United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

August 22, 2025

Date of Report (Date of earliest event reported)

FG Merger II Corp.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 001-42493 | 86-2579471 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

|

104 S. Walnut Street, Unit 1A, |

60143 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (847) 751-9017

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | FGMC | THE NASDAQ STOCK MARKET LLC | ||

| Rights | FGMCR | THE NASDAQ STOCK MARKET LLC | ||

| Units | FGMCU | THE NASDAQ STOCK MARKET LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference is an investor presentation, which will be used by FG Merger II Corp., a Nevada corporation (“FGMC”), and BOXABL Inc., a Nevada corporation (“BOXABL”), from time to time, with respect to the previously announced proposed business combination (the “Business Combination”) between FGMC and BOXABL.

The foregoing (including Exhibit 99.1) is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any registration statement, report or other document filed by FGMC or BOXABL pursuant to the Securities Act of 1933, as amended, or the Exchange Act.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends that are not statements of historical matters. These forward-looking statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K, and on current expectations of the respective management of BOXABL or FGMC and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of BOXABL or FGMC. Potential risks and uncertainties that could cause the actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: the outcome of any legal proceedings that may be instituted in connection with the Business Combination, delays in obtaining or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete the Business Combination, the risk that the Business Combination disrupt current plans and operations, the inability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the surviving company to grow and manage growth profitably with customers and suppliers and retain key employees, costs related to the Business Combination, the risk that the Business Combination does not close, changes in applicable laws or regulations, the possibility that BOXABL or FGMC may be adversely affected by other economic, business, and/or competitive factors, economic uncertainty caused by the impacts from the conflict in Russia and Ukraine and rising levels of inflation and interest rates, the risk that the approval of BOXABL stockholders of the Business Combination is not obtained, the risk that the approval of the shareholders of FGMC of the Business Combination is not obtained, the amount of redemption requests made by FGMC’s shareholders and the amount of funds remaining in FGMC’s trust account after the satisfaction of such requests, BOXABL’s and FGMC’s ability to satisfy the conditions to closing of the Business Combination, the risks discussed in BOXABL’s public reports filed with the U.S. Securities and Exchange Commission (the “SEC”), and the risks discussed in FGMC’s public reports filed with the SEC, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, as well as preliminary and definitive joint proxy statements/prospectuses that FGMC and/or BOXABL intend to file with the SEC in connection with the Business Combination. If any of these risks materialize or BOXABL’s or FGMC’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither BOXABL nor FGMC presently know or that BOXABL or FGMC believe are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect BOXABL’s and FGMC’s expectations, plans, or forecasts of future events and views as of the date of this Current Report on Form 8-K. BOXABL and FGMC anticipate that subsequent events and developments may cause their assessments to change. BOXABL and FGMC specifically disclaim any obligation to update or revise any forward-looking statements, except as required by law. These forward-looking statements should not be relied upon as representing BOXABL’s or FGMC’s assessments as of any date subsequent to the date of this Current Report on Form 8-K. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Important Information for Investors and Stockholders

This communication is being made in respect of the proposed transaction involving BOXABL and FGMC. In connection with the transaction, FGMC intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement/prospectus. Investors and stockholders are urged to read the registration statement and joint proxy statement/prospectus and all other relevant documents filed or to be filed with the SEC carefully and in their entirety when they become available, as they will contain important information about the proposed transaction. Copies of the registration statement, joint proxy statement/prospectus, and other documents filed with the SEC will be available free of charge at the SEC’s website at www.sec.gov.

Participants in the Solicitation

FGMC and BOXABL and certain of their respective directors, executive officers and other members of management and employees may be considered participants in the solicitation of proxies with respect to the Business Combination under the rules of the SEC. Information about the directors and executive officers of FGMC and BOXABL and a description of their interests in FGMC, BOXABL and the Business Combination are set forth in FGMC’s Annual Report on Form 10-K for the year ended December 31, 2024, and/or will be contained in the registration statement and the joint proxy statement/prospectus when available, which documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed transaction and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Investor Presentation. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 22, 2025

FG MERGER II CORP.

| By: | /s/ Hassan R. Baqar | |

| Name: | Hassan R. Baqar | |

| Title: | Chief Financial Officer |

Exhibit 99.1

Where HOUSING meets mass production .

