normal commercial terms, and is in the interests of the Company and its Shareholders as a whole. In reaching this view, the Directors have considered the following factors:

| (i) | Strategic allocation and portfolio diversification |

The Subscription is guided by the Group’s core treasury management principle: enhancing investment returns on the fundamental premise of capital preservation, representing a strategic and forward-looking allocation for the Group and providing the Group with disciplined exposure to the emerging digital assets. This initiative is intended to diversify the Group’s existing investment portfolio, which is consistent with the Group’s objective of achieving consistent, long-term risk-adjusted returns through prudent capital allocation into sectors with growth potential.

As set out in the section “Principal Terms of Olive Digital Fund” above, the Fund’s dual-allocation strategy is designed to generate both income and capital appreciation. The Fund has a target internal rate of return (IRR) exceeding mid-single digit range, driven principally by the agreed-upon lending interest rate and potential appreciation of its Bitcoin holdings. This structure directly supports the Group’s overarching investment strategy, which is fundamentally guided by capital preservation and prudent risk management. The Subscription is structured such that the Group’s principal capital is allocated to the Fund’s lower-risk, yield-generating activities. Consequently, the Group’s exposure to more volatile assets, such as Bitcoin, is funded solely from the interest income generated by the Fund, thereby creating upside potential while strictly defining and limiting the Group’s direct capital risk.

| (ii) | Access to a high-growth digital assets ecosystem |

The Subscription enables the Group to gain strategic exposure to the fast-evolving digital asset ecosystem through a professionally managed and regulated investment vehicle. By participating via the Fund, the Company is able to capture opportunities in one of the highest-growth sectors of global finance without assuming the full operational, custody, and compliance burdens associated with direct investment.

This approach allows the Group to benefit from the potential upside of digital assets in a structured and diversified manner, as the Fund’s dual-allocation strategy combines stablecoin lending with reinvestment of yield proceeds into Bitcoin and other digital assets. Such an allocation provides a balance between near-term income generation and long-term capital appreciation, while reducing concentration risk that would otherwise arise from direct, single-asset purchases.

| (iii) | Expertise of a specialized management team |

While the Investment Manager is a newly established entity and a member of the Group, it is operated under the Company’s own brand, Olive Asset Management, the Company’s business that manages USD-denominated private equity funds and private secondary products. Over the past two and a half years, the Company has significantly enhanced the competitiveness of its overseas primary market product shelf, which allows the Company to offer private equity products that are on par with those provided by leading global private banks.

The Board’s decision is predicated on the capability and deep domain expertise of the Company’s very own investment management team. The management team of the Investment Manager is comprised of seasoned professionals who possess a demonstrable track record and a unique combination of expertise in blockchain technology and private equity investment experience. For the details of the biography of the management team of the Investment Manager, please refer to “Information on the Parties — (iv) Investment Manager — Olive Partners Management” below.

| (iv) | Risk-managed framework and enhanced oversight |

Olive Digital Fund provides the Group with a structured and institutional-grade vehicle designed to mitigate risks inherent in the digital asset market. Unlike direct investment in crypto exchanges or speculative trading, the Fund adopts a disciplined risk management framework that combines secured lending, portfolio diversification, and ongoing monitoring of counterparties and collateral. This structure reduces exposure to concentrated risks such as extreme asset price volatility, counterparty default, or operational failures in custody and trading.

A key benefit of this approach is the alignment of governance and oversight. Through its relationship with the Investment Manager, the Group is able to exert a greater degree of influence over operational policies, investment protocols, and risk controls than would typically be possible with an unaffiliated third-party manager. This enhanced oversight ensures that investment activities remain consistent with the Group’s overall risk appetite, compliance standards, and fiduciary responsibilities to its Shareholders.

Furthermore, the Fund’s framework incorporates collateralized lending arrangements and structured reinvestment mechanics, which provide an additional layer of protection compared to unstructured exposure to digital assets. These features allow the Group to capture the growth potential of the sector while managing downside risks in a more transparent and measurable way.

Taken together, these elements enable the Subscription to serve as a risk-adjusted gateway to digital asset exposure: it offers the Group potential returns while safeguarding capital through formalized governance, structured protocols, and enhanced monitoring, thereby ensuring that the Company’s and Shareholders’ interests are prioritized and protected.

| (v) | Alternative investment opportunities |

In assessing the Subscription, the Board also considered alternative investment opportunities for gaining exposure to this sector, such as the direct purchase of digital assets on crypto and digital asset exchanges. These alternatives were ultimately not pursued as they were deemed inconsistent with the Group’s risk management framework, which prioritizes a structured, risk-mitigated approach over direct speculative investment. The Subscription was therefore identified as the most suitable vehicle to achieve the Group’s strategic objectives in this area.

Having considered the reasons set out above, the Directors (including the independent Directors) are of the view that the terms of the Subscription are fair and reasonable and in the interests of the Company and its Shareholders as a whole.

INFORMATION ON THE PARTIES

| (i) | The Company and Joy Triple Star |

The Company is a leading and pioneer wealth management service provider offering comprehensive one-stop advisory services on global investment and asset allocation primarily for Mandarin-speaking high-net-worth investors.

Joy Triple Star, the Subscriber, is a wholly owned subsidiary of the Company established under the law of the British Virgin Islands with limited liability on January 12, 2008 and acts as an investment holding platform within the Group.

| (ii) | Olive Digital Fund |

Olive Digital Fund is an exempted limited partnership established and registered in accordance with Section 9 of the Exempted Limited Partnership Act (As Revised) of the Cayman Islands on June 25, 2025.

Based on information provided by the Investment Manager:

| a. | As of the date of this announcement, the Subscriber has not yet made any capital contributions to the Fund. However, assuming the Fund achieves its target size and the full amount of the capital commitments by the Subscriber and all other Limited Partners is contributed to the Fund, the Subscriber would hold approximately 62.5% of the aggregate partnership interests in the Fund. |

| b. | Given the Fund’s structure and its objective to raise additional capital through one or more subsequent closings, the Fund’s size is expected to increase over the fundraising period, which will continue for 12 months from the date of the Limited Partnership Agreement, with the General Partner having the discretion to extend such period for one additional month. Accordingly, the Fund is expected to have a broader investor base over its term. Consequently, and as contemplated by the Fund’s constitutional documents, the Subscriber’s percentage interest in the Fund is expected to be diluted as the Fund admits new investors in subsequent closings of the further subscriptions. |

| (iii) | General Partner — Olive Partners Cayman |

The General Partner is Olive Partners Cayman, an exempted company with limited liability incorporated in the Cayman Islands, and each shareholder of which is an employee of the Group who is an Independent Third Party. As of the date of this announcement, the directors of Olive Partners Cayman were Mr. Byron Ye (“Mr. Ye”) and Mr. Wei Zhou (“Mr. Zhou”), who concurrently served as the directors of the Investment Manager, making it an affiliate of Olive Partners Cayman.

| (iv) | Investment Manager — Olive Partners Management |

The Investment Manager is Olive Partners Management, a limited liability company incorporated in Delaware on July 8, 2024, and a member of the Group controlled by the Company through a series of contractual arrangements. Each registered member of Olive Partners Management is an employee of the Group.

The Affiliation with the Group through Contractual Arrangements

Since its establishment in July 2024, the Investment Manager has generated investment advisory and management fees, which have not constituted a material source of revenue for the Group during this initial period. Its assets as of December 31, 2024 and June 30, 2025 were not material to the Group, being less than 0.1% of the total assets of the Group.

Through contractual arrangements, the Company exercises effective control over Olive Partners Management for the operation of the Group’s U.S.-based asset investment management business.

Reasons for Adopting the Contractual Arrangements

In the United States, certain transactions involving foreign investment are subject to review by the Committee on Foreign Investment in the United States (CFIUS), an inter-agency body authorized to assess the national security effects of such investments. CFIUS has broad jurisdiction to review investments by foreign persons in U.S. businesses, particularly in sensitive sectors involving technology, critical infrastructure, and personal data. Depending on the nature of the transactions and the sectors involved, CFIUS may require mandatory filings or encourage voluntary notices for CFIUS review of the transactions. In the current geopolitical environment, investments made by China-based investors are subject to heightened scrutiny and additional regulatory oversight, which can lead to increased compliance requirements, potential transaction delays, and the risk of prohibition or forced divestment.

In practice, certain asset investment opportunities (including in the digital assets space) or fund structures in the U.S. market may have specific requirements regarding the nationality, residency, or corporate structure of investment managers. This complex and evolving landscape presents unique operational challenges and considerations for China-based asset management companies seeking to invest in the United States.

The Company adopted the contractual arrangements to enhance its ability to effectively access and manage investment opportunities in the U.S. asset management market and mitigate potential operational hurdles encountered by foreign-owned investment managers under Olive Partners Management, while remaining mindful of the complex regulatory landscape applicable to foreign investors. By utilizing this arrangement, the Company aims to better position itself to participate in the dynamic U.S. market, including in emerging and specialized sectors such as digital assets.

Structure of the Contractual Arrangements

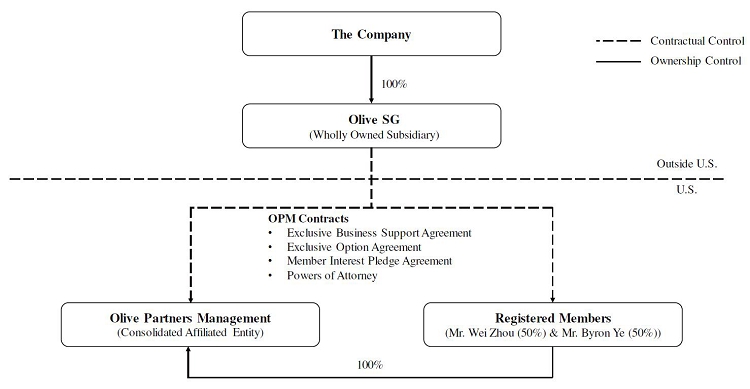

The Company, through Olive SG, its wholly owned subsidiary, entered into a series of contractual arrangement with Olive Partners Management and/or its registered members, being Mr. Ye and Mr. Zhou, on July 8, 2024. The agreements underlying the contractual arrangements with Olive Partners Management and/or its registered members include an exclusive business support agreement, an exclusive option agreement, a membership interest pledge agreement and powers of attorney (together, the “OPM Contracts”).

The OPM Contracts enable the Group to (a) exercise effective control over Olive Partners Management, primarily through the irrevocable powers of attorney granted by its registered members, which empower the Group to exercise all member rights; (b) receive the economic benefits generated by Olive Partners Management, pursuant to the exclusive business support agreement under which Olive SG provides services in exchange for service fees; (c) have an exclusive and irrevocable option to acquire (by itself or through a designated third party) all or part of the membership interests in Olive Partners Management; and (d) receive a pledge of the membership interests in Olive Partners Management as collateral to secure the registered members’ and Olive Partners Management’s performance of their obligations under the OPM Contracts. The OPM Contracts allow the Group to consolidate the financial results of Olive Partners Management as a variable interest entity.

The diagram below illustrates the summary of structure under the OPM Contracts:

Based on its review of the OPM Contracts, the Company’s U.S. legal advisor has confirmed that each of these contracts is, and taken as a whole are, valid and legally binding on the parties thereto.

Reputation and Experience

The Investment Manager’s team comprises talented, competent and capable professionals with specialized expertise in investment and assets management.

| a. | Experienced Team |

The management of Olive Partners Management is led by its managing director, Mr. Ye, an employee of the Group. He is an accomplished investment professional with over 25 years of experience and a strong track record in private equity and venture capital, with a focus on identifying high-potential companies, guiding them through critical growth phases, and generating long-term value for investors.

Mr. Ye is supported by Mr. Zhou, also a director at Olive Partners Management and an employee of the Group. Mr. Zhou focuses on identifying investment opportunities within U.S. private markets, including venture capital and private equity fund investments, technology direct/co-investments, secondaries, and special opportunities.

While Olive Partners Management itself was recently established in July 2024, the collective experience and professional capabilities of its management team provide the necessary foundation for executing sophisticated digital asset investment strategies. The management team members’ diverse backgrounds in traditional investment management, technology sector investments, and alternative asset classes position them well to navigate the complexities of the digital asset ecosystem and capitalize on emerging opportunities in this rapidly evolving market.

| b. | Strategic Network and Market Access |

The management team of Olive Partners Management leverages extensive networks and relationships within both traditional investment management and the digital asset ecosystem. Their professional backgrounds provide access to a broad spectrum of investment opportunities, including direct investments in blockchain technology companies, digital asset funds, and other digital asset-related ventures. This network enables Olive Partners Management to identify and evaluate investment opportunities that may not be readily accessible to other market participants, thereby enhancing the potential for attractive risk-adjusted returns for the Fund.

| (v) | Administrator – Maples Fund Services (Cayman) Limited |

Maples Fund Services (Cayman) Limited is a Cayman Islands company regulated by the Cayman Islands Monetary Authority and is engaged to provide fund administration services, including net asset value calculation, investor services, and maintenance of the books and records of Olive Digital Fund.

| (vi) | Custodians |

City National Bank

City National Bank is a national banking association regulated by the Office of the Comptroller of the Currency in the United States and serves as a fiat currency custodian for the U.S. dollar holdings of Olive Digital Fund.