Investor Presentation Transforming the housing market with modular building systems designed to deliver affordable, high - quality homes at unprecedented speed Important Disclosures This presentation (this “Presentation”) is being furnished for the exclusive use of, and solely for the purpose of assisting, th e parties (such parties, together with their subsidiaries and affiliates, the “Recipients”) to whom it is addressed in making th eir independent evaluation with respect to a proposed business combination (the “Business Combination”) between Boxabl Inc. (the “Company,” “BOXABL,” “we, “us” or “our”), FG Merger II Corp. ("SPAC") and FG Merger Sub II Inc . The provision of this Presentation shall not be taken as any form of commitment on the part of the Company or SPAC to proceed wi th any negotiations of the Business Combination or any other transaction, and each of the Company and SPAC reserve the right to discontinue discussions or negotiations regarding any transaction at any time and for any reason or no reason. No Representations or Warranties No representations or warranties, express or implied, are given in, or in respect of, the accuracy or completeness of the information contained in this Presentation or any other information (whether written or oral) that has been or will be provided to you . To the fullest extent permitted by law, neither the Company, SPAC nor any of their respective subsidiaries, equity holders, affiliat es, representatives, partners, directors, officers, employees, advisers or agents shall be responsible or liable for any direct, in direct or consequential loss or loss of profit arising from the use of this Presentation, its contents, its accuracy or sufficiency, it s o missions, its errors, reliance on the information contained within it, or on opinions communicated in relation thereto or oth erw ise arising in connection therewith. In addition, this Presentation does not purport to be inclusive of all of the information necessary to mak e an evaluation of the Company, SPAC or the Business Combination. Viewers of this Presentation should each make their own evaluation of the Company, SPAC and of the relevance and adequacy of the information and should make such other investigation s a s they deem necessary. Nothing herein should be construed as legal, financial, tax or other advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein. The g ene ral explanations included in this Presentation cannot, and are not intended to, address your specific investment objectives, fin ancial situations, or financial needs. Forward - Looking Statements This Presentation contains certain forward - looking statements within the meaning of the federal securities laws with respect to the Business Combination, including expectations, hopes, beliefs, intentions, plans, prospects, financial results or strategi es regarding the Company and the proposed Business Combination. Any statements other than statements of historical fact contained in this Pre sentation, including statements regarding the anticipated benefits and timing of the completion of the Business Combination, statements about the Company’s market opportunity and the potential growth of that market, our ability to complete the contem pla ted PIPE of up to $55M , the Company’s strategy, outcomes and growth prospects, trends in the Company’s industry and markets and the competitive environment in which the Company operates, are forward - looking statements. These forward - looking statements generally are identified by the words “believe,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportu nit y,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions or the ne gat ive of such terms. Forward - looking statements (including projections) are predictions, and other statements about future events or conditions that are based on current expectations, estimates and assumptions and, as a result, are subject to risks and uncertainties. M any factors could cause actual future events to differ materially from the forward - looking statements in this document, which facto rs will be discussed in documents of the Company and SPAC filed, or to be filed, with the Securities and Exchange Commission (“SEC”). An y forward - looking statement made by us in this presentation is based on information currently available to us and speaks only as of the date on which it is made. Except to the extent required by law, we undertake no obligation to update or revise any for ward - looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise. Industry and Market Data In this Presentation, the Company and SPAC rely on and refer to certain information and statistics regarding the markets and ind ustries in which the Company competes. Such information and statistics are based on the Company’s management’s estimates and/or obtained from third - party sources, including reports by market research firms and company filings. While the Company beli eves such third - party information is reliable, there can be no assurance as to the accuracy or completeness of the indicated information. Neither the Company nor SPAC has independently verified the accuracy or completeness of the information provided by the third - party sources. Each of the Company and SPAC expressly disclaims any responsibility or liability for any damages or losses in connection with the use of such information herein. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the propert y o f their respective owners, and the Company’s or SPAC’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, service marks, trade names and copyrights. Solely for convenience, some of the trademarks, service ma rks, trade names and copyrights referred to in this Presentation may be listed without the TM, © or ® symbols, but the Compan y and SPAC will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trade mar ks, service marks, trade names and copyrights.

Important Disclosures No Offer or Solicitation This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination or (ii) an offer to sell, a solicitation of an offer to buy or a recommendation to pur cha se any security of the Company, SPAC or any of their respective affiliates. No such offering of securities shall be made except by means of a pr ospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom. Investment in any securities described herein has not been approved or disapproved by the SEC or any other regulatory authority nor has any aut hor ity passed upon or endorsed the merits of the offering or the accuracy or adequacy of the information contained herein. Any representation to the contrary is a criminal offense. Additional Information and Where to Find It In connection with the Business Combination, the Company and SPAC intend to file relevant materials with the SEC, including a re gistration statement on Form S - 4, which will include a document that serves as a joint proxy statement and prospectus , referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all the Company and SPAC shareholders. The Comp any and SPAC will also file other documents regarding the Business Combination with the SEC. Before making any voting or investment decision, investors, shareholders and other interested persons of the Company and SPAC ar e urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that wil l b e filed with the SEC in connection with Business Combination carefully and in their entirety as they become available because t hey will contain important information about the Business Combination. Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospect us and all other relevant documents filed or that will be filed with the SEC by the Company and SPAC through the website maintai ned by the SEC at www.sec.gov. The documents filed by the Company and SPAC with the SEC also may be obtained free of charge, once available, on the SEC’s we bsi te at www.sec.gov or by directing a request to: FG Merger II Corp., 104 S. Walnut Street, Unit 1A, Itasca, IL 60143, or upon written request to Boxabl Inc., 5345 E. N. Belt Road, Las Vegas, NV 89115, respectively. Participants in Solicitation The Company, SPAC and their respective directors and executive officers may be deemed under SEC rules to be participants in t he solicitation of proxies from the Company’s shareholders and SPAC’s shareholders in connection with the Business Combination. A list of the names of the directors and executive officers of the Company and SPAC, and information regarding their interests in the Business Combinati on and their ownership of the Company’s securities and SPAC’s securities are, or will be, contained in the Company’s filings and SPAC’s filings with the SEC. Additional information regarding the interests of the persons who may, under SEC rules, be deeme d p articipants in the solicitation of proxies of the Company’s shareholders and SPAC’s shareholders in connection with the Business Combination, including the names and interests of the Company’s directors and ex ecu tive officers, will be set forth in the proxy statement/prospectus included in the Form S - 4 for the Business Combination, which is expected to be filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph.