Coinbase Custody Trust Company, LLC

Coinbase Custody Trust Company, LLC is a New York limited purpose trust company regulated by the New York State Department of Financial Services and is engaged to provide digital asset custody solutions for the cryptocurrency and stablecoin positions of Olive Digital Fund, including USDC and Bitcoin.

To the best of the Directors’ knowledge, information and belief having made all reasonable enquiries, save as disclosed above, all the other Limited Partners, the General Partner, the Investment Manager, the administrator, the custodians and their respective ultimate beneficial owners are Independent Third Parties.

IMPLICATIONS UNDER THE HONG KONG LISTING RULES

The Subscription constitutes a discloseable transaction under Rule 14.06(2) of the Hong Kong Listing Rules as one or more of the applicable percentage ratios are more than 5% but are less than 25% and are therefore subject to the reporting and announcement requirements under Chapter 14 of the Hong Kong Listing Rules.

DEFINITION

In this announcement, unless the context otherwise requires, the following expressions should have the following meanings:

| “ADS(s)” | American Depositary Shares (one ADS representing five Shares) | |

| “Articles” or “Articles of Association” | the memorandum of association and articles of association of the Company, as amended or supplemented from time to time | |

| “Bitcoin” | a type of cryptocurrency that operates using blockchain technology | |

| “Board” | the board of Directors | |

| “China” or “PRC” | the People’s Republic of China, excluding, for the purposes of this announcement only, Taiwan and the special administrative regions of Hong Kong and Macau, except where the context otherwise requires |

| “Company” | Noah Holdings Limited, an exempted company with limited liability incorporated in the Cayman Islands on June 29, 2007, carrying on business in Hong Kong as “Noah Holdings Private Wealth and Asset Management Limited (諾亞控股私人財富資產管理有限公司)” | |

| “Consolidated Affiliated Entity” | the entity that are controlled by the Company through contractual arrangements | |

| “Director(s)” | the director(s) of the Company | |

| “Fund Documents” | means, collectively, the Confidential Private Placement Memorandum, the Limited Partnership Agreement, the Subscription Agreement, and any related ancillary documents regarding the Subscription, in each case as amended and supplemented from time to time | |

| “General Partner” or “Olive Partners Cayman” | Olive Partners Cayman GP I, Ltd., an exempted company under the law of the Cayman Islands with limited liability on June 25, 2025 | |

| “Group”, “our Group”, “the Group”, “Noah”,“our ”, “us” or “we” | the Company, its subsidiaries and the Consolidated Affiliated Entities from time to time | |

| “HK$” | Hong Kong dollars, the lawful currency of Hong Kong | |

| “Hong Kong” | the Hong Kong Special Administrative Region of the PRC | |

| “Hong Kong Listing Rules” | the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited | |

| “Hong Kong Stock Exchange” | The Stock Exchange of Hong Kong Limited or “HKEX” | |

| “Independent Third Party(ies)” | person(s) who are independent of the Group and independent of connected persons of the Company | |

| “Investment Manager” or “Olive Partners Management” | Olive Partners Management LLC, a Delaware limited liability company established on July 8, 2024 | |

| “Joy Triple Star” | Joy Triple Star Holdings Limited, a company established under the law of the British Virgin Islands with limited liability on January 12, 2008 and a wholly owned subsidiary of the Company | |

| “Limited Partner(s)” | the limited partners(s) of Olive Digital Fund |

| “Limited Partnership Agreement” | the amended and restated exempted limited partnership agreement of Olive Digital Fund | |

| “Olive Digital Fund”, “Fund” or “Partnership” | Olive Partners Digital Yield Fund I, LP, an exempted limited partnership established and registered in accordance with Section 9 of the Exempted Limited Partnership Act (As Revised) of the Cayman Islands on June 25, 2025 |

| “Olive SG” | Olive Capital Investments SG Pte. Ltd., an exempt private company limited by shares incorporated in Singapore on May 16, 2024 and a wholly owned subsidiary of the Company | |

| “RMB” or “Renminbi” | Renminbi yuan, the lawful currency of China | |

| “SEC” | the United States Securities and Exchange Commission | |

| “SFO” | the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), as amended or supplemented from time to time | |

| “Share(s)” | ordinary share(s) in the share capital of the Company, and upon the revised Articles of Association becoming effective, any share(s) in the capital of the Company | |

| “Shareholder(s)” | the holder(s) of the Share(s), and where the context requires, ADSs | |

| “subsidiary” or “subsidiaries” | has the meaning ascribed thereto in section 15 of the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), as amended or supplemented from time to time | |

| “Subscribed Interests” | Class A Interests of the Fund in connection with a total capital commitment of US$50.0 million (equivalent to approximately HK$389.2 million) subscribed by the Subscriber | |

| “Subscriber” | Joy Triple Star | |

| “Subscription” | the subscription by the Subscriber of Subscribed Interests in accordance with the terms of the Fund Documents |

| “USDC” | USD Coin, a digital stablecoin issued by Circle Internet Financial, LLC that is designed to maintain a 1:1 value with the U.S. dollar | |

| “U.S.” or “United States” | the United States of America, its territories, its possessions and all areas subject to its jurisdiction | |

| “U.S. dollar(s)” or “US$” | United States dollar(s), the lawful currency of the United States | |

| “%” | per cent |

For the purpose of this announcement and for illustrative purpose only, conversions of US$ to HK$ are based on the exchange rate of US$1.00 = HK$7.7849. No representation is made that any amounts in HK$ or US$ can be or could have been converted at the relevant dates at the above rate or at any other rates or at all.

| By order of the Board | |

| Noah Holdings Private Wealth and Asset Management Limited | |

| Jingbo Wang | |

| Chairwoman of the Board |

Hong Kong, August 28, 2025

As of the date of this announcement, the Board comprises Ms. Jingbo Wang, the chairwoman, and Mr. Zhe Yin as Directors; Ms. Chia-Yue Chang, Mr. Boquan He and Mr. David Zhang as non-executive Directors; and Ms. Xiangrong Li, Ms. Cynthia Jinhong Meng and Ms. May Yihong Wu as independent Directors.

Exhibit 99.2

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

Noah Holdings

Noah Holdings Private Wealth and Asset Management Limited

諾亞控股私人財富資產管理有限公司

(Incorporated in the Cayman Islands with limited liability under the name Noah Holdings Limited and

carrying on business in Hong Kong as Noah Holdings Private Wealth and Asset Management Limited)

(Stock Code: 6686)

INSIDE INFORMATION

INTERIM RESULTS ANNOUNCEMENT

FOR THE SIX MONTHS ENDED JUNE 30, 2025

This announcement is issued pursuant to Rule 13.09 of the Hong Kong Listing Rules and the Inside Information Provision under Part XIVA of the SFO.

The Board is pleased to announce the unaudited consolidated interim results of the Company for the six months ended June 30, 2025, together with the comparative figures for the corresponding period in 2024. These interim results have been prepared under the U.S. GAAP, which are different from the IFRS, and reviewed by the Audit Committee.

In this announcement, “Noah,” “we,” “us” and “our” refer to the Company and where the context otherwise requires, the Group. Certain amounts and percentage figures included in this announcement have been subject to rounding adjustments, or have been rounded to one or two decimal places. Any discrepancies in any table, chart or elsewhere between totals and sums of amounts listed therein are due to rounding.

BUSINESS HIGHLIGHTS

The global macroeconomic environment in the first half of 2025 was volatile, marked by trade fragmentation and diverging monetary policies that added to existing growth constraints. Against this backdrop, liquidity conditions remained relatively tight as global central banks maintained policy rates at multi-year highs to rein in inflation. Geopolitical headwinds – ranging from renewed trade tensions to technology-export controls – sustained bouts of market volatility and reinforced investors’ preference for safe-haven assets. China’s economy remained under pressure, with subdued consumer demand and ongoing weakness in the real estate sector weighing on overall growth. Within China’s wealth management industry, HNW individuals continued to prioritize wealth preservation and liquidity. As a result, demand is gradually shifting toward providers of high-quality global strategies where transparency, diversification and downside protection are more readily obtained.

Our firm’s disciplined, forward-looking strategy continues to provide us with flexibility to navigate this challenging environment and ensure the resilience of our business. As highlighted in our semi-annual CIO1 report for the second half of 2025, we are also witnessing a major paradigm shift occurring. If the past two decades were defined by strategies to hedge against inflation and allocate into inflation-protected assets, the next twenty years will pivot to a new imperative: understanding, embracing, and profiting from technology-driven deflation. We are guiding clients to embrace this evolving landscape where growth is no longer fueled by debt-driven asset bubbles but by deflationary forces and efficiency dividends enabled by technological innovation. In response, our adaptive allocation framework is designed to balance current defensive positioning with future-facing offensive opportunities through three strategic pillars: inflation-hedged anchors, deflation-hedged assets, and flexible bridge holdings.

Our commitment to overseas expansion continues delivering promising results. By combining our personalized service model with an expanding portfolio of global products, we have established a significant competitive advantage. In the first half of 2025, we made notable progress: we established our ARK global headquarters in Singapore, entered into a strategic partnership with Tokyo Star Bank in Japan through our ARK Japan subsidiary, and officially joined the Family Office Association of Hong Kong. These developments position us at the crossroads of Asia’s evolving capital flows, enabling us to turn regional headwinds into long-term strategic advantages. As ever, we continue seeing tremendous growth potential in serving global Chinese HNW investors overseas who share our cultural values and place their trust in our long-standing track record. As a key booking center, Singapore has demonstrated robust momentum, with deposit volumes rising steadily and transaction value through Singapore-based channels increasing substantially, signaling clear potential for further expansion among local clients.

By consistently focusing on client and employee education, we believe we are strongly positioned to guide stakeholders through the coming market shifts. Our global growth journey has only just begun, and we remain confident in our ability to navigate challenges and capitalize on the opportunities that lie ahead.

FINANCIAL HIGHLIGHTS

During the Reporting Period, we successfully navigated through a complex macroeconomic environment both domestically and internationally, while simultaneously advancing our internal structure transformation. As a result of these efforts and strategic focus, our net revenue for the six months ended June 30, 2025 was RMB1,244.1 million, representing a slight decrease of 1.7% as compared to the corresponding period in 2024, mainly due to a decline in distribution of insurance products. Our net income attributable to the Shareholders increased by 41.6% from RMB231.3 million for the six months ended June 30, 2024 to RMB327.5 million for the six months ended June 30, 2025. Similarly, our Non-GAAP net income attributable to the Shareholders increased by 33.9% from RMB267.2 million during the same period last year to RMB357.8 million for the Reporting Period, mainly due to an increase in the fair value of the funds managed by Gopher and a decrease in one-off expenses Gopher paid to one of its funds as general partner.

| 1. | “CIO” refers to the chief investment officer of the Company. |

Despite the challenges, we remain committed to investing in the overseas market by expanding our international relationship managers team and actively increasing our influence and wallet share among our Chinese clients globally. The transaction value of overseas products we distributed increased by 0.6% from RMB16.3 billion for the six months ended June 30, 2024 to RMB16.4 billion for the Reporting Period. Notably, we raised US$420 million for overseas hedge funds and structured products, marking a significant 282.0% year-over-year increase. Additionally, our AUM for overseas products grew by 5.9% from RMB39.1 billion as of June 30, 2024 to RMB41.4 billion as of June 30, 2025, and our overseas AUA grew by 6.6% from RMB8.5 billion as of June 30, 2024 to RMB9.1 billion as of June 30, 2025.

Non-GAAP Financial Measures

| For

the Six Months Ended June 30, |

||||||||||||

| 2024 (Unaudited) |

2025 (Unaudited) |

Change (%) |

||||||||||

| (RMB in thousands, except percentages) | ||||||||||||

| Total revenues | 1,274,843 | 1,254,722 | (1.6 | )% | ||||||||

| Net revenues | 1,265,389 | 1,244,095 | (1.7 | )% | ||||||||

| Income from operations | 255,501 | 347,034 | 35.8 | % | ||||||||

| Income before taxes and income from | ||||||||||||

| equity in affiliates | 372,441 | 416,982 | 12.0 | % | ||||||||

| Net income | 235,556 | 328,356 | 39.4 | % | ||||||||

| Net income attributable to the shareholders of the Company | 231,278 | 327,540 | 41.6 | % | ||||||||

| Non-GAAP Financial Measures: | ||||||||||||

| Net income attributable to the shareholders of the Company | 231,278 | 327,540 | 41.6 | % | ||||||||

| Add: share-based compensation expense | 58,479 | 37,788 | (35.4 | )% | ||||||||

| Add: settlement expense (reversal) | (11,476 | ) | – | N.A | ||||||||

| Less: tax effect of adjustments | 11,061 | 7,558 | (31.7 | )% | ||||||||

| Adjusted net income attributable to the shareholders of the Company (non-GAAP) | 267,220 | 357,770 | 33.9 | % | ||||||||

Adjusted net income attributable to the Shareholders is a non-GAAP financial measure that excludes the income statement effects of all forms of share-based compensation expenses, non-cash settlement expenses (reversal) and net of relevant tax impact. A reconciliation of adjusted net income attributable to the Shareholders from net income attributable to the Shareholders, the most directly comparable GAAP measure, can be obtained by subtracting expenses for share-based compensations and non-cash settlement. All tax expense impact of such adjustments would also be considered. The Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance the overall understanding of the Company’s past performance and future prospects.