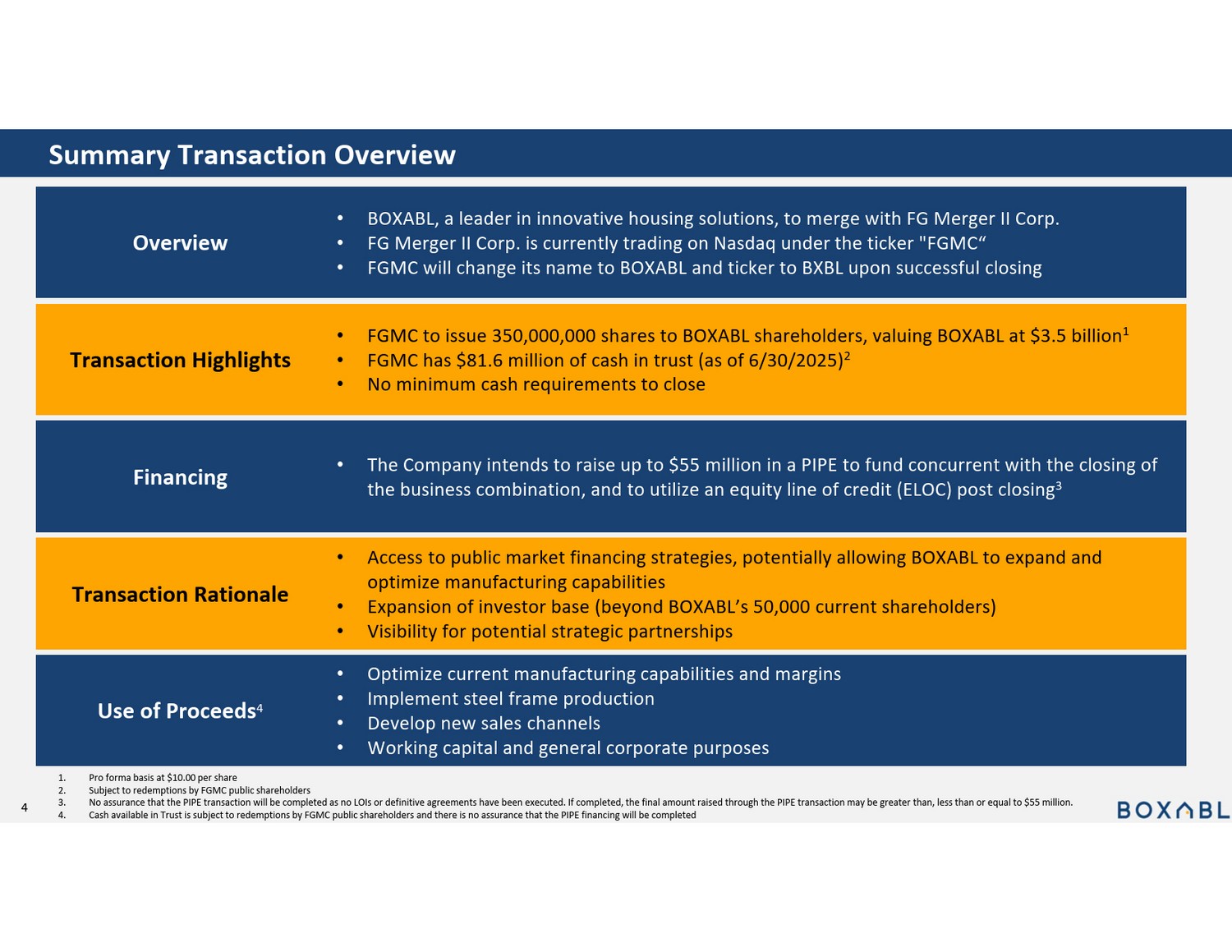

Summary Transaction Overview • BOXABL, a leader in innovative housing solutions, to merge with FG Merger II Corp. • FG Merger II Corp. is currently trading on Nasdaq under the ticker "FGMC“ • FGMC will change its name to BOXABL and ticker to BXBL upon successful closing Overview Transaction Highlights • FGMC to issue 350,000,000 shares to BOXABL shareholders, valuing BOXABL at $3.5 billion 1 • FGMC has $81.6 million of cash in trust (as of 6/30/2025) 2 • No minimum cash requirements to close Financing • The Company intends to raise up to $55 million in a PIPE to fund concurrent with the closing of the business combination, and to utilize an equity line of credit (ELOC) post closing 3 Transaction Rationale • Access to public market financing strategies, potentially allowing BOXABL to expand and optimize manufacturing capabilities • Expansion of investor base (beyond BOXABL’s 50,000 current shareholders) • Visibility for potential strategic partnerships Use of Proceeds 4 • Optimize current manufacturing capabilities and margins • Implement steel frame production • Develop new sales channels • Working capital and general corporate purposes 4 1. Pro forma basis at $10.00 per share 2. Subject to redemptions by FGMC public shareholders 3. No assurance that the PIPE transaction will be completed as no LOIs or definitive agreements have been executed. If completed , t he final amount raised through the PIPE transaction may be greater than, less than or equal to $55 million. 4.