The non-GAAP financial measures disclosed by the Company should not be considered a substitute for financial measures prepared in accordance with U.S. GAAP. The financial results reported in accordance with U.S. GAAP and reconciliation of U.S. GAAP to non-GAAP results should be carefully evaluated. The non-GAAP financial measures used by the Company may be prepared differently from and, therefore, may not be comparable to similarly titled measures used by other companies.

When evaluating the Company’s operating performance in the Reporting Period, management reviewed non-GAAP net income results reflecting adjustments to exclude the impact of share-based compensation, non-cash settlement expenses (reversal) and net of relevant tax impact. As such, the Company’s management believes that the presentation of the non-GAAP adjusted net income attributable to the Shareholders provides important supplemental information to investors regarding financial and business trends relating to its results of operations in a manner consistent with that used by management. Pursuant to U.S. GAAP, the Company recognized significant amounts of expenses for all forms of share-based compensation and non-cash settlement expenses (reversal) (net of tax impact). To make its financial results comparable period by period, the Company utilizes non-GAAP adjusted net income to better understand its historical business operations. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

BUSINESS REVIEW AND OUTLOOK

Business Review for the Reporting Period

While the first half of 2025 continued to bring challenges, it presented an opportunity for our Company to demonstrate our resilience through cost management and acceleration in our global expansion.

Wealth Management Business

During the Reporting Period, we generated total revenue of RMB862.7 million from our wealth management business, representing a 2.2% decrease from RMB881.8 million in the first half of 2024, mainly due to (i) a 3.5% decrease in total revenue generated from one-time commissions from RMB324.1 million for the six months ended June 30, 2024 to RMB312.8 million for the six months ended June 30, 2025, primarily due to reduced distribution of insurance products; (ii) a 3.3% decrease in total revenue generated from recurring service fees from RMB481.5 million for the six months ended June 30, 2024 to RMB465.7 million for the six months ended June 30, 2025, primarily due to a decrease in AUM associated with a decrease in existing private equity products in mainland China; and (iii) a 13.4% decrease in total revenue generated from other service fees from RMB65.1 million for the six months ended June 30, 2024 to RMB56.4 million for the six months ended June 30, 2025, primarily due to a reduction in value-added services provided to our clients. In the first half of 2025, we achieved an aggregate transaction value of RMB33.1 billion for the different types of investment products that we distributed, remaining stable compared to the six months ended June 30, 2024.

Asset Management Business

During the Reporting Period, we generated total revenue of RMB362.8 million from our asset management business, representing a 2.8% decrease compared to the six months ended June 30, 2024, mainly due to (i) a 1.4% decrease in recurring service fees in the six months ended June 30, 2025 which was effectively flat; and (ii) a 23.7% decrease in performance-based income in the six months ended June 30, 2025 compared to the same period in 2024, resulting from a decrease in income generated from domestic private equity products. Despite these challenges, through Gopher Asset Management, one of our Consolidated Affiliated Entities, and Olive Asset Management, a wholly-owned subsidiary of the Company, our AUM slightly decreased by 5.8% from RMB154.0 billion as of June 30, 2024 to RMB145.1 billion as of June 30, 2025, among which our overseas AUM reached RMB41.4 billion, representing an increase of 5.9% compared to RMB39.1 billion as of June 30, 2024, primarily driven by new fundraising of our actively managed USD products.

As of June 30, 2025, we maintained a sound capital structure with total assets of RMB11.7 billion and no interest-bearing liabilities. Throughout the Reporting Period, we remained committed to full compliance with all relevant laws and regulations that had a material impact on our business, such as the SFO, the Insurance Ordinance (Chapter 41 of the Laws of Hong Kong), and the Trustee Ordinance (Chapter 29 of the Laws of Hong Kong), among others.

Domestic Business Performance and Strategy

Domestically, our business continued to be impacted by a complex macroeconomic environment in China, with varied sectoral performance and continued structural adjustments. Our revenue contracted modestly during the Reporting Period as compared to the same period in 2024, despite a significant decrease from distribution of insurance products due to intensified market competition we faced as we continue to invest in building our commission-only broker team; the impact was partially offset by an increase of 9.6% in contribution from public securities products. While contributions from private equity products declined by 12.7%, they performed better than expected, supported by the fact that some of the funds gradually extended their terms.

Operating within China’s evolving economic landscape, we maintained disciplined execution of our domestic strategy despite persistent headwinds. Ongoing challenges in the property sector and cautious consumer sentiment created a complex environment for wealth management services. However, we view this period of consolidation as an opportunity to consolidate and reinforce our operational foundation for future growth. Our domestic operations benefited from the cost optimization initiatives implemented in late 2024, resulting in an 11.2% year-over-year reduction in operating expenses. Going forward, we remain focused on cost control, innovative client acquisition strategies, and operational restructuring to improve efficiency.

Looking ahead, we believe the growing sophistication of global Chinese investors and their increasing demand for diversified investment solutions align well with our evolving product suite. We continue to invest in talent development and technology infrastructure to ensure readiness to capture emerging opportunities. As domestic capital market conditions continue improving, we expect our strong brand recognition and operational discipline to position us for sustainable growth over the long term.

Details of the development of our domestic business structured around three core segments during the Reporting Period are as follows:

Domestic public securities

Domestic public securities, operating under the Noah Upright brand, is the business that distributes mutual funds and private secondary products. During the Reporting Period, this segment concentrated on developing an “online-first, offline-supported” business model, with the goal of facilitating global asset allocation through RMB-denominated products. Following policy incentives introduced in September 2024, the A-share and Hong Kong markets continued showing strong performance, driving a year-over-year increase of over 75% in transaction value contributed by the segment, primarily driven by a more than 180% increase in fundraising for our RMB-denominated private secondary products during the first half of 2025. Looking ahead, we believe sustained capital market activity and continued policy support will create new opportunities for client acquisition, enabling us to further expand our market share.