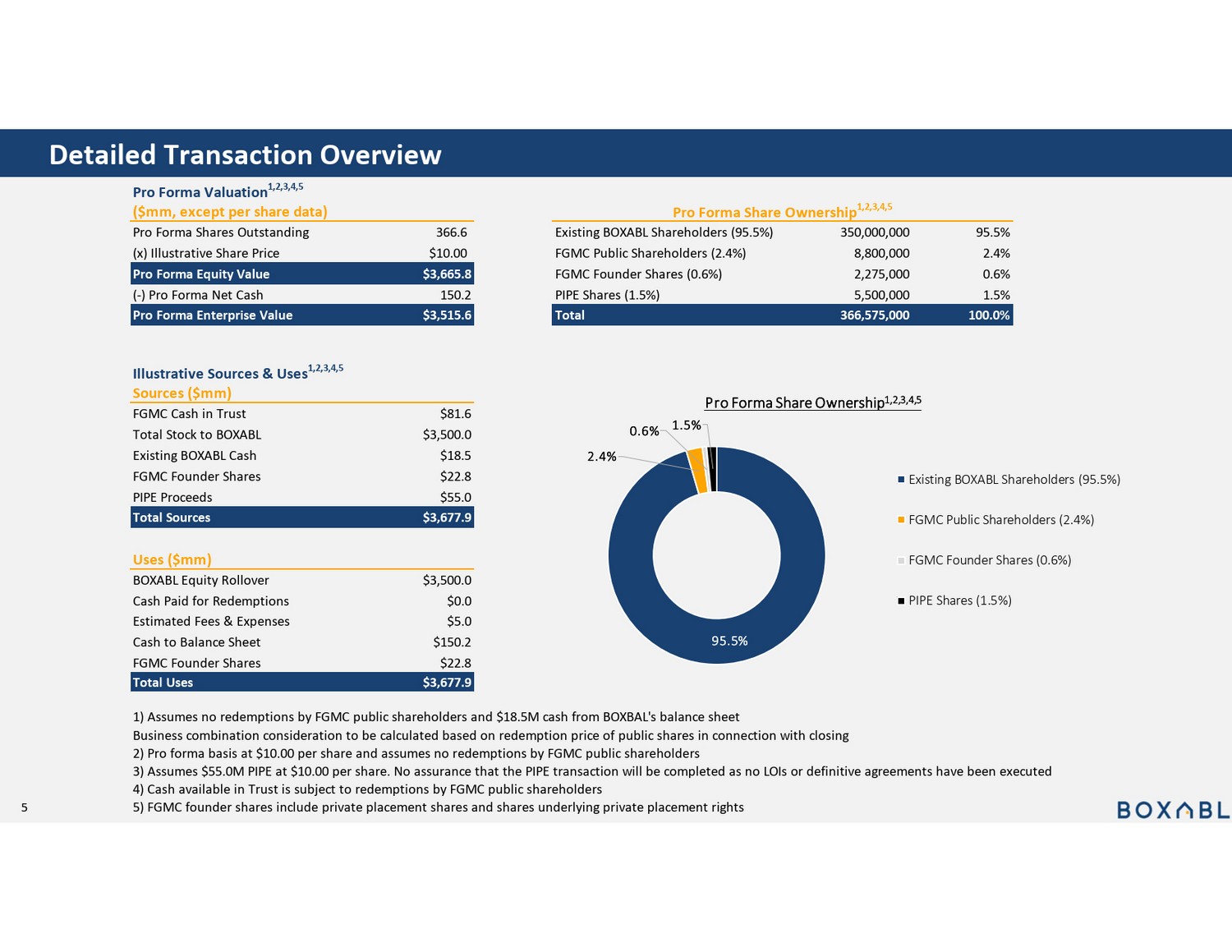

Cash available in Trust is subject to redemptions by FGMC public shareholders and there is no assurance that the PIPE financi ng will be completed Detailed Transaction Overview 5 Pro Forma Valuation 1,2,3,4,5 ($mm, except per share data) Pro Forma Shares Outstanding 366.6 Existing BOXABL Shareholders (95.5%) 350,000,000 95.5% (x) Illustrative Share Price $10.00 FGMC Public Shareholders (2.4%) 8,800,000 2.4% Pro Forma Equity Value $3,665.8 FGMC Founder Shares (0.6%) 2,275,000 0.6% (-) Pro Forma Net Cash 150.2 PIPE Shares (1.5%) 5,500,000 1.5% Pro Forma Enterprise Value $3,515.6 Total 366,575,000 100.0% Illustrative Sources & Uses 1,2,3,4,5 Sources ($mm) FGMC Cash in Trust $81.6 Total Stock to BOXABL $3,500.0 Existing BOXABL Cash $18.5 FGMC Founder Shares $22.8 PIPE Proceeds $55.0 Total Sources $3,677.9 Uses ($mm) BOXABL Equity Rollover $3,500.0 Cash Paid for Redemptions $0.0 Estimated Fees & Expenses $5.0 Cash to Balance Sheet $150.2 FGMC Founder Shares $22.8 Total Uses $3,677.9 1) Assumes no redemptions by FGMC public shareholders and $18.5M cash from BOXBAL's balance sheet Business combination consideration to be calculated based on redemption price of public shares in connection with closing 2) Pro forma basis at $10.00 per share and assumes no redemptions by FGMC public shareholders 3) Assumes $55.0M PIPE at $10.00 per share. No assurance that the PIPE transaction will be completed as no LOIs or definitive agreements have been executed 4) Cash available in Trust is subject to redemptions by FGMC public shareholders 5) FGMC founder shares include private placement shares and shares underlying private placement rights Pro Forma Share Ownership 1,2,3,4,5 95.5% 2.4% 0.6% 1.5% Pro Forma Share Ownership 1,2,3,4,5 Existing BOXABL Shareholders (95.5%) FGMC Public Shareholders (2.4%) FGMC Founder Shares (0.6%) PIPE Shares (1.5%)

BOXABL Highlights Investor Base & Fundraising Track Record: Substantial investor interest to date – $230M+ 1 raised across 50,000+ investors – 2 Reg A+ offerings BOXABL’s Scalable Solution & Technology: BOXABL'S flagship product, the Casita, is a 361 square foot studio unit. The Casita unfolds on - site in less than an hour. To date, the Company has produced 700+ units 2 . BOXABL has 53+ patent filings Products (In Development): The Baby Box, a smaller 120 square foot unit built to RV code, intended for simpler, no foundation - setups. Plans for stackable and connectable box models that can be combined to form townhomes, multifamily units, or larger single - family homes Customer Expansion: While the Company has traditionally sold Casitas as accessory dwelling units (ADUs), BOXABL is expanding into various verticals including business - to - business, business - to - government, and development projects Primary Use of Proceeds – Efficiency 3 : Use of proceeds for the transaction include implementing steel frame production for the Casita and products in development, resulting in potential margin improvement and manufacturing efficiency National Problem: National housing crisis – Demand for housing drastically exceeds supply - Too expensive (and lengthy) to build and/or buy a traditional home for a large population 6 1. $230M was raised through a combination of Reg A and Reg D offerings 2. Total number of Casitas produced does not represent the total number of Casitas sold 3.

Cash available in Trust is subject to redemptions by FGMC public shareholders and there is no assurance that the PIPE financi ng will be completed BOXABL’s Unique Investor Base & Fundraising Track Record Fundraising Pedigree $230M+ 1 in equity capital raised since inception Strategic investors include D.R. Horton Crowdfunding Track Record 2 Reg A+ offerings Thousands of repeat investors BOXABL is a prolific crowdfunding issuer, having raised $230M+ 1 from 50,000+ individual investors since 2020 BOXABL has a unique track record of attracting retail investors and high - profile construction focused strategic investors 7 1.

$230M was raised through a combination of Reg A and Reg D offerings National Problem Home Prices Median U.S. home prices reached $446,766 in June, 2025 1 1. Financial Times: Housing is Where the Buck Stops - https://www.ft.com/content/067cd458 - 0029 - 4f32 - b6d9 - f82716625654 2. NAHB: Supply - Chain Issues Lengthened Single - Family Build Times - https://www.nahb.org/blog/2023/07/2022 - single - family - build - times 3. Realtor.com: Housing Supply Gap Reaches Nearly 4 Million in 2024 - https://www.realtor.com/research/us - housing - supply - gap - 2025/ Affordability Approximately 75% of Americans cannot afford the median - priced home 1 Inefficiencies The average single - family home takes over 10 months to build 2 Shortages Rampant demand and lacking supply; housing gap of 3.8 million homes 3 The average American cannot afford to build or purchase a home Those who can afford to build struggle with lengthy delays and construction inefficiencies 8 BOXABL’s Technology Shipping Technology BOXABL houses are manufactured in the Las Vegas facility, fold up on site, and ship at a cheaper price to the consumer Cheaper shipping allows BOXABL to cover a large radius from its Las Vegas facility – enabling mass production and low costs BOXABL Ships 8.5ft Wide Traditional Modular 14ft Manufacturing Technology BOXABL uses building materials and manufacturing methods compatible with automation to dramatically reduce both materials and labor costs Building Technology 53 Patent Filings BOXABL has developed a stackable/connectable modular housing solution, allowing one housing product to appeal to a wide variety of housing needs 9 53+ Patents

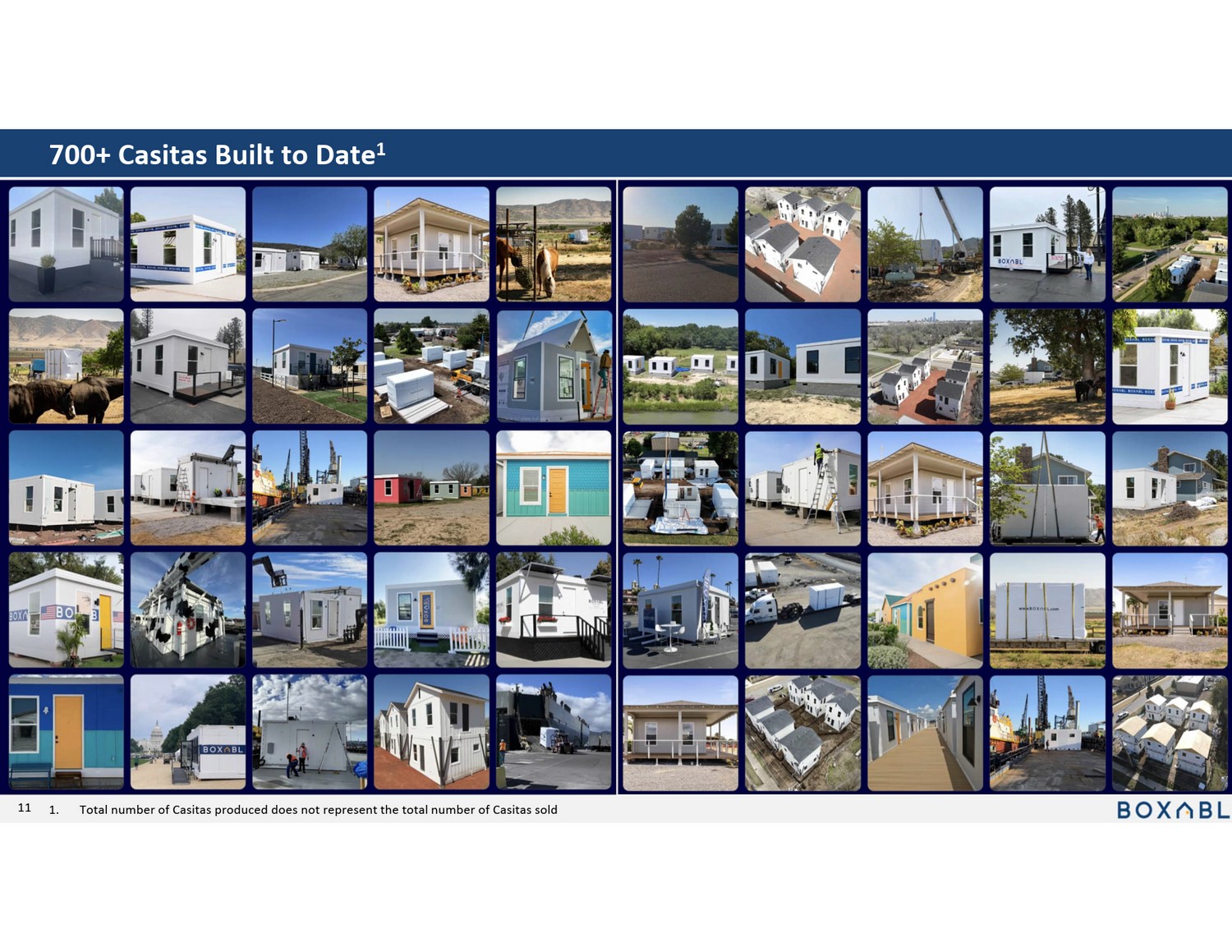

The Casita • BOXABL’s flagship product • Manufactured at BOXABL’s Las Vegas factories (400k sqft ) • 361 sqft studio unit • Full kitchen, bathroom and utilities • Unfolds on site in less than an hour • 700+ Casitas built to date 1 BOXABL’s Scalable Solution Efficiencies • BOXABL builds all houses on an assembly line with mass production capabilities • Casita priced at approximately $60,000 (not including installation) • BOXABL currently can build one house every 4 hours • BOXABL is able to sell in 15 states (and growing) 2 • Delivered via standard 8.5’ wide truck 10 1. Total number of Casitas produced does not represent the total number of Casitas sold 2. Product is being sold as a Park Model RV in states that don’t have a state - regulated modular program 700+ Casitas Built to Date 1 11 1.