Domestic asset management

Domestic asset management, operating under the Gopher Asset Management brand, is the business that manages RMB-denominated private equity funds and private secondary products. The focus remains on managing primary market exits and cross-border ETF products in the secondary market. Due to the absence of new fundraising for RMB-denominated private equity funds in the first half of 2025, the gradual expiration of legacy products is expected to reduce the management fee base. In response, we are accelerating the expansion of our overseas investment product offerings and growing our secondary market. These efforts aim to offset – and ultimately exceed – the impact of the declining management fee base from maturing onshore products.

Domestic insurance

Domestic insurance, operating under the Glory brand, is the business that distributes insurance products, consisting mainly of life and health insurance products. In the first half of 2025, revenue from this segment was impacted by adjustments to our sales team structure and a strategic shift in product focus. While the transition to a new model will require time to be reflected in our financial results, we believe this restructuring positions the business for long-term, stable growth. Looking ahead, we will prioritize the recruitment of commission-only brokers to drive the delivery of comprehensive family succession planning services, further strengthening this segment’s future potential.

Overseas Business Expansion and Vision

At the end of 2024, we executed a clear strategic vision to expand our global presence, and in the first half of 2025, we achieved considerable progress. Overseas revenue accounted for 48% of total net revenue in the first half of 2025, representing a year-over-year increase. This was primarily driven by contributions from our exclusive alternative investment products, which rose 18.9% compared to the same period last year.

To meet the evolving needs of a growing global client base, we continue to offer a comprehensive suite of products denominated in both RMB and USD. Our competitive edge is anchored in an extensive network of esteemed product and investment partners worldwide, enabling us to continuously enhance our portfolio of high-quality, exclusive alternative investment solutions. Building on this strong foundation, the Group will strategically venture into frontier non-traditional asset ecosystems to capture new growth opportunities and further diversify our value proposition.

Through strategic expansion in key markets such as Singapore, Japan, and Hong Kong, we have transformed ARK into a truly global wealth management platform. We intend to ride on this momentum by pursuing quality opportunities in new markets, including the U.S. and Canada, while continuing to develop more innovative products in both RMB and USD, and deepening local expertise in the jurisdictions we operate.

Our overseas operations are structured into three core segments:

Overseas wealth management

Overseas wealth management, operating under the ARK Wealth Management brand, is the business that provides offline and online wealth management services.

As of June 30, 2025, our overseas registered clients exceeded 18,800, representing a 13.0% year-over-year increase. The number of active clients surpassed 3,600, representing a 12.5% year-over-year increase. Our overseas AUA, including distributed products, reached US$9.1 billion, reflecting a 6.6% increase compared to the same period last year. Looking ahead, we will continue to deepen our coverage in these key markets while expanding our client base through both existing relationships and new client acquisition. To cater to the diverse needs and preferences of our clientele, we will design and introduce tailored suites of investment products aligned with a range of thematic strategies.

Overseas asset management

Overseas asset management, operating under the Olive Asset Management brand, is the business that manages USD-denominated private equity funds and private secondary products. Over the past two and a half years, we have significantly enhanced the competitiveness of our overseas primary market product shelf through the establishment of a dedicated U.S. product center. This allows us to offer private equity products that are on par with those provided by leading global private banks. On the secondary market side, we have expanded partnerships with top-tier global managers and diversified our offerings in structured products and hedge funds.

In the first half of 2025, fundraising for hedge funds and structured products reached US$420 million, representing a 282.0% year-over-year increase. We raised US$340 million in USD-denominated private equity and private credit funds, representing a 0.8% year-over-year increase. As of June 30, 2025, our actively managed overseas AUM reached US$41.4 billion, representing an increase of 5.9% compared to the same period last year. Moving forward, we will continue to strengthen our global alternative investment capabilities to meet the evolving needs of our clients.

Overseas insurance and comprehensive services

Overseas insurance and comprehensive services, operating under the Glory Family Heritage brand, is the business that provides comprehensive overseas services such as insurance, trust services and other services.

In recent years, competition in the overseas insurance market – particularly in Hong Kong – has intensified, resulting in a decline in revenue from this segment in the first half of 2025. In response, we are actively exploring new business models and expanding our insurance offerings beyond Hong Kong to other international markets. We are also investing in the recruitment of licensed, commission-only brokers to enhance our client acquisition efforts. By the end of 2025, Glory Family Heritage aims to establish a team of 150 self-employed, commission-based brokers to catalyze the next phase of client growth for this segment.

Business Outlook

We believe the operational adjustments implemented throughout 2024 and early 2025 are beginning to yield meaningful results. The successful establishment of our global headquarters in Singapore and the rapid growth of our overseas business validate our strategic direction and position us well for the future. Looking ahead, we remain firmly focused on three key areas:

First, we will continue expanding our client base. Domestically, improving market conditions and industry consolidation create opportunities to serve clients seeking established, trusted wealth management partners. Overseas, we continue to see considerable untapped potential, particularly in jurisdictions with large populations of global Chinese HNW investors who remain underserved by local institutions where they live. We are actively exploring opportunities in new markets, including the U.S. and Canada. At the same time, we continue to invest in building a team of commission-only brokers to drive the turnaround of our insurance businesses.

Second, we will enhance our product offerings and investment capabilities to better serve our increasingly diverse client base. The road to achieving this is multifaceted, but is ultimately rooted in our “Global Network, Local Depth” approach – leveraging our presence across multiple jurisdictions to source best-in-class investment opportunities globally, while maintaining deep local market expertise. As our client base continues to expand, we will diversify our suite of offerings and enhance our global investment and asset-allocation frameworks to offer more competitive portfolios and strategic allocations. In the primary market, we will reinforce our distinctive ecosystem of product and investment partners – broadening our catalog, crafting bespoke investment approaches and securing exclusive opportunities. In the secondary market, we will leverage our global research and investment expertise to identify leading strategies from top-tier fund managers, strengthening our capacity to deliver robust, resilient asset-allocation solutions.

Third, we remain committed to maintaining operational excellence while pursuing growth remains paramount. Our cost reduction measures have played an instrumental role in navigating the current economic landscape, and we believe they provide a solid foundation for margin expansion as revenue rebounds.

Looking ahead, with our strengthened operational foundation, clear strategic focus, robust balance sheet, and healthy cash reserves, we remain confident in our ability to deliver sustainable growth and create lasting value for our clients and shareholders.