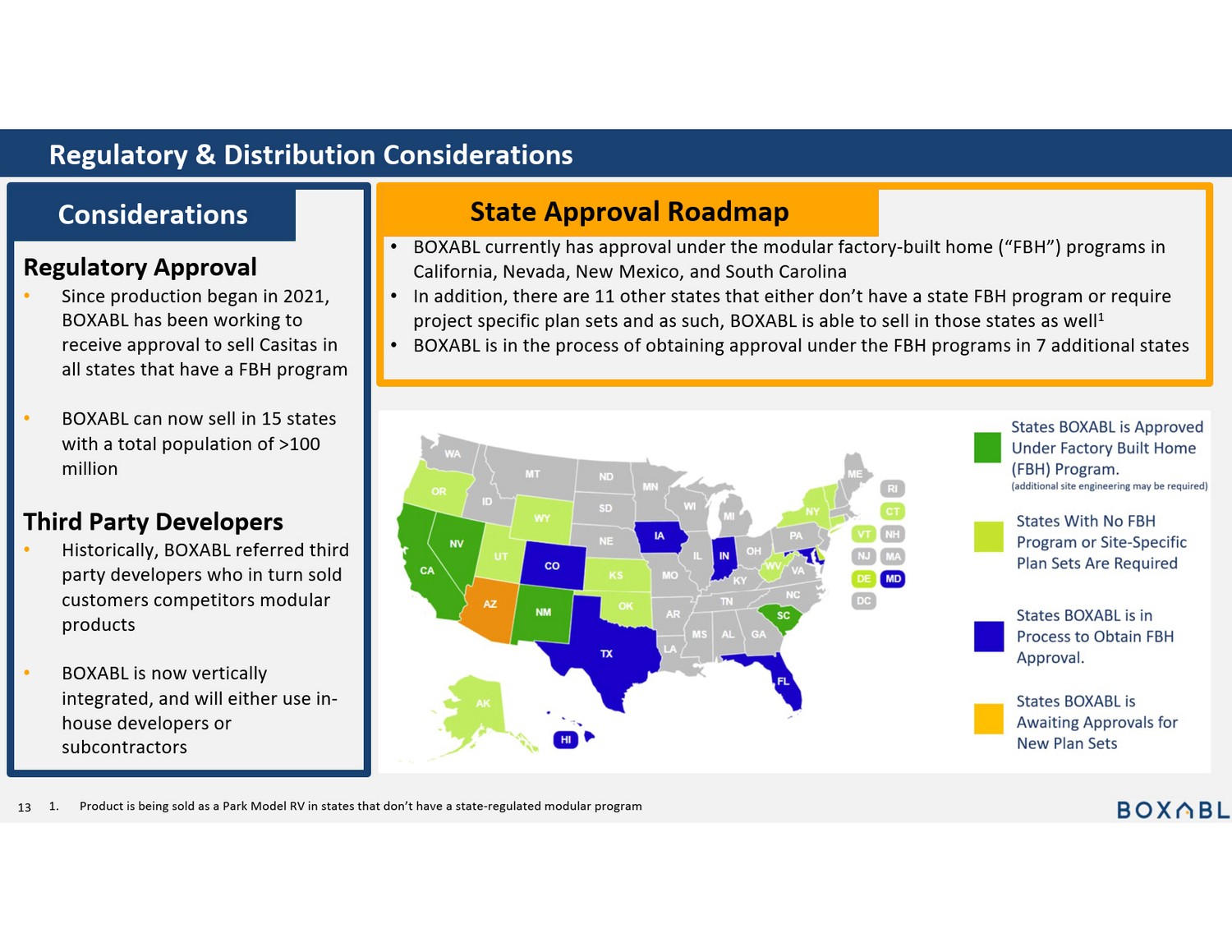

Total number of Casitas produced does not represent the total number of Casitas sold Meet the Baby Box & BOXABL’s Stackable Solutions Baby Box – BOXABL’s Next Product to Market • 120 sqft unit • Built to meet RV code • Intended for simpler, no - foundation setups • Ready to be mass produced at facility • Priced from $20,000 Stackable Solutions (In Market) Larger Builds (Multiple Beds) Townhomes With the ability to manufacture Baby Box and Stackable Solutions in - house, there’s no residential buildout too small or large for BOXABL 12 State Approval Roadmap Considerations Regulatory Approval • Since production began in 2021, BOXABL has been working to receive approval to sell Casitas in all states that have a FBH program • BOXABL can now sell in 15 states with a total population of >100 million Third Party Developers • Historically, BOXABL referred third party developers who in turn sold customers competitors modular products • BOXABL is now vertically integrated, and will either use in - house developers or subcontractors Regulatory & Distribution Considerations • BOXABL currently has approval under the modular factory - built home (“FBH”) programs in California, Nevada, New Mexico, and South Carolina • In addition, there are 11 other states that either don’t have a state FBH program or require project specific plan sets and as such, BOXABL is able to sell in those states as well 1 • BOXABL is in the process of obtaining approval under the FBH programs in 7 additional states 13 1.

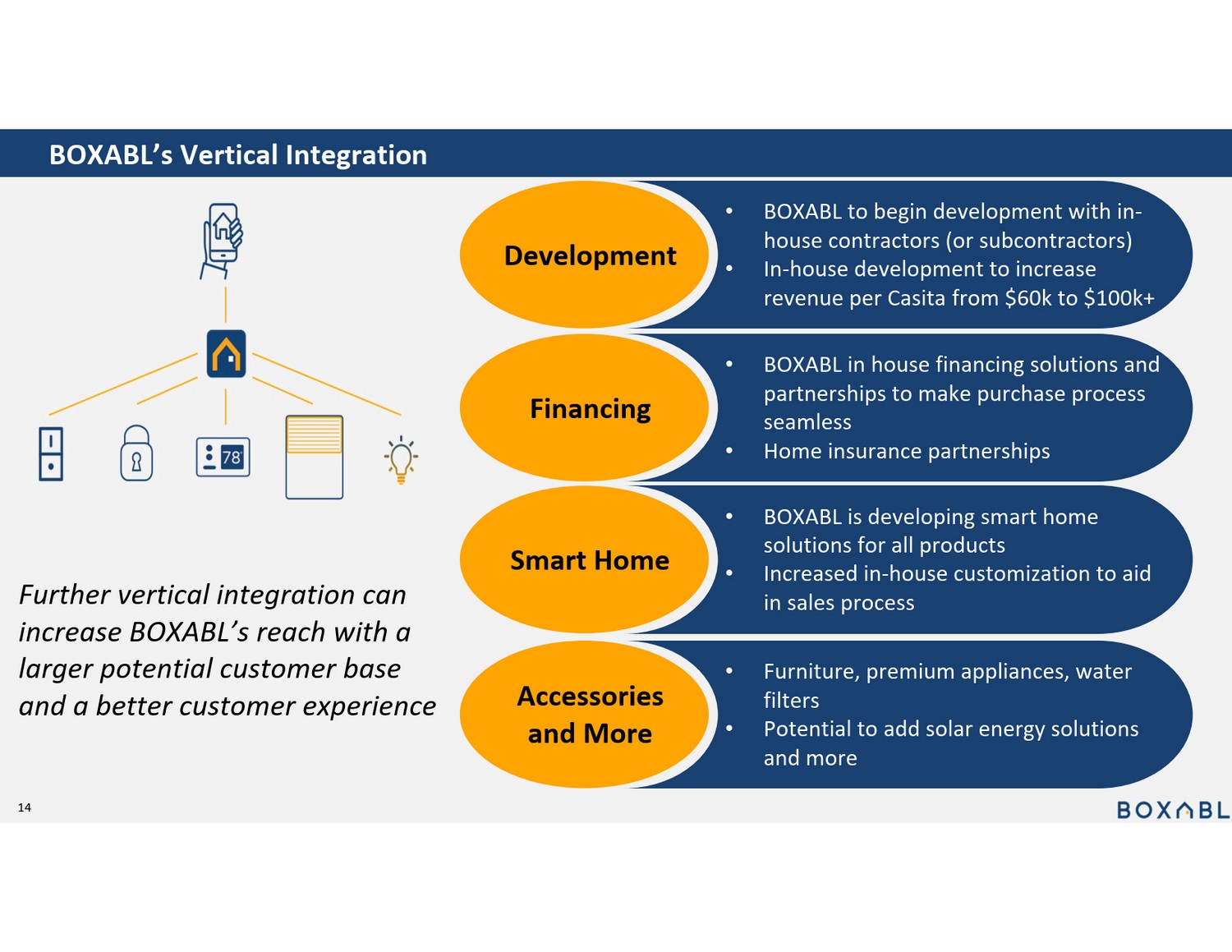

Product is being sold as a Park Model RV in states that don’t have a state - regulated modular program BOXABL’s Vertical Integration • BOXABL to begin development with in - house contractors (or subcontractors) • In - house development to increase revenue per Casita from $60k to $100k+ Development • BOXABL is developing smart home solutions for all products • Increased in - house customization to aid in sales process Smart Home • BOXABL in house financing solutions and partnerships to make purchase process seamless • Home insurance partnerships Financing • Furniture, premium appliances, water filters • Potential to add solar energy solutions and more Accessories and More Further vertical integration can increase BOXABL’s reach with a larger potential customer base and a better customer experience 14 BOXABL’s Vision • Manufactures the Casita in its 3 factory buildings totaling over 400,000+ sqft in Las Vegas • Has built over 700 Casitas 1 • Can manufacture one Casita in 4 hours • Primarily sells Casitas as ADUs (ramping up larger orders - B2B) • Markets the Casita for approximately $60,000 per house • Can sell in 15 states (and growing) 2 • Delivers Casitas via standard 8.5’ wide truck from BOXABL’s Las Vegas facility BOXABL set out to produce housing at a fraction of the cost & time as compared to traditional single - family builds….and has delivered.

BOXABL Presently… BOXABL’s Vision is to… • Manufacture in strategic locations around the country to allow for faster (and cheaper) delivery • Develop and install projects in - house, increasing revenue per Casita to $100,000+ • Increase automation capabilities to enable building one house per minute • Market products primarily to multi - family projects and communities – build out apartments, townhomes & more • Obtain approval to build and deliver modular houses in all 50 states and expand internationally • Continue to build partnerships with large national homebuilders • Vertically integrate financing, AI, real estate, accessories & more 15 1. Total number of Casitas produced does not represent the total number of Casitas sold 2.