MANAGEMENT DISCUSSION AND ANALYSIS

Revenues

Historically, our revenues were derived from three business segments: wealth management, asset management and other services. Following a comprehensive evaluation of the nature of the Company’s evolving business operations and recent organizational adjustments, management has determined that a new segmentation approach adopted since the fourth quarter of 2024 has also been utilized to present management’s understanding of the financial performance and strategic progress of each business segment. As a result, besides representing our revenue under the traditional three business segments, the Company also discloses the Company’s revenues and operational costs and expenses for each of its six domestic and overseas business segments as well as headquarters in this analysis. This refined segmentation approach is designed to enhance resource allocation, provide investors with insights into the Company’s financial performance across its diverse business segments, and ensure alignment with the Company’s long-term strategic objectives. For the Reporting Period, the same disclosure approach will be implemented.

| For the Six Months Ended June 30, | ||||||||||||

| 2024 (Unaudited) |

2025 (Unaudited) |

Change (%) |

||||||||||

| (RMB in thousands) | ||||||||||||

| Revenues: | ||||||||||||

| Wealth management business: | ||||||||||||

| One-time commissions | 324,061 | 312,759 | (3.5 | )% | ||||||||

| Recurring service fees | 481,518 | 465,676 | (3.3 | )% | ||||||||

| Performance-based income | 11,082 | 27,878 | 151.6 | % | ||||||||

| Other service fees | 65,093 | 56,368 | (13.4 | )% | ||||||||

| Total revenue for wealth management business | 881,754 | 862,681 | (2.2 | )% | ||||||||

| Asset management business: | ||||||||||||

| One-time commissions | 44 | 1,880 | 4172.7 | % | ||||||||

| Recurring service fees | 342,010 | 337,100 | (1.4 | )% | ||||||||

| Performance-based income | 31,218 | 23,830 | (23.7 | )% | ||||||||

| Total revenue for asset management business | 373,272 | 362,810 | (2.8 | )% | ||||||||

| Other businesses: | ||||||||||||

| Other service fees | 19,817 | 29,231 | 47.5 | % | ||||||||

| Total revenue for other business | 19,817 | 29,231 | 47.5 | % | ||||||||

| Total revenues | 1,274,843 | 1,254,722 | (1.6 | )% | ||||||||

Our total revenue decreased by 1.6% from RMB1,274.8 million for the six months ended June 30, 2024 to RMB1,254.7 million for the six months ended June 30, 2025. The decrease in total revenues was primarily due to a decrease in recurring service fees from private equity products in mainland China.

Wealth Management Business

For the wealth management business, our total revenue decreased by 2.2% from RMB881.8 million for the six months ended June 30, 2024 to RMB862.7 million for the six months ended June 30, 2025. Our transaction value remained stable at RMB33.1 billion for the six months ended June 30, 2025 as compared to RMB33.3 billion for the six months ended June 30, 2024.

| · | Total revenue from one-time commissions decreased by 3.5% from RMB324.1 million for the six months ended June 30, 2024 to RMB312.8 million for the six months ended June 30, 2025, primarily due to a decrease in distribution of insurance products. |

| · | Total revenue from recurring service fees decreased by 3.3% from RMB481.5 million for the six months ended June 30, 2024 to RMB465.7 million for the six months ended June 30, 2025, primarily due to a decrease in recurring service fees generated from domestic private equity products. |

| · | Total revenue from performance-based income increased by 151.6% from RMB11.1 million for the six months ended June 30, 2024 to RMB27.9 million for the six months ended June 30, 2025, primarily due to an increase in performance-based income from private secondary products. |

| · | Total revenue from other service fees decreased by 13.4% from RMB65.1 million for the six months ended June 30, 2024 to RMB56.4 million for the six months ended June 30, 2025, primarily due to a reduction in value-added services that we offered to our HNW clients. |

Asset Management Business

For the asset management business, our total revenue decreased by 2.8% from RMB373.3 million for the six months ended June 30, 2024 to RMB362.8 million for the six months ended June 30, 2025. Our AUM slightly decreased by 5.8%, from RMB154.0 billion as of June 30, 2024 to RMB145.1 billion as of June 30, 2025.

| · | Total revenue from one-time commissions increased significantly from RMB44,000 for the six months ended June 30, 2024 to RMB1.9 million for the six months ended June 30, 2025, mainly due to an increase in distribution of private secondary products domestically. |

| · | Total revenue from recurring service fees slightly decreased by 1.4% from RMB342.0 million for the six months ended June 30, 2024 to RMB337.1 million for the six months ended June 30, 2025, mainly due to a decrease in recurring service fees generated from domestic private equity products. |

| · | Total revenue from performance-based income decreased by 23.7% from RMB31.2 million for the six months ended June 30, 2024 to RMB23.8 million for the six months ended June 30, 2025, primarily due to a decrease in performance-based income from private equity products domestically. |

Other Businesses

For other businesses, our total revenue was RMB29.2 million for the six months ended June 30, 2025, representing a 47.5% increase from RMB19.8 million for the six months ended June 30, 2024, primarily due to an increase in other revenues relating to our suspended lending business.

The details in relation to our revenues generated under the refined segmentation approach are set forth as follows.

| For the Six Months Ended June 30, | ||||||||||||

| 2024 (Unaudited) |

2025 (Unaudited) |

Change (%) |

||||||||||

| (RMB in thousands) | ||||||||||||

| Revenues: | ||||||||||||

| Domestic public securities(1) | ||||||||||||

| One-time commissions | 13,173 | 35,497 | 169.5 | % | ||||||||

| Recurring service fees | 218,171 | 195,801 | (10.3 | )% | ||||||||

| Performance-based income | 6,547 | 29,487 | 350.4 | % | ||||||||

| Total revenue for domestic public securities | 237,891 | 260,785 | 9.6 | % | ||||||||

| Domestic asset management(2) | ||||||||||||

| One-time commissions | 1,220 | 381 | (68.8 | )% | ||||||||

| Recurring service fees | 378,554 | 342,631 | (9.5 | )% | ||||||||

| Performance-based income | 13,822 | 1,353 | (90.2 | )% | ||||||||

| Total revenue for domestic asset management | 393,596 | 344,365 | (12.5 | )% | ||||||||

| Domestic insurance(3) | ||||||||||||

| One-time commissions | 30,616 | 13,673 | (55.3 | )% | ||||||||

| Total revenue for domestic insurance | 30,616 | 13,673 | (55.3 | )% | ||||||||

| Overseas wealth management(4) | ||||||||||||

| One-time commissions | 220,448 | 176,694 | (19.8 | )% | ||||||||

| Recurring service fees | 67,813 | 79,303 | 16.9 | % | ||||||||

| Other service fees | 40,806 | 35,403 | (13.2 | )% | ||||||||

| Total revenue for overseas wealth management | 329,067 | 291,400 | (11.4 | )% | ||||||||

| Overseas asset management(5) | ||||||||||||

| One-time commissions | 8,489 | 14,318 | 68.7 | % | ||||||||

| Recurring service fees | 158,253 | 185,041 | 16.9 | % | ||||||||

| Performance-based income | 21,931 | 20,868 | (4.8 | )% | ||||||||

| Total revenue for Overseas asset management | 188,673 | 220,227 | 16.7 | % | ||||||||

| Overseas insurance and comprehensive services(6) | ||||||||||||

| One-time commissions | 50,159 | 74,076 | 47.7 | % | ||||||||

| Other service fees | 17,490 | 15,172 | (13.3 | )% | ||||||||

| Total revenue for overseas insurance and comprehensive | 67,649 | 89,248 | 31.9 | % | ||||||||

| For the Six Months Ended June 30, | ||||||||||||

| 2024 (Unaudited) |

2025 (Unaudited) |

Change (%) |

||||||||||

| (RMB in thousands) | ||||||||||||

| Headquarters(7) | ||||||||||||

| Recurring service fees | 737 | – | N.A. | |||||||||

| Other service fees | 26,614 | 35,024 | 31.6 | % | ||||||||

| Total revenue for headquarters | 27,351 | 35,024 | 28.1 | % | ||||||||

| Total revenues | 1,274,843 | 1,254,722 | (1.6 | )% | ||||||||

Notes:

| (1) | Operates under the Noah Upright brand. |

| (2) | Operates under the Gopher Asset Management brand. |

| (3) | Operates under the Glory brand. |

| (4) | Operates under the ARK Wealth Management brand. |

| (5) | Operates under the Olive Asset Management brand. |

| (6) | Operates under the Glory Family Heritage brand. |

| (7) | Headquarters reflects revenue generated from corporate operations at the Company’s headquarters in Shanghai as well as administrative costs and expenses that were not directly allocated to the aforementioned six business segments. |

Domestic public securities

Domestic public securities is the business that distributes mutual funds and private secondary products. Our total revenue increased by 9.6% from RMB237.9 million for the six months ended June 30, 2024 to RMB260.8 million for the six months ended June 30, 2025. The change was primarily due to an increase in one-time commissions generated from distribution of private secondary products and an increase in performance-based income from private secondary products.

Domestic asset management

Domestic asset management is the business that manages RMB-denominated private equity funds and private secondary products. Our total revenue decreased by 12.5% from RMB393.6 million for the six months ended June 30, 2024 to RMB344.4 million for the six months ended June 30, 2025. The change was primarily due to a decrease in private equity products AUM in mainland China.

Domestic insurance

Domestic insurance is the business that distributes insurance products, consisting mainly of life and health insurance products. Our total revenue decreased by 55.3% from RMB30.6 million for the six months ended June 30, 2024 to RMB13.7 million for the six months ended June 30, 2025. The change was primarily due to a decrease in distribution of domestic insurance products.

Overseas wealth management

Overseas wealth management is the business that provides offline and online wealth management services. Our total revenue decreased by 11.4% from RMB329.1 million for the six months ended June 30, 2024 to RMB291.4 million for the six months ended June 30, 2025. The change was primarily due to a decrease in allocated commission gained from distribution of overseas insurance products.

Overseas asset management

Overseas asset management is the business that manages USD-denominated private equity funds and private secondary products. Our total revenue increased by 16.7% from RMB188.7 million for the six months ended June 30, 2024 to RMB220.2 million for the six months ended June 30, 2025. The change was primarily due to an increase in one-time commissions and recurring service fees generated from distribution of overseas investment products managed by Olive Asset Management.

Overseas insurance and comprehensive services

Overseas insurance and comprehensive services is the business that provides comprehensive overseas services such as insurance, trust services and other services. Our total revenue increased by 31.9% from RMB67.6 million for the six months ended June 30, 2024 to RMB89.2 million for the six months ended June 30, 2025. The change was primarily due to an increase in allocated commission gained from distribution of overseas insurance products by commission-only brokers.

Headquarters

Headquarters reflects revenue generated from corporate operations at the Company’s headquarters in Shanghai as well as administrative costs and expenses that were not directly allocated to the aforementioned six business segments. Our total revenue increased by 28.1% from RMB27.4 million for the six months ended June 30, 2024 to RMB35.0 million for the six months ended June 30, 2025. The change was primarily due to more value-added services that we offered to our HNW clients.

Operating Costs and Expenses

Our financial condition and operating results are directly affected by our operating cost and expenses, primarily consisting of (i) compensation and benefits, including salaries and commissions for our relationship managers, share-based compensation expenses, performance-based bonuses, and other employee salaries and bonuses, (ii) selling expenses, (iii) general and administrative expenses, (iv) provision for credit losses, and (v) other operating expenses, which are partially offset by the receipt of government subsidies. Our operating costs and expenses are primarily affected by several factors, including the number of our employees, rental expenses and certain non-cash charges.

Our operating costs and expenses decreased by 11.2% from RMB1,009.9 million for the six months ended June 30, 2024 to RMB897.1 million for the six months ended June 30, 2025, which was primarily due to our cost control strategy on employee compensation and a decrease in one-off expense Gopher paid to one of its funds as general partner.

The details in relation to the operating costs and expenses under the traditional segmentation approach for the six months ended June 30, 2024 and 2025 are set forth as follows, facilitating investors’ comprehensive understanding of the Company’s operational and financial trends in terms of costs and expenses during the Reporting Period.

| For the Six Months Ended June 30, | ||||||||||||

| 2024 (Unaudited) |

2025 (Unaudited) |

Change (%) |

||||||||||

| (RMB in thousands) | ||||||||||||

| Wealth management | 747,550 | 654,642 | (12.4 | )% | ||||||||

| Asset management | 201,272 | 149,745 | (25.6 | )% | ||||||||

| Other businesses | 61,066 | 92,674 | 51.8 | % | ||||||||

| Total operating costs and expenses | 1,009,888 | 897,061 | (11.2 | )% | ||||||||

Wealth Management Business

For the wealth management business, our operating costs and expenses decreased by 12.4% from RMB747.6 million for the six months ended June 30, 2024 to RMB654.6 million for the six months ended June 30, 2025, primarily due to lower traveling expenses and our cost control strategy on employee compensation.

Asset Management Business