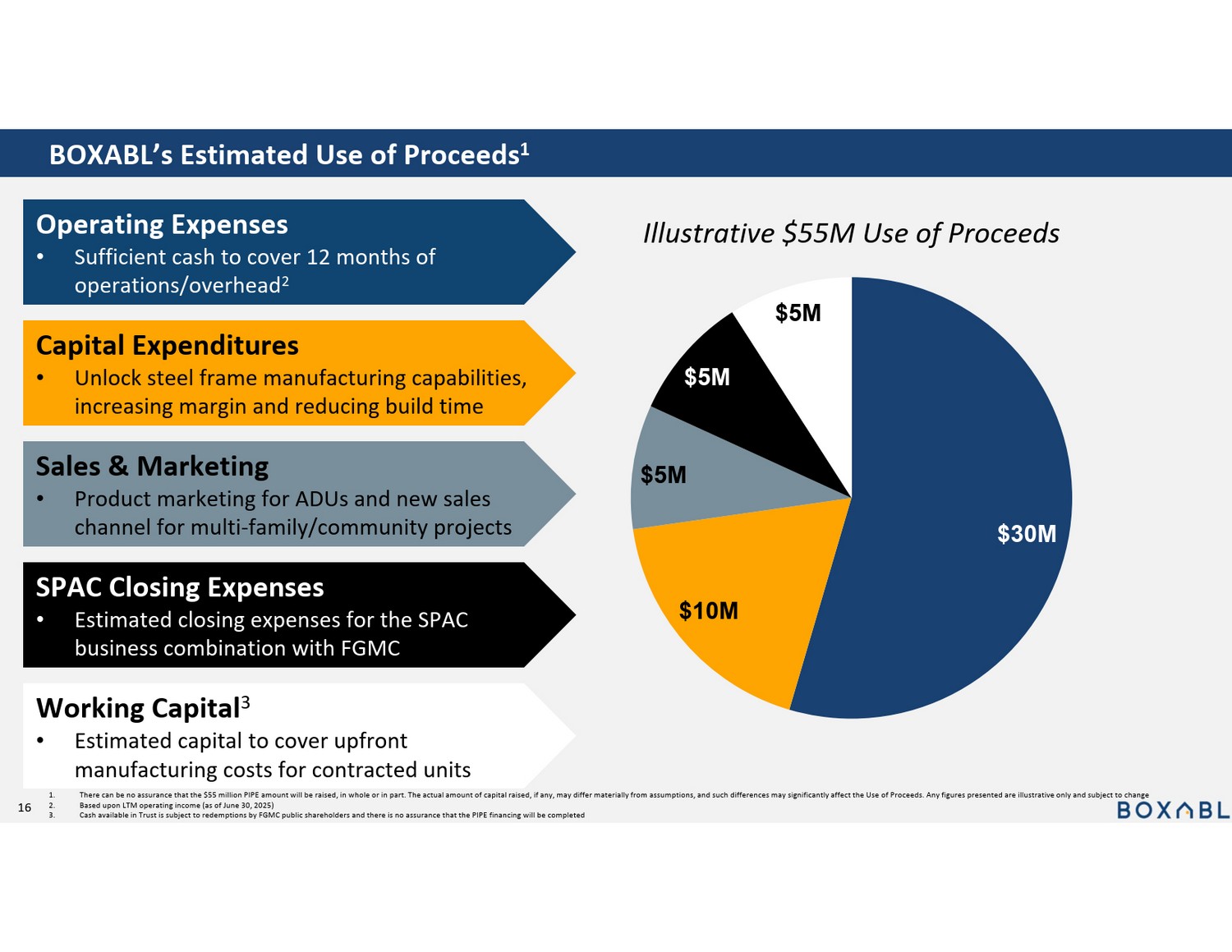

Product is being sold as a Park Model RV in states that don’t have a state - regulated modular program $30M $10M $5M $5M $5M BOXABL’s Estimated Use of Proceeds 1 Operating Expenses • Sufficient cash to cover 12 months of operations/overhead 2 Capital Expenditures • Unlock steel frame manufacturing capabilities, increasing margin and reducing build time Sales & Marketing • Product marketing for ADUs and new sales channel for multi - family/community projects SPAC Closing Expenses • Estimated closing expenses for the SPAC business combination with FGMC Working Capital 3 • Estimated capital to cover upfront manufacturing costs for contracted units 1. There can be no assurance that the $55 million PIPE amount will be raised, in whole or in part. The actual amount of capital rai sed, if any, may differ materially from assumptions, and such differences may significantly affect the Use of Proceeds. Any f igu res presented are illustrative only and subject to change 2. Based upon LTM operating income (as of June 30, 2025) 3.

Cash available in Trust is subject to redemptions by FGMC public shareholders and there is no assurance that the PIPE financi ng will be completed Illustrative $55M Use of Proceeds 16 Meet the BOXABL Team Paolo Tiramani, Founder & Co - CEO • Co - chief executive officer and majority shareholder of BOXABL • Industrial and mechanical engineer with 150+ patent filings • Oversees strategy, product vision, and financial investments, including personal real estate acquisitions linked to leadership compensation practices Galiano Tiramani, Founder & Co - CEO • Co - chief executive officer and large BOXABL shareholder • Responsible for operational leadership, growth planning and public representation • Oversees and coordinates marketing for both unit sales and fundraising efforts • Responsible for marketing BOXABL’s $230M+ 1 Reg A+ campaigns Martin Costas, CFO • Joined BOXABL as chief financial officer in October 2023 to support finance and growth strategy • Responsible for overseeing financial operations during a period of rapid scaling, including fundraising initiatives and expansion planning • 25 +years of diversified corporate experience, including a career in public accounting at PwC 17 1.

$230M was raised through a combination of Reg A and Reg D offerings Meet the FGMC Team Larry Swets, CFA Chief Executive Officer • 30 years+ of financial services experience including investment management, insurance and merchant banking • CEO of FG Financial Group • Over a decade of SPAC experience • Numerous successful M&A transactions, SPACs, PIPEs, and investment exits Hassan Baqar Chief Financial Officer • 20 years+ of financial services experience focused on corporate development, mergers & acquisitions, capital raising, investments and real estate • Over a decade of SPAC experience including FG New America Acquisition Corp’s merger with OppFi and Aldel Financial‘s merger with Hagerty Kyle Cerminara, CFA Senior Advisor • 20 years+ of financial services experience including investment management, insurance and merchant banking • Co - Founder of Fundamental Global • Numerous successful M&A transactions, SPACs, PIPEs, and investment exits • Public company CEO, Chairman, Director with decades of experience Reputable SPAC management team with notable track record, including 6 successful SPAC transactions BOXABL Investment Thesis • Massive Market Opportunity: BOXABL addresses the U.S. housing affordability crisis with demand exceeding a 3.8 million unit gap • Disruptive Technology: The foldable BOXABL design enables mass production, efficient shipping, and rapid on - site setup • Scalable Growth Model: Transition from ADU sales to large - scale multifamily and community projects, with vertical integration in development, financing, and smart home solutions • Attractive Public Market Candidate: Combination with SPAC provides access to capital markets and institutional expansion opportunities to expand on fundraising capabilities to address opportunity 18 Where HOUSING meets mass production . Investor Presentation Transforming the housing market with modular building systems designed to deliver affordable, high - quality homes at unprecedented speed 